- UDR Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

8-K Filing

UDR (UDR) 8-KRegulation FD Disclosure

Filed: 19 Mar 07, 12:00am

| UDR Investor Day March 19, 2007 Tom Toomey, CEO |

| Today, UDR is announcing a new vision and identity Vision: To be the innovative real estate investment of choice New name and identity Why this? Why now? |

| Why this mark? UDR is focused on the future Logo represents a door or window to the future Every home has a door |

| Why now? Our new name and identity symbolize our future We have built a strong team, capital base and infrastructure We have a new vision and the right strategies to deliver growth |

| Our vision To be the innovative real estate investment of choice |

| Our vision: To be the innovative real estate investment of choice "Innovation is the fuel for growth." Gary Hamel and Gary Getz, in 'Funding Growth in an Age of Austerity' "Creativity is thinking up new things. Innovation is doing new things." Theodore Levitt |

| UDR has demonstrated innovation: Internet marketing Development Full-scale redevelopment Kitchen and bath program 1.1 million unique visitors went to our website in 2006. 34% of 2006 leases were initiated via the Internet. Our vision: To be the innovative real estate investment of choice |

| UDR has demonstrated innovation: Internet marketing Development Full-scale redevelopment Kitchen and bath program Our vision: To be the innovative real estate investment of choice $2B Development Pipeline |

| UDR has demonstrated innovation: Internet marketing Development Full-scale redevelopment Kitchen and bath program 100% Growth in Cash Flow Our vision: To be the innovative real estate investment of choice |

| UDR has demonstrated innovation: Internet marketing Development Full-scale redevelopment Kitchen and bath program 10% Targeted ROI Our vision: To be the innovative real estate investment of choice |

| "of choice" Our vision: To be the innovative real estate investment of choice |

| "of choice" means: Preferred employer Preferred partner Preferred investment Our vision: To be the innovative real estate investment of choice |

| We have the right growth strategies to deliver superior value creation We have the management bench, discipline and capital resources to implement our plan We can improve our strong past performance to deliver future growth Today, we will demonstrate our vision, strategies and team |

| We have the right strategies ... |

| Florida: 16% California: 27% Texas: 12% D.C. Corridor: 14% Strategy 1: Strengthen our research-driven portfolio |

| Expand development, redevelopment, land entitlement and short-term hold investments Agility Innovation Opportunity Strategy 2: Expand RE3 |

| Grow net operating income through automation and efficiency. Strategy 3: Transform operations to grow NOI |

| Leverage research capabilities and operating, financial and investment platforms to attract a variety of low cost capital Strategy 4: Source low-cost capital |

| Favorable fundamentals: long-term trends for apartments (demographic, employment, immigration, etc.) Value-creation competencies in all phases of the real estate cycle Where we want to be in terms of team expertise "Targeted" national footprint focused on future opportunity Pace is accelerating; focused on the future UDR is unique: This is the right time ... |

| We have a clear vision and the right growth strategies to deliver superior value creation We have the management bench, discipline and capital resources to implement our plan We can improve our strong past performance to deliver future growth In summary ... |

| Mike Ernst Chief Financial Officer Executive Vice President Martha Carlin Executive Vice President Property Operations Mark Wallis Senior Executive Vice President Legal, Acquisitions, Dispositions, Development & Asset Quality We have the right team ... |

| UDR Investor Day |

| Mark Wallis Senior EVP Acquisitions, Dispositions, Asset Quality & Development |

| Leverage our capacity and infrastructure with quality assets in selected markets Strategy: Strengthen our research-driven portfolio |

| "Research-driven" is more complex than high-barrier markets For us, "research-driven" incorporates rigorous analysis to measure 2 key factors and determine where: Home affordability index is low The demand/supply ratio for multi-family housing is favorable Demographic trends are favorable Job growth expectations are high |

| Strategy: Expand RE3 Solve the market cycle puzzle by expanding development, redevelopment, land entitlement and condo conversions. Why now? What is the objective? How do we measure success? |

| Why now? The time is right to expand RE3 In the past: REITs have expanded significantly over the last 15 years They traditionally have been required to hold assets for 4 years or more Today: REITs must have the flexibility to compete in the marketplace or they will miss significant opportunities RE3 solves the puzzle of market cycles by enabling us to sell assets sooner RE3 allows us to generate more income through innovative fee structures |

| Our objective is to outperform the industry To accelerate growth in FFO and outperform the industry To diversify income base To supplement profits from traditional operations To reach a goal of 20% of FFO from RE3 |

| We have a strong team with over 150 years of experience Richard Giannotti EVP Redevelopment Matt Akin SVP Acquisitions and Dispositions Les Boeckel SVP Condominiums Mark Culwell SVP Development Doug Walker SVP Asset Quality Scott St. Clair VP Kitchen and Bath Program |

| We expect our development & redevelopment efforts to create $800M-$1.2B in value We have a four-pronged approach: In-house development Pre-sale development Joint ventures Redevelopment |

| Two research-driven examples that emphasize different drivers "Research-driven" incorporates rigorous analysis to measure 2 key factors and determine where: Home affordability index is low The demand/supply ratio for multi-family housing is favorable Demographic trends are favorable Job growth expectations are high |

| Home affordability index (low) is the key driver Example: Caroline Village, Woodbridge, VA |

| The supply/demand ratio for multi-family housing (favorable) is the key driver Surprise, AZ 382 Homes $46 million Budget $120,000 Cost per Home Expected 6.25% to 6.75% Return Expected Start Date: 4Q07 Expected Completion Date: 1Q10 |

| Our pipeline is robust, with a high percentage of our Q4 shadow pipeline under contract Warner Center - Los Angeles, CA 438 Stadium Village - Surprise, AZ 382 Woodlands - Houston, TX 324 North Hyde Park - Tampa, FL 250 Woodbridge - Woodbridge, VA 322 Bennet - Dallas, TX 460 Carolina Corporate Center - Raleigh, NC 300 Baseline - Rancho Cucamonga, CA 593 Lake Elsinore - Lake Elsinore, CA 590 Box Springs - Monero Valley, CA 240 Centennial Plaza - Richardson, TX 330 Addison - Dallas, TX 993 Total Future Development - Under Contract / Investigation 5,222 Estimated UDR Investment $779M Purchased/Under Contract Deletion Estimated # of Homes |

| We bring expertise and innovation to a variety of product types Garden Wrap Podium Mid rise Mixed-use High rise |

| We bring expertise and innovation to a variety of product types Garden Wrap Podium Mid rise Mixed-use High rise |

| We bring expertise and innovation to a variety of product types Garden Wrap Podium Mid rise Mixed-use High rise |

| We bring expertise and innovation to a variety of product types Garden Wrap Podium Mid rise Mixed-use High rise |

| We bring expertise and innovation to a variety of product types Garden Wrap Podium Mid rise Mixed-use High rise |

| We bring expertise and innovation to a variety of product types Garden Wrap Podium Mid rise Mixed-use High rise |

| RE3: innovative land acquisition and development Brookhaven - Addision, TX Addison: Day time population: 100,000 Night time population: 16,000 Potential to triple density to 5,000 + homes Retail, office and other zoning Estimated Start: 4Q 2007 Return on Costs: 6.5% - 7.0% |

| RE3: innovative land acquisition and development |

| RE3: innovative JV structures 989 Elements - Bellevue, WA 166 Homes High-Rise Closed Joint Venture in Jan '07 Structure: 49% UDR / 51% Su Development Managed by UDR Ground Floor Retail Total Cost of $58 million - UDR interest $28 million |

| Kitchen and bath program: innovative capital improvements Before After |

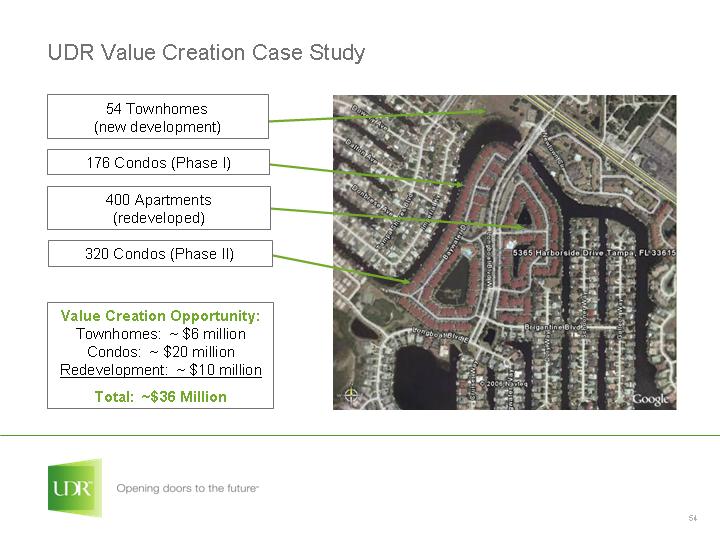

| Our goal for condos is to harvest value from existing properties 54 Townhomes (new development) 176 Condos (Phase I) 400 Apartments (redeveloped) 320 Condos (Phase II) Value Creation Opportunity: Townhomes: ~ $6 million Condos: ~ $20 million Redevelopment: ~ $10 million Total: ~$36 Million Island Walk, Tampa, FL |

| Both acquisitions and dispositions create value for RE3 purchased mid-2006, forecasted sale in 2007 |

| Both acquisitions and dispositions create value for RE3 Las Colinas, TX 367 Homes $32 million Cost $85,200 Cost per Home Sold in Q4 for $45 million |

| In summary, our strategies are working and we're accelerating our pace. Our research-driven portfolio is positioned to outperform the industry Our innovative redevelopment program creates significant value We bring innovation and expertise to many product types RE3 supplements and diversifies our traditional business and accelerates FFO growth |

| UDR Investor Day |

| Mike Ernst EVP and CFO |

| We have an experienced finance and accounting team Stacy Riffe SVP, CFO of RE3 Dave Messenger SVP, Chief Accounting Officer Larry Thede VP, Investor Relations VPs managing Treasury, Risk, Legal and Tax, with average experience in excess of 23 years |

| Strategy: Source a variety of low-cost capital Leverage research capabilities and operating, investment and financial infrastructure to attract low-cost capital alternatives and optimize ROIC Why now? What is the benefit? How do we measure success? |

| Why now? We have a great platform to support growth and value creation Experienced team Broad market knowledge Ability to create value in many ways Ability to co-invest significant capital Research capabilities Transparency Flexibility |

| What is the benefit? This strategy produces higher returns with lower risk Reduces need to access common equity Generates fee income to supplement property income Increases potential for dividend increases Lowers overall corporate risk |

| How do we measure success? Increased ROIC Stabilized Investment Development Unleveraged IRR 7.5% - 8.5% 8 - 9% Leveraged IRR 11 - 13% 15 - 20% Leveraged IRR w/ profit from fees @ 20% interest 13 - 15% 22 - 28% Leveraged IRR w/ profit from fees and promote @ 20% interest 13 - 20% 22 - 38% |

| How do we measure success? We have closed or expect to close a number of ventures in the next 12 months JPI - Marina Del Rey John Su - Bellevue, Washington Pre-sale program Texas stabilized portfolio - selling 80% interest Development |

| In summary, we have the right strategy to create value Allocating capital to value creating investments Optimizing return on invested capital Managing risk |

| Martha Carlin EVP Operations |

| Strategy: Transform operations to grow NOI Grow NOI through Automation and efficiency |

| We have a strong team Pat Gregory CIO Erin Ditto SVP, Property Operations Tom Spangler SVP, Business Opportunities Jerry Davis VP, Area Director, So. CA and AZ Louis Kovalsky VP, Area Director, MD, VA, DC Dennis Sandidge VP, Area Director, FL, NC, SC Steve Taraborelli VP, Marketing Steve Lefkovits Joshua Tree Consulting |

| We've given this strategy a name Operations 2.0 |

| UDR's new operating model: "Operations 2.0" |

| UDR's new operating model: "Operations 2.0" new banking model |

| UDR's new operating model: "Operations 2.0" Phase 1: Planning - 2007 Phase 2 : Testing and implementation - - starts in 2008 |

| UDR's new operating model: "Operations 2.0" We create competitive advantage in this landscape through: Marketing Labor efficiencies Self-service Yield management Process reengineering |

| Operations 2.0: Customized offerings drive a unique model What we mean by transformational change: We will merge these technologies to create a new operating model |

| Why expand our vision now? Customers expect it Current model not responsive to the times Market is saturated with undifferentiated investment platforms The cost of technology is dropping If we don't change, "generation Y" will change our model for us |

| Why do we believe UDR can deliver this new operating model? Parts of this model are already in place Here are some examples of the new world of marketing ... |

| (Video) |

| Steve Taraborelli VP, Marketing |

| Low Cost of Customer Acquisition |

| Organic Search Engine Visitors 2003 82,000 2004 271,000 2005 427,000 2006 645,000 Tot. 1,425,000 We've significantly increased visits at no cost to UDR 1.4 million search engine visitor referrals cost UDR $0.00 61,000 free leads generated from Google, Yahoo & MSN 20% closing rate translates into 12,200 lease sales $117,000,000 earned last four years at zero marketing cost Website Visitors & ROI |

| Online Traffic Generation examples |

| Our content is passed along for free UDR content placed in social communities who share same interests Helps in search engine marketing efforts No marketing cost to UDR |

| UDR Microsites - private label apartment websites Capture organic search engine searchers Results: 2004-06 25 Microsites Search engine optimized for free visitor traffic 175,000 Unique Visitors 3,000 Online Reservations Cost: $4,400 over three years |

| Blogging increases search engine penetration Content distribution at no cost to UDR Use Blogs to dominate the search engine rankings Search engine optimized No marketing cost to UDR |

| 2003 49,000 2004 162,000 2005 268,000 2006 386,000 Lead Stream Up 44% in '06 vs '05 Email, phone and udrt.com leads are up 44% |

| Innovation at almost zero cost |

| Skype-In & Skype-Out Reach out to customers around the world 88,000 website visitors are outside USA Use Voice-Over-IP technology to engage with international apartment prospects No marketing cost to UDR |

| Instant Messaging - Meebo UDR associates cans handle multiple IM accounts for enhanced online support Using Instant Messaging technology Simplifies online instant messaging with multiple prospects who use different IM accounts Enhances the online customer experience No marketing cost to UDR |

| Really Simple Syndication (RSS) enables automatic price & incentive updates Users will get automatic pricing & incentive email updates when this content changes. RSS bypasses email spam filters for users who opt-in for such content. |

| NextRentals.com Non-branded Internet Listing Services Website 2005-06 Results 186,000 Unique Visitors 1,800 Coupon Downloads (leads) 1,000's of email, phone and drive-by leads generated. Reduces UDR payments to Rent.com by $125 |

| We are leveraging existing technologies to extend reach, at little or no cost Technologies used to extend our marketing communications reach at little or no cost to UDR: Social Search Marketing Microsites Blogging Skype Meebo RSS NextRentals.com ILS Website |

| Marketing Summary High yield, low cost results - easily scalable with velocity Leveraging technology to increase lead stream and sales Using technology to make it easier to make a sales transaction with UDR |

| The new model of property management Operations 2.0 |

| In summary, we're improving both the customer experience and our margins Utilizing technology to improve customer experience and reduce costs Taking a fresh approach to all areas of operations Enhancing and extending best-of-breed technologies to fit our needs Providing industry-leading platform to RE3 Improving margins by 200-300 basis points |

| UDR Investor Day |

| UDR 2007 Investor Day March 19, 2007 Value Creation Initiatives Development, Redevelopment |

| Statements contained in this presentation, which are not historical facts, are forward-looking statements, as the term is defined in the Private Securities Litigation Reform Act of 1995. You can identify these forward-looking statements by the Company's use of words such as, "expects," "plans," "estimates," "projects," "intends," "believes," and similar expressions that do not relate to historical matters. Such forward- looking statements are subject to risks and uncertainties which can cause actual results to differ materially from those currently anticipated, due to a number of factors, which include, but are not limited to, unfavorable changes in the apartment market, changing economic conditions, the impact of competition and competitive pricing, acquisitions or new developments not achieving anticipated results, delays in completing developments and lease-ups on schedule, difficulties in selling existing apartment communities, and other risk factors discussed in documents filed by the Company with the Securities and Exchange Commission from time to time including the Company's Annual Report on Form 10-K and the Company's Quarterly Reports on Form 10-Q. All forward-looking statements in this presentation are made as of today, based upon information known to management as of the date hereof. The Company assumes no obligation to update or revise any of its forward-looking statements even if experience or future changes show that indicated results or events will not be realized. Mill Creek San Ramon, CA The Mandolin Dallas, TX Parker's Landing Tampa, FL Safe Harbor Statement |

| Garden Wrap Podium Mid Rise Mixed Use High Rise Executive Summary UDR Development |

| Development Pipeline $1.9 Billion Identified, In Process 21 Communities 11,069 Homes $170 million Budgeted, $357 million Total Investment 13 Communities 4,635 Homes Redevelopment Pipeline Pipeline |

| Economics Why develop/redevelop? Value Creation: Gaining new assets/redeveloped communities at cost in high performance markets Growth: 150 to 200 basis point spread between build and buying retail Future deliveries offer greater promise of future NOI growth Focus on high growth markets with stronger operating metrics Product: Replacing aging, capital intensive assets with little rent growth potential |

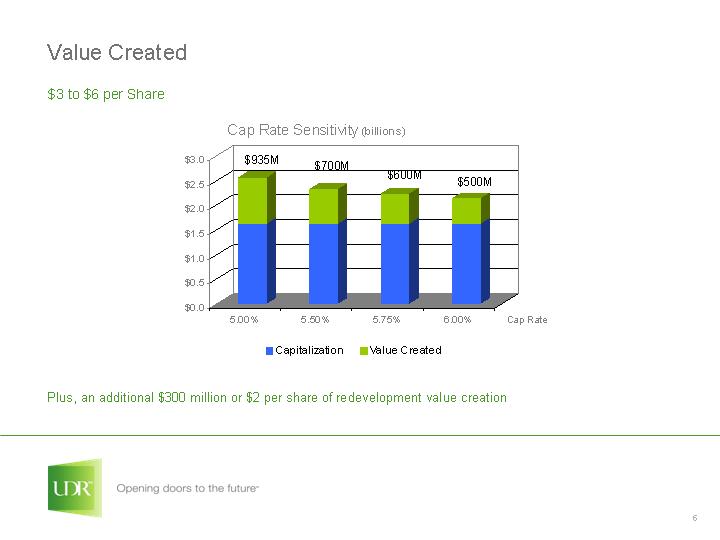

| Value Created Plus, an additional $300 million or $2 per share of redevelopment value creation $3 to $6 per Share |

| Development Process Approach Identifying Opportunities - Research Driven Product - Appropriately Designed to Fit Opportunity Utilized For Best Execution: Wholly Owned - Joint Ventures - Pre Sales Annual Deliveries - $300-$500M - Requires Pipeline of $2.5B Research Driven Analysis Permit Trends Job Formation SF Trends Income Trends Occupancy Trends Rental Rate Growth |

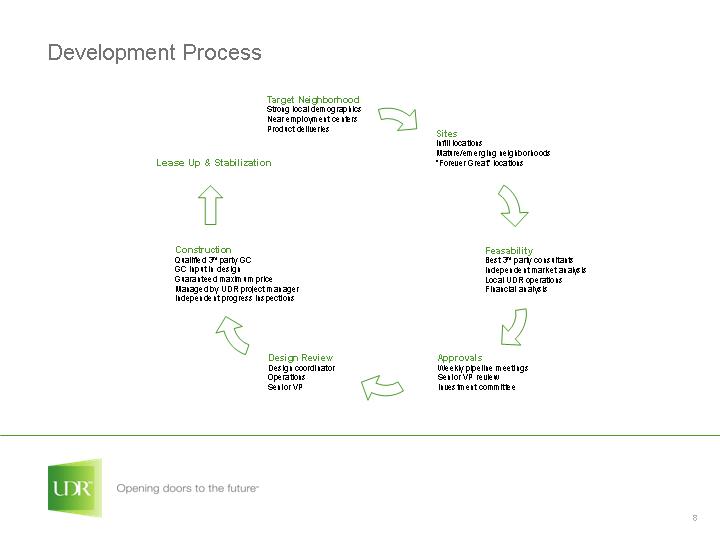

| Development Process Lease Up & Stabilization Construction Qualified 3rd party GC GC input in design Guaranteed maximum price Managed by UDR project manager Independent progress inspections Target Neighborhood Strong local demographics Near employment centers Product deliveries Sites Infill locations Mature/emerging neighborhoods "Forever Great" locations Feasability Best 3rd party consultants Independent market analysis Local UDR operations Financial analysis Approvals Weekly pipeline meetings Senior VP review Investment committee Design Review Design coordinator Operations Senior VP |

| Development The Team: Experience approaching 150 years Diverse background including Finance, Operations, Analysis, Construction, Brokerage, Urban Planning and Development Competent leadership Defined focus Results driven |

| Intentionally Left Blank |

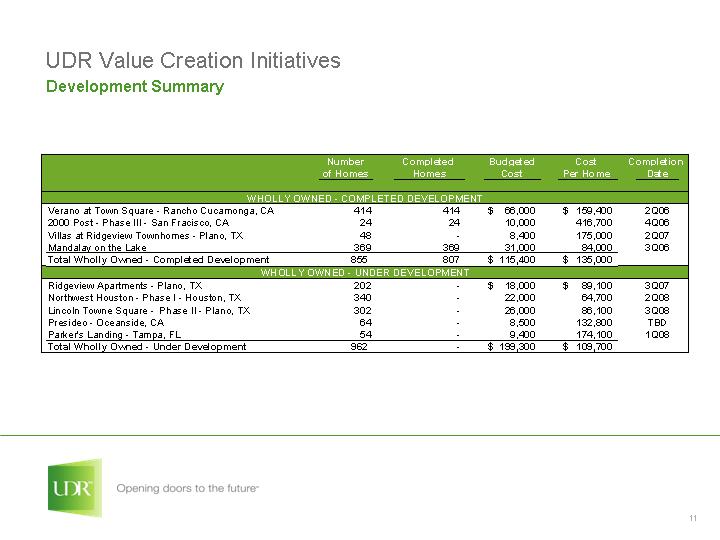

| UDR Value Creation Initiatives Development Summary |

| UDR Value Creation Initiatives Completed Wholly Owned Development - Verano at Town Square Rancho Cucamonga, CA 414 Homes $68 million Cost $164,250 Cost per Home 7.5% to 8.0% Return as Apartment Homes In Lease-Up: 90.8% Leased Estimated $38 million Value Created |

| UDR Value Creation Initiatives Wholly Owned Development - Lincoln at Towne Square Phase II Plano, TX 302 Homes $26 million Budget $86,100 Cost per Home 6.5% to 7.0% Return Expected Completion - 3Q08 Estimated $8 million Value Created |

| Wholly Owned Development - Northwest Houston Houston, TX 340 Homes $22 million Budget $64,700 Cost per Home 6.8% Return Est. Completion: 2Q 2008 UDR Value Creation Initiatives |

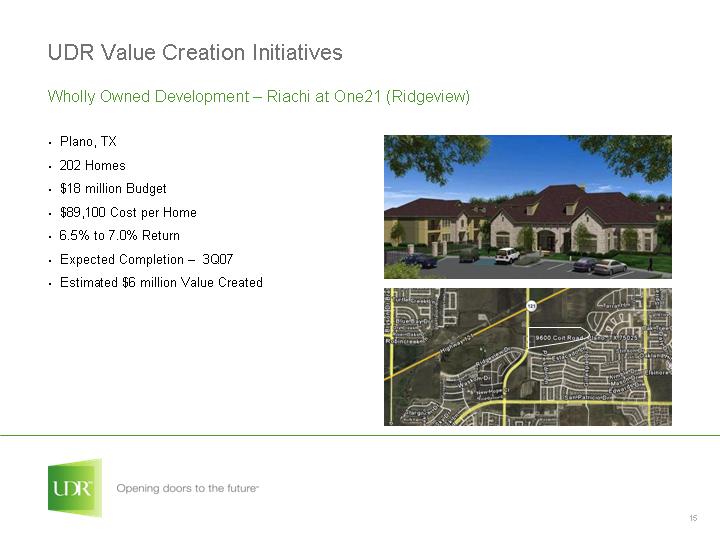

| UDR Value Creation Initiatives Wholly Owned Development - Riachi at One21 (Ridgeview) Plano, TX 202 Homes $18 million Budget $89,100 Cost per Home 6.5% to 7.0% Return Expected Completion - 3Q07 Estimated $6 million Value Created |

| UDR Value Creation Initiatives Completed Wholly Owned Development - Mandalay on the Lake Las Colinas, TX 367 Homes $32 million Cost $85,200 Cost per Home Sold in Q4 for $45 million SOLD |

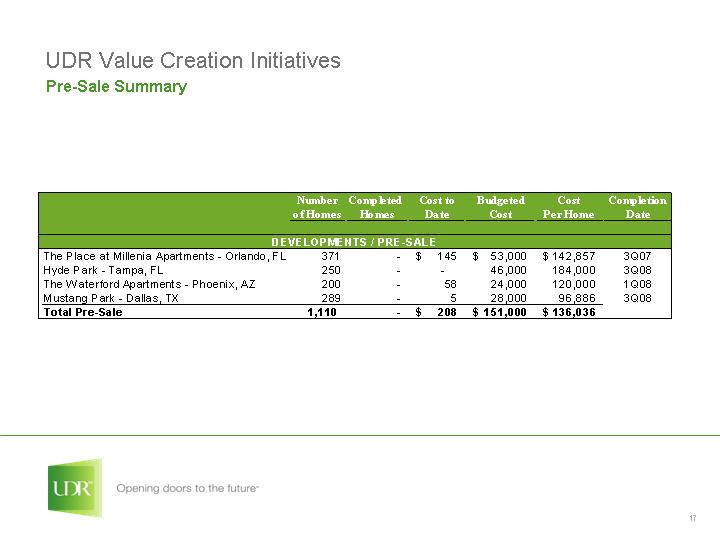

| Pre-Sale Summary UDR Value Creation Initiatives |

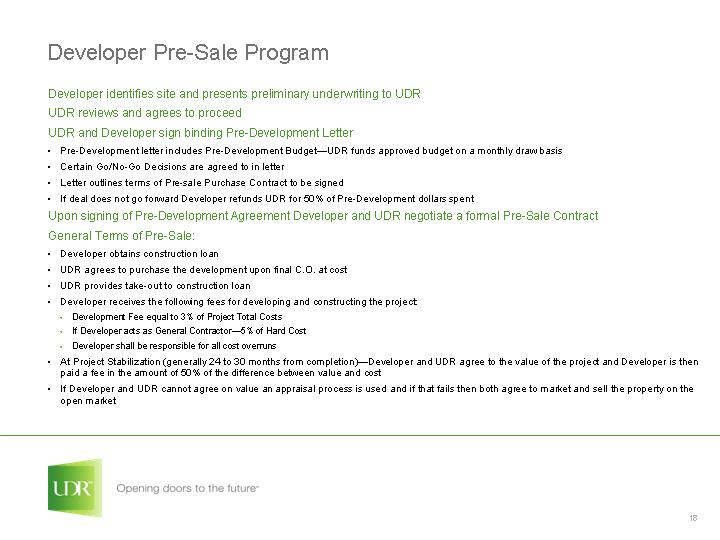

| Developer Pre-Sale Program Developer identifies site and presents preliminary underwriting to UDR UDR reviews and agrees to proceed UDR and Developer sign binding Pre-Development Letter Pre-Development letter includes Pre-Development Budget-UDR funds approved budget on a monthly draw basis Certain Go/No-Go Decisions are agreed to in letter Letter outlines terms of Pre-sale Purchase Contract to be signed If deal does not go forward Developer refunds UDR for 50% of Pre-Development dollars spent Upon signing of Pre-Development Agreement Developer and UDR negotiate a formal Pre-Sale Contract General Terms of Pre-Sale: Developer obtains construction loan UDR agrees to purchase the development upon final C.O. at cost UDR provides take-out to construction loan Developer receives the following fees for developing and constructing the project: Development Fee equal to 3% of Project Total Costs If Developer acts as General Contractor-5% of Hard Cost Developer shall be responsible for all cost overruns At Project Stabilization (generally 24 to 30 months from completion)-Developer and UDR agree to the value of the project and Developer is then paid a fee in the amount of 50% of the difference between value and cost If Developer and UDR cannot agree on value an appraisal process is used and if that fails then both agree to market and sell the property on the open market |

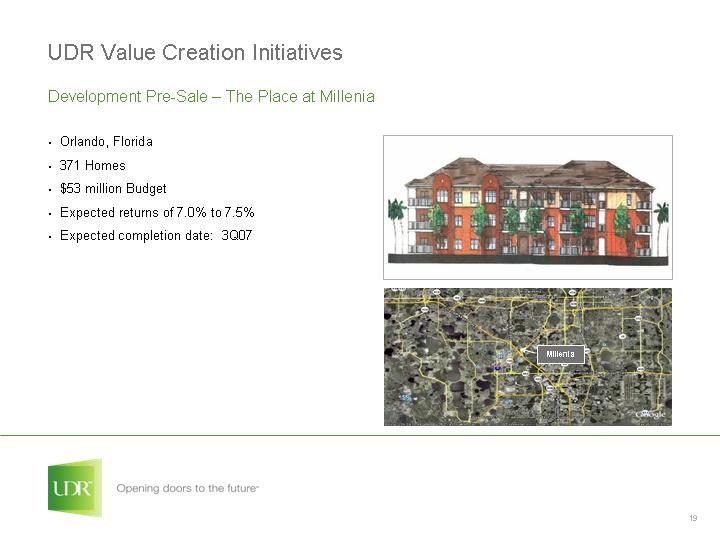

| UDR Value Creation Initiatives Development Pre-Sale - The Place at Millenia Orlando, Florida 371 Homes $53 million Budget Expected returns of 7.0% to 7.5% Expected completion date: 3Q07 Millenia |

| UDR Value Creation Initiatives Development Pre-Sale - The Waterford Phoenix, Arizona 200 Homes $24 million Budget Expected returns of 7.0% to 7.5% Expected completion date: 1Q08 |

| UDR Value Creation Initiatives Development Pre-Sale - Mustang Park Dallas, TX 289 Homes $28 million Budget Expected Returns of 7.0% to 7.5% Expected Completion Date: 3Q08 |

| Intentionally Left Blank |

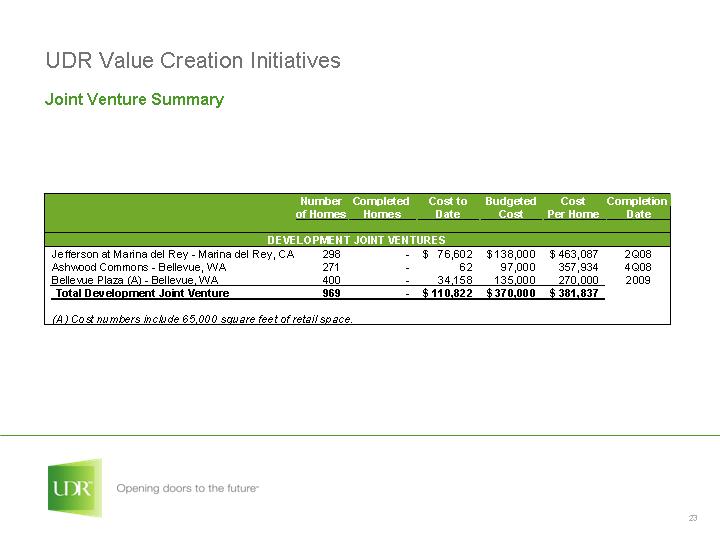

| UDR Value Creation Initiatives Joint Venture Summary |

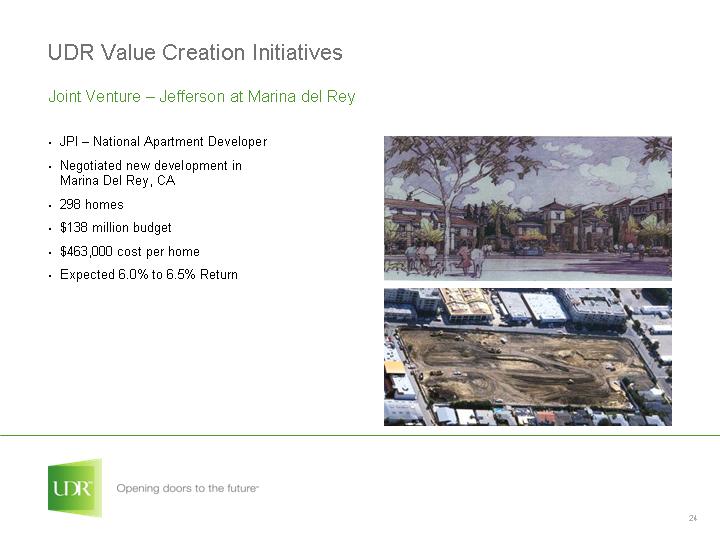

| UDR Value Creation Initiatives Joint Venture - Jefferson at Marina del Rey JPI - National Apartment Developer Negotiated new development in Marina Del Rey, CA 298 homes $138 million budget $463,000 cost per home Expected 6.0% to 6.5% Return |

| Bellevue Plaza Development Site UDR Value Creation Initiatives Joint Venture - Bellevue Plaza Proposed High Rise Development 400 Homes $135 million Budget $270,000 Cost per Home Ground Floor Retail Expected 6.0% - 6.5% Return Structure: 49% UDR/51% SU Development |

| UDR Value Creation Initiatives Joint Venture - Bellevue Plaza 989 Elements - Bellevue, WA 166 Homes High-Rise Closed Joint Venture in Jan '07 Structure: 49% UDR / 51% Su Development Managed by UDR Ground Floor Retail Total Cost of $58 million - UDR interest $28 million |

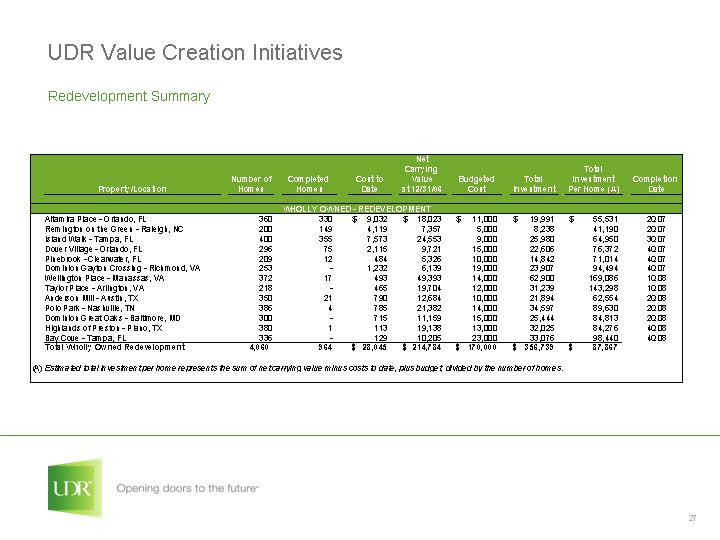

| UDR Value Creation Initiatives Redevelopment Summary |

| UDR Value Creation Initiatives Redevelopment Reinvest with Exterior Upgrades and Interior Renovations 13 Communities Underway - 4,635 Homes $170 million Budgeted Cost - $357 million Total Investment Targeting 8% to 10% Stabilized ROI |

| UDR Value Creation Initiatives Redevelopment - Legacy at Mayland Richmond, VA Built in 1973, Purchased by UDR in December 1991. 576 Homes Redevelopment Completed 4Q06 100% Growth in Cash Flow to $4.6M in 33 Months 11% Cash on Cash Return Value Created: > $36 million After Before |

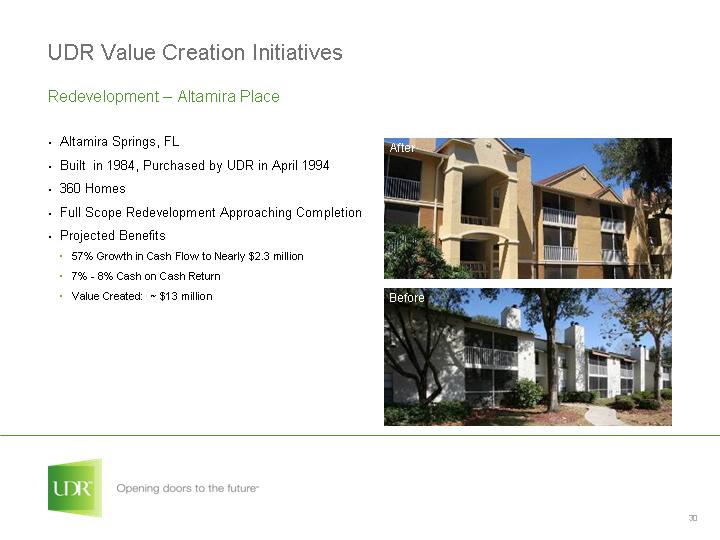

| UDR Value Creation Initiatives Redevelopment - Altamira Place Altamira Springs, FL Built in 1984, Purchased by UDR in April 1994 360 Homes Full Scope Redevelopment Approaching Completion Projected Benefits 57% Growth in Cash Flow to Nearly $2.3 million 7% - 8% Cash on Cash Return Value Created: ~ $13 million After Before |

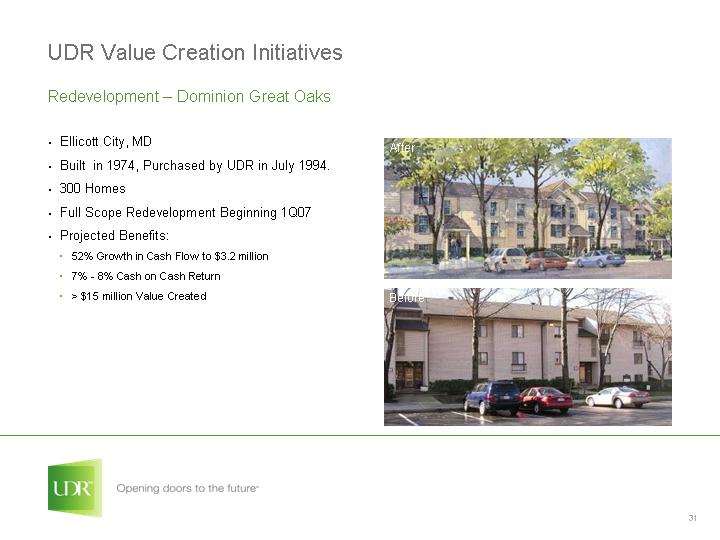

| UDR Value Creation Initiatives Redevelopment - Dominion Great Oaks Ellicott City, MD Built in 1974, Purchased by UDR in July 1994. 300 Homes Full Scope Redevelopment Beginning 1Q07 Projected Benefits: 52% Growth in Cash Flow to $3.2 million 7% - 8% Cash on Cash Return > $15 million Value Created After Before |

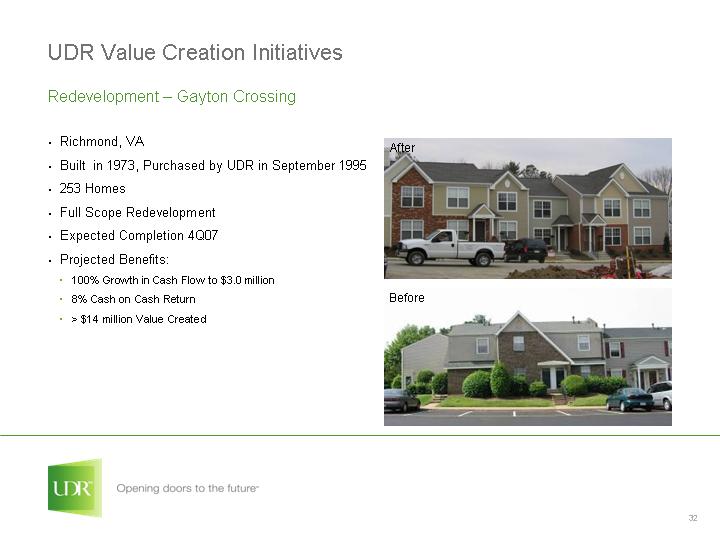

| UDR Value Creation Initiatives Redevelopment - Gayton Crossing Richmond, VA Built in 1973, Purchased by UDR in September 1995 253 Homes Full Scope Redevelopment Expected Completion 4Q07 Projected Benefits: 100% Growth in Cash Flow to $3.0 million 8% Cash on Cash Return > $14 million Value Created After Before |

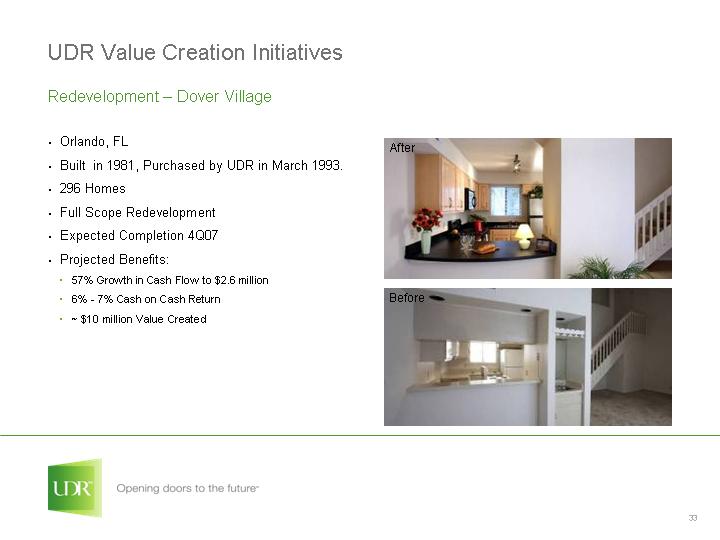

| UDR Value Creation Initiatives Redevelopment - Dover Village Orlando, FL Built in 1981, Purchased by UDR in March 1993. 296 Homes Full Scope Redevelopment Expected Completion 4Q07 Projected Benefits: 57% Growth in Cash Flow to $2.6 million 6% - 7% Cash on Cash Return ~ $10 million Value Created After Before |

| Redevelopment - Wellington Place Manassas, VA Built in 1987, Purchased by UDR in September 2005 372 Homes Full Scope Redevelopment Construction Began November 2006 Projected Benefits: 36% Growth in Cash Flow to $4.0 million 7% - 8% Cash on Cash Return $14 million Value Created UDR Value Creation Initiatives After Before |

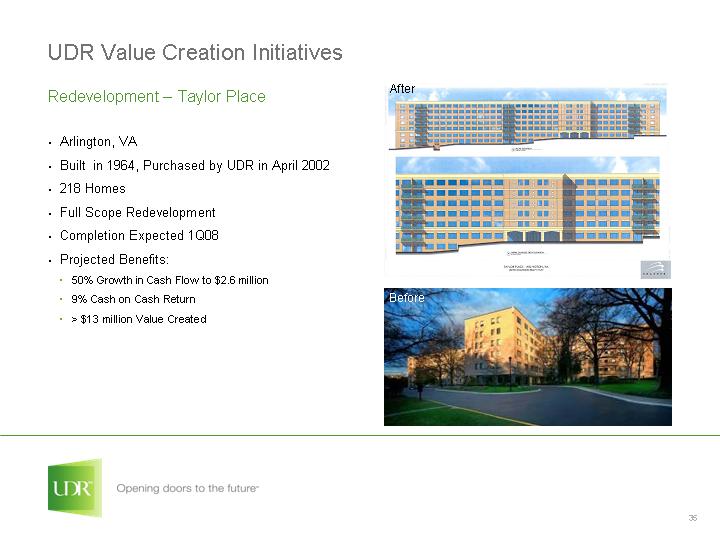

| UDR Value Creation Initiatives Redevelopment - Taylor Place Arlington, VA Built in 1964, Purchased by UDR in April 2002 218 Homes Full Scope Redevelopment Completion Expected 1Q08 Projected Benefits: 50% Growth in Cash Flow to $2.6 million 9% Cash on Cash Return > $13 million Value Created After Before |

| Intentionally Left Blank |

| Remington on the Green - Raleigh, NC UDR Value Creation Initiatives Redevelopment - Kitchen/Bath Program Goals of K/B Program Increase NAV Low-Risk Redevelopment Attract Higher-Grade Resident Higher rent Better care of asset Neighborhood quality Flexibility/Modernization Standardization --> Lower cost maintenance After Before |

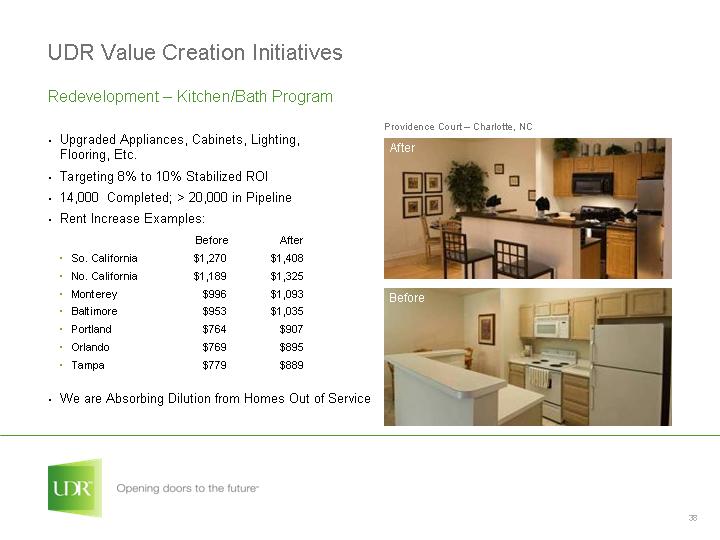

| Providence Court - Charlotte, NC After Before UDR Value Creation Initiatives Redevelopment - Kitchen/Bath Program Upgraded Appliances, Cabinets, Lighting, Flooring, Etc. Targeting 8% to 10% Stabilized ROI 14,000 Completed; > 20,000 in Pipeline Rent Increase Examples: Before After So. California $1,270 $1,408 No. California $1,189 $1,325 Monterey $996 $1,093 Baltimore $953 $1,035 Portland $764 $907 Orlando $769 $895 Tampa $779 $889 We are Absorbing Dilution from Homes Out of Service |

| Legacy at Mayland - Richmond, VA UDR Value Creation Initiatives Redevelopment - Kitchen/Bath Program How We Are Doing It Better? Complexity of execution Cross department cohesion Start with good location Cutting edge design Better cabinets Granite Stainless Steel New lighting Flexibility/adaptation Reconfiguration/modernization Flexible resource allocation After Before |

| Intentionally Left Blank |

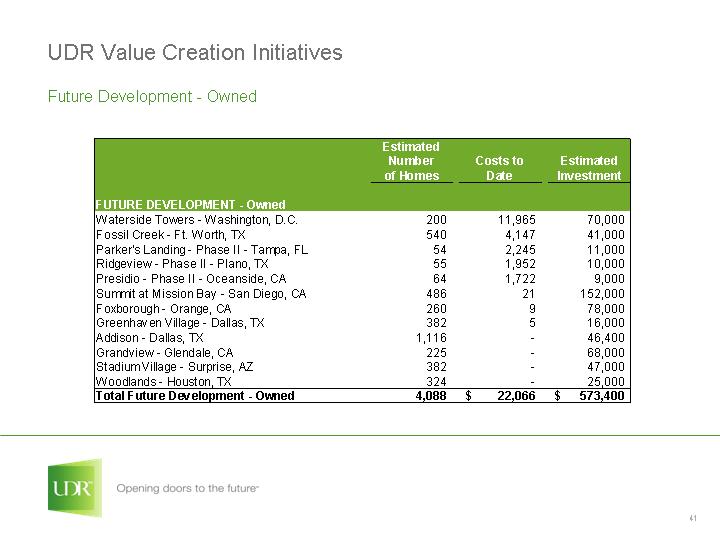

| UDR Value Creation Initiatives Future Development - Owned |

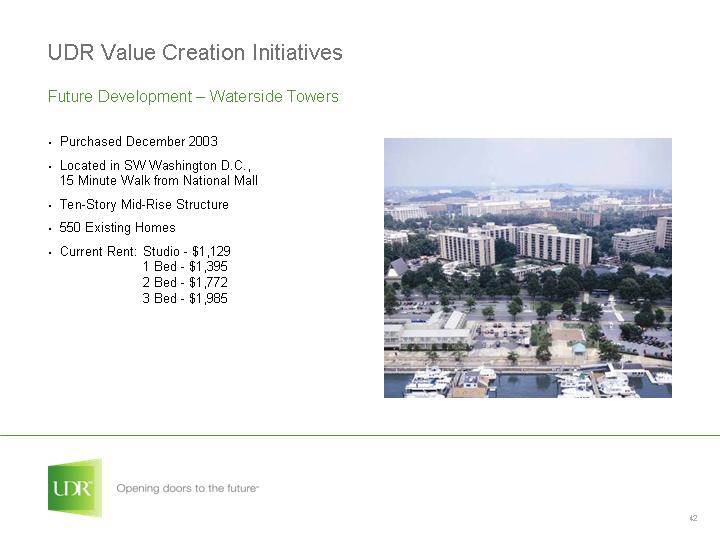

| UDR Value Creation Initiatives Future Development - Waterside Towers Purchased December 2003 Located in SW Washington D.C., 15 Minute Walk from National Mall Ten-Story Mid-Rise Structure 550 Existing Homes Current Rent: Studio - $1,129 1 Bed - $1,395 2 Bed - $1,772 3 Bed - $1,985 |

| UDR Value Creation Initiatives Future Development - Waterside Towers Planned Expansion on Existing Property 11 story tower 200 homes 12,000 to 18,000 sq. ft. for retail Estimated cost: $70 million Timing: Zoning - 18 mos. Pre-Construction - 14 mos. Construction - 24 mos. Contingency - 4 mos. Total - 60 mos. |

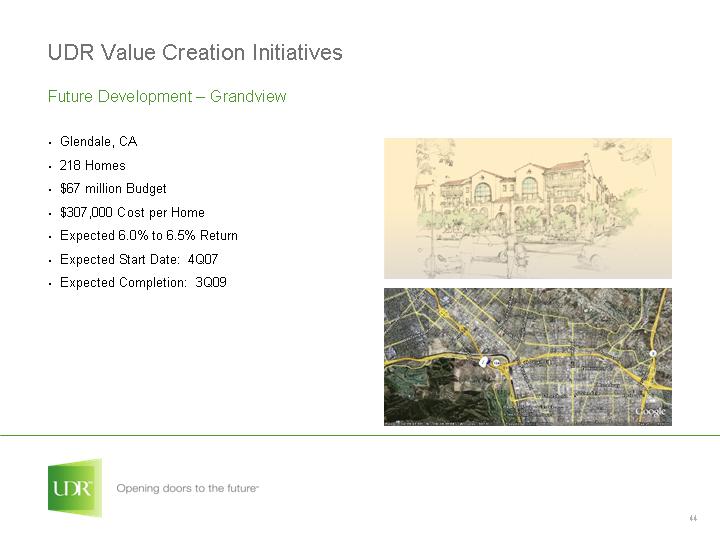

| UDR Value Creation Initiatives Future Development - Grandview Glendale, CA 218 Homes $67 million Budget $307,000 Cost per Home Expected 6.0% to 6.5% Return Expected Start Date: 4Q07 Expected Completion: 3Q09 |

| UDR Value Creation Initiatives Future Development - Summit at Mission Bay San Diego, CA 486 Homes $165 million Budget $340,000 Cost per Home Expected 5.5% to 6.0% Return Expected Start Date: TBD |

| UDR Value Creation Initiatives Future Development - Foxborough Orange, CA 260 Homes $77 million Budget $296,000 Cost per Home Expected 6.0% to 6.5% Return Expected Start Date: TBD |

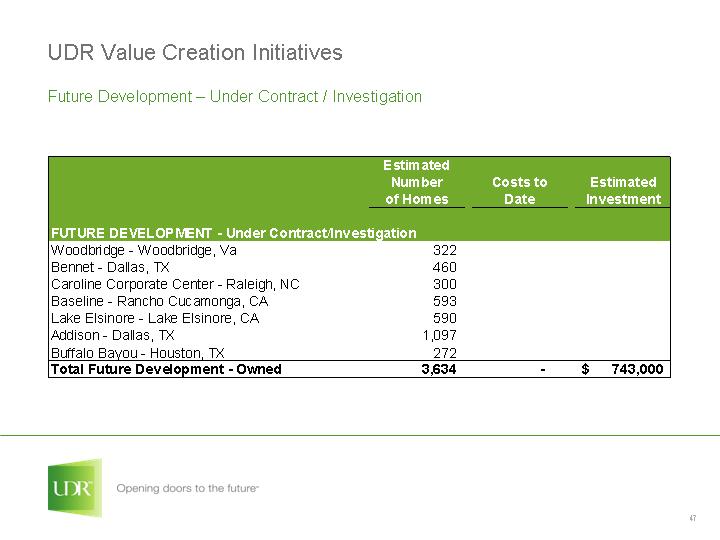

| UDR Value Creation Initiatives Future Development - Under Contract / Investigation |

| UDR Value Creation Initiatives Future Development - Stadium Village Surprise, AZ 382 Homes $46 million Budget $120,000 Cost per Home Expected 6.25% to 6.75% Return Expected Start Date: 4Q07 Expected Completion Date: 1Q10 |

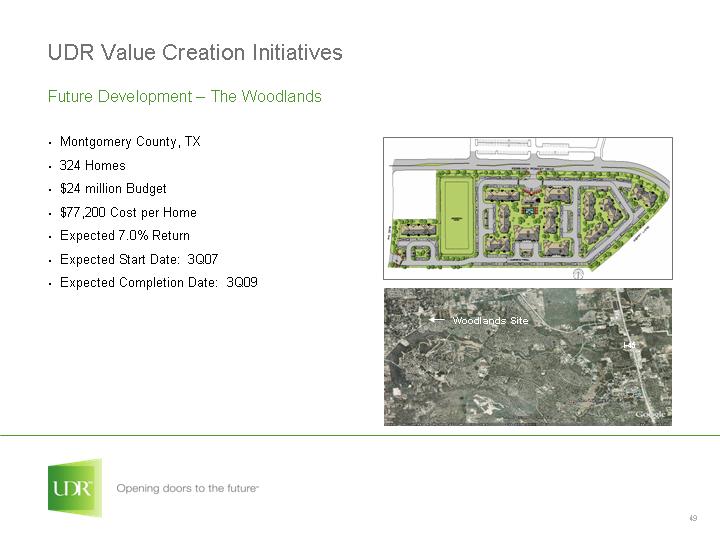

| UDR Value Creation Initiatives Future Development - The Woodlands Montgomery County, TX 324 Homes $24 million Budget $77,200 Cost per Home Expected 7.0% Return Expected Start Date: 3Q07 Expected Completion Date: 3Q09 Woodlands Site I-45 |

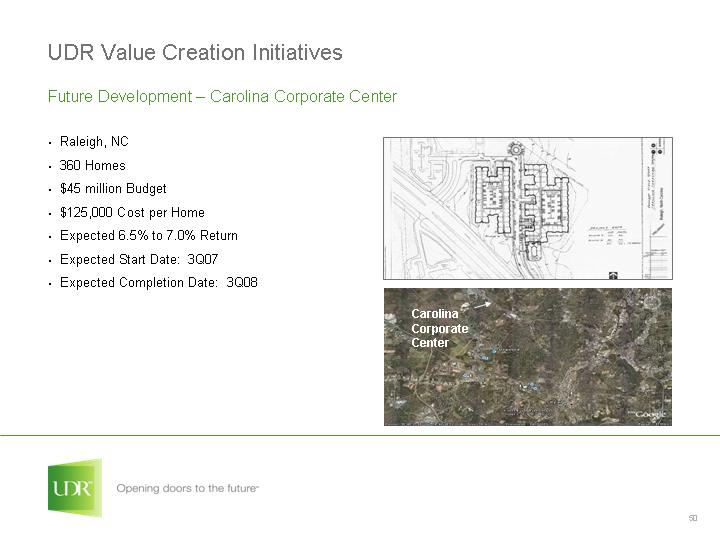

| UDR Value Creation Initiatives Future Development - Carolina Corporate Center Raleigh, NC 360 Homes $45 million Budget $125,000 Cost per Home Expected 6.5% to 7.0% Return Expected Start Date: 3Q07 Expected Completion Date: 3Q08 Carolina Corporate Center |

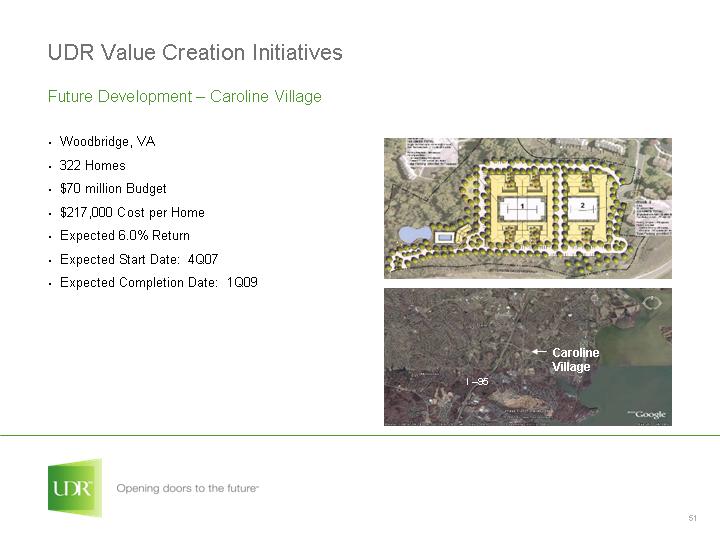

| UDR Value Creation Initiatives Future Development - Caroline Village Woodbridge, VA 322 Homes $70 million Budget $217,000 Cost per Home Expected 6.0% Return Expected Start Date: 4Q07 Expected Completion Date: 1Q09 Caroline Village I -95 |

| Intentionally Left Blank |

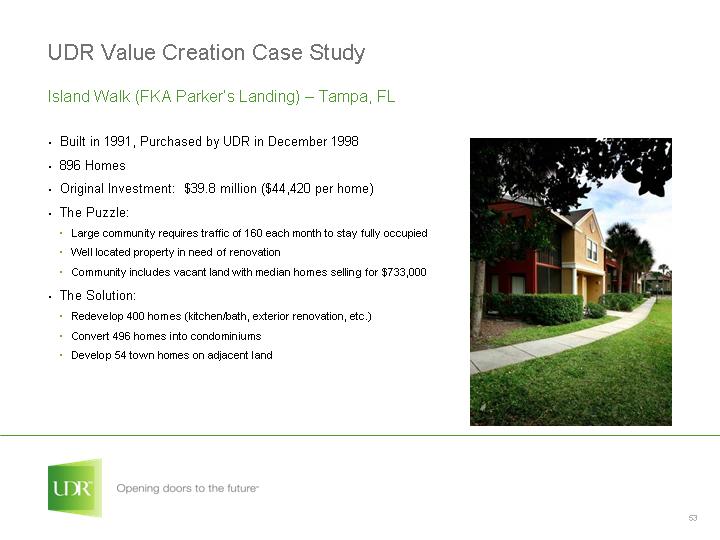

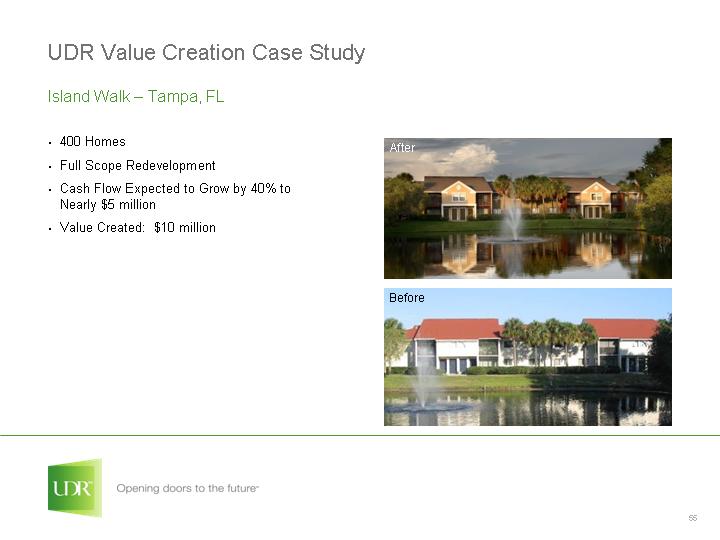

| UDR Value Creation Case Study Island Walk (FKA Parker's Landing) - Tampa, FL Built in 1991, Purchased by UDR in December 1998 896 Homes Original Investment: $39.8 million ($44,420 per home) The Puzzle: Large community requires traffic of 160 each month to stay fully occupied Well located property in need of renovation Community includes vacant land with median homes selling for $733,000 The Solution: Redevelop 400 homes (kitchen/bath, exterior renovation, etc.) Convert 496 homes into condominiums Develop 54 town homes on adjacent land |

| 54 Townhomes (new development) 176 Condos (Phase I) 400 Apartments (redeveloped) 320 Condos (Phase II) Value Creation Opportunity: Townhomes: ~ $6 million Condos: ~ $20 million Redevelopment: ~ $10 million Total: ~$36 Million UDR Value Creation Case Study |

| UDR Value Creation Case Study Island Walk - Tampa, FL 400 Homes Full Scope Redevelopment Cash Flow Expected to Grow by 40% to Nearly $5 million Value Created: $10 million After Before |

| UDR Value Creation Case Study Island Walk - Condo Conversion The Gallery at Bayport Phase I 176 homes sold at average price of $155,500 The Gallery at Bayport Phase II 320 homes First closings expected in 2007 Value Created: $20M |

| UDR Value Creation Case Study Island Walk - Town Homes 54 Town Homes Expected Sales Price: $400,000 per Home First Closings Expected in 2007/2008 Value Created: > $6 million |

| UDR - Summary Compelling Value Creation Strategy Creating Value and Making Money 5 Ways Strong Operator Delivering Stable, Predictable Returns, 6.0% 2006 Same Store Revenue Growth Disciplined Approach to Buying Communities Capturing Value through Sales, created by Demand for Institutional-quality Apartments in Job Growth Markets Creating Value through Development and Redevelopment $1 billion investment totaling 7,775 homes $1.3 billion annual future investment totaling 8,368 homes $75+ million invested in 2006 for over 7,500 kitchen and bath renovations |

| Statements contained in this presentation, which are not historical facts, are forward-looking statements, as the term is defined in the Private Securities Litigation Reform Act of 1995. You can identify these forward-looking statements by the Company's use of words such as, "expects," "plans," "estimates," "projects," "intends," "believes," and similar expressions that do not relate to historical matters. Such forward- looking statements are subject to risks and uncertainties which can cause actual results to differ materially from those currently anticipated, due to a number of factors, which include, but are not limited to, unfavorable changes in the apartment market, changing economic conditions, the impact of competition and competitive pricing, acquisitions or new developments not achieving anticipated results, delays in completing developments and lease-ups on schedule, difficulties in selling existing apartment communities, and other risk factors discussed in documents filed by the Company with the Securities and Exchange Commission from time to time including the Company's Annual Report on Form 10-K and the Company's Quarterly Reports on Form 10-Q. All forward-looking statements in this presentation are made as of today, based upon information known to management as of the date hereof. The Company assumes no obligation to update or revise any of its forward-looking statements even if experience or future changes show that indicated results or events will not be realized. Mill Creek San Ramon, CA The Mandolin Dallas, TX Parker's Landing Tampa, FL Safe Harbor Statement |