UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-3990

Northwestern Mutual Series Fund, Inc.

(Exact name of registrant as specified in charter)

720 East Wisconsin Avenue,

Milwaukee Wisconsin 53202

(Address of principal executive offices) (Zip code)

Barbara E. Courtney, Controller and Chief Accounting Officer Northwestern Mutual Series Fund, Inc.

(Name and address of agent for service)

Registrant’s telephone number, including area code: 414-271-1444

Date of fiscal year end: December 31

Date of reporting period: December 31, 2012

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

| Item 1. | Reports to Stockholders |

[Attached EDGARIZED ANNUAL REPORT]

Annual Report December 31, 2012

Northwestern Mutual Series Fund, Inc.

A Series Fund Offering 28 Portfolios

| | · | | Focused Appreciation Portfolio |

| | · | | Large Cap Core Stock Portfolio |

| | · | | Large Cap Blend Portfolio |

| | · | | Index 500 Stock Portfolio |

| | · | | Large Company Value Portfolio |

| | · | | Domestic Equity Portfolio |

| | · | | Equity Income Portfolio |

| | · | | Mid Cap Growth Stock Portfolio |

| | · | | Index 400 Stock Portfolio |

| | · | | Mid Cap Value Portfolio |

| | · | | Small Cap Growth Stock Portfolio |

| | · | | Index 600 Stock Portfolio |

| | · | | Small Cap Value Portfolio |

| | · | | International Growth Portfolio |

| | · | | Research International Core Portfolio |

| | · | | International Equity Portfolio |

| | · | | Emerging Markets Equity Portfolio |

| | · | | Short-Term Bond Portfolio |

| | · | | Long-Term U.S. Government Bond Portfolio |

| | · | | Inflation Protection Portfolio |

| | · | | High Yield Bond Portfolio |

| | · | | Multi-Sector Bond Portfolio |

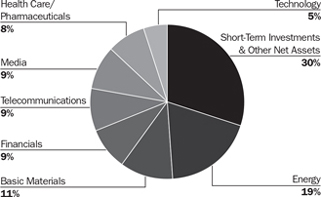

| | · | | Commodities Return Strategy Portfolio |

| | · | | Asset Allocation Portfolio |

Letter to Clients

December 31, 2012

At this time last year, we shared our views with contract holders about markets being dominated by macroeconomic themes, as opposed to individual, company specific factors. The macroeconomic landscape led to “risk on/risk off” trades and sharp volatility. A similar market environment was again the primary story of 2012, as markets continued to react to an uncertain economic outlook. Risk aversion in markets rose considerably over the summer of 2012 as the economic outlook dimmed, declining later in the year upon the announcements of additional stimulus from the world’s central banks. Measuring returns from the beginning to the end of the year, riskier assets generally outperformed their less risky counterparts, which was a notable divergence from 2011 market performance. For example, international markets outperformed the U.S., as the European Union took additional steps toward financial reform and economic growth stabilized in the developing world.

In the United States, investors’ preference for riskier assets was also evident, as all of the major U.S. equity indices posted double-digit returns. Mid-sized companies, as measured by the S&P MidCap 400® Index, led the rally, followed by the S&P SmallCap 600® Index and the S&P 500® Index of larger companies.

Similarly, within fixed income markets, high yield corporate bonds rallied along with other credit sensitive bonds. Within the universe of corporate debt, lower quality bonds generally outperformed higher quality, investment grade debt. Bonds that offered more stability and lower yields—Treasurys and mortgage-backed securities—lagged the corporate bond market while posting solid returns.

At a high level, markets responded favorably to the coordinated efforts of policy makers to stimulate the global economy. However, the economy continued to grow at a relatively slow pace with high unemployment. In our view, the optimism that markets expressed during 2012 was somewhat disconnected with the long-term outlook for global growth. Unanswered questions regarding growth rates and debt levels in the developed world lingered despite the robust market performance. In our opinion, the biggest concern for financial markets is whether developed countries across the globe will have the ability to grow their way out of debt without the help of economic and financial stimulus.

For all that was uncertain, we found some reasons for optimism. Profit margins on average hit all time highs, while companies continued to hold record amounts of cash on comparatively healthy balance sheets. How corporations decide to utilize these resources is likely to be an important influence on the economy at this point in the business cycle. With some clarity in economic policy, a broad-based move toward capital spending and infrastructure projects could increase economic growth.

Given all of the economic crosscurrents and market volatility, we have a somewhat cautious outlook going into 2013, as we believe that slow economic growth is likely to persist. We also think that the public and private sectors will continue to grapple with policy decisions that could shape the investment landscape for many years.

Despite all of the economic challenges that we have seen over the last several years, we continue to believe that spreading investment risk across many different asset classes can act as an implicit hedge against uncertainty.

While markets remain relatively unpredictable, investors still have control over determining their goals through careful financial planning and saving for the future. To reach your important financial targets, we would encourage you to work with a financial professional to develop a plan consistent with your risk tolerance, goals, and other wealth and life cycle considerations.

R. David Ells, CFA

President of Northwestern Mutual Series Fund, Inc.

Managing Director of Mason Street Advisors, LLC

Northwestern Mutual Series Fund, Inc.

Table of Contents

| | | | |

Expense Examples | | | i | |

Series Fund Overviews and Schedules of Investments: | | | | |

Growth Stock Portfolio | | | 1 | |

Focused Appreciation Portfolio | | | 5 | |

Large Cap Core Stock Portfolio | | | 8 | |

Large Cap Blend Portfolio | | | 12 | |

Index 500 Stock Portfolio | | | 15 | |

Large Company Value Portfolio | | | 22 | |

Domestic Equity Portfolio | | | 27 | |

Equity Income Portfolio | | | 30 | |

Mid Cap Growth Stock Portfolio | | | 35 | |

Index 400 Stock Portfolio | | | 39 | |

Mid Cap Value Portfolio | | | 45 | |

Small Cap Growth Stock Portfolio | | | 50 | |

Index 600 Stock Portfolio | | | 54 | |

Small Cap Value Portfolio | | | 62 | |

International Growth Portfolio | | | 66 | |

Research International Core Portfolio | | | 70 | |

International Equity Portfolio | | | 76 | |

Emerging Markets Equity Portfolio | | | 81 | |

Money Market Portfolio | | | 86 | |

Short-Term Bond Portfolio | | | 90 | |

Select Bond Portfolio | | | 97 | |

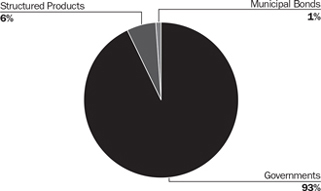

Long-Term U.S. Government Bond Portfolio | | | 112 | |

Inflation Protection Portfolio | | | 119 | |

High Yield Bond Portfolio | | | 129 | |

Multi-Sector Bond Portfolio | | | 140 | |

Commodities Return Strategy Portfolio | | | 161 | |

Balanced Portfolio | | | 165 | |

Asset Allocation Portfolio | | | 189 | |

Benchmark Definitions | | | 211 | |

Statements of Assets and Liabilities | | | 214 | |

Consolidated Statement of Assets and Liabilities (Commodities Return Strategy Portfolio) | | | 218 | |

Statements of Operations | | | 220 | |

Consolidated Statement of Operations (Commodities Return Strategy Portfolio) | | | 224 | |

Statements of Changes in Net Assets | | | 226 | |

Consolidated Statement of Changes in Net Assets (Commodities Return Strategy Portfolio) | | | 234 | |

Statement of Cash Flows | | | 235 | |

Financial Highlights | | | 236 | |

Notes to Financial Statements | | | 244 | |

Report of Independent Registered Public Accounting Firm | | | 265 | |

Proxy Voting and Portfolio Holdings | | | 266 | |

Director and Officer Information | | | 267 | |

Approval and Continuance of Investment Sub-Advisory Agreements | | | 270 | |

Mason Street Advisors, LLC (“Mason Street Advisors”), adviser to the Northwestern Mutual Series Fund, Inc., is a wholly owned subsidiary of The Northwestern Mutual Life Insurance Company. Mason Street Advisors is the principal investment adviser for all the Portfolios of the Northwestern Mutual Series Fund, Inc., and has engaged and oversees sub-advisers who provide day-to-day management for certain of the Portfolios. Each sub-adviser may be replaced without the approval of shareholders. Please see the Series Fund prospectus for more information.

The views expressed in the portfolio manager commentaries set forth in the following pages reflect those of the portfolio managers only through the end of the period covered by this report and do not necessarily represent the views of any affiliated organization. The views expressed are not guarantees of future performance or economic results and involve certain risks, uncertainties and assumptions that could cause actual outcomes and results to differ materially from the views expressed herein. These views are subject to change at any time based upon market conditions or other events and should not be relied upon as investment advice. Mason Street Advisors disclaims any responsibility to update these views.

Expense Examples (unaudited)

Example

As a shareholder of each Portfolio, you incur two types of costs: (1) transaction costs and (2) ongoing costs, including management fees and other Portfolio expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in the Portfolios and to compare these costs with the ongoing costs of investing in other mutual funds.

The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period (July 1, 2012 to December 31, 2012).

Actual Expenses

The first line of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line of the table below for each Portfolio provides information about hypothetical account values and hypothetical expenses based on each Portfolio’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Portfolio’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in a Portfolio and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs or separate account charges. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs or separate account charges were included, your costs would have been higher.

| | | | | | | | | | | | | | | | |

| | | Beginning Account Value

July 1, 2012 | | | Ending Account Value

December 31, 2012 | | | Expenses Paid During

Period July 1, 2012 to

December 31, 2012* | | | Annualized

Expense Ratio | |

| | | | |

Growth Stock Portfolio | | | | | | | | | | | | | | | | |

Actual | | | $1,000.00 | | | | $1,032.55 | | | | $2.30 | | | | 0.45 | % |

Hypothetical (5% return before expenses) | | | 1,000.00 | | | | 1,022.87 | | | | 2.29 | | | | 0.45 | |

| | | | |

Focused Appreciation Portfolio | | | | | | | | | | | | | | | | |

Actual | | | 1,000.00 | | | | 1,057.83 | | | | 3.88 | | | | 0.75 | |

Hypothetical (5% return before expenses) | | | 1,000.00 | | | | 1,021.37 | | | | 3.81 | | | | 0.75 | |

| | | | |

Large Cap Core Stock Portfolio | | | | | | | | | | | | | | | | |

Actual | | | 1,000.00 | | | | 1,044.00 | | | | 2.41 | | | | 0.47 | |

Hypothetical (5% return before expenses) | | | 1,000.00 | | | | 1,022.77 | | | | 2.39 | | | | 0.47 | |

| | | | |

Large Cap Blend Portfolio | | | | | | | | | | | | | | | | |

Actual | | | 1,000.00 | | | | 1,088.71 | | | | 4.46 | | | | 0.85 | |

Hypothetical (5% return before expenses) | | | 1,000.00 | | | | 1,020.86 | | | | 4.32 | | | | 0.85 | |

| | | | |

Index 500 Stock Portfolio | | | | | | | | | | | | | | | | |

Actual | | | 1,000.00 | | | | 1,058.42 | | | | 1.14 | | | | 0.22 | |

Hypothetical (5% return before expenses) | | | 1,000.00 | | | | 1,024.03 | | | | 1.12 | | | | 0.22 | |

Expense Examples (unaudited)

| | | | | | | | | | | | | | | | |

| | | Beginning Account Value

July 1, 2012 | | | Ending Account Value

December 31, 2012 | | | Expenses Paid During

Period July 1, 2012 to

December 31, 2012* | | | Annualized

Expense Ratio | |

| | | | |

Large Company Value Portfolio | | | | | | | | | | | | | | | | |

Actual | | | $1,000.00 | | | | $1,076.72 | | | | $4.18 | | | | 0.80 | % |

Hypothetical (5% return before expenses) | | | 1,000.00 | | | | 1,021.11 | | | | 4.06 | | | | 0.80 | |

| | | | |

Domestic Equity Portfolio | | | | | | | | | | | | | | | | |

Actual | | | 1,000.00 | | | | 1,088.59 | | | | 3.10 | | | | 0.59 | |

Hypothetical (5% return before expenses) | | | 1,000.00 | | | | 1,022.17 | | | | 3.00 | | | | 0.59 | |

| | | | |

Equity Income Portfolio | | | | | | | | | | | | | | | | |

Actual | | | 1,000.00 | | | | 1,082.92 | | | | 3.61 | | | | 0.69 | |

Hypothetical (5% return before expenses) | | | 1,000.00 | | | | 1,021.67 | | | | 3.51 | | | | 0.69 | |

| | | | |

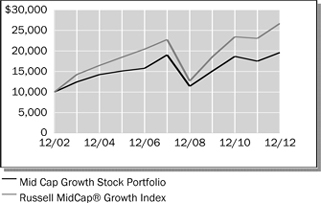

Mid Cap Growth Stock Portfolio | | | | | | | | | | | | | | | | |

Actual | | | 1,000.00 | | | | 1,052.89 | | | | 2.73 | | | | 0.53 | |

Hypothetical (5% return before expenses) | | | 1,000.00 | | | | 1,022.47 | | | | 2.69 | | | | 0.53 | |

| | | | |

Index 400 Stock Portfolio | | | | | | | | | | | | | | | | |

Actual | | | 1,000.00 | | | | 1,090.90 | | | | 1.52 | | | | 0.29 | |

Hypothetical (5% return before expenses) | | | 1,000.00 | | | | 1,023.68 | | | | 1.48 | | | | 0.29 | |

| | | | |

Mid Cap Value Portfolio | | | | | | | | | | | | | | | | |

Actual | | | 1,000.00 | | | | 1,087.05 | | | | 4.98 | | | | 0.95 | |

Hypothetical (5% return before expenses) | | | 1,000.00 | | | | 1,020.36 | | | | 4.82 | | | | 0.95 | |

| | | | |

Small Cap Growth Stock Portfolio | | | | | | | | | | | | | | | | |

Actual | | | 1,000.00 | | | | 1,027.85 | | | | 3.11 | | | | 0.61 | |

Hypothetical (5% return before expenses) | | | 1,000.00 | | | | 1,022.07 | | | | 3.10 | | | | 0.61 | |

| | | | |

Index 600 Stock Portfolio | | | | | | | | | | | | | | | | |

Actual | | | 1,000.00 | | | | 1,075.51 | | | | 1.77 | | | | 0.34 | |

Hypothetical (5% return before expenses) | | | 1,000.00 | | | | 1,023.43 | | | | 1.73 | | | | 0.34 | |

| | | | |

Small Cap Value Portfolio | | | | | | | | | | | | | | | | |

Actual | | | 1,000.00 | | | | 1,103.14 | | | | 4.76 | | | | 0.90 | |

Hypothetical (5% return before expenses) | | | 1,000.00 | | | | 1,020.61 | | | | 4.57 | | | | 0.90 | |

| | | | |

International Growth Portfolio | | | | | | | | | | | | | | | | |

Actual | | | 1,000.00 | | | | 1,147.81 | | | | 4.37 | | | | 0.81 | |

Hypothetical (5% return before expenses) | | | 1,000.00 | | | | 1,021.06 | | | | 4.12 | | | | 0.81 | |

| | | | |

Research International Core Portfolio | | | | | | | | | | | | | | | | |

Actual | | | 1,000.00 | | | | 1,128.45 | | | | 5.83 | | | | 1.09 | |

Hypothetical (5% return before expenses) | | | 1,000.00 | | | | 1,019.66 | | | | 5.53 | | | | 1.09 | |

| | | | |

International Equity Portfolio | | | | | | | | | | | | | | | | |

Actual | | | 1,000.00 | | | | 1,172.63 | | | | 3.77 | | | | 0.69 | |

Hypothetical (5% return before expenses) | | | 1,000.00 | | | | 1,021.67 | | | | 3.51 | | | | 0.69 | |

Expense Examples (unaudited)

| | | | | | | | | | | | | | | | |

| | | Beginning Account Value

July 1, 2012 | | | Ending Account Value

December 31, 2012 | | | Expenses Paid During

Period July 1, 2012 to

December 31, 2012* | | | Annualized

Expense Ratio | |

| | | | |

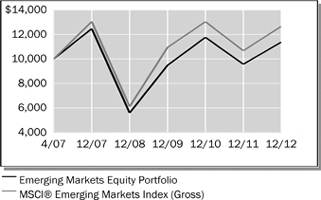

Emerging Markets Equity Portfolio | | | | | | | | | | | | | | | | |

Actual | | | $1,000.00 | | | | $1,125.23 | | | | $7.85 | | | | 1.47 | % |

Hypothetical (5% return before expenses) | | | 1,000.00 | | | | 1,017.75 | | | | 7.46 | | | | 1.47 | |

| | | | |

Money Market Portfolio | | | | | | | | | | | | | | | | |

Actual | | | 1,000.00 | | | | 1,000.39 | | | | 0.85 | | | | 0.17 | |

Hypothetical (5% return before expenses) | | | 1,000.00 | | | | 1,024.28 | | | | 0.87 | | | | 0.17 | |

| | | | |

Short-Term Bond Portfolio | | | | | | | | | | | | | | | | |

Actual | | | 1,000.00 | | | | 1,010.73 | | | | 2.22 | | | | 0.44 | |

Hypothetical (5% return before expenses) | | | 1,000.00 | | | | 1,022.92 | | | | 2.24 | | | | 0.44 | |

| | | | |

Select Bond Portfolio | | | | | | | | | | | | | | | | |

Actual | | | 1,000.00 | | | | 1,019.20 | | | | 1.62 | | | | 0.32 | |

Hypothetical (5% return before expenses) | | | 1,000.00 | | | | 1,023.53 | | | | 1.63 | | | | 0.32 | |

| | | | |

Long-Term U.S. Government Bond Portfolio | | | | | | | | | | | | | | | | |

Actual | | | 1,000.00 | | | | 994.50 | | | | 3.47 | | | | 0.69 | |

Hypothetical (5% return before expenses) | | | 1,000.00 | | | | 1,021.42 | | | | 3.52 | | | | 0.69 | |

| | | | |

Inflation Protection Portfolio | | | | | | | | | | | | | | | | |

Actual | | | 1,000.00 | | | | 1,032.30 | | | | 3.32 | | | | 0.65 | |

Hypothetical (5% return before expenses) | | | 1,000.00 | | | | 1,021.87 | | | | 3.30 | | | | 0.65 | |

| | | | |

High Yield Bond Portfolio | | | | | | | | | | | | | | | | |

Actual | | | 1,000.00 | | | | 1,071.81 | | | | 2.55 | | | | 0.49 | |

Hypothetical (5% return before expenses) | | | 1,000.00 | | | | 1,022.67 | | | | 2.49 | | | | 0.49 | |

| | | | |

Multi-Sector Bond Portfolio | | | | | | | | | | | | | | | | |

Actual | | | 1,000.00 | | | | 1,073.52 | | | | 4.59 | | | | 0.88 | |

Hypothetical (5% return before expenses) | | | 1,000.00 | | | | 1,020.71 | | | | 4.47 | | | | 0.88 | |

| | | | |

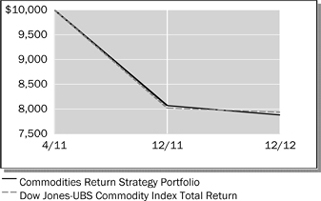

Commodities Return Strategy Portfolio | | | | | | | | | | | | | | | | |

Actual | | | 1,000.00 | | | | 1,024.70 | | | | 4.63 | | | | 0.91 | |

Hypothetical (5% return before expenses) | | | 1,000.00 | | | | 1,020.33 | | | | 4.62 | | | | 0.91 | |

| | | | |

Balanced Portfolio | | | | | | | | | | | | | | | | |

Actual | | | 1,000.00 | | | | 1,047.22 | | | | 1.54 | | | | 0.30 | |

Hypothetical (5% return before expenses) | | | 1,000.00 | | | | 1,023.63 | | | | 1.53 | | | | 0.30 | |

| | | | |

Asset Allocation Portfolio | | | | | | | | | | | | | | | | |

Actual | | | 1,000.00 | | | | 1,054.46 | | | | 2.89 | | | | 0.56 | |

Hypothetical (5% return before expenses) | | | 1,000.00 | | | | 1,022.32 | | | | 2.85 | | | | 0.56 | |

| * | Expenses are equal to the Portfolio’s annualized expense ratio, multiplied by the average account value over the period, multiplied by 184/366 (to reflect the one-half year period). |

Growth Stock Portfolio

| | | | |

| Objective: | | Portfolio Strategy: | | Net Assets: |

| Long-term growth of capital. Current income is a secondary objective. | | Invest in well-established companies with above average potential for earnings growth. | | $534 million |

Portfolio Overview

Mason Street Advisors acts as the investment adviser for the Growth Stock Portfolio (the “Portfolio”). Normally, the Portfolio invests in the equity securities of well established, medium and large capitalization companies that are selected for their above average earnings growth potential, with an emphasis on companies that have strong financial characteristics. In evaluating individual companies, the Portfolio considers factors such as the company management team, product outlook, competitive position, global exposure, financial characteristics and valuation.

Market Overview

Equity markets finished the year with solid gains despite economic uncertainty and significant volatility. Throughout the year, investors shifted their focus from uncertainty regarding the pace of global economic growth to evaluating fiscal and economic stimulus measures implemented globally. The economic slowdown in China, fiscal and debt crises in Europe, and the slow pace of growth in the U.S. drove volatility. As these issues arose, policy makers responded with stimulus and financing measures designed to calm markets. Ultimately, investors embraced risk, as record profit margins in the U.S. and remarkable cash flow generation propelled equity markets during the year.

As measured by the relevant Russell Indices, growth-oriented stocks posted double-digit returns, but trailed value shares, in part due to the volatility of growth expectations. Growth investors base investments on evaluating the future growth opportunities of more expensive, rapid growth companies. The economic environment added to concerns about the growth that these types of companies could experience going forward.

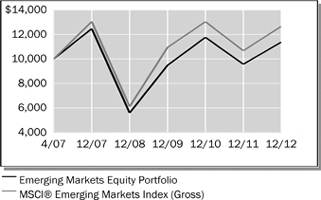

Portfolio Results

The Growth Stock Portfolio returned 12.94% for the twelve months ended December 31, 2012. By comparison, the Russell 1000® Growth Index (the “Index”) returned 15.26%. (The Index is unmanaged, cannot be invested in directly, and does not include administrative expenses or sales charges.) The Portfolio trailed the 16.00% average return of its Large Cap Growth Funds peer group, according to Lipper® Analytical Services, Inc., an independent mutual fund ranking agency.

The Portfolio’s underperformance relative to the Index was largely attributable to stock selection in the Healthcare and Energy sectors. In the Healthcare space, the Portfolio’s position in Express Scripts was a negative contributor. The company faced difficulty managing its growth plans, as markets became somewhat concerned with its long-term growth potential, particularly after it acquired MedCo. The Portfolio’s performance was also hurt by Allergan, as the company missed its high growth targets which led to underperformance relative to slower growth large pharmaceutical companies. This positioning hurt performance relative to the Index. The Portfolio did not hold Amgen or Regeneron, as their paths to sustainable, long-term growth were unclear to the portfolio managers. Both Index stocks participated in the biotechnology rally, adding return to the Index, and in turn, detracting from the Portfolio’s relative results.

The Portfolio’s holdings in Energy lagged as a result of holdings in the equipment and services and oil, gas and consumable fuels industries. National Oilwell Varco, Inc. was a stock that we favored for its strong exposure to offshore drilling. However, the company made acquisitions unrelated to its core business and the stock declined during 2012. Similarly, the portfolio managers felt Weatherford International, Ltd. had turnaround growth potential, but its shares declined as the company struggled to execute on its plans. In the oil, gas & consumable fuels industry, Portfolio holdings in Occidental Petroleum Corp., Anadarko Petroleum Corp., and Concho Resources, Inc., hurt performance compared with the Index. Occidental Petroleum was the most significant detractor, as the stock’s price sank on market concerns about returns on capital due to higher than expected production costs.

Shifting to positive contributors to relative results, the Portfolio’s emphasis on holdings in some higher quality banks in the Financials sector helped performance. Picks in banks, such as J.P. Morgan and Chase & Co. and Wells Fargo & Co. worked well for the Portfolio. Cellular tower operator American Tower also did well thanks to growing demand for telecommunication infrastructure needed to support new, data-intensive smartphones. In the beverages industry, the Portfolio benefited from seeking growth in a mid-sized, faster growing company (Monster Beverage Corp.), while deemphasizing the slower growth, household names (PepsiCo Inc. and Coca-Cola Co.).

Portfolio Manager Outlook

We believe that the current environment of slow global growth and heightened volatility is likely to persist in 2013. Early in the year, the economy could benefit from capital spending decisions that companies have delayed due to economic and legislative uncertainty. The pace of global growth will largely depend upon China. If China improves, Europe is likely to follow, as Chinese consumers are a large source of demand for European exports. The cyclical growth stocks in the Portfolio may benefit from this theme.

Growth Stock Portfolio

|

Relative Performance

|

| | | | | | | | | | | | |

Average Annual Total Returns For Periods Ended December 31, 2012 | |

| | | 1 Year | | | 5 Years | | | 10 Years | |

Growth Stock Portfolio | | | 12.94% | | | | 0.99% | | | | 5.56% | |

Russell 1000® Growth Index | | | 15.26% | | | | 3.12% | | | | 7.52% | |

Lipper® Variable Insurance Products (VIP) Large Cap Growth Funds Average | | | 16.00% | | | | 1.45% | | | | 7.23% | |

|

The performance data quoted represents past

performance. Past performance is historical and does

not guarantee future performance. Investment return

and principal value will fluctuate, so that shares, when

redeemed, may be worth more or less than their

original cost. Current performance may be lower or

higher than the performance data quoted. For the

most recent month-end performance information visit

www.northwesternmutual.com. |

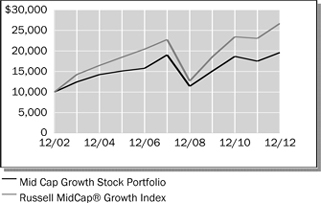

This chart assumes an initial investment of $10,000 made on 12/31/02. Returns shown include deductions for management and other portfolio expenses, and reinvestment of all dividends. Returns exclude deductions for separate account sale loads and account fees. Please refer to the Benchmark Definitions section of this report for information about the indices cited in the above chart and graph. |

| The Portfolio may invest in derivative instruments as a cash management strategy, to seek to enhance returns, for hedging purposes or as alternatives to direct investments. Use of these instruments may involve certain costs and imposes certain risks such as liquidity risk, interest rate risk, market risk, credit risk, management risk and the risk of mispricing or improper valuation. Certain derivatives involve leverage, which could magnify losses, and portfolios investing in derivatives could lose more than the principal amount invested in those instruments. |

Top 10 Equity Holdings 12/31/12

| | | | |

Security Description | | | % of Net Assets | |

Apple, Inc. | | | 7.1% | |

Qualcomm, Inc. | | | 2.8% | |

Google, Inc. - Class A | | | 2.6% | |

Monsanto Co. | | | 2.2% | |

Visa, Inc. - Class A | | | 2.0% | |

Schlumberger, Ltd. | | | 2.0% | |

American Tower Corp. | | | 2.0% | |

EMC Corp. | | | 1.8% | |

International Business Machines Corp. | | | 1.8% | |

Microsoft Corp. | | | 1.7% | |

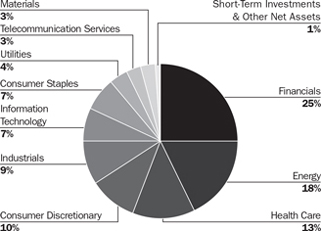

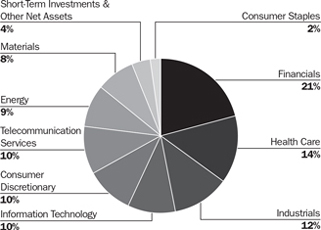

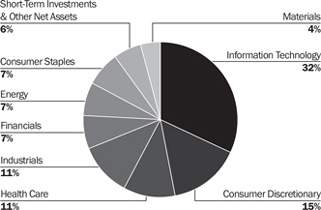

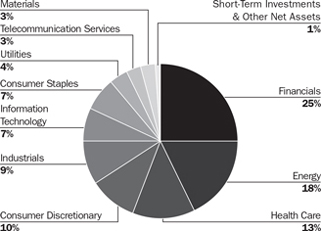

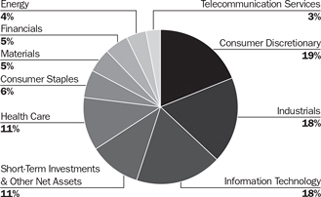

Sector Allocation 12/31/12

Sector Allocation is based on Net Assets.

Sector Allocation and Top 10 Holdings are subject to change.

Growth Stock Portfolio

Schedule of Investments

December 31, 2012

| | | | | | | | | | |

| | | Common Stocks (94.1%) | | Shares/

$ Par | | | Value

$ (000’s) | |

| |

| | Consumer Discretionary (14.8%) | |

| * | | Amazon.com, Inc. | | | 22,750 | | | | 5,713 | |

| | Comcast Corp. - Class A | | | 175,250 | | | | 6,551 | |

| * | | Delphi Automotive PLC | | | 135,000 | | | | 5,164 | |

| | Dick’s Sporting Goods, Inc. | | | 95,900 | | | | 4,362 | |

| * | | Dollar General Corp. | | | 162,900 | | | | 7,182 | |

| | Las Vegas Sands Corp. | | | 95,900 | | | | 4,427 | |

| | Limited Brands, Inc. | | | 123,800 | | | | 5,826 | |

| | Macy’s, Inc. | | | 118,550 | | | | 4,626 | |

| * | | Michael Kors Holdings, Ltd. | | | 121,000 | | | | 6,175 | |

| | News Corp. - Class A | | | 146,500 | | | | 3,742 | |

| * | | Priceline.com, Inc. | | | 7,500 | | | | 4,659 | |

| | Starbucks Corp. | | | 146,450 | | | | 7,853 | |

| | Target Corp. | | | 89,000 | | | | 5,266 | |

| | Viacom, Inc. - Class B | | | 147,600 | | | | 7,784 | |

| | | | | | | | | | |

| | Total | | | | | | | 79,330 | |

| | | | | | | | | | |

| |

| | Consumer Staples (6.8%) | |

| | Costco Wholesale Corp. | | | 59,900 | | | | 5,916 | |

| | CVS Caremark Corp. | | | 133,229 | | | | 6,442 | |

| | The Estee Lauder Cos., Inc. - Class A | | | 89,800 | | | | 5,375 | |

| | PepsiCo, Inc. | | | 83,500 | | | | 5,714 | |

| | Philip Morris International, Inc. | | | 97,200 | | | | 8,130 | |

| | Whole Foods Market, Inc. | | | 54,400 | | | | 4,968 | |

| | | | | | | | | | |

| | Total | | | | | | | 36,545 | |

| | | | | | | | | | |

| |

| | Energy (6.9%) | |

| | Anadarko Petroleum Corp. | | | 95,250 | | | | 7,078 | |

| * | | Concho Resources, Inc. | | | 45,700 | | | | 3,681 | |

| | National-Oilwell Varco, Inc. | | | 76,900 | | | | 5,256 | |

| | Occidental Petroleum Corp. | | | 94,500 | | | | 7,240 | |

| | Schlumberger, Ltd. | | | 154,000 | | | | 10,671 | |

| * | | Weatherford International, Ltd. | | | 243,954 | | | | 2,730 | |

| | | | | | | | | | |

| | Total | | | | | | | 36,656 | |

| | | | | | | | | | |

| |

| | Financials (7.2%) | |

| | American Express Co. | | | 147,400 | | | | 8,472 | |

| | American Tower Corp. | | | 134,525 | | | | 10,395 | |

| | Invesco, Ltd. | | | 123,400 | | | | 3,219 | |

| | JPMorgan Chase & Co. | | | 186,400 | | | | 8,196 | |

| | Wells Fargo & Co. | | | 234,250 | | | | 8,007 | |

| | | | | | | | | | |

| | Total | | | | | | | 38,289 | |

| | | | | | | | | | |

| |

| | Health Care (11.4%) | |

| | Abbott Laboratories | | | 57,000 | | | | 3,734 | |

| * | | Alexion Pharmaceuticals, Inc. | | | 55,700 | | | | 5,225 | |

| | AmerisourceBergen Corp. | | | 160,000 | | | | 6,909 | |

| | | | | | | | | | |

| | | Common Stocks (94.1%) | | Shares/

$ Par | | | Value

$ (000’s) | |

| |

| | Health Care continued | |

| * | | Biogen Idec, Inc. | | | 35,000 | | | | 5,133 | |

| * | | Catamaran Corp. | | | 137,400 | | | | 6,473 | |

| * | | Express Scripts Holding Co. | | | 107,250 | | | | 5,791 | |

| * | | Gilead Sciences, Inc. | | | 110,300 | | | | 8,102 | |

| | Johnson & Johnson | | | 73,400 | | | | 5,145 | |

| | Perrigo Co. | | | 35,400 | | | | 3,683 | |

| | UnitedHealth Group, Inc. | | | 68,300 | | | | 3,705 | |

| * | | Vertex Pharmaceuticals, Inc. | | | 60,850 | | | | 2,552 | |

| * | | Watson Pharmaceuticals, Inc. | | | 49,700 | | | | 4,274 | |

| | | | | | | | | | |

| | Total | | | | | | | 60,726 | |

| | | | | | | | | | |

| |

| | Industrials (11.1%) | |

| | The Boeing Co. | | | 100,050 | | | | 7,540 | |

| | C.H. Robinson Worldwide, Inc. | | | 42,400 | | | | 2,681 | |

| | Cummins, Inc. | | | 28,975 | | | | 3,139 | |

| | Danaher Corp. | | | 155,150 | | | | 8,673 | |

| | FedEx Corp. | | | 59,768 | | | | 5,482 | |

| | Honeywell International, Inc. | | | 110,400 | | | | 7,007 | |

| | Precision Castparts Corp. | | | 33,712 | | | | 6,386 | |

| | SPX Corp. | | | 55,075 | | | | 3,863 | |

| | Union Pacific Corp. | | | 52,500 | | | | 6,600 | |

| | United Technologies Corp. | | | 94,777 | | | | 7,773 | |

| | | | | | | | | | |

| | Total | | | | | | | 59,144 | |

| | | | | | | | | | |

| |

| | Information Technology (32.0%) | |

| | Apple, Inc. | | | 71,200 | | | | 37,952 | |

| | Avago Technologies, Ltd. | | | 127,700 | | | | 4,043 | |

| * | | Baidu, Inc., ADR | | | 15,000 | | | | 1,504 | |

| | Broadcom Corp. - Class A | | | 193,450 | | | | 6,425 | |

| * | | Citrix Systems, Inc. | | | 45,900 | | | | 3,018 | |

| * | | Cognizant Technology Solutions Corp. - Class A | | | 103,700 | | | | 7,679 | |

| * | | eBay, Inc. | | | 149,900 | | | | 7,648 | |

| * | | EMC Corp. | | | 386,000 | | | | 9,766 | |

| * | | Facebook, Inc. - Class A | | | 56,400 | | | | 1,502 | |

| * | | Google, Inc. - Class A | | | 19,742 | | | | 14,004 | |

| | Intel Corp. | | | 119,700 | | | | 2,469 | |

| | International Business Machines Corp. | | | 50,500 | | | | 9,673 | |

| | MasterCard, Inc. - Class A | | | 13,000 | | | | 6,387 | |

| | Microsoft Corp. | | | 338,400 | | | | 9,045 | |

| * | | NetApp, Inc. | | | 72,200 | | | | 2,422 | |

| | Oracle Corp. | | | 234,500 | | | | 7,814 | |

| | Qualcomm, Inc. | | | 243,500 | | | | 15,102 | |

| * | | Salesforce.com, Inc. | | | 39,800 | | | | 6,690 | |

| | Visa, Inc. - Class A | | | 70,700 | | | | 10,717 | |

| * | | VMware, Inc. - Class A | | | 25,200 | | | | 2,372 | |

| * | | Yahoo!, Inc. | | | 224,100 | | | | 4,460 | |

| | | | | | | | | | |

| | Total | | | | | | | 170,692 | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | Common Stocks (94.1%) | | Shares/

$ Par | | | Value

$ (000’s) | |

| |

| | Materials (3.9%) | |

| | BHP Billiton, Ltd., ADR | | | 53,800 | | | | 4,220 | |

| | CF Industries Holdings, Inc. | | | 25,000 | | | | 5,079 | |

| | Monsanto Co. | | | 121,781 | | | | 11,527 | |

| | | | | | | | | | |

| | Total | | | | | | | 20,826 | |

| | | | | | | | | | |

| | | |

| | Total Common Stocks | | | | | | | | |

| | (Cost: $436,681) | | | | | | | 502,208 | |

| | | | | | | | | | |

| |

| | | Short-Term Investments (5.8%) | |

| |

| | Federal Government & Agencies (0.4%) | |

| (b) | | Federal Home Loan Mortgage Corp., 0.12%, 3/4/13 | | | 2,000,000 | | | | 2,000 | |

| | | | | | | | | | |

| | Total | | | | | | | 2,000 | |

| | | | | | | | | | |

| |

| | Finance Services (1.9%) | |

| | Alpine Securitization Corp., 0.18%, 1/9/13 | | | 5,000,000 | | | | 5,000 | |

| | Govco LLC,

0.23%, 1/22/13 | | | 5,000,000 | | | | 4,999 | |

| | | | | | | | | | |

| | Total | | | | | | | 9,999 | |

| | | | | | | | | | |

| |

| | Personal Credit Institutions (0.9%) | |

| | Old Line Funding LLC, 0.19%, 3/25/13 | | | 5,000,000 | | | | 4,998 | |

| | | | | | | | | | |

| | Total | | | | | | | 4,998 | |

| | | | | | | | | | |

| |

| | Restaurants (1.7%) | |

| | Darden Restaurants, Inc., 0.28%, 1/2/13 | | | 9,100,000 | | | | 9,100 | |

| | | | | | | | | | |

| | Total | | | | | | | 9,100 | |

| | | | | | | | | | |

| |

| | Retail Food and Drug (0.9%) | |

| | CVS Caremark Corp., 0.28%, 1/2/13 | | | 5,000,000 | | | | 5,000 | |

| | | | | | | | | | |

| | Total | | | | | | | 5,000 | |

| | | | | | | | | | |

| | | |

| | Total Short-Term Investments | | | | | | | | |

| | (Cost: $31,096) | | | | | | | 31,097 | |

| | | | | | | | | | |

| | | |

| | Total Investments (99.9%) | | | | | | | | |

| | (Cost: $467,777)(a) | | | | | | | 533,305 | |

| | | | | | | | | | |

| | Other Assets, Less | | | | | | | | |

| | Liabilities (0.1%) | | | | | | | 510 | |

| | | | | | | | | | |

| | Net Assets (100.0%) | | | | | | | 533,815 | |

| | | | | | | | | | |

The Accompanying Notes are an Integral Part of the Financial Statements.

Growth Stock Portfolio

ADR after the name of a security represents—American Depositary Receipt.

| (a) | At December 31, 2012 the aggregate cost of securities for federal tax purposes (in thousands) was $468,317 and the net unrealized appreciation of investments based on that cost was $64,988 which is comprised of $75,696 aggregate gross unrealized appreciation and $10,708 aggregate gross unrealized depreciation. |

| (b) | All or a portion of the securities have been pledged as collateral for open futures positions or when-issued securities. Information regarding open futures contracts as of period end is summarized below. |

| | | | | | | | |

| Issuer (000’s) | | Number of

Contracts | | Expiration Date | | Unrealized

Appreciation/

(Depreciation)

(000’s) | |

S&P 500 Mini Index Futures (Long) (Total Notional Value at December 31, 2012, $16,920) | | 237 | | 3/13 | | $ | (92) | |

The following is a summary of the inputs used in valuing the Portfolio’s assets and liabilities at December 31, 2012. See Note 3 for additional information on portfolio valuation.

| | | | | | | | | | | | | | |

| | | Valuation Inputs | | | |

| Description | | Level 1 –

Quoted Prices | | | Level 2 –

Other Significant

Observable Inputs | | | Level 3 – Significant Unobservable Inputs | | | |

| | | (Amounts in thousands) | | | |

Assets: | | | | | | | | | | | | | | |

Common Stocks | | $ | 502,208 | | | $ | - | | | $ | - | | | |

Short-Term Investments | | | - | | | | 31,097 | | | | - | | | |

Liabilities: | | | | | | | | | | | | | | |

Other Financial Instruments^ | | | | | | | | | | | | | | |

Futures | | | (92 | ) | | | - | | | | - | | | |

Total | | $ | 502,116 | | | $ | 31,097 | | | $ | - | | | |

^ Other financial instruments are derivative instruments such as futures, forwards, written options and swaps contracts, which are valued at the unrealized appreciation (depreciation) on the instrument and short sales, which are valued at market value.

The Accompanying Notes are an Integral Part of the Financial Statements.

Focused Appreciation Portfolio

| | | | |

| Objective: | | Portfolio Strategy: | | Net Assets: |

Long-term growth of capital. | | Invest in equity securities selected for their growth potential. | | $389 million |

Portfolio Overview

Mason Street Advisors, the investment adviser for the Focused Appreciation Portfolio (the “Portfolio”), has engaged Janus Capital Management LLC (“Janus”) to act as sub-adviser for the Portfolio. In seeking to implement its growth strategy, the Portfolio employs a “bottom up” approach. That is, the Portfolio looks at companies one at a time to determine if a company is an attractive investment opportunity and is consistent with the Portfolio’s investment policies. The Portfolio may invest in companies of any size, from larger, well established companies to smaller, emerging growth companies. As a non-diversified fund, the Portfolio may hold larger positions in a smaller number of companies and, in anticipation of such investments, may hold a correspondingly larger position in cash pending investment. The Portfolio invests primarily in a core group of 20-40 common stocks.

Market Overview

In 2012, there was evidence that investors began to recognize the underlying fundamentals of individual businesses once again. This was a stark contrast from 2011, a year in which correlations were high and market sentiment was dominated more strongly by macroeconomic events. In the recent environment, it appears company analysis and individual stock selection have increased in importance for generating relative performance.

Portfolio Results

The Focused Appreciation Portfolio returned 20.14% for the twelve months ended December 31, 2012. By comparison, the Russell® 1000 Growth Index (the “Index”) returned 15.26%. (The Index is unmanaged, cannot be invested in directly, and does not include administrative expenses or sales charges.) The Portfolio outperformed the 16.00% average return of its Large Cap Growth Funds peer group, according to Lipper® Analytical Services, Inc., an independent mutual fund ranking agency.

In providing attribution commentary on this Portfolio, it should be noted that the concentrated nature of the Portfolio can result in one holding, or a small number of holdings, producing a significant effect on the Portfolio’s relative results.

The Portfolio’s stock selections in the Information Technology and Consumer Discretionary sectors were the largest contributors to relative performance. Meanwhile, the Portfolio’s holdings in the Materials and Industrials sectors hurt relative performance.

Within Information Technology, the sector experienced a proliferation of data usage through mobile devices at work and at home, with broad implications for content owners, Internet companies and device manufacturers. The data growth trend provided a solid backdrop for companies with strong competitive positions, such as Apple, eBay and Crown Castle, three of the Portfolio’s top performing stocks during the year. On the downside, the Portfolio held a position in Facebook, which underperformed as the company experienced difficulty monetizing its position as the leading social networking company.

One of the predominant themes represented in some of the Portfolio’s Consumer Discretionary holdings was the growing wealth of many emerging market consumers. The portfolio manager‘s main investing thesis in the sector was identifying companies with strong brands and growth prospects in their core markets that were well positioned to capture growth from emerging markets, based on the view that emerging consumers were willing to pay a premium for brands that represented quality or social status. Within the sector, the portfolio manager invested in luxury goods, lifestyle and fashion brands that had the potential to deliver rapid earnings growth in emerging economies and solid earnings in more mature markets. This theme resulted in the Consumer Discretionary sector being the second largest contributor to relative performance.

The Portfolio’s relative underperformance in the Materials sector was due to one holding in particular, Turquoise Hill Resource Partners. The Portfolio also lagged the Index in the Industrials sector. The Portfolio’s holdings were largely concentrated in transport services, logistics and asset light companies that tend to underperform the more cyclical names in the sector in a broad rally. For example, one of the Portfolio’s weakest holdings in the sector was the logistics company C.H. Robinson Worldwide. The company was impacted by a shortage of trucking capacity, which reduced profitability as truckers were able to demand better pricing.

Portfolio Manager Outlook

The following forward looking comments are the opinion of Janus, the Portfolio’s sub-adviser.

We have been encouraged to see the market respond more to the underlying fundamentals of companies this year. We think this will be the case going into 2013. Much attention has been paid to today’s macroeconomic risks and uncertainties. We believe these are “known unknowns” that are already priced into the market, so we expect business fundamentals to be the biggest driver of stock performance in the coming months. In that environment, we believe the type of wide moat, long-duration growth companies we seek to identify should be recognized by the market for the strength of their businesses and the elements that set them apart from their competitors.

| | | | | | |

| | Focused Appreciation Portfolio | | | 5 | |

Focused Appreciation Portfolio

Relative Performance

| | | | | | | | | | | | |

Average Annual Total Returns For Periods Ended December 31, 2012 | |

| | | 1 Year | | | 5 Years | | | Since

Inception* | |

Focused Appreciation Portfolio | | | 20.14% | | | | 1.06% | | | | 9.26% | |

Russell 1000® Growth Index | | | 15.26% | | | | 3.12% | | | | 7.11% | |

Lipper® Variable Insurance Products (VIP) Large Cap Growth Funds Average | | | 16.00% | | | | 1.45% | | | | - | |

*Inception date of 5/1/03

|

The performance data quoted represents past performance. Past performance is historical and does not guarantee future performance. Investment return and principal value will fluctuate, so that shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. For the most recent month-end performance information visit www.northwesternmutual.com. |

This chart assumes an initial investment of $10,000 made on 5/1/03 (commencement of the Portfolio’s operations). Returns shown reflect fee waivers, deductions for management and other portfolio expenses, and reinvestment of all dividends. In the absence of fee waivers, total return would be reduced. Returns exclude deductions for separate account sale loads and account fees. Please refer to the Benchmark Definitions section of this report for information about the indices cited in the above chart and graph. |

| As a non-diversified portfolio, the Portfolio may hold fewer securities because of its focused investment strategy. Holding fewer securities increases the risk that the value of the Portfolio could go down because of the poor performance of a single investment. |

|

| The Portfolio may invest in derivative instruments for hedging purposes, to earn income or to seek to enhance returns. Use of these instruments may involve certain costs and imposes certain risks such as liquidity risk, interest rate risk, market risk, credit risk, management risk and the risk of mispricing or improper valuation. Certain derivatives involve leverage, which could magnify losses, and portfolios investing in derivatives could lose more than the principal amount invested in those instruments. |

Top 10 Equity Holdings 12/31/12

| | | | |

Security Description | | | % of Net Assets | |

Apple, Inc. | | | 10.4% | |

Celgene Corp. | | | 6.3% | |

News Corp. - Class A | | | 5.8% | |

Express Scripts Holding Co. | | | 5.6% | |

eBay, Inc. | | | 5.3% | |

FANUC Corp., ADR | | | 4.7% | |

Precision Castparts Corp. | | | 4.5% | |

Limited Brands, Inc. | | | 4.4% | |

Crown Castle International Corp. | | | 4.2% | |

Oracle Corp. | | | 4.0% | |

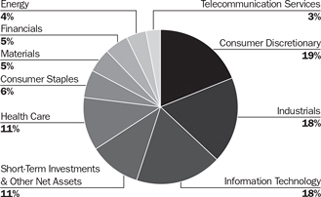

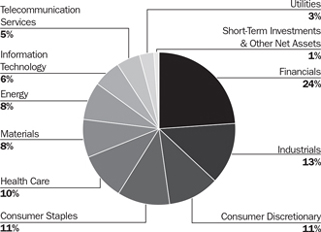

Sector Allocation 12/31/12

Sector Allocation is based on Net Assets.

Sector Allocation and Top 10 Holdings are subject to change.

| | | | |

| 6 | | Focused Appreciation Portfolio | | |

Focused Appreciation Portfolio

Schedule of Investments

December 31, 2012

| | | | | | | | | | |

| | | Common Stocks (91.4%) | | Shares/

$ Par | | | Value

$ (000’s) | |

| |

| | Consumer Discretionary (21.3%) | |

| * | | Amazon.com, Inc. | | | 35,129 | | | | 8,822 | |

| | Compagnie Financiere Richemont SA, ADR | | | 1,448,952 | | | | 11,287 | |

| | Limited Brands, Inc. | | | 362,408 | | | | 17,055 | |

| | Marriott International, Inc. - Class A | | | 254,773 | | | | 9,496 | |

| * | | MGM Resorts International | | | 671,144 | | | | 7,812 | |

| | News Corp. - Class A | | | 878,728 | | | | 22,443 | |

| | NIKE, Inc. - Class B | | | 112,500 | | | | 5,805 | |

| | | | | | | | | | |

| | Total | | | | | | | 82,720 | |

| | | | | | | | | | |

| |

| | Consumer Staples (1.5%) | |

| * | | Monster Beverage Corp. | | | 109,223 | | | | 5,776 | |

| | | | | | | | | | |

| | Total | | | | | | | 5,776 | |

| | | | | | | | | | |

| |

| | Financials (1.7%) | |

| | Prudential PLC, ADR | | | 226,107 | | | | 6,455 | |

| | | | | | | | | | |

| | Total | | | | | | | 6,455 | |

| | | | | | | | | | |

| |

| | Health Care (14.8%) | |

| * | | Celgene Corp. | | | 313,232 | | | | 24,658 | |

| * | | Express Scripts Holding Co. | | | 404,986 | | | | 21,869 | |

| * | | Gilead Sciences, Inc. | | | 61,153 | | | | 4,492 | |

| * | | Intuitive Surgical, Inc. | | | 4,757 | | | | 2,333 | |

| * | | Vertex Pharmaceuticals, Inc. | | | 103,280 | | | | 4,331 | |

| | | | | | | | | | |

| | Total | | | | | | | 57,683 | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | Common Stocks (91.4%) | | Shares/

$ Par | | | Value

$ (000’s) | |

| |

| | Industrials (16.1%) | |

| | C.H. Robinson Worldwide, Inc. | | | 110,231 | | | | 6,969 | |

| * | | FANUC Corp., ADR | | | 588,672 | | | | 18,290 | |

| | Iron Mountain, Inc. | | | 223,546 | | | | 6,941 | |

| | Precision Castparts Corp. | | | 91,430 | | | | 17,319 | |

| | United Parcel Service, Inc. - Class B | | | 178,734 | | | | 13,178 | |

| | | | | | | | | | |

| | Total | | | | | | | 62,697 | |

| | | | | | | | | | |

| |

| | Information Technology (29.2%) | |

| | Amphenol Corp. - Class A | | | 69,729 | | | | 4,511 | |

| | Apple, Inc. | | | 75,695 | | | | 40,348 | |

| * | | eBay, Inc. | | | 401,198 | | | | 20,469 | |

| * | | EMC Corp. | | | 538,976 | | | | 13,636 | |

| | MasterCard, Inc. - Class A | | | 9,047 | | | | 4,444 | |

| | Microsoft Corp. | | | 423,333 | | | | 11,316 | |

| | Oracle Corp. | | | 471,303 | | | | 15,704 | |

| | TE Connectivity, Ltd. | | | 87,329 | | | | 3,242 | |

| | | | | | | | | | |

| | Total | | | | | | | 113,670 | |

| | | | | | | | | | |

| |

| | Materials (2.6%) | |

| * | | Turquoise Hill Resources, Ltd. | | | 1,330,386 | | | | 10,124 | |

| | | | | | | | | | |

| | Total | | | | | | | 10,124 | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | Common Stocks (91.4%) | | Shares/

$ Par | | | Value

$ (000’s) | |

| |

| | Telecommunication Services (4.2%) | |

| * | | Crown Castle International Corp. | | | 224,006 | | | | 16,164 | |

| | | | | | | | | | |

| | Total | | | | | | | 16,164 | |

| | | | | | | | | | |

| | | |

| | Total Common Stocks | | | | | | | | |

| | (Cost: $264,607) | | | | | | | 355,289 | |

| | | | | | | | | | |

| |

| | | Short-Term Investments (4.9%) | |

| |

| | Commercial Banks Non-US (4.9%) | |

| | BNP Paribas Finance, Inc., 0.01%, 1/2/13 | | | 19,000,000 | | | | 19,000 | |

| | | | | | | | | | |

| | Total | | | | | | | 19,000 | |

| | | | | | | | | | |

| | | |

| | Total Short-Term Investments | | | | | | | | |

| | (Cost: $19,000) | | | | | | | 19,000 | |

| | | | | | | | | | |

| | | |

| | Total Investments (96.3%) | | | | | | | | |

| | (Cost: $283,607)(a) | | | | | | | 374,289 | |

| | | | | | | | | | |

| | Other Assets, Less | | | | | | | | |

| | Liabilities (3.7%) | | | | | | | 14,331 | |

| | | | | | | | | | |

| | Net Assets (100.0%) | | | | | | | 388,620 | |

| | | | | | | | | | |

ADR after the name of a security represents—American Depositary Receipt.

| (a) | At December 31, 2012 the aggregate cost of securities for federal tax purposes (in thousands) was $285,463 and the net unrealized appreciation of investments based on that cost was $88,826 which is comprised of $103,040 aggregate gross unrealized appreciation and $14,214 aggregate gross unrealized depreciation. |

The following is a summary of the inputs used in valuing the Portfolio’s assets and liabilities at December 31, 2012. See Note 3 for additional information on portfolio valuation.

| | | | | | | | | | | | | | |

| | | Valuation Inputs | | | |

| Description | | Level 1 –

Quoted Prices | | | Level 2 –

Other Significant

Observable Inputs | | | Level 3 – Significant

Unobservable Inputs | | | |

| | | (Amounts in thousands) | | | |

Assets: | | | | | | | | | | | | | | |

Common Stocks | | $ | 355,289 | | | $ | - | | | $ | - | | | |

Short-Term Investments | | | - | | | | 19,000 | | | | - | | | |

Total | | $ | 355,289 | | | $ | 19,000 | | | $ | - | | | |

The Accompanying Notes are an Integral Part of the Financial Statements.

| | | | | | |

| | Focused Appreciation Portfolio | | | 7 | |

Large Cap Core Stock Portfolio

| | | | |

| Objective: | | Portfolio Strategy: | | Net Assets: |

| Long-term growth of capital and income. | | Invest primarily in equity securities of large capitalization companies. | | $385 million |

Portfolio Overview

Mason Street Advisors acts as the investment adviser for the Large Cap Core Stock Portfolio (the “Portfolio”). Normally, the Portfolio invests in equity securities of large capitalization companies that may include both “growth” and “value” stocks, and may represent companies across all market sectors. In selecting investments, the Portfolio looks for companies with characteristics such as strong management teams, solid balance sheets, consistent earnings growth, sustainable cash flows and leading market shares in their industries. The Portfolio may be broadly diversified, potentially reflecting all sectors of the S&P 500® Index (the “Index”). Economic outlook and/or absolute valuation determines the relative attractiveness of market sectors and sector weights may differ from those in the Index, reflecting the economic outlook.

Market Overview

Equity markets finished the year with solid gains despite economic uncertainty and significant volatility. Throughout the year, investors shifted their focus from uncertainty regarding the pace of global economic growth to evaluating fiscal and economic stimulus measures implemented globally. The economic slowdown in China, fiscal and debt crises in Europe, and the slow pace of growth in the U.S. drove volatility. As these issues arose, policy makers responded with stimulus and financing measures designed to calm markets. Ultimately, investors embraced risk, as record profit margins in the U.S. and remarkable cash flow generation propelled equity markets during the year.

Portfolio Results

The Portfolio returned 11.63% for the twelve months ended December 31, 2012. By comparison, the Index returned 16.00%. (The Index is unmanaged, cannot be invested in directly, and does not include administrative expenses or sales charges.) The Portfolio trailed the 15.02% average return of its Large Cap Core Funds peer group, according to Lipper® Analytical Services, Inc., an independent mutual fund ranking agency.

The broad market environment worked against the Portfolio’s investment process. While the Portfolio focused on companies with strong financial characteristics and attractive valuations, the stocks that performed best in the Index generally had highly levered balance sheets with low returns on equity. Stock selection in the Energy sector was the biggest detractor to performance relative to the Index. The Portfolio’s positions in Occidental Petroleum Corp., Weatherford International Ltd. and Anadarko Petroleum Corp. were the largest negative contributors. Occidental Petroleum Corp. continued to follow its growth strategy, but investors grew impatient with its execution. Weatherford International Ltd. experienced accounting issues.

The Materials sector was another source of performance weakness. In the metals and mining industry, HudBay Minerals, a small copper producer, was growing production that the portfolio managers believed had the potential to pay off in the long term, but the stock declined during the Portfolio’s holding period over concerns about China’s near-term rate of growth. Similarly, Cliff’s Natural Resources, Inc. was unable to lower costs at one of its mines while iron ore prices declined, hurting the company’s profitability.

In the Industrials sector, machinery stocks weighed on performance. Dover Corp. declined after an acquisition did not deliver anticipated cost savings, while Caterpillar Inc. tumbled as slower growth in China weighed on its orders for machinery. The Portfolio’s positioning in Health Care stocks also underperformed the Index’s Health Care holdings. In particular, the Portfolio did not hold Abbott Laboratories when the shares rallied after the company announced spinoff plans. Bristol-Meyers Squibb Co. also detracted from performance, as the stock fell when one of its highly anticipated drug offerings failed during testing.

Looking at positive contributors to relative results, the Portfolio’s positioning in the Utilities sector aided the Portfolio. The Portfolio avoided underperformers in the electrical utilities space and overweighted American Water Works Co. In the Consumer Discretionary sector, the Portfolio’s positions in media stocks News Corp., CIA and Comcast Corp. delivered solid results. Both companies pursued shareholder friendly policies with share buybacks and dividend payouts, driving their share prices higher.

Portfolio Manager Outlook

We are cautiously optimistic going into 2013. While Washington will likely dominate the headlines near-term, once investors can look past this and focus on the economy’s fundamentals, it is likely they will see an improving housing market and a rebound in China. If the economy’s fundamentals allow companies to maintain their record high margins, equity valuations are reasonable and should not be an impediment for another positive year in the stock market. Also to the benefit of equities, there seem to be a lack of alternative investments with expectations of outsized returns.

| | | | |

| 8 | | Large Cap Core Stock Portfolio | | |

Large Cap Core Stock Portfolio

Relative Performance

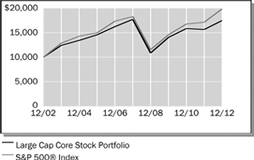

| | | | | | | | | | | | |

Average Annual Total Returns

For Periods Ended December 31, 2012 | |

| | | 1 Year | | | 5 Years | | | 10 Years | |

Large Cap Core Stock Portfolio | | | 11.63% | | | | -0.27% | | | | 5.74% | |

S&P 500® Index | | | 16.00% | | | | 1.66% | | | | 7.10% | |

Lipper® Variable Insurance Products (VIP) Large Cap Core Funds Average | | | 15.02% | | | | 0.53% | | | | 6.55% | |

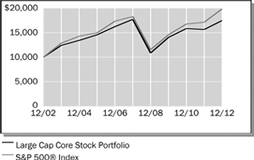

The performance data quoted represents past performance. Past performance is historical and does not guarantee future performance. Investment return and principal value will fluctuate, so that shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. For the most recent month-end performance information visit www.northwesternmutual.com.

This chart assumes an initial investment of $10,000 made on 12/31/02. Returns shown include deductions for management and other portfolio expenses, and reinvestment of all dividends. Returns exclude deductions for separate account sale loads and account fees. Please refer to the Benchmark Definitions section of this report for information about the indices cited in the above chart and graph.

The Portfolio may invest in derivative instruments as a cash management strategy, to generate income or as alternatives to direct investments. Use of these instruments may involve certain costs and imposes certain risks such as liquidity risk, interest rate risk, market risk, credit risk, management risk and the risk of mispricing or improper valuation. Certain derivatives involve leverage, which could magnify losses, and portfolios investing in derivatives could lose more than the principal amount invested in those instruments.

Top 10 Equity Holdings 12/31/12

| | | | |

| Security Description | | % of Net Assets | |

Apple, Inc. | | | 4.1% | |

JPMorgan Chase & Co. | | | 2.7% | |

Exxon Mobil Corp. | | | 2.6% | |

Chevron Corp. | | | 2.6% | |

Microsoft Corp. | | | 2.5% | |

Johnson & Johnson | | | 2.5% | |

International Business Machines Corp. | | | 2.4% | |

Wells Fargo & Co. | | | 2.4% | |

General Electric Co. | | | 2.2% | |

Citigroup, Inc. | | | 2.2% | |

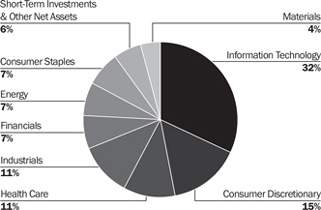

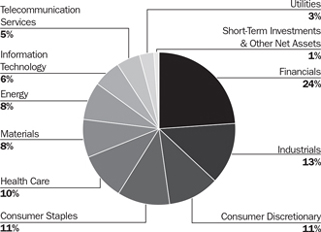

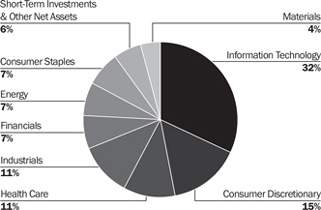

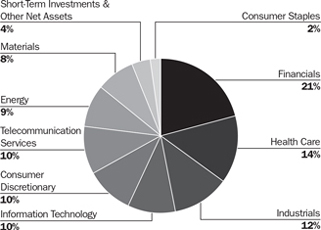

Sector Allocation 12/31/12

Sector Allocation is based on Net Assets.

Sector Allocation and Top 10 Holdings are subject to change.

| | | | | | |

| | Large Cap Core Stock Portfolio | | | 9 | |

Large Cap Core Stock Portfolio

Schedule of Investments

December 31, 2012

| | | | | | | | | | |

| | | Common Stocks (96.9%) | | Shares/ $ Par | | | Value $ (000’s) | |

| |

| | Consumer Discretionary (11.0%) | |

| | Comcast Corp. - Class A | | | 141,100 | | | | 5,274 | |

| * | | Delphi Automotive PLC | | | 89,375 | | | | 3,419 | |

| | Dick’s Sporting Goods, Inc. | | | 66,500 | | | | 3,025 | |

| * | | Dollar General Corp. | | | 97,150 | | | | 4,283 | |

| | Las Vegas Sands Corp. | | | 61,700 | | | | 2,848 | |

| | Macy’s, Inc. | | | 90,750 | | | | 3,541 | |

| | News Corp. - Class A | | | 239,975 | | | | 6,129 | |

| | Starbucks Corp. | | | 59,800 | | | | 3,207 | |

| | Target Corp. | | | 78,300 | | | | 4,633 | |

| | Viacom, Inc. - Class B | | | 112,200 | | | | 5,917 | |

| | | | | | | | | | |

| | Total | | | | | | | 42,276 | |

| | | | | | | | | | |

| |

| | Consumer Staples (8.7%) | |

| | Beam, Inc. | | | 47,775 | | | | 2,919 | |

| | Church & Dwight Co., Inc. | | | 73,050 | | | | 3,913 | |

| | Costco Wholesale Corp. | | | 22,800 | | | | 2,252 | |

| | CVS Caremark Corp. | | | 124,172 | | | | 6,004 | |

| | The Estee Lauder Cos., Inc. - Class A | | | 38,400 | | | | 2,299 | |

| | Mead Johnson Nutrition Co. | | | 43,975 | | | | 2,897 | |

| | PepsiCo, Inc. | | | 71,300 | | | | 4,879 | |

| | Philip Morris International, Inc. | | | 97,650 | | | | 8,167 | |

| | | | | | | | | | |

| | Total | | | | | | | 33,330 | |

| | | | | | | | | | |

| |

| | Energy (12.0%) | |

| | Anadarko Petroleum Corp. | | | 86,025 | | | | 6,393 | |

| | Chevron Corp. | | | 91,050 | | | | 9,846 | |

| | Exxon Mobil Corp. | | | 116,874 | | | | 10,115 | |

| | National-Oilwell Varco, Inc. | | | 35,500 | | | | 2,426 | |

| | Occidental Petroleum Corp. | | | 67,375 | | | | 5,162 | |

| | Schlumberger, Ltd. | | | 87,300 | | | | 6,049 | |

| * | | Weatherford International, Ltd. | | | 347,853 | | | | 3,892 | |

| * | | Whiting Petroleum Corp. | | | 56,600 | | | | 2,455 | |

| | | | | | | | | | |

| | Total | | | | | | | 46,338 | |

| | | | | | | | | | |

| |

| | Financials (15.7%) | |

| | American Express Co. | | | 91,650 | | | | 5,268 | |

| | American Tower Corp. | | | 96,250 | | | | 7,437 | |

| | BlackRock, Inc. | | | 15,625 | | | | 3,230 | |

| | Citigroup, Inc. | | | 211,030 | | | | 8,348 | |

| | The Goldman Sachs Group, Inc. | | | 38,550 | | | | 4,917 | |

| | Invesco, Ltd. | | | 181,550 | | | | 4,737 | |

| | JPMorgan Chase & Co. | | | 236,946 | | | | 10,418 | |

| | MetLife, Inc. | | | 106,250 | | | | 3,500 | |

| | | | | | | | | | |

| | | Common Stocks (96.9%) | | Shares/

$ Par | | | Value

$ (000’s) | |

| |

| | Financials continued | |

| | PNC Financial Services Group, Inc. | | | 61,080 | | | | 3,562 | |

| | Wells Fargo & Co. | | | 267,250 | | | | 9,135 | |

| | | | | | | | | | |

| | Total | | | | | | | 60,552 | |

| | | | | | | | | | |

| |

| | Health Care (11.2%) | |

| | Abbott Laboratories | | | 41,800 | | | | 2,738 | |

| * | | Alexion Pharmaceuticals, Inc. | | | 15,800 | | | | 1,482 | |

| | AmerisourceBergen Corp. | | | 102,500 | | | | 4,426 | |

| * | | Biogen Idec, Inc. | | | 15,400 | | | | 2,259 | |

| | Eli Lilly and Co. | | | 38,700 | | | | 1,909 | |

| * | | Express Scripts Holding Co. | | | 45,300 | | | | 2,446 | |

| * | | Gilead Sciences, Inc. | | | 46,100 | | | | 3,386 | |

| | Johnson & Johnson | | | 135,200 | | | | 9,477 | |

| | Perrigo Co. | | | 26,000 | | | | 2,705 | |

| | Pfizer, Inc. | | | 226,150 | | | | 5,672 | |

| | UnitedHealth Group, Inc. | | | 82,750 | | | | 4,488 | |

| * | | Watson Pharmaceuticals, Inc. | | | 25,700 | | | | 2,210 | |

| | | | | | | | | | |

| | Total | | | | | | | 43,198 | |

| | | | | | | | | | |

| |

| | Industrials (11.5%) | |

| | The Boeing Co. | | | 75,300 | | | | 5,675 | |

| | Cummins, Inc. | | | 23,550 | | | | 2,552 | |

| | Danaher Corp. | | | 91,434 | | | | 5,111 | |

| | FedEx Corp. | | | 65,553 | | | | 6,012 | |

| | General Electric Co. | | | 406,625 | | | | 8,535 | |

| | Precision Castparts Corp. | | | 22,220 | | | | 4,209 | |

| | SPX Corp. | | | 40,600 | | | | 2,848 | |

| | Union Pacific Corp. | | | 28,950 | | | | 3,640 | |

| | United Technologies Corp. | | | 69,275 | | | | 5,681 | |

| | | | | | | | | | |

| | Total | | | | | | | 44,263 | |

| | | | | | | | | | |

| |

| | Information Technology (20.4%) | |

| | Apple, Inc. | | | 29,400 | | | | 15,671 | |

| | Avago Technologies, Ltd. | | | 77,000 | | | | 2,438 | |

| | Broadcom Corp. - Class A | | | 106,450 | | | | 3,535 | |

| * | | Cognizant Technology Solutions Corp. -

Class A | | | 45,700 | | | | 3,384 | |

| * | | eBay, Inc. | | | 39,600 | | | | 2,020 | |

| * | | EMC Corp. | | | 127,900 | | | | 3,236 | |

| * | | Google, Inc. - Class A | | | 8,150 | | | | 5,781 | |

| | Intel Corp. | | | 243,600 | | | | 5,026 | |

| | International Business Machines Corp. | | | 48,850 | | | | 9,357 | |

| | Microsoft Corp. | | | 360,100 | | | | 9,626 | |

| | Oracle Corp. | | | 175,400 | | | | 5,844 | |

| | Qualcomm, Inc. | | | 82,500 | | | | 5,117 | |

| | Visa, Inc. - Class A | | | 27,500 | | | | 4,169 | |

| * | | Yahoo!, Inc. | | | 166,400 | | | | 3,311 | |

| | | | | | | | | | |

| | Total | | | | | | | 78,515 | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | Common Stocks (96.9%) | | Shares/

$ Par | | | Value

$ (000’s) | |

| | | |

| | Materials (3.4%) | | | | | | | | |

| | BHP Billiton, Ltd., ADR | | | 39,900 | | | | 3,130 | |

| | Celanese Corp. | | | 46,600 | | | | 2,075 | |

| | CF Industries Holdings, Inc. | | | 10,800 | | | | 2,194 | |

| | Monsanto Co. | | | 59,500 | | | | 5,632 | |

| | | | | | | | | | |

| | Total | | | | | | | 13,031 | |

| | | | | | | | | | |

| | | |

| | Telecommunication Services (1.0%) | | | | | | | | |

| | Vodafone Group PLC, ADR | | | 147,900 | | | | 3,726 | |

| | | | | | | | | | |

| | Total | | | | | | | 3,726 | |

| | | | | | | | | | |

| | | |

| | Utilities (2.0%) | | | | | | | | |

| | American Water Works Co., Inc. | | | 204,550 | | | | 7,595 | |

| | | | | | | | | | |

| | Total | | | | | | | 7,595 | |

| | | | | | | | | | |

| | | |

| | Total Common Stocks | | | | | | | | |

| | (Cost: $334,905) | | | | | | | 372,824 | |

| | | | | | | | | | |

| | |

| | | Short-Term Investments (3.0%) | | | | |

| | Federal Government & Agencies (0.5%) | |

| (b) | | Federal Home Loan Mortgage Corp., 0.12%, 3/4/13 | | | 2,000,000 | | | | 2,000 | |

| | | | | | | | | | |

| | Total | | | | | | | 2,000 | |

| | | | | | | | | | |

| | | |

| | Restaurants (2.5%) | | | | | | | | |

| | Darden Restaurants, Inc., 0.28%, 1/2/13 | | | 9,500,000 | | | | 9,500 | |

| | | | | | | | | | |

| | Total | | | | | | | 9,500 | |

| | | | | | | | | | |

| | | |

| | Total Short-Term Investments | | | | | | | | |

| | (Cost: $11,499) | | | | | | | 11,500 | |

| | | | | | | | | | |

| | | |

| | Total Investments (99.9%) | | | | | | | | |

| | (Cost: $346,404)(a) | | | | | | | 384,324 | |

| | | | | | | | | | |

| | Other Assets, Less | | | | | | | | |

| | Liabilities (0.1%) | | | | | | | 355 | |

| | | | | | | | | | |

| | Net Assets (100.0%) | | | | | | | 384,679 | |

| | | | | | | | | | |

The Accompanying Notes are an Integral Part of the Financial Statements.

| | | | |

| 10 | | Large Cap Core Stock Portfolio | | |

Large Cap Core Stock Portfolio

ADR after the name of a security represents—American Depositary Receipt.

| (a) | At December 31, 2012 the aggregate cost of securities for federal tax purposes (in thousands) was $346,914 and the net unrealized appreciation of investments based on that cost was $37,410 which is comprised of $46,198 aggregate gross unrealized appreciation and $8,788 aggregate gross unrealized depreciation. |

| (b) | All or a portion of the securities have been pledged as collateral for open futures positions or when-issued securities. Information regarding open futures contracts as of period end is summarized below. |

| | | | | | | | |

| Issuer (000’s) | | Number of

Contracts | | Expiration Date | | Unrealized

Appreciation/

(Depreciation)

(000’s) | |

S&P 500 Mini Index Futures (Long) (Total Notional Value at December 31, 2012, $4,855) | | 68 | | 3/13 | | $ | (26) | |

The following is a summary of the inputs used in valuing the Portfolio’s assets and liabilities at December 31, 2012. See Note 3 for additional information on portfolio valuation.

| | | | | | | | | | | | | | |

| | | Valuation Inputs | | | |

| Description | | Level 1 –

Quoted Prices | | | Level 2 –

Other Significant

Observable Inputs | | | Level 3 – Significant

Unobservable Inputs | | | |

| | | (Amounts in thousands) | | | |

Assets: | | | | | | | | | | | | | | |

Common Stocks | | $ | 372,824 | | | $ | - | | | $ | - | | | |

Short-Term Investments | | | - | | | | 11,500 | | | | - | | | |

Liabilities: | | | | | | | | | | | | | | |

Other Financial Instruments^ | | | | | | | | | | | | | | |

Futures | | | (26 | ) | | | - | | | | - | | | |

Total | | $ | 372,798 | | | $ | 11,500 | | | $ | - | | | |

^ Other financial instruments are derivative instruments such as futures, forwards, written options and swaps contracts, which are valued at the unrealized appreciation (depreciation) on the instrument and short sales, which are valued at market value.

The Accompanying Notes are an Integral Part of the Financial Statements.

| | | | | | |

| | Large Cap Core Stock Portfolio | | | 11 | |

Large Cap Blend Portfolio

| | | | |

| Objective: | | Portfolio Strategy: | | Net Assets: |

| Long-term growth of capital and income. | | Invest primarily in equity securities of U.S. large capitalization companies listed or traded on U.S. securities exchanges. | | $79 million |

Portfolio Overview

Effective October 1, 2012, the Board of Directors of the Northwestern Mutual Series Fund, Inc. appointed Fiduciary Management, Inc. (“FMI”) to act as sub-adviser to the Large Cap Blend Portfolio (the “Portfolio”). Prior to that time, the Portfolio was sub-advised by Capital Guardian Trust Company (“Capital Guardian”). Normally, the Portfolio invests in equity securities of large capitalization companies listed or traded on U.S. securities exchanges. In selecting investments, greater consideration is given to potential appreciation and future dividends than to current income. The Portfolio uses fundamental analysis to look for stocks of good businesses that are selling at value prices, typically invested in a core group of 20-30 large capitalization stocks and ADRs.

Market Overview

Equity markets finished the year with solid gains despite economic uncertainty and significant volatility. Throughout the year, investors shifted their focus from uncertainty regarding the pace of global economic growth to evaluating fiscal and economic stimulus measures implemented globally. The economic slowdown in China, fiscal and debt crises in Europe, and the slow pace of growth in the U.S. drove volatility. As these issues arose, policy makers responded with stimulus and financing measures designed to calm markets. Ultimately, investors embraced risk, as record profit margins in the U.S. and remarkable cash flow generation propelled equity markets during the year.

Portfolio Results

The Portfolio returned 15.20% for the twelve months ended December 31, 2012. By comparison, the S&P 500® Index (the “Index”) returned 16.00%. (The Index is unmanaged, cannot be invested in directly, and does not include administrative expenses or sales charges.) The Portfolio outperformed the 15.02% average return of its Large Cap Core Funds peer group, according to Lipper® Analytical Services, Inc., an independent mutual fund ranking agency.

As noted above, prior to October 1, 2012, the Portfolio was managed by Capital Guardian. With respect to the period prior to October 1, 2012, the Portfolio underperformed the Index primarily due to stock selection and an overweight stance within the Materials sector, especially among metals and mining stocks Allegheny Technologies, Cliffs Natural Resources and Barrick Gold. Stock selection in the Telecommunication Services and Utilities sectors was a drag on relative results during the period as well.

On the positive side, stock selection in the Consumer Discretionary sector was the largest contributor to relative returns. Individual stocks within this sector included Comcast, Home Depot, Time Warner Cable and Scripps Networks Interactive.

The following attribution comments relate to the period October 1, 2012 through December 31, 2012, during which FMI acted as the Portfolio’s sub-adviser.

The Portfolio outperformed the Index during the October 1, 2012 through December 31, 2012 period primarily due to stock selection in the Information Technology sector. Within the sector, electronic equipment company TE Connectivity Ltd. was a strong performer for the Portfolio during the period. An overweight position in the Industrials sector was beneficial as well.

In terms of detractors, the Energy and Financials sectors held back relative returns for the Portfolio. Within the Energy sector, the Portfolio’s investment in Devon Energy detracted from Portfolio performance. In Financials, the Portfolio was hurt by an underweight in Real Estate Investment Trusts (“REITs”) and lower quality money center banks.

Portfolio Manager Outlook

The following forward looking comments are the opinion of FMI, the Portfolio’s current sub-adviser.

Regarding our investments and outlook for 2013, the summary is that it is more of the same. The Federal Reserve induced rally has kept the market trading higher, even while fundamentals appear to be darkening. Of course, there is a chance we are reading the tea leaves incorrectly. A mid-December purchasing managers survey showed expectations for a pick-up in growth in 2013 versus 2012. We hope these expectations come to fruition, but we are not staking the Portfolio on such an outcome. The Portfolio remains fairly balanced with a mixture of reasonably priced cyclical and more defensive businesses. Overall, the Portfolio is still tilted toward the cautious side.

The extensive stock market valuation work that we do every quarter again shows stocks to be well above their long-term valuation averages. Valuations for the market have been elevated for almost three years. We continue to find reasonable businesses at decent prices and our stocks trade at a very meaningful discount to the S&P 500. We do not see great opportunities in some of the assets that have been hot the past several years: gold, bonds, farmland, timber and REITs. Owning high quality equities of well financed and durable business franchises, particularly those that operate on a global basis, seems like the prudent approach, and that is the one we are taking.

| | | | |

| 12 | | Large Cap Blend Portfolio | | |

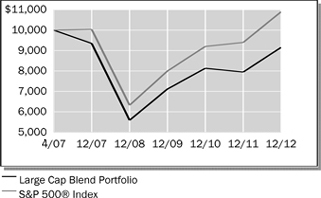

Large Cap Blend Portfolio

Relative Performance

| | | | | | | | | | | | |

Average Annual Total Returns

For Periods Ended December 31, 2012 | |

| | | 1 Year | | | 5 Years | | | Since

Inception* | |

Large Cap Blend Portfolio | | | 15.20% | | | | -0.42% | | | | -1.54% | |

S&P 500® Index | | | 16.00% | | | | 1.66% | | | | 1.53% | |

Lipper® Variable Insurance Products (VIP) Large Cap Core Funds Average | | | 15.02% | | | | 0.53% | | | | - | |

| * | Inception date of 4/30/07 |

|

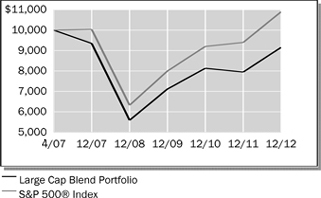

The performance data quoted represents past

performance. Past performance is historical and does

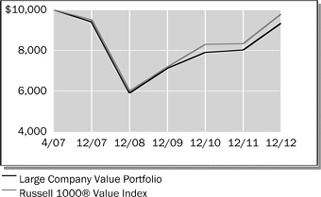

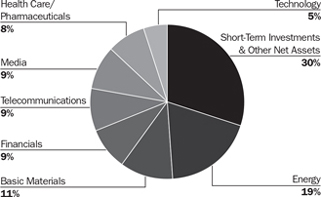

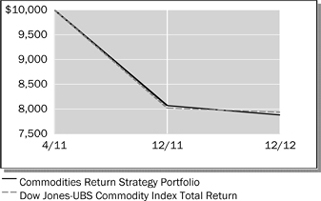

not guarantee future performance. Investment return