UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR/A

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-3990

Northwestern Mutual Series Fund, Inc.

(Exact name of registrant as specified in charter)

720 East Wisconsin Avenue,

Milwaukee Wisconsin 53202

(Address of principal executive offices) (Zip code)

Phil J. Rinzel, Controller and Chief Accounting Officer Northwestern Mutual Series Fund, Inc.

(Name and address of agent for service)

Registrant’s telephone number, including area code: 414-271-1444

Date of fiscal year end: December 31

Date of reporting period: December 31, 2023

Explanatory Note:

The Registrant is filing this amendment (“Amendment”) to its Form N-CSR for the year ended December 31, 2023, originally filed with the Securities and Exchange Commission on March 4, 2024 (Accession Number 0001193125-24-057220) to amend Item 1, “Reports to Stockholders” for Northwestern Mutual Series Fund, Inc. The sole purpose of this amendment is to replace the Report of Independent Registered Public Accounting Firm set forth on pages 254-255. Items 1 (except as noted above) through 13 (a)(1) of the Registrant’s Form N-CSR originally filed on March 4, 2024 are incorporated herein by reference. Other than the aforementioned, no other information or disclosures contained in the original filing are being amended by this Amendment.

REPORT ON FORM N-CSR

RESPONSES FOR NORTHWESTERN MUTUAL SERIES FUND, INC.

| Item 1. | Reports to Stockholders |

(a) The registrant’s annual report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940, as amended (the “Investment Company Act”), is as follows:

Annual Report December 31, 2023

Northwestern Mutual Series Fund, Inc.

A Series Fund Offering 27 Portfolios

| | | | |

● Growth Stock Portfolio | | | | ● International Growth Portfolio |

| | |

● Focused Appreciation Portfolio | | | | ● Research International Core Portfolio |

| | |

● Large Cap Core Stock Portfolio | | | | ● International Equity Portfolio |

| | |

● Large Cap Blend Portfolio | | | | ● Emerging Markets Equity Portfolio |

| | |

● Index 500 Stock Portfolio | | | | ● Government Money Market Portfolio |

| | |

● Large Company Value Portfolio | | | | ● Short-Term Bond Portfolio |

| | |

● Domestic Equity Portfolio | | | | ● Select Bond Portfolio |

| | |

● Equity Income Portfolio | | | | ● Long-Term U.S. Government Bond Portfolio |

| | |

● Mid Cap Growth Stock Portfolio | | | | ● Inflation Protection Portfolio |

| | |

● Index 400 Stock Portfolio | | | | ● High Yield Bond Portfolio |

| | |

● Mid Cap Value Portfolio | | | | ● Multi-Sector Bond Portfolio |

| | |

● Small Cap Growth Stock Portfolio | | | | ● Balanced Portfolio |

| | |

● Index 600 Stock Portfolio | | | | ● Asset Allocation Portfolio |

| | |

● Small Cap Value Portfolio | | | | |

As permitted by regulations adopted by the Securities and Exchange Commission, paper copies of the Fund’s shareholder reports are no longer sent by mail unless you specifically request paper copies of the reports from Northwestern Mutual, the issuer of your variable annuity and/or variable life insurance contract. Instead, your Fund annual and semi-annual reports will be made available on a website and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you already elected to receive shareholder reports electronically, you will not be affected by this change, will continue to receive reports electronically, and you need not take any action. You may elect to receive all future reports in paper free of charge by informing Northwestern Mutual that you wish to continue receiving paper copies of your shareholder reports. Your election to receive reports in paper will apply to all future shareholder reports.

Northwestern Mutual Series Fund, Inc.

Table of Contents

Mason Street Advisors, LLC (“Mason Street Advisors”), adviser to the Northwestern Mutual Series Fund, Inc., is a wholly owned subsidiary of The Northwestern Mutual Life Insurance Company. Mason Street Advisors is the principal investment adviser for all the Portfolios of the Northwestern Mutual Series Fund, Inc., and has engaged and oversees sub-advisers who provide day-to-day management for certain of the Portfolios. Each sub-adviser may be replaced without the approval of shareholders. Please see the Series Fund prospectus for more information.

The views expressed in the portfolio manager commentaries set forth in the following pages reflect those of the portfolio managers only through the end of the period covered by this report and do not necessarily represent the views of any affiliated organization. The views expressed are not guarantees of future performance or economic results and involve certain risks, uncertainties and assumptions that could cause actual outcomes and results to differ materially from the views expressed herein. These views are subject to change at any time based upon market conditions or other events and should not be relied upon as investment advice. Mason Street Advisors disclaims any responsibility to update these views.

Expense Examples (unaudited)

EXAMPLE

As a shareholder of each Portfolio, you incur two types of costs: (1) transaction costs and (2) ongoing costs, including management fees and other Portfolio expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in the Portfolios and to compare these costs with the ongoing costs of investing in other mutual funds.

The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period (July 1, 2023 to December 31, 2023).

ACTUAL EXPENSES

The first line of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

HYPOTHETICAL EXAMPLE FOR COMPARISON PURPOSES

The second line of the table below for each Portfolio provides information about hypothetical account values and hypothetical expenses based on each Portfolio’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Portfolio’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in a Portfolio and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs or separate account charges. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs or separate account charges were included, your costs would have been higher.

| | | | | | | | | | | | | | | | |

| | | Beginning Account Value

July 1, 2023 | | | Ending Account Value

December 31, 2023 | | | Expenses Paid During

Period July 1, 2023 to

December 31, 2023* | | | Annualized

Expense Ratio | |

| | | | |

Growth Stock Portfolio | | | | | | | | | | | | | | | | |

Actual | | | $1,000.00 | | | | $1,111.26 | | | | $2.29 | | | | 0.43 | % |

Hypothetical (5% return before expenses) | | | 1,000.00 | | | | 1,023.04 | | | | 2.19 | | | | 0.43 | |

| | | | |

Focused Appreciation Portfolio | | | | | | | | | | | | | | | | |

Actual | | | 1,000.00 | | | | 1,099.05 | | | | 3.28 | | | | 0.62 | |

Hypothetical (5% return before expenses) | | | 1,000.00 | | | | 1,022.08 | | | | 3.16 | | | | 0.62 | |

| | | | |

Large Cap Core Stock Portfolio | | | | | | | | | | | | | | | | |

Actual | | | 1,000.00 | | | | 1,086.76 | | | | 2.31 | | | | 0.44 | |

Hypothetical (5% return before expenses) | | | 1,000.00 | | | | 1,022.99 | | | | 2.24 | | | | 0.44 | |

| | | | |

Large Cap Blend Portfolio | | | | | | | | | | | | | | | | |

Actual | | | 1,000.00 | | | | 1,101.16 | | | | 4.03 | | | | 0.76 | |

Hypothetical (5% return before expenses) | | | 1,000.00 | | | | 1,021.37 | | | | 3.87 | | | | 0.76 | |

| | | | |

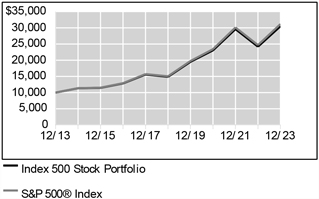

Index 500 Stock Portfolio | | | | | | | | | | | | | | | | |

Actual | | | 1,000.00 | | | | 1,079.42 | | | | 1.05 | | | | 0.20 | |

Hypothetical (5% return before expenses) | | | 1,000.00 | | | | 1,024.20 | | | | 1.02 | | | | 0.20 | |

1

Expense Examples (unaudited)

| | | | | | | | | | | | | | | | |

| | | Beginning Account Value

July 1, 2023 | | | Ending Account Value

December 31, 2023 | | | Expenses Paid During

Period July 1, 2023 to

December 31, 2023* | | | Annualized

Expense Ratio | |

| | | | |

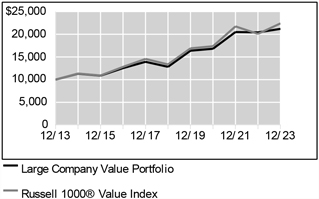

Large Company Value Portfolio | | | | | | | | | | | | | | | | |

Actual | | | $1,000.00 | | | | $1,029.07 | | | | $3.89 | | | | 0.76 | % |

Hypothetical (5% return before expenses) | | | 1,000.00 | | | | 1,021.37 | | | | 3.87 | | | | 0.76 | |

| | | | |

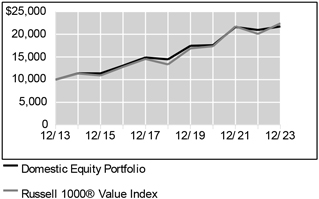

Domestic Equity Portfolio | | | | | | | | | | | | | | | | |

Actual | | | 1,000.00 | | | | 1,039.70 | | | | 2.57 | | | | 0.50 | |

Hypothetical (5% return before expenses) | | | 1,000.00 | | | | 1,022.68 | | | | 2.55 | | | | 0.50 | |

| | | | |

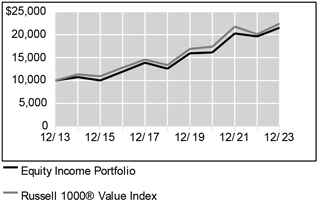

Equity Income Portfolio | | | | | | | | | | | | | | | | |

Actual | | | 1,000.00 | | | | 1,070.25 | | | | 2.97 | | | | 0.57 | |

Hypothetical (5% return before expenses) | | | 1,000.00 | | | | 1,022.33 | | | | 2.91 | | | | 0.57 | |

| | | | |

Mid Cap Growth Stock Portfolio | | | | | | | | | | | | | | | | |

Actual | | | 1,000.00 | | | | 1,056.09 | | | | 2.80 | | | | 0.54 | |

Hypothetical (5% return before expenses) | | | 1,000.00 | | | | 1,022.48 | | | | 2.75 | | | | 0.54 | |

| | | | |

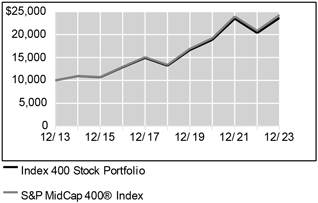

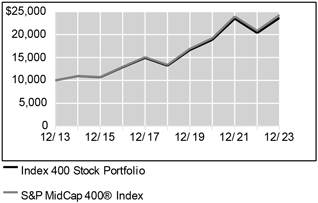

Index 400 Stock Portfolio | | | | | | | | | | | | | | | | |

Actual | | | 1,000.00 | | | | 1,068.36 | | | | 1.30 | | | | 0.25 | |

Hypothetical (5% return before expenses) | | | 1,000.00 | | | | 1,023.95 | | | | 1.28 | | | | 0.25 | |

| | | | |

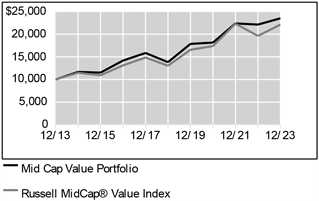

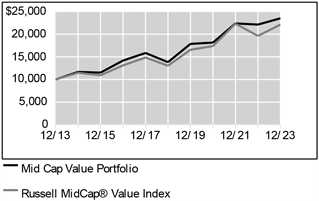

Mid Cap Value Portfolio | | | | | | | | | | | | | | | | |

Actual | | | 1,000.00 | | | | 1,034.24 | | | | 3.69 | | | | 0.72 | |

Hypothetical (5% return before expenses) | | | 1,000.00 | | | | 1,021.58 | | | | 3.67 | | | | 0.72 | |

| | | | |

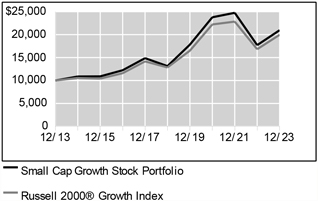

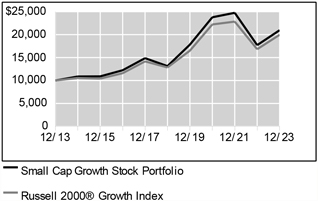

Small Cap Growth Stock Portfolio | | | | | | | | | | | | | | | | |

Actual | | | 1,000.00 | | | | 1,046.04 | | | | 2.89 | | | | 0.56 | |

Hypothetical (5% return before expenses) | | | 1,000.00 | | | | 1,022.38 | | | | 2.85 | | | | 0.56 | |

| | | | |

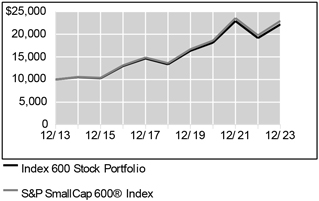

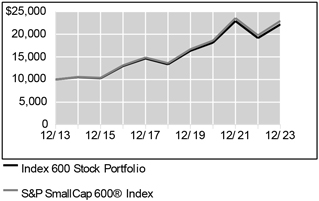

Index 600 Stock Portfolio | | | | | | | | | | | | | | | | |

Actual | | | 1,000.00 | | | | 1,093.13 | | | | 1.48 | | | | 0.28 | |

Hypothetical (5% return before expenses) | | | 1,000.00 | | | | 1,023.79 | | | | 1.43 | | | | 0.28 | |

| | | | |

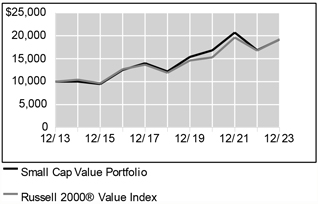

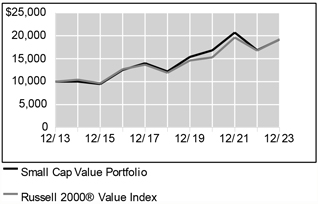

Small Cap Value Portfolio | | | | | | | | | | | | | | | | |

Actual | | | 1,000.00 | | | | 1,096.72 | | | | 4.60 | | | | 0.87 | |

Hypothetical (5% return before expenses) | | | 1,000.00 | | | | 1,020.82 | | | | 4.43 | | | | 0.87 | |

| | | | |

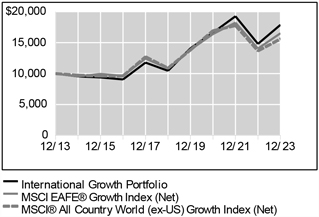

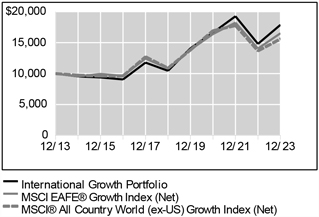

International Growth Portfolio | | | | | | | | | | | | | | | | |

Actual | | | 1,000.00 | | | | 1,051.77 | | | | 3.21 | | | | 0.62 | |

Hypothetical (5% return before expenses) | | | 1,000.00 | | | | 1,022.08 | | | | 3.16 | | | | 0.62 | |

| | | | |

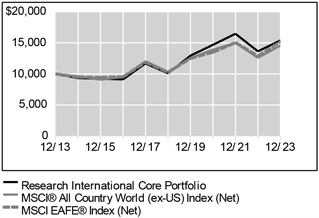

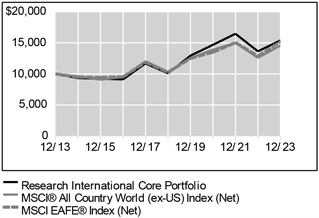

Research International Core Portfolio | | | | | | | | | | | | | | | | |

Actual | | | 1,000.00 | | | | 1,028.13 | | | | 3.83 | | | | 0.75 | |

Hypothetical (5% return before expenses) | | | 1,000.00 | | | | 1,021.42 | | | | 3.82 | | | | 0.75 | |

| | | | |

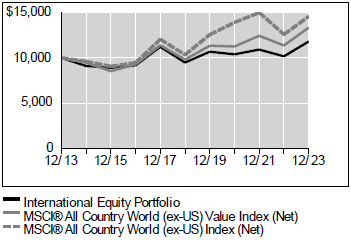

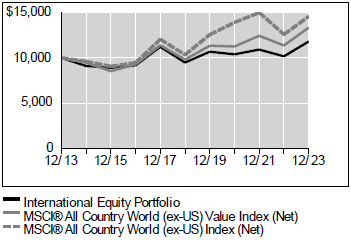

International Equity Portfolio | | | | | | | | | | | | | | | | |

Actual | | | 1,000.00 | | | | 1,052.70 | | | | 3.52 | | | | 0.68 | |

Hypothetical (5% return before expenses) | | | 1,000.00 | | | | 1,021.78 | | | | 3.47 | | | | 0.68 | |

| | | | |

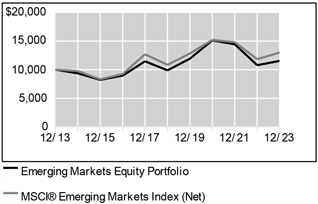

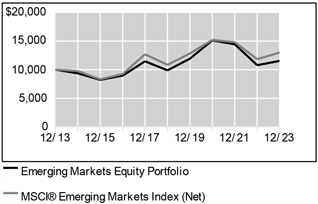

Emerging Markets Equity Portfolio | | | | | | | | | | | | | | | | |

Actual | | | 1,000.00 | | | | 1,016.77 | | | | 4.63 | | | | 0.91 | |

Hypothetical (5% return before expenses) | | | 1,000.00 | | | | 1,020.62 | | | | 4.63 | | | | 0.91 | |

2

Expense Examples (unaudited)

| | | | | | | | | | | | | | | | |

| | | Beginning Account Value

July 1, 2023 | | | Ending Account Value

December 31, 2023 | | | Expenses Paid During

Period July 1, 2023 to

December 31, 2023* | | | Annualized

Expense Ratio | |

| | | | |

Government Money Market Portfolio | | | | | | | | | | | | | | | | |

Actual | | | $1,000.00 | | | | $1,025.64 | | | | $1.68 | | | | 0.33 | % |

Hypothetical (5% return before expenses) | | | 1,000.00 | | | | 1,023.54 | | | | 1.68 | | | | 0.33 | |

| | | | |

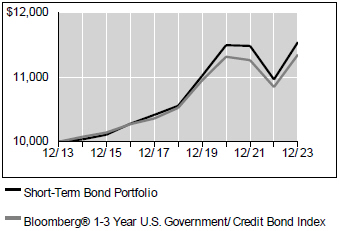

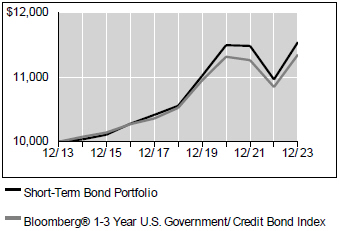

Short-Term Bond Portfolio | | | | | | | | | | | | | | | | |

Actual | | | 1,000.00 | | | | 1,036.90 | | | | 2.00 | | | | 0.39 | |

Hypothetical (5% return before expenses) | | | 1,000.00 | | | | 1,023.24 | | | | 1.99 | | | | 0.39 | |

| | | | |

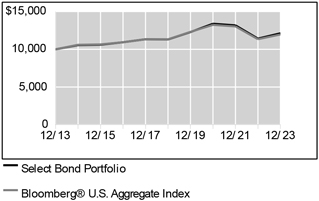

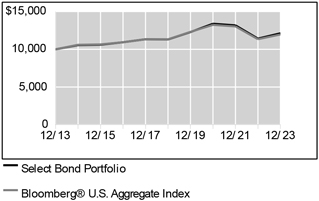

Select Bond Portfolio | | | | | | | | | | | | | | | | |

Actual | | | 1,000.00 | | | | 1,034.76 | | | | 1.59 | | | | 0.31 | |

Hypothetical (5% return before expenses) | | | 1,000.00 | | | | 1,023.64 | | | | 1.58 | | | | 0.31 | |

| | | | |

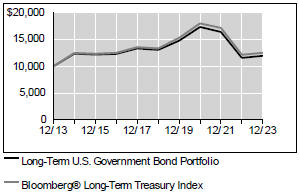

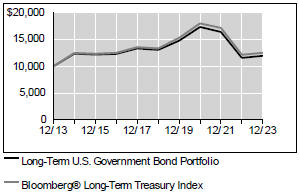

Long-Term U.S. Government Bond Portfolio | | | | | | | | | | | | | | | | |

Actual | | | 1,000.00 | | | | 989.13 | | | | 12.08 | | | | 2.41 | |

Hypothetical (5% return before expenses) | | | 1,000.00 | | | | 1,013.06 | | | | 12.23 | | | | 2.41 | |

| | | | |

Inflation Protection Portfolio | | | | | | | | | | | | | | | | |

Actual | | | 1,000.00 | | | | 1,016.68 | | | | 2.54 | | | | 0.50 | |

Hypothetical (5% return before expenses) | | | 1,000.00 | | | | 1,022.68 | | | | 2.55 | | | | 0.50 | |

| | | | |

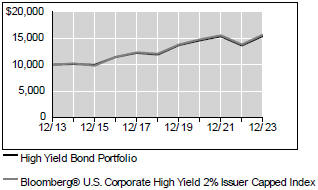

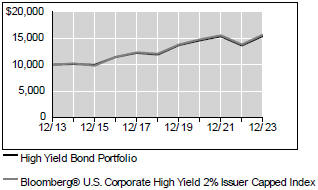

High Yield Bond Portfolio | | | | | | | | | | | | | | | | |

Actual | | | 1,000.00 | | | | 1,075.79 | | | | 2.35 | | | | 0.45 | |

Hypothetical (5% return before expenses) | | | 1,000.00 | | | | 1,022.94 | | | | 2.29 | | | | 0.45 | |

| | | | |

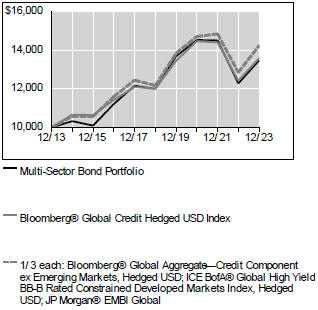

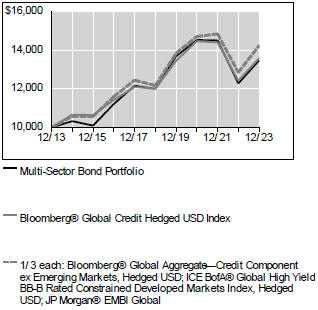

Multi-Sector Bond Portfolio | | | | | | | | | | | | | | | | |

Actual | | | 1,000.00 | | | | 1,063.23 | | | | 3.85 | | | | 0.74 | |

Hypothetical (5% return before expenses) | | | 1,000.00 | | | | 1,021.48 | | | | 3.77 | | | | 0.74 | |

| | | | |

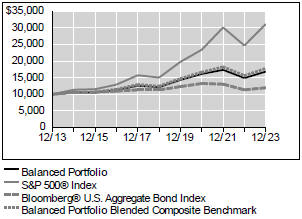

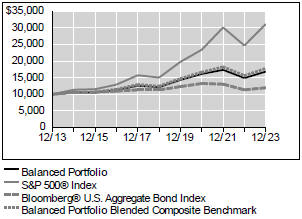

Balanced Portfolio | | | | | | | | | | | | | | | | |

Actual | | | 1,000.00 | | | | 1,053.98 | | | | 0.31 | | | | 0.06 | |

Hypothetical (5% return before expenses) | | | 1,000.00 | | | | 1,024.90 | | | | 0.31 | | | | 0.06 | |

| | | | |

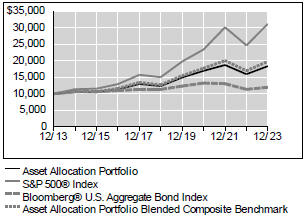

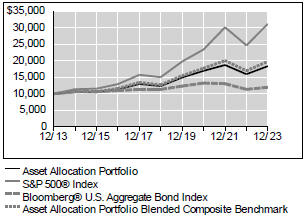

Asset Allocation Portfolio | | | | | | | | | | | | | | | | |

Actual | | | 1,000.00 | | | | 1,058.41 | | | | 0.52 | | | | 0.10 | |

Hypothetical (5% return before expenses) | | | 1,000.00 | | | | 1,024.70 | | | | 0.51 | | | | 0.10 | |

* Expenses are equal to the Portfolio’s annualized expense ratio, multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period). Expenses are based on the direct expenses of the Portfolio and do not include the effect of the underlying Portfolios’ expenses which are disclosed in the Fee and Expense table and described more fully in a footnote to that table in the Prospectus.

3

Growth Stock Portfolio (unaudited)

| | | | |

| Objective: | | Portfolio Strategy: | | Net Assets: |

| Long-term growth of capital. Current income is a secondary objective. | | Invest in equity securities of medium and large capitalization companies exhibiting the potential for earnings growth or share price appreciation. | | $1.1 billion |

PORTFOLIO OVERVIEW

Mason Street Advisors, LLC (“Mason Street Advisors”), the investment adviser for the Growth Stock Portfolio (the “Portfolio”), has engaged T. Rowe Price Associates, Inc. (“T. Rowe Price”) to act as sub-adviser for the Portfolio. The Portfolio invests in “blue chip” growth companies, which are companies that are well established in their industries and have the potential for above-average earnings growth. The Portfolio looks for companies with leading market positions, seasoned management and strong financial fundamentals. The Portfolio’s investment approach reflects the belief that solid company fundamentals (with an emphasis on the potential for strong growth in earnings per share or operating cash flow) combined with a positive outlook for a company’s industry will ultimately reward investors with strong investment performance. The Portfolio may look for companies with good prospects for dividend growth.

MARKET OVERVIEW

U.S. equities posted strong gains in 2023, driven by generally favorable corporate earnings, a resilient economy and increased investor interest in artificial intelligence. The market overcame bearish factors such as regional bank turmoil in March; uncertainty about the debt ceiling; geopolitical concerns stemming from the ongoing Russian invasion of Ukraine and from Israel’s response to deadly Hamas attacks in early October; and a sluggish Chinese economic recovery. Arguably, the most significant factor affecting the U.S. economy throughout the year was rising interest rates in response to elevated inflation. The U.S. Federal Reserve (the “Fed”) raised short-term interest rates four times through the end of July, lifting the fed funds target rate to a range of 5.25% – 5.50%. Equities rallied through year-end as Fed officials projected at their mid-December policy meeting that there could be three, quarter-point interest rate cuts in 2024. Generally, growth stocks strongly outperformed value stocks across all market capitalizations, especially among large-capitalization stocks.

PORTFOLIO RESULTS

The Portfolio returned 49.69% for the twelve months ended December 31, 2023. By comparison, the Portfolio’s benchmark, the Russell 1000® Growth Index (the “Index”), returned 42.68%. (The Index is unmanaged, cannot be invested in directly and does not incur expenses.)

Overall, security selection and sector allocation contributed to the Portfolio’s relative return for the reporting period. More specifically, an overweight allocation and stock selection in the Communication Services sector contributed to relative performance. Shares of Meta Platforms advanced strongly for the year, driven by the company’s continued focus on cost discipline, a rebound in digital advertising spending and improving monetization trends within short-form videos.

An underweight allocation and favorable stock picks in the Industrials sector also contributed to the Portfolio’s relative return. For this sector, the Portfolio focuses on areas of secular, rather than cyclical, growth. As such, the Portfolio continued to emphasize unique, company-specific opportunities believed to drive meaningful growth regardless of the economic backdrop.

The Information Technology sector also contributed, due to favorable stock choices, although this was partially offset by an underweight allocation to the sector. Shares of NVIDIA Corporation advanced sharply amid expectations of elevated future demand for advanced graphics processing units (“GPUs”) that are critical for the development of artificial intelligence (“AI”) infrastructure.

On the downside, an overweight allocation and stock selection in the Financials sector detracted from the Portfolio’s relative performance. Chubb, a global insurance provider, declined amid an earnings miss driven by losses in its North American agriculture segment due to a drought in corn-producing states.

The Healthcare sector also detracted, driven by an overweight allocation, although this was partially offset by favorable stock selection in the sector. The Portfolio’s overweight allocation to Healthcare emphasized select managed care companies positioned to benefit from industry consolidation and the implementation of cost-effective solutions. Innovative medical device and equipment manufacturers that are focused on meaningfully improving patient outcomes also represented some of the more attractive opportunities in the sector.

4

Growth Stock Portfolio (unaudited)

PORTFOLIO MANAGER OUTLOOK

The following forward-looking comments are the opinion of T. Rowe Price, the Portfolio’s sub-adviser.

Continued trends in disinflation, alongside a handful of benign jobs reports, have increased the likelihood of a soft landing for the economy. The Fed’s pivot to less aggressive actions — and implied rate cut cadence — has encouraged an appetite for risk as the probability of a recession continues to decline. We believe equity returns are likely to be more subdued in 2024; the possibility of future increases will likely hinge on the ability of companies to demonstrate meaningful earnings and free cash flow growth. From a positioning standpoint, we continue to refrain from taking a pronounced stance on macroeconomic implications. Instead, we are aiming for a balanced approach of offensive ideas that can thrive if the economy continues to improve and defensive positions that can provide downside support. Similarly, predicting election outcomes and subsequent market impacts is not an area of focus at this stage. However, as political agendas come into focus and the balance of political power crystalizes, actionable idiosyncratic investment opportunities may present themselves.

Relative Performance

| | | | | | |

Average Annual Total Returns For Periods Ended December 31, 2023 |

| | | 1 Year | | 5 Years | | 10 Years |

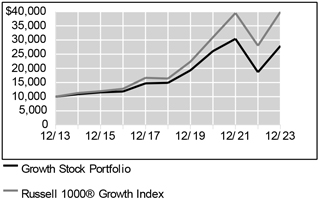

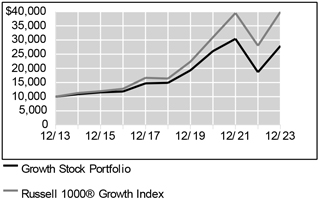

Growth Stock Portfolio | | 49.69% | | 13.38% | | 10.82% |

Russell 1000® Growth Index | | 42.68% | | 19.50% | | 14.86% |

The performance data quoted represents past performance. Past performance is historical and does not guarantee future performance. Investment return and principal value will fluctuate, so that shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. For the most recent month-end performance information visit www.northwesternmutual.com.

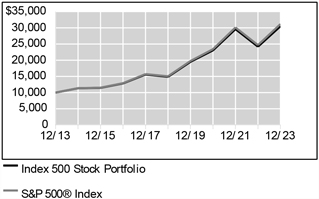

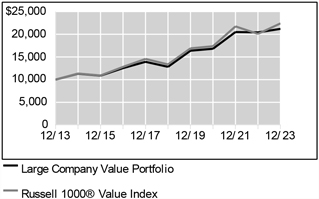

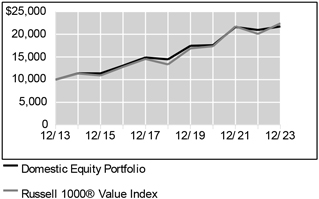

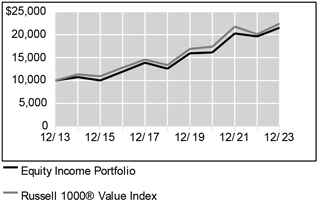

This chart assumes an initial investment of $10,000 made on 12/31/13. Returns shown reflect fee waivers, deductions for management and other portfolio expenses, and reinvestment of all dividends. In the absence of fee waivers, total return would be reduced. Returns exclude deductions for separate account sale loads and account fees. Please refer to the Benchmark Definitions section of

this report for information about the indices cited in the above chart and graph.

The Portfolio may invest a relatively high percentage of its assets in a particular sector. The Portfolio will have greater exposure to the risks associated with that sector and its performance will be tied more closely to the performance of the sector.

Top 10 Holdings 12/31/23

| | | | | | | | |

| | | | |

| | | Security Description | | % of Net Assets | | | | |

| | | | |

| | | Microsoft Corp. | | 10.2% | | | | |

| | | | |

| | | Amazon.com, Inc. | | 8.7% | | | | |

| | | | |

| | | Apple, Inc. | | 8.6% | | | | |

| | | | |

| | | Alphabet, Inc., Various | | 8.0% | | | | |

| | | | |

| | | NVIDIA Corp. | | 6.8% | | | | |

| | | | |

| | | Meta Platforms, Inc. - Class A | | 5.8% | | | | |

| | | | |

| | | Visa, Inc. - Class A | | 3.5% | | | | |

| | | | |

| | | UnitedHealth Group, Inc. | | 3.5% | | | | |

| | | | |

| | | Eli Lilly & Co. | | 3.2% | | | | |

| | | | |

| | | Mastercard, Inc. - Class A | | 2.8% | | | | |

Sector Allocation 12/31/23

| | | | | | | | |

| | | | |

| | | Sector | | % of Net Assets | | | | |

| | | | |

| | | Information Technology | | 38.3% | | | | |

| | | | |

| | | Communication Services | | 16.7% | | | | |

| | | | |

| | | Consumer Discretionary | | 16.1% | | | | |

| | | | |

| | | Health Care | | 13.4% | | | | |

| | | | |

| | | Financials | | 10.6% | | | | |

| | | | |

| | | Industrials | | 1.6% | | | | |

| | | | |

| | | Consumer Staples | | 1.4% | | | | |

| | | | |

| | | Materials | | 1.0% | | | | |

| | | | |

| | | Utilities | | 0.5% | | | | |

| | | | |

| | | Energy | | 0.3% | | | | |

| | | | |

| | | Short-Term Investments & Other Net Assets | | 0.1% | | | | |

Sector Allocation and Top 10 Holdings are subject to change.

5

Growth Stock Portfolio

SCHEDULE OF INVESTMENTS

December 31, 2023

| | | | | | | | |

Common Stocks (99.9%) | | Shares/ Par + | | | Value $ (000’s) | |

Communication Services (16.7%) | |

Alphabet, Inc. - Class A * | | | 90,053 | | | | 12,579 | |

Alphabet, Inc. - Class C * | | | 518,516 | | | | 73,074 | |

Meta Platforms, Inc. - Class A * | | | 174,711 | | | | 61,841 | |

Netflix, Inc. * | | | 35,155 | | | | 17,116 | |

Sea, Ltd., ADR * | | | 55,676 | | | | 2,255 | |

T-Mobile US, Inc. | | | 73,808 | | | | 11,834 | |

| | | | | | | | |

Total | | | | | | | 178,699 | |

| | | | | | | | |

|

Consumer Discretionary (16.1%) | |

Amazon.com, Inc. * | | | 607,583 | | | | 92,316 | |

Booking Holdings, Inc. * | | | 3,089 | | | | 10,958 | |

Carvana Co. * | | | 55,200 | | | | 2,922 | |

Chipotle Mexican Grill, Inc. * | | | 4,792 | | | | 10,959 | |

DoorDash, Inc. * | | | 31,001 | | | | 3,066 | |

Lululemon Athletica, Inc. * | | | 11,986 | | | | 6,128 | |

NIKE, Inc. - Class B | | | 32,018 | | | | 3,476 | |

Ross Stores, Inc. | | | 53,822 | | | | 7,449 | |

Tesla, Inc. * | | | 115,439 | | | | 28,684 | |

The TJX Cos., Inc. | | | 56,483 | | | | 5,299 | |

| | | | | | | | |

Total | | | | | | | 171,257 | |

| | | | | | | | |

|

Consumer Staples (1.4%) | |

Colgate-Palmolive Co. | | | 33,100 | | | | 2,638 | |

Dollar General Corp. | | | 52,899 | | | | 7,192 | |

Mondelez International, Inc. | | | 41,200 | | | | 2,984 | |

The Procter & Gamble Co. | | | 17,100 | | | | 2,506 | |

| | | | | | | | |

Total | | | | | | | 15,320 | |

| | | | | | | | |

|

Energy (0.3%) | |

Schlumberger, Ltd. | | | 67,000 | | | | 3,487 | |

| | | | | | | | |

Total | | | | | | | 3,487 | |

| | | | | | | | |

|

Financials (10.6%) | |

Adyen NV * | | | 196,321 | | | | 2,529 | |

The Charles Schwab Corp. | | | 62,921 | | | | 4,329 | |

Chubb, Ltd. | | | 52,892 | | | | 11,954 | |

Fiserv, Inc. * | | | 18,694 | | | | 2,483 | |

The Goldman Sachs Group, Inc. | | | 8,554 | | | | 3,300 | |

Marsh & McLennan Cos., Inc. | | | 37,728 | | | | 7,148 | |

Mastercard, Inc. - Class A | | | 70,709 | | | | 30,158 | |

Morgan Stanley | | | 59,165 | | | | 5,517 | |

MSCI, Inc. | | | 2,349 | | | | 1,329 | |

S&P Global, Inc. | | | 14,409 | | | | 6,347 | |

| | | | | | | | |

Common Stocks (99.9%) | | Shares/ Par + | | | Value $ (000’s) | |

Financials continued | |

Visa, Inc. - Class A | | | 143,855 | | | | 37,453 | |

| | | | | | | | |

Total | | | | | | | 112,547 | |

| | | | | | | | |

|

Health Care (13.4%) | |

Align Technology, Inc. * | | | 3,197 | | | | 876 | |

AstraZeneca PLC, ADR | | | 41,203 | | | | 2,775 | |

Danaher Corp. | | | 30,742 | | | | 7,112 | |

Elevance Health, Inc. | | | 10,474 | | | | 4,939 | |

Eli Lilly & Co. | | | 58,677 | | | | 34,204 | |

Humana, Inc. | | | 15,368 | | | | 7,036 | |

Intuitive Surgical, Inc. * | | | 51,501 | | | | 17,374 | |

Stryker Corp. | | | 21,714 | | | | 6,502 | |

Teleflex, Inc. | | | 6,727 | | | | 1,677 | |

Thermo Fisher Scientific, Inc. | | | 25,928 | | | | 13,762 | |

UnitedHealth Group, Inc. | | | 70,989 | | | | 37,374 | |

Veeva Systems, Inc. - Class A * | | | 12,767 | | | | 2,458 | |

Zoetis, Inc. | | | 34,933 | | | | 6,895 | |

| | | | | | | | |

Total | | | | | | | 142,984 | |

| | | | | | | | |

|

Industrials (1.6%) | |

Cintas Corp. | | | 4,012 | | | | 2,418 | |

General Electric Co. | | | 47,734 | | | | 6,092 | |

Old Dominion Freight | | | | | | | | |

Line, Inc. | | | 10,754 | | | | 4,359 | |

TransDigm Group, Inc. | | | 2,931 | | | | 2,965 | |

Veralto Corp. | | | 10,635 | | | | 875 | |

| | | | | | | | |

Total | | | | | | | 16,709 | |

| | | | | | | | |

|

Information Technology (38.3%) | |

Advanced Micro Devices, Inc. * | | | 54,461 | | | | 8,028 | |

Apple, Inc. | | | 474,049 | | | | 91,269 | |

ASML Holding NV | | | 17,837 | | | | 13,501 | |

Atlassian Corp. - Class A * | | | 18,006 | | | | 4,283 | |

Bill.com Holdings, Inc. * | | | 29,951 | | | | 2,444 | |

Confluent, Inc. - Class A * | | | 58,611 | | | | 1,372 | |

CrowdStrike Holdings, Inc. * | | | 10,186 | | | | 2,601 | |

Datadog, Inc. - Class A * | | | 19,624 | | | | 2,382 | |

Fortinet, Inc. * | | | 15,057 | | | | 881 | |

Intuit, Inc. | | | 22,263 | | | | 13,915 | |

Lam Research Corp. | | | 2,513 | | | | 1,968 | |

Microsoft Corp. | | | 290,699 | | | | 109,314 | |

MongoDB, Inc. * | | | 16,589 | | | | 6,782 | |

Monolithic Power Systems, Inc. | | | 11,119 | | | | 7,014 | |

NVIDIA Corp. | | | 147,468 | | | | 73,029 | |

Roper Technologies, Inc. | | | 15,863 | | | | 8,648 | |

| | | | | | | | |

Common Stocks (99.9%) | | Shares/ Par + | | | Value $ (000’s) | |

Information Technology continued | |

ServiceNow, Inc. * | | | 39,609 | | | | 27,983 | |

Shopify, Inc. * | | | 99,202 | | | | 7,728 | |

Snowflake, Inc. * | | | 13,106 | | | | 2,608 | |

Synopsys, Inc. * | | | 27,494 | | | | 14,157 | |

Taiwan Semiconductor Manufacturing Co., Ltd., ADR | | | 38,883 | | | | 4,044 | |

TE Connectivity, Ltd. | | | 14,836 | | | | 2,084 | |

Texas Instruments, Inc. | | | 14,936 | | | | 2,546 | |

| | | | | | | | |

Total | | | | | | | 408,581 | |

| | | | | | | | |

|

Materials (1.0%) | |

Linde PLC | | | 13,332 | | | | 5,476 | |

The Sherwin-Williams Co. | | | 17,269 | | | | 5,386 | |

| | | | | | | | |

Total | | | | | | | 10,862 | |

| | | | | | | | |

|

Utilities (0.5%) | |

Constellation Energy Corp. | | | 46,600 | | | | 5,447 | |

| | | | | | | | |

Total | | | | | | | 5,447 | |

| | | | | | | | |

|

Total Common Stocks | |

(Cost: $645,913) | | | | | | | 1,065,893 | |

| | | | | | | | |

|

Total Investments (99.9%) | |

(Cost: $645,913)@ | | | | | | | 1,065,893 | |

| | | | | | | | |

|

Other Assets, Less | |

Liabilities (0.1%) | | | | | | | 1,210 | |

| | | | | | | | |

| |

Net Assets (100.0%) | | | | 1,067,103 | |

| | | | | | | | |

The Accompanying Notes are an Integral Part of the Financial Statements.

6

Growth Stock Portfolio

| + | All par is stated in U.S. Dollar unless otherwise noted. |

| @ | At December 31, 2023, the aggregate cost of investments, including derivatives, for federal tax purposes (in thousands) was $654,095 and the net unrealized appreciation of investments based on that cost was $411,798 which is comprised of $439,420 aggregate gross unrealized appreciation and $27,622 aggregate gross unrealized depreciation. |

The following is a summary of the inputs used in valuing the Portfolio’s Investments at December 31, 2023. See Note 3 for additional information on portfolio valuation.

| | | | | | | | | | | | | | |

| | | | | Valuation Inputs | |

| Description | | | | Level 1 - Quoted Prices | | | Level 2 - Other Significant Observable Inputs | | | Level 3 - Significant Unobservable Inputs | |

| | | | | (Amounts in thousands) | |

Assets: | | | | | | | | | | | | | | |

Common Stocks | | | | $ | 1,065,893 | | | $ | — | | | $ | — | |

| | | | | | |

Total Assets: | | | | $ | 1,065,893 | | | $ | — | | | $ | — | |

| | | | | | |

The Accompanying Notes are an Integral Part of the Financial Statements.

7

Focused Appreciation Portfolio (unaudited)

| | | | |

| Objective: | | Portfolio Strategy: | | Net Assets: |

| Long-term growth of capital. | | Invest in equity securities selected for their growth potential. | | $1.3 billion |

PORTFOLIO OVERVIEW

Mason Street Advisors, LLC (“Mason Street Advisors”), the investment adviser for the Focused Appreciation Portfolio (the “Portfolio”), has engaged Loomis, Sayles & Company, L.P. (“Loomis Sayles”) to act as sub-adviser for the Portfolio. The Portfolio invests primarily in the equity securities of companies selected for their growth potential. The Portfolio focuses on equity securities of large capitalization companies but may invest in companies of any size. The Portfolio employs a growth style of equity management that emphasizes companies with sustainable competitive advantages, long-term structural growth drivers, profitable cash flow returns, and management teams focused on creating long-term value for shareholders. The Portfolio invests primarily in a core group of 30-40 securities but may exceed this range.

MARKET OVERVIEW

The U.S. equity market overcame several potential headwinds to post a robust total return in 2023. The interest-rate outlook was a key driver of volatility throughout the year, as the U.S Federal Reserve (the “Fed”) continued to raise rates — albeit at a slower pace than in 2022 — to combat inflation. This issue became more prominent in late summer and early autumn, when rising energy prices fueled concerns that persistent inflation could compel the Fed to keep rates higher for longer than anticipated. The backdrop changed considerably in the fourth quarter after a series of lower-than-expected inflation reports. In addition, Fed Chairman Jerome Powell surprised the markets in December by indicating that the central bank was likely finished raising rates and possibly on track to begin enacting rate cuts in 2024. Not least, it appeared that Gross Domestic Product growth would remain in positive territory and potentially allow the Fed to achieve the ideal outcome of a soft landing for the economy. Stocks rose in response, bringing most major large-cap indices to near all-time highs by year-end.

The late rally was broad-based, with strong participation from market segments — including the value style, small-caps and mid-caps — that had underperformed for most of 2023. Despite this shift, growth stocks were the key source of market leadership over the full year. Mega-cap technology-related companies produced particularly large gains that were fueled, in part, by excitement about the long-term prospects for artificial intelligence. On the other hand, the more traditionally defensive segments of the market lagged.

PORTFOLIO RESULTS

The Portfolio returned 50.99% for the twelve months ended December 31, 2023. By comparison, the Portfolio’s benchmark, the Russell 1000® Growth Index (the “Index”), returned 42.68%. (The Index is unmanaged, cannot be invested in directly and does not incur expenses.)

Stock selection in the Information Technology, Communication Services, Healthcare, Industrials and Consumer Staples sectors, as well as the allocations in the Communication Services and Consumer Staples sectors contributed positively to the Portfolio’s relative performance. Nvidia Corporation, Meta Platforms and Amazon.com were among the top contributors to the Portfolio’s performance.

Stock selection in the Financials and Consumer Discretionary sectors, as well as the allocations in the Information Technology, Financials, Healthcare and Industrials sectors detracted from the Portfolio’s relative performance. Illumina, PayPal Holdings and Deere & Company were among the largest detractors from performance.

During the year, a position was initiated in Thermo Fisher Scientific and existing positions were increased in Amazon. com, Block, Illumina, PayPal Holdings, Tesla and The Walt Disney Company as near-term price weaknesses created more attractive reward-to-risk opportunities. Existing positions were trimmed in Roche Holding and Novartis as well as in Meta Platforms and Nvidia Corporation as they reached the Portfolio’s maximum allowable position size of eight percent.

PORTFOLIO MANAGER OUTLOOK

The following forward-looking comments are the opinion of Loomis Sayles, the Portfolio’s sub-adviser.

We employ a style of equity management that emphasizes companies with sustainable competitive advantages, long-term secular growth drivers, attractive cash flow returns on invested capital and management teams focused on creating long-

8

Focused Appreciation Portfolio (unaudited)

term value for shareholders. We aim to invest in companies when they trade at a significant discount to the estimate of intrinsic value.

Our investment process is characterized by bottom-up fundamental research and a long-term investment time horizon. All aspects of our quality-growth-valuation investment thesis must be present simultaneously for us to make an investment. Often our research is completed well in advance of the opportunity to invest. We are patient investors and maintain coverage of high quality businesses in order to take advantage of meaningful price dislocations if and when they occur. The nature of the process leads to a lower turnover Portfolio where sector positioning is the result of stock selection. As of December 31, 2023, we were overweight in the Communication Services, Financials, Healthcare and Industrials sectors relative to the benchmark. We were underweight in the Information Technology, Consumer Staples and Consumer Discretionary sectors. We held no positions in the Energy, Real Estate, Materials or Utilities sectors.

Relative Performance

| | | | | | |

Average Annual Total Returns For Periods Ended December 31, 2023 |

| | | 1 Year | | 5 Years | | 10 Years |

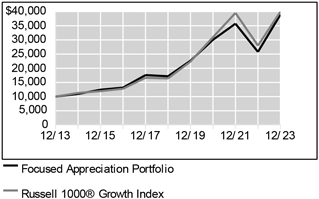

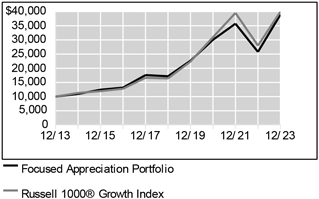

Focused Appreciation Portfolio | | 50.99% | | 17.78% | | 14.56% |

Russell 1000® Growth Index | | 42.68% | | 19.50% | | 14.86% |

The performance data quoted represents past performance. Past performance is historical and does not guarantee future performance. Investment return and principal value will fluctuate, so that shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. For the most recent month-end performance information visit www.northwesternmutual.com.

This chart assumes an initial investment of $10,000 made on 12/31/13. Returns shown reflect fee waivers, deductions for management and other portfolio expenses, and reinvestment of all dividends. In the absence of fee waivers, total return would be reduced. Returns exclude deductions for separate account sale loads and account fees. Please refer to the Benchmark Definitions section of this report for information about the indices cited in the above chart and graph.

The Portfolio may invest a relatively high percentage of its assets in a particular sector. The Portfolio will have greater exposure to the risks associated with that sector and its performance will be tied more closely to the performance of the sector.

Top 10 Holdings 12/31/23

| | | | | | | | |

| | | | |

| | | Security Description | | % of Net Assets | | | | |

| | | | |

| | | Meta Platforms, Inc. - Class A | | 7.7% | | | | |

| | | | |

| | | NVIDIA Corp. | | 7.5% | | | | |

| | | | |

| | | Alphabet, Inc., Various | | 6.2% | | | | |

| | | | |

| | | The Boeing Co. | | 5.7% | | | | |

| | | | |

| | | Visa, Inc. - Class A | | 5.5% | | | | |

| | | | |

| | | Amazon.com, Inc. | | 5.5% | | | | |

| | | | |

| | | Tesla, Inc. | | 5.2% | | | | |

| | | | |

| | | Microsoft Corp. | | 5.1% | | | | |

| | | | |

| | | Netflix, Inc. | | 4.4% | | | | |

| | | | |

| | | Oracle Corp. | | 4.0% | | | | |

Sector Allocation 12/31/23

| | | | | | | | |

| | | | |

| | | Sector | | % of Net Assets | | | | |

| | | | |

| | | Information Technology | | 28.2% | | | | |

| | | | |

| | | Communication Services | | 21.1% | | | | |

| | | | |

| | | Consumer Discretionary | | 14.8% | | | | |

| | | | |

| | | Health Care | | 13.3% | | | | |

| | | | |

| | | Financials | | 10.5% | | | | |

| | | | |

| | | Industrials | | 7.9% | | | | |

| | | | |

| | | Consumer Staples | | 3.0% | | | | |

| | | | |

| | | Short-Term Investments & Other Net Assets | | 1.2% | | | | |

Sector Allocation and Top 10 Holdings are subject to change.

9

Focused Appreciation Portfolio

SCHEDULE OF INVESTMENTS

December 31, 2023

| | | | | | | | |

Common Stocks

(98.8%) | | Shares/ Par + | | | Value $ (000’s) | |

Communication Services (21.1%) | |

Alphabet, Inc. - Class A * | | | 368,300 | | | | 51,448 | |

Alphabet, Inc. - Class C * | | | 198,351 | | | | 27,953 | |

Meta Platforms, Inc. - Class A * | | | 279,042 | | | | 98,770 | |

Netflix, Inc. * | | | 114,843 | | | | 55,915 | |

The Walt Disney Co. | | | 392,504 | | | | 35,439 | |

| | | | | | | | |

Total | | | | | | | 269,525 | |

| | | | | | | | |

|

Consumer Discretionary (14.8%) | |

Alibaba Group Holding, Ltd., ADR | | | 133,950 | | | | 10,382 | |

Amazon.com, Inc. * | | | 462,936 | | | | 70,338 | |

Starbucks Corp. | | | 228,296 | | | | 21,919 | |

Tesla, Inc. * | | | 268,568 | | | | 66,734 | |

Yum China Holdings, Inc. | | | 130,958 | | | | 5,557 | |

Yum! Brands, Inc. | | | 111,922 | | | | 14,624 | |

| | | | | | | | |

Total | | | | | | | 189,554 | |

| | | | | | | | |

|

Consumer Staples (3.0%) | |

Monster Beverage Corp. * | | | 674,180 | | | | 38,839 | |

| | | | | | | | |

Total | | | | | | | 38,839 | |

| | | | | | | | |

| | | | | | | | |

Common Stocks

(98.8%) | | Shares/ Par + | | | Value $ (000’s) | |

Financials (10.5%) | |

Block, Inc. - Class A * | | | 205,592 | | | | 15,903 | |

FactSet Research | | | | | | | | |

Systems, Inc. | | | 42,612 | | | | 20,328 | |

PayPal Holdings, Inc. * | | | 186,484 | | | | 11,452 | |

SEI Investments Co. | | | 242,734 | | | | 15,426 | |

Visa, Inc. - Class A | | | 271,056 | | | | 70,569 | |

| | | | | | | | |

Total | | | | | | | 133,678 | |

| | | | | | | | |

|

Health Care (13.3%) | |

Illumina, Inc. * | | | 120,171 | | | | 16,733 | |

Intuitive Surgical, Inc. * | | | 49,373 | | | | 16,656 | |

Novartis AG, ADR | | | 161,734 | | | | 16,330 | |

Novo Nordisk A/S, ADR | | | 243,125 | | | | 25,151 | |

Regeneron Pharmaceuticals, Inc. * | | | 31,907 | | | | 28,024 | |

Roche Holding AG, ADR | | | 367,913 | | | | 13,330 | |

Sandoz Group AG * | | | 32,347 | | | | 1,035 | |

Thermo Fisher Scientific, Inc. | | | 33,362 | | | | 17,708 | |

Vertex Pharmaceuticals, Inc. * | | | 85,794 | | | | 34,909 | |

| | | | | | | | |

Total | | | | | | | 169,876 | |

| | | | | | | | |

| | | | | | | | |

Common Stocks

(98.8%) | | Shares/ Par + | | | Value $ (000’s) | |

Industrials (7.9%) | |

The Boeing Co. * | | | 280,216 | | | | 73,041 | |

Deere & Co. | | | 19,943 | | | | 7,975 | |

Expeditors International of Washington, Inc. | | | 161,723 | | | | 20,571 | |

| | | | | | | | |

Total | | | | | | | 101,587 | |

| | | | | | | | |

|

Information Technology (28.2%) | |

Autodesk, Inc. * | | | 163,097 | | | | 39,711 | |

Microsoft Corp. | | | 174,074 | | | | 65,459 | |

NVIDIA Corp. | | | 192,387 | | | | 95,274 | |

Oracle Corp. | | | 490,356 | | | | 51,698 | |

QUALCOMM, Inc. | | | 156,552 | | | | 22,642 | |

Salesforce, Inc. * | | | 163,745 | | | | 43,088 | |

Shopify, Inc. * | | | 340,844 | | | | 26,552 | |

Workday, Inc. - Class A * | | | 56,827 | | | | 15,687 | |

| | | | | | | | |

Total | | | | | | | 360,111 | |

| | | | | | | | |

| |

Total Common Stocks

(Cost: $693,361) | | | | 1,263,170 | |

| | | | | | | | |

| |

Total Investments (98.8%)

(Cost: $693,361)@ | | | | 1,263,170 | |

| | | | | | | | |

| |

Other Assets, Less

Liabilities (1.2%) | | | | 15,949 | |

| | | | | | | | |

| |

Net Assets (100.0%) | | | | 1,279,119 | |

| | | | | | | | |

| + | All par is stated in U.S. Dollar unless otherwise noted. |

| @ | At December 31, 2023, the aggregate cost of investments, including derivatives, for federal tax purposes (in thousands) was $697,751 and the net unrealized appreciation of investments based on that cost was $565,419 which is comprised of $615,616 aggregate gross unrealized appreciation and $50,197 aggregate gross unrealized depreciation. |

The following is a summary of the inputs used in valuing the Portfolio’s Investments at December 31, 2023. See Note 3 for additional information on portfolio valuation.

| | | | | | | | | | | | | | |

| | | | | Valuation Inputs | |

| Description | | | | Level 1 - Quoted

Prices | | | Level 2 - Other

Significant

Observable Inputs | | | Level 3

- Significant

Unobservable

Inputs | |

| | | | | (Amounts in thousands) | |

Assets: | | | | | | | | | | | | | | |

Common Stocks | | | | $ | 1,263,170 | | | $ | — | | | $ | — | |

| | | | | | |

Total Assets: | | | | $ | 1,263,170 | | | $ | — | | | $ | — | |

| | | | | | |

The Accompanying Notes are an Integral Part of the Financial Statements.

10

Large Cap Core Stock Portfolio (unaudited)

| | | | |

| Objective: | | Portfolio Strategy: | | Net Assets: |

| Long-term growth of capital and income. | | Invest primarily in common stocks of large capitalization U.S. companies. | | $669 million |

PORTFOLIO OVERVIEW

Mason Street Advisors, LLC (“Mason Street Advisors”), the investment adviser for the Large Cap Core Stock Portfolio (the “Portfolio”), has engaged Wellington Management Company LLP (“Wellington”) to act as sub-adviser for the Portfolio. The Portfolio allocates its assets across a variety of industries, selecting companies in each industry based on the research of a team of global industry analysts. The Portfolio typically seeks to maintain representation in each major industry represented by broad-based, large cap U.S. equity indices. The Portfolio utilizes a “bottom-up” approach, which is the use of fundamental analysis to identify specific securities for purchase or sale. Fundamental analysis of a company involves the assessment of a variety of factors, including the company’s business environment, management quality, balance sheet, income statement, anticipated earnings, revenues and dividends, and other related measures or indicators of valuation and growth potential. The Portfolio’s sector exposures generally conform with the sector weights present in the Portfolio’s benchmark index.

MARKET OVERVIEW

U.S. equities rose during the twelve months ended December 31, 2023 amid easing inflation, optimism for lower interest rates, strong performances in select mega-capitalization technology companies and steady Gross Domestic Product growth. Early in 2023, the collapse of two U.S. regional banks prompted swift policy actions by federal regulators, which helped stabilize liquidity and stem the potential for broader contagion. The U.S. Federal Reserve (the “Fed”) slowed its pace of policy tightening. Shares of a narrow group of mega-capitalization technology companies surged, helping growth stocks significantly outperform their value counterparts. These companies benefited from investor optimism about earnings potential and growth prospects and exuberance surrounding generative artificial intelligence (“AI”). U.S. equities fell in the third quarter, pressured by rising U.S. Treasury yields amid views that the Fed would keep interest rates elevated for a prolonged period. In the fourth quarter, U.S. equities rallied, registering their largest quarterly return in three years as gains broadened beyond those select mega-capitalization stocks that dominated the stock market’s earlier performance. A rapid descent in inflation prompted the Fed to pivot, with policymakers anticipating 75 bps of interest rate cuts in 2024. Large-capitalization stocks outperformed mid-and small-capitalization stocks.

PORTFOLIO RESULTS

The Portfolio returned 25.78% for the twelve months ended December 31, 2023. By comparison, the S&P 500® Index (the “Index”) returned 26.29% for the year. (The Index is unmanaged, cannot be invested in directly and does not incur expenses.)

An underweight allocation to the Information Technology sector and overweight allocation to the Healthcare sector detracted from the Portfolio’s relative performance, while strong stock selection within the Communication Services, Healthcare and Energy sectors contributed.

Top detractors from the Portfolio’s relative performance included underweight positions in Information Technology sector companies NVIDIA Corporation and Apple. NVIDIA Corporation benefited from strong data center demand and the growing need for chips in AI and language learning models. Apple saw its install base grew to 2 billion devices, supporting share prices. Finally, an underweight position in Consumer Discretionary sector company Tesla also weighed on performance. Shares of Tesla rose over the period after reporting strong financial results in 2022. Investors were optimistic that demand would remain strong and outpace production capacity following vehicle price cuts.

Top contributors to the Portfolio’s relative performance included an overweight position in Communication Services sector company Meta Platforms. Meta Platforms advanced amid strong revenues, an increase to their stock buyback authorization, cost-cutting efforts and a rebound in online advertising. In the Consumer Discretionary sector, an overweight position in Amazon.com contributed as shares benefited as cost cutting measures and advancements in AI boosted investor sentiment. Finally, an out-of-benchmark position in Financials sector company Ares Management contributed, benefiting from healthy results with continued fundraising momentum as underlying demand for the firm’s strategies remained strong.

11

Large Cap Core Stock Portfolio (unaudited)

PORTFOLIO MANAGER OUTLOOK

The following forward-looking comments are the opinion of Wellington, the Portfolio’s sub-adviser.

The final quarter of 2023 was marked by a significant market rally in December, closing out a resilient year for global equity markets. The broad rally underscored the adaptability of global equity markets, even as geopolitical tensions and policy uncertainties posed headwinds.

Inflation remains at the forefront of global economic considerations. As 2023 drew to a close, the market observed indications of inflationary pressures beginning to ease in most of the world, including the U.S. However, officials warn that inflation mitigation is an ongoing process, and premature rate cuts could lead to a trend reversal in 2024. While the recent rally is generally pricing in positivity, we acknowledge monetary policy effects typically are felt with a lag and global growth remains at risk. We will continue to closely track these macroeconomic developments.

Relative Performance

| | | | | | |

Average Annual Total Returns For Periods Ended December 31, 2023 |

| | | 1 Year | | 5 Years | | 10 Years |

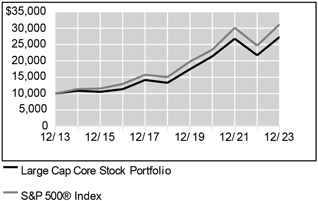

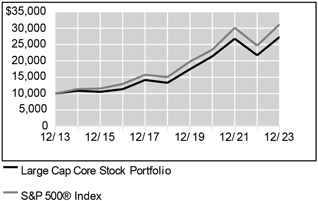

Large Cap Core Stock Portfolio | | 25.78% | | 15.50% | | 10.57% |

S&P 500® Index | | 26.29% | | 15.70% | | 12.03% |

The performance data quoted represents past performance. Past performance is historical and does not guarantee future performance. Investment return and principal value will fluctuate, so that shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. For the most recent month-end performance information visit www.northwesternmutual.com.

This chart assumes an initial investment of $10,000 made on 12/31/13. Returns shown reflect fee waivers, deductions for management and other portfolio expenses, and reinvestment of all dividends. In the absence of fee waivers, total return would be reduced. Returns exclude deductions for separate account sale loads and account fees. Please refer to the Benchmark Definitions section of this report for information about the indices cited in the above chart and graph.

The Portfolio may invest a relatively high percentage of its assets in a particular sector. The Portfolio will have greater exposure to the risks associated with that sector and its performance will be tied more closely to the performance of the sector.

Top 10 Holdings 12/31/23

| | | | | | | | |

| | | | |

| | | Security Description | | % of Net Assets | | | | |

| | | | |

| | | Microsoft Corp. | | 8.8% | | | | |

| | | | |

| | | Amazon.com, Inc. | | 5.5% | | | | |

| | | | |

| | | Apple, Inc. | | 5.1% | | | | |

| | | | |

| | | Alphabet, Inc. - Class A | | 3.3% | | | | |

| | | | |

| | | Meta Platforms, Inc. - Class A | | 2.4% | | | | |

| | | | |

| | | Berkshire Hathaway, Inc. - Class B | | 2.2% | | | | |

| | | | |

| | | JPMorgan Chase & Co. | | 2.2% | | | | |

| | | | |

| | | Advanced Micro Devices, Inc. | | 1.7% | | | | |

| | | | |

| | | Adobe, Inc. | | 1.7% | | | | |

| | | | |

| | | Eli Lilly & Co. | | 1.7% | | | | |

Sector Allocation 12/31/23

| | | | | | | | |

| | | | |

| | | Sector | | % of Net Assets | | | | |

| | | | |

| | | Information Technology | | 26.6% | | | | |

| | | | |

| | | Health Care | | 13.8% | | | | |

| | | | |

| | | Financials | | 13.7% | | | | |

| | | | |

| | | Consumer Discretionary | | 10.3% | | | | |

| | | | |

| | | Industrials | | 9.3% | | | | |

| | | | |

| | | Communication Services | | 8.8% | | | | |

| | | | |

| | | Energy | | 5.0% | | | | |

| | | | |

| | | Consumer Staples | | 4.5% | | | | |

| | | | |

| | | Utilities | | 2.6% | | | | |

| | | | |

| | | Materials | | 2.5% | | | | |

| | | | |

| | | Real Estate | | 2.1% | | | | |

| | | | |

| | | Short-Term Investments & Other Net Assets | | 0.7% | | | | |

| | | | |

| | | Investment Companies | | 0.1% | | | | |

Sector Allocation and Top 10 Holdings are subject to change.

12

Large Cap Core Stock Portfolio

SCHEDULE OF INVESTMENTS

December 31, 2023

| | | | | | | | |

Common Stocks (99.2%) | | Shares/ Par + | | | Value

$ (000’s) | |

Communication Services (8.8%) | |

Alphabet, Inc. - Class A * | | | 157,635 | | | | 22,020 | |

Meta Platforms, Inc. -Class A * | | | 45,879 | | | | 16,239 | |

Netflix, Inc. * | | | 10,542 | | | | 5,133 | |

Omnicom Group, Inc. | | | 46,574 | | | | 4,029 | |

Spotify Technology SA * | | | 19,531 | | | | 3,670 | |

T-Mobile US, Inc. | | | 48,561 | | | | 7,786 | |

| | | | | | | | |

Total | | | | | | | 58,877 | |

| | | | | | | | |

|

Consumer Discretionary (10.3%) | |

Amazon.com, Inc. * | | | 241,733 | | | | 36,729 | |

AutoZone, Inc. * | | | 1,909 | | | | 4,936 | |

Chipotle Mexican Grill, Inc. * | | | 2,416 | | | | 5,525 | |

Lennar Corp. - Class A | | | 25,289 | | | | 3,769 | |

Marriott International, Inc. - Class A | | | 15,084 | | | | 3,402 | |

Tesla, Inc. * | | | 12,977 | | | | 3,225 | |

The TJX Cos., Inc. | | | 118,455 | | | | 11,112 | |

| | | | | | | | |

Total | | | | | | | 68,698 | |

| | | | | | | | |

|

Consumer Staples (4.5%) | |

Constellation Brands, Inc. - Class A | | | 25,962 | | | | 6,276 | |

Haleon PLC | | | 558,873 | | | | 4,599 | |

Monster Beverage Corp. * | | | 156,217 | | | | 9,000 | |

Philip Morris International, Inc. | | | 111,860 | | | | 10,524 | |

| | | | | | | | |

Total | | | | | | | 30,399 | |

| | | | | | | | |

|

Energy (5.0%) | |

BP PLC, ADR | | | 228,659 | | | | 8,094 | |

ConocoPhillips | | | 42,300 | | | | 4,910 | |

EOG Resources, Inc. | | | 12,787 | | | | 1,547 | |

EQT Corp. | | | 34,900 | | | | 1,349 | |

Marathon Petroleum Corp. | | | 31,947 | | | | 4,740 | |

Schlumberger, Ltd. | | | 39,434 | | | | 2,052 | |

Shell PLC | | | 129,715 | | | | 8,535 | |

Targa Resources Corp. | | | 23,188 | | | | 2,014 | |

| | | | | | | | |

Total | | | | | | | 33,241 | |

| | | | | | | | |

|

Financials (13.7%) | |

Arch Capital Group, Ltd. * | | | 29,864 | | | | 2,218 | |

Ares Management Corp. - Class A | | | 79,605 | | | | 9,466 | |

Berkshire Hathaway, Inc. - Class B * | | | 41,421 | | | | 14,773 | |

Block, Inc. - Class A * | | | 64,395 | | | | 4,981 | |

Chubb, Ltd. | | | 15,598 | | | | 3,525 | |

Everest Re Group, Ltd. | | | 8,083 | | | | 2,858 | |

| | | | | | | | |

Common Stocks (99.2%) | | Shares/ Par + | | | Value

$ (000’s) | |

Financials continued | |

FLEETCOR Technologies, Inc. * | | | 12,815 | | | | 3,622 | |

Global Payments, Inc. | | | 38,221 | | | | 4,854 | |

Intercontinental Exchange, Inc. | | | 33,202 | | | | 4,264 | |

JPMorgan Chase & Co. | | | 86,319 | | | | 14,683 | |

KKR & Co., Inc. | | | 57,451 | | | | 4,760 | |

Marsh & McLennan Cos., Inc. | | | 12,519 | | | | 2,372 | |

PayPal Holdings, Inc. * | | | 36,888 | | | | 2,265 | |

The Progressive Corp. | | | 26,455 | | | | 4,214 | |

S&P Global, Inc. | | | 18,028 | | | | 7,942 | |

Visa, Inc. - Class A | | | 20,055 | | | | 5,221 | |

| | | | | | | | |

Total | | | | | | | 92,018 | |

| | | | | | | | |

|

Health Care (13.8%) | |

Abbott Laboratories | | | 36,600 | | | | 4,029 | |

AbbVie, Inc. | | | 11,220 | | | | 1,739 | |

Agilent Technologies, Inc. | | | 18,922 | | | | 2,631 | |

Alnylam Pharmaceuticals, Inc. * | | | 3,395 | | | | 650 | |

AmerisourceBergen Corp. | | | 18,228 | | | | 3,744 | |

AstraZeneca PLC, ADR | | | 59,488 | | | | 4,006 | |

Biogen, Inc. * | | | 5,518 | | | | 1,428 | |

Boston Scientific Corp. * | | | 64,551 | | | | 3,732 | |

Centene Corp. * | | | 29,861 | | | | 2,216 | |

Danaher Corp. | | | 23,492 | | | | 5,435 | |

Dexcom, Inc. * | | | 21,756 | | | | 2,700 | |

Edwards Lifesciences Corp. * | | | 36,377 | | | | 2,774 | |

Elevance Health, Inc. | | | 4,918 | | | | 2,319 | |

Eli Lilly & Co. | | | 19,583 | | | | 11,415 | |

Gilead Sciences, Inc. | | | 11,872 | | | | 962 | |

GSK PLC, ADR | | | 49,636 | | | | 1,839 | |

HCA Healthcare, Inc. | | | 10,006 | | | | 2,708 | |

Humana, Inc. | | | 5,937 | | | | 2,718 | |

Illumina, Inc. * | | | 10,195 | | | | 1,420 | |

Insulet Corp. * | | | 8,227 | | | | 1,785 | |

Laboratory Corp. of America Holdings | | | 9,940 | | | | 2,259 | |

Merck & Co., Inc. | | | 66,781 | | | | 7,280 | |

Moderna, Inc. * | | | 2,685 | | | | 267 | |

Molina Healthcare, Inc. * | | | 7,234 | | | | 2,614 | |

Novartis AG, ADR | | | 22,198 | | | | 2,241 | |

Pfizer, Inc. | | | 68,432 | | | | 1,970 | |

Regeneron Pharmaceuticals, Inc. * | | | 1,941 | | | | 1,705 | |

Stryker Corp. | | | 5,513 | | | | 1,651 | |

| | | | | | | | |

Common Stocks (99.2%) | | Shares/ Par + | | | Value

$ (000’s) | |

Health Care continued | |

UnitedHealth Group, Inc. | | | 11,773 | | | | 6,198 | |

Vertex Pharmaceuticals, Inc. * | | | 6,069 | | | | 2,469 | |

Zoetis, Inc. | | | 16,957 | | | | 3,347 | |

| | | | | | | | |

Total | | | | | | | 92,251 | |

| | | | | | | | |

|

Industrials (9.3%) | |

AerCap Holdings NV * | | | 15,271 | | | | 1,135 | |

The Boeing Co. * | | | 10,379 | | | | 2,705 | |

Builders FirstSource, Inc. * | | | 26,236 | | | | 4,380 | |

C.H. Robinson Worldwide, Inc. | | | 89,319 | | | | 7,716 | |

Ceridian HCM Holding, Inc. * | | | 50,869 | | | | 3,414 | |

Deere & Co. | | | 1,323 | | | | 529 | |

Delta Air Lines, Inc. | | | 185,964 | | | | 7,481 | |

Emerson Electric Co. | | | 15,731 | | | | 1,531 | |

Equifax, Inc. | | | 6,662 | | | | 1,647 | |

Fortive Corp. | | | 52,953 | | | | 3,899 | |

General Dynamics Corp. | | | 25,350 | | | | 6,583 | |

Ingersoll-Rand, Inc. | | | 39,898 | | | | 3,086 | |

Johnson Controls International PLC | | | 30,273 | | | | 1,745 | |

Raytheon Technologies Corp. | | | 30,950 | | | | 2,604 | |

Trane Technologies PLC | | | 9,170 | | | | 2,237 | |

Uber Technologies, Inc. * | | | 115,785 | | | | 7,129 | |

Veralto Corp. | | | 7,830 | | | | 644 | |

Waste Connections, Inc. | | | 18,976 | | | | 2,833 | |

Westinghouse Air Brake Technologies Corp. | | | 6,799 | | | | 863 | |

| | | | | | | | |

Total | | | | | | | 62,161 | |

| | | | | | | | |

|

Information Technology (26.6%) | |

Adobe, Inc. * | | | 19,175 | | | | 11,440 | |

Advanced Micro Devices, Inc. * | | | 78,281 | | | | 11,539 | |

Apple, Inc. | | | 177,669 | | | | 34,207 | |

First Solar, Inc. * | | | 6,833 | | | | 1,177 | |

HubSpot, Inc. * | | | 8,706 | | | | 5,054 | |

Intuit, Inc. | | | 16,096 | | | | 10,060 | |

KLA Corp. | | | 9,406 | | | | 5,468 | |

Marvell Technology, Inc. | | | 50,416 | | | | 3,041 | |

Micron Technology, Inc. | | | 54,457 | | | | 4,647 | |

Microsoft Corp. | | | 156,153 | | | | 58,720 | |

NVIDIA Corp. | | | 14,750 | | | | 7,305 | |

The Accompanying Notes are an Integral Part of the Financial Statements.

13

Large Cap Core Stock Portfolio

| | | | | | | | |

Common Stocks (99.2%) | | Shares/ Par + | | | Value $ (000’s) | |

Information Technology continued | |

ON Semiconductor | | | | | | | | |

Corp. * | | | 29,091 | | | | 2,430 | |

ServiceNow, Inc. * | | | 14,099 | | | | 9,961 | |

Synopsys, Inc. * | | | 9,823 | | | | 5,058 | |

Texas Instruments, Inc. | | | 45,321 | | | | 7,725 | |

| | | | | | | | |

Total | | | | | | | 177,832 | |

| | | | | | | | |

|

Materials (2.5%) | |

Ball Corp. | | | 17,875 | | | | 1,028 | |

Celanese Corp. - Class A | | | 23,302 | | | | 3,621 | |

Crown Holdings, Inc. | | | 13,913 | | | | 1,281 | |

FMC Corp. | | | 34,673 | | | | 2,186 | |

Linde PLC | | | 13,257 | | | | 5,445 | |

PPG Industries, Inc. | | | 19,206 | | | | 2,872 | |

| | | | | | | | |

Total | | | | | | | 16,433 | |

| | | | | | | | |

| | | | | | | | |

Common Stocks (99.2%) | | Shares/ Par + | | | Value $ (000’s) | |

Real Estate (2.1%) | |

CBRE Group,

Inc. - Class A * | | | 41,367 | | | | 3,851 | |

CoStar Group, Inc. * | | | 15,751 | | | | 1,376 | |

Extra Space Storage, Inc. | | | 14,349 | | | | 2,301 | |

Prologis, Inc. | | | 27,463 | | | | 3,661 | |

Welltower, Inc. | | | 35,433 | | | | 3,195 | |

| | | | | | | | |

Total | | | | | | | 14,384 | |

| | | | | | | | |

|

Utilities (2.6%) | |

Atmos Energy Corp. | | | 24,393 | | | | 2,827 | |

Edison International | | | 52,872 | | | | 3,780 | |

Exelon Corp. | | | 72,965 | | | | 2,619 | |

NextEra Energy, Inc. | | | 57,813 | | | | 3,512 | |

| | | | | | | | |

Common Stocks (99.2%) | | Shares/ Par + | | | Value $ (000’s) | |

Utilities continued | |

PG&E Corp. | | | 257,784 | | | | 4,648 | |

| | | | | | | | |

Total | | | | | | | 17,386 | |

| | | | | | | | |

| |

Total Common Stocks

(Cost: $523,741) | | | | 663,680 | |

| | | | | | | | |

|

Investment Companies (0.1%) | |

| |

Investment Companies (0.1%) | |

SPDR S&P 500 ETF Trust | | | 1,643 | | | | 781 | |

| | | | | | | | |

Total | | | | | | | 781 | |

| | | | | | | | |

| |

Total Investment Companies

(Cost: $698) | | | | 781 | |

| | | | | | | | |

| |

Total Investments (99.3%)

(Cost: $524,439)@ | | | | 664,461 | |

| | | | | | | | |

| |

Other Assets, Less

Liabilities (0.7%) | | | | 4,435 | |

| | | | | | | | |

| |

Net Assets (100.0%) | | | | 668,896 | |

| | | | | | | | |

| + | All par is stated in U.S. Dollar unless otherwise noted. |

| @ | At December 31, 2023, the aggregate cost of investments, including derivatives, for federal tax purposes (in thousands) was $528,012 and the net unrealized appreciation of investments based on that cost was $136,449 which is comprised of $147,169 aggregate gross unrealized appreciation and $10,720 aggregate gross unrealized depreciation. |

The following is a summary of the inputs used in valuing the Portfolio’s Investments at December 31, 2023. See Note 3 for additional information on portfolio valuation.

| | | | | | | | | | | | | | |

| | | | | Valuation Inputs | |

| Description | | | | Level 1 - Quoted Prices | | | Level 2 - Other Significant Observable Inputs | | | Level 3

- Significant Unobservable Inputs | |

| | | | | (Amounts in thousands) | |

Assets: | | | | | | | | | | | | | | |

Common Stocks | | | | $ | 663,680 | | | $ | — | | | $ | — | |

Investment Companies | | | | | 781 | | | | — | | | | — | |

| | | | | | |

Total Assets: | | | | $ | 664,461 | | | $ | — | | | $ | — | |

| | | | | | |

The Accompanying Notes are an Integral Part of the Financial Statements.

14

Large Cap Blend Portfolio (unaudited)

| | | | |

| Objective: | | Portfolio Strategy: | | Net Assets: |

| Long-term growth of capital and income. | | Invest primarily in equity securities of large-and medium-capitalization U.S. companies listed or traded on U.S. securities exchanges. | | $188 million |

PORTFOLIO OVERVIEW

Mason Street Advisors, LLC (“Mason Street Advisors”), the investment adviser for the Large Cap Blend Portfolio (the “Portfolio”), has engaged J.P. Morgan Investment Management, Inc. (“JP Morgan”) to act as sub-adviser for the Portfolio. JP Morgan was appointed sub-adviser to the Portfolio effective July 31, 2023. Prior to that time, the Portfolio was sub-advised by Fiduciary Management, Inc. (“FMI”). Normally, the Portfolio invests in equity securities of large-and medium-capitalization U.S. companies listed or traded on U.S. securities exchanges. The Portfolio may also invest up to 20% of its net assets in common stocks of foreign issuers, and may hold American Depositary Receipts (ADRs). The Portfolio focuses on those equity securities that it considers attractively valued and seeks to outperform the benchmark through superior stock selection.

MARKET OVERVIEW

The U.S. equity markets ended the year strong despite witnessing the second largest bank failure in the history of the United States. The U.S. Federal Reserve (the “Fed”) hiked the fed funds target rate to 5.25% - 5.50%, the highest level in more than 22 years to curb record high inflation. The Consumer Price Index was at 6.4% in January 2023 and trended downwards to 3.1% in November 2023. Meanwhile, third quarter Gross Domestic Product (GDP) was a bright spot, with GDP rising at 4.9% annualized; the increase was primarily driven by an increase in consumer spending and inventory investment. The labor market experienced some weakness as the unemployment rate went up from 3.4% in January 2023 to 3.7% in November 2023. Business spending held up better than expected despite tighter lending standards, supported by increased spending on intellectual property with greater emphasis on building and integrating artificial intelligence capabilities. Finally, earnings forecasts for 2024 witnessed an uptick towards the end of the year as recession fears subsided.

PORTFOLIO RESULTS

The Portfolio returned 20.61% for the twelve months ended December 31, 2023. By comparison, the Portfolio’s benchmark, the S&P 500® Index (the “Index”) returned 26.29%. (The Index is unmanaged, cannot be invested in directly and does not incur expenses.)

As noted above, prior to July 31, 2023, the Portfolio was managed by FMI. With respect to the period prior to July 31, 2023, relative performance was hindered by sector allocation weakness, mainly due to an underweight in Information Technology stocks, which was the top performing Index group and most heavily weighted group in the Index, followed by an overweight in the Financials sector. Financials sector investments detracted from the Portfolio’s relative performance due to holdings Charles Schwab Corp. and Northern Trust’s hangover from the Silicon Valley Bank crisis.

The following performance attribution comments relate to the period July 31, 2023, through December 31, 2023, during which time JP Morgan acted as the Portfolio’s sub-adviser.

The Portfolio saw relative strength during this period, as stock selection in the Industrials, Financials, and Healthcare sectors helped the most. Alternatively, stock selection within Utilities, Consumer Discretionary and Information Technology detracted the most from performance versus the Index.

At the individual stock level, the top contributors were positions in Progressive Corporation, Eaton Corp., Regeneron Pharmaceuticals, Inc. and Microsoft Corp., while top detractors included NextEra Energy, Inc., Bristol-Myers Squibb Company and an underweight position in Eli Lilly and Company.

PORTFOLIO MANAGER OUTLOOK

The following forward-looking comments are the opinion of JP Morgan, the Portfolio’s sub-adviser.

We continue to focus on fundamentals of the economy and company earnings. Our analysts’ estimates for S&P 500® Index earnings currently project 12% for 2024 and 12% for 2025. While subject to revision, this forecast includes our best analysis of earnings expectations.

15

Large Cap Blend Portfolio (unaudited)

Easing inflation and improved prospects for growth have helped fuel optimism for a soft landing. However, be it the U.S. election, higher policy rates or significant geopolitical tension, risks continue to remain that could push the economy into recession in 2024. Through the volatility, we continue to focus on high conviction stocks and take advantage of market dislocations for compelling stock selection opportunities.

Relative Performance

| | | | | | |

| Average Annual Total Returns |

| For Periods Ended December 31, 2023 |

| | | |

| | | 1 Year | | 5 Years | | 10 Years |

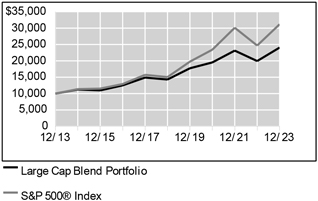

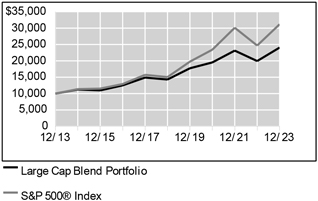

Large Cap Blend Portfolio | | 20.61% | | 10.94% | | 9.17% |

S&P 500® Index | | 26.29% | | 15.70% | | 12.03% |

The performance data quoted represents past performance. Past performance is historical and does not guarantee future performance. Investment return and principal value will fluctuate, so that shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. For the most recent month-end performance information visit www.northwesternmutual.com.

This chart assumes an initial investment of $10,000 made on 12/31/13. Returns shown reflect fee waivers, deductions for management and other portfolio expenses, and reinvestment of all dividends. In the absence of fee waivers, total return would be reduced. Returns exclude deductions for separate account sale loads and account fees. Please refer to the Benchmark Definitions section of this report for information about the indices cited in the above chart and graph.

The Portfolio may invest a relatively high percentage of its assets in a particular sector. The Portfolio will have greater exposure to the risks associated with that sector and its performance will be tied more closely to the performance of the sector.

Top 10 Holdings 12/31/23

| | | | | | | | |

| | | | |

| | | Security Description | | % of Net Assets | | | | |

| | | | |

| | | Microsoft Corp. | | 9.5% | | | | |

| | | | |

| | | Apple, Inc. | | 5.1% | | | | |

| | | | |

| | | Amazon.com, Inc. | | 4.7% | | | | |

| | | | |

| | | NVIDIA Corp. | | 3.4% | | | | |

| | | | |

| | | UnitedHealth Group, Inc. | | 3.2% | | | | |

| | | | |

| | | Alphabet, Inc. - Class A | | 3.1% | | | | |

| | | | |

| | | Meta Platforms, Inc. - Class A | | 2.9% | | | | |

| | | | |

| | | AbbVie, Inc. | | 2.7% | | | | |

| | | | |

| | | Morgan Stanley | | 2.5% | | | | |

| | | | |

| | | NXP Semiconductors NV | | 2.5% | | | | |

Sector Allocation 12/31/23

| | | | | | | | | | |

| | | | |

| | | Sector | | | % of Net Assets | | | | | |

| | | | |

| | | Information Technology | | | 29.7% | | | | | |

| | | | |

| | | Health Care | | | 14.1% | | | | | |

| | | | |

| | | Consumer Discretionary | | | 11.7% | | | | | |

| | | | |

| | | Financials | | | 11.6% | | | | | |

| | | | |

| | | Industrials | | | 11.4% | | | | | |

| | | | |

| | | Communication Services | | | 6.0% | | | | | |

| | | | |

| | | Energy | | | 5.4% | | | | | |

| | | | |

| | | Utilities | | | 4.1% | | | | | |

| | | | |

| | | Materials | | | 2.9% | | | | | |

| | | | |

| | | Real Estate | | | 2.4% | | | | | |

| | | | |

| | | Consumer Staples | | | 2.3% | | | | | |

| | | | |

| | | Short-Term Investments & Other Net Assets | | | -1.6% | | | | | |

Sector Allocation and Top 10 Holdings are subject to change.

16

Large Cap Blend Portfolio

SCHEDULE OF INVESTMENTS

December 31, 2023

| | | | | | | | |

Common Stocks (101.6%) | | Shares/ Par + | | | Value $ (000’s) | |

Communication Services (6.0%) | |

Alphabet, Inc.

- Class A * | | | 41,364 | | | | 5,778 | |

Meta Platforms, Inc.

- Class A * | | | 15,502 | | | | 5,487 | |

| | | | | | | | |

Total | | | | | | | 11,265 | |

| | | | | | | | |

|

Consumer Discretionary (11.7%) | |

Amazon.com, Inc. * | | | 58,025 | | | | 8,816 | |

Lowe’s Companies, Inc. | | | 19,676 | | | | 4,379 | |

Marriott International, Inc. - Class A | | | 5,153 | | | | 1,162 | |

McDonald’s Corp. | | | 15,019 | | | | 4,453 | |

Tesla, Inc. * | | | 5,137 | | | | 1,277 | |

The TJX Cos., Inc. | | | 19,394 | | | | 1,819 | |

| | | | | | | | |

Total | | | | | | | 21,906 | |

| | | | | | | | |

|

Consumer Staples (2.3%) | |

The Coca-Cola Co. | | | 75,131 | | | | 4,427 | |

| | | | | | | | |

Total | | | | | | | 4,427 | |

| | | | | | | | |

|

Energy (5.4%) | |

Baker Hughes | | | 133,848 | | | | 4,575 | |

ConocoPhillips | | | 21,663 | | | | 2,514 | |

Pioneer Natural Resources Co. | | | 13,330 | | | | 2,998 | |

| | | | | | | | |

Total | | | | | | | 10,087 | |

| | | | | | | | |

|

Financials (11.6%) | |

American Express Co. | | | 16,325 | | | | 3,058 | |

Ameriprise Financial, Inc. | | | 7,127 | | | | 2,707 | |

FLEETCOR Technologies, Inc. * | | | 3,221 | | | | 910 | |

Morgan Stanley | | | 51,135 | | | | 4,768 | |

The Progressive Corp. | | | 10,383 | | | | 1,654 | |

S&P Global, Inc. | | | 4,326 | | | | 1,906 | |

U.S. Bancorp | | | 59,138 | | | | 2,560 | |

| | | | | | | | |

Common Stocks (101.6%) | | Shares/ Par + | | | Value $ (000’s) | |

Financials continued | |

Wells Fargo & Co. | | | 86,743 | | | | 4,270 | |

| | | | | | | | |

Total | | | | | | | 21,833 | |

| | | | | | | | |

|

Health Care (14.1%) | |

AbbVie, Inc. | | | 33,186 | | | | 5,143 | |

Biogen, Inc. * | | | 6,144 | | | | 1,590 | |

Bristol-Myers Squibb Co. | | | 46,707 | | | | 2,397 | |

Danaher Corp. | | | 9,528 | | | | 2,204 | |

Eli Lilly & Co. | | | 1,839 | | | | 1,072 | |

Regeneron Pharmaceuticals, Inc. * | | | 4,112 | | | | 3,611 | |

Stryker Corp. | | | 9,285 | | | | 2,780 | |

UnitedHealth Group, Inc. | | | 11,487 | | | | 6,048 | |

Vertex Pharmaceuticals, Inc. * | | | 4,168 | | | | 1,696 | |

| | | | | | | | |

Total | | | | | | | 26,541 | |

| | | | | | | | |

|

Industrials (11.4%) | |

CSX Corp. | | | 53,782 | | | | 1,865 | |

Deere & Co. | | | 11,801 | | | | 4,719 | |

Eaton Corp. PLC | | | 16,014 | | | | 3,856 | |

Howmet Aerospace, Inc. | | | 19,530 | | | | 1,057 | |

Norfolk Southern Corp. | | | 11,838 | | | | 2,798 | |

Northrop Grumman Corp. | | | 7,815 | | | | 3,658 | |

Trane Technologies PLC | | | 8,850 | | | | 2,159 | |

Uber Technologies, Inc. * | | | 22,409 | | | | 1,380 | |

| | | | | | | | |

Total | | | | | | | 21,492 | |

| | | | | | | | |

| | | | | | | | |

Common Stocks (101.6%) | | Shares/ Par + | | | Value $ (000’s) | |

Information Technology (29.7%) | |