Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2005

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

ARMSTRONG HOLDINGS, INC.

(Exact name of registrant as specified in its charter)

| Pennsylvania | 000-50408 | 23-3033414 | ||

(State or other jurisdiction of incorporation or organization) | (Commission file number) | (I.R.S. Employer Identification No.) |

| P. O. Box 3001, Lancaster, Pennsylvania | 17604 | |

| (Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code (717) 397-0611

Securities registered pursuant to Section 12(b) of the Act: None

Securities registered pursuant to Section 12(g) of the Act:

Title of each class | ||

Common Stock ($1 par value) Preferred Stock Purchase Rights |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months, and (2) has been subject to such filing requirements for the past 90 days.

Yes x No ¨

Table of Contents

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is an accelerated filer (as defined in Rule 12b-2 of the Act).

Yes x No ¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act).

Yes ¨ No x

The aggregate market value of the Common Stock of Armstrong Holdings, Inc. held by non-affiliates based on the closing price ($2.42 per share) on the over-the-counter (OTC) Bulletin Board (trading symbol ACKHQ) on June 30, 2005, was approximately $98.1 million. As of February 10, 2006, the number of shares outstanding of registrant’s Common Stock was 40,664,461.

ARMSTRONG WORLD INDUSTRIES, INC.

(Exact name of registrant as specified in its charter)

| Pennsylvania | 1-2116 | 23-0366390 | ||

(State or other jurisdiction of incorporation or organization) | (Commission file number) | (I.R.S. Employer Identification No.) |

| P. O. Box 3001, Lancaster, Pennsylvania | 17604 | |

| (Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code (717) 397-0611

Securities registered pursuant to Section 12(b) of the Act: None

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months, and (2) has been subject to such filing requirements for the past 90 days.

Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

2

Table of Contents

Indicate by check mark whether the registrant is an accelerated filer (as defined in Rule 12b-2 of the Act).

Yes ¨ No x

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act).

Yes ¨ No x

Documents Incorporated by Reference

None

3

Table of Contents

4

Table of Contents

Uncertainties Affecting Forward-Looking Statements

Our disclosures here and in other public documents and comments contain forward-looking statements within the meaning of the Private Securities Litigation Reform Act. Those statements provide our future expectations or forecasts, and can be identified by our use of words such as “anticipate,” “estimate,” “expect,” “project,” “intend,” “plan,” “believe,” “outlook,” etc. in discussions of future operating or financial performance or the outcome of contingencies such as liabilities or legal proceedings.

Any of our forward-looking statements may turn out to be wrong. Actual future results may differ materially. Forward-looking statements involve risks and uncertainties because they relate to events and depend on circumstances that may or may not occur in the future. We undertake no obligation to update any forward-looking statement.

You should take into account risks and uncertainties that affect our business, operations and financial condition in evaluating any investment decision involving Armstrong. It is not possible to predict all factors that could cause actual results to differ materially from expected and historical results. The discussion in the “Risk Factors” section below at Item 1A. is a summary of what we currently believe to be our most significant risk factors. Related disclosures in subsequent 10-K, 10-Q and 8-K reports should also be consulted.

5

Table of Contents

PART I

| ITEM 1. | BUSINESS |

General

Armstrong World Industries, Inc. (“AWI”) is a Pennsylvania corporation incorporated in 1891. Armstrong Holdings, Inc. is a Pennsylvania corporation and the publicly held parent holding company of AWI. Armstrong Holdings, Inc.’s only significant asset and operation is its indirect ownership, through Armstrong Worldwide, Inc. (a Delaware Corporation), of all of the capital stock of AWI. We include separate financial statements for Armstrong Holdings, Inc. and its subsidiaries and AWI and its subsidiaries in this report because both companies have public securities that are registered under the Securities Exchange Act of 1934 (the “Securities Exchange Act”). The differences between the financial statements of Armstrong Holdings, Inc. and its subsidiaries and AWI and its subsidiaries are primarily due to transactions that occurred in 2000 related to the formation of Armstrong Holdings, Inc. and to employee compensation-related stock activity. In 2005, we reversed a $1.6 million contingent liability of Armstrong Holdings, Inc. that was originally established when Armstrong Holdings, Inc. was formed, because the liability is no longer probable. Due to the lack of material differences in the operations, when we refer in this document to Armstrong Holdings, Inc. and its subsidiaries as “AHI,” “Armstrong,” “we” and “us,” we are also effectively referring to AWI and its subsidiaries. We use the term “AWI” when we are referring solely to Armstrong World Industries, Inc.

We maintain a website at http://www.armstrong.com. Information contained on our website is not incorporated into this document. Annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, all amendments to those reports and other information about us are available free of charge through this website as soon as reasonably practicable after the reports are electronically filed with the Securities and Exchange Commission (“SEC”).

We are a leading global producer of flooring products and ceiling systems for use primarily in the construction and renovation of residential, commercial and institutional buildings. Through our United States (“U.S.”) operations and U.S. and international subsidiaries, we design, manufacture and sell flooring products (resilient, wood, carpeting and sports flooring) and ceiling systems (primarily mineral fiber, fiberglass and metal), around the world. We also design, manufacture and sell kitchen and bathroom cabinets in the U.S.

Our business strategy focuses on product innovation, product quality and customer service. In our businesses, these factors are the primary determinants of market share gain or loss. Our objective is to ensure that anyone buying a floor or ceiling can find an Armstrong product that meets his or her needs. Our cabinet strategy is more focused – on stock cabinets in select geographic markets. In these segments, we have the same objectives: high quality, good customer service and products that meet our customers’ needs. Our markets are very competitive, which limits our pricing flexibility. This requires that we increase our productivity each year – both in our plants and in our administration of the businesses.

Chapter 11 Proceeding

On December 6, 2000, AWI filed a voluntary petition for relief under Chapter 11 of the U.S. Bankruptcy Code in the United States Bankruptcy Court for the District of Delaware (the “Bankruptcy Court”) in order to use the court-supervised reorganization process to achieve a resolution of its asbestos liability. Also filing under Chapter 11 were two of AWI’s wholly-owned subsidiaries, Nitram Liquidators, Inc. and Desseaux Corporation of North America, Inc. The Chapter 11 cases are being jointly administered under case number 00-4471 (the “Chapter 11 Case”). AWI is operating its business and managing its properties as a debtor-in-possession subject to the provisions of the Bankruptcy Code. See Note 1 of the Consolidated Financial Statements for information on the Chapter 11 Case and Note 30 of the Consolidated Financial Statements for information on asbestos litigation.

6

Table of Contents

Reportable Segments

Resilient Flooring �� produces a broad range of floor coverings for homes and commercial and institutional buildings. Resilient Flooring products include vinyl sheet, vinyl tile, linoleum flooring and luxury vinyl tile. In addition, our Resilient Flooring segment sources and sells laminate flooring products, ceramic tile products, adhesives, installation and maintenance materials and accessories. Resilient Flooring products are offered in a wide variety of types, designs and colors. We sell these products to wholesalers, large home centers, retailers, contractors and to the manufactured homes industry.

Wood Flooring — produces and sources wood flooring products for use in new residential construction and renovation, with some commercial applications in stores, restaurants and high-end offices. The product offering includes solid wood (predominantly pre-finished), engineered wood floors in various wood species (with oak being the primary species of choice) and related accessories. Virtually all of our Wood Flooring’s sales are in North America. Our Wood Flooring products are generally sold to independent wholesale flooring distributors and large home centers under the brand names Bruce®, Hartco®, Robbins®, Timberland™ and Armstrong™.

Textiles and Sports Flooring (“TSF”) — produces carpeting and sports flooring products that are sold mainly in Europe. Carpeting products consist principally of carpet tiles and broadloom used in commercial applications and in the leisure and travel industry. Sports flooring products include artificial turf and other sports surfaces. Our TSF products are sold primarily through retailers, contractors, distributors and other industrial businesses.

Building Products — produces suspended mineral fiber, soft fiber and metal ceiling systems for use in commercial, institutional and residential settings. In addition, our Building Products segment sources and sells wood ceiling systems. The products are available in numerous colors, performance characteristics and designs, and offer attributes such as acoustical control, rated fire protection and aesthetic appeal. Commercial ceiling materials and accessories are sold to ceiling systems contractors and to resale distributors. Residential ceiling products are sold primarily in North America through wholesalers and retailers (including large home centers). Suspension system (grid) products manufactured by WAVE are sold by both Armstrong and our WAVE joint venture.

Cabinets — produces kitchen and bathroom cabinetry and related products, which are used primarily in the U.S. residential new construction and renovation markets. Through our system of company-owned and independent distribution centers and through direct sales to builders, our Cabinets segment provides design, fabrication and installation services to single and multi-family homebuilders, remodelers and consumers under the brand names Armstrong™ and Bruce®.

Unallocated Corporate—includes assets and expenses that have not been allocated to the business units. Unallocated Corporate assets are primarily deferred tax assets, cash and the U.S. prepaid pension cost. Expenses included in Unallocated Corporate are corporate departments’ expenses that have not been allocated to other reportable segments, and the U.S. pension credit. Expenses for our corporate departments (including computer services, human resources, legal, finance and other) are allocated to the reportable segments when the departments provide specific work to the reportable segment and the expense allocation can be based on known metrics, such as time reporting, headcount or square-footage. The remaining expenses, which cannot be attributable to the reportable segments without a high degree of generalization, are reported in Unallocated Corporate.

7

Table of Contents

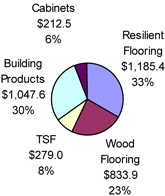

The following chart illustrates the breakdown of our consolidated net sales for the year ended December 31, 2005 by segment:

2005 Consolidated Net Sales by Segment

(in $ millions)

See Note 3 of the Consolidated Financial Statements and Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations of this Form 10-K for additional financial information on our reportable segments.

Markets

The major markets in which we compete are:

North American Residential markets.The North American Residential markets account for nearly one-half of our total consolidated net sales. Our Resilient Flooring, Wood Flooring, Building Products and Cabinets segments sell products for use in the home. Homeowners have a multitude of finishing solution options for every room in their house. For flooring, they can choose from our vinyl and wood products, for which we are the market’s largest provider, or from our laminate and ceramic products. We compete directly with other domestic and international suppliers of these products. Our flooring products also compete with carpet, which we do not offer in this market. Our ceiling products compete against mineral fiber and fiberglass products from other manufacturers, as well as drywall installations. In the kitchen and bath areas, we compete with thousands of other cabinet manufacturers that include large diversified corporations as well as small local craftsmen.

Our products are used in new home construction and existing home renovation work. Industry estimates are that existing home renovation (also known as replacement / remodel) work represents approximately two-thirds of the total North American residential market opportunity. Key U.S. statistics that indicate market opportunity include existing home sales (a key indicator for renovation opportunity), housing starts, housing completions, interest rates and consumer confidence. For our Resilient Flooring and Wood Flooring products, we believe there is some longer-term correlation between these statistics and our revenue, after reflecting a lag period between change in construction activity and our operating results of approximately several months. However, we believe that consumers’ preferences for product type, style, color, availability and affordability also significantly impact our revenue. Further, changes in inventory levels and product focus at national home centers, which are our largest customers, can also significantly impact our revenue. Sales of our ceiling products in this market appear to follow the trend of existing home sales, with a several month lag period between change in existing home sales and our related operating results.

8

Table of Contents

North American Commercial markets. The North American Commercial markets account for approximately one-fourth of our total consolidated net sales. Many of our products, primarily ceilings and Resilient Flooring, are used in commercial and institutional buildings. Our revenue opportunities come from new construction as well as renovation of existing buildings. Renovation work is estimated to represent approximately three-fourths of the total North American commercial market opportunity. We focus on four major segments of commercial building – office, education, retail and healthcare, as most of our revenue in these markets comes from these building segments. We monitor U.S. construction starts (an indicator of U.S. monthly construction activity that provides us a reasonable indication of upcoming opportunity) and follow new projects. We have found that our revenue from new construction can lag behind construction starts by as much as one year. We also monitor office vacancy rates and general employment levels, which can indicate movement in renovation and new construction opportunities. We believe that these statistics, taking into account the time-lag effect, provide a reasonable indication of our future revenue opportunity from these markets.

Non-North American markets. The non-North American markets account for a little more than one-fourth of our total consolidated net sales. The vast majority of our revenues generated outside of North America is in Europe and is commercial in nature. For the countries in which we have significant revenue, we monitor various national statistics (such as GDP) as well as known new projects. Revenues come primarily from new construction and renovation work.

The following table provides an estimate of our segments’ 2005 net sales, by major markets.

(Estimated percentages of individual segment’s sales) | North American Residential | North American | Non-North American | Total | ||||||||

Resilient Flooring | 45 | % | 30 | % | 25 | % | 100 | % | ||||

Wood Flooring | 95 | % | 5 | % | — | 100 | % | |||||

Textiles & Sports Flooring | — | 5 | % | 95 | % | 100 | % | |||||

Building Products | 10 | % | 50 | % | 40 | % | 100 | % | ||||

Cabinets | 100 | % | — | — | 100 | % |

Geographic Areas

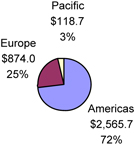

We sell our products in more than 80 countries. Approximately 72% of our 2005 revenue was derived from sales in the Americas, the vast majority of which came in the United States and Canada. The following chart illustrates the breakdown of our consolidated net sales for the year ended December 31, 2005 by region, based on where the sale was made:

2005 Consolidated Net Sales by Geography

(in $ millions)

9

Table of Contents

See Note 3 of the Consolidated Financial Statements and Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations of this Form 10-K for financial information by geographic areas.

Customers

We use our market positions and brand recognition to develop long-standing relationships with our customers. We principally sell products through building materials distributors, who re-sell our products to retailers, builders, contractors, installers and others. In the North American retail market, which sells to end-users in the light commercial and residential segments, we have important relationships with national home centers such as The Home Depot, Inc. and Lowe’s Companies, Inc. In the residential market, we have important relationships with major homebuilders and buying groups. In the commercial market, we sell to several contractors and subcontractors’ alliances.

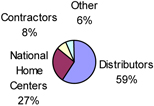

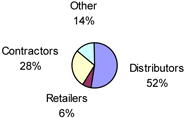

The following charts illustrate the estimated breakdown of our 2005 consolidated net sales geographically by distribution channel:

| 2005 Americas Sale by Customer Type | 2005 Non-Americas Sales by Customer Type | |

|  |

Net sales to specific customers in excess of 10% of our consolidated net sales for 2005, 2004 and 2003 were:

Customer | 2005 | 2004 | 2003 | ||||||||

The Home Depot, Inc. | $ | 384.1 | $ | 393.4 | $ | 400.0 | |||||

Lowe’s Companies, Inc. | (1 | ) | (1 | ) | 318.7 | ||||||

| (1) | Net sales to Lowe’s Companies, Inc. were less than 10% of consolidated net sales for these years. |

Net sales to these customers were recorded in our Resilient Flooring, Wood Flooring and Building Products segments. No other customers accounted for 10% or more of our total consolidated net sales.

Competition

There is strong competition in all of the reportable segments in which we do business. Principal methods of competition include product performance, product styling, service and price. Competition in the U.S. markets comes from both domestic manufacturers and international producers. Additionally, some of our products compete with alternative products, such as our resilient, laminate and wood flooring products competing with carpet products, and our ceiling products competing with drywall. There has been excess industry capacity in many geographic markets, which tends to increase price competition. The following companies are our primary competitors:

Flooring segments – Congoleum Corporation, Forbo Holding AG, Gerflor Group, Interface, Inc., Mannington Mills, Inc., Mohawk Industries, Inc., Pergo AB, Shaw Industries, Inc., Tarkett AG and Wilsonart International.

10

Table of Contents

Building Products – Celotex Limited, Chicago Metallic Corporation, Knauf AMF GmbH & Co. KG, Odenwald Faserplattenwerk GmbH, Rockfon A/S and USG Corporation.

Cabinets – American Woodmark Corporation, Fortune Brands, Inc. and Masco Corporation

Raw Materials

Raw materials essential to our businesses are purchased worldwide in the ordinary course of business from numerous suppliers. The principal raw materials used in each business include the following:

Business | Principal Raw Materials | |

Resilient Flooring | Polyvinylchloride (“PVC”) resins and films, plasticizers, backings, limestone, pigments, linseed oil, inks and stabilizers | |

Wood Flooring | Hardwood lumber, veneer, coatings, and stains | |

Textiles and Sports Flooring | Yarn, latex, bitumen and wool | |

Building Products | Mineral fibers, perlite, waste paper, clays, starches, and steel used in the production of metal ceilings and for our joint venture’s manufacturing of ceiling grids | |

Cabinets | Lumber, veneer, plywood, particleboard, fiberboard and components, such as doors and hardware | |

We also purchase significant amounts of packaging materials for all products and use substantial amounts of energy, such as electricity and natural gas, and water in our manufacturing operations.

In general, adequate supplies of raw materials are available to all of our businesses. However, availability can change for a number of reasons, including environmental conditions, laws and regulations, shifts in demand by other industries competing for the same materials, transportation disruptions and/or business decisions made by, or events that affect, our suppliers. There is no assurance that a significant shortage of raw materials will not occur.

Prices for certain high usage raw materials can fluctuate dramatically. Cost increases for these materials can have a significant adverse impact on our manufacturing costs. Given the competitiveness of our markets, we may not be able to recover the increased manufacturing costs through increasing selling prices to our customers.

Sourced Products

Some of the products that we sell are sourced from third parties. The primary sourced products include laminate, wood flooring, vinyl tile and ceramic products, specialized ceiling products, and installation-related products and accessories for some of our manufactured products. For certain sourced products, the majority of our purchases come from one supplier. Sales of sourced products represented between 10% to 15% of our total consolidated revenue in 2005, 2004 and 2003.

We purchase some of our sourced products from suppliers that are located outside of the U.S, primarily from Asia and Europe. The costs for these products are exposed to changes in foreign currency exchange rates, which can adversely affect our reported results from one period to the next. Our largest foreign currency exposure for sourced products is to the Euro.

In general, we believe we have adequate supplies of sourced products. We cannot guarantee that a significant shortage will not occur.

11

Table of Contents

Hedging

We use financial instruments to hedge the following exposures: raw material and sourced product purchases, cross-currency intercompany loans, and natural gas. We use derivative financial instruments as risk management tools and not for speculative trading purposes. See Item 7A. Quantitative and Qualitative Disclosures About Market Risk of this Form 10-K for more information.

Patent and Intellectual Property Rights

Patent protection is important to our business in the U.S. and other markets. Our competitive position has been enhanced by U.S. and foreign patents on products and processes developed or perfected within Armstrong or obtained through acquisitions and licenses. In addition, we also benefit from our trade secrets for certain products and processes.

Patent protection extends for varying periods according to the date of patent filing or grant and the legal term of a patent in the various countries where patent protection is obtained. The actual protection afforded by a patent, which can vary from country to country, depends upon the type of patent, the scope of its coverage, and the availability of legal remedies. Although we consider that, in the aggregate, our patents, licenses and trade secrets constitute a valuable asset of material importance to our business, we do not regard any of our businesses as being materially dependent upon any single patent or trade secret, or any group of related patents or trade secrets.

Certain of our trademarks, including without limitation, house marks , Armstrong™, Bruce®, Desso®, Hartco®, Robbins®, Timberland®, and DLW™, and product line marks Allwood™, Arteffects®, Axiom®, Cirrus®, Corlon®, Cortega®, Designer Solarian®, Excelon®, Fundamentals® , Medintech®, Natural Inspirations™, Nature’s Gallery®, Second Look®, Solarian®, ToughGuard® and Ultima™ are important to our business because of their significant brand name recognition. Trademark protection continues in some countries as long as the mark is used, and continues in other countries, as long as the mark is registered. Registrations are generally for fixed, but renewable, terms.

, Armstrong™, Bruce®, Desso®, Hartco®, Robbins®, Timberland®, and DLW™, and product line marks Allwood™, Arteffects®, Axiom®, Cirrus®, Corlon®, Cortega®, Designer Solarian®, Excelon®, Fundamentals® , Medintech®, Natural Inspirations™, Nature’s Gallery®, Second Look®, Solarian®, ToughGuard® and Ultima™ are important to our business because of their significant brand name recognition. Trademark protection continues in some countries as long as the mark is used, and continues in other countries, as long as the mark is registered. Registrations are generally for fixed, but renewable, terms.

Employees

As of December 31, 2005, we had approximately 14,900 full-time and part-time employees worldwide, with approximately 10,500 employees located in the United States. Approximately 9,900 of the 14,900 are production and maintenance employees, of whom approximately 7,500 are located in the U.S. Approximately 72% of the production and maintenance employees in the U.S. are represented by labor unions. This percentage includes all production and maintenance employees at our plants and warehouses where labor unions exist, regardless of whether or not the employees actually pay union dues. Outside the U.S., most of our production employees are covered by either industry-sponsored and/or state-sponsored collective bargaining mechanisms.

Research & Development

Research and development (“R&D”) activities are important and necessary in helping us improve our products’ competitiveness. Principal R&D functions include the development and improvement of products and manufacturing processes. We spent $48.5 million in 2005, $47.0 million in 2004 and $46.1 million in 2003 on R&D activities worldwide.

Environmental Matters

Most of our manufacturing and certain of our research facilities are affected by various federal, state and local environmental requirements relating to the discharge of materials or the protection of the environment. We make expenditures necessary for compliance with applicable environmental requirements at our operating facilities.

We are involved in proceedings under the Comprehensive Environmental Response, Compensation and Liability Act (“CERCLA”), and similar state “Superfund” laws at 28 sites. We have also been remediating environmental contamination resulting from past industrial activity at certain of our former plant sites. Certain of AWI’s environmental liabilities are subject to discharge through its Chapter 11 Case while others are not. Those environmental obligations that AWI has with respect to property that it owns or

12

Table of Contents

operates or for which a non-debtor subsidiary is liable are likely to be unaffected by the Chapter 11 Case. Therefore, AWI and its subsidiaries will be required to continue meeting their ongoing environmental compliance obligations at such properties.

See Note 30 of the Consolidated Financial Statements for a full description of our environmental matters.

Information Filed With the Bankruptcy Court

Under applicable bankruptcy law, AWI is required to file periodically with the Bankruptcy Court various documents, including certain financial information on an unconsolidated basis. This information includes statements, schedules, and monthly operating reports in forms prescribed by Federal Bankruptcy Law. We caution that such materials are prepared according to requirements under Federal Bankruptcy Law. While they accurately provide then-current information required under Federal Bankruptcy Law, they are nonetheless unconsolidated, unaudited, and are prepared in a format different from that used in our consolidated financial statements filed under the securities laws. Accordingly, we believe the substance and format do not allow meaningful comparison with our regular publicly disclosed consolidated financial statements. The materials filed with the Bankruptcy Court are not prepared for the purpose of providing a basis for an investment decision relating to the stock of AHI or the debt securities of AWI, or for comparison with other financial information filed with the SEC.

Notwithstanding the foregoing, most of AWI’s filings with the Bankruptcy Court are available to the public at the office of the Clerk of the Bankruptcy Court. Those filings may also be obtained through private document retrieval services. We undertake no obligation to make any further public announcement with respect to the documents filed with the Bankruptcy Court or any matters referred to in them.

See Note 1 of the Consolidated Financial Statements for discussion of certain items filed with the Bankruptcy Court, and www.armstrongplan.com for documents related to AWI’s Plan of Reorganization.

13

Table of Contents

| ITEM 1A. | RISK FACTORS |

As noted in the introductory section titled, “Uncertainties Affecting Forward-Looking Statements” above, our business, operations and financial condition are subject to various risks. You should take them into account in evaluating any investment decision involving Armstrong. It is not possible to predict or identify all factors that could cause actual results to differ materially from expected and historical results. The following discussion is a summary of what we believe to be our most significant risk factors. These and other factors could cause our actual results to differ materially from those in forward-looking statements made in this report.

We try to reduce both the likelihood that these risks will affect our businesses and the damage they could have if they do occur. But, no matter how accurate our foresight, how well we evaluate risks, and how effective we are at mitigating them, it is still possible that one of these problems or some other issue could have serious consequences for us. See related discussions in this document and our other SEC filings for more details and subsequent disclosures.

Asbestos and Chapter 11

Asbestos personal injury claims are our biggest risk. Our balance sheet currently reflects an implied asbestos liability for AWI that results in negative equity for us. The size of our asbestos liability has not been finally determined in our Chapter 11 reorganization case. It could end up being substantially larger or smaller than the amount currently shown on our balance sheet. Even if that liability should be substantially reduced (for example by federal legislation), we may still have negative equity. Consequently an investment in Armstrong’s stock during our Chapter 11 Case is highly uncertain and speculative. See the discussions of our Chapter 11 Case and of proposed asbestos legislation in this document and in past SEC filings for details.

Claims, Litigation and Regulatory Actions

While we strive to ensure that our products comply with applicable government regulatory standards and internal requirements, and that our products perform effectively and safely, customers from time to time could claim that our products do not meet contractual requirements, and users could be harmed by use or misuse of our products. This could give rise to breach of contract, warranty or recall claims, or claims for negligence, product liability, strict liability, personal injury or property damage. The building materials industry has been subject to claims relating to silicates, mold, PVC, formaldehyde, toxic fumes, fire-retardant properties and other issues, as well as for incidents of catastrophic loss, such as building fires. Product liability insurance coverage may not be available or adequate in all circumstances. In addition, claims may arise related to patent infringement, environmental liabilities, distributor terminations, commercial contracts, antitrust or competition law, employment law and employee benefits issues, and other regulatory matters. While we have in place processes and policies to mitigate these risks and to investigate and address such claims as they arise, we cannot predict the costs to defend or resolve such claims.

Construction activity variability and the size of our market opportunity

Our businesses have greater sales opportunities when construction activity is strong and, conversely, have fewer opportunities when such activity declines. Construction activity tends to increase when economies are strong, interest rates are favorable, government spending is strong, and consumers are confident. Since most of our sales are in the U.S., its economy is the most important for our business, but conditions in Europe and Asia also are relevant.

Raw materials and sourced product issues

The cost and availability of raw materials, packaging materials and energy are critical to our operations. For example, we use substantial quantities of natural gas, petroleum-based raw materials, hardwood lumber and mineral fiber in our manufacturing operations. The cost of these items has been volatile and availability has sometimes been tight. We source some of these materials from a limited number of suppliers, which increases the risk of unavailability. The impact of increased costs is greatest where our ability to pass along increased costs is limited, whether due to competitive pressures or other factors.

14

Table of Contents

Consumer preference and competition

Our customers consider our products’ pricing, styling and performance, and our customer service when deciding whether to purchase our products. Shifting consumer preference, e.g. from residential vinyl products to other hard-surface flooring, styling preferences or inability to offer new competitive performance features could hurt our sales. These risks are inherent in our highly competitive markets. For certain products, there is excess industry capacity in several geographic markets, which tends to increase competition based on price as well as on other factors. And competition from overseas competitors who have a lower cost structure is a particular threat in some areas, such as our U.S. flooring businesses.

International trade and operations

A significant portion of our products move in international trade, particularly among the U.S., Canada, Europe and Asia. Also, approximately 30% of our annual revenues are from operations outside the U.S. Our international trade is subject to currency exchange fluctuations, trade regulations, import duties, logistics costs and delays and other related risks. In addition, our international business is subject to variable tax rates, credit risks in emerging markets, political risks, and loss of sales to local competitors following currency devaluations in countries where we import products for sale.

Challenges in executing operational restructuring actions

We monitor how effectively and profitably our businesses service our customers. To stay competitive, we look for ways to make our operations more efficient and effective. We reduce, move or expand our plants and operations as needed, and we currently have several of these actions in various stages of completion. Each action generally involves substantial planning and capital investment. We can err in planning and executing our actions, which could create risks to our customer service and cause unplanned costs.

Labor contracts

Most of our manufacturing employees are represented by unions and are covered by collective bargaining or similar agreements that must be periodically renegotiated. Although we believe that we will reach new contracts as older ones expire, our negotiations may result in a significant increase in our costs. Failure to reach new contracts could lead to work stoppages, which could have a material adverse effect on our operations.

Dependence on key customers

Some of our businesses are dependent on a few key customers. For example, much of our North America revenue comes from sales to home center retailers, including The Home Depot, Inc. and Lowe’s Companies, Inc. Together these customers account for approximately 20% of our consolidated total sales. We do not have long-term contracts with these customers. The loss of sales to one of these major customers, or changes in our business relationship with them, could have a material adverse impact on our results.

15

Table of Contents

| ITEM 2. | PROPERTIES |

Our world headquarters are in Lancaster, Pennsylvania. We own a 100-acre, multi-building campus comprising the site of our corporate headquarters, most operational headquarters, our U.S. R&D operations and marketing, and customer service headquarters. Altogether, our headquarters’ operations occupy approximately one million square feet of floor space.

We produce and market Armstrong products and services throughout the world, operating 41 manufacturing plants in 12 countries as of December 31, 2005. Three of our plants are leased and the remaining 38 are owned. We have 24 plants located throughout the United States. In addition, Armstrong has an interest through its WAVE joint venture in seven additional plants in five countries.

Business Segment | Number of Plants | Location of Principal Facilities | ||

Resilient Flooring | 13 | US (California, Illinois, Mississippi, Oklahoma, Pennsylvania), Australia, Canada, Germany, Sweden and the U.K. | ||

Wood Flooring | 9 | US (Arkansas, Kentucky, Missouri, Tennessee, Texas, West Virginia) | ||

Textiles and Sports Flooring | 3 | Belgium, Germany and The Netherlands | ||

Building Products | 14 | US (Alabama, Florida, Georgia, Oregon, Pennsylvania), China, France, Germany and the U.K. | ||

Cabinets | 2 | US (Nebraska and Pennsylvania) |

Sales and administrative offices are leased and/or owned worldwide, and leased facilities are utilized to supplement our owned warehousing facilities.

For information on consolidation of production and related plant closures in 2005, see Note 13 of the Consolidated Financial Statements and “Cost Reduction Initiatives” in Item 7. Management Discussion and Analysis of Financial Condition and Results of Operations of this Form 10-K.

Production capacity and the extent of utilization of our facilities are difficult to quantify with certainty. In any one facility, maximum capacity and utilization vary periodically depending upon demand for the product that is being manufactured. We believe our facilities are adequate and suitable to support the business. Additional incremental investments in plant facilities are made as appropriate to balance capacity with anticipated demand, improve quality and service, and reduce costs.

16

Table of Contents

| ITEM 3. | LEGAL PROCEEDINGS |

See Note 30 of the Consolidated Financial Statements, which is incorporated herein by reference, for a full description of our legal proceedings.

| ITEM 4. | SUBMISSION OF MATTERS TO A VOTE OF SECURITY HOLDERS |

No matters were submitted to a vote of stockholders during the fourth quarter of 2005.

17

Table of Contents

PART II

| ITEM 5. | MARKET FOR THE REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES |

As a result of filing the POR on November 4, 2002, the New York Stock Exchange stopped trading on the Exchange of the common stock of AHI (traded under the ticker symbol “ACK”). Since November 14, 2002, Armstrong Holding’s common stock trades on the over-the-counter (OTC) Bulletin Board under the ticker symbol (ACKHQ). As of February 10, 2006, there were approximately 6,714 holders of record of Armstrong Holding’s Common Stock.

| First | Second | Third | Fourth | Total Year | |||||||||||

2005 | |||||||||||||||

Price range of common stock—high | $ | 2.82 | $ | 4.40 | $ | 3.10 | $ | 2.34 | $ | 4.40 | |||||

Price range of common stock—low | $ | 1.65 | $ | 1.50 | $ | 1.99 | $ | 1.49 | $ | 1.49 | |||||

2004 | |||||||||||||||

Price range of common stock—high | $ | 1.39 | $ | 1.55 | $ | 2.30 | $ | 3.51 | $ | 3.51 | |||||

Price range of common stock—low | $ | 0.95 | $ | 0.76 | $ | 1.16 | $ | 1.20 | $ | 0.76 | |||||

There were no dividends declared or paid during 2005 or 2004. The DIP Facility stipulates that AWI will not declare or pay any dividends either directly or indirectly and bankruptcy law bars dividends by companies in Chapter 11.

No company securities were repurchased by the company during 2005.

18

Table of Contents

| ITEM 6. | SELECTED FINANCIAL DATA |

The following data is presented for continuing operations.

| (Dollars in millions except for per-share data) | For Year | 2005 | 2004 | 2003 | 2002 | 2001 | ||||||||||||||||

Income statement data | ||||||||||||||||||||||

Net sales | $ | 3,558.4 | $ | 3,497.3 | $ | 3,259.0 | $ | 3,172.3 | $ | 3,138.7 | ||||||||||||

Cost of goods sold | 2,821.1 | 2,811.0 | 2,597.4 | 2,404.5 | 2,364.7 | |||||||||||||||||

Selling, general and administrative expenses | 652.7 | 635.0 | 612.1 | 630.8 | 596.6 | |||||||||||||||||

Charge for asbestos liability, net | — | — | 81.0 | 2,500.0 | 22.0 | |||||||||||||||||

Goodwill impairment | — | 108.4 | — | — | — | |||||||||||||||||

Restructuring charges, net | 23.2 | 18.3 | 8.6 | 1.9 | 9.0 | |||||||||||||||||

Goodwill amortization | — | — | — | — | 22.8 | |||||||||||||||||

Equity (earnings) from joint venture | (39.3 | ) | (31.6 | ) | (20.8 | ) | (19.7 | ) | (16.2 | ) | ||||||||||||

Operating income (loss) | 100.7 | (43.8 | ) | (19.3 | ) | (2,345.2 | ) | 139.8 | ||||||||||||||

Interest expense | 8.5 | 8.4 | 9.0 | 11.3 | 12.7 | |||||||||||||||||

Other non-operating expense | 1.5 | 3.1 | 5.7 | 3.6 | 10.3 | |||||||||||||||||

Other non-operating (income) | (12.0 | ) | (6.4 | ) | (5.0 | ) | (7.5 | ) | (13.3 | ) | ||||||||||||

Chapter 11 reorganization (income) costs, net | (1.2 | ) | 6.9 | 9.4 | 23.5 | 12.5 | ||||||||||||||||

Income tax expense (benefit) | 2.2 | 24.6 | (1.6 | ) | (827.8 | ) | 43.2 | |||||||||||||||

Earnings (loss) from continuing operations before cumulative change in accounting principle | 101.7 | (80.4 | ) | (36.8 | ) | (1,548.3 | ) | 74.4 | ||||||||||||||

Per common share – basic (a) | $ | 2.51 | $ | (1.99 | ) | $ | (0.91 | ) | $ | (38.23 | ) | $ | 1.84 | |||||||||

Per common share – diluted (a) | $ | 2.50 | $ | (1.99 | ) | $ | (0.91 | ) | $ | (38.23 | ) | $ | 1.82 | |||||||||

Cumulative effect of a change in accounting principle, net of tax of $2.2 | — | — | — | (593.8 | ) | — | ||||||||||||||||

Earnings (loss) from continuing operations | 101.7 | (80.4 | ) | (36.8 | ) | (2,142.1 | ) | 74.4 | ||||||||||||||

Per common share – basic (a) | $ | 2.51 | $ | (1.99 | ) | $ | (0.91 | ) | $ | (52.89 | ) | $ | 1.84 | |||||||||

Per common share – diluted (a) | $ | 2.50 | $ | (1.99 | ) | $ | (0.91 | ) | $ | (52.89 | ) | $ | 1.82 | |||||||||

Earnings (loss) from discontinued operations | 10.4 | (0.4 | ) | (2.5 | ) | (0.7 | ) | 18.4 | ||||||||||||||

Net earnings (loss) | $ | 112.1 | $ | (80.8 | ) | $ | (39.3 | ) | $ | (2,142.8 | ) | $ | 92.8 | |||||||||

Per common share – basic (a) | $ | 2.77 | $ | (2.00 | ) | $ | (0.97 | ) | $ | (52.91 | ) | $ | 2.29 | |||||||||

Per common share – diluted (a) | $ | 2.75 | $ | (2.00 | ) | $ | (0.97 | ) | $ | (52.91 | ) | $ | 2.27 | |||||||||

Dividends declared per share of common stock | — | — | — | — | — | |||||||||||||||||

| For Year | 2005 | 2004 | 2003 | 2002 | 2001 | |||||||||||||||||

Average number of common shares outstanding (in millions) | 40.5 | 40.5 | 40.5 | 40.5 | 40.5 | |||||||||||||||||

Average number of employees | 14,900 | 15,400 | 15,800 | 16,700 | 16,800 | |||||||||||||||||

Balance sheet data (December 31) | ||||||||||||||||||||||

Working capital | $ | 1,137.9 | $ | 994.1 | $ | 943.3 | $ | 859.3 | $ | 748.0 | ||||||||||||

Total assets | 4,606.0 | 4,609.4 | 4,647.8 | 4,504.8 | 4,038.1 | |||||||||||||||||

Liabilities subject to compromise | 4,864.7 | 4,866.2 | 4,858.5 | 4,861.1 | 2,357.6 | |||||||||||||||||

Net long-term debt (b) | 21.5 | 29.2 | 39.4 | 39.9 | 50.3 | |||||||||||||||||

Shareholders’ equity (deficit) | (1,305.3 | ) | (1,411.7 | ) | (1,330.2 | ) | (1,346.7 | ) | 760.4 | |||||||||||||

Notes:

| (a) | See definition of basic and diluted earnings per share in Note 2 of the Consolidated Financial Statements. |

| (b) | Net long-term debt excludes debt subject to compromise for all periods presented. |

Certain prior year amounts have been reclassified to conform to the current year presentation. See Note 2 of the Consolidated Financial Statements.

19

Table of Contents

| ITEM 7. | MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

Separate financial statements for AHI and AWI and its subsidiaries are included in this document because both have outstanding public securities. The difference between the financial statements of Armstrong Holdings, Inc. and its subsidiaries and AWI and its subsidiaries is primarily due to the formation of Armstrong Holdings, Inc. and to employee compensation-related stock activity. The following discussion and analysis pertains to both AHI and AWI and its subsidiaries. The AHI 2005 income statement (but not the AWI income statement) includes the reversal of a $1.6 million contingent liability which was established when AHI was created. This is the only significant difference in the financial statements.

This discussion should be read in conjunction with the financial statements and the accompanying notes included elsewhere in this Form 10-K. Certain prior year amounts have been reclassified to conform to the current year presentation. This discussion contains forward-looking statements based on our current expectations, which are inherently subject to risks and uncertainties. Actual results and the timing of certain events may differ significantly from those referred to in such forward-looking statements. We undertake no obligation beyond what is required under applicable securities law to publicly update or revise any forward-looking statement to reflect current or future events or circumstances, including those set forth in the section entitled “Uncertainties Affecting Forward-Looking Statements” and elsewhere in this Form 10-K.

References to performance excluding the translation effect of changes in foreign exchange rates are non-GAAP measures. We believe that this information improves the comparability of business performance by excluding the impacts of changes in foreign exchange rates when translating comparable foreign currency amounts. We calculate the translation effect of foreign exchange rates by applying the current year’s foreign exchange rates to the equivalent period’s foreign currency amounts as reported in the prior year. Additionally, we reference operating income prior to goodwill impairment. We believe that this non-GAAP reference provides a clearer picture of our operating performance. Furthermore, management evaluates the performance of the businesses excluding these items.

OVERVIEW

We are a leading global producer of flooring products and ceiling systems for use primarily in the construction and renovation of residential, commercial and institutional buildings. Through our United States (“U.S.”) operations and U.S. and international subsidiaries, we design, manufacture and sell flooring products (resilient, wood, carpeting and sports flooring) and ceiling systems (primarily mineral fiber, fiberglass and metal) around the world. We also design, manufacture and sell kitchen and bathroom cabinets in the U.S. We own and operate 41 manufacturing plants in 12 countries, including 24 plants located throughout the United States. Through WAVE, our joint venture with Worthington Industries, Inc., we also have an interest in 7 additional plants in 5 countries that produce suspension system (grid) products for our ceiling systems.

We report our financial results through the following segments: Resilient Flooring, Wood Flooring, Textiles and Sports Flooring, Building Products, Cabinets and Unallocated Corporate. See “Reportable Segment Results” for additional financial information on our segments.

On December 6, 2000, AWI filed a voluntary petition for relief under Chapter 11 of the U.S. Bankruptcy Code in the United States Bankruptcy Court for the District of Delaware (the “Bankruptcy Court”) in order to use the court-supervised reorganization process to achieve a resolution of its asbestos liability. Also filing under Chapter 11 were two of AWI’s wholly-owned subsidiaries, Nitram Liquidators, Inc. and Desseaux Corporation of North America, Inc. The Chapter 11 cases are being jointly administered under case number 00-4471 (the “Chapter 11 Case”). AWI is operating its business and managing its properties as a debtor-in-possession subject to the provisions of the Bankruptcy Code. See Note 1 of the Consolidated Financial Statements for information on the Chapter 11 Case and Note 30 of the Consolidated Financial Statements for information on asbestos litigation.

20

Table of Contents

Management’s Discussion and Analysis of Financial Condition and Results of Operations

(dollar amounts in millions)

Our consolidated net sales for 2005 were $3.6 billion, approximately 2% greater than consolidated net sales in 2004. Excluding the translation effect of foreign exchange rates, net sales in 2005 increased by approximately 1% from net sales in 2004. Operating income was $100.7 million in 2005, as compared to operating income prior to non-cash goodwill impairment charges of $64.6 million in 2004. (For a reconciliation of non-GAAP measures, see “Results of Operations, 2005 Compared to 2004”.) 2004 operating income also included a $44.8 million fixed asset impairment charge for our European resilient flooring business. Cash and cash equivalents increased by $86.3 million in 2005, which was higher than the cash increase in 2004. In 2005:

| • | Building Products generated record results in a strengthening commercial market. Improved pricing offset significant price increases in raw materials, energy and freight. |

| • | Wood Flooring’s operating performance improved on increased sales, reduced lumber costs and manufacturing efficiencies related to cost reduction initiatives. These benefits were partially offset by lower prices and by fixed asset impairment charges. |

| • | Cabinet’s results deteriorated due to manufacturing inefficiencies related to plant consolidation, and to investments in process improvement initiatives. |

| • | Textiles and Sports Flooring generated a smaller operating loss, primarily due to sales volume increases, improved mix and reduced overhead expenses. |

| • | Resilient Flooring incurred a smaller operating loss, primarily due to significantly lower impairment charges. Operating results were hurt by substantial increases in the costs of petroleum-based raw materials and by significant volume declines in vinyl and laminate flooring. These were only partially offset by improved prices and benefits from cost reduction initiatives. |

Factors Affecting Revenues

For an estimate of our segments’ 2005 net sales by major markets, see “Markets” in Item 1. Business of this Form 10-K.

Markets. We compete in building material markets around the world. The majority of our sales opportunity is in the North American and European markets. During 2005, these markets experienced the following:

| • | In the North American residential market, housing construction remained strong, with approximately 2.07 million housing units started in 2005 compared to approximately 1.95 million in 2004. Housing starts in the fourth quarter of 2005 rose approximately 5% from starts in the fourth quarter of 2004, but were essentially unchanged compared to the third quarter of 2005. Sales of existing homes were also strong in 2005, with approximately 7.1 million homes sold in 2005 compared to approximately 6.8 million in 2004. |

U.S. retail sales of building materials, garden equipment and supply stores (an indicator of home renovation activity) increased approximately 10% in 2005 over sales levels in 2004. This was partially due to strong sales of existing homes during the periods, after allowing for the usual lag for renovation-related expenditures.

For several years, vinyl flooring products, measured as a percent of the total residential flooring market, has been declining, while laminate, ceramic and hardwood flooring products have increased. This trend of changing consumer preferences for flooring also continued in 2005. For 2006, we estimate the residential replacement markets will remain flat and that it is likely that new construction demand will decline from record 2005 levels. A key consideration in changes in market segments is that margins for products sold into new construction tend to be lower than those sold into the renovation segment. Further, we expect the category of vinyl products to

21

Table of Contents

Management’s Discussion and Analysis of Financial Condition and Results of Operations

(dollar amounts in millions)

continue to decline in units sold, while laminate, ceramic and hardwood flooring should continue to increase.

| • | The North American commercial market strengthened overall in 2005, with renovation increasing in the office and education segments, and construction completions in the office, healthcare, retail and education segments increasing by approximately 2%, 10%, 9% and 9%, respectively. Industry statistics indicate that commercial starts could marginally improve in 2006, with improvements anticipated in office, education and health care, while the retail segment will decline slightly. Indications are for a further decline in office vacancy rates, which could also positively impact the renovation segment of this market. |

Strong global demand for steel contributed to increased raw material costs for our WAVE joint venture, which were offset by price increases. However, an extended steel shortage could cause U.S. construction starts to be delayed or postponed, which could reduce our commercial sales.

| • | In Europe, we experienced soft market conditions in the Western European countries. In 2006, we anticipate nominal growth in the Western European markets, but expect strong growth in Eastern European markets, where lower margin and lower cost products constitute a growing portion of our sales. |

| • | In the Pacific Rim, we experienced slower demand in China, but continued strong demand in other regions, particularly India. We expect incremental growth in 2006. |

Quality and Customer Service. Our quality and customer service are critical components of our total value proposition. In 2005, we experienced the following:

| • | Hurricane Katrina significantly damaged our Building Products location in Mobile, Alabama. Production was suspended at Mobile for approximately two weeks. Lead times for customer orders were extended for a short period of time and other Building Products plants were utilized to service the market. In general, these actions resulted in minimal customer service issues in our U.S. markets. |

| • | Order fulfillment for the Cabinets business deteriorated when, following the closure of the Morristown plant, the remaining two plants were unable to produce to demand. The majority of these issues were resolved in the fourth quarter of 2005. |

Pricing Initiatives. During 2005 and 2004, we modified prices in response to changes in costs for raw materials and energy and to market conditions and the competitive environment. The net impact of these pricing initiatives improved sales in 2005 compared to 2004.

The most significant of these pricing actions were:

| • | In Resilient Flooring, we increased prices for selected U.S. products several times in 2004 and announced price increases effective in the fourth quarter of 2005. We also made price concessions for certain products and geographical regions to respond to competitive conditions. |

| • | In Wood Flooring, price changes were implemented to reflect raw material cost changes and in response to competitive conditions. For example, in 2004, selling prices were increased on solid wood products in response to increased lumber costs. In 2005, we decreased prices on solid wood products in response to declining lumber prices and competitive conditions. |

| • | In Building Products, we implemented several price increases during 2004 and 2005 and announced price increases effective in the fourth quarter of 2005 in reaction to inflationary cost pressures. |

22

Table of Contents

Management’s Discussion and Analysis of Financial Condition and Results of Operations

(dollar amounts in millions)

| • | In Cabinets, we increased prices effective in June 2004 and in the first quarter of 2005. |

We estimate that the various pricing actions provided a net increase to our total consolidated net sales in 2005 compared to 2004 of approximately $38 million.

Impact From Major Customers’ Decisions. Lowe’s Companies, Inc. (“Lowe’s”), one of our largest customers, increased its purchasing of laminate flooring products from other suppliers in the second quarter of 2004. Further, Lowe’s advised us in 2004 that they would reduce the number of laminate flooring products they purchase from us starting in the first quarter of 2005. Our total laminate flooring sales declined approximately 20% in 2005, compared to 2004, primarily as a result of these actions. We currently estimate that the Lowe’s decision will incrementally reduce 2006 sales by approximately $30 million.

Certain national retailers dedicated less of their selling space to vinyl flooring products as customer demand for these products declined. This action contributed to the sales volume decline experienced in our Resilient Flooring Americas business.

Factors Affecting Operating Costs

Operating Expenses. Our operating expenses consist of direct production costs (principally raw materials, labor and energy) and manufacturing overhead costs, costs to purchase sourced products and selling, general and administrative (“SG&A”) expenses.

Our largest individual raw material expenditures are for lumber and veneers, PVC resins, backings for various flooring products and plasticizers. Fluctuations in the prices of these raw materials are generally beyond our control and have a direct impact on our financial results. In 2005, we experienced the following:

| • | PVC is a widely used, oil-based raw material. We experience cost pressures on PVC when energy prices increase and when industrial demand for the material increases. In January 2005, a U.S. supplier ceased producing PVC resins. While we have been able to address our PVC needs from other suppliers, the reduced manufacturing capacity led to upward pricing pressure. During 2005, this pressure increased as hurricanes that affected the Gulf Coast of the U.S., and an October fire at a manufacturing facility of one of our PVC resin suppliers, reduced PVC production. Cost to acquire PVC resin and plasticizers prices increased by approximately $40 million in 2005 compared to 2004. In 2006, we expect further year-on-year increases. |

| • | Prices for hardwood lumber decreased in 2005. Our cost for acquiring lumber in 2005 was approximately $56 million lower than in 2004. The reduction in our lumber cost was partially due to reduced purchases of more expensive pre-dried lumber due to improved efficiencies in our lumber yards. In 2006 we expect lumber prices to increase slightly from 2005 levels. |

We incurred approximately $14 million of additional costs for natural gas in 2005 compared to 2004 due to price increases. In 2006, we expect further year-on-year increases due to pricing pressures.

In our normal course of business, we transfer certain products between locations to take advantage of our production capabilities and to better service our customers’ needs. During 2005, we incurred approximately $17 million of additional freight costs, due to rising fuel costs and additional logistics measures taken to maintain customer service levels.

23

Table of Contents

Management’s Discussion and Analysis of Financial Condition and Results of Operations

(dollar amounts in millions)

Cost Reduction Initiatives. During 2004, we implemented several manufacturing and organizational changes to improve our cost structure and enhance our competitive position. We did not initiate any additional manufacturing or organizational changes in 2005 but did incur costs in 2005 related to previously announced cost reduction initiatives and for changes to the U.S. defined benefit pension plan. The major 2004 initiatives were:

| • | We ceased production of certain products at our Resilient Flooring manufacturing plant in Lancaster, Pennsylvania, transferring production to other Resilient Flooring plants. |

| • | We announced that we would cease production at our Building Products plant in The Netherlands. Acceptance of the closure proposal was received from the local works council in the fourth quarter of 2004. The plant ceased production in the first quarter of 2005, and production was transferred to another Building Products location. |

| • | We ceased production at our Cabinets manufacturing plant in Morristown, Tennessee, transferring production to other Cabinets plants. |

| • | We restructured the sales force and management structure in our North America flooring organization. |

| • | We announced that we would cease production at our Wood Flooring manufacturing plant in Searcy, Arkansas. Production ended in the first quarter of 2005, and was transferred to other Wood Flooring plants. We recorded an impairment charge related to this closure. |

We incurred the following net expenses in 2005 due to implementing these cost reduction initiatives:

| Cost of Goods Sold | Restructuring Charges | Total Expenses | |||||||

Resilient Flooring | $ | 12.7 | $ | 16.2 | $ | 28.9 | |||

Wood Flooring | 13.9 | 0.1 | 14.0 | ||||||

Textiles & Sports Flooring | — | 0.2 | 0.2 | ||||||

Building Products | 1.6 | 6.3 | 7.9 | ||||||

Cabinets | 1.2 | 0.4 | 1.6 | ||||||

Corporate Unallocated | — | — | — | ||||||

Total Consolidated | $ | 29.4 | $ | 23.2 | $ | 52.6 | |||

Cost of goods sold includes $14.3 million of fixed asset impairments, $7.1 million of accelerated depreciation and $8.0 million of other related costs in 2005.

During 2004, we recorded the following amounts related to both the above mentioned cost reduction initiatives, and to the following:

| • | We recorded an additional asset impairment charge on one of our Wood Flooring plants that was closed in 2003. |

24

Table of Contents

Management’s Discussion and Analysis of Financial Condition and Results of Operations

(dollar amounts in millions)

We incurred the following expenses in 2004 due to implementing these cost reduction initiatives:

| Cost of Goods Sold | Restructuring Charges | Total Expenses | |||||||

Resilient Flooring | $ | 28.1 | $ | 4.1 | $ | 32.2 | |||

Wood Flooring | 0.8 | 2.0 | 2.8 | ||||||

Textiles & Sports Flooring | 0.1 | 0.4 | 0.5 | ||||||

Building Products | 2.5 | 10.9 | 13.4 | ||||||

Cabinets | 1.9 | 0.4 | 2.3 | ||||||

Corporate Unallocated | — | 0.5 | 0.5 | ||||||

Total Consolidated | $ | 33.4 | $ | 18.3 | $ | 51.7 | |||

Cost of goods sold includes $18.9 million of fixed asset impairments, $13.2 million of accelerated depreciation and $1.3 million of other related costs.

We recorded gains within SG&A in 2004 of $2.9 million in Wood Flooring and TSF related to sales of buildings that had previously been reserved as part of cost reduction initiatives.

See Note 13 of the Consolidated Financial Statements for more information on restructuring charges.

We expect to incur additional expenses of approximately $32 million in 2006 to implement the 2004 cost reduction initiatives. In addition, we expect to realize a gain of approximately $15 million in the first half of 2006 from the sale of a warehouse which became available as a result of one of these initiatives. Once completely implemented, we believe that the annual cost savings from our 2004 initiatives will be approximately $58 million, when compared to the 2004 cost baseline. These projected savings will not be fully realized until 2007. We will continue to evaluate additional cost reduction actions in 2006.

Employee Benefits. We recorded a pre-tax charge of $16.9 million in the fourth quarter of 2005 in cost of goods sold ($11.4 million) and SG&A ($5.5 million), related to changes made to the U.S. defined benefit pension plan. The changes are considered a curtailment under SFAS No. 88 “Employers’ Accounting for Settlements and Curtailments of Defined Benefit Pension Plans and for Termination Benefits”. The changes are expected to reduce Armstrong’s retirement-related expenses by approximately $13 million in 2006 and $15 million in 2007, based on pension assumptions for 2006.

Non-cash Impairment Charges. 2004 included a $108.4 million charge for goodwill impairment and a $44.8 million charge for fixed asset impairment, both related to the European resilient flooring business.

Factors Affecting Cash Flow

Historically, excluding the cash demands for asbestos-related claims in 2000 and prior years, we typically generate positive cash flow from our operating activities. The amount of cash generated in any one period is dependent on a number of factors, including the amount of operating profit generated and the amount of working capital (such as inventory, receivables and payables) required to operate our businesses. We typically invest in property, plant & equipment (“PP&E”) and computer software.

During 2005, our cash and cash equivalents balance increased by $86.3 million, which was $54.7 million more than during 2004. The increase, compared to 2004, was primarily due to proceeds received from the sale of some notes receivable for $38.3 million and the proceeds from the sale of an equity affiliate for $20.6 million.

Employees

As of December 31, 2005, we had approximately 14,900 full-time and part-time employees worldwide. This compares to approximately 15,500 employees as of December 31, 2004. The decline largely reflects headcount reductions associated with cost reduction initiatives in Resilient Flooring.

25

Table of Contents

Management’s Discussion and Analysis of Financial Condition and Results of Operations

(dollar amounts in millions)

During 2005, we negotiated six collective bargaining agreements, with no locations experiencing a work stoppage. Throughout 2006, collective bargaining agreements covering certain employees at six plants will expire. As of the date of this filing, no employees are working under an expired contract.

Late in September 2004, our Hoogezand, The Netherlands plant (see “Cost Reduction Initiatives” and Note 13 of the Consolidated Financial Statements) experienced a 14 day work stoppage unrelated to a collective bargaining agreement, which delayed shipments of certain products. This work stoppage did not have a material impact on operations.

CRITICAL ACCOUNTING ESTIMATES

Many accounting entries require us to make estimates. These entries include asbestos-related liability and insurance assets, allowances for bad debts, inventory obsolescence and lower of cost or market charges, warranty, workers compensation, pension obligations, asset impairments, restructuring reserves, tax valuation allowances, general liability and environmental claims. When preparing an entry that requires an estimate to be made, we determine what factors are most likely to affect the estimate. We gather information relevant to these factors from inside and outside the company. This information is evaluated and an estimate is made.

The following are the critical accounting estimates that management believes could have a significant impact to the financial statements if the estimates and judgments used by management turn out to be incorrect. Management has discussed the application of these critical accounting estimates with our Audit Committee.

Asbestos-related Estimates– We record contingent liabilities, including asbestos-related liabilities, when a loss is probable and the amount of loss can be reasonably estimated. Prior to its Chapter 11 Filing, AWI estimated its probable asbestos-related personal injury liability based upon a variety of factors including historical settlement amounts, the incidence of past claims, the mix of the injuries and occupations of the plaintiffs, the number of cases pending against it and the status and results of broad-based settlement discussions. As of September 30, 2000, AWI had recorded a liability of $758.8 million for its asbestos-related personal injury liability that it determined was probable and estimable through 2006. Due to the increased uncertainty created as a result of the Filing, the only change made to the previously recorded liability through the third quarter of 2002 was to record October and November 2000 payments of $68.2 million against the accrual. The asbestos-related personal injury liability balance recorded at December 31, 2001 was $690.6 million, which was recorded in liabilities subject to compromise.

AWI filed an initial POR and disclosure statement with respect to the POR during the fourth quarter of 2002. In March 2003, AWI filed an amended POR and disclosure statement. Based upon the foregoing, the discussions AWI had with the different creditors’ committees and the hearings held before the Bankruptcy Court, management believed that it was reasonably likely that the asbestos-related personal injury liability would be satisfied substantially in the manner set forth in the POR. As a result, AWI concluded that it could reasonably estimate its probable liability for current and future asbestos-related personal injury claims. Accordingly, in the fourth quarter of 2002, AWI recorded a $2.5 billion charge to increase the liability in accordance with AICPA Statement of Position 90-7, “Financial Reporting by Entities in Reorganization under the Bankruptcy Code” (“SOP 90-7”). The recorded asbestos-related liability for personal injury claims of approximately $3.2 billion at December 31, 2005 and 2004, which was treated as a liability subject to compromise, represents the estimated amount of liability that is implied based upon the negotiated resolution reflected in the POR, the total consideration expected to be paid to the Asbestos PI Trust pursuant to the POR and a recovery value percentage for the allowed claims of the Asbestos PI Trust that is equal to the estimated recovery value percentage for the allowed non-asbestos unsecured claims. See “Asbestos-Related Litigation” in Note 30 of the Consolidated Financial Statements for further discussion on the Asbestos PI Trust and the treatment of asbestos-related claims under the POR.

26

Table of Contents

Management’s Discussion and Analysis of Financial Condition and Results of Operations

(dollar amounts in millions)

In February of 2005, the U.S. District Court denied confirmation of the POR in its current form. On December 29, 2005, the U.S. Court of Appeals affirmed the District Court’s decision to deny confirmation of the POR. AWI filed a modified POR with the Court on February 21, 2006. AWI is also monitoring a proposed asbestos claims litigation reform bill in Congress. AWI is unable to predict when and if the modified POR will be confirmed and, if confirmed, when the POR will be implemented. See “Recent Developments and Next Steps in the Chapter 11 Process” in Note 1 of the Consolidated Financial Statements. Therefore, the timing and terms of resolution of the Chapter 11 Case remain uncertain. As long as this uncertainty exists, future changes to the recorded asbestos-related personal injury liability are possible and could be material to AWI’s financial position and the results of its operations. Management will continue to review the recorded liability in light of future developments in the Chapter 11 Case and make changes to the recorded liability if and when it is appropriate.

Additionally, AWI has a recorded asset of $98.6 million as of December 31, 2005 representing estimated insurance recoveries related to its asbestos liability. Approximately $79 million of the recorded asset is determined from agreed coverage in place. During the second quarter of 2003, AWI reduced its previously recorded insurance asset for asbestos-related personal injury claims by $73 million reflecting management’s assessment of probable insurance recoveries in light of an unfavorable ruling in an alternative dispute resolution procedure. See “Asbestos-Related Litigation” in Note 30 of the Consolidated Financial Statements for further discussion.

The total amount of the estimated insurance recoveries asset recorded reflects the belief in the availability of insurance in this amount, based upon prior success in insurance recoveries, settlement agreements that provide such coverage, the nonproducts recoveries by other companies and the opinion of outside counsel. In our opinion, such insurance is either available through settlement or probable of recovery through negotiation or litigation. Although AWI revised its recorded asbestos liability by $2.5 billion in the fourth quarter of 2002, no increase has been recorded in the estimated insurance recovery asset. While we believe that the process of pursuing disputed insurance coverage may result in additional settlement amounts beyond those recorded, there has been no increase in the recorded amounts due to the uncertainties remaining in the process. The estimate of probable recoveries may be revised depending on the developments in the matters discussed above as well as events that occur in AWI’s Chapter 11 Case.

U.S. Pension Credit and Postretirement Benefit Costs – We maintain pension and postretirement plans throughout the world, with the most significant plans located in the U.S. The U.S. defined benefit pension plans were closed to new salaried and salaried production employees on January 1, 2005. On January 13, 2006 we announced that benefits will be frozen for certain non-production salaried employees effective February 28, 2006. Our defined benefit pension and postretirement benefit costs are developed from actuarial valuations. These valuations are calculated using a number of assumptions, which are determined in accordance with generally accepted accounting principles (“GAAP”). Each assumption represents management’s best estimate of the future. The assumptions that have the most significant impact on reported results are the discount rate, the estimated long-term return on plan assets and the estimated inflation in health care costs. These assumptions are updated annually at the beginning of the year and applied in the valuations recorded for that year.