Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

[X] ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2007

OR

[ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to

ARMSTRONG WORLD INDUSTRIES, INC.

(Exact name of registrant as specified in its charter)

| Pennsylvania | 1-2116 | 23-0366390 | ||

(State or other jurisdiction of incorporation or organization) | Commission file number | (I.R.S. Employer Identification No.) |

| P. O. Box 3001, Lancaster, Pennsylvania | 17604 | |

| (Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code (717) 397-0611

Securities registered pursuant to Section 12(b) of the Act: None

Securities registered pursuant to Section 12(g) of the Act:

Title of each class

Common Stock ($0.01 par value)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes x No¨

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Yes ¨ Nox

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months, and (2) has been subject to such filing requirements for the past 90 days.

Yes x No¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. [ ]

Table of Contents

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer (as defined in Rule 12b-2 of the Act).

Large accelerated filer x Accelerated filer¨ Non-accelerated filer ¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act).

Yes ¨ Nox

Indicate by check mark whether the registrant has filed all documents and reports required to be filed by Section 12, 13 or 15(d) of the Securities Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court.

Yes x No¨

The aggregate market value of the Common Stock of Armstrong World Industries, Inc. held by non-affiliates based on the closing price ($50.15 per share) on the New York Stock Exchange (trading symbol AWI) on June 30, 2007, was approximately $975 million. As of February 21, 2007, the number of shares outstanding of registrant’s Common Stock was 56,870,880.

Documents Incorporated by Reference

None

2

Table of Contents

3

Table of Contents

Uncertainties Affecting Forward-Looking Statements

Our disclosures here and in other public documents and comments contain forward-looking statements within the meaning of the Private Securities Litigation Reform Act. Those statements provide our future expectations or forecasts, and can be identified by our use of words such as “anticipate,” “estimate,” “expect,” “project,” “intend,” “plan,” “believe,” “outlook,” etc. in discussions of future operating or financial performance, the outcome of contingencies such as liabilities or legal proceedings, or our ability to pay any dividends or take any particular corporate action.

Any of our forward-looking statements may turn out to be wrong. Our actual future results, or our ability to pay any dividend or take any particular corporate action, may differ materially. Forward-looking statements involve risks and uncertainties because they relate to events and depend on circumstances that may or may not occur in the future. We undertake no obligation to update any forward-looking statement.

You should take into account risks and uncertainties that affect our business, operations and financial condition in evaluating any investment decision involving Armstrong. It is not possible to predict all factors that could cause actual results to differ materially from expected and historical results. The discussion in the “Risk Factors” section below at Item 1A is a summary of what we currently believe to be our most significant risk factors. Related disclosures in subsequent 10-K, 10-Q and 8-K reports should also be consulted.

4

Table of Contents

Armstrong World Industries, Inc. (“AWI” or “the Company”) is a Pennsylvania corporation incorporated in 1891. We are a leading global producer of flooring products and ceiling systems for use primarily in the construction and renovation of commercial, institutional and residential buildings. Through our United States (“U.S.”) operations and U.S. and international subsidiaries, we design, manufacture and sell flooring products (primarily resilient and wood flooring) and ceiling systems (primarily mineral fiber, fiberglass and metal) around the world. We also design, manufacture and sell kitchen and bathroom cabinets in the U.S.

Our business strategy focuses on providing value to customers through product innovation, product quality and customer service. In our businesses, these factors are the primary determinants of market share gain or loss. Our objective is to ensure that anyone buying a hard surface floor or ceiling can find an Armstrong product that meets his or her needs. Our cabinet strategy is more focused – on stock cabinets in select geographic markets. In these segments, we have the same objectives: high quality, good customer service and products that meet our customers’ needs. Our markets are very competitive, which limits our pricing flexibility. This requires that we increase our productivity each year – both in our plants and in our administration of the businesses.

We maintain a website at http://www.armstrong.com. Information contained on our website is not incorporated into this document. Annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, all amendments to those reports and other information about us are available free of charge through this website as soon as reasonably practicable after the reports are electronically filed with the Securities and Exchange Commission (“SEC”). These materials are also available from the SEC’s website at www.sec.gov.

On December 6, 2000, AWI filed a voluntary petition for relief under Chapter 11 of the U.S. Bankruptcy Code in order to use the court-supervised reorganization process to achieve a resolution of AWI’s asbestos-related liability. On October 2, 2006, AWI’s plan of reorganization (the “POR”), as confirmed by the U.S. District Court for the District of Delaware by order dated August 18, 2006, became effective, and AWI emerged from Chapter 11. See Note 1 to the Consolidated Financial Statements for additional information about AWI’s Chapter 11 case.

In connection with its emergence from bankruptcy on October 2, 2006 (the “Effective Date”), AWI adopted fresh-start reporting in accordance with AICPA Statement of Position 90-7, “Financial Reporting by Entities in Reorganization under the Bankruptcy Code” (“SOP 90-7”). Adopting fresh-start reporting has resulted in material adjustments to the historical carrying amount of reorganized Armstrong’s assets and liabilities. See Note 3 to the Consolidated Financial Statements for more information. As a result, our post-emergence financial statements are not comparable to our pre-emergence financial statements. Despite the lack of comparability, we have combined the 2006 results of the Predecessor Company (which represent the first nine months of 2006 and include the impact of emergence) with the results of the Successor Company (which represent the last three months of 2006) to facilitate the year-to-year discussion of operating results in certain sections of this Form 10-K. The combined financial information for 2006 is merely cumulative and does not give pro forma effect to the Predecessor’s results as if the consummation of the POR and the related fresh-start reporting and other adjustments had occurred at the beginning of the period presented. Combining pre-emergence and post-emergence results is not in accordance with U.S. generally accepted accounting principles (“GAAP”).

5

Table of Contents

Reportable Segments

Resilient Flooring — produces and sources a broad range of floor coverings primarily for homes and commercial and institutional buildings. Manufactured products in this segment include vinyl sheet, vinyl tile, linoleum flooring, automotive carpeting and other specialized textile floor products. In addition, our Resilient Flooring segment sources and sells laminate flooring products, ceramic tile products, adhesives, installation and maintenance materials and accessories. Resilient Flooring products are offered in a wide variety of types, designs and colors. We sell these products to wholesalers, large home centers, retailers, contractors and to the manufactured homes industry.

Wood Flooring — produces and sources wood flooring products for use in new residential construction and renovation, with some commercial applications in stores, restaurants and high-end offices. The product offering includes pre-finished solid and engineered wood floors in various wood species, and related accessories. Virtually all of our Wood Flooring’s sales are in North America. Our Wood Flooring products are generally sold to independent wholesale flooring distributors and large home centers. Our products are principally sold under the brand names Bruce®, Hartco®, Robbins®, Timberland®, Armstrong™, HomerWood® and Capella®.

Building Products — produces suspended mineral fiber, soft fiber and metal ceiling systems for use in commercial, institutional and residential settings. In addition, our Building Products segment sources complementary ceiling products. Our products are available in numerous colors, performance characteristics and designs, and offer attributes such as acoustical control, rated fire protection and aesthetic appeal. Commercial ceiling materials and accessories are sold to ceiling systems contractors and to resale distributors. Residential ceiling products are sold primarily in North America to wholesalers and retailers (including large home centers). Suspension system (grid) products manufactured by WAVE are sold by both Armstrong and our WAVE joint venture.

Cabinets — produces kitchen and bathroom cabinetry and related products, which are used primarily in the U.S. residential new construction and renovation markets. Through our system of Company-owned and independent distribution centers and through direct sales to builders, our Cabinets segment provides design, fabrication and installation services to single and multi-family homebuilders, remodelers and consumers under the brand names Armstrong® and Bruce®.

Unallocated Corporate - includes assets and expenses that have not been allocated to the business units. Unallocated Corporate assets are primarily deferred income tax assets, cash and cash equivalents, the Armstrong brand name and the U.S. prepaid pension cost. Expenses for our corporate departments and certain benefit plans are allocated to the reportable segments based on known metrics, such as time reporting, headcount, square-footage or net sales. The remaining expenses, which cannot be attributable to the reportable segments without a high degree of generalization, are reported in Unallocated Corporate.

6

Table of Contents

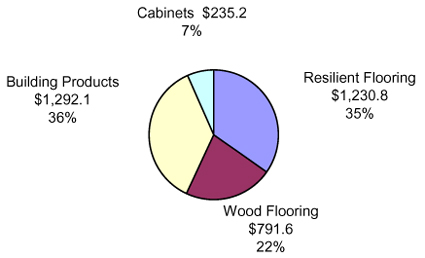

The following chart illustrates the breakdown of our consolidated net sales for the year ended December 31, 2007 by segment:

2007 Consolidated Net Sales by Segment

(in millions)

See Note 4 to the Consolidated Financial Statements and Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations of this Form 10-K for additional financial information on our reportable segments.

Markets

The major markets in which we compete are:

North American Residential.Approximately 45% of our total consolidated net sales are for North American residential use. Our Resilient Flooring, Wood Flooring, Building Products and Cabinets segments sell products for use in the home. Homeowners have a multitude of finishing solution options for every room in their house. For flooring, they can choose from our vinyl and wood products, for which we are North America’s largest provider, or from our laminate and ceramic products. We compete directly with other domestic and international suppliers of these products. Our flooring products also compete with carpet, which we do not offer. Our ceiling products compete against mineral fiber and fiberglass products from other manufacturers, as well as drywall. In the kitchen and bath areas, we compete with thousands of other cabinet manufacturers that include large diversified corporations as well as small local craftsmen.

Our products are used in new home construction and existing home renovation work. Industry estimates are that existing home renovation (also known as replacement / remodel) work represents approximately two-thirds of the total North American residential market opportunity. Key U.S. statistics that indicate market opportunity include existing home sales (a key indicator for renovation opportunity), housing starts, housing completions, interest rates and consumer confidence. For our Resilient Flooring and Wood Flooring products, we believe there is some longer-term correlation between these statistics and our revenue, after reflecting a lag period between change in construction activity and our operating results of several months. However, we believe that consumers’ preferences for product type, style, color, availability and affordability also significantly impact our revenue. Further, changes in inventory levels

7

Table of Contents

and product focus at national home centers, which are our largest customers, can also significantly impact our revenue. Sales of our ceiling products for residential use appear to follow the trend of existing home sales, with a several month lag period between change in existing home sales and our related operating results.

North American Commercial. Approximately 30% of our total consolidated net sales are for North American commercial use. Many of our products, primarily ceilings and Resilient Flooring, are used in commercial and institutional buildings. Our revenue opportunities come from new construction as well as renovation of existing buildings. Renovation work is estimated to represent approximately three-fourths of the total North American commercial market opportunity. Most of our revenue comes from four major segments of commercial building – office, education, retail and healthcare. We monitor U.S. construction starts (an indicator of U.S. monthly construction activity that provides us a reasonable indication of upcoming opportunity) and follow new projects. We have found that our revenue from new construction can lag behind construction starts by as much as one year. We also monitor office vacancy rates, GDP and general employment levels, which can indicate movement in renovation and new construction opportunities. We believe that these statistics, taking into account the time-lag effect, provide a reasonable indication of our future revenue opportunity from commercial renovation and new construction.

Outside of North America. The geographies outside of North America account for about one-fourth of our total consolidated net sales. Most of our revenues generated outside of North America are in Europe and are commercial in nature. For the countries in which we have significant revenue, we monitor various national statistics (such as GDP) as well as known new projects. Revenues come primarily from new construction and renovation work.

The following table provides an estimate of our segments’ 2007 net sales, by major markets.

(Estimated percentages of individual segment’s sales) | North American Residential | North American Commercial | Outside of North America | Total | ||||

Resilient Flooring | 35% | 30% | 35% | 100% | ||||

Wood Flooring | 95% | 5% | - | 100% | ||||

Building Products | 10% | 50% | 40% | 100% | ||||

Cabinets | 100% | - | - | 100% |

8

Table of Contents

Geographic Areas

We sell our products in more than 80 countries. Approximately 74% of our 2007 revenue was derived from sales in the Americas, the vast majority of which came in the United States and Canada. The following chart illustrates the breakdown of our consolidated net sales for the year ended December 31, 2007 by region, based on where the sale was made:

2007 Consolidated Net Sales by Geography

(in millions)

See Note 4 to the Consolidated Financial Statements and Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations of this Form 10-K for financial information by geographic areas.

Customers

We use our reputation, capabilities, service and brand recognition to develop long-standing relationships with our customers. We principally sell products through building materials distributors, who re-sell our products to retailers, builders, contractors, installers and others. In the commercial sector, we also sell to several contractors and to subcontractors’ alliances. In the North American retail channel, which sells to end-users in the residential and light commercial segments, we have important relationships with national home centers such as The Home Depot, Inc. and Lowe’s Companies, Inc. In the North American residential sector, we have important relationships with major homebuilders and buying groups.

9

Table of Contents

The following charts illustrate the estimated breakdown of our 2007 consolidated net sales geographically by distribution channel:

Net sales to The Home Depot, Inc. were $364.1 million in 2006 and $384.1 million in 2005, which was in excess of 10% of our consolidated net sales for those years. Net sales to The Home Depot were less than 10% of consolidated net sales in 2007. Net sales to The Home Depot were recorded in our Resilient Flooring, Wood Flooring and Building Products segments. No other customers accounted for 10% or more of our total consolidated net sales.

Product Array and Impact on Performance

Each of our businesses offers a wide assortment of products that are differentiated by style/design and by performance attributes. Pricing for products within the assortment vary according to the level of value they provide. Changes in the relative quantity of products purchased at the different value points can impact year-to-year comparisons of net sales and operating income. Where significant, we discuss the impact of these relative changes as “product mix,” “customer mix” or “geographic mix” in Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations of this Form 10-K.

10

Table of Contents

Competition

There is strong competition in all of our businesses. Principal methods of competition include product performance, product styling, service and price. Competition in North America comes from both domestic and international manufacturers. Additionally, some of our products compete with alternative products or finishing solutions. Our resilient, laminate and wood flooring products compete with carpet products, and our ceiling products compete with drywall and exposed structure (also known as open plenum). There is excess industry capacity for certain products in some geographies, which tends to increase price competition. The following companies are our primary competitors:

Flooring segments – Amtico International, Inc., Balta Industries, N.V., Beaulieu International Group, N.V., Congoleum Corporation, Faus, Inc., Forbo Holding AG, Gerflor Group, Interface, Inc., Krono Holding AG, Mannington Mills, Inc., Mohawk Industries, Inc., Pfleiderer AG, Shaw Industries, Inc., Tarkett AG and Wilsonart International.

Building Products – CertainTeed, Chicago Metallic Corporation, Georgia-Pacific Corporation, Knauf AMF GmbH & Co. KG, Lafarge SA, Odenwald Faserplattenwerk GmbH, Rockfon A/S, Saint-Gobain and USG Corporation.

Cabinets – American Woodmark Corporation, Fortune Brands, Inc. and Masco Corporation.

Raw Materials

Raw materials essential to our businesses are purchased worldwide in the ordinary course of business from numerous suppliers. The principal raw materials used in each business include the following:

| Business | Principal Raw Materials | |||

| Resilient Flooring | Polyvinylchloride (“PVC”) resins and films, plasticizers, backings, limestone, pigments, linseed oil, inks and stabilizers | |||

| Wood Flooring | Hardwood lumber, veneer, coatings and stains | |||

| Building Products | Mineral fibers, perlite, waste paper, clays, starches and steel used in the production of metal ceilings and for our joint venture’s manufacturing of ceiling grids | |||

| Cabinets | Lumber, veneer, plywood, particleboard, fiberboard and components, such as doors and hardware | |||

We also purchase significant amounts of packaging materials and consume substantial amounts of energy, such as electricity and natural gas, and water.

In general, adequate supplies of raw materials are available to all of our businesses. However, availability can change for a number of reasons, including environmental conditions, laws and regulations, shifts in demand by other industries competing for the same materials, transportation disruptions and/or business decisions made by, or events that affect, our suppliers. There is no assurance that a significant shortage of raw materials will not occur.

Prices for certain high usage raw materials can fluctuate dramatically. Cost increases for these materials can have a significant adverse impact on our manufacturing costs. Given the competitiveness of our markets, we may not be able to recover the increased manufacturing costs through increasing selling prices to our customers.

11

Table of Contents

Sourced Products

Some of the products that we sell are sourced from third parties. The primary sourced products include laminate, wood flooring, vinyl sheet and tile and ceramic products, specialized ceiling products, and installation-related products and accessories for some of our manufactured products. We purchase some of our sourced products from suppliers that are located outside of the U.S, primarily from Asia and Europe. Sales of sourced products represented approximately 10% to 15% of our total consolidated revenue in 2007, 2006 and 2005.

In general, we believe we have adequate supplies of sourced products. However, we cannot guarantee that a significant shortage will not occur.

Hedging

We use financial instruments to hedge the following exposures: sourced product purchases denominated in foreign currency, cross-currency intercompany loans and energy. We use derivative financial instruments as risk management tools and not for speculative trading purposes. See Item 7A. Quantitative and Qualitative Disclosures About Market Risk and Note 20 to the Consolidated Financial Statements of this Form 10-K for more information.

Patent and Intellectual Property Rights

Patent protection is important to our business in the U.S. and other markets. Our competitive position has been enhanced by U.S. and foreign patents on products and processes developed or perfected within Armstrong or obtained through acquisitions and licenses. In addition, we benefit from our trade secrets for certain products and processes.

Patent protection extends for varying periods according to the date of patent filing or grant and the legal term of a patent in the various countries where patent protection is obtained. The actual protection afforded by a patent, which can vary from country to country, depends upon the type of patent, the scope of its coverage, and the availability of legal remedies. Although we consider that, in the aggregate, our patents, licenses and trade secrets constitute a valuable asset of material importance to our business, we do not regard any of our businesses as being materially dependent upon any single patent or trade secret, or any group of related patents or trade secrets.

Certain of our trademarks, including without limitation, house marks , Armstrong™, Bruce®, Hartco®, Robbins®, Timberland®, Capella®, HomerWood® and DLW™, and product line marks Allwood™, Arteffects®, Axiom®, Cirrus®, Corlon®, Cortega®, Designer Solarian®, Dune™, Excelon®, Fundamentals® , Infusions®, Medintech®, Natural Creations®, Natural Inspirations®, Nature’s Gallery®, Optima®, Rhinofloor®, Sahara™, Scala®, Second Look®, Solarian®, SoundScapes®, ToughGuard® and Ultima® are important to our business because of their significant brand name recognition. Trademark protection continues in some countries as long as the mark is used, and continues in other countries as long as the mark is registered. Registrations are generally for fixed, but renewable, terms.

, Armstrong™, Bruce®, Hartco®, Robbins®, Timberland®, Capella®, HomerWood® and DLW™, and product line marks Allwood™, Arteffects®, Axiom®, Cirrus®, Corlon®, Cortega®, Designer Solarian®, Dune™, Excelon®, Fundamentals® , Infusions®, Medintech®, Natural Creations®, Natural Inspirations®, Nature’s Gallery®, Optima®, Rhinofloor®, Sahara™, Scala®, Second Look®, Solarian®, SoundScapes®, ToughGuard® and Ultima® are important to our business because of their significant brand name recognition. Trademark protection continues in some countries as long as the mark is used, and continues in other countries as long as the mark is registered. Registrations are generally for fixed, but renewable, terms.

Employees

As of December 31, 2007, we had approximately 12,900 full-time and part-time employees worldwide, with approximately 9,300 employees located in the United States. Approximately 8,600 of the 12,900 are production and maintenance employees, of whom approximately 6,600 are located in the U.S. Approximately 67% of the production and maintenance employees in the U.S. are represented by labor unions. This percentage includes all production and maintenance employees at our plants and warehouses where labor unions exist. Outside the U.S., most of our production employees are covered by either industry-sponsored and/or state-sponsored collective bargaining mechanisms.

Research & Development

Research and development (“R&D”) activities are important and necessary in helping us improve our products’ competitiveness. Principal R&D functions include the development and improvement of products and manufacturing processes. We spent $43.8 million in 2007, $43.8 million in 2006 and $42.4 million in 2005 on R&D activities worldwide.

12

Table of Contents

Environmental Matters

Most of our manufacturing and certain of our research facilities are affected by various federal, state and local environmental requirements relating to the discharge of materials or the protection of the environment. We make expenditures necessary for compliance with applicable environmental requirements at each of our operating facilities.

We are actively involved in proceedings under the Comprehensive Environmental Response, Compensation and Liability Act (“CERCLA”), and similar state “Superfund” laws at four off-site locations. We have also been investigating and/or remediating environmental contamination allegedly resulting from past industrial activity at five domestic and five international current or former plant sites. Certain of AWI’s environmental liabilities were discharged through its Chapter 11 Case while others were not. Those environmental obligations that AWI has with respect to property that it owns or operates or for which a non-debtor subsidiary is liable were unaffected by the Chapter 11 Case. Therefore, AWI and its subsidiaries are required to continue meeting their ongoing environmental compliance obligations at such properties.

Liabilities of $7.0 million and $5.9 million at December 31, 2007 and December 31, 2006, respectively, were for potential environmental liabilities that we consider probable and for which a reasonable estimate of the probable liability could be made.

13

Table of Contents

As noted in the introductory section titled, “Uncertainties Affecting Forward-Looking Statements” above, our business, operations and financial condition are subject to various risks. These risks should be taken into account in evaluating any investment decision involving Armstrong. It is not possible to predict or identify all factors that could cause actual results to differ materially from expected and historical results. The following discussion is a summary of what we believe to be our most significant risk factors. These and other factors could cause our actual results to differ materially from those in forward-looking statements made in this report.

We try to reduce both the likelihood that these risks will affect our businesses and their potential impact. But, no matter how accurate our foresight, how well we evaluate risks, and how effective we are at mitigating them, it is still possible that one of these problems or some other issue could have serious consequences for us, up to and including a materially adverse effect. See related discussions in this document and our other SEC filings for more details and subsequent disclosures.

Claims, Litigation and Regulatory Actions

While we strive to ensure that our products comply with applicable government regulatory standards and internal requirements, and that our products perform effectively and safely, customers from time to time could claim that our products do not meet contractual requirements, and users could be harmed by use or misuse of our products. This could give rise to breach of contract, warranty or recall claims, or claims for negligence, product liability, strict liability, personal injury or property damage. The building materials industry has been subject to claims relating to silicates, mold, PVC, formaldehyde, toxic fumes, fire-retardant properties and other issues, as well as for incidents of catastrophic loss, such as building fires. Product liability insurance coverage may not be available or adequate in all circumstances. In addition, claims may arise related to patent infringement, environmental liabilities, distributor terminations, commercial contracts, antitrust or competition law, employment law and employee benefits issues, and other regulatory matters. While we have in place processes and policies to mitigate these risks and to investigate and address such claims as they arise, we cannot predict the costs to defend or resolve such claims.

Construction activity variability and the size of the market opportunity

Our businesses have greater sales opportunities when construction activity is strong and, conversely, have fewer opportunities when such activity declines. Construction activity tends to increase when economies are strong, interest rates are favorable, government spending is strong, and consumers are confident. Since most of our sales are in the U.S., its economy is the most important for our business, but conditions in Europe, Canada and Asia also are relevant.

Raw materials and sourced product issues

The cost and availability of raw materials, packaging materials, energy and sourced products are critical to our operations. For example, we use substantial quantities of natural gas, petroleum-based raw materials, hardwood lumber and mineral fiber in our manufacturing operations. The cost of some items has been volatile in recent years and availability has sometimes been tight. We source some materials from a limited number of suppliers, which, among other things, increases the risk of unavailability. Limited availability could cause us to reformulate products or to limit our production. The impact of increased costs is greatest where our ability to pass along increased costs through price increases on our products is limited, whether due to competitive pressures or other factors.

Consumer preference and competition

Our customers consider our products’ performance, product styling, customer service and price when deciding whether to purchase our products. Shifting consumer preference in our highly competitive markets, e.g. from residential vinyl products to other flooring products, styling preferences or inability to offer new competitive performance features could hurt our sales. For certain products, there is excess industry capacity in several geographic markets, which tends to increase price competition, as does competition from overseas competitors with lower cost structures.

14

Table of Contents

International trade and operations

A significant portion of our products move in international trade, particularly among the U.S., Canada, Europe and Asia. Also, approximately 30% of our annual revenues are from operations outside the U.S. Our international trade is subject to currency exchange fluctuations, trade regulations, import duties, logistics costs and delays and other related risks. They are also subject to variable tax rates, credit risks in emerging markets, political risks, uncertain legal systems, restrictions on repatriating profits to the U.S., and loss of sales to local competitors following currency devaluations in countries where we import products for sale.

Challenges in executing operational restructuring actions

We look for ways to make our operations more efficient and effective. We reduce, move and expand our plants and operations as needed. Each action generally involves substantial planning and capital investment. We can err in planning and executing our actions, which could hurt our customer service and cause unplanned costs.

Labor contracts

Most of our manufacturing employees are represented by unions and are covered by collective bargaining or similar agreements that must be periodically renegotiated. Although we anticipate that we will reach new contracts as current ones expire, our negotiations may result in a significant increase in our costs. Failure to reach new contracts could lead to work stoppages, which could hurt production, revenues, profits and customer relations.

Dependence on key customers

Some of our businesses are dependent on a few key customers. For example, much of our North America revenue comes from sales to home center retailers, including The Home Depot, Inc. and Lowe’s Companies, Inc. We do not have long-term contracts with them. The loss of sales to one of these major customers, or changes in our business relationship with them, could hurt both our revenues and profits.

15

Table of Contents

Our world headquarters are in Lancaster, Pennsylvania. We own a 100-acre, multi-building campus comprising the site of our corporate headquarters, most operational headquarters, our U.S. R&D operations and marketing, and customer service headquarters. Altogether, our headquarters’ operations occupy approximately one million square feet of floor space.

We produce and market Armstrong products and services throughout the world, operating 40 manufacturing plants in 10 countries as of December 31, 2007. Three of our plants are leased and the remaining 37 are owned. We have 25 plants located throughout the United States. In addition, we have an interest through our WAVE joint venture in seven additional plants in five countries.

Business Segment | Number of Plants | Location of Principal Facilities | ||||||

| Resilient Flooring | 13 | U.S. (California, Illinois, Mississippi, Oklahoma, Pennsylvania), Australia, Canada, Germany, Sweden and the U.K. | ||||||

| Wood Flooring | 11 | U.S. (Arkansas, Kentucky, Mississippi, Missouri, North Carolina, Pennsylvania, Tennessee, Texas, West Virginia) | ||||||

| Building Products | 14 | U.S. (Alabama, Florida, Georgia, Oregon, Pennsylvania), China, France, Germany and the U.K. | ||||||

| Cabinets | 2 | U.S. (Nebraska and Pennsylvania) | ||||||

Sales and administrative offices are leased and/or owned worldwide, and leased facilities are utilized to supplement our owned warehousing facilities.

Production capacity and the extent of utilization of our facilities are difficult to quantify with certainty. In any one facility, utilization of our capacity varies periodically depending upon demand for the product that is being manufactured. We believe our facilities are adequate and suitable to support the business. Additional incremental investments in plant facilities are made as appropriate to balance capacity with anticipated demand, improve quality and service, and reduce costs.

16

Table of Contents

See Note 32 to the Consolidated Financial Statements, which is incorporated herein by reference, for a full description of our legal proceedings.

ITEM 4. SUBMISSION OF MATTERS TO A VOTE OF SECURITY HOLDERS

No matters were submitted to a vote of stockholders during the fourth quarter of 2007.

17

Table of Contents

ITEM 4A. EXECUTIVE OFFICERS OF THE COMPANY

Executive Officer Information

The following information is current as of February 28, 2008. Each executive officer serves a one-year term until reelected or until his earlier death, resignation, retirement or removal.

Michael D. Lockhart

Age 58; Director since November 2000 and Chairman of the Board and Chief Executive Officer since March 2001. Chairman and Chief Executive Officer of our former holding company from August 2000 – December 2007. Mr. Lockhart previously served as Chairman and Chief Executive Officer of General Signal (a diversified manufacturer) headquartered in Stamford, Connecticut from September 1995 until it was acquired in October 1998. He joined General Signal as President and Chief Operating Officer in September 1994. From 1981 until 1994, Mr. Lockhart worked for General Electric in various executive capacities in the GE Credit Corporation (now GE Capital), GE Transportation Systems and GE Aircraft Engines.

F. Nicholas Grasberger, III

Age 44; Senior Vice President and Chief Financial Officer since January 2005. Previously Vice President and Chief Financial Officer of Kennametal, Inc. (a manufacturer of cutting tools and wear parts) August 2000 – December 2004. Formerly employed at H. J. Heinz (a global U.S. based food company) for eleven years, his last title being Treasurer.

Donald A. McCunniff

Age 50; Senior Vice President, Human Resources since March 2006. Previously Vice President Human Resources, Corporate, Honeywell International. Joined Honeywell in 1995 and served in various senior level Human Resources positions in Defense and Space, Electronics, Process Automation, and Aircraft Landing Systems.

Frank J. Ready

Age 46; President and Chief Executive Officer, North American Flooring Operations since June 2004. Previously Senior Vice President, Sales and Marketing, July 2003 – June 2004; Senior Vice President, Operations, December 2002 – July 2003; Senior Vice President, Marketing, June 2000 – December 2002.

John N. Rigas

Age 59; Senior Vice President and General Counsel since November 2000. Previously Deputy General Counsel-Litigation, March 1999 – November 2000; worked for Dow Corning Corporation (specialty chemical company) October 1982 – March 1999, his last title being Senior Managing Counsel.

William C. Rodruan

Age 53; Vice President and Controller since July 1999. Previously Director, Corporate Transformation and Shared Services, February 1997 – July 1999, and Vice President of Finance, Corporate Retail Accounts July 1994 – February 1997.

Stephen J. Senkowski

Age 56; Executive Vice President since April 2004, and President and Chief Executive Officer, Armstrong Building Products since October 2000; Senior Vice President, Americas, Building Products Operations, April 2000 – October 2000; President/Chief Executive Officer, WAVE (the Company’s ceiling grid joint venture) July 1997 – April 2000; Vice President, Innovation Process, Building Products Operations 1994 – July 1997.

18

Table of Contents

ITEM 5. MARKET FOR THE REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

Following AWI’s emergence from Chapter 11, AWI’s new common shares began trading on the New York Stock Exchange on October 10, 2006 under the ticker symbol “AWI”. As of February 21, 2007, there were approximately 800 holders of record of AWI’s Common Stock.

| 2007 | First | Second | Third | Fourth | Total Year | ||||||

Price range of common stock—high | $ | 56.72 | $ 57.48 | $ 52.47 | $ 44.28 | $ 57.48 | |||||

Price range of common stock—low | $ | 41.55 | $ 49.85 | $ 35.04 | $ 38.00 | $ 35.04 | |||||

| 2006 | |||||||||||

Price range of common stock—high | n/a | n/a | n/a | $ 42.50 | $ 42.50 | ||||||

Price range of common stock—low | n/a | n/a | n/a | $ 30.00 | $ 30.00 | ||||||

The above figures represent the high and low intra-day sale prices for our common stock as reported by the New York Stock Exchange.

There were no dividends declared or paid during 2007 or 2006.

No Company securities were repurchased by the Company during 2007 or 2006.

On February 25, 2008, our Board of Directors declared a special cash dividend of $4.50 per common share, payable on March 31, 2008, to shareholders of record on March 11, 2008. This special cash dividend will result in an aggregate payment to our shareholders of approximately $260 million, based on the number of common shares currently outstanding.

19

Table of Contents

ITEM 6. SELECTED FINANCIAL DATA

| Successor Company | Predecessor Company | |||||||||||

| (Dollars in millions except for per-share data) | Year 2007 | Three Months Ended December 31, 2006 | Nine Months Ended September 30, 2006(1) | Year 2005 | Year 2004 | Year 2003 | ||||||

Income statement data | ||||||||||||

Net sales | $ 3,549.7 | $ 817.3 | $ 2,608.6 | $ 3,326.6 | $ 3,279.1 | $ 3,069.0 | ||||||

Cost of goods sold | 2,685.3 | 660.4 | 2,028.7 | 2,651.8 | 2,654.4 | 2,461.4 | ||||||

Selling, general and administrative expenses | 613.5 | 144.0 | 417.0 | 590.0 | 567.7 | 552.4 | ||||||

Charge for asbestos liability, net | – | – | – | – | – | 81.0 | ||||||

Goodwill impairment | – | – | – | – | 108.4 | – | ||||||

Restructuring charges, net | 0.2 | 1.7 | 10.0 | 23.0 | 17.9 | 2.3 | ||||||

Equity (earnings) from joint ventures | (46.0) | (5.3) | (41.4) | (39.3) | (31.6) | (20.8) | ||||||

Operating income (loss) | 296.7 | 16.5 | 194.3 | 101.1 | (37.7) | (7.3) | ||||||

Interest expense | 55.0 | 13.4 | 5.2 | 7.7 | 7.9 | 8.9 | ||||||

Other non-operating expense | 1.4 | 0.3 | 1.0 | 1.5 | 3.1 | 5.7 | ||||||

Other non-operating (income) | (18.2) | (4.3) | (7.2) | (11.8) | (6.4) | (4.6) | ||||||

Chapter 11 reorganization (income) costs, net | (0.7) | - | (1,955.5) | (1.2) | 6.9 | 9.4 | ||||||

Income tax expense (benefit) | 106.4 | 3.8 | 726.6 | (1.2) | 21.4 | – | ||||||

Earnings (loss) from continuing operations | 152.8 | 3.3 | 1,424.2 | 106.1 | (70.6) | (26.7) | ||||||

Per common share – basic (a) | $ 2.73 | $ 0.06 | n/a | n/a | n/a | n/a | ||||||

Per common share – diluted (a) | $ 2.69 | $ 0.06 | n/a | n/a | n/a | n/a | ||||||

(Loss) earnings from discontinued operations | (7.5) | (1.1) | (68.4) | 5.0 | (9.1) | (12.6) | ||||||

Net earnings (loss) | $ 145.3 | $ 2.2 | $ 1,355.8 | $ 111.1 | $(79.7) | $ (39.3) | ||||||

Per common share – basic (a) | $ 2.59 | $ 0.04 | n/a | n/a | n/a | n/a | ||||||

Per common share – diluted (a) | $ 2.56 | $ 0.04 | n/a | n/a | n/a | n/a | ||||||

Dividends declared per share of common stock | n/a | n/a | n/a | n/a | n/a | n/a | ||||||

Average number of common shares outstanding (in millions) | 56.6 | 55.0 | n/a | n/a | n/a | n/a | ||||||

Average number of employees | 13,500 | 14,500 | 14,700 | 14,900 | 15,400 | 15,800 | ||||||

Balance sheet data (end of period) | ||||||||||||

Working capital | $ 1,003.7 | $ 854.6 | $ 1,128.0 | $985.8 | $933.3 | |||||||

Total assets | 4,649.9 | 4,159.9 | 4,606.0 | 4,609.4 | 4,647.8 | |||||||

Liabilities subject to compromise | - | 1.3 | 4,869.4 | 4,870.9 | 4,863.2 | |||||||

Net long-term debt (b) | 485.8 | 801.5 | 21.5 | 29.2 | 39.4 | |||||||

Shareholders’ equity (deficit) | 2,437.2 | 2,164.5 | (1,319.9) | (1,425.3) | (1,345.0) | |||||||

(1) Reflects the effects of the Plan of Reorganization and fresh-start reporting. See Note 3 to the Consolidated Financial Statements.

Notes:

| (a) | See definition of basic and diluted earnings per share in Note 2 of the Consolidated Financial Statements. The common stock of the Predecessor Company was not publicly traded. |

| (b) | Net long-term debt excludes debt subject to compromise for all periods presented. |

Certain prior year amounts have been reclassified to conform to the current year presentation. See Note 2 to the Consolidated Financial Statements.

20

Table of Contents

| ITEM 7. | MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

Armstrong World Industries, Inc. (“AWI”) is a Pennsylvania corporation incorporated in 1891. When we refer to “we”, “our” and “us” in this report, we are referring to AWI and its subsidiaries. References in this report to “reorganized Armstrong” are to AWI as it was reorganized under the Plan of Reorganization (“POR”) on October 2, 2006, and its subsidiaries collectively. We use the term “AWI” when we are referring solely to Armstrong World Industries, Inc.

This discussion should be read in conjunction with the financial statements and the accompanying notes included elsewhere in this Form 10-K. This discussion contains forward-looking statements based on our current expectations, which are inherently subject to risks and uncertainties. Actual results and the timing of certain events may differ significantly from those referred to in such forward-looking statements. We undertake no obligation beyond what is required under applicable securities law to publicly update or revise any forward-looking statement to reflect current or future events or circumstances, including those set forth in the section entitled “Uncertainties Affecting Forward-Looking Statements” and elsewhere in this Form 10-K.

Financial performance metrics excluding the translation effect of changes in foreign exchange rates are not in compliance with U.S. generally accepted accounting principles (“GAAP”). We believe that this information improves the comparability of business performance by excluding the impacts of changes in foreign exchange rates when translating comparable foreign currency amounts. We calculate the translation effect of foreign exchange rates by applying constant foreign exchange rates to the equivalent periods’ reported foreign currency amounts. We believe that this non-GAAP metric provides a clearer picture of our operating performance. Furthermore, management evaluates the performance of the businesses excluding the effects of foreign exchange rates.

In connection with its emergence from bankruptcy on October 2, 2006 (the “Effective Date”), AWI adopted fresh-start reporting in accordance with AICPA Statement of Position 90-7, “Financial Reporting by Entities in Reorganization under the Bankruptcy Code” (“SOP 90-7”). Adopting fresh-start reporting has resulted in material adjustments to the historical carrying amount of reorganized Armstrong’s assets and liabilities. See Note 3 to the Consolidated Financial Statements for more information. As a result, our post-emergence financial statements are not comparable to our pre-emergence financial statements. Despite the lack of comparability, we have combined the 2006 results of the Predecessor Company (which represent the first nine months of 2006 and include the impact of emergence) with the results of the Successor Company (which represent the last three months of 2006) to facilitate the year-to-year discussion of operating results in certain sections of this Form 10-K, including relevant portions of Management’s Discussion and Analysis. The combined financial information for 2006 merely combines the Predecessor and Successor periods and does not give pro forma effect to the Predecessor’s results as if the consummation of the POR and the related fresh-start reporting and other adjustments had occurred at the beginning of the period presented. Combining pre-emergence and post-emergence results is not in accordance with GAAP.

We maintain a website at http://www.armstrong.com. Information contained on our website is not necessarily incorporated into this document. Annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, all amendments to those reports and other information about us are available free of charge through this website as soon as reasonably practicable after the reports are electronically filed with the Securities and Exchange Commission (“SEC”). These materials are also available from the SEC’s website at www.sec.gov.

21

Table of Contents

Management’s Discussion and Analysis of Financial Condition and Results of Operations

(dollar amounts in millions)

OVERVIEW

We are a leading global producer of flooring products and ceiling systems for use primarily in the construction and renovation of residential, commercial and institutional buildings. Through our United States (“U.S.”) operations and U.S. and international subsidiaries, we design, manufacture and sell flooring products (primarily resilient and wood) and ceiling systems (primarily mineral fiber, fiberglass and metal) around the world. We also design, manufacture and sell kitchen and bathroom cabinets in the U.S. As of December 31, 2007 we operated 40 manufacturing plants in 10 countries, including 25 plants located throughout the U.S. Through WAVE, our joint venture with Worthington Industries, Inc., we also have an interest in 7 additional plants in 5 countries that produce suspension system (grid) products for our ceiling systems.

We report our financial results through the following segments: Resilient Flooring, Wood Flooring, Building Products, Cabinets and Unallocated Corporate. See “Results of Operations” and “Reportable Segment Results” for additional financial information on our consolidated company and our segments.

Our consolidated net sales for 2007 were $3.5 billion, approximately 4% greater than combined consolidated net sales in 2006. Operating income was $296.7 million in 2007, as compared to $210.8 million in 2006. Cash and cash equivalents increased by $250.5 million in 2007 compared to a $338.4 million decrease in 2006. In 2007:

| • | Building Products generated record sales and operating income, despite modest slowing in the U.S. commercial markets toward the end of the year. |

| • | Wood Flooringsales declines reflect a significant exposure to new residential housing activity. Operating income benefited from the impact of fresh-start reporting and from manufacturing efficiencies that partially offset the impact of lower sales and higher raw material costs. |

| • | Despite declines in the residential U.S. housing market, a strong start to the year drove modestly higher sales forCabinets.Operating income increased primarily due to a large insurance settlement related to a warehouse fire. |

| • | ForResilient Flooring,growth in international sales and substantial improvement in Americas’ manufacturing and selling, general and administrative (“SG&A”) efficiencies drove significantly higher operating income on roughly flat sales. |

| • | Corporate Unallocatedexpense increased by $9 million, primarily due to the impact of costs related to our review of strategic alternatives and Chapter 11 related post-emergence expenses, partially offset by the impact of fresh-start reporting. |

Factors Affecting Revenues

For an estimate of our segments’ 2007 net sales by major markets, see “Markets” in Item 1. Business of this Form 10-K.

Markets. We compete in building material markets around the world. The majority of our sales are in North America and Europe. During 2007, these markets experienced the following:

| • | In 2007, housing starts in the North American residential market declined nearly 23% to 1.57 million units (at seasonally adjusted and annualized rates). The Canadian housing activity was flat at 0.23 million units, while the U.S. accounted for almost the entirety of the overall decline, falling 25.8% in 2007 to 1.34 million units started versus 1.81 million in 2006. Housing completions in the U.S. decreased by 23.9% in 2007 with approximately 1.514 million units completed. The sales of existing homes continued to fall in 2007, and registered a 12.8% decrease for the entire year over 2006, to 5.68 million. |

22

Table of Contents

Management’s Discussion and Analysis of Financial Condition and Results of Operations

(dollar amounts in millions)

U.S. retail sales through building materials, garden equipment and supply stores (an indicator of home renovation activity) decreased 1.7% in 2007 over sales levels in 2006, according to figures from the U.S. Census Bureau. This reflects the overall weakness in the housing market, and we do not expect improvement in this area until housing sales stabilize.

| • | The North American commercial market strengthened in 2007 with construction completions in the office, healthcare, retail and education segments increasing by approximately 15.7%, 9.7%, 5.7% and 11.0%, respectively, in nominal dollar terms. |

| • | Markets in Western European countries experienced modest growth, while Eastern European markets continued to grow. |

| • | Growth continued across most Pacific Rim markets. |

Quality and Customer Service. Our quality and customer service are critical components of our total value proposition. In 2007, we experienced no significant quality or customer service issues.

Pricing Initiatives. We periodically modify prices in response to changes in costs for raw materials and energy, and to market conditions and the competitive environment. The net impact of these pricing initiatives improved sales in 2007 compared to 2006.

The most significant of these pricing actions were:

| • | Resilient Flooring implemented price increases on selected products in 2007. |

| • | Wood Flooring had no significant pricing actions in 2007. |

| • | Building Products implemented price increases in Europe in February 2007 and in North America in June and December 2007. |

| • | Cabinets implemented a February 2007 price increase. |

In certain cases, realized price increases are less than the announced price increases because of competitive reactions and changing market conditions.

We estimate pricing actions increased our total consolidated net sales in 2007 compared to 2006 by approximately $60 million.

Mix.Each of our businesses offers a wide assortment of products that are differentiated by style/design and by performance attributes. Pricing for products within the assortment varies according to the level of value they provide. Changes in the relative quantity of products purchased at the different value points can impact year-to-year comparisons of net sales and operating income. We estimate mix changes increased our total consolidated net sales in 2007 compared to 2006 by approximately $60 million.

Factors Affecting Operating Costs

Operating Expenses. Our operating expenses consist of direct production costs (principally raw materials, labor and energy) and manufacturing overhead costs, costs to purchase sourced products and SG&A expenses.

Our largest individual raw material expenditures are for lumber and veneers, PVC resins and plasticizers. Natural gas is also a significant input cost. Fluctuations in the prices of these inputs are generally beyond our control and have a direct impact on our financial results. In 2007 the net impact of these input costs was approximately $35 million higher than in the same period of the previous year.

23

Table of Contents

Management’s Discussion and Analysis of Financial Condition and Results of Operations

(dollar amounts in millions)

Cost Reduction Initiatives. During 2004, we implemented several significant manufacturing and organizational programs to improve our cost structure and enhance our competitive position. We have incurred costs in subsequent years related to these previously announced cost reduction initiatives. The major 2004 programs were:

| • | We ceased production of certain products at our Resilient Flooring manufacturing plant in Lancaster, Pennsylvania, transferring production to other Resilient Flooring plants. |

| • | We announced that we would cease production at our Building Products plant in The Netherlands. The plant ceased production in the first quarter of 2005, and production was transferred to another Building Products location. |

| • | We ceased production at our Cabinets manufacturing plant in Morristown, Tennessee, transferring production to other Cabinets plants. |

| • | We restructured the sales force and management structure in our North America flooring organization. |

| • | We announced that we would cease production at our Wood Flooring manufacturing plant in Searcy, Arkansas. Production ended in the first quarter of 2005, and was transferred to other Wood Flooring plants. |

These initiatives have been fully implemented, and we do not expect to incur additional expenses in future periods for these initiatives. We have realized our projected annual cost savings of approximately $58 million, when compared to the 2004 cost baseline. These projected savings were not fully realized until 2007.

We did not initiate any additional manufacturing or organizational programs in 2005.

In 2006 we announced that we would cease production at our Wood Flooring manufacturing plant in Nashville, Tennessee.

We incurred $0.2 million of restructuring charges in the Building Products segment in 2007 to implement the above cost reduction initiatives.

We incurred the following net expenses in 2006 to implement these cost reduction initiatives:

| Cost of Goods Sold | SG&A | Restructuring Charges | Total Expenses | |||||

Resilient Flooring | $ 10.1 | $ 7.4 | $ 9.9 | $ 27.4 | ||||

Wood Flooring | 0.7 | - | 1.4 | 2.1 | ||||

Building Products | 0.2 | - | 0.5 | 0.7 | ||||

Cabinets | - | - | - | - | ||||

Corporate Unallocated | - | - | (0.1) | (0.1) | ||||

Total Consolidated | $ 11.0 | $ 7.4 | $ 11.7 | $ 30.1 | ||||

Cost of goods sold includes $0.7 million of fixed asset impairments (incurred in the nine months ended September 30, 2006), $0.3 million of accelerated depreciation (incurred in the nine months ended September 30, 2006) and $10.0 million of other related costs in 2006 ($0.6 million incurred in the three months ended December 31, 2006 and $9.4 million incurred in the nine months ended September 30, 2006). The Resilient Flooring SG&A costs in 2006 (incurred in the nine months ended September 30, 2006) relate to the Lancaster Plant cost reduction initiative.

In 2006, we recorded a gain of $14.3 million from the sale of a warehouse which became available as a result of the Resilient Flooring cost reduction initiatives. This gain was recorded in SG&A.

24

Table of Contents

Management’s Discussion and Analysis of Financial Condition and Results of Operations

(dollar amounts in millions)

We incurred the following net expenses in 2005 due to implementing these cost reduction initiatives:

| Cost of Goods Sold | Restructuring Charges | Total Expenses | ||||

Resilient Flooring | $ 12.7 | $ 16.2 | $ 28.9 | |||

Wood Flooring | 13.9 | 0.1 | 14.0 | |||

Building Products | 1.6 | 6.3 | 7.9 | |||

Cabinets | 1.2 | 0.4 | 1.6 | |||

Corporate Unallocated | - | - | - | |||

Total Consolidated | $ 29.4 | $ 23.0 | $ 52.4 | |||

Cost of goods sold includes $14.3 million of fixed asset impairments, $7.1 million of accelerated depreciation and $8.0 million of other related costs in 2005.

See Note 15 to the Consolidated Financial Statements for more information on restructuring charges.

On-going Cost Improvements.In addition to the above-mentioned cost reduction programs we have an ongoing focus on continually improving our cost structure. As a result of these cost reduction initiatives and our on-going improvement efforts, we have realized significant reductions in our manufacturing conversion costs.

Fresh Start Reporting.In connection with its emergence from bankruptcy on October 2, 2006, AWI adopted fresh-start reporting. For administrative convenience, we selected September 30, 2006, following the close of business, as the date to adopt fresh-start reporting. See Note 3 to the Consolidated Financial Statements for more information.

Adopting fresh-start reporting resulted in material adjustments to the historical carrying amount of reorganized Armstrong’s assets and liabilities. Certain of these adjustments impacted our statements of earnings for the periods following emergence, through changes in depreciation and amortization, costs for benefit plans, costs for hedging-related activity, inventory-related costs and WAVE expenses. In 2006, fresh-start reporting impacted fourth quarter earnings. Fresh-start reporting impacted all periods in 2007, with the fourth quarter’s impact being different than the first three quarters due to the revisions made to the fresh-start balance sheet based upon filing our federal income tax return in September 2007 (see Note 3 to the Consolidated Financial Statements for more information). Please see page 34 for the dollar impact of fresh-start reporting by operating expense type for each period.

Employee Benefits. We recorded a pre-tax charge of $16.9 million in the fourth quarter of 2005 in cost of goods sold ($11.4 million) and SG&A ($5.5 million), related to changes made to the U.S. defined benefit pension plan. The changes were considered a curtailment under SFAS No. 88 “Employers’ Accounting for Settlements and Curtailments of Defined Benefit Pension Plans and for Termination Benefits” (“FAS 88”).

Review of Strategic Alternatives. On February 15, 2007, we announced that we had initiated a review of our strategic alternatives. On February 29, 2008, we announced that we have completed the strategic review process after extensive evaluation of alternatives, including a possible sale of our individual businesses and the entire company. The Board of Directors concluded that it is in the best interest of Armstrong and its shareholders to continue to execute our strategic operating plan under our current structure as a publicly traded company. We anticipate payments to advisors in conjunction with this conclusion will cost approximately $4.5 million in 2008.

See also “Results of Operations” for further discussion of other significant items affecting operating costs.

25

Table of Contents

Management’s Discussion and Analysis of Financial Condition and Results of Operations

(dollar amounts in millions)

Factors Affecting Cash Flows

Typically, we generate cash in our operating activities, excluding the effects of our emergence from Chapter 11 in 2006. The amount of cash generated in a period is dependent on a number of factors, including the amount of operating profit generated, the amount of working capital (such as inventory, receivables and payables) required to operate our businesses and investments in property, plant & equipment and computer software (“PP&E”).

During 2007, our cash and cash equivalents increased by $250.5 million, as net cash from operating activities, including distributions from WAVE of $117.5 million and net U.S. federal income tax refunds of $209.1 million, more than offset net cash used for investing activities and for $300 million of voluntary debt principal prepayments. This compared to a cash and cash equivalents decrease of $338.4 million in 2006, which was primarily due to $1.1 billion of Chapter 11 emergence-related payments to creditors, partially offset by $800 million from new debt.

Deferred Income Taxes

Our Consolidated Balance Sheet as of December 31, 2007 includes deferred income tax assets of $972.7 million (see Note 16 to the Consolidated Financial Statements). Included in these amounts were deferred tax assets of $407.1 million and $66.3 million, respectively, relating to federal and state net operating loss carryforwards. These net operating losses arose in 2006 as a result of the amounts paid to the Asbestos Personal Injury Settlement Trust (“Asbestos PI Trust”). We have concluded, based on the weight of available evidence, that all but $9.1 million of these income tax benefits are more likely than not to be realized in the future. This amount represents a decrease of $14.5 million from the valuation allowances previously recorded with respect to these income tax benefits as of December 31, 2006.

In arriving at this conclusion, we considered the profit before tax generated for the years 1996 through 2007, as well as future reversals of existing taxable temporary differences and projections of future profit before tax. The federal income tax deduction resulting from the amounts paid to the Asbestos PI Trust created a net operating loss in 2006. Under the Internal Revenue Code, a net operating loss resulting from the payment of asbestos claims, including payments to the Asbestos PI Trust, can be carried back and offset against our federal taxable income in either the two or the ten preceding years, generating a refund of taxes paid for those years. We had assumed a two-year carryback for purposes of calculating the income tax provision for 2006. We continued to evaluate the carryback alternatives prior to filing our federal income tax return in September, 2007. The completed analysis indicated that the net present value from a ten-year carryback was modestly more than that from a two-year carryback, so we filed a ten-year carryback. Since the realizable book value of the net operating loss based on a ten-year carryback is lower than the calculation based upon a two-year carryback, the fresh–start balance sheet was revised to reflect the ten-year value. See Note 3 to the Consolidated Financial Statements for more information.

In addition, any loss remaining after carryback is available as a carryforward adjustment to reduce income taxes payable in future tax years. If certain specified changes occur in our ownership, there could be an annual limitation on the amount of the carryforwards that can be utilized. However, we cannot anticipate this change in assessing our valuation allowances. As a result, it is more likely than not that we will realize the federal deferred income tax asset value relating to these carryforwards.

In contrast to the results under the Internal Revenue Code, most states do not allow the carryback of a net operating loss in any significant amount. As a result, most of the state income tax benefits resulting from the amounts paid to the Asbestos PI Trust will be realized through a reduction of future state income tax liabilities by offsetting the net operating losses resulting from our payments to the Asbestos PI Trust against future state taxable income. Based on projections of future taxable income (consistent with historical results and anticipated future trends), for the loss carryforward periods allowed under current state income tax laws (generally five to twenty years) in the states in which we conduct business operations, we have concluded that all but $9.1 million of the $66.3 million of deferred state income tax benefits relating to our state net operating loss carryforwards is more likely than not to be realized.

26

Table of Contents

Management’s Discussion and Analysis of Financial Condition and Results of Operations

(dollar amounts in millions)

We estimate we will need to generate future taxable income of approximately $1,163.2 million for federal income tax purposes, and $1,392.3 million for state income tax purposes in order to fully realize these deferred income tax assets.

Employees

As of December 31, 2007, we had approximately 12,900 full-time and part-time employees worldwide. This compares to approximately 14,500 employees as of December 31, 2006. The decline reflects the sale of our European Textiles and Sports Flooring business in April 2007 and headcount reductions as part of ongoing cost reduction efforts, primarily in the wood flooring segment.

During 2007, we negotiated two collective bargaining agreements and none of our locations experienced work stoppages. On December 31, 2007 the labor contract covering approximately 140 production employees at our Montreal resilient flooring plant expired. Management and labor are presently negotiating, and neither party believes a work stoppage is likely. Throughout 2008, collective bargaining agreements covering approximately 1,200 employees at six plants are scheduled to expire.

CRITICAL ACCOUNTING ESTIMATES

In preparing our consolidated financial statements in accordance with U.S. generally accepted accounting principles (“GAAP”), we are required to make certain estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements, and the reported amounts of revenues and expenses during the reporting period. We evaluate our estimates and assumptions on an on-going basis, using relevant information from inside and outside the Company. We believe that our estimates and assumptions are reasonable. However, actual results may differ from what was estimated and could have a significant impact on the financial statements.

We have identified the following as our critical accounting estimates. We have discussed the application of these critical accounting estimates with our Audit Committee.

Fresh-Start Reporting and Reorganization Value– As part of our emergence from bankruptcy on October 2, 2006, we implemented fresh-start reporting in accordance with AICPA Statement of Position 90-7 (“SOP 90-7”),Financial Reporting by Entities in Reorganization under the Bankruptcy Code. Our assets, liabilities and equity were adjusted to fair value. In this regard, our Consolidated Financial Statements for periods subsequent to October 2, 2006 reflect a new basis of accounting and are not comparable to our historical consolidated financial statements for periods prior to October 2, 2006.

Under fresh-start reporting, a reorganization value is determined and allocated to our net assets based on their relative fair values in a manner similar to the accounting provisions applied to business combinations under Statement of Financial Accounting Standards No. 141,Business Combinations. The estimates and assumptions used to derive the reorganization value and allocation of value to balance sheet accounts are inherently subject to significant business, economic and competitive uncertainties and contingencies, many of which are beyond our control. Modification to these assumptions could have significantly changed the reorganization value, and hence the resultant fair values of our assets and liabilities. Adjustments to the allocation of value to the balance sheet accounts could be made in future periods for tax-related items (see “Income Taxes” below).

The adoption of fresh-start reporting had a material effect on our Consolidated Financial Statements and was based on assumptions that employed a high degree of judgment. See Notes 1 and 3 to the Consolidated Financial Statements for further information relative to our reorganization and the assumptions used to value reorganized Armstrong.

27

Table of Contents

Management’s Discussion and Analysis of Financial Condition and Results of Operations

(dollar amounts in millions)

U.S. Pension Credit and Postretirement Benefit Costs – We maintain pension and postretirement plans throughout the world, with the most significant plans located in the U.S. The U.S. defined benefit pension plans were closed to new salaried and salaried production employees on January 1, 2005. We also froze benefits for certain non-production salaried employees effective February 28, 2006. Our defined benefit pension and postretirement benefit costs are developed from actuarial valuations. These valuations are calculated using a number of assumptions. Each assumption represents management’s best estimate of the future. The assumptions that have the most significant impact on reported results are the discount rate, the estimated long-term return on plan assets and the estimated inflation in health care costs. These assumptions are generally updated annually. However, we also updated each of these assumptions and adopted Statement of Financial Accounting Standards No. 158, “Employers’ Accounting for Defined Benefit Pension and Other Postretirement Plans,” as part of adopting fresh-start reporting in accordance with SOP 90-7.

The discount rate is used to determine retirement plan liabilities and to determine the interest cost component of net periodic pension and postretirement cost. Management utilizes the yield for Moody’s AA-rated long-term corporate bonds as the primary basis for determining the discount rate. The duration of the securities underlying the Moody’s AA-rated bond index is reasonably comparable to the duration of our retirement plan liabilities based on our review of the Hewitt yield curve. As of December 31, 2007, we assumed a discount rate of 5.85% compared with a discount rate of 5.75% as of December 31, 2006 for the U.S. plans. This increase is consistent with the increase in U.S. corporate bond yields during the year. The effects of the increased discount rate will be amortized against earnings as described below. A one-quarter percentage point decrease in the discount rate to 5.60% would increase 2008 operating income by $0.6 million, as the resulting decrease in the interest cost component of the pension expense calculation would more than offset the increased service cost component. A one-quarter percentage point increase in the discount rate to 6.10% would reduce 2008 operating income by $0.4 million.

We have two U.S. defined benefit pension plans, a qualified funded plan and a nonqualified unfunded plan. For the funded plan, the expected long-term return on plan assets represents a long-term view of the future estimated investment return on plan assets. This estimate is determined based on the target allocation of plan assets among asset classes and input from investment professionals on the expected performance of the equity and bond markets over 10 to 20 years. Over the last 10 years, the annualized return was approximately 8.2% compared to an average expected return of 8.5%. The expected long-term return on plan assets used in determining our 2007 U.S. pension credit was 8.0%. The actual return on plan assets achieved for 2007 was 10.4%. In accordance with GAAP, this excess will be amortized into earnings as described below. We do not expect to make cash contributions to the qualified funded plan during 2008. We have assumed a return on plan assets during 2008 of 8.0%. A one-quarter percentage point increase or decrease in this assumption would increase or decrease 2008 operating income by approximately $5.5 million. Contributions to the unfunded plan were $3.2 million in 2007 and were made on a monthly basis to fund benefit payments. We estimate the contributions to be approximately $3.4 million in 2008. See Note 18 to the Consolidated Financial Statements for more details.

28

Table of Contents

Management’s Discussion and Analysis of Financial Condition and Results of Operations

(dollar amounts in millions)

The estimated inflation in health care costs represents a long-term view (5-10 years) of the expected inflation in our postretirement health care costs. We separately estimate expected health care cost increases for pre-65 retirees and post-65 retirees due to the influence of Medicare coverage at age 65, as illustrated below:

| Assumptions | Actual | |||||||||||

| Post 65 | Pre 65 | Overall | Post 65 | Pre 65 | Overall | |||||||

| 2006, nine months ended September 30 | 9.0% | 7.0% | 8.0% | |||||||||

| 2006, three months ended December 31 | 12.0% | 11.5% | 11.8% | |||||||||

2006, full year | 9 % | (1)% | 6 % | |||||||||

2007 | 12.0% | 11.5% | 11.8% | (2)% | (3)% | (2)% | ||||||

2008 | 11.0% | 10.5% | 10.8% | |||||||||

Actual health care cost increases were lower than expected in 2007, primarily due to favorable experience in medical claims costs and the impact of the implementation of a prescription drug deductible for certain retirees. In accordance with GAAP, the difference between the actual and expected health care costs is amortized into earnings as described below. As of December 31, 2007, health care cost increases are estimated to decrease by 1 percentage point per year until 2014, after which they are constant at 5%. A one percentage point increase in the assumed health care cost trend rate would reduce 2008 operating income by $0.6 million, while a one percentage point decrease in the assumed health care cost trend rate would increase 2008 operating income by $0.6 million. See Note 18 to the Consolidated Financial Statements for more details.

Actual results that differ from our various pension and postretirement plan estimates are captured as actuarial gains/losses and are amortized into future earnings over the expected remaining service period of plan participants, which is approximately 10 years depending on the participants in the plan, in accordance with GAAP. Changes in assumptions could have significant effects on earnings in future years.