Exhibit 99.2

| Earnings Call Presentation 4th Quarter 2011 February 27, 2012 |

| Safe Harbor Statement Our disclosures in this presentation and in our other public documents and comments contain forward-looking statements within the meaning of the Private Securities Litigation Reform Act. Those statements provide our future expectations or forecasts and can be identified by our use of words such as "anticipate," "estimate," "expect," "project," "intend," "plan," "believe," "outlook," and other words or phrases of similar meaning in connection with any discussion of future operating or financial performance. Forward-looking statements, by their nature, address matters that are uncertain and involve risks because they relate to events and depend on circumstances that may or may not occur in the future. A more detailed discussion of the risks and uncertainties that may affect our ability to achieve the projected performance is included in the "Risk Factors" and "Management's Discussion and Analysis" sections of our recent reports on Forms 10-K and 10-Q filed with the SEC. As a result, our actual results may differ materially from our expected results and from those expressed in our forward-looking statements. Forward-looking statements speak only as of the date they are made. We undertake no obligation to update any forward-looking statements beyond what is required under applicable securities law. In addition, we will be referring to non-GAAP financial measures within the meaning of SEC Regulation G. A reconciliation of the differences between these measures with the most directly comparable financial measures calculated in accordance with GAAP are included within this presentation and available on the Investor Relations of our website at www.armstrong.com. The guidance in this presentation is only effective as of the date given, February 27, 2012, and will not be updated or affirmed unless and until we publicly announce updated or affirmed guidance. 2 |

| All figures throughout the presentation are in $ millions unless otherwise noted. Figures may not add due to rounding. Basis of Presentation Explanation When reporting our financial results within this presentation, we make several adjustments. Management uses the non-GAAP measures below in managing the business and believes the adjustments provide meaningful comparisons of operating performance between periods. As reported results will be footnoted throughout the presentation. 3 We report in comparable dollars to remove the effects of currency translation on the P&L. The budgeted exchange rate for the current year is used for all currency translations in the current year and prior years. We remove the impact of discrete expenses and income. Examples include plant closures, restructuring actions, and other large unusual items. Taxes for normalized Net Income and EPS for all periods presented are calculated using a constant 42%, which is based on the full year historical tax rate. Comparable Dollars Other Adjustments Net Sales Yes No Gross Profit Yes Yes SG&A Expense Yes Yes Equity Earnings Yes Yes Operating Income Yes Yes Net Income Yes Yes Cash Flow No No Return on Capital Yes Yes EBITDA Yes Yes What Items Are Adjusted |

| As reported Net Sales: $652 million in 2011 and $643 million in 2010. As reported Operating Income (Loss): $22 million in 2011 and ($30) million in 2010 As reported EPS: $0.14 in 2011 and $(0.36) in 2010. Key Metrics - Fourth Quarter 2011 2011 2010 Variance Net Sales (1) $647 $641 0.9% Operating Income (2) 26 19 36.1% % of Sales 4.1% 3.0% 110 bps EBITDA 51 47 9.1% % of Sales 7.9% 7.3% 60 bps Earnings Per Share (3) $0.16 $0.11 45.5% Free Cash Flow 90 43 112% Net (Cash) Debt 362 559 (197) 4 |

| 2011 2010 V EBITDA- Adjusted $51 $47 $4 Depreciation and Amortization (25) (28) 3 Operating Income - Adjusted $26 $19 $7 Foreign Exchange Movements 1 1 - Cost Reduction Initiatives (3) (9) 6 Accelerated Depreciation (not included above) - (11) 11 Executive Transition Costs - (1) 1 Restructuring (1) (7) 6 Impairments (1) (22) 21 Operating Income - As Reported $22 ($30) $52 Interest (Expense) Income (11) (8) (3) EBT $11 ($38) $49 Tax (Expense) Benefit (2) 17 (19) Net Income $9 ($21) $30 Fourth Quarter 2011 - Adjusted EBITDA to Reported Net Income 5 |

| (CHART) Fourth Quarter Sales and EBITDA by Segment - 2011 vs. 2010 6 |

| (CHART) ($6) EBITDA Bridge - Fourth Quarter 2011 vs. Prior Year 7 $8 $12 $5 $2 |

| (CHART) $(7) ($4) Free Cash Flow - Fourth Quarter 2011 vs. Prior Year 8 |

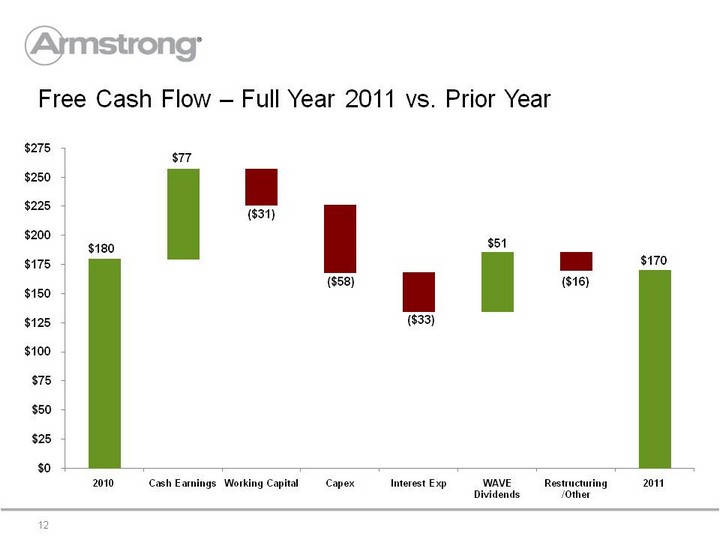

| As reported Net Sales: $2,860 million in 2011 and $2,766 million in 2010. As reported Operating Income: $239 million in 2011 and $81 million in 2010 As reported EPS: $1.90 in 2011 and $ 0.19 in 2010. 2011 Actual 2010 Actual Variance Net Sales (1) $2,819 $2,786 1.2% Operating Income (2) 272 188 43.7% % of Sales 9.7% 6.8% 290 bps EBITDA 377 303 24.4% % of Sales 13.4% 10.9% 250 bps Earnings Per Share (3) $2.23 $1.73 28.9% Free Cash Flow 170 180 (6)% Net (Cash) Debt 362 559 (197) Key Metrics - Full Year 2011 9 |

| (CHART) Full Year Sales and EBITDA by Segment - 2011 vs. 2010 10 |

| (CHART) ($25) EBITDA Bridge - Full Year 2011 vs. Prior Year 11 $67 $65 $10 $48 |

| (CHART) ($33) ($16) Free Cash Flow - Full Year 2011 vs. Prior Year 12 |

| Cost Savings Program Cost Savings Program 13 Incremental Savings ($M) Cumulative Expected Total Savings $35M $150M Savings of $185M $20 $15 $65 $50 $35 SG&A Savings Structural Manufacturing and Productivity Improvements Cumulative savings of $185 million expected from manufacturing and SG&A, net of inflation and investments. |

| (CHART) AWI - Return on Invested Capital (ROIC) - As Reported Highest ROIC (7.4%) since emergence in 2006 14 Trailing 12 months |

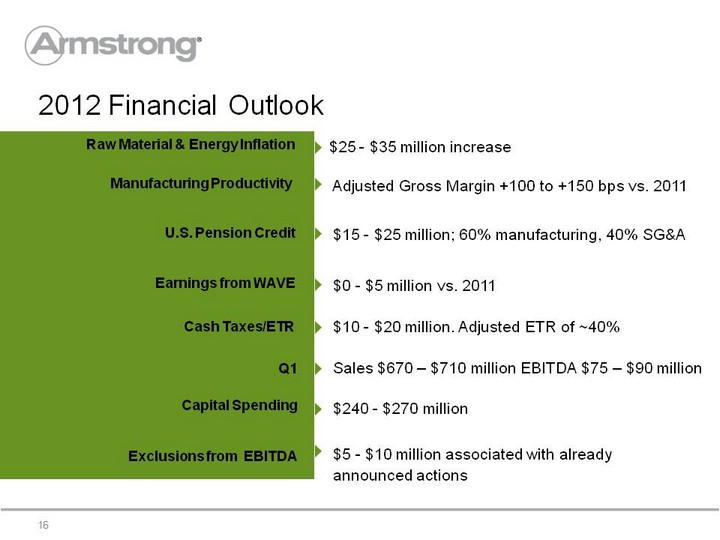

| 2012 Estimate Range 2012 Estimate Range 2012 Estimate Range 2011 Variance Variance Variance Net Sales(1) 2,900 to 3,000 2,819 3% to 6% Operating Income(2) 310 to 350 272 14% to 29% EBITDA 420 to 460 377 11% to 22% Earnings Per Share(3) $2.75 to $3.15 $2.23 23% to 41% Free Cash Flow 50 to 100 170 (71%) to (41%) Sales figures include foreign exchange impact. As reported Operating Income: $240 - $280 million in 2012 and $239 million 2011. As reported earnings per share: $2.55- $3.00 in 2012 and $1.90 in 2011. Key Metrics - Guidance 2012 15 |

| 2012 Financial Outlook $25 - $35 million increase Adjusted Gross Margin +100 to +150 bps vs. 2011 $15 - $25 million; 60% manufacturing, 40% SG&A $0 - $5 million vs. 2011 $10 - $20 million. Adjusted ETR of ~40% Sales $670 - $710 million EBITDA $75 - $90 million $240 - $270 million $5 - $10 million associated with already announced actions Raw Material & Energy Inflation Manufacturing Productivity U.S. Pension Credit Earnings from WAVE Cash Taxes/ETR Q1 Capital Spending Exclusions from EBITDA 16 |

| Appendix 17 |

| 2011 2010 V EBITDA- Adjusted $377 $303 $74 Depreciation and Amortization (105) (115) 10 Operating Income - Adjusted $272 $188 $84 Foreign Exchange Movements 3 1 2 Cost Reduction Initiatives (15) (17) 2 Laminate Duty refunds - 7 (7) Accelerated Depreciation (not included above) (9) (31) 22 Executive transition costs - (15) 15 Restructuring (9) (22) 13 Impairments (3) (30) 27 Operating Income - As Reported $239 $81 $158 Interest (Expense) Income (46) (14) (32) EBT $193 $67 $126 Healthcare Reform- Medicare Subsidy Elimination - (22) 22 Tax (Expense) Benefit (81) (34) (47) Net Income $112 $11 $101 Full 2011 - Adjusted EBITDA to Reported Net Income 18 |

| 2012 Estimate Range 2012 Estimate Range 2012 Estimate Range Adjusted Operating Income 310 to 350 D&A 110 110 110 Adjusted EBITDA 420 to 460 Changes in Working Capital (20) to - Capex (240) to (270) Pension Credit (15) to (25) Interest Expense (40) to (45) Cash Taxes (10) to (20) Other, including cash payments for restructuring and one-time items (20) (20) (20) Free Cash Flow 50 to 100 Adjusted Operating Income to Free Cash Flow 19 |

| Fourth Quarter Fourth Quarter Fourth Quarter Fourth Quarter Fourth Quarter Fourth Quarter Fourth Quarter Fourth Quarter Fourth Quarter Fourth Quarter 2011 Reported Comparability(1) Adjustments FX(2) Adj 2011 Adjusted 2010 Reported Comparability(1) Adjustments FX(2) Adj 2010 Adjusted 2010 Adjusted Net Sales 652 - (5) 647 643 - (2) 641 641 Operating Income 22 5 (1) 26 (30) 50 (1) 19 19 EPS $0.14 $0.02 $- $0.16 ($0.36) $0.47 $ - $0.11 $0.11 Full Year Full Year Full Year Full Year Full Year Full Year Full Year Full Year Full Year Full Year 2011 Reported Comparability(1) Adjustments FX(2) Adj 2011 Adjusted 2010 Reported Comparability(1) Adjustments FX(2) Adj FX(2) Adj 2010 Adjusted Net Sales 2,859 - (40) 2,819 2,766 - 20 20 2,786 Operating Income 239 36 (3) 272 81 108 (1) (1) 188 EPS $1.90 $0.35 ($0.02) $2.23 $0.19 $1.54 $- $- $1.73 See earnings press release and 10-K for additional detail on comparability adjustments Eliminates impact of foreign exchange movements Consolidated Results 20 |

| Eliminates impact of foreign exchange movements and non-recurring items; see earnings press release and 10-Q for additional detail. Fourth Quarter Fourth Quarter Fourth Quarter Fourth Quarter Fourth Quarter Fourth Quarter Fourth Quarter 2011 Reported Comparability(1) Adjustments 2011 Adjusted 2010 Reported Comparability(1) Adjustments 2010 Adjusted Building Products 35 - 35 16 16 32 Resilient Flooring (5) 3 (2) (2) 3 1 Wood Flooring 9 1 10 (32) 28 (4) Cabinets (2) - (2) (1) - (1) Unallocated Corporate (Expense) Income (15) - (15) (11) 2 (9) Full Year Full Year Full Year Full Year Full Year Full Year Full Year 2011 Reported Comparability(1) Adjustments 2011 Adjusted 2010 Reported Comparability(1) Adjustments 2010 Adjusted Building Products 226 11 237 171 27 198 Resilient Flooring 16 21 37 13 18 31 Wood Flooring 43 - 43 (46) 39 (7) Cabinets (1) 1 - (6) - (6) Unallocated Corporate (Expense) Income (45) - (45) (51) 23 (28) Segment Operating Income (Loss) 21 Eliminates impact of foreign exchange movements and non-recurring items; see earnings press release and 10-Q for additional detail. |

| Fourth Quarter Fourth Quarter Full Year Full Year ($ millions) 2011 2010 2011 2010 Net cash from operations 82 49 212 190 Net cash provided by (used for) investing 24 (37) (18) (41) Add back (subtract) adjustments to reconcile to free cash flow Restricted cash (20) 30 (28) 30 Acquisition (divestiture) 4 1 4 1 Free Cash Flow 90 43 170 180 Cash Flow 22 |