Earnings Call Presentation 3rd Quarter 2017 October 30, 2017 Exhibit 99.2

Our disclosures in this presentation, including without limitation, those relating to future financial results market conditions and guidance, and in our other public documents and comments contain forward-looking statements within the meaning of the Private Securities Litigation Reform Act. Those statements provide our future expectations or forecasts and can be identified by our use of words such as “anticipate,” “estimate,” “expect,” “project,” “intend,” “plan,” “believe,” “outlook,” “target,” “predict,” “may,” “will,” “would,” “could,” “should,” “seek,” and other words or phrases of similar meaning in connection with any discussion of future operating or financial performance. Forward-looking statements, by their nature, address matters that are uncertain and involve risks because they relate to events and depend on circumstances that may or may not occur in the future. As a result, our actual results may differ materially from our expected results and from those expressed in our forward-looking statements. A more detailed discussion of the risks and uncertainties that may affect our ability to achieve the projected performance is included in the “Risk Factors” and “Management’s Discussion and Analysis” sections of our reports on Forms 10-K and 10-Q filed with the U.S. Securities and Exchange Commission (“SEC”). Forward-looking statements speak only as of the date they are made. We undertake no obligation to update any forward-looking statements beyond what is required under applicable securities law. In addition, we will be referring to non-GAAP financial measures within the meaning of SEC Regulation G. A reconciliation of the differences between these measures with the most directly comparable financial measures calculated in accordance with GAAP are included within this presentation and available on the Investor Relations page of our website at www.armstrongceilings.com. The guidance in this presentation is only effective as of the date given, October 30, 2017, and will not be updated or affirmed unless and until we publicly announce updated or affirmed guidance. Safe Harbor Statement

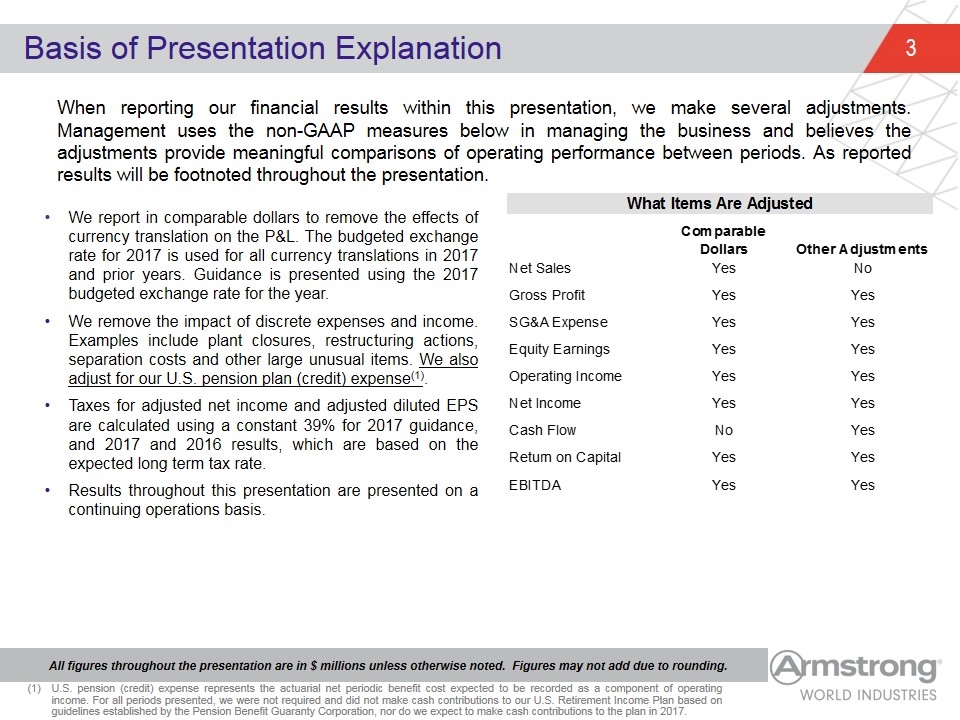

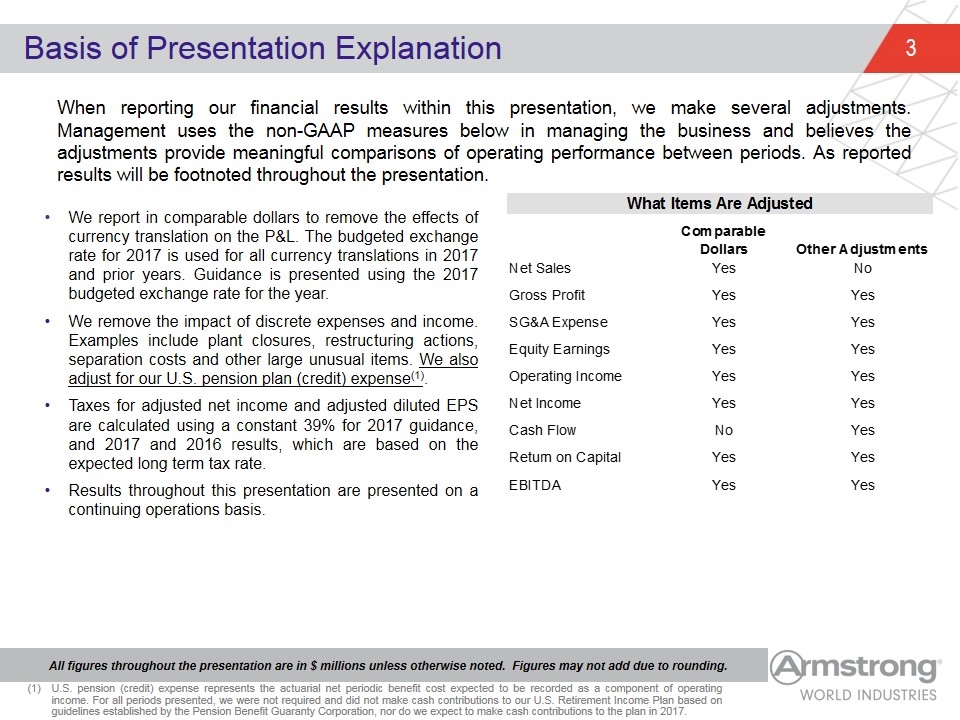

All figures throughout the presentation are in $ millions unless otherwise noted. Figures may not add due to rounding. When reporting our financial results within this presentation, we make several adjustments. Management uses the non-GAAP measures below in managing the business and believes the adjustments provide meaningful comparisons of operating performance between periods. As reported results will be footnoted throughout the presentation. Basis of Presentation Explanation We report in comparable dollars to remove the effects of currency translation on the P&L. The budgeted exchange rate for 2017 is used for all currency translations in 2017 and prior years. Guidance is presented using the 2017 budgeted exchange rate for the year. We remove the impact of discrete expenses and income. Examples include plant closures, restructuring actions, separation costs and other large unusual items. We also adjust for our U.S. pension plan (credit) expense(1). Taxes for adjusted net income and adjusted diluted EPS are calculated using a constant 39% for 2017 guidance, and 2017 and 2016 results, which are based on the expected long term tax rate. Results throughout this presentation are presented on a continuing operations basis. U.S. pension (credit) expense represents the actuarial net periodic benefit cost expected to be recorded as a component of operating income. For all periods presented, we were not required and did not make cash contributions to our U.S. Retirement Income Plan based on guidelines established by the Pension Benefit Guaranty Corporation, nor do we expect to make cash contributions to the plan in 2017. What Items Are Adjusted Comparable Dollars Other Adjustments Net Sales Yes No Gross Profit Yes Yes SG&A Expense Yes Yes Equity Earnings Yes Yes Operating Income Yes Yes Net Income Yes Yes Cash Flow No Yes Return on Capital Yes Yes EBITDA Yes Yes

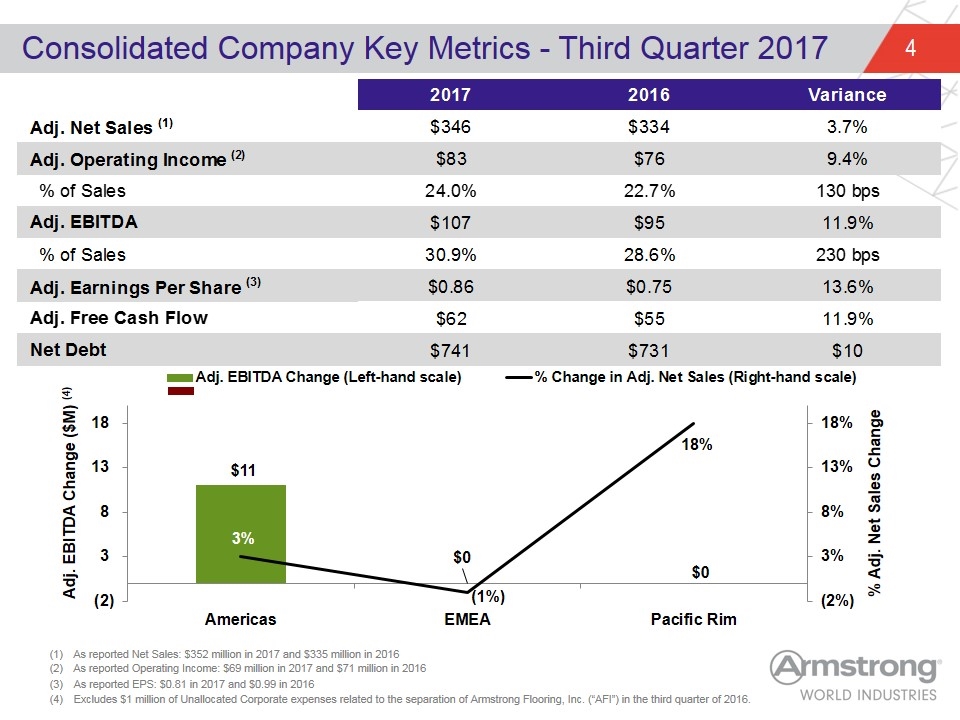

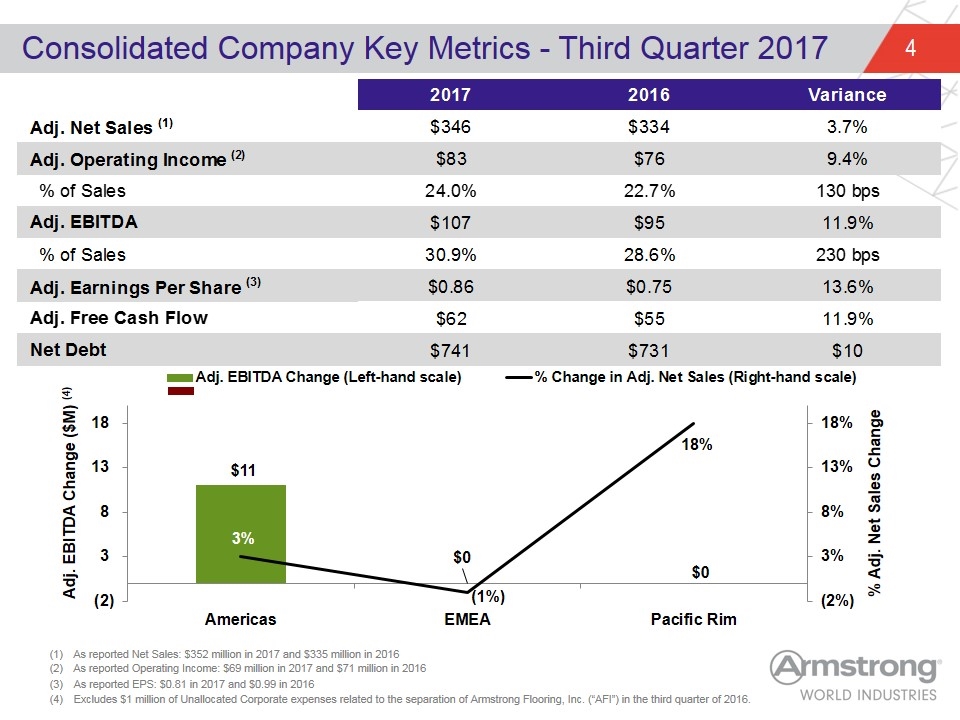

Consolidated Company Key Metrics - Third Quarter 2017 As reported Net Sales: $352 million in 2017 and $335 million in 2016 As reported Operating Income: $69 million in 2017 and $71 million in 2016 As reported EPS: $0.81 in 2017 and $0.99 in 2016 Excludes $1 million of Unallocated Corporate expenses related to the separation of Armstrong Flooring, Inc. (“AFI”) in the third quarter of 2016. 2017 2016 Variance Adj. Net Sales (1) $346.09820069496999 $333.6600220781902 3.7% Adj. Operating Income (2) $82.915223927443193 $75.8209733689812 9.4% % of Sales 0.23957138107319909 0.22724020965032857 130 10 Adj. EBITDA $106.760984759523 64 $95.3772650294013 0.1193546462735382 % of Sales 0.30947021031934135 0.28585164154622789 230 1E-3 Adj. Earnings Per Share (3) $0.8562803738317758 $0.7537857142857145 0.13597320512127903 Adj. Free Cash Flow $61.9 $55.3 0.11934900542495483 Net Debt $741.3 $731.2 $10.099999999999909

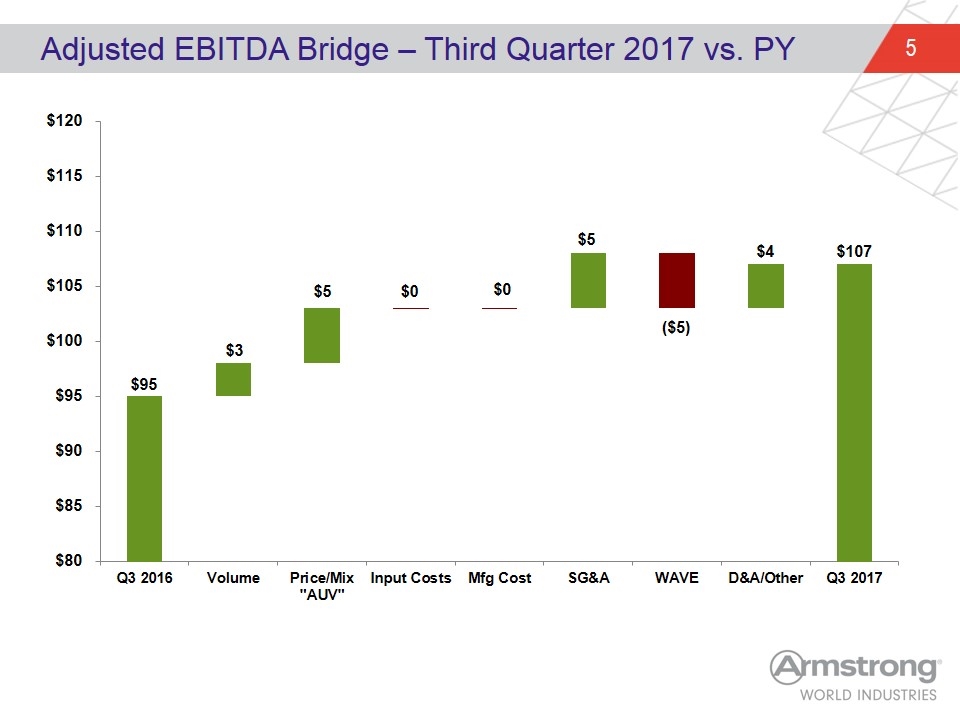

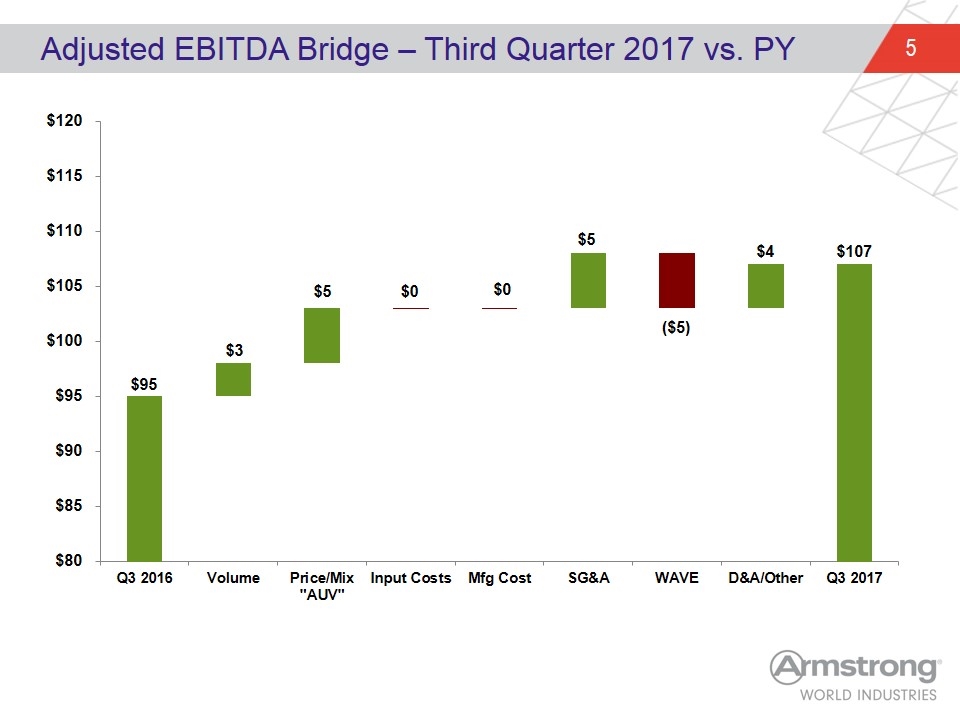

Adjusted EBITDA Bridge – Third Quarter 2017 vs. PY $3 $5 $0 $5 $0 ($5) $4

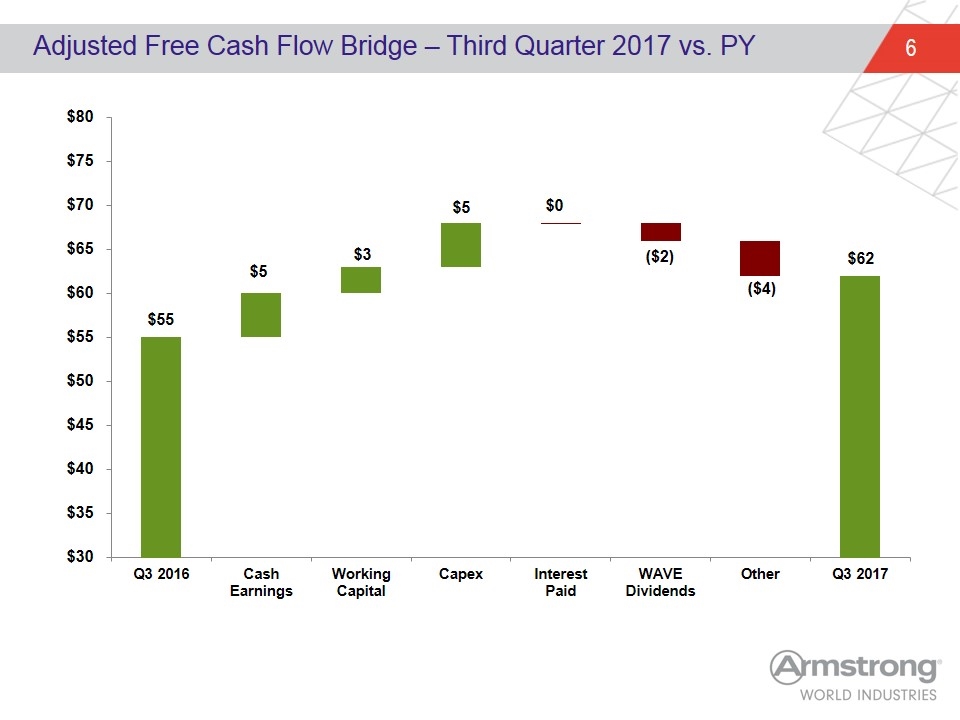

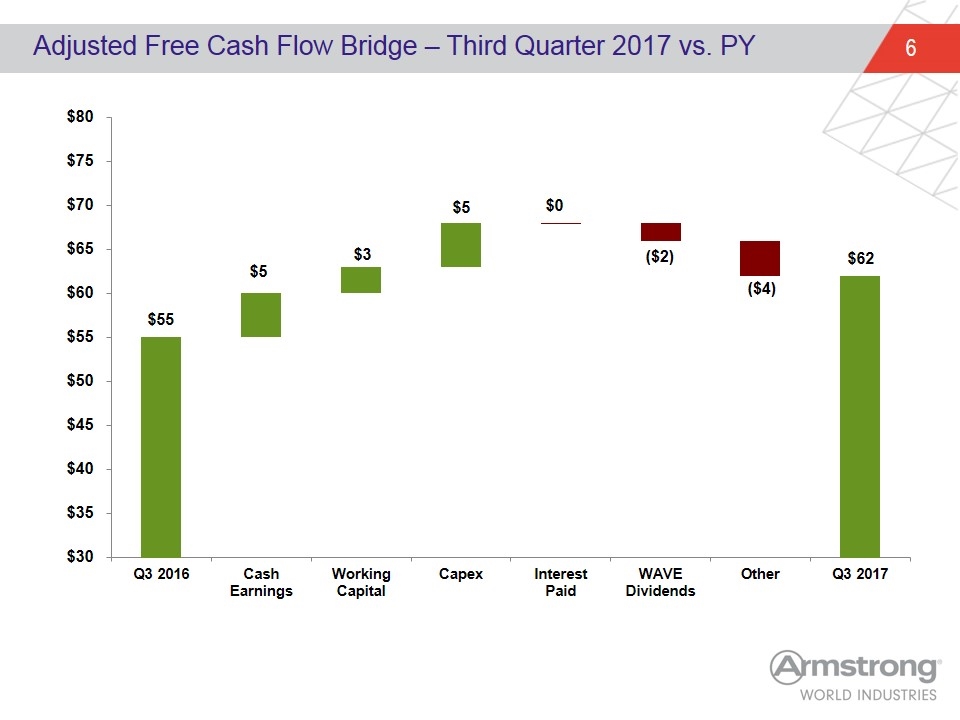

Adjusted Free Cash Flow Bridge – Third Quarter 2017 vs. PY $5 $0 $5 $3 ($2) ($4)

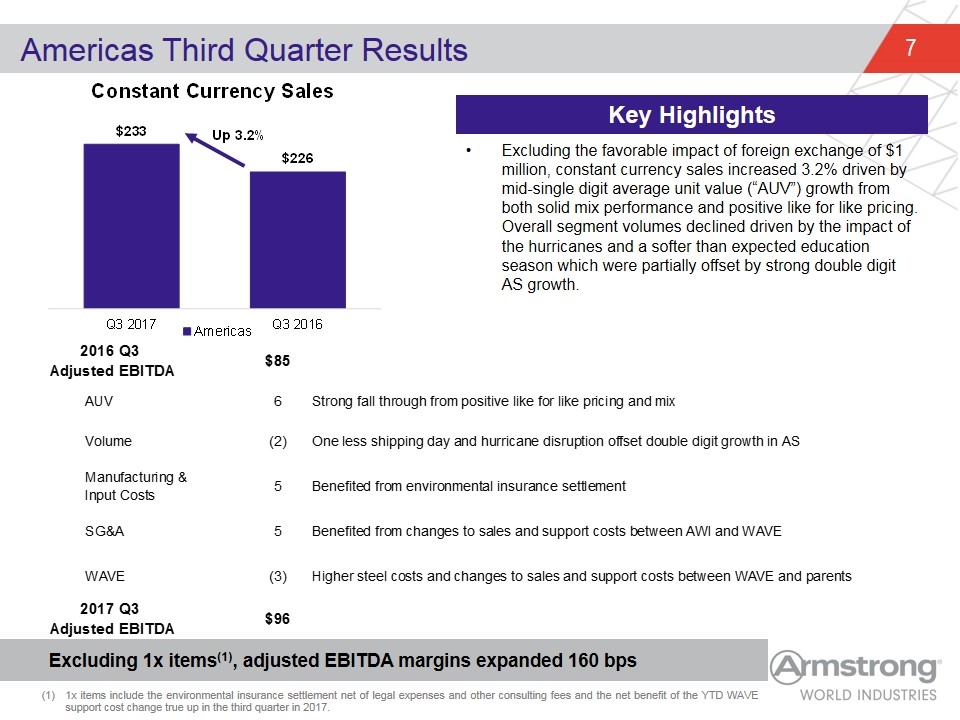

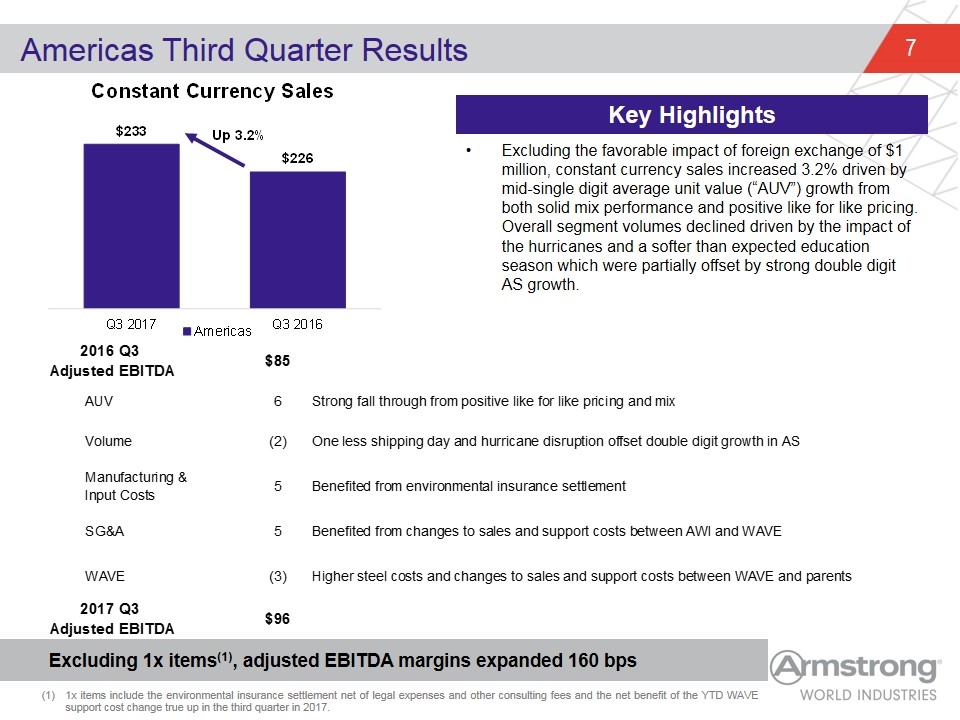

Excluding the favorable impact of foreign exchange of $1 million, constant currency sales increased 3.2% driven by mid-single digit average unit value (“AUV”) growth from both solid mix performance and positive like for like pricing. Overall segment volumes declined driven by the impact of the hurricanes and a softer than expected education season which were partially offset by strong double digit AS growth. Americas Third Quarter Results Excluding 1x items(1), adjusted EBITDA margins expanded 160 bps Key Highlights 1x items include the environmental insurance settlement net of legal expenses and other consulting fees and the net benefit of the YTD WAVE support cost change true up in the third quarter in 2017. 2016 Q3 Adjusted EBITDA $85.295672443572755 AUV 6 Strong fall through from positive like for like pricing and mix Volume -2 One less shipping day and hurricane disruption offset double digit growth in AS Manufacturing & Input Costs 5 Benefited from environmental insurance settlement SG&A 5 Benefited from changes to sales and support costs between AWI and WAVE WAVE -3 Higher steel costs and changes to sales and support costs between WAVE and parents 2017 Q3 Adjusted EBITDA $95.994407177599896

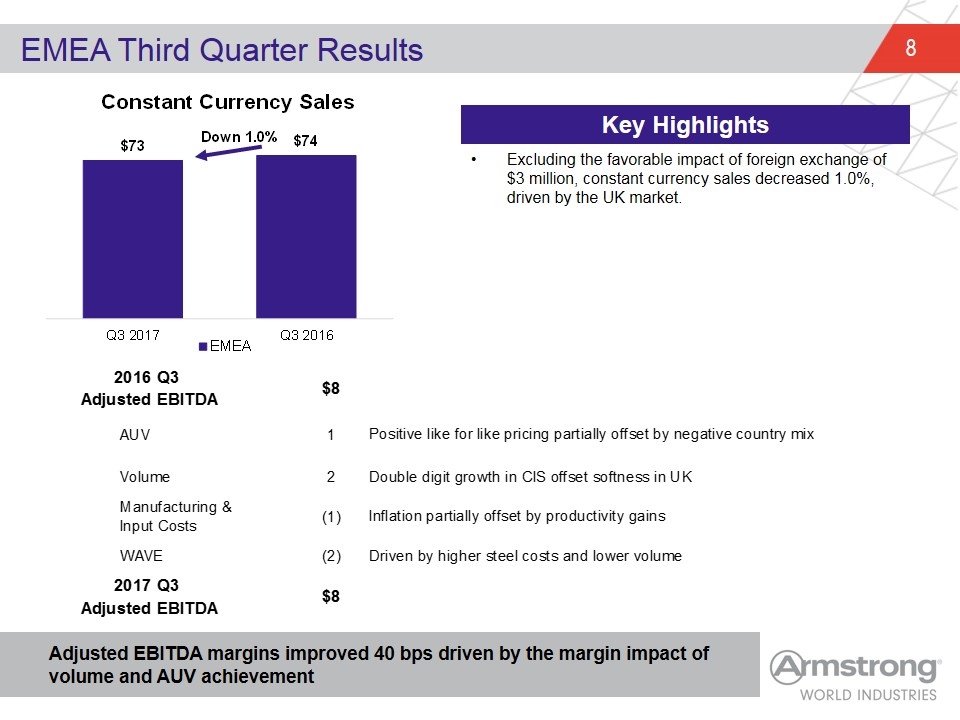

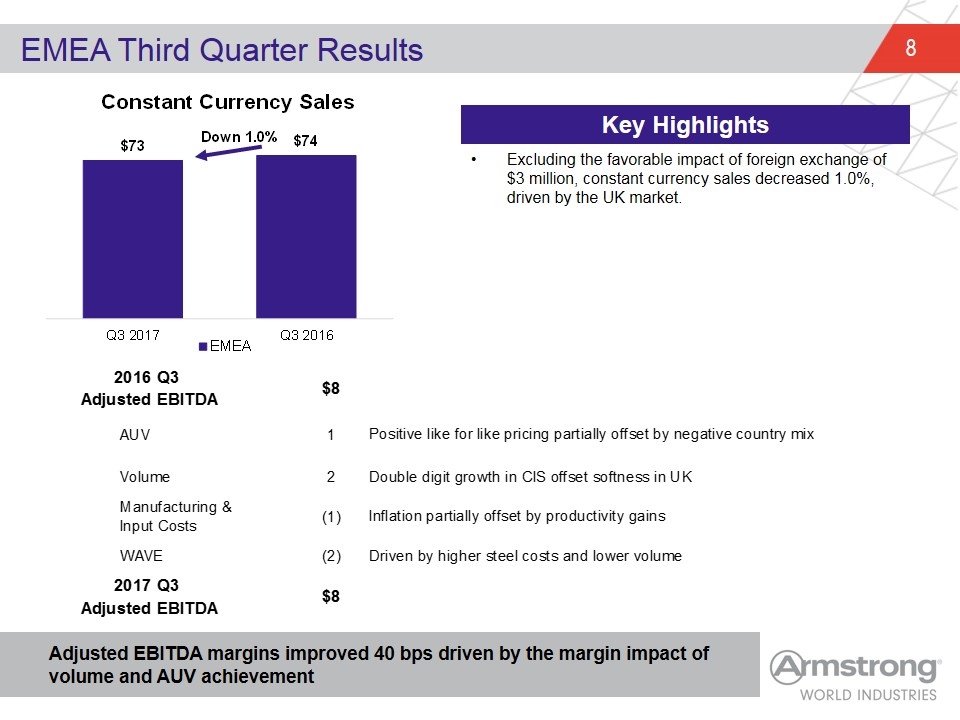

Excluding the favorable impact of foreign exchange of $3 million, constant currency sales decreased 1.0%, driven by the UK market. EMEA Third Quarter Results Adjusted EBITDA margins improved 40 bps driven by the margin impact of volume and AUV achievement Key Highlights 2016 Q3 Adjusted EBITDA $7.5476140079397762 AUV 1 Positive like for like pricing partially offset by negative country mix Volume 2 Double digit growth in CIS offset softness in UK Manufacturing & Input Costs -1 Inflation partially offset by productivity gains WAVE -2 Driven by higher steel costs and lower volume 2017 Q3 Adjusted EBITDA $7.7439692799400586

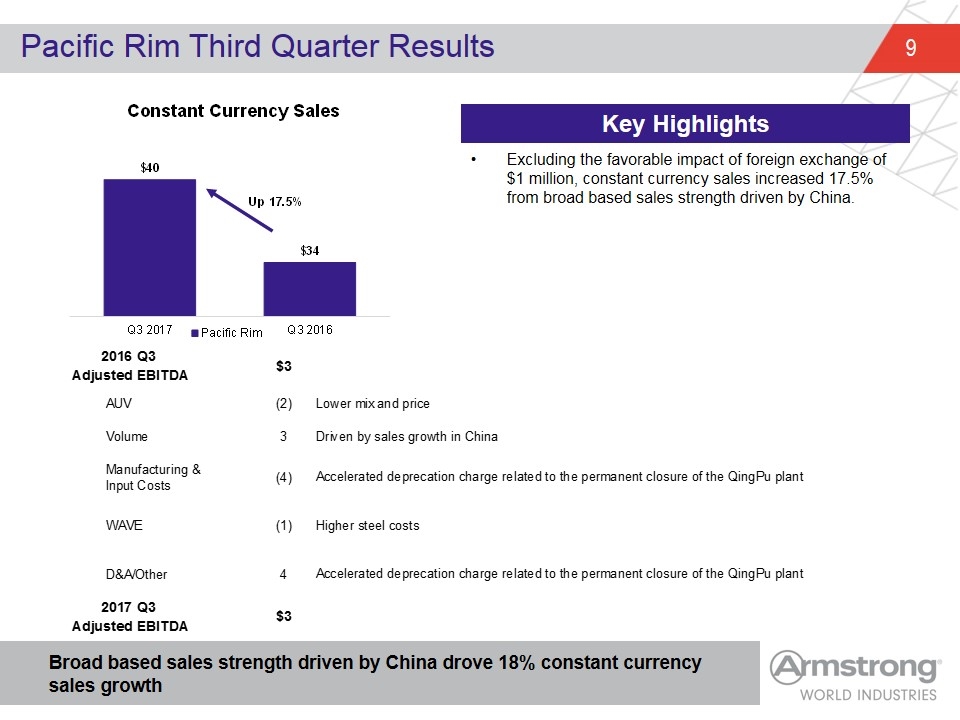

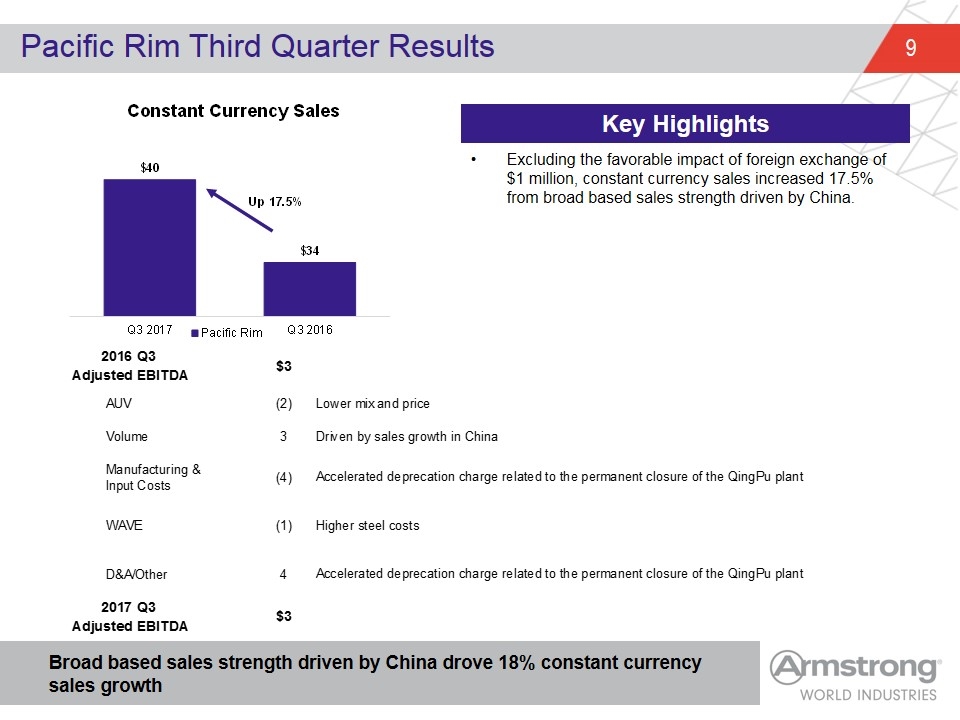

Excluding the favorable impact of foreign exchange of $1 million, constant currency sales increased 17.5% from broad based sales strength driven by China. Pacific Rim Third Quarter Results Broad based sales strength driven by China drove 18% constant currency sales growth Key Highlights 2016 Q3 Adjusted EBITDA $3.3428010963848616 AUV -2 Lower mix and price Volume 3 Driven by sales growth in China Manufacturing & Input Costs -4 Accelerated deprecation charge related to the permanent closure of the QingPu plant WAVE -1 Higher steel costs D&A/Other 4 Accelerated deprecation charge related to the permanent closure of the QingPu plant 2017 Q3 Adjusted EBITDA $3.0967189696668345 adjustment

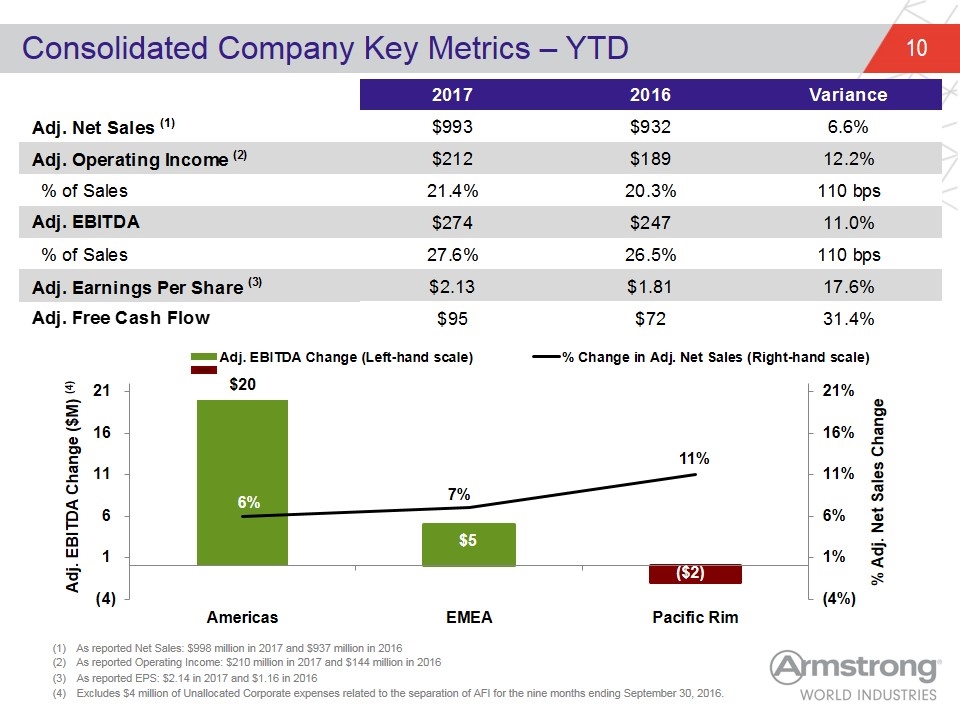

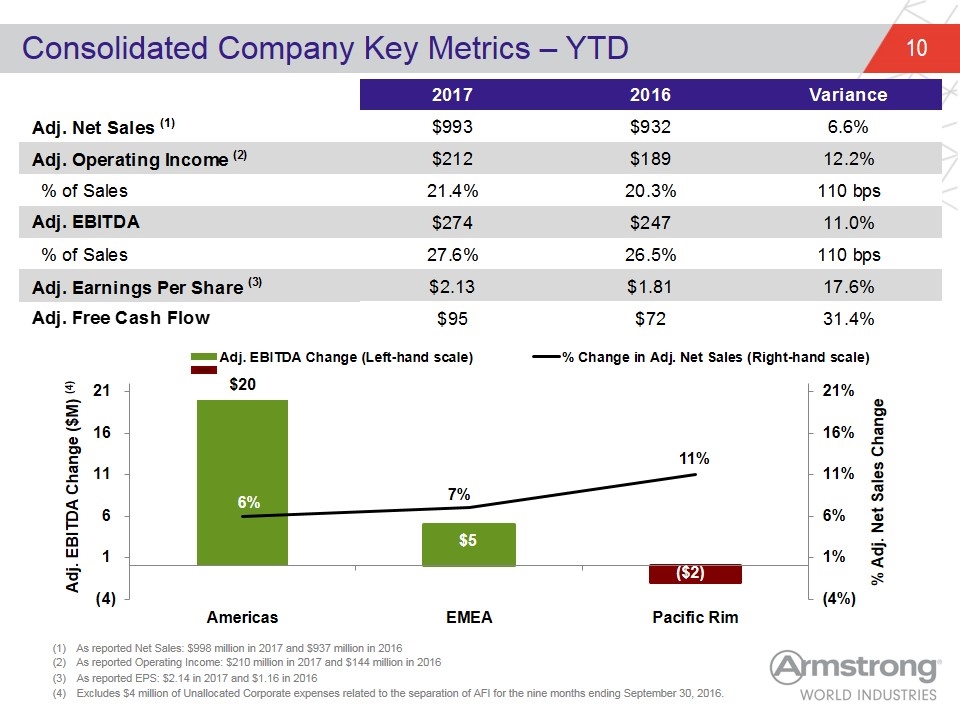

Consolidated Company Key Metrics – YTD As reported Net Sales: $998 million in 2017 and $937 million in 2016 As reported Operating Income: $210 million in 2017 and $144 million in 2016 As reported EPS: $2.14 in 2017 and $1.16 in 2016 Excludes $4 million of Unallocated Corporate expenses related to the separation of AFI for the nine months ending September 30, 2016. 2017 2016 Variance Adj. Net Sales (1) $993.07701052056052 $931.60222958396946 6.6% Adj. Operating Income (2) $212 $188.97454092911602 0.12184423868779651 % of Sales 0.2144779052924323 0.20284895734256386 110 1E-3 Adj. EBITDA $274.19237768220199 $247.08906074840601 0.10969047699522985 % of Sales 0.27610384167333935 0.26523021618223253 110 Adj. Earnings Per Share (3) $2.1310601799981499 $1.8125714285714289 0.17571100724992483 Adj. Free Cash Flow $95 $72.3 0.31396957123098207

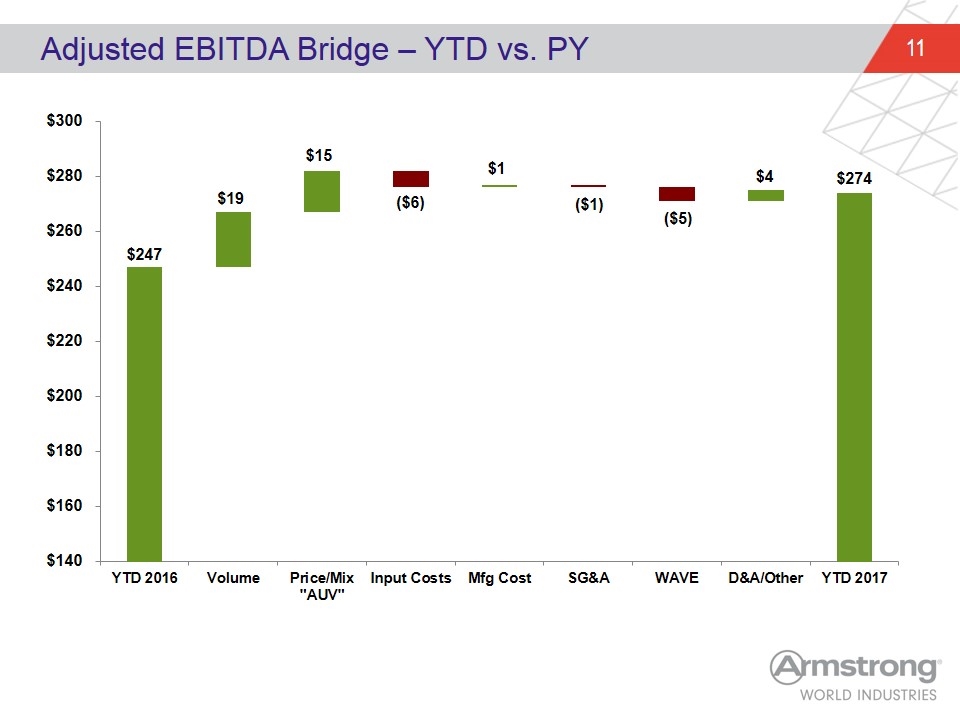

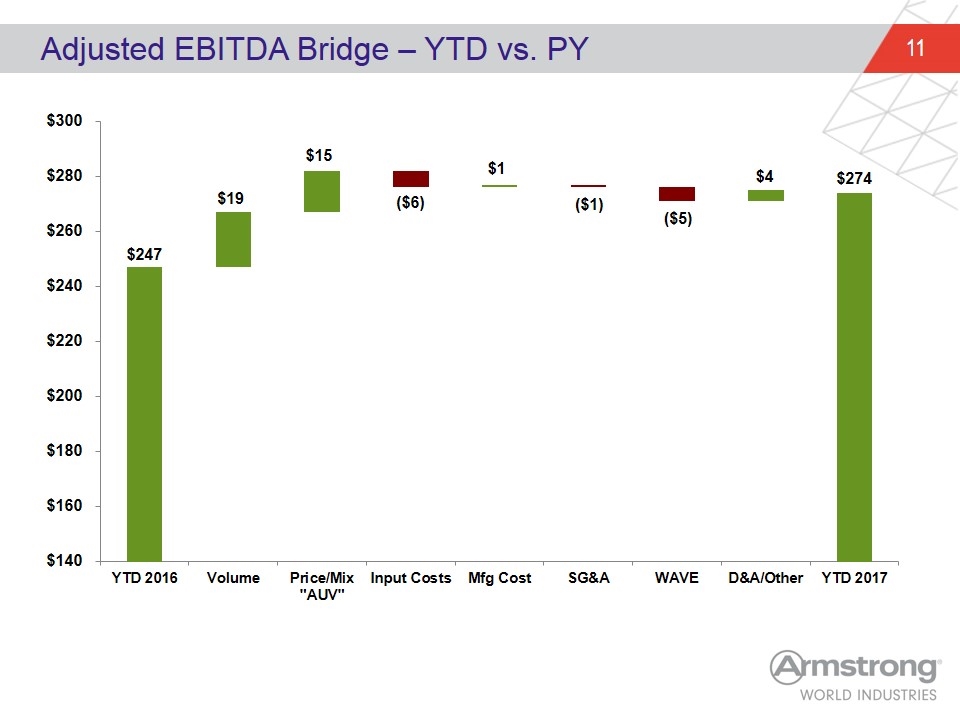

Adjusted EBITDA Bridge – YTD vs. PY $19 $15 ($6) ($1) $1 ($5)

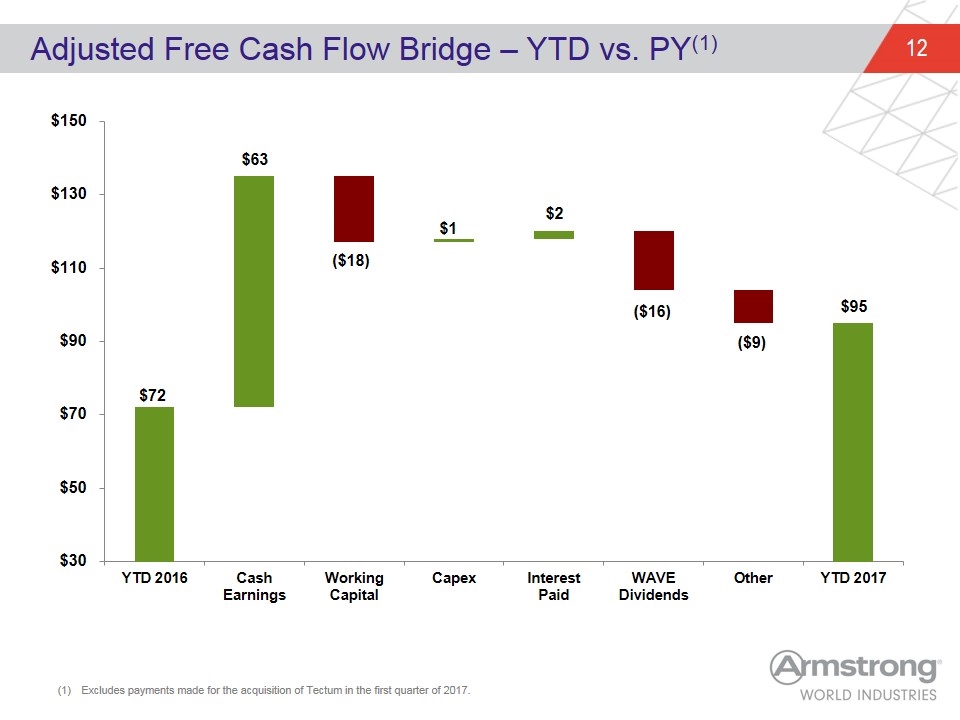

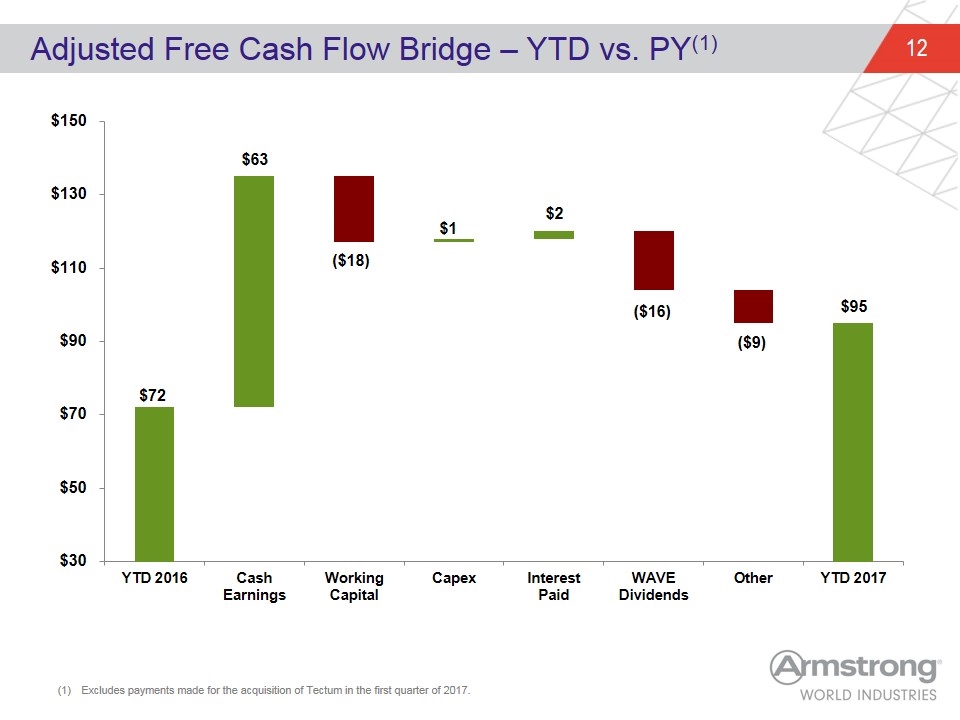

Adjusted Free Cash Flow Bridge – YTD vs. PY(1) $63 Excludes payments made for the acquisition of Tectum in the first quarter of 2017. ($16) $2 ($9) $1

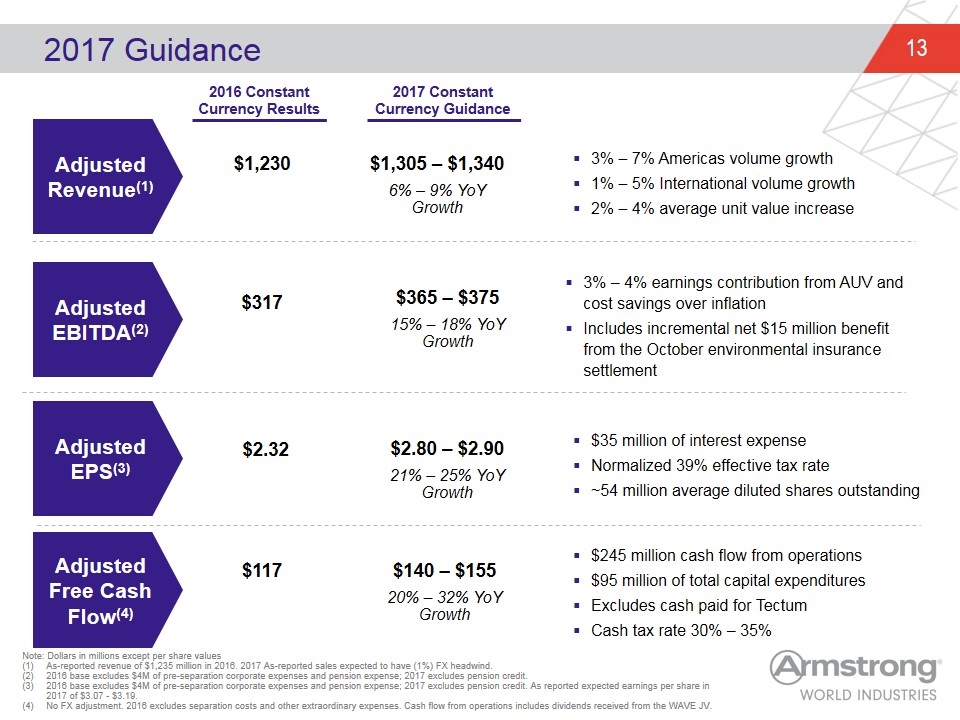

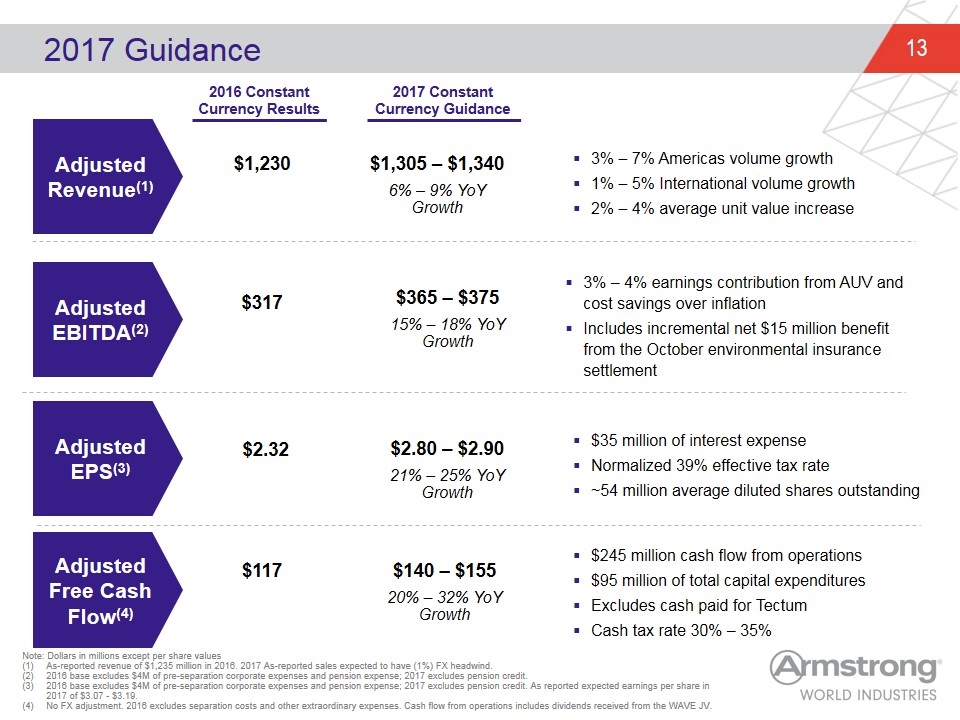

2017 Guidance $2.80 – $2.90 21% – 25% YoY Growth $2.32 Adjusted EBITDA(2) Adjusted EPS(3) Adjusted Free Cash Flow(4) Adjusted Revenue(1) $1,230 $317 $1,305 – $1,340 6% – 9% YoY Growth $365 – $375 15% – 18% YoY Growth $140 – $155 20% – 32% YoY Growth $117 Note: Dollars in millions except per share values As-reported revenue of $1,235 million in 2016. 2017 As-reported sales expected to have (1%) FX headwind. 2016 base excludes $4M of pre-separation corporate expenses and pension expense; 2017 excludes pension credit. 2016 base excludes $4M of pre-separation corporate expenses and pension expense; 2017 excludes pension credit. As reported expected earnings per share in 2017 of $3.07 - $3.19. No FX adjustment. 2016 excludes separation costs and other extraordinary expenses. Cash flow from operations includes dividends received from the WAVE JV. 3% – 7% Americas volume growth 1% – 5% International volume growth 2% – 4% average unit value increase 3% – 4% earnings contribution from AUV and cost savings over inflation Includes incremental net $15 million benefit from the October environmental insurance settlement $35 million of interest expense Normalized 39% effective tax rate ~54 million average diluted shares outstanding $245 million cash flow from operations $95 million of total capital expenditures Excludes cash paid for Tectum Cash tax rate 30% – 35% 2016 Constant Currency Results 2017 Constant Currency Guidance

Appendix

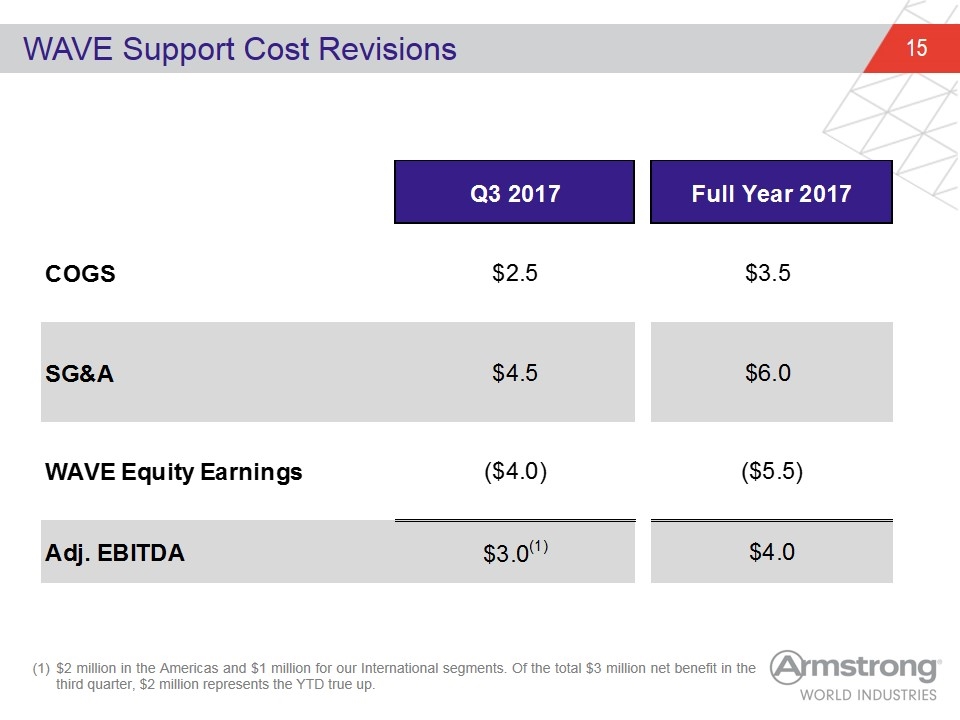

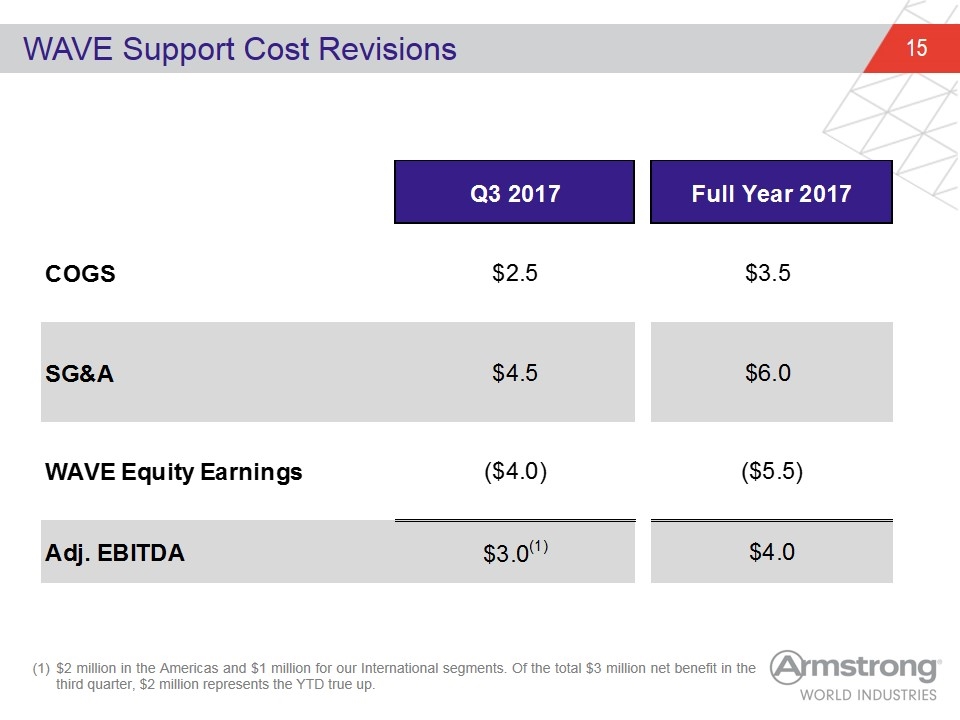

WAVE Support Cost Revisions $2 million in the Americas and $1 million for our International segments. Of the total $3 million net benefit in the third quarter, $2 million represents the YTD true up. Q3 2017 Full Year 2017 COGS $2.5 $3.5 SG&A $4.5 $6 WAVE Equity Earnings $-4 $-5.5 Adj. EBITDA $3.0(1) $4

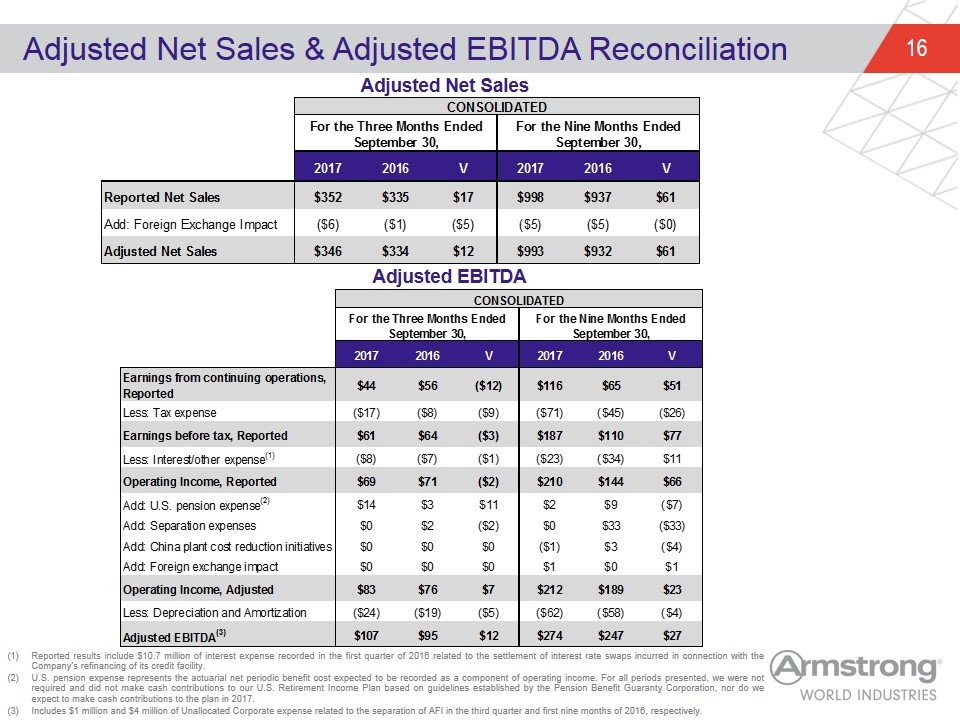

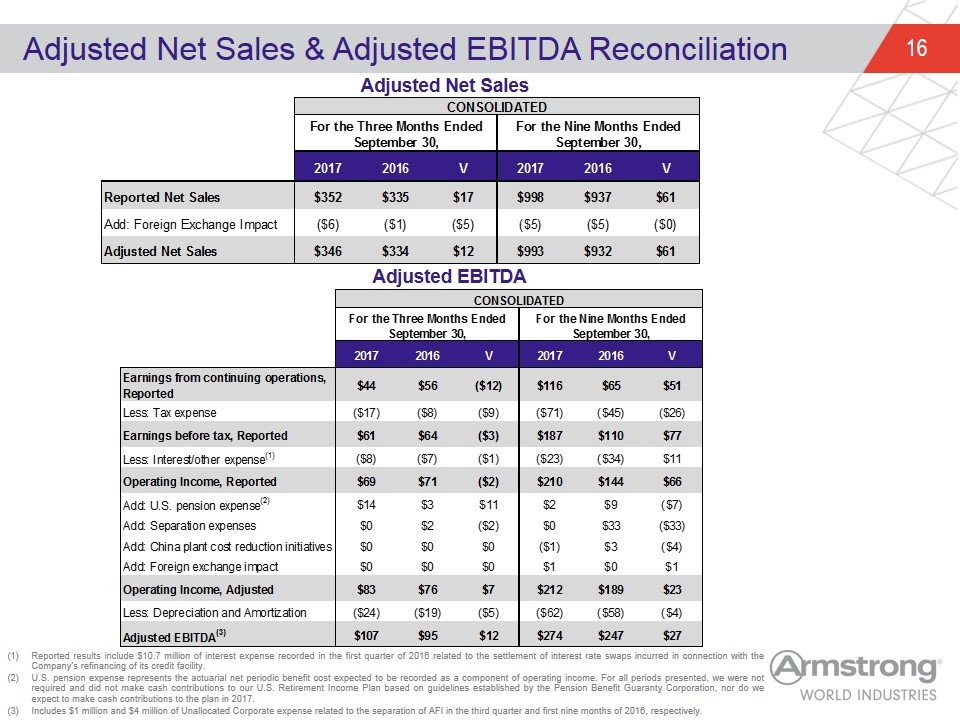

Adjusted Net Sales & Adjusted EBITDA Reconciliation Reported results include $10.7 million of interest expense recorded in the first quarter of 2016 related to the settlement of interest rate swaps incurred in connection with the Company’s refinancing of its credit facility. U.S. pension expense represents the actuarial net periodic benefit cost expected to be recorded as a component of operating income. For all periods presented, we were not required and did not make cash contributions to our U.S. Retirement Income Plan based on guidelines established by the Pension Benefit Guaranty Corporation, nor do we expect to make cash contributions to the plan in 2017. Includes $1 million and $4 million of Unallocated Corporate expense related to the separation of AFI in the third quarter and first nine months of 2016, respectively. Adjusted Net Sales Adjusted EBITDA CONSOLIDATED For the Three Months Ended September 30, For the Nine Months Ended September 30, qtr YTD 2017 2016 V 2017 2016 V Earnings from continuing operations, Reported $43.499999999999986 $55.899999999999984 $-12.399999999999999 $115.80000000000007 $65.400000000000006 $51 rounding Less: Tax expense $-17 $-8 $-9 $-71 $-45 $-26 Earnings before tax, Reported $61.199999999999982 $63.599999999999987 $-3 $186.70000000000007 $109.80000000000001 $76.900000000000063 rounding Less: Interest/other expense(1) $-8 $-7 $-1 $-23 $-34 $11 Operating Income, Reported $68.999999999999986 $70.999999999999986 $-2 $210.40000000000006 $144.30000000000001 $66.100000000000051 Add: U.S. pension expense(2) $14 $3 $11 $2 $9 $-7 Add: Separation expenses $0 $2 $-2 $0 $33 $-33 Add: China plant cost reduction initiatives $0 $0 $0 $-1 $3 $-4 Add: Foreign exchange impact $0 $0 $0 $1 $0 $1 Operating Income, Adjusted $82.915223927443193 $75.8209733689812 $7.0942505584619937 $212 $188.97454092911602 $23.025459070883983 Less: Depreciation and Amortization $-23.845760832079804 $-18.556291660420101 $-5.2894691716597038 $-62.192377682201993 $-58.114519819289995 $-4.0778578629119977 Adjusted EBITDA(3) $106.760984759523 $95.3772650294013 $12 $274.19237768220199 $247.08906074840601 $27.103316933795981 rounding CONSOLIDATED For the Three Months Ended September 30, For the Nine Months Ended September 30, 2017 2016 V 2017 2016 V Reported Net Sales $351.9 $334.9 $17 $998.1 $936.6 $61 Add: Foreign Exchange Impact $-5.8017993050299879 $-1.2399779218097819 $-4.5618213832202059 $-5.0229894794395022 $-4.997770416030562 $-2.5219063408940201E-2 Adjusted Net Sales $346.09820069496999 $333.6600220781902 $12.438178616779794 $993.07701052056052 $931.60222958396946 $61.47478093659106

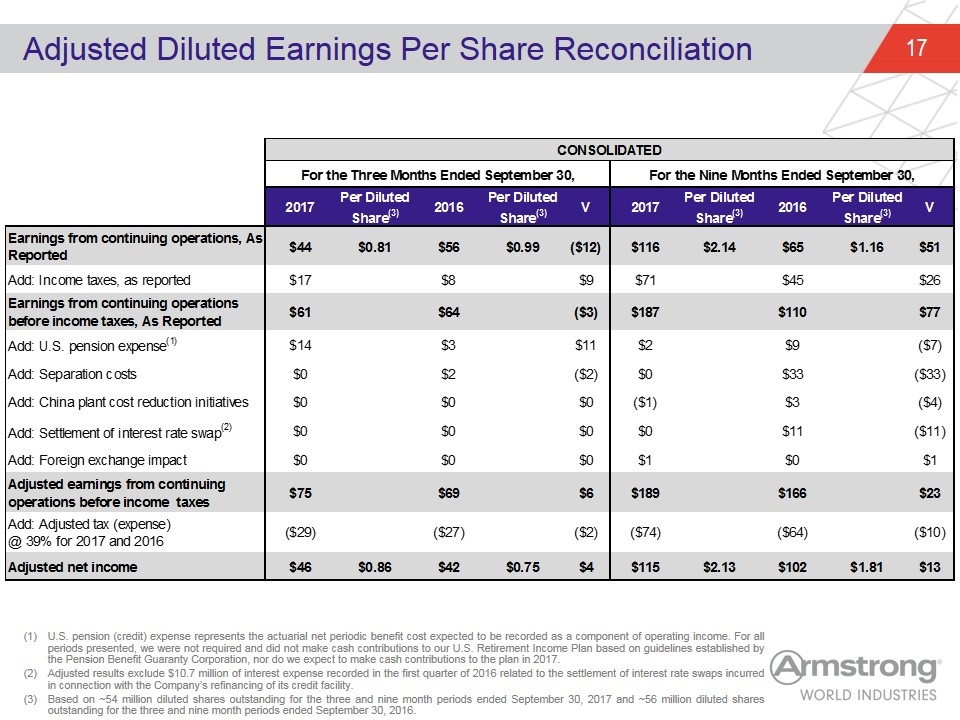

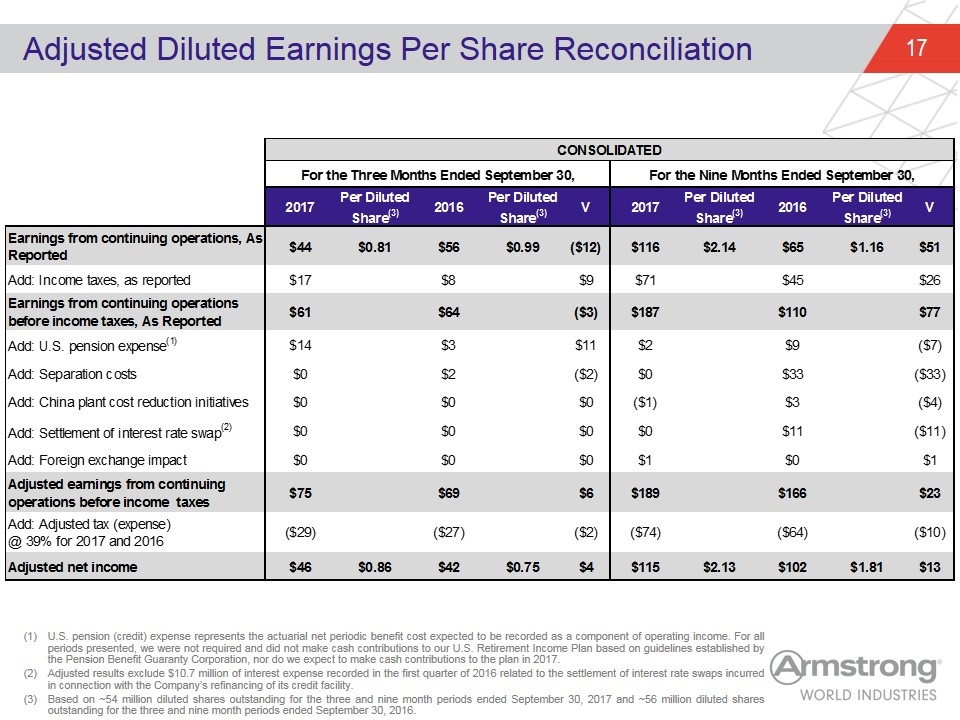

Adjusted Diluted Earnings Per Share Reconciliation U.S. pension (credit) expense represents the actuarial net periodic benefit cost expected to be recorded as a component of operating income. For all periods presented, we were not required and did not make cash contributions to our U.S. Retirement Income Plan based on guidelines established by the Pension Benefit Guaranty Corporation, nor do we expect to make cash contributions to the plan in 2017. Adjusted results exclude $10.7 million of interest expense recorded in the first quarter of 2016 related to the settlement of interest rate swaps incurred in connection with the Company’s refinancing of its credit facility. Based on ~54 million diluted shares outstanding for the three and nine month periods ended September 30, 2017 and ~56 million diluted shares outstanding for the three and nine month periods ended September 30, 2016. CONSOLIDATED For the Three Months Ended September 30, For the Nine Months Ended September 30, 2017 Per DilutedShare(3) 2016 Per DilutedShare(3) V 2017 Per DilutedShare(3) 2016 Per DilutedShare(3) V Qtr YTD Earnings from continuing operations, As Reported $43.499999999999986 $0.81 $55.899999999999984 $0.99 $-12.399999999999999 $115.80000000000007 $2.14 $65.400000000000006 $1.1599999999999999 $51 rounding Add: Income taxes, as reported $17 $7.7 $9.3000000000000007 $70.900000000000006 $45.4 $25.500000000000007 Earnings from continuing operations before income taxes, As Reported $61.199999999999982 $63.599999999999987 $-3 $186.70000000000007 $109.80000000000001 $77 rounding rounding Add: U.S. pension expense(1) $14 $3 $11 $2 $9 $-7 Add: Separation costs $0 $2 $-2 $0 $33 $-33 Add: China plant cost reduction initiatives $0 $0 $0 $-1 $3 $-4 Add: Settlement of interest rate swap(2) $0 $0 $0 $0 $11 $-11 Add: Foreign exchange impact $0 $0 $0 $1 $0 $1 Adjusted earnings from continuing operations before income taxes $75.100000000000009 $69.200000000000017 $5.8999999999999915 $189.4658093473775 $166.40000000000003 $23.065809347377467 Add: Adjusted tax (expense) @ 39% for 2017 and 2016 $-29 $-27 $-2 $-74 $-64 $-10 Adjusted net income $45.811000000000007 $0.8562803738317758 $42.21200000000001 $0.7537857142857145 $3.5989999999999966 $114.86414370190028 $2.1310601799981499 $101.50400000000002 $1.81 $13.360143701900256

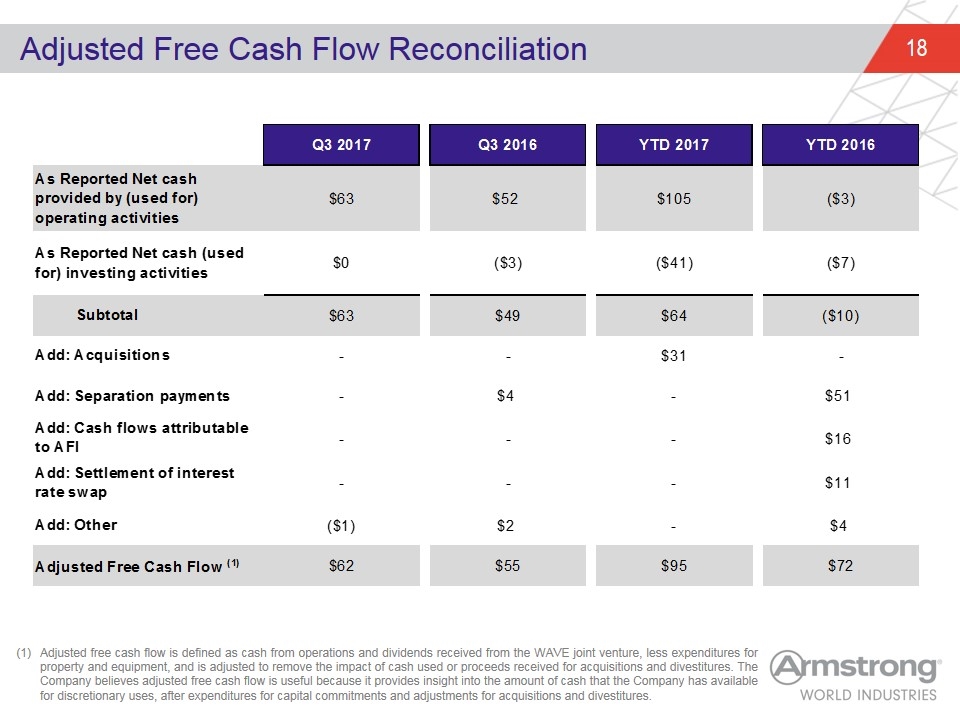

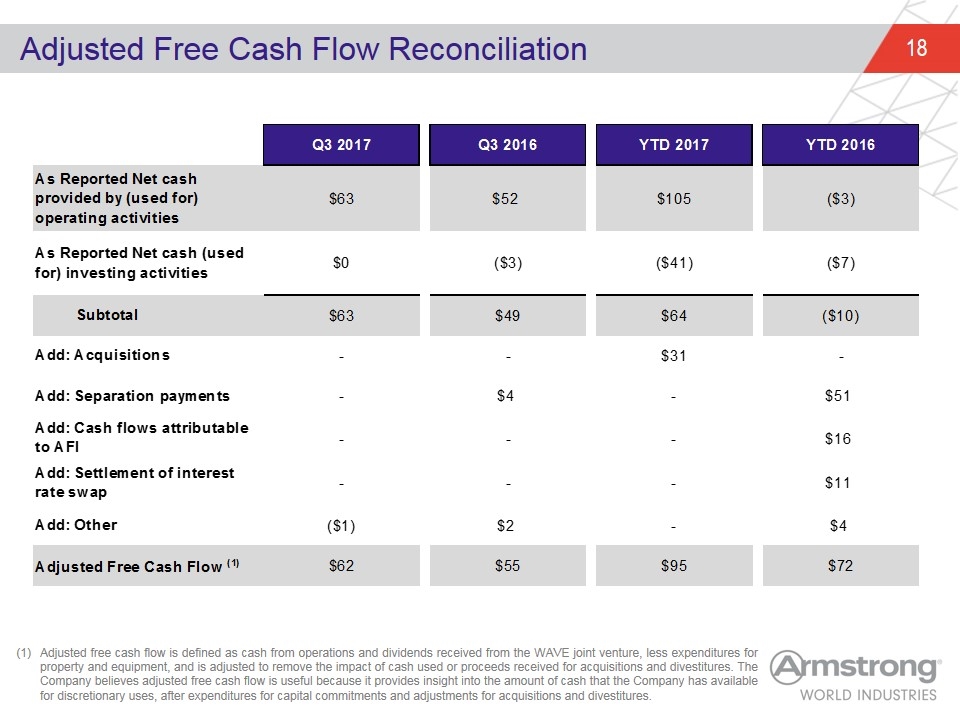

Adjusted Free Cash Flow Reconciliation Adjusted free cash flow is defined as cash from operations and dividends received from the WAVE joint venture, less expenditures for property and equipment, and is adjusted to remove the impact of cash used or proceeds received for acquisitions and divestitures. The Company believes adjusted free cash flow is useful because it provides insight into the amount of cash that the Company has available for discretionary uses, after expenditures for capital commitments and adjustments for acquisitions and divestitures. Q3 2017 Q3 2016 YTD 2017 YTD 2016 As Reported Net cash provided by (used for) operating activities $63 $52 $104.89999999999998 $-2.6000000000000423 As Reported Net cash (used for) investing activities $0 $-3 $-41.300000000000004 $-6.900000000000003 Subtotal $63 $49 $63.599999999999973 $-9.5000000000000462 Add: Acquisitions - - $31 - Add: Separation payments - $4 - $51 Add: Cash flows attributable to AFI - - - $16 Add: Settlement of interest rate swap - - - $11 Add: Other $-1 $2 - $4 Adjusted Free Cash Flow (1) $62 $55 $95 $72

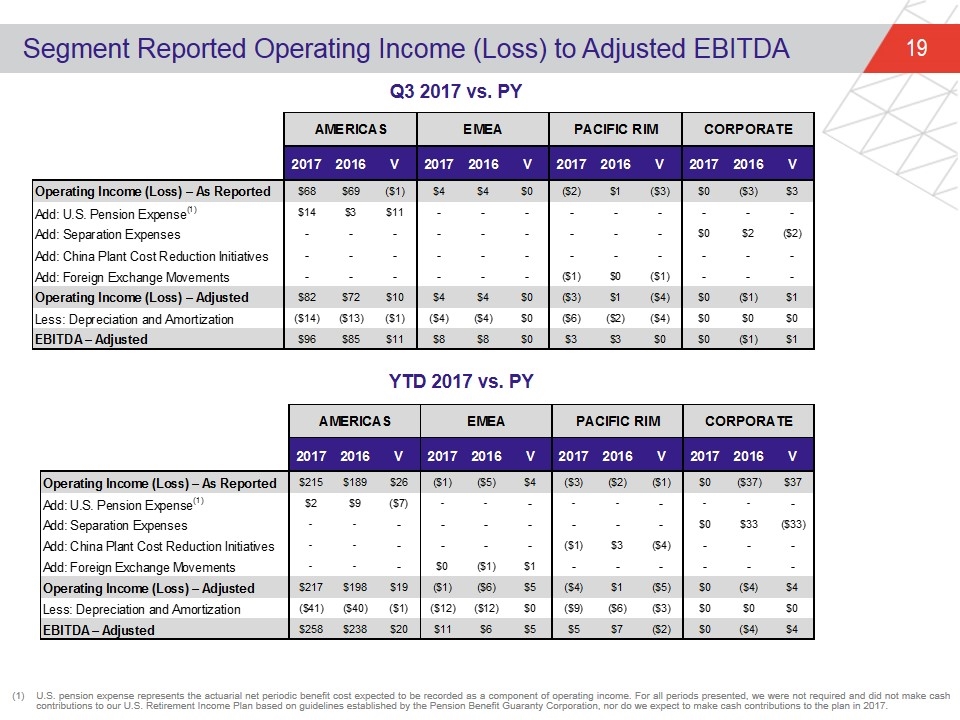

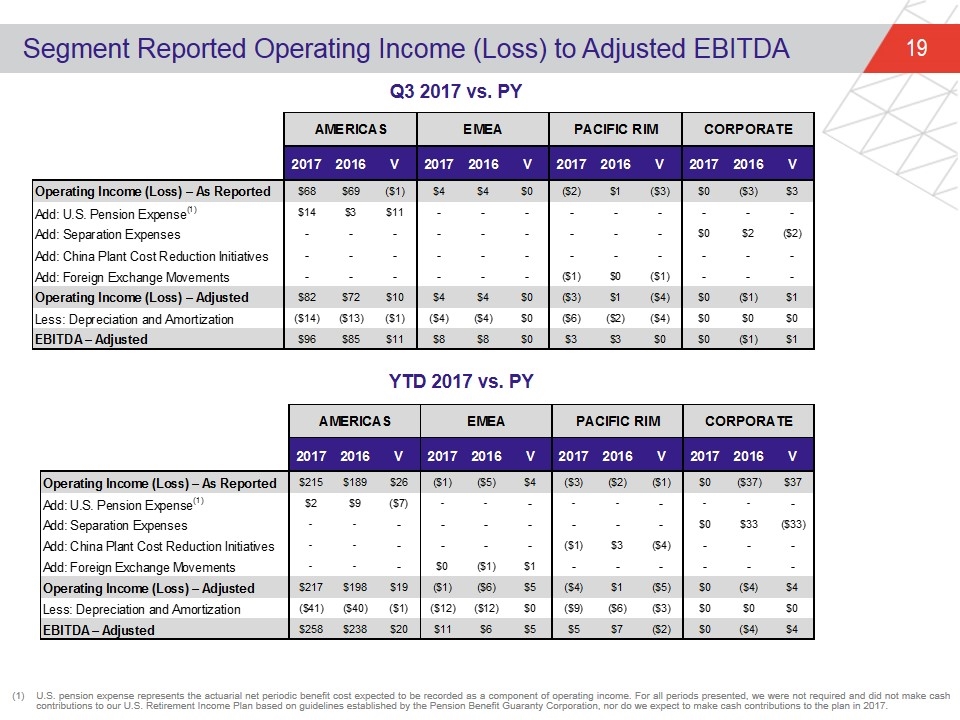

Segment Reported Operating Income (Loss) to Adjusted EBITDA Q3 2017 vs. PY YTD 2017 vs. PY U.S. pension expense represents the actuarial net periodic benefit cost expected to be recorded as a component of operating income. For all periods presented, we were not required and did not make cash contributions to our U.S. Retirement Income Plan based on guidelines established by the Pension Benefit Guaranty Corporation, nor do we expect to make cash contributions to the plan in 2017. AMERICAS EMEA PACIFIC RIM CORPORATE 2016 V 2017 2016 V 2017 2016 V 2017 2016 V 2017 2016 V Operating Income (Loss) – As Reported $214.7 $189 $25.699999999999989 $-1.1000000000000001 $-5.2 $4.0999999999999996 $-3.2 $-2.4 $-1 $0 $-37.1 $37.1 Add: U.S. Pension Expense(1) $2 $9 $-7 - - - - - - - - - Add: Separation Expenses - - - - - - - - - $0 $33 $-33 Add: China Plant Cost Reduction Initiatives - - - - - - $-1 $3 $-4 - - - Add: Foreign Exchange Movements - - - $0 $-1 $1 - - - - - - Operating Income (Loss) – Adjusted $217.34194657190002 $198.49007641370613 $18.85187015819389 $-1.0992581127599044 $-6.0121536066070984 $4.912895493847194 $-4.1926468827478587 $0.58936338841084557 $-4.782010271158704 $0 $-4.0999999999999996 $4.0999999999999996 Less: Depreciation and Amortization $-40.837027946199981 $-39.734596099299864 $-1.1024318469001173 $-11.943056558279991 $-12.360032625560013 $0 $-9.4159096013300108 $-6.019891094430009 $-3.3960185069000017 $0 $0 $0 EBITDA – Adjusted $258.17897451810001 $238.224672513006 $19.954302005094007 $10.843798445520086 $6.3478790189529137 $5 $5.223262718582153 $6.6092544828408544 $-2 $0 $-4.0999999999999996 $4.0999999999999996 AMERICAS EMEA PACIFIC RIM CORPORATE rounding factor 2016 V 2017 2016 V 2017 2016 V 2017 2016 V 2017 2016 V Operating Income (Loss) – As Reported $67.599999999999994 $68.599999999999994 $-1 $3.8 $4.0999999999999996 $0 $-2.4 $1 $-3.4 $0 $-2.7 $2.7 Add: U.S. Pension Expense(1) $14 $3 $11 - - - - - - - - - Add: Separation Expenses - - - - - - - - - $0 $2 $-2 Add: China Plant Cost Reduction Initiatives - - - - - - - - - - - - Add: Foreign Exchange Movements - - - - - - $-1 $0 $-1 - - - Operating Income (Loss) – Adjusted $81.943180698600003 $71.685253354272717 $10 $3.683889517600071 $3.6224925568197688 $0 $-2.6377356210731762 $1.3220499763848554 $-3.9597855974580316 $0 $-0.8 $0.8 Less: Depreciation and Amortization $-14.051226478999894 $-13 $-1.0512264789998937 $-4.0600797623399876 $-3.9251214511200074 $0 $-5.7344545907400111 $-2.0207511200000061 $-3.713703470740005 $0 $0 $0 EBITDA – Adjusted $95.994407177599896 $85.295672443572755 $11 $7.7439692799400586 $7.5476140079397762 $0 $3.0967189696668345 $3.3428010963848616 $0 $0 $-0.8 $0.8

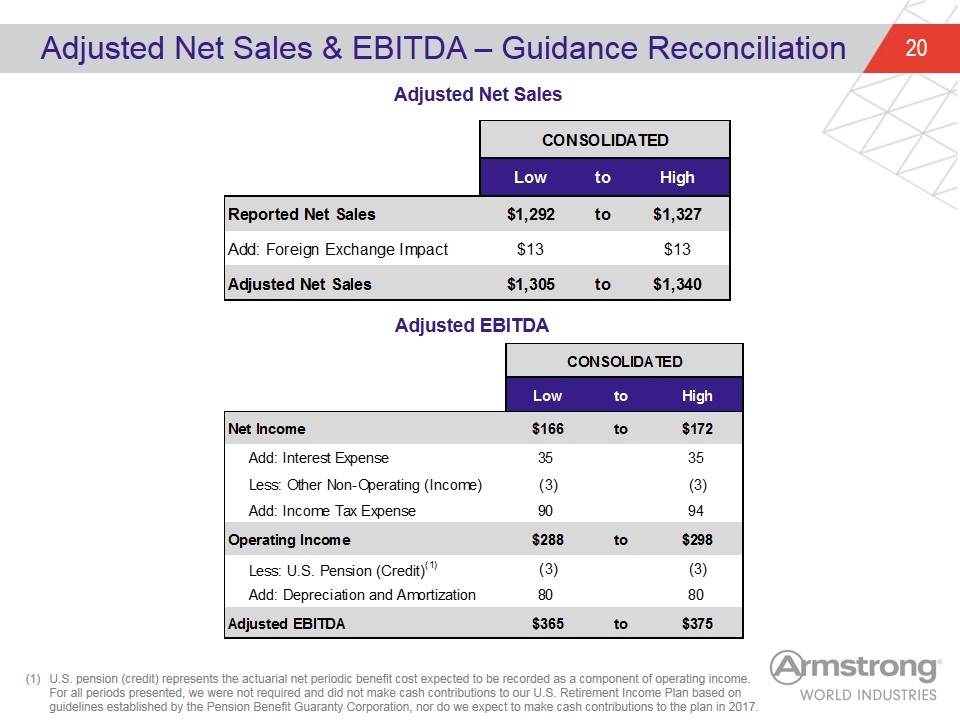

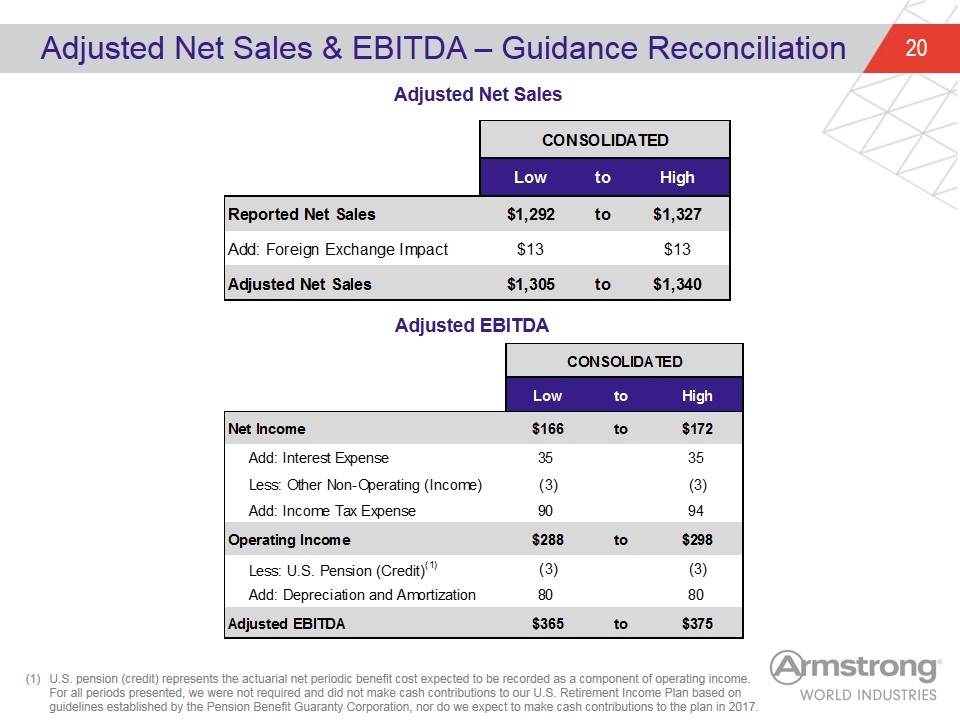

Adjusted Net Sales & EBITDA – Guidance Reconciliation U.S. pension (credit) represents the actuarial net periodic benefit cost expected to be recorded as a component of operating income. For all periods presented, we were not required and did not make cash contributions to our U.S. Retirement Income Plan based on guidelines established by the Pension Benefit Guaranty Corporation, nor do we expect to make cash contributions to the plan in 2017. Adjusted Net Sales Adjusted EBITDA CONSOLIDATED Low to High Reported Net Sales $1,292 to $1,327 Add: Foreign Exchange Impact $13 $13 Adjusted Net Sales $1,305 to $1,340 CONSOLIDATED Low to High Net Income $166 to $172 Add: Interest Expense 35 35 Less: Other Non-Operating (Income) -3 -3 Add: Income Tax Expense 90 94 Operating Income $288 to $298 Less: U.S. Pension (Credit)(1) -3 -3 Add: Depreciation and Amortization 80 80 Adjusted EBITDA $365 to $375

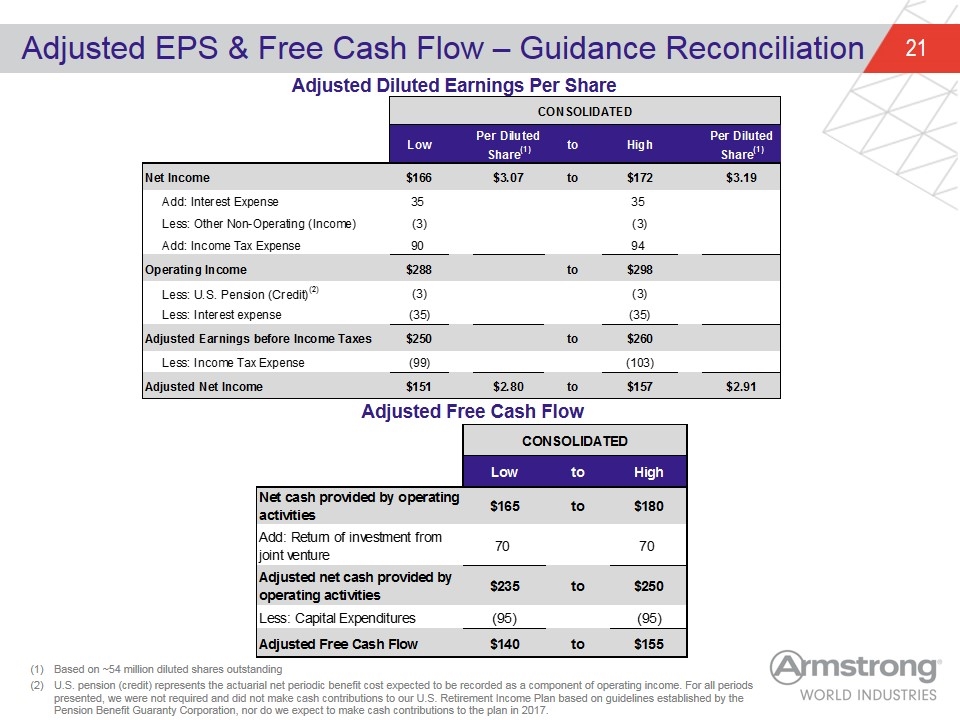

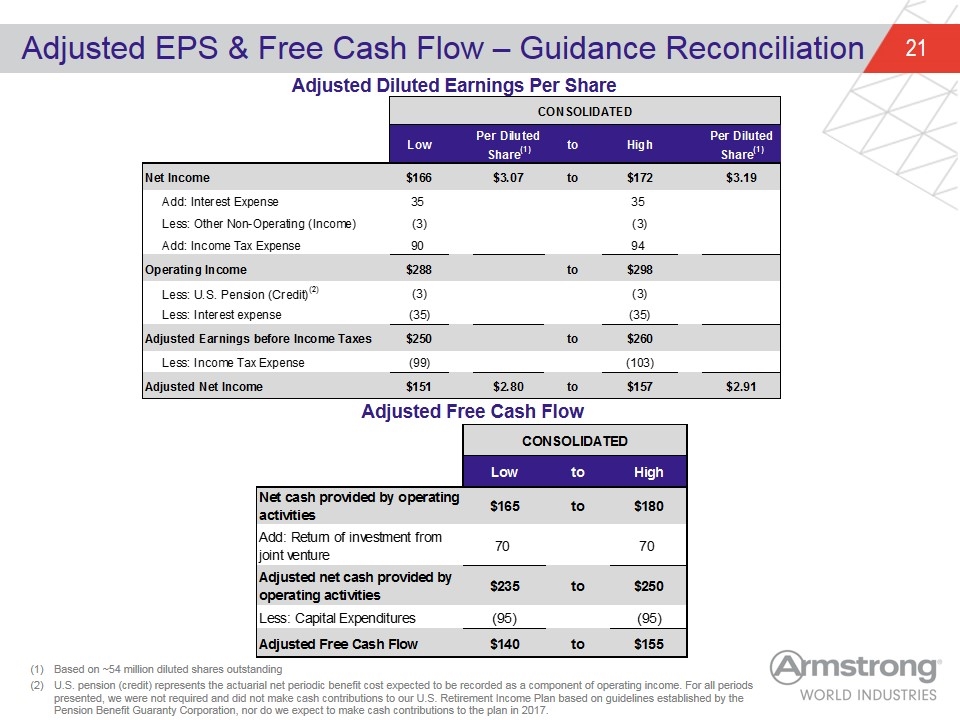

Adjusted EPS & Free Cash Flow – Guidance Reconciliation Based on ~54 million diluted shares outstanding U.S. pension (credit) represents the actuarial net periodic benefit cost expected to be recorded as a component of operating income. For all periods presented, we were not required and did not make cash contributions to our U.S. Retirement Income Plan based on guidelines established by the Pension Benefit Guaranty Corporation, nor do we expect to make cash contributions to the plan in 2017. Adjusted Diluted Earnings Per Share Adjusted Free Cash Flow CONSOLIDATED Low to High Net cash provided by operating activities $165 to $180 Add: Return of investment from joint venture 70 70 Adjusted net cash provided by operating activities $235 to $250 Less: Capital Expenditures -95 -95 Adjusted Free Cash Flow $140 to $155 CONSOLIDATED Low Per DilutedShare(1) to High Per DilutedShare(1) Net Income $166 $3.07 to $172 $3.19 Add: Interest Expense 35 35 Less: Other Non-Operating (Income) -3 -3 Add: Income Tax Expense 90 94 Operating Income $288 to $298 Less: U.S. Pension (Credit)(2) -3 -3 Less: Interest expense -35 -35 Adjusted Earnings before Income Taxes $250 to $260 Less: Income Tax Expense -99 -103 Adjusted Net Income $151 $2.8 to $157 $2.91