UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-4000

Summit Mutual Funds, Inc.

(Exact name of registrant as specified in charter)

312 Walnut Street, Suite 2500, Cincinnati, Ohio 45202

(Address of principal executive offices) (Zip code)

John F. Labmeier, Esq.

Summit Investment Partners, Inc.

312 Walnut Street, Suite 2500

Cincinnati, Ohio 45202

(Name and address of agent for service)

(513) 632-1600

Registrant's telephone number, including area code

Date of fiscal year end: September 30, 2007

Date of reporting period: September 30, 2007

Item 1. Report to Stockholders.

Summit Mutual Funds, Inc. – Apex Series |

| Message from the President | 1 |

Fund Expenses | 2 |

| | |

| Portfolio Managers’ Reports and Financial Statements: | |

Nasdaq-100 Index Fund | 3 |

Everest Fund | 10 |

Bond Fund | 16 |

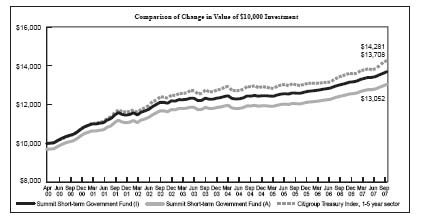

Short-term Government Fund | 25 |

High Yield Bond Fund | 31 |

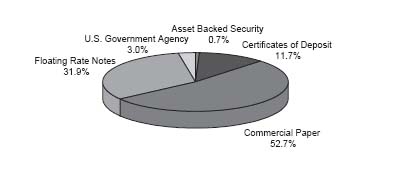

Money Market Fund | 38 |

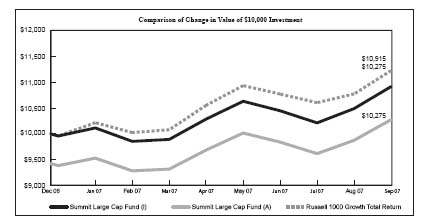

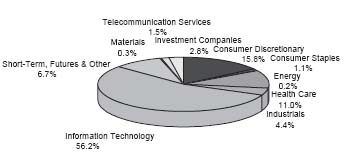

Large Cap Growth Fund | 45 |

| | |

| Notes to Financial Statements | 51 |

| | |

| Report of Independent Registered Public Accounting Firm | 55 |

Important Considerations about Investing in Summit Mutual Funds

A description of the policies and procedures that the Funds use to determine how to vote proxies relating to portfolio securities and information regarding how the Funds voted portfolio securities during the most recent 12 month period ended September 30 is available without charge, upon request, by calling 1-877-546-FUND, or on the Funds’ website at www.summitfunds.com, or on the Securities and Exchange Commission’s website at www.sec.gov.

This Fund files a complete Schedule of Investments in Securities with the SEC for the first and third quarters of each fiscal year on Form N-Q. The Funds’ Form N-Q is available on the Fund’s or SEC’s website. The Funds’ Form N-Q may also be reviewed and copied at the SEC’s Public Reference Room in Washington, DC. Information on the operation of the Public Reference Room may be obtained by calling 1-800-SEC-0330.

This report has been prepared for the information of shareholders and is not authorized for distribution to prospective purchasers of shares unless it is preceded or accompanied by an effective prospectus for Summit Mutual Funds, Inc.

Mutual fund investing involves risk. Principal loss is possible.

The Short-term Government Fund, Money Market Fund, High Yield Bond Fund, and Bond Fund invest in debt securities. Investments in debt securities typically decrease in value when interest rates rise. This risk is usually greater for longer-term debt securities.

Investments by the High Yield Bond Fund and Bond Fund in lower-rated and non-rated securities present a greater risk of loss to principal and interest than higher-rated securities.

An investment in the Money Market Fund is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. Although the Fund seeks to preserve the value of your investment at $1.00 per share, it is possible to lose money by investing in the Fund.

Because the Nasdaq-100 Index Fund has expenses, and the Nasdaq-100 Index does not, the Fund may be unable to replicate precisely the performance of the Index. While the Fund remains small, it may have a greater risk that its performance will not match that of the Index.

All indexes listed in the report are unmanaged, and are not available for direct investment.

The Manager Comments provided in this report reflect the opinions of the Fund’s Portfolio Managers and are not intended to be a forecast of future events, a guarantee of future results, nor investment advice.

Summit Mutual Funds, Inc. MESSAGE FROM THE PRESIDENT |

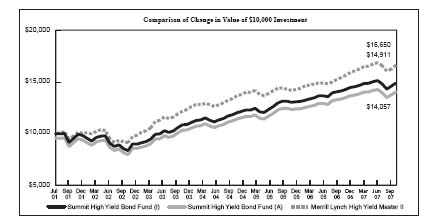

We are pleased to send you Summit Mutual Funds’ 2007 Annual Report for the twelve-month period ended September 30, 2007. We welcome new and thank existing investors in the Summit Funds as we strive to help you reach your financial goals. Financial markets performed well over the last year, providing positive returns in all of the major domestic stock and bond indexes. Large cap growth equities, as measured by the Nasdaq 100 Index, lead the major market indexes over the last 12 months, providing a return of 27.01%. International equities also performed well, with the EAFE International index providing a return of 24.86% (in U.S. dollars and net of foreign taxes) over the same period. In the fixed income markets, high yield indexes outperformed broader, investment grade fixed income indexes, such as the Lehman Aggregate Bond Index. Economic indicators continue to provide mixed signals, but it appears that the economy may slow going into 2008. The fallout from poorly underwritten sub-prime mortgage loans continues to negatively affect the housing market and is slowly spreading to other sectors of the economy. In addition, tightening credit standards will negatively impact the economy, although to what degree is still up for debate. As always, employment and the consumer’s willingness and ability to spend will play a major role in the magnitude and duration of any slowdown. International growth remains strong, and a weaker U.S. dollar should benefit exporters and producers of commodities that are denominated in U.S. dollars, such as oil. Oil prices remain at very high levels, and continue to increase as of this writing, with no immediate end in sight. Higher energy prices will put a further drag on the economy. | The Federal Reserve Board reacted to the tightening credit markets and the prospect for slower growth by cutting the Fed Funds rate 0.50% in September 2007 to 4.75%. Given the current structure of U.S. Treasury Securities interest rates over all maturities, the marketplace is anticipating further cuts in the Fed Funds Rate. Chairman Bernanke continues to weigh the risks of slowing growth and tighter credit against a weaker dollar and long term inflation risks. For now, it appears that Chairman Bernanke is more concerned about the former than the latter. Hence, the direction of short-term rates is downward for now. Equity markets have mostly ignored the issues in the credit markets and have instead chosen to focus on price to earnings multiples and the possibility of improved earnings in the future. For the fiscal year ended September 30th, the large cap S&P 500 Index advanced 16.44%, the S&P MidCap 400 Index improved 18.76% and the small cap Russell 2000 Index rose 12.34%. Small cap stocks lagged for the first time in several years. In addition, growth stocks outperformed value stocks for the year, which suggests the market may be changing its focus. “Maintain the proper perspective (and) have realistic expectations . . .” Fixed income markets provided positive returns over the last twelve months, as well. Short and intermediate term interest rates declined materially, while longer term interest rates were mostly unchanged. The 2 year Treasury yield declined 0.70% to 3.98%, while the 10 year Treasury rate remained mostly unchanged at 4.59%. Credit spreads (the interest rate difference between risk-free U.S. Treasury securities and other fixed income securities) generally widened during the period, as market participants began repricing risk in June 2007. In this environment, the Lehman Aggregate Bond Index provided a positive return of 5.14% over the last twelve months. The high yield market provided an even higher return of 7.75% as measured by the Merrill Lynch High Yield Master II Index during the same period. | “Proper diversification of your investments . . . is an important component of achieving your long-term investment goals.” Looking out into 2008, there is much uncertainty regarding the rate of U.S. economic growth, corporate profitability and interest rates. The Federal Reserve, through its actions, has made it clear that it will provide liquidity to the market when needed. However, it has also made it clear that it is not their job to bail out investors who simply made bad investments. Our message remains the same though, as we enter 2008. Maintain the proper perspective, have realistic expectations and ensure that your investment strategy is appropriate for your risk tolerance and time horizon. Concepts such as asset allocation and portfolio rebalancing are critical. Proper diversification of your investments, both within and across asset sectors, is an important component of achieving your long-term investment goals. Summit Mutual Funds provides a solid foundation for diversified investment planning with choices across equity and fixed income styles. Thank you for choosing Summit Funds and for the trust that you have placed in us. Steven R. Sutermeister President |

Summit Mutual Funds, Inc. – Apex Series 2007 ANNUAL REPORT – FUND EXPENSES (UNAUDITED) |

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments, and (2) ongoing costs, including management fees, distribution and/or service (12b-1) fees, and other Fund expenses. The following Example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds. Please note that the expenses shown in the Example do not reflect transactional costs. If transactional costs were included, your costs would have been higher.

The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period April 1, 2007 through September 30, 2007.

Actual Expenses

The first section of the table below provides information about actual account values and actual net expenses. You may use the information in this section, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first section under the heading entitled “Expenses Paid” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second section of the table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio, net of fee waivers and expense reimbursements, and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses cannot be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund with those of other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds.

The information below is net of any applicable fee waivers and/or expense reductions, which lower expenses and increase performance. Please note that the second section of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds.

| | | | | |

| | | | | Expenses Paid* |

| | Beginning | Ending | Annualized | During Period |

| | Account Value | Account Value | Expense | April 1, 2007 to |

| Fund | April 1, 2007 | September 30, 2007 | Ratio | September 30, 2007 |

| | | | | |

Based on Actual Return | | | | |

| Nasdaq-100 Index Fund | $1,000.00 | $1,178.50 | 0.65% | $3.55 |

| Everest Fund Class I | 1,000.00 | 1,044.30 | 0.90% | 4.61 |

| Everest Fund Class A | 1,000.00 | 1,042.90 | 1.15% | 5.89 |

| Bond Fund Class I | 1,000.00 | 1,006.00 | 0.79% | 3.97 |

| Bond Fund Class A | 1,000.00 | 1,004.80 | 1.05% | 5.28 |

| Short-term Government Fund Class I | 1,000.00 | 1,026.20 | 0.73% | 3.71 |

| Short-term Government Fund Class A | 1,000.00 | 1,024.90 | 0.98% | 4.97 |

| High Yield Bond Fund Class I | 1,000.00 | 1,001.60 | 1.30% | 6.52 |

| High Yield Bond Fund Class A | 1,000.00 | 1,000.40 | 1.57% | 7.87 |

| Money Market Fund | 1,000.00 | 1,025.10 | 0.45% | 2.28 |

| Large Cap Growth Fund Class I | 1,000.00 | 1,103.10 | 1.10% | 5.80 |

| Large Cap Growth Fund Class A | 1,000.00 | 1,102.60 | 1.35% | 7.12 |

| | | | | |

Based on Hypothetical Return | | | | |

| (5% return before expenses) | | | | |

| Nasdaq-100 Index Fund | $1,000.00 | $1,021.81 | 0.65% | $3.29 |

| Everest Fund Class I | 1,000.00 | 1,020.51 | 0.90% | 4.56 |

| Everest Fund Class A | 1,000.00 | 1,019.25 | 1.15% | 5.82 |

| Bond Fund Class I | 1,000.00 | 1,021.26 | 0.79% | 4.00 |

| Bond Fund Class A | 1,000.00 | 1,019.90 | 1.05% | 5.32 |

| Short-term Government Fund Class I | 1,000.00 | 1,021.41 | 0.73% | 3.70 |

| Short-term Government Fund Class A | 1,000.00 | 1,020.16 | 0.98% | 4.96 |

| High Yield Bond Fund Class I | 1,000.00 | 1,018.80 | 1.30% | 6.58 |

| High Yield Bond Fund Class A | 1,000.00 | 1,017.35 | 1.57% | 7.94 |

| Money Market Fund | 1,000.00 | 1,022.81 | 0.45% | 2.28 |

| Large Cap Growth Fund Class I | 1,000.00 | 1,019.55 | 1.10% | 5.57 |

| Large Cap Growth Fund Class A | 1,000.00 | 1,018.30 | 1.35% | 6.83 |

* Expenses are equal to the Fund’s annualized net expense ratio, multiplied by the average account value over the period, multiplied by 183/365 (to reflect the one-half year period).

Summit Mutual Funds, Inc. – Apex Series |

Summit Nasdaq-100 Index Fund - Average Annual Total Return |

1-Y ear | 5-Year | Since Inception |

| | |

Past performance is not predictive of future results. Performance does not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. Absent limitation of expenses during certain of the periods shown, performance would have been lower.

| Managers: | Gary R. Rodmaker Nick J. Kotsonis Kevin P. Aug |

| Inception Date: | December 28, 1999 |

| Total Net Assets: | $24.1 Million |

| Number Of Equity Holdings: | 101 |

| Median Cap Size: | $10,033 Million |

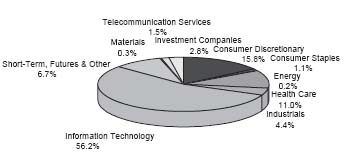

Top 10 Equity Holdings | | Sector Allocations |

| | (% of net assets) | | |

Apple, Inc.Microsoft Corp. | | |  |

“Nasdaq” and related marks are trademarks or service marks of The Nasdaq Stock Market, Inc. and have been licensed for use for certain purposes by Summit Mutual Funds, Inc. and the Nasdaq-100 Index Fund. Nasdaq makes no warranty, express or implied, and bears no liability with respect to Summit Mutual Funds, its use of The Index, or any data include therein.

Summit Mutual Funds, Inc. – Apex Series |

Objective – Seeks investment results that correspond to the investment performance of U.S. common stocks, as represented by the Nasdaq-100 Index (the “Index”).

Strategy – The Nasdaq-100 Index Fund (the “Fund”) will attempt to achieve, in both rising and falling markets, a correlation of at least 95% between the total return of its net assets before expenses and the total return of the Index.

Managers’ Comments:

For the year ended September 30, 2007, the Summit Nasdaq-100 Index Fund’s total return for Class I shares was 26.16% (after waivers and reimbursements). This compares to a 27.01% total return for the Nasdaq-100 Index. The difference of 0.85% is referred to as “tracking error” and is largely attributed to the Fund’s operating expenses. These expenses represent the Fund’s costs for advisory, administration, accounting, custody and other services. The remaining difference can be caused by a number of factors, including the timing and size of shareholder subscriptions and redemptions into and out of the Fund, broker’s commissions or other trading costs, and holding security positions in amounts that are different than the weightings in the Index, among others. While an exact replication of the capitalization weightings of securities in the Index is not feasible, the Fund’s objectives and strategies call for a correlation of at least 95% between the Fund’s pre-expense total return and that of the Index. The Fund achieved this level of correlation for the period presented.

A correlation coefficient is a measure of the interdependence of two random variables that ranges in value from -1 to +1, indicating perfect negative correlation at -1, absence of correlation at zero, and perfect positive correlation at +1.

Summit Mutual Funds, Inc. – Apex Series |

| NASDAQ-100 INDEX FUND | FINANCIAL HIGHLIGHTS |

FINANCIAL HIGHLIGHTS | | | | | | | | | | | | | | | |

| Computed on the basis of a share of capital stock outstanding throughout the period. | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | Fiscal Year Ended September 30, |

| | | 2007 | | | 2006 | | | 2005 | | | 2004 | | | 2003 | |

| Net asset value, beginning of period | | $ | 21.68 | | | $ | 21.09 | | | $ | 18.71 | | | $ | 17.35 | | | $ | 11.18 | |

| INVESTMENT ACTIVITIES: | | | | | | | | | | | | | | | | | | | | |

| Net investment income / (loss) | | | 0.01 | | | | 0.05 | (2) | | | 0.16 | | | | (0.07 | ) | | | (0.04 | ) |

| Net realized and unrealized gains / (losses) | | | 5.64 | | | | 0.61 | | | | 2.31 | | | | 1.43 | | | | 6.21 | |

| Total from Investment Activities | | | 5.65 | | | | 0.66 | | | | 2.47 | | | | 1.36 | | | | 6.17 | |

| DISTRIBUTIONS: | | | | | | | | | | | | | | | | | | | | |

| Net investment income | | | (0.06 | ) | | | (0.07 | ) | | | (0.09 | ) | | | — | | | | — | |

| Total Distributions | | | (0.06 | ) | | | (0.07 | ) | | | (0.09 | ) | | | — | | | | — | |

| Net asset value, end of period | | $ | 27.27 | | | $ | 21.68 | | | $ | 21.09 | | | $ | 18.71 | | | $ | 17.35 | |

| | | | | | | | | | | | | | | | | | | | | |

| Total return | | | 26.16 | % | | | 3.08 | % | | | 13.20 | % | | | 7.84 | % | | | 55.19 | % |

| | | | | | | | | | | | | | | | | | | | | |

| RATIOS/SUPPLEMENTAL DATA: | | | | | | | | | | | | | | | | | | | | |

Ratio of expenses to average net assets – net(1) | | | 0.65 | % | | | 0.65 | % | | | 0.65 | % | | | 0.65 | % | | | 0.65 | % |

| Ratio of expenses to average net assets – gross | | | 1.10 | % | | | 1.09 | % | | | 1.13 | % | | | 1.13 | % | | | 1.38 | % |

| Ratio of net investment income / (loss) to average net assets | | | 0.06 | % | | | 0.25 | % | | | 0.79 | % | | | -0.33 | % | | | -0.33 | % |

| Portfolio turnover rate | | | 15.20 | % | | | 12.89 | % | | | 10.60 | % | | | 4.92 | % | | | 7.68 | % |

| Net assets, end of period (000’s) | | $ | 24,130 | | | $ | 15,644 | | | $ | 17,040 | | | $ | 16,874 | | | $ | 15,847 | |

(1) Net expenses represent gross expenses reduced by fees waived and/or reimbursed by the Adviser.

(2) Per share amounts are based on average shares outstanding.

The accompanying notes are an integral part of the financial statements.

Summit Mutual Funds, Inc. – Apex Series |

| SCHEDULE OF INVESTMENTS | NASDAQ-100 INDEX FUND |

September 30, 2007 | | | | | | |

| | | SHARES | | | VALUE | |

COMMON STOCKS - 90.5% | | | | | | |

Consumer Discretionary - 15.8% | | | | | | |

Amazon.Com, Inc. (a) | | | 3,415 | | | $ | 318,107 | |

Apollo Group, Inc. - Class A(a)(c) | | | 2,178 | | | | 131,007 | |

Bed Bath & Beyond, Inc. (a) | | | 4,540 | | | | 154,905 | |

Comcast Corp. (a) | | | 18,018 | | | | 435,675 | |

Discovery Holding Co. (a) | | | 2,965 | | | | 85,540 | |

eBay, Inc. (a) | | | 12,651 | | | | 493,642 | |

EchoStar Communications Corp. - Class A (a) | | | 2,674 | | | | 125,170 | |

Expedia, Inc. (a)(c) | | | 3,416 | | | | 108,902 | |

Garmin Ltd. (c) | | | 2,494 | | | | 297,784 | |

IAC/InterActiveCorp (a) | | | 3,721 | | | | 110,402 | |

Lamar Advertising Co. - Class A(c) | | | 987 | | | | 48,333 | |

Liberty Global, Inc. (a) (c) | | | 2,412 | | | | 98,940 | |

Liberty Media Corp. - Interactive(a) | | | 7,224 | | | | 138,773 | |

PetSmart, Inc. (c) | | | 1,676 | | | | 53,464 | |

| Ross Stores, Inc. | | | 1,701 | | | | 43,614 | |

Sears Holdings Corporation(a)(c) | | | 1,853 | | | | 235,702 | |

Sirius Satellite Radio, Inc. (a)(c) | | | 19,748 | | | | 68,920 | |

| Staples, Inc. | | | 5,973 | | | | 128,360 | |

Starbucks Corp. (a) | | | 12,911 | | | | 338,268 | |

Virgin Media, Inc. (c) | | | 4,443 | | | | 107,832 | |

Wynn Resorts Ltd. (c) | | | 1,487 | | | | 234,292 | |

XM Satellite Radio Holdings, Inc. - Class A (a) (c) | | | 3,927 | | | | 55,646 | |

| | | | | | | | 3,813,278 | |

Consumer Staples - 1.1% | | | | | | | | |

| Costco Wholesale Corp. | | | 2,870 | | | | 176,132 | |

Whole Foods Market, Inc. (c) | | | 1,724 | | | | 84,407 | |

| | | | | | | | 260,539 | |

Energy - 0.2% | | | | | | | | |

Patterson-UTI Energy, Inc. (c) | | | 1,969 | | | | 44,440 | |

Health Care - 11.0% | | | | | | | | |

Amgen, Inc. (a) | | | 6,312 | | | | 357,070 | |

Amylin Pharmaceuticals, Inc. (a)(c) | | | 1,577 | | | | 78,850 | |

Biogen Idec, Inc. (a) | | | 3,876 | | | | 257,095 | |

Celgene Corp. (a)(c) | | | 4,722 | | | | 336,726 | |

Cephalon, Inc. (a) | | | 801 | | | | 58,521 | |

| Dentsply International, I nc. | | | 1,814 | | | | 75,535 | |

Express Scripts, Inc. (a) | | | 2,863 | | | | 159,813 | |

Genzyme Corp. (a) | | | 4,117 | | | | 255,089 | |

Gilead Sciences, Inc. (a) | | | 11,351 | | | | 463,915 | |

Intuitive Surgical, Inc. (a) | | | 466 | | | | 107,180 | |

Patterson Companies, Inc. (a) | | | 1,659 | | | | 64,054 | |

Sepracor, Inc. (a) | | | 1,285 | | | | 35,338 | |

Teva Pharmaceutical Industries Ltd. - ADR (c) | | | 7,609 | | | | 338,372 | |

Vertex Pharmaceuticals, Inc. (a) (c) | | | 1,702 | | | | 65,374 | |

| | | | | | | | 2,652,932 | |

Industrials - 4.4% | | | | | | | | |

C.H. Robinson Worldwide, Inc. (c) | | | 2,122 | | | | 115,203 | |

| Cintas Corp. | | | 2,368 | | | | 87,853 | |

| Expeditors International Washington, Inc. | | | 2,603 | | | | 123,122 | |

Fastenal Co. (c) | | | 1,797 | | | | 81,602 | |

Foster Wheeler Ltd (a) | | | 915 | | | | 120,121 | |

Joy Global, Inc. (c) | | | 1,326 | | | | 67,440 | |

Monster Worldwide, Inc. (a)(c) | | | 1,661 | | | | 56,574 | |

| | | SHARES | | | VALUE | |

Industrials - 4.4% (Continued) | | | | | | |

| Paccar, Inc. | | | 3,465 | | | $ | 295,391 | |

Ryanair Holdings PLC - ADR(a)(c) | | | 1,447 | | | | 60,065 | |

UAL Corp. (a) (c) | | | 1,217 | | | | 56,627 | |

| | | | | | | | 1,063,998 | |

Information Technology - 56.2% | | | | | | | | |

Activision, Inc. (a)(c) | | | 3,148 | | | | 67,965 | |

Adobe Systems, Inc. (a) | | | 7,167 | | | | 312,911 | |

Akamai Technologies, Inc. (a)(c) | | | 1,964 | | | | 56,426 | |

| Altera Corp. | | | 6,026 | | | | 145,106 | |

Apple, Inc. (a) | | | 15,092 | | | | 2,317,226 | |

| Applied Materials, Inc. | | | 8,890 | | | | 184,023 | |

Autodesk, Inc. (a) | | | 2,998 | | | | 149,810 | |

BEA Systems, Inc. (a)(c) | | | 4,522 | | | | 62,720 | |

Broadcom Corp. - Class A (a) | | | 5,311 | | | | 193,533 | |

Cadence Design Systems, Inc. (a) | | | 3,629 | | | | 80,528 | |

CDW Corp. (a) | | | 1,027 | | | | 89,554 | |

Check Point Software Technologies(a) | | | 2,772 | | | | 69,799 | |

Checkfree Corp. (a)(c) | | | 1,042 | | | | 48,495 | |

Cisco Systems, Inc. (a) | | | 26,979 | | | | 893,275 | |

Citrix Systems, Inc. (a) | | | 2,667 | | | | 107,534 | |

Cognizant Technology Solutions Corp. - Class A (a) | | | 1,742 | | | | 138,959 | |

Dell, Inc. (a) | | | 10,391 | | | | 286,792 | |

Electronic Arts, Inc. (a) | | | 3,904 | | | | 218,585 | |

Fiserv, Inc. (a) | | | 2,568 | | | | 130,609 | |

Flextronics International Ltd. (a)(c) | | | 8,217 | | | | 91,866 | |

Google, Inc. - Class A (a) | | | 1,763 | | | | 1,000,097 | |

Infosys Technologies Ltd - ADR(c) | | | 1,385 | | | | 67,020 | |

| Intel Corp. | | | 25,444 | | | | 657,982 | |

Intuit, Inc. (a) | | | 5,276 | | | | 159,863 | |

Juniper Networks, Inc. (a) | | | 4,202 | | | | 153,835 | |

| Kla-Tencor Corp. | | | 2,887 | | | | 161,037 | |

Lam Research Corp. (a)(c) | | | 1,586 | | | | 84,470 | |

Linear Technology Corp. (c) | | | 3,690 | | | | 129,113 | |

Logitech International S.A. (a)(c) | | | 2,213 | | | | 65,394 | |

Marvell Technology Group Ltd. (a) | | | 6,947 | | | | 113,722 | |

| Maxim Integrated Products, Inc. | | | 5,589 | | | | 164,037 | |

Microchip Technology, Inc. (c) | | | 2,257 | | | | 81,974 | |

| Microsoft Corp. | | | 40,147 | | | | 1,182,731 | |

Network Appliance, Inc. (a) | | | 4,629 | | | | 124,566 | |

Nvidia Corp. (a) | | | 6,705 | | | | 242,989 | |

Oracle Corp. (a) | | | 26,526 | | | | 574,288 | |

| Paychex, Inc. | | | 4,506 | | | | 184,746 | |

| Qualcomm, Inc. | | | 25,124 | | | | 1,061,740 | |

Research In Motion Ltd. (a) | | | 6,968 | | | | 686,697 | |

SanDisk Corp. (a)(c) | | | 2,603 | | | | 143,425 | |

Sun Microsystems, Inc. (a) | | | 19,347 | | | | 108,537 | |

Symantec Corp. (a) | | | 11,482 | | | | 222,521 | |

Telefonaktiebolaget LM Ericsson - ADR (c) | | | 1,764 | | | | 70,207 | |

Tellabs, Inc. (a)(c) | | | 3,105 | | | | 29,560 | |

VeriSign, Inc. (a) | | | 2,923 | | | | 98,622 | |

| Xilinx, Inc. | | | 4,915 | | | | 128,478 | |

Yahoo!, Inc. (a) | | | 8,035 | | | | 215,659 | |

| | | | | | | | 13,559,026 | |

Materials - 0.3% | | | | | | | | |

Sigma-Aldrich Corp. (c) | | | 1,568 | | | | 76,424 | |

The accompanying notes are an integral part of the financial statements.

Summit Mutual Funds, Inc. – Apex Series |

| NASDAQ-100 INDEX FUND | SCHEDULE OF INVESTMENTS |

| | | SHARES | | | VALUE | |

Telecommunication Services - 1.5% | | | | | | |

Level 3 Communications, Inc. (a)(c) | | | 18,581 | | | $ | 86,402 | |

Millicom International Cellular S.A. (a)(c) | | | 1,214 | | | | 101,854 | |

NII Holdings, Inc. (a) (c) | | | 2,088 | | | | 171,529 | |

| | | | | | | | 359,785 | |

| TOTAL COMMON STOCKS | | | | | | | | |

| (Cost $13,971,398) | | | | | | | 21,830,422 | |

| | | | | | | | | |

INVESTMENT COMPANIES - 2.8% | | | | | | | | |

Powershares QQQ Trust (c) | | | 13,240 | | | | 680,668 | |

| TOTAL INVESTMENT COMPANIES | | | | | | | | |

| (Cost $646,147) | | | | | | | 680,668 | |

| | | | | | | | | |

SHORT TERM INVESTMENTS (e) - 6.3% | | | | | | | | |

Money Market Funds - 5.1% | | | | | | | | |

| Northern Institutional Diversified Assets Portfolio | | | 1,231,532 | | | | 1,231,532 | |

| | | PRINCIPAL | | | | |

| | | AMOUNT | | | VALUE | |

U.S. Treasury Bills - 1.2% | | | | | | |

| 4.010%, 12/13/2007 | | $ | 300,000 | | | $ | 297,781 | |

| TOTAL SHORT TERM | | | | | | | | |

| INVESTMENTS (Cost $1,529,117) | | | | | | | 1,529,313 | |

Total Investments | | | | | | | | |

(Cost $16,146,662) (b) - 99.6% | | | | | | | 24,040,403 | |

Northern Institutional Liquid | | | | | | | | |

Assets Portfolio (d) - 16.3% | | | | | | | 3,921,718 | |

Liabilities in Excess of Other Assets - (15.9)% | | | | | | | (3,832,130 | ) |

TOTAL NET ASSETS - 100.0% | | | | | | $ | 24,129,991 | |

| ADR American Depository Receipt |

(a) | Non-income producing security. |

(b) | For federal income tax purposes, cost is $16,513,147 and gross unrealized appreciation and depreciation of securities as of September 30, 2007 was $8,533,363, and ($1,006,107), respectively, with a net appreciation / (depreciation) of $7,527,256. |

(c) | All or a portion of the security is out on loan. |

(d) | This security was purchased with cash collateral held from securities lending. The market values of the securities on loan, the collateral purchased with cash, and the noncash collateral accepted are $4,140,052, $3,921,718, and $323,288, respectively. |

(e) | Securities and other assets with an aggregate value of $1,479,800 have been segregated with the custodian or designated to cover margin requirements for the following open futures contracts as of September 30, 2007: |

| | | Unrealized | |

| | | Appreciation/ | |

Type | Contracts | (Depreciation) | |

| Nasdaq 100 E-Mini (12/07) | 20 | $28,986 | |

| Nasdaq 100 Futures (12/07) | 3 | $27,666 | |

The accompanying notes are an integral part of the financial statements.

Summit Mutual Funds, Inc. – Apex Series |

| FINANCIAL STATEMENTS | NASDAQ-100 INDEX FUND |

STATEMENT OF ASSETS AND LIABILITIES | | | |

September 30, 2007 | | | |

| | | | |

| ASSETS | | | |

| Investments in securities, at value | | $ | 24,040,403 | |

| Collateral for securities loaned, | | | | |

| at fair value | | | 3,921,718 | |

| Receivables: | | | | |

| Shares sold | | | 116,053 | |

| Interest and dividends | | | 5,207 | |

| Receivable from adviser | | | 809 | |

| Prepaid expenses and other | | | 8,009 | |

| | | | 28,092,199 | |

| LIABILITIES | | | | |

| Payables: | | | | |

| Payable upon return of securities loaned | | | 3,921,718 | |

| Variation margin | | | 5,425 | |

| Shares redeemed | | | 2,593 | |

| Professional fees | | | 18,829 | |

| Fund accounting fees | | | 4,496 | |

| Custodian fees | | | 3,448 | |

| Directors’ fees | | | 39 | |

| Other accrued expenses | | | 5,660 | |

| | | | 3,962,208 | |

| NET ASSETS* | | | | |

| Paid-in capital | | | 28,419,065 | |

| Accumulated undistributed net | | | | |

| investment income / (loss) | | | 10,650 | |

| Accumulated net realized gain / (loss) | | | | |

| on investments and futures contracts | | | (12,250,117 | ) |

| Net unrealized appreciation / (depreciation) | | | | |

| on investments and futures contracts | | | 7,950,393 | |

| | | $ | 24,129,991 | |

| Investments at cost | | $ | 16,146,662 | |

| Shares authorized - Class I ($.10 par value) | | | 20,000,000 | |

| NET ASSET VALUE (NAV) BY SHARE CLASS | | | | | |

| | | | | | |

| Share Class | Net Assets | Outstanding | | per share | |

| Class I | $24,129,991 | 884,946 | | $ | 27.27 | |

| | | | | | | |

| * | FEDERAL TAX DATA AS OF SEPTEMBER 30, 2007 | | |

| | Percentage of ordinary distributions designated as | | |

| | qualified dividend income | | 100.00% |

| | Dividends received deduction for corporate shareholders | | 99.00% |

| | Undistributed ordinary income | $ | 10,650 |

| | Unrealized appreciation | $ | 7,583,908 |

Capital Loss Carryforward |

Expiring September 30: |

2009 | 2010 | 2012 | 2013 | 2014 | 2015 |

| $(3,158,440) | $(2,454,653) | $(1,364,110) | $(1,719,950) | $(2,359,145) | $(770,682) |

STATEMENT OF OPERATIONS | | | |

For the year ended September 30, 2007 | | | |

| | | | |

| INVESTMENT INCOME | | | |

| Interest | | $ | 10,681 | |

| Dividends | | | 114,216 | |

| Foreign dividend taxes withheld | | | (423 | ) |

| Other income | | | 5,809 | |

| | | | 130,283 | |

| EXPENSES | | | | |

| Advisory fees | | | 64,239 | |

| Transfer agent fees | | | 27,695 | |

| Registration fees | | | 26,823 | |

| Professional fees | | | 21,890 | |

| Fund accounting fees | | | 19,624 | |

| Administration fees | | | 18,354 | |

| Custodian fees | | | 12,837 | |

| Royalty fee | | | 4,751 | |

| Directors’ fees | | | 2,248 | |

| Shareholder reporting fees | | | 1,271 | |

12b-1 fees - Class A (1) | | | 332 | |

| Other expenses | | | 2,532 | |

| | | | 202,596 | |

| Reimbursements and waivers | | | (82,963 | ) |

| | | | 119,633 | |

| NET INVESTMENT INCOME / (LOSS) | | | 10,650 | |

| | | | | |

| REALIZED AND UNREALIZED GAIN / (LOSS) | | | | |

| Net realized gain / (loss) on investments | | | (102,039 | ) |

| Net realized gain / (loss) | | | | |

| on futures contracts | | | 31,243 | |

| | | | (70,796 | ) |

| Net change in unrealized | | | | |

| appreciation / (depreciation) on | | | | |

| investments and futures contracts | | | 4,481,638 | |

| NET REALIZED AND UNREALIZED | | | | |

| GAIN / (LOSS) | | | 4,410,842 | |

| NET INCREASE / (DECREASE) | | | | |

| IN NET ASSETS FROM OPERATIONS | | $ | 4,421,492 | |

| TRANSACTIONS WITH AFFILIATES: | | | |

| Percent of Current | |

| Net Asset Value | |

| Advisory | Administration | Expense | Reimbursements |

| Fee | Fee | Limit | and Waivers |

| 0.35% | 0.10% | 0.65% | $82,963 |

| | |

(1) | Effective February 28, 2007 the Nasdaq-100 Index Fund converted its |

| | Class A shares into Class I shares. Class A shares no longer exist. |

The accompanying notes are an integral part of the financial statements.

Summit Mutual Funds, Inc. – Apex Series |

| NASDAQ-100 INDEX FUND | FINANCIAL STATEMENTS |

STATEMENTS OF CHANGES IN NET ASSETS | | | | | | |

Fiscal Year Ended September 30, | | | | | | |

| | | 2007 | | | 2006 | |

| OPERATIONS | | | | | | |

| Net investment income / (loss) | | $ | 10,650 | | | $ | 42,705 | |

| Net realized gain / (loss) on investments and futures | | | (70,796 | ) | | | (902,593 | ) |

| Net change in unrealized appreciation / (depreciation) | | | | | | | | |

| on investments and futures contracts | | | 4,481,638 | | | | 1,321,046 | |

| | | | 4,421,492 | | | | 461,158 | |

| DISTRIBUTIONS TO SHAREHOLDERS* | | | | | | | | |

| Class I | | | | | | | | |

| Net investment income | | | (42,315 | ) | | | (56,989 | ) |

Class A (1) | | | | | | | | |

| Net investment income | | | (388 | ) | | | (285 | ) |

| | | | (42,703 | ) | | | (57,274 | ) |

| FUND SHARE TRANSACTIONS | | | | | | | | |

| Class I | | | | | | | | |

| Proceeds from shares sold | | | 9,431,036 | | | | 4,338,298 | |

| Reinvestment of distributions | | | 42,311 | | | | 56,984 | |

| Payments for shares redeemed | | | (6,113,390 | ) | | | (6,191,574 | ) |

Transfer in from Class A (1) | | | 750,651 | | | | — | |

| | | | 4,110,608 | | | | (1,796,292 | ) |

| Class A | | | | | | | | |

| Proceeds from shares sold | | | 526,589 | | | | 73,328 | |

| Reinvestment of distributions | | | 388 | | | | 285 | |

| Payments for shares redeemed | | | (36,384 | ) | | | (67,780 | ) |

Transfer out to Class I (1) | | | (750,651 | ) | | | — | |

| | | | (260,058 | ) | | | 5,833 | |

| NET INCREASE / (DECREASE) IN NET ASSETS | | | 8,229,339 | | | | (1,386,575 | ) |

| NET ASSETS | | | | | | | | |

| Beginning of period | | | 15,900,652 | | | | 17,287,227 | |

| End of period | | $ | 24,129,991 | | | $ | 15,900,652 | |

| | | | | | | | | |

| ACCUMULATED UNDISTRIBUTED NET INVESTMENT INCOME | | $ | 10,650 | | | $ | 42,703 | |

| FUND SHARE TRANSACTIONS CLASS I | | | | | | |

| Sold | | | 385,765 | | | | 200,560 | |

| Reinvestment of distributions | | | 1,808 | | | | 2,610 | |

| Redeemed | | | (256,999 | ) | | | (289,473 | ) |

Transfer in from Class A (1) | | | 32,608 | | | | — | |

| Net increase / (decrease) from fund share transactions | | | 163,182 | | | | (86,303 | ) |

| FUND SHARE TRANSACTIONS Class A | | | | | | | | |

| Sold | | | 22,485 | | | | 3,513 | |

| Reinvestment of distributions | | | 17 | | | | 13 | |

| Redeemed | | | (1,568 | ) | | | (3,394 | ) |

Transfer out to Class I (1) | | | (32,851 | ) | | | — | |

| Net increase / (decrease) from fund share transactions | | | (11,917 | ) | | | 132 | |

| | | | | | | | | |

| TOTAL COST OF PURCHASES OF: | | | | | | | | |

| Common Stocks | | $ | 5,265,840 | | | $ | 2,032,570 | |

| | | $ | | | | $ | 2,032,570 | |

| TOTAL POCEEDS FROM SALES OF: | | | | | | | | |

| Common Stocks | | $ | 2,207,003 | | | $ | 2,431,155 | |

| | | $ | | | | $ | 2,431,155 | |

| | | | | | | | | |

| *TAX CHARACTER OF DISTRIBUTIONS PAID | | | | | | | | |

| Ordinary income | | $ | 42,703 | | | $ | 57,274 | |

| | | $ | 42,703 | | | $ | 57,274 | |

| | | | | | | | | |

(1) | Effective February 28, 2007, the Nasdaq-100 Index Fund converted its Class A shares into Class I shares. | | |

| | Class A shares no longer exist. | | |

The accompanying notes are an integral part of the financial statements.

Summit Mutual Funds, Inc. – Apex Series |

Summit Everest Fund Class I - Average Annual Total Return |

1-Y ear | 5-Year | Since Inception |

| 14.88% | 18.08% | 9.59% |

Summit Everest Fund Class A - Average Annual Total Return |

1-Y ear | 5-Year | Since Inception |

| 7.99% | 16.47% | 8.48% |

Past performance is not predictive of future results. Performance does not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. Prior to July 1, 2002, Class A share performance is based on Class I performance, adjusted to reflect Class A sales charges and expenses.

| Managers: | |

| Inception Date: | December 29, 1999 |

| Total Net Assets: | $102.7 Million |

| Number Of Equity Holdings: | 58 |

| Median Cap Size: | $50,095 Million |

| Average Price-to-earnings Ratio: | 14.4x |

| Average Price-to-book Ratio: | 2.10x |

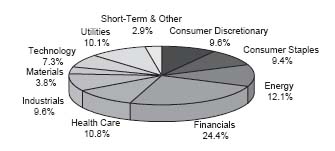

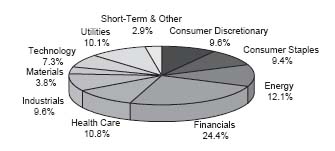

Top 10 Equity Holdings | | Sector Allocations |

| | (% of net assets) | | |

Devon Energy Corp. Motorola, Inc. Altria Group, Inc. Wal-Mart Stores, Inc. 3M Co. | | |  |

Summit Mutual Funds, Inc. – Apex Series |

Objective – Seeks primarily long-term appreciation of capital, without incurring unduly high risk, by investing primarily in common stocks and other equity securities. Current income is a secondary objective.

Strategy – The Everest Fund (the “Fund”) seeks special opportunities in securities that are selling at discount from theoretical price/earnings ratios and that seem capable of recovering from their temporarily out-of-favor status (a “value” investment style).

Managers’ Comments:

The Everest Fund’s Class I total return performance for the year ended September 30, 2007 was 14.88% versus 14.45% for the Russell 1000 Value Index (the “Index”) and 16.44% for the S&P 500 Stock Index.

Widely reported credit problems with sub-prime residential mortgages intensified during the most recent quarter and culminated with the Federal Reserve Bank (the Fed) cutting interest rates 0.50% fearing that diminishing liquidity in the financial markets would threaten the overall economy more than inflation. The Fed had waited until weakness in the housing sector started to affect broader markets and confidence on Main Street. By summer’s end, the credit contagion had spread to money market funds, foreign banks, other sectors of the fixed income markets, as well as the equity markets. As seems to be the case based on recent history, when the equity markets weaken because of financial fears, the Fed “rides to the rescue” with lower interest rates to facilitate deal making that hopes to mitigate a crisis. The shouts of “moral hazard” (bailing out bad lenders) fall on deaf ears when weakness threatens the overall economy.

Contributors to Performance

Underweighting the Financial Services sector was the top contributor to Fund performance during the fiscal year. A significant underweight of the sector at 25% versus 35% for the Index was maintained as we believed a 35% concentration in any one sector was too high. Sub-sector selection and stock selection drove positive returns as the portfolio overweighted Investment Managers, underweighted Banks, and had no exposure to real estate investment trusts (REITS). Positive returns were also attributable to stock selection in Technology. Nokia and Cisco were top ten contributors to return. Finally, superior stock selection in the Producer Durables sector boosted returns. The portfolio concentrated on global infrastructure plays with exposure to Caterpillar, Tyco, Honeywell, and Ingersoll-Rand, with the latter three being top contributors to returns. Investors moved to these stocks as concerns mounted about an economic slowdown in the U.S.

Detractors to Performance

Underweighting the Energy sector was the biggest detractor to performance. This sector had the largest gains as volatile oil prices moved from lows of $50 to highs over $80 a barrel. Returns in this sector were also hurt by the Fund’s position in Nabors Industries as it suffered from a slowdown in U.S. and Canadian natural gas drilling. Consumer Discretionary sector returns lagged mainly due to a holding in Gannett. This sub-sector underperformed as real estate and auto advertising dollars fell and circulation declined. Lastly, an underweighting of Utilities along with poor stock selection was a drag on relative return as the sector outperformed the Index.

The last twelve months witnessed a domestic housing slowdown coupled with rising energy prices and a devaluing dollar. The fear is that the American consumer will be forced to retrench by the inability to “cash-out” from refinancing the equity on a house and paying higher prices for imported goods - especially energy and other industrial goods. The Federal Reserve is trying to ease this sharp pain by reducing interest rates. Even so, the American consumer’s finances may be stretched as the excesses of the past few years work their way out of the economy.

Industries directly involved with housing have been hurt severely already. Energy company values have risen to reflect some of the price changes and the Fund has taken profits here. Conversely, some financial and media companies’ values are overly discounted from the housing damage, and the Fund is considering adding exposure here. Another sector that appears to offer attractive opportunities is Healthcare, which could actually benefit from the political year 2008 instead of coming under attack as in the past.

Summit Everest Fund will continue to invest in companies that are temporarily out of favor and pare those that reach full valuation in light of the Federal Reserve’s attempts to resuscitate the American consumer.

Summit Mutual Funds, Inc. – Apex Series |

| FINANCIAL HIGHLIGHTS | EVEREST FUND |

FINANCIAL HIGHLIGHTS | | | | | | | | | | | | | | | |

| Computed on the basis of a share of capital stock outstanding throughout the period. | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | Class I |

| | | Year Ended September 30, |

| | | 2007 | | | 2006 | | | 2005 | | | 2004 | | | 2003 | |

| Net asset value, beginning of period | | $ | 63.81 | | | $ | 61.56 | | | $ | 58.15 | | | $ | 49.88 | | | $ | 39.85 | |

| INVESTMENT ACTIVITIES: | | | | | | | | | | | | | | | | | | | | |

| Net investment income / (loss) | | | 0.93 | (1) | | | 0.96 | (1) | | | 0.90 | | | | 0.80 | | | | 0.74 | |

| Net realized and unrealized gains / (losses) | | | 8.32 | | | | 8.13 | | | | 6.97 | | | | 8.27 | | | | 10.13 | |

| Total from Investment Activities | | | 9.25 | | | | 9.09 | | | | 7.87 | | | | 9.07 | | | | 10.87 | |

| DISTRIBUTIONS: | | | | | | | | | | | | | | | | | | | | |

| Net investment income | | | (0.99 | ) | | | (0.65 | ) | | | (0.79 | ) | | | (0.80 | ) | | | (0.80 | ) |

| Net realized gains | | | (3.51 | ) | | | (6.19 | ) | | | (3.67 | ) | | | — | | | | (0.04 | ) |

| Total Distributions | | | (4.50 | ) | | | (6.84 | ) | | | (4.46 | ) | | | (0.80 | ) | | | (0.84 | ) |

| Net asset value, end of period | | $ | 68.56 | | | $ | 63.81 | | | $ | 61.56 | | | $ | 58.15 | | | $ | 49.88 | |

| | | | | | | | | | | | | | | | | | | | | |

| Total return | | | 14.88 | % | | | 16.13 | % | | | 13.96 | % | | | 18.29 | % | | | 27.63 | % |

| | | | | | | | | | | | | | | | | | | | | |

| RATIOS / SUPPLEMENTAL DATA: | | | | | | | | | | | | | | | | | | | | |

| Ratio of expenses to average net assets | | | 0.91 | % | | | 0.92 | % | | | 0.97 | % | | | 0.97 | % | | | 0.98 | % |

| Ratio of net investment income / (loss) to average net assets | | | 1.38 | % | | | 1.59 | % | | | 1.51 | % | | | 1.46 | % | | | 1.64 | % |

Portfolio turnover rate (2) | | | 50.86 | % | | | 54.89 | % | | | 63.46 | % | | | 73.43 | % | | | 58.23 | % |

| Net assets, end of period (000’s) | | $ | 95,460 | | | $ | 80,383 | | | $ | 65,755 | | | $ | 61,042 | | | $ | 48,821 | |

| | | | | | | | | | | | | | | | | | | | | |

| | | Class A |

| | | Fiscal Year Ended September 30, |

| | | 2007 | | | 2006 | | | 2005 | | | 2004 | | | 2003 | |

| Net asset value, beginning of period | | $ | 63.25 | | | $ | 61.14 | | | $ | 58.62 | | | $ | 50.34 | | | $ | 39.84 | |

| INVESTMENT ACTIVITIES: | | | | | | | | | | | | | | | | | | | | |

| Net investment income / (loss) | | | 0.75 | (1) | | | 0.80 | (1) | | | 1.26 | | | | 0.66 | | | | 0.61 | |

| Net realized and unrealized gains / (losses) | | | 8.24 | | | | 8.09 | | | | 6.46 | | | | 8.35 | | | | 10.22 | |

| Total from Investment Activities | | | 8.99 | | | | 8.89 | | | | 7.72 | | | | 9.01 | | | | 10.83 | |

| DISTRIBUTIONS: | | | | | | | | | | | | | | | | | | | | |

| Net investment income | | | (0.87 | ) | | | (0.59 | ) | | | (1.53 | ) | | | (0.73 | ) | | | (0.29 | ) |

| Net realized gains | | | (3.51 | ) | | | (6.19 | ) | | | (3.67 | ) | | | — | | | | (0.04 | ) |

| Total Distributions | | | (4.38 | ) | | | (6.78 | ) | | | (5.20 | ) | | | (0.73 | ) | | | (0.33 | ) |

| Net asset value, end of period | | $ | 67.86 | | | $ | 63.25 | | | $ | 61.14 | | | $ | 58.62 | | | $ | 50.34 | |

| | | | | | | | | | | | | | | | | | | | | |

Total return (3) | | | 14.58 | % | | | 15.87 | % | | | 13.65 | % | | | 17.99 | % | | | 27.32 | % |

| | | | | | | | | | | | | | | | | | | | | |

| RATIOS / SUPPLEMENTAL DATA: | | | | | | | | | | | | | | | | | | | | |

| Ratio of expenses to average net assets | | | 1.16 | % | | | 1.17 | % | | | 1.22 | % | | | 1.22 | % | | | 1.23 | % |

| Ratio of net investment income / (loss) to average net assets | | | 1.13 | % | | | 1.34 | % | | | 1.03 | % | | | 1.17 | % | | | 1.39 | % |

Portfolio turnover rate (2) | | | 50.86 | % | | | 54.89 | % | | | 63.46 | % | | | 73.43 | % | | | 58.23 | % |

| Net assets, end of period (000’s) | | $ | 7,201 | | | $ | 2,903 | | | $ | 875 | | | $ | 16 | | | $ | 5 | |

| | | | | | | | | | | | | | | | | | | | | |

(1) Per share amounts are based on average shares outstanding.

(2) Portfolio Turnover is calculated on the basis of the Fund as a whole without distinguishing between the classes of shares issued.

(3) Total return calculations do not include any sales charges.

The accompanying notes are an integral part of the financial statements.

Summit Mutual Funds, Inc. – Apex Series |

| EVEREST FUND | SCHEDULE OF INVESTMENTS |

September 30, 2007 | | | | | | |

| | | SHARES | | | VALUE | |

COMMON STOCKS - 97.1% | | | | | | |

Consumer Discretionary - 9.6% | | | | | | |

| CBS Corporation - Class B | | | 41,474 | | | $ | 1,306,431 | |

| Gannett Co, Inc. | | | 38,800 | | | | 1,695,560 | |

| Honda Motor Co. Ltd. - ADR | | | 62,000 | | | | 2,068,320 | |

| News Corp. - Class B | | | 43,900 | | | | 1,026,821 | |

| Sony Corp. - ADR | | | 26,200 | | | | 1,259,172 | |

| Time Warner, Inc. | | | 67,600 | | | | 1,241,136 | |

Viacom, Inc. - Class B (a) | | | 31,674 | | | | 1,234,336 | |

| | | | | | | | 9,831,776 | |

Consumer Staples - 9.4% | | | | | | | | |

| Altria Group, Inc. | | | 34,700 | | | | 2,412,691 | |

| CVS Caremark Corp. | | | 40,500 | | | | 1,605,015 | |

| Kraft Foods, Inc. | | | 57,301 | | | | 1,977,458 | |

| Unilever NV - ADR | | | 39,100 | | | | 1,206,235 | |

| Wal-Mart Stores, Inc. | | | 55,200 | | | | 2,409,480 | |

| | | | | | | | 9,610,879 | |

Energy - 12.1% | | | | | | | | |

| Chevron Corp. | | | 23,606 | | | | 2,209,049 | |

| ConocoPhillips | | | 24,854 | | | | 2,181,436 | |

| Devon Energy Corp. | | | 31,400 | | | | 2,612,480 | |

Nabors Industries Ltd. (a) | | | 39,400 | | | | 1,212,338 | |

| Royal Dutch Shell PLC - ADR | | | 26,600 | | | | 2,185,988 | |

| Spectra Energy Corp. | | | 80,824 | | | | 1,978,572 | |

| | | | | | | | 12,379,863 | |

Financials - 24.4% | | | | | | | | |

| AllianceBernstein Holding LP | | | 22,000 | | | | 1,937,540 | |

| The Allstate Corp. | | | 31,500 | | | | 1,801,485 | |

| Bank of America Corp. | | | 48,292 | | | | 2,427,639 | |

| The Bank Of New York Mellon Corp | | | 34,434 | | | | 1,519,917 | |

| Capital One Financial Corp. | | | 15,100 | | | | 1,003,093 | |

| Citigroup, Inc. | | | 52,900 | | | | 2,468,843 | |

| Discover Financial Services | | | 41,700 | | | | 867,360 | |

| Genworth Financial, Inc. - Class A | | | 65,200 | | | | 2,003,596 | |

| Hartford Financial Services Group, Inc. | | | 17,200 | | | | 1,591,860 | |

| JPMorgan Chase & Co. | | | 43,664 | | | | 2,000,684 | |

| Legg Mason, Inc. | | | 27,600 | | | | 2,326,404 | |

| Metlife, Inc. | | | 15,700 | | | | 1,094,761 | |

| Morgan Stanley | | | 22,000 | | | | 1,386,000 | |

| The Travelers Companies, Inc. | | | 20,600 | | | | 1,037,004 | |

| Wells Fargo & Co. | | | 45,700 | | | | 1,627,834 | |

| | | | | | | | 25,094,020 | |

Health Care - 10.8% | | | | | | | | |

Covidien Ltd (a) | | | 26,325 | | | | 1,092,487 | |

| GlaxoSmithKline PLC - ADR | | | 38,500 | | | | 2,048,200 | |

| Johnson & Johnson | | | 29,900 | | | | 1,964,430 | |

| Pfizer, Inc. | | | 98,800 | | | | 2,413,684 | |

| UnitedHealth Group, Inc. | | | 39,700 | | | | 1,922,671 | |

Wellpoint, Inc. (a) | | | 20,300 | | | | 1,602,076 | |

| | | | | | | | 11,043,548 | |

Industrials - 9.6% | | | | | | | | |

| 3M Co. | | | 25,400 | | | | 2,376,932 | |

| Caterpillar, Inc. | | | 16,900 | | | | 1,325,467 | |

| FedEx Corp. | | | 16,700 | | | | 1,749,325 | |

| Ingersoll-Rand Co. Ltd. - Class A | | | 19,400 | | | | 1,056,718 | |

| | | SHARES | | | VALUE | |

Industrials - 9.6% (Continued) | | | | | | |

| Southwest Airlines Co. | | | 141,900 | | | $ | 2,100,120 | |

| Tyco International Ltd | | | 27,825 | | | | 1,233,760 | |

| | | | | | | | 9,842,322 | |

Materials - 3.8% | | | | | | | | |

| The Dow Chemical Co. | | | 45,400 | | | | 1,954,924 | |

| Newmont Mining Corp. | | | 44,700 | | | | 1,999,431 | |

| | | | | | | | 3,954,355 | |

Technology - 7.3% | | | | | | | | |

Cisco Systems, Inc. (a) | | | 44,500 | | | | 1,473,395 | |

| International Business Machines Corp. | | | 10,100 | | | | 1,189,780 | |

| Motorola, Inc. | | | 136,100 | | | | 2,521,933 | |

| Nokia OYJ - ADR | | | 33,000 | | | | 1,251,690 | |

| Tyco Electronics Ltd | | | 30,925 | | | | 1,095,673 | |

| | | | | | | | 7,532,471 | |

Utilities - 10.1% | | | | | | | | |

| AT&T, Inc. | | | 47,100 | | | | 1,992,801 | |

| Citizens Communications Co. | | | 96,100 | | | | 1,376,152 | |

| Duke Energy Corporation | | | 104,648 | | | | 1,955,871 | |

| Southern Co. | | | 55,500 | | | | 2,013,540 | |

| Sprint Nextel Corp. | | | 73,000 | | | | 1,387,000 | |

| Verizon Communications, Inc. | | | 37,200 | | | | 1,647,216 | |

| | | | | | | | 10,372,580 | |

| TOTAL COMMON STOCKS | | | | | | | | |

| (Cost $86,539,843) | | | | | | | 99,661,814 | |

| | | | | | | | | |

SHORT TERM INVESTMENTS - 1.6% | | | | | | | | |

Money Market Funds - 1.6% | | | | | | | | |

| Northern Institutional Diversified Assets Portfolio | | | 1,695,522 | | | | 1,695,522 | |

| TOTAL SHORT TERM INVESTMENTS | | | | | | | | |

| (Cost $1,695,522) | | | | | | | 1,695,522 | |

Total Investments | | | | | | | | |

(Cost $88,235,365) (b) - 98.7% | | | | | | | 101,357,336 | |

Other Assets in Excess of Liabilities - 1.3% | | | | | | | 1,303,737 | |

TOTAL NET ASSETS - 100.0% | | | | | | $ | 102,661,073 | |

| ADR | American Depository Receipt |

| (a) | Non-income producing security. |

| (b) | For federal income tax purposes, cost is $88,322,076 and gross unrealized appreciation |

| | and depreciation of securities as of September 30, 2007 was $15,872,992 and |

| | ($2,837,732), respectively, with a net appreciation / (depreciation) of $13,035,260. |

The accompanying notes are an integral part of the financial statements.

Summit Mutual Funds, Inc. – Apex Series |

| FINANCIAL STATEMENTS | EVEREST FUND |

STATEMENT OF ASSETS AND LIABILITIES | | | |

September 30, 2007 | | | |

| | | | |

| ASSETS | | | |

| Investments in securities, at value | | $ | 101,357,336 | |

| Cash | | | 11,579 | |

| Receivables: | | | | |

| Securities sold | | | 1,737,463 | |

| Shares sold | | | 120,862 | |

| Interest and dividends | | | 162,334 | |

| Prepaid expenses and other | | | 9,702 | |

| | | | 103,399,276 | |

| LIABILITIES | | | | |

| Payables: | | | | |

| Shares redeemed | | | 625,653 | |

| Advisory fees | | | 54,027 | |

| Professional fees | | | 23,652 | |

| Administration fees | | | 8,442 | |

| Fund accounting fees | | | 7,922 | |

| 12b-1 fees | | | 3,189 | |

| Custodian fees | | | 1,982 | |

| Directors’ fees | | | 200 | |

| Other accrued expenses | | | 13,136 | |

| | | | 738,203 | |

| NET ASSETS* | | | | |

| Paid-in capital | | | 81,934,473 | |

| Accumulated undistributed net | | | | |

| investment income / (loss) | | | 1,050,130 | |

| Accumulated net realized gain / (loss) | | | | |

| on investments and futures contracts | | | 6,554,499 | |

| Net unrealized appreciation / (depreciation) | | | | |

| on investments | | | 13,121,971 | |

| | | $ | 102,661,073 | |

| Investments at cost | | $ | 88,235,365 | |

| Shares authorized - Class I ($.10 par value) | | | 20,000,000 | |

| Shares authorized - Class A ($.10 par value) | | | 20,000,000 | |

| NET ASSET VALUE (NAV) BY SHARE CLASS | | | | | |

| | | | | | |

| Share Class | Net Assets | Outstanding | | per share | |

| Class I | $95,460,136 | | | $ | 68.56 | |

| Class A | $7,200,937 | 106,107 | | $ | 67.86 | |

| Class A maximum offering price per share | | | | | |

| (net asset value plus sales charge of 5.75% | | | | | |

| of offering price) | | | $ | 72.00 | |

| * | FEDERAL TAX DATA AS OF SEPTEMBER 30, 2007 | | |

| | Percentage of ordinary distributions designated as | | |

| | qualified dividend income | | 71.17% |

| | Dividends received deduction for corporate shareholders | | 43.80% |

| | Undistributed ordinary income | $ | 4,030,885 |

| | Undistributed long-term income | $ | 3,660,457 |

| | Unrealized appreciation | $ | 13,035,260 |

STATEMENT OF OPERATIONS | | | |

For the year ended September 30, 2007 | | | |

| | | | |

| INVESTMENT INCOME | | | |

| Dividends | | $ | 2,370,042 | |

| Foreign dividend taxes withheld | | | (33,020 | ) |

| | | | 2,337,022 | |

| EXPENSES | | | | |

| Advisory fees | | | 654,623 | |

| Administration fees | | | 102,285 | |

| Transfer agent fees | | | 43,316 | |

| Professional fees | | | 36,019 | |

| Fund accounting fees | | | 34,615 | |

| 12b-1 fees - Class A | | | 13,952 | |

| Directors’ fees | | | 13,582 | |

| Custodian fees | | | 8,598 | |

| Shareholder reporting fees | | | 7,757 | |

| Other expenses | | | 25,775 | |

| | | | 940,522 | |

| NET INVESTMENT INCOME / (LOSS) | | | 1,396,500 | |

| | | | | |

| REALIZED AND UNREALIZED GAIN / (LOSS) | | | | |

| Net realized gain / (loss) on investments | | | 6,739,020 | |

| Net change in unrealized appreciation / | | | | |

| (depreciation) on investments | | | 5,038,638 | |

| | | | | |

| NET REALIZED AND UNREALIZED | | | | |

| GAIN / (LOSS) | | | 11,777,658 | |

| | | | | |

| NET INCREASE / (DECREASE) IN | | | | |

| NET ASSETS FROM OPERATIONS | | $ | 13,174,158 | |

| TRANSACTIONS WITH AFFILIATES: | | |

| Percent of Current | |

Net Asset Value | |

| Advisory | Administration | |

| Fee | Fee | |

| 0.64% | 0.10% | |

The accompanying notes are an integral part of the financial statements.

Summit Mutual Funds, Inc. – Apex Series |

| EVEREST FUND | FINANCIAL STATEMENTS |

STATEMENTS OF CHANGES IN NET ASSETS | | | | | | |

Fiscal Year Ended September 30, | | | | | | |

| | | 2007 | | | 2006 | |

| OPERATIONS | | | | | | |

| Net investment income / (loss) | | $ | 1,396,500 | | | $ | 1,152,406 | |

| Net realized gain / (loss) on investments | | | 6,739,020 | | | | 5,437,897 | |

| Net change in unrealized appreciation / (depreciation) on investments | | | 5,038,638 | | | | 4,330,169 | |

| | | | 13,174,158 | | | | 10,920,472 | |

| DISTRIBUTIONS TO SHAREHOLDERS* | | | | | | | | |

| Class I | | | | | | | | |

| Net investment income | | | (1,386,540 | ) | | | (696,479 | ) |

| Net realized gain on investments | | | (4,945,799 | ) | | | (6,582,347 | ) |

| Class A | | | | | | | | |

| Net investment income | | | (42,835 | ) | | | (11,177 | ) |

| Net realized gain on investments | | | (173,103 | ) | | | (117,031 | ) |

| | | | (6,548,277 | ) | | | (7,407,034 | ) |

| FUND SHARE TRANSACTIONS | | | | | | | | |

| Class I | | | | | | | | |

| Proceeds from shares sold | | | 22,370,635 | | | | 12,448,983 | |

| Reinvestment of distributions | | | 6,321,707 | | | | 7,275,015 | |

| Payments for shares redeemed | | | (19,842,615 | ) | | | (8,483,868 | ) |

| | | | 8,849,727 | | | | 11,240,130 | |

| Class A | | | | | | | | |

| Proceeds from shares sold | | | 5,073,833 | | | | 1,919,862 | |

| Reinvestment of distributions | | | 177,053 | | | | 127,861 | |

| Payments for shares redeemed | | | (1,351,151 | ) | | | (145,468 | ) |

| | | | 3,899,735 | | | | 1,902,255 | |

| NET INCREASE / (DECREASE) IN NET ASSETS | | | 19,375,343 | | | | 16,655,823 | |

| NET ASSETS | | | | | | | | |

| Beginning of period | | | 83,285,730 | | | | 66,629,907 | |

| End of period | | $ | 102,661,073 | | | $ | 83,285,730 | |

| ACCUMULATED UNDISTRIBUTED NET INVESTMENT INCOME | | $ | 1,050,130 | | | $ | 1,081,013 | |

| FUND SHARE TRANSACTIONS | | | | | | |

| Class I | | | | | | |

| Sold | | | 332,151 | | | | 205,063 | |

| Reinvestment of distributions | | | 97,422 | | | | 127,744 | |

| Redeemed | | | (296,831 | ) | | | (141,309 | ) |

| Net increase / (decrease) from fund share transactions | | | 132,742 | | | | 191,498 | |

| | | | | | | | | |

| Class A | | | | | | | | |

| Sold | | | 77,555 | | | | 31,794 | |

| Reinvestment of distributions | | | 2,751 | | | | 2,261 | |

| Redeemed | | | (20,087 | ) | | | (2,477 | ) |

| Net increase / (decrease) from fund share transactions | | | 60,219 | | | | 31,578 | |

| TOTAL COST OF PURCHASES OF: | | | | | | | | |

| Common Stocks | | $ | 55,685,468 | | | $ | 46,885,635 | |

| | | $ | 55,685,468 | | | $ | 46,885,635 | |

| TOTAL PROCEEDS FROM SALES OF: | | | | | | | | |

| Common Stocks | | $ | 49,963,165 | | | $ | 38,920,524 | |

| | | $ | | | | $ | 38,920,524 | |

| | | | | | | | | |

| *TAX CHARACTER OF DISTRIBUTIONS PAID | | | | | | | | |

| | $ | 2,627,688 | | | $ | 707,656 | |

| Long-term capital gains | | | 3,920,589 | | | | 6,699,378 | |

| | | $ | 6,548,277 | | | $ | 7,407,034 | |

| | | | | | | | | |

| ** The percentage of taxable ordinary income distributions that are designated as short-term capital gain | | | | | | | | |

| distributions under Internal Revenue Section 871 (k)(2)(C) is 45.60% | | | | | | | | |

The accompanying notes are an integral part of the financial statements.

Summit Mutual Funds, Inc. – Apex Series |

Summit Bond Fund Class I - Average Annual Total Return |

1-Y ear | 5-Year | Since Inception |

| 4.12% | 5.08% | 5.66% |

Summit Bond Fund Class A - Average Annual Total Return |

1-Y ear | 5-Year | Since Inception |

| -0.54% | 3.91% | 4.80% |

Past performance is not predictive of future results. Performance does not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. Prior to February 1, 2007, Class A share performance is based on Class I performance, adjusted to reflect Class A sales charges and expenses.

| Managers: | |

| Inception Date: | |

| Total Net Assets: | $92.5 Million |

Number Of Fixed Income Holdings: | 158 |

| Average Duration: | 4.80 years |

| Average Maturity: | 12.27 years |

| Weighted Average Maturity: | 6.09 years |

| Average Credit Quality: | A1/A+ |

| 30-day SEC Yield - Class I: | 5.14% |

| 30-day SEC Yield - Class A: | 4.68% |

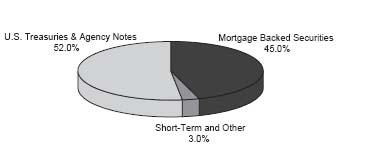

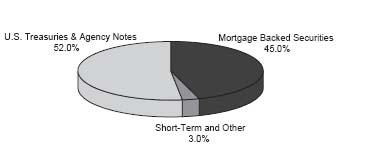

Quality Breakdown | | Sector Allocations |

| | (% of portfolio) | | |

| | |  |

Summit Mutual Funds, Inc. – Apex Series |

Objective – Seeks a high level of current income, as is consistent with a reasonable investment risk, by investing primarily in long-term, fixed-income, investment-grade corporate bonds.

Strategy – Under normal circumstances, the Bond Fund (the “Fund”) will invest at least 80% of the value of its assets in fixed income securities. Further, the Fund normally will invest at least 75% of the value of its assets in publicly-traded straight debt securities which have a rating within the four highest grades as rated by a national rating agency. Up to 25% of the portfolio may be invested in below investment grade debt securities or convertible debt securities.

Managers’ Comments:

For the year ended September 30, 2007, the Summit Bond Fund – Class I shares provided a total return of 4.12% compared to 5.14% for the Lehman Brothers Aggregate Bond Index (Index).

The Bond Fund’s underweighting of Treasury bonds, which outperformed corporate bonds over the last year, detracted from performance. Also, the Fund’s non-agency mortgage-backed securities underperformed the broad indices, while the Fund’s high yield exposure outperformed.

Short-term interest rates declined during the period, as the Federal Reserve Board (Fed) cut the Fed Funds rate by 0.50% on September 18, 2007, to 4.75%. Meanwhile, longer term interest rates remained relatively unchanged from September 2006 levels. The current slope of the U.S. Treasury yield curve suggests that the Fed may cut short-term rates further, as the yields on all Treasury securities with maturities from 1 to 10 years are below the Fed Funds rate of 4.75%. For example, the 2 year Treasury yield was 3.98% and the 10 year Treasury yield was 4.59% at September 30, 2007.

The Federal Reserve’s recent decision to cut interest rates after 17 consecutive 0.25% rate increases since January 2003 came in response to a material change in the credit markets during the third quarter of 2007 and concerns of a slowing overall economy. Continued weakness in the housing market and the fear that sub-prime loan defaults would spread to other sectors of the economy caused credit markets to seize-up during the third quarter of 2007. Borrowed capital has generally become more costly, and more importantly, more scarce. Credit spreads (the interest rate difference between risk-free U.S. Treasury securities and other fixed income securities) that started the summer at historically tight levels have widened across the entire quality spectrum, as market participants re-evaluate and re-price risk in their portfolios. In this environment, corporate and non-agency mortgage-backed securities underperformed U.S. Treasury and agency securities.

The outlook for the economy remains cloudy as we enter into 2008. Tightening credit will almost certainly slow economic growth, as will the continued slump in housing and the decline in household net worth that results from declining home prices. In addition, the relentless rise in energy prices will continue to cause a drag on consumer demand. However, these items are partially offset by lower interest rates, strong economic growth internationally and the declining value of the U.S. dollar, which makes exports more competitive. In this environment, Summit believes that caution is in order, but that investment managers must be willing to take advantage of opportunities as they arise.

Summit Mutual Funds, Inc. – Apex Series |

| FINANCIAL HIGHLIGHTS | BOND FUND |

FINANCIAL HIGHLIGHTS | | | | | | | | | | | | | | | |

| Computed on the basis of a share of capital stock outstanding throughout the period. | | | | | | | | | | | | | |

| | | Class I |

| | | Fiscal Year Ended September 30, |

| | | 2007 | | | 2006 | | | 2005 | | | 2004 | | | 2003 | |

| Net asset value, beginning of period | | $ | 49.88 | | | $ | 50.18 | | | $ | 51.40 | | | $ | 51.73 | | | $ | 50.35 | |

| INVESTMENT ACTIVITIES: | | | | | | | | | | | | | | | | | | | | |

| Net investment income / (loss) | | | 2.55 | | | | 2.59 | | | | 2.47 | | | | 2.44 | | | | 3.34 | |

| Net realized and unrealized gains / (losses) | | | (0.54 | ) | | | (0.44 | ) | | | (1.15 | ) | | | 0.06 | | | | 1.12 | |

| Total from Investment Activities | | | 2.01 | | | | 2.15 | | | | 1.32 | | | | 2.50 | | | | 4.46 | |

| DISTRIBUTIONS: | | | | | | | | | | | | | | | | | | | | |

| Net investment income | | | (2.60 | ) | | | (2.45 | ) | | | (2.54 | ) | | | (2.83 | ) | | | (3.08 | ) |

| Total Distributions | | | (2.60 | ) | | | (2.45 | ) | | | (2.54 | ) | | | (2.83 | ) | | | (3.08 | ) |

| Net asset value, end of period | | $ | 49.29 | | | $ | 49.88 | | | $ | 50.18 | | | $ | 51.40 | | | $ | 51.73 | |

| | | | | | | | | | | | | | | | | | | | | |

| Total return | | | 4.12 | % | | | 4.46 | % | | | 2.64 | % | | | 5.05 | % | | | 9.22 | % |

| | | | | | | | | | | | | | | | | | | | | |

| RATIOS / SUPPLEMENTAL DATA: | | | | | | | | | | | | | | | | | | | | |

| Ratio of expenses to average net assets | | | 0.76 | % | | | 0.71 | % | | | 0.74 | % | | | 0.72 | % | | | 0.69 | % |

| Ratio of net investment income / (loss) to average net assets | | | 5.08 | % | | | 5.17 | % | | | 4.82 | % | | | 4.82 | % | | | 6.53 | % |

Portfolio turnover rate (3) | | | 87.91 | % | | | 62.28 | % | | | 46.97 | % | | | 79.28 | % | | | 125.15 | % |

| Net assets, end of period (000’s) | | $ | 92,451 | | | $ | 94,666 | | | $ | 97,119 | | | $ | 92,148 | | | $ | 91,745 | |

| | Class A | |

| | Period from | |

| | February 1, 2007(2) | |

| | to September 30, | |

| | 2007 | |

| Net asset value, beginning of period | | $ | 49.75 | | |

| | | | | | |

| INVESTMENT ACTIVITIES: | | | | | |

| Net investment income / (loss) | | | 1.33 | | |

| Net realized and unrealized gains / (losses) | | | (0.38 | ) | |

| Total from Investment Activities | | | 0.95 | | |

| | | | | | |

| DISTRIBUTIONS: | | | | | |

| Net investment income | | | (1.24 | ) | |

| Total Distributions | | | (1.24 | ) | |

| Net asset value, end of period | | $ | 49.46 | | |

Total return(4) | | | 1.92 | % | |

| | | | | | |

| RATIOS / SUPPLEMENTAL DATA: | | | | | |

| Ratio of expenses to average net assets | | | 1.03 | %(1) | |

| Ratio of net investment income / (loss) to average net assets | | | 4.84 | %(1) | |

Portfolio turnover rate(3) | | | 87.91 | % | |

| Net assets, end of period (000’s) | | $ | 77 | | |

(1) Annualized.

(2) Commencement of operations.

(3) Portfolio Turnover is calculated on the basis of the Fund as a whole without distinguishing between the classes of shares issued.

(4) Total return calculations do not include any sales charges.

The accompanying notes are an integral part of the financial statements.

Summit Mutual Funds, Inc. – Apex Series |

| BOND FUND | SCHEDULE OF INVESTMENTS |

September 30, 2007 | | | | | | |

| | | SHARES | | | VALUE | |

COMMON STOCKS - 0.0% | | | | | | |

Consumer Discretionary - 0.0% | | | | | | |

Avado Brands, Inc. (a) (g) (i) | | | 4,803 | | | $ | 48 | |

Intermet Corp. (a) (g) (i) | | | 4,772 | | | | 4,772 | |

| | | | | | | | 4,820 | |

| TOTAL COMMON STOCKS | | | | | | | | |

| (Cost $184,387) | | | | | | | 4,820 | |

| | | | | | | | | |

PREFERRED STOCKS - 0.0% | | | | | | | | |

Consumer Discretionary - 0.0% | | | | | | | | |

| ION Media Networks, Inc. 12.0% Payment-in-Kind Dividend | | | 2 | | | | 3,260 | |

| TOTAL PREFERRED STOCKS | | | | | | | | |

| (Cost $0) | | | | | | | 3,260 | |

| | | | | | | | | |

| | | PRINCIPAL | | | | |

| | | AMOUNT | | | VALUE | |

ASSET BACKED SECURITIES - 1.7% | | | | | | |

| America West Airlines, Inc. - AMBAC Insured | | | | | | |

| 7.100%, 10/02/2022 | | $ | 590,064 | | | $ | 613,666 | |

| Asset Backed Funding Certificates | | | | | | | | |

| Series 2005-AQ1, 5.240%, 11/25/2034 | | | 400,000 | | | | 347,265 | |

| Centex Home Equity | | | | | | | | |

| Series 2001-B, 7.360%, 07/25/2032 | | | 131,575 | | | | 113,390 | |

| First Franklin Mortgage Loan Asset Backed Certificates | | | | | | | | |

| Series 2003-FF2, 7.795%, 07/25/2033 | | | 236,923 | | | | 226,139 | |

| JET Equipment Trust | | | | | | | | |

Series 1995-B, 7.630%, 02/15/2015 (b) (h) (i) | | | 234,360 | | | | 119,772 | |

| Residential Asset Mortgage Products, Inc. | | | | | | | | |

| Series 2003-RZ3, 4.120%, 06/25/2033 | | | 205,526 | | | | 192,250 | |

| TOTAL ASSET BACKED SECURITIES | | | | | | | | |

| (Cost $1,784,193) | | | | | | | 1,612,482 | |

| | | | | | | | | |

CORPORATE BONDS - 39.9% | | | | | | | | |

Consumer Discretionary - 5.9% | | | | | | | | |

| COX Communications, Inc. | | | | | | | | |

| 5.450%, 12/15/2014 | | | 770,000 | | | | 746,988 | |

| Daimler Finance North America LLC | | | | | | | | |

| 6.500%, 11/15/2013 | | | 750,000 | | | | 777,693 | |

| Echostar DBS Corporation | | | | | | | | |

| 6.625%, 10/01/2014 | | | 375,000 | | | | 376,875 | |

| General Motors Corp. | | | | | | | | |

7.700%, 04/15/2016 (e) | | | 150,000 | | | | 134,625 | |

| Idearc, Inc. | | | | | | | | |

| 8.000%, 11/15/2016 | | | 300,000 | | | | 299,250 | |

| Intcomex, Inc. | | | | | | | | |

11.750%, 01/15/2011 (e) | | | 375,000 | | | | 382,500 | |

| ION Media Networks, Inc. | | | | | | | | |

11.000%, 07/31/2013 (e) | | | 325,940 | | | | 260,752 | |

| MDC Holdings, Inc. | | | | | | | | |

| 5.500%, 05/15/2013 | | | 350,000 | | | | 328,998 | |

| NVR, Inc. | | | | | | | | |

5.000%, 06/15/2010 (e) | | | 490,000 | | | | 489,474 | |

| R.H. Donnelley Corp. | | | | | | | | |

6.875%, 01/15/2013 (e) | | | 375,000 | | | | 354,375 | |

| Radio One, Inc. | | | | | | | | |

8.875%, 07/01/2011 (e) | | | 93,000 | | | | 92,070 | |

| | | PRINCIPAL | | | | |

| | | AMOUNT | | | VALUE | |

Consumer Discretionary - 5.9% (Continued) | | | | | | |

| TCI Communications, Inc. | | | | | | |

| 8.750%, 08/01/2015 | | $ | 770,000 | | | $ | 892,621 | |

| Yankee Acquisition Corp. | | | | | | | | |

9.750%, 02/15/2017 (e) | | | 300,000 | | | | 283,500 | |

| | | | | | | | 5,419,721 | |

Consumer Staples - 0.6% | | | | | | | | |

| Constellation Brands, Inc. | | | | | | | | |

7.250%, 09/01/2016 (e) | | | 375,000 | | | | 375,000 | |

| Del Monte Corp. | | | | | | | | |

6.750%, 02/15/2015 (e) | | | 188,000 | | | | 180,480 | |

| | | | | | | | 555,480 | |

Energy - 4.8% | | | | | | | | |

| Canadian Oil Sands Ltd. | | | | | | | | |

5.800%, 08/15/2013 (b) | | | 700,000 | | | | 693,818 | |

| Chesapeake Energy Corp. | | | | | | | | |

| 6.625%, 01/15/2016 | | | 375,000 | | | | 373,125 | |

| Complete Production Services Inc. | | | | | | | | |

| 8.000%, 12/15/2016 | | | 375,000 | | | | 370,781 | |

| Encore Acquisition Co. | | | | | | | | |

| 7.250%, 12/01/2017 | | | 125,000 | | | | 118,437 | |

| Enterprise Products Operating LP | | | | | | | | |

| 6.300%, 09/15/2017 | | | 500,000 | | | | 500,683 | |

| Nexen, Inc. | | | | | | | | |

| 5.875%, 03/10/2035 | | | 100,000 | | | | 91,590 | |

| Peabody Energy Corp. | | | | | | | | |

| 7.375%, 11/01/2016 | | | 200,000 | | | | 211,000 | |

| Pioneer Natural Resources Co. | | | | | | | | |

| 6.650%, 03/15/2017 | | | 375,000 | | | | 350,574 | |

| Plains All American Pipeline LP | | | | | | | | |

| 4.750%, 08/15/2009 | | | 750,000 | | | | 747,151 | |

| Range Resources Corp. | | | | | | | | |

| 7.375%, 07/15/2013 | | | 90,000 | | | | 91,350 | |

7.500%, 05/15/2016 (e) | | | 125,000 | | | | 127,500 | |

| Transcanada Pipelines Ltd | | | | | | | | |

6.350%, 05/15/2067 (c) | | | 770,000 | | | | 739,003 | |

| | | | | | | | 4,415,012 | |

Financials - 13.0% | | | | | | | | |

| AXA SA | | | | | | | | |

| 5.362%, 02/06/2049 | | | 1,050,000 | | | | 861,000 | |

| Capmark Financial Group, Inc. | | | | | | | | |

6.300%, 05/10/2017 (b) | | | 770,000 | | | | 670,130 | |

| Colonial Realty LP | | | | | | | | |

| 6.050%, 09/01/2016 | | | 770,000 | | | | 743,620 | |

| Conocophillips Australia Funding Co. | | | | | | | | |

| 5.500%, 04/15/2013 | | | 770,000 | | | | 772,991 | |

| Ford Motor Credit Co. LLC | | | | | | | | |

| 5.800%, 01/12/2009 | | | 281,000 | | | | 271,408 | |

8.105%, 01/13/2012 (c) | | | 187,000 | | | | 176,698 | |

8.000%, 12/15/2016 (e) | | | 94,000 | | | | 87,937 | |

| Health Care REIT, Inc. | | | | | | | | |

| 8.000%, 09/12/2012 | | | 750,000 | | | | 822,811 | |

| Host Marriott LP | | | | | | | | |

6.750%, 06/01/2016 (e) | | | 375,000 | | | | 371,250 | |

| iStar Financial, Inc. | | | | | | | | |

| 5.950%, 10/15/2013 | | | 770,000 | | | | 722,650 | |

The accompanying notes are an integral part of the financial statements.

Summit Mutual Funds, Inc. – Apex Series |

| SCHEDULE OF INVESTMENTS | BOND FUND |

| | | PRINCIPAL | | | | |

| | | AMOUNT | | | VALUE | |

Financials - 13.0% (Continued) | | | | | | |

| Landsbanki Islands HF | | | | | | |

6.100%, 08/25/2011 (b) | | $ | 770,000 | | | $ | 780,112 | |

| Lincoln National Corp. | | | | | | | | |

6.050%, 04/20/2067 (c) | | | 760,000 | | | | 731,798 | |

| Nationwide Health Properties, Inc. | | | | | | | | |

| 6.000%, 05/20/2015 | | | 700,000 | | | | 706,009 | |

| NXP BV/NXP Funding LLC | | | | | | | | |

7.875%, 10/15/2014 (e) | | | 175,000 | | | | 168,437 | |

| Prime Property Fund, Inc. | | | | | | | | |

5.500%, 01/15/2014 (b) | | | 500,000 | | | | 497,886 | |

| R.H. Donnelley Finance Corp. I | | | | | | | | |

10.875%, 12/15/2012 (b) | | | 187,000 | | | | 199,155 | |

| Rabobank Capital Funding II | | | | | | | | |

5.260%, 12/29/2049 (b) (c) | | | 750,000 | | | | 709,182 | |

| Swiss Re Capital I | | | | | | | | |

6.854%, 05/29/2049 (b) (c) | | | 750,000 | | | | 756,001 | |

| Vale Overseas Ltd | | | | | | | | |

| 6.250%, 01/23/2017 | | | 750,000 | | | | 758,399 | |

| Ventas Realty LP | | | | | | | | |

| 7.125%, 06/01/2015 | | | 113,000 | | | | 115,260 | |

| WMC Finance USA Ltd | | | | | | | | |

| 5.125%, 05/15/2013 | | | 750,000 | | | | 739,043 | |

| Xstrata Finance Canada Ltd. | | | | | | | | |

5.800%, 11/15/2016 (b) | | | 350,000 | | | | 348,044 | |

| | | | | | | | 12,009,821 | |

Health Care - 0.7% | | | | | | | | |

| Community Health Systems, Inc. | | | | | | | | |

8.875%, 07/15/2015 (b) (e) | | | 187,000 | | | | 192,142 | |

| DaVita, Inc. | | | | | | | | |

7.250%, 03/15/2015 (e) | | | 94,000 | | | | 94,235 | |

| HCA, Inc. | | | | | | | | |

9.250%, 11/15/2016 (b) | | | 375,000 | | | | 398,438 | |

| | | | | | | | 684,815 | |

Industrials - 4.3% | | | | | | | | |

| American Railcar Industries, Inc. | | | | | | | | |

7.500%, 03/01/2014 (e) | | | 75,000 | | | | 74,625 | |

| Ametek, Inc. | | | | | | | | |

| 7.200%, 07/15/2008 | | | 750,000 | | | | 757,619 | |

| Aramark Corp. | | | | | | | | |

| 8.500%, 02/01/2015 | | | 300,000 | | | | 306,000 | |

| Caterpillar, Inc. | | | | | | | | |

| 5.700%, 08/15/2016 | | | 770,000 | | | | 768,351 | |

| DRS Technologies, Inc. | | | | | | | | |

7.625%, 02/01/2018 (e) | | | 93,000 | | | | 94,860 | |

| Dynegy Holdings, Inc. | | | | | | | | |

7.750%, 06/01/2019 (b) | | | 150,000 | | | | 143,437 | |

| Joy Global, Inc. | | | | | | | | |

| 6.000%, 11/15/2016 | | | 750,000 | | | | 748,380 | |

| Kansas City Southern De Mexico | | | | | | | | |

7.375%, 06/01/2014 (b) | | | 150,000 | | | | 146,625 | |

| Mueller Water Products, Inc. | | | | | | | | |

7.375%, 06/01/2017 (b) | | | 150,000 | | | | 139,500 | |

| Raytheon Co. | | | | | | | | |

| 5.500%, 11/15/2012 | | | 770,000 | | | | 778,606 | |

| | | | | | | | 3,958,003 | |

| | | PRINCIPAL | | | | |

| | | AMOUNT | | | VALUE | |

Information Technology - 1.4% | | | | | | |

| Intuit, Inc. | | | | | | |

| 5.750%, 03/15/2017 | | $ | 770,000 | | | $ | 734,886 | |