UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-4008

Fidelity Investment Trust

(Exact name of registrant as specified in charter)

245 Summer St., Boston, Massachusetts 02210

(Address of principal executive offices) (Zip code)

Scott C. Goebel, Secretary

245 Summer St.

Boston, Massachusetts 02210

(Name and address of agent for service)

Registrant's telephone number, including area code: 617-563-7000

Date of fiscal year end: | October 31 |

| |

Date of reporting period: | April 30, 2015 |

This report on Form N-CSR relates solely to the Registrant's Fidelity Diversified International Fund, Fidelity Emerging Markets Discovery Fund, Fidelity Emerging Europe, Middle East, Africa (EMEA) Fund, Fidelity Global Commodity Stock Fund, Fidelity Global Equity Income Fund, Fidelity International Capital Appreciation Fund, Fidelity Overseas Fund, Fidelity Total Emerging Markets Fund, Fidelity Total International Equity Fund, and Fidelity Worldwide Fund (each, a "Fund" and collectively, the "Funds").

Item 1. Reports to Stockholders

ContentsShareholder Expense ExampleInvestment Changes (Unaudited)Investments April 30, 2015Financial StatementsNotes to Financial StatementsReport of Independent Registered Public Accounting Firm

Fidelity®

Diversified International

Fund -

Class K

Semiannual Report

April 30, 2015

(Fidelity Cover Art)

Contents

Shareholder Expense Example | (Click Here) | An example of shareholder expenses. |

Investment Changes | (Click Here) | A summary of major shifts in the fund's investments over the past six months. |

Investments | (Click Here) | A complete list of the fund's investments with their market values. |

Financial Statements | (Click Here) | Statements of assets and liabilities, operations, and changes in net assets, as well as financial highlights. |

Notes | (Click Here) | Notes to the financial statements. |

Report of Independent Registered Public Accounting Firm | (Click Here) | |

To view a fund's proxy voting guidelines and proxy voting record for the 12-month period ended June 30, visit http://www.fidelity.com/proxyvotingresults or visit the Securities and Exchange Commission's (SEC) web site at http://www.sec.gov. You may also call 1-800-835-5092 to request a free copy of the proxy voting guidelines.

Standard & Poor's, S&P and S&P 500 are registered service marks of The McGraw-Hill Companies, Inc. and have been licensed for use by Fidelity Distributors Corporation.

Other third-party marks appearing herein are the property of their respective owners.

All other marks appearing herein are registered or unregistered trademarks or service marks of FMR LLC or an affiliated company. © 2015 FMR LLC. All rights reserved.

This report and the financial statements contained herein are submitted for the general information of the shareholders of the fund. This report is not authorized for distribution to prospective investors in the fund unless preceded or accompanied by an effective prospectus.

A fund files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. Forms N-Q are available on the SEC's web site at http://www.sec.gov. A fund's Forms N-Q may be reviewed and copied at the SEC's Public Reference Room in Washington, DC. Information regarding the operation of the SEC's Public Reference Room may be obtained by calling 1-800-SEC-0330. For a complete list of a fund's portfolio holdings, view the most recent holdings listing, semiannual report, or annual report on Fidelity's web site at http://www.fidelity.com, http://www.advisor.fidelity.com, or http://www.401k.com, as applicable.

NOT FDIC INSURED • MAY LOSE VALUE • NO BANK GUARANTEE

Neither the fund nor Fidelity Distributors Corporation is a bank.

Semiannual Report

Fidelity Diversified International Fund

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including redemption fees and (2) ongoing costs, including management fees and other Fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period (November 1, 2014 to April 30, 2015).

Actual Expenses

The first line of the accompanying table for each class of the Fund provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000.00 (for example, an $8,600 account value divided by $1,000.00 = 8.6), then multiply the result by the number in the first line for a class of the Fund under the heading entitled "Expenses Paid During Period" to estimate the expenses you paid on your account during this period. A small balance maintenance fee of $12.00 that is charged once a year may apply for certain accounts with a value of less than $2,000. This fee is not included in the table below. If it was, the estimate of expenses you paid during the period would be higher, and your ending account value lower, by this amount. In addition, the Fund, as a shareholder in the underlying Fidelity Central Funds, will indirectly bear its pro-rata share of the fees and expenses incurred by the underlying Fidelity Central Funds. These fees and expenses are not included in the Fund's annualized expense ratio used to calculate the expense estimate in the table below.

Hypothetical Example for Comparison Purposes

The second line of the accompanying table for each class of the Fund provides information about hypothetical account values and hypothetical expenses based on a Class' actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Class' actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds. A small balance maintenance fee of $12.00 that is charged once a year may apply for certain accounts with a value of less than $2,000. This fee is not included in the table below. If it was, the estimate of expenses you paid during the period would be higher, and your ending account value lower, by this amount. In addition, the Fund, as a shareholder in the underlying Fidelity Central Funds, will indirectly bear its pro-rata share of the fees and expenses incurred by the underlying Fidelity Central Funds. These fees and expenses are not included in the Fund's annualized expense ratio used to calculate the expense estimate in the table below.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transaction costs. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| Annualized

Expense Ratio B | Beginning

Account Value

November 1, 2014 | Ending

Account Value

April 30, 2015 | Expenses Paid

During Period*

November 1, 2014

to April 30, 2015 |

Diversified International | .98% | | | |

Actual | | $ 1,000.00 | $ 1,073.20 | $ 5.04 |

HypotheticalA | | $ 1,000.00 | $ 1,019.93 | $ 4.91 |

Class K | .86% | | | |

Actual | | $ 1,000.00 | $ 1,073.60 | $ 4.42 |

HypotheticalA | | $ 1,000.00 | $ 1,020.53 | $ 4.31 |

A 5% return per year before expenses

B Annualized expense ratio reflects expenses net of applicable fee waivers.

* Expenses are equal to each Class' annualized expense ratio, multiplied by the average account value over the period, multiplied by 181/365 (to reflect the one-half year period).

Semiannual Report

Fidelity Diversified International Fund

Investment Changes (Unaudited)

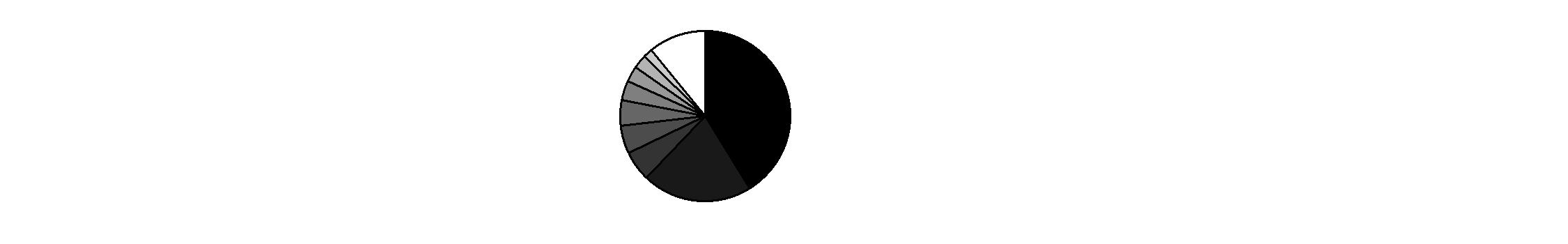

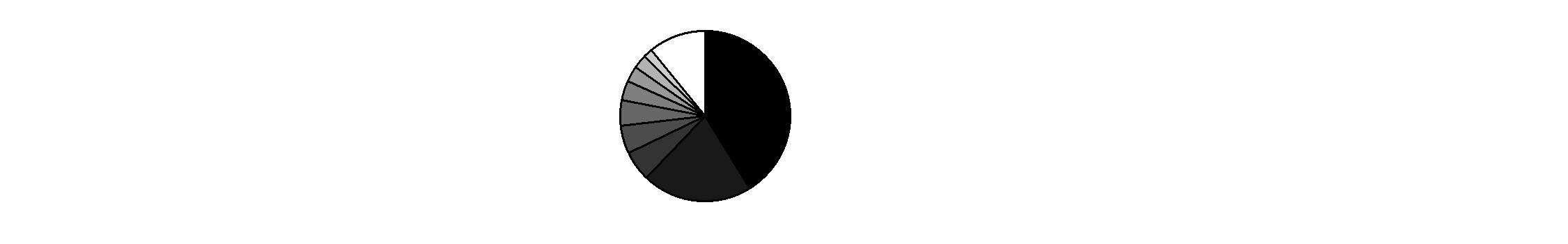

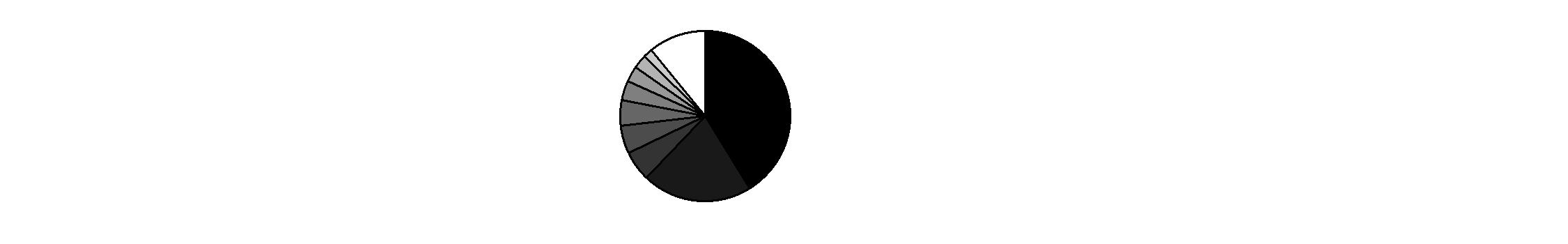

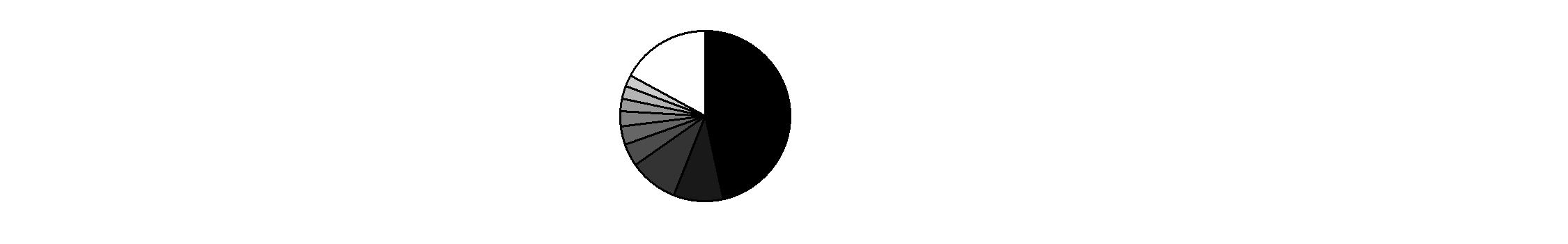

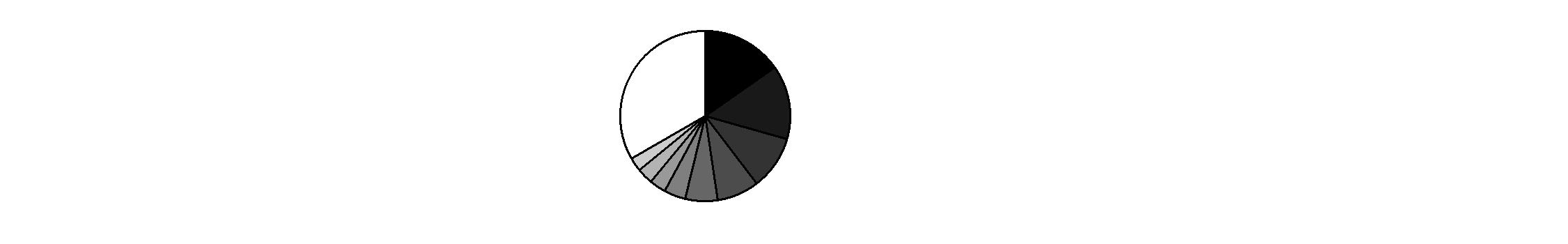

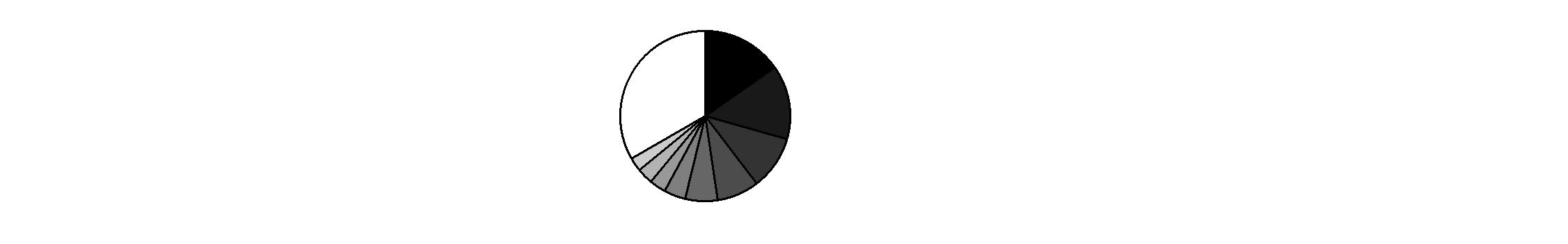

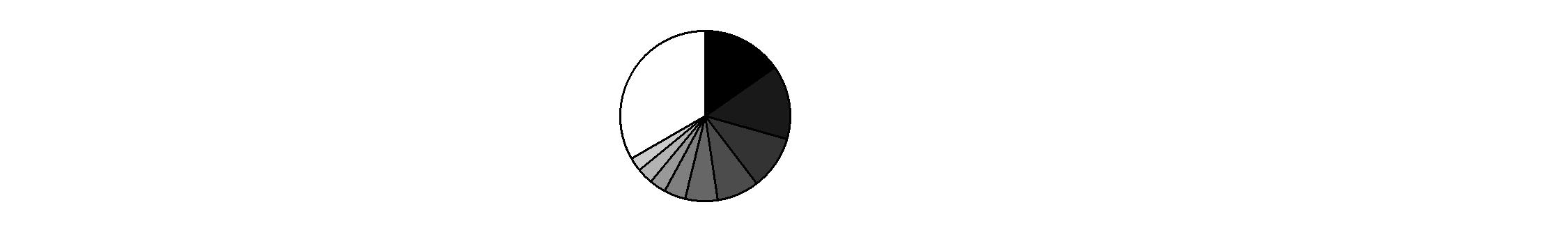

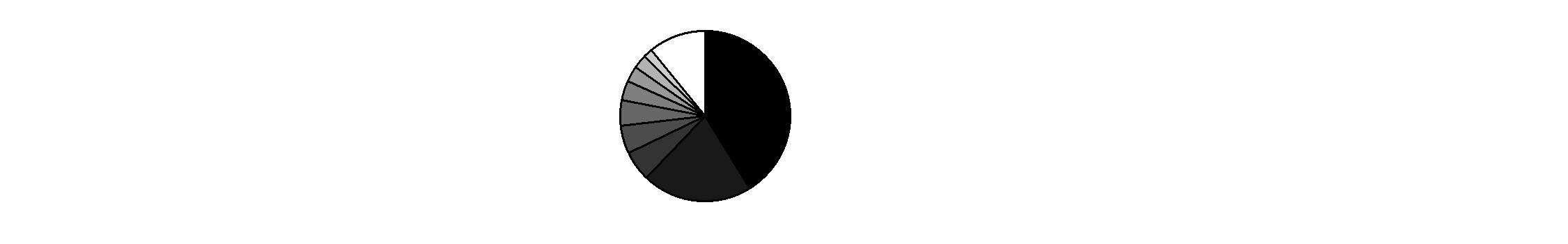

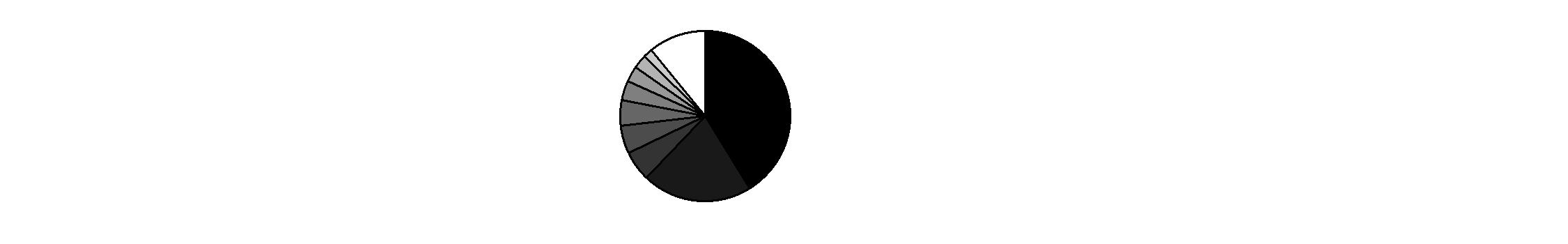

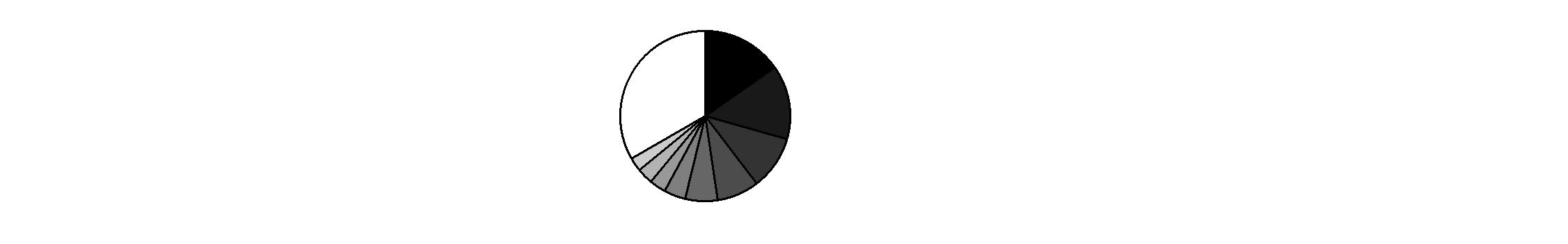

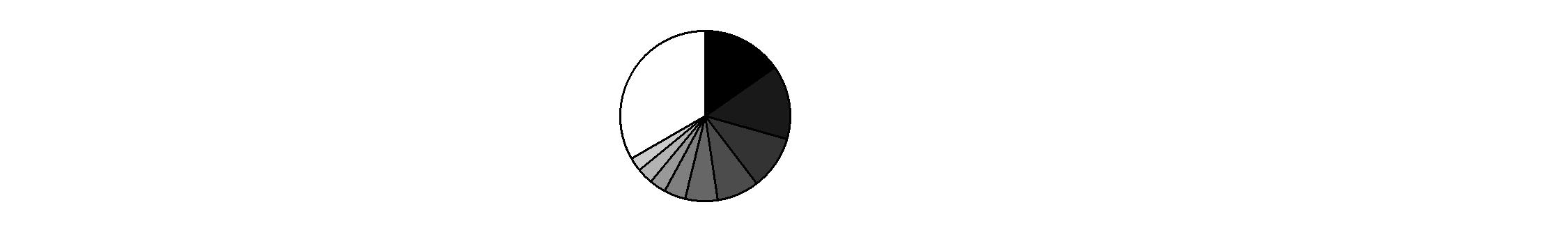

Geographic Diversification (% of fund's net assets) |

As of April 30, 2015 |

| United Kingdom | 17.3% | |

| Japan | 15.4% | |

| United States of America* | 12.2% | |

| Germany | 7.2% | |

| Switzerland | 4.6% | |

| France | 4.2% | |

| Canada | 3.3% | |

| Netherlands | 3.1% | |

| Belgium | 2.9% | |

| Other | 29.8% | |

* Includes Short-Term Investments and Net Other Assets (Liabilities). |

Percentages are based on country or territory of incorporation and are adjusted for the effect of futures contracts, if applicable. |

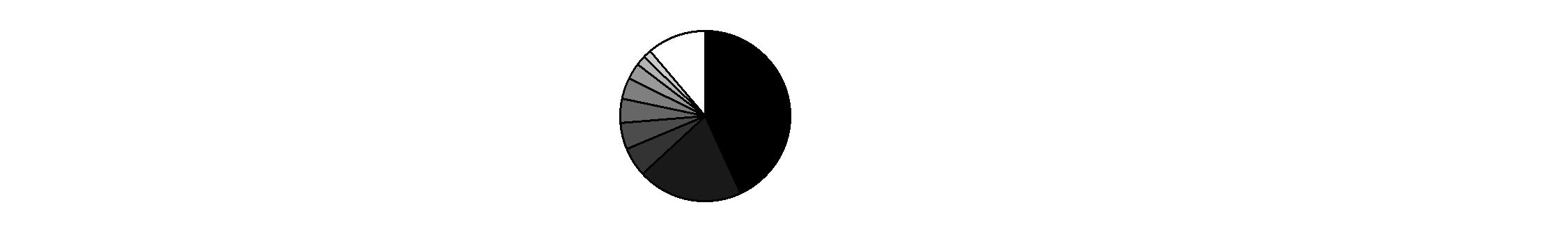

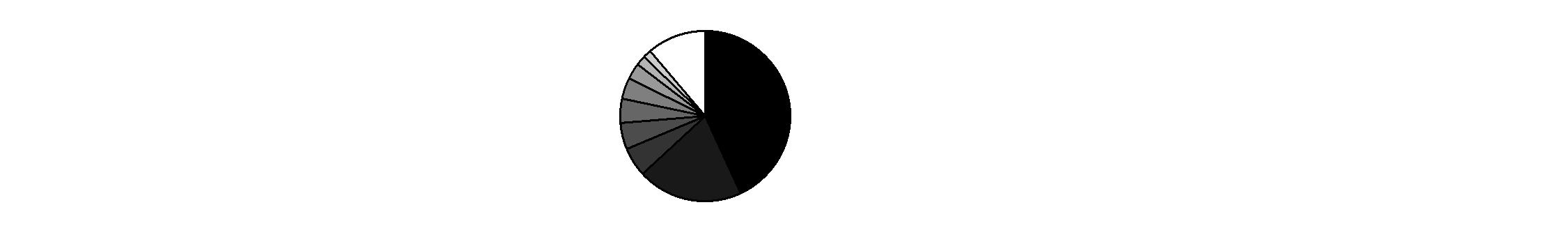

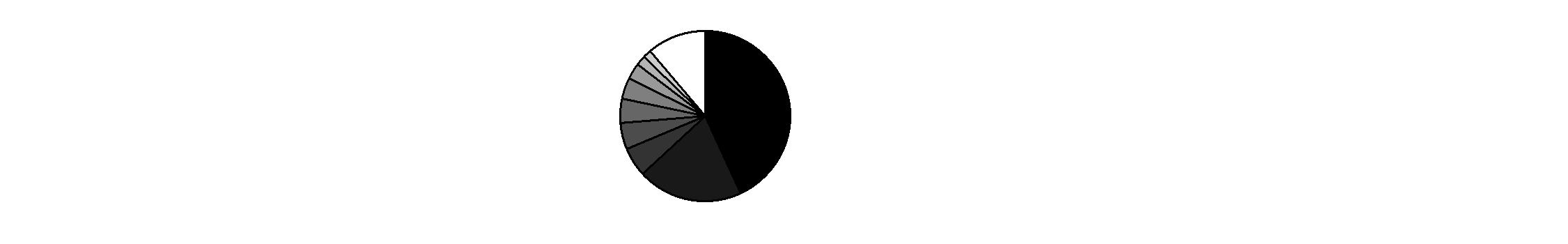

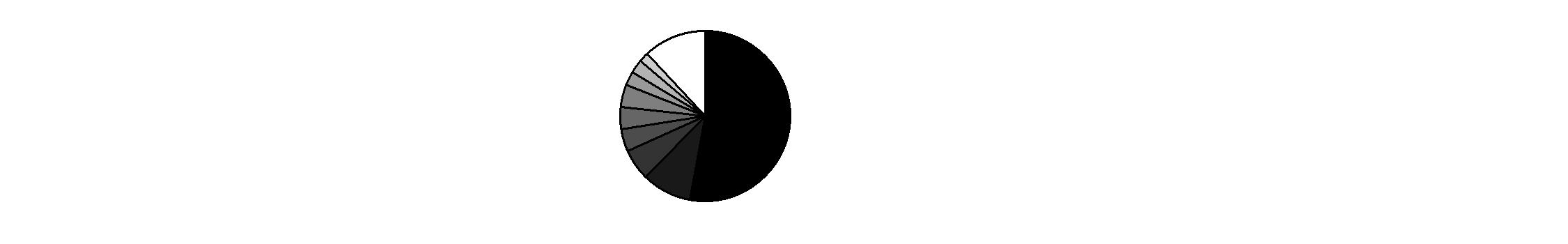

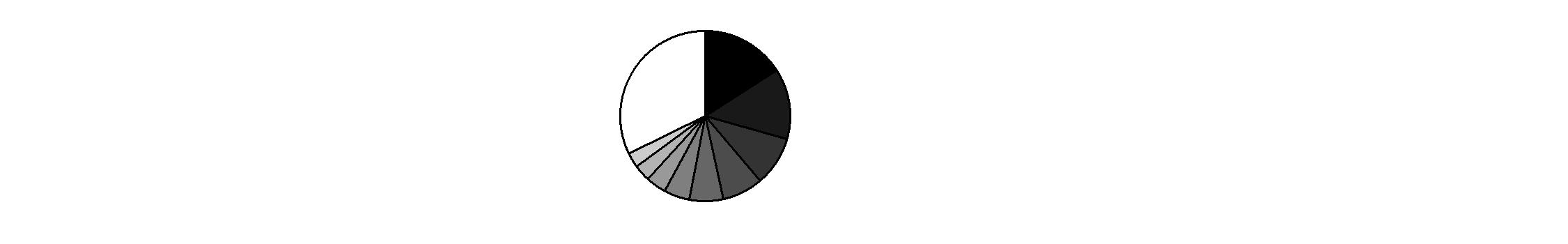

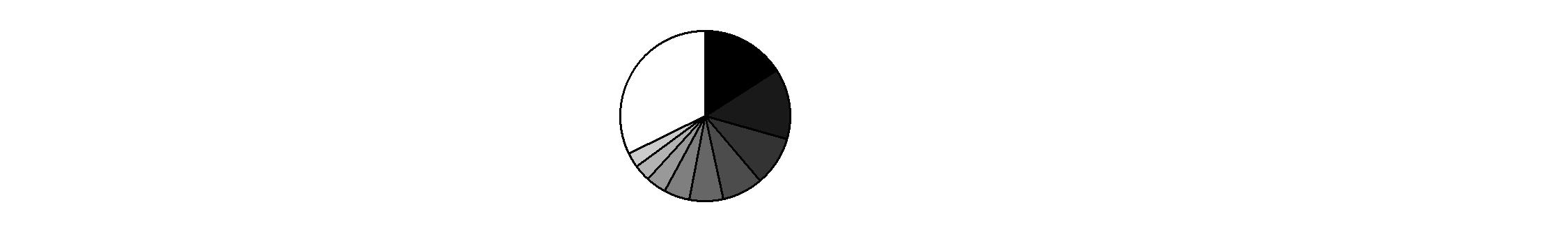

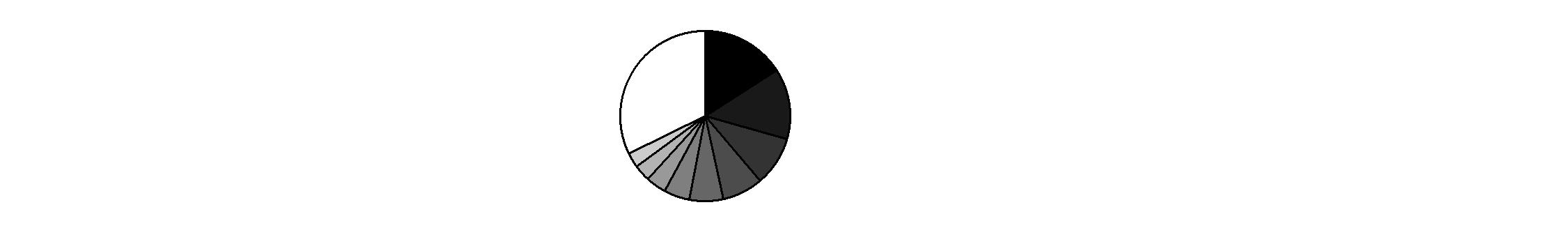

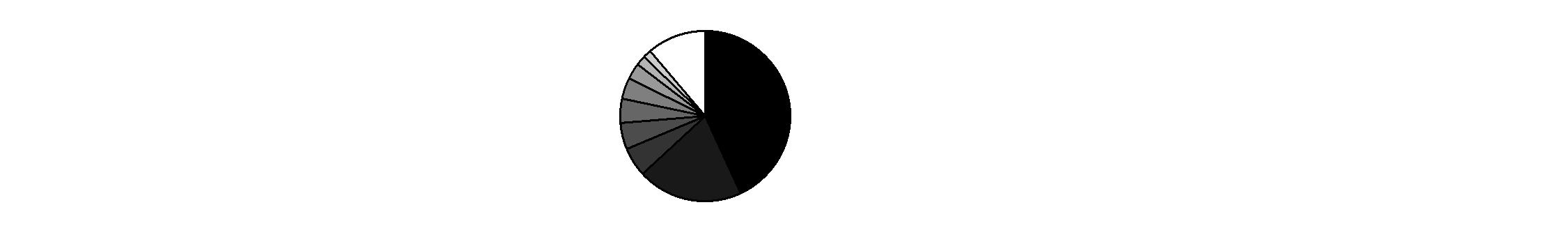

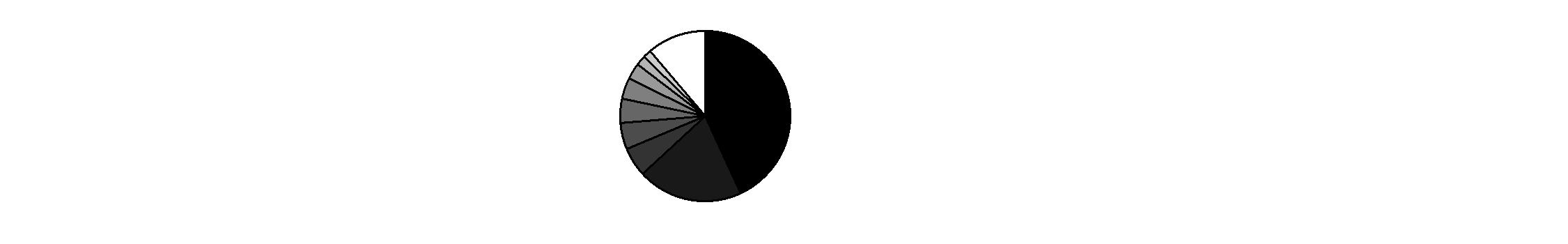

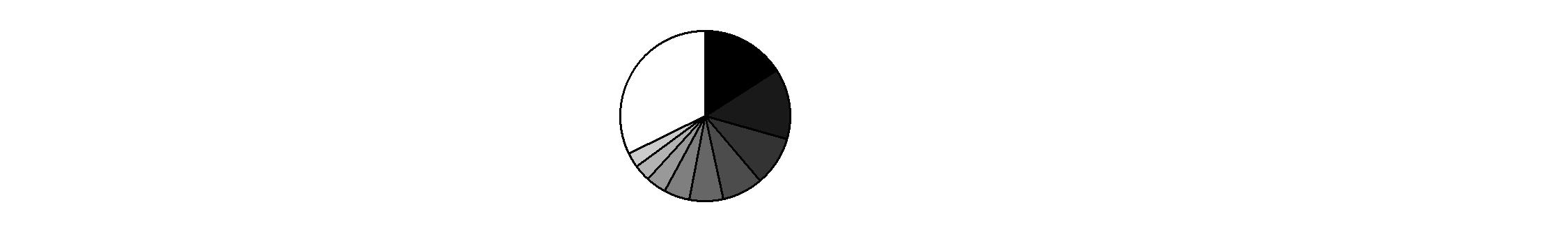

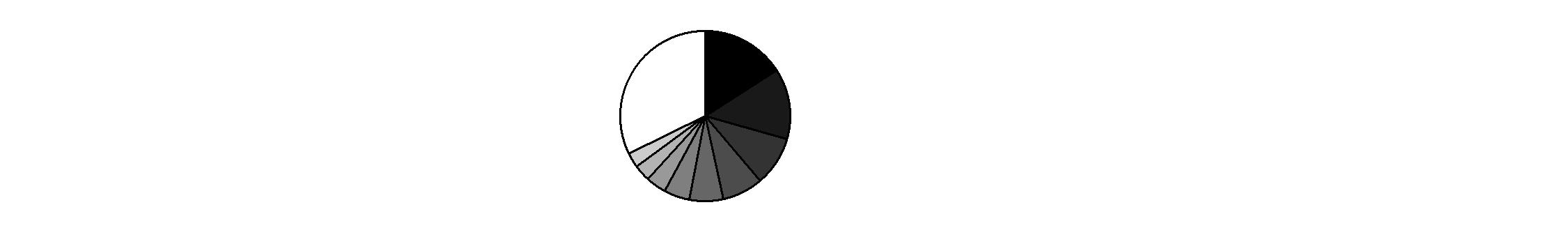

As of October 31, 2014 |

| Japan | 17.2% | |

| United Kingdom | 16.3% | |

| United States of America* | 11.1% | |

| Germany | 6.2% | |

| Switzerland | 5.1% | |

| France | 4.0% | |

| Canada | 3.6% | |

| Netherlands | 3.3% | |

| Cayman Islands | 3.2% | |

| Other | 30.0% | |

* Includes Short-Term Investments and Net Other Assets (Liabilities). |

Percentages are based on country or territory of incorporation and are adjusted for the effect of futures contracts, if applicable. |

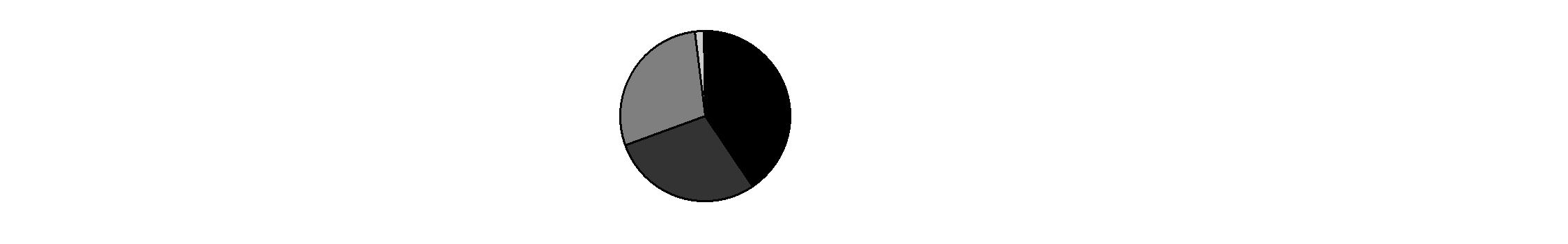

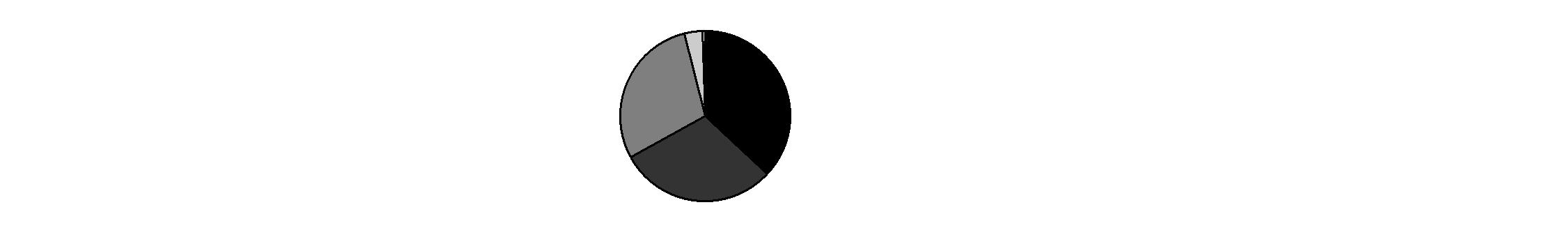

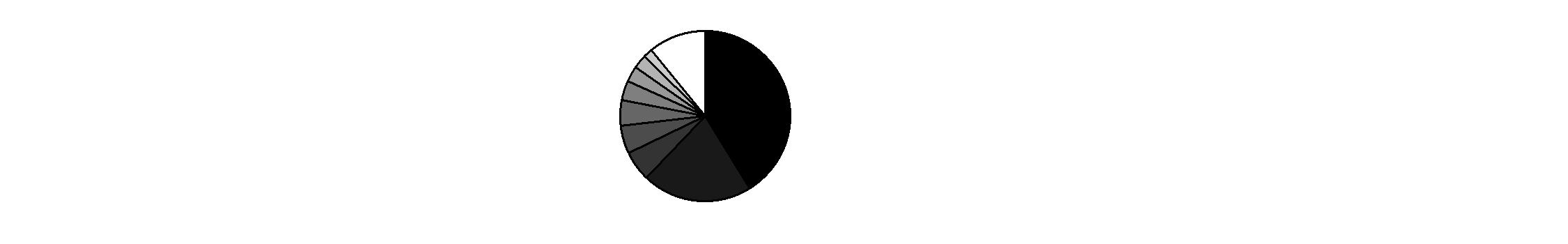

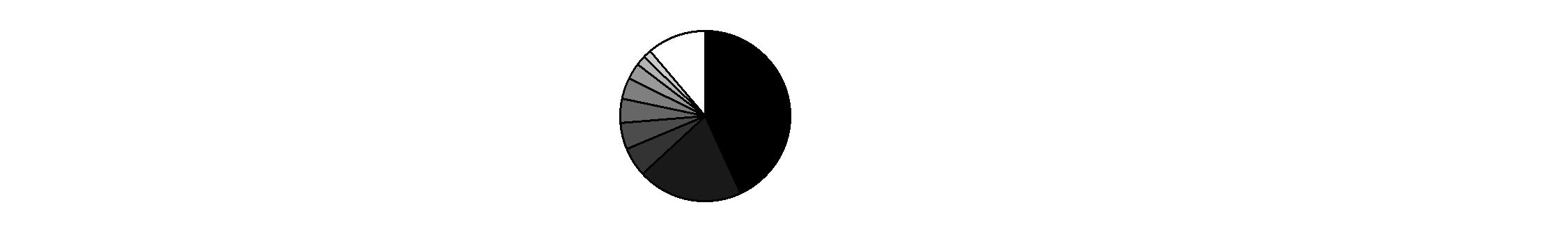

Asset Allocation as of April 30, 2015 |

| % of fund's

net assets | % of fund's net assets

6 months ago |

Stocks and Equity Futures | 94.7 | 96.6 |

Other Investments | 0.1 | 0.1 |

Short-Term Investments and Net Other Assets (Liabilities) | 5.2 | 3.3 |

Top Ten Stocks as of April 30, 2015 |

| % of fund's

net assets | % of fund's net assets

6 months ago |

Novo Nordisk A/S Series B (Denmark, Pharmaceuticals) | 1.8 | 1.8 |

ORIX Corp. (Japan, Diversified Financial Services) | 1.8 | 1.8 |

Anheuser-Busch InBev SA NV (Belgium, Beverages) | 1.8 | 1.6 |

Bayer AG (Germany, Pharmaceuticals) | 1.5 | 1.6 |

AIA Group Ltd. (Hong Kong, Insurance) | 1.5 | 1.2 |

Mitsubishi UFJ Financial Group, Inc. (Japan, Banks) | 1.3 | 0.9 |

Lloyds Banking Group PLC (United Kingdom, Banks) | 1.3 | 1.1 |

Roche Holding AG (participation certificate) (Switzerland, Pharmaceuticals) | 1.3 | 1.4 |

Hoya Corp. (Japan, Electronic Equipment & Components) | 1.3 | 1.2 |

Prudential PLC (United Kingdom, Insurance) | 1.2 | 1.2 |

| 14.8 | |

Market Sectors as of April 30, 2015 |

| % of fund's

net assets | % of fund's net assets

6 months ago |

Financials | 21.5 | 21.0 |

Consumer Discretionary | 17.4 | 15.6 |

Health Care | 16.0 | 15.9 |

Information Technology | 12.4 | 13.7 |

Consumer Staples | 10.9 | 11.7 |

Industrials | 6.8 | 6.9 |

Materials | 3.9 | 4.9 |

Telecommunication Services | 3.1 | 3.6 |

Energy | 2.5 | 3.4 |

Semiannual Report

Fidelity Diversified International Fund

Investments April 30, 2015

Showing Percentage of Net Assets

Common Stocks - 92.7% |

| Shares | | Value |

Argentina - 0.1% |

YPF SA Class D sponsored ADR | 1,214,900 | | $ 37,103,046 |

Australia - 1.5% |

Ansell Ltd. | 3,168,821 | | 65,424,497 |

Australia & New Zealand Banking Group Ltd. | 7,919,475 | | 213,017,932 |

CSL Ltd. | 1,712,208 | | 123,273,879 |

TOTAL AUSTRALIA | | 401,716,308 |

Austria - 0.1% |

Andritz AG | 638,000 | | 37,352,833 |

Bailiwick of Guernsey - 0.1% |

Amdocs Ltd. | 428,500 | | 23,597,495 |

Bailiwick of Jersey - 2.3% |

Experian PLC | 2,046,572 | | 36,552,348 |

Shire PLC | 3,280,700 | | 266,601,559 |

Wolseley PLC | 2,664,074 | | 157,565,077 |

WPP PLC | 5,631,109 | | 131,325,896 |

TOTAL BAILIWICK OF JERSEY | | 592,044,880 |

Belgium - 2.9% |

Anheuser-Busch InBev SA NV | 3,734,030 | | 454,611,988 |

Fagron NV | 765,600 | | 33,839,469 |

KBC Groep NV | 3,514,187 | | 231,209,913 |

UCB SA | 348,400 | | 25,096,248 |

TOTAL BELGIUM | | 744,757,618 |

Bermuda - 0.2% |

Travelport Worldwide Ltd. (e) | 2,769,800 | | 43,845,934 |

Brazil - 0.1% |

Cielo SA | 1,191,720 | | 16,588,638 |

Canada - 3.3% |

Agrium, Inc. | 512,300 | | 53,077,082 |

Alimentation Couche-Tard, Inc. Class B (sub. vtg.) | 5,405,881 | | 206,915,528 |

AutoCanada, Inc. | 404,675 | | 13,399,723 |

CGI Group, Inc. Class A (sub. vtg.) (a) | 4,153,000 | | 174,794,314 |

Constellation Software, Inc. | 72,738 | | 28,516,431 |

Constellation Software, Inc. rights 9/15/15 (a) | 72,738 | | 21,704 |

Fairfax India Holdings Corp. (a)(f) | 6,411,100 | | 77,510,199 |

Imperial Oil Ltd. | 1,336,200 | | 58,896,905 |

Keyera Corp. (e) | 1,261,400 | | 44,402,535 |

PrairieSky Royalty Ltd. (e) | 482,600 | | 13,252,000 |

Suncor Energy, Inc. | 3,173,200 | | 103,336,119 |

Tourmaline Oil Corp. (a) | 1,561,200 | | 53,881,780 |

TransForce, Inc. | 683,800 | | 15,444,302 |

TOTAL CANADA | | 843,448,622 |

Cayman Islands - 1.4% |

Alibaba Group Holding Ltd. sponsored ADR | 634,100 | | 51,545,989 |

Baidu.com, Inc. sponsored ADR (a) | 180,900 | | 36,230,652 |

|

| Shares | | Value |

China Modern Dairy Holdings Ltd. (e) | 112,612,000 | | $ 45,913,376 |

Melco Crown Entertainment Ltd. sponsored ADR (e) | 3,343,700 | | 68,278,354 |

PW Medtech Group Ltd. (a)(e) | 81,259,000 | | 34,912,680 |

Sands China Ltd. | 19,962,800 | | 81,777,280 |

Tencent Holdings Ltd. | 2,487,100 | | 51,330,960 |

TOTAL CAYMAN ISLANDS | | 369,989,291 |

Chile - 0.1% |

Sociedad Quimica y Minera de Chile SA (PN-B) sponsored ADR | 1,004,043 | | 21,928,299 |

China - 1.0% |

Daqin Railway Co. Ltd. (A Shares) | 30,304,900 | | 68,252,959 |

Inner Mongoli Yili Industries Co. Ltd. | 4,741,300 | | 27,869,317 |

Kweichow Moutai Co. Ltd. | 2,059,100 | | 83,731,024 |

Qingdao Haier Co. Ltd. | 18,866,189 | | 82,456,694 |

Weifu High-Technology Co. Ltd.

(B Shares) | 1,891,797 | | 8,850,541 |

TOTAL CHINA | | 271,160,535 |

Curacao - 0.2% |

Schlumberger Ltd. | 676,525 | | 64,006,030 |

Denmark - 2.3% |

Genmab A/S (a) | 1,651,576 | | 127,173,324 |

Novo Nordisk A/S Series B | 8,590,495 | | 482,276,167 |

TOTAL DENMARK | | 609,449,491 |

Egypt - 0.0% |

Edita Food Industries SAE (a) | 1,282,026 | | 4,276,192 |

Finland - 0.4% |

Nokia Corp. | 4,512,700 | | 30,449,145 |

Sampo Oyj (A Shares) | 1,367,800 | | 66,275,780 |

TOTAL FINLAND | | 96,724,925 |

France - 4.2% |

Accor SA | 947,700 | | 51,966,975 |

Air Liquide SA | 774,170 | | 101,246,285 |

AXA SA (e) | 5,968,800 | | 150,926,193 |

BNP Paribas SA | 1,629,676 | | 102,916,180 |

Bureau Veritas SA | 1,554,900 | | 36,614,138 |

Danone SA | 886,300 | | 64,134,590 |

LVMH Moet Hennessy - Louis Vuitton SA | 165,152 | | 28,879,521 |

Numericable Group SA (a) | 1,262,154 | | 70,074,799 |

Publicis Groupe SA | 1,676,616 | | 140,618,735 |

Rexel SA | 1,648,300 | | 31,064,936 |

Sanofi SA | 2,931,607 | | 298,409,771 |

TOTAL FRANCE | | 1,076,852,123 |

Germany - 5.5% |

adidas AG (e) | 612,100 | | 50,152,984 |

Bayer AG | 2,666,162 | | 383,747,653 |

Brenntag AG | 926,900 | | 55,614,625 |

Continental AG (e) | 534,700 | | 125,309,523 |

Common Stocks - continued |

| Shares | | Value |

Germany - continued |

Deutsche Boerse AG | 410,300 | | $ 33,999,040 |

Fresenius SE & Co. KGaA | 3,826,100 | | 227,625,932 |

Gerry Weber International AG (Bearer) (e) | 148,600 | | 4,857,092 |

GfK AG | 45,625 | | 1,745,834 |

KION Group AG | 878,500 | | 38,974,580 |

Linde AG | 604,929 | | 118,209,012 |

OSRAM Licht AG | 1,659,916 | | 87,450,791 |

ProSiebenSat.1 Media AG | 2,204,590 | | 112,714,517 |

SAP AG (e) | 1,936,878 | | 146,360,219 |

Symrise AG | 611,700 | | 37,089,463 |

TOTAL GERMANY | | 1,423,851,265 |

Hong Kong - 1.7% |

AIA Group Ltd. | 55,745,200 | | 372,567,284 |

Galaxy Entertainment Group Ltd. | 5,320,000 | | 25,740,109 |

Hang Seng Bank Ltd. | 1,400,700 | | 27,343,338 |

Melco International Development Ltd. | 2,137,000 | | 3,628,506 |

TOTAL HONG KONG | | 429,279,237 |

India - 2.7% |

Apollo Hospitals Enterprise Ltd. (a) | 2,227,126 | | 39,853,155 |

Axis Bank Ltd. (a) | 6,699,871 | | 60,144,843 |

Bharti Infratel Ltd. | 14,300,000 | | 90,303,662 |

HCL Technologies Ltd. | 1,694,017 | | 23,473,181 |

HDFC Bank Ltd. | 9,951,238 | | 177,762,255 |

Housing Development Finance Corp. Ltd. | 8,291,778 | | 152,662,964 |

ITC Ltd. (a) | 13,515,862 | | 68,560,123 |

LIC Housing Finance Ltd. | 3,150,214 | | 21,318,624 |

Lupin Ltd. | 1,787,333 | | 49,854,473 |

Sun Pharmaceutical Industries Ltd. (a) | 774,113 | | 11,436,700 |

TOTAL INDIA | | 695,369,980 |

Indonesia - 0.6% |

PT Astra International Tbk | 41,254,700 | | 21,800,941 |

PT Bank Central Asia Tbk | 84,159,300 | | 87,486,717 |

PT Bank Rakyat Indonesia Tbk | 65,102,000 | | 58,384,629 |

TOTAL INDONESIA | | 167,672,287 |

Ireland - 2.4% |

Actavis PLC (a) | 861,800 | | 243,768,748 |

DCC PLC (United Kingdom) | 874,989 | | 55,661,201 |

Greencore Group PLC | 13,127,300 | | 71,236,361 |

Horizon Pharma PLC (a) | 1,113,600 | | 31,314,432 |

Kerry Group PLC Class A | 514,900 | | 37,872,131 |

Perrigo Co. PLC | 298,700 | | 54,745,736 |

Ryanair Holdings PLC sponsored ADR | 2,047,700 | | 132,793,345 |

TOTAL IRELAND | | 627,391,954 |

Isle of Man - 0.2% |

Optimal Payments PLC (a) | 4,660,775 | | 21,180,120 |

|

| Shares | | Value |

Optimal Payments PLC rights 5/1/15 (a) | 7,767,958 | | $ 16,491,233 |

Playtech Ltd. | 267,402 | | 3,359,313 |

TOTAL ISLE OF MAN | | 41,030,666 |

Israel - 1.5% |

Check Point Software Technologies Ltd. (a) | 1,546,400 | | 129,093,472 |

Teva Pharmaceutical Industries Ltd. sponsored ADR | 4,160,600 | | 251,383,452 |

TOTAL ISRAEL | | 380,476,924 |

Italy - 1.1% |

Intesa Sanpaolo SpA | 45,101,500 | | 151,518,642 |

Mediaset SpA | 12,785,300 | | 65,711,511 |

UniCredit SpA | 1,879,467 | | 13,491,064 |

World Duty Free SpA (a) | 5,262,070 | | 58,742,146 |

TOTAL ITALY | | 289,463,363 |

Japan - 15.4% |

Astellas Pharma, Inc. | 17,700,500 | | 275,609,160 |

Don Quijote Holdings Co. Ltd. | 1,779,100 | | 135,735,365 |

Fast Retailing Co. Ltd. | 264,500 | | 104,181,210 |

Glory Ltd. | 1,108,800 | | 30,688,640 |

GMO Internet, Inc. | 2,495,800 | | 31,375,128 |

Hoya Corp. | 8,528,800 | | 328,707,601 |

Japan Exchange Group, Inc. | 4,817,200 | | 139,179,359 |

Japan Tobacco, Inc. | 7,012,400 | | 244,879,065 |

KDDI Corp. | 8,167,000 | | 193,250,351 |

Keyence Corp. | 500,710 | | 267,303,590 |

Komatsu Ltd. | 1,577,900 | | 31,745,973 |

Minebea Ltd. | 515,000 | | 7,896,565 |

Misumi Group, Inc. | 439,400 | | 16,489,861 |

Mitsubishi Electric Corp. | 5,334,000 | | 69,660,489 |

Mitsubishi UFJ Financial Group, Inc. | 47,606,200 | | 338,211,103 |

NEC Corp. | 35,470,000 | | 118,009,101 |

NGK Spark Plug Co. Ltd. | 1,611,400 | | 45,124,586 |

Nitori Holdings Co. Ltd. | 1,085,000 | | 83,446,341 |

Olympus Corp. (a) | 1,285,600 | | 46,294,458 |

OMRON Corp. | 1,996,600 | | 91,680,008 |

ORIX Corp. | 30,868,900 | | 474,714,319 |

Rakuten, Inc. | 16,040,600 | | 280,236,509 |

Seven & i Holdings Co. Ltd. | 1,647,700 | | 70,825,302 |

SHIMANO, Inc. | 660,600 | | 94,631,627 |

Shinsei Bank Ltd. | 23,876,000 | | 48,857,762 |

SoftBank Corp. | 3,113,200 | | 194,607,227 |

Suzuki Motor Corp. | 2,118,300 | | 68,467,977 |

TDK Corp. | 567,700 | | 40,892,709 |

Tsuruha Holdings, Inc. | 1,465,500 | | 106,290,867 |

TOTAL JAPAN | | 3,978,992,253 |

Common Stocks - continued |

| Shares | | Value |

Korea (South) - 1.0% |

Orion Corp. | 82,708 | | $ 96,214,058 |

Samsung Electronics Co. Ltd. | 120,511 | | 157,755,949 |

TOTAL KOREA (SOUTH) | | 253,970,007 |

Luxembourg - 1.3% |

Altice SA (a) | 2,774,413 | | 293,377,743 |

Eurofins Scientific SA | 196,500 | | 55,351,056 |

TOTAL LUXEMBOURG | | 348,728,799 |

Netherlands - 3.1% |

AEGON NV | 23,573,900 | | 185,995,841 |

AerCap Holdings NV (a) | 375,000 | | 17,505,000 |

IMCD Group BV | 1,560,300 | | 58,145,201 |

ING Groep NV (Certificaten Van Aandelen) | 10,336,900 | | 158,584,120 |

LyondellBasell Industries NV Class A | 149,300 | | 15,455,536 |

Reed Elsevier NV | 4,386,677 | | 105,795,342 |

Unilever NV (Certificaten Van Aandelen) (Bearer) | 6,061,557 | | 264,408,789 |

TOTAL NETHERLANDS | | 805,889,829 |

Norway - 0.2% |

Telenor ASA | 2,366,200 | | 53,441,072 |

Philippines - 0.4% |

Alliance Global Group, Inc. | 161,934,956 | | 92,192,040 |

Singapore - 0.4% |

United Overseas Bank Ltd. | 5,107,700 | | 94,534,139 |

South Africa - 1.0% |

Naspers Ltd. Class N | 1,705,399 | | 268,223,406 |

Spain - 1.8% |

Amadeus IT Holding SA Class A | 3,618,200 | | 164,924,636 |

Hispania Activos Inmobiliarios SA (a) | 1,688,000 | | 24,054,407 |

Inditex SA | 8,388,824 | | 269,189,635 |

Prosegur Compania de Seguridad SA (Reg.) | 384,618 | | 2,217,153 |

TOTAL SPAIN | | 460,385,831 |

Sweden - 2.1% |

ASSA ABLOY AB (B Shares) | 1,182,000 | | 68,572,329 |

HEXPOL AB (B Shares) | 212,200 | | 22,739,647 |

Nordea Bank AB | 12,696,000 | | 161,304,584 |

Svenska Cellulosa AB (SCA) (B Shares) (e) | 7,139,600 | | 180,595,973 |

Svenska Handelsbanken AB (A Shares) | 2,399,200 | | 110,744,596 |

TOTAL SWEDEN | | 543,957,129 |

Switzerland - 4.6% |

Actelion Ltd. | 720,402 | | 94,791,115 |

Compagnie Financiere Richemont SA Series A | 1,219,454 | | 108,693,539 |

Nestle SA | 515,865 | | 40,022,984 |

Roche Holding AG (participation certificate) | 1,152,134 | | 329,689,014 |

|

| Shares | | Value |

Sika AG (Bearer) | 21,758 | | $ 74,681,001 |

Sunrise Communications Group AG | 442,688 | | 41,169,818 |

Syngenta AG (Switzerland) | 732,496 | | 245,114,997 |

UBS Group AG | 12,414,107 | | 248,000,761 |

TOTAL SWITZERLAND | | 1,182,163,229 |

Taiwan - 1.2% |

Taiwan Semiconductor Manufacturing Co. Ltd. sponsored ADR | 12,964,500 | | 316,852,380 |

Thailand - 0.3% |

Kasikornbank PCL (For. Reg.) | 12,195,800 | | 77,715,612 |

United Kingdom - 17.3% |

Al Noor Hospitals Group PLC | 4,020,800 | | 55,379,968 |

Associated British Foods PLC | 2,238,600 | | 97,733,362 |

B&M European Value Retail S.A. | 24,794,391 | | 114,762,712 |

Babcock International Group PLC | 2,965,900 | | 45,751,759 |

Barclays PLC | 13,273,224 | | 51,930,862 |

BG Group PLC | 12,670,102 | | 229,500,563 |

British American Tobacco PLC sponsored ADR | 1,533,300 | | 168,831,663 |

BT Group PLC | 28,069,100 | | 195,770,459 |

Bunzl PLC | 1,785,570 | | 50,205,361 |

Capita Group PLC | 2,211,700 | | 38,711,836 |

Compass Group PLC | 5,782,476 | | 102,221,072 |

easyJet PLC | 2,317,600 | | 64,083,173 |

Essentra PLC | 12,044,112 | | 176,799,328 |

Exova Group Ltd. PLC | 8,076,188 | | 23,436,431 |

GlaxoSmithKline PLC | 5,944,900 | | 137,307,547 |

Hikma Pharmaceuticals PLC | 2,920,378 | | 91,326,602 |

HSBC Holdings PLC sponsored ADR | 1,955,057 | | 97,029,479 |

IMI PLC | 2,330,935 | | 44,666,739 |

Imperial Tobacco Group PLC | 1,142,139 | | 55,771,237 |

Indivior PLC (a) | 9,735,942 | | 29,665,545 |

Intertek Group PLC | 650,200 | | 25,985,593 |

ITV PLC | 36,891,800 | | 143,233,068 |

Johnson Matthey PLC | 1,554,482 | | 79,478,853 |

Liberty Global PLC: | | | |

Class A (a) | 861,100 | | 44,897,754 |

Class C (a) | 611,600 | | 30,855,220 |

Lloyds Banking Group PLC | 284,226,800 | | 336,603,640 |

London Stock Exchange Group PLC | 2,043,300 | | 79,536,307 |

Meggitt PLC | 12,349,148 | | 99,798,090 |

Melrose PLC | 6,491,400 | | 26,342,041 |

Micro Focus International PLC | 2,408,000 | | 46,347,115 |

Next PLC | 2,126,400 | | 239,072,163 |

Poundland Group PLC | 9,141,236 | | 43,727,851 |

Prudential PLC | 12,791,652 | | 318,480,735 |

Reckitt Benckiser Group PLC | 2,439,787 | | 217,151,889 |

Rolls-Royce Group PLC | 8,966,900 | | 142,958,473 |

SABMiller PLC | 2,553,000 | | 135,137,673 |

Schroders PLC | 1,360,700 | | 67,488,472 |

Spectris PLC | 1,783,600 | | 58,619,159 |

Common Stocks - continued |

| Shares | | Value |

United Kingdom - continued |

Sports Direct International PLC (a) | 5,818,200 | | $ 54,996,098 |

St. James's Place Capital PLC | 13,447,200 | | 183,429,346 |

Virgin Money Holdings Uk PLC (a) | 6,520,500 | | 39,430,461 |

Vodafone Group PLC | 14,038,200 | | 49,459,509 |

Whitbread PLC | 1,707,020 | | 137,072,636 |

TOTAL UNITED KINGDOM | | 4,470,987,844 |

United States of America - 6.7% |

Alexion Pharmaceuticals, Inc. (a) | 592,100 | | 100,201,083 |

Alliance Data Systems Corp. (a) | 262,300 | | 77,984,413 |

Amgen, Inc. | 566,000 | | 89,377,060 |

Celgene Corp. (a) | 532,600 | | 57,552,756 |

Celldex Therapeutics, Inc. (a) | 475,513 | | 11,412,312 |

CF Industries Holdings, Inc. | 205,484 | | 59,070,485 |

Energizer Holdings, Inc. | 149,900 | | 20,479,338 |

FedEx Corp. | 151,000 | | 25,605,070 |

Fidelity National Information Services, Inc. | 1,217,400 | | 76,075,326 |

Google, Inc.: | | | |

Class A (a) | 142,605 | | 78,257,346 |

Class C (a) | 255,003 | | 137,023,312 |

Las Vegas Sands Corp. | 1,734,200 | | 91,704,496 |

MasterCard, Inc. Class A | 1,639,400 | | 147,890,274 |

McGraw Hill Financial, Inc. | 2,225,200 | | 232,088,360 |

Mead Johnson Nutrition Co. Class A | 627,700 | | 60,208,984 |

Noble Energy, Inc. | 1,186,656 | | 60,187,192 |

Oceaneering International, Inc. | 458,200 | | 25,251,402 |

Qorvo, Inc. (a) | 395,919 | | 26,095,021 |

QUALCOMM, Inc. | 1,522,700 | | 103,543,600 |

ResMed, Inc. (e) | 336,000 | | 21,483,840 |

The Blackstone Group LP | 1,964,300 | | 80,457,728 |

Total System Services, Inc. | 197,300 | | 7,805,188 |

Visa, Inc. Class A | 2,223,800 | | 146,881,990 |

TOTAL UNITED STATES OF AMERICA | | 1,736,636,576 |

TOTAL COMMON STOCKS (Cost $17,895,880,351) |

23,994,048,082

|

Preferred Stocks - 1.7% |

| | | |

Convertible Preferred Stocks - 0.0% |

United States of America - 0.0% |

NJOY, Inc.: | | | |

Series C (a)(j) | 770,400 | | 6,217,128 |

Series D (a)(j) | 250,743 | | 2,023,496 |

TOTAL UNITED STATES OF AMERICA | | 8,240,624 |

|

| Shares | | Value |

Nonconvertible Preferred Stocks - 1.7% |

Germany - 1.7% |

Henkel AG & Co. KGaA | 1,927,400 | | $ 223,881,894 |

Volkswagen AG (e) | 772,426 | | 198,857,804 |

TOTAL GERMANY | | 422,739,698 |

United Kingdom - 0.0% |

Rolls-Royce Group PLC | 1,264,332,900 | | 1,940,751 |

TOTAL NONCONVERTIBLE PREFERRED STOCKS | | 424,680,449 |

TOTAL PREFERRED STOCKS (Cost $302,699,628) |

432,921,073

|

Government Obligations - 0.0% |

| Principal Amount (d) | | |

United States of America - 0.0% |

U.S. Treasury Bills, yield at date of purchase 0.02% 6/25/15 to 7/2/15 (i)

(Cost $2,749,914) | | $ 2,750,000 | |

2,750,000

|

Preferred Securities - 0.1% |

|

Ireland - 0.1% |

Baggot Securities Ltd. 10.24% (g)(h)

(Cost $30,791,904) | EUR | 20,050,000 | |

24,087,062

|

Money Market Funds - 6.8% |

| Shares | | |

Fidelity Cash Central Fund, 0.15% (b) | 1,301,610,319 | | 1,301,610,319 |

Fidelity Securities Lending Cash Central Fund, 0.17% (b)(c) | 466,184,845 | | 466,184,845 |

TOTAL MONEY MARKET FUNDS (Cost $1,767,795,164) |

1,767,795,164

|

TOTAL INVESTMENT

PORTFOLIO - 101.3% (Cost $19,999,916,961) | 26,221,601,381 |

NET OTHER ASSETS

(LIABILITIES) - (1.3)% | | (336,329,910) |

NET ASSETS - 100% | $ 25,885,271,471 |

Futures Contracts |

| Expiration Date | | Underlying Face Amount at Value | | Unrealized Appreciation/(Depreciation) |

Purchased |

Equity Index Contracts |

746 CME Nikkei 225 Index Contracts (United States) | June 2015 | | $ 72,511,200 | | $ 2,167,140 |

The face value of futures purchased as a percentage of net assets is 0.3% |

|

Currency Abbreviations |

EUR | - | European Monetary Unit |

Legend |

(a) Non-income producing |

(b) Affiliated fund that is generally available only to investment companies and other accounts managed by Fidelity Investments. The rate quoted is the annualized seven-day yield of the fund at period end. A complete unaudited listing of the fund's holdings as of its most recent quarter end is available upon request. In addition, each Fidelity Central Fund's financial statements, which are not covered by the Fund's Report of Independent Registered Public Accounting Firm, are available on the SEC's website or upon request. |

(c) Investment made with cash collateral received from securities on loan. |

(d) Amount is stated in United States dollars unless otherwise noted. |

(e) Security or a portion of the security is on loan at period end. |

(f) Affiliated company |

(g) Security exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be resold in transactions exempt from registration, normally to qualified institutional buyers. At the end of the period, the value of these securities amounted to $24,087,062 or 0.1% of net assets. |

(h) Security is perpetual in nature with no stated maturity date. |

(i) Security or a portion of the security was pledged to cover margin requirements for futures contracts. At period end, the value of securities pledged amounted to $2,750,000. |

(j) Restricted securities - Investment in securities not registered under the Securities Act of 1933 (excluding 144A issues). At the end of the period, the value of restricted securities (excluding 144A issues) amounted to $8,240,624 or 0.0% of net assets. |

Additional information on each restricted holding is as follows: |

Security | Acquisition Date | Acquisition Cost |

NJOY, Inc. Series C | 6/7/13 | $ 6,227,143 |

NJOY, Inc. Series D | 2/14/14 | $ 4,244,101 |

Affiliated Central Funds |

Information regarding fiscal year to date income earned by the Fund from investments in Fidelity Central Funds is as follows: |

Fund | Income earned |

Fidelity Cash Central Fund | $ 672,396 |

Fidelity Securities Lending Cash Central Fund | 3,084,965 |

Total | $ 3,757,361 |

Other Affiliated Issuers |

An affiliated company is a company in which the Fund has ownership of at least 5% of the voting securities. Fiscal year to date transactions with companies which are or were affiliates are as follows: |

Affiliate | Value, beginning of period | Purchases | Sales

Proceeds | Dividend Income | Value,

end of

period |

Fairfax India Holdings Corp. | $ - | $ 61,051,750 | $ 174,636* | $ - | $ 77,510,199 |

* Includes the value of securities delivered through in-kind transactions.

See accompanying notes which are an integral part of the financial statements.

Semiannual Report

Other Information |

Categorizations in the Schedule of Investments are based on country or territory of incorporation. |

The following is a summary of the inputs used, as of April 30, 2015, involving the Fund's assets and liabilities carried at fair value. The inputs or methodology used for valuing securities may not be an indication of the risk associated with investing in those securities. For more information on valuation inputs, and their aggregation into the levels used in the tables below, please refer to the Investment Valuation section in the accompanying Notes to Financial Statements. |

Valuation Inputs at Reporting Date: |

Description | Total | Level 1 | Level 2 | Level 3 |

Investments in Securities: | | | | |

Equities: | | | | |

Consumer Discretionary | $ 4,503,501,458 | $ 785,458,958 | $ 3,709,801,876 | $ 8,240,624 |

Consumer Staples | 2,802,674,643 | 782,999,603 | 2,019,675,040 | - |

Energy | 689,817,572 | 460,317,009 | 229,500,563 | - |

Financials | 5,546,907,590 | 1,592,117,005 | 3,954,790,585 | - |

Health Care | 4,146,179,391 | 1,185,994,803 | 2,960,184,588 | - |

Industrials | 1,737,939,703 | 353,733,467 | 1,384,206,236 | - |

Information Technology | 3,177,056,712 | 1,760,026,675 | 1,417,030,037 | - |

Materials | 1,004,889,988 | 149,531,402 | 855,358,586 | - |

Telecommunication Services | 818,002,098 | 90,303,662 | 727,698,436 | - |

Government Obligations | 2,750,000 | - | 2,750,000 | - |

Preferred Securities | 24,087,062 | - | 24,087,062 | - |

Money Market Funds | 1,767,795,164 | 1,767,795,164 | - | - |

Total Investments in Securities: | $ 26,221,601,381 | $ 8,928,277,748 | $ 17,285,083,009 | $ 8,240,624 |

Derivative Instruments: | | | | |

Assets | | | | |

Futures Contracts | $ 2,167,140 | $ 2,167,140 | $ - | $ - |

The following is a summary of transfers between Level 1 and Level 2 for the period ended April 30, 2015. Transfers are assumed to have occurred at the beginning of the period, and are primarily attributable to the valuation techniques used for foreign equity securities, as discussed in the accompanying Notes to Financial Statements: |

Transfers | Total |

Level 1 to Level 2 | $ 6,570,853,844 |

Level 2 to Level 1 | $ 1,726,505,975 |

Value of Derivative Instruments |

The following table is a summary of the Fund's value of derivative instruments by primary risk exposure as of April 30, 2015. For additional information on derivative instruments, please refer to the Derivative Instruments section in the accompanying Notes to Financial Statements. |

Primary Risk Exposure /

Derivative Type | Value |

| Asset | Liability |

Equity Risk | | |

Futures Contracts (a) | $ 2,167,140 | $ - |

Total Value of Derivatives | $ 2,167,140 | $ - |

(a) Reflects gross cumulative appreciation (depreciation) on futures contracts as presented in the Schedule of Investments. Only the period end receivable or payable for daily variation margin and net unrealized appreciation (depreciation) are presented in the Statement of Assets and Liabilities. |

See accompanying notes which are an integral part of the financial statements.

Semiannual Report

Fidelity Diversified International Fund

Statement of Assets and Liabilities

| April 30, 2015 |

| | |

Assets | | |

Investment in securities, at value (including securities loaned of $447,280,586) - See accompanying schedule: Unaffiliated issuers (cost $18,171,216,347) | $ 24,376,296,018 | |

Fidelity Central Funds (cost $1,767,795,164) | 1,767,795,164 | |

Other affiliated issuers (cost $60,905,450) | 77,510,199 | |

Total Investments (cost $19,999,916,961) | | $ 26,221,601,381 |

Cash | | 4,910,899 |

Receivable for investments sold | | 131,642,029 |

Receivable for fund shares sold | | 18,179,874 |

Dividends receivable | | 106,540,894 |

Distributions receivable from Fidelity Central Funds | | 1,137,326 |

Prepaid expenses | | 18,850 |

Other receivables | | 1,584,541 |

Total assets | | 26,485,615,794 |

| | |

Liabilities | | |

Payable for investments purchased | $ 89,894,106 | |

Payable for fund shares redeemed | 19,628,824 | |

Accrued management fee | 16,024,746 | |

Payable for daily variation margin for derivative instruments | 1,473,350 | |

Other affiliated payables | 2,750,853 | |

Other payables and accrued expenses | 4,387,599 | |

Collateral on securities loaned, at value | 466,184,845 | |

Total liabilities | | 600,344,323 |

| | |

Net Assets | | $ 25,885,271,471 |

Net Assets consist of: | | |

Paid in capital | | $ 19,732,426,286 |

Undistributed net investment income | | 93,878,014 |

Accumulated undistributed net realized gain (loss) on investments and foreign currency transactions | | (163,199,419) |

Net unrealized appreciation (depreciation) on investments and assets and liabilities in foreign currencies | | 6,222,166,590 |

Net Assets | | $ 25,885,271,471 |

| | |

Diversified International:

Net Asset Value, offering price and redemption price per share ($14,413,038,871 ÷ 384,582,997 shares) | | $ 37.48 |

| | |

Class K:

Net Asset Value, offering price and redemption price per share ($11,472,232,600 ÷ 306,566,165 shares) | | $ 37.42 |

Statement of Operations

| Six months ended April 30, 2015 |

| | |

Investment Income | | |

Dividends | | $ 230,470,096 |

Interest | | 191,662 |

Income from Fidelity Central Funds | | 3,757,361 |

Income before foreign taxes withheld | | 234,419,119 |

Less foreign taxes withheld | | (15,426,189) |

Total income | | 218,992,930 |

| | |

Expenses | | |

Management fee

Basic fee | $ 83,794,579 | |

Performance adjustment | 13,698,336 | |

Transfer agent fees | 14,761,307 | |

Accounting and security lending fees | 1,213,938 | |

Custodian fees and expenses | 1,234,847 | |

Independent trustees' compensation | 49,228 | |

Appreciation in deferred trustee compensation account | 16 | |

Registration fees | 108,368 | |

Audit | 138,801 | |

Legal | 41,640 | |

Miscellaneous | 483,572 | |

Total expenses before reductions | 115,524,632 | |

Expense reductions | (386,469) | 115,138,163 |

Net investment income (loss) | | 103,854,767 |

Realized and Unrealized Gain (Loss) Net realized gain (loss) on: | | |

Investment securities: | | |

Unaffiliated issuers | 21,683,695 | |

Other affiliated issuers | 28,336 | |

Foreign currency transactions | (2,131,902) | |

Futures contracts | 3,161,727 | |

Total net realized gain (loss) | | 22,741,856 |

Change in net unrealized appreciation (depreciation) on: Investment securities (net of increase in deferred foreign taxes of $1,849,162) | 1,629,155,157 | |

Assets and liabilities in foreign currencies | 1,808,240 | |

Futures contracts | 2,167,140 | |

Total change in net unrealized appreciation (depreciation) | | 1,633,130,537 |

Net gain (loss) | | 1,655,872,393 |

Net increase (decrease) in net assets resulting from operations | | $ 1,759,727,160 |

See accompanying notes which are an integral part of the financial statements.

Semiannual Report

Fidelity Diversified International Fund

Financial Statements - continued

Statement of Changes in Net Assets

| Six months ended April 30,

2015 | Year ended

October 31,

2014 |

Increase (Decrease) in Net Assets | | |

Operations | | |

Net investment income (loss) | $ 103,854,767 | $ 447,924,506 |

Net realized gain (loss) | 22,741,856 | 2,252,453,091 |

Change in net unrealized appreciation (depreciation) | 1,633,130,537 | (2,019,550,205) |

Net increase (decrease) in net assets resulting from operations | 1,759,727,160 | 680,827,392 |

Distributions to shareholders from net investment income | (285,525,428) | (245,684,040) |

Distributions to shareholders from net realized gain | (625,108,082) | (169,078,602) |

Total distributions | (910,633,510) | (414,762,642) |

Share transactions - net increase (decrease) | 120,327,039 | (1,324,765,796) |

Redemption fees | 113,481 | 253,426 |

Total increase (decrease) in net assets | 969,534,170 | (1,058,447,620) |

| | |

Net Assets | | |

Beginning of period | 24,915,737,301 | 25,974,184,921 |

End of period (including undistributed net investment income of $93,878,014 and undistributed net investment income of $275,548,675, respectively) | $ 25,885,271,471 | $ 24,915,737,301 |

Financial Highlights - Diversified International

| Six months ended

April 30, | Years ended October 31, |

| 2015 | 2014 | 2013 | 2012 | 2011 | 2010 |

Selected Per-Share Data | | | | | | |

Net asset value, beginning of period | $ 36.22 | $ 35.89 | $ 29.07 | $ 27.49 | $ 29.49 | $ 26.86 |

Income from Investment Operations | | | | | | |

Net investment income (loss) D | .14 | .60G | .44 | .42 | .53H | .37 |

Net realized and unrealized gain (loss) | 2.43 | .28 | 6.90 | 1.65 | (1.99) | 2.61 |

Total from investment operations | 2.57 | .88 | 7.34 | 2.07 | (1.46) | 2.98 |

Distributions from net investment income | (.40) | (.32) | (.46) | (.49) | (.46) | (.35) |

Distributions from net realized gain | (.92) | (.23) | (.07) | - | (.08) | - |

Total distributions | (1.31) L | (.55) | (.52) K | (.49) | (.54) | (.35) |

Redemption fees added to paid in capital D, J | - | - | - | - | - | - |

Net asset value, end of period | $ 37.48 | $ 36.22 | $ 35.89 | $ 29.07 | $ 27.49 | $ 29.49 |

Total ReturnB, C | 7.32% | 2.48% | 25.66% | 7.72% | (5.07)% | 11.15% |

Ratios to Average Net Assets E, I | | | | | | |

Expenses before reductions | .98%A | .93% | .94% | 1.01% | .90% | .98% |

Expenses net of fee waivers, if any | .98%A | .93% | .94% | 1.01% | .89% | .98% |

Expenses net of all reductions | .98%A | .92% | .92% | .99% | .87% | .96% |

Net investment income (loss) | .78%A | 1.65%G | 1.38% | 1.53% | 1.78%H | 1.34% |

Supplemental Data | | | | | | |

Net assets, end of period (000 omitted) | $ 14,413,039 | $ 13,781,306 | $ 14,432,586 | $ 13,269,769 | $ 17,285,369 | $ 26,527,229 |

Portfolio turnover rateF | 33% A, M | 39%M | 52% | 35% | 45% | 57% |

A Annualized B Total returns for periods of less than one year are not annualized. C Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown. D Calculated based on average shares outstanding during the period. E Fees and expenses of any underlying Fidelity Central Funds are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of the expenses of any underlying Fidelity Central Funds. F Amount does not include the portfolio activity of any underlying Fidelity Central Funds. G Investment income per share reflects a large, non-recurring dividend which amounted to $.18 per share. Excluding this non-recurring dividend, the ratio of net investment income (loss) to average net assets would have been 1.16%. H Investment income per share reflects a large, non-recurring dividend which amounted to $.10 per share. Excluding this non-recurring dividend, the ratio of net investment income (loss) to average net assets would have been 1.44%. I Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from brokerage service arrangements or reductions from other expense offset arrangements and do not represent the amount paid by the class during periods when reimbursements or reductions occur. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from brokerage service arrangements or other expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the class. J Amount represents less than $.01 per share. K Total distributions of $.52 per share is comprised of distributions from net investment income of $.456 and distributions from net realized gain of $.068 per share. L Total distributions of $1.31 per share is comprised of distributions from net investment income of $.397 and distributions from net realized gain of $.917 per share. M Portfolio turnover rate excludes securities received or delivered in-kind. |

See accompanying notes which are an integral part of the financial statements.

Semiannual Report

Financial Highlights - Class K

| Six months ended

April 30, | Years ended October 31, |

| 2015 | 2014 | 2013 | 2012 | 2011 | 2010 |

Selected Per-Share Data | | | | | | |

Net asset value, beginning of period | $ 36.20 | $ 35.87 | $ 29.06 | $ 27.51 | $ 29.51 | $ 26.89 |

Income from Investment Operations | | | | | | |

Net investment income (loss) D | .16 | .65G | .49 | .47 | .58H | .42 |

Net realized and unrealized gain (loss) | 2.42 | .28 | 6.90 | 1.63 | (1.97) | 2.61 |

Total from investment operations | 2.58 | .93 | 7.39 | 2.10 | (1.39) | 3.03 |

Distributions from net investment income | (.45) | (.37) | (.51) | (.55) | (.53) | (.41) |

Distributions from net realized gain | (.92) | (.23) | (.07) | - | (.08) | - |

Total distributions | (1.36) K | (.60) | (.58) | (.55) | (.61) | (.41) |

Redemption fees added to paid in capital D, J | - | - | - | - | - | - |

Net asset value, end of period | $ 37.42 | $ 36.20 | $ 35.87 | $ 29.06 | $ 27.51 | $ 29.51 |

Total ReturnB, C | 7.36% | 2.63% | 25.86% | 7.86% | (4.87)% | 11.33% |

Ratios to Average Net Assets E, I | | | | | | |

Expenses before reductions | .86%A | .80% | .80% | .84% | .73% | .79% |

Expenses net of fee waivers, if any | .86%A | .80% | .80% | .84% | .72% | .79% |

Expenses net of all reductions | .85%A | .79% | .78% | .83% | .70% | .77% |

Net investment income (loss) | .91%A | 1.78%G | 1.52% | 1.70% | 1.95%H | 1.54% |

Supplemental Data | | | | | | |

Net assets, end of period (000 omitted) | $ 11,472,233 | $ 11,134,431 | $ 11,541,599 | $ 8,885,304 | $ 8,115,192 | $ 7,697,405 |

Portfolio turnover rateF | 33% A, L | 39%L | 52% | 35% | 45% | 57% |

A Annualized B Total returns for periods of less than one year are not annualized. C Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown. D Calculated based on average shares outstanding during the period. E Fees and expenses of any underlying Fidelity Central Funds are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of the expenses of any underlying Fidelity Central Funds. F Amount does not include the portfolio activity of any underlying Fidelity Central Funds. G Investment income per share reflects a large, non-recurring dividend which amounted to $.18 per share. Excluding this non-recurring dividend, the ratio of net investment income (loss) to average net assets would have been 1.29%. H Investment income per share reflects a large, non-recurring dividend which amounted to $.10 per share. Excluding this non-recurring dividend, the ratio of net investment income (loss) to average net assets would have been 1.61%. I Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from brokerage service arrangements or reductions from other expense offset arrangements and do not represent the amount paid by the class during periods when reimbursements or reductions occur. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from brokerage service arrangements or other expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the class. J Amount represents less than $.01 per share. K Total distributions of $1.36 per share is comprised of distributions from net investment income of $.446 and distributions from net realized gain of $.917 per share. L Portfolio turnover rate excludes securities received or delivered in-kind. |

See accompanying notes which are an integral part of the financial statements.

Semiannual Report

For the period ended April 30, 2015

1. Organization.

Fidelity® Diversified International Fund (the Fund) is a fund of Fidelity Investment Trust (the Trust) and is authorized to issue an unlimited number of shares. The Trust is registered under the Investment Company Act of 1940, as amended (the 1940 Act), as an open-end management investment company organized as a Massachusetts business trust. The Fund offers Diversified International and Class K shares, each of which has equal rights as to assets and voting privileges. Each class has exclusive voting rights with respect to matters that affect that class. The Fund's investments in emerging markets can be subject to social, economic, regulatory, and political uncertainties and can be extremely volatile.

2. Investments in Fidelity Central Funds.

The Fund invests in Fidelity Central Funds, which are open-end investment companies generally available only to other investment companies and accounts managed by the investment adviser and its affiliates. The Fund's Schedule of Investments lists each of the Fidelity Central Funds held as of period end, if any, as an investment of the Fund, but does not include the underlying holdings of each Fidelity Central Fund. As an Investing Fund, the Fund indirectly bears its proportionate share of the expenses of the underlying Fidelity Central Funds.

The Money Market Central Funds seek preservation of capital and current income and are managed by Fidelity Investments Money Management, Inc. (FIMM), an affiliate of the investment adviser. Annualized expenses of the Money Market Central Funds as of their most recent shareholder report date are less than .01%.

A complete unaudited list of holdings for each Fidelity Central Fund is available upon request or at the Securities and Exchange Commission (the SEC) website at www.sec.gov. In addition, the financial statements of the Fidelity Central Funds, which are not covered by the Fund's Report of Independent Registered Public Accounting Firm, are available on the SEC website or upon request.

3. Significant Accounting Policies.

The financial statements have been prepared in conformity with accounting principles generally accepted in the United States of America (GAAP), which require management to make certain estimates and assumptions at the date of the financial statements. Actual results could differ from those estimates. Subsequent events, if any, through the date that the financial statements were issued have been evaluated in the preparation of the financial statements. The following summarizes the significant accounting policies of the Fund:

Investment Valuation. Investments are valued as of 4:00 p.m. Eastern time on the last calendar day of the period. The Board of Trustees (the Board) has delegated the day to day responsibility for the valuation of the Fund's investments to the Fidelity Management & Research Company (FMR) Fair Value Committee (the Committee). In accordance with valuation policies and procedures approved by the Board, the Fund attempts to obtain prices from one or more third party pricing vendors or brokers to value its investments. When current market prices, quotations or currency exchange rates are not readily available or reliable, investments will be fair valued in good faith by the Committee, in accordance with procedures adopted by the Board. Factors used in determining fair value vary by investment type and may include market or investment specific events, changes in interest rates and credit quality. The frequency with which these procedures are used cannot be predicted and they may be utilized to a significant extent. The Committee oversees the Fund's valuation policies and procedures and reports to the Board on the Committee's activities and fair value determinations. The Board monitors the appropriateness of the procedures used in valuing the Fund's investments and ratifies the fair value determinations of the Committee.

The Fund categorizes the inputs to valuation techniques used to value its investments into a disclosure hierarchy consisting of three levels as shown below:

Level 1 - quoted prices in active markets for identical investments

Level 2 - other significant observable inputs (including quoted prices for similar investments, interest rates, prepayment speeds, etc.)

Level 3 - unobservable inputs (including the Fund's own assumptions based on the best information available)

Valuation techniques used to value the Fund's investments by major category are as follows:

Equity securities, including restricted securities, for which market quotations are readily available, are valued at the last reported sale price or official closing price as reported by a third party pricing vendor on the primary market or exchange on which they are traded and are categorized as Level 1 in the hierarchy. In the event there were no sales during the day or closing prices are not available, securities are valued at the last quoted bid price or may be valued using the last available price and are generally categorized as Level 2 in the hierarchy. For foreign equity securities, when market or security specific events arise, comparisons to the valuation of American Depositary Receipts (ADRs), futures contracts, Exchange-Traded Funds (ETFs) and certain indexes as well as quoted prices for similar securities may be used and would be categorized as Level 2 in the hierarchy. Utilizing these techniques may result in transfers between Level 1 and Level 2. For equity securities, including restricted securities, where observable inputs are limited, assumptions about market activity and risk are used and these securities may be categorized as Level 3 in the hierarchy.

Semiannual Report

Notes to Financial Statements - continued

3. Significant Accounting Policies - continued

Investment Valuation - continued

Debt securities, including restricted securities, are valued based on evaluated prices received from third party pricing vendors or from brokers who make markets in such securities. Preferred securities and U.S. government and government agency obligations are valued by pricing vendors who utilize matrix pricing which considers yield or price of bonds of comparable quality, coupon, maturity and type or by broker-supplied prices. When independent prices are unavailable or unreliable, debt securities may be valued utilizing pricing methodologies which consider similar factors that would be used by third party pricing vendors. Debt securities are generally categorized as Level 2 in the hierarchy but may be Level 3 depending on the circumstances.

Futures contracts are valued at the settlement price established each day by the board of trade or exchange on which they are traded and are categorized as Level 1 in the hierarchy. Investments in open-end mutual funds, including the Fidelity Central Funds, are valued at their closing net asset value (NAV) each business day and are categorized as Level 1 in the hierarchy.

Changes in valuation techniques may result in transfers in or out of an assigned level within the disclosure hierarchy. The aggregate value of investments by input level, as of April 30, 2015, including information on transfers between Levels 1 and 2, is included at the end of the Fund's Schedule of Investments.

Foreign Currency. The Fund may use foreign currency contracts to facilitate transactions in foreign-denominated securities. Gains and losses from these transactions may arise from changes in the value of the foreign currency or if the counterparties do not perform under the contracts' terms.

Foreign-denominated assets, including investment securities, and liabilities are translated into U.S. dollars at the exchange rates at period end. Purchases and sales of investment securities, income and dividends received and expenses denominated in foreign currencies are translated into U.S. dollars at the exchange rate in effect on the transaction date.

The effects of exchange rate fluctuations on investments are included with the net realized and unrealized gain (loss) on investment securities. Other foreign currency transactions resulting in realized and unrealized gain (loss) are disclosed separately.

Investment Transactions and Income. For financial reporting purposes, the Fund's investment holdings and NAV include trades executed through the end of the last business day of the period. The NAV per share for processing shareholder transactions is calculated as of the close of business of the New York Stock Exchange (NYSE), normally 4:00 p.m. Eastern time and includes trades executed through the end of the prior business day. Gains and losses on securities sold are determined on the basis of identified cost and may include proceeds received from litigation. Dividend income is recorded on the ex-dividend date, except for certain dividends from foreign securities where the ex-dividend date may have passed, which are recorded as soon as the Fund is informed of the ex-dividend date. Non-cash dividends included in dividend income, if any, are recorded at the fair market value of the securities received. Income and capital gain distributions from Fidelity Central Funds, if any, are recorded on the ex-dividend date. Distributions received on securities that represent a return of capital or capital gain are recorded as a reduction of cost of investments and/or as a realized gain. Subsequent to ex-dividend date the Fund determines the components of these distributions, based upon receipt of tax filings or other correspondence relating to the underlying investment. Interest income is accrued as earned and includes coupon interest and amortization of premium and accretion of discount on debt securities as applicable. Investment income is recorded net of foreign taxes withheld where recovery of such taxes is uncertain.

Class Allocations and Expenses. Investment income, realized and unrealized capital gains and losses, common expenses of the Fund, and certain fund-level expense reductions, if any, are allocated daily on a pro-rata basis to each class based on the relative net assets of each class to the total net assets of the Fund. Each class differs with respect to transfer agent fees incurred. Certain expense reductions may also differ by class. For the reporting period, the allocated portion of income and expenses to each class as a percent of its average net assets may vary due to the timing of recording these transactions in relation to fluctuating net assets of the classes. Expenses directly attributable to a fund are charged to that fund. Expenses attributable to more than one fund are allocated among the respective funds on the basis of relative net assets or other appropriate methods. Expense estimates are accrued in the period to which they relate and adjustments are made when actual amounts are known.

Deferred Trustee Compensation. Under a Deferred Compensation Plan (the Plan), independent Trustees may elect to defer receipt of a portion of their annual compensation. Deferred amounts are invested in a cross-section of Fidelity funds, are marked-to-market and remain in the Fund until distributed in accordance with the Plan. The investment of deferred amounts and the offsetting payable to the Trustees are included in the accompanying Statement of Assets and Liabilities.

Income Tax Information and Distributions to Shareholders. Each year, the Fund intends to qualify as a regulated investment company under Subchapter M of the Internal Revenue Code, including distributing substantially all of its taxable income and realized gains. As a result, no provision for U.S. Federal income taxes is required. The Fund files a U.S. federal tax return, in addition to state and local tax returns as required. The Fund's federal income tax returns are subject to examination by the Internal Revenue Service (IRS) for a period of three fiscal years after they are filed. State and local tax returns may be subject to examination for an additional fiscal year depending on the jurisdiction. Foreign taxes are provided for based on the Fund's understanding of the tax rules and rates that exist in the foreign markets in which it invests. The Fund is subject to a tax imposed on capital

Semiannual Report

3. Significant Accounting Policies - continued

Income Tax Information and Distributions to Shareholders - continued

gains by certain countries in which it invests. An estimated deferred tax liability for net unrealized appreciation on the applicable securities is included in Other payables and accrued expenses on the Statement of Assets & Liabilities.

Distributions are declared and recorded on the ex-dividend date. Income dividends and capital gain distributions are declared separately for each class. Income and capital gain distributions are determined in accordance with income tax regulations, which may differ from GAAP.

Capital accounts within the financial statements are adjusted for permanent book-tax differences. These adjustments have no impact on net assets or the results of operations. Capital accounts are not adjusted for temporary book-tax differences which will reverse in a subsequent period.

Book-tax differences are primarily due to in-kind transactions, futures contracts, foreign currency transactions, certain foreign taxes, passive foreign investment companies (PFIC), market discount, partnerships, deferred trustees compensation, capital loss carryforwards and losses deferred due to wash sales.

The federal tax cost of investment securities and unrealized appreciation (depreciation) as of period end were as follows:

Gross unrealized appreciation | $ 6,372,625,217 |

Gross unrealized depreciation | (337,595,915) |

Net unrealized appreciation (depreciation) on securities and other investments | $ 6,035,029,302 |

| |

Tax cost | $ 20,186,572,079 |

Short-Term Trading (Redemption) Fees. Shares held by investors in the Fund less than 30 days may have been subject to a redemption fee equal to 1.00% of the NAV of shares redeemed. All redemption fees, which reduce the proceeds of the shareholder redemption, are retained by the Fund and accounted for as an addition to paid in capital.

Restricted Securities. The Fund may invest in securities that are subject to legal or contractual restrictions on resale. These securities generally may be resold in transactions exempt from registration or to the public if the securities are registered. Disposal of these securities may involve time-consuming negotiations and expense, and prompt sale at an acceptable price may be difficult. Information regarding restricted securities is included at the end of the Fund's Schedule of Investments.

New Accounting Pronouncement. In June 2014, the Financial Accounting Standards Board issued Accounting Standard Update No. 2014-11, Repurchase-to-Maturity Transactions, Repurchase Financings, and Disclosures (the Update). The Update amends the accounting for certain repurchase agreements and expands disclosure requirements for reverse repurchase agreements, securities lending and other similar transactions. The disclosure requirements are effective for annual and interim reporting periods beginning after December 15, 2014. Management is currently evaluating the impact of the Update on the Fund's financial statements and related disclosures.

4. Derivative Instruments.

Risk Exposures and the Use of Derivative Instruments. The Fund's investment objective allows the Fund to enter into various types of derivative contracts, including futures contracts. Derivatives are investments whose value is primarily derived from underlying assets, indices or reference rates and may be transacted on an exchange or over-the-counter (OTC). Derivatives may involve a future commitment to buy or sell a specified asset based on specified terms, to exchange future cash flows at periodic intervals based on a notional principal amount, or for one party to make one or more payments upon the occurrence of specified events in exchange for periodic payments from the other party.

The Fund used derivatives to increase returns and to manage exposure to certain risks as defined below. The success of any strategy involving derivatives depends on analysis of numerous economic factors, and if the strategies for investment do not work as intended, the Fund may not achieve its objectives.

The Fund's use of derivatives increased or decreased its exposure to the following risk:

Equity Risk | Equity risk relates to the fluctuations in the value of financial instruments as a result of changes in market prices (other than those arising from interest rate risk or foreign exchange risk), whether caused by factors specific to an individual investment, its issuer, or all factors affecting all instruments traded in a market or market segment. |

Semiannual Report

Notes to Financial Statements - continued

4. Derivative Instruments - continued

Risk Exposures and the Use of Derivative Instruments - continued

The Fund is also exposed to additional risks from investing in derivatives, such as liquidity risk and counterparty credit risk. Liquidity risk is the risk that the Fund will be unable to close out the derivative in the open market in a timely manner. Counterparty credit risk is the risk that the counterparty will not be able to fulfill its obligation to the Fund. Counterparty credit risk related to exchange-traded futures contracts may be mitigated by the protection provided by the exchange on which they trade.

Investing in derivatives may involve greater risks than investing in the underlying assets directly and, to varying degrees, may involve risk of loss in excess of any initial investment and collateral received and amounts recognized in the Statement of Assets and Liabilities. In addition, there may be the risk that the change in value of the derivative contract does not correspond to the change in value of the underlying instrument.

Futures Contracts. A futures contract is an agreement between two parties to buy or sell a specified underlying instrument for a fixed price at a specified future date. The Fund used futures contracts to manage its exposure to the stock market.

Upon entering into a futures contract, a fund is required to deposit either cash or securities (initial margin) with a clearing broker in an amount equal to a certain percentage of the face value of the contract. Futures contracts are marked-to-market daily and subsequent daily payments (variation margin) are made or received by a fund depending on the daily fluctuations in the value of the futures contracts and are recorded as unrealized appreciation or (depreciation). This receivable and/or payable, if any, is included in daily variation margin for derivative instruments in the Statement of Assets and Liabilities. Realized gain or (loss) is recorded upon the expiration or closing of a futures contract.

Any open futures contracts at period end are presented in the Schedule of Investments under the caption "Futures Contracts." The underlying face amount at value reflects each contract's exposure to the underlying instrument or index at period end and is representative of volume of activity during the period. Securities deposited to meet initial margin requirements are identified in the Schedule of Investments.

During the period the Fund recognized net realized gain (loss) of $3,161,727 and a change in net unrealized appreciation (depreciation) of $2,167,140 related to its investment in futures contracts. These amounts are included in the Statement of Operations.

5. Purchases and Sales of Investments.

Purchases and sales of securities, other than short-term securities and in-kind transactions, aggregated $3,884,307,124 and $4,889,228,098, respectively.

Redemptions In-Kind. During the period, 8,849,634 shares of the Fund held by unaffiliated entities were redeemed for cash and investments, including accrued interest with a value of $309,648,354. The net realized gain of $90,257,760 on investments delivered through in-kind redemptions is included in the accompanying Statement of Operations. The amount of in-kind redemptions is included in share transactions in the accompanying Statement of Changes in Net Assets as well as Note 11: Share Transactions. The Fund recognized no gain or loss for federal income tax purposes.

6. Fees and Other Transactions with Affiliates.

Management Fee. Fidelity Management & Research Company (the investment adviser) and its affiliates provide the Fund with investment management related services for which the Fund pays a monthly management fee. The management fee is the sum of an individual fund fee rate that is based on an annual rate of .424% of the Fund's average net assets and an annualized group fee rate that averaged .25% during the period. The group fee rate is based upon the average net assets of all the mutual funds advised by the investment adviser, including any mutual funds previously advised by the investment adviser that are currently advised by Fidelity SelectCo, LLC, an affiliate of the investment adviser. The group fee rate decreases as assets under management increase and increases as assets under management decrease. In addition, the management fee is subject to a performance adjustment (up to a maximum of ± .20% of the Fund's average net assets over a 36 month performance period). The upward or downward adjustment to the management fee is based on the relative investment performance of Diversified International as compared to its benchmark index, the MSCI EAFE Index, over the same 36 month performance period. For the reporting period, the total annualized management fee rate, including the performance adjustment, was .78% of the Fund's average net assets. The performance adjustment included in the management fee rate may be higher or lower than the maximum performance adjustment rate due to the difference between the average net assets for the reporting and performance periods.

Transfer Agent Fees. Fidelity Investments Institutional Operations Company, Inc., (FIIOC), an affiliate of the investment adviser, is the transfer, dividend disbursing and shareholder servicing agent for each class of the Fund. FIIOC receives account fees and asset-based fees that vary according to the account size and type of account of the shareholders of Diversified International. FIIOC receives an asset-based fee of Class K's average net assets. FIIOC pays for typesetting, printing and mailing of shareholder reports, except proxy statements.

Semiannual Report

6. Fees and Other Transactions with Affiliates - continued

Transfer Agent Fees - continued

For the period, transfer agent fees for each class were as follows:

| Amount | % of

Class-Level Average

Net Assets* |

Diversified International | $ 12,172,201 | .18 |

Class K | 2,589,106 | .05 |

| $ 14,761,307 | |

* Annualized

Accounting and Security Lending Fees. Fidelity Service Company, Inc. (FSC), an affiliate of the investment adviser, maintains the Fund's accounting records. The accounting fee is based on the level of average net assets for each month. Under a separate contract, FSC administers the security lending program. The security lending fee is based on the number and duration of lending transactions.

Brokerage Commissions. The Fund placed a portion of its portfolio transactions with brokerage firms which are affiliates of the investment adviser. Brokerage commissions are included in net realized gain (loss) and change in net unrealized appreciation (depreciation) in the Statement of Operations. The commissions paid to these affiliated firms were $20,918 for the period.

7. Committed Line of Credit.

The Fund participates with other funds managed by the investment adviser or an affiliate in a $4.25 billion credit facility (the "line of credit") to be utilized for temporary or emergency purposes to fund shareholder redemptions or for other short-term liquidity purposes. The Fund has agreed to pay commitment fees on its pro-rata portion of the line of credit, which amounted to $19,408 and is reflected in Miscellaneous expenses on the Statement of Operations. During the period, the Fund did not borrow on this line of credit.

8. Security Lending.

The Fund lends portfolio securities through a lending agent from time to time in order to earn additional income. For equity securities, a lending agent is used and may loan securities to certain qualified borrowers, including Fidelity Capital Markets (FCM), a broker-dealer affiliated with the Fund. On the settlement date of the loan, the Fund receives collateral (in the form of U.S. Treasury obligations, letters of credit and/or cash) against the loaned securities and maintains collateral in an amount not less than 100% of the market value of the loaned securities during the period of the loan. The market value of the loaned securities is determined at the close of business of the Fund and any additional required collateral is delivered to the Fund on the next business day. If the borrower defaults on its obligation to return the securities loaned because of insolvency or other reasons, the Fund may apply collateral received from the borrower against the obligation. The Fund may experience delays and costs in recovering the securities loaned. Any cash collateral received is invested in the Fidelity Securities Lending Cash Central Fund. The value of loaned securities and cash collateral at period end are disclosed on the Fund's Statement of Assets and Liabilities. At period end, there were no security loans outstanding with FCM. Security lending income represents the income earned on investing cash collateral, less rebates paid to borrowers and any lending agent fees associated with the loan, plus any premium payments received for lending certain types of securities. Security lending income is presented in the Statement of Operations as a component of income from Fidelity Central Funds. Total security lending income during the period amounted to $3,084,965, including $9,512 from securities loaned to FCM.

9. Expense Reductions.

Commissions paid to certain brokers with whom the investment adviser, or its affiliates, places trades on behalf of the Fund include an amount in addition to trade execution, which may be rebated back to the Fund to offset certain expenses. This amount totaled $354,820 for the period. In addition, through arrangements with the Fund's custodian, credits realized as a result of uninvested cash balances were used to reduce the Fund's expenses. During the period, these credits reduced the Fund's custody expenses by $114.

In addition, the investment adviser reimbursed a portion of the Fund's operating expenses, including certain Diversified International expenses during the period in the amount of $31,535.

Semiannual Report

Notes to Financial Statements - continued

10. Distributions to Shareholders.

Distributions to shareholders of each class were as follows:

| Six months ended

April 30,

2015 | Year ended

October 31,

2014 |

From net investment income | | |

Diversified International | $ 149,948,658 | $ 126,517,539 |

Class K | 135,576,770 | 119,166,501 |

Total | $ 285,525,428 | $ 245,684,040 |

From net realized gain | | |

Diversified International | $ 346,354,986 | $ 93,097,870 |

Class K | 278,753,096 | 75,980,732 |

Total | $ 625,108,082 | $ 169,078,602 |

11. Share Transactions.

Share transactions for each class were as follows and may contain automatic conversions between classes or exchanges between funds:

| Shares | Dollars |

| Six months ended April 30,

2015 | Year ended

October 31,

2014 | Six months ended April 30,

2015 | Year ended

October 31,

2014 |

Diversified International | | | | |

Shares sold | 42,434,624 | 63,463,792 | $ 1,529,668,310 | $ 2,320,618,859 |

Reinvestment of distributions | 13,245,636 | 5,837,698 | 468,498,147 | 207,822,041 |

Shares redeemed | (51,565,185) | (90,929,350) | (1,852,414,988) | (3,326,061,359) |

Net increase (decrease) | 4,115,075 | (21,627,860) | $ 145,751,469 | $ (797,620,459) |

Class K | | | | |

Shares sold | 33,259,394 | 73,871,959 | $ 1,198,491,072 | $ 2,700,737,555 |

Reinvestment of distributions | 11,737,390 | 5,492,463 | 414,329,866 | 195,147,232 |

Shares redeemed | (46,044,631) A | (93,499,195) B | (1,638,245,368) A | (3,423,030,124) B |

Net increase (decrease) | (1,047,847) | (14,134,773) | $ (25,424,430) | $ (527,145,337) |

A Amount includes in-kind redemptions (see Note 5: Redemptions In-Kind).

B Amount includes in-kind redemptions.

12. Other.

The Fund's organizational documents provide former and current trustees and officers with a limited indemnification against liabilities arising in connection with the performance of their duties to the Fund. In the normal course of business, the Fund may also enter into contracts that provide general indemnifications. The Fund's maximum exposure under these arrangements is unknown as this would be dependent on future claims that may be made against the Fund. The risk of material loss from such claims is considered remote.

Semiannual Report

To the Trustees of Fidelity Investment Trust and Shareholders of Fidelity Diversified International Fund: