UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-4008

Fidelity Investment Trust

(Exact name of registrant as specified in charter)

245 Summer St., Boston, MA 02210

(Address of principal executive offices) (Zip code)

Marc Bryant, Secretary

245 Summer St.

Boston, Massachusetts 02210

(Name and address of agent for service)

Registrant's telephone number, including area code:

617-563-7000

| |

Date of fiscal year end: | October 31 |

|

|

Date of reporting period: | April 30, 2017 |

Item 1.

Reports to Stockholders

Fidelity Advisor® International Small Cap Fund -

Class A, Class M (formerly Class T), Class C and Class I

Semi-Annual Report April 30, 2017 Class A, Class M, Class C and Class I are classes of Fidelity® International Small Cap Fund |

|

Contents

To view a fund's proxy voting guidelines and proxy voting record for the 12-month period ended June 30, visit http://www.fidelity.com/proxyvotingresults or visit the Securities and Exchange Commission's (SEC) web site at http://www.sec.gov.

You may also call 1-877-208-0098 to request a free copy of the proxy voting guidelines.

Standard & Poor's, S&P and S&P 500 are registered service marks of The McGraw-Hill Companies, Inc. and have been licensed for use by Fidelity Distributors Corporation.

Other third-party marks appearing herein are the property of their respective owners.

All other marks appearing herein are registered or unregistered trademarks or service marks of FMR LLC or an affiliated company. © 2017 FMR LLC. All rights reserved.

This report and the financial statements contained herein are submitted for the general information of the shareholders of the Fund. This report is not authorized for distribution to prospective investors in the Fund unless preceded or accompanied by an effective prospectus.

A fund files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. Forms N-Q are available on the SEC’s web site at http://www.sec.gov. A fund's Forms N-Q may be reviewed and copied at the SEC’s Public Reference Room in Washington, DC. Information regarding the operation of the SEC's Public Reference Room may be obtained by calling 1-800-SEC-0330.

For a complete list of a fund's portfolio holdings, view the most recent holdings listing, semiannual report, or annual report on Fidelity's web site at http://www.fidelity.com, http://www.institutional.fidelity.com, or http://www.401k.com, as applicable.

NOT FDIC INSURED •MAY LOSE VALUE •NO BANK GUARANTEE

Neither the Fund nor Fidelity Distributors Corporation is a bank.

Investment Summary (Unaudited)

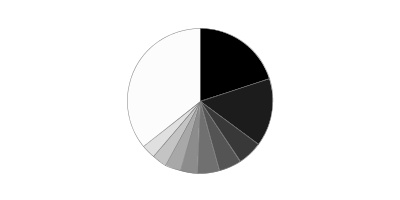

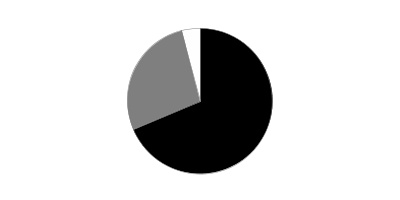

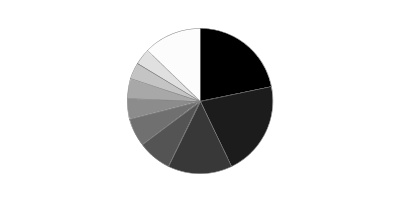

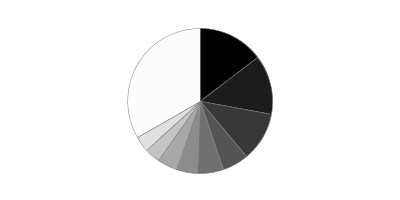

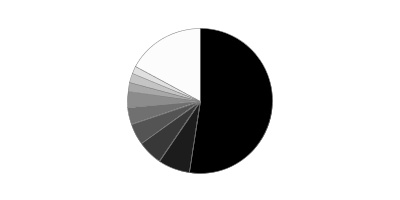

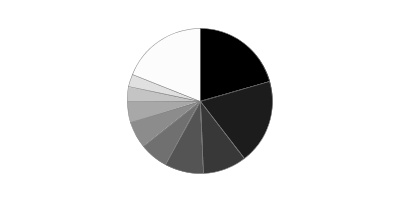

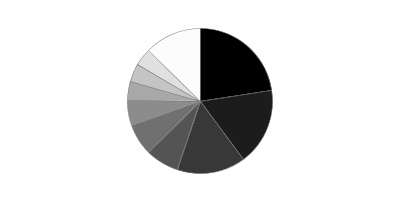

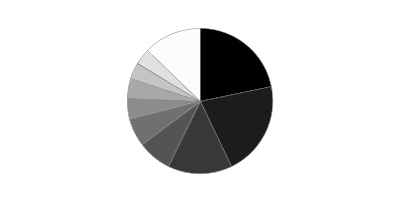

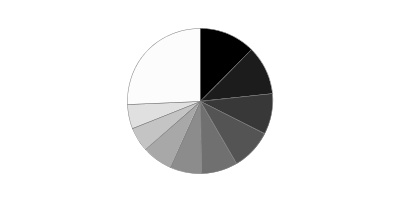

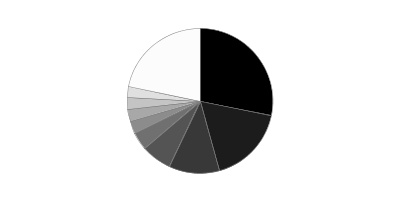

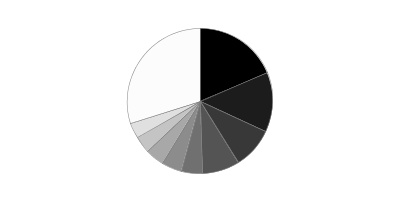

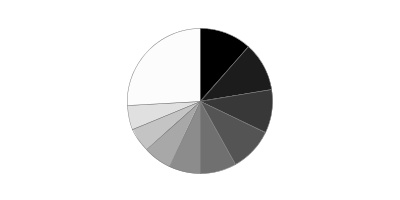

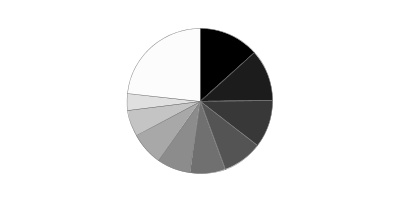

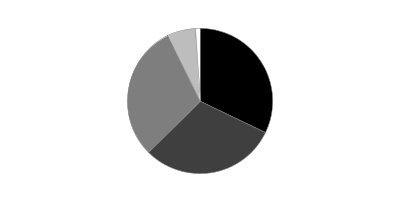

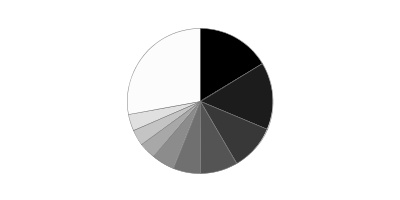

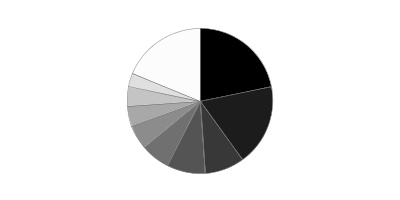

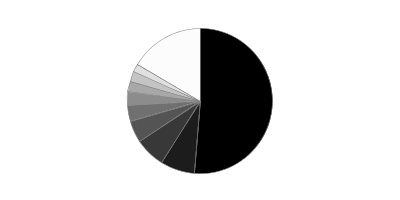

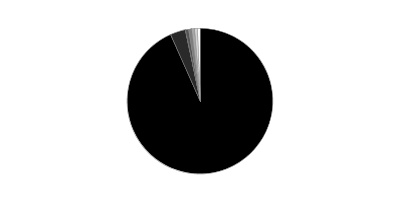

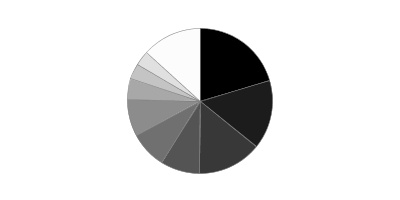

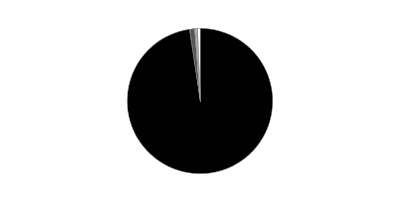

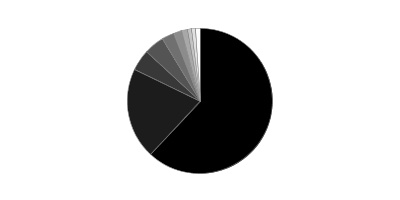

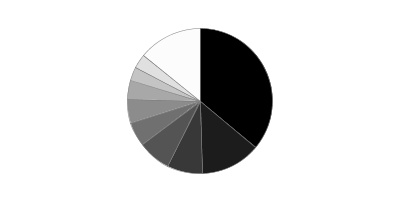

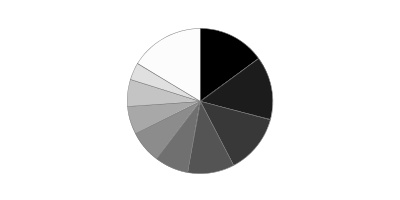

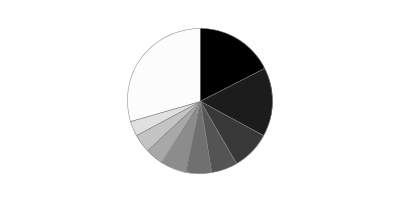

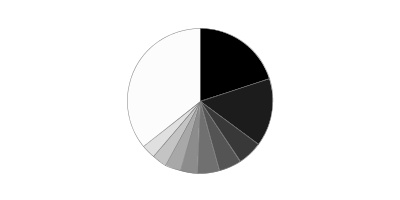

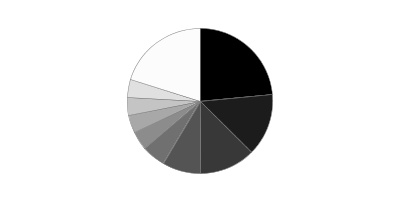

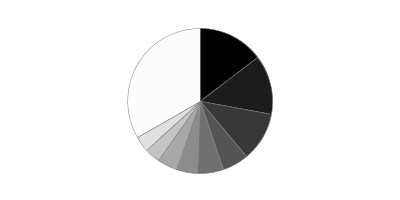

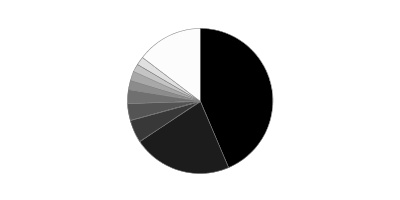

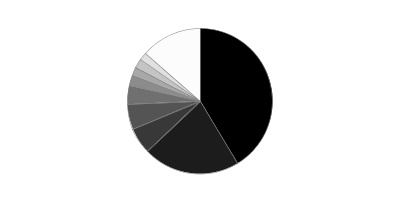

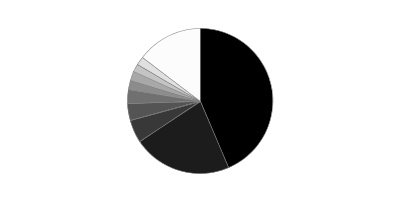

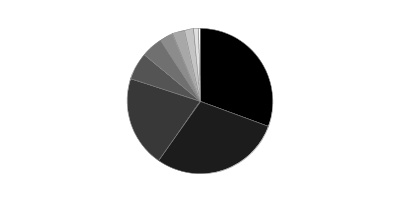

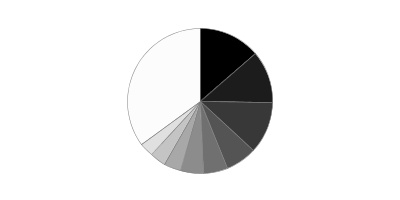

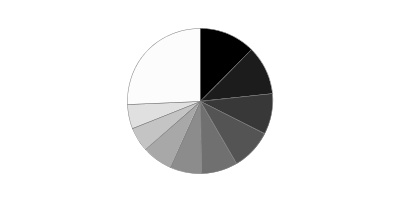

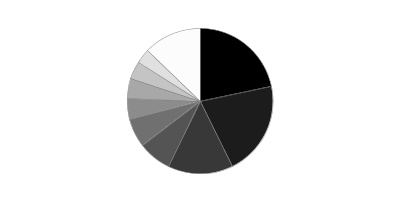

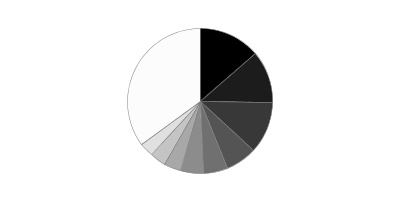

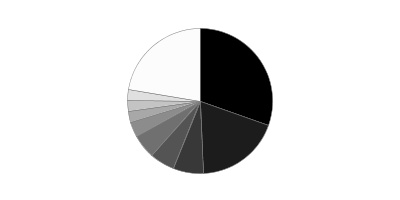

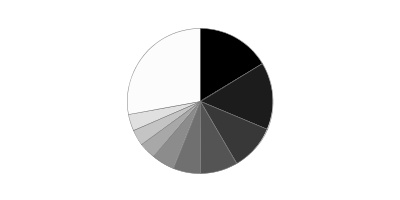

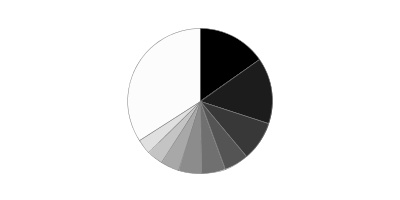

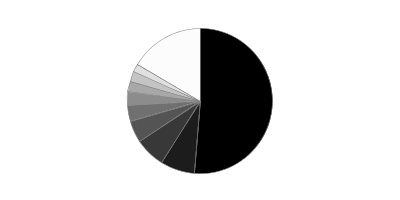

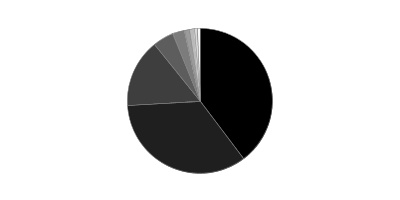

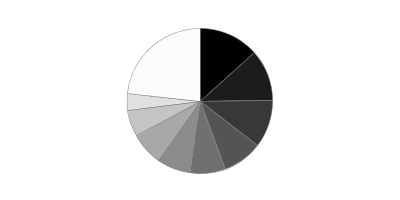

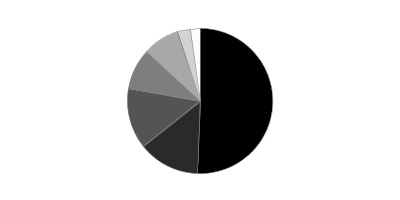

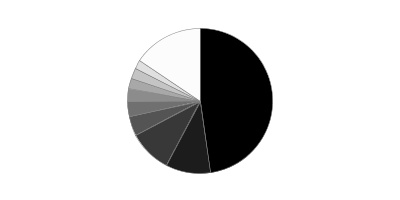

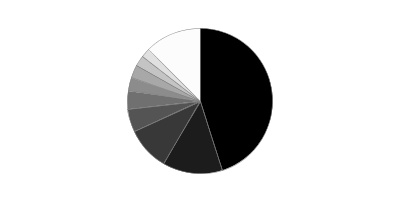

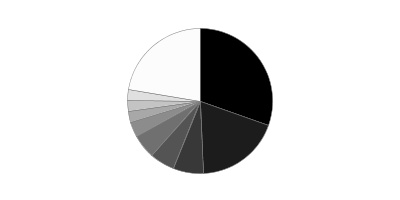

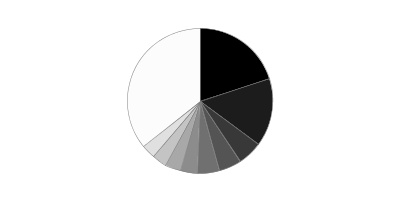

Geographic Diversification (% of fund's net assets)

| As of April 30, 2017 |

| | Japan | 20.1% |

| | United Kingdom | 15.0% |

| | United States of America* | 5.6% |

| | Canada | 5.0% |

| | Australia | 4.9% |

| | Cayman Islands | 3.7% |

| | France | 3.5% |

| | Austria | 3.3% |

| | Finland | 3.0% |

| | Other | 35.9% |

* Includes Short-Term investments and Net Other Assets (Liabilities).

Percentages are based on country or territory of incorporation and are adjusted for the effect of futures contracts, if applicable.

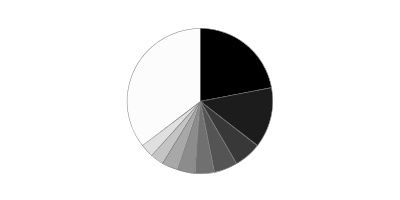

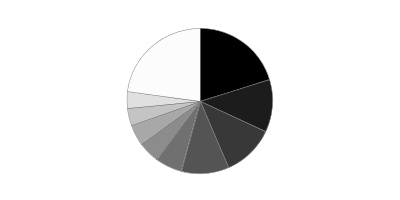

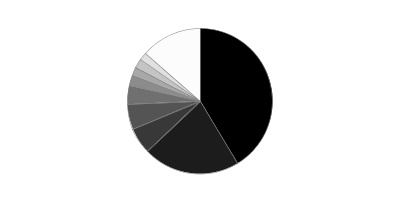

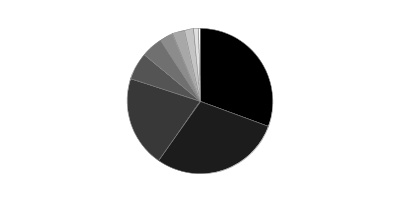

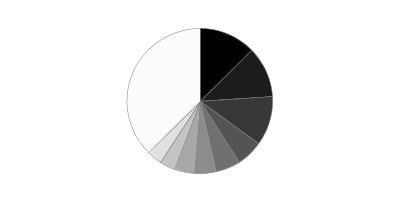

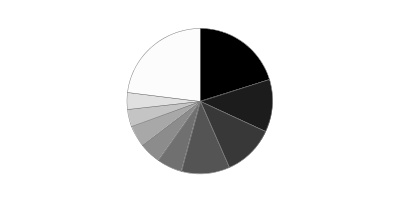

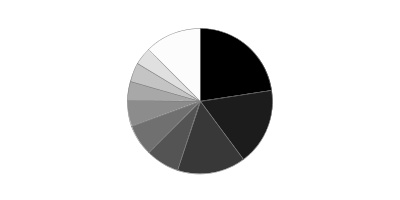

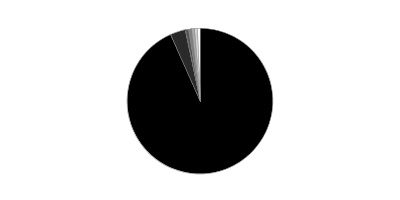

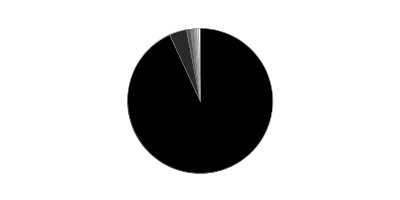

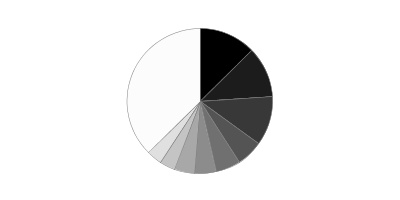

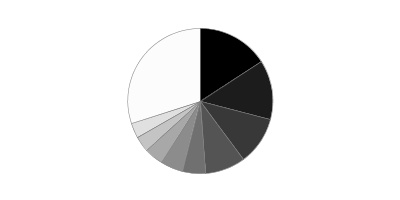

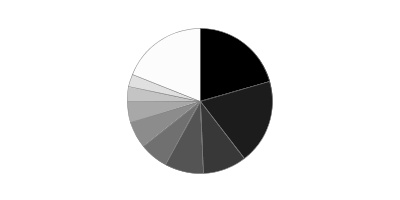

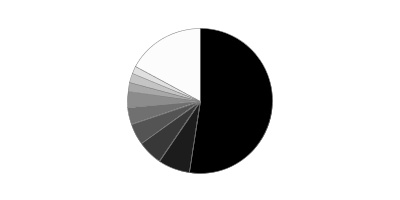

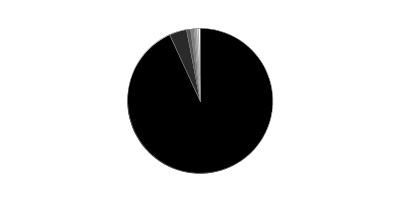

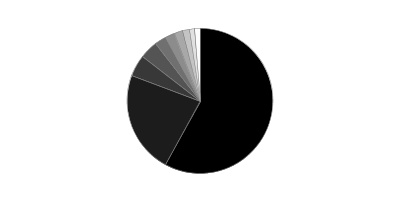

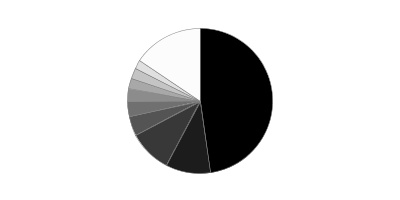

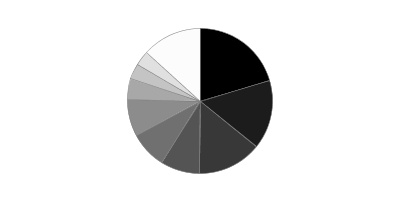

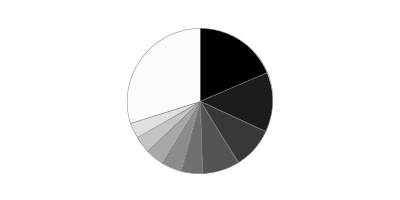

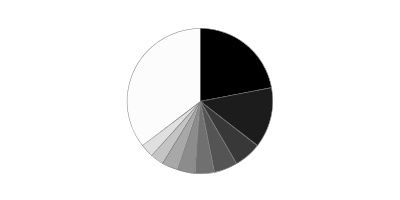

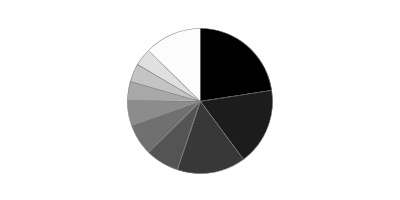

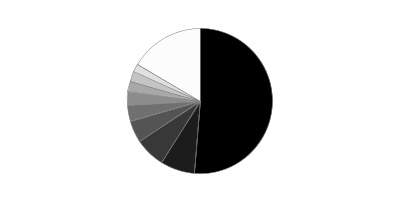

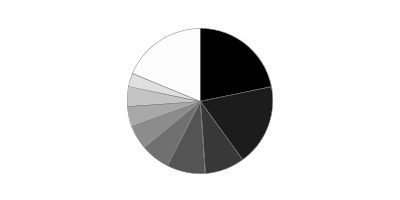

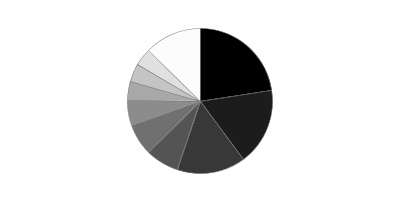

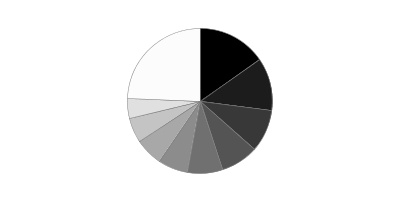

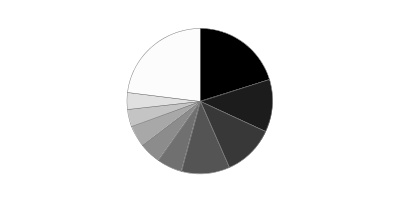

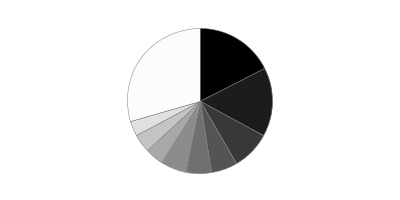

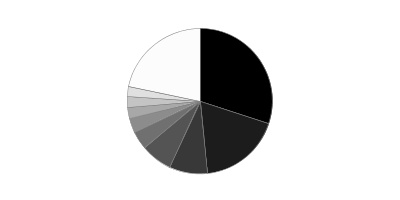

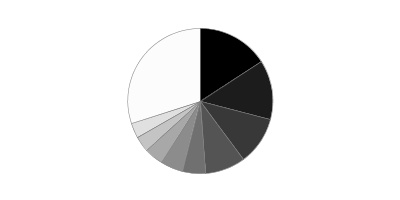

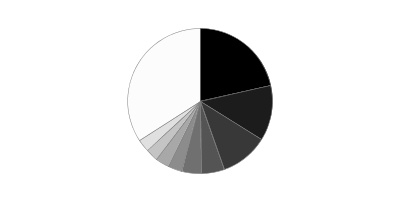

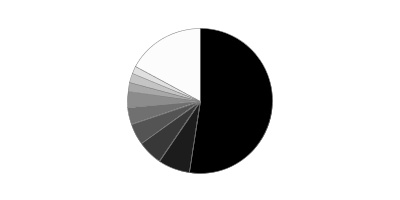

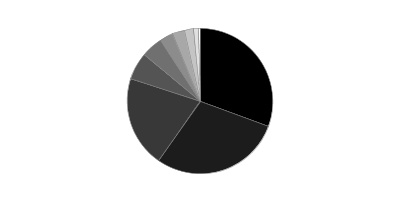

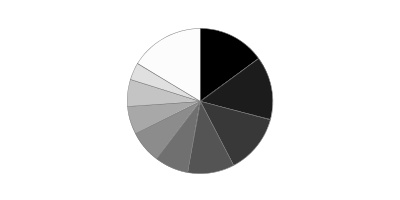

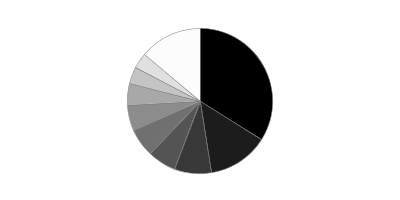

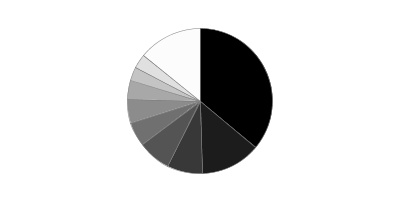

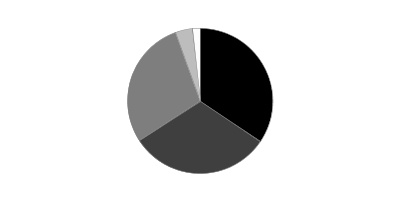

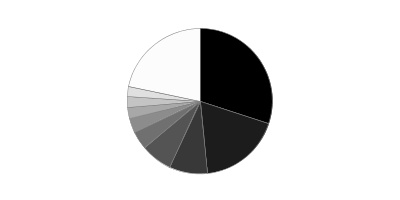

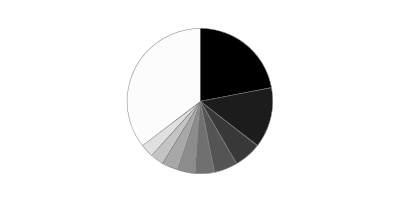

| As of October 31, 2016 |

| | Japan | 22.1% |

| | United Kingdom | 13.5% |

| | United States of America* | 6.0% |

| | Canada | 5.2% |

| | Australia | 4.3% |

| | Cayman Islands | 4.0% |

| | France | 3.6% |

| | Switzerland | 2.9% |

| | Finland | 2.8% |

| | Other | 35.6% |

* Includes Short-Term investments and Net Other Assets (Liabilities).

Percentages are based on country or territory of incorporation and are adjusted for the effect of futures contracts, if applicable.

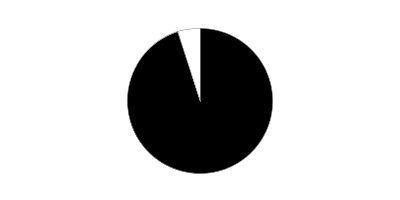

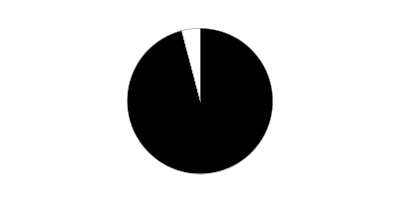

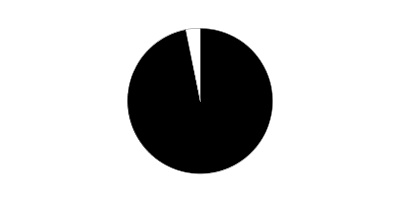

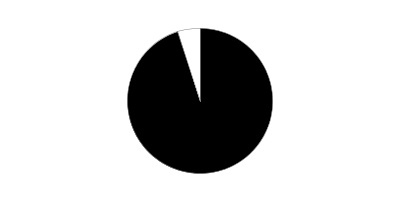

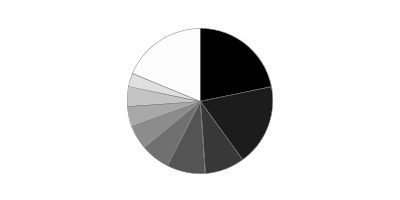

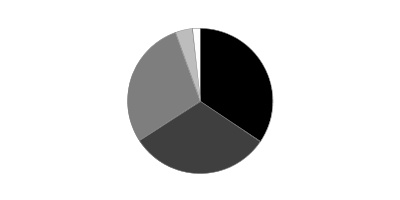

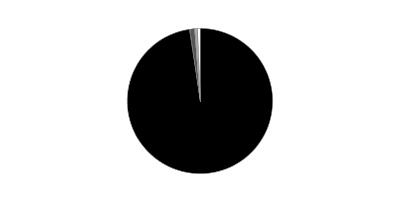

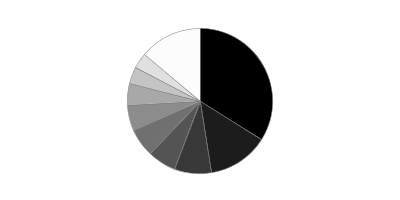

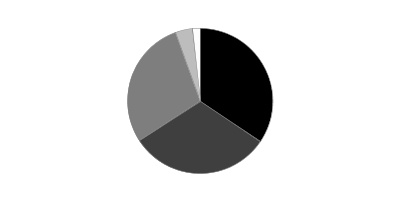

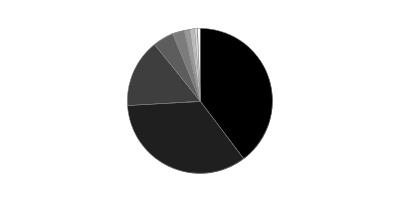

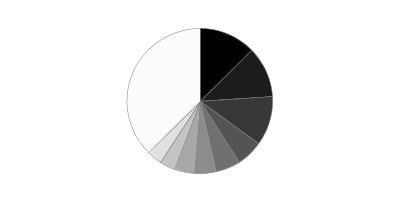

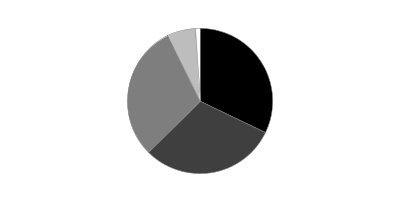

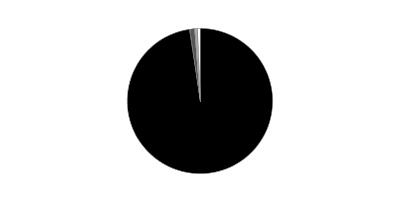

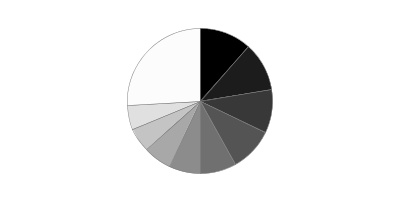

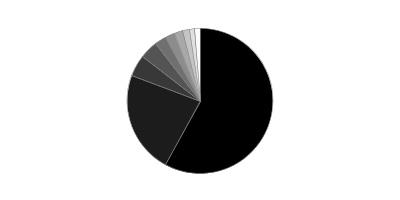

Asset Allocation as of April 30, 2017

| | % of fund's net assets | % of fund's net assets 6 months ago |

| Stocks | 94.8 | 94.8 |

| Short-Term Investments and Net Other Assets (Liabilities) | 5.2 | 5.2 |

Top Ten Stocks as of April 30, 2017

| | % of fund's net assets | % of fund's net assets 6 months ago |

| Micro Focus International PLC (United Kingdom, Software) | 1.2 | 1.2 |

| S Foods, Inc. (Japan, Food Products) | 0.9 | 0.9 |

| IWG PLC (Bailiwick of Jersey, Commercial Services & Supplies) | 0.9 | 0.6 |

| JSR Corp. (Japan, Chemicals) | 0.9 | 1.0 |

| GUD Holdings Ltd. (Australia, Household Durables) | 0.8 | 0.8 |

| Kaken Pharmaceutical Co. Ltd. (Japan, Pharmaceuticals) | 0.8 | 0.8 |

| Paysafe Group PLC (Isle of Man, IT Services) | 0.8 | 0.6 |

| Tsuruha Holdings, Inc. (Japan, Food & Staples Retailing) | 0.8 | 0.8 |

| Frutarom Industries Ltd. (Israel, Chemicals) | 0.8 | 0.9 |

| SITC International Holdings Co. Ltd. (Cayman Islands, Marine) | 0.8 | 0.8 |

| | 8.7 | |

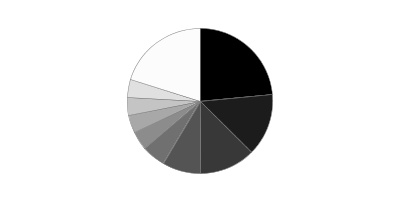

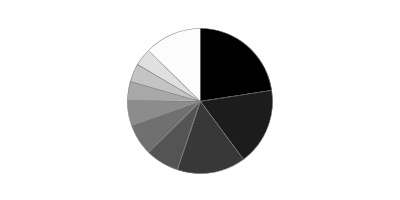

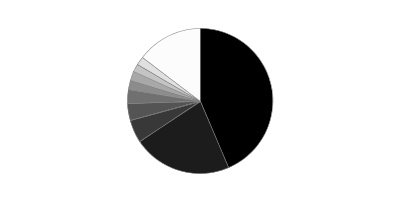

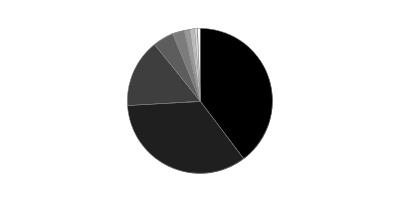

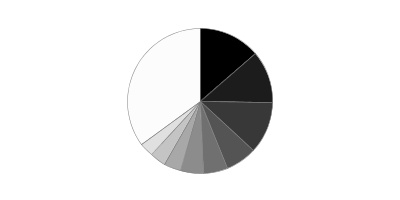

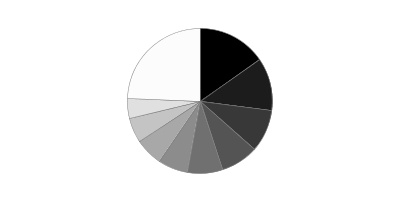

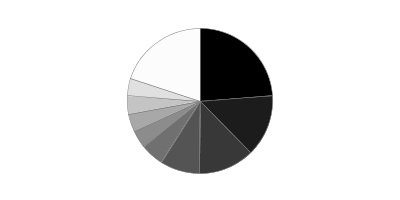

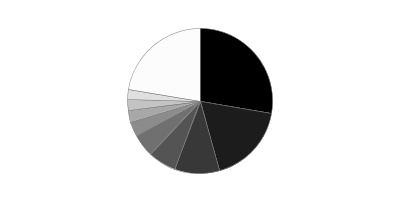

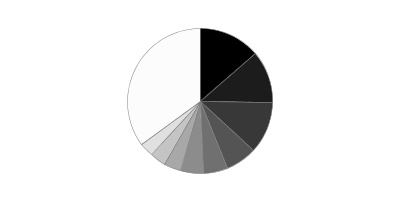

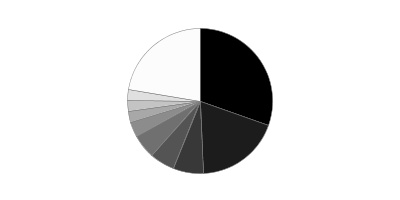

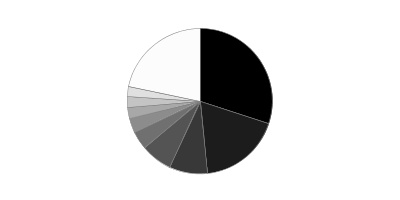

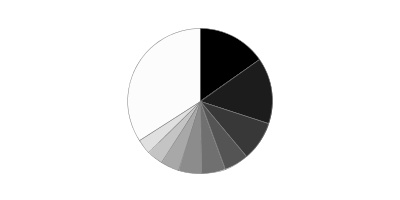

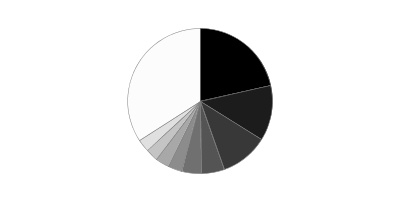

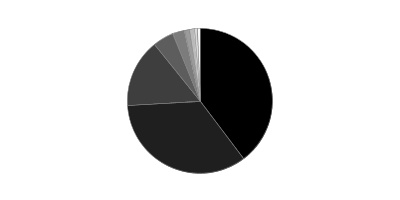

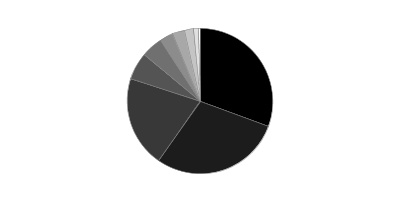

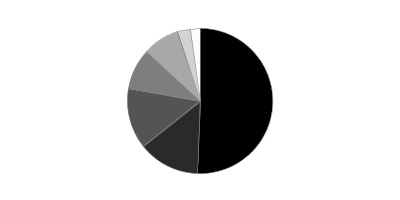

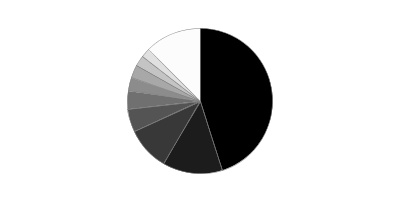

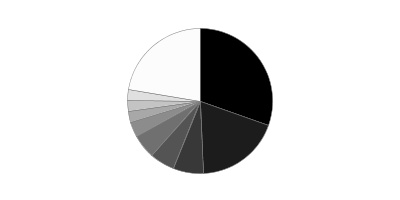

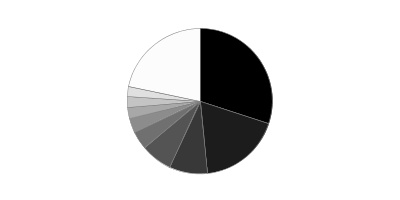

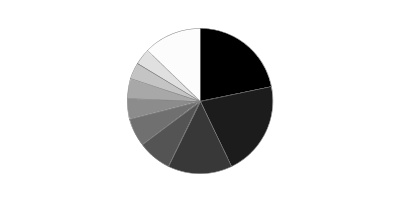

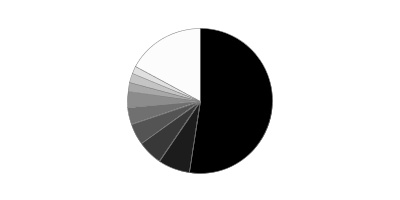

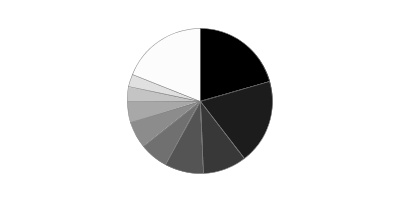

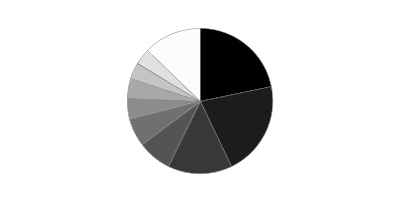

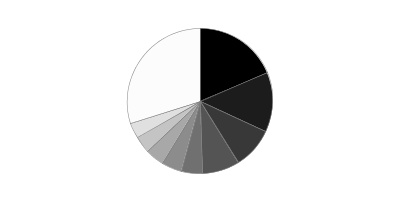

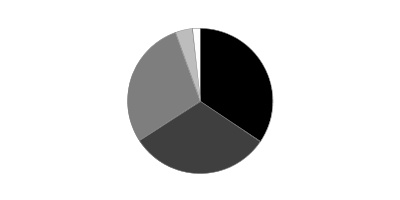

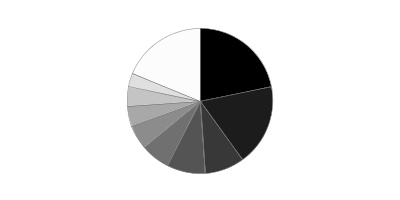

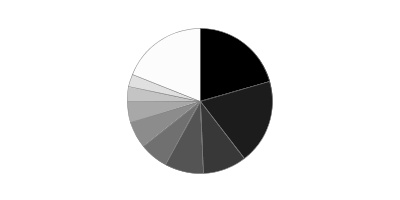

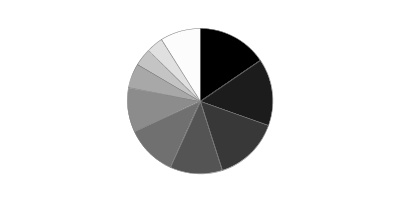

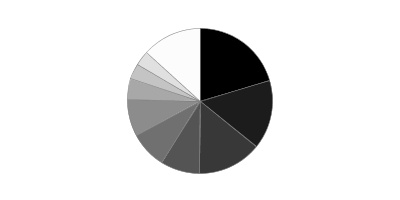

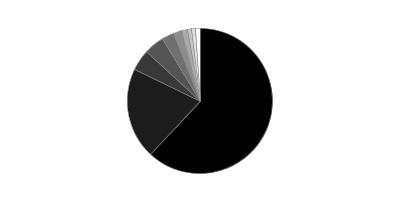

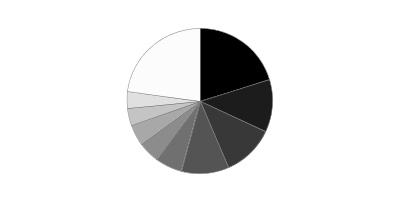

Top Market Sectors as of April 30, 2017

| | % of fund's net assets | % of fund's net assets 6 months ago |

| Industrials | 18.3 | 18.4 |

| Consumer Discretionary | 17.2 | 16.2 |

| Financials | 12.7 | 13.9 |

| Materials | 9.8 | 9.7 |

| Information Technology | 9.3 | 9.7 |

| Consumer Staples | 8.8 | 8.4 |

| Health Care | 8.6 | 9.5 |

| Real Estate | 6.1 | 4.8 |

| Energy | 3.7 | 3.9 |

| Utilities | 0.3 | 0.3 |

Investments April 30, 2017 (Unaudited)

Showing Percentage of Net Assets

| Common Stocks - 93.4% | | | |

| | | Shares | Value |

| Australia - 4.9% | | | |

| Asaleo Care Ltd. | | 3,943,545 | $5,300,503 |

| Aub Group Ltd. | | 616,464 | 5,566,995 |

| Austal Ltd. | | 3,190,191 | 4,096,818 |

| Challenger Ltd. | | 517,919 | 5,126,951 |

| GUD Holdings Ltd. | | 1,209,665 | 11,268,117 |

| Imdex Ltd. (a) | | 15,092,652 | 7,006,854 |

| Life Healthcare Group Ltd. | | 2,135,290 | 3,421,657 |

| Nanosonics Ltd. (a) | | 1,806,209 | 4,273,866 |

| Pact Group Holdings Ltd. | | 1,183,938 | 6,250,056 |

| Programmed Maintenance Services Ltd. | | 4,927,825 | 6,346,723 |

| Servcorp Ltd. | | 861,308 | 3,798,740 |

| SomnoMed Ltd. (a)(b) | | 992,506 | 2,199,838 |

|

| TOTAL AUSTRALIA | | | 64,657,118 |

|

| Austria - 3.3% | | | |

| Andritz AG | | 145,932 | 8,070,588 |

| Buwog-Gemeinnuetzige Wohnung | | 341,791 | 9,229,638 |

| IMMOFINANZ Immobilien Anlagen AG (b) | | 4,183,443 | 8,703,917 |

| Palfinger AG (a) | | 33,893 | 1,384,117 |

| RHI AG | | 308,031 | 8,975,646 |

| Wienerberger AG | | 314,200 | 7,358,548 |

|

| TOTAL AUSTRIA | | | 43,722,454 |

|

| Bailiwick of Jersey - 0.9% | | | |

| IWG PLC | | 2,779,200 | 11,695,165 |

| Belgium - 0.5% | | | |

| Barco NV | | 67,583 | 6,655,818 |

| Bermuda - 1.4% | | | |

| BW Offshore Ltd. (a) | | 1,659,938 | 4,272,610 |

| Hiscox Ltd. | | 492,381 | 7,219,125 |

| Petra Diamonds Ltd. (a) | | 4,358,474 | 7,321,689 |

|

| TOTAL BERMUDA | | | 18,813,424 |

|

| Brazil - 0.3% | | | |

| MAHLE Metal Leve SA | | 662,300 | 4,217,036 |

| British Virgin Islands - 0.3% | | | |

| Gem Diamonds Ltd. | | 3,674,562 | 4,176,279 |

| Canada - 5.0% | | | |

| AutoCanada, Inc. (b) | | 382,084 | 6,572,164 |

| Dorel Industries, Inc. Class B (sub. vtg.) | | 195,603 | 4,700,032 |

| Genesis Land Development Corp. | | 1,872,122 | 4,388,697 |

| Lassonde Industries, Inc. Class A (sub. vtg.) | | 44,669 | 7,813,353 |

| McCoy Global, Inc. (a) | | 1,341,870 | 1,916,887 |

| North West Co., Inc. | | 279,700 | 6,597,810 |

| Open Text Corp. | | 272,096 | 9,434,309 |

| ShawCor Ltd. Class A | | 164,385 | 4,124,527 |

| TransForce, Inc. | | 261,000 | 5,682,517 |

| Western Forest Products, Inc. | | 4,516,800 | 7,114,113 |

| Whitecap Resources, Inc. (b) | | 1,131,353 | 8,006,205 |

|

| TOTAL CANADA | | | 66,350,614 |

|

| Cayman Islands - 3.7% | | | |

| AMVIG Holdings Ltd. | | 17,298,000 | 5,782,049 |

| Best Pacific International Holdings Ltd. | | 5,304,000 | 4,657,327 |

| China High Precision Automation Group Ltd. (a) | | 712,000 | 1 |

| China Metal Recycling (Holdings) Ltd. (a) | | 436,800 | 1 |

| Greatview Aseptic Pack Co. Ltd. | | 6,561,000 | 3,399,285 |

| Haitian International Holdings Ltd. | | 2,703,000 | 6,623,407 |

| Lifestyle International Holdings Ltd. | | 3,561,000 | 5,081,682 |

| Pico Far East Holdings Ltd. | | 18,482,000 | 7,484,659 |

| SITC International Holdings Co. Ltd. | | 14,414,000 | 10,321,724 |

| Value Partners Group Ltd. (b) | | 6,679,000 | 6,182,391 |

|

| TOTAL CAYMAN ISLANDS | | | 49,532,526 |

|

| Chile - 0.7% | | | |

| Quinenco SA | | 2,156,335 | 5,857,666 |

| Vina San Pedro SA | | 394,698,308 | 3,844,051 |

|

| TOTAL CHILE | | | 9,701,717 |

|

| China - 0.5% | | | |

| Qingdao Port International Co. Ltd. | | 11,307,000 | 6,018,112 |

| Denmark - 1.2% | | | |

| Jyske Bank A/S (Reg.) | | 156,703 | 8,374,170 |

| Scandinavian Tobacco Group A/S | | 401,913 | 7,016,150 |

|

| TOTAL DENMARK | | | 15,390,320 |

|

| Finland - 3.0% | | | |

| Amer Group PLC (A Shares) (b) | | 386,245 | 8,561,991 |

| Asiakastieto Group Oyj | | 376,423 | 7,368,375 |

| Cramo Oyj (B Shares) | | 233,810 | 6,079,432 |

| Olvi PLC (A Shares) | | 180,338 | 5,578,958 |

| Oriola-KD Oyj | | 1,700,800 | 7,169,877 |

| Tikkurila Oyj | | 285,646 | 5,663,006 |

|

| TOTAL FINLAND | | | 40,421,639 |

|

| France - 3.5% | | | |

| Altarea SCA | | 37,300 | 7,522,809 |

| Maisons du Monde SA | | 175,000 | 6,073,392 |

| Rexel SA | | 358,500 | 6,404,430 |

| The Lisi Group | | 94,909 | 3,721,837 |

| The Vicat Group | | 124,556 | 8,861,186 |

| Thermador Groupe SA | | 47,752 | 4,805,782 |

| Wendel SA | | 66,635 | 9,338,125 |

|

| TOTAL FRANCE | | | 46,727,561 |

|

| Germany - 1.9% | | | |

| Axel Springer Verlag AG | | 165,400 | 9,280,568 |

| CompuGroup Medical AG | | 133,049 | 6,550,848 |

| mutares AG | | 188,600 | 2,876,188 |

| SHW Group | | 171,439 | 6,013,302 |

|

| TOTAL GERMANY | | | 24,720,906 |

|

| Greece - 0.5% | | | |

| Metka Industrial-Construction | | 946,716 | 7,218,804 |

| Hong Kong - 2.6% | | | |

| Dah Sing Banking Group Ltd. | | 4,430,800 | 8,909,050 |

| Far East Horizon Ltd. | | 6,811,000 | 6,269,551 |

| Magnificent Hotel Investment Ltd. | | 160,416,000 | 3,897,822 |

| Sino Land Ltd. | | 4,832,440 | 8,188,312 |

| Techtronic Industries Co. Ltd. | | 1,607,500 | 6,902,556 |

|

| TOTAL HONG KONG | | | 34,167,291 |

|

| India - 0.5% | | | |

| Edelweiss Financial Services Ltd. | | 1,069,635 | 2,789,303 |

| Torrent Pharmaceuticals Ltd. (a) | | 201,745 | 4,452,103 |

|

| TOTAL INDIA | | | 7,241,406 |

|

| Indonesia - 0.7% | | | |

| PT ACE Hardware Indonesia Tbk | | 71,443,900 | 5,011,632 |

| PT Media Nusantara Citra Tbk | | 34,093,000 | 4,667,996 |

|

| TOTAL INDONESIA | | | 9,679,628 |

|

| Ireland - 2.0% | | | |

| C&C Group PLC | | 911,912 | 3,761,800 |

| Mincon Group PLC | | 5,972,545 | 6,766,129 |

| Origin Enterprises PLC | | 866,600 | 7,032,706 |

| United Drug PLC (United Kingdom) | | 989,149 | 9,570,159 |

|

| TOTAL IRELAND | | | 27,130,794 |

|

| Isle of Man - 0.8% | | | |

| Paysafe Group PLC (a) | | 1,820,600 | 10,703,149 |

| Israel - 0.8% | | | |

| Frutarom Industries Ltd. | | 177,789 | 10,450,958 |

| Italy - 1.4% | | | |

| Banca Generali SpA | | 247,100 | 7,103,292 |

| Banco di Desio e della Brianza SpA | | 1,862,695 | 5,092,874 |

| Recordati SpA | | 169,661 | 6,285,447 |

|

| TOTAL ITALY | | | 18,481,613 |

|

| Japan - 20.1% | | | |

| A/S One Corp. | | 142,500 | 6,308,477 |

| Aeon Delight Co. Ltd. | | 254,400 | 7,759,229 |

| Arc Land Sakamoto Co. Ltd. | | 564,200 | 6,979,429 |

| Aucnet, Inc. | | 233,600 | 2,818,497 |

| Broadleaf Co. Ltd. | | 819,600 | 5,315,728 |

| Central Automotive Products Ltd. | | 337,000 | 3,491,680 |

| Daiwa Industries Ltd. | | 495,600 | 4,881,532 |

| Dexerials Corp. | | 771,000 | 6,930,182 |

| Fuji Corp. | | 149,100 | 2,677,714 |

| Funai Soken Holdings, Inc. | | 203,520 | 3,910,651 |

| GMO Internet, Inc. | | 706,500 | 8,384,835 |

| Iida Group Holdings Co. Ltd. | | 533,351 | 8,487,685 |

| Japan Meat Co. Ltd. | | 380,900 | 6,338,367 |

| JSR Corp. | | 635,300 | 11,603,237 |

| Kaken Pharmaceutical Co. Ltd. | | 183,200 | 10,862,992 |

| Kotobuki Spirits Co. Ltd. | | 137,000 | 3,693,070 |

| Meitec Corp. | | 147,000 | 6,349,451 |

| Minebea Mitsumi, Inc. | | 534,000 | 7,717,192 |

| Miraca Holdings, Inc. | | 118,300 | 5,454,694 |

| Mitani Shoji Co. Ltd. | | 251,100 | 7,827,517 |

| Morinaga & Co. Ltd. | | 169,000 | 7,989,504 |

| Nihon Parkerizing Co. Ltd. | | 785,300 | 10,080,864 |

| Nitori Holdings Co. Ltd. | | 61,200 | 7,966,019 |

| Otsuka Corp. | | 121,400 | 6,501,529 |

| PALTAC Corp. | | 224,500 | 6,625,746 |

| Paramount Bed Holdings Co. Ltd. | | 237,400 | 9,955,999 |

| Ricoh Leasing Co. Ltd. | | 236,400 | 7,655,564 |

| S Foods, Inc. (b) | | 383,000 | 11,939,224 |

| San-Ai Oil Co. Ltd. | | 617,400 | 5,239,385 |

| Shinsei Bank Ltd. | | 5,058,000 | 9,437,668 |

| Ship Healthcare Holdings, Inc. | | 265,000 | 7,124,512 |

| TKC Corp. | | 242,200 | 6,583,234 |

| Toshiba Plant Systems & Services Corp. | | 617,200 | 10,037,978 |

| Tsuruha Holdings, Inc. | | 103,100 | 10,451,043 |

| VT Holdings Co. Ltd. | | 1,312,400 | 6,675,316 |

| Welcia Holdings Co. Ltd. | | 208,300 | 6,708,204 |

| Yamada Consulting Group Co. Ltd. | | 168,200 | 7,710,267 |

|

| TOTAL JAPAN | | | 266,474,215 |

|

| Korea (South) - 1.2% | | | |

| BGFretail Co. Ltd. | | 39,299 | 3,782,736 |

| Fila Korea Ltd. | | 54,731 | 3,338,899 |

| Hy-Lok Corp. | | 125,792 | 2,476,917 |

| NS Shopping Co. Ltd. | | 38,218 | 5,711,199 |

|

| TOTAL KOREA (SOUTH) | | | 15,309,751 |

|

| Luxembourg - 0.4% | | | |

| SAF-Holland SA | | 318,400 | 5,500,773 |

| Mexico - 0.2% | | | |

| Credito Real S.A.B. de CV | | 2,307,500 | 3,234,747 |

| Netherlands - 2.9% | | | |

| Amsterdam Commodities NV | | 261,855 | 7,302,109 |

| Arcadis NV (b) | | 212,989 | 3,690,102 |

| Basic-Fit NV | | 344,300 | 6,019,488 |

| BinckBank NV | | 1,026,016 | 5,099,788 |

| IMCD Group BV | | 142,000 | 7,648,956 |

| Philips Lighting NV | | 268,100 | 9,070,804 |

|

| TOTAL NETHERLANDS | | | 38,831,247 |

|

| New Zealand - 0.7% | | | |

| EBOS Group Ltd. | | 707,802 | 8,898,236 |

| Norway - 1.6% | | | |

| ABG Sundal Collier ASA | | 8,682,510 | 5,683,171 |

| Ekornes A/S | | 398,197 | 6,260,959 |

| Kongsberg Gruppen ASA (b) | | 318,133 | 4,965,039 |

| Spectrum ASA (a) | | 795,172 | 3,658,199 |

|

| TOTAL NORWAY | | | 20,567,368 |

|

| Philippines - 0.2% | | | |

| Century Pacific Food, Inc. | | 9,401,500 | 3,093,123 |

| Romania - 0.4% | | | |

| Banca Transilvania SA | | 7,850,048 | 5,199,019 |

| Singapore - 1.6% | | | |

| Boustead Projs. Pte Ltd. (a) | | 994,106 | 608,353 |

| Boustead Singapore Ltd. | | 4,499,905 | 2,866,489 |

| Hour Glass Ltd. | | 8,087,500 | 3,994,113 |

| Mapletree Industrial (REIT) | | 4,336,794 | 5,556,212 |

| Wing Tai Holdings Ltd. | | 5,630,000 | 7,616,004 |

|

| TOTAL SINGAPORE | | | 20,641,171 |

|

| South Africa - 0.6% | | | |

| Clicks Group Ltd. | | 726,051 | 7,292,700 |

| Spain - 0.7% | | | |

| Hispania Activos Inmobiliarios SA | | 576,585 | 8,705,106 |

| Sweden - 1.4% | | | |

| Addlife AB (a) | | 99,154 | 1,886,291 |

| AddTech AB (B Shares) | | 281,419 | 5,067,722 |

| Coor Service Management Holding AB | | 515,800 | 3,217,453 |

| Granges AB | | 825,021 | 8,569,421 |

|

| TOTAL SWEDEN | | | 18,740,887 |

|

| Switzerland - 1.4% | | | |

| Daetwyler Holdings AG | | 36,603 | 6,194,920 |

| Vontobel Holdings AG | | 145,334 | 8,559,369 |

| VZ Holding AG | | 15,361 | 4,272,519 |

|

| TOTAL SWITZERLAND | | | 19,026,808 |

|

| Taiwan - 2.8% | | | |

| King's Town Bank | | 5,243,000 | 5,030,837 |

| Lumax International Corp. Ltd. | | 314,000 | 537,134 |

| Makalot Industrial Co. Ltd. | | 1,616,540 | 6,792,859 |

| Test Research, Inc. | | 2,867,000 | 3,808,690 |

| Tripod Technology Corp. | | 2,812,000 | 7,936,459 |

| Yageo Corp. | | 2,485,000 | 8,756,659 |

| Yung Chi Paint & Varnish Manufacturing Co. Ltd. | | 1,578,000 | 4,281,375 |

|

| TOTAL TAIWAN | | | 37,144,013 |

|

| Thailand - 1.1% | | | |

| Delta Electronics PCL (For. Reg.) | | 2,800,300 | 7,445,884 |

| TISCO Financial Group PCL | | 3,290,000 | 7,250,361 |

|

| TOTAL THAILAND | | | 14,696,245 |

|

| Turkey - 0.3% | | | |

| Aygaz A/S | | 989,000 | 3,945,475 |

| United Kingdom - 15.0% | | | |

| AEW UK REIT PLC (b) | | 3,009,468 | 3,902,735 |

| Alliance Pharma PLC | | 8,615,465 | 5,300,406 |

| Amec Foster Wheeler PLC | | 857,310 | 6,029,406 |

| Ashmore Group PLC | | 1,267,607 | 5,710,196 |

| Bond International Software PLC (a) | | 899,666 | 12 |

| Cineworld Group PLC | | 687,076 | 6,264,902 |

| Close Brothers Group PLC | | 341,180 | 7,476,886 |

| Countrywide PLC | | 3,323,607 | 7,307,289 |

| Diploma PLC | | 295,551 | 4,245,226 |

| Elementis PLC | | 1,348,200 | 5,311,906 |

| Empiric Student Property PLC | | 3,213,272 | 4,557,204 |

| Essentra PLC | | 1,112,800 | 7,804,632 |

| Exova Group Ltd. PLC | | 1,395,369 | 4,310,367 |

| Informa PLC | | 1,072,291 | 8,916,297 |

| ITE Group PLC | | 2,854,064 | 6,542,953 |

| James Fisher and Sons PLC | | 182,700 | 3,800,327 |

| Jardine Lloyd Thompson Group PLC | | 402,000 | 5,711,754 |

| John Wood Group PLC | | 811,800 | 7,985,712 |

| LivaNova PLC (a) | | 189,100 | 9,965,570 |

| Luxfer Holdings PLC sponsored ADR | | 843,509 | 9,860,620 |

| McColl's Retail Group PLC | | 3,083,652 | 8,267,468 |

| Mears Group PLC | | 1,465,810 | 9,891,274 |

| Melrose Industries PLC | | 2,514,228 | 7,701,452 |

| Micro Focus International PLC | | 459,944 | 15,417,225 |

| PayPoint PLC | | 352,811 | 4,647,291 |

| Sinclair Pharma PLC (a) | | 12,139,907 | 5,267,409 |

| Spectris PLC | | 195,480 | 6,987,925 |

| Ten Entertainment Group PLC | | 2,193,500 | 4,694,788 |

| The Restaurant Group PLC | | 761,100 | 3,445,290 |

| Topps Tiles PLC | | 5,532,808 | 7,434,821 |

| Ultra Electronics Holdings PLC | | 114,125 | 3,092,284 |

| Volution Group PLC | | 114,700 | 291,177 |

|

| TOTAL UNITED KINGDOM | | | 198,142,804 |

|

| United States of America - 0.4% | | | |

| Dillard's, Inc. Class A (b) | | 86,694 | 4,800,247 |

| Wecast Network, Inc. warrants 8/30/17 (a)(c) | | 27,500 | 1,612 |

|

| TOTAL UNITED STATES OF AMERICA | | | 4,801,859 |

|

| TOTAL COMMON STOCKS | | | |

| (Cost $1,081,086,065) | | | 1,238,119,879 |

|

| Preferred Stocks - 1.4% | | | |

| Convertible Preferred Stocks - 0.2% | | | |

| India - 0.2% | | | |

| PC Jeweller Ltd. 13.00% (c) | | 20,810,176 | 3,217,165 |

| Nonconvertible Preferred Stocks - 1.2% | | | |

| Brazil - 1.2% | | | |

| Alpargatas SA (PN) | | 1,841,800 | 7,717,566 |

| Banco ABC Brasil SA | | 1,390,219 | 7,805,076 |

| | | | 15,522,642 |

| TOTAL PREFERRED STOCKS | | | |

| (Cost $14,008,204) | | | 18,739,807 |

|

| Money Market Funds - 6.4% | | | |

| Fidelity Cash Central Fund, 0.85% (d) | | 65,961,149 | 65,974,342 |

| Fidelity Securities Lending Cash Central Fund 0.86% (d)(e) | | 18,369,526 | 18,371,363 |

| TOTAL MONEY MARKET FUNDS | | | |

| (Cost $84,336,820) | | | 84,345,705 |

| TOTAL INVESTMENT PORTFOLIO - 101.2% | | | |

| (Cost $1,179,431,089) | | | 1,341,205,391 |

| NET OTHER ASSETS (LIABILITIES) - (1.2)% | | | (16,009,111) |

| NET ASSETS - 100% | | | $1,325,196,280 |

Categorizations in the Schedule of Investments are based on country or territory of incorporation.

Legend

(a) Non-income producing

(b) Security or a portion of the security is on loan at period end.

(c) Restricted securities - Investment in securities not registered under the Securities Act of 1933 (excluding 144A issues). At the end of the period, the value of restricted securities (excluding 144A issues) amounted to $3,218,777 or 0.2% of net assets.

(d) Affiliated fund that is generally available only to investment companies and other accounts managed by Fidelity Investments. The rate quoted is the annualized seven-day yield of the fund at period end. A complete unaudited listing of the fund's holdings as of its most recent quarter end is available upon request. In addition, each Fidelity Central Fund's financial statements are available on the SEC's website or upon request.

(e) Investment made with cash collateral received from securities on loan.

Additional information on each restricted holding is as follows:

| Security | Acquisition Date | Acquisition Cost |

| PC Jeweller Ltd. 13.00% | 7/28/16 | $3,105,681 |

| Wecast Network, Inc. warrants 8/30/17 | 9/14/12 | $0 |

Affiliated Central Funds

Information regarding fiscal year to date income earned by the Fund from investments in Fidelity Central Funds is as follows:

| Fund | Income earned |

| Fidelity Cash Central Fund | $171,359 |

| Fidelity Securities Lending Cash Central Fund | 112,622 |

| Total | $283,981 |

Investment Valuation

The following is a summary of the inputs used, as of April 30, 2017, involving the Fund's assets and liabilities carried at fair value. The inputs or methodology used for valuing securities may not be an indication of the risk associated with investing in those securities. For more information on valuation inputs, and their aggregation into the levels used below, please refer to the Investment Valuation section in the accompanying Notes to Financial Statements.

| | Valuation Inputs at Reporting Date: |

| Description | Total | Level 1 | Level 2 | Level 3 |

| Investments in Securities: | | | | |

| Equities: | | | | |

| Consumer Discretionary | $227,947,796 | $219,017,820 | $3,218,777 | $5,711,199 |

| Consumer Staples | 116,786,729 | 116,786,729 | -- | -- |

| Energy | 47,899,747 | 47,899,747 | -- | -- |

| Financials | 169,991,120 | 169,991,120 | -- | -- |

| Health Care | 114,948,381 | 114,948,381 | -- | -- |

| Industrials | 243,101,730 | 243,101,730 | -- | -- |

| Information Technology | 122,750,940 | 122,750,927 | -- | 13 |

| Materials | 130,011,105 | 130,011,104 | -- | 1 |

| Real Estate | 79,476,663 | 79,476,663 | -- | -- |

| Utilities | 3,945,475 | 3,945,475 | -- | -- |

| Money Market Funds | 84,345,705 | 84,345,705 | -- | -- |

| Total Investments in Securities: | $1,341,205,391 | $1,332,275,401 | $3,218,777 | $5,711,213 |

See accompanying notes which are an integral part of the financial statements.

Financial Statements

Statement of Assets and Liabilities

| | | April 30, 2017 (Unaudited) |

| Assets | | |

Investment in securities, at value (including securities loaned of $17,465,466) — See accompanying schedule:

Unaffiliated issuers (cost $1,095,094,269) | $1,256,859,686 | |

| Fidelity Central Funds (cost $84,336,820) | 84,345,705 | |

| Total Investments (cost $1,179,431,089) | | $1,341,205,391 |

| Receivable for investments sold | | 3,343 |

| Receivable for fund shares sold | | 3,346,211 |

| Dividends receivable | | 6,828,862 |

| Distributions receivable from Fidelity Central Funds | | 70,707 |

| Prepaid expenses | | 575 |

| Other receivables | | 555,557 |

| Total assets | | 1,352,010,646 |

| Liabilities | | |

| Payable to custodian bank | $264,922 | |

| Payable for investments purchased | 5,616,421 | |

| Payable for fund shares redeemed | 1,045,432 | |

| Accrued management fee | 1,049,176 | |

| Distribution and service plan fees payable | 26,355 | |

| Other affiliated payables | 236,342 | |

| Other payables and accrued expenses | 202,708 | |

| Collateral on securities loaned | 18,373,010 | |

| Total liabilities | | 26,814,366 |

| Net Assets | | $1,325,196,280 |

| Net Assets consist of: | | |

| Paid in capital | | $1,156,961,463 |

| Undistributed net investment income | | 6,128,094 |

| Accumulated undistributed net realized gain (loss) on investments and foreign currency transactions | | 467,665 |

| Net unrealized appreciation (depreciation) on investments and assets and liabilities in foreign currencies | | 161,639,058 |

| Net Assets | | $1,325,196,280 |

| Calculation of Maximum Offering Price | | |

| Class A: | | |

| Net Asset Value and redemption price per share ($40,308,447 ÷ 1,560,157 shares) | | $25.84 |

| Maximum offering price per share (100/94.25 of $25.84) | | $27.42 |

| Class M: | | |

| Net Asset Value and redemption price per share ($15,096,405 ÷ 586,994 shares) | | $25.72 |

| Maximum offering price per share (100/96.50 of $25.72) | | $26.65 |

| Class C: | | |

| Net Asset Value and offering price per share ($15,352,410 ÷ 613,564 shares)(a) | | $25.02 |

| International Small Cap: | | |

| Net Asset Value, offering price and redemption price per share ($1,180,177,592 ÷ 44,928,811 shares) | | $26.27 |

| Class I: | | |

| Net Asset Value, offering price and redemption price per share ($74,261,426 ÷ 2,808,295 shares) | | $26.44 |

(a) Redemption price per share is equal to net asset value less any applicable contingent deferred sales charge.

See accompanying notes which are an integral part of the financial statements.

Statement of Operations

| | | Six months ended April 30, 2017 (Unaudited) |

| Investment Income | | |

| Dividends | | $15,017,057 |

| Income from Fidelity Central Funds | | 283,981 |

| Income before foreign taxes withheld | | 15,301,038 |

| Less foreign taxes withheld | | (1,542,244) |

| Total income | | 13,758,794 |

| Expenses | | |

| Management fee | | |

| Basic fee | $4,718,749 | |

| Performance adjustment | 769,953 | |

| Transfer agent fees | 1,076,041 | |

| Distribution and service plan fees | 146,145 | |

| Accounting and security lending fees | 257,855 | |

| Custodian fees and expenses | 169,982 | |

| Independent trustees' fees and expenses | 2,159 | |

| Registration fees | 75,025 | |

| Audit | 42,318 | |

| Legal | 1,089 | |

| Miscellaneous | 3,793 | |

| Total expenses before reductions | 7,263,109 | |

| Expense reductions | (51,181) | 7,211,928 |

| Net investment income (loss) | | 6,546,866 |

| Realized and Unrealized Gain (Loss) | | |

| Net realized gain (loss) on: | | |

| Investment securities: | | |

| Unaffiliated issuers | 9,687,148 | |

| Fidelity Central Funds | (957) | |

| Foreign currency transactions | (65,079) | |

| Total net realized gain (loss) | | 9,621,112 |

Change in net unrealized appreciation (depreciation) on:

Investment securities (net of decrease in deferred foreign taxes of $7,171) | 112,488,557 | |

| Assets and liabilities in foreign currencies | 66,516 | |

| Total change in net unrealized appreciation (depreciation) | | 112,555,073 |

| Net gain (loss) | | 122,176,185 |

| Net increase (decrease) in net assets resulting from operations | | $128,723,051 |

See accompanying notes which are an integral part of the financial statements.

Statement of Changes in Net Assets

| | Six months ended April 30, 2017 (Unaudited) | Year ended October 31, 2016 |

| Increase (Decrease) in Net Assets | | |

| Operations | | |

| Net investment income (loss) | $6,546,866 | $15,277,971 |

| Net realized gain (loss) | 9,621,112 | 12,084,769 |

| Change in net unrealized appreciation (depreciation) | 112,555,073 | 49,975,496 |

| Net increase (decrease) in net assets resulting from operations | 128,723,051 | 77,338,236 |

| Distributions to shareholders from net investment income | (14,393,212) | (10,933,091) |

| Distributions to shareholders from net realized gain | (12,478,859) | (23,540,154) |

| Total distributions | (26,872,071) | (34,473,245) |

| Share transactions - net increase (decrease) | 232,106,959 | 74,066,306 |

| Redemption fees | 93,065 | 222,176 |

| Total increase (decrease) in net assets | 334,051,004 | 117,153,473 |

| Net Assets | | |

| Beginning of period | 991,145,276 | 873,991,803 |

| End of period | $1,325,196,280 | $991,145,276 |

| Other Information | | |

| Undistributed net investment income end of period | $6,128,094 | $13,974,440 |

See accompanying notes which are an integral part of the financial statements.

Financial Highlights — Fidelity International Small Cap Fund Class A

| | Six months ended (Unaudited) April 30, | Years ended October 31, | | | | |

| | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 |

| Selected Per–Share Data | | | | | | |

| Net asset value, beginning of period | $23.81 | $22.69 | $24.98 | $26.34 | $19.74 | $18.97 |

| Income from Investment Operations | | | | | | |

| Net investment income (loss)A | .11 | .34 | .27 | .17 | .06 | .06 |

| Net realized and unrealized gain (loss) | 2.49 | 1.64 | 1.05 | (.89) | 6.94 | 1.09 |

| Total from investment operations | 2.60 | 1.98 | 1.32 | (.72) | 7.00 | 1.15 |

| Distributions from net investment income | (.28) | (.25) | (.16) | (.05) | (.07) | (.11) |

| Distributions from net realized gain | (.29) | (.62) | (3.45) | (.60) | (.33) | (.27) |

| Total distributions | (.57) | (.87) | (3.61) | (.65) | (.40) | (.38) |

| Redemption fees added to paid in capitalA | –B | .01 | –B | .01 | –B | –B |

| Net asset value, end of period | $25.84 | $23.81 | $22.69 | $24.98 | $26.34 | $19.74 |

| Total ReturnC,D,E | 11.20% | 9.11% | 6.21% | (2.79)% | 36.18% | 6.28% |

| Ratios to Average Net AssetsF,G | | | | | | |

| Expenses before reductions | 1.59%H | 1.61% | 1.59% | 1.50% | 1.61% | 1.63% |

| Expenses net of fee waivers, if any | 1.59%H | 1.61% | 1.58% | 1.50% | 1.61% | 1.63% |

| Expenses net of all reductions | 1.58%H | 1.61% | 1.58% | 1.50% | 1.60% | 1.60% |

| Net investment income (loss) | .89%H | 1.50% | 1.18% | .65% | .25% | .32% |

| Supplemental Data | | | | | | |

| Net assets, end of period (000 omitted) | $40,308 | $36,480 | $28,238 | $24,572 | $24,020 | $14,125 |

| Portfolio turnover rateI | 16%H | 29% | 36% | 102% | 54% | 68% |

A Calculated based on average shares outstanding during the period.

B Amount represents less than $.005 per share.

C Total returns for periods of less than one year are not annualized.

D Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

E Total returns do not include the effect of the sales charges.

F Fees and expenses of any underlying Fidelity Central Funds are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of the expenses of any underlying Fidelity Central Funds.

G Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from brokerage service arrangements or reductions from other expense offset arrangements and do not represent the amount paid by the class during periods when reimbursements or reductions occur. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from brokerage service arrangements or other expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the class.

H Annualized

I Amount does not include the portfolio activity of any underlying Fidelity Central Funds.

See accompanying notes which are an integral part of the financial statements.

Financial Highlights — Fidelity International Small Cap Fund Class M

| | Six months ended (Unaudited) April 30, | Years ended October 31, | | | | |

| | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 |

| Selected Per–Share Data | | | | | | |

| Net asset value, beginning of period | $23.65 | $22.55 | $24.81 | $26.17 | $19.59 | $18.80 |

| Income from Investment Operations | | | | | | |

| Net investment income (loss)A | .07 | .27 | .21 | .10 | –B | .01 |

| Net realized and unrealized gain (loss) | 2.48 | 1.63 | 1.04 | (.87) | 6.90 | 1.08 |

| Total from investment operations | 2.55 | 1.90 | 1.25 | (.77) | 6.90 | 1.09 |

| Distributions from net investment income | (.19) | (.19) | (.06) | – | – | (.03) |

| Distributions from net realized gain | (.29) | (.62) | (3.45) | (.60) | (.32) | (.27) |

| Total distributions | (.48) | (.81) | (3.51) | (.60) | (.32) | (.30) |

| Redemption fees added to paid in capitalA | –B | .01 | –B | .01 | –B | –B |

| Net asset value, end of period | $25.72 | $23.65 | $22.55 | $24.81 | $26.17 | $19.59 |

| Total ReturnC,D,E | 11.01% | 8.79% | 5.90% | (3.00)% | 35.80% | 5.97% |

| Ratios to Average Net AssetsF,G | | | | | | |

| Expenses before reductions | 1.87%H | 1.90% | 1.87% | 1.77% | 1.87% | 1.88% |

| Expenses net of fee waivers, if any | 1.87%H | 1.90% | 1.86% | 1.77% | 1.87% | 1.88% |

| Expenses net of all reductions | 1.86%H | 1.90% | 1.86% | 1.76% | 1.85% | 1.85% |

| Net investment income (loss) | .61%H | 1.21% | .90% | .38% | (.01)% | .07% |

| Supplemental Data | | | | | | |

| Net assets, end of period (000 omitted) | $15,096 | $13,331 | $12,400 | $12,296 | $13,530 | $9,262 |

| Portfolio turnover rateI | 16%H | 29% | 36% | 102% | 54% | 68% |

A Calculated based on average shares outstanding during the period.

B Amount represents less than $.005 per share.

C Total returns for periods of less than one year are not annualized.

D Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

E Total returns do not include the effect of the sales charges.

F Fees and expenses of any underlying Fidelity Central Funds are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of the expenses of any underlying Fidelity Central Funds.

G Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from brokerage service arrangements or reductions from other expense offset arrangements and do not represent the amount paid by the class during periods when reimbursements or reductions occur. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from brokerage service arrangements or other expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the class.

H Annualized

I Amount does not include the portfolio activity of any underlying Fidelity Central Funds.

See accompanying notes which are an integral part of the financial statements.

Financial Highlights — Fidelity International Small Cap Fund Class C

| | Six months ended (Unaudited) April 30, | Years ended October 31, | | | | |

| | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 |

| Selected Per–Share Data | | | | | | |

| Net asset value, beginning of period | $22.97 | $21.96 | $24.27 | $25.68 | $19.18 | $18.38 |

| Income from Investment Operations | | | | | | |

| Net investment income (loss)A | .01 | .16 | .09 | (.02) | (.11) | (.08) |

| Net realized and unrealized gain (loss) | 2.41 | 1.59 | 1.02 | (.85) | 6.79 | 1.07 |

| Total from investment operations | 2.42 | 1.75 | 1.11 | (.87) | 6.68 | .99 |

| Distributions from net investment income | (.08) | (.13) | – | – | – | – |

| Distributions from net realized gain | (.29) | (.62) | (3.42) | (.55) | (.18) | (.19) |

| Total distributions | (.37) | (.75) | (3.42) | (.55) | (.18) | (.19) |

| Redemption fees added to paid in capitalA | –B | .01 | –B | .01 | –B | –B |

| Net asset value, end of period | $25.02 | $22.97 | $21.96 | $24.27 | $25.68 | $19.18 |

| Total ReturnC,D,E | 10.73% | 8.26% | 5.37% | (3.43)% | 35.15% | 5.46% |

| Ratios to Average Net AssetsF,G | | | | | | |

| Expenses before reductions | 2.38%H | 2.40% | 2.36% | 2.23% | 2.33% | 2.38% |

| Expenses net of fee waivers, if any | 2.38%H | 2.40% | 2.35% | 2.22% | 2.33% | 2.38% |

| Expenses net of all reductions | 2.37%H | 2.39% | 2.35% | 2.22% | 2.32% | 2.35% |

| Net investment income (loss) | .10%H | .71% | .41% | (.07)% | (.47)% | (.43)% |

| Supplemental Data | | | | | | |

| Net assets, end of period (000 omitted) | $15,352 | $12,187 | $11,359 | $12,576 | $13,426 | $6,799 |

| Portfolio turnover rateI | 16%H | 29% | 36% | 102% | 54% | 68% |

A Calculated based on average shares outstanding during the period.

B Amount represents less than $.005 per share.

C Total returns for periods of less than one year are not annualized.

D Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

E Total returns do not include the effect of the contingent deferred sales charge.

F Fees and expenses of any underlying Fidelity Central Funds are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of the expenses of any underlying Fidelity Central Funds.

G Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from brokerage service arrangements or reductions from other expense offset arrangements and do not represent the amount paid by the class during periods when reimbursements or reductions occur. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from brokerage service arrangements or other expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the class.

H Annualized

I Amount does not include the portfolio activity of any underlying Fidelity Central Funds.

See accompanying notes which are an integral part of the financial statements.

Financial Highlights — Fidelity International Small Cap Fund

| | Six months ended (Unaudited) April 30, | Years ended October 31, | | | | |

| | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 |

| Selected Per–Share Data | | | | | | |

| Net asset value, beginning of period | $24.23 | $23.06 | $25.34 | $26.67 | $19.99 | $19.23 |

| Income from Investment Operations | | | | | | |

| Net investment income (loss)A | .15 | .40 | .34 | .25 | .12 | .11 |

| Net realized and unrealized gain (loss) | 2.52 | 1.67 | 1.07 | (.90) | 7.02 | 1.10 |

| Total from investment operations | 2.67 | 2.07 | 1.41 | (.65) | 7.14 | 1.21 |

| Distributions from net investment income | (.34) | (.29) | (.24) | (.09) | (.14) | (.18) |

| Distributions from net realized gain | (.29) | (.62) | (3.45) | (.60) | (.33) | (.27) |

| Total distributions | (.63) | (.91) | (3.69) | (.69) | (.46)B | (.45) |

| Redemption fees added to paid in capitalA | –C | .01 | –C | .01 | –C | –C |

| Net asset value, end of period | $26.27 | $24.23 | $23.06 | $25.34 | $26.67 | $19.99 |

| Total ReturnD,E | 11.34% | 9.39% | 6.53% | (2.48)% | 36.56% | 6.55% |

| Ratios to Average Net AssetsF,G | | | | | | |

| Expenses before reductions | 1.27%H | 1.34% | 1.31% | 1.21% | 1.33% | 1.35% |

| Expenses net of fee waivers, if any | 1.27%H | 1.34% | 1.31% | 1.20% | 1.32% | 1.35% |

| Expenses net of all reductions | 1.26%H | 1.33% | 1.31% | 1.20% | 1.31% | 1.33% |

| Net investment income (loss) | 1.21%H | 1.77% | 1.45% | .95% | .53% | .59% |

| Supplemental Data | | | | | | |

| Net assets, end of period (000 omitted) | $1,180,178 | $906,420 | $811,534 | $842,031 | $1,029,629 | $692,769 |

| Portfolio turnover rateI | 16%H | 29% | 36% | 102% | 54% | 68% |

A Calculated based on average shares outstanding during the period.

B Total distributions of $.46 per share is comprised of distributions from net investment income of $.136 and distributions from net realized gain of $.327 per share.

C Amount represents less than $.005 per share.

D Total returns for periods of less than one year are not annualized.

E Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

F Fees and expenses of any underlying Fidelity Central Funds are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of the expenses of any underlying Fidelity Central Funds.

G Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from brokerage service arrangements or reductions from other expense offset arrangements and do not represent the amount paid by the class during periods when reimbursements or reductions occur. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from brokerage service arrangements or other expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the class.

H Annualized

I Amount does not include the portfolio activity of any underlying Fidelity Central Funds.

See accompanying notes which are an integral part of the financial statements.

Financial Highlights — Fidelity International Small Cap Fund Class I

| | Six months ended (Unaudited) April 30, | Years ended October 31, | | | | |

| | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 |

| Selected Per–Share Data | | | | | | |

| Net asset value, beginning of period | $24.42 | $23.24 | $25.34 | $26.67 | $20.00 | $19.24 |

| Income from Investment Operations | | | | | | |

| Net investment income (loss)A | .14 | .41 | .36 | .29 | .16 | .13 |

| Net realized and unrealized gain (loss) | 2.54 | 1.69 | 1.07 | (.90) | 7.00 | 1.10 |

| Total from investment operations | 2.68 | 2.10 | 1.43 | (.61) | 7.16 | 1.23 |

| Distributions from net investment income | (.37) | (.31) | (.08) | (.13) | (.16) | (.20) |

| Distributions from net realized gain | (.29) | (.62) | (3.45) | (.60) | (.33) | (.27) |

| Total distributions | (.66) | (.93) | (3.53) | (.73) | (.49) | (.47) |

| Redemption fees added to paid in capitalA | –B | .01 | –B | .01 | –B | –B |

| Net asset value, end of period | $26.44 | $24.42 | $23.24 | $25.34 | $26.67 | $20.00 |

| Total ReturnC,D | 11.31% | 9.43% | 6.60% | (2.35)% | 36.68% | 6.65% |

| Ratios to Average Net AssetsE,F | | | | | | |

| Expenses before reductions | 1.31%G | 1.31% | 1.24% | 1.08% | 1.20% | 1.25% |

| Expenses net of fee waivers, if any | 1.31%G | 1.31% | 1.23% | 1.08% | 1.20% | 1.25% |

| Expenses net of all reductions | 1.30%G | 1.31% | 1.23% | 1.08% | 1.18% | 1.22% |

| Net investment income (loss) | 1.17%G | 1.80% | 1.53% | 1.07% | .66% | .70% |

| Supplemental Data | | | | | | |

| Net assets, end of period (000 omitted) | $74,261 | $22,727 | $10,070 | $8,092 | $67,038 | $9,503 |

| Portfolio turnover rateH | 16%G | 29% | 36% | 102% | 54% | 68% |

A Calculated based on average shares outstanding during the period.

B Amount represents less than $.005 per share.

C Total returns for periods of less than one year are not annualized.

D Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

E Fees and expenses of any underlying Fidelity Central Funds are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of the expenses of any underlying Fidelity Central Funds.

F Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from brokerage service arrangements or reductions from other expense offset arrangements and do not represent the amount paid by the class during periods when reimbursements or reductions occur. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from brokerage service arrangements or other expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the class.

G Annualized

H Amount does not include the portfolio activity of any underlying Fidelity Central Funds.

See accompanying notes which are an integral part of the financial statements.

Notes to Financial Statements (Unaudited)

For the period ended April 30, 2017

1. Organization.

Fidelity International Small Cap Fund (the Fund) is a fund of Fidelity Investment Trust (the Trust) and is authorized to issue an unlimited number of shares. The Trust is registered under the Investment Company Act of 1940, as amended (the 1940 Act), as an open-end management investment company organized as a Massachusetts business trust. The Fund offers Class A, Class M (formerly Class T), Class C, International Small Cap and Class I shares, each of which has equal rights as to assets and voting privileges. Each class has exclusive voting rights with respect to matters that affect that class. The Fund's investments in emerging markets can be subject to social, economic, regulatory, and political uncertainties and can be extremely volatile.

After the close of business on June 24, 2016, all outstanding Class B shares were converted to Class A shares. All prior fiscal period dollar and share amounts for Class B presented in the Notes to Financial Statements are for the period November 1, 2015 through June 24, 2016.

2. Investments in Fidelity Central Funds.

The Fund invests in Fidelity Central Funds, which are open-end investment companies generally available only to other investment companies and accounts managed by the investment adviser and its affiliates. The Fund's Schedule of Investments lists each of the Fidelity Central Funds held as of period end, if any, as an investment of the Fund, but does not include the underlying holdings of each Fidelity Central Fund. As an Investing Fund, the Fund indirectly bears its proportionate share of the expenses of the underlying Fidelity Central Funds.

The Money Market Central Funds seek preservation of capital and current income and are managed by Fidelity Investments Money Management, Inc. (FIMM), an affiliate of the investment adviser. Annualized expenses of the Money Market Central Funds as of their most recent shareholder report date are less than .005%.

A complete unaudited list of holdings for each Fidelity Central Fund is available upon request or at the Securities and Exchange Commission (the SEC) website at www.sec.gov. In addition, the financial statements of the Fidelity Central Funds are available on the SEC website or upon request.

3. Significant Accounting Policies.

The Fund is an investment company and applies the accounting and reporting guidance of the Financial Accounting Standards Board (FASB) Accounting Standards Codification Topic 946 Financial Services – Investments Companies. The financial statements have been prepared in conformity with accounting principles generally accepted in the United States of America (GAAP), which require management to make certain estimates and assumptions at the date of the financial statements. Actual results could differ from those estimates. Subsequent events, if any, through the date that the financial statements were issued have been evaluated in the preparation of the financial statements. The following summarizes the significant accounting policies of the Fund:

Investment Valuation. Investments are valued as of 4:00 p.m. Eastern time on the last calendar day of the period. The Board of Trustees (the Board) has delegated the day to day responsibility for the valuation of the Fund's investments to the Fair Value Committee (the Committee) established by the Fund's investment adviser. In accordance with valuation policies and procedures approved by the Board, the Fund attempts to obtain prices from one or more third party pricing vendors or brokers to value its investments. When current market prices, quotations or currency exchange rates are not readily available or reliable, investments will be fair valued in good faith by the Committee, in accordance with procedures adopted by the Board. Factors used in determining fair value vary by investment type and may include market or investment specific events. The frequency with which these procedures are used cannot be predicted and they may be utilized to a significant extent. The Committee oversees the Fund's valuation policies and procedures and reports to the Board on the Committee's activities and fair value determinations. The Board monitors the appropriateness of the procedures used in valuing the Fund's investments and ratifies the fair value determinations of the Committee.

The Fund categorizes the inputs to valuation techniques used to value its investments into a disclosure hierarchy consisting of three levels as shown below:

- Level 1 – quoted prices in active markets for identical investments

- Level 2 – other significant observable inputs (including quoted prices for similar investments, interest rates, prepayment speeds, etc.)

- Level 3 – unobservable inputs (including the Fund's own assumptions based on the best information available)

Valuation techniques used to value the Fund's investments by major category are as follows:

Equity securities, including restricted securities, for which market quotations are readily available, are valued at the last reported sale price or official closing price as reported by a third party pricing vendor on the primary market or exchange on which they are traded and are categorized as Level 1 in the hierarchy. In the event there were no sales during the day or closing prices are not available, securities are valued at the last quoted bid price or may be valued using the last available price and are generally categorized as Level 2 in the hierarchy. For foreign equity securities, when market or security specific events arise, comparisons to the valuation of American Depositary Receipts (ADRs), futures contracts, Exchange-Traded Funds (ETFs) and certain indexes as well as quoted prices for similar securities may be used and would be categorized as Level 2 in the hierarchy. Utilizing these techniques may result in transfers between Level 1 and Level 2. For equity securities, including restricted securities, where observable inputs are limited, assumptions about market activity and risk are used and these securities may be categorized as Level 3 in the hierarchy.

Investments in open-end mutual funds, including the Fidelity Central Funds, are valued at their closing net asset value (NAV) each business day and are categorized as Level 1 in the hierarchy.

Changes in valuation techniques may result in transfers in or out of an assigned level within the disclosure hierarchy. The aggregate value of investments by input level as of April 30, 2017 is included at the end of the Fund's Schedule of Investments.

Foreign Currency. The Fund may use foreign currency contracts to facilitate transactions in foreign-denominated securities. Gains and losses from these transactions may arise from changes in the value of the foreign currency or if the counterparties do not perform under the contracts' terms.

Foreign-denominated assets, including investment securities, and liabilities are translated into U.S. dollars at the exchange rates at period end. Purchases and sales of investment securities, income and dividends received and expenses denominated in foreign currencies are translated into U.S. dollars at the exchange rate in effect on the transaction date.

The effects of exchange rate fluctuations on investments are included with the net realized and unrealized gain (loss) on investment securities. Other foreign currency transactions resulting in realized and unrealized gain (loss) are disclosed separately.

Investment Transactions and Income. For financial reporting purposes, the Fund's investment holdings and NAV include trades executed through the end of the last business day of the period. The NAV per share for processing shareholder transactions is calculated as of the close of business of the New York Stock Exchange (NYSE), normally 4:00 p.m. Eastern time and includes trades executed through the end of the prior business day. Gains and losses on securities sold are determined on the basis of identified cost and may include proceeds received from litigation. Dividend income is recorded on the ex-dividend date, except for certain dividends from foreign securities where the ex-dividend date may have passed, which are recorded as soon as the Fund is informed of the ex-dividend date. Non-cash dividends included in dividend income, if any, are recorded at the fair market value of the securities received. Income and capital gain distributions from Fidelity Central Funds, if any, are recorded on the ex-dividend date. Certain distributions received by the Fund represent a return of capital or capital gain. The Fund determines the components of these distributions subsequent to the ex-dividend date, based upon receipt of tax filings or other correspondence relating to the underlying investment. These distributions are recorded as a reduction of cost of investments and/or as a realized gain. Investment income is recorded net of foreign taxes withheld where recovery of such taxes is uncertain.

Class Allocations and Expenses. Investment income, realized and unrealized capital gains and losses, common expenses of the Fund, and certain fund-level expense reductions, if any, are allocated daily on a pro-rata basis to each class based on the relative net assets of each class to the total net assets of the Fund. Each class differs with respect to transfer agent and distribution and service plan fees incurred. Certain expense reductions may also differ by class. For the reporting period, the allocated portion of income and expenses to each class as a percent of its average net assets may vary due to the timing of recording these transactions in relation to fluctuating net assets of the classes. Expenses directly attributable to a fund are charged to that fund. Expenses attributable to more than one fund are allocated among the respective funds on the basis of relative net assets or other appropriate methods. Expense estimates are accrued in the period to which they relate and adjustments are made when actual amounts are known.

Income Tax Information and Distributions to Shareholders. Each year, the Fund intends to qualify as a regulated investment company under Subchapter M of the Internal Revenue Code, including distributing substantially all of its taxable income and realized gains. As a result, no provision for U.S. Federal income taxes is required. The Fund files a U.S. federal tax return, in addition to state and local tax returns as required. The Fund's federal income tax returns are subject to examination by the Internal Revenue Service (IRS) for a period of three fiscal years after they are filed. State and local tax returns may be subject to examination for an additional fiscal year depending on the jurisdiction. Foreign taxes are provided for based on the Fund's understanding of the tax rules and rates that exist in the foreign markets in which it invests. The Fund is subject to a tax imposed on capital gains by certain countries in which it invests. An estimated deferred tax liability for net unrealized appreciation on the applicable securities is included in Other payables and accrued expenses on the Statement of Assets & Liabilities.

Distributions are declared and recorded on the ex-dividend date. Income dividends and capital gain distributions are declared separately for each class. Income and capital gain distributions are determined in accordance with income tax regulations, which may differ from GAAP.

Capital accounts within the financial statements are adjusted for permanent book-tax differences. These adjustments have no impact on net assets or the results of operations. Capital accounts are not adjusted for temporary book-tax differences which will reverse in a subsequent period.

Book-tax differences are primarily due to foreign currency transactions, certain foreign taxes, passive foreign investment companies (PFIC) and losses deferred due to wash sales.

The federal tax cost of investment securities and unrealized appreciation (depreciation) as of period end were as follows:

| Gross unrealized appreciation | $238,432,680 |

| Gross unrealized depreciation | (77,233,134) |

| Net unrealized appreciation (depreciation) on securities | $161,199,546 |

| Tax cost | $1,180,005,845 |

Short-Term Trading (Redemption) Fees. Shares held by investors in the Fund less than 90 days may have been subject to a redemption fee equal to 2.00% of the NAV of shares redeemed. All redemption fees, which reduce the proceeds of the shareholder redemption, are retained by the Fund and accounted for as an addition to paid in capital.

Restricted Securities. The Fund may invest in securities that are subject to legal or contractual restrictions on resale. These securities generally may be resold in transactions exempt from registration or to the public if the securities are registered. Disposal of these securities may involve time-consuming negotiations and expense, and prompt sale at an acceptable price may be difficult. Information regarding restricted securities is included at the end of the Fund's Schedule of Investments.

4. Purchases and Sales of Investments.

Purchases and sales of securities, other than short-term securities, aggregated $278,457,187 and $82,932,855, respectively.

5. Fees and Other Transactions with Affiliates.

Management Fee. Fidelity Management & Research Company (the investment adviser) and its affiliates provide the Fund with investment management related services for which the Fund pays a monthly management fee. The management fee is the sum of an individual fund fee rate that is based on an annual rate of .60% of the Fund's average net assets and an annualized group fee rate that averaged .25% during the period. The group fee rate is based upon the average net assets of all the mutual funds advised by the investment adviser, including any mutual funds previously advised by the investment adviser that are currently advised by Fidelity SelectCo, LLC, an affiliate of the investment adviser. The group fee rate decreases as assets under management increase and increases as assets under management decrease. In addition, the management fee is subject to a performance adjustment (up to a maximum of +/- .20% of the Fund's average net assets over a 36 month performance period). The upward or downward adjustment to the management fee is based on the relative investment performance of International Small Cap as compared to its benchmark index, the MSCI ACWI (All Country World Index) ex USA Small Cap Index effective April 1, 2014 (the MSCI EAFE Small Cap Index prior to April 1, 2014), over the same 36 month performance period. For the reporting period, the total annualized management fee rate, including the performance adjustment, was .99% of the Fund's average net assets. The performance adjustment included in the management fee rate may be higher or lower than the maximum performance adjustment rate due to the difference between the average net assets for the reporting and performance periods.

Distribution and Service Plan Fees. In accordance with Rule 12b-1 of the 1940 Act, the Fund has adopted separate Distribution and Service Plans for each class of shares. Certain classes pay Fidelity Distributors Corporation (FDC), an affiliate of the investment adviser, separate Distribution and Service Fees, each of which is based on an annual percentage of each class' average net assets. In addition, FDC may pay financial intermediaries for selling shares of the Fund and providing shareholder support services. For the period, the Distribution and Service Fee rates, total fees and amounts retained by FDC were as follows:

| | Distribution

Fee | Service

Fee | Total Fees | Retained

by FDC |

| Class A | -% | .25% | $48,310 | $– |

| Class M | .25% | .25% | 34,852 | – |

| Class C | .75% | .25% | 62,983 | 11,728 |

| | | | $146,145 | $11,728 |

Sales Load. FDC may receive a front-end sales charge of up to 5.75% for selling Class A shares and 3.50% for selling Class M shares, some of which is paid to financial intermediaries for selling shares of the Fund. Depending on the holding period, FDC may receive contingent deferred sales charges levied on Class A, Class M and Class C redemptions. The deferred sales charges range from 1.00% for Class C shares, 1.00% for certain purchases of Class A shares and .25% for certain purchases of Class M shares.

For the period, sales charge amounts retained by FDC were as follows:

| | Retained

by FDC |

| Class A | $16,871 |

| Class M | 1,880 |

| Class C(a) | 1,020 |

| | $19,771 |

(a) When Class C shares are initially sold, FDC pays commissions from its own resources to financial intermediaries through which the sales are made.

Transfer Agent Fees. Fidelity Investments Institutional Operations Company, Inc., (FIIOC), an affiliate of the investment adviser, is the transfer, dividend disbursing and shareholder servicing agent for each class of the Fund. FIIOC receives account fees and asset-based fees that vary according to the account size and type of account of the shareholders of the respective classes of the Fund. IIOC pays for typesetting, printing and mailing of shareholder reports, except proxy statements.

For the period, transfer agent fees for each class were as follows:

| | Amount | % of

Class-Level Average

Net Assets(a) |

| Class A | $48,648 | .25 |

| Class M | 19,975 | .29 |

| Class C | 18,483 | .29 |

| International Small Cap | 939,656 | .19 |

| Class I | 49,279 | .23 |

| | $1,076,041 | |

(a) Annualized

Accounting and Security Lending Fees. Fidelity Service Company, Inc. (FSC), an affiliate of the investment adviser, maintains the Fund's accounting records. The accounting fee is based on the level of average net assets for each month. Under a separate contract, FSC administers the security lending program. The security lending fee is based on the number and duration of lending transactions.

Brokerage Commissions. The Fund placed a portion of its portfolio transactions with brokerage firms which are affiliates of the investment adviser. Brokerage commissions are included in net realized gain (loss) and change in net unrealized appreciation (depreciation) in the Statement of Operations. The commissions paid to these affiliated firms were $2,789 for the period.

Interfund Trades. The Fund may purchase from or sell securities to other Fidelity Funds under procedures adopted by the Board. The procedures have been designed to ensure these interfund trades are executed in accordance with Rule 17a-7 of the 1940 Act. Interfund trades are included within the respective purchases and sales amounts shown in the Purchases and Sales of Investments note.

6. Committed Line of Credit.

The Fund participates with other funds managed by the investment adviser or an affiliate in a $4.25 billion credit facility (the "line of credit") to be utilized for temporary or emergency purposes to fund shareholder redemptions or for other short-term liquidity purposes. The Fund has agreed to pay commitment fees on its pro-rata portion of the line of credit, which amounted to $1,807 and is reflected in Miscellaneous expenses on the Statement of Operations. During the period, the Fund did not borrow on this line of credit.

7. Security Lending.

The Fund lends portfolio securities through a lending agent from time to time in order to earn additional income. For equity securities, a lending agent is used and may loan securities to certain qualified borrowers, including Fidelity Capital Markets (FCM), a broker-dealer affiliated with the Fund. On the settlement date of the loan, the Fund receives collateral (in the form of U.S. Treasury obligations, letters of credit and/or cash) against the loaned securities and maintains collateral in an amount not less than 100% of the market value of the loaned securities during the period of the loan. The market value of the loaned securities is determined at the close of business of the Fund and any additional required collateral is delivered to the Fund on the next business day. The Fund or borrower may terminate the loan at any time, and if the borrower defaults on its obligation to return the securities loaned because of insolvency or other reasons, the Fund may apply collateral received from the borrower against the obligation. The Fund may experience delays and costs in recovering the securities loaned. Any cash collateral received is invested in the Fidelity Securities Lending Cash Central Fund. The value of loaned securities and cash collateral at period end are disclosed on the Fund's Statement of Assets and Liabilities. The value of securities loaned to FCM at period end was $903,189. Security lending income represents the income earned on investing cash collateral, less rebates paid to borrowers and any lending agent fees associated with the loan, plus any premium payments received for lending certain types of securities. Security lending income is presented in the Statement of Operations as a component of income from Fidelity Central Funds. Total security lending income during the period amounted to $112,622, including $11,707 from securities loaned to FCM.

8. Expense Reductions.

Commissions paid to certain brokers with whom the investment adviser, or its affiliates, places trades on behalf of the Fund include an amount in addition to trade execution, which may be rebated back to the Fund to offset certain expenses. This amount totaled $46,521 for the period. In addition, through arrangements with the Fund's custodian, credits realized as a result of certain uninvested cash balances were used to reduce the Fund's expenses. During the period, these credits reduced the Fund's expenses by $37.

In addition, during the period the investment adviser reimbursed and/or waived a portion of fund-level operating expenses in the amount of $4,623.

9. Distributions to Shareholders.

Distributions to shareholders of each class were as follows:

| | Six months ended April 30, 2017 | Year ended October 31, 2016 |

| From net investment income | | |

| Class A | $440,395 | $319,347 |

| Class M | 105,144 | 106,306 |

| Class B | – | 996 |

| Class C | 42,573 | 64,383 |

| International Small Cap | 13,342,577 | 10,307,620 |

| Class I | 462,523 | 134,439 |

| Total | $14,393,212 | $10,933,091 |

| From net realized gain | | |

| Class A | $461,138 | $788,825 |

| Class M | 163,369 | 339,739 |

| Class B | – | 10,287 |

| Class C | 151,895 | 319,340 |

| International Small Cap | 11,341,189 | 21,811,338 |

| Class I | 361,268 | 270,625 |

| Total | $12,478,859 | $23,540,154 |

10. Share Transactions.

Share transactions for each class were as follows and may contain automatic conversions between classes or exchanges between affiliated funds:

| | Shares | Shares | Dollars | Dollars |

| | Six months ended April 30, 2017 | Year ended October 31, 2016 | Six months ended April 30, 2017 | Year ended October 31, 2016 |

| Class A | | | | |

| Shares sold | 493,177 | 622,254 | $11,804,074 | $13,846,907 |

| Reinvestment of distributions | 38,390 | 49,226 | 881,445 | 1,077,561 |

| Shares redeemed | (503,251) | (383,922) | (12,141,598) | (8,560,022) |

| Net increase (decrease) | 28,316 | 287,558 | $543,921 | $6,364,446 |

| Class M | | | | |

| Shares sold | 70,799 | 133,036 | $1,669,865 | $2,846,482 |

| Reinvestment of distributions | 11,602 | 20,220 | 265,460 | 440,798 |

| Shares redeemed | (59,070) | (139,487) | (1,417,904) | (3,059,683) |

| Net increase (decrease) | 23,331 | 13,769 | $517,421 | $227,597 |

| Class B | | | | |

| Shares sold | – | 2,210 | $– | $44,410 |

| Reinvestment of distributions | – | 493 | – | 10,648 |

| Shares redeemed | – | (20,270) | – | (435,806) |

| Net increase (decrease) | – | (17,567) | $– | $(380,748) |

| Class C | | | | |

| Shares sold | 168,930 | 222,957 | $3,988,717 | $4,942,382 |

| Reinvestment of distributions | 8,175 | 16,869 | 182,379 | 358,801 |

| Shares redeemed | (93,994) | (226,514) | (2,152,912) | (4,770,771) |

| Net increase (decrease) | 83,111 | 13,312 | $2,018,184 | $530,412 |

| International Small Cap | | | | |

| Shares sold | 9,867,347 | 11,991,539 | $240,657,082 | $277,123,750 |

| Reinvestment of distributions | 1,029,746 | 1,408,054 | 24,013,687 | 31,286,953 |

| Shares redeemed | (3,376,773) | (11,188,601) | (82,018,784) | (253,612,350) |

| Net increase (decrease) | 7,520,320 | 2,210,992 | $182,651,985 | $54,798,353 |

| Class I | | | | |

| Shares sold | 2,063,330 | 924,076 | $50,964,089 | $21,994,159 |

| Reinvestment of distributions | 29,052 | 16,670 | 682,131 | 373,252 |

| Shares redeemed | (214,660) | (443,477) | (5,270,772) | (9,841,165) |

| Net increase (decrease) | 1,877,722 | 497,269 | $46,375,448 | $12,526,246 |

11. Other.

The Fund's organizational documents provide former and current trustees and officers with a limited indemnification against liabilities arising in connection with the performance of their duties to the Fund. In the normal course of business, the Fund may also enter into contracts that provide general indemnifications. The Fund's maximum exposure under these arrangements is unknown as this would be dependent on future claims that may be made against the Fund. The risk of material loss from such claims is considered remote.

Shareholder Expense Example

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments or redemption proceeds, redemption fees and (2) ongoing costs, including management fees, distribution and/or service (12b-1) fees and other Fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period (November 1, 2016 to April 30, 2017).

Actual Expenses

The first line of the accompanying table for each class of the Fund provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000.00 (for example, an $8,600 account value divided by $1,000.00 = 8.6), then multiply the result by the number in the first line for a class of the Fund under the heading entitled "Expenses Paid During Period" to estimate the expenses you paid on your account during this period. A small balance maintenance fee of $12.00 that is charged once a year may apply for certain accounts with a value of less than $2,000. This fee is not included in the table below. If it was, the estimate of expenses you paid during the period would be higher, and your ending account value lower, by this amount. In addition, the Fund, as a shareholder in the underlying Fidelity Central Funds, will indirectly bear its pro-rata share of the fees and expenses incurred by the underlying Fidelity Central Funds. These fees and expenses are not included in the Fund's annualized expense ratio used to calculate the expense estimate in the table below.

Hypothetical Example for Comparison Purposes

The second line of the accompanying table for each class of the Fund provides information about hypothetical account values and hypothetical expenses based on a Class' actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Class' actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds. A small balance maintenance fee of $12.00 that is charged once a year may apply for certain accounts with a value of less than $2,000. This fee is not included in the table below. If it was, the estimate of expenses you paid during the period would be higher, and your ending account value lower, by this amount. In addition, the Fund, as a shareholder in the underlying Fidelity Central Funds, will indirectly bear its pro-rata share of the fees and expenses incurred by the underlying Fidelity Central Funds. These fees and expenses are not included in the Fund's annualized expense ratio used to calculate the expense estimate in the table below.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transaction costs. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | Annualized Expense Ratio-A | Beginning

Account Value

November 1, 2016 | Ending

Account Value

April 30, 2017 | Expenses Paid

During Period-B

November 1, 2016

to April 30, 2017 |

| Class A | 1.59% | | | |

| Actual | | $1,000.00 | $1,112.00 | $8.33 |

| Hypothetical-C | | $1,000.00 | $1,016.91 | $7.95 |

| Class M | 1.87% | | | |

| Actual | | $1,000.00 | $1,110.10 | $9.78 |

| Hypothetical-C | | $1,000.00 | $1,015.52 | $9.35 |

| Class C | 2.38% | | | |

| Actual | | $1,000.00 | $1,107.30 | $12.44 |

| Hypothetical-C | | $1,000.00 | $1,012.99 | $11.88 |

| International Small Cap | 1.27% | | | |

| Actual | | $1,000.00 | $1,113.40 | $6.65 |

| Hypothetical-C | | $1,000.00 | $1,018.50 | $6.36 |

| Class I | 1.31% | | | |

| Actual | | $1,000.00 | $1,113.10 | $6.86 |

| Hypothetical-C | | $1,000.00 | $1,018.30 | $6.56 |

A Annualized expense ratio reflects expenses net of applicable fee waivers.

B Expenses are equal to each Class' annualized expense ratio, multiplied by the average account value over the period, multiplied by 181/365 (to reflect the one-half year period).

C 5% return per year before expenses

AISC-SANN-0617

1.800644.113

Fidelity® Emerging Markets Discovery Fund

Fidelity® Total Emerging Markets Fund

Semi-Annual Report April 30, 2017 |

|

Contents

To view a fund's proxy voting guidelines and proxy voting record for the 12-month period ended June 30, visit http://www.fidelity.com/proxyvotingresults or visit the Securities and Exchange Commission's (SEC) web site at http://www.sec.gov.

You may also call 1-800-544-8544 to request a free copy of the proxy voting guidelines.

Standard & Poor's, S&P and S&P 500 are registered service marks of The McGraw-Hill Companies, Inc. and have been licensed for use by Fidelity Distributors Corporation.

Other third-party marks appearing herein are the property of their respective owners.

All other marks appearing herein are registered or unregistered trademarks or service marks of FMR LLC or an affiliated company. © 2017 FMR LLC. All rights reserved.

This report and the financial statements contained herein are submitted for the general information of the shareholders of the Funds. This report is not authorized for distribution to prospective investors in the Funds unless preceded or accompanied by an effective prospectus.

A fund files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. Forms N-Q are available on the SEC’s web site at http://www.sec.gov. A fund's Forms N-Q may be reviewed and copied at the SEC’s Public Reference Room in Washington, DC. Information regarding the operation of the SEC's Public Reference Room may be obtained by calling 1-800-SEC-0330.

For a complete list of a fund's portfolio holdings, view the most recent holdings listing, semiannual report, or annual report on Fidelity's web site at http://www.fidelity.com, http://www.institutional.fidelity.com, or http://www.401k.com, as applicable.

NOT FDIC INSURED •MAY LOSE VALUE •NO BANK GUARANTEE