UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-4008

Fidelity Investment Trust

(Exact name of registrant as specified in charter)

245 Summer St., Boston, Massachusetts 02210

(Address of principal executive offices) (Zip code)

Scott C. Goebel, Secretary

245 Summer St.

Boston, Massachusetts 02210

(Name and address of agent for service)

Registrant's telephone number, including area code: 617-563-7000

Date of fiscal year end: | October 31 |

| |

Date of reporting period: | April 30, 2015 |

This report on Form N-CSR relates solely to the Registrant's Fidelity International Discovery Fund, Fidelity International Growth Fund, Fidelity International Small Cap Fund, Fidelity International Small Cap Opportunities Fund, and Fidelity International Value Fund (each, a "Fund" and collectively, the "Funds").

Item 1. Reports to Stockholders

ContentsShareholder Expense ExampleInvestment Changes (Unaudited)Investments April 30, 2015 (Unaudited)Financial StatementsNotes to Financial StatementsContentsShareholder Expense ExampleInvestment Changes (Unaudited)Investments April 30, 2015 (Unaudited)Financial StatementsNotes to Financial StatementsContentsShareholder Expense ExampleInvestment Changes (Unaudited)Investments April 30, 2015 (Unaudited)Financial StatementsNotes to Financial StatementsContentsShareholder Expense ExampleInvestment Changes (Unaudited)Investments April 30, 2015 (Unaudited)Financial StatementsNotes to Financial StatementsContentsShareholder Expense ExampleInvestment Changes (Unaudited)Investments April 30, 2015Financial StatementsNotes to Financial StatementsReport of Independent Registered Public Accounting FirmContentsShareholder Expense ExampleInvestment Changes (Unaudited)Investments April 30, 2015Financial StatementsNotes to Financial StatementsReport of Independent Registered Public Accounting FirmContentsShareholder Expense ExampleInvestment Changes (Unaudited)Investments April 30, 2015Financial StatementsNotes to Financial StatementsReport of Independent Registered Public Accounting FirmContentsShareholder Expense ExampleInvestment Changes (Unaudited)Investments April 30, 2015 (Unaudited)Financial StatementsNotes to Financial StatementsContentsShareholder Expense ExampleInvestment Changes (Unaudited)Investments April 30, 2015 (Unaudited)Financial StatementsNotes to Financial StatementsContentsShareholder Expense ExampleInvestment Changes (Unaudited)Investments April 30, 2015 (Unaudited)Financial StatementsNotes to Financial StatementsContentsShareholder Expense ExampleInvestment Changes (Unaudited)Investments April 30, 2015 (Unaudited)Financial StatementsNotes to Financial StatementsContentsShareholder Expense ExampleInvestment Changes (Unaudited)Investments April 30, 2015 (Unaudited)Financial StatementsNotes to Financial StatementsContentsShareholder Expense ExampleInvestment Changes (Unaudited)Investments April 30, 2015 (Unaudited)Financial StatementsNotes to Financial StatementsContentsShareholder Expense ExampleInvestment Changes (Unaudited)Investments April 30, 2015 (Unaudited)Financial StatementsNotes to Financial StatementsContentsShareholder Expense ExampleInvestment Changes (Unaudited)Investments April 30, 2015 (Unaudited)Financial StatementsNotes to Financial StatementsContentsShareholder Expense ExampleInvestment Changes (Unaudited)Investments April 30, 2015 (Unaudited)Financial StatementsNotes to Financial StatementsContentsShareholder Expense ExampleInvestment Changes (Unaudited)Investments April 30, 2015 (Unaudited)Financial StatementsNotes to Financial StatementsContentsShareholder Expense ExampleInvestment Changes (Unaudited)Investments April 30, 2015 (Unaudited)Financial StatementsNotes to Financial Statements

(Fidelity Investment logo)(registered trademark)

Fidelity Advisor®

International Growth

Fund - Class A, Class T, Class B

and Class C

Semiannual Report

April 30, 2015

(Fidelity Cover Art)

Class A, Class T,

Class B, and Class C are

classes of Fidelity®

International Growth Fund

Contents

Shareholder Expense Example | (Click Here) | An example of shareholder expenses. |

Investment Changes | (Click Here) | A summary of major shifts in the fund's investments over the past six months. |

Investments | (Click Here) | A complete list of the fund's investments with their market values. |

Financial Statements | (Click Here) | Statements of assets and liabilities, operations, and changes in net assets, as well as financial highlights. |

Notes | (Click Here) | Notes to financial statements. |

To view a fund's proxy voting guidelines and proxy voting record for the 12-month period ended June 30, visit http://www.fidelity.com/proxyvotingresults or visit the Securities and Exchange Commission's (SEC) web site at http://www.sec.gov. You may also call 1-877-208-0098 to request a free copy of the proxy voting guidelines.

Standard & Poor's, S&P and S&P 500 are registered service marks of The McGraw-Hill Companies, Inc. and have been licensed for use by Fidelity Distributors Corporation.

Other third-party marks appearing herein are the property of their respective owners.

All other marks appearing herein are registered or unregistered trademarks or service marks of FMR LLC or an affiliated company. © 2015 FMR LLC. All rights reserved.

This report and the financial statements contained herein are submitted for the general information of the shareholders of the fund. This report is not authorized for distribution to prospective investors in the fund unless preceded or accompanied by an effective prospectus.

A fund files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. Forms N-Q are available on the SEC's web site at http://www.sec.gov. A fund's Forms N-Q may be reviewed and copied at the SEC's Public Reference Room in Washington, DC. Information regarding the operation of the SEC's Public Reference Room may be obtained by calling 1-800-SEC-0330. For a complete list of a fund's portfolio holdings, view the most recent holdings listing, semiannual report, or annual report on Fidelity's web site at http://www.fidelity.com, http://www.advisor.fidelity.com, or http://www.401k.com, as applicable.

NOT FDIC INSURED • MAY LOSE VALUE • NO BANK GUARANTEE

Neither the fund nor Fidelity Distributors Corporation is a bank.

Semiannual Report

Shareholder Expense Example

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments or redemption proceeds, redemption fees and (2) ongoing costs, including management fees, distribution and/or service (12b-1) fees and other Fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period (November 1, 2014 to April 30, 2015).

Actual Expenses

The first line of the accompanying table for each class of the Fund provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000.00 (for example, an $8,600 account value divided by $1,000.00 = 8.6), then multiply the result by the number in the first line for a class of the Fund under the heading entitled "Expenses Paid During Period" to estimate the expenses you paid on your account during this period. A small balance maintenance fee of $12.00 that is charged once a year may apply for certain accounts with a value of less than $2,000. This fee is not included in the table below. If it was, the estimate of expenses you paid during the period would be higher, and your ending account value lower, by this amount. In addition, the Fund, as a shareholder in the underlying Fidelity Central Funds, will indirectly bear its pro-rata share of the fees and expenses incurred by the underlying Fidelity Central Funds. These fees and expenses are not included in the Fund's annualized expense ratio used to calculate the expense estimate in the table below.

Hypothetical Example for Comparison Purposes

The second line of the accompanying table for each class of the Fund provides information about hypothetical account values and hypothetical expenses based on a Class' actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Class' actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds. A small balance maintenance fee of $12.00 that is charged once a year may apply for certain accounts with a value of less than $2,000. This fee is not included in the table below. If it was, the estimate of expenses you paid during the period would be higher, and your ending account value lower, by this amount. In addition, the Fund, as a shareholder in the underlying Fidelity Central Funds, will indirectly bear its pro-rata share of the fees and expenses incurred by the underlying Fidelity Central Funds. These fees and expenses are not included in the Fund's annualized expense ratio used to calculate the expense estimate in the table below.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transaction costs. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

Semiannual Report

Shareholder Expense Example - continued

| Annualized

Expense Ratio B | Beginning

Account Value

November 1, 2014 | Ending

Account Value

April 30, 2015 | Expenses Paid

During Period*

November 1, 2014

to April 30, 2015 |

Class A | 1.28% | | | |

Actual | | $ 1,000.00 | $ 1,066.70 | $ 6.56 |

HypotheticalA | | $ 1,000.00 | $ 1,018.45 | $ 6.41 |

Class T | 1.60% | | | |

Actual | | $ 1,000.00 | $ 1,065.00 | $ 8.19 |

HypotheticalA | | $ 1,000.00 | $ 1,016.86 | $ 8.00 |

Class B | 2.06% | | | |

Actual | | $ 1,000.00 | $ 1,061.40 | $ 10.53 |

HypotheticalA | | $ 1,000.00 | $ 1,014.58 | $ 10.29 |

Class C | 2.09% | | | |

Actual | | $ 1,000.00 | $ 1,061.60 | $ 10.68 |

HypotheticalA | | $ 1,000.00 | $ 1,014.43 | $ 10.44 |

International Growth | 1.00% | | | |

Actual | | $ 1,000.00 | $ 1,067.20 | $ 5.13 |

HypotheticalA | | $ 1,000.00 | $ 1,019.84 | $ 5.01 |

Institutional Class | 1.00% | | | |

Actual | | $ 1,000.00 | $ 1,067.80 | $ 5.13 |

HypotheticalA | | $ 1,000.00 | $ 1,019.84 | $ 5.01 |

Class Z | .87% | | | |

Actual | | $ 1,000.00 | $ 1,068.90 | $ 4.46 |

HypotheticalA | | $ 1,000.00 | $ 1,020.48 | $ 4.36 |

A 5% return per year before expenses

B Annualized expense ratio reflects expenses net of applicable fee waivers.

* Expenses are equal to each Class' annualized expense ratio, multiplied by the average account value over the period, multiplied by 181/365 (to reflect the one-half year period).

Semiannual Report

Investment Changes (Unaudited)

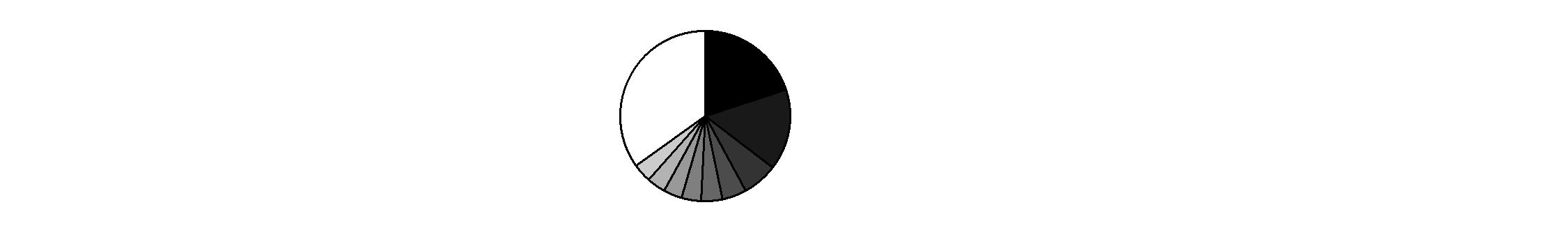

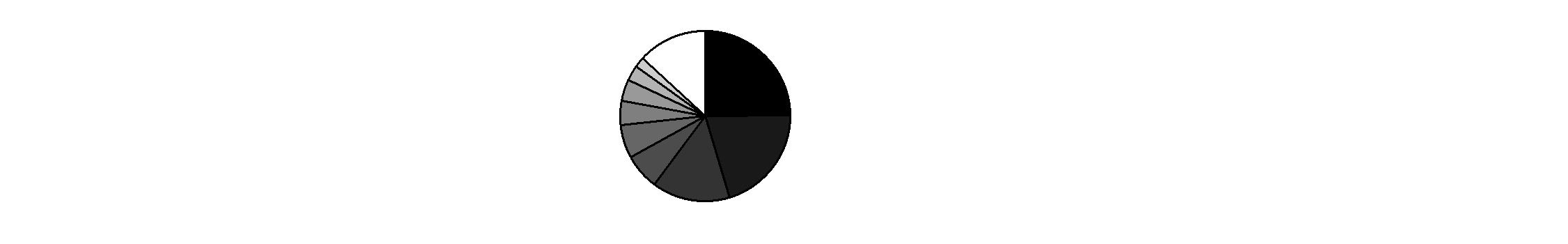

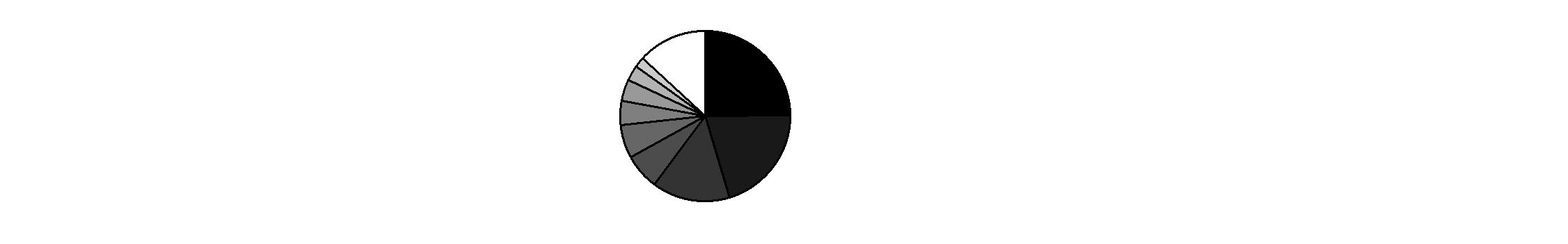

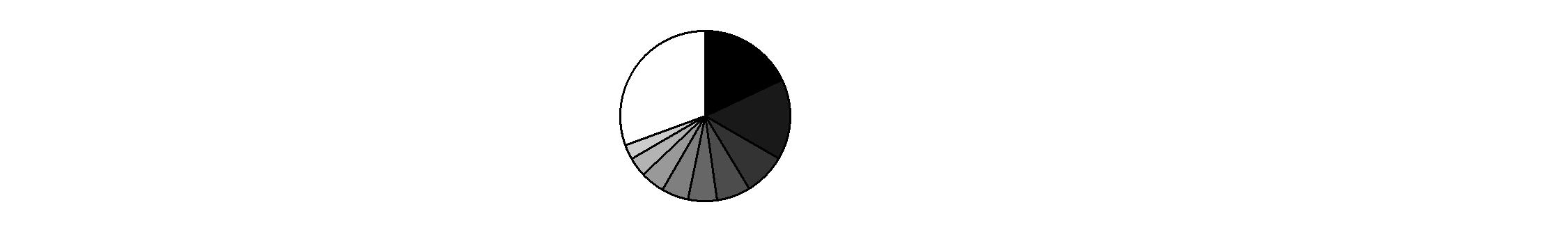

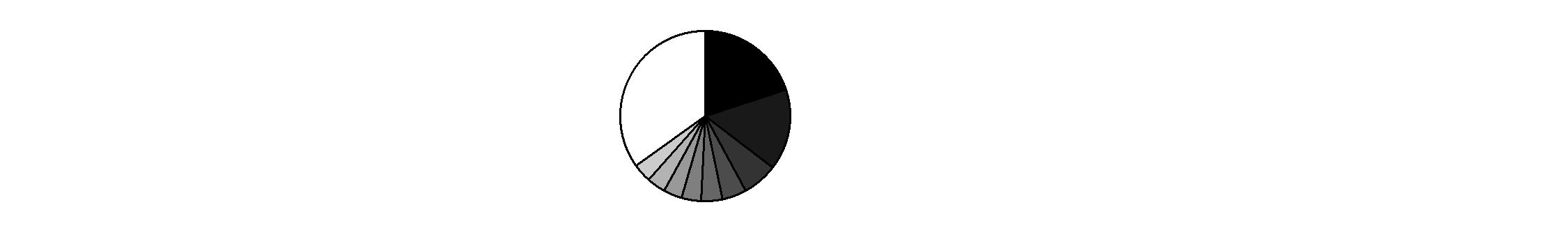

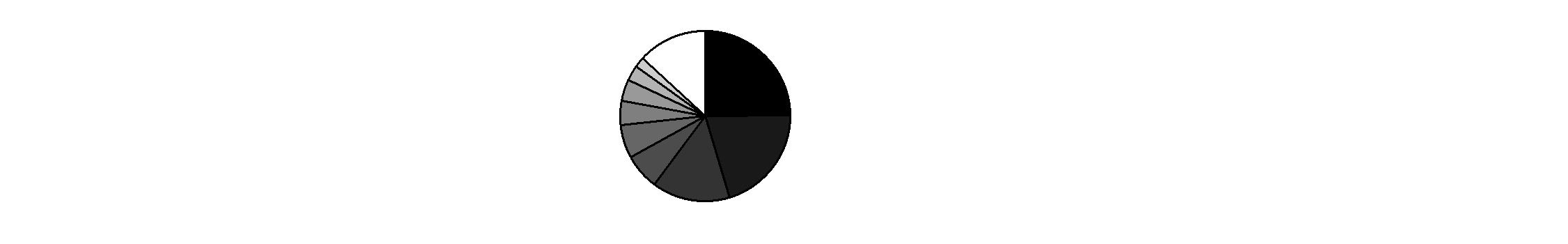

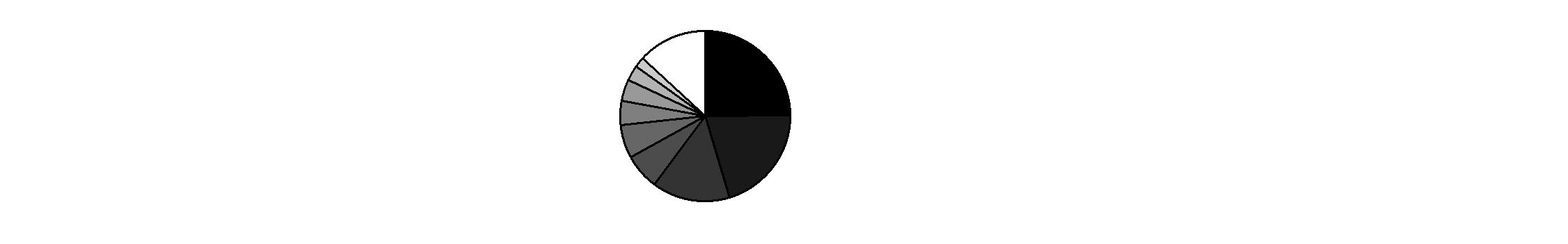

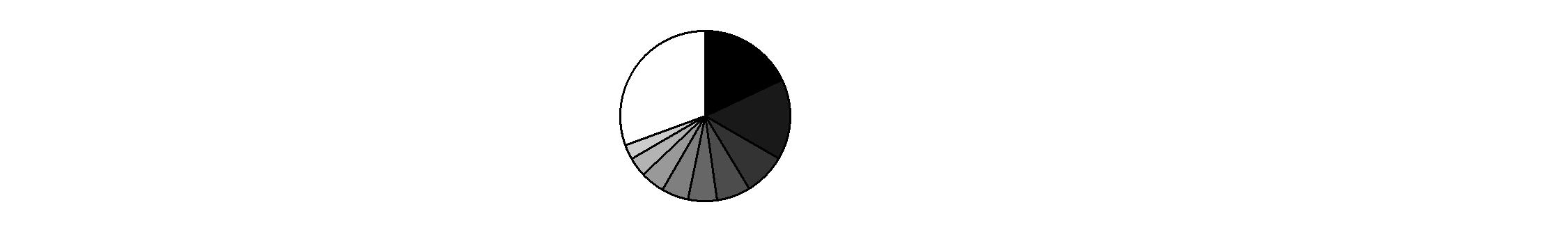

Geographic Diversification (% of fund's net assets) |

As of April 30, 2015 |

| United States of America* 16.9% | |

| Japan 15.2% | |

| Switzerland 14.2% | |

| United Kingdom 12.5% | |

| Sweden 5.6% | |

| Belgium 4.6% | |

| Germany 3.8% | |

| Australia 3.3% | |

| Denmark 2.9% | |

| Other 21.0% | |

Percentages are based on country or territory of incorporation and are adjusted for the effect of futures contracts, if applicable. |

* Includes Short-Term Investments and Net Other Assets (Liabilities) |

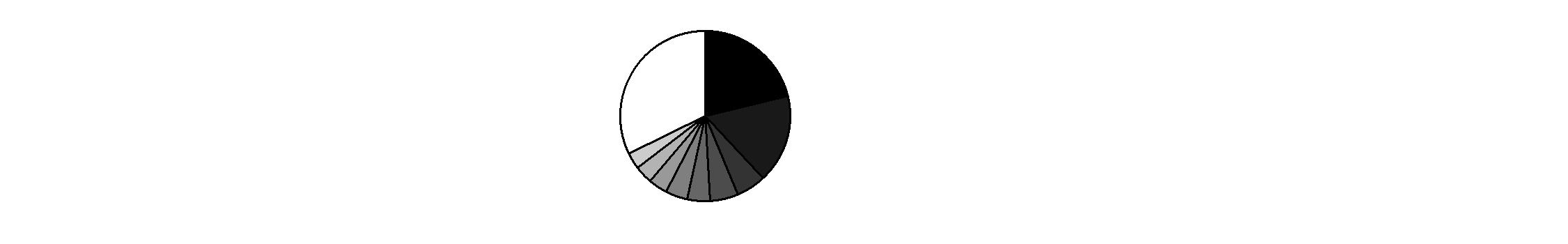

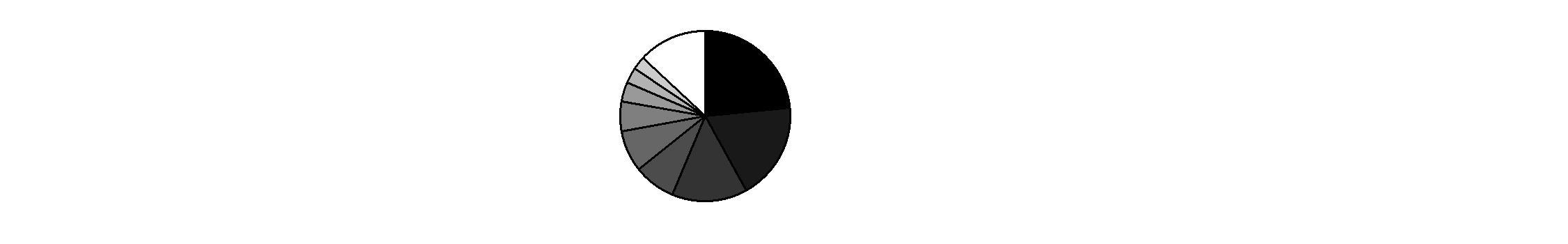

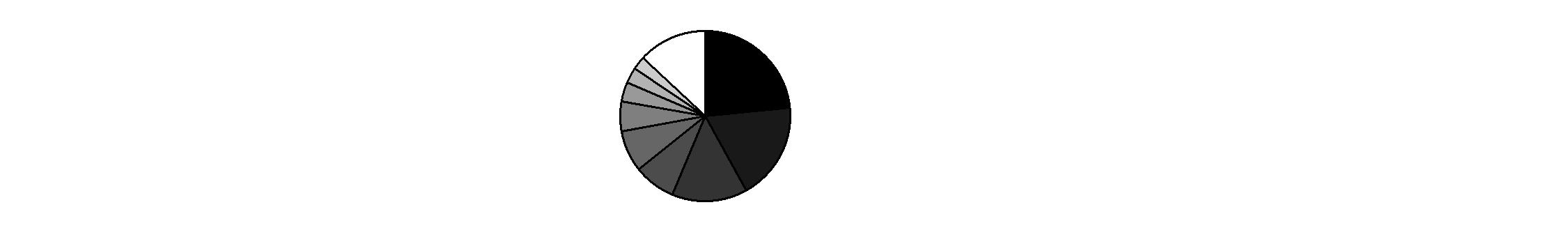

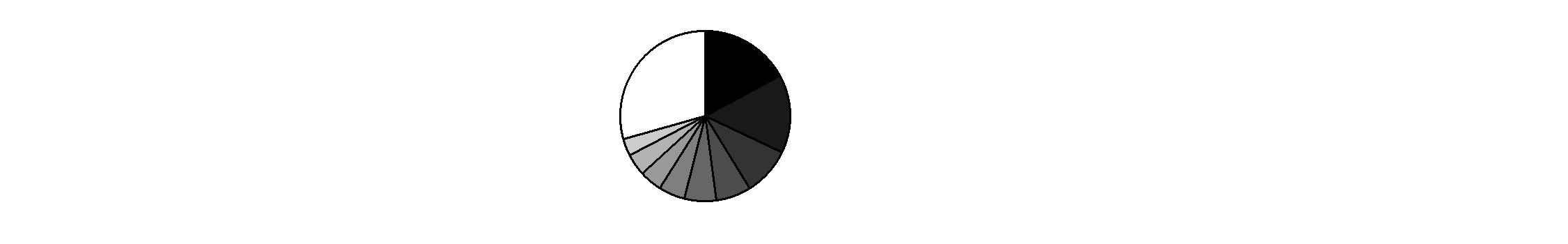

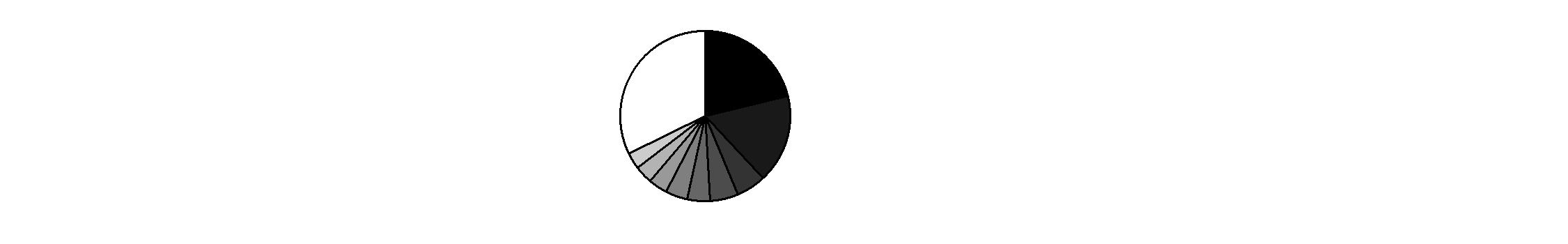

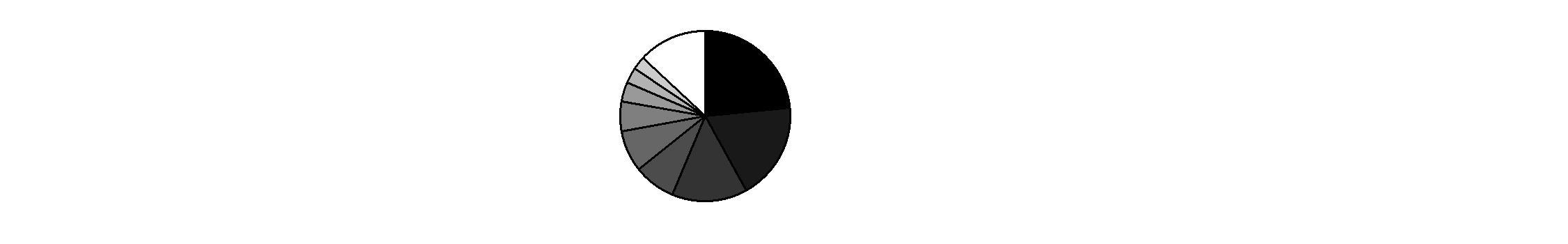

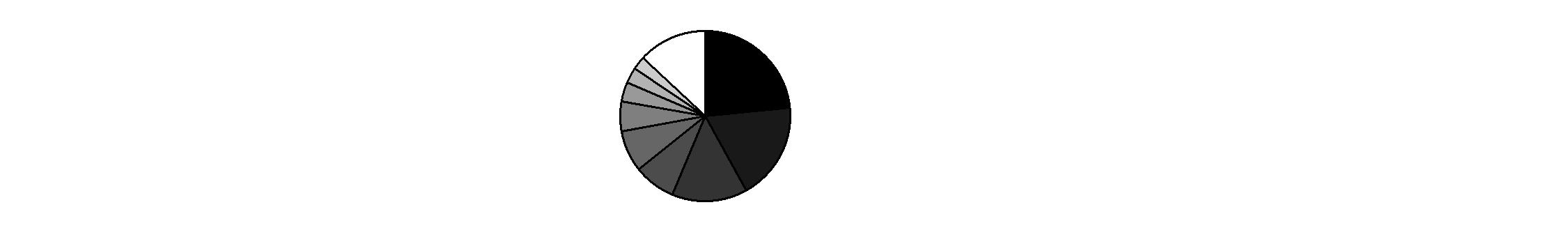

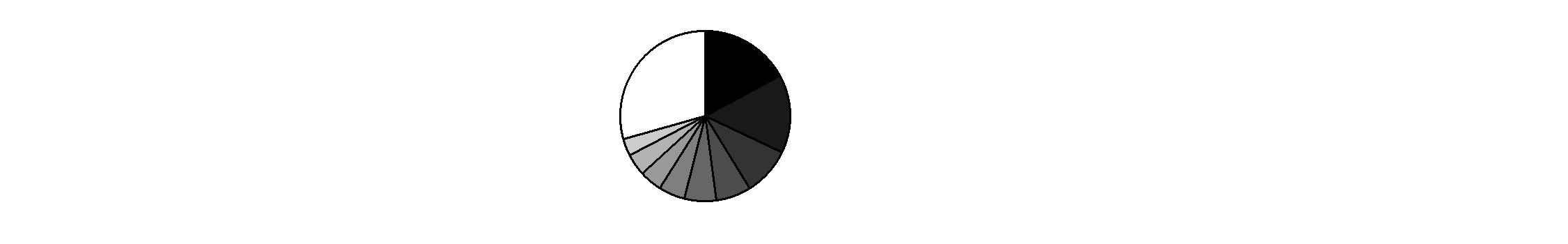

As of October 31, 2014 |

| United States of America* 18.8% | |

| United Kingdom 15.5% | |

| Japan 14.2% | |

| Switzerland 12.4% | |

| Sweden 5.6% | |

| Germany 4.6% | |

| Belgium 4.5% | |

| Australia 3.5% | |

| Denmark 2.8% | |

| Other 18.1% | |

Percentages are based on country or territory of incorporation and are adjusted for the effect of futures contracts, if applicable. |

* Includes Short-Term Investments and Net Other Assets (Liabilities) |

Asset Allocation as of April 30, 2015 |

| % of fund's

net assets | % of fund's net assets

6 months ago |

Stocks | 98.1 | 96.7 |

Short-Term Investments and Net Other Assets (Liabilities) | 1.9 | 3.3 |

Top Ten Stocks as of April 30, 2015 |

| % of fund's

net assets | % of fund's net assets

6 months ago |

Novartis AG (Switzerland, Pharmaceuticals) | 3.9 | 1.4 |

Roche Holding AG (participation certificate) (Switzerland, Pharmaceuticals) | 3.8 | 4.5 |

Nestle SA (Switzerland, Food Products) | 3.6 | 3.7 |

Anheuser-Busch InBev SA NV (Belgium, Beverages) | 2.9 | 3.0 |

DENSO Corp. (Japan, Auto Components) | 2.5 | 2.6 |

Novo Nordisk A/S Series B sponsored ADR (Denmark, Pharmaceuticals) | 2.3 | 2.2 |

Reckitt Benckiser Group PLC (United Kingdom, Household Products) | 2.2 | 2.2 |

CSL Ltd. (Australia, Biotechnology) | 2.1 | 2.3 |

Keyence Corp. (Japan, Electronic Equipment & Components) | 2.1 | 2.3 |

Inditex SA (Spain, Specialty Retail) | 2.0 | 1.7 |

| 27.4 | |

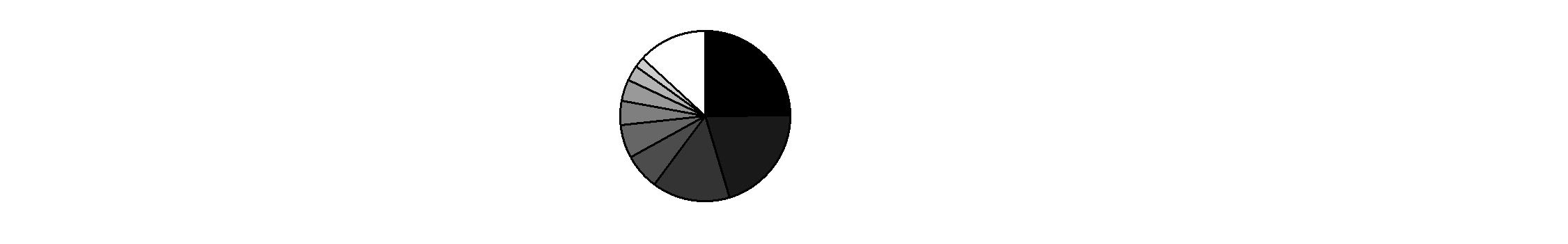

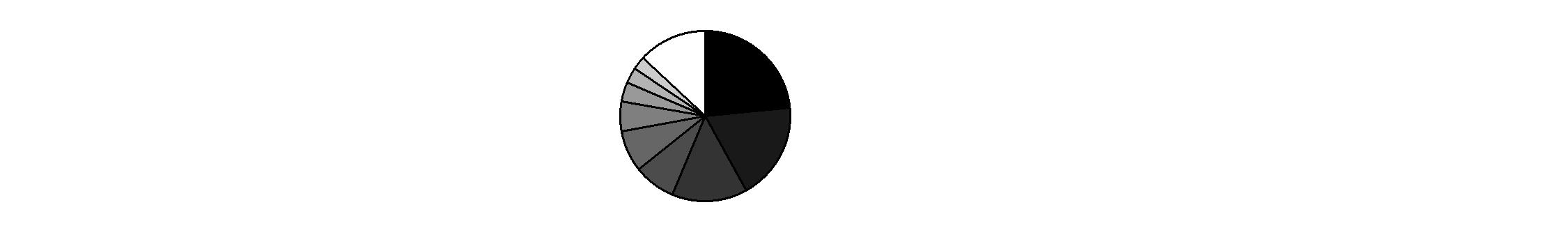

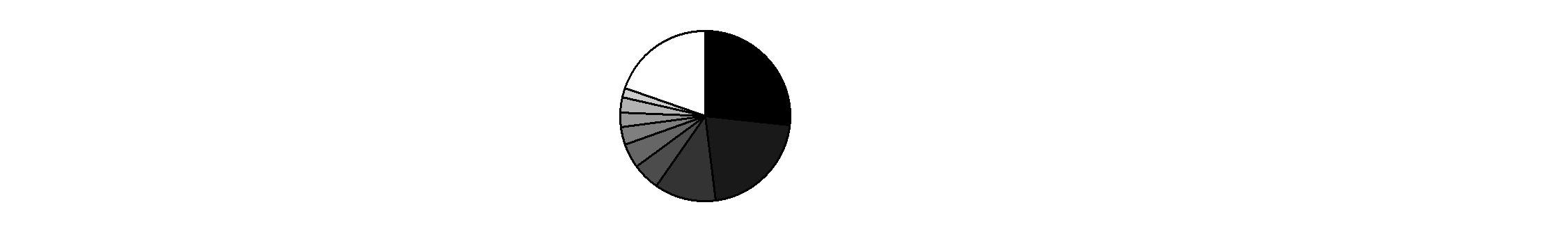

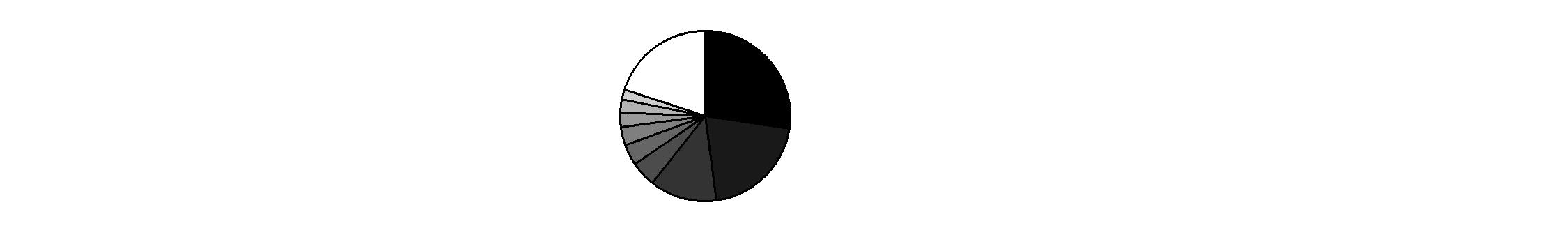

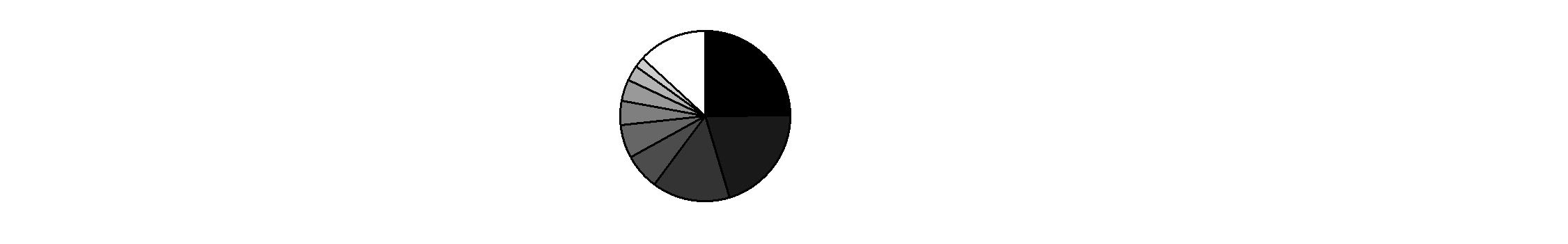

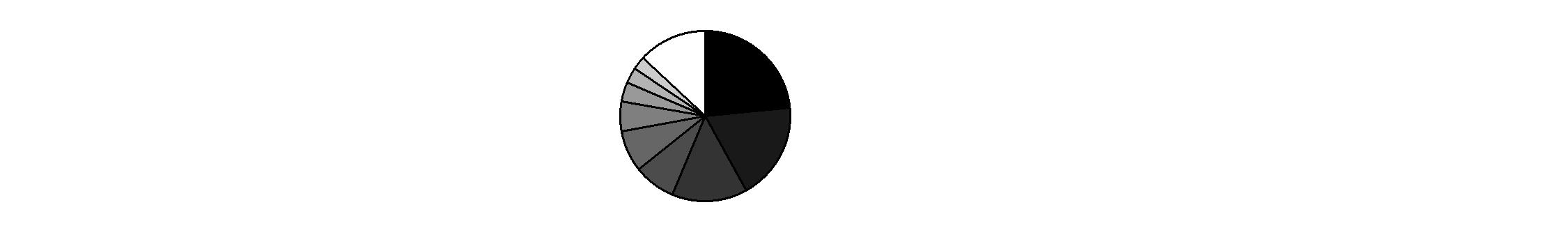

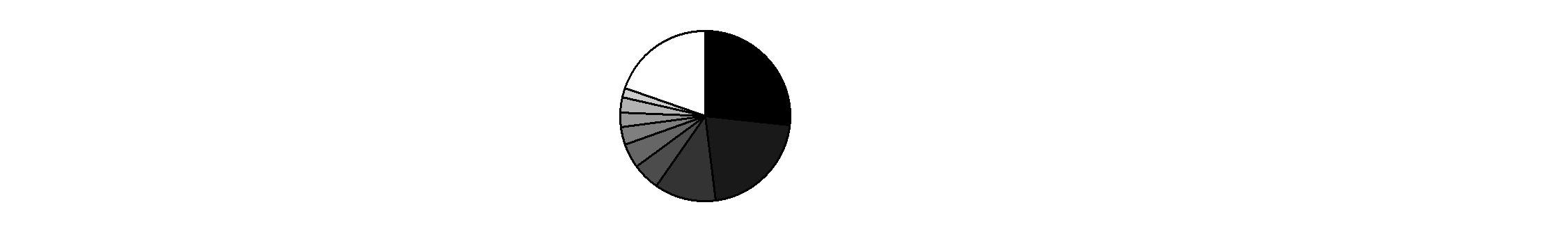

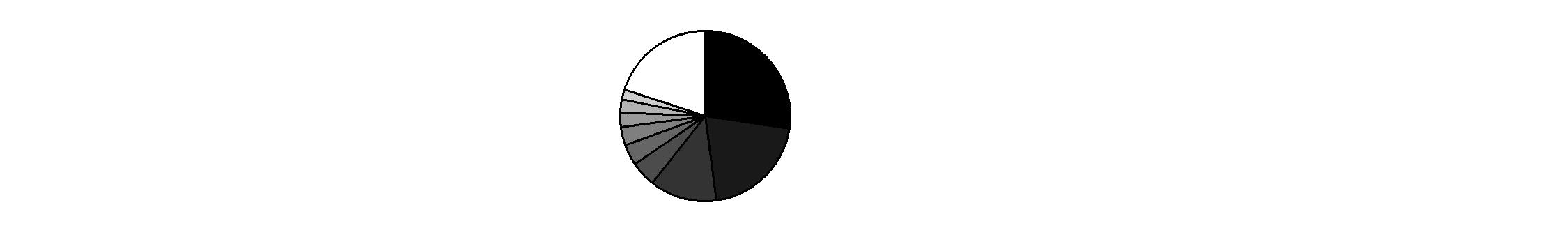

Market Sectors as of April 30, 2015 |

| % of fund's

net assets | % of fund's net assets

6 months ago |

Health Care | 17.5 | 16.1 |

Financials | 16.6 | 15.2 |

Consumer Discretionary | 15.2 | 15.5 |

Consumer Staples | 15.0 | 14.8 |

Industrials | 14.9 | 14.8 |

Information Technology | 10.5 | 9.9 |

Materials | 5.9 | 7.4 |

Energy | 1.5 | 2.2 |

Telecommunication Services | 1.0 | 0.8 |

Semiannual Report

Investments April 30, 2015 (Unaudited)

Showing Percentage of Net Assets

Common Stocks - 98.1% |

| Shares | | Value |

Australia - 3.3% |

CSL Ltd. | 358,731 | | $ 25,827,564 |

Sydney Airport unit | 1,399,868 | | 5,970,964 |

Transurban Group unit | 1,001,094 | | 7,858,780 |

TOTAL AUSTRALIA | | 39,657,308 |

Austria - 1.1% |

Andritz AG | 232,697 | | 13,623,655 |

Bailiwick of Jersey - 1.5% |

Shire PLC | 224,700 | | 18,259,935 |

Belgium - 4.6% |

Anheuser-Busch InBev SA NV | 293,391 | | 35,719,870 |

KBC Groep NV | 307,165 | | 20,209,395 |

TOTAL BELGIUM | | 55,929,265 |

Bermuda - 0.4% |

Lazard Ltd. Class A | 94,792 | | 5,026,820 |

Canada - 1.0% |

Canadian Pacific Railway Ltd. | 33,600 | | 6,406,140 |

Pason Systems, Inc. | 166,800 | | 3,002,815 |

ShawCor Ltd. Class A | 93,800 | | 3,175,906 |

TOTAL CANADA | | 12,584,861 |

Cayman Islands - 0.7% |

58.com, Inc. ADR (a) | 60,000 | | 4,576,800 |

Alibaba Group Holding Ltd. sponsored ADR | 52,500 | | 4,267,725 |

TOTAL CAYMAN ISLANDS | | 8,844,525 |

Denmark - 2.9% |

Jyske Bank A/S (Reg.) (a) | 156,300 | | 7,653,838 |

Novo Nordisk A/S Series B sponsored ADR | 487,700 | | 27,442,879 |

TOTAL DENMARK | | 35,096,717 |

Finland - 0.2% |

Tikkurila Oyj | 143,900 | | 2,963,794 |

France - 1.1% |

Safran SA | 181,900 | | 13,290,951 |

Germany - 3.8% |

Bayer AG | 169,500 | | 24,396,577 |

Linde AG | 109,177 | | 21,334,248 |

TOTAL GERMANY | | 45,730,825 |

Common Stocks - continued |

| Shares | | Value |

Hong Kong - 1.6% |

AIA Group Ltd. | 2,943,400 | | $ 19,671,910 |

India - 0.6% |

Housing Development Finance Corp. Ltd. | 382,886 | | 7,049,455 |

Ireland - 2.3% |

CRH PLC sponsored ADR | 470,766 | | 13,157,910 |

James Hardie Industries PLC: | | | |

CDI | 657,915 | | 7,606,566 |

sponsored ADR | 132,300 | | 7,640,325 |

TOTAL IRELAND | | 28,404,801 |

Israel - 0.3% |

Azrieli Group | 76,600 | | 3,304,734 |

Italy - 0.9% |

Azimut Holding SpA | 160,900 | | 4,722,852 |

Interpump Group SpA | 328,551 | | 5,525,153 |

TOTAL ITALY | | 10,248,005 |

Japan - 15.2% |

Aozora Bank Ltd. | 1,161,000 | | 4,342,651 |

Astellas Pharma, Inc. | 1,159,500 | | 18,054,226 |

Coca-Cola Central Japan Co. Ltd. | 232,500 | | 4,344,747 |

DENSO Corp. | 615,100 | | 30,537,113 |

East Japan Railway Co. | 84,200 | | 7,442,189 |

Fanuc Corp. | 57,500 | | 12,647,855 |

Fast Retailing Co. Ltd. | 33,900 | | 13,352,526 |

Hoya Corp. | 190,500 | | 7,342,041 |

Japan Tobacco, Inc. | 182,800 | | 6,383,534 |

Keyence Corp. | 47,162 | | 25,177,392 |

Mitsui Fudosan Co. Ltd. | 467,000 | | 13,843,890 |

Nintendo Co. Ltd. | 14,800 | | 2,484,921 |

OSG Corp. | 239,500 | | 4,979,655 |

Seven Bank Ltd. | 1,660,400 | | 8,946,022 |

SHO-BOND Holdings Co. Ltd. | 155,600 | | 6,859,729 |

USS Co. Ltd. | 806,200 | | 14,195,412 |

Yamato Kogyo Co. Ltd. | 122,900 | | 2,891,581 |

TOTAL JAPAN | | 183,825,484 |

Kenya - 0.5% |

Safaricom Ltd. | 31,648,900 | | 5,821,256 |

Common Stocks - continued |

| Shares | | Value |

Korea (South) - 0.9% |

BGFretail Co. Ltd. | 58,982 | | $ 6,434,241 |

NAVER Corp. | 8,111 | | 4,894,718 |

TOTAL KOREA (SOUTH) | | 11,328,959 |

Mexico - 0.4% |

Fomento Economico Mexicano S.A.B. de CV sponsored ADR (a) | 55,655 | | 5,036,221 |

Netherlands - 1.3% |

ING Groep NV (Certificaten Van Aandelen) | 1,004,264 | | 15,406,971 |

South Africa - 2.2% |

Clicks Group Ltd. | 741,557 | | 5,690,595 |

MTN Group Ltd. | 298,500 | | 5,996,974 |

Naspers Ltd. Class N | 91,200 | | 14,343,842 |

TOTAL SOUTH AFRICA | | 26,031,411 |

Spain - 2.8% |

Amadeus IT Holding SA Class A | 83,168 | | 3,790,960 |

Hispania Activos Inmobiliarios SA (a) | 152,200 | | 2,168,887 |

Inditex SA | 764,918 | | 24,545,514 |

Prosegur Compania de Seguridad SA (Reg.) | 519,249 | | 2,993,241 |

TOTAL SPAIN | | 33,498,602 |

Sweden - 5.6% |

ASSA ABLOY AB (B Shares) | 373,361 | | 21,660,096 |

Atlas Copco AB (A Shares) | 394,109 | | 12,301,320 |

Fagerhult AB | 332,053 | | 5,957,816 |

H&M Hennes & Mauritz AB (B Shares) (d) | 290,349 | | 11,543,338 |

Intrum Justitia AB | 111,300 | | 3,505,081 |

Svenska Handelsbanken AB (A Shares) | 287,940 | | 13,291,013 |

TOTAL SWEDEN | | 68,258,664 |

Switzerland - 14.2% |

Nestle SA | 562,111 | | 43,610,944 |

Novartis AG | 458,277 | | 46,777,337 |

Roche Holding AG (participation certificate) | 162,679 | | 46,551,425 |

Schindler Holding AG: | | | |

(participation certificate) | 60,338 | | 10,207,251 |

(Reg.) | 10,980 | | 1,829,115 |

UBS Group AG | 1,143,661 | | 22,953,276 |

TOTAL SWITZERLAND | | 171,929,348 |

Common Stocks - continued |

| Shares | | Value |

Taiwan - 0.7% |

Taiwan Semiconductor Manufacturing Co. Ltd. | 1,751,000 | | $ 8,429,791 |

Turkey - 0.5% |

Coca-Cola Icecek Sanayi A/S | 327,534 | | 5,557,759 |

Tupras Turkiye Petrol Rafinelleri A/S | 26,425 | | 641,691 |

TOTAL TURKEY | | 6,199,450 |

United Kingdom - 12.5% |

Associated British Foods PLC | 112,334 | | 4,904,306 |

Babcock International Group PLC | 445,884 | | 6,878,174 |

BAE Systems PLC | 1,074,300 | | 8,322,828 |

Berendsen PLC | 338,973 | | 5,388,841 |

Informa PLC | 780,736 | | 6,649,190 |

InterContinental Hotel Group PLC ADR | 520,196 | | 22,165,552 |

Johnson Matthey PLC | 223,577 | | 11,431,231 |

Lloyds Banking Group PLC | 3,231,800 | | 3,827,351 |

Prudential PLC | 929,440 | | 23,140,774 |

Reckitt Benckiser Group PLC | 299,945 | | 26,696,438 |

Rolls-Royce Group PLC | 320,137 | | 5,103,915 |

SABMiller PLC | 410,766 | | 21,743,032 |

Shaftesbury PLC | 214,233 | | 2,755,055 |

Unite Group PLC | 319,676 | | 2,924,612 |

TOTAL UNITED KINGDOM | | 151,931,299 |

United States of America - 15.0% |

Autoliv, Inc. (d) | 139,269 | | 16,534,016 |

Berkshire Hathaway, Inc. Class B (a) | 58,384 | | 8,244,405 |

BorgWarner, Inc. | 208,292 | | 12,330,886 |

Cummins, Inc. | 37,282 | | 5,154,609 |

Dril-Quip, Inc. (a) | 33,600 | | 2,678,592 |

FMC Technologies, Inc. (a) | 64,352 | | 2,837,923 |

Google, Inc. Class A (a) | 28,236 | | 15,495,070 |

Martin Marietta Materials, Inc. | 42,400 | | 6,048,360 |

MasterCard, Inc. Class A | 211,700 | | 19,097,457 |

McGraw Hill Financial, Inc. | 63,000 | | 6,570,900 |

Mead Johnson Nutrition Co. Class A | 46,144 | | 4,426,132 |

Mohawk Industries, Inc. (a) | 67,800 | | 11,763,300 |

Moody's Corp. | 50,600 | | 5,440,512 |

National Oilwell Varco, Inc. | 48,472 | | 2,637,362 |

Oceaneering International, Inc. | 76,413 | | 4,211,120 |

Philip Morris International, Inc. | 131,708 | | 10,993,667 |

PriceSmart, Inc. | 56,000 | | 4,505,760 |

ResMed, Inc. | 83,600 | | 5,345,384 |

Common Stocks - continued |

| Shares | | Value |

United States of America - continued |

Solera Holdings, Inc. | 53,689 | | $ 2,604,990 |

SS&C Technologies Holdings, Inc. | 165,100 | | 9,934,067 |

Union Pacific Corp. | 44,500 | | 4,727,235 |

Visa, Inc. Class A | 300,700 | | 19,861,235 |

TOTAL UNITED STATES OF AMERICA | | 181,442,982 |

TOTAL COMMON STOCKS (Cost $1,027,694,550) |

1,188,827,999

|

Nonconvertible Preferred Stocks - 0.0% |

| | | |

United Kingdom - 0.0% |

Rolls-Royce Group PLC

(Cost $66,024) | 43,842,117 | |

67,298

|

Money Market Funds - 5.2% |

| | | |

Fidelity Cash Central Fund, 0.15% (b) | 33,969,782 | | 33,969,782 |

Fidelity Securities Lending Cash Central Fund, 0.17% (b)(c) | 28,799,550 | | 28,799,550 |

TOTAL MONEY MARKET FUNDS (Cost $62,769,332) |

62,769,332

|

TOTAL INVESTMENT PORTFOLIO - 103.3% (Cost $1,090,529,906) | | 1,251,664,629 |

NET OTHER ASSETS (LIABILITIES) - (3.3)% | | (40,438,405) |

NET ASSETS - 100% | $ 1,211,226,224 |

Legend |

(a) Non-income producing |

(b) Affiliated fund that is generally available only to investment companies and other accounts managed by Fidelity Investments. The rate quoted is the annualized seven-day yield of the fund at period end. A complete unaudited listing of the fund's holdings as of its most recent quarter end is available upon request. In addition, each Fidelity Central Fund's financial statements are available on the SEC's website or upon request. |

(c) Investment made with cash collateral received from securities on loan. |

(d) Security or a portion of the security is on loan at period end. |

Affiliated Central Funds |

Information regarding fiscal year to date income earned by the Fund from investments in Fidelity Central Funds is as follows: |

Fund | Income earned |

Fidelity Cash Central Fund | $ 20,457 |

Fidelity Securities Lending Cash Central Fund | 88,876 |

Total | $ 109,333 |

Other Information |

Categorizations in the Schedule of Investments are based on country or territory of incorporation. |

The following is a summary of the inputs used, as of April 30, 2015, involving the Fund's assets and liabilities carried at fair value. The inputs or methodology used for valuing securities may not be an indication of the risk associated with investing in those securities. For more information on valuation inputs, and their aggregation into the levels used in the tables below, please refer to the Investment Valuation section in the accompanying Notes to Financial Statements. |

Valuation Inputs at Reporting Date: |

Description | Total | Level 1 | Level 2 | Level 3 |

Investments in Securities: | | | | |

Equities: | | | | |

Consumer Discretionary | $ 184,344,223 | $ 77,137,596 | $ 107,206,627 | $ - |

Consumer Staples | 179,663,712 | 42,644,375 | 137,019,337 | - |

Energy | 19,185,409 | 19,185,409 | - | - |

Financials | 201,495,323 | 78,262,012 | 123,233,311 | - |

Health Care | 212,655,327 | 58,615,827 | 154,039,500 | - |

Industrials | 178,701,891 | 30,185,026 | 148,516,865 | - |

Information Technology | 127,957,167 | 80,732,062 | 47,225,105 | - |

Materials | 73,074,015 | 34,453,161 | 38,620,854 | - |

Telecommunication Services | 11,818,230 | 11,818,230 | - | - |

Money Market Funds | 62,769,332 | 62,769,332 | - | - |

Total Investments in Securities: | $ 1,251,664,629 | $ 495,803,030 | $ 755,861,599 | $ - |

The following is a summary of transfers between Level 1 and Level 2 for the period ended April 30, 2015. Transfers are assumed to have occurred at the beginning of the period, and are primarily attributable to the valuation techniques used for foreign equity securities, as discussed in the accompanying Notes to Financial Statements: |

Transfers | Total |

Level 1 to Level 2 | $ 248,647,805 |

Level 2 to Level 1 | $ 41,812,143 |

See accompanying notes which are an integral part of the financial statements.

Semiannual Report

Statement of Assets and Liabilities

| April 30, 2015 (Unaudited) |

| | |

Assets | | |

Investment in securities, at value (including securities loaned of $27,233,266) - See accompanying schedule: Unaffiliated issuers (cost $1,027,760,574) | $ 1,188,895,297 | |

Fidelity Central Funds (cost $62,769,332) | 62,769,332 | |

Total Investments (cost $1,090,529,906) | | $ 1,251,664,629 |

Receivable for investments sold | | 124,239 |

Receivable for fund shares sold | | 4,293,703 |

Dividends receivable | | 4,820,951 |

Distributions receivable from Fidelity Central Funds | | 18,038 |

Prepaid expenses | | 633 |

Other receivables | | 3,224 |

Total assets | | 1,260,925,417 |

| | |

Liabilities | | |

Payable for investments purchased | $ 14,063,184 | |

Payable for fund shares redeemed | 5,660,260 | |

Accrued management fee | 691,109 | |

Distribution and service plan fees payable | 78,455 | |

Other affiliated payables | 223,662 | |

Other payables and accrued expenses | 182,973 | |

Collateral on securities loaned, at value | 28,799,550 | |

Total liabilities | | 49,699,193 |

| | |

Net Assets | | $ 1,211,226,224 |

Net Assets consist of: | | |

Paid in capital | | $ 1,063,032,291 |

Undistributed net investment income | | 5,618,110 |

Accumulated undistributed net realized gain (loss) on investments and foreign currency transactions | | (18,515,467) |

Net unrealized appreciation (depreciation) on investments and assets and liabilities in foreign currencies | | 161,091,290 |

Net Assets | | $ 1,211,226,224 |

See accompanying notes which are an integral part of the financial statements.

Semiannual Report

Financial Statements - continued

Statement of Assets and Liabilities - continued

| April 30, 2015 (Unaudited) |

| | |

Calculation of Maximum Offering Price Class A:

Net Asset Value and redemption price per share ($146,479,182 ÷ 12,542,743 shares) | | $ 11.68 |

| | |

Maximum offering price per share (100/94.25 of $11.68) | | $ 12.39 |

Class T:

Net Asset Value and redemption price per share ($24,745,240 ÷ 2,122,363 shares) | | $ 11.66 |

| | |

Maximum offering price per share (100/96.50 of $11.66) | | $ 12.08 |

Class B:

Net Asset Value and offering price per share ($930,198 ÷ 80,307 shares)A | | $ 11.58 |

| | |

Class C:

Net Asset Value and offering price per share ($42,955,244 ÷ 3,720,744 shares)A | | $ 11.54 |

| | |

International Growth:

Net Asset Value, offering price and redemption price per share ($791,049,158 ÷ 67,306,562 shares) | | $ 11.75 |

| | |

Institutional Class:

Net Asset Value, offering price and redemption price per share ($204,971,698 ÷ 17,470,190 shares) | | $ 11.73 |

| | |

Class Z:

Net Asset Value, offering price and redemption price per share ($95,504 ÷ 8,131 shares) | | $ 11.75 |

A Redemption price per share is equal to net asset value less any applicable contingent deferred sales charge.

See accompanying notes which are an integral part of the financial statements.

Semiannual Report

Statement of Operations

Six months ended April 30, 2015 (Unaudited) |

| | |

Investment Income | | |

Dividends | | $ 12,423,622 |

Income from Fidelity Central Funds | | 109,333 |

Income before foreign taxes withheld | | 12,532,955 |

Less foreign taxes withheld | | (1,163,626) |

Total income | | 11,369,329 |

| | |

Expenses | | |

Management fee

Basic fee | $ 3,561,662 | |

Performance adjustment | 160,548 | |

Transfer agent fees | 1,003,307 | |

Distribution and service plan fees | 413,862 | |

Accounting and security lending fees | 238,837 | |

Custodian fees and expenses | 58,425 | |

Independent trustees' compensation | 1,910 | |

Registration fees | 81,387 | |

Audit | 36,181 | |

Legal | 1,347 | |

Miscellaneous | 9,212 | |

Total expenses before reductions | 5,566,678 | |

Expense reductions | (5,617) | 5,561,061 |

Net investment income (loss) | | 5,808,268 |

Realized and Unrealized Gain (Loss) Net realized gain (loss) on: | | |

Investment securities: | | |

Unaffiliated issuers | (9,220,558) | |

Foreign currency transactions | (186,753) | |

Total net realized gain (loss) | | (9,407,311) |

Change in net unrealized appreciation (depreciation) on: Investment securities (net of increase in deferred foreign taxes of $107,830) | 72,214,086 | |

Assets and liabilities in foreign currencies | 142,771 | |

Total change in net unrealized appreciation (depreciation) | | 72,356,857 |

Net gain (loss) | | 62,949,546 |

Net increase (decrease) in net assets resulting from operations | | $ 68,757,814 |

See accompanying notes which are an integral part of the financial statements.

Semiannual Report

Financial Statements - continued

Statement of Changes in Net Assets

| Six months ended

April 30, 2015

(Unaudited) | Year ended

October 31,

2014 |

Increase (Decrease) in Net Assets | | |

Operations | | |

Net investment income (loss) | $ 5,808,268 | $ 8,064,649 |

Net realized gain (loss) | (9,407,311) | (8,929,624) |

Change in net unrealized appreciation (depreciation) | 72,356,857 | 17,872,842 |

Net increase (decrease) in net assets resulting

from operations | 68,757,814 | 17,007,867 |

Distributions to shareholders from net investment income | (7,019,920) | (2,592,643) |

Distributions to shareholders from net realized gain | - | (513,441) |

Total distributions | (7,019,920) | (3,106,084) |

Share transactions - net increase (decrease) | 212,672,136 | 336,569,228 |

Redemption fees | 25,087 | 42,228 |

Total increase (decrease) in net assets | 274,435,117 | 350,513,239 |

| | |

Net Assets | | |

Beginning of period | 936,791,107 | 586,277,868 |

End of period (including undistributed net investment income of $5,618,110 and undistributed net investment income of $6,829,762, respectively) | $ 1,211,226,224 | $ 936,791,107 |

See accompanying notes which are an integral part of the financial statements.

Semiannual Report

Financial Highlights - Class A

| Six months ended

April 30, 2015 | Years ended October 31, |

| (Unaudited) | 2014 | 2013 | 2012 | 2011 | 2010 |

Selected Per-Share Data | | | | | |

Net asset value, beginning of period | $ 11.01 | $ 10.78 | $ 8.91 | $ 8.09 | $ 8.38 | $ 7.01 |

Income from Investment Operations | | | | | | |

Net investment income (loss) E | .05 | .09 | .08 | .08 | .08 | .05 |

Net realized and unrealized gain (loss) | .68 | .18 | 1.88 | .81 | (.31) | 1.39 |

Total from investment operations | .73 | .27 | 1.96 | .89 | (.23) | 1.44 |

Distributions from net investment income | (.06) | (.03) | (.08) | (.06) | (.05) | (.05) |

Distributions from net realized gain | - | (.01) | (.01) | (.01) | (.01) | (.03) |

Total distributions | (.06) | (.04) | (.09) | (.07) | (.06) | (.07) J |

Redemption fees added to paid in capital E, I | - | - | - | - | - | - |

Net asset value, end of period | $ 11.68 | $ 11.01 | $ 10.78 | $ 8.91 | $ 8.09 | $ 8.38 |

Total ReturnB, C, D | 6.67% | 2.54% | 22.18% | 11.10% | (2.76)% | 20.68% |

Ratios to Average Net Assets F, H | | | | | |

Expenses before reductions | 1.28%A | 1.35% | 1.44% | 1.58% | 1.77% | 2.13% |

Expenses net of fee waivers, if any | 1.28%A | 1.35% | 1.43% | 1.45% | 1.45% | 1.50% |

Expenses net of all reductions | 1.28%A | 1.34% | 1.42% | 1.44% | 1.43% | 1.48% |

Net investment income (loss) | .95%A | .84% | .80% | .99% | .92% | .74% |

Supplemental Data | | | | | | |

Net assets, end of period (000 omitted) | $ 146,479 | $ 119,017 | $ 74,595 | $ 21,874 | $ 6,352 | $ 3,084 |

Portfolio turnover rate G | 23%A | 27% | 32% | 32% | 68% | 87% |

A Annualized

B Total returns for periods of less than one year are not annualized.

C Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

D Total returns do not include the effect of the sales charges.

E Calculated based on average shares outstanding during the period.

F Fees and expenses of any underlying Fidelity Central Funds are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of the expenses of any underlying Fidelity Central Funds.

G Amount does not include the portfolio activity of any underlying Fidelity Central Funds.

H Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from brokerage service arrangements or reductions from other expense offset arrangements and do not represent the amount paid by the class during periods when reimbursements or reductions occur. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from brokerage service arrangements or other expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the class.

I Amount represents less than $.01 per share.

J Total distributions of $.07 per share is comprised of distributions from net investment income of $.046 and distributions from net realized gain of $.025 per share.

See accompanying notes which are an integral part of the financial statements.

Semiannual Report

Financial Highlights - Class T

| Six months ended

April 30, 2015 | Years ended October 31, |

| (Unaudited) | 2014 | 2013 | 2012 | 2011 | 2010 |

Selected Per-Share Data | | | | | |

Net asset value, beginning of period | $ 10.96 | $ 10.75 | $ 8.89 | $ 8.08 | $ 8.38 | $ 7.00 |

Income from Investment Operations | | | | | | |

Net investment income (loss) E | .03 | .06 | .05 | .06 | .06 | .04 |

Net realized and unrealized gain (loss) | .68 | .18 | 1.88 | .81 | (.31) | 1.39 |

Total from investment operations | .71 | .24 | 1.93 | .87 | (.25) | 1.43 |

Distributions from net investment income | (.01) | (.02) | (.07) | (.05) | (.04) | (.02) |

Distributions from net realized gain | - | (.01) | (.01) | (.01) | (.01) | (.03) |

Total distributions | (.01) | (.03) | (.07)J | (.06) | (.05) | (.05) |

Redemption fees added to paid in capital E, I | - | - | - | - | - | - |

Net asset value, end of period | $ 11.66 | $ 10.96 | $ 10.75 | $ 8.89 | $ 8.08 | $ 8.38 |

Total ReturnB, C, D | 6.50% | 2.21% | 21.91% | 10.82% | (3.03)% | 20.47% |

Ratios to Average Net Assets F, H | | | | | |

Expenses before reductions | 1.60%A | 1.65% | 1.69% | 1.85% | 2.03% | 2.41% |

Expenses net of fee waivers, if any | 1.60%A | 1.65% | 1.69% | 1.70% | 1.70% | 1.75% |

Expenses net of all reductions | 1.60%A | 1.65% | 1.68% | 1.69% | 1.68% | 1.73% |

Net investment income (loss) | .63%A | .53% | .54% | .74% | .67% | .49% |

Supplemental Data | | | | | | |

Net assets, end of period (000 omitted) | $ 24,745 | $ 26,369 | $ 23,118 | $ 10,690 | $ 2,917 | $ 1,034 |

Portfolio turnover rate G | 23%A | 27% | 32% | 32% | 68% | 87% |

A Annualized

B Total returns for periods of less than one year are not annualized.

C Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

D Total returns do not include the effect of the sales charges.

E Calculated based on average shares outstanding during the period.

F Fees and expenses of any underlying Fidelity Central Funds are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of the expenses of any underlying Fidelity Central Funds.

G Amount does not include the portfolio activity of any underlying Fidelity Central Funds.

H Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from brokerage service arrangements or reductions from other expense offset arrangements and do not represent the amount paid by the class during periods when reimbursements or reductions occur. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from brokerage service arrangements or other expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the class.

I Amount represents less than $.01 per share.

J Total distributions of $.07 per share is comprised of distributions from net investment income of $ .069 and distributions from net realized gain of $.005 per share.

See accompanying notes which are an integral part of the financial statements.

Semiannual Report

Financial Highlights - Class B

| Six months ended

April 30, 2015 | Years ended October 31, |

| (Unaudited) | 2014 | 2013 | 2012 | 2011 | 2010 |

Selected Per-Share Data | | | | | |

Net asset value, beginning of period | $ 10.91 | $ 10.73 | $ 8.88 | $ 8.06 | $ 8.36 | $ 6.98 |

Income from Investment Operations | | | | | | |

Net investment income (loss) E | .01 | -I | -I | .02 | .01 | -I |

Net realized and unrealized gain (loss) | .66 | .19 | 1.89 | .80 | (.30) | 1.38 |

Total from investment operations | .67 | .19 | 1.89 | .82 | (.29) | 1.38 |

Distributions from net investment income | - | - | (.03) | - | (.01) | - |

Distributions from net realized gain | - | (.01) | (.01) | - | -I | - |

Total distributions | - | (.01) | (.04) | - | (.01) | - |

Redemption fees added to paid in capital E, I | - | - | - | - | - | - |

Net asset value, end of period | $ 11.58 | $ 10.91 | $ 10.73 | $ 8.88 | $ 8.06 | $ 8.36 |

Total ReturnB, C, D | 6.14% | 1.76% | 21.35% | 10.17% | (3.47)% | 19.77% |

Ratios to Average Net Assets F, H | | | | | |

Expenses before reductions | 2.06%A | 2.14% | 2.19% | 2.35% | 2.55% | 2.87% |

Expenses net of fee waivers, if any | 2.06%A | 2.14% | 2.18% | 2.20% | 2.20% | 2.25% |

Expenses net of all reductions | 2.06%A | 2.14% | 2.17% | 2.19% | 2.18% | 2.23% |

Net investment income (loss) | .16%A | .04% | .05% | .24% | .17% | (.01)% |

Supplemental Data | | | | | | |

Net assets, end of period (000 omitted) | $ 930 | $ 1,404 | $ 1,579 | $ 1,116 | $ 473 | $ 581 |

Portfolio turnover rate G | 23%A | 27% | 32% | 32% | 68% | 87% |

A Annualized

B Total returns for periods of less than one year are not annualized.

C Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

D Total returns do not include the effect of the contingent deferred sales charge.

E Calculated based on average shares outstanding during the period.

F Fees and expenses of any underlying Fidelity Central Funds are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of the expenses of any underlying Fidelity Central Funds.

G Amount does not include the portfolio activity of any underlying Fidelity Central Funds.

H Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from brokerage service arrangements or reductions from other expense offset arrangements and do not represent the amount paid by the class during periods when reimbursements or reductions occur. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from brokerage service arrangements or other expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the class.

I Amount represents less than $.01 per share.

See accompanying notes which are an integral part of the financial statements.

Semiannual Report

Financial Highlights - Class C

| Six months ended

April 30, 2015 | Years ended October 31, |

| (Unaudited) | 2014 | 2013 | 2012 | 2011 | 2010 |

Selected Per-Share Data | | | | | |

Net asset value, beginning of period | $ 10.87 | $ 10.69 | $ 8.84 | $ 8.03 | $ 8.34 | $ 6.98 |

Income from Investment Operations | | | | | | |

Net investment income (loss) E | .01 | .01 | .01 | .02 | .01 | -I |

Net realized and unrealized gain (loss) | .66 | .18 | 1.87 | .80 | (.31) | 1.38 |

Total from investment operations | .67 | .19 | 1.88 | .82 | (.30) | 1.38 |

Distributions from net investment income | - | - | (.02) | (.01) | (.01) | - |

Distributions from net realized gain | - | (.01) | (.01) | (.01) | (.01) | (.02) |

Total distributions | - | (.01) | (.03) | (.01)K | (.01)J | (.02) |

Redemption fees added to paid in capital E, I | - | - | - | - | - | - |

Net asset value, end of period | $ 11.54 | $ 10.87 | $ 10.69 | $ 8.84 | $ 8.03 | $ 8.34 |

Total ReturnB, C, D | 6.16% | 1.77% | 21.29% | 10.27% | (3.57)% | 19.82% |

Ratios to Average Net Assets F, H | | | | | |

Expenses before reductions | 2.09%A | 2.12% | 2.19% | 2.33% | 2.52% | 2.89% |

Expenses net of fee waivers, if any | 2.09%A | 2.12% | 2.18% | 2.20% | 2.20% | 2.25% |

Expenses net of all reductions | 2.08%A | 2.12% | 2.17% | 2.19% | 2.18% | 2.24% |

Net investment income (loss) | .14%A | .06% | .05% | .24% | .17% | (.01)% |

Supplemental Data | | | | | | |

Net assets, end of period (000 omitted) | $ 42,955 | $ 32,737 | $ 17,196 | $ 5,648 | $ 2,767 | $ 1,261 |

Portfolio turnover rate G | 23%A | 27% | 32% | 32% | 68% | 87% |

A Annualized

B Total returns for periods of less than one year are not annualized.

C Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

D Total returns do not include the effect of the contingent deferred sales charge.

E Calculated based on average shares outstanding during the period.

F Fees and expenses of any underlying Fidelity Central Funds are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of the expenses of any underlying Fidelity Central Funds.

G Amount does not include the portfolio activity of any underlying Fidelity Central Funds.

H Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from brokerage service arrangements or reductions from other expense offset arrangements and do not represent the amount paid by the class during periods when reimbursements or reductions occur. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from brokerage service arrangements or other expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the class.

I Amount represents less than $.01 per share.

J Total distributions of $.01 per share is comprised of distributions from net investment income of $.008 and distributions from net realized gain of

$.005 per share.

K Total distributions of $.01 per share is comprised of distributions from net investment income of $.007 and distributions from net realized gain of $.006 per share.

See accompanying notes which are an integral part of the financial statements.

Semiannual Report

Financial Highlights - International Growth

| Six months ended

April 30, 2015 | Years ended October 31, |

| (Unaudited) | 2014 | 2013 | 2012 | 2011 | 2010 |

Selected Per-Share Data | | | | | |

Net asset value, beginning of period | $ 11.10 | $ 10.84 | $ 8.95 | $ 8.12 | $ 8.40 | $ 7.02 |

Income from Investment Operations | | | | | | |

Net investment income (loss) D | .07 | .13 | .11 | .11 | .10 | .07 |

Net realized and unrealized gain (loss) | .67 | .19 | 1.88 | .81 | (.30) | 1.39 |

Total from investment operations | .74 | .32 | 1.99 | .92 | (.20) | 1.46 |

Distributions from net investment income | (.09) | (.05) | (.10) | (.08) | (.07) | (.06) |

Distributions from net realized gain | - | (.01) | (.01) | (.01) | (.01) | (.03) |

Total distributions | (.09) | (.06) | (.10)J | (.09) | (.08) | (.08)I |

Redemption fees added to paid in capital D, H | - | - | - | - | - | - |

Net asset value, end of period | $ 11.75 | $ 11.10 | $ 10.84 | $ 8.95 | $ 8.12 | $ 8.40 |

Total ReturnB, C | 6.72% | 2.96% | 22.48% | 11.41% | (2.47)% | 20.97% |

Ratios to Average Net Assets E, G | | | | | |

Expenses before reductions | 1.00%A | 1.04% | 1.13% | 1.28% | 1.52% | 1.89% |

Expenses net of fee waivers, if any | 1.00%A | 1.04% | 1.13% | 1.20% | 1.20% | 1.25% |

Expenses net of all reductions | 1.00%A | 1.04% | 1.11% | 1.19% | 1.18% | 1.23% |

Net investment income (loss) | 1.23%A | 1.14% | 1.11% | 1.24% | 1.17% | .99% |

Supplemental Data | | | | | | |

Net assets, end of period (000 omitted) | $ 791,049 | $ 635,607 | $ 430,914 | $ 149,526 | $ 53,437 | $ 28,454 |

Portfolio turnover rateF | 23%A | 27% | 32% | 32% | 68% | 87% |

A Annualized

B Total returns for periods of less than one year are not annualized.

C Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

D Calculated based on average shares outstanding during the period.

E Fees and expenses of any underlying Fidelity Central Funds are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of the expenses of any underlying Fidelity Central Funds.

F Amount does not include the portfolio activity of any underlying Fidelity Central Funds.

G Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from brokerage service arrangements or reductions from other expense offset arrangements and do not represent the amount paid by the class during periods when reimbursements or reductions occur. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from brokerage service arrangements or other expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the class.

H Amount represents less than $.01 per share.

I Total distributions of $.08 per share is comprised of distributions from net investment income of $.057 and distributions from net realized gain of $.025 per share.

J Total distributions of $.10 per share is comprised of distributions from net investment income of $.097 and distributions from net realized gain of $.005 per share.

See accompanying notes which are an integral part of the financial statements.

Semiannual Report

Financial Highlights - Institutional Class

| Six months ended

April 30, 2015 | Years ended October 31, |

| (Unaudited) | 2014 | 2013 | 2012 | 2011 | 2010 |

Selected Per-Share Data | | | | | |

Net asset value, beginning of period | $ 11.08 | $ 10.84 | $ 8.94 | $ 8.12 | $ 8.40 | $ 7.02 |

Income from Investment Operations | | | | | | |

Net investment income (loss) D | .07 | .13 | .11 | .10 | .10 | .07 |

Net realized and unrealized gain (loss) | .68 | .18 | 1.90 | .81 | (.30) | 1.39 |

Total from investment operations | .75 | .31 | 2.01 | .91 | (.20) | 1.46 |

Distributions from net investment income | (.10) | (.06) | (.10) | (.08) | (.07) | (.06) |

Distributions from net realized gain | - | (.01) | (.01) | (.01) | (.01) | (.03) |

Total distributions | (.10) | (.07) | (.11) | (.09) | (.08) | (.08)I |

Redemption fees added to paid in capital D, H | - | - | - | - | - | - |

Net asset value, end of period | $ 11.73 | $ 11.08 | $ 10.84 | $ 8.94 | $ 8.12 | $ 8.40 |

Total ReturnB, C | 6.78% | 2.84% | 22.66% | 11.28% | (2.47)% | 20.97% |

Ratios to Average Net Assets E, G | | | | | |

Expenses before reductions | 1.00%A | 1.04% | 1.11% | 1.27% | 1.50% | 1.92% |

Expenses net of fee waivers, if any | 1.00%A | 1.04% | 1.11% | 1.20% | 1.20% | 1.25% |

Expenses net of all reductions | 1.00%A | 1.04% | 1.09% | 1.19% | 1.18% | 1.23% |

Net investment income (loss) | 1.23%A | 1.14% | 1.13% | 1.24% | 1.17% | .99% |

Supplemental Data | | | | | | |

Net assets, end of period (000 omitted) | $ 204,972 | $ 121,554 | $ 38,771 | $ 3,992 | $ 493 | $ 113 |

Portfolio turnover rate F | 23%A | 27% | 32% | 32% | 68% | 87% |

A Annualized

B Total returns for periods of less than one year are not annualized.

C Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

D Calculated based on average shares outstanding during the period.

E Fees and expenses of any underlying Fidelity Central Funds are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of the expenses of any underlying Fidelity Central Funds.

F Amount does not include the portfolio activity of any underlying Fidelity Central Funds.

G Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from brokerage service arrangements or reductions from other expense offset arrangements and do not represent the amount paid by the class during periods when reimbursements or reductions occur. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from brokerage service arrangements or other expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the class.

H Amount represents less than $.01 per share.

I Total distributions of $.08 per share is comprised of distributions from net investment income of $.057 and distributions from net realized gain of $.025 per share.

See accompanying notes which are an integral part of the financial statements.

Semiannual Report

Financial Highlights - Class Z

| Six months ended

April 30, 2015 | Years ended

October 31, |

| (Unaudited) | 2014 | 2013 G |

Selected Per-Share Data | | | |

Net asset value, beginning of period | $ 11.10 | $ 10.84 | $ 10.26 |

Income from Investment Operations | | | |

Net investment income (loss) D | .08 | .14 | .02 |

Net realized and unrealized gain (loss) | .68 | .19 | .56 |

Total from investment operations | .76 | .33 | .58 |

Distributions from net investment income | (.11) | (.06) | - |

Distributions from net realized gain | - | (.01) | - |

Total distributions | (.11) | (.07) | - |

Redemption fees added to paid in capital D, I | - | - | - |

Net asset value, end of period | $ 11.75 | $ 11.10 | $ 10.84 |

Total ReturnB, C | 6.89% | 3.07% | 5.65% |

Ratios to Average Net Assets E, H | | | |

Expenses before reductions | .87%A | .88% | .94%A |

Expenses net of fee waivers, if any | .87%A | .88% | .94%A |

Expenses net of all reductions | .87%A | .88% | .93%A |

Net investment income (loss) | 1.36%A | 1.30% | .65%A |

Supplemental Data | | | |

Net assets, end of period (000 omitted) | $ 96 | $ 104 | $ 106 |

Portfolio turnover rateF | 23%A | 27% | 32% |

A Annualized

B Total returns for periods of less than one year are not annualized.

C Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

D Calculated based on average shares outstanding during the period.

E Fees and expenses of any underlying Fidelity Central Funds are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of the expenses of any underlying Fidelity Central Funds.

F Amount does not include the portfolio activity of any underlying Fidelity Central Funds.

G For the period August 13, 2013 (commencement of sale of shares) to October 31, 2013.

H Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from brokerage service arrangements or reductions from other expense offset arrangements and do not represent the amount paid by the class during periods when reimbursements or reductions occur. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from brokerage service arrangements or other expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the class.

I Amount represents less than $.01 per share.

See accompanying notes which are an integral part of the financial statements.

Semiannual Report

For the period ended April 30, 2015 (Unaudited)

1. Organization.

Fidelity® International Growth Fund (the Fund) is a fund of Fidelity Investment Trust (the Trust) and is authorized to issue an unlimited number of shares. The Trust is registered under the Investment Company Act of 1940, as amended (the 1940 Act), as an open-end management investment company organized as a Massachusetts business trust. The Fund offers Class A, Class T, Class C, International Growth, Institutional Class and Class Z shares, each of which, along with Class B shares, has equal rights as to assets and voting privileges. Class B shares are closed to new accounts and additional purchases, except for exchanges and reinvestments. Each class has exclusive voting rights with respect to matters that affect that class. Class B shares will automatically convert to Class A shares after a holding period of seven years from the initial date of purchase.

2. Investments in Fidelity Central Funds.

The Fund invests in Fidelity Central Funds, which are open-end investment companies generally available only to other investment companies and accounts managed by the investment adviser and its affiliates. The Fund's Schedule of Investments lists each of the Fidelity Central Funds held as of period end, if any, as an investment of the Fund, but does not include the underlying holdings of each Fidelity Central Fund. As an Investing Fund, the Fund indirectly bears its proportionate share of the expenses of the underlying Fidelity Central Funds.

The Money Market Central Funds seek preservation of capital and current income and are managed by Fidelity Investments Money Management, Inc. (FIMM), an affiliate of the investment adviser. Annualized expenses of the Money Market Central Funds as of their most recent shareholder report date are less than .01%.

A complete unaudited list of holdings for each Fidelity Central Fund is available upon request or at the Securities and Exchange Commission (the SEC) website at www.sec.gov. In addition, the financial statements of the Fidelity Central Funds are available on the SEC website or upon request.

3. Significant Accounting Policies.

The financial statements have been prepared in conformity with accounting principles generally accepted in the United States of America (GAAP), which require management to make certain estimates and assumptions at the date of the financial statements. Actual results could differ from those estimates. Subsequent events, if any, through the date that the financial statements were issued have been evaluated in the preparation of

Semiannual Report

3. Significant Accounting Policies - continued

the financial statements. The following summarizes the significant accounting policies of the Fund:

Investment Valuation. Investments are valued as of 4:00 p.m. Eastern time on the last calendar day of the period. The Board of Trustees (the Board) has delegated the day to day responsibility for the valuation of the Fund's investments to the Fidelity Management & Research Company (FMR) Fair Value Committee (the Committee). In accordance with valuation policies and procedures approved by the Board, the Fund attempts to obtain prices from one or more third party pricing vendors or brokers to value its investments. When current market prices, quotations or currency exchange rates are not readily available or reliable, investments will be fair valued in good faith by the Committee, in accordance with procedures adopted by the Board. Factors used in determining fair value vary by investment type and may include market or investment specific events. The frequency with which these procedures are used cannot be predicted and they may be utilized to a significant extent. The Committee oversees the Fund's valuation policies and procedures and reports to the Board on the Committee's activities and fair value determinations. The Board monitors the appropriateness of the procedures used in valuing the Fund's investments and ratifies the fair value determinations of the Committee.

The Fund categorizes the inputs to valuation techniques used to value its investments into a disclosure hierarchy consisting of three levels as shown below:

Level 1 - quoted prices in active markets for identical investments

Level 2 - other significant observable inputs (including quoted prices for similar investments, interest rates, prepayment speeds, etc.)

Level 3 - unobservable inputs (including the Fund's own assumptions based on the best information available)

Valuation techniques used to value the Fund's investments by major category are as follows:

Equity securities, including restricted securities, for which market quotations are readily available, are valued at the last reported sale price or official closing price as reported by a third party pricing vendor on the primary market or exchange on which they are traded and are categorized as Level 1 in the hierarchy. In the event there were no sales during the day or closing prices are not available, securities are valued at the last quoted bid price or may be valued using the last available price and are generally categorized as Level 2 in the hierarchy. For foreign equity securities, when market or security specific events arise, comparisons to the valuation of American Depositary Receipts (ADRs),

Semiannual Report

Notes to Financial Statements (Unaudited) - continued

3. Significant Accounting Policies - continued

Investment Valuation - continued

futures contracts, Exchange-Traded Funds (ETFs) and certain indexes as well as quoted prices for similar securities may be used and would be categorized as Level 2 in the hierarchy. Utilizing these techniques may result in transfers between Level 1 and Level 2. For equity securities, including restricted securities, where observable inputs are limited, assumptions about market activity and risk are used and these securities may be categorized as Level 3 in the hierarchy.

Investments in open-end mutual funds ,including the Fidelity Central Funds, are valued at their closing net asset value (NAV) each business day and are categorized as Level 1 in the hierarchy.

Changes in valuation techniques may result in transfers in or out of an assigned level within the disclosure hierarchy. The aggregate value of investments by input level, as of April 30, 2015, including information on transfers between Levels 1 and 2, is included at the end of the Fund's Schedule of Investments.

Foreign Currency. The Fund may use foreign currency contracts to facilitate transactions in foreign-denominated securities. Gains and losses from these transactions may arise from changes in the value of the foreign currency or if the counterparties do not perform under the contracts' terms.

Foreign-denominated assets, including investment securities, and liabilities are translated into U.S. dollars at the exchange rates at period end. Purchases and sales of investment securities, income and dividends received and expenses denominated in foreign currencies are translated into U.S. dollars at the exchange rate in effect on the transaction date.

The effects of exchange rate fluctuations on investments are included with the net realized and unrealized gain (loss) on investment securities. Other foreign currency transactions resulting in realized and unrealized gain (loss) are disclosed separately.

Investment Transactions and Income. For financial reporting purposes, the Fund's investment holdings and NAV include trades executed through the end of the last business day of the period. The NAV per share for processing shareholder transactions is calculated as of the close of business of the New York Stock Exchange (NYSE), normally 4:00 p.m. Eastern time and includes trades executed through the end of the prior business day. Gains and losses on securities sold are determined on the basis of identified cost and may include proceeds received from litigation. Dividend income is recorded on the ex-dividend date, except for certain dividends from foreign securities where the ex-dividend date may have passed, which are recorded as soon as the Fund is informed of the ex-dividend date. Non-cash dividends included in dividend income, if any, are

Semiannual Report

3. Significant Accounting Policies - continued

Investment Transactions and Income - continued

recorded at the fair market value of the securities received. Income and capital gain distributions from Fidelity Central Funds, if any, are recorded on the ex-dividend date. Investment income is recorded net of foreign taxes withheld where recovery of such taxes is uncertain.

Class Allocations and Expenses. Investment income, realized and unrealized capital gains and losses, common expenses of the Fund, and certain fund-level expense reductions, if any, are allocated daily on a pro-rata basis to each class based on the relative net assets of each class to the total net assets of the Fund. Each class differs with respect to transfer agent and distribution and service plan fees incurred. Certain expense reductions may also differ by class. For the reporting period, the allocated portion of income and expenses to each class as a percent of its average net assets may vary due to the timing of recording these transactions in relation to fluctuating net assets of the classes. Expenses directly attributable to a fund are charged to that fund. Expenses attributable to more than one fund are allocated among the respective funds on the basis of relative net assets or other appropriate methods. Expense estimates are accrued in the period to which they relate and adjustments are made when actual amounts are known.

Income Tax Information and Distributions to Shareholders. Each year, the Fund intends to qualify as a regulated investment company under Subchapter M of the Internal Revenue Code, including distributing substantially all of its taxable income and realized gains. As a result, no provision for U.S. Federal income taxes is required. The Fund files a U.S. federal tax return, in addition to state and local tax returns as required. The Fund's federal income tax returns are subject to examination by the Internal Revenue Service (IRS) for a period of three fiscal years after they are filed. State and local tax returns may be subject to examination for an additional fiscal year depending on the jurisdiction. Foreign taxes are provided for based on the Fund's understanding of the tax rules and rates that exist in the foreign markets in which it invests. The Fund is subject to a tax imposed on capital gains by certain countries in which it invests. An estimated deferred tax liability for net unrealized appreciation on the applicable securities is included in Other payables and accrued expenses on the Statement of Assets & Liabilities.

Distributions are declared and recorded on the ex-dividend date. Income dividends and capital gain distributions are declared separately for each class. Income and capital gain distributions are determined in accordance with income tax regulations, which may differ from GAAP.

Capital accounts within the financial statements are adjusted for permanent book-tax differences. These adjustments have no impact on net assets or the results of operations.

Semiannual Report

Notes to Financial Statements (Unaudited) - continued

3. Significant Accounting Policies - continued

Income Tax Information and Distributions to Shareholders - continued

Capital accounts are not adjusted for temporary book-tax differences which will reverse in a subsequent period.

Book-tax differences are primarily due to foreign currency transactions, passive foreign investment companies (PFIC), partnerships, capital loss carryforwards and losses deferred due to wash sales.

The federal tax cost of investment securities and unrealized appreciation (depreciation) as of period end were as follows:

Gross unrealized appreciation | $ 176,980,396 |

Gross unrealized depreciation | (17,086,885) |

Net unrealized appreciation (depreciation) on securities | $ 159,893,511 |

| |

Tax cost | $ 1,091,771,118 |

Capital loss carryforwards are only available to offset future capital gains of the Fund to the extent provided by regulations and may be limited. Under the Regulated Investment Company Modernization Act of 2010 (the Act), the Fund is permitted to carry forward capital losses incurred in taxable years beginning after December 22, 2010 for an unlimited period and such capital losses are required to be used prior to any losses that expire. The capital loss carryforward information presented below, including any applicable limitation, is estimated as of prior fiscal period end and is subject to adjustment.

No expiration | |

Short-term | (7,236,154) |

Long-term | (1,281,020) |

Total no expiration | (8,517,174) |

Short-Term Trading (Redemption) Fees. Shares held by investors in the Fund less than 30 days may have been subject to a redemption fee equal to 1.00% of the NAV of shares redeemed. All redemption fees, which reduce the proceeds of the shareholder redemption, are retained by the Fund and accounted for as an addition to paid in capital.

New Accounting Pronouncement. In June 2014, the Financial Accounting Standards Board issued Accounting Standard Update No. 2014-11, Repurchase-to-Maturity Transactions, Repurchase Financings, and Disclosures (the Update). The Update amends the accounting for certain repurchase agreements and expands disclosure requirements for reverse repurchase agreements, securities lending and other similar transactions. The disclosure requirements are effective for annual and interim reporting periods beginning after December 15, 2014. Management is currently evaluating the impact of the Update on the Fund's financial statements and related disclosures.

Semiannual Report

4. Purchases and Sales of Investments.

Purchases and sales of securities, other than short-term securities, aggregated $333,149,467 and $113,267,857, respectively.

5. Fees and Other Transactions with Affiliates.

Management Fee. FMR (the investment adviser) and its affiliates provide the Fund with investment management related services for which the Fund pays a monthly management fee. The management fee is the sum of an individual fund fee rate that is based on an annual rate of .45% of the Fund's average net assets and an annualized group fee rate that averaged .25% during the period. The group fee rate is based upon the average net assets of all the mutual funds advised by the investment adviser, including any mutual funds previously advised by the investment adviser that are currently advised by Fidelity SelectCo, LLC, an affiliate of the investment adviser. The group fee rate decreases as assets under management increase and increases as assets under management decrease. In addition, the management fee is subject to a performance adjustment (up to a maximum of ± .xx% of the Fund's average net assets over a 36 month performance period). The upward or downward adjustment to the management fee is based on the relative investment performance of International Growth as compared to its benchmark index, the MSCI EAFE Growth Index, over the same 36 month performance period. For the reporting period, the total annualized management fee rate, including the performance adjustment, was .73% of the Fund's average net assets. The performance adjustment included in the management fee rate may be higher or lower than the maximum performance adjustment rate due to the difference between the average net assets for the reporting and performance periods.

Distribution and Service Plan Fees. In accordance with Rule 12b-1 of the 1940 Act, the Fund has adopted separate Distribution and Service Plans for each class of shares. Certain classes pay Fidelity Distributors Corporation (FDC), an affiliate of the investment adviser, separate Distribution and Service Fees, each of which is based on an annual percentage of each class' average net assets. In addition, FDC may pay financial intermediaries for selling shares of the Fund and providing shareholder support services. For the period, the Distribution and Service Fee rates, total fees and amounts retained by FDC were as follows:

| Distribution

Fee | Service

Fee | Total Fees | Retained

by FDC |

Class A | -% | .25% | $ 164,169 | $ 6,099 |

Class T | .25% | .25% | 68,217 | 1,156 |

Class B | .75% | .25% | 6,444 | 4,861 |

Class C | .75% | .25% | 175,032 | 57,103 |

| | | $ 413,862 | $ 69,219 |

Semiannual Report

Notes to Financial Statements (Unaudited) - continued

5. Fees and Other Transactions with Affiliates - continued

Sales Load. FDC may receive a front-end sales charge of up to 5.75% for selling Class A shares and 3.50% for selling Class T shares, some of which is paid to financial intermediaries for selling shares of the Fund. Depending on the holding period, FDC may receive contingent deferred sales charges levied on Class A, Class T, Class B, and Class C redemptions. The deferred sales charges range from 5.00% to 1.00% for Class B shares, 1.00% for Class C shares, 1.00% for certain purchases of Class A shares and .25% for certain purchases of Class T shares.

For the period, sales charge amounts retained by FDC were as follows:

| Retained

by FDC |

Class A | $ 47,114 |

Class T | 7,615 |

Class B* | 218 |

Class C* | 2,684 |

| $ 57,631 |

* When Class B and Class C shares are initially sold, FDC pays commissions from its own resources to financial intermediaries through which the sales are made.

Transfer Agent Fees. Fidelity Investments Institutional Operations Company, Inc., (FIIOC), an affiliate of the investment adviser, is the transfer, dividend disbursing and shareholder servicing agent for each class of the Fund. FIIOC receives account fees and asset-based fees that vary according to the account size and type of account of the shareholders of the respective classes of the Fund, except for Class Z. FIIOC receives an asset-based fee of Class Z's average net assets. FIIOC pays for typesetting, printing and mailing of shareholder reports, except proxy statements.

For the period, transfer agent fees for each class were as follows:

| Amount | % of

Class-Level Average

Net Assets* |

Class A | $ 142,394 | .22 |

Class T | 39,333 | .29 |

Class B | 1,596 | .25 |

Class C | 48,190 | .27 |

International Growth | 633,070 | .19 |

Institutional Class | 138,698 | .19 |

Class Z | 26 | .05 |

| $ 1,003,307 | |

* Annualized

Semiannual Report

5. Fees and Other Transactions with Affiliates - continued

Accounting and Security Lending Fees. Fidelity Service Company, Inc. (FSC), an affiliate of the investment adviser, maintains the Fund's accounting records. The accounting fee is based on the level of average net assets for each month. Under a separate contract, FSC administers the security lending program. The security lending fee is based on the number and duration of lending transactions.

Brokerage Commissions. The Fund placed a portion of its portfolio transactions with brokerage firms which are affiliates of the investment adviser. Brokerage commissions are included in net realized gain (loss) and change in net unrealized appreciation (depreciation) in the Statement of Operations. The commissions paid to these affiliated firms were $525 for the period.

6. Committed Line of Credit.

The Fund participates with other funds managed by the investment adviser or an affiliate in a $4.25 billion credit facility (the "line of credit") to be utilized for temporary or emergency purposes to fund shareholder redemptions or for other short-term liquidity purposes. The Fund has agreed to pay commitment fees on its pro-rata portion of the line of credit, which amounted to $764 and is reflected in Miscellaneous expenses on the Statement of Operations. During the period, the Fund did not borrow on this line of credit.

7. Security Lending.

The Fund lends portfolio securities through a lending agent from time to time in order to earn additional income. For equity securities, a lending agent is used and may loan securities to certain qualified borrowers, including Fidelity Capital Markets (FCM), a broker-dealer affiliated with the Fund. On the settlement date of the loan, the Fund receives collateral (in the form of U.S. Treasury obligations, letters of credit and/or cash) against the loaned securities and maintains collateral in an amount not less than 100% of the market value of the loaned securities during the period of the loan. The market value of the loaned securities is determined at the close of business of the Fund and any additional required collateral is delivered to the Fund on the next business day. If the borrower defaults on its obligation to return the securities loaned because of insolvency or other reasons, the Fund may apply collateral received from the borrower against the obligation. The Fund may experience delays and costs in recovering the securities loaned. Any cash collateral received is invested in the Fidelity Securities Lending Cash Central Fund. The value of loaned securities and cash collateral at period end are disclosed on the Fund's Statement of Assets and Liabilities. Security lending income represents the income earned on investing cash collateral, less rebates paid to borrowers

Semiannual Report

Notes to Financial Statements (Unaudited) - continued

7. Security Lending - continued

and any lending agent fees associated with the loan, plus any premium payments received for lending certain types of securities. Security lending income is presented in the Statement of Operations as a component of income from Fidelity Central Funds. Total security lending income during the period amounted to $88,876, including $2,973 from securities loaned to FCM.

8. Expense Reductions.

Commissions paid to certain brokers with whom the investment adviser, or its affiliates, places trades on behalf of the Fund include an amount in addition to trade execution, which may be rebated back to the Fund to offset certain expenses. This amount totaled $5,164 for the period. In addition, through arrangements with the Fund's custodian, credits realized as a result of uninvested cash balances were used to reduce the Fund's expenses. During the period, these credits reduced the Fund's custody expenses by $4.

In addition, the investment adviser reimbursed a portion of the Fund's operating expenses, including certain International Growth expenses during the period in the amount of $449.

9. Distributions to Shareholders.

Distributions to shareholders of each class were as follows:

| Six months ended

April 30,

2015 | Year ended

October 31,

2014 |

From net investment income | | |

Class A | $ 684,921 | $ 253,092 |

Class T | 29,128 | 40,595 |

International Growth | 5,239,951 | 2,051,403 |

Institutional Class | 1,064,912 | 246,949 |

Class Z | 1,008 | 604 |

Total | $ 7,019,920 | $ 2,592,643 |

From net realized gain | | |

Class A | $ - | $ 66,995 |

Class T | - | 20,298 |

Class B | - | 1,337 |

Class C | - | 16,479 |

International Growth | - | 369,252 |

Institutional Class | - | 38,992 |

Class Z | - | 88 |

Total | $ - | $ 513,441 |

Semiannual Report

10. Share Transactions.