0000744822fmr:C000053902_NoLoadClassMember_5YRMember2019-10-312024-10-310000744822fmr:C000105581Memberfmr:TH2Member2024-10-310000744822fmr:C000225964Memberfmr:TH4Member2024-10-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-04008

Fidelity Investment Trust

(Exact name of registrant as specified in charter)

245 Summer St., Boston, Massachusetts 02210

(Address of principal executive offices) (Zip code)

Nicole Macarchuk, Secretary

245 Summer St.

Boston, Massachusetts 02210

(Name and address of agent for service)

Registrant's telephone number, including area code:

617-563-7000

| |

Date of fiscal year end: | October 31 |

|

|

Date of reporting period: | October 31, 2024 |

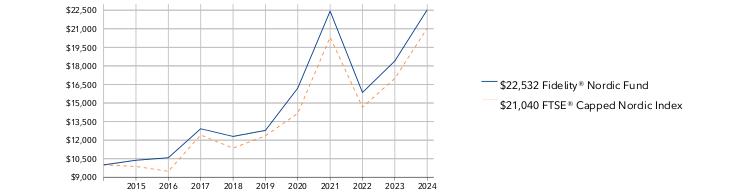

This report on Form N-CSR relates solely to the Registrant’s Fidelity Canada Fund, Fidelity China Region Fund, Fidelity Diversified International Fund, Fidelity Diversified International K6 Fund, Fidelity Emerging Asia Fund, Fidelity Emerging Markets Discovery Fund, Fidelity Emerging Markets Fund, Fidelity Europe Fund, Fidelity Global Equity Income Fund, Fidelity International Capital Appreciation Fund, Fidelity International Capital Appreciation K6 Fund, Fidelity International Discovery Fund, Fidelity International Discovery K6 Fund, Fidelity International Growth Fund, Fidelity International Small Cap Fund, Fidelity International Small Cap Opportunities Fund, Fidelity International Value Fund, Fidelity Japan Fund, Fidelity Japan Smaller Companies Fund, Fidelity Nordic Fund, Fidelity Overseas Fund, Fidelity Pacific Basin Fund, Fidelity Total International Equity Fund, and Fidelity Worldwide Fund (the “Funds”).

Item 1.

Reports to Stockholders

| |

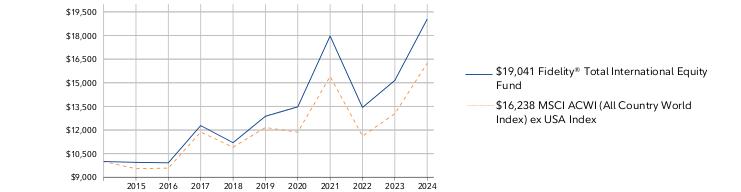

| | ANNUAL SHAREHOLDER REPORT | AS OF OCTOBER 31, 2024 | This report describes changes to the Fund that occurred during the reporting period. |

| | Fidelity® Total International Equity Fund Fidelity Advisor® Total International Equity Fund Class I : FTEIX |

| | | |

This annual shareholder report contains information about Fidelity® Total International Equity Fund for the period November 1, 2023 to October 31, 2024. You can find additional information about the Fund at fundresearch.fidelity.com/prospectus/sec. You can also request this information by contacting us at 1-877-208-0098 or by sending an e-mail to fidfunddocuments@fidelity.com.

What were your Fund costs for the last year?(based on hypothetical $10,000 investment)

FUND COST (PREVIOUS YEAR)

| | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | |

| Class I | $ 109 | 0.97% | |

What affected the Fund's performance this period?

•International stocks achieved a strong gain for the 12 months ending October 31, 2024. Resilient global economic growth and a slowing in the pace of inflation in certain regions, as well as a shift to global monetary easing, contributed to a favorable backdrop, despite persistent geopolitical risk.

•Against this backdrop, an overweight in the United States and stock picks in Japan contributed to the fund's performance versus the MSCI All Country World ex US Index (Net MA) for the fiscal year.

•By sector, the biggest contributor to performance versus the benchmark was stock selection in materials. An underweight in consumer staples also boosted relative performance. Also bolstering our relative result were picks and an overweight in industrials, primarily within the capital goods industry.

•The top individual relative contributor was an overweight in Taiwan Semiconductor (+100%). The company was the fund's largest holding. The second-largest relative contributor was an overweight in CRH (+83%). The stock was among our largest holdings. An overweight in China Life Insurance (+65%) also contributed.

•In contrast, from a regional standpoint, stock picks in Canada and the United States detracted from the fund's relative result.

•By sector, the biggest detractor from performance versus the benchmark was stock selection in financials. Also hurting our result was security selection in information technology, primarily within the technology hardware & equipment industry, and consumer staples, primarily within the consumer staples distribution & retail industry. Lastly, the fund's position in cash detracted.

•The largest individual relative detractor was an overweight in Samsung Electronics (-13%). The stock was among our biggest holdings. The second-largest relative detractor was an overweight in Wal Mart De Mexico (-21%). This period we increased our stake in Wal Mart De Mexico. An overweight in Edenred (-38%) also detracted.

•Notable changes in positioning include higher allocations to Germany and the United Kingdom. By sector, meaningful changes in positioning include decreased exposure to consumer discretionary and energy.

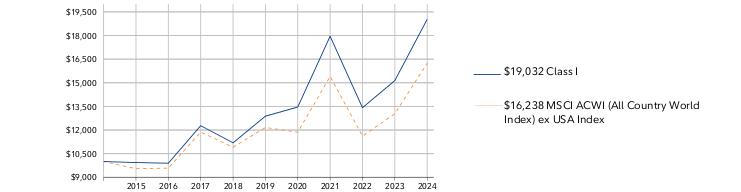

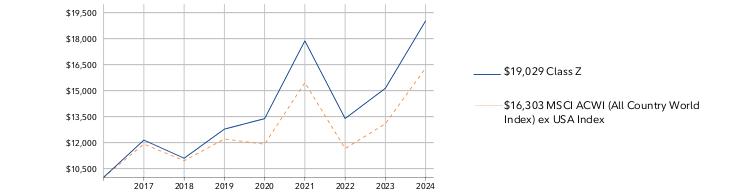

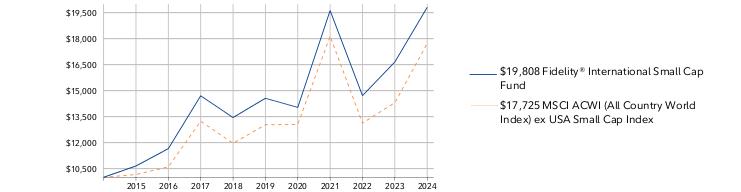

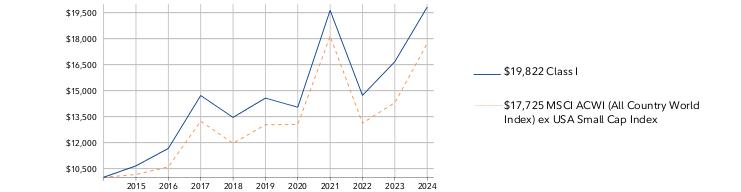

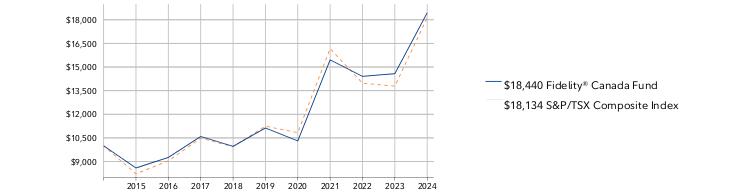

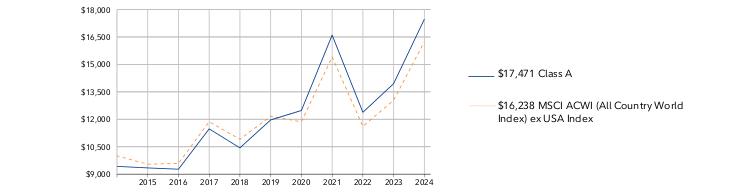

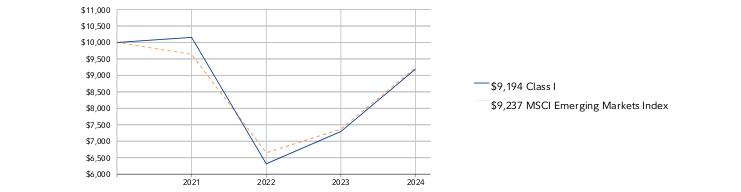

How did the Fund perform over the past 10 years?

CUMULATIVE PERFORMANCE

October 31, 2014 through October 31, 2024.

Initial investment of $10,000.

Class I | $10,000 | $9,936 | $9,894 | $12,276 | $11,189 | $12,880 | $13,460 | $17,956 | $13,416 | $15,142 | $19,032 |

MSCI ACWI (All Country World Index) ex USA Index | $10,000 | $9,545 | $9,583 | $11,868 | $10,910 | $12,161 | $11,862 | $15,403 | $11,613 | $13,038 | $16,238 |

| | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 |

AVERAGE ANNUAL TOTAL RETURNS:| | 1 Year | 5 Year | 10 Year |

| Class I | 25.69% | 8.12% | 6.65% |

| MSCI ACWI (All Country World Index) ex USA Index | 24.55% | 5.95% | 4.97% |

Visit institutional.fidelity.com for more recent performance information. |

The Fund's past performance is not a good predictor of the Fund's future performance. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. |

Key Fund Statistics(as of October 31, 2024)

KEY FACTS | | |

| Fund Size | $319,759,338 | |

| Number of Holdings | 305 | |

| Total Advisory Fee | $2,246,403 | |

| Portfolio Turnover | 33% | |

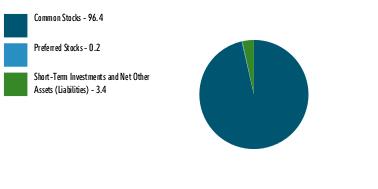

What did the Fund invest in?

(as of October 31, 2024)

MARKET SECTORS (% of Fund's net assets) | | |

| Financials | 23.8 | |

| Industrials | 20.0 | |

| Information Technology | 14.0 | |

| Materials | 10.5 | |

| Consumer Discretionary | 9.5 | |

| Health Care | 5.5 | |

| Energy | 5.0 | |

| Communication Services | 4.2 | |

| Consumer Staples | 3.6 | |

| Real Estate | 0.3 | |

| Utilities | 0.2 | |

| |

| Common Stocks | 96.4 |

| Preferred Stocks | 0.2 |

| Short-Term Investments and Net Other Assets (Liabilities) | 3.4 |

ASSET ALLOCATION (% of Fund's net assets) |

|

|

| United States | 14.5 |

| Japan | 10.8 |

| China | 9.3 |

| United Kingdom | 8.6 |

| France | 6.5 |

| Canada | 6.3 |

| Germany | 5.9 |

| Taiwan | 4.8 |

| Korea (South) | 3.9 |

| Others | 29.4 |

GEOGRAPHIC DIVERSIFICATION (% of Fund's net assets) |

|

| |

|

TOP HOLDINGS(% of Fund's net assets) | | |

| Taiwan Semiconductor Manufacturing Co Ltd | 3.4 | |

| Tencent Holdings Ltd | 2.5 | |

| CRH PLC | 1.8 | |

| Samsung Electronics Co Ltd | 1.8 | |

| SAP SE | 1.6 | |

| Novo Nordisk A/S Series B | 1.6 | |

| Linde PLC | 1.6 | |

| ASML Holding NV | 1.5 | |

| Canadian Pacific Kansas City Ltd | 1.5 | |

| BAE Systems PLC | 1.3 | |

| | 18.6 | |

How has the Fund changed?

This is a summary of certain changes to the Fund since November 1, 2023. For more complete information, you may review the Fund's next prospectus, which we expect to be available by December 30, 2024 at fundresearch.fidelity.com/prospectus/sec or upon request at 1-877-208-0098 or by sending an e-mail to fidfunddocuments@fidelity.com.

The fees associated with this class changed during the reporting year.The variations in class fees are primarily the result of the following changes: - Management fee

- Operating expenses

- Performance adjustment fee

- Expense reductions

The fund's transfer agent and pricing & bookkeeping fees were changed to a fixed rate effective December 1, 2023, through February 29, 2024, in anticipation of the transition to a new management fee structure. Effective March 1, 2024, the fund's management contract was amended to incorporate administrative services previously covered under separate services agreements (transfer agent and pricing & bookkeeping). The amended contract incorporates a basic fee rate that may vary by class (subject to a performance adjustment). The Adviser or an affiliate pays certain expenses of managing and operating the fund out of each class's management fee. The class reduced its contractual expense cap during the reporting period. |

|

The fund's sub-advisory agreement with FIL Investments (Japan) Limited was not renewed. | |

| Fidelity, the Fidelity Investments Logo and all other Fidelity trademarks or service marks used herein are trademarks or service marks of FMR LLC. Any third-party marks that are used herein are trademarks or service marks of their respective owners. © 2024 FMR LLC. All rights reserved. |

| | For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit fundresearch.fidelity.com/prospectus/sec 1.9913946.100 1984-TSRA-1224 |

| |

| | ANNUAL SHAREHOLDER REPORT | AS OF OCTOBER 31, 2024 | This report describes changes to the Fund that occurred during the reporting period. |

| | Fidelity® Europe Fund Fidelity Advisor® Europe Fund Class A : FHJUX |

| | | |

This annual shareholder report contains information about Fidelity® Europe Fund for the period November 1, 2023 to October 31, 2024. You can find additional information about the Fund at fundresearch.fidelity.com/prospectus/sec. You can also request this information by contacting us at 1-877-208-0098 or by sending an e-mail to fidfunddocuments@fidelity.com.

What were your Fund costs for the last year?(based on hypothetical $10,000 investment)

FUND COST (PREVIOUS YEAR)

| | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | |

| Class A | $ 103 | 0.93% | |

What affected the Fund's performance this period?

•International stocks achieved a strong gain for the 12 months ending October 31, 2024. Resilient global economic growth and a slowing in the pace of inflation in certain regions, as well as a shift to global monetary easing, contributed to a favorable backdrop, despite persistent geopolitical risk.

•Against this backdrop, stock picks in Europe ex U.K., primarily in France, and the U.K. detracted from the fund's performance versus the MSCI Europe Index (Net MA) for the fiscal year.

•By sector, security selection was the primary detractor, especially within consumer staples. Picks and an underweight in financials, primarily within the banks industry, also hampered the fund's result. Also hurting our result was stock selection in materials.

•The biggest individual relative detractor was an overweight in Davide Campari Milano (-39%). The second-largest relative detractor was an overweight in Diageo (-16%). Not owning Schneider Electric, a benchmark component that gained roughly 71%, was another notable relative detractor.

•In contrast, from a regional standpoint, an underweight in Europe ex U.K., along with stock selection in Belgium and in Sweden, contributed to the fund's relative result.

•By sector, the biggest contributor to performance versus the benchmark was stock selection in health care, primarily within the pharmaceuticals, biotechnology & life sciences industry. Stock picks in communication services, primarily within the media & entertainment industry, also boosted the fund's relative performance.

•The top individual relative contributor was an overweight in UCB (+165%). Although we reduced the fund's exposure to the stock, it was among the fund's biggest holdings at period end. A second notable relative contributor was an overweight in SAP (+76%). The stock was among our largest holdings, even though we trimmed the position. A non-benchmark stake in Hemnet gained 81% and notably helped.

•Notable changes in positioning include decreased exposure to France and a higher allocation to Italy. By sector, meaningful changes in positioning include increased exposure to communication services and a lower allocation to consumer staples.

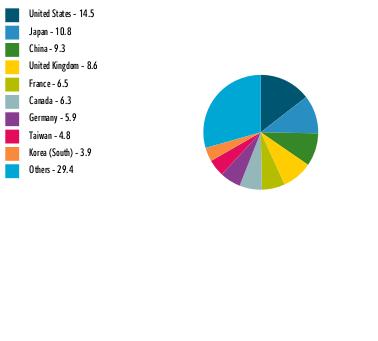

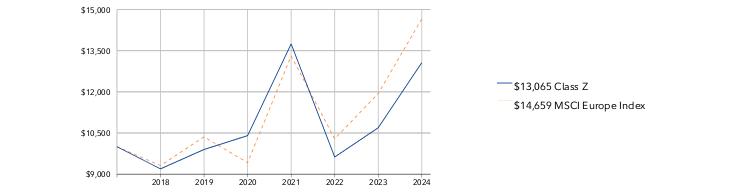

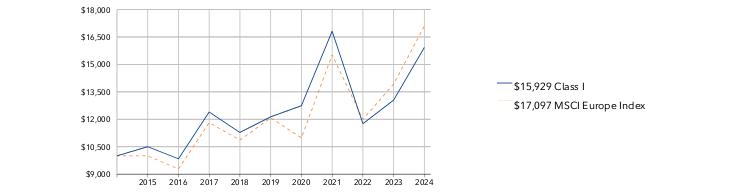

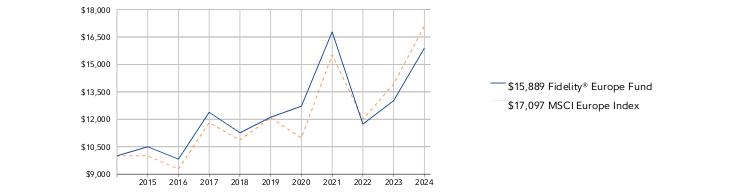

How did the Fund perform over the past 10 years?

CUMULATIVE PERFORMANCE

October 31, 2014 through October 31, 2024.

Initial investment of $10,000 and the current sales charge was paid.

Class A | $9,425 | $9,861 | $9,201 | $11,558 | $10,481 | $11,237 | $11,756 | $15,471 | $10,784 | $11,926 | $14,517 |

MSCI Europe Index | $10,000 | $10,004 | $9,281 | $11,817 | $10,862 | $12,081 | $10,984 | $15,520 | $11,998 | $13,925 | $17,097 |

| | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 |

AVERAGE ANNUAL TOTAL RETURNS:| | 1 Year | 5 Year | 10 Year |

| Class A (incl. 5.75% sales charge) | 14.73% | 4.02% | 3.80% |

| Class A (without 5.75% sales charge) | 21.73% | 5.26% | 4.41% |

| MSCI Europe Index | 22.78% | 7.19% | 5.51% |

Visit institutional.fidelity.com for more recent performance information. |

The Fund's past performance is not a good predictor of the Fund's future performance. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. |

Key Fund Statistics(as of October 31, 2024)

KEY FACTS | | |

| Fund Size | $580,672,025 | |

| Number of Holdings | 101 | |

| Total Advisory Fee | $3,255,111 | |

| Portfolio Turnover | 31% | |

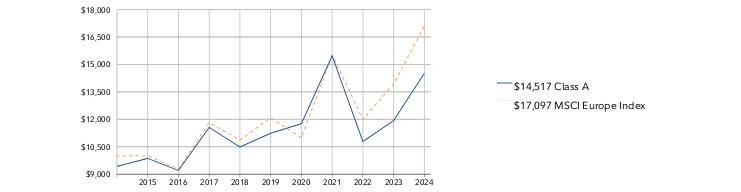

What did the Fund invest in?

(as of October 31, 2024)

MARKET SECTORS (% of Fund's net assets) | | |

| Financials | 18.9 | |

| Health Care | 16.4 | |

| Industrials | 14.6 | |

| Consumer Discretionary | 12.3 | |

| Information Technology | 11.2 | |

| Consumer Staples | 8.4 | |

| Communication Services | 4.7 | |

| Energy | 4.4 | |

| Materials | 4.1 | |

| Real Estate | 1.0 | |

| Utilities | 0.8 | |

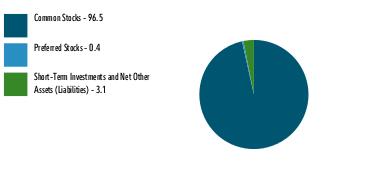

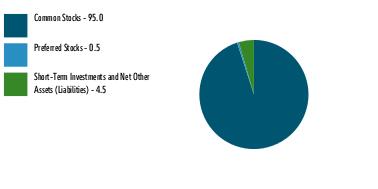

| |

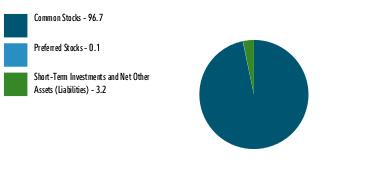

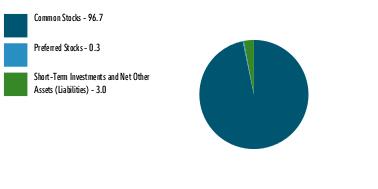

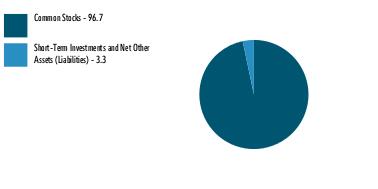

| Common Stocks | 96.7 |

| Preferred Stocks | 0.1 |

| Short-Term Investments and Net Other Assets (Liabilities) | 3.2 |

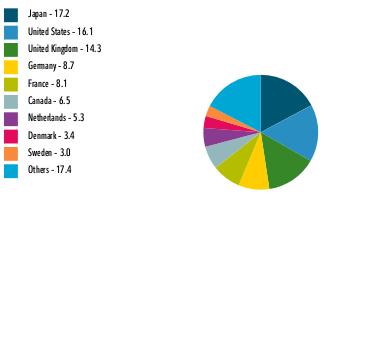

ASSET ALLOCATION (% of Fund's net assets) |

|

|

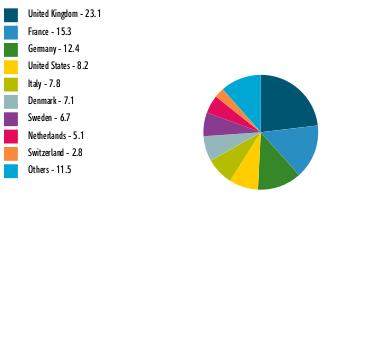

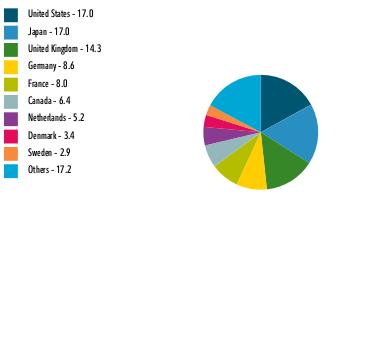

| United Kingdom | 23.1 |

| France | 15.3 |

| Germany | 12.4 |

| United States | 8.2 |

| Italy | 7.8 |

| Denmark | 7.1 |

| Sweden | 6.7 |

| Netherlands | 5.1 |

| Switzerland | 2.8 |

| Others | 11.5 |

GEOGRAPHIC DIVERSIFICATION (% of Fund's net assets) |

|

| |

|

TOP HOLDINGS(% of Fund's net assets) | | |

| Novo Nordisk A/S Series B | 5.6 | |

| SAP SE | 3.9 | |

| ASML Holding NV | 3.8 | |

| Astrazeneca PLC | 3.7 | |

| Shell PLC | 2.7 | |

| RELX PLC | 2.5 | |

| Air Liquide SA | 2.3 | |

| UCB SA | 2.2 | |

| LVMH Moet Hennessy Louis Vuitton SE | 2.1 | |

| UniCredit SpA | 1.7 | |

| | 30.5 | |

How has the Fund changed?

This is a summary of certain changes to the Fund since November 1, 2023. For more complete information, you may review the Fund's next prospectus, which we expect to be available by December 30, 2024 at fundresearch.fidelity.com/prospectus/sec or upon request at 1-877-208-0098 or by sending an e-mail to fidfunddocuments@fidelity.com.

The fees associated with this class changed during the reporting year.The variations in class fees are primarily the result of the following changes: - Management fee

- Operating expenses

The fund's transfer agent and pricing & bookkeeping fees were changed to a fixed rate effective December 1, 2023, through February 29, 2024, in anticipation of the transition to a new management fee structure. Effective March 1, 2024, the fund's management contract was amended to incorporate administrative services previously covered under separate services agreements (transfer agent and pricing & bookkeeping). The amended contract incorporates a basic fee rate that may vary by class (subject to a performance adjustment). The Adviser or an affiliate pays certain expenses of managing and operating the fund out of each class's management fee. | |

| Fidelity, the Fidelity Investments Logo and all other Fidelity trademarks or service marks used herein are trademarks or service marks of FMR LLC. Any third-party marks that are used herein are trademarks or service marks of their respective owners. © 2024 FMR LLC. All rights reserved. |

| | For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit fundresearch.fidelity.com/prospectus/sec 1.9913828.100 2632-TSRA-1224 |

| |

| | ANNUAL SHAREHOLDER REPORT | AS OF OCTOBER 31, 2024 | This report describes changes to the Fund that occurred during the reporting period. |

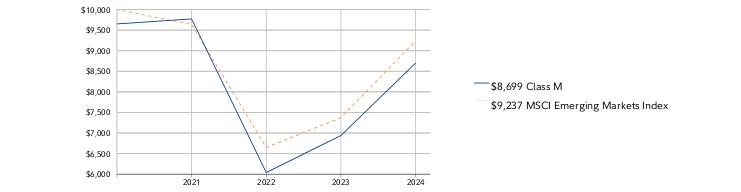

| | Fidelity® Total International Equity Fund Fidelity Advisor® Total International Equity Fund Class M : FTTEX |

| | | |

This annual shareholder report contains information about Fidelity® Total International Equity Fund for the period November 1, 2023 to October 31, 2024. You can find additional information about the Fund at fundresearch.fidelity.com/prospectus/sec. You can also request this information by contacting us at 1-877-208-0098 or by sending an e-mail to fidfunddocuments@fidelity.com.

What were your Fund costs for the last year?(based on hypothetical $10,000 investment)

FUND COST (PREVIOUS YEAR)

| | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | |

| Class M | $ 167 | 1.48% | |

What affected the Fund's performance this period?

•International stocks achieved a strong gain for the 12 months ending October 31, 2024. Resilient global economic growth and a slowing in the pace of inflation in certain regions, as well as a shift to global monetary easing, contributed to a favorable backdrop, despite persistent geopolitical risk.

•Against this backdrop, an overweight in the United States and stock picks in Japan contributed to the fund's performance versus the MSCI All Country World ex US Index (Net MA) for the fiscal year.

•By sector, the biggest contributor to performance versus the benchmark was stock selection in materials. An underweight in consumer staples also boosted relative performance. Also bolstering our relative result were picks and an overweight in industrials, primarily within the capital goods industry.

•The top individual relative contributor was an overweight in Taiwan Semiconductor (+100%). The company was the fund's largest holding. The second-largest relative contributor was an overweight in CRH (+83%). The stock was among our largest holdings. An overweight in China Life Insurance (+65%) also contributed.

•In contrast, from a regional standpoint, stock picks in Canada and the United States detracted from the fund's relative result.

•By sector, the biggest detractor from performance versus the benchmark was stock selection in financials. Also hurting our result was security selection in information technology, primarily within the technology hardware & equipment industry, and consumer staples, primarily within the consumer staples distribution & retail industry. Lastly, the fund's position in cash detracted.

•The largest individual relative detractor was an overweight in Samsung Electronics (-13%). The stock was among our biggest holdings. The second-largest relative detractor was an overweight in Wal Mart De Mexico (-21%). This period we increased our stake in Wal Mart De Mexico. An overweight in Edenred (-38%) also detracted.

•Notable changes in positioning include higher allocations to Germany and the United Kingdom. By sector, meaningful changes in positioning include decreased exposure to consumer discretionary and energy.

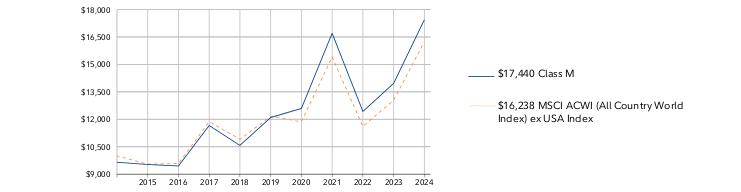

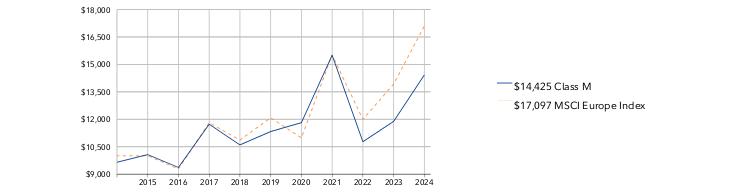

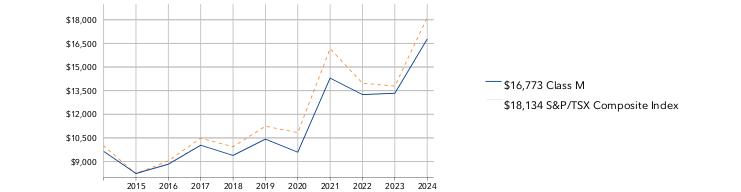

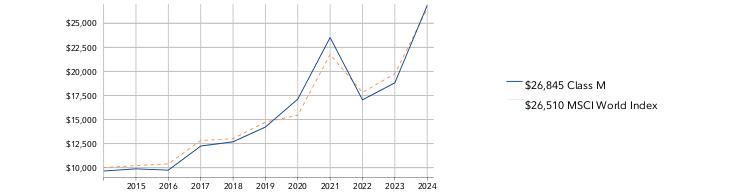

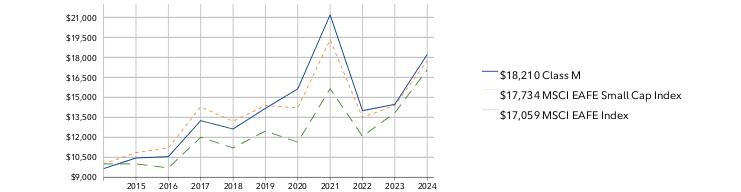

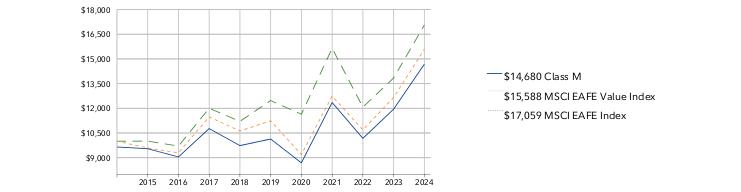

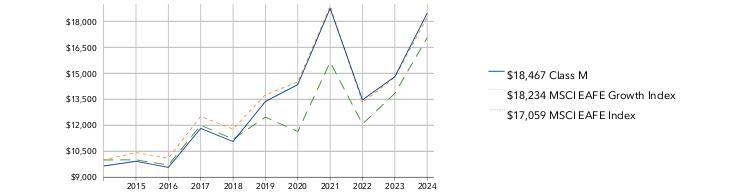

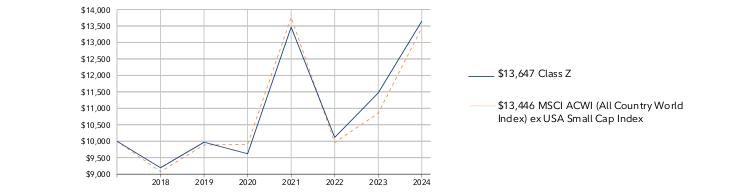

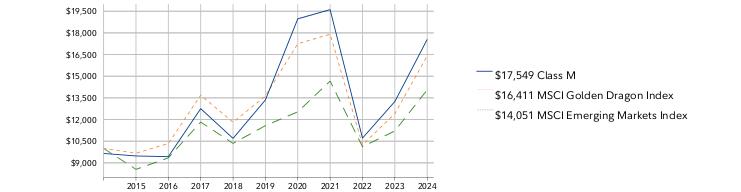

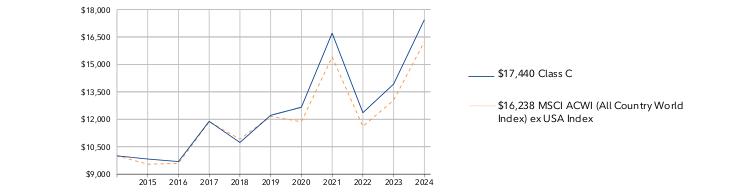

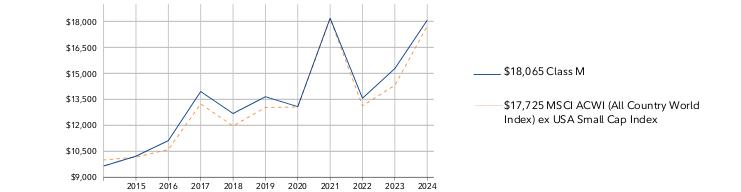

How did the Fund perform over the past 10 years?

CUMULATIVE PERFORMANCE

October 31, 2014 through October 31, 2024.

Initial investment of $10,000 and the current sales charge was paid.

Class M | $9,650 | $9,528 | $9,446 | $11,657 | $10,573 | $12,094 | $12,593 | $16,702 | $12,427 | $13,962 | $17,440 |

MSCI ACWI (All Country World Index) ex USA Index | $10,000 | $9,545 | $9,583 | $11,868 | $10,910 | $12,161 | $11,862 | $15,403 | $11,613 | $13,038 | $16,238 |

| | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 |

AVERAGE ANNUAL TOTAL RETURNS:| | 1 Year | 5 Year | 10 Year |

| Class M (incl. 3.50% sales charge) | 20.54% | 6.83% | 5.72% |

| Class M (without 3.50% sales charge) | 24.91% | 7.60% | 6.10% |

| MSCI ACWI (All Country World Index) ex USA Index | 24.55% | 5.95% | 4.97% |

Visit institutional.fidelity.com for more recent performance information. |

The Fund's past performance is not a good predictor of the Fund's future performance. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. |

Key Fund Statistics(as of October 31, 2024)

KEY FACTS | | |

| Fund Size | $319,759,338 | |

| Number of Holdings | 305 | |

| Total Advisory Fee | $2,246,403 | |

| Portfolio Turnover | 33% | |

What did the Fund invest in?

(as of October 31, 2024)

MARKET SECTORS (% of Fund's net assets) | | |

| Financials | 23.8 | |

| Industrials | 20.0 | |

| Information Technology | 14.0 | |

| Materials | 10.5 | |

| Consumer Discretionary | 9.5 | |

| Health Care | 5.5 | |

| Energy | 5.0 | |

| Communication Services | 4.2 | |

| Consumer Staples | 3.6 | |

| Real Estate | 0.3 | |

| Utilities | 0.2 | |

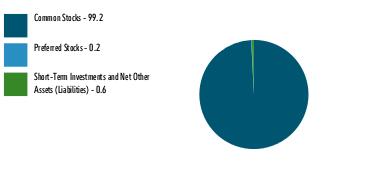

| |

| Common Stocks | 96.4 |

| Preferred Stocks | 0.2 |

| Short-Term Investments and Net Other Assets (Liabilities) | 3.4 |

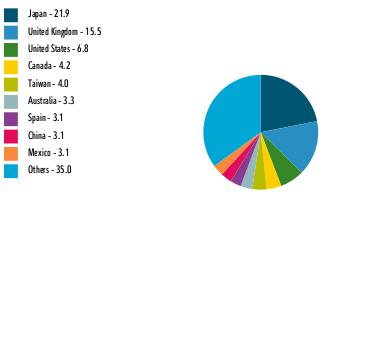

ASSET ALLOCATION (% of Fund's net assets) |

|

|

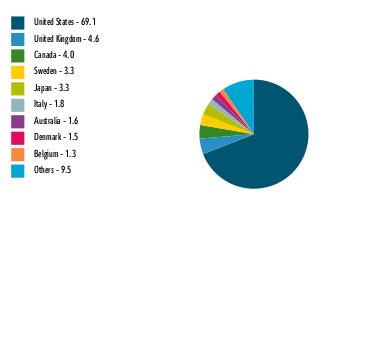

| United States | 14.5 |

| Japan | 10.8 |

| China | 9.3 |

| United Kingdom | 8.6 |

| France | 6.5 |

| Canada | 6.3 |

| Germany | 5.9 |

| Taiwan | 4.8 |

| Korea (South) | 3.9 |

| Others | 29.4 |

GEOGRAPHIC DIVERSIFICATION (% of Fund's net assets) |

|

| |

|

TOP HOLDINGS(% of Fund's net assets) | | |

| Taiwan Semiconductor Manufacturing Co Ltd | 3.4 | |

| Tencent Holdings Ltd | 2.5 | |

| CRH PLC | 1.8 | |

| Samsung Electronics Co Ltd | 1.8 | |

| SAP SE | 1.6 | |

| Novo Nordisk A/S Series B | 1.6 | |

| Linde PLC | 1.6 | |

| ASML Holding NV | 1.5 | |

| Canadian Pacific Kansas City Ltd | 1.5 | |

| BAE Systems PLC | 1.3 | |

| | 18.6 | |

How has the Fund changed?

This is a summary of certain changes to the Fund since November 1, 2023. For more complete information, you may review the Fund's next prospectus, which we expect to be available by December 30, 2024 at fundresearch.fidelity.com/prospectus/sec or upon request at 1-877-208-0098 or by sending an e-mail to fidfunddocuments@fidelity.com.

The fees associated with this class changed during the reporting year.The variations in class fees are primarily the result of the following changes: - Management fee

- Operating expenses

- Performance adjustment fee

- Expense reductions

The fund's transfer agent and pricing & bookkeeping fees were changed to a fixed rate effective December 1, 2023, through February 29, 2024, in anticipation of the transition to a new management fee structure. Effective March 1, 2024, the fund's management contract was amended to incorporate administrative services previously covered under separate services agreements (transfer agent and pricing & bookkeeping). The amended contract incorporates a basic fee rate that may vary by class (subject to a performance adjustment). The Adviser or an affiliate pays certain expenses of managing and operating the fund out of each class's management fee. The class reduced its contractual expense cap during the reporting period. |

|

The fund's sub-advisory agreement with FIL Investments (Japan) Limited was not renewed. | |

| Fidelity, the Fidelity Investments Logo and all other Fidelity trademarks or service marks used herein are trademarks or service marks of FMR LLC. Any third-party marks that are used herein are trademarks or service marks of their respective owners. © 2024 FMR LLC. All rights reserved. |

| | For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit fundresearch.fidelity.com/prospectus/sec 1.9913945.100 1983-TSRA-1224 |

| |

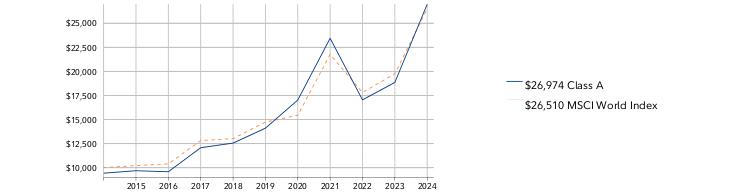

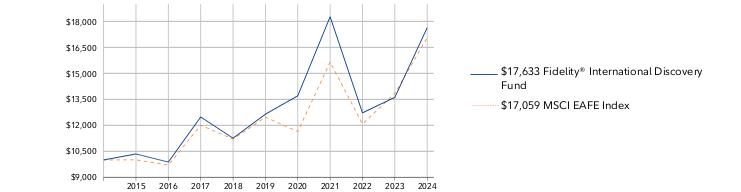

| | ANNUAL SHAREHOLDER REPORT | AS OF OCTOBER 31, 2024 | This report describes changes to the Fund that occurred during the reporting period. |

| | Fidelity® International Discovery Fund Fidelity Advisor® International Discovery Fund Class A : FAIDX |

| | | |

This annual shareholder report contains information about Fidelity® International Discovery Fund for the period November 1, 2023 to October 31, 2024. You can find additional information about the Fund at fundresearch.fidelity.com/prospectus/sec. You can also request this information by contacting us at 1-877-208-0098 or by sending an e-mail to fidfunddocuments@fidelity.com.

What were your Fund costs for the last year?(based on hypothetical $10,000 investment)

FUND COST (PREVIOUS YEAR)

| | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | |

| Class A | $ 100 | 0.87% | |

What affected the Fund's performance this period?

•International stocks achieved a strong gain for the 12 months ending October 31, 2024. Resilient global economic growth and a slowing in the pace of inflation in certain regions, as well as a shift to global monetary easing, contributed to a favorable backdrop, despite persistent geopolitical risk.

•Against this backdrop, picks in Europe ex U.K. and Japan contributed to the fund's performance versus the MSCI EAFE Index (Net MA) for the fiscal year.

•By sector, the biggest contributor to performance versus the benchmark was stock picking in industrials, primarily within the capital goods industry. Stock picking and an overweight in information technology, primarily within the semiconductors & semiconductor equipment industry, also boosted the fund's relative performance, as did stock picking in consumer discretionary.

•The top individual relative contributor was our non-benchmark stake in Nvidia (+121%). This period we decreased our investment in Nvidia. A second notable relative contributor was our non-benchmark stake in Taiwan Semiconductor (+96%). The company was one of our largest holdings. Another notable relative contributor was an overweight in Hitachi (+109%), the fund's biggest holding at period end.

•In contrast, from a regional standpoint, a non-benchmark allocation to Canada and an underweight in Asia Pacific ex Japan detracted from the fund's relative result.

•By sector, the biggest detractor from performance versus the benchmark was stock selection in consumer staples. Security selection in financials also hampered the fund's result. Also hurting our result were stock picks and an underweight in communication services, primarily within the media & entertainment industry. Lastly, the fund's position in cash detracted.

•The fund's non-benchmark stake in PDD returned -47% and was the largest individual relative detractor. This was a position we established this period. A second notable relative detractor was an overweight in L'Oréal (-9%), which was among the fund's biggest holdings this period. A non-benchmark stake in One97 Communications returned about -29% and notably hurt. The stock was not held at period end.

•Notable changes in positioning include increased exposure to Germany and a lower allocation to India. By sector, meaningful changes in positioning include increased exposure to industrials and a lower allocation to consumer staples.

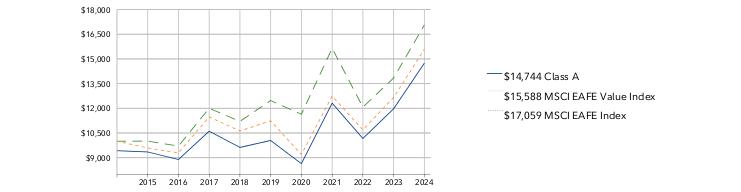

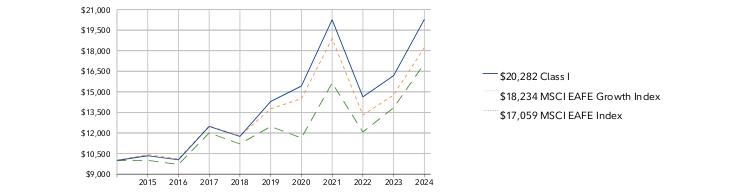

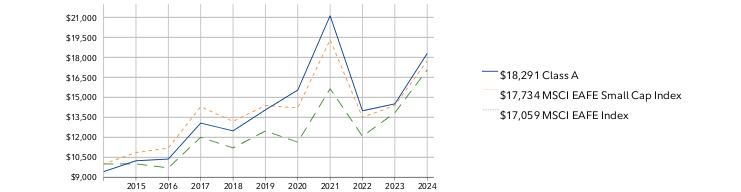

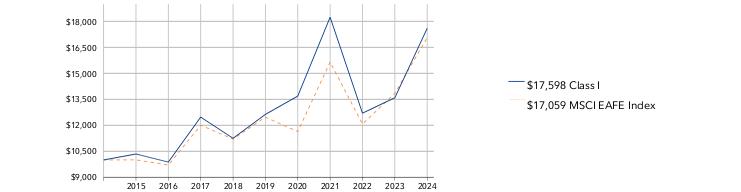

How did the Fund perform over the past 10 years?

CUMULATIVE PERFORMANCE

October 31, 2014 through October 31, 2024.

Initial investment of $10,000 and the current sales charge was paid.

Class A | $9,425 | $9,716 | $9,247 | $11,639 | $10,463 | $11,708 | $12,647 | $16,803 | $11,666 | $12,442 | $16,068 |

MSCI EAFE Index | $10,000 | $10,008 | $9,705 | $12,004 | $11,206 | $12,472 | $11,638 | $15,647 | $12,073 | $13,841 | $17,059 |

| | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 |

AVERAGE ANNUAL TOTAL RETURNS:| | 1 Year | 5 Year | 10 Year |

| Class A (incl. 5.75% sales charge) | 21.72% | 5.28% | 4.86% |

| Class A (without 5.75% sales charge) | 29.14% | 6.54% | 5.48% |

| MSCI EAFE Index | 23.25% | 6.46% | 5.49% |

Visit institutional.fidelity.com for more recent performance information. |

The Fund's past performance is not a good predictor of the Fund's future performance. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. |

Key Fund Statistics(as of October 31, 2024)

KEY FACTS | | |

| Fund Size | $9,841,033,775 | |

| Number of Holdings | 142 | |

| Total Advisory Fee | $45,667,963 | |

| Portfolio Turnover | 44% | |

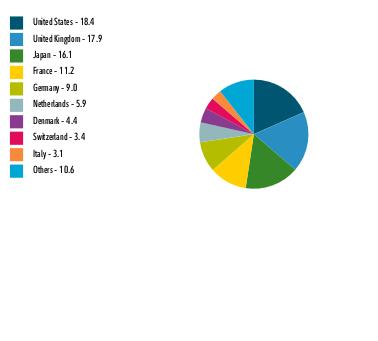

What did the Fund invest in?

(as of October 31, 2024)

MARKET SECTORS (% of Fund's net assets) | | |

| Financials | 22.3 | |

| Industrials | 22.0 | |

| Consumer Discretionary | 14.1 | |

| Information Technology | 11.8 | |

| Health Care | 9.8 | |

| Materials | 5.4 | |

| Consumer Staples | 4.1 | |

| Communication Services | 3.3 | |

| Energy | 3.1 | |

| Real Estate | 1.0 | |

| |

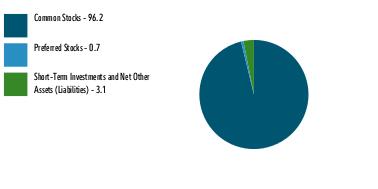

| Common Stocks | 96.2 |

| Preferred Stocks | 0.7 |

| Short-Term Investments and Net Other Assets (Liabilities) | 3.1 |

ASSET ALLOCATION (% of Fund's net assets) |

|

|

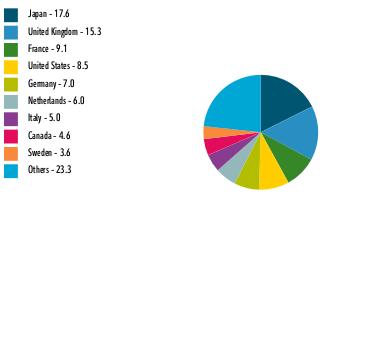

| Japan | 17.6 |

| United Kingdom | 15.3 |

| France | 9.1 |

| United States | 8.5 |

| Germany | 7.0 |

| Netherlands | 6.0 |

| Italy | 5.0 |

| Canada | 4.6 |

| Sweden | 3.6 |

| Others | 23.3 |

GEOGRAPHIC DIVERSIFICATION (% of Fund's net assets) |

|

| |

|

TOP HOLDINGS(% of Fund's net assets) | | |

| Hitachi Ltd | 3.1 | |

| UniCredit SpA | 2.7 | |

| Novo Nordisk A/S Series B | 2.7 | |

| ASML Holding NV | 2.1 | |

| Taiwan Semiconductor Manufacturing Co Ltd | 2.0 | |

| Constellation Software Inc/Canada | 2.0 | |

| Unilever PLC | 2.0 | |

| Compass Group PLC | 1.7 | |

| UCB SA | 1.7 | |

| ITOCHU Corp | 1.6 | |

| | 21.6 | |

How has the Fund changed?

This is a summary of certain changes to the Fund since November 1, 2023. For more complete information, you may review the Fund's next prospectus, which we expect to be available by December 30, 2024 at fundresearch.fidelity.com/prospectus/sec or upon request at 1-877-208-0098 or by sending an e-mail to fidfunddocuments@fidelity.com.

The fees associated with this class changed during the reporting year.The variations in class fees are primarily the result of the following changes: - Management fee

- Performance adjustment fee

- Operating expenses

The fund's transfer agent and pricing & bookkeeping fees were changed to a fixed rate effective December 1, 2023, through February 29, 2024, in anticipation of the transition to a new management fee structure. Effective March 1, 2024, the fund's management contract was amended to incorporate administrative services previously covered under separate services agreements (transfer agent and pricing & bookkeeping). The amended contract incorporates a basic fee rate that may vary by class (subject to a performance adjustment). The Adviser or an affiliate pays certain expenses of managing and operating the fund out of each class's management fee. | The fund's sub-advisory agreement with FIL Investments (Japan) Limited was not renewed.

|

| Fidelity, the Fidelity Investments Logo and all other Fidelity trademarks or service marks used herein are trademarks or service marks of FMR LLC. Any third-party marks that are used herein are trademarks or service marks of their respective owners. © 2024 FMR LLC. All rights reserved. |

| | For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit fundresearch.fidelity.com/prospectus/sec 1.9913835.100 1397-TSRA-1224 |

| |

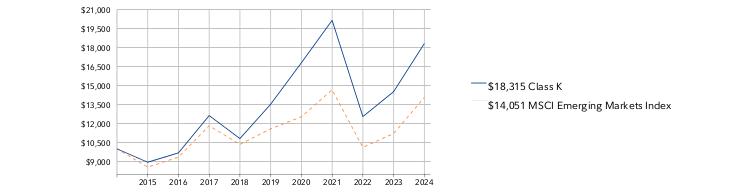

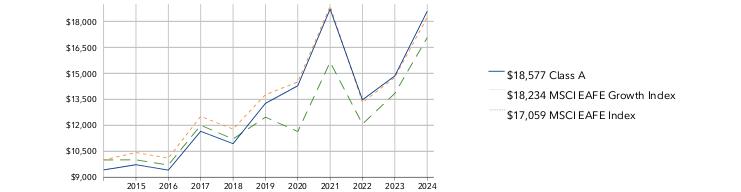

| | ANNUAL SHAREHOLDER REPORT | AS OF OCTOBER 31, 2024 | This report describes changes to the Fund that occurred during the reporting period. |

| | Fidelity® International Discovery Fund Fidelity® International Discovery Fund Class K : FIDKX |

| | | |

This annual shareholder report contains information about Fidelity® International Discovery Fund for the period November 1, 2023 to October 31, 2024. You can find additional information about the Fund at fundresearch.fidelity.com/prospectus/sec. You can also request this information by contacting us at 1-800-835-5092 or by sending an e-mail to fidfunddocuments@fidelity.com.

What were your Fund costs for the last year?(based on hypothetical $10,000 investment)

FUND COST (PREVIOUS YEAR)

| | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | |

| Class K | $ 58 | 0.51% | |

What affected the Fund's performance this period?

•International stocks achieved a strong gain for the 12 months ending October 31, 2024. Resilient global economic growth and a slowing in the pace of inflation in certain regions, as well as a shift to global monetary easing, contributed to a favorable backdrop, despite persistent geopolitical risk.

•Against this backdrop, picks in Europe ex U.K. and Japan contributed to the fund's performance versus the MSCI EAFE Index (Net MA) for the fiscal year.

•By sector, the biggest contributor to performance versus the benchmark was stock picking in industrials, primarily within the capital goods industry. Stock picking and an overweight in information technology, primarily within the semiconductors & semiconductor equipment industry, also boosted the fund's relative performance, as did stock picking in consumer discretionary.

•The top individual relative contributor was our non-benchmark stake in Nvidia (+121%). This period we decreased our investment in Nvidia. A second notable relative contributor was our non-benchmark stake in Taiwan Semiconductor (+96%). The company was one of our largest holdings. Another notable relative contributor was an overweight in Hitachi (+109%), the fund's biggest holding at period end.

•In contrast, from a regional standpoint, a non-benchmark allocation to Canada and an underweight in Asia Pacific ex Japan detracted from the fund's relative result.

•By sector, the biggest detractor from performance versus the benchmark was stock selection in consumer staples. Security selection in financials also hampered the fund's result. Also hurting our result were stock picks and an underweight in communication services, primarily within the media & entertainment industry. Lastly, the fund's position in cash detracted.

•The fund's non-benchmark stake in PDD returned -47% and was the largest individual relative detractor. This was a position we established this period. A second notable relative detractor was an overweight in L'Oréal (-9%), which was among the fund's biggest holdings this period. A non-benchmark stake in One97 Communications returned about -29% and notably hurt. The stock was not held at period end.

•Notable changes in positioning include increased exposure to Germany and a lower allocation to India. By sector, meaningful changes in positioning include increased exposure to industrials and a lower allocation to consumer staples.

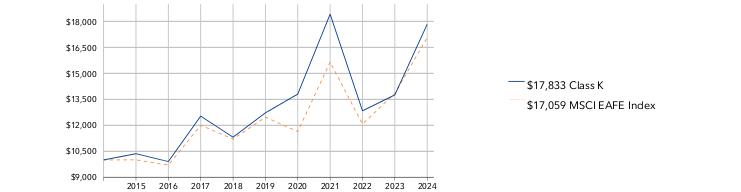

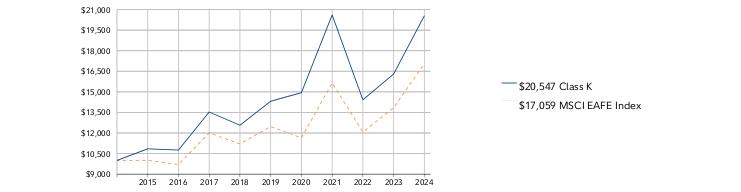

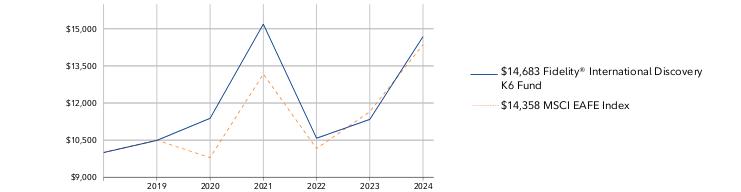

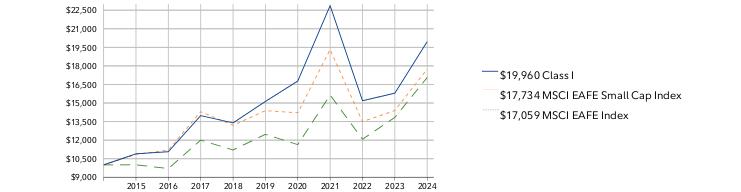

How did the Fund perform over the past 10 years?

CUMULATIVE PERFORMANCE

October 31, 2014 through October 31, 2024.

Initial investment of $10,000.

Class K | $10,000 | $10,361 | $9,907 | $12,530 | $11,315 | $12,718 | $13,802 | $18,413 | $12,838 | $13,755 | $17,833 |

MSCI EAFE Index | $10,000 | $10,008 | $9,705 | $12,004 | $11,206 | $12,472 | $11,638 | $15,647 | $12,073 | $13,841 | $17,059 |

| | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 |

AVERAGE ANNUAL TOTAL RETURNS:| | 1 Year | 5 Year | 10 Year |

| Class K | 29.64% | 6.99% | 5.96% |

| MSCI EAFE Index | 23.25% | 6.46% | 5.49% |

Visit www.401k.com for more recent performance information. |

The Fund's past performance is not a good predictor of the Fund's future performance. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. |

Key Fund Statistics(as of October 31, 2024)

KEY FACTS | | |

| Fund Size | $9,841,033,775 | |

| Number of Holdings | 142 | |

| Total Advisory Fee | $45,667,963 | |

| Portfolio Turnover | 44% | |

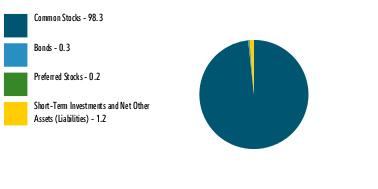

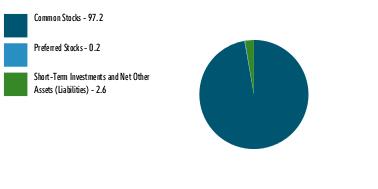

What did the Fund invest in?

(as of October 31, 2024)

MARKET SECTORS (% of Fund's net assets) | | |

| Financials | 22.3 | |

| Industrials | 22.0 | |

| Consumer Discretionary | 14.1 | |

| Information Technology | 11.8 | |

| Health Care | 9.8 | |

| Materials | 5.4 | |

| Consumer Staples | 4.1 | |

| Communication Services | 3.3 | |

| Energy | 3.1 | |

| Real Estate | 1.0 | |

| |

| Common Stocks | 96.2 |

| Preferred Stocks | 0.7 |

| Short-Term Investments and Net Other Assets (Liabilities) | 3.1 |

ASSET ALLOCATION (% of Fund's net assets) |

|

|

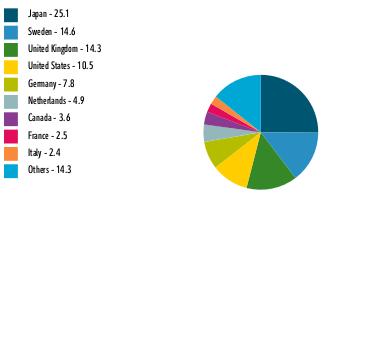

| Japan | 17.6 |

| United Kingdom | 15.3 |

| France | 9.1 |

| United States | 8.5 |

| Germany | 7.0 |

| Netherlands | 6.0 |

| Italy | 5.0 |

| Canada | 4.6 |

| Sweden | 3.6 |

| Others | 23.3 |

GEOGRAPHIC DIVERSIFICATION (% of Fund's net assets) |

|

| |

|

TOP HOLDINGS(% of Fund's net assets) | | |

| Hitachi Ltd | 3.1 | |

| UniCredit SpA | 2.7 | |

| Novo Nordisk A/S Series B | 2.7 | |

| ASML Holding NV | 2.1 | |

| Taiwan Semiconductor Manufacturing Co Ltd | 2.0 | |

| Constellation Software Inc/Canada | 2.0 | |

| Unilever PLC | 2.0 | |

| Compass Group PLC | 1.7 | |

| UCB SA | 1.7 | |

| ITOCHU Corp | 1.6 | |

| | 21.6 | |

How has the Fund changed?

This is a summary of certain changes to the Fund since November 1, 2023. For more complete information, you may review the Fund's next prospectus, which we expect to be available by December 30, 2024 at fundresearch.fidelity.com/prospectus/sec or upon request at 1-800-835-5092 or by sending an e-mail to fidfunddocuments@fidelity.com.

The fees associated with this class changed during the reporting year.The variations in class fees are primarily the result of the following changes: - Management fee

- Performance adjustment fee

The fund's transfer agent and pricing & bookkeeping fees were changed to a fixed rate effective December 1, 2023, through February 29, 2024, in anticipation of the transition to a new management fee structure. Effective March 1, 2024, the fund's management contract was amended to incorporate administrative services previously covered under separate services agreements (transfer agent and pricing & bookkeeping). The amended contract incorporates a basic fee rate that may vary by class (subject to a performance adjustment). The Adviser or an affiliate pays certain expenses of managing and operating the fund out of each class's management fee. | The fund's sub-advisory agreement with FIL Investments (Japan) Limited was not renewed.

|

| Fidelity, the Fidelity Investments Logo and all other Fidelity trademarks or service marks used herein are trademarks or service marks of FMR LLC. Any third-party marks that are used herein are trademarks or service marks of their respective owners. © 2024 FMR LLC. All rights reserved. |

| | For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit fundresearch.fidelity.com/prospectus/sec 1.9913839.100 2093-TSRA-1224 |

| |

| | ANNUAL SHAREHOLDER REPORT | AS OF OCTOBER 31, 2024 | |

| | Fidelity® International Capital Appreciation K6 Fund Fidelity® International Capital Appreciation K6 Fund : FAPCX |

| | | |

This annual shareholder report contains information about Fidelity® International Capital Appreciation K6 Fund for the period November 1, 2023 to October 31, 2024. You can find additional information about the Fund at fundresearch.fidelity.com/prospectus/sec. You can also request this information by contacting us at 1-800-835-5092 or by sending an e-mail to fidfunddocuments@fidelity.com.

What were your Fund costs for the last year?(based on hypothetical $10,000 investment)

FUND COST (PREVIOUS YEAR)

| | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | |

| Fidelity® International Capital Appreciation K6 Fund | $ 75 | 0.66% | |

What affected the Fund's performance this period?

•International stocks achieved a strong gain for the 12 months ending October 31, 2024. Resilient global economic growth and a slowing in the pace of inflation in certain regions, as well as a shift to global monetary easing, contributed to a favorable backdrop, despite persistent geopolitical risk.

•Against this backdrop, security selection and an underweight in emerging markets and stock selection in Europe ex U.K. contributed to the fund's performance versus the MSCI All Country World ex US Index (Net MA) for the fiscal year.

•By sector, market selection was the primary contributor, led by an overweight in information technology, where an overweight in semiconductors & semiconductor equipment helped most. Picks and an overweight in industrials also boosted relative performance. Also contributing to our result was a lack of exposure to the lagging energy sector.

•The fund's non-benchmark stake in Nvidia gained 221% and was the top individual relative contributor. The stock was not held at period end. A second notable relative contributor was an overweight in Taiwan Semiconductor Manufacturing (+99%). The company was the fund's largest holding. Another notable relative contributor was an overweight in Brookfield Asset Management (+91%).

•In contrast, from a regional standpoint, security selection in Canada and an overweight in Europe ex U.K., primarily in France, detracted from the fund's relative result.

•By sector, the biggest detractor from performance versus the benchmark was stock selection in information technology, primarily within the software & services industry. Also hurting our result were stock picks in consumer staples and health care.

•The biggest individual relative detractor was our stake in OBIC (-23%). A second notable relative detractor was an underweight in Shopify (+66%). An overweight in LVMH Moet Hennessy Louis Vuitton (-5%) also hurt. The stock was among our largest holdings.

•Notable changes in positioning include increased exposure to China and Japan. By sector, meaningful changes in positioning include increased exposure to communication services and a lower allocation to consumer staples, where we liquidated all of the fund's holdings.

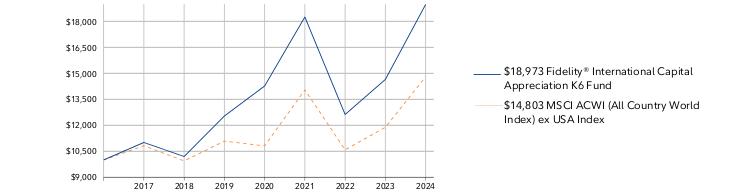

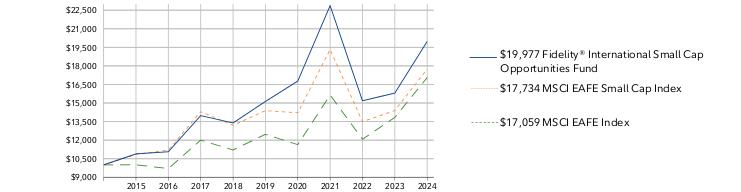

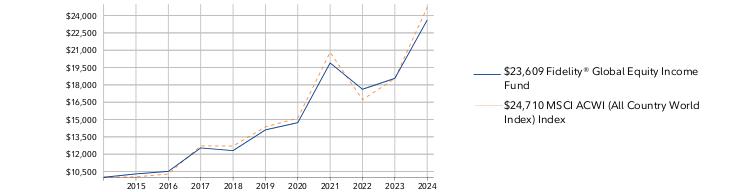

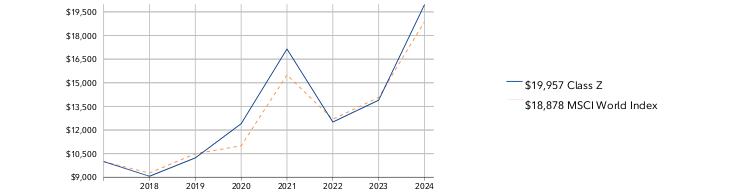

How did the Fund perform over the life of Fund?

CUMULATIVE PERFORMANCE

May 25, 2017 through October 31, 2024.

Initial investment of $10,000.

Fidelity® International Capital Appreciation K6 Fund | $10,000 | $11,010 | $10,199 | $12,535 | $14,267 | $18,252 | $12,624 | $14,646 |

MSCI ACWI (All Country World Index) ex USA Index | $10,000 | $10,820 | $9,946 | $11,087 | $10,814 | $14,042 | $10,587 | $11,886 |

| | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 |

AVERAGE ANNUAL TOTAL RETURNS:| | 1 Year | 5 Year | Life of Fund A |

| Fidelity® International Capital Appreciation K6 Fund | 29.54% | 8.64% | 8.99% |

| MSCI ACWI (All Country World Index) ex USA Index | 24.55% | 5.95% | 5.41% |

A From May 25, 2017

Visit www.401k.com for more recent performance information. |

The Fund's past performance is not a good predictor of the Fund's future performance. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. |

Key Fund Statistics(as of October 31, 2024)

KEY FACTS | | |

| Fund Size | $1,620,633,433 | |

| Number of Holdings | 62 | |

| Total Advisory Fee | $10,484,013 | |

| Portfolio Turnover | 84% | |

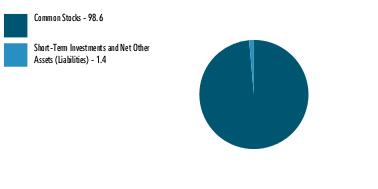

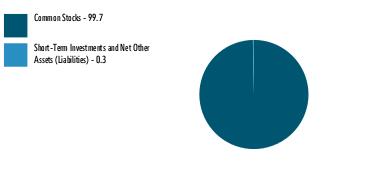

What did the Fund invest in?

(as of October 31, 2024)

MARKET SECTORS (% of Fund's net assets) | | |

| Industrials | 30.5 | |

| Financials | 21.2 | |

| Information Technology | 18.1 | |

| Consumer Discretionary | 11.5 | |

| Materials | 8.7 | |

| Health Care | 4.5 | |

| Communication Services | 4.1 | |

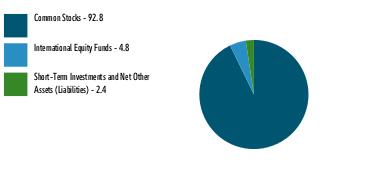

| |

| Common Stocks | 98.6 |

| Short-Term Investments and Net Other Assets (Liabilities) | 1.4 |

ASSET ALLOCATION (% of Fund's net assets) |

|

|

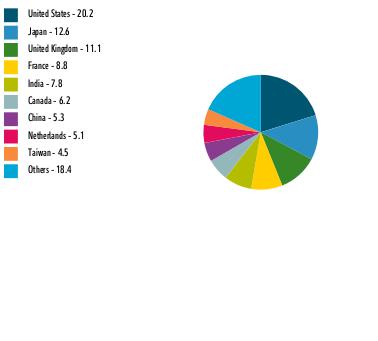

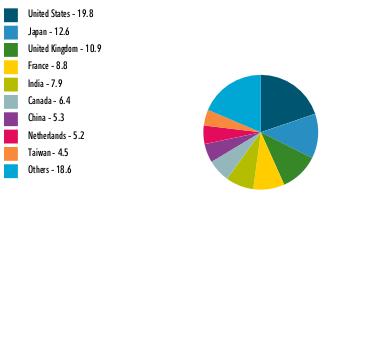

| United States | 20.2 |

| Japan | 12.6 |

| United Kingdom | 11.1 |

| France | 8.8 |

| India | 7.8 |

| Canada | 6.2 |

| China | 5.3 |

| Netherlands | 5.1 |

| Taiwan | 4.5 |

| Others | 18.4 |

GEOGRAPHIC DIVERSIFICATION (% of Fund's net assets) |

|

| |

|

TOP HOLDINGS(% of Fund's net assets) | | |

| Taiwan Semiconductor Manufacturing Co Ltd | 4.5 | |

| Novo Nordisk A/S Series B | 2.9 | |

| Tencent Holdings Ltd | 2.5 | |

| SAP SE | 2.5 | |

| ASML Holding NV | 2.3 | |

| LVMH Moet Hennessy Louis Vuitton SE | 2.3 | |

| Schneider Electric SE | 2.1 | |

| Hitachi Ltd | 1.9 | |

| ABB Ltd | 1.8 | |

| Keyence Corp | 1.7 | |

| | 24.5 | |

| Fidelity, the Fidelity Investments Logo and all other Fidelity trademarks or service marks used herein are trademarks or service marks of FMR LLC. Any third-party marks that are used herein are trademarks or service marks of their respective owners. © 2024 FMR LLC. All rights reserved. |

| | For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit fundresearch.fidelity.com/prospectus/sec 1.9913993.100 2953-TSRA-1224 |

| |

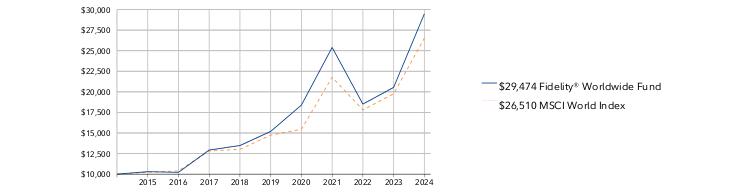

| | ANNUAL SHAREHOLDER REPORT | AS OF OCTOBER 31, 2024 | This report describes changes to the Fund that occurred during the reporting period. |

| | Fidelity® International Discovery Fund Fidelity Advisor® International Discovery Fund Class C : FCADX |

| | | |

This annual shareholder report contains information about Fidelity® International Discovery Fund for the period November 1, 2023 to October 31, 2024. You can find additional information about the Fund at fundresearch.fidelity.com/prospectus/sec. You can also request this information by contacting us at 1-877-208-0098 or by sending an e-mail to fidfunddocuments@fidelity.com.

What were your Fund costs for the last year?(based on hypothetical $10,000 investment)

FUND COST (PREVIOUS YEAR)

| | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | |

| Class C | $ 184 | 1.62% | |

What affected the Fund's performance this period?

•International stocks achieved a strong gain for the 12 months ending October 31, 2024. Resilient global economic growth and a slowing in the pace of inflation in certain regions, as well as a shift to global monetary easing, contributed to a favorable backdrop, despite persistent geopolitical risk.

•Against this backdrop, picks in Europe ex U.K. and Japan contributed to the fund's performance versus the MSCI EAFE Index (Net MA) for the fiscal year.

•By sector, the biggest contributor to performance versus the benchmark was stock picking in industrials, primarily within the capital goods industry. Stock picking and an overweight in information technology, primarily within the semiconductors & semiconductor equipment industry, also boosted the fund's relative performance, as did stock picking in consumer discretionary.

•The top individual relative contributor was our non-benchmark stake in Nvidia (+121%). This period we decreased our investment in Nvidia. A second notable relative contributor was our non-benchmark stake in Taiwan Semiconductor (+96%). The company was one of our largest holdings. Another notable relative contributor was an overweight in Hitachi (+109%), the fund's biggest holding at period end.

•In contrast, from a regional standpoint, a non-benchmark allocation to Canada and an underweight in Asia Pacific ex Japan detracted from the fund's relative result.

•By sector, the biggest detractor from performance versus the benchmark was stock selection in consumer staples. Security selection in financials also hampered the fund's result. Also hurting our result were stock picks and an underweight in communication services, primarily within the media & entertainment industry. Lastly, the fund's position in cash detracted.

•The fund's non-benchmark stake in PDD returned -47% and was the largest individual relative detractor. This was a position we established this period. A second notable relative detractor was an overweight in L'Oréal (-9%), which was among the fund's biggest holdings this period. A non-benchmark stake in One97 Communications returned about -29% and notably hurt. The stock was not held at period end.

•Notable changes in positioning include increased exposure to Germany and a lower allocation to India. By sector, meaningful changes in positioning include increased exposure to industrials and a lower allocation to consumer staples.

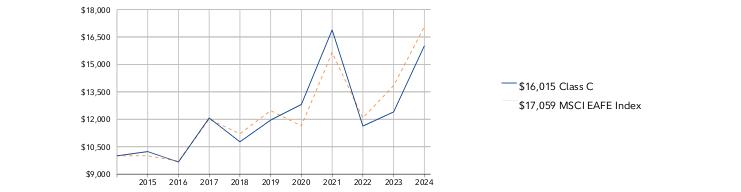

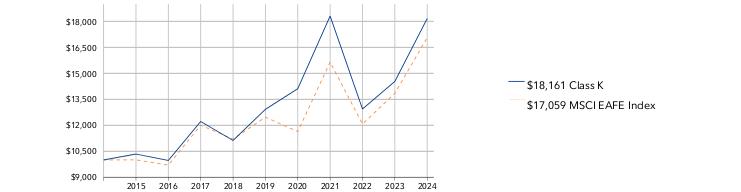

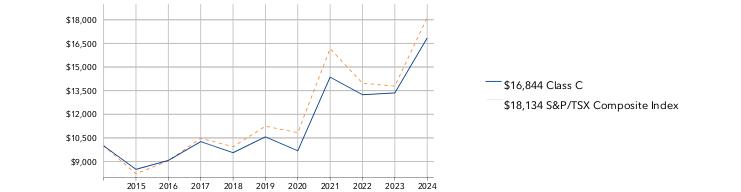

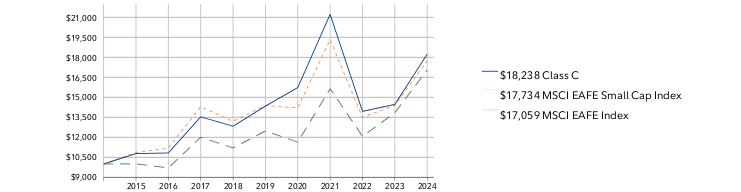

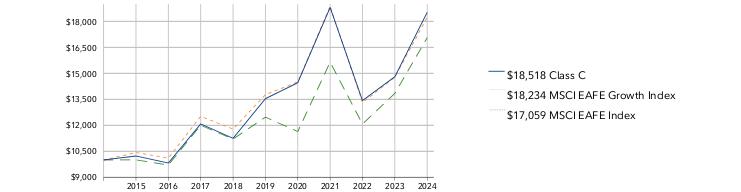

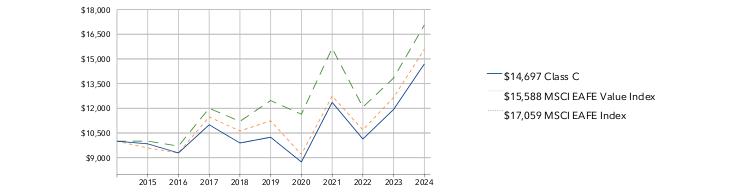

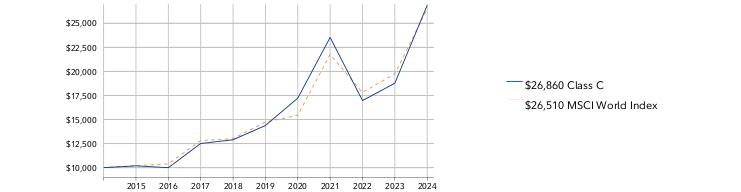

How did the Fund perform over the past 10 years?

CUMULATIVE PERFORMANCE

October 31, 2014 through October 31, 2024.

Initial investment of $10,000.

Class C | $10,000 | $10,233 | $9,663 | $12,072 | $10,767 | $11,954 | $12,813 | $16,886 | $11,628 | $12,401 | $16,015 |

MSCI EAFE Index | $10,000 | $10,008 | $9,705 | $12,004 | $11,206 | $12,472 | $11,638 | $15,647 | $12,073 | $13,841 | $17,059 |

| | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 |

AVERAGE ANNUAL TOTAL RETURNS:| | 1 Year | 5 Year | 10 Year |

| Class C (incl. contingent deferred sales charge) | 27.20% | 5.71% | 4.82% |

| Class C | 28.20% | 5.71% | 4.82% |

| MSCI EAFE Index | 23.25% | 6.46% | 5.49% |

Visit institutional.fidelity.com for more recent performance information. |

The Fund's past performance is not a good predictor of the Fund's future performance. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. |

Key Fund Statistics(as of October 31, 2024)

KEY FACTS | | |

| Fund Size | $9,841,033,775 | |

| Number of Holdings | 142 | |

| Total Advisory Fee | $45,667,963 | |

| Portfolio Turnover | 44% | |

What did the Fund invest in?

(as of October 31, 2024)

MARKET SECTORS (% of Fund's net assets) | | |

| Financials | 22.3 | |

| Industrials | 22.0 | |

| Consumer Discretionary | 14.1 | |

| Information Technology | 11.8 | |

| Health Care | 9.8 | |

| Materials | 5.4 | |

| Consumer Staples | 4.1 | |

| Communication Services | 3.3 | |

| Energy | 3.1 | |

| Real Estate | 1.0 | |

| |

| Common Stocks | 96.2 |

| Preferred Stocks | 0.7 |

| Short-Term Investments and Net Other Assets (Liabilities) | 3.1 |

ASSET ALLOCATION (% of Fund's net assets) |

|

|

| Japan | 17.6 |

| United Kingdom | 15.3 |

| France | 9.1 |

| United States | 8.5 |

| Germany | 7.0 |

| Netherlands | 6.0 |

| Italy | 5.0 |

| Canada | 4.6 |

| Sweden | 3.6 |

| Others | 23.3 |

GEOGRAPHIC DIVERSIFICATION (% of Fund's net assets) |

|

| |

|

TOP HOLDINGS(% of Fund's net assets) | | |

| Hitachi Ltd | 3.1 | |

| UniCredit SpA | 2.7 | |

| Novo Nordisk A/S Series B | 2.7 | |

| ASML Holding NV | 2.1 | |

| Taiwan Semiconductor Manufacturing Co Ltd | 2.0 | |

| Constellation Software Inc/Canada | 2.0 | |

| Unilever PLC | 2.0 | |

| Compass Group PLC | 1.7 | |

| UCB SA | 1.7 | |

| ITOCHU Corp | 1.6 | |

| | 21.6 | |

How has the Fund changed?

This is a summary of certain changes to the Fund since November 1, 2023. For more complete information, you may review the Fund's next prospectus, which we expect to be available by December 30, 2024 at fundresearch.fidelity.com/prospectus/sec or upon request at 1-877-208-0098 or by sending an e-mail to fidfunddocuments@fidelity.com.

The fees associated with this class changed during the reporting year.The variations in class fees are primarily the result of the following changes: - Management fee

- Performance adjustment fee

- Operating expenses

The fund's transfer agent and pricing & bookkeeping fees were changed to a fixed rate effective December 1, 2023, through February 29, 2024, in anticipation of the transition to a new management fee structure. Effective March 1, 2024, the fund's management contract was amended to incorporate administrative services previously covered under separate services agreements (transfer agent and pricing & bookkeeping). The amended contract incorporates a basic fee rate that may vary by class (subject to a performance adjustment). The Adviser or an affiliate pays certain expenses of managing and operating the fund out of each class's management fee. | The fund's sub-advisory agreement with FIL Investments (Japan) Limited was not renewed.

|

| Fidelity, the Fidelity Investments Logo and all other Fidelity trademarks or service marks used herein are trademarks or service marks of FMR LLC. Any third-party marks that are used herein are trademarks or service marks of their respective owners. © 2024 FMR LLC. All rights reserved. |

| | For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit fundresearch.fidelity.com/prospectus/sec 1.9913836.100 1399-TSRA-1224 |

| |

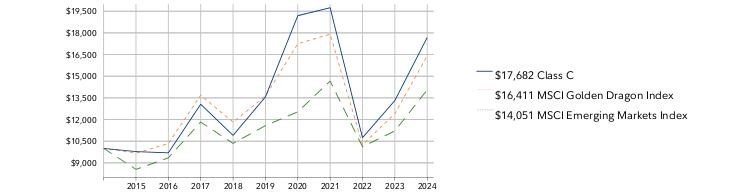

| | ANNUAL SHAREHOLDER REPORT | AS OF OCTOBER 31, 2024 | This report describes changes to the Fund that occurred during the reporting period. |

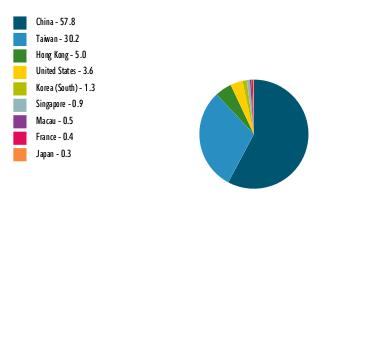

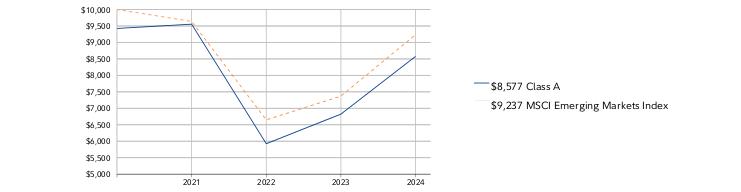

| | Fidelity® Emerging Markets Discovery Fund Fidelity® Emerging Markets Discovery Fund : FEDDX |

| | | |

This annual shareholder report contains information about Fidelity® Emerging Markets Discovery Fund for the period November 1, 2023 to October 31, 2024. You can find additional information about the Fund at fundresearch.fidelity.com/prospectus/sec. You can also request this information by contacting us at 1-800-544-8544 or by sending an e-mail to fidfunddocuments@fidelity.com.

What were your Fund costs for the last year?(based on hypothetical $10,000 investment)

FUND COST (PREVIOUS YEAR)

| | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | |

| Fidelity® Emerging Markets Discovery Fund | $ 107 | 1.00% | |

What affected the Fund's performance this period?

•International stocks achieved a strong gain for the 12 months ending October 31, 2024. Resilient global economic growth and a slowing in the pace of inflation in certain regions, as well as a shift to global monetary easing, contributed to a favorable backdrop, despite persistent geopolitical risk.

•Against this backdrop, an underweight in Emerging Asia, primarily in India, and stock picking and an overweight in Latin America, primarily in Brazil, detracted from the fund's performance versus the MSCI Emerging Markets SMID Index (Net MA) for the fiscal year.

•By sector, security selection was the primary detractor, especially within financials. Also hurting our result were stock picks in health care, primarily within the pharmaceuticals, biotechnology & life sciences industry, and consumer staples.

•The largest individual relative detractor was our stake in Pharmaron Beijing (-48%). The second-largest relative detractor was Hanon Systems (-52%). The stock was not held at period end. Another notable relative detractor was an overweight in Nanya Technology (-34%).

•In contrast, from a regional standpoint, stock selection in Africa, primarily in South Africa, and stock picks and an underweight in the Middle East, primarily in United Arab Emirates, contributed to the fund's relative result.

•By sector, the biggest contributor to performance versus the benchmark was security selection in communication services, primarily within the media & entertainment industry. Stock picks and an underweight in materials and stock selection and an overweight in industrials, primarily within the capital goods industry, also boosted the fund's relative performance.

•The top individual relative contributor was an overweight in International Games System (+243%). This period we decreased our investment in the stock, which was nonetheless one of our largest holdings as of October 31. The second-largest relative contributor was a non-benchmark stake in Hindustan Aeronautics (+136%), where we decreased our investment this period. Another notable relative contributor was an overweight in Bharat Electronics (+111%).

•Notable changes in positioning include increased exposure to Taiwan and South Africa. By sector, meaningful changes in positioning include lower allocations to health care and utilities.

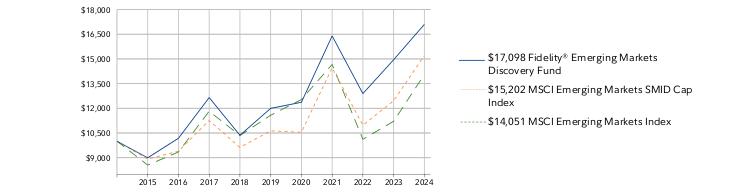

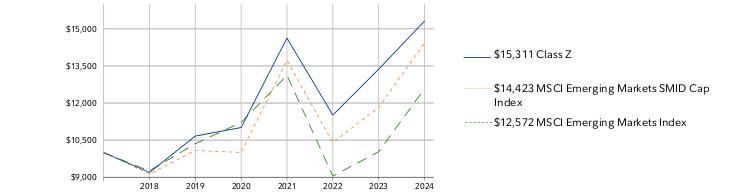

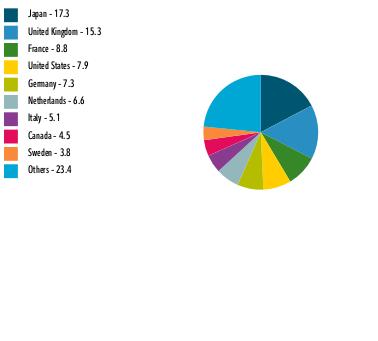

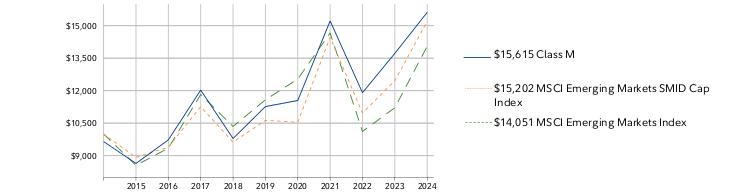

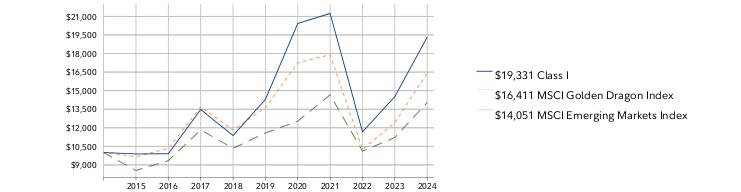

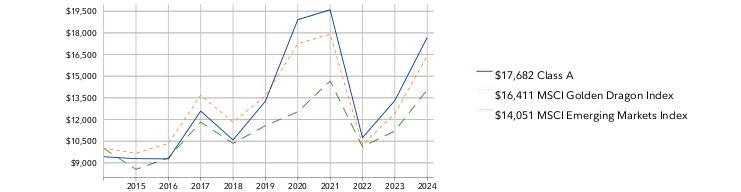

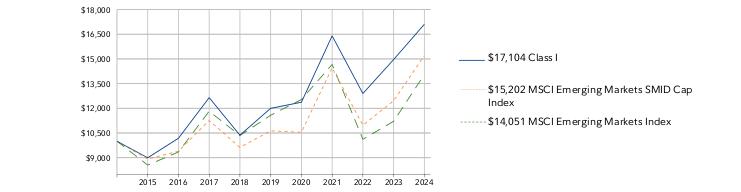

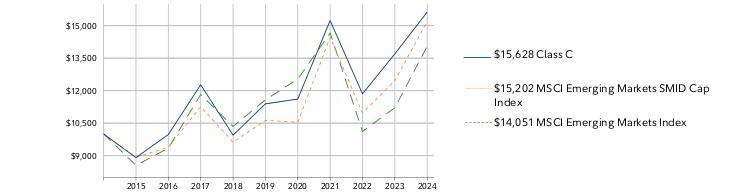

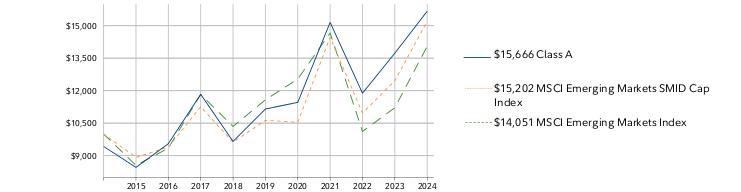

How did the Fund perform over the past 10 years?

CUMULATIVE PERFORMANCE

October 31, 2014 through October 31, 2024.

Initial investment of $10,000.

Fidelity® Emerging Markets Discovery Fund | $10,000 | $8,993 | $10,178 | $12,652 | $10,361 | $11,996 | $12,364 | $16,398 | $12,893 | $14,948 | $17,098 |

MSCI Emerging Markets SMID Cap Index | $10,000 | $8,919 | $9,391 | $11,258 | $9,624 | $10,629 | $10,543 | $14,461 | $10,969 | $12,456 | $15,202 |

MSCI Emerging Markets Index | $10,000 | $8,550 | $9,346 | $11,823 | $10,347 | $11,577 | $12,535 | $14,663 | $10,115 | $11,211 | $14,051 |

| | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 |

AVERAGE ANNUAL TOTAL RETURNS:| | 1 Year | 5 Year | 10 Year |

| Fidelity® Emerging Markets Discovery Fund | 14.38% | 7.35% | 5.51% |

| MSCI Emerging Markets SMID Cap Index | 22.04% | 7.42% | 4.28% |

| MSCI Emerging Markets Index | 25.33% | 3.95% | 3.46% |

Visit www.fidelity.com for more recent performance information. |

The Fund's past performance is not a good predictor of the Fund's future performance. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. |

Key Fund Statistics(as of October 31, 2024)

KEY FACTS | | |

| Fund Size | $1,183,237,609 | |

| Number of Holdings | 111 | |

| Total Advisory Fee | $10,611,763 | |

| Portfolio Turnover | 29% | |

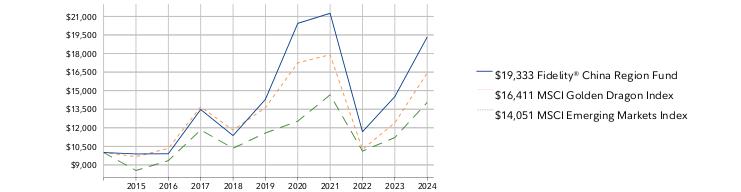

What did the Fund invest in?

(as of October 31, 2024)

MARKET SECTORS (% of Fund's net assets) | | |

| Industrials | 21.0 | |

| Consumer Discretionary | 18.3 | |

| Financials | 14.5 | |

| Information Technology | 10.9 | |

| Consumer Staples | 7.8 | |

| Real Estate | 7.4 | |

| Health Care | 4.6 | |

| Materials | 4.6 | |

| Utilities | 3.9 | |

| Energy | 3.3 | |

| Communication Services | 3.2 | |

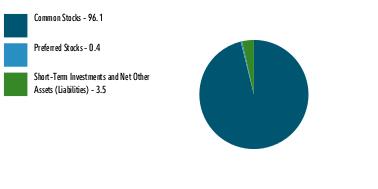

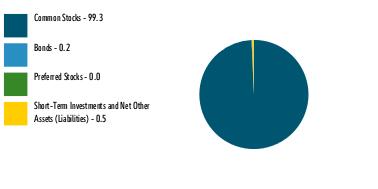

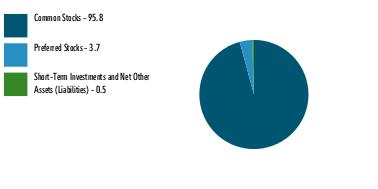

| |

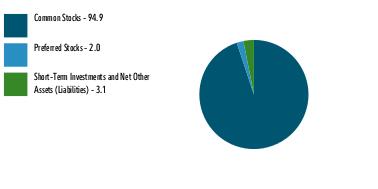

| Common Stocks | 99.5 |

| Short-Term Investments and Net Other Assets (Liabilities) | 0.5 |

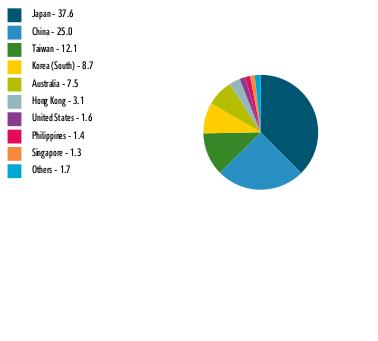

ASSET ALLOCATION (% of Fund's net assets) |

|

|

| China | 21.4 |

| Taiwan | 17.6 |

| India | 13.3 |

| Brazil | 11.7 |

| Korea (South) | 6.2 |

| South Africa | 5.4 |

| Mexico | 4.8 |

| Saudi Arabia | 2.3 |

| Hong Kong | 2.2 |

| Others | 15.1 |

GEOGRAPHIC DIVERSIFICATION (% of Fund's net assets) |

|

| |

|

TOP HOLDINGS(% of Fund's net assets) | | |

| Impala Platinum Holdings Ltd | 1.8 | |

| Shriram Finance Ltd | 1.4 | |

| SITC International Holdings Co Ltd | 1.4 | |

| Bizlink Holding Inc | 1.4 | |

| Yageo Corp | 1.4 | |

| Torrent Pharmaceuticals Ltd | 1.3 | |

| Mr Price Group Ltd | 1.3 | |

| International Games System Co Ltd | 1.3 | |

| Nien Made Enterprise Co Ltd | 1.3 | |

| Coway Co Ltd | 1.3 | |

| | 13.9 | |

How has the Fund changed?

This is a summary of certain changes to the Fund since November 1, 2023. For more complete information, you may review the Fund's next prospectus, which we expect to be available by December 30, 2024 at fundresearch.fidelity.com/prospectus/sec or upon request at 1-800-544-8544 or by sending an e-mail to fidfunddocuments@fidelity.com.

The fees associated with this class changed during the reporting year.The variations in class fees are primarily the result of the following changes: - Management fee

- Operating expenses

The fund's transfer agent and pricing & bookkeeping fees were changed to a fixed rate effective December 1, 2023, through February 29, 2024, in anticipation of the transition to a new management fee structure. Effective March 1, 2024, the fund's management contract was amended to incorporate administrative services previously covered under separate services agreements (transfer agent and pricing & bookkeeping). The amended contract incorporates a management fee rate that may vary by class. The Adviser or an affiliate pays certain expenses of managing and operating the fund out of each class's management fee. | The fund's sub-advisory agreement with FIL Investments (Japan) Limited was not renewed

|

| Fidelity, the Fidelity Investments Logo and all other Fidelity trademarks or service marks used herein are trademarks or service marks of FMR LLC. Any third-party marks that are used herein are trademarks or service marks of their respective owners. © 2024 FMR LLC. All rights reserved. |

| | For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit fundresearch.fidelity.com/prospectus/sec 1.9913973.100 2374-TSRA-1224 |

| |

| | ANNUAL SHAREHOLDER REPORT | AS OF OCTOBER 31, 2024 | This report describes changes to the Fund that occurred during the reporting period. |

| | Fidelity® Japan Fund Fidelity® Japan Fund : FJPNX |

| | | |

This annual shareholder report contains information about Fidelity® Japan Fund for the period November 1, 2023 to October 31, 2024. You can find additional information about the Fund at fundresearch.fidelity.com/prospectus/sec. You can also request this information by contacting us at 1-800-544-8544 or by sending an e-mail to fidfunddocuments@fidelity.com.

What were your Fund costs for the last year?(based on hypothetical $10,000 investment)

FUND COST (PREVIOUS YEAR)

| | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | |

| Fidelity® Japan Fund | $ 76 | 0.68% | |

What affected the Fund's performance this period?

•International stocks achieved a strong gain for the 12 months ending October 31, 2024. Resilient global economic growth and a slowing in the pace of inflation in certain regions, as well as a shift to global monetary easing, contributed to a favorable backdrop, despite persistent geopolitical risk.

•With that said, in March 2024, the Bank of Japan raised short-term interest rates for the first time in 17 years, ending its negative interest rate policy.

•Against this backdrop, stock selection in Japan and a non-benchmark allocation to the United States contributed to the fund's performance versus the TOPIX Total Return Index for the fiscal year.

•By sector, security selection was the primary contributor, led by industrials, where our stock picks in capital goods helped most. Stock picking in financials and consumer discretionary also boosted the fund's relative performance.

•The top individual relative contributor was an overweight in IHI (+196%). The second-largest relative contributor was an overweight in Hitachi (+109%). The stock was among the fund's largest holdings. An overweight in Dexerials (+115%) also helped. We trimmed our stakes in all three stocks.

•In contrast, from a regional standpoint, non-benchmark allocations to emerging markets and Asia Pacific ex Japan modestly detracted from the fund's relative result.

•By sector, the biggest detractor from performance versus the benchmark was stock selection in information technology, primarily within the semiconductors & semiconductor equipment industry. Security selection in energy also hampered the fund's result. Also hurting our result was an underweight in industrials, primarily within the capital goods industry.

•The largest individual relative detractor this period was avoiding Recruit Holdings, a benchmark component that gained 120%. The second-largest relative detractor was our non-benchmark stake in JTOWER (-31%). The stock was not held at period end. An overweight in TechnoPro Holdings (-4%) also hurt, and we reduced our exposure to the stock.

•By sector, meaningful changes in positioning include increased exposure to materials and industrials.

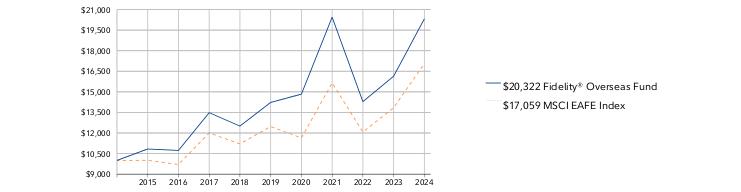

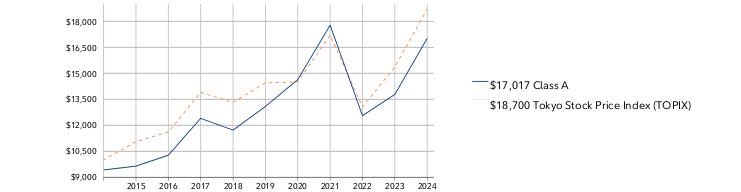

How did the Fund perform over the past 10 years?

CUMULATIVE PERFORMANCE

October 31, 2014 through October 31, 2024.

Initial investment of $10,000.

Fidelity® Japan Fund | $10,000 | $10,266 | $10,964 | $13,280 | $12,579 | $14,101 | $15,816 | $19,257 | $13,642 | $15,012 | $18,581 |

Tokyo Stock Price Index (TOPIX) | $10,000 | $11,061 | $11,611 | $13,898 | $13,325 | $14,450 | $14,503 | $17,203 | $13,066 | $15,363 | $18,700 |

| | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 |

AVERAGE ANNUAL TOTAL RETURNS:| | 1 Year | 5 Year | 10 Year |

| Fidelity® Japan Fund | 23.78% | 5.67% | 6.39% |

| Tokyo Stock Price Index (TOPIX) | 21.72% | 5.29% | 6.46% |

Visit www.fidelity.com for more recent performance information. |

The Fund's past performance is not a good predictor of the Fund's future performance. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. |

Key Fund Statistics(as of October 31, 2024)

KEY FACTS | | |

| Fund Size | $692,986,086 | |

| Number of Holdings | 89 | |

| Total Advisory Fee | $3,522,427 | |

| Portfolio Turnover | 21% | |

What did the Fund invest in?

(as of October 31, 2024)

MARKET SECTORS (% of Fund's net assets) | | |

| Industrials | 25.1 | |

| Information Technology | 18.9 | |

| Consumer Discretionary | 14.7 | |

| Financials | 13.4 | |

| Materials | 7.8 | |

| Health Care | 7.1 | |

| Communication Services | 4.2 | |

| Consumer Staples | 3.2 | |

| Energy | 1.9 | |

| Utilities | 1.9 | |

| Real Estate | 1.1 | |

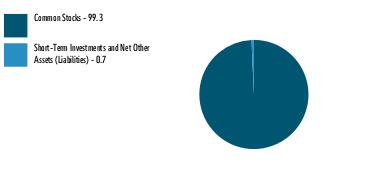

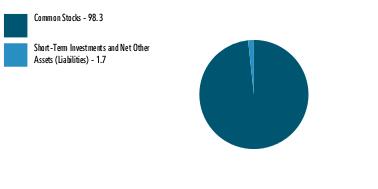

| |

| Common Stocks | 99.3 |

| Short-Term Investments and Net Other Assets (Liabilities) | 0.7 |

ASSET ALLOCATION (% of Fund's net assets) |

|

|

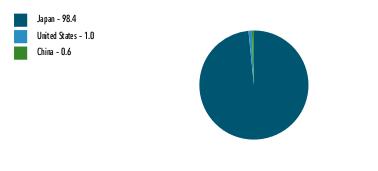

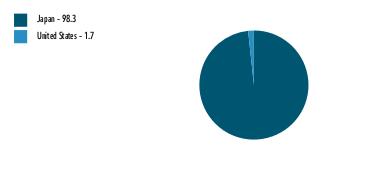

| Japan | 98.4 |

| United States | 1.0 |

| China | 0.6 |

GEOGRAPHIC DIVERSIFICATION (% of Fund's net assets) |

|

| |

|

TOP HOLDINGS(% of Fund's net assets) | | |

| Sumitomo Mitsui Financial Group Inc | 6.0 | |

| Hitachi Ltd | 5.0 | |

| Sony Group Corp | 3.8 | |

| Shin-Etsu Chemical Co Ltd | 3.3 | |

| Hoya Corp | 3.3 | |

| ORIX Corp | 3.1 | |

| Renesas Electronics Corp | 2.7 | |

| Fujitsu Ltd | 2.6 | |

| FUJIFILM Holdings Corp | 2.4 | |

| Denso Corp | 2.3 | |

| | 34.5 | |

How has the Fund changed?

This is a summary of certain changes to the Fund since November 1, 2023. For more complete information, you may review the Fund's next prospectus, which we expect to be available by December 30, 2024 at fundresearch.fidelity.com/prospectus/sec or upon request at 1-800-544-8544 or by sending an e-mail to fidfunddocuments@fidelity.com.

The fees associated with this class changed during the reporting year.The variations in class fees are primarily the result of the following changes: - Management fee

- Performance adjustment fee

- Operating expenses

The fund's transfer agent and pricing & bookkeeping fees were changed to a fixed rate effective December 1, 2023, through February 29, 2024, in anticipation of the transition to a new management fee structure. Effective March 1, 2024, the fund's management contract was amended to incorporate administrative services previously covered under separate services agreements (transfer agent and pricing & bookkeeping). The amended contract incorporates a basic fee rate that may vary by class (subject to a performance adjustment). The Adviser or an affiliate pays certain expenses of managing and operating the fund out of each class's management fee. | The fund's sub-advisory agreement with FIL Investments (Japan) Limited was not renewed.

|

| Fidelity, the Fidelity Investments Logo and all other Fidelity trademarks or service marks used herein are trademarks or service marks of FMR LLC. Any third-party marks that are used herein are trademarks or service marks of their respective owners. © 2024 FMR LLC. All rights reserved. |

| | For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit fundresearch.fidelity.com/prospectus/sec 1.9913887.100 350-TSRA-1224 |

| |

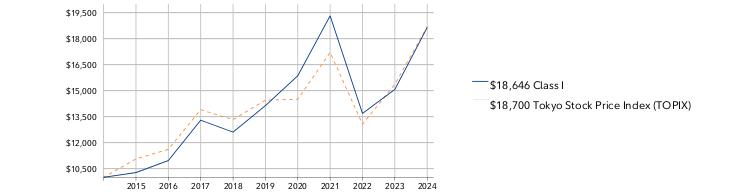

| | ANNUAL SHAREHOLDER REPORT | AS OF OCTOBER 31, 2024 | This report describes changes to the Fund that occurred during the reporting period. |

| | Fidelity® Japan Fund Fidelity Advisor® Japan Fund Class M : FJPTX |

| | | |

This annual shareholder report contains information about Fidelity® Japan Fund for the period November 1, 2023 to October 31, 2024. You can find additional information about the Fund at fundresearch.fidelity.com/prospectus/sec. You can also request this information by contacting us at 1-877-208-0098 or by sending an e-mail to fidfunddocuments@fidelity.com.

What were your Fund costs for the last year?(based on hypothetical $10,000 investment)

FUND COST (PREVIOUS YEAR)

| | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | |

| Class M | $ 136 | 1.22% | |

What affected the Fund's performance this period?

•International stocks achieved a strong gain for the 12 months ending October 31, 2024. Resilient global economic growth and a slowing in the pace of inflation in certain regions, as well as a shift to global monetary easing, contributed to a favorable backdrop, despite persistent geopolitical risk.

•With that said, in March 2024, the Bank of Japan raised short-term interest rates for the first time in 17 years, ending its negative interest rate policy.

•Against this backdrop, stock selection in Japan and a non-benchmark allocation to the United States contributed to the fund's performance versus the TOPIX Total Return Index for the fiscal year.

•By sector, security selection was the primary contributor, led by industrials, where our stock picks in capital goods helped most. Stock picking in financials and consumer discretionary also boosted the fund's relative performance.

•The top individual relative contributor was an overweight in IHI (+196%). The second-largest relative contributor was an overweight in Hitachi (+109%). The stock was among the fund's largest holdings. An overweight in Dexerials (+115%) also helped. We trimmed our stakes in all three stocks.

•In contrast, from a regional standpoint, non-benchmark allocations to emerging markets and Asia Pacific ex Japan modestly detracted from the fund's relative result.

•By sector, the biggest detractor from performance versus the benchmark was stock selection in information technology, primarily within the semiconductors & semiconductor equipment industry. Security selection in energy also hampered the fund's result. Also hurting our result was an underweight in industrials, primarily within the capital goods industry.

•The largest individual relative detractor this period was avoiding Recruit Holdings, a benchmark component that gained 120%. The second-largest relative detractor was our non-benchmark stake in JTOWER (-31%). The stock was not held at period end. An overweight in TechnoPro Holdings (-4%) also hurt, and we reduced our exposure to the stock.

•By sector, meaningful changes in positioning include increased exposure to materials and industrials.

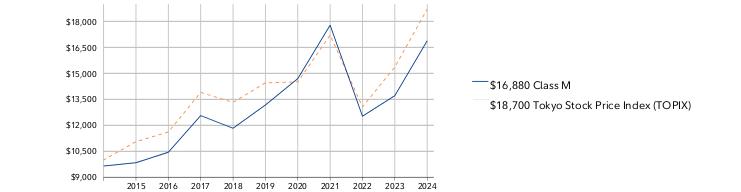

How did the Fund perform over the past 10 years?

CUMULATIVE PERFORMANCE

October 31, 2014 through October 31, 2024.

Initial investment of $10,000 and the current sales charge was paid.

Class M | $9,650 | $9,841 | $10,446 | $12,560 | $11,831 | $13,172 | $14,693 | $17,779 | $12,525 | $13,712 | $16,880 |

Tokyo Stock Price Index (TOPIX) | $10,000 | $11,061 | $11,611 | $13,898 | $13,325 | $14,450 | $14,503 | $17,203 | $13,066 | $15,363 | $18,700 |

| | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 |

AVERAGE ANNUAL TOTAL RETURNS:| | 1 Year | 5 Year | 10 Year |

| Class M (incl. 3.50% sales charge) | 18.79% | 4.34% | 5.37% |

| Class M (without 3.50% sales charge) | 23.10% | 5.09% | 5.75% |

| Tokyo Stock Price Index (TOPIX) | 21.72% | 5.29% | 6.46% |

Visit institutional.fidelity.com for more recent performance information. |

The Fund's past performance is not a good predictor of the Fund's future performance. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. |

Key Fund Statistics(as of October 31, 2024)

KEY FACTS | | |

| Fund Size | $692,986,086 | |

| Number of Holdings | 89 | |

| Total Advisory Fee | $3,522,427 | |

| Portfolio Turnover | 21% | |

What did the Fund invest in?

(as of October 31, 2024)

MARKET SECTORS (% of Fund's net assets) | | |

| Industrials | 25.1 | |

| Information Technology | 18.9 | |

| Consumer Discretionary | 14.7 | |

| Financials | 13.4 | |

| Materials | 7.8 | |

| Health Care | 7.1 | |

| Communication Services | 4.2 | |

| Consumer Staples | 3.2 | |

| Energy | 1.9 | |

| Utilities | 1.9 | |

| Real Estate | 1.1 | |

| |

| Common Stocks | 99.3 |

| Short-Term Investments and Net Other Assets (Liabilities) | 0.7 |

ASSET ALLOCATION (% of Fund's net assets) |

|

|

| Japan | 98.4 |

| United States | 1.0 |

| China | 0.6 |

GEOGRAPHIC DIVERSIFICATION (% of Fund's net assets) |

|

| |

|

TOP HOLDINGS(% of Fund's net assets) | | |

| Sumitomo Mitsui Financial Group Inc | 6.0 | |

| Hitachi Ltd | 5.0 | |

| Sony Group Corp | 3.8 | |

| Shin-Etsu Chemical Co Ltd | 3.3 | |

| Hoya Corp | 3.3 | |

| ORIX Corp | 3.1 | |

| Renesas Electronics Corp | 2.7 | |

| Fujitsu Ltd | 2.6 | |

| FUJIFILM Holdings Corp | 2.4 | |

| Denso Corp | 2.3 | |

| | 34.5 | |

How has the Fund changed?

This is a summary of certain changes to the Fund since November 1, 2023. For more complete information, you may review the Fund's next prospectus, which we expect to be available by December 30, 2024 at fundresearch.fidelity.com/prospectus/sec or upon request at 1-877-208-0098 or by sending an e-mail to fidfunddocuments@fidelity.com.

The fees associated with this class changed during the reporting year.The variations in class fees are primarily the result of the following changes: - Management fee

- Performance adjustment fee

- Operating expenses

- Expense reductions

The fund's transfer agent and pricing & bookkeeping fees were changed to a fixed rate effective December 1, 2023, through February 29, 2024, in anticipation of the transition to a new management fee structure. Effective March 1, 2024, the fund's management contract was amended to incorporate administrative services previously covered under separate services agreements (transfer agent and pricing & bookkeeping). The amended contract incorporates a basic fee rate that may vary by class (subject to a performance adjustment). The Adviser or an affiliate pays certain expenses of managing and operating the fund out of each class's management fee. | The fund's sub-advisory agreement with FIL Investments (Japan) Limited was not renewed.

|

| Fidelity, the Fidelity Investments Logo and all other Fidelity trademarks or service marks used herein are trademarks or service marks of FMR LLC. Any third-party marks that are used herein are trademarks or service marks of their respective owners. © 2024 FMR LLC. All rights reserved. |

| | For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit fundresearch.fidelity.com/prospectus/sec 1.9913884.100 2259-TSRA-1224 |

| |

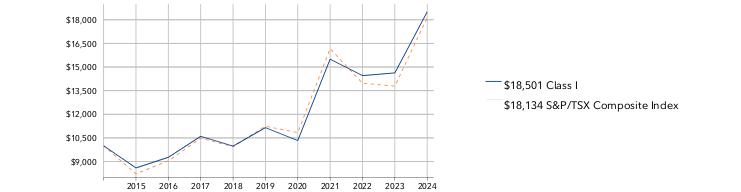

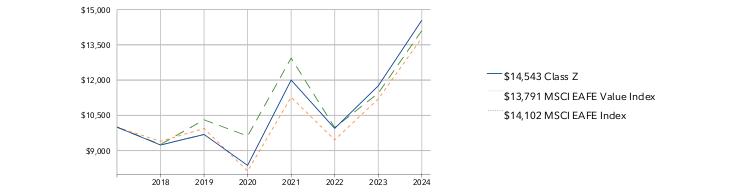

| | ANNUAL SHAREHOLDER REPORT | AS OF OCTOBER 31, 2024 | This report describes changes to the Fund that occurred during the reporting period. |

| | Fidelity® International Value Fund Fidelity Advisor® International Value Fund Class A : FIVMX |

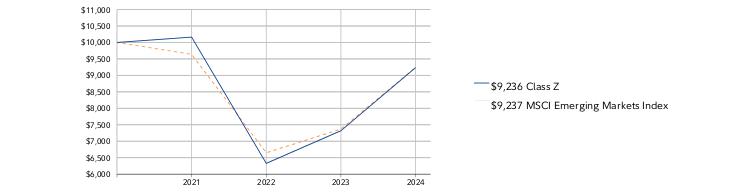

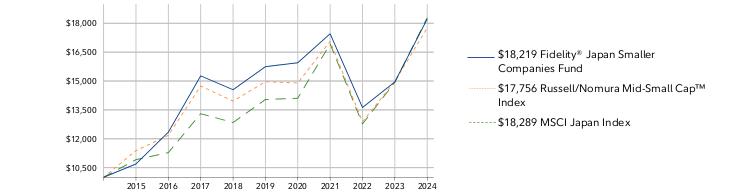

| | | |