Annual Report November 30, 2006

EATON VANCE

PRIME

RATE

RESERVES

IMPORTANT NOTICES REGARDING PRIVACY,

DELIVERY OF SHAREHOLDER DOCUMENTS,

PORTFOLIO HOLDINGS AND PROXY VOTING

Privacy. The Eaton Vance organization is committed to ensuring your financial privacy. Each of the financial institutions identified below has in effect the following policy ("Privacy Policy") with respect to nonpublic personal information about its customers:

• Only such information received from you, through application forms or otherwise, and information about your Eaton Vance fund transactions will be collected. This may include information such as name, address, social security number, tax status, account balances and transactions.

• None of such information about you (or former customers) will be disclosed to anyone, except as permitted by law (which includes disclosure to employees necessary to service your account). In the normal course of servicing a customer's account, Eaton Vance may share information with unaffiliated third parties that perform various required services such as transfer agents, custodians and broker/dealers.

• Policies and procedures (including physical, electronic and procedural safeguards) are in place that are designed to protect the confidentiality of such information.

• We reserve the right to change our Privacy Policy at any time upon proper notification to you. Customers may want to review our Policy periodically for changes by accessing the link on our homepage: www.eatonvance.com.

Our pledge of privacy applies to the following entities within the Eaton Vance organization: the Eaton Vance Family of Funds, Eaton Vance Management, Eaton Vance Investment Counsel, Boston Management and Research, and Eaton Vance Distributors, Inc.

In addition, our Privacy Policy only applies to those Eaton Vance customers who are individuals and who have a direct relationship with us. If a customer's account (i.e., fund shares) is held in the name of a third-party financial adviser/

broker-dealer, it is likely that only such adviser's privacy policies apply to the customer. This notice supersedes all previously issued privacy disclosures.

For more information about Eaton Vance's Privacy Policy, please call 1-800-262-1122.

Delivery of Shareholder Documents. The Securities and Exchange Commission (the "SEC") permits funds to deliver only one copy of shareholder documents, including prospectuses, proxy statements and shareholder reports, to fund investors with multiple accounts at the same residential or post office box address. This practice is often called "householding" and it helps eliminate duplicate mailings to shareholders.

Eaton Vance, or your financial adviser, may household the mailing of your documents indefinitely unless you instruct Eaton Vance, or your financial adviser, otherwise.

If you would prefer that your Eaton Vance documents not be householded, please contact Eaton Vance at 1-800-262-1122, or contact your financial adviser.

Your instructions that householding not apply to delivery of your Eaton Vance documents will be effective within 30 days of receipt by Eaton Vance or your financial adviser.

Portfolio Holdings. Each Eaton Vance Fund and its underlying Portfolio (if applicable) will file a schedule of its portfolio holdings on Form N-Q with the SEC for the first and third quarters of each fiscal year. The Form N-Q will be available on the Eaton Vance website www.eatonvance.com, by calling Eaton Vance at 1-800-262-1122 or in the EDGAR database on the SEC's website at www.sec.gov. Form N-Q may also be reviewed and copied at the SEC's public reference room in Washington, D.C. (call 1-800-732-0330 for information on the operation of the public reference room).

Proxy Voting. From time to time, funds are required to vote proxies related to the securities held by the funds. The Eaton Vance Funds or their underlying Portfolios (if applicable) vote proxies according to a set of policies and procedures approved by the Funds' and Portfolios' Boards. You may obtain a description of these policies and procedures and information on how the Funds or Portfolios voted proxies relating to portfolio securities during the most recent 12 month period ended June 30, without charge, upon request, by calling 1-800-262-1122. This description is also available on the SEC's website at www.sec.gov.

Eaton Vance Prime Rate Reserves as of November 30, 2006

ManageMenT's dIscussIon of fund PerforMance

Performance for the Past Year

· Eaton Vance Prime Rate Reserves (the "Fund") had a total return of 6.02% during the year ended November 30, 2006.(1) This return resulted from no change in NAV of $9.39 on November 30, 2006, and on November 30, 2005, and the reinvestment of all distributions.

· The Fund distributed $0.551 in income dividends during the year ended November 30, 2006. Based on a $9.39 net asset value on November 30, 2006, the Fund had a distribution rate of 6.38%.(2) The Fund's SEC 30-day yield at November 30, 2006, was

6.48%.(3)

· For comparison, the Fund's benchmark - the S&P/ LSTA Leveraged Loan Index - an unmanaged loan market index - had a total return of 6.57% for the year ended November 30, 2006.(4)

Investment Environment

· The loan market enjoyed relatively stable fundamentals during the fiscal year, with default rates remaining low by historical standards. Technical factors came more into balance, as record new issuance from strong merger and acquisition activity met robust investor demand. Loan credit spreads stabilized during the fiscal year, after a period during which they had narrowed.

· The Federal Reserve raised its Federal Funds rate - a key short-term interest rate benchmark - by 25 basis points (0.25%) on five occasions during the fiscal year ended November 30, 2006. The London Inter-Bank Offered Rate (LIBOR) - the benchmark over which loan interest rates are typically set - rose in lockstep with those actions, increasing the Fund's total return.

The Portfolio's Investments

· Senior Debt Portfolio's investments included 485 borrowers at November 30, 2006, with an average loan size of 0.20% of total investments, and no industry constituting more than 8.0% of total investments. Chemicals/plastics, building and development (including manufacturers of building products and companies that manage/own apartments, shopping malls and commercial office buildings, among others), health care, cable/satellite television and business equipment/services and were the Portfolio's largest industry weightings.*

· Senior Debt Portfolio had an 11.5% exposure in European loans at November 30, 2006. European loan issuance has grown significantly in 2006 and now represents a significant portion of the global loan market. European loans increased the Portfolio's investment universe, presenting further opportunities for diversification. In addition, because European spreads were slightly wider than the U.S.market, European exposure provided selected opportunities for yield enhancement. All of the Portfolio's foreign loans were either dollar-denominated or hedged to help protect against foreign currency risk.

The views expressed in this report are those of the portfolio managers and are current only through the end of the period of the report as stated on the cover. These views are subject to change at any time based upon market or other conditions, and the investment adviser disclaims any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a fund are based on many factors, may not be relied on as an indication of trading intent on behalf of any Eaton Vance fund.

* Holdings and industry weightings are subject to change due to active management.

Past performance is no guarantee of future results. Returns are historical and are calculated by determining the percentage change in net asset value or share price (as applicable) with all distributions reinvested. Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Performance is for the stated time period only; due to market volatility, the Fund's current performance may be lower or higher than the quoted return. For performance as of the most recent month end, please refer to www.eatonvance.com.

Fund shares are not insured by the FDIC and are not deposits or other obligations of, or guaranteed by, any depository institution. Shares are subject to investment risks, including possible loss of principal invested.

(1) Total return at net asset value does not reflect applicable early withdrawal charge (EWC). If EWC was included, return would be lower. Absent a fee waiver by the investment adviser, the returns would be lower. (2) The Fund's distribution rate represents actual distributions paid to shareholders and is calculated daily by dividing the last distribution per share (annualized) by the net asset value. (3) The Fund's SEC yield is calculated by dividing the net investment income per share for the 30-day period by the net asset value at the end of the period and annualizing the result. Yield will vary. (4) It is not possible to invest directly in an Index. The Index's total return reflects changes in the value of the loans constituting the Index and accrual of interest and does not reflect the expenses that would have been incurred if an investor individually purchased or sold the loans represented in the Index.

1

Eaton Vance Prime Rate Reserves as of November 30, 2006

fund PerforMance

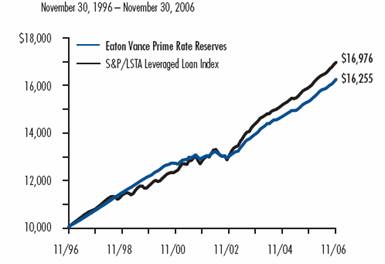

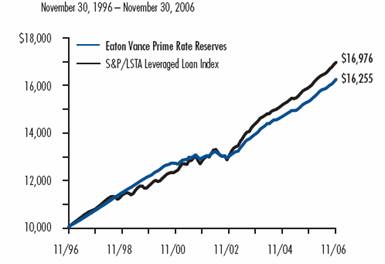

The line graph and table set forth below provide information about the Fund's performance. The line graph compares the performance of the Fund with that of the S&P/LSTA Leveraged Loan Index, an unmanaged loan market index. The lines on the graph represent the total returns of a hypothetical investment of $10,000 in the Fund and in the S&P/LSTA Leveraged Loan Index. The table includes the total return of the Fund at net asset value and public offering price. The performance presented below does not reflect the deduction of taxes, if any, that a shareholder would pay on distributions or the repurchase of Fund shares.

Performance(1) As of 11/30/06

Average Annual Total Returns (at net asset value) | | | |

One year | | 6.02 | % |

Five years | | 4.69 | |

Ten years | | 4.98 | |

SEC Average Annual Total Returns (including applicable EWC) | | | |

One year | | 3.02 | % |

Five years | | 4.69 | |

Ten years | | 4.98 | |

(1) Average Annual Total Returns at net asset value do not include the applicable early withdrawal charge (EWC). If the EWC was deducted, returns would be lower. SEC Average Annual Total Returns reflect applicable EWC based on the following schedule: 3% - 1st year; 2.5% - 2nd year; 2% - 3rd year; 1% - 4th year.

Past performance is no guarantee of future results. Returns are historical and are calculated by determining the percentage change in net asset value or share price (as applicable) with all distributions reinvested. Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Performance is for the stated time period only; due to market volatility, the Fund's current performance may be lower or higher than the quoted return. For performance as of the most recent month end, please refer to www.eatonvance.com.

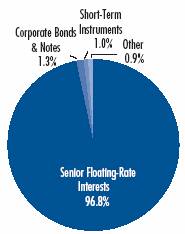

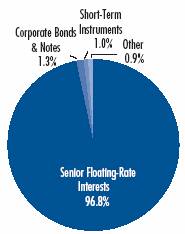

fund Allocations(2)

(2) Reflects the Fund's investments in Senior Debt Portfolio as of November 30, 2006. Allocations are shown as a percentage of the Portfolios total investments. Fund allocations may not be representative of current or future investments and are subject to change due to active management.

Comparison of Change in value of a $10,000 Investment in Easton Vance Prime Rate Reserves vs. the S&P/LISA Leveraged Loan Index*

* Sources: Standard & Poor's; Thomson Financial. Fund operations commenced on 8/4/89.

It is not possible to invest directly in an Index. The Index's total returns do not reflect the expenses that would have been incurred if an investor individually purchased or sold the securities represented in the Index.

Diversification by Industries(3)

Chemicals & Plastics | | 7.5 | % |

Building & Development | | 7.1 | |

Health Care | | 5.9 | |

Cable & Satellite Television | | 5.8 | |

Business Equip. & Services | | 5.7 | |

Publishing | | 5.1 | |

Leisure Goods/Activities/Movies | | 4.8 | |

Radio & Television | | 4.3 | |

Automotive | | 4.3 | |

Lodging & Casinos | | 3.8 | |

Telecommunications | | 3.6 | |

Containers & Glass Products | | 3.5 | |

Conglomerates | | 3.0 | |

Retailers (Except Food & Drug) | | 2.9 | |

Electronics/Electrical | | 2.8 | |

Financial Intermediaries | | 2.5 | |

Oil & Gas | | 2.2 | |

Food Products | | 2.2 | |

Utilities | | 2.1 | |

Forest Products | | 2.1 | % |

Nonferrous Metals/Minerals | | 2.0 | |

Aerospace & Defense | | 1.7 | |

Food Service | | 1.7 | |

Home Furnishings | | 1.3 | |

Food/Drug Retailers | | 1.3 | |

Industrial Equipment | | 1.2 | |

Equipment Leasing | | 1.2 | |

Ecological Services & Equip. | | 1.1 | |

Air Transport | | 1.0 | |

Insurance | | 0.9 | |

Beverage & Tobacco | | 0.8 | |

Rail Industries | | 0.6 | |

Clothing/Textiles | | 0.5 | |

Surface Transport | | 0.5 | |

Drugs | | 0.5 | |

Cosmetics/Toiletries | | 0.3 | |

Farming/Agriculture | | 0.2 | |

Steel | | 0.1 | |

(3) Reflects the Fund's investments in Senior Debt Portfolio as of November 30, 2006. Industries are shown as a percentage of the Portfolio's total investments. Statistics may not be representative of current or future investments and are subject to change due to active management.

2

Eaton Vance Prime Rate Reserves as of November 30, 2006

FINANCIAL STATEMENTS

Statement of Assets and Liabilities

As of November 30, 2006

| Assets | |

Investment in Senior Debt Portfolio, at value

(identified cost, $1,250,495,267) | | $ | 1,277,230,022 | | |

| Receivable for Fund shares sold | | | 886,932 | | |

| Total assets | | $ | 1,278,116,954 | | |

| Liabilities | |

| Dividends payable | | $ | 3,153,769 | | |

| Payable to affiliate for distribution fees | | | 761,055 | | |

| Payable to affiliate for Trustees' fees | | | 580 | | |

| Payable for Fund shares redeemed | | | 9,915 | | |

| Accrued expenses | | | 325,417 | | |

| Total liabilities | | $ | 4,250,736 | | |

| Net Assets | | $ | 1,273,866,218 | | |

| Sources of Net Assets | |

| Paid-in capital | | $ | 1,584,494,373 | | |

Accumulated net realized loss from Portfolio

(computed on the basis of identified cost) | | | (338,149,044 | ) | |

| Accumulated undistributed net investment income | | | 786,134 | | |

Net unrealized appreciation from Portfolio

(computed on the basis of identified cost) | | | 26,734,755 | | |

| Total | | $ | 1,273,866,218 | | |

Net Asset Value, Offering Price and

Redemption Price Per Share | |

($1,273,866,218 ÷ 135,732,803 shares of beneficial

interest outstanding) | | $ | 9.39 | | |

Statement of Operations

For the Year Ended

November 30, 2006

| Investment Income | |

| Interest allocated from Portfolio | | $ | 98,222,226 | | |

| Expenses allocated from Portfolio | | | (7,146,065 | ) | |

| Net investment income from Portfolio | | $ | 91,076,161 | | |

| Expenses | |

| Trustees' fees and expenses | | $ | 3,408 | | |

| Distribution fees | | | 9,657,606 | | |

| Transfer and dividend disbursing agent fees | | | 1,116,099 | | |

| Printing and postage | | | 256,714 | | |

| Legal and accounting services | | | 40,933 | | |

| Registration fees | | | 36,240 | | |

| Custodian fee | | | 28,105 | | |

| Miscellaneous | | | 11,306 | | |

| Total expenses | | $ | 11,150,411 | | |

| Net investment income | | $ | 79,925,750 | | |

Realized and Unrealized

Gain (Loss) from Portfolio | |

Net realized gain (loss) -

Investment transactions (identified cost basis) | | $ | 3,029,722 | | |

| Swap contracts | | | 155,168 | | |

Foreign currency and forward foreign currency

exchange contract transactions | | | (9,171,517 | ) | |

| Net realized loss | | $ | (5,986,627 | ) | |

Change in unrealized appreciation (depreciation) -

Investments (identified cost basis) | | $ | 8,704,493 | | |

| Swap contracts | | | 238,829 | | |

| Foreign currency and forward foreign currency exchange contracts | | | (1,346,980 | ) | |

| Net change in unrealized appreciation (depreciation) | | $ | 7,596,342 | | |

| Net realized and unrealized gain | | $ | 1,609,715 | | |

| Net increase in net assets from operations | | $ | 81,535,465 | | |

See notes to financial statements

3

Eaton Vance Prime Rate Reserves as of November 30, 2006

FINANCIAL STATEMENTS CONT'D

Statements of Changes in Net Assets

Increase (Decrease)

in Net Assets | | Year Ended

November 30, 2006 | | Year Ended

November 30, 2005 | |

From operations -

Net investment income | | $ | 79,925,750 | | | $ | 65,518,404 | | |

Net realized gain (loss) from investment

transactions, swap contracts,

foreign currency, and forward

foreign currency exchange

contract transactions | | | (5,986,627 | ) | | | 849,299 | | |

Net change in unrealized appreciation

(depreciation) from investments,

swap contracts, foreign

currency, and forward foreign

currency exchange contracts | | | 7,596,342 | | | | 185,299 | | |

| Net increase in net assets from operations | | $ | 81,535,465 | | | $ | 66,553,002 | | |

Distributions to shareholders -

From net investment income | | $ | (80,790,251 | ) | | $ | (65,849,722 | ) | |

| Total distributions to shareholders | | $ | (80,790,251 | ) | | $ | (65,849,722 | ) | |

Transactions in shares of beneficial interest -

Proceeds from sale of shares | | $ | 53,849,567 | | | $ | 68,846,515 | | |

Net asset value of shares issued to

shareholders in payment of

distributions declared | | | 42,998,968 | | | | 34,492,758 | | |

| Cost of shares redeemed | | | (252,093,538 | ) | | | (312,531,946 | ) | |

Net decrease in net assets from

Fund share transactions | | $ | (155,245,003 | ) | | $ | (209,192,673 | ) | |

| Net decrease in net assets | | $ | (154,499,789 | ) | | $ | (208,489,393 | ) | |

| Net Assets | |

| At beginning of year | | $ | 1,428,366,007 | | | $ | 1,636,855,400 | | |

| At end of year | | $ | 1,273,866,218 | | | $ | 1,428,366,007 | | |

Accumulated undistributed

net investment income

included in net assets | |

| At end of year | | $ | 786,134 | | | $ | 184,800 | | |

See notes to financial statements

4

Eaton Vance Prime Rate Reserves as of November 30, 2006

FINANCIAL STATEMENTS CONT'D

Financial Highlights

| | | Year Ended November 30, | | Period Ended

November 30, | | Year Ended

December 31, | |

| | | 2006(1) | | 2005(1) | | 2004 | | 2003 | | 2002(1)(2) | | 2001 | |

| Net asset value - Beginning of year | | $ | 9.390 | | | $ | 9.380 | | | $ | 9.180 | | | $ | 8.840 | | | $ | 9.160 | | | $ | 9.500 | | |

| Income (loss) from operations | |

| Net investment income | | $ | 0.545 | | | $ | 0.393 | | | $ | 0.282 | | | $ | 0.298 | | | $ | 0.332 | | | $ | 0.590 | | |

| Net realized and unrealized gain (loss) | | | 0.006 | | | | 0.013 | | | | 0.199 | | | | 0.339 | | | | (0.319 | ) | | | (0.352 | ) | |

| Total income from operations | | $ | 0.551 | | | $ | 0.406 | | | $ | 0.481 | | | $ | 0.637 | | | $ | 0.013 | | | $ | 0.238 | | |

| Less distributions | |

| From net investment income | | $ | (0.551 | ) | | $ | (0.396 | ) | | $ | (0.281 | ) | | $ | (0.297 | ) | | $ | (0.333 | ) | | $ | (0.578 | ) | |

| Total distributions | | $ | (0.551 | ) | | $ | (0.396 | ) | | $ | (0.281 | ) | | $ | (0.297 | ) | | $ | (0.333 | ) | | $ | (0.578 | ) | |

| Net asset value - End of year | | $ | 9.390 | | | $ | 9.390 | | | $ | 9.380 | | | $ | 9.180 | | | $ | 8.840 | | | $ | 9.160 | | |

| Total Return(3) | | | 6.02 | % | | | 4.41 | % | | | 5.30 | % | | | 7.32 | % | | | 0.13 | % | | | 2.54 | % | |

| Ratios/Supplemental Data | |

| Net assets, end of year (000's omitted) | | $ | 1,273,866 | | | $ | 1,428,366 | | | $ | 1,636,855 | | | $ | 1,840,559 | | | $ | 2,206,150 | | | $ | 3,165,119 | | |

| Ratios (As a percentage of average daily net assets): | |

| Expenses before custodian fee reduction(4) | | | 1.32 | % | | | 1.33 | % | | | 1.31 | % | | | 1.31 | % | | | 1.26 | %(5) | | | 1.26 | % | |

| Expenses after custodian fee reduction(4) | | | 1.32 | % | | | 1.33 | % | | | 1.31 | % | | | 1.31 | % | | | 1.26 | %(5) | | | 1.26 | % | |

| Interest expense(4) | | | 0.01 | % | | | 0.00 | %(6) | | | 0.00 | %(6) | | | 0.01 | % | | | 0.01 | %(5) | | | 0.01 | % | |

| Net investment income | | | 5.79 | % | | | 4.18 | % | | | 3.02 | % | | | 3.34 | % | | | 4.01 | %(5) | | | 6.25 | % | |

| Portfolio Turnover of the Portfolio | | | 51 | % | | | 65 | % | | | 87 | % | | | 47 | % | | | 42 | % | | | 33 | % | |

(1) Net investment income was computed using average shares outstanding.

(2) For the eleven-month period ended November 30, 2002.

(3) Returns are historical and are calculated by determining the percentage change in net asset value with all distributions reinvested. Total return is not computed on an annualized basis.

(4) Includes the Fund's share of the Portfolio's allocated expenses.

(5) Annualized.

(6) Represents less than 0.01%.

See notes to financial statements

5

Eaton Vance Prime Rate Reserves as of November 30, 2006

NOTES TO FINANCIAL STATEMENTS

1 Significant Accounting Policies

Eaton Vance Prime Rate Reserves (the Fund) is a closed-end management investment company. The Fund is an entity of the type commonly known as a Massachusetts business trust and is registered under the Investment Company Act of 1940 (the 1940 Act), as amended. The Fund invests all of its investable assets in interests in the Senior Debt Portfolio (the Portfolio), a New York Trust, having the same investment objective as the Fund. The value of the Fund's investment in the Portfolio reflects the Fund's proportionate interest in the net assets of the Portfolio (48.3% at November 30, 2006). The performance of the Fund is directly affected by the performance of the Portfolio. The financial statements of the Portfolio, including the portfolio of investments, are included elsewhere in this report and should be read in conjunction with the Fund's financial statements.

The following is a summary of significant accounting policies of the Fund. The policies are in conformity with accounting principles generally accepted in the United States of America.

A Investment Valuation - Valuation of securities by the Portfolio is discussed in Note 1A of the Portfolio's Notes to Financial Statements, which are included elsewhere in this report.

B Income - The Fund's net investment income or loss consists of the Fund's pro rata share of the net investment income or loss of the Portfolio, less all actual and accrued expenses of the Fund.

C Federal Taxes - The Fund's policy is to comply with the provisions of the Internal Revenue Code applicable to regulated investment companies and to distribute to shareholders, each year, substantially all of its net investment income and all or substantially all of its net realized capital gains. Accordingly, no provision for federal income or excise tax is necessary. At November 30, 2006, the Fund, for federal income tax purposes had a capital loss carryover of $341,476,962 which will expire on November 30, 2007 ($5,906,636), November 30, 2008 ($44,323,516), November 30, 2009 ($118,172,997), November 30, 2010 ($85,893,275), November 30, 2011 ($86,475,719) and November 30, 2013 ($704,819). These amounts will reduce taxable income arising from future net realized gain on investments, if any, to the extent permitted by the Internal Revenue Code, and thus will reduce the amount of the distributions to shareholders which would otherwise be necessary to relieve the Fund of any liability for federal income or excise tax.

D Use of Estimates - The preparation of the financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities at the date of the financial statements and the reported amounts of income and expense during the reporting period. Actual results could differ from those estimates.

E Indemnifications - Under the Fund's organizational documents, its officers and Trustees may be indemnified against certain liabilities and expenses arising out of the performance of their duties to the Fund, and shareholders are indemnified against personal liability for the obligations of the Fund. Additionally, in the normal course of business, the Fund enters into agreements with service providers that may contain indemnification clauses. The Fund's maximum exposure under these arrangements is unknown as this would involve future claims that may be made against the Fund that have not yet occurred.

F Expense Reduction - Investors Bank & Trust Company (IBT) serves as custodian of the Fund. Pursuant to the custodian agreement, IBT receives a fee reduced by credits which are determined based on the average daily cash balance the Fund maintains with IBT. All credit balances used to reduce the Fund's custodian fees are reported as a reduction of expenses in the Statement of Operations.

G Other - Investment transactions are accounted for on the date the securities are purchased or sold. Dividends to shareholders are recorded on the ex-dividend date.

2 Distributions to Shareholders

The net investment income of the Fund is determined daily, and substantially all of the net investment income so determined is declared daily as a dividend to shareholders of record at the time of declaration. Such daily dividends will be paid monthly. Distributions of realized capital gains, if any, are made at least annually. Shareholders may reinvest capital gain distributions in additional shares of the Fund at the net asset value as of the ex-dividend date. Distributions are paid in the form of additional shares or, at the election of the shareholder, in cash. The Fund distinguishes between distributions on a tax basis and those on a financial reporting basis. Accounting principles generally accepted in the United States of America require that only distributions in excess of tax basis earnings and profits be reported in the financial statements as a return of capital. Permanent differences between book and tax

6

Eaton Vance Prime Rate Reserves as of November 30, 2006

NOTES TO FINANCIAL STATEMENTS CONT'D

accounting relating to distributions are reclassified to paid-in capital. These differences are primarily related to foreign currency transactions and tax accounting for straddles.

The tax character of the distributions declared for the years ended November 30, 2006 and November 30, 2005 was as follows:

| | | Year Ended November 30, | |

| | | 2006 | | 2005 | |

| Distributions declared from: | |

|

| Ordinary income | | $ | 80,790,251 | | | $ | 65,849,722 | | |

|

During the year ended November 30, 2006, accumulated undistributed of net investment income was increased by $1,465,835, accumulated net realized loss was decreased by $8,977,574 and paid-in-capital was decreased by $10,443,409 due to differences in book and tax accounting for mixed straddles, swap contracts and foreign currency transactions. This change had no effect on net asset or net asset value per share.

At Novemer 30, 2006, the components of distributable earnings (accumulated losses) on a tax basis were as follows:

| Undistributed ordinary income | | $ | 3,939,903 | | |

| Capital loss carryforward | | $ | (341,476,962 | ) | |

| Unrealized appreciation | | $ | 30,062,673 | | |

| Other temporary differences | | $ | (3,153,769 | ) | |

3 Shares of Beneficial Interest

The Declaration of Trust permits the Trustees to issue an unlimited number of full and fractional shares of beneficial interest (without par value). The Fund operates as an interval fund, meaning that it continuously accepts new shareholder investments but permits share repurchases (of at least 5% and up to 25% or more of its shares) at net asset value only once a quarter. It is a fundamental policy of the Fund (which may only be changed by shareholder vote) that the Fund will conduct repurchase offers ending on a date (fixed by the Trustees) in the months of February, May, August and November and the repurchase price will be determined no more than 14 days following the repurchase request deadline. Payment for all shares repurchased pursuant to these offers normally will be made no later than 7 days after the repurchase pricing date. Shareholders will be sent notification of each repurchase offer at least 21 days prior to the repurchase request deadline. An early withdrawal charge will be imposed on most shares accepted for repurchase which have been held less than four years (see Note 6). During the years ended November 30, 2006 and November 30, 2005, the Fund made four repurchase offers in each fiscal year as follows:

| | | Repurchase Offer Amount | | Amount Repurchased | |

Repurchase

Request Deadline | | Shares | | Amount | | Shares | | Amount | |

| February 22, 2006 | | | 45,000,630 | | | $ | 423,905,931 | | | | 6,869,244 | | | $ | 64,709,386 | | |

| May 22, 2006 | | | 43,661,940 | | | | 412,168,710 | | | | 6,440,150 | | | | 60,795,058 | | |

| August 22, 2006 | | | 42,520,605 | | | | 399 268,486 | | | | 6,007,804 | | | | 56,413,479 | | |

| November 22, 2006 | | | 41,414,748 | | | | 388,470,339 | | | | 7,374,652 | | | | 70,175,615 | | |

| Total | | | 172,597,923 | | | $ | 1,623,813,466 | | | | 26,691,850 | | | $ | 252,093,538 | | |

| | | Repurchase Offer Amount | | Amount Repurchased | |

Repurchase

Request Deadline | | Shares | | Amount | | Shares | | Amount | |

| Feb. 22, 2005 | | | 51,478,843 | | | $ | 484,415,915 | | | | 8,058,382 | | | $ | 75,829,995 | | |

| May 23, 2005 | | | 43,762,978 | | | | 409,183,848 | | | | 9,329,723 | | | | 87,233,771 | | |

| Aug. 22, 2005 | | | 48,113,749 | | | | 452,750,382 | | | | 7,920,576 | | | | 74,532,061 | | |

| Nov. 22, 2005 | | | 46,685,721 | | | | 438,378,922 | | | | 7,980,432 | | | | 74,936,119 | | |

| Total | | | 190,041,291 | | | $ | 1,784,729,067 | | | | 33,289,113 | | | $ | 312,531,946 | | |

All transactions in Fund shares were as follows:

| | | Year Ended November 30, | |

| | | 2006 | | 2005 | |

| Sales | | | 5,724,241 | | | | 7,326,260 | | |

Issued to shareholders electing to

receive payments of distributions

in Fund shares | | | 4,571,953 | | | | 3,671,449 | | |

| Redemptions | | | (26,691,850 | ) | | | (33,289,113 | ) | |

| Net decrease | | | (16,395,656 | ) | | | (22,291,404 | ) | |

4 Transactions with Affiliates

Eaton Vance Management (EVM) serves as the administrator of the Fund. Effective May 1, 1999, EVM has agreed to waive its administration fee as long as the distribution fee (Note 5) is being paid by the Fund. The Portfolio has engaged Boston Management and Research (BMR), a subsidiary of EVM, to render investment advisory services (see Note 2 of the Portfolio's Notes to Financial Statements which are included elsewhere in this report). Except as to Trustees of the Fund and the Portfolio who are not members of EVM's or BMR's organization, officers and Trustees receive remuneration for their services to the Fund out of such investment adviser fee. EVM serves as the sub-transfer agent of the Fund and receives from the transfer

7

Eaton Vance Prime Rate Reserves as of November 30, 2006

NOTES TO FINANCIAL STATEMENTS CONT'D

agent an aggregate fee based upon the actual expenses incurred by EVM in the performance of those services. For the year ended November 30, 2006, EVM received $72,861 in sub-transfer agent fees.

Certain officers and Trustees of the Fund and of the Portfolio are officers of the above organizations.

5 Distribution Plan

The Fund has in effect a distribution plan (the Plan) that allows the Fund to pay distribution fees for the sale and distribution of shares. The Plan requires the Fund to pay the Principal Underwriter, Eaton Vance Distributors, Inc. (EVD), a subsidiary of EVM, an amount equal to 0.70% of the Fund's average daily net assets, for providing ongoing distribution services and facilities to the Fund. For the year ended November 30, 2006 the distribution fees amounted to $9,657,606. Certain officers and Trustees of the Fund are officers or directors of EVD.

6 Early Withdrawal Charge

EVD compensates investment dealers for sales commissions at a rate of 3% of the purchase price of shares purchased through such dealers. EVD also pays additional compensation to each dealer ranging from 0.10% to 0.30% per annum of the value of Fund shares sold by such dealer that are outstanding for specified periods of time. An early withdrawal charge (EWC) to recover distribution costs will be charged to repurchasing shareholders and paid to EVD in connection with most shares held for less than four years which are accepted by the Fund for repurchase. The EWC is imposed at declining rates that begin at 3% in the case of repurchases in the first year after purchase, declining to 2.5%, 2%, 1% and 0% in the second, third and fourth year and thereafter, respectively. The EWC is based on the lower of the net asset value at the time of purchase or at the time of repurchase. Shares acquired through the reinvestment of distributions are exempt from the EWC. Redemptions are made first from shares that are not subject to an EWC. The total early withdrawal charges received by EVD for the year ended November 30, 2006 amounted to approximately $459,318.

7 Investment Transactions

Increases and decreases in the Fund's investment in the Portfolio for the year ended November 30, 2006 aggregated $54,370,831 and $299,854,583, respectively.

8 Recently Issued Accounting Pronouncements

In June 2006, the Financial Accounting Standards Board ("FASB") issued FASB Interpretation No. 48, ("FIN 48") "Accounting for Uncertainty in Income Taxes - an interpretation of FASB Statement No. 109". FIN 48 clarifies the accounting for uncertainty in income taxes recognized in accordance with FASB Statement No. 109, "Accounting for Income Taxes." This interpretation prescribes a recognition threshold and measurement attribute for the financial statement recognition and measurement of a tax position taken or expected to be taken in a tax return. It also provides guidance on de-recognition, classification, interest and penalties, accounting in interim periods, disclosure and transition. FIN 48 is effective for fiscal years beginning after December 15, 2006. Management is currently evaluating the impact of applying the various provisions of FIN 48.

In September 2006, FASB issued Statement of Financial Accounting Standards No. 157, ("FAS 157") "Fair Value Measurements". FAS 157 defines fair value, establishes a framework for measuring fair value in accordance with generally accepted accounting principles and expands disclosure about fair value measurements. FAS 157 is effective for fiscal years beginning after November 15, 2007. Management is currently evaluating the impact the adoption of FAS 157 will have on the Fund's financial statement disclosures.

8

Eaton Vance Prime Rate Reserves as of November 30, 2006

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Trustees and Shareholders

of Eaton Vance Prime Rate Reserves:

We have audited the accompanying statement of assets and liabilities of Eaton Vance Prime Rate Reserves (the "Fund") as of November 30, 2006, the related statement of operations for the year then ended, the statements of changes in net assets for each of the two years in the period then ended, and the financial highlights for each of the four years in the period then ended, the period from January 1, 2002 to November 30, 2002, and the year ended December 31, 2001. These financial statements and financial highlights are the responsibility of the Fund's management. Our responsibility is to express an opinion on these financial statements and financial highlights based on our audits.

We conducted our audits in accordance with standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audits to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement. The Fund is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. Our audits included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Fund's internal control over financial reporting. Accordingly, we express no such opinion. An audit also includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements and financial highlights referred to above present fairly, in all material respects, the financial position of the Eaton Vance Prime Rate Reserves Fund as of November 30, 2006, the results of its operations for the year then ended, the changes in its net assets for each of the two years in the period then ended and its financial highlights for the respective stated periods in conformity with accounting principles generally accepted in the United States of America.

DELOITTE & TOUCHE LLP

Boston, Massachusetts

January 16, 2007

9

Eaton Vance Prime Rate Reserves as of November 30, 2006

FEDERAL TAX INFORMATION (Unaudited)

The Form 1099-DIV you receive in January 2007 will show the tax status of all distributions paid to your account in calendar 2006. Shareholders are advised to consult their own tax adviser with respect to the tax consequences of their investment in the Fund.

10

Senior Debt Portfolio as of November 30, 2006

PORTFOLIO OF INVESTMENTS

| Senior, Floating Rate Interests - 100.3%(1) | | | |

Principal

Amount | | Borrower/Tranche Description | | Value | |

| Aerospace and Defense - 1.8% | | | |

| AWAS Capital, Inc. | | | |

| $ | 8,662,812 | | | | | Term Loan, 7.19%, Maturing March 22, 2013 | | $ | 8,489,555 | | |

| Be Aerospace, Inc. | | | |

| | 1,400,000 | | | | | Term Loan, 7.15%, Maturing August 24, 2012 | | | 1,407,875 | | |

| Dresser Rand Group, Inc. | | | |

| | 1,032,477 | | | | | Term Loan, 7.46%, Maturing October 29, 2011 | | | 1,038,930 | | |

| Evergreen International Aviation | | | |

| | 3,100,000 | | | | | Term Loan, 8.82%, Maturing October 31, 2011 | | | 3,053,500 | | |

| Hexcel Corp. | | | |

| | 3,223,197 | | | | | Term Loan, 7.13%, Maturing March 1, 2012 | | | 3,231,255 | | |

| IAP Worldwide Services, Inc. | | | |

| | 3,176,000 | | | | | Term Loan, 7.25%, Maturing December 30, 2012 | | | 3,152,180 | | |

| Jet Aviation Holding, AG | | | |

| | 1,500,000 | | | | | Term Loan, 7.62%, Maturing May 15, 2013 | | | 1,496,250 | | |

| K&F Industries, Inc. | | | |

| | 2,324,865 | | | | | Term Loan, 7.32%, Maturing November 18, 2012 | | | 2,335,399 | | |

| Spirit Aerosystems, Inc. | | | |

| | 2,736,643 | | | | | Term Loan, 7.11%, Maturing December 31, 2011 | | | 2,743,911 | | |

| Standard Aero Holdings, Inc. | | | |

| | 2,399,621 | | | | | Term Loan, 7.61%, Maturing August 24, 2012 | | | 2,408,620 | | |

| Transdigm, Inc. | | | |

| | 5,000,000 | | | | | Term Loan, 7.39%, Maturing June 23, 2013 | | | 5,033,750 | | |

| Vought Aircraft Industries, Inc. | | | |

| | 2,000,000 | | | | | Revolving Loan, 7.82%,

Maturing December 22, 2009(2) | | | 1,910,000 | | |

| | 1,000,000 | | | | | Term Loan, 7.33%, Maturing December 22, 2010 | | | 1,005,313 | | |

| | 3,250,565 | | | | | Term Loan, 7.88%, Maturing December 17, 2011 | | | 3,268,849 | | |

| Wam Aquisition, S.A. | | | |

| | 2,417,800 | | | | | Term Loan, 8.12%, Maturing April 8, 2013 | | | 2,438,453 | | |

| | 2,417,800 | | | | | Term Loan, 8.62%, Maturing April 8, 2014 | | | 2,448,274 | | |

| Wyle Laboratories, Inc. | | | |

| | 972,315 | | | | | Term Loan, 8.12%, Maturing January 28, 2011 | | | 977,481 | | |

| | | $ | 46,439,595 | | |

| Air Transport - 1.0% | | | |

| Airport Development and Investment | | | |

| $ | 3,500,000 | | | GBP | | Term Loan, 9.12%, Maturing April 7, 2011 | | $ | 6,910,926 | | |

| Delta Air Lines, Inc. | | | |

| | 4,275,000 | | | | | Term Loan, 8.12%, Maturing March 16, 2008 | | | 4,313,407 | | |

| | 4,225,000 | | | | | Term Loan, 10.12%, Maturing March 16, 2008 | | | 4,303,560 | | |

| Northwest Airlines, Inc. | | | |

| | 6,450,000 | | | | | DIP Loan, 7.82%, Maturing August 21, 2008 | | | 6,492,331 | | |

Principal

Amount | | Borrower/Tranche Description | | Value | |

| Air Transport (continued) | | | |

| United Airlines, Inc. | | | |

| $ | 4,483,719 | | | | | Term Loan, 9.12%, Maturing February 1, 2012 | | $ | 4,531,358 | | |

| | 640,531 | | | | | Term Loan, 9.13%, Maturing February 1, 2012 | | | 647,337 | | |

| | | $ | 27,198,919 | | |

| Automotive - 4.6% | | | |

| AA Acquisitions Co., Ltd. | | | |

| $ | 1,000,000 | | | GBP | | Term Loan, 7.58%, Maturing June 25, 2012 | | $ | 1,996,933 | | |

| | 1,000,000 | | | GBP | | Term Loan, 8.08%, Maturing June 25, 2013 | | | 2,005,824 | | |

| Accuride Corp. | | | |

| | 7,444,820 | | | | | Term Loan, 7.44%, Maturing January 31, 2012 | | | 7,461,110 | | |

| Affina Group, Inc. | | | |

| | 3,994,314 | | | | | Term Loan, 8.38%, Maturing November 30, 2011 | | | 4,015,536 | | |

| Citation Corp. | | | |

| | 5,931,750 | | | | | Term Loan, 13.87%, Maturing May 23, 2009(4) | | | 3,737,002 | | |

| Collins & Aikman Products Co. | | | |

| | 2,318,912 | | | | | Term Loan, 11.75%, Maturing August 31, 2009(3) | | | 1,097,135 | | |

| CSA Acquisition Corp. | | | |

| | 1,358,760 | | | | | Term Loan, 7.88%, Maturing December 23, 2011 | | | 1,360,884 | | |

| | 1,308,686 | | | | | Term Loan, 7.88%, Maturing December 23, 2011 | | | 1,310,732 | | |

| Dana Corp. | | | |

| | 3,325,000 | | | | | DIP Loan, 7.65%, Maturing April 13, 2008 | | | 3,331,234 | | |

| Dayco Products, LLC | | | |

| | 5,284,250 | | | | | Term Loan, 8.02%, Maturing June 21, 2011 | | | 5,268,836 | | |

| Exide Technologies, Inc. | | | |

| | 1,764,628 | | | | | Term Loan, 11.75%, Maturing May 5, 2010 | | | 1,855,066 | | |

| | 1,786,253 | | | | | Term Loan, 11.75%, Maturing May 5, 2010 | | | 1,877,799 | | |

| Federal-Mogul Corp. | | | |

| | 6,000,000 | | | | | Term Loan, 7.82%, Maturing December 9, 2006 | | | 5,920,626 | | |

| | 11,852,057 | | | | | Revolving Loan, 9.07%,

Maturing December 9, 2006(2) | | | 11,896,502 | | |

| | 5,351,062 | | | | | Term Loan, 9.07%, Maturing December 9, 2006 | | | 5,381,161 | | |

| Goodyear Tire & Rubber Co. | | | |

| | 7,500,000 | | | | | Revolving Loan, 7.57%, Maturing April 30, 2010(2) | | | 7,469,535 | | |

| | 1,175,000 | | | | | Term Loan, 7.57%, Maturing April 30, 2010 | | | 1,178,462 | | |

| | 10,605,000 | | | | | Term Loan, 8.14%, Maturing April 30, 2010 | | | 10,723,362 | | |

| HLI Operating Co., Inc. | | | |

| | 2,719,527 | | | | | Term Loan, 8.96%, Maturing June 3, 2009 | | | 2,735,165 | | |

| Insurance Auto Auctions, Inc. | | | |

| | 2,406,522 | | | | | Term Loan, 7.89%, Maturing May 19, 2012 | | | 2,417,050 | | |

| Keystone Automotive Operations, Inc. | | | |

| | 1,714,103 | | | | | Term Loan, 7.88%, Maturing October 30, 2009 | | | 1,718,388 | | |

| Kwik Fit Group Ltd. | | | |

| | 1,250,000 | | | GBP | | Term Loan, 7.58%, Maturing August 31, 2013 | | | 2,484,554 | | |

| | 1,250,000 | | | GBP | | Term Loan, 8.08%, Maturing August 31, 2014 | | | 2,495,823 | | |

See notes to financial statements

11

Senior Debt Portfolio as of November 30, 2006

PORTFOLIO OF INVESTMENTS CONT'D

Principal

Amount | | Borrower/Tranche Description | | Value | |

| Automotive (continued) | | | |

| R.J. Tower Corp. | | | |

| $ | 7,000,000 | | | | | DIP Revolving Loan, 8.42%,

Maturing February 2, 2007(2) | | $ | 6,965,000 | | |

| Tenneco Automotive, Inc. | | | |

| | 3,600,741 | | | | | Term Loan, 7.36%, Maturing December 10, 2010 | | | 3,620,995 | | |

| | 2,383,463 | | | | | Term Loan, 7.32%, Maturing December 12, 2010 | | | 2,396,870 | | |

| Trimas Corp. | | | |

| | 375,000 | | | | | Term Loan, 8.13%, Maturing August 2, 2011 | | | 376,992 | | |

| | 1,625,000 | | | | | Term Loan, 8.13%, Maturing August 2, 2013 | | | 1,633,634 | | |

| TRW Automotive, Inc. | | | |

| | 6,032,956 | | | | | Term Loan, 7.19%, Maturing June 30, 2012 | | | 6,026,827 | | |

| United Components, Inc. | | | |

| | 4,829,458 | | | | | Term Loan, 7.63%, Maturing June 30, 2010 | | | 4,847,568 | | |

| Vanguard Car Rental USA | | | |

| | 4,675,000 | | | | | Term Loan, 8.35%, Maturing June 14, 2013 | | | 4,709,576 | | |

| | | $ | 120,316,181 | | |

| Beverage and Tobacco - 0.8% | | | |

| Alliance One International, Inc. | | | |

| $ | 2,482,550 | | | | | Term Loan, 8.82%, Maturing May 13, 2010 | | $ | 2,513,582 | | |

| Culligan International Co. | | | |

| | 2,069,165 | | | | | Term Loan, 7.07%, Maturing September 30, 2011 | | | 2,074,986 | | |

| National Dairy Holdings, L.P. | | | |

| | 4,641,537 | | | | | Term Loan, 7.32%, Maturing March 15, 2012 | | | 4,653,141 | | |

| National Distribution Co. | | | |

| | 2,420,000 | | | | | Term Loan, 11.82%, Maturing June 22, 2010 | | | 2,426,050 | | |

| Reynolds American, Inc. | | | |

| | 7,279,250 | | | | | Term Loan, 7.14%, Maturing May 31, 2012 | | | 7,337,258 | | |

| Southern Wine & Spirits of America, Inc. | | | |

| | 2,134,013 | | | | | Term Loan, 6.87%, Maturing May 31, 2012 | | | 2,141,350 | | |

| Sunny Delight Beverages Co. | | | |

| | 254,197 | | | | | Term Loan, 11.38%, Maturing August 20, 2010 | | | 249,431 | | |

| | | $ | 21,395,798 | | |

| Building and Development - 7.2% | | | |

| 401 North Wabash Venture, LLC | | | |

| $ | 5,500,000 | | | | | Term Loan, 9.07%, Maturing May 7, 2008(2) | | $ | 5,540,392 | | |

| Beacon Sales Acquisition, Inc. | | | |

| | 2,000,000 | | | | | Term Loan, 7.32%, Maturing September 30, 2013 | | | 2,005,000 | | |

| Biomed Realty, L.P. | | | |

| | 10,965,000 | | | | | Term Loan, 7.57%, Maturing May 31, 2010 | | | 10,937,587 | | |

| Capital Automotive REIT | | | |

| | 4,000,130 | | | | | Term Loan, 7.07%, Maturing December 16, 2010 | | | 4,013,567 | | |

| Empire Hawkeye Partners, L.P. | | | |

| | 6,800,000 | | | | | Term Loan, 6.97%, Maturing December 1, 2009(2) | | | 6,783,000 | | |

Principal

Amount | | Borrower/Tranche Description | | Value | |

| Building and Development (continued) | | | |

| Epco / Fantome, LLC | | | |

| $ | 5,100,000 | | | | | Term Loan, 8.37%, Maturing November 23, 2010 | | $ | 5,125,500 | | |

| Formica Corp. | | | |

| | 3,383,000 | | | | | Term Loan, 8.49%, Maturing March 15, 2013 | | | 3,381,944 | | |

| FT-FIN Acquisition, LLC | | | |

| | 4,432,587 | | | | | Term Loan, 7.13%, Maturing November 17, 2007(2) | | | 4,443,668 | | |

| Gables GP, Inc. | | | |

| | 280,724 | | | | | Term Loan, 7.07%, Maturing March 30, 2007 | | | 281,192 | | |

| Hearthstone Housing Partners II, LLC | | | |

| | 13,750,000 | | | | | Revolving Loan, 7.39%,

Maturing December 1, 2007(2) | | | 13,715,625 | | |

| Hovstone Holdings, LLC | | | |

| | 4,410,000 | | | | | Term Loan, 7.37%, Maturing February 28, 2009 | | | 4,343,850 | | |

| Landsource Communities, LLC | | | |

| | 9,721,000 | | | | | Term Loan, 7.88%, Maturing March 31, 2010 | | | 9,593,412 | | |

| Lanoga Corp. | | | |

| | 3,865,313 | | | | | Term Loan, 7.12%, Maturing June 29, 2013 | | | 3,855,649 | | |

| LNR Property Corp. | | | |

| | 7,225,000 | | | | | Term Loan, 8.12%, Maturing July 3, 2011 | | | 7,257,361 | | |

| MAAX Corp. | | | |

| | 3,077,379 | | | | | Term Loan, 8.38%, Maturing June 4, 2011 | | | 3,061,993 | | |

| Materis | | | |

| | 823,329 | | | EUR | | Term Loan, 5.93%, Maturing April 27, 2014 | | | 1,104,930 | | |

| | 876,671 | | | EUR | | Term Loan, 6.30%, Maturing April 27, 2015 | | | 1,181,601 | | |

| Mattamy Funding Partnership | | | |

| | 694,006 | | | | | Term Loan, 7.63%, Maturing April 11, 2013 | | | 689,235 | | |

| Mueller Group, Inc. | | | |

| | 6,595,611 | | | | | Term Loan, 7.40%, Maturing October 3, 2012 | | | 6,635,462 | | |

| NCI Building Systems, Inc. | | | |

| | 2,345,501 | | | | | Term Loan, 6.84%, Maturing May 3, 2010 | | | 2,346,967 | | |

| Newkirk Master, L.P. | | | |

| | 4,405,457 | | | | | Term Loan, 7.07%, Maturing August 11, 2008 | | | 4,412,343 | | |

| | 3,440,259 | | | | | Term Loan, 7.07%, Maturing August 11, 2008 | | | 3,445,636 | | |

| Nortek, Inc. | | | |

| | 6,710,538 | | | | | Term Loan, 7.36%, Maturing August 27, 2011 | | | 6,699,002 | | |

| Panolam Industries Holdings, Inc. | | | |

| | 2,404,844 | | | | | Term Loan, 8.12%, Maturing September 30, 2012 | | | 2,416,868 | | |

| Ply Gem Industries, Inc. | | | |

| | 1,000,000 | | | | | Term Loan, 8.32%, Maturing August 15, 2011 | | | 1,007,813 | | |

| | 342,031 | | | | | Term Loan, 8.32%, Maturing August 15, 2011 | | | 341,817 | | |

| | 5,130,469 | | | | | Term Loan, 8.32%, Maturing August 15, 2011 | | | 5,127,262 | | |

| Rubicon GSA II, LLC | | | |

| | 7,025,000 | | | | | Term Loan, 8.07%, Maturing July 31, 2008 | | | 7,025,000 | | |

| South Edge, LLC | | | |

| | 4,475,000 | | | | | Term Loan, 7.38%, Maturing October 31, 2009 | | | 4,388,297 | | |

See notes to financial statements

12

Senior Debt Portfolio as of November 30, 2006

PORTFOLIO OF INVESTMENTS CONT'D

Principal

Amount | | Borrower/Tranche Description | | Value | |

| Building and Development (continued) | | | |

| Stile Acquisition Corp. | | | |

| $ | 6,676,316 | | | | | Term Loan, 7.38%, Maturing April 6, 2013 | | $ | 6,550,094 | | |

| Stile U.S. Acquisition Corp. | | | |

| | 6,687,690 | | | | | Term Loan, 7.38%, Maturing April 6, 2013 | | | 6,561,252 | | |

| TE / Tousa Senior, LLC | | | |

| | 3,750,000 | | | | | Term Loan, 8.25%, Maturing August 1, 2008 | | | 3,103,125 | | |

| | 2,000,000 | | | | | Revolving Loan, 9.75%, Maturing August 1, 2008(2) | | | 1,580,000 | | |

| The Woodlands Commercial Property, Inc. | | | |

| | 2,940,000 | | | | | Term Loan, 7.35%, Maturing September 1, 2009 | | | 2,943,675 | | |

| | 735,000 | | | | | Term Loan, 7.35%, Maturing August 29, 2009 | | | 735,919 | | |

| Tousa/Kolter, LLC | | | |

| | 7,410,000 | | | | | Term Loan, 7.62%, Maturing January 7, 2008(2) | | | 7,419,262 | | |

| TRU 2005 RE Holding Co. | | | |

| | 13,750,000 | | | | | Term Loan, 8.32%, Maturing December 9, 2008 | | | 13,776,854 | | |

| Trustreet Properties, Inc. | | | |

| | 5,150,000 | | | | | Term Loan, 7.32%, Maturing April 8, 2010 | | | 5,162,875 | | |

| United Subcontractors, Inc. | | | |

| | 2,675,000 | | | | | Term Loan, 12.86%, Maturing June 27, 2013 | | | 2,594,750 | | |

| WCI Communities, Inc. | | | |

| | 8,300,000 | | | | | Term Loan, 7.32%, Maturing December 23, 2010 | | | 8,071,750 | | |

| | | $ | 189,661,529 | | |

| Business Equipment and Services - 5.9% | | | |

| Acco Brands Corp. | | | |

| $ | 1,802,350 | | | | | Term Loan, 7.11%, Maturing August 17, 2012 | | $ | 1,807,701 | | |

| Activant Solutions, Inc. | | | |

| | 2,295,692 | | | | | Term Loan, 7.38%, Maturing May 1, 2013 | | | 2,280,628 | | |

| Affiliated Computer Services | | | |

| | 2,481,250 | | | | | Term Loan, 7.39%, Maturing March 20, 2013 | | | 2,489,004 | | |

| | 6,533,625 | | | | | Term Loan, 7.40%, Maturing March 20, 2013 | | | 6,550,776 | | |

| Affinion Group, Inc. | | | |

| | 6,887,180 | | | | | Term Loan, 8.12%, Maturing October 17, 2012 | | | 6,933,455 | | |

| Allied Security Holdings, LLC | | | |

| | 3,832,500 | | | | | Term Loan, 8.37%, Maturing June 30, 2010 | | | 3,861,244 | | |

| Audatex North America, Inc. | | | |

| | 1,000,000 | | | EUR | | Term Loan, 9.13%, Maturing January 13, 2013 | | | 1,357,447 | | |

| | 997,500 | | | EUR | | Term Loan, 5.75%, Maturing April 13, 2013 | | | 1,334,357 | | |

| Buhrmann US, Inc. | | | |

| | 6,722,971 | | | | | Term Loan, 7.13%, Maturing December 31, 2010 | | | 6,735,576 | | |

| DynCorp International, LLC | | | |

| | 4,402,950 | | | | | Term Loan, 7.75%, Maturing February 11, 2011 | | | 4,429,553 | | |

| Gate Gourmet Borrower, LLC | | | |

| | 1,556,622 | | | | | Term Loan, 8.12%, Maturing March 9, 2012 | | | 1,576,080 | | |

| | 195,556 | | | | | Term Loan, 8.12%, Maturing March 9, 2012 | | | 192,622 | | |

| | 3,134,250 | | | EUR | | Term Loan, 6.13%, Maturing March 9, 2013 | | | 4,210,435 | | |

Principal

Amount | | Borrower/Tranche Description | | Value | |

| Business Equipment and Services (continued) | | | |

| Info USA, Inc. | | | |

| $ | 1,985,000 | | | | | Term Loan, 7.07%, Maturing February 14, 2012 | | $ | 1,982,519 | | |

| Iron Mountain, Inc. | | | |

| | 5,069,162 | | | | | Term Loan, 7.10%, Maturing April 2, 2011 | | | 5,083,949 | | |

| | 9,534,983 | | | | | Term Loan, 7.13%, Maturing April 2, 2011 | | | 9,558,821 | | |

| Language Line, Inc. | | | |

| | 7,860,100 | | | | | Term Loan, 8.63%, Maturing June 11, 2011 | | | 7,920,277 | | |

| Mitchell International, Inc. | | | |

| | 4,035,448 | | | | | Term Loan, 7.37%, Maturing August 15, 2011 | | | 4,050,581 | | |

| N.E.W. Holdings I, LLC | | | |

| | 2,554,413 | | | | | Term Loan, 8.12%, Maturing August 8, 2013 | | | 2,567,185 | | |

| Nielsen Finance, LLC | | | |

| | 20,850,000 | | | | | Term Loan, 8.13%, Maturing August 9, 2013 | | | 20,939,780 | | |

| Protection One, Inc. | | | |

| | 3,235,013 | | | | | Term Loan, 7.85%, Maturing March 31, 2012 | | | 3,249,166 | | |

| Quantum Corp. | | | |

| | 950,000 | | | | | Term Loan, 9.44%, Maturing August 22, 2012 | | | 951,187 | | |

| Sungard Data Systems, Inc. | | | |

| | 26,205,190 | | | | | Term Loan, 7.88%, Maturing February 11, 2013 | | | 26,430,397 | | |

| TDS Investor Corp. | | | |

| | 1,000,000 | | | EUR | | Term Loan, 6.13%, Maturing August 23, 2013 | | | 1,332,040 | | |

| | 8,197,002 | | | | | Term Loan, 8.37%, Maturing August 23, 2013 | | | 8,224,085 | | |

| | 802,998 | | | | | Term Loan, 8.37%, Maturing August 23, 2013 | | | 805,651 | | |

| Transaction Network Services, Inc. | | | |

| | 2,808,685 | | | | | Term Loan, 7.39%, Maturing May 4, 2012 | | | 2,808,685 | | |

| US Investigations Services, Inc. | | | |

| | 2,451,697 | | | | | Term Loan, 7.89%, Maturing October 14, 2012 | | | 2,463,955 | | |

| | 1,755,601 | | | | | Term Loan, 7.89%, Maturing October 14, 2012 | | | 1,763,647 | | |

| West Corp. | | | |

| | 7,200,000 | | | | | Term Loan, 8.07%, Maturing October 24, 2013 | | | 7,194,211 | | |

| Western Inventory Services | | | |

| | 749,905 | | | | | Term Loan, 7.86%, Maturing March 31, 2011 | | | 753,654 | | |

| | 854,891 | | | | | Term Loan, 7.87%, Maturing March 31, 2011 | | | 859,166 | | |

| Williams Scotsman, Inc. | | | |

| | 2,570,000 | | | | | Term Loan, 6.82%, Maturing June 27, 2010 | | | 2,566,787 | | |

| | | $ | 155,264,621 | | |

| Cable and Satellite Television - 5.7% | | | |

| Atlantic Broadband Finance, LLC | | | |

| $ | 5,825,081 | | | | | Term Loan, 8.14%, Maturing September 1, 2011 | | $ | 5,905,176 | | |

| Bragg Communications, Inc. | | | |

| | 3,333,148 | | | | | Term Loan, 7.12%, Maturing August 31, 2011 | | | 3,337,314 | | |

| Bresnan Broadband Holdings, LLC | | | |

| | 5,000,000 | | | | | Term Loan, 7.13%, Maturing March 29, 2014 | | | 4,994,375 | | |

See notes to financial statements

13

Senior Debt Portfolio as of November 30, 2006

PORTFOLIO OF INVESTMENTS CONT'D

Principal

Amount | | Borrower/Tranche Description | | Value | |

| Cable and Satellite Television (continued) | | | |

| Cablecom Luxembourg SCA | | | |

| $ | 2,000,000 | | | EUR | | Term Loan, 5.79%, Maturing September 28, 2012 | | $ | 2,668,001 | | |

| Casema | | | |

| | 658,133 | | | EUR | | Term Loan, 6.17%, Maturing November 17, 2014 | | | 880,696 | | |

| | 341,867 | | | EUR | | Term Loan, 6.17%, Maturing November 17, 2014 | | | 457,477 | | |

| | 1,000,000 | | | EUR | | Term Loan, 6.67%, Maturing November 17, 2015 | | | 1,344,951 | | |

| Charter Communications Operating, LLC | | | |

| | 25,888,627 | | | | | Term Loan, 8.01%, Maturing April 28, 2013 | | | 26,098,972 | | |

| CSC Holdings, Inc. | | | |

| | 9,552,000 | | | | | Term Loan, 7.12%, Maturing March 29, 2013 | | | 9,546,823 | | |

| Insight Midwest Holdings, LLC | | | |

| | 3,893,750 | | | | | Term Loan, 7.61%, Maturing April 6, 2014 | | | 3,918,327 | | |

| | 11,681,250 | | | | | Term Loan, 7.61%, Maturing April 6, 2014 | | | 11,754,982 | | |

| Kabel Deutschland GmbH | | | |

| | 5,400,000 | | | EUR | | Term Loan, 5.38%, Maturing March 31, 2012 | | | 7,175,478 | | |

| Kablecom | | | |

| | 1,000,000 | | | EUR | | Term Loan, 0.00%, Maturing November 17, 2014(2) | | | 1,330,583 | | |

| | 1,000,000 | | | EUR | | Term Loan, 0.00%, Maturing November 17, 2015(2) | | | 1,337,211 | | |

| Mediacom Broadband Group | | | |

| | 1,965,150 | | | | | Term Loan, 7.00%, Maturing January 31, 2015 | | | 1,958,087 | | |

| Mediacom Illinois, LLC | | | |

| | 3,000,000 | | | | | Term Loan, 6.72%, Maturing September 30, 2012 | | | 2,948,304 | | |

| | 6,023,750 | | | | | Term Loan, 7.24%, Maturing January 31, 2015 | | | 6,014,070 | | |

| NTL Investment Holdings, Ltd. | | | |

| | 4,000,000 | | | | | Term Loan, 7.36%, Maturing March 30, 2013 | | | 4,019,168 | | |

| | 1,562,881 | | | GBP | | Term Loan, 7.45%, Maturing March 30, 2012 | | | 3,073,182 | | |

| | 1,337,119 | | | GBP | | Term Loan, 7.45%, Maturing March 30, 2012 | | | 2,629,255 | | |

| | 1,000,000 | | | GBP | | Term Loan, 7.64%, Maturing March 30, 2013 | | | 2,002,703 | | |

| Persona Communications Corp. | | | |

| | 1,005,667 | | | | | Term Loan, 0.00%, Maturing October 12, 2013(2) | | | 1,011,952 | | |

| | 1,619,333 | | | | | Term Loan, 8.12%, Maturing October 12, 2013 | | | 1,629,454 | | |

| | 675,000 | | | | | Term Loan, 11.37%, Maturing April 12, 2014 | | | 679,219 | | |

| PKS Media (Netherlands) B.V. | | | |

| | 2,412,500 | | | EUR | | Term Loan, 5.24%, Maturing October 5, 2012 | | | 3,207,323 | | |

| | 1,000,000 | | | EUR | | Term Loan, 5.74%, Maturing October 5, 2013 | | | 1,341,975 | | |

| | 1,000,000 | | | EUR | | Term Loan, 6.24%, Maturing October 5, 2014 | | | 1,348,115 | | |

| San Juan Cable, LLC | | | |

| | 992,500 | | | | | Term Loan, 7.39%, Maturing October 31, 2012 | | | 994,206 | | |

| UGS Corp. | | | |

| | 7,308,413 | | | | | Term Loan, 7.13%, Maturing March 31, 2012 | | | 7,302,325 | | |

| UPC Broadband Holding B.V. | | | |

| | 3,665,833 | | | EUR | | Term Loan, 5.51%, Maturing March 31, 2013 | | | 4,877,832 | | |

| | 2,790,000 | | | | | Term Loan, 7.64%, Maturing April 1, 2013 | | | 2,794,271 | | |

| | 4,150,000 | | | EUR | | Term Loan, 5.51%, Maturing December 31, 2013 | | | 5,522,762 | | |

| | 2,790,000 | | | | | Term Loan, 7.64%, Maturing December 31, 2013 | | | 2,794,271 | | |

Principal

Amount | | Borrower/Tranche Description | | Value | |

| Cable and Satellite Television (continued) | | | |

| Ypso Holding SA | | | |

| $ | 4,961,371 | | | EUR | | Term Loan, 5.87%, Maturing July 28, 2014 | | $ | 6,489,643 | | |

| | 1,914,679 | | | EUR | | Term Loan, 5.87%, Maturing July 28, 2014 | | | 2,504,466 | | |

| | 3,123,950 | | | EUR | | Term Loan, 5.87%, Maturing July 28, 2014 | | | 4,086,233 | | |

| | | $ | 149,979,182 | | |

| Chemicals and Plastics - 7.7% | | | |

| Basell Af S.A.R.L. | | | |

| $ | 358,974 | | | EUR | | Term Loan, 5.81%, Maturing August 1, 2013 | | $ | 481,522 | | |

| | 641,026 | | | EUR | | Term Loan, 5.84%, Maturing August 1, 2013 | | | 859,861 | | |

| | 550,909 | | | | | Term Loan, 7.60%, Maturing August 1, 2013 | | | 557,623 | | |

| | 110,176 | | | | | Term Loan, 7.60%, Maturing August 1, 2013 | | | 111,519 | | |

| | 358,974 | | | EUR | | Term Loan, 6.56%, Maturing August 1, 2014 | | | 483,623 | | |

| | 641,026 | | | EUR | | Term Loan, 6.59%, Maturing August 1, 2014 | | | 863,612 | | |

| | 905,236 | | | | | Term Loan, 8.35%, Maturing August 1, 2014 | | | 916,551 | | |

| | 181,047 | | | | | Term Loan, 8.35%, Maturing August 1, 2014 | | | 183,310 | | |

| Brenntag Holding GmbH and Co. KG | | | |

| | 2,117,647 | | | EUR | | Term Loan, 6.03%, Maturing December 23, 2013 | | | 2,849,737 | | |

| | 883,636 | | | | | Term Loan, 8.08%, Maturing December 23, 2013 | | | 891,368 | | |

| | 3,616,364 | | | | | Term Loan, 8.08%, Maturing December 23, 2013 | | | 3,654,223 | | |

| | 496,877 | | | EUR | | Term Loan, 6.28%, Maturing December 23, 2014 | | | 671,161 | | |

| | 385,476 | | | EUR | | Term Loan, 6.28%, Maturing December 23, 2014 | | | 524,472 | | |

| Celanese Holdings, LLC | | | |

| | 14,058,993 | | | | | Term Loan, 7.12%, Maturing April 6, 2011 | | | 14,101,676 | | |

| Ferro Corp. | | | |

| | 9,500,000 | | | | | Term Loan, 8.57%, Maturing June 6, 2012(2) | | | 9,488,125 | | |

| Gentek, Inc. | | | |

| | 1,485,804 | | | | | Term Loan, 7.36%, Maturing February 28, 2011 | | | 1,493,698 | | |

| Georgia Gulf Corp. | | | |

| | 4,242,188 | | | | | Term Loan, 7.32%, Maturing October 3, 2013 | | | 4,266,809 | | |

| Hexion Specialty Chemicals, Inc. | | | |

| | 2,523,368 | | | | | Term Loan, 7.87%, Maturing May 5, 2013 | | | 2,519,538 | | |

| | 11,616,194 | | | | | Term Loan, 7.88%, Maturing May 5, 2013 | | | 11,598,561 | | |

| Huntsman, LLC | | | |

| | 2,280,000 | | | EUR | | Term Loan, 5.44%, Maturing August 16, 2012 | | | 3,017,533 | | |

| | 18,905,402 | | | | | Term Loan, 7.07%, Maturing August 16, 2012 | | | 18,908,030 | | |

| Ineos Group | | | |

| | 2,950,000 | | | | | Term Loan, 7.61%, Maturing December 14, 2012 | | | 2,966,225 | | |

| | 1,925,000 | | | | | Term Loan, 7.61%, Maturing December 14, 2013 | | | 1,944,117 | | |

| | 1,925,000 | | | | | Term Loan, 8.11%, Maturing December 14, 2014 | | | 1,944,117 | | |

| Innophos, Inc. | | | |

| | 1,247,310 | | | | | Term Loan, 7.57%, Maturing August 10, 2010 | | | 1,251,988 | | |

| Invista B.V. | | | |

| | 8,957,429 | | | | | Term Loan, 6.88%, Maturing April 29, 2011 | | | 8,937,839 | | |

| | 4,748,099 | | | | | Term Loan, 6.88%, Maturing April 29, 2011 | | | 4,737,715 | | |

See notes to financial statements

14

Senior Debt Portfolio as of November 30, 2006

PORTFOLIO OF INVESTMENTS CONT'D

Principal

Amount | | Borrower/Tranche Description | | Value | |

| Chemicals and Plastics (continued) | | | |

| ISP Chemo, Inc. | | | |

| $ | 7,139,125 | | | | | Term Loan, 7.41%, Maturing February 16, 2013 | | $ | 7,154,745 | | |

| Kranton Polymers, LLC | | | |

| | 5,299,138 | | | | | Term Loan, 7.38%, Maturing May 12, 2013 | | | 5,315,698 | | |

| Lucite International Group | | | |

| | 635,878 | | | | | Term Loan, 0.00%, Maturing July 7, 2013(2) | | | 640,456 | | |

| | 1,809,587 | | | | | Term Loan, 8.07%, Maturing July 7, 2013 | | | 1,822,616 | | |

| Lyondell Chemical Co. | | | |

| | 11,870,250 | | | | | Term Loan, 7.12%, Maturing August 16, 2013 | | | 11,927,749 | | |

| Mosaic Co. | | | |

| | 7,136,325 | | | | | Term Loan, 7.01%, Maturing February 21, 2012 | | | 7,138,109 | | |

| Nalco Co. | | | |

| | 15,769,086 | | | | | Term Loan, 7.16%, Maturing November 4, 2010 | | | 15,832,257 | | |

| PQ Corp. | | | |

| | 3,851,353 | | | | | Term Loan, 7.38%, Maturing February 10, 2012 | | | 3,867,402 | | |

| Professional Paint, Inc. | | | |

| | 2,319,188 | | | | | Term Loan, 7.63%, Maturing May 31, 2012 | | | 2,322,086 | | |

| Rockwood Specialties Group, Inc. | | | |

| | 9,145,228 | | | | | Term Loan, 7.38%, Maturing July 30, 2012 | | | 9,195,526 | | |

| Sigmakalon (BC) Holdco B.V. | | | |

| | 1,940,000 | | | EUR | | Term Loan, 5.49%, Maturing September 9, 2012 | | | 2,569,456 | | |

| | 92,758 | | | EUR | | Term Loan, 5.99%, Maturing September 9, 2013 | | | 124,021 | | |

| | 1,204,580 | | | EUR | | Term Loan, 5.99%, Maturing September 9, 2013 | | | 1,610,564 | | |

| | 2,202,661 | | | EUR | | Term Loan, 5.99%, Maturing September 9, 2013 | | | 2,945,031 | | |

| | 729,480 | | | EUR | | Term Loan, 6.49%, Maturing September 9, 2014 | | | 979,376 | | |

| | 181,330 | | | EUR | | Term Loan, 6.49%, Maturing September 9, 2014 | | | 242,766 | | |

| | 178,614 | | | EUR | | Term Loan, 6.49%, Maturing September 9, 2014 | | | 239,802 | | |

| | 2,135,161 | | | EUR | | Term Loan, 6.49%, Maturing September 9, 2014 | | | 2,866,597 | | |

| | 183,030 | | | GBP | | Term Loan, 8.08%, Maturing September 9, 2014 | | | 363,630 | | |

| Solo Cup Co. | | | |

| | 9,376,072 | | | | | Term Loan, 8.62%, Maturing February 27, 2011 | | | 9,417,093 | | |

| TPG Spring UK, Ltd. | | | |

| | 4,546,143 | | | EUR | | Term Loan, 6.12%, Maturing June 27, 2013 | | | 6,037,692 | | |

| | 4,546,143 | | | EUR | | Term Loan, 6.62%, Maturing June 27, 2013 | | | 6,058,784 | | |

| Wellman, Inc. | | | |

| | 5,400,000 | | | | | Term Loan, 9.37%, Maturing February 10, 2009 | | | 5,325,750 | | |

| | | $ | 204,221,759 | | |

| Clothing / Textiles - 0.6% | | | |

| Hanesbrands, Inc. | | | |

| $ | 5,225,000 | | | | | Term Loan, 7.68%, Maturing September 5, 2013 | | $ | 5,268,367 | | |

| | 2,025,000 | | | | | Term Loan, 9.19%, Maturing March 5, 2014 | | | 2,072,914 | | |

| Propex Fabrics, Inc. | | | |

| | 3,005,297 | | | | | Term Loan, 7.63%, Maturing July 31, 2012 | | | 3,007,175 | | |

Principal

Amount | | Borrower/Tranche Description | | Value | |

| Clothing / Textiles (continued) | | | |

| St. John Knits International, Inc. | | | |

| $ | 2,222,358 | | | | | Term Loan, 9.32%, Maturing March 23, 2012 | | $ | 2,211,246 | | |

| The William Carter Co. | | | |

| | 2,322,764 | | | | | Term Loan, 6.87%, Maturing July 14, 2012 | | | 2,320,949 | | |

| | | $ | 14,880,651 | | |

| Conglomerates - 3.1% | | | |

| Amsted Industries, Inc. | | | |

| $ | 5,444,779 | | | | | Term Loan, 7.37%, Maturing April 5, 2013 | | $ | 5,444,779 | | |

| Blount, Inc. | | | |

| | 1,800,896 | | | | | Term Loan, 7.10%, Maturing August 9, 2010 | | | 1,806,149 | | |

| Dundee Holdco 4 Limited | | | |

| | 728,900 | | | EUR | | Term Loan, 9.29%, Maturing August 17, 2015 | | | 978,271 | | |

| Dundee Holding, Inc. | | | |

| | 1,841,300 | | | | | Term Loan, 8.07%, Maturing February 17, 2014 | | | 1,845,903 | | |

| Education Management, LLC | | | |

| | 4,937,625 | | | | | Term Loan, 7.88%, Maturing June 1, 2013 | | | 4,972,806 | | |

| Euramax Europe B.V. | | | |

| | 1,401,756 | | | EUR | | Term Loan, 6.29%, Maturing June 29, 2012 | | | 1,851,904 | | |

| Euramax International, Inc. | | | |

| | 2,138,811 | | | | | Term Loan, 8.19%, Maturing June 29, 2012 | | | 2,146,296 | | |

| Goodman Global Holdings, Inc. | | | |

| | 3,863,786 | | | | | Term Loan, 7.19%, Maturing December 23, 2011 | | | 3,865,397 | | |

| ISS Holdings A/S | | | |

| | 2,504,202 | | | EUR | | Term Loan, 5.97%, Maturing December 31, 2013 | | | 3,372,610 | | |

| | 1,704,757 | | | GBP | | Term Loan, 7.68%, Maturing December 31, 2013 | | | 3,393,582 | | |

| Jarden Corp. | | | |

| | 1,609,959 | | | | | Term Loan, 7.12%, Maturing January 24, 2012 | | | 1,608,148 | | |

| | 10,565,577 | | | | | Term Loan, 7.37%, Maturing January 24, 2012 | | | 10,585,388 | | |

| Johnson Diversey, Inc. | | | |

| | 1,060,665 | | | | | Term Loan, 7.87%, Maturing December 16, 2010 | | | 1,067,626 | | |

| | 5,133,675 | | | | | Term Loan, 7.87%, Maturing December 16, 2011 | | | 5,181,002 | | |

| Platinum 100, Ltd. | | | |

| | 1,000,000 | | | GBP | | Term Loan, 7.81%, Maturing January 15, 2013 | | | 1,980,648 | | |

| | 1,000,000 | | | GBP | | Term Loan, 8.31%, Maturing January 15, 2014 | | | 1,988,290 | | |

| Polymer Group, Inc. | | | |

| | 2,000,000 | | | | | Revolving Loan, 0.00%,

Maturing November 22, 2010(2) | | | 1,960,000 | | |

| | 8,585,125 | | | | | Term Loan, 7.61%, Maturing November 22, 2012 | | | 8,609,275 | | |

| PP Acquisition Corp. | | | |

| | 6,651,689 | | | | | Term Loan, 8.32%, Maturing November 12, 2011 | | | 6,701,577 | | |

| RBS Global | | | |

| | 4,150,000 | | | | | Term Loan, 7.88%, Maturing July 19, 2013 | | | 4,168,165 | | |

| RGIS Holdings, LLC | | | |

| | 3,722,166 | | | | | Term Loan, 7.87%, Maturing February 15, 2013 | | | 3,721,004 | | |

See notes to financial statements

15

Senior Debt Portfolio as of November 30, 2006

PORTFOLIO OF INVESTMENTS CONT'D

Principal

Amount | | Borrower/Tranche Description | | Value | |

| Conglomerates (continued) | | | |

| Sensata Technologies Finance Co. | | | |

| $ | 2,443,875 | | | | | Term Loan, 7.13%, Maturing April 26, 2013 | | $ | 2,429,280 | | |

| Terex Corp. | | | |

| | 2,144,625 | | | | | Term Loan, 7.12%, Maturing July 13, 2013 | | | 2,152,667 | | |

| Walter Industries, Inc. | | | |

| | 1,011,196 | | | | | Term Loan, 7.12%, Maturing October 3, 2012 | | | 1,014,103 | | |

| | | $ | 82,844,870 | | |

| Containers and Glass Products - 3.6% | | | |

| Altivity Packaging LLC | | | |

| $ | 1,171,609 | | | | | Term Loan, 7.60%, Maturing June 30, 2013 | | $ | 1,183,179 | | |

| | 3,915,641 | | | | | Term Loan, 7.60%, Maturing June 30, 2013 | | | 3,954,308 | | |

| Consolidated Container Holding, LLC | | | |

| | 3,812,250 | | | | | Term Loan, 8.63%, Maturing December 15, 2008 | | | 3,831,311 | | |

| Crown Americas, Inc. | | | |

| | 990,000 | | | EUR | | Term Loan, 5.34%, Maturing November 15, 2012 | | | 1,311,474 | | |

| | 1,361,250 | | | | | Term Loan, 7.12%, Maturing November 15, 2012 | | | 1,364,865 | | |

| Graham Packaging Holdings Co. | | | |

| | 845,696 | | | | | Term Loan, 7.69%, Maturing October 7, 2011 | | | 849,925 | | |

| | 14,983,125 | | | | | Term Loan, 7.73%, Maturing October 7, 2011 | | | 15,058,041 | | |

| Graphic Packaging International, Inc. | | | |

| | 2,000,000 | | | | | Revolving Loan, 0.00%,

Maturing August 8, 2007(2) | | | 1,957,500 | | |

| | 18,513,120 | | | | | Term Loan, 7.90%, Maturing August 8, 2010 | | | 18,749,496 | | |

| IPG (US), Inc. | | | |

| | 3,459,401 | | | | | Term Loan, 7.64%, Maturing July 28, 2011 | | | 3,455,076 | | |

| JSG Acquisitions | | | |

| | 5,500,000 | | | EUR | | Term Loan, 5.86%, Maturing December 31, 2014 | | | 7,350,431 | | |

| | 5,500,000 | | | EUR | | Term Loan, 6.26%, Maturing December 31, 2014 | | | 7,383,056 | | |

| OI European Group B.V. | | | |

| | 4,000,000 | | | EUR | | Term Loan, 4.90%, Maturing June 14, 2013 | | | 5,273,202 | | |

| Owens Illinois, Inc. | | | |

| | 5,000,000 | | | | | Term Loan, 6.82%, Maturing June 14, 2013 | | | 5,008,750 | | |

| Pregis Corp. | | | |

| | 2,475,000 | | | EUR | | Term Loan, 5.88%, Maturing October 12, 2012 | | | 3,297,140 | | |

| Smurfit-Stone Container Corp. | | | |

| | 1,986,462 | | | | | Term Loan, 4.73%, Maturing November 1, 2010 | | | 2,002,038 | | |

| | 8,331,277 | | | | | Term Loan, 7.66%, Maturing November 1, 2011 | | | 8,396,602 | | |

| | 4,952,523 | | | | | Term Loan, 7.67%, Maturing November 1, 2011 | | | 4,991,355 | | |

| | | $ | 95,417,749 | | |

Principal

Amount | | Borrower/Tranche Description | | Value | |

| Cosmetics / Toiletries - 0.3% | | | |

| Prestige Brands, Inc. | | | |

| $ | 6,364,325 | | | | | Term Loan, 7.71%, Maturing April 7, 2011 | | $ | 6,400,124 | | |

| Revlon Consumer Products Corp. | | | |

| | 2,181,976 | | | | | Term Loan, 11.42%, Maturing July 9, 2010 | | | 2,240,163 | | |

| | | $ | 8,640,287 | | |

| Drugs - 0.5% | | | |

| Warner Chilcott Corp. | | | |

| $ | 2,660,623 | | | | | Term Loan, 7.62%, Maturing January 18, 2012 | | $ | 2,675,826 | | |

| | 9,690,859 | | | | | Term Loan, 7.62%, Maturing January 18, 2012 | | | 9,746,232 | | |

| | | $ | 12,422,058 | | |

| Ecological Services and Equipment - 1.1% | | | |

| Allied Waste Industries, Inc. | | | |

| $ | 3,402,869 | | | | | Term Loan, 5.33%, Maturing January 15, 2012 | | $ | 3,403,399 | | |

| | 3,671,996 | | | | | Term Loan, 7.16%, Maturing January 15, 2012 | | | 3,671,644 | | |

| Duratek, Inc. | | | |

| | 1,833,400 | | | | | Term Loan, 7.76%, Maturing June 7, 2013 | | | 1,845,433 | | |

| Energysolutions, LLC | | | |

| | 192,610 | | | | | Term Loan, 7.57%, Maturing June 7, 2013 | | | 193,874 | | |

| | 4,046,610 | | | | | Term Loan, 7.76%, Maturing June 7, 2013 | | | 4,073,168 | | |

| Environmental Systems, Inc. | | | |

| | 2,679,268 | | | | | Term Loan, 8.87%, Maturing December 12, 2008 | | | 2,696,013 | | |

| | 500,000 | | | | | Term Loan, 15.36%, Maturing December 12, 2010 | | | 512,500 | | |

| Sensus Metering Systems, Inc. | | | |

| | 3,438,775 | | | | | Term Loan, 7.44%, Maturing December 17, 2010 | | | 3,438,775 | | |

| | 456,771 | | | | | Term Loan, 7.49%, Maturing December 17, 2010 | | | 456,771 | | |

| Sulo GmbH | | | |

| | 3,750,000 | | | EUR | | Term Loan, 6.12%, Maturing January 19, 2014 | | | 5,013,005 | | |

| | 3,750,000 | | | EUR | | Term Loan, 6.62%, Maturing January 19, 2015 | | | 5,034,812 | | |

| | | $ | 30,339,394 | | |

| Electronics / Electrical - 2.8% | | | |

| Advanced Micro Devices, Inc. | | | |

| $ | 7,109,726 | | | | | Term Loan, 7.62%, Maturing December 31, 2013 | | $ | 7,145,275 | | |

| AMI Semiconductor, Inc. | | | |

| | 1,282,822 | | | | | Term Loan, 6.82%, Maturing April 1, 2012 | | | 1,278,813 | | |

| Aspect Software, Inc. | | | |

| | 6,150,000 | | | | | Term Loan, 8.44%, Maturing July 11, 2011 | | | 6,187,478 | | |

| Communications & Power, Inc. | | | |

| | 1,416,667 | | | | | Term Loan, 7.57%, Maturing July 23, 2010 | | | 1,422,865 | | |

| Enersys Capital, Inc. | | | |

| | 3,616,750 | | | | | Term Loan, 7.42%, Maturing March 17, 2011 | | | 3,639,355 | | |

See notes to financial statements

16

Senior Debt Portfolio as of November 30, 2006

PORTFOLIO OF INVESTMENTS CONT'D

Principal

Amount | | Borrower/Tranche Description | | Value | |

| Electronics / Electrical (continued) | | | |

| FCI International S.A.S. | | | |

| $ | 662,180 | | | | | Term Loan, 8.33%, Maturing November 1, 2013 | | $ | 671,285 | | |

| | 687,820 | | | | | Term Loan, 8.33%, Maturing November 1, 2013 | | | 690,185 | | |

| | 687,820 | | | | | Term Loan, 8.83%, Maturing November 1, 2013 | | | 693,624 | | |

| | 662,180 | | | | | Term Loan, 8.83%, Maturing November 1, 2013 | | | 671,285 | | |

| Ganymed 347 VV GmbH | | | |

| | 329,460 | | | EUR | | Term Loan, 5.75%, Maturing April 30, 2013 | | | 440,483 | | |

| | 670,540 | | | EUR | | Term Loan, 6.46%, Maturing April 30, 2013 | | | 896,500 | | |

| | 329,460 | | | EUR | | Term Loan, 6.25%, Maturing April 30, 2014 | | | 442,653 | | |

| | 670,540 | | | EUR | | Term Loan, 6.96%, Maturing April 30, 2014 | | | 900,748 | | |

| Infor Enterprise Solutions | | | |

| | 8,115,714 | | | | | Term Loan, 9.12%, Maturing July 28, 2012 | | | 8,213,776 | | |

| | 4,234,286 | | | | | Term Loan, 9.12%, Maturing July 28, 2012 | | | 4,289,861 | | |

| Invensys International Holding | | | |

| | 1,083,333 | | | | | Term Loan, 7.62%, Maturing December 15, 2010 | | | 1,090,781 | | |

| | 1,166,667 | | | | | Term Loan, 7.40%, Maturing January 15, 2011 | | | 1,174,687 | | |

| Network Solutions, LLC | | | |

| | 3,086,675 | | | | | Term Loan, 10.37%, Maturing January 9, 2012 | | | 3,125,258 | | |