| As filed with the Securities and Exchange Commission on May 18, 2010 |

| 1933 Act File No. ___________ |

U.S. SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM N-14

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933 x

Pre-Effective Amendment No. ___ ¨

Post-Effective Amendment No. ___ ¨

EATON VANCE MUTUAL FUNDS TRUST

(Exact name of Registrant as Specified in Charter)

Two International Place, Boston, Massachusetts 02110

(Address of Principal Executive Offices)

(617) 482-8260

(Registrant's Telephone Number)

Maureen A. Gemma

Two International Place, Boston, Massachusetts 02110

(Name and Address of Agent for Service) |

Approximate Date of Proposed Public Offering: As soon as practicable after the effective date of the registration statement.

It is proposed that this filing will go effective on the 30th day after filing pursuant to Rule 488 under the Securities Act of 1933, as amended.

Title of Securities Being Registered: Shares of Beneficial Interest of Eaton Vance Structured Emerging Markets Fund

No filing fee is required because an indefinite number of shares have previously been registered pursuant to Rule 24f-2 under the Investment Company Act of 1940, as amended. Pursuant to Rule 429, this Registration Statement relates to shares previously registered on Form N-1A (File No. 02-90946).

CONTENTS OF REGISTRATION STATEMENT ON FORM N-14

This Registration Statement consists of the following papers and documents.

| |

| Cover Sheet | |

| | |

| Part A - | Proxy Statement/Prospectus |

| | |

| Part B - | Statement of Additional Information |

| | |

| Part C - | Other Information |

| | |

| Signature Page | |

| | |

| Exhibit Index | |

| | |

| Exhibits | |

EATON VANCE EMERGING MARKETS FUND

Two International Place

Boston, Massachusetts 02110 |

Dear Shareholder:

We cordially invite you to attend a Special Meeting of Shareholders of Eaton Vance Emerging Markets Fund (the “EM Fund”) on August 13, 2010 to consider a proposal to approve an Agreement and Plan of Reorganization to convert shares of the EM Fund into Class A shares of Eaton Vance Structured Emerging Markets Fund (the “SEM Fund”) (the “Reorganization”).

The investment objective for each Fund is to provide long term capital appreciation. The investment policies of each Fund are substantially similar. The enclosed combined Proxy Statement and Prospectus (“Proxy Statement/Prospectus”) describes the Reorganization in detail. We ask you to read the enclosed information carefully and to submit your vote promptly.

After consideration and recommendation by Eaton Vance Management, the Board of Trustees of the EM Fund has determined that it is in the best interests of the EM Fund if the EM Fund is merged into the SEM Fund. We believe that you would benefit from the Reorganization because you would become shareholders of a larger, more diversified fund with a lower expense ratio.

We realize that most shareholders will not be able to attend the meeting and vote their shares in person. However, the EM Fund does need your vote. You can vote by mail or by telephone, as explained in the enclosed material. If you later decide to attend the meeting, you may revoke your proxy and vote your shares in person. By voting promptly, you can help the EM Fund avoid the expense of additional mailings.

If you would like additional information concerning this proposal, please call one of our service representatives at 1-800-262-1122 Monday through Friday, 8:00 a.m. to 6:00 p.m. Eastern time. Your participation in this vote is extremely important.

| | Sincerely,

Thomas E. Faust Jr.

President

Eaton Vance Special Investment Trust |

Your vote is important – please return your proxy card promptly.

Shareholders are urged to sign and mail the enclosed proxy in the enclosed postage prepaid envelope or vote by telephone by following the enclosed instructions. Your vote is important whether you own a few shares or many shares.

EATON VANCE EMERGING MARKETS FUND

Two International Place

Boston, Massachusetts 02110 |

NOTICE OF SPECIAL MEETING OF SHAREHOLDERS

To Be Held August 13, 2010 |

A Special Meeting of Shareholders of Eaton Vance Emerging Markets Fund (the “EM Fund”) will be held at the principal office of the EM Fund, Two International Place, Boston, Massachusetts 02110, on Friday, August 13, 2010 at 3:00 P.M. (Eastern time), for the following purposes:

| 1. | To consider and act upon a proposal to approve an Agreement and Plan of Reorganization (the “Plan”) to convert shares of the EM Fund into Class A shares of Eaton Vance Structured Emerging Markets Fund (the “SEM Fund”). The Plan provides for the transfer of all of the assets and liabilities of the EM Fund to the SEM Fund in exchange for Class A shares of the SEM Fund; and |

| |

| 2. | To consider and act upon any other matters which may properly come before the meeting and any adjourned or postponed session thereof. |

The meeting is called pursuant to the By-Laws of Eaton Vance Special Investment Trust (the “Trust”). The Board of Trustees of the Trust has fixed the close of business on June 15, 2010 as the record date for the determination of the shareholders of the EM Fund entitled to notice of, and to vote at, the meeting and any adjournments or postponements thereof.

| | By Order of the Board of Trustees,

Maureen A. Gemma

Secretary

Eaton Vance Special Investment Trust |

[June 29, 2010]

Boston, Massachusetts |

IMPORTANT

Shareholders can help the Board of Trustees of the EM Fund avoid the necessity and additional expense of further solicitations, which may be necessary to obtain a quorum, by promptly returning the enclosed proxy or voting by telephone. The enclosed addressed envelope requires no postage if mailed in the United States and is included for your convenience.

PROXY STATEMENT/PROSPECTUS

Acquisition of the Assets of

EATON VANCE EMERGING MARKETS FUND

By And In Exchange For Shares of

EATON VANCE STRUCTURED EMERGING MARKETS FUND |

Two International Place

Boston, Massachusetts 02110 |

We are sending you this combined Proxy Statement and Prospectus (“Proxy Statement/Prospectus”) in connection with the Special Meeting of Shareholders (the “Special Meeting”) of Eaton Vance Emerging Markets Fund (the “EM Fund”) to be held on August 13, 2010 at 3:00 p.m., Eastern time, at Two International Place, Boston, Massachusetts 02110. This document is both the Proxy Statement of the EM Fund and a Prospectus of Eaton Vance Structured Emerging Markets Fund (the “SEM Fund”). The EM Fund and the SEM Fund hereinafter are sometimes referred to as a “Fund” or collectively as the “Funds”. The EM Fund is a series of Eaton Vance Special Investment Trust (the “SI Trust”) and the SEM Fund is a series of Eaton Vance Mutual Funds Trust (the “MF Trust”) (collectively, the “Trusts”). The Trusts are each Massachusetts business trusts registered as open-end management investment companies. A proxy card is enclosed with the foregoing Notice of a Special Meeting of Shareholders for the benefit of shareholders who wish to vote, but do not expect to be present at the Special Meeting. Shareholders also may vote by telephone. The proxy is solicited on behalf of the Board of Trustees of the SI Trust (the “Board” or “Trustees”).

This Proxy Statement/Prospectus relates to the proposed reorganization of each class of shares of the EM Fund into Class A shares of the SEM Fund (the “Reorganization”). The Form of Agreement and Plan of Reorganization (the “Plan”) is attached as Appendix A and provides for the transfer of all of the assets and liabilities of the EM Fund to the SEM Fund in exchange for shares of the SEM Fund. Following the transfer, Class A shares of SEM Fund will be distributed to shareholders of the EM Fund and EM Fund will be terminated. As a result, each shareholder of the EM Fund will receive Class A shares of SEM Fund equal to the value of such shareholder’s EM Fund shares, calculated as of the close of regular trading on the New York Stock Exchange on the Closing date (as defined herein).

Each proxy will be voted in accordance with its instructions. If no instruction is given, an executed proxy will authorize the persons named as proxies, or any of them, to vote in favor of each matter. A written proxy is revocable by the person giving it, prior to exercise by a signed writing filed with the Fund’s proxy tabulator, Computershare Fund Services, 280 Oser Avenue, Hauppauge, New York 11788, or by executing and delivering a later dated proxy, or by attending the Special Meeting and voting the shares in person. Proxies voted by telephone may be revoked at any time in the same manner that proxies voted by mail may be revoked. This Proxy Statement/Prospectus is initially being mailed to shareholders on or about [June 29, 2010]. Supplementary solicitations may be made by mail, telephone, telegraph, facsimile or electronic means.

The Trustees have fixed the close of business on June 15, 2010 as the record date (“Record Date”) for the determination of the shareholders entitled to notice of and to vote at the Special Meeting and any adjournments or postponements thereof. Shareholders at the close of business on the Record Date will be entitled to one vote for each share of the EM Fund held. The number of shares of beneficial interest of each class of each Fund outstanding and the persons who held of record more than five percent of the outstanding shares of each Fund as of the Record Date, along with such information for the combined fund as if the Reorganization was consummated on the Record Date, are set forth in Appendix C.

This Proxy Statement/Prospectus sets forth concisely the information that you should know when considering the Reorganization. You should read and retain this Proxy Statement/Prospectus for future reference. This Proxy Statement/Prospectus is accompanied by the Prospectus of the SEM Fund dated March 1, 2010 (the “SEM Fund Prospectus”), which is incorporated by reference herein. A Statement of Additional Information dated [June 29, 2010] that relates to this Proxy Statement/Prospectus and contains additional information about the SEM Fund and the Reorganization is on file with the Securities and Exchange Commission (the “SEC”) and is incorporated by reference into this Proxy Statement/Prospectus.

The Prospectus (the “EM Fund Prospectus”) and the Statement of Additional Information (the “EM Fund SAI”) of the EM Fund, each dated May 1, 2010, and the Statement of Additional Information of the SEM Fund dated March 1, 2010 (the “SEM Fund SAI”) are on file with the SEC and are incorporated by reference into this Proxy Statement/Prospectus.

The Annual Reports to Shareholders for EM Fund (dated December 31, 2009) and SEM Fund (dated October 31, 2009), have been filed with the SEC and are incorporated by reference into this Proxy Statement/Prospectus.

To ask questions about this Proxy Statement/Prospectus, please call our toll-free number at 1-800-262-1122 Monday through Friday, 8:00 am to 6:00 pm Eastern time.

Copies of each of the documents incorporated by reference referred to above are available upon oral or written request and without charge. To obtain a copy, write to the Funds, c/o Eaton Vance Management, Two International Place, Boston, MA 02110, Attn: Proxy Coordinator – Mutual Fund Operations, or call 1-800-262-1122 Monday through Friday, 8:00 a.m. to 6:00 p.m. Eastern time. The foregoing documents may be obtained on the Internet at www.eatonvance.com. In addition, the SEC maintains a website at www.sec.gov that contains the documents described above, material incorporated by reference, and other information about the EM Fund and the SEM Fund.

THESE SECURITIES HAVE NOT BEEN APPROVED OR DISAPPROVED BY THE SECURITIES AND EXCHANGE COMMISSION NOR HAS THE SECURITIES AND EXCHANGE COMMISSION PASSED UPON THE ACCURACY OR ADEQUACY OF THIS PROXY STATEMENT/PROSPECTUS. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

ii

TABLE OF CONTENTS

| | |

| | | Page |

| SUMMARY | | 1 |

| | |

FUND EXPENSES | 2 |

| | |

REASONS FOR THE REORGANIZATION | 3 |

| | |

INFORMATION ABOUT THE REORGANIZATION | 5 |

| | |

HOW DO THE BUSINESS, INVESTMENT OBJECTIVES, PRINCIPAL STRATEGIES AND POLICIES OF THE | |

EM FUND COMPARE TO THAT OF THE SEM FUND? | 9 |

| | |

PRINCIPAL RISK FACTORS | 12 |

| | |

COMPARATIVE INFORMATION ON SHAREHOLDER RIGHTS | 12 |

| | |

| INFORMATION ABOUT THE FUNDS | 13 |

| | |

| VOTING INFORMATION | 14 |

| | |

| DISSENTERS RIGHTS | 15 |

| | |

| SEM FUND FINANCIAL HIGHLIGHTS | 16 |

| | |

| EM FUND FINANCIAL HIGHLIGHTS | 17 |

| | | |

| EXPERTS | | 18 |

| | |

| APPENDIX A: FORM OF AGREEMENT AND PLAN OF REORGANIZATION | A-1 |

| | |

| APPENDIX B: MANAGEMENT’S DISCUSSION OF FUND PERFORMANCE | B-1 |

| | |

| APPENDIX C: OUTSTANDING SHARES AND 5% HOLDERS | C-1 |

iii

The following is a summary of certain information contained in or incorporated by reference in this Proxy Statement/Prospectus. This summary is not intended to be a complete statement of all material features of the proposed Reorganization and is qualified in its entirety by reference to the full text of this Proxy Statement/ Prospectus, the Plan and the other documents referred to herein.

Proposed Transaction. The Trustees of the SI Trust have approved the Plan, which provides for the transfer of all of the assets of the EM Fund to the SEM Fund in exchange for the issuance of Class A shares of SEM Fund and the assumption of all of the EM Fund’s liabilities by the SEM Fund at a closing to be held as soon as practicable following approval of the Reorganization by shareholders of the EM Fund at the Special Meeting, or any adjournments or postponements thereof, and the satisfaction of all the other conditions to the Reorganization (the “Closing”). The Plan is attached hereto as Appendix A. The value of each shareholder’s account with the SEM Fund immediately after the Reorganization will be the same as the value of such shareholder’s account with the EM Fund immediately prior to the Reorganization. Following the transfer, Class A shares of SEM Fund will be distributed to shareholders of the EM Fund and the EM Fu nd will be terminated. As a result of the Reorganization, each shareholder of the EM Fund will receive full and fractional Class A shares of SEM Fund equal in value at the close of regular trading on the New York Stock Exchange on the Closing date to the value of such shareholder’s shares of the EM Fund. At or prior to the Closing, the EM Fund shall declare a dividend or dividends which, together with all previous such dividends, shall have the effect of distributing to its shareholders all of its investment company taxable income, its net tax-exempt interest income, and all of its net capital gains, if any, realized for the taxable year ending at the Closing. The Trustees, including the Trustees who are not “interested persons” of the SI Trust as defined in the Investment Company Act of 1940, as amended (the “1940 Act”) (“Independent Trustees”), have determined that the interests of existing shareholders of EM Fund will not be diluted as a result of the transaction contemp lated by the Reorganization and that the Reorganization is in the best interests of the EM Fund. The Board of Trustees of MF Trust (including the Independent Trustees of MF Trust) has also approved the Plan on behalf of the SEM Fund.

Background for the Proposed Transaction. In approving the Plan, the Board of Trustees of SI Trust considered a number of factors, including the proposed terms of the Reorganization. The Trustees considered similarities between the Funds’ investment objective and policies and, among other things, the lower total operating expenses that would be realized by the EM Fund’s shareholders and the expected tax-free nature of the Reorganization. Moreover, the Trustees considered that shareholders of EM Fund would benefit from a larger, more diversified fund with increased investment opportunities and flexibility as a result of the Reorganization.

The Board of Trustees of the SI Trust believes that the proposed Reorganization is in the best interests of EM Fund and has recommended that the EM Fund’s shareholders vote for the Reorganization.

Objectives, Restrictions and Policies. The EM Fund and SEM Fund have substantially similar investment objectives and policies. In addition, there are no material differences between the Fund’s fundamental and non-fundamental investment restrictions.

The SEM Fund invests directly in securities. The EM Fund is a “feeder” fund investing in a “master” fund. In a master-feeder structure, the feeder fund invests all or substantially all of its assets in a single master fund, which directly owns a portfolio of securities. The master fund in which EM Fund invests its assets, Emerging Markets Portfolio, is sometimes referred to herein as the “Portfolio”.

Fund Fees, Expenses and Services. SEM Fund (total net assets of approximately $1.31 billion as of March 31, 2010) is significantly larger than EM Fund (total net assets of approximately $58.4 million as of March 31, 2010). As described below, SEM Fund has a lower total expense ratio than EM Fund. As the result of the Reorganization, the EM Fund’s shareholders are expected to benefit from the SEM Fund’s lower expense ratio.

1

EM Fund offers Classes A and B shares, while SEM Fund offers Class A, C and I shares. As a result of the Reorganization, shareholders of each class of shares of EM Fund would receive Class A shares of the SEM Fund. The privileges and services associated with the Class A shares of each Fund are identical. Class B shares of EM Fund differ in that they are subject to a 1.00% distribution fee and a contingent deferred sales charge (“CDSC”) (while Class A shares of each Fund have a front-end sales charge). Class B shares of EM Fund have a conversion feature, whereby they convert to the lower cost Class A shares eight years after their initial purchase. Former Class B shareholders of the EM Fund receiving Class A shares of the SEM Fund as a result of the Reorganization will have any remaining CDSC waived, but such shareholders will have a Class A front-end sales charge for additional purchases of SEM Fund. It is beneficial to Class B shareholders of EM Fund to be exchanged into the lower cost Class A shares of SEM Fund. Class C and Class I shares of SEM Fund will not be offered as part of the Reorganization.

Distribution Arrangements. Shares of each Fund are sold on a continuous basis by Eaton Vance Distributors, Inc. (“EVD”), the Funds’ principal underwriter. Class A shares of each Fund are sold at net asset value per share plus a front-end sales charge. Class A shares of EM Fund pay a distribution fee to the principal underwriter of 0.50% annually of average daily net assets on shares outstanding for less than twelve months and a distribution fee of 0.25% annually of average daily net assets on shares outstanding for more than twelve months. Class A shares of EM Fund also pay service fees to the principal underwriter equal to 0.25% of average daily net assets annually with respect to shares that have remained outstanding for more than one year. Class B shares of EM Fund are subject to distribution and service fees equal to 1.00% annually of average daily net assets. Class A shares of SEM Fund pay distribution and service fees equal to 0.25% of average daily net assets annually. As a result of the Reorganization, shareholders of each class of shares of EM Fund would receive Class A shares of the SEM Fund.

Redemption Procedures and Exchange Privileges. The EM Fund and the SEM Fund offer the same redemption features pursuant to which proceeds of a redemption are remitted by wire or check after receipt of proper documents including signature guarantees. The Class A shares of each Fund have the same exchange privileges.

Tax Consequences. The EM Fund expects to obtain an opinion of counsel that the Reorganization will be tax-free for federal income tax purposes. As such, the EM Fund’s shareholders will not recognize a taxable gain or loss on the receipt of shares of the SEM Fund in liquidation of their interests in EM Fund. Their tax basis in SEM Fund shares received in the Reorganization will be the same as their tax basis in the EM Fund shares, and the tax holding period will be the same.

Expenses shown are those for the year ended March 31, 2010 and on a pro forma basis giving effect to the Reorganization as of such date.

| | |

| Fund Fees and Expenses | | |

| |

| Shareholder Fees (fees paid directly from your investment) | Class A | Class B |

|

| Maximum Sales Charge (Load) (as a percentage of offering price) | 5.75% | None |

| Maximum Deferred Sales Charge (Load) (as a percentage of the lower of | | |

| net asset value at purchase or redemption) | None | 5.00% |

| Redemption Fee (as a percentage of amount redeemed or exchanged) | 1.00% | None |

2

| | | | |

| Annual Fund Operating Expenses (expenses | | | | Pro Forma |

| you pay each year as a percentage of the | EM Fund | SEM Fund | Combined Fund |

| value of your investment) (1) | Class A | Class B | Class A | Class A |

|

| Management Fees | 1.25% | 1.25% | 0.97% | 0.97% |

| Distribution and Service (12b-1) Fees | 0.50% | 1.00% | 0.25% | 0.25% |

| Other Expenses(1) | 0.89% | 0.89% | 0.37% | 0.37% |

| Total Annual Fund Operating Expenses(4) | 2.64% | 3.14% | 1.59% | 1.59% |

| Less Expense Reduction(2)(3) | (0.14%) | (0.14)% | 0.00% | 0.00% |

| Net Annual Fund Operating Expenses | 2.50% | 3.00% | 1.59% | 1.59% |

| (1) | Expenses of the EM Fund in the table above and the example below reflect the expenses of the EM Fund and Emerging Markets Portfolio. |

| (2) | EM Fund: The Adviser and the Administrator have agreed to reduce the Total Annual Fund Operating Expenses by 0.05% annually. This agreement is contractual in nature and may not be terminated without shareholder approval. This reduction relates to ordinary operating expenses only. |

| (3) | EM Fund: Effective April 27, 2009, the Adviser and the Administrator have agreed to further reduce the Total Annual Fund Operating Expenses by an additional 0.10% annually through April 30, 2011. This reduction relates to ordinary operating expenses only. |

| (4) | SEM Fund: Investment adviser, sub-adviser and administrator have agreed to limit the Total Annual Fund Operating Expenses (other than Acquired Fund Fees and Expenses allocated from unaffiliated investment companies) of Class A to 1.60%. This expense limitation will continue through February 28, 2011. Thereafter, the expense limitation may be changed or terminated at any time. The expense limitation relates to ordinary operating expenses only and amounts reimbursed may be subject to recoupment. |

Example. This Example is intended to help you compare the cost of investing in the Pro Forma Combined Fund after the Reorganization with the cost of investing in the Funds without the Reorganization. The Example assumes that you invest $10,000 in a Fund for the time periods indicated and then redeem all of your shares at the end of those periods. The Example also assumes that your investment has a 5% return each year and that the operating expenses remain the same as stated in the Fund Fees and Expenses table above. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

| | | | | | | | |

| | Expenses with Redemption | Expenses without Redemption |

| | 1 Year | 3 Year | 5 Year | 10 Years | 1 Year | 3 Year | 5 Year | 10 Years |

|

| EM Fund | | | | | | | | |

| Class A shares | $ 814 | $1,326 | $1,864 | $3,325 | $ 814 | $1,326 | $1,864 | $3,325 |

| Class B shares | $ 803 | $1,345 | $1,813 | $3,280 | $ 313 | $ 945 | $1,613 | $3,280 |

| SEM Fund | | | | | | | | |

| Class A shares | $ 727 | $1,048 | $1,391 | $2,356 | $ 727 | $1,048 | $1,391 | $2,356 |

| Pro Forma Combined | | | | | | | | |

| Fund | | | | | | | | |

| Class A shares | $ 727 | $1,048 | $1,391 | $2,356 | $ 727 | $1,048 | $1,391 | $2,356 |

| REASONS FOR THE REORGANIZATION |

The Reorganization was proposed to the Board of Trustees of the SI Trust by Eaton Vance Management (“EVM” or “Eaton Vance”) in response to inquiries from the Trustees with respect to the investment performance, expense levels and decline in assets experienced by the Fund in recent years. In reaching the decision to recommend that the shareholders of the EM Fund vote to approve the Reorganization, the Trustees considered a number of factors, including factors identified by EVM in connection with its recommendation that the Trustees approve the Reorganization. The Trustees, including the Independent Trustees, concluded that the Reorganization would be in the best interests of the EM Fund and that the interests of existing shareholders would not be diluted as a consequence thereof. The factors considered by the Trustees include the following:

| |

| • | Changes in Objectives, Restrictions and Policies. The Funds have the same investment |

| objectives and similar policies and restrictions. Each Fund invests 80% of its net assets in equity |

| securities of |

3

| |

| companies located in emerging market countries. While EM Fund utilizes fundamental |

| research in making investment decisions, SEM Fund employs quantitative investment techniques and |

| analyses. EM Fund generally holds approximately 60 portfolio securities, while SEM Fund generally |

| holds over 1,500 portfolio securities. The Funds’ fundamental and non-fundamental investment |

| restrictions are substantially the same. |

| |

| • | Effect on Class Structure and Services. EM Fund offers Class A and B shares, while SEM Fund |

| offers Class A, C and I shares. As a result of the Reorganization, shareholders of each Class of |

| shares of EM Fund would receive Class A shares of SEM Fund. The privileges and services |

| associated with Class A shares of each Fund are identical. Class B shares of EM Fund differ from |

| Class A shares in that they are subject to 1.00% distribution and service fees and also to a contingent |

| deferred sales charge (while Class A shares of each Fund have a front-end sales charge). Class B |

| shares of EM Fund have a conversion feature, whereby they convert to the lower cost Class A shares |

| eight years after their initial purchase. Former Class B shareholders of the EM Fund will not be |

| subject to a CDSC upon the redemption of the Class A shares they receive as a result of the |

| Reorganization, but will have to pay a front-end sales charge on additional purchases of Class A |

| shares of the SEM Fund (as described above in “Distribution Arrangements”). It is beneficial to Class |

| B shareholders of EM Fund to be exchanged into the lower cost Class A shares of SEM Fund. |

| |

| • | Effect on Fund Fees and Expenses. The annual management fees of SEM Fund are 0.25% lower |

| than those of EM Fund. The annual advisory fee rate for EM Fund is 0.75% annually of average daily |

| net assets less than $500 million, and at reduced rates on net assets of $500 million and above. The |

| annual advisory fee rate for SEM Fund is 0.85% annually of average daily net assets less than $500 |

| million; 0.80% on assets from $500 million to $1 billion; 0.775% on assets from $1 billion to $2.5 |

| billion; and at reduced rates thereafter. In addition, EM Fund currently pays to EVM management |

| fees equal to 0.25% and administrative fees equal to 0.25% annually on average daily net assets up |

| to $500 million, and at reduced rates thereafter. EVM has contractually agreed to reduce total annual |

| operating expenses of the EM Fund by 0.15%. For its services as administrator of SEM Fund, EVM |

| receives 0.15% annually of average daily net assets. |

| |

| If the Reorganization is consummated, EVM estimates EM Fund will realize a significant reduction in |

| other expenses. On a pro forma basis assuming the consummation of the Reorganization on March |

| 31, 2010, the total fund expenses payable by former EM Fund shareholders would decrease by |

| approximately 90 basis points (or 0.90%) for Class A shareholders and by approximately 140 basis |

| points (or 1.40%) for Class B shareholders after the Reorganization. |

| |

| • | Costs of the Reorganization. EM Fund will bear the costs of the Reorganization, including legal, |

| printing, mailing and solicitation costs. These costs are estimated at approximately $70,000. |

| |

| • | Tax Consequences. EM Fund expects to receive an opinion from counsel that the Reorganization |

| will be tax-free for federal income tax purposes. As such, EM Fund shareholders would not recognize |

| a taxable gain or loss on the receipt of shares of SEM Fund in liquidation of their interest in EM Fund. |

| Their tax basis in the SEM Fund shares received in the Reorganization would be the same as their |

| tax basis in their EM Fund shares, and the tax holding period would be the same. SEM Fund’s tax |

| basis for the assets received in the Reorganization would be the same as EM Fund’s basis |

| immediately before the Reorganization, and SEM Fund’s tax holding period for those assets would |

| include the EM Fund’s holding period. It is possible that the Reorganization would preclude utilization |

| of approximately $300,000 in capital loss carryforwards of EM Fund. However, these carryforwards |

| could be offset with capital gains realized by EM Fund prior to the Reorganization. |

| |

| • | Relative Performance. The SEM total return for Class A shares for the applicable periods ended |

| December 31, 2009, as described in “Performance Information” below, exceeded that of Class A |

| shares of the EM Fund. |

| |

4

| |

| • | No Dilution. After the Reorganization, each former EM Fund shareholder will own shares of SEM |

| Fund equal to the aggregate value of his or her EM Fund shares immediately prior to the |

| Reorganization. Because shares of SEM Fund will be issued at the per share net asset value of the |

| Fund in exchange for the assets of EM Fund, that, net of the liabilities of EM Fund assumed by SEM |

| Fund, will equal the aggregate value of those shares, the net asset value per share of SEM Fund will |

| be unchanged. Thus, the Reorganization will not result in any dilution to shareholders. |

| |

| • | Impact on EVM. After the Reorganization, EVM will continue to serve as investment adviser and |

| Parametric Portfolio Associates LLC (“Parametric”) as sub-adviser to SEM Fund. EVM and its |

| affiliates will collect advisory, administrative and distribution and service fees on EM Fund assets |

| acquired by SEM Fund pursuant to the Reorganization. In the case of advisory fees, EVM would |

| collect fees on the EM Fund assets at the incremental advisory fee rates applicable to SEM Fund, |

| currently 0.775% annually. EVM will no longer collect the management and administration fees and |

| EVD will no longer collect the Class A 0.25% distribution fee from EM Fund. EVD receives a |

| distribution fee of 0.50% annually of average daily net assets on EM Class A shares outstanding for |

| less than twelve months, and 0.25% annually thereafter. EVD receives a distribution fee of 0.25% |

| annually of average daily net assets on SEM Class A shares. At current asset levels, the |

| Reorganization would result in approximately $70,000 in lost fee revenue annually to EVM and |

| approximately $264,000 in increased fee revenue annually to Parametric. The Reorganization will |

| result in a decrease in fee revenues payable annually to EM Fund’s investment adviser, Lloyd George |

| Investment Management (Bermuda) Limited (“Lloyd George Management”), of approximately |

| $374,000. |

| |

| In addition, because Class B shares of EM Fund will be exchanged for Class A shares of SEM Fund |

| in the Reorganization, EVD will no longer receive distribution support payments from Lloyd George |

| Management based on Class B shares of EM Fund of approximately $18,000 annually and will |

| extinguish the remaining liability for distribution and service fees payable on EM Fund Class B shares |

| of approximately $7,000. |

| |

| Other Considerations. It is likely that EM Fund will dispose of securities in advance of the |

| Reorganization as is consistent with the treatment of the Reorganization as tax-free and, in that |

| connection, it will realize capital gains. EVM believes that EM Fund has sufficient capital loss |

| carryforwards to offset any such gain. EM Fund also will incur transaction costs in connection with |

| such sales equal to approximately 50 basis points (or 0.50% of total net assets). EVM believes that |

| the substantial benefits that will accrue to EM Fund shareholders as a result of the Reorganization |

| (such as the estimated expense reduction of approximately 90 basis points (or 0.90%) for Class A |

| shares and 140 basis points (or 1.40%) for Class B shares) outweigh any such costs. |

The Board of Trustees of the SI Trust believes that the proposed Reorganization is in the best interest of the EM Fund and recommends that the EM Fund’s shareholders vote for the Reorganization.

INFORMATION ABOUT THE REORGANIZATION

At a meeting held on April 26, 2010, the Board of Trustees of the SI Trust approved the Plan in the form set forth as Appendix A to this Proxy Statement/Prospectus. The summary of the Plan is not intended to be a complete statement of all material features of the Plan and is qualified in its entirety by reference to the full text of the Plan attached hereto as Appendix A.

Agreement and Plan of Reorganization. The Plan provides that, at the Closing, the Trust shall transfer all of the assets of the EM Fund and assign all liabilities to SEM Fund, and SEM Fund shall acquire such assets and shall assume such liabilities upon delivery by SEM Fund to the EM Fund on the Closing date of Class A shares of SEM Fund (including, if applicable, fractional shares). The value of Class A shares issued to the EM Fund by SEM Fund will be the same as the value of Class A and Class B shares that the EM Fund has outstanding on the Closing date. The SEM Fund shares received by the EM Fund will be distributed to the EM Fund’s shareholders, and the EM Fund shareholders will receive shares of Class A of the SEM Fund equal in value to those of the EM Fund held by the shareholder.

5

SEM Fund will assume all liabilities, expenses, costs, charges and reserves of the EM Fund on the Closing date. At or prior to the Closing, the EM Fund shall declare (if any) a dividend or dividends which, together with all previous such dividends, shall have the effect of distributing to the EM Fund’s shareholders all of the EM Fund’s investment company taxable income, net tax-exempt interest income, and net capital gain, if any, realized (after reduction for any available capital loss carry-forwards) in all taxable years ending at or prior to the Closing.

At, or as soon as practicable after the Closing, the EM Fund shall liquidate and distribute pro rata to its shareholders of record as of the close of trading on the New York Stock Exchange on the Closing date the full and fractional SEM Fund Class A shares equal in value to the EM Fund’s shares exchanged. Such liquidation and distribution will be accomplished by the establishment of shareholder accounts on the share records of SEM Fund in the name of each shareholder of the EM Fund, representing the respective pro rata number of full and fractional SEM Fund Class A shares due such shareholder. All of SEM Fund’s future distributions attributable to the shares issued in the Reorganization will be paid to shareholders in cash or invested in additional shares of SEM Fund at the price in effect as described in the SEM Fund’s current prospectus on the respective payment dates in a ccordance with instructions previously given by the shareholder to the Fund’s transfer agent.

The consummation of the Plan is subject to the conditions set forth therein. Notwithstanding approval by shareholders of the EM Fund, the Plan may be terminated at any time prior to the consummation of the Reorganization without liability on the part of either party or its respective officers, trustees or shareholders, by either party on written notice to the other party if certain specified representations and warranties or conditions have not been performed or do not exist on or before December 31, 2010. The Plan may be amended by written agreement of its parties without approval of shareholders and a party may waive without shareholder approval any default by the other or any failure to satisfy any of the conditions to its obligations; provided, however, that following the Special Meeting, no such amendment or waiver may have the effect of changing the provision for determining the number of SEM Fund shares to be issued to the EM Fund’s shareholders to the detriment of such shareholders without their further approval.

Costs of the Reorganization. The EM Fund will bear the costs of the Reorganization, including legal, printing, mailing and solicitation costs. The costs of the Reorganization are estimated at approximately $70,000.

Description of SEM Fund Shares. Full and fractional Class A shares of SEM Fund will be distributed to the EM Fund’s shareholders in accordance with the procedures under the Plan as described above. Each SEM Fund Class A share will be fully paid, non-assessable when issued and transferable without restrictions and will have no preemptive or cumulative voting rights and have only such conversion or exchange rights as the Trustees may grant in their discretion.

Federal Income Tax Consequences. It is expected that the Reorganization will qualify as a tax-free transaction under Section 368(a) of the Internal Revenue Code, which is expected to be confirmed by the legal opinion of K&L Gates LLP at the Closing. Accordingly, shareholders of the EM Fund will not recognize any capital gain or loss and the EM Fund’s assets and capital loss carry-forwards should be transferred to SEM Fund without recognition of gain or loss.

It is possible, however, that the Reorganization may fail to satisfy all of the requirements necessary for tax-free treatment, in which event the transaction will nevertheless proceed on a taxable basis. In this event, the Reorganization will result in the recognition of gain or loss to the EM Fund’s shareholders depending upon their tax basis (generally, the original purchase price) for their EM Fund shares, which includes the amounts paid for shares issued in reinvested distributions, and the net asset value of shares of SEM Fund received in the Reorganization. Shareholders of the EM Fund would, in the event of a taxable transaction, receive a new tax basis in the shares they receive of SEM Fund (equal to their initial value) for calculation of gain or loss upon their ultimate disposition and would start a new holding period for such shares.

6

Shareholders should consult their tax advisers regarding the effect, if any, of the proposed Reorganization in light of their individual circumstances. Because the foregoing discussion relates only to the federal income tax consequences of the Reorganization, shareholders should also consult their tax advisers as to state and local tax consequences, if any.

Capitalization. The following table (which is unaudited) sets forth the capitalization of EM Fund and SEM Fund as of March 31, 2010, and on a pro forma basis as of that date giving effect to the proposed acquisition of assets of the EM Fund at net asset value.

| | | |

| | Net Assets | Net Asset Value per Share | Shares Outstanding |

| EM Fund | | | |

| Class A | $46,514,486 | $18.91 | 2,460,017 |

| Adjustments* | -51,870 | $-0.02 | |

| Class B | 11,778,404 | $17.53 | 671,861 |

| Adjustments* | -13,130 | $-0.02 | |

| Total | $58,292,890 | | 3,131,878 |

| Adjustments* | -65,000 | | |

| Total | $58,227,890 | | |

| |

| SEM Fund | | | |

| Class A | $ 116,435,026 | $13.85 | 8,406,526 |

| Class C | 19,503,812 | $13.70 | 1,423,361 |

| Class I | 1,185,744,045 | $13.86 | 85,523,176 |

| Total | $ 1,321,682,883 | | 95,353,063 |

| |

| |

| Pro Forma Combined After Reorganization | | | |

| Class A | $ 174,662,916 | $13.85 | 12,610,706 |

| Class C | 19,503,812 | $13.70 | 1,423,361 |

| Class I | 1,185,744,045 | $13.86 | 85,523,176 |

| Total | $1,379,910,773 | | 99,557,243 |

*The EM Fund will bear the expenses of the Reorganization including those as described in “How Will Proxies be Solicited and Tabulated?” below.

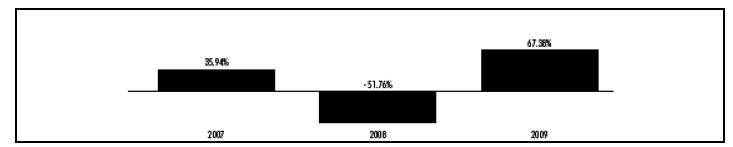

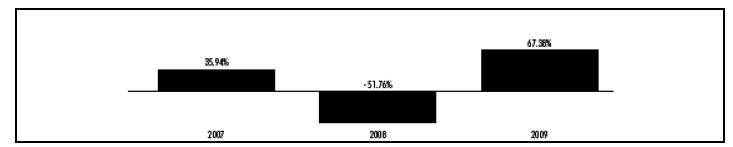

Performance Information. The following bar charts and tables provide some indication of the risks of investing in the Fund by showing changes in the performance from year to year and how the Fund’s average annual returns over time compare with those of broad-based securities market indices. The returns in the bar chart of EM Fund are for Class B shares and the returns in the bar chart for SEM Fund are for Class A shares, and do not reflect a sales charge. If the sales charge was reflected, the returns would be lower. Past performance (both before and after taxes) is no guarantee of future results. Each Fund’s performance reflects the effects of expense reductions. Absent these reductions, performance would have been lower. Updated Fund performance information can be obtained by visiting www.eatonvance.com.

7

During the ten years ended December 31, 2009, the highest quarterly total return for Class B was 29.02% for the quarter ended June 30, 2009, and the lowest quarterly return was –30.61% for the quarter ended December 31, 2008.

During the period from December 31, 2006 through December 31, 2009, the highest quarterly total return for Class A was 37.04% for the quarter ended June 30, 2009, and the lowest quarterly return was –30.11% for the quarter ended December 31, 2008.

| | | |

| EM Fund Average Annual Total Return as of December 31, 2009 | Investment Period |

| | One Year | Five Years | Ten Years |

| Class A Return Before Taxes | 56.55% | 6.06% | 6.64% |

| Class B Return Before Taxes | 60.22% | 6.52% | 6.69% |

| Class B Return After Taxes on Distributions | 60.63% | 5.63% | 6.22% |

| Class B Return After Taxes on Distributions and the Sale of Class B Shares | 39.56% | 6.31% | 6.25% |

| Morgan Stanley Capital International (MSCI) Emerging Markets Index | 78.51% | 15.51% | 9.78% |

| (reflects net dividends, which reflect the deduction of withholding taxes) | | | |

| | | |

| | |

| SEM Fund Average Annual Total Return as of December 31, 2009 | Investment Period |

| | One Year | Life of Fund |

| Class A Return Before Taxes | 57.80% | 7.21% |

| Class A Return After Taxes on Distributions | 57.81% | 7.19% |

| Class A Return After Taxes on Distributions and the Sale of Class A Shares | 37.95% | 6.31% |

| Morgan Stanley Capital International (MSCI) Emerging Markets Index (reflects ne | 78.51% | 10.81% |

| dividends, which reflect the deduction of withholding taxes) | | |

| S&P/International Finance Corporation (IFCI) Emerging Markets Index | 81.02% | 11.31% |

| These returns reflect the maximum sales charge for Class A (5.75%) and any applicable contingent deferred sales charge (“CDSC”) for Class B. Class A of SEM Fund commenced operations on June 30, 2006. Life of Fund returns for SEM Fund are calculated from June 30, 2006. The MSCI Emerging Markets Index and the S&P IFCI Emerging Markets Index are unmanaged indices of common stocks |

8

traded in emerging markets. Investors cannot invest directly in an Index. (Source for MSCI Emerging Markets Index: Lipper, Inc.; source for S&P IFCI Emerging Markets Index: Bloomberg.)

After-tax returns are calculated using the highest historical individual federal income tax rates and do not reflect the impact of state and local taxes. Actual after-tax returns depend on a shareholder’s tax situation and the actual characterization of distributions, and may differ from those shown. After-tax returns are not relevant to shareholders who hold shares in tax-deferred accounts or to shares held by nontaxable entities. After-tax returns for Class A shares will vary from the after-tax returns presented for Class B shares. Return After Taxes on Distributions for a period may be the same as Return Before Taxes for that period because no taxable distributions were made during that period. Also, Return After Taxes on Distributions and Sale of Fund Shares for a period may be greater than or equal to Return After Taxes on Distributions for the same period because of losses realized on the sale of Fund shares.

Management’s Discussion of Fund Performance. The total returns of SEM Fund and the factors that materially affected its performance during the most recent fiscal year are contained in its Annual Report dated October 31, 2009, which is incorporated by reference into this Proxy Statement/Prospectus and relevant portions of which are attached hereto as Appendix B.

The performance of EM Fund is described under the captions “Performance Information” and “Portfolio Composition” in the Annual Report of EM Fund for the year ended December 31, 2009, which was previously mailed to EM Fund shareholders and is incorporated by reference into this Proxy Statement/Prospectus.

HOW DO THE BUSINESS, INVESTMENT OBJECTIVES, PRINCIPAL STRATEGIES AND POLICIES OF THE EM FUND COMPARE TO THAT OF THE SEM FUND?

Below is a summary comparing the business, investment objectives, principal investment strategies and policies of the EM Fund and the SEM Fund. Each Fund’s current prospectus contains a detailed discussion of each Fund’s respective investment strategies and other investment policies.

| | |

| | EM Fund | SEM Fund |

|

| Business | A diversified series of the SI Trust. | A diversified series of the MF Trust. |

|

| Master-Feeder | The EM Fund seeks to meet its | The SEM Fund invests directly in securities. |

| Structure | investment objective by investing in | |

| | Emerging Markets Portfolio. | |

|

| Investment | Seeks long-term capital appreciation. | Same |

| Objective | | |

|

| 80% | Under normal market conditions, invests at | Same |

| Investment | least 80% of its net assets in equity | |

| Policy | securities of companies located in emerging | |

| | market countries. | |

|

| Emerging | Emerging market countries are defined as | Emerging market countries are defined as |

| Market | those considered to be developing. | countries generally not considered to be |

| Countries | Emerging market countries include countries | developed market countries, and therefore |

| | in Asia, Latin America, the Middle East, | not included in the Morgan Stanley Capital |

| | Southern Europe, Eastern Europe, Africa | International (MSCI) World Index. |

| | and the region comprising the former Soviet | |

| | Union. Emerging market countries are | |

| | countries that are generally considered to be | |

| | developing or emerging countries by the | |

| | International Bank for Reconstruction and | |

| | Development or the international Finance | |

| | Corporation, as well as countries that are | |

|

9

| | |

| | EM Fund | SEM Fund |

|

| | classified by the United Nations or otherwise | |

| | regarded by their own authorities as | |

| | developing. | |

| | |

| | The EM Fund ordinarily invests in at least | |

| | three emerging market countries at all times. | |

|

| Emerging | A company will be considered to be located | Same |

| Market | in an emerging market country if it is | |

| Companies | domiciled in or derives more than 50% of its | |

| | revenues or profits from emerging market | |

| | countries. | |

|

| Securities | Securities acquired by the EM Fund are | Same with the following exception: |

| Acquired by the | typically listed on stock exchanges in | For purposes of the SEM Fund’s 80% |

| Fund | emerging market countries, but also may | Policy, depositary receipts are considered |

| | include securities traded in markets outside | as being located in emerging markets if the |

| | these countries, including securities trading | company is domiciled in or derives more |

| | in the form of depositary receipts. | than 50% of its revenues or profits from |

| | | emerging market countries. |

|

| Derivatives | The portfolio manager may (but is not | The SEM Fund may engage in derivative |

| | obligated to) use investments such as | transactions as a substitute for the purchase |

| | forward contracts and options to attempt to | or sale of securities or currencies or to |

| | mitigate the adverse effects of foreign | attempt to mitigate the adverse effects of |

| | currency fluctuations. The EM Fund may | foreign currency fluctuations. Such |

| | invest up to 20% of its total assets in index or | transactions may include foreign currency |

| | stock futures for the limited purpose of | exchange contracts, options and equity- |

| | managing cash flows. | linked securities (such as participation |

| | | notes, equity swaps and zero strike calls |

| | | and warrants). |

|

| Buy/Sell | The portfolio manager employs a principally | The SEM Fund seeks to employ a top- |

| Strategy | bottom-up approach to managing the EM | down, disciplined and structured investment |

| | Fund and also seeks to manage issuer risk | process that emphasizes broad exposure |

| | by maintaining a broadly diversified portfolio. | and diversification among emerging market |

| | In managing the EM Fund, the portfolio | countries, economic sectors and issuers. |

| | manager looks for stocks that will grow in | This strategy utilizes targeted allocation and |

| | value over time, regardless of short-term | periodic rebalancing to take advantage of |

| | market fluctuations. Stocks will be sold when | certain quantitative and behavioral |

| | the portfolio manager believes they have | characteristics of emerging markets |

| | achieved their perceived value or when a | identified by the portfolio managers. The |

| | country’s stock market is expected to be | portfolio managers select and allocate |

| | depressed for an extended period. | across countries based on factors such as |

| | | size, liquidity, level of economic |

| | | development, local economic diversification, |

| | | and perceived risk and potential for growth. |

| | | The SEM Fund maintains a bias to broad |

| | | inclusion; that is, the SEM Fund intends to |

| | | allocate its portfolio holdings to more |

| | | emerging market countries rather than fewer |

| | | emerging market countries. Relative to |

| | | capitalization-weighted country indexes, |

| | | individual country allocation targets |

| | | emphasize the less represented emerging |

| | | market countries. The SEM Fund’s country |

| | | allocations are rebalanced to their target |

|

10

| | |

| | EM Fund | SEM Fund |

|

| | | weights if they exceed a pre-determined |

| | | overweight. This has the effect of reducing |

| | | exposure to countries with strong relative |

| | | performance and increasing exposure to |

| | | countries which have underperformed. |

| | | Within each country, the Fund seeks to |

| | | maintain exposure across key economic |

| | | sectors, such as industrial/ technology, |

| | | consumer, utilities, basic industry/ resource |

| | | and financial. Relative to capitalization- |

| | | weighted country indexes, the portfolio |

| | | managers target weights to these sectors to |

| | | emphasize the less represented sectors. |

| | | The portfolio managers select individual |

| | | securities as representatives of their |

| | | economic sectors and generally weight |

| | | them by their relative capitalization within |

| | | that sector. |

|

| Private | The EM Fund may make direct investments | Not allowed. |

| Placements | in companies in private placement | |

| | transactions. | |

|

| Fixed Income | Not allowed. | The SEM Fund may invest in convertible |

| and Convertible | | instruments, which will generally not be |

| Securities | | rated, but will typically be equivalent in |

| | | credit quality to securities rated below |

| | | investment grade (i.e., rated lower than BBB |

| | | by S&P Ratings Group or Fitch Ratings and |

| | | lower than Baa by Moody’s Investors |

| | | Service, Inc.). Such lower rated debt |

| | | securities will not exceed 20% of total |

| | | assets. |

|

| Short Sales | Not allowed. | The SEM Fund may enter short sales. |

|

| Securities | May seek to earn income by lending portfolio | Same |

| Lending | securities to broker-dealers or other | |

| | institutional borrowers. May lend up to one- | |

| | third of the value of its total assets (including | |

| | borrowings) or such other amount as is | |

| | permitted under relevant law. | |

|

| Borrowing | May borrow in accordance with applicable | Same |

| | regulations, but currently intends to borrow | |

| | only for temporary purposes (such as to | |

| | satisfy redemption requests, to remain fully | |

| | invested in anticipation of expected cash | |

| | inflows and settle transactions). The Fund | |

| | will not purchase additional investment | |

| | securities while outstanding borrowings | |

| | exceed 5% of the value of its total assets. | |

|

| Cash and Cash | May invest in cash or cash equivalents, | Same |

| Equivalents | including high quality short-term instruments | |

| | or an affiliated investment vehicle that | |

| | invests in such instruments, for cash | |

| | management purposes. During unusual | |

11

| | |

| | EM Fund | SEM Fund |

|

| | market conditions, the Fund may invest up to | |

| | 100% of its assets in cash and cash | |

| | equivalents temporarily, which may be | |

| | inconsistent with its investment objective. | |

|

| Illiquid | May not own illiquid securities if more than | Same |

| Securities | 15% of its net assets would be invested in | |

| | securities that are not readily marketable. | |

|

| Investment | Lloyd George Management (adviser of | Eaton Vance Management (“EVM”), Two |

| Adviser | the Emerging Markets Portfolio) | International Place, Boston, MA 02110 |

|

| Investment | None | Parametric Portfolio Associates LLC |

| Sub-Adviser | | (“Parametric”), a majority owned affiliate of |

| | | Eaton Vance Corp., 1151 Fairview Avenue |

| | | N., Seattle, WA 98109 |

|

| Manager | Eaton Vance | None |

|

| Administrator | Eaton Vance | Same |

|

| Portfolio | Kathryn L. Langridge | Thomas Seto |

| Manager(s) | * Director and Senior Portfolio Manager of | * Vice President and Director of Portfolio |

| | Lloyd George Management | Management of Parametric |

| | * Portfolio manager of the Portfolio since | * Portfolio manager of the Fund since |

| | October 2, 2007 | March 1, 2007 |

| | | David Stein |

| | | * Managing Director and Chief Investment |

| | | Officer of Parametric |

| | | * Portfolio manager of the Fund since |

| | | March 1, 2007 |

|

| Distributor | Eaton Vance Distributors, Inc. | Same |

|

Generally. As discussed above, the Funds have substantially similar investment objectives and policies and, as such, are subject to substantially similar types of risks. See “Principal Risks” in the SEM Fund Prospectus for a description of the principal risks of investing in the Fund.

The SEM Fund’s investment adviser uses quantitative investment techniques and analyses in making investment decisions for the Fund, but there can be no assurance that these will achieve the desired results. The SEM Fund’s strategy is highly dependent on a quantitatively-based country weighting process, a structured sector allocation and a proprietary disciplined rebalancing model that generally has not been independently tested or otherwise reviewed. Securities and exposures selected using this proprietary strategy may be weighted differently than in capitalization-weighted indices and therefore may differ in relative contribution to performance.

Principal Differences between the EM Fund and the SEM Fund. Although EM Fund and the SEM Fund have similar policies, the SEM Fund may invest in additional types of derivatives that the EM Fund did not invest in. To the extent that the SEM Fund utilizes such derivatives, the SEM Fund may have a higher risk profile than the EM Fund.

COMPARATIVE INFORMATION ON SHAREHOLDER RIGHTS

General. EM Fund is a series of Eaton Vance Special Investment Trust and SEM Fund is a series of Eaton Vance Mutual Funds Trust. Each Trust is a Massachusetts business trust governed by an

12

Amended and Restated Declaration of Trust dated September 27, 1993 and August 17, 1993, respectively, as amended from time to time, and by applicable Massachusetts law.

Shareholder Liability. Under Massachusetts law, shareholders of a Massachusetts business trust could, under certain circumstances, be held personally liable for the obligations of the trust, including its other series. However, the Declaration of Trust disclaims shareholder liability for acts or obligations of the trust and other series of the trust and requires that notice of such disclaimer be given in each agreement, obligation, or instrument entered into or executed by the trust or the trustees. Indemnification out of the trust property for all losses and expenses of any shareholder held personally liable by virtue of his or her status as such for the obligations of the trust is provided for in the Declaration of Trust and By-Laws. Thus, the risk of a shareholder incurring financial loss on account of shareholder liability is considered to be remote because it is limited to circumstances in which the respective disclaimers are inoperative and t he series would be unable to meet their respective obligations.

Copies of the Declaration of Trust may be obtained from the Trust upon written request at its principal office or from the Secretary of the Commonwealth of Massachusetts.

| INFORMATION ABOUT THE FUNDS |

Information about SEM Fund is included in the current SEM Fund Prospectus, a copy of which is included herewith and incorporated by reference herein. Additional information about SEM Fund is included in the SEM Fund SAI, which has been filed with the SEC and is incorporated by reference herein. Information concerning the operation and management of the EM Fund is incorporated herein by reference from the EM Fund Prospectus and EM Fund SAI. Copies may be obtained without charge on Eaton Vance’s website at www.eatonvance.com, by writing Eaton Vance Distributors, Inc., Two International Place, Boston, MA 02110 or by calling 1-800-262-1122 Monday through Friday, 8:00 a.m. to 6:00 p.m. Eastern time.

You will find and may copy information about each Fund (including the statement of additional information and shareholder reports): at the SEC’s public reference room in Washington, DC (call 1-202-942-8090 for information on the operation of the public reference room); on the EDGAR Database on the SEC’s Internet site (http://www.sec.gov); or, upon payment of copying fees, by writing to the SEC’s public reference section, 100 F Street NE, Washington, DC 20549-0102, or by electronic mail at publicinfo@sec.gov.

The Trusts, on behalf of the Funds, are currently subject to the informational requirements of the Securities Exchange Act of 1934, as amended, and in accordance therewith files proxy material, reports and other information with the SEC. These reports can be inspected and copied at the SEC’s public reference section, 100 F Street NE, Washington, DC 20549-0102, as well as at the following regional offices: New York Regional Office, 3 World Financial Center, Suite 400, New York, NY 10281-1022; and Chicago Regional Office, 175 W. Jackson Boulevard, Suite 900, Chicago, IL 60604. Copies of such material can also be obtained from the Public Reference Branch, Office of Consumer Affairs and Information Services, Securities and Exchange Commission, 100 F Street, NE, Washington, DC 20549 at prescribed rates.

Householding: One Proxy Statement/Prospectus may be delivered to multiple shareholders at the same address unless you request otherwise. You may request that we do not household proxy statements and/or obtain additional copies of the Proxy Statement/Prospectus by calling 1-800-262-1122 Monday through Friday, 8:00 a.m. to 6:00 p.m. Eastern time or writing to Eaton Vance Management, ATTN: Proxy Coordinator – Mutual Fund Operations, Two International Place, Boston, MA 02110.

13

What is the Vote Required to Approve the Proposal?

The affirmative vote of the holders of a majority of EM Fund’s outstanding shares, as defined in the 1940 Act, is required to approve the Plan. Such “majority” vote is the vote of the holders of the lesser of (a) 67% or more of the shares of EM Fund present or represented by proxy at the Special Meeting, if the holders of more than 50% of the outstanding shares are present or represented by proxy, or (b) 50% of the outstanding shares of EM Fund. Class A and Class B shareholders of EM Fund will vote together as a single group. Approval of the Plan by EM Fund shareholders is a condition of the consummation of the Reorganization.

How Do I Vote in Person?

If you do attend the Special Meeting and wish to vote in person, we will provide you with a ballot prior to the vote. However, if your shares are held in the name of your broker, bank or other nominee, you must bring a letter from the nominee indicating that you are the beneficial owner of the shares on the Record Date and authorizing you to vote. Please call the Fund at 1-800-262-1122 Monday through Friday, 8:00 a.m. to 6:00 p.m. Eastern time if you have any questions about attending the Special Meeting. If you plan to attend the Special Meeting in person, please be prepared to present photo identification.

How Do I Vote By Proxy?

Whether you plan to attend the Special Meeting or not, we urge you to complete, sign and date the enclosed proxy card and to return it promptly in the envelope provided. Returning the proxy card will not affect your right to attend the Special Meeting and vote.

If you properly fill in and sign your proxy card and send it to us in time to vote at the Special Meeting, your “proxy” (the individual named on your proxy card) will vote your shares as you have directed. If you sign your proxy card but do not make specific choices, your proxy will vote your shares “FOR” the proposal and in accordance with management’s recommendation on other matters.

If you authorize a proxy, you may revoke it at any time before it is exercised by sending in another proxy card with a later date or by notifying the Secretary of the EM Fund before the Special Meeting that you have revoked your proxy; such notice must be in writing and sent to the Secretary of the EM Fund at the address set forth on the cover page of this Proxy Statement/Prospectus. In addition, although merely attending the Special Meeting will not revoke your proxy, if you are present at the Special Meeting you may withdraw your proxy and vote in person. Shareholders may also transact any other business not currently contemplated that may properly come before the Special Meeting in the discretion of the proxies or their substitutes.

How Will Proxies be Solicited and Tabulated?

The expense of preparing, printing and mailing this Proxy Statement/Prospectus and enclosures and the costs of soliciting proxies on behalf of the EM Fund’s Board of Trustees will be borne by the EM Fund. Proxies will be solicited by mail and may be solicited in person or by telephone, facsimile or other electronic means by officers of the EM Fund, by personnel of Eaton Vance, by the EM Fund’s transfer agent, PNC Global Investment Servicing, by broker-dealer firms or by a professional solicitation organization. The EM Fund has retained Computershare Fund Services (“Computershare”) to assist in the solicitation of proxies, for which the EM Fund will pay an estimated fee of approximately $20,000, which assumes a moderate level of solicitation activity. If a greater solicitation effort is required, the solicitation costs would be higher. The expenses connected with the solicitation of this proxy and with any further proxies which may be solicited by the EM Fund� 6;s officers, by Eaton Vance personnel, by the transfer agent, by broker-dealer firms or by Computershare, in person, or by telephone, by telegraph, by facsimile or other electronic means, will be borne by the EM Fund. A written proxy may be delivered to the EM Fund or its transfer agent prior to the meeting by facsimile machine, graphic communication

14

equipment or other electronic transmission. The EM Fund will reimburse banks, broker-dealer firms, and other persons holding shares registered in their names or in the names of their nominees, for their expenses incurred in sending proxy material to and obtaining proxies from the beneficial owners of such shares. Total estimated costs of the Reorganization are approximately $70,000.

Shareholders also may choose to give their proxy votes by telephone rather than return their proxy cards. Please see the proxy card for details. The EM Fund may arrange for Eaton Vance, its affiliates or agents to contact shareholders who have not returned their proxy cards and offer to have votes recorded by telephone. If the EM Fund records votes by telephone, it will use procedures designed to authenticate shareholders’ identities, to allow shareholders to authorize the voting of their shares in accordance with their instructions, and to confirm that their instructions have been properly recorded. If the enclosed proxy card is executed and returned, or a telephonic vote is delivered, that vote may nevertheless be revoked at any time prior to its use by written notification received by the EM Fund, by the execution of a later-dated proxy card, by the EM Fund’s receipt of a subsequent valid telephonic vote, or by attending the meeting and voting in person.

All proxy cards solicited by the Board of Trustees that are properly executed and telephonic votes that are properly delivered and received by the Secretary prior to the meeting, and which are not revoked, will be voted at the meeting. Shares represented by such proxies will be voted in accordance with the instructions thereon. If no specification is made on the proxy card, it will be voted FOR the matters specified on the proxy card. Abstentions and broker non-votes (i.e., proxies from brokers or nominees indicating that such persons have not received instructions from the beneficial owner or other person entitled to vote shares on a particular matter with respect to which the broker or nominee does not have discretionary power) will be treated as shares that are present at the meeting, but which have not been voted. Accordingly, abstentions and broker non-votes will assist the EM Fund in obtaining a quorum, but may have the effect of a “No” vote on the proposal.

How is a Quorum Determined and What Happens if There is an Adjournment?

What constitutes a quorum for purposes of conducting a valid shareholder meeting, such as the Special Meeting, is set forth in the Trust’s By-Laws. Under the By-Laws of the Trust, the presence, in person or by proxy, of a majority of the outstanding shares is necessary to establish a quorum.

If a quorum is not present at the Special Meeting, the persons named as proxies in the enclosed proxy card may propose to adjourn the meeting to permit further solicitation of proxies in favor of the proposal. A meeting, including the Special Meeting, may be adjourned one or more times. Each such adjournment requires the affirmative vote of the holders of a majority of EM Fund’s shares that are present at the meeting, in person or by proxy. The persons named as proxies will vote in favor of or against, or will abstain with respect to, adjournment in the same proportions they are authorized to vote for or against, or to abstain with respect to, the proposal.

THE TRUSTEES OF THE TRUST, INCLUDING THE INDEPENDENT TRUSTEES, RECOMMEND

APPROVAL OF THE PLAN OF REORGANIZATION.

DISSENTERS RIGHTS |

Neither the Declaration of Trust nor Massachusetts law grants the shareholders of the EM Fund any rights in the nature of dissenters rights of appraisal with respect to any action upon which such shareholders may be entitled to vote; however, the normal right of mutual fund shareholders to redeem their shares (subject to any applicable contingent deferred sales charges) is not affected by the proposed Reorganization.

15

| SEM FUND FINANCIAL HIGHLIGHTS |

The financial highlights are intended to help you understand SEM Fund’s financial performance for the periods indicated. Certain information in the table reflects the financial results for a single Fund share. The total returns in the table represent the rate an investor would have earned (or lost) on an investment in the Fund assuming reinvestment of all distributions at net asset value. This information has been audited by Deloitte & Touche LLP, an independent registered public accounting firm, except that information prior to November 1, 2006 was audited by another independent registered public accounting firm. The report of Deloitte & Touche LLP and SEM Fund’s financial statements are incorporated herein by reference and included in SEM Fund’s annual report, which is available on request.

| | | | |

| | | Period Ended October 31, | |

|

|

| | 2009 | 2008 | 2007 | 2006(1) |

| | Class A | Class A | Class A | Class A |

|

| Net asset value – Beginning of year | $8.290 | $17.500 | $11.150 | $10.000 |

|

| Income (loss) from operations | | | | |

|

| Net investment income(2) | $0.121 | $0.190 | $0.110 | $0.010 |

| Net realized and unrealized gain (loss) | 4.120 | (9.216) | 6.215 | 1.140 |

|

| Total income (loss) from operations | $4.241 | $(9.026) | $6.325 | $1.150 |

|

| Less distributions | | | | |

|

| From net investment income | $(0.092) | $(0.087) | $ - | $ - |

|

| From net realized gains | | (0.098) | - | - |

|

| Total distributions | $(0.092) | $(0.185) | $ - | $ - |

|

| Redemption fees(2) | $0.001 | $0.001 | $0.025 | $0.000(6) |

|

| Net asset value – End of period | $12.440 | $8.290 | $17.500 | $11.500 |

|

| Total Return(3) | 51.81% | (52.10)% | 56.95% | 11.50%(5) |

|

| Ratios/Supplemental Data | | | | |

|

| Net assets, end of year (000’s omitted) | $104,727 | $74,062 | $81,611 | $1,451 |

| Ratios (As a percentage of average daily net | | | | |

| assets): | | | | |

| Expenses(7)(8) | 1.57% | 1.50% | 1.50% | 1.50%(4) |

| Net investment income | 1.26% | 1.33% | 0.77% | 0.32%(4) |

| Portfolio Turnover | 11% | 5% | 6% | 6%(5) |

|

| |

| (1) | For Class A shares of SEM Fund, for the period from the start of business, June 30, 2006, to October 31, 2006. |

| (2) | Computed using average shares outstanding. |

| (3) | Returns are historical and are calculated by determining the percentage change in net asset value with all distributions reinvested and do not reflect the effect of sales charges. |

| (4) | Annualized. |

| (5) | Not annualized. |

| (6) | Amount represents less than $0.0005 per share. |

| (7) | The adviser and administrator waived a portion of its fees and subsidized certain operating expenses (equal to 0.02%, 0.20%, 0.52% and 9.49% of average daily net assets |

| | for the years ended October 31, 2009, 2008 and 2007 and the period ended October 31, 2006, respectively). |

| (8) | Excludes the effect of custody fee credits, if any, of less than 0.005%. |

| |

16

| EM FUND FINANCIAL HIGHLIGHTS |

The financial highlights are intended to help you understand EM Fund’s financial performance for the periods indicated. Certain information in the table reflects the financial results for a single Fund share. The total returns in the table represent the rate an investor would have earned (or lost) on an investment in the Fund assuming reinvestment of all distributions at net asset value. This information has been audited by Deloitte & Touche LLP, an independent registered public accounting firm. The report of Deloitte & Touche LLP and EM Fund’s financial statements are incorporated herein by reference and included in EM Fund’s annual report, which is available on request.

| | | | | | | | | | |

| | Year Ended December 31, |

|

|

| | 2009 | 2008 | 2007 | 2006 | 2005 |

|

|

| | Class A | Class B | Class A | Class B | Class A | Class B | Class A | Class B | Class A | Class B |

|

| Net asset value – Beginning of year | $11.370 | $10.600 | $30.090 | $28.410 | $28.540 | $27.320 | $23.960 | $22.990 | $20.040 | $19.290 |

|

| Income (loss) from operations | | | | | | | | | | |

|

| Net investment income (loss)(1) | $0.002 | $(0.071) | $(0.002) | $(0.103) | $0.171 | $0.009 | $0.231 | $0.149 | $0.117 | $0.027 |

| Net realized and unrealized gain (loss) | 7.507 | 7.000 | (15.951) | (14.940) | 6.617 | 6.319 | 5.909 | 5.594 | 5.880 | 5.635 |

|

| Total income (loss) from Operations | $7.509 | $6.929 | $(15.953) | $(15.043) | $6.788 | $6.328 | $6.140 | $5.743 | $5.997 | $5.662 |

|

| Less distributions | | | | | | | | | | |

|

| From net investment income | $ - | $ - | $ - | $ - | $ - | $(0.052) | $(0.148) | $(0.001) | $(0.127) | $(0.012) |

|

| From net realized gain | - | - | (2.768) | (2.768) | (5.188) | (5.188) | (1.414) | (1.414) | (1.951) | (1.951) |

|

| Total distributions | $ - | $ - | $(2.768) | $(2.768) | $(5.240) | $(5.240) | $(1.562) | $(1.415) | $(2.078) | $(1.963) |

|

| Redemption fees(1) | $0.001 | $0.001 | $0.001 | $0.001 | $0.002 | $0.002 | $0.002 | $0.002 | $0.001 | $0.001 |

|

| Net asset value – End of year | $18.880 | $17.530 | $11.370 | $10.600 | $30.090 | $28.410 | $28.540 | $27.320 | $23.960 | $22.990 |

|

| Total Return(2) | 66.05% | 65.22% | (57.87)% | (58.07)% | 24.29% | 23.68% | 25.68% | 25.03% | 30.27% | 29.69% |

|

| Ratios/Supplemental Data | | | | | | | | | | |

|

| Net assets, end of year | $49,305 | $12,518 | $33,791 | $8,388 | $144,419 | $33,870 | $148,614 | $31,078 | $91,770 | $26,283 |

| (000’s omitted) | | | | | | | | | | |

| Ratios (As a percentage of | | | | | | | | | | |

| average | | | | | | | | | | |

| daily net assets): | | | | | | | | | | |

| Expenses(3)(4) | 2.56%(5) | 3.06%(5) | 2.37% | 2.87% | 2.23% | 2.73% | 2.30% | 2.80% | 2.41%(5) | 2.91%(5) |

| Net investment income (loss) | 0.01% | (0.52)% | (0.01)% | (0.51)% | 0.55% | 0.03% | 0.88% | 0.59% | 0.53% | 0.13% |

| Portfolio Turnover of the Portfolio | 75% | 75% | 114% | 114% | 68% | 68% | 35% | 35% | 32% | 32% |

|

| (1) | Computed using average shares outstanding. |

| (2) | Returns are historical and are calculated by determining the percentage change in net asset value with all distributions reinvested and do not reflect the effect of sales charges. |

| (3) | Includes the Fund’s share of the Portfolio’s allocated expenses. |

| (4) | Excludes the effect of custody fee credits, if any, or less than 0.005%. |

| (5) | The investment adviser to the Portfolio and manager subsidized certain operating expenses (equal to 0.10% of average daily net assets for the year ended December 31, 2009). The investment adviser to the |

| Portfolio voluntarily waived a portion of its investment adviser fee (equal to less than 0.01% of average daily net assets for the year ended December 31, 2005). Absent this waiver and/or subsidy, total |

| return would be lower. |

17

The financial statements incorporated in this Proxy Statement/Prospectus by reference from EVM Fund’s Annual Report for the year ended December 31, 2009 and SEM Fund’s Annual Report for the year ended October 31, 2009 on Form N-CSR have been audited by Deloitte & Touche LLP, an independent registered public accounting firm, as stated in their reports, which are incorporated herein by reference, and have been so incorporated in reliance upon the reports of such firm given upon their authority as experts in accounting and auditing.

18

FORM OF AGREEMENT AND PLAN OF REORGANIZATION

THIS AGREEMENT AND PLAN OF REORGANIZATION (“Agreement”) is made as of this ____ day of ___________, 2010, by and among Eaton Vance Special Investment Trust (“Special Investment Trust”), a Massachusetts business trust, on behalf of its series Eaton Vance Emerging Markets Fund (“Acquired Fund”), and Eaton Vance Mutual Funds Trust (“Mutual Funds Trust”), on behalf of its series Eaton Vance Structured Emerging Markets Fund (“Acquiring Fund”).