EXHIBIT (17 (b) (ii)

IMPORTANT NOTICES REGARDING PRIVACY,

DELIVERY OF SHAREHOLDER DOCUMENTS,

PORTFOLIO HOLDINGS AND PROXY VOTING

Privacy. The Eaton Vance organization is committed to ensuring your financial privacy. Each of the financial institutions identified below has in effect the following policy (Privacy Policy) with respect to nonpublic personal information about its customers:

| Only such information received from you, through application forms or otherwise, and information about |

| | your Eaton Vance fund transactions will be collected. This may include information such as name, address, |

| | social security number, tax status, account balances and transactions. |

| None of such information about you (or former customers) will be disclosed to anyone, except as permitted |

| | by law (which includes disclosure to employees necessary to service your account). In the normal course of |

| | servicing a customer’s account, Eaton Vance may share information with unaffiliated third parties that |

| | perform various required services such as transfer agents, custodians and broker/dealers. |

| Policies and procedures (including physical, electronic and procedural safeguards) are in place that are |

| | designed to protect the confidentiality of such information. |

| We reserve the right to change our Privacy Policy at any time upon proper notification to you. Customers |

| | may want to review our Privacy Policy periodically for changes by accessing the link on our homepage: |

| | www. eatonvance.com. |

Our pledge of privacy applies to the following entities within the Eaton Vance organization: the Eaton Vance Family of Funds, Eaton Vance Management, Eaton Vance Investment Counsel, Boston Management and Research, and Eaton Vance Distributors, Inc.

In addition, our Privacy Policy applies only to those Eaton Vance customers who are individuals and who have a direct relationship with us. If a customer’s account (i.e., fund shares) is held in the name of a third-party financial adviser/ broker-dealer, it is likely that only such adviser’s privacy policies apply to the customer. This notice supersedes all previously issued privacy disclosures.

For more information about Eaton Vance’s Privacy Policy, please call 1-800-262-1122.

Delivery of Shareholder Documents. The Securities and Exchange Commission (the “SEC”) permits funds to deliver only one copy of shareholder documents, including prospectuses, proxy statements and shareholder reports, to fund investors with multiple accounts at the same residential or post office box address. This practice is often called “householding” and it helps eliminate duplicate mailings to shareholders.

Eaton Vance, or your financial adviser, may household the mailing of your documents indefinitely unless you instruct Eaton Vance, or your financial adviser, otherwise.

If you would prefer that your Eaton Vance documents not be householded, please contact Eaton Vance at 1-800-262-1122, or contact your financial adviser.

Your instructions that householding not apply to delivery of your Eaton Vance documents will be effective within 30 days of receipt by Eaton Vance or your financial adviser.

Portfolio Holdings. Each Eaton Vance Fund and its underlying Portfolio(s) (if applicable) will file a schedule of portfolio holdings on Form N-Q with the SEC for the first and third quarters of each fiscal year. The Form N-Q will be available on the Eaton Vance website at www.eatonvance.com, by calling Eaton Vance at 1-800-262-1122 or in the EDGAR database on the SEC’s website at www.sec.gov. Form N-Q may also be reviewed and copied at the SEC’s public reference room in Washington, D.C. (call 1-800-732-0330 for information on the operation of the public reference room).

Proxy Voting. From time to time, funds are required to vote proxies related to the securities held by the funds. The Eaton Vance Funds or their underlying Portfolios (if applicable) vote proxies according to a set of policies and procedures approved by the Funds’ and Portfolios’ Boards. You may obtain a description of these policies and procedures and information on how the Funds or Portfolios voted proxies relating to portfolio securities during the most recent 12 month period ended June 30, without charge, upon request, by calling 1-800-262-1122. This description is also available on the SEC’s website at www.sec.gov.

Eaton Vance Structured Emerging Markets Fund as of October 31, 2009

MANAGEMENT’S DISCUSSION OF FUND PERFORMANCE

Economic and Market Conditions

• Despite an extremely volatile year, emerging markets generated strong positive performance, as measured by the MSCI Emerging Markets Index (the Index), which recorded a return of 64.13% for the 12 months ending October 31, 2009.1 As the period began late last fall, global equities were already in the midst of a dramatic decline, dragged lower by the failure or near-collapse of several major financial institutions struggling under the enormous weight of troubled assets. On the verge of illiquidity, the credit markets virtually ceased operating, worldwide economic activity ground to a near standstill, and anxious equity investors stayed on the sidelines. At the beginning of the second quarter, however, equity markets began a rally in response to indications that the concerted global effort by world banks to alleviate the credit crisis and stimulate economic growth was succeeding. Th e volatile period finished on a decidedly positive note, with many market indexes for European, U.S. and Asian equities posting solid annual gains.

• Against this backdrop, emerging markets fared very well, with some economies proving more resilient to the financial crisis and global recession than anticipated. Equity indexes tracking the performance of emerging markets widely outperformed the 27.71% return of foreign developed markets, as measured by the MSCI Europe, Australasia and Far East Index.

• Top performers in the Index on an absolute-return basis for the year ending October 31, 2009, included Indonesia (+126%), Peru (+117%), Russia (+110%), Colombia (+94%), Brazil (+92%) and China (+83%). The Index’s nearly 20% weighting in China made the most significant contribution to returns, followed by a 15% allocation to Brazil. By contrast, countries such as Pakistan (-44%) and Jordan (-25%) did not fare as well.

| Past performance is no guarantee of future results. Returns are historical and are calculated by determining the percentage change in net asset value or offering price (as applicable) with all distributions reinvested. Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Performance is for the stated time period only; due to market volatility, the Fund’s current performance may be lower or higher than the quoted return. For performance as of the most recent month end, please refer to www.eatonvance.com. |

Management Discussion

• For the year ending October 31, 2009, the Fund recorded a double-digit return, although it under-performed the Index, its primary benchmark, and the S&P/IFCI Emerging Markets Index, its secondary benchmark. Looking at individual countries, China and Brazil had strong positive returns but the Fund’s underweight in both countries detracted from performance relative to the Index. Fund holdings in Nigeria and United Arab Emirates also were a drag on relative performance, as was the Fund’s exposure to Qatar, Jordan, Kuwait, Ghana and Saudi Arabia. Russia and Indonesia were among the top contributors to the Fund’s return, as the Fund was significantly overweighted in both countries versus the Index. An overweight to Argentina, as well as underweightings in Taiwan and Korea, also added to performance.

• With any multicountry portfolio, country selection and weighting have the largest effect on the risk and return experience of the Fund’s strategy. Our research into emerging countries has resulted in some important observations. Individually, emerging markets can be volatile, but they also exhibit relatively low correlations among each other and developed markets. We believe that due to this tendency to move relatively

| |

| Total Return Performance | |

| 10/31/08 – 10/31/09 | |

| Class A2 | 51.81% |

| Class C2 | 50.69 |

| Class I2 | 52.15 |

| MSCI Emerging Markets Index1 | 64.13 |

| S&P/IFCI Emerging Markets Index1 | 65.33 |

| Lipper Emerging Markets Funds Average1 | 56.55 |

| See page 3 for more performance information. | |

1 It is not possible to invest directly in an Index or a Lipper Classification. The Indices’ total returns do not reflect commissions or expenses that would have been incurred if an investor individually purchased or sold the securities represented in the Indices. MSCI Index returns reflect dividends net of any applicable foreign withholding taxes. The Lipper total return is the average total return, at net asset value, of the funds that are in the same Lipper Classification as the Fund.

2 These returns do not include the 5.75% maximum sales charge for Class A shares or the applicable contingent deferred sales charge (CDSC) for Class C shares. If sales charges were deducted, the returns would be lower. Class I shares are offered to certain investors at net asset value. Absent expense limitations by the adviser, the sub-adviser and the administrator, the returns would be lower.

Fund shares are not insured by the FDIC and are not deposits or other obligations of, or guaranteed by, any depository institution. Shares are subject to investment risks, including possible loss of principal invested.

1

Eaton Vance Structured Emerging Markets Fund as of October 31, 2009

MANAGEMENT’S DISCUSSION OF FUND PERFORMANCE

independently, a structured portfolio that balances exposure to a broad array of emerging market countries can substantially reduce volatility compared to the level found in individual countries or more traditionally concentrated active strategies. While during the depths of the global financial crisis, there was a phenomenon where cross-country correlations rose and markets behaved more similarly than usual. However, they reverted to the historic norm of moving independent of each other as markets recovered throughout the year.

The views expressed throughout this report are those of the portfolio managers and are current only through the end of the period of the report as stated on the cover. These views are subject to change at any time based upon market or other conditions, and the investment adviser disclaims any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a fund are based on many factors, may not be relied on as an indication of trading intent on behalf of any Eaton Vance fund. Portfolio information provided in the report may not be representative of the Fund’s current or future investments and may change due to active management.

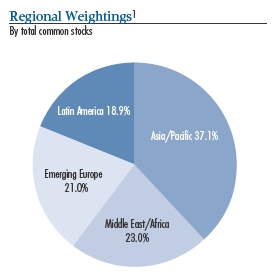

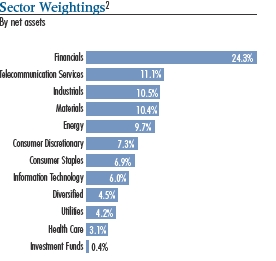

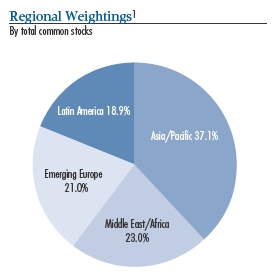

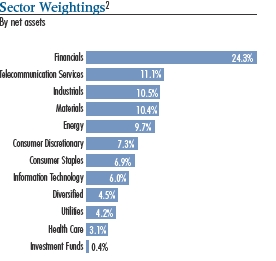

Portfolio Composition

1 As a percentage of the Fund’s total common stocks as of 10/31/09.

2 As a percentage of the Fund’s net assets as of 10/31/09. Excludes cash equivalents.

2

Eaton Vance Structured Emerging Markets Fund as of October 31, 2009

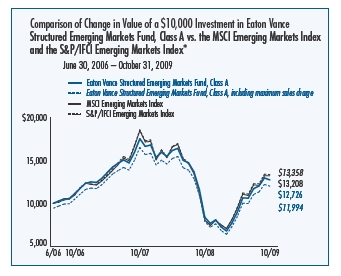

FUND PERFORMANCE

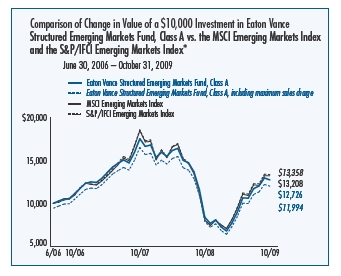

The line graph and table set forth below provide information about the Fund’s performance. The line graph compares the performance of Class A of the Fund with that of the MSCI Emerging Markets Index and the S&P/IFCI Emerging Markets Index, each an unmanaged index of common stocks traded in emerging markets and available to foreign investors. The lines on the graph represent the total returns of a hypothetical investment of $10,000 in each of Class A, the MSCI Emerging Markets Index and the S&P/IFCI Emerging Markets Index. Class A total returns are presented at net asset value and maximum public offering price. The table includes the total returns of each Class of the Fund at net asset value and maximum public offering price. The performance presented below does not reflect the deduction of taxes, if any, that a shareholder would pay on distributions or redemptions of Fund shares.

| * | Source: Lipper, Bloomberg. Class A of the Fund commenced invest- ment operations on 6/30/06. |

| | A $10,000 hypothetical investment at net asset value in Class C shares and Class I shares on 6/30/06 (inception date) would have been valued at $12,398 and $12,814, respectively, on 10/31/09. It is not possible to invest directly in an Index. The Indices’ total returns do not reflect commissions or expenses that would have been incurred if an investor individually purchased or sold the securities represented in the Indices. |

| | | |

| Performance1 | Class A | Class C | Class I |

| Share Class Symbol | EAEMX | ECEMX | EIEMX |

|

| Average Annual Total Returns (at net asset value) | | | |

| One Year | 51.81% | 50.69% | 52.15% |

| Life of Fund† | 7.48 | 6.65 | 7.71 |

| | |

| SEC Average Annual Total Returns (including sales charge or applicable CDSC) | |

|

| One Year | 43.01% | 49.69% | 52.15% |

| Life of Fund† | 5.59 | 6.65 | 7.71 |

| † Inception Dates For All Share Classes: 6/30/06 | | | |

1 Average Annual Total Returns do not include the 5.75% maximum sales charge for Class A shares or the applicable contingent deferred sales charge (CDSC) for Class C shares. If sales charges were deducted, the returns would be lower. SEC Average Annual Total Returns for Class A reflect the maximum 5.75% sales charge and, for Class C, reflect a 1% CDSC for the first year. Class A and Class I shares are subject to a 1% redemption fee if redeemed or exchanged within 90 days of settlement of purchase. Class I shares are offered to certain investors at net asset value. Absent expense limitations by the adviser, the sub-adviser and the administrator, the returns would be lower.

| | | |

| Total Annual | | | |

| Operating Expenses2 | Class A | Class C | Class I |

|

| Gross Expense Ratio | 1.72% | 2.47% | 1.48% |

| Net Expense Ratio | 1.62 | 2.37 | 1.37 |

2Source: Prospectus dated 3/1/09. Net expense ratio reflects a contractual expense limitation that continues through February 28, 2010. Thereafter, the expense limitation may be changed or terminated at any time. Without this expense limitation, expenses would be higher.

Past performance is no guarantee of future results. Returns are historical and are calculated by determining the percentage change in net asset value or offering price (as applicable) with all distributions reinvested. Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Performance is for the stated time period only; due to market volatility, the Fund’s current performance may be lower or higher than the quoted return. For performance as of the most recent month end, please refer to www.eatonvance.com.

3

Eaton Vance Structured Emerging Markets Fund as of October 31, 2009

FUND EXPENSES |

Example: As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchases and redemption fees (if applicable); and (2) ongoing costs, including management fees; distribution or service fees; and other Fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds. The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period (May 1, 2009 – October 31, 2009).

Actual Expenses: The first section of the table below provides information about actual account values and actual expenses. You may use the information in this section, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first section under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes: The second section of the table below provides information about hypothetical account values and hypothetical expenses based on the actual Fund expense ratio and an assumed rate of return of 5% per year (before expenses), which is not the actual return of the Fund. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in your Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads) or redemption fees (if applicable). Therefore, the second section of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would be higher.

| | | | |

| Eaton Vance Structured Emerging Markets Fund |

| |

| | | Beginning Account Value | Ending Account Value | Expenses Paid During Period* |

| | | (5/1/09) | (10/31/09) | (5/1/09 – 10/31/09) |

|

| Actual | | | |

| Class A | $1,000.00 | $1,416.90 | $9.75** |

| Class C | $1,000.00 | $1,409.90 | $14.27** |

| Class I | $1,000.00 | $1,417.50 | $8.23** |

| |

|

| Hypothetical | | | |

| (5% return per year before expenses) | | |

| Class A | $1,000.00 | $1,017.10 | $8.13** |

| Class C | $1,000.00 | $1,013.40 | $11.93** |

| Class I | $1,000.00 | $1,018.40 | $6.87** |

| |

| * | Expenses are equal to the Fund’s annualized expense ratio of 1.60% for Class A shares, 2.35% for Class C shares and |

| | 1.35% for Class I shares, multiplied by the average account value over the period, multiplied by 184/365 (to reflect the |

| | one-half year period). The Example assumes that the $1,000 was invested at the net asset value per share determined at |

| | the close of business on April 30, 2009. | | |

| |

| ** | Absent an expense limitation by affiliates, the expenses would be higher. | |

4

Eaton Vance Structured Emerging Markets Fund as of October 31, 2009

PORTFOLIO OF INVESTMENTS |

| | |

| Common Stocks — 97.3% | | |

| |

| Security | Shares | Value |

|

| |

| Argentina — 0.8% | | |

|

| Banco Macro SA, Class B ADR | 46,050 | $ 1,346,042 |

| BBVA Banco Frances SA ADR | 28,788 | 182,228 |

| Cresud SA ADR | 98,500 | 1,213,520 |

| Grupo Financiero Galicia SA, Class B ADR(1) | 88,700 | 514,460 |

| IRSA Inversiones y Representaciones SA GDR(1) | 14,500 | 125,280 |

| MercadoLibre, Inc.(1) | 41,600 | 1,488,864 |

| Petrobras Energia SA ADR | 67,925 | 1,163,555 |

| Telecom Argentina SA, Class B ADR(1) | 119,360 | 2,017,184 |

|

| | | $ 8,051,133 |

|

| |

| Botswana — 0.7% | | |

|

| Barclays Bank of Botswana | 723,650 | $ 708,665 |

| Botswana Insurance Holdings Ltd. | 326,490 | 400,194 |

| First National Bank of Botswana | 4,730,800 | 1,875,657 |

| Letshego | 173,200 | 349,139 |

| Sechaba Breweries Ltd. | 1,113,200 | 2,172,660 |

| Standard Chartered Bank | 531,120 | 1,251,744 |

|

| | | $ 6,758,059 |

|

| |

| Brazil — 6.1% | | |

|

| AES Tiete SA, PFC Shares | 32,900 | $ 370,723 |

| All America Latina Logistica SA | 103,500 | 763,207 |

| American Banknote SA | 4,700 | 46,957 |

| Anhanguera Educacional Participacoes SA(1) | 4,800 | 66,349 |

| B2W Companhia Global do Varejo | 16,970 | 491,298 |

| Banco Bradesco SA, PFC Shares | 149,150 | 2,926,103 |

| Banco do Brasil SA | 53,300 | 853,538 |

| Banco Nossa Caixa SA | 7,500 | 268,307 |

| BM&F Bovespa SA | 90,251 | 584,049 |

| BR Malls Participacoes SA(1) | 22,000 | 243,529 |

| Bradespar SA, PFC Shares | 31,500 | 651,780 |

| Brasil Telecom Participacoes SA | 7,100 | 130,949 |

| Brasil Telecom Participacoes SA, PFC Shares | 36,500 | 367,362 |

| Brasil Telecom SA, PFC Shares | 26,600 | 226,348 |

| Braskem SA, PFC Shares | 11,460 | 76,114 |

| BRF-Brasil Foods SA(1) | 59,120 | 1,433,029 |

| Centrais Eletricas Brasileiras SA, Class B, PFC Shares | 73,400 | 937,500 |

| Cia Brasileira de Distribuicao Grupo Pao de Acucar, | | |

| PFC Shares | 29,782 | 901,102 |

| Cia Brasileira de Distribuicao Grupo Pao de Acucar, | | |

| Class B, PFC Shares | 1,387 | 41,966 |

| Cia de Bebidas das Americas, PFC Shares | 33,758 | 3,061,139 |

| Cia de Companhia de Concessoes Rodoviarias (CCR) | 22,000 | 434,605 |

| Cia de Saneamento Basico do Estado de Sao Paulo | 28,220 | 536,654 |

| | |

| Security | Shares | Value |

|

| |

| Brazil (continued) | | |

|

| Cia de Saneamento de Minas Gerais-Copasa MG | 3,900 | $ 69,627 |

| Cia de Transmissao de Energia Eletrica Paulista, PFC | | |

| Shares | 8,890 | 245,212 |

| Cia Energetica de Minas Gerais, PFC Shares | 55,504 | 866,777 |

| Cia Energetica de Sao Paulo, PFC Shares | 17,500 | 204,643 |

| Cia Paranaense de Energia-Copel, PFC Shares | 10,100 | 175,729 |

| Cia Siderurgica Nacional SA (CSN) | 31,600 | 1,045,799 |

| Contax Participacoes SA, PFC Shares | 1,910 | 85,655 |

| Cosan SA Industria e Comercio(1) | 40,000 | 421,208 |

| CPFL Energia SA | 20,600 | 355,495 |

| Cyrela Brazil Realty SA | 46,000 | 587,534 |

| Diagnosticos da America SA(1) | 3,800 | 94,051 |

| Duratex SA | 39,187 | 269,166 |

| EDP-Energias do Brasil SA | 17,900 | 289,595 |

| Eletropaulo Metropolitana SA, Class B, PFC Shares | 11,280 | 210,988 |

| Empresa Brasileira de Aeronautica SA(1) | 105,700 | 536,420 |

| Estacio Participacoes SA | 13,900 | 181,483 |

| Fertilizantes Fosfatados SA, PFC Shares | 25,300 | 240,132 |

| Gafisa SA | 9,300 | 138,001 |

| Gerdau SA | 5,000 | 57,249 |

| Gerdau SA, PFC Shares | 73,200 | 1,092,847 |

| GVT Holding SA(1) | 22,900 | 655,177 |

| Investimentos Itau SA, PFC Shares | 335,395 | 1,905,826 |

| Itau Unibanco Holding SA, PFC Shares | 212,022 | 4,031,981 |

| Itausa-Investimentos Itau SA | 12,545 | 85,456 |

| JBS SA | 73,400 | 407,083 |

| LLX Logistica SA(1) | 90,000 | 356,608 |

| Localiza Rent a Car SA | 38,100 | 400,119 |

| Lojas Americanas SA, PFC Shares | 58,370 | 384,362 |

| Lojas Renner SA | 17,700 | 311,478 |

| Lupatech SA(1) | 21,200 | 326,857 |

| M Dias Branco SA | 4,300 | 92,708 |

| Marfrig Frigorificos e Comercio de Alimentos SA(1) | 48,500 | 556,968 |

| Medial Saude SA(1) | 12,200 | 99,035 |

| Metalurgica Gerdau SA, PFC Shares | 19,200 | 348,774 |

| MRV Engenharia e Participacoes SA | 18,800 | 349,832 |

| Natura Cosmeticos SA | 15,100 | 270,439 |

| Net Servicos de Comunicacao SA, PFC Shares | 42,836 | 534,964 |

| PDG Realty SA Empreendimentos e Participacoes | 10,600 | 89,657 |

| Petroleo Brasileiro SA | 56,800 | 1,305,858 |

| Petroleo Brasileiro SA, PFC Shares | 424,800 | 8,449,700 |

| Randon Participacoes SA, PFC Shares | 21,200 | 161,262 |

| Redecard SA | 58,200 | 863,947 |

| Rossi Residencial SA | 39,800 | 266,373 |

| Souza Cruz SA | 14,600 | 515,509 |

| Suzano Papel e Celulose SA | 29,300 | 254,479 |

| Tam SA, PFC Shares | 14,800 | 212,137 |

| Tele Norte Leste Participacoes SA | 3,700 | 85,065 |

See notes to financial statements

5

Eaton Vance Structured Emerging Markets Fund as of October 31, 2009

PORTFOLIO OF INVESTMENTS CO N T ’ D |

| | |

| Security | Shares | Value |

|

| |

| Brazil (continued) | | |

|

| Tele Norte Leste Participacoes SA, PFC Shares | 56,900 | $ 1,088,516 |

| Telemar Norte Leste SA, PFC Shares | 3,500 | 110,309 |

| Telesp-Telecomunicacoes de Sao Paulo SA, PFC Shares | 9,600 | 238,147 |

| Terna Participacoes SA | 5,000 | 104,167 |

| Tim Participacoes SA, PFC Shares | 156,500 | 368,685 |

| Totvs SA | 3,298 | 179,709 |

| Tractebel Energia SA | 21,600 | 256,267 |

| Ultrapar Participacoes SA, PFC Shares | 15,746 | 683,971 |

| Usinas Siderurgicas de Minas Gerais SA, PFC Shares | 30,525 | 797,088 |

| Vale SA | 47,300 | 1,202,906 |

| Vale SA, PFC Shares | 276,740 | 6,197,430 |

| Vivo Participacoes SA, PFC Shares | 23,675 | 580,586 |

| Votorantim Celulose e Papel SA(1) | 2,457 | 33,892 |

| Weg SA | 92,300 | 911,683 |

|

| | | $ 58,655,229 |

|

| |

| Bulgaria — 0.4% | | |

|

| Bulgarian American Credit Bank JSCO(1) | 5,700 | $ 76,784 |

| CB First Investment Bank AD(1) | 235,000 | 493,051 |

| Central Cooperative Bank AD(1) | 227,900 | 251,947 |

| Chimimport AD(1) | 329,922 | 620,163 |

| Corporate Commercial Bank AD(1) | 10,400 | 469,778 |

| Doverie Holding AD(1) | 13,760 | 40,017 |

| MonBat AD(1) | 60,235 | 317,357 |

| Petrol AD(1) | 102,500 | 357,142 |

| Sopharma AD(1) | 354,600 | 1,069,101 |

| Vivacom | 44,690 | 103,423 |

|

| | | $ 3,798,763 |

|

| |

| Chile — 3.1% | | |

|

| Administradora de Fondos de Pensiones Provida SA | 44,300 | $ 115,558 |

| AES Gener SA | 1,010,500 | 428,218 |

| Almendral SA | 2,512,600 | 242,529 |

| Antarchile SA, Series A | 38,340 | 660,723 |

| Banco de Chile | 13,030,222 | 1,030,736 |

| Banco de Chile ADR | 2,580 | 119,970 |

| Banco de Credito e Inversiones | 39,113 | 1,135,194 |

| Banco Santander Chile SA | 35,182,310 | 1,789,099 |

| Banmedica SA | 76,180 | 80,492 |

| Cap SA | 32,412 | 842,425 |

| Cencosud SA | 561,531 | 1,729,171 |

| Cia Cervecerias Unidas SA | 82,290 | 580,424 |

| Cia General de Electricidad SA | 61,050 | 384,617 |

| Cia SudAmericana de Vapores SA(1) | 350,331 | 288,341 |

| Colbun SA | 3,335,910 | 785,364 |

| Corpbanca SA | 58,054,570 | 393,627 |

| | |

| Security | Shares | Value |

|

| |

| Chile (continued) | | |

|

| Embotelladora Andina SA, Class B, PFC Shares | 170,541 | $ 523,234 |

| Empresa Nacional de Electricidad SA | 1,229,463 | 1,889,522 |

| Empresas CMPC SA | 41,146 | 1,472,406 |

| Empresas Copec SA | 203,576 | 2,739,946 |

| Empresas La Polar SA | 156,400 | 792,383 |

| Enersis SA | 5,325,221 | 1,891,584 |

| ENTEL SA | 51,500 | 684,791 |

| Grupo Security SA | 1,212,785 | 338,059 |

| Invercap SA | 19,700 | 163,255 |

| Inversiones Aguas Metropolitanas SA | 306,600 | 362,065 |

| Lan Airlines SA | 65,195 | 874,506 |

| Madeco SA | 5,047,652 | 327,986 |

| Masisa SA | 444,800 | 65,771 |

| Minera Valparaiso SA | 12,324 | 371,380 |

| Parque Arauco SA | 452,000 | 468,302 |

| Quinenco SA | 162,900 | 322,149 |

| Ripley Corp. SA | 264,000 | 200,380 |

| S.A.C.I. Falabella SA | 506,600 | 2,431,814 |

| Salfacorp SA | 170,000 | 294,887 |

| Sigdo Koppers SA | 176,300 | 154,402 |

| SM-Chile SA, Class B | 2,424,500 | 279,917 |

| Sociedad de Inversiones Oro Blanco SA | 13,300,000 | 192,881 |

| Sociedad de Inversiones Pampa Calichera SA, Class A | 244,730 | 384,875 |

| Sociedad Quimica y Minera de Chile SA, Series B | 38,540 | 1,415,444 |

| Sonda SA | 381,500 | 525,959 |

| Vina Concha y Toro SA | 255,010 | 540,326 |

|

| | | $ 30,314,712 |

|

| |

| China — 6.4% | | |

|

| Agile Property Holdings, Ltd. | 200,000 | $ 255,481 |

| Air China, Ltd., Class H(1) | 520,000 | 281,478 |

| Alibaba.com Ltd. | 161,000 | 371,757 |

| Aluminum Corp. of China Ltd., Class H(1) | 402,000 | 437,928 |

| American Oriental Bioengineering, Inc.(1) | 21,600 | 85,536 |

| Angang Steel Co., Ltd., Class H | 214,000 | 395,546 |

| Anhui Conch Cement Co., Ltd., Class H | 58,000 | 375,280 |

| Baidu, Inc. ADR(1) | 3,870 | 1,462,550 |

| Bank of China, Ltd., Class H | 4,177,000 | 2,401,877 |

| Bank of Communications, Ltd., Class H | 381,000 | 456,036 |

| Beijing Capital International Airport Co., Ltd., | | |

| Class H(1) | 310,000 | 208,472 |

| Beijing Enterprises Holdings, Ltd. | 69,000 | 411,269 |

| BOC Hong Kong Holdings, Ltd. | 127,500 | 292,846 |

| BYD Co., Ltd., Class H(1) | 74,200 | 680,261 |

| BYD Electronic Co., Ltd.(1) | 415,000 | 386,367 |

| Chaoda Modern Agriculture Holdings, Ltd. | 269,958 | 208,582 |

| China Agri-Industries Holdings, Ltd. | 453,000 | 433,929 |

| | | | |

| See notes to financial statements |

| 6 |

Eaton Vance Structured Emerging Markets Fund as of October 31, 2009

PORTFOLIO OF INVESTMENTS CO N T ’ D |

| | |

| Security | Shares | Value |

|

| |

| China (continued) | | |

|

| China Bluechemical, Ltd., Class H | 468,000 | $ 248,403 |

| China CITIC Bank, Class H | 239,000 | 178,300 |

| China Coal Energy Co., Class H | 311,000 | 430,340 |

| China Communication Services Corp., Ltd., Class H | 378,000 | 196,498 |

| China Communications Construction Co., Ltd., Class H | 481,000 | 517,719 |

| China Construction Bank, Class H | 2,449,000 | 2,111,360 |

| China COSCO Holdings Co., Ltd., Class H | 220,975 | 272,076 |

| China Dongxiang Group Co. | 634,000 | 387,365 |

| China Everbright International, Ltd. | 171,000 | 78,076 |

| China Everbright, Ltd. | 100,000 | 236,244 |

| China Green (Holdings), Ltd. | 72,000 | 63,163 |

| China International Marine Containers Co., Ltd., | | |

| Class B | 146,472 | 146,066 |

| China Life Insurance Co., Ltd., Class H | 545,000 | 2,502,391 |

| China Medical Technologies, Inc. ADR | 9,700 | 152,290 |

| China Mengniu Dairy Co., Ltd.(1) | 297,000 | 830,270 |

| China Merchants Bank Co., Ltd., Class H | 533,650 | 1,365,259 |

| China Merchants Holdings International Co., Ltd. | 154,000 | 492,127 |

| China Mobile, Ltd. | 620,000 | 5,812,141 |

| China National Building Material Co., Ltd., Class H | 122,000 | 262,554 |

| China National Materials Co., Ltd., Class H | 180,000 | 142,645 |

| China Oilfield Services, Ltd., Class H | 110,000 | 118,857 |

| China Overseas Land & Investment, Ltd. | 230,160 | 496,204 |

| China Petroleum & Chemical Corp., Class H | 1,367,000 | 1,155,874 |

| China Pharmaceutical Group, Ltd. | 524,000 | 294,162 |

| China Railway Construction Corp., Class H | 171,000 | 226,231 |

| China Railway Group, Ltd., Class H(1) | 738,000 | 580,065 |

| China Resources Enterprise, Ltd. | 202,000 | 677,814 |

| China Resources Land, Ltd. | 124,000 | 299,018 |

| China Resources Power Holdings Co., Ltd. | 237,600 | 493,428 |

| China Shenhua Energy Co., Ltd., Class H | 259,500 | 1,162,512 |

| China Shipping Container Lines Co., Ltd., Class H(1) | 568,000 | 203,274 |

| China Shipping Development Co., Ltd., Class H | 74,000 | 104,609 |

| China Southern Airlines Co., Ltd., Class H(1) | 234,000 | 68,360 |

| China Taiping Insurance Holdings Co., Ltd.(1) | 101,000 | 353,400 |

| China Telecom Corp., Ltd., Class H | 2,000,000 | 883,954 |

| China Travel International Investment Hong Kong, | | |

| Ltd. | 468,000 | 95,535 |

| China Unicom, Ltd. | 690,372 | 876,077 |

| China Vanke Co., Ltd., Class B | 445,120 | 550,567 |

| China Yurun Food Group, Ltd. | 214,000 | 438,737 |

| China Zhongwang Holdings, Ltd.(1) | 464,000 | 435,578 |

| Chongqing Changan Automobile Co., Ltd., Class B | 212,136 | 157,722 |

| Citic Pacific, Ltd. | 205,000 | 527,002 |

| CNOOC, Ltd. | 1,411,000 | 2,092,066 |

| Cnpc Hong Kong, Ltd. | 200,000 | 209,105 |

| Cosco Pacific, Ltd. | 198,000 | 274,011 |

| Country Garden Holdings Co. | 626,000 | 240,021 |

| | |

| Security | Shares | Value |

|

| |

| China (continued) | | |

|

| Ctrip.com International, Ltd. ADR(1) | 9,000 | $ 481,860 |

| Datang International Power Generation Co., Ltd., | | |

| Class H | 396,000 | 185,048 |

| Dazhong Transportation Group Co., Ltd., Class B | 84,750 | 59,014 |

| Denway Motors, Ltd. | 984,000 | 471,010 |

| Dongfeng Motor Corp., Class H | 664,000 | 790,289 |

| Fibrechem Technologies, Ltd.(1) | 100,200 | 0 |

| Focus Media Holding, Ltd. ADR(1) | 33,500 | 403,340 |

| FU JI Food & Catering Services(1) | 83,000 | 0 |

| Global Bio-chem Technology Group Co., Ltd. | 1,000,000 | 244,675 |

| Golden Eagle Retail Group, Ltd. | 168,000 | 288,947 |

| Guangdong Investment, Ltd. | 352,000 | 185,749 |

| Guangzhou R&F Properties Co., Ltd., Class H | 162,400 | 304,310 |

| Harbin Power Equipment Co., Ltd., Class H | 248,000 | 230,377 |

| Hengdeli Holdings, Ltd. | 210,000 | 68,377 |

| Huaneng Power International, Inc., Class H | 512,000 | 326,180 |

| Industrial & Commercial Bank of China, Ltd., Class H | 3,378,000 | 2,687,587 |

| Inner Mongolia Eerduosi Cashmere Products Co., Ltd., | | |

| Class B | 110,000 | 78,042 |

| Inner Mongolia Yitai Coal Co., Ltd., Class B | 49,800 | 319,282 |

| Jiangsu Expressway Co., Ltd., Class H | 360,000 | 319,227 |

| Jiangxi Copper Co., Ltd., Class H | 174,000 | 394,239 |

| Kingboard Chemical Holdings, Ltd. | 48,500 | 195,208 |

| Konka Group Co., Ltd., Class B | 303,800 | 118,327 |

| Lenovo Group, Ltd. | 512,000 | 287,664 |

| Li Ning Co., Ltd. | 192,500 | 523,490 |

| Maanshan Iron & Steel Co., Ltd., Class H(1) | 166,000 | 99,930 |

| Mindray Medical International, Ltd. ADR | 10,300 | 316,519 |

| NetEase.com, Inc. ADR(1) | 14,300 | 552,266 |

| New Oriental Education & Technology Group, Inc. | | |

| ADR(1) | 7,400 | 516,816 |

| Nine Dragons Paper Holdings, Ltd. | 181,000 | 257,900 |

| Parkson Retail Group, Ltd. | 345,000 | 558,542 |

| PetroChina Co., Ltd., Class H | 1,856,000 | 2,233,287 |

| PICC Property & Casualty Co., Ltd., Class H(1) | 360,000 | 265,616 |

| Ping An Insurance (Group) Co. of China, Ltd., | | |

| Class H | 82,000 | 718,122 |

| Poly (Hong Kong) Investment, Ltd. | 93,000 | 106,413 |

| Ports Design, Ltd. | 39,500 | 106,197 |

| Shanda Interactive Entertainment, Ltd. ADR(1) | 5,800 | 253,344 |

| Shandong Chenming Paper Holdings, Ltd., Class H | 79,800 | 55,639 |

| Shandong Weigao Group Medical Polymer Co., Ltd., | | |

| Class H | 124,000 | 435,097 |

| Shanghai Electric Group Co., Ltd., Class H | 640,000 | 300,562 |

| Shanghai Friendship Group, Inc. Co., Class B | 48,620 | 58,007 |

| Shanghai Industrial Holdings, Ltd. | 53,000 | 248,980 |

| Shanghai Jin Jiang International Hotels Group Co., | | |

| Ltd., Class H | 404,000 | 123,322 |

| Shanghai Zhenhua Heavy Industry Co., Ltd., Class B | 224,250 | 186,028 |

See notes to financial statements

7

Eaton Vance Structured Emerging Markets Fund as of October 31, 2009

PORTFOLIO OF INVESTMENTS CO N T ’ D |

| | |

| Security | Shares | Value |

|

| |

| China (continued) | | |

|

| Shimao Property Holdings, Ltd. | 49,000 | $ 91,145 |

| SINA Corp.(1) | 4,500 | 168,255 |

| Sino-Ocean Land Holdings, Ltd. | 195,000 | 189,391 |

| Sinopec Shanghai Petrochemical Co., Ltd., Class H(1) | 254,000 | 101,799 |

| Sinotrans Shipping, Ltd. | 512,000 | 229,939 |

| Sinotruk Hong Kong, Ltd. | 55,500 | 65,992 |

| Sohu.com, Inc.(1) | 5,300 | 294,680 |

| Suntech Power Holdings Co., Ltd. ADR(1) | 27,000 | 342,090 |

| Tencent Holdings, Ltd. | 79,600 | 1,386,041 |

| Tingyi (Cayman Islands) Holding Corp. | 334,000 | 745,233 |

| Tsingtao Brewery Co., Ltd., Class H | 76,000 | 308,769 |

| Want Want China Holdings, Ltd. | 1,231,000 | 723,221 |

| Wumart Stores, Inc., Class H | 55,000 | 93,409 |

| Yangzijiang Shipbuilding Holdings, Ltd. | 355,000 | 248,495 |

| Yantai Changyu Pioneer Wine Co., Ltd., Class B | 50,200 | 369,021 |

| Yanzhou Coal Mining Co., Ltd., Class H | 260,000 | 401,950 |

| Zhejiang Expressway Co., Ltd., Class H | 210,000 | 178,879 |

| Zijin Mining Group Co., Ltd., Class H | 352,000 | 340,714 |

| ZTE Corp., Class H | 115,752 | 643,610 |

|

| | | $ 61,862,127 |

|

| |

| Colombia — 0.7% | | |

|

| Almacenes Exito SA | 102,500 | $ 796,226 |

| Banco de Bogota | 3,600 | 57,586 |

| Bancolombia SA ADR, PFC Shares | 28,700 | 1,135,946 |

| Cementos Argos SA | 22,360 | 111,772 |

| Cia Colombiana de Inversiones SA | 21,337 | 517,293 |

| Cia de Cemento Argos SA | 72,900 | 553,173 |

| Corporacion Financiera Colombiana SA | 11,604 | 128,772 |

| Ecopetrol SA | 799,340 | 1,018,904 |

| Empresa de Telecommunicaciones de Bogota SA | 647,380 | 312,283 |

| Grupo Aval Acciones y Valores SA | 215,300 | 79,534 |

| Grupo de Inversiones Suramericana | 43,700 | 491,502 |

| Grupo Nacional de Chocolates SA | 67,045 | 698,434 |

| Interconexion Electrica SA | 131,760 | 765,334 |

| ISAGEN SA ESP | 426,200 | 446,333 |

| Proenergia Internacional(1)(2) | 4,360 | 0 |

| Promigas SA | 4,360 | 83,691 |

| Textiles Fabricato Tejicondor SA(1) | 4,522,600 | 47,475 |

|

| | | $ 7,244,258 |

|

| |

| Croatia — 0.7% | | |

|

| Adris Grupa DD, PFC Shares | 11,430 | $ 604,794 |

| Atlantska Plovidba DD | 5,167 | 1,042,438 |

| Dalekovod DD(1) | 4,050 | 320,735 |

| Ericsson Nikola Tesla | 1,100 | 297,965 |

| | |

| Security | Shares | Value |

|

| |

| Croatia (continued) | | |

|

| Hrvatske Telekomunikacije DD | 56,585 | $ 3,066,982 |

| INA Industrija Nafte DD(1) | 2,037 | 689,878 |

| Institut IGH DD | 350 | 254,251 |

| Koncar-Elektroindustrija DD(1) | 3,419 | 315,661 |

| Podravka Prehrambena Industija DD(1) | 5,675 | 324,156 |

| Privredna Banka Zagreb DD(1) | 3,177 | 389,374 |

|

| | | $ 7,306,234 |

|

| |

| Czech Republic — 1.9% | | |

|

| CEZ AS | 139,760 | $ 6,882,362 |

| Komercni Banka AS | 23,364 | 4,581,696 |

| New World Resources NV, Class A | 226,200 | 2,023,819 |

| Philip Morris CR AS | 1,613 | 775,452 |

| Telefonica 02 Czech Republic AS | 98,804 | 2,327,929 |

| Unipetrol AS(1) | 195,323 | 1,458,252 |

|

| | | $ 18,049,510 |

|

| |

| Egypt — 1.6% | | |

|

| Alexandria Mineral Oils Co. | 7,520 | $ 56,781 |

| Arab Cotton Ginning | 292,800 | 278,316 |

| Commercial International Bank | 133,902 | 1,386,290 |

| Delta Sugar Co.(1) | 19,428 | 90,394 |

| Eastern Tobacco | 16,004 | 364,182 |

| Egypt Kuwaiti Holding Co. | 274,179 | 649,462 |

| Egyptian Financial & Industrial Co. | 87,400 | 380,621 |

| Egyptian Financial Group-Hermes Holding SAE | 133,671 | 778,718 |

| Egyptian for Tourism Resorts(1) | 377,250 | 155,103 |

| Egyptian International Pharmaceutical Industrial Co. | 23,900 | 160,790 |

| Egyptian Media Production City(1) | 292,174 | 309,453 |

| El Ezz Aldekhela Steel Alexa Co. | 2,400 | 353,883 |

| El Ezz Steel Rebars SAE | 213,145 | 624,064 |

| El Sewedy Cables Holding Co. | 35,673 | 475,021 |

| El Watany Bank of Egypt | 12,400 | 100,052 |

| Maridive & Oil Services SAE | 119,000 | 518,092 |

| Medinet Nasr for Housing | 10,375 | 61,079 |

| Misr Beni Suef Cement Co. | 5,940 | 140,904 |

| MobiNil-Egyptian Co. for Mobil Services | 14,100 | 542,252 |

| National Societe General Bank | 38,700 | 197,550 |

| Olympic Group Financial Investments | 119,400 | 664,923 |

| Orascom Construction Industries (OCI) | 58,622 | 2,751,360 |

| Orascom Telecom Holding SAE | 243,990 | 1,627,194 |

| Oriental Weavers Co. | 31,299 | 189,994 |

| Palm Hills Developments SAE(1) | 105,000 | 168,813 |

| Pioneers Holding | 272,000 | 332,980 |

| Sidi Kerir Petrochemicals Co. | 227,000 | 485,107 |

| Six of October Development & Investment Co.(1) | 14,000 | 249,196 |

See notes to financial statements

8

Eaton Vance Structured Emerging Markets Fund as of October 31, 2009

PORTFOLIO OF INVESTMENTS CO N T ’ D |

| | |

| Security | Shares | Value |

|

| |

| Egypt (continued) | | |

|

| South Valley Cement(1) | 226,702 | $ 322,747 |

| Suez Cement Co. | 10,700 | 66,126 |

| Talaat Moustafa Group(1) | 389,300 | 515,012 |

| Telecom Egypt | 203,284 | 658,642 |

|

| | | $ 15,655,101 |

|

| |

| Estonia — 0.8% | | |

|

| AS Baltika(1) | 22,505 | $ 24,251 |

| AS Merko Ehitus | 105,168 | 819,705 |

| AS Nordecon International | 349,200 | 726,177 |

| AS Norma | 17,006 | 94,931 |

| AS Olympic Entertainment Group(1) | 1,319,390 | 1,397,787 |

| AS Tallink Group, Ltd.(1) | 4,723,752 | 2,615,374 |

| AS Tallinna Kaubamaja | 208,840 | 1,181,579 |

| AS Tallinna Vesi | 42,390 | 622,396 |

|

| | | $ 7,482,200 |

|

| |

| Ghana — 0.2% | | |

|

| Aluworks Ghana, Ltd.(1) | 457,409 | $ 119,807 |

| CAL Bank, Ltd. | 1,298,010 | 199,589 |

| Cocoa Processing Co., Ltd. | 269,722 | 5,656 |

| Ghana Commercial Bank, Ltd. | 1,453,841 | 914,525 |

| HFC Bank Ghana, Ltd. | 1,235,326 | 535,315 |

| Produce Buying Co., Ltd. | 582,428 | 72,615 |

| Standard Chartered Bank of Ghana, Ltd. | 24,700 | 504,962 |

|

| | | $ 2,352,469 |

|

| |

| Hungary — 2.1% | | |

|

| EGIS Rt. | 6,664 | $ 702,526 |

| Fotex Holding SE Co., Ltd.(1) | 25,100 | 55,867 |

| Magyar Telekom Rt. | 1,004,520 | 4,330,646 |

| MOL Hungarian Oil & Gas Rt.(1) | 59,450 | 4,966,701 |

| OTP Bank Rt.(1) | 232,000 | 6,523,716 |

| Richter Gedeon Rt. | 19,810 | 4,125,664 |

|

| | | $ 20,705,120 |

|

| |

| India — 6.0% | | |

|

| ABB, Ltd. | 5,400 | $ 87,005 |

| ACC, Ltd. | 20,570 | 323,580 |

| Aditya Birla Nuvo, Ltd. | 3,402 | 56,858 |

| Areva T&D India, Ltd. | 34,500 | 203,095 |

| Asian Paints, Ltd. | 8,730 | 302,146 |

| Axis Bank, Ltd. | 28,600 | 542,785 |

| Bajaj Auto, Ltd. | 13,280 | 389,841 |

| Bajaj Hindusthan, Ltd. | 40,000 | 163,167 |

| | |

| Security | Shares | Value |

|

| |

| India (continued) | | |

|

| Bajaj Holdings & Investment, Ltd. | 5,130 | $ 52,717 |

| Bank of Baroda | 9,660 | 103,358 |

| Bank of India | 64,300 | 448,956 |

| Bharat Forge, Ltd. | 19,650 | 101,639 |

| Bharat Heavy Electricals, Ltd. | 24,640 | 1,151,421 |

| Bharti Airtel, Ltd. | 425,860 | 2,629,284 |

| Cairn India, Ltd.(1) | 79,000 | 435,929 |

| Canara Bank, Ltd. | 12,400 | 89,964 |

| Cipla, Ltd. | 95,010 | 565,099 |

| Colgate-Palmolive (India), Ltd. | 9,000 | 133,260 |

| Container Corp. of India, Ltd. | 14,760 | 343,763 |

| Crompton Greaves, Ltd. | 16,800 | 135,102 |

| Dabur India, Ltd. | 72,200 | 232,173 |

| Deccan Chronicle Holdings, Ltd. | 27,600 | 79,807 |

| Divi’s Laboratories, Ltd. | 7,400 | 82,676 |

| DLF, Ltd. | 31,200 | 241,815 |

| Dr. Reddy’s Laboratories, Ltd. | 22,620 | 484,213 |

| Educomp Solutions, Ltd. | 24,565 | 409,750 |

| Essar Oil, Ltd.(1) | 102,130 | 283,570 |

| Exide Industries, Ltd. | 35,200 | 72,640 |

| Gail India, Ltd. | 105,050 | 765,417 |

| GlaxoSmithKline Pharmaceuticals, Ltd. | 4,480 | 148,065 |

| Glenmark Pharmaceuticals, Ltd. | 44,960 | 212,102 |

| GMR Infrastructure(1) | 248,000 | 325,308 |

| Grasim Industries, Ltd. | 2,830 | 129,680 |

| Gujarat Ambuja Cements, Ltd. | 44,800 | 84,063 |

| Gujarat State Petronet, Ltd.(1) | 144,200 | 243,776 |

| GVK Power & Infrastructure, Ltd.(1) | 180,000 | 167,287 |

| HCL Technologies, Ltd. | 21,100 | 135,283 |

| HDFC Bank, Ltd. | 32,624 | 1,113,976 |

| Hero Honda Motors, Ltd. | 20,500 | 676,769 |

| Hindalco Industries, Ltd. | 90,810 | 232,708 |

| Hindustan Unilever, Ltd. | 288,600 | 1,705,695 |

| Hindustan Zinc, Ltd. | 6,840 | 129,820 |

| Housing Development & Infrastructure, Ltd.(1) | 29,714 | 196,035 |

| Housing Development Finance Corp. | 44,700 | 2,486,953 |

| ICICI Bank, Ltd. | 125,670 | 2,081,089 |

| Idea Cellular, Ltd.(1) | 273,500 | 297,236 |

| IFCI, Ltd. | 68,000 | 62,486 |

| Indiabulls Financial Services, Ltd. | 18,100 | 63,961 |

| Indiabulls Real Estate, Ltd.(1) | 91,700 | 470,962 |

| Indiabulls Securities, Ltd. | 94,300 | 90,804 |

| Indian Hotels Co., Ltd. | 52,680 | 80,728 |

| Indian Oil Corp., Ltd. | 71,000 | 465,580 |

| Infosys Technologies, Ltd. | 82,600 | 3,850,764 |

| Infosys Technologies, Ltd. ADR | 3,800 | 174,800 |

| Infrastructure Development Finance Co., Ltd. | 76,600 | 236,543 |

| ITC, Ltd. | 276,530 | 1,495,974 |

See notes to financial statements

9

Eaton Vance Structured Emerging Markets Fund as of October 31, 2009

PORTFOLIO OF INVESTMENTS CO N T ’ D |

| | |

| Security | Shares | Value |

|

| |

| India (continued) | | |

|

| IVRCL Infrastructures & Projects, Ltd. | 95,800 | $ 699,447 |

| Jaiprakash Associates, Ltd. | 111,200 | 489,233 |

| Jindal Steel & Power, Ltd. | 77,700 | 1,041,500 |

| JSW Steel, Ltd. | 7,600 | 120,200 |

| Kotak Mahindra Bank, Ltd. | 59,100 | 876,920 |

| Lanco Infratech, Ltd.(1) | 13,900 | 141,658 |

| Larsen & Toubro, Ltd. | 36,360 | 1,195,456 |

| Larsen & Toubro, Ltd. GDR | 1,600 | 53,419 |

| Lupin, Ltd. | 3,900 | 102,163 |

| Mahindra & Mahindra, Ltd. | 53,480 | 1,028,377 |

| Maruti Udyog, Ltd. | 25,450 | 746,417 |

| Motor Industries Co., Ltd. | 1,130 | 101,760 |

| Mphasis, Ltd. | 14,800 | 210,347 |

| Mundra Port & Special Economic Zone, Ltd. | 29,400 | 310,966 |

| Nestle India, Ltd. | 9,530 | 518,629 |

| Nicholas Piramal India, Ltd. | 32,000 | 254,177 |

| NTPC, Ltd. | 305,300 | 1,364,441 |

| Oil & Natural Gas Corp., Ltd. | 70,470 | 1,682,322 |

| Power Grid Corp. of India, Ltd. | 185,700 | 403,664 |

| Punj Lloyd, Ltd. | 36,200 | 152,094 |

| Ranbaxy Laboratories, Ltd.(1) | 28,560 | 233,138 |

| Reliance Capital, Ltd. | 36,835 | 573,493 |

| Reliance Communications, Ltd. | 230,960 | 848,155 |

| Reliance Industries, Ltd. | 126,419 | 5,103,639 |

| Reliance Infrastructure, Ltd. | 41,400 | 909,836 |

| Reliance Natural Resources, Ltd.(1) | 207,800 | 277,872 |

| Reliance Power, Ltd.(1) | 145,300 | 425,528 |

| Satyam Computer Services, Ltd. | 144,150 | 311,051 |

| Sesa Goa, Ltd. | 37,000 | 238,583 |

| Shree Renuka Sugars, Ltd. | 55,000 | 214,225 |

| Siemens India, Ltd. | 7,380 | 78,914 |

| State Bank of India | 12,000 | 551,199 |

| State Bank of India GDR | 9,600 | 876,812 |

| Steel Authority of India, Ltd. | 155,400 | 537,563 |

| Sterlite Industries (India), Ltd. | 49,280 | 796,436 |

| Sun Pharmaceuticals Industries, Ltd. | 22,200 | 651,334 |

| Sun TV Network, Ltd. | 12,400 | 81,505 |

| Suzlon Energy, Ltd.(1) | 78,150 | 108,107 |

| Tata Communications, Ltd. | 31,000 | 251,639 |

| Tata Consultancy Services, Ltd. | 85,500 | 1,141,963 |

| Tata Motors, Ltd. | 21,050 | 248,634 |

| Tata Power Co., Ltd. | 29,990 | 837,650 |

| Tata Steel, Ltd. | 38,896 | 384,386 |

| Tata Tea, Ltd. | 11,800 | 214,252 |

| Tata Teleservices Maharashtra, Ltd.(1) | 365,500 | 202,551 |

| Titan Industries, Ltd. | 3,300 | 87,389 |

| Torrent Power, Ltd. | 44,700 | 262,954 |

| Unitech, Ltd. | 35,100 | 59,518 |

| | |

| Security | Shares | Value |

|

| |

| India (continued) | | |

|

| United Spirits, Ltd. | 18,500 | $ 411,787 |

| Voltas, Ltd. | 39,000 | 131,367 |

| Wipro, Ltd. | 52,100 | 668,177 |

| Zee Entertainment Enterprises, Ltd. | 73,557 | 354,612 |

|

| | | $ 57,836,936 |

|

| |

| Indonesia — 3.0% | | |

|

| Adaro Energy PT | 6,000,000 | $ 946,599 |

| Aneka Tambang Tbk PT | 2,434,000 | 565,643 |

| Astra Argo Lestari Tbk PT | 321,000 | 712,611 |

| Astra International Tbk PT | 1,254,200 | 4,035,133 |

| Bakrie & Brothers Tbk PT(1) | 47,245,500 | 479,706 |

| Bakrie Sumatera Plantations Tbk PT | 556,500 | 39,586 |

| Bank Central Asia Tbk PT | 4,759,500 | 2,241,256 |

| Bank Danamon Indonesia Tbk PT | 2,004,803 | 935,253 |

| Bank Mandiri Tbk PT | 3,135,500 | 1,504,585 |

| Bank Pan Indonesia Tbk PT(1) | 1,456,500 | 116,935 |

| Bank Rakyat Indonesia PT | 2,407,500 | 1,751,931 |

| Barito Pacific Tbk PT(1) | 665,800 | 94,842 |

| Berlian Laju Tanker Tbk PT | 904,000 | 66,057 |

| Bumi Resources Tbk PT | 11,727,000 | 2,823,128 |

| Energi Mega Persada Tbk PT(1) | 1,550,700 | 44,842 |

| Gudang Garam Tbk PT | 179,000 | 263,315 |

| Indah Kiat Pulp & Paper Corp. Tbk PT(1) | 1,021,000 | 188,928 |

| Indocement Tunggal Prakarsa Tbk PT | 167,000 | 190,157 |

| Indofood Sukses Makmur Tbk PT | 2,314,000 | 731,314 |

| Indosat Tbk PT | 1,134,000 | 602,357 |

| International Nickel Indonesia Tbk PT(1) | 1,665,500 | 690,199 |

| Kalbe Farma Tbk PT | 1,745,500 | 218,912 |

| Lippo Karawaci Tbk PT(1) | 5,149,500 | 348,333 |

| Medco Energi Internasional Tbk PT | 2,095,000 | 585,519 |

| Perusahaan Gas Negara PT | 3,904,000 | 1,452,615 |

| Perusahaan Perkebunan London Sumatra Indonesia | | |

| Tbk PT | 155,500 | 123,985 |

| PT AKR Corporindo Tbk | 861,500 | 100,762 |

| PT Indo Tambangraya Megah Tbk | 221,500 | 516,501 |

| Semen Gresik (Persero) Tbk PT | 301,000 | 212,718 |

| Tambang Batubara Bukit Asam Tbk PT | 404,500 | 630,161 |

| Telekomunikasi Indonesia Tbk PT | 2,855,000 | 2,458,479 |

| Unilever Indonesia Tbk PT | 711,800 | 744,457 |

| United Tractors Tbk PT | 1,577,000 | 2,417,932 |

|

| | | $ 28,834,751 |

|

| |

| Israel — 3.1% | | |

|

| Alony Hetz Properties & Investments, Ltd. | 18,100 | $ 64,290 |

| Alvarion, Ltd.(1) | 8,900 | 35,706 |

| Avner Oil & Gas, Ltd. | 850,000 | 266,867 |

See notes to financial statements

10

Eaton Vance Structured Emerging Markets Fund as of October 31, 2009

PORTFOLIO OF INVESTMENTS CO N T ’ D |

| | |

| Security | Shares | Value |

|

| |

| Israel (continued) | | |

|

|

| Bank Hapoalim B.M.(1) | 354,331 | $ 1,293,573 |

| Bank Leumi Le-Israel(1) | 432,508 | 1,689,153 |

| Bezeq Israeli Telecommunication Corp., Ltd. | 546,135 | 1,218,821 |

| Cellcom Israel, Ltd. | 26,200 | 788,358 |

| Check Point Software Technologies, Ltd.(1) | 55,206 | 1,715,250 |

| Clal Industries, Ltd.(1) | 14,400 | 73,463 |

| Clal Insurance Enterprise Holdings, Ltd.(1) | 2,810 | 59,487 |

| Delek Group, Ltd. | 2,130 | 351,895 |

| Discount Investment Corp. | 16,400 | 385,361 |

| Elbit Systems, Ltd. | 9,950 | 602,831 |

| Ezchip Semiconductor, Ltd.(1) | 6,700 | 80,199 |

| Frutarom | 8,107 | 65,755 |

| Gazit Globe (1982), Ltd. | 12,000 | 110,902 |

| Gilat Satellite Networks, Ltd.(1) | 11,760 | 52,802 |

| Harel Insurance Investments & Financial Services, | | |

| Ltd.(1) | 11,680 | 552,873 |

| Housing & Construction Holdings, Ltd. | 118,000 | 206,684 |

| IDB Holding Corp., Ltd. | 2,900 | 68,193 |

| Israel Chemicals, Ltd. | 235,061 | 2,745,614 |

| Israel Corp., Ltd.(1) | 1,275 | 876,878 |

| Israel Discount Bank, Ltd., Series A | 346,200 | 660,870 |

| Isramco Negev 2, LP(1) | 3,686,000 | 379,057 |

| Koor Industries, Ltd. | 8,510 | 243,996 |

| Makhteshim-Agan Industries, Ltd. | 104,897 | 490,278 |

| Mellanox Technologies, Ltd.(1) | 4,200 | 73,853 |

| Menorah Mivtachim Holdings, Ltd.(1) | 6,900 | 79,109 |

| Migdal Insurance & Financial, Ltd. Holdings(1) | 38,400 | 60,185 |

| Mizrahi Tefahot Bank, Ltd.(1) | 61,040 | 496,086 |

| Ness Technologies, Inc.(1) | 17,200 | 113,348 |

| Nice Systems, Ltd.(1) | 18,423 | 573,274 |

| Oil Refineries, Ltd. | 162,600 | 89,304 |

| Orbotech, Ltd.(1) | 20,000 | 186,000 |

| Ormat Industries, Ltd. | 27,300 | 237,985 |

| Osem Investment, Ltd. | 19,544 | 253,535 |

| Partner Communications Co., Ltd. | 41,300 | 783,083 |

| Paz Oil Co., Ltd. | 2,100 | 327,093 |

| Strauss Group, Ltd. | 23,300 | 302,011 |

| Supersol, Ltd. | 26,000 | 123,043 |

| Teva Pharmaceutical Industries, Ltd. ADR | 220,704 | 11,141,138 |

|

| | | $ 29,918,203 |

|

|

| |

| Jordan — 0.8% | | |

|

|

| Arab Bank PLC | 201,285 | $ 3,790,785 |

| Arab Potash Co., PLC | 23,800 | 1,010,362 |

| Bank of Jordan | 11,100 | 35,391 |

| Capital Bank of Jordan(1) | 185,557 | 361,551 |

| Jordan Ahli Bank | 14,700 | 31,474 |

| | |

| Security | Shares | Value |

|

| |

| Jordan (continued) | | |

|

|

| Jordan Petroleum Refinery | 28,400 | $ 292,298 |

| Jordan Phosphate Mines | 15,900 | 387,610 |

| Jordan Steel | 57,402 | 213,781 |

| Jordan Telecom Corp. | 37,600 | 270,897 |

| Jordanian Electric Power Co. | 113,889 | 603,112 |

| Lafarge Jordan Cement | 5,600 | 55,700 |

| Middle East Complex for Engineering, Electric, & | | |

| Heavy Industries PLC(1) | 69,800 | 150,469 |

| Taameer Jordan Co.(1) | 279,605 | 229,122 |

| Union Land Development(1) | 32,100 | 99,710 |

| United Arab Investors(1) | 335,925 | 284,582 |

|

| | | $ 7,816,844 |

|

|

| |

| Kazakhstan — 0.3% | | |

|

|

| KazMunaiGas Exploration Production GDR | 123,400 | $ 2,910,702 |

|

| | | $ 2,910,702 |

|

|

| |

| Kenya — 0.8% | | |

|

|

| Athi River Mining, Ltd. | 78,100 | $ 99,578 |

| Bamburi Cement Co., Ltd. | 172,700 | 378,929 |

| Barclays Bank of Kenya, Ltd. | 716,965 | 427,263 |

| East African Breweries, Ltd. | 884,080 | 1,679,648 |

| Equity Bank, Ltd. | 5,398,700 | 1,032,289 |

| KenolKobil, Ltd. | 409,000 | 255,625 |

| Kenya Airways, Ltd. | 345,800 | 112,079 |

| Kenya Commercial Bank, Ltd. | 2,795,300 | 731,866 |

| Kenya Electricity Generating Co., Ltd. | 2,321,100 | 322,535 |

| Kenya Power & Lighting, Ltd. | 83,900 | 158,368 |

| Mumias Sugar Co., Ltd. | 856,800 | 78,577 |

| Nation Media Group, Ltd. | 206,200 | 330,526 |

| Safaricom, Ltd. | 34,362,672 | 1,840,258 |

| Standard Chartered Bank Kenya, Ltd. | 62,800 | 121,555 |

|

| | | $ 7,569,096 |

|

|

| |

| Kuwait — 0.9% | | |

|

|

| Aerated Concrete Industries Co. | 189,000 | $ 264,382 |

| Agility(1) | 50,000 | 202,833 |

| Al Safwa Group Co.(1) | 800,000 | 144,302 |

| Boubyan Bank KSC(1) | 100,000 | 181,850 |

| Boubyan Petrochemicals Co. | 220,000 | 319,287 |

| Burgan Bank SAK(1) | 196,000 | 267,319 |

| Burgan Co. For Well Drilling, Trading & | | |

| Maintenance KSCC | 75,250 | 148,205 |

| Commercial Bank of Kuwait SAK | 50,000 | 173,107 |

| Commercial Real Estate Co. KSCC(1) | 406,600 | 179,163 |

| Global Investment House KSCC(1) | 527,500 | 199,231 |

See notes to financial statements

11

Eaton Vance Structured Emerging Markets Fund as of October 31, 2009

PORTFOLIO OF INVESTMENTS CO N T ’ D |

| | |

| Security | Shares | Value |

|

| |

| Kuwait (continued) | | |

|

|

| Gulf Bank(1) | 260,000 | $ 295,506 |

| Gulf Cable & Electrical Industries | 50,000 | 323,082 |

| Kuwait Finance House KSC | 247,100 | 1,019,682 |

| Kuwait Foods Co. (Americana) | 45,000 | 283,266 |

| Kuwait International Bank(1) | 154,000 | 119,559 |

| Kuwait Projects Co. Holdings KSC | 45,000 | 76,325 |

| Mabanee Co. SAKC(1) | 38,500 | 95,594 |

| Mobile Telecommunications Co. | 387,500 | 1,571,953 |

| National Bank of Kuwait SAK | 322,750 | 1,354,433 |

| National Industries Group Holding(1) | 390,000 | 511,453 |

| National Investment Co.(1) | 120,000 | 182,549 |

| National Real Estate Co.(1) | 210,000 | 212,457 |

| Sultan Center Food Products Co.(1) | 220,000 | 187,725 |

|

| | | $ 8,313,263 |

|

|

| |

| Latvia — 0.1% | | |

|

|

| Grindeks(1) | 42,000 | $ 393,716 |

| Latvian Shipping Co.(1) | 735,000 | 686,512 |

|

| | | $ 1,080,228 |

|

|

| |

| Lebanon — 0.3% | | |

|

|

| Solidere | 83,555 | $ 2,182,457 |

| Solidere GDR(3) | 28,500 | 748,856 |

|

| | | $ 2,931,313 |

|

|

| |

| Lithuania — 0.3% | | |

|

|

| Apranga PVA(1) | 278,536 | $ 268,568 |

| Invalda PVA(1) | 19,100 | 17,298 |

| Klaipedos Nafta PVA | 1,345,900 | 548,656 |

| Lietuvos Dujos | 31,900 | 32,257 |

| Lietuvos Energija(1) | 42,400 | 54,510 |

| Pieno Zvaigzdes | 63,600 | 81,106 |

| Rokiskio Suris(1) | 69,800 | 90,506 |

| Rytu Skirstomieji Tinklai(1) | 88,200 | 80,109 |

| Sanitas(1) | 55,400 | 223,885 |

| Siauliu Bankas(1) | 774,861 | 353,963 |

| Ukio Bankas Commercial Bank(1) | 1,672,935 | 850,198 |

|

| | | $ 2,601,056 |

|

|

| |

| Malaysia — 3.1% | | |

|

|

| Airasia Bhd(1) | 915,300 | $ 359,890 |

| Alliance Financial Group Bhd | 385,700 | 275,587 |

| AMMB Holdings Bhd | 459,200 | 631,363 |

| Astro All Asia Networks PLC | 414,000 | 399,290 |

| Batu Kawan Bhd | 90,500 | 262,441 |

| | |

| Security | Shares | Value |

|

| |

| Malaysia (continued) | | |

|

|

| Berjaya Sports Toto Bhd | 297,214 | $ 374,632 |

| British American Tobacco Malaysia Bhd | 35,500 | 466,214 |

| Bursa Malaysia Bhd | 131,700 | 311,498 |

| CIMB Group Holdings Bhd | 363,800 | 1,319,842 |

| Dialog Group Bhd | 221,900 | 83,712 |

| Digi.com Bhd | 65,600 | 418,897 |

| Gamuda Bhd | 1,076,200 | 982,617 |

| Genting Bhd | 626,600 | 1,317,198 |

| Genting Plantations Bhd | 163,400 | 292,131 |

| Hong Leong Bank Bhd | 178,000 | 389,227 |

| Hong Leong Financial Group Bhd | 145,000 | 262,328 |

| IGB Corp. Bhd(1) | 173,500 | 98,544 |

| IJM Corp. Bhd | 645,490 | 900,354 |

| IOI Corp. Bhd | 925,705 | 1,435,313 |

| Kencana Petroleum Bhd | 233,700 | 148,042 |

| Kinsteel Bhd | 202,200 | 54,490 |

| KNM Group Bhd | 4,983,800 | 1,131,071 |

| Kuala Lumpur Kepong Bhd | 128,500 | 561,176 |

| Kulim (Malaysia) Bhd | 141,000 | 303,212 |

| Lafarge Malayan Cement Bhd | 270,150 | 476,729 |

| Lion Industries Corp. Bhd | 540,300 | 220,935 |

| Malayan Banking Bhd | 727,487 | 1,408,920 |

| Malaysian Airline System Bhd(1) | 165,733 | 150,044 |

| Malaysian Airline System Bhd, PFC Shares | 33,533 | 7,714 |

| Malaysian Bulk Carriers Bhd | 102,200 | 92,934 |

| Malaysian Resources Corp. Bhd(1) | 949,000 | 374,968 |

| MISC Bhd | 317,000 | 824,009 |

| MMC Corp. Bhd | 540,000 | 391,351 |

| Multi-Purpose Holdings Bhd | 121,440 | 65,781 |

| Parkson Holdings Bhd | 205,040 | 304,213 |

| Petra Perdana Bhd | 83,400 | 63,281 |

| Petronas Dagangan Bhd | 259,700 | 675,582 |

| Petronas Gas Bhd | 135,200 | 386,450 |

| PLUS (Projek Lebuhraya Utara Selatan) | | |

| Expressways Bhd | 411,900 | 397,038 |

| PPB Group Bhd | 117,700 | 519,772 |

| Public Bank Bhd | 306,720 | 955,468 |

| Resorts World Bhd | 1,117,800 | 892,847 |

| RHB Capital Bhd | 62,100 | 97,424 |

| SapuraCrest Petroleum Bhd | 208,100 | 125,552 |

| Sarawak Energy Bhd | 152,400 | 115,353 |

| Shell Refining Co. Bhd | 36,900 | 115,701 |

| Sime Darby Bhd | 1,254,839 | 3,244,518 |

| Sino Hua-An International Bhd(1) | 401,500 | 54,737 |

| SP Setia Bhd | 228,600 | 257,059 |

| TA Enterprise Bhd | 323,000 | 72,170 |

| TA Global Bhd(1) | 193,800 | 55,242 |

| TA Global Bhd, PFC Shares(1) | 193,800 | 0 |

See notes to financial statements

12

Eaton Vance Structured Emerging Markets Fund as of October 31, 2009

PORTFOLIO OF INVESTMENTS CO N T ’ D |

| | |

| Security | Shares | Value |

|

| |

| Malaysia (continued) | | |

|

|

| Tanjong PLC | 72,100 | $ 319,029 |

| Telekom Malaysia Bhd | 381,100 | 334,922 |

| Tenaga Nasional Bhd | 502,100 | 1,230,658 |

| Titan Chemicals Corp. Bhd(1) | 168,000 | 56,559 |

| TM International Bhd(1) | 1,004,850 | 855,769 |

| Top Glove Corp. Bhd | 97,000 | 231,090 |

| UEM Land Holdings Bhd(1) | 510,500 | 247,275 |

| UMW Holdings Bhd | 78,000 | 143,653 |

| Wah Seong Corp. Bhd | 432,125 | 304,552 |

| WCT Bhd | 351,800 | 267,960 |

| WTK Holdings Bhd | 154,250 | 51,998 |

| YNH Property Bhd(1) | 158,059 | 77,772 |

| YTL Corp. Bhd | 189,006 | 401,930 |

| YTL Power International Bhd | 615,821 | 386,970 |

|

| | | $ 30,034,998 |

|

|

| |

| Mauritius — 0.8% | | |

|

|

| Ireland Blyth, Ltd. | 31,600 | $ 62,418 |

| Mauritius Commercial Bank | 509,000 | 2,448,100 |

| Mauritius Development Investment Trust Co., Ltd. | 80,700 | 12,005 |

| Naiade Resorts, Ltd. | 359,100 | 528,263 |

| New Mauritius Hotels, Ltd. | 525,350 | 2,316,386 |

| Rogers & Co., Ltd. | 13,200 | 141,283 |

| State Bank of Mauritius, Ltd. | 425,800 | 1,126,083 |

| Sun Resorts, Ltd. | 234,775 | 620,892 |

| United Basalt Products, Ltd. | 36,000 | 84,496 |

| United Docks, Ltd.(1) | 27,400 | 83,332 |

|

| | | $ 7,423,258 |

|

|

| |

| Mexico — 6.2% | | |

|

|

| Alfa SA de CV, Series A | 281,000 | $ 1,436,524 |

| America Movil SAB de CV, Series L | 5,940,920 | 13,043,815 |

| Axtel SA de CV, Series CPO(1) | 367,100 | 273,857 |

| Banco Compartamos SA de CV | 282,800 | 1,159,793 |

| Bolsa Mexicana de Valores SA de CV(1) | 630,000 | 725,248 |

| Carso Global Telecom SA de CV, Series A1(1) | 171,400 | 665,933 |

| Carso Infraestructura y Construccion SA(1) | 358,400 | 200,864 |

| Cemex SAB de CV, Series CPO(1) | 5,100,658 | 5,311,676 |

| Coca-Cola Femsa SA de CV, Series L | 30,200 | 164,452 |

| Consorcio ARA SA de CV(1) | 459,200 | 288,657 |

| Corporacion GEO SA de CV, Series B(1) | 194,300 | 514,896 |

| Corporacion Moctezuma SA de CV | 27,500 | 58,421 |

| Desarrolladora Homex SA de CV(1) | 81,500 | 485,775 |

| Embotelladoras Arca SA | 100,000 | 250,611 |

| Empresas ICA SAB de CV(1) | 513,100 | 1,125,002 |

| Fomento Economico Mexicano SA de CV, Series UBD | 784,900 | 3,328,933 |

| | |

| Security | Shares | Value |

|

| |

| Mexico (continued) | | |

|

|

| Grupo Aeroportuario del Pacifico SA de CV, Class B | 41,500 | $ 104,349 |

| Grupo Aeroportuario del Sureste SAB de CV, Class B | 95,500 | 390,571 |

| Grupo Bimbo SA de CV, Series A | 223,300 | 1,290,544 |

| Grupo Carso SA de CV, Series A1 | 484,700 | 1,503,612 |

| Grupo Elektra SA de CV | 24,000 | 979,722 |

| Grupo Financiero Banorte SA de CV, Class O | 1,469,300 | 4,819,493 |

| Grupo Financiero Inbursa SA de CV, Class O | 1,027,700 | 2,900,871 |

| Grupo Mexico SA de CV, Series B(1) | 2,363,326 | 4,653,714 |

| Grupo Modelo SA de CV, Series C(1) | 260,000 | 1,205,112 |

| Grupo Simec SA de CV, Series B(1) | 92,000 | 225,197 |

| Grupo Televisa SA, Series CPO | 535,800 | 2,045,607 |

| Impulsora del Desarrollo y el Empleo en America | | |

| Latina SA de CV, Series B1(1) | 919,900 | 905,705 |

| Industrias CH SA, Series B(1) | 25,700 | 82,606 |

| Industrias Penoles SA de CV | 67,800 | 1,255,381 |

| Kimberly-Clark de Mexico SA de CV | 189,500 | 752,044 |

| Mexichem SA de CV | 597,991 | 971,459 |

| Organizacion Soriana SAB de CV, Class B(1) | 120,000 | 267,288 |

| Promotora y Operadora de Infraestructura SA de CV(1) | 77,700 | 141,233 |

| Telefonos de Mexico SA de CV, Series L | 1,636,000 | 1,385,249 |

| Telmex Internacional SAB de CV, Class L | 1,602,300 | 1,031,491 |

| TV Azteca SA de CV, Series CPO | 625,000 | 321,878 |

| Urbi Desarrollos Urbanos SA de CV(1) | 178,400 | 351,294 |

| Wal-Mart de Mexico SAB de CV, Series V | 848,100 | 3,018,250 |

|

| | | $ 59,637,127 |

|

|

| |

| Morocco — 1.5% | | |

|

|

| Attijariwafa Bank | 46,400 | $ 1,587,342 |

| Banque Centrale Populaire | 25,280 | 877,211 |

| Banque Marocaine du Commerce Exterieur (BMCE) | 63,600 | 2,013,756 |

| Banque Marocaine pour le Commerce et l’Industrie | | |

| (BMCI) | 2,860 | 321,677 |

| Centrale Laitiere | 85 | 112,463 |

| Ciments du Maroc | 2,250 | 459,514 |

| Compagnie Generale Immobiliere | 2,150 | 523,827 |

| Cosumar Compagnie Sucriere Marocaine et de | | |

| Raffinage | 1,230 | 241,825 |

| Credit Immobilier et Hotelier | 1,440 | 68,729 |

| Douja Promotion Groupe Addoha SA | 56,300 | 831,163 |

| Holcim Maroc SA | 2,260 | 537,420 |

| Lafarge Ciments | 3,010 | 572,628 |

| Managem(1) | 7,755 | 268,160 |

| Maroc Telecom | 142,500 | 2,619,534 |

| ONA SA | 10,770 | 1,836,352 |

| RISMA(1) | 1,900 | 63,693 |

| Samir(1) | 3,480 | 267,263 |

| Societe des Brasseries du Maroc | 1,590 | 687,052 |

| Societe Nationale d’Investissement | 2,375 | 522,604 |

See notes to financial statements

13

Eaton Vance Structured Emerging Markets Fund as of October 31, 2009

PORTFOLIO OF INVESTMENTS CO N T ’ D |

| | |

| Security | Shares | Value |

|

| |

| Morocco (continued) | | |

|

|

| SONASID (Societe Nationale de Siderurgie) | 1,320 | $ 358,013 |

| Wafa Assurance | 1,090 | 272,958 |

|

| | | $ 15,043,184 |

|

|

| |

| Nigeria — 0.8% | | |

|

|

| Access Bank PLC | 5,970,288 | $ 252,499 |

| Afribank Nigeria PLC(1) | 5,727,146 | 96,022 |

| African Petroleum PLC | 285,989 | 64,121 |

| Ashaka Cement PLC | 221,861 | 19,313 |

| Benue Cement Co. PLC | 1,460,000 | 408,184 |

| Dangote Sugar Refinery PLC | 5,767,032 | 574,993 |

| Diamond Bank PLC | 5,100,000 | 257,776 |

| Ecobank Transnational, Inc. | 1,922,518 | 184,968 |

| Fidelity Bank/Nigeria | 12,200,000 | 181,541 |

| First Bank of Nigeria PLC | 9,985,105 | 983,019 |

| First City Monument Bank PLC(1) | 4,500,000 | 182,889 |

| Guaranty Trust Bank PLC | 6,274,612 | 644,763 |

| Guiness Nigeria PLC | 442,075 | 398,750 |

| Intercontinental Bank PLC(1) | 3,062,209 | 56,552 |

| Lafarge Cement WAPCO Nigeria PLC | 1,228,000 | 251,898 |

| Nestle Foods Nigeria PLC | 151,000 | 213,615 |

| Nigerian Breweries PLC | 1,848,611 | 668,043 |

| Oando PLC | 448,000 | 276,508 |

| Oceanic Bank International PLC(1) | 4,301,220 | 68,124 |

| PlatinumHabib Bank PLC | 2,767,885 | 39,987 |

| PZ Cussons Nigeria PLC | 1,185,000 | 173,558 |

| Skye Bank PLC | 4,525,000 | 149,451 |

| UAC of Nigeria PLC | 900,000 | 244,734 |

| Union Bank of Nigeria PLC | 4,658,654 | 224,751 |

| United Bank for Africa PLC | 6,181,798 | 487,420 |

| Zenith Bank, Ltd. | 6,479,912 | 619,628 |

|

| | | $ 7,723,107 |

|

|

| |

| Oman — 0.8% | | |

|

|

| Bank Dhofar SAOG | 373,466 | $ 586,799 |

| Bank Muscat SAOG | 567,695 | 1,329,460 |

| Bank Sohar(1) | 887,000 | 498,351 |

| Dhofar International Development & Investment | | |

| Holding Co. | 27,600 | 28,986 |

| Galfar Engineering & Contracting SAOG | 368,360 | 612,486 |

| National Bank of Oman, Ltd. | 184,410 | 154,755 |

| Oman Cables Industry SAOG | 93,600 | 352,231 |

| Oman Cement Co., SAOG | 205,500 | 392,350 |

| Oman Flour Mills Co., Ltd. SAOG | 164,100 | 248,782 |

| Oman International Bank SAOG | 342,950 | 263,400 |

| Oman Telecommunications Co. | 486,400 | 1,654,808 |

| Ominvest | 172,199 | 221,076 |

| | |

| Security | Shares | Value |

|

| |

| Oman (continued) | | |

|

|

| Raysut Cement Co., SAOG | 130,245 | $ 509,575 |

| Renaissance Holdings Co. | 301,173 | 524,991 |

| Shell Oman Marketing Co. | 34,398 | 186,777 |

|

| | | $ 7,564,827 |

|

|

| |

| Pakistan — 0.8% | | |

|

|

| Adamjee Insurance Co., Ltd. | 201,050 | $ 305,770 |

| Allied Bank, Ltd. | 117,524 | 81,900 |

| Azgard Nine, Ltd.(1) | 491,400 | 141,940 |

| Bank Alfalah, Ltd.(1) | 1,295,638 | 208,172 |

| D.G. Khan Cement Co., Ltd.(1) | 258,360 | 89,373 |

| Engro Chemical Pakistan, Ltd. | 326,200 | 649,271 |

| Fauji Fertilizer Co., Ltd. | 292,352 | 367,368 |

| Habib Bank, Ltd. | 160,000 | 236,930 |

| Hub Power Co., Ltd. | 1,346,700 | 467,470 |

| Indus Motor Co., Ltd. | 24,000 | 53,525 |

| Jahangir Siddiqui & Co., Ltd.(1) | 500,000 | 211,031 |

| Kot Addu Power Co., Ltd. | 218,000 | 120,240 |

| Lucky Cement, Ltd. | 326,500 | 256,972 |

| Muslim Commercial Bank, Ltd. | 489,102 | 1,249,145 |

| National Bank of Pakistan | 211,694 | 209,410 |

| Nishat Mills, Ltd. | 937,800 | 676,925 |

| Oil & Gas Development Co., Ltd. | 524,000 | 649,974 |

| Pakistan Oil Fields, Ltd. | 124,000 | 321,894 |

| Pakistan Petroleum, Ltd. | 224,742 | 469,156 |

| Pakistan State Oil Co., Ltd. | 93,700 | 342,668 |

| Pakistan Telecommunication Co., Ltd. | 1,706,100 | 383,566 |

| SUI Northern Gas Pipelines, Ltd. | 211,000 | 67,550 |

| United Bank, Ltd. | 362,587 | 250,942 |

|

| | | $ 7,811,192 |

|

|

| |

| Peru — 1.5% | | |

|

|

| Alicorp SA | 384,800 | $ 284,400 |

| Austral Group SA(1) | 658,650 | 76,982 |

| Cia de Minas Buenaventura SA ADR | 77,980 | 2,617,789 |

| Cia Minera Atacocha SA, Class B, PFC Shares | 39,750 | 20,907 |

| Cia Minera Milpo SA(1) | 317,997 | 830,793 |

| Credicorp, Ltd. | 45,770 | 3,156,635 |

| Edegel SA | 1,180,000 | 608,456 |

| Edelnor SA | 108,248 | 101,401 |

| Empresa Agroindustrial Casa Grande SA(1) | 69,120 | 180,582 |

| Energia del Sur SA | 39,900 | 167,336 |

| Ferreyros SA | 331,542 | 307,722 |

| Grana y Montero SA | 210,612 | 208,512 |

| Luz del Sur SAA | 90,550 | 138,517 |

| Minsur SA | 162,200 | 401,458 |

See notes to financial statements

14

Eaton Vance Structured Emerging Markets Fund as of October 31, 2009

PORTFOLIO OF INVESTMENTS CO N T ’ D |

| | |

| Security | Shares | Value |

|

| |

| Peru (continued) | | |

|

|

| Sociedad Minera Cerro Verde SA | 19,790 | $ 451,212 |

| Sociedad Minera el Brocal SA | 8,970 | 131,050 |

| Southern Copper Corp. | 111,180 | 3,502,170 |

| Volcan Cia Minera SA, Class B(1) | 1,157,519 | 1,364,830 |

|

| | | $ 14,550,752 |

|

|

| |

| Philippines — 1.6% | | |

|

|

| Aboitiz Equity Ventures, Inc. | 3,911,000 | $ 675,115 |

| Aboitiz Power Corp. | 1,765,000 | 274,257 |

| Alliance Global Group, Inc.(1) | 4,540,000 | 403,577 |

| Altlas Consolidated Mining & Development Corp.(1) | 500,000 | 91,394 |

| Ayala Corp. | 134,196 | 812,006 |

| Ayala Land, Inc. | 3,951,800 | 854,472 |

| Banco De Oro | 701,020 | 508,840 |

| Bank of the Philippine Islands | 943,100 | 917,619 |

| Benpres Holdings Corp.(1) | 4,600,000 | 336,775 |

| Filinvest Land, Inc. | 3,449,000 | 64,929 |

| First Gen Corp.(1) | 709,950 | 234,085 |

| First Philippine Holdings Corp.(1) | 70,100 | 68,621 |

| Globe Telecom, Inc. | 18,040 | 345,879 |

| Holcim Philippines, Inc. | 1,492,000 | 150,299 |

| International Container Terminal Services, Inc. | 388,900 | 164,668 |

| JG Summit Holding, Inc. | 2,411,900 | 318,790 |

| Jollibee Foods Corp. | 363,300 | 386,475 |

| Manila Electric Co. | 300,400 | 1,167,999 |

| Manila Water Co. | 254,600 | 85,936 |

| Megaworld Corp. | 2,476,800 | 77,870 |

| Megaworld Corp.(4) | 619,200 | 19,468 |

| Metropolitan Bank & Trust Co. | 581,600 | 491,979 |

| Philex Mining Corp.(1) | 4,017,125 | 955,125 |

| Philippine Long Distance Telephone Co. | 45,620 | 2,451,816 |

| PNOC Energy Development Corp. | 4,051,000 | 349,865 |

| Robinsons Land Corp. | 411,400 | 104,465 |

| San Miguel Corp., Class B | 649,500 | 894,501 |

| SM Investments Corp. | 155,938 | 1,018,426 |

| SM Prime Holdings, Inc. | 3,202,799 | 664,142 |

| Universal Robina Corp. | 1,399,600 | 365,017 |

| Vista Land & Lifescapes, Inc.(1) | 3,675,000 | 150,164 |

|

| | | $ 15,404,574 |

|

|

| |

| Poland — 3.0% | | |

|

|

| Agora SA(1) | 79,030 | $ 518,594 |

| AmRest Holdings NV(1) | 4,410 | 107,338 |

| Bank Handlowy w Warszawie SA(1) | 14,170 | 310,753 |

| Bank Millennium SA(1) | 176,600 | 289,844 |

| Bank Pekao SA(1) | 58,138 | 3,120,511 |

| | |

| Security | Shares | Value |

|

| |

| Poland (continued) | | |

|

|

| Bank Zachodni WBK SA(1) | 10,600 | $ 565,886 |

| Bioton SA(1) | 3,980,100 | 313,063 |

| BRE Bank SA(1) | 6,003 | 556,501 |

| Budimex SA | 18,100 | 496,787 |

| Cersanit SA(1) | 87,100 | 426,276 |

| Cyfrowy Polsat SA | 111,200 | 536,839 |

| Debica SA | 2,520 | 53,964 |

| Dom Development SA | 7,570 | 115,187 |

| Echo Investment SA(1) | 150,000 | 215,121 |

| Eurocash SA | 63,000 | 307,539 |

| Farmacol SA(1) | 4,040 | 57,688 |

| Getin Holding SA(1) | 233,150 | 663,544 |

| Globe Trade Centre SA(1) | 53,590 | 462,378 |

| Grupa Kety SA(1) | 9,600 | 348,406 |

| Grupa Lotos SA(1) | 26,453 | 240,445 |

| ING Bank Slaski SA w Katowicach(1) | 1,685 | 378,117 |

| KGHM Polska Miedz SA | 64,080 | 2,156,973 |

| LPP SA(1) | 275 | 136,062 |

| Mondi Swiecie SA(1) | 9,600 | 234,439 |

| Mostostal-Warszawa SA(1) | 3,160 | 72,252 |

| Multimedia Polska SA(1) | 89,740 | 215,685 |

| Netia SA(1) | 401,654 | 584,635 |

| NG2 SA | 3,810 | 53,184 |

| Orbis SA(1) | 30,000 | 474,295 |

| PBG SA(1) | 11,720 | 912,886 |

| Polimex Mostostal SA | 636,500 | 818,440 |

| Polish Oil & Gas | 558,200 | 679,710 |

| Polnord SA(1) | 20,350 | 241,656 |

| Polski Koncern Naftowy Orlen SA(1) | 151,000 | 1,571,717 |

| Powszechna Kasa Oszczednosci Bank Polski SA | 264,710 | 3,136,546 |

| Przedsiebiorstwo Eksportu i Importu KOPEX SA(1) | 13,800 | 122,786 |

| Softbank SA | 68,173 | 1,369,739 |

| Telekomunikacja Polska SA | 767,350 | 4,503,355 |

| TVN SA | 260,420 | 1,290,525 |

| Vistula Group SA(1) | 400,000 | 301,202 |

| Zaklad Przetworstwa Hutniczego Stalprodukt SA | 1,900 | 346,937 |

|

| | | $ 29,307,805 |

|

|

| |

| Qatar — 1.6% | | |

|

|

| Aamal Holding | 60,200 | $ 525,728 |

| Barwa Real Estate Co.(1) | 40,993 | 383,063 |

| Commercial Bank of Qatar | 34,157 | 667,035 |

| Doha Bank, Ltd. | 33,176 | 424,558 |

| First Finance Co. | 53,357 | 329,536 |

| Gulf International Services QSC | 61,750 | 560,619 |

| Industries Qatar | 89,335 | 2,722,241 |

| Masraf Al Rayan | 223,300 | 759,237 |

See notes to financial statements

15

Eaton Vance Structured Emerging Markets Fund as of October 31, 2009

PORTFOLIO OF INVESTMENTS CO N T ’ D |

| | |

| Security | Shares | Value |

|

| |

| Qatar (continued) | | |

|

|

| Qatar Electricity & Water Co. | 37,000 | $ 1,012,144 |

| Qatar Fuel | 10,020 | 458,210 |

| Qatar Gas Transport Co., Ltd. (NAKILAT)(1) | 203,330 | 1,351,033 |

| Qatar Insurance Co. | 18,635 | 329,662 |

| Qatar International Islamic Bank | 27,943 | 346,564 |

| Qatar Islamic Bank | 34,387 | 775,102 |

| Qatar National Bank | 48,092 | 2,010,558 |

| Qatar National Cement Co. | 10,500 | 235,874 |

| Qatar National Navigation | 23,896 | 437,736 |

| Qatar Shipping Co. | 43,836 | 403,618 |

| Qatar Telecom QSC | 41,902 | 1,852,855 |

| Salam International Investment Co., Ltd. | 53,000 | 164,507 |

| United Development Co. | 4,780 | 49,645 |

|