UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act File Number: 811-04015

Eaton Vance Mutual Funds Trust

(Exact Name of Registrant as Specified in Charter)

Two International Place, Boston, Massachusetts 02110

(Address of Principal Executive Offices)

Maureen A. Gemma

Two International Place, Boston, Massachusetts 02110

(Name and Address of Agent for Services)

(617) 482-8260

(Registrant’s Telephone Number)

February 28

Date of Fiscal Year End

February 28, 2017

Date of Reporting Period

Item 1. Reports to Stockholders

Parametric Dividend Income Fund

Annual Report

February 28, 2017

Commodity Futures Trading Commission Registration. Effective December 31, 2012, the Commodity Futures Trading Commission (“CFTC”) adopted certain regulatory changes that subject registered investment companies and advisers to regulation by the CFTC if a fund invests more than a prescribed level of its assets in certain CFTC-regulated instruments (including futures, certain options and swap agreements) or markets itself as providing investment exposure to such instruments. The Fund has claimed an exclusion from the definition of the term “commodity pool operator” under the Commodity Exchange Act. Accordingly, neither the Fund nor the adviser with respect to the operation of the Fund is subject to CFTC regulation. Because of its management of other strategies, the Fund’s adviser is registered with the CFTC as a commodity pool operator and a commodity trading advisor.

Fund shares are not insured by the FDIC and are not deposits or other obligations of, or guaranteed by, any depository institution. Shares are subject to investment risks, including possible loss of principal invested.

This report must be preceded or accompanied by a current summary prospectus or prospectus. Before investing, investors should consider carefully the investment objective, risks, and charges and expenses of a mutual fund. This and other important information is contained in the summary prospectus and prospectus, which can be obtained from a financial advisor. Prospective investors should read the prospectus carefully before investing. For further information, please call 1-800-260-0761.

Annual Report February 28, 2017

Parametric Dividend Income Fund

Table of Contents

| | | | |

| |

Management’s Discussion of Fund Performance | | | 2 | |

| |

Performance | | | 3 | |

| |

Fund Profile | | | 4 | |

| |

Endnotes and Additional Disclosures | | | 5 | |

| |

Fund Expenses | | | 6 | |

| |

Financial Statements | | | 7 | |

| |

Report of Independent Registered Public Accounting Firm | | | 20 | |

| |

Federal Tax Information | | | 21 | |

| |

Management and Organization | | | 22 | |

| |

Important Notices | | | 25 | |

Parametric Dividend Income Fund

February 28, 2017

Management’s Discussion of Fund Performance1

Economic and Market Conditions

U.S. stock markets trended upward during the 12-month period ended February 28, 2017, enduring several downdrafts but ending the fiscal year sharply higher, boosted late in the period by Donald Trump’s surprise win in the November 2016 U.S. presidential election.

U.S. stocks opened the period on the upside amid positive drivers which included a turnaround in oil prices after a prolonged decline, and a generally improving global economic outlook. In June 2016, however, Great Britain’s vote to leave the European Union sparked a plunge in stocks worldwide. But equity markets, led by the U.S., recovered quickly. Helped by stronger economic indicators, major U.S. stock indexes reached multiple record highs during July and August 2016.

As summer ended, however, falling oil prices and fears about a possible interest rate increase caused U.S. equity markets to retreat. In late September 2016, the U.S. Federal Reserve’s (the Fed’s) decision to leave rates unchanged, along with an agreement by the Organization of the Petroleum Exporting Countries (OPEC) to curb oil production, sent stocks briefly higher. For the next month or so, stock prices trended downward as investors awaited the results of the November 8 U.S. presidential election.

After the U.S. presidential election, U.S. stocks began a dramatic rally that continued through the end of the period, with the Dow Jones Industrial Average2 breaking 20,000 for the first time and nearing 21,000 as the period closed. The rally was in part driven by the new administration’s announced intentions to cut regulations, reduce corporate and personal taxes and initiate increased spending on infrastructure. Additional drivers of the rally included improving corporate earnings and a December 2016 rate increase by the Fed amid stronger economic growth reports.

For the 12-month period, the blue-chip Dow Jones Industrial Average advanced 29.33%, while the broader U.S. equity market, as represented by the S&P 500 Index, returned 24.98%. The technology-laden NASDAQ Composite Index delivered a 29.37% gain. Small-cap U.S. stocks, as measured by the Russell 2000® Index, outperformed large-cap stocks, as measured by the S&P 500 Index during the period. Value stocks as a group outpaced growth stocks in both the large- and small-cap categories, as measured by the Russell value and growth indexes.

Fund Performance

For the 12-month period ended February 28, 2017, Parametric Dividend Income Fund (the Fund) had a total return of 23.97% for Investor Class shares at net asset value (NAV), outperforming the Fund’s primary benchmark, the NASDAQ US Dividend Achievers™ Select Index (the Index), which returned 20.34% for the same period.

The bulk of the Fund’s excess returns versus the Index can be attributed to the Fund’s equally-weighted sectors. The Fund’s overweight to the energy sector, which was the strongest performing sector in the Index, boosted Fund performance. An underweight to the consumer staples sector, which underperformed for the period, also helped Fund performance versus the Index.

The largest detractor from the Fund’s relative performance was an underweight to the industrials sector, coupled with security selection in that sector. The Index’s second largest sector allocation was to industrials, which ended up as the second best performing sector in the Index. The Fund’s equal sector weighting approach resulted in holding approximately half the Index weight in this sector. Within the industrials sector, the Fund’s inclusion of five underperforming non- Index names, combined with the omission of two strongly performing railroads (CSX Corp. and Norfolk Southern Corp.) explain the majority of the selection-based underperformance versus the Index.

See Endnotes and Additional Disclosures in this report.

Past performance is no guarantee of future results. Returns are historical and are calculated by determining the percentage change in net asset value (NAV) or offering price (as applicable) with all distributions reinvested. Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Performance less than or equal to one year is cumulative. Performance is for the stated time period only; due to market volatility, the Fund’s current performance may be lower or higher than quoted. Returns are before taxes unless otherwise noted. For performance as of the most recent month-end, please refer to eatonvance.com.

Parametric Dividend Income Fund

February 28, 2017

Performance2,3

Portfolio Managers Thomas Seto, Timothy W. Atwill, Ph.D., CFA and Alexander Paulsen, each of Parametric Portfolio Associates LLC

| | | | | | | | | | | | | | | | | | | | |

| % Average Annual Total Returns | | Class Inception Date | | | Performance Inception Date | | | One Year | | | Five Years | | | Since Inception | |

Investor Class at NAV | | | 03/26/2014 | | | | 03/26/2014 | | | | 23.97 | % | | | — | | | | 11.12 | % |

Institutional Class at NAV | | | 03/26/2014 | | | | 03/26/2014 | | | | 24.26 | | | | — | | | | 11.40 | |

NASDAQ US Dividend Achievers™ Select Index | | | — | | | | — | | | | 20.34 | % | | | 11.93 | % | | | 9.27 | % |

S&P 500 Index | | | — | | | | — | | | | 24.98 | | | | 14.00 | | | | 10.99 | |

| | | | | |

| | | | | | | | | | | | | | | | | | | | |

| % Total Annual Operating Expense Ratios4 | | | | | | | | | | | Investor

Class | | | Institutional

Class | |

Gross | | | | | | | | | | | | | | | 3.82 | % | | | 3.57 | % |

Net | | | | | | | | | | | | | | | 0.65 | | | | 0.40 | |

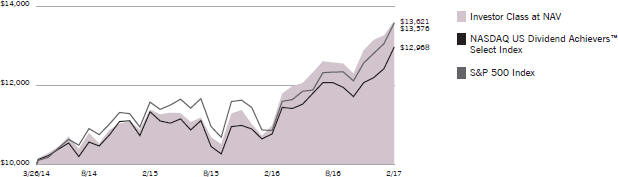

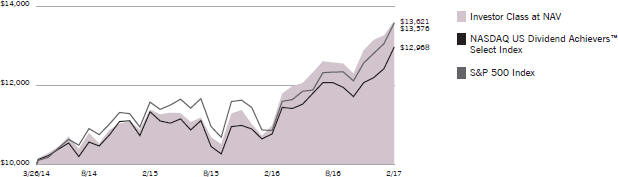

Growth of $10,000

This graph shows the change in value of a hypothetical investment of $10,000 in Investor Class of the Fund for the period indicated. For comparison, the same investment is shown in the indicated index.

| | | | | | | | | | | | | | | | |

| Growth of Investment | | Amount Invested | | | Period Beginning | | | At NAV | | | With Maximum Sales Charge | |

Institutional Class | | $ | 50,000 | | | | 03/26/2014 | | | $ | 68,614 | | | | N.A. | |

See Endnotes and Additional Disclosures in this report.

Past performance is no guarantee of future results. Returns are historical and are calculated by determining the percentage change in net asset value (NAV) or offering price (as applicable) with all distributions reinvested. Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Performance less than or equal to one year is cumulative. Performance is for the stated time period only; due to market volatility, the Fund’s current performance may be lower or higher than quoted. Returns are before taxes unless otherwise noted. For performance as of the most recent month-end, please refer to eatonvance.com.

Parametric Dividend Income Fund

February 28, 2017

Fund Profile

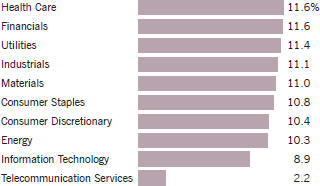

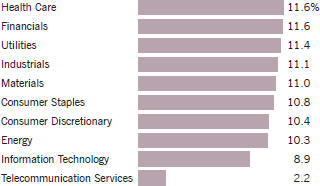

Sector Allocation (% of net assets)5

Top 10 Holdings (% of net assets)5

| | | | |

| |

Teleflex, Inc. | | | 0.6 | % |

| |

Philip Morris International, Inc. | | | 0.6 | |

| |

Bristol-Myers Squibb Co. | | | 0.6 | |

| |

Patterson Cos., Inc. | | | 0.6 | |

| |

Amgen, Inc. | | | 0.6 | |

| |

Clorox Co. (The) | | | 0.6 | |

| |

Cardinal Health, Inc. | | | 0.6 | |

| |

AmerisourceBergen Corp. | | | 0.6 | |

| |

Thermo Fisher Scientific, Inc. | | | 0.6 | |

| |

Abbott Laboratories | | | 0.6 | |

Total | | | 6.0 | % |

See Endnotes and Additional Disclosures in this report.

Parametric Dividend Income Fund

February 28, 2017

Endnotes and Additional Disclosures

| 1 | The views expressed in this report are those of the portfolio manager(s) and are current only through the date stated at the top of this page. These views are subject to change at any time based upon market or other conditions, and Eaton Vance and the Fund(s) disclaim any responsibility to update such views. These views may not be relied upon as investment advice and, because investment decisions are based on many factors, may not be relied upon as an indication of trading intent on behalf of any Eaton Vance fund. This commentary may contain statements that are not historical facts, referred to as “forward looking statements”. The Fund’s actual future results may differ significantly from those stated in any forward looking statement, depending on factors such as changes in securities or financial markets or general economic conditions, the volume of sales and purchases of Fund shares, the continuation of investment advisory, administrative and service contracts, and other risks discussed from time to time in the Fund’s filings with the Securities and Exchange Commission. |

| 2 | Dow Jones Industrial Average is a price-weighted average of 30 blue-chip stocks that are generally the leaders in their industry. S&P 500 Index is an unmanaged index of large-cap stocks commonly used as a measure of U.S. stock market performance. NASDAQ Composite Index is a market capitalization-weighted index of all domestic and international securities listed on NASDAQ. Russell 2000® Index is an unmanaged index of 2,000 U.S. small- cap stocks. NASDAQ US Dividend Achievers™ Select Index is an unmanaged index of stocks with at least ten consecutive years of increasing regular dividends. Source: Nasdaq, Inc. The information is provided by Nasdaq (with its affiliates, are referred to as the “Corporations”) and Nasdaq’s third party licensors on an “as is” basis and the Corporations make no guarantees and bear no liability of any kind with respect to the information or the Fund. Unless otherwise stated, index returns do not reflect the effect of any applicable sales charges, commissions, expenses, taxes or leverage, as applicable. It is not possible to invest directly in an index. |

| 3 | Returns are historical and are calculated by determining the percentage change in NAV with all distributions reinvested. Unless otherwise stated, performance does not reflect the deduction of taxes on Fund distributions or redemptions of Fund shares. Performance since inception for an index, if presented, is the performance since the Fund’s or oldest share class’ inception, as applicable. |

| 4 | Source: Fund prospectus. Net expense ratios reflect a contractual expense reimbursement that continues through 6/30/18. Without the reimbursement, performance would have been lower. The expense ratios for the current reporting period can be found in the Financial Highlights section of this report. |

| 5 | Excludes cash and cash equivalents. |

| | Fund profile subject to change due to active management. |

Parametric Dividend Income Fund

February 28, 2017

Fund Expenses

Example: As a Fund shareholder, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchases and redemption fees (if applicable); and (2) ongoing costs, including management fees; distribution and/or service fees; and other Fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of Fund investing and to compare these costs with the ongoing costs of investing in other mutual funds. The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period (September 1, 2016 – February 28, 2017).

Actual Expenses: The first section of the table below provides information about actual account values and actual expenses. You may use the information in this section, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first section under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes: The second section of the table below provides information about hypothetical account values and hypothetical expenses based on the actual Fund expense ratio and an assumed rate of return of 5% per year (before expenses), which is not the actual Fund return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in your Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads) or redemption fees (if applicable). Therefore, the second section of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would be higher.

| | | | | | | | | | | | | | | | |

| | | Beginning

Account Value

(9/1/16) | | | Ending

Account Value

(2/28/17) | | | Expenses Paid

During Period*

(9/1/16 – 2/28/17) | | | Annualized

Expense

Ratio | |

| | | | |

| | | | | | | | | | | | | | | | |

Actual | | | | | | | | | | | | | |

Investor Class | | $ | 1,000.00 | | | $ | 1,082.90 | | | $ | 3.41 | ** | | | 0.66 | % |

Institutional Class | | $ | 1,000.00 | | | $ | 1,084.40 | | | $ | 2.33 | ** | | | 0.45 | % |

| | | | | | | | | | | | | | | | | |

| | | | |

| | | | | | | | | | | | | | | | |

Hypothetical | | | | | | | | | | | | | |

(5% return per year before expenses) | | | | | | | | | | | | | |

Investor Class | | $ | 1,000.00 | | | $ | 1,021.50 | | | $ | 3.31 | ** | | | 0.66 | % |

Institutional Class | | $ | 1,000.00 | | | $ | 1,022.60 | | | $ | 2.26 | ** | | | 0.45 | % |

| | | | |

| | | | | | | | | | | | | | | | |

| Effective November 1, 2016, the contractual expense caps of the Fund changed. If these changes had been in place during the entire reporting period, the actual and hypothetical ending account values, expenses paid and annualized expense ratios would have been as follows: | |

| | | | |

| | | | | | | | | | | | | | | | |

| | | Beginning

Account Value

(9/1/16) | | | Ending

Account Value

(2/28/17) | | | Expenses Paid

During Period*

(9/1/16 – 2/28/17) | | | Annualized

Expense

Ratio | |

| | | | |

| | | | | | | | | | | | | | | | |

Actual | | | | | | | | | | | | | |

Investor Class | | $ | 1,000.00 | | | $ | 1,082.90 | | | $ | 3.36 | ** | | | 0.65 | % |

Institutional Class | | $ | 1,000.00 | | | $ | 1,084.40 | | | $ | 2.07 | ** | | | 0.40 | % |

| | | | | | | | | | | | | | | | | |

| | | | |

| | | | | | | | | | | | | | | | |

Hypothetical | | | | | | | | | | | | | |

(5% return per year before expenses) | | | | | | | | | | | | | |

Investor Class | | $ | 1,000.00 | | | $ | 1,021.60 | | | $ | 3.26 | ** | | | 0.65 | % |

Institutional Class | | $ | 1,000.00 | | | $ | 1,022.80 | | | $ | 2.01 | ** | | | 0.40 | % |

| * | Expenses are equal to the Fund’s annualized expense ratio for the indicated Class, multiplied by the average account value over the period, multiplied by 181/365 (to reflect the one-half year period). The Example assumes that the $1,000 was invested at the net asset value per share determined at the close of business on August 31, 2016. |

| ** | Absent an allocation of certain expenses to affiliates, expenses would be higher. |

Parametric Dividend Income Fund

February 28, 2017

Portfolio of Investments

| | | | | | | | |

| Common Stocks — 99.3% | |

| | |

| | | | | | | | |

| Security | | Shares | | | Value | |

| | | | | | | | |

| | |

Aerospace & Defense — 2.2% | | | | | | | | |

Boeing Co. (The) | | | 573 | | | $ | 103,272 | |

Lockheed Martin Corp. | | | 375 | | | | 99,967 | |

Raytheon Co. | | | 599 | | | | 92,336 | |

United Technologies Corp. | | | 869 | | | | 97,806 | |

| | | | | | | | | |

| | | $ | 393,381 | |

| | | | | | | | | |

|

Air Freight & Logistics — 0.5% | |

United Parcel Service, Inc., Class B | | | 904 | | | $ | 95,607 | |

| | | | | | | | | |

| | | $ | 95,607 | |

| | | | | | | | | |

|

Automobiles — 1.1% | |

Ford Motor Co. | | | 7,666 | | | $ | 96,055 | |

General Motors Co. | | | 2,610 | | | | 96,152 | |

| | | | | | | | | |

| | | $ | 192,207 | |

| | | | | | | | | |

|

Banks — 3.3% | |

F.N.B. Corp. | | | 5,870 | | | $ | 91,396 | |

People’s United Financial, Inc. | | | 5,081 | | | | 97,555 | |

Trustmark Corp. | | | 2,940 | | | | 97,138 | |

United Bankshares, Inc. | | | 2,152 | | | | 96,302 | |

Valley National Bancorp | | | 7,854 | | | | 97,154 | |

Wells Fargo & Co. | | | 1,690 | | | | 97,817 | |

| | | | | | | | | |

| | | $ | 577,362 | |

| | | | | | | | | |

|

Beverages — 1.7% | |

Coca-Cola Co. (The) | | | 2,292 | | | $ | 96,172 | |

Dr Pepper Snapple Group, Inc. | | | 1,059 | | | | 98,953 | |

PepsiCo, Inc. | | | 914 | | | | 100,888 | |

| | | | | | | | | |

| | | $ | 296,013 | |

| | | | | | | | | |

|

Biotechnology — 1.2% | |

AbbVie, Inc. | | | 1,569 | | | $ | 97,027 | |

Amgen, Inc. | | | 594 | | | | 104,859 | |

| | | | | | | | | |

| | | $ | 201,886 | |

| | | | | | | | | |

|

Capital Markets — 1.6% | |

CME Group, Inc. | | | 788 | | | $ | 95,710 | |

T. Rowe Price Group, Inc. | | | 1,395 | | | | 99,338 | |

Thomson Reuters Corp. | | | 2,123 | | | | 89,803 | |

| | | | | | | | | |

| | | $ | 284,851 | |

| | | | | | | | | |

| | | | | | | | |

| Security | | Shares | | | Value | |

| | | | | | | | |

|

Chemicals — 4.4% | |

Air Products and Chemicals, Inc. | | | 708 | | | $ | 99,453 | |

Dow Chemical Co. (The) | | | 1,575 | | | | 98,060 | |

E.I. du Pont de Nemours & Co. | | | 1,247 | | | | 97,939 | |

LyondellBasell Industries NV, Class A | | | 1,006 | | | | 91,787 | |

Mosaic Co. (The) | | | 3,061 | | | | 95,473 | |

Praxair, Inc. | | | 796 | | | | 94,493 | |

RPM International, Inc. | | | 1,803 | | | | 96,082 | |

Scotts Miracle-Gro Co. (The), Class A | | | 1,021 | | | | 92,533 | |

| | | | | | | | | |

| | | $ | 765,820 | |

| | | | | | | | | |

|

Commercial Services & Supplies — 3.3% | |

Covanta Holding Corp. | | | 6,003 | | | $ | 97,249 | |

KAR Auction Services, Inc. | | | 2,089 | | | | 93,629 | |

Pitney Bowes, Inc. | | | 6,481 | | | | 88,401 | |

Republic Services, Inc. | | | 1,649 | | | | 102,155 | |

RR Donnelley & Sons Co. | | | 5,615 | | | | 94,163 | |

Waste Management, Inc. | | | 1,362 | | | | 99,862 | |

| | | | | | | | | |

| | | $ | 575,459 | |

| | | | | | | | | |

|

Communications Equipment — 1.7% | |

Cisco Systems, Inc. | | | 2,820 | | | $ | 96,388 | |

Harris Corp. | | | 926 | | | | 101,767 | |

Motorola Solutions, Inc. | | | 1,245 | | | | 98,318 | |

| | | | | | | | | |

| | | $ | 296,473 | |

| | | | | | | | | |

|

Containers & Packaging — 3.9% | |

AptarGroup, Inc. | | | 1,304 | | | $ | 97,161 | |

Avery Dennison Corp. | | | 1,273 | | | | 102,744 | |

Bemis Co., Inc. | | | 1,937 | | | | 96,017 | |

Greif, Inc., Class A | | | 1,654 | | | | 94,327 | |

International Paper Co. | | | 1,867 | | | | 98,391 | |

Sonoco Products Co. | | | 1,731 | | | | 92,297 | |

WestRock Co. | | | 1,765 | | | | 94,816 | |

| | | | | | | | | |

| | | $ | 675,753 | |

| | | | | | | | | |

|

Distributors — 0.5% | |

Genuine Parts Co. | | | 977 | | | $ | 93,509 | |

| | | | | | | | | |

| | | $ | 93,509 | |

| | | | | | | | | |

|

Diversified Telecommunication Services — 2.2% | |

AT&T, Inc. | | | 2,268 | | | $ | 94,780 | |

CenturyLink, Inc. | | | 3,678 | | | | 89,228 | |

Cogent Communications Group, Inc. | | | 2,330 | | | | 96,578 | |

Verizon Communications, Inc. | | | 1,977 | | | | 98,119 | |

| | | | | | | | | |

| | | $ | 378,705 | |

| | | | | | | | | |

| | | | |

| | 7 | | See Notes to Financial Statements. |

Parametric Dividend Income Fund

February 28, 2017

Portfolio of Investments — continued

| | | | | | | | |

| Security | | Shares | | | Value | |

| | | | | | | | |

|

Electric Utilities — 6.3% | |

ALLETE, Inc. | | | 1,473 | | | $ | 99,000 | |

American Electric Power Co., Inc. | | | 1,376 | | | | 92,151 | |

Duke Energy Corp. | | | 1,229 | | | | 101,454 | |

Entergy Corp. | | | 1,342 | | | | 102,878 | |

Eversource Energy | | | 1,741 | | | | 102,127 | |

Exelon Corp. | | | 2,706 | | | | 99,337 | |

FirstEnergy Corp. | | | 3,179 | | | | 103,095 | |

Pinnacle West Capital Corp. | | | 1,240 | | | | 101,916 | |

PPL Corp. | | | 2,756 | | | | 101,641 | |

Southern Co. (The) | | | 1,949 | | | | 99,048 | |

Xcel Energy, Inc. | | | 2,327 | | | | 101,713 | |

| | | | | | | | | |

| | | $ | 1,104,360 | |

| | | | | | | | | |

|

Electrical Equipment — 1.1% | |

Eaton Corp. PLC | | | 1,346 | | | $ | 96,885 | |

Emerson Electric Co. | | | 1,604 | | | | 96,400 | |

| | | | | | | | | |

| | | $ | 193,285 | |

| | | | | | | | | |

|

Energy Equipment & Services — 2.7% | |

Baker Hughes, Inc. | | | 1,535 | | | $ | 92,530 | |

Halliburton Co. | | | 1,857 | | | | 99,275 | |

Helmerich & Payne, Inc. | | | 1,347 | | | | 92,094 | |

Oceaneering International, Inc. | | | 3,466 | | | | 98,157 | |

Schlumberger, Ltd. | | | 1,219 | | | | 97,959 | |

| | | | | | | | | |

| | | $ | 480,015 | |

| | | | | | | | | |

|

Food & Staples Retailing — 1.7% | |

CVS Health Corp. | | | 1,213 | | | $ | 97,744 | |

Sysco Corp. | | | 1,799 | | | | 94,843 | |

Wal-Mart Stores, Inc. | | | 1,426 | | | | 101,146 | |

| | | | | | | | | |

| | | $ | 293,733 | |

| | | | | | | | | |

|

Food Products — 2.3% | |

Conagra Brands, Inc. | | | 2,430 | | | $ | 100,141 | |

Flowers Foods, Inc. | | | 5,116 | | | | 98,534 | |

General Mills, Inc. | | | 1,648 | | | | 99,490 | |

Kellogg Co. | | | 1,304 | | | | 96,587 | |

| | | | | | | | | |

| | | $ | 394,752 | |

| | | | | | | | | |

|

Health Care Equipment & Supplies — 2.9% | |

Abbott Laboratories | | | 2,293 | | | $ | 103,369 | |

Baxter International, Inc. | | | 2,021 | | | | 102,909 | |

Becton, Dickinson and Co. | | | 542 | | | | 99,213 | |

| | | | | | | | |

| Security | | Shares | | | Value | |

| | | | | | | | |

|

Health Care Equipment & Supplies (continued) | |

Medtronic PLC | | | 1,269 | | | $ | 102,675 | |

Teleflex, Inc. | | | 568 | | | | 108,590 | |

| | | | | | | | | |

| | | $ | 516,756 | |

| | | | | | | | | |

|

Health Care Providers & Services — 4.0% | |

AmerisourceBergen Corp. | | | 1,133 | | | $ | 103,681 | |

Anthem, Inc. | | | 615 | | | | 101,364 | |

Cardinal Health, Inc. | | | 1,277 | | | | 103,909 | |

Owens & Minor, Inc. | | | 2,671 | | | | 96,370 | |

Patterson Cos., Inc. | | | 2,310 | | | | 104,990 | |

Quest Diagnostics, Inc. | | | 1,047 | | | | 102,020 | |

UnitedHealth Group, Inc. | | | 585 | | | | 96,747 | |

| | | | | | | | | |

| | | $ | 709,081 | |

| | | | | | | | | |

|

Hotels, Restaurants & Leisure — 3.3% | |

Cracker Barrel Old Country Store, Inc. | | | 594 | | | $ | 95,628 | |

Darden Restaurants, Inc. | | | 1,325 | | | | 98,951 | |

DineEquity, Inc. | | | 1,554 | | | | 92,960 | |

Las Vegas Sands Corp. | | | 1,797 | | | | 95,151 | |

McDonald’s Corp. | | | 778 | | | | 99,312 | |

Six Flags Entertainment Corp. | | | 1,590 | | | | 96,370 | |

| | | | | | | | | |

| | | $ | 578,372 | |

| | | | | | | | | |

|

Household Durables — 2.3% | |

Garmin, Ltd. | | | 2,000 | | | $ | 103,220 | |

Leggett & Platt, Inc. | | | 2,008 | | | | 98,753 | |

MDC Holdings, Inc. | | | 3,541 | | | | 103,362 | |

Tupperware Brands Corp. | | | 1,604 | | | | 96,866 | |

| | | | | | | | | |

| | | $ | 402,201 | |

| | | | | | | | | |

|

Household Products — 2.9% | |

Church & Dwight Co., Inc. | | | 1,919 | | | $ | 95,643 | |

Clorox Co. (The) | | | 763 | | | | 104,386 | |

Colgate-Palmolive Co. | | | 1,406 | | | | 102,610 | |

Kimberly-Clark Corp. | | | 770 | | | | 102,064 | |

Procter & Gamble Co. (The) | | | 1,092 | | | | 99,448 | |

| | | | | | | | | |

| | | $ | 504,151 | |

| | | | | | | | | |

|

Industrial Conglomerates — 1.7% | |

3M Co. | | | 540 | | | $ | 100,629 | |

General Electric Co. | | | 3,166 | | | | 94,378 | |

Honeywell International, Inc. | | | 795 | | | | 98,978 | |

| | | | | | | | | |

| | | $ | 293,985 | |

| | | | | | | | | |

| | | | |

| | 8 | | See Notes to Financial Statements. |

Parametric Dividend Income Fund

February 28, 2017

Portfolio of Investments — continued

| | | | | | | | |

| Security | | Shares | | | Value | |

| | | | | | | | |

|

Insurance — 6.1% | |

Aflac, Inc. | | | 1,347 | | | $ | 97,455 | |

Arthur J. Gallagher & Co. | | | 1,759 | | | | 100,175 | |

Chubb, Ltd. | | | 720 | | | | 99,482 | |

Cincinnati Financial Corp. | | | 1,245 | | | | 90,835 | |

Endurance Specialty Holdings, Ltd. | | | 1,063 | | | | 98,785 | |

Everest Re Group, Ltd. | | | 430 | | | | 101,110 | |

Marsh & McLennan Cos., Inc. | | | 1,272 | | | | 93,467 | |

Old Republic International Corp. | | | 4,603 | | | | 95,328 | |

Progressive Corp. (The) | | | 2,528 | | | | 99,047 | |

Travelers Cos., Inc. (The) | | | 807 | | | | 98,648 | |

Validus Holdings, Ltd. | | | 1,678 | | | | 96,754 | |

| | | | | | | | | |

| | | $ | 1,071,086 | |

| | | | | | | | | |

|

IT Services — 4.4% | |

Accenture PLC, Class A | | | 827 | | | $ | 101,307 | |

Amdocs, Ltd. | | | 1,626 | | | | 98,617 | |

Automatic Data Processing, Inc. | | | 930 | | | | 95,437 | |

Broadridge Financial Solutions, Inc. | | | 1,428 | | | | 99,003 | |

International Business Machines Corp. | | | 539 | | | | 96,923 | |

Jack Henry & Associates, Inc. | | | 967 | | | | 90,676 | |

Paychex, Inc. | | | 1,605 | | | | 98,579 | |

Western Union Co. | | | 4,835 | | | | 94,959 | |

| | | | | | | | | |

| | | $ | 775,501 | |

| | | | | | | | | |

|

Leisure Products — 0.5% | |

Mattel, Inc. | | | 3,605 | | | $ | 92,757 | |

| | | | | | | | | |

| | | $ | 92,757 | |

| | | | | | | | | |

|

Life Sciences Tools & Services — 0.6% | |

Thermo Fisher Scientific, Inc. | | | 656 | | | $ | 103,438 | |

| | | | | | | | | |

| | | $ | 103,438 | |

| | | | | | | | | |

|

Machinery — 1.6% | |

Caterpillar, Inc. | | | 980 | | | $ | 94,727 | |

Cummins, Inc. | | | 645 | | | | 95,776 | |

Illinois Tool Works, Inc. | | | 737 | | | | 97,291 | |

| | | | | | | | | |

| | | $ | 287,794 | |

| | | | | | | | | |

|

Media — 1.6% | |

Cinemark Holdings, Inc. | | | 2,241 | | | $ | 93,831 | |

Omnicom Group, Inc. | | | 1,090 | | | | 92,759 | |

Regal Entertainment Group, Class A | | | 4,592 | | | | 99,095 | |

| | | | | | | | | |

| | | $ | 285,685 | |

| | | | | | | | | |

| | | | | | | | |

| Security | | Shares | | | Value | |

| | | | | | | | |

|

Metals & Mining — 2.2% | |

Commercial Metals Co. | | | 4,587 | | | $ | 96,923 | |

Compass Minerals International, Inc. | | | 1,264 | | | | 95,811 | |

Kaiser Aluminum Corp. | | | 1,250 | | | | 98,538 | |

Nucor Corp. | | | 1,578 | | | | 98,735 | |

| | | | | | | | | |

| | | $ | 390,007 | |

| | | | | | | | | |

|

Multi-Utilities — 5.1% | |

Ameren Corp. | | | 1,834 | | | $ | 100,302 | |

Avista Corp. | | | 2,488 | | | | 99,197 | |

Centerpoint Energy, Inc. | | | 3,670 | | | | 100,264 | |

Consolidated Edison, Inc. | | | 1,294 | | | | 99,690 | |

Dominion Resources, Inc. | | | 1,260 | | | | 97,826 | |

DTE Energy Co. | | | 981 | | | | 99,454 | |

Public Service Enterprise Group, Inc. | | | 2,194 | | | | 100,880 | |

SCANA Corp. | | | 1,392 | | | | 96,535 | |

WEC Energy Group, Inc. | | | 1,629 | | | | 98,180 | |

| | | | | | | | | |

| | | $ | 892,328 | |

| | | | | | | | | |

|

Multiline Retail — 0.5% | |

Target Corp. | | | 1,479 | | | $ | 86,921 | |

| | | | | | | | | |

| | | $ | 86,921 | |

| | | | | | | | | |

|

Oil, Gas & Consumable Fuels — 7.6% | |

Chevron Corp. | | | 848 | | | $ | 95,400 | |

ConocoPhillips | | | 1,998 | | | | 95,065 | |

EOG Resources, Inc. | | | 994 | | | | 96,408 | |

Exxon Mobil Corp. | | | 1,118 | | | | 90,916 | |

HollyFrontier Corp. | | | 3,465 | | | | 101,455 | |

Kinder Morgan, Inc. | | | 4,317 | | | | 91,995 | |

Marathon Petroleum Corp. | | | 1,960 | | | | 97,216 | |

Occidental Petroleum Corp. | | | 1,398 | | | | 91,639 | |

Oneok, Inc. | | | 1,763 | | | | 95,290 | |

Phillips 66 | | | 1,152 | | | | 90,075 | |

Targa Resources Corp. | | | 1,660 | | | | 93,790 | |

Valero Energy Corp. | | | 1,469 | | | | 99,818 | |

Western Refining, Inc. | | | 2,639 | | | | 96,376 | |

Williams Cos., Inc. (The) | | | 3,367 | | | | 95,421 | |

| | | | | | | | | |

| | | $ | 1,330,864 | |

| | | | | | | | | |

|

Paper & Forest Products — 0.6% | |

Domtar Corp. | | | 2,554 | | | $ | 97,282 | |

| | | | | | | | | |

| | | $ | 97,282 | |

| | | | | | | | | |

| | | | |

| | 9 | | See Notes to Financial Statements. |

Parametric Dividend Income Fund

February 28, 2017

Portfolio of Investments — continued

| | | | | | | | |

| Security | | Shares | | | Value | |

| | | | | | | | |

|

Pharmaceuticals — 2.9% | |

Bristol-Myers Squibb Co. | | | 1,872 | | | $ | 106,161 | |

Eli Lilly & Co. | | | 1,164 | | | | 96,391 | |

Johnson & Johnson | | | 838 | | | | 102,412 | |

Merck & Co., Inc. | | | 1,542 | | | | 101,572 | |

Pfizer, Inc. | | | 3,026 | | | | 103,247 | |

| | | | | | | | | |

| | | $ | 509,783 | |

| | | | | | | | | |

|

Professional Services — 0.6% | |

Nielsen Holdings PLC | | | 2,306 | | | $ | 102,294 | |

| | | | | | | | | |

| | | $ | 102,294 | |

| | | | | | | | | |

|

Semiconductors & Semiconductor Equipment — 2.2% | |

Linear Technology Corp. | | | 1,495 | | | $ | 96,547 | |

Maxim Integrated Products, Inc. | | | 2,107 | | | | 93,340 | |

QUALCOMM, Inc. | | | 1,767 | | | | 99,801 | |

Texas Instruments, Inc. | | | 1,218 | | | | 93,323 | |

| | | | | | | | | |

| | | $ | 383,011 | |

| | | | | | | | | |

|

Software — 0.6% | |

CA, Inc. | | | 3,046 | | | $ | 98,294 | |

| | | | | | | | | |

| | | $ | 98,294 | |

| | | | | | | | | |

|

Specialty Retail — 0.6% | |

Home Depot, Inc. (The) | | | 684 | | | $ | 99,118 | |

| | | | | | | | | |

| | | $ | 99,118 | |

| | | | | | | | | |

|

Thrifts & Mortgage Finance — 0.5% | |

New York Community Bancorp, Inc. | | | 6,259 | | | $ | 95,638 | |

| | | | | | | | | |

| | | $ | 95,638 | |

| | | | | | | | | |

|

Tobacco — 2.3% | |

Altria Group, Inc. | | | 1,330 | | | $ | 99,643 | |

Philip Morris International, Inc. | | | 983 | | | | 107,491 | |

Reynolds American, Inc. | | | 1,584 | | | | 97,527 | |

Vector Group, Ltd. | | | 4,256 | | | | 96,952 | |

| | | | | | | | | |

| | | $ | 401,613 | |

| | | | | | | | | |

| |

Total Common Stocks

(identified cost $16,196,761) | | | $ | 17,401,131 | |

| | | | | | | | | |

| | | | | | | | |

| Short-Term Investments — 9.3% | |

| | |

| | | | | | | | |

| Description | | Units | | | Value | |

| | | | | | | | |

Eaton Vance Cash Reserves Fund, LLC, 0.92%(1) | | | 1,626,327 | | | $ | 1,626,815 | |

| | | | | | | | | |

| |

Total Short-Term Investments

(identified cost $1,626,650) | | | $ | 1,626,815 | |

| | | | | | | | | |

| |

Total Investments — 108.6%

(identified cost $17,823,411) | | | $ | 19,027,946 | |

| | | | | | | | | |

| |

Other Assets, Less Liabilities — (8.6)% | | | $ | (1,508,575 | ) |

| | | | | | | | | |

| |

Net Assets — 100.0% | | | $ | 17,519,371 | |

| | | | | | | | | |

The percentage shown for each investment category in the Portfolio of Investments is based on net assets.

| (1) | Affiliated investment company, available to Eaton Vance portfolios and funds, which invests in high quality, U.S. dollar denominated money market instruments. The rate shown is the annualized seven-day yield as of February 28, 2017. |

| | | | |

| | 10 | | See Notes to Financial Statements. |

Parametric Dividend Income Fund

February 28, 2017

Statement of Assets and Liabilities

| | | | |

| Assets | | February 28, 2017 | |

Unaffiliated investments, at value (identified cost, $16,196,761) | | $ | 17,401,131 | |

Affiliated investment, at value (identified cost, $1,626,650) | | | 1,626,815 | |

Dividends receivable | | | 47,356 | |

Dividends receivable from affiliated investment | | | 250 | |

Receivable for investments sold | | | 93,977 | |

Receivable for Fund shares sold | | | 198,323 | |

Receivable from affiliates | | | 16,870 | |

Total assets | | $ | 19,384,722 | |

| |

| Liabilities | | | | |

Payable for investments purchased | | $ | 1,803,893 | |

Payable for Fund shares redeemed | | | 10,263 | |

Payable to affiliates: | | | | |

Investment adviser and administration fee | | | 3,571 | |

Distribution and service fees | | | 444 | |

Accrued expenses | | | 47,180 | |

Total liabilities | | $ | 1,865,351 | |

Net Assets | | $ | 17,519,371 | |

| |

| Sources of Net Assets | | | | |

Paid-in capital | | $ | 16,288,399 | |

Accumulated distributions in excess of net realized gain | | | (31,498 | ) |

Accumulated undistributed net investment income | | | 57,935 | |

Net unrealized appreciation | | | 1,204,535 | |

Total | | $ | 17,519,371 | |

| |

| Investor Class Shares | | | | |

Net Assets | | $ | 2,449,589 | |

Shares Outstanding | | | 201,315 | |

Net Asset Value, Offering Price and Redemption Price Per Share | | | | |

(net assets ÷ shares of beneficial interest outstanding) | | $ | 12.17 | |

| |

| Institutional Class Shares | | | | |

Net Assets | | $ | 15,069,782 | |

Shares Outstanding | | | 1,236,731 | |

Net Asset Value, Offering Price and Redemption Price Per Share | | | | |

(net assets ÷ shares of beneficial interest outstanding) | | $ | 12.19 | |

| | | | |

| | 11 | | See Notes to Financial Statements. |

Parametric Dividend Income Fund

February 28, 2017

Statement of Operations

| | | | |

| Investment Income | | Year Ended February 28, 2017 | |

Dividends (net of foreign taxes, $211) | | $ | 210,190 | |

Interest allocated from/dividends from affiliated investment | | | 1,118 | |

Expenses allocated from affiliated investment | | | (4 | ) |

Total investment income | | $ | 211,304 | |

| |

| Expenses | | | | |

Investment adviser and administration fee | | $ | 27,953 | |

Distribution and service fees | | | | |

Investor Class | | | 1,582 | |

Trustees’ fees and expenses | | | 898 | |

Custodian fee | | | 33,097 | |

Transfer and dividend disbursing agent fees | | | 2,007 | |

Legal and accounting services | | | 36,996 | |

Printing and postage | | | 7,926 | |

Registration fees | | | 37,316 | |

Miscellaneous | | | 9,845 | |

Total expenses | | $ | 157,620 | |

Deduct — | | | | |

Allocation of expenses to affiliates | | $ | 122,955 | |

Total expense reductions | | $ | 122,955 | |

| |

Net expenses | | $ | 34,665 | |

| |

Net investment income | | $ | 176,639 | |

| |

| Realized and Unrealized Gain (Loss) | | | | |

Net realized gain (loss) — | | | | |

Investment transactions | | $ | 20,490 | |

Investment transactions in/allocated from affiliated investment | | | (27 | ) |

Net realized gain | | $ | 20,463 | |

Change in unrealized appreciation (depreciation) — | | | | |

Investments | | $ | 1,207,840 | |

Investments — affiliated investment | | | 165 | |

Net change in unrealized appreciation (depreciation) | | $ | 1,208,005 | |

| |

Net realized and unrealized gain | | $ | 1,228,468 | |

| |

Net increase in net assets from operations | | $ | 1,405,107 | |

| | | | |

| | 12 | | See Notes to Financial Statements. |

Parametric Dividend Income Fund

February 28, 2017

Statements of Changes in Net Assets

| | | | | | | | |

| Increase (Decrease) in Net Assets | | Year Ended February 28, 2017 | | | Year Ended February 29, 2016 | |

From operations — | | | | | | | | |

Net investment income | | $ | 176,639 | | | $ | 115,679 | |

Net realized gain from investment transactions | | | 20,463 | | | | 26,551 | |

Net change in unrealized appreciation (depreciation) from investments | | | 1,208,005 | | | | (259,551 | ) |

Net increase (decrease) in net assets from operations | | $ | 1,405,107 | | | $ | (117,321 | ) |

Distributions to shareholders — | | | | | | | | |

From net investment income | | | | | | | | |

Investor Class | | $ | (12,981 | ) | | $ | (1,129 | ) |

Institutional Class | | | (120,440 | ) | | | (110,718 | ) |

From net realized gain | | | | | | | | |

Investor Class | | | (8,948 | ) | | | (1,541 | ) |

Institutional Class | | | (27,001 | ) | | | (59,833 | ) |

Total distributions to shareholders | | $ | (169,370 | ) | | $ | (173,221 | ) |

Transactions in shares of beneficial interest — | | | | | | | | |

Proceeds from sale of shares | | | | | | | | |

Investor Class | | $ | 2,289,405 | | | $ | 75,656 | |

Institutional Class | | | 10,777,632 | | | | 395,519 | |

Net asset value of shares issued to shareholders in payment of distributions declared | | | | | | | | |

Investor Class | | | 21,929 | | | | 2,670 | |

Institutional Class | | | 147,441 | | | | 170,551 | |

Cost of shares redeemed | | | | | | | | |

Investor Class | | | (76,452 | ) | | | (224 | ) |

Institutional Class | | | (662,418 | ) | | | (15,216 | ) |

Net increase in net assets from Fund share transactions | | $ | 12,497,537 | | | $ | 628,956 | |

| | |

Net increase in net assets | | $ | 13,733,274 | | | $ | 338,414 | |

| | |

| Net Assets | | | | | | | | |

At beginning of year | | $ | 3,786,097 | | | $ | 3,447,683 | |

At end of year | | $ | 17,519,371 | | | $ | 3,786,097 | |

| | |

Accumulated undistributed net investment income included in net assets | | | | | | | | |

At end of year | | $ | 57,935 | | | $ | 14,827 | |

| | | | |

| | 13 | | See Notes to Financial Statements. |

Parametric Dividend Income Fund

February 28, 2017

Financial Highlights

| | | | | | | | | | | | |

| | | Investor Class | |

| | | Year Ended

February 28, 2017 | | | Year Ended

February 29, 2016 | | | Period Ended February 28, 2015(1) | |

Net asset value — Beginning of period | | $ | 10.080 | | | $ | 10.930 | | | $ | 10.000 | |

| | | |

| Income (Loss) From Operations | | | | | | | | | | | | |

Net investment income(2) | | $ | 0.275 | | | $ | 0.284 | | | $ | 0.230 | |

Net realized and unrealized gain (loss) | | | 2.114 | | | | (0.666 | ) | | | 1.143 | |

| | | |

Total income (loss) from operations | | $ | 2.389 | | | $ | (0.382 | ) | | $ | 1.373 | |

| | | |

| Less Distributions | | | | | | | | | | | | |

From net investment income | | $ | (0.249 | ) | | $ | (0.301 | ) | | $ | (0.197 | ) |

From net realized gain | | | (0.050 | ) | | | (0.167 | ) | | | (0.246 | ) |

| | | |

Total distributions | | $ | (0.299 | ) | | $ | (0.468 | ) | | $ | (0.443 | ) |

| | | |

Net asset value — End of period | | $ | 12.170 | | | $ | 10.080 | | | $ | 10.930 | |

| | | |

Total Return(3)(4) | | | 23.97 | % | | | (3.51 | )% | | | 13.88 | %(5) |

|

| Ratios/Supplemental Data | |

Net assets, end of period (000’s omitted) | | $ | 2,450 | | | $ | 97 | | | $ | 22 | |

Ratios (as a percentage of average daily net assets): | | | | | | | | | | | | |

Expenses(4) | | | 0.68 | % | | | 0.85 | % | | | 0.88 | %(6) |

Net investment income | | | 2.34 | % | | | 2.77 | % | | | 2.33 | %(6) |

Portfolio Turnover | | | 26 | % | | | 31 | % | | | 39 | %(5) |

| (1) | For the period from the start of business, March 26, 2014, to February 28, 2015. |

| (2) | Computed using average shares outstanding. |

| (3) | Returns are historical and are calculated by determining the percentage change in net asset value with all distributions reinvested. |

| (4) | The investment adviser and administrator and/or the sub-adviser reimbursed certain operating expenses (equal to 1.60%, 3.22% and 4.84% of average daily net assets for the years ended February 28, 2017 and February 29, 2016 and the period ended February 28, 2015, respectively). Absent this reimbursement, total return would be lower. |

| | | | |

| | 14 | | See Notes to Financial Statements. |

Parametric Dividend Income Fund

February 28, 2017

Financial Highlights — continued

| | | | | | | | | | | | |

| | | Institutional Class | |

| | | Year Ended

February 28, 2017 | | | Year Ended

February 29, 2016 | | | Period Ended February 28, 2015(1) | |

Net asset value — Beginning of period | | $ | 10.090 | | | $ | 10.930 | | | $ | 10.000 | |

| | | |

| Income (Loss) From Operations | | | | | | | | | | | | |

Net investment income(2) | | $ | 0.310 | | | $ | 0.334 | | | $ | 0.249 | |

Net realized and unrealized gain (loss) | | | 2.108 | | | | (0.683 | ) | | | 1.143 | |

| | | |

Total income (loss) from operations | | $ | 2.418 | | | $ | (0.349 | ) | | $ | 1.392 | |

| | | |

| Less Distributions | | | | | | | | | | | | |

From net investment income | | $ | (0.268 | ) | | $ | (0.324 | ) | | $ | (0.216 | ) |

From net realized gain | | | (0.050 | ) | | | (0.167 | ) | | | (0.246 | ) |

| | | |

Total distributions | | $ | (0.318 | ) | | $ | (0.491 | ) | | $ | (0.462 | ) |

| | | |

Net asset value — End of period | | $ | 12.190 | | | $ | 10.090 | | | $ | 10.930 | |

| | | |

Total Return(3)(4) | | | 24.26 | % | | | (3.21 | )% | | | 14.09 | %(5) |

|

| Ratios/Supplemental Data | |

Net assets, end of period (000’s omitted) | | $ | 15,070 | | | $ | 3,689 | | | $ | 3,426 | |

Ratios (as a percentage of average daily net assets): | | | | | | | | | | | | |

Expenses(4) | | | 0.51 | % | | | 0.60 | % | | | 0.63 | %(6) |

Net investment income | | | 2.71 | % | | | 3.21 | % | | | 2.54 | %(6) |

Portfolio Turnover | | | 26 | % | | | 31 | % | | | 39 | %(5) |

| (1) | For the period from the start of business, March 26, 2014, to February 28, 2015. |

| (2) | Computed using average shares outstanding. |

| (3) | Returns are historical and are calculated by determining the percentage change in net asset value with all distributions reinvested. |

| (4) | The investment adviser and administrator and/or the sub-adviser reimbursed certain operating expenses (equal to 1.89%, 3.22% and 4.84% of average daily net assets for the years ended February 28, 2017 and February 29, 2016 and the period ended February 28, 2015, respectively). Absent this reimbursement, total return would be lower. |

| | | | |

| | 15 | | See Notes to Financial Statements. |

Parametric Dividend Income Fund

February 28, 2017

Notes to Financial Statements

1 Significant Accounting Policies

Parametric Dividend Income Fund (the Fund) is a diversified series of Eaton Vance Mutual Funds Trust (the Trust). The Trust is a Massachusetts business trust registered under the Investment Company Act of 1940, as amended (the 1940 Act), as an open-end management investment company. The Fund’s investment objective is total return and current income. The Fund offers Investor Class and Institutional Class shares, which are offered at net asset value and are not subject to a sales charge. Each class represents a pro-rata interest in the Fund, but votes separately on class-specific matters and (as noted below) is subject to different expenses. Realized and unrealized gains and losses and net investment income and losses, other than class-specific expenses, are allocated daily to each class of shares based on the relative net assets of each class to the total net assets of the Fund. Each class of shares differs in its distribution plan and certain other class-specific expenses.

The following is a summary of significant accounting policies of the Fund. The policies are in conformity with accounting principles generally accepted in the United States of America (U.S. GAAP). The Fund is an investment company and follows accounting and reporting guidance in the Financial Accounting Standards Board (FASB) Accounting Standards Codification Topic 946.

A Investment Valuation — The following methodologies are used to determine the market value or fair value of investments.

Equity Securities. Equity securities listed on a U.S. securities exchange generally are valued at the last sale or closing price on the day of valuation or, if no sales took place on such date, at the mean between the closing bid and asked prices therefore on the exchange where such securities are principally traded. Equity securities listed on the NASDAQ Global or Global Select Market generally are valued at the NASDAQ official closing price. Unlisted or listed securities for which closing sales prices or closing quotations are not available are valued at the mean between the latest available bid and asked prices.

Affiliated Fund. The Fund may invest in Eaton Vance Cash Reserves Fund, LLC (Cash Reserves Fund), an affiliated investment company managed by Eaton Vance Management (EVM). While Cash Reserves Fund is not a registered money market mutual fund, it conducts all of its investment activities in accordance with the requirements of Rule 2a-7 under the 1940 Act. Investments in Cash Reserves Fund are valued at the closing net asset value per unit on the valuation day. Cash Reserves Fund generally values its investment securities based on available market quotations provided by a third party pricing service. Prior to Cash Reserves Fund’s issuance of units in October 2016, the value of the Fund’s investment in Cash Reserves Fund reflected the Fund’s proportionate interest in its net assets and the Fund recorded its pro-rata share of Cash Reserves Fund’s income, expenses and realized gain or loss.

Fair Valuation. Investments for which valuations or market quotations are not readily available or are deemed unreliable are valued at fair value using methods determined in good faith by or at the direction of the Trustees of the Fund in a manner that fairly reflects the security’s value, or the amount that the Fund might reasonably expect to receive for the security upon its current sale in the ordinary course. Each such determination is based on a consideration of relevant factors, which are likely to vary from one pricing context to another. These factors may include, but are not limited to, the type of security, the existence of any contractual restrictions on the security’s disposition, the price and extent of public trading in similar securities of the issuer or of comparable companies or entities, quotations or relevant information obtained from broker/dealers or other market participants, information obtained from the issuer, analysts, and/or the appropriate stock exchange (for exchange-traded securities), an analysis of the company’s or entity’s financial condition, and an evaluation of the forces that influence the issuer and the market(s) in which the security is purchased and sold.

B Investment Transactions — Investment transactions for financial statement purposes are accounted for on a trade date basis. Realized gains and losses on investments sold are determined on the basis of identified cost.

C Income — Dividend income is recorded on the ex-dividend date for dividends received in cash and/or securities. However, if the ex-dividend date has passed, certain dividends from foreign securities are recorded as the Fund is informed of the ex-dividend date. Withholding taxes on foreign dividends and capital gains have been provided for in accordance with the Fund’s understanding of the applicable countries’ tax rules and rates. Interest income is recorded on the basis of interest accrued, adjusted for amortization of premium or accretion of discount.

D Federal Taxes — The Fund’s policy is to comply with the provisions of the Internal Revenue Code applicable to regulated investment companies and to distribute to shareholders each year substantially all of its net investment income, and all or substantially all of its net realized capital gains. Accordingly, no provision for federal income or excise tax is necessary.

As of February 28, 2017, the Fund had no uncertain tax positions that would require financial statement recognition, de-recognition, or disclosure. The Fund files a U.S. federal income tax return annually after its fiscal year-end, which is subject to examination by the Internal Revenue Service for a period of three years from the date of filing.

E Expenses — The majority of expenses of the Trust are directly identifiable to an individual fund. Expenses which are not readily identifiable to a specific fund are allocated taking into consideration, among other things, the nature and type of expense and the relative size of the funds.

F Use of Estimates — The preparation of the financial statements in conformity with U.S. GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities at the date of the financial statements and the reported amounts of income and expense during the reporting period. Actual results could differ from those estimates.

G Indemnifications — Under the Trust’s organizational documents, its officers and Trustees may be indemnified against certain liabilities and expenses arising out of the performance of their duties to the Fund. Under Massachusetts law, if certain conditions prevail, shareholders of a Massachusetts business

Parametric Dividend Income Fund

February 28, 2017

Notes to Financial Statements — continued

trust (such as the Trust) could be deemed to have personal liability for the obligations of the Trust. However, the Trust’s Declaration of Trust contains an express disclaimer of liability on the part of Fund shareholders and the By-laws provide that the Trust shall assume the defense on behalf of any Fund shareholders. Moreover, the By-laws also provide for indemnification out of Fund property of any shareholder held personally liable solely by reason of being or having been a shareholder for all loss or expense arising from such liability. Additionally, in the normal course of business, the Fund enters into agreements with service providers that may contain indemnification clauses. The Fund’s maximum exposure under these arrangements is unknown as this would involve future claims that may be made against the Fund that have not yet occurred.

2 Distributions to Shareholders and Income Tax Information

It is the present policy of the Fund to make quarterly distributions of all or substantially all of its net investment income and to distribute annually all or substantially all of its net realized capital gains. Distributions to shareholders are recorded on the ex-dividend date. Distributions are declared separately for each class of shares. Shareholders may reinvest income and capital gain distributions in additional shares of the same class of the Fund at the net asset value as of the ex-dividend date or, at the election of the shareholder, receive distributions in cash. Distributions to shareholders are determined in accordance with income tax regulations, which may differ from U.S. GAAP. As required by U.S. GAAP, only distributions in excess of tax basis earnings and profits are reported in the financial statements as a return of capital. Permanent differences between book and tax accounting relating to distributions are reclassified to paid-in capital. For tax purposes, distributions from short-term capital gains are considered to be from ordinary income.

The tax character of distributions declared for the years ended February 28, 2017 and February 29, 2016 was as follows:

| | | | | | | | |

| | | Year Ended February 28, 2017 | | | Year Ended February 29, 2016 | |

| | |

Distributions declared from: | | | | | | | | |

Ordinary income | | $ | 169,370 | | | $ | 139,583 | |

Long-term capital gains | | $ | — | | | $ | 33,638 | |

During the year ended February 28, 2017, accumulated distributions in excess of net realized gain was decreased by $110 and accumulated undistributed net investment income was decreased by $110 due to differences between book and tax accounting for return of capital distributions from securities. These reclassifications had no effect on the net assets or net asset value per share of the Fund.

As of February 28, 2017, the components of distributable earnings (accumulated losses) on a tax basis were as follows:

| | | | |

Undistributed ordinary income | | $ | 67,286 | |

Undistributed long-term capital gains | | $ | 3,539 | |

Net unrealized appreciation | | $ | 1,160,147 | |

The differences between components of distributable earnings (accumulated losses) on a tax basis and the amounts reflected in the Statement of Assets and Liabilities are primarily due to wash sales, investments in partnerships, the tax treatment of short-term capital gains and return of capital distributions from securities.

The cost and unrealized appreciation (depreciation) of investments of the Fund at February 28, 2017, as determined on a federal income tax basis, were as follows:

| | | | |

| |

Aggregate cost | | $ | 17,867,799 | |

| |

Gross unrealized appreciation | | $ | 1,306,669 | |

Gross unrealized depreciation | | | (146,522 | ) |

| |

Net unrealized appreciation | | $ | 1,160,147 | |

3 Investment Adviser and Administration Fee and Other Transactions with Affiliates

The investment adviser and administration fee is earned by EVM as compensation for investment advisory and administrative services rendered to the Fund. Pursuant to the investment advisory and administration agreement and subsequent fee reduction agreement between the Fund and EVM effective

Parametric Dividend Income Fund

February 28, 2017

Notes to Financial Statements — continued

November 1, 2016, the fee is computed at an annual rate of 0.30% of the Fund’s average daily net assets up to $1 billion and is payable monthly. On net assets of $1 billion and over, the annual fee is reduced. The fee reduction cannot be terminated or reduced without the approval of a majority vote of the Trustees of the Fund who are not interested persons of EVM or the Fund and by the vote of a majority of shareholders. Prior to November 1, 2016, the fee was computed an at annual rate of 0.55% of the Fund’s average daily net assets up to $1 billion and at reduced rates on net assets of $1 billion and over. For the year ended February 28, 2017, the investment adviser and administration fee amounted to $27,953 or 0.42% of the Fund’s average daily net assets. Pursuant to a sub-advisory agreement, EVM has delegated the investment management of the Fund to Parametric Portfolio Associates LLC (Parametric), a majority-owned subsidiary of Eaton Vance Corp. EVM pays Parametric a portion of its investment adviser and administration fee for sub-advisory services provided to the Fund. The Fund invests its cash in Cash Reserves Fund. EVM does not currently receive a fee for advisory services provided to Cash Reserves Fund.

Effective November 1, 2016, EVM and Parametric have agreed to reimburse the Fund’s expenses to the extent that total annual operating expenses (relating to ordinary operating expenses only) exceed 0.65% and 0.40% of the Fund’s average daily net assets for Investor Class and Institutional Class, respectively. This agreement may be changed or terminated after June 30, 2018. Prior to November 1, 2016, EVM and Parametric had agreed to reimburse the Fund’s expenses to the extent that total annual operating expenses (relating to ordinary operating expenses only) exceeded 0.85% and 0.60% of the average daily net assets of Investor Class and Institutional Class, respectively. Pursuant to these agreements, EVM and Parametric were allocated $122,955 in total of the Fund’s operating expenses for the year ended February 28, 2017.

EVM provides sub-transfer agency and related services to the Fund pursuant to a Sub-Transfer Agency Support Services Agreement. For the year ended February 28, 2017, EVM earned $150 from the Fund pursuant to such agreement, which is included in transfer and dividend disbursing agent fees on the Statement of Operations. Eaton Vance Distributors, Inc. (EVD), an affiliate of EVM and the Fund’s principal underwriter, received distribution and service fees from Investor Class shares (see Note 4).

Trustees and officers of the Fund who are members of EVM’s organization receive remuneration for their services to the Fund out of the investment adviser and administration fee. Trustees of the Fund who are not affiliated with EVM may elect to defer receipt of all or a percentage of their annual fees in accordance with the terms of the Trustees Deferred Compensation Plan. For the year ended February 28, 2017, no significant amounts have been deferred. Certain officers and Trustees of the Fund are officers of EVM.

4 Distribution Plan

The Fund has in effect a distribution plan for Investor Class shares (Investor Class Plan) pursuant to Rule 12b-1 under the 1940 Act. Pursuant to the Investor Class Plan, the Fund pays EVD a distribution and service fee of 0.25% per annum of its average daily net assets attributable to Investor Class shares for distribution services and facilities provided to the Fund by EVD, as well as for personal services and/or the maintenance of shareholder accounts. Distribution and service fees paid or accrued to EVD for the year ended February 28, 2017 amounted to $1,582 for Investor Class shares.

Distribution and service fees are subject to the limitations contained in the Financial Industry Regulatory Authority Rule 2341(d).

5 Purchases and Sales of Investments

Purchases and sales of investments, other than short-term obligations, aggregated $14,192,274 and $1,793,008, respectively, for the year ended February 28, 2017.

6 Shares of Beneficial Interest

The Fund’s Declaration of Trust permits the Trustees to issue an unlimited number of full and fractional shares of beneficial interest (without par value). Such shares may be issued in a number of different series (such as the Fund) and classes. Transactions in Fund shares were as follows:

| | | | | | | | |

| Investor Class | | Year Ended

February 28, 2017 | | | Year Ended

February 29, 2016 | |

| | |

Sales | | | 196,341 | | | | 7,373 | |

Issued to shareholders electing to receive payments of distributions in Fund shares | | | 1,872 | | | | 263 | |

Redemptions | | | (6,492 | ) | | | (22 | ) |

| | |

Net increase | | | 191,721 | | | | 7,614 | |

Parametric Dividend Income Fund

February 28, 2017

Notes to Financial Statements — continued

| | | | | | | | |

| Institutional Class | | Year Ended

February 28, 2017 | | | Year Ended

February 29, 2016 | |

| | |

Sales | | | 916,002 | | | | 37,274 | |

Issued to shareholders electing to receive payments of distributions in Fund shares | | | 13,019 | | | | 16,591 | |

Redemptions | | | (58,060 | ) | | | (1,487 | ) |

| | |

Net increase | | | 870,961 | | | | 52,378 | |

At February 28, 2017, EVM owned 23.5% of the value of the outstanding shares of the Fund.

7 Line of Credit

The Fund participates with other portfolios and funds managed by EVM and its affiliates in a $625 million unsecured line of credit agreement with a group of banks, which is in effect through September 1, 2017. Borrowings are made by the Fund solely to facilitate the handling of unusual and/or unanticipated short-term cash requirements. Interest is charged to the Fund based on its borrowings at an amount above either the Eurodollar rate or Federal Funds rate. In addition, a fee computed at an annual rate of 0.15% on the daily unused portion of the line of credit is allocated among the participating portfolios and funds at the end of each quarter. Because the line of credit is not available exclusively to the Fund, it may be unable to borrow some or all of its requested amounts at any particular time. The Fund did not have any significant borrowings or allocated fees during the year ended February 28, 2017.

8 Fair Value Measurements

Under generally accepted accounting principles for fair value measurements, a three-tier hierarchy to prioritize the assumptions, referred to as inputs, is used in valuation techniques to measure fair value. The three-tier hierarchy of inputs is summarized in the three broad levels listed below.

| • | | Level 1 – quoted prices in active markets for identical investments |

| • | | Level 2 – other significant observable inputs (including quoted prices for similar investments, interest rates, prepayment speeds, credit risk, etc.) |

| • | | Level 3 – significant unobservable inputs (including a fund’s own assumptions in determining the fair value of investments) |

In cases where the inputs used to measure fair value fall in different levels of the fair value hierarchy, the level disclosed is determined based on the lowest level input that is significant to the fair value measurement in its entirety. The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities.

At February 28, 2017, the hierarchy of inputs used in valuing the Fund’s investments, which are carried at value, were as follows:

| | | | | | | | | | | | | | | | |

| Asset Description | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| | | | |

Common Stocks | | $ | 17,401,131 | * | | $ | — | | | $ | — | | | $ | 17,401,131 | |

Short-Term Investments | | | — | | | | 1,626,815 | | | | — | | | | 1,626,815 | |

| | | | |

Total Investments | | $ | 17,401,131 | | | $ | 1,626,815 | | | $ | — | | | $ | 19,027,946 | |

| * | The level classification by major category of investments is the same as the category presentation in the Portfolio of Investments. |

The Fund held no investments or other financial instruments as of February 29, 2016 whose fair value was determined using Level 3 inputs. At February 28, 2017, there were no investments transferred between Level 1 and Level 2 during the year then ended.

Parametric Dividend Income Fund

February 28, 2017

Report of Independent Registered Public Accounting Firm

To the Trustees of Eaton Vance Mutual Funds Trust and Shareholders of Parametric Dividend Income Fund:

We have audited the accompanying statement of assets and liabilities of Parametric Dividend Income Fund (the “Fund”) (one of the funds constituting Eaton Vance Mutual Funds Trust), including the portfolio of investments, as of February 28, 2017, and the related statement of operations for the year then ended, the statements of changes in net assets for each of the two years in the period then ended, and the financial highlights for each of the periods presented. These financial statements and financial highlights are the responsibility of the Fund’s management. Our responsibility is to express an opinion on these financial statements and financial highlights based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement. The Fund is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. Our audits included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Fund’s internal control over financial reporting. Accordingly, we express no such opinion. An audit also includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. Our procedures included confirmation of securities owned as of February 28, 2017, by correspondence with the custodian and brokers; where replies were not received from brokers, we performed other auditing procedures. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, such financial statements and financial highlights referred to above present fairly, in all material respects, the financial position of Parametric Dividend Income Fund as of February 28, 2017, the results of its operations for the year then ended, the changes in its net assets for each of the two years in the period then ended, and the financial highlights for each of the periods presented, in conformity with accounting principles generally accepted in the United States of America.

DELOITTE & TOUCHE LLP

Boston, Massachusetts

April 19, 2017

Parametric Dividend Income Fund

February 28, 2017

Federal Tax Information (Unaudited)

The Form 1099-DIV you receive in February 2018 will show the tax status of all distributions paid to your account in calendar year 2017. Shareholders are advised to consult their own tax adviser with respect to the tax consequences of their investment in the Fund. As required by the Internal Revenue Code and/or regulations, shareholders must be notified regarding the status of qualified dividend income for individuals, the dividends received deduction for corporations and capital gains dividends.

Qualified Dividend Income. For the fiscal year ended February 28, 2017, the Fund designates approximately $182,870, or up to the maximum amount of such dividends allowable pursuant to the Internal Revenue Code, as qualified dividend income eligible for the reduced tax rate of 15%.

Dividends Received Deduction. Corporate shareholders are generally entitled to take the dividends received deduction on the portion of the Fund’s dividend distribution that qualifies under tax law. For the Fund’s fiscal 2017 ordinary income dividends, 80.58% qualifies for the corporate dividends received deduction.

Capital Gains Dividends. The Fund hereby designates as a capital gain dividend with respect to the taxable year ended February 28, 2017, $3,539 or, if subsequently determined to be different, the net capital gain of such year.

Parametric Dividend Income Fund

February 28, 2017

Management and Organization

Fund Management. The Trustees of Eaton Vance Mutual Funds Trust (the Trust) are responsible for the overall management and supervision of the Trust’s affairs. The Trustees and officers of the Trust are listed below. Except as indicated, each individual has held the office shown or other offices in the same company for the last five years. Trustees and officers of the Trust hold indefinite terms of office. The “Noninterested Trustees” consist of those Trustees who are not “interested persons” of the Trust, as that term is defined under the 1940 Act. The business address of each Trustee and officer is Two International Place, Boston, Massachusetts 02110. As used below, “EVC” refers to Eaton Vance Corp., “EV” refers to Eaton Vance, Inc., “EVM” refers to Eaton Vance Management, “BMR” refers to Boston Management and Research, “EVMI” refers to Eaton Vance Management (International) Limited and “EVD” refers to Eaton Vance Distributors, Inc. EVC and EV are the corporate parent and trustee, respectively, of EVM and BMR. EVD is the Fund’s principal underwriter and a wholly-owned subsidiary of EVC. EVMI is an indirect, wholly-owned subsidiary of EVC. Each officer affiliated with Eaton Vance may hold a position with other Eaton Vance affiliates that is comparable to his or her position with EVM listed below. Each Trustee oversees 177 portfolios in the Eaton Vance Complex (including all master and feeder funds in a master feeder structure). Each officer serves as an officer of certain other Eaton Vance funds. Each Trustee and officer serves until his or her successor is elected.

| | | | | | |

| Name and Year of Birth | | Position(s) with the Trust | | Trustee Since(1) | | Principal Occupation(s) and Directorships During Past Five Years and Other Relevant Experience |

Interested Trustee | | | | |

| | | |

Thomas E. Faust Jr. 1958 | | Trustee | | 2007 | | Chairman, Chief Executive Officer and President of EVC, Director and President of EV, Chief Executive Officer and President of EVM and BMR, and Director of EVD and EVMI. Trustee and/or officer of 177 registered investment companies. Mr. Faust is an interested person because of his positions with EVM, BMR, EVD, EVMI, EVC and EV, which are affiliates of the Trust. Directorships in the Last Five Years.(2) Director of EVC and Hexavest Inc. (investment management firm). |

| | | |

| | | | | | |

Noninterested Trustees | | | | |

| | | |

Scott E. Eston 1956 | | Trustee | | 2011 | | Private investor. Formerly held various positions at Grantham, Mayo, Van Otterloo and Co., LLC (investment management firm) (1997-2009), including Chief Operating Officer (2002-2009), Chief Financial Officer (1997-2009) and Chairman of the Executive Committee (2002-2008); President and Principal Executive Officer, GMO Trust (open-end registered investment company) (2006-2009). Former Partner, Coopers and Lybrand LLP (now PricewaterhouseCoopers) (a registered public accounting firm) (1987-1997). Mr. Eston has apprised the Board of Trustees that he intends to retire as a Trustee of all Eaton Vance funds effective September 30, 2017. Directorships in the Last Five Years.(2) None. |

| | | |

Mark R. Fetting(3) 1954 | | Trustee | | 2016 | | Private investor. Formerly held various positions at Legg Mason, Inc. (investment management firm) (2000-2012), including President, Chief Executive Officer, Director and Chairman (2008-2012), Senior Executive Vice President (2004-2008) and Executive Vice President (2001-2004). Formerly, President of Legg Mason family of funds (2001-2008). Formerly, Division President and Senior Officer of Prudential Financial Group, Inc. and related companies (investment management firm) (1991-2000). Directorships in the Last Five Years. Formerly, Director and Chairman of Legg Mason, Inc. (2008-2012); Director/Trustee and Chairman of Legg Mason family of funds (14 funds) (2008-2012); and Director/Trustee of the Royce family of funds (35 funds) (2001-2012). |

| | | |

Cynthia E. Frost 1961 | | Trustee | | 2014 | | Private investor. Formerly, Chief Investment Officer of Brown University (university endowment) (2000-2012); Portfolio Strategist for Duke Management Company (university endowment manager) (1995-2000); Managing Director, Cambridge Associates (investment consulting company) (1989-1995); Consultant, Bain and Company (management consulting firm) (1987-1989); Senior Equity Analyst, BA Investment Management Company (1983-1985). Directorships in the Last Five Years. None. |

| | | |

George J. Gorman 1952 | | Trustee | | 2014 | | Principal at George J. Gorman LLC (consulting firm). Formerly, Senior Partner at Ernst & Young LLP (a registered public accounting firm) (1974-2009). Directorships in the Last Five Years. Formerly, Trustee of the BofA Funds Series Trust (11 funds) (2011-2014) and of the Ashmore Funds (9 funds) (2010-2014). |

Parametric Dividend Income Fund

February 28, 2017

Management and Organization — continued

| | | | | | |

| Name and Year of Birth | | Position(s) with the Trust | | Trustee Since(1) | | Principal Occupation(s) and Directorships During Past Five Years and Other Relevant Experience |

Noninterested Trustees (continued) | | | | |

| | | |

Valerie A. Mosley 1960 | | Trustee | | 2014 | | Chairwoman and Chief Executive Officer of Valmo Ventures (a consulting and investment firm). Former Partner and Senior Vice President, Portfolio Manager and Investment Strategist at Wellington Management Company, LLP (investment management firm) (1992-2012). Former Chief Investment Officer, PG Corbin Asset Management (1990-1992). Formerly worked in institutional corporate bond sales at Kidder Peabody (1986-1990). Directorships in the Last Five Years.(2) Director of Dynex Capital, Inc. (mortgage REIT) (since 2013). |

| | | |