UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act File Number: 811-04015

Eaton Vance Mutual Funds Trust

(Exact Name of Registrant as Specified in Charter)

Two International Place, Boston, Massachusetts 02110

(Address of Principal Executive Offices)

Maureen A. Gemma

Two International Place, Boston, Massachusetts 02110

(Name and Address of Agent for Services)

(617) 482-8260

(Registrant’s Telephone Number)

January 31

Date of Fiscal Year End

July 31, 2018

Date of Reporting Period

Item 1. Reports to Stockholders

Eaton Vance

Emerging Markets Debt Fund

Semiannual Report

July 31, 2018

Commodity Futures Trading Commission Registration. Effective December 31, 2012, the Commodity Futures Trading Commission (“CFTC”) adopted certain regulatory changes that subject registered investment companies and advisers to regulation by the CFTC if a fund invests more than a prescribed level of its assets in certain CFTC-regulated instruments (including futures, certain options and swap agreements) or markets itself as providing investment exposure to such instruments. The Fund is considered to be a commodity pool operator under CFTC regulations. The Fund’s adviser is registered with the CFTC as a commodity pool operator and a commodity trading advisor. The CFTC has neither reviewed nor approved the Fund’s investment strategies.

Fund shares are not insured by the FDIC and are not deposits or other obligations of, or guaranteed by, any depository institution. Shares are subject to investment risks, including possible loss of principal invested.

This report must be preceded or accompanied by a current summary prospectus or prospectus. Before investing, investors should consider carefully the investment objective, risks, and charges and expenses of a mutual fund. This and other important information is contained in the summary prospectus and prospectus, which can be obtained from a financial advisor. Prospective investors should read the prospectus carefully before investing. For further information, please call 1-800-262-1122.

Semiannual Report July 31, 2018

Eaton Vance

Emerging Markets Debt Fund

Table of Contents

| | | | |

Performance | | | 2 | |

| |

Fund Profile | | | 2 | |

| |

Endnotes and Additional Disclosures | | | 3 | |

| |

Fund Expenses | | | 4 | |

| |

Financial Statements | | | 5 | |

| |

Board of Trustees’ Contract Approval | | | 21 | |

| |

Officers and Trustees | | | 24 | |

| |

Important Notices | | | 25 | |

Eaton Vance

Emerging Markets Debt Fund

July 31, 2018

Performance1,2

Portfolio Managers John R. Baur, Michael A. Cirami, CFA and Eric A. Stein, CFA

| | | | | | | | | | | | | | | | | | | | | | | | |

| % Cumulative Total Returns | | Class Inception Date | | | Performance

Inception Date | | | Six Months | | | One Year | | | Five Years | | | Since

Inception | |

Class I at NAV | | | 05/01/2018 | | | | 05/01/2018 | | | | — | | | | — | | | | — | | | | –1.26 | % |

JPMorgan Emerging Market Bond Index (EMBI) Global Diversified | | | — | | | | — | | | | –2.76 | % | | | 0.07 | % | | | 5.42 | % | | | 0.70 | % |

| % Total Annual Operating Expense Ratios3 | | | | | | | | | | | | | | | | | Class I | |

Gross | | | | | | | | | | | | | | | | | | | | | | | 1.00 | % |

Net | | | | | | | | | | | | | | | | | | | | | | | 0.85 | |

Fund Profile

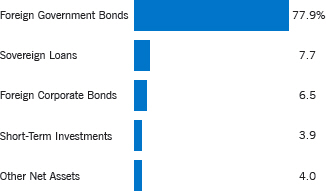

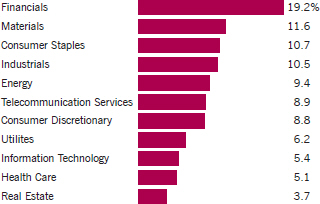

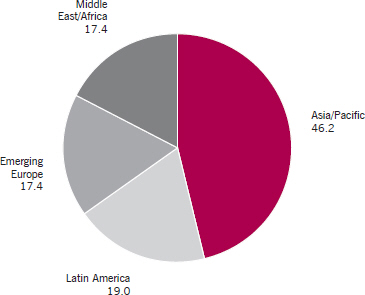

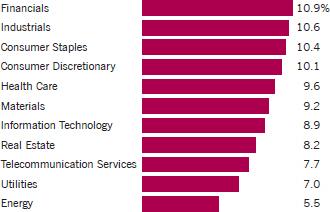

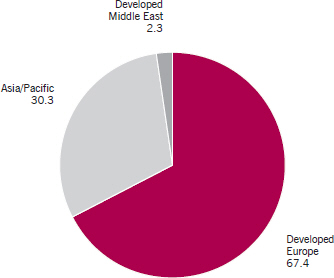

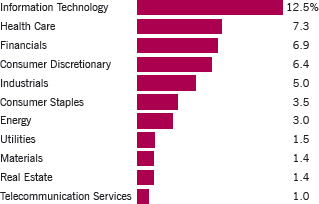

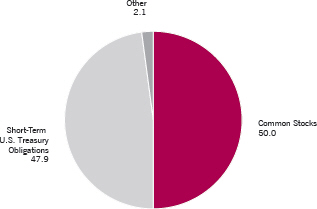

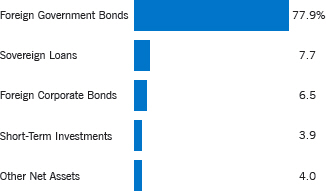

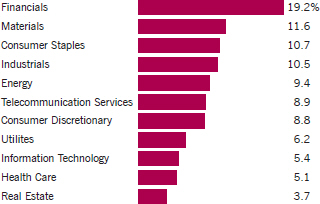

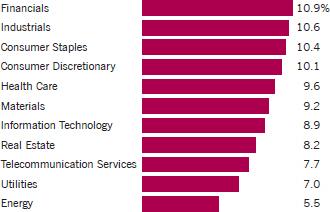

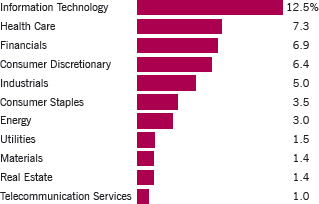

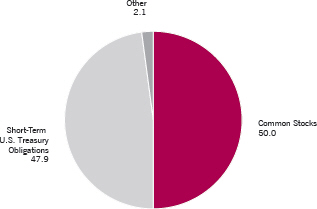

Asset Allocation (% of net assets)4

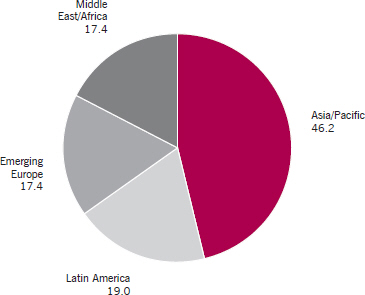

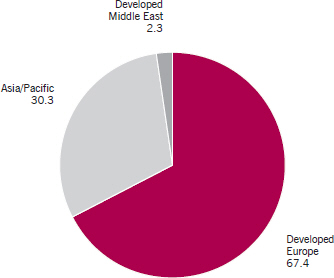

Country Allocation (% of net assets)5

| | | | | | | | | | |

Turkey | | | 6.0 | % | | Egypt | | | 2.6 | % |

| | | |

Argentina | | | 5.7 | | | Fiji | | | 2.6 | |

| | | |

Tanzania | | | 5.1 | | | United Arab Emirates | | | 2.6 | |

| | | |

Sri Lanka | | | 5.0 | | | Macedonia | | | 2.6 | |

| | | |

El Salvador | | | 4.9 | | | Romania | | | 2.5 | |

| | | |

Indonesia | | | 4.1 | | | Croatia | | | 2.5 | |

| | | |

Honduras | | | 4.0 | | | Barbados | | | 2.5 | |

| | | |

Lithuania | | | 3.0 | | | Albania | | | 2.5 | |

| | | |

Dominican Republic | | | 2.9 | | | Colombia | | | 2.4 | |

| | | |

Georgia | | | 2.7 | | | Saudi Arabia | | | 2.4 | |

| | | |

Angola | | | 2.7 | | | Tunisia | | | 2.4 | |

| | | |

Armenia | | | 2.6 | | | India | | | 2.4 | |

| | | |

Bahamas | | | 2.6 | | | China | | | 2.3 | |

| | | |

Nigeria | | | 2.6 | | | Vietnam | | | 1.8 | |

| | | |

Serbia | | | 2.6 | | | Brazil | | | 1.5 | |

See Endnotes and Additional Disclosures in this report.

Past performance is no guarantee of future results. Returns are historical and are calculated by determining the percentage change in net asset value (NAV) or offering price (as applicable) with all distributions reinvested. Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Performance less than or equal to one year is cumulative. Performance is for the stated time period only; due to market volatility, the Fund’s current performance may be lower or higher than quoted. Returns are before taxes unless otherwise noted. For performance as of the most recent month-end, please refer to eatonvance.com.

Eaton Vance

Emerging Markets Debt Fund

July 31, 2018

Endnotes and Additional Disclosures

| 1 | JPMorgan Emerging Market Bond Index (EMBI) Global Diversified is a market-cap weighted index that measures USD-denominated Brady Bonds, Eurobonds, and traded loans issued by sovereign entities. Unless otherwise stated, index returns do not reflect the effect of any applicable sales charges, commissions, expenses, taxes or leverage, as applicable. It is not possible to invest directly in an index. |

| 2 | Class I shares are offered at net asset value (NAV). Cumulative Total Returns are historical and are calculated by determining the percentage change in NAV with all distributions reinvested. Unless otherwise stated, performance does not reflect the deduction of taxes on Fund distributions or redemptions of Fund shares. Performance since inception for an index, if presented, is the performance since the Fund’s or oldest share class’ inception, as applicable. |

| 3 | Source: Fund prospectus. Net expense ratio reflects a contractual expense reimbursement that continues through 5/31/19. Without the reimbursement, performance would have been lower. The expense ratios for the current reporting period can be found in the Financial Highlights section of this report. |

| 4 | Other Net Assets represents other assets less liabilities and includes any investment type that represents less than 1% of net assets. |

| 5 | Excludes cash and cash equivalents. |

| | Fund profile subject to change due to active management. |

Eaton Vance

Emerging Markets Debt Fund

July 31, 2018

Fund Expenses

Example: As a Fund shareholder, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchases and redemption fees (if applicable); and (2) ongoing costs, including management fees and other Fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of Fund investing and to compare these costs with the ongoing costs of investing in other mutual funds. The actual expense Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period (May 1, 2018 – July 31, 2018). The hypothetical expense Example is based on an investment of $1,000 invested for the one-half year period (February 1, 2018 – July 31, 2018).

Actual Expenses: The first section of the table below provides information about actual account values and actual expenses. You may use the information in this section, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first section under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes: The second section of the table below provides information about hypothetical account values and hypothetical expenses based on the actual Fund expense ratio and an assumed rate of return of 5% per year (before expenses), which is not the actual Fund return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in your Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads) or redemption fees (if applicable). Therefore, the second section of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would be higher.

| | | | | | | | | | | | | | | | |

| | | Beginning

Account Value

(5/1/18) | | | Ending

Account Value

(7/31/18) | | | Expenses Paid

During Period

(5/1/18 – 7/31/18) | | | Annualized

Expense

Ratio | |

| | | |

Actual* | | | | | | | | | | | | | |

Class I | | $ | 1,000.00 | | | $ | 987.40 | | | $ | 2.13 | *** | | | 0.85 | % |

| * | The Fund had not commenced operations on February 1, 2018. Actual expenses are equal to the Fund’s annualized expense ratio for the indicated Class, multiplied by the average account value over the period, multiplied by 92/365 (to reflect the period from commencement of operations on May 1, 2018 to July 31, 2018). The Example assumes that the $1,000 was invested at the net asset value per share determined at the opening of business on May 1, 2018. |

| | | | | | | | | | | | | | | | |

| | | Beginning

Account Value

(2/1/18) | | | Ending

Account Value

(7/31/18) | | | Expenses Paid

During Period

(2/1/18 – 7/31/18) | | | Annualized

Expense

Ratio | |

| | | |

Hypothetical** | | | | | | | | | | | | | |

(5% return per year before expenses) | | | | | | | | | | | | | |

Class I | | $ | 1,000.00 | | | $ | 1,020.60 | | | $ | 4.26 | *** | | | 0.85 | % |

| ** | Hypothetical expenses are equal to the Fund’s annualized expense ratio for the indicated Class, multiplied by the average account value over the period, multiplied by 181/365 (to reflect the one-half year period). The Example assumes that the $1,000 was invested at the net asset value per share determined at the opening of business on May 1, 2018. |

| *** | Absent an allocation of certain expenses to an affiliate, expenses would be higher. |

Eaton Vance

Emerging Markets Debt Fund

July 31, 2018

Portfolio of Investments (Unaudited)

| | | | | | | | | | |

| Foreign Government Bonds — 77.9% | |

| Security | | | | Principal

Amount

(000’s omitted) | | | Value | |

|

| Albania — 2.5% | |

Republic of Albania, 5.75%, 11/12/20(1) | | EUR | | | 150 | | | $ | 192,763 | |

Total Albania | | | $ | 192,763 | |

|

| Angola — 2.7% | |

Republic of Angola, 8.25%, 5/9/28(1) | | USD | | | 200 | | | $ | 208,102 | |

Total Angola | | | $ | 208,102 | |

|

| Argentina — 5.7% | |

Republic of Argentina, 6.25%, 11/9/47 | | EUR | | | 220 | | | $ | 210,452 | |

Republic of Argentina, 6.625%, 7/6/28 | | USD | | | 270 | | | | 239,153 | |

Total Argentina | | | $ | 449,605 | |

|

| Armenia — 2.6% | |

Republic of Armenia, 6.00%, 9/30/20(1) | | USD | | | 200 | | | $ | 206,278 | |

Total Armenia | | | $ | 206,278 | |

|

| Bahamas — 2.6% | |

Commonwealth of Bahamas, 5.75%, 1/16/24(1) | | USD | | | 200 | | | $ | 204,500 | |

Total Bahamas | | | $ | 204,500 | |

|

| Barbados — 2.5% | |

Government of Barbados, 7.25%, 12/15/21(1)(2) | | USD | | | 350 | | | $ | 192,920 | |

Total Barbados | | | $ | 192,920 | |

|

| Brazil — 1.5% | |

Federative Republic of Brazil, 8.875%, 4/15/24 | | USD | | | 100 | | | $ | 121,450 | |

Total Brazil | | | $ | 121,450 | |

|

| Colombia — 2.4% | |

Republic of Colombia, 2.625%, 3/15/23 | | USD | | | 200 | | | $ | 191,375 | |

Total Colombia | | | $ | 191,375 | |

|

| Croatia — 2.5% | |

Croatia, 3.875%, 5/30/22(1) | | EUR | | | 150 | | | $ | 195,988 | |

Total Croatia | | | $ | 195,988 | |

|

| Dominican Republic — 2.9% | |

Dominican Republic, 8.625%, 4/20/27(1) | | USD | | | 200 | | | $ | 227,500 | |

Total Dominican Republic | | | $ | 227,500 | |

| | | | | | | | | | |

| Security | | | | Principal

Amount

(000’s omitted) | | | Value | |

|

| Egypt — 2.6% | |

Arab Republic of Egypt, 6.125%, 1/31/22(1) | | USD | | | 200 | | | $ | 203,280 | |

Total Egypt | | | $ | 203,280 | |

|

| El Salvador — 4.9% | |

Republic of El Salvador, 7.75%, 1/24/23(1) | | USD | | | 365 | | | $ | 387,670 | |

Total El Salvador | | | $ | 387,670 | |

|

| Fiji — 2.6% | |

Republic of Fiji, 6.625%, 10/2/20(1) | | USD | | | 200 | | | $ | 203,038 | |

Total Fiji | | | $ | 203,038 | |

|

| Georgia — 2.7% | |

Republic of Georgia, 6.875%, 4/12/21(1) | | USD | | | 200 | | | $ | 213,874 | |

Total Georgia | | | $ | 213,874 | |

|

| Honduras — 4.0% | |

Republic of Honduras, 8.75%, 12/16/20(1) | | USD | | | 285 | | | $ | 312,562 | |

Total Honduras | | | $ | 312,562 | |

|

| Indonesia — 4.1% | |

Republic of Indonesia, 3.70%, 1/8/22(1) | | USD | | | 320 | | | $ | 319,431 | |

Total Indonesia | | | $ | 319,431 | |

|

| Lithuania — 3.0% | |

Republic of Lithuania, 7.375%, 2/11/20(1) | | USD | | | 220 | | | $ | 234,880 | |

Total Lithuania | | | $ | 234,880 | |

|

| Macedonia — 2.6% | |

Republic of Macedonia, 2.75%, 1/18/25(1) | | EUR | | | 170 | | | $ | 200,001 | |

Total Macedonia | | | $ | 200,001 | |

|

| Romania — 2.5% | |

Romania, 6.75%, 2/7/22(1) | | USD | | | 180 | | | $ | 197,710 | |

Total Romania | | | $ | 197,710 | |

|

| Saudi Arabia — 2.4% | |

Saudi International Bond, 3.25%, 10/26/26(1) | | USD | | | 200 | | | $ | 188,990 | |

Total Saudi Arabia | | | $ | 188,990 | |

|

| Serbia — 2.6% | |

Republic of Serbia, 4.875%, 2/25/20(1) | | USD | | | 200 | | | $ | 203,855 | |

Total Serbia | | | $ | 203,855 | |

| | | | |

| | 5 | | See Notes to Financial Statements. |

Eaton Vance

Emerging Markets Debt Fund

July 31, 2018

Portfolio of Investments (Unaudited) — continued

| | | | | | | | | | |

| Security | | | | Principal

Amount

(000’s omitted) | | | Value | |

|

| Sri Lanka — 5.0% | |

Republic of Sri Lanka, 6.125%, 6/3/25(1) | | USD | | | 400 | | | $ | 389,319 | |

Total Sri Lanka | | | $ | 389,319 | |

|

| Tunisia — 2.4% | |

Banque Centrale de Tunisie International Bond, 5.625%, 2/17/24(1) | | EUR | | | 156 | | | $ | 185,577 | |

Total Tunisia | | | $ | 185,577 | |

|

| Turkey — 6.0% | |

Republic of Turkey, 6.125%, 10/24/28 | | USD | | | 215 | | | $ | 196,666 | |

Republic of Turkey, 6.25%, 9/26/22 | | USD | | | 275 | | | | 272,468 | |

Total Turkey | | | $ | 469,134 | |

|

| United Arab Emirates — 2.6% | |

Dubai DOF Sukuk, Ltd., 3.875%, 1/30/23(1) | | USD | | | 200 | | | $ | 201,238 | |

Total United Arab Emirates | | | $ | 201,238 | |

| |

Total Foreign Government Bonds

(identified cost $6,288,718) | | | $ | 6,101,040 | |

|

| Foreign Corporate Bonds — 6.5% | |

| Security | | | | Principal

Amount

(000’s omitted) | | | Value | |

|

| China — 2.3% | |

State Grid Overseas Investment 2016, Ltd., 2.875%, 5/18/26(1) | | USD | | | 200 | | | $ | 184,105 | |

Total China | | | $ | 184,105 | |

|

| India — 2.4% | |

Export-Import Bank of India, 3.375%, 8/5/26(1) | | USD | | | 200 | | | $ | 184,534 | |

Total India | | | $ | 184,534 | |

|

| Vietnam — 1.8% | |

Debt and Asset Trading Corp., 1.00%, 10/10/25(1) | | USD | | | 200 | | | $ | 139,500 | |

Total Vietnam | | | $ | 139,500 | |

| |

Total Foreign Corporate Bonds

(identified cost $512,816) | | | $ | 508,139 | |

| | | | | | | | | | |

| Sovereign Loans — 7.7% | |

| Borrower | | | | Principal

Amount

(000’s omitted) | | | Value | |

|

| Nigeria — 2.6% | |

Bank of Industry Limited, Term Loan, 8.31%, (3 mo. USD LIBOR + 6.00%), Maturing May 21, 2021(3)(4) | | USD | | | 200 | | | $ | 203,953 | |

Total Nigeria | | | $ | 203,953 | |

|

| Tanzania — 5.1% | |

Government of the United Republic of Tanzania, Term Loan, 7.53%, (6 mo. USD LIBOR + 5.20%), Maturing May 23, 2023(3)(4) | | USD | | | 400 | | | $ | 402,712 | |

Total Tanzania | | | $ | 402,712 | |

| |

Total Sovereign Loans

(identified cost $595,588) | | | $ | 606,665 | |

|

| Short-Term Investments — 3.9% | |

| Description | | | | Units | | | Value | |

Eaton Vance Cash Reserves Fund, LLC, 2.16%(5) | | | 304,315 | | | $ | 304,315 | |

| |

Total Short-Term Investments

(identified cost $304,332) | | | $ | 304,315 | |

| |

Total Investments — 96.0%

(identified cost $7,701,454) | | | $ | 7,520,159 | |

| |

Other Assets, Less Liabilities — 4.0% | | | $ | 316,354 | |

| |

Net Assets — 100.0% | | | $ | 7,836,513 | |

The percentage shown for each investment category in the Portfolio of Investments is based on net assets.

| (1) | Security exempt from registration under Regulation S of the Securities Act of 1933, which exempts from registration securities offered and sold outside the United States. Security may not be offered or sold in the United States except pursuant to an exemption from, or in a transaction not subject to, the registration requirements of the Securities Act of 1933. At July 31, 2018, the aggregate value of these securities is $5,377,615 or 68.6% of the Fund’s net assets. |

| (2) | Issuer is in default with respect to interest payments. |

| (3) | Loan is subject to scheduled mandatory prepayments. Maturity date shown reflects the final maturity date. |

| (4) | Variable rate security. The stated interest rate represents the rate in effect at July 31, 2018. |

| (5) | Affiliated investment company, available to Eaton Vance portfolios and funds, which invests in high quality, U.S. dollar denominated money market instruments. The rate shown is the annualized seven-day yield as of July 31, 2018. |

| | | | |

| | 6 | | See Notes to Financial Statements. |

Eaton Vance

Emerging Markets Debt Fund

July 31, 2018

Portfolio of Investments (Unaudited) — continued

| | | | | | | | | | | | | | | | | | | | | | | | |

| Forward Foreign Currency Exchange Contracts | |

| | | | | |

| Currency Purchased | | | Currency Sold | | | Counterparty | | Settlement

Date | | | Unrealized

Appreciation | | | Unrealized

(Depreciation) | |

| | | | | | | |

| USD | | | 208,279 | | | EUR | | | 172,574 | | | Standard Chartered Bank | | | 8/6/18 | | | $ | 6,422 | | | $ | — | |

| USD | | | 108,646 | | | EUR | | | 92,507 | | | Standard Chartered Bank | | | 10/30/18 | | | | — | | | | (255 | ) |

| USD | | | 186,876 | | | EUR | | | 159,116 | | | Standard Chartered Bank | | | 10/30/18 | | | | — | | | | (439 | ) |

| USD | | | 198,623 | | | EUR | | | 169,119 | | | Standard Chartered Bank | | | 10/30/18 | | | | — | | | | (467 | ) |

| USD | | | 200,655 | | | EUR | | | 170,848 | | | Standard Chartered Bank | | | 10/30/18 | | | | — | | | | (472 | ) |

| USD | | | 114,911 | | | EUR | | | 97,161 | | | Barclays Bank PLC | | | 11/15/18 | | | | 378 | | | | — | |

| | | | | | | |

| | | | | | | | | | | | | | | | | | | $ | 6,800 | | | $ | (1,633 | ) |

| | | | | | | | | | | | | | | | | | | | |

| Futures Contracts | |

| | | | | |

| Description | | Number of

Contracts | | | Position | | | Expiration

Month/Year | | | Notional

Amount | | | Value/Net

Unrealized

Depreciation | |

| | | | | |

Interest Rate Futures | | | | | | | | | | | | | | | | | | | | |

| U.S. 5-Year Treasury Note | | | 10 | | | | Long | | | | Sep-18 | | | $ | 1,131,250 | | | $ | (786 | ) |

| U.S. 10-Year Treasury Note | | | 12 | | | | Long | | | | Sep-18 | | | | 1,433,063 | | | | (941 | ) |

| | | | | |

| | | | | | | | | | | | | | | | | | | $ | (1,727 | ) |

| | | | | | | | | | | | | | | | | | |

| Centrally Cleared Interest Rate Swaps | |

| | | | | | |

| Counterparty | | Notional

Amount

(000’s omitted) | | | Fund

Pays/Receives

Floating Rate | | Floating Rate | | Annual

Fixed Rate | | Termination

Date | | Value/Net

Unrealized

Appreciation

(Depreciation) | |

| | | | | | | |

| LCH.Clearnet | | EUR | | | 130 | | | Receives | | 6-month Euro Interbank Offered Rate (pays semi-annually) | | 0.36%

(pays annually) | | 5/8/23 | | $ | (701 | ) |

| LCH.Clearnet | | EUR | | | 165 | | | Receives | | 6-month Euro Interbank Offered Rate (pays semi-annually) | | 0.37%

(pays annually) | | 5/9/23 | | | (935 | ) |

| LCH.Clearnet | | EUR | | | 90 | | | Receives | | 6-month Euro Interbank Offered Rate (pays semi-annually) | | 0.40%

(pays annually) | | 5/15/23 | | | (620 | ) |

| LCH.Clearnet | | EUR | | | 52 | | | Receives | | 6-month Euro Interbank Offered Rate (pays semi-annually) | | 1.60%

(pays annually)(1) | | 5/18/48 | | | (25 | ) |

| LCH.Clearnet | | EUR | | | 50 | | | Receives | | 6-month Euro Interbank Offered Rate (pays semi-annually) | | 1.46%

(pays annually) | | 5/31/48 | | | 676 | |

| LCH.Clearnet | | USD | | | 213 | | | Receives | | 3-month USD-LIBOR-BBA (pays quarterly) | | 3.11%

(pays semi-annually) | | 5/17/28 | | | (1,865 | ) |

| | | | | | | |

| | | | | | | | | | | | | | | | | $ | (3,470 | ) |

| (1) | Upfront payment is exchanged with the counterparty as a result of the standardized trading coupon. |

| | | | |

| | 7 | | See Notes to Financial Statements. |

Eaton Vance

Emerging Markets Debt Fund

July 31, 2018

Portfolio of Investments (Unaudited) — continued

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Centrally Cleared Credit Default Swaps — Sell Protection | |

| | | | | | | | |

| Reference Entity | | Counterparty | | Notional Amount*

(000’s omitted) | | | Contract

Annual

Fixed Rate** | | | Termination

Date | | | Current

Market

Annual

Fixed Rate*** | | | Market

Value | | | Unamortized

Upfront

Payments | | | Net Unrealized

Appreciation

(Depreciation) | |

| | | | | | | | |

| Brazil | | ICE Clear Credit | | $ | 200 | | |

| 1.00%

(pays quarterly)(1) |

| | | 6/20/23 | | | | 2.13 | % | | $ | (9,642 | ) | | $ | 7,327 | | | $ | (2,315 | ) |

| Mexico | | ICE Clear Credit | | | 200 | | |

| 1.00%

(pays quarterly)(1) |

| | | 6/20/23 | | | | 1.14 | | | | (1,055 | ) | | | 1,331 | | | | 276 | |

| Russia | | ICE Clear Credit | | | 200 | | |

| 1.00%

(pays quarterly)(1) |

| | | 6/20/23 | | | | 1.31 | | | | (2,569 | ) | | | 3,387 | | | | 818 | |

| | | | | | | | |

Total | | | | $ | 600 | | | | | | | | | | | | | | | $ | (13,266 | ) | | $ | 12,045 | | | $ | (1,221 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Credit Default Swaps — Sell Protection | |

| | | | | | | | |

| Reference Entity | | Counterparty | | Notional Amount*

(000’s omitted) | | | Contract

Annual

Fixed Rate** | | | Termination Date | | | Current

Market

Annual

Fixed Rate*** | | | Market

Value | | | Unamortized

Upfront

Payments

Received | | | Net Unrealized

Depreciation | |

| | | | | | | | |

| Turkey | | Citibank, N.A. | | $ | 210 | | |

| 1.00%

(pays quarterly)(1) |

| | | 6/20/23 | | | | 3.21 | % | | $ | (19,238 | ) | | $ | 14,487 | | | $ | (4,751 | ) |

| | | | | | | | |

Total | | | | $ | 210 | | | | | | | | | | | | | | | $ | (19,238 | ) | | $ | 14,487 | | | $ | (4,751 | ) |

| * | If the Fund is the seller of credit protection, the notional amount is the maximum potential amount of future payments the Fund could be required to make if a credit event, as defined in the credit default swap agreement, were to occur. At July 31, 2018, such maximum potential amount for all open credit default swaps in which the Fund is the seller was $810,000. |

| ** | The contract annual fixed rate represents the fixed rate of interest received by the Fund (as a seller of protection) on the notional amount of the credit default swap contract. |

| *** | Current market annual fixed rates, utilized in determining the net unrealized appreciation or depreciation as of period end, serve as an indicator of the market’s perception of the current status of the payment/performance risk associated with the credit derivative. The current market annual fixed rate of a particular reference entity reflects the cost, as quoted by the pricing vendor, of selling protection against default of that entity as of period end and may include upfront payments required to be made to enter into the agreement. The higher the fixed rate, the greater the market perceived risk of a credit event involving the reference entity. A rate identified as “Defaulted” indicates a credit event has occurred for the reference entity. |

| (1) | Upfront payment is exchanged with the counterparty as a result of the standardized trading coupon. |

Abbreviations:

| | | | |

| LIBOR | | – | | London Interbank Offered Rate |

Currency Abbreviations:

| | | | |

| EUR | | – | | Euro |

| USD | | – | | United States Dollar |

| | | | |

| | 8 | | See Notes to Financial Statements. |

Eaton Vance

Emerging Markets Debt Fund

July 31, 2018

Statement of Assets and Liabilities (Unaudited)

| | | | |

| Assets | | July 31, 2018 | |

Unaffiliated investments, at value (identified cost, $7,397,122) | | $ | 7,215,844 | |

Affiliated investment, at value (identified cost, $304,332) | | | 304,315 | |

Deposits for derivatives collateral — | | | | |

Financial futures contracts | | | 19,400 | |

Centrally cleared swap contracts | | | 206,969 | |

Foreign currency, at value (identified cost, $12,154) | | | 12,135 | |

Interest receivable | | | 118,189 | |

Dividends receivable from affiliated investment | | | 394 | |

Receivable for variation margin on open financial futures contracts | | | 48,183 | |

Receivable for open forward foreign currency exchange contracts | | | 6,800 | |

Receivable from affiliate | | | 8,040 | |

Total assets | | $ | 7,940,269 | |

| |

| Liabilities | | | | |

Payable for variation margin on open centrally cleared swap contracts | | $ | 3,886 | |

Payable for open forward foreign currency exchange contracts | | | 1,633 | |

Payable for open swap contracts | | | 4,751 | |

Premium received on open non-centrally cleared swap contracts | | | 14,487 | |

Due to custodian | | | 32,657 | |

Payable to affiliate: | | | | |

Investment adviser and administration fee | | | 4,309 | |

Accrued expenses | | | 42,033 | |

Total liabilities | | $ | 103,756 | |

Net Assets | | $ | 7,836,513 | |

| |

| Sources of Net Assets | | | | |

Paid-in capital | | $ | 8,000,000 | |

Accumulated undistributed net investment income | | | 397 | |

Accumulated net realized gain | | | 23,555 | |

Net unrealized depreciation | | | (187,439 | ) |

Total | | $ | 7,836,513 | |

| |

| Class I Shares | | | | |

Net Assets | | $ | 7,836,513 | |

Shares Outstanding | | | 800,000 | |

Net Asset Value, Offering Price and Redemption Price Per Share | | | | |

(net assets ÷ shares of beneficial interest outstanding) | | $ | 9.80 | |

| | | | |

| | 9 | | See Notes to Financial Statements. |

Eaton Vance

Emerging Markets Debt Fund

July 31, 2018

Statement of Operations (Unaudited)

| | | | |

| Investment Income | | Period Ended

July 31, 2018(1) | |

Interest | | $ | 71,821 | |

Dividends from affiliated investment | | | 4,298 | |

Total investment income | | $ | 76,119 | |

| |

| Expenses | | | | |

Investment adviser and administration fee | | $ | 12,734 | |

Trustees’ fees and expenses | | | 417 | |

Custodian fee | | | 8,273 | |

Transfer and dividend disbursing agent fees | | | 896 | |

Legal and accounting services | | | 18,281 | |

Printing and postage | | | 3,014 | |

Registration fees | | | 11,911 | |

Miscellaneous | | | 2,664 | |

Total expenses | | $ | 58,190 | |

Deduct — | | | | |

Allocation of expenses to affiliate | | $ | 41,508 | |

Total expense reductions | | $ | 41,508 | |

| |

Net expenses | | $ | 16,682 | |

| |

Net investment income | | $ | 59,437 | |

| |

| Realized and Unrealized Gain (Loss) | | | | |

Net realized gain (loss) — | | | | |

Investment transactions | | $ | 961 | |

Investment transactions — affiliated investment | | | 768 | |

Financial futures contracts | | | 3,377 | |

Swap contracts | | | 2,031 | |

Foreign currency transactions | | | (677 | ) |

Forward foreign currency exchange contracts | | | 17,095 | |

Net realized gain | | $ | 23,555 | |

Change in unrealized appreciation (depreciation) — | | | | |

Investments | | $ | (181,278 | ) |

Investments — affiliated investment | | | (17 | ) |

Financial futures contracts | | | (1,727 | ) |

Swap contracts | | | (9,442 | ) |

Foreign currency | | | (142 | ) |

Forward foreign currency exchange contracts | | | 5,167 | |

Net change in unrealized appreciation (depreciation) | | $ | (187,439 | ) |

| |

Net realized and unrealized loss | | $ | (163,884 | ) |

| |

Net decrease in net assets from operations | | $ | (104,447 | ) |

| (1) | For the period from the start of business, May 1, 2018, to July 31, 2018. |

| | | | |

| | 10 | | See Notes to Financial Statements. |

Eaton Vance

Emerging Markets Debt Fund

July 31, 2018

Statement of Changes in Net Assets

| | | | |

| Increase (Decrease) in Net Assets | | Period Ended July 31, 2018 (Unaudited)(1) | |

From operations — | | | | |

Net investment income | | $ | 59,437 | |

Net realized gain | | | 23,555 | |

Net change in unrealized appreciation (depreciation) | | | (187,439 | ) |

Net decrease in net assets from operations | | $ | (104,447 | ) |

Distributions to shareholders — | | | | |

From net investment income | | $ | (59,040 | ) |

Total distributions to shareholders | | $ | (59,040 | ) |

Transactions in shares of beneficial interest — | | | | |

Proceeds from sale of shares | | $ | 8,000,000 | |

Net increase in net assets from Fund share transactions | | $ | 8,000,000 | |

| |

Net increase in net assets | | $ | 7,836,513 | |

| |

| Net Assets | | | | |

At beginning of period | | $ | — | |

At end of period | | $ | 7,836,513 | |

| |

Accumulated undistributed net investment income

included in net assets | | | | |

At end of period | | $ | 397 | |

| (1) | For the period from the start of business, May 1, 2018, to July 31, 2018. |

| | | | |

| | 11 | | See Notes to Financial Statements. |

Eaton Vance

Emerging Markets Debt Fund

July 31, 2018

Financial Highlights

| | | | |

| | | Class I | |

| | | Period Ended July 31, 2018 (Unaudited)(1) | |

Net asset value — Beginning of period | | $ | 10.000 | |

| |

| Income (Loss) From Operations | | | | |

Net investment income(2) | | $ | 0.074 | |

Net realized and unrealized loss | | | (0.200 | ) |

| |

Total loss from operations | | $ | (0.126 | ) |

| |

| Less Distributions | | | | |

From net investment income | | $ | (0.074 | ) |

| |

Total distributions | | $ | (0.074 | ) |

| |

Net asset value — End of period | | $ | 9.800 | |

| |

Total Return(3)(4) | | | (1.26 | )%(5) |

| |

| Ratios/Supplemental Data | | | | |

Net assets, end of period (000’s omitted) | | $ | 7,837 | |

Ratios (as a percentage of average daily net assets): | | | | |

Expenses(4) | | | 0.85 | %(6) |

Net investment income | | | 3.03 | %(6) |

Portfolio Turnover | | | 11 | %(5) |

| (1) | For the period from the start of business, May 1, 2018, to July 31, 2018. |

| (2) | Computed using average shares outstanding. |

| (3) | Returns are historical and are calculated by determining the percentage change in net asset value with all distributions reinvested. |

| (4) | The investment adviser and administrator reimbursed certain operating expenses (equal to 2.12% of average daily net assets for the period ended July 31, 2018). Absent this reimbursement, total return would be lower. |

| | | | |

| | 12 | | See Notes to Financial Statements. |

Eaton Vance

Emerging Markets Debt Fund

July 31, 2018

Notes to Financial Statements (Unaudited)

1 Significant Accounting Policies

Eaton Vance Emerging Markets Debt Fund (the Fund) is a non-diversified series of Eaton Vance Mutual Funds Trust (the Trust). The Trust is a Massachusetts business trust registered under the Investment Company Act of 1940, as amended (the 1940 Act), as an open-end management investment company. The Fund commenced operations on May 1, 2018. The Fund’s investment objective is total return. The Fund offers Class I shares, which are sold at net asset value and are not subject to a sales charge.

The following is a summary of significant accounting policies of the Fund. The policies are in conformity with accounting principles generally accepted in the United States of America (U.S. GAAP). The Fund is an investment company and follows accounting and reporting guidance in the Financial Accounting Standards Board (FASB) Accounting Standards Codification Topic 946.

A Investment Valuation — The following methodologies are used to determine the market value or fair value of investments.

Debt Obligations. Debt obligations are generally valued on the basis of valuations provided by third party pricing services, as derived from such services’ pricing models. Inputs to the models may include, but are not limited to, reported trades, executable bid and asked prices, broker/dealer quotations, prices or yields of securities with similar characteristics, interest rates, anticipated prepayments, benchmark curves or information pertaining to the issuer, as well as industry and economic events. The pricing services may use a matrix approach, which considers information regarding securities with similar characteristics to determine the valuation for a security. Short-term obligations purchased with a remaining maturity of sixty days or less for which a valuation from a third party pricing service is not readily available may be valued at amortized cost, which approximates fair value.

Derivatives. Financial futures contracts are valued at the closing settlement price established by the board of trade or exchange on which they are traded. Forward foreign currency exchange contracts are generally valued at the mean of the average bid and average asked prices that are reported by currency dealers to a third party pricing service at the valuation time. Such third party pricing service valuations are supplied for specific settlement periods and the Fund’s forward foreign currency exchange contracts are valued at an interpolated rate between the closest preceding and subsequent settlement period reported by the third party pricing service. Swaps are normally valued using valuations provided by a third party pricing service. Such pricing service valuations are based on the present value of fixed and projected floating rate cash flows over the term of the swap contract, and in the case of credit default swaps, based on credit spread quotations obtained from broker/dealers and expected default recovery rates determined by the pricing service using proprietary models. Future cash flows on swaps are discounted to their present value using swap rates provided by electronic data services or by broker/dealers.

Foreign Securities and Currencies. Foreign securities and currencies are valued in U.S. dollars, based on foreign currency exchange rate quotations supplied by a third party pricing service. The pricing service uses a proprietary model to determine the exchange rate. Inputs to the model include reported trades and implied bid/ask spreads.

Affiliated Fund. The Fund may invest in Eaton Vance Cash Reserves Fund, LLC (Cash Reserves Fund), an affiliated investment company managed by Eaton Vance Management (EVM). While Cash Reserves Fund is not a registered money market mutual fund, it conducts all of its investment activities in accordance with the requirements of Rule 2a-7 under the 1940 Act. Investments in Cash Reserves Fund are valued at the closing net asset value per unit on the valuation day. Cash Reserves Fund generally values its investment securities based on available market quotations provided by a third party pricing service.

Fair Valuation. Investments for which valuations or market quotations are not readily available or are deemed unreliable are valued at fair value using methods determined in good faith by or at the direction of the Trustees of the Fund in a manner that fairly reflects the security’s value, or the amount that the Fund might reasonably expect to receive for the security upon its current sale in the ordinary course. Each such determination is based on a consideration of relevant factors, which are likely to vary from one pricing context to another. These factors may include, but are not limited to, the type of security, the existence of any contractual restrictions on the security’s disposition, the price and extent of public trading in similar securities of the issuer or of comparable companies or entities, quotations or relevant information obtained from broker/dealers or other market participants, information obtained from the issuer, analysts, and/or the appropriate stock exchange (for exchange-traded securities), an analysis of the company’s or entity’s financial condition, and an evaluation of the forces that influence the issuer and the market(s) in which the security is purchased and sold.

B Investment Transactions — Investment transactions for financial statement purposes are accounted for on a trade date basis. Realized gains and losses on investments sold are determined on the basis of identified cost.

C Income — Interest income is recorded on the basis of interest accrued, adjusted for amortization of premium or accretion of discount. Dividend income is recorded on the ex-dividend date for dividends received in cash and/or securities.

D Federal Taxes — The Fund’s policy is to comply with the provisions of the Internal Revenue Code applicable to regulated investment companies and to distribute to shareholders each year substantially all of its net investment income, and all or substantially all of its net realized capital gains. Accordingly, no provision for federal income or excise tax is necessary.

As of July 31, 2018, the Fund had no uncertain tax positions that would require financial statement recognition, de-recognition, or disclosure. The Fund files a U.S. federal income tax return annually after its fiscal year-end, which is subject to examination by the Internal Revenue Service for a period of three years from the date of filing.

Eaton Vance

Emerging Markets Debt Fund

July 31, 2018

Notes to Financial Statements (Unaudited) — continued

E Foreign Currency Translation — Investment valuations, other assets, and liabilities initially expressed in foreign currencies are translated each business day into U.S. dollars based upon current exchange rates. Purchases and sales of foreign investment securities and income and expenses denominated in foreign currencies are translated into U.S. dollars based upon currency exchange rates in effect on the respective dates of such transactions. Recognized gains or losses on investment transactions attributable to changes in foreign currency exchange rates are recorded for financial statement purposes as net realized gains and losses on investments. That portion of unrealized gains and losses on investments that results from fluctuations in foreign currency exchange rates is not separately disclosed.

F Use of Estimates — The preparation of the financial statements in conformity with U.S. GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities at the date of the financial statements and the reported amounts of income and expense during the reporting period. Actual results could differ from those estimates.

G Indemnifications — Under the Trust’s organizational documents, its officers and Trustees may be indemnified against certain liabilities and expenses arising out of the performance of their duties to the Fund. Under Massachusetts law, if certain conditions prevail, shareholders of a Massachusetts business trust (such as the Trust) could be deemed to have personal liability for the obligations of the Trust. However, the Trust’s Declaration of Trust contains an express disclaimer of liability on the part of Fund shareholders and the By-laws provide that the Trust shall assume the defense on behalf of any Fund shareholders. Moreover, the By-laws also provide for indemnification out of Fund property of any shareholder held personally liable solely by reason of being or having been a shareholder for all loss or expense arising from such liability. Additionally, in the normal course of business, the Fund enters into agreements with service providers that may contain indemnification clauses. The Fund’s maximum exposure under these arrangements is unknown as this would involve future claims that may be made against the Fund that have not yet occurred.

H Financial Futures Contracts — Upon entering into a financial futures contract, the Fund is required to deposit with the broker, either in cash or securities, an amount equal to a certain percentage of the contract amount (initial margin). Subsequent payments, known as variation margin, are made or received by the Fund each business day, depending on the daily fluctuations in the value of the underlying security, and are recorded as unrealized gains or losses by the Fund. Gains (losses) are realized upon the expiration or closing of the financial futures contracts. Should market conditions change unexpectedly, the Fund may not achieve the anticipated benefits of the financial futures contracts and may realize a loss. Futures contracts have minimal counterparty risk as they are exchange traded and the clearinghouse for the exchange is substituted as the counterparty, guaranteeing counterparty performance.

I Forward Foreign Currency Exchange Contracts — The Fund may enter into forward foreign currency exchange contracts for the purchase or sale of a specific foreign currency at a fixed price on a future date. The forward foreign currency exchange contracts are adjusted by the daily exchange rate of the underlying currency and any gains or losses are recorded as unrealized until such time as the contracts have been closed. Risks may arise upon entering these contracts from the potential inability of counterparties to meet the terms of their contracts and from movements in the value of a foreign currency relative to the U.S. dollar.

J Interest Rate Swaps — Swap contracts are privately negotiated agreements between the Fund and a counterparty. Certain swap contracts may be centrally cleared (“centrally cleared swaps”), whereby all payments made or received by the Fund pursuant to the contract are with a central clearing party (CCP) rather than the original counterparty. The CCP guarantees the performance of the original parties to the contract. Upon entering into centrally cleared swaps, the Fund is required to deposit with the CCP, either in cash or securities, an amount of initial margin determined by the CCP, which is subject to adjustment.

Pursuant to interest rate swap agreements, the Fund either makes floating-rate payments to the counterparty (or CCP in the case of centrally cleared swaps) based on a benchmark interest rate in exchange for fixed-rate payments or the Fund makes fixed-rate payments to the counterparty (or CCP in the case of a centrally cleared swap) in exchange for payments on a floating benchmark interest rate. Payments received or made are recorded as realized gains or losses. During the term of the outstanding swap agreement, changes in the underlying value of the swap are recorded as unrealized gains or losses. For centrally cleared swaps, the daily change in valuation is recorded as a receivable or payable for variation margin and settled in cash with the CCP daily. The value of the swap is determined by changes in the relationship between two rates of interest. The Fund is exposed to credit loss in the event of non-performance by the swap counterparty. In the case of centrally cleared swaps, counterparty risk is minimal due to protections provided by the CCP. Risk may also arise from movements in interest rates.

K Credit Default Swaps — When the Fund is the buyer of a credit default swap contract, the Fund is entitled to receive the par (or other agreed-upon) value of a referenced debt obligation (or basket of debt obligations) from the counterparty (or CCP in the case of a centrally cleared swap) to the contract if a credit event by a third party, such as a U.S. or foreign corporate issuer or sovereign issuer, on the debt obligation occurs. In return, the Fund pays the counterparty a periodic stream of payments over the term of the contract provided that no credit event has occurred. If no credit event occurs, the Fund would have spent the stream of payments and received no proceeds from the contract. When the Fund is the seller of a credit default swap contract, it receives the stream of payments, but is obligated to pay to the buyer of the protection an amount up to the notional amount of the swap and in certain instances take delivery of securities of the reference entity upon the occurrence of a credit event, as defined under the terms of that particular swap agreement. Credit events are contract specific but may include bankruptcy, failure to pay, restructuring, obligation acceleration and repudiation/moratorium. If the Fund is a seller of protection and a credit event occurs, the maximum potential amount of future payments that the Fund could be required to make would be an amount equal to the notional amount of the agreement. This potential amount would be partially offset by any recovery value of the respective referenced obligation, or net amount received from the settlement of a buy protection credit default swap agreement entered into by the

Eaton Vance

Emerging Markets Debt Fund

July 31, 2018

Notes to Financial Statements (Unaudited) — continued

Fund for the same referenced obligation. As the seller, the Fund may create economic leverage to its portfolio because, in addition to its total net assets, the Fund is subject to investment exposure on the notional amount of the swap. The interest fee paid or received on the swap contract, which is based on a specified interest rate on a fixed notional amount, is accrued daily as a component of unrealized appreciation (depreciation) and is recorded as realized gain upon receipt or realized loss upon payment. The Fund also records an increase or decrease to unrealized appreciation (depreciation) in an amount equal to the daily valuation. For centrally cleared swaps, the daily change in valuation is recorded as a receivable or payable for variation margin and settled in cash with the CCP daily. All upfront payments, if any, are amortized over the life of the swap contract as realized gains or losses. Those upfront payments that are paid or received, typically for non-centrally cleared swaps, are recorded as other assets or other liabilities, respectively, net of amortization. For financial reporting purposes, unamortized upfront payments, if any, are netted with unrealized appreciation or depreciation on swap contracts to determine the market value of swaps as presented in Notes 6 and 10. The Fund segregates assets in the form of cash or liquid securities in an amount equal to the notional amount of the credit default swaps of which it is the seller. The Fund segregates assets in the form of cash or liquid securities in an amount equal to any unrealized depreciation of the credit default swaps of which it is the buyer, marked-to-market on a daily basis. These transactions involve certain risks, including the risk that the seller may be unable to fulfill the transaction. In the case of centrally cleared swaps, counterparty risk is minimal due to protections provided by the CCP.

L Interim Financial Statements — The interim financial statements relating to July 31, 2018 and for the period then ended have not been audited by an independent registered public accounting firm, but in the opinion of the Fund’s management, reflect all adjustments, consisting only of normal recurring adjustments, necessary for the fair presentation of the financial statements.

2 Distributions to Shareholders and Income Tax Information

It is the present policy of the Fund to make monthly distributions of all or substantially all of its net investment income and to distribute annually all or substantially all of its net realized capital gains. Distributions to shareholders are recorded on the ex-dividend date. Shareholders may reinvest income and capital gain distributions in additional shares of the Fund at the net asset value as of the ex-dividend date or, at the election of the shareholder, receive distributions in cash. Distributions to shareholders are determined in accordance with income tax regulations, which may differ from U.S. GAAP. As required by U.S. GAAP, only distributions in excess of tax basis earnings and profits are reported in the financial statements as a return of capital. Permanent differences between book and tax accounting relating to distributions are reclassified to paid-in capital. For tax purposes, distributions from short-term capital gains are considered to be from ordinary income.

The cost and unrealized appreciation (depreciation) of investments, including open derivative contracts, of the Fund at July 31, 2018, as determined on a federal income tax basis, were as follows:

| | | | |

| |

Aggregate cost | | $ | 7,715,747 | |

| |

Gross unrealized appreciation | | $ | 33,406 | |

Gross unrealized depreciation | | | (234,996 | ) |

| |

Net unrealized depreciation | | $ | (201,590 | ) |

3 Investment Adviser and Administration Fee and Other Transactions with Affiliates

The investment adviser and administration fee is earned by EVM as compensation for investment advisory and administrative services rendered to the Fund. The fee is computed at an annual rate of 0.65% of the Fund’s average daily net assets up to $500 million and is payable monthly. On net assets of $500 million and over, the annual fee is reduced. For the period ended July 31, 2018, the investment adviser and administration fee amounted to $12,734 or 0.65% (annualized) of the Fund’s average daily net assets. The Fund invests its cash in Cash Reserves Fund. EVM does not currently receive a fee for advisory services provided to Cash Reserves Fund.

EVM has agreed to reimburse the Fund’s expenses to the extent that total annual operating expenses (relating to ordinary operating expenses only) exceed 0.85% of the Fund’s average daily net assets for Class I. This agreement may be changed or terminated after May 31, 2019. Pursuant to this agreement, EVM was allocated $41,508 of the Fund’s operating expenses for the period ended July 31, 2018.

EVM provides sub-transfer agency and related services to the Fund pursuant to a Sub-Transfer Agency Support Services Agreement. For the period ended July 31, 2018, EVM earned no fees from the Fund pursuant to such agreement.

Trustees and officers of the Fund who are members of EVM’s organization receive remuneration for their services to the Fund out of the investment adviser and administration fee. Trustees of the Fund who are not affiliated with EVM may elect to defer receipt of all or a percentage of their annual fees in accordance with the terms of the Trustees Deferred Compensation Plan. For the period ended July 31, 2018, no significant amounts have been deferred. Certain officers and Trustees of the Fund are officers of EVM.

Eaton Vance

Emerging Markets Debt Fund

July 31, 2018

Notes to Financial Statements (Unaudited) — continued

4 Purchases and Sales of Investments

Purchases and sales of investments, other than short-term obligations, aggregated $8,189,183 and $783,643, respectively, for the period ended July 31, 2018.

5 Shares of Beneficial Interest

The Trust’s Declaration of Trust permits the Trustees to issue an unlimited number of full and fractional shares of beneficial interest (without par value) in one or more series (such as the Fund). Transactions in Fund shares were as follows:

| | | | |

| | | Period Ended

July 31, 2018

(Unaudited)(1) | |

| |

Sales | | | 800,000 | |

| |

Net increase | | | 800,000 | |

| (1) | For the period from the start of business, May 1, 2018, to July 31, 2018. |

At July 31, 2018, EVM owned 100% of the outstanding shares of the Fund.

6 Financial Instruments

The Fund may trade in financial instruments with off-balance sheet risk in the normal course of its investing activities. These financial instruments may include forward foreign currency exchange contracts, financial futures contracts and swap contracts and may involve, to a varying degree, elements of risk in excess of the amounts recognized for financial statement purposes. The notional or contractual amounts of these instruments represent the investment the Fund has in particular classes of financial instruments and do not necessarily represent the amounts potentially subject to risk. The measurement of the risks associated with these instruments is meaningful only when all related and offsetting transactions are considered. A summary of obligations under these financial instruments at July 31, 2018 is included in the Portfolio of Investments. At July 31, 2018, the Fund had sufficient cash and/or securities to cover commitments under these contracts.

In the normal course of pursuing its investment objective, the Fund is subject to the following risks:

Credit Risk: The Fund enters into credit default swap contracts to enhance total return and/or as a substitute for the purchase or sale of securities.

Foreign Exchange Risk: The Fund engages in forward foreign currency exchange contracts to enhance total return and to seek to hedge against fluctuations in currency exchange rates.

Interest Rate Risk: The Fund utilizes various interest rate derivatives including interest rate futures contracts and interest rate swaps to enhance total return, to seek to hedge against fluctuations in interest rates, and/or to change the effective duration of its portfolio.

The Fund enters into over-the-counter (OTC) derivatives that may contain provisions whereby the counterparty may terminate the contract under certain conditions, including but not limited to a decline in the Fund’s net assets below a certain level over a certain period of time, which would trigger a payment by the Fund for those derivatives in a liability position. At July 31, 2018, the fair value of derivatives with credit-related contingent features in a net liability position was $20,871. At July 31, 2018, there were no assets pledged by the Fund for such liability.

The OTC derivatives in which the Fund invests are subject to the risk that the counterparty to the contract fails to perform its obligations under the contract. To mitigate this risk, the Fund has entered into an International Swaps and Derivatives Association, Inc. Master Agreement (“ISDA Master Agreement”) or similar agreement with substantially all its derivative counterparties. An ISDA Master Agreement is a bilateral agreement between the Fund and a counterparty that governs certain OTC derivatives and typically contains, among other things, set-off provisions in the event of a default and/or termination event as defined under the relevant ISDA Master Agreement. Under an ISDA Master Agreement, the Fund may, under certain circumstances, offset with the counterparty certain derivative financial instruments’ payables and/or receivables with collateral held and/or posted and create one single net payment. The provisions of the ISDA Master Agreement typically permit a single net payment in the event of default including the bankruptcy or insolvency of the counterparty. However, bankruptcy or insolvency laws of a particular jurisdiction may impose restrictions on or prohibitions against the right of offset in bankruptcy or insolvency. Certain ISDA Master Agreements allow counterparties to OTC derivatives to terminate derivative contracts prior to maturity in the event the Fund’s net assets decline by a stated percentage or the Fund fails to meet the terms of its ISDA Master Agreements, which would cause the counterparty to accelerate payment by the Fund of any net liability owed to it.

Eaton Vance

Emerging Markets Debt Fund

July 31, 2018

Notes to Financial Statements (Unaudited) — continued

The collateral requirements for derivatives traded under an ISDA Master Agreement are governed by a Credit Support Annex to the ISDA Master Agreement. Collateral requirements are determined at the close of business each day and are typically based on changes in market values for each transaction under an ISDA Master Agreement and netted into one amount for such agreement. Generally, the amount of collateral due from or to a counterparty is subject to a minimum transfer threshold amount before a transfer is required, which may vary by counterparty. Collateral pledged for the benefit of the Fund and/or counterparty is held in segregated accounts by the Fund’s custodian and cannot be sold, re-pledged, assigned or otherwise used while pledged. The portion of such collateral representing cash, if any, is reflected as deposits for derivatives collateral and, in the case of cash pledged by a counterparty for the benefit of the Fund, a corresponding liability on the Statement of Assets and Liabilities. Securities pledged by the Fund as collateral, if any, are identified as such in the Portfolio of Investments.

The fair value of open derivative instruments (not considered to be hedging instruments for accounting disclosure purposes) by risk exposure at July 31, 2018 was as follows:

| | | | | | | | | | | | | | | | |

| | | Fair Value | |

| Statement of Assets and Liabilities Caption | | Credit | | | Foreign

Exchange | | | Interest

Rate | | | Total | |

| | | | | | | | | | | | | | | | |

| | | | |

Net unrealized depreciation* | | $ | — | | | $ | — | | | $ | 676 | | | $ | 676 | |

Receivable for open forward foreign currency exchange contracts | | | — | | | | 6,800 | | | | — | | | | 6,800 | |

| | | | |

Total Asset Derivatives | | $ | — | | | $ | 6,800 | | | $ | 676 | | | $ | 7,476 | |

| | | | |

Derivatives not subject to master netting or similar agreements | | $ | — | | | $ | — | | | $ | 676 | | | $ | 676 | |

| | | | |

Total Asset Derivatives subject to master netting or similar agreements | | $ | — | | | $ | 6,800 | | | $ | — | | | $ | 6,800 | |

| | | | |

| | | Credit | | | Foreign

Exchange | | | Interest

Rate | | | Total | |

| | | | |

Net unrealized depreciation* | | $ | (13,266 | ) | | $ | — | | | $ | (5,873 | ) | | $ | (19,139 | ) |

Payable for open forward foreign currency exchange contracts | | | — | | | | (1,633 | ) | | | — | | | | (1,633 | ) |

Payable for open swap contracts; Premium received on open non-centrally cleared swap contracts | | | (19,238 | ) | | | — | | | | — | | | | (19,238 | ) |

| | | | |

Total Liability Derivatives | | $ | (32,504 | ) | | $ | (1,633 | ) | | $ | (5,873 | ) | | $ | (40,010 | ) |

| | | | |

Derivatives not subject to master netting or similar agreements | | $ | (13,266 | ) | | $ | — | | | $ | (5,873 | ) | | $ | (19,139 | ) |

| | | | |

Total Liability Derivatives subject to master netting or similar agreements | | $ | (19,238 | ) | | $ | (1,633 | ) | | $ | — | | | $ | (20,871 | ) |

| * | For futures contracts and centrally cleared swap contracts, amount represents value as shown in the Portfolio of Investments. Only the current day’s variation margin on open futures contracts and centrally cleared swap contracts is reported within the Statement of Assets and Liabilities as Receivable or Payable for variation margin on open financial futures contracts and centrally cleared swap contracts, as applicable. |

Eaton Vance

Emerging Markets Debt Fund

July 31, 2018

Notes to Financial Statements (Unaudited) — continued

The Fund’s derivative assets and liabilities at fair value by risk, which are reported gross in the Statement of Assets and Liabilities, are presented in the table above. The following tables present the Fund’s derivative assets and liabilities by counterparty, net of amounts available for offset under a master netting agreement and net of the related collateral received by the Fund for such assets and pledged by the Fund for such liabilities as of July 31, 2018.

| | | | | | | | | | | | | | | | | | | | |

| Counterparty | | Derivative

Assets Subject to

Master Netting

Agreement | | | Derivatives

Available

for Offset | | | Non-cash

Collateral

Received(a) | | | Cash

Collateral

Received(a) | | | Net Amount of Derivative Assets(b) | |

| | | | | |

Barclays Bank PLC | | $ | 378 | | | $ | — | | | $ | — | | | $ | — | | | $ | 378 | |

Standard Chartered Bank | | | 6,422 | | | | (1,633 | ) | | | — | | | | — | | | | 4,789 | |

| | | | | |

| | | $ | 6,800 | | | $ | (1,633 | ) | | $ | — | | | $ | — | | | $ | 5,167 | |

| | | | | |

| Counterparty | | Derivative

Liabilities Subject to

Master Netting

Agreement | | | Derivatives

Available

for Offset | | | Non-cash

Collateral

Pledged(a) | | | Cash

Collateral

Pledged(a) | | | Net Amount

of Derivative

Liabilities(c) | |

| | | | | |

Citibank, N.A. | | $ | (19,238 | ) | | $ | — | | | $ | — | | | $ | — | | | $ | (19,238 | ) |

Standard Chartered Bank | | | (1,633 | ) | | | 1,633 | | | | — | | | | — | | | | — | |

| | | | | |

| | | $ | (20,871 | ) | | $ | 1,633 | | | $ | — | | | $ | — | | | $ | (19,238 | ) |

| (a) | In some instances, the total collateral received and/or pledged may be more than the amount shown due to overcollateralization. |

| (b) | Net amount represents the net amount due from the counterparty in the event of default. |

| (c) | Net amount represents the net amount payable to the counterparty in the event of default. |

The effect of derivative instruments (not considered to be hedging instruments for accounting disclosure purposes) on the Statement of Operations by risk exposure for the period ended July 31, 2018 was as follows:

| | | | | | | | | | | | |

| Statement of Operations Caption | | Credit | | | Foreign

Exchange | | | Interest

Rate | |

| | | |

Net realized gain (loss) — | | | | | | | | | | | | |

Financial futures contracts | | $ | — | | | $ | — | | | $ | 3,377 | |

Swap contracts | | | 2,012 | | | | — | | | | 19 | |

Forward foreign currency exchange contracts | | | — | | | | 17,095 | | | | — | |

| | | |

Total | | $ | 2,012 | | | $ | 17,095 | | | $ | 3,396 | |

| | | |

Change in unrealized appreciation (depreciation) — | | | | | | | | | | | | |

Financial futures contracts | | $ | — | | | $ | — | | | $ | (1,727 | ) |

Swap contracts | | | (5,972 | ) | | | — | | | | (3,470 | ) |

Forward foreign currency exchange contracts | | | — | | | | 5,167 | | | | — | |

| | | |

Total | | $ | (5,972 | ) | | $ | 5,167 | | | $ | (5,197 | ) |

Eaton Vance

Emerging Markets Debt Fund

July 31, 2018

Notes to Financial Statements (Unaudited) — continued

The average notional cost of futures contracts and average notional amounts of other derivative contracts outstanding during the period ended July 31, 2018, which are indicative of the volume of these derivative types, were approximately as follows:

| | | | | | | | | | |

Futures

Contracts — Long | | | Forward

Foreign Currency

Exchange Contracts* | | | Swap

Contracts | |

| | |

| | $1,409,000 | | | $ | 1,037,000 | | | $ | 1,591,000 | |

| * | The average notional amount for forward foreign currency exchange contracts is based on the absolute value of notional amounts of currency purchased and currency sold. |

7 Line of Credit

The Fund participates with other portfolios and funds managed by EVM and its affiliates in a $625 million unsecured line of credit agreement with a group of banks, which is in effect through October 30, 2018. Borrowings are made by the Fund solely to facilitate the handling of unusual and/or unanticipated short-term cash requirements. Interest is charged to the Fund based on its borrowings at an amount above either the Eurodollar rate or Federal Funds rate. In addition, a fee computed at an annual rate of 0.15% on the daily unused portion of the line of credit is allocated among the participating portfolios and funds at the end of each quarter. Because the line of credit is not available exclusively to the Fund, it may be unable to borrow some or all of its requested amounts at any particular time. The Fund did not have any significant borrowings or allocated fees during the period ended July 31, 2018.

8 Overdraft Advances

Pursuant to the custodian agreement, State Street Bank and Trust Company (SSBT) may, in its discretion, advance funds to the Fund to make properly authorized payments. When such payments result in an overdraft, the Fund is obligated to repay SSBT at the current rate of interest charged by SSBT for secured loans (currently, the Federal Funds rate plus 2%). This obligation is payable on demand to SSBT. SSBT has a lien on the Fund’s assets to the extent of any overdraft. At July 31, 2018, the Fund had a payment due to SSBT pursuant to the foregoing arrangement of $32,657. Based on the short-term nature of these payments and the variable interest rate, the carrying value of the overdraft advances approximated its fair value at July 31, 2018. If measured at fair value, overdraft advances would have been considered as Level 2 in the fair value hierarchy (see Note 10) at July 31, 2018. The Fund’s average overdraft advances during the period ended July 31, 2018 were not significant.

9 Risks Associated with Foreign Investments

The Fund’s investments in foreign instruments can be adversely affected by changes in currency exchange rates and political, economic and market developments abroad. In emerging or less developed countries, these risks can be more significant. Investment markets in emerging market countries are typically substantially smaller, less liquid and more volatile than the major markets in developed countries. Emerging market countries may have relatively unstable governments and economies. Emerging market investments often are subject to speculative trading, which typically contributes to volatility.

The Fund may have difficulties enforcing its legal or contractual rights in a foreign country. Economic data as reported by foreign governments and other issuers may be delayed, inaccurate or fraudulent. In the event of a default by a sovereign entity, there are typically no assets to be seized or cash flows to be attached. Furthermore, the willingness or ability of a foreign government to renegotiate defaulted debt may be limited.

10 Fair Value Measurements

Under generally accepted accounting principles for fair value measurements, a three-tier hierarchy to prioritize the assumptions, referred to as inputs, is used in valuation techniques to measure fair value. The three-tier hierarchy of inputs is summarized in the three broad levels listed below.

| • | | Level 1 – quoted prices in active markets for identical investments |

| • | | Level 2 – other significant observable inputs (including quoted prices for similar investments, interest rates, prepayment speeds, credit risk, etc.) |

| • | | Level 3 – significant unobservable inputs (including a fund’s own assumptions in determining the fair value of investments) |

In cases where the inputs used to measure fair value fall in different levels of the fair value hierarchy, the level disclosed is determined based on the lowest level input that is significant to the fair value measurement in its entirety. The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities.

Eaton Vance

Emerging Markets Debt Fund

July 31, 2018

Notes to Financial Statements (Unaudited) — continued

At July 31, 2018, the hierarchy of inputs used in valuing the Fund’s investments and open derivative instruments, which are carried at value, were as follows:

| | | | | | | | | | | | | | | | |

| Asset Description | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| | | | |

Foreign Government Bonds | | $ | — | | | $ | 6,101,040 | | | $ | — | | | $ | 6,101,040 | |

Foreign Corporate Bonds | | | — | | | | 508,139 | | | | — | | | | 508,139 | |

Sovereign Loans | | | — | | | | 606,665 | | | | — | | | | 606,665 | |

Short-Term Investments | | | — | | | | 304,315 | | | | — | | | | 304,315 | |

| | | | |

Total Investments | | $ | — | | | $ | 7,520,159 | | | $ | — | | | $ | 7,520,159 | |

| | | | |

Forward Foreign Currency Exchange Contracts | | $ | — | | | $ | 6,800 | | | $ | — | | | $ | 6,800 | |

Swap Contracts | | | — | | | | 676 | | | | — | | | | 676 | |

| | | | |

Total | | $ | — | | | $ | 7,527,635 | | | $ | — | | | $ | 7,527,635 | |

| | | | |

Liability Description | | | | | | | | | | | | | | | | |

| | | | |

Forward Foreign Currency Exchange Contracts | | $ | — | | | $ | (1,633 | ) | | $ | — | | | $ | (1,633 | ) |

Futures Contracts | | | (1,727 | ) | | | — | | | | — | | | | (1,727 | ) |

Swap Contracts | | | — | | | | (36,650 | ) | | | — | | | | (36,650 | ) |

| | | | |

Total | | $ | (1,727 | ) | | $ | (38,283 | ) | | $ | — | | | $ | (40,010 | ) |

Eaton Vance

Emerging Markets Debt Fund

July 31, 2018

Board of Trustees’ Contract Approval

Overview of the Contract Review Process

The Investment Company Act of 1940, as amended (the “1940 Act”), provides, in substance, that for a fund to enter into an investment advisory agreement with an investment adviser, the fund’s board of trustees, including a majority of the trustees who are not “interested persons” of the fund (“Independent Trustees”), must approve the agreement and its terms at an in-person meeting called for the purpose of considering such approval.

At a meeting of the Board of Trustees (each a “Board”) of the registered investment companies advised by either Eaton Vance Management or its affiliate, Boston Management and Research, (the “Eaton Vance Funds”) held on April 24 and 25, 2018 (the “Meeting”), the Board, including a majority of the Independent Trustees, voted to approve the investment advisory and administrative agreement of Eaton Vance Emerging Markets Debt (the “Fund”) with Eaton Vance Management (the “Adviser”).

Prior to voting its approval of the investment advisory and administrative agreement, the Board received information from the Adviser that the Board considered reasonably necessary to evaluate the terms of the agreement. The Board considered information furnished by the Adviser for the Meeting relating specifically to the Fund, as well as information furnished for prior meetings of the Board and its committees. The Board also considered information provided in connection with the annual contract review process for other Eaton Vance Funds.

The information that the Board considered included, among other things, the following:

Information about Fees and Expenses

| • | | The advisory and related fees payable by the Fund and the anticipated expense ratio of the Fund; |

| • | | Information comparing the advisory and related fees to be payable by the Fund with fees paid by comparable funds, as identified by an independent data provider (“comparable funds”); |

| • | | Information comparing the expected total expense ratio and its components to comparable funds; |

| • | | Pro forma profitability analyses for the Adviser with respect to the Fund; |

Information about Portfolio Management and Trading

| • | | Descriptions of the investment management services provided by the Adviser, including with respect to the Fund’s investment strategies and policies; |

| • | | The procedures and processes used to determine the fair value of fund assets and actions taken to monitor and test the effectiveness of such procedures and processes; |

| • | | Information about policies and practices with respect to trading, including processes for monitoring best execution of portfolio transactions; |

| • | | Information about the allocation of brokerage transactions and the benefits received by the Adviser as a result of brokerage allocation, including information with respect to “soft dollars”; |

Information about the Adviser

| • | | Reports detailing the financial results and condition of the Adviser; |

| • | | Descriptions of the qualifications, education and experience of the individual investment professionals whose responsibilities will include portfolio management and investment research for the Fund, and information relating to their responsibilities with respect to managing other mutual funds and investment accounts; |

| • | | The Codes of Ethics of the Adviser and its affiliates, together with information relating to compliance with and the administration of such codes; |

| • | | Policies and procedures relating to proxy voting and the handling of corporate actions and class actions; |

| • | | Information concerning the resources devoted to compliance efforts undertaken by the Adviser and its affiliates (including descriptions of various compliance programs) and their record of compliance; |

| • | | Information concerning the business continuity and disaster recovery plans of the Adviser and its affiliates; |

Other Relevant Information

| • | | Information concerning the nature, cost and character of the administrative and other non-investment advisory services provided by the Adviser and its affiliates; |

| • | | Information concerning management of the relationship with the custodian, subcustodians and fund accountants by the Adviser and its affiliates; and |

| • | | The terms of the investment advisory and administrative agreement. |

Results of the Process

Based on its consideration of the foregoing, and such other information as it deemed relevant, including the factors and conclusions described below, the Board concluded that the terms of the Fund’s investment advisory and administrative agreement with the Adviser, including its fee structure, are in the interests of shareholders and, therefore, the Board, including a majority of the Independent Trustees, voted to approve the agreement for the Fund. The

Eaton Vance

Emerging Markets Debt Fund

July 31, 2018

Board of Trustees’ Contract Approval — continued

conclusions reached with respect to the agreement were based on a comprehensive evaluation of all the information provided and not any single factor. Moreover, each member of the Board may have placed varying emphasis on particular factors in reaching conclusions with respect to the agreement.

Nature, Extent and Quality of Services

In considering whether to approve the investment advisory and administrative agreement of the Fund, the Board evaluated the nature, extent and quality of services to be provided to the Fund by the Adviser.