UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act File Number: 811-04015

Eaton Vance Mutual Funds Trust

(Exact Name of Registrant as Specified in Charter)

Two International Place, Boston, Massachusetts 02110

(Address of Principal Executive Offices)

Deidre E. Walsh

Two International Place, Boston, Massachusetts 02110

(Name and Address of Agent for Services)

(617) 482-8260

(Registrant’s Telephone Number)

December 31

Date of Fiscal Year End

December 31, 2021

Date of Reporting Period

Item 1. Reports to Stockholders

Eaton Vance

Stock Fund

Annual Report

December 31, 2021

Commodity Futures Trading Commission Registration. The Commodity Futures Trading Commission (“CFTC”) has adopted regulations that subject registered investment companies and advisers to regulation by the CFTC if a fund invests more than a prescribed level of its assets in certain CFTC-regulated instruments (including futures, certain options and swap agreements) or markets itself as providing investment exposure to such instruments. The investment adviser has claimed an exclusion from the definition of “commodity pool operator” under the Commodity Exchange Act with respect to its management of the Fund. Accordingly, neither the Fund nor the adviser with respect to the operation of the Fund is subject to CFTC regulation. Because of its management of other strategies, the Fund’s adviser is registered with the CFTC as a commodity pool operator. The adviser is also registered as a commodity trading advisor.

Fund shares are not insured by the FDIC and are not deposits or other obligations of, or guaranteed by, any depository institution. Shares are subject to investment risks, including possible loss of principal invested.

This report must be preceded or accompanied by a current summary prospectus or prospectus. Before investing, investors should consider carefully the investment objective, risks, and charges and expenses of a mutual fund. This and other important information is contained in the summary prospectus and prospectus, which can be obtained from a financial intermediary. Prospective investors should read the prospectus carefully before investing. For further information, please call 1-800-262-1122.

Annual Report December 31, 2021

Eaton Vance

Stock Fund

Eaton Vance

Stock Fund

December 31, 2021

Management’s Discussion of Fund Performance1

Economic and Market Conditions

The 12-month period starting January 1, 2021, was notable for a U.S. equity rally that lasted for most of the period and resulted in U.S. stocks outperforming most other stock markets in developed economies. Except for temporary retreats in September and November, broad-market indexes generally posted strong returns during the period. Investors cheered the reopening of businesses that had been affected by the pandemic and the rollout of several highly effective COVID-19 vaccines.

COVID-19, however, continued to have a firm grip on the U.S. economy. Disease rates advanced and declined with second, third, and fourth waves of infections. Worker shortages led to global supply-chain disruptions. From computer chips to shipping containers, scarcities of key items led to temporary factory shutdowns and empty store shelves. Those shortages — combined with high demand from consumers eager to spend money saved earlier in the pandemic — led to higher year-over-year inflation than the U.S. had seen in decades.

Still, investor optimism about a recovering economy drove stock prices up during most of the period. A significant pullback, however, occurred in September 2021 when virtually every major U.S. stock index reported negative returns. Unexpectedly weak job creation in August and the U.S. Federal Reserve’s (the Fed’s) announcement that it might soon begin tapering its monthly bond purchases — which had stimulated the economy earlier — combined to drive stocks into negative territory. Rising COVID-19 infections also weighed on equity performance in September.

In the final quarter of 2021, however, stock prices came roaring back. Even the late-November news of a new and more transmissible COVID-19 variant — Omicron — caused only a temporary market retreat. The Fed’s actions to tamp down inflation were applauded by investors, with stocks gaining ground after the central bank announced that tapering would be accelerated and that three possible interest rate hikes were forecast for 2022. Just two trading days before year-end, the S&P 500® Index closed at its 70th new all-time high for the period, and the Dow Jones Industrial Average® (DJIA) closed at an all-time high as well.

For the period as a whole, the broad-market S&P 500® Index returned 28.71%; the blue-chip DJIA was up 20.95%; and the technology-laden Nasdaq Composite Index rose 22.18%. Large-cap U.S. stocks, as measured by the Russell 1000® Index, outperformed their small-cap counterparts, as measured by the Russell 2000® Index. In the large-cap space, growth stocks modestly outperformed value stocks, but in the small-cap space, value stocks strongly outperformed growth stocks during the period.

Fund Performance

For the 12-month period ended December 31, 2021, Eaton Vance Stock Fund (the Fund) returned 22.78% for Class A shares at net asset value (NAV), underperforming its benchmark, the S&P 500® Index (the Index), which returned 28.71%.

Stock selections in the information technology (IT) and consumer discretionary sectors, along with stock selections and an underweight position relative to the Index in the energy sector — the best-performing sector in the Index during the period — detracted from Fund performance versus the Index.

In the IT sector, underweighting NVIDIA Corp. (NVIDIA) — a maker of computer graphics processing units used in gaming, data center, and self-driving vehicle applications — and not owning the stock until late in the period hurt returns relative to the Index. NVIDIA’s stock price more than doubled during the period, driven by long-term tailwinds — growth in the gaming, artificial intelligence, and autonomous vehicle industries — and by a sharp increase in gaming and data center demand during the pandemic. By period-end, NVIDIA was sold from the Fund.

Elsewhere in the IT sector, the Fund’s overweight position in Cognizant Technology Solutions Corp. (Cognizant), a business consultant, declined in price during the early part of the period. Competition from other IT service providers as well as in-house management turnover weighed on Cognizant’s stock performance. By period-end, Cognizant was sold from the Fund.

In the consumer discretionary sector, the Fund’s overweight position in e-commerce giant Amazon.com, Inc. (Amazon) detracted from returns relative to the Index during the period. Early in the COVID-19 pandemic, Amazon benefited from a shift toward online shopping during a period when consumers were largely confined to their homes. As the global economy reopened, however, growth in online shopping began to slow as consumers returned to brick-and-mortar retailers. As a result, Amazon’s stock underperformed the Index during the period.

In contrast, stock selections in the health care and communication services sectors contributed to performance versus the Index during the period. In health care, performance relative to the Index benefited from the Fund’s overweight position in Anthem, Inc. (Anthem), a large provider of medical insurance. Anthem’s relationship as an exclusive Blue Cross Blue Shield licensee in numerous states, as well as its recent acquisition of a top-tier Medicare/Medicaid insurer, helped the company deliver strong earnings growth and stock performance during the period. Higher membership figures and a premium rate increase boosted Anthem’s earnings as well.

In the communication services sector, the Fund’s overweight position in Alphabet, Inc. (Alphabet), parent company of search engine Google, performed strongly as positive e-commerce trends drove increased demand for search engine advertising and engagement. In addition, growth in viewership and ad sales on video sharing platform YouTube, an Alphabet subsidiary, exceeded analyst expectations during the period and provided an additional tailwind for Alphabet’s stock price.

See Endnotes and Additional Disclosures in this report.

Past performance is no guarantee of future results. Returns are historical and are calculated by determining the percentage change in net asset value (NAV) or offering price (as applicable) with all distributions reinvested. Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Performance for periods less than or equal to one year is cumulative. Performance is for the stated time period only; due to market volatility, current Fund performance may be lower or higher than the quoted return. For performance as of the most recent month-end, please refer to eatonvance.com.

Eaton Vance

Stock Fund

December 31, 2021

Performance2,3

Portfolio Manager(s) Charles B. Gaffney

| | | | | | | | | | | | | | | | | | | | |

| % Average Annual Total Returns | | Class

Inception Date | | | Performance

Inception Date | | | One Year | | | Five Years | | | Ten Years | |

| | | | | |

Class A at NAV | | | 11/01/2001 | | | | 11/01/2001 | | | | 22.78 | % | | | 17.19 | % | | | 15.54 | % |

Class A with 5.75% Maximum Sales Charge | | | — | | | | — | | | | 15.72 | | | | 15.81 | | | | 14.86 | |

Class C at NAV | | | 10/01/2009 | | | | 11/01/2001 | | | | 21.88 | | | | 16.32 | | | | 14.85 | |

Class C with 1% Maximum Sales Charge | | | — | | | | — | | | | 20.88 | | | | 16.32 | | | | 14.85 | |

Class I at NAV | | | 09/03/2008 | | | | 11/01/2001 | | | | 23.12 | | | | 17.48 | | | | 15.83 | |

|

| |

| | | | | |

S&P 500® Index | | | — | | | | — | | | | 28.71 | % | | | 18.46 | % | | | 16.54 | % |

| | | | | |

| % Total Annual Operating Expense Ratios4 | | | | | | | | Class A | | | Class C | | | Class I | |

| | | | | |

Gross | | | | | | | | | | | 1.08 | % | | | 1.83 | % | | | 0.83 | % |

Net | | | | | | | | | | | 0.98 | | | | 1.73 | | | | 0.73 | |

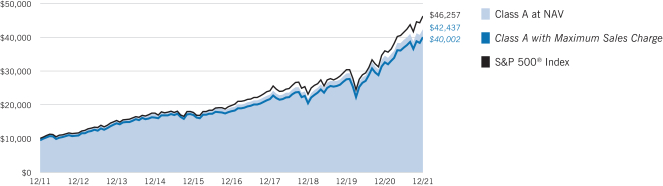

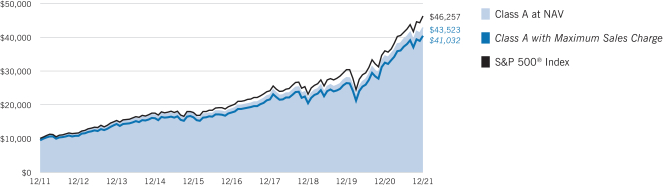

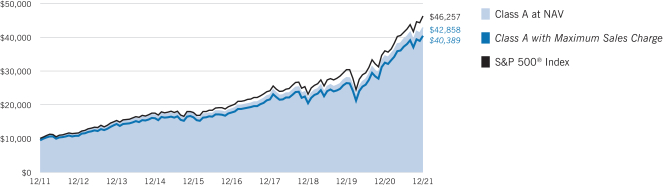

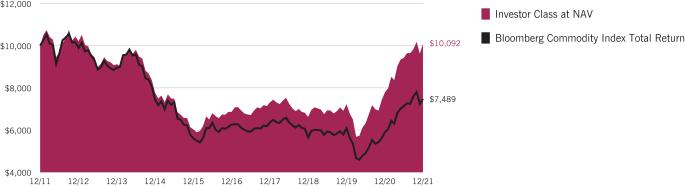

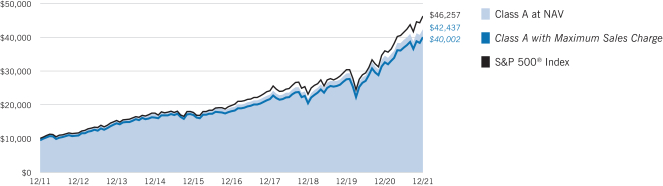

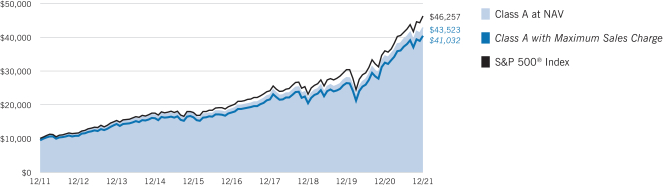

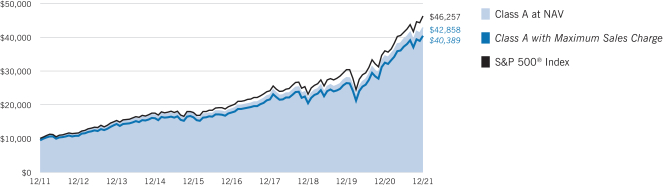

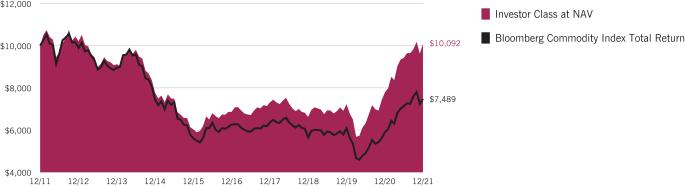

Growth of $10,000

This graph shows the change in value of a hypothetical investment of $10,000 in Class A of the Fund for the period indicated. For comparison, the same investment is shown in the indicated index.

| | | | | | | | | | | | | | | | |

| Growth of Investment | | Amount Invested | | | Period Beginning | | | At NAV | | | With Maximum Sales Charge | |

| | | | |

Class C | | | $10,000 | | | | 12/31/2011 | | | | $39,959 | | | | N.A. | |

Class I | | | $250,000 | | | | 12/31/2011 | | | | $1,087,706 | | | | N.A. | |

See Endnotes and Additional Disclosures in this report.

Past performance is no guarantee of future results. Returns are historical and are calculated by determining the percentage change in net asset value (NAV) or offering price (as applicable) with all distributions reinvested. Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Performance for periods less than or equal to one year is cumulative. Performance is for the stated time period only; due to market volatility, current Fund performance may be lower or higher than the quoted return. For performance as of the most recent month-end, please refer to eatonvance.com.

Eaton Vance

Stock Fund

December 31, 2021

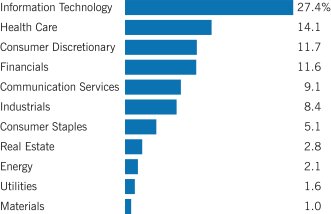

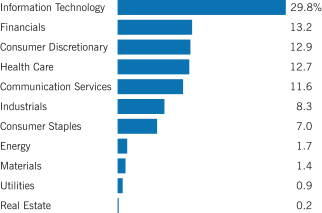

Fund Profile5

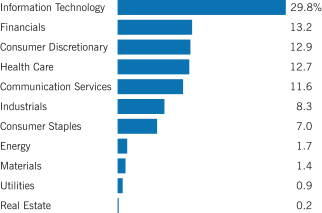

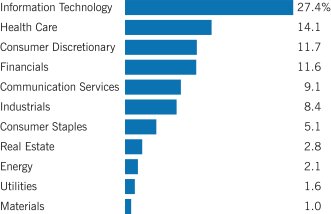

Sector Allocation (% of net assets)6

Top 10 Holdings (% of net assets)6

| | | | |

| |

Microsoft Corp. | | | 7.2 | % |

| |

Apple, Inc. | | | 6.0 | |

| |

Alphabet, Inc., Class C | | | 5.5 | |

| |

Amazon.com, Inc. | | | 5.4 | |

| |

Wells Fargo & Co. | | | 2.3 | |

| |

AbbVie, Inc. | | | 2.2 | |

| |

S&P Global, Inc. | | | 2.2 | |

| |

PNC Financial Services Group, Inc. (The) | | | 2.1 | |

| |

ConocoPhillips | | | 2.1 | |

| |

Visa, Inc., Class A | | | 2.0 | |

| |

Total | | | 37.0 | % |

See Endnotes and Additional Disclosures in this report.

Eaton Vance

Stock Fund

December 31, 2021

Endnotes and Additional Disclosures

| 1 | The views expressed in this report are those of the portfolio manager(s) and are current only through the date stated at the top of this page. These views are subject to change at any time based upon market or other conditions, and Eaton Vance and the Fund(s) disclaim any responsibility to update such views. These views may not be relied upon as investment advice and, because investment decisions are based on many factors, may not be relied upon as an indication of trading intent on behalf of any Eaton Vance fund. This commentary may contain statements that are not historical facts, referred to as “forward-looking statements.” The Fund’s actual future results may differ significantly from those stated in any forward-looking statement, depending on factors such as changes in securities or financial markets or general economic conditions, the volume of sales and purchases of Fund shares, the continuation of investment advisory, administrative and service contracts, and other risks discussed from time to time in the Fund’s filings with the Securities and Exchange Commission. |

| 2 | S&P 500® Index is an unmanaged index of large-cap stocks commonly used as a measure of U.S. stock market performance. S&P Dow Jones Indices are a product of S&P Dow Jones Indices LLC (“S&P DJI”) and have been licensed for use. S&P® and S&P 500® are registered trademarks of S&P DJI; Dow Jones® is a registered trademark of Dow Jones Trademark Holdings LLC (“Dow Jones”); S&P DJI, Dow Jones and their respective affiliates do not sponsor, endorse, sell or promote the Fund, will not have any liability with respect thereto and do not have any liability for any errors, omissions, or interruptions of the S&P Dow Jones Indices. Unless otherwise stated, index returns do not reflect the effect of any applicable sales charges, commissions, expenses, taxes or leverage, as applicable. It is not possible to invest directly in an index. |

| 3 | Total Returns at NAV do not include applicable sales charges. If sales charges were deducted, the returns would be lower. Total Returns shown with maximum sales charge reflect the stated maximum sales charge. Unless otherwise stated, performance does not reflect the deduction of taxes on Fund distributions or redemptions of Fund shares. |

Effective November 5, 2020, Class C shares automatically convert to Class A shares eight years after purchase. The average annual total returns listed for Class C reflect conversion to Class A shares after eight years. Prior to November 5, 2020, Class C shares automatically converted to Class A shares ten years after purchase.

| 4 | Source: Fund prospectus. Net expense ratios reflect a contractual expense reimbursement that continues through 4/30/22. The expense ratios for the current reporting period can be found in the Financial Highlights section of this report. Performance reflects expenses waived and/or reimbursed, if applicable. Without such waivers and/or reimbursements, performance would have been lower. |

| 5 | Fund invests in an affiliated investment company (Portfolio) with the same objective(s) and policies as the Fund. References to investments are to the Portfolio’s holdings. |

| 6 | Excludes cash and cash equivalents. |

Fund profile subject to change due to active management.

Additional Information

Dow Jones Industrial Average® is a price-weighted average of 30 blue-chip stocks that are generally the leaders in their industry. Nasdaq Composite Index is a market capitalization-weighted index of all domestic and international securities listed on Nasdaq. Source: Nasdaq, Inc. The information is provided by Nasdaq (with its affiliates, are referred to as the “Corporations”) and Nasdaq’s third party licensors on an “as is” basis and the Corporations make no guarantees and bear no liability of any kind with respect to the information or the Fund. Russell 1000® Index is an unmanaged index of 1,000 U.S. large-cap stocks. Russell 2000® Index is an unmanaged index of 2,000 U.S. small-cap stocks.

Eaton Vance

Stock Fund

December 31, 2021

Fund Expenses

Example: As a Fund shareholder, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchases and redemption fees (if applicable); and (2) ongoing costs, including management fees; distribution and/or service fees; and other Fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of Fund investing and to compare these costs with the ongoing costs of investing in other mutual funds. The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period (July 1, 2021 – December 31, 2021).

Actual Expenses: The first section of the table below provides information about actual account values and actual expenses. You may use the information in this section, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first section under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes: The second section of the table below provides information about hypothetical account values and hypothetical expenses based on the actual Fund expense ratio and an assumed rate of return of 5% per year (before expenses), which is not the actual Fund return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in your Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads) or redemption fees (if applicable). Therefore, the second section of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would be higher.

| | | | | | | | | | | | | | | | |

| | | Beginning

Account Value

(7/1/21) | | | Ending

Account Value

(12/31/21) | | | Expenses Paid

During Period*

(7/1/21 – 12/31/21) | | | Annualized

Expense

Ratio | |

| | | | |

Actual | | | | | | | | | | | | | | | | |

Class A | | $ | 1,000.00 | | | $ | 1,082.50 | | | $ | 5.14 | ** | | | 0.98 | % |

Class C | | $ | 1,000.00 | | | $ | 1,078.60 | | | $ | 9.06 | ** | | | 1.73 | % |

Class I | | $ | 1,000.00 | | | $ | 1,083.80 | | | $ | 3.83 | ** | | | 0.73 | % |

| | | | | |

Hypothetical | | | | | | | | | | | | | | | | |

(5% return per year before expenses) | | | | | | | | | | | | | | | | |

Class A | | $ | 1,000.00 | | | $ | 1,020.27 | | | $ | 4.99 | ** | | | 0.98 | % |

Class C | | $ | 1,000.00 | | | $ | 1,016.48 | | | $ | 8.79 | ** | | | 1.73 | % |

Class I | | $ | 1,000.00 | | | $ | 1,021.53 | | | $ | 3.72 | ** | | | 0.73 | % |

| * | Expenses are equal to the Fund’s annualized expense ratio for the indicated Class, multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period). The Example assumes that the $1,000 was invested at the net asset value per share determined at the close of business on June 30, 2021. The Example reflects the expenses of both the Fund and the Portfolio. |

| ** | Absent an allocation of certain expenses to an affiliate, expenses would be higher. |

Eaton Vance

Stock Fund

December 31, 2021

Statement of Assets and Liabilities

| | | | |

| Assets | | December 31, 2021 | |

| |

Investment in Stock Portfolio, at value (identified cost, $60,174,547) | | $ | 111,308,285 | |

| |

Receivable for Fund shares sold | | | 3,658 | |

| |

Total assets | | $ | 111,311,943 | |

|

| Liabilities | |

| |

Payable for Fund shares redeemed | | $ | 9,968,589 | |

| |

Payable to affiliates: | | | | |

| |

Distribution and service fees | | | 19,002 | |

| |

Trustees’ fees | | | 125 | |

| |

Other | | | 1,403 | |

| |

Accrued expenses | | | 42,607 | |

| |

Total liabilities | | $ | 10,031,726 | |

| |

Net Assets | | $ | 101,280,217 | |

|

| Sources of Net Assets | |

| |

Paid-in capital | | $ | 50,883,329 | |

| |

Distributable earnings | | | 50,396,888 | |

| |

Total | | $ | 101,280,217 | |

| |

| Class A Shares | | | | |

| |

Net Assets | | $ | 61,304,210 | |

| |

Shares Outstanding | | | 2,541,220 | |

| |

Net Asset Value and Redemption Price Per Share | | | | |

| |

(net assets ÷ shares of beneficial interest outstanding) | | $ | 24.12 | |

| |

Maximum Offering Price Per Share | | | | |

| |

(100 ÷ 94.25 of net asset value per share) | | $ | 25.59 | |

|

| Class C Shares | |

| |

Net Assets | | $ | 7,418,451 | |

| |

Shares Outstanding | | | 319,345 | |

| |

Net Asset Value and Offering Price Per Share* | | | | |

| |

(net assets ÷ shares of beneficial interest outstanding) | | $ | 23.23 | |

|

| Class I Shares | |

| |

Net Assets | | $ | 32,557,556 | |

| |

Shares Outstanding | | | 1,348,489 | |

| |

Net Asset Value, Offering Price and Redemption Price Per Share | | | | |

| |

(net assets ÷ shares of beneficial interest outstanding) | | $ | 24.14 | |

On sales of $50,000 or more, the offering price of Class A shares is reduced.

| * | Redemption price per share is equal to the net asset value less any applicable contingent deferred sales charge. |

| | | | |

| | 7 | | See Notes to Financial Statements. |

Eaton Vance

Stock Fund

December 31, 2021

Statement of Operations

| | | | |

| Investment Income | | Year Ended

December 31, 2021 | |

| |

Dividends allocated from Portfolio (net of foreign taxes, $20,278) | | $ | 1,304,137 | |

| |

Expenses allocated from Portfolio | | | (695,914 | ) |

| |

Total investment income from Portfolio | | $ | 608,223 | |

| |

| Expenses | | | | |

| |

Distribution and service fees | | | | |

| |

Class A | | $ | 153,629 | |

| |

Class C | | | 71,522 | |

| |

Trustees’ fees and expenses | | | 500 | |

| |

Custodian fee | | | 17,995 | |

| |

Transfer and dividend disbursing agent fees | | | 60,627 | |

| |

Legal and accounting services | | | 28,331 | |

| |

Printing and postage | | | 13,571 | |

| |

Registration fees | | | 53,359 | |

| |

Miscellaneous | | | 10,255 | |

| |

Total expenses | | $ | 409,789 | |

| |

Deduct — | | | | |

| |

Allocation of expenses to affiliate | | $ | 72,100 | |

| |

Total expense reductions | | $ | 72,100 | |

| |

Net expenses | | $ | 337,689 | |

| |

Net investment income | | $ | 270,534 | |

| |

| Realized and Unrealized Gain (Loss) from Portfolio | | | | |

| |

Net realized gain (loss) — | | | | |

| |

Investment transactions | | $ | 16,204,412 | (1) |

| |

Foreign currency transactions | | | (1,628 | ) |

| |

Net realized gain | | $ | 16,202,784 | |

| |

Change in unrealized appreciation (depreciation) — | | | | |

| |

Investments | | $ | 6,248,435 | |

| |

Foreign currency | | | (1,009 | ) |

| |

Net change in unrealized appreciation (depreciation) | | $ | 6,247,426 | |

| |

Net realized and unrealized gain | | $ | 22,450,210 | |

| |

Net increase in net assets from operations | | $ | 22,720,744 | |

| (1) | Includes $394,517 of net realized gains from redemptions in-kind. |

| | | | |

| | 8 | | See Notes to Financial Statements. |

Eaton Vance

Stock Fund

December 31, 2021

Statements of Changes in Net Assets

| | | | | | | | |

| | | Year Ended December 31, | |

| Increase (Decrease) in Net Assets | | 2021 | | | 2020 | |

| | |

From operations — | | | | | | | | |

| | |

Net investment income | | $ | 270,534 | | | $ | 519,303 | |

| | |

Net realized gain | | | 16,202,784 | (1) | | | 2,240,515 | |

| | |

Net change in unrealized appreciation (depreciation) | | | 6,247,426 | | | | 13,485,858 | |

| | |

Net increase in net assets from operations | | $ | 22,720,744 | | | $ | 16,245,676 | |

| | |

Distributions to shareholders — | | | | | | | | |

| | |

Class A | | $ | (6,966,059 | ) | | $ | (1,138,968 | ) |

| | |

Class C | | | (798,464 | ) | | | (209,512 | ) |

| | |

Class I | | | (4,902,730 | ) | | | (860,335 | ) |

| | |

Total distributions to shareholders | | $ | (12,667,253 | ) | | $ | (2,208,815 | ) |

| | |

Transactions in shares of beneficial interest — | | | | | | | | |

| | |

Proceeds from sale of shares | | | | | | | | |

| | |

Class A | | $ | 2,087,298 | | | $ | 5,471,439 | |

| | |

Class C | | | 778,431 | | | | 1,020,161 | |

| | |

Class I | | | 4,307,668 | | | | 13,482,298 | |

| | |

Net asset value of shares issued to shareholders in payment of distributions declared | | | | | | | | |

| | |

Class A | | | 6,762,071 | | | | 1,105,764 | |

| | |

Class C | | | 798,464 | | | | 208,098 | |

| | |

Class I | | | 4,902,730 | | | | 860,279 | |

| | |

Cost of shares redeemed | | | | | | | | |

| | |

Class A | | | (13,638,219 | ) | | | (11,491,645 | ) |

| | |

Class C | | | (1,173,818 | ) | | | (3,021,646 | ) |

| | |

Class I | | | (21,423,736 | ) | | | (15,796,778 | ) |

| | |

Net asset value of shares converted | | | | | | | | |

| | |

Class A | | | 323,952 | | | | 4,018,356 | |

| | |

Class C | | | (323,952 | ) | | | (4,018,356 | ) |

| | |

Net decrease in net assets from Fund share transactions | | $ | (16,599,111 | ) | | $ | (8,162,030 | ) |

| | |

Other capital — | | | | | | | | |

| | |

Portfolio transaction fee contributed to Portfolio | | $ | (68,869 | ) | | $ | (41,788 | ) |

| | |

Portfolio transaction fee allocated from Portfolio | | | 75,872 | | | | 40,066 | |

| | |

Net increase (decrease) in net assets from other capital | | $ | 7,003 | | | $ | (1,722 | ) |

| | |

Net increase (decrease) in net assets | | $ | (6,538,617 | ) | | $ | 5,873,109 | |

|

| Net Assets | |

| | |

At beginning of year | | $ | 107,818,834 | | | $ | 101,945,725 | |

| | |

At end of year | | $ | 101,280,217 | | | $ | 107,818,834 | |

| (1) | Includes $394,517 of net realized gains from redemptions in-kind. |

| | | | |

| | 9 | | See Notes to Financial Statements. |

Eaton Vance

Stock Fund

December 31, 2021

Financial Highlights

| | | | | | | | | | | | | | | | | | | | |

| | | Class A | |

| |

| | | Year Ended December 31, | |

| | | 2021 | | | 2020 | | | 2019 | | | 2018 | | | 2017 | |

| | | | | |

Net asset value — Beginning of year | | $ | 22.120 | | | $ | 19.110 | | | $ | 14.720 | | | $ | 17.490 | | | $ | 15.740 | |

| | | | | |

| Income (Loss) From Operations | | | | | | | | | | | | | | | | | | | | |

| | | | | |

Net investment income(1) | | $ | 0.049 | | | $ | 0.097 | | | $ | 0.114 | | | $ | 0.144 | | | $ | 0.178 | |

| | | | | |

Net realized and unrealized gain (loss) | | | 4.959 | | | | 3.346 | | | | 5.023 | | | | (1.133 | ) | | | 2.933 | |

| | | | | |

Total income (loss) from operations | | $ | 5.008 | | | $ | 3.443 | | | $ | 5.137 | | | $ | (0.989 | ) | | $ | 3.111 | |

| | | | | |

| Less Distributions | | | | | | | | | | | | | | | | | | | | |

| | | | | |

From net investment income | | $ | (0.097 | ) | | $ | (0.041 | ) | | $ | (0.096 | ) | | $ | (0.145 | ) | | $ | (0.168 | ) |

| | | | | |

From net realized gain | | | (2.913 | ) | | | (0.392 | ) | | | (0.653 | ) | | | (1.637 | ) | | | (1.191 | ) |

| | | | | |

Total distributions | | $ | (3.010 | ) | | $ | (0.433 | ) | | $ | (0.749 | ) | | $ | (1.782 | ) | | $ | (1.359 | ) |

| | | | | |

Portfolio transaction fee, net(1) | | $ | 0.002 | | | $ | — | (2) | | $ | 0.002 | | | $ | 0.001 | | | $ | (0.002 | ) |

| | | | | |

Net asset value — End of year | | $ | 24.120 | | | $ | 22.120 | | | $ | 19.110 | | | $ | 14.720 | | | $ | 17.490 | |

| | | | | |

Total Return(3)(4) | | | 22.78 | % | | | 18.22 | % | | | 35.01 | % | | | (5.89 | )% | | | 19.91 | % |

| | | | | |

| Ratios/Supplemental Data | | | | | | | | | | | | | | | | | | | | |

| | | | | |

Net assets, end of year (000’s omitted) | | $ | 61,304 | | | $ | 60,148 | | | $ | 53,153 | | | $ | 42,087 | | | $ | 51,999 | |

| | | | | |

Ratios (as a percentage of average daily net assets):(5) | | | | | | | | | | | | | | | | | | | | |

| | | | | |

Expenses(4) | | | 0.98 | % | | | 0.98 | % | | | 0.98 | % | | | 0.98 | % | | | 0.98 | % |

| | | | | |

Net investment income | | | 0.20 | % | | | 0.51 | % | | | 0.65 | % | | | 0.80 | % | | | 1.05 | % |

| | | | | |

Portfolio Turnover of the Portfolio | | | 44 | % | | | 70 | % | | | 55 | % | | | 90 | % | | | 101 | % |

| (1) | Computed using average shares outstanding. |

| (2) | Amount is less than $(0.0005). |

| (3) | Returns are historical and are calculated by determining the percentage change in net asset value with all distributions reinvested and do not reflect the effect of sales charges. |

| (4) | The administrator waived its fees and/or reimbursed certain operating expenses (equal to 0.07%, 0.10%, 0.12%, 0.12% and 0.13% of average daily net assets for the years ended December 31, 2021, 2020, 2019, 2018 and 2017, respectively). Absent the waivers and reimbursement, total return would be lower. |

| (5) | Includes the Fund’s share of the Portfolio’s allocated expenses. |

| | | | |

| | 10 | | See Notes to Financial Statements. |

Eaton Vance

Stock Fund

December 31, 2021

Financial Highlights — continued

| | | | | | | | | | | | | | | | | | | | |

| | | Class C | |

| |

| | | Year Ended December 31, | |

| | | 2021 | | | 2020 | | | 2019 | | | 2018 | | | 2017 | |

| | | | | |

Net asset value — Beginning of year | | $ | 21.400 | | | $ | 18.610 | | | $ | 14.380 | | | $ | 17.100 | | | $ | 15.420 | |

| | | | | |

| Income (Loss) From Operations | | | | | | | | | | | | | | | | | | | | |

| | | | | |

Net investment income (loss)(1) | | $ | (0.130 | ) | | $ | (0.040 | ) | | $ | (0.018 | ) | | $ | 0.008 | | | $ | 0.050 | |

| | | | | |

Net realized and unrealized gain (loss) | | | 4.784 | | | | 3.235 | | | | 4.899 | | | | (1.096 | ) | | | 2.851 | |

| | | | | |

Total income (loss) from operations | | $ | 4.654 | | | $ | 3.195 | | | $ | 4.881 | | | $ | (1.088 | ) | | $ | 2.901 | |

| | | | | |

| Less Distributions | | | | | | | | | | | | | | | | | | | | |

| | | | | |

From net investment income | | $ | — | | | $ | (0.013 | ) | | $ | — | | | $ | (0.010 | ) | | $ | (0.028 | ) |

| | | | | |

From net realized gain | | | (2.826 | ) | | | (0.392 | ) | | | (0.653 | ) | | | (1.623 | ) | | | (1.191 | ) |

| | | | | |

Total distributions | | $ | (2.826 | ) | | $ | (0.405 | ) | | $ | (0.653 | ) | | $ | (1.633 | ) | | $ | (1.219 | ) |

| | | | | |

Portfolio transaction fee, net(1) | | $ | 0.002 | | | $ | — | (2) | | $ | 0.002 | | | $ | 0.001 | | | $ | (0.002 | ) |

| | | | | |

Net asset value — End of year | | $ | 23.230 | | | $ | 21.400 | | | $ | 18.610 | | | $ | 14.380 | | | $ | 17.100 | |

| | | | | |

Total Return(3)(4) | | | 21.88 | % | | | 17.36 | % | | | 34.04 | % | | | (6.60 | )% | | | 18.94 | % |

| | | | | |

| Ratios/Supplemental Data | | | | | | | | | | | | | | | | | | | | |

| | | | | |

Net assets, end of year (000’s omitted) | | $ | 7,418 | | | $ | 6,728 | | | $ | 11,418 | | | $ | 11,627 | | | $ | 16,196 | |

| | | | | |

Ratios (as a percentage of average daily net assets):(5) | | | | | | | | | | | | | | | | | | | | |

| | | | | |

Expenses(4) | | | 1.73 | % | | | 1.73 | % | | | 1.73 | % | | | 1.73 | % | | | 1.73 | % |

| | | | | |

Net investment income (loss) | | | (0.55 | )% | | | (0.22 | )% | | | (0.11 | )% | | | 0.05 | % | | | 0.30 | % |

| | | | | |

Portfolio Turnover of the Portfolio | | | 44 | % | | | 70 | % | | | 55 | % | | | 90 | % | | | 101 | % |

| (1) | Computed using average shares outstanding. |

| (2) | Amount is less than $(0.0005). |

| (3) | Returns are historical and are calculated by determining the percentage change in net asset value with all distributions reinvested and do not reflect the effect of sales charges. |

| (4) | The administrator waived its fees and/or reimbursed certain operating expenses (equal to 0.07%, 0.10%, 0.12%, 0.12% and 0.13% of average daily net assets for the years ended December 31, 2021, 2020, 2019, 2018 and 2017, respectively). Absent the waivers and reimbursement, total return would be lower. |

| (5) | Includes the Fund’s share of the Portfolio’s allocated expenses. |

| | | | |

| | 11 | | See Notes to Financial Statements. |

Eaton Vance

Stock Fund

December 31, 2021

Financial Highlights — continued

| | | | | | | | | | | | | | | | | | | | |

| | | Class I | |

| |

| | | Year Ended December 31, | |

| | | 2021 | | | 2020 | | | 2019 | | | 2018 | | | 2017 | |

| | | | | |

Net asset value — Beginning of year | | $ | 22.130 | | | $ | 19.110 | | | $ | 14.720 | | | $ | 17.490 | | | $ | 15.750 | |

| | | | | |

| Income (Loss) From Operations | | | | | | | | | | | | | | | | | | | | |

| | | | | |

Net investment income(1) | | $ | 0.110 | | | $ | 0.146 | | | $ | 0.158 | | | $ | 0.190 | | | $ | 0.219 | |

| | | | | |

Net realized and unrealized gain (loss) | | | 4.974 | | | | 3.354 | | | | 5.023 | | | | (1.132 | ) | | | 2.931 | |

| | | | | |

Total income (loss) from operations | | $ | 5.084 | | | $ | 3.500 | | | $ | 5.181 | | | $ | (0.942 | ) | | $ | 3.150 | |

| | | | | |

| Less Distributions | | | | | | | | | | | | | | | | | | | | |

| | | | | |

From net investment income | | $ | (0.163 | ) | | $ | (0.088 | ) | | $ | (0.140 | ) | | $ | (0.192 | ) | | $ | (0.217 | ) |

| | | | | |

From net realized gain | | | (2.913 | ) | | | (0.392 | ) | | | (0.653 | ) | | | (1.637 | ) | | | (1.191 | ) |

| | | | | |

Total distributions | | $ | (3.076 | ) | | $ | (0.480 | ) | | $ | (0.793 | ) | | $ | (1.829 | ) | | $ | (1.408 | ) |

| | | | | |

Portfolio transaction fee, net(1) | | $ | 0.002 | | | $ | — | (2) | | $ | 0.002 | | | $ | 0.001 | | | $ | (0.002 | ) |

| | | | | |

Net asset value — End of year | | $ | 24.140 | | | $ | 22.130 | | | $ | 19.110 | | | $ | 14.720 | | | $ | 17.490 | |

| | | | | |

Total Return(3)(4) | | | 23.12 | % | | | 18.52 | % | | | 35.32 | % | | | (5.63 | )% | | | 20.14 | % |

| | | | | |

| Ratios/Supplemental Data | | | | | | | | | | | | | | | | | | | | |

| | | | | |

Net assets, end of year (000’s omitted) | | $ | 32,558 | | | $ | 40,943 | | | $ | 37,375 | | | $ | 29,455 | | | $ | 35,068 | |

| | | | | |

Ratios (as a percentage of average daily net assets):(5) | | | | | | | | | | | | | | | | | | | | |

| | | | | |

Expenses(4) | | | 0.73 | % | | | 0.73 | % | | | 0.73 | % | | | 0.73 | % | | | 0.73 | % |

| | | | | |

Net investment income | | | 0.45 | % | | | 0.76 | % | | | 0.89 | % | | | 1.06 | % | | | 1.28 | % |

| | | | | |

Portfolio Turnover of the Portfolio | | | 44 | % | | | 70 | % | | | 55 | % | | | 90 | % | | | 101 | % |

| (1) | Computed using average shares outstanding. |

| (2) | Amount is less than $(0.0005). |

| (3) | Returns are historical and are calculated by determining the percentage change in net asset value with all distributions reinvested. |

| (4) | The administrator waived its fees and/or reimbursed certain operating expenses (equal to 0.07%, 0.10%, 0.12%, 0.12% and 0.13% of average daily net assets for the years ended December 31, 2021, 2020, 2019, 2018 and 2017, respectively). Absent the waivers and reimbursement, total return would be lower. |

| (5) | Includes the Fund’s share of the Portfolio’s allocated expenses. |

| | | | |

| | 12 | | See Notes to Financial Statements. |

Eaton Vance

Stock Fund

December 31, 2021

Notes to Financial Statements

1 Significant Accounting Policies

Eaton Vance Stock Fund (the Fund) is a diversified series of Eaton Vance Mutual Funds Trust (the Trust). The Trust is a Massachusetts business trust registered under the Investment Company Act of 1940, as amended (the 1940 Act), as an open-end management investment company. The Fund offers three classes of shares. Class A shares are generally sold subject to a sales charge imposed at time of purchase. Class C shares are sold at net asset value and are generally subject to a contingent deferred sales charge (see Note 5). Effective January 25, 2019, Class C shares generally automatically convert to Class A shares ten years after their purchase and, effective November 5, 2020, automatically convert to Class A shares eight years after their purchase as described in the Fund’s prospectus. Class I shares are sold at net asset value and are not subject to a sales charge. Each class represents a pro-rata interest in the Fund, but votes separately on class-specific matters and (as noted below) is subject to different expenses. Realized and unrealized gains and losses and net investment income and losses, other than class-specific expenses, are allocated daily to each class of shares based on the relative net assets of each class to the total net assets of the Fund. Each class of shares differs in its distribution plan and certain other class-specific expenses. The Fund invests all of its investable assets in interests in Stock Portfolio (the Portfolio), a Massachusetts business trust, having the same investment objective and policies as the Fund. The value of the Fund’s investment in the Portfolio reflects the Fund’s proportionate interest in the net assets of the Portfolio (12.8% at December 31, 2021). The performance of the Fund is directly affected by the performance of the Portfolio. The financial statements of the Portfolio, including the portfolio of investments, are included elsewhere in this report and should be read in conjunction with the Fund’s financial statements.

The following is a summary of significant accounting policies of the Fund. The policies are in conformity with accounting principles generally accepted in the United States of America (U.S. GAAP). The Fund is an investment company and follows accounting and reporting guidance in the Financial Accounting Standards Board (FASB) Accounting Standards Codification Topic 946.

A Investment Valuation — Valuation of securities by the Portfolio is discussed in Note 1A of the Portfolio’s Notes to Financial Statements, which are included elsewhere in this report.

B Income — The Fund’s net investment income or loss consists of the Fund’s pro-rata share of the net investment income or loss of the Portfolio, less all actual and accrued expenses of the Fund.

C Federal Taxes — The Fund’s policy is to comply with the provisions of the Internal Revenue Code applicable to regulated investment companies and to distribute to shareholders each year substantially all of its net investment income, and all or substantially all of its net realized capital gains. Accordingly, no provision for federal income or excise tax is necessary.

As of December 31, 2021, the Fund had no uncertain tax positions that would require financial statement recognition, de-recognition, or disclosure. The Fund files a U.S. federal income tax return annually after its fiscal year-end, which is subject to examination by the Internal Revenue Service for a period of three years from the date of filing.

D Expenses — The majority of expenses of the Trust are directly identifiable to an individual fund. Expenses which are not readily identifiable to a specific fund are allocated taking into consideration, among other things, the nature and type of expense and the relative size of the funds.

E Use of Estimates — The preparation of the financial statements in conformity with U.S. GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities at the date of the financial statements and the reported amounts of income and expense during the reporting period. Actual results could differ from those estimates.

F Indemnifications — Under the Trust’s organizational documents, its officers and Trustees may be indemnified against certain liabilities and expenses arising out of the performance of their duties to the Fund. Under Massachusetts law, if certain conditions prevail, shareholders of a Massachusetts business trust (such as the Trust) could be deemed to have personal liability for the obligations of the Trust. However, the Trust’s Declaration of Trust contains an express disclaimer of liability on the part of Fund shareholders and the By-laws provide that the Trust shall assume, upon request by the shareholder, the defense on behalf of any Fund shareholders. Moreover, the By-laws also provide for indemnification out of Fund property of any shareholder held personally liable solely by reason of being or having been a shareholder for all loss or expense arising from such liability. Additionally, in the normal course of business, the Fund enters into agreements with service providers that may contain indemnification clauses. The Fund’s maximum exposure under these arrangements is unknown as this would involve future claims that may be made against the Fund that have not yet occurred.

G Other — Investment transactions are accounted for on a trade date basis.

2 Distributions to Shareholders and Income Tax Information

It is the present policy of the Fund to make at least one distribution annually (normally in December) of all or substantially all of its net investment income and to distribute annually all or substantially all of its net realized capital gains. Distributions to shareholders are recorded on the ex-dividend date. Distributions are declared separately for each class of shares. Shareholders may reinvest income and capital gain distributions in additional shares of the same class of the Fund at the net asset value as of the ex-dividend date or, at the election of the shareholder, receive distributions in cash. Distributions to shareholders are determined in accordance with income tax regulations, which may differ from U.S. GAAP. As required by U.S. GAAP, only distributions in excess of tax basis earnings and profits are reported in the financial statements as a return of capital. Permanent differences between book and tax accounting relating to distributions are reclassified to paid-in capital. For tax purposes, distributions from short-term capital gains are considered to be from ordinary income.

Eaton Vance

Stock Fund

December 31, 2021

Notes to Financial Statements — continued

The tax character of distributions declared for the years ended December 31, 2021 and December 31, 2020 was as follows:

| | | | | | | | |

| | | Year Ended December 31, | |

| | | 2021 | | | 2020 | |

| | |

Ordinary income | | $ | 1,515,122 | | | $ | 290,052 | |

| | |

Long-term capital gains | | $ | 11,152,131 | | | $ | 1,918,763 | |

During the year ended December 31, 2021, distributable earnings was decreased by $1,900,612 and paid-in capital was increased by $1,900,612 due to the Fund’s use of equalization accounting and the Fund’s investment in the Portfolio. Tax equalization accounting allows the Fund to treat as a distribution that portion of redemption proceeds representing a redeeming shareholder’s portion of undistributed taxable income and net capital gains. These reclassifications had no effect on the net assets or net asset value per share of the Fund.

As of December 31, 2021, the components of distributable earnings (accumulated loss) on a tax basis were as follows:

| | | | |

| | |

Undistributed ordinary income | | $ | 261,918 | |

| |

Undistributed long-term capital gains | | | 5,462,340 | |

| |

Net unrealized appreciation | | | 44,672,630 | |

| |

Distributable earnings | | $ | 50,396,888 | |

3 Investment Adviser Fee and Other Transactions with Affiliates

Effective March 1, 2021, the Fund entered into an investment advisory agreement with Eaton Vance Management (EVM). Pursuant to the agreement, the Fund pays an investment adviser fee on its average daily net assets that are not invested in other investment companies for which EVM or its affiliates serve as investment adviser and receive an advisory fee, at a per annum rate as follows and is payable monthly:

| | | | |

| Average Daily Net Assets | | Annual Fee Rate | |

| |

Up to $500 million | | | 0.600 | % |

| |

$500 million but less than $1 billion | | | 0.575 | % |

| |

$1 billion but less than $2.5 billion | | | 0.550 | % |

| |

$2.5 billion but less than $5 billion | | | 0.530 | % |

| |

$5 billion and over | | | 0.515 | % |

For the year ended December 31, 2021, the Fund incurred no investment adviser fee on such assets. To the extent that the Fund’s assets are invested in the Portfolio, the Fund is allocated its share of the Portfolio’s investment adviser fee. The Portfolio has engaged Boston Management and Research (BMR) to render investment advisory services. See Note 2 of the Portfolio’s Notes to Financial Statements which are included elsewhere in this report. EVM also serves as the administrator of the Fund, but receives no compensation.

EVM has agreed to reimburse the Fund’s expenses to the extent that total annual operating expenses (relating to ordinary operating expenses only) exceed 0.98%, 1.73% and 0.73% of the Fund’s average daily net assets for Class A, Class C and Class I, respectively. This agreement may be changed or terminated after April 30, 2022. Pursuant to this agreement, EVM was allocated $72,100 of the Fund’s operating expenses for the year ended December 31, 2021.

EVM provides sub-transfer agency and related services to the Fund pursuant to a Sub-Transfer Agency Support Services Agreement. For the year ended December 31, 2021, EVM earned $10,858 from the Fund pursuant to such agreement, which is included in transfer and dividend disbursing agent fees on the Statement of Operations. The Fund was informed that Eaton Vance Distributors, Inc. (EVD), an affiliate of EVM and the Fund’s principal underwriter, received $3,099 as its portion of the sales charge on sales of Class A shares for the year ended December 31, 2021. EVD also received distribution and service fees from Class A and Class C shares (see Note 4) and contingent deferred sales charges (see Note 5).

Trustees and officers of the Fund who are members of EVM’s or BMR’s organizations receive remuneration for their services to the Fund out of the investment adviser fee. Certain officers and Trustees of the Fund and the Portfolio are officers of the above organizations.

Eaton Vance

Stock Fund

December 31, 2021

Notes to Financial Statements — continued

4 Distribution Plans

The Fund has in effect a distribution plan for Class A shares (Class A Plan) pursuant to Rule 12b-1 under the 1940 Act. Pursuant to the Class A Plan, the Fund pays EVD a distribution and service fee of 0.25% per annum of its average daily net assets attributable to Class A shares for distribution services and facilities provided to the Fund by EVD, as well as for personal services and/or the maintenance of shareholder accounts. Distribution and service fees paid or accrued to EVD for the year ended December 31, 2021 amounted to $153,629 for Class A shares.

The Fund also has in effect a distribution plan for Class C shares (Class C Plan) pursuant to Rule 12b-1 under the 1940 Act. Pursuant to the Class C Plan, the Fund pays EVD amounts equal to 0.75% per annum of its average daily net assets attributable to Class C shares for providing ongoing distribution services and facilities to the Fund. For the year ended December 31, 2021, the Fund paid or accrued to EVD $53,641 for Class C shares.

Pursuant to the Class C Plan, the Fund also makes payments of service fees to EVD, financial intermediaries and other persons in amounts equal to 0.25% per annum of its average daily net assets attributable to that class. Service fees paid or accrued are for personal services and/or the maintenance of shareholder accounts. They are separate and distinct from the sales commissions and distribution fees payable to EVD. Service fees paid or accrued for the year ended December 31, 2021 amounted to $17,881 for Class C shares.

Distribution and service fees are subject to the limitations contained in the Financial Industry Regulatory Authority Rule 2341(d).

5 Contingent Deferred Sales Charges

A contingent deferred sales charge (CDSC) of 1% generally is imposed on redemptions of Class C shares made within 12 months of purchase. Class A shares may be subject to a 1% CDSC if redeemed within 18 months of purchase (depending on the circumstances of purchase). Generally, the CDSC is based upon the lower of the net asset value at date of redemption or date of purchase. No charge is levied on shares acquired by reinvestment of dividends or capital gain distributions. For the year ended December 31, 2021, the Fund was informed that EVD received approximately $1,000 and $300 of CDSCs paid by Class A and Class C shareholders, respectively.

6 Investment Transactions

For the year ended December 31, 2021, increases and decreases in the Fund’s investment in the Portfolio aggregated $1,252,286 and $20,883,943, respectively. In addition, a Portfolio transaction fee is imposed by the Portfolio on the combined daily inflows or outflows of the Fund and the Portfolio’s other investors as more fully described at Note 1H of the Portfolio’s financial statements included herein. Such fee is allocated to the Fund based on its pro-rata interest in the Portfolio. The amount of the Portfolio transaction fee imposed on the Fund, if any, and the allocation of such fee are presented as Other capital on the Statements of Changes in Net Assets.

7 Shares of Beneficial Interest

The Fund’s Declaration of Trust permits the Trustees to issue an unlimited number of full and fractional shares of beneficial interest (without par value). Such shares may be issued in a number of different series (such as the Fund) and classes. Transactions in Fund shares were as follows:

| | | | | | | | |

| | | Year Ended December 31, | |

| Class A | | 2021 | | | 2020 | |

| | |

Sales | | | 87,276 | | | | 300,201 | |

| | |

Issued to shareholders electing to receive payments of distributions in Fund shares | | | 283,050 | | | | 54,382 | |

| | |

Redemptions | | | (561,982 | ) | | | (610,510 | ) |

| | |

Converted from Class C shares | | | 13,720 | | | | 193,561 | |

| | |

Net decrease | | | (177,936 | ) | | | (62,366 | ) |

Eaton Vance

Stock Fund

December 31, 2021

Notes to Financial Statements — continued

| | | | | | | | |

| | | Year Ended December 31, | |

| Class C | | 2021 | | | 2020 | |

| | |

Sales | | | 33,931 | | | | 57,033 | |

| | |

Issued to shareholders electing to receive payments of distributions in Fund shares | | | 34,686 | | | | 10,608 | |

| | |

Redemptions | | | (49,461 | ) | | | (166,542 | ) |

| | |

Converted to Class A shares | | | (14,216 | ) | | | (200,172 | ) |

| | |

Net increase (decrease) | | | 4,940 | | | | (299,073 | ) |

| |

| | | Year Ended December 31, | |

| Class I | | 2021 | | | 2020 | |

| | |

Sales | | | 177,151 | | | | 711,979 | |

| | |

Issued to shareholders electing to receive payments of distributions in Fund shares | | | 205,049 | | | | 42,001 | |

| | |

Redemptions | | | (883,434 | ) | | | (859,557 | ) |

| | |

Net decrease | | | (501,234 | ) | | | (105,577 | ) |

Eaton Vance

Stock Fund

December 31, 2021

Report of Independent Registered Public Accounting Firm

To the Trustees of Eaton Vance Mutual Funds Trust and Shareholders of Eaton Vance Stock Fund:

Opinion on the Financial Statements and Financial Highlights

We have audited the accompanying statement of assets and liabilities of Eaton Vance Stock Fund (the “Fund”) (one of the funds constituting Eaton Vance Mutual Funds Trust), as of December 31, 2021, the related statement of operations for the year then ended, the statements of changes in net assets for each of the two years in the period then ended, the financial highlights for each of the five years in the period then ended, and the related notes. In our opinion, the financial statements and financial highlights present fairly, in all material respects, the financial position of the Fund as of December 31, 2021, and the results of its operations for the year then ended, the changes in its net assets for each of the two years in the period then ended, and the financial highlights for each of the five years in the period then ended, in conformity with accounting principles generally accepted in the United States of America.

Basis for Opinion

These financial statements and financial highlights are the responsibility of the Fund’s management. Our responsibility is to express an opinion on the Fund’s financial statements and financial highlights based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (PCAOB) and are required to be independent with respect to the Fund in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement, whether due to error or fraud. The Fund is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. As part of our audits, we are required to obtain an understanding of internal control over financial reporting but not for the purpose of expressing an opinion on the effectiveness of the Fund’s internal control over financial reporting. Accordingly, we express no such opinion.

Our audits included performing procedures to assess the risks of material misstatement of the financial statements and financial highlights, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements and financial highlights. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements and financial highlights. We believe that our audits provide a reasonable basis for our opinion.

/s/ Deloitte & Touche LLP

Boston, Massachusetts

February 23, 2022

We have served as the auditor of one or more Eaton Vance investment companies since 1959.

Eaton Vance

Stock Fund

December 31, 2021

Federal Tax Information (Unaudited)

The Form 1099-DIV you received in February 2022 showed the tax status of all distributions paid to your account in calendar year 2021. Shareholders are advised to consult their own tax adviser with respect to the tax consequences of their investment in the Fund. As required by the Internal Revenue Code and/or regulations, shareholders must be notified regarding the status of qualified business income, qualified dividend income for individuals, the dividends received deduction for corporations and capital gains dividends.

Qualified Business Income. For the fiscal year ended December 31, 2021, the Fund designates $16,775, or up to the maximum amount of such dividends allowable pursuant to the Internal Revenue Code, as qualified business income.

Qualified Dividend Income. For the fiscal year ended December 31, 2021, the Fund designates approximately $1,238,530, or up to the maximum amount of such dividends allowable pursuant to the Internal Revenue Code, as qualified dividend income eligible for the reduced tax rate of 15%.

Dividends Received Deduction. Corporate shareholders are generally entitled to take the dividends received deduction on the portion of the Fund’s dividend distribution that qualifies under tax law. For the Fund’s fiscal 2021 ordinary income dividends, 70.85% qualifies for the corporate dividends received deduction.

Capital Gains Dividends. The Fund hereby designates as a capital gain dividend with respect to the taxable year ended December 31, 2021, $15,752,124 or, if subsequently determined to be different, the net capital gain of such year.

Stock Portfolio

December 31, 2021

Portfolio of Investments

| | | | | | | | |

| Common Stocks — 94.9% | |

| Security | | Shares | | | Value | |

|

| Auto Components — 1.6% | |

| | |

Aptiv PLC(1) | | | 86,456 | | | $ | 14,260,917 | |

| |

| | | | $ | 14,260,917 | |

|

| Automobiles — 0.9% | |

| | |

Tesla, Inc.(1) | | | 7,200 | | | $ | 7,608,816 | |

| |

| | | | $ | 7,608,816 | |

|

| Banks — 4.4% | |

| | |

PNC Financial Services Group, Inc. (The) | | | 90,970 | | | $ | 18,241,304 | |

| | |

Wells Fargo & Co. | | | 417,210 | | | | 20,017,736 | |

| |

| | | | $ | 38,259,040 | |

|

| Beverages — 3.4% | |

| | |

Coca-Cola Co. (The) | | | 257,246 | | | $ | 15,231,536 | |

| | |

Coca-Cola Europacific Partners PLC | | | 250,060 | | | | 13,985,856 | |

| |

| | | | $ | 29,217,392 | |

|

| Biotechnology — 3.1% | |

| | |

AbbVie, Inc. | | | 144,416 | | | $ | 19,553,926 | |

| | |

Neurocrine Biosciences, Inc.(1) | | | 89,416 | | | | 7,615,561 | |

| |

| | | | $ | 27,169,487 | |

|

| Building Products — 1.1% | |

| | |

AZEK Co., Inc. (The)(1) | | | 200,950 | | | $ | 9,291,928 | |

| |

| | | | $ | 9,291,928 | |

|

| Capital Markets — 7.3% | |

| | |

Goldman Sachs Group, Inc. (The) | | | 31,190 | | | $ | 11,931,735 | |

| | |

Intercontinental Exchange, Inc. | | | 110,204 | | | | 15,072,601 | |

| | |

S&P Global, Inc. | | | 40,636 | | | | 19,177,347 | |

| | |

Tradeweb Markets, Inc., Class A | | | 171,429 | | | | 17,166,900 | |

| |

| | | | $ | 63,348,583 | |

|

| Commercial Services & Supplies — 1.2% | |

| | |

Waste Management, Inc. | | | 61,978 | | | $ | 10,344,128 | |

| |

| | | | $ | 10,344,128 | |

|

| Containers & Packaging — 1.0% | |

| | |

AptarGroup, Inc. | | | 72,454 | | | $ | 8,874,166 | |

| |

| | | | $ | 8,874,166 | |

| | | | | | | | |

| Security | | Shares | | | Value | |

|

| Electric Utilities — 1.6% | |

| | |

NextEra Energy, Inc. | | | 148,440 | | | $ | 13,858,358 | |

| |

| | | | $ | 13,858,358 | |

|

| Electrical Equipment — 1.2% | |

| | |

AMETEK, Inc. | | | 73,256 | | | $ | 10,771,562 | |

| |

| | | | $ | 10,771,562 | |

|

| Electronic Equipment, Instruments & Components — 1.4% | |

| | |

TE Connectivity, Ltd. | | | 76,400 | | | $ | 12,326,376 | |

| |

| | | | $ | 12,326,376 | |

|

| Entertainment — 1.2% | |

| | |

Walt Disney Co. (The)(1) | | | 66,982 | | | $ | 10,374,842 | |

| |

| | | | $ | 10,374,842 | |

|

| Equity Real Estate Investment Trusts (REITs) — 2.8% | |

| | |

EastGroup Properties, Inc. | | | 46,522 | | | $ | 10,600,038 | |

| | |

Lamar Advertising Co., Class A | | | 112,290 | | | | 13,620,777 | |

| |

| | | | $ | 24,220,815 | |

|

| Food & Staples Retailing — 1.7% | |

| | |

Sysco Corp. | | | 189,990 | | | $ | 14,923,715 | |

| |

| | | | $ | 14,923,715 | |

|

| Health Care Equipment & Supplies — 1.9% | |

| | |

Boston Scientific Corp.(1) | | | 254,436 | | | $ | 10,808,441 | |

| | |

Teleflex, Inc. | | | 18,500 | | | | 6,076,880 | |

| |

| | | | $ | 16,885,321 | |

|

| Health Care Providers & Services — 1.8% | |

| | |

Anthem, Inc. | | | 33,224 | | | $ | 15,400,653 | |

| |

| | | | $ | 15,400,653 | |

|

| Hotels, Restaurants & Leisure — 1.3% | |

| | |

Marriott International, Inc., Class A(1) | | | 69,128 | | | $ | 11,422,711 | |

| |

| | | | $ | 11,422,711 | |

|

| Interactive Media & Services — 6.7% | |

| | |

Alphabet, Inc., Class C(1) | | | 16,589 | | | $ | 48,001,764 | |

| | |

Meta Platforms, Inc., Class A(1) | | | 32,076 | | | | 10,788,763 | |

| |

| | | | $ | 58,790,527 | |

| | | | |

| | 19 | | See Notes to Financial Statements. |

Stock Portfolio

December 31, 2021

Portfolio of Investments — continued

| | | | | | | | |

| Security | | Shares | | | Value | |

|

| Internet & Direct Marketing Retail — 5.4% | |

| | |

Amazon.com, Inc.(1) | | | 13,996 | | | $ | 46,667,423 | |

| |

| | | | $ | 46,667,423 | |

|

| IT Services — 3.7% | |

| | |

Automatic Data Processing, Inc. | | | 60,796 | | | $ | 14,991,078 | |

| | |

Visa, Inc., Class A | | | 81,030 | | | | 17,560,011 | |

| |

| | | | $ | 32,551,089 | |

|

| Life Sciences Tools & Services — 3.9% | |

| | |

Danaher Corp. | | | 51,992 | | | $ | 17,105,888 | |

| | |

Thermo Fisher Scientific, Inc. | | | 25,034 | | | | 16,703,686 | |

| |

| | | | $ | 33,809,574 | |

|

| Machinery — 1.1% | |

| | |

Stanley Black & Decker, Inc. | | | 51,938 | | | $ | 9,796,546 | |

| |

| | | | $ | 9,796,546 | |

|

| Oil, Gas & Consumable Fuels — 2.1% | |

| | |

ConocoPhillips | | | 251,256 | | | $ | 18,135,658 | |

| |

| | | | $ | 18,135,658 | |

|

| Pharmaceuticals — 3.4% | |

| | |

Eli Lilly & Co. | | | 49,100 | | | $ | 13,562,402 | |

| | |

Pfizer, Inc. | | | 96,400 | | | | 5,692,420 | |

| | |

Zoetis, Inc. | | | 41,922 | | | | 10,230,226 | |

| |

| | | | $ | 29,485,048 | |

|

| Professional Services — 2.2% | |

| | |

Booz Allen Hamilton Holding Corp. | | | 113,090 | | | $ | 9,588,901 | |

| | |

Clarivate PLC(1) | | | 421,188 | | | | 9,906,342 | |

| |

| | | | $ | 19,495,243 | |

|

| Road & Rail — 1.5% | |

| | |

Union Pacific Corp. | | | 52,424 | | | $ | 13,207,178 | |

| |

| | | | $ | 13,207,178 | |

|

| Semiconductors & Semiconductor Equipment — 6.3% | |

| | |

Analog Devices, Inc. | | | 91,086 | | | $ | 16,010,186 | |

| | |

Lam Research Corp. | | | 16,200 | | | | 11,650,230 | |

| | |

NVIDIA Corp. | | | 25,500 | | | | 7,499,805 | |

| | |

Taiwan Semiconductor Manufacturing Co., Ltd. ADR | | | 69,039 | | | | 8,306,082 | |

| | |

Texas Instruments, Inc. | | | 62,347 | | | | 11,750,539 | |

| |

| | | | $ | 55,216,842 | |

| | | | | | | | |

| Security | | Shares | | | Value | |

|

| Software — 9.9% | |

| | |

Bill.com Holdings, Inc.(1) | | | 31,200 | | | $ | 7,773,480 | |

| | |

Intuit, Inc. | | | 24,254 | | | | 15,600,658 | |

| | |

Microsoft Corp. | | | 187,598 | | | | 63,092,959 | |

| |

| | | | $ | 86,467,097 | |

|

| Specialty Retail — 1.7% | |

| | |

TJX Cos., Inc. (The) | | | 198,134 | | | $ | 15,042,333 | |

| |

| | | | $ | 15,042,333 | |

|

| Technology Hardware, Storage & Peripherals — 6.0% | |

| | |

Apple, Inc. | | | 293,484 | | | $ | 52,113,954 | |

| |

| | | | $ | 52,113,954 | |

|

| Textiles, Apparel & Luxury Goods — 0.9% | |

| | |

Deckers Outdoor Corp.(1) | | | 20,518 | | | $ | 7,515,949 | |

| |

| | | | $ | 7,515,949 | |

|

| Wireless Telecommunication Services — 1.2% | |

| | |

T-Mobile US, Inc.(1) | | | 86,208 | | | $ | 9,998,404 | |

| |

| | | | $ | 9,998,404 | |

| |

Total Common Stocks

(identified cost $507,783,336) | | | $ | 826,851,675 | |

|

| Short-Term Investments — 0.3% | |

| Description | | Units | | | Value | |

| | |

Eaton Vance Cash Reserves Fund, LLC, 0.08%(2) | | | 2,248,701 | | | $ | 2,248,476 | |

| |

Total Short-Term Investments

(identified cost $2,248,476) | | | $ | 2,248,476 | |

| |

Total Investments — 95.2%

(identified cost $510,031,812) | | | $ | 829,100,151 | |

| |

Other Assets, Less Liabilities — 4.8% | | | $ | 42,209,395 | |

| |

Net Assets — 100.0% | | | $ | 871,309,546 | |

The percentage shown for each investment category in the Portfolio of Investments is based on net assets.

| (1) | Non-income producing security. |

| (2) | Affiliated investment company, available to Eaton Vance portfolios and funds, which invests in high quality, U.S. dollar denominated money market instruments. The rate shown is the annualized seven-day yield as of December 31, 2021. |

Abbreviations:

| | | | |

| | |

| ADR | | – | | American Depositary Receipt |

| | | | |

| | 20 | | See Notes to Financial Statements. |

Stock Portfolio

December 31, 2021

Statement of Assets and Liabilities

| | | | |

| Assets | | December 31, 2021 | |

| |

Unaffiliated investments, at value (identified cost, $507,783,336) | | $ | 826,851,675 | |

| |

Affiliated investment, at value (identified cost, $2,248,476) | | | 2,248,476 | |

| |

Dividends receivable | | | 244,593 | |

| |

Dividends receivable from affiliated investment | | | 93 | |

| |

Receivable for investments sold | | | 42,354,951 | |

| |

Tax reclaims receivable | | | 135,816 | |

| |

Total assets | | $ | 871,835,604 | |

| |

| Liabilities | | | | |

| |

Payable to affiliates: | | | | |

| |

Investment adviser fee | | $ | 429,926 | |

| |

Trustees’ fees | | | 10,295 | |

| |

Accrued expenses | | | 85,837 | |

| |

Total liabilities | | $ | 526,058 | |

| |

Net Assets applicable to investors’ interest in Portfolio | | $ | 871,309,546 | |

| | | | |

| | 21 | | See Notes to Financial Statements. |

Stock Portfolio

December 31, 2021

Statement of Operations

| | | | |

| Investment Income | | Year Ended

December 31, 2021 | |

| |

Dividends (net of foreign taxes, $154,516) | | $ | 9,906,044 | |

| |

Dividends from affiliated investment | | | 1,479 | |

| |

Total investment income | | $ | 9,907,523 | |

| |

| Expenses | | | | |

| |

Investment adviser fee | | $ | 4,970,765 | |

| |

Trustees’ fees and expenses | | | 41,836 | |

| |

Custodian fee | | | 204,317 | |

| |

Legal and accounting services | | | 52,438 | |

| |

Miscellaneous | | | 24,624 | |

| |

Total expenses | | $ | 5,293,980 | |

| |

Net investment income | | $ | 4,613,543 | |

| |

| Realized and Unrealized Gain (Loss) | | | | |

| |

Net realized gain (loss) — | | | | |

| |

Investment transactions | | $ | 123,850,522 | (1) |

| |

Investment transactions — affiliated investment | | | (1,372 | ) |

| |

Foreign currency transactions | | | (11,938 | ) |

| |

Net realized gain | | $ | 123,837,212 | |

| |

Change in unrealized appreciation (depreciation) — | | | | |

| |

Investments | | $ | 46,450,706 | |

| |

Foreign currency | | | (7,691 | ) |

| |

Net change in unrealized appreciation (depreciation) | | $ | 46,443,015 | |

| |

Net realized and unrealized gain | | $ | 170,280,227 | |

| |

Net increase in net assets from operations | | $ | 174,893,770 | |

| (1) | Includes $3,096,043 of net realized gains from redemptions in-kind. |

| | | | |

| | 22 | | See Notes to Financial Statements. |

Stock Portfolio

December 31, 2021

Statements of Changes in Net Assets

| | | | | | | | |

| | | Year Ended December 31, | |

| Increase (Decrease) in Net Assets | | 2021 | | | 2020 | |

| | |

From operations — | | | | | | | | |

| | |

Net investment income | | $ | 4,613,543 | | | $ | 5,837,934 | |

| | |

Net realized gain | | | 123,837,212 | (1) | | | 18,275,199 | |

| | |

Net change in unrealized appreciation (depreciation) | | | 46,443,015 | | | | 96,276,139 | |

| | |

Net increase in net assets from operations | | $ | 174,893,770 | | | $ | 120,389,272 | |

| | |

Capital transactions — | | | | | | | | |

| | |

Contributions | | $ | 23,356,815 | | | $ | 78,327,454 | |

| | |

Withdrawals | | | (131,961,931 | ) | | | (78,095,172 | ) |

| | |

Portfolio transaction fee | | | 574,923 | | | | 276,897 | |

| | |

Net increase (decrease) in net assets from capital transactions | | $ | (108,030,193 | ) | | $ | 509,179 | |

| | |

Net increase in net assets | | $ | 66,863,577 | | | $ | 120,898,451 | |

| | |

| Net Assets | | | | | | | | |

| | |

At beginning of year | | $ | 804,445,969 | | | $ | 683,547,518 | |

| | |

At end of year | | $ | 871,309,546 | | | $ | 804,445,969 | |

| (1) | Includes $3,096,043 of net realized gains from redemptions in-kind. |

| | | | |

| | 23 | | See Notes to Financial Statements. |

Stock Portfolio

December 31, 2021

Financial Highlights

| | | | | | | | | | | | | | | | | | | | |

| | | Year Ended December 31, | |

| Ratios/Supplemental Data | | 2021 | | | 2020 | | | 2019 | | | 2018 | | | 2017 | |

| | | | | |

Ratios (as a percentage of average daily net assets): | | | | | | | | | | | | | | | | | | | | |

| | | | | |

Expenses | | | 0.63 | % | | | 0.64 | % | | | 0.63 | % | | | 0.64 | % | | | 0.64 | % |

| | | | | |

Net investment income | | | 0.55 | % | | | 0.84 | % | | | 0.99 | % | | | 1.14 | % | | | 1.38 | % |

| | | | | |

Portfolio Turnover | | | 44 | % | | | 70 | % | | | 55 | % | | | 90 | % | | | 101 | % |

| | | | | |

Total Return | | | 23.21 | % | | | 18.61 | % | | | 35.47 | % | | | (5.57 | )% | | | 20.31 | % |

| | | | | |

Net assets, end of year (000’s omitted) | | $ | 871,310 | | | $ | 804,446 | | | $ | 683,548 | | | $ | 516,615 | | | $ | 647,405 | |

| | | | |

| | 24 | | See Notes to Financial Statements. |

Stock Portfolio

December 31, 2021

Notes to Financial Statements

1 Significant Accounting Policies

Stock Portfolio (the Portfolio) is a Massachusetts business trust registered under the Investment Company Act of 1940, as amended (the 1940 Act), as a diversified, open-end management investment company. The Portfolio’s investment objective is to achieve long-term capital appreciation by investing in a diversified portfolio of equity securities. The Declaration of Trust permits the Trustees to issue interests in the Portfolio. At December 31, 2021, Eaton Vance Stock Fund, Eaton Vance Stock NextShares and Eaton Vance Balanced Fund held an interest of 12.8%, 0.2% and 87.1%, respectively, in the Portfolio.

The following is a summary of significant accounting policies of the Portfolio. The policies are in conformity with accounting principles generally accepted in the United States of America (U.S. GAAP). The Portfolio is an investment company and follows accounting and reporting guidance in the Financial Accounting Standards Board (FASB) Accounting Standards Codification Topic 946.

A Investment Valuation — The following methodologies are used to determine the market value or fair value of investments.

Equity Securities. Equity securities listed on a U.S. securities exchange generally are valued at the last sale or closing price on the day of valuation or, if no sales took place on such date, at the mean between the closing bid and ask prices on the exchange where such securities are principally traded. Equity securities listed on the NASDAQ National Market System are valued at the NASDAQ official closing price. Unlisted or listed securities for which closing sales prices or closing quotations are not available are valued at the mean between the latest available bid and ask prices.

Foreign Securities and Currencies. Foreign securities and currencies are valued in U.S. dollars, based on foreign currency exchange rate quotations supplied by a third party pricing service. The pricing service uses a proprietary model to determine the exchange rate. Inputs to the model include reported trades and implied bid/ask spreads. The daily valuation of exchange-traded foreign securities generally is determined as of the close of trading on the principal exchange on which such securities trade. Events occurring after the close of trading on foreign exchanges may result in adjustments to the valuation of foreign securities to more accurately reflect their fair value as of the close of regular trading on the New York Stock Exchange. When valuing foreign equity securities that meet certain criteria, the Portfolio’s Trustees have approved the use of a fair value service that values such securities to reflect market trading that occurs after the close of the applicable foreign markets of comparable securities or other instruments that have a strong correlation to the fair-valued securities.

Affiliated Fund. The Portfolio may invest in Eaton Vance Cash Reserves Fund, LLC (Cash Reserves Fund), an affiliated investment company managed by Eaton Vance Management (EVM). While Cash Reserves Fund is not a registered money market mutual fund, it conducts all of its investment activities in accordance with the requirements of Rule 2a-7 under the 1940 Act. Investments in Cash Reserves Fund are valued at the closing net asset value per unit on the valuation day. Cash Reserves Fund generally values its investment securities based on available market quotations provided by a third party pricing service.

Fair Valuation. Investments for which valuations or market quotations are not readily available or are deemed unreliable are valued at fair value using methods determined in good faith by or at the direction of the Trustees of the Portfolio in a manner that most fairly reflects the security’s “fair value”, which is the amount that the Portfolio might reasonably expect to receive for the security upon its current sale in the ordinary course. Each such determination is based on a consideration of relevant factors, which are likely to vary from one pricing context to another. These factors may include, but are not limited to, the type of security, the existence of any contractual restrictions on the security’s disposition, the price and extent of public trading in similar securities of the issuer or of comparable companies or entities, quotations or relevant information obtained from broker/dealers or other market participants, information obtained from the issuer, analysts, and/or the appropriate stock exchange (for exchange-traded securities), an analysis of the company’s or entity’s financial statements, and an evaluation of the forces that influence the issuer and the market(s) in which the security is purchased and sold.

B Investment Transactions — Investment transactions for financial statement purposes are accounted for on a trade date basis. Realized gains and losses on investments sold are determined on the basis of identified cost.

C Income — Dividend income is recorded on the ex-dividend date for dividends received in cash and/or securities. However, if the ex-dividend date has passed, certain dividends from foreign securities are recorded as the Portfolio is informed of the ex-dividend date. Withholding taxes on foreign dividends and capital gains have been provided for in accordance with the Portfolio’s understanding of the applicable countries’ tax rules and rates.