UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act File Number: 811-04015

Eaton Vance Mutual Funds Trust

(Exact Name of Registrant as Specified in Charter)

Two International Place, Boston, Massachusetts 02110

(Address of Principal Executive Offices)

Deidre E. Walsh

Two International Place, Boston, Massachusetts 02110

(Name and Address of Agent for Services)

(617) 482-8260

(Registrant’s Telephone Number)

October 31

Date of Fiscal Year End

October 31, 2022

Date of Reporting Period

Item 1. Reports to Stockholders

Eaton Vance

Tax-Managed Equity Asset Allocation Fund

Annual Report

October 31, 2022

Commodity Futures Trading Commission Registration. The Commodity Futures Trading Commission (“CFTC”) has adopted regulations that subject registered investment companies and advisers to regulation by the CFTC if a fund invests more than a prescribed level of its assets in certain CFTC-regulated instruments (including futures, certain options and swap agreements) or markets itself as providing investment exposure to such instruments. The investment adviser has claimed an exclusion from the definition of “commodity pool operator” under the Commodity Exchange Act with respect to its management of the Fund. Accordingly, neither the Fund nor the adviser with respect to the operation of the Fund is subject to CFTC regulation. Because of its management of other strategies, the Fund’s adviser is registered with the CFTC as a commodity pool operator. The adviser is also registered as a commodity trading advisor.

Fund shares are not insured by the FDIC and are not deposits or other obligations of, or guaranteed by, any depository institution. Shares are subject to investment risks, including possible loss of principal invested.

This report must be preceded or accompanied by a current summary prospectus or prospectus. Before investing, investors should consider carefully the investment objective, risks, and charges and expenses of a mutual fund. This and other important information is contained in the summary prospectus and prospectus, which can be obtained from a financial intermediary. Prospective investors should read the prospectus carefully before investing. For further information, please call 1-800-262-1122.

Annual Report October 31, 2022

Eaton Vance

Tax-Managed Equity Asset Allocation Fund

Eaton Vance

Tax-Managed Equity Asset Allocation Fund

October 31, 2022

Management’s Discussion of Fund Performance†

Economic and Market Conditions

The 12-month period starting November 1, 2021, was dominated by the ongoing effects of one black swan event — the COVID-19 pandemic — and fallout from another — Russia’s invasion of Ukraine in February 2022.

In the opening months of the period, stock investors as well as consumers appeared to take a “glass is half full” approach. In both the U.S. and Europe, consumers rushed to spend money saved earlier in the pandemic. Major U.S. equity indexes closed at new all-time highs during the final months of 2021.

But as the new year began, investors appeared to reevaluate the twin threats of inflation and interest rate hikes, and stock performance turned negative. In February, Russia’s invasion of Ukraine sent shock waves through U.S. and global markets, exacerbating inflationary pressures on energy and food costs. Central banks around the world — including the U.S. Federal Reserve (the Fed), the Bank of England, and the European Central Bank (ECB) — initiated their first interest rate hikes in years. In Europe, looming energy shortages caused by the Russia-Ukraine conflict pushed inflation rates even higher and stock prices lower during the period.

In the U.S., investors began to expect the Fed would raise interest rates at every policy meeting in 2022 and, in turn, worried that aggressive rate hikes could tip the economy into recession. At its June, July, and September 2022 meetings, the Fed hiked the federal funds rate 0.75% each time — to a 3.00%-3.25% range — its first moves of that magnitude since 1994. Higher interest rates, inflation, and recessionary worries drove stock prices down around the globe.

As the period came to a close in October 2022, however, U.S. and European stocks delivered positive performance for the first time in months — driven by a combination of better-than-expected U.S. company earnings; improving investor sentiment that stocks had been oversold during the August-September market pullback; government measures to address Europe’s energy crisis; and hope that central bank rate hikes would help tame inflation.

Meanwhile in the world’s second-largest economy, China’s zero-COVID policy severely restricted economic output. The MSCI Golden Dragon Index, a measure of Chinese large-cap and mid-cap stocks, lost more ground in October and was one of the worst-performing major indexes during the period, declining 42.74%.

Major equity indexes elsewhere also suffered significant losses. For the period as a whole, the MSCI ACWI Index, a broad measure of global equities, returned -19.96%; the S&P 500® Index, a broad measure of U.S. stocks, returned -14.61%; and the technology-laden Nasdaq Composite Index returned -28.56%. The MSCI EAFE Index of developed-market international equities returned -23.00%, while the MSCI Emerging Markets Index, dragged down by its China allocation, returned -31.03% during the period.

Fund Performance

For the 12-month period ended October 31, 2022, Eaton Vance Tax-Managed Equity Asset Allocation Fund (the Fund) returned -16.91% for Class A shares at net asset value (NAV). The Fund underperformed its primary benchmark, the Russell 3000® Index (the Index), which returned -16.52%; and outperformed its secondary benchmark consisting of 80% the Index, 10% MSCI EAFE Index, and 10% ICE BofA Fixed Rate Preferred Securities Index (the Blended Index), which returned -17.08% during the period.

The Fund’s performance is a function of the returns of the underlying portfolios in which it invests and the Fund’s allocation among these portfolios, as well as the performance of the Fund’s direct investments. The Fund invests in tax-managed portfolios across equity market capitalizations and investment styles, as well as direct investments, which include preferred stocks and hybrid securities.

Most major equity asset classes delivered negative returns during the period. Amid the worldwide stock market decline, U.S. equities generally outperformed international markets. U.S. large-cap stocks modestly outperformed U.S. small-cap stocks during the period, while U.S. value stocks — both large-cap and small-cap — declined less than their growth stock counterparts. In this volatile market, the Fund’s international and U.S. multi-cap allocations were the largest drags on Fund performance relative to the U.S.-based, large-cap weighted Index.

The Fund’s allocations to Tax-Managed Growth Portfolio, Tax-Managed Multi-Cap Growth Portfolio, and Tax-Managed International Equity Portfolio all underperformed the Index and detracted from Fund performance versus the Index during the period. In contrast, the Fund’s allocations to Tax-Managed Value Portfolio and Tax-Managed Small-Cap Portfolio outperformed the Index and contributed to returns relative to the Index. The Fund’s direct investments in preferred stocks and other hybrid securities also outperformed the Index and contributed modestly to relative performance.

Fund management made no significant changes to the Fund’s allocation mix during the period. As of period-end, allocations to the Fund’s underlying components were as follows: Tax-Managed Multi-Cap Growth Portfolio (13.8%); Tax-Managed Growth Portfolio (35.7%); Tax-Managed Value Portfolio (28.5%); Tax-Managed International Equity Portfolio (4.6%); Tax-Managed Small-Cap Portfolio (10.8%); and direct investments in preferred stocks and other hybrid securities, including exchange-traded funds that invest in preferred securities and similar instruments (6.6%).

See Endnotes and Additional Disclosures in this report.

Past performance is no guarantee of future results. Returns are historical and are calculated by determining the percentage change in net asset value (NAV) or offering price (as applicable) with all distributions reinvested. Furthermore, returns do not reflect the deduction of taxes that shareholders may have to pay on Fund distributions or upon the redemption of Fund shares. Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Performance for periods less than or equal to one year is cumulative. Performance is for the stated time period only; due to market volatility, current Fund performance may be lower or higher than the quoted return. For performance as of the most recent month-end, please refer to eatonvance.com.

Eaton Vance

Tax-Managed Equity Asset Allocation Fund

October 31, 2022

Performance

Portfolio Manager(s) John H. Croft, CFA and Douglas R. Rogers, CFA, CMT

| | | | | | | | | | | | | | | | | | | | |

| % Average Annual Total Returns1,2 | | Class

Inception Date | | | Performance

Inception Date | | | One Year | | | Five Years | | | Ten Years | |

| | | | | |

Class A at NAV | | | 03/04/2002 | | | | 03/04/2002 | | | | (16.91 | )% | | | 7.32 | % | | | 9.68 | % |

Class A with 5.25% Maximum Sales Charge | | | — | | | | — | | | | (21.28 | ) | | | 6.17 | | | | 9.09 | |

Class C at NAV | | | 03/04/2002 | | | | 03/04/2002 | | | | (17.53 | ) | | | 6.52 | | | | 9.02 | |

Class C with 1% Maximum Deferred Sales Charge | | | — | | | | — | | | | (18.34 | ) | | | 6.52 | | | | 9.02 | |

Class I at NAV | | | 09/11/2015 | | | | 03/04/2002 | | | | (16.68 | ) | | | 7.59 | | | | 9.87 | |

|

| |

| | | | | |

Russell 3000® Index | | | — | | | | — | | | | (16.52 | )% | | | 9.86 | % | | | 12.45 | % |

MSCI EAFE Index | | | — | | | | — | | | | (23.00 | ) | | | (0.09 | ) | | | 4.12 | |

ICE BofA Fixed Rate Preferred Securities Index | | | — | | | | — | | | | (16.32 | ) | | | 0.60 | | | | 3.33 | |

Blended Index | | | — | | | | — | | | | (17.08 | ) | | | 7.99 | | | | 10.75 | |

| | | | | |

| % After-Tax Returns with Maximum Sales Charge2 | | Class

Inception Date | | | Performance

Inception Date | | | One Year | | | Five Years | | | Ten Years | |

| | | | | |

Class A After Taxes on Distributions | | | 03/04/2002 | | | | 03/04/2002 | | | | (21.68 | )% | | | 5.72 | % | | | 8.33 | % |

Class A After Taxes on Distributions and Sale of Fund Shares | | | — | | | | — | | | | (12.04 | ) | | | 4.98 | | | | 7.47 | |

| | | | | |

Class C After Taxes on Distributions | | | 03/04/2002 | | | | 03/04/2002 | | | | (18.70 | ) | | | 6.18 | | | | 8.35 | |

Class C After Taxes on Distributions and Sale of Fund Shares | | | — | | | | — | | | | (10.35 | ) | | | 5.30 | | | | 7.45 | |

| | | | | |

Class I After Taxes on Distributions | | | 09/11/2015 | | | | 03/04/2002 | | | | (17.15 | ) | | | 7.07 | | | | 9.06 | |

Class I After Taxes on Distributions and Sale of Fund Shares | | | — | | | | — | | | | (9.24 | ) | | | 6.16 | | | | 8.15 | |

| | | | | |

| % Total Annual Operating Expense Ratios3 | | | | | | | | Class A | | | Class C | | | Class I | |

| | | | | |

| | | | | | | | | | | 1.20 | % | | | 1.95 | % | | | 0.95 | % |

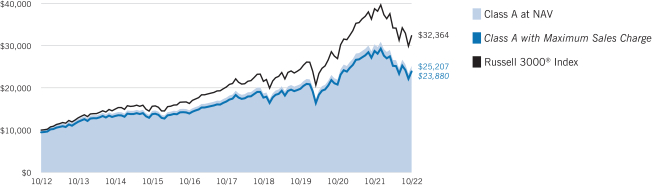

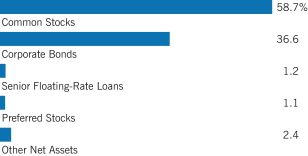

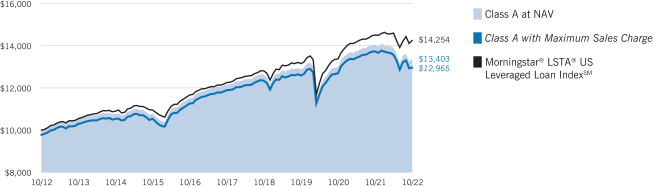

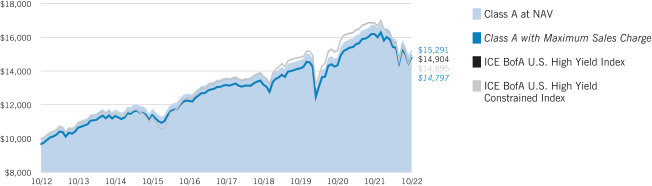

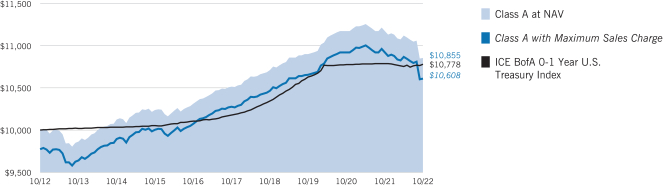

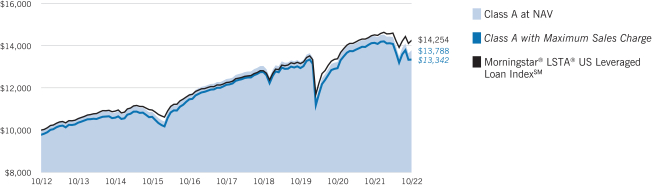

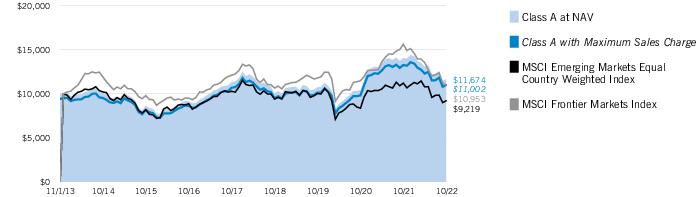

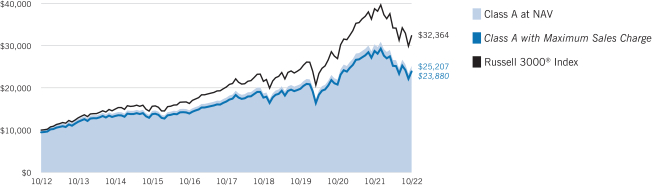

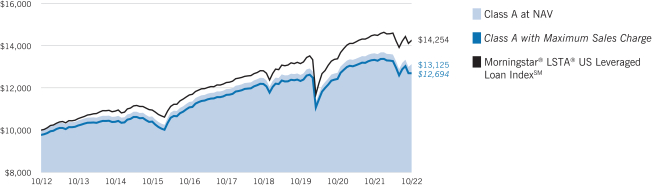

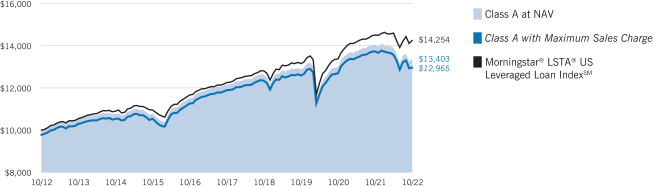

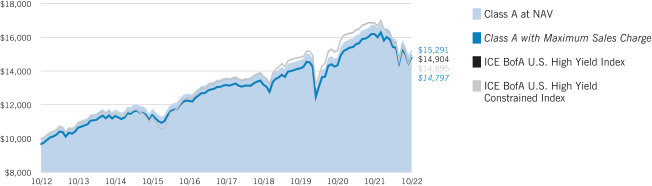

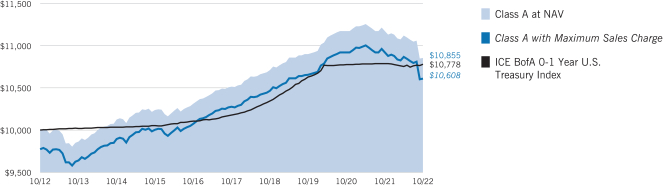

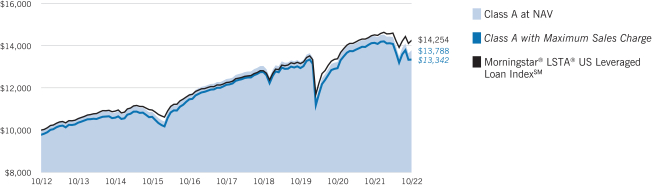

Growth of $10,000

This graph shows the change in value of a hypothetical investment of $10,000 in Class A of the Fund for the period indicated. For comparison, the same investment is shown in the indicated index.

| | | | | | | | | | | | | | | | |

| Growth of Investment2 | | Amount Invested | | | Period Beginning | | | At NAV | | | With Maximum Sales Charge | |

| | | | |

Class C | | | $10,000 | | | | 10/31/2012 | | | | $23,728 | | | | N.A. | |

Class I, at minimum investment | | | $1,000,000 | | | | 10/31/2012 | | | | $2,564,905 | | | | N.A. | |

See Endnotes and Additional Disclosures in this report.

Past performance is no guarantee of future results. Returns are historical and are calculated by determining the percentage change in net asset value (NAV) or offering price (as applicable) with all distributions reinvested. Furthermore, returns do not reflect the deduction of taxes that shareholders may have to pay on Fund distributions or upon the redemption of Fund shares. Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Performance for periods less than or equal to one year is cumulative. Performance is for the stated time period only; due to market volatility, current Fund performance may be lower or higher than the quoted return. For performance as of the most recent month-end, please refer to eatonvance.com.

Eaton Vance

Tax-Managed Equity Asset Allocation Fund

October 31, 2022

Fund Profile

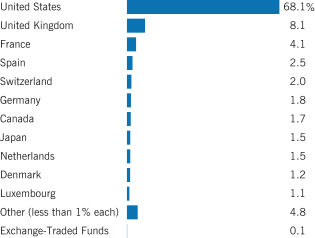

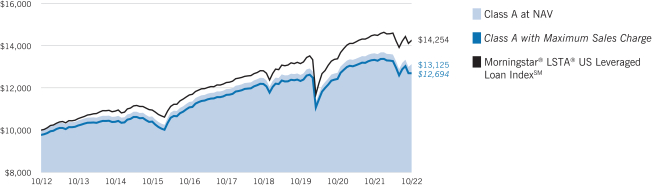

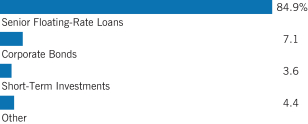

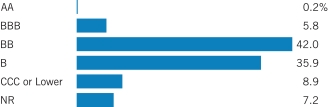

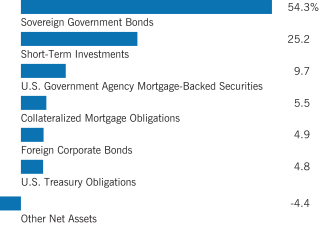

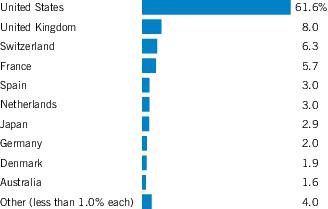

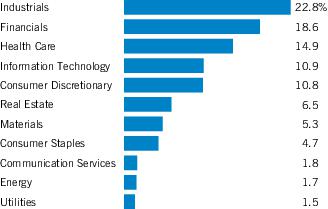

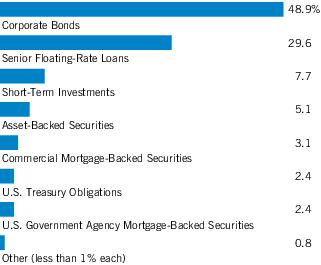

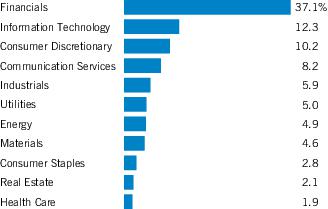

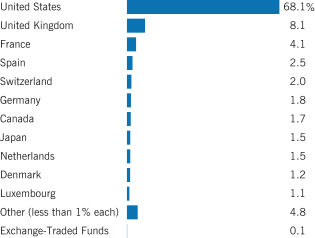

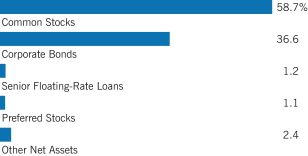

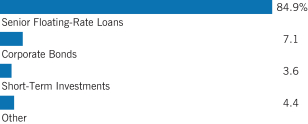

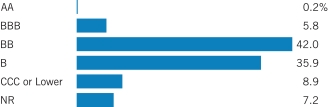

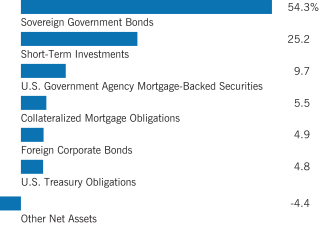

Portfolio Allocation (% of total investments)1

Footnotes:

| 1 | Fund primarily invests in one or more affiliated investment companies (Portfolios) and may also invest directly. Unless otherwise noted, references to investments are to the aggregate holdings of the Fund, including its pro rata share of each Portfolio or Fund in which it invests. Debt obligations are hybrid instruments, as determined by the investment adviser. These instruments have characteristics of both equity and debt. |

Eaton Vance

Tax-Managed Equity Asset Allocation Fund

October 31, 2022

Endnotes and Additional Disclosures

| † | The views expressed in this report are those of the portfolio manager(s) and are current only through the date stated at the top of this page. These views are subject to change at any time based upon market or other conditions, and Eaton Vance and the Fund(s) disclaim any responsibility to update such views. These views may not be relied upon as investment advice and, because investment decisions are based on many factors, may not be relied upon as an indication of trading intent on behalf of any Eaton Vance fund. This commentary may contain statements that are not historical facts, referred to as “forward-looking statements.” The Fund’s actual future results may differ significantly from those stated in any forward-looking statement, depending on factors such as changes in securities or financial markets or general economic conditions, the volume of sales and purchases of Fund shares, the continuation of investment advisory, administrative and service contracts, and other risks discussed from time to time in the Fund’s filings with the Securities and Exchange Commission. |

| 1 | Russell 3000® Index is an unmanaged index of the 3,000 largest U.S. stocks. MSCI EAFE Index is an unmanaged index of equities in the developed markets, excluding the U.S. and Canada. MSCI indexes are net of foreign withholding taxes. Source: MSCI. MSCI data may not be reproduced or used for any other purpose. MSCI provides no warranties, has not prepared or approved this report, and has no liability hereunder. ICE BofA Fixed Rate Preferred Securities Index is an unmanaged index of fixed-rate, preferred securities issued in the U.S. ICE® BofA® indices are not for redistribution or other uses; provided “as is”, without warranties, and with no liability. Eaton Vance has prepared this report and ICE Data Indices, LLC does not endorse it, or guarantee, review, or endorse Eaton Vance’s products. BofA® is a licensed registered trademark of Bank of America Corporation in the United States and other countries. The Blended Index consists of 80% Russell 3000® Index, 10% MSCI EAFE Index and 10% ICE BofA Fixed Rate Preferred Securities Index, rebalanced monthly. Unless otherwise stated, index returns do not reflect the effect of any applicable sales charges, commissions, expenses, taxes or leverage, as applicable. It is not possible to invest directly in an index. |

| 2 | Total Returns at NAV do not include applicable sales charges. If sales charges were deducted, the returns would be lower. Total Returns shown with maximum sales charge reflect the stated maximum sales charge. Unless otherwise stated, performance does not reflect the deduction of taxes on Fund distributions or redemptions of Fund shares. After-tax returns are calculated using certain assumptions, including using the highest historical individual federal income tax rates, and do not reflect the impact of state/local taxes. Actual after-tax returns depend on a shareholder’s tax situation and the actual characterization of distributions and may differ from those shown. After-tax returns are not relevant to shareholders who hold shares in tax-deferred accounts or shares held by nontaxable entities. Return After Taxes on Distributions may be the same as Return Before Taxes for the same period because no taxable distributions were made during that period. Return After Taxes on Distributions and Sale of Fund Shares may be greater than or equal to Return After Taxes on Distributions for the same period because of losses realized on the sale of Fund shares. The Fund’s after-tax returns also may reflect foreign tax credits passed by the Fund to its shareholders. |

Performance prior to the inception date of a class may be linked to the performance of an older class of the Fund. This linked performance is

adjusted for any applicable sales charge, but is not adjusted for class expense differences. If adjusted for such differences, the performance would be different. The performance of Class I is linked to Class A. Performance presented in the Financial Highlights included in the financial statements is not linked.

Effective November 5, 2020, Class C shares automatically convert to Class A shares eight years after purchase. The average annual total returns listed for Class C reflect conversion to Class A shares after eight years. Prior to November 5, 2020, Class C shares automatically converted to Class A shares ten years after purchase.

| 3 | Source: Fund prospectus. The expense ratios for the current reporting period can be found in the Financial Highlights section of this report. Performance reflects expenses waived and/or reimbursed, if applicable. Without such waivers and/or reimbursements, performance would have been lower. |

Fund profile subject to change due to active management.

Important Notice to Shareholders

Effective November 18, 2022, the portfolio manager of the Fund is Douglas R. Rogers, CFA, CMT.

Additional Information

S&P 500® Index is an unmanaged index of large-cap stocks commonly used as a measure of U.S. stock market performance. S&P Dow Jones Indices are a product of S&P Dow Jones Indices LLC (“S&P DJI”) and have been licensed for use. S&P® and S&P 500® are registered trademarks of S&P DJI; Dow Jones® is a registered trademark of Dow Jones Trademark Holdings LLC (“Dow Jones”); S&P DJI, Dow Jones and their respective affiliates do not sponsor, endorse, sell or promote the Fund, will not have any liability with respect thereto and do not have any liability for any errors, omissions, or interruptions of the S&P Dow Jones Indices. Nasdaq Composite Index is a market capitalization-weighted index of all domestic and international securities listed on Nasdaq. Source: Nasdaq, Inc. The information is provided by Nasdaq (with its affiliates, are referred to as the “Corporations”) and Nasdaq’s third party licensors on an “as is” basis and the Corporations make no guarantees and bear no liability of any kind with respect to the information or the Fund. MSCI Golden Dragon Index is an unmanaged index of common stocks traded in China, Hong Kong and Taiwan. MSCI ACWI Index is an unmanaged free-float-adjusted, market-capitalization-weighted index designed to measure the equity market performance of developed and emerging markets. MSCI Emerging Markets Index is an unmanaged index of emerging markets common stocks.

Eaton Vance

Tax-Managed Equity Asset Allocation Fund

October 31, 2022

Fund Expenses

Example

As a Fund shareholder, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchases and redemption fees (if applicable); and (2) ongoing costs, including management fees; distribution and/or service fees; and other Fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of Fund investing and to compare these costs with the ongoing costs of investing in other mutual funds. The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period (May 1, 2022 to October 31, 2022).

Actual Expenses

The first section of the table below provides information about actual account values and actual expenses. You may use the information in this section, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first section under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second section of the table below provides information about hypothetical account values and hypothetical expenses based on the actual Fund expense ratio and an assumed rate of return of 5% per year (before expenses), which is not the actual Fund return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in your Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads) or redemption fees (if applicable). Therefore, the second section of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would be higher.

| | | | | | | | | | | | | | | | |

| | | Beginning

Account Value

(5/1/22) | | | Ending

Account Value

(10/31/22) | | | Expenses Paid

During Period*

(5/1/22 – 10/31/22) | | | Annualized

Expense

Ratio | |

| | | | |

Actual | | | | | | | | | | | | | | | | |

Class A | | $ | 1,000.00 | | | $ | 946.50 | | | $ | 6.13 | | | | 1.25 | % |

Class C | | $ | 1,000.00 | | | $ | 942.80 | | | $ | 9.79 | | | | 2.00 | % |

Class I | | $ | 1,000.00 | | | $ | 947.90 | | | $ | 4.91 | | | | 1.00 | % |

| | | | | |

Hypothetical | | | | | | | | | | | | | | | | |

(5% return per year before expenses) | | | | | | | | | | | | | | | | |

Class A | | $ | 1,000.00 | | | $ | 1,018.90 | | | $ | 6.36 | | | | 1.25 | % |

Class C | | $ | 1,000.00 | | | $ | 1,015.12 | | | $ | 10.16 | | | | 2.00 | % |

Class I | | $ | 1,000.00 | | | $ | 1,020.16 | | | $ | 5.09 | | | | 1.00 | % |

| * | Expenses are equal to the Fund’s annualized expense ratio for the indicated Class, multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period). The Example assumes that the $1,000 was invested at the net asset value per share determined at the close of business on April 30, 2022. The Example reflects the expenses of both the Fund and the Portfolios. |

Eaton Vance

Tax-Managed Equity Asset Allocation Fund

October 31, 2022

Portfolio of Investments

| | | | | | | | |

| Investments in Affiliated Portfolios — 93.5% | |

| Description | | | | | Value | |

| | |

Tax-Managed Growth Portfolio

(identified cost, $72,982,061) | | | | | | $ | 201,886,366 | |

| | |

Tax-Managed International Equity Portfolio

(identified cost, $26,797,225) | | | | | | | 26,020,381 | |

| | |

Tax-Managed Multi-Cap Growth Portfolio

(identified cost, $33,790,952) | | | | | | | 78,228,784 | |

| | |

Tax-Managed Small-Cap Portfolio

(identified cost, $52,931,170) | | | | | | | 61,217,994 | |

| | |

Tax-Managed Value Portfolio

(identified cost, $94,750,801) | | | | | | | 161,144,461 | |

| |

Total Investments in Affiliated Portfolios

(identified cost $281,252,209) | | | $ | 528,497,986 | |

|

| Debt Obligations — 4.0%(1) | |

| Security | | Principal

Amount

(000’s omitted) | | | Value | |

|

| Banks — 2.4% | |

| | |

Banco Davivienda S.A., 6.65% to 4/22/31(2)(3)(4) | | $ | 200 | | | $ | 136,305 | |

| | |

Banco Mercantil del Norte S.A./Grand Cayman, 8.375% to 10/14/30(2)(3)(4) | | | 600 | | | | 522,639 | |

|

| Barclays PLC: | |

| | |

6.125% to 12/15/25(3)(4) | | | 471 | | | | 409,181 | |

| | |

8.00% to 3/15/29(3)(4) | | | 526 | | | | 472,534 | |

|

| BNP Paribas S.A.: | |

| | |

4.625% to 2/25/31(2)(3)(4) | | | 203 | | | | 140,831 | |

| | |

7.75% to 8/16/29(2)(3)(4) | | | 675 | | | | 638,101 | |

|

| Citigroup, Inc.: | |

| | |

Series M, 6.30% to 5/15/24(3)(4) | | | 704 | | | | 659,120 | |

| | |

Series W, 4.00% to 12/10/25(3)(4) | | | 238 | | | | 201,348 | |

|

| Credit Suisse Group AG: | |

| | |

5.25% to 2/11/27(2)(3)(4) | | | 230 | | | | 163,300 | |

| | |

9.75% to 6/23/27(2)(3)(4) | | | 800 | | | | 762,102 | |

| | |

Farm Credit Bank of Texas, Series 3, 6.20% to 6/15/28(2)(3)(4) | | | 473 | | | | 419,369 | |

| | |

HSBC Holdings PLC, 4.60% to 12/17/30(3)(4) | | | 721 | | | | 477,446 | |

| | |

Huntington Bancshares, Inc., Series F, 5.625% to 7/15/30(3)(4) | | | 395 | | | | 360,969 | |

| | |

ING Groep NV, 6.50% to 4/16/25(3)(4) | | | 243 | | | | 221,689 | |

| | |

JPMorgan Chase & Co., Series KK, 3.65% to 6/1/26(3)(4) | | | 881 | | | | 731,186 | |

| | |

KeyCorp, Series D, 5.00% to 9/15/26(3)(4) | | | 975 | | | | 856,394 | |

| | |

Lloyds Banking Group PLC, 7.50% to 6/27/24(3)(4) | | | 600 | | | | 573,458 | |

|

| Natwest Group PLC: | |

| | |

4.60% to 6/28/31(3)(4) | | | 200 | | | | 129,631 | |

| | |

6.00% to 12/29/25(3)(4) | | | 229 | | | | 204,360 | |

| | |

8.00% to 8/10/25(3)(4) | | | 778 | | | | 735,113 | |

| | | | | | | | |

| Security | | Principal

Amount

(000’s omitted) | | | Value | |

|

| Banks (continued) | |

|

| PNC Financial Services Group, Inc. (The): | |

| | |

Series S, 5.00% to 11/1/26(3)(4) | | $ | 485 | | | $ | 417,692 | |

| | |

Series U, 6.00% to 5/15/27(3)(4) | | | 800 | | | | 744,000 | |

| | |

Societe Generale S.A., 5.375% to 11/18/30(2)(3)(4) | | | 506 | | | | 367,787 | |

| | |

Standard Chartered PLC, 4.75% to 1/14/31(2)(3)(4) | | | 577 | | | | 385,359 | |

| | |

SVB Financial Group, Series C, 4.00% to 5/15/26(3)(4) | | | 600 | | | | 420,628 | |

| | |

Toronto-Dominion Bank (The), 8.125% to 10/31/27, 10/31/82(4) | | | 775 | | | | 785,656 | |

| | |

Truist Financial Corp., Series Q, 5.10% to 3/1/30(3)(4) | | | 134 | | | | 117,930 | |

|

| UBS Group AG: | |

| | |

4.375% to 2/10/31(2)(3)(4) | | | 419 | | | | 292,106 | |

| | |

6.875% to 8/7/25(3)(4)(5) | | | 348 | | | | 331,078 | |

| | |

Wells Fargo & Co., Series BB, 3.90% to 3/15/26(3)(4) | | | 784 | | | | 666,106 | |

| | |

| | | | | | | $ | 13,343,418 | |

|

| Capital Markets — 0.2% | |

| | |

AerCap Holdings NV, 5.875% to 10/10/24, 10/10/79(4) | | $ | 425 | | | $ | 382,993 | |

|

| Charles Schwab Corp. (The): | |

| | |

Series G, 5.375% to 6/1/25(3)(4) | | | 651 | | | | 638,794 | |

| | |

Series I, 4.00% to 6/1/26(3)(4) | | | 467 | | | | 384,528 | |

| | |

| | | | | | | $ | 1,406,315 | |

|

| Diversified Financial Services — 0.2% | |

| | |

American AgCredit Corp., Series QIB, 5.25% to 6/15/26(2)(3)(4) | | $ | 914 | | | $ | 839,737 | |

| | |

Goldman Sachs Group, Inc. (The), Series V, 4.125% to 11/10/26(3)(4) | | | 143 | | | | 112,434 | |

| | |

| | | | | | | $ | 952,171 | |

|

| Electric Utilities — 0.4% | |

| | |

Dominion Energy, Inc., Series C, 4.35% to 1/15/27(3)(4) | | $ | 583 | | | $ | 485,225 | |

| | |

Edison International, Series B, 5.00% to 12/15/26(3)(4) | | | 199 | | | | 161,688 | |

| | |

Emera, Inc., Series 16-A, 6.75% to 6/15/26, 6/15/76(4) | | | 450 | | | | 421,142 | |

| | |

Sempra Energy, 4.125% to 1/1/27, 4/1/52(4) | | | 581 | | | | 438,285 | |

| | |

Southern California Edison Co., Series E, 6.981%, (3 mo. USD LIBOR + 4.199%)(3)(6) | | | 249 | | | | 244,698 | |

| | |

Southern Co. (The), Series B, 6.923%, (3 mo. USD LIBOR + 3.63%), 3/15/57(6) | | | 366 | | | | 364,170 | |

| | |

| | | | | | | $ | 2,115,208 | |

|

| Food Products — 0.1% | |

| | |

Land O’ Lakes, Inc., 8.00%(2)(3) | | $ | 824 | | | $ | 817,997 | |

| | |

| | | | | | | $ | 817,997 | |

Eaton Vance

Tax-Managed Equity Asset Allocation Fund

October 31, 2022

Portfolio of Investments — continued

| | | | | | | | |

| Security | | Principal

Amount

(000’s omitted) | | | Value | |

|

| Gas Utilities — 0.1% | |

| | |

NiSource, Inc., 5.65% to 6/15/23(3)(4) | | $ | 645 | | | $ | 596,625 | |

| | |

| | | | | | | $ | 596,625 | |

|

| Independent Power and Renewable Electricity Producers — 0.1% | |

| | |

Algonquin Power & Utilities Corp., 4.75% to 1/18/27, 1/18/82(4) | | $ | 408 | | | $ | 329,460 | |

| | |

| | | | | | | $ | 329,460 | |

|

| Insurance — 0.2% | |

| | |

QBE Insurance Group, Ltd., 5.875% to 5/12/25(2)(3)(4) | | $ | 1,004 | | | $ | 916,504 | |

| | |

| | | | | | | $ | 916,504 | |

|

| Multi-Utilities — 0.1% | |

| | |

Centerpoint Energy, Inc., Series A, 6.125% to 9/1/23(3)(4) | | $ | 900 | | | $ | 845,828 | |

| | |

| | | | | | | $ | 845,828 | |

|

| Oil, Gas & Consumable Fuels — 0.2% | |

| | |

DCP Midstream, L.P., Series A, 7.375% to 12/15/22(3)(4) | | $ | 399 | | | $ | 394,035 | |

| | |

EnLink Midstream Partners, L.P., Series C, 6.00% to 12/15/22(3)(4) | | | 658 | | | | 507,055 | |

| | |

Odebrecht Oil & Gas Finance, Ltd., 0.00%(2)(3) | | | 550 | | | | 963 | |

| | |

Plains All American Pipeline, L.P., Series B, 6.125% to 12/5/22(3)(4) | | | 442 | | | | 371,501 | |

| | |

| | | | | | | $ | 1,273,554 | |

|

| Pipelines — 0.0%(7) | |

| | |

Energy Transfer, L.P., Series B, 6.625% to 2/15/28(3)(4) | | $ | 359 | | | $ | 258,480 | |

| | |

| | | | | | | $ | 258,480 | |

| |

Total Debt Obligations

(identified cost $26,169,090) | | | $ | 22,855,560 | |

|

| Exchange-Traded Funds — 0.9% | |

| Security | | Shares | | | Value | |

|

| Equity Funds — 0.9% | |

| | |

Global X U.S. Preferred ETF | | | 130,000 | | | $ | 2,551,900 | |

| | |

iShares Preferred & Income Securities ETF | | | 86,286 | | | | 2,632,586 | |

| |

Total Exchange-Traded Funds

(identified cost $6,710,738) | | | $ | 5,184,486 | |

| | | | | | | | |

| Preferred Stocks — 1.6% | |

| Security | | Shares | | | Value | |

|

| Banks — 0.6% | |

| | |

Bank of America Corp., 4.25% | | | 52,040 | | | $ | 868,027 | |

| | |

Citizens Financial Group, Inc., 5.00% | | | 28,000 | | | | 539,840 | |

| | |

| First Republic Bank: | | | | | | |

| | |

Series M, 4.00% | | | 27,012 | | | | 405,450 | |

| | |

Series N, 4.50% | | | 8,273 | | | | 139,317 | |

| | |

| JPMorgan Chase & Co.: | | | | | | |

| | |

Series JJ, 4.55% | | | 28,660 | | | | 521,899 | |

| | |

Series LL, 4.625% | | | 17,500 | | | | 324,450 | |

| | |

KeyCorp, 5.65% | | | 25,000 | | | | 528,500 | |

| | |

Truist Financial Corp., 5.25% | | | 5,773 | | | | 121,637 | |

| | |

Wells Fargo & Co., Series L, 7.50% (Convertible) | | | 116 | | | | 135,202 | |

| | |

| | | | | | | $ | 3,584,322 | |

|

| Capital Markets — 0.1% | |

| | |

Stifel Financial Corp., Series D, 4.50% | | | 36,350 | | | $ | 588,506 | |

| | |

| | | | | | | $ | 588,506 | |

|

| Electric Utilities — 0.2% | |

| | |

Brookfield BRP Holdings Canada, Inc., 4.625% | | | 24,000 | | | $ | 349,680 | |

| | |

SCE Trust III, Series H, 5.75% to 3/15/24(4) | | | 13,981 | | | | 270,392 | |

| | |

SCE Trust IV, Series J, 5.375% to 9/15/25(4) | | | 5,882 | | | | 105,523 | |

| | |

SCE Trust V, Series K, 5.45% to 3/15/26(4) | | | 5,504 | | | | 105,567 | |

| | |

SCE Trust VI, 5.00% | | | 1,041 | | | | 17,853 | |

| | |

| | | | | | | $ | 849,015 | |

|

| Equity Real Estate Investment Trusts (REITs) — 0.0%(7) | |

| | |

SITE Centers Corp., Series A, 6.375% | | | 11,958 | | | $ | 239,877 | |

| | |

| | | | | | | $ | 239,877 | |

|

| Insurance — 0.3% | |

| | |

American Equity Investment Life Holding Co., Series B, 6.625% to 9/1/25(4) | | | 22,403 | | | $ | 518,854 | |

| | |

Arch Capital Group, Ltd., Series G, 4.55% | | | 14,252 | | | | 250,265 | |

| | |

RenaissanceRe Holdings, Ltd., Series G, 4.20% | | | 43,000 | | | | 716,810 | |

| | |

| | | | | | | $ | 1,485,929 | |

|

| Oil, Gas & Consumable Fuels — 0.2% | |

| | |

NuStar Energy, L.P., Series B, 9.126% (3 mo. USD LIBOR + 5.643%)(6) | | | 53,257 | | | $ | 1,131,179 | |

| | |

| | | | | | | $ | 1,131,179 | |

Eaton Vance

Tax-Managed Equity Asset Allocation Fund

October 31, 2022

Portfolio of Investments — continued

| | | | | | | | |

| Security | | Shares | | | Value | |

|

| Pipelines — 0.1% | |

| | |

| Energy Transfer, L.P.: | | | | | | |

| | |

Series C, 7.375% to 5/15/23(4) | | | 15,000 | | | $ | 336,000 | |

| | |

Series E, 7.60% to 5/15/24(4) | | | 14,960 | | | | 344,529 | |

| | |

| | | | | | | $ | 680,529 | |

|

| Real Estate Management & Development — 0.1% | |

| | |

| Brookfield Property Partners, L.P.: | | | | | | |

| | |

Series A, 5.75% | | | 2,080 | | | $ | 31,470 | |

| | |

Series A-1, 6.50% | | | 14,575 | | | | 242,674 | |

| | |

Series A2, 6.375% | | | 19,390 | | | | 316,057 | |

| | |

| | | | | | | $ | 590,201 | |

| |

Total Preferred Stocks

(identified cost $11,254,708) | | | $ | 9,149,558 | |

| |

Total Investments — 100.0%

(identified cost $325,386,745) | | | $ | 565,687,590 | |

| |

Other Assets, Less Liabilities — (0.0)%(7) | | | $ | (151,778 | ) |

| |

Net Assets — 100.0% | | | $ | 565,535,812 | |

The percentage shown for each investment category in the Portfolio of Investments is based on net assets.

| (1) | Debt obligations are hybrid instruments, as determined by the investment adviser. These instruments have characteristics of both equity and debt. |

| (2) | Security exempt from registration under Rule 144A of the Securities Act of 1933, as amended. These securities may be sold in certain transactions in reliance on an exemption from registration (normally to qualified institutional buyers). At October 31, 2022, the aggregate value of these securities is $6,403,100 or 1.1% of the Fund’s net assets. |

| (3) | Perpetual security with no stated maturity date but may be subject to calls by the issuer. |

| (4) | Security converts to variable rate after the indicated fixed-rate coupon period. |

| (5) | Security exempt from registration under Regulation S of the Securities Act of 1933, as amended, which exempts from registration securities offered and sold outside the United States. Security may not be offered or sold in the United States except pursuant to an exemption from, or in a transaction not subject to, the registration requirements of the Securities Act of 1933, as amended. At October 31, 2022, the aggregate value of these securities is $331,078 or 0.1% of the Fund’s net assets. |

| (6) | Variable rate security. The stated interest rate represents the rate in effect at October 31, 2022. |

| (7) | Amount is less than 0.05% or (0.05)%, as applicable. |

Abbreviations:

| | | | |

| | |

| LIBOR | | – | | London Interbank Offered Rate |

Currency Abbreviations:

| | | | |

| | |

| USD | | – | | United States Dollar |

Eaton Vance

Tax-Managed Equity Asset Allocation Fund

October 31, 2022

Statement of Assets and Liabilities

| | | | |

| Assets | | October 31, 2022 | |

| |

Unaffiliated investments, at value (identified cost $44,134,536) | | $ | 37,189,604 | |

| |

Affiliated investments, at value (identified cost $281,252,209) | | | 528,497,986 | |

| |

Interest and dividends receivable | | | 378,966 | |

| |

Receivable for Fund shares sold | | | 103,417 | |

| |

Total assets | | $ | 566,169,973 | |

|

| Liabilities | |

| |

Payable for investments purchased | | $ | 6,629 | |

| |

Payable for Fund shares redeemed | | | 201,233 | |

| |

Payable to affiliates: | | | | |

| |

Investment adviser fee | | | 84,498 | |

| |

Administration fee | | | 69,225 | |

| |

Distribution and service fees | | | 111,181 | |

| |

Trustees’ fees | | | 42 | |

| |

Accrued expenses | | | 161,353 | |

| |

Total liabilities | | $ | 634,161 | |

| |

Net Assets | | $ | 565,535,812 | |

|

| Sources of Net Assets | |

| |

Paid-in capital | | $ | 211,897,866 | |

| |

Distributable earnings | | | 353,637,946 | |

| |

Net Assets | | $ | 565,535,812 | |

| |

| Class A Shares | | | | |

| |

Net Assets | | $ | 405,235,817 | |

| |

Shares Outstanding | | | 15,786,830 | |

| |

Net Asset Value and Redemption Price Per Share | | | | |

| |

(net assets ÷ shares of beneficial interest outstanding) | | $ | 25.67 | |

| |

Maximum Offering Price Per Share | | | | |

| |

(100 ÷ 94.75 of net asset value per share) | | $ | 27.09 | |

|

| Class C Shares | |

| |

Net Assets | | $ | 34,489,599 | |

| |

Shares Outstanding | | | 1,463,074 | |

| |

Net Asset Value and Offering Price Per Share* | | | | |

| |

(net assets ÷ shares of beneficial interest outstanding) | | $ | 23.57 | |

|

| Class I Shares | |

| |

Net Assets | | $ | 125,810,396 | |

| |

Shares Outstanding | | | 4,901,108 | |

| |

Net Asset Value, Offering Price and Redemption Price Per Share | | | | |

| |

(net assets ÷ shares of beneficial interest outstanding) | | $ | 25.67 | |

On sales of $50,000 or more, the offering price of Class A shares is reduced.

| * | Redemption price per share is equal to the net asset value less any applicable contingent deferred sales charge. |

| | | | |

| | 10 | | See Notes to Financial Statements. |

Eaton Vance

Tax-Managed Equity Asset Allocation Fund

October 31, 2022

Statement of Operations

| | | | |

| Investment Income | | Year Ended

October 31, 2022 | |

| |

Dividend income (net of foreign taxes withheld of $2,384) | | $ | 855,775 | |

| |

Dividend income allocated from affiliated Portfolios (net of foreign taxes withheld of $186,743) | | | 8,978,246 | |

| |

Interest income | | | 1,477,691 | |

| |

Securities lending income allocated from affiliated Portfolios, net | | | 23,346 | |

| |

Expenses allocated from affiliated Portfolios | | | (3,458,635 | ) |

| |

Total investment income | | $ | 7,876,423 | |

| |

| Expenses | | | | |

| |

Investment adviser fee | | $ | 1,343,186 | |

| |

Administration fee | | | 938,752 | |

| |

Distribution and service fees: | | | | |

| |

Class A | | | 1,129,175 | |

| |

Class C | | | 384,543 | |

| |

Trustees’ fees and expenses | | | 500 | |

| |

Custodian fee | | | 43,997 | |

| |

Transfer and dividend disbursing agent fees | | | 317,566 | |

| |

Legal and accounting services | | | 73,735 | |

| |

Printing and postage | | | 24,327 | |

| |

Registration fees | | | 53,970 | |

| |

Miscellaneous | | | 13,024 | |

| |

Total expenses | | $ | 4,322,775 | |

| |

Net investment income | | $ | 3,553,648 | |

|

| Realized and Unrealized Gain (Loss) | |

| |

Net realized gain (loss): | | | | |

| |

Investment transactions | | $ | (1,104,279 | ) |

| |

Foreign currency transactions | | | (62,278 | ) |

| |

Net realized gain (loss) allocated from affiliated Portfolios: | | | | |

| |

Investment transactions | | | 13,800,229 | (1) |

| |

Foreign currency transactions | | | (19,029 | ) |

| |

Net realized gain | | $ | 12,614,643 | |

| |

Change in unrealized appreciation (depreciation): | | | | |

| |

Investments | | $ | (8,326,388 | ) |

| |

Foreign currency | | | (11 | ) |

| |

Change in unrealized appreciation (depreciation) allocated from affiliated Portfolios: | | | | |

| |

Investments | | | (125,405,612 | ) |

| |

Foreign currency | | | (17,178 | ) |

| |

Net change in unrealized appreciation (depreciation) | | $ | (133,749,189 | ) |

| |

Net realized and unrealized loss | | $ | (121,134,546 | ) |

| |

Net decrease in net assets from operations | | $ | (117,580,898 | ) |

| (1) | Includes $12,229,272 of net realized gains from redemptions in-kind. |

| | | | |

| | 11 | | See Notes to Financial Statements. |

Eaton Vance

Tax-Managed Equity Asset Allocation Fund

October 31, 2022

Statements of Changes in Net Assets

| | | | | | | | |

| | | Year Ended October 31, | |

| Increase (Decrease) in Net Assets | | 2022 | | | 2021 | |

| | |

From operations: | | | | | | | | |

| | |

Net investment income | | $ | 3,553,648 | | | $ | 2,276,461 | |

| | |

Net realized gain | | | 12,614,643 | (1) | | | 28,051,800 | (2) |

| | |

Net change in unrealized appreciation (depreciation) | | | (133,749,189 | ) | | | 166,128,891 | |

| | |

Net increase (decrease) in net assets from operations | | $ | (117,580,898 | ) | | $ | 196,457,152 | |

| | |

Distributions to shareholders: | | | | | | | | |

| | |

Class A | | $ | (13,091,273 | ) | | $ | (2,498,854 | ) |

| | |

Class C | | | (955,498 | ) | | | — | |

| | |

Class I | | | (4,252,703 | ) | | | (910,066 | ) |

| | |

Total distributions to shareholders | | $ | (18,299,474 | ) | | $ | (3,408,920 | ) |

| | |

Transactions in shares of beneficial interest: | | | | | | | | |

| | |

Class A | | $ | (10,281,966 | ) | | $ | (761,966 | ) |

| | |

Class C | | | (818,985 | ) | | | (14,736,486 | ) |

| | |

Class I | | | 5,460,422 | | | | 14,040,656 | |

| | |

Net decrease in net assets from Fund share transactions | | $ | (5,640,529 | ) | | $ | (1,457,796 | ) |

| | |

Net increase (decrease) in net assets | | $ | (141,520,901 | ) | | $ | 191,590,436 | |

|

| Net Assets | |

| | |

At beginning of year | | $ | 707,056,713 | | | $ | 515,466,277 | |

| | |

At end of year | | $ | 565,535,812 | | | $ | 707,056,713 | |

| (1) | Includes $12,229,272 of net realized gains from redemptions in-kind. |

| (2) | Includes $10,062,663 of net realized gains from redemptions in-kind. |

| | | | |

| | 12 | | See Notes to Financial Statements. |

Eaton Vance

Tax-Managed Equity Asset Allocation Fund

October 31, 2022

Financial Highlights

| | | | | | | | | | | | | | | | | | | | |

| | | Class A | |

| |

| | | Year Ended October 31, | |

| | | 2022 | | | 2021 | | | 2020 | | | 2019 | | | 2018 | |

| | | | | |

Net asset value — Beginning of year | | $ | 31.710 | | | $ | 23.070 | | | $ | 22.370 | | | $ | 20.450 | | | $ | 19.970 | |

| | | | | |

| Income (Loss) From Operations | | | | | | | | | | | | | | | | | | | | |

| | | | | |

Net investment income(1) | | $ | 0.157 | | | $ | 0.102 | | | $ | 0.165 | | | $ | 0.193 | | | $ | 0.160 | |

| | | | | |

Net realized and unrealized gain (loss) | | | (5.384 | ) | | | 8.690 | | | | 0.969 | | | | 2.122 | | | | 0.951 | |

| | | | | |

Total income (loss) from operations | | $ | (5.227 | ) | | $ | 8.792 | | | $ | 1.134 | | | $ | 2.315 | | | $ | 1.111 | |

| | | | | |

| Less Distributions | | | | | | | | | | | | | | | | | | | | |

| | | | | |

From net investment income | | $ | (0.104 | ) | | $ | (0.152 | ) | | $ | (0.154 | ) | | $ | (0.163 | ) | | $ | (0.171 | ) |

| | | | | |

From net realized gain | | | (0.709 | ) | | | — | | | | (0.280 | ) | | | (0.232 | ) | | | (0.460 | ) |

| | | | | |

Total distributions | | $ | (0.813 | ) | | $ | (0.152 | ) | | $ | (0.434 | ) | | $ | (0.395 | ) | | $ | (0.631 | ) |

| | | | | |

Net asset value — End of year | | $ | 25.670 | | | $ | 31.710 | | | $ | 23.070 | | | $ | 22.370 | | | $ | 20.450 | |

| | | | | |

Total Return(2) | | | (16.91 | )% | | | 38.24 | % | | | 5.07 | % | | | 11.75 | % | | | 5.60 | % |

| | | | | |

| Ratios/Supplemental Data | | | | | | | | | | | | | | | | | | | | |

| | | | | |

Net assets, end of year (000’s omitted) | | $ | 405,236 | | | $ | 513,507 | | | $ | 373,289 | | | $ | 379,547 | | | $ | 272,567 | |

| | | | | |

Ratios (as a percentage of average daily net assets):(3) | | | | | | | | | | | | | | | | | | | | |

| | | | | |

Expenses | | | 1.25 | %(4) | | | 1.26 | % | | | 1.28 | % | | | 1.33 | % | | | 1.31 | % |

| | | | | |

Net investment income | | | 0.56 | % | | | 0.35 | % | | | 0.74 | % | | | 0.91 | % | | | 0.77 | % |

| | | | | |

Portfolio Turnover of the Fund(5) | | | 5 | % | | | 6 | % | | | 7 | % | | | 7 | % | | | 6 | % |

| (1) | Computed using average shares outstanding. |

| (2) | Returns are historical and are calculated by determining the percentage change in net asset value with all distributions reinvested and do not reflect the effect of sales charges. |

| (3) | Includes the Fund’s share of the Portfolios’ allocated expenses. |

| (4) | Includes a reduction by the investment adviser of a portion of the Portfolios’ adviser fees due to the Portfolios’ investments in the Liquidity Fund (equal to less than 0.005% of average daily net assets for the year ended October 31, 2022). |

| (5) | Percentage includes both the Fund’s contributions to and withdrawals from the Portfolios and purchases and sales of securities held directly by the Fund, if any. |

| | | | |

| | 13 | | See Notes to Financial Statements. |

Eaton Vance

Tax-Managed Equity Asset Allocation Fund

October 31, 2022

Financial Highlights — continued

| | | | | | | | | | | | | | | | | | | | |

| | | Class C | |

| |

| | | Year Ended October 31, | |

| | | 2022 | | | 2021 | | | 2020 | | | 2019 | | | 2018 | |

| | | | | |

Net asset value — Beginning of year | | $ | 29.230 | | | $ | 21.310 | | | $ | 20.700 | | | $ | 18.930 | | | $ | 18.520 | |

| | | | | |

| Income (Loss) From Operations | | | | | | | | | | | | | | | | | | | | |

| | | | | |

Net investment income (loss)(1) | | $ | (0.049 | ) | | $ | (0.102 | ) | | $ | 0.001 | | | $ | 0.043 | | | $ | 0.005 | |

| | | | | |

Net realized and unrealized gain (loss) | | | (4.963 | ) | | | 8.022 | | | | 0.889 | | | | 1.965 | | | | 0.892 | |

| | | | | |

Total income (loss) from operations | | $ | (5.012 | ) | | $ | 7.920 | | | $ | 0.890 | | | $ | 2.008 | | | $ | 0.897 | |

| | | | | |

| Less Distributions | | | | | | | | | | | | | | | | | | | | |

| | | | | |

From net investment income | | $ | — | | | $ | — | | | $ | — | | | $ | (0.006 | ) | | $ | (0.027 | ) |

| | | | | |

From net realized gain | | | (0.648 | ) | | | — | | | | (0.280 | ) | | | (0.232 | ) | | | (0.460 | ) |

| | | | | |

Total distributions | | $ | (0.648 | ) | | $ | — | | | $ | (0.280 | ) | | $ | (0.238 | ) | | $ | (0.487 | ) |

| | | | | |

Net asset value — End of year | | $ | 23.570 | | | $ | 29.230 | | | $ | 21.310 | | | $ | 20.700 | | | $ | 18.930 | |

| | | | | |

Total Return(2) | | | (17.53 | )% | | | 37.17 | % | | | 4.29 | % | | | 10.88 | % | | | 4.86 | % |

| | | | | |

| Ratios/Supplemental Data | | | | | | | | | | | | | | | | | | | | |

| | | | | |

Net assets, end of year (000’s omitted) | | $ | 34,490 | | | $ | 43,788 | | | $ | 44,822 | | | $ | 56,979 | | | $ | 147,004 | |

| | | | | |

Ratios (as a percentage of average daily net assets):(3) | | | | | | | | | | | | | | | | | | | | |

| | | | | |

Expenses | | | 2.00 | %(4) | | | 2.01 | % | | | 2.03 | % | | | 2.08 | % | | | 2.06 | % |

| | | | | |

Net investment income (loss) | | | (0.19 | )% | | | (0.38 | )% | | | 0.00 | %(5) | | | 0.23 | % | | | 0.03 | % |

| | | | | |

Portfolio Turnover of the Fund(6) | | | 5 | % | | | 6 | % | | | 7 | % | | | 7 | % | | | 6 | % |

| (1) | Computed using average shares outstanding. |

| (2) | Returns are historical and are calculated by determining the percentage change in net asset value with all distributions reinvested and do not reflect the effect of sales charges. |

| (3) | Includes the Fund’s share of the Portfolios’ allocated expenses. |

| (4) | Includes a reduction by the investment adviser of a portion of the Portfolios’ adviser fees due to the Portfolios’ investments in the Liquidity Fund (equal to less than 0.005% of average daily net assets for the year ended October 31, 2022). |

| (5) | Amount is less than 0.005%. |

| (6) | Percentage includes both the Fund’s contributions to and withdrawals from the Portfolios and purchases and sales of securities held directly by the Fund, if any. |

| | | | |

| | 14 | | See Notes to Financial Statements. |

Eaton Vance

Tax-Managed Equity Asset Allocation Fund

October 31, 2022

Financial Highlights — continued

| | | | | | | | | | | | | | | | | | | | |

| | | Class I | |

| |

| | | Year Ended October 31, | |

| | | 2022 | | | 2021 | | | 2020 | | | 2019 | | | 2018 | |

| | | | | |

Net asset value — Beginning of year | | $ | 31.700 | | | $ | 23.060 | | | $ | 22.360 | | | $ | 20.450 | | | $ | 19.970 | |

| | | | | |

| Income (Loss) From Operations | | | | | | | | | | | | | | | | | | | | |

| | | | | |

Net investment income(1) | | $ | 0.227 | | | $ | 0.172 | | | $ | 0.220 | | | $ | 0.244 | | | $ | 0.207 | |

| | | | | |

Net realized and unrealized gain (loss) | | | (5.369 | ) | | | 8.678 | | | | 0.968 | | | | 2.113 | | | | 0.952 | |

| | | | | |

Total income (loss) from operations | | $ | (5.142 | ) | | $ | 8.850 | | | $ | 1.188 | | | $ | 2.357 | | | $ | 1.159 | |

| | | | | |

| Less Distributions | | | | | | | | | | | | | | | | | | | | |

| | | | | |

From net investment income | | $ | (0.179 | ) | | $ | (0.210 | ) | | $ | (0.208 | ) | | $ | (0.215 | ) | | $ | (0.219 | ) |

| | | | | |

From net realized gain | | | (0.709 | ) | | | — | | | | (0.280 | ) | | | (0.232 | ) | | | (0.460 | ) |

| | | | | |

Total distributions | | $ | (0.888 | ) | | $ | (0.210 | ) | | $ | (0.488 | ) | | $ | (0.447 | ) | | $ | (0.679 | ) |

| | | | | |

Net asset value — End of year | | $ | 25.670 | | | $ | 31.700 | | | $ | 23.060 | | | $ | 22.360 | | | $ | 20.450 | |

| | | | | |

Total Return(2) | | | (16.68 | )% | | | 38.56 | % | | | 5.31 | % | | | 12.02 | % | | | 5.85 | % |

| | | | | |

| Ratios/Supplemental Data | | | | | | | | | | | | | | | | | | | | |

| | | | | |

Net assets, end of year (000’s omitted) | | $ | 125,810 | | | $ | 149,762 | | | $ | 97,355 | | | $ | 89,758 | | | $ | 65,649 | |

| | | | | |

Ratios (as a percentage of average daily net assets):(3) | | | | | | | | | | | | | | | | | | | | |

| | | | | |

Expenses | | | 1.00 | %(4) | | | 1.01 | % | | | 1.03 | % | | | 1.08 | % | | | 1.06 | % |

| | | | | |

Net investment income | | | 0.81 | % | | | 0.60 | % | | | 0.99 | % | | | 1.16 | % | | | 0.99 | % |

| | | | | |

Portfolio Turnover of the Fund(5) | | | 5 | % | | | 6 | % | | | 7 | % | | | 7 | % | | | 6 | % |

| (1) | Computed using average shares outstanding. |

| (2) | Returns are historical and are calculated by determining the percentage change in net asset value with all distributions reinvested. |

| (3) | Includes the Fund’s share of the Portfolios’ allocated expenses. |

| (4) | Includes a reduction by the investment adviser of a portion of the Portfolios’ adviser fees due to the Portfolios’ investments in the Liquidity Fund (equal to less than 0.005% of average daily net assets for the year ended October 31, 2022). |

| (5) | Percentage includes both the Fund’s contributions to and withdrawals from the Portfolios and purchases and sales of securities held directly by the Fund, if any. |

| | | | |

| | 15 | | See Notes to Financial Statements. |

Eaton Vance

Tax-Managed Equity Asset Allocation Fund

October 31, 2022

Notes to Financial Statements

1 Significant Accounting Policies

Eaton Vance Tax-Managed Equity Asset Allocation Fund (the Fund) is a diversified series of Eaton Vance Mutual Funds Trust (the Trust). The Trust is a Massachusetts business trust registered under the Investment Company Act of 1940, as amended (the 1940 Act), as an open-end management investment company. The Fund offers three classes of shares. Class A shares are generally sold subject to a sales charge imposed at time of purchase. Class C shares are sold at net asset value and are generally subject to a contingent deferred sales charge (see Note 5). Effective November 5, 2020, Class C shares automatically convert to Class A shares eight years after their purchase as described in the Fund’s prospectus. Class I shares are sold at net asset value and are not subject to a sales charge. Each class represents a pro-rata interest in the Fund, but votes separately on class-specific matters and (as noted below) is subject to different expenses. Realized and unrealized gains and losses and net investment income and losses, other than class-specific expenses, are allocated daily to each class of shares based on the relative net assets of each class to the total net assets of the Fund. Each class of shares differs in its distribution plan and certain other class-specific expenses. The Fund’s investment objective is to achieve long-term, after-tax returns for its shareholders. The Fund currently pursues its objective by investing directly in securities and in interests in five tax-managed equity portfolios managed by Eaton Vance Management (EVM) or its affiliates (the Portfolios), which are Massachusetts business trusts. The value of the Fund’s investments in the Portfolios reflects the Fund’s proportionate interest in their net assets. The Portfolios and the Fund’s proportionate interest in each of their net assets at October 31, 2022 were as follows: Tax-Managed Growth Portfolio (0.7%), Tax-Managed Value Portfolio (18.3%), Tax-Managed International Equity Portfolio (43.7%), Tax-Managed Multi-Cap Growth Portfolio (43.7%) and Tax-Managed Small-Cap Portfolio (34.1%). The performance of the Fund is directly affected by the performance of the Portfolios. A copy of each Portfolio’s financial statements is available by calling Eaton Vance at

1-800-262-1122 or in the EDGAR database on the Securities and Exchange Commission’s website at www.sec.gov.

The following is a summary of significant accounting policies of the Fund. The policies are in conformity with accounting principles generally accepted in the United States of America (U.S. GAAP). The Fund is an investment company and follows accounting and reporting guidance in the Financial Accounting Standards Board (FASB) Accounting Standards Codification Topic 946.

A Investment Valuation — The valuation policies common to the Portfolios are as follows:

Equity Securities. Equity securities (common stocks and exchange-traded funds) listed on a U.S. securities exchange generally are valued at the last sale or closing price on the day of valuation or, if no sales took place on such date, at the mean between the closing bid and ask prices on the exchange where such securities are principally traded. Equity securities listed on the NASDAQ National Market System are valued at the NASDAQ official closing price. Unlisted or listed securities for which closing sales prices or closing quotations are not available are valued at the mean between the latest available bid and ask prices.

Foreign Securities and Currencies. Foreign securities and currencies are valued in U.S. dollars, based on foreign currency exchange rate quotations supplied by a third party pricing service. The pricing service uses a proprietary model to determine the exchange rate. Inputs to the model include reported trades and implied bid/ask spreads. The daily valuation of exchange-traded foreign securities generally is determined as of the close of trading on the principal exchange on which such securities trade. Events occurring after the close of trading on foreign exchanges may result in adjustments to the valuation of foreign securities to more accurately reflect their fair value as of the close of regular trading on the New York Stock Exchange. When valuing foreign equity securities that meet certain criteria, the Fund’s Trustees have approved the use of a fair value service that values such securities to reflect market trading that occurs after the close of the applicable foreign markets of comparable securities or other instruments that have a strong correlation to the fair-valued securities.

Other. Investments in management investment companies (including money market funds) that do not trade on an exchange are valued at the net asset value as of the close of each business day.

Fair Valuation. In connection with Rule 2a-5 of the 1940 Act, which became effective September 8, 2022, the Trustees have designated the Portfolios’ investment adviser as its valuation designee. Investments for which valuations or market quotations are not readily available or are deemed unreliable are valued by the investment adviser, as valuation designee, at fair value using methods that most fairly reflect the security’s “fair value”, which is the amount that the Portfolios might reasonably expect to receive for the security upon its current sale in the ordinary course. Each such determination is based on a consideration of relevant factors, which are likely to vary from one pricing context to another. These factors may include, but are not limited to, the type of security, the existence of any contractual restrictions on the security’s disposition, the price and extent of public trading in similar securities of the issuer or of comparable companies or entities, quotations or relevant information obtained from broker/dealers or other market participants, information obtained from the issuer, analysts, and/or the appropriate stock exchange (for exchange-traded securities), an analysis of the company’s or entity’s financial statements, and an evaluation of the forces that influence the issuer and the market(s) in which the security is purchased and sold.

In addition to investing in the Portfolios, the Fund may invest directly in securities. The valuation policies of the Fund are consistent with the valuation policies of the Portfolios. Additional valuation policies of the Fund are as follows:

Debt Obligations. Debt obligations are generally valued on the basis of valuations provided by third party pricing services, as derived from such services’ pricing models. Inputs to the models may include, but are not limited to, reported trades, executable bid and ask prices, broker/dealer quotations, prices or yields of securities with similar characteristics, interest rates, anticipated prepayments, benchmark curves or information pertaining to the issuer, as well as

Eaton Vance

Tax-Managed Equity Asset Allocation Fund

October 31, 2022

Notes to Financial Statements — continued

industry and economic events. The pricing services may use a matrix approach, which considers information regarding securities with similar characteristics to determine the valuation for a security. Short-term debt obligations purchased with a remaining maturity of sixty days or less for which a valuation from a third party pricing service is not readily available may be valued at amortized cost, which approximates fair value.

Preferred Equity Securities. Preferred equity securities that are not listed or traded in the over-the-counter market are valued by a third party pricing service that uses various techniques that consider factors including, but not limited to, prices or yields of securities with similar characteristics, benchmark yields, broker/dealer quotes, quotes of underlying common stock, issuer spreads, as well as industry and economic events.

B Income — The Fund’s net investment income or loss includes the Fund’s pro-rata share of the net investment income or loss of the Portfolios, less all actual and accrued expenses of the Fund. Dividend income is recorded on the ex-dividend date for dividends received in cash and/or securities. However, if the ex-dividend date has passed, certain dividends from foreign securities are recorded as the Fund is informed of the ex-dividend date. Withholding taxes on foreign dividends and capital gains have been provided for in accordance with the Fund’s understanding of the applicable countries’ tax rules and rates. Distributions from investment companies are recorded as dividend income, capital gains or return of capital based on the nature of the distribution. Interest income is recorded on the basis of interest accrued, adjusted for amortization of premium or accretion of discount.

C Federal Taxes — The Fund’s policy is to comply with the provisions of the Internal Revenue Code applicable to regulated investment companies and to distribute to shareholders each year substantially all of its net investment income, and all or substantially all of its net realized capital gains. Accordingly, no provision for federal income or excise tax is necessary.

As of October 31, 2022, the Fund had no uncertain tax positions that would require financial statement recognition, de-recognition, or disclosure. The Fund files a U.S. federal income tax return annually after its fiscal year-end, which is subject to examination by the Internal Revenue Service for a period of three years from the date of filing.

D Foreign Currency Translation — Investment valuations, other assets, and liabilities initially expressed in foreign currencies are translated each business day into U.S. dollars based upon current exchange rates. Purchases and sales of foreign investment securities and income and expenses denominated in foreign currencies are translated into U.S. dollars based upon currency exchange rates in effect on the respective dates of such transactions. Recognized gains or losses on investment transactions attributable to changes in foreign currency exchange rates are recorded for financial statement purposes as net realized gains and losses on investments. That portion of unrealized gains and losses on investments that results from fluctuations in foreign currency exchange rates is not separately disclosed.

E Expenses — The majority of expenses of the Trust are directly identifiable to an individual fund. Expenses which are not readily identifiable to a specific fund are allocated taking into consideration, among other things, the nature and type of expense and the relative size of the funds.

F Use of Estimates — The preparation of the financial statements in conformity with U.S. GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities at the date of the financial statements and the reported amounts of income and expense during the reporting period. Actual results could differ from those estimates.

G Indemnifications — Under the Trust’s organizational documents, its officers and Trustees may be indemnified against certain liabilities and expenses arising out of the performance of their duties to the Fund. Under Massachusetts law, if certain conditions prevail, shareholders of a Massachusetts business trust (such as the Trust) could be deemed to have personal liability for the obligations of the Trust. However, the Trust’s Declaration of Trust contains an express disclaimer of liability on the part of Fund shareholders and the By-laws provide that the Trust shall assume, upon request by the shareholder, the defense on behalf of any Fund shareholders. Moreover, the By-laws also provide for indemnification out of Fund property of any shareholder held personally liable solely by reason of being or having been a shareholder for all loss or expense arising from such liability. Additionally, in the normal course of business, the Fund enters into agreements with service providers that may contain indemnification clauses. The Fund’s maximum exposure under these arrangements is unknown as this would involve future claims that may be made against the Fund that have not yet occurred.

H Other — Investment transactions are accounted for on a trade date basis. Realized gains and losses on investments sold are determined on the basis of identified cost.

2 Distributions to Shareholders and Income Tax Information

It is the present policy of the Fund to make at least one distribution annually (normally in December) of all or substantially all of its net investment income and to distribute annually all or substantially all of its net realized capital gains. Distributions to shareholders are recorded on the ex-dividend date. Distributions are declared separately for each class of shares. Shareholders may reinvest income and capital gain distributions in additional shares of the same class of the Fund at the net asset value as of the ex-dividend date or, at the election of the shareholder, receive distributions in cash. Distributions to shareholders are determined in accordance with income tax regulations, which may differ from U.S. GAAP. As required by U.S. GAAP, only distributions in excess of tax basis earnings and profits are reported in the financial statements as a return of capital. Permanent differences between book and tax accounting relating to distributions are reclassified to paid-in capital. For tax purposes, distributions from short-term capital gains are considered to be from ordinary income.

Eaton Vance

Tax-Managed Equity Asset Allocation Fund

October 31, 2022

Notes to Financial Statements — continued

The tax character of distributions declared for the years ended October 31, 2022 and October 31, 2021 was as follows:

| | | | | | | | |

| | | Year Ended October 31, | |

| | | 2022 | | | 2021 | |

| | |

Ordinary income | | $ | 3,810,323 | | | $ | 3,408,920 | |

| | |

Long-term capital gains | | $ | 14,489,151 | | | $ | — | |

During the year ended October 31, 2022, distributable earnings was decreased by $346,153 and paid-in capital was increased by $346,153 due to the Fund’s use of equalization accounting. Tax equalization accounting allows the Fund to treat as a distribution that portion of redemption proceeds representing a redeeming shareholder’s portion of undistributed taxable income and net capital gains. These reclassifications had no effect on the net assets or net asset value per share of the Fund.

As of October 31, 2022, the components of distributable earnings (accumulated loss) on a tax basis were as follows:

| | | | |

| | |

Undistributed ordinary income | | $ | 2,251,108 | |

| |

Undistributed long-term capital gains | | | 1,278,229 | |

| |

Net unrealized appreciation | | | 350,108,609 | |

| |

Distributable earnings | | $ | 353,637,946 | |

The cost and unrealized appreciation (depreciation) of investments of the Fund, including the affiliated Portfolios, at October 31, 2022, as determined on a federal income tax basis, were as follows:

| | | | |

Aggregate cost | | $ | 215,586,328 | |

| |

Gross unrealized appreciation | | | 357,897,950 | |

| |

Gross unrealized depreciation | | | (7,796,688 | ) |

| |

Net unrealized appreciation | | $ | 350,101,262 | |

3 Investment Adviser Fee and Other Transactions with Affiliates

The investment adviser fee is earned by Eaton Vance Management (EVM), an indirect, wholly-owned subsidiary of Morgan Stanley, as compensation for investment advisory services rendered to the Fund. Pursuant to the investment advisory agreement between the Fund and EVM, and an amendment to the agreement that took effect on July 1, 2022, the investment adviser fee is computed at an annual rate as a percentage of the Fund’s average daily net assets as follows and is payable monthly:

| | | | | | | | |

| Average Daily Net Assets | | Annual Fee Rate (Prior to July 1, 2022) | | | Annual Fee Rate (Effective July 1, 2022) | |

| | |

Up to $500 million | | | 0.750 | % | | | 0.700 | % |

| | |

$500 million but less than $1 billion | | | 0.700 | % | | | 0.600 | % |

| | |

$1 billion but less than $1.5 billion | | | 0.675 | % | | | 0.575 | % |

| | |

$1.5 billion but less than $2.5 billion | | | 0.650 | % | | | 0.550 | % |

| | |

$2.5 billion and over | | | 0.625 | % | | | 0.525 | % |

The investment adviser fee payable by the Fund is reduced by the Fund’s allocable share of any fee paid pursuant to an investment advisory agreement by any investment company advised by EVM or its affiliates in which the Fund invests. Effective April 26, 2022, the Portfolios may invest in a money market fund, the Institutional Class of the Morgan Stanley Institutional Liquidity Funds - Government Portfolio (the “Liquidity Fund”), an open-end management investment company managed by Morgan Stanley Investment Management Inc., a wholly-owned subsidiary of Morgan Stanley. The investment adviser fee paid by the Portfolios is reduced by an amount equal to their pro-rata share of the advisory and administration fees paid by the Portfolios due to their

Eaton Vance

Tax-Managed Equity Asset Allocation Fund

October 31, 2022

Notes to Financial Statements — continued

investments in the Liquidity Fund. For the year ended October 31, 2022, the Fund’s allocated share of the reduction of the investment adviser fee paid by the Portfolios was $2,019 relating to the Portfolios’ investments in the Liquidity Fund. Prior to April 26, 2022, the Portfolios may have invested their cash in Eaton Vance Cash Reserves Fund, LLC (Cash Reserves Fund), an affiliated investment company managed by EVM. EVM did not receive a fee for advisory services provided to Cash Reserves Fund.

For the year ended October 31, 2022, the Fund’s investment adviser fee totaled $4,528,896, of which $3,185,710 was allocated from the Portfolios and $1,343,186 was paid or accrued directly by the Fund. For the year ended October 31, 2022, the Fund’s investment adviser fee, including the fees allocated from the Portfolios, was 0.72% of the Fund’s average daily net assets. The administration fee is earned by EVM as compensation for administering the business affairs of the Fund and is computed at an annual rate of 0.15% of the Fund’s average daily net assets. For the year ended October 31, 2022, the administration fee amounted to $938,752.

EVM provides sub-transfer agency and related services to the Fund pursuant to a Sub-Transfer Agency Support Services Agreement. For the year ended October 31, 2022, EVM earned $95,571 from the Fund pursuant to such agreement, which is included in transfer and dividend disbursing agent fees on the Statement of Operations. The Fund was informed that Eaton Vance Distributors, Inc. (EVD), an affiliate of EVM and the Fund’s principal underwriter, received $30,631 as its portion of the sales charge on sales of Class A shares for the year ended October 31, 2022. EVD also received distribution and service fees from Class A and Class C shares (see Note 4) and contingent deferred sales charges (see Note 5).

Trustees and officers of the Fund and the Portfolios who are members of EVM’s organization receive remuneration for their services to the Fund out of the investment adviser fee. Certain officers and Trustees of the Fund and the Portfolios are officers of EVM.

4 Distribution Plans

The Fund has in effect a distribution plan for Class A shares (Class A Plan) pursuant to Rule 12b-1 under the 1940 Act. Pursuant to the Class A Plan, the Fund pays EVD a distribution and service fee of 0.25% per annum of its average daily net assets attributable to Class A shares for distribution services and facilities provided to the Fund by EVD, as well as for personal services and/or the maintenance of shareholder accounts. Distribution and service fees paid or accrued to EVD for the year ended October 31, 2022 amounted to $1,129,175 for Class A shares.

The Fund also has in effect a distribution plan for Class C shares (Class C Plan) pursuant to Rule 12b-1 under the 1940 Act. Pursuant to the Class C Plan, the Fund pays EVD amounts equal to 0.75% per annum of its average daily net assets attributable to Class C shares for providing ongoing distribution services and facilities to the Fund. For the year ended October 31, 2022, the Fund paid or accrued to EVD $288,407 for Class C shares.

Pursuant to the Class C Plan, the Fund also makes payments of service fees to EVD, financial intermediaries and other persons in amounts equal to 0.25% per annum of its average daily net assets attributable to that class. Service fees paid or accrued are for personal services and/or the maintenance of shareholder accounts. They are separate and distinct from the sales commissions and distribution fees payable to EVD. Service fees paid or accrued for the year ended October 31, 2022 amounted to $96,136 for Class C shares.

Distribution and service fees are subject to the limitations contained in the Financial Industry Regulatory Authority Rule 2341(d).

5 Contingent Deferred Sales Charges

A contingent deferred sales charge (CDSC) of 1% generally is imposed on redemptions of Class C shares made within 12 months of purchase. Class A shares may be subject to a 1% CDSC if redeemed within 12 months (18 months prior to April 29, 2022) of purchase (depending on the circumstances of purchase). Generally, the CDSC is based upon the lower of the net asset value at date of redemption or date of purchase. No charge is levied on shares acquired by reinvestment of dividends or capital gain distributions. For the year ended October 31, 2022, the Fund was informed that EVD received approximately $400 and $2,000 of CDSCs paid by Class A and Class C shareholders, respectively.

6 Investment Transactions

For the year ended October 31, 2022, increases and decreases in the Fund’s investments in the Portfolios were as follows:

| | | | | | | | |

| Portfolio | | Contributions | | | Withdrawals | |

| | |

Tax-Managed Growth Portfolio | | $ | 4,037,761 | | | $ | 15,212,950 | |

| | |

Tax-Managed International Equity Portfolio | | | 1,101,161 | | | | 4,059,300 | |

| | |

Tax-Managed Multi-Cap Growth Portfolio | | | 1,594,969 | | | | 6,032,177 | |

| | |

Tax-Managed Small-Cap Portfolio | | | 1,476,823 | | | | 5,585,349 | |

| | |

Tax-Managed Value Portfolio | | | 3,662,522 | | | | 13,851,666 | |

Eaton Vance

Tax-Managed Equity Asset Allocation Fund

October 31, 2022

Notes to Financial Statements — continued

7 Purchases and Sales of Investments

Purchases and sales of investments, other than short-term obligations and investments in the Portfolios, aggregated $18,736,376 and $12,169,993, respectively, for the year ended October 31, 2022.

8 Shares of Beneficial Interest

The Fund’s Declaration of Trust permits the Trustees to issue an unlimited number of full and fractional shares of beneficial interest (without par value). Such shares may be issued in a number of different series (such as the Fund) and classes. Transactions in Fund shares, including direct exchanges pursuant to share class conversions for all periods presented, were as follows:

| | | | | | | | | | | | | | | | |

| | | Year Ended

October 31, 2022 | | | Year Ended

October 31, 2021 | |

| | | Shares | | | Amount | | | Shares | | | Amount | |

Class A | | | | | | | | | | | | | | | | |

| | | | |

Sales | | | 622,834 | | | $ | 17,651,843 | | | | 1,091,500 | | | $ | 30,128,272 | |

| | | | |

Issued to shareholders electing to receive payments of distributions in Fund shares | | | 391,331 | | | | 12,049,069 | | | | 87,075 | | | | 2,297,913 | |

| | | | |