UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act File Number: 811-04015

Eaton Vance Mutual Funds Trust

(Exact Name of Registrant as Specified in Charter)

Two International Place, Boston, Massachusetts 02110

(Address of Principal Executive Offices)

Deidre E. Walsh

Two International Place, Boston, Massachusetts 02110

(Name and Address of Agent for Services)

(617) 482-8260

(Registrant’s Telephone Number)

October 31

Date of Fiscal Year End

October 31, 2022

Date of Reporting Period

| Item 1. | Reports to Stockholders |

Eaton Vance

Emerging Markets Local Income Fund

Annual Report

October 31, 2022

Commodity Futures Trading Commission Registration. The Commodity Futures Trading Commission (“CFTC”) has adopted regulations that subject registered investment companies and advisers to regulation by the CFTC if a fund invests more than a prescribed level of its assets in certain CFTC-regulated instruments (including futures, certain options and swap agreements) or markets itself as providing investment exposure to such instruments. The adviser is registered with the CFTC as a commodity pool operator with respect to its management of the Fund. As the commodity pool operator of the Fund, the adviser has claimed relief under the Commodity Exchange Act from certain reporting and recordkeeping requirements. The adviser is also registered as a commodity trading advisor.

Fund shares are not insured by the FDIC and are not deposits or other obligations of, or guaranteed by, any depository institution. Shares are subject to investment risks, including possible loss of principal invested.

This report must be preceded or accompanied by a current summary prospectus or prospectus. Before investing, investors should consider carefully the investment objective, risks, and charges and expenses of a mutual fund. This and other important information is contained in the summary prospectus and prospectus, which can be obtained from a financial intermediary. Prospective investors should read the prospectus carefully before investing. For further information, please call 1-800-262-1122.

Annual Report October 31, 2022

Eaton Vance

Emerging Markets Local Income Fund

Eaton Vance

Emerging Markets Local Income Fund

October 31, 2022

Management’s Discussion of Fund Performance†

Economic and Market Conditions

The world’s equity and fixed-income markets posted broad losses during the 12-month period ended October 31, 2022. The declines were due to several factors, including high inflation in many countries, aggressive monetary tightening by the U.S. Federal Reserve (the Fed), and slowing global economic growth.

During the period, U.S. inflation surged as strong consumer demand following the relaxation of COVID-19 restrictions coincided with supply shortages created by the pandemic. Production and trade disruptions resulting from Russia’s February 2022 invasion of Ukraine added to inflationary pressures by driving up prices of energy and grains. The Fed responded by increasing short-term interest rates at the fastest pace in decades and signaling that it would continue hiking rates until inflation was under control -- even if it meant pushing the U.S. economy into recession.

The European Central Bank and Bank of England also raised interest rates during the period in efforts to tame inflation, despite signs of deterioration in the European economy. Conversely, the Bank of Japan held its main policy rate at −0.1%. Inflation rose in Japan during the period but remained low compared to inflation in other developed countries. The widening differential between interest rates in Japan and the U.S. contributed to a substantial weakening in the Japanese yen versus the U.S. dollar during the period.

In China, government policies helped contain inflation but also significantly slowed economic growth. First, China maintained its zero-COVID policy, which led to lockdowns of major cities during the period. Second, Chinese leaders renewed their focus on the country’s “common prosperity” agenda, implementing measures that negatively affected certain sectors of China’s economy, including real estate and technology.

During the period, a number of emerging and frontier nations either defaulted on their sovereign debt or were pushed to the brink of default. Rising food and energy prices pressured these governments to offer subsidies to consumers, putting additional stress on fiscal balances already strained by pandemic-related spending. In addition, broad strength in the U.S. dollar made servicing U.S. dollar-denominated debt more expensive.

On a positive note, we believe there were signs late in the period that inflation may have peaked in several major emerging-market economies. Central banks in these countries indicated that they were at, or near, the end of their tightening cycles.

Fund Performance

For the 12-month period ended October 31, 2022, Eaton Vance Emerging Markets Local Income Fund (the Fund) returned -20.47% for Class A shares at net asset value (NAV), underperforming its benchmark, the J.P. Morgan Government Bond Index: Emerging Markets (JPM GBI-EM) Global Diversified (Unhedged) (the Index), which returned -20.27%.

The Fund’s interest rate exposures had the largest negative impact on performance relative to the Index during the period, and positioning in sovereign credit also detracted. On the plus side, currency exposure was the top contributor to relative performance, and corporate credit exposure added value as well.

On a regional basis, relative returns in Eastern European positions were negatively affected by an out-of-Index position in Ukrainian local bonds. This investment performed poorly due to the Russia-Ukraine war, which led to a steep sell-off in Ukrainian local assets. The unfavorable impact of this exposure was partly offset by underweight positions in local interest rates in Russia, Poland, and Hungary, as interest rates increased and bond prices declined in these three nations during the period. By period-end, the local interest rate position in Russia was sold from the Fund.

In Asia, an out-of-Index position in South Korean local interest rates hurt relative performance given the global trend of rising rates during the period. Conversely, a lack of exposure to the Chinese yuan was helpful amid the slowdown in China’s economy.

In Latin America, overweight exposure to Colombian interest rates detracted from returns versus the Index, while an overweight position in Brazilian rates was a notable contributor. Inflation in Brazil moderated during the period, prompting the country’s central bank to pause its rate-hiking campaign.

In the Middle East & Africa, the Fund’s lack of exposure to Egypt late in the period was a major contributor to performance relative to the Index. During this time, the Egyptian pound fell sharply, pressured by the Egyptian government’s decision to adopt a more flexible exchange-rate system to help secure a loan from the International Monetary Fund.

The Fund used derivatives extensively to both hedge select undesired risk exposures as well as gain select desired risk exposures. Some of the above commentary about notable drivers of performance at the country level involved the use of derivatives. The Fund’s use of derivatives broadly detracted from returns versus the Index during the period. In particular, interest rate swaps, which are used both to gain and hedge desired exposures, detracted from Fund performance versus the Index. Currency forwards, which are also used both to gain and hedge desired exposures and are the other major derivative type used by the Fund, further detracted from relative performance during the period.

See Endnotes and Additional Disclosures in this report.

Past performance is no guarantee of future results. Returns are historical and are calculated by determining the percentage change in net asset value (NAV) or offering price (as applicable) with all distributions reinvested. Furthermore, returns do not reflect the deduction of taxes that shareholders may have to pay on Fund distributions or upon the redemption of Fund shares. Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Performance for periods less than or equal to one year is cumulative. Performance is for the stated time period only; due to market volatility, current Fund performance may be lower or higher than the quoted return. For performance as of the most recent month-end, please refer to eatonvance.com.

Eaton Vance

Emerging Markets Local Income Fund

October 31, 2022

Performance

Portfolio Manager(s) John R. Baur, Brian Shaw, CFA and Patrick Campbell, CFA

| % Average Annual Total Returns1,2 | Class

Inception Date | Performance

Inception Date | One Year | Five Years | Ten Years |

| Class A at NAV | 06/27/2007 | 06/27/2007 | (20.47)% | (2.35)% | (1.26)% |

| Class A with 3.25% Maximum Sales Charge | — | — | (22.98) | (2.99) | (1.58) |

| Class C at NAV | 08/03/2010 | 06/27/2007 | (21.31) | (3.08) | (1.81) |

| Class C with 1% Maximum Deferred Sales Charge | — | — | (22.01) | (3.08) | (1.81) |

| Class I at NAV | 11/30/2009 | 06/27/2007 | (20.48) | (2.12) | (1.00) |

|

| J.P. Morgan Government Bond Index: Emerging Markets (JPM GBI-EM) Global Diversified (Unhedged) | — | — | (20.27)% | (3.54)% | (2.56)% |

| % Total Annual Operating Expense Ratios3 | Class A | Class C | Class I |

| | 1.16% | 1.86% | 0.86% |

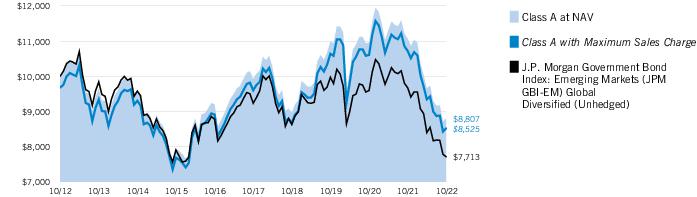

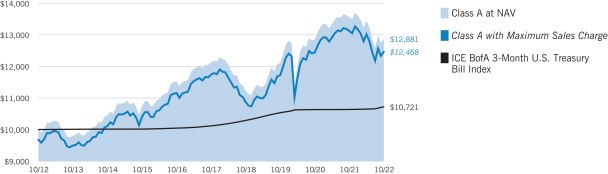

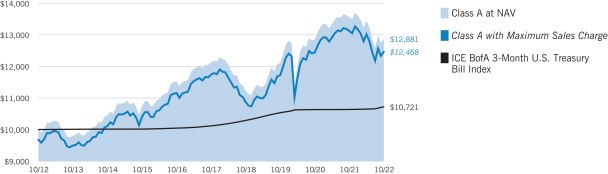

Growth of $10,000

This graph shows the change in value of a hypothetical investment of $10,000 in Class A of the Fund for the period indicated. For comparison, the same investment is shown in the indicated index.

| Growth of Investment | Amount Invested | Period Beginning | At NAV | With Maximum Sales Charge |

| Class C | $10,000 | 10/31/2012 | $8,333 | N.A. |

| Class I, at minimum investment | $1,000,000 | 10/31/2012 | $904,635 | N.A. |

See Endnotes and Additional Disclosures in this report.

Past performance is no guarantee of future results. Returns are historical and are calculated by determining the percentage change in net asset value (NAV) or offering price (as applicable) with all distributions reinvested. Furthermore, returns do not reflect the deduction of taxes that shareholders may have to pay on Fund distributions or upon the redemption of Fund shares. Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Performance for periods less than or equal to one year is cumulative. Performance is for the stated time period only; due to market volatility, current Fund performance may be lower or higher than the quoted return. For performance as of the most recent month-end, please refer to eatonvance.com.

Eaton Vance

Emerging Markets Local Income Fund

October 31, 2022

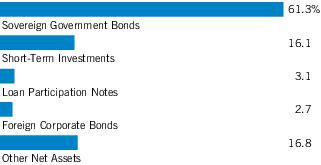

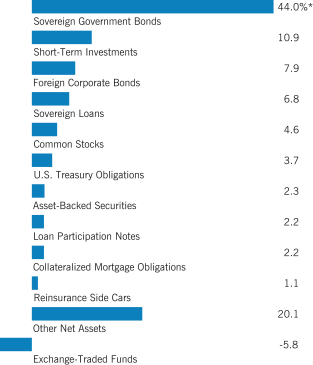

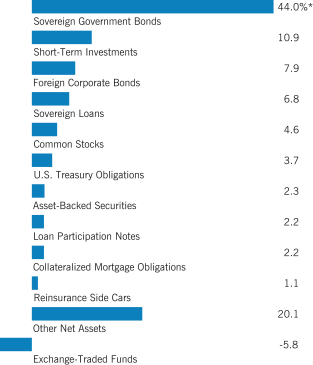

| Asset Allocation (% of net assets)1 |

| Foreign Currency Exposure (% of net assets)2 |

| Brazil | 12.9% |

| Mexico | 10.3 |

| Indonesia | 9.9 |

| Singapore | 8.0 |

| Poland | 6.8 |

| Thailand | 6.1 |

| Dominican Republic | 5.3 |

| Czech Republic | 5.3 |

| Ukraine | 5.2 |

| Malaysia | 5.1 |

| Serbia | 4.2 |

| Uzbekistan | 4.0 |

| South Africa | 3.6 |

| Uruguay | 3.5 |

| Romania | 3.5 |

| Colombia | 3.0 |

| Hungary | 2.7 |

| Kazakhstan | 2.5 |

| Peru | 2.5 |

| China | 2.4 |

| Korea | 2.0 |

| Uganda | 1.9 |

| Other | 2.0 3 |

| Euro | -3.9 |

| Total Long | 113.5 |

| Total Short | -4.7 |

| Total Net | 108.8 |

Footnotes:

Fund invests in an affiliated investment company (Portfolio) with the same objective(s) and policies as the Fund. References to investments are to the Portfolio’s holdings.

| 1 | Other Net Assets represents other assets less liabilities and includes any investment type that represents less than 1% of net assets. |

| 2 | Currency exposures include all foreign exchange denominated assets and currency derivatives. Total exposures may exceed 100% due to implicit leverage created by derivatives. |

| 3 | Includes amounts each less than 1.0% or –1.0%, as applicable. |

Eaton Vance

Emerging Markets Local Income Fund

October 31, 2022

Endnotes and Additional Disclosures

| † | The views expressed in this report are those of the portfolio manager(s) and are current only through the date stated at the top of this page. These views are subject to change at any time based upon market or other conditions, and Eaton Vance and the Fund(s) disclaim any responsibility to update such views. These views may not be relied upon as investment advice and, because investment decisions are based on many factors, may not be relied upon as an indication of trading intent on behalf of any Eaton Vance fund. This commentary may contain statements that are not historical facts, referred to as “forward-looking statements.” The Fund’s actual future results may differ significantly from those stated in any forward-looking statement, depending on factors such as changes in securities or financial markets or general economic conditions, the volume of sales and purchases of Fund shares, the continuation of investment advisory, administrative and service contracts, and other risks discussed from time to time in the Fund’s filings with the Securities and Exchange Commission. |

| | |

| 1 | J.P. Morgan Government Bond Index: Emerging Markets (JPM GBI-EM) Global Diversified (Unhedged) is an unmanaged index of local-currency bonds with maturities of more than one year issued by emerging markets governments. Information has been obtained from sources believed to be reliable but J.P. Morgan does not warrant its completeness or accuracy. The Index is used with permission. The Index may not be copied, used, or distributed without J.P. Morgan’s prior written approval. Copyright 2021, J.P. Morgan Chase & Co. All rights reserved. Unless otherwise stated, index returns do not reflect the effect of any applicable sales charges, commissions, expenses, taxes or leverage, as applicable. It is not possible to invest directly in an index. |

| 2 | Total Returns at NAV do not include applicable sales charges. If sales charges were deducted, the returns would be lower. Total Returns shown with maximum sales charge reflect the stated maximum sales charge. Unless otherwise stated, performance does not reflect the deduction of taxes on Fund distributions or redemptions of Fund shares.Effective November 5, 2020, Class C shares automatically convert to Class A shares eight years after purchase. The average annual total returns listed for Class C reflect conversion to Class A shares after eight years. Prior to November 5, 2020, Class C shares automatically converted to Class A shares ten years after purchase. |

| 3 | Source: Fund prospectus. The expense ratios for the current reporting period can be found in the Financial Highlights section of this report. Performance reflects expenses waived and/or reimbursed, if applicable. Without such waivers and/or reimbursements, performance would have been lower. |

| | Fund profile subject to change due to active management. |

Eaton Vance

Emerging Markets Local Income Fund

October 31, 2022

Example

As a Fund shareholder, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchases and redemption fees (if applicable); and (2) ongoing costs, including management fees; distribution and/or service fees; and other Fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of Fund investing and to compare these costs with the ongoing costs of investing in other mutual funds. The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period (May 1, 2022 to October 31, 2022).

Actual Expenses

The first section of the table below provides information about actual account values and actual expenses. You may use the information in this section, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first section under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second section of the table below provides information about hypothetical account values and hypothetical expenses based on the actual Fund expense ratio and an assumed rate of return of 5% per year (before expenses), which is not the actual Fund return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in your Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads) or redemption fees (if applicable). Therefore, the second section of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would be higher.

| | Beginning

Account Value

(5/1/22) | Ending

Account Value

(10/31/22) | Expenses Paid

During Period*

(5/1/22 – 10/31/22) | Annualized

Expense

Ratio |

| Actual | | | | |

| Class A | $1,000.00 | $ 912.20 | $5.74 | 1.19% |

| Class C | $1,000.00 | $ 907.90 | $9.14 | 1.90% |

| Class I | $1,000.00 | $ 910.70 | $4.33 | 0.90% |

| |

| Hypothetical | | | | |

| (5% return per year before expenses) | | | | |

| Class A | $1,000.00 | $1,019.21 | $6.06 | 1.19% |

| Class C | $1,000.00 | $1,015.63 | $9.65 | 1.90% |

| Class I | $1,000.00 | $1,020.67 | $4.58 | 0.90% |

| * | Expenses are equal to the Fund's annualized expense ratio for the indicated Class, multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period). The Example assumes that the $1,000 was invested at the net asset value per share determined at the close of business on April 30, 2022. The Example reflects the expenses of both the Fund and the Portfolio. |

Eaton Vance

Emerging Markets Local Income Fund

October 31, 2022

Statement of Assets and Liabilities

| | October 31, 2022 |

| Assets | |

| Investment in Emerging Markets Local Income Portfolio, at value (identified cost $1,081,061,207) | $ 831,430,236 |

| Receivable for Fund shares sold | 1,895,141 |

| Total assets | $ 833,325,377 |

| Liabilities | |

| Payable for Fund shares redeemed | $ 3,127,711 |

| Payable to affiliates: | |

| Distribution and service fees | 51,555 |

| Trustees' fees | 43 |

| Other | 4,725 |

| Accrued expenses | 350,147 |

| Total liabilities | $ 3,534,181 |

| Net Assets | $ 829,791,196 |

| Sources of Net Assets | |

| Paid-in capital | $ 987,119,888 |

| Accumulated loss | (157,328,692) |

| Net Assets | $ 829,791,196 |

| Class A Shares | |

| Net Assets | $ 87,882,831 |

| Shares Outstanding | 27,289,873 |

Net Asset Value and Redemption Price Per Share

(net assets ÷ shares of beneficial interest outstanding) | $ 3.22 |

Maximum Offering Price Per Share

(100 ÷ 96.75 of net asset value per share) | $ 3.33 |

| Class C Shares | |

| Net Assets | $ 33,976,129 |

| Shares Outstanding | 10,435,925 |

Net Asset Value and Offering Price Per Share*

(net assets ÷ shares of beneficial interest outstanding) | $ 3.26 |

| Class I Shares | |

| Net Assets | $ 707,932,236 |

| Shares Outstanding | 219,967,325 |

Net Asset Value, Offering Price and Redemption Price Per Share

(net assets ÷ shares of beneficial interest outstanding) | $ 3.22 |

| On sales of $100,000 or more, the offering price of Class A shares is reduced. |

| * | Redemption price per share is equal to the net asset value less any applicable contingent deferred sales charge. |

7

See Notes to Financial Statements.

Eaton Vance

Emerging Markets Local Income Fund

October 31, 2022

| | Year Ended |

| | October 31, 2022 |

| Investment Income | |

| Dividend income allocated from Portfolio | $ 665,701 |

| Interest income allocated from Portfolio (net of foreign taxes withheld of $1,796,379) | 77,130,750 |

| Expenses allocated from Portfolio | (8,284,846) |

| Total investment income from Portfolio | $ 69,511,605 |

| Expenses | |

| Distribution and service fees: | |

| Class A | $ 343,397 |

| Class C | 445,833 |

| Trustees’ fees and expenses | 500 |

| Custodian fee | 60,326 |

| Transfer and dividend disbursing agent fees | 772,688 |

| Legal and accounting services | 57,971 |

| Printing and postage | 372,372 |

| Registration fees | 92,024 |

| Miscellaneous | 17,513 |

| Total expenses | $ 2,162,624 |

| Net investment income | $ 67,348,981 |

| Realized and Unrealized Gain (Loss) from Portfolio | |

| Net realized gain (loss): | |

| Investment transactions (net of foreign capital gains taxes of $265,099) | $ (66,276,484) |

| Futures contracts | 4,642,689 |

| Swap contracts | (47,686,429) |

| Foreign currency transactions | (5,696,180) |

| Forward foreign currency exchange contracts | (17,812,193) |

| Non-deliverable bond forward contracts | (18,633,766) |

| Net realized loss | $(151,462,363) |

| Change in unrealized appreciation (depreciation): | |

| Investments (including net decrease in accrued foreign capital gains taxes of $1,195,024) | $ (175,679,884) |

| Futures contracts | (269,053) |

| Swap contracts | 4,859,563 |

| Foreign currency | (872,864) |

| Forward foreign currency exchange contracts | 7,127,568 |

| Non-deliverable bond forward contracts | 507,066 |

| Net change in unrealized appreciation (depreciation) | $(164,327,604) |

| Net realized and unrealized loss | $(315,789,967) |

| Net decrease in net assets from operations | $(248,440,986) |

8

See Notes to Financial Statements.

Eaton Vance

Emerging Markets Local Income Fund

October 31, 2022

Statements of Changes in Net Assets

| | Year Ended October 31, |

| | 2022 | 2021 |

| Increase (Decrease) in Net Assets | | |

| From operations: | | |

| Net investment income | $ 67,348,981 | $ 73,990,839 |

| Net realized gain (loss) | (151,462,363) | 14,421,284 |

| Net change in unrealized appreciation (depreciation) | (164,327,604) | (95,065,101) |

| Net decrease in net assets from operations | $ (248,440,986) | $ (6,652,978) |

| Distributions to shareholders: | | |

| Class A | $ — | $ (3,528,165) |

| Class C | — | (1,336,288) |

| Class I | — | (29,959,647) |

| Total distributions to shareholders | $ — | $ (34,824,100) |

| Tax return of capital to shareholders: | | |

| Class A | $ (13,947,887) | $ (11,744,917) |

| Class C | (5,086,599) | (4,324,921) |

| Class I | (114,849,166) | (107,917,807) |

| Total tax return of capital to shareholders | $ (133,883,652) | $ (123,987,645) |

| Transactions in shares of beneficial interest: | | |

| Class A | $ (17,218,330) | $ 30,113,299 |

| Class C | (9,079,577) | 4,959,581 |

| Class I | (183,103,782) | 379,512,959 |

| Net increase (decrease) in net assets from Fund share transactions | $ (209,401,689) | $ 414,585,839 |

| Net increase (decrease) in net assets | $ (591,726,327) | $ 249,121,116 |

| Net Assets | | |

| At beginning of year | $1,421,517,523 | $ 1,172,396,407 |

| At end of year | $ 829,791,196 | $1,421,517,523 |

9

See Notes to Financial Statements.

Eaton Vance

Emerging Markets Local Income Fund

October 31, 2022

| | Class A |

| | Year Ended October 31, |

| | 2022 | 2021 | 2020 | 2019 | 2018 |

| Net asset value — Beginning of year | $ 4.590 | $ 5.030 | $ 5.760 | $ 5.190 | $ 6.310 |

| Income (Loss) From Operations | | | | | |

| Net investment income(1) | $ 0.234 | $ 0.228 | $ 0.286 | $ 0.363 | $ 0.408 |

| Net realized and unrealized gain (loss) | (1.125) | (0.168) | (0.293) | 0.759 | (0.970) |

| Total income (loss) from operations | $ (0.891) | $ 0.060 | $ (0.007) | $ 1.122 | $ (0.562) |

| Less Distributions | | | | | |

| From net investment income | $ — | $ (0.123) | $ (0.198) | $ (0.552) | $ — |

| Tax return of capital | (0.479) | (0.377) | (0.525) | — | (0.558) |

| Total distributions | $ (0.479) | $ (0.500) | $ (0.723) | $ (0.552) | $ (0.558) |

| Net asset value — End of year | $ 3.220 | $ 4.590 | $ 5.030 | $ 5.760 | $ 5.190 |

| Total Return(2) | (20.47)% | 1.06% | (0.31)% (3) | 22.64% (3) | (9.65)% (3) |

| Ratios/Supplemental Data | | | | | |

| Net assets, end of year (000’s omitted) | $87,883 | $145,043 | $129,954 | $152,308 | $107,550 |

| Ratios (as a percentage of average daily net assets):(4) | | | | | |

| Expenses | 1.19% (5) | 1.16% | 1.20% (3) | 1.20% (3) | 1.23% (3)(6) |

| Net investment income | 5.99% | 4.53% | 5.40% | 6.57% | 6.84% |

| Portfolio Turnover of the Portfolio | 33% | 56% | 56% | 46% | 52% |

| (1) | Computed using average shares outstanding. |

| (2) | Returns are historical and are calculated by determining the percentage change in net asset value with all distributions reinvested and do not reflect the effect of sales charges. |

| (3) | The investment adviser reimbursed certain operating expenses (equal to 0.02%, 0.02% and 0.09% of average daily net assets for the years ended October 31, 2020, 2019 and 2018, respectively). Absent this reimbursement, total return would be lower. |

| (4) | Includes the Fund’s share of the Portfolio’s allocated expenses. |

| (5) | Includes a reduction by the investment adviser of a portion of the Portfolio's adviser fee due to the Portfolio’s investment in the Liquidity Fund (equal to less than 0.005% of average daily net assets for the year ended October 31, 2022). |

| (6) | Includes interest expense, including on securities sold short and/or reverse repurchase agreements if applicable, of 0.02% of average daily net assets for the year ended October 31, 2018. |

10

See Notes to Financial Statements.

Eaton Vance

Emerging Markets Local Income Fund

October 31, 2022

Financial Highlights — continued

| | Class C |

| | Year Ended October 31, |

| | 2022 | 2021 | 2020 | 2019 | 2018 |

| Net asset value — Beginning of year | $ 4.650 | $ 5.080 | $ 5.820 | $ 5.240 | $ 6.380 |

| Income (Loss) From Operations | | | | | |

| Net investment income(1) | $ 0.209 | $ 0.194 | $ 0.250 | $ 0.328 | $ 0.373 |

| Net realized and unrealized gain (loss) | (1.142) | (0.154) | (0.298) | 0.770 | (0.992) |

| Total income (loss) from operations | $ (0.933) | $ 0.040 | $ (0.048) | $ 1.098 | $ (0.619) |

| Less Distributions | | | | | |

| From net investment income | $ — | $ (0.115) | $ (0.190) | $ (0.518) | $ — |

| Tax return of capital | (0.457) | (0.355) | (0.502) | — | (0.521) |

| Total distributions | $ (0.457) | $ (0.470) | $ (0.692) | $ (0.518) | $ (0.521) |

| Net asset value — End of year | $ 3.260 | $ 4.650 | $ 5.080 | $ 5.820 | $ 5.240 |

| Total Return(2) | (21.31)% | 0.46% | (0.90)% (3) | 21.87% (3) | (10.42)% (3) |

| Ratios/Supplemental Data | | | | | |

| Net assets, end of year (000’s omitted) | $33,976 | $58,639 | $59,169 | $62,869 | $44,416 |

| Ratios (as a percentage of average daily net assets):(4) | | | | | |

| Expenses | 1.89% (5) | 1.86% | 1.90% (3) | 1.90% (3) | 1.93% (3)(6) |

| Net investment income | 5.28% | 3.82% | 4.68% | 5.88% | 6.17% |

| Portfolio Turnover of the Portfolio | 33% | 56% | 56% | 46% | 52% |

| (1) | Computed using average shares outstanding. |

| (2) | Returns are historical and are calculated by determining the percentage change in net asset value with all distributions reinvested and do not reflect the effect of sales charges. |

| (3) | The investment adviser reimbursed certain operating expenses (equal to 0.02%, 0.02% and 0.09% of average daily net assets for the years ended October 31, 2020, 2019 and 2018, respectively). Absent this reimbursement, total return would be lower. |

| (4) | Includes the Fund’s share of the Portfolio’s allocated expenses. |

| (5) | Includes a reduction by the investment adviser of a portion of the Portfolio's adviser fee due to the Portfolio’s investment in the Liquidity Fund (equal to less than 0.005% of average daily net assets for the year ended October 31, 2022). |

| (6) | Includes interest expense, including on securities sold short and/or reverse repurchase agreements if applicable, of 0.02% of average daily net assets for the year ended October 31, 2018. |

11

See Notes to Financial Statements.

Eaton Vance

Emerging Markets Local Income Fund

October 31, 2022

Financial Highlights — continued

| | Class I |

| | Year Ended October 31, |

| | 2022 | 2021 | 2020 | 2019 | 2018 |

| Net asset value — Beginning of year | $ 4.590 | $ 5.020 | $ 5.760 | $ 5.190 | $ 6.310 |

| Income (Loss) From Operations | | | | | |

| Net investment income(1) | $ 0.246 | $ 0.243 | $ 0.301 | $ 0.381 | $ 0.427 |

| Net realized and unrealized gain (loss) | (1.126) | (0.158) | (0.302) | 0.757 | (0.971) |

| Total income (loss) from operations | $ (0.880) | $ 0.085 | $ (0.001) | $ 1.138 | $ (0.544) |

| Less Distributions | | | | | |

| From net investment income | $ — | $ (0.127) | $ (0.202) | $ (0.568) | $ — |

| Tax return of capital | (0.490) | (0.388) | (0.537) | — | (0.576) |

| Total distributions | $ (0.490) | $ (0.515) | $ (0.739) | $ (0.568) | $ (0.576) |

| Net asset value — End of year | $ 3.220 | $ 4.590 | $ 5.020 | $ 5.760 | $ 5.190 |

| Total Return(2) | (20.48)% | 1.36% | (0.01)% (3) | 23.00% (3) | (9.38)% (3) |

| Ratios/Supplemental Data | | | | | |

| Net assets, end of year (000’s omitted) | $707,932 | $1,217,836 | $983,273 | $938,608 | $555,630 |

| Ratios (as a percentage of average daily net assets):(4) | | | | | |

| Expenses | 0.89% (5) | 0.86% | 0.90% (3) | 0.90% (3) | 0.93% (3)(6) |

| Net investment income | 6.28% | 4.86% | 5.68% | 6.90% | 7.15% |

| Portfolio Turnover of the Portfolio | 33% | 56% | 56% | 46% | 52% |

| (1) | Computed using average shares outstanding. |

| (2) | Returns are historical and are calculated by determining the percentage change in net asset value with all distributions reinvested. |

| (3) | The investment adviser reimbursed certain operating expenses (equal to 0.02%, 0.02% and 0.09% of average daily net assets for the years ended October 31, 2020, 2019 and 2018, respectively). Absent this reimbursement, total return would be lower. |

| (4) | Includes the Fund’s share of the Portfolio’s allocated expenses. |

| (5) | Includes a reduction by the investment adviser of a portion of the Portfolio's adviser fee due to the Portfolio’s investment in the Liquidity Fund (equal to less than 0.005% of average daily net assets for the year ended October 31, 2022). |

| (6) | Includes interest expense, including on securities sold short and/or reverse repurchase agreements if applicable, of 0.02% of average daily net assets for the year ended October 31, 2018. |

12

See Notes to Financial Statements.

Eaton Vance

Emerging Markets Local Income Fund

October 31, 2022

Notes to Financial Statements

1 Significant Accounting Policies

Eaton Vance Emerging Markets Local Income Fund (the Fund) is a non-diversified series of Eaton Vance Mutual Funds Trust (the Trust). The Trust is a Massachusetts business trust registered under the Investment Company Act of 1940, as amended (the 1940 Act), as an open-end management investment company. The Fund offers three classes of shares. Class A shares are generally sold subject to a sales charge imposed at time of purchase. Class C shares are sold at net asset value and are generally subject to a contingent deferred sales charge (see Note 5). Effective November 5, 2020, Class C shares automatically convert to Class A shares eight years after their purchase as described in the Fund’s prospectus. Class I shares are sold at net asset value and are not subject to a sales charge. Each class represents a pro-rata interest in the Fund, but votes separately on class-specific matters and (as noted below) is subject to different expenses. Realized and unrealized gains and losses and net investment income and losses, other than class-specific expenses, are allocated daily to each class of shares based on the relative net assets of each class to the total net assets of the Fund. Each class of shares differs in its distribution plan and certain other class-specific expenses. The Fund invests substantially all of its investable assets in interests in Emerging Markets Local Income Portfolio (the Portfolio), a Massachusetts business trust, having the same investment objective and policies as the Fund. The value of the Fund’s investment in the Portfolio reflects the Fund’s proportionate interest in the net assets of the Portfolio (86.7% at October 31, 2022). The performance of the Fund is directly affected by the performance of the Portfolio. The financial statements of the Portfolio, including the portfolio of investments, are included elsewhere in this report and should be read in conjunction with the Fund’s financial statements.

The following is a summary of significant accounting policies of the Fund. The policies are in conformity with accounting principles generally accepted in the United States of America (U.S. GAAP). The Fund is an investment company and follows accounting and reporting guidance in the Financial Accounting Standards Board (FASB) Accounting Standards Codification Topic 946.

A Investment Valuation—Valuation of securities by the Portfolio is discussed in Note 1A of the Portfolio's Notes to Financial Statements, which are included elsewhere in this report.

B Income— The Fund's net investment income or loss consists of the Fund's pro-rata share of the net investment income or loss of the Portfolio, less all actual and accrued expenses of the Fund.

C Federal and Other Taxes—The Fund’s policy is to comply with the provisions of the Internal Revenue Code applicable to regulated investment companies and to distribute to shareholders each year substantially all of its net investment income, and all or substantially all of its net realized capital gains. Accordingly, no provision for federal income or excise tax is necessary.

In addition to the requirements of the Internal Revenue Code, the Fund may also be required to recognize its pro-rata share of the capital gains taxes incurred by the Portfolio. In doing so, the daily net asset value would reflect the Fund’s pro-rata share of the estimated reserve for such taxes incurred by the Portfolio.

As of October 31, 2022, the Fund had no uncertain tax positions that would require financial statement recognition, de-recognition, or disclosure. The Fund files a U.S. federal income tax return annually after its fiscal year-end, which is subject to examination by the Internal Revenue Service for a period of three years from the date of filing.

D Expenses—The majority of expenses of the Trust are directly identifiable to an individual fund. Expenses which are not readily identifiable to a specific fund are allocated taking into consideration, among other things, the nature and type of expense and the relative size of the funds.

E Use of Estimates—The preparation of the financial statements in conformity with U.S. GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities at the date of the financial statements and the reported amounts of income and expense during the reporting period. Actual results could differ from those estimates.

F Indemnifications—Under the Trust’s organizational documents, its officers and Trustees may be indemnified against certain liabilities and expenses arising out of the performance of their duties to the Fund. Under Massachusetts law, if certain conditions prevail, shareholders of a Massachusetts business trust (such as the Trust) could be deemed to have personal liability for the obligations of the Trust. However, the Trust’s Declaration of Trust contains an express disclaimer of liability on the part of Fund shareholders and the By-laws provide that the Trust shall assume, upon request by the shareholder, the defense on behalf of any Fund shareholders. Moreover, the By-laws also provide for indemnification out of Fund property of any shareholder held personally liable solely by reason of being or having been a shareholder for all loss or expense arising from such liability. Additionally, in the normal course of business, the Fund enters into agreements with service providers that may contain indemnification clauses. The Fund's maximum exposure under these arrangements is unknown as this would involve future claims that may be made against the Fund that have not yet occurred.

G Other—Investment transactions are accounted for on a trade date basis.

Eaton Vance

Emerging Markets Local Income Fund

October 31, 2022

Notes to Financial Statements — continued

2 Distributions to Shareholders and Income Tax Information

The Fund expects to pay any required income distributions monthly and intends to distribute annually all or substantially all of its net realized capital gains. The Fund may include in its distributions amounts attributable to the imputed interest on foreign currency exposures and certain other derivative positions which, in certain circumstances, may result in a return of capital for federal income tax purposes. Distributions to shareholders are recorded on the ex-dividend date. Distributions are declared separately for each class of shares. Shareholders may reinvest income and capital gain distributions in additional shares of the same class of the Fund at the net asset value as of the ex-dividend date or, at the election of the shareholder, receive distributions in cash. Distributions to shareholders are determined in accordance with income tax regulations, which may differ from U.S. GAAP. As required by U.S. GAAP, only distributions in excess of tax basis earnings and profits are reported in the financial statements as a return of capital. Permanent differences between book and tax accounting relating to distributions are reclassified to paid-in capital. For tax purposes, distributions from short-term capital gains are considered to be from ordinary income.

The tax character of distributions declared for the years ended October 31, 2022 and October 31, 2021 was as follows:

| | Year Ended October 31, |

| | 2022 | 2021 |

| Ordinary income | $ — | $ 34,824,100 |

| Tax return of capital | $133,883,652 | $123,987,645 |

During the year ended October 31, 2022, accumulated loss was decreased by $126,799,228 and paid-in capital was decreased by $126,799,228 due to differences between book and tax accounting, primarily for net operating losses. These reclassifications had no effect on the net assets or net asset value per share of the Fund.

As of October 31, 2022, the components of distributable earnings (accumulated loss) on a tax basis were as follows:

| Deferred capital losses | $ (44,681,829) |

| Net unrealized depreciation | (112,646,863) |

| Accumulated loss | $(157,328,692) |

At October 31, 2022, the Fund, for federal income tax purposes, had deferred capital losses of $44,681,829 which would reduce its taxable income arising from future net realized gains on investment transactions, if any, to the extent permitted by the Internal Revenue Code, and thus would reduce the amount of distributions to shareholders, which would otherwise be necessary to relieve the Fund of any liability for federal income or excise tax. The deferred capital losses are treated as arising on the first day of the Fund’s next taxable year and retain the same short-term or long-term character as when originally deferred. Of the deferred capital losses at October 31, 2022, $44,681,829 are short-term.

3 Investment Adviser Fee and Other Transactions with Affiliates

The investment adviser fee is earned by Eaton Vance Management (EVM), an indirect, wholly-owned subsidiary of Morgan Stanley, as compensation for investment advisory services rendered to the Fund. The investment adviser fee is computed at an annual rate as a percentage of the Fund’s average daily net assets that are not invested in other investment companies for which EVM or its affiliates serve as investment adviser or administrator as follows and is payable monthly:

| Average Daily Net Assets | Annual Fee Rate |

| Up to $1 billion | 0.650% |

| $1 billion but less than $2 billion | 0.625% |

| $2 billion but less than $5 billion | 0.600% |

| $5 billion and over | 0.575% |

For the year ended October 31, 2022, the Fund incurred no investment adviser fee on such assets. To the extent the Fund’s assets are invested in the Portfolio, the Fund is allocated its share of the Portfolio’s investment adviser fee. The Portfolio has engaged Boston Management and Research (BMR) to render investment advisory services. See Note 2 of the Portfolio’s Notes to Financial Statements which are included elsewhere in this report. EVM also serves as the administrator of the Fund, but receives no compensation. EVM has agreed to reimburse the Fund’s expenses to the extent that total annual

Eaton Vance

Emerging Markets Local Income Fund

October 31, 2022

Notes to Financial Statements — continued

operating expenses (relating to ordinary operating expenses only and excluding such expenses as borrowing costs, taxes or litigation expenses) exceed 1.20%, 1.90% and 0.90% of the Fund’s average daily net assets for Class A, Class C and Class I, respectively. This agreement may be changed or terminated after February 28, 2023. Pursuant to this agreement, no operating expenses were allocated to EVM for the year ended October 31, 2022.

EVM provides sub-transfer agency and related services to the Fund pursuant to a Sub-Transfer Agency Support Services Agreement. For the year ended October 31, 2022, EVM earned $20,080 from the Fund pursuant to such agreement, which is included in transfer and dividend disbursing agent fees on the Statement of Operations. The Fund was informed that Eaton Vance Distributors, Inc. (EVD), an affiliate of EVM and the Fund's principal underwriter, received $51,604 as its portion of the sales charge on sales of Class A shares for the year ended October 31, 2022. The Fund was informed that Morgan Stanley affiliated broker-dealers, which may be deemed to be affiliates of EVM, BMR and EVD, also received a portion of the sales charge on sales of Class A shares for the year ended October 31, 2022 in the amount of $1,551. EVD also received distribution and service fees from Class A and Class C shares (see Note 4) and contingent deferred sales charges (see Note 5).

Trustees and officers of the Fund who are members of EVM’s or BMR's organizations receive remuneration for their services to the Fund out of the investment adviser fee. Certain officers and Trustees of the Fund and the Portfolio are officers of the above organizations.

4 Distribution Plans

The Fund has in effect a distribution plan for Class A shares (Class A Plan) pursuant to Rule 12b-1 under the 1940 Act. Pursuant to the Class A Plan, the Fund pays EVD a distribution and service fee of 0.30% per annum of its average daily net assets attributable to Class A shares for distribution services and facilities provided to the Fund by EVD, as well as for personal services and/or the maintenance of shareholder accounts. Distribution and service fees paid or accrued to EVD for the year ended October 31, 2022 amounted to $343,397 for Class A shares.

The Fund also has in effect a distribution plan for Class C shares (Class C Plan) pursuant to Rule 12b-1 under the 1940 Act. Pursuant to the Class C Plan, the Fund pays EVD amounts equal to 0.75% per annum of its average daily net assets attributable to Class C shares for providing ongoing distribution services and facilities to the Fund. For the year ended October 31, 2022, the Fund paid or accrued to EVD $334,375 for Class C shares.

Pursuant to the Class C Plan, the Fund also makes payments of service fees to EVD, financial intermediaries and other persons in amounts equal to 0.25% per annum of its average daily net assets attributable to that class. Service fees paid or accrued are for personal services and/or the maintenance of shareholder accounts. They are separate and distinct from the sales commissions and distribution fees payable to EVD. Service fees paid or accrued for the year ended October 31, 2022 amounted to $111,458 for Class C shares.

Distribution and service fees are subject to the limitations contained in the Financial Industry Regulatory Authority Rule 2341(d).

5 Contingent Deferred Sales Charges

A contingent deferred sales charge (CDSC) of 1% generally is imposed on redemptions of Class C shares made within 12 months of purchase. Class A shares may be subject to a 0.75% (1% prior to April 29, 2022) CDSC if redeemed within 12 months (18 months prior to April 29, 2022) of purchase (depending on the circumstances of purchase). Generally, the CDSC is based upon the lower of the net asset value at date of redemption or date of purchase. No charge is levied on shares acquired by reinvestment of dividends or capital gain distributions. For the year ended October 31, 2022, the Fund was informed that EVD received approximately $9,000 and $8,000 of CDSCs paid by Class A and Class C shareholders, respectively.

6 Investment Transactions

For the year ended October 31, 2022, increases and decreases in the Fund's investment in the Portfolio aggregated $109,200,430 and $451,022,305, respectively.

Eaton Vance

Emerging Markets Local Income Fund

October 31, 2022

Notes to Financial Statements — continued

7 Shares of Beneficial Interest

The Fund’s Declaration of Trust permits the Trustees to issue an unlimited number of full and fractional shares of beneficial interest (without par value). Such shares may be issued in a number of different series (such as the Fund) and classes. Transactions in Fund shares, including direct exchanges pursuant to share class conversions for all periods presented, were as follows:

| | Year Ended

October 31, 2022 | | Year Ended

October 31, 2021 |

| | Shares | Amount | | Shares | Amount |

| Class A | | | | | |

| Sales | 8,744,229 | $ 34,415,385 | | 18,274,543 | $ 92,948,187 |

| Issued to shareholders electing to receive payments of distributions in Fund shares | 3,336,364 | 12,695,340 | | 2,799,887 | 13,895,628 |

| Redemptions | (16,356,773) | (64,329,055) | | (15,367,242) | (76,730,516) |

| Net increase (decrease) | (4,276,180) | $ (17,218,330) | | 5,707,188 | $ 30,113,299 |

| Class C | | | | | |

| Sales | 1,633,628 | $ 6,788,155 | | 3,368,182 | $ 17,293,127 |

| Issued to shareholders electing to receive payments of distributions in Fund shares | 1,277,313 | 4,922,131 | | 1,095,871 | 5,499,953 |

| Redemptions | (5,096,503) | (20,789,863) | | (3,486,291) | (17,833,499) |

| Net increase (decrease) | (2,185,562) | $ (9,079,577) | | 977,762 | $ 4,959,581 |

| Class I | | | | | |

| Sales | 103,149,612 | $ 411,448,840 | | 212,433,306 | $ 1,086,953,947 |

| Issued to shareholders electing to receive payments of distributions in Fund shares | 27,991,737 | 106,732,653 | | 25,659,906 | 127,179,340 |

| Redemptions | (176,382,555) | (701,285,275) | | (168,623,621) | (834,620,328) |

| Net increase (decrease) | (45,241,206) | $(183,103,782) | | 69,469,591 | $ 379,512,959 |

Eaton Vance

Emerging Markets Local Income Fund

October 31, 2022

Report of Independent Registered Public Accounting Firm

To the Trustees of Eaton Vance Mutual Funds Trust and Shareholders of Eaton Vance Emerging Markets Local Income Fund:

Opinion on the Financial Statements and Financial Highlights

We have audited the accompanying statement of assets and liabilities of Eaton Vance Emerging Markets Local Income Fund (the “Fund”) (one of the funds constituting Eaton Vance Mutual Funds Trust), as of October 31, 2022, the related statement of operations for the year then ended, the statements of changes in net assets for each of the two years in the period then ended, the financial highlights for each of the five years in the period then ended, and the related notes. In our opinion, the financial statements and financial highlights present fairly, in all material respects, the financial position of the Fund as of October 31, 2022, and the results of its operations for the year then ended, the changes in its net assets for each of the two years in the period then ended, and the financial highlights for each of the five years in the period then ended, in conformity with accounting principles generally accepted in the United States of America.

Basis for Opinion

These financial statements and financial highlights are the responsibility of the Fund's management. Our responsibility is to express an opinion on the Fund's financial statements and financial highlights based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (PCAOB) and are required to be independent with respect to the Fund in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement, whether due to error or fraud. The Fund is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. As part of our audits, we are required to obtain an understanding of internal control over financial reporting but not for the purpose of expressing an opinion on the effectiveness of the Fund’s internal control over financial reporting. Accordingly, we express no such opinion.

Our audits included performing procedures to assess the risks of material misstatement of the financial statements and financial highlights, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements and financial highlights. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements and financial highlights. We believe that our audits provide a reasonable basis for our opinion.

/s/ Deloitte & Touche LLP

Boston, Massachusetts

December 29, 2022

We have served as the auditor of one or more Eaton Vance investment companies since 1959.

Eaton Vance

Emerging Markets Local Income Fund

October 31, 2022

Federal Tax Information (Unaudited)

The Form 1099-DIV you receive in February 2023 will show the tax status of all distributions paid to your account in calendar year 2022. Shareholders are advised to consult their own tax adviser with respect to the tax consequences of their investment in the Fund. As required by the Internal Revenue Code and/or regulations, shareholders must be notified regarding the status of the foreign tax credit and 163(j) interest dividends.

Foreign Tax Credit. For the fiscal year ended October 31, 2022, the Fund paid foreign taxes of $1,926,271 and recognized foreign source income of $76,319,136.

163(j) Interest Dividends. For the fiscal year ended October 31, 2022, the Fund designates 100% of distributions from net investment income as a 163(j) interest dividend.

Emerging Markets Local Income Portfolio

October 31, 2022

| Foreign Corporate Bonds — 2.7% |

| Security | Principal

Amount

(000's omitted) | Value |

| Brazil — 0.9% |

| Simpar Finance S.a.r.l., 10.75%, 2/12/28(1) | BRL | 53,195 | $ 8,354,153 |

| | | | $ 8,354,153 |

| Colombia — 0.3% |

| Patrimonio Autonomo Union del Sur, 6.66%, 2/28/41(2) | COP | 18,185,000 | $ 2,964,095 |

| | | | $ 2,964,095 |

| Mexico — 0.0%(3) |

| Petroleos Mexicanos, 7.19%, 9/12/24(2) | MXN | 10,630 | $ 488,910 |

| | | | $ 488,910 |

| Peru — 1.2% |

| Alicorp SAA, 6.875%, 4/17/27(1) | PEN | 25,530 | $ 5,961,284 |

| Telefonica del Peru SAA, 7.375%, 4/10/27(2) | PEN | 24,500 | 5,397,216 |

| | | | $ 11,358,500 |

| Uzbekistan — 0.3% |

| Nederlandse Financierings-Maatschappij voor Ontwikkelingslanden NV (FMO), 15.00%, 12/8/22(1) | UZS | 34,000,000 | $ 3,049,577 |

| | | | $ 3,049,577 |

Total Foreign Corporate Bonds

(identified cost $25,394,686) | | | $ 26,215,235 |

| Loan Participation Notes — 3.1% |

| Security | Principal

Amount

(000's omitted) | Value |

| Uzbekistan — 3.1% |

| Daryo Finance BV (borrower - Uzbek Industrial and Construction Bank ATB), 18.75%, 6/15/23(1)(4)(5) | UZS | 159,708,000 | $ 14,300,922 |

| Europe Asia Investment Finance BV (borrower - Joint Stock Commercial Bank "Asaka"), 18.70%, 7/26/23(1)(4)(5) | UZS | 168,539,054 | 15,079,756 |

Total Loan Participation Notes

(identified cost $32,881,388) | | | $ 29,380,678 |

| Sovereign Government Bonds — 61.3% |

| Security | Principal

Amount

(000's omitted) | Value |

| Argentina — 0.1% |

| Provincia de Cordoba, 6.875%, 12/10/25(1) | USD | 1,106 | $ 846,272 |

| | | | $ 846,272 |

| Armenia — 0.6% |

| Republic of Armenia, 7.15%, 3/26/25(1) | USD | 5,828 | $ 5,728,085 |

| | | | $ 5,728,085 |

| Azerbaijan — 0.3% |

| Republic of Azerbaijan, 4.75%, 3/18/24(1) | USD | 3,142 | $ 3,080,178 |

| | | | $ 3,080,178 |

| Bahrain — 0.3% |

| CBB International Sukuk Programme Co. WLL, 6.25%, 11/14/24(1) | USD | 2,624 | $ 2,641,116 |

| | | | $ 2,641,116 |

| Bolivia — 0.3% |

| Bolivian Government International Bond, 5.95%, 8/22/23(1) | USD | 2,762 | $ 2,644,615 |

| | | | $ 2,644,615 |

| Bosnia and Herzegovina — 0.1% |

| Republic of Srpska: | | | |

| 1.50%, 6/30/23 | BAM | 32 | $ 16,315 |

| 1.50%, 10/30/23 | BAM | 88 | 43,986 |

| 1.50%, 12/15/23 | BAM | 10 | 4,793 |

| 1.50%, 5/31/25 | BAM | 1,669 | 781,811 |

| 1.50%, 6/9/25 | BAM | 160 | 77,177 |

| 1.50%, 12/24/25 | BAM | 232 | 115,843 |

| 1.50%, 9/25/26 | BAM | 145 | 72,273 |

| 1.50%, 9/26/27 | BAM | 55 | 25,425 |

| | | | $ 1,137,623 |

| Brazil — 0.4% |

| Nota do Tesouro Nacional, 10.00%, 1/1/27 | BRL | 22,375 | $ 4,114,701 |

| | | | $ 4,114,701 |

| China — 2.0% |

| China Government Bond: | | | |

| 2.68%, 5/21/30 | CNY | 40,600 | $ 5,568,123 |

19

See Notes to Financial Statements.

Emerging Markets Local Income Portfolio

October 31, 2022

Portfolio of Investments — continued

| Security | Principal

Amount

(000's omitted) | Value |

| China (continued) |

| China Government Bond: (continued) | | | |

| 3.53%, 10/18/51 | CNY | 93,820 | $ 13,847,468 |

| | | | $ 19,415,591 |

| Colombia — 2.5% |

| Republic of Colombia: | | | |

| 2.625%, 3/15/23 | USD | 3,500 | $ 3,447,066 |

| 4.00%, 2/26/24 | USD | 3,429 | 3,289,748 |

| Titulos De Tesoreria B: | | | |

| 5.75%, 11/3/27 | COP | 27,398,000 | 4,027,515 |

| 6.00%, 4/28/28 | COP | 18,865,200 | 2,744,340 |

| 7.00%, 3/26/31 | COP | 64,677,900 | 8,790,405 |

| 7.00%, 6/30/32 | COP | 5,447,000 | 712,701 |

| 10.00%, 7/24/24 | COP | 3,528,300 | 687,059 |

| | | | $ 23,698,834 |

| Costa Rica — 0.7% |

| Costa Rica Government Bond, 9.66%, 9/30/26(1) | CRC | 4,136,100 | $ 6,752,472 |

| | | | $ 6,752,472 |

| Czech Republic — 0.4% |

| Czech Republic Government Bond, 0.95%, 5/15/30(1) | CZK | 140,000 | $ 3,987,779 |

| | | | $ 3,987,779 |

| Dominican Republic — 5.1% |

| Dominican Republic: | | | |

| 8.00%, 1/15/27(1) | DOP | 111,360 | $ 1,746,879 |

| 8.00%, 2/12/27(1) | DOP | 568,540 | 8,866,241 |

| 8.90%, 2/15/23(1) | DOP | 145,250 | 2,675,276 |

| 12.00%, 8/8/25(2) | DOP | 836,870 | 14,761,457 |

| 12.75%, 9/23/29(2) | DOP | 587,800 | 11,092,860 |

| 13.00%, 6/10/34(1) | DOP | 312,000 | 5,708,155 |

| Dominican Republic Central Bank Notes: | | | |

| 8.00%, 3/12/27(1) | DOP | 36,140 | 538,626 |

| 12.00%, 10/3/25(2) | DOP | 221,270 | 3,895,602 |

| | | | $ 49,285,096 |

| Ecuador — 0.2% |

| Republic of Ecuador, 1.50% to 7/31/23, 7/31/40(1)(6) | USD | 6,853 | $ 2,288,275 |

| | | | $ 2,288,275 |

| El Salvador — 0.5% |

| Republic of El Salvador, 7.75%, 1/24/23(1) | USD | 4,660 | $ 4,252,080 |

| | | | $ 4,252,080 |

| Security | Principal

Amount

(000's omitted) | Value |

| Honduras — 0.2% |

| Honduras Government International Bond, 7.50%, 3/15/24(1) | USD | 2,218 | $ 2,218,000 |

| | | | $ 2,218,000 |

| Hungary — 0.7% |

| Hungary Government Bond, 3.25%, 10/22/31 | HUF | 4,850,000 | $ 7,114,005 |

| | | | $ 7,114,005 |

| Indonesia — 6.1% |

| Indonesia Government Bond: | | | |

| 6.50%, 2/15/31 | IDR | 339,135,000 | $ 20,334,619 |

| 7.50%, 5/15/38 | IDR | 267,486,000 | 17,042,961 |

| 7.50%, 4/15/40 | IDR | 45,427,000 | 2,872,553 |

| 8.25%, 5/15/36 | IDR | 242,576,000 | 16,197,032 |

| 8.375%, 4/15/39 | IDR | 22,764,000 | 1,544,770 |

| 9.50%, 5/15/41 | IDR | 5,702,000 | 427,465 |

| | | | $ 58,419,400 |

| Iraq — 0.2% |

| Republic of Iraq, 6.752%, 3/9/23(1) | USD | 1,710 | $ 1,687,582 |

| | | | $ 1,687,582 |

| Ivory Coast — 0.1% |

| Ivory Coast Government International Bond, 5.125%, 6/15/25(1) | EUR | 721 | $ 666,926 |

| | | | $ 666,926 |

| Jordan — 0.4% |

| Kingdom of Jordan, 4.95%, 7/7/25(1) | USD | 4,503 | $ 4,217,442 |

| | | | $ 4,217,442 |

| Macedonia — 0.6% |

| North Macedonia Government International Bond: | | | |

| 2.75%, 1/18/25(1) | EUR | 913 | $ 823,941 |

| 5.625%, 7/26/23(1) | EUR | 5,192 | 5,122,434 |

| | | | $ 5,946,375 |

| Malaysia — 1.2% |

| Malaysia Government Bond: | | | |

| 3.828%, 7/5/34 | MYR | 28,100 | $ 5,496,585 |

| 4.254%, 5/31/35 | MYR | 27,750 | 5,633,437 |

| | | | $ 11,130,022 |

20

See Notes to Financial Statements.

Emerging Markets Local Income Portfolio

October 31, 2022

Portfolio of Investments — continued

| Security | Principal

Amount

(000's omitted) | Value |

| Mexico — 3.2% |

| Mexican Bonos: | | | |

| 7.75%, 11/13/42 | MXN | 230,000 | $ 9,371,617 |

| 8.50%, 5/31/29 | MXN | 39,000 | 1,844,030 |

| 8.50%, 11/18/38 | MXN | 410,469 | 18,271,349 |

| 10.00%, 11/20/36 | MXN | 22,074 | 1,120,646 |

| | | | $ 30,607,642 |

| Oman — 0.3% |

| Oman Government International Bond, 4.875%, 2/1/25(1) | USD | 3,173 | $ 3,091,454 |

| | | | $ 3,091,454 |

| Paraguay — 0.2% |

| Republic of Paraguay, 4.625%, 1/25/23(1) | USD | 2,330 | $ 2,326,528 |

| | | | $ 2,326,528 |

| Peru — 2.4% |

| Peru Government Bond: | | | |

| 5.94%, 2/12/29 | PEN | 4,380 | $ 987,224 |

| 6.15%, 8/12/32 | PEN | 6,602 | 1,413,466 |

| 6.714%, 2/12/55 | PEN | 4,100 | 830,512 |

| 6.85%, 2/12/42 | PEN | 19,284 | 4,093,957 |

| 6.90%, 8/12/37 | PEN | 8,763 | 1,891,033 |

| 6.95%, 8/12/31 | PEN | 59,887 | 13,834,224 |

| | | | $ 23,050,416 |

| Romania — 3.2% |

| Romania Government International Bond: | | | |

| 2.75%, 2/26/26(1) | EUR | 2,755 | $ 2,487,020 |

| 3.624%, 5/26/30(1) | EUR | 2,755 | 2,144,069 |

| Romanian Government Bond: | | | |

| 3.25%, 6/24/26 | RON | 57,650 | 9,589,911 |

| 4.15%, 1/26/28 | RON | 48,045 | 7,722,013 |

| 4.85%, 4/22/26 | RON | 32,030 | 5,668,019 |

| 5.80%, 7/26/27 | RON | 16,020 | 2,824,513 |

| | | | $ 30,435,545 |

| Serbia — 3.9% |

| Serbia Treasury Bond: | | | |

| 4.50%, 1/11/26 | RSD | 1,114,580 | $ 8,757,149 |

| 4.50%, 8/20/32 | RSD | 3,298,130 | 21,393,150 |

| 5.875%, 2/8/28 | RSD | 970,810 | 7,626,941 |

| | | | $ 37,777,240 |

| Security | Principal

Amount

(000's omitted) | Value |

| Seychelles — 0.1% |

| Republic of Seychelles, 8.00%, 1/1/26(1) | USD | 688 | $ 674,683 |

| | | | $ 674,683 |

| South Africa — 12.4% |

| Republic of South Africa: | | | |

| 8.25%, 3/31/32 | ZAR | 147,394 | $ 6,613,121 |

| 8.50%, 1/31/37 | ZAR | 369,200 | 15,504,566 |

| 8.75%, 1/31/44 | ZAR | 408,487 | 16,882,091 |

| 8.75%, 2/28/48 | ZAR | 231,000 | 9,504,090 |

| 9.00%, 1/31/40 | ZAR | 334,480 | 14,345,197 |

| 10.50%, 12/21/26 | ZAR | 980,230 | 56,004,172 |

| | | | $118,853,237 |

| Suriname — 0.5% |

| Republic of Suriname, 9.25%, 10/26/26(1)(7) | USD | 5,529 | $ 4,439,787 |

| | | | $ 4,439,787 |

| Thailand — 3.8% |

| Thailand Government Bond: | | | |

| 1.585%, 12/17/35 | THB | 528,144 | $ 10,972,076 |

| 3.30%, 6/17/38 | THB | 594,751 | 14,658,518 |

| 3.40%, 6/17/36 | THB | 205,000 | 5,239,907 |

| 4.875%, 6/22/29 | THB | 183,489 | 5,363,958 |

| | | | $ 36,234,459 |

| Ukraine — 4.1% |

| Ukraine Government Bond: | | | |

| 9.79%, 5/26/27(4) | UAH | 914,377 | $ 8,188,451 |

| 9.99%, 5/22/24(4) | UAH | 589,859 | 6,896,361 |

| 10.00%, 8/23/23(4) | UAH | 38,483 | 402,061 |

| 10.95%, 11/1/23(4) | UAH | 12,367 | 129,208 |

| 11.67%, 11/22/23(4) | UAH | 118,929 | 1,242,542 |

| 12.52%, 5/13/26(4) | UAH | 166,150 | 1,529,241 |

| 15.84%, 2/26/25(4) | UAH | 1,853,842 | 20,751,963 |

| 15.97%, 4/19/23(4) | UAH | 2,910 | 30,403 |

| | | | $ 39,170,230 |

| United Arab Emirates — 0.3% |

| Sharjah Sukuk Ltd., 3.764%, 9/17/24(1) | USD | 2,747 | $ 2,629,665 |

| | | | $ 2,629,665 |

| Uruguay — 1.8% |

| Uruguay Government Bond, 3.875%, 7/2/40(8) | UYU | 678,613 | $ 16,847,962 |

21

See Notes to Financial Statements.

Emerging Markets Local Income Portfolio

October 31, 2022

Portfolio of Investments — continued

| Security | Principal

Amount

(000's omitted) | Value |

| Uruguay (continued) |

| Uruguay Monetary Regulation Bill, 0.00%, 7/3/24 | UYU | 38,225 | $ 783,044 |

| | | | $ 17,631,006 |

| Uzbekistan — 0.5% |

| Republic of Uzbekistan: | | | |

| 4.75%, 2/20/24(1) | USD | 3,100 | $ 2,960,113 |

| 14.00%, 7/19/24(1) | UZS | 5,000,000 | 437,758 |

| 14.50%, 11/25/23(1) | UZS | 11,470,000 | 1,032,022 |

| | | | $ 4,429,893 |

| Vietnam — 0.3% |

| Vietnam Government International Bond, 4.80%, 11/19/24(1) | USD | 3,124 | $ 3,022,470 |

| | | | $ 3,022,470 |

| Zambia — 1.3% |

| Zambia Government Bond: | | | |

| 11.00%, 1/25/26 | ZMW | 100,560 | $ 4,136,824 |

| 11.00%, 12/27/26 | ZMW | 73,540 | 2,733,385 |

| 12.00%, 3/22/28 | ZMW | 31,390 | 1,070,406 |

| 12.00%, 5/31/28 | ZMW | 14,200 | 476,572 |

| 12.00%, 11/1/28 | ZMW | 21,800 | 712,711 |

| 12.00%, 2/21/29 | ZMW | 47,550 | 1,517,673 |

| 13.00%, 12/27/31 | ZMW | 57,140 | 1,731,079 |

| 14.00%, 12/5/31 | ZMW | 4,800 | 154,681 |

| | | | $ 12,533,331 |

Total Sovereign Government Bonds

(identified cost $838,113,831) | | | $588,180,055 |

| Short-Term Investments — 16.1% |

| Security | Shares | Value |

| Morgan Stanley Institutional Liquidity Funds - Government Portfolio, Institutional Class, 2.88%(9) | | 34,198,985 | $ 34,198,985 |

Total Affiliated Fund

(identified cost $34,198,985) | | | $ 34,198,985 |

| Sovereign Government Securities — 8.6% |

| Security | Principal

Amount

(000's omitted) | Value |

| Israel — 4.8% |

| Bank of Israel Treasury Bill: | | | |

| 0.00%, 12/7/22 | ILS | 156,100 | $ 44,114,689 |

| 0.00%, 1/4/23 | ILS | 5,359 | 1,510,546 |

| | | | $ 45,625,235 |

| Uganda — 1.9% |

| Uganda Treasury Bill: | | | |

| 0.00%, 3/30/23 | UGX | 22,640,400 | $ 5,683,418 |

| 0.00%, 4/13/23 | UGX | 16,824,100 | 4,199,437 |

| 0.00%, 4/27/23 | UGX | 1,425,700 | 353,813 |

| 0.00%, 5/25/23 | UGX | 31,532,000 | 7,738,089 |

| | | | $ 17,974,757 |

| Ukraine — 0.3% |

| Ukraine Treasury Bill, 0.00%, 3/1/23(4) | UAH | 122,375 | $ 2,887,584 |

| | | | $ 2,887,584 |

| Uruguay — 1.6% |

| Uruguay Monetary Regulation Bill: | | | |

| 0.00%, 11/11/22 | UYU | 118,450 | $ 2,905,215 |

| 0.00%, 11/16/22 | UYU | 31,006 | 759,278 |

| 0.00%, 11/23/22 | UYU | 236,075 | 5,768,358 |

| 0.00%, 1/11/23 | UYU | 262,600 | 6,316,621 |

| | | | $ 15,749,472 |

Total Sovereign Government Securities

(identified cost $85,759,735) | | | $ 82,237,048 |

| U.S. Treasury Obligations — 3.9% |

| Security | Principal

Amount

(000's omitted) | Value |

| U.S. Treasury Bill: | | | |

| 0.00%, 11/8/22(10) | $ | 15,950 | $ 15,941,739 |

| 0.00%, 11/15/22(10) | | 21,700 | 21,674,726 |

Total U.S. Treasury Obligations

(identified cost $37,617,744) | | | $ 37,616,465 |

Total Short-Term Investments

(identified cost $157,576,464) | | | $154,052,498 |

22

See Notes to Financial Statements.

Emerging Markets Local Income Portfolio

October 31, 2022

Portfolio of Investments — continued

| | | Value |

Total Investments — 83.2%

(identified cost $1,053,966,369) | | | $797,828,466 |

| Other Assets, Less Liabilities — 16.8% | | | $160,902,065 |

| Net Assets — 100.0% | | | $958,730,531 |

| The percentage shown for each investment category in the Portfolio of Investments is based on net assets. |

| (1) | Security exempt from registration under Regulation S of the Securities Act of 1933, as amended, which exempts from registration securities offered and sold outside the United States. Security may not be offered or sold in the United States except pursuant to an exemption from, or in a transaction not subject to, the registration requirements of the Securities Act of 1933, as amended. At October 31, 2022, the aggregate value of these securities is $138,483,635 or 14.4% of the Portfolio's net assets. |

| (2) | Security exempt from registration under Rule 144A of the Securities Act of 1933, as amended. These securities may be sold in certain transactions in reliance on an exemption from registration (normally to qualified institutional buyers). At October 31, 2022, the aggregate value of these securities is $38,600,140 or 4.0% of the Portfolio's net assets. |

| (3) | Amount is less than 0.05%. |

| (4) | For fair value measurement disclosure purposes, security is categorized as Level 3 (see Note 8). |

| (5) | Limited recourse note whose payments by the issuer are limited to amounts received by the issuer from the borrower pursuant to a loan agreement with the borrower. |

| (6) | Step coupon security. Interest rate represents the rate in effect at October 31, 2022. |

| (7) | Issuer is in default with respect to interest and/or principal payments. For a variable rate security, interest rate has been adjusted to reflect non-accrual status. |

| (8) | Inflation-linked security whose principal is adjusted for inflation based on changes in a designated inflation index or inflation rate for the applicable country. Interest is calculated based on the inflation-adjusted principal. |

| (9) | May be deemed to be an affiliated investment company. The rate shown is the annualized seven-day yield as of October 31, 2022. |

| (10) | Security (or a portion thereof) has been pledged to cover collateral requirements on open derivative contracts. |

| Forward Foreign Currency Exchange Contracts (Centrally Cleared) |

| Currency Purchased | Currency Sold | Settlement

Date | Value/Unrealized

Appreciation

(Depreciation) |

| BRL | 83,521,000 | USD | 15,230,497 | 11/3/22 | $ 938,509 |

| BRL | 47,329,000 | USD | 8,678,806 | 11/3/22 | 483,715 |

| BRL | 53,195,000 | USD | 9,914,452 | 11/3/22 | 383,680 |

| BRL | 11,137,000 | USD | 2,038,325 | 11/3/22 | 117,710 |

| BRL | 7,610,000 | USD | 1,396,927 | 11/3/22 | 76,308 |

| BRL | 400,000 | USD | 75,357 | 11/3/22 | 2,079 |

| BRL | 100,000 | USD | 18,850 | 11/3/22 | 509 |

| BRL | 7,000,000 | USD | 1,363,332 | 11/3/22 | (8,187) |

| BRL | 34,074,000 | USD | 6,683,208 | 11/3/22 | (86,750) |

| BRL | 110,858,000 | USD | 21,562,251 | 11/3/22 | (101,018) |

| USD | 2,446,226 | BRL | 12,900,000 | 11/3/22 | (51,112) |

| USD | 3,405,405 | BRL | 17,900,000 | 11/3/22 | (59,894) |

| USD | 6,490,026 | BRL | 34,554,000 | 11/3/22 | (199,356) |

| USD | 9,950,193 | BRL | 52,850,452 | 11/3/22 | (281,237) |

| USD | 14,974,129 | BRL | 80,164,000 | 11/3/22 | (544,988) |

23

See Notes to Financial Statements.

Emerging Markets Local Income Portfolio

October 31, 2022

Portfolio of Investments — continued

| Forward Foreign Currency Exchange Contracts (Centrally Cleared) (continued) |

| Currency Purchased | Currency Sold | Settlement

Date | Value/Unrealized

Appreciation

(Depreciation) |

| USD | 9,700,390 | BRL | 53,195,000 | 11/3/22 | $ (597,742) |

| USD | 19,320,190 | BRL | 103,660,548 | 11/3/22 | (747,673) |

| BRL | 66,930,800 | USD | 12,406,080 | 11/4/22 | 548,024 |

| BRL | 10,328,827 | USD | 1,909,902 | 11/4/22 | 89,188 |

| USD | 14,857,621 | BRL | 77,259,627 | 11/4/22 | (95,573) |

| USD | 17,235,892 | ZAR | 296,164,336 | 11/18/22 | 1,132,749 |

| USD | 782,688 | ZAR | 13,448,922 | 11/18/22 | 51,439 |

| BRL | 103,660,548 | USD | 19,198,531 | 12/2/22 | 745,295 |

| BRL | 34,554,000 | USD | 6,449,168 | 12/2/22 | 198,867 |

| BRL | 77,259,627 | USD | 14,765,902 | 12/2/22 | 98,505 |

| BRL | 25,600,000 | USD | 4,848,898 | 12/2/22 | 76,427 |

| BRL | 25,600,000 | USD | 4,867,855 | 12/2/22 | 57,471 |

| BRL | 4,940,000 | USD | 937,234 | 12/2/22 | 13,200 |

| BRL | 30,106,000 | USD | 5,848,778 | 12/2/22 | (56,518) |

| USD | 9,852,021 | BRL | 53,195,000 | 12/2/22 | (382,460) |

| CLP | 7,662,300,480 | USD | 8,162,411 | 12/21/22 | (107,615) |

| COP | 267,305,447 | USD | 59,827 | 12/21/22 | (6,162) |

| COP | 669,840,234 | USD | 149,919 | 12/21/22 | (15,443) |

| COP | 17,745,107,000 | USD | 3,599,413 | 12/21/22 | (36,912) |

| COP | 155,687,623,689 | USD | 34,733,095 | 12/21/22 | (3,477,302) |

| EUR | 10,518,605 | USD | 10,584,023 | 12/21/22 | (146,526) |

| EUR | 232,869,495 | USD | 234,317,771 | 12/21/22 | (3,243,905) |

| IDR | 98,100,000,000 | USD | 6,250,000 | 12/21/22 | 18,033 |

| IDR | 85,900,000,000 | USD | 5,473,429 | 12/21/22 | 15,093 |

| IDR | 76,890,000,000 | USD | 4,899,100 | 12/21/22 | 13,734 |

| IDR | 74,380,000,000 | USD | 4,740,720 | 12/21/22 | 11,739 |

| IDR | 68,460,462,674 | USD | 4,363,744 | 12/21/22 | 10,491 |

| IDR | 46,458,231,000 | USD | 2,969,810 | 12/21/22 | (1,393) |

| IDR | 46,678,064,232 | USD | 3,118,280 | 12/21/22 | (135,817) |

| IDR | 102,741,465,413 | USD | 6,899,345 | 12/21/22 | (334,750) |

| IDR | 352,113,312,995 | USD | 23,519,378 | 12/21/22 | (1,021,338) |

| KRW | 440,000,000 | USD | 308,462 | 12/21/22 | 90 |

| KRW | 2,833,400,000 | USD | 2,035,503 | 12/21/22 | (48,566) |

| KRW | 4,601,400,000 | USD | 3,305,627 | 12/21/22 | (78,870) |

| KRW | 8,555,100,000 | USD | 6,146,040 | 12/21/22 | (146,729) |

| KRW | 8,897,400,000 | USD | 6,394,475 | 12/21/22 | (155,124) |

| KRW | 8,555,100,000 | USD | 6,161,978 | 12/21/22 | (162,667) |

| PEN | 7,203,306 | USD | 1,794,099 | 12/21/22 | 3,946 |

| PEN | 13,554,568 | USD | 3,457,445 | 12/21/22 | (74,037) |

| PEN | 63,737,218 | USD | 16,298,161 | 12/21/22 | (388,468) |

| USD | 10,203,828 | COP | 45,737,641,000 | 12/21/22 | 1,021,556 |

| USD | 5,125,511 | COP | 22,974,590,000 | 12/21/22 | 513,140 |

| USD | 4,274,784 | COP | 19,209,683,000 | 12/21/22 | 418,255 |

| USD | 2,458,543 | COP | 11,020,172,000 | 12/21/22 | 246,137 |

24

See Notes to Financial Statements.

Emerging Markets Local Income Portfolio

October 31, 2022

Portfolio of Investments — continued

| Forward Foreign Currency Exchange Contracts (Centrally Cleared) (continued) |

| Currency Purchased | Currency Sold | Settlement

Date | Value/Unrealized

Appreciation

(Depreciation) |

| USD | 2,433,158 | COP | 10,933,638,859 | 12/21/22 | $ 238,125 |

| USD | 2,147,278 | COP | 9,649,265,000 | 12/21/22 | 210,095 |

| USD | 1,222,206 | COP | 5,492,103,191 | 12/21/22 | 119,613 |

| USD | 1,029,980 | COP | 4,628,443,000 | 12/21/22 | 100,776 |

| USD | 586,253 | COP | 2,634,385,000 | 12/21/22 | 57,374 |

| USD | 2,296,964 | COP | 11,347,000,000 | 12/21/22 | 18,944 |

| USD | 2,286,937 | COP | 11,346,000,000 | 12/21/22 | 9,119 |

| USD | 2,284,995 | COP | 11,345,000,000 | 12/21/22 | 7,377 |

| USD | 1,920,346 | COP | 9,547,000,000 | 12/21/22 | 3,694 |

| USD | 47,728,127 | EUR | 47,433,128 | 12/21/22 | 660,750 |

| USD | 35,576,732 | EUR | 35,356,839 | 12/21/22 | 492,526 |

| USD | 15,093,289 | EUR | 15,000,000 | 12/21/22 | 208,952 |

| USD | 8,282,029 | EUR | 8,230,839 | 12/21/22 | 114,657 |

| USD | 6,659,334 | EUR | 6,618,174 | 12/21/22 | 92,192 |

| USD | 5,538,197 | EUR | 5,503,967 | 12/21/22 | 76,671 |

| USD | 5,185,654 | EUR | 5,153,602 | 12/21/22 | 71,790 |

| USD | 1,155,484 | EUR | 1,148,342 | 12/21/22 | 15,997 |

| USD | 707,750 | EUR | 703,376 | 12/21/22 | 9,798 |

| USD | 396,156 | EUR | 398,508 | 12/21/22 | 721 |

| USD | 16,406,328 | IDR | 245,622,414,013 | 12/21/22 | 712,451 |

| USD | 3,687,617 | IDR | 55,128,400,000 | 12/21/22 | 165,226 |

| USD | 3,402,804 | IDR | 50,944,061,062 | 12/21/22 | 147,768 |

| USD | 2,730,746 | IDR | 40,692,600,000 | 12/21/22 | 130,720 |

| USD | 1,167,254 | IDR | 17,394,000,000 | 12/21/22 | 55,876 |

| USD | 89,144 | IDR | 1,334,599,288 | 12/21/22 | 3,871 |

| USD | 57,714 | IDR | 859,900,000 | 12/21/22 | 2,771 |

| USD | 55,727 | IDR | 830,000,000 | 12/21/22 | 2,695 |

| USD | 56,057 | IDR | 839,900,000 | 12/21/22 | 2,392 |

| USD | 14,683 | IDR | 218,800,000 | 12/21/22 | 703 |

| USD | 14,447,030 | PEN | 56,498,002 | 12/21/22 | 344,347 |

| USD | 6,306,008 | PEN | 24,778,196 | 12/21/22 | 121,027 |

| USD | 5,738,661 | PEN | 22,534,000 | 12/21/22 | 113,862 |

| USD | 3,359,198 | PEN | 13,440,151 | 12/21/22 | 4,350 |

| USD | 28,538 | PEN | 114,417 | 12/21/22 | (22) |

| USD | 3,326,274 | PEN | 13,350,000 | 12/21/22 | (6,071) |

| BRL | 113,618,000 | USD | 20,780,499 | 1/4/23 | 926,279 |

| BRL | 72,310,542 | USD | 13,235,447 | 1/4/23 | 579,519 |

| IDR | 50,196,000,000 | USD | 3,291,239 | 1/11/23 | (87,743) |

| IDR | 53,482,000,000 | USD | 3,504,718 | 1/11/23 | (91,511) |

| IDR | 60,168,000,000 | USD | 3,946,996 | 1/11/23 | (107,089) |

| BRL | 80,164,000 | USD | 14,691,200 | 2/2/23 | 529,912 |

| BRL | 52,850,452 | USD | 9,761,271 | 2/2/23 | 273,690 |

| USD | 5,258,970 | IDR | 80,173,000,000 | 7/11/23 | 190,068 |

| USD | 3,018,893 | IDR | 46,020,000,000 | 7/11/23 | 109,299 |

25

See Notes to Financial Statements.

Emerging Markets Local Income Portfolio

October 31, 2022

Portfolio of Investments — continued

| Forward Foreign Currency Exchange Contracts (Centrally Cleared) (continued) |

| Currency Purchased | Currency Sold | Settlement

Date | Value/Unrealized

Appreciation

(Depreciation) |

| USD | 2,471,594 | IDR | 37,653,000,000 | 7/11/23 | $ 91,000 |

| | | | | | $ 1,216,318 |

| Forward Foreign Currency Exchange Contracts (OTC) |

| Currency Purchased | Currency Sold | Counterparty | Settlement

Date | Unrealized

Appreciation | Unrealized

(Depreciation) |

| KZT | 253,765,227 | USD | 525,938 | Citibank, N.A. | 11/1/22 | $ 17,282 | $ — |

| KZT | 253,765,226 | USD | 525,938 | Citibank, N.A. | 11/1/22 | 17,282 | — |

| KZT | 54,546,232 | USD | 113,049 | Citibank, N.A. | 11/1/22 | 3,715 | — |

| KZT | 54,546,232 | USD | 113,049 | Citibank, N.A. | 11/1/22 | 3,715 | — |

| USD | 116,495 | KZT | 54,546,231 | Citibank, N.A. | 11/1/22 | — | (269) |

| USD | 116,495 | KZT | 54,546,231 | Citibank, N.A. | 11/1/22 | — | (269) |

| USD | 541,967 | KZT | 253,765,226 | Citibank, N.A. | 11/1/22 | — | (1,253) |