UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act File Number: 811-04015

Eaton Vance Mutual Funds Trust

(Exact Name of Registrant as Specified in Charter)

Two International Place, Boston, Massachusetts 02110

(Address of Principal Executive Offices)

Deidre E. Walsh

Two International Place, Boston, Massachusetts 02110

(Name and Address of Agent for Services)

(617) 482-8260

(Registrant’s Telephone Number)

January 31

Date of Fiscal Year End

January 31, 2023

Date of Reporting Period

Item 1. Reports to Stockholders

Parametric

International Equity Fund

Annual Report

January 31, 2023

Commodity Futures Trading Commission Registration. The Commodity Futures Trading Commission (“CFTC”) has adopted regulations that subject registered investment companies and advisers to regulation by the CFTC if a fund invests more than a prescribed level of its assets in certain CFTC-regulated instruments (including futures, certain options and swap agreements) or markets itself as providing investment exposure to such instruments. The investment adviser has claimed an exclusion from the definition of “commodity pool operator” under the Commodity Exchange Act with respect to its management of the Fund. Accordingly, neither the Fund nor the adviser with respect to the operation of the Fund is subject to CFTC regulation. Because of its management of other strategies, the Fund's adviser and Parametric Portfolio Associates LLC (Parametric), sub-adviser to the Fund, are registered with the CFTC as commodity pool operators. The adviser and Parametric are also registered as commodity trading advisors.

Fund shares are not insured by the FDIC and are not deposits or other obligations of, or guaranteed by, any depository institution. Shares are subject to investment risks, including possible loss of principal invested.

This report must be preceded or accompanied by a current summary prospectus or prospectus. Before investing, investors should consider carefully the investment objective, risks, and charges and expenses of a mutual fund. This and other important information is contained in the summary prospectus and prospectus, which can be obtained from a financial intermediary. Prospective investors should read the prospectus carefully before investing. For further information, please call 1-800-260-0761.

Annual Report January 31, 2023

Parametric

International Equity Fund

Parametric

International Equity Fund

January 31, 2023

Management’s Discussion of Fund Performance†

Economic and Market Conditions

Developed equity markets outside the U.S. declined sharply during the first half of the 12-month period ended January 31, 2023, as measured by the MSCI EAFE Index (the Index). During the second half of the period, international stocks mounted a strong comeback, finishing the period in slightly negative territory. Overall results at the country level were mixed, with 14 of the 21 international markets within the Index recording losses during the period.

Overseas markets impacted by Russia’s war in Ukraine -- as well as markets with high technology exposures -- fared the worst during the period. Conversely, a strong showing from energy stocks benefitted a handful of energy-rich nations. U.S.-based investors faced an added challenge from the U.S. dollar’s relative strength, resulting in losses from foreign currency depreciation during the period.

In Europe, the war in Ukraine weighed strongly on international markets. In particular, Germany and Austria experienced acute losses due to their dependence on Russian energy. High inflation, rising interest rates, and the possibility of a near-term recession across the region also punished stocks. Countries with higher industrial exposure -- specifically Ireland, Finland, and Sweden -- were particularly vulnerable during the period. Additionally, a strong pullback in technology stocks, including key semiconductor manufacturing equipment suppliers, challenged markets in the Netherlands. In contrast, rising energy prices enabled both the U.K. and Portugal to deliver positive returns.

Turning to the Pacific region, stock performance in Japan trailed the broader Index largely due to a fierce decline in the yen versus the U.S. dollar -- a side effect of rising U.S. rates. Meanwhile, the Bank of Japan continued its growth-oriented low interest rate policy during the period. Australia and New Zealand experienced the highest Index returns, resulting from double-digit gains from a handful of sectors, including utilities and industrials.

Fund Performance

For the 12-month period ended January 31, 2023, Parametric International Equity Fund (the Fund) returned -5.51% for Class A shares at net asset value (NAV), underperforming its benchmark, the Index, which returned -2.83%.

Factors detracting from the Fund’s performance relative to the Index included sector diversification across the U.K., which resulted in an overweight exposure to real estate. Property stocks in the U.K. fell sharply as the Bank of England pursued aggressive interest rate increases to slow the pace of inflation. In Germany, the Fund’s stock selections, which emphasized medium- and small-size companies, also detracted from relative performance versus the Index. This was partially the result of including underperforming small-cap stocks within the utilities and health care sectors. The Fund’s sector allocations in Sweden further detracted from relative returns during the period. This was partially due to an overweight position in communication services, which experienced sharp declines.

The Fund’s emphasis on diversification at the sector level within each country also detracted from relative returns. The Fund’s emphasis on diversification -- via a system of broad security representation with an emphasis on reducing portfolio risk -- further detracted from relative performance during the period.

In contrast, the Fund’s emphasis on diversification -- via a system of targeting country weights and systematically rebalancing them as they change -- contributed to performance relative to the Index during the period. Based on diversification targets, the Fund held underweight exposures to larger countries, and overweight exposures to smaller countries.

Factors contributing to the Fund’s performance relative to the Index included an underweight exposure to Japan, where markets fell for U.S.-based investors due to a sharply depreciating yen. The Fund’s active sector allocations within Japan also improved relative returns during the period. This was due in part to an underweight position in the consumer discretionary sector, which fell.

In Switzerland, the Fund’s stock selections within the financials sector also added to relative performance -- partially the result of excluding high beta stocks. Additionally, sector allocations in Singapore contributed to relative returns, resulting from an underweight position in communication services during the period.

See Endnotes and Additional Disclosures in this report.

Past performance is no guarantee of future results. Returns are historical and are calculated by determining the percentage change in net asset value (NAV) or offering price (as applicable) with all distributions reinvested. Furthermore, returns do not reflect the deduction of taxes that shareholders may have to pay on Fund distributions or upon the redemption of Fund shares. Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Performance for periods less than or equal to one year is cumulative. Performance is for the stated time period only; due to market volatility, current Fund performance may be lower or higher than the quoted return. For performance as of the most recent month-end, please refer to eatonvance.com.

Parametric

International Equity Fund

January 31, 2023

Performance

Portfolio Manager(s) Thomas C. Seto, Paul Bouchey, CFA and Jennifer Sireklove, CFA, each of Parametric Portfolio Associates LLC

| % Average Annual Total Returns1,2 | Class

Inception Date | Performance

Inception Date | One Year | Five Years | Ten Years |

| Class A at NAV | 04/01/2010 | 04/01/2010 | (5.51)% | 2.00% | 5.02% |

| Class A with 5.25% Maximum Sales Charge | — | — | (10.48) | 0.90 | 4.46 |

| Class I at NAV | 04/01/2010 | 04/01/2010 | (5.30) | 2.26 | 5.29 |

| Class R at NAV | 08/10/2015 | 04/01/2010 | (5.77) | 1.76 | 4.83 |

| Class R6 at NAV | 08/10/2015 | 04/01/2010 | (5.29) | 2.28 | 5.31 |

|

| MSCI EAFE Index | — | — | (2.83)% | 2.13% | 4.95% |

| % Total Annual Operating Expense Ratios3 | Class A | Class I | Class R | Class R6 |

| Gross | 0.79% | 0.54% | 1.04% | 0.51% |

| Net | 0.75 | 0.50 | 1.00 | 0.47 |

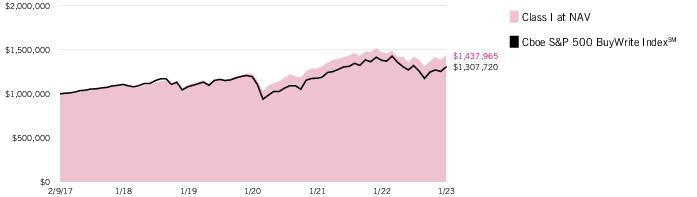

Growth of $10,000

This graph shows the change in value of a hypothetical investment of $10,000 in Class A of the Fund for the period indicated. For comparison, the same investment is shown in the indicated index.

| Growth of Investment2 | Amount Invested | Period Beginning | At NAV | With Maximum Sales Charge |

| Class I, at minimum investment | $1,000,000 | 01/31/2012 | $1,675,109 | N.A. |

| Class R | $10,000 | 01/31/2012 | $16,027 | N.A. |

| Class R6, at minimum investment | $5,000,000 | 01/31/2012 | $8,389,886 | N.A. |

See Endnotes and Additional Disclosures in this report.

Past performance is no guarantee of future results. Returns are historical and are calculated by determining the percentage change in net asset value (NAV) or offering price (as applicable) with all distributions reinvested. Furthermore, returns do not reflect the deduction of taxes that shareholders may have to pay on Fund distributions or upon the redemption of Fund shares. Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Performance for periods less than or equal to one year is cumulative. Performance is for the stated time period only; due to market volatility, current Fund performance may be lower or higher than the quoted return. For performance as of the most recent month-end, please refer to eatonvance.com.

Parametric

International Equity Fund

January 31, 2023

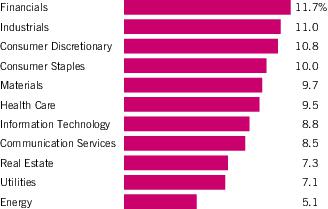

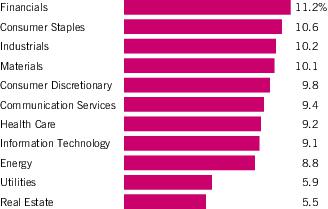

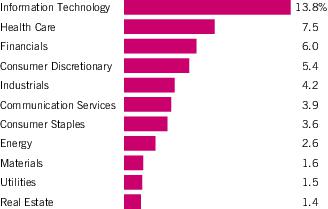

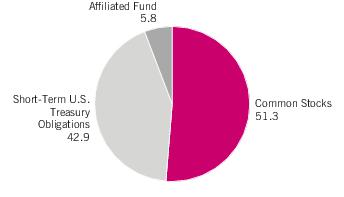

| Sector Allocation (% of net assets)1 |

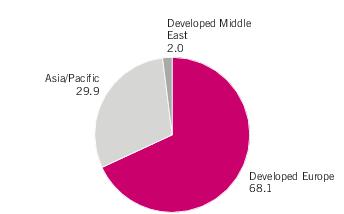

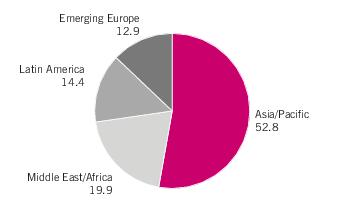

| Geographic Allocation (% of common stocks) |

| Top 10 Holdings (% of net assets)1 |

| Nestle S.A. | 1.2% |

| Cie Financiere Richemont S.A. | 1.1 |

| Air Liquide S.A. | 0.9 |

| E.ON SE | 0.9 |

| CSL, Ltd. | 0.8 |

| Deutsche Telekom AG | 0.7 |

| TotalEnergies SE | 0.7 |

| Novo Nordisk A/S, Class B | 0.7 |

| Vonovia SE | 0.6 |

| AstraZeneca PLC | 0.6 |

| Total | 8.2% |

Footnotes:

| 1 | Excludes cash and cash equivalents. |

Parametric

International Equity Fund

January 31, 2023

Endnotes and Additional Disclosures

| † | The views expressed in this report are those of the portfolio manager(s) and are current only through the date stated at the top of this page. These views are subject to change at any time based upon market or other conditions, and Eaton Vance and the Fund(s) disclaim any responsibility to update such views. These views may not be relied upon as investment advice and, because investment decisions are based on many factors, may not be relied upon as an indication of trading intent on behalf of any Eaton Vance fund. This commentary may contain statements that are not historical facts, referred to as “forward-looking statements.” The Fund’s actual future results may differ significantly from those stated in any forward-looking statement, depending on factors such as changes in securities or financial markets or general economic conditions, the volume of sales and purchases of Fund shares, the continuation of investment advisory, administrative and service contracts, and other risks discussed from time to time in the Fund’s filings with the Securities and Exchange Commission. |

| | |

| 1 | MSCI EAFE Index is an unmanaged index of equities in the developed markets, excluding the U.S. and Canada. MSCI indexes are net of foreign withholding taxes. Source: MSCI. MSCI data may not be reproduced or used for any other purpose. MSCI provides no warranties, has not prepared or approved this report, and has no liability hereunder. Unless otherwise stated, index returns do not reflect the effect of any applicable sales charges, commissions, expenses, taxes or leverage, as applicable. It is not possible to invest directly in an index. |

| 2 | Total Returns at NAV do not include applicable sales charges. If sales charges were deducted, the returns would be lower. Total Returns shown with maximum sales charge reflect the stated maximum sales charge. Unless otherwise stated, performance does not reflect the deduction of taxes on Fund distributions or redemptions of Fund shares.Performance prior to the inception date of a class may be linked to the performance of an older class of the Fund. This linked performance is adjusted for any applicable sales charge, but is not adjusted for class expense differences. If adjusted for such differences, the performance would be different. The performance of Class R is linked to Class A and the performance of Class R6 is linked to Class I. Performance presented in the Financial Highlights included in the financial statements is not linked. |

| 3 | Source: Fund prospectus. Net expense ratios reflect a contractual expense reimbursement that continues through 5/31/23. The expense ratios for the current reporting period can be found in the Financial Highlights section of this report. Performance reflects expenses waived and/or reimbursed, if applicable. Without such waivers and/or reimbursements, performance would have been lower. |

| | Fund profile subject to change due to active management. |

| | Important Notice to Shareholders |

| | Effective April 29, 2022, the Fund’s Institutional Class shares were redesignated as Class I shares. This share class redesignation did not result in changes to the annual operating expenses of Class I or the Fund. |

| | Additional Information |

| | Diversification cannot ensure a profit or eliminate the risk of loss. |

Parametric

International Equity Fund

January 31, 2023

Example

As a Fund shareholder, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchases; and (2) ongoing costs, including management fees; distribution and/or service fees; and other Fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of Fund investing and to compare these costs with the ongoing costs of investing in other mutual funds. The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period (August 1, 2022 to January 31, 2023).

Actual Expenses

The first section of the table below provides information about actual account values and actual expenses. You may use the information in this section, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first section under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second section of the table below provides information about hypothetical account values and hypothetical expenses based on the actual Fund expense ratio and an assumed rate of return of 5% per year (before expenses), which is not the actual Fund return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in your Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads). Therefore, the second section of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would be higher.

| | Beginning

Account Value

(8/1/22) | Ending

Account Value

(1/31/23) | Expenses Paid

During Period*

(8/1/22 – 1/31/23) | Annualized

Expense

Ratio |

| Actual | | | | |

| Class A | $1,000.00 | $1,069.10 | $4.02** | 0.77% |

| Class I | $1,000.00 | $1,070.80 | $2.71** | 0.52% |

| Class R | $1,000.00 | $1,067.50 | $5.32** | 1.02% |

| Class R6 | $1,000.00 | $1,070.20 | $2.56** | 0.49% |

| |

| Hypothetical | | | | |

| (5% return per year before expenses) | | | | |

| Class A | $1,000.00 | $1,021.32 | $3.92** | 0.77% |

| Class I | $1,000.00 | $1,022.58 | $2.65** | 0.52% |

| Class R | $1,000.00 | $1,020.06 | $5.19** | 1.02% |

| Class R6 | $1,000.00 | $1,022.74 | $2.50** | 0.49% |

| * | Expenses are equal to the Fund's annualized expense ratio for the indicated Class, multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period). The Example assumes that the $1,000 was invested at the net asset value per share determined at the close of business on July 31, 2022. |

| ** | Absent an allocation of certain expenses to affiliates, expenses would be higher. |

Parametric

International Equity Fund

January 31, 2023

| Security | Shares | Value |

| Australia — 8.9% |

| Abacus Property Group | | 53,600 | $ 106,212 |

| AGL Energy, Ltd. | | 148,900 | 807,525 |

| Altium, Ltd. | | 15,400 | 426,381 |

| Alumina, Ltd. | | 168,000 | 186,893 |

| Ampol, Ltd. | | 21,940 | 475,788 |

| ANZ Group Holdings, Ltd. | | 23,500 | 418,215 |

| APA Group | | 220,500 | 1,650,202 |

| ARB Corp., Ltd.(1) | | 10,500 | 238,581 |

| ASX, Ltd.(1) | | 7,100 | 347,439 |

| Aurizon Holdings, Ltd. | | 93,148 | 243,466 |

| Austal, Ltd. | | 72,300 | 84,846 |

| Bank of Queensland, Ltd.(1) | | 45,200 | 223,507 |

| Bapcor, Ltd.(1) | | 14,665 | 66,321 |

| Beach Energy, Ltd. | | 76,266 | 81,954 |

| Bendigo & Adelaide Bank, Ltd.(1) | | 46,000 | 327,907 |

| BHP Group, Ltd. | | 55,644 | 1,948,772 |

| Brambles, Ltd. | | 73,365 | 623,863 |

| Breville Group, Ltd.(1) | | 13,134 | 211,758 |

| BWP Trust | | 45,954 | 127,831 |

| carsales.com, Ltd. | | 39,900 | 645,991 |

| Centuria Industrial REIT | | 91,244 | 216,950 |

| Centuria Office REIT | | 67,500 | 76,633 |

| Charter Hall Long Wale REIT | | 52,200 | 168,931 |

| Charter Hall Retail REIT | | 75,300 | 213,837 |

| Cleanaway Waste Management, Ltd. | | 123,300 | 238,913 |

| Coles Group, Ltd. | | 110,100 | 1,384,796 |

| Collins Foods, Ltd.(1) | | 20,500 | 116,969 |

| Commonwealth Bank of Australia | | 18,223 | 1,422,525 |

| Cooper Energy, Ltd.(1)(2) | | 664,724 | 84,590 |

| Cromwell Property Group(1) | | 165,783 | 85,181 |

| CSL, Ltd. | | 18,810 | 3,971,739 |

| CSR, Ltd. | | 49,000 | 183,382 |

| Dexus | | 66,800 | 387,310 |

| Domino's Pizza Enterprises, Ltd.(1) | | 4,231 | 228,085 |

| Evolution Mining, Ltd. | | 80,276 | 182,420 |

| Fortescue Metals Group, Ltd. | | 21,869 | 345,433 |

| Goodman Group | | 82,383 | 1,175,076 |

| GPT Group (The) | | 93,066 | 301,677 |

| GUD Holdings, Ltd.(1) | | 15,500 | 92,079 |

| GWA Group, Ltd. | | 67,200 | 103,342 |

| Hansen Technologies, Ltd. | | 66,850 | 252,590 |

| Harvey Norman Holdings, Ltd.(1) | | 71,004 | 225,419 |

| IDP Education, Ltd.(1) | | 11,300 | 251,464 |

| Infomedia, Ltd.(1) | | 61,241 | 47,936 |

| Security | Shares | Value |

| Australia (continued) |

| Ingenia Communities Group | | 56,700 | $ 186,729 |

| InvoCare, Ltd.(1) | | 17,400 | 142,200 |

| IPH, Ltd. | | 40,216 | 243,248 |

| IRESS, Ltd. | | 53,584 | 378,138 |

| JB Hi-Fi, Ltd.(1) | | 7,099 | 244,081 |

| Johns Lyng Group, Ltd.(1) | | 18,400 | 76,689 |

| Karoon Energy, Ltd.(2) | | 178,776 | 295,732 |

| Lendlease Corp., Ltd.(1) | | 44,678 | 272,817 |

| Lifestyle Communities, Ltd.(1) | | 8,330 | 116,131 |

| Link Administration Holdings, Ltd. | | 96,491 | 131,513 |

| Lottery Corp. Ltd.(2) | | 131,400 | 438,239 |

| Medibank Private, Ltd. | | 101,100 | 210,620 |

| Metcash, Ltd.(1) | | 235,800 | 698,774 |

| Mirvac Group | | 178,300 | 288,063 |

| Monadelphous Group, Ltd.(1) | | 19,351 | 190,727 |

| National Storage REIT | | 49,500 | 81,464 |

| Newcrest Mining, Ltd. | | 23,300 | 370,216 |

| NEXTDC, Ltd.(2) | | 46,000 | 325,086 |

| Nine Entertainment Co. Holdings, Ltd. | | 187,800 | 271,715 |

| Northern Star Resources, Ltd. | | 16,596 | 147,879 |

| Orica, Ltd. | | 16,599 | 174,183 |

| Orora, Ltd. | | 65,655 | 138,921 |

| PEXA Group, Ltd.(1)(2) | | 12,831 | 118,466 |

| Premier Investments, Ltd.(1) | | 11,500 | 227,404 |

| Qube Holdings, Ltd. | | 200,231 | 435,398 |

| REA Group, Ltd.(1) | | 8,300 | 744,275 |

| Reece, Ltd.(1) | | 19,700 | 226,430 |

| Region RE, Ltd. | | 118,852 | 228,064 |

| Rio Tinto, Ltd. | | 6,100 | 547,397 |

| Smartgroup Corp, Ltd. | | 19,240 | 77,094 |

| Sonic Healthcare, Ltd. | | 6,400 | 143,344 |

| Suncorp Group, Ltd. | | 46,300 | 411,577 |

| Tabcorp Holdings, Ltd. | | 131,400 | 97,735 |

| Technology One, Ltd. | | 50,588 | 523,050 |

| Telstra Group, Ltd. | | 605,373 | 1,749,638 |

| TPG Telecom, Ltd.(1) | | 143,163 | 489,587 |

| Transurban Group | | 156,841 | 1,537,691 |

| Viva Energy Group, Ltd.(3) | | 103,423 | 213,820 |

| Washington H. Soul Pattinson & Co., Ltd.(1) | | 21,300 | 433,815 |

| Waypoint REIT, Ltd. | | 90,348 | 178,397 |

| Wesfarmers, Ltd. | | 50,585 | 1,783,460 |

| Westpac Banking Corp. | | 43,700 | 735,290 |

| Whitehaven Coal, Ltd. | | 51,161 | 304,210 |

| Woodside Energy Group, Ltd. | | 84,289 | 2,182,569 |

| Woolworths Group, Ltd. | | 82,196 | 2,100,720 |

| | | | $ 41,913,325 |

7

See Notes to Financial Statements.

Parametric

International Equity Fund

January 31, 2023

Portfolio of Investments — continued

| Security | Shares | Value |

| Austria — 1.1% |

| ams-OSRAM AG(2) | | 36,100 | $ 337,248 |

| ANDRITZ AG | | 8,266 | 494,319 |

| AT&S Austria Technologie & Systemtechnik AG | | 3,400 | 116,660 |

| BAWAG Group AG(2)(3) | | 2,540 | 157,340 |

| CA Immobilien Anlagen AG | | 19,001 | 592,609 |

| Erste Group Bank AG | | 12,487 | 473,808 |

| Kontron AG | | 9,400 | 191,015 |

| Lenzing AG | | 500 | 35,411 |

| Mayr-Melnhof Karton AG | | 1,059 | 177,456 |

| Oesterreichische Post AG | | 3,944 | 140,456 |

| OMV AG | | 11,017 | 551,844 |

| PIERER Mobility AG(1) | | 3,400 | 297,331 |

| Porr AG | | 3,440 | 49,531 |

| Rhi Magnesita NV | | 4,792 | 159,384 |

| Schoeller-Bleckmann Oilfield Equipment AG | | 1,500 | 110,030 |

| Telekom Austria AG | | 47,242 | 317,546 |

| UNIQA Insurance Group AG | | 10,300 | 86,617 |

| Verbund AG | | 6,987 | 594,895 |

| voestalpine AG | | 9,846 | 327,149 |

| | | | $ 5,210,649 |

| Belgium — 2.1% |

| Ackermans & van Haaren NV | | 5,210 | $ 901,615 |

| Ageas S.A./NV | | 9,300 | 454,044 |

| AGFA-Gevaert NV(2) | | 34,606 | 108,472 |

| Anheuser-Busch InBev S.A./NV | | 15,644 | 944,299 |

| Care Property Invest NV(1) | | 5,528 | 86,674 |

| Cofinimmo S.A. | | 1,791 | 162,908 |

| Deceuninck NV(1) | | 37,650 | 101,664 |

| D'Ieteren Group | | 4,359 | 833,072 |

| Econocom Group S.A./NV | | 65,622 | 203,838 |

| Elia Group S.A./NV | | 7,250 | 1,018,033 |

| Etablissements Franz Colruyt NV(1) | | 1,550 | 40,988 |

| Euronav NV | | 35,460 | 558,387 |

| EVS Broadcast Equipment S.A. | | 8,119 | 196,786 |

| Fagron | | 11,540 | 170,627 |

| Gimv NV | | 1,766 | 83,118 |

| Groupe Bruxelles Lambert NV | | 3,834 | 327,980 |

| Intervest Offices & Warehouses NV | | 3,632 | 79,333 |

| Melexis NV | | 5,898 | 628,281 |

| Montea NV | | 1,519 | 121,907 |

| Proximus SADP | | 65,274 | 668,870 |

| Shurgard Self Storage S.A. | | 3,517 | 169,710 |

| Sofina S.A.(1) | | 1,080 | 256,578 |

| Solvay S.A. | | 4,500 | 524,392 |

| UCB S.A. | | 7,912 | 649,612 |

| Security | Shares | Value |

| Belgium (continued) |

| Umicore S.A. | | 15,100 | $ 570,848 |

| VGP NV | | 731 | 73,042 |

| Xior Student Housing NV(1) | | 2,621 | 88,058 |

| | | | $ 10,023,136 |

| Denmark — 4.4% |

| Alm Brand A/S | | 123,800 | $ 229,749 |

| AP Moller - Maersk A/S, Class A | | 200 | 426,190 |

| AP Moller - Maersk A/S, Class B | | 360 | 783,105 |

| Bakkafrost P/F | | 10,422 | 646,700 |

| Carlsberg A/S, Class B | | 13,939 | 1,978,803 |

| Chr. Hansen Holding A/S | | 16,689 | 1,232,231 |

| Coloplast A/S, Class B | | 4,800 | 579,525 |

| DFDS A/S | | 7,534 | 283,997 |

| DSV A/S | | 9,000 | 1,488,870 |

| Jyske Bank A/S(2) | | 5,280 | 380,811 |

| Matas A/S | | 10,900 | 118,617 |

| Netcompany Group A/S(2)(3) | | 7,200 | 286,538 |

| Noble Corp. PLC(2) | | 3,438 | 139,324 |

| Novo Nordisk A/S, Class B | | 23,628 | 3,269,873 |

| Novozymes A/S, Class B | | 30,900 | 1,607,929 |

| Orsted A/S(3) | | 30,773 | 2,740,397 |

| Pandora A/S | | 15,110 | 1,258,224 |

| Ringkjoebing Landbobank A/S | | 3,660 | 532,613 |

| Scandinavian Tobacco Group A/S(3) | | 17,900 | 311,106 |

| SimCorp A/S | | 6,765 | 473,752 |

| Spar Nord Bank A/S | | 18,500 | 294,684 |

| Sydbank A/S | | 10,400 | 474,222 |

| Topdanmark A/S | | 7,227 | 390,097 |

| Tryg A/S | | 30,420 | 698,081 |

| | | | $ 20,625,438 |

| Finland — 2.2% |

| Elisa Oyj | | 19,097 | $ 1,088,016 |

| Fortum Oyj | | 49,106 | 738,173 |

| Kemira Oyj | | 12,500 | 202,804 |

| Kesko Oyj, Class B | | 42,956 | 1,000,595 |

| Kojamo Oyj | | 33,700 | 517,451 |

| Kone Oyj, Class B | | 14,714 | 802,444 |

| Metsa Board Oyj | | 21,700 | 193,706 |

| Neste Oyj | | 20,735 | 991,180 |

| Nokia Oyj | | 180,027 | 853,601 |

| Nokian Renkaat Oyj | | 13,200 | 158,117 |

| Nordea Bank Abp | | 90,529 | 1,058,319 |

| Orion Oyj, Class B | | 16,913 | 906,108 |

| TietoEVRY Oyj | | 4,494 | 136,860 |

8

See Notes to Financial Statements.

Parametric

International Equity Fund

January 31, 2023

Portfolio of Investments — continued

| Security | Shares | Value |

| Finland (continued) |

| Tokmanni Group Corp. | | 46,810 | $ 603,550 |

| UPM-Kymmene Oyj | | 14,960 | 542,243 |

| Valmet Oyj(1) | | 8,331 | 261,617 |

| YIT Oyj(1) | | 23,700 | 69,354 |

| | | | $ 10,124,138 |

| France — 8.7% |

| Air Liquide S.A. | | 25,663 | $ 4,086,221 |

| Alstom S.A.(1) | | 7,150 | 212,606 |

| Altarea SCA(1) | | 1,700 | 231,700 |

| Amundi S.A.(3) | | 8,135 | 532,598 |

| Atos SE(1)(2) | | 8,580 | 113,183 |

| AXA S.A. | | 46,000 | 1,435,155 |

| BioMerieux | | 2,400 | 244,670 |

| Bollore SE | | 70,500 | 394,474 |

| Bouygues S.A. | | 7,300 | 240,491 |

| Bureau Veritas S.A. | | 12,318 | 352,190 |

| Carmila S.A. | | 12,300 | 185,657 |

| Carrefour S.A. | | 18,800 | 357,594 |

| Casino Guichard Perrachon S.A.(1)(2) | | 25,468 | 312,976 |

| Cie Generale des Etablissements Michelin SCA | | 15,760 | 498,328 |

| Credit Agricole S.A. | | 31,407 | 378,179 |

| Danone S.A. | | 35,118 | 1,925,845 |

| Dassault Aviation S.A. | | 500 | 85,382 |

| Dassault Systemes SE | | 48,930 | 1,819,750 |

| Edenred | | 16,250 | 885,129 |

| Eiffage S.A. | | 1,470 | 157,012 |

| Engie S.A. | | 166,000 | 2,357,177 |

| Esker S.A. | | 1,000 | 166,968 |

| EssilorLuxottica S.A. | | 5,934 | 1,088,766 |

| Eurazeo SE | | 7,500 | 526,104 |

| Eutelsat Communications S.A.(1) | | 30,600 | 234,010 |

| Gaztransport & Technigaz S.A. | | 1,301 | 143,834 |

| Gecina S.A. | | 5,134 | 608,121 |

| Getlink SE | | 15,500 | 262,163 |

| Hermes International | | 470 | 879,609 |

| ICADE (1) | | 6,600 | 313,501 |

| IPSOS | | 3,200 | 207,384 |

| JCDecaux SE(2) | | 6,200 | 140,299 |

| Klepierre S.A. | | 22,539 | 572,048 |

| La Francaise des Jeux SAEM(3) | | 3,700 | 158,316 |

| Legrand S.A. | | 2,962 | 264,104 |

| LVMH Moet Hennessy Louis Vuitton SE | | 3,070 | 2,680,035 |

| Mercialys S.A. | | 6,500 | 72,188 |

| Metropole Television S.A. | | 17,662 | 281,302 |

| Neoen S.A.(3) | | 14,031 | 526,856 |

| Security | Shares | Value |

| France (continued) |

| Nexity S.A.(1) | | 8,700 | $ 262,818 |

| Orange S.A. | | 138,000 | 1,460,420 |

| Pernod Ricard S.A. | | 5,500 | 1,138,665 |

| Quadient S.A. | | 11,000 | 193,992 |

| Remy Cointreau S.A. | | 800 | 150,631 |

| Rothschild & Co. | | 5,492 | 231,971 |

| Rubis SCA | | 18,900 | 528,922 |

| Sanofi | | 24,504 | 2,399,540 |

| Schneider Electric SE | | 6,400 | 1,038,180 |

| SCOR SE | | 20,167 | 497,766 |

| SEB S.A. | | 1,980 | 207,060 |

| SOITEC (2) | | 1,400 | 212,333 |

| Solutions 30 SE(2) | | 22,000 | 54,880 |

| Sopra Steria Group SACA | | 1,900 | 316,014 |

| Teleperformance | | 1,408 | 391,405 |

| Thales S.A. | | 3,000 | 396,778 |

| TotalEnergies SE | | 55,615 | 3,438,161 |

| Ubisoft Entertainment S.A.(2) | | 7,800 | 161,511 |

| Vinci S.A. | | 6,130 | 692,626 |

| Vivendi SE | | 65,095 | 699,105 |

| Voltalia S.A.(1)(2) | | 12,800 | 242,268 |

| Wendel SE | | 4,600 | 487,085 |

| | | | $ 41,134,056 |

| Germany — 8.8% |

| adidas AG | | 4,700 | $ 756,776 |

| AIXTRON SE | | 4,400 | 131,100 |

| Allianz SE | | 7,080 | 1,692,926 |

| Aurubis AG | | 2,000 | 211,514 |

| Auto1 Group SE(2)(3) | | 9,800 | 79,394 |

| BASF SE | | 32,981 | 1,890,980 |

| Bayer AG | | 24,500 | 1,525,001 |

| Bayerische Motoren Werke AG | | 7,760 | 790,470 |

| Bayerische Motoren Werke AG, PFC Shares | | 3,109 | 294,543 |

| Bechtle AG | | 6,000 | 252,845 |

| Befesa S.A.(3) | | 1,424 | 81,682 |

| Beiersdorf AG | | 14,396 | 1,750,231 |

| Brenntag SE | | 4,300 | 320,986 |

| Cancom SE | | 2,500 | 86,187 |

| CompuGroup Medical SE & Co. KGaA | | 3,284 | 153,912 |

| Covestro AG(3) | | 10,700 | 492,676 |

| Cropenergies AG | | 5,200 | 67,708 |

| Daimler Truck Holding AG(2) | | 9,600 | 322,595 |

| Delivery Hero SE(2)(3) | | 4,067 | 245,878 |

| Deutsche Bank AG | | 38,800 | 517,814 |

| Deutsche Boerse AG | | 3,740 | 669,244 |

9

See Notes to Financial Statements.

Parametric

International Equity Fund

January 31, 2023

Portfolio of Investments — continued

| Security | Shares | Value |

| Germany (continued) |

| Deutsche Post AG | | 17,200 | $ 740,575 |

| Deutsche Telekom AG | | 155,495 | 3,464,242 |

| Deutsche Wohnen SE | | 32,030 | 756,528 |

| E.ON SE | | 372,100 | 4,056,973 |

| Evonik Industries AG | | 13,300 | 295,640 |

| Evotec SE(2) | | 10,547 | 207,386 |

| Fielmann AG | | 2,817 | 106,173 |

| Freenet AG | | 5,700 | 138,563 |

| Fresenius Medical Care AG & Co. KGaA | | 7,965 | 299,123 |

| FUCHS PETROLUB SE | | 3,686 | 121,990 |

| FUCHS PETROLUB SE, PFC Shares | | 6,200 | 247,345 |

| Gea Group AG | | 5,400 | 243,648 |

| Gerresheimer AG | | 1,300 | 96,140 |

| Hamborner REIT AG | | 30,510 | 238,799 |

| Hannover Rueck SE | | 1,100 | 223,375 |

| HelloFresh SE(2) | | 22,200 | 539,710 |

| Henkel AG & Co. KGaA, PFC Shares | | 20,150 | 1,436,701 |

| Hugo Boss AG | | 3,420 | 232,253 |

| Jenoptik AG | | 7,300 | 226,870 |

| K+S AG | | 10,800 | 258,514 |

| Knorr-Bremse AG | | 3,291 | 216,311 |

| Merck KGaA | | 3,620 | 755,596 |

| Muenchener Rueckversicherungs-Gesellschaft AG | | 2,969 | 1,072,425 |

| Nemetschek SE | | 3,482 | 186,163 |

| Puma SE | | 4,602 | 314,263 |

| QIAGEN NV(2) | | 8,108 | 395,533 |

| Rational AG | | 240 | 157,868 |

| Rheinmetall AG | | 950 | 221,975 |

| SAP SE | | 24,652 | 2,922,247 |

| Sartorius AG, PFC Shares | | 669 | 299,988 |

| Siemens AG | | 11,040 | 1,724,506 |

| Siemens Healthineers AG(3) | | 8,008 | 429,458 |

| Suedzucker AG | | 19,600 | 317,974 |

| Symrise AG | | 5,300 | 563,441 |

| TeamViewer AG(2)(3) | | 21,345 | 300,685 |

| Telefonica Deutschland Holding AG | | 143,547 | 422,799 |

| Uniper SE(1) | | 61,000 | 190,110 |

| United Internet AG | | 7,500 | 174,123 |

| Varta AG | | 3,100 | 94,375 |

| VERBIO Vereinigte BioEnergie AG | | 2,600 | 163,904 |

| Volkswagen AG | | 1,700 | 297,568 |

| Volkswagen AG, PFC Shares | | 4,800 | 665,715 |

| Vonovia SE | | 105,550 | 2,981,566 |

| Zalando SE(2)(3) | | 8,600 | 401,061 |

| | | | $ 41,534,664 |

| Security | Shares | Value |

| Hong Kong — 4.2% |

| AIA Group, Ltd. | | 191,000 | $ 2,159,760 |

| ASMPT, Ltd. | | 43,700 | 360,946 |

| Bank of East Asia, Ltd. (The) | | 206,400 | 265,144 |

| Beijing Tong Ren Tang Chinese Medicine Co., Ltd.(1) | | 47,000 | 71,607 |

| BOC Hong Kong Holdings, Ltd. | | 95,000 | 332,014 |

| Budweiser Brewing Co. APAC, Ltd.(3) | | 446,100 | 1,407,587 |

| Cafe de Coral Holdings, Ltd. | | 84,000 | 147,054 |

| Cathay Pacific Airways, Ltd.(1)(2) | | 175,000 | 174,407 |

| China Evergrande New Energy Vehicle Group, Ltd.(2)(4) | | 834,500 | 0 |

| China Ruyi Holdings, Ltd.(1)(2) | | 708,000 | 189,307 |

| China Tobacco International HK Co., Ltd.(1) | | 93,000 | 143,627 |

| China Traditional Chinese Medicine Holdings Co., Ltd. | | 306,000 | 146,608 |

| Chow Sang Sang Holdings International, Ltd. | | 101,000 | 153,917 |

| Chow Tai Fook Jewellery Group, Ltd. | | 159,600 | 341,650 |

| CK Asset Holdings, Ltd. | | 69,000 | 441,152 |

| CK Hutchison Holdings, Ltd. | | 130,500 | 830,496 |

| CLP Holdings, Ltd. | | 130,000 | 965,891 |

| Fortune REIT | | 129,000 | 111,641 |

| Fosun International, Ltd. | | 259,500 | 240,932 |

| Galaxy Entertainment Group, Ltd. | | 140,000 | 974,582 |

| Global Cord Blood Corp.(1)(2)(4) | | 29,600 | 44,216 |

| Green Future Food Hydrocolloid Marine Science Co., Ltd.(2) | | 232,000 | 127,735 |

| Hang Seng Bank, Ltd. | | 29,100 | 484,608 |

| Henderson Land Development Co., Ltd. | | 71,867 | 265,476 |

| HK Electric Investments & HK Electric Investments, Ltd. | | 507,500 | 350,801 |

| HKT Trust and HKT, Ltd. | | 590,000 | 773,004 |

| Hong Kong & China Gas Co., Ltd. | | 992,502 | 996,492 |

| Hysan Development Co., Ltd. | | 29,000 | 97,569 |

| Jardine Matheson Holdings, Ltd. | | 14,400 | 765,440 |

| Kerry Logistics Network, Ltd. | | 66,500 | 129,859 |

| Kerry Properties, Ltd. | | 56,500 | 143,250 |

| Link REIT | | 79,400 | 635,546 |

| LK Technology Holdings, Ltd.(1) | | 95,000 | 110,811 |

| Luk Fook Holdings International, Ltd. | | 26,000 | 90,167 |

| MGM China Holdings, Ltd.(1)(2) | | 166,400 | 210,228 |

| MTR Corp., Ltd. | | 69,000 | 369,254 |

| New World Development Co., Ltd. | | 77,000 | 230,145 |

| NWS Holdings, Ltd. | | 210,000 | 197,907 |

| Pacific Basin Shipping, Ltd. | | 802,000 | 283,017 |

| Pacific Textiles Holdings, Ltd. | | 244,000 | 87,841 |

| PCCW, Ltd. | | 858,000 | 421,590 |

| Power Assets Holdings, Ltd. | | 131,500 | 744,049 |

| Sands China, Ltd.(2) | | 166,000 | 622,514 |

| Shangri-La Asia, Ltd.(2) | | 200,000 | 174,622 |

| Sino Land Co., Ltd. | | 210,000 | 272,890 |

10

See Notes to Financial Statements.

Parametric

International Equity Fund

January 31, 2023

Portfolio of Investments — continued

| Security | Shares | Value |

| Hong Kong (continued) |

| SJM Holdings, Ltd.(1)(2) | | 358,000 | $ 203,023 |

| Sun Hung Kai Properties, Ltd. | | 46,000 | 652,355 |

| Superb Summit International Group, Ltd.(1)(2)(4) | | 230,000 | 0 |

| Swire Properties, Ltd. | | 87,600 | 246,205 |

| VSTECS Holdings, Ltd. | | 600,000 | 375,409 |

| VTech Holdings, Ltd. | | 55,200 | 364,916 |

| Yuexiu REIT(1) | | 255,000 | 83,300 |

| | | | $ 20,012,561 |

| Ireland — 2.2% |

| Bank of Ireland Group PLC | | 164,765 | $ 1,760,323 |

| CRH PLC | | 36,402 | 1,700,794 |

| DCC PLC | | 8,700 | 495,534 |

| Fineos Corp. Holdings PLC CDI(2) | | 41,347 | 56,327 |

| Flutter Entertainment PLC(2) | | 10,303 | 1,600,396 |

| Glenveagh Properties PLC(2)(3) | | 77,242 | 79,138 |

| ICON PLC(2) | | 6,900 | 1,591,899 |

| Irish Continental Group PLC | | 69,445 | 325,858 |

| Irish Residential Properties REIT PLC | | 146,474 | 182,233 |

| Kerry Group PLC, Class A | | 17,218 | 1,613,328 |

| Kingspan Group PLC | | 13,022 | 837,523 |

| Uniphar PLC | | 37,081 | 135,717 |

| | | | $ 10,379,070 |

| Israel — 2.0% |

| Airport City, Ltd.(2) | | 10,800 | $ 171,069 |

| Amot Investments, Ltd. | | 23,381 | 137,231 |

| AudioCodes, Ltd. | | 3,200 | 61,344 |

| Azrieli Group, Ltd. | | 3,567 | 229,760 |

| Bank Hapoalim B.M. | | 30,857 | 277,730 |

| Bank Leumi Le-Israel B.M. | | 30,251 | 267,340 |

| Bezeq The Israeli Telecommunication Corp., Ltd. | | 557,912 | 924,579 |

| Check Point Software Technologies, Ltd.(2) | | 1,900 | 241,680 |

| Compugen, Ltd.(1)(2) | | 65,000 | 56,472 |

| CyberArk Software, Ltd.(2) | | 800 | 112,704 |

| Danel Adir Yeoshua, Ltd. | | 1,100 | 84,583 |

| Delta Galil, Ltd. | | 2,040 | 80,416 |

| Elbit Systems, Ltd. | | 1,726 | 289,768 |

| Electra, Ltd. | | 365 | 187,056 |

| Energix-Renewable Energies, Ltd. | | 82,890 | 274,412 |

| First International Bank of Israel, Ltd. (The) | | 2,095 | 84,625 |

| Fiverr International, Ltd.(2) | | 3,600 | 133,524 |

| Fox Wizel, Ltd. | | 1,500 | 135,666 |

| Hilan, Ltd. | | 1,200 | 58,471 |

| ICL Group, Ltd. | | 104,523 | 829,874 |

| Inrom Construction Industries, Ltd. | | 40,400 | 158,132 |

| Security | Shares | Value |

| Israel (continued) |

| Kenon Holdings, Ltd. | | 8,468 | $ 263,894 |

| Maytronics, Ltd. | | 41,700 | 508,310 |

| Mivne Real Estate KD, Ltd. | | 32,500 | 104,280 |

| Mizrahi Tefahot Bank, Ltd. | | 5,560 | 183,650 |

| Nano-X Imaging, Ltd.(2) | | 7,700 | 70,994 |

| Nice, Ltd.(2) | | 1,294 | 267,610 |

| Oil Refineries, Ltd. | | 912,196 | 315,491 |

| OPC Energy, Ltd.(2) | | 27,100 | 281,422 |

| Paz Oil Co., Ltd.(2) | | 3,454 | 430,581 |

| Radware, Ltd.(2) | | 1,700 | 36,210 |

| Reit 1, Ltd. | | 43,316 | 214,696 |

| Shapir Engineering and Industry, Ltd. | | 14,000 | 106,205 |

| Shufersal, Ltd. | | 60,653 | 340,341 |

| Strauss Group, Ltd. | | 13,500 | 345,424 |

| Taro Pharmaceutical Industries, Ltd.(2) | | 2,100 | 62,622 |

| Teva Pharmaceutical Industries, Ltd. ADR(2) | | 76,000 | 801,040 |

| Tower Semiconductor, Ltd.(2) | | 4,400 | 185,087 |

| Turpaz Industries, Ltd. | | 14,200 | 70,884 |

| Victory Supermarket Chain, Ltd. | | 10,200 | 113,670 |

| | | | $ 9,498,847 |

| Italy — 4.4% |

| Assicurazioni Generali SpA | | 32,700 | $ 638,347 |

| Banco BPM SpA | | 78,600 | 353,762 |

| Bio-On SpA(1)(2)(4) | | 12,900 | 0 |

| BPER Banca SpA | | 32,400 | 89,006 |

| Brunello Cucinelli SpA | | 2,764 | 230,215 |

| Buzzi Unicem SpA | | 7,400 | 166,635 |

| Cementir Holding NV | | 48,418 | 381,909 |

| Davide Campari-Milano NV | | 117,234 | 1,257,578 |

| De'Longhi SpA | | 10,450 | 241,229 |

| DiaSorin SpA | | 7,620 | 991,970 |

| Digital Bros SpA(1) | | 8,900 | 210,547 |

| Enav SpA(3) | | 46,000 | 211,781 |

| Enel SpA | | 241,988 | 1,424,854 |

| Eni SpA | | 143,031 | 2,200,994 |

| Ferrari NV | | 4,010 | 1,002,036 |

| Fila SpA | | 5,500 | 42,785 |

| Fincantieri SpA(2) | | 128,000 | 84,372 |

| FinecoBank Banca Fineco SpA | | 14,011 | 251,523 |

| GVS SpA(1)(2)(3) | | 23,883 | 126,186 |

| Hera SpA | | 46,677 | 134,085 |

| Infrastrutture Wireless Italiane SpA(3) | | 69,878 | 765,777 |

| Interpump Group SpA | | 11,400 | 594,509 |

| Intesa Sanpaolo SpA | | 324,473 | 853,127 |

| Iren SpA | | 42,400 | 76,790 |

11

See Notes to Financial Statements.

Parametric

International Equity Fund

January 31, 2023

Portfolio of Investments — continued

| Security | Shares | Value |

| Italy (continued) |

| Italgas SpA | | 24,300 | $ 142,245 |

| Juventus Football Club SpA(1)(2) | | 771,785 | 249,418 |

| MFE-MediaForEurope NV, Class B(1) | | 257,715 | 174,498 |

| Moncler SpA | | 7,800 | 488,184 |

| Nexi SpA(2)(3) | | 11,200 | 98,642 |

| Poste Italiane SpA(3) | | 16,700 | 178,423 |

| Prada SpA | | 44,500 | 284,558 |

| Prysmian SpA | | 19,300 | 788,167 |

| RAI Way SpA(3) | | 46,700 | 266,718 |

| Recordati Industria Chimica e Farmaceutica SpA | | 25,147 | 1,101,652 |

| Reply SpA | | 2,780 | 360,864 |

| Salvatore Ferragamo SpA(1) | | 11,072 | 219,729 |

| Saras SpA(2) | | 195,900 | 339,639 |

| Snam SpA | | 48,800 | 248,564 |

| STMicroelectronics NV | | 48,800 | 2,297,196 |

| Technogym SpA(3) | | 16,800 | 149,015 |

| Terna - Rete Elettrica Nazionale | | 52,300 | 413,790 |

| Tinexta SpA(1) | | 5,327 | 144,897 |

| Unipol Gruppo SpA | | 33,400 | 174,928 |

| UnipolSai Assicurazioni SpA(1) | | 64,182 | 170,725 |

| Webuild SpA(1) | | 166,800 | 294,117 |

| | | | $ 20,915,986 |

| Japan — 13.3% |

| Advance Residence Investment Corp.(1) | | 88 | $ 214,963 |

| Aeon Co., Ltd.(1) | | 19,900 | 407,983 |

| AGC, Inc. | | 4,800 | 176,860 |

| Air Water, Inc. | | 12,300 | 150,491 |

| Ajinomoto Co., Inc. | | 13,400 | 441,779 |

| Alfresa Holdings Corp. | | 13,900 | 173,986 |

| Asahi Intecc Co., Ltd.(1) | | 8,800 | 154,389 |

| Astellas Pharma, Inc. | | 45,900 | 675,654 |

| Azbil Corp. | | 3,900 | 109,974 |

| Bandai Namco Holdings, Inc. | | 4,200 | 280,870 |

| Bank of Kyoto, Ltd. (The) | | 4,500 | 209,377 |

| Bridgestone Corp. | | 8,600 | 321,065 |

| Brother Industries, Ltd. | | 7,500 | 116,492 |

| Calbee, Inc. | | 7,600 | 171,640 |

| Canon, Inc. | | 14,100 | 312,912 |

| Capcom Co., Ltd. | | 3,600 | 116,654 |

| Casio Computer Co., Ltd. | | 15,400 | 159,193 |

| Central Japan Railway Co. | | 1,700 | 207,357 |

| Chiba Bank, Ltd. (The) | | 14,600 | 110,469 |

| Chubu Electric Power Co., Inc. | | 62,200 | 669,961 |

| Chugai Pharmaceutical Co., Ltd. | | 17,600 | 456,281 |

| Chugoku Electric Power Co., Inc. (The) | | 36,100 | 198,459 |

| Security | Shares | Value |

| Japan (continued) |

| Concordia Financial Group, Ltd.(1) | | 70,500 | $ 309,802 |

| Cosmos Pharmaceutical Corp. | | 600 | 58,624 |

| CyberAgent, Inc.(1) | | 26,800 | 250,632 |

| Dai Nippon Printing Co., Ltd. | | 5,700 | 134,575 |

| Daicel Corp. | | 19,800 | 146,090 |

| Daido Steel Co., Ltd. | | 4,700 | 177,708 |

| Daifuku Co., Ltd. | | 2,700 | 148,672 |

| Daiichi Sankyo Co., Ltd. | | 32,500 | 1,020,725 |

| Daikin Industries, Ltd. | | 2,300 | 399,497 |

| Daito Trust Construction Co., Ltd. | | 3,600 | 355,747 |

| Daiwa House Industry Co., Ltd. | | 22,600 | 542,739 |

| Daiwa House REIT Investment Corp. | | 141 | 306,778 |

| Daiwa Office Investment Corp. | | 35 | 164,815 |

| Daiwa Securities Group, Inc. | | 26,700 | 126,000 |

| DeNA Co., Ltd.(1) | | 17,400 | 243,979 |

| Denka Co., Ltd. | | 7,700 | 159,734 |

| DIC Corp. | | 5,600 | 104,115 |

| Disco Corp. | | 800 | 240,346 |

| East Japan Railway Co.(1) | | 4,400 | 245,336 |

| ENEOS Holdings, Inc. | | 262,200 | 938,727 |

| Ezaki Glico Co., Ltd. | | 6,000 | 167,663 |

| Fast Retailing Co., Ltd.(1) | | 900 | 546,623 |

| Frontier Real Estate Investment Corp. | | 19 | 73,267 |

| FUJIFILM Holdings Corp. | | 4,600 | 243,437 |

| Fujitsu, Ltd. | | 2,400 | 341,710 |

| Fukuoka Financial Group, Inc. | | 12,200 | 281,474 |

| GLP J-REIT | | 270 | 305,521 |

| GMO Payment Gateway, Inc. | | 2,100 | 194,317 |

| Hakuhodo DY Holdings, Inc. | | 21,800 | 235,600 |

| Hamamatsu Photonics K.K. | | 3,600 | 192,349 |

| Hankyu Hanshin Holdings, Inc. | | 4,400 | 130,779 |

| Hikari Tsushin, Inc. | | 1,400 | 199,834 |

| Hirose Electric Co., Ltd. | | 1,040 | 135,392 |

| Hisamitsu Pharmaceutical Co., Inc.(1) | | 4,700 | 146,358 |

| House Foods Group, Inc. | | 7,700 | 164,283 |

| Hoya Corp. | | 5,700 | 626,840 |

| Hulic Co., Ltd. | | 29,000 | 238,374 |

| Ibiden Co., Ltd. | | 3,900 | 152,213 |

| Idemitsu Kosan Co., Ltd. | | 26,400 | 660,020 |

| Industrial & Infrastructure Fund Investment Corp.(1) | | 174 | 192,834 |

| Ito En, Ltd. | | 3,200 | 114,175 |

| ITOCHU Corp.(1) | | 10,800 | 349,076 |

| Iwatani Corp.(1) | | 8,200 | 353,430 |

| Japan Exchange Group, Inc.(1) | | 19,100 | 292,317 |

| Japan Logistics Fund, Inc.(1) | | 71 | 161,897 |

| Japan Post Bank Co., Ltd.(1) | | 10,000 | 88,849 |

12

See Notes to Financial Statements.

Parametric

International Equity Fund

January 31, 2023

Portfolio of Investments — continued

| Security | Shares | Value |

| Japan (continued) |

| Japan Post Holdings Co., Ltd. | | 25,800 | $ 226,510 |

| Japan Real Estate Investment Corp. | | 45 | 192,937 |

| Japan Tobacco, Inc. | | 25,500 | 519,994 |

| JSR Corp. | | 10,200 | 229,502 |

| Kajima Corp. | | 10,500 | 128,953 |

| Kakaku.com, Inc. | | 14,000 | 233,409 |

| Kaneka Corp. | | 6,400 | 168,028 |

| Kansai Paint Co., Ltd. | | 14,300 | 201,389 |

| Kao Corp. | | 9,900 | 400,176 |

| KDDI Corp. | | 43,400 | 1,355,965 |

| Keikyu Corp. | | 13,700 | 141,968 |

| Keio Corp.(1) | | 2,200 | 80,750 |

| Keisei Electric Railway Co., Ltd.(1) | | 2,300 | 67,089 |

| Kenedix Office Investment Corp. | | 90 | 213,801 |

| Kewpie Corp. | | 9,800 | 170,623 |

| Keyence Corp. | | 2,300 | 1,058,848 |

| Kintetsu Group Holdings Co., Ltd.(1) | | 2,200 | 71,643 |

| Kirin Holdings Co., Ltd. | | 17,700 | 272,752 |

| Kobayashi Pharmaceutical Co., Ltd.(1) | | 3,300 | 236,914 |

| Kobe Bussan Co., Ltd. | | 3,700 | 106,825 |

| Kubota Corp. | | 14,300 | 214,904 |

| Kuraray Co., Ltd. | | 19,500 | 161,402 |

| Kyocera Corp. | | 6,300 | 326,916 |

| Kyowa Kirin Co., Ltd. | | 9,500 | 211,859 |

| Kyushu Electric Power Co., Inc. | | 55,000 | 316,615 |

| LaSalle Logiport REIT | | 165 | 199,915 |

| Lasertec Corp. | | 1,100 | 208,255 |

| Lawson, Inc. | | 4,600 | 183,937 |

| Lion Corp. | | 17,300 | 191,506 |

| Makita Corp.(1) | | 4,000 | 106,547 |

| Marubeni Corp. | | 14,600 | 179,121 |

| Marui Group Co., Ltd. | | 14,700 | 250,496 |

| Maruichi Steel Tube, Ltd. | | 9,300 | 200,250 |

| MatsukiyoCocokara & Co. | | 3,200 | 159,630 |

| Medipal Holdings Corp. | | 12,500 | 166,887 |

| MEIJI Holdings Co., Ltd. | | 5,300 | 273,335 |

| MISUMI Group, Inc. | | 3,200 | 80,536 |

| Mitsubishi Chemical Group Corp. | | 50,700 | 284,500 |

| Mitsubishi Corp. | | 10,700 | 358,300 |

| Mitsubishi Electric Corp. | | 15,600 | 171,924 |

| Mitsubishi Estate Co., Ltd. | | 46,600 | 598,955 |

| Mitsubishi Gas Chemical Co., Inc. | | 14,200 | 207,498 |

| Mitsubishi Heavy Industries, Ltd. | | 4,700 | 184,287 |

| Mitsubishi Materials Corp. | | 12,200 | 209,557 |

| Mitsubishi UFJ Financial Group, Inc.(5) | | 183,600 | 1,344,848 |

| Mitsui & Co., Ltd. | | 13,100 | 386,486 |

| Security | Shares | Value |

| Japan (continued) |

| Mitsui Chemicals, Inc. | | 10,600 | $ 249,508 |

| Mitsui Fudosan Co., Ltd. | | 33,800 | 633,535 |

| Mitsui Fudosan Logistics Park, Inc.(1) | | 42 | 146,583 |

| Mizuho Financial Group, Inc. | | 48,380 | 755,717 |

| MS&AD Insurance Group Holdings, Inc. | | 9,300 | 298,285 |

| Murata Manufacturing Co., Ltd. | | 8,700 | 497,122 |

| NEC Corp. | | 6,600 | 238,442 |

| Nexon Co., Ltd. | | 20,900 | 503,952 |

| Nichirei Corp. | | 7,300 | 152,756 |

| Nidec Corp. | | 4,200 | 232,759 |

| Nihon Kohden Corp. | | 9,200 | 241,693 |

| Nihon M&A Center Holdings, Inc. | | 8,600 | 87,921 |

| Nintendo Co., Ltd. | | 26,600 | 1,153,317 |

| Nippon Accommodations Fund, Inc.(1) | | 49 | 219,933 |

| Nippon Building Fund, Inc. | | 54 | 236,000 |

| Nippon Express Holdings, Inc. | | 2,500 | 145,082 |

| Nippon Gas Co., Ltd. | | 11,100 | 177,171 |

| Nippon Kayaku Co., Ltd. | | 17,700 | 164,365 |

| Nippon Paint Holdings Co., Ltd.(1) | | 29,500 | 269,319 |

| Nippon Paper Industries Co., Ltd. | | 10,000 | 74,451 |

| Nippon Prologis REIT, Inc. | | 135 | 306,334 |

| Nippon Shinyaku Co., Ltd. | | 4,300 | 221,304 |

| Nippon Shokubai Co., Ltd. | | 3,500 | 148,173 |

| Nippon Telegraph & Telephone Corp. | | 26,100 | 782,622 |

| Nissan Motor Co., Ltd. | | 58,500 | 210,187 |

| Nissin Foods Holdings Co., Ltd. | | 2,200 | 171,991 |

| Nitori Holdings Co., Ltd.(1) | | 2,200 | 291,183 |

| Nitto Denko Corp. | | 3,300 | 213,303 |

| NOF Corp. | | 4,300 | 183,168 |

| Nomura Research Institute, Ltd. | | 6,700 | 160,851 |

| NTT Data Corp. | | 10,500 | 162,869 |

| Obic Co., Ltd. | | 1,700 | 272,555 |

| Odakyu Electric Railway Co., Ltd.(1) | | 5,100 | 67,052 |

| Oji Holdings Corp. | | 48,300 | 199,612 |

| Omron Corp. | | 4,700 | 271,945 |

| Ono Pharmaceutical Co., Ltd. | | 19,100 | 414,445 |

| Oracle Corp. Japan | | 1,900 | 130,163 |

| Oriental Land Co., Ltd. | | 2,600 | 433,212 |

| Osaka Gas Co., Ltd. | | 25,700 | 414,718 |

| Otsuka Corp. | | 4,400 | 144,758 |

| Otsuka Holdings Co., Ltd. | | 16,800 | 538,951 |

| Pan Pacific International Holdings Corp. | | 14,900 | 275,548 |

| PeptiDream, Inc.(2) | | 5,800 | 90,558 |

| Pigeon Corp. | | 8,000 | 127,143 |

| Rakuten Group, Inc.(1) | | 18,600 | 94,831 |

| Relo Group, Inc. | | 3,900 | 66,091 |

13

See Notes to Financial Statements.

Parametric

International Equity Fund

January 31, 2023

Portfolio of Investments — continued

| Security | Shares | Value |

| Japan (continued) |

| Resona Holdings, Inc. | | 44,400 | $ 245,697 |

| Resonac Holdings Corp.(1) | | 12,600 | 215,341 |

| Ricoh Co., Ltd. | | 25,600 | 198,723 |

| Rinnai Corp. | | 1,700 | 134,181 |

| ROHM Co., Ltd. | | 1,600 | 128,210 |

| Rohto Pharmaceutical Co., Ltd. | | 5,600 | 103,328 |

| Ryohin Keikaku Co., Ltd. | | 9,000 | 99,793 |

| Santen Pharmaceutical Co., Ltd. | | 16,700 | 130,189 |

| Sawai Group Holdings Co., Ltd. | | 3,400 | 105,195 |

| SECOM Co., Ltd. | | 2,000 | 119,151 |

| Sekisui House Reit, Inc. | | 380 | 207,732 |

| Sekisui House, Ltd.(1) | | 16,000 | 302,388 |

| Seven Bank, Ltd. | | 101,900 | 209,400 |

| SG Holdings Co., Ltd. | | 5,100 | 78,700 |

| Shikoku Electric Power Co., Inc. | | 45,400 | 262,489 |

| Shimadzu Corp. | | 7,900 | 242,775 |

| Shimano, Inc. | | 1,800 | 321,004 |

| Shimizu Corp. | | 15,300 | 85,767 |

| Shin-Etsu Chemical Co., Ltd. | | 10,700 | 1,577,426 |

| Shizuoka Financial Group, Inc. | | 47,100 | 399,014 |

| SMC Corp. | | 500 | 253,955 |

| SoftBank Corp.(1) | | 51,900 | 593,845 |

| Sony Group Corp. | | 11,800 | 1,054,348 |

| Square Enix Holdings Co., Ltd. | | 7,100 | 335,768 |

| Sumitomo Corp. | | 9,500 | 170,524 |

| Sumitomo Mitsui Financial Group, Inc. | | 20,300 | 882,260 |

| Sumitomo Mitsui Trust Holdings, Inc. | | 7,200 | 262,286 |

| Sumitomo Realty & Development Co., Ltd. | | 15,000 | 365,657 |

| Suntory Beverage & Food, Ltd. | | 6,700 | 226,244 |

| Suzuken Co., Ltd. | | 5,100 | 134,324 |

| Sysmex Corp. | | 4,900 | 325,287 |

| Taisei Corp. | | 4,500 | 155,349 |

| Taisho Pharmaceutical Holdings Co., Ltd.(1) | | 4,000 | 168,263 |

| Taiyo Yuden Co., Ltd. | | 3,600 | 122,276 |

| TEIJIN, Ltd. | | 12,200 | 125,274 |

| TIS, Inc. | | 4,100 | 118,225 |

| Tobu Railway Co., Ltd. | | 3,200 | 75,082 |

| Toho Co., Ltd.(1) | | 9,300 | 343,481 |

| Toho Gas Co., Ltd. | | 10,100 | 198,078 |

| Tohoku Electric Power Co., Inc. | | 55,600 | 299,045 |

| Tokai Carbon Co., Ltd. | | 18,400 | 158,749 |

| Tokio Marine Holdings, Inc. | | 30,200 | 632,530 |

| Tokyo Gas Co., Ltd. | | 22,300 | 466,955 |

| Tokyo Ohka Kogyo Co., Ltd. | | 4,000 | 197,146 |

| Tokyu Corp.(1) | | 9,800 | 126,022 |

| Toppan, Inc. | | 7,900 | 127,286 |

| Security | Shares | Value |

| Japan (continued) |

| Toshiba Corp.(1) | | 3,500 | $ 120,213 |

| Tosoh Corp. | | 20,400 | 266,902 |

| TOTO, Ltd. | | 3,200 | 124,361 |

| Toyo Suisan Kaisha, Ltd. | | 4,500 | 185,944 |

| Toyota Industries Corp. | | 2,100 | 127,832 |

| Toyota Motor Corp. | | 100,600 | 1,477,383 |

| Trend Micro, Inc.(1)(2) | | 3,900 | 193,105 |

| Tsuruha Holdings, Inc. | | 2,400 | 176,706 |

| Unicharm Corp. | | 9,200 | 350,940 |

| USS Co., Ltd. | | 8,100 | 133,230 |

| Welcia Holdings Co., Ltd.(1) | | 8,400 | 187,746 |

| West Japan Railway Co. | | 4,300 | 180,078 |

| Yakult Honsha Co., Ltd. | | 3,300 | 235,580 |

| Yamaguchi Financial Group, Inc. | | 32,200 | 222,706 |

| Yamato Holdings Co., Ltd. | | 6,600 | 115,480 |

| Yamazaki Baking Co., Ltd. | | 15,300 | 179,006 |

| Z Holdings Corp. | | 120,000 | 349,166 |

| Zeon Corp. | | 17,700 | 174,106 |

| ZOZO, Inc. | | 8,300 | 215,163 |

| | | | $ 62,728,511 |

| Netherlands — 4.3% |

| ABN AMRO Bank NV(3) | | 28,000 | $ 464,731 |

| Aegon NV | | 67,600 | 372,867 |

| ASML Holding NV | | 4,324 | 2,860,964 |

| ASR Nederland NV | | 9,400 | 444,916 |

| Corbion NV | | 20,000 | 769,621 |

| Euronext NV(1)(3) | | 5,900 | 478,088 |

| Flow Traders, Ltd. | | 7,300 | 187,852 |

| IMCD NV(1) | | 2,576 | 408,378 |

| JDE Peet's NV(1) | | 24,360 | 730,141 |

| Just Eat Takeaway.com NV(1)(2)(3) | | 2,700 | 69,265 |

| Koninklijke Ahold Delhaize NV(1) | | 61,972 | 1,849,676 |

| Koninklijke DSM NV | | 13,608 | 1,750,016 |

| Koninklijke KPN NV | | 360,750 | 1,233,348 |

| Koninklijke Philips NV | | 77,457 | 1,337,330 |

| Koninklijke Vopak NV | | 7,400 | 222,966 |

| NN Group NV | | 15,250 | 662,583 |

| NSI NV | | 5,968 | 155,767 |

| PostNL NV(1) | | 71,792 | 150,319 |

| Prosus NV | | 29,973 | 2,420,177 |

| SBM Offshore NV | | 23,217 | 364,996 |

| Signify NV(3) | | 11,700 | 423,603 |

| Universal Music Group NV(1) | | 57,500 | 1,469,836 |

| Van Lanschot Kempen NV | | 2,900 | 83,444 |

14

See Notes to Financial Statements.

Parametric

International Equity Fund

January 31, 2023

Portfolio of Investments — continued

| Security | Shares | Value |

| Netherlands (continued) |

| Vastned Retail NV | | 7,610 | $ 175,422 |

| Wolters Kluwer NV | | 12,695 | 1,384,047 |

| | | | $ 20,470,353 |

| New Zealand — 1.1% |

| a2 Milk Co. Ltd.(1)(2) | | 116,564 | $ 559,044 |

| Argosy Property, Ltd. | | 144,849 | 107,942 |

| Auckland International Airport, Ltd.(2) | | 78,452 | 431,763 |

| Contact Energy, Ltd. | | 42,066 | 211,556 |

| Fisher & Paykel Healthcare Corp., Ltd. | | 43,051 | 706,518 |

| Fletcher Building, Ltd. | | 68,021 | 223,990 |

| Genesis Energy, Ltd. | | 38,800 | 71,927 |

| Goodman Property Trust | | 193,400 | 257,742 |

| Heartland Group Holdings, Ltd.(1) | | 183,499 | 215,043 |

| Infratil, Ltd. | | 32,081 | 184,692 |

| KMD Brands, Ltd. | | 208,980 | 143,629 |

| Mercury NZ, Ltd. | | 39,400 | 153,067 |

| Pacific Edge, Ltd.(2) | | 114,000 | 36,850 |

| Precinct Properties New Zealand, Ltd. | | 265,100 | 215,451 |

| Pushpay Holdings, Ltd.(2) | | 115,268 | 96,670 |

| SKYCITY Entertainment Group, Ltd.(2) | | 206,639 | 336,199 |

| Spark New Zealand, Ltd. | | 182,931 | 616,795 |

| Vulcan Steel, Ltd.(1) | | 20,400 | 130,735 |

| Xero, Ltd.(2) | | 9,014 | 496,820 |

| | | | $ 5,196,433 |

| Norway — 2.1% |

| ArcticZymes Technologies ASA(1)(2) | | 12,002 | $ 52,824 |

| Atea ASA | | 34,789 | 392,411 |

| Autostore Holdings, Ltd.(1)(2)(3) | | 51,765 | 119,540 |

| Bergenbio ASA(2) | | 43,369 | 29,170 |

| Borregaard ASA | | 27,054 | 417,097 |

| Crayon Group Holding ASA(2)(3) | | 3,863 | 38,908 |

| DHT Holdings, Inc. | | 13,700 | 117,409 |

| DNB Bank ASA | | 36,251 | 677,878 |

| Elmera Group ASA(3) | | 31,479 | 46,626 |

| Entra ASA(3) | | 25,083 | 296,684 |

| Equinor ASA | | 24,689 | 752,438 |

| Europris ASA(3) | | 45,674 | 294,259 |

| Frontline PLC(1) | | 12,400 | 170,864 |

| Gjensidige Forsikring ASA | | 16,200 | 291,170 |

| Golden Ocean Group, Ltd. | | 2,700 | 25,866 |

| Kongsberg Gruppen ASA | | 13,520 | 538,254 |

| Mowi ASA | | 36,150 | 668,474 |

| Nordic Semiconductor ASA(2) | | 34,208 | 545,483 |

| Opera, Ltd. ADR(1) | | 47,000 | 311,140 |

| Security | Shares | Value |

| Norway (continued) |

| Orkla ASA | | 75,100 | $ 560,675 |

| Scatec ASA(3) | | 24,917 | 203,228 |

| Schibsted ASA, Class B | | 22,734 | 475,252 |

| SFL Corp, Ltd. | | 9,700 | 98,746 |

| SpareBank 1 SMN | | 14,400 | 183,640 |

| Telenor ASA | | 86,591 | 906,487 |

| TOMRA Systems ASA | | 23,400 | 413,088 |

| Var Energi ASA | | 12,354 | 37,579 |

| Veidekke ASA | | 20,997 | 216,804 |

| Yara International ASA | | 18,306 | 813,359 |

| | | | $ 9,695,353 |

| Portugal — 1.1% |

| Banco Comercial Portugues S.A. | | 4,163,853 | $ 887,104 |

| Corticeira Amorim SGPS S.A. | | 35,138 | 347,597 |

| CTT-Correios de Portugal S.A.(1) | | 79,156 | 306,195 |

| EDP-Energias de Portugal S.A. | | 174,295 | 865,942 |

| Galp Energia SGPS S.A., Class B | | 68,129 | 932,553 |

| Jeronimo Martins SGPS S.A. | | 39,521 | 858,030 |

| Navigator Co. S.A. (The) | | 156,508 | 547,947 |

| NOS SGPS S.A. | | 100,048 | 429,035 |

| REN - Redes Energeticas Nacionais SGPS S.A. | | 29,300 | 80,530 |

| | | | $ 5,254,933 |

| Singapore — 2.2% |

| AEM Holdings, Ltd.(1) | | 17,700 | $ 46,985 |

| BW LPG, Ltd.(3) | | 9,091 | 75,240 |

| CapitaLand Ascendas REIT | | 109,000 | 239,869 |

| CapitaLand China Trust REIT | | 113,100 | 107,847 |

| CapitaLand Investment, Ltd. | | 86,400 | 261,758 |

| City Developments, Ltd. | | 26,300 | 166,922 |

| ComfortDelGro Corp., Ltd. | | 231,600 | 212,180 |

| Flex, Ltd.(2) | | 43,200 | 1,008,720 |

| Genting Singapore, Ltd.(1) | | 921,500 | 697,906 |

| Keppel Corp., Ltd. | | 76,300 | 440,530 |

| Keppel DC REIT | | 35,456 | 55,264 |

| Keppel Infrastructure Trust(1) | | 497,885 | 218,305 |

| Keppel REIT | | 110,000 | 81,072 |

| Manulife US REIT | | 113,000 | 37,383 |

| Mapletree Industrial Trust(1) | | 71,610 | 130,141 |

| Mapletree Logistics Trust(1) | | 80,800 | 104,458 |

| Mapletree Pan Asia Commercial Trust(1) | | 83,109 | 115,640 |

| Nanofilm Technologies International, Ltd.(1) | | 31,300 | 34,590 |

| Oversea-Chinese Banking Corp., Ltd. | | 72,300 | 714,349 |

| Parkway Life REIT | | 33,400 | 103,375 |

| Raffles Medical Group, Ltd. | | 150,700 | 166,690 |

15

See Notes to Financial Statements.

Parametric

International Equity Fund

January 31, 2023

Portfolio of Investments — continued

| Security | Shares | Value |

| Singapore (continued) |

| Sea, Ltd. ADR(2) | | 7,900 | $ 509,155 |

| Sembcorp Industries, Ltd. | | 141,300 | 389,659 |

| Sheng Siong Group, Ltd. | | 201,600 | 251,946 |

| Singapore Airlines, Ltd.(1) | | 92,700 | 419,177 |

| Singapore Exchange, Ltd. | | 40,400 | 284,558 |

| Singapore Post, Ltd. | | 292,300 | 124,871 |

| Singapore Technologies Engineering, Ltd. | | 121,200 | 340,759 |

| Singapore Telecommunications, Ltd.(6) | | 311,400 | 596,381 |

| Singapore Telecommunications, Ltd.(6) | | 84,700 | 161,633 |

| Suntec Real Estate Investment Trust | | 89,800 | 96,009 |

| UMS Holdings, Ltd.(1) | | 56,725 | 57,368 |

| United Overseas Bank, Ltd. | | 29,100 | 661,461 |

| UOL Group, Ltd. | | 19,600 | 104,577 |

| Venture Corp., Ltd. | | 27,200 | 384,101 |

| Wilmar International, Ltd. | | 367,200 | 1,141,632 |

| | | | $ 10,542,511 |

| Spain — 4.4% |

| Acerinox S.A. | | 74,810 | $ 810,188 |

| Aena SME S.A.(2)(3) | | 4,771 | 716,838 |

| Almirall S.A. | | 39,433 | 397,330 |

| Amadeus IT Group S.A.(2) | | 36,160 | 2,278,223 |

| Banco de Sabadell S.A. | | 103,800 | 135,704 |

| Banco Santander S.A. | | 341,173 | 1,192,379 |

| Bankinter S.A. | | 35,852 | 258,672 |

| CaixaBank S.A. | | 135,566 | 601,501 |

| Cellnex Telecom S.A.(3) | | 58,584 | 2,295,789 |

| Cia de Distribucion Integral Logista Holdings S.A. | | 14,897 | 403,611 |

| Ebro Foods S.A.(1) | | 21,785 | 374,245 |

| Enagas S.A. | | 10,500 | 188,279 |

| Ferrovial S.A. | | 13,638 | 402,433 |

| Fluidra S.A.(1) | | 17,023 | 300,525 |

| Global Dominion Access S.A.(3) | | 31,250 | 133,999 |

| Grifols S.A.(1)(2) | | 92,600 | 1,225,843 |

| Iberdrola S.A. | | 135,919 | 1,594,570 |

| Iberdrola S.A.(2) | | 2,266 | 26,462 |

| Indra Sistemas S.A. | | 10,400 | 126,987 |

| Industria de Diseno Textil S.A. | | 76,175 | 2,378,245 |

| Laboratorios Farmaceuticos Rovi S.A. | | 11,900 | 504,238 |

| Linea Directa Aseguradora S.A. Cia de Seguros y Reaseguros(1) | | 94,840 | 98,838 |

| Mapfre S.A.(1) | | 69,417 | 139,628 |

| Merlin Properties Socimi S.A. | | 122,600 | 1,198,130 |

| Neinor Homes S.A.(3) | | 10,000 | 100,335 |

| Red Electrica Corp. S.A. | | 20,678 | 365,978 |

| Repsol S.A. | | 132,966 | 2,184,210 |

| Security | Shares | Value |

| Spain (continued) |

| Telefonica S.A. | | 23,741 | $ 90,193 |

| Viscofan S.A.(1) | | 5,805 | 374,136 |

| | | | $ 20,897,509 |

| Sweden — 4.3% |

| AcadeMedia AB(3) | | 13,600 | $ 64,058 |

| Alfa Laval AB | | 4,650 | 146,129 |

| Arjo AB, Class B | | 29,560 | 114,707 |

| Assa Abloy AB, Class B | | 10,010 | 235,798 |

| Atlas Copco AB, Class A | | 30,400 | 360,728 |

| Atlas Copco AB, Class B | | 18,000 | 189,857 |

| Atrium Ljungberg AB, Class B | | 7,700 | 137,659 |

| Attendo AB(2)(3) | | 51,800 | 130,219 |

| Axfood AB | | 15,887 | 409,181 |

| Betsson AB, Class B | | 10,576 | 87,667 |

| BHG Group AB(2) | | 25,600 | 37,713 |

| BICO Group AB(1)(2) | | 14,705 | 148,804 |

| Bilia AB, Class A | | 7,790 | 90,009 |

| Billerud AB | | 45,811 | 532,197 |

| BioGaia AB, Class B | | 21,245 | 186,813 |

| Boozt AB(1)(2)(3) | | 9,100 | 118,056 |

| Camurus AB(2) | | 3,700 | 88,549 |

| Castellum AB(1) | | 19,834 | 272,144 |

| Catena AB | | 3,800 | 158,977 |

| Cibus Nordic Real Estate AB | | 7,400 | 104,899 |

| Clas Ohlson AB, Class B | | 10,600 | 70,680 |

| Dios Fastigheter AB | | 19,400 | 147,834 |

| Electrolux AB, Class B(1) | | 16,000 | 226,621 |

| Elekta AB, Class B | | 42,160 | 306,874 |

| Embracer Group AB(1)(2) | | 41,890 | 195,255 |

| Epiroc AB, Class A | | 7,626 | 148,377 |

| Epiroc AB, Class B | | 7,415 | 123,626 |

| Essity AB, Class B | | 64,435 | 1,683,309 |

| Evolution AB(3) | | 8,498 | 955,099 |

| Fabege AB | | 29,218 | 276,145 |

| Fingerprint Cards AB, Class B(1)(2) | | 205,863 | 58,919 |

| Getinge AB, Class B | | 22,900 | 515,881 |

| Hansa Biopharma AB(1)(2) | | 12,250 | 73,693 |

| HMS Networks AB | | 2,700 | 100,657 |

| Holmen AB, Class B | | 16,716 | 689,461 |

| Hufvudstaden AB, Class A | | 11,700 | 176,204 |

| Husqvarna AB, Class B(1) | | 11,370 | 96,735 |

| Industrivarden AB, Class A | | 8,280 | 219,340 |

| Industrivarden AB, Class C(1) | | 6,400 | 168,606 |

| Indutrade AB | | 4,047 | 89,873 |

| Investor AB, Class A | | 17,770 | 354,664 |

16

See Notes to Financial Statements.

Parametric

International Equity Fund

January 31, 2023

Portfolio of Investments — continued

| Security | Shares | Value |

| Sweden (continued) |

| Investor AB, Class B | | 38,860 | $ 755,126 |

| JM AB | | 7,000 | 130,495 |

| MIPS AB(1) | | 2,200 | 84,192 |

| Mycronic AB(1) | | 26,942 | 575,903 |

| Oatly Group AB ADR(1)(2) | | 40,700 | 99,308 |

| Orron Energy AB | | 29,152 | 54,044 |

| Paradox Interactive AB | | 8,600 | 152,851 |

| Saab AB, Class B | | 2,757 | 112,867 |

| Sagax AB, Class B | | 17,833 | 443,596 |

| Samhallsbyggnadsbolaget i Norden AB(1) | | 42,000 | 82,919 |

| Sandvik AB(1) | | 11,780 | 243,465 |

| Securitas AB, Class B(1) | | 12,200 | 111,673 |

| Skanska AB, Class B | | 9,000 | 158,851 |

| SkiStar AB | | 4,900 | 53,064 |

| Spotify Technology S.A.(2) | | 9,100 | 1,025,752 |

| Stillfront Group AB(2) | | 27,900 | 48,694 |

| Svenska Cellulosa AB SCA, Class B | | 67,464 | 936,828 |

| Svenska Handelsbanken AB, Class A | | 34,300 | 357,681 |

| Swedbank AB, Class A | | 22,300 | 428,972 |

| Swedish Orphan Biovitrum AB(2) | | 22,039 | 491,482 |

| Tele2 AB, Class B | | 46,720 | 403,498 |

| Telefonaktiebolaget LM Ericsson, Class B | | 180,300 | 1,045,823 |

| Telia Co. AB | | 130,400 | 336,776 |

| Tethys Oil AB | | 12,500 | 75,236 |

| Thule Group AB(3) | | 6,300 | 150,972 |

| Truecaller AB, Class B(1)(2) | | 69,800 | 248,038 |

| Vitec Software Group AB, Class B | | 3,000 | 127,074 |

| Vitrolife AB | | 8,300 | 177,957 |

| Volvo AB, Class B | | 17,650 | 350,238 |

| Volvo Car AB, Class B(2) | | 32,400 | 161,660 |

| Wallenstam AB, Class B | | 49,600 | 227,697 |

| Wihlborgs Fastigheter AB | | 19,700 | 162,192 |

| | | | $ 20,106,941 |

| Switzerland — 8.8% |

| Allreal Holding AG | | 2,301 | $ 394,382 |

| ALSO Holding AG | | 802 | 163,363 |

| Baloise Holding AG | | 2,338 | 384,538 |

| Banque Cantonale Vaudoise(1) | | 708 | 67,300 |

| Belimo Holding AG | | 401 | 211,505 |

| BKW AG | | 1,702 | 244,751 |

| Bossard Holding AG, Class A | | 825 | 210,221 |

| Bucher Industries AG | | 637 | 290,260 |

| Bystronic AG | | 167 | 125,490 |

| Cembra Money Bank AG | | 1,279 | 113,558 |

| Cie Financiere Richemont S.A. | | 34,378 | 5,299,616 |

| Security | Shares | Value |

| Switzerland (continued) |

| Daetwyler Holding AG, Bearer Shares | | 493 | $ 104,559 |

| DKSH Holding AG | | 3,161 | 269,302 |

| Dottikon Es Holding AG(2) | | 1,055 | 312,514 |

| EMS-Chemie Holding AG | | 577 | 430,142 |

| Flughafen Zurich AG(2) | | 2,030 | 369,853 |

| Forbo Holding AG | | 151 | 198,675 |

| Galenica AG(3) | | 2,594 | 202,870 |

| Geberit AG | | 1,283 | 730,004 |

| Givaudan S.A. | | 553 | 1,792,953 |

| Gurit Holding AG(1) | | 2,480 | 277,064 |

| Helvetia Holding AG | | 2,514 | 314,497 |

| Huber+Suhner AG | | 3,060 | 293,464 |

| Idorsia, Ltd.(1)(2) | | 20,736 | 348,794 |

| Inficon Holding AG | | 310 | 324,571 |

| Intershop Holding AG | | 234 | 156,962 |

| Komax Holding AG | | 695 | 228,665 |

| Kuehne & Nagel International AG | | 2,860 | 681,986 |

| Landis & Gyr Group AG(1) | | 3,124 | 230,150 |

| LEM Holding S.A. | | 128 | 283,404 |

| Logitech International S.A. | | 19,419 | 1,136,337 |

| Mobimo Holding AG | | 1,337 | 343,799 |

| Nestle S.A. | | 46,541 | 5,678,423 |

| Novartis AG | | 25,632 | 2,317,364 |

| Roche Holding AG PC | | 7,834 | 2,445,543 |

| Roche Holding AG, Bearer Shares(1) | | 271 | 99,197 |

| Schindler Holding AG | | 1,944 | 393,250 |

| Schindler Holding AG PC(1) | | 2,311 | 492,560 |

| Schweiter Technologies AG | | 220 | 194,186 |

| Sensirion Holding AG(2)(3) | | 2,300 | 273,699 |

| SFS Group AG | | 1,848 | 212,621 |

| SGS S.A. | | 211 | 514,552 |

| SIG Group AG | | 27,641 | 685,109 |

| Sika AG | | 9,105 | 2,587,157 |

| Stadler Rail AG | | 9,144 | 349,753 |

| Swatch Group AG (The) | | 4,311 | 283,266 |

| Swatch Group AG (The), Bearer Shares | | 2,437 | 882,361 |

| Swiss Life Holding AG | | 895 | 529,704 |

| Swiss Prime Site AG | | 8,728 | 777,737 |

| Swiss Re AG | | 8,196 | 858,211 |

| Swisscom AG | | 2,576 | 1,522,044 |

| u-blox Holding AG | | 1,652 | 197,597 |

| UBS Group AG | | 82,122 | 1,752,925 |

| Valiant Holding AG | | 2,200 | 251,378 |

| Zehnder Group AG | | 2,230 | 165,975 |

| Zurich Insurance Group AG | | 3,307 | 1,635,406 |

| | | | $ 41,635,567 |

17

See Notes to Financial Statements.

Parametric

International Equity Fund

January 31, 2023

Portfolio of Investments — continued

| Security | Shares | Value |

| United Kingdom — 8.9% |

| 3i Group PLC | | 11,056 | $ 215,700 |

| abrdn PLC(1) | | 48,718 | 128,315 |

| Admiral Group PLC | | 5,900 | 160,393 |

| Antofagasta PLC | | 15,200 | 326,595 |

| Assura PLC | | 231,800 | 159,541 |

| AstraZeneca PLC | | 22,470 | 2,943,850 |

| Auto Trader Group PLC(3) | | 65,800 | 510,508 |

| Aviva PLC | | 24,342 | 137,285 |

| B&M European Value Retail S.A. | | 40,600 | 224,531 |

| BAE Systems PLC | | 46,033 | 487,307 |

| Bellway PLC | | 5,400 | 141,240 |

| Berkeley Group Holdings PLC | | 4,063 | 208,057 |

| Big Yellow Group PLC | | 13,089 | 195,225 |

| BP PLC | | 220,700 | 1,333,083 |

| British American Tobacco PLC | | 21,800 | 835,677 |

| BT Group PLC | | 428,500 | 660,187 |

| Bunzl PLC | | 6,100 | 223,938 |

| Burberry Group PLC | | 13,190 | 401,779 |

| Centamin PLC | | 159,300 | 218,379 |

| Civitas Social Housing PLC | | 184,520 | 129,930 |

| Compass Group PLC | | 42,800 | 1,022,407 |

| Croda International PLC | | 5,987 | 510,312 |

| Darktrace PLC(1)(2) | | 28,400 | 73,773 |

| Derwent London PLC | | 8,000 | 255,198 |

| Diploma PLC | | 3,800 | 128,544 |

| Direct Line Insurance Group PLC | | 42,288 | 92,723 |

| Domino's Pizza Group PLC | | 39,048 | 151,237 |

| DS Smith PLC | | 55,300 | 242,098 |

| Endava PLC ADR(2) | | 3,000 | 263,610 |

| Essentra PLC | | 29,000 | 77,500 |

| Experian PLC | | 11,138 | 407,311 |

| Fresnillo PLC | | 32,200 | 327,083 |

| Games Workshop Group PLC | | 1,807 | 209,599 |

| Grainger PLC | | 69,506 | 222,598 |

| Great Portland Estates PLC | | 23,683 | 166,589 |

| Greggs PLC | | 7,435 | 248,269 |

| Halma PLC | | 30,280 | 806,175 |

| Hikma Pharmaceuticals PLC | | 40,830 | 863,722 |

| Hill & Smith PLC | | 9,718 | 151,242 |

| Hiscox, Ltd. | | 11,000 | 153,100 |

| Howden Joinery Group PLC | | 23,000 | 196,254 |

| HSBC Holdings PLC | | 175,600 | 1,293,882 |

| IG Group Holdings PLC | | 14,640 | 143,945 |

| IMI PLC | | 6,650 | 119,069 |

| Imperial Brands PLC | | 17,600 | 441,518 |

| Inchcape PLC | | 19,600 | 220,985 |

| Security | Shares | Value |

| United Kingdom (continued) |

| InterContinental Hotels Group PLC | | 5,400 | $ 374,887 |

| Intertek Group PLC | | 4,100 | 220,363 |

| J Sainsbury PLC | | 46,200 | 149,830 |

| Johnson Matthey PLC | | 9,700 | 270,948 |

| Kingfisher PLC | | 47,900 | 165,251 |

| Land Securities Group PLC | | 51,600 | 452,058 |

| Lloyds Banking Group PLC | | 889,520 | 578,895 |

| London Stock Exchange Group PLC | | 4,413 | 403,988 |

| LondonMetric Property PLC | | 90,700 | 211,337 |

| LXi REIT PLC | | 118,300 | 164,666 |

| Manchester United PLC, Class A | | 9,700 | 218,735 |

| Marks & Spencer Group PLC(2) | | 83,100 | 149,897 |

| Marshalls PLC | | 23,600 | 98,847 |

| Mondi PLC | | 19,940 | 376,025 |

| Moneysupermarket.com Group PLC | | 34,300 | 101,264 |

| National Grid PLC | | 152,616 | 1,940,191 |

| NatWest Group PLC | | 88,311 | 336,911 |

| NCC Group PLC | | 72,058 | 166,989 |

| Next PLC | | 3,900 | 319,309 |

| Nomad Foods, Ltd.(2) | | 11,900 | 211,701 |

| Ocado Group PLC(1)(2) | | 12,900 | 103,231 |

| Pearson PLC | | 43,914 | 500,803 |

| Pennon Group PLC | | 32,533 | 369,315 |

| Persimmon PLC | | 9,800 | 171,160 |

| Phoenix Group Holdings PLC | | 17,800 | 141,081 |

| Primary Health Properties PLC | | 121,769 | 168,709 |

| Reckitt Benckiser Group PLC | | 9,000 | 641,348 |

| RELX PLC | | 26,380 | 783,721 |

| Rentokil Initial PLC | | 39,000 | 236,474 |

| Rightmove PLC | | 66,300 | 481,728 |

| Rio Tinto PLC | | 18,000 | 1,409,422 |

| Rotork PLC | | 45,595 | 179,609 |

| RS Group PLC | | 10,009 | 116,363 |

| Safestore Holdings PLC | | 19,133 | 238,238 |

| Sage Group PLC (The) | | 69,800 | 670,615 |

| Segro PLC | | 63,853 | 657,277 |

| Severn Trent PLC | | 18,700 | 650,777 |

| Shaftesbury PLC(1) | | 30,747 | 149,749 |

| Shell PLC | | 84,770 | 2,488,657 |

| Sirius Real Estate, Ltd. | | 111,884 | 116,826 |

| Softcat PLC | | 18,500 | 276,832 |

| Spectris PLC | | 7,300 | 289,408 |

| Spirax-Sarco Engineering PLC | | 1,720 | 245,688 |

| Spirent Communications PLC | | 89,600 | 242,824 |

| Ssp Group PLC(2) | | 30,000 | 96,047 |

| St. James's Place PLC | | 9,400 | 142,539 |

18

See Notes to Financial Statements.

Parametric

International Equity Fund

January 31, 2023

Portfolio of Investments — continued

| Security | Shares | Value |

| United Kingdom (continued) |

| Standard Chartered PLC | | 38,500 | $ 323,385 |

| Supermarket Income REIT PLC | | 90,300 | 107,277 |

| Taylor Wimpey PLC | | 90,000 | 130,583 |

| Telecom Plus PLC | | 16,000 | 394,071 |

| Tritax Big Box REIT PLC | | 152,000 | 292,868 |

| UK Commercial Property REIT, Ltd. | | 180,544 | 129,052 |

| Unilever PLC | | 24,121 | 1,227,736 |

| United Utilities Group PLC | | 29,800 | 389,935 |

| Victrex PLC | | 6,800 | 154,758 |

| Vistry Group PLC | | 23,112 | 212,865 |

| Vodafone Group PLC | | 1,150,800 | 1,327,808 |

| Wise PLC, Class A(2) | | 33,600 | 225,241 |

| | | | $ 41,826,375 |

Total Common Stocks

(identified cost $429,759,513) | | | $469,726,356 |

| Security | Shares | Value |

| Webuild SpA, Exp. 8/2/30(1)(4) | | 15,093 | $ 0 |

Total Warrants

(identified cost $0) | | | $ 0 |

| Short-Term Investments — 2.6% |

| Security | Shares | Value |

| Morgan Stanley Institutional Liquidity Funds - Government Portfolio, Institutional Class, 4.14%(7) | | 1,199,635 | $ 1,199,635 |

Total Affiliated Fund

(identified cost $1,199,635) | | | $ 1,199,635 |

| Securities Lending Collateral — 2.3% |

| Security | Shares | Value |

| State Street Navigator Securities Lending Government Money Market Portfolio, 4.35%(8) | | 10,847,429 | $ 10,847,429 |

Total Securities Lending Collateral

(identified cost $10,847,429) | | | $ 10,847,429 |

Total Short-Term Investments

(identified cost $12,047,064) | | | $ 12,047,064 |

| | | Value |

Total Investments — 102.1%

(identified cost $441,806,577) | | | $481,773,420 |

| Other Assets, Less Liabilities — (2.1)% | | | $ (9,826,922) |

| Net Assets — 100.0% | | | $471,946,498 |

| The percentage shown for each investment category in the Portfolio of Investments is based on net assets. |

| (1) | All or a portion of this security was on loan at January 31, 2023. The aggregate market value of securities on loan at January 31, 2023 was $28,364,383. |

| (2) | Non-income producing security. |