UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act File Number: 811-04015

Eaton Vance Mutual Funds Trust

(Exact Name of Registrant as Specified in Charter)

Two International Place, Boston, Massachusetts 02110

(Address of Principal Executive Offices)

Deidre E. Walsh

Two International Place, Boston, Massachusetts 02110

(Name and Address of Agent for Services)

(617) 482-8260

(Registrant’s Telephone Number)

September 30

Date of Fiscal Year End

September 30, 2023

Date of Reporting Period

Item 1. Reports to Stockholders

Eaton Vance

Total Return Bond Fund

Annual Report

September 30, 2023

Commodity Futures Trading Commission Registration. The Commodity Futures Trading Commission (“CFTC”) has adopted regulations that subject registered investment companies and advisers to regulation by the CFTC if a fund invests more than a prescribed level of its assets in certain CFTC-regulated instruments (including futures, certain options and swap agreements) or markets itself as providing investment exposure to such instruments. The investment adviser has claimed an exclusion from the definition of “commodity pool operator” under the Commodity Exchange Act with respect to its management of the Fund. Accordingly, neither the Fund nor the adviser with respect to the operation of the Fund is subject to CFTC regulation. Because of its management of other strategies, the Fund's adviser is registered with the CFTC as a commodity pool operator. The adviser is also registered as a commodity trading advisor.

Fund shares are not insured by the FDIC and are not deposits or other obligations of, or guaranteed by, any depository institution. Shares are subject to investment risks, including possible loss of principal invested.

This report must be preceded or accompanied by a current summary prospectus or prospectus. Before investing, investors should consider carefully the investment objective, risks, and charges and expenses of a mutual fund. This and other important information is contained in the summary prospectus and prospectus, which can be obtained from a financial intermediary. Prospective investors should read the prospectus carefully before investing. For further information, please call 1-800-262-1122.

Annual Report September 30, 2023

Eaton Vance

Total Return Bond Fund

Eaton Vance

Total Return Bond Fund

September 30, 2023

Management’s Discussion of Fund Performance†

Economic and Market Conditions

For fixed-income investors, the dominant event during the 12-month period ended September 30, 2023, was the series of U.S. Federal Reserve (Fed) interest rate hikes -- six during the period, and 11 in total -- that brought the federal funds rate to its highest level in 22 years.

But while the Fed’s campaign to tamp down inflation led to negative performance for government bonds, corporate bond returns were strongly positive during the period -- buoyed in part by the very factors that were fueling inflation: record low unemployment, strong job creation, and robust consumer spending.

By the summer of 2023, a majority of economists and market observers seemed to be coming around to the view that Jerome Powell’s Fed might be able to accomplish what had seldom, if ever, been done before: raise rates significantly to lower inflation and still bring the economy in for a soft landing without a recession.

One cloud that hung over fixed-income markets during the period, however, was fear that even after it finished raising rates, the Fed would leave rates higher for longer than investors had previously anticipated. During the final two months of the period -- and especially after the Fed’s September 2023 meeting -- longer-term interest rates rose dramatically, as investor expectations of how high rates would go -- and how long they would stay there -- seemed to get higher and longer.

Against the backdrop of the Fed’s aggressive monetary tightening campaign, U.S. Treasurys were the worst-performing major fixed-income asset class during the 12-month period, with the Bloomberg U.S. Treasury Index returning -0.81%.

In contrast, the strong U.S. economy and increasing confidence in a soft-landing scenario served as tailwinds for investment-grade corporate bonds. Even in a rising-rate environment, the Bloomberg U.S. Corporate Bond Index returned 3.65% during the period.

High yield bonds were the standout performer among major fixed-income asset classes, with the Bloomberg U.S. Corporate High Yield Index returning 10.28% during the period. With a strong U.S. economy helping keep bond defaults low, and a recession looking increasingly remote, investors gravitated toward riskier investments with greater yields.

Asset-backed securities -- including bonds backed by automobile and consumer loans -- benefited from strong consumer balance sheets and spending during the period, with the Bloomberg U.S. Asset-Backed Securities Index returning 2.81%.

Mortgage-backed securities (MBS), however, were dogged by two technical factors that depressed prices, causing the Bloomberg U.S. Mortgage-Backed Securities Index to return -0.17% during the period. As the Fed lowered its balance sheet, it sold off much of its MBS holdings. And several regional banks that had been significant buyers of MBS were forced by the banking crisis of March 2023 to liquidate their assets. The resulting release of a significant amount of MBS into the market led prices to fall and the asset class to deliver negative returns.

Fund Performance

For the 12-month period ended September 30, 2023, Eaton Vance Total Return Bond Fund (the Fund) returned 1.03% for Class A shares at net asset value (NAV), outperforming its benchmark, the Bloomberg U.S. Aggregate Bond Index (the Index), which returned 0.64%.

During a period marked by a significant rise in interest rates, the Fund’s overweight position in the short end of the yield curve -- where duration, or sensitivity to interest rate changes, was lower -- and underweight position in the long end of the curve -- where duration was higher -- contributed to Fund performance versus the Index. The benefit of this duration strategy was especially pronounced during the final two months of the period, when the yield curve steepened as long-term rates rose dramatically.

The Fund’s overweight allocation to asset-backed securities (ABS) also contributed to Fund returns relative to the Index, as ABS generally outperformed the Index. Within the asset class, security selections -- including data-center bonds buoyed by enthusiasm for artificial intelligence-related investments -- helped Index-relative performance during the period.

The Fund’s out-of-Index allocation to high yield bonds, which outperformed most other areas of the fixed-income market during the period, contributed to relative performance as well.

An overweight allocation to investment-grade corporate bonds, which outperformed the Index, also helped returns versus the Index. Within the asset class, the Fund’s overweight positions in higher credit-quality financial services firms benefited Index-relative returns. Higher quality companies were largely unaffected by the regional banking crisis of March 2023, and financial services firms were able to adjust to inflationary pressures faster than industrial firms within the asset class.

See Endnotes and Additional Disclosures in this report.

Past performance is no guarantee of future results. Returns are historical and are calculated by determining the percentage change in net asset value (NAV) or offering price (as applicable) with all distributions reinvested. Furthermore, returns do not reflect the deduction of taxes that shareholders may have to pay on Fund distributions or upon the redemption of Fund shares. Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Performance for periods less than or equal to one year is cumulative. Performance is for the stated time period only; due to market volatility, current Fund performance may be lower or higher than the quoted return. For performance as of the most recent month-end, please refer to eatonvance.com.

Eaton Vance

Total Return Bond Fund

September 30, 2023

Management’s Discussion of Fund Performance† — continued

In addition, the Fund’s out-of-Index allocation to non-agency mortgage-backed securities (MBS) -- which were largely unaffected by the technical factors that caused agency MBS within the Index to deliver negative returns -- contributed to Index-relative performance. The Fund’s non-agency MBS holdings consisted mainly of low-interest mortgages originated in 2018-2020 that had built up significant equity. Those securities performed strongly during the period.

In contrast, the Fund’s overweight allocation to non-agency commercial mortgage-backed securities (CMBS) was the largest detractor from Fund performance versus the Index during the period. The ongoing weakness in commercial real estate, in the wake of pandemic-related changes to the work environment, was exacerbated during the period by rising interest rates and the banking crisis of March 2023.

The Fund’s use of derivatives, which are not represented within the Index, also detracted from returns relative to the Index. The Fund uses derivatives primarily for duration management, by investing in U.S. Treasury futures and options on Treasury futures.

Security selections within the Fund’s U.S. Treasury holdings dragged on Index-relative performance during the period as well.

See Endnotes and Additional Disclosures in this report.

Past performance is no guarantee of future results. Returns are historical and are calculated by determining the percentage change in net asset value (NAV) or offering price (as applicable) with all distributions reinvested. Furthermore, returns do not reflect the deduction of taxes that shareholders may have to pay on Fund distributions or upon the redemption of Fund shares. Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Performance for periods less than or equal to one year is cumulative. Performance is for the stated time period only; due to market volatility, current Fund performance may be lower or higher than the quoted return. For performance as of the most recent month-end, please refer to eatonvance.com.

Eaton Vance

Total Return Bond Fund

September 30, 2023

Performance

Portfolio Manager(s) Vishal Khanduja, CFA and Brian Ellis, CFA

| % Average Annual Total Returns1,2 | Class

Inception Date | Performance

Inception Date | One Year | Five Years | Ten Years |

| Class A at NAV | 11/17/2009 | 11/17/2009 | 1.03% | 0.59% | 2.41% |

| Class A with 3.25% Maximum Sales Charge | — | — | (2.22) | (0.08) | 2.07 |

| Class C at NAV | 11/17/2009 | 11/17/2009 | 0.17 | (0.17) | 1.80 |

| Class C with 1% Maximum Deferred Sales Charge | — | — | (0.79) | (0.17) | 1.80 |

| Class I at NAV | 11/17/2009 | 11/17/2009 | 1.28 | 0.84 | 2.66 |

| Class R6 at NAV | 06/30/2023 | 11/17/2009 | 1.29 | 0.84 | 2.66 |

|

| Bloomberg U.S. Aggregate Bond Index | — | — | 0.64% | 0.10% | 1.13% |

| % Total Annual Operating Expense Ratios3 | Class A | Class C | Class I | Class R6 |

| Gross | 0.86% | 1.61% | 0.61% | 0.55% |

| Net | 0.74 | 1.49 | 0.49 | 0.43 |

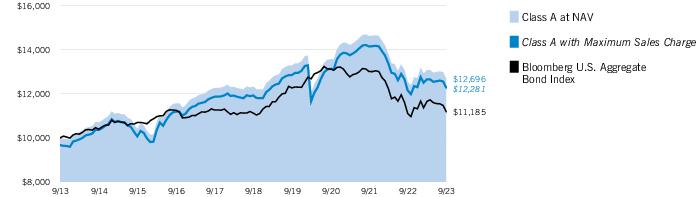

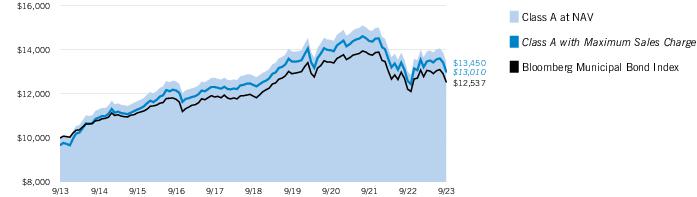

Growth of $10,000

This graph shows the change in value of a hypothetical investment of $10,000 in Class A of the Fund for the period indicated. For comparison, the same investment is shown in the indicated index.

| Growth of Investment | Amount Invested | Period Beginning | At NAV | With Maximum Sales Charge |

| Class C | $10,000 | 09/30/2013 | $11,951 | N.A. |

| Class I, at minimum investment | $1,000,000 | 09/30/2013 | $1,300,428 | N.A. |

| Class R6, at minimum investment | $5,000,000 | 09/30/2013 | $6,503,148 | N.A. |

See Endnotes and Additional Disclosures in this report.

Past performance is no guarantee of future results. Returns are historical and are calculated by determining the percentage change in net asset value (NAV) or offering price (as applicable) with all distributions reinvested. Furthermore, returns do not reflect the deduction of taxes that shareholders may have to pay on Fund distributions or upon the redemption of Fund shares. Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Performance for periods less than or equal to one year is cumulative. Performance is for the stated time period only; due to market volatility, current Fund performance may be lower or higher than the quoted return. For performance as of the most recent month-end, please refer to eatonvance.com.

Eaton Vance

Total Return Bond Fund

September 30, 2023

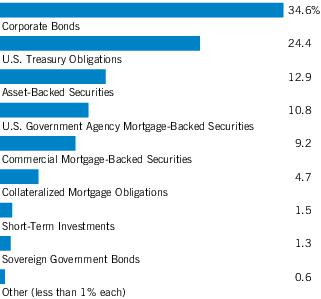

| Asset Allocation (% of total investments) |

| Credit Quality (% of bond holdings)1 |

Footnotes:

| 1 | For purposes of the Fund’s rating restrictions, ratings are based on Moody’s Investors Service, Inc. (“Moody’s”), S&P Global Ratings (“S&P”) or Fitch Ratings (“Fitch”), or Kroll for securitized debt instruments only (such as asset-backed securities and mortgage-backed securities) as applicable. If securities are rated differently by the ratings agencies, the highest rating is applied. Ratings, which are subject to change, apply to the creditworthiness of the issuers of the underlying securities and not to the Fund or its shares. Credit ratings measure the quality of a bond based on the issuer’s creditworthiness, with ratings ranging from AAA, being the highest, to D, being the lowest based on S&P’s measures. Ratings of BBB or higher by S&P, Fitch or Kroll (Baa or higher by Moody’s) are considered to be investment-grade quality. Credit ratings are based largely on the ratings agency’s analysis at the time of rating. The rating assigned to any particular security is not necessarily a reflection of the issuer’s current financial condition and does not necessarily reflect its assessment of the volatility of a security’s market value or of the liquidity of an investment in the security. Holdings designated as “Not Rated” (if any) are not rated by the national ratings agencies stated above. |

Eaton Vance

Total Return Bond Fund

September 30, 2023

Endnotes and Additional Disclosures

| † | The views expressed in this report are those of the portfolio manager(s) and are current only through the date stated at the top of this page. These views are subject to change at any time based upon market or other conditions, and Eaton Vance and the Fund(s) disclaim any responsibility to update such views. These views may not be relied upon as investment advice and, because investment decisions are based on many factors, may not be relied upon as an indication of trading intent on behalf of any Eaton Vance fund. This commentary may contain statements that are not historical facts, referred to as “forward-looking statements.” The Fund’s actual future results may differ significantly from those stated in any forward-looking statement, depending on factors such as changes in securities or financial markets or general economic conditions, the volume of sales and purchases of Fund shares, the continuation of investment advisory, administrative and service contracts, and other risks discussed from time to time in the Fund’s filings with the Securities and Exchange Commission. |

| | |

| 1 | Bloomberg U.S. Aggregate Bond Index is an unmanaged index of domestic investment-grade bonds, including corporate, government and mortgage-backed securities. Unless otherwise stated, index returns do not reflect the effect of any applicable sales charges, commissions, expenses, taxes or leverage, as applicable. It is not possible to invest directly in an index. |

| 2 | Total Returns at NAV do not include applicable sales charges. If sales charges were deducted, the returns would be lower. Total Returns shown with maximum sales charge reflect the stated maximum sales charge. Unless otherwise stated, performance does not reflect the deduction of taxes on Fund distributions or redemptions of Fund shares.Effective November 5, 2020, Class C shares automatically convert to Class A shares eight years after purchase. The average annual total returns listed for Class C reflect conversion to Class A shares after eight years. Prior to November 5, 2020, Class C shares automatically converted to Class A shares ten years after purchase.Performance prior to the inception date of a class may be linked to the performance of an older class of the Fund. This linked performance is adjusted for any applicable sales charge, but is not adjusted for class expense differences. If adjusted for such differences, the performance would be different. The performance of Class R6 is linked to Class I. Performance presented in the Financial Highlights included in the financial statements is not linked.Effective May 1, 2015, the Fund changed its investment objective and policies. Prior to May 1, 2015, the Fund invested primarily in Build America Bonds. Performance prior to May 1, 2015 reflects the Fund’s performance under its former investment objective and policies. |

| 3 | Source: Fund prospectus. Net expense ratios reflect a contractual expense reimbursement that continues through 2/1/25. The expense ratios for the current reporting period can be found in the Financial Highlights section of this report. Performance reflects expenses waived and/or reimbursed, if applicable. Without such waivers and/or reimbursements, performance would have been lower. |

| | Fund profile subject to change due to active management. |

| | Additional Information |

| | Bloomberg U.S. Treasury Index measures the performance of U.S. Treasuries with a maturity of one year or more. Bloomberg U.S. Corporate Bond Index measures the performance of investment-grade U.S. corporate securities with a maturity of one year or more. Bloomberg U.S. Corporate High Yield Index measures USD-denominated, non-investment grade corporate securities. Bloomberg U.S. Mortgage-Backed Securities Index measures agency mortgage-backed pass-through securities issued by Ginnie Mae (GNMA), Fannie Mae (FNMA), and Freddie Mac (FHLMC). Bloomberg U.S. Asset-Backed Securities Index tracks the performance of U.S. dollar denominated investment grade, fixed rate asset-backed securities publicly issued in the U.S. domestic market. |

| | Duration is a measure of the expected change in price of a bond — in percentage terms — given a one percent change in interest rates, all else being constant. Securities with lower durations tend to be less sensitive to interest rate changes. |

| | Yield curve is a graphical representation of the yields offered by bonds of various maturities. The yield curve flattens when long-term interest rates fall and/or short-term interest rates increase, and the yield curve steepens when long-term interest rates increase and/or short-term interest rates fall. |

Eaton Vance

Total Return Bond Fund

September 30, 2023

Example

As a Fund shareholder, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchases; and (2) ongoing costs, including management fees; distribution and/or service fees; and other Fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of Fund investing and to compare these costs with the ongoing costs of investing in other mutual funds. The actual expense Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period (April 1, 2023 to September 30, 2023) for Class A, Class C and Class I and (June 30, 2023 to September 30, 2023) for Class R6. The hypothetical expense Example is based on an investment of $1,000 invested for the one-half year period (April 1, 2023 to September 30, 2023).

Actual Expenses

The first section of the table below provides information about actual account values and actual expenses. You may use the information in this section, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first section under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second section of the table below provides information about hypothetical account values and hypothetical expenses based on the actual Fund expense ratio and an assumed rate of return of 5% per year (before expenses), which is not the actual Fund return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in your Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads). Therefore, the second section of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would be higher.

| | Beginning

Account Value

(4/1/23) | Ending

Account Value

(9/30/23) | Expenses Paid

During Period

(4/1/23 – 9/30/23) | Annualized

Expense

Ratio |

| Actual* | | | | |

| Class A | $1,000.00 | $ 970.50 | $3.66** | 0.74% |

| Class C | $1,000.00 | $ 965.80 | $7.34** | 1.49% |

| Class I | $1,000.00 | $ 971.60 | $2.42** | 0.49% |

| Class R6 | $1,000.00 | $ 977.70 | $1.08** | 0.43% |

| |

| Hypothetical *** | | | | |

| (5% return per year before expenses) | | | | |

| Class A | $1,000.00 | $1,021.36 | $3.75** | 0.74% |

| Class C | $1,000.00 | $1,017.60 | $7.54** | 1.49% |

| Class I | $1,000.00 | $1,022.61 | $2.48** | 0.49% |

| Class R6 | $1,000.00 | $1,022.91 | $2.18** | 0.43% |

| * | Class R6 had not commenced operations on April 1, 2023. Actual expenses are equal to the Fund’s annualized expense ratio for the indicated Class, multiplied by the average account value over the period, multiplied by 183/365 (to reflect the one-half year period); 93/365 for Class R6 (to reflect the period from the commencement of operations on June 30, 2023 to September 30, 2023). The Example assumes that the $1,000 was invested at the net asset value per share determined at the close of business on March 31, 2023 (June 30, 2023 for Class R6). |

| ** | Absent an allocation of certain expenses to affiliate(s), expenses would be higher. |

| *** | Hypothetical expenses are equal to the Fund’s annualized expense ratio for the indicated Class, multiplied by the average account value over the period, multiplied by 183/365 (to reflect the one-half year period). The Example assumes that the $1,000 was invested at the net asset value per share determined at the close of business on March 31, 2023 (June 30, 2023 for Class R6). |

Eaton Vance

Total Return Bond Fund

September 30, 2023

| Asset-Backed Securities — 14.2% |

| Security | Principal

Amount

(000's omitted) | Value |

| Aaset Trust, Series 2019-2, Class B, 4.458%, 10/16/39(1) | $ | 3,084 | $ 1,306,512 |

| ACHV ABS Trust: | | | |

| Series 2023-1PL, Class B, 6.80%, 3/18/30(1) | | 3,200 | 3,199,535 |

| Series 2023-3PL, Class B, 7.17%, 8/19/30(1) | | 2,750 | 2,763,712 |

| Avant Credit Card Master Trust, Series 2021-1A, Class A, 1.37%, 4/15/27(1) | | 1,450 | 1,347,375 |

| Avant Loans Funding Trust, Series 2021-REV1, Class D, 4.30%, 7/15/30(1) | | 5,213 | 4,737,920 |

| Business Jet Securities, LLC, Series 2020-1A, Class A, 2.981%, 11/15/35(1) | | 323 | 302,703 |

| Coinstar Funding, LLC, Series 2017-1A, Class A2, 5.216%, 4/25/47(1) | | 3,193 | 2,670,418 |

| Cologix Canadian Issuer L.P., Series 2022-1CAN, Class C, 7.74%, 1/25/52(1)(2) | | 2,800 | 1,842,238 |

| Cologix Data Centers US Issuer, LLC: | | | |

| Series 2021-1A, Class B, 3.79%, 12/26/51(1) | | 4,300 | 3,735,944 |

| Series 2021-1A, Class C, 5.99%, 12/26/51(1) | | 2,900 | 2,379,202 |

| Conn's Receivables Funding, LLC: | | | |

| Series 2021-A, Class C, 4.59%, 5/15/26(1) | | 4,758 | 4,747,413 |

| Series 2022-A, Class B, 9.52%, 12/15/26(1) | | 1,516 | 1,522,895 |

| Series 2022-A, Class C, 0.00%, 12/15/26(1) | | 3,700 | 3,159,937 |

| Series 2023-A, Class B, 10.00%, 1/17/28(1) | | 3,167 | 3,177,035 |

| Diamond Infrastructure Funding, LLC, Series 2021-1A, Class C, 3.475%, 4/15/49(1) | | 992 | 863,340 |

| Diamond Issuer, Series 2021-1A, Class B, 2.701%, 11/20/51(1) | | 1,000 | 818,825 |

| Driven Brands Funding, LLC: | | | |

| Series 2018-1A, Class A2, 4.739%, 4/20/48(1) | | 2,568 | 2,480,239 |

| Series 2019-1A, Class A2, 4.641%, 4/20/49(1) | | 1,922 | 1,817,782 |

| Series 2019-2A, Class A2, 3.981%, 10/20/49(1) | | 4,129 | 3,779,524 |

| ExteNet, LLC: | | | |

| Series 2019-1A, Class A2, 3.204%, 7/25/49(1) | | 2,475 | 2,380,200 |

| Series 2019-1A, Class B, 4.14%, 7/25/49(1) | | 3,502 | 3,361,879 |

| Series 2019-1A, Class C, 5.219%, 7/25/49(1) | | 3,040 | 2,886,842 |

| Falcon Aerospace, Ltd.: | | | |

| Series 2019-1, Class A, 3.597%, 9/15/39(1) | | 1,656 | 1,506,648 |

| Series 2019-1, Class B, 4.791%, 9/15/39(1) | | 4,067 | 3,099,908 |

| Series 2019-1, Class C, 6.656%, 9/15/39(1) | | 3,191 | 942,410 |

| FMC GMSR Issuer Trust: | | | |

| Series 2021-GT1, Class A, 3.62%, 7/25/26(1)(3) | | 2,285 | 1,879,117 |

| Series 2021-GT2, Class A, 3.85%, 10/25/26(1)(3) | | 1,690 | 1,390,980 |

| Series 2022-GT2, Class A, 7.90%, 7/25/27(1) | | 2,197 | 2,167,623 |

| GAIA Aviation, Ltd., Series 2019-1, Class A, 3.967%, 12/15/44(1)(4) | | 672 | 606,252 |

| Security | Principal

Amount

(000's omitted) | Value |

| Hertz Vehicle Financing, LLC, Series 2021-1A, Class D, 3.98%, 12/26/25(1) | $ | 5,000 | $ 4,739,320 |

| Horizon Aircraft Finance II, Ltd., Series 2019-1, Class A, 3.721%, 7/15/39(1) | | 1,732 | 1,507,202 |

| JPMorgan Chase Bank NA: | | | |

| Series 2021-3, Class D, 1.009%, 2/26/29(1) | | 394 | 374,862 |

| Series 2021-3, Class E, 2.102%, 2/26/29(1) | | 231 | 219,961 |

| Lunar Aircraft, Ltd.: | | | |

| Series 2020-1A, Class B, 4.335%, 2/15/45(1) | | 544 | 388,689 |

| Series 2020-1A, Class C, 6.413%, 2/15/45(1) | | 314 | 71,447 |

| Lunar Structured Aircraft Portfolio Notes, Series 2021-1, Class A, 2.636%, 10/15/46(1) | | 6,198 | 5,324,261 |

| Mosaic Solar Loan Trust, Series 2019-2A, Class B, 3.28%, 9/20/40(1) | | 1,612 | 1,393,193 |

| MVW, LLC, Series 2020-1A, Class A, 1.74%, 10/20/37(1) | | 183 | 169,009 |

| Neighborly Issuer, LLC, Series 2021-1A, Class A2, 3.584%, 4/30/51(1) | | 2,449 | 2,051,263 |

| NRZ Excess Spread-Collateralized Notes: | | | |

| Series 2021-FHT1, Class A, 3.104%, 7/25/26(1) | | 357 | 319,062 |

| Series 2021-GNT1, Class A, 3.474%, 11/25/26(1) | | 3,478 | 3,137,104 |

| Octane Receivables Trust, Series 2022-1, Class A2, 4.18%, 3/20/28(1) | | 1,206 | 1,188,196 |

| Oportun Issuance Trust, Series 2021-B, Class C, 3.65%, 5/8/31(1) | | 496 | 455,598 |

| Pagaya AI Debt Selection Trust: | | | |

| Series 2021-2, 3.00%, 1/25/29(1) | | 575 | 555,593 |

| Series 2021-3, Class C, 3.27%, 5/15/29(1) | | 2,900 | 2,511,397 |

| Series 2021-5, Class C, 3.93%, 8/15/29(1) | | 4,319 | 3,769,731 |

| Pagaya AI Technology In Housing Trust, Series 2023-1, Class F, 3.60%, 10/25/40(1)(5) | | 1,323 | 830,962 |

| Planet Fitness Master Issuer, LLC, Series 2019-1A, Class A2, 3.858%, 12/5/49(1) | | 2,349 | 1,964,303 |

| PMT Issuer Trust - FMSR: | | | |

| Series 2021-FT1, Class A, 8.434%, (1 mo. SOFR + 3.00%), 3/25/26(1)(6) | | 390 | 380,815 |

| Series 2022-FT1, Class A, 9.505%, (30-day average SOFR + 4.19%), 6/25/27(1)(6) | | 3,500 | 3,505,641 |

| Prosper Marketplace Issuance Trust, Series 2023-1A, Class A, 7.06%, 7/16/29(1) | | 3,250 | 3,252,750 |

| Raptor Aircraft Finance I, LLC, Series 2019-1, Class A, 4.213%, 8/23/44(1) | | 1,311 | 1,051,244 |

| Retained Vantage Data Centers Issuer, LLC: | | | |

| Series 2023-1A, Class A2B, 5.25%, 9/15/48(1) | | 4,877 | 3,191,621 |

| Series 2023-1A, Class B, 5.75%, 9/15/48(1) | | 4,890 | 4,360,364 |

| ServiceMaster Funding, LLC: | | | |

| Series 2020-1, Class A2I, 2.841%, 1/30/51(1) | | 637 | 540,158 |

| Series 2020-1, Class A2II, 3.337%, 1/30/51(1) | | 745 | 587,403 |

8

See Notes to Financial Statements.

Eaton Vance

Total Return Bond Fund

September 30, 2023

Portfolio of Investments — continued

| Security | Principal

Amount

(000's omitted) | Value |

| SERVPRO Master Issuer, LLC, Series 2019-1A, Class A2, 3.882%, 10/25/49(1) | $ | 4,697 | $ 4,306,393 |

| Sonic Capital, LLC, Series 2020-1A, Class A2I, 3.845%, 1/20/50(1) | | 3,793 | 3,448,856 |

| Stack Infrastructure Issuer, LLC: | | | |

| Series 2019-2A, Class A2, 3.08%, 10/25/44(1) | | 1,135 | 1,088,567 |

| Series 2020-1A, Class A2, 1.893%, 8/25/45(1) | | 1,096 | 995,824 |

| STAR Trust: | | | |

| Series 2021-SFR1, Class G, 8.648%, (1 mo. SOFR + 3.31%), 4/17/38(1)(6) | | 2,494 | 2,407,635 |

| Series 2021-SFR1, Class H, 9.898%, (1 mo. SOFR + 4.56%), 4/17/38(1)(6) | | 1,600 | 1,565,515 |

| Sunnova Helios II Issuer, LLC: | | | |

| Series 2019-AA, Class C, 5.32%, 6/20/46(1) | | 989 | 750,675 |

| Series 2021-A, Class B, 3.15%, 2/20/48(1) | | 2,864 | 2,235,176 |

| Series 2021-B, Class B, 2.01%, 7/20/48(1) | | 2,313 | 1,863,953 |

| Sunnova Helios X Issuer, LLC, Series 2022-C, Class B, 5.60%, 11/22/49(1) | | 3,699 | 3,460,763 |

| Sunnova Sol Issuer, LLC, Series 2020-1A, Class B, 5.54%, 2/1/55(1) | | 8,418 | 7,012,904 |

| Theorem Funding Trust, Series 2021-1A, Class B, 1.84%, 12/15/27(1) | | 2,253 | 2,213,767 |

| Vantage Data Centers Issuer, LLC: | | | |

| Series 2020-2A, Class A2, 1.992%, 9/15/45(1) | | 3,088 | 2,586,750 |

| Series 2021-1A, Class A2, 2.165%, 10/15/46(1) | | 3,858 | 3,381,266 |

| Willis Engine Structured Trust V: | | | |

| Series 2020-A, Class B, 4.212%, 3/15/45(1) | | 1,471 | 1,188,006 |

| Series 2020-A, Class C, 6.657%, 3/15/45(1) | | 505 | 364,193 |

Total Asset-Backed Securities

(identified cost $168,613,065) | | | $ 153,585,800 |

| Collateralized Mortgage Obligations — 5.2% |

| Security | Principal

Amount

(000's omitted) | Value |

| Bellemeade Re, Ltd., Series 2021-2A, Class M1A, 6.515%, (30-day average SOFR + 1.20%), 6/25/31(1)(6) | $ | 1,161 | $ 1,161,594 |

| Cascade Funding Mortgage Trust, Series 2022-HB10, Class M2, 3.25%, 11/25/35(1)(3) | | 2,000 | 1,760,968 |

| Cascade MH Asset Trust, Series 2022-MH1, Class A, 4.25% to 7/25/27, 8/25/54(1)(4) | | 2,041 | 1,794,916 |

| CFMT, LLC, Series 2023-HB11, Class M2, 4.00%, 2/25/37(1)(3) | | 2,500 | 2,147,641 |

| Eagle Re, Ltd., Series 2021-2, Class M1B, 7.365%, (30-day average SOFR + 2.05%), 4/25/34(1)(6) | | 1,500 | 1,506,288 |

| Federal Home Loan Mortgage Corp., Series 5324, Class MZ, 6.00%, 7/25/53 | | 233 | 216,510 |

| Security | Principal

Amount

(000's omitted) | Value |

| Federal Home Loan Mortgage Corp. Structured Agency Credit Risk Debt Notes: | | | |

| Series 2019-DNA4, Class M2, 7.379%, (30-day average SOFR + 2.064%), 10/25/49(1)(6) | $ | 53 | $ 53,391 |

| Series 2019-HQA3, Class B1, 8.429%, (30-day average SOFR + 3.11%), 9/25/49(1)(6) | | 1,395 | 1,458,494 |

| Series 2019-HQA4, Class B1, 8.379%, (30-day average SOFR + 3.06%), 11/25/49(1)(6) | | 941 | 969,838 |

| Series 2020-HQA2, Class B1, 9.529%, (30-day average SOFR + 4.21%), 3/25/50(1)(6) | | 1,878 | 2,047,995 |

| Series 2021-DNA2, Class B1, 8.715%, (30-day average SOFR + 3.40%), 8/25/33(1)(6) | | 2,165 | 2,225,053 |

| Federal National Mortgage Association Connecticut Avenue Securities: | | | |

| Series 2019-R01, Class 2B1, 9.779%, (30-day average SOFR + 4.46%), 7/25/31(1)(6) | | 1,390 | 1,481,037 |

| Series 2019-R02, Class 1B1, 9.579%, (30-day average SOFR + 4.26%), 8/25/31(1)(6) | | 552 | 582,185 |

| Series 2019-R03, Class 1B1, 9.529%, (30-day average SOFR + 4.21%), 9/25/31(1)(6) | | 1,125 | 1,187,374 |

| Series 2019-R06, Class 2B1, 9.179%, (30-day average SOFR + 3.864%), 9/25/39(1)(6) | | 5,455 | 5,603,111 |

| Series 2019-R07, Class 1B1, 8.829%, (30-day average SOFR + 3.51%), 10/25/39(1)(6) | | 3,081 | 3,149,955 |

| Series 2020-R02, Class 2B1, 8.429%, (30-day average SOFR + 3.11%), 1/25/40(1)(6) | | 1,612 | 1,629,316 |

| Series 2021-R01, Class 1B2, 11.315%, (30-day average SOFR + 6.00%), 10/25/41(1)(6) | | 1,995 | 2,029,032 |

| Series 2021-R02, Class 2B1, 8.615%, (30-day average SOFR + 3.30%), 11/25/41(1)(6) | | 584 | 588,212 |

| Finance of America HECM Buyout, Series 2022-HB2, Class M5, 6.00%, 8/1/32(1)(3) | | 1,000 | 594,148 |

| Government National Mortgage Association: | | | |

| Series 2023-84, Class DL, 6.00%, 6/20/53 | | 1,002 | 979,072 |

| Series 2023-84, Class MW, 6.00%, 6/20/53 | | 1,051 | 1,027,055 |

| Series 2023-98, Class BW, 6.00%, 7/20/53 | | 1,190 | 1,164,210 |

| Series 2023-99, Class AL, 6.00%, 7/20/53 | | 1,190 | 1,163,902 |

| Series 2023-102, Class SG, 2.742%, (22.55% - 30-day average SOFR x 3.727), 7/20/53(7) | | 1,792 | 1,628,323 |

| Series 2023-116, Class CY, 6.00%, 8/20/53 | | 2,770 | 2,709,223 |

| Series 2023-133, Class S, 5.66%, (21.60% - 30-day average SOFR x 3.00), 9/20/53(7) | | 3,845 | 3,713,868 |

| JP Morgan Mortgage Trust, Series 2023-HE2, Class A1, 7.016%, (30-day average SOFR + 1.70%), 3/25/54(1)(6) | | 4,443 | 4,443,000 |

| LHOME Mortgage Trust: | | | |

| Series 2023-RTL2, Class A1, 8.00% to 1/25/26, 6/25/28(1)(4) | | 1,550 | 1,549,640 |

| Series 2023-RTL3, Class A1, 8.00%, 8/25/28(1)(3) | | 1,624 | 1,624,281 |

9

See Notes to Financial Statements.

Eaton Vance

Total Return Bond Fund

September 30, 2023

Portfolio of Investments — continued

| Security | Principal

Amount

(000's omitted) | Value |

| MFRA Trust, Series 2023-NQM1, Class A2, 5.75% to 1/25/26, 11/25/67(1)(4) | $ | 1,517 | $ 1,465,671 |

| Oaktown Re VI, Ltd., Series 2021-1A, Class M1B, 7.365%, (30-day average SOFR + 2.05%), 10/25/33(1)(6) | | 697 | 698,290 |

| PNMAC GMSR Issuer Trust: | | | |

| Series 2018-GT1, Class A, 9.284%, (1 mo. SOFR + 3.85%), 2/25/25(1)(6) | | 775 | 774,923 |

| Series 2018-GT2, Class A, 8.084%, (1 mo. SOFR + 2.65%), 8/25/25(1)(6) | | 445 | 445,017 |

| RMF Buyout Issuance Trust, Series 2020-HB1, Class M5, 6.00%, 10/25/50(1) | | 1,180 | 773,260 |

Total Collateralized Mortgage Obligations

(identified cost $56,280,766) | | | $ 56,346,793 |

| Commercial Mortgage-Backed Securities — 10.1% |

| Security | Principal

Amount

(000's omitted) | Value |

| BAMLL Commercial Mortgage Securities Trust: | | | |

| Series 2019-BPR, Class ENM, 3.843%, 11/5/32(1)(3) | $ | 7,255 | $ 2,400,166 |

| Series 2019-BPR, Class FNM, 3.843%, 11/5/32(1)(3) | | 7,215 | 1,597,190 |

| BBCMS Mortgage Trust, Series 2017-C1, Class D, 3.709%, 2/15/50(1)(3) | | 3,500 | 2,320,186 |

| BX Commercial Mortgage Trust: | | | |

| Series 2021-VOLT, Class C, 6.547%, (1 mo. SOFR + 1.214%), 9/15/36(1)(6) | | 6,379 | 6,139,731 |

| Series 2021-VOLT, Class D, 7.097%, (1 mo. SOFR + 1.764%), 9/15/36(1)(6) | | 474 | 453,429 |

| CFCRE Commercial Mortgage Trust: | | | |

| Series 2016-C3, Class D, 3.052%, 1/10/48(1)(3) | | 1,500 | 1,148,250 |

| Series 2016-C7, Class D, 4.514%, 12/10/54(1)(3) | | 1,725 | 1,191,847 |

| COMM Mortgage Trust: | | | |

| Series 2013-CR11, Class D, 4.828%, 8/10/50(1)(3) | | 3,603 | 3,230,765 |

| Series 2013-CR13, Class C, 4.95%, 11/10/46(3) | | 1,000 | 902,936 |

| Series 2015-CR22, Class D, 4.203%, 3/10/48(1)(3) | | 2,324 | 1,832,328 |

| CSMC Trust: | | | |

| Series 2016-NXSR, Class D, 4.574%, 12/15/49(1)(3) | | 2,000 | 1,269,422 |

| Series 2020-TMIC, Class A, 8.948%, (1 mo. SOFR + 3.614%), 12/15/35(1)(6) | | 4,240 | 4,236,992 |

| Series 2021-4SZN, Class A, 9.30%, (1 mo. SOFR + 3.967%), 11/15/23(1)(6) | | 5,344 | 5,183,418 |

| Series 2021-BPNY, Class A, 9.162%, (1 mo. SOFR + 3.83%), 8/15/26(1)(6) | | 3,917 | 3,441,362 |

| Series 2021-WEHO, Class A, 9.417%, (1 mo. SOFR + 4.083%), 4/15/26(1)(6) | | 396 | 387,760 |

| Series 2022-CNTR, Class A, 9.277%, (1 mo. SOFR + 3.944%), 1/15/24(1)(6) | | 3,745 | 3,218,497 |

| Series 2022-NWPT, Class A, 8.475%, (1 mo. SOFR + 3.143%), 9/9/24(1)(6) | | 3,163 | 3,196,616 |

| Security | Principal

Amount

(000's omitted) | Value |

| Extended Stay America Trust: | | | |

| Series 2021-ESH, Class C, 7.147%, (1 mo. SOFR + 1.814%), 7/15/38(1)(6) | $ | 3,019 | $ 2,978,029 |

| Series 2021-ESH, Class D, 7.697%, (1 mo. SOFR + 2.36%), 7/15/38(1)(6) | | 1,844 | 1,817,151 |

| Federal National Mortgage Association Multifamily Connecticut Avenue Securities Trust: | | | |

| Series 2019-01, Class M10, 8.679%, (30-day average SOFR + 3.364%), 10/25/49(1)(6) | | 2,813 | 2,751,254 |

| Series 2020-01, Class M10, 9.179%, (30-day average SOFR + 3.864%), 3/25/50(1)(6) | | 7,229 | 7,069,758 |

| JPMBB Commercial Mortgage Securities Trust: | | | |

| Series 2014-C22, Class D, 4.70%, 9/15/47(1)(3) | | 1,980 | 1,338,654 |

| Series 2014-C25, Class D, 4.081%, 11/15/47(1)(3) | | 3,575 | 1,514,390 |

| Series 2015-C29, Class D, 3.827%, 5/15/48(3) | | 500 | 327,970 |

| JPMorgan Chase Commercial Mortgage Securities Trust: | | | |

| Series 2013-C16, Class D, 5.10%, 12/15/46(1)(3) | | 1,500 | 1,293,373 |

| Series 2014-DSTY, Class B, 3.771%, 6/10/27(1) | | 1,384 | 202,721 |

| Med Trust: | | | |

| Series 2021-MDLN, Class E, 8.597%, (1 mo. SOFR + 3.26%), 11/15/38(1)(6) | | 4,150 | 3,956,130 |

| Series 2021-MDLN, Class F, 9.447%, (1 mo. SOFR + 4.11%), 11/15/38(1)(6) | | 3,200 | 3,041,932 |

| Morgan Stanley Bank of America Merrill Lynch Trust: | | | |

| Series 2016-C29, Class C, 4.878%, 5/15/49(3)(8) | | 4,199 | 3,633,419 |

| Series 2016-C29, Class D, 3.00%, 5/15/49(1)(8) | | 3,048 | 2,189,292 |

| Series 2016-C32, Class D, 3.396%, 12/15/49(1)(3)(8) | | 5,000 | 3,303,944 |

| Morgan Stanley Capital I Trust: | | | |

| Series 2019-BPR, Class B, 8.022%, (1 mo. SOFR + 2.69%), 5/15/36(1)(6)(8) | | 3,960 | 3,787,158 |

| Series 2019-BPR, Class C, 8.972%, (1 mo. SOFR + 3.642%), 5/15/36(1)(6)(8) | | 2,219 | 2,100,512 |

| Natixis Commercial Mortgage Securities Trust, Series 2018-FL1, Class C, 7.647%, (1 mo. SOFR + 2.314%), 6/15/35(1)(6) | | 3,219 | 1,479,171 |

| Taubman Centers Commercial Mortgage Trust, Series 2022-DPM, Class A, 7.518%, (1 mo. SOFR + 2.19%), 5/15/37(1)(6) | | 2,000 | 1,955,600 |

| UBS-Barclays Commercial Mortgage Trust, Series 2013-C6, Class D, 4.103%, 4/10/46(1)(3) | | 1,982 | 1,643,334 |

| VMC Finance, LLC, Series 2021-HT1, Class B, 9.945%, (1 mo. SOFR + 4.614%), 1/18/37(1)(6) | | 8,477 | 8,040,665 |

| Wells Fargo Commercial Mortgage Trust: | | | |

| Series 2015-C31, Class D, 3.852%, 11/15/48 | | 5,598 | 4,238,079 |

| Series 2015-NXS1, Class C, 3.848%, 5/15/48(3) | | 1,000 | 877,287 |

| Series 2016-C35, Class D, 3.142%, 7/15/48(1) | | 2,150 | 1,529,444 |

| Series 2016-C36, Class D, 2.942%, 11/15/59(1) | | 6,000 | 3,476,594 |

10

See Notes to Financial Statements.

Eaton Vance

Total Return Bond Fund

September 30, 2023

Portfolio of Investments — continued

| Security | Principal

Amount

(000's omitted) | Value |

| WF-RBS Commercial Mortgage Trust: | | | |

| Series 2013-UBS1, Class D, 5.206%, 3/15/46(1)(3) | $ | 350 | $ 339,546 |

| Series 2014-C24, Class D, 3.692%, 11/15/47(1) | | 4,150 | 2,478,465 |

Total Commercial Mortgage-Backed Securities

(identified cost $130,429,427) | | | $ 109,514,767 |

| Security | Principal

Amount

(000's omitted) | Value |

| Aerospace & Defense — 0.0%(9) |

| Spirit Airlines, Inc., 1.00%, 5/15/26 | $ | 200 | $ 167,300 |

| | | | $ 167,300 |

| Biotechnology — 0.0%(9) |

| BioMarin Pharmaceutical, Inc., 0.599%, 8/1/24 | $ | 175 | $ 170,188 |

| | | | $ 170,188 |

| Commercial Services — 0.0%(9) |

| Block, Inc., 0.125%, 3/1/25 | $ | 170 | $ 158,610 |

| | | | $ 158,610 |

| Computers — 0.0%(9) |

| Rapid7, Inc., 0.25%, 3/15/27 | $ | 175 | $ 149,953 |

| | | | $ 149,953 |

| Diversified Financial Services — 0.1% |

| Ares Capital Corp., 4.625%, 3/1/24 | $ | 250 | $ 254,844 |

| Ford Motor Co., 0.00%, 3/15/26 | | 200 | 197,500 |

| | | | $ 452,344 |

| Electric Utilities — 0.0%(9) |

| NRG Energy, Inc., 2.75%, 6/1/48 | $ | 200 | $ 212,600 |

| | | | $ 212,600 |

| Leisure Time — 0.0%(9) |

| NCL Corp., Ltd., 1.125%, 2/15/27 | $ | 200 | $ 166,500 |

| | | | $ 166,500 |

| Oil and Gas — 0.0%(9) |

| NextEra Energy Partners, L.P., 2.50%, 6/15/26(1) | $ | 200 | $ 170,600 |

| | | | $ 170,600 |

| Security | Principal

Amount

(000's omitted) | Value |

| Pharmaceuticals — 0.0%(9) |

| Dexcom, Inc., 0.25%, 11/15/25 | $ | 175 | $ 165,812 |

| Jazz Investments I, Ltd., 2.00%, 6/15/26 | | 200 | 204,625 |

| | | | $ 370,437 |

| Software — 0.1% |

| Akamai Technologies, Inc., 1.125%, 2/15/29(1) | $ | 200 | $ 202,700 |

| Bill Holdings, Inc., 0.00%, 12/1/25 | | 175 | 176,750 |

| Tyler Technologies, Inc., 0.25%, 3/15/26 | | 175 | 169,837 |

| | | | $ 549,287 |

Total Convertible Bonds

(identified cost $2,665,769) | | | $ 2,567,819 |

| Security | Principal

Amount

(000's omitted) | Value |

| Aerospace & Defense — 0.3% |

| Delta Air Lines, Inc./SkyMiles IP, Ltd., 4.75%, 10/20/28(1) | $ | 3,106 | $ 2,952,912 |

| | | | $ 2,952,912 |

| Agriculture — 0.3% |

| BAT Capital Corp., 6.421%, 8/2/33 | $ | 3,273 | $ 3,183,881 |

| | | | $ 3,183,881 |

| Auto Manufacturers — 1.1% |

| General Motors Financial Co., Inc.: | | | |

| 5.80%, 6/23/28 | $ | 2,280 | $ 2,228,664 |

| 5.85%, 4/6/30 | | 5,704 | 5,467,343 |

| Hyundai Capital America, 5.70%, 6/26/30(1) | | 4,761 | 4,583,393 |

| | | | $ 12,279,400 |

| Banks — 10.9% |

| ABN AMRO Bank NV, 6.339% to 9/18/26, 9/18/27(1)(10) | $ | 2,300 | $ 2,295,234 |

| African Export-Import Bank (The), 3.994%, 9/21/29(11) | | 2,200 | 1,809,632 |

| AIB Group PLC, 6.608% to 9/13/28, 9/13/29(1)(10) | | 2,829 | 2,819,075 |

| Banco Mercantil del Norte S.A./Grand Cayman, 7.50% to 6/27/29(1)(10)(12) | | 745 | 664,074 |

| Banco Santander S.A.: | | | |

| 4.175% to 3/24/27, 3/24/28(10) | | 400 | 369,525 |

| 6.921%, 8/8/33 | | 5,400 | 5,167,083 |

11

See Notes to Financial Statements.

Eaton Vance

Total Return Bond Fund

September 30, 2023

Portfolio of Investments — continued

| Security | Principal

Amount

(000's omitted) | Value |

| Banks (continued) |

| Bank Hapoalim BM, 3.255% to 10/21/26, 1/21/32(1)(10)(11) | $ | 2,600 | $ 2,226,234 |

| Bank Leumi Le-Israel BM, 7.129% to 4/18/28, 7/18/33(1)(10)(11) | | 2,360 | 2,321,678 |

| Bank of America Corp.: | | | |

| 3.846% to 3/8/32, 3/8/37(10) | | 3,300 | 2,686,568 |

| 5.872% to 9/15/33, 9/15/34(10) | | 5,327 | 5,186,918 |

| Barclays PLC: | | | |

| 4.375%, 9/11/24 | | 3,500 | 3,430,550 |

| 6.496% to 9/13/26, 9/13/27(10) | | 5,396 | 5,383,853 |

| BBVA Bancomer S.A., 8.45% to 6/29/33, 6/29/38(1)(10) | | 2,261 | 2,230,158 |

| BBVA Bancomer S.A./Texas, 5.125% to 1/18/28, 1/18/33(1)(10) | | 2,270 | 1,956,308 |

| BNP Paribas S.A., 8.50%(1)(10)(12) | | 5,510 | 5,404,333 |

| BPCE S.A., 3.648% to 1/14/32, 1/14/37(1)(10) | | 1,518 | 1,169,658 |

| CaixaBank S.A., 6.208% to 1/18/28, 1/18/29(1)(10) | | 3,962 | 3,879,098 |

| Danske Bank A/S, 5.375%, 1/12/24(1) | | 5,212 | 5,191,567 |

| Fifth Third Bancorp, 6.339% to 7/27/28, 7/27/29(10) | | 3,113 | 3,076,888 |

| HSBC Holdings PLC: | | | |

| 6.161% to 3/9/28, 3/9/29(10) | | 2,144 | 2,123,589 |

| 7.39% to 11/3/27, 11/3/28(10) | | 3,399 | 3,517,700 |

| Intesa Sanpaolo SpA: | | | |

| 7.778% to 6/20/53, 6/20/54(1)(10) | | 2,500 | 2,256,702 |

| 8.248% to 11/21/32, 11/21/33(1)(10) | | 3,183 | 3,210,669 |

| KeyBank N.A.: | | | |

| 4.15%, 8/8/25 | | 3,055 | 2,878,193 |

| 5.85%, 11/15/27 | | 1,690 | 1,608,171 |

| KeyCorp, 4.789% to 6/1/32, 6/1/33(10) | | 750 | 625,609 |

| Macquarie Bank, Ltd., 6.798%, 1/18/33(1) | | 2,408 | 2,365,255 |

| Macquarie Group, Ltd., 2.871% to 1/14/32, 1/14/33(1)(10) | | 3,071 | 2,323,790 |

| PNC Financial Services Group, Inc.: | | | |

| 5.068% to 1/24/33, 1/24/34(10) | | 3,000 | 2,722,517 |

| 6.25% to 3/15/30(10)(12) | | 5,734 | 4,929,604 |

| Societe Generale S.A.: | | | |

| 6.221% to 6/15/32, 6/15/33(1)(10) | | 2,600 | 2,357,788 |

| 9.375% to 11/22/27(1)(10)(12) | | 2,389 | 2,346,873 |

| Synchrony Bank: | | | |

| 5.40%, 8/22/25 | | 1,200 | 1,157,045 |

| 5.625%, 8/23/27 | | 1,002 | 935,850 |

| Synchrony Financial, 4.875%, 6/13/25 | | 563 | 539,991 |

| Synovus Bank/Columbus, GA, 5.625%, 2/15/28 | | 4,405 | 3,993,966 |

| Texas Capital Bancshares, Inc., 4.00% to 5/6/26, 5/6/31(10) | | 3,393 | 2,817,778 |

| Toronto-Dominion Bank (The), 8.125% to 10/31/27, 10/31/82(10) | | 4,577 | 4,564,889 |

| Security | Principal

Amount

(000's omitted) | Value |

| Banks (continued) |

| Truist Financial Corp., 5.867% to 6/8/33, 6/8/34(10) | $ | 9,760 | $ 9,193,220 |

| U.S. Bancorp, 5.836% to 6/10/33, 6/12/34(10) | | 2,463 | 2,324,891 |

| UBS Group AG, 4.375% to 2/10/31(1)(10)(12) | | 3,315 | 2,383,231 |

| | | | $ 118,445,755 |

| Building Materials — 0.3% |

| Cemex SAB de CV, 9.125% to 3/14/28(1)(10)(12) | $ | 2,796 | $ 2,914,145 |

| | | | $ 2,914,145 |

| Chemicals — 1.2% |

| Celanese US Holdings, LLC: | | | |

| 6.35%, 11/15/28 | $ | 3,776 | $ 3,730,483 |

| 6.55%, 11/15/30 | | 1,485 | 1,454,013 |

| 6.70%, 11/15/33 | | 3,258 | 3,173,775 |

| Sasol Financing USA, LLC, 8.75%, 5/3/29(1) | | 5,000 | 4,812,354 |

| | | | $ 13,170,625 |

| Commercial Services — 0.7% |

| Ashtead Capital, Inc.: | | | |

| 4.25%, 11/1/29(1) | $ | 2,785 | $ 2,468,143 |

| 5.95%, 10/15/33(1) | | 3,750 | 3,564,020 |

| Western Union Co. (The), 6.20%, 11/17/36 | | 2,075 | 2,025,356 |

| | | | $ 8,057,519 |

| Computers — 1.2% |

| Kyndryl Holdings, Inc.: | | | |

| 2.70%, 10/15/28 | $ | 4,800 | $ 3,948,986 |

| 3.15%, 10/15/31 | | 6,646 | 5,038,729 |

| Seagate HDD Cayman: | | | |

| 5.75%, 12/1/34 | | 2,589 | 2,189,352 |

| 9.625%, 12/1/32(1) | | 1,901 | 2,050,223 |

| | | | $ 13,227,290 |

| Consumer Products — 0.1% |

| Natura Cosmeticos S.A., 4.125%, 5/3/28(1) | $ | 1,042 | $ 895,816 |

| | | | $ 895,816 |

| Diversified Financial Services — 4.0% |

| Ally Financial, Inc.: | | | |

| 3.875%, 5/21/24 | $ | 3,500 | $ 3,435,547 |

| 8.00%, 11/1/31 | | 5,825 | 5,886,160 |

| Alpha Holding S.A. de CV, 9.00%, 2/10/25(1)(13) | | 2,946 | 44,191 |

| American AgCredit Corp., Series A, 5.25% to 6/15/26(1)(10)(12) | | 1,431 | 1,314,731 |

12

See Notes to Financial Statements.

Eaton Vance

Total Return Bond Fund

September 30, 2023

Portfolio of Investments — continued

| Security | Principal

Amount

(000's omitted) | Value |

| Diversified Financial Services (continued) |

| Aviation Capital Group, LLC: | | | |

| 6.25%, 4/15/28(1) | $ | 2,518 | $ 2,464,727 |

| 6.375%, 7/15/30(1) | | 4,930 | 4,778,307 |

| Brookfield Finance, Inc., 4.70%, 9/20/47 | | 3,240 | 2,527,590 |

| CI Financial Corp.: | | | |

| 3.20%, 12/17/30 | | 3,912 | 2,970,290 |

| 4.10%, 6/15/51 | | 4,504 | 2,610,982 |

| Inversiones La Construccion S.A., 4.75%, 2/7/32(11) | | 2,250 | 1,756,980 |

| Jefferies Financial Group, Inc., 5.875%, 7/21/28 | | 4,453 | 4,360,551 |

| OneMain Finance Corp.: | | | |

| 3.50%, 1/15/27 | | 1,700 | 1,457,334 |

| 5.375%, 11/15/29 | | 2,696 | 2,261,135 |

| Rocket Mortgage, LLC/Rocket Mortgage Co.-Issuer, Inc., 3.875%, 3/1/31(1) | | 2,900 | 2,316,187 |

| UniCredit SpA, 5.861% to 6/19/27, 6/19/32(1)(10) | | 5,038 | 4,588,030 |

| | | | $ 42,772,742 |

| Electric Utilities — 0.6% |

| Cometa Energia S.A. de CV, 6.375%, 4/24/35(11) | $ | 1,929 | $ 1,798,510 |

| Edison International, Series B, 5.00% to 12/15/26(10)(12) | | 2,996 | 2,568,097 |

| Minejesa Capital BV, 4.625%, 8/10/30(11) | | 2,100 | 1,873,725 |

| | | | $ 6,240,332 |

| Electrical and Electronic Equipment — 0.4% |

| Jabil, Inc., 3.00%, 1/15/31 | $ | 1,468 | $ 1,190,692 |

| Vontier Corp., 2.95%, 4/1/31 | | 3,671 | 2,835,268 |

| | | | $ 4,025,960 |

| Entertainment — 0.1% |

| WarnerMedia Holdings, Inc., 5.391%, 3/15/62 | $ | 1,825 | $ 1,349,139 |

| | | | $ 1,349,139 |

| Foods — 0.4% |

| Smithfield Foods, Inc., 5.20%, 4/1/29(1) | $ | 4,300 | $ 3,932,301 |

| | | | $ 3,932,301 |

| Health Care — 1.3% |

| Centene Corp.: | | | |

| 2.50%, 3/1/31 | $ | 3,824 | $ 2,942,142 |

| 3.375%, 2/15/30 | | 990 | 826,855 |

| HCA, Inc.: | | | |

| 3.50%, 7/15/51 | | 2,996 | 1,873,494 |

| 5.00%, 3/15/24 | | 5,000 | 4,975,141 |

| Security | Principal

Amount

(000's omitted) | Value |

| Health Care (continued) |

| HCA, Inc.: (continued) | | | |

| 5.25%, 6/15/49 | $ | 3,700 | $ 3,044,289 |

| | | | $ 13,661,921 |

| Insurance — 3.2% |

| American National Group, Inc., 6.144%, 6/13/32(1) | $ | 3,300 | $ 2,989,375 |

| ASR Nederland N.V., 7.00% to 9/7/33, 12/7/43(10)(11) | | 2,860 | 3,113,385 |

| Athene Global Funding, 2.646%, 10/4/31(1) | | 5,300 | 3,932,292 |

| F&G Annuities & Life, Inc., 7.40%, 1/13/28 | | 9,102 | 9,093,415 |

| Global Atlantic Fin Co.: | | | |

| 3.125%, 6/15/31(1) | | 4,532 | 3,234,757 |

| 7.95%, 6/15/33(1) | | 2,200 | 2,116,383 |

| Hanwha Life Insurance Co., Ltd., 3.379% to 2/4/27, 2/4/32(10)(11) | | 2,100 | 1,865,626 |

| Liberty Mutual Group, Inc., 4.125% to 9/15/26, 12/15/51(1)(10) | | 3,769 | 3,104,770 |

| Radian Group, Inc., 4.875%, 3/15/27 | | 2,508 | 2,346,083 |

| Stewart Information Services Corp., 3.60%, 11/15/31 | | 4,244 | 3,126,676 |

| | | | $ 34,922,762 |

| Leisure Time — 0.8% |

| Brunswick Corp., 5.10%, 4/1/52 | $ | 6,491 | $ 4,476,324 |

| NCL Corp., Ltd., 5.875%, 3/15/26(1) | | 2,550 | 2,357,228 |

| Viking Cruises, Ltd., 5.875%, 9/15/27(1) | | 2,525 | 2,307,168 |

| | | | $ 9,140,720 |

| Media — 0.3% |

| CCO Holdings, LLC/CCO Holdings Capital Corp., 5.125%, 5/1/27(1) | $ | 3,275 | $ 3,054,793 |

| | | | $ 3,054,793 |

| Oil and Gas — 1.9% |

| Enviva Partners, L.P./Enviva Partners Finance Corp., 6.50%, 1/15/26(1) | $ | 3,339 | $ 2,726,527 |

| Hunt Oil Co. of Peru, LLC Sucursal Del Peru, 8.55%, 9/18/33(1) | | 1,170 | 1,182,542 |

| National Fuel Gas Co., 2.95%, 3/1/31 | | 5,065 | 3,988,198 |

| Neptune Energy Bondco PLC, 6.625%, 5/15/25(1) | | 1,315 | 1,303,823 |

| Occidental Petroleum Corp., 7.50%, 5/1/31 | | 3,000 | 3,187,105 |

| Petroleos Mexicanos: | | | |

| 6.50%, 3/13/27 | | 2,450 | 2,162,148 |

| 10.00%, 2/7/33(1) | | 2,912 | 2,594,973 |

| Var Energi ASA, 7.50%, 1/15/28(1) | | 3,000 | 3,083,647 |

| | | | $ 20,228,963 |

13

See Notes to Financial Statements.

Eaton Vance

Total Return Bond Fund

September 30, 2023

Portfolio of Investments — continued

| Security | Principal

Amount

(000's omitted) | Value |

| Pipelines — 1.2% |

| Enbridge, Inc., 8.25% to 10/15/28, 1/15/84(10) | $ | 5,500 | $ 5,398,016 |

| Midwest Connector Capital Co., LLC, 4.625%, 4/1/29(1) | | 4,344 | 3,973,238 |

| ONEOK, Inc., 6.05%, 9/1/33 | | 3,685 | 3,622,425 |

| | | | $ 12,993,679 |

| Real Estate Investment Trusts (REITs) — 3.6% |

| American Assets Trust, L.P., 3.375%, 2/1/31 | $ | 3,290 | $ 2,467,085 |

| CBRE Services, Inc., 5.95%, 8/15/34 | | 3,725 | 3,517,949 |

| Corporate Office Properties, L.P., 2.90%, 12/1/33 | | 3,331 | 2,339,926 |

| EPR Properties: | | | |

| 3.60%, 11/15/31 | | 1,200 | 890,638 |

| 3.75%, 8/15/29 | | 2,672 | 2,148,972 |

| 4.95%, 4/15/28 | | 3,444 | 3,054,829 |

| HAT Holdings I, LLC/HAT Holdings II, LLC: | | | |

| 3.75%, 9/15/30(1) | | 5,251 | 4,024,915 |

| 6.00%, 4/15/25(1) | | 1,600 | 1,558,622 |

| Iron Mountain, Inc., 4.50%, 2/15/31(1) | | 2,633 | 2,168,535 |

| Newmark Group, Inc., 6.125%, 11/15/23 | | 5,419 | 5,414,150 |

| Sun Communities Operating, L.P.: | | | |

| 4.20%, 4/15/32 | | 1,865 | 1,592,573 |

| 5.70%, 1/15/33 | | 1,632 | 1,545,395 |

| VICI Properties, L.P./VICI Note Co., Inc.: | | | |

| 5.625%, 5/1/24(1) | | 3,000 | 2,983,624 |

| 5.75%, 2/1/27(1) | | 5,908 | 5,725,193 |

| | | | $ 39,432,406 |

| Retail — 1.1% |

| Bath & Body Works, Inc., 6.875%, 11/1/35 | $ | 2,845 | $ 2,544,094 |

| Dick's Sporting Goods, Inc., 4.10%, 1/15/52 | | 7,104 | 4,319,894 |

| Lithia Motors, Inc., 4.375%, 1/15/31(1) | | 2,811 | 2,328,343 |

| Macy's Retail Holdings, LLC, 5.875%, 4/1/29(1) | | 2,778 | 2,435,042 |

| | | | $ 11,627,373 |

| Semiconductors — 0.3% |

| Foundry JV Holdco, LLC, 5.875%, 1/25/34(1) | $ | 3,873 | $ 3,703,898 |

| | | | $ 3,703,898 |

| Software — 1.2% |

| Concentrix Corp.: | | | |

| 6.60%, 8/2/28 | $ | 8,433 | $ 8,142,797 |

| 6.85%, 8/2/33 | | 4,820 | 4,456,616 |

| | | | $ 12,599,413 |

| Security | Principal

Amount

(000's omitted) | Value |

| Technology — 0.3% |

| CDW, LLC/CDW Finance Corp., 3.276%, 12/1/28 | $ | 3,087 | $ 2,666,171 |

| | | | $ 2,666,171 |

| Telecommunications — 1.1% |

| Nokia Oyj, 4.375%, 6/12/27 | $ | 1,110 | $ 1,028,831 |

| Rogers Communications, Inc., 4.55%, 3/15/52 | | 2,456 | 1,793,342 |

| SES Global Americas Holdings GP, 5.30%, 3/25/44(1) | | 1,360 | 917,112 |

| SES S.A., 5.30%, 4/4/43(1) | | 810 | 546,197 |

| Sprint, LLC, 7.125%, 6/15/24 | | 7,960 | 8,015,306 |

| | | | $ 12,300,788 |

| Transportation — 0.2% |

| Penske Truck Leasing Co., L.P./PTL Finance Corp., 6.20%, 6/15/30(1) | $ | 2,330 | $ 2,298,024 |

| | | | $ 2,298,024 |

Total Corporate Bonds

(identified cost $443,068,722) | | | $ 412,078,728 |

| Security | Shares | Value |

| Real Estate Management & Development — 0.3% |

| Brookfield Property Partners, L.P.: | | | |

| Series A, 5.75% | | 187,034 | $ 2,382,813 |

| Series A2, 6.375% | | 74,772 | 1,009,422 |

| | | | $ 3,392,235 |

| Wireless Telecommunication Services — 0.2% |

| United States Cellular Corp., 5.50% | | 107,100 | $ 1,762,866 |

| | | | $ 1,762,866 |

Total Preferred Stocks

(identified cost $9,222,650) | | | $ 5,155,101 |

| Sovereign Government Bonds — 1.5% |

| Security | Principal

Amount

(000's omitted) | Value |

| Mexico — 0.9% |

| Mexican Udibonos, 4.00%, 11/30/28 | MXN | 82,585 | $ 4,454,855 |

| Mexico Bonos, 8.00%, 9/5/24 | MXN | 85,000 | 4,734,664 |

| | | | $ 9,189,519 |

14

See Notes to Financial Statements.

Eaton Vance

Total Return Bond Fund

September 30, 2023

Portfolio of Investments — continued

| Security | Principal

Amount

(000's omitted) | Value |

| South Africa — 0.2% |

| Republic of South Africa, 5.875%, 4/20/32 | USD | 3,118 | $ 2,659,966 |

| | | | $ 2,659,966 |

| Uruguay — 0.4% |

| Uruguay Government International Bond, 9.75%, 7/20/33 | UYU | 148,900 | $ 3,906,188 |

| | | | $ 3,906,188 |

Total Sovereign Government Bonds

(identified cost $15,972,207) | | | $ 15,755,673 |

| U.S. Government Agency Mortgage-Backed Securities — 11.9% |

| Security | Principal

Amount

(000's omitted) | Value |

| Federal National Mortgage Association: | | | |

| 2.00%, 4/1/51 | $ | 1,078 | $ 834,328 |

| 4.00%, 30-Year, TBA(14) | | 8,514 | 7,585,439 |

| 4.50%, 30-Year, TBA(14) | | 18,576 | 17,064,515 |

| 5.00%, 30-Year, TBA(14) | | 56,420 | 53,257,428 |

| 5.50%, 30-Year, TBA(14) | | 44,455 | 42,982,450 |

| 6.00%, 30-Year, TBA(14) | | 7,500 | 7,405,367 |

Total U.S. Government Agency Mortgage-Backed Securities

(identified cost $131,648,056) | | $ 129,129,527 |

| U.S. Treasury Obligations — 26.8% |

| Security | Principal

Amount

(000's omitted) | Value |

| U.S. Treasury Bond: | | | |

| 2.375%,2/15/42 | $ | 72,222 | $ 49,944,616 |

| 2.875%,5/15/43 | | 18,118 | 13,429,614 |

| 2.875%,5/15/52 | | 5,503 | 3,903,046 |

| 3.625%,2/15/53 | | 8,233 | 6,810,878 |

| 3.625%,5/15/53 | | 23,536 | 19,492,589 |

| 3.875%,2/15/43 | | 4,455 | 3,877,938 |

| 3.875%,5/15/43 | | 1,600 | 1,391,250 |

| 4.00%,11/15/52 | | 6,082 | 5,392,073 |

| U.S. Treasury Floating Rate Notes, 5.572%, (3 mo. USTMMR + 0.169%), 4/30/25(6) | | 5,000 | 5,002,515 |

| U.S. Treasury Note: | | | |

| 1.25%,6/30/28 | | 5,600 | 4,796,312 |

| 3.25%,8/31/24 | | 42,180 | 41,343,167 |

| 3.50%,1/31/28 | | 7,543 | 7,199,735 |

| Security | Principal

Amount

(000's omitted) | Value |

| U.S. Treasury Note: (continued) | | | |

| 3.50%,4/30/28 | $ | 12,455 | $ 11,872,631 |

| 3.50%,4/30/30 | | 6,961 | 6,515,877 |

| 3.625%,3/31/28 | | 5,750 | 5,513,262 |

| 3.625%,5/31/28 | | 8,900 | 8,531,137 |

| 3.625%,3/31/30 | | 2,822 | 2,662,270 |

| 3.75%,5/31/30 | | 7,505 | 7,126,232 |

| 4.00%,2/29/28 | | 6,228 | 6,067,678 |

| 4.125%,7/31/28 | | 9,300 | 9,100,195 |

| 4.625%,9/15/26 | | 4,601 | 4,578,714 |

| 5.25%,11/15/28 | | 22,355 | 22,958,410 |

| 5.375%,2/15/31 | | 21,475 | 22,539,522 |

| 6.25%,5/15/30 | | 5,520 | 6,023,269 |

| 6.75%,8/15/26 | | 13,295 | 13,973,253 |

Total U.S. Treasury Obligations

(identified cost $307,081,624) | | | $ 290,046,183 |

| Security | Principal

Amount | Value |

| Financial Intermediaries — 0.0% |

| Alpha Holding S.A., Escrow Certificates(15)(16) | | $6,250,000 | $ 0 |

Total Miscellaneous

(identified cost $0) | | | $ 0 |

| Short-Term Investments — 1.6% |

| Security | Shares | Value |

| Morgan Stanley Institutional Liquidity Funds - Government Portfolio, Institutional Class, 5.27%(17) | | 7,241,977 | $ 7,241,977 |

Total Affiliated Fund

(identified cost $7,241,977) | | | $ 7,241,977 |

| Security | Principal

Amount

(000's omitted) | Value |

| Harley-Davidson Financial Services, Inc., 6.195%(1)(18) | $ | 5,000 | $ 4,958,566 |

15

See Notes to Financial Statements.

Eaton Vance

Total Return Bond Fund

September 30, 2023

Portfolio of Investments — continued

| Security | Principal

Amount

(000's omitted) | Value |

| Jabil, Inc., 6.197%(1)(18) | $ | 5,430 | $ 5,423,512 |

Total Commercial Paper

(identified cost $10,383,462) | | | $ 10,382,078 |

Total Short-Term Investments

(identified cost $17,625,439) | | | $ 17,624,055 |

Total Purchased Call Options — 0.0%(9)

(identified cost $115,525) | | | $ 118,594 |

Total Investments — 110.1%

(identified cost $1,282,723,250) | | | $1,191,923,040 |

| Other Assets, Less Liabilities — (10.1)% | | | $ (109,732,446) |

| Net Assets — 100.0% | | | $1,082,190,594 |

| The percentage shown for each investment category in the Portfolio of Investments is based on net assets. |

| (1) | Security exempt from registration under Rule 144A of the Securities Act of 1933, as amended. These securities may be sold in certain transactions in reliance on an exemption from registration (normally to qualified institutional buyers). At September 30, 2023, the aggregate value of these securities is $465,353,110 or 43.0% of the Fund's net assets. |

| (2) | Principal Amount is denominated in Canadian dollars. |

| (3) | Weighted average fixed-rate coupon that changes/updates monthly. Rate shown is the rate at September 30, 2023. |

| (4) | Step coupon security. Interest rate represents the rate in effect at September 30, 2023. |

| (5) | When-issued security. |

| (6) | Variable rate security. The stated interest rate represents the rate in effect at September 30, 2023. |

| (7) | Inverse floating-rate security whose coupon varies inversely with changes in the interest rate index. The stated interest rate represents the coupon rate in effect at September 30, 2023. |

| (8) | Represents an investment in an issuer that may be deemed to be an affiliate (see Note 10). |

| (9) | Amount is less than 0.05%. |

| (10) | Security converts to variable rate after the indicated fixed-rate coupon period. |

| (11) | Security exempt from registration under Regulation S of the Securities Act of 1933, as amended, which exempts from registration securities offered and sold outside the United States. Security may not be offered or sold in the United States except pursuant to an exemption from, or in a transaction not subject to, the registration requirements of the Securities Act of 1933, as amended. At September 30, 2023, the aggregate value of these securities is $16,765,770 or 1.5% of the Fund's net assets. |

| (12) | Perpetual security with no stated maturity date but may be subject to calls by the issuer. |

| (13) | Issuer is in default with respect to interest and/or principal payments. |

| (14) | TBA (To Be Announced) securities are purchased on a forward commitment basis with an approximate principal amount and maturity date. The actual principal amount and maturity date are determined upon settlement. |

| (15) | For fair value measurement disclosure purposes, security is categorized as Level 3 (see Note 11). |

| (16) | Non-income producing security. |

| (17) | May be deemed to be an affiliated investment company. The rate shown is the annualized seven-day yield as of September 30, 2023. |

| (18) | Rate shown reflects the yield at September 30, 2023. |

| Country Concentration of Portfolio(1) |

| Country | Percentage of

Total Investments | Value |

| United States | 85.9% | $1,024,054,978 |

| Mexico | 2.0 | 23,554,026 |

| Canada | 1.8 | 21,707,347 |

| United Kingdom | 1.5 | 18,227,658 |

| France | 0.9 | 11,278,652 |

| Cayman Islands | 0.9 | 10,763,887 |

| Italy | 0.8 | 10,055,401 |

| Spain | 0.8 | 9,415,706 |

| Ireland | 0.7 | 8,143,336 |

| South Africa | 0.6 | 7,472,320 |

| Bermuda | 0.5 | 6,044,465 |

| Netherlands | 0.5 | 5,408,619 |

| Denmark | 0.4 | 5,191,567 |

| Australia | 0.4 | 4,689,045 |

| Israel | 0.4 | 4,547,912 |

| Uruguay | 0.3 | 3,906,188 |

| Norway | 0.3 | 3,083,647 |

| Switzerland | 0.2 | 2,383,231 |

| Indonesia | 0.2 | 1,873,725 |

| South Korea | 0.2 | 1,865,626 |

| Supranational | 0.2 | 1,809,632 |

| Chile | 0.1 | 1,756,980 |

| Luxembourg | 0.1 | 1,463,309 |

| Peru | 0.1 | 1,182,542 |

| Finland | 0.1 | 1,028,831 |

| Brazil | 0.1 | 895,816 |

| Total Investments | 100.0% | $1,191,804,446 |

| (1) | Depictions do not reflect the Fund’s option positions. |

16

See Notes to Financial Statements.

Eaton Vance

Total Return Bond Fund

September 30, 2023

Portfolio of Investments — continued

| Purchased Call Options (Exchange-Traded) — 0.0%(1) |

| Description | Number of

Contracts | Notional

Amount | Exercise

Price | Expiration

Date | Value |

| U.S. 10-Year Treasury Note Futures 12/2023 | 230 | $24,854,375 | $110.00 | 11/24/23 | $ 118,594 |

| Total Investments | | | | | $118,594 |

| (1) | Amount is less than 0.05%. |

| Forward Foreign Currency Exchange Contracts (OTC) |

| Currency Purchased | Currency Sold | Counterparty | Settlement

Date | Unrealized

Appreciation | Unrealized

(Depreciation) |

| BRL | 14,473,357 | USD | 2,899,310 | State Street Bank and Trust Company | 11/10/23 | $ — | $ (34,779) |

| BRL | 12,300,000 | USD | 2,499,238 | State Street Bank and Trust Company | 11/10/23 | — | (64,853) |

| JPY | 717,000,000 | USD | 5,130,557 | JPMorgan Chase Bank, N.A. | 11/10/23 | — | (303,458) |

| USD | 2,102,377 | CAD | 2,799,001 | Citibank, N.A. | 11/10/23 | 40,554 | — |

| USD | 3,211,947 | CAD | 4,340,530 | State Street Bank and Trust Company | 11/10/23 | 14,590 | — |

| USD | 3,222,475 | EUR | 2,907,464 | JPMorgan Chase Bank, N.A. | 11/10/23 | 143,705 | — |

| | | | | | | $198,849 | $(403,090) |

| Futures Contracts |

| Description | Number of

Contracts | Position | Expiration

Date | Notional

Amount | Value/Unrealized

Appreciation

(Depreciation) |

| Interest Rate Futures | | | | | |

| U.S. 2-Year Treasury Note | 1,298 | Long | 12/29/23 | $263,118,798 | $ (975,983) |

| U.S. 5-Year Treasury Note | 352 | Long | 12/29/23 | 37,086,500 | (239,084) |

| U.S. 10-Year Treasury Note | 92 | Long | 12/19/23 | 9,941,750 | (28,829) |

| U.S. Long Treasury Bond | 109 | Long | 12/19/23 | 12,402,156 | (515,454) |

| U.S. Ultra-Long Treasury Bond | 48 | Long | 12/19/23 | 5,697,000 | (196,220) |

| U.S. Ultra 10-Year Treasury Note | (55) | Short | 12/19/23 | (6,135,938) | 134,854 |

| | | | | | $ (1,820,716) |

| Abbreviations: |

| OTC | – Over-the-counter |

| SOFR | – Secured Overnight Financing Rate |

| TBA | – To Be Announced |

| USTMMR | – U.S. Treasury Money Market Rate |

| Currency Abbreviations: |

| BRL | – Brazilian Real |

| CAD | – Canadian Dollar |

| EUR | – Euro |

| JPY | – Japanese Yen |

| MXN | – Mexican Peso |

| USD | – United States Dollar |

| UYU | – Uruguayan Peso |

17

See Notes to Financial Statements.

Eaton Vance

Total Return Bond Fund

September 30, 2023

Statement of Assets and Liabilities

| | September 30, 2023 |

| Assets | |

| Unaffiliated investments, at value (identified cost $1,258,282,642) | $ 1,169,666,738 |

| Affiliated investments, at value (identified cost $24,440,608) | 22,256,302 |

| Deposits for derivatives collateral — Futures contracts | 2,746,985 |

| Foreign currency, at value (identified cost $1,950) | 1,930 |

| Interest and dividends receivable | 10,703,946 |

| Interest and dividends receivable from affiliated investments | 109,624 |

| Receivable for investments sold | 13,525,148 |

| Receivable for Fund shares sold | 2,174,484 |

| Receivable for variation margin on open futures contracts | 306,774 |

| Receivable for open forward foreign currency exchange contracts | 198,849 |

| Tax reclaims receivable | 40,703 |

| Receivable from affiliates | 177,862 |

| Trustees' deferred compensation plan | 18,379 |

| Prepaid expenses | 4,230 |

| Total assets | $1,221,931,954 |

| Liabilities | |

| Payable for when-issued securities/forward purchase commitments | $ 131,595,511 |

| Payable for Fund shares redeemed | 3,069,634 |

| Payable for open forward foreign currency exchange contracts | 403,090 |

| Distributions payable | 11,995 |

| Due to custodian | 3,849,719 |

| Payable to affiliates: | |

| Investment adviser fee | 397,020 |

| Distribution and service fees | 42,508 |

| Trustees' deferred compensation plan | 18,379 |

| Accrued expenses | 353,504 |

| Total liabilities | $ 139,741,360 |

| Net Assets | $1,082,190,594 |

| Sources of Net Assets | |

| Paid-in capital | $ 1,257,129,980 |

| Accumulated loss | (174,939,386) |

| Net Assets | $1,082,190,594 |

| Class A Shares | |

| Net Assets | $ 86,928,527 |

| Shares Outstanding | 8,842,735 |

Net Asset Value and Redemption Price Per Share

(net assets ÷ shares of beneficial interest outstanding) | $ 9.83 |

Maximum Offering Price Per Share

(100 ÷ 96.75 of net asset value per share) | $ 10.16 |

| Class C Shares | |

| Net Assets | $ 29,457,381 |

| Shares Outstanding | 2,998,212 |

Net Asset Value and Offering Price Per Share*

(net assets ÷ shares of beneficial interest outstanding) | $ 9.82 |

| Class I Shares | |

| Net Assets | $ 965,755,802 |

| Shares Outstanding | 98,321,879 |

Net Asset Value, Offering Price and Redemption Price Per Share

(net assets ÷ shares of beneficial interest outstanding) | $ 9.82 |

18

See Notes to Financial Statements.

Eaton Vance

Total Return Bond Fund

September 30, 2023

Statement of Assets and Liabilities — continued

| | September 30, 2023 |

| Class R6 Shares | |

| Net Assets | $48,884 |

| Shares Outstanding | 4,978 |

Net Asset Value, Offering Price and Redemption Price Per Share

(net assets ÷ shares of beneficial interest outstanding) | $ 9.82 |

| On sales of $100,000 or more, the offering price of Class A shares is reduced. |

| * | Redemption price per share is equal to the net asset value less any applicable contingent deferred sales charge. |

19

See Notes to Financial Statements.

Eaton Vance

Total Return Bond Fund

September 30, 2023

| | Year Ended |

| | September 30, 2023 |

| Investment Income | |

| Dividend income (net of foreign taxes withheld of $37,259) | $ 502,383 |

| Dividend income from affiliated investments | 899,994 |

| Interest and other income | 45,457,717 |

| Interest income from affiliated investments | 1,110,960 |

| Total investment income | $ 47,971,054 |

| Expenses | |

| Investment adviser fee | $ 3,900,401 |

| Distribution and service fees: | |

| Class A | 217,502 |

| Class C | 301,434 |

| Trustees’ fees and expenses | 56,194 |

| Custodian fee | 226,664 |

| Transfer and dividend disbursing agent fees | 764,248 |

| Legal and accounting services | 77,845 |

| Printing and postage | 85,313 |

| Registration fees | 122,655 |

| Miscellaneous | 47,927 |

| Total expenses | $ 5,800,183 |

| Deduct: | |

| Waiver and/or reimbursement of expenses by affiliates | $ 1,055,145 |

| Total expense reductions | $ 1,055,145 |

| Net expenses | $ 4,745,038 |

| Net investment income | $ 43,226,016 |

| Realized and Unrealized Gain (Loss) | |

| Net realized gain (loss): | |

| Investment transactions | $ (55,567,231) |

| Investment transactions - affiliated investments | (2,187,060) |

| Futures contracts | (1,324,951) |

| Swap contracts | (34,725) |

| Foreign currency transactions | (44,013) |

| Forward foreign currency exchange contracts | (443,672) |

| Net realized loss | $(59,601,652) |

| Change in unrealized appreciation (depreciation): | |

| Investments | $ 17,491,598 |

| Investments - affiliated investments | 975,449 |

| Futures contracts | (2,210,407) |

| Foreign currency | (7,716) |

| Forward foreign currency exchange contracts | (335,793) |

| Net change in unrealized appreciation (depreciation) | $ 15,913,131 |

| Net realized and unrealized loss | $(43,688,521) |

| Net decrease in net assets from operations | $ (462,505) |

20

See Notes to Financial Statements.

Eaton Vance

Total Return Bond Fund

September 30, 2023

Statements of Changes in Net Assets

| | Year Ended September 30, |

| | 2023 | 2022 |

| Increase (Decrease) in Net Assets | | |

| From operations: | | |

| Net investment income | $ 43,226,016 | $ 22,335,702 |

| Net realized loss | (59,601,652) | (16,488,780) |

| Net change in unrealized appreciation (depreciation) | 15,913,131 | (115,384,239) |

| Net decrease in net assets from operations | $ (462,505) | $(109,537,317) |

| Distributions to shareholders: | | |

| Class A | $ (4,282,150) | $ (3,691,989) |

| Class C | (1,256,979) | (1,157,380) |

| Class I | (39,402,038) | (23,898,871) |

| Class R6(1) | (713) | — |

| Total distributions to shareholders | $ (44,941,880) | $ (28,748,240) |

| Transactions in shares of beneficial interest: | | |

| Class A | $ 3,949,587 | $ (2,427,026) |

| Class C | 41,155 | (10,600,672) |

| Class I | 483,872,938 | 4,787,852 |

| Class R6(1) | 50,713 | — |

| Net increase (decrease) in net assets from Fund share transactions | $ 487,914,393 | $ (8,239,846) |

| Net increase (decrease) in net assets | $ 442,510,008 | $(146,525,403) |

| Net Assets | | |

| At beginning of year | $ 639,680,586 | $ 786,205,989 |

| At end of year | $1,082,190,594 | $ 639,680,586 |

| (1) | For the period from the commencement of operations, June 30, 2023, to September 30, 2023. |

21

See Notes to Financial Statements.

Eaton Vance

Total Return Bond Fund

September 30, 2023

| | Class A |

| | Year Ended September 30, |

| | 2023 | 2022 | 2021 | 2020 | 2019 |

| Net asset value — Beginning of year | $10.230 | $ 12.340 | $ 11.820 | $ 11.990 | $ 11.570 |

| Income (Loss) From Operations | | | | | |

| Net investment income(1) | $ 0.484 | $ 0.325 | $ 0.330 | $ 0.395 | $ 0.427 |

| Net realized and unrealized gain (loss) | (0.380) | (2.017) | 0.573 | (0.143) | 0.451 |

| Total income (loss) from operations | $ 0.104 | $ (1.692) | $ 0.903 | $ 0.252 | $ 0.878 |

| Less Distributions | | | | | |

| From net investment income | $ (0.504) | $ (0.345) | $ (0.323) | $ (0.413) | $ (0.458) |

| From net realized gain | — | (0.073) | (0.060) | (0.009) | — |

| Total distributions | $ (0.504) | $ (0.418) | $ (0.383) | $ (0.422) | $ (0.458) |

| Net asset value — End of year | $ 9.830 | $10.230 | $ 12.340 | $ 11.820 | $ 11.990 |

| Total Return(2)(3) | 1.03% | (14.10)% | 7.72% | 2.21% | 7.76% |

| Ratios/Supplemental Data | | | | | |

| Net assets, end of year (000’s omitted) | $86,929 | $ 86,430 | $107,380 | $136,688 | $137,889 |

| Ratios (as a percentage of average daily net assets): | | | | | |

| Expenses (3) | 0.74% (4) | 0.74% (4) | 0.74% | 0.74% | 0.74% |

| Net investment income | 4.73% | 2.84% | 2.70% | 3.38% | 3.62% |

| Portfolio Turnover | 190% (5) | 118% (5) | 85% (5) | 89% | 75% |

| (1) | Computed using average shares outstanding. |

| (2) | Returns are historical and are calculated by determining the percentage change in net asset value with all distributions reinvested and do not reflect the effect of sales charges. |

| (3) | The investment adviser reimbursed certain operating expenses (equal to 0.12%, 0.10%, 0.08%, 0.11% and 0.11% of average daily net assets for the years ended September 30, 2023, 2022, 2021, 2020 and 2019, respectively). Absent this reimbursement, total return would be lower. |

| (4) | Includes a reduction by the investment adviser of a portion of its adviser fee due to the Fund’s investment in the Liquidity Fund (equal to less than 0.005% of average daily net assets for the years ended September 30, 2023 and 2022, respectively). |

| (5) | Includes the effect of To-Be-Announced (TBA) transactions. |

22

See Notes to Financial Statements.

Eaton Vance

Total Return Bond Fund

September 30, 2023

Financial Highlights — continued

| | Class C |

| | Year Ended September 30, |

| | 2023 | 2022 | 2021 | 2020 | 2019 |

| Net asset value — Beginning of year | $10.220 | $ 12.330 | $ 11.820 | $ 11.990 | $ 11.560 |

| Income (Loss) From Operations | | | | | |

| Net investment income(1) | $ 0.407 | $ 0.236 | $ 0.238 | $ 0.307 | $ 0.344 |

| Net realized and unrealized gain (loss) | (0.381) | (2.014) | 0.564 | (0.142) | 0.456 |

| Total income (loss) from operations | $ 0.026 | $ (1.778) | $ 0.802 | $ 0.165 | $ 0.800 |

| Less Distributions | | | | | |

| From net investment income | $ (0.426) | $ (0.259) | $ (0.232) | $ (0.326) | $ (0.370) |

| From net realized gain | — | (0.073) | (0.060) | (0.009) | — |

| Total distributions | $ (0.426) | $ (0.332) | $ (0.292) | $ (0.335) | $ (0.370) |

| Net asset value — End of year | $ 9.820 | $10.220 | $12.330 | $11.820 | $11.990 |

| Total Return(2)(3) | 0.17% | (14.67)% | 6.83% | 1.45% | 7.05% |

| Ratios/Supplemental Data | | | | | |

| Net assets, end of year (000’s omitted) | $29,457 | $ 30,639 | $ 48,423 | $ 54,189 | $ 52,001 |

| Ratios (as a percentage of average daily net assets): | | | | | |

| Expenses (3) | 1.49% (4) | 1.49% (4) | 1.49% | 1.49% | 1.49% |