United States

Securities and Exchange Commission

Washington, D.C. 20549

Form N-CSR

Certified Shareholder Report of Registered Management Investment Companies

811-4017

(Investment Company Act File Number)

Federated Equity Funds

(Exact Name of Registrant as Specified in Charter)

Federated Investors Funds

4000 Ericsson Drive

Warrendale, Pennsylvania 15086-7561

(Address of Principal Executive Offices)

(412) 288-1900

(Registrant's Telephone Number)

John W. McGonigle, Esquire

Federated Investors Tower

1001 Liberty Avenue

Pittsburgh, Pennsylvania 15222-3779

(Name and Address of Agent for Service)

(Notices should be sent to the Agent for Service)

Date of Fiscal Year End: 09/30/2010

Date of Reporting Period: 09/30/2010

Item 1. Reports to Stockholders

Federated Clover Small Value Fund(Successor to the Touchstone Diversified Small Cap Value Fund Established 1996)

A Portfolio of Federated Equity Funds

ANNUAL SHAREHOLDER REPORTSeptember 30, 2010

Class A Shares

Class C Shares

FINANCIAL HIGHLIGHTS

SHAREHOLDER EXPENSE EXAMPLE

MANAGEMENT'S DISCUSSION OF FUND PERFORMANCE

PORTFOLIO OF INVESTMENTS SUMMARY TABLE

PORTFOLIO OF INVESTMENTS

STATEMENT OF ASSETS AND LIABILITIES

STATEMENT OF OPERATIONS

STATEMENT OF CHANGES IN NET ASSETS

NOTES TO FINANCIAL STATEMENTS

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

BOARD OF TRUSTEES AND TRUST OFFICERS

EVALUATION AND APPROVAL OF ADVISORY CONTRACT

VOTING PROXIES ON FUND PORTFOLIO SECURITIES

QUARTERLY PORTFOLIO SCHEDULE

Financial Highlights - Class A Shares

(For a Share Outstanding Throughout Each Period)

| Year Ended September 30, | PeriodEnded

9/30/20071,3,4 |

| 2010 | 20091,2 | 20081,3 |

| Net Asset Value, Beginning of Period | $16.07 | $17.97 | $27.81 | $38.31 |

| Income From Investment Operations: | | | | |

| Net investment income | 0.055 | 0.105 | 0.05 | 0.03 |

| Net realized and unrealized gain (loss) on investments | 2.21 | (1.07) | (2.30) | 0.54 |

| TOTAL FROM INVESTMENT OPERATIONS | 2.26 | (0.97) | (2.25) | 0.57 |

| Less Distributions: | | | | |

| Distributions from net investment income | (0.01) | (0.12) | (0.11) | — |

| Distributions from net realized gain on investments | (0.14) | (0.81) | (7.48) | (11.07) |

| TOTAL DISTRIBUTIONS | (0.15) | (0.93) | (7.59) | (11.07) |

| Net Asset Value, End of Period | $18.18 | $16.07 | $17.97 | $27.81 |

| Total Return6 | 14.16% | (3.41)% | (8.85)% | 1.68% |

| Ratios to Average Net Assets: | | | | |

| Net expenses | 1.31% | 1.45% | 1.45% | 1.28%7 |

| Net investment income | 0.30% | 1.12% | 0.67% | 0.23%7 |

| Expense waiver/reimbursement8 | 0.39% | 0.11% | 4.42% | 0.53%7 |

| Supplemental Data: | | | | |

| Net assets, end of period (000 omitted) | $106,030 | $102,599 | $625 | $205 |

| Portfolio turnover | 72% | 68% | 67% | 79% |

| 1 | Touchstone Diversified Small Cap Value Fund (the “Predecessor Fund”) was reorganized into Federated Clover Small Value Fund (the “Fund”) as of the close of business on August 28, 2009. The Fund is the successor to the Predecessor Fund. The performance information and financial information presented incorporates the operations of the Predecessor Fund, which, as a result of the reorganization, are the Fund's operations. See Note 2 to the Financial Statements. |

| 2 | Beginning with the year ended September 30, 2009, the Fund was audited by KPMG LLP. The previous years were audited by another independent registered public accounting firm. |

| 3 | Due to the reorganization: (1) the number of outstanding shares of the Predecessor Fund decreased by a factor of 1.42; and (2) since the Predecessor Fund's total number of shares outstanding decreased, the net asset value increased. The reorganization did not affect the value of the Predecessor Fund's net assets or each shareholder's proportional ownership interest in those assets. Per share data has been restated, where applicable. |

| 4 | Reflects operations for the period from November 20, 2006 (commencement of operations) to September 30, 2007. |

| 5 | Per share numbers have been calculated using the average shares method. |

| 6 | Based on net asset value, which does not reflect the sales charge, redemption fee or contingent deferred sales charge, if applicable. Total returns for periods of less than one year are not annualized. |

| 7 | Computed on an annualized basis. |

| 8 | This expense decrease is reflected in both the net expense and the net investment income ratios shown above. |

See Notes which are an integral part of the Financial Statements

Annual Shareholder Report1

Financial Highlights - Class C Shares

(For a Share Outstanding Throughout Each Period)

| Year Ended September 30, | PeriodEnded

9/30/20071,3,4 |

| 2010 | 20091,2 | 20081,3 |

| Net Asset Value, Beginning of Period | $16.02 | $17.88 | $27.90 | $38.60 |

| Income From Investment Operations: | | | | |

| Net investment income (loss) | (0.08)5 | 0.015 | (0.01) | (0.06) |

| Net realized and unrealized gain (loss) on investments | 2.19 | (1.01) | (2.44) | 0.43 |

| TOTAL FROM INVESTMENT OPERATIONS | 2.11 | (1.00) | (2.45) | 0.37 |

| Less Distributions: | | | | |

| Distributions from net investment income | — | (0.05) | (0.09) | — |

| Distributions from net realized gain on investments | (0.14) | (0.81) | (7.48) | (11.07) |

| TOTAL DISTRIBUTIONS | (0.14) | (0.86) | (7.57) | (11.07) |

| Net Asset Value, End of Period | $17.99 | $16.02 | $17.88 | $27.90 |

| Total Return6 | 13.28% | (3.64)% | (9.56)% | 1.26% |

| Ratios to Average Net Assets: | | | | |

| Net expenses | 2.06% | 2.20% | 2.20% | 1.86%7 |

| Net investment income (loss) | (0.44)% | 0.08% | (0.09)% | (0.38)%7 |

| Expense waiver/reimbursement8 | 0.39% | 0.93% | 2.19% | — |

| Supplemental Data: | | | | |

| Net assets, end of period (000 omitted) | $7,075 | $5,071 | $619 | $79 |

| Portfolio turnover | 72% | 68% | 67% | 79% |

| 1 | Touchstone Diversified Small Cap Value Fund (the “Predecessor Fund”) was reorganized into Federated Clover Small Value Fund (the “Fund”) as of the close of business on August 28, 2009. The Fund is the successor to the Predecessor Fund. The performance information and financial information presented incorporates the operations of the Predecessor Fund, which, as a result of the reorganization, are the Fund's operations. See Note 2 to the Financial Statements. |

| 2 | Beginning with the year ended September 30, 2009, the Fund was audited by KPMG LLP. The previous years were audited by another independent registered public accounting firm. |

| 3 | Due to the reorganization: (1) the number of outstanding shares of the Predecessor Fund decreased by a factor of 1.42; and (2) since the Predecessor Fund's total number of shares outstanding decreased, the net asset value increased. The reorganization did not affect the value of the Predecessor Fund's net assets or each shareholder's proportional ownership interest in those assets. Per share data has been restated, where applicable. |

| 4 | Reflects operations for the period from November 20, 2006 (commencement of operations) to September 30, 2007. |

| 5 | Per share numbers have been calculated using the average shares method. |

| 6 | Based on net asset value, which does not reflect the sales charge, redemption fee or contingent deferred sales charge, if applicable. Total returns for periods of less than one year are not annualized. |

| 7 | Computed on an annualized basis. |

| 8 | This expense decrease is reflected in both the net expense and the net investment income ratios shown above. |

See Notes which are an integral part of the Financial Statements

Annual Shareholder Report2

Shareholder Expense Example (unaudited)

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase or redemption payments; and (2) ongoing costs, including management fees and to the extent applicable, distribution (12b-1) fees and/or shareholder services fees and other Fund expenses. This Example is intended to help you to understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds. It is based on an investment of $1,000 invested at the beginning of the period and held for the entire period from April 1, 2010 to September 30, 2010.

ACTUAL EXPENSES

The first section of the table below provides information about actual account values and actual expenses. You may use the information in this section, together with the amount you invested, to estimate the expenses that you incurred over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first section under the heading entitled “Expenses Paid During Period” to estimate the expenses attributable to your investment during this period.

HYPOTHETICAL EXAMPLE FOR COMPARISON PURPOSES

The second section of the table below provides information about hypothetical account values and hypothetical expenses based on the Fund's actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund's actual return. Thus, you should not use the hypothetical account values and expenses to estimate the actual ending account balance or your expenses for the period. Rather, these figures are required to be provided to enable you to compare the ongoing costs of investing in the Fund with other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Annual Shareholder Report3

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transaction costs, such as sales charges (loads) on purchase or redemption payments. Therefore, the second section of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transaction costs were included, your costs would have been higher. | Beginning

Account Value

4/1/2010 | Ending

Account Value

9/30/2010 | Expenses Paid

During Period1 |

| Actual: | | | |

| Class A Shares | $1,000 | $1,000.60 | $6.57 |

| Class C Shares | $1,000 | $996.10 | $10.31 |

Hypothetical (assuming a 5% return

before expenses): | | | |

| Class A Shares | $1,000 | $1,018.50 | $6.63 |

| Class C Shares | $1,000 | $1,014.74 | $10.40 |

| 1 | Expenses are equal to the Fund's annualized net expense ratios, multiplied by the average account value over the period, multiplied by 183/365 (to reflect the one-half-year period). The annualized net expense ratios are as follows: |

| Class A Shares | 1.31% |

| Class C Shares | 2.06% |

Annual Shareholder Report4

Performance data quoted represents past performance which is no guarantee of future results. Investment return and principal value will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Mutual fund performance changes over time and current performance may be lower or higher than what is stated. For current to the most recent month-end performance and after-tax returns, visit FederatedInvestors.com or call 1-800-341-7400.

Management's Discussion of Fund Performance (unaudited)

For the fiscal year ended September 30, 2010, the Fund produced a total return, based on net asset value, of 14.16% for Class A Shares and 13.28% for Class C Shares. For the same period, the total return for the Russell 2000® Value Index1 (RU2V), a broad-based securities market index, was 11.84%. The Fund's total return for the fiscal year reflected actual cash flows, transaction costs and other expenses which were not reflected in the total return of the RU2V.

The following discussion will focus on the performance of the Fund's

Class A Shares.

MARKET OVERVIEW

The Fund's fiscal year was characterized by see-saw market action driven by alternating waves of encouraging and dispiriting news flow. Reevaluations of the velocity and direction of interest rates, employment, housing, currencies and earnings kept investors paralyzed and largely on the sidelines, and declining market volumes were a symptom of the apathetic mood. During this period, the broad market, as measured by the Standard & Poor's 500 Index (S&P 500),2 managed to return 10.16%. Despite lingering economic woes, the ever-forward-looking stock market took an optimistic turn in September, to finish the period firmly in positive territory.

| 1 | The Russell 2000 Value Index measures the performance of the small-cap value segment of the U.S. equity universe. It includes those Russell 2000 companies with lower price-to-book ratios and lower forecasted growth values. The index is unmanaged, and unlike the Fund, is not affected by cash flows. It is not possible to invest directly in an index. |

| 2 | The S&P 500 Index is an unmanaged capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries. The index is unmanaged and, unlike the Fund, is not affected by cash flows. It is not possible to invest directly in an index. |

Annual Shareholder Report5

FUND PERFORMANCE

The key driver of performance for the Fund3 versus the RU2V was strong stock selection across multiple sectors and industries. Particularly strong contributions were derived from the Materials and Health Care sectors. Small sector over- and underweights relative to the RU2V also made a modest positive contribution to performance. Detracting from performance during the reporting period was stock selection within the Information Technology space. The Fund's overall outperformance during this rollercoaster period was also driven by Fund management's focus on deploying capital to inexpensive stocks with improving fundamentals as well as its adherence to risk controls.

Individual stocks that contributed to the Fund's outperformance resided in multiple sectors across the Fund. In the Materials sector, iron ore producer Cliffs Natural Resources benefitted from resurgent demand. In the Information Technology sector, optical components company Finisar Corp. enjoyed improving markets driven by rapid increases in band-width consumption. Within Consumer Staples, The Pantry, Inc., a convenience store operator, benefitted from improving margins in response to operational realignments. Tenneco, an automobile components supplier, produced strong returns as the auto industry continued to regain its footing. The top five positive individual contributors were: United Continental Holdings; Finisar Corp.; Cliffs Natural Resources; Tenneco; and The Pantry, Inc. As referenced earlier, the contribution of individual sector over- and underweights were modest and in total had a small positive impact on overall portfolio performance.

POSITIONING AND STRATEGY

During the reporting period, many of the Fund's stock selections focused on companies with the financial strength to weather today's uncertain environment. The Fund's emphasis on companies with consistent cash flows and strong balance sheets is an integral part of the Adviser's investment process. Across various industries during the fiscal year, adaptations to today's more competitive business environment presented opportunities for stronger companies to bolster their balance sheets and improve their strategic position.

| 3 | Because the Fund invests in smaller companies, it may be more volatile and subject to greater short-term risk than funds that invest in larger companies. Smaller companies may have limited resources, product lines and markets and their securities may trade less frequently and in more limited volumes than securities of larger companies. Value stocks tend to have higher dividends and thus have a higher income-related component in their total return than growth stocks. Value stocks also may lag growth stocks in performance, particularly in late stages of a market advance. |

Annual Shareholder Report6

During the period, the volatility of the broad market presented opportunities for the Fund to purchase companies whose long-term intrinsic value appeared to be underestimated by the market. Fund management observed multiple situations surrounded by fear, uncertainty or adverse news flow which provided opportunities that could be acted upon to the potential benefit of shareholders. Fund management's disciplined approach to evaluating these situations resulted in purchases across multiple sectors within the portfolio.The Fund concluded the fiscal year with small overweights relative to the RU2V in Information Technology and Materials, while being underweight in the Financial Services sector. The Fund's characteristically small sector over- or underweights relative to the RU2V were driven not by economic forecasts; but rather, by the analysts' view of company-specific opportunities within each sector. While the Fund's managers remained cognizant of macroeconomic factors, the investment approach focused primarily on bottom-up, fundamental analysis that sought to construct a well-diversified,4 risk-controlled portfolio.

| 4 | Diversification does not assure a profit nor protect against loss. |

Annual Shareholder Report7

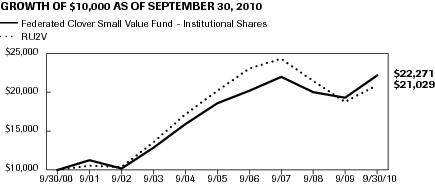

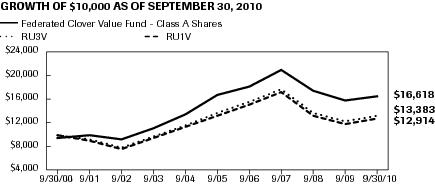

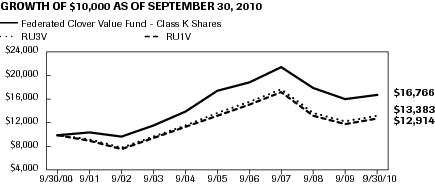

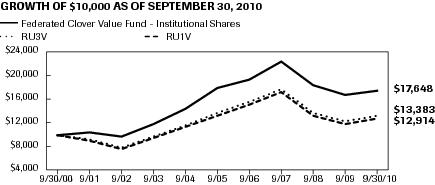

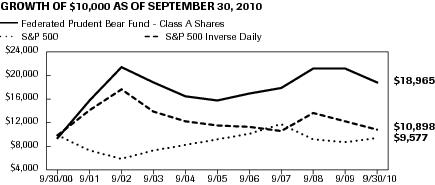

GROWTH OF A $10,000 INVESTMENT - CLASS a SHARES1

The graph below illustrates the hypothetical investment of $10,0002 in the Federated Clover Small Value Fund (the “Fund”) from September 30, 2000 to September 30, 2010, compared to the Russell 2000® Value Index (RU2V).3

| Average Annual Total Returns4 for the Period Ended 9/30/2010 | |

| 1 Year | 7.88% |

| 5 Years | 2.38% |

| 10 Years | 7.69% |

Performance data quoted represents past performance which is no guarantee of future results. Investment return and principal value will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Mutual fund performance changes over time and current performance may be lower or higher than what is stated. For current to the most recent month-end performance and after-tax returns, visit FederatedInvestors.com or call 1-800-341-7400. Returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Mutual funds are not obligations of or guaranteed by any bank and are not federally insured. Total returns shown include the maximum sales charge of 5.50%.

| 1 | Federated Clover Small Value Fund is the successor to Touchstone Diversified Small Cap Value Fund, a portfolio of Touchstone Funds Group Trust, pursuant to a reorganization that took place as of the close of business on August 28, 2009. The information presented above, for the periods prior to August 28, 2009, is historical information for Touchstone Diversified Small Cap Value Fund. |

| 2 | Represents a hypothetical investment of $10,000 in the Fund after deducting the maximum sales charge of 5.50% ($10,000 investment minus $550 sales charges = $9,450). The Fund's performance assumes the reinvestment of all dividends and distributions. The RU2V has been adjusted to reflect reinvestment of dividends on securities in the index. |

| 3 | The RU2V is not adjusted to reflect sales charges, expenses or other fees that the Securities and Exchange Commission (SEC) requires to be reflected in the Fund's performance. The index is unmanaged, and unlike the Fund, is not affected by cash flows. It is not possible to invest directly in an index. |

| 4 | Total returns quoted reflect all applicable sales charges. |

Annual Shareholder Report8

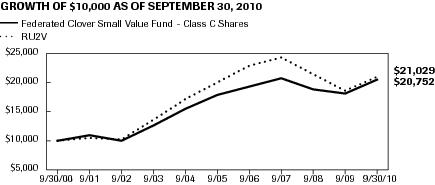

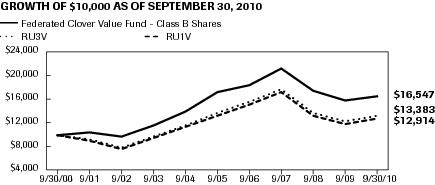

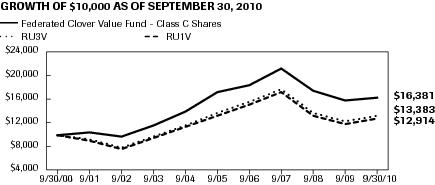

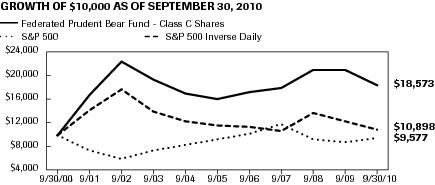

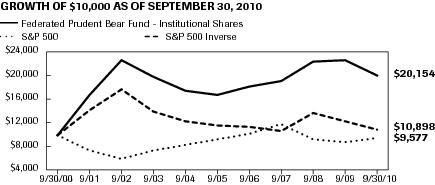

GROWTH OF A $10,000 INVESTMENT - CLASS c SHARES1

The graph below illustrates the hypothetical investment of $10,0002 in the Federated Clover Small Value Fund (the “Fund”) from September 30, 2000 to September 30, 2010, compared to the Russell 2000® Value Index (RU2V).3

| Average Annual Total Returns4 for the Period Ended 9/30/2010 | |

| 1 Year | 12.28% |

| 5 Years | 2.91% |

| 10 Years | 7.57% |

Performance data quoted represents past performance which is no guarantee of future results. Investment return and principal value will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Mutual fund performance changes over time and current performance may be lower or higher than what is stated. For current to the most recent month-end performance and after-tax returns, visit FederatedInvestors.com or call 1-800-341-7400. Returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Mutual funds are not obligations of or guaranteed by any bank and are not federally insured. Total returns shown include the maximum contingent deferred sales charge of 1.00%.

| 1 | Federated Clover Small Value Fund is the successor to Touchstone Diversified Small Cap Value Fund, a portfolio of Touchstone Funds Group Trust, pursuant to a reorganization that took place as of the close of business on August 28, 2009. The information presented above, for the periods prior to August 28, 2009, is historical information for Touchstone Diversified Small Cap Value Fund. |

| 2 | Represents a hypothetical investment of $10,000 in the Fund. A 1.00% contingent deferred sales charge would be applied in any redemption less than one year from the purchase date. The Fund's performance assumes the reinvestment of all dividends and distributions. The RU2V has been adjusted to reflect reinvestment of dividends on securities in the index. |

| 3 | The RU2V is not adjusted to reflect sales charges, expenses or other fees that the SEC requires to be reflected in the Fund's performance. The index is unmanaged, and unlike the Fund, is not affected by cash flows. It is not possible to invest directly in an index. |

| 4 | Total returns quoted reflect all applicable contingent deferred sales charges. |

Annual Shareholder Report9

Portfolio of Investments Summary Table (unaudited)

At September 30, 2010, the Fund's sector composition1 was as follows:

| Sector Composition | Percentage of

Total Net Assets |

| Financials | 31.8% |

| Industrials | 13.6% |

| Consumer Discretionary | 11.5% |

| Information Technology | 10.2% |

| Energy | 7.2% |

| Materials | 6.6% |

| Utilities | 6.4% |

| Health Care | 4.9% |

| Consumer Staples | 2.8% |

| Cash Equivalents2 | 4.4% |

| Other Assets and Liabilities — Net3 | 0.6% |

| TOTAL | 100.0% |

| 1 | Except for Cash Equivalents and Other Assets and Liabilities, sector classifications are based upon, and individual portfolio securities are assigned to, the classifications of the Global Industry Classification Standard (GICS) except that the Adviser assigns a classification to securities not classified by the GICS and to securities for which the Adviser does not have access to the classification made by the GICS. |

| 2 | Cash Equivalents include any investments in money market mutual funds and/or overnight repurchase agreements. |

| 3 | Assets, other than investments in securities, less liabilities. See Statement of Assets and Liabilities. |

Annual Shareholder Report10

Portfolio of Investments

September 30, 2010

| Shares | | | Value |

| | COMMON STOCKS – 95.0% | |

| | Consumer Discretionary – 11.5% | |

| 77,680 | 1 | Asbury Automotive Group, Inc. | 1,092,958 |

| 107,800 | | bebe stores, Inc. | 777,238 |

| 108,242 | 1 | Build-A-Bear Workshop, Inc. | 654,864 |

| 123,000 | | Callaway Golf Co. | 861,000 |

| 84,435 | | Cooper Tire & Rubber Co. | 1,657,459 |

| 55,575 | | Dillards, Inc., Class A | 1,313,793 |

| 55,150 | | Finish Line, Inc., Class A | 767,137 |

| 224,475 | | Hot Topic, Inc. | 1,344,605 |

| 47,725 | 1 | JAKKS Pacific, Inc. | 841,869 |

| 66,650 | | Jones Apparel Group, Inc. | 1,309,006 |

| 77,400 | 1 | K-Swiss, Inc., Class A | 986,850 |

| 89,900 | 1 | La-Z Boy Chair Co. | 758,756 |

| 51,775 | | Rent-A-Center, Inc. | 1,158,724 |

| 77,735 | | Service Corp. International | 670,076 |

| 51,975 | 1 | Skechers USA, Inc., Class A | 1,220,893 |

| 103,525 | | Spartan Motors, Inc. | 480,356 |

| 37,660 | 1 | Tenneco Automotive, Inc. | 1,091,010 |

| 46,275 | 1 | Volcom, Inc. | 884,778 |

| 329,970 | 1 | Wet Seal, Inc., Class A | 1,118,598 |

| | TOTAL | 18,989,970 |

| | Consumer Staples – 2.8% | |

| 192,275 | 1 | Alliance One International, Inc. | 797,941 |

| 32,945 | | Spartan Stores, Inc. | 477,702 |

| 55,425 | 1 | The Pantry, Inc. | 1,336,297 |

| 42,530 | 1 | TreeHouse Foods, Inc. | 1,960,633 |

| | TOTAL | 4,572,573 |

| | Energy – 7.2% | |

| 82,950 | 1 | Complete Production Services, Inc. | 1,696,328 |

| 10,400 | 1 | Dril-Quip, Inc. | 645,944 |

| 30,075 | 1 | Forest Oil Corp. | 893,228 |

| 110,130 | 1 | Helix Energy Solutions Group, Inc. | 1,226,848 |

| 384,500 | 1 | Kodiak Oil & Gas Corp. | 1,303,455 |

| 93,425 | 1 | Newpark Resources, Inc. | 784,770 |

| 53,725 | | RPC, Inc. | 1,136,821 |

| 27,615 | | SM Energy Co. | 1,034,458 |

Annual Shareholder Report11

| Shares | | | Value |

| 68,675 | 1 | Venoco, Inc. | 1,348,090 |

| 18,875 | 1 | Whiting Petroleum Corp. | 1,802,751 |

| | TOTAL | 11,872,693 |

| | Financials – 31.8% | |

| 85,250 | | Alterra Capital Holdings Ltd. | 1,698,180 |

| 36,040 | | American Campus Communities, Inc. | 1,097,058 |

| 170,900 | | Anworth Mortgage Asset Corp. | 1,218,517 |

| 44,145 | | Ares Capital Corp. | 690,869 |

| 40,358 | | Argo Group International Holdings Ltd. | 1,402,037 |

| 123,325 | | Boston Private Financial Holdings | 806,546 |

| 116,450 | 1 | CNO Financial Group, Inc. | 645,133 |

| 14,925 | | Cash America International, Inc. | 522,375 |

| 37,225 | | City Holding Co. | 1,141,691 |

| 42,180 | | Columbia Banking Systems, Inc. | 828,837 |

| 49,875 | | Delphi Financial Group, Inc., Class A | 1,246,376 |

| 135,775 | 1 | DiamondRock Hospitality Co. | 1,288,505 |

| 78,370 | | Dime Community Bancorp, Inc. | 1,085,424 |

| 33,145 | 1 | E*Trade Group, Inc. | 481,928 |

| 65,375 | | East West Bancorp, Inc. | 1,064,305 |

| 75,350 | | Employers Holdings, Inc. | 1,188,269 |

| 143,920 | | FNB Corp. (PA) | 1,231,955 |

| 86,200 | | First Niagara Financial Group, Inc. | 1,004,230 |

| 74,425 | | First Potomac Realty Trust | 1,116,375 |

| 61,044 | | FirstMerit Corp. | 1,118,326 |

| 93,665 | | Flushing Financial Corp. | 1,082,767 |

| 254,425 | | Hersha Hospitality Trust | 1,317,921 |

| 31,640 | | Highwoods Properties, Inc. | 1,027,351 |

| 18,055 | | Iberiabank Corp. | 902,389 |

| 40,030 | | Independent Bank Corp.- Massachusetts | 901,476 |

| 115,975 | 1 | Knight Capital Group, Inc., Class A | 1,436,930 |

| 53,920 | | LTC Properties, Inc. | 1,376,038 |

| 26,025 | | Lazard Ltd., Class A | 912,957 |

| 216,150 | | Lexington Realty Trust | 1,547,634 |

| 144,160 | | MFA Mortgage Investments, Inc. | 1,099,941 |

| 73,730 | 1 | MGIC Investment Corp. | 680,528 |

| 173,320 | | Maiden Holdings Ltd. | 1,318,965 |

| 70,630 | | Montpelier Re Holdings Ltd. | 1,223,312 |

| 173,010 | | National Penn Bancshares, Inc. | 1,081,312 |

Annual Shareholder Report12

| Shares | | | Value |

| 61,325 | | National Retail Properties, Inc. | 1,539,871 |

| 58,995 | | Newalliance Bancshares, Inc. | 744,517 |

| 49,075 | 1 | Ocwen Financial Corp. | 497,621 |

| 141,800 | | Old National Bancorp | 1,488,900 |

| 66,125 | | Oriental Financial Group | 879,462 |

| 33,410 | | Platinum Underwriters Holdings Ltd. | 1,454,003 |

| 18,971 | | Potlatch Corp. | 645,014 |

| 23,725 | 1 | ProAssurance Corp. | 1,366,323 |

| 27,100 | | Prosperity Bancshares, Inc. | 879,937 |

| 15,200 | 1 | SVB Financial Group | 643,264 |

| 47,760 | | Sun Communities, Inc. | 1,466,232 |

| 45,105 | | Trustmark Corp. | 980,583 |

| 44,225 | | Umpqua Holdings Corp. | 501,512 |

| 59,370 | | Washington Federal, Inc. | 905,986 |

| 50,900 | | Webster Financial Corp. Waterbury | 893,804 |

| 29,100 | | Wintrust Financial Corp. | 943,131 |

| | TOTAL | 52,616,617 |

| | Health Care – 4.9% | |

| 158,660 | 1 | Akorn, Inc. | 640,986 |

| 14,150 | 1 | Amerigroup Corp. | 600,950 |

| 66,740 | 1 | Celera Corp. | 449,828 |

| 16,925 | 1 | Covance, Inc. | 791,921 |

| 25,975 | 1 | Coventry Health Care, Inc. | 559,242 |

| 26,075 | 1 | ICON PLC, ADR | 563,742 |

| 25,480 | 1 | Magellan Health Services, Inc. | 1,203,675 |

| 45,050 | 1 | Merit Medical Systems, Inc. | 715,844 |

| 33,700 | | Omnicare, Inc. | 804,756 |

| 21,030 | 1 | Par Pharmaceutical Cos., Inc. | 611,552 |

| 42,790 | 1 | ViroPharma, Inc. | 637,999 |

| 35,475 | 1 | Wright Medical Group, Inc. | 511,195 |

| | TOTAL | 8,091,690 |

| | Industrials – 13.6% | |

| 154,250 | 1 | Air Transport Services Group Inc. | 939,382 |

| 31,130 | | Ampco-Pittsburgh Corp. | 772,647 |

| 45,375 | | Arkansas Best Corp. | 1,099,436 |

| 62,220 | | Barnes Group, Inc. | 1,094,450 |

| 49,830 | 1 | Ceradyne, Inc. | 1,163,530 |

| 21,385 | | Curtiss Wright Corp. | 647,966 |

Annual Shareholder Report13

| Shares | | | Value |

| 39,160 | | Deluxe Corp. | 749,131 |

| 31,185 | 1 | EnPro Industries, Inc. | 975,467 |

| 27,135 | 1 | Esterline Technologies Corp. | 1,552,936 |

| 24,825 | 1 | Exponent, Inc. | 833,872 |

| 30,500 | | Freightcar America, Inc. | 750,300 |

| 43,900 | 1 | GrafTech International Ltd. | 686,157 |

| 43,025 | 1 | Hub Group, Inc. | 1,258,911 |

| 91,875 | 1 | Interline Brands, Inc. | 1,657,425 |

| 125,075 | 1 | Jet Blue Airways Corp. | 836,752 |

| 91,530 | 1 | Pike Electric Corp. | 666,338 |

| 67,875 | 1 | RailAmerica, Inc. | 653,636 |

| 36,790 | 1 | School Specialty, Inc. | 478,638 |

| 116,550 | | Seaspan Corp. | 1,438,227 |

| 19,350 | 1 | Thomas & Betts Corp. | 793,737 |

| 54,650 | | Tredegar Industries, Inc. | 1,037,257 |

| 13,140 | | Triumph Group, Inc. | 980,113 |

| 32,725 | 1 | UAL Corp. | 773,292 |

| 18,708 | 1 | URS Corp. | 710,530 |

| | TOTAL | 22,550,130 |

| | Information Technology – 10.2% | |

| 15,975 | 1 | Anixter International, Inc. | 862,490 |

| 92,200 | 1 | Arris Group, Inc. | 900,794 |

| 38,090 | | Black Box Corp. | 1,221,166 |

| 33,635 | 1 | CSG Systems International, Inc. | 613,166 |

| 51,570 | | CTS Corp. | 496,103 |

| 85,236 | 1 | Finisar Corp. | 1,601,585 |

| 79,520 | 1 | Insight Enterprises, Inc. | 1,243,693 |

| 39,610 | 1 | j2 Global Communications, Inc. | 942,322 |

| 27,625 | | MTS Systems Corp. | 856,375 |

| 35,510 | 1 | NICE-Systems Ltd., ADR | 1,111,108 |

| 79,200 | 1 | Oplink Communications, Inc. | 1,571,328 |

| 94,520 | 1 | SeaChange International, Inc. | 700,393 |

| 90,360 | 1 | Symmetricom, Inc. | 516,859 |

| 126,200 | | Technitrol, Inc. | 556,542 |

| 43,645 | 1 | Verifone Systems, Inc. | 1,356,050 |

| 32,700 | 1 | ViaSat, Inc. | 1,344,297 |

| 130,200 | 1 | Zoran Corp. | 994,728 |

| | TOTAL | 16,888,999 |

Annual Shareholder Report14

| Shares | | | Value |

| | Materials – 6.6% | |

| 36,445 | 1 | Brush Engineered Materials, Inc. | 1,036,496 |

| 78,775 | 1 | Calgon Carbon Corp. | 1,142,237 |

| 73,175 | 1 | Ferro Corp. | 943,226 |

| 46,475 | 1 | Globe Specialty Metals Inc. | 652,509 |

| 129,825 | 1 | Hecla Mining Co. | 820,494 |

| 36,790 | | Innospec, Inc. | 560,312 |

| 32,625 | | Koppers Holdings, Inc. | 876,634 |

| 15,525 | | Minerals Technologies, Inc. | 914,733 |

| 13,825 | 1 | Molycorp, Inc. | 391,109 |

| 94,910 | | Myers Industries, Inc. | 815,277 |

| 24,880 | 1 | OM Group, Inc. | 749,386 |

| 41,775 | 1 | RTI International Metals | 1,279,150 |

| 62,075 | 1 | Thompson Creek Metals Co., Inc. | 669,168 |

| | TOTAL | 10,850,731 |

| | Utilities – 6.4% | |

| 22,265 | | AGL Resources, Inc. | 854,086 |

| 7,825 | | ITC Holdings Corp. | 487,106 |

| 22,400 | | Idacorp, Inc. | 804,608 |

| 24,720 | | MGE Energy, Inc. | 978,665 |

| 45,900 | | Northwestern Corp. | 1,308,150 |

| 120,875 | | Portland General Electric Co. | 2,451,345 |

| 68,425 | | Questar Corp. | 1,199,490 |

| 101,530 | | Westar Energy, Inc. | 2,460,072 |

| | TOTAL | 10,543,522 |

| | TOTAL COMMON STOCKS

(IDENTIFIED COST $142,344,957) | 156,976,925 |

| | MUTUAL FUND – 4.4% | |

| 7,291,642 | 2,3 | Federated Prime Value Obligations Fund, Institutional Shares, 0.23%

(AT NET ASSET VALUE) | 7,291,642 |

| | TOTAL INVESTMENTS — 99.4%

(IDENTIFIED COST $149,636,599)4 | 164,268,567 |

| | OTHER ASSETS AND LIABILITIES - NET — 0.6%5 | 971,941 |

| | TOTAL NET ASSETS — 100% | $165,240,508 |

| 1 | Non-income producing security. |

| 2 | Affiliated company. |

| 3 | 7-Day net yield. |

| 4 | The cost of investments for federal tax purposes amounts to $151,010,283. |

| 5 | Assets, other than investments in securities, less liabilities. See Statement of Assets and Liabilities. |

Note: The categories of investments are shown as a percentage of total net assets at September 30, 2010.

Annual Shareholder Report15

Various inputs are used in determining the value of the Fund's investments. These inputs are summarized in the three broad levels listed below:

Level 1 — quoted prices in active markets for identical securities

Level 2 — other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.)

Level 3 — significant unobservable inputs (including the Fund's own assumptions in determining the fair value of investments)

The inputs or methodology used for valuing securities are not an indication of the risk associated with investing in those securities.

As of September 30, 2010, all investments of the Fund utilized Level 1 inputs in valuing the Fund's assets carried at fair value.

The following acronym is used throughout this portfolio:

| ADR | — American Depositary Receipt |

See Notes which are an integral part of the Financial Statements

Annual Shareholder Report16

Statement of Assets and Liabilities

September 30, 2010

| Assets: | | |

| Total investments in securities, at value including $7,291,642 of investments in an affiliated issuer (Note 6) (identified cost $149,636,599) | | $164,268,567 |

| Income receivable | | 130,543 |

| Receivable for investments sold | | 3,926,884 |

| Receivable for shares sold | | 1,238,203 |

| TOTAL ASSETS | | 169,564,197 |

| Liabilities: | | |

| Payable for investments purchased | $4,079,812 | |

| Payable for shares redeemed | 128,518 | |

| Payable for Directors'/Trustees' fees | 299 | |

| Payable for distribution services fee (Note 6) | 4,106 | |

| Payable for shareholder services fee (Note 6) | 38,136 | |

| Accrued expenses | 72,818 | |

| TOTAL LIABILITIES | | 4,323,689 |

| Net assets for 9,086,178 shares outstanding | | $165,240,508 |

| Net Assets Consist of: | | |

| Paid-in capital | | $167,632,754 |

| Net unrealized appreciation of investments | | 14,631,968 |

| Accumulated net realized loss on investments | | (17,452,164) |

| Undistributed net investment income | | 427,950 |

| TOTAL NET ASSETS | | $165,240,508 |

| Net Asset Value, Offering Price and Redemption Proceeds Per Share | | |

| Class A Shares: | | |

| Net asset value per share ($106,029,787 ÷ 5,833,132 shares outstanding), no par value, unlimited shares authorized | | $18.18 |

| Offering price per share (100/94.50 of $18.18) | | $19.24 |

| Redemption proceeds per share | | $18.18 |

| Class C Shares: | | |

| Net asset value per share ($7,075,137 ÷ 393,224 shares outstanding), no par value, unlimited shares authorized | | $17.99 |

| Offering price per share | | $17.99 |

| Redemption proceeds per share (99.00/100 of $17.99) | | $17.81 |

| Institutional Shares: | | |

| Net asset value per share ($52,135,584 ÷ 2,859,822 shares outstanding), no par value, unlimited shares authorized | | $18.23 |

| Offering price per share | | $18.23 |

| Redemption proceeds per share | | $18.23 |

See Notes which are an integral part of the Financial Statements

Annual Shareholder Report17

Statement of Operations

Year Ended September 30, 2010

| Investment Income: | | | |

| Dividends (including $9,630 received from an affiliated issuer (Note 6) and net of foreign taxes withheld of $1,573) | | | $2,141,931 |

| Expenses: | | | |

| Investment adviser fee (Note 6) | | $1,186,146 | |

| Administrative personnel and services fee (Note 6) | | 230,000 | |

| Custodian fees | | 28,845 | |

| Transfer and dividend disbursing agent fees and expenses | | 249,795 | |

| Directors'/Trustees' fees | | 1,588 | |

| Auditing fees | | 40,500 | |

| Legal fees | | 4,932 | |

| Portfolio accounting fees | | 69,411 | |

| Distribution services fee — Class C Shares (Note 6) | | 42,954 | |

| Shareholder services fee — Class A Shares (Note 6) | | 246,654 | |

| Shareholder services fee — Class C Shares (Note 6) | | 14,330 | |

| Account administration fee — Class A Shares | | 185 | |

| Share registration costs | | 50,921 | |

| Printing and postage | | 52,346 | |

| Insurance premiums | | 4,527 | |

| Miscellaneous | | 787 | |

| TOTAL EXPENSES | | 2,223,921 | |

| Waivers and Reimbursement (Note 6): | | | |

| Waiver/reimbursement of investment adviser fee | $(472,642) | | |

| Waiver of administrative personnel and services fee | (43,683) | | |

| TOTAL WAIVERS AND REIMBURSEMENT | | (516,325) | |

| Net expenses | | | 1,707,596 |

| Net investment income | | | 434,335 |

| Realized and Unrealized Gain on Investments: | | | |

| Net realized gain on investments | | | 6,346,111 |

| Net change in unrealized appreciation of investments | | | 9,363,073 |

| Net realized and unrealized gain on investments | | | 15,709,184 |

| Change in net assets resulting from operations | | | $16,143,519 |

See Notes which are an integral part of the Financial Statements

Annual Shareholder Report18

Statement of Changes in Net Assets

| Year Ended September 30 | 2010 | 2009 |

| Increase (Decrease) in Net Assets | | |

| Operations: | | |

| Net investment income | $434,335 | $964,464 |

| Net realized gain (loss) on investments | 6,346,111 | (22,889,037) |

| Net change in unrealized appreciation/depreciation of investments | 9,363,073 | 13,402,567 |

| CHANGE IN NET ASSETS RESULTING FROM OPERATIONS | 16,143,519 | (8,522,006) |

| Distributions to Shareholders: | | |

| Distributions from net investment income | | |

| Class A Shares | (33,735) | (810,062) |

| Class C Shares | — | (2,791) |

| Institutional Shares | (22,528) | — |

| Distributions from net realized gain on investments | | |

| Class A Shares | (790,862) | (5,479,391) |

| Class C Shares | (42,004) | (30,402) |

| Institutional Shares | (146,162) | — |

| CHANGE IN NET ASSETS RESULTING FROM DISTRIBUTIONS TO SHAREHOLDERS | (1,035,291) | (6,322,646) |

| Share Transactions: | | |

| Proceeds from sale of shares | 103,114,617 | 17,673,694 |

| Exchange of Successor Fund shares in connection with the tax-free reorganization of Touchstone Diversified Small Cap Value Fund (Note 2) | — | 19,896,773 |

| Net asset value of shares issued to shareholders in payment of distributions declared | 1,013,962 | 6,154,348 |

| Cost of shares redeemed | (70,828,204) | (36,016,916) |

| CHANGE IN NET ASSETS RESULTING FROM SHARE TRANSACTIONS | 33,300,375 | 7,707,899 |

| Change in net assets | 48,408,603 | (7,136,753) |

| Net Assets: | | |

| Beginning of period | 116,831,905 | 123,968,658 |

| End of period (including undistributed net investment income of $427,950 and $49,878, respectively) | $165,240,508 | $116,831,905 |

See Notes which are an integral part of the Financial Statements

Annual Shareholder Report19

Notes to Financial Statements

September 30, 2010

1. ORGANIZATION

Federated Equity Funds (the “Trust”) is registered under the Investment Company Act of 1940, as amended (the “Act”), as an open-end management investment company. The Trust consists of 12 diversified portfolios. The financial statements included herein are only those of Federated Clover Small Value Fund (the “Fund”). The financial statements of the other portfolios are presented separately. The assets of each portfolio are segregated and a shareholder's interest is limited to the portfolio in which shares are held. Each portfolio pays its own expenses. The Fund offers three classes of shares: Class A Shares, Class C Shares and Institutional Shares. All shares of the Fund have equal rights with respect to voting, except on class-specific matters. The financial highlights of the Institutional Shares are presented separately. The investment objective of the Fund is to seek capital appreciation.

2. reorganization

The Fund is the successor (“Successor Fund”) to Touchstone Diversified Small Cap Value Fund (the “Predecessor Fund”), a portfolio of Touchstone Funds Group Trust, pursuant to a reorganization that took place as of the close of business on August 28, 2009. On that date, Class A Shares, Class C Shares and Class Z Shares of the Predecessor Fund were exchanged for Class A Shares, Class C Shares and Class A Shares of the Fund, respectively. As a result of the reorganization on August 28, 2009, the Predecessor Fund became the accounting survivor. Accordingly, the performance information presented in the financial statements for the periods prior to August 28, 2009, is historical information of the Predecessor Fund.

On August 28, 2009, the Fund received a tax-free transfer of assets from Touchstone Diversified Small Cap Value Fund, as follows:

Shares of the

Fund Issued | Touchstone

Diversified Small

Cap Value Fund

Net Assets

Received | Unrealized

Depreciation1 | Net Assets

of the Fund

Immediately

Prior to

Combination | Net Assets

of the Fund

Immediately

After

Combination |

| 6,128,495 | $94,465,611 | $(1,599,031) | $19,896,773 | $114,362,384 |

| 1 | Unrealized depreciation is included in the Touchstone Diversified Small Cap Value Fund Net Assets Received amount shown above. |

On the date of the reorganization, the Successor Fund's net assets included $2,163,853 of net unrealized appreciation.

3. SIGNIFICANT ACCOUNTING POLICIES

The following is a summary of significant accounting policies consistently followed by the Fund in the preparation of its financial statements. These policies are in conformity with U.S. generally accepted accounting principles (GAAP).

Investment Valuation

In calculating its net asset value (NAV), the Fund generally values investments as follows:

- Equity securities listed on an exchange or traded through a regulated market system are valued at their last reported sale price or official closing price in their principal exchange or market.

Annual Shareholder Report20

- Shares of other mutual funds are valued based upon their reported NAVs.

- Fixed-income securities acquired with remaining maturities greater than 60 days are fair valued using price evaluations provided by a pricing service approved by the Board of Trustees (the “Trustees”).

- Fixed-income securities acquired with remaining maturities of 60 days or less are valued at their cost (adjusted for the accretion of any discount or amortization of any premium).

- Derivative contracts listed on exchanges are valued at their reported settlement or closing price.

- Over-the-counter (OTC) derivative contracts are fair valued using price evaluations provided by a pricing service approved by the Trustees.

If the Fund cannot obtain a price or price evaluation from a pricing service for an investment, the Fund may attempt to value the investment based upon the mean of bid and asked quotations or fair value the investment based on price evaluations, from one or more dealers. If any price, quotation, price evaluation or other pricing source is not readily available when the NAV is calculated, the Fund uses the fair value of the investment determined in accordance with the procedures described below. There can be no assurance that the Fund could purchase or sell an investment at the price used to calculate the Fund's NAV.

Fair Valuation and Significant Events Procedures

The Trustees have authorized the use of pricing services to provide evaluations of the current fair value of certain investments for purposes of calculating the NAV. Factors considered by pricing services in evaluating an investment include the yields or prices of investments of comparable quality, coupon, maturity, call rights and other potential prepayments, terms and type, reported transactions, indications as to values from dealers and general market conditions. Some pricing services provide a single price evaluation reflecting the bid-side of the market for an investment (a “bid” evaluation). Other pricing services offer both bid evaluations and price evaluations indicative of a price between the prices bid and asked for the investment (a “mid” evaluation). The Fund normally uses bid evaluations for U.S. Treasury and Agency securities, mortgage-backed securities and municipal securities. The Fund normally uses mid evaluations for other types of fixed-income securities and OTC derivative contracts. In the event that market quotations and price evaluations are not available for an investment, the fair value of the investment is determined in accordance with procedures adopted by the Trustees.

The Trustees also have adopted procedures requiring an investment to be priced at its fair value whenever the Adviser determines that a significant event affecting the value of the investment has occurred between the time as of which the price of the investment would otherwise be determined and the time as of which the NAV is computed. An event is considered significant if there is both an affirmative expectation that the investment's value will change in response to the event and a reasonable basis for quantifying the resulting change in value. Examples of significant events that may occur after the close of the principal market on which a security is traded, or after the time of a price evaluation provided by a pricing service or a dealer, include:

- With respect to securities traded in foreign markets, significant trends in U.S. equity markets or in the trading of foreign securities index futures or options contracts;

- With respect to price evaluations of fixed-income securities determined before the close of regular trading on the NYSE, actions by the Federal Reserve Open Market Committee and other significant trends in U.S. fixed-income markets;

Annual Shareholder Report21

- Political or other developments affecting the economy or markets in which an issuer conducts its operations or its securities are traded; and

- Announcements concerning matters such as acquisitions, recapitalizations, litigation developments, a natural disaster affecting the issuer's operations or regulatory changes or market developments affecting the issuer's industry.

The Trustees have approved the use of a pricing service to determine the fair value of equity securities traded principally in foreign markets when the Adviser determines that there has been a significant trend in the U.S. equity markets or in index futures trading. For other significant events, the Fund may seek to obtain more current quotations or price evaluations from alternative pricing sources. If a reliable alternative pricing source is not available, the Fund will determine the fair value of the investment using another method approved by the Trustees.

Investment Income, Gains and Losses, Expenses and Distributions

Investment transactions are accounted for on a trade-date basis. Realized gains and losses from investment transactions are recorded on an identified-cost basis. Interest income and expenses are accrued daily. Dividend income and distributions to shareholders are recorded on the ex-dividend date. Foreign dividends are recorded on the ex-dividend date or when the Fund is informed of the ex-dividend date. Distributions of net investment income are declared and paid annually. Non-cash dividends included in dividend income, if any, are recorded at fair value. Investment income, realized and unrealized gains and losses, and certain fund-level expenses are allocated to each class based on relative average daily net assets, except that each class may bear certain expenses unique to that class such as account administration, distribution services and shareholder services fees. Dividends are declared separately for each class. No class has preferential dividend rights; differences in per share dividend rates are generally due to differences in separate class expenses.

Premium and Discount Amortization

All premiums and discounts on fixed-income securities are amortized/accreted for financial statement purposes.

Federal Taxes

It is the Fund's policy to comply with the Subchapter M provision of the Internal Revenue Code (the “Code”) and to distribute to shareholders each year substantially all of its income. Accordingly, no provision for federal income tax is necessary. As of and during the year ended September 30, 2010, the Fund did not have a liability for any uncertain tax positions. The Fund recognizes interest and penalties, if any, related to tax liabilities as income tax expense in the Statement of Operations. As of September 30, 2010, tax years 2009 and 2010 remain subject to examination by the Fund's major tax jurisdictions, which include the United States of America and the Commonwealth of Massachusetts.

The Fund may be subject to taxes imposed by governments of countries in which it invests. Such taxes are generally based on either income or gains earned or repatriated. The Fund accrues and applies such taxes to net investment income, net realized gains and net unrealized gains as income and/or gains are earned.

Annual Shareholder Report22

When-Issued and Delayed Delivery TransactionsThe Fund may engage in when-issued or delayed delivery transactions. The Fund records when-issued securities on the trade date and maintains security positions such that sufficient liquid assets will be available to make payment for the securities purchased. Securities purchased on a when-issued or delayed delivery basis are marked to market daily and begin earning interest on the settlement date. Losses may occur on these transactions due to changes in market conditions or the failure of counterparties to perform under the contract.

Securities Lending

The Fund participates in a securities lending program providing for the lending of equity securities to qualified brokers. The Fund normally receives cash collateral for securities loaned that is invested in an affiliated money market fund or short-term securities including repurchase agreements. Collateral is maintained at a minimum level of 100% of the market value of investments loaned, plus interest, if applicable. In accordance with the Fund's securities lending agreement, the market value of securities on loan is determined each day at the close of business and any additional collateral required to cover the value of securities on loan is delivered to the Fund on the next business day. Earnings on collateral are allocated between the securities lending agent, as a fee for its services under the program, and the Fund, according to agreed-upon rates.

As of September 30, 2010, the Fund had no outstanding securities on loan.

Other

The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the amounts of assets, liabilities, expenses and revenues reported in the financial statements. Actual results could differ from those estimated.

4. SHARES OF BENEFICIAL INTEREST

The following tables summarize share activity:

| Year Ended September 30 | 2010 | 2009 |

| Class A Shares: | Shares | Amount | Shares | Amount |

| Shares sold | 2,991,044 | $52,885,211 | 411,102 | $4,295,554 |

| Transfer in Class Z Shares1 | — | — | 8,469,843 | 116,130,888 |

| Shares issued to shareholders in payment of distributions declared | 51,050 | 807,289 | 21,333 | 176,843 |

| Exchange of Successor Fund shares in connection with the tax-free reorganization of Touchstone Diversified Small Cap Value Fund | — | — | 511,629 | 7,886,533 |

Adjustment of Predecessor Fund

shares in connection with

tax-free reorganization | — | — | (2,538,389) | — |

| Shares redeemed | (3,594,710) | (62,243,784) | (539,185) | (6,137,710) |

NET CHANGE RESULTING

FROM CLASS A

SHARE TRANSACTIONS | (552,616) | $(8,551,284) | 6,336,333 | $122,352,108 |

Annual Shareholder Report23

| Year Ended September 30 | 2010 | 2009 |

| Class C Shares: | Shares | Amount | Shares | Amount |

| Shares sold | 203,409 | $3,613,984 | 42,358 | $394,233 |

| Shares issued to shareholders in payment of distributions declared | 2,433 | 38,222 | 1,978 | 16,109 |

| Exchange of Successor Fund shares in connection with the tax-free reorganization of Touchstone Diversified Small Cap Value Fund | — | — | 264,944 | 4,073,170 |

Adjustment of Predecessor Fund

shares in connection with

tax-free reorganization | — | — | (25,050) | — |

| Shares redeemed | (129,220) | (2,191,574) | (17,176) | (215,460) |

NET CHANGE RESULTING

FROM CLASS C

SHARE TRANSACTIONS | 76,622 | $1,460,632 | 267,054 | $4,268,052 |

| Year Ended

9/30/2010 | Period Ended

9/30/20092 |

| Institutional Shares: | Shares | Amount | Shares | Amount |

| Shares sold | 2,654,753 | $46,615,422 | 54,875 | $885,430 |

| Exchange of Successor Fund shares in connection with the tax-free reorganization of Touchstone Diversified Small Cap Value Fund | — | — | 514,618 | 7,937,070 |

| Shares issued to shareholders in payment of distributions declared | 10,582 | 168,451 | — | — |

| Shares redeemed | (375,006) | (6,392,846) | — | — |

NET CHANGE RESULTING

FROM INSTITUTIONAL

SHARE TRANSACTIONS | 2,290,329 | $40,391,027 | 569,493 | $8,822,500 |

| Year Ended September 30 | 2010 | 2009 |

| Class Z Shares:1 | Shares | Amount | Shares | Amount |

| Shares sold | — | $ — | 1,326,917 | $12,098,477 |

| Shares issued to shareholders in payment of distributions declared | — | — | 720,122 | 5,961,396 |

| Shares redeemed | — | — | (3,299,698) | (29,663,746) |

NET CHANGE RESULTING

FROM CLASS Z

SHARE TRANSACTIONS | — | $ — | (1,252,659) | $(11,603,873) |

FINAL REDEMPTION

FROM CLASS Z SHARES | — | $ — | (8,469,843) | $(116,130,888) |

NET CHANGE RESULTING

FROM TOTAL FUND

SHARE TRANSACTIONS | 1,814,335 | $33,300,375 | (2,549,622) | $7,707,899 |

| 1 | At the close of business on August 28, 2009, Class Z Shares were reorganized into Class A Shares. |

| 2 | Reflects operations for the period from August 29, 2009 (deemed the date of initial investment, pursuant to a reorganization that took place on August 28, 2009) to September 30, 2009. |

Annual Shareholder Report24

5. FEDERAL TAX INFORMATION

The tax character of distributions as reported on the Statement of Changes in Net Assets for the years ended September 30, 2010 and 2009, was as follows:

| 2010 | 2009 |

| Ordinary income1 | $1,035,291 | $812,853 |

| Long-term capital gains | $ — | $5,509,793 |

| 1 | For tax purposes, short-term capital gain distributions are considered ordinary income distributions. |

As of September 30, 2010, the components of distributable earnings on a tax basis were as follows:

| Undistributed ordinary income | $427,950 |

| Net unrealized appreciation | $13,258,284 |

| Capital loss carryforwards | $(16,078,480) |

The difference between book-basis and tax-basis net unrealized appreciation/depreciation is attributable in part to differing treatments for the deferral of losses on wash sales and REIT adjustments.

At September 30, 2010, the cost of investments for federal tax purposes was $151,010,283. The net unrealized appreciation of investments for federal tax purposes was $13,258,284. This consists of net unrealized appreciation from investments for those securities having an excess of value over cost of $21,186,947 and net unrealized depreciation from investments for those securities having an excess of cost over value of $7,928,663.

At September 30, 2010, the Fund had a capital loss carryforward of $16,078,480 which will reduce the Fund's taxable income arising from future net realized gains on investments, if any, to the extent permitted by the Code and thus will reduce the amount of distributions to shareholders which would otherwise be necessary to relieve the Fund of any liability for federal income tax. Pursuant to the Code, such capital loss carryforward will expire in 2017.

As a result of the tax-free transfer of assets from Touchstone Diversified Small Cap Value Fund, the use of certain capital loss carryforwards listed above may be limited.

The Fund used capital loss carryforwards of $5,437,692 to offset taxable capital gains realized during the year ended September 30, 2010.

6. INVESTMENT ADVISER FEE AND OTHER TRANSACTIONS WITH AFFILIATES

Investment Adviser Fee

Federated Global Investment Management Corporation is the Fund's investment adviser (the “Adviser”). The advisory agreement between the Fund and the Adviser provides for an annual fee equal to 0.90% of the Fund's average daily net assets. Subject to the terms described in the Expense Limitation note, the Adviser may voluntarily choose to waive any portion of its fee. For the year ended September 30, 2010, the Adviser voluntarily waived $467,306 of its fee.

Prior to close of business on August 28, 2009, the Predecessor Fund's investment adviser was Touchstone Advisors, Inc. After the close of business on August 28, 2009, the Predecessor Fund was reorganized into the Fund. The annual investment adviser fee did not change due to this reorganization.

Annual Shareholder Report25

Administrative FeeFederated Administrative Services (FAS), under the Administrative Services Agreement, provides the Fund with administrative personnel and services. The fee paid to FAS is based on the average aggregate daily net assets of certain Federated funds as specified below:

| Administrative Fee | Average Aggregate Daily Net Assets

of the Federated Funds |

| 0.150% | on the first $5 billion |

| 0.125% | on the next $5 billion |

| 0.100% | on the next $10 billion |

| 0.075% | on assets in excess of $20 billion |

The administrative fee received during any fiscal year shall be at least $150,000 per portfolio and $40,000 per each additional class of Shares. Subject to the terms described in the Expense Limitation note, FAS may voluntarily choose to waive any portion of its fee. For the year ended September 30, 2010, the net fee paid to FAS was 0.141% of average daily net assets of the Fund. FAS waived $43,683 of its fee.

Prior to close of business on August 28, 2009, Touchstone Advisors, Inc. provided administrative services to the Predecessor Fund.

Distribution Services Fee

The Fund has adopted a Distribution Plan (the “Plan”) pursuant to Rule 12b-1 under the Act. Under the terms of the Plan, the Fund will compensate Federated Securities Corp. (FSC), the principal distributor, from the daily net assets of the Fund's Class A Shares and Class C Shares to finance activities intended to result in the sale of these shares. The Plan provides that the Fund may incur distribution expenses at the following percentages of average daily net assets annually, to compensate FSC:

| Share Class Name | Percentage of Average Daily

Net Assets of Class |

| Class A Shares | 0.05% |

| Class C Shares | 0.75% |

Subject to the terms described in the Expense Limitation note, FSC may voluntarily choose to waive any portion of its fee. When FSC receives fees, it may pay some or all of them to financial intermediaries whose customers purchase shares. For the year ended September 30, 2010, FSC retained $320 of fees paid by the Fund. For the year ended September 30, 2010, the Fund's Class A Shares did not incur a distribution services fee; however, it may begin to incur this fee upon approval of the Trustees.

Prior to close of business on August 28, 2009, Touchstone Securities, Inc., was the principal distributor for the Predecessor Fund.

Sales Charges

Front-end sales charges and contingent deferred sales charges (CDSC) do not represent expenses of the Fund. They are deducted from the proceeds of sales of Fund shares prior to investment or from redemption proceeds prior to remittance, as applicable. For the year ended September 30, 2010, FSC retained $13,936 in sales charges from the sale of Class A Shares. FSC also retained $174 of CDSC relating to redemptions of Class C Shares.

Annual Shareholder Report26

Shareholder Services FeeThe Fund may pay fees (“Service Fees”) up to 0.25% of the average daily net assets of the Fund's Class A Shares and Class C Shares to financial intermediaries or to Federated Shareholder Services Company (FSSC) for providing services to shareholders and maintaining shareholder accounts. Subject to the terms described in the Expense Limitation note, FSSC may voluntarily reimburse the Fund for Service Fees. For the year ended September 30, 2010, FSSC received $38,040 of fees paid by the Fund.

Prior to close of business on August 28, 2009, Touchstone Securities, Inc., received Service Fees from the Predecessor Fund.

Expense Limitation

Effective December 1, 2010, the Adviser and its affiliates (which may include FSC, FAS and FSSC) have voluntarily agreed to waive their fees and/or reimburse expenses so that the total annual fund operating expenses (as shown in the financial highlights) paid by the Fund's Class A Shares, Class C Shares and Institutional Shares (after the voluntary waivers and reimbursements) will not exceed 1.26%, 2.01% and 1.01% (the “Fee Limit”), respectively, through the later of (the “Termination Date”): (a) November 30, 2011; or (b) the date of the Fund's next effective Prospectus. While the Adviser and its affiliates currently do not anticipate terminating or increasing these arrangements prior to the Termination Date, these arrangements may only be terminated or the Fee Limit increased prior to the Termination Date with the agreement of the Trustees.

General

Certain Officers and Trustees of the Fund are Officers and Directors or Trustees of the above companies.

Transactions with Affiliated Companies

Affiliated holdings are mutual funds which are managed by the Adviser or an affiliate of the Adviser. The Adviser has agreed to reimburse the Fund for certain investment adviser fees as a result of transactions in other affiliated mutual funds. For the year ended September 30, 2010, the Adviser reimbursed $5,336. Transactions with the affiliated company during the year ended September 30, 2010, were as follows:

| Affiliate | Balance of

Shares Held

9/30/2009 | Purchases/

Additions | Sales/

Reductions | Balance of

Shares Held

9/30/2010 | Value | Dividend

Income |

| Federated Prime Value Obligations Fund, Institutional Shares | 3,636,312 | 75,708,421 | 72,053,091 | 7,291,642 | $7,291,642 | $9,630 |

7. Investment TRANSACTIONS

Purchases and sales of investments, excluding long-term U.S. government securities and short-term obligations, for the year ended September 30, 2010, were as follows:

| Purchases | $120,907,008 |

| Sales | $91,534,267 |

Annual Shareholder Report27

8. LINE OF CREDIT

The Fund participates in a $100,000,000 unsecured, uncommitted revolving line of credit (LOC) agreement with PNC Bank. The LOC was made available for extraordinary or emergency purposes, primarily for financing redemption payments. Borrowings are charged interest at a rate offered to the Fund by PNC Bank at the time of the borrowing. As of September 30, 2010, there were no outstanding loans. During the year ended September 30, 2010, the Fund did not utilize the LOC.

9. INTERFUND LENDING

Pursuant to an Exemptive Order issued by the Securities and Exchange Commission, the Fund, along with other funds advised by subsidiaries of Federated Investors, Inc., may participate in an interfund lending program. This program provides an alternative credit facility allowing the Fund to borrow from other participating affiliated funds. As of September 30, 2010, there were no outstanding loans. During the year ended September 30, 2010, the program was not utilized.

10. Legal Proceedings

Since February, 2004, Federated Investors, Inc. and related entities (collectively, “Federated”), have been named as defendants in several lawsuits that are now pending in the United States District Court for the Western District of Pennsylvania. These lawsuits have been consolidated into a single action alleging excessive advisory fees involving one of the Federated-sponsored mutual funds (“Federated Funds”). Federated and its counsel have been defending this litigation. Additional lawsuits based upon similar allegations may be filed in the future. The potential impact of these lawsuits, all of which seek monetary damages, attorneys' fees and expenses, and future potential similar suits is uncertain. Although we do not believe that these lawsuits will have a material adverse effect on the Federated Funds, there can be no assurance that these suits, ongoing adverse publicity and/or other developments resulting from the allegations in these matters will not result in increased redemptions, or reduced sales, of shares of the Federated Funds or other adverse consequences for the Federated Funds.

11. Subsequent events

Management has evaluated subsequent events through the date the financial statements were issued, and determined that no events have occurred that require additional disclosure.

12. FEDERAL TAX INFORMATION (UNAUDITED)

For the fiscal year ended September 30, 2010, 100.0% of total income (including short-term capital gain) distributions made by the Fund are qualifying dividends which may be subject to a maximum tax rate of 15%, as provided for by the Jobs and Growth Tax Relief Act of 2003. Complete information is reported in conjunction with the reporting of your distributions on Form 1099-DIV.

Of the ordinary income (including short-term capital gain) distributions made by the Fund during the year ended September 30, 2010, 100.0% qualify for the dividend received deduction available to corporate shareholders.

Annual Shareholder Report28

Report of Independent Registered Public Accounting Firm

TO THE BOARD OF TRUSTEES OF THE FEDERATED EQUITY FUNDS AND SHAREHOLDERS OF Federated clover small value fund:

We have audited the accompanying statement of assets and liabilities, including the portfolio of investments, of the Federated Clover Small Value Fund (the “Fund”), a portfolio of Federated Equity Funds, as of September 30, 2010, and the related statement of operations for the year then ended, the statements of changes in net assets for each of the years or periods in the two-year period then ended, and the financial highlights for each of the years or periods in the two-year period then ended. These financial statements and financial highlights are the responsibility of the Fund's management. Our responsibility is to express an opinion on these financial statements and financial highlights based on our audits. The financial highlights for the periods presented prior to October 1, 2008, were audited by other independent registered public accountants whose report thereon dated November 25, 2008, expressed an unqualified opinion on those statements.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. Our procedures included confirmation of securities owned as of September 30, 2010, by correspondence with the custodian, transfer agent and brokers, or by other appropriate auditing procedures. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements and financial highlights referred to above present fairly, in all material respects, the financial position of the Federated Clover Small Value Fund as of September 30, 2010, and the results of its operations for the year then ended, the changes in its net assets for the two years or periods in the period then ended, and the financial highlights for each of the years or periods in the two-year period then ended, in conformity with U.S. generally accepted accounting principles.

Boston, Massachusetts

November 22, 2010

Annual Shareholder Report29

Board of Trustees and Trust Officers

The Board of Trustees is responsible for managing the Trust's business affairs and for exercising all the Trust's powers except those reserved for the shareholders. The following tables give information about each Trustee and the senior officers of the Fund. Where required, the tables separately list Trustees who are “interested persons” of the Fund (i.e., “Interested” Trustees) and those who are not (i.e., “Independent” Trustees). Unless otherwise noted, the address of each person listed is Federated Investors Tower, 1001 Liberty Avenue, Pittsburgh, PA 15222. The address of all Independent Trustees listed is 4000 Ericsson Drive, Warrendale, PA 15086-7561; Attention: Mutual Fund Board. As of December 31, 2009, the Trust comprised 13 portfolio(s), and the Federated Fund Family consisted of 43 investment companies (comprising 145 portfolios). Unless otherwise noted, each Officer is elected annually. Unless otherwise noted, each Trustee oversees all portfolios in the Federated Fund Family and serves for an indefinite term. The Fund's Statement of Additional Information includes additional information about Trust Trustees and is available, without charge and upon request, by calling 1-800-341-7400.

Interested TRUSTEES Background

Name

Birth Date

Positions Held with Trust

Date Service Began | Principal Occupation(s) for Past Five Years,

Other Directorships Held and Previous Position(s) |

John F. Donahue*

Birth Date: July 28, 1924

Trustee

Began serving: April 1984 | Principal Occupations: Director or Trustee of the Federated Fund Family; Chairman and Director, Federated Investors, Inc.; Chairman of the Federated Fund Family's Executive Committee.

Previous Positions: Chairman of the Federated Fund Family; Trustee, Federated Investment Management Company; Chairman and Director, Federated Investment Counseling. |

J. Christopher Donahue*

Birth Date: April 11, 1949

President and Trustee

Began serving: January 2000 | Principal Occupations: Principal Executive Officer and President of the Federated Fund Family; Director or Trustee of some of the Funds in the Federated Fund Family; President, Chief Executive Officer and Director, Federated Investors, Inc.; Chairman and Trustee, Federated Investment Management Company; Trustee, Federated Investment Counseling; Chairman and Director, Federated Global Investment Management Corp.; Chairman, Federated Equity Management Company of Pennsylvania and Passport Research, Ltd. (investment advisory subsidiary of Federated); Trustee, Federated Shareholder Services Company; Director, Federated Services Company.

Previous Positions: President, Federated Investment Counseling; President and Chief Executive Officer, Federated Investment Management Company, Federated Global Investment Management Corp. and Passport Research, Ltd. |

| * | Family relationships and reasons for “interested” status: John F. Donahue is the father of J. Christopher Donahue; both are “interested” due to their beneficial ownership of shares of Federated Investors, Inc. and the positions they hold with Federated and its subsidiaries. |

Annual Shareholder Report30

INDEPENDENT TRUSTEES Background

Name

Birth Date

Positions Held with Trust

Date Service Began | Principal Occupation(s) for Past Five Years,

Other Directorships Held, Previous Position(s) and Qualifications |

John T. Conroy, Jr., Ph.D.

Birth Date: June 23, 1937

Trustee

Began serving: November 1991 | Principal Occupations: Director or Trustee of the Federated Fund Family; Chairman of the Board, Investment Properties Corporation; Partner or Trustee in private real estate ventures in Southwest Florida; Assistant Professor in Theology, Blessed Edmund Rice School for Pastoral Ministry.

Previous Positions: President, Investment Properties Corporation; Senior Vice President, John R. Wood and Associates, Inc., Realtors; President, Naples Property Management, Inc. and Northgate Village Development Corporation.

Qualifications: Business management and director experience. |

Nicholas P. Constantakis, CPA

Birth Date: September 3, 1939

Trustee

Began serving: February 1998 | Principal Occupation: Director or Trustee of the Federated Fund Family.

Other Directorship Held: Director and Chairman of the Audit Committee, Michael Baker Corporation (architecture, engineering and construction services).

Previous Position: Partner, Andersen Worldwide SC.

Qualifications: Public accounting and director experience. |

John F. Cunningham

Birth Date: March 5, 1943

Trustee

Began serving: January 1999 | Principal Occupation: Director or Trustee of the Federated Fund Family.

Other Directorships Held: Chairman, President and Chief Executive Officer, Cunningham & Co., Inc. (strategic business consulting); Trustee Associate, Boston College.

Previous Positions: Director, Redgate Communications and EMC Corporation (computer storage systems); Chairman of the Board and Chief Executive Officer, Computer Consoles, Inc.; President and Chief Operating Officer, Wang Laboratories; Director, First National Bank of Boston; Director, Apollo Computer, Inc.

Qualifications: Business management and director experience. |

Maureen Lally-Green

Birth Date: July 5, 1949

Trustee

Began serving: August 2009 | Principal Occupations: Director or Trustee of the Federated Fund Family; Director, Office of Church Relations, Diocese of Pittsburgh; Adjunct Professor of Law, Duquesne University School of Law.

Other Directorships Held: Trustee, St. Francis University; Director, Ireland Institute of Pittsburgh; Director, UPMC Mercy Hospital; Regent, St. Vincent Seminary; Director, Epilepsy Foundation of Western and Central Pennsylvania; Director, Saint Thomas More Society, Allegheny County; Director, Carlow University.

Previous Position: Pennsylvania Superior Court Judge.

Qualifications: Legal and director experience. |

Annual Shareholder Report31

Name

Birth Date

Positions Held with Trust

Date Service Began | Principal Occupation(s) for Past Five Years,

Other Directorships Held, Previous Position(s) and Qualifications |

Peter E. Madden

Birth Date: March 16, 1942

Trustee

Began serving: November 1991 | Principal Occupation: Director or Trustee, and Chairman of the Board of Directors or Trustees, of the Federated Fund Family.

Other Directorship Held: Board of Overseers, Babson College.

Previous Positions: Representative, Commonwealth of Massachusetts General Court; President, Chief Operating Officer and Director, State Street Bank and Trust Company and State Street Corporation (retired); Director, VISA USA and VISA International; Chairman and Director, Massachusetts Bankers Association; Director, Depository Trust Corporation; Director, The Boston Stock Exchange.

Qualifications: Business management, mutual fund services and director experience. |

Charles F. Mansfield, Jr.

Birth Date: April 10, 1945

Trustee

Began serving: January 1999 | Principal Occupations: Director or Trustee and Chairman of the Audit Committee of the Federated Fund Family; Management Consultant.