United States

Securities and Exchange Commission

Washington, D.C. 20549

Form N-CSR

Certified Shareholder Report of Registered Management Investment Companies

811-4017

(Investment Company Act File Number)

Federated Equity Funds

_______________________________________________________________

(Exact Name of Registrant as Specified in Charter)

Federated Investors Funds

4000 Ericsson Drive

Warrendale, Pennsylvania 15086-7561

(Address of Principal Executive Offices)

(412) 288-1900

(Registrant's Telephone Number)

John W. McGonigle, Esquire

Federated Investors Tower

1001 Liberty Avenue

Pittsburgh, Pennsylvania 15222-3779

(Name and Address of Agent for Service)

(Notices should be sent to the Agent for Service)

Date of Fiscal Year End: 10/31/2012

Date of Reporting Period: 10/31/2012

Item 1. Reports to Stockholders

Annual Shareholder Report

October 31, 2012

| Share Class | Ticker |

| A | FEDEX |

| B | CPABX |

| C | CPACX |

| R | CPAKX |

| Institutional | CPAIX |

Federated Capital Appreciation Fund

Fund Established 1977

A Portfolio of Federated Equity Funds

Dear Valued Shareholder,

I am pleased to present the Annual Shareholder Report for your fund covering the period from November 1, 2011 through October 31, 2012. This report includes Management's Discussion of Fund Performance, a complete listing of your fund's holdings, performance information and financial statements along with other important fund information.

In addition, our website, FederatedInvestors.com, offers easy access to Federated resources that include timely fund updates, economic and market insights from our investment strategists, and financial planning tools. We invite you to register to take full advantage of its capabilities.

Thank you for investing with Federated. I hope you find this information useful and look forward to keeping you informed.

Sincerely,

J. Christopher Donahue, President

Not FDIC Insured • May Lose Value • No Bank Guarantee

Management's Discussion of Fund Performance (unaudited)

The Fund's total return, based on net asset value, for the 12-month reporting period ended October 31, 2012, was 9.46% for the Class A Shares, 8.45% for the Class B Shares, 8.52% for the Class C Shares, 9.14% for the Class R Shares and 9.67% for the Institutional Shares. The total return of the Standard and Poor's 500 Index (S&P 500),1 the Fund's broad-based securities market index, was 15.21% for the same period. The Fund's total return for the fiscal year reflected actual cash flows, transaction costs and other expenses which were not reflected in the total return of the S&P 500.

The following discussion will focus on the performance of the Fund's Institutional Shares.

MARKET OVERVIEW

Stocks, as measured by the S&P 500, rose 15.21% during the 12-month period. While mixed, equity market performance during the fiscal year was led by the market's preference for mostly cyclically leveraged stocks. Telecom Services and Healthcare were the strongest performing sectors within the S&P 500, rising 26.22% and 21.95%, respectively. Energy and Materials were the notable underperforming sectors within the S&P 500.

FUND PERFORMANCE

During the reporting period, the Fund underperformed the S&P 500. The majority of the Fund's underperformance was driven by stock selection. The Fund's relative performance was constrained by poor stock selection within the Information Technology, Healthcare and Materials sectors.

The Fund began the reporting period with overweight positions in the cyclical or growth areas of the market (Industrials, Consumer Discretionary, Energy and Technology). The Fund increased this positioning as the year progressed. While the market had plenty of things to worry about (i.e. European debt crisis, the threat of simultaneous spending cuts and tax increases in the U.S. that are slated to take place at the end of 2012 (i.e., the “fiscal cliff”), U.S. presidential election and Middle East uncertainty), Fund management believed the U.S. economy was showing positive signs of growth, primarily in the housing sector and employment. These trends, coupled with the Federal Reserve continuing to add stimulus through quantitative easing measures, led to the pro-cyclical positioning of the Fund. The sector tilt toward the pro-cyclical areas disappointed, however, during the reporting period as stock selection in the Industrials and Energy sectors underperformed the S&P 500. Investments in the Telecom and Consumer Staples sectors, on the other hand, outperformed the S&P 500. Fund management continued to see positive developments for stocks and thus saw no reason, based on the following factors, to shift

Annual Shareholder Report

strategy: corporations were in good financial shape, the Federal Reserve continued to be very accommodating, the U.S. government showed progress towards a resolution to improve the fiscal situation and the European Central Bank was being proactive on resolving the European debt crisis.

The top five positive contributors within the portfolio were: Apple Computers, Discover Financials, Pharmasset Inc., General Electric Co. and Discovery Communications. The largest negative contributors were: Idenix Pharmaceuticals, Centene Corp., Newmont Mining Corp., Sandisk Corp. and ON Semiconductor.

Please note that a Special Meeting of Shareholders of the Fund will be held at 4000 Ericsson Drive, Warrendale, Pennsylvania 15086-7561, at 10:00 AM (Eastern Time), on March 11, 2013 so that shareholders may approve or disapprove a proposed Agreement and Plan of Reorganization pursuant to which Federated Equity Income Fund, Inc., would acquire all or substantially all of the assets of the Fund in exchange for Class A Shares, Class B Shares, Class C Shares, Class R Shares and Institutional Shares of Federated Equity Income Fund, Inc. The shares of Federated Equity Income Fund, Inc. held by the Fund would then be distributed to the Fund's Shareholders, pro rata, in complete liquidation and termination of the Fund. A prospectus/proxy statement with respect to the proposed reorganization will be mailed to shareholders and filed with the Securities and Exchange Commission (SEC). Shareholders are urged to read the prospectus/proxy statement as it contains important information. The prospectus/proxy statement and other relevant documents will be available free of charge on the SEC's website at www.sec.gov or by calling 1-800-341-7000.

| 1 | The S&P 500 Index is a capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries. The index is unmanaged, and it is not possible to invest directly in an index. |

Annual Shareholder Report

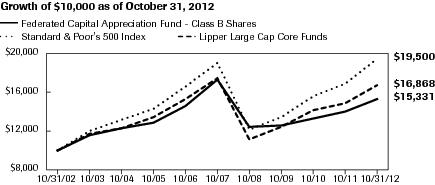

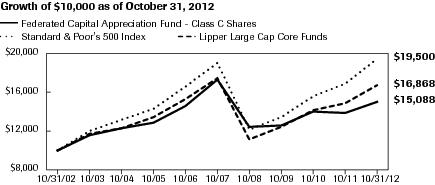

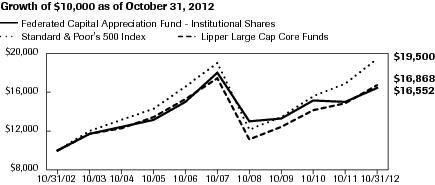

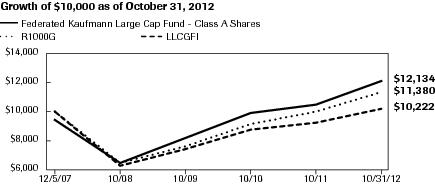

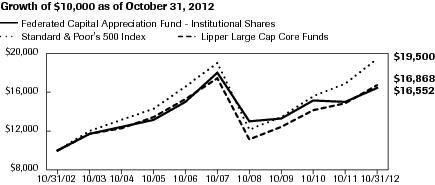

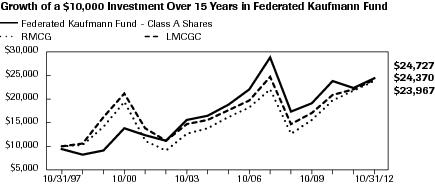

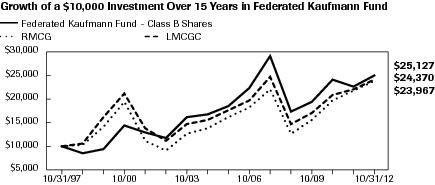

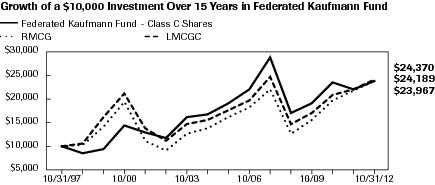

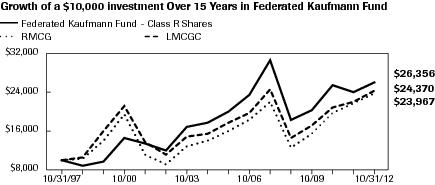

FUND PERFORMANCE AND GROWTH OF A $10,000 INVESTMENT

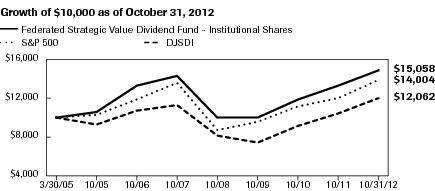

The Fund's Institutional Shares and Class R Shares commenced operations on December 31, 2007 and April 8, 2003, respectively. For the period prior to the commencement of operations of the Institutional Shares, the performance information shown is for the Fund's Class A Shares. The performance of the Class A Shares has not been adjusted to reflect the expenses of the Institutional Shares since the Institutional Shares have a lower expense ratio than the expense ratio of the Class A Shares. The performance of Class A Shares has been adjusted to remove any voluntary waiver of Fund expenses that may have occurred during the period prior to the commencement of operations of the Institutional Shares. For the period prior to commencement of operations of the Class R Shares, the performance information shown is for the Fund's Class A Shares, adjusted to reflect the expense of the Class R Shares. The Average Annual Total Return table below shows returns for each class averaged over the stated periods. The graphs below illustrate the hypothetical investment of $10,0001 in the Federated Capital Appreciation Fund (the “Fund”) from October 31, 2002 to October 31, 2012, compared to the Standard & Poor's 500 Index (S&P 500)2 and the Lipper Large-Cap Core Funds Average (LLCCFA).2

Average Annual Total Returns for the Period Ended 10/31/2012

(returns reflect all applicable sales charges and contingent deferred sales charges as specified below in footnote #1)

| Share Class | 1 Year | 5 Years | 10 Years |

| Class A Shares | 3.45% | -3.10% | 4.45% |

| Class B Shares | 2.95% | -3.13% | 4.37% |

| Class C Shares | 7.52% | -2.79% | 4.20% |

| Class R Shares | 9.14% | -2.35% | 4.62% |

| Institutional Shares | 9.67% | -1.75% | 5.17% |

Performance data quoted represents past performance which is no guarantee of future results. Investment return and principal value will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Mutual fund performance changes over time and current performance may be lower or higher than what is stated. For current to the most recent month-end performance and after-tax returns, visit FederatedInvestors.com or call 1-800-341-7400. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Mutual funds are not obligations of or guaranteed by any bank and are not federally insured.

Annual Shareholder Report

Growth of a $10,000 Investment–CLASS A SHARES

| Federated Capital Appreciation Fund - Class A Shares | C000026725 | Standard & Poor's 500 Index | Lipper Large Cap Core Funds Average |

| 10/31/2002 | 9,450 | 10,000 | 10,000 |

| 10/31/2003 | 11,046 | 12,080 | 11,731 |

| 10/31/2004 | 11,815 | 13,218 | 12,391 |

| 10/31/2005 | 12,432 | 14,370 | 13,426 |

| 10/31/2006 | 14,263 | 16,721 | 15,337 |

| 10/31/2007 | 17,084 | 19,155 | 17,570 |

| 10/31/2008 | 12,352 | 12,240 | 11,222 |

| 10/31/2009 | 12,564 | 13,440 | 12,439 |

| 10/31/2010 | 14,222 | 15,660 | 14,237 |

| 10/31/2011 | 14,114 | 16,926 | 15,003 |

| 10/31/2012 | 15,449 | 19,500 | 16,868 |

41 graphic description end -->

| ■ | Total returns shown include the maximum sales charge of 5.50% ($10,000 investment minus $550 sales charge = $9,450). |

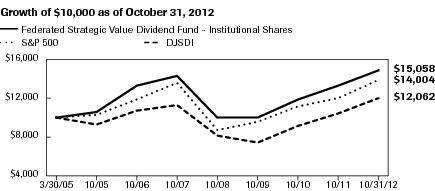

Growth of a $10,000 Investment–CLASS B SHARES

| Federated Capital Appreciation Fund - Class B Shares | C000026726 | Standard & Poor's 500 Index | Lipper Large Cap Core Funds Average |

| 10/31/2002 | 10,000 | 10,000 | 10,000 |

| 10/31/2003 | 11,599 | 12,080 | 11,731 |

| 10/31/2004 | 12,317 | 13,218 | 12,391 |

| 10/31/2005 | 12,855 | 14,370 | 13,426 |

| 10/31/2006 | 14,633 | 16,721 | 15,337 |

| 10/31/2007 | 17,387 | 19,155 | 17,570 |

| 10/31/2008 | 12,468 | 12,240 | 11,222 |

| 10/31/2009 | 12,571 | 13,440 | 12,439 |

| 10/31/2010 | 13,390 | 15,660 | 14,237 |

| 10/31/2011 | 14,006 | 16,926 | 15,003 |

| 10/31/2012 | 15,331 | 19,500 | 16,868 |

41 graphic description end -->

| ■ | Total returns shown include the maximum contingent deferred sales charge of 5.50%, as applicable. |

Annual Shareholder Report

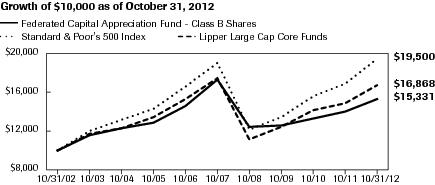

Growth of a $10,000 Investment–CLASS C SHARES

| Federated Capital Appreciation Fund - Class C Shares | C000026727 | Standard & Poor's 500 Index | Lipper Large Cap Core Funds Average |

| 10/31/2002 | 10,000 | 10,000 | 10,000 |

| 10/31/2003 | 11,595 | 12,080 | 11,731 |

| 10/31/2004 | 12,313 | 13,218 | 12,391 |

| 10/31/2005 | 12,848 | 14,370 | 13,426 |

| 10/31/2006 | 14,621 | 16,721 | 15,337 |

| 10/31/2007 | 17,383 | 19,155 | 17,570 |

| 10/31/2008 | 12,468 | 12,240 | 11,222 |

| 10/31/2009 | 12,579 | 13,440 | 12,439 |

| 10/31/2010 | 14,126 | 15,660 | 14,237 |

| 10/31/2011 | 13,904 | 16,926 | 15,003 |

| 10/31/2012 | 15,088 | 19,500 | 16,868 |

41 graphic description end -->

| ■ | Total returns shown include the maximum contingent deferred sales charge of 1.00%, as applicable. |

Growth of a $10,000 Investment–CLASS R SHARES

| Federated Capital Appreciation Fund - Class R Shares | C000026728 | Standard & Poor's 500 Index | Lipper Large Cap Core Funds Average |

| 10/31/2002 | 10,000 | 10,000 | 10,000 |

| 10/31/2003 | 11,646 | 12,080 | 11,731 |

| 10/31/2004 | 12,403 | 13,218 | 12,391 |

| 10/31/2005 | 12,989 | 14,370 | 13,426 |

| 10/31/2006 | 14,836 | 16,721 | 15,337 |

| 10/31/2007 | 17,693 | 19,155 | 17,570 |

| 10/31/2008 | 12,729 | 12,240 | 11,222 |

| 10/31/2009 | 12,895 | 13,440 | 12,439 |

| 10/31/2010 | 14,532 | 15,660 | 14,237 |

| 10/31/2011 | 14,391 | 16,926 | 15,003 |

| 10/31/2012 | 15,707 | 19,500 | 16,868 |

41 graphic description end -->

Annual Shareholder Report

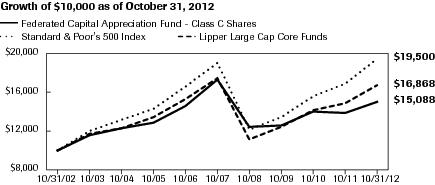

Growth of a $10,000 Investment–INSTITUTIONAL SHARES

| Federated Capital Appreciation Fund - Institutional Shares | C000060702 | Standard & Poor's 500 Index | Lipper Large Cap Core Funds Average |

| 10/31/2002 | 10,000 | 10,000 | 10,000 |

| 10/31/2003 | 11,689 | 12,080 | 11,731 |

| 10/31/2004 | 12,503 | 13,218 | 12,391 |

| 10/31/2005 | 13,155 | 14,370 | 13,426 |

| 10/31/2006 | 15,093 | 16,721 | 15,337 |

| 10/31/2007 | 18,078 | 19,155 | 17,570 |

| 10/31/2008 | 13,096 | 12,240 | 11,222 |

| 10/31/2009 | 13,354 | 13,440 | 12,439 |

| 10/31/2010 | 15,164 | 15,660 | 14,237 |

| 10/31/2011 | 15,092 | 16,926 | 15,003 |

| 10/31/2012 | 16,552 | 19,500 | 16,868 |

41 graphic description end -->

| 1 | Represents a hypothetical investment of $10,000 in the Fund after deducting applicable sales charges: For Class A Shares, the maximum sales charge of 5.50% ($10,000 investment minus $550 sales charge = $9,450); for Class B Shares, the maximum contingent deferred sales charge is 5.50% on any redemption less than one year from the purchase date; for Class C Shares, the maximum contingent deferred sales charge is 1.00% on any redemption less than one year from the purchase date. The Fund's performance assumes the reinvestment of all dividends and distributions. The S&P 500 and LLCCFA have been adjusted to reflect reinvestment of dividends on securities in the index and average. |

| 2 | The S&P 500 is not adjusted to reflect sales loads, expenses or other fees that the Securities and Exchange Commission (SEC) requires to be reflected in the Fund's performance. The LLCCFA represents the average of the total returns reported by all of the mutual funds designated by Lipper, Inc. as falling into the category indicated, and is not adjusted to reflect sales charges. Total returns of the LLCCFA are reported net of expenses or other fees that the SEC requires to be reflected in a fund's performance. The S&P 500 is unmanaged and, unlike the Fund, is not affected by cash flows. It is not possible to invest in an index or average. |

Annual Shareholder Report

Portfolio of Investments Summary Table (unaudited)

At October 31, 2012, the Fund's sector composition1 was as follows:

| Sector Composition | Percentage of

Total Net Assets |

| Information Technology | 19.7% |

| Financials | 17.8% |

| Industrials | 13.4% |

| Health Care | 12.7% |

| Energy | 12.6% |

| Consumer Discretionary | 12.4% |

| Consumer Staples | 5.7% |

| Materials | 5.1% |

| Cash Equivalents2 | 0.6% |

| Other Assets and Liabilities—Net3,4 | (0.0)% |

| TOTAL | 100.0% |

| 1 | Except for Cash Equivalents and Other Assets and Liabilities, sector classifications are based upon, and individual portfolio securities are assigned to, the classifications of the Global Industry Classification Standard (GICS) except that the Adviser assigns a classification to securities not classified by the GICS and to securities for which the Adviser does not have access to the classification made by the GICS. |

| 2 | Cash Equivalents include any investments in money market mutual funds and/or overnight repurchase agreements. |

| 3 | Represents less than 0.1%. |

| 4 | Assets, other than investments in securities, less liabilities. See Statement of Assets and Liabilities.

|

Annual Shareholder Report

Portfolio of Investments

October 31, 2012

| Shares | | | Value |

| | COMMON STOCKS—99.4% | |

| | Consumer Discretionary—12.4% | |

| 245,100 | | Comcast Corp., Class A | $9,193,701 |

| 762,310 | | D. R. Horton, Inc. | 15,978,018 |

| 60,703 | 1 | Discovery Communications, Inc. | 3,582,691 |

| 238,500 | | Foot Locker, Inc. | 7,989,750 |

| 239,000 | 1 | Hyatt Hotels Corp. | 8,723,500 |

| 310,600 | | Las Vegas Sands Corp. | 14,424,264 |

| 186,700 | | Macy's, Inc. | 7,107,669 |

| 56,400 | | Nike, Inc., Class B | 5,153,832 |

| 14,500 | 1 | Priceline.com, Inc. | 8,319,665 |

| 205,456 | | Scripps Networks Interactive | 12,475,288 |

| 211,600 | 1 | TRW Automotive Holdings Corp. | 9,841,516 |

| 126,300 | | Walt Disney Co. | 6,197,541 |

| | TOTAL | 108,987,435 |

| | Consumer Staples—5.7% | |

| 303,200 | | Altria Group, Inc. | 9,641,760 |

| 550,400 | | Kroger Co. | 13,881,088 |

| 348,388 | | The Coca-Cola Co. | 12,953,066 |

| 188,200 | | Wal-Mart Stores, Inc. | 14,118,764 |

| | TOTAL | 50,594,678 |

| | Energy—12.6% | |

| 163,600 | 1 | Cameron International Corp. | 8,284,704 |

| 141,993 | | Chevron Corp. | 15,649,049 |

| 136,700 | | Exxon Mobil Corp. | 12,462,939 |

| 251,700 | | Halliburton Co. | 8,127,393 |

| 449,200 | | Marathon Oil Corp. | 13,502,952 |

| 158,800 | | National-Oilwell, Inc. | 11,703,560 |

| 172,500 | | Occidental Petroleum Corp. | 13,620,600 |

| 160,221 | | Phillips 66 | 7,556,022 |

| 126,200 | | Schlumberger Ltd. | 8,774,686 |

| 240,200 | | Transocean Ltd. | 10,974,738 |

| | TOTAL | 110,656,643 |

| | Financials—17.8% | |

| 264,800 | 1 | American International Group, Inc. | 9,249,464 |

| 181,100 | | Bank of New York Mellon Corp. | 4,474,981 |

| 51,900 | | BlackRock, Inc. | 9,844,392 |

Annual Shareholder Report

| Shares | | | Value |

| | COMMON STOCKS—continued | |

| | Financials—continued | |

| 304,800 | | Citigroup, Inc. | $11,396,472 |

| 277,600 | | Discover Financial Services | 11,381,600 |

| 162,900 | | Goldman Sachs Group, Inc. | 19,937,331 |

| 489,855 | | J.P. Morgan Chase & Co. | 20,417,156 |

| 645,170 | | MetLife, Inc. | 22,897,083 |

| 279,700 | | PNC Financial Services Group | 16,275,743 |

| 551,900 | | SunTrust Banks, Inc. | 15,011,680 |

| 468,974 | | Wells Fargo & Co. | 15,799,734 |

| | TOTAL | 156,685,636 |

| | Health Care—12.7% | |

| 269,737 | 1 | Amarin Corporation PLC., ADR | 3,177,502 |

| 70,512 | | Amgen, Inc. | 6,102,461 |

| 272,700 | | Bristol-Myers Squibb Co. | 9,067,275 |

| 136,700 | 1 | Gilead Sciences, Inc. | 9,180,772 |

| 178,200 | | GlaxoSmithKline PLC, ADR | 8,001,180 |

| 138,200 | | Humana, Inc. | 10,264,114 |

| 213,300 | | Johnson & Johnson | 15,105,906 |

| 97,300 | | McKesson Corp. | 9,079,063 |

| 237,900 | | Merck & Co., Inc. | 10,855,377 |

| 352,800 | 1 | Mylan, Inc. | 8,939,952 |

| 704,000 | | Pfizer, Inc. | 17,508,480 |

| 78,800 | | UnitedHealth Group, Inc. | 4,412,800 |

| | TOTAL | 111,694,882 |

| | Industrials—13.4% | |

| 266,100 | | Danaher Corp. | 13,765,353 |

| 88,700 | | Dover Corp. | 5,164,114 |

| 663,519 | | General Electric Co. | 13,973,710 |

| 266,807 | | Honeywell International, Inc. | 16,339,261 |

| 185,900 | | Northrop Grumman Corp. | 12,769,471 |

| 103,000 | | Parker-Hannifin Corp. | 8,101,980 |

| 153,520 | | Union Pacific Corp. | 18,887,565 |

| 162,300 | | United Parcel Service, Inc. | 11,888,475 |

| 221,810 | | United Technologies Corp. | 17,336,670 |

| | TOTAL | 118,226,599 |

| | Information Technology—19.7% | |

| 65,927 | | Accenture PLC | 4,444,139 |

| 68,400 | 1 | Alliance Data Systems Corp. | 9,784,620 |

| 54,620 | | Apple, Inc. | 32,504,362 |

Annual Shareholder Report

| Shares | | | Value |

| | COMMON STOCKS—continued | |

| | Information Technology—continued | |

| 147,900 | 1 | Broadcom Corp. | $4,664,027 |

| 642,560 | 1 | EMC Corp. | 15,691,315 |

| 210,900 | 1 | eBay, Inc. | 10,184,361 |

| 55,100 | 1 | F5 Networks, Inc. | 4,544,648 |

| 28,400 | 1 | Google, Inc. | 19,305,468 |

| 529,500 | | Intel Corp. | 11,450,437 |

| 673,631 | | Microsoft Corp. | 19,222,061 |

| 376,941 | 1 | NXP Semiconductors NV | 9,144,589 |

| 204,100 | | Oracle Corp. | 6,337,305 |

| 229,300 | | Qualcomm, Inc. | 13,431,247 |

| 95,000 | | Visa, Inc., Class A | 13,182,200 |

| | TOTAL | 173,890,779 |

| | Materials—5.1% | |

| 27,500 | | CF Industries Holdings, Inc. | 5,642,725 |

| 168,300 | | Du Pont (E.I.) de Nemours & Co. | 7,492,716 |

| 193,600 | | Eastman Chemical Co. | 11,468,864 |

| 163,400 | | Freeport-McMoran Copper & Gold, Inc. | 6,352,992 |

| 91,200 | | Newmont Mining Corp. | 4,974,960 |

| 76,800 | | PPG Industries, Inc. | 8,991,744 |

| | TOTAL | 44,924,001 |

| | TOTAL COMMON STOCKS

(IDENTIFIED COST $784,965,260) | 875,660,653 |

| | MUTUAL FUND—0.6% | |

| 5,296,925 | 2,3 | Federated Prime Value Obligations Fund, Institutional Shares, 0.16%

(AT NET ASSET VALUE) | 5,296,925 |

| | TOTAL INVESTMENTS—100.0%

(IDENTIFIED COST $790,262,185)4 | 880,957,578 |

| | OTHER ASSETS AND LIABILITIES - NET—(0.0)%5 | (221,158) |

| | TOTAL NET ASSETS—100% | $880,736,420 |

| 1 | Non-income producing security. |

| 2 | Affiliated holding. |

| 3 | 7-Day net yield. |

| 4 | The cost of investments for federal tax purposes amounts to $795,812,980. |

| 5 | Assets, other than investments in securities, less liabilities. See Statement of Assets and Liabilities. |

Note: The categories of investments are shown as a percentage of total net assets at October 31, 2012.

Annual Shareholder Report

Various inputs are used in determining the value of the Fund's investments. These inputs are summarized in the three broad levels listed below:

Level 1—quoted prices in active markets for identical securities, including investment companies with daily net asset values, if applicable.

Level 2—other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.). Also includes securities valued at amortized cost.

Level 3—significant unobservable inputs (including the Fund's own assumptions in determining the fair value of investments).

The inputs or methodology used for valuing securities are not an indication of the risk associated with investing in those securities.

As of October 31, 2012, all investments of the Fund utilized Level 1 inputs in valuing the Fund's assets carried at fair value.

The following acronym is used throughout this portfolio:

| ADR | —American Depositary Receipt |

See Notes which are an integral part of the Financial Statements

Annual Shareholder Report

Financial Highlights–Class A Shares

(For a Share Outstanding Throughout Each Period)

| Year Ended October 31 | 2012 | 2011 | 2010 | 2009 | 2008 |

| Net Asset Value, Beginning of Period | $17.89 | $18.13 | $16.13 | $16.03 | $28.14 |

| Income From Investment Operations: | | | | | |

| Net investment income | 0.131 | 0.111 | 0.101 | 0.171 | 0.181 |

| Net realized and unrealized gain (loss) on investments and foreign currency transactions | 1.55 | (0.24) | 2.02 | 0.09 | (6.60) |

| TOTAL FROM INVESTMENT OPERATIONS | 1.68 | (0.13) | 2.12 | 0.26 | (6.42) |

| Less Distributions: | | | | | |

| Distributions from net investment income | (0.11) | (0.11) | (0.12) | (0.16) | (0.15) |

| Distributions from net realized gain on investments and foreign currency transactions | — | — | — | — | (5.54) |

| TOTAL DISTRIBUTIONS | (0.11) | (0.11) | (0.12) | (0.16) | (5.69) |

| Net Asset Value, End of Period | $19.46 | $17.89 | $18.13 | $16.13 | $16.03 |

| Total Return2 | 9.46% | (0.76)% | 13.20% | 1.71% | (27.70)% |

| Ratios to Average Net Assets: | | | | | |

| Net expenses | 1.24%3 | 1.24%3 | 1.24%3 | 1.23%3 | 1.25%3 |

| Net investment income | 0.68% | 0.58% | 0.58% | 1.11% | 0.88% |

| Expense waiver/reimbursement4 | 0.09% | 0.07% | 0.04% | 0.08% | 0.01% |

| Supplemental Data: | | | | | |

| Net assets, end of period (000 omitted) | $645,433 | $784,928 | $865,886 | $943,922 | $939,280 |

| Portfolio turnover | 113% | 175% | 245% | 254% | 252% |

| 1 | Per share numbers have been calculated using the average shares method. |

| 2 | Based on net asset value, which does not reflect the sales charge, redemption fee or contingent deferred sales charge, if applicable. |

| 3 | The net expense ratio is calculated without reduction for expense offset arrangements. The net expense ratios are 1.24%, 1.24%, 1.23%, 1.22% and 1.24% for the years ended October 31, 2012, 2011, 2010, 2009 and 2008, respectively, after taking into account these expense reductions. |

| 4 | This expense decrease is reflected in both the net expense and the net investment income ratios shown above. |

See Notes which are an integral part of the Financial Statements

Annual Shareholder Report

Financial Highlights–Class B Shares

(For a Share Outstanding Throughout Each Period)

| Year Ended October 31 | 2012 | 2011 | 2010 | 2009 | 2008 |

| Net Asset Value, Beginning of Period | $16.93 | $17.20 | $15.32 | $15.24 | $27.07 |

| Income From Investment Operations: | | | | | |

| Net investment income (loss) | (0.03)1 | (0.05)1 | (0.04)1 | 0.041 | 0.021 |

| Net realized and unrealized gain (loss) on investments and foreign currency transactions | 1.46 | (0.22) | 1.92 | 0.08 | (6.31) |

| TOTAL FROM INVESTMENT OPERATIONS | 1.43 | (0.27) | 1.88 | 0.12 | (6.29) |

| Less Distributions: | | | | | |

| Distributions from net investment income | — | — | — | (0.04) | — |

| Distributions from net realized gain on investments and foreign currency transactions | — | — | — | — | (5.54) |

| TOTAL DISTRIBUTIONS | — | — | — | (0.04) | (5.54) |

| Net Asset Value, End of Period | $18.36 | $16.93 | $17.20 | $15.32 | $15.24 |

| Total Return2 | 8.45% | (1.57)% | 12.27% | 0.83% | (28.29)% |

| Ratios to Average Net Assets: | | | | | |

| Net expenses | 2.10%3 | 2.10%3 | 2.10%3 | 2.10%3 | 2.05%3 |

| Net investment income (loss) | (0.15)% | (0.28)% | (0.27)% | 0.31% | 0.10% |

| Expense waiver/reimbursement4 | 0.12% | 0.04% | 0.01% | 0.02% | 0.01% |

| Supplemental Data: | | | | | |

| Net assets, end of period (000 omitted) | $37,533 | $64,708 | $116,426 | $163,827 | $221,131 |

| Portfolio turnover | 113% | 175% | 245% | 254% | 252% |

| 1 | Per share numbers have been calculated using the average shares method. |

| 2 | Based on net asset value, which does not reflect the sales charge, redemption fee or contingent deferred sales charge, if applicable. |

| 3 | The net expense ratio is calculated without reduction for expense offset arrangements. The net expense ratios are 2.10%, 2.10%, 2.09%, 2.09% and 2.04% for the years ended October 31, 2012, 2011, 2010, 2009 and 2008, respectively, after taking into account these expense reductions. |

| 4 | This expense decrease is reflected in both the net expense and the net investment income (loss) ratios shown above. |

See Notes which are an integral part of the Financial Statements

Annual Shareholder Report

Financial Highlights–Class C Shares

(For a Share Outstanding Throughout Each Period)

| Year Ended October 31 | 2012 | 2011 | 2010 | 2009 | 2008 |

| Net Asset Value, Beginning of Period | $16.90 | $17.17 | $15.29 | $15.23 | $27.05 |

| Income From Investment Operations: | | | | | |

| Net investment income (loss) | (0.03)1 | (0.04)1 | (0.04)1 | 0.041 | 0.021 |

| Net realized and unrealized gain (loss) on investments and foreign currency transactions | 1.47 | (0.23) | 1.92 | 0.09 | (6.30) |

| TOTAL FROM INVESTMENT OPERATIONS | 1.44 | (0.27) | 1.88 | 0.13 | (6.28) |

| Less Distributions: | | | | | |

| Distributions from net investment income | — | — | — | (0.07) | — |

| Distributions from net realized gain on investments and foreign currency transactions | — | — | — | — | (5.54) |

| TOTAL DISTRIBUTIONS | — | — | — | (0.07) | (5.54) |

| Net Asset Value, End of Period | $18.34 | $16.90 | $17.17 | $15.29 | $15.23 |

| Total Return2 | 8.52% | (1.57)% | 12.30% | 0.89% | (28.27)% |

| Ratios to Average Net Assets: | | | | | |

| Net expenses | 2.06%3 | 2.06%3 | 2.06%3 | 2.06%3 | 2.03%3 |

| Net investment income (loss) | (0.14)% | (0.24)% | (0.23)% | 0.30% | 0.11% |

| Expense waiver/reimbursement4 | 0.05% | 0.02% | 0.01% | 0.02% | 0.01% |

| Supplemental Data: | | | | | |

| Net assets, end of period (000 omitted) | $57,705 | $64,550 | $77,045 | $83,060 | $88,572 |

| Portfolio turnover | 113% | 175% | 245% | 254% | 252% |

| 1 | Per share numbers have been calculated using the average shares method. |

| 2 | Based on net asset value, which does not reflect the sales charge, redemption fee or contingent deferred sales charge, if applicable. |

| 3 | The net expense ratio is calculated without reduction for expense offset arrangements. The net expense ratios are 2.06%, 2.06%, 2.05%, 2.05% and 2.02% for the years ended October 31, 2012, 2011, 2010, 2009 and 2008, respectively, after taking into account these expense reductions. |

| 4 | This expense decrease is reflected in both the net expense and the net investment income (loss) ratios shown above. |

See Notes which are an integral part of the Financial Statements

Annual Shareholder Report

Financial Highlights–Class R Shares

(For a Share Outstanding Throughout Each Period)

| Year Ended October 31 | 2012 | 2011 | 2010 | 2009 | 2008 |

| Net Asset Value, Beginning of Period | $17.72 | $17.93 | $15.94 | $15.90 | $27.98 |

| Income From Investment Operations: | | | | | |

| Net investment income | 0.091 | 0.071 | 0.021 | 0.111 | 0.071 |

| Net realized and unrealized gain (loss) on investments and foreign currency transactions | 1.52 | (0.24) | 2.00 | 0.08 | (6.55) |

| TOTAL FROM INVESTMENT OPERATIONS | 1.61 | (0.17) | 2.02 | 0.19 | (6.48) |

| Less Distributions: | | | | | |

| Distributions from net investment income | (0.08) | (0.04) | (0.03) | (0.15) | (0.06) |

| Distributions from net realized gain on investments and foreign currency transactions | — | — | — | — | (5.54) |

| TOTAL DISTRIBUTIONS | (0.08) | (0.04) | (0.03) | (0.15) | (5.60) |

| Net Asset Value, End of Period | $19.25 | $17.72 | $17.93 | $15.94 | $15.90 |

| Total Return2 | 9.14% | (0.97)% | 12.70% | 1.30% | (28.05)% |

| Ratios to Average Net Assets: | | | | | |

| Net expenses | 1.46%3 | 1.47%3 | 1.69%3 | 1.71%3 | 1.70%3 |

| Net investment income | 0.47% | 0.36% | 0.14% | 0.78% | 0.33% |

| Expense waiver/reimbursement4 | 0.27% | 0.24% | 0.01% | 0.02% | 0.01% |

| Supplemental Data: | | | | | |

| Net assets, end of period (000 omitted) | $22,943 | $28,461 | $22,290 | $21,994 | $39,155 |

| Portfolio turnover | 113% | 175% | 245% | 254% | 252% |

| 1 | Per share numbers have been calculated using the average shares method. |

| 2 | Based on net asset value. |

| 3 | The net expense ratio is calculated without reduction for expense offset arrangements. The net expense ratios are 1.46%, 1.47%, 1.68%, 1.70% and 1.69% for the years ended October 31, 2012, 2011, 2010, 2009 and 2008, respectively, after taking into account these expense reductions. |

| 4 | This expense decrease is reflected in both the net expense and the net investment income ratios shown above. |

See Notes which are an integral part of the Financial Statements

Annual Shareholder Report

Financial Highlights–Institutional Shares

(For a Share Outstanding Throughout Each Period)

| Year Ended October 31, | Period

Ended

10/31/20081 |

| 2012 | 2011 | 2010 | 2009 |

| Net Asset Value, Beginning of Period | $17.91 | $18.15 | $16.14 | $16.06 | $21.34 |

| Income From Investment Operations: | | | | | |

| Net investment income | 0.182 | 0.162 | 0.152 | 0.182 | 0.152 |

| Net realized and unrealized gain (loss) on investments and foreign currency transactions | 1.53 | (0.24) | 2.03 | 0.11 | (5.43) |

| TOTAL FROM INVESTMENT OPERATIONS | 1.71 | (0.08) | 2.18 | 0.29 | (5.28) |

| Less Distributions: | | | | | |

| Distributions from net investment income | (0.16) | (0.16) | (0.17) | (0.21) | — |

| Net Asset Value, End of Period | $19.46 | $17.91 | $18.15 | $16.14 | $16.06 |

| Total Return3 | 9.67% | (0.47)% | 13.55% | 1.97% | (24.74)% |

| Ratios to Average Net Assets: | | | | | |

| Net expenses | 0.98%5 | 0.98%5 | 0.95%5 | 0.96%5 | 0.96%4,5 |

| Net investment income | 0.93% | 0.85% | 0.89% | 1.22% | 0.93%4 |

| Expense waiver/reimbursement6 | 0.08% | 0.02% | 0.01% | 0.03% | 0.02%4 |

| Supplemental Data: | | | | | |

| Net assets, end of period (000 omitted) | $117,123 | $118,716 | $168,884 | $211,470 | $75,775 |

| Portfolio turnover | 113% | 175% | 245% | 254% | 252%7 |

| 1 | Reflects operations for the period from December 31, 2007 (date of initial investment) to October 31, 2008. |

| 2 | Per share numbers have been calculated using the average shares method. |

| 3 | Based on net asset value. Total returns for periods of less than one year are not annualized. |

| 4 | Computed on an annualized basis. |

| 5 | The net expense ratio is calculated without reduction for expense offset arrangements. The net expense ratios are 0.98%, 0.98%, 0.94%, 0.95% and 0.94% for the years ended October 31, 2012, 2011, 2010 and 2009 and for the period ended October 31, 2008, respectively, after taking into account these expense reductions. |

| 6 | This expense decrease is reflected in both the net expense and the net investment income ratios shown above. |

| 7 | Portfolio turnover is calculated at the Fund level. Percentage indicated was calculated for the year ended October 31, 2008. |

See Notes which are an integral part of the Financial Statements

Annual Shareholder Report

Statement of Assets and Liabilities

October 31, 2012

| Assets: | | |

| Total investment in securities, at value including $5,296,925 of investment in an affiliated holding (Note 5) (identified cost $790,262,185) | | $880,957,578 |

| Income receivable | | 849,552 |

| Receivable for investments sold | | 11,945,992 |

| Receivable for shares sold | | 458,130 |

| TOTAL ASSETS | | 894,211,252 |

| Liabilities: | | |

| Payable for investments purchased | $10,628,472 | |

| Payable for shares redeemed | 1,964,902 | |

| Bank overdraft | 8,846 | |

| Payable for Directors'/Trustees' fees | 2,917 | |

| Payable for distribution services fee (Note 5) | 67,391 | |

| Payable for shareholder services fee (Note 5) | 355,918 | |

| Accrued expenses | 446,386 | |

| TOTAL LIABILITIES | | 13,474,832 |

| Net assets for 45,573,304 shares outstanding | | $880,736,420 |

| Net Assets Consist of: | | |

| Paid-in capital | | $832,344,370 |

| Net unrealized appreciation of investments and translation of assets and liabilities in foreign currency | | 90,688,076 |

| Accumulated net realized loss on investments and foreign currency transactions | | (48,006,687) |

| Undistributed net investment income | | 5,710,661 |

| TOTAL NET ASSETS | | $880,736,420 |

Annual Shareholder Report

Statement of Assets and Liabilities–continued

| Net Asset Value, Offering Price and Redemption Proceeds Per Share | | |

| Class A Shares: | | |

Net asset value per share ($645,433,272 ÷ 33,173,592 shares outstanding),

no par value, unlimited shares authorized | | $19.46 |

| Offering price per share (100/94.50 of $19.46) | | $20.59 |

| Redemption proceeds per share | | $19.46 |

| Class B Shares: | | |

Net asset value per share ($37,532,551 ÷ 2,044,295 shares outstanding),

no par value, unlimited shares authorized | | $18.36 |

| Offering price per share | | $18.36 |

| Redemption proceeds per share (94.50/100 of $18.36) | | $17.35 |

| Class C Shares: | | |

Net asset value per share ($57,705,234 ÷ 3,146,096 shares outstanding),

no par value, unlimited shares authorized | | $18.34 |

| Offering price per share | | $18.34 |

| Redemption proceeds per share (99.00/100 of $18.34) | | $18.16 |

| Class R Shares: | | |

Net asset value per share ($22,942,666 ÷ 1,191,628 shares outstanding),

no par value, unlimited shares authorized | | $19.25 |

| Offering price per share | | $19.25 |

| Redemption proceeds per share | | $19.25 |

| Institutional Shares: | | |

Net asset value per share ($117,122,697 ÷ 6,017,693 shares outstanding),

no par value, unlimited shares authorized | | $19.46 |

| Offering price per share | | $19.46 |

| Redemption proceeds per share | | $19.46 |

See Notes which are an integral part of the Financial Statements

Annual Shareholder Report

Statement of Operations

Year Ended October 31, 2012

| Investment Income: | | | |

| Dividends (including $11,248 received from an affiliated holding (Note 5) and net of foreign taxes withheld of $28,184) | | | $18,312,085 |

| Expenses: | | | |

| Investment adviser fee (Note 5) | | $7,124,983 | |

| Administrative fee (Note 5) | | 741,131 | |

| Custodian fees | | 44,649 | |

| Transfer and dividend disbursing agent fees and expenses (Note 2) | | 2,095,428 | |

| Directors'/Trustees' fees | | 6,990 | |

| Auditing fees | | 27,451 | |

| Legal fees | | 9,023 | |

| Portfolio accounting fees | | 173,236 | |

| Distribution services fee (Note 5) | | 970,094 | |

| Shareholder services fee (Note 5) | | 2,071,309 | |

| Account administration fee (Note 2) | | 10,334 | |

| Share registration costs | | 78,492 | |

| Printing and postage | | 87,452 | |

| Insurance premiums | | 5,778 | |

| Miscellaneous | | 9,595 | |

| TOTAL EXPENSES | | 13,455,945 | |

| Waivers, Reimbursements and Reduction: | | | |

| Waiver/reimbursement of investment adviser fee (Note 5) | $(181,211) | | |

| Waiver of administrative fee (Note 5) | (15,204) | | |

| Waiver of distribution services fee (Note 5) | (64,641) | | |

| Reimbursement of transfer and dividend disbursing agent fees and expenses (Note 2) | (613,701) | | |

| Fees paid indirectly from directed brokerage arrangements (Note 6) | (5,220) | | |

| TOTAL WAIVERS, REIMBURSEMENTS AND REDUCTION | | (879,977) | |

| Net expenses | | | 12,575,968 |

| Net investment income | | | 5,736,117 |

| Realized and Unrealized Gain on Investments and Foreign Currency Transactions: | | | |

| Net realized gain on investments and foreign currency transactions | | | 77,773,513 |

| Net change in unrealized appreciation of investments and translation of assets and liabilities in foreign currency | | | 2,991,827 |

| Net realized and unrealized gain on investments and foreign currency transactions | | | 80,765,340 |

| Change in net assets resulting from operations | | | $86,501,457 |

See Notes which are an integral part of the Financial Statements

Annual Shareholder Report

Statement of Changes in Net Assets

| Year Ended October 31 | 2012 | 2011 |

| Increase (Decrease) in Net Assets | | |

| Operations: | | |

| Net investment income | $5,736,117 | $5,917,944 |

| Net realized gain on investments and foreign currency transactions | 77,773,513 | 98,051,399 |

| Net change in unrealized appreciation/depreciation of investments and translation of assets and liabilities in foreign currency | 2,991,827 | (110,625,929) |

| CHANGE IN NET ASSETS RESULTING FROM OPERATIONS | 86,501,457 | (6,656,586) |

| Distributions to Shareholders: | | |

| Distributions from net investment income | | |

| Class A Shares | (4,497,058) | (5,067,934) |

| Class R Shares | (128,597) | (46,090) |

| Institutional Shares | (942,623) | (1,517,759) |

CHANGE IN NET ASSETS RESULTING

FROM DISTRIBUTIONS TO SHAREHOLDERS | (5,568,278) | (6,631,783) |

| Share Transactions: | | |

| Proceeds from sale of shares | 81,966,716 | 170,731,406 |

| Proceeds from shares issued in connection with the tax-free transfer of assets from EquiTrust Series Fund, Inc., Blue Chip Portfolio | — | 45,934,321 |

| Proceeds from shares issued in connection with the tax-free transfer of assets from EquiTrust Series Fund, Inc., Value Growth Portfolio | — | 62,700,801 |

| Proceeds from shares issued in connection with the tax-free transfer of assets from Performance Large Cap Equity Fund | 66,276,418 | — |

| Net asset value of shares issued to shareholders in payment of distributions declared | 4,785,572 | 4,919,430 |

| Cost of shares redeemed | (414,588,861) | (460,166,012) |

CHANGE IN NET ASSETS RESULTING

FROM SHARE TRANSACTIONS | (261,560,155) | (175,880,054) |

| Change in net assets | (180,626,976) | (189,168,423) |

| Net Assets: | | |

| Beginning of period | 1,061,363,396 | 1,250,531,819 |

| End of period (including undistributed net investment income of $5,710,661 and $5,566,226, respectively) | $880,736,420 | $1,061,363,396 |

See Notes which are an integral part of the Financial Statements

Annual Shareholder Report

Notes to Financial Statements

October 31, 2012

1. ORGANIZATION

Federated Equity Funds (the “Trust”) is registered under the Investment Company Act of 1940, as amended (the “Act”), as an open-end management investment company. The Trust consists of 13 portfolios. The financial statements included herein are only those of Federated Capital Appreciation Fund (the “Fund”), a diversified portfolio. The financial statements of the other portfolios are presented separately. The assets of each portfolio are segregated and a shareholder's interest is limited to the portfolio in which shares are held. Each portfolio pays its own expenses. The Fund offers five classes of shares: Class A Shares, Class B Shares, Class C Shares, Class R Shares and Institutional Shares. All shares of the Fund have equal rights with respect to voting, except on class-specific matters. The investment objective of the Fund is to provide capital appreciation.

On September 21, 2012, the Fund acquired all of the net assets of Performance Large Cap Equity Fund (the “Acquired Fund”), an open-end investment company in a tax-free reorganization in exchange for shares of the Fund, pursuant to a plan of reorganization approved by the Acquired Fund's shareholders on September 19, 2012. The purpose of the transaction was to combine two portfolios with comparable investment objectives and strategies. For financial reporting purposes, assets received and shares issued by the Fund were recorded at fair value; however, the cost basis of the investments received from the Acquired Fund was carried forward to align ongoing reporting of the Fund's realized and unrealized gains and losses with amounts distributable to shareholders for tax purposes.

Assuming the acquisition had been completed on November 1, 2011, the beginning of the annual reporting period of the Fund, the Fund's pro forma results of operations for the year ended October 31, 2012, are as follows:

| Net investment income* | $6,472,106 |

| Net realized and unrealized gain on investments | $105,730,829 |

| Net increase in net assets resulting from operations | $112,202,935 |

| * | Net investment income includes $30,069 of pro forma eliminated expenses. |

Because the combined investment portfolios have been managed as a single integrated portfolio since the acquisition was completed, it is not practicable to separate the amounts of revenue and earnings of the Acquired Fund that has been included in the Fund's Statement of Operations as of October 31, 2012.

For every one share of Performance Large Cap Equity Fund Class A Shares exchanged, a shareholder received 0.495 shares of Federated Capital Appreciation Fund Class A Shares.

For every one share of Performance Large Cap Equity Fund Class B Shares exchanged, a shareholder received 0.444 shares of Federated Capital Appreciation Fund Class A Shares.

For every one share of Performance Large Cap Equity Fund Institutional Class Shares exchanged, a shareholder received 0.503 shares of Federated Capital Appreciation Fund Institutional Shares.

Annual Shareholder Report

The Fund received net assets from the Acquired Fund as the result of the tax-free reorganization as follows:

Shares of the

Fund Issued | Performance

Large Cap

Equity Fund

Net Assets

Received | Unrealized

Appreciation1 | Net Assets

of the Fund

Immediately

Prior to

Combination | Net Assets

of the Fund

Immediately

After

Combination |

| 3,282,647 | $66,276,418 | $16,014,302 | $873,800,901 | $940,077,319 |

| 1 | Unrealized Appreciation is included in the Acquired Fund Net Assets Received amount shown above. |

On July 15, 2011, the Fund acquired all of the net assets of EquiTrust Series Fund, Inc., Blue Chip Portfolio and EquiTrust Series Fund, Inc., Value Growth Portfolio (the “Acquired Funds”), open-end investment companies, in a tax-free reorganization in exchange for shares of the Fund, pursuant to a plan of reorganization approved by the Acquired Funds' shareholders on July 15, 2011. The purpose of the transaction was to combine three portfolios with comparable investment objectives and strategies. For financial reporting purposes, assets received and shares issued by the Fund were recorded at fair value; however, the cost basis of the investments received from the Acquired Funds was carried forward to align ongoing reporting of the Fund's realized and unrealized gains and losses with amounts distributable to shareholders for tax purposes.

Assuming the acquisition had been completed on November 1, 2010, the beginning of the annual reporting period of the Fund, the Fund's pro forma results of operations for the year ended October 31, 2011, were as follows:

| Net investment income* | $6,688,461 |

| Net realized and unrealized loss on investments | $(820,269) |

| Net increase in net assets resulting from operations | $5,868,192 |

| * | Net investment income includes $13,847 of pro forma additional expenses. |

Because the combined investment portfolios have been managed as a single integrated portfolio since the acquisition was completed, it is not practicable to separate the amounts of revenue and earnings of the Acquired Funds that has been included in the Fund's Statement of Operations as of October 31, 2011.

For every one share of EquiTrust Series Fund, Inc., Blue Chip Portfolio Class A Shares exchanged, a shareholder received 2.145 shares of Federated Capital Appreciation Fund Class A Shares.

For every one share of EquiTrust Series Fund, Inc., Blue Chip Portfolio Class B Shares exchanged, a shareholder received 2.143 shares of Federated Capital Appreciation Fund Class A Shares.

For every one share of EquiTrust Series Fund, Inc., Blue Chip Portfolio Class I Shares exchanged, a shareholder received 2.160 shares of Federated Capital Appreciation Fund Institutional Shares.

For every one share of EquiTrust Series Fund, Inc., Value Growth Portfolio Class A Shares or Class B Shares exchanged, a shareholder received 0.801 shares of Federated Capital Appreciation Fund Class A Shares.

Annual Shareholder Report

For every one share of EquiTrust Series Fund, Inc., Value Growth Portfolio Class I Shares exchanged, a shareholder received 0.810 shares of Federated Capital Appreciation Fund Institutional Shares.

On July 15, 2011, the Fund received assets from EquiTrust Series Fund, Inc., Blue Chip Portfolio as a result of a tax-free reorganization, as follows:

Shares of the

Fund Issued | EquiTrust

Series Fund, Inc.,

Blue Chip

Portfolio

Net Assets

Received | Unrealized

Appreciation1 | Net Assets

of the Fund

Immediately

Prior to

Combination | Net Assets

of the Fund

Immediately

After

Combination2 |

| 2,398,660 | $45,934,321 | $16,560,900 | $1,140,815,602 | $1,249,450,724 |

| 1 | Unrealized Appreciation is included in the EquiTrust Series Fund, Inc., Blue Chip Portfolio Net Assets Received amount shown above. |

| 2 | Net Assets of the Fund Immediately After Combination includes the net assets received from EquiTrust Series Fund, Inc., Value Growth Portfolio, which also reorganized into the Fund on July 15, 2011. |

On July 15, 2011, the Fund received assets from EquiTrust Series Fund, Inc., Value Growth Portfolio as a result of a tax-free reorganization, as follows:

Shares of the

Fund Issued | EquiTrust

Series Fund, Inc.,

Value Growth

Portfolio

Net Assets

Received | Unrealized

Appreciation1 | Net Assets

of the Fund

Immediately

Prior to

Combination | Net Assets

of the Fund

Immediately

After

Combination2 |

| 3,274,169 | $62,700,801 | $2,500,605 | $1,140,815,602 | $1,249,450,724 |

| 1 | Unrealized Appreciation is included in the EquiTrust Series Fund, Inc., Value Growth Portfolio Net Assets Received amount shown above. |

| 2 | Net Assets of the Fund immediately After Combination includes the net assets received from EquiTrust Series Fund, Inc., Blue Chip Portfolio, which also reorganized into the Fund on July 15, 2011. |

2. SIGNIFICANT ACCOUNTING POLICIES

The following is a summary of significant accounting policies consistently followed by the Fund in the preparation of its financial statements. These policies are in conformity with U.S. generally accepted accounting principles (GAAP).

Investment Valuation

In calculating its net asset value (NAV), the Fund generally values investments as follows:

| ■ | Equity securities listed on an exchange or traded through a regulated market system are valued at their last reported sale price or official closing price in their principal exchange or market. |

| ■ | Shares of other mutual funds are valued based upon their reported NAVs. |

| ■ | Derivative contracts listed on exchanges are valued at their reported settlement or closing price. |

| ■ | Over-the-counter (OTC) derivative contracts are fair valued using price evaluations provided by a pricing service approved by the Board of Trustees (the “Trustees”). |

| ■ | Fixed-income securities acquired with remaining maturities greater than 60 days are fair valued using price evaluations provided by a pricing service approved by the Trustees. |

Annual Shareholder Report

| ■ | Fixed-income securities acquired with remaining maturities of 60 days or less are valued at their cost (adjusted for the accretion of any discount or amortization of any premium), which approximates market value. |

| ■ | For securities that are fair valued in accordance with procedures established by and under the general supervision of the Trustees, certain factors may be considered such as: the purchase price of the security, information obtained by contacting the issuer, analysis of the issuer's financial statements or other available documents, fundamental analytical data, the nature and duration of restrictions on disposition, the movement of the market in which the security is normally traded and public trading in similar securities of the issuer or comparable issuers. |

If the Fund cannot obtain a price or price evaluation from a pricing service for an investment, the Fund may attempt to value the investment based upon the mean of bid and asked quotations or fair value the investment based on price evaluations, from one or more dealers. If any price, quotation, price evaluation or other pricing source is not readily available when the NAV is calculated, the Fund uses the fair value of the investment determined in accordance with the procedures described below. There can be no assurance that the Fund could purchase or sell an investment at the price used to calculate the Fund's NAV.

Fair Valuation and Significant Events Procedures

The Trustees have appointed a Valuation Committee comprised of officers of the Fund, Federated Equity Management Company of Pennsylvania (“Adviser”) and the Adviser's affiliated companies to determine fair value of securities and in overseeing the calculation of the NAV. The Trustees have also authorized the use of pricing services recommended by the Valuation Committee to provide fair value evaluations of the current value of certain investments for purposes of calculating the NAV. The Valuation Committee employs various methods for reviewing third-party pricing service evaluations including periodic reviews of third-party pricing services' policies, procedures and valuation methods (including key inputs and assumptions), transactional back-testing, comparisons of evaluations of different pricing services and review of price challenges by the Adviser based on recent market activity. In the event that market quotations and price evaluations are not available for an investment, the Valuation Committee determines the fair value of the investment in accordance with procedures adopted by the Trustees. The Trustees periodically review and approve the fair valuations made by the Valuation Committee and any changes made to the procedures.

Factors considered by pricing services in evaluating an investment include the yields or prices of investments of comparable quality, coupon, maturity, call rights and other potential prepayments, terms and type, reported transactions, indications as to values from dealers and general market conditions. Some pricing services provide a single price evaluation reflecting the bid-side of the market for an investment (a “bid” evaluation). Other pricing services offer both bid evaluations and price evaluations indicative of a price between the prices bid and asked for the investment (a “mid” evaluation). The Fund normally uses bid evaluations for U.S. Treasury and Agency securities and mortgage-backed securities. The Fund normally uses mid evaluations for other types of fixed-income securities and OTC derivative contracts. In the event that market quotations and price evaluations are not available for an investment, the fair value of the investment is determined in accordance with procedures adopted by the Trustees.

The Trustees also have adopted procedures requiring an investment to be priced at its fair value whenever the Adviser determines that a significant event affecting the value of the investment has occurred between the time as of which the price of the investment would otherwise be determined and the time as of which the NAV is computed. An event is considered significant if there is both an affirmative expectation that the investment's value

Annual Shareholder Report

will change in response to the event and a reasonable basis for quantifying the resulting change in value. Examples of significant events that may occur after the close of the principal market on which a security is traded, or after the time of a price evaluation provided by a pricing service or a dealer, include:

| ■ | With respect to securities traded in foreign markets, significant trends in U.S. equity markets or in the trading of foreign securities index futures contracts; |

| ■ | Political or other developments affecting the economy or markets in which an issuer conducts its operations or its securities are traded; and |

| ■ | Announcements concerning matters such as acquisitions, recapitalizations, litigation developments, a natural disaster affecting the issuer's operations or regulatory changes or market developments affecting the issuer's industry. |

The Trustees have approved the use of a pricing service to determine the fair value of equity securities traded principally in foreign markets when the Adviser determines that there has been a significant trend in the U.S. equity markets or in index futures trading. For other significant events, the Fund may seek to obtain more current quotations or price evaluations from alternative pricing sources. If a reliable alternative pricing source is not available, the Fund will determine the fair value of the investment using another method approved by the Trustees.

Repurchase Agreements

The Fund may invest in repurchase agreements for short-term liquidity purposes. It is the policy of the Fund to require the other party to a repurchase agreement to transfer to the Fund's custodian or sub-custodian eligible securities or cash with a market value (after transaction costs) at least equal to the repurchase price to be paid under the repurchase agreement. The eligible securities are transferred to accounts with the custodian or sub-custodian in which the Fund holds a “securities entitlement” and exercises “control” as those terms are defined in the Uniform Commercial Code. The Fund has established procedures for monitoring the market value of the transferred securities and requiring the transfer of additional eligible securities if necessary to equal at least the repurchase price. These procedures also allow the other party to require securities to be transferred from the account to the extent that their market value exceeds the repurchase price or in exchange for other eligible securities of equivalent market value.

The insolvency of the other party or other failure to repurchase the securities may delay the disposition of the underlying securities or cause the Fund to receive less than the full repurchase price. Under the terms of the repurchase agreement, any amounts received by the Fund in excess of the repurchase price and related transaction costs must be remitted to the other party.

The Fund may enter into repurchase agreements in which eligible securities are transferred into joint trading accounts maintained by the custodian or sub-custodian for investment companies and other clients advised by the Fund's Adviser and its affiliates. The Fund will participate on a pro rata basis with the other investment companies and clients in its share of the securities transferred under such repurchase agreements and in its share of proceeds from any repurchase or other disposition of such securities.

Investment Income, Gains and Losses, Expenses and Distributions

Investment transactions are accounted for on a trade-date basis. Realized gains and losses from investment transactions are recorded on an identified-cost basis. Interest income and expenses are accrued daily. Dividend income and distributions to shareholders are recorded on the ex-dividend date. Foreign dividends are recorded on the ex-dividend date or when the

Annual Shareholder Report

Fund is informed of the ex-dividend date. Distributions of net investment income are declared and paid annually. Non-cash dividends included in dividend income, if any, are recorded at fair value. Investment income, realized and unrealized gains and losses, and certain fund-level expenses are allocated to each class based on relative average daily net assets, except that Class A Shares, Class B Shares, Class C Shares, Class R Shares and Institutional Shares may bear distribution services fees, shareholder services fees, account administration fees and certain transfer and dividend disbursing agent fees unique to those classes. For the year ended October 31, 2012, transfer and dividend disbursing agent fees and account administration fees for the Fund were as follows:

| Transfer and

Dividend

Disbursing

Agent Fees

Incurred | Transfer and

Dividend

Disbursing

Agent Fees

Reimbursed | Account

Administration

Fees Incurred |

| Class A Shares | $1,507,986 | $(492,345) | $5,753 |

| Class B Shares | 174,247 | (47,703) | — |

| Class C Shares | 144,803 | (14,976) | 4,581 |

| Class R Shares | 93,232 | — | — |

| Institutional Shares | 175,160 | (58,677) | — |

| TOTAL | $2,095,428 | $(613,701) | $10,334 |

Dividends are declared separately for each class. No class has preferential dividend rights; differences in per share dividend rates are generally due to differences in separate class expenses.

Premium and Discount Amortization

All premiums and discounts on fixed-income securities are amortized/accreted using the effective interest rate method.

Federal Taxes

It is the Fund's policy to comply with the Subchapter M provision of the Internal Revenue Code (the “Code”) and to distribute to shareholders each year substantially all of its income. Accordingly, no provision for federal income tax is necessary. As of and during the year ended October 31, 2012, the Fund did not have a liability for any uncertain tax positions. The Fund recognizes interest and penalties, if any, related to tax liabilities as income tax expense in the Statement of Operations. As of October 31, 2012, tax years 2009 through 2012 remain subject to examination by the Fund's major tax jurisdictions, which include the United States of America and the Commonwealth of Massachusetts.

The Fund may be subject to taxes imposed by governments of countries in which it invests. Such taxes are generally based on either income or gains earned or repatriated. The Fund accrues and applies such taxes to net investment income, net realized gains and net unrealized gains as income and/or gains are earned.

Annual Shareholder Report

When-Issued and Delayed Delivery Transactions

The Fund may engage in when-issued or delayed delivery transactions. The Fund records when-issued securities on the trade date and maintains security positions such that sufficient liquid assets will be available to make payment for the securities purchased. Securities purchased on a when-issued or delayed delivery basis are marked to market daily and begin earning interest on the settlement date. Losses may occur on these transactions due to changes in market conditions or the failure of counterparties to perform under the contract.

Foreign Exchange Contracts

The Fund enters into foreign exchange contracts for the delayed delivery of securities or foreign currency exchange transactions. The Fund enters into foreign exchange contracts to protect assets against adverse changes in foreign currency exchange rates or exchange control regulations. Purchased contracts are used to acquire exposure to foreign currencies, whereas, contracts to sell are used to hedge the Fund's securities against currency fluctuations. Risks may arise upon entering into these transactions from the potential inability of counterparties to meet the terms of their commitments and from unanticipated movements in security prices or foreign exchange rates. The foreign exchange contracts are adjusted by the daily exchange rate of the underlying currency and any gains or losses are recorded for financial statement purposes as unrealized until the settlement date.

At October 31, 2012, the Fund had no outstanding foreign exchange contracts.

The average value at settlement date payable of foreign exchange contracts purchased by the Fund throughout the period was $108. This is based on the contracts held as of each month-end throughout the fiscal period.

Foreign Currency Translation

The accounting records of the Fund are maintained in U.S. dollars. All assets and liabilities denominated in foreign currencies (FCs) are translated into U.S. dollars based on the rates of exchange of such currencies against U.S. dollars on the date of valuation. Purchases and sales of securities, income and expenses are translated at the rate of exchange quoted on the respective date that such transactions are recorded. The Fund does not isolate that portion of the results of operations resulting from changes in foreign exchange rates on investments from the fluctuations arising from changes in market prices of securities held. Such fluctuations are included with the net realized and unrealized gain or loss from investments.

Reported net realized foreign exchange gains or losses arise from sales of portfolio securities, sales and maturities of short-term securities, sales of FCs, currency gains or losses realized between the trade and settlement dates on securities transactions, the difference between the amounts of dividends, interest and foreign withholding taxes recorded on the Fund's books, and the U.S. dollar equivalent of the amounts actually received or paid. Net unrealized foreign exchange gains and losses arise from changes in the value of assets and liabilities other than investments in securities at fiscal year end, resulting from changes in the exchange rate.

Annual Shareholder Report

Additional Disclosure Related to Derivative Instruments

The Effect of Derivative Instruments on the Statement of Operations for the Year Ended October 31, 2012

| Amount of Realized Gain or (Loss) on Derivatives Recognized in Income |

| Forward

Currency

Contracts |

| Foreign exchange contracts | $10,965 |

Other

The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the amounts of assets, liabilities, expenses and revenues reported in the financial statements. Actual results could differ from those estimated.

3. SHARES OF BENEFICIAL INTEREST

The following tables summarize share activity:

| Year Ended October 31 | 2012 | 2011 |

| Class A Shares: | Shares | Amount | Shares | Amount |

| Shares sold | 2,901,338 | $54,877,487 | 6,348,935 | $118,719,508 |

| Proceeds from shares issued in connection with the tax-free transfer of assets from Performance Large Cap Equity Fund | 727,763 | 14,693,527 | — | — |

| Proceeds from shares issued in connection with the tax-free transfer of assets from EquiTrust Series Fund, Inc., Blue Chip Portfolio | — | — | 1,717,167 | 32,883,740 |

| Proceeds from shares issued in connection with the tax-free transfer of assets from EquiTrust Series Fund, Inc., Value Growth Portfolio | — | — | 2,627,334 | 50,314,097 |

| Shares issued to shareholders in payment of distributions declared | 238,447 | 4,122,755 | 236,902 | 4,503,506 |

| Shares redeemed | (14,558,975) | (275,370,710) | (14,816,248) | (276,732,168) |

NET CHANGE RESULTING FROM

CLASS A SHARE TRANSACTIONS | (10,691,427) | $(201,676,941) | (3,885,910) | $(70,311,317) |

| Year Ended October 31 | 2012 | 2011 |

| Class B Shares: | Shares | Amount | Shares | Amount |

| Shares sold | 100,604 | $1,808,447 | 239,736 | $4,307,221 |

| Shares redeemed | (1,879,400) | (33,588,938) | (3,184,584) | (56,582,380) |

NET CHANGE RESULTING FROM

CLASS B SHARE TRANSACTIONS | (1,778,796) | $(31,780,491) | (2,944,848) | $(52,275,159) |

Annual Shareholder Report

| Year Ended October 31 | 2012 | 2011 |

| Class C Shares: | Shares | Amount | Shares | Amount |

| Shares sold | 351,259 | $6,287,483 | 643,711 | $11,449,334 |

| Shares redeemed | (1,024,472) | (18,317,225) | (1,311,476) | (23,150,602) |

NET CHANGE RESULTING FROM

CLASS C SHARE TRANSACTIONS | (673,213) | $(12,029,742) | (667,765) | $(11,701,268) |

| Year Ended October 31 | 2012 | 2011 |

| Class R Shares: | Shares | Amount | Shares | Amount |

| Shares sold | 450,095 | $8,530,768 | 911,364 | $17,186,429 |

| Shares issued to shareholders in payment of distributions declared | 7,101 | 121,703 | 2,219 | 41,834 |

| Shares redeemed | (871,981) | (16,650,019) | (550,444) | (10,056,912) |

NET CHANGE RESULTING FROM

CLASS R SHARE TRANSACTIONS | (414,785) | $(7,997,548) | 363,139 | $7,171,351 |

| Year Ended October 31 | 2012 | 2011 |

| Institutional Shares: | Shares | Amount | Shares | Amount |

| Shares sold | 554,685 | $10,462,531 | 1,008,664 | $19,068,914 |

| Proceeds from shares issued in connection with the tax-free transfer of assets from Performance Large Cap Equity Fund | 2,554,884 | 51,582,891 | — | — |

| Proceeds from shares issued in connection with the tax-free transfer of assets from EquiTrust Series Fund, Inc., Blue Chip Portfolio | — | — | 681,493 | 13,050,581 |

| Proceeds from shares issued in connection with the tax-free transfer of assets from EquiTrust Series Fund, Inc., Value Growth Portfolio | — | — | 646,835 | 12,386,704 |

| Shares issued to shareholders in payment of distributions declared | 31,369 | 541,114 | 19,710 | 374,090 |

| Shares redeemed | (3,751,920) | (70,661,969) | (5,030,797) | (93,643,950) |

| NET CHANGE RESULTING FROM INSTITUTIONAL SHARE TRANSACTIONS | (610,982) | $(8,075,433) | (2,674,095) | $(48,763,661) |

| NET CHANGE RESULTING FROM TOTAL FUND SHARE TRANSACTIONS | (14,169,203) | $(261,560,155) | (9,809,479) | $(175,880,054) |

Annual Shareholder Report

4. FEDERAL TAX INFORMATION

The timing and character of income and capital gain distributions are determined in accordance with income tax regulations, which may differ from GAAP. These differences are due in part to differing treatments for capital loss carryforwards acquired through mergers, wash sales deferrals acquired through mergers, foreign cash reclasses and regulatory settlement proceeds.

For the year ended October 31, 2012, permanent differences identified and reclassified among the components of net assets were as follows:

| Increase (Decrease) |

| Paid-In Capital | Undistributed

Net Investment

Income (Loss) | Accumulated

Net Realized

Gain (Loss) |

| $4,221,786 | $(23,404) | $(4,198,382) |

Net investment income (loss), net realized gains (losses), and net assets were not affected by this reclassification.

The tax character of distributions as reported on the Statement of Changes in Net Assets for the years ended October 31, 2012 and 2011, was as follows:

| 2012 | 2011 |

| Ordinary income | $5,568,278 | $6,631,783 |

As of October 31, 2012, the components of distributable earnings on a tax basis were as follows:

| Undistributed ordinary income | $5,710,661 |

| Undistributed long-term capital gain | $6,488,927 |

| Net unrealized appreciation | $85,137,281 |

| Capital loss carryforwards | $(48,944,819) |

The difference between book-basis and tax-basis net unrealized appreciation/depreciation is attributable to differing treatments for the deferral of losses on wash sales.

At October 31, 2012, the cost of investments for federal tax purposes was $795,812,980. The net unrealized appreciation of investments for federal tax purposes excluding any unrealized appreciation/depreciation resulting from the translation from FCs to U.S. dollars of assets and liabilities other than investments in securities was $85,144,598. This consists of net unrealized appreciation from investments for those securities having an excess of value over cost of $99,031,267 and net unrealized depreciation from investments for those securities having an excess of cost over value of $13,886,669.

At October 31, 2012, the Fund had a capital loss carryforward of $48,944,819 which will reduce the Fund's taxable income arising from future net realized gains on investments, if any, to the extent permitted by the Code, thereby reducing the amount of distributions to shareholders which would otherwise be necessary to relieve the Fund of any liability for federal income tax. Pursuant to the Code, a net capital loss incurred in taxable years beginning on or before December 22, 2010, is characterized as short-term and may be carried forward

Annual Shareholder Report

for a maximum of eight tax years (“Carryforward Limit”), whereas a net capital loss incurred in taxable years beginning after December 22, 2010, retains its character as either short-term or long-term, does not expire and is required to be utilized prior to the losses which have a Carryforward Limit.

The following schedule summarizes the Fund's capital loss carryforward and expiration year:

| Expiration Year | Short-Term | Long-Term | Total |

| 2017 | $48,944,819 | NA | $48,944,819 |

The Fund used capital loss carryforwards of $67,662,442 to offset capital gains realized during the year ended October 31, 2012.

As a result of the tax-free transfer of assets from fund mergers, the use of certain capital loss carryforwards listed above may be limited.

5. INVESTMENT ADVISER FEE AND OTHER TRANSACTIONS WITH AFFILIATES

Investment Adviser Fee

The advisory agreement between the Fund and the Adviser provides for an annual fee equal to 0.75% of the Fund's average daily net assets. Subject to the terms described in the Expense Limitation note, the Adviser may voluntarily choose to waive any portion of its fee. For the year ended October 31, 2012, the Adviser voluntarily waived $175,085 of its fee.

Administrative Fee

Federated Administrative Services (FAS), under the Administrative Services Agreement, provides the Fund with administrative personnel and services. The fee paid to FAS is based on the average aggregate daily net assets of certain Federated funds as specified below, plus certain out-of-pocket expenses:

| Administrative Fee | Average Aggregate Daily Net Assets

of the Federated Funds |

| 0.150% | on the first $5 billion |

| 0.125% | on the next $5 billion |

| 0.100% | on the next $10 billion |

| 0.075% | on assets in excess of $20 billion |

Prior to September 1, 2012, the administrative fee received during any fiscal year was at least $150,000 per portfolio and $40,000 per each additional class of Shares. Subject to the terms described in the Expense Limitation note, FAS may voluntarily choose to waive any portion of its fee. For the year ended October 31, 2012, FAS waived $15,204 of its fee. The net fee paid to FAS was 0.076% of average daily net assets of the Fund.

Annual Shareholder Report

Distribution Services Fee

The Fund has adopted a Distribution Plan (the “Plan”) pursuant to Rule 12b-1 under the Act. Under the terms of the Plan, the Fund will compensate Federated Securities Corp. (FSC), the principal distributor, from the daily net assets of the Fund's Class A Shares, Class B Shares, Class C Shares and Class R Shares to finance activities intended to result in the sale of these shares. The Plan provides that the Fund may incur distribution expenses at the following percentages of average daily net assets annually, to compensate FSC:

| Share Class Name | Percentage of Average Daily

Net Assets of Class |

| Class A Shares | 0.05% |

| Class B Shares | 0.75% |

| Class C Shares | 0.75% |

| Class R Shares | 0.50% |

Subject to the terms described in the Expense Limitation note, FSC may voluntarily choose to waive any portion of its fee. For the year ended October 31, 2012, distribution services fees for the Fund were as follows:

| Distribution

Services

Fees Incurred | Distribution

Services

Fees Waived |

| Class B Shares | $376,820 | $— |

| Class C Shares | 463,993 | — |

| Class R Shares | 129,281 | (64,641) |

| TOTAL | $970,094 | $(64,641) |

When FSC receives fees, it may pay some or all of them to financial intermediaries whose customers purchase shares. For the year ended October 31, 2012, FSC retained $111,329 of fees paid by the Fund. For the year ended October 31, 2012, the Fund's Class A Shares did not incur a distribution services fee; however, it may begin to incur this fee upon approval of the Trustees.

Sales Charges

Front-end sales charges and contingent deferred sales charges (CDSC) do not represent expenses of the Fund. They are deducted from the proceeds of sales of Fund shares prior to investment or from redemption proceeds prior to remittance, as applicable. For the year ended October 31, 2012, FSC retained $26,601 in sales charges from the sale of Class A Shares. FSC also retained $2,014 of CDSC relating to redemptions of Class A Shares, $26,084 relating to redemptions of Class B Shares and $805 relating to redemptions of Class C Shares.

Annual Shareholder Report

Shareholder Services Fee

The Fund may pay fees (“Service Fees”) up to 0.25% of the average daily net assets of the Fund's Class A Shares, Class B Shares and Class C Shares to financial intermediaries or to Federated Shareholder Services Company (FSSC) for providing services to shareholders and maintaining shareholder accounts. Subject to the terms described in the Expense Limitation note, FSSC may voluntarily reimburse the Fund for Service Fees. For the year ended October 31, 2012, Service Fees for the Fund were as follows:

| Service

Fees

Incurred |

| Class A Shares | $1,795,620 |

| Class B Shares | 125,606 |

| Class C Shares | 150,083 |

| TOTAL | $2,071,309 |

For the year ended October 31, 2012, FSSC did not receive any fees paid by the Fund.

Expense Limitation