CHAPTER I

Ontario’s Plan for Prosperity

Section A: Jobs and Growth

Section A: Jobs and Growth

HIGHLIGHTS

Investing in Knowledge and Skills

þ | 20,000 new student spaces in colleges and universities, starting in 2010–11, through a new annual investment of $310 million. |

| More than 1,000,000 Ontarians receive skills training and employment assistance annually. |

| Full-day learning for four- and five-year-olds begins in September 2010, benefiting up to 35,000 children in nearly 600 schools. |

Helping Job Creation and Economic Growth in Northern Ontario

| $150 million a year, on average, over three years for a new Northern Industrial Electricity Rate Program. |

| $45 million over three years for a new skills training program to help Aboriginal Peoples and northern Ontarians benefit from developing economic opportunities such as the Ring of Fire. This Budget also announces a Ring of Fire Coordinator to work with all parties to advance the area’s economic promise. |

| A proposed permanent Northern Ontario Energy Credit of up to $130 for single people and up to $200 for families (including single parents) annually, to help northern Ontario residents with the higher energy costs they face. |

Job Opportunities through the Green Economy

| 50,000 jobs over three years through the Green Energy Act, 2009. |

| A new water strategy to protect Ontario’s water resources and promote jobs in the water sector. |

Short-Term Infrastructure Investments

| Record investment over 2009–10 and 2010–11 for roads, bridges, transit, energy retrofits and other infrastructure, creating and preserving more than 300,000 jobs. |

Ontario's Tax Plan for Jobs and Growth

| Helps create nearly 600,000 net new jobs within 10 years. |

| Personal Income Tax cuts for 93 per cent of income tax payers. |

| Enhanced sales tax credits and property tax credits for low- to middle-income families and individuals, starting in 2010. |

| Corporate Income Tax cuts, including reducing the small business income tax rate from 5.5 per cent to 4.5 per cent on July 1, 2010. |

| Over $4.2 billion in Sales Tax Transition Benefits to help Ontarians adjust to the Harmonized Sales Tax. |

Advancing the Poverty Reduction Agenda

| Target to reduce child poverty by 25 per cent over five years, which would move 90,000 children out of poverty by 2013. |

| $63.5 million in annual child care funding to replace discontinued federal funding, keeping approximately 8,500 Ontario children in child care. |

| Increase adult basic-needs allowances and maximum shelter allowances by one per cent for people on Ontario Disability Support Program and Ontario Works. This would provide an additional $20 million to families and individuals in 2010–11. |

| Ontario’s minimum wage will rise to $10.25 per hour on March 31, 2010. |

| Personal income tax cuts will result in 90,000 lower-income taxpayers no longer paying Ontario personal income tax, starting in 2010. |

| Number of employment standards officers increased to expand protection for some of the province’s most vulnerable workers. |

OPENING ONTARIO THROUGH KNOWLEDGE AND SKILLS

Six years ago, the McGuinty government began building a solid foundation for economic growth and prosperity through its investments in education and skills training. With its five-year Open Ontario plan, the government will continue to invest in Ontarians’ knowledge and skills through postsecondary education, skills training, jobs programs and full-day learning.

Postsecondary Education

Ontario’s colleges and universities play a critical role in equipping people for success and preparing them to generate the ideas, products and jobs that will ensure future prosperity.

Ontario has one of the highest rates of postsecondary education attainment in the world at 62 per cent. However, as the economy changes, 70 per cent of all new jobs will require postsecondary education or training.

The Plan:

The McGuinty government made the largest multi-year investment in postsecondary education in 40 years through Reaching Higher, announced in 2005. Postsecondary education remains a top government priority. Through its Open Ontario plan, the government’s goal is to raise Ontario’s postsecondary attainment rate to 70 per cent. There will be a place for every qualified Ontarian who wants to go to college or university. The government will also increase international student enrolment by 50 per cent while guaranteeing spaces for qualified Ontario students.

These measures will make Ontario one of the leading jurisdictions for postsecondary education in the world.

As part of the Open Ontario plan, commitments to postsecondary education in the 2010 Budget include:

| adding 20,000 new spaces to colleges and universities in 2010–11, through a new investment of $310 million. This is in addition to providing $155 million in 2009–10 to fully support enrolment growth at colleges and universities, including $65 million announced through the Fall 2009 Ontario Economic Outlook and Fiscal Review; |

| aggressively promoting Ontario postsecondary schools abroad to encourage the world’s best students to study here, settle here and help Ontario build a stronger economy; |

| improving students’ ability to navigate Ontario’s postsecondary system by providing additional resources to support the implementation of a credit transfer system; and |

| creating the new Ontario Online Institute, which will bring the best professors from Ontario’s postsecondary institutions into the homes of those who want to pursue higher learning. |

REACHING HIGHER The Results: þ More than 120,000 additional students are attending college and university, a 31 per cent increase over 2002–03. þ University per-student operating funding is 27 per cent higher and college per-student operating funding is 44 per cent higher in 2008–09 compared with 2002–03. þ 186,000 students are benefiting in 2009–10 from enhancements to the Ontario Student Assistance Program (OSAP) that have been introduced since 2004–05. þ The degree completion rate has increased to 78 per cent from 73 per cent in 2002–03 for university students and to 65 per cent from 57 per cent for college students. þ A total of 260 additional first-year medical student spaces will be created by 2011–12, a 38 per cent increase since 2004–05. þ More than 15,000 new graduate spaces will be created by 2011–12, an increase of over 62 per cent since 2002–03. |

Employment and Training Supports

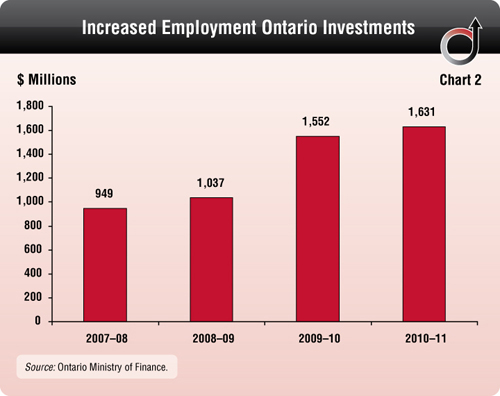

Each year, more than one million Ontarians rely on Employment Ontario for help in finding work and acquiring job training. Over the past two years, demand for employment and training services has increased sharply because of the global recession. In response, the government boosted Employment Ontario spending on jobs and skills training to about $1.6 billion in each of 2009–10 and 2010–11, with a special focus on workers affected by the economic recession. Additional employment and training services are also provided through a number of ministries.

The Plan:

The government will:

| þ | improve customer service by creating one-stop access for all Ontarians to Employment Ontario across the province. The new service delivery model will be in place by August 2010; |

| þ | continue to deliver the Second Career Strategy by helping an additional 30,000 unemployed workers get training. This will bring the total number of participants to nearly 60,000 since the program began in June 2008; |

| þ | invest, for the second consecutive year, an additional $39 million in 2010–11 in its Summer Jobs programs, including targeted resources for youth in high-needs neighbourhoods. This brings spending in the summer of 2010 to $96 million — 69 per cent more than in the summer of 2008. The programs will support nearly 110,000 jobs and services for students this summer; |

| þ | implement the federal–provincial Targeted Initiative for Older Workers agreement to support skills training projects in hard-hit communities. These projects will help unemployed older workers in vulnerable communities to develop the skills required to find a good job in today’s labour market; |

| | ú | the Targeted Initiative for Older Workers will serve workers aged 55 to 64 living in communities of fewer than 250,000 people that have high unemployment or rely on a single industry that has been hard hit by the recession; |

| þ | continue workplace-based pilots for literacy training that respond to the changing needs of workers and provide them with literacy skills to work safely, effectively and productively; |

| þ | further enhance apprenticeship programs, including increasing the number of apprentices who complete the program; and |

| þ | provide improved training and employment supports for groups traditionally underrepresented in postsecondary education, training and the workforce. |

Over 1,000,000 Ontarians Get Skills Training and Table 1 Employment Assistance Annually |

| Selected Programs | Clients Served Since 2008 |

| Job Connect | 489,867 |

| Employment Assistance Services | 367,758 |

| Rapid Re-employment and Training Services | 120,465 |

| 2009 Summer Jobs and Services | 110,521 |

| Literacy and Basic Skills | 101,981 |

| Apprenticeship Registration | 50,273 |

| Ontario Skills Development Program | 27,871 |

| Second Career | 27,101 |

| Self-Employment Benefit | 5,800 |

| Targeted Wage Subsidy | 4,460 |

| Job Creation Partnership | 1,895 |

Early learning is an important part of the McGuinty government’s Open Ontario plan to increase student achievement, build a stronger workforce and help break the cycle of poverty. An educated, healthy and employable workforce is critical to the economic future of the province.

Various studies, including Dr. Charles Pascal’s 2009 report, “With Our Best Future in Mind: Implementing Early Learning in Ontario,”1 have found that full-day early learning is associated with improved reading and numeracy, smoother transitions to Grade 1, and increased secondary school graduation rates. Full-day learning also makes it easier for parents to participate in the job market.

____________________

| 1 | See www.ontario.ca/en/initiatives/early_learning/ONT06_018865 for the full report. |

The Plan:

Beginning in September 2010, the government will introduce full-day learning for four- and five-year-olds, benefiting up to 35,000 children in nearly 600 schools. The program will be phased in over time, with a goal of having early learning fully implemented by 2015–16. In the next two years, the government will provide about $245 million in capital grants to implement full-day learning. At full implementation, the Early Learning Program will employ up to an additional 3,800 teachers and 20,000 early childhood educators.

This is part of the McGuinty government’s ongoing plan to strengthen education, which has already led to smaller class sizes, higher test scores and an improved graduation rate.

The federal government ended its commitment to provide the ongoing funding necessary to maintain approximately 8,500 child care spaces across Ontario. To continue support for these spaces, Ontario is permanently filling the funding gap left by the federal government with an investment of $63.5 million annually. This initiative will help to ensure that low-income working parents continue to have access to quality child care and play an active role in the labour force.

OPENING ONTARIO TO INVESTMENT AND JOBS

Jobs and Growth for Northern Ontario

In recent years, Ontario’s resource-based industries have faced significant challenges, including the strong Canadian dollar and increased global competition. The mining and forest products industries — mainstays of northern Ontario’s economy — have been particularly hard hit by weak demand and soft commodity prices during the recession.

A further challenge for northern Ontario is that many of its towns and cities rely on a single, resource-based industry. Over the past three years, northern Ontario has experienced a longer and deeper employment decline than the overall Ontario economy. Employment in northern Ontario has fallen by more than twice the rate of the province as a whole.

The government recognizes the unique circumstances of northern communities. The Open Ontario plan will help strengthen the northern economy, while protecting the boreal-forest region.

The Plan:

As part of the Open Ontario plan, the 2010 Budget proposes initiatives that will enhance job creation and economic growth in northern Ontario. These include:

þ | creating a three-year Northern Industrial Electricity Rate Program (NIERP), averaging $150 million annually, that would provide electricity price rebates of two cents per kilowatt-hour. This would, on average, reduce industrial electricity prices by about 25 per cent for large facilities, based on 2009 levels. The rebate would be available to qualifying large northern industrial facilities that commit to an electricity efficiency and sustainability plan. The program will help protect and create jobs in the north; |

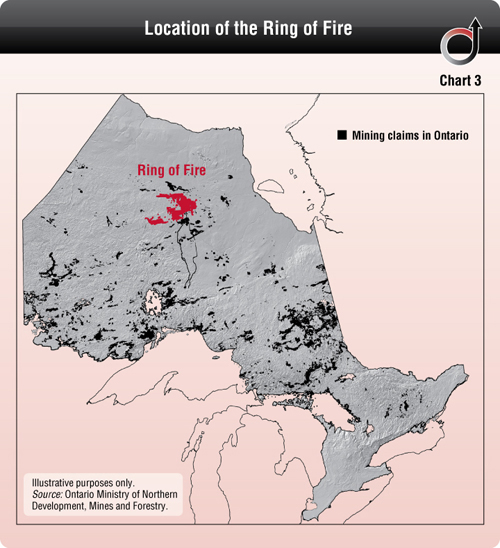

| providing $45 million over the next three years for a new project-based skills training program to help Aboriginal Peoples and northern Ontarians participate in and benefit from emerging economic development opportunities, such as the Ring of Fire — an area with potentially large deposits of minerals such as chromite, nickel, copper and platinum. The program will also help build capacity in the north to undertake base mapping, develop resource inventories and gather other information. This will support community land-use planning and environmentally sustainable development that benefit Aboriginal Peoples and northern Ontarians. It will help to implement the proposed Far North Act, 2010; |

| establishing a Ring of Fire Coordinator to work and consult with Aboriginal Peoples and northern Ontarians and the mining community to encourage responsible and sustainable economic development related to the Ring of Fire; |

| proposing a new permanent Northern Ontario Energy Credit to help eligible low- to middle-income northern residents with the higher energy costs they face; |

| partnering with Sudbury and Thunder Bay to establish pilot economic development planning areas; and |

| implementing the Targeted Initiative for Older Workers, which will benefit unemployed older workers throughout the province, including northern Ontario. |

The government is also making significant infrastructure investments to strengthen northern communities, with total planned investment of about $1.2 billion in northern highways, hospitals, water and wastewater systems, and other infrastructure that is forecast to support 10,000 jobs in 2010–11. These investments include:

| the Thunder Bay Consolidated Courthouse, which will improve access to justice and spur downtown revitalization; |

| the Ontario Provincial Police Modernization project, which will involve the construction of new detachments, regional command centres and forensic identification units in 16 communities, including nine northern locations; |

| expanding the 100-kilometre corridor of Highways 11/17 between Thunder Bay and Nipigon to four lanes. Construction on two projects along this corridor is to begin in 2010–11, with work on the remainder to follow; and |

| providing up to $15 million to support Huron Central Railway’s proposal for $33 million of infrastructure investments on the Sault Ste. Marie to Sudbury rail line. |

Northern Ontario Energy Credit

þ The government recognizes that people living in the north tend to pay more for energy. Energy costs are higher, for example, because of more severe winters and heavier reliance on more expensive home heating fuels. The Province proposes to help low- to middle-income families and single people in the north with their energy costs by introducing a new permanent Northern Ontario Energy Credit. Eligible Ontarians living in northern Ontario would qualify for this refundable credit.

þ Northern residents who pay rent or property tax for their principal residence would be eligible for an annual credit of up to $130 for a single person and up to $200 for a family (including single parents). To target the assistance to those who need it most, the credit would be income-tested. The credit would be reduced for a single person with adjusted net income over $35,000 and eliminated when income exceeds $48,000, and reduced for families with adjusted family net income over $45,000 and eliminated when income exceeds $65,000, as shown in Table 2.

Northern Ontario Energy Credit &# 160; Table 2 |

| Single Person | Family (including Single Parents) |

Maximum Benefit | Benefit Reduction Range | Maximum Benefit | Benefit Reduction Range |

| $130 | $35,000 – $48,000 | $200 | $45,000 –$65,000 |

þ In subsequent years, this permanent credit would be paid on a quarterly basis and delivered along with the proposed new Ontario Energy and Property Tax Credit. See Chapter III: Tax and Pension Systems for Ontario’s Future for further details.

þ For 2010, about a quarter of a million families and single people, or over half of northerners, would benefit from about $35 million in assistance.

STRENGTHENING NORTHERN ONTARIO The Results: þ Ontario has moved forward on a number of initiatives that support key recommendations of Dr. Robert Rosehart, the Northwestern Ontario Economic Facilitator. For example, by: — establishing a new Northern Ontario Entrepreneur Program, under the Northern Ontario Heritage Fund Corporation (NOHFC). The NOHFC’s programs approved grants to more than 940 projects in 2009–10, leading to the creation and retention of more than 2,300 jobs in the north; and — accelerating Business Education Tax (BET) rate cuts for northern businesses. Northern businesses benefit from the full implementation of the accelerated BET reduction in 2010, with savings totalling more than $70 million. þ The Northern Ontario School of Medicine, which opened in 2005, celebrated the graduation of its first 55 medical school students in the spring of 2009. |

Jobs in the Green Economy

The McGuinty government is making Ontario a leader in the green economy. Targeted investments and regulatory reforms are creating thousands of clean-technology jobs.

The Plan:

In 2009, the government enacted the Green Energy Act, 2009 (GEA) to support the growth of clean, renewable energy sources and help build Ontario’s green economy infrastructure by attracting new investments and promoting conservation.

Ontario is a Green Economy Leader The Green Energy Act, 2009 “is the single best green energy program on the North American continent.” Al Gore, November 2009. |

The GEA will help create 50,000 jobs for Ontarians in its first three years and boost investments in renewable generation through North America’s first comprehensive feed-in tariff (FIT) program, which pays renewable energy generators for the electricity they produce under long-term contracts.

On March 10, 2010, the Ontario Power Authority (OPA) announced it had issued the first 510 FIT contracts, totalling 112 megawatts (MW), enough to power more than 13,000 homes. These projects are to be built in 120 communities across Ontario by a number of groups, such as farmers, municipalities, local distribution companies, commercial businesses, industrial customers, school boards and hospitals. About 95 per cent of the projects are for solar generation, with other projects from biogas, water, wind and biomass.

Ontario is achieving early success in the green economy by attracting a $7 billion proposed investment by the consortium led by Samsung C&T Corporation and Korea Electric Power Corporation, the single-largest investment in renewable energy in provincial history.

Samsung C&T Corporation and Korea Electric Power Corporation Investment þ The proposed $7 billion investment by the consortium led by Samsung C&T Corporation and Korea Electric Power Corporation would: — build 2,500 megawatts (MW) of wind and solar power, tripling Ontario’s generation capacity from renewable wind and solar sources. The first phase of the project, a 500 MW cluster (400 MW of wind and 100 MW of solar), is scheduled to be completed in about three years; — create more than 16,000 new green energy jobs to supply, build, install and operate the renewable generation projects; and — lay the groundwork with major partners to attract four manufacturing plants. This is expected to account for 1,440 manufacturing and related jobs (out of the 16,000 new green jobs), building wind and solar technology for use in Ontario and export across North America. Three of the four facilities are scheduled to be ready in 2013, while the fourth is scheduled to be in operation by the end of 2015. þ The consortium also intends to use Ontario-made steel in its renewable energy projects for items such as wind turbine towers. |

A cornerstone of the Green Energy Act, 2009 is the creation of a culture of conservation. For the past six years, Ontario has worked very hard to become a leading jurisdiction on energy conservation by setting tough targets and investing millions of dollars in new programs for residents and businesses.

The Industrial Transmission Connected Electricity Efficiency Program, administered by the Ontario Power Authority, would target the province’s largest electricity users that are directly connected to the transmission grid. These industrial users account for about 10 per cent of Ontario’s electricity usage and spend over $1 billion on electricity per year.

This five-year program will further the productivity and global competitiveness of Ontario’s industrial sector, conserve electricity and result in an estimated 5,500 jobs. Together with the Northern Industrial Electricity Rate Program announced in the Budget, Ontario will enhance electricity conservation, efficiency and sustainability across the province.

Expanding Opportunities through Clean Water Technologies

Global demand for water is expected to increase rapidly and the market opportunity for clean water and wastewater technologies is enormous. The Conference Board of Canada recently reported the value of this market to be over $400 billion US worldwide and predicted it would double every five to six years. Ontario is well positioned to become a global leader in the water and wastewater sector as it begins to sell its services and technologies around the world.

Protecting Ontario’s water resources is critical to the development of a strong and green economy. The Province is also strengthening the water technology sector to take advantage of emerging opportunities arising in the global water technology market.

For example, in 2009–10, the Province is investing $100 million to help the City of Hamilton upgrade the Woodward Avenue Wastewater Treatment Plant. This important project will achieve many environmental, social and economic benefits.

Water Technology Water technology relates to the protection, quality and treatment of water. There are over 300 companies providing water technologies and services in Ontario. Companies like Echologics Engineering and Real Tech are leaders in water technologies such as the acoustic detection of water loss and ultra-violet photometry instrumentation. Both have benefited from support programs at the MaRS Centre, such as the Ontario Business Mentorship and Entrepreneurship Program. |

The Plan:

As part of its Open Ontario plan, the government is developing a wide-ranging water strategy to make Ontario the North American leader in water conservation and innovation, and protect Ontario’s water resources for future generations. The strategy will promote new business and employment opportunities in the water sector through supporting the commercialization of water and wastewater technologies.

Looking Ahead Ontario’s water strategy will: þ work with colleges, universities and entrepreneurs to create jobs and attract clean water expertise and investment to the province; þimprove the efficiency of Ontario’s water and wastewater infrastructure; þintroduce a new Water Opportunities Act to support the development of new technologies for water conservation and treatment; and þpromote Ontario’s water technology sector at home and abroad. |

Ontario has great potential in water research, education and innovation. Over 21 water-related institutes are in the Greater Toronto Area, and seven universities and colleges across the province have research institutes working in this area. Ontario is home to leading clean-technology organizations, such as the Ontario Clean Water Initiative, which helps to expand Ontario’s water clusters and strengths. Ontario is also home to the United Nations University Institute for Water, Environment and Health, which focuses on resolving global water problems through the development of scientific research and capacity.

Financial Services

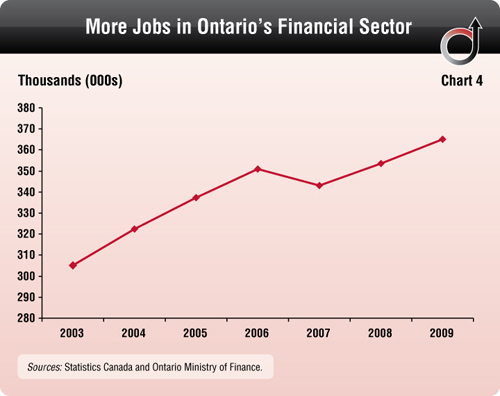

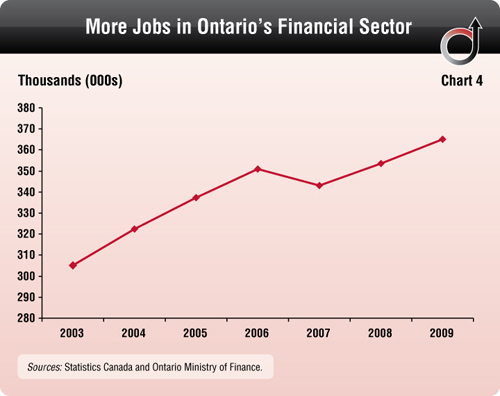

Ontario’s financial services sector is a world leader and a critical part of the province’s economy. It provides thousands of jobs and drives significant economic activity.

Toronto is home to globally successful insurance companies and investment and pension funds. Canada’s banks — largely based in Ontario — enjoy a global reputation as the soundest in the world. Toronto is home to five of the 13 largest banks in North America by market capitalization and is the third-largest financial centre in North America.

The Plan:

The government is providing the financial services sector with support and flexibility to stimulate future growth while also protecting the interests of consumers and investors.

The provincial government is:

þ | partnering with industry and other governments to establish a Financial Services Leadership Council consisting of major |

| | financial-sector CEOs and government leaders. This Council will guide the work of the Toronto Financial Services Alliance (TFSA) |

| as it implements a plan to improve the sector’s competitiveness, create thousands of high-paying jobs and make Toronto one of the top 10 financial centres in the world; |

þ | supporting the work of the Council and TFSA to create opportunities by leveraging Ontario’s excellent record in the financial services sector and its highly skilled and diverse workforce. Projects such as TFSA’s Global Integrative Risk Management Institute, which will promote best practices for financial risk management, provide a unique opportunity to capitalize on the financial sector’s reputation for safety and soundness; |

þ | actively working with the federal government and other interested provinces and territories to put in place a Canadian Securities Regulator. The Province is committed to the establishment of a strong national regulator that will reflect Ontario’s economic interests, enhance investor protection and improve the industry’s international competitiveness. The government believes the new regulator should locate its principal operations in Toronto and will continue to press the federal government to that end; |

þ | continuing to pursue important measures to enhance the regulation of Ontario’s capital markets. In particular, the government plans to propose reforms to the Securities Act and the Commodity Futures Act, including changes to update them, strengthen the oversight of |

| | credit-rating agencies and bolster capital markets enforcement; and |

þ | working with the credit union sector, Deposit Insurance Corporation of Ontario and Financial Services Commission of Ontario on an ongoing basis to address emerging issues and support the sector’s growth and competitiveness. This follows the successful implementation on October 1, 2009 of a multi-year legislative project to modernize regulatory requirements, update investment and lending powers, and strengthen consumer protection. |

A strong and stable future for the Financial Services Sector The Results: þ In the 2009 Budget, the government announced that it would partner with the City of Toronto and TFSA to advance Toronto’s position as a global leader in financial services. þ Ontario has established the Centre of Excellence in Financial Services Education and is working with the sector and postsecondary institutions to attract foreign students and develop the best financial services sector talent. þ Since 2003, employment in the financial services sector grew by 60,000 to 365,000 jobs in 2009. þ The sector supports an estimated 280,000 ancillary jobs, including high-paying business services jobs (such as software design). |

Opening International and Interprovincial Markets

Markets around the world look to Ontario’s products, people and ideas.

The Province is helping to open markets and create new trade opportunities for Ontario’s businesses by securing new interprovincial and international trade agreements. These agreements will lay the foundation for continued economic growth and improved employment in Ontario. New trade agreements will expand Ontario’s economy.

The Plan:

Ontario is working with the federal government and other provinces to negotiate a Canada–European Union Comprehensive Economic and Trade Agreement (CETA). This would provide Ontario’s exporters with greater access to one of the largest and richest export markets in the world.

In addition, as Ontario’s economy shows signs of recovery, and trade and traffic volumes increase, it is critical that Ontario’s borders with the United States, Canada’s most important trading partner, operate as effectively as possible. Federal investment in technology and human resources at borders is critical to ensuring traffic flows as efficiently as possible. The federal government’s recent budget commitment to invest $87 million over two years to improve border efficiency and to expand and promote trusted traveller programs is a positive and welcome step in this regard.

The government is also working with other provinces and the federal government to improve the Agreement on Internal Trade by promoting greater mobility of goods, services and labour.

Ontario is advancing its interests in Washington, D.C. by establishing an office located in the Canadian Embassy. This office will promote the linkages and interests of the Ontario/U.S. relationship affected by U.S. policies through ongoing monitoring and focused advocacy. These include such important issues as border, trade, climate change, water, air and related matters.

Opening international and interprovincial markets The Results: þ Canada and the United States recently reached an agreement under which the United States has waived the Buy American provisions of the American Recovery and Reinvestment Act of 2009. Ontario businesses will be able to participate in U.S. infrastructure projects and gain access to a variety of state and local public works projects, estimated at nearly $65 billion US. þ The Ontario–Quebec Trade and Cooperation Agreement, signed in September 2009, will increase trade and investment between Ontario and Quebec, promote innovation and reduce long-standing barriers to business. It includes precedent-setting chapters on financial services, energy cooperation and regulatory cooperation. þ Since 2003, Ontario’s merchandise exports to countries other than the United States have increased by almost 80 per cent, to $25 billion in 2009, accounting for 20 per cent of Ontario’s total merchandise exports compared to about seven per cent a decade ago. þ Ontario’s total exports of services have grown strongly since 2003, reaching $91 billion in 2009 and accounting for almost one-third of Ontario’s overall exports. |

Business Enterprise Opportunities The government is reviewing ways to maximize the returns on its major government business enterprises. The goal of this review is to determine whether those enterprises, as they exist and are managed today, are serving Ontarians’ and the province’s long-term economic interests. This review of government business enterprises will determine whether a different approach could create increased economic growth and new jobs for Ontarians. |

Support for Key Economic Sectors Since 2003, the McGuinty government has invested in key sectors of the economy to strengthen Ontario’s competitiveness, sustain and create jobs, and position the province for long-term growth. Initiatives include: þ Auto — $4.8 billion to General Motors and Chrysler to preserve at least 85,000 jobs and ensure the future global competitiveness of a sector that directly and indirectly supported about 400,000 Ontario jobs in 2008; þ Manufacturing — Lowering business costs by more than $1.2 billion a year in tax relief, when fully implemented, and providing over $708 million since 2005 through the Next Generation of Jobs Fund and the Advanced Manufacturing Investment Strategy, securing about 10,300 jobs and leveraging over $3.9 billion in investments; þ Small Business — Implementing significant tax and regulatory reforms to help small business development, including cutting the Corporate Income Tax rate for small business from 5.5 per cent to 4.5 per cent, eliminating the small business deduction surtax and providing one-time transitional assistance of up to $1,000 to help small businesses adapt to the HST; þ Creative Industries — Enhancements to tax credits have driven exceptional growth, creating over 23,000 jobs since 2003 — an increase of 12 per cent. In 2009 alone, film and television production increased 40 per cent; þ Agriculture — $1.8 billion in ongoing support for Ontario farmers since 2003, through farm income stabilization and support programs and by increasing base expenditures through the Ministry of Agriculture, Food and Rural Affairs by 53 per cent; þ Innovation — Committed more than $1.3 billion over the next three years for research and innovation through such programs as the Innovation Demonstration Fund, Ontario Research Fund, Ontario Emerging Technology Fund and Ontario Network of Excellence; þ Tourism — Creating 13 new tourism regions and contributing $40 million in ongoing annual funding, plus transition funding of $25 million per year for the next two years, to enhance the sector’s competitiveness through improved coordination in marketing and development. For more information, see the Sector Highlights that accompany the 2010 Budget at www.ontario.ca/budget.

| |

INFRASTRUCTURE INVESTMENTS

Modern infrastructure boosts productivity, supports economic growth and improves the quality of life that Ontarians enjoy. By 2003, Ontario’s infrastructure had been neglected for almost 30 years. Underinvestment, aging infrastructure and growth pressures led to a substantial infrastructure deficit.

The Province responded in 2005 by introducing its $30 billion ReNew Ontario plan. The plan, which invested in schools, hospitals, public transit, roads, bridges and other infrastructure, was completed in 2008–09 — a year ahead of schedule.

In the 2009 Budget, the government responded to the global economic crisis by launching significant short-term infrastructure investments to stimulate economic growth and help preserve and create jobs across the province. The government is successfully rolling out its infrastructure stimulus investments. Infrastructure investment is at a record level in 2009–10 and will be even higher next year. These investments are creating jobs now and will contribute to productivity growth and better public services in the future.

The Plan:

The government’s infrastructure investment plan is creating jobs in communities across Ontario and will build future prosperity by modernizing and expanding the province’s public infrastructure.

In addition to its stimulus investments, the government continues to make long-term infrastructure investments that will raise Ontario’s economic growth potential. The government will undertake a comprehensive review of capital by the end of 2010. Following this review, the government is committed to introducing a 10-year infrastructure plan in 2011.

The Economic Impact of Public Infrastructure in Ontario Conference Board of Canada, March 2010 The Conference Board of Canada recently produced a report that assessed the economic impact of public infrastructure investment in Ontario.1 þ Public infrastructure investment provided over 180,000 direct, indirect and induced full-year jobs in 2009, rising to nearly 225,000 jobs in 2010. (Induced jobs are generated by the spending from those directly and indirectly employed.) þ The extra boost to infrastructure spending, partly due to new stimulus measures to counter the global recession, helped lift Ontario real gross domestic product growth by 0.9 percentage points in 2009 and is expected to add a further 0.4 percentage points in 2010. þ Additional spinoff benefits from investments in infrastructure that the Conference Board identified include improved health, improved educational attainment and reduced transit times. þ Investment in public infrastructure in Ontario supports business-sector productivity growth. Since 2000, programs such as Move Ontario and ReNew Ontario have lifted the contribution of public capital investment to productivity growth to 0.23 percentage points annually, up from 0.16 percentage points in the previous two decades. ____________________ 1 Pedro Antunes, Kip Beckman and Jacqueline Johnson, “The Economic Impact of Public Infrastructure in Ontario,” The Conference Board of Canada, March 2010. |

Short-Term Stimulus Investments

The government has fully allocated its short-term stimulus investment programs for municipalities, universities and colleges. These projects must be completed by March 31, 2011. The majority of the projects are underway. Roads are being reconstructed, watermains are being replaced and arenas are being upgraded. This spring, further work will begin to improve playgrounds and sports fields across Ontario to help children and youth be active and fit.

In addition, upgrades to social and affordable housing are underway and new projects will continue to be approved on a rolling basis. The projects range from replacing roofs and windows to major renovations.

In total, over 5,400 stimulus projects have been approved to date and are expected to be completed by March 31, 2011.

Details on the stimulus investment projects in Ontario communities can be found on the government’s Revitalizing Ontario’s Infrastructure website at ontario.ca/infrastructure.

Ongoing Infrastructure Investments

The Province is also making ongoing long-term infrastructure investments that will continue to lay the foundation for future economic growth. Expanding transit and highways will improve the movement of people and goods, helping to lower travel times and transportation costs. Improvements to schools, colleges and universities will help equip Ontarians for future jobs and build a more prosperous future.

The Results: þ Infrastructure investments are creating jobs across Ontario: ● the government’s infrastructure investments are creating and preserving more than 300,000 jobs over two years; ● since July 2009, employment in Ontario’s construction sector has rebounded due, in part, to infrastructure investments; and ● the government’s infrastructure stimulus investments will continue to boost the economy this coming year. According to Statistics Canada’s Private and Public Investment Intentions Survey, total investment in Ontario is expected to increase by a strong 6.0 per cent in 2010. This projected rise reflects a significant 16.4 per cent jump in public-sector investment plans. |

2015 Pan/Parapan American Games In November 2009, Ontario won the rights to host the Toronto 2015 Pan/Parapan American Games, which will be the first major international multi-sport games hosted in the province since the 1930s. The Games will lead to the construction of more than $700 million in new and upgraded sports and recreation facilities. The Athletes’ Village for the 2015 Pan/Parapan American Games will be located in the West Don Lands in the City of Toronto. The Village will be built to accommodate 8,500 athletes and officials. The 2015 Pan/Parapan American Games will serve as a catalyst for the continued rejuvenation and redevelopment of Toronto’s waterfront into a dynamic and vibrant place to live, work and play. Hosting the 2015 Pan/Parapan American Games will accelerate the development of the West Don Lands. After the Games, the Athletes’ Village will be converted into a mixed-use community in keeping with Waterfront Toronto’s award-winning West Don Lands Precinct Plan. The government will work in partnership with Waterfront Toronto, Infrastructure Ontario, the Games organizing committee and the local communities adjacent to the West Don Lands site to determine the design of the Athletes’ Village as well as the mix of housing, including affordable housing, for the post-Games community. Construction on the GO Georgetown South Service Expansion is underway and is expected to be completed by 2015. This capacity expansion will facilitate the Union-Pearson Rail Link, providing a rail connection between Toronto Pearson International Airport and Union Station that will help improve mobility during the Games. |

ONTARIO’S TAX PLAN FOR JOBS AND GROWTH

As economies around the world emerge from the recession, the role governments play in job creation will begin to shift. During the height of the recession, the most important action governments could take to create and protect jobs was to inject fiscal stimulus directly into the economy, which the Ontario government did and continues to do through record levels of infrastructure investment and other targeted initiatives. As economies begin to recover, the key role for government is to create the best possible climate to promote investment and job creation by the business sector.

The Open Ontario plan achieves this transition through the Tax Plan for Jobs and Growth. At the same time that the government begins to wind down its stimulus investments, the tax plan will be in effect. These tax measures, which were announced in the 2009 Budget, will transform Ontario into one of the most tax-competitive jurisdictions in the industrialized world for new business investment.

Ontario's Tax Plan for Jobs and Growth Supports New Investment, More Jobs and Higher Incomes “The 2009 Ontario Budget measures, together with other recent tax changes, will have a profound impact on Ontario’s competitiveness by lowering the tax burden on new business investment. Within ten years, Ontario will benefit from: þ increased capital investment of $47 billion; þ increased annual incomes of up to 8.8 per cent, or $29.4 billion; and þ an estimated 591,000 net new jobs.” Jack M. Mintz, “Ontario’s Bold Move to Create Jobs and Growth,” School of Public Policy, University of Calgary, November 2009. “As has been the experience in other provinces in which Bell operates, savings from a single sales tax structure will accelerate our investment in Ontario. Fewer dollars going toward taxes in 2010 mean more dollars that Bell will reinvest in our networks and service in the province next year.” George Cope, President and CEO of Bell and BCE, March 30, 2009. “Coming into this budget we had serious concerns that tax harmonization would mean low-income families paying more for their basic needs such as children’s shoes and meals. The Sales Tax Credit is a sensible, forward-looking way to deal with that, and could become an important long-term piece of the economic security puzzle for poor people in the future. We applaud the government’s plan.” Michael Oliphant, Director of Research and Communications, Daily Bread Food Bank, March 26, 2009. |

The Plan:

The tax plan supports jobs and growth by:

| þ | replacing the Retail Sales Tax with a more modern, value-added tax that will be combined with the federal Goods and Services Tax (GST) to create a Harmonized Sales Tax (HST) starting July 1, 2010; |

| cutting Personal Income Tax (PIT) for 93 per cent of income tax payers — which includes eliminating Ontario PIT for 90,000 people with lower incomes — and enhancing sales and property tax credits for low- to middle-income families and individuals, starting in 2010; |

| providing eligible Ontario residents with up to three Sales Tax Transition Benefit payments totalling up to $300 for single people and up to $1,000 for families and single parents — over $4.2 billion in payments will be delivered in June 2010, December 2010 and June 2011, helping 6.6 million Ontario families and single people adjust to the HST; |

| reducing corporate income taxes for large and small businesses, beginning July 1, 2010; and |

| providing $400 million in temporary support to small businesses to help in the transition to the HST. |

See Chapter III: Tax and Pension Systems for Ontario’s Future for further details on the tax measures.

Ontario’s poverty reduction plan to Support jobs and growth

The Province has made a permanent commitment to break the cycle of poverty. In 2008, the McGuinty government announced a long-term poverty reduction plan that will provide the tools that families and individuals need to succeed and participate fully in society. The Open Ontario plan needs all Ontarians working at their best to compete in the global economy. This plan will help Ontario reach its full economic potential and lead to sustained economic growth. Supporting the vulnerable and helping them to succeed is not only fair but is also good for the economy.

This commitment to poverty reduction is particularly important in the context of the current economic challenges facing Ontario and Canada.

Opportunities for children

The government released its vision for poverty reduction, Breaking the Cycle: Ontario’s Poverty Reduction Strategy, in December 2008. The Poverty Reduction Strategy outlines a long-term plan for reducing poverty and ensuring that low-income Ontarians, especially children, have the opportunity to reach their full potential. The Province set a target to reduce child poverty by 25 per cent over five years, which would move 90,000 children out of poverty by 2013. Attaining this goal will require having a committed federal partner and an engaged community sector, in addition to a strengthened economy.

To ensure that children have better opportunities to succeed, the government will introduce full-day learning for four- and five-year-olds in September 2010. This initiative will serve up to 35,000 children in nearly 600 schools across Ontario, with a focus on low-income areas. Full-day learning will be phased in over time, with the goal of being fully implemented by 2015–16. This will provide young children with an enriched environment that will help them develop the necessary skills for future success, while also providing their parents with expanded opportunities to participate in the workforce.

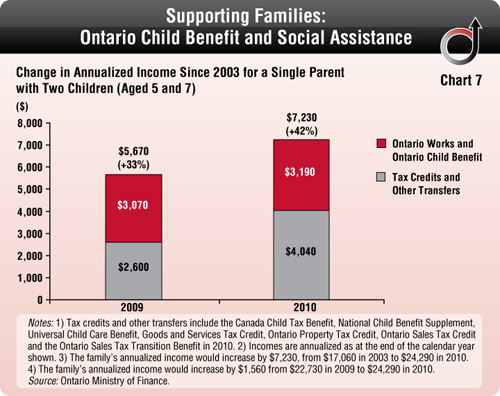

In 2007, the government introduced the Ontario Child Benefit (OCB) to make it easier for low- to moderate-income parents to leave social assistance for employment, which helps build economic prosperity for the province. In July 2009, the OCB was increased from a maximum of $600 to $1,100 annually per child, two full years ahead of schedule. This increase provides benefits to more than 210,000 additional children annually. The government remains committed to increasing the maximum annual OCB from the current level of $1,100 to $1,310 per child by 2013.

The Province will work with school boards and municipalities to enhance and maintain existing child care and other programs for young children, offering more support for low-income working parents with young children.

The federal government ended its commitment to provide the ongoing funding necessary to maintain approximately 8,500 child care spaces across Ontario. To continue support for these spaces, Ontario is permanently filling the funding gap left by the federal government with an investment of $63.5 million annually. This initiative will help to ensure that low-income working parents continue to have access to quality child care and play an active role in the labour force.

The investments by the government in early childhood education, child care and the OCB are the foundations of the Poverty Reduction Strategy. These initiatives provide effective tools for breaking the cycle of intergenerational poverty and support the Open Ontario plan for jobs and growth. A more prosperous economy provides additional resources to invest in programs that assist low-income families and lift them out of poverty.

Opportunities for low-income working adults

The government’s poverty reduction agenda aims to provide opportunities to the most disadvantaged Ontarians by increasing their chances of work, which will help to ensure the province’s long-term prosperity.

Ontario’s minimum wage will rise to $10.25 per hour on March 31, 2010. This is the seventh consecutive year that the government has helped low-income working families and individuals by increasing the minimum wage since taking office in 2003. These increases follow a nine-year period during which Ontario’s minimum wage was frozen at $6.85.

As part of Ontario’s Tax Plan for Jobs and Growth, the government is providing a new permanent refundable sales tax credit of up to $260 per person and enhancing property tax relief for low- to middle-income Ontarians starting in 2010. In addition, about 90,000 lower-income taxpayers will no longer pay Ontario Personal Income Tax as a result of the reduction to the first income bracket tax rate that took effect on January 1, 2010.

Fairness and safety in the workplace are the right of all Ontarians. The government has introduced a number of initiatives aimed at improving the working conditions of low-income working adults. In the 2009 Budget, the government invested an additional $4.5 million annually to increase the number of employment standards officers in the province. In this Budget, the government is investing an additional $6 million over two years. This initiative will help reduce the backlog of employment standards claims and improve the protection of Ontario’s employees, thereby reducing hardship for workers and their families.

In its Poverty Reduction Strategy, the McGuinty government encouraged the federal government to double the Working Income Tax Benefit (WITB) from the original $1,000 level. In 2009, the federal government increased the maximum WITB for families from $1,044 to $1,680 annually. This is a step in the right direction but falls short of what low-income working families need to succeed. Ontario continues to call on the federal government to increase the annual benefit to at least $2,000 per family.

Transforming social assistance

Social assistance is the social safety net program that many Ontarians must turn to when they have exhausted other resources, particularly in these difficult economic times.

Since 2003, the McGuinty government has been committed to supporting families and individuals on social assistance. Social assistance rates have increased by 11 per cent and program rules have been modernized to provide transitional support to work. For example, coverage for upfront child care costs was extended to people who need it to continue to work or pursue employment-assistance activities.

In addition, the government has increased social assistance program expenditures by over $2 billion, or almost 50 per cent, since 2003. The government expects to provide more than $500 million in further support for families and individuals on social assistance in 2010–11, reflecting the impact of the recession on low-income individuals and families.

The Province continues to support people in making the transition from social assistance to employment. Almost 237,000 people on social assistance participate in Ontario Works employment-assistance activities per month.

In this Budget, the government is proposing to increase adult basic-needs allowances and maximum shelter allowances by one per cent for people on the Ontario Disability Support Program and Ontario Works in the fall of this year. Families receiving Temporary Care Assistance and Assistance for Children with Severe Disabilities, as well as people living in long-term care homes who receive the comfort allowance, would benefit from this increase.

Partly as a result of this increase to social assistance benefits, a single-parent family on Ontario Works with two children aged five and seven would receive $1,560 more per year than in 2009. This would represent an increase of $7,230, or 42 per cent, from the family’s 2003 annualized income.

This initiative would provide families and individuals on social assistance with additional benefits of about $57 million annually. Municipalities would not be required to contribute to the proposed rate increase until January 2011.

In the Poverty Reduction Strategy, the government announced that it would review social assistance programs to remove barriers to employment and increase opportunities for success. The review is an integral part of the government’s longer-term vision for a transformation of social assistance that would increase people’s opportunities for work and guarantee security for those who cannot work. The government would also make social assistance programs easier to understand, more transparent, and sustainable in the long term, so that the system can continue to support the most vulnerable Ontarians.

The Special Diet Allowance (SDA) is a social assistance benefit that helps people pay for extra food costs related to specific medical conditions. Last fall, the Auditor General of Ontario reported that many applications for the SDA were associated with questionable circumstances and recommended that the government review the allowance so as to limit its possible abuse.

The program is not sustainable and is not achieving the intended results. With the help of its partners, the government plans to create a new nutritional supplement program that would be administered by the Ministry of Health and Long-Term Care on behalf of the Ministry of Community and Social Services. It would be medically based and would help individuals with severe medical needs who are on social assistance. The transition to the nutritional supplement program would occur over the next several months. This would give recipients the opportunity to adjust to the new program.

The government will announce details regarding these changes in the near future.

The results of ontario’s poverty reduction agenda: Families and Children Key achievements in the Poverty Reduction Strategy include: þ expanding the Children in Need of Treatment Program, which provides urgent dental and general anesthesia services, to include children in low-income families from birth to age 17; and þ creating Ontario’s After-School Initiative, which supports after-school activities in high-needs communities. Social Assistance Families and individuals face significant barriers to leaving social assistance for employment. The government has worked to reduce these barriers (sometimes referred to as the welfare wall) by helping people become more financially independent. Measures taken include: þ allowing full-time postsecondary students who have employment earnings to keep all of their social assistance benefits; þ changing the rules governing the receipt of earnings so that people can keep a larger portion of their social assistance benefits; þ extending health benefits to people making the transition from social assistance to employment; and þ increasing the amount of social assistance benefits that parents can keep if they have employment earnings and incur unlicensed child care costs. Other Key Initiatives þ Signing an affordable housing agreement with the federal government in June 2009 to deliver new affordable housing and renovate social housing. As part of the federal–provincial stimulus package, over 3,000 social housing projects have been committed. þ Providing ongoing funding for municipal rent banks to assist tenants who are at risk of eviction or homelessness. |

Ontario’s Plan for Prosperity

Section B: Managing Responsibly

Section B: Managing Responsibly

HIGHLIGHTS

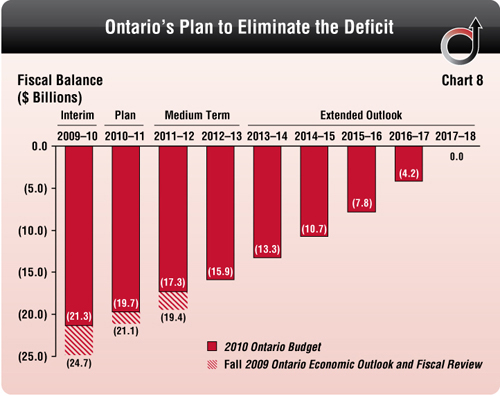

þ The 2009–10 deficit is $21.3 billion, down from the $24.7 billion projected in the Fall 2009 Ontario Economic Outlook and Fiscal Review.

þ The government has a realistic and responsible plan to cut the deficit in half in five years and eliminate it in eight years.

þ To address the current fiscal challenge, while protecting public services, the government proposes to:

● Extend the freeze on MPP pay from one year to three years.

● Freeze the compensation structures of non-bargained political and Legislative Assembly staff for two years.

● Freeze the compensation structures for the Broader Public Sector and the Ontario Public Service for all non-bargained employees for two years.

● Respect all current collective agreements. However, the fiscal plan provides no funding for incremental compensation increases for any future collective agreements.

● Work with transfer partners and bargaining agents, as agreements are renegotiated, to seek agreements of at least two years’ duration. These agreements should help manage spending pressures, protect public services that Ontarians rely on and provide no net increase in compensation.

þ The government is also:

● Phasing construction of a number of major long-term capital projects.

● Proposing to reform Ontario’s drug system to keep drugs affordable and permit savings from the program to be reinvested in health care.

● Modernizing government services to improve customer service and efficiency.

● Freezing internal operating expenses at or below 2010–11 levels.

● Launching a comprehensive expenditure management review process.

THE PLAN TO ELIMINATE THE DEFICIT

Since 2003, the McGuinty government has laid the foundation for a stronger Ontario by investing in health care, education, families and infrastructure. It has made significant progress on delivering services that are targeted more effectively, are more responsive to the public’s needs and ensure the best value for money. It has made responsible fiscal choices that have led to the elimination of the $5.5 billion deficit it inherited in 2003–04 and three consecutive surpluses from 2005–06 to 2007–08.

Ontario’s economy was hard hit by the global economic recession relative to other provinces, and so too were Ontario government revenues. In 2009–10, Ontario government own-source revenues were $9.1 billion (10.5 per cent) below their pre-recession level. 1 Own-source revenues are not expected to return to their pre-recession level until 2012–13.

____________________

| 1 | Revenues excluding federal transfers. |

The Plan:

In response to the economic crisis, the government took action by making short-term stimulus investments to create jobs and lessen the impact of the recession on families and businesses. It also made the decision to preserve public services that Ontarians rely on, particularly in these difficult economic times. The government’s infrastructure investments are creating and preserving more than 300,000 jobs over two years.

The Province’s actions have paid off. However, these necessary investments resulted in the Province projecting a deficit of $24.7 billion for 2009–10 at the time of the Fall 2009 Ontario Economic Outlook and Fiscal Review. The government has introduced measures to achieve fiscal savings both this year and over the medium term, which have allowed it to do better than the deficit projections published in the Fall 2009 Ontario Economic Outlook and Fiscal Review.

The Province is following a realistic and responsible plan to eliminate the deficit. There are now clear signs that the Ontario economy has stabilized and that recovery is taking shape. However, growth in the Ontario economy and revenues alone cannot bring the Province back to balance. The government has demonstrated its ability to manage program expense in the past and it will continue to demonstrate that restraint in order to return to a balanced budget. The government’s plan will cut the Provincial deficit in half in five years and balance the budget in 2017–18.

Key elements of the government’s plan to balance the budget by 2017–18 include:

þ holding the annual growth in program expense to an average of 1.9 per cent beyond 2012–13;

þ continually adopting efficiency practices, maximizing returns from government business enterprises and managing overall expenditures;

þ | building on the government’s previous expenditure management measures and the recent work of the Treasury Board Working Group, the government will proceed with an ongoing comprehensive review of major government programs and services; |

þ promoting principled and sustainable federal–provincial arrangements; and

þ maintaining a cautious and prudent fiscal plan, including contingency funds and a reserve.

Ontario’s Fiscal Recovery Plan1 Table 3 ($ Billions) |

| | Plan | Medium-Term Outlook | Extended Outlook |

| | 10–11 | 11–12 | 12–13 | 13–14 | 14–15 | 15–16 | 16–17 | 17–18 |

| Revenue | 106.9 | 107.7 | 112.0 | 117.6 | 123.4 | 129.6 | 136.1 | 142.9 |

| Expense | | | | | | | | |

Programs | 115.9 | 112.9 | 114.3 | 116.5 | 118.7 | 121.0 | 123.3 | 125.7 |

Interest on Debt | 10.0 | 11.1 | 12.5 | 13.3 | 14.4 | 15.4 | 15.9 | 16.2 |

| Total Expense | 125.9 | 124.1 | 126.9 | 129.9 | 133.2 | 136.5 | 139.3 | 141.9 |

| Reserve | 0.7 | 1.0 | 1.0 | 1.0 | 1.0 | 1.0 | 1.0 | 1.0 |

| Surplus/ (Deficit) | (19.7) | (17.3) | (15.9) | (13.3) | (10.7) | (7.8) | (4.2) | 0.0 |

1Reflects the inclusion of the fiscally neutral accounting changes from incorporating the education property tax. Note: Numbers may not add due to rounding. |

The government’s plan is producing results. The Province is now projecting a $21.3 billion deficit in 2009–10, an improvement of $3.4 billion from the $24.7 billion deficit forecast published in the Fall 2009 Ontario Economic Outlook and Fiscal Review (see Chapter II, Section B).

2009 EXPENDITURE MANAGEMENT REVIEW

The government launched an expenditure management review in the Fall 2009 Ontario Economic Outlook and Fiscal Review to ensure that every dollar spent on service delivery is spent more effectively. The review was led by the Treasury Board Working Group.

In this Budget, the Province is announcing new expenditure management measures to support its commitment to return to a stronger fiscal footing. It is also introducing measures that will help ensure the sustainability of public services and government resources in the decades ahead.

EXPENDITURE MANAGEMENT MEASURES

The government is constantly implementing efficiencies in the way it delivers services.

The Results: þ Since 2003–04, Ontario’s spending per capita on general government services has consistently remained in the bottom three among provincial governments. In 2008–09, general government services spending was $134 per person, 28 per cent below the $186 average per person of other provincial governments and the second lowest among the provinces. þ Between 2004–05 and 2007–08, the government identified savings of $806 million through the creation of more streamlined processes, lowering administrative costs, making better use of technology, and establishing ongoing cost-avoidance and cost-reduction initiatives. As the global recession took hold last year, the Province moved quickly to restrain its spending. The government: þ froze the salaries of Members of Provincial Parliament in 2009–10; þ froze the size of the Ontario Public Service (OPS) at 68,645 full-time equivalent staff and began to reduce the size of the OPS with a commitment to reduce it by five per cent by March 31, 2012 through attrition and other measures; þsaved an estimated $111 million in the last five months of the 2008–09 fiscal year through expenditure management, including reducing travel and consulting costs; freezing the purchase of government vehicles and the existing government real estate footprint; and increasing green workplace practices to reduce printing, photocopying and fax costs; and þ will save approximately $100 million annually in salaries and overhead by moving to the Harmonized Sales Tax. |

In the face of current fiscal challenges, the government is taking additional steps in this Budget to find efficiencies and reduce the overall cost of government administration.

COMPENSATION MEASURES

The government is committed to maintaining the gains made in improving the public services that Ontarians value so highly, while addressing the fiscal challenges faced by Ontario. Central to meeting this commitment is the management of public-sector compensation costs.

Compensation costs account for the majority of Ontario-funded program spending, either paid directly through the Ontario Public Service (OPS) or as part of the government’s transfer payments to schools, hospitals and many other public-sector partners.

Protecting services requires limiting compensation growth to direct scarce resources to service delivery.

As an immediate step, the government would extend the existing freeze in the salaries of Members of Provincial Parliament for a total of three years. The compensation structures for non-bargaining political and Legislative Assembly staff would also be frozen for two years.

The government will also introduce legislation that would freeze compensation structures in the broader public sector and the OPS for two years for all non-bargained employees. The legislation would apply to substantially all organizations covered by the Public Sector Salary Disclosure Act, except for municipalities. It must be inclusive to be effective in controlling growth in compensation costs and in protecting services and jobs.

In two years, these measures would help redirect up to $750 million to sustaining service delivery in the public sector.

Going forward, the fiscal plan provides no funding for incremental compensation increases for any future collective agreements.

All existing collective agreements in the public sector will be honoured. As agreements are renegotiated, the government will work with transfer payment partners and bargaining agents to seek agreements of at least two years’ duration. These agreements should help manage spending pressures, protect public services that Ontarians rely on and provide no net increase in compensation.

BASE OPERATING EXPENSE FROZEN

The government’s prudent and responsible plan to manage expenditures has a significant impact on base operating expenses, resulting in a decline. These expenditures will in effect be held at or below 2010–11 levels over the medium term.

SLOWING THE PACE OF LONG-TERM INFRASTRUCTURE INVESTMENTS

The government recognizes the importance of balancing the need to continue to invest in infrastructure to help build a stronger economy with the need to be fiscally responsible.

It remains committed to delivering economic stimulus projects to help continue the drive towards economic recovery. These investments have played a critical role in creating jobs in Ontario. However, as the economic recovery takes a stronger hold, the Province is also focused on a plan to return to fiscal balance and expects its partners to ensure that stimulus funds are spent by March 31, 2011.

To ensure the right balance between infrastructure priorities and managing down the deficit, the government will undertake a comprehensive review of capital to be completed before the end of 2010.

Following this comprehensive review, the government will launch a 10-year capital plan in 2011.

In the current fiscal environment, the government has revised the scope and timing of some capital investments. To help manage infrastructure spending over the coming years, the government will:

þ | working with Metrolinx, phase construction of transit projects, which would result in approximately $4 billion in appropriation savings and reduced borrowing over the next five years; |

þ | delay some investments in government office space by five years, resulting in appropriation savings of over $1.4 billion; |

þ | delay the construction of the Toronto West Courthouse by one year, resulting in appropriation savings of $130 million over four years; and |

þ | eliminate the Ontario Bus Replacement Program and include bus replacement costs as eligible expenses under the gas tax funding program, which supports municipal transit; |

● the government acknowledges that municipalities have current commitments under the Ontario Bus Replacement Program, and will work with them to ensure these commitments are met by providing one-time funding of almost $174 million in 2009–10.

ONGOING COMPREHENSIVE EXPENDITURE MANAGEMENT REVIEW

Building on the work of the government’s previous expenditure management measures and the recent work of the Treasury Board Working Group, the government will continue with a comprehensive review of all government programs and services. The comprehensive review will be overseen by Treasury Board and will ensure that the government’s resources are focused on delivering the programs and services that support:

þ jobs and economic growth;

þ access to high-quality health care and education; and

þ clean and strong communities, including effective supports for the most vulnerable.

The goal of the review is to move resources from low-priority areas to high-priority areas and to move forward the Open Ontario plan.

TRANSFORMING PUBLIC SERVICES

The Province is dedicated to transforming government and modernizing the services it delivers to Ontarians. In this area, Ontario has been internationally recognized as a leading-edge government and is committed to building on its successes — most notably, ServiceOntario.

SERVICEONTARIO ServiceOntario is a one-stop delivery network that provides Ontarians with fast, easy access to government information and services including registrations, certifications and licensing. Services can be accessed online, in person, at kiosks and by phone. Ontario is the North American leader in offering service guarantees for basic transactions. |

TRANSFORMING THE HEALTH CARE SYSTEM

Since 2003, the McGuinty government has taken significant steps to transform the delivery of public health care services, creating a system that is focused on patients.

However, the cost of delivering quality health care services is steadily increasing in Ontario and other jurisdictions. Increases are driven by demand and cost drivers, including changes in medical technology and demographics. For example, costs to the public system tend to rise with age and Ontario’s population aged 65 and over will more than double to 3.7 million by 2030.

Today, health sector spending accounts for about 46 cents of every program dollar. 2 If left unchecked, cost drivers could push health care spending to 70 cents of every program dollar in 12 years. The Province will continue to face challenges in managing the growth in health care spending without crowding out other priorities such as investing in schools, helping the vulnerable, protecting the environment, and investing in infrastructure and economic development.

The Plan:

Under the Open Ontario plan, the government is committed to improving the quality and accountability of the health care system. Specifically, as part of this Budget, the government is proposing to:

þ introduce changes to the statutes governing Ontario’s drug system that would facilitate lower generic drug prices. Ontarians pay more for generic drugs than those in other countries. The government would also increase supports for pharmacies in rural and underserviced areas and support the expansion of clinical services provided by pharmacists;

þ increase the efficiency and effectiveness of the health care system by:

● introducing legislation to make health care providers and executives more accountable for improving patient care;

● reviewing the Public Hospitals Act to create a hospital system that taps into the expertise of community partners and health professionals;

● creating an independent, expert advisory body to provide recommendations on clinical practice guidelines; and

þ strike a working committee composed of the Ministry of Health and Long-Term Care, Ministry of Finance, Local Health Integration Network representatives and Ontario Hospital Association. The committee will examine the hospital working capital issue and apply appropriate remedies for the hospitals struggling the most with inherited debt. The working committee would be responsible for putting in place an accountability structure to ensure that hospitals pulled out of negative working capital position stay on the right track.

____________________

| 2 | Controlling for time-limited investments and the presentation of education sector expense introduced in this Budget (see Addendum to the 2010 Ontario Budget: Ontario’s Plan to Enhance Accountability, Transparency and Financial Management), health sector expense would account for 46 per cent in 2009–10 and 45 per cent in 2010-11. |

TRANSFORMING ONTARIO’S BENEFIT PROGRAMS

Current Benefits Delivery System

The McGuinty government provides support through benefit programs that are designed to meet Ontarians’ needs arising from various circumstances. This support helps a variety of recipients, from children to seniors, and takes on many forms, including payments and in-kind benefits.

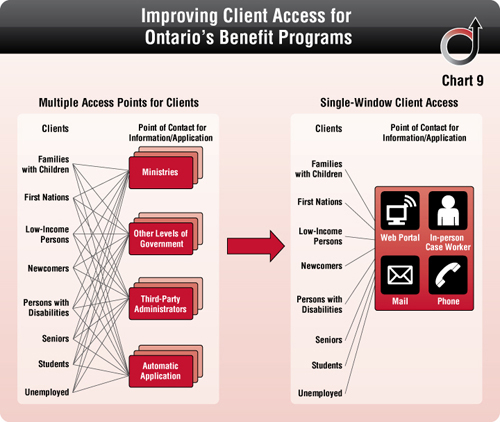

Over time, a wide range of programs has been designed to meet specific needs and different policy objectives. These programs are delivered by different administrators including ministries, other levels of government and third-party agents such as non-governmental organizations. As a result, people who need benefits often must navigate through a complex array of access points.

The Plan:

The government will continue to improve the current system of benefits to increase support for those who need it and to simplify access.

The government will undertake a comprehensive review of other jurisdictions’ models of coordinated and integrated benefits administration. In transforming Ontario’s benefits systems, the government will:

þ create a new web portal to help centralize access to program information while improving client service;

þ implement an automated income verification process for those benefit programs whose eligibility criteria include income; and

þ consult with its key service delivery partners on new and innovative ways to further simplify client access to benefit programs while improving program fairness and integrity.

TRANSFORMING EMPLOYMENT ONTARIO

Employment Ontario encompasses training and employment programs and services provided by the government through the Ministry of Training, Colleges and Universities.

The Plan:

A transformation of the Employment Ontario service delivery structure is currently underway and includes a new one-stop service delivery model that will:

þ improve customer service by making it easier for job seekers, employers and communities to access the programs and services they need; and

þ ensure Employment Ontario remains responsive to local community needs and the changing demands of the global economy.

See Section A of this chapter for more information on Employment Ontario.