UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

| Investment Company Act file number: | 811 - 04024 | |

| Exact name of registrant as specified in charter: | Dryden California | |

| Municipal Fund | ||

| Address of principal executive offices: | Gateway Center 3, | |

| 100 Mulberry Street, | ||

| Newark, New Jersey 07102 | ||

| Name and address of agent for service: | Deborah A. Docs | |

| Gateway Center 3, | ||

| 100 Mulberry Street, | ||

| Newark, New Jersey 07102 | ||

| Registrant’s telephone number, including area code: | 973-367-7521 | |

| Date of fiscal year end: | 8/31/2004 | |

| Date of reporting period: | 8/31/2004 | |

Item 1 – Reports to Stockholders – [ INSERT REPORT ]

Dryden California Municipal Fund/California Series

| AUGUST 31, 2004 | ANNUAL REPORT |

FUND TYPE

Municipal bond

OBJECTIVE

Maximize current income that is exempt from California state and federal income taxes, consistent with the preservation of capital

This report is not authorized for distribution to prospective investors unless preceded or accompanied by a current prospectus.

The views expressed in this report and information about the Series’ portfolio holdings are for the period covered by this report and are subject to change thereafter.

JennisonDryden is a registered trademark of The Prudential Insurance Company of America.

Dear Shareholder,

October 15, 2004

We hope that you find the annual report for the California Series informative and useful. As a JennisonDryden mutual fund shareholder, you may be thinking where you can find additional growth opportunities. You could invest in last year’s top-performing asset class and hope that history repeats itself or you could stay in cash while waiting for the “right moment” to invest.

We believe it is wise to take advantage of developing domestic and global investment opportunities through a diversified portfolio of stock and bond mutual funds. A diversified asset allocation offers two advantages. It helps you manage downside risk by not being overly exposed to any particular asset class, plus it gives you a better opportunity of having at least some of your assets in the right place at the right time. Your financial professional can help you create a diversified investment plan that may include mutual funds that cover all the basic asset classes and is reflective of your personal investor profile and tolerance for risk.

JennisonDryden mutual funds give you a wide range of choices that can help you make progress toward your financial goals. Our funds offer the experience, resources, and professional discipline of three leading asset managers. They are recognized and respected in the institutional market and by discerning investors for excellence in their respective strategies. JennisonDryden equity funds are advised by Jennison Associates LLC and/or Quantitative Management Associates LLC (QMA). Prudential Investment Management, Inc. (PIM) advises the JennisonDryden fixed income and money market funds. Jennison Associates, QMA, and PIM are registered investment advisers and Prudential Financial companies.

Thank you for choosing JennisonDryden mutual funds.

Sincerely,

Judy A. Rice, President

Dryden California Municipal Fund/California Series

| Dryden California Municipal Fund/California Series | 1 |

Your Series’ Performance

Series objective

The investment objective of the Dryden California Municipal Fund/California Series (the Series) is to maximize current income that is exempt from California state and federal income taxes, consistent with the preservation of capital. There can be no assurance that the Series will achieve its investment objective.

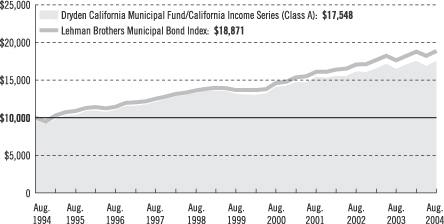

Performance data quoted represent past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the past performance data quoted. An investor may obtain performance data current to the most recent month-end by visiting our website at www.jennisondryden.com or by calling (800) 225-1852. The maximum initial sales charge is 4.00% (Class A shares).

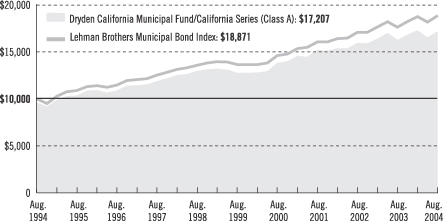

| Cumulative Total Returns1 as of 8/31/04 | ||||||||||

| One Year | Five Years | Ten Years | Since Inception2 | |||||||

Class A | 5.75 | % | 34.78 | % | 79.24% (78.94) | 150.38% (149.96) | ||||

Class B | 5.48 | 33.24 | 73.87 (73.58) | 284.40 (269.63) | ||||||

Class C | 5.22 | 31.61 | 69.61 (69.32) | 69.68 (69.40) | ||||||

Class Z | 6.01 | 36.46 | N/A | 59.19 (59.06) | ||||||

Lehman Brothers Municipal Bond Index3 | 7.11 | 38.09 | 88.71 | *** | ||||||

Lipper CA Muni Debt Funds Avg.4 | 7.04 | 31.68 | 75.54 | **** | ||||||

| Average Annual Total Returns1 as of 9/30/04 | ||||||||||

| One Year | Five Years | Ten Years | Since Inception2 | |||||||

Class A | –1.14 | % | 5.41 | % | 5.78% (5.76) | 6.19% (6.18) | ||||

Class B | –2.16 | 5.85 | 5.89 (5.87) | 6.98 (6.77) | ||||||

Class C | 1.49 | 5.75 | 5.63 (5.61) | 5.39 (5.38) | ||||||

Class Z | 3.22 | 6.52 | N/A | 6.04 (6.03) | ||||||

Lehman Brothers Municipal Bond Index3 | 4.60 | 6.77 | 6.77 | *** | ||||||

Lipper CA Muni Debt Funds Avg.4 | 4.64 | 5.80 | 6.00 | **** | ||||||

| Distributions and Yields1 as of 8/31/04 | ||||||||||||||

| Total Distributions Paid for 12 Months | 30-Day SEC Yield | Taxable Equivalent 30-Day Yield5 at Tax Rates of | ||||||||||||

| 33% | 35% | |||||||||||||

Class A | $ | 0.65 | 3.12 | % | 5.13 | % | 5.29 | % | ||||||

Class B | $ | 0.62 | 3.01 | 4.95 | 5.11 | |||||||||

Class C | $ | 0.59 | 2.76 | 4.54 | 4.68 | |||||||||

Class Z | $ | 0.68 | 3.53 | 5.81 | 5.99 | |||||||||

| 2 | Visit our website at www.jennisondryden.com |

The cumulative total returns do not reflect the deduction of applicable sales charges. If reflected, the applicable sales charges would reduce the cumulative total returns performance quoted. Class A shares are subject to a maximum front-end sales charge of 4.00%. Under certain circumstances, Class A shares may be subject to a contingent deferred sales charge (CDSC) of 1%. Class B and Class C shares are subject to a maximum CDSC of 5% and 1% respectively. Class Z shares are not subject to a sales charge.

1Source: Prudential Investments LLC and Lipper Inc. The average annual total returns take into account applicable sales charges. During certain periods shown, fee waivers and/or expense reimbursements were in effect. Without such fee waivers and expense reimbursements, the returns for the classes would have been lower. Class A, Class B, and Class C shares are subject to an annual distribution and service (12b-1) fee of up to 0.3%, 0.5%, and 1.0% respectively. Approximately seven years after purchase, Class B shares will automatically convert to Class A shares on a quarterly basis. Class Z shares are not subject to a 12b-1 fee. The returns in the tables do not reflect the deduction of taxes that a shareholder would pay on fund distributions or following the redemption of fund shares. Without waiver of fees and/or expense subsidization, the Series’ returns would have been lower, as indicated in parentheses.

2Inception dates: Class A, 1/22/90; Class B, 9/19/84; Class C, 8/1/94; and Class Z, 9/18/96.

3The Lehman Brothers Municipal Bond Index is an unmanaged index of over 39,000 long-term investment-grade municipal bonds. It gives a broad look at how long-term investment-grade municipal bonds have performed.

4The Lipper California (CA) Muni Debt Funds Average (Lipper Average) represents returns based on an average return of all funds in the Lipper CA Muni Debt Funds category for the periods noted. Funds in the Lipper Average limit their assets to those securities that are exempt from taxation in California.

5Taxable equivalent yields reflect federal and applicable state tax rates.

Investors cannot invest directly in an index. The returns for the Lehman Brothers Municipal Bond Index would be lower if they included the effects of sales charges, operating expenses of a mutual fund, or taxes. Returns for the Lipper Average reflect the deduction of operating expenses, but not sales charges or taxes.

***Lehman Brothers Municipal Bond Index Closest Month-End to Inception cumulative total returns as of 8/31/04 are 172.15% for Class A, 403.01% for Class B, 89.37% for Class C, and 62.45% for Class Z. Lehman Brothers Municipal Bond Index Closest Month-End to Inception average annual total returns as of 9/30/04 are 7.10% for Class A, 8.44% for Class B, 6.54% for Class C, and 6.32% for Class Z.

****Lipper Average Closest Month-End to Inception cumulative total returns as of 8/31/04 are 152.94% for Class A, 338.59% for Class B, 76.13% for Class C, and 51.85% for Class Z. Lipper Average Closest Month-End to Inception average annual total returns as of 9/30/04 are 6.57% for Class A, 7.68% for Class B, 5.78% for Class C, and 5.43% for Class Z.

| Dryden California Municipal Fund/California Series | 3 |

Your Series’ Performance (continued)

| Five Largest Issues expressed as a percentage of net assets as of 8/31/04 | |||

Orange Cnty. Loc. Trans. Auth., 2/14/11, 6.20% | 5.2 | % | |

So. California Pub. Pwr. Auth., 7/01/16, Zero Coupon | 4.2 | ||

Los Angeles California Cmnty. Coll. Dist., 8/01/17, 5.50% | 3.8 | ||

Santa Margarita/Dana Point Auth., 8/01/2012, 7.25% | 3.4 | ||

California St. Hsg. Fin. Agcy., 2/01/2015, Zero Coupon | 3.3 |

Issues are subject to change.

| Credit Quality expressed as a percentage of net assets as of 8/31/04 | |||

Aaa | 58.6 | % | |

Aa | 10.7 | ||

A | 15.1 | ||

Baa | 9.5 | ||

NR | 5.5 | ||

Other assets in excess of liabilities | 0.6 |

Source: Moody’s rating, defaulting to S&P when not rated by Moody’s. Credit quality is subject to change.

| 4 | Visit our website at www.jennisondryden.com |

Investment Adviser’s Report

Prudential Investment Management, Inc.

Momentous year in California municipal bond market

Prices of municipal bonds rallied, declined sharply, and rallied again during the Series’ fiscal year that began September 1, 2003. The resumption of the rally late in the reporting period helped municipal bonds return a respectable 7.11% for the 12 months ended August 31, 2004, based on the Lehman Brothers Municipal Bond Index (the Index). In addition to the volatile market conditions, investors in California municipal bonds encountered significant political and fiscal developments. Governor Gray Davis was recalled and succeeded by Governor Arnold Schwarzenegger in November 2003, and the Golden State experienced financial challenges that affected its credit rating.

Although the Series’ holdings were diversified across many sectors of the California municipal securities market to limit risk, all classes of the Series’ shares underperformed the Series’ benchmark, the Index, for the reporting period. The relative performance of the Series was hindered by its smaller exposure to California general obligation (GO) bonds compared to the Index, and the Series’ returns were pressured by its overweight exposure to municipal debt securities in the 10-year maturity range compared to the Index. Municipal bonds maturing in more than 25 years outperformed shorter-term bonds during the reporting period. Compared to its peer group, all classes of the Series’ shares lagged the Lipper California Municipal Debt Funds Average (the Lipper Average) for the 12 months ended August 31, 2004.

A shift in our investment discipline

For several months after the reporting period began, municipal bond prices generally worked their way higher as the Federal Reserve (the Fed) left short-term interest rates at historically low levels. This was done to support an economic recovery that was failing to produce many jobs, based on data released from September 2003 through March 2004. In late March 2004 we initiated a shift in our investment discipline that had an impact on the Series’ duration, a measure of its sensitivity to changes in interest rates. In managing the Series’ duration, we previously focused more on the durations of funds in its Lipper peer group. However, in the volatile trading environment, our efforts to match the changes in the peer group durations were sometimes unsuccessful and contributed to the Series’ underperformance versus its Lipper Average. Therefore we began implementing a strategy that positions the Series’ duration and other investment characteristics more in line with the Index. To that end, we lengthened the Series’ duration in late March 2004.

Shortly afterward, government figures released in early April, May, and June 2004 showed that the job market had finally begun to improve along with the rest of the

| Dryden California Municipal Fund/California Series | 5 |

Investment Adviser’s Report (continued)

economy. These figures and a pick-up in inflation caused the financial markets to speculate that the Fed would soon hike short-term rates to lessen the amount of monetary stimulus in the economy. Anticipation of tighter monetary policy pushed bond yields higher, which caused bond prices to fall. A longer duration during that time detracted from the Series’ returns by making the Series more sensitive to the rise in interest rates. However, we believe this strategy of focusing on the benchmark will enhance the risk profile of the Series and improve the predictability of its performance over the longer term.

Late rebound in the municipal bond market

The Fed raised the target for the federal funds rate—the rate banks charge each other for overnight loans—to 1.25% from 1.00% in June and to 1.50% from 1.25% in August 2004. Fed policymakers reiterated that further rate hikes would likely occur at a “measured” pace, but warned they would respond to changing economic prospects as needed in order to maintain price stability in the economy. Meanwhile, the economic expansion had already begun to slow as high oil prices seemed to hurt consumer spending. Moderating economic growth and the possibility of a gradual rise in rates soothed some concerns about investing in debt securities. Thus the municipal bond rally resumed late in the reporting period, which enhanced the Series’ performance.

Working to preserve interest income

Even though the Fed began a new round of rate hikes during the reporting period, the level of yields in the municipal bond market remained relatively low overall. With this in mind, we tried to maintain interest income in the Series by making adjustments to its balance of high-quality bonds versus low-quality bonds. We sold some Aaa-rated, insured zero coupon bonds, which are so named because they pay no periodic interest and are sold at discount prices to make up for their lack of periodic interest payments. Proceeds were used to selectively purchase lower-quality municipal bonds with above-market coupon rates. As you may recall, municipal bonds in the 10-year maturity range underperformed long-term municipal bonds. Nevertheless, many of the Series’ bonds in the 10-year maturity range provided attractive interest income, so we were reluctant to sell them.

Series held too few California GO bonds

As previously mentioned, a smaller exposure to California GO bonds than the Index detracted from the Series’ performance relative to the Index. Improvement in California’s liquidity position and economic conditions helped boost the value of its GO bonds during the reporting period. Governor Schwarzenegger took steps to bring the state’s financial situation under control. He ultimately submitted a plan to voters

| 6 | Visit our website at www.jennisondryden.com |

that called for deficit financing via newly issued economic recovery bonds to restore California’s liquidity position, which would help it promptly pay its obligations. Voters approved the plan and California began to issue the bonds in the spring of 2004. (Notwithstanding this important event, California continues to suffer from a structural imbalance between its projected revenues and projected expenditures.) Moody’s Investors Service Inc., which had earlier downgraded its rating of California GO bonds to Baa1 from A3, reinstated its A3 rating and assigned a positive ratings outlook in May 2004. Standard & Poor’s Ratings Services upgraded California GO bonds three levels from BBB to single-A with a stable ratings outlook in August 2004.

Moving in and out of California tobacco-related bonds

Among other key sectors in the municipal securities market, the Series participated in tobacco-related bonds on an opportunistic basis. This means we purchased bonds when we believed their yields adequately compensated the Series for the risk of owning them, with the intention of selling them when they were no longer attractive on a relative basis. California tobacco-related debt securities, known as Golden St. Tobacco Securitization Asset-Backed Bonds, are supported by payments of tobacco companies to the state government under the Master Settlement Agreement (MSA). They are also subject to appropriation from the California state legislature. Consequently, in the event that the MSA payments are insufficient to pay debt service on the bonds in the first instance, bondholders would be paid from appropriated funds of the state of California. While the Series benefited from its exposure to Golden St. Tobacco Securitization Asset-Backed Bonds, the tobacco-related sector remains volatile due to the risk of further judgments against tobacco companies.

| Dryden California Municipal Fund/California Series | 7 |

Fees and Expenses

As a shareholder of the Series, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments and redemptions, as applicable, and (2) ongoing costs, including management fees, distribution and/or service (12b-1) fees, and other Series expenses, as applicable. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Series and to compare these costs with the ongoing costs of investing in other mutual funds.

The example is based on an investment of $1,000 invested at the beginning of the period and held through the six-month period ended August 31, 2004.

Actual Expenses

The first line for each share class in the following table provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value ÷ $1,000 = 8.6), then multiply the result by the number in the first line under the heading “Expenses Paid During the Six-Month Period” to estimate the expenses you paid on your account during this period. The Series may charge additional fees to holders of certain accounts that are not included in the expenses shown in the table. These fees apply to Individual Retirement Accounts (IRAs), 403(b) accounts, and 529 plan accounts. As of the close of the six months covered by the table, IRA fees included a setup fee of $5, a maintenance fee of up to $36 annually ($18 for the six-month period), and a termination fee of $10. 403(b) accounts and Section 529 plan accounts are each charged an annual $25 fiduciary maintenance fee ($12.50 for the six-month period). Some of the fees vary in amount, or are waived, based on your total account balance or the number of JennisonDryden or Strategic Partners funds, including the Series, that you own. You should consider the additional fees that were charged to your Series account over the six-month period when you estimate the total ongoing expenses paid over the period and the impact of these fees on your ending account value, as these additional expenses are not reflected in the information provided in the expense table. Additional fees have the effect of reducing investment returns.

Hypothetical Example for Comparison Purposes

The second line for each share class in the following table provides information about hypothetical account values and hypothetical expenses based on the Series’ actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Series’ actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Series and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical

| 8 | Visit our website at www.jennisondryden.com |

examples that appear in the shareholder reports of the other funds. The Series may charge additional fees to holders of certain accounts that are not included in the expenses shown in the table. These fees apply to Individual Retirement Accounts (IRAs), 403(b) accounts, and 529 plan accounts. As of the close of the six months covered by the table, IRA fees included a setup fee of $5, a maintenance fee of up to $36 annually ($18 for the six-month period), and a termination fee of $10. 403(b) accounts and Section 529 plan accounts are each charged an annual $25 fiduciary maintenance fee ($12.50 for the six-month period). Some of the fees vary in amount, or are waived, based on your total account balance or the number of JennisonDryden or Strategic Partners funds, including the Series, that you own. You should consider the additional fees that were charged to your Series account over the six-month period when you estimate the total ongoing expenses paid over the period and the impact of these fees on your ending account value, as these additional expenses are not reflected in the information provided in the expense table. Additional fees have the effect of reducing investment returns.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only, and do not reflect any transactional costs such as sales charges (loads). Therefore the second line for each share class in the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| Dryden California Municipal Fund/ California Series | Beginning Account Value March 1, 2004 | Ending Account Value August 31, 2004 | Annualized Expense Ratio Based on the Six-Month Period | Expenses Paid During the Six- Month Period* | ||||||||||

| Class A | Actual | $ | 1,000 | $ | 994 | 1.04 | % | $ | 5.21 | |||||

| Hypothetical | $ | 1,000 | $ | 1,020 | 1.04 | % | $ | 5.28 | ||||||

| Class B | Actual | $ | 1,000 | $ | 994 | 1.29 | % | $ | 6.47 | |||||

| Hypothetical | $ | 1,000 | $ | 1,019 | 1.29 | % | $ | 6.55 | ||||||

| Class C | Actual | $ | 1,000 | $ | 993 | 1.54 | % | $ | 7.71 | |||||

| Hypothetical | $ | 1,000 | $ | 1,017 | 1.54 | % | $ | 7.81 | ||||||

| Class Z | Actual | $ | 1,000 | $ | 995 | 0.79 | % | $ | 3.96 | |||||

| Hypothetical | $ | 1,000 | $ | 1,021 | 0.79 | % | $ | 4.01 | ||||||

* Series expenses for each share class are equal to the annualized expense ratio for each share class (provided in the table), multiplied by the average account value over the period, multiplied by the 184 days in the six-month period ended August 31, 2004, and divided by the 366 days in the Series’ current fiscal year (to reflect the six-month period).

| Dryden California Municipal Fund/California Series | 9 |

This Page Intentionally Left Blank

Portfolio of Investments

as of August 31, 2004

| Description (a) | Moody’s Rating (Unaudited) | Interest Rate | Maturity Date | Principal Amount (000) | Value (Note 1) | ||||||||

LONG-TERM INVESTMENTS 96.1% | |||||||||||||

Municipal Bonds | |||||||||||||

Abag Fin. Auth. Rev., Schs. of Sacred Heart, Ser. A | Baa3 | 6.45% | 6/01/30 | $ | 1,500 | $ | 1,591,365 | ||||||

Antelope Valley California | |||||||||||||

Health Care Dist. Ser. A, F.S.A. | Aaa | 5.20 | 1/01/17 | 1,000 | 1,079,080 | ||||||||

Baldwin Park Pub. Fin. Auth. Rev., Tax Alloc. | NR | 7.05 | 9/01/14 | 1,020 | (e) | 1,040,400 | |||||||

Baldwin Park Uni. Sch. Dis., Election of 2002, F.S.A. | Aaa | 5.00 | 8/01/22 | 1,065 | 1,118,889 | ||||||||

California St., G.O. | A3 | 5.50 | 4/01/30 | 2,000 | 2,122,220 | ||||||||

California St., M.B.I.A. | Aaa | 5.25 | 2/01/27 | 1,500 | 1,570,545 | ||||||||

California St. Dept. Wtr. Res. Pwr. Sup. Rev., Ser A | A2 | 5.00 | 5/01/17 | 2,000 | 2,128,580 | ||||||||

California St. Econ. Recov., | Aaa | 5.25 | 7/01/13 | 1,500 | 1,698,510 | ||||||||

California St. Hsg. Fin. Agcy. Rev., Sngl. Fam. Mtge., Ser. A | Aa2 | Zero | 2/01/15 | 8,420 | 3,742,353 | ||||||||

California St. Pub. Works Brd. Dept. Mental Hlth., Lease Rev. | Baa1 | 5.50 | 6/01/18 | 1,970 | 2,159,810 | ||||||||

California Statewide Cmnty. | A(c) | 2.30(g) | 4/01/34 | 1,250 | 1,248,150 | ||||||||

Central California Joint Pwrs. Hlth. Fin. Auth., C.O.P. | Baa2 | 6.00 | 2/01/30 | 1,000 | 1,025,110 | ||||||||

Chino Basin Reg. Fin. Auth. Rev., Inland Empire Util. Agcy. Swr. Proj., M.B.I.A. | Aaa | 5.75 | 11/01/19 | 200 | 226,288 | ||||||||

Corona-Norco Uni. Sch. Dist. Spec. Tax, Cmnty. Facs. Dist. No. 98-1, M.B.I.A. | Aaa | 5.00 | 9/01/22 | 1,060 | 1,109,258 | ||||||||

Foothill/Eastern Corridor Agcy. Toll Rd. Rev., M.B.I.A. | Aaa | 5.375 | 1/15/15 | 500 | 550,970 | ||||||||

Golden St. Tobacco Secur. Corp., Tobacco Settlement Rev., | |||||||||||||

Enhanced Asset Bkd., Ser. B | Baa1 | 5.50 | 6/01/19 | 595 | 613,760 | ||||||||

Enhanced Asset Bkd., Ser. B | Baa1 | 5.625 | 6/01/20 | 675 | 697,559 | ||||||||

Enhanced Asset Bkd., Ser. B | Baa1 | 5.50 | 6/01/43 | 1,500 | 1,539,675 | ||||||||

Ser. 2003-A-1 | Baa3 | 6.75 | 6/01/39 | 1,000 | 933,110 | ||||||||

See Notes to Financial Statements.

| Dryden California Municipal Fund/California Series | 11 |

Portfolio of Investments

as of August 31, 2004 Cont’d.

| Description (a) | Moody’s Rating (Unaudited) | Interest Rate | Maturity Date | Principal Amount (000) | Value (Note 1) | ||||||||

Kings Cnty. Wste. Mgmt. Auth., Solid Wste. Rev., A.M.T. | BBB(c) | 7.20% | 10/01/14 | $ | 1,150 | $ | 1,178,060 | ||||||

Long Beach Redev. Agcy., Dist. No. 3, Spec. Tax Rev. | NR | 6.375 | 9/01/23 | 3,000 | (h) | 3,166,860 | |||||||

Los Angeles California Cmnty. Coll. Dist. Ser. A, G.O., M.B.I.A. | Aaa | 5.50 | 8/01/17 | 3,800 | 4,263,182 | ||||||||

Los Angeles California Unified Sch. Dist. | |||||||||||||

C.O.P., Admin. Bldg. Proj., | Aaa | 5.00 | 10/01/31 | 1,500 | 1,516,875 | ||||||||

Election of 1997, Ser. F, G.O., F.G.I.C. | Aaa | 5.00 | 7/01/21 | 1,000 | 1,056,210 | ||||||||

Los Angeles Cnty., Correctional Facs. Proj., C.O.P., M.B.I.A., E.T.M. | Aaa | Zero | 9/01/10 | 3,770 | 3,101,466 | ||||||||

Los Angeles Conv. & Exhib. Ctr. Auth., C.O.P. | Aaa | 9.00 | 12/01/10 | 1,250 | (d)(e) | 1,367,263 | |||||||

Los Angeles Dept. Wtr. & Pwr. Rev., Pwr. Sys., Ser. A-A-1 | Aaa | 5.25 | 7/01/20 | 630 | 681,566 | ||||||||

Los Angeles Hbr. Dept. Rev., Ser. B, A.M.T. | Aa2 | 5.375 | 11/01/23 | 1,000 | 1,050,880 | ||||||||

Metro. Wtr. Dist. of Southern California, | |||||||||||||

Rev. Linked, S.A.V.R.S. & R.I.B.S. | Aa2 | 5.75 | 8/10/18 | 1,000 | 1,177,370 | ||||||||

Waterworks Rev., Ser. A | Aa2 | 5.75 | 7/01/21 | 2,240 | 2,632,022 | ||||||||

Orange Cnty. Loc. Trans. Auth., | |||||||||||||

Linked S.A.V.R.S. & R.I.B.S., A.M.B.A.C. | Aaa | 6.20 | 2/14/11 | 5,000 | 5,854,200 | ||||||||

Spec. Tax Rev., R.I.B.S. | Aa2 | 10.544(b) | 2/14/11 | 750 | 1,006,260 | ||||||||

Puerto Rico Comnwlth., | NR | 9.732 | 7/01/10 | 1,000 | (h) | 1,311,920 | |||||||

Redding Elec. Sys. Linked, | |||||||||||||

R.I.B.S., M.B.I.A., E.T.M. | Aaa | 11.184(b) | 7/01/22 | 1,750 | 2,454,795 | ||||||||

S.A.V.R.S., R.I.B.S., M.B.I.A. | Aaa | 6.368 | 7/01/22 | 50 | 60,068 | ||||||||

Sacramento City Fin. Auth. Rev., | |||||||||||||

Cap. Impv., Ser. A, A.M.B.A.C. | Aaa | 5.00 | 12/01/26 | 2,000 | 2,038,860 | ||||||||

City Hall & Redev. Projs., | Aaa | 5.375 | 12/01/19 | 1,000 | 1,107,410 | ||||||||

See Notes to Financial Statements.

| 12 | Visit our website at www.jennisondryden.com |

| Description (a) | Moody’s Rating (Unaudited) | Interest Rate | Maturity Date | Principal Amount (000) | Value (Note 1) | |||||||

Sacramento Mun. Utility Dist. Elec. Rev., Ser. N, M.B.I.A. | Aaa | 5.00% | 8/15/28 | $ | 2,500 | $ | 2,544,000 | |||||

San Diego Redev., Agcy. Tax Alloc. North Bay Redev. | Baa1 | 5.875 | 9/01/29 | 1,000 | 1,034,930 | |||||||

San Diego Uni. Sch. Dist., Election of 1998, Ser. B | Aaa | 6.00 | 7/01/19 | 1,000 | 1,214,530 | |||||||

San Francisco City & Cnty. Arpt. Comn. Intl. Arpt. Rev., Second Ser., A.M.T., F.S.A. | Aaa | 5.00 | 5/01/18 | 2,500 | 2,572,875 | |||||||

San Francisco City & Cnty., Redev. Agcy., Lease Rev., Cap. Apprec. | A1 | Zero | 7/01/09 | 2,000 | 1,700,080 | |||||||

San Jose Redev. Agcy. Tax Alloc. Merged Area Redev. Proj., F.G.I.C. | Aaa | 5.00 | 8/01/25 | 2,000 | 2,047,600 | |||||||

Santa Margarita/Dana Point Auth., | ||||||||||||

Impvt. Dists. 1-2-2A & 8, | Aaa | 7.25 | 8/01/09 | 1,000 | 1,206,000 | |||||||

Impvt. Dists. 3, | Aaa | 7.25 | 8/01/08 | 2,500 | 2,951,750 | |||||||

Impvt. Dists. 3, | Aaa | 7.25 | 8/01/09 | 1,400 | 1,688,400 | |||||||

Impvt. Dists. 3, | Aaa | 7.25 | 8/01/14 | 1,000 | 1,297,630 | |||||||

Ser. A, M.B.I.A., Rev. | Aaa | 7.25 | 8/01/13 | 1,990 | 2,550,762 | |||||||

Ser. B, M.B.I.A., Rev. | Aaa | 7.25 | 8/01/12 | 3,000 | 3,796,110 | |||||||

So. California Pub. Pwr. Auth., | ||||||||||||

Proj. Rev. | A2 | 6.75 | 7/01/10 | 2,265 | 2,669,846 | |||||||

Proj. Rev. | A2 | 6.75 | 7/01/11 | 1,195 | 1,424,344 | |||||||

Proj. Rev. | A2 | 6.75 | 7/01/13 | 1,000 | 1,213,260 | |||||||

Proj. Rev., A.M.B.A.C., E.T.M. | Aaa | Zero | 7/01/16 | 7,925 | 4,757,061 | |||||||

Stockton Cmnty. Facs. Dist. No. 90-2, Brookside Estates | NR | 6.20 | 8/01/15 | 700 | 732,004 | |||||||

Stockton Redev. Agcy. Rev. Stockton Events Ctr., Arena Proj., F.G.I.C. | Aaa | 5.00 | 9/01/36 | 500 | 505,570 | |||||||

Torrance California Hosp. Rev., Torrance Mem. Med. Ctr., | A1 | 6.00 | 6/01/22 | 2,000 | 2,196,040 | |||||||

Univ. California Hosp. Rev. UCLA Med. Ctr., | Aaa | 5.125 | 9/01/31 | 2,500 | 2,565,150 | |||||||

See Notes to Financial Statements.

| Dryden California Municipal Fund/California Series | 13 |

Portfolio of Investments

as of August 31, 2004 Cont’d.

| Description (a) | Moody’s Rating (Unaudited) | Interest Rate | Maturity Date | Principal Amount (000) | Value (Note 1) | ||||||||

Univ. California Rev. Multi. Purpose Proj., Ser. O, F.G.I.C. | Aaa | 5.25% | 5/15/30 | $ | 2,000 | $ | 2,083,500 | ||||||

Vacaville Cmnty. Redev. Agcy., Cmnty. Hsg. Fin. Multi-fam. | A-(c) | 7.375 | 11/01/14 | 1,110 | (e) | 1,143,522 | |||||||

Victor Elementary Sch. Dist., | Aaa | 5.375 | 8/01/19 | 1,290 | 1,426,456 | ||||||||

Virgin Islands Pub. Fin. Auth. Rev., | |||||||||||||

Gross Rcpts. Taxes Ln. Nt., F.S.A. | Aaa | 5.25 | 10/01/19 | 1,000 | 1,109,870 | ||||||||

Gross Rcpts. Taxes Ln. Nt., F.S.A. | Aaa | 5.25 | 10/01/21 | 1,000 | 1,097,630 | ||||||||

Total long-term investments (cost $100,193,743) | 108,749,819 | ||||||||||||

SHORT-TERM INVESTMENTS 3.3% | |||||||||||||

Municipal Bonds | |||||||||||||

California Hsg. Fin. Agcy. Rev., Multi-Fam. Hsg., Ser. A, A.M.T., F.R.D.D | VMIG1 | 1.45 | 9/01/04 | 250 | 250,000 | ||||||||

California St. | |||||||||||||

Mun. Secs. Tr. Rcpts., Ser. | A-1+(c) | 1.34 | 9/01/04 | 1,150 | 1,150,000 | ||||||||

Mun. Secs. Tr. Rcpts., Ser. | A-1+(c) | 1.34 | 9/01/04 | 1,300 | 1,300,000 | ||||||||

Mun. Secs. Tr. Cert., G.O., Ser. 2001-135, Class. A, F.G.I.C., F.R.D.D., 144A | A-1(c) | 1.34 | 9/01/04 | 700 | 700,000 | ||||||||

Ser. 2001-136, Class. A, F.G.I.C., F.R.D.D., 144A | A-1(c) | 1.34 | 9/01/04 | 300 | 300,000 | ||||||||

Total short-term investments (cost $3,700,000) | 3,700,000 | ||||||||||||

Total Investments 99.4% | 112,449,819 | ||||||||||||

Other assets in excess of | 708,256 | ||||||||||||

Net Assets 100% | $ | 113,158,075 | |||||||||||

See Notes to Financial Statements.

| 14 | Visit our website at www.jennisondryden.com |

| (a) | The following abbreviations are used in the portfolio descriptions: |

A.M.B.A.C.—American Municipal Bond Assurance Corporation.

A.M.T.—Alternative Minimum Tax.

C.O.P.—Certificates of Participation.

E.T.M.—Escrowed to Maturity.

F.G.I.C.—Financial Guaranty Insurance Company.

F.R.D.D.—Floating Rate (Daily) Demand Note.(f)

F.S.A.—Financial Security Assurance.

G.O.—General Obligation.

M.B.I.A.—Municipal Bond Insurance Corporation.

R.I.B.S.—Residential Interest Bearing Securities.

S.A.V.R.S.—Select Auction Variable Rate Securities.

T.C.R.S.—Transferable Custodial Receipts

| (b) | Inverse floating rate bond. The coupon is inversely indexed to a floating interest rate. The rate shown is the rate at year end. |

| (c) | Standard & Poor’s rating. |

| (d) | Partial principal amount pledged as collateral for financial futures contracts. |

| (e) | Prerefunded issues are secured by escrowed cash and/or direct U.S. guaranteed obligations. |

| (f) | For purposes of amortized cost valuation, the maturity date of Floating Rate Demand Notes is considered to be the later of the next date on which the security can be redeemed at par, or the next date on which the rate of interest is adjusted. |

| (g) | Floating rate. Rate shown is the rate in effect at August 31, 2004. |

| (h) | Indicates illiquid securities restricted as to resale. The aggregate cost of such securities was $4,017,822 and was approximately 3.6% of net assets. |

| NR—Not | Rated by Moody’s or Standard & Poor’s. |

The fund’s current Statement of Additional Information contains a description of Moody’s and Standard & Poor’s ratings.

The industry classification of portfolio holdings and other assets in excess of liabilities shown as a percentage of net assets as of August 31, 2004 were as follows:

| Special Tax/Assessment District | 27.0 | % | |

| General Obligation | 18.1 | ||

| Power | 15.2 | ||

| Lease Backed Certificate of Participation | 10.6 | ||

| Healthcare | 6.7 | ||

| Education | 4.8 | ||

| Housing | 4.5 | ||

| Water & Sewer | 4.2 | ||

| Transportation | 4.0 | ||

| Tobacco | 3.3 | ||

| Solid Waste/Resource Recovery | 1.0 | ||

| 99.4 | |||

| Other assets in excess of liabilities | 0.6 | ||

| 100.0 | % | ||

See Notes to Financial Statements.

| Dryden California Municipal Fund/California Series | 15 |

Statement of Assets and Liabilities

as of August 31, 2004

Assets | ||||

Investments, at value (cost $103,893,743) | $ | 112,449,819 | ||

Cash | 44,678 | |||

Interest receivable | 1,098,902 | |||

Receivable for Series shares sold | 316 | |||

Prepaid expenses | 4,982 | |||

Total assets | 113,598,697 | |||

Liabilities | ||||

Payable for Series shares reacquired | 178,932 | |||

Accrued expenses | 99,335 | |||

Dividends payable | 71,137 | |||

Management fee payable | 47,805 | |||

Distribution fee payable | 27,377 | |||

Deferred Trustees’ fees | 14,911 | |||

Due to broker-variation margin | 1,125 | |||

Total liabilities | 440,622 | |||

Net Assets | $ | 113,158,075 | ||

Net assets were comprised of: | ||||

Shares of beneficial interest, at par | $ | 94,520 | ||

Paid-in capital in excess of par | 101,392,619 | |||

| 101,487,139 | ||||

Overdistributed net investment income | (53,318 | ) | ||

Accumulated net realized gain on investments | 3,186,560 | |||

Net unrealized appreciation on investments | 8,537,694 | |||

Net assets, August 31, 2004 | $ | 113,158,075 | ||

See Notes to Financial Statements.

| 16 | Visit our website at www.jennisondryden.com |

Class A | |||

Net asset value and redemption price per share | |||

($89,238,805 ÷ 7,453,756 shares of beneficial interest issued and outstanding) | $ | 11.97 | |

Maximum sales charge (4% of offering price) | 0.50 | ||

Maximum offering price to public | $ | 12.47 | |

Class B | |||

Net asset value, offering price and redemption price per share | |||

($17,665,703 ÷ 1,475,923 shares of beneficial interest issued and outstanding) | $ | 11.97 | |

Class C | |||

Net asset value, offering price and redemption price per share | |||

($1,736,171 ÷ 145,056 shares of beneficial interest issued and outstanding) | $ | 11.97 | |

Class Z | |||

Net asset value, offering price and redemption price per share | |||

($4,517,396 ÷ 377,301 shares of beneficial interest issued and outstanding) | $ | 11.97 | |

See Notes to Financial Statements.

| Dryden California Municipal Fund/California Series | 17 |

Statement of Operations

Year Ended August 31, 2004

Net Investment Income | ||||

Income | ||||

Interest | $ | 6,008,251 | ||

Expenses | ||||

Management fee | 603,545 | |||

Distribution fee—Class A | 235,083 | |||

Distribution fee—Class B | 98,614 | |||

Distribution fee—Class C | 16,110 | |||

Custodian’s fees and expenses | 114,000 | |||

Reports to shareholders | 53,000 | |||

Transfer agent’s fees and expenses | 46,000 | |||

Registration fees | 44,000 | |||

Legal fees and expenses | 38,000 | |||

Audit fee | 26,000 | |||

Trustees’ fees | 13,000 | |||

Miscellaneous | 10,076 | |||

Total expenses | 1,297,428 | |||

Net investment income | 4,710,823 | |||

Realized And Unrealized Gain (Loss) On Investments | ||||

Net realized gain (loss) on: | ||||

Investment transactions | 5,327,420 | |||

Financial futures transactions | (1,035,453 | ) | ||

Interest rate swap transactions | (44,671 | ) | ||

Options written transactions | 15,260 | |||

| 4,262,556 | ||||

Net change in unrealized appreciation (depreciation) on: | ||||

Investments | (2,310,780 | ) | ||

Financial futures | 15,384 | |||

| (2,295,396 | ) | |||

Net gain on investments | 1,967,160 | |||

Net Increase In Net Assets Resulting From Operations | $ | 6,677,983 | ||

See Notes to Financial Statements.

| 18 | Visit our website at www.jennisondryden.com |

Statement of Changes in Net Assets

| Year Ended August 31, | ||||||||

| 2004 | 2003 | |||||||

Increase (Decrease) In Net Assets | ||||||||

Operations | ||||||||

Net investment income | $ | 4,710,823 | $ | 5,593,774 | ||||

Net realized gain on investments | 4,262,556 | 1,704,541 | ||||||

Net change in unrealized appreciation (depreciation) on investments | (2,295,396 | ) | (4,598,499 | ) | ||||

Net increase in net assets resulting from operations | 6,677,983 | 2,699,816 | ||||||

Dividends and distributions (Note 1) | ||||||||

Dividends from net investment income | ||||||||

Class A | (3,695,744 | ) | (4,322,771 | ) | ||||

Class B | (726,345 | ) | (937,844 | ) | ||||

Class C | (73,929 | ) | (83,781 | ) | ||||

Class Z | (200,892 | ) | (190,604 | ) | ||||

| (4,696,910 | ) | (5,535,000 | ) | |||||

Distributions from net realized gains | ||||||||

Class A | (1,462,100 | ) | (707,585 | ) | ||||

Class B | (319,113 | ) | (168,739 | ) | ||||

Class C | (34,029 | ) | (12,098 | ) | ||||

Class Z | (91,318 | ) | (28,302 | ) | ||||

| (1,906,560 | ) | (916,724 | ) | |||||

Series share transactions (Net of share conversions) (Note 6) | ||||||||

Net proceeds from shares sold | 9,360,453 | 23,670,413 | ||||||

Net asset value of shares issued in reinvestment of dividends | 3,991,685 | 3,718,587 | ||||||

Cost of shares reacquired | (25,439,241 | ) | (32,912,886 | ) | ||||

Net decrease in net assets from Series share transactions | (12,087,103 | ) | (5,523,886 | ) | ||||

Total decrease | (12,012,590 | ) | (9,275,794 | ) | ||||

Net Assets | ||||||||

Beginning of year | 125,170,665 | 134,446,459 | ||||||

End of year | $ | 113,158,075 | $ | 125,170,665 | ||||

See Notes to Financial Statements.

| Dryden California Municipal Fund/California Series | 19 |

Notes to Financial Statements

Dryden California Municipal Fund (the “Fund”), is registered under the Investment Company Act of 1940 as an open-end management investment company. The Fund was organized as a Massachusetts business trust on May 18, 1984 and consists of three series. These financial statements relate only to California Series (the ‘Series’). The financial statements of the other series are not presented herein. The assets of each series are invested in separate, independently managed portfolios. The Series commenced investment operations on September 19, 1984. The Series is diversified and seeks to achieve its investment objective of obtaining the maximum amount of income exempt from federal and California state income taxes with the minimum of risk by investing in “investment grade” tax-exempt securities whose ratings are within the four highest ratings categories by a nationally recognized statistical rating organization or, if not rated, are of comparable quality. The ability of the issuers of the securities held by the Series to meet their obligations may be affected by economic developments in a specific state, industry or region.

Note 1. Accounting Policies

The following is a summary of significant accounting policies followed by the Fund, and the Series, in the preparation of its financial statements.

Securities Valuations: The Fund values municipal securities (including commitments to purchase such securities on a “when-issued” basis) as of the close of trading on the New York Stock Exchange, on the basis of prices provided by a pricing service which uses information with respect to transactions in comparable securities and various relationships between securities in determining values. Securities listed on a securities exchange (other than options on securities and indices) are valued at the last sale price on such exchange on the day of valuation or, if there was no sale on such day, at the mean between the last reported bid and asked prices, or at the last bid price on such day in the absence of an asked price. Securities traded via Nasdaq are valued at the Nasdaq Official Closing Price (NOCP) on the day of valuation, or if there was no NOCP, at the last sale price. Securities that are actively traded in the over-the-counter market, including listed securities for which the primary market is believed by Prudential Investments LLC (“PI” or “Manager”) in consultation with the subadviser, to be over-the-counter, are valued at market value using prices provided, by an independent pricing agent or principal market marker. Futures contracts and options thereon traded on a commodities exchange or board of trade are valued at the last sale price at the close of trading on such exchange or board of trade or, if there was no sale on the applicable commodities exchange or board of trade on such day, at the mean between the most recently quoted prices on such exchange or board of trade or at the

| 20 | Visit our website at www.jennisondryden.com |

last bid price in the absence of an asked price. Prices may be obtained from independent pricing services which use information provided by market makers or estimates of market values obtained from yield data relating to investments or securities with similar characteristics. Securities for which reliable market quotations are not readily available or whose values have been affected by events occurring after the close of the security’s foreign market and before the Fund’s normal pricing time, are valued at fair value in accordance with Board of Trustees’ approved fair valuation procedures. Using fair value to price securities may result in a value that is different from a security’s most recent closing price and from the price used by other mutual funds to calculate their net asset values.

Short-term securities which mature in sixty days or less are valued at amortized cost, which approximates market value. The amortized cost method involves valuing a security at its cost on the date of purchase and thereafter assuming a constant amortization to maturity of the difference between the principal amount due at maturity and cost. Short-term securities which mature in more than sixty days are valued at current market quotations.

Restricted Securities: The Series may hold up to 15% of its net assets in illiquid securities, including those which are restricted as to disposition under securities law (“restricted securities”). The restricted securities held by the Series at August 31, 2004 include registration rights under which the Series may demand registration by the issuers. Restricted securities, sometimes referred to as private placements, are valued pursuant to the valuation procedures noted above.

Financial Futures Contracts: A financial futures contract is an agreement to purchase (long) or sell (short) an agreed amount of securities at a set price for delivery on a future date. Upon entering into a financial futures contract, the Series is required to pledge to the broker an amount of cash and/or other assets equal to a certain percentage of the contract amount. This amount is known as the “initial margin.” Subsequent payments, known as “variation margin,” are made or received by the Series each day, depending on the daily fluctuations in the value of the underlying security. Such variation margin is recorded for financial statement purposes on a daily basis as unrealized gain or loss. When the contract expires or is closed, the gain or loss is realized and is presented in the Statement of Operations as net realized gain or loss on financial futures contracts.

The Series invests in financial futures contracts in order to hedge its existing portfolio securities, or securities the Series intends to purchase, against fluctuations in value caused by changes in prevailing interest rates or market conditions. Should interest rates move unexpectedly, the Series may not achieve the anticipated benefits of the

| Dryden California Municipal Fund/California Series | 21 |

Notes to Financial Statements

financial futures contracts and may realize a loss. The use of futures transactions involves the risk of imperfect correlation in movements in the price of futures contracts, interest rates and the underlying hedged assets.

Inverse Floaters: The Series invests in variable rate securities commonly called “inverse floaters”. The interest rates on these securities have an inverse relationship to the interest rate of other securities or the value of an index. Changes in interest rates on the other security or index inversely affect the rate paid on the inverse floater, and the inverse floater’s price will be more volatile than that of a fixed-rate bond. Additionally, some of these securities contain a “leverage factor” whereby the interest rate moves inversely by a “factor” to the benchmark rate. Certain interest rate movements and other market factors can substantially affect the liquidity of inverse floating rate notes.

Options: The Series may either purchase or write options in order to hedge against adverse market movements or fluctuations in value caused by changes in prevailing interest rates with respect to securities, which the Series currently owns or intends to purchase. The Series’ principal reason for writing options is to realize, through receipt of premiums, a greater current return than would be realized on the underlying security alone. When the Series purchases an option, it pays a premium and an amount equal to that premium is recorded as an asset. When the Series writes an option, it receives a premium and an amount equal to that premium is recorded as a liability. The asset or liability is adjusted daily to reflect the current market value of the option. If an option expires unexercised, the Series realizes a gain or loss to the extent of the premium received or paid. If an option is exercised, the premium received or paid is recorded as an adjustment to the proceeds from the sale or the cost of the purchase determining whether the Series has realized a gain or loss. The difference between the premium and the amount received or paid on effecting a closing purchase or sale transaction is also treated as a realized gain or loss. Gain or loss on purchased options is included in net realized gain or loss on investment transactions. Gain or loss on written options is presented separately as net realized gain or loss on options written.

The Series, as writer of an option, may have no control over whether the underlying securities may be sold (called) or purchased (put). As a result, the Series bears the market risk of an unfavorable change in the price of the security underlying the written option. The Series, as purchaser of an option, bears the risk of the potential inability of the counterparties to meet the terms of their contracts.

| 22 | Visit our website at www.jennisondryden.com |

Interest Rate Swaps: The Series may enter into interest rate swaps. In a simple interest rate swap, one investor pays a floating rate of interest on a notional principal amount and receives a fixed rate of interest on the same notional principal amount for a specified period of time. Alternatively, an investor may pay a fixed rate and receive a floating rate. Interest rate swaps were conceived as asset/liability management tools. In more complex swaps, the notional principal amount may decline (or amortize) over time.

During the term of the swap, changes in the value of the swap are recognized as unrealized gains or losses by “marking-to-market” to reflect the market value of the swap. When the swap is terminated, the Series will record a realized gain or loss equal to the difference between the proceeds from (or cost of) the closing transaction and the Series’ basis in the contract, if any.

The Series is exposed to credit loss in the event of non-performance by the other party to the interest rate swap. However, the Series does not anticipate non-performance by any counterparty.

Written options, future contracts and swap contracts involve elements of both market and certain risk in excess of the amounts reflected in the Statement of Assets and Liabilities.

Securities Transactions and Net Investment Income: Securities transactions are recorded on the trade date. Realized and unrealized gains and losses from securities transactions are calculated on the identified cost basis. Interest income, including amortization of premium and accretion of discount on debt securities, as required, is recorded on the accrual basis.

Net investment income or loss (other than distribution fees, which are charged directly to the respective class) and realized and unrealized gains and losses are allocated daily to each class of shares based upon the relative proportion of net assets of each class at the beginning of the day.

Taxes: For federal income tax purposes, each series in the Fund is treated as a separate taxpaying entity. It is the Series’ policy to meet the requirements of the Internal Revenue Code applicable to regulated investment companies and to distribute all of its taxable net income and capital gains, if any, to shareholders. Therefore, no federal income tax provision is required.

Dividends and Distributions: The Series declares daily dividends from net investment income. Payment of dividends is made monthly. Distributions of net capital gains, if any, are made annually. Dividends and distributions to shareholders, which are determined in accordance with federal income tax regulation and which may differ

| Dryden California Municipal Fund/California Series | 23 |

Notes to Financial Statements

from generally accepted accounting principles, are recorded on the ex-dividend date. Permanent book/tax differences relating to income and gains are reclassified amongst undistributed net investment income, accumulated net realized gain or loss and paid-in capital in excess of par, as appropriate.

Custody Fee Credits: The Fund has an arrangement with its custodian bank, whereby uninvested assets earn credits which reduce the fees charged by the custodian. The Fund could have invested a portion of the assets utilized in connection with the expense offset arrangements in an income producing asset if they had not entered into such arrangements.

Estimates: The preparation of the financial statements requires management to make estimates and assumptions that affect the reported amounts and disclosures in the financial statements. Actual results could differ from those estimates.

Note 2. Agreements

The Fund has a management agreement with PI. Pursuant to this agreement, PI has responsibility for all investment advisory services and supervises the subadviser’s performance of such services. PI has entered into a subadvisory agreement with Prudential Investment Management, Inc. (“PIM”). The subadvisory agreement provides that PIM will furnish investment advisory services in connection with the management of the Series. In connection therewith, PIM is obligated to keep certain books and records of the Series. PI pays for the services of PIM, the cost of compensation of officers of the Series, occupancy and certain clerical and bookkeeping costs of the Series. The Series bears all other costs and expenses.

The management fee paid to PI is accrued daily and payable monthly, at an annual rate of .50 of 1% of the average daily net assets of the Series.

The Series has a distribution agreement with Prudential Investment Management Services LLC (“PIMS”), which acts as the distributor of the Class A, Class B, Class C and Class Z shares of the Series. The Series compensates PIMS for distributing and servicing the Series’ Class A, Class B and Class C shares, pursuant to plans of distribution (the “Class A, B and C Plans”), regardless of expenses actually incurred by it. The distribution fees are accrued daily and payable monthly. No distribution or service fees are paid to PIMS as distributor for Class Z shares of the Series.

| 24 | Visit our website at www.jennisondryden.com |

Pursuant to the Class A, B and C Plans, the Series compensates PIMS for distribution-related activities at an annual rate of up to .30 of 1%, .50 of 1% and 1% of the average daily net assets of the Class A, B and C shares, respectively. PIMS has contractually agreed to limit such fees to .25% and ..75 of 1% of the Class A and C shares, respectively.

PIMS has advised the Series that they received approximately $28,900 and $1,000 in front-end sales charges resulting from sales of Class A and Class C shares, respectively, during the year ended August 31, 2004. From these fees, PIMS paid such sales charges to affiliated broker-dealers, which in turn paid commissions to salespersons and incurred other distribution costs.

PIMS has advised the Series that for the year ended August 31, 2004, it received approximately $25,300 and $6,400 in contingent deferred sales charges imposed upon redemptions by Class B and Class C shareholders, respectively.

PI, PIMS and PIM are indirect, wholly-owned subsidiaries of Prudential Financial, Inc. (“Prudential”).

The Series, along with other affiliated registered investment companies (the “Companies”), is party to a syndicated credit agreement (“SCA”) with a group of banks. The SCA provided for a commitment of $800 million, through April 30, 2004, and allowed the Companies to increase the commitment to $1 billion, if necessary. Effective May 1, 2004, the commitment provided by the SCA was reduced to $500 million and the SCA was renewed under the same terms and conditions. The expiration date of the renewed SCA is October 29, 2004. Interest on any borrowings will be incurred at market rates. The Companies pay a commitment fee of .08 of 1% of the unused portion of the SCA. The commitment fee is accrued daily and paid quarterly and is allocated to the Companies pro rata based on net assets. The purpose of the SCA is to serve as an alternative source of funding for capital share redemptions. The Series did not borrow any amounts pursuant to the SCA during the year ended August 31, 2004.

Note 3. Other Transactions with Affiliates

Prudential Mutual Fund Services LLC (“PMFS”), an affiliate of PI and an indirect, wholly-owned subsidiary of Prudential, serves as the Fund’s transfer agent. During the year ended August 31, 2004, the Series incurred fees of approximately $33,200 for the services of PMFS. As of August 31 2004, approximately $2,600 of such fees were due to PMFS. Transfer agent fees and expenses in the Statement of Operations include certain out-of-pocket expenses paid to nonaffiliates, where applicable.

| Dryden California Municipal Fund/California Series | 25 |

Notes to Financial Statements

The Series pays networking fees to affiliated and unaffiliated broker/dealers. These networking fees are payments made to broker/dealers that clear mutual fund transactions through a national clearing system. The Series incurred approximately $6,100 in total networking fees, of which the amount relating to the services of Wachovia Securities, LLC (“Wachovia”) an affiliate of PI, were approximately $3,200 for the year ended August 31, 2004. As of August 31, 2004 approximately $300 of such fees were due to Wachovia. These amounts are included in transfer agent’s fees and expenses in the Statement of Operations.

Note 4. Portfolio Securities

Purchases and sales of portfolio securities, other than short-term investments, for the year ended August 31, 2004 were $83,719,488 and $99,175,053 respectively.

During the year ended August 31, 2004, the Series entered into financial futures contracts. Details of open contracts at August 31, 2004 are as follows:

| Number of Contracts | Type | Expiration Date | Value at Trade Date | Value at August 31, 2004 | Unrealized Depreciation | |||||||||||

| Short Positions: | ||||||||||||||||

| U.S. Treasury | ||||||||||||||||

| 3 | 10 yr Notes | Sep. 04 | $ | (322,024 | ) | $ | (340,406 | ) | $ | (18,382 | ) | |||||

Transactions in options written during the year ended August 31, 2004 were as follows:

| Number of Contracts | Premiums Received | ||||||

Options outstanding as of August 31, 2003 | — | $ | — | ||||

Options written | 36 | 15,260 | |||||

Options expired | (36 | ) | (15,260 | ) | |||

Options outstanding as of August 31, 2004 | — | $ | — | ||||

Note 5. Distributions and Tax Information

In order to present overdistributed net investment income and accumulated net realized gains or losses on the Statement of Assets and Liabilities that more closely represent their tax character, certain adjustments have been made to paid-in-capital in excess of par, overdistributed net investment income and accumulated net realized gain or loss on investments.

| 26 | Visit our website at www.jennisondryden.com |

For the year ended August 31, 2004, the adjustments were to decrease overdistributed net investment income by $13,913, and increase accumulated net realized gain by $13,913 due to the difference in the treatment of accreting market discount between financial and tax reporting. Net investment income, net realized gains and net assets were not affected by this change.

For the years ended August 31, 2004 and August 31, 2003, the tax character of total dividends paid, as reflected in the Statement of Changes in Net Assets, were as follows.

Year | Tax-Exempt | Ordinary Income | Long-Term | Total | ||||

2004 | $4,696,910 | $124,036 | $1,782,524 | $6,603,470 | ||||

2003 | $5,535,000 | — | $916,724 | $6,451,724 |

As of August 31, 2004, the accumulated undistributed earnings on a tax basis were $17,819 of tax-exempt income (including a timing difference of $71,137 for dividends payable) and $3,024,492 of long-term capital gain.

The United States federal income tax basis of the Series’ investments and the net unrealized appreciation as of August 31, 2004 were as follows:

Tax Basis of Investments | Appreciation | Depreciation | Total Net | |||

| $103,750,057 | $8,805,737 | $105,975 | $8,699,762 |

The difference between book basis and tax basis is primarily attributable to the difference in the treatment of market discount for book and tax purposes.

Note 6. Capital

The Series offers Class A, Class B, Class C and Class Z shares. Class A shares are sold with a front-end sales charge of up to 4%. Prior to March 15, 2004, Class A shares were sold with a front-end sales charge of 3%. Effective on March 15, 2004, all investors who purchase Class A shares in an amount of $1 million or more and sell these shares within 12 months of purchase are subject to a contingent deferred sales charge (CDSC) of 1%, including investors who purchase their shares through broker-dealers affiliated with Prudential. Class B shares are sold with a CDSC which declines from 5% to zero depending upon the period of time the shares are held. Prior to February 2, 2004, Class C shares were sold with a front-end sales charge of 1% and a CDSC of 1% during the first 18 months. Class C shares purchased on or after February 2, 2004 are not subject to an initial front-end sales charge and the CDSC for Class C shares is 12 months from the date of purchase. Class B shares will automatically convert to Class A shares on a quarterly basis approximately seven years after

| Dryden California Municipal Fund/California Series | 27 |

Notes to Financial Statements

purchase. A special exchange privilege is also available for shareholders who qualify to purchase Class A shares at net asset value. Class Z shares are not subject to any sales or redemption charge and are offered exclusively for sale to limited group of investors.

The Series has authorized an unlimited number of shares of beneficial interest of each class at $.01 par value per share.

Transactions in shares of beneficial interest were as follows:

Class A | Shares | Amount | |||||

Year ended August 31, 2004: | |||||||

Shares sold | 341,993 | $ | 4,105,547 | ||||

Shares issued in reinvestment of dividends and distributions | 259,117 | 3,116,626 | |||||

Shares reacquired | (1,347,278 | ) | (16,060,612 | ) | |||

Net increase (decrease) in shares outstanding before conversion | (746,168 | ) | (8,838,439 | ) | |||

Shares issued upon conversion from Class B | 134,385 | 1,619,117 | |||||

Net increase (decrease) in shares outstanding | (611,783 | ) | $ | (7,219,322 | ) | ||

Year ended August 31, 2003: | |||||||

Shares sold | 1,240,808 | $ | 15,185,316 | ||||

Shares issued in reinvestment of dividends and distributions | 236,644 | 2,890,708 | |||||

Shares reacquired | (2,024,588 | ) | (24,720,854 | ) | |||

Net increase (decrease) in shares outstanding before conversion | (547,136 | ) | (6,644,830 | ) | |||

Shares issued upon conversion from Class B | 260,421 | 3,251,425 | |||||

Net increase (decrease) in shares outstanding | (286,715 | ) | $ | (3,393,405 | ) | ||

Class B | |||||||

Year ended August 31, 2004: | |||||||

Shares sold | 63,757 | $ | 764,836 | ||||

Shares issued in reinvestment of dividends and distributions | 46,396 | 558,519 | |||||

Shares reacquired | (270,220 | ) | (3,207,869 | ) | |||

Net increase (decrease) in shares outstanding before conversion | (160,067 | ) | (1,884,514 | ) | |||

Shares reacquired upon conversion into Class A | (134,439 | ) | (1,619,117 | ) | |||

Net increase (decrease) in shares outstanding | (294,506 | ) | $ | (3,503,631 | ) | ||

Year ended August 31, 2003: | |||||||

Shares sold | 174,886 | $ | 2,157,303 | ||||

Shares issued in reinvestment of dividends and distributions | 50,521 | 616,800 | |||||

Shares reacquired | (291,605 | ) | (3,547,746 | ) | |||

Net increase (decrease) in shares outstanding before conversion | (66,198 | ) | (773,643 | ) | |||

Shares reacquired upon conversion into Class A | (260,448 | ) | (3,251,425 | ) | |||

Net increase (decrease) in shares outstanding | (326,646 | ) | $ | (4,025,068 | ) | ||

| 28 | Visit our website at www.jennisondryden.com |

Class C | Shares | Amount | |||||

Year ended August 31, 2004: | |||||||

Shares sold | 10,855 | $ | 132,326 | ||||

Shares issued in reinvestment of dividends and distributions | 7,455 | 89,714 | |||||

Shares reacquired | (83,932 | ) | (1,004,262 | ) | |||

Net increase (decrease) in shares outstanding | (65,622 | ) | $ | (782,222 | ) | ||

Year ended August 31, 2003: | |||||||

Shares sold | 111,503 | $ | 1,367,428 | ||||

Shares issued in reinvestment of dividends and distributions | 5,792 | 70,778 | |||||

Shares reacquired | (77,218 | ) | (941,790 | ) | |||

Net increase (decrease) in shares outstanding | 40,077 | $ | 496,416 | ||||

Class Z | |||||||

Year ended August 31, 2004: | |||||||

Shares sold | 363,951 | $ | 4,357,744 | ||||

Shares issued in reinvestment of dividends and distributions | 18,845 | 226,826 | |||||

Shares reacquired | (431,062 | ) | (5,166,498 | ) | |||

Net increase (decrease) in shares outstanding | (48,266 | ) | $ | (581,928 | ) | ||

Year ended August 31, 2003: | |||||||

Shares sold | 403,777 | $ | 4,960,366 | ||||

Shares issued in reinvestment of dividends and distributions | 11,470 | 140,301 | |||||

Shares reacquired | (301,224 | ) | (3,702,496 | ) | |||

Net increase (decrease) in shares outstanding | 114,023 | $ | 1,398,171 | ||||

| Dryden California Municipal Fund/California Series | 29 |

Financial Highlights

| Class A | ||||

| Year Ended August 31, 2004 | ||||

Per Share Operating Performance: | ||||

Net Asset Value, Beginning Of Year | $ | 11.95 | ||

Income from investment operations | ||||

Net investment income | .47 | |||

Net realized and unrealized gain (loss) on investment transactions | .20 | |||

Total from investment operations | .67 | |||

Less Distributions | ||||

Dividends from net investment income | (.47 | ) | ||

Distributions in excess of net investment income | — | |||

Distributions from net realized gains | (.18 | ) | ||

Total distributions | (.65 | ) | ||

Net asset value, end of year | $ | 11.97 | ||

Total Return(b): | 5.75 | % | ||

Ratios/Supplemental Data: | ||||

Net assets, end of year (000) | $ | 89,239 | ||

Average net assets (000) | $ | 94,033 | ||

Ratios to average net assets: | ||||

Expenses, including distribution and service (12b-1) fees(d) | 1.04 | % | ||

Expenses, excluding distribution and service (12b-1) fees | .79 | % | ||

Net investment income | 3.94 | % | ||

For Class A, B, C and Z shares: | ||||

Portfolio turnover rate | 74 | % | ||

| (a) | Less than $.005 per share. |

| (b) | Total return does not consider the effects of sales loads. Total return is calculated assuming a purchase of shares on the first day and a sale on the last day of each year reported, and includes reinvestment of dividends and distributions. |

| (c) | Effective September 1, 2001, the Series has adopted the provisions of the AICPA Audit and Accounting Guide for Investment Companies and began accreting market discount on debt securities. The effect of this change for the year ended August 31, 2002 was to increase net investment income and decrease net realized and unrealized gain (loss) per share by less than $.005 and increase the ratio of net investment income from 4.37% to 4.38%. Per share amounts and ratios for the year ended prior to August 31, 2002 have not been restated to reflect this change in presentation. |

| (d) | The distributor of the Series contractually agreed to limit its distribution and service (12b-1) fees to .25 of 1% on the average daily net assets of Class A shares. |

See Notes to Financial Statements.

| 30 | Visit our website at www.jennisondryden.com |

| Class A | ||||||||||||||

| Year Ended August 31, | ||||||||||||||

| 2003 | 2002(c) | 2001 | 2000 | |||||||||||

| $ | 12.30 | $ | 12.36 | $ | 11.78 | $ | 11.45 | |||||||

| .51 | .53 | .56 | .58 | |||||||||||

| (.27 | ) | .05 | .58 | .33 | ||||||||||

| .24 | .58 | 1.14 | .91 | |||||||||||

| (.51 | ) | (.53 | ) | (.56 | ) | (.58 | ) | |||||||

| — | — | — | — | (a) | ||||||||||

| (.08 | ) | (.11 | ) | — | — | |||||||||

| (.59 | ) | (.64 | ) | (.56 | ) | (.58 | ) | |||||||

| $ | 11.95 | $ | 12.30 | $ | 12.36 | $ | 11.78 | |||||||

| 2.02 | % | 4.92 | % | 9.91 | % | 8.35 | % | |||||||

| $ | 96,409 | $ | 102,729 | $ | 103,368 | $ | 94,776 | |||||||

| $ | 103,428 | $ | 102,429 | $ | 99,324 | $ | 93,560 | |||||||

| .97 | % | .97 | % | .98 | % | .93 | % | |||||||

| .72 | % | .72 | % | .73 | % | .68 | % | |||||||

| 4.22 | % | 4.38 | % | 4.66 | % | 5.13 | % | |||||||

| 63 | % | 30 | % | 48 | % | 25 | % | |||||||

See Notes to Financial Statements.

| Dryden California Municipal Fund/California Series | 31 |

Financial Highlights

Cont’d

| Class B | ||||

| Year Ended August 31, 2004 | ||||

Per Share Operating Performance: | ||||

Net Asset Value, Beginning Of Year | $ | 11.95 | ||

Income from investment operations | ||||

Net investment income | .44 | |||

Net realized and unrealized gain (loss) on investment transactions | .20 | |||

Total from investment operations | .64 | |||

Less Distributions | ||||

Dividends from net investment income | (.44 | ) | ||

Distributions in excess of net investment income | — | |||

Distributions from net realized gains | (.18 | ) | ||

Total distributions | (.62 | ) | ||

Net asset value, end of year | $ | 11.97 | ||

Total Return(b): | 5.48 | % | ||

Ratios/Supplemental Data: | ||||

Net assets, end of year (000) | $ | 17,666 | ||

Average net assets (000) | $ | 19,723 | ||

Ratios to average net assets: | ||||

Expenses, including distribution and service (12b-1) fees | 1.29 | % | ||

Expenses, excluding distribution and service (12b-1) fees | .79 | % | ||

Net investment income | 3.69 | % | ||

| (a) | Less than $.005 per share. |

| (b) | Total return does not consider the effects of sales loads. Total return is calculated assuming a purchase of shares on the first day and a sale on the last day of each year reported, and includes reinvestment of dividends and distributions. |

| (c) | Effective September 1, 2001, the Series has adopted the provisions of the AICPA Audit and Accounting Guide for Investment Companies and began accreting market discount on debt securities. The effect of this change for the year ended August 31, 2002 was to increase net investment income and decrease net realized and unrealized gain (loss) per share by less than $.005 and no effect on the ratio of net investment income. Per share amounts and ratios for the year ended prior to August 31, 2002 have not been restated to reflect this change in presentation. |

See Notes to Financial Statements.

| 32 | Visit our website at www.jennisondryden.com |

| Class B | ||||||||||||||

| Year Ended August 31, | ||||||||||||||

| 2003 | 2002(c) | 2001 | 2000 | |||||||||||

| $ | 12.30 | $ | 12.36 | $ | 11.78 | $ | 11.44 | |||||||

| .48 | .50 | .53 | .56 | |||||||||||

| (.27 | ) | .05 | .58 | .34 | ||||||||||

| .21 | .55 | 1.11 | .90 | |||||||||||

| (.48 | ) | (.50 | ) | (.53 | ) | (.56 | ) | |||||||

| — | — | — | — | (a) | ||||||||||

| (.08 | ) | (.11 | ) | — | — | |||||||||

| (.56 | ) | (.61 | ) | (.53 | ) | (.56 | ) | |||||||

| $ | 11.95 | $ | 12.30 | $ | 12.36 | $ | 11.78 | |||||||

| 1.76 | % | 4.67 | % | 9.63 | % | 8.18 | % | |||||||

| $ | 21,157 | $ | 25,787 | $ | 27,554 | $ | 32,403 | |||||||

| $ | 23,862 | $ | 26,110 | $ | 28,540 | $ | 38,348 | |||||||

| 1.22 | % | 1.22 | % | 1.23 | % | 1.18 | % | |||||||

| .72 | % | .72 | % | .73 | % | .68 | % | |||||||

| 3.97 | % | 4.13 | % | 4.41 | % | 4.89 | % | |||||||

See Notes to Financial Statements.

| Dryden California Municipal Fund/California Series | 33 |

Financial Highlights

Cont’d

| Class C | ||||

| Year Ended August 31, 2004 | ||||

Per Share Operating Performance: | ||||

Net Asset Value, Beginning Of Year | $ | 11.95 | ||

Income from investment operations | ||||

Net investment income | .41 | |||

Net realized and unrealized gain (loss) on investment transactions | .20 | |||

Total from investment operations | .61 | |||

Less Distributions | ||||

Dividends from net investment income | (.41 | ) | ||

Distributions in excess of net investment income | — | |||

Distributions from net realized gains | (.18 | ) | ||

Total distributions | (.59 | ) | ||

Net asset value, end of year | $ | 11.97 | ||

Total Return(b): | 5.22 | % | ||

Ratios/Supplemental Data: | ||||

Net assets, end of year (000) | $ | 1,736 | ||

Average net assets (000) | $ | 2,148 | ||

Ratios to average net assets: | ||||

Expenses, including distribution and service (12b-1) fees(d) | 1.54 | % | ||

Expenses, excluding distribution and service (12b-1) fees | .79 | % | ||

Net investment income | 3.45 | % | ||

| (a) | Less than $.005 per share. |

| (b) | Total return does not consider the effects of sales loads. Total return is calculated assuming a purchase of shares on the first day and a sale on the last day of each year reported, and includes reinvestment of dividends and distributions. |

| (c) | Effective September 1, 2001, the Series has adopted the provisions of the AICPA Audit and Accounting Guide for Investment Companies and began accreting market discount on debt securities. The effect of this change for the year ended August 31, 2002 was to increase net investment income and decrease net realized and unrealized gain (loss) per share by less than $.005 and no effect on the ratio of net investment income. Per share amounts and ratios for the year ended prior to August 31, 2002 have not been restated to reflect this change in presentation. |

| (d) | The distributor of the Series contractually agreed to limit its distribution and service (12b-1) fees to .75 of 1% on the average daily net assets of Class C shares. |

See Notes to Financial Statements.

| 34 | Visit our website at www.jennisondryden.com |

| Class C | ||||||||||||||

| Year Ended August 31, | ||||||||||||||

| 2003 | 2002(c) | 2001 | 2000 | |||||||||||

| $ | 12.30 | $ | 12.36 | $ | 11.78 | $ | 11.44 | |||||||

| .45 | .47 | .50 | .53 | |||||||||||

| (.27 | ) | .05 | .58 | .34 | ||||||||||

| .18 | .52 | 1.08 | .87 | |||||||||||

| (.45 | ) | (.47 | ) | (.50 | ) | (.53 | ) | |||||||

| — | — | — | — | (a) | ||||||||||

| (.08 | ) | (.11 | ) | — | — | |||||||||

| (.53 | ) | (.58 | ) | (.50 | ) | (.53 | ) | |||||||

| $ | 11.95 | $ | 12.30 | $ | 12.36 | $ | 11.78 | |||||||

| 1.51 | % | 4.41 | % | 9.36 | % | 7.91 | % | |||||||

| $ | 2,518 | $ | 2,098 | $ | 1,519 | $ | 1,112 | |||||||

| $ | 2,271 | $ | 1,778 | $ | 1,226 | $ | 1,290 | |||||||

| 1.47 | % | 1.47 | % | 1.48 | % | 1.43 | % | |||||||

| .72 | % | .72 | % | .73 | % | .68 | % | |||||||

| 3.74 | % | 3.89 | % | 4.14 | % | 4.64 | % | |||||||

See Notes to Financial Statements.

| Dryden California Municipal Fund/California Series | 35 |

Financial Highlights

Cont’d

| Class Z | ||||

| Year Ended August 31, 2004 | ||||

Per Share Operating Performance: | ||||

Net Asset Value, Beginning Of Year | $ | 11.95 | ||

Income from investment operations | ||||

Net investment income | .50 | |||

Net realized and unrealized gain (loss) on investment transactions | .20 | |||

Total from investment operations | .70 | |||

Less Distributions | ||||

Dividends from net investment income | (.50 | ) | ||

Distributions in excess of net investment income | — | |||

Distributions from net realized gains | (.18 | ) | ||

Total distributions | (.68 | ) | ||

Net asset value, end of year | $ | 11.97 | ||

Total Return(b): | 6.01 | % | ||

Ratios/Supplemental Data: | ||||

Net assets, end of year (000) | $ | 4,517 | ||

Average net assets (000) | $ | 4,805 | ||

Ratios to average net assets: | ||||

Expenses, including distribution and service (12b-1) fees | .79 | % | ||

Expenses, excluding distribution and service (12b-1) fees | .79 | % | ||

Net investment income | 4.19 | % | ||

| (a) | Less than $.005 per share. |

| (b) | Total return does not consider the effects of sales load. Total return is calculated assuming a purchase of shares on the first day and a sale on the last day of each year reported, and includes reinvestment of dividends and distributions. |