UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-1810

Oppenheimer Global Fund

(Exact name of registrant as specified in charter)

6803 South Tucson Way, Centennial, Colorado 80112-3924

(Address of principal executive offices) (Zip code)

Arthur S. Gabinet

OFI Global Asset Management, Inc.

Two World Financial Center, New York, New York 10281-1008

(Name and address of agent for service)

Registrant’s telephone number, including area code: (303) 768-3200

Date of fiscal year end: September 30

Date of reporting period: 3/28/2013

Item 1. Reports to Stockholders.

Table of Contents

Class A Shares

AVERAGE ANNUAL TOTAL RETURNS AT 3/28/13

| | | | | | | | |

| | | Class A Shares of the Fund | | | | |

| | | Without Sales Charge | | With Sales Charge | | MSCI AC World Index | | MSCI World Index |

6-Month | | 14.89% | | 8.29% | | 9.57% | | 10.41% |

|

1-Year | | 13.59 | | 7.05 | | 10.55 | | 11.85 |

|

5-Year | | 4.57 | | 3.34 | | 2.06 | | 2.23 |

|

10-Year | | 11.34 | | 10.68 | | 9.36 | | 8.88 |

|

The performance data quoted represents past performance, which does not guarantee future results. The investment return and principal value of an investment in the Fund will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Fund returns include changes in share price, reinvested distributions, and a 5.75% maximum applicable sales charge except where “without sales charge” is indicated. Current performance may be lower or higher than the performance quoted. Returns do not consider capital gains or income taxes on an individual’s investment. Returns for periods of less than one year are cumulative and not annualized. For performance data current to the most recent month-end, visit oppenheimerfunds.com or call 1.800.CALL OPP (225.5677).

March 28, 2013 was the last business day of the Fund’s reporting period. See Note 1 of the accompanying Notes to Financial Statements. Index returns are calculated through March 31, 2013.

2 OPPENHEIMER GLOBAL FUND

Fund Performance Discussion

The Fund’s Class A shares (without sales charge) produced a return of 14.89% during the reporting period, outperforming the MSCI AC World Index (the “Index”), which returned 9.57%. Contributors to the Fund’s performance were broad based, with meaningful contributions from holdings in information technology, financials, consumer discretionary, industrials, health care and consumer staples. On a country basis, the Fund’s holdings in the United States, Sweden, Germany and the Netherlands were of particular strength.

MARKET OVERVIEW

Although macroeconomic concerns remained during the period, global equities performed positively on the back of improved investor sentiment. Central banks throughout the world took action to help bolster the markets. In Europe, the European Central Bank (the “ECB”) committed to potentially unlimited bond purchases to ease financing pressure on countries such as Spain and Italy. Under the plan, these and other members of the European Union (excluding Greece) would be able to maintain access to funding at sustainable interest rates, on the condition that they continue with strict reform programs. In the U.S., the Federal Reserve (the “Fed”) introduced a third round of quantitative easing, under which it announced plans to purchase mortgage-backed bonds on a monthly basis until the labor market shows signs of substantial improvement. In addition to these actions, concerns regarding an economic slowdown in the emerging markets also eased, in the hope that China’s new leadership may adopt more stimulative fiscal policies than their predecessors.

Global markets experienced some pullback in the wake of the U.S. presidential election as investors contemplated the potential effect of higher taxes on the world’s largest economy and the possible repercussions on others. Non-U.S. markets eventually shrugged off this worry, while emerging markets did so to a greater degree. The lack of visibility about resolution of the “fiscal cliff” also weighed further on both business and consumer spending before the U.S. Congress enacted a last minute temporary resolution in early January 2013. In addition, the onset of a package of broad federal spending cuts, known as the sequestration, kicked in after Congress could not come to an agreement on the federal budget. These developments were not enough to halt the overall positive performance of equities, which resumed an upward trend through the end of the reporting period.

FUND REVIEW

On an individual stock basis, Telefonaktiebolaget LM Ericsson (“Ericsson”), European Aeronautic Defence & Space Co. NV (“EADS”), PPR and UBS AG, all of which

OPPENHEIMER GLOBAL FUND 3

were top ten weighted holdings, made the strongest positive impact on Fund returns. Ericsson is a world-leading provider of telecommunications equipment and related services to mobile and fixed network operators. Ericsson announced strong equipment sales growth as North American operators increased their capex spending significantly. In Europe, operators are beginning transition from widening coverage areas with hardware purchases to deepening service delivery with software upgrades. With its dominance of the installed infrastructure, we believe Ericsson is poised to benefit from this higher margin business.

EADS is the Franco-German manufacturer of Airbus planes. The company is enjoying strong sales and earnings as it supplies a world air fleet that is renewing itself and expanding. EADS, like most aircraft manufacturers, has some defense business, but at roughly 25% of earnings, the percentage is significantly below that of its chief rival, Boeing. Consequently, EADS has been less affected by declining defense spending in the U.S. and Europe.

PPR (which is changing its name to Kering) has gradually transformed itself over the past 20 years into a leading luxury player in apparel and jewelry with brands such as Gucci, YSL, Stella McCartney and Bottega Veneta. PPR is benefiting from strong demand growth for luxury goods, especially in emerging markets. We believe that this is a long-term secular trend and that strong

brands confer a durable competitive advantage to their holders.

UBS has one of the leading wealth management franchises in the world. The firm has made the decision to focus on this core business and gradually withdraw from investment banking, a significantly less profitable, more capital intensive activity. With this redeployment of capital, we believe shareholders may potentially receive more of the benefit of UBS’ strong position in a wealth management industry experiencing strong secular growth worldwide.

While detractors from performance were limited this period, the most significant was Fusion-io, Inc. Fusion-io produces solid state data storage components. The market for this technology is at an early stage of development, and therefore Fusion-io’s stock tends to be relatively volatile. During the reporting period, investors were disappointed by revenues that were below aggressive projections as the company’s two biggest clients, Apple and Facebook, slowed their data center expansion. Growth in sales to other customers accelerated and the customer base of large companies continues to expand. We believe the data storage market will increasingly move toward solid state technology, and Fusion-io’s leading intellectual property in this area positions the company to be a key beneficiary of this secular trend.

Nidec Corp. and Technip SA detracted from performance to a lesser degree. Nidec, a

4 OPPENHEIMER GLOBAL FUND

Japanese company, experienced declines largely due to the negative sentiment generated by weak PC sales. Nidec manufactures roughly 80% of the brushless motors used in disc drives, which are in turn used in PCs. However, disc drives are also used in data warehouses. The adoption of mobile devices that is driving down PC usage is also driving up demand for the data warehouses that comprise the “computer cloud” upon which mobile devices rely. We believe growth in data warehouses that generates disc drive demand has the potential to counteract the decline in PC-generated demand.

Technip is a global oil service company. During the period, shares of Technip suffered from investors’ negative read-through of competitor Saipem’s poor results. Technip, by contrast, announced results in line with analyst expectations, but investors’ caution on the sector led to the sell-off. We retain our conviction in Technip, a company we have owned for over 10 years and that we know very well. Business is strong with rising volumes, backlog and margins.

STRATEGY & OUTLOOK

Regardless of whether we are in a fast or a slow growth world, we believe the companies in the Fund have the potential to grow at above the general rate of the economies in which they operate by virtue of the secular currents driving them and their advantages globally. We have a long-term investment horizon and build the portfolio from the bottom up, focusing on businesses

advantaged by long-term trends. We invest in companies that we believe are capable of producing solid and sustainable growth through the business cycle, that have made strong returns on invested capital, and that demonstrate good cash flow generation characteristics. We are patient investors and wait for those companies to be out of favor so they are reasonably priced when we buy.

While we are underweight financials, we have been increasing the Fund’s exposure to the sector by adding to names we already own. We think financial institutions that are in the consumer lending business will do well. Capital is relatively short, and the purveyors of capital who can raise it cheaply should get paid. The improving U.S. housing market has lifted housing prices. This in turn should increase consumer confidence, as household balance sheets get better. Job creation is also a result of improving housing values, as small business owners tend to be funded by the value of the real estate they own. Moreover, financial institutions appear reasonably valued and collateral on their balance sheets does not seem to be overstated, as in the past.

With regard to the recent events in Cyprus, while we do not view them as positive, we do think the outcome was the best of the range of choices that could have been made. The outcome reinforces our view that the Europeans will at some stage reflate, as the U.S. and Japan have done, and that the Euro will decline against the U.S. dollar as a result. Monetary easing in Europe would also have

OPPENHEIMER GLOBAL FUND 5

the effect of enabling reform to happen at a more rapid pace, in our opinion. We note that we have already seen some improvement in Spain and Portugal, for instance, in their export numbers and some labor market changes.

In our view, it is much easier to implement reform in a reflationary than a deflationary environment and so we are positive on recent events in Japan. As reflation takes hold and real interest rates turn negative, we expect that bank deposits will be put to more productive use and Japanese corporations will employ their capital more profitably. Given the extreme risk averseness in Japan after 20 years of deflation, we do not expect this to

happen quickly, but we do expect it to happen.

In emerging markets, we think that valuations have improved. We are positive on India, where we expect spending to rise as we move toward next year’s elections. In Latin America, Mexico and the Andean region are performing well, but Brazil has been a disappointment and pressure is building for policy changes there.

| | |

| |  |

| | Rajeev Bhaman Portfolio Manager |

6 OPPENHEIMER GLOBAL FUND

Top Holdings and Allocations*

| | | | |

TOP TEN COMMON STOCK HOLDINGS | |

| |

Telefonaktiebolaget LM Ericsson, Cl. B | | | 3.6% | |

| | | | |

European Aeronautic Defence & Space Co. NV | | | 2.4 | |

| | | | |

SAP AG | | | 2.3 | |

| | | | |

eBay, Inc. | | | 2.2 | |

| | | | |

Google, Inc., Cl. A | | | 2.2 | |

| | | | |

Siemens AG | | | 2.0 | |

| | | | |

UBS AG | | | 2.0 | |

| | | | |

PPR | | | 2.0 | |

| | | | |

LVMH Moet Hennessy Louis Vuitton SA | | | 2.0 | |

| | | | |

Colgate-Palmolive Co. | | | 2.0 | |

| |

Portfolio holdings and allocations are subject to change. Percentages are as of March 28, 2013, and are based on net assets. For more current Fund holdings, please visit oppenheimerfunds.com.

| | | | |

TOP TEN GEOGRAPHICAL HOLDINGS | |

| |

United States | | | 39.6% | |

| | | | |

Germany | | | 10.4 | |

| | | | |

Japan | | | 8.2 | |

| | | | |

France | | | 6.0 | |

| | | | |

Sweden | | | 5.3 | |

| | | | |

Switzerland | | | 4.9 | |

| | | | |

Brazil | | | 4.1 | |

| | | | |

India | | | 3.7 | |

| | | | |

Spain | | | 3.6 | |

| | | | |

United Kingdom | | | 3.4 | |

| |

Portfolio holdings and allocation are subject to change. Percentages are as of March 28, 2013, and are based on total market value of investments.

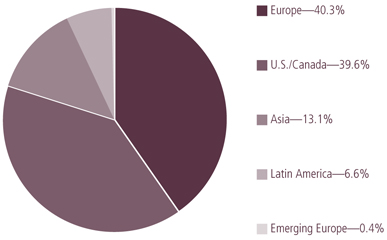

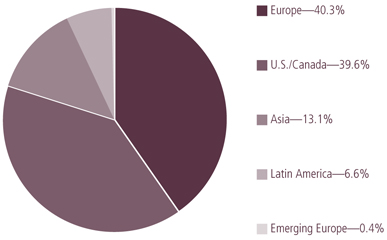

REGIONAL ALLOCATION

Portfolio holdings and allocations are subject to change. Percentages are as of March 28, 2013, and are based on the total market value of investments.

*March 28, 2013 was the last business day of the Fund’s reporting period. See Note 1 of the accompanying Notes to Financial Statements.

OPPENHEIMER GLOBAL FUND 7

Share Class Performance

AVERAGE ANNUAL TOTAL RETURNS WITHOUT SALES CHARGE AS OF 3/28/13

| | | | | | | | | | | | | | | | | | | | |

| | | Inception Date | | | 6-Month | | | 1-Year | | | 5-Year | | | 10-Year | |

Class A (OPPAX) | | | 12/22/69 | | | | 14.89% | | | | 13.59% | | | | 4.57% | | | | 11.34% | |

Class B (OGLBX) | | | 8/17/93 | | | | 14.40% | | | | 12.63% | | | | 3.68% | | | | 10.80% | |

Class C (OGLCX) | | | 10/2/95 | | | | 14.49% | | | | 12.79% | | | | 3.79% | | | | 10.50% | |

Class I (OGLIX) | | | 1/27/12 | | | | 15.18% | | | | 14.15% | | | | 19.42% | * | | | N/A | |

Class N (OGLNX) | | | 3/1/01 | | | | 14.71% | | | | 13.21% | | | | 4.24% | | | | 10.93% | |

Class Y (OGLYX) | | | 11/17/98 | | | | 15.06% | | | | 13.92% | | | | 4.92% | | | | 11.69% | |

AVERAGE ANNUAL TOTAL RETURNS WITH SALES CHARGE AS OF 3/28/13

| | | | | | | | | | | | | | | | | | | | |

| | | Inception Date | | | 6-Month | | | 1-Year | | | 5-Year | | | 10-Year | |

Class A (OPPAX) | | | 12/22/69 | | | | 8.29% | | | | 7.05% | | | | 3.34% | | | | 10.68% | |

Class B (OGLBX) | | | 8/17/93 | | | | 9.40% | | | | 7.63% | | | | 3.33% | | | | 10.80% | |

Class C (OGLCX) | | | 10/2/95 | | | | 13.49% | | | | 11.79% | | | | 3.79% | | | | 10.50% | |

Class I (OGLIX) | | | 1/27/12 | | | | 15.18% | | | | 14.15% | | | | 19.42% | * | | | N/A | |

Class N (OGLNX) | | | 3/1/01 | | | | 13.71% | | | | 12.21% | | | | 4.24% | | | | 10.93% | |

Class Y (OGLYX) | | | 11/17/98 | | | | 15.06% | | | | 13.92% | | | | 4.92% | | | | 11.69% | |

*Shows performance since inception.

The performance data quoted represents past performance, which does not guarantee future results. The investment return and principal value of an investment in the Fund will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted. Returns do not consider capital gains or income taxes on an individual’s investment. For performance data current to the most recent month-end, visit oppenheimerfunds.com or call 1.800.CALL OPP (225.5677). Fund returns include changes in share price, reinvested distributions, and the applicable sales charge: for Class A shares, the current maximum initial sales charge of 5.75%; for Class B shares, the contingent deferred sales charge of 5% (1-year) and 2% (5-year); and for Class C and N shares, the contingent deferred sales charge of 1% for the 1-year period. There is no sales charge for Class I and Y shares. Because Class B shares convert to Class A shares 72 months after purchase, the 10-year return for Class B shares uses Class A performance for the period after conversion. Returns for periods of less than one year are cumulative and not annualized.

March 28, 2013 was the last business day of the Fund’s reporting period. See Note 1 of the accompanying Notes to Financial Statements.

The Fund’s performance is compared to the performance of the MSCI AC World Index, a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed and emerging markets and the MSCI World Index, an index of issuers listed on the stock exchanges of foreign countries and the United States. It is widely recognized as a measure of global stock market performance. The Fund has changed its benchmark from the MSCI World Index to the MSCI AC World Index, which it believes is a more appropriate measure of the Fund’s performance. Indices are unmanaged and cannot be

8 OPPENHEIMER GLOBAL FUND

purchased by investors. Index performance includes reinvestment of income, but does not reflect transaction costs, fees, expenses or taxes. Index performance is shown for illustrative purposes only as a benchmark for the Fund’s performance, and does not predict or depict performance of the Fund. The Fund’s performance reflects the effects of the Fund’s business and operating expenses.

The Fund’s investment strategy and focus can change over time. The mention of specific fund holdings does not constitute a recommendation by OppenheimerFunds, Inc. or its affiliates.

Before investing in any of the Oppenheimer funds, investors should carefully consider a fund’s investment objectives, risks, charges and expenses. Fund prospectuses and summary prospectuses contain this and other information about the funds, and may be obtained by asking your financial advisor, visiting oppenheimerfunds.com, or calling 1.800.CALL OPP (225.5677). Read prospectuses and summary prospectuses carefully before investing.

Shares of Oppenheimer funds are not deposits or obligations of any bank, are not guaranteed by any bank, are not insured by the FDIC or any other agency, and involve investment risks, including the possible loss of the principal amount invested.

OPPENHEIMER GLOBAL FUND 9

Fund Expenses

Fund Expenses. As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, which may include sales charges (loads) on purchase payments, contingent deferred sales charges on redemptions; and (2) ongoing costs, including management fees; distribution and service fees; and other Fund expenses. These examples are intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The examples are based on an investment of $1,000.00 invested at the beginning of the period and held for the entire 6-month period ended March 28, 2013.

Actual Expenses. The first section of the table provides information about actual account values and actual expenses. You may use the information in this section for the class of shares you hold, together with the amount you invested, to estimate the expense that you paid over the period. Simply divide your account value by $1,000.00 (for example, an $8,600.00 account value divided by $1,000.00 = 8.60), then multiply the result by the number in the first section under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes. The second section of the table provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio for each class of shares, and an assumed rate of return of 5% per year for each class before expenses, which is not the actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example for the class of shares you hold with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as front-end or contingent deferred sales charges (loads), or a $12.00 fee imposed annually on accounts valued at less than $500.00 (subject to exceptions described in the Statement of Additional Information). Therefore, the “hypothetical” section of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

10 OPPENHEIMER GLOBAL FUND

| | | | | | | | | | | | |

| Actual | | Beginning

Account Value

October 1, 2012 | | | Ending

Account Value

March 28, 2013 | | | Expenses

Paid During

6 Months Ended

March 28, 2013 | |

| |

Class A | | $ | 1,000.00 | | | $ | 1,148.90 | | | $ | 6.18 | |

| |

Class B | | | 1,000.00 | | | | 1,144.00 | | | | 10.72 | |

| |

Class C | | | 1,000.00 | | | | 1,144.90 | | | | 9.88 | |

| |

Class I | | | 1,000.00 | | | | 1,151.80 | | | | 3.70 | |

| |

Class N | | | 1,000.00 | | | | 1,147.10 | | | | 7.98 | |

| |

Class Y | | | 1,000.00 | | | | 1,150.60 | | | | 4.76 | |

| | | |

| Hypothetical | | | | | | | | | |

(5% return before expenses) | | | | | | | | | | | | |

| |

Class A | | | 1,000.00 | | | | 1,018.78 | | | | 5.81 | |

| |

Class B | | | 1,000.00 | | | | 1,014.57 | | | | 10.08 | |

| |

Class C | | | 1,000.00 | | | | 1,015.35 | | | | 9.28 | |

| |

Class I | | | 1,000.00 | | | | 1,021.09 | | | | 3.47 | |

| |

Class N | | | 1,000.00 | | | | 1,017.12 | | | | 7.50 | |

| |

Class Y | | | 1,000.00 | | | | 1,020.11 | | | | 4.47 | |

Expenses are equal to the Fund’s annualized expense ratio for that class, multiplied by the average account value over the period, multiplied by 179/365 (to reflect the one-half year period). Those annualized expense ratios, excluding indirect expenses from affiliated fund, based on the 6-month period ended March 28, 2013 are as follows:

| | | | | | | | |

| Class | | Expense Ratios | | | |

| | |

Class A | | | 1.17% | | |

| | |

Class B | | | 2.03 | | |

| | |

Class C | | | 1.87 | | |

| | |

Class I | | | 0.70 | | |

| | |

Class N | | | 1.51 | | |

| | |

Class Y | | | 0.90 | | |

The expense ratios reflect voluntary waivers and/or reimbursements of expenses by the Fund’s Manager and Transfer Agent. Some of these undertakings may be modified or terminated at any time, as indicated in the Fund’s prospectus. The “Financial Highlights” tables in the Fund’s financial statements, included in this report, also show the gross expense ratios, without such waivers or reimbursements and reduction to custodian expenses, if applicable.

OPPENHEIMER GLOBAL FUND 11

| | | | |

| | STATEMENT OF INVESTMENTS March 28, 2013* / Unaudited | | |

| | | | | | | | | | | | |

| | | Shares | | | Value | | | | | |

| | | | | |

Common Stocks—99.5% | | | | | | | | | |

| | | | | |

Consumer Discretionary—17.1% | | | | | | | | | |

| | | | | |

Automobiles—1.9% | | | | | | | | | | | | |

Bayerische Motoren Werke (BMW) AG, Preference | | | 2,667,317 | | | $ | 170,390,861 | | | | | |

| | | | | |

Hotels, Restaurants & Leisure—3.5% | | | | | | | | | |

Carnival Corp. | | | 3,433,772 | | | | 117,778,380 | | | | | |

| | | | | |

Lottomatica Group SpA | | | 1,511,954 | | | | 35,525,340 | | | | | |

| | | | | |

McDonald’s Corp. | | | 1,659,740 | | | | 165,459,481 | | | | | |

| | | | | | | | | | | | |

| | | | | | | 318,763,201 | | | | | |

| | | | | |

Media—3.4% | | | | | | | | | | | | |

Grupo Televisa SAB, Sponsored ADR | | | 3,221,764 | | | | 85,731,140 | | | | | |

| | | | | |

Walt Disney Co. (The) | | | 3,121,460 | | | | 177,298,928 | | | | | |

| | | | | |

Zee Entertainment Enterprises Ltd. | | | 14,003,568 | | | | 54,365,278 | | | | | |

| | | | | | | | | | | | |

| | | | | | | 317,395,346 | | | | | |

| | | | | |

Multiline Retail—2.0% | | | | | | | | | | | | |

PPR | | | 831,151 | | | | 182,611,427 | | | | | |

| | | | | |

Specialty Retail—3.2% | | | | | | | | | | | | |

Industria de Diseno Textil SA (Inditex) | | | 1,178,063 | | | | 156,993,769 | | | | | |

| | | | | |

Tiffany & Co. | | | 2,027,028 | | | | 140,959,527 | | | | | |

| | | | | | | | | | | | |

| | | | | | | 297,953,296 | | | | | |

| | | | | |

Textiles, Apparel & Luxury Goods—3.1% | | | | | |

Brunello Cucinelli SpA1 | | | 488,470 | | | | 10,281,305 | | | | | |

| | | | | |

LVMH Moet Hennessy Louis Vuitton SA | | | 1,059,000 | | | | 181,766,456 | | | | | |

| | | | | |

Tod’s SpA | | | 665,885 | | | | 95,343,175 | | | | | |

| | | | | | | | | | | | |

| | | | | | | 287,390,936 | | | | | |

| | | | | | | | | | | | |

| | | | | |

Consumer Staples—8.3% | | | | | | | | | |

| | | | | |

Beverages—3.1% | | | | | | | | | | | | |

Carlsberg AS, Cl. B | | | 683,173 | | | | 66,480,283 | | | | | |

| | | | | |

Compania de Bebidas das Americas, Preference, ADR | | | 1,979,850 | | | | 83,807,051 | | | | | |

| | | | | |

Fomento Economico Mexicano SAB de CV, UBD | | | 12,554,873 | | | | 142,519,940 | | | | | |

| | | | | | | | | | | | |

| | | | | | | 292,807,274 | | | | | |

| | | | | |

Food & Staples Retailing—0.1% | | | | | | | | | |

E-Mart Co. Ltd. | | | 41,488 | | | | 8,184,986 | | | | | |

| | | | | |

Food Products—3.1% | | | | | | | | | | | | |

Nestle SA | | | 1,547,381 | | | | 111,901,091 | | | | | |

| | | | | |

Unilever plc | | | 4,113,239 | | | | 173,996,126 | | | | | |

| | | | | | | | | | | | |

| | | | | | | 285,897,217 | | | | | |

| | | | | |

Household Products—2.0% | | | | | | | | | |

Colgate-Palmolive Co. | | | 1,535,170 | | | | 181,196,115 | | | | | |

| | | | | | | | |

| | | Shares | | | Value | |

| |

Energy—3.3% | | | | | | | | |

| |

Energy Equipment & Services—2.6% | | | | | |

Technip SA | | | 1,427,630 | | | $ | 146,363,999 | |

| |

Transocean Ltd.1 | | | 1,719,028 | | | | 89,320,695 | |

| | | | | | | | |

| | | | | | | 235,684,694 | |

| |

Oil, Gas & Consumable Fuels—0.7% | | | | | |

Repsol SA | | | 3,266,060 | | | | 66,357,593 | |

| | | | | | | | |

| |

Financials—17.7% | | | | | | | | |

| |

Capital Markets—3.5% | | | | | | | | |

Credit Suisse Group AG1 | | | 2,121,829 | | | | 55,998,152 | |

| |

Goldman Sachs Group, Inc. (The) | | | 566,391 | | | | 83,344,436 | |

| |

UBS AG1 | | | 11,935,149 | | | | 182,931,021 | |

| | | | | | | | |

| | | | | | | 322,273,609 | |

| |

Commercial Banks—5.1% | | | | | | | | |

Banco Bilbao Vizcaya Argentaria SA | | | 12,602,025 | | | | 109,889,495 | |

| |

ICICI Bank Ltd., Sponsored ADR | | | 3,270,460 | | | | 140,302,734 | |

| |

Itau Unibanco Holding SA, Preference, ADR | | | 5,552,700 | | | | 98,838,060 | |

| |

Societe Generale1 | | | 1,128,956 | | | | 37,243,288 | |

| |

Sumitomo Mitsui Financial Group, Inc. | | | 2,116,900 | | | | 86,868,180 | |

| | | | | | | | |

| | | | | | | 473,141,757 | |

| |

Diversified Financial Services—3.8% | | | | | |

BM&FBovespa SA | | | 14,069,700 | | | | 94,621,909 | |

| |

Citigroup, Inc. | | | 1,659,790 | | | | 73,429,110 | |

| |

McGraw-Hill Cos., Inc. (The) | | | 2,795,039 | | | | 145,565,631 | |

| |

Moscow Exchange (The)1 | | | 19,142,006 | | | | 33,498,510 | |

| | | | | | | | |

| | | | | | | 347,115,160 | |

| |

Insurance—4.8% | | | | | | | | |

Allianz SE | | | 1,068,444 | | | | 145,107,523 | |

| |

Dai-ichi Life Insurance Co. Ltd. (The) | | | 73,498 | | | | 98,737,154 | |

| |

Fidelity National Financial, Inc., Cl. A | | | 2,331,060 | | | | 58,812,644 | |

| |

Prudential plc | | | 8,271,549 | | | | 134,598,133 | |

| | | | | | | | |

| | | | | | | 437,255,454 | |

| |

Real Estate Management & Development—0.5% | |

DLF Ltd. | | | 10,603,848 | | | | 46,347,862 | |

| | | | | | | | |

| |

Health Care—10.7% | | | | | | | | |

| |

Biotechnology—2.2% | | | | | | | | |

Gilead Sciences, Inc.1 | | | 1,943,560 | | | | 95,098,391 | |

| |

Medivation, Inc.1 | | | 488,981 | | | | 22,869,641 | |

| |

Theravance, Inc.1 | | | 2,045,545 | | | | 48,315,773 | |

| |

ThromboGenics NV1 | | | 313,553 | | | | 15,108,470 | |

12 OPPENHEIMER GLOBAL FUND

| | | | | | | | | | | | |

| | | Shares | | | Value | | | | | |

| | | | | |

Biotechnology (Continued) | | | | | | | | | | | | |

Vertex Pharmaceuticals, Inc.1 | | | 449,690 | | | $ | 24,723,956 | | | | | |

| | | | | | | | | | | | |

| | | | | | | 206,116,231 | | | | | |

| | | | | |

Health Care Equipment & Supplies—2.0% | | | | | | | | | |

St. Jude Medical, Inc. | | | 997,330 | | | | 40,332,025 | | | | | |

| | | | | |

Swiss Medical SA1,2,3 | | | 49,975,200 | | | | 13,655,074 | | | | | |

| | | | | |

Zimmer Holdings, Inc. | | | 1,807,844 | | | | 135,986,026 | | | | | |

| | | | | | | | | | | | |

| | | | | | | 189,973,125 | | | | | |

| | | | | |

Health Care Providers & Services—3.4% | | | | | | | | | |

Aetna, Inc. | | | 2,874,379 | | | | 146,938,254 | | | | | |

| | | | | |

WellPoint, Inc. | | | 2,528,935 | | | | 167,491,365 | | | | | |

| | | | | | | | | | | | |

| | | | | | | 314,429,619 | | | | | |

| | | | | |

Pharmaceuticals—3.1% | | | | | | | | | | | | |

Allergan, Inc. | | | 316,610 | | | | 35,343,174 | | | | | |

| | | | | |

Bayer AG | | | 1,431,426 | | | | 147,652,262 | | | | | |

| | | | | |

Roche Holding AG | | | 435,697 | | | | 101,431,620 | | | | | |

| | | | | | | | | | | | |

| | | | | | | 284,427,056 | | | | | |

| | | | | | | | | | | | |

| | | | | |

Industrials—13.3% | | | | | | | | | | | | |

| | | | | |

Aerospace & Defense—3.5% | | | | | | | | | | | | |

Embraer SA, ADR | | | 2,782,135 | | | | 99,238,755 | | | | | |

| | | | | |

European Aeronautic Defence & Space Co. | | | 4,402,408 | | | | 224,036,097 | | | | | |

| | | | | | | | | | | | |

| | | | | | | 323,274,852 | | | | | |

| | | | | |

Air Freight & Couriers—1.1% | | | | | | | | | | | | |

United Parcel Service, Inc., Cl. B | | | 1,160,680 | | | | 99,702,412 | | | | | |

| | | | | |

Building Products—1.6% | | | | | | | | | | | | |

Assa Abloy AB, Cl. B | | | 3,708,331 | | | | 151,427,808 | | | | | |

| | | | | |

Construction & Engineering—0.8% | | | | | | | | | |

FLSmidth & Co. AS | | | 1,109,390 | | | | 67,399,565 | | | | | |

| | | | | |

Electrical Equipment—2.0% | | | | | | | | | | | | |

Emerson Electric Co. | | | 1,481,960 | | | | 82,797,105 | | | | | |

| | | | | |

Nidec Corp. | | | 843,008 | | | | 50,509,768 | | | | | |

| | | | | |

Prysmian SpA | | | 2,377,571 | | | | 48,915,414 | | | | | |

| | | | | | | | | | | | |

| | | | | | | 182,222,287 | | | | | |

| | | | | |

Industrial Conglomerates—3.6% | | | | | | | | | |

3M Co. | | | 1,351,510 | | | | 143,679,028 | | | | | |

| | | | | |

Siemens AG | | | 1,706,851 | | | | 183,851,499 | | | | | |

| | | | | | | | | | | | |

| | | | | | | 327,530,527 | | | | | |

| | | | | |

Machinery—0.7% | | | | | | | | | | | | |

FANUC Corp. | | | 398,600 | | | | 61,323,094 | | | | | |

| | | | | | | | | | | | |

| | | | | |

Information Technology—26.0% | | | | | | | | | |

| | | | | |

Communications Equipment—4.6% | | | | | | | | | |

Juniper Networks, Inc.1 | | | 4,849,912 | | | | 89,917,368 | | | | | |

| | | | | |

Telefonaktiebolaget LM Ericsson, Cl. B | | | 26,599,561 | | | | 331,445,988 | | | | | |

| | | | | | | | | | | | |

| | | | | | | 421,363,356 | | | | | |

| | | | | |

Computers & Peripherals—0.5% | | | | | | | | | |

Fusion-io, Inc.1 | | | 2,708,522 | | | | 44,338,505 | | | | | |

| | | | | | | | |

| | | Shares | | | Value | |

| |

Electronic Equipment, Instruments, & Components—3.4% | |

Hoya Corp. | | | 463,576 | | | $ | 8,696,821 | |

| |

Keyence Corp. | | | 371,553 | | | | 114,146,235 | |

| |

Kyocera Corp. | | | 589,100 | | | | 54,083,080 | |

| |

Murata Manufacturing Co. Ltd. | | | 1,881,204 | | | | 142,152,051 | |

| | | | | | | | |

| | | | | | | 319,078,187 | |

| |

Internet Software & Services—5.0% | | | | | |

eBay, Inc.1 | | | 3,712,098 | | | | 201,269,954 | |

| |

Facebook, Inc., Cl. A1 | | | 2,279,870 | | | | 58,319,075 | |

| |

Google, Inc., Cl. A1 | | | 251,900 | | | | 200,016,157 | |

| | | | | | | | |

| | | | | | | 459,605,186 | |

| |

IT Services—1.1% | | | | | | | | |

Infosys Ltd. | | | 1,827,345 | | | | 97,619,307 | |

| |

Semiconductors & Semiconductor Equipment—4.5% | |

Altera Corp. | | | 4,717,207 | | | | 167,319,332 | |

| |

Maxim Integrated Products, Inc. | | | 4,874,905 | | | | 159,165,648 | |

| |

Taiwan Semiconductor Manufacturing Co. Ltd. | | | 26,242,726 | | | | 87,760,976 | |

| | | | | | | | |

| | | | | | | 414,245,956 | |

| |

Software—6.9% | | | | | | | | |

Adobe Systems, Inc.1 | | | 3,447,164 | | | | 149,986,106 | |

| |

Intuit, Inc. | | | 2,206,690 | | | | 144,869,198 | |

| |

Microsoft Corp. | | | 4,427,812 | | | | 126,679,701 | |

| |

SAP AG | | | 2,700,251 | | | | 216,332,294 | |

| | | | | | | | |

| | | | | | | 637,867,299 | |

| | | | | | | | |

| |

Materials—1.2% | | | | | | | | |

| |

Chemicals—1.0% | | | | | | | | |

Linde AG | | | 495,579 | | | | 92,144,163 | |

| |

Metals & Mining—0.2% | | | | | | | | |

Iluka Resources Ltd. | | | 1,811,148 | | | | 17,709,111 | |

| | | | | | | | |

| |

Telecommunication Services—1.4% | | | | | |

| |

Wireless Telecommunication Services—1.4% | | | | | |

KDDI Corp. | | | 3,185,600 | | | | 133,279,114 | |

| | | | | | | | |

| |

Utilities—0.5% | | | | | | | | |

| |

Electric Utilities—0.5% | | | | | | | | |

Fortum OYJ | | | 2,500,355 | | | | 50,539,695 | |

| | | | | | | | |

Total Common Stocks (Cost $5,913,414,804) | | | | | | | 9,166,383,243 | |

OPPENHEIMER GLOBAL FUND 13

| | | | |

| | STATEMENT OF INVESTMENTS Unaudited / (Continued) | | |

| | | | | | | | | | |

| | | Shares | | | Value | | | |

| | | |

Investment Company—0.2% | | | | | | | | | | |

Oppenheimer Institutional Money Market Fund, Cl. E, 0.14%2,4 | | | | | | | | | | |

(Cost $16,026,738) | | | 16,026,738 | | | $ | 16,026,738 | | | |

| | | | | | | | | | |

| | | | | | | | |

| | | | | | Value | |

| |

Total Investments, at Value | | | | | | | | |

(Cost $5,929,441,542) | | | 99.7% | | | $ | 9,182,409,981 | |

| |

Assets in Excess of Other Liabilities | | | 0.3 | | | | 30,038,196 | |

| | | | |

Net Assets | | | 100.0% | | | $ | 9,212,448,177 | |

| | | | |

Footnotes to Statement of Investments

* March 28, 2013 represents the last day of the Fund’s semiannual period. See Note 1 of the accompanying Notes.

1. Non-income producing security.

2. Is or was an affiliate, as defined in the Investment Company Act of 1940, at or during the period ended March 28, 2013, by virtue of the Fund owning at least 5% of the voting securities of the issuer or as a result of the Fund and the issuer having the same investment adviser. Transactions during the period in which the issuer was an affiliate are as follows:

| | | | | | | | | | | | | | | | |

| | | Shares

September 28,

2012a | | | Gross

Additions | | | Gross

Reductions | | | Shares

March 28,

2013 | |

| |

Oppenheimer Institutional Money Market Fund, Cl. E | | | 2,399,404 | | | | 304,520,190 | | | | 290,892,856 | | | | 16,026,738 | |

Swiss Medical SA | | | 49,975,200 | | | | — | | | | — | | | | 49,975,200 | |

| | | | |

| | | | | | | | | Value | | | Income | |

| |

Oppenheimer Institutional Money Market Fund, Cl. E | | | | | | | | | | $ | 16,026,738 | | | $ | 10,379 | |

Swiss Medical SA | | | | | | | | | | | 13,655,074 | | | | — | |

| | | | | | | | | | | | |

| | | | | | | | | | $ | 29,681,812 | | | $ | 10,379 | |

| | | | | | | | | | | | |

a. September 28, 2012 represents the last business day of the Fund’s 2012 fiscal year. See Note 1 of the accompanying Notes.

3. Restricted security. The aggregate value of restricted securities as of March 28, 2013 was $13,655,074, which represents 0.15% of the Fund’s net assets. See Note 7 of the accompanying Notes. Information concerning restricted securities is as follows:

| | | | | | | | | | | | | | | | |

| Security | | Acquisition

Dates | | | Cost | | | Value | | | Unrealized

Depreciation | |

| |

Swiss Medical SA | | | 5/16/94-8/31/11 | | | $ | 30,390,000 | | | $ | 13,655,074 | | | $ | 16,734,926 | |

4. Rate shown is the 7-day yield as of March 28, 2013.

Distribution of investments representing geographic holdings, as a percentage of total investments at value, is as follows:

| | | | | | | | | | | | | | | | |

| Geographic Holdings | | Value | | | | | | | | | Percent | | | |

|

United States | | $ | 3,634,349,879 | | | | | | | | | | 39.6% | | | |

Germany | | | 955,478,602 | | | | | | | | | | 10.4 | | | |

Japan | | | 749,795,497 | | | | | | | | | | 8.2 | | | |

France | | | 547,985,170 | | | | | | | | | | 6.0 | | | |

Sweden | | | 482,873,796 | | | | | | | | | | 5.3 | | | |

Switzerland | | | 452,261,884 | | | | | | | | | | 4.9 | | | |

Brazil | | | 376,505,775 | | | | | | | | | | 4.1 | | | |

India | | | 338,635,181 | | | | | | | | | | 3.7 | | | |

Spain | | | 333,240,857 | | | | | | | | | | 3.6 | | | |

United Kingdom | | | 308,594,259 | | | | | | | | | | 3.4 | | | |

Mexico | | | 228,251,080 | | | | | | | | | | 2.4 | | | |

Netherlands | | | 224,036,097 | | | | | | | | | | 2.4 | | | |

14 OPPENHEIMER GLOBAL FUND

Footnotes to Statement of Investments (Continued)

| | | | | | | | | | |

| Geographic Holdings (Continued) | | Value | | | Percent | | | |

|

Italy | | $ | 190,065,234 | | | | 2.1% | | | |

Denmark | | | 133,879,848 | | | | 1.5 | | | |

Taiwan | | | 87,760,976 | | | | 0.9 | | | |

Finland | | | 50,539,695 | | | | 0.5 | | | |

Russia | | | 33,498,510 | | | | 0.4 | | | |

Australia | | | 17,709,111 | | | | 0.2 | | | |

Belgium | | | 15,108,470 | | | | 0.2 | | | |

Argentina | | | 13,655,074 | | | | 0.1 | | | |

South Korea | | | 8,184,986 | | | | 0.1 | | | |

| | | |

Total | | $ | 9,182,409,981 | | | | 100.0% | | | |

| | | |

| | | | | | | | | | | | |

|

Spot Currency Exchange Contracts as of March 28, 2013 are as follows: |

| | | | | | | | | | | | | | | | | | | | | | | | |

Broker/Contract Description | | Buy/

Sell | | | Contract

Amount

(000’s) | | | Expiration

Dates | | | Value | | | Unrealized

Appreciation | | | Unrealized

Depreciation | |

| |

Barclays Capital | | | | | | | | | | | | | | | | | | | | | | | | |

Japanese Yen (JPY) | | | Sell | | | | 213,441 | JPY | | | 4/2/13 | | | $ | 2,267,390 | | | | $ – | | | | $ 713 | |

| |

Citigroup | | | | | | | | | | | | | | | | | | | | | | | | |

Japanese Yen (JPY) | | | Sell | | | | 350,963 | JPY | | | 4/1/13 | | | | 3,728,298 | | | | – | | | | 5,082 | |

| |

Deutsche Bank Securities, Inc. | | | | | | | | | | | | | | | | | | | | | | | | |

Euro (EUR) | | | Sell | | | | 7,378 | EUR | | | 4/3/13 | | | | 9,457,266 | | | | 1,623 | | | | – | |

| |

JPMorgan Chase | | | | | | | | | | | | | | | | | | | | | | | | |

Japanese Yen (JPY) | | | Sell | | | | 628,898 | JPY | | | 4/1/13 | | | | 6,680,812 | | | | – | | | | 9,942 | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Total unrealized appreciation and depreciation | | | | | | | | | | | | | | | | | | | $ 1,623 | | | | $ 15,737 | |

| | | | | | | | | | | | | | | | | | | | |

See accompanying Notes to Financial Statements.

OPPENHEIMER GLOBAL FUND 15

| | | | |

| | |

| | STATEMENT OF ASSETS AND LIABILITIES March 28, 20131 Unaudited | | |

| | | | |

| |

Assets | | | | |

Investments, at value—see accompanying statement of investments: | | | | |

Unaffiliated companies (cost $5,883,024,804) | | $ | 9,152,728,169 | |

Affiliated companies (cost $46,416,738) | | | 29,681,812 | |

| | | | |

| | | 9,182,409,981 | |

| |

Cash | | | 2,039,823 | |

| |

Cash—foreign currencies (cost $6,680,812) | | | 6,680,812 | |

| |

Unrealized appreciation on foreign currency exchange contracts | | | 1,623 | |

| |

Receivables and other assets: | | | | |

Investments sold | | | 15,452,953 | |

Shares of beneficial interest sold | | | 12,673,513 | |

Dividends | | | 12,575,956 | |

Other | | | 2,363,758 | |

| | | | |

Total assets | | | 9,234,198,419 | |

|

| |

Liabilities | | | | |

Unrealized depreciation on foreign currency exchange contracts | | | 15,737 | |

| |

Payables and other liabilities: | | | | |

Shares of beneficial interest redeemed | | | 15,728,545 | |

Trustees’ compensation | | | 2,516,326 | |

Transfer and shareholder servicing agent fees | | | 1,772,845 | |

Distribution and service plan fees | | | 1,486,914 | |

Shareholder communications | | | 177,776 | |

Other | | | 52,099 | |

| | | | |

Total liabilities | | | 21,750,242 | |

|

| |

Net Assets | | $ | 9,212,448,177 | |

| | | | |

|

| |

Composition of Net Assets | | | | |

Paid-in capital | | $ | 5,827,161,792 | |

| |

Accumulated net investment income | | | 16,665,814 | |

| |

Accumulated net realized gain on investments and foreign currency transactions | | | 115,628,131 | |

| |

Net unrealized appreciation on investments and translation of assets and liabilities denominated in foreign currencies | | | 3,252,992,440 | |

| | | | |

Net Assets | | $ | 9,212,448,177 | |

| | | | |

1. March 28, 2013 represents the last business day of the Fund’s semiannual period. See Note 1 of the accompanying Notes.

16 OPPENHEIMER GLOBAL FUND

| | | | |

| |

Net Asset Value Per Share | | | | |

Class A Shares: | | | | |

Net asset value and redemption price per share (based on net assets of $7,028,272,811 and 101,744,040 shares of beneficial interest outstanding) | | $ | 69.08 | |

Maximum offering price per share (net asset value plus sales charge of 5.75% of offering price) | | $ | 73.29 | |

| |

Class B Shares: | | | | |

Net asset value, redemption price (excludes applicable contingent deferred sales charge) and offering price per share (based on net assets of $155,592,017 and 2,434,897 shares of beneficial interest outstanding) | | $ | 63.90 | |

| |

Class C Shares: | | | | |

Net asset value, redemption price (excludes applicable contingent deferred sales charge) and offering price per share (based on net assets of $626,890,085 and 9,670,930 shares of beneficial interest outstanding) | | $ | 64.82 | |

| |

Class I Shares: | | | | |

Net asset value, redemption price and offering price per share (based on net assets of $46,577,599 and 673,158 shares of beneficial interest outstanding) | | $ | 69.19 | |

| |

Class N Shares: | | | | |

Net asset value, redemption price (excludes applicable contingent deferred sales charge) and offering price per share (based on net assets of $201,622,368 and 2,929,922 shares of beneficial interest outstanding) | | $ | 68.81 | |

| |

Class Y Shares: | | | | |

Net asset value, redemption price and offering price per share (based on net assets of $1,153,493,297 and 16,677,303 shares of beneficial interest outstanding) | | $ | 69.17 | |

See accompanying Notes to Financial Statements.

OPPENHEIMER GLOBAL FUND 17

| | | | |

| | |

| | STATEMENTOF OPERATIONS For the Six Months Ended March 28, 20131 Unaudited | | |

| | | | | | |

| |

Investment Income | | | | | | |

Dividends: | | | | | | |

Unaffiliated companies (net of foreign withholding taxes of $4,670,522) | | | | $ | 72,791,350 | |

Affiliated companies | | | | | 10,379 | |

| |

Interest | | | | | 1,922 | |

| | | | | | |

Total investment income | | | | | 72,803,651 | |

|

| |

Expenses | | | | | | |

Management fees | | | | | 28,652,599 | |

| |

Distribution and service plan fees: | | | | | | |

Class A | | | | | 7,814,387 | |

Class B | | | | | 776,267 | |

Class C | | | | | 2,944,738 | |

Class N | | | | | 473,731 | |

| |

Transfer and shareholder servicing agent fees: | | | | | | |

Class A | | | | | 8,974,783 | |

Class B | | | | | 371,489 | |

Class C | | | | | 632,323 | |

Class I | | | | | 4,353 | |

Class N | | | | | 344,138 | |

Class Y | | | | | 1,176,753 | |

| |

Shareholder communications: | | | | | | |

Class A | | | | | 155,541 | |

Class B | | | | | 25,817 | |

Class C | | | | | 24,602 | |

Class I | | | | | 85 | |

Class N | | | | | 4,502 | |

Class Y | | | | | 10,617 | |

| |

Custodian fees and expenses | | | | | 500,455 | |

| |

Trustees’ compensation | | | | | 210,194 | |

| |

Other | | | | | 217,531 | |

| | | | | | |

Total expenses | | | | | 53,314,905 | |

Less waivers and reimbursements of expenses | | | | | (105,709) | |

| | | | | | |

Net expenses | | | | | 53,209,196 | |

| | |

| | | | | | |

Net Investment Income | | | | | 19,594,455 | |

1. March 28, 2013 represents the last day of the Funds semiannual period. See Note 1 of the accompanying Notes.

18 OPPENHEIMER GLOBAL FUND

| | | | |

| | |

| | STATEMENT OF OPERATIONS Unaudited / (Continued) | | |

| | | | |

| |

Realized and Unrealized Gain (Loss) | | | | |

Net realized gain on: | | | | |

Investments from unaffiliated companies | | $ | 189,334,890 | |

Foreign currency transactions | | | 102,329 | |

| | | | |

Net realized gain | | | 189,437,219 | |

| |

Net change in unrealized appreciation/depreciation on: | | | | |

Investments | | | 1,148,318,296 | |

Translation of assets and liabilities denominated in foreign currencies | | | (142,050,095) | |

| | | | |

Net change in unrealized appreciation/depreciation | | | 1,006,268,201 | |

|

| |

Net Increase in Net Assets Resulting from Operations | | $ | 1,215,299,875 | |

| | | | |

See accompanying Notes to Financial Statements.

OPPENHEIMER GLOBAL FUND 19

| | | | |

| | |

| | STATEMENTSOF CHANGES IN NET ASSETS | | |

| | | | | | | | |

| | | Six Months Ended

March 28, 20131

(Unaudited) | | | Year Ended

September 28,

20121 | |

| |

Operations | | | | | | | | |

Net investment income | | $ | 19,594,455 | | | $ | 78,304,116 | |

| |

Net realized gain | | | 189,437,219 | | | | 24,195,058 | |

| |

Net change in unrealized appreciation/depreciation | | | 1,006,268,201 | | | | 1,401,165,559 | |

| | | | | | | | |

Net increase in net assets resulting from operations | | | 1,215,299,875 | | | | 1,503,664,733 | |

|

| |

Dividends and/or Distributions to Shareholders | | | | | | | | |

Dividends from net investment income: | | | | | | | | |

Class A | | | (65,741,979) | | | | (122,995,858) | |

Class B | | | (222,097) | | | | (1,672,837) | |

Class C | | | (2,344,820) | | | | (6,946,078) | |

Class I | | | (200,784) | | | | — | |

Class N | | | (1,214,430) | | | | (3,060,177) | |

Class Y | | | (13,359,955) | | | | (16,463,572) | |

| | | | |

| | | (83,084,065) | | | | (151,138,522) | |

|

| |

Distributions from net realized gain: | | | | | | | | |

Class A | | | (10,891,818) | | | | (1,821,891) | |

Class B | | | (281,578) | | | | (60,157) | |

Class C | | | (1,038,462) | | | | (179,662) | |

Class I | | | (22,007) | | | | — | |

Class N | | | (316,746) | | | | (56,805) | |

Class Y | | | (1,678,281) | | | | (209,646) | |

| | | | |

| | | (14,228,892) | | | | (2,328,161) | |

|

| |

Beneficial Interest Transactions | | | | | | | | |

Net increase (decrease) in net assets resulting from beneficial interest transactions: | | | | | | | | |

Class A | | | (339,930,281) | | | | (724,764,047) | |

Class B | | | (29,053,799) | | | | (64,989,113) | |

Class C | | | (31,646,064) | | | | (97,381,209) | |

Class I | | | 30,367,418 | | | | 12,235,015 | |

Class N | | | (16,100,836) | | | | (31,489,738) | |

Class Y | | | 44,165,014 | | | | 155,906,635 | |

| | | | | | | | |

| | | (342,198,548) | | | | (750,482,457) | |

|

| |

Net Assets | | | | | | | | |

Total increase | | | 755,788,370 | | | | 599,715,593 | |

| |

Beginning of period | | | 8,436,659,807 | | | | 7,836,944,214 | |

| | | | | | | | |

| | |

End of period (including accumulated net investment income of $16,665,814 and $80,155,424, respectively) | | $ | 9,212,448,177 | | | $ | 8,436,659,807 | |

| | | | |

1. March 28, 2012 and September 28, 2012 represents the last business day of the Fund’s respective reporting periods. See Note 1 of the accompanying Notes.

See accompanying Notes to Financial Statements.

20 OPPENHEIMER GLOBAL FUND

| | | | | | | | | | | | | | | | | | | | | | | | |

| Class A | | Six Months

Ended March 28,

20131

(Unaudited) | | | Year Ended

September 28,

20121 | | | Year Ended

September 30,

2011 | | | Year Ended

September 30,

2010 | | | Year Ended

September 30,

2009 | | | Year Ended

September 30,

2008 �� | |

| |

Per Share Operating Data | | | | | | | | | | | | | | | | | | | | | | | | |

Net asset value, beginning of period | | $ | 60.82 | | | $ | 51.78 | | | $ | 56.31 | | | $ | 50.85 | | | $ | 54.88 | | | $ | 81.53 | |

| |

Income (loss) from investment operations: | | | | | | | | | | | | | | | | | | | | | | | | |

Net investment income2 | | | 0.16 | | | | 0.56 | | | | 1.06 | | | | 0.41 | | | | 0.43 | | | | 0.83 | |

Net realized and unrealized gain (loss) | | | 8.82 | | | | 9.56 | | | | (4.66) | | | | 5.33 | | | | (0.44) | | | | (22.19) | |

| | | | |

Total from investment operations | | | 8.98 | | | | 10.12 | | | | (3.60) | | | | 5.74 | | | | (0.01) | | | | (21.36) | |

| |

Dividends and/or distributions to shareholders: | | | | | | | | | | | | | | | | | | | | | | | | |

Dividends from net investment income | | | (0.63) | | | | (1.06) | | | | (0.50) | | | | (0.28) | | | | (0.93) | | | | (0.68) | |

Distributions from net realized gain | | | (0.10) | | | | (0.02) | | | | (0.43) | | | | 0.00 | | | | (3.09) | | | | (4.61) | |

| | | | |

Total dividends and/or distributions to shareholders | | | (0.73) | | | | (1.08) | | | | (0.93) | | | | (0.28) | | | | (4.02) | | | | (5.29) | |

| |

Net asset value, end of period | | $ | 69.07 | | | $ | 60.82 | | | $ | 51.78 | | | $ | 56.31 | | | $ | 50.85 | | | $ | 54.88 | |

| | | | |

| |

Total Return, at Net Asset Value3 | | | 14.89% | | | | 19.80% | | | | (6.59)% | | | | 11.32% | | | | 3.58% | | | | (27.90)% | |

| |

Ratios/Supplemental Data | | | | | | | | | | | | | | | | | | | | | | | | |

Net assets, end of period (in thousands) | | $ | 7,028,273 | | | $ | 6,509,607 | | | $ | 6,181,685 | | | $ | 7,282,538 | | | $ | 7,191,702 | | | $ | 8,663,347 | |

| |

Average net assets (in thousands) | | $ | 6,774,934 | | | $ | 6,551,108 | | | $ | 7,646,696 | | | $ | 7,229,903 | | | $ | 6,099,806 | | | $ | 11,573,269 | |

| |

Ratios to average net assets:4 | | | | | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | 0.48% | | | | 0.99% | | | | 1.74% | | | | 0.78% | | | | 1.05% | | | | 1.22% | |

Total expenses5 | | | 1.17% | | | | 1.22% | | | | 1.16% | | | | 1.20% | | | | 1.27% | | | | 1.09% | |

Expenses after payments, waivers and/or reimbursements and reduction to custodian expenses | | | 1.17% | | | | 1.22% | | | | 1.16% | | | | 1.20% | | | | 1.26% | | | | 1.09% | |

| |

Portfolio turnover rate | | | 5% | | | | 12% | | | | 13% | | | | 13% | | | | 8% | | | | 10% | |

OPPENHEIMER GLOBAL FUND 21

| | | | |

| | |

| | FINANCIAL HIGHLIGHTS (Continued) | | |

1. March 28, 2013 and September 28, 2012 represents the last business day of the Fund’s respective reporting periods. See Note 1 of the accompanying Notes.

2. Per share amounts calculated based on the average shares outstanding during the period.

3. Assumes an initial investment on the business day before the first day of the fiscal period, with all dividends and distributions reinvested in additional shares on the reinvestment date, and redemption at the net asset value calculated on the last business day of the fiscal period. Sales charges are not reflected in the total returns. Total returns are not annualized for periods less than one full year. Returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

4. Annualized for periods less than one full year.

5. Total expenses including indirect expenses from affiliated fund were as follows:

| | | | |

Six Months Ended March 28, 2013 | | | 1.17 | % |

Year Ended September 28, 2012 | | | 1.22 | % |

Year Ended September 30, 2011 | | | 1.16 | % |

Year Ended September 30, 2010 | | | 1.20 | % |

Year Ended September 30, 2009 | | | 1.27 | % |

Year Ended September 30, 2008 | | | 1.09 | % |

See accompanying Notes to Financial Statements.

22 OPPENHEIMER GLOBAL FUND

| | | | | | | | | | | | | | | | | | | | | | | | |

| Class B | | Six Months

Ended

March 28,

20131

(Unaudited) | | | Year Ended

September 28,

20121 | | | Year Ended

September 30,

2011 | | | Year Ended

September 30,

2010 | | | Year Ended

September 30,

2009 | | | Year Ended

September 30,

2008 | |

| |

Per Share Operating Data | | | | | | | | | | | | | | | | | | | | | | | | |

Net asset value, beginning of period | | $ | 56.03 | | | $ | 47.59 | | | $ | 51.82 | | | $ | 46.96 | | | $ | 50.67 | | | $ | 75.58 | |

| |

Income (loss) from investment operations: | | | | | | | | | | | | | | | | | | | | | | | | |

Net investment income (loss)2 | | | (0.12) | | | | 0.06 | | | | 0.44 | | | | (0.06) | | | | 0.08 | | | | 0.23 | |

Net realized and unrealized gain (loss) | | | 8.16 | | | | 8.84 | | | | (4.24) | | | | 4.92 | | | | (0.35) | | | | (20.52) | |

| | | | |

Total from investment operations | | | 8.04 | | | | 8.90 | | | | (3.80) | | | | 4.86 | | | | (0.27) | | | | (20.29) | |

| |

Dividends and/or distributions to shareholders: | | | | | | | | | | | | | | | | | | | | | | | | |

Dividends from net investment income | | | (0.08) | | | | (0.44) | | | | 0.00 | | | | 0.00 | | | | (0.35) | | | | (0.01) | |

Distributions from net realized gain | | | (0.10) | | | | (0.02) | | | | (0.43) | | | | 0.00 | | | | (3.09) | | | | (4.61) | |

| | | | |

Total dividends and/or distributions to shareholders | | | (0.18) | | | | (0.46) | | | | (0.43) | | | | 0.00 | | | | (3.44) | | | | (4.62) | |

| |

Net asset value, end of period | | $ | 63.89 | | | $ | 56.03 | | | $ | 47.59 | | | $ | 51.82 | | | $ | 46.96 | | | $ | 50.67 | |

| | | | |

| |

Total Return, at Net Asset Value3 | | | 14.40% | | | | 18.81% | | | | (7.44)% | | | | 10.35% | | | | 2.74% | | | | (28.47)% | |

| |

Ratios/Supplemental Data | | | | | | | | | | | | | | | | | | | | | | | | |

Net assets, end of period (in thousands) | | $ | 155,592 | | | $ | 163,538 | | | $ | 197,530 | | | $ | 308,804 | | | $ | 397,381 | | | $ | 559,138 | |

| |

Average net assets (in thousands) | | $ | 159,210 | | | $ | 182,874 | | | $ | 282,805 | | | $ | 344,445 | | | $ | 364,488 | | | $ | 856,275 | |

| |

Ratios to average net assets:4 | | | | | | | | | | | | | | | | | | | | | | | | |

Net investment income (loss) | | | (0.39)% | | | | 0.11% | | | | 0.77% | | | | (0.12)% | | | | 0.22% | | | | 0.37% | |

Total expenses5 | | | 2.15% | | | | 2.24% | | | | 2.20% | | | | 2.23% | | | | 2.28% | | | | 1.88% | |

Expenses after payments, waivers and/or reimbursements and reduction to custodian expenses | | | 2.03% | | | | 2.07% | | | | 2.07% | | | | 2.07% | | | | 2.08% | | | | 1.88% | |

| |

Portfolio turnover rate | | | 5% | | | | 12% | | | | 13% | | | | 13% | | | | 8% | | | | 10% | |

OPPENHEIMER GLOBAL FUND 23

| | | | |

| | |

| | FINANCIAL HIGHLIGHTS (Continued) | | |

1. March 28, 2013 and September 28, 2012 represents the last business day of the Fund’s respective reporting periods. See Note 1 of the accompanying Notes.

2. Per share amounts calculated based on the average shares outstanding during the period.

3. Assumes an initial investment on the business day before the first day of the fiscal period, with all dividends and distributions reinvested in additional shares on the reinvestment date, and redemption at the net asset value calculated on the last business day of the fiscal period. Sales charges are not reflected in the total returns. Total returns are not annualized for periods less than one full year. Returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

4. Annualized for periods less than one full year.

5. Total expenses including indirect expenses from affiliated fund were as follows:

| | | | |

Six Months Ended March 28, 2013 | | | 2.15 | % |

Year Ended September 28, 2012 | | | 2.24 | % |

Year Ended September 30, 2011 | | | 2.20 | % |

Year Ended September 30, 2010 | | | 2.23 | % |

Year Ended September 30, 2009 | | | 2.28 | % |

Year Ended September 30, 2008 | | | 1.88 | % |

See accompanying Notes to Financial Statements.

24 OPPENHEIMER GLOBAL FUND

| | | | | | | | | | | | | | | | | | | | | | | | |

| Class C | | Six Months

Ended

March 28,

20131

(Unaudited) | | | Year Ended

September 28,

20121 | | | Year Ended

September 30,

2011 | | | Year Ended

September 30,

2010 | | | Year Ended

September 30,

2009 | | | Year Ended

September 30,

2008 | |

| |

Per Share Operating Data | | | | | | | | | | | | | | | | | | | | | | | | |

Net asset value, beginning of period | | $ | 56.93 | | | $ | 48.46 | | | $ | 52.78 | | | $ | 47.76 | | | $ | 51.57 | | | $ | 76.93 | |

| |

Income (loss) from investment operations: | | | | | | | | | | | | | | | | | | | | | | | | |

Net investment income (loss)2 | | | (0.06) | | | | 0.14 | | | | 0.56 | | | | 0.01 | | | | 0.11 | | | | 0.30 | |

Net realized and unrealized gain (loss) | | | 8.28 | | | | 8.96 | | | | (4.34) | | | | 5.01 | | | | (0.38) | | | | (20.92) | |

| | | | |

Total from investment operations | | | 8.22 | | | | 9.10 | | | | (3.78) | | | | 5.02 | | | | (0.27) | | | | (20.62) | |

| |

Dividends and/or distributions to shareholders: | | | | | | | | | | | | | | | | | | | | | | | | |

Dividends from net investment income | | | (0.24) | | | | (0.61) | | | | (0.11) | | | | 0.00 | | | | (0.45) | | | | (0.13) | |

Distributions from net realized gain | | | (0.10) | | | | (0.02) | | | | (0.43) | | | | 0.00 | | | | (3.09) | | | | (4.61) | |

| | | | |

Total dividends and/or distributions to shareholders | | | (0.34) | | | | (0.63) | | | | (0.54) | | | | 0.00 | | | | (3.54) | | | | (4.74) | |

| |

Net asset value, end of period | | $ | 64.81 | | | $ | 56.93 | | | $ | 48.46 | | | $ | 52.78 | | | $ | 47.76 | | | $ | 51.57 | |

| | | | |

| |

Total Return, at Net Asset Value3 | | | 14.49% | | | | 18.93% | | | | (7.30)% | | | | 10.51% | | | | 2.78% | | | | (28.44)% | |

| |

Ratios/Supplemental Data | | | | | | | | | | | | | | | | | | | | | | | | |

Net assets, end of period (in thousands) | | $ | 626,890 | | | $ | 580,390 | | | $ | 581,865 | | | $ | 712,439 | | | $ | 735,502 | | | $ | 928,311 | |

| |

Average net assets (in thousands) | | $ | 604,724 | | | $ | 591,634 | | | $ | 735,113 | | | $ | 721,680 | | | $ | 637,892 | | | $ | 1,273,124 | |

| |

Ratios to average net assets:4 | | | | | | | | | | | | | | | | | | | | | | | | |

Net investment income (loss) | | | (0.21)% | | | | 0.26% | | | | 0.98% | | | | 0.02% | | | | 0.28% | | | | 0.47% | |

Total expenses5 | | | 1.87% | | | | 1.94% | | | | 1.91% | | | | 1.95% | | | | 2.04% | | | | 1.83% | |

Expenses after payments, waivers and/or reimbursements and reduction to custodian expenses | | | 1.87% | | | | 1.94% | | | | 1.91% | | | | 1.95% | | | | 2.03% | | | | 1.83% | |

| |

Portfolio turnover rate | | | 5% | | | | 12% | | | | 13% | | | | 13% | | | | 8% | | | | 10% | |

OPPENHEIMER GLOBAL FUND 25

| | | | |

| | |

| | FINANCIAL HIGHLIGHTS (Continued) | | |

1. March 28, 2013 and September 28, 2012 represents the last business day of the Fund’s respective reporting periods. See Note 1 of the accompanying Notes.

2. Per share amounts calculated based on the average shares outstanding during the period.

3. Assumes an initial investment on the business day before the first day of the fiscal period, with all dividends and distributions reinvested in additional shares on the reinvestment date, and redemption at the net asset value calculated on the last business day of the fiscal period. Sales charges are not reflected in the total returns. Total returns are not annualized for periods less than one full year. Returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

4. Annualized for periods less than one full year.

5. Total expenses including indirect expenses from affiliated fund were as follows:

| | | | |

Six Months Ended March 28, 2013 | | | 1.87 | % |

Year Ended September 28, 2012 | | | 1.94 | % |

Year Ended September 30, 2011 | | | 1.91 | % |

Year Ended September 30, 2010 | | | 1.95 | % |

Year Ended September 30, 2009 | | | 2.04 | % |

Year Ended September 30, 2008 | | | 1.83 | % |

See accompanying Notes to Financial Statements.

26 OPPENHEIMER GLOBAL FUND

| | | | | | | | |

| Class I | | Six Months

Ended

March 28,

20131

(Unaudited) | | | Period Ended

September 28,

20121,2 | |

| |

Per Share Operating Data | | | | | | | | |

Net asset value, beginning of period | | $ | 61.08 | | | $ | 57.08 | |

| |

Income (loss) from investment operations: | | | | | | | | |

Net investment income3 | | | 0.31 | | | | 0.53 | |

Net realized and unrealized gain | | | 8.86 | | | | 3.47 | |

| | | | |

Total from investment operations | | | 9.17 | | | | 4.00 | |

| |

Dividends and/or distributions to shareholders: | | | | | | | | |

Dividends from net investment income | | | (0.96) | | | | 0.00 | |

Distributions from net realized gain | | | (0.10) | | | | 0.00 | |

| | | | |

Total dividends and/or distributions to shareholders | | | (1.06) | | | | 0.00 | |

| |

Net asset value, end of period | | $ | 69.19 | | | $ | 61.08 | |

| | | | |

| |

Total Return, at Net Asset Value4 | | | 15.18% | | | | 7.01% | |

| |

Ratios/Supplemental Data | | | | | | | | |

Net assets, end of period (in thousands) | | $ | 46,578 | | | $ | 12,762 | |

| |

Average net assets (in thousands) | | $ | 30,367 | | | $ | 6,763 | |

| |

Ratios to average net assets:5 | | | | | | | | |

Net investment income | | | 0.93% | | | | 1.37% | |

Total expenses6 | | | 0.70% | | | | 0.73% | |

Expenses after payments, waivers and/or reimbursements and reduction to custodian expenses | | | 0.70% | | | | 0.73% | |

| |

Portfolio turnover rate | | | 5% | | | | 12% | |

OPPENHEIMER GLOBAL FUND 27

| | | | |

| | |

| | FINANCIAL HIGHLIGHTS (Continued) | | |

1. March 28, 2013 and September 28, 2012 represents the last business day of the Fund’s respective reporting periods. See Note 1 of the accompanying Notes.

2. For the period from January 27, 2012 (inception of offering) to September 28, 2012.

3. Per share amounts calculated based on the average shares outstanding during the period.

4. Assumes an initial investment on the business day before the first day of the fiscal period, with all dividends and distributions reinvested in additional shares on the reinvestment date, and redemption at the net asset value calculated on the last business day of the fiscal period. Sales charges are not reflected in the total returns. Total returns are not annualized for periods less than one full year. Returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

5. Annualized for periods less than one full year.

6. Total expenses including indirect expenses from affiliated fund were as follows:

| | | | |

Six Months Ended March 28, 2013 | | | 0.70 | % |

Period Ended September 28, 2012 | | | 0.73 | % |

See accompanying Notes to Financial Statements.

28 OPPENHEIMER GLOBAL FUND

| | | | | | | | | | | | | | | | | | | | | | | | |

| Class N | | Six Months

Ended

March 28,

20131

(Unaudited) | | | Year Ended

September 28,

20121 | | | Year Ended

September 30,

2011 | | | Year Ended

September 30,

2010 | | | Year Ended

September 30,

2009 | | | Year Ended

September 30,

2008 | |

| |

Per Share Operating Data | | | | | | | | | | | | | | | | | | | | | | | | |

Net asset value, beginning of period | | $ | 60.47 | | | $ | 51.46 | | | $ | 55.96 | | | $ | 50.57 | | | $ | 54.39 | | | $ | 80.81 | |

| |

Income (loss) from investment operations: | | | | | | | | | | | | | | | | | | | | | | | | |

Net investment income2 | | | 0.05 | | | | 0.38 | | | | 0.85 | | | | 0.27 | | | | 0.30 | | | | 0.55 | |

Net realized and unrealized gain (loss) | | | 8.78 | | | | 9.49 | | | | (4.63) | | | | 5.30 | | | | (0.36) | | | | (22.02) | |

| | | | |

Total from investment operations | | | 8.83 | | | | 9.87 | | | | (3.78) | | | | 5.57 | | | | (0.06) | | | | (21.47) | |

| |

Dividends and/or distributions to shareholders: | | | | | | | | | | | | | | | | | | | | | | | | |

Dividends from net investment income | | | (0.40) | | | | (0.84) | | | | (0.29) | | | | (0.18) | | | | (0.67) | | | | (0.34) | |

Distributions from net realized gain | | | (0.10) | | | | (0.02) | | | | (0.43) | | | | 0.00 | | | | (3.09) | | | | (4.61) | |

| | | | |

Total dividends and/or distributions to shareholders | | | (0.50) | | | | (0.86) | | | | (0.72) | | | | (0.18) | | | | (3.76) | | | | (4.95) | |

| |

Net asset value, end of period | | $ | 68.80 | | | $ | 60.47 | | | $ | 51.46 | | | $ | 55.96 | | | $ | 50.57 | | | $ | 54.39 | |

| | | | |

| |

Total Return, at Net Asset Value3 | | | 14.71% | | | | 19.40% | | | | (6.91)% | | | | 11.04% | | | | 3.26% | | | | (28.18)% | |

| |

Ratios/Supplemental Data | | | | | | | | | | | | | | | | | | | | | | | | |

Net assets, end of period (in thousands) | | $ | 201,622 | | | $ | 192,647 | | | $ | 192,212 | | | $ | 228,375 | | | $ | 227,912 | | | $ | 269,219 | |

| |

Average net assets (in thousands) | | $ | 195,275 | | | $ | 203,213 | | | $ | 237,342 | | | $ | 226,536 | | | $ | 190,548 | | | $ | 379,408 | |

| |

Ratios to average net assets:4 | | | | | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | 0.14% | | | | 0.67% | | | | 1.39% | | | | 0.51% | | | | 0.75% | | | | 0.82% | |

Total expenses5 | | | 1.52% | | | | 1.55% | | | | 1.50% | | | | 1.47% | | | | 1.88% | | | | 1.50% | |

Expenses after payments, waivers and/or reimbursements and reduction to custodian expenses | | | 1.51% | | | | 1.55% | | | | 1.50% | | | | 1.47% | | | | 1.55% | | | | 1.49% | |

| |

Portfolio turnover rate | | | 5% | | | | 12% | | | | 13% | | | | 13% | | | | 8% | | | | 10% | |

OPPENHEIMER GLOBAL FUND 29

| | | | |

| | |

| | FINANCIAL HIGHLIGHTS (Continued) | | |

1. March 28, 2013 and September 28, 2012 represents the last business day of the Fund’s respective reporting periods. See Note 1 of the accompanying Notes.

2. Per share amounts calculated based on the average shares outstanding during the period.

3. Assumes an initial investment on the business day before the first day of the fiscal period, with all dividends and distributions reinvested in additional shares on the reinvestment date, and redemption at the net asset value calculated on the last business day of the fiscal period. Sales charges are not reflected in the total returns. Total returns are not annualized for periods less than one full year. Returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

4. Annualized for periods less than one full year.

5. Total expenses including indirect expenses from affiliated fund were as follows:

| | | | |

Six Months Ended March 28, 2013 | | | 1.52 | % |

Year Ended September 28, 2012 | | | 1.55 | % |

Year Ended September 30, 2011 | | | 1.50 | % |

Year Ended September 30, 2010 | | | 1.47 | % |

Year Ended September 30, 2009 | | | 1.88 | % |

Year Ended September 30, 2008 | | | 1.50 | % |

See accompanying Notes to Financial Statements.

30 OPPENHEIMER GLOBAL FUND

| | | | | | | | | | | | | | | | | | | | | | | | |

| Class Y | | Six Months

Ended

March 28,

20131

(Unaudited) | | | Year Ended

September 28,

20121 | | | Year Ended

September 30,

2011 | | | Year Ended

September 30,

2010 | | | Year Ended

September 30,

2009 | | | Year Ended

September 30,

2008 | |

| |

Per Share Operating Data | | | | | | | | | | | | | | | | | | | | | | | | |

Net asset value, beginning of period | | $ | 61.00 | | | $ | 51.95 | | | $ | 56.52 | | | $ | 51.02 | | | $ | 55.25 | | | $ | 82.04 | |

| |

Income (loss) from investment operations: | | | | | | | | | | | | | | | | | | | | | | | | |

Net investment income2 | | | 0.25 | | | | 0.72 | | | | 1.26 | | | | 0.66 | | | | 0.61 | | | | 1.13 | |

Net realized and unrealized gain (loss) | | | 8.84 | | | | 9.58 | | | | (4.72) | | | | 5.29 | | | | (0.53) | | | | (22.34) | |

| | | | |

Total from investment operations | | | 9.09 | | | | 10.30 | | | | (3.46) | | | | 5.95 | | | | 0.08 | | | | (21.21) | |

| |

Dividends and/or distributions to shareholders: | | | | | | | | | | | | | | | | | | | | | | | | |

Dividends from net investment income | | | (0.83) | | | | (1.23) | | | | (0.68) | | | | (0.45) | | | | (1.22) | | | | (0.97) | |

Distributions from net realized gain | | | (0.10) | | | | (0.02) | | | | (0.43) | | | | 0.00 | | | | (3.09) | | | | (4.61) | |

| | | | |

Total dividends and/or distributions to shareholders | | | (0.93) | | | | (1.25) | | | | (1.11) | | | | (0.45) | | | | (4.31) | | | | (5.58) | |

| |

Net asset value, end of period | | $ | 69.16 | | | $ | 61.00 | | | $ | 51.95 | | | $ | 56 .52 | | | $ | 51.02 | | | $ | 55.25 | |

| | | | |

| |

Total Return, at Net Asset Value3 | | | 15.06% | | | | 20.15% | | | | (6.36)% | | | | 11.72% | | | | 4.02% | | | | (27.61)% | |

| |

Ratios/Supplemental Data | | | | | | | | | | | | | | | | | | | | | | | | |

Net assets, end of period (in thousands) | | $ | 1,153,493 | | | $ | 977,716 | | | $ | 683,652 | | | $ | 577,600 | | | $ | 845,597 | | | $ | 788,833 | |

| |

Average net assets (in thousands) | | $ | 1,055,864 | | | $ | 839,762 | | | $ | 713,559 | | | $ | 788,663 | | | $ | 714,502 | | | $ | 975,493 | |

| |

Ratios to average net assets:4 | | | | | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | 0.76% | | | | 1.26% | | | | 2.07% | | | | 1.24% | | | | 1.50% | | | | 1.65% | |

Total expenses5 | | | 0.90% | | | | 0.93% | | | | 0.92% | | | | 0.83% | | | | 0.85% | | | | 0.70% | |

Expenses after payments, waivers and/or reimbursements and reduction to custodian expenses | | | 0.90% | | | | 0.93% | | | | 0.90% | | | | 0.83% | | | | 0.85% | | | | 0.70% | |

| |

Portfolio turnover rate | | | 5% | | | | 12% | | | | 13% | | | | 13% | | | | 8% | | | | 10% | |

OPPENHEIMER GLOBAL FUND 31

| | | | |

| | |

| | FINANCIAL HIGHLIGHTS (Continued) | | |

1. March 28, 2013 and September 28, 2012 represents the last business day of the Fund’s respective reporting periods. See Note 1 of the accompanying Notes.

2. Per share amounts calculated based on the average shares outstanding during the period.

3. Assumes an initial investment on the business day before the first day of the fiscal period, with all dividends and distributions reinvested in additional shares on the reinvestment date, and redemption at the net asset value calculated on the last business day of the fiscal period. Sales charges are not reflected in the total returns. Total returns are not annualized for periods less than one full year. Returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

4. Annualized for periods less than one full year.

5. Total expenses including indirect expenses from affiliated fund were as follows:

| | | | |

Six Months Ended March 28, 2013 | | | 0.90 | % |

Year Ended September 28, 2012 | | | 0.93 | % |

Year Ended September 30, 2011 | | | 0.92 | % |

Year Ended September 30, 2010 | | | 0.83 | % |

Year Ended September 30, 2009 | | | 0.85 | % |

Year Ended September 30, 2008 | | | 0.70 | % |

See accompanying Notes to Financial Statements.

32 OPPENHEIMER GLOBAL FUND

| | | | |

| | |

| | NOTESTO FINANCIAL STATEMENTS | | |

1. Significant Accounting Policies

Oppenheimer Global Fund (the “Fund”) is registered under the Investment Company Act of 1940, as amended, as an open-end management investment company. The Fund’s investment objective is to seek capital appreciation. The Fund’s investment adviser was OppenheimerFunds, Inc. (“OFI” or the “Sub-Adviser”) through December 31, 2012. Effective January 1, 2013, the Fund’s investment adviser is OFI Global Asset Management, Inc. (“OFI Global” or the “Manager”), a wholly-owned subsidiary of OFI. The Manager has entered into a sub-advisory agreement with OFI, as of the same effective date.