UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-04033

Sit Mutual Funds II, Inc.

(Exact name of registrant as specified in charter)

3300 IDS Center

80 South Eighth Street

Minneapolis, MN 55402

(Address of principal executive offices)

Paul E. Rasmussen, VP Treasurer

Sit Mutual Funds, Inc.

3300 IDS Center

80 South Eighth Street

Minneapolis, MN 55402

(Name and address of agent for service)

Copy to:

Mike Radmer, Esq.

Dorsey & Whitney

Suite 1500

50 South Sixth Street

Minneapolis, MN 55402-1498

Registrant’s telephone number, including area code:

(612) 334-5888

Date of fiscal year end: March 31, 2011

Date of reporting period: March 31, 2011

| Item 1: | Reports to Stockholders |

|

Sit Mutual Funds BOND FUNDS ANNUAL REPORT TABLE OF CONTENTS |

This document must be preceded or accompanied by a Prospectus.

CHAIRMAN’S LETTER

Year Ended March 31, 2011

Dear fellow shareholders:

U.S. fixed-income markets performed well over the first half of the last year, but significant and conflicting forces challenged the markets during the latter half of the year. Some of these forces included: improving economic conditions in the U.S. economy; a massive increase in the money supply as a result of the Federal Reserve’s second round of quantitative easing (QE2); a sovereign debt crisis in Europe; political instability in the Middle East; and fiscal concerns at all levels of government in the U.S.

Taxable bond yields increased and the yield curve steepened during the last six months, with short-term yields remaining at historic lows and longer-term U.S. Treasury yields increasing. Specifically, the one-year maturity U.S.Treasury bill yield increased 2 basis points to 0.27%, while the 30-year U.S. Treasury bond yield increased 82 basis points to 4.51%. Most taxable bond sectors experienced negative returns over the last six months, but still delivered strong returns over the last year. Commercial mortgage-backed securities and home equity securities were the strongest sectors for both the six-month and one-year time periods. Lower quality bonds outperformed higher quality bonds during the last six and twelve months. In terms of duration, longer bonds outperformed shorter bonds during the last year; however, this trend reversed during the last six-months with shorter duration outperforming longer duration bonds.

Tax-exempt bond yields showed a similar pattern of increased yields and more pronounced yield curve steepening during the six-month period. The one-year Municipal Market Data (MMD) AAA GO increased 2 basis points to 0.30%, while the 30-year MMD AAA GO increased 110 basis points to 4.80%. The sharp rise in yields that began in the fourth quarter of 2010 continued through mid-January before settling at lower levels in February and March. The slowing pace of mutual fund redemptions, combined with the lowest quarterly issuance volume since the first quarter of 2000 and the entrance of taxable crossover buyers, helped stabilize the market recently. The Barclays Five-year Municipal Bond Index produced a total return of -1.0% and +3.2% for the six-month and one-year periods ended March 31, respectively. Among revenue bonds, housing and resource recovery bonds led the six-month and one-year periods. Intermediate duration bonds outperformed shorter and longer duration over the last year while shorter duration bonds outperformed over the last six-months.

U.S. economic activity is at a new high after recovering from the severe contraction of activity resulting from the financial crisis. The final estimate fourth quarter 2010 real GDP growth was revised up to +3.1% from the previous estimate of +2.8%. Impressively, year-over-year changes in real GDP components have actually been remarkably steady in the +2.5 to +3.0% range over the past four quarters.

The nonfarm payroll report, released on April 1st, revealed that 216,000 jobs were created in March, compared with the consensus expectation of 190,000 jobs. Even more notably, private sector payrolls grew by 564,000 in the first quarter, which is the highest level since the first quarter of 2006 and marked the fifth consecutive quarterly

increase. The unemployment rate drifted downward to 8.8%, compared to 9.8% as recently as November. The full one percentage point decline in four months is the steepest reduction over such a period since January 1984. However, the labor participation rate, which had been in a moderate downtrend since 2000 and had accelerated with the recession, has yet to show improvement and remains at 64.2% vs. 66.0% at the beginning of the recession and 67.3% in early 2000.

Inflation, as measured by the headline Consumer Price Index for All Urban Consumers (CPI), increased +0.5% from the January level or +2.1% year-over-year in February. Not surprisingly, energy costs continued to rise, up +3.4% from January. Core CPI, which excludes the volatile food and energy components, increased +0.2%, slightly ahead of the +0.1% consensus estimate. While inflation is clearly increasing, much of the rise has been caused by food and energy commodities, which will be “transitory,” according to a recent FOMC statement. Nonetheless, investors are clearly beginning to sharpen their focus on inflation expectations.

Through the first five months of fiscal year 2011, the federal budget deficit stands at $641 billion, approximately $10 billion less than the comparable period last year. Furthermore, the Congressional Budget Office (CBO) estimates that the fiscal 2011 deficit will be $1.48 trillion versus a 2010 deficit of $1.29 trillion. Despite all of the news grabbing headlines from Washington surrounding the debate on the budget, none of the current proposals from Congress will meaningfully change the budget outlook for 2011.

The Federal Reserve’s U.S. trade-weighted major currencies dollar index declined -1.6% in March from the February level and -5.8% on a year-over-year basis. The dollar is very near the all-time lows that were reached in early 2008. Given the fiscal difficulties the U.S. faces over both the near and long term, we do not expect a sustained rally in the dollar, but there may be short-term, technically driven rallies.

We expect the current economic recovery to continue at a subpar pace. Consumer spending continues to be subdued, as improvements in employment have been measureable but slow. Two significant problems remaining in the U.S. economy are high unemployment and a weak housing market. Significant job creation is naturally one of the last things to occur in any economic recovery. In a general economic cycle, recessions cause corporations to lose money, followed by workforce reductions and bankruptcies until the surviving companies are once again profitable. But after a few quarters of stable operations and profits, corporations will risk hiring people and expand their businesses. We believe the moderate economic growth should continue to create jobs but the process will be long, slow and erratic.

Likewise, the very weak housing market has begun to stabilize even though a full recovery will take considerable time. While home prices are near their lows, year-over-year home price comparisons are distorted because last year’s home prices were artificially inflated

| | |

| | | |

2 | | SIT MUTUAL FUNDS ANNUAL REPORT |

by the home buyer tax credit that expired in April of 2010. One of our preferred housing data points is the trend in unsold housing inventory. We like to include homes that are also in foreclosure (often referred to as “shadow inventory”) and properties owned by borrowers that are more than 60 days delinquent on their mortgage. This measure of total housing inventory has steadily declined for 15 months and we expect this trend to continue.

The rapid deterioration of the federal deficit and, to a lesser degree, state and local budgets remain challenging to the economy. The Federal Reserve’s aggressive money printing program is already distorting financial markets (the real challenge will come when the Fed tries to reverse the process). The normal threat of rising inflation that comes with an expanding economy is heightened by the Fed’s 30% increase in the money supply over the past three years. Recent external factors will likely continue to slow the recovery both globally and in the U.S., namely: continuing issues surrounding the European sovereign debt crisis; unrest in the Middle East; and the earthquake in Japan. The revolutions in the Middle East will have unpredictable outcomes. Japan’s earthquake, tsunami, and nuclear crisis have disrupted the lives of everyone in the country and many companies around the world, but we expect the extraordinary culture and work ethic of the Japanese to help them recover from this terrible tragedy. While the effect on the Japanese people will be long term, we expect the effects on the world economy to be more limited.

As Japan recovers from the massive earthquake, employment improves, and housing stabilizes, there will be little to stop the gradual rising trend in interest rates. Treasury yields for most 5 to 10-year maturities have already risen by a full percentage point since last November, when the Fed announced their intention to print $600 billion by “purchasing” U.S. Treasury bonds. Shifting from recovery mode to a phase of economic expansion, accompanied by high unemployment, a weak housing market, the Japanese earthquake, and the fact that the U.S. is waging multiple wars simultaneously all serve to create multiple opposing pressures on the direction of interest rates. Wars, natural disasters, weak housing markets, and high unemployment tend to push rates lower. Improving economic growth, printing money, and rising inflation expectations tend to push rates higher. We believe the effects of the latter will eventually outweigh those of the former.

Our current taxable bond strategy continues to be underweighting U.S. Treasury bonds and investing in securities that will minimize the negative effects of rising interest rates (if not directly benefit).

Examples include variable rate securities; short average life bonds with high levels of principal repayments 2 to 3 years from now; inflation-linked securities; and short duration, high-coupon, government agency mortgage securities. We have also been able to maintain portfolio yields at levels more than 1% higher than their benchmarks.

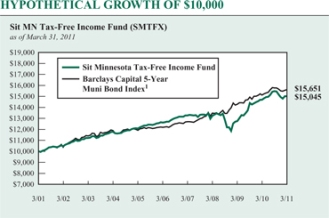

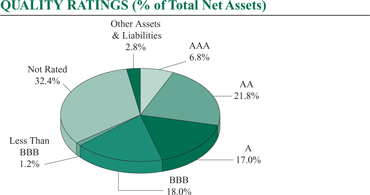

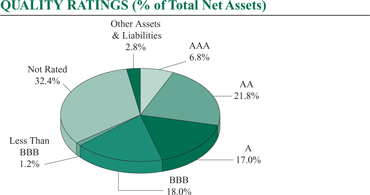

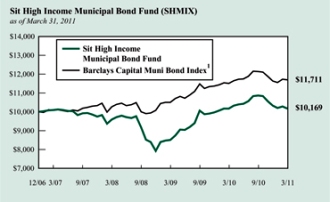

Our tax-exempt strategy continues to favor revenue bonds over general obligation bonds with significant weightings in A or BBB rated tax-exempt credits. Tax-exempt bond yields remain quite high relative to taxable bond yields, particularly for intermediate and longer duration bonds. Specifically, the ratio of MMD AAA GO to U.S. Treasuries ended the year at 107% for 30-year bonds and 84% for 10-year bonds versus longer-term averages of 90% and 82%, respectively. Furthermore, yield spreads between AAA and A or BBB tax-exempts also remain quite high. We expect yield ratios between tax-exempts and taxables to decline and quality spreads to narrow as tax-exempt supply normalizes and as credit concerns lessen as state and local bond issuers make progress in moving towards balanced budgets. The slope of the tax-exempt municipal yield curve, as measured by the MMD AAA general obligation curve, steepened markedly over the year to 448 basis points from 385 basis points at the end of last March, placing it at the high end of the range experienced over the last 30 years. As a result, although inflation expectations are increasing modestly, we continue to position municipal portfolios modestly longer than their benchmarks.

All portfolios continue to emphasize high levels of current income and diversification to manage risk. Thank you for your continued interest in the Sit family of mutual funds.

With best wishes,

Roger J. Sit

Chairman and President

Sit Mutual Funds

|

|

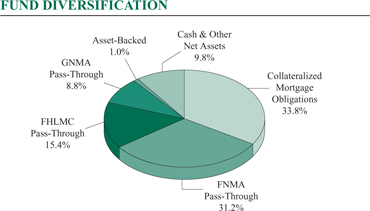

Sit U.S. Government Securities Fund |

OBJECTIVE & STRATEGY

The objective of the U.S. Government Securities Fund is to provide high current income and safety of principal, which it seeks to attain by investing solely in debt obligations issued, guaranteed or insured by the U.S. government or its agencies or its instrumentalities.

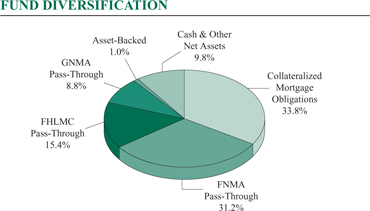

Agency mortgage securities and U.S. Treasury securities are the principal holdings in the Fund. The mortgage securities that the Fund purchases consist of pass-through securities including those issued by Government National Mortgage Association (GNMA), Federal National Mortgage Asociation (FNMA), and Federal Home Loan Mortgage Corporation (FHLMC).

The Sit U.S. Government Securities Fund provided a return of +4.37% during the fiscal year ended March 31, 2011, compared to the return of the Barclays Capital Intermediate Government Bond Index of +3.83%. The Fund’s 30-day SEC yield was 3.25% and its 12-month distribution rate was 2.83%.

During the twelve-month period, the Fund benefited from its holdings in older, high-coupon, agency mortgage pass-through securities and collateralized mortgage obligations, which provide a meaningful income advantage in excess of 2% relative to the benchmark. The Fund’s positions in U.S. Treasury securities provided a slight positive return, as a flight to quality spurred by international geopolitical concerns was only partially offset by investor inflation fears. The Federal housing agencies completed a buyout operation of delinquent loans that had built up throughout the crisis years that detracted from returns. Since the completion of this one-time purchase event, normal buyouts have returned to historical levels. The Fund’s modest cash position hurt relative performance due to the very low levels of interest rates currently available on cash-equivalent investments.

In the first quarter of 2011, the Treasury released a proposal offering various long-term options for the future of the housing market. As the current role of the Federal housing agencies evolves, we expect there will continue to be government sponsorship of the housing market into the foreseeable future and we expect the viability of our strategy to continue.

Economic activity in the U.S. is at a new high after finally recovering from the severe contraction of activity resulting from the financial crisis. While the economic outlook continues to improve, head-winds still remain. An improving but still high unemployment rate, a weak housing market, revolutions in the Middle East, natural catastrophes and fiscal issues at home, all present challenges in the year ahead. We continue to believe that the inflationary environment likely to result from the Federal Reserve’s massive monetary stimulus plan is likely to push interest rates higher. In order to minimize the negative effects of a rising interest rate environment, we are maintaining an underweight to the U.S. Treasury sector. We also continue to focus on older, high-coupon, agency mortgage pass-through

The chart above illustrates the total value of a hypothetical $10,000 investment in the Fund over the past 10 years (or for the life of the Fund if shorter) as compared to the performance of the Barclays Capital Intermediate Government Bond Index. Past performance does not guarantee future results. Returns include the reinvestment of distributions. The chart does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

1 The Barclays Capital Intermediate Government Bond Index is a sub-index of the Barclays Capital Government Bond Index covering issues with remaining maturities of between three and five years. The Barclays Capital Government Bond Index is an index that measures the performance of all public U.S. government obligations with remaining maturities of one year or more. The returns include the reinvestment of income and do not include any transaction costs, management fees or other costs. It is not possible to invest directly in an index.

securities, as these continue to provide high levels of income with relatively stable prices, especially compared to the low absolute levels of shorter term interest rates available from other investment alternatives. This high level of income and principal stability has been and continues to be a fundamental focus of the Fund since its inception.

Michael C. Brilley

Bryce A. Doty, CFA

Senior Portfolio Managers

Mark H. Book, CFA

Portfolio Manager

| | |

| | | |

4 | | SIT MUTUAL FUNDS ANNUAL REPORT |

COMPARATIVE RATES OF RETURNS

| | | | | | | | | | | | |

as of March 31, 2011 | |

| | | Sit U.S. Government Securities Fund | | | Barclays Capital Inter. Gov’t Bond Index1 | | | Lipper U.S. Gov’t Fund Index2 | |

| One Year | | | 4.37 | % | | | 3.83 | % | | | 4.66 | % |

| Five Years | | | 5.91 | | | | 5.48 | | | | 5.17 | |

| Ten Years | | | 4.81 | | | | 4.81 | | | | 4.66 | |

| Since Inception (6/2/87) | | | 6.50 | | | | 6.54 | | | | 6.14 | |

Performance figures are historical and do not guarantee future results. Investment returns and principal value will vary, and you may have a gain or loss when you sell shares. Current performance may be lower or higher than the performance data quoted. Contact the Fund for performance data current to the most recent month-end. Returns include changes in share price as well as reinvestment of all dividends and capital gains and all fee waivers. Without the fee waivers total return and yield figures would have been lower. Returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Management fees and administrative expenses are included in the Fund’s performance. Returns for periods greater than one year are compounded average annual rates of return.

1 The Barclays Capital Intermediate Government Bond Index is a sub-index of the Barclays Capital Government Bond Index covering issues with remaining maturities of between three and five years. The Barclays Capital Government Bond Index is an index that measures the performance of all public U.S. government obligations with remaining maturities of one year or more. The returns include the reinvestment of income and do not include any transaction costs, management fees or other costs. It is not possible to invest directly in an index.

2 The Lipper returns are obtained from Lipper Analytical Services, Inc., a large independent evaluator of mutual funds.

Based on total assets as of March 31, 2011. Subject to change

PORTFOLIO SUMMARY

| | |

Net Asset Value 3/31/11: | | $11.29 Per Share |

Net Asset Value 3/31/10: | | $11.13 Per Share |

Total Net Assets: | | $1,057.2 Million |

30-day SEC Yield 3: | | 3.25% |

12-month Distribution Rate 3: | | 2.83% |

Effective Duration 4: | | 1.5 Years |

3 The SEC Yield reflects the rate at which the Fund is earning income on its current portfolio of securities, while the distribution rate reflects the Fund’s past dividends paid to shareholders based on the net investment income distributed and the average NAV during the past 12 months. Accordingly, the Fund’s SEC yield and distribution rate may differ.

4 Duration is a measure of estimated price sensitivity relative to changes in interest rates. Portfolios with longer durations are typically more sensitive to changes in interest rates. For example, if interest rates rise by 1%, the market value of a security with an effective duration of 5 years would decrease by 5%, with all other factors being constant. The correlation between duration and price sensitivity is greater for securities rated investment-grade than it is for securities rated below investment-grade. Duration estimates are based on assumptions by the Adviser and are subject to a number of limitations. Effective duration is calculated based on historical price changes of securities held by the Fund, and therefore is a more accurate estimate of price sensitivity provided interest rates remain within their historical range.

ESTIMATED AVERAGE LIFE

| | | | |

| |

0-1 Year | | | 9.8 | % |

1-5 Years | | | 89.0 | % |

5-10 Years | | | 1.2 | % |

10-20 Years | | | 0.0 | % |

20+ Years | | | 0.0 | % |

The Adviser’s estimates of the dollar weighted average life of the portfolio’s securities, which differ from their stated maturities. The Fund’s average stated maturity was 20.1 years as of March 31, 2011.

SCHEDULE OF INVESTMENTS

March 31, 2011

Sit U.S. Government Securities Fund

| | | | | | | | |

| | | | | |

Principal Amount ($) | | Coupon Rate (%) | | Maturity Date | | | | Fair Value ($) |

Mortgage Pass-Through Securities - 55.4% | | | | |

Federal Home Loan Mortgage Corporation - 15.4% |

222,952 | | 5.50 | | 8/1/17-3/1/33 | | | | 239,494 |

334,300 | | 6.38 | | 12/1/26-12/1/27 | | | | 375,116 |

18,351,977 | | 6.50 | | 4/1/28-10/1/36 | | | | 20,569,112 |

1,005,715 | | 6.88 | | 2/17/31 | | | | 1,152,837 |

50,260 | | 7.00 | | 2/1/16 | | | | 51,080 |

49,134,314 | | 7.00 | | 4/1/28-1/1/39 | | | | 56,162,312 |

164,257 | | 7.38 | | 12/17/24 | | | | 189,400 |

54,705,490 | | 7.50 | | 9/1/26-10/1/38 | | | | 63,137,345 |

163,193 | | 7.95 | | 10/1/25-11/1/25 | | | | 191,682 |

2,291,457 | | 8.00 | | 5/1/17-1/1/37 | | | | 2,666,267 |

33,859 | | 8.25 | | 12/1/17 | | | | 38,347 |

3,666,961 | | 8.50 | | 5/1/16-8/1/36 | | | | 4,333,221 |

53,090 | | 9.00 | | 11/1/15 | | | | 60,502 |

6,566,816 | | 9.00 | | 10/1/16-11/1/36 | | | | 7,735,088 |

126,328 | | 9.25 | | 6/1/16-3/1/19 | | | | 135,619 |

712,810 | | 9.50 | | 10/1/16-12/17/21 | | | | 829,454 |

96,518 | | 9.75 | | 12/1/16-12/1/17 | | | | 104,461 |

2,723,099 | | 10.00 | | 9/1/20-7/1/30 | | | | 3,088,560 |

17,578 | | 10.25 | | 2/1/17 | | | | 17,646 |

12,487 | | 10.50 | | 10/1/13 | | | | 13,304 |

123,540 | | 10.50 | | 6/1/19 | | | | 139,186 |

842,845 | | 11.00 | | 9/17/16-8/15/20 | | | | 936,285 |

9,233 | | 13.00 | | 5/1/17 | | | | 11,026 |

| | | | | | | | |

| | | | | | | | 162,177,344 |

| | | | | | | | |

Federal National Mortgage Association - 31.2% |

13,942,535 | | 4.00 | | 1/1/41 | | | | 13,734,294 |

71,306 | | 5.76 | | 3/1/33 | | | | 77,660 |

10,913 | | 5.99 | | 3/1/19 | | 1 | | 11,625 |

1,934,443 | | 6.00 | | 9/1/28-9/1/37 | | | | 2,118,440 |

588,611 | | 6.15 | | 8/1/36 | | 1 | | 588,844 |

404,562 | | 6.20 | | 11/1/27 | | | | 456,088 |

124,215 | | 6.35 | | 10/1/30 | | | | 140,555 |

78,259 | | 6.49 | | 2/1/32 | | | | 88,482 |

20,091,882 | | 6.50 | | 1/1/22-8/1/37 | | | | 22,629,726 |

1,384,968 | | 6.74 | | 12/1/15 | | | | 1,513,214 |

195,338 | | 6.91 | | 11/1/26-8/1/27 | | | | 225,549 |

257,754 | | 6.95 | | 8/1/21 | | 1 | | 268,512 |

138,432,547 | | 7.00 | | 6/1/17-1/1/40 | | | | 159,361,477 |

210,267 | | 7.45 | | 6/1/16 | | | | 211,943 |

299,410 | | 7.50 | | 11/1/12 | | | | 315,590 |

69,584,227 | | 7.50 | | 6/1/22-4/1/38 | | | | 80,013,541 |

188,220 | | 7.62 | | 12/1/16 | | | | 192,633 |

395,715 | | 7.95 | | 9/15/20 | | | | 454,176 |

10,637,223 | | 8.00 | | 4/1/16-3/1/38 | | | | 12,418,757 |

548,112 | | 8.17 | | 11/15/31 | | | | 651,162 |

12,458 | | 8.25 | | 4/1/22 | | | | 13,501 |

269,220 | | 8.33 | | 7/15/20 | | | | 315,051 |

163,099 | | 8.38 | | 7/20/28 | | | | 187,749 |

1,360,745 | | 8.45 | | 3/15/32 | | | | 1,630,098 |

127,790 | | 8.46 | | 9/15/30 | | | | 149,144 |

| | | | | | |

| | | | |

Principal Amount ($) | | Coupon Rate (%) | | Maturity Date | | Fair Value ($) |

92,307 | | 8.50 | | 9/1/12 | | 97,327 |

200,943 | | 8.50 | | 2/1/16 | | 220,316 |

13,348,098 | | 8.50 | | 9/1/17-12/1/37 | | 15,581,098 |

216,712 | | 8.59 | | 7/20/30 | | 253,442 |

51,906 | | 8.87 | | 12/15/25 | | 61,267 |

7,066,867 | | 9.00 | | 10/1/19-2/1/38 | | 8,271,590 |

112,512 | | 9.25 | | 10/1/16-2/1/17 | | 126,718 |

128,119 | | 9.40 | | 5/15/28 | | 152,898 |

4,030,358 | | 9.50 | | 11/1/18-8/1/31 | | 4,680,191 |

418,187 | | 9.55 | | 8/20/25 | | 474,533 |

15,141 | | 9.75 | | 1/15/13 | | 16,271 |

184,043 | | 9.75 | | 10/1/21-4/1/25 | | 203,605 |

15,328 | | 10.00 | | 7/1/13 | | 15,565 |

136,510 | | 10.00 | | 2/1/15 | | 149,441 |

219,650 | | 10.00 | | 3/1/15 | | 242,206 |

819,920 | | 10.00 | | 11/1/16-6/1/30 | | 930,742 |

142,390 | | 10.16 | | 7/15/20 | | 157,747 |

150,896 | | 10.18 | | 7/1/20 | | 168,317 |

21,094 | | 10.25 | | 8/15/13 | | 22,700 |

15,796 | | 10.50 | | 5/1/15 | | 15,885 |

78,865 | | 10.50 | | 6/1/15 | | 87,807 |

202,425 | | 10.50 | | 12/1/17-6/1/28 | | 232,520 |

83,947 | | 11.27 | | 8/15/20 | | 94,712 |

36,983 | | 11.57 | | 12/15/26 | | 42,280 |

| | | | | | |

| | | | | | 330,066,989 |

| | | | | | |

Government National Mortgage Association - 8.8% |

1,253,280 | | 5.45 | | 7/15/27 | | 1,335,524 |

303,165 | | 5.50 | | 9/15/25 | | 331,658 |

3,704,540 | | 5.61 | | 11/15/34 | | 3,966,530 |

409,572 | | 5.76 | | 3/20/33-5/20/33 | | 446,134 |

7,936,733 | | 5.85 | | 12/15/30 | | 8,405,673 |

390,463 | | 6.00 | | 9/15/18-11/20/28 | | 427,829 |

76,686 | | 6.05 | | 3/20/33 | | 84,043 |

8,904,912 | | 6.09 | | 3/15/41-7/15/41 | | 9,412,968 |

2,868,220 | | 6.15 | | 1/15/42 | | 2,953,160 |

1,031,348 | | 6.20 | | 3/15/32 | | 1,151,887 |

52,583 | | 6.25 | | 5/15/13 | | 56,032 |

415,193 | | 6.25 | | 12/15/23-1/15/24 | | 471,103 |

5,875,721 | | 6.35 | | 4/20/30-11/20/31 | | 6,335,677 |

499,674 | | 6.38 | | 8/15/26-4/15/28 | | 562,945 |

343,364 | | 6.49 | | 11/20/31-6/20/32 | | 376,611 |

27,034,221 | | 6.50 | | 4/15/24-2/15/41 | | 30,133,783 |

112,812 | | 6.57 | | 9/20/32-3/20/33 | | 127,972 |

45,863 | | 6.75 | | 9/15/15 | | 50,492 |

302,498 | | 6.75 | | 8/15/28-6/15/29 | | 346,791 |

886,218 | | 6.91 | | 7/20/26-2/20/27 | | 1,015,944 |

54,159 | | 6.93 | | 2/20/25 | | 62,018 |

1,580,559 | | 7.00 | | 6/20/38-2/20/39 | | 1,793,393 |

161,772 | | 7.02 | | 4/20/26 | | 184,294 |

271,822 | | 7.05 | | 2/15/23-4/20/27 | | 310,112 |

779,558 | | 7.10 | | 5/20/25 | | 890,785 |

| | |

See accompanying notes to financial statements. | | |

6 | | SIT MUTUAL FUNDS ANNUAL REPORT |

| | | | | | | | |

| | | | | |

Principal Amount ($) | | Coupon Rate (%) | | Maturity Date | | | | Fair Value ($) |

| | | | |

315,530 | | 7.15 | | 12/20/26-4/20/27 | | | | 361,126 |

152,246 | | 7.25 | | 5/15/29-6/15/29 | | | | 175,818 |

51,722 | | 7.27 | | 7/20/22 | | | | 59,025 |

55,937 | | 7.38 | | 1/15/29 | | | | 64,817 |

4,801,401 | | 7.50 | | 5/15/16-3/15/39 | | | | 5,540,825 |

21,931 | | 7.55 | | 10/20/22 | | | | 25,169 |

2,666,545 | | 7.60 | | 12/15/33 | | | | 2,831,478 |

95,223 | | 7.63 | | 12/15/29 | | | | 110,747 |

64,872 | | 7.65 | | 7/20/22 | | | | 74,661 |

380,561 | | 7.75 | | 6/15/20-11/15/20 | | | | 436,139 |

47,148 | | 7.90 | | 1/20/21 | | | | 52,722 |

766,521 | | 7.95 | | 2/15/20-3/20/27 | | | | 891,636 |

468,649 | | 7.99 | | 2/20/21-6/20/22 | | | | 540,383 |

121,567 | | 8.00 | | 10/15/14 | | | | 133,591 |

7,145,831 | | 8.00 | | 5/15/16-9/15/31 | | | | 8,364,833 |

399,668 | | 8.10 | | 5/20/19-7/20/20 | | | | 451,468 |

5,082 | | 8.25 | | 12/15/11 | | | | 5,250 |

13,337 | | 8.25 | | 8/15/15 | | | | 14,932 |

306,884 | | 8.25 | | 4/15/19-2/15/20 | | | | 350,797 |

33,220 | | 8.38 | | 10/15/19 | | | | 38,465 |

166,958 | | 8.40 | | 2/15/19-2/15/20 | | | | 193,941 |

4,367 | | 8.50 | | 1/15/12 | | | | 4,651 |

23,201 | | 8.50 | | 4/15/15 | | | | 26,078 |

326,759 | | 8.50 | | 9/15/16-12/20/26 | | | | 384,649 |

35,482 | | 8.60 | | 6/15/18 | | | | 40,971 |

29,490 | | 8.63 | | 10/15/18 | | | | 33,459 |

18,138 | | 8.75 | | 11/15/11 | | | | 18,929 |

1,522 | | 9.00 | | 6/15/11 | | | | 1,589 |

1,892 | | 9.00 | | 8/15/11 | | | | 1,908 |

5,431 | | 9.00 | | 9/15/11 | | | | 5,672 |

3,290 | | 9.00 | | 9/15/11 | | | | 3,436 |

32,330 | | 9.00 | | 1/15/17-7/15/17 | | | | 37,457 |

17,217 | | 9.10 | | 5/15/18 | | | | 20,076 |

9,179 | | 9.50 | | 3/20/16 | | | | 10,509 |

147,527 | | 9.50 | | 11/20/16-8/20/19 | | | | 172,951 |

2,444 | | 9.75 | | 11/15/12 | | | | 2,658 |

222,496 | | 10.00 | | 11/15/17-6/15/21 | | | | 258,234 |

368,545 | | 10.50 | | 2/15/20-8/15/21 | | | | 412,762 |

17,995 | | 11.50 | | 8/15/18 | | | | 19,195 |

| | | | | | | | |

| | | | | | | | 93,406,365 |

| | | | | | | | |

Total Mortgage Pass-Through Securities

(cost: $564,902,639) | | | | 585,650,698 |

| | | | | | | | |

| | |

Collateralized Mortgage Obligations - 33.8% | | | | |

Federal Home Loan Mortgage Corporation - 8.3% |

112,019 | | 5.40 | | 3/25/44 | | 1 | | 116,903 |

203,887 | | 5.50 | | 2/15/34 | | | | 212,208 |

223,588 | | 6.00 | | 9/15/21-6/15/28 | | | | 233,538 |

4,448,275 | | 6.50 | | 9/15/23-10/25/43 | | | | 4,939,902 |

330,499 | | 6.50 | | 9/25/43 | | 1 | | 371,855 |

| | | | | | | | |

| | | | | |

Principal Amount ($) | | Coupon Rate (%) | | Maturity Date | | | | Fair Value ($) |

147,133 | | 6.70 | | 9/15/23 | | | | 162,186 |

365,005 | | 6.95 | | 3/15/28 | | | | 368,954 |

42,819,926 | | 7.00 | | 12/15/20-3/25/43 | | | | 47,426,663 |

19,972,256 | | 7.50 | | 6/15/17-9/25/43 | | | | 23,047,437 |

5,955,086 | | 8.00 | | 3/15/21-1/15/30 | | | | 6,726,231 |

96,325 | | 8.25 | | 6/15/22 | | | | 108,976 |

555,901 | | 8.30 | | 11/15/20 | | | | 627,316 |

1,014,987 | | 8.50 | | 10/15/22-3/15/32 | | | | 1,151,697 |

12,184 | | 9.15 | | 10/15/20 | | | | 13,484 |

1,551,216 | | 9.50 | | 2/15/20-2/25/42 | | | | 1,806,973 |

129,221 | | 10.00 | | 6/15/20 | | | | 148,328 |

| | | | | | | | |

| | | | | | | | 87,462,651 |

| | | | | | | | |

Federal National Mortgage Association - 15.5% |

655,430 | | 5.50 | | 1/25/37 | | | | 679,152 |

1,773,088 | | 6.50 | | 12/25/23-12/25/42 | | | | 1,981,113 |

301,134 | | 6.51 | | 3/25/29 | | 1 | | 337,212 |

6,448,237 | | 6.75 | | 4/25/37 | | | | 7,468,872 |

41,266 | | 6.85 | | 12/18/27 | | | | 45,652 |

31,327,220 | | 7.00 | | 1/25/21-8/25/44 | | | | 34,769,969 |

1,553,004 | | 7.00 | | 6/25/42 | | | | 1,726,340 |

2,501,261 | | 7.12 | | 6/17/40 | | 1 | | 2,800,798 |

945,576 | | 7.13 | | 1/17/37 | | 1 | | 945,145 |

46,915,323 | | 7.50 | | 8/20/27-1/25/48 | | | | 52,643,561 |

15,105,464 | | 7.50 | | 6/19/30-12/25/42 | | 1 | | 17,350,288 |

11,674,329 | | 7.62 | | 7/25/37 | | 1 | | 12,884,029 |

21,455 | | 7.70 | | 3/25/23 | | | | 24,102 |

554,395 | | 8.00 | | 7/25/22-7/25/44 | | | | 651,242 |

8,599,176 | | 8.50 | | 1/25/21-10/25/30 | | | | 9,920,007 |

23,619 | | 8.70 | | 12/25/19 | | | | 25,938 |

1,771,867 | | 8.71 | | 11/25/37 | | 1 | | 2,093,696 |

33,048 | | 8.75 | | 9/25/20 | | | | 36,400 |

102,093 | | 8.95 | | 10/25/20 | | | | 115,757 |

1,865,596 | | 8.95 | | 11/25/37 | | 1 | | 2,110,153 |

3,775,683 | | 9.00 | | 7/25/19-6/25/30 | | | | 4,275,013 |

65,362 | | 9.05 | | 12/25/18 | | | | 72,913 |

2,980,091 | | 9.05 | | 2/25/44 | | 1 | | 3,683,206 |

81,297 | | 9.25 | | 1/25/20 | | | | 92,415 |

4,044,328 | | 9.50 | | 12/25/18-12/25/41 | | | | 5,014,015 |

1,548,166 | | 9.51 | | 6/25/32 | | 1 | | 1,766,946 |

170,685 | | 9.60 | | 3/25/20 | | | | 195,529 |

| | | | | | | | |

| | | | | | | | 163,709,463 |

| | | | | | | | |

Government National Mortgage Association - 5.7% | | | | |

46,536,322 | | 7.00 | | 9/16/23-6/20/40 | | | | 52,423,679 |

401,406 | | 7.50 | | 6/20/26-5/16/27 | | | | 455,115 |

4,365,981 | | 8.00 | | 10/16/29-3/16/30 | | | | 4,989,794 |

1,944,311 | | 8.50 | | 9/20/30-2/20/32 | | | | 1,959,720 |

| | | | | | | | |

| | | | | | | | 59,828,308 |

| | | | | | | | |

Vendee Mortgage Trust - 4.3% | | | | |

1,041,756 | | 6.00 | | 2/15/30 | | | | 1,099,433 |

| | |

See accompanying notes to financial statements. | | |

MARCH 31, 2011 | | 7 |

SCHEDULE OF INVESTMENTS

March 31, 2011

Sit U.S. Government Securities Fund (Continued)

| | | | | | | | |

Principal Amount ($)/ Contracts/Quantity | | Coupon Rate (%) | | Maturity Date | | | | Fair Value ($) |

| | | | |

23,531,350 | | 6.50 | | 1/15/29-8/15/31 | | | | 27,244,891 |

3,365,144 | | 7.00 | | 3/15/28 | | | | 3,849,817 |

646,659 | | 7.25 | | 9/15/25 | | | | 722,311 |

3,752,109 | | 7.75 | | 5/15/22-9/15/24 | | | | 4,275,592 |

6,864,372 | | 8.11 | | 3/15/25 | | 1 | | 8,516,112 |

273,181 | | 8.29 | | 12/15/26 | | | | 319,572 |

| | | | | | | | |

| | | | | | | | 46,027,728 |

| | | | | | | | |

Total Collateralized Mortgage Obligations (cost: $350,525,989) | | | | 357,028,150 |

| | | | | | | | |

Asset-Backed Securities - 1.0% | | | | |

Federal Home Loan Mortgage Corporation - 0.7% |

99,414 | | 6.09 | | 9/25/29 | | 1 | | 106,257 |

250,000 | | 6.28 | | 10/27/31 | | | | 278,444 |

551,964 | | 7.00 | | 11/25/30 | | | | 569,921 |

4,308,166 | | 7.15 | | 9/25/28 | | | | 4,821,107 |

1,410,070 | | 7.27 | | 8/25/28 | | 1 | | 1,492,031 |

| | | | | | | | |

| | | | | | | | 7,267,760 |

| | | | | | | | |

Federal National Mortgage Association - 0.3% |

112,003 | | 0.69 | | 11/25/32 | | 1 | | 107,841 |

99,035 | | 5.41 | | 9/26/33 | | | | 97,085 |

156,776 | | 5.75 | | 2/25/33 | | | | 146,824 |

480,541 | | 6.47 | | 10/25/31 | | | | 488,467 |

923,432 | | 6.50 | | 5/25/32 | | | | 994,036 |

851,527 | | 6.59 | | 10/25/31 | | | | 956,962 |

236,161 | | 6.83 | | 7/25/31 | | | | 239,003 |

137,971 | | 7.80 | | 6/25/26 | | 1 | | 137,876 |

| | | | | | | | |

| | | | | | | | 3,168,094 |

| | | | | | | | |

Total Asset-Backed Securities

(cost: $10,155,642) | | | | 10,435,854 |

| | | | | | | | |

Put Options Purchased 10 - 0.0% | | | | |

1,000 | | U.S. Treasury 5 Year Future

Put Options: $117 strike

May 2011 expiration | | | | |

Total Put Options Purchased

(cost: $629,980) | | | | 648,438 |

| | | | | | | | |

| | | |

Short-Term Securities - 10.3% | | | | | | |

17,250,098 | | Dreyfus Gov’t Cash Mgmt. Fund, 0.004% | | 17,250,098 |

10,000,000 | | FHLB, A.D.N. 0.05%, 4/1/11 6 | | | | 10,000,000 |

5,000,000 | | FHLB, A.D.N. 0.05%, 4/4/11 6 | | | | 4,999,979 |

6,600,000 | | FHLB, A.D.N. 0.05%, 4/5/11 6 | | | | 6,599,963 |

10,000,000 | | FHLB, A.D.N. 0.07%, 4/6/11 6 | | | | 9,999,903 |

10,000,000 | | FHLB, A.D.N. 0.07%, 4/8/11 6 | | | | 9,999,864 |

6,000,000 | | FHLB, A.D.N. 0.08%, 4/13/11 6 | | | | 5,999,840 |

3,350,000 | | FHLMC, A.D.N. 0.07%, 4/4/11 6 | | | | 3,349,980 |

1,000,000 | | FHLMC, A.D.N. 0.07%, 4/5/11 6 | | | | 999,992 |

10,000,000 | | U.S. Treasury Bill, 0.02%, 4/14/11 6 | | | | 9,999,930 |

20,000,000 | | U.S. Treasury Bill, 0.04%, 4/28/11 6 | | | | 19,999,392 |

| | | | | | | | |

| | | | | |

Quantity/ Contracts | | Coupon Rate (%) | | Maturity Date | | | | Fair Value ($) |

| | | |

10,000,000 | | U.S. Treasury Bill, 0.14%, 4/28/11 6 | | | | 9,999,186 |

| | | | | | | | |

| | |

Total Short-Term Securities

(cost: $109,197,873) | | | | 109,198,127 |

| | | | | | | | |

Total Investments in Securities - 100.5%

(cost: $1,035,412,123) | | | | 1,062,961,267 |

| | | | | | | | |

| | |

Call Options Written 10 - 0.0% | | | | |

750 | | U.S. Treasury 2 Year Future

Call Options: $109.25 strike

May 2011 expiration | | | | |

Total Call Options Written

(premiums received: $300,953) | | | | (105,470) |

| | | | | | | | |

| | |

Other Assets and Liabilities, net - (0.5%) | | | | (5,701,975) |

| | | | | | | | |

| | | |

Total Net Assets - 100.0% | | | | | | $1,057,153,822 |

| | | | | | | | |

| 1 | Variable rate security. Rate disclosed is as of March 31, 2011. |

| 6 | Zero coupon security. Rate disclosed is the effective yield on purchase date. |

| 10 | The amount of $2,700,000 in cash was segregated with the broker to cover put options purchased and call options written as of March 31, 2011. |

Numeric footnotes not disclosed are not applicable to this Schedule of Investments.

| | |

See accompanying notes to financial statements. | | |

8 | | SIT MUTUAL FUNDS ANNUAL REPORT |

For a complete list of security holdings refer to our company website at www.sitfunds.com.

A summary of the inputs used to value the Fund’s net assets as of March 31, 2011 is as follows (see note 2 - significant accounting policies in the notes to financial statements):

| | | | | | | | | | | | | | | | |

| | | Investment in Securities | |

| | | Level 1

Quoted

Price ($) | | | Level 2

Other significant

observable inputs ($) | | | Level 3 Significant

unobservable inputs ($) | | | Total ($) | |

Assets | | | | | | | | | | | | | | | | |

Collateralized Mortgage Obligations | | | — | | | | 357,028,150 | | | | — | | | | 357,028,150 | |

Mortgage Pass-Through Securities | | | — | | | | 585,650,698 | | | | — | | | | 585,650,698 | |

Asset-Backed Securities | | | — | | | | 10,435,854 | | | | — | | | | 10,435,854 | |

Short-Term Securities | | | 17,250,098 | | | | 91,948,029 | | | | — | | | | 109,198,127 | |

Put Options Purchased | | | 648,438 | | | | — | | | | — | | | | 648,438 | |

| | | 17,898,536 | | | | 1,045,062,731 | | | | — | | | | 1,062,961,267 | |

Liabilities | | | | | | | | | | | | | | | | |

Call Options Written | | | (105,470 | ) | | | — | | | | — | | | | (105,470 | ) |

| | |

See accompanying notes to financial statements. | | |

MARCH 31, 2011 | | 9 |

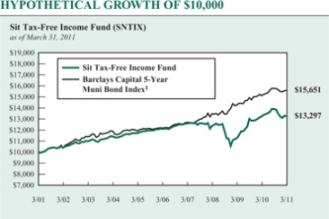

OBJECTIVE & STRATEGY

The objective of the Tax-Free Income Fund is to provide a high level of current income that is exempt from federal income tax, consistent with preservation of capital, by investing primarily in investment-grade municipal securities.

Such municipal securities generate interest income that is exempt from both federal regular income tax and federal alternative minimum tax. During normal market conditions, the Fund invests 100% of its net assets in such tax-exempt municipal securities.

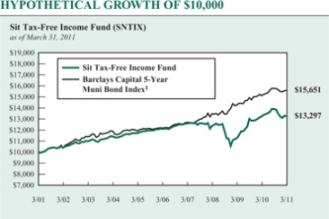

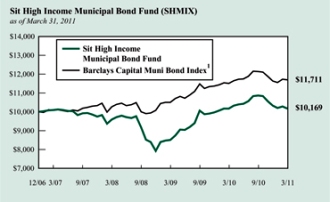

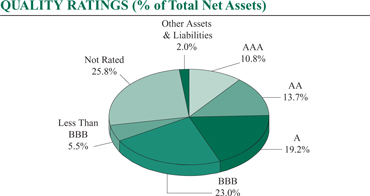

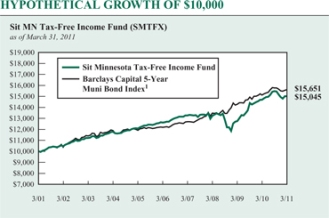

The Sit Tax-Free Income Fund provided a return of +0.26% for the fiscal year ended March 31, 2011, compared to a return of +3.25% for the Barclays Capital 5-Year Municipal Bond Index. The Fund’s 30 day SEC yield was 5.76% as of March 31, 2011.

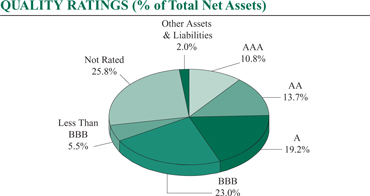

During the last 12 months, tax-exempt yield levels were stable for maturities of four years or less, but rose on longer maturities. Yields on five-year maturity bonds increased by 0.10%, while the longest maturity yields rose by 0.63%. Yields rose across all bond rating categories of the Barclays Municipal Index, with a smaller increase of 0.29% for AAA-rated bonds compared to a 0.58% rise for A-rated bonds and a 0.66% rise for Baa-rated issues. The larger rise in yields for lower rated bonds reflected fears of higher possible levels of municipal defaults forecasted by several prominent analysts in the fourth quarter of 2010. While we expect there will be some municipal defaults in 2011, we do not expect a substantial increase in the number of defaults compared to prior years. Furthermore, we believe that the increase in defaults is more likely to occur among general obligation bonds than revenue bonds, with the latter improving in quality as the economy continues to recover.

The Fund’s underperformance over the past twelve months was primarily attributable to market value declines for A-rated bonds and longer duration holdings. The five largest sectors in which the Fund invests each account for more than 10% of the Fund’s investments; while all of those sectors underperformed the Barclay’s 5-Year Municipal Bond Index, only the Multi-Family sector underperformed by more than 2%. The credit quality of the Fund’s investments improved modestly compared to a year ago, as non-rated holdings were reduced by more than 5%, and all four investment grades had higher weightings than a year earlier. The Fund is highly diversified with over 300 security holdings across 44 states and two territories as of March 31, 2011. The Fund’s average duration of 6.4 years was longer than the Barclays Capital Municipal 5-Year Bond Index’s duration, which negatively affected the Fund’s relative return.

Looking forward, we expect yield spreads for A and BBB issues as well as non-rated bonds to narrow over the coming year from their current historically wide levels. We expect state and local governments to make substantial progress in balancing their budgets

The chart above illustrates the total value of a hypothetical $10,000 investment in the Fund over the past 10 years (or for the life of the Fund if shorter) as compared to the performance of the Barclays Capital 5-Year Municipal Bond Index. Past performance does not guarantee future results. Returns include the reinvestment of distributions. The chart does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

1 The Barclays Capital 5-Year Municipal Bond Index is the 5 year (4-6) component of the Municipal Bond Index, an unmanaged, rules-based, market-value-weighted index for the long-term tax-exempt bond market. The index includes bonds with a minimum credit rating of BBB. The returns include the reinvestment of income and do not include any transaction costs, management fees or other costs. It is not possible to invest directly in an index.

as they cut expenditures and see improved revenue streams as the economy continues to grow at a moderate pace of +2.5% to +3%. We also believe the Fund’s 5.76% 30-day SEC yield represents attractive value in this low inflation environment.

Michael C. Brilley

Debra A. Sit, CFA

Paul J. Jungquist, CFA

Senior Portfolio Managers

| | |

| | | |

10 | | SIT MUTUAL FUNDS ANNUAL REPORT |

COMPARATIVE RATES OF RETURNS

| | | | | | |

| as of March 31, 2011 |

| | | Sit

Tax-Free

Income

Fund | | Barclays

Capital

5-Year Muni

Bond Index1 | | Lipper

General

Muni. Bond

Fund Index2 |

One Year | | 0.26% | | 3.25% | | 0.12% |

Five Years | | 1.85 | | 5.13 | | 2.95 |

Ten Years | | 2.89 | | 4.58 | | 3.89 |

Since Inception (9/29/88) | | 5.03 | | 5.70 | | 5.66 |

| | | | | | | |

Performance figures are historical and do not guarantee future results. Investment returns and principal value will vary, and you may have a gain or loss when you sell shares. Current performance may be lower or higher than the performance data quoted. Contact the Fund for performance data current to the most recent month-end. Returns include changes in share price as well as reinvestment of all dividends and capital gains and all fee waivers. Without the fee waivers total return and yield figures would have been lower. Returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Management fees and administrative expenses are included in the Fund’s performance. Returns for periods greater than one year are compounded average annual rates of return.

1 The Barclays Capital 5-Year Municipal Bond Index is the 5 year (4-6) component of the Municipal Bond Index, an unmanaged, rules-based, market-value-weighted index for the long-term tax-exempt bond market. The index includes bonds with a minimum credit rating of BBB. The returns include the reinvestment of income and do not include any transaction costs, management fees or other costs. It is not possible to invest directly in an index.

2 The Lipper returns are obtained from Lipper Analytical Services, Inc., a large independent evaluator of mutual funds.

FUND DIVERSIFICATION

| | | | |

Other Revenue | | | 17.5% | |

Hospital/Health Care | | | 15.6% | |

Education/Student Loan | | | 14.0% | |

Single Family Mortgage | | | 11.9% | |

Multifamily Mortgage | | | 11.1% | |

Closed-End Mutual Funds | | | 6.9% | |

Sectors less than 5% | | | 21.0% | |

Cash & Other Net Assets | | | 2.0% | |

| | | | | |

Based on total net assets as of March 31, 2011. Subject to change.

PORTFOLIO SUMMARY

| | | | |

Net Asset Value 3/31/11: | | $8.52 Per Share | | |

Net Asset Value 3/31/10: | | $8.90 Per Share | | |

Total Net Assets: | | $140.4 Million | | |

30-day SEC Yield 3: | | 5.76% | | |

Tax Equivalent Yield 4: | | 8.86% | | |

12-month Distribution Rate 3: | | 4.63% | | |

Average Maturity: | | 16.1 Years | | |

Effective Duration 5: | | 6.4 Years | | |

3 The SEC Yield reflects the rate at which the Fund is earning income on its current portfolio of securities, while the distribution rate reflects the Fund’s past dividends paid to shareholders based on the net investment income distributed and the average NAV during the past 12 months. Accordingly, the Fund’s SEC yield and distribution rate may differ.

4 The tax-equivalent yield is based on an assumed tax rate of 35.0%.

5 Duration is a measure of estimated price sensitivity relative to changes in interest rates. Portfolios with longer durations are typically more sensitive to changes in interest rates. For example, if interest rates rise by 1%, the market value of a security with an effective duration of 5 years would decrease by 5%, with all other factors being constant. The correlation between duration and price sensitivity is greater for securities rated investment-grade than it is for securities rated below investment-grade. Duration estimates are based on assumptions by the Adviser and are subject to a number of limitations. Effective duration is calculated based on historical price changes of securities held by the Fund, and therefore is a more accurate estimate of price sensitivity provided interest rates remain within their historical range.

Lower of Moody’s, S&P, Fitch or Duff & Phelps ratings used.

Adviser’s Assessment of Non-Rated Securities:

| | | | |

AAA | | | 0.5% | |

AA | | | 2.0 | |

A | | | 0.5 | |

BBB | | | 6.4 | |

BB | | | 11.2 | |

<BB | | | 5.2 | |

| | | | |

Total | | | 25.8% | |

SCHEDULE OF INVESTMENTS

March 31, 2011

Sit Tax-Free Income Fund

| | | | | | | | | | | | | | | | |

Principal

Amount ($) | | | Name of Issuer | | Coupon

Rate (%) | | | Maturity

Date | | | Fair Value ($) | |

| | Municipal Bonds - 91.1% | | | | | | | | | | | | |

| Alabama - 0.4% | | | | | | | | | | | | |

| | 380,000 | | | ASMS Public Education Building Rev. (ASMSF LLC Proj.) (AMBAC Insured) 9 | | | 4.38 | | | | 9/1/26 | | | | 360,707 | |

| | 215,000 | | | Birmingham-Southern College Private Education Building Rev. | | | 5.35 | | | | 12/1/19 | | | | 167,780 | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | 528,487 | |

| | | | | | | | | | | | | | | | |

| Alaska - 0.3% | | | | | | | | | | | | |

| | 500,000 | | | AK Hsg. Finance Corp. Mtg. Rev. (GO of Corp. Insured) | | | 4.50 | | | | 12/1/35 | | | | 461,425 | |

| | | | | | | | | | | | | | | | |

| Arizona - 2.9% | | | | | | | | | | | | |

| | 1,049,893 | | | AZ Health Facs. Auth. Rev. (New Arizona Family Proj.) | | | 5.25 | | | | 7/1/27 | | | | 842,833 | |

| | 250,000 | | | Festival Ranch Community Facs. District G.O. | | | 6.25 | | | | 7/15/24 | | | | 246,758 | |

| | 225,000 | | | Flagstaff Industrial Dev. Auth. Rev. (Sr. Living Community Proj.) | | | 5.50 | | | | 7/1/22 | | | | 198,194 | |

| | 495,000 | | | Pima Co. Industrial Dev. Auth. Education Rev. (AZ Charter Schools Proj.) | | | 5.00 | | | | 7/1/26 | | | | 390,857 | |

| | 450,000 | | | Pima Co. Industrial Dev. Auth. Education Rev. (Center For Academic Success Proj.) 4 | | | 5.38 | | | | 7/1/22 | | | | 397,822 | |

| | 490,000 | | | Pima Co. Industrial Dev. Auth. Education Rev. (Choice Education & Dev. Corp. Proj.) | | | 6.00 | | | | 6/1/16 | | | | 473,105 | |

| | 250,000 | | | Pima Co. Industrial Dev. Auth. Education Rev. (Coral Academy Science Proj.) | | | 6.38 | | | | 12/1/18 | | | | 244,140 | |

| | 250,000 | | | Pima Co. Industrial Dev. Auth. Education Rev. (Noah Webster Basic School Proj.) | | | 5.25 | | | | 12/15/16 | | | | 246,712 | |

| | 400,000 | | | Pima Co. Industrial Dev. Auth. Education Rev. (Tucson Country Day School Proj.) | | | 5.00 | | | | 6/1/22 | | | | 342,016 | |

| | 500,000 | | | Quail Creek Community Facs. District G.O. | | | 5.15 | | | | 7/15/16 | | | | 480,410 | |

| | 150,000 | | | Westpark Community Facs. District G.O. | | | 4.90 | | | | 7/15/16 | | | | 142,824 | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | 4,005,671 | |

| | | | | | | | | | | | | | | | |

| California - 10.5% | | | | | | | | | | | | |

| | 500,000 | | | Agua Caliente Band of Cahuilla Indians Rev. 4 | | | 6.00 | | | | 7/1/18 | | | | 471,475 | |

| | 250,000 | | | Alameda Corridor Transportation Auth. Rev. Capital Appreciation (AMBAC Insured) 6 | | | 6.71 | | | | 10/1/24 | | | | 201,903 | |

| | 250,000 | | | Alameda Corridor Transportation Auth. Rev. Sr. Lien (NATL-RE Insured) | | | 5.25 | | | | 10/1/21 | | | | 241,392 | |

| | 340,000 | | | CA Co. Tobacco Securitization Agy. Rev. (Golden Gate Tobacco Proj.) | | | 4.50 | | | | 6/1/21 | | | | 285,012 | |

| | 500,000 | | | CA Co. Tobacco Securitization Agy. Rev. (Golden Gate Tobacco Proj.) | | | 5.00 | | | | 6/1/36 | | | | 331,415 | |

| | 350,000 | | | CA Community Hsg. Fin. Agy. Lease Rev. Pass Thru Obligation | | | 4.85 | | | | 11/1/12 | | | | 171,728 | |

| | 600,000 | | | CA Finance Auth. Education Rev. (American Heritage Education Foundation Proj.) | | | 5.25 | | | | 6/1/26 | | | | 490,146 | |

| | 250,000 | | | CA Finance Auth. Rev. (Kern Regional Center Proj.) 9 | | | 6.88 | | | | 5/1/25 | | | | 257,910 | |

| | 250,000 | | | CA Finance Auth. Rev. (Literacy First Proj.) | | | 5.50 | | | | 9/1/22 | | | | 226,122 | |

| | 495,000 | | | CA Govt. Finance Auth. Lease Rev. (Placer Co. Transportation Proj.) | | | 6.00 | | | | 12/1/28 | | | | 495,554 | |

| | 250,000 | | | CA Hsg. Finance Agy. Home Mtg. Rev. | | | 5.20 | | | | 8/1/28 | | | | 242,130 | |

| | 250,000 | | | CA Hsg. Finance Agy. Home Mtg. Rev. | | | 5.50 | | | | 8/1/38 | | | | 230,145 | |

| | 500,000 | | | CA Infrastructure & Economic Dev. Bank Rev. | | | 6.00 | | | | 2/1/30 | | | | 515,100 | |

| | 500,000 | | | CA School Facs. Finance Auth. Rev. (Azusa Unified School District) (AGM Insured) 6 | | | 6.00 | | | | 8/1/29 | | | | 348,720 | |

| | 580,000 | | | CA Statewide Communities Dev. Auth. Multifamily Rev. (Orange Tree Proj.) (GNMA Collateral) | | | 6.15 | | | | 11/20/36 | | | | 650,435 | |

| | 500,000 | | | CA Statewide Communities Dev. Auth. Rev. (Lancer Education Student Hsg. Proj.) | | | 5.40 | | | | 6/1/17 | | | | 481,690 | |

| | 350,000 | | | CA Statewide Communities Dev. Auth. Rev. (Sunedison Huntington Beach Solar Proj.) | | | 6.00 | | | | 1/1/21 | | | | 342,968 | |

| | 510,000 | | | CA Statewide Communities Dev. Auth. Rev. (Sunedison Irvine School District) | | | 5.25 | | | | 1/1/16 | | | | 503,222 | |

| | 250,000 | | | CA Statewide Communities Dev. Auth. School Facs. Rev. (Aspire Public Schools) | | | 5.00 | | | | 7/1/20 | | | | 233,942 | |

| | 450,000 | | | CA Statewide Communities Dev. Auth. Special Tax (Orinda Proj.) | | | 6.00 | | | | 9/1/29 | | | | 373,784 | |

| | 1,000,000 | | | Colton Joint Unified School District (AGM Insured) 6 | | | 5.80 | | | | 8/1/35 | | | | 431,600 | |

| | 500,000 | | | Hartnell Community College G.O. 6 | | | 7.00 | | | | 8/1/34 | | | | 236,295 | |

| | 500,000 | | | Hawthorne School District C.O.P. (AGM Insured) 6 | | | 6.00 | | | | 12/1/29 | | | | 383,230 | |

| | 250,000 | | | Imperial Community College District G.O. Capital Appreciation (AGM Insured) 6 | | | 0.97 | | | | 8/1/40 | | | | 188,573 | |

| | 500,000 | | | Lemon Grove Community Dev. Agency Tax Allocation (Redev. Proj.) | | | 5.15 | | | | 8/1/25 | | | | 441,455 | |

| | 215,000 | | | Lindsay-Strathmore Irrigation District C.O.P. 9 | | | 4.50 | | | | 8/1/30 | | | | 176,876 | |

| | 250,000 | | | Los Angeles Unified School District C.O.P. (Administration Building Proj.) (AMBAC Insured) 9 | | | 5.00 | | | | 10/1/31 | | | | 219,130 | |

| | 560,000 | | | Manteca Unified School District Capital Appreciation C.O.P. (NATL-RE Insured) 6 | | | 7.55 | | | | 9/15/25 | | | | 199,360 | |

| | 250,000 | | | Marina Coast Water District Rev. | | | 5.00 | | | | 6/1/20 | | | | 249,582 | |

| | |

See accompanying notes to financial statements. | | |

12 | | SIT MUTUAL FUNDS ANNUAL REPORT |

| | | | | | | | | | | | | | |

Principal

Amount ($) | | | Name of Issuer | | Coupon

Rate (%) | | Maturity

Date | | | Fair Value ($) | |

| | 500,000 | | | Northern CA Gas Auth. No. 1 Rev. 1 | | 0.92 | | | 7/1/27 | | | | 352,395 | |

| | 650,000 | | | Poway Unified School District (AMBAC Insured) | | 5.00 | | | 9/15/31 | | | | 576,778 | |

| | 600,000 | | | Redondo Beach School District G.O. 6 | | 6.38 | | | 8/1/34 | | | | 427,644 | |

| | 500,000 | | | Richmond Community Redev. Agy. Tax Allocation | | 6.00 | | | 9/1/30 | | | | 486,020 | |

| | 500,000 | | | Riverside Co. Redev. Agy. Tax Allocation (Interstate 215 Corridor) | | 6.00 | | | 10/1/25 | | | | 475,850 | |

| | 500,000 | | | Sacramento Co. Water Financing Auth. Rev. (NATL-RE FGIC Insured) 1 | | 0.78 | | | 6/1/39 | | | | 302,160 | |

| | 1,000,000 | | | San Bernardino City Unified School District G.O. Capital Appreciation (NATL-RE Insured) 6 | | 4.72 | | | 8/1/29 | | | | 267,900 | |

| | 250,000 | | | San Joaquin Hills Toll Road Rev. Ref. (NATL-RE Insured) | | 5.25 | | | 1/15/30 | | | | 178,963 | |

| | 385,000 | | | Santa Rosa Rancheria Tachi Yokut Tribe Enterprise Rev. 4 | | 4.88 | | | 3/1/16 | | | | 350,612 | |

| | 350,000 | | | Southwest Community Finance Auth. Rev. (Riverside Co. Proj.) 9 | | 6.00 | | | 5/1/24 | | | | 367,602 | |

| | 500,000 | | | Tustin Unified School District G.O. Capital Appreciation 6 | | 6.05 | | | 8/1/28 | | | | 291,675 | |

| | 400,000 | | | Upland C.O.P. (San Antonio Community Hospital Proj.) | | 6.38 | | | 1/1/32 | | | | 397,900 | |

| | 500,000 | | | Val Verde Unified School District G.O. Capital Appreciation (AGM Insured) 6 | | 6.13 | | | 8/1/34 | | | | 225,805 | |

| | 250,000 | | | Vallejo City Unified School District Special Tax (Community Facilities District No. 2) (XLCA Insured) | | 4.15 | | | 9/1/31 | | | | 162,963 | |

| | 500,000 | | | Westminster School District G.O. 6 | | 5.37 | | | 8/1/24 | | | | 214,805 | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | 14,699,966 | |

| | | | | | | | | | | | | | |

| Colorado - 3.6% | | | | | | | | | | |

| | 250,000 | | | CO Education & Cultural Facs. Auth. Rev. (CO Springs Charter Academy Proj.) | | 5.60 | | | 7/1/34 | | | | 225,110 | |

| | 500,000 | | | CO Education & Cultural Facs. Auth. Rev. Ref. (Vail Mountain School Proj.) | | 6.00 | | | 5/1/30 | | | | 466,650 | |

| | 425,000 | | | CO Hsg. Finance Auth. Single Family Mtg. Rev. | | 5.50 | | | 11/1/29 | | | | 432,892 | |

| | 625,000 | | | CO Hsg. Finance Auth. Single Family Mtg. Rev. (FHA Insured) | | 5.00 | | | 11/1/34 | | | | 627,569 | |

| | 1,000,000 | | | Compark Business Campus Metro District G.O. (Radian Insured) | | 5.75 | | | 12/1/27 | | | | 812,880 | |

| | 965,000 | | | Denver Health & Hospital Auth. Healthcare Rev. 1 | | 1.31 | | | 12/1/33 | | | | 628,659 | |

| | 500,000 | | | Kremmling Memorial Hospital District C.O.P. | | 6.00 | | | 12/1/22 | | | | 471,920 | |

| | 654,593 | | | Lyons Rev. (Longmont Humane Society Proj.) | | 4.75 | | | 11/30/16 | | | | 591,379 | |

| | 500,000 | | | Regional Transportation District Private Activity Rev. (Denver Trans. Partners) | | 6.00 | | | 1/15/34 | | | | 459,880 | |

| | 350,000 | | | University of Colorado Hospital Auth. (AMBAC Insured) | | 5.00 | | | 11/15/29 | | | | 315,766 | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | 5,032,705 | |

| | | | | | | | | | | | | | |

| Connecticut - 1.4% | | | | | | | | | | |

| | 100,000 | | | CT Dev. Auth. First Mtg. Gross Rev. (Church Homes, Inc.) | | 5.70 | | | 4/1/12 | | | | 100,161 | |

| | 300,000 | | | CT Hsg. Finance Auth. Rev. | | 5.15 | | | 11/15/34 | | | | 299,169 | |

| | 500,000 | | | CT Hsg. Finance Auth. Rev. (GO of Auth.) | | 4.75 | | | 11/15/35 | | | | 467,610 | |

| | 500,000 | | | Hamden Facs. Rev. (Whitney Center Proj.) | | 6.13 | | | 1/1/14 | | | | 501,170 | |

| | 500,000 | | | Harbor Point Infrastructure Improvement District Special Obligation Rev. Tax Allocation | | 7.00 | | | 4/1/22 | | | | 510,695 | |

| | 300,000 | | | Mashantucket Western Pequot Tribe Sub. Special Rev. 2, 4, 5 | | 5.75 | | | 9/1/18 | | | | 113,970 | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | 1,992,775 | |

| | | | | | | | | | | | | | |

| Delaware - 0.2% | | | | | | | | | | |

| | 500,000 | | | Millsboro Special Obligation Rev. (Plantation Lakes Dev. District) | | 5.45 | | | 7/1/36 | | | | 331,585 | |

| | | | | | | | | | | | | | |

| Florida - 6.1% | | | | | | | | | | |

| | 500,000 | | | Bay Co. Educational Facs. Rev. (Bay Haven Charter) | | 5.25 | | | 9/1/30 | | | | 384,615 | |

| | 1,000,000 | | | Capital Trust Agy. Rev. (American Opportunity Proj.) | | 5.88 | | | 6/1/38 | | | | 319,750 | |

| | 335,000 | | | Capital Trust Agy. Rev. (Golf Villas, Rivermill, and Village Square Apartments Proj.) | | 4.75 | | | 6/1/13 | | | | 107,116 | |

| | 415,000 | | | Collier County Industrial Dev. Auth. Rev. (NCH Healthcare System Proj.) | | 6.25 | | | 10/1/39 | | | | 407,957 | |

| | 400,000 | | | Connerton West Community Dev. District Cap. Improvement Special Assessment Rev. (Pasco Co.) 2, 5 | | 5.13 | | | 5/1/16 | | | | 159,880 | |

| | 100,000 | | | Fiddlers Creek Community Dev. District No. 2 Special Assessment Rev. 2, 5 | | 5.75 | | | 5/1/13 | | | | 31,880 | |

| | 250,000 | | | Florida Gulf Coast University Fin. Corp. Rev. (Hsg. Acquisition Proj.) | | 5.00 | | | 2/1/31 | | | | 232,152 | |

| | 250,000 | | | Florida Higher Educational Facs. Fin. Auth. Rev. (Bethune-Cookman University) | | 5.38 | | | 7/1/32 | | | | 240,635 | |

| | 300,000 | | | Florida Hsg. Finance Corp. (FHLMC Collateralized) | | 5.05 | | | 1/1/27 | | | | 299,460 | |

| | 250,000 | | | Florida Hsg. Finance Corp. (GNMA/FNMA Collateralized) | | 5.00 | | | 7/1/26 | | | | 253,122 | |

| | 40,000 | | | Forest Creek Community Dev. District Capital Improvement Special Assessment Rev. 2, 5 | | 7.00 | | | 11/1/13 | | | | 38,431 | |

| | |

See accompanying notes to financial statements. | | |

MARCH 31, 2011 | | 13 |

SCHEDULE OF INVESTMENTS

March 31, 2011

Sit Tax-Free Income Fund (Continued)

| | | | | | | | | | | | | | | | |

Principal

Amount ($) | | | Name of Issuer | | Coupon

Rate (%) | | | Maturity

Date | | | Fair

Value ($) | |

| | 250,000 | | | Gramercy Farms Community Dev. District Special Assessment 2, 5 | | | 5.10 | | | | 5/1/14 | | | | 109,600 | |

| | 80,000 | | | Highlands Co. Health Facs. Auth. Rev. (Adventist Health) | | | 5.00 | | | | 11/15/30 | | | | 74,503 | |

| | 500,000 | | | Highlands Co. Health Facs. Auth. Rev. (Adventist Health) 1 | | | 5.00 | | | | 11/15/31 | | | | 461,250 | |

| | 445,000 | | | Jacksonville Economic Dev. Commission Health Care Facs. Rev. Ref. | | | 6.00 | | | | 9/1/17 | | | | 442,873 | |

| | 500,000 | | | Lake Ashton Community Dev. District Cap. Improvement Special Assessment Rev. 2, 5 | | | 5.00 | | | | 11/1/11 | | | | 179,500 | |

| | 1,000,000 | | | Lee Co. Industrial Dev. Auth. Health Care Facs. Rev. (Lee Charter Foundation) | | | 5.25 | | | | 6/15/27 | | | | 802,060 | |

| | 250,000 | | | Magnolia Creek Community Dev. District Rev. 2, 5 | | | 5.60 | | | | 5/1/14 | | | | 119,825 | |

| | 265,000 | | | Miami-Dade Co. Special Obligation (NATL-RE Insured) 6 | | | 5.44 | | | | 10/1/33 | | | | 50,119 | |

| | 250,000 | | | Naples Hospital Rev. (Naples Community Hospital, Inc. Proj.) (NATL-RE Insured) | | | 5.50 | | | | 10/1/26 | | | | 238,648 | |

| | 230,000 | | | New River Community Dev. District Cap. Improvement Special Assessment Rev. 2, 5 | | | 5.00 | | | | 5/1/13 | | | | 2 | |

| | 135,000 | | | New River Community Dev. District Cap. Improvement Special Assessment Rev. 6 | | | 1.96 | | | | 5/1/15 | | | | 108,340 | |

| | 275,000 | | | New River Community Dev. District Cap. Improvement Special Assessment Rev. 6 | | | 1.85 | | | | 5/1/18 | | | | 107,330 | |

| | 140,000 | | | New River Community Dev. District Cap. Improvement Special Assessment Rev. 6 | | | 0.40 | | | | 5/1/38 | | | | 78,072 | |

| | 350,000 | | | New River Community Dev. District Cap. Improvement Special Assessment Rev. 6 | | | 0.80 | | | | 5/1/38 | | | | 122,017 | |

| | 10,000 | | | Parklands Lee Community Dev. District Special Assessment 2, 5 | | | 5.13 | | | | 5/1/11 | | | | 4,943 | |

| | 750,000 | | | Riverwood Estates Community Dev. District Special Assessment 2, 5 | | | 5.00 | | | | 5/1/13 | | | | 128,625 | |

| | 750,000 | | | Sarasota Co. Health Facs. Auth. Retirement Rev. Ref. (Village on the Isle) | | | 5.50 | | | | 1/1/27 | | | | 648,075 | |

| | 500,000 | | | Seminole Tribe Special Obligation Rev. 4 | | | 5.50 | | | | 10/1/24 | | | | 439,830 | |

| | 600,000 | | | Tallahassee Health Facs. Rev. (Memorial Health Care Proj.) | | | 6.38 | | | | 12/1/30 | | | | 592,326 | |

| | 750,000 | | | Tolomato Community Dev. District Special Assessment 2, 5 | | | 6.38 | | | | 5/1/17 | | | | 562,605 | |

| | 650,000 | | | Waters Edge Community Dev. District Cap. Improvement Special Assessment Rev. 2, 5 | | | 5.00 | | | | 11/1/12 | | | | 285,545 | |

| | 500,000 | | | Waterset North Community Dev. District Special Assessment Rev. 2, 5 | | | 6.55 | | | | 11/1/15 | | | | 305,340 | |

| | 50,000 | | | West Villages Improvement District Special Assessment Rev. (Unit of Dev. No. 3) 2, 5 | | | 5.50 | | | | 5/1/37 | | | | 22,055 | |

| | 450,000 | | | Zephyr Ridge Community Dev. District Special Assessment Rev. 2, 5 | | | 5.25 | | | | 5/1/13 | | | | 178,335 | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | 8,536,816 | |

| | | | | | | | | | | | | | | | |

| Georgia - 2.2% | | | | | | | | | | | | |

| | 250,000 | | | Atlanta Airport General Rev. Ref. (NATL-RE FGIC Insured) | | | 5.75 | | | | 1/1/20 | | | | 252,080 | |

| | 1,355,000 | | | East Point Tax Allocation | | | 8.00 | | | | 2/1/26 | | | | 1,357,805 | |

| | 225,000 | | | Gainesville & Hall Co. Development Auth. Rev. | | | 6.38 | | | | 11/15/29 | | | | 226,534 | |

| | 300,000 | | | Georgia State Environmental Loan Acquisition Corp. Rev. | | | 5.13 | | | | 2/15/31 | | | | 301,947 | |

| | 750,000 | | | Georgia State Environmental Loan Acquisition Corp. Rev. | | | 5.13 | | | | 3/15/31 | | | | 743,025 | |

| | 250,000 | | | Medical Center Hospital Auth. Rev. Ref. (Spring Harbor Green Island Proj.) | | | 5.25 | | | | 7/1/27 | | | | 204,128 | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | 3,085,519 | |

| | | | | | | | | | | | | | | | |

| Guam - 0.3% | | | | | | | | | | | | |

| | 450,000 | | | Northern Mariana Islands Commonwealth G.O. | | | 5.00 | | | | 10/1/22 | | | | 366,309 | |

| | | | | | | | | | | | | | | | |

| Idaho - 0.7% | | | | | | | | | | | | |

| | 320,000 | | | ID Hsg. & Fin. Assoc. Nonprofit Facs. Rev. (Compass Public Charter School Proj.) | | | 5.50 | | | | 7/1/30 | | | | 257,245 | |

| | 250,000 | | | ID Hsg. & Fin. Assoc. Nonprofit Facs. Rev. (Idaho Arts Charter School Proj.) | | | 5.50 | | | | 12/1/18 | | | | 241,938 | |

| | 250,000 | | | ID Hsg. & Fin. Assoc. Nonprofit Facs. Rev. (Liberty Charter School Proj.) | | | 5.50 | | | | 6/1/21 | | | | 233,880 | |

| | 250,000 | | | ID Hsg. & Fin. Assoc. Nonprofit Facs. Rev. (Victory Charter School Proj.) | | | 5.63 | | | | 7/1/21 | | | | 230,620 | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | 963,683 | |

| | | | | | | | | | | | | | | | |

| Illinois - 8.0% | | | | | | | | | | | | |

| | 10,000 | | | Chicago Metro Hsg. Dev. Corp. Mtg. Rev. Ref. (Section 8) (FHA Insured) | | | 6.85 | | | | 7/1/22 | | | | 10,016 | |

| | 500,000 | | | Harvey Ref. & Improvement G.O. | | | 5.50 | | | | 12/1/27 | | | | 390,575 | |

| | 500,000 | | | IL Dev. Ref. Auth. Rev. Ref. (Chicago Charter School Foundation Proj.) | | | 5.00 | | | | 12/1/36 | | | | 391,890 | |

| | 250,000 | | | IL Fin. Auth. Rev. | | | 6.00 | | | | 10/1/24 | | | | 244,580 | |

| | 250,000 | | | IL Fin. Auth. Rev. (DePaul University) | | | 6.00 | | | | 10/1/32 | | | | 252,245 | |

| | 250,000 | | | IL Fin. Auth. Rev. (Local Government PG-Metro. Proj.) | | | 5.00 | | | | 12/1/24 | | | | 235,105 | |

| | 500,000 | | | IL Fin. Auth. Rev. (Luther Hillside Village Proj.) | | | 5.25 | | | | 2/1/37 | | | | 412,520 | |

| | |

See accompanying notes to financial statements. | | |

14 | | SIT MUTUAL FUNDS ANNUAL REPORT |

| | | | | | | | | | | | | | | | |

Principal

Amount ($) | | | Name of Issuer | | Coupon

Rate (%) | | | Maturity

Date | | | Fair Value ($) | |

| | 395,000 | | | IL Fin. Auth. Rev. (TEMPS-50-The Admiral at the Lake Proj.) | | | 6.00 | | | | 5/15/17 | | | | 383,379 | |

| | 1,000,000 | | | IL Fin. Auth. Sports Facs. Rev. (North Shore Ice Arena Proj.) | | | 6.25 | | | | 12/1/38 | | | | 697,160 | |

| | 500,000 | | | IL Fin. Auth. Sports Facs. Rev. (United Sports Organizations of Barrington Proj.) 2, 4, 5 | | | 6.13 | | | | 10/1/27 | | | | 99,825 | |

| | 500,000 | | | IL Fin. Auth. Sports Facs. Rev. (United Sports Organizations of Barrington Proj.) 2, 4, 5 | | | 6.25 | | | | 10/1/37 | | | | 99,540 | |

| | 210,000 | | | IL Health Facs. Auth. Rev. (Ingalls Health System Proj.) (NATL-RE Insured) | | | 6.25 | | | | 5/15/14 | | | | 207,154 | |

| | 250,000 | | | Lake County Community Consolidated School District No. 50 Woodland G.O. | | | 5.63 | | | | 1/1/26 | | | | 257,542 | |

| | 115,000 | | | Lombard Public Facs. Corp. Rev. First Tier (Conference Center & Hotel Proj.) | | | 6.38 | | | | 1/1/15 | | | | 76,696 | |

| | 1,925,000 | | | Lombard Public Facs. Corp. Rev. First Tier (Conference Center & Hotel Proj.) | | | 5.25 | | | | 1/1/36 | | | | 1,303,398 | |

| | 550,000 | | | Lombard Public Facs. Corp. Rev. First Tier (Conference Center & Hotel Proj.) (ACA Insured) | | | 5.50 | | | | 1/1/25 | | | | 364,832 | |

| | 2,000,000 | | | Malta Tax Allocation Rev. | | | 5.75 | | | | 12/30/25 | | | | 1,233,580 | |

| | 818,000 | | | Manhattan Special Service Area Special Tax No. 07-6 (Groebe Farm-Stonegate) 2, 5 | | | 5.75 | | | | 3/1/22 | | | | 326,873 | |

| | 310,000 | | | Northern Illinios University Rev. (Auxiliary Facs.) (AGM Insured) | | | 5.50 | | | | 4/1/26 | | | | 314,393 | |

| | 500,000 | | | Railsplitter Tobacco Settlement Auth. Rev. | | | 6.25 | | | | 6/1/24 | | | | 499,500 | |

| | 2,475,000 | | | Southwestern IL Dev. Auth. Rev. (Anderson Hospital Proj.) | | | 5.63 | | | | 8/15/29 | | | | 2,266,778 | |

| | 445,000 | | | Southwestern IL Dev. Auth. Rev. (Village of Sauget Proj.) | | | 5.63 | | | | 11/1/26 | | | | 298,889 | |

| | 650,000 | | | Southwestern IL Dev. Auth. Tax Allocation Ref. (Local Govt. Program) | | | 7.00 | | | | 10/1/22 | | | | 597,148 | |

| | 280,000 | | | St. Clair County Township High School District No. 203 O’Fallon G.O. (AMBAC Insured) | | | 5.75 | | | | 12/1/26 | | | | 286,661 | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | 11,250,279 | |

| | | | | | | | | | | | | | | | |

| Indiana - 2.1% | | | | | | | | | | | | |

| | 220,000 | | | Crown Point Economic Dev. Rev. (Wittenberg Village Proj.) | | | 6.50 | | | | 11/15/13 | | | | 217,796 | |

| | 300,000 | | | Damon Run Conservancy Dist. G.O. (St Intercept Insured) | | | 6.10 | | | | 7/1/25 | | | | 298,836 | |

| | 100,000 | | | Elkhart Co. Hospital Auth. Rev. (Elkhart General Hospital Proj.) (AMBAC-TCRS Insured) | | | 5.25 | | | | 8/15/28 | | | | 93,091 | |

| | 400,000 | | | Hammond Public Improvement Board Rev. | | | 6.50 | | | | 8/15/25 | | | | 404,192 | |

| | 500,000 | | | IN Finance Auth. Hospital Rev. (Floyd Memorial Hospital & Health Proj.) | | | 5.13 | | | | 3/1/30 | | | | 459,365 | |

| | 250,000 | | | IN Finance Auth. Rev. (Drexel Foundation Education Facs. Proj.) | | | 6.00 | | | | 10/1/21 | | | | 240,228 | |

| | 360,000 | | | IN Health Facs. Fin. Auth. Hospital Rev. (Community Foundation Northwest IN) | | | 6.38 | | | | 8/1/21 | | | | 364,810 | |

| | 305,000 | | | IN Health Facs. Fin. Auth. Hospital Rev. (Community Hospital of Anderson Proj.) | | | 6.00 | | | | 1/1/23 | | | | 305,180 | |

| | 60,000 | | | IN Health Facs. Fin. Auth. Hospital Rev. (Community Hospital of Anderson Proj.) (NATL-RE Insured) | | | 6.00 | | | | 1/1/14 | | | | 60,148 | |

| | 400,000 | | | St. Joseph Co. Hospital Auth. Health Facs. Rev. (Madison Center) 2, 5 | | | 5.25 | | | | 2/15/28 | | | | 73,960 | |

| | 500,000 | | | Vigo Co. Hospital Auth. Rev. (Union Hospital, Inc. Proj.) 4 | | | 5.50 | | | | 9/1/27 | | | | 400,815 | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | 2,918,421 | |

| | | | | | | | | | | | | | | | |

| Iowa - 1.0% | | | | | | | | | | | | |

| | 410,000 | | | IA Finance Auth. Sr. Hsg. Rev. Ref. (Walnut Ridge Proj.) | | | 5.00 | | | | 12/1/14 | | | | 359,681 | |

| | 500,000 | | | IA Finance Auth. Sr. Living Facs. Rev. (Deerfield Retirement Community, Inc.) | | | 5.00 | | | | 11/15/21 | | | | 369,975 | |

| | 500,000 | | | IA Student Loan Liquidity Corp. Rev. | | | 5.25 | | | | 12/1/24 | | | | 496,255 | |

| | 250,000 | | | Iowa Student Loan Liquidity Corp. Rev. | | | 5.80 | | | | 12/1/31 | | | | 233,998 | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | 1,459,909 | |

| | | | | | | | | | | | | | | | |

| Kansas - 0.5% | | | | | | | | | | | | |

| | 500,000 | | | Overland Park Transportation Dev. District Sales Tax Rev. (Oak Park Mall Proj.) | | | 5.90 | | | | 4/1/32 | | | | 491,150 | |

| | 500,000 | | | Wyandotte Co. Govt. Special Obligation Rev. 6 | | | 6.07 | | | | 6/1/21 | | | | 269,005 | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | 760,155 | |

| | | | | | | | | | | | | | | | |

| Kentucky - 0.2% | | | | | | | | | | | | |

| | 350,000 | | | Kentucky Economic Development Fin. Auth. Rev. | | | 6.63 | | | | 10/1/28 | | | | 351,760 | |

| | | | | | | | | | | | | | | | |

| Louisiana - 2.8% | | | | | | | | | | | | |

| | 267,696 | | | Denham Springs/Livingston Hsg. & Mtg. Finance Auth. Rev. | | | 5.00 | | | | 11/1/40 | | | | 270,518 | |

| | 1,055,000 | | | Jefferson Parish Finance Auth. Single Family Mtg. Rev. | | | 5.00 | | | | 6/1/38 | | | | 1,036,464 | |

| | 1,680,000 | | | LA Hsg. Fin. Agy. Single Family Mtg. Rev. | | | 5.70 | | | | 12/1/38 | | | | 1,774,147 | |

| | 185,000 | | | LA Hsg. Fin. Agy. Single Family Mtg. Rev. (Home Ownership Program) | | | 6.00 | | | | 12/1/28 | | | | 192,835 | |

| | 750,000 | | | LA Public Facs. Auth. Rev. Ref. (Tulane Univ. Proj.) (NATL-RE Insured) 1 | | | 0.91 | | | | 2/15/36 | | | | 514,102 | |

| | |

See accompanying notes to financial statements. | | |

MARCH 31, 2011 | | 15 |

SCHEDULE OF INVESTMENTS

March 31, 2011

Sit Tax-Free Income Fund (Continued)

| | | | | | | | | | | | | | |

Principal Amount ($) | | Name of Issuer | | Coupon Rate (%) | | | Maturity Date | | | Fair Value ($) | |

| 114,000 | | Lafayette Public Finance Auth. Single Family Mortgage-Backed Rev. | | | 5.35 | | | | 1/1/41 | | | | 117,203 | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | 3,905,269 | |

| | | | | | | | | | | | | | |

Maine - 0.3% | | | | | | | | | | | | |

| 360,000 | | ME Education Auth. Student Loan Rev. (Assured Guaranty) | | | 5.63 | | | | 12/1/27 | | | | 363,841 | |

| | | | | | | | | | | | | | |

Maryland - 0.3% | | | | | | | | | | | | |

| 515,000 | | MD Health & Higher Education Facs. Auth. Rev. (Patterson Park School) | | | 5.75 | | | | 7/1/30 | | | | 453,854 | |

| | | | | | | | | | | | | | |

Massachusetts - 1.0% | | | | | | | | | | | | |

| 350,000 | | MA Dev. Fin. Agy. Rev. (Foxborough Regional Charter School) | | | 6.38 | | | | 7/1/30 | | | | 341,257 | |

| 110,000 | | MA Development Finance Agency Facs. Rev. | | | 6.25 | | | | 6/1/14 | | | | 107,573 | |

| 480,000 | | MA Education Finance Auth. Education Rev. | | | 5.15 | | | | 1/1/26 | | | | 481,973 | |

| 240,000 | | MA Education Finance Auth. Education Rev. | | | 5.25 | | | | 1/1/28 | | | | 236,563 | |

| 250,000 | | MA Health & Educational Facilities Auth. Rev. | | | 6.00 | | | | 7/1/22 | | | | 253,428 | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | 1,420,794 | |

| | | | | | | | | | | | | | |

Michigan - 2.5% | | | | | | | | | | | | |

| 470,000 | | Flint Hospital Building Auth. Rev. (Hurley Medical Center) | | | 6.00 | | | | 7/1/20 | | | | 436,517 | |

| 250,000 | | MI Finance Auth. Ltd. Obligation Rev. (Public School Academy-University Learning Proj.) | | | 6.25 | | | | 11/1/20 | | | | 246,450 | |

| 250,000 | | MI Hospital Finance Auth. Rev. (Mid-Michigan Obligation Group Proj.) | | | 6.13 | | | | 6/1/34 | | | | 252,290 | |

| 500,000 | | MI Hospital Finance Auth. Rev. Ref. (Mclaren Health Care Proj.) (NATL-RE-IBC Insured) | | | 5.00 | | | | 6/1/28 | | | | 459,900 | |

| 115,000 | | MI Public Education Facs. Auth. Ltd. Rev. Ref. (Black River School Proj.) | | | 5.13 | | | | 9/1/11 | | | | 115,524 | |

| 500,000 | | MI Public Education Facs. Auth. Ltd. Rev. Ref. (Nataki Talibah Proj.) (Q-SBLF Insured) | | | 6.25 | | | | 10/1/23 | | | | 422,220 | |

| 500,000 | | MI Public Education Facs. Auth. Ltd. Rev. Ref. (Richfield Public School Proj.) | | | 5.00 | | | | 9/1/22 | | | | 425,400 | |

| 650,000 | | MI Public Education Facs. Auth. Rev. Ref. (Bradford Proj.) 4 | | | 6.00 | | | | 9/1/16 | | | | 653,536 | |

| 220,000 | | MI Strategic Fund Rev. (Detroit Edison Pollution Control Proj.) | | | 5.45 | | | | 9/1/29 | | | | 220,004 | |

| 345,000 | | MI Tobacco Settlement Finance Auth. Sr. Rev. | | | 5.13 | | | | 6/1/22 | | | | 272,612 | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | 3,504,453 | |

| | | | | | | | | | | | | | |

Minnesota - 2.4% | | | | | | | | | | | | |

| 2,053,048 | | Intermediate School District 287 Lease Rev. | | | 5.30 | | | | 11/1/32 | | | | 1,877,882 | |

| 500,000 | | Minneapolis Mulitfamily Hsg. Rev. (Riverside Plaza) | | | 6.00 | | | | 11/1/13 | | | | 496,325 | |

| 585,000 | | MN Hsg. Fin. Agy. Residential Hsg. Rev. | | | 5.10 | | | | 1/1/40 | | | | 566,941 | |

| 571,157 | | St. Paul Hsg. & Redev. Auth. Rev. (Nursing Home NTS-Episcopal) | | | 5.63 | | | | 10/1/33 | | | | 478,350 | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | 3,419,498 | |

| | | | | | | | | | | | | | |

Mississippi - 0.4% | | | | | | | | | | | | |

| 185,000 | | MS Home Corp. Single Family Mtg. Rev. (GNMA/FNMA/FHLMC Collateralized) | | | 5.60 | | | | 6/1/38 | | | | 197,132 | |

| 290,000 | | MS Home Corp. Single Family Mtg. Rev. (GNMA/FNMA/FHLMC Collateralized) | | | 6.75 | | | | 6/1/39 | | | | 315,662 | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | 512,794 | |

| | | | | | | | | | | | | | |

Missouri - 4.4% | | | | | | | | | | | | |

| 500,000 | | Chillicothe Tax Increment Rev. (South U.S. 65 Proj.) | | | 5.63 | | | | 4/1/27 | | | | 402,735 | |

| 480,000 | | Community Memorial Hospital District Rev. | | | 6.68 | | | | 12/1/34 | | | | 472,104 | |

| 250,000 | | Independence 39th St. Transportation District Rev. Ref. & Improvement | | | 6.88 | | | | 9/1/32 | | | | 221,372 | |

| 1,000,000 | | Joplin Industrial Dev. Auth. Rev. Ref. (Christian Homes, Inc. Proj.) | | | 5.50 | | | | 5/15/17 | | | | 1,000,960 | |

| 500,000 | | Kansas City Industrial Dev. Auth. Multifamily Hsg. Rev. (Grand Blvd. Lofts) | | | 5.00 | | | | 1/1/12 | | | | 499,815 | |

| 500,000 | | Kansas City Industrial Dev. Auth. Rev. (Kansas City Pkg. LLC) | | | 5.45 | | | | 9/1/23 | | | | 466,595 | |

| 500,000 | | Kirkwood Industrial Dev. Auth. Retirement Community Rev. (Aberdeen Heights) | | | 7.00 | | | | 11/15/15 | | | | 497,420 | |

| 750,000 | | Lakeside 370 Levee District Improvement Special Tax | | | 7.00 | | | | 4/1/28 | | | | 670,125 | |

| 500,000 | | Meadows Transportation Development Dist. Rev. | | | 5.40 | | | | 5/1/35 | | | | 453,755 | |

| 400,000 | | MO Health & Education Facs. Auth. Education Facs. Rev. (Riverside Horizons) (ACA Insured) | | | 4.50 | | | | 5/1/27 | | | | 378,060 | |

| 250,000 | | MO Health & Educational Facs. Auth. (Senior Living Facs.-Lutheran Senior) | | | 5.38 | | | | 2/1/35 | | | | 213,980 | |

| | |

See accompanying notes to financial statements. | | |