UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act File Number: 811-02258

Eaton Vance Series Trust II

(Exact Name of Registrant as Specified in Charter)

Two International Place, Boston, Massachusetts 02110

(Address of Principal Executive Offices)

Maureen A. Gemma

Two International Place, Boston, Massachusetts 02110

(Name and Address of Agent for Services)

(617) 482-8260

(Registrant’s Telephone Number)

June 30

Date of Fiscal Year End

June 30, 2018

Date of Reporting Period

Item 1. Reports to Stockholders

Parametric Tax-Managed Emerging Markets Fund

Annual Report

June 30, 2018

Commodity Futures Trading Commission Registration. Effective December 31, 2012, the Commodity Futures Trading Commission (“CFTC”) adopted certain regulatory changes that subject registered investment companies and advisers to regulation by the CFTC if a fund invests more than a prescribed level of its assets in certain CFTC-regulated instruments (including futures, certain options and swap agreements) or markets itself as providing investment exposure to such instruments. The Fund has claimed an exclusion from the definition of the term “commodity pool operator” under the Commodity Exchange Act. Accordingly, neither the Fund nor the adviser with respect to the operation of the Fund is subject to CFTC regulation. Because of its management of other strategies, the Fund’s adviser is registered with the CFTC as a commodity pool operator and a commodity trading advisor.

Fund shares are not insured by the FDIC and are not deposits or other obligations of, or guaranteed by, any depository institution. Shares are subject to investment risks, including possible loss of principal invested.

This report must be preceded or accompanied by a current summary prospectus or prospectus. Before investing, investors should consider carefully the investment objective, risks, and charges and expenses of a mutual fund. This and other important information is contained in the summary prospectus and prospectus, which can be obtained from a financial advisor. Prospective investors should read the prospectus carefully before investing. For further information, please call 1-800-260-0761.

Annual Report June 30, 2018

Parametric Tax-Managed Emerging Markets Fund

Table of Contents

| | | | |

Management’s Discussion of Fund Performance | | | 2 | |

| |

Performance | | | 3 | |

| |

Fund Profile | | | 4 | |

| |

Endnotes and Additional Disclosures | | | 5 | |

| |

Fund Expenses | | | 6 | |

| |

Financial Statements | | | 7 | |

| |

Report of Independent Registered Public Accounting Firm | | | 40 | |

| |

Federal Tax Information | | | 41 | |

| |

Board of Trustees’ Contract Approval | | | 42 | |

| |

Management and Organization | | | 45 | |

| |

Important Notices | | | 47 | |

Parametric Tax-Managed Emerging Markets Fund

June 30, 2018

Management’s Discussion of Fund Performance1

Economic and Market Conditions

For the 12-month period ended June 30, 2018, emerging market equities advanced over 8%, as measured by the MSCI Emerging Markets Index (the Index),2 despite facing notable performance deterioration during the first half of 2018.

Emerging market equities experienced a sharp, broad-based rally in the latter half of 2017 based on dramatic returns in the technology sector of China, Taiwan, and South Korea, as well as a strong rebound in Russia and other oil exporters on the back of the rally in crude oil prices. Through January of 2018, investors continued to be attracted to the asset class, due to its appealing valuations and strong earnings growth, with their enthusiasm overcoming fears of a North Korean crisis and further tightening moves by the U.S. Federal Reserve (the Fed). Historically, emerging market equities have suffered in times of Fed tightening.

However, early 2018 saw a marked increase in the dispersion of country-level results amid a heightening of volatility. While U.S. investors continued to be attracted to the emerging markets, flows began to slow due to growing concerns around the increasingly likely tariffs being floated by the U.S. government, and their implications on the export-driven economies of the emerging markets. As the year progressed, these concerns fed into a broad decline, as investors reacted to the continued escalation of the U.S.-China trade war and its implications on global trade. While the Chinese tariff situation was the most visible, the U.S. tariffs on steel and aluminum also impacted South Korea’s export-driven economy. In addition, the trade implications of an increasingly tenuous state of the North American Free Trade Agreement (NAFTA) hurt Mexican equities. Additionally, with the Fed raising interest rates, investors re-assessed the balance sheets of a number of developing countries, sparking a broad currency crisis across the emerging markets, providing further headwinds to emerging market equity returns.

Frontier markets (as measured by the MSCI Frontier Markets Index) generally delivered moderately lower returns than emerging markets (as measured by the Index).

Fund Performance

For the 12-month period ended June 30, 2018, Parametric Tax-Managed Emerging Markets Fund (the Fund) had a total return of 3.63% for Institutional Class shares at net asset

value (NAV), underperforming the Fund’s benchmark, the Index, which had a total return of 8.20% for the same period.

An underweight to China detracted from relative performance as Chinese markets continued to rally on strong economic growth for most of the period. An overweight to Mexico also hurt relative returns as markets underperformed on investor fears that the NAFTA would be modified or canceled. An overweight to Turkey further detracted from performance due to recent drops in the lira and the country’s unstable political environment.

An underweight to South Korea contributed to relative performance as markets have lagged due to signs of an economic slowdown, as well as concerns around U.S. steel tariffs. An underweight to Taiwan also aided relative results, partially due to weakness in the country’s semiconductor industry, and an overall slowdown in economic growth. The inclusion of Vietnam and Kazakhstan, both non-Index countries, also contributed to returns.

See Endnotes and Additional Disclosures in this report.

Past performance is no guarantee of future results. Returns are historical and are calculated by determining the percentage change in net asset value (NAV) or offering price (as applicable) with all distributions reinvested. Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Performance less than or equal to one year is cumulative. Performance is for the stated time period only; due to market volatility, the Fund’s current performance may be lower or higher than quoted. Returns are before taxes unless otherwise noted. For performance as of the most recent month-end, please refer to eatonvance.com.

Parametric Tax-Managed Emerging Markets Fund

June 30, 2018

Performance2,3

Portfolio Managers Thomas C. Seto and Timothy W. Atwill, Ph.D., CFA, each of Parametric Portfolio Associates LLC

| | | | | | | | | | | | | | | | | | | | |

| % Average Annual Total Returns | | Class Inception Date | | | Performance Inception Date | | | One Year | | | Five Years | | | Ten Years | |

Institutional Class at NAV | | | 06/30/1998 | | | | 06/30/1998 | | | | 3.63 | % | | | 3.08 | % | | | 2.01 | % |

MSCI Emerging Markets Index | | | — | | | | — | | | | 8.20 | % | | | 5.01 | % | | | 2.26 | % |

| | | | | |

| | | | | | | | | | | | | | | | | | | | |

% After-Tax Returns | | Class

Inception Date | | | Performance

Inception Date | | | One Year | | | Five Years | | | Ten Years | |

After Taxes on Distributions | | | 06/30/1998 | | | | 06/30/1998 | | | | 3.32 | % | | | 2.80 | % | | | 1.83 | % |

After Taxes on Distributions and Sales of Fund Shares | | | — | | | | — | | | | 2.63 | | | | 2.56 | | | | 1.76 | |

| | | | | |

| | | | | | | | | | | | | | | | | | | | |

| % Total Annual Operating Expense Ratio4 | | | | | | | | | | | | | | Institutional

Class | |

| | | | | | | | | | | | | | | | | | | 0.95 | % |

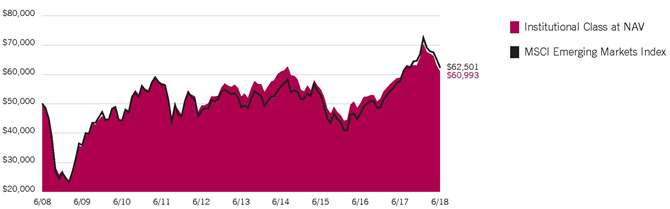

Growth of $50,000

This graph shows the change in value of a hypothetical investment of $50,000 in Institutional Class of the Fund for the period indicated. For comparison, the same investment is shown in the indicated index.

See Endnotes and Additional Disclosures in this report.

Past performance is no guarantee of future results. Returns are historical and are calculated by determining the percentage change in net asset value (NAV) or offering price (as applicable) with all distributions reinvested. Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Performance less than or equal to one year is cumulative. Performance is for the stated time period only; due to market volatility, the Fund’s current performance may be lower or higher than quoted. Returns are before taxes unless otherwise noted. For performance as of the most recent month-end, please refer to eatonvance.com.

Parametric Tax-Managed Emerging Markets Fund

June 30, 2018

Fund Profile

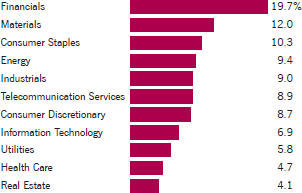

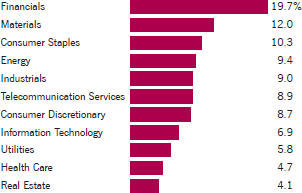

Sector Allocation (% of net assets)5

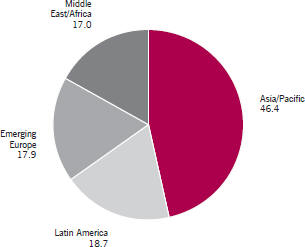

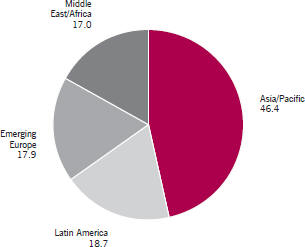

Geographic Allocation (% of common stocks)

Top 10 Holdings (% of net assets)5

| | | | |

America Movil SAB de CV, Series L | | | 1.2 | % |

| |

Naspers, Ltd., Class N | | | 1.0 | |

| |

Sberbank of Russia PJSC | | | 0.8 | |

| |

China Mobile, Ltd. | | | 0.7 | |

| |

Lukoil PJSC ADR | | | 0.6 | |

| |

Credicorp, Ltd. | | | 0.6 | |

| |

Samsung Electronics Co., Ltd. | | | 0.6 | |

| |

MTN Group, Ltd. | | | 0.5 | |

| |

Sasol, Ltd. | | | 0.5 | |

| |

Gazprom PJSC ADR | | | 0.5 | |

| |

Total | | | 7.0 | % |

See Endnotes and Additional Disclosures in this report.

Parametric Tax-Managed Emerging Markets Fund

June 30, 2018

Endnotes and Additional Disclosures

| 1 | The views expressed in this report are those of the portfolio manager(s) and are current only through the date stated at the top of this page. These views are subject to change at any time based upon market or other conditions, and Eaton Vance and the Fund(s) disclaim any responsibility to update such views. These views may not be relied upon as investment advice and, because investment decisions are based on many factors, may not be relied upon as an indication of trading intent on behalf of any Eaton Vance fund. This commentary may contain statements that are not historical facts, referred to as “forward looking statements”. The Fund’s actual future results may differ significantly from those stated in any forward looking statement, depending on factors such as changes in securities or financial markets or general economic conditions, the volume of sales and purchases of Fund shares, the continuation of investment advisory, administrative and service contracts, and other risks discussed from time to time in the Fund’s filings with the Securities and Exchange Commission. |

| 2 | MSCI Emerging Markets Index is an unmanaged index of emerging markets common stocks. MSCI Frontier Markets Index is an unmanaged index that measures the performance of stock markets with less-developed economies and financial markets than emerging markets, and that typically have more restrictions on foreign stock ownership. MSCI indexes are net of foreign withholding taxes. Source: MSCI. MSCI data may not be reproduced or used for any other purpose. MSCI provides no warranties, has not prepared or approved this report, and has no liability hereunder. Unless otherwise stated, index returns do not reflect the effect of any applicable sales charges, commissions, expenses, taxes or leverage, as applicable. It is not possible to invest directly in an index. |

| 3 | Institutional Class shares are offered at net asset value (NAV). Prior to September 1, 2016, Institutional Class shares were subject to a 2% redemption fee at the time of exchange or redemption. Returns are historical and are calculated by determining the percentage change in NAV with all distributions reinvested. Unless otherwise stated, performance does not reflect the deduction of taxes on Fund distributions or redemptions of Fund shares. Performance since inception for an index, if presented, is the performance since the Fund’s or oldest share class’ inception, as applicable. After-tax returns are calculated using certain assumptions, including using the highest historical individual federal income tax rates, and do not reflect the impact of state/ local taxes. Actual after-tax returns depend on a shareholder’s tax situation and the actual characterization of distributions and may differ from those shown. After-tax returns are not relevant to shareholders who hold shares in tax-deferred accounts or shares held by nontaxable entities. Return After Taxes on Distributions may be the same as Return Before Taxes for the same period because no taxable distributions were made during that period. Return After Taxes on Distributions and Sale of Fund Shares may be greater than or equal to Return After Taxes on Distributions for the same period because of losses realized on the sale of Fund shares. The Fund’s after-tax returns also may reflect foreign tax credits passed by the Fund to its shareholders. |

| 4 | Source: Fund prospectus. The expense ratio for the current reporting period can be found in the Financial Highlights section of this report. |

| 5 | Excludes cash and cash equivalents. |

| | Fund profile subject to change due to active management. |

Parametric Tax-Managed Emerging Markets Fund

June 30, 2018

Fund Expenses

Example: As a Fund shareholder, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchases and redemption fees (if applicable); and (2) ongoing costs, including management fees and other Fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of Fund investing and to compare these costs with the ongoing costs of investing in other mutual funds. The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period (January 1, 2018 – June 30, 2018).

Actual Expenses: The first section of the table below provides information about actual account values and actual expenses. You may use the information in this section, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first section under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes: The second section of the table below provides information about hypothetical account values and hypothetical expenses based on the actual Fund expense ratio and an assumed rate of return of 5% per year (before expenses), which is not the actual Fund return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in your Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads) or redemption fees (if applicable). Therefore, the second section of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would be higher.

| | | | | | | | | | | | | | | | |

| | | Beginning

Account Value

(1/1/18) | | | Ending

Account Value

(6/30/18) | | | Expenses Paid

During Period*

(1/1/18 – 6/30/18) | | | Annualized

Expense

Ratio | |

| | | | |

Actual | | | | | | | | | | | | | | | | |

Institutional Class | | $ | 1,000.00 | | | $ | 929.20 | | | $ | 4.54 | | | | 0.95 | % |

| | | | |

Hypothetical | | | | | | | | | | | | | |

(5% return per year before expenses) | | | | | | | | | | | | | | | | |

Institutional Class | | $ | 1,000.00 | | | $ | 1,020.10 | | | $ | 4.76 | | | | 0.95 | % |

| * | Expenses are equal to the Fund’s annualized expense ratio for the indicated Class, multiplied by the average account value over the period, multiplied by 181/365 (to reflect the one-half year period). The Example assumes that the $1,000 was invested at the net asset value per share determined at the close of business on December 31, 2017. |

Parametric Tax-Managed Emerging Markets Fund

June 30, 2018

Portfolio of Investments

| | | | | | | | |

| Common Stocks — 98.7% | |

| Security | | Shares | | | Value | |

|

| Argentina — 0.5% | |

Adecoagro SA(1) | | | 128,000 | | | $ | 1,017,600 | |

Arcos Dorados Holdings, Inc., Class A | | | 465,200 | | | | 3,233,140 | |

Banco Macro SA, Class B | | | 130,676 | | | | 761,241 | |

Cresud SA ADR | | | 18,602 | | | | 275,682 | |

Grupo Financiero Galicia SA, Class B ADR | | | 37,200 | | | | 1,226,856 | |

IRSA Inversiones y Representaciones SA | | | 119,544 | | | | 204,992 | |

Ledesma SAAI(1) | | | 259,501 | | | | 107,658 | |

MercadoLibre, Inc. | | | 18,200 | | | | 5,440,526 | |

Molinos Agro SA | | | 18,283 | | | | 135,898 | |

Molinos Rio de la Plata SA, Class B(1) | | | 75,026 | | | | 111,534 | |

Pampa Energia SA ADR(1) | | | 67,360 | | | | 2,409,467 | |

Ternium Argentina SA | | | 2,005,200 | | | | 925,477 | |

Transportadora de Gas del Sur SA(1) | | | 252,923 | | | | 594,598 | |

YPF SA ADR | | | 101,600 | | | | 1,379,728 | |

| | | | $ | 17,824,397 | |

|

| Bahrain — 0.6% | |

Ahli United Bank BSC | | | 16,892,374 | | | $ | 10,145,133 | |

Al Salam Bank-Bahrain BSC | | | 14,953,766 | | | | 4,748,533 | |

GFH Financial Group BSC | | | 11,232,727 | | | | 4,016,485 | |

Ithmaar Holding BSC(1) | | | 21,954,746 | | | | 2,288,950 | |

| | | | $ | 21,199,101 | |

|

| Bangladesh — 0.7% | |

ACI, Ltd. | | | 124,952 | | | $ | 520,429 | |

Aftab Automobiles, Ltd. | | | 378,354 | | | | 239,221 | |

Al-Arafah Islami Bank, Ltd. | | | 2,174,488 | | | | 584,273 | |

Bangladesh Export Import Co., Ltd. | | | 4,835,385 | | | | 1,512,781 | |

Bangladesh Submarine Cable Co., Ltd. | | | 274,602 | | | | 338,521 | |

BBVA Banco Frances SA | | | 76,594 | | | | 315,114 | |

Beximco Pharmaceuticals, Ltd. | | | 522,666 | | | | 593,014 | |

BRAC Bank, Ltd.(1) | | | 477,896 | | | | 411,194 | |

British American Tobacco Bangladesh Co., Ltd. | | | 41,583 | | | | 1,719,406 | |

BSRM Steels, Ltd. | | | 1,250,000 | | | | 1,082,079 | |

City Bank, Ltd. (The) | | | 933,797 | | | | 376,152 | |

Grameenphone, Ltd. | | | 656,933 | | | | 3,059,327 | |

Heidelberger Cement Bangladesh, Ltd. | | | 103,700 | | | | 452,207 | |

Islami Bank Bangladesh, Ltd. | | | 1,587,087 | | | | 449,784 | |

Jamuna Oil Co., Ltd. | | | 212,850 | | | | 475,880 | |

Khulna Power Co., Ltd. | | | 972,814 | | | | 784,922 | |

LafargeHolcim Bangladesh, Ltd. | | | 396,773 | | | | 268,301 | |

LankaBangla Finance, Ltd. | | | 1,102,357 | | | | 356,295 | |

Malek Spinning Mills, Ltd. | | | 1,020,000 | | | | 208,141 | |

| | | | | | | | |

| Security | | Shares | | | Value | |

|

| Bangladesh (continued) | |

Meghna Petroleum, Ltd. | | | 210,100 | | | $ | 476,194 | |

National Bank, Ltd.(1) | | | 5,261,530 | | | | 615,988 | |

Olympic Industries, Ltd. | | | 351,256 | | | | 943,962 | |

Padma Oil Co., Ltd. | | | 175,100 | | | | 478,983 | |

Pubali Bank, Ltd. | | | 2,018,443 | | | | 556,867 | |

Renata, Ltd. | | | 26,401 | | | | 408,535 | |

Singer Bangladesh, Ltd. | | | 165,593 | | | | 357,052 | |

Social Islami Bank, Ltd.(1) | | | 2,833,792 | | | | 545,161 | |

Southeast Bank, Ltd.(1) | | | 2,195,925 | | | | 408,991 | |

Square Pharmaceuticals, Ltd. | | | 609,170 | | | | 2,140,453 | |

Summit Power, Ltd. | | | 1,464,390 | | | | 664,688 | |

Titas Gas Transmission & Distribution Co., Ltd. | | | 1,570,295 | | | | 730,999 | |

Unique Hotel & Resorts, Ltd. | | | 1,004,743 | | | | 623,204 | |

United Airways Bangladesh, Ltd.(1) | | | 7,278,815 | | | | 330,866 | |

United Commercial Bank, Ltd. | | | 1,270,726 | | | | 265,633 | |

| | | | $ | 23,294,617 | |

|

| Botswana — 0.3% | |

Barclays Bank of Botswana, Ltd. | | | 1,308,506 | | | $ | 703,908 | |

Botswana Insurance Holdings, Ltd. | | | 801,726 | | | | 1,356,749 | |

First National Bank of Botswana, Ltd. | | | 7,511,600 | | | | 1,604,619 | |

Letshego Holdings, Ltd. | | | 16,310,999 | | | | 2,888,548 | |

Sechaba Breweries Holdings, Ltd. | | | 1,086,400 | | | | 2,007,667 | |

Sefalana Holding Co. | | | 991,000 | | | | 842,442 | |

Standard Chartered Bank Botswana, Ltd.(1) | | | 850,790 | | | | 345,979 | |

| | | | $ | 9,749,912 | |

|

| Brazil — 5.9% | |

Aliansce Shopping Centers SA | | | 206,800 | | | $ | 791,824 | |

AMBEV SA | | | 2,062,925 | | | | 9,570,120 | |

Atacadao Distribuicao Comercio e Industria Ltda | | | 144,200 | | | | 563,294 | |

B2W Cia Digital(1) | | | 263,000 | | | | 1,825,376 | |

B3 SA - Brasil Bolsa Balcao | | | 554,763 | | | | 2,927,150 | |

Banco Bradesco SA, PFC Shares | | | 849,538 | | | | 5,896,297 | |

Banco do Brasil SA | | | 56,600 | | | | 418,394 | |

BR Malls Participacoes SA(1) | | | 1,876,400 | | | | 4,696,144 | |

BR Properties SA | | | 113,000 | | | | 265,316 | |

Braskem SA, PFC Shares | | | 119,600 | | | | 1,566,380 | |

BRF SA(1) | | | 48,966 | | | | 227,411 | |

BRF SA ADR(1) | | | 25,600 | | | | 119,808 | |

CCR SA | | | 160,000 | | | | 417,777 | |

Centrais Eletricas Brasileiras SA, PFC Shares(1) | | | 671,366 | | | | 2,347,161 | |

Cia Brasileira de Distribuicao ADR, PFC Shares | | | 14,300 | | | | 285,714 | |

Cia Brasileira de Distribuicao, PFC Shares | | | 64,756 | | | | 1,301,385 | |

Cia de Saneamento Basico do Estado de Sao Paulo | | | 125,400 | | | | 753,549 | |

| | | | |

| | 7 | | See Notes to Financial Statements. |

Parametric Tax-Managed Emerging Markets Fund

June 30, 2018

Portfolio of Investments — continued

| | | | | | | | |

| Security | | Shares | | | Value | |

|

| Brazil (continued) | |

Cia de Saneamento Basico do Estado de Sao Paulo ADR | | | 372,098 | | | $ | 2,236,309 | |

Cia de Transmissao de Energia Eletrica Paulista, PFC Shares | | | 39,663 | | | | 593,551 | |

Cia Hering | | | 155,800 | | | | 572,831 | |

Cia Siderurgica Nacional SA(1) | | | 147,100 | | | | 298,318 | |

Cia Siderurgica Nacional SA ADR(1) | | | 62,200 | | | | 125,644 | |

Cielo SA | | | 2,324,338 | | | | 9,907,260 | |

Construtora Tenda SA(1) | | | 62,686 | | | | 384,777 | |

Cosan SA Industria e Comercio | | | 137,900 | | | | 1,251,712 | |

CPFL Energia SA | | | 468,491 | | | | 2,619,416 | |

CVC Brasil Operadora e Agencia de Viagens SA | | | 143,121 | | | | 1,669,114 | |

Cyrela Brazil Realty SA Empreendimentos e Participacoes | | | 191,224 | | | | 542,724 | |

Duratex SA | | | 335,583 | | | | 753,292 | |

EcoRodovias Infraestrutura e Logistica SA | | | 146,900 | | | | 280,477 | |

EDP-Energias do Brasil SA | | | 344,100 | | | | 1,231,418 | |

Eletropaulo Metropolitana Eletricidade de Sao Paulo SA(1) | | | 205,868 | | | | 2,231,974 | |

Embraer SA | | | 805,332 | | | | 5,040,922 | |

Embraer SA ADR | | | 26,152 | | | | 651,185 | |

Engie Brasil Energia SA | | | 96,100 | | | | 848,740 | |

Equatorial Energia SA | | | 197,000 | | | | 2,886,063 | |

Estacio Participacoes SA | | | 275,300 | | | | 1,731,746 | |

Even Construtora e Incorporadora SA(1) | | | 652,400 | | | | 614,400 | |

Ez Tec Empreendimentos e Participacoes SA | | | 143,494 | | | | 597,190 | |

Fibria Celulose SA | | | 24,585 | | | | 460,332 | |

Fibria Celulose SA ADR | | | 54,900 | | | | 1,020,591 | |

Fleury SA | | | 310,300 | | | | 2,117,638 | |

Gafisa SA(1) | | | 126,986 | | | | 338,782 | |

Gerdau SA, PFC Shares | | | 227,900 | | | | 817,929 | |

Gol Linhas Aereas Inteligentes SA, PFC Shares(1) | | | 242,400 | | | | 651,695 | |

Hypera SA | | | 541,800 | | | | 3,859,665 | |

Iguatemi Empresa de Shopping Centers SA | | | 191,000 | | | | 1,519,819 | |

Instituto Hermes Pardini SA | | | 81,900 | | | | 371,913 | |

Itau Unibanco Holding SA, PFC Shares | | | 646,567 | | | | 6,729,669 | |

Itausa-Investimentos Itau SA, PFC Shares | | | 1,233,454 | | | | 2,921,527 | |

JBS SA | | | 653,902 | | | | 1,569,061 | |

Klabin SA | | | 190,200 | | | | 961,858 | |

Klabin SA, PFC Shares | | | 981,500 | | | | 792,645 | |

Linx SA | | | 60,800 | | | | 277,665 | |

Localiza Rent a Car SA | | | 768,528 | | | | 4,705,456 | |

Lojas Americanas SA, PFC Shares | | | 642,690 | | | | 2,764,276 | |

Lojas Renner SA | | | 602,691 | | | | 4,567,125 | |

M Dias Branco SA | | | 60,700 | | | | 585,740 | |

Magazine Luiza SA | | | 53,508 | | | | 1,767,010 | |

Marcopolo SA, PFC Shares | | | 786,900 | | | | 680,156 | |

| | | | | | | | |

| Security | | Shares | | | Value | |

|

| Brazil (continued) | |

MRV Engenharia e Participacoes SA | | | 476,800 | | | $ | 1,481,177 | |

Multiplan Empreendimentos Imobiliarios SA | | | 288,200 | | | | 4,238,509 | |

Natura Cosmeticos SA | | | 143,300 | | | | 1,119,188 | |

Odontoprev SA | | | 779,700 | | | | 2,629,344 | |

Oi SA ADR(1) | | | 315,800 | | | | 262,114 | |

Oi SA, PFC Shares(1) | | | 548,684 | | | | 409,133 | |

Pagseguro Digital, Ltd., Class A(1) | | | 225,100 | | | | 6,246,525 | |

Petroleo Brasileiro SA | | | 92,600 | | | | 463,986 | |

Petroleo Brasileiro SA ADR | | | 187,400 | | | | 1,656,616 | |

Petroleo Brasileiro SA, PFC Shares | | | 3,577,077 | | | | 15,865,304 | |

Qualicorp Consultoria e Corretora de Seguros SA | | | 633,900 | | | | 3,019,233 | |

Raia Drogasil SA | | | 107,800 | | | | 1,846,848 | |

Randon SA Implementos e Participacoes, PFC Shares | | | 198,512 | | | | 316,021 | |

Rumo SA(1) | | | 387,599 | | | | 1,410,087 | |

Sao Martinho SA | | | 133,410 | | | | 614,428 | |

Suzano Papel e Celulose SA | | | 156,400 | | | | 1,814,696 | |

Telefonica Brasil SA ADR | | | 568,800 | | | | 6,751,656 | |

Telefonica Brasil SA, PFC Shares | | | 214,905 | | | | 2,536,220 | |

TIM Participacoes SA | | | 2,024,444 | | | | 6,884,389 | |

Totvs SA | | | 298,000 | | | | 2,091,363 | |

Transmissora Alianca de Energia Electrica SA | | | 444,093 | | | | 2,142,692 | |

Ultrapar Participacoes SA | | | 103,648 | | | | 1,228,827 | |

Usinas Siderurgicas de Minas Gerais SA, Class A, PFC Shares | | | 226,900 | | | | 428,538 | |

Vale SA | | | 944,787 | | | | 12,088,496 | |

Weg SA | | | 1,175,096 | | | | 4,926,868 | |

| | | | $ | 192,994,973 | |

|

| Bulgaria — 0.1% | |

Albena AD(1) | | | 3,379 | | | $ | 114,754 | |

Bulgartabak Holding | | | 3,450 | | | | 32,364 | |

CB First Investment Bank AD(1) | | | 54,000 | | | | 114,175 | |

Chimimport AD | | | 825,588 | | | | 1,116,560 | |

Industrial Holding Bulgaria PLC(1) | | | 576,865 | | | | 334,115 | |

Petrol AD(1) | | | 19,052 | | | | 11,318 | |

Sopharma AD | | | 303,500 | | | | 737,007 | |

| | | | $ | 2,460,293 | |

|

| Chile — 2.9% | |

AES Gener SA | | | 1,713,702 | | | $ | 424,626 | |

Aguas Andinas SA, Series A | | | 2,872,891 | | | | 1,569,242 | |

Almendral SA | | | 7,092,000 | | | | 520,996 | |

AntarChile SA | | | 73,000 | | | | 1,173,215 | |

Banco de Chile | | | 29,664,258 | | | | 4,585,419 | |

Banco de Chile ADR | | | 4,043 | | | | 375,837 | |

| | | | |

| | 8 | | See Notes to Financial Statements. |

Parametric Tax-Managed Emerging Markets Fund

June 30, 2018

Portfolio of Investments — continued

| | | | | | | | |

| Security | | Shares | | | Value | |

|

| Chile (continued) | |

Banco de Credito e Inversiones SA | | | 61,015 | | | $ | 4,060,694 | |

Banco Santander Chile ADR | | | 118,249 | | | | 3,716,566 | |

Besalco SA | | | 596,000 | | | | 547,295 | |

Cap SA | | | 86,946 | | | | 864,663 | |

Cencosud SA | | | 1,993,533 | | | | 4,927,426 | |

Cia Cervecerias Unidas SA ADR | | | 119,300 | | | | 2,975,342 | |

Cia Sud Americana de Vapores SA(1) | | | 10,829,733 | | | | 306,629 | |

Colbun SA | | | 5,553,984 | | | | 1,145,826 | |

Embotelladora Andina SA, Series A ADR | | | 25,100 | | | | 510,785 | |

Embotelladora Andina SA, Series A, PFC Shares | | | 179,519 | | | | 631,921 | |

Embotelladora Andina SA, Series B ADR | | | 49,672 | | | | 1,143,449 | |

Empresa Nacional de Telecomunicaciones SA | | | 300,687 | | | | 2,761,197 | |

Empresas CMPC SA | | | 1,633,649 | | | | 5,950,588 | |

Empresas COPEC SA | | | 887,267 | | | | 13,579,200 | |

Enel Americas SA | | | 7,896,770 | | | | 1,395,783 | |

Enel Americas SA ADR | | | 140,171 | | | | 1,234,907 | |

Enel Chile SA | | | 4,683,503 | | | | 462,118 | |

Enel Chile SA ADR | | | 257,006 | | | | 1,254,189 | |

Engie Energia Chile SA | | | 253,400 | | | | 465,385 | |

Forus SA | | | 64,662 | | | | 206,734 | |

Inversiones Aguas Metropolitanas SA | | | 613,640 | | | | 937,184 | |

Itau CorpBanca | | | 145,664,426 | | | | 1,422,546 | |

Latam Airlines Group SA | | | 169,643 | | | | 1,674,634 | |

Latam Airlines Group SA ADR | | | 248,748 | | | | 2,460,118 | |

Masisa SA | | | 3,179,276 | | | | 199,497 | |

Parque Arauco SA | | | 818,312 | | | | 2,301,911 | |

Quinenco SA | | | 457,241 | | | | 1,329,676 | |

Ripley Corp. SA | | | 1,334,100 | | | | 1,265,914 | |

S.A.C.I. Falabella | | | 1,179,842 | | | | 10,812,593 | |

Salfacorp SA | | | 1,194,378 | | | | 1,846,419 | |

Sigdo Koppers SA | | | 678,341 | | | | 1,095,383 | |

Sociedad Matriz SAAM SA | | | 6,677,681 | | | | 610,133 | |

Sociedad Quimica y Minera de Chile SA ADR | | | 107,600 | | | | 5,170,180 | |

Sociedad Quimica y Minera de Chile SA, Series A | | | 19,125 | | | | 918,956 | |

Sonda SA | | | 1,859,824 | | | | 2,761,009 | |

Vina Concha y Toro SA | | | 146,373 | | | | 301,306 | |

Vina Concha y Toro SA ADR | | | 26,701 | | | | 1,111,029 | |

| | | | $ | 93,008,520 | |

|

| China — 11.0% | |

3SBio, Inc.(2) | | | 527,000 | | | $ | 1,190,843 | |

AECC Aviation Power Co., Ltd. | | | 66,500 | | | | 223,642 | |

Agile Group Holdings, Ltd. | | | 486,000 | | | | 826,902 | |

Agricultural Bank of China, Ltd., Class H | | | 1,705,000 | | | | 795,773 | |

Air China, Ltd., Class H | | | 1,770,000 | | | | 1,701,690 | |

| | | | | | | | |

| Security | | Shares | | | Value | |

|

| China (continued) | |

Aisino Corp. | | | 73,800 | | | $ | 280,989 | |

Alibaba Group Holding, Ltd. ADR(1) | | | 19,000 | | | | 3,525,070 | |

Aluminum Corp. of China, Ltd., Class H(1) | | | 5,922,000 | | | | 2,595,482 | |

Angang Steel Co., Ltd., Class H | | | 1,148,000 | | | | 1,031,454 | |

Anhui Conch Cement Co., Ltd., Class H | | | 1,034,500 | | | | 5,899,652 | |

ANTA Sports Products, Ltd. | | | 676,000 | | | | 3,564,755 | |

AVIC Aircraft Co., Ltd., Class A | | | 162,200 | | | | 382,293 | |

Baidu, Inc. ADR(1) | | | 13,700 | | | | 3,329,100 | |

Bank of Beijing Co., Ltd. | | | 395,520 | | | | 360,155 | |

Bank of China, Ltd., Class H | | | 5,324,000 | | | | 2,640,301 | |

Bank of Communications, Ltd., Class H | | | 2,201,300 | | | | 1,684,786 | |

Bank of Nanjing Co., Ltd. | | | 294,427 | | | | 343,151 | |

Bank of Ningbo Co., Ltd., Class A | | | 87,300 | | | | 214,360 | |

BBMG Corp., Class H | | | 3,378,000 | | | | 1,241,418 | |

BeiGene, Ltd. ADR(1) | | | 24,425 | | | | 3,754,855 | |

Beijing Capital Co., Ltd. | | | 323,000 | | | | 205,906 | |

Beijing Capital International Airport Co., Ltd., Class H | | | 596,000 | | | | 626,056 | |

Beijing Enterprises Holdings, Ltd. | | | 223,500 | | | | 1,085,163 | |

Beijing Enterprises Water Group, Ltd. | | | 3,456,000 | | | | 1,879,248 | |

Beijing Orient Landscape & Environment Co., Ltd., Class A(3) | | | 94,800 | | | | 215,061 | |

Beijing Oriental Yuhong Waterproof Technology Co., Ltd., Class A | | | 82,619 | | | | 211,775 | |

Beijing Originwater Technology Co., Ltd., Class A | | | 82,900 | | | | 173,922 | |

Beijing Sanju Environmental Protection and New Material Co., Ltd., Class A(1) | | | 46,600 | | | | 157,373 | |

Beijing Tongrentang Co., Ltd. | | | 47,000 | | | | 249,856 | |

Beijing Water Business Doctor Co., Ltd., Class A | | | 73,000 | | | | 126,345 | |

Beijing Xinwei Technology Group Co., Ltd.(1)(3) | | | 80,600 | | | | 0 | |

Beiqi Foton Motor Co., Ltd. | | | 407,100 | | | | 124,556 | |

BOE Technology Group Co., Ltd., Class A | | | 911,100 | | | | 485,303 | |

BYD Co., Ltd., Class H | | | 575,000 | | | | 3,545,817 | |

Cangzhou Mingzhu Plastic Co., Ltd., Class A | | | 165,750 | | | | 146,430 | |

CGN Power Co., Ltd., Class H(2) | | | 6,329,000 | | | | 1,634,214 | |

Changchun High & New Technology Industries, Inc., Class A | | | 10,400 | | | | 356,932 | |

Changjiang Securities Co., Ltd., Class A | | | 141,300 | | | | 115,726 | |

Chengdu Xingrong Environment Co., Ltd., Class A | | | 238,200 | | | | 145,786 | |

China Agri-Industries Holdings, Ltd. | | | 2,380,000 | | | | 907,668 | |

China Baoan Group Co., Ltd., Class A | | | 175,040 | | | | 129,423 | |

China Bluechemical, Ltd., Class H | | | 1,348,000 | | | | 494,939 | |

China Cinda Asset Management Co., Ltd., Class H | | | 3,202,000 | | | | 1,025,425 | |

China CITIC Bank Corp., Ltd., Class H | | | 1,627,000 | | | | 1,016,144 | |

China Coal Energy Co., Ltd., Class H | | | 1,005,000 | | | | 414,771 | |

China Communications Construction Co., Ltd., Class H | | | 1,677,000 | | | | 1,615,027 | |

China Communications Services Corp., Ltd., Class H | | | 2,166,000 | | | | 1,368,740 | |

| | | | |

| | 9 | | See Notes to Financial Statements. |

Parametric Tax-Managed Emerging Markets Fund

June 30, 2018

Portfolio of Investments — continued

| | | | | | | | |

| Security | | Shares | | | Value | |

|

| China (continued) | |

China Construction Bank Corp., Class H | | | 6,290,580 | | | $ | 5,756,137 | |

China Dongxiang Group Co., Ltd. | | | 3,981,000 | | | | 730,480 | |

China Eastern Airlines Corp., Ltd., Class H | | | 1,436,000 | | | | 968,675 | |

China Everbright Bank Co., Ltd. | | | 341,400 | | | | 188,385 | |

China Everbright International, Ltd. | | | 1,156,000 | | | | 1,488,788 | |

China Everbright, Ltd. | | | 456,000 | | | | 834,297 | |

China Evergrande Group(1) | | | 757,000 | | | | 1,921,990 | |

China Fortune Land Development Co., Ltd. | | | 52,400 | | | | 202,896 | |

China Gas Holdings, Ltd. | | | 1,086,000 | | | | 4,353,984 | |

China Gezhouba Group Co., Ltd. | | | 152,700 | | | | 165,508 | |

China Huishan Dairy Holdings Co., Ltd.(1)(3) | | | 1,750,000 | | | | 0 | |

China International Marine Containers Co., Ltd. | | | 413,812 | | | | 540,807 | |

China International Travel Service Corp., Ltd. | | | 62,976 | | | | 611,589 | |

China Life Insurance Co., Ltd., Class H | | | 178,000 | | | | 456,657 | |

China Longyuan Power Group Corp., Ltd., Class H | | | 2,519,000 | | | | 2,023,540 | |

China Medical System Holdings, Ltd. | | | 702,000 | | | | 1,398,277 | |

China Mengniu Dairy Co., Ltd. | | | 1,601,000 | | | | 5,399,812 | |

China Merchants Bank Co., Ltd., Class H | | | 512,500 | | | | 1,885,185 | |

China Merchants Port Holdings Co., Ltd. | | | 790,000 | | | | 1,599,974 | |

China Merchants Securities Co., Ltd. | | | 76,998 | | | | 158,794 | |

China Merchants Shekou Industrial Zone Holdings Co., Ltd.(3) | | | 935,251 | | | | 0 | |

China Minsheng Banking Corp., Ltd., Class H | | | 1,036,920 | | | | 740,972 | |

China Mobile, Ltd. | | | 2,416,900 | | | | 21,445,019 | |

China Modern Dairy Holdings, Ltd.(1) | | | 2,514,000 | | | | 471,833 | |

China Molybdenum Co., Ltd., Class H | | | 4,218,000 | | | | 2,032,967 | |

China National Building Material Co., Ltd., Class H | | | 2,156,000 | | | | 2,122,057 | |

China National Nuclear Power Co., Ltd. | | | 227,000 | | | | 192,967 | |

China Northern Rare Earth Group High-Tech Co., Ltd. | | | 185,300 | | | | 317,765 | |

China Oilfield Services, Ltd., Class H | | | 1,832,000 | | | | 1,725,405 | |

China Overseas Land & Investment, Ltd. | | | 760,360 | | | | 2,495,655 | |

China Pacific Insurance (Group) Co., Ltd., Class H | | | 282,800 | | | | 1,089,348 | |

China Petroleum & Chemical Corp., Class H | | | 11,161,800 | | | | 9,991,117 | |

China Power International Development, Ltd. | | | 2,268,000 | | | | 522,396 | |

China Railway Construction Corp., Ltd., Class H | | | 947,500 | | | | 958,472 | |

China Railway Group, Ltd., Class H | | | 2,265,000 | | | | 1,707,764 | |

China Resources Beer Holdings Co., Ltd. | | | 968,000 | | | | 4,687,494 | |

China Resources Cement Holdings, Ltd. | | | 870,000 | | | | 875,555 | |

China Resources Gas Group, Ltd. | | | 610,000 | | | | 2,637,149 | |

China Resources Land, Ltd. | | | 537,111 | | | | 1,804,185 | |

China Resources Pharmaceutical Group, Ltd.(2) | | | 278,000 | | | | 384,377 | |

China Resources Phoenix Healthcare Holdings Co., Ltd. | | | 803,000 | | | | 980,128 | |

China Resources Power Holdings Co., Ltd. | | | 1,087,000 | | | | 1,910,314 | |

China Shenhua Energy Co., Ltd., Class H | | | 1,654,500 | | | | 3,913,298 | |

China Shipbuilding Industry Co., Ltd.(1) | | | 375,300 | | | | 228,336 | |

China South City Holdings, Ltd. | | | 1,106,000 | | | | 214,952 | |

| | | | | | | | |

| Security | | Shares | | | Value | |

|

| China (continued) | |

China Southern Airlines Co., Ltd., Class H | | | 2,064,500 | | | $ | 1,617,755 | |

China Sports Industry Group Co., Ltd.(3) | | | 69,000 | | | | 96,981 | |

China State Construction Engineering Corp., Ltd. | | | 331,520 | | | | 273,086 | |

China Taiping Insurance Holdings Co., Ltd. | | | 277,000 | | | | 861,211 | |

China Telecom Corp., Ltd., Class H | | | 7,572,000 | | | | 3,553,067 | |

China Travel International Investment Hong Kong, Ltd. | | | 1,660,000 | | | | 645,482 | |

China Unicom (Hong Kong), Ltd. | | | 2,590,290 | | | | 3,228,757 | |

China United Network Communications, Ltd., Class A | | | 808,166 | | | | 597,350 | |

China Vanke Co., Ltd., Class H | | | 723,217 | | | | 2,522,204 | |

China Yangtze Power Co., Ltd. | | | 236,900 | | | | 575,923 | |

Chongqing Changan Automobile Co., Ltd., Class A | | | 98,738 | | | | 133,928 | |

CIFI Holdings Group Co., Ltd. | | | 990,000 | | | | 627,117 | |

CITIC Guoan Information Industry Co., Ltd., Class A | | | 138,800 | | | | 98,726 | |

CITIC, Ltd. | | | 1,614,000 | | | | 2,270,480 | |

CNOOC, Ltd. | | | 5,344,500 | | | | 9,158,038 | |

COFCO Tunhe Sugar Co., Ltd. | | | 116,500 | | | | 132,080 | |

COSCO SHIPPING Development Co., Ltd., Class H(1) | | | 3,803,000 | | | | 633,257 | |

COSCO SHIPPING Energy Transportation Co., Ltd., Class H | | | 1,778,000 | | | | 854,731 | |

COSCO SHIPPING Holdings Co., Ltd., Class H(1) | | | 2,729,150 | | | | 1,247,494 | |

COSCO SHIPPING Ports, Ltd. | | | 528,000 | | | | 439,156 | |

Country Garden Holdings Co., Ltd. | | | 2,431,000 | | | | 4,261,536 | |

Country Garden Services Holdings Co., Ltd.(1) | | | 279,425 | | | | 358,292 | |

CSPC Pharmaceutical Group, Ltd. | | | 2,054,000 | | | | 6,167,752 | |

Ctrip.com International, Ltd. ADR(1) | | | 108,700 | | | | 5,177,381 | |

Daqin Railway Co., Ltd. | | | 164,362 | | | | 203,587 | |

Datang International Power Generation Co., Ltd., Class H(1) | | | 3,276,000 | | | | 999,545 | |

Deluxe Family Co., Ltd. | | | 311,800 | | | | 183,347 | |

DHC Software Co., Ltd., Class A | | | 183,200 | | | | 237,048 | |

Dong-E-E-Jiao Co., Ltd., Class A | | | 55,200 | | | | 447,304 | |

Dongfeng Motor Group Co., Ltd., Class H | | | 1,748,000 | | | | 1,842,417 | |

Dr Peng Telecom & Media Group Co., Ltd. | | | 145,878 | | | | 263,377 | |

East Money Information Co., Ltd., Class A | | | 113,760 | | | | 225,540 | |

Fullshare Holdings, Ltd. | | | 3,655,000 | | | | 1,805,495 | |

GD Power Development Co., Ltd. | | | 566,200 | | | | 224,591 | |

GEM Co., Ltd., Class A | | | 217,400 | | | | 197,898 | |

Gemdale Corp. | | | 247,101 | | | | 379,821 | |

GoerTek, Inc., Class A | | | 63,700 | | | | 97,646 | |

Golden Eagle Retail Group, Ltd. | | | 366,000 | | | | 439,466 | |

Great Wall Motor Co., Ltd., Class H | | | 2,510,250 | | | | 1,910,593 | |

Gree Electric Appliances, Inc. of Zhuhai, Class A | | | 129,000 | | | | 914,913 | |

Greentown China Holdings, Ltd. | | | 235,500 | | | | 314,678 | |

Guangdong Baolihua New Energy Stock Co., Ltd., Class A | | | 257,300 | | | | 269,919 | |

Guangdong Golden Dragon Development, Inc., Class A | | | 98,800 | | | | 148,630 | |

| | | | |

| | 10 | | See Notes to Financial Statements. |

Parametric Tax-Managed Emerging Markets Fund

June 30, 2018

Portfolio of Investments — continued

| | | | | | | | |

| Security | | Shares | | | Value | |

|

| China (continued) | |

Guangdong Investment, Ltd. | | | 2,320,000 | | | $ | 3,671,711 | |

Guangdong Shaoneng Group Co., Ltd., Class A | | | 215,400 | | | | 142,637 | |

Guangdong Wens Foodstuffs Group Co., Ltd., Class A | | | 188,528 | | | | 625,993 | |

Guanghui Energy Co., Ltd. | | | 682,345 | | | | 421,373 | |

Guangzhou Automobile Group Co., Ltd., Class H | | | 2,451,199 | | | | 2,384,800 | |

Guangzhou Baiyunshan Pharmaceutical Holdings Co., Ltd., Class H | | | 210,000 | | | | 924,064 | |

Guangzhou R&F Properties Co., Ltd., Class H | | | 670,400 | | | | 1,345,463 | |

Guosen Securities Co., Ltd., Class A | | | 176,600 | | | | 241,866 | |

Guoxuan High-Tech Co., Ltd., Class A | | | 63,830 | | | | 135,109 | |

Guoyuan Securities Co., Ltd., Class A | | | 159,500 | | | | 177,913 | |

Han’s Laser Technology Industry Group Co., Ltd., Class A | | | 46,800 | | | | 374,504 | |

Hangzhou Hikvision Digital Technology Co., Ltd., Class A | | | 111,200 | | | | 621,508 | |

Harbin Pharmaceutical Group Co., Ltd. | | | 150,695 | | | | 90,170 | |

Henan Shuanghui Investment & Development Co., Ltd., Class A | | | 61,400 | | | | 244,139 | |

Hengan International Group Co., Ltd. | | | 403,000 | | | | 3,865,514 | |

Hengtong Optic-electric Co., Ltd. | | | 98,560 | | | | 326,911 | |

Hesteel Co., Ltd., Class A | | | 284,800 | | | | 126,568 | |

Huabao International Holdings, Ltd. | | | 492,000 | | | | 313,377 | |

Huadian Fuxin Energy Corp., Ltd. | | | 820,000 | | | | 191,732 | |

Huadian Power International Corp., Ltd., Class H | | | 2,642,000 | | | | 1,042,538 | |

Huadong Medicine Co., Ltd., Class A | | | 97,500 | | | | 708,415 | |

Hualan Biological Engineering, Inc., Class A | | | 62,200 | | | | 301,371 | |

Huaneng Power International, Inc., Class H | | | 6,520,000 | | | | 4,308,412 | |

Huaneng Renewables Corp., Ltd., Class H | | | 2,704,000 | | | | 896,277 | |

Huatai Securities Co., Ltd. | | | 73,700 | | | | 166,402 | |

Huaxia Bank Co., Ltd. | | | 287,622 | | | | 323,199 | |

Huayu Automotive Systems Co., Ltd. | | | 82,100 | | | | 293,391 | |

Hubei Energy Group Co., Ltd., Class A | | | 272,100 | | | | 168,579 | |

Humanwell Healthcare Group Co., Ltd. | | | 69,600 | | | | 138,663 | |

Hundsun Technologies, Inc. | | | 33,750 | | | | 268,775 | |

Iflytek Co., Ltd., Class A | | | 37,950 | | | | 182,935 | |

iKang Healthcare Group, Inc. ADR(1) | | | 14,800 | | | | 302,808 | |

Industrial & Commercial Bank of China, Ltd., Class H | | | 4,715,000 | | | | 3,516,635 | |

Industrial Bank Co., Ltd. | | | 179,000 | | | | 388,843 | |

Inner Mongolia BaoTou Steel Union Co., Ltd.(1) | | | 737,800 | | | | 173,546 | |

Inner Mongolia Yili Industrial Group Co., Ltd., Class A | | | 113,200 | | | | 475,454 | |

JD.com, Inc. ADR(1) | | | 39,400 | | | | 1,534,630 | |

Jiangsu Changjiang Electronics Technology Co., Ltd. | | | 76,294 | | | | 194,145 | |

Jiangsu Expressway Co., Ltd., Class H | | | 796,000 | | | | 947,863 | |

Jiangsu Hengrui Medicine Co., Ltd. | | | 64,116 | | | | 731,606 | |

Jiangsu Yanghe Brewery Joint-Stock Co., Ltd., Class A | | | 25,000 | | | | 494,596 | |

Jiangsu Yuyue Medical Equipment & Supply Co., Ltd., Class A | | | 81,550 | | | | 238,996 | |

Jiangxi Copper Co., Ltd., Class H | | | 1,415,000 | | | | 1,796,729 | |

| | | | | | | | |

| Security | | Shares | | | Value | |

|

| China (continued) | |

Jiangxi Ganfeng Lithium Co., Ltd., Class A | | | 36,900 | | | $ | 214,246 | |

Jilin Aodong Pharmaceutical Group Co., Ltd., Class A | | | 64,100 | | | | 173,626 | |

Jinyu Bio-Technology Co., Ltd. | | | 73,710 | | | | 189,994 | |

Jizhong Energy Resources Co., Ltd., Class A | | | 283,400 | | | | 175,652 | |

Jonjee Hi-Tech Industrial And Commercial Holding Co., Ltd. | | | 90,800 | | | | 383,252 | |

Kaidi Ecological and Environmental Technology Co., Ltd., Class A(1)(3) | | | 321,500 | | | | 121,073 | |

Kangde Xin Composite Material Group Co., Ltd., Class A(1)(3) | | | 113,300 | | | | 233,670 | |

Kangmei Pharmaceutical Co., Ltd. | | | 106,000 | | | | 365,195 | |

Kingboard Chemical Holdings, Ltd. | | | 169,200 | | | | 616,245 | |

Kingfa Sci & Tech Co., Ltd. | | | 171,400 | | | | 134,878 | |

Kweichow Moutai Co., Ltd. | | | 10,010 | | | | 1,102,438 | |

KWG Property Holding, Ltd. | | | 618,500 | | | | 772,538 | |

Lee & Man Paper Manufacturing, Ltd. | | | 876,000 | | | | 883,776 | |

Lenovo Group, Ltd. | | | 2,596,000 | | | | 1,397,323 | |

Lepu Medical Technology Beijing Co., Ltd., Class A | | | 69,200 | | | | 382,221 | |

Leyou Technologies Holdings, Ltd.(1) | | | 1,240,000 | | | | 381,921 | |

Li Ning Co., Ltd.(1) | | | 1,892,312 | | | | 2,081,607 | |

Liaoning Cheng Da Co., Ltd.(1) | | | 72,015 | | | | 164,747 | |

Longfor Properties Co., Ltd. | | | 841,000 | | | | 2,261,162 | |

LONGi Green Energy Technology Co., Ltd. | | | 94,641 | | | | 237,363 | |

Lonking Holdings, Ltd. | | | 2,438,000 | | | | 1,116,546 | |

Luxshare Precision Industry Co., Ltd., Class A | | | 153,300 | | | | 519,799 | |

Luye Pharma Group, Ltd. | | | 1,117,000 | | | | 1,141,311 | |

Luzhou Laojiao Co., Ltd., Class A | | | 31,300 | | | | 287,267 | |

Maanshan Iron & Steel Co., Ltd., Class H(1) | | | 2,099,000 | | | | 928,768 | |

Midea Group Co., Ltd., Class A | | | 96,300 | | | | 756,477 | |

MMG, Ltd.(1) | | | 796,000 | | | | 554,159 | |

NARI Technology Co., Ltd. | | | 85,600 | | | | 203,740 | |

NavInfo Co., Ltd., Class A | | | 64,800 | | | | 197,414 | |

NetEase, Inc. ADR | | | 5,200 | | | | 1,313,884 | |

Neusoft Corp. | | | 74,400 | | | | 146,439 | |

New Hope Liuhe Co., Ltd., Class A | | | 264,326 | | | | 252,660 | |

New Oriental Education & Technology Group, Inc. ADR | | | 50,300 | | | | 4,761,398 | |

Nine Dragons Paper Holdings, Ltd. | | | 1,412,000 | | | | 1,791,559 | |

O-film Tech Co., Ltd., Class A | | | 65,793 | | | | 159,818 | |

Offshore Oil Engineering Co., Ltd. | | | 168,800 | | | | 133,722 | |

Oriental Energy Co., Ltd., Class A | | | 137,900 | | | | 202,867 | |

Parkson Retail Group, Ltd.(1) | | | 664,500 | | | | 81,223 | |

PetroChina Co., Ltd., Class H | | | 2,088,300 | | | | 1,590,896 | |

PICC Property & Casualty Co., Ltd., Class H | | | 513,000 | | | | 551,743 | |

Ping An Bank Co., Ltd., Class A | | | 457,200 | | | | 626,318 | |

Ping An Insurance (Group) Co. of China, Ltd., Class H | | | 477,500 | | | | 4,372,789 | |

Pingdingshan Tianan Coal Mining Co., Ltd.(1) | | | 262,515 | | | | 165,696 | |

| | | | |

| | 11 | | See Notes to Financial Statements. |

Parametric Tax-Managed Emerging Markets Fund

June 30, 2018

Portfolio of Investments — continued

| | | | | | | | |

| Security | | Shares | | | Value | |

|

| China (continued) | |

Poly Property Group Co., Ltd. | | | 1,579,000 | | | $ | 649,695 | |

Poly Real Estate Group Co., Ltd., Class A | | | 292,400 | | | | 536,254 | |

Power Construction Corp. of China, Ltd. | | | 186,917 | | | | 150,494 | |

Qingdao Haier Co., Ltd. | | | 135,829 | | | | 393,608 | |

Qinghai Salt Lake Industry Co., Ltd., Class A(1) | | | 106,500 | | | | 173,427 | |

Qingling Motors Co., Ltd., Class H | | | 1,448,966 | | | | 444,331 | |

SAIC Motor Corp., Ltd. | | | 90,100 | | | | 474,645 | |

Sanan Optoelectronics Co., Ltd. | | | 132,000 | | | | 381,467 | |

Sany Heavy Industry Co., Ltd. | | | 219,800 | | | | 296,389 | |

SDIC Power Holdings Co., Ltd. | | | 200,900 | | | | 220,222 | |

Semiconductor Manufacturing International Corp.(1) | | | 1,241,200 | | | | 1,608,128 | |

Shandong Gold Mining Co., Ltd. | | | 44,309 | | | | 161,088 | |

Shandong Nanshan Aluminum Co., Ltd. | | | 409,500 | | | | 167,906 | |

Shanghai Dazhong Public Utilities Group Co., Ltd., Class A | | | 220,886 | | | | 124,140 | |

Shanghai Electric Group Co., Ltd., Class H(1) | | | 1,644,000 | | | | 552,554 | |

Shanghai Fosun Pharmaceutical Group Co., Ltd. | | | 545,000 | | | | 2,979,615 | |

Shanghai Industrial Holdings, Ltd. | | | 291,000 | | | | 676,080 | |

Shanghai Jahwa United Co., Ltd., Class A | | | 50,376 | | | | 300,995 | |

Shanghai Oriental Pearl Group Co., Ltd., Class A | | | 65,600 | | | | 148,956 | |

Shanghai Pharmaceuticals Holding Co., Ltd., Class H | | | 756,400 | | | | 2,081,836 | |

Shanghai Pudong Development Bank Co., Ltd., Class A | | | 221,426 | | | | 319,871 | |

Shanghai Zhangjiang High-Tech Park Development Co., Ltd., Class A | | | 75,400 | | | | 130,662 | |

Shanxi Lu’an Environmental Energy Development Co., Ltd. | | | 152,200 | | | | 212,385 | |

Shanxi Securities Co., Ltd., Class A | | | 168,700 | | | | 171,326 | |

Shanxi Xishan Coal & Electricity Power Co., Ltd., Class A | | | 232,100 | | | | 262,467 | |

Shenergy Co., Ltd. | | | 227,799 | | | | 172,842 | |

Shenwan Hongyuan Group Co., Ltd., Class A | | | 357,100 | | | | 235,093 | |

Shenzhen Energy Group Co., Ltd., Class A | | | 241,960 | | | | 180,103 | |

Shenzhen Inovance Technology Co., Ltd., Class A | | | 60,600 | | | | 299,523 | |

Shenzhen Investment, Ltd. | | | 1,384,000 | | | | 502,885 | |

Shenzhen Overseas Chinese Town Co., Ltd., Class A | | | 176,600 | | | | 192,238 | |

Shenzhen Salubris Pharmaceuticals Co., Ltd., Class A | | | 56,300 | | | | 315,319 | |

Shenzhen Sunway Communication Co., Ltd., Class A | | | 52,400 | | | | 242,045 | |

Shenzhen Zhongjin Lingnan Nonfemet Co., Ltd., Class A | | | 219,739 | | | | 160,869 | |

Shimao Property Holdings, Ltd. | | | 214,500 | | | | 559,244 | |

Shui On Land, Ltd. | | | 1,556,500 | | | | 393,605 | |

Siasun Robot & Automation Co., Ltd., Class A | | | 69,900 | | | | 182,996 | |

Sichuan Changhong Electric Co., Ltd. | | | 307,800 | | | | 132,675 | |

Sichuan Chuantou Energy Co., Ltd. | | | 152,000 | | | | 199,899 | |

Sihuan Pharmaceutical Holdings Group, Ltd. | | | 928,000 | | | | 206,089 | |

SINA Corp.(1) | | | 8,700 | | | | 736,803 | |

Sino Biopharmaceutical, Ltd. | | | 3,257,500 | | | | 4,974,873 | |

Sino-Ocean Group Holding, Ltd. | | | 1,881,500 | | | | 1,088,796 | |

| | | | | | | | |

| Security | | Shares | | | Value | |

|

| China (continued) | |

Sinopec Oilfield Service Corp., Class H(1) | | | 4,801,500 | | | $ | 640,604 | |

Sinopec Shanghai Petrochemical Co., Ltd., Class H | | | 3,662,000 | | | | 2,226,188 | |

Sinopharm Group Co., Ltd., Class H | | | 756,800 | | | | 3,041,660 | |

SOHO China, Ltd. | | | 381,500 | | | | 180,970 | |

Sohu.com, Ltd. ADR(1) | | | 8,700 | | | | 308,850 | |

Sun Art Retail Group, Ltd. | | | 1,281,000 | | | | 1,671,157 | |

Sunac China Holdings, Ltd. | | | 750,000 | | | | 2,608,506 | |

Suning.com Co., Ltd, Class A | | | 138,200 | | | | 292,914 | |

Tasly Pharmaceutical Group Co., Ltd. | | | 82,976 | | | | 322,830 | |

TBEA Co., Ltd. | | | 168,219 | | | | 175,665 | |

TCL Corp., Class A | | | 372,800 | | | | 162,881 | |

Tencent Holdings, Ltd. | | | 242,900 | | | | 12,197,314 | |

Tianqi Lithium Corp., Class A | | | 31,855 | | | | 237,931 | |

Tibet Water Resources, Ltd.(1) | | | 528,000 | | | | 199,807 | |

Tingyi (Cayman Islands) Holding Corp. | | | 1,198,000 | | | | 2,775,076 | |

Tonghua Dongbao Pharmaceutical Co., Ltd. | | | 106,833 | | | | 385,663 | |

Tongling Nonferrous Metals Group Co., Ltd., Class A | | | 443,200 | | | | 147,652 | |

TravelSky Technology, Ltd., Class H | | | 984,000 | | | | 2,856,192 | |

Tsinghua Tongfang Co., Ltd. | | | 106,100 | | | | 140,331 | |

Tsingtao Brewery Co., Ltd., Class H | | | 654,000 | | | | 3,583,313 | |

Tus-Sound Environmental Resources Co., Ltd., Class A | | | 78,680 | | | | 207,163 | |

Uni-President China Holdings, Ltd. | | | 290,000 | | | | 372,070 | |

United Laboratories International Holdings, Ltd. (The) | | | 362,000 | | | | 376,394 | |

Wanhua Chemical Group Co., Ltd. | | | 52,720 | | | | 360,180 | |

Want Want China Holdings, Ltd. | | | 3,646,000 | | | | 3,242,123 | |

Weibo Corp. ADR(1) | | | 5,140 | | | | 456,226 | |

Weichai Power Co., Ltd., Class H | | | 907,200 | | | | 1,246,383 | |

Western Mining Co., Ltd. | | | 274,000 | | | | 259,418 | |

Western Securities Co., Ltd., Class A | | | 166,539 | | | | 189,360 | |

WH Group, Ltd.(2) | | | 3,991,500 | | | | 3,229,868 | |

Wintime Energy Co., Ltd. | | | 659,389 | | | | 175,703 | |

Wuliangye Yibin Co., Ltd., Class A | | | 107,600 | | | | 1,229,109 | |

Xinhu Zhongbao Co., Ltd.(1) | | | 301,800 | | | | 174,205 | |

Xinjiang Zhongtai Chemical Co., Ltd., Class A | | | 104,700 | | | | 151,953 | |

Yang Quan Coal Industry Group Co., Ltd.(1) | | | 189,257 | | | | 203,458 | |

Yangzijiang Shipbuilding Holdings, Ltd. | | | 1,652,000 | | | | 1,093,406 | |

Yanzhou Coal Mining Co., Ltd., Class H | | | 1,652,000 | | | | 2,151,232 | |

Yonghui Superstores Co., Ltd. | | | 140,200 | | | | 161,184 | |

Youngor Group Co., Ltd. | | | 201,880 | | | | 234,413 | |

Yuan Longping High-tech Agriculture Co., Ltd., Class A | | | 84,332 | | | | 239,740 | |

Yuexiu Property Co., Ltd. | | | 3,386,000 | | | | 644,747 | |

Yunnan Baiyao Group Co., Ltd., Class A | | | 40,421 | | | | 651,475 | |

Yunnan Chihong Zinc & Germanium Co., Ltd. | | | 222,100 | | | | 182,209 | |

Zhaojin Mining Industry Co., Ltd., Class H | | | 409,500 | | | | 313,259 | |

Zhejiang China Commodities City Group Co., Ltd. | | | 354,157 | | | | 229,432 | |

Zhejiang Dahua Technology Co., Ltd., Class A | | | 94,600 | | | | 320,988 | |

| | | | |

| | 12 | | See Notes to Financial Statements. |

Parametric Tax-Managed Emerging Markets Fund

June 30, 2018

Portfolio of Investments — continued

| | | | | | | | |

| Security | | Shares | | | Value | |

|

| China (continued) | |

Zhejiang Expressway Co., Ltd., Class H | | | 870,000 | | | $ | 774,815 | |

Zhejiang Huahai Pharmaceutical Co., Ltd. | | | 70,080 | | | | 281,642 | |

Zhejiang Longsheng Group Co., Ltd. | | | 155,000 | | | | 278,958 | |

Zhejiang Wanfeng Auto Wheel Co., Ltd., Class A | | | 84,800 | | | | 120,271 | |

Zhejiang Zheneng Electric Power Co., Ltd. | | | 246,600 | | | | 172,887 | |

Zhengzhou Yutong Bus Co., Ltd. | | | 66,400 | | | | 192,318 | |

Zhongjin Gold Corp., Ltd. | | | 120,570 | | | | 125,113 | |

Zhuzhou CRRC Times Electric Co., Ltd., Class H | | | 288,000 | | | | 1,365,828 | |

Zijin Mining Group Co., Ltd., Class H | | | 7,732,000 | | | | 2,964,204 | |

ZTE Corp., Class H(1) | | | 708,739 | | | | 1,071,610 | |

| | | | $ | 358,760,042 | |

|

| Colombia — 1.7% | |

Almacenes Exito SA | | | 569,955 | | | $ | 3,150,158 | |

Avianca Holdings SA, PFC Shares | | | 614,449 | | | | 493,689 | |

Banco Davivienda SA, PFC Shares | | | 190,600 | | | | 2,406,032 | |

Banco de Bogota SA | | | 49,573 | | | | 1,151,779 | |

Bancolombia SA | | | 86,292 | | | | 1,039,844 | |

Bancolombia SA ADR, PFC Shares | | | 127,200 | | | | 6,077,616 | |

Bolsa de Valores de Colombia | | | 171,383 | | | | 657,220 | |

Celsia SA ESP | | | 833,260 | | | | 1,320,514 | |

Cementos Argos SA | | | 509,458 | | | | 1,703,379 | |

Cementos Argos SA, PFC Shares | | | 190,626 | | | | 559,316 | |

Cemex Latam Holdings SA(1) | | | 266,452 | | | | 754,525 | |

Corporacion Financiera Colombiana SA | | | 161,465 | | | | 1,398,128 | |

Ecopetrol SA | | | 4,549,600 | | | | 4,695,430 | |

Ecopetrol SA ADR | | | 425,800 | | | | 8,750,190 | |

Empresa de Telecommunicaciones de Bogota

SA(1) | | | 2,267,738 | | | | 300,194 | |

Fabricato SA(1) | | | 34,115,900 | | | | 84,561 | |

Grupo Argos SA | | | 466,160 | | | | 3,158,574 | |

Grupo Argos SA, PFC Shares | | | 147,122 | | | | 893,458 | |

Grupo Aval Acciones y Valores SA | | | 1,723,100 | | | | 711,332 | |

Grupo Aval Acciones y Valores SA, PFC Shares | | | 3,247,601 | | | | 1,362,839 | |

Grupo de Inversiones Suramericana SA | | | 295,106 | | | | 3,785,669 | |

Grupo Energia Bogota SA ESP | | | 2,602,208 | | | | 1,811,127 | |

Grupo Nutresa SA | | | 450,615 | | | | 4,150,937 | |

Interconexion Electrica SA | | | 945,400 | | | | 4,676,925 | |

Odinsa SA(3) | | | 53,817 | | | | 192,790 | |

Organizacion Terpel SA | | | 13,768 | | | | 54,066 | |

| | | | $ | 55,340,292 | |

|

| Croatia — 0.7% | |

AD Plastik DD | | | 51,587 | | | $ | 1,602,464 | |

Adris Grupa DD, PFC Shares | | | 45,976 | | | | 3,081,077 | |

Atlantic Grupa DD | | | 15,350 | | | | 2,362,698 | |

Atlantska Plovidba DD(1) | | | 13,025 | | | | 980,041 | |

| | | | | | | | |

| Security | | Shares | | | Value | |

|

| Croatia (continued) | |

Ericsson Nikola Tesla DD | | | 5,610 | | | $ | 926,235 | |

Hrvatski Telekom DD | | | 284,978 | | | | 6,806,752 | |

Koncar-Elektroindustrija DD | | | 7,227 | | | | 757,591 | |

Kras DD | | | 3,067 | | | | 190,521 | |

Ledo DD(1)(3) | | | 983 | | | | 48,246 | |

Petrokemija DD(1) | | | 5,816 | | | | 8,170 | |

Podravka Prehrambena Industrija DD | | | 50,437 | | | | 2,565,120 | |

Privredna Banka Zagreb DD | | | 3,310 | | | | 392,943 | |

Valamar Riviera DD | | | 643,639 | | | | 4,117,803 | |

Zagrebacka Banka DD | | | 30,550 | | | | 292,658 | |

| | | | $ | 24,132,319 | |

|

| Czech Republic — 0.6% | |

CEZ AS | | | 348,557 | | | $ | 8,258,438 | |

Komercni Banka AS | | | 237,911 | | | | 9,991,744 | |

New World Resources PLC, Class A(1)(3) | | | 860,500 | | | | 0 | |

Philip Morris CR AS | | | 2,867 | | | | 1,968,520 | |

| | | | $ | 20,218,702 | |

|

| Egypt — 0.8% | |

Alexandria Mineral Oils Co. | | | 1,324,759 | | | $ | 863,257 | |

Commercial International Bank Egypt SAE | | | 1,127,929 | | | | 5,339,612 | |

Eastern Tobacco | | | 285,483 | | | | 2,836,132 | |

Egypt Kuwait Holding Co. SAE | | | 873,388 | | | | 1,005,718 | |

Egyptian Financial Group-Hermes Holding Co.(1) | | | 473,418 | | | | 612,415 | |

Egyptian International Pharmaceuticals EIPICO | | | 85,424 | | | | 644,963 | |

Egyptian Resorts Co.(1) | | | 2,375,648 | | | | 252,023 | |

ElSewedy Electric Co. | | | 281,540 | | | | 3,135,601 | |

Ezz Steel(1) | | | 740,231 | | | | 1,212,454 | |

Global Telecom Holding SAE(1) | | | 6,446,866 | | | | 1,683,263 | |

Juhayna Food Industries | | | 1,017,936 | | | | 687,598 | |

Maridive & Oil Services SAE(1) | | | 787,652 | | | | 385,752 | |

Medinet Nasr Housing(1) | | | 1,851,070 | | | | 1,104,113 | |

Orascom Telecom Media and Technology Holding SAE(1) | | | 8,189,110 | | | | 326,718 | |

Oriental Weavers Co. | | | 756,427 | | | | 518,679 | |

Pioneers Holding(1) | | | 516,023 | | | | 236,507 | |

Sidi Kerir Petrochemicals Co. | | | 616,480 | | | | 891,576 | |

Six of October Development & Investment Co.(1) | | | 275,153 | | | | 366,563 | |

Talaat Moustafa Group | | | 3,963,160 | | | | 2,597,982 | |

Telecom Egypt | | | 1,189,277 | | | | 936,695 | |

| | | | $ | 25,637,621 | |

|

| Estonia — 0.3% | |

AS Baltika(1) | | | 226,000 | | | $ | 55,364 | |

AS Merko Ehitus | | | 75,000 | | | | 858,411 | |

| | | | |

| | 13 | | See Notes to Financial Statements. |

Parametric Tax-Managed Emerging Markets Fund

June 30, 2018

Portfolio of Investments — continued

| | | | | | | | |

| Security | | Shares | | | Value | |

|

| Estonia (continued) | |

AS Tallink Grupp | | | 5,354,470 | | | $ | 6,697,053 | |

AS Tallinna Kaubamaja Grupp | | | 202,800 | | | | 2,179,059 | |

AS Tallinna Vesi | | | 35,235 | | | | 421,487 | |

Nordecon AS | | | 223,282 | | | | 281,463 | |

| | | | $ | 10,492,837 | |

|

| Ghana — 0.2% | |

Aluworks Ghana, Ltd.(1) | | | 5,176,100 | | | $ | 97,269 | |

CAL Bank, Ltd.(1) | | | 5,036,062 | | | | 1,346,523 | |

Ghana Commercial Bank, Ltd. | | | 1,384,370 | | | | 1,493,822 | |

Societe Generale Ghana, Ltd.(1) | | | 949,667 | | | | 248,694 | |

Standard Chartered Bank of Ghana, Ltd.(1) | | | 242,700 | | | | 1,367,262 | |

Unilever Ghana, Ltd. | | | 249,000 | | | | 924,706 | |

| | | | $ | 5,478,276 | |

|

| Greece — 1.4% | |

Aegean Airlines SA | | | 64,124 | | | $ | 630,958 | |

Alpha Bank AE(1) | | | 1,763,300 | | | | 3,929,298 | |

Athens Water Supply & Sewage Co. SA | | | 210,831 | | | | 1,377,169 | |

Costamare, Inc. | | | 34,966 | | | | 279,029 | |

Diana Shipping, Inc.(1) | | | 226,620 | | | | 1,090,042 | |

Eurobank Ergasias SA(1) | | | 2,774,000 | | | | 2,884,337 | |

FF Group(1)(3) | | | 43,721 | | | | 196,060 | |

GasLog, Ltd. | | | 92,216 | | | | 1,761,326 | |

GEK Terna Holding Real Estate Construction SA(1) | | | 120,661 | | | | 721,309 | |

Grivalia Properties REIC AE | | | 18,430 | | | | 184,819 | |

Hellenic Exchanges - Athens Stock Exchange SA | | | 114,224 | | | | 618,495 | |

Hellenic Petroleum SA | | | 132,875 | | | | 1,108,641 | |

Hellenic Telecommunications Organization SA | | | 527,055 | | | | 6,502,206 | |

Holding Co. ADMIE IPTO SA(1) | | | 970,278 | | | | 1,958,382 | |

JUMBO SA | | | 138,902 | | | | 2,285,017 | |

LAMDA Development SA(1) | | | 26,908 | | | | 193,115 | |

Marfin Investment Group Holdings SA(1) | | | 1,699,487 | | | | 203,301 | |

Motor Oil (Hellas) Corinth Refineries SA | | | 142,800 | | | | 2,866,958 | |

Mytilineos Holdings SA | | | 240,653 | | | | 2,408,858 | |

National Bank of Greece SA(1) | | | 1,214,700 | | | | 370,695 | |

Navios Maritime Holdings, Inc.(1) | | | 455,437 | | | | 387,987 | |

OPAP SA | | | 328,441 | | | | 3,703,147 | |

Piraeus Bank SA(1) | | | 169,722 | | | | 574,292 | |

Public Power Corp. SA(1) | | | 854,178 | | | | 1,837,723 | |

Safe Bulkers, Inc.(1) | | | 43,997 | | | | 149,590 | |

Star Bulk Carriers Corp.(1) | | | 62,600 | | | | 805,036 | |

StealthGas, Inc.(1) | | | 81,587 | | | | 320,637 | |

Terna Energy SA | | | 83,956 | | | | 503,429 | |

Titan Cement Co. SA | | | 193,774 | | | | 4,901,088 | |

| | | | | | | | |

| Security | | Shares | | | Value | |

|

| Greece (continued) | |

Tsakos Energy Navigation, Ltd. | | | 159,400 | | | $ | 592,968 | |

Viohalco SA(1) | | | 184,517 | | | | 737,741 | |

| | | | $ | 46,083,653 | |

|

| Hungary — 0.7% | |

Magyar Telekom Telecommunications PLC | | | 1,327,936 | | | $ | 1,888,560 | |

MOL Hungarian Oil & Gas PLC | | | 740,736 | | | | 7,127,816 | |

OTP Bank Nyrt | | | 226,778 | | | | 8,187,863 | |

Richter Gedeon Nyrt. | | | 309,705 | | | | 5,639,578 | |

| | | | $ | 22,843,817 | |

|

| India — 6.4% | |

ABB India, Ltd. | | | 33,400 | | | $ | 581,143 | |

ACC, Ltd. | | | 54,200 | | | | 1,058,474 | |

Adani Enterprises, Ltd. | | | 119,200 | | | | 196,293 | |

Adani Green Energy, Ltd.(1) | | | 90,711 | | | | 35,813 | |

Adani Ports and Special Economic Zone, Ltd. | | | 719,546 | | | | 3,916,858 | |

Adani Power, Ltd.(1) | | | 518,864 | | | | 122,055 | |

Aditya Birla Capital, Ltd.(1) | | | 55,662 | | | | 108,247 | |

Aditya Birla Fashion and Retail, Ltd.(1) | | | 137,831 | | | | 276,463 | |

Ambuja Cements, Ltd. | | | 468,923 | | | | 1,423,843 | |

Apollo Hospitals Enterprise, Ltd. | | | 61,400 | | | | 946,068 | |

Ashok Leyland, Ltd. | | | 820,626 | | | | 1,511,231 | |

Asian Paints, Ltd. | | | 182,388 | | | | 3,365,373 | |

Aurobindo Pharma, Ltd. | | | 119,800 | | | | 1,059,055 | |

Axis Bank, Ltd. | | | 157,800 | | | | 1,172,005 | |

Bajaj Auto, Ltd. | | | 42,600 | | | | 1,746,143 | |

Bajaj Holdings & Investment, Ltd. | | | 11,100 | | | | 466,786 | |

Balrampur Chini Mills, Ltd. | | | 262,700 | | | | 243,505 | |

Bharat Forge, Ltd. | | | 86,272 | | | | 773,592 | |

Bharat Heavy Electricals, Ltd. | | | 555,450 | | | | 582,939 | |

Bharat Petroleum Corp., Ltd. | | | 183,600 | | | | 1,008,156 | |

Bharti Airtel, Ltd. | | | 1,940,801 | | | | 10,812,830 | |

Bharti Infratel, Ltd. | | | 158,000 | | | | 694,223 | |

Biocon, Ltd. | | | 235,200 | | | | 2,119,774 | |

Bosch, Ltd. | | | 3,900 | | | | 998,576 | |

Cadila Healthcare, Ltd.(1) | | | 78,069 | | | | 431,559 | |

Century Textiles & Industries, Ltd. | | | 50,000 | | | | 648,509 | |

CESC, Ltd. | | | 24,742 | | | | 331,600 | |

Cipla, Ltd. | | | 207,400 | | | | 1,867,091 | |

Coal India, Ltd. | | | 372,500 | | | | 1,436,078 | |

Colgate-Palmolive (India), Ltd. | | | 46,200 | | | | 798,839 | |

Container Corp. Of India, Ltd. | | | 174,750 | | | | 1,657,186 | |

Cummins India, Ltd. | | | 79,700 | | | | 756,828 | |

Dabur India, Ltd. | | | 278,000 | | | | 1,580,884 | |

| | | | |

| | 14 | | See Notes to Financial Statements. |

Parametric Tax-Managed Emerging Markets Fund

June 30, 2018

Portfolio of Investments — continued

| | | | | | | | |

| Security | | Shares | | | Value | |

|

| India (continued) | |

Divi’s Laboratories, Ltd. | | | 49,800 | | | $ | 755,270 | |

DLF, Ltd. | | | 853,042 | | | | 2,350,983 | |

Dr. Reddy’s Laboratories, Ltd. | | | 24,300 | | | | 790,010 | |

Dr. Reddy’s Laboratories, Ltd. ADR | | | 12,700 | | | | 408,940 | |

Eicher Motors, Ltd. | | | 5,359 | | | | 2,245,240 | |

GAIL (India), Ltd. | | | 744,070 | | | | 3,698,038 | |

GlaxoSmithKline Pharmaceuticals, Ltd. | | | 8,000 | | | | 326,419 | |

Glenmark Pharmaceuticals, Ltd. | | | 114,000 | | | | 973,357 | |

Godrej Consumer Products, Ltd. | | | 28,750 | | | | 512,398 | |

Grasim Industries, Ltd. | | | 39,759 | | | | 584,620 | |

Great Eastern Shipping Co., Ltd. (The) | | | 56,700 | | | | 233,604 | |

Havells India, Ltd. | | | 93,600 | | | | 742,101 | |

HCL Technologies, Ltd. | | | 193,371 | | | | 2,614,676 | |

HDFC Bank, Ltd. | | | 198,400 | | | | 6,119,037 | |

Hero MotoCorp, Ltd. | | | 51,542 | | | | 2,609,070 | |

Hindalco Industries, Ltd. | | | 436,910 | | | | 1,469,429 | |

Hindustan Petroleum Corp., Ltd. | | | 302,850 | | | | 1,147,453 | |

Hindustan Unilever, Ltd. | | | 546,109 | | | | 13,040,193 | |

Hindustan Zinc, Ltd. | | | 244,148 | | | | 992,411 | |

Housing Development & Infrastructure, Ltd.(1) | | | 785,700 | | | | 236,353 | |

Housing Development Finance Corp., Ltd. | | | 239,575 | | | | 6,675,657 | |

ICICI Bank, Ltd. | | | 585,238 | | | | 2,347,923 | |

Idea Cellular, Ltd.(1) | | | 1,996,679 | | | | 1,721,540 | |

Indiabulls Real Estate, Ltd.(1) | | | 834,325 | | | | 1,900,565 | |

Indian Hotels Co., Ltd. (The) | | | 208,584 | | | | 402,059 | |

Indian Oil Corp., Ltd. | | | 755,390 | | | | 1,725,297 | |

Infosys, Ltd. | | | 532,890 | | | | 10,242,994 | |

ITC, Ltd. | | | 1,537,650 | | | | 5,948,430 | |

Jindal Steel & Power, Ltd.(1) | | | 90,000 | | | | 292,854 | |

JSW Energy, Ltd.(1) | | | 1,158,270 | | | | 1,102,384 | |

JSW Steel, Ltd. | | | 602,000 | | | | 2,871,021 | |

Kotak Mahindra Bank, Ltd. | | | 204,617 | | | | 4,018,862 | |

Larsen & Toubro, Ltd. | | | 168,867 | | | | 3,143,733 | |

Larsen & Toubro, Ltd. GDR(4) | | | 108,000 | | | | 1,970,563 | |

LIC Housing Finance, Ltd. | | | 62,800 | | | | 429,636 | |

Lupin, Ltd. | | | 97,200 | | | | 1,285,664 | |

Mahindra & Mahindra, Ltd. | | | 281,200 | | | | 3,680,689 | |

Maruti Suzuki India, Ltd. | | | 39,964 | | | | 5,144,643 | |

Mphasis, Ltd. | | | 34,428 | | | | 542,660 | |

Nestle India, Ltd. | | | 12,100 | | | | 1,732,907 | |

NHPC, Ltd. | | | 1,887,800 | | | | 648,244 | |

NTPC, Ltd. | | | 2,100,300 | | | | 4,888,889 | |

Oil & Natural Gas Corp., Ltd. | | | 937,863 | | | | 2,162,783 | |

Omaxe, Ltd. | | | 79,785 | | | | 255,128 | |

Oracle Financial Services Software, Ltd.(1) | | | 8,100 | | | | 482,018 | |

Petronet LNG, Ltd. | | | 185,900 | | | | 598,389 | |

| | | | | | | | |

| Security | | Shares | | | Value | |

|

| India (continued) | |

Piramal Enterprises, Ltd. | | | 43,598 | | | $ | 1,610,190 | |

Power Grid Corporation of India, Ltd. | | | 1,419,700 | | | | 3,886,949 | |

Reliance Communications, Ltd.(1) | | | 2,089,059 | | | | 415,907 | |

Reliance Industries, Ltd. | | | 855,696 | | | | 12,167,047 | |

Reliance Infrastructure, Ltd. | | | 171,400 | | | | 980,082 | |

Reliance Power, Ltd.(1) | | | 546,400 | | | | 255,228 | |

Siemens, Ltd. | | | 72,300 | | | | 1,034,026 | |

State Bank of India GDR(1)(4) | | | 49,600 | | | | 1,862,370 | |

Sun Pharmaceutical Industries, Ltd. | | | 473,300 | | | | 3,899,743 | |

Tata Chemicals, Ltd. | | | 58,600 | | | | 595,387 | |

Tata Communications, Ltd. | | | 124,400 | | | | 1,081,310 | |

Tata Consultancy Services, Ltd. | | | 235,214 | | | | 6,334,147 | |

Tata Global Beverages, Ltd. | | | 156,000 | | | | 612,663 | |

Tata Motors, Ltd.(1) | | | 305,826 | | | | 1,200,464 | |

Tata Power Co., Ltd. (The) | | | 1,002,648 | | | | 1,078,412 | |

Tata Steel, Ltd. | | | 173,884 | | | | 1,439,477 | |

Tata Steel, Ltd. (partially paid shares) | | | 11,992 | | | | 24,206 | |

Tech Mahindra, Ltd. | | | 143,648 | | | | 1,369,088 | |

Titan Co., Ltd. | | | 169,235 | | | | 2,166,422 | |

UltraTech Cement, Ltd. | | | 34,391 | | | | 1,907,729 | |

Unitech, Ltd.(1) | | | 2,242,680 | | | | 137,792 | |

United Spirits, Ltd.(1) | | | 107,665 | | | | 1,044,606 | |

UPL, Ltd. | | | 156,642 | | | | 1,415,224 | |

Vedanta, Ltd. | | | 656,840 | | | | 2,266,711 | |

Voltas, Ltd. | | | 224,100 | | | | 1,705,466 | |

Wipro, Ltd. | | | 309,642 | | | | 1,178,011 | |

Zee Entertainment Enterprises, Ltd. | | | 316,895 | | | | 2,518,193 | |

| | | | $ | 206,980,003 | |

|

| Indonesia — 2.7% | |

Adaro Energy Tbk PT | | | 28,006,600 | | | $ | 3,494,551 | |

Adhi Karya Persero Tbk PT | | | 1,270,800 | | | | 158,552 | |

AKR Corporindo Tbk PT | | | 4,660,500 | | | | 1,396,053 | |

Alam Sutera Realty Tbk PT | | | 12,514,600 | | | | 285,595 | |

Aneka Tambang Tbk | | | 8,587,500 | | | | 532,046 | |

Astra Argo Lestari Tbk PT | | | 654,000 | | | | 510,575 | |

Astra International Tbk PT | | | 16,668,000 | | | | 7,673,855 | |

Bank Central Asia Tbk PT | | | 3,787,000 | | | | 5,655,618 | |

Bank Danamon Indonesia Tbk PT | | | 3,237,181 | | | | 1,441,136 | |

Bank Mandiri Persero Tbk PT | | | 6,199,200 | | | | 2,965,870 | |

Bank Negara Indonesia Persero Tbk PT | | | 3,878,700 | | | | 1,905,838 | |

Bank Pan Indonesia Tbk PT(1) | | | 6,253,772 | | | | 370,548 | |

Bank Rakyat Indonesia Persero Tbk PT | | | 17,541,500 | | | | 3,469,548 | |

Bukit Asam Tbk PT | | | 10,799,500 | | | | 2,982,847 | |

Bumi Serpong Damai Tbk PT(1) | | | 8,439,700 | | | | 920,786 | |

| | | | |

| | 15 | | See Notes to Financial Statements. |

Parametric Tax-Managed Emerging Markets Fund

June 30, 2018

Portfolio of Investments — continued

| | | | | | | | |

| Security | | Shares | | | Value | |

|

| Indonesia (continued) | |

Charoen Pokphand Indonesia Tbk PT | | | 4,000,700 | | | $ | 1,026,673 | |

Ciputra Development Tbk PT | | | 7,986,900 | | | | 567,107 | |

Gudang Garam Tbk PT | | | 498,500 | | | | 2,335,761 | |

Hanson International Tbk PT(1) | | | 110,720,800 | | | | 1,018,693 | |

Indah Kiat Pulp & Paper Corp. Tbk PT | | | 3,326,500 | | | | 4,313,521 | |

Indo Tambangraya Megah Tbk PT | | | 1,269,200 | | | | 1,979,607 | |

Indocement Tunggal Prakarsa Tbk PT | | | 2,045,500 | | | | 1,945,090 | |

Indofood CBP Sukses Makmur Tbk PT | | | 2,546,000 | | | | 1,573,055 | |

Indofood Sukses Makmur Tbk PT | | | 4,080,900 | | | | 1,893,180 | |

Indosat Tbk PT | | | 1,322,500 | | | | 293,117 | |

Jasa Marga (Persero) Tbk PT | | | 3,247,500 | | | | 945,987 | |

Kalbe Farma Tbk PT | | | 52,943,300 | | | | 4,503,215 | |

Lippo Karawaci Tbk PT | | | 26,506,000 | | | | 627,489 | |

Matahari Putra Prima Tbk PT(1) | | | 5,148,000 | | | | 84,632 | |

Mitra Keluarga Karyasehat Tbk PT(1) | | | 935,900 | | | | 122,730 | |

Pakuwon Jati Tbk PT | | | 21,726,100 | | | | 802,854 | |

Perusahaan Gas Negara Persero Tbk PT | | | 20,779,500 | | | | 2,884,011 | |

Perusahaan Perkebunan London Sumatra Indonesia Tbk PT | | | 7,099,000 | | | | 489,438 | |

PP Persero Tbk PT | | | 4,793,002 | | | | 664,742 | |

Semen Indonesia Persero Tbk PT | | | 4,703,500 | | | | 2,337,985 | |

Sigmagold Inti Perkasa Tbk PT(1)(3) | | | 27,503,000 | | | | 47,981 | |

Summarecon Agung Tbk PT | | | 3,982,700 | | | | 251,048 | |

Telekomunikasi Indonesia Persero Tbk PT | | | 39,828,600 | | | | 10,430,900 | |

Unilever Indonesia Tbk PT | | | 918,500 | | | | 2,951,675 | |

United Tractors Tbk PT | | | 3,148,000 | | | | 6,931,617 | |

Vale Indonesia Tbk PT(1) | | | 4,748,000 | | | | 1,336,400 | |

Waskita Karya Persero Tbk PT | | | 1,713,400 | | | | 229,542 | |

Wijaya Karya Persero Tbk PT | | | 6,352,000 | | | | 586,497 | |

| | | | $ | 86,937,965 | |

|

| Jordan — 0.8% | |

Al-Eqbal Investment Co. PLC(1) | | | 71,512 | | | $ | 3,134,998 | |

Alia The Royal Jordanian Airlines PLC(1) | | | 115,334 | | | | 73,361 | |

Arab Bank PLC | | | 1,185,444 | | | | 11,511,441 | |

Arab Potash Co. PLC | | | 67,492 | | | | 1,425,415 | |

Bank of Jordan | | | 314,674 | | | | 1,086,411 | |

Cairo Amman Bank | | | 276,535 | | | | 584,689 | |

Capital Bank of Jordan | | | 470,740 | | | | 586,233 | |

Jordan Ahli Bank | | | 364,735 | | | | 596,376 | |

Jordan Islamic Bank | | | 260,193 | | | | 1,212,760 | |

Jordan Kuwait Bank | | | 51,749 | | | | 226,104 | |

Jordan Petroleum Refinery | | | 591,748 | | | | 2,144,788 | |

Jordan Phosphate Mines(1) | | | 83,990 | | | | 384,690 | |

Jordan Steel(1) | | | 269,400 | | | | 185,983 | |

Jordan Telecommunications Co. | | | 245,934 | | | | 609,731 | |

| | | | | | | | |

| Security | | Shares | | | Value | |

|

| Jordan (continued) | |

Jordanian Electric Power Co. | | | 494,491 | | | $ | 970,789 | |

Union Investment Corp. PLC(1) | | | 252,817 | | | | 417,182 | |

| | | | $ | 25,150,951 | |

|

| Kazakhstan — 0.7% | |

Halyk Savings Bank of Kazakhstan JSC GDR(4)(5) | | | 40,294 | | | $ | 487,557 | |

Halyk Savings Bank of Kazakhstan JSC GDR(4)(5) | | | 716,100 | | | | 8,661,924 | |

KAZ Minerals PLC(1) | | | 819,418 | | | | 9,057,001 | |

Kcell JSC GDR(4) | | | 544,503 | | | | 2,336,509 | |

Nostrum Oil & Gas PLC(1) | | | 390,353 | | | | 994,723 | |

| | | | $ | 21,537,714 | |

|

| Kenya — 0.7% | |