QuickLinks -- Click here to rapidly navigate through this documentUNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| Filed by the Registrantý |

Filed by a Party other than the Registranto |

Check the appropriate box: |

o |

|

Preliminary Proxy Statement |

o |

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

ý |

|

Definitive Proxy Statement |

o |

|

Definitive Additional Materials |

o |

|

Soliciting Material Pursuant to §240.14a-12

|

SEALY CORPORATION |

(Name of Registrant as Specified In Its Charter) |

N/A |

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

| | | | | |

| Payment of Filing Fee (Check the appropriate box): |

ý |

|

No fee required. |

o |

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | | (1) | | Title of each class of securities to which transaction applies:

|

| | | (2) | | Aggregate number of securities to which transaction applies:

|

| | | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

| | | (4) | | Proposed maximum aggregate value of transaction:

|

| | | (5) | | Total fee paid:

|

o |

|

Fee paid previously with preliminary materials. |

o |

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

|

|

(1) |

|

Amount Previously Paid:

|

| | | (2) | | Form, Schedule or Registration Statement No.:

|

| | | (3) | | Filing Party:

|

| | | (4) | | Date Filed:

|

SEALY CORPORATION

ONE OFFICE PARKWAY

TRINITY, NORTH CAROLINA 27370

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To Be Held April 25, 2007

March 27, 2007

To our stockholders:

On behalf of your board of directors, we are pleased to invite you to attend the 2007 annual meeting of stockholders of Sealy Corporation. The meeting will be held on Wednesday, April 25, 2007 at 9:00 a.m., local time, at the Grandover Resort & Conference Center, 1000 Club Road, Greensboro, North Carolina 27407.

At the meeting, you will be asked to:

- (1)

- Elect eight directors to serve until their successors are duly elected and qualified;

- (2)

- Ratify the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for the fiscal year ending December 2, 2007; and

- (3)

- Transact any other business properly brought before the meeting.

Sealy Corporation's board of directors set March 27, 2007 as the record date for the meeting. This means that owners of record of shares of Sealy common stock at the close of business on that date are entitled to:

- •

- notice of and to vote at the meeting, and

- •

- vote at the meeting and any adjournment or postponements of the meeting..

We urge each shareowner to sign and return the enclosed proxy card or to use telephone or Internet voting.

| | | Sincerely, |

|

|

[Insert signature] |

|

|

David J. McIlquham

Chairman and Chief Executive Officer |

This Notice of Annual Meeting, Proxy Statement and accompanying proxy card

are being distributed on or about March 27, 2007.

TABLE OF CONTENTS

| | PAGE

|

|---|

| GENERAL INFORMATION ABOUT SEALY'S ANNUAL MEETING | | 1 |

| | Stockholders Entitled to Vote | | 1 |

| | Required Vote | | 1 |

BOARD RECOMMENDATIONS AND APPROVAL REQUIREMENTS |

|

1 |

PROXIES AND VOTING PROCEDURES |

|

2 |

| | How Proxies are Voted | | 2 |

| | How to Revoke or Change Your Proxy | | 3 |

| | Method and Cost of Proxy Solicitation | | 3 |

| | Stockholder Director Nominations and Proposals for the 2008 Annual Meeting | | 3 |

PROPOSAL ONE—ELECTION OF DIRECTORS |

|

3 |

| | General Information | | 4 |

| | Nominees for Election at the Annual Meeting | | 4 |

PROPOSAL TWO—RATIFICATION OF APPOINTMENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM |

|

5 |

OTHER MATTERS |

|

6 |

CORPORATE GOVERNANCE AND RELATED MATTERS |

|

6 |

| | Director Independence | | 6 |

| | Meetings of the Board of Directors | | 6 |

| | Audit Committee | | 7 |

| | Compensation Committee | | 8 |

| | Nominating / Corporate Governance Committee | | 8 |

| | Presiding Director of Non-Management Executive Sessions | | 9 |

| | Corporate Governance Guidelines | | 9 |

| | Codes of Business Conduct and Ethics | | 9 |

| | Director Candidate Recommendations by Stockholders | | 9 |

| | Stockholder Communications with the Board of Directors | | 10 |

| | Director Compensation | | 10 |

| | Limitation on Directors' Liability and Indemnification | | 11 |

| AUDIT COMMITTEE REPORT AND AUDITOR FEES | | 11 |

| | Audit Committee Report | | 11 |

| | Audit and Related Fees | | 12 |

EXECUTIVE COMPENSATION |

|

13 |

| | Compensation Committee Report | | 13 |

| | Compensation Committee Interlocks and Insider Participation | | 15 |

| | Summary Compensation Table | | 16 |

| | Option Grants in Last Fiscal Year Table | | 17 |

| | Aggregated Option/SAR Exercises in Last Fiscal Year and Year-End Option/SAR Values | | 18 |

| | Compensation Pursuant to Plans and Other Arrangements | | 18 |

BENEFICIAL OWNERSHIP OF COMMON STOCK |

|

22 |

| | Section 16(a) Beneficial Ownership Reporting Compliance | | 24 |

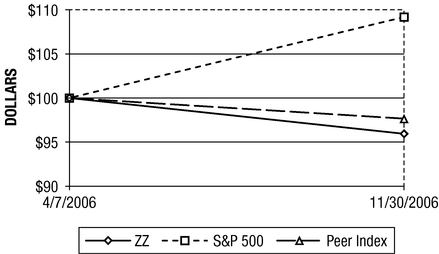

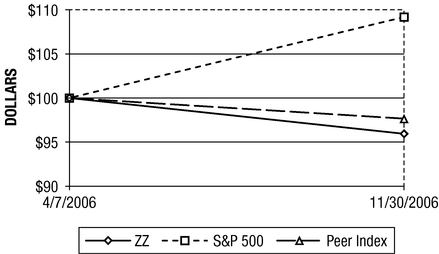

| STOCK PERFORMANCE GRAPH | | 25 |

CERTAIN RELATIONSHIPS AND RELATED PARTY TRANSACTIONS |

|

26 |

OTHER MATTERS |

|

28 |

| | Householding of Annual Meeting Materials | | 28 |

EXHIBIT A: Sealy Corporation's Audit Committee Charter |

|

A-1 |

i

SEALY CORPORATION.

ONE OFFICE PARKWAY

TRINITY, NORTH CAROLINA 27370

PROXY STATEMENT

For the Annual Meeting of Stockholders to be Held on

April 25, 2007

GENERAL INFORMATION ABOUT SEALY'S ANNUAL MEETING

We are providing this proxy statement in connection with the solicitation by the board of directors of Sealy Corporation ("Sealy") of proxies to be voted at our 2007 annual meeting of stockholders and at any adjournment of the annual meeting. You are cordially invited to attend the annual meeting, which will be held at the Grandover Resort & Conference Center, 1000 Club Road, Greensboro, North Carolina 27407, on Wednesday, April 25, 2007 at 9:00 a.m. local time.

Stockholders Entitled to Vote

The record date for the annual meeting is March 27, 2007. Only stockholders of record as of the close of business on that date are entitled to notice of and to vote at the annual meeting. On March 27, 2007, there were 91,532,208 shares of common stock outstanding.

Required Vote

The presence in person or by proxy of the holders of a majority of the shares outstanding on the record date is necessary to constitute a quorum for the transaction of business at the meeting. Each stockholder is entitled to one vote, in person or by proxy, for each share of common stock held as of the record date on each matter to be voted on. Abstentions and broker non-votes are included in determining whether a quorum is present. A broker non-vote occurs when a nominee holding shares for a beneficial owner does not vote on a particular proposal because the nominee does not have discretionary power with respect to that item and has not received instructions from the beneficial owner.

Directors will be elected by a plurality of the votes present in person or represented by proxy and entitled to vote at the annual meeting. Thus, an abstention or broker non-vote will have no effect on the outcome of the vote on election of directors at the annual meeting. For the ratification of the appointment of Deloitte & Touche LLP and all other matters, the affirmative vote of a majority of the votes present in person or represented by proxy and entitled to vote at the annual meeting is required.

As of March 27, 2007, affiliates of Kohlberg Kravis Roberts & Co. L.P., or KKR, beneficially own and have the right to vote approximately 50.9% of the outstanding shares of our common stock and have advised us that they intend to vote all such shares in favor of the nominees for director and ratification of Deloitte & Touche LLP. As a result, we are assured a quorum at the annual meeting, the election of the directors, and the ratification of the appointment of Deloitte & Touche LLP.

BOARD RECOMMENDATIONS AND APPROVAL REQUIREMENTS

Delaware law and Sealy's certificate of incorporation and by-laws govern the vote on each proposal. The board of directors' recommendation is set forth together with the description of each

1

item in this proxy statement. In summary, the board of directors' recommendations and approval requirements are:

PROPOSAL 1. ELECTION OF DIRECTORS

The first item to be voted on is the election of eight directors to serve until their successors are duly elected and qualified. The board of directors has nominated eight people as directors, each of whom is currently serving as a director of Sealy.

You may find information about these nominees, beginning on Page 4.

You may vote in favor of all the nominees, withhold your votes as to all nominees, or withhold your votes as to specific nominees. Assuming a quorum, each share of common stock may be voted for as many nominees as there are directors to be elected. Directors will be elected by a plurality of the votes cast. Stockholders may not cumulate their votes. Abstentions and broker non-votes will have no effect on the outcome of the vote on election of directors at the annual meeting.

The board of directors unanimously recommends a vote FOR each director nominee.

PROPOSAL 2. RATIFICATION OF APPOINTMENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

The second item to be voted on is the ratification of the appointment of Deloitte & Touche LLP as Sealy's independent registered public accounting firm for the fiscal year ending December 2, 2007.

You may find information about this proposal beginning on Page 5.

You may vote in favor of the proposal, vote against the proposal, or abstain from voting. Assuming a quorum, the proposal will pass if approved by a majority of the shares present in person or represented and entitled to vote on the matter. Abstentions will have the same effect as votes against the proposal and broker non-votes will have no effect on the outcome of the vote.

The board of directors unanimously recommends a vote FOR the ratification of the appointment of Deloitte & Touche LLP as Sealy's independent registered public accounting firm.

OTHER MATTERS TO COME BEFORE THE ANNUAL MEETING

The board of directors is not aware of any other business to be presented for a vote of the stockholders at the annual meeting. If any other matters are properly presented for a vote, the people named as proxies will have discretionary authority, to the extent permitted by law, to vote on such matters according to their best judgment.

PROXIES AND VOTING PROCEDURES

Your vote is important and you are encouraged to vote your shares promptly.

How Proxies are Voted

You may vote by completing and mailing the enclosed proxy card; electronically by telephone or on the Internet by following instructions included on the proxy card; or by voting in person at the annual meeting. Each proxy will be voted as directed. However, if a proxy solicited by the board of directors does not specify how it is to be voted, it will be voted as the board of directors recommends—that is, FOR the election of the eight nominees for director named in this proxy statement and FOR the ratification of the appointment of Deloitte & Touche LLP as Sealy's independent registered public accounting firm for fiscal year ending December 2, 2007. If any other matters are properly presented at the annual meeting for consideration, such as consideration of a motion to adjourn the annual meeting

2

to another time or place, the persons named as proxies will have discretion to vote on those matters according to their best judgment to the same extent as the person delivering the proxy would be entitled to vote. At the date this proxy statement went to press, we did not anticipate that any other matters would be raised at the annual meeting.

How to Revoke or Change Your Proxy

If you submit a proxy and then wish to change your vote or vote in person at the annual meeting, you will need to revoke the proxy that you have submitted. You can revoke your proxy at any time before it is voted by delivery of a properly executed, later-dated proxy or a written revocation of your proxy. A later-dated proxy or written revocation must be received before the annual meeting by the Corporate Secretary of Sealy, Kenneth L. Walker, at One Office Parkway, Trinity, North Carolina 27370, or it must be delivered to the Corporate Secretary at the annual meeting before proxies are voted. You will be able to change your proxy as many times as you wish prior to its being voted at the annual meeting and the last proxy received chronologically will supersede any prior proxies.

Method and Cost of Proxy Solicitation

This proxy solicitation is being made on behalf of Sealy and the expense of preparing, printing and mailing this proxy statement is being paid by us. Proxies may be solicited by officers, directors and employees of Sealy in person, by mail, telephone, facsimile or other electronic means. We will not specially compensate those persons for their solicitation activities. We have hired Georgeson Shareholder Communications to distribute and solicit proxies. We will pay Georgeson Shareholder Communications a fee of $1,200 plus reasonable expenses, for these services. In accordance with the regulations of the Securities and Exchange Commission and the New York Stock Exchange, we will reimburse brokerage firms and other custodians, nominees and fiduciaries for their expenses incurred in sending proxies and proxy materials to beneficial owners of our common stock.

Stockholder Director Nominations and Proposals for the 2008 Annual Meeting

Any proposal to be presented at our 2008 Annual Meeting of Stockholders must be received at the Company's principal office no later than December 1, 2007, in order to be considered for inclusion in the Company's proxy materials for such meeting. Any such proposals must comply with the requirements of Rule 14a-8 under the Exchange Act of 1934, as amended, or the Exchange Act, and be submitted in writing and addressed to the attention of the Corporate Secretary at One Office Parkway, Trinity, North Carolina 27370.

In accordance with our bylaws, proposals of stockholders intended to be presented at our 2008 Annual Meeting of Stockholders without inclusion of such proposals in our proxy statement and form of proxy relating to that annual meeting must be received by us at the above address not less than sixty days nor more than ninety days prior to the meeting; provided, that in the event that less than seventy days notice or prior public announcement of the date of the meeting is given or made to stockholders, notice by the stockholder to be timely must be so received not later than the tenth day following the date on which such notice of the date of the annual meeting was mailed or such public announcement was made.

PROPOSAL ONE

ELECTION OF DIRECTORS

The first agenda item to be voted on is the election of eight directors to serve until their successors are duly elected and qualified.

3

General Information

The board of directors currently consists of eight directors. Directors are generally elected for one-year terms. The term of office for all current directors expires at the annual meeting and thereafter until the person's successor has been duly elected and qualified.

�� This year's nominees have been nominated to serve for a one-year term expiring at the 2008 annual meeting of stockholders and thereafter until the person's successor has been duly elected and qualified. We have inquired of the nominees and determined that they will serve if elected. If, for any reason, any nominee becomes unavailable for election and the board of directors selects a substitute nominee, the proxies will be voted for the substitute nominee selected by the board of directors. The board of directors has no reason to believe that any of the named nominees is not available or will not serve if elected.

The nominees are all current directors of Sealy, and a description of the background of each is set forth below.

Nominees for Election at the Annual Meeting

Name

| | Age

| | Position

|

|---|

| Brian F. Carroll | | 35 | | Director |

| James W. Johnston | | 60 | | Director |

| David J. McIlquham | | 52 | | Director, Chairman, President & CEO |

| Gary E. Morin | | 58 | | Director |

| Dean B. Nelson | | 48 | | Director |

| Paul J. Norris | | 59 | | Director |

| Richard W. Roedel | | 57 | | Director |

| Scott M. Stuart | | 47 | | Director |

Brian F. Carroll. Mr. Carroll, age 35, has been a member of KKR since January 2006 and before that, an executive of KKR since July 1999. From September 1997 to June 1999, Mr. Carroll earned an M.B.A. at Stanford University Graduate School of Business. Before attending business school, from March 1995 to July 1997, he was an executive of KKR. Mr. Carroll is also a member of the board of directors of Rockwood Specialties Group, Inc. He has been a director of our company since April 2004.

James W. Johnston. Mr. Johnston, age 60, has been President and Chief Executive Officer of Stonemarker Enterprises, Inc., a consulting and investment company, since 1996. Mr. Johnston was Vice Chairman of RJR Nabisco, Inc., a diversified manufacturer of consumer products, from 1995 to 1996. He also served as Chairman and CEO of R. J. Reynolds Tobacco Co. from 1989 to 1995, Chairman of R. J. Reynolds Tobacco Co. from 1995 to 1996 and Chairman of R. J. Reynolds Tobacco International from 1993 to 1996. Mr. Johnston served on the board of RJR Nabisco, Inc. and RJR Nabisco Holdings Corp. from 1989 to 1996. From 1984 until joining Reynolds, Mr. Johnston was Division Executive, Northeast Division, of Citibank, N.A., a subsidiary of Citicorp, where he was responsible for Citibank's New York Banking Division, its banking activities in upstate New York, Maine and Mid-Atlantic regions, and its national student loan business. He has been a director of our company since March 1993.

David J. McIlquham. Mr. McIlquham, age 52, has been Chief Executive Officer since April 2002 and has been President since February 2001. He was elected Chairman of our board of directors in April 2004. He had been Chief Operating Officer from February 2001 to April 2002. Prior to that, he had been Corporate Vice President, Sales and Marketing since September 1998 and was Corporate Vice President, Marketing since joining us in 1990 until 1998. He has been a director since April 2002.

4

Gary E. Morin. Mr. Morin, age 58, was the Executive Vice President and Chief Financial Officer of Lexmark International, Inc. from 2000 until his retirement in 2005, where in addition to corporate finance functions, he was responsible for Lexmark's investor relations, corporate communications, strategy and development, and internal audit and security functions. Prior to joining Lexmark he held senior financial and operating positions with Huffy Corporation and Tambrands. He currently serves on the board of directors of Citrix Systems, Inc. He has been a director of the company since July 2006.

Dean B. Nelson. Mr. Nelson, age 48, has been Chief Executive Officer of Capstone Consulting LLC, a strategic consulting firm, since March 2000. He is also Chairman, CEO, President and a director of PRIMEDIA Inc., a targeted media company. From August 1985 to February 2000, Mr. Nelson was employed by Boston Consulting Group, Inc., a strategic consulting firm, where he was a Senior Vice President from December 1998 to February 2000 and held various other positions from August 1985 to November 1998. He has been a director of our company since April 2004.

Paul J. Norris. Mr. Norris, age 59, has been the non-executive Chairman and director of W.R. Grace & Co., a specialty chemicals and materials company, since May 2005, and has performed advisory services for KKR since 2001. He was Chief Executive Officer of W.R. Grace from 1998 through May 2005 and was also Chairman of W.R. Grace from 1999 through May 2005 (W.R. Grace filed for bankruptcy under Chapter 11 of the United States Bankruptcy Code in April 2001). He is also a director of FMC Corporation. He has been a director of our company since January 2006.

Richard W. Roedel. Mr. Roedel, age 57, is currently a director and Chairman of the Audit Committee for Brightpoint, Inc., Luna Innovations Incorporated, and Dade Behring Holdings, Inc. He is also a director and Audit Committee member for HIS, Inc. From 1985 through 2000, Mr. Roedel was employed by the accounting firm BDO Seidman LLP, the United States member firm of BDO International, as an Audit Partner, being promoted in 1990 to Managing Partner in Chicago, and then to Managing Partner in New York in 1994, and finally in 1999 to Chairman and Chief Executive Officer. Mr. Roedel joined the Board of Directors of Take-Two Interactive Software, Inc., a publisher of video games, in November 2002 and served in various capacities with that company through June 2005 including Chairman and Chief Executive Officer. Mr. Roedel is a director of the Association of Audit Committee Members, Inc., a non-profit association of audit committee members decicated to strengthening the audit committee by developing best practices. Mr. Roedel is a Certified Public Accountant. He has been a director of the company since August 2006.

Scott M. Stuart. Mr. Stuart, age 47, has been a founding partner of Sageview Capital since November 2005, and from 1996 through 2005 was a Member of KKR and had worked for KKR since 1986. He has been a director of our company since April 2004.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS THAT STOCKHOLDERS VOTE "FOR" THE NOMINEES LISTED ABOVE.

PROPOSAL TWO

RATIFICATION OF APPOINTMENT OF INDEPENDENT REGISTERED

PUBLIC ACCOUNTING FIRM

The second agenda item to be voted on is the ratification of the appointment of Deloitte & Touche LLP as independent registered public accounting firm for the fiscal year ending December 2, 2007.

The audit committee of the board of directors has appointed Deloitte & Touche LLP to audit our consolidated financial statements for the fiscal year ending December 2, 2007. We are asking our stockholders to ratify the appointment of Deloitte & Touche LLP as our independent registered public accounting firm. Although stockholder ratification of the appointment is not required, the board of directors is submitting the appointment of Deloitte & Touche LLP to our stockholders for ratification as a matter of good corporate practice.

5

Even if the appointment is ratified, the audit committee may in its discretion select a different independent registered public accounting firm at any time during the year if it determines that such a change would be in the best interests of Sealy and our stockholders. If the appointment is not ratified by our stockholders, the audit committee will reconsider the appointment.

A representative of Deloitte & Touche LLP is expected to attend the annual meeting and be available to respond to appropriate questions. The representative will be afforded an opportunity to make a statement, if he or she desires to do so.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS THAT STOCKHOLDERS VOTE "FOR" RATIFICATION OF THE APPOINTMENT OF DELOITTE & TOUCHE LLP AS SEALY'S INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM.

OTHER MATTERS

As of the date of this proxy statement, we know of no business that will be presented for consideration at the annual meeting other than the items referred to above. If any other matter is properly brought before the annual meeting for action by stockholders, proxies in the enclosed form returned to Sealy will be voted in accordance with the recommendation of the board of directors, or in the absence of such a recommendation, in accordance with the judgment of the proxy holder.

CORPORATE GOVERNANCE AND RELATED MATTERS

Director Independence

We avail ourselves of the "controlled company" exception under the New York Stock Exchange ("NYSE") rules which eliminates the requirements that we have a majority of independent directors on our board of directors, compensation committee and nominating/governance committee. Accordingly, we have a compensation committee with only one independent director and a nominating/corporate governance committee composed entirely of non-independent directors. On March 26, 2007 Mr. Carroll resigned from our audit committee and was replaced by Mr. Johnston. As a result, we now have an audit committee consisting of three members composed entirely of independent members. The nominating/governance committee of the board of directors has determined that James W. Johnston, Gary E. Morin and Richard W. Roedel are independent directors within the meaning of applicable NYSE listing standards and the applicable provisions of the Securities Exchange Act of 1934, as amended.

When making "independence" determinations, the nominating and governance committee and the board of directors shall broadly consider all relevant facts and circumstances, as well as any other facts and considerations specified by the NYSE, by law or by any rule or regulation of any other regulatory body or self-regulatory body applicable to Sealy. When assessing the materiality of a director's relationship with Sealy, the board of directors shall consider the issue not merely from the standpoint of the director, but also from that of persons or organizations with which the director has an affiliation.

Meetings of the Board of Directors

The board of directors is required to meet at least four times annually, or more frequently as circumstances dictate. The board of directors met nine times in fiscal 2006, either in person or by telephone. All directors are expected to participate, whether in person or by telephone, in all board meetings. Each director attended at least 75% of all board of directors and applicable committee meetings during fiscal 2006.

6

Audit Committee

Our audit committee currently consists of Richard W. Roedel, James W. Johnston, and Gary E. Morin. Mr. Roedel is the chairperson of the audit committee. The board of directors has determined that all of members of the audit committee are financially literate and meet the independence and expertise requirements mandated by the applicable New York Stock Exchange listing standards, Section 10A(m)(3) of the Securities Exchange Act of 1934 and our independence standards. Mr. Roedel has been designated by the board of directors as the "audit committee financial expert". Mr. Roedel currently serves on the audit committees of four other public companies. The board of directors reviewed Mr. Roedel's obligations as a member of other audit committees in accordance with New York Stock Exchange rules and determined that his simultaneous service on those other audit committees does not impair his ability to effectively serve on Sealy's audit committee.

Our audit committee is responsible for (1) selecting the independent auditors, (2) approving the overall scope of the audit, (3) assisting the board of directors in monitoring the integrity of our financial statements, the independent accountant's qualifications and independence, the performance of the independent accountants and our internal audit function and our compliance with legal and regulatory requirements, (4) annually reviewing an independent auditors' report describing the auditing firms' internal quality-control procedures, any material issues raised by the most recent internal quality-control review, or peer review, of the auditing firm, (5) discussing the annual audited financial and quarterly statements with management and the independent auditor, (6) discussing earnings press releases, as well as financial information and earnings guidance provided to analysts and rating agencies, (7) discussing policies with respect to risk assessment and risk management, (8) meeting separately, periodically, with management, internal auditors and the independent auditor, (9) reviewing with the independent auditor any audit problems or difficulties and managements' response, (10) setting clear hiring policies for employees or former employees of the independent auditors, (11) handling such other matters that are specifically delegated to the audit committee by the board of directors from time to time and (12) reporting regularly to the full board of directors.

The audit committee has adopted a formal policy concerning the pre-approval of audit and non-audit services to be provided by our independent registered public accounting firm. The policy requires that all services to be performed by Deloitte & Touche LLP, including audit services, audit-related services and permitted non-audit services, be pre-approved by the audit committee. Pre-approval is generally provided for up to one year, and any pre-approval is detailed as to the particular service or category of services and is subject to a budget. Specific services being provided by the independent accountants are regularly reviewed in accordance with the pre-approval policy and the audit committee may pre-approve particular services on a case-by-case basis. The audit committee has delegated the authority to grant pre-approvals to Mr. Roedel, the audit committee chair, when the full audit committee is unable to do so. At each subsequent audit committee meeting, the audit committee reviews these pre-approvals, receives updates on the services actually provided by the independent accountants, and management may present additional services for approval. For fiscal 2006, the audit committee pre-approved all audit, audit-related and non-audit services performed by Deloitte & Touche LLP.

Our audit committee is required to meet at least four times annually, or more frequently as circumstances dictate. The committee met twelve times in fiscal 2006.

Our board of directors has adopted a written charter for the audit committee, which is available on our website atwww.sealy.com in the "Investor Relations—Corporate Governance" section, and upon written request by our stockholders at no cost. A copy of our audit committee charter is included as Appendix A to this proxy statement.

7

Compensation Committee

Our compensation committee currently consists of Brian F. Carroll, James W. Johnston and Scott M. Stuart. Mr. Johnston is an independent director and Messrs. Carroll and Stuart are not independent, as permitted by the "controlled company" exception. Mr. Johnston is the chairperson of the compensation committee.

Our compensation committee is responsible for (1) reviewing key employee compensation policies, plans and programs, (2) reviewing and approving the compensation of our executive officers, (3) reviewing and approving employment contracts and other similar arrangements between us and our executive officers, (4) reviewing and consulting with the chief executive officer on the selection of officers and evaluation of executive performance and other related matters, (5) administration of stock plans and other incentive compensation plans and (6) such other matters that are specifically delegated to the compensation committee by the board of directors from time to time.

Our compensation committee is required to meet at least two times annually, or more frequently, as circumstances dictate. Our compensation committee met six times in fiscal 2006.

Our board of directors has adopted a written charter for the compensation committee which is available on our website atwww.sealy.com in the "Investor Relations—Corporate Governance" section, and upon written request by our stockholders at no cost.

Nominating/Corporate Governance Committee

Our nominating/corporate governance committee consists of Brian F. Carroll, Dean B. Nelson and David J. McIlquham, none of whom are independent, as permitted by the "controlled company" exception. Mr. Nelson is the chairperson of the nominating/corporate governance committee.

The nominating/corporate governance committee is responsible for (1) developing and recommending criteria for selecting new directors, (2) overseeing evaluations of the board of directors and its members, (3) screening and recommending to the board of directors individuals qualified to become executive officers and (4) handling such other matters that are specifically delegated to the nominating/corporate governance committee by the board of directors from time to time.

In nominating candidates to serve as directors, the board of directors' objective, with the assistance of the nominating/corporate governance committee, is to select individuals with skills and experience that can be of assistance to management in operating our business. When evaluating the recommendations of the nominating/corporate governance committee, the board of directors should consider whether individual directors possess the following personal characteristics: integrity, accountability, informed judgment, financial literacy, mature confidence and high performance standards. The board of directors as a whole should possess all of the following core competencies, with each candidate contributing knowledge, experience and skills in at least one domain: accounting and finance, business judgment, management, industry knowledge, leadership and strategy/vision. For a description of the procedures for stockholders to submit proposals regarding director nominations, see "Stockholder Director Nominations" below.

Our nominating/corporate governance committee is required to meet at least two times annually, or more frequently as circumstances dictate. Our nominating/corporate governance committee met only one time in fiscal 2006 because the committee was established during the fiscal year in connection with Sealy becoming a public company in April 2006.

Our board of directors has adopted a written charter for the nominating/corporate governance committee which is available at our website atwww.sealy.com in the "Investor Relations—Corporate Governance" section, and upon written request by our stockholders at no cost.

8

Presiding Director of Non-Management Executive Sessions

At each executive session of non-management members of the board of directors, the non-management members in attendance determine which member will preside at such session.

Corporate Governance Guidelines

The board of directors has adopted Corporate Governance Guidelines which set forth the board of directors' core principles of corporate governance and are designed to promote its effective functioning and assist the board of directors in fulfilling its responsibilities. The board of directors will review and amend these guidelines from time to time as it deems necessary and appropriate. The Corporate Governance Guidelines are available on our website atwww.sealy.com in the "Investor Relations—Corporate Governance" section, and upon written request by our stockholders at no cost.

Code of Business Conduct and Ethics

We are committed to conducting business in accordance with the highest ethical standards and all applicable laws, rules and regulations. We have adopted a Code of Business Conduct and Ethics that applies to our employees, executive officers and directors. Our Code of Business Conduct and Ethics is available on our website atwww.sealy.com, in the "Investor Relations—Corporate Governance" section, and upon written request by our stockholders at no cost.

Director Candidate Recommendations by Stockholders

Each director candidate recommendation by a stockholder should be accompanied by certain information relating to the stockholder making such recommendation, as well as information concerning the recommended candidate, including the name, address and relevant qualifications of the recommended candidate. A stockholder who wishes to recommend a candidate for election to the board of directors should submit it to the nominating/corporate governance committee by December 1, 2007:

By mail:

Stockholder Director Recommendation

Nominating/Corporate Governance Committee

c/o: Senior Vice President, General Counsel, & Secretary

Sealy Corporation

One Office Parkway

Trinity, North Carolina 27370

By fax:

9

Stockholder and Interested Person Communications with the Board of Directors

Any stockholder or interested person may communicate with (i) the board of directors as a whole, (ii) the independent directors as a group, (iii) any individual member of the board of directors, or (iv) any committee of the board of directors by submitting those communications to the appropriate person or group:

By mail:

Stockholder Communication to the Board of Directors

[Name of Appropriate Person or Group]

c/o: Senior Vice President, General Counsel, & Secretary

Sealy Corporation

One Office Parkway

Trinity, North Carolina 27370

By fax:

All appropriate stockholder or interested person communications received by the Senior Vice President, General Counsel & Secretary will be forwarded to the appropriate person or group. Inappropriate communications include those not related to the duties or responsibilities of the board of directors. In addition, the receipt of any accounting, internal controls or audit-related complaints or concerns will be forwarded to the audit committee.

A copy of these procedures is available on our website atwww.sealy.com in the "Investor Relations—Corporate Governance" section, and upon written request by our stockholders at no cost.

Director Compensation

Our non-employee directors each receive a retainer of $40,000 per year plus $1,500 for each board meeting attended in person and $500 for each board meeting attended by telephone. The board committee members receive an additional annual retainer of $16,000 for the Chairman of the audit committee, $4,000 for other committee chairs, $4,000 for other audit committee members, and $2,000 for members of other Board committees. Committee members are paid $1,000 for each meeting attended in person and $500 per telephonic meeting attended. All fees are paid on a quarterly basis. The directors may elect to defer all or a portion of these fees into stock appreciation units. Annually, each director may elect to defer all or a portion of their fees as a Sealy director under the Sealy Director's Deferred Compensation Plan. Under this plan, on the date director fees become payable, Sealy credits the deferred compensation account of each director with the number of share units of Sealy's common stock which is equal to the deferred portion of any fee due the director at such time, divided by the per share market value of Sealy's shares on that date. Sealy also credits each director's deferred compensation account with the number of share units equal to any cash dividends (or the fair market value of dividends paid in property other than dividends payable in common stock) payable on the number of shares of common stock represented in each director's deferred compensation account divided by Sealy's per share stock value on the dividend payment date. Distributions from a director's deferred compensation account shall be paid in Sealy's common stock or the cash equivalent thereof, at the election of Sealy, and shall begin on either the first day of the calendar year following or six months following (whichever is later), the later of the attainment of the director's retirement date (as indicated in the director's deferral election) or separation from Sealy's board of directors.

10

Limitation on Directors' Liability and Indemnification

Our certificate of incorporation limits the liability of directors to the maximum extent permitted by Delaware law. Under Delaware law, a director will not be personally liable for monetary damages for breach of his or her fiduciary duty as a director, except for liability for:

- •

- breach of his or her duty of loyalty to us or our stockholders;

- •

- acts or omissions not in good faith or that involve intentional misconduct or a knowing violation of law;

- •

- unlawful payments of dividends or unlawful stock repurchases or redemptions as provided in Section 174 of the Delaware General Corporation Law; or

- •

- any transaction from which he or she derived an improper personal benefit.

Our bylaws provide that we:

- •

- are required to indemnify our directors and executive officers to the maximum extent permitted by Delaware law;

- •

- may indemnify our employees and agents as set forth in Delaware General Corporation Law, subject to very limited exceptions;

- •

- are required to advance expenses, as incurred, to our directors and executive officers in connection with a legal proceeding; and

- •

- may advance expenses, as incurred, to our employees and agents in connection with a legal proceeding.

We also maintain directors' and officers' liability insurance to cover our directors, executive officers and some of our employees for liabilities, including liabilities under securities laws. We believe that our certificate of incorporation, bylaws and insurance are necessary to attract and retain qualified persons as directors and executive officers.

The limitation of liability and indemnification provisions in our certificate of incorporation and bylaws may discourage stockholders from bringing a lawsuit against directors for breach of their fiduciary duty. They may also reduce the likelihood of derivative litigation against directors and executive officers, even though an action, if successful, might benefit us and other stockholders. Furthermore, a stockholder's investment may be adversely affected to the extent we pay the costs of settlement and damage awards against directors and executive officers as required by these indemnification provisions.

At present, we are not aware of any pending litigation or proceeding involving any of our directors or executive officers in which indemnification is required or permitted and we are not aware of any threatened litigation or proceeding that may result in a claim for indemnification.

AUDIT COMMITTEE REPORT AND AUDITOR FEES

Audit Committee Report

The audit committee reviews Sealy's financial reporting process on behalf of the board of directors. Management has the primary responsibility for the financial statements and the reporting process, including the system of internal controls. The independent registered public accounting firm is responsible for expressing an opinion on those audited consolidated financial statements in conformity with accounting principles generally accepted in the United States.

In fulfilling its responsibilities, the audit committee has reviewed and discussed the audited consolidated financial statements contained in Sealy's Annual Report on Form 10-K for the year ended

11

November 26, 2006 with Sealy's management and independent registered public accounting firm. The audit committee has also discussed with the independent registered public accountant the matters required to be discussed by Statement on Auditing Standards No. 61,Communications With Audit Committees, including the quality, not just the acceptability of the accounting principles, the reasonableness of significant judgments, and the clarity of the disclosures in the financial statements. In addition, the audit committee reviewed and discussed with the independent registered public accounting firm the auditor's independence from Sealy and its management, including the matters in the written disclosures and letter which were received by the audit committee from the independent registered public accountant, as required by Independence Standards Board Standard No. 1,Independence Discussions with Audit Committees.

Based on the reviews and discussions referred to above, the audit committee approved the audited consolidated financial statements and recommended to the board of directors that they be included in Sealy's Annual Report on Form 10-K for the year ended November 26, 2006, for filing with the Securities and Exchange Commission. The audit committee has also selected Deloitte & Touche LLP as Sealy's independent registered public accounting firm and are presenting the selection to the stockholders for ratification.

| | | Richard W. Roedel,Chairperson

James W. Johnston

Gary E. Morin |

The preceding audit committee report is provided only for the purpose of this proxy statement. This report shall not be incorporated, in whole or in part, in any other Sealy filing under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended.

Audit and Related Fees

The following table summarizes aggregate fees billed to us by Deloitte & Touche LLP for the fiscal years ended November 26, 2006 and November 27, 2005, with the following notes explaining the services underlying the table captions:

| | 2006

| | 2005

|

|---|

| | (thousands)

|

|---|

| Audit fees(1) | | $ | 882 | | $ | 1,092 |

| Audit-related fees(2) | | | 581 | | | 917 |

| Tax fees | | | — | | | 4 |

| All other fees(3) | | | 429 | | | 46 |

| | |

| |

|

| Total | | $ | 1,892 | | $ | 2,059 |

- (1)

- Includes fees for the audit of our annual consolidated financial statements.

- (2)

- Includes fees for international statutory audits as well as services related to our various public filings, including the initial public offering of Sealy Corporation stock and Form 10-Q filings.

- (3)

- Includes fees related to due diligence reviews of potential mergers, acquisitions and dispositions.

For additional information, please see "Audit Committee" beginning on page 7.

12

EXECUTIVE COMPENSATION

Compensation Committee Report

Compensation Philosophy, Policies and Plans for Executive Officers

The compensation committee operates pursuant to a charter which delegates responsibility for the compensation and benefits of Sealy's executive officers and other members of senior management to the compensation committee. The compensation committee is primarily responsible for:

- •

- Discharging the responsibilities of the board of directors to the shareholders, potential shareholders and investment community with respect to our compensation and benefit programs and compensation of our executives; and

- •

- Producing an annual report on executive compensation for inclusion in our annual proxy statement, in accordance with applicable New York Stock Exchange, Securities and Exchange Commission and other regulatory bodies.

Sealy and its subsidiaries seek to attract and retain highly qualified and talented professionals. The marketplace in which Sealy competes is highly competitive. Further, our compensation policies, while designed to secure the services of appropriate professionals, must also support our vision of creating a dynamic company, and delivering superior value and growth.

In furtherance of these goals, Sealy's executive compensation program is reviewed and approved by the compensation committee. The compensation committee has retained Watson Wyatt, a human resources consulting firm, to provide advisory services in connection with reviewing its compensation program, including the compensation of our chairman, president and chief executive officer, executive officers and key employees. Our consultant provided data that reflect the compensation practices for public companies of comparable business character and size to assist the compensation committee's review. In addition, the compensation committee considered published compensation survey data provided by our consultants for similar executive job descriptions.

There are three main elements to our senior executive compensation:

- •

- Cash compensation through salaries;

- •

- Variable annual cash compensation through the Sealy Corporation Bonus Plan (the "Bonus Plan"); and

- •

- Long term equity compensation through our previous 1998 Stock Option Plan and our current 2004 Stock Option Plan.

Base salaries are set at levels designed to be competitive in the labor markets in which our senior executives operate. The compensation committee annually reviews the performance of our executive officers, including our chairman and chief executive officer, based on quantitative and qualitative criteria as well as comparisons to survey data and establishes appropriate increases in base salary compensation.

Annual cash bonuses under the Bonus Plan are offered to both attract and retain employees while also motivating them to better achieve the company's financial goals through rewards for contributions to the success of the company. The compensation committee believes that there should be a strong relationship between annual bonus pay and corporate performance and in addition a significant portion

13

of executive compensation should be "at risk" (i.e., directly dependent upon the achievement of pre-established corporate and/or individual performance goals).

Target annual bonus payments, expressed as a percentage of base salary, have been set by the Bonus Plan for most bonus eligible employees based on job responsibilities. For selected senior company executives the compensation committee determines the applicable bonus percentage. Bonus award payments under the Bonus Plan for the year may range from zero to 200% of the named executive officer's or key employee's target, based on the performance by Sealy's and the executive's business unit compared to the pre-established performance goal or goals. The quantitative performance goals are determined at the beginning of the year by our board of directors or the compensation committee and currently include such factors as earnings before interest tax depreciation & amortization ("EBITDA") and free cash flow or net debt level. Each year, three levels are set for each goal: minimum, target and maximum.

Generally, a Bonus Plan participant must be employed at the end of the fiscal year for which a bonus is payable in order to be eligible to receive a bonus for such fiscal year. Bonuses are paid in a single lump sum by March 6 immediately following the end of the applicable fiscal year. The board may amend, terminate or otherwise modify the Bonus Plan at any time.

Owning an equity interest is a fundamental part of our compensation philosophy and furthers the goal of aligning management compensation with the interests of stockholders. Our executive officers and certain key employees have been granted stock options to acquire Sealy shares under our 2004 and 1998 Stock Options Plans. Historically, these grants have not been annual but have been made periodically based generally on events such as significant changes at Sealy or individual changes in responsibilities or positions.

As part of our Recapitalization, as described in our Annual Report on Form 10-K for the fiscal year ended November 26, 2006, all then outstanding stock options under our 1998 stock option plan were either paid out or rolled over into new fully vested 10 year term options ("Rollover Options"). In April 2004 the company adopted the 2004 Stock Option Plan that provides for the grant of cash and cashless exercise stock options, stock appreciation rights and/or dividend equivalent rights to management and other key employees on terms and subject to conditions as established by the compensation committee of our board of directors or certain of the committee's designees. Since April 2004 all stock options granted by the company ("New Options") have been granted under the 2004 Stock Option Plan.

The New Options have been granted either as "time options," which vest and become exercisable ratably on a monthly basis over the three to five years following the date of grant, or "performance options," which vest and become exercisable over several fiscal years through fiscal year 2008 upon the achievement of certain EBITDA performance targets, and in any event by the eighth anniversary of the date of grant.

All Rollover Options and New Options, and any common stock for which such options are exercised, are governed by a management stockholders' agreement and a sale participation agreement, which together provide for the following:

- •

- transfer restrictions until April 7, 2009, subject to certain exceptions;

- •

- in the event of termination of employment, call and put rights with respect to the Rollover Options and New Options and any common stock for which such options have been exercised;

- •

- "piggyback" registration rights on behalf of the members of management; and

- •

- "tag-along" rights on behalf of the members of management and "drag-along" rights for KKR.

14

All option grants made under our 1998 and 2004 Stock Option Plans have been made in the form of non-qualified stock options at exercise prices equal to or above the fair market value of Sealy's common stock at the date of grant. For all stock option grants made in fiscal 2006, the committee used the applicable method provided in the 2004 Stock Option Plan to determine the fair market value for stock option grants, which is the average closing price of company's stock on the five closing days prior to the date on which a stock option is granted.

Mr. McIlquham's base salary was raised to $675,000 during 2006 and he received a cash bonus under the Bonus Plan of $252,461 in March 2007 based on the Sealy's fiscal 2006 performance. The base salary and target bonus percentage portions of Mr. McIlquham's compensation package were based on comparable competitive salary and bonus information and the annual performance of Sealy compared to earlier years. Factors include the performance criteria described above, as well as Mr. McIlquham's overall leadership and influence on the financial performance and strategic direction of Sealy. Mr. McIlquham's actual annual bonus payout was based on Sealy's fiscal 2006 EBITDA and net debt results versus the targets established in advance by the compensation committee of the board of directors.

Section 162(m) of the Internal Revenue Code generally allows a deduction to publicly traded companies for certain qualifying performance based compensation. Section 162(m) disallows a deduction to the extent certain non-performance based compensation over $1 million paid to the chief executive officer or any of the four other most highly compensated executive officers. Because Sealy became publicly traded in 2006, Sealy believes that Section 162(m) deduction limits for fiscal 2006 will not be applicable. Sealy believes its Bonus Plan is exempt from Section 162(m) until its 2010 annual stockholder's meeting under relief provided to companies that become publicly held in connection with an initial public offering. In addition, Sealy believes the Bonus Plan satisfies the requirements for exemption under Internal Revenue Code Section 162(m) as a performance based plan. To maintain flexibility in compensating executive officers in a manner consistent with its goals, the compensation committee has not adopted a policy that all compensation must be deductible. The compensation committee will continue to monitor this matter.

| | | James W. Johnston,Chairperson

Brian F. Carroll

Scott M. Stuart |

Compensation Committee Interlocks and Insider Participation

The compensation levels of our executive officers are currently determined by the compensation committee as described in this proxy statement. None of the members of Sealy's compensation committee during fiscal 2006 or as of the date of this proxy is or has been an officer or employee of Sealy. None of our executive officers has served on the compensation committee or board of any company that employed any member of Sealy's compensation committee or Sealy's board of directors.

15

Summary Compensation Table

The following table sets forth information concerning the annual and long-term compensation for services in all capacities to the Company for each of the years ended November 26, 2006, November 27, 2005 and November 28, 2004, of those persons who served as (i) the chief executive officer during fiscal 2006, 2005 and 2004, and (ii) the other four most highly compensated executive officers of the Company for fiscal 2006 (collectively, the "Named Executive Officers"):

Name and Principal Position

| | Year

| | Salary

| | Bonus (a)

| | Other Annual

Compensation

| | Restricted Stock

Award($)

| | Underlying

Options(b)

| | LTIP

Payout

| | All Other

Compensation(c)

|

|---|

| David J. McIlquham | | 2006 | | $ | 659,896 | | $ | 252,461 | | $ | 6,690,953 | (d) | — | | 425,154 | | $ | — | | $ | 22,108 |

| Chairman, President and CEO | | 2005 | | $ | 621,250 | | $ | 745,104 | | $ | — | | — | | — | | $ | — | | $ | 30,522 |

| | | 2004 | | $ | 575,417 | | $ | 542,293 | | $ | 1,030,794 | (e) | — | | 3,483,573 | (f) | $ | — | | $ | 1,869,538 |

James B. Hirshorn(g) |

|

2006 |

|

$ |

415,005 |

|

$ |

144,101 |

(h) |

$ |

2,218,727 |

(d) |

— |

|

343,736 |

|

$ |

— |

|

$ |

21,333 |

| Former Senior Executive VP— | | 2005 | | $ | 370,497 | | $ | 308,163 | | $ | — | | — | | — | | $ | — | | $ | 29,737 |

| Finance, Operations and | | 2004 | | $ | 336,917 | | $ | 211,703 | | $ | 397,495 | (e) | — | | 1,088,793 | (f) | $ | — | | $ | 1,066,779 |

| Research and Development | | | | | | | | | | | | | | | | | | | | | |

Lawrence J. Rogers |

|

2006 |

|

$ |

315,537 |

|

$ |

131,292 |

(h) |

$ |

742,380 |

(d) |

— |

|

48,373 |

|

$ |

— |

|

$ |

20,932 |

| President, North America | | 2005 | | $ | 303,468 | | $ | 187,208 | | $ | — | | — | | — | | $ | — | | $ | 29,265 |

| | | 2004 | | $ | 293,282 | | $ | 160,482 | | $ | 126,974 | (e) | — | | 347,717 | (f) | $ | — | | $ | 3,202,409 |

Jeffrey C. Ackerman |

|

2006 |

|

$ |

253,750 |

|

$ |

106,040 |

(i) |

$ |

66,561 |

(j) |

— |

|

244,914 |

|

$ |

— |

|

$ |

1,323 |

| Executive Vice President & | | 2005 | | $ | — | | $ | — | | $ | — | | — | | — | | $ | — | | $ | — |

| Chief Finacial Officer | | 2004 | | $ | — | | $ | — | | $ | — | | — | | — | | $ | — | | $ | — |

Philip Dobbs |

|

2006 |

|

$ |

300,078 |

|

$ |

54,397 |

(h) |

$ |

113,911 |

(d) |

— |

|

10,997 |

|

$ |

— |

|

$ |

15,466 |

| Senior Vice President, | | 2005 | | $ | 195,347 | | $ | 231,759 | (i) | $ | 57,961 | (j) | — | | 293,243 | (f) | $ | — | | $ | 1,724 |

| Marketing | | 2004 | | $ | — | | $ | — | | $ | — | | — | | — | | $ | — | | $ | — |

- (a)

- Represents amounts paid to each of the named executive officers for bonus payments under the Sealy's annual bonus plan and to the extent noted below for Chairman's Award bonuses and employment signing bonuses.

- (b)

- The named executive officers have been granted ten year non-qualified stock options to acquire shares of our Class A common stock at or above the then current fair market value as follows: (1) Grants made on July 20, 2004 at $5.79 each: 3,483,573 options to Mr. McIlquham, 1,088,793 to Mr. Hirshorn and 347,715 options to Mr. Rogers; (2) Grants made on April 6, 2005 at $8.23 each: 293,242 options to Mr. Dobbs; (3) Grants made on April 6, 2006 at $16.00 each: 278,790 options to Mr. McIlquham, 297,507 options to Mr. Hirshorn, 31,720 options to Mr. Rogers, 214,124 options to Mr. Ackerman and 7,.211 options to Mr. Dobbs; (4) Grants made on April 19, 2006 at $16.55 each: 88,280 options to Mr. McIlquham, 27,883 options to Mr. Hirshorn, 10,044 options to Mr. Rogers and 2,284 options to Mr. Dobbs; (5) Grants made on April 27, 2006 at $16.00 each: 25,390 options to Mr. Ackerman; (6) Grants made on July 18, 2006 at $16.55 each: 58,084 options to Mr. McIlquham, 18,346 options to Mr. Hirshorn, 6,609 options to Mr. Rogers, 5,400 options to Mr. Ackerman and 1,502 options to Mr. Dobbs. After the end of fiscal 2006 Mr. Hirshorn left Sealy's employ and exercised all of his in-the-money exercisable Sealy stock options. In 2006 Mr. Dobbs exercised 841 of his options that were granted in 2005.

- (c)

- Represents amounts paid on behalf of the named executive officers for the following five respective categories of compensation: (i) company premiums for life and accidental death and dismemberment insurance (ii) company premiums for long-term disability benefits, (iii) company contributions to our defined contribution plans, (iv) stock option payouts (associated with the Recapitalization) and (v) transaction bonus (associated with the Recapitalization). Amounts for each of the named executive officers for each of the five respective preceding categories is as follows: Mr. McIlquham: (2006-$2,120, $1,088, $18,900, $0, $0; 2005-$2,014, $1,088, $27,450, $0, $0; 2004-$1,916, $1,088, $24,000, $1,320,534, $522,000); Mr. Hirshorn: (2006-$1,345, $1,088, $18,900, $0, $0; 2005-$1,200, $1,087, $27,450, $0, $0; 2004-$1,122, $1,078, $24,000; $820,879, $219,700); Mr. Rogers (2006-$1,022, $1,010, $18,900, $0, $0; 2005-$982, $971, $27,312, $0, $0; 2004-$977, $939, $23,463 $2,912,398, $264,632); Mr. Ackerman: (2006-$666, $657, $0, $0, $0; 2005-$0, $0, $0, $0, $0; 2004-$0, $0, $0, $0, $0); Mr. Dobbs (2006-$972, $960, $13,534, $0, $0; 2005-$867, $857, $0, $0, $0; 2004-$0, $0, $0, $0, $0).

- (d)

- Represents amounts paid to the named executive officers as a result of the Company's April 2006 initial public offering of stock for three items: (1) a bonus for waiving rights to sell shares in the initial public offering; (2) a bonus to cover the cost to exercise a portion of the individual's options into shares; (3) a payment resulting from the Compensation Committee's adjustment of the number of options and exercise prices as a result of the reverse stock split prior to the initial public offering. Amounts for each of the named executive officers for each of these three preceding items is as follows: Mr. McIlquham: ($4,676,024, $1,977,680, $37,249); Mr. Hirshorn: ($1,626,979, $579,086, $12,662); Mr. Rogers ($519,022, $219,516, $3,842); Mr. Ackerman: ($0, $0, $0); Mr. Dobbs: ($94,906, $18,726, $279).

- (e)

- Represents bonus amounts paid to the named executive officers as option holders in the Recapitalization.

- (f)

- All option share amounts for prior years presented have been adjusted to reflect the reverse stock split of 0.7595 to one which became effective on March 23, 2006.

- (g)

- Mr. Hirshorn resigned as Senior Executive Vice President—Finance, Operations and Research and Development and left the Company on December 15, 2006. Since his resignation, he has exercised all of his 1,146,432 in-the-money exercisable Sealy stock options.

- (h)

- Includes Chairman's Award bonuses as follows: Mr. Hirshorn $25,000; Mr. Rogers $5,000; and Mr. Dobbs $5,000.

- (i)

- Includes signing bonuses as follows: Mr. Ackerman $50,000 and Mr. Dobbs $100,000.

- (j)

- Represents amounts paid on behalf of the named executive officers for relocation expenses incurred.

16

Option Grants in Last Fiscal Year

| |

| |

| |

| |

| | Potential Realizable

Value At Assumed

Annual Rates of Stock

Price Appreciation

For Option Term(b)

|

|---|

| | Number of

Securities

Underlying

Options

Granted

| | Individual Grants(a)

| |

|

|---|

Name

| | % of Total

Options Granted

to Employees in Fiscal Year

| | Exercise or Base

Price ($/Sh)

| | Expiration

Date

|

|---|

| | 5%($)

| | 10%($)

|

|---|

| David J. McIlquham | | 278,790 | | 13.6 | % | $ | 16.00 | | 04/06/16 | | 2,805,272 | | 7,109,112 |

| Chairman, President and Chief | | 88,280 | | 4.3 | % | $ | 16.55 | | 04/19/16 | | 918,836 | | 2,328,512 |

| Executive Officer | | 58,084 | | 2.8 | % | $ | 16.55 | | 07/18/16 | | 604,550 | | 1,532,049 |

James B. Hirshorn(c) |

|

297,507 |

|

14.5 |

% |

$ |

16.00 |

|

04/06/16 |

|

2,993,609 |

|

7,586,393 |

| Former Senior Executive Vice | | 27,883 | | 1.4 | % | $ | 16.55 | | 04/19/16 | | 290,212 | | 735,454 |

| President—Finance, | | 18,346 | | 0.9 | % | $ | 16.55 | | 07/18/16 | | 190,949 | | 483,902 |

| Operations and Research and Development | | | | | | | | | | | | | |

Lawrence J. Rogers |

|

31,720 |

|

1.5 |

% |

$ |

16.00 |

|

04/06/16 |

|

319,177 |

|

808,856 |

| President, North America | | 10,044 | | 0.5 | % | $ | 16.55 | | 04/19/16 | | 104,540 | | 264,925 |

| | | 6,609 | | 0.3 | % | $ | 16.55 | | 07/18/16 | | 68,788 | | 174,322 |

Jeffrey C. Ackerman |

|

214,124 |

|

10.4 |

% |

$ |

16.00 |

|

04/06/16 |

|

2,154,583 |

|

5,460,136 |

| Executive Vice President & | | 25,390 | | 1.2 | % | $ | 16.00 | | 04/27/16 | | 255,482 | | 647,442 |

| Chief Financial Officer | | 5,400 | | 0.3 | % | $ | 12.62 | | 07/18/16 | | 42,858 | | 108,610 |

Phillip Dobbs |

|

7,211 |

|

0.4 |

% |

$ |

16.00 |

|

04/06/16 |

|

72,559 |

|

183,880 |

| Senior Vice President, | | 2,284 | | 0.1 | % | $ | 16.55 | | 04/27/16 | | 23,772 | | 60,244 |

| Marketing | | 1,502 | | 0.1 | % | $ | 16.55 | | 07/18/16 | | 15,633 | | 39,617 |

- (a)

- All stock options described above relate to options to purchase shares of Class A common stock. All grants were issued as "New Options" under the terms described for such under "—Compensation Pursuant to Plans and Other Arrangements," below.

- (b)

- Potential Realizable Value is based on certain assumed rates of appreciation from the option exercise price since the board of directors determined that the stock's then fair market value was equal to or less than such option exercise price. These values are not intended to be a forecast of our stock price. Actual gains, if any, on stock option exercises are dependent on the future performance of the stock. There can be no assurance that the amounts reflected in this table will be achieved. In accordance with rules promulgated by the SEC, Potential Realizable Value is based upon the exercise price of the options.

- (c)

- Mr. Hirshorn resigned as Senior Executive Vice President—Finance, Operations and Research and Development and left the Company on December 15, 2006. Since his resignation, he has exercised all of his 1,146,432 in-the-money exercisable Sealy stock options.

17

Aggregated Option/SAR Exercises in Last Fiscal Year and FY-End/Option Values

| |

| |

| | Number Of Securities

Underlying Unexercised Options

At FY-End(#)

| | Value Of Unexercised

In-the-money Options

At FY-End($)(b)

|

|---|

| | Shares

Acquired

On

Exercise(#)

| |

|

|---|

Name

| | Value Realized

As of 11/26/06

| | Exercisable (a)

| | Unexercisable

| | Exercisable

| | Unexercisable

|

|---|

David J. McIlquham

Chairman, President and CEO | | 65,264 | | $ | 1,031,171 | | 3,282,784 | | 1,830,168 | | $ | 36,125,286 | | $ | 14,012,218 |

James B. Hirshorn(c)

Former Sr Executive Vice President—Finance, Operations and Research and Development | | 20,245 | | $ | 285,455 | | 1,168,475 | | 733,350 | | $ | 12,188,606 | | $ | 4,501,125 |

Lawrence J. Rogers

President, North America | | 7,244 | | $ | 114,455 | | 356,987 | | 188,233 | | $ | 4,170,091 | | $ | 1,403,477 |

Jeffrey C. Ackerman

Executive Vice President & CFO | | 0 | | $ | 0 | | 65,686 | | 179,228 | | $ | 1,463 | | $ | 13,171 |

Phillip Dobbs

Senior Vice President, Marketing | | 841 | | $ | 6,535 | | 119,735 | | 183,663 | | $ | 838,418 | | $ | 1,237,629 |

- (a)

- Includes options exercisable within 60 days after November 26, 2006, including performance options vesting upon the company's achievement of certain fiscal 2006 stock option performance goals.

- (b)

- Options are in-the-money if the fair market value of the Class A common stock exceeds the exercise price. The New York Stock Exchange closing price as of November 26, 2006 was $15.33 per share.

- (c)

- Mr. Hirshorn resigned as Senior Executive Vice President—Finance, Operations and Research and Development and left the Company on December 15, 2006. Since his resignation, he had exercised all of his 1,146,432 in-the-money exercisable Sealy stock options.

Compensation Pursuant To Plans and Other Arrangements

Rollover Options and New Options-2004 Stock Option Plan. All outstanding options, whether or not vested, to purchase our common stock, other than certain options held by members of management that those members elected to rollover, which we refer to as Rollover Options, were canceled and converted into a right to receive cash consideration upon the completion of the Recapitalization. The Rollover Options, which had an aggregate initial intrinsic value of $24.6 million, represent options to purchase shares of our Class A common stock. In July 2004, we granted to these members of management new options to purchase our Class A common stock, or New Options, in an amount based on a multiple of the value of the member's Rollover Options. The New Options were granted under a stock option plan established after the completion of the Recapitalization that provides for the grant of cash and cashless exercise stock options, stock appreciation rights and/or dividend equivalent rights to management and other key employees on terms and subject to conditions as established by the compensation committee of our board of directors or certain of the committee's designees. The plan provided twenty million shares of our Class A common stock for grants, which was reduced to 15,190,000 shares in connection with our 0.7595 to 1 reverse stock split in March 2006. The exercise

18

price for the New Options granted in 2004 is the per share transaction value of the common stock in the Recapitalization reduced by the effect of the dividend we paid in July 2004.

As of February 28, 2007, there were 9,826,530 shares underlying the current outstanding stock options granted under Sealy's 2004 Stock Option Plan. There were 4,429,377 shares reserved for future grants under this plan. As of February 28, 2007, there are 3,457,442 shares underlying the current outstanding "rolled over" stock options that were granted under Sealy's 1998 Stock Option Plan. There are no further shares reserved for grants under the 1998 Stock Option Plan.

The New Options were granted in part as "time options," which vest and become exercisable ratably on a monthly basis over the first five years following the date of grant, and granted in part as "performance options," which vest and become exercisable over the five fiscal years through fiscal year 2008 upon the achievement of certain EBITDA performance targets, and in any event by the eighth anniversary of the date of grant.

All Rollover Options and New Options, and any common stock for which such options are exercised, are governed by a management stockholders agreement and a sale participation agreement, which together provide for the following:

- •

- transfer restrictions until April 7, 2009 of purchase, subject to certain exceptions;

- •

- in the event of termination of employment, call and put rights with respect to the Rollover Options and New Options and any common stock for which such options have been exercised;

- •

- "piggyback" registration rights on behalf of the members of management; and

- •

- "tag-along" rights on behalf of the members of management and "drag-along" rights for KKR.

Executive Put Options. Concurrent with the Recapitalization, two of our current executive officers were given options to sell their shares of our stock back to us upon their retirement. The sales price per share is based on a formula which takes into account changes in our equity since the Recapitalization, including, among other things, consolidated net income, additional capital contributions, and capital distributions.

Executive Employment Agreements. On January 14, 2005, Mr. McIlquham entered into an amended employment agreement with us as Chief Executive Officer. That agreement has a perpetual two-year term and provides for an annual base salary of $625,000, subject to annual increase by our board of directors plus a performance bonus between zero and one hundred twenty percent of his base salary. In addition, eight of our other employees, including Lawrence J. Rogers, Jeffrey C. Ackerman and Philip Dobbs, currently have employment agreements that provide, among other things, a perpetual one-year employment term thereafter, during which such employees will receive base salary (not less than their current salary) and a performance bonus between zero and ninety percent for Mr. Rogers, zero and eighty percent for Mr. Ackerman and zero and seventy percent for Mr. Dobbs of base salary and substantially the same benefits as they received as of the date of such agreements. For the fiscal year ending November 26, 2006, the compensation committee of the our Board of Directors determined that the bonuses to be paid pursuant to those employment agreements were to be based 70% on our achievement of an Adjusted EBITDA target, and 30% on our achievement in net debt reduction and in some instances specific segment bonuses. Each such target represented an improvement over our prior year performance.

Upon written notice, we may terminate any of these agreements for cause upon immediate notice thereof, or upon the death or disability of the employee. In the event we terminate an agreement for any reason other than cause, death or disability, the employee will be entitled for one year thereafter (two years in the case of Mr. McIlquham) to continue to receive his annual base salary (at the highest rate in effect during the past year), participate in our annual bonus plan and receive benefits, including medical, dental and life insurance which would otherwise be available to him during his employment. If

19

at any time our Executive Severance Benefit Plan would provide better cash severance benefits to the employee than the foregoing severance provisions, the employee may elect to receive such better cash severance benefits in lieu thereof, while continuing to receive any other benefits available under the agreement. These agreements also contain confidentiality and non-competition covenants and other terms and conditions customary to executive employment agreements.

Deferred Compensation Agreements. On December 18, 1997, Mr. Rogers, entered into deferred compensation agreement with us pursuant to which he elected to defer an aggregate $94,106 of compensation, which was paid out as part of the Recapitalization on April 6, 2004.

Severance Benefit Plans. Effective December 1, 1992, we established the Sealy Executive Severance Benefit Plan, or the Executive Severance Plan, for employees in certain salary grades. Benefit eligibility includes, with certain exceptions, termination as a result of a permanent reduction in work force or the closing of a plant or other facility, termination for inadequate job performance, termination of employment by the participant following a reduction in base compensation, reduction in salary grade which would result in the reduction in potential plan benefits or involuntary transfer to another location. Benefits include cash severance payments calculated using various multipliers varying by salary grade, subject to specified minimums and maximums depending on such salary grades. Such cash severance payments are made in equal semi-monthly installments calculated in accordance with the Executive Severance Plan until paid in full. Certain executive-level officers would be entitled to a minimum of one-year's salary and a maximum of two-year's salary under the Executive Severance Plan. However, if a participant becomes employed prior to completion of the payment of benefits, such semi-monthly installments shall be reduced by the participant's base compensation for the corresponding period from the participant's new employer. Participants receiving cash severance payments under the Executive Severance Plan also would receive six months of contributory health and dental coverage and six months of group term life insurance coverage.