QuickLinks -- Click here to rapidly navigate through this documentUNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| Filed by the Registrantý |

Filed by a Party other than the Registranto |

Check the appropriate box: |

o |

|

Preliminary Proxy Statement |

o |

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

ý |

|

Definitive Proxy Statement |

o |

|

Definitive Additional Materials |

o |

|

Soliciting Material Pursuant to §240.14a-12 |

SEALY CORPORATION |

(Name of Registrant as Specified In Its Charter) |

N/A |

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

| | | | | |

| Payment of Filing Fee (Check the appropriate box): |

ý |

|

No fee required. |

o |

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | | (1) | | Title of each class of securities to which transaction applies:

|

| | | (2) | | Aggregate number of securities to which transaction applies:

|

| | | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

| | | (4) | | Proposed maximum aggregate value of transaction:

|

| | | (5) | | Total fee paid:

|

o |

|

Fee paid previously with preliminary materials. |

o |

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

|

|

(1) |

|

Amount Previously Paid:

|

|

|

(2) |

|

Form, Schedule or Registration Statement No.:

|

| | | (3) | | Filing Party:

|

| | | (4) | | Date Filed:

|

SEALY CORPORATION

ONE OFFICE PARKWAY

TRINITY, NORTH CAROLINA 27370

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To Be Held April 30, 2008

March 31, 2008

To our stockholders:

On behalf of your board of directors, we are pleased to invite you to attend the 2008 annual meeting of stockholders of Sealy Corporation. The meeting will be held on Wednesday, April 30, 2008 at 9:00 a.m., local time, at the Grandover Resort & Conference Center, 1000 Club Road, Greensboro, North Carolina 27407.

At the meeting, you will be asked to:

- (1)

- Elect seven directors to serve until their successors are duly elected and qualified;

- (2)

- Ratify the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for the fiscal year ending November 30, 2008; and

- (3)

- Transact any other business properly brought before the meeting.

Sealy Corporation's board of directors set March 25, 2008 as the record date for the meeting. This means that owners of record of shares of Sealy common stock at the close of business on that date are entitled to:

- •

- notice of and to vote at the meeting, and

- •

- vote at the meeting and any adjournment or postponements of the meeting.

We urge each stockholder to sign and return the enclosed proxy card or to use telephone or Internet voting.

Sealy's proxy statement and 2007 Annual Report to Stockholders are enclosed and are also available, respectively under Proxy and Annual Filings, at http://www.sealy.com/secfilings/.

This Notice of Annual Meeting, Proxy Statement and accompanying proxy card

are being distributed on or about March 31, 2008.

TABLE OF CONTENTS

| | PAGE

|

|---|

| GENERAL INFORMATION ABOUT SEALY'S ANNUAL MEETING | | 1 |

| | Stockholders Entitled to Vote | | 1 |

| | Required Vote | | 1 |

| BOARD RECOMMENDATIONS AND APPROVAL REQUIREMENTS | | 1 |

| PROXIES AND VOTING PROCEDURES | | 2 |

| | How Proxies are Voted | | 2 |

| | How to Revoke or Change Your Proxy | | 3 |

| | Method and Cost of Proxy Solicitation | | 3 |

| | Stockholder Director Nominations and Proposals for the 2009 | | 3 |

| PROPOSAL ONE—ELECTION OF DIRECTORS | | 4 |

| | General Information | | 4 |

| | Nominees for Election at the Annual Meeting | | 4 |

| PROPOSAL TWO—RATIFICATION OF APPOINTMENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM | | 6 |

| OTHER MATTERS | | 6 |

| CORPORATE GOVERNANCE AND RELATED MATTERS | | 6 |

| | Director Independence | | 6 |

| | Meetings of the Board of Directors | | 7 |

| | Audit Committee | | 7 |

| | Compensation Committee | | 8 |

| | Compensation Committee Interlocks and Insider Participation | | 8 |

| | Nominating/Corporate Governance Committee | | 9 |

| | Presiding Director of Non-Management Executive Sessions | | 9 |

| | Corporate Governance Guidelines | | 9 |

| | Code of Business Conduct and Ethics | | 9 |

| | Director Candidate Recommendations by Stockholders | | 10 |

| | Stockholder Communication with the Board of Directors | | 10 |

| | Director Compensation | | 11 |

| | Director Compensation Table | | 11 |

| | Limitation on Directors' Liability and Indemnification | | 12 |

| AUDIT COMMITTEE REPORT AND AUDIT FEES | | 12 |

| | Audit Committee Report | | 12 |

| | Audit and Related Fees | | 13 |

| EXECUTIVE COMPENSATION | | 14 |

| | Compensation Discussion and Analysis | | 14 |

| | Compensation Committee Report | | 21 |

| | Executive Compensation Tables and Supplemental Information | | 22 |

| | | Summary Compensation Table | | 22 |

| | | Grant Plan-Based Awards in Fiscal 2007 Table | | 23 |

| | | Outstanding Equity Awards at Fiscal 2007 Year End Table | | 24 |

| | | Option Exercises and Stock Vested in Fiscal 2007 | | 25 |

| | | Pension Benefit Table | | 25 |

| | | Nonqualified Deferred Compensation for Fiscal 2007 Table | | 25 |

| | | Potential Payments Upon Termination or Change in Control | | 25 |

| BENEFICIAL OWNERSHIP OF COMMON STOCK | | 27 |

| | Security Ownership of Certain Beneficial Owners and Management | | 28 |

| | Section 16(a) Beneficial Ownership Reporting Compliance | | 29 |

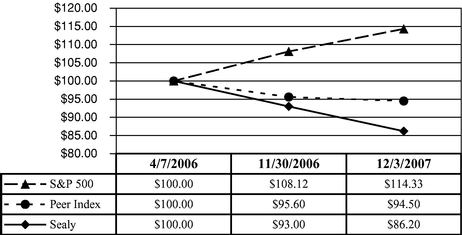

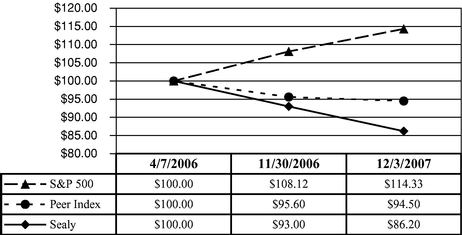

| | Stock Performance Graph | | 30 |

| CERTAIN RELATIONSHIPS AND RELATED PERSON TRANSACTIONS | | 31 |

| OTHER MATTERS | | 33 |

| | Householding of Annual Meeting Materials | | 33 |

i

SEALY CORPORATION

ONE OFFICE PARKWAY

TRINITY, NORTH CAROLINA 27370

PROXY STATEMENT

For the Annual Meeting of Stockholders to be Held on

April 30, 2008

GENERAL INFORMATION ABOUT SEALY'S ANNUAL MEETING

We are providing this proxy statement in connection with the solicitation by the board of directors of Sealy Corporation ("Sealy") of proxies to be voted at our 2008 annual meeting of stockholders and at any adjournment of the annual meeting. You are cordially invited to attend the annual meeting, which will be held at the Grandover Resort & Conference Center, 1000 Club Road, Greensboro, North Carolina 27407, on Wednesday, April 30, 2008 at 9:00 a.m. local time.

Stockholders Entitled to Vote

The record date for the annual meeting is March 25, 2008. Only stockholders of record as of the close of business on that date are entitled to notice of and to vote at the annual meeting. On March 25, 2008, there were 90,982,170 shares of common stock outstanding.

Required Vote

The presence in person or by proxy of the holders of a majority of the shares outstanding on the record date is necessary to constitute a quorum for the transaction of business at the meeting. Each stockholder is entitled to one vote, in person or by proxy, for each share of common stock held as of the record date on each matter to be voted on. Abstentions and broker non-votes are included in determining whether a quorum is present. A broker non-vote occurs when a nominee holding shares for a beneficial owner does not vote on a particular proposal because the nominee does not have discretionary power with respect to that item and has not received instructions from the beneficial owner.

Directors will be elected by a plurality of the votes present in person or represented by proxy and entitled to vote at the annual meeting. Thus, an abstention or broker non-vote will have no effect on the outcome of the vote on election of directors at the annual meeting. For the ratification of the appointment of Deloitte & Touche LLP and all other matters, the affirmative vote of a majority of the votes present in person or represented by proxy and entitled to vote at the annual meeting is required.

As of March 25, 2008, affiliates of Kohlberg Kravis Roberts & Co. L.P., or KKR, beneficially own and have the right to vote approximately 51.2% of the outstanding shares of our common stock and have advised us that they intend to vote all such shares in favor of the nominees for director and ratification of Deloitte & Touche LLP. As a result, we are assured a quorum at the annual meeting, the election of the directors, and the ratification of the appointment of Deloitte & Touche LLP.

BOARD RECOMMENDATIONS AND APPROVAL REQUIREMENTS

Delaware law and Sealy's certificate of incorporation and by-laws govern the vote on each proposal. The board of directors' recommendation is set forth together with the description of each

1

item in this proxy statement. In summary, the board of directors' recommendations and approval requirements are:

PROPOSAL 1. ELECTION OF DIRECTORS

The first item to be voted on is the election of seven directors to serve until their successors are duly elected and qualified. The board of directors has nominated seven people as directors, each of whom is currently serving as a director of Sealy.

You may find information about these nominees, beginning on Page 4.

You may vote in favor of all the nominees, withhold your votes as to all nominees, or withhold your votes as to specific nominees. Assuming a quorum, each share of common stock may be voted for as many nominees as there are directors to be elected. Directors will be elected by a plurality of the votes cast. Stockholders may not cumulate their votes. Abstentions and broker non-votes will have no effect on the outcome of the vote on election of directors at the annual meeting.

The board of directors unanimously recommends a vote FOR each director nominee.

PROPOSAL 2. RATIFICATION OF APPOINTMENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

The second item to be voted on is the ratification of the appointment of Deloitte & Touche LLP as Sealy's independent registered public accounting firm for the fiscal year ending November 30, 2008.

You may find information about this proposal beginning on Page 6.

You may vote in favor of the proposal, vote against the proposal, or abstain from voting. Assuming a quorum, the proposal will pass if approved by a majority of the shares present in person or represented and entitled to vote on the matter. Abstentions will have the same effect as votes against the proposal and broker non-votes will have no effect on the outcome of the vote.

The board of directors unanimously recommends a vote FOR the ratification of the appointment of Deloitte & Touche LLP as Sealy's independent registered public accounting firm.

OTHER MATTERS TO COME BEFORE THE ANNUAL MEETING

The board of directors is not aware of any other business to be presented for a vote of the stockholders at the annual meeting. If any other matters are properly presented for a vote, the people named as proxies will have discretionary authority, to the extent permitted by law, to vote on such matters according to their best judgment.

PROXIES AND VOTING PROCEDURES

Your vote is important and you are encouraged to vote your shares promptly.

How Proxies are Voted

You may vote by completing and mailing the enclosed proxy card; electronically by telephone or on the Internet by following instructions included on the proxy card; or by voting in person at the annual meeting. Each proxy will be voted as directed. However, if a proxy solicited by the board of directors does not specify how it is to be voted, it will be voted as the board of directors recommends—that is, FOR the election of the seven nominees for director named in this proxy statement and FOR the ratification of the appointment of Deloitte & Touche LLP as Sealy's independent registered public accounting firm for the fiscal year ending November 30, 2008. If any other matters are properly presented at the annual meeting for consideration, such as consideration of a motion to adjourn the

2

annual meeting to another time or place, the persons named as proxies will have discretion to vote on those matters according to their best judgment to the same extent as the person delivering the proxy would be entitled to vote. At the date this proxy statement went to press, we did not anticipate that any other matters would be raised at the annual meeting.

How to Revoke or Change Your Proxy

If you submit a proxy and then wish to change your vote or vote in person at the annual meeting, you will need to revoke the proxy that you have submitted. You can revoke your proxy at any time before it is voted by delivery of a properly executed, later-dated proxy or a written revocation of your proxy. A later-dated proxy or written revocation must be received before the annual meeting by the Corporate Secretary of Sealy, Kenneth L. Walker, at One Office Parkway, Trinity, North Carolina 27370, or it must be delivered to the Corporate Secretary at the annual meeting before proxies are voted. You will be able to change your proxy as many times as you wish prior to its being voted at the annual meeting and the last proxy received chronologically will supersede any prior proxies.

Method and Cost of Proxy Solicitation

This proxy solicitation is being made on behalf of Sealy and the expense of preparing, printing and mailing this proxy statement is being paid by us. Proxies may be solicited by officers, directors and employees of Sealy in person, by mail, telephone, facsimile or other electronic means. We will not specially compensate those persons for their solicitation activities. We have hired Georgeson Shareholder Communications to distribute and solicit proxies. We will pay Georgeson Shareholder Communications a fee of $1,200, plus reasonable expenses, for these services. In accordance with the regulations of the Securities and Exchange Commission and the New York Stock Exchange, we will reimburse brokerage firms and other custodians, nominees and fiduciaries for their expense incurred in sending proxies and proxy materials to beneficial owners of our common stock.

Stockholder Director Nominations and Proposals for the 2009 Annual Meeting

Any proposal to be presented at our 2009 Annual Meeting of Stockholders must be received at the Company's principal office no later than December 1, 2008, in order to be considered for inclusion in the Company's proxy materials for such meeting. Any such proposals must comply with the requirements of Rule 14a-8 under the Exchange Act of 1934, as amended, or the Exchange Act, and be submitted in writing and addressed to the attention of the Corporate Secretary at One Office Parkway, Trinity, North Carolina 27370.

In accordance with our bylaws, proposals of stockholders intended to be presented at our 2009 Annual Meeting of Stockholders without inclusion of such proposals in our proxy statement and form of proxy relating to that meeting must be received by us at the above address not less than sixty days nor more than ninety days prior to the meeting; provided, that in the event that less than seventy days notice or prior public announcement of the date of the meeting is given or made to stockholders, notice by the stockholder to be timely must be so received not later than the tenth day following the date on which such notice of the date of the annual meeting was mailed or such public announcement was made.

3

PROPOSAL ONE

ELECTION OF DIRECTORS

The first agenda item to be voted on is the election of seven directors to serve until their successors are duly elected and qualified.

General Information

The board of directors currently consists of seven directors. Directors are generally elected for one-year terms. The term of office for all current directors expires at the annual meeting and thereafter until the person's successor has been duly elected and qualified.

This year's nominees have been nominated to serve for a one-year term expiring at the 2009 annual meeting of stockholders and thereafter until the person's successor has been duly elected and qualified. We have inquired of the nominees and determined that they will serve if elected. If, for any reason, any nominee becomes unavailable for election and the board of directors selects a substitute nominee, the proxies will be voted for the substitute nominee selected by the board of directors. The board of directors has no reason to believe that any of the named nominees is not available or will not serve if elected.

The nominees are all current directors of Sealy, and a description of the background of each is set forth below.

Nominees for Election at the Annual Meeting

Name

| | Age

| | Position

|

|---|

| Brian F. Carroll | | 36 | | Director |

| James W. Johnston | | 61 | | Director |

| Gary E. Morin | | 59 | | Director |

| Dean B. Nelson | | 49 | | Director |

| Paul J. Norris | | 60 | | Director, Non-Executive Chairman |

| Richard W. Roedel | | 58 | | Director |

| Scott M. Stuart | | 48 | | Director |

Brian F. Carroll. Mr. Carroll, age 36, has been a member of KKR since January 2006 and before that, an executive of KKR since July 1999. From September 1997 to June 1999, Mr. Carroll earned an M.B.A. at Stanford University Graduate School of Business. Before attending business school, from March 1995 to July 1997, he was an executive of KKR. Mr. Carroll is also a member of the Board of Directors of Rockwood Specialties Group, Inc. and Harman International Industries Inc. He has been a director of our company since April 2004.

James W. Johnston. Mr. Johnston, age 61, has been President and Chief Executive Officer of Stonemarker Enterprises, Inc., a consulting and investment company, since 1996. Mr. Johnston was Vice Chairman of RJR Nabisco, Inc., a diversified manufacturer of consumer products, from 1995 to 1996. He also served as Chairman and CEO of R. J. Reynolds Tobacco Co. from 1989 to 1995, Chairman of R. J. Reynolds Tobacco Co. from 1995 to 1996 and Chairman of R. J. Reynolds Tobacco International from 1993 to 1996. Mr. Johnston served on the board of RJR Nabisco, Inc. and RJR Nabisco Holdings Corp. from 1989 to 1996. From 1984 until joining Reynolds, Mr. Johnston was Division Executive, Northeast Division, of Citibank, N.A., a subsidiary of Citicorp, where he was responsible for Citibank's New York Banking Division, its banking activities in upstate New York, Maine and Mid-Atlantic regions, and its national student loan business. He has been a director of our company since March 1993.

4

Gary E. Morin. Mr. Morin, age 59, was the Vice President and Chief Financial Officer of Lexmark International, Inc. from 1996 to 2000 and was the Executive Vice President and Chief Financial Officer of Lexmark International, Inc. from 2000 until 2005, where in addition to corporate finance functions, he was responsible for Lexmark's corporate communications, strategy and security functions. He retired from Lexmark as Executive Vice President in 2006. Prior to joining Lexmark he held senior financial and operating positions with Huffy Corporation and Tambrands. He currently serves on the Board of Directors of Citrix Systems, Inc. He has been a director of our company since July 2006.

Dean B. Nelson. Mr. Nelson, age 49, has been Chief Executive Officer of Capstone Consulting LLC, a strategic consulting firm, since March 2000. He is also Chairman of PRIMEDIA Inc., a targeted media company. From August 1985 to February 2000, Mr. Nelson was employed by Boston Consulting Group, Inc., a strategic consulting firm, where he was a Senior Vice President from December 1998 to February 2000 and held various other positions from August 1985 to November 1998. Mr. Nelson is a member of the Board of Directors of PRIMEDIA Inc., and two private companies, Toys "R" Us, Inc. and Dollar General Corporation. He has been a director of our company since April 2004.

Paul J. Norris. Mr. Norris, age 60, was elected our Non-Executive Chairman in March 2008. He was the non-executive Chairman of W.R. Grace & Co., a specialty chemicals and materials company, from May 2005 until January 2008, and has performed advisory services for KKR since 2001. He was Chief Executive Officer of W.R. Grace from 1998 through May 2005 and was also Chairman of W.R. Grace from 1999 through May 2005 (W.R. Grace filed for bankruptcy under Chapter 11 of the United States Bankruptcy Code in April 2001). He currently serves on the Board of Directors of W.R. Grace & Co. and FMC Corporation. He has been a director of our company since January 2006.

Richard W. Roedel. Mr. Roedel, age 58, is currently a director and Chairman of the audit committee for Brightpoint, Inc., and Luna Innovations Incorporated. He is also a director and audit committee member for HIS, Inc. From 1985 through 2000, Mr. Roedel was employed by the accounting firm BDO Seidman LLP, the United States member firm of BDO International, as an Audit Partner, being promoted in 1990 to Managing Partner in Chicago, and then to Managing Partner in New York in 1994, and finally in 1999 to Chairman and Chief Executive. Mr. Roedel joined the Board of Directors of Take-Two Interactive Software, Inc., a publisher of video games, in November 2002 and served in various capacities with that company through June 2005 including Chairman and Chief Executive Officer. Mr. Roedel is a director of the Association of Audit Committee Members, Inc., a non-profit association of audit committee members dedicated to strengthening the audit committee by developing best practices. Mr. Roedel is a certified public accountant. He has been a director of our company since August 2006.

Scott M. Stuart. Mr. Stuart, age 48, has been a founding partner of Sageview Capital since November 2005, and from 1996 through 2005 was a member of KKR and had worked for KKR since 1986. He is also a member of the Board of Directors of The Boyds Collection, Ltd. He has been a director of our company since April 2004.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS THAT STOCKHOLDERS VOTE "FOR" THE NOMINEES LISTED ABOVE.

5

PROPOSAL TWO

RATIFICATION OF APPOINTMENT OF

INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

The second agenda item to be voted on is the ratification of the appointment of Deloitte & Touche LLP as independent registered public accounting firm for the fiscal year ending November 30, 2008.

The audit committee of the board of directors has appointed Deloitte & Touche LLP to audit our consolidated financial statements for the fiscal year ending November 30, 2008. We are asking our stockholders to ratify the appointment of Deloitte & Touche LLP as our independent registered public accounting firm. Although stockholder ratification of the appointment is not required, the board of directors is submitting the appointment of Deloitte & Touche LLP to our stockholders for ratification as a matter of good corporate practice.

Even if the appointment is ratified, the audit committee may in its discretion select a different independent registered public accounting firm at any time during the year if it determines that such a change would be in the best interests of Sealy and our stockholders. If the appointment is not ratified by our stockholders, the audit committee will reconsider the appointment.

A representative of Deloitte & Touche LLP is expected to attend the annual meeting and be available to respond to appropriate questions. The representative will be afforded an opportunity to make a statement, if he or she desires to do so.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS THAT STOCKHOLDERS VOTE "FOR" RATIFICATION OF THE APPOINTMENT OF DELOITTE & TOUCHE LLP AS SEALY'S INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM.

OTHER MATTERS

As of the date of this proxy statement, we know of no business that will be presented for consideration at the annual meeting other than the items referred to above. If any other matter is properly brought before the annual meeting for action by stockholders, proxies in the enclosed form returned to Sealy will be voted in accordance with the recommendation of the board of directors, or in the absence of such a recommendation, in accordance with the judgment of the proxy holder.

CORPORATE GOVERNANCE AND RELATED MATTERS

Director Independence

We avail ourselves of the "controlled company" exception under the New York Stock Exchange ("NYSE") rules which eliminates the requirements that we have a majority of independent directors on our board of directors, compensation committee and nominating/governance committee. Accordingly, we have a compensation committee with only one independent director and a nominating/corporate governance committee composed entirely of non-independent directors. We have an audit committee consisting of three members composed entirely of independent members. The nominating and governance committee of the board of directors has determined that James W. Johnston, Gary E. Morin and Richard W. Roedel are independent directors within the meaning of applicable NYSE listing standards and the applicable provisions of the Securities Exchange Act of 1934, as amended.

When making "independence" determinations, the nominating and governance committee and the board of directors broadly considers all relevant facts and circumstances, as well as any other facts and considerations specified by the NYSE, by law or by any rule or regulation of any other regulatory body or self-regulatory body applicable to Sealy. When assessing the materiality of a director's relationship

6

with Sealy, the board of directors considers the issue not merely from the standpoint of the director, but also from that of persons or organizations with which the director has an affiliation.

Meetings of the Board of Directors

The board of directors is required to meet at least four times annually, or more frequently as circumstances dictate. The board of directors met nine times in fiscal 2007, either in person or by telephone. All directors are expected to participate, whether in person or by telephone, in all board meetings. Each director attended at least 75% of all board of directors and applicable committee meetings during fiscal 2007.

Audit Committee

Our audit committee currently consists of Richard W. Roedel, James W. Johnston, and Gary E. Morin. Mr. Roedel is the chairperson of the audit committee. The board of directors has determined that all members of the audit committee are financially literate and meet the independence and expertise requirements mandated by the applicable New York Stock Exchange listing standards, Section 10A(m)(3) and Securities Exchange Act of 1934 and our independence standards. Mr. Roedel has been designated by the board of directors as the "audit committee financial expert". Mr. Roedel currently serves on the audit committees of three other public companies. The nominating/corporate governance committee and the board of directors reviewed Mr. Roedel's obligations as a member of other audit committees in accordance with New York Stock Exchange rules and determined that his simultaneous service on those other audit committees does not impair his ability to effectively serve on Sealy's audit committee.

Our audit committee is responsible for (1) selecting the independent auditors, (2) approving the overall scope of the audit, (3) assisting the board of directors in monitoring the integrity of our financial statements, the independent accountant's qualifications and independence, the performance of the independent accountants and our internal audit function and our compliance with legal and regulatory requirements, (4) annually reviewing an independent auditors' report describing the auditing firms' internal quality-control procedures, any material issues raised by the most recent internal quality-control review, or peer review, of the auditing firm, (5) discussing the annual audited financial and quarterly statements with management and the independent auditor, (6) discussing earnings press releases, as well as financial information and earnings guidance provided to analysts and rating agencies, (7) discussing policies with respect to risk assessment and risk management, (8) meeting separately, periodically, with management, internal auditors and the independent auditor, (9) reviewing with the independent auditor any audit problems or difficulties and managements' response, (10) setting clear hiring policies for employees or former employees of the independent auditors, (11) handling such other matters that are specifically delegated to the audit committee by the board of directors from time to time and (12) reporting regularly to the full board of directors.

The audit committee has adopted a formal policy concerning the pre-approval of audit and non-audit services to be provided by our independent registered public accounting firm. The policy requires that all services to be performed by Deloitte & Touche LLP, including audit services, audit-related services and permitted non-audit services, be pre-approved by the audit committee. Pre-approval is generally provided for up to one year, and any pre-approval is detailed as to the particular service or category of services and is subject to a budget. Specific services being provided by the independent accountants are regularly reviewed in accordance with the pre-approval policy and the audit committee may pre-approve particular services on a case-by-case basis. The audit committee has delegated the authority to grant pre-approvals to Mr. Roedel, the audit committee chair, when the full audit committee is unable to do so. At each subsequent audit committee meeting, the audit committee reviews these pre-approvals, receives updates on the services actually provided by the independent accountants, and management may present additional services for approval. For fiscal 2007, the audit

7

committee pre-approved all audit, audit-related and non-audit services performed by Deloitte & Touche LLP.

Our audit committee is required to meet at least four times annually, or more frequently as circumstances dictate. The committee met eight times in fiscal 2007.

Our board of directors has adopted a written charter for the audit committee, which is available on our website atwww.sealy.com in the "Investor Relations—Corporate Governance" section, and upon written request by our stockholders at no cost.

Compensation Committee

Our compensation committee currently consists of Brian F. Carroll, James W. Johnston and Scott M. Stuart. Mr. Johnston is an independent director and Messrs. Carroll and Stuart are not independent, as permitted by the "controlled company" exception. Mr. Johnston is the chairperson of the compensation committee.

The compensation committee operates pursuant to a charter which delegates responsibility for the compensation and benefits of Sealy's executive officers and other members of senior management to the compensation committee. The compensation committee is primarily responsible for:

- •

- Discharging the responsibilities of the board of directors to the shareholders, potential shareholders and investment community with respect to our compensation and benefit programs and compensation of our executives; and

- •

- Producing an annual report on executive compensation for inclusion in our annual proxy statement, in accordance with applicable New York Stock Exchange, Securities and Exchange Commission and other regulatory bodies.

Our compensation committee is responsible for (1) reviewing key employee compensation policies, plans and programs, (2) reviewing and approving the compensation of our executive officers, (3) reviewing and approving employment contracts and other similar arrangements between us and our executive officers, (4) reviewing and consulting with the chief executive officer on the selection of officers and evaluation of executive performance and other related matters, (5) administration of stock plans and other incentive compensation plans and (6) such other matters that are specifically delegated to the compensation committee by the board of directors from time to time.

Our compensation committee is required to meet at least two times annually, or more frequently, as circumstances dictate. Our compensation committee met six times in fiscal 2007.

The written charter for the compensation committee which Sealy's board of directors has adopted is available on our website atwww.sealy.com in the "Investor Relations—Corporate Governance" section, and upon written request by our stockholders at no cost.

Compensation Committee Interlocks and Insider Participation

The compensation levels of our executive officers are currently determined by the compensation committee as described in this proxy statement. None of the members of Sealy's compensation committee during fiscal 2007 or as of the date of this proxy is or has been an officer or employee of Sealy. None of our executive officers has served on the compensation committee or board of any company that employed any member of Sealy's compensation committee or Sealy's board of directors.

8

Nominating /Corporate Governance Committee

Our nominating/corporate governance committee consists of Brian F. Carroll, Dean B. Nelson and Paul J. Norris, none of whom are independent, as permitted by the "controlled company" exception. Mr. Nelson is the chairperson of the nominating/corporate governance committee.

The nominating/corporate governance committee is responsible for (1) developing and recommending criteria for selecting new directors, (2) overseeing evaluations of the board of directors and its members, (3) screening and recommending to the board of directors individuals qualified to become executive officers and (4) handling such other matters that are specifically delegated to the nominating/corporate governance committee by the board of directors from time to time.

In nominating candidates to serve as directors, the board of directors' objective, with the assistance of the nominating/corporate governance committee, is to select individuals with skills and experience that can be of assistance to management in operating our business. When evaluating the recommendations of the nominating/corporate governance committee, the board of directors should consider whether individual directors possess the following personal characteristics: integrity, accountability, informed judgment, financial literacy, mature confidence and high performance standards. The board of directors as a whole should possess all of the following core competencies, with each candidate contributing knowledge, experience and skills in at least one domain: accounting and finance, business judgment, management, industry knowledge, leadership and strategy/vision. For a description of the procedures for stockholders to submit proposals regarding director nominations, see "Stockholder Director Nominations" below.

Our nominating/corporate governance committee is required to meet at least two times annually, or more frequently as circumstances dictate. Our nominating/corporate governance committee met twice in fiscal 2007.

Our board of directors has adopted a written charter for the nominating/corporate governance committee which is available at our website atwww.sealy.com in the "Investor Relations—Corporate Governance" section, and upon written request by our stockholders at no cost.

Presiding Director of Non-Management Executive Sessions

At each executive session of non-management members of the board of directors, the Non-Executive Chairman will preside and in his absence the non-management directors in attendance will determine which of them will conduct such session.

Corporate Governance Guidelines

The board of directors has adopted Corporate Governance Guidelines which set forth the board of directors' core principles of corporate governance and are designed to promote its effective functioning and assist the board of directors in fulfilling its responsibilities. The board of directors will review and amend these guidelines from time to time as it deems necessary and appropriate. The Corporate Governance Guidelines are available on our website atwww.sealy.com in the "Investor Relations—Corporate Governance" section, and upon written request by our stockholders at no cost.

Code of Business Conduct and Ethics

We are committed to conducting business in accordance with the highest ethical standards and all applicable laws, rules and regulations. We have adopted a Code of Business Conduct and Ethics that applies to our employees, executive officers and directors. Our Code of Business Conduct and Ethics is available on our website atwww.sealy.com, in the "Investor Relations—Corporate Governance" section, and upon written request by our stockholders at no cost.

9

Director Candidate Recommendations by Stockholders

Each director candidate recommendation by a stockholder should be accompanied by certain information relating to the stockholder making such recommendation, as well as information concerning the recommended candidate, including the name, address and relevant qualifications of the recommended candidate. A stockholder who wishes to recommend a candidate for election to the board of directors should submit it to the nominating/corporate governance committee by December 1, 2008:

Stockholder Communications with the Board of Directors

Any stockholder may communicate with (i) the board of directors as a whole, (ii) the independent directors as a group, (iii) any individual member of the board of directors, or (iv) any committee of the board of directors by submitting those communications to the appropriate person or group:

By mail:

Stockholder Communication to the Board of Directors

[Name of Appropriate Person or Group]

c/o: Senior Vice President, General Counsel & Secretary

Sealy Corporation

One Office Parkway

Trinity, North Carolina 27370

By fax:

All appropriate stockholder communications received by the Senior Vice President, General Counsel & Secretary will be forwarded to the appropriate person or group. Inappropriate communications include those not related to the duties or responsibilities of the board of directors. In addition, the receipt of any accounting, internal controls or audit-related complaints or concerns will be forwarded to the audit committee.

A copy of these procedures is available on our website atwww.sealy.com in the "Investor Relations—Corporate Governance" section, and upon written request by our stockholders at no cost.

10

Director Compensation

Our non-employee directors each receive a retainer of $40,000 per year plus $1,500 for each board meeting attended in person and $500 for each board meeting attended by telephone. The board committee members receive an additional annual retainer of $22,000 for the Chairman of the audit committee, $4,000 for other committee chairs, $10,000 for other audit committee members, and $2,000 for members of other Board committees. Committee members are paid $1,000 for each committee meeting attended in person and $500 per telephonic committee meeting attended. All fees are paid on a quarterly basis. The directors may elect to defer all or a portion of these fees into stock appreciation units. Annually, each director may elect to defer all or a portion of his or her fees as a Sealy director under the Sealy Director's Deferred Compensation Plan. Under this plan, on the date director fees become payable, Sealy credits the deferred compensation account of each director with the number of share units of Sealy's common stock which is equal to the deferred portion of any fee due to the director at such time, divided by the per share market value of Sealy's shares on that date. Sealy also credits each director's deferred compensation account with the number of share units equal to any cash dividends (or the fair market value of dividends paid in property other than dividends payable in common stock) payable on the number of shares of common stock represented in each director's deferred compensation account divided by Sealy's per share stock value on the dividend payment date. Our non-employee directors do not receive any stock awards, option grants, pension benefits, defined contribution benefits, insurance coverage, medical benefits, or perquisites for their service as a Sealy director.

Distributions from a director's deferred compensation account shall be paid in Sealy's common stock or the cash equivalent thereof, at the election of Sealy, and shall begin on either the first day of the calendar year following or six months following (whichever is later), the later of the director's retirement date (as indicated in the director's deferral election) or separation from Sealy's board of directors.

Director Compensation Table for Fiscal Year 2007

The following Table details the compensation provided to each non-employee director for fiscal year 2007.

|

|---|

| | Fees Earned

or Paid in

Cash(1)($)

| | Stock

Awards

($)

| | Option

Awards

($)

| | Non-Equity

Incentive Plan

Compensation

($)

| | Change in Pension

Value and Nonqualified

Deferred Compensation

Earnings($)

| | All Other

Compensation

($)

| | Total

($)

|

|---|

|

| Mr. Carroll | | $ | 54,000 | | | | | | | | | | $ | 3,733 | | $ | 57,733 |

|

| Mr. Johnston | | $ | 65,500 | | | | | | | | | | $ | 3,018 | | $ | 68,518 |

|

| Mr. Morin | | $ | 60,500 | | | | | | | | | | | 0 | | $ | 60,000 |

|

| Mr. Nelson | | $ | 50,000 | | | | | | | | | | $ | 3,319 | | $ | 53,319 |

|

| Mr. Norris | | $ | 47,500 | | | | | | | | | | $ | 1,439 | | $ | 48,939 |

|

| Mr. Roedel | | $ | 75,500 | | | | | | | | | | $ | 1,151 | | $ | 76,651 |

|

| Mr. Stuart | | $ | 50,500 | | | | | | | | | | $ | 3,414 | | $ | 53,914 |

|

- (1)

- 100% of Mr. Morin's and 50% of Mr. Johnston's fees were paid in cash. The balance of all other directors fees were deferred into Sealy stock units under the Sealy Director's Deferred Compensation Plan described above. As of March 3, 2008 the following directors held the indicated number of Sealy share units under the Sealy Director's Deferred Compensation Plan: Mr. Carroll—15,819, Mr. Johnston—12,236, Mr. Nelson—14,033, Mr. Norris—7,447, Mr. Roedel—8,072, and Mr. Stuart—14,483.

11

Limitation on Directors' Liability and Indemnification

Our certificate of incorporation limits the liability of directors to the maximum extent permitted by Delaware law. Under Delaware law, a director will not be personally liable for monetary damages for breach of his or her fiduciary duty as a director, except for liability for:

- •

- breach of his or her duty of loyalty to us or our stockholders;

- •

- acts or omissions not in good faith or that involve intentional misconduct or a knowing violation of law;

- •

- unlawful payments of dividends or unlawful stock repurchases or redemptions as provided in Section 174 of the Delaware General Corporation Law; or

- •

- any transaction from which he or she derived an improper personal benefit.

Our bylaws provide that we:

- •

- are required to indemnify our directors and executive officers to the maximum extent permitted by Delaware law;

- •

- may indemnify our employees and agents as set forth in Delaware General Corporation Law, subject to very limited exceptions;

- •

- are required to advance expenses, as incurred, to our directors and executive officers in connection with a legal proceeding; and

- •

- may advance expenses, as incurred, to our employees and agents in connection with a legal proceeding.

We also maintain directors' and officers' liability insurance to cover our directors, executive officers and some of our employees for liabilities, including liabilities under securities laws. We believe that our certificate of incorporation, bylaws and insurance are necessary to attract and retain qualified persons as directors and executive officers.

The limitation of liability and indemnification provisions in our certificate of incorporation and bylaws may discourage stockholders from bringing a lawsuit against directors for breach of their fiduciary duty. They may also reduce the likelihood of derivative litigation against directors and executive officers, even though an action, if successful, might benefit us and other stockholders. Furthermore, a stockholder's investment may be adversely affected to the extent we pay the costs of settlement and damage awards against directors and executive officers as required by these indemnification provisions.

At present, we are not aware of any pending litigation or proceeding involving any of our directors or executive officers in which indemnification is required or permitted and we are not aware of any threatened litigation or proceeding that may result in a claim for indemnification.

AUDIT COMMITTEE REPORT AND AUDITOR FEES

Audit Committee Report

The audit committee reviews Sealy's financial reporting process on behalf of the board of directors. Management has the primary responsibility for the financial statements and the reporting process, including the system of internal controls. The independent registered public accounting firm is responsible for expressing an opinion on those audited consolidated financial statements in conformity with accounting principles generally accepted in the United States.

In fulfilling its responsibilities, the audit committee has reviewed and discussed the audited consolidated financial statements contained in Sealy's Annual Report on Form 10-K for the year ended

12

December 2, 2007 with Sealy's management and independent registered public accounting firm. The audit committee has also discussed with the independent registered public accountant the matters required to be discussed by Statement on Auditing Standards No. 61,Communications With Audit Committees, including the quality, not just the acceptability of the accounting principles, the reasonableness of significant judgments, and the clarity of the disclosures in the financial statements. In addition, the audit committee reviewed and discussed with the independent registered public accounting firm the auditor's independence from Sealy and its management, including the matters in the written disclosures and letter which were received by the audit committee from the independent registered public accountant, as required by Independence Standards Board Standard No. 1,Independence Discussions with Audit Committees.

Based on the reviews and discussions referred to above, the audit committee approved the audited consolidated financial statements and recommended to the board of directors that they be included in Sealy's Annual Report on Form 10-K for the year ended December 2, 2007, for filing with the Securities and Exchange Commission. The audit committee has also selected Deloitte & Touche as Sealy's independent registered public accounting firm and is presenting the selection to the stockholders for ratification.

The preceding audit committee report is provided only for the purpose of this proxy statement. This report shall not be incorporated, in whole or in part, in any other Sealy filing under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended.

Audit and Related Fees

The following table summarizes aggregate fees billed to us by Deloitte & Touche LLP for the fiscal years ended December 2, 2007 and November 26, 2006, with the following notes explaining the services underlying the table captions:

| | 2007

| | 2006

|

|---|

| | (thousands)

|

|---|

| Audit fees(1) | | $ | 1,577 | | $ | 882 |

| Audit-related fees(2) | | | 281 | | | 581 |

| Tax fees | | | — | | | — |

| All other fees(3) | | | 425 | | | 429 |

| | |

| |

|

| Total | | $ | 2,283 | | $ | 1,892 |

- (1)

- Includes fees for the audit of our annual consolidated financial statements.

- (2)

- Includes fees for international statutory audits as well as services related to our various public filings, including the initial public offering of Sealy Corporation stock and Form 10-Q filings.

- (3)

- Includes fees related to due diligence reviews of potential mergers, acquisitions and dispositions.

For additional information, please see "Audit Committee" beginning on page 7.

13

EXECUTIVE COMPENSATION

Compensation Discussion and Analysis

Objectives of the Executive Compensation Program

The compensation of the Company's executive officers is currently determined by the compensation committee of the Board. Sealy and its subsidiaries seek to attract and retain highly qualified and talented professionals. The marketplace in which Sealy competes is highly competitive. Further, our compensation policies, while designed to secure the services of appropriate professionals, must also support our vision of creating a dynamic company and delivering superior value and growth.

In light of these objectives, the compensation committee determines executive compensation consistent with a philosophy of compensating executive officers based on their responsibilities, the company's financial performance as measured against established goals, and individual officer contributions and achievements.

The primary elements of the company's executive compensation program are:

- (1)

- base salaries,

- (2)

- variable annual cash compensation earned through the Sealy Corporation Bonus Plan (the "Bonus Plan"),

- (3)

- long-term equity compensation through our previous 1998 Stock Option Plan and our current 2004 Stock Option Plan.

Officer salaries are targeted at the median of competitive market practices, with bonus opportunities structured so that the combined level of salary and bonus received (annual cash compensation) varies with market compensation levels based on the level of performance achievement. If target bonuses are paid, annual cash compensation is expected to approximate the market median. If performance achievements result in earned bonuses at above-target levels, annual cash compensation can be in the market's upper quartile. Salaries and target bonus opportunities for officers also reflect internal equity considerations as well as external market references.

Sealy was a privately held company until April of 2006. As a private equity portfolio company, Sealy provided its management team, including the named executive officers who were with the company prior to July 2005, with an opportunity to earn a significant amount of compensation based on an allocation of potential equity ownership in the company through stock options. A significant number of stock options were granted at the time of the company's recapitalization in 2004, with additional stock options granted in conjunction with the Initial Public Offering in 2006. Other executives and key employees, including Mr. Ackerman and Mr. Dobbs among the named executive officers, received equity grants upon being hired by the company. During fiscal year 2007, three of the Named Executive Officers received additional equity grants in conjunction with promotions and increased responsibility levels. The committee believes these equity allocations provide significant motivation for management to create and sustain stockholder value.

The compensation committee intends to continue to emphasize and reward this ownership mentality, although with an approach more consistent with other publicly traded companies. In early 2008, the committee began to transition the company towards an annual systematic equity award granting program within the existing structure of our 2004 Stock Option Plan. Initial grants under this program were intended to improve the motivation and retention value of our long-term incentives and provide competitive equity opportunities relative to our industry segment and general industry as a whole.

The company's believes that executive officers should participate in retirement and benefit programs that are available to all salaried employees, but that supplemental executive benefits and perquisites for executive officers will be minimal if offered at all.

14

The compensation committee has overall responsibility for establishing, implementing, and monitoring the executive compensation program for the company's executive officers. To aid the compensation committee in setting compensation, our Chief Executive Officer ("CEO") provides recommendations annually to the Compensation Committee regarding the compensation for all executive officers, other than the CEO. Each member of our senior executive management team, in turn, participates in an annual performance review with the CEO and provides input about his or her contributions to our success for the relevant period. The compensation committee reviews the performance of each senior executive officer annually. The CEO participates in such annual performance review with the compensation committee.

During fiscal year 2007, the compensation committee retained the services of an independent compensation consultant, Watson Wyatt Worldwide, to assist it in the evaluation of key elements of our executive officer compensation programs. Watson Wyatt prepared a report for the committee on market practices that included competitive references for total direct compensation and each element (salary, bonus and annualized long-term incentive values) for each Sealy executive position. The consultant also provided advice to the compensation committee with respect to competitive practices and the amounts and nature of compensation paid to executive officers.

Compensation Benchmarking and Peer Group

As discussed above, through the information and analysis provided by the compensation consultant, the compensation committee compared base salary and target bonus opportunities for each Sealy officer to our market sector and industry in general. This approach ensures that our compensation remains competitive in our market and relative to our industry peers.

In evaluating the level of compensation provided to our named executive officers, the compensation committee considered compensation data from a group of peer companies. The compensation committee members determined the peer group companies after reviewing potential candidates identified by the consultant. At the time of the selection, the potential companies all had revenues between $600 million and $3 billion and equity market values between $500 million and $2.5 billion. Sealy's revenues, total assets and employee count were all between the 40th and 60th percentile of the selected peer companies. At the time of the selection, Sealy's EBITDA, operating margin and equity market value approximated or exceeded the 75th percentile of the selected peer companies.

The peer group consists of 14 companies, all but one of which are classified as Household Durables industry companies by Standard & Poors. Select Comfort Corporation, classified by S&P as a Specialty Retail industry company, was added to the peer group as it is considered to be a direct competitor to Sealy. The other peer group companies were American Greetings, Blyth, Blount International, Ethan Allen Interiors, Furniture Brands International, Interface, Jarden, La-Z-Boy, Simmons Company, Snap-On, Tempur-Pedic International, Tupperware Brands and Yankee Candle.

In addition to the peer group compensation information, the consultant's report also provided the compensation committee with market pay references derived from recognized executive compensation surveys. The consultant developed market references for each executive officer position in order to gauge the pay of other officers holding similar positions at comparable organizations. For fiscal year 2007, the survey data was derived from executive pay reports published by Watson Wyatt and Mercer HR Consulting. The references reflected data from manufacturing companies or general industry samples with revenues similar to Sealy ($1.7 billion). The specific companies included in these surveys are not identified to the compensation committee.

The consultant's report concluded that base salaries for Sealy's named executive officers generally were positioned between the median and 75th percentile market references. The CEO's base salary was determined to be below both the survey-based median reference and the proxy peer median. The report found that target bonus opportunities for Sealy's named executive officers generally were

15

positioned below the median references, and this resulted in target total cash compensation (salary plus target bonus) that was also generally below the median. In determining adjustments to salaries and target bonus opportunities for Sealy's named executive officers during fiscal year 2007, the committee took into consideration the consultant's findings in light of the company's objective to position targeted cash compensation for officers at or near the market median.

Elements of the Executive Compensation Program

The company's philosophy is to target base salaries at a market median level. Because relevant market data may not be available for every position, each salaried position including those held by the named executive officers is assigned to a pay grade in the company's internal salary structure. The midpoint of each grade is intended to approximate the market median, and grade assignments reflect both available market data as well as internal comparisons to positions with similar levels of responsibility. Grade assignments for officer positions are developed by Sealy management and approved by the committee. Actual salaries paid to officers are determined by the compensation committee with reference to the experience of the officers, the company's past practice and the officers' individual performance.

After consideration of the market data developed by Watson Wyatt, the salaries for Messrs. Rogers, Ackerman and Hofmann were determined by the committee in December 2006 at the time their promotions or changes in job responsibilities were announced. At that time, Mr. Rogers' salary was increased by 14 percent to $365,000, Mr. Ackerman's salary was increased by 10 percent to $320,000 and Mr. Hofmann's salary was increased by 14 percent to $300,000. These increases were consistent with the company's compensation policy regarding promotional increase percentages.

In conjunction with the company's annual salary review process for salaried employees, in April 2007, the committee approved an increase to Mr. McIlquham's salary of 3.8% to $700,650 which took effect in September 2007. This percentage increase was equal to the company's salary percentage increase budget of 3.8% for domestic salaried employees. After that increase Mr. McIlquham's salary remained below the median survey-based salary reference and the median peer group salary reference. The compensation committee approved an increase to Mr. Dobbs' salary of 3.0% to $315,000 which took effect in April 2007.

Our Bonus Plan is a cash-based based short-term performance incentive program. The compensation committee, with input from the executive officers establishes minimum, target and maximum goals for the Bonus Plan based on the financial performance measures selected for that year. For fiscal year 2007 EBITDA and net cash flow were established as the corporate level goals for determining payments under the Bonus Plan. Goals typically correspond with projections contained in our annual budget, which is approved by the Board of Directors at the beginning of the fiscal year. For certain corporate executives, goals are established only at the corporate level. For executives who manage business units or certain functions, goals are established both at the corporate level and at the business unit or functional level.

Target annual bonuses, expressed as a percentage of base salary, have been established by the compensation committee for each named executive officer based on consideration of job responsibilities and review of external market references. During 2007, after reviewing the consultant's report on market practices, the compensation committee increased the CEO's target bonus opportunity from 60 percent of salary to 70 percent of salary. Based on the April 1, 2007 effective date of this change, Mr. McIlquham's prorated bonus target for fiscal year 2007 was 66.7 percent. Upon their promotions and increased job responsibilities at the beginning of fiscal year 2007, the compensation committee increased the target bonus for Mr. Rogers from 35 percent to 45 percent of salary and the target bonus

16

for Mr. Ackerman from 35 percent to 40 percent of salary. The compensation committee made these changes to more closely align the officers' target bonuses with the market median references as reported by the consultant.

For corporate level goals in fiscal year 2007, the actual annual bonus is determined by the attainment of each year's pre-established goals, with 70% of the award based upon the attainment of the EBITDA goal and 30% of the 2007 award based upon attainment of the net cash flow goal. The target annual bonus for named executive officers who manage business units or certain functions is equally weighted between corporate and business unit/function goals. There is no guaranteed minimum bonus under the Bonus Plan, and a Bonus Plan participant must be employed at the end of the fiscal year for which a bonus is payable in order to be eligible to receive a bonus for such fiscal year. Bonuses are paid in a lump sum upon the compensation committee's certification of performance results following the end of the applicable fiscal year. The fiscal year 2007 Bonus Plan corporate performance goals and actual results as applicable to our named executive officers were as follows:

2007 Bonus Plan Achievement for Mr. McIlquham and Mr. Ackerman

(All $ in millions, except Achieved Bonus)

| | Minimum

| | Target

| | Maximum

| | Weighting

| | Result

Achieved

| | Achieved

Bonus

|

|---|

| Corporate EBITDA | | $ | 259.2 | | $ | 278.7 | | $ | 298.2 | | 70 | % | $ | 212.6 | | -0- |

| Corporate Net Cash Flow | | $ | 223.0 | | $ | 239.8 | | $ | 256.6 | | 30 | % | $ | 178.9 | | -0- |

2007 Bonus Plan Achievement for Mr. Rogers

| | Minimum

| | Target

| | Maximum

| | Weighting

| | Result

Achieved

| | Achieved

Bonus

|

|---|

| Corporate EBITDA | | $ | 259.2 | | $ | 278.7 | | $ | 298.2 | | 35 | % | $ | 212.6 | | | -0- |

| Corporate Net Cash Flow | | $ | 223.0 | | $ | 239.8 | | $ | 256.6 | | 15 | % | $ | 178.9 | | | -0- |

| NA EBITDA | | $ | 280.9 | | $ | 302.0 | | $ | 323.2 | | 40 | % | $ | 223.3 | | | -0- |

| NA Operations(1) | | | 0 | % | | 100 | % | | 200 | % | 10 | % | | 156.9 | % | $ | 26,106 |

2007 Bonus Plan Achievement for Mr. Hofmann

| | Minimum

| | Target

| | Maximum

| | Weighting

| | Result

Achieved

| | Achieved

Bonus

|

|---|

| Corporate EBITDA | | $ | 259.2 | | $ | 278.7 | | $ | 298.2 | | 35 | % | $ | 212.6 | | | -0- |

| Corporate Net Cash Flow | | $ | 223.0 | | $ | 239.8 | | $ | 256.6 | | 15 | % | $ | 178.9 | | | -0- |

| NA EBITDA | | $ | 280.9 | | $ | 302.0 | | $ | 323.2 | | 10 | % | $ | 223.3 | | | -0- |

| NA Operations(1) | | | 0 | % | | 100 | % | | 200 | % | 40 | % | | 156.9 | % | $ | 66,756 |

2007 Bonus Plan Achievement for Mr. Dobbs

| | Minimum

| | Target

| | Maximum

| | Weighting

| | Result

Achieved

| | Achieved

Bonus

|

|---|

| Corporate EBITDA | | $ | 259.2 | | $ | 278.7 | | $ | 298.2 | | 35 | % | $ | 212.6 | | | -0- |

| Corporate Net Cash Flow | | $ | 223.0 | | $ | 239.8 | | $ | 256.6 | | 15 | % | $ | 178.9 | | | -0- |

| Marketing IMO(2) | | $ | 639.9 | | $ | 688.1 | | $ | 736.2 | | 50 | % | $ | 640.0 | | $ | 109 |

- (1)

- The performance of the company's North American manufacturing plants ("NA Operations") is determined by measuring actual achievement against several established measurements with various assigned weightings. Different measurements are used for bedding, components and latex plants as well as for bedding plants in Canada, Mexico and Puerto Rico. Measurements include labor cost per unit produced, scrap percentage to standard material cost, distribution cost per unit sold, fixed

17

manufacturing spend, inventory days on hand, cost of quality per unit and two safety metrics—frequency and severity. Individual goals are set for each plant. The overall achievement for NA Operations is calculated as a percentage of target and is a weighted average of the individual manufacturing plants' percentage achievement for the Company's U.S. bedding plants, components plants, latex plant and Canadian, Mexican and Puerto Rican bedding plants.

- (2)

- "Marketing IMO" means, Marketing Income from Operations which is defined as Domestic Bedding Gross Margin less Marketing Departmental Expenses.

Because the minimum goals relating to the corporate performance metrics were not achieved during fiscal year 2007, no payments were generated to named executive officers under the Bonus Plan pursuant to results in these areas. Partial bonus payments were generated for Messrs. Hofmann, Dobbs and Rogers based on business unit results in applicable areas exceeding the minimum goals.

In May 2007 the company reorganized its domestic sales force and realigned its operating regions. To ensure focus on implementation and execution of business objectives, the compensation committee approved a discretionary bonus guaranty of up to two thirds of the second half fiscal year 2007 bonus targets for certain affected domestic units, if certain business and individual performance goals were achieved. Following determination of payments under the Bonus Plan for fiscal year 2007, the compensation committee decided to award discretionary bonuses to various employees including the named executive officers. The compensation committee for fiscal year 2007 awarded the following discretionary bonus amounts to the named executive officers:

Named Executive Officers Discretionary Bonus Payments for Fiscal 2007

| Mr. McIlquham | | $ | 151,503 |

| Mr. Rogers | | $ | 45,024 |

| Mr. Ackerman | | $ | 42,472 |

| Mr. Hofmann | | $ | 17,392 |

| Mr. Dobbs | | $ | 50,609 |

As discussed above, the company's historical equity grant allocations have been based on significant events and were not considered as part of the annual compensation process. During fiscal year 2007, the only equity grants to named executive officers were made in conjunction with their promotions or announced changes in responsibilities. In determining the grants made in fiscal year 2007 to Messrs. Rogers, Ackerman and Hofmann, the compensation committee reviewed market information on annual grant values in general industry as compiled by Watson Wyatt. The compensation committee also reviewed the overall equity positions and grant history for each of the three officers being considered for grants as well as those of other executive officers. The grants of stock options made to these officers were determined by the compensation committee after consideration of this information.

Consistent with previous equity grants made by the company, the fiscal year 2007 stock option grants to these officers consisted of both "time options" and "performance options." The "time options" vest and become exercisable ratably on a monthly basis over the 36-month period from the date of grant. The "performance options" vest on the eighth anniversary of grant, but can become exercisable at the end of fiscal year 2007 if Sealy achieves $294 million in management EBITDA in fiscal year 2008.

The 2004 Stock Option Plan specifies that the exercise price for stock options shall be no less than the fair market value of the stock on the date of grant. At the time these grants to the named executive officers were approved by the compensation committee, the Plan defined fair market value as the average closing price of the company's stock on the five trading days prior to the grant date. As such, the exercise price for the options granted on December 22, 2006 to Messrs. Rogers, Ackerman and Hofmann was established at $14.99 (the average closing price for the five trading days ending on and including December 22, 2006), even though the closing stock price on that day was $14.92. In July of 2007, the 2004 Stock Option Plan was amended so that fair market value of the stock is now defined as the closing price on the date of grant.

18

The Sealy Benefit Equalization Plan was established to provide a vehicle to restore qualified plan benefits, specifically those relating to the Sealy Profit Sharing Plan, which are reduced as a result of limitations imposed under the Internal Revenue Code on qualified benefit plans. The Benefit Equalization Plan is a nonqualified deferred compensation plan that ensures that participating executives, including the named executive officers, receive their full profit-sharing contribution and earnings on previously credited contributions. Earnings on balances in the Benefit Equalization Plan equal the rate of return on investments made by each participant in the qualified Profit Sharing Plan. No voluntary deferrals currently may be made to the Benefit Equalization Plan.

Sealy generally does not provide other supplemental benefits or perquisites to its executives. Our executives do not have company cars or car allowances, club memberships or financial planning allowances. Health care, disability and life insurance benefits for Sealy executives are the same as those provided to all active salaried employees.

Each of our named executive officers has an employment agreement with a perpetual one-year term, except for the Chief Executive Officer whose agreement has a perpetual two-year term. The employment agreements specify minimum salaries and annual bonus opportunities. For purposes of the employment agreements the following result in "Cause" or "Good Reason" for terminating an employment agreement:

"Cause" exists if the employee:

- •

- Commits a felony;

- •

- Materially breaches or defaults on the employment agreement; or

- •

- Either grossly negligently or willfully causes material economic harm to Sealy or materially adversely effects Sealy's operations, property or business.

"Good Reason" exists if any of the following occurs:

- •

- Reduction in the employee's salary;

- •

- Material reduction in the employee's position, authority or office;

- •

- Material reduction in the employee's responsibilities or duties;

- •

- Material adverse change in the employee's benefits;

- •

- Requiring a relocation of more than 25 miles;

- •

- Material breach of the employment agreement by Sealy; and

- •

- If a purchaser of substantially all of Sealy's assets does not assume the employment agreement.

The timing and benefits provided by the employment agreement differ based on the reason for the termination as follows:

- •

- Termination by Sealy for "Cause" or upon employee's death or permanent disability or termination

- •

- Immediate termination

- •

- No benefit under employment agreement

19

- •

- Resignation "Without Good Reason"

- •

- Thirty days notice of resignation

- •

- No benefit under employment agreement

- •

- Termination as a result of death or permanent disability

- •

- No benefit under employment agreement

- •

- Resignation by the employee for "Good Reason"

- •

- Immediately upon Notice

- •

- Benefits under employment agreement

- •

- Termination by Sealy "Without Cause"

- •

- Thirty days notice of termination

- •

- Benefits under employment agreement

In the event of a resignation for "Good Reason" or a termination "Without Cause" involving an employee with an employment agreement, the employee will be entitled for one year thereafter (two years in the case of Mr. McIlquham) to:

- •

- Continue to receive his annual base salary (at the highest rate in effect during the past year);

- •

- Participate in our annual bonus plan;

- •

- Receive benefits, including medical, dental and life insurance which would otherwise be available to him during his employment; and

- •

- Receive up to one year of outplacement services from a nationally recognized executive outplacement firm.

Under his employment agreement, Mr. Rogers may elect within five days after termination to take his salary and bonus continuation in a lump sum payable within thirty days of his termination of employment with Sealy.

If at any time our Executive Severance Benefit Plan (described below) would provide better cash severance benefits to the employee than the foregoing severance provisions, the employee may elect to receive such better cash severance benefits in lieu thereof, while continuing to receive any other benefits available under the agreement. These agreements also contain confidentiality and non-competition covenants and other terms and conditions customary to executive employment agreements.

Effective December 1, 1992, we established the Sealy Executive Severance Benefit Plan, or the Executive Severance Plan, for employees in certain salary grades. Benefit eligibility includes, with certain exceptions, termination as a result of a permanent reduction in work force or the closing of a plant or other facility, termination for inadequate job performance, termination of employment by the participant following a reduction in base compensation, reduction in salary grade which would result in the reduction in potential plan benefits or involuntary transfer to another location. Benefits include cash severance payments calculated using various multipliers varying by salary grade, subject to specified minimums and maximums depending on such salary grades. Such cash severance payments are made in equal semi-monthly installments calculated in accordance with the Executive Severance Plan until paid in full. Certain executive-level officers would be entitled to a minimum of one-year's salary and a maximum of two-year's salary under the Executive Severance Plan. However, if a participant

20

becomes employed prior to completion of the payment of benefits, such semi-monthly installments shall be reduced by the participant's base compensation for the corresponding period from the participant's new employer. Participants receiving cash severance payments under the Executive Severance Plan also would receive six months of contributory health and dental coverage and six months of group term life insurance coverage.

We currently follow the terminal accrual approach to accounting for severance benefits under the Executive Severance Plan and record the estimated cost of these benefits as expense at the date of the event giving rise to payment of the benefits.

Impact of Tax, Accounting and Regulatory Considerations on Compensation Programs

Section 162(m) of the Internal Revenue Code generally allows a deduction to publicly traded companies for certain qualifying performance based compensation. Section 162(m) disallows a deduction to the extent certain non-performance based compensation over $1 million is paid to the chief executive officer or any of the four other most highly compensated executive officers. Sealy believes its Bonus Plan is exempt from Section 162(m) until its 2010 annual stockholder's meeting under relief provided to companies that become publicly held in connection with an initial public offering. In addition, Sealy believes the Bonus Plan satisfies the requirements for exemption under Internal Revenue Code Section 162(m) as a performance based plan.

To maintain flexibility in compensating executive officers in a manner consistent with its goals, the compensation committee has not adopted a policy that all compensation must be deductible. The discretionary bonus payments made to Named Executive Officers during 2007 were made even though such payments do not qualify as "performance based compensation" under Section 162(m). The compensation committee will continue to monitor this issue.

As described above, the company amended its 2004 Stock Option Plan to modify the determination of fair market value of the stock for purposes of establishing the exercise price of option grants. Although the use of a multi-day average stock price was consistent with tax-related requirements and did not have a material impact on the accounting expense related to such grants, the change was made to conform to typical practices of other publicly traded companies. Also, the modification to the Plan was made in recognition of the new proxy disclosure requirements regarding the grant of stock options with an exercise price that differed from the closing stock price on the date of grant.

Report of the Compensation Committee