UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 20-F/A

NORSAT INTERNATIONAL INC.

British Columbia, Canada

![[norsat20f033106002.gif]](https://capedge.com/proxy/20-FA/0001137171-06-000868/norsatlogo.gif)

(Mark One)

| |

| REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR |

X | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31st, 2005 |

OR |

| | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

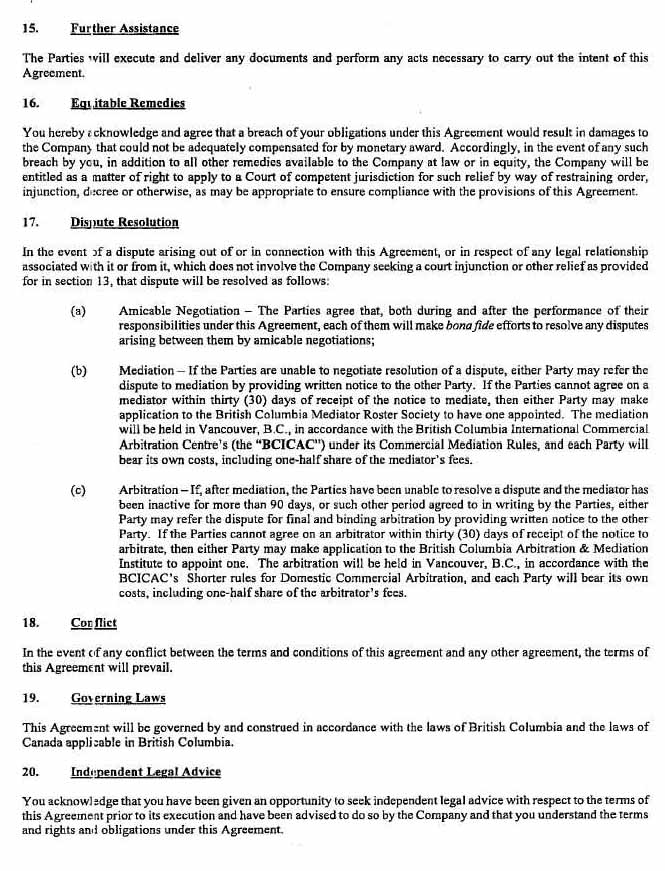

For the transition period from _________________ to ________________ |

Commission file number: 0-12600

Securities registered or to be registered pursuant to Section 12(b) of the Act.

| | |

Title of each class | | Name of each exchange on which registered |

N/A | | N/A |

Securities registered or to be registered pursuant to Section 12(g) of the Act.

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act.

|

Common Shares |

Title of Class |

Indicate the number of outstanding shares of each of the issuer's classes of capital or common stock as of the close of the period covered by the annual report. 42,708,082 common shares.

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

[X] Yes [ ] No

Indicate by check mark which financial statement item the registrant has elected to follow.

[X] Item 17 [ ] Item 18

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of accelerated filer and large accelerated filer in Rule 12b-2 of the Exchange Act.

Large accelerated filer___

Accelerated filer___

Non-accelerated filer X

(APPLICABLE ONLY TO ISSUERS INVOLVED IN BANKRUPTCY PROCEEDINGS DURING THE PAST FIVE YEARS)

Indicate by check mark whether the registrant has filed all documents and reports required to be filed by Sections 12, 13 or 15(d) of the Securities Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court.

[ ] Yes [ ] No

2

Table Of Contents

| 1. | IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS | 5 |

| 2. | OFFER STATISTICS AND EXPECTED TIMETABLE | 5 |

| 3. | KEY INFORMATION | 5 |

| A. | SELECTED FINANCIAL DATA | 5 |

| B. | CAPITALIZATION AND INDEBTEDNESS | 7 |

| C. | REASONS FOR THE OFFER AND USE OF PROCEEDS | 7 |

| D. | RISK FACTORS | 7 |

| 4. | INFORMATION ON THE COMPANY | 10 |

| A. | HISTORY AND DEVELOPMENT OF THE COMPANY | 10 |

| B. | BUSINESS OVERVIEW | 14 |

| C. | ORGANIZATIONAL STRUCTURE | 18 |

| D. | PROPERTY, PLANTS AND EQUIPMENT | 18 |

| 4A. | UNRESOLVED STAFF COMMENTS | 18 |

| 5. | OPERATING AND FINANCIAL REVIEW AND PROSPECTS | 19 |

| A. | OPERATING RESULTS | 19 |

| B. | LIQUIDITY AND CAPITAL RESOURCES | 32 |

| C. | RESEARCH AND DEVELOPMENT, PATENTS AND LICENSES, ETC | 32 |

| D. | TREND INFORMATION | 33 |

| E. | OFF-BALANCE SHEET ARRANGEMENTS | 34 |

| F. | TABULAR DISCLOSURE OF CONTRACTUAL OBLIGATIONS | 34 |

| G. | SAFE HARBOR | 34 |

| 6. | DIRECTORS, SENIOR MANAGEMENT AND EMPLOYEES | 35 |

| A. | DIRECTORS AND SENIOR MANAGEMENT | 35 |

| B. | COMPENSATION | 37 |

| C. | BOARD PRACTICES | 38 |

| D. | EMPLOYEES | 43 |

| E. | SHARE OWNERSHIP | 43 |

| 7. | MAJOR SHAREHOLDERS AND RELATED PARTY TRANSACTIONS | 45 |

| A. | MAJOR SHAREHOLDERS | 45 |

| B. | RELATED PARTY TRANSACTIONS | 45 |

| C. | INTERESTS OF EXPERTS AND COUNSEL | 45 |

| 8. | FINANCIAL INFORMATION | 46 |

| A. | CONSOLIDATED FINANCIAL STATEMENTS | 46 |

| B. | SIGNIFICANT CHANGES | 79 |

| 9. | THE OFFER AND LISTING | 80 |

| 10. | ADDITIONAL INFORMATION | 81 |

| A. | SHARE CAPITAL | 81 |

| B. | MEMORANDUM AND ARTICLES OF ASSOCIATION | 81 |

| C. | MATERIAL CONTRACTS | 83 |

| D. | EXCHANGE CONTROLS | 83 |

| E. | TAXATION | 84 |

| F. | DIVIDENDS AND PAYING AGENTS | 87 |

| G. | STATEMENT BY EXPERTS | 87 |

| H. | DOCUMENTS ON DISPLAY | 87 |

| I. | SUBSIDIARY INFORMATION | 88 |

3

| 11. | QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK | 88 |

| 12. | DESCRIPTION OF SECURITIES OTHER THAN EQUITY SECURITIES | 88 |

| PART II | 89 |

| 13. | DEFAULTS, DIVIDEND ARREARAGES AND DELINQUENCIES | 89 |

| 14. | MATERIAL MODIFICATIONS TO THE RIGHTS OF SECURITY HOLDERS AND USE OF | |

| | PROCEEDS | 89 |

| 15. | CONTROLS AND PROCEDURES | 89 |

| 16. | [RESERVED] | 89 |

| A. | AUDIT COMMITTEE FINANCIAL EXPERT | 89 |

| B. | CODE OF ETHICS | 89 |

| C. | PRINCIPAL ACCOUNTANT FEES AND SERVICES | 89 |

| B. | EXEMPTIONS FROM THE LISTING STANDARDS FOR AUDIT COMMITTEES | 89 |

| PART III | 90 |

| 17. | FINANCIAL STATEMENTS | 90 |

| 18. | FINANCIAL STATEMENTS | 90 |

| 19. | EXHIBITS | 90 |

Note:

All dollar amounts presented in the Annual Report on Form 20-F are presented in Canadian dollars unless otherwise indicated. Reference should be made to Item 3A for information on exchange rates between the Canadian dollar and the United States dollar.

4

PART I

1.

Identity of Directors, Senior Management and Advisers

Not applicable.

2.

Offer Statistics and Expected Timetable

Not applicable.

3.

Key Information

A. Selected financial data

Table 1 below summarizes selected consolidated financial data for the Company calculated in accordance with Canadian generally accepted accounting principles ("Canadian GAAP"). Table 2 below summarizes certain corresponding information calculated in accordance with United States generally accepted accounting principles ("U.S. GAAP"). The information for each of the years in the three year period ended December 31, 2005 and as at December 31, 2005 and 2004 have been extracted from the more detailed consolidated financial statements and related notes included herein and should be read in conjunction with such financial statements appearing under the heading "Item 8 - Financial Information" and with the information appearing under the heading "Item 5 - Operating and Financial Review and Prospects". Reference is made to Note 22 of the consolidated financial statements of Norsat included herein for a discussion of the material differences between Canadian GAAP and U.S. GAAP, and their effect on the Company's financial statements. Information for the years ended December 31, 2002 and 2001 and as at December 31, 2002, and 2001 has been extracted from audited consolidated financial statements not disclosed elsewhere herein.

Table 1: Selected Financial Information according to Canadian GAAP

| | | | | |

Year Ended December 31 | 2005 | 2004 | 2003 | 2002 | 2001 |

Sales ($000's) | 18,116 | 17,521 | 12,980 | 14,675 | 20,599 |

Earnings (loss) from continuing operations ($000's) | (5,888) | 429 | (8,169) | (6,182) | (22,598) |

Net earnings (loss) ($000's) | (5,889) | 1,153 | (8,245) | (6,270) | (22,572) |

Earnings (loss) per share from continuing operations - basic and diluted ($) | (0.14) | 0.01 | (0.23) | (0.18) | (0.71) |

Earnings (loss) per share - basic and diluted ($) | (0.14) | 0.03 | (0.23) | (0.19) | (0.71) |

Weighted average number of shares - basic (000s) | 42,518 | 40,282 | 36,101 | 33,501 | 31,803 |

Weighted average number of shares - diluted (000s) | 42,518 | 40,721 | 36,101 | 33,501 | 31,803 |

Dividends per share | - | - | - | - | - |

As at December 31 | | | | | |

Total assets ($000s) | 10,524 | 12,199 | 9,515 | 17,026 | 20,025 |

Net assets ($000s) | 3,554 | 8,096 | 5,175 | 8,971 | 11,376 |

Long-term debt (excluding current portion) ($000s) | 2,008 | 1,468 | 1,271 | 1,251 | - |

Capital Stock ($000s) | 41,416 | 40,901 | 39,153 | 34,715 | 33,974 |

5

Table 2: Selected Financial Information according to US GAAP.

| | | | | | |

| | |

Year Ended December 31 | 2005 | 2004 | 2003 | 2002 | 2001 |

Sales ($000's) | 18,116 | 17,521 | 12,980 | 14,675 | 20,599 |

Earnings (loss) from continuing operations ($000's) | (5,858) | 897 | (7,349) | (5,811) | (19,873) |

Net earnings (loss) ($000's) | (5,858) | 1,622 | (7,425) | (5,899) | (19,848) |

Earnings (loss) per share from continuing operations - basic and diluted ($) | (0.12) | 0.02 | (0.21) | (0.17) | (0.62) |

Earnings (loss) per share - basic and diluted ($) | (0.12) | 0.04 | (0.21) | (0.17) | (0.62) |

Weighted average number of shares - basic (000s) | 42,518 | 40,282 | 36,101 | 33,501 | 31,803 |

Weighted average number of shares - diluted (000s) | 42,518 | 40,721 | 36,101 | 33,501 | 31,803 |

Dividends per share | - | - | - | - | - |

As at December 31 | | | | | |

Total assets ($000s) | 10,869 | 12,632 | 9,991 | 17,276 | 19,909 |

Net assets ($000s) | 2,956 | 7,593 | 4,330 | 7,317 | 11,281 |

Long-term debt (excluding current portion ($000s) | 2,941 | 2,404 | 2,593 | 3,155 | - |

Capital Stock ($000s) | 116,401 | 115,535 | 113,788 | 109,350 | 108,608 |

In this Form 20-F Annual Report unless otherwise specified, all monetary amounts are expressed in Canadian dollars. The following tables set out the exchange rates, based on the noon buying rates for the Bank of Canada, for the conversion of United States dollars into Canadian dollars in effect at the closing rate on March 30, 2006, the range of high and low exchange rates for such periods, and the average exchange rates (based on the average of the noon day exchange rates) on each day of the year in such periods.

The close of business on March 29, 2006: 1.1724

| | | | | | |

| | Last Six Months Ended |

| | 2006 | 2005 |

| | Feb. | Jan. | Dec. | Nov. | Oct. | Sep. |

High for period | 1.1352 | 1.1372 | 1.1734 | 1.1961 | 1.1887 | 1.1882 |

Low for period | 1.1614 | 1.1794 | 1.1507 | 1.1657 | 1.1659 | 1.1611 |

| | | | | |

| | Year Ended December 31 |

| | 2005 | 2004 | 2003 | 2002 | 2001 |

Average for period | 1.2116 | 1.3015 | 1.4015 | 1.5704 | 1.5484 |

B.

Capitalization and indebtedness

Not applicable.

C.

Reasons for the offer and use of proceeds

Not applicable.

D.

Risk factors

Investors should carefully consider the risks and uncertainties described below before making an investment decision. If any of the following risks actually occur, our business, financial condition or operating results could be materially harmed. This could cause the trading price of our common shares to decline, and you may lose all or part of your investment.

Risks Associated With Our Financial Results

Our inability to generate sufficient cash flows may result in us not being a going concern. Our consolidated financial statements have been prepared on the going concern basis, which presumes the realization of assets and the settlement of liabilities in the normal course of operations. The application of the going concern basis is dependent upon the Company having sufficient available cash resources and achieving profitable operations to generate sufficient cash flows to fund continued operations, or, in the absence of adequate cash flows from operations, obtaining additional financing. For the year ended December 31, 2005, the Company was not profitable. The Company has previously reported losses and negative cash flows from operations in four of the last five fiscal years. While management believes the Company has sufficient cash flows to continue operations for the next 12 months, the Company may need to rely on a dditional funding to sustain operations after that point.

Our inability to accurately forecast our results from quarter to quarter may affect our cash resources and result in wide fluctuations in the market price of our stock. Our operating results have varied on a quarterly basis in the past and may fluctuate significantly in the future as a result of a variety of factors, many of which are described below. Due to these and other factors, most of which are outside of our control, our quarterly revenues and operating results are difficult to forecast. As a result, we may not be able to accurately predict our necessary cash expenditures during each quarter or obtain financing in a timely manner to cover any shortfalls. We also believe that period-to-period comparisons of our operating results may not be meaningful and one should not rely on any such comparisons as an indication of our future performance.

Risks Associated With Our Business And Operations

We cannot be sure we will be able to identify emerging technology and market trends, enhance our existing technologies or develop new technologies in order to effectively compete in the satellite communications industry. The satellite communications industry is characterized by rapid technological changes, short technology and product life cycles, pressure to provide improved solutions at increasingly lower prices and frequent introduction of new technologies and products. To succeed, we must be able to identify emerging trends and enhance our existing technologies and develop new technologies and products to meet market requirements. To drive sales, our satellite products must meet the needs of our customers and potential customers and must be competitively priced. Additionally, there must be sufficient interest in and demand for our products. If we do not develop these new technologies and products in a timely and cost ef fective manner, or if others develop new technologies before us, we will not achieve profitability in the satellite communications industry and we may not be able to participate in selling these new technologies or products.

|

We have customer and supplier concentration. A significant portion of our revenues has been recognized from a limited number of customers. For example, during 2005, the Satellite Systems business unit generated approximately 74% (2004: 87%) of its sales from the United States government. We expect that a majority of our Satellite Systems revenues will continue to depend on sales of products to a small number of customers. We also expect that customers will vary from period-to-period. If we fail to successfully sell our products to one or more targeted customers in any particular period, or are unable to diversify our number of customers and segments, our revenues and profits will be adversely affected. The Company purchases substantially all of its microwave products from four suppliers, and certain critical components for its Omnilink product from sole source suppliers. If any of t hese suppliers is unable or unwilling to supply to us and at prices that we deem fair, and we are unable to diversify our number and range of suppliers to mitigate this risk, our revenues and profits will be adversely affected.

We cannot be sure that we will be able to compete effectively with our current competitors. The satellite communications industry is intensely competitive. Our competitors have technologies, products and resources that may be more advantageous and they compete directly with us. Some of these competitors are large, established companies which have significantly greater resources than we have. Our ability to compete effectively will depend on our ability to increase sales and attract new customers in a timely and cost effective manner and market and sell these products at competitive prices. We are dependent on others for the supply and manufacture of components and products we sell. We have outsourced substantially all of the manufacturing of the microwave products we sell and, with the progression of the portable terminals from development to production, we rely on our suppliers to provide components for the production of t erminal products. If either the manufacturers or suppliers cannot deliver products to us on time, and at competitive pricing, our revenues and profits will be adversely affected.

We have limited intellectual property protection. Our success and ability to compete are dependent, in part, upon proprietary technology. Due to the rapid technological changes in our markets and since our technology is, in part, proprietary, we rely primarily on trade secrets and we do not have adequate patent applications to protect our technology. We are however continuing to apply for new patent protection as it relates to Globetrekker products. We also enter into confidentiality, and non-compete agreements with our employees and limit the access to and distribution of our product design documentation and other proprietary information. We cannot be sure that these efforts will deter misappropriation or prevent an unauthorized third party from obtaining or using information, which we deem to be proprietary. Although we believe that our technology does not currently infringe upon patents held by others, we cannot be sure that such in fringements do not exist or will not exist in the future, particularly as the number of products and competitors in our industry segment grows.

If we experience rapid growth and do not manage it effectively, this may impact our profitability. If our technologies and products achieve wide acceptance we may experience rapid growth. We may have to hire more employees, including additional management, improve our financial control systems, and expand and manage our technical, sales and support service operations. We would need increased revenues and additional funding to operate these increased activities. If we do not manage our growth effectively, profitability may be impacted.

We depend on our key employees and we cannot be sure that we will be able to keep these employees or hire and train replacements. Our success depends on the skills, experience and performance of our senior management and other key personnel. While we offer competitive compensation packages and stock options to attract key employees, we do not carry key person insurance on these employees. Highly skilled technical employees and management in the satellite communications industry are in demand and the market for such persons is highly competitive. We cannot be sure that we will be able to retain these employees or hire replacements. If we do not successfully retain our key personnel or hire and train replacements

we will be unable to develop the new products and technologies necessary to compete in our markets or to effectively manage our business.

We may be subject to product liability claims, which are not fully covered by insurance. The manufacture sale and marketing of our satellite products expose us to the risk of product liability claims. Given the complex nature of our products, they may contain undetected errors or performance problems, particularly when new products are introduced. Although our products undergo extensive testing prior to introduction to the market, it is typical in the satellite communications industry for such products to contain errors and performance problems, which are discovered after commercial introduction. If these defects and errors are discovered after shipment, they could result in a loss of sales revenues, delay in market acceptance, product returns, warranty claims and the loss of a potential market. In addition, components and other products manufactured and distributed by others, which are incorporated into our products, may also contain such defects and errors, which could substantially reduce the performance of our products. We are also at risk of exposure to potential product liability claims from distributors and end-users for damages resulting from defects in products that we distribute. Although product defects have not been a significant factor, we maintain product liability insurance. We cannot be sure that this insurance will be adequate to cover all claims brought against us or that this insurance will continue to be available to us on acceptable terms. If these claims are not fully covered by our product liability insurance, they could severely and negatively impact our business liability insurance coverage and our available cash resources. A product liability claim, even one without merit or for which we have substantial coverage, could result in significant legal defence costs, thereby increasing our expenses, lowering our earnings and, depending on revenues, potentially resulting in additional losses.

Since we sell our products around the world, we face financial risks associated with currency fluctuations and other risks relating to our international operations, which may adversely impact our business and results of operations. To be successful, we believe we must expand our international operations. Therefore, we expect to commit significant resources in order to expand our international sales and marketing activities, including the hiring of an international sales force and agents. If we do not maintain or increase international market demand for our products, our business will be negatively impacted. We are increasingly subject to a number of risks associated with international business activities, which may increase our costs, lengthen our sales cycle and require significant management attention. These risks include:

Increased expenses associated with marketing services in foreign countries;

General economic conditions in international markets;

Unexpected changes in regulatory requirements resulting in unanticipated costs and delays;

Tariffs, export controls and other trade barriers;

Longer accounts receivable payment cycles and difficulties in collecting accounts receivable; and

Potentially adverse tax consequences, including restrictions on the repatriation of earnings.

While we expect our international revenues and expenses to be denominated primarily in US dollars, a portion of our international revenues and expenses may be denominated in other foreign currencies in the future. Accordingly, as our reporting currency is the Canadian dollar, we could experience the risks of fluctuating currencies and could choose to engage in currency hedging activities, which may be unsuccessful and expensive.

Risks That May Affect The Value Of Norsat Shares

The exercise of our existing outstanding options, warrants, warrants to be issued, conversion of long-term debt and the number of shares available for future issuance may substantially dilute the value of our common shares. The Company has 75,000,000 shares of Common Stock authorized, of which 42,708,082 were outstanding at December 31, 2005 and an additional 6,666,961 shares have been reserved for issuance upon the exercise of outstanding options or warrants or warrants to be issued or conversion of long-term debt as of such date. Although our Board of Directors has no present intention to do so, it has the authority, within parameters set by the Toronto Stock Exchange (the "TSX"), without action by the shareholders, to issue authorized and unissued shares of Common Stock. Any series of Preferred Stock, if and when established and issued, could also have rights superior to shares of our Common Stock, particularly in regard to voting, the payment of dividends and upon liquidation of Norsat. Convertible debt, if issued to raise additional working capital for the company could also have dilutive effect on the shareholders.

4.

Information on the Company

A.

History and development of the Company

The Company was incorporated in Canada under the name "Norsat International Inc." on October 15, 1982 pursuant to theCompany Act (British Columbia). Effective September 27, 1989, the Company changed its name to NII Norsat International, Inc. At the Company's Annual General Meeting held on June 9, 1999, shareholders passed a special resolution to change the Company's name back to Norsat International Inc. Since July 2, 1999, the Company has operated under the name Norsat International Inc.

Head Office Contact Information

The Company's head office is located at:

300-4401 Still Creek Drive

Burnaby, British Columbia

Canada V5C 6G9

Telephone: 604-292-9000

Fax: 604-292-9100

Email: investor@norsat.com

www.norsat.com

Important Events

Throughout the year, we focused our attention on growing revenues from both our satellite systems and microwave components business units despite an increasingly price-conscious and competitive market. The following were important events during the year:

o

In 2005, Norsat focused its research and development efforts to design and develop a family of ultra-portable satellite systems known as the Norsat GLOBETrekkerTM. The product was launched in Q3 2005 and production units are scheduled to roll out in the second quarter of 2006.

o

By November 2005, the Company had delivered its OmniLink portable satellite systems to Ireland's Department of Defense in conjunction with NextiraOne.

o

In October 2005, the Company announced a partnership with Arrowhead Global Solutions, a Native American-owned small business provider of commercial satellite products, bandwidth and services to the United States Department of Defense.

o

On September 19, 2005, the Board of Directors and Audit Committee of the Board announced the retention of Ernst & Young LLP as its auditing firm for the fiscal year ending December 31, 2005.

o

In September 2005, the Company announced that it had expanded its portfolio of microwave products to include Block-up Converters in the extended Ku-band, Ka and X-band low noise block down-converters, and custom block down-converters.

o

On September 29, 2005, the Company announced that it had fulfilled an order to supply portable satellite systems to the 1st Calvary Division of the U.S. Army. The order was in excess of US$800,000. Troops from the 1st Cavalry Division based out of Fort Hood, Texas, used the portable satellite systems to transmit high fidelity data and video, as part of their engagement in Joint Task Force Katrina.

o

In August 2005, the Company announced that it had successfully leveraged its strong supply record to the U.S. Army to secure an order for a portable satellite system with the U.S. Marine Corps.

o

On June 30, 2005, the Company announced it had been awarded a US $3.3 million order by the U.S. Army Forces Central Command. The order called for the supply of Norsat NewsLink TM portable satellite terminals, spares, training and maintenance to support the expansion of the U.S. Army's DVIDS (Digital Video and Imagery Distribution) System.

o

In May 2005, an Asian military customer became the first non-US military customer to have placed an order for the Company's OmniLink portable satellite systems to be used for in-theater operations.

o

In the second quarter of 2005, Norsat appointed both a new Board and new executive team.

o

Norsat introduced the first commercialized highly stable phase locked loop low noise block downconverters (PLL LBN's) for X and Ka frequencies.

o

Norsat partnered with UAE-based Atlas Telecom to penetrate the markets in the Gulf Cooperation Countries.

o

In February 2005, Norsat introduced a product family of solid state high power amplifiers.

o

Norsat received proceeds from financing activities of $0.5 million. All of these proceeds were through the exercise of share purchase options at various times during the year.

Business Development

In 2005, Norsat experienced continued and growing demand for its portable satellite systems, driven in part by the global war on terror and the net-centric transformation of the militaries of Allied Nations. In response to this demand increase, Norsat accelerated its sales and marketing activities across both business units to execute against an aggressive growth strategy to capture a greater share of this growing market.

The following principles have been central to this growth strategy:

1.

Leverage the Company's Reliable Supply Record

Norsat is the primary supplier of portable satellite systems to the US Army's DVIDS (Digital Video and Imagery Distribution System) program and enjoys a reliable supply record. The DVIDS Program enables Norsat satellite systems to be used by multiple U.S. Armed Services engaged in peacekeeping and reconstruction activities. In 2005, Norsat successfully leveraged its supply record with the U.S. Army to secure orders from other services within the U.S. military, most notably the U.S. Marine Corps and more recently, the U.S. Air Force.

In 2005, an active effort to focus on the Company's reliable supply record with the US Army also enabled it to gain a beachhead with other nations' militaries. Through one of Norsat's partners, NextiraOne, Norsat is upgrading the Irish Department of Defence's capabilities to meet both their defence and emergency planning requirements. Norsat is also supplying satellite systems to an Asian military currently involved in peacekeeping operations. Norsat continues to leverage its relationship with the aforementioned military placements and with other agencies engaged in the global war on terror both directly and through its network of alternate distribution channels.

Norsat has also similarly expanded its presence within the broadcast industry. Among those media corporations acquiring Norsat systems to enhance their ability to report breaking new stories, were ITN, the largest British broadcaster, CBS affiliate KTVA in Alaska and an Australian broadcaster.

2.

Recruit and Nurture Strategic Channel Partners

Recognizing that partnerships are a key to sustained growth, Norsat has been actively pursuing strategic relationships with players in both the United States and elsewhere.

As part of this coordinated thrust to recruit strategic partners, the Company has:

i.

entered into a partnership with Arrowhead Global Solutions to jointly bid on significant, multi-year opportunities sponsored by the U.S. Department of Defense;

ii.

successfully signed a frame agreement with one of the world's largest satellite service providers and;

iii.

been engaged in discussions with one of the world's largest defense integrators about an OEM arrangement, wherein the GLOBEtrekker would become part of their product line.

In a strategic move to rapidly establish partnerships necessary to penetrate certain sectors of the market, Norsat accelerated its sales, marketing and product development activities with the goal of bringing the industry's first broadband-capable, backpackable system, the GLOBETrekker, to market. The capabilities of the GLOBETrekker have been sought after in both, the defense and broadcast sectors.

The demand for highly portable satellite systems in the defence segment is strong as the U.S. military and those of other Allied Nations reorganize themselves into a more net-centric force capable of dealing with asymmetric terrorist threats.

3.

Multiply Trade Show Presence

In an effort to showcase the capabilities of Norsat's Omnilink portfolio of products, Norsat employed a mixture of direct sales efforts, partnerships with industry leaders, and participation in industry leading trade shows.

The introduction of GLOBEtrekker, heralded a significant change in how Norsat participated in trade shows. Launched in Amsterdam at IBC and in London two weeks later at the Defence Systems and Equipment International (DSEI) show, the product was then exhibited in the display areas of three (3) strategic partners at Milcom 2005 where Norsat did not have its own booth.

Norsat intends to continue this approach to trade shows in the future as a means to gain broader access to client opportunities through partnerships and reduce the cost of trade show participation by Norsat.

4.

Promote Microwave Products

While "word-of-mouth" referrals and a global network of distributors had traditionally been the primary means of lead generation in the more mature microwave components business the Company added a number of new initiatives to help growth of the microwave components business unit. These initiatives included:

·

adding a sales resource and launching a "win-back" program;

·

designing a product catalogue; and

·

participating in the National Association of Broadcasters (NAB) show.

Research and Development

Research and development activities and projects were focused on those that produced near-term and tangible results, with the main development being the GLOBETrekker family of products.

GLOBETrekker

We focused our efforts on developing the next generation of ultra portable satellite systems, the GLOBEtrekker. Significant R&D effort was expended on this new backpackable ultra portable system. The GLOBETrekker product is suited for "Grab and Go" missions where users may be required to deploy to a site and set up at a location on short notice.

Human Resources

Employee Productivity

We continued to focus on improving employee productivity. In 2004, we implemented an employee incentive program to assign personal goals in support of the overall corporate strategy and, further to align those goals with shareholder objectives. Particular attention was paid to ensuring that the personal and corporate goals were challenging, clearly defined and assessable by management. This program was continued and further refined during 2005.

Leadership

In 2005 we recruited new members to our executive team.

Mr. William J. Coyne III joined the Company on May 16, 2005 as President & Chief Executive Officer. Mr. Coyne previously held executive level positions at several international telecommunications organizations including Sprint and Cable & Wireless. During his 10-year tenure with Sprint, he was the Vice President & General Manager - Northeast Division Mr. Coyne was then recruited by Cable & Wireless. Mr. Coyne's 9 years with Cable & Wireless included multiple executive level positions culminating in being named COO of the U.S. operation. Mr. Coyne then went on to assist several private, entrepreneurial companies in their efforts to be more efficient and productive in their Sales, Marketing and Customer Service business units.

William Comerford was hired as Senior VP Global sales in August 2005.

Bill Comerford has more than 25 years of senior level experience in sales marketing human resources and operations in both private and public communication corporations. Mr. Comerford's experience includes senior positions with Cable & Wireless and Sprint/Global One. Mr. Comerford has an MBA from George Washington University and a BSc in Marketing from Pennsylvania State University.

Mr. George Dorin joined the Company on September 28, 2005 as Chief Financial Officer. Mr. Dorin is a member of the Institute of Chartered Accountants of BC and has a Masters degree in Finance from the London School of Economics in England and degrees in Science and Accounting from the University of British Columbia. Mr. Dorin has over 25 years of national and international experience in financial management, strategic planning, Corporate development and corporate finances and most recently served as CFO and Corporate Secretary of GPS Industries, a wireless technology company with offices in Canada, the United States and England. Mr. Dorin also currently serves on the Board of Directors and is Chair of the Audit Committee of Cantronic Systems, a public technology company in Coquitlam, B.C.

Capital Expenditure

A description of the Company's principal Capital Expenditures over the last three years is as follows:

·

During 2005, 2004, and 2003 the Company made net purchases of property and equipment in the amounts of $290,048, $185,332, and $98,497 respectively, primarily relating to the purchase of an upgraded ERP system and test equipment.

B.

Business overview

Company Overview

Founded in 1977, Canadian based Norsat International Inc. designs, develops and markets satellite ground equipment which enables high speed transmission of data, audio and video over satellite.

While Norsat International's products have traditionally addressed the government and broadcast television markets, there is growing focus for its portable satellite systems in the disaster recovery, business continuity and tele-health markets.

Product Line

The Company's portfolio of satellite ground equipment comprises primarily of microwave components and portable satellite systems. These components and systems are designed to interoperate with geostationary satellites orbiting the earth.

Microwave Components

Microwave components enable the transmission, reception and amplification of signals to and from satellites. The Company's product portfolio of microwave components includes a comprehensive range of satellite receivers (LNBs), transmitters (BUCs), transceivers, solid state power amplifiers (SSPAs) and other customized products.

Satellite Systems

Portable satellite systems provide rapidly deployable broadband connectivity over satellite where traditional communications infrastructure is insufficient, unreliable, damaged or non-existent. The Company's product portfolio of portable satellite systems include the Norsat GLOBETrekker and OmniLink satellite systems.

The GLOBETrekker is an intelligent, ultra-portable satellite system that enables users to establish a reliable broadband connection on short notice. It is designed to be carried in a backpack, is airline checkable, and fits in small vehicles. The GLOBETrekker is ideal for users who are highly mobile and need to establish broadband connectivity on short notice. Examples of such users include Special Forces, first responders, business continuity managers, Search and Rescue personnel and journalists.

The OmniLinkTM product family also addresses the demanding needs of users seeking to establish broadband connectivity on a temporary basis but for longer periods of time. This product line is ideal for use by government and peace-keeping agencies, broadcasters, resource exploration companies, distance education institutions, financial institutions, and large corporations.

Innovation in Technology

In September 2005, Norsat launched the GLOBETrekker, the industry's first intelligent, backpackable, broadband-capable satellite system. Production units are scheduled to roll out in the first half of 2006.

Early in the year, Norsat led the microwave components industry by introducing new transmitters in the extended Ku-band, C-band and Ka-Band.

Customers

Norsat's extensive customer list includes various government, educational and financial institutions, broadcasters and Fortune 1000 companies. Recent customers include the US Military, including the US Air Force, US Army, US Marines, CBS Affiliate KTVA Anchorage and the Irish Department of Defence.

Norsat distributes its products and services to its worldwide customer base from offices in North America and Europe, and through a global network of partners and distributors.

Two business units

Norsat operates two strategic business units: Microwave Products and Satellite Systems. While both business units provide core elements of the satellite ground infrastructure, the characteristics and dynamics of the markets in which the two business units operate are markedly dissimilar.

Microwave Products Business Unit

Norsat's Microwave Products are typically used in commercial settings as components of a complete system or as replacement parts for existing systems. The product line includes a full range of radio frequency (RF) and associated components including Norsat's traditional satellite receivers (LNBs) and accessories as well as satellite transmitters, transceivers, and custom satellite outdoor units.

Product Overview

Low Noise Block down converters ("LNBs"), are required by every satellite antenna (or "dish") irrespective of aperture or location. The LNB is mounted at the focal point of the dish to convert incoming microwave signals into electrical signals that are routed to the remote receiver or indoor unit. Reliability is critical for these products as they are used in remote areas around the world.

Satellite transmitters or Block Up Converters ("BUCs") and transceivers provide a complementary offering to Norsat's traditional LNB business. Norsat provides Ku and Ka-band BUCs and transceiver products, which are required for two-way satellite networks.

The satellite BUCs convert electrical signals into microwave signals that can be transmitted to an orbiting satellite. Norsat's transceiver provides customers with an easy to install solution that consists of the BUC, LNB, filters and other hardware.

Market Profile

Norsat's primary customers include resellers, system integrators, antenna manufacturers and service providers located in North America, Europe and Asia. These customers integrate Norsat's components into a complete satellite solution for end user customers located all over the world. On the microwave components side of the business, we will be focusing on the solid-state amplifier line and on military satellite components.

Satellite Systems Business Unit

Product Overview

The Norsat GLOBETrekkerTM is an intelligent, ultra-portable satellite system that enables users to establish a reliable broadband connection on short notice - anywhere in the world - even in harsh and hostile conditions. It is sleekly designed to be carried in a backpack, is airline checkable, fits in small vehicles and is even helicopter- and parachute- friendly.

The Norsat OmniLinkTM family of portable satellite terminals combines Norsat's expertise in radio frequency (RF), video transmission, and satellite data networking technologies. The OmniLinkTM products enable the broadband transmission of large amounts of data and images, quickly and easily, without access to a telecommunications network or infrastructure.

In 2005, the Company's Satellite revenues were derived primarily from the sale of the OmniLink portable satellite systems; a video version (Norsat NewsLinkTM) and a data version (Norsat SecureLinkTM). These products are two of the smallest and most lightweight Ku-band, two-way communication devices available. The Norsat portable satellite terminals can be carried in three suitcases and deployed and set up easily in the field in several minutes without tools. They allow for the transmission of broadcast quality MPEG-2 video via DVB-S over satellite. The terminals are ideally suited for the transmission of video, voice, and IP data to and from remote or hostile environments.

Market Profile

The market for portable satellite communications comprises of users that need to establish broadband connectivity on short notice or redeploy their telecommunications infrastructure following an engagement. The primary markets for portable satellite systems are defense, emergency services (first responders, homeland security), and broadcasters. There has been growing interest from Fortune 1000 companies to employ such systems as part of a business continuity program wherein such systems would be used as a "backup measure" should their primary means of communications fail in the event of a natural disaster, an outage or a terrorist attack.

The overall market is going through a significant transformation due to the growth in the government sector. This change in demand is attributable to measures being taken by governments and corporations to counter the threat of terrorism.

The improved demand for portable satellite communications equipment stems from an initiative to "transform" the armed forces. With the onset of Operation Iraqi Freedom in 2003, the need to accelerate the "transformation" has become a top priority. Under this initiative, field units are being equipped with communications gear that will give them real-time access to the same information available at command and control centers.

Most programs within the government and broadcast sectors tend follow a formal competitive tendering process. From time to time, the government may indicate a preference for certain classes of vendors in the interest of social policy or national security objectives. It is thus, critical that a vendor such as Norsat align themselves with such pre-qualified contractors.

C.

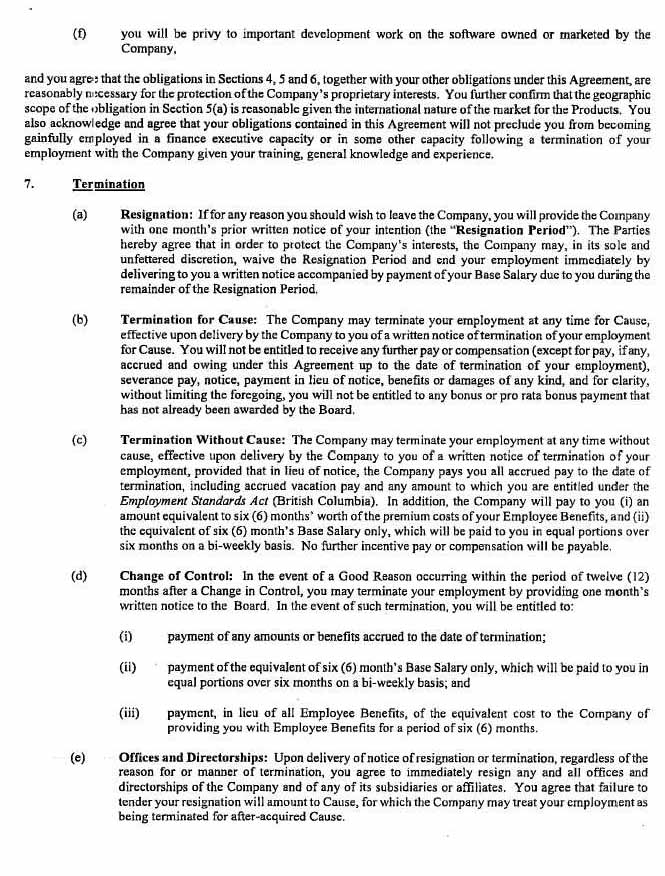

Organizational structure

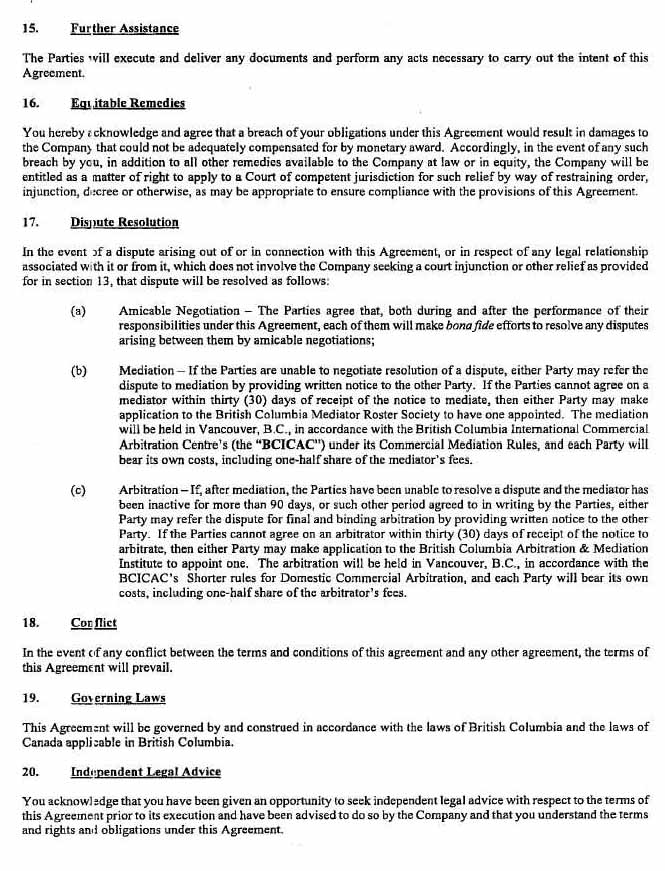

![[norsat20f033106008.gif]](https://capedge.com/proxy/20-FA/0001137171-06-000868/flowchart.jpg)

All subsidiary Companies are 100% owned by Norsat International Inc.

Norsat Atlanta Inc. and Norsat America Inc. are inactive companies.

D.

Property, plants and equipment

Description of Property

Our Company's head office and principal place of business since June 1, 1999 has been located in Burnaby, British Columbia, Canada. The current lease expires September 30, 2006. The Company has negotiated a new lease on new building and will be relocating to Richmond, British Columbia, Canada in September 2006.

The new lease will be for approximately 23,400 square feet of space, and will house the Company's corporate office, engineering and production department and include warehouse space. The company existing warehouse facility is approximately 5,000 square feet, located in Burnaby and the lease will expire at the end of September, 2006.

The monthly rent for this space will be approximately $ 35,000 and is for a term of five years. The Company has the option for a further five year term at the end of this lease, with a new rate to be negotiated.

In addition to the minimum rent, the Company is responsible to pay maintenance, utilities and taxes.

The location of the Company's head office and warehouse is well situated for access to labour and transportation, being readily accessible to the United States border and to the Vancouver International Airport and a short haul distance from the major sea ports of Vancouver and Seattle. Norsat also operates out of leased premises in Lincoln, England, Great Britain.

4A.

Unresolved Staff Comments

Not applicable

5.

Operating and Financial Review and Prospects

A.

Operating results

The following information should be read in conjunction with the Company's 2005 consolidated financial statements and related notes included therein, which are prepared in accordance with generally accepted accounting principles in Canada (Canadian GAAP). These principles differ in certain respects from generally accepted accounting principles in the United States (U.S. GAAP). The differences as they affect the financial statements of the Company are described in Note 22 to the Company's audited consolidated financial statements. All amounts following are expressed in Canadian Dollars unless otherwise indicated.

The Company has expanded its operations to include the development and production of complete satellite terminals, broadband software management systems and integration services. Since 2002, Norsat has focused its marketing and development efforts on producing high-speed portable satellite terminals geared to meet customers' needs in several promising new areas with particular focus on Government, Broadcast & Commercial markets.

Today, the Company generates revenue from two business units, Microwave Products and Satellite Systems:

The Microwave business supplies satellite signal receivers, transmitters and other ground station products for the worldwide commercial market. Over the past several years, the Microwave business has been maturing. Markets for microwave products continue to be subject to increased competition and price erosion. The Company is committed to maintaining its strong position in this market.

The Satellite Systems business designs, manufactures and markets the OmniLink and GLOBETrekker family of products, portable satellite systems. These satellite systems provide rapidly deployable broadband satellite data and video connectivity in areas where traditional communications infrastructure is insufficient, damaged, or non-existent. For 2005 the Company had two core products available: a "video" version of the OmniLink called Norsat NewsLinkTM and a "data" version, the Norsat SecureLinkTM.

Results of Operations

Fiscal 2005 Compared to Fiscal 2004

| | | | |

Quarterly Financial Data (unaudited) (Expressed in thousands of dollars, except per share amounts) |

| | Three Months Ended |

| | Mar 31 | Jun 30 | Sep 30 | Dec 31 |

2005 | | | | |

Sales | $2,519 | $6,155 | $4,721 | $4,721 |

Earnings (loss) from continuing operations | ($1,187) | ($1,241) | ($1,377) | ($2,083) |

Net earnings (loss) | ($1,188) | ($1,241) | ($1,377) | ($2,083) |

Earnings (loss) per share from continuing operations - Basic | ($0.03) | ($0.03) | ($0.03) | ($0.05) |

- Diluted | ($0.03) | ($0.03) | ($0.03) | ($0.05) |

Earnings (loss) per share - Basic | ($0.03) | ($0.03) | ($0.03) | ($0.05) |

Weighted average common shares outstanding | | | | |

basic and diluted | 42,052 | 42,052 | 42,259 | 42,646 |

| | | | | |

2004 | | | | |

Sales | $4,358 | $3,371 | $5,005 | $4,787 |

Earnings (loss) from continuing operations | 12 | ($355) | $1,006 | ($233) |

Net earnings (loss) | $ 732 | ($355) | $1,008 | ($232) |

Earnings (loss) per share from continuing operations - Basic | ($0.00) | ($0.01) | $0.03 | ($0.01) |

- Diluted | ($0.00) | ($0.01) | $0.02 | ($0.01) |

Earnings (loss) per share - Basic | ($0.02) | ($0.01) | $0.03 | ($0.01) |

- Diluted | ($0.02) | ($0.01) | $0.02 | ($0.01) |

Weighted average common shares outstanding - basic | 39,715 | 39,880 | 40,037 | 41,512 |

- diluted | 41,495 | 39,880 | 40,638 | 41,512 |

Results of Operations

| | | | | | |

Sales ($000's) | Three Months Ended (2005) | Year Ended |

Mar 31 | Jun 30 | Sep 30 | Dec 31 | 2005 | 2005 |

Microwave | $1,945 | $1,938 | $2,839 | $3,330 | $ 10,052 | $ 9,493 |

Satellite Systems: | | | | | | |

Portable Terminals | 574 | 4,217 | 1,881 | 1,392 | 8,064 | 8,028 |

| | | | | | | |

| | 574 | 4,217 | 1,881 | 1,392 | 8,064 | 8,028 |

| | $2,519 | $6,155 | $4,720 | $4,722 | $18,116 | $17,521 |

Revenues for 2005 were $18.1 million, up from the $17.5 million earned in 2004

The Microwave business maintained stable revenue levels through the year. Despite continued pricing pressures, and the erosion of the US dollar revenues increased by 5.9%. The majority of our business is from repeat customers. We also introduced several new lines of transmitters targeted on the emerging two-way satellite networks

The Satellite Systems business unit revenues were flat year over year. The Company has continued to benefit from a growing need for portable transmission equipment, including satellite newsgathering companies and the military. Forty nine satellite systems, with various options and service packs were sold in 2005 compared to forty four satellite systems in 2004. These portable satellite systems are being used for a number of applications including the transmission of time-sensitive field reports, video footage, and closed two-way video-based communications.

| | | | | | |

Gross Margin | Three Months Ended (2005) | Year Ended |

Mar 31 | Jun 30 | Sep 30 | Dec 31 | 2005 | 2004 |

Microwave | 36% | 43% | 50% | 30% | 45% | 36% |

Satellite Systems | 46% | 54% | 64% | 37% | 44% | 57% |

Combined | 38% | 50% | 55% | 32% | 45% | 45% |

Gross margins in 2005 were 45% compared to 45% in the prior year.

The Microwave business margins remained stable over the prior year due to continuing initiatives to achieve significant reductions in the cost of product. However, margins declined in the later part of the year as a result of market pricing pressures. For fiscal 2006, the Company is expecting margins to be under continuing pressure.

The Satellite Systems business also achieved stable margins year to year reflecting that a majority of the Company's revenues were direct sales to the end customer rather than through our reseller and channel partners. For fiscal 2006, the Company is expecting margins to remain strong especially with the introduction of the new GLOBETrekker family of products.

| | | | | | |

Operating Costs ($000's) | Three Months Ended (2005) | Year Ended |

Mar 31 | Jun 30 | Sep 30 | Dec 31 | 2005 | 2004 |

S G & A | $1,478 | $3,026 | $2,760 | $2,358 | $9,622 | $5,251 |

Product development | 409 | 506 | 735 | 626 | 2,276 | 1,495 |

Amortization | 159 | 174 | 181 | 112 | 626 | 621 |

TPC Funding | | | | | | (620) |

| | $2,046 | $3,706 | $3,676 | $3,095 | $12,524 | $6,747 |

Selling and marketing efforts were focused on addressing our customers needs, and developing partnerships with resellers in key markets in order to realize sales growth. A significant amount of the increased selling costs during 2005 was attributable to the hiring and compensation of a senior sales force with their related travel and entertainment costs. These costs are expected to decline in 2006 and should support revenue growth. Included in these increased costs was the attendance at three additional International tradeshows to introduce the Company's new GLOBETrekker satellite system. This is twice the number of shows regularly attended by the Company.

Increased administrative costs incurred during 2005 include significant additional legal fees and consulting costs related to staff turnover and regulatory compliance. Also, in 2005 we paid a severance of $270k to the former CEO as per a settlement agreement dated May 1, 2005. Included in administrative expenses is a charge for stock based compensation of $833,116 in 2005, compared with a charge of $135,890 in 2004.

During 2004 the Company signed an amendment to its Technology Partnerships Canada (TPC) agreement with the federal government. The amendment provided for an increase in funding of $620,000 and was recognized in full in fiscal 2004. In 2004 the Company recorded a recovery from discontinued operations totaling $724,166, which arose substantially from a settlement of a liability with a supplier. Both one-time items reduced the administrative costs for 2004.

| | | | | | |

| | Three Months Ended (2005) | Year Ended |

Mar 31 | Jun 30 | Sep 30 | Dec 31 | 2005 | 2004 |

Earnings (loss) from continuing operations before other expenses | $(1,087) | ($607) | $(1,065) | $(1,641) | $(4,400) | $1,177 |

Other expenses | $470 | $262 | $311 | $445 | $1,488 | $754 |

Earnings (loss) from continuing operations before income taxes | $(1,557) | ($869) | $(1,376) | $(2,086) | $(5,888) | $424 |

As shown in the consolidated statement of operations, the net effect of the above factors was a loss from continuing operations before other expenses of $4.4 million, compared to earnings of $1.2 million in 2004.

Other expenses for 2005 were $1.5 million compared to $0.8 million during 2004. This increase was primarily due to the write off of goodwill of $0.4 million in 2005, and the modification of convertible debt causing another $0.4m increase in other expenses.

The combined effect of the above resulted in a net loss from continuing operations for 2005 of $5.9 million or $ 0.14 per share compared to net earnings of $ 0.4 million, or $ 0.01 in 2004

For 2005, the net loss was $5.9 million or $0.14 per share - basic and diluted, compared to net earnings of $1.2 million or $0.03 per share - basic and diluted for 2004.

Critical Accounting Estimates

The Company prepares its consolidated financial statements in accordance with accounting principles generally accepted in Canada, and makes estimates and assumptions that affect its reported amounts of assets, liabilities, revenue and expenses, and the related disclosures of contingent liabilities. The Company bases its estimates on historical experience and other assumptions that it believes are reasonable in the circumstances. Actual results may differ from these estimates.

Management has discussed the development and selection of the Company's critical accounting estimates with the Audit Committee of the Company's Board of Directors, and the Audit Committee has reviewed the following disclosures.

The following critical accounting policies reflect the Company's more significant estimates and assumptions used in preparing its consolidated financial statements:

Ø

The Company maintains an allowance for doubtful accounts for estimated losses that may arise if any of its customers are unable to make required payments. Management specifically analyzes the age of outstanding customer balances, historical bad debt experience, customer credit-worthiness and changes in customer payment terms when making estimates of the uncollectability of the Company's accounts receivable balance. If the Company determines that the financial condition of any of its customers deteriorates, increases in the allowance may be made. At December 31, 2005 the Company has recorded an allowance for doubtful accounts in the amount of $ 255,000 (2004 - $28,000) as a reduction to accounts receivable.

Ø

The Company values its finished goods and work-in-process inventories at the lower of weighted average cost and net realizable value. Net realizable value reflects the current estimated net selling price or value in use of the item in inventory in a non-forced sale. The Company assesses the need for inventory write-downs based on its assessment of estimated net realizable value using assumptions about future demand and market conditions. When the results of these assumptions differ from the Company's projections, an additional inventory write-down may be required. In addition, changes in the underlying factors used in the company's projections may necessitate additional write-downs in the future. Market factors are generally outside of the Company's control. At December 31, 2005 the Company has recorded an estimate for obsolescence in the amount of $ 1,050,000 (2004 - $1,168,000) as a reduction to inventory.

Ø

The Company assesses the impairment of goodwill on an annual basis and identifiable intangibles, long-lived assets and goodwill whenever events or changes in circumstance indicate that the carrying value may not be recoverable. Factors the Company considers important, which could trigger an impairment review, include significant underperformance relative to plan, a change in the Company's business strategy, or significant negative industry or economic trends. When the Company believes that the carrying value of intangibles, long-lived assets or goodwill may not be recoverable based upon the existence of one or more of the above indicators of potential impairment, the Company determines what impairment, if any, exists based on projected net undiscounted and discounted cash flows expected to be generated from these assets. Effective January 1, 2002, the Company adopted CICA section 3062 "Goodwill and Other Intangible Assets". Under this section, goodwill is no longer amortized, but is tested for impairment annually, or more frequently if events or changes in circumstances indicate that the asset might be impaired. Additionally, the Company designated December 31 as the date for annual impairment reviews. At December 31, 2005, a write-down of goodwill of $440,000 was required (2004 - nil) based on this review.

Ø

The Company generates a portion of its revenue from multiple elements sales arrangements. Revenue is allocated under these arrangements by the residual value method whereby the fair value of undelivered elements is determined by reference to objective evidence from comparable arrangements with the balance of the fees assigned to the delivered elements. Revenue is recognized for each element when there are no remaining performance obligations required and is based on their relative fair value at the inception of the sales arrangement. To date, the

Company has obtained objective evidence of fair value of the undelivered elements in sales arrangements to support the use of the residual method of allocating revenue. If in the future fair value cannot be determined, either due to changes in contract elements or other factors, it will necessary to defer revenue until objective evidence of fair value exists or when the final elements are delivered.

Related Party Transactions

During the year ended December 31, 2005, the Company entered into an joint strategic marketing agreement with a US New York based private company involved in the business of selling, financing and leasing medical equipment technologies and telemedicine services to hospitals, medical facilities on a worldwide basis. Two of the directors of the Company at the time of entering into the agreement were partners in a firm which has a controlling equity interest in the New York company. In accordance with the agreement Norsat International Inc. was to pay monthly amount of $35,000 USD to this company retroactively from June 15th, till November 1, 2007. Subsequently, cancellation notice was given and the agreement was terminated September 1st, 2005. A total of $87,000 USD was paid for the period of June 15th to September 1st, 2005.

During 2005, Norsat International Inc. paid $22,637 GBP ($45,842 CDN Equivalent) to a legal firm based in London, England for corporate legal services specific to the Company's UK Subsidiary. A director of the Company is a partner in the UK firm.

Recent Accounting Pronouncements

o

On January 27, 2005, the Canadian Institute of Chartered Accountants (the "CICA") issued CICA Handbook Section 1530 Comprehensive Income, Section 3855 Financial Instruments - Recognition and Measurement, and Section 3865 Hedges. These standards will be effective for us from January 1, 2007. The impact of implementing these new standards is not yet determinable as it will be dependent on our outstanding positions and their fair values at the time of transition.

o

On January 1, 2004, the Company adopted the Canadian Institute of Chartered Accountants ("CICA") issued section 3063, "Impairment of Long-Lived Assets". The section provides accounting guidance for the determination of a long-lived asset impairment as well as recognition, measurement and disclosure of impairment. The adoption of this section did not have a material affect on the Company's financial results.

o

In 2003, CICA section 3870 "Stock-Based Compensation and Other Stock-Based Payments" was amended to require the fair value method to be applied to all employee stock-based compensation awards for fiscal years beginning on or after January 1, 2004. During the fourth quarter of 2003, the Company elected to early adopt the fair value method to their employee awards, granted on or after January 1, 2003. Prior stock option grants were and continue to be accounted for by the settlement method under which generally no compensation expense is assigned on the grant. In 2005 the total compensation expensed was $833,116 and is included in selling, general and administrative expense based on the following assumptions: expected annual volatility of 78% and a risk free interest rate of 3.3%, During 2005 the Company granted stock options having a weighted average fair values of $0.99 per option. (2004 $0.82) The fair values were determined using the Black-Scholes option-pricing model. The total compensation expensed in 2004 was $135,890. In 2004 there were 327,000 options granted and in 2005 1,877,500 options were granted to employees, advisors and directors of the Company.

o

In December 2003, the Emerging Issues Committee issued EIC-141, “Revenue Recognition” and EIC-142, “Revenue Arrangements with Multiple Deliverables”. In 1999, the U.S. Securities and Exchange Commission (“SEC”) issued Staff Accounting Bulletin No. 101 (“SAB 101”). In 2003 the SEC updated SAB 101 and issued SAB 103, which generally deals with similar revenue recognition issues. SAB 103 provides the SEC’s views in applying US generally accepted accounting principles to selected revenue recognition issues. Various securities regulators in Canada had previously indicated, that it was their view, that these SAB’s were consistent with CICA 3400, and that they would look to these SAB’s when determining whether Canadian reporting issuers have complied with Canadian GAAP. EIC-141 provides general interpretive guidance on the application of CICA 3400 by summarizing the principles set forth in SAB 103 that, in the Committee’s view, are generally appropriate as interpretive guidance on the application of CICA 3400. EIC-142 addresses how to determine whether an arrangement, for instance a sales arrangement, involving multiple deliverables contains more than one unit of accounting and how the arrangement consideration should be measured and allocated. As the Company had already been accounting for its revenue contracts in accordance with the principles of these abstracts, their adoption did not have a material affect on the Company's financial results

Fiscal 2004 Compared to Fiscal 2003

| | | | | | |

Sales ($000's) | Three Months Ended (2004) | Year Ended |

Mar 31 | Jun 30 | Sep 30 | Dec 31 | 2004 | 2003 |

Microwave | $2,655 | $2,238 | $2,030 | $2,570 | $ 9,493 | $ 9,542 |

Satellite Systems: | | | | | | |

Portable Terminals | 1,703 | 1,133 | 2,975 | 2,217 | 8,028 | 1,542 |

Other Systems | - | - | - | - | - | 1,896 |

| | 1,703 | 1,133 | 2,975 | 2,217 | 8,028 | 3,438 |

| | $4,358 | $3,371 | $5,005 | $4,787 | $17,521 | $12,980 |

Revenues for 2004 were $17.5 million, up 35% from the $13.0 million earned in 2003.

The Microwave business maintained stable revenue levels through the year. Although unit volumes increased over 2003, continued pricing pressures, and the erosion of the US dollar resulted in revenues being flat year-over-year. The majority of our business is from repeat customers demanding high quality, reliable product that Norsat delivers. We also introduced several new lines of transmitters targeted on the emerging two-way satellite networks.

Looking into fiscal 2005, the Company is well positioned with very competitively priced products, and plans to introduce several new lines of solid-state power amplifiers and low noise blockers to satisfy the continued emergence of two-way networks around the world.

The Satellite Systems business revenues reflect the effect of a full year of our portable terminal business following its successful launch in the fourth quarter of 2003. The Company has benefited from a growing need for portable transmission equipment, including satellite newsgathering companies and the military. Over 40 terminals, with various options and service packs were sold in 2004. These portable terminals are being used for a number of applications including the transmission of time-sensitive field reports, quality video footage and closed two-way video-based communications. The 2003 results also include revenue from smaller custom system sales which were not present in 2004.

| | | | | | |

Gross Margin | Three Months Ended (2004) | Year Ended |

Mar 31 | Jun 30 | Sep 30 | Dec 31 | 2004 | 2003 |

Microwave | 45% | 44% | 37% | 20% | 36% | 25% |

Satellite Systems | 50% | 53% | 65% | 53% | 57% | 39% |

Combined | 47% | 47% | 52% | 35% | 45% | 28% |

Gross margins in 2004 were 45% compared to 28% in the prior year.

The Microwave business margins improved significantly over the prior year due to initiatives in the latter part of 2003 to achieve significant reductions in the cost of product. However, margins declined in the later part of the year as a result of market pricing pressures, and the impact of a declining US dollar. Margins in 2003 reflect a conscious effort to reduce inventory levels through a number of higher volume lower margin contracts as well as the higher cost of product in the first part of 2003. For fiscal 2005, the Company is expecting margins to remain strong.

The Satellite Systems business achieved strong margins throughout the year reflecting that a majority of the Company's revenues were direct sales to the end customer rather than through our reseller and channel partners. Margins in 2003 include a number of lower margin demonstration equipment

sales to resellers and sales of terminals through our reseller and channel partners. For fiscal 2005, the Company is expecting margins to remain strong.

| | | | | | |

Operating Costs ($000's) | Three Months Ended (2004) | Year Ended |

Mar 31 | Jun 30 | Sep 30 | Dec 31 | 2004 | 2003 |

S G & A | $1,425 | $1,205 | $1,376 | $1,245 | $5,251 | $ 5,745 |

Product development | 361 | 435 | 370 | 329 | 1,495 | 3,313 |

Amortization | 150 | 154 | 154 | 163 | 621 | 1,102 |

Restructuring charge | - | - | - | - | - | 1,233 |

| | $1,936 | $1,794 | $1,900 | $1,737 | $7,367 | $11,393 |

Selling, general and administrative (SG&A) expenses decreased by 9% to $5.3 million from $5.7 million in 2003. We continue to focus on tight cost control and while we believe our costs are appropriate for the size of the company, we will continue to seek opportunities to address administrative costs wherever possible, however the increasing cost of regulatory compliance may hinder these efforts.

Selling and marketing efforts continue to be focused on our customers needs, and developing strong partnerships with resellers in key markets to help leverage further sales to these customers. These costs are expected to increase in 2005 to support revenue growth.

Product development activities decreased 55% to $1.5 million from $3.3 million in 2003. The significant reduction reflects the closure of the Company's Winnipeg research and development center in 2003 and the commercial release of the Norsat NewsLinkTM Model 3200 and the Norsat SecureLinkTM Model 3210 in 2003. On-going development activities are focused on projects generating near-term revenue from our line of portable terminals.

Amortization declined 44% to $0.6 million compared to $1.1 million in the previous year, reflecting the Company's efforts to minimize capital expenditures and the closure of our Winnipeg operations in 2003.

In 2004 the Company incurred no restructuring charges compared to $1.2 million, in 2003. The 2003 cost reflects the severance and related benefits for approximately 40 employees.

During 2004 the Company signed an amendment to its Technology Partnerships Canada (TPC) agreement with the federal government. The amendment provided for an increase in funding of approximately $620,000 and a revision to the royalty period to commence January 1, 2004 and expire on December 31, 2011. All $620,000 of the contributions were recognized in fiscal 2004 and the current program is complete.

| | | | | | |

| | Three Months Ended (2004) | Year Ended |

Mar 31 | Jun 30 | Sep 30 | Dec 31 | 2004 | 2003 |

Earnings (loss) from continuing operations before other expenses and income taxes | $113 | ($209) | $1,220 | $53 | $1,177 | ($7,038) |

As shown on the consolidated statement of operations, the net effect of the above factors were earnings from continuing operations before other expenses of $1.2 million compared to a loss of $7.0 million in 2003.

Other expenses for 2004 were $0.8 million compared to $1.1 million during 2003. This cost reduction was primarily due to lower foreign currency losses and the effects of the loss on disposal of equipment in 2003, resulting from the closure of our Winnipeg operations.

The combined effect of the above resulted in net earnings from continuing operations for 2004 of $0.4 million or $0.01 per share compared to a loss of $8.2 million or $0.23 in 2003

Discontinued operations realized a recovery of $0.7 million compared to a loss of $0.1 million during 2003. The recovery was a result of a settlement on a liability with a supplier during the first quarter.

For 2004 net earnings were $1.2 million or $0.03 per share - basic and diluted, compared to a net loss of $8.2 million or $0.23 per share - basic and diluted for 2003.

Fiscal 2003 Compared to Fiscal 2002

| | | | | | |

Revenues ($000's) | Three Months Ended (2003) | Year Ended |

Mar 31 | Jun 30 | Sep 30 | Dec 31 | 2003 | 2002 |

Microwave | $2,789 | $2,159 | $2,238 | $2,356 | $9,542 | $10,794 |

Satellite Systems: | | | | | | |

Portable Terminals | - | 300 | 198 | 1,044 | 1,542 | - |

Other Systems | 577 | 54 | 1,265 | - | 1,896 | 3,881 |

| | 577 | 354 | 1,463 | 1,044 | 3,438 | 3,881 |

| | $3,366 | $2,513 | $3,701 | $3,400 | $12,980 | $14,675 |

Revenues for 2003 were $12.9 million, down 12% from the $14.7 million earned in 2002. Microwave sales experienced significant pricing pressures during the first half of the year resulting from increased price competition, a declining US dollar and a focused effort to reduce inventory levels. Although the Company did experience pricing pressures, it was able to maintain stable revenue levels through the year by increasing market share and consequently increasing volume. In addition, the Company was able to drastically reduce its higher cost inventory, and subsequently reduce the cost of its products by as much as 70%. Looking into fiscal 2004, the Company is well positioned with very competitively priced products, and plans to introduce several new lines of transmitters focused on the emerging two-way satellite networks.

The Satellite Systems segment continued to generate revenue from smaller custom system sales throughout the first three quarters of fiscal 2003. During the fourth quarter, the Company launched the commercial release of its portable terminals and immediately realized revenues in excess of $1 million. The 2002 comparative Satellite Systems revenues included a $1.5 million Open Networks system sale and a $2.3 million dollar custom project. Looking into fiscal 2004, the Company has successfully launched its line of portable satellite terminals. The Company is now selling two types of satellite terminals, a "video" version named the Norsat NewsLinkTM and a "data" version named the Norsat SecureLinkTM. With channel partners now in place in major markets around the world, the Company is well positioned to globally offer portable satellite terminals into the broadcast, military, homeland security, disaster relief, medical, and resource markets. The portable terminals provide a competitive advantage where communications infrastructure does not exist.

| | | | | | |

Gross Margin | Three Months Ended (2003) | Year Ended |

Mar 31 | Jun 30 | Sep 30 | Dec 31 | 2003 | 2002 |

Microwave | 16% | 24% | 28% | 32% | 25% | 38% |

Satellite Systems | 52% | -2% | 42% | 42% | 39% | 51% |

| | 22% | 20% | 34% | 35% | 28% | 41% |

Gross margins in 2003 were 28% compared to 41% in the prior year. Microwave margins suffered early in the year as a result of market pricing pressures, focused efforts to reduce inventory levels and the impact of a falling US dollar. The Company was able to counter these negative events through significant reductions in the cost of product. These efforts are now being realized with Microwave margins steadily increasing from 16% in Q1 to 24% in Q2, 28% in Q3 and finally 32% in Q4. For Fiscal 2004, the Company is expecting margins to continue to improve as the Company's sales of the lower-cost product continue.

Satellite Systems margins fluctuated during the first half of the year, as the Company was partnering with broadcasters during the war in Iraq to obtain direct customer feedback. The launch of the portable terminals in the fourth quarter resulted in stronger margins, however, they were offset by a

number of lower margin demonstration equipment sales to resellers. Looking into 2004, with the successful launch of the portable terminals, the Company expects the margins to continue to improve.

| | | | | | |

Operating Costs ($000's) | Three Months Ended (2003) | Year Ended |

Mar 31 | Jun 30 | Sep 30 | Dec 31 | 2003 | 2002 |

S G & A | 1,719 | 1,677 | 1,286 | 1,063 | 5,745 | 5,830 |

Product Development | 1,249 | 1,049 | 651 | 367 | 3,313 | 5,103 |

| | $2,968 | $2,723 | $1,937 | $1,430 | $9,058 | $10,933 |

Selling, general and administrative (SG&A) expenses remained relatively unchanged decreasing by 1% to $5.7 million from $5.8 million in 2002. However, on a quarterly basis expenses were substantially less in the third and fourth quarters, primarily due to a continued reduction in administrative costs and tight cost control. Selling and marketing efforts were focused on developing strong partnerships with resellers in key markets around the world to help leverage further sales.

Product development activities decreased 35% to $3.3 million from $5.1 million in 2002. The reduction was a result of the Company having completed the commercial release of the Norsat NewsLinkTM Model 3200 and the Norsat SecureLinkTM Model 3210 during the end of the third quarter.

In addition, as a result of the agreement with Novra Technologies Inc. to assume development and support costs associated with DVB Open Networks technology, the Company was able to close its Winnipeg research and development center. This agreement allowed the Company to further reduce its operating costs, while maintaining the ability to pursue opportunistic revenues in the future. Fourth quarter and on-going development activities are focused on projects generating near-term revenue from the line of portable terminals.

During the fourth quarter of fiscal 2003, the Company reduced its quarterly operating costs by more than one-half of what it was spending in the early part of the year.

The funding segment of the agreement between the Company and Technology Partnerships Canada ("TPC") has been completed and, as a result, contributions for 2003 were $667,000 compared to $2.8 million for 2002.