UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 20-F

NORSAT INTERNATIONAL INC.

British Columbia, Canada

![[norsat20f033009002.gif]](https://capedge.com/proxy/20-F/0001137171-09-000215/norsat20f033009002.gif)

(Mark One)

| |

☐ | REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR |

[x] | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31st, 2008 |

OR |

☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from _________________ to ________________ |

| SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 Date of event requiring this shell company report |

Commission file number: 0-12600

Norsat International Inc.

(Exact name of Registrant as specified in its charter)

British Columbia, Canada

(Jurisdiction of incorporation or organization)

110– 4020 Viking Way, Richmond, British Columbia, Canada V6V 2N2

(Address of principal executive offices)

Securities registered or to be registered pursuant to Section 12(b) of the Act.

| | |

Title of each class | | Name of each exchange on which registered |

N/A | | N/A |

Securities registered or to be registered pursuant to Section 12(g) of the Act.

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act.

|

Common Shares |

Title of Class |

Indicate the number of outstanding shares of each of the issuer's classes of capital or common stock as of the close of the period covered by the annual report: 54,313,305 common shares.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act

Yes___

No_X_

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934.

Yes___

No_X_

Note – Checking the box above will not relieve any registrant required to file reports pursuant to Section13 or 15(d) of the Securities Exchange Act of 1934 from their obligation under those Sections.

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

[x]Yes ☐ No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of accelerated filer and large accelerated filer in Rule 12b-2 of the Exchange Act.

Large accelerated filer___

Accelerated filer___

Non-accelerated filer_X_

Indicate by check mark which financial statement item the registrant has elected to follow.

[x] Item 17☐ Item 18

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

☐ Yes[x] No

(APPLICABLE ONLY TO ISSUERS INVOLVED IN BANKRUPTCY PROCEEDINGS DURING THE PAST FIVE YEARS)

Indicate by check mark whether the registrant has filed all documents and reports required to be filed by Sections 12, 13 or 15(d) of the Securities Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court. ☐Yes☐No

Table Of Contents

PART I

5

1.

IDENTITY OF DIRECTORS, SENIOR MANAGEMENT, AND ADVISERS

5

2.

OFFER STATISTICS AND EXPECTED TIMETABLE

5

3.

KEY INFORMATION

5

A.

SELECTED FINANCIAL DATA

5

B.

CAPITALIZATION AND INDEBTEDNESS

7

C.

REASONS FOR THE OFFER AND USE OF PROCEEDS

7

D.

RISK FACTORS

7

4.

INFORMATION ON THE COMPANY

11

A.

HISTORY AND DEVELOPMENT OF THE COMPANY

11

B.

BUSINESS OVERVIEW

14

C.

ORGANIZATIONAL STRUCTURE

18

D.

PROPERTY, PLANTS AND EQUIPMENT

19

4A.

UNRESOLVED STAFF COMMENTS

19

5.

OPERATING AND FINANCIAL REVIEW AND PROSPECTS

19

A.

OPERATING RESULTS

19

RECENT ACCOUNTING PRONOUNCEMENTS

26

CHANGE IN REPORTING CURRENCY

26

INVENTORIES

26

CAPITAL DISCLOSURES

27

FINANCIAL STATEMENT – PRESENTATION

27

CONVERGENCE WITH INTERNATIONAL FINANCIAL REPORTING STANDARDS

27

RECENT U.S. GAAP PRONOUNCEMENTS

27

DERIVATIVE INSTRUMENT AND HEDGING ACTIVITY DISCLOSURES

27

NON-CONTROLLING INTERESTS

27

BUSINESS COMBINATIONS

28

RECENTLY ADOPTED U.S. GAAP POLICIES

28

FAIR VALUE OPTION FOR FINANCIAL ASSETS AND LIABILITIES

28

FAIR VALUE MEASUREMENTS

28

B.

LIQUIDITY AND CAPITAL RESOURCES

30

C.

RESEARCH AND DEVELOPMENT, PATENTS AND LICENSES, ETC.

31

D.

TREND INFORMATION

32

E.

OFF-BALANCE SHEET ARRANGEMENTS

32

F.

TABULAR DISCLOSURE OF CONTRACTUAL OBLIGATIONS

33

G.

SAFE HARBOR

33

6.

DIRECTORS, SENIOR MANAGEMENT AND EMPLOYEES

33

A.

DIRECTORS AND SENIOR MANAGEMENT

33

B.

COMPENSATION

35

C.

BOARD PRACTICES

37

D.

EMPLOYEES

40

E.

SHARE OWNERSHIP

42

7.

MAJOR SHAREHOLDERS AND RELATED PARTY TRANSACTIONS

43

A.

MAJOR SHAREHOLDERS

43

B.

RELATED PARTY TRANSACTIONS

43

C.

INTERESTS OF EXPERTS AND COUNSEL

44

8.

FINANCIAL INFORMATION

45

A.

CONSOLIDATED FINANCIAL STATEMENTS

45

B.

SIGNIFICANT CHANGES

82

9.

THE OFFER AND LISTING

83

10.

ADDITIONAL INFORMATION

84

A.

SHARE CAPITAL

84

B.

MEMORANDUM AND ARTICLES OF ASSOCIATION

84

C.

MATERIAL CONTRACTS

86

D.

EXCHANGE CONTROLS

87

E.

TAXATION

87

F.

DIVIDENDS AND PAYING AGENTS

90

G.

STATEMENT BY EXPERTS

90

H.

DOCUMENTS ON DISPLAY

91

I.

SUBSIDIARY INFORMATION

91

11.

QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

91

RISKS ASSOCIATED WITH FOREIGN EXCHANGE

91

RISKS ASSOCIATED WITH CURRENT MARKET CONDITIONS

92

12.

DESCRIPTION OF SECURITIES OTHER THAN EQUITY SECURITIES

92

PART II

93

13.

DEFAULTS, DIVIDEND ARREARAGES AND DELINQUENCIES

93

14.

MATERIAL MODIFICATIONS TO THE RIGHTS OF SECURITY HOLDERS AND USE OF PROCEEDS

93

15.

CONTROLS AND PROCEDURES

93

16A.

AUDIT COMMITTEE FINANCIAL EXPERT

94

16B.

CODE OF ETHICS

94

16C.

PRINCIPAL ACCOUNTANT FEES AND SERVICES

95

16D.

EXEMPTIONS FROM THE LISTING STANDARDS FOR AUDIT COMMITTEES

95

16E.

PURCHASES OF EQUITY SECURITIES BY THE ISSUER

95

PART III

95

17.

FINANCIAL STATEMENTS

95

18.

FINANCIAL STATEMENTS

95

19.

EXHIBITS

96

Note:

All dollar amounts presented in the Annual Report on Form 20-F are presented in United States dollars unless otherwise indicated. Reference should be made to Item 3A for information on exchange rates between the Canadian dollar and the United States dollar.

PART I

1.

IDENTITY OF DIRECTORS, SENIOR MANAGEMENT, AND ADVISERS

Not applicable.

2.

OFFER STATISTICS AND EXPECTED TIMETABLE

Not applicable.

3.

KEY INFORMATION

A.

Selected financial data

Table 1 below summarizes selected consolidated financial data for Norsat International Inc.(“the Company”, or “Norsat”) for the last five fiscal years ended December 31, 2008, 2007, 2006, 2005, and 2004 prepared in accordance with Canadian generally accepted accounting principles (“Canadian GAAP”). Table 2 below summarizes certain corresponding information calculated in accordance with United States generally accepted accounting principles (“U.S. GAAP”). The information for the last three fiscal years ended December 31, 2008, 2007, and 2006 have been extracted from the Company’s audited consolidated financial statements and related notes included herein and should be read in conjunction with such financial statements appearing under the heading “Item 8 - Financial Information” and with the information appearing under the heading “Item 5 - Opera ting and Financial Review and Prospects”. Information for the year ended December 31, 2005 and 2004 have been extracted from audited consolidated financial statements not disclosed elsewhere and presented below.

In this Form 20-F Annual Report, unless otherwise specified, all monetary amounts are expressed in United States dollars.

Reference is made to Note 28 of the consolidated financial statements included herein for a discussion of the material differences between Canadian GAAP and U.S. GAAP, and their effect on the Company’s financial statements.

Table 1: Selected Financial Information according to Canadian GAAP

| | | | | |

Year Ended December 31 | 2008 | 2007 | 2006 | 2005 | 2004 |

Sales ($000’s) | 18,057 | 16,451 | 13,448 | 14,953 | 13,461 |

Earnings (loss) from operations ($000’s) | 2,200 | 1,385 | (3,876) | (4,861) | 330 |

Net earnings (loss) ($000’s) | 2,200 | 1,385 | (3,833) | (4,861) | 886 |

Earnings (loss) per share from operations – basic and diluted ($) | 0.04 | 0.03 |

(0.08) | (0.11) | 0.02 |

Earnings (loss) per share – basic and diluted ($) | 0.04 | 0.02 | (0.08) | (0.11) | 0.02 |

Weighted average number of shares – basic (000s) | 53,352 | 50,599 | 46,681 | 42,518 | 40,282 |

Weighted average number of shares – diluted (000s) | 53,352 | 55,806 | 46,681 | 42,518 | 40,721 |

Dividends per share | - | - | - | - | - |

As at December 31 | | | | | |

Total assets ($000s) | 13,327 | 9,528 | 8,427 | 9,049 | 10,148 |

Net assets ($000s) | 8,604 | 5,797 | 3,074 | 3,056 | 6,735 |

| | | | | |

Long-term debt (excluding current portion) ($000s) | - | - | - | 1,726 | 1,221 |

Capital Stock ($000s) | 37,825 | 35,343 | 35,009 | 31,983 | 31,570 |

Table 2: Selected Financial Information according to US GAAP.

| | | | | |

Year Ended December 31 |

2008 |

2007 |

2006 | 2005 | 2004 |

Sales ($000’s) | 18,057 | 16,398 | 13,448 | 14,953 | 13,461 |

Earnings (loss) from operations ($000’s) | 2,427 | 1,479 | (3,514) | (4,266) | 685 |

Net earnings (loss) ($000’s) | 2,427 | 1,479 | (3,468) | (4,267) | 1,246 |

Earnings (loss) per share from operations – basic and diluted ($) | 0.05 | 0.03 | (0.07) | (0.10) | 0.02 |

Earnings (loss) per share – basic and diluted ($) | 0.05 | 0.03 | (0.07) | (0.10) | 0.03 |

Weighted average number of shares – basic (000s) | 53,352 | 50,599 | 46,681 | 42,518 | 40,282 |

Weighted average number of shares – diluted (000s) | 53,352 | 55,806 | 46,681 | 42,518 | 40,721 |

Dividends per share | - | - | - | - | - |

As at December 31 | | | | | |

Total assets ($000s) | 13,297 | 9,528 | 8,424 | 9,034 | 10,509 |

Net assets ($000s) | 8,574 | 5,797 | 3,007 | 2,772 | 6,317 |

Long-term debt (excluding current portion ($000s) | - | - | - | - | - |

Capital Stock ($000s) | 95,310 | 92,828 | 92,494 | 89,549 | 89,135 |

The exchange rate as of the date of close of business on March 24, 2009 was 1.2318.

The following tables set out the Exchange Rates, based on the noon buying rates for the Bank of Canada, for the conversion of United States dollars into Canadian dollars (“Exchange Rates”).

Table I presents the range of high and low Exchange Rates for each of the six month periods ending February 29th, January 31st, December 31st, November 30th, October 31st and September 30th (collectively “Month Close Dates”)

Table II presents the average of the Exchange Rates on each of the Month Close Dates.

| | | | | | |

TABLE I | Last Six Months Ended |

2009 | 2008 |

Feb. | Jan. | Dec. | Nov. | Oct. | Sep. |

High for period | 1.2160 | 1.2741 | 1.2969 | 1.2855 | 1.2943 | 1.0796 |

Low for period | 1.2731 | 1.1823 | 1.1965 | 1.1499 | 1.0609 | 1.0338 |

| | | | | |

TABLE II | Year Ended December 31 |

| 2008 | 2007 | 2006 | 2005 | 2004 |

Average for period | 1.0660 | 1.0767 | 1.1344 | 1.2116 | 1.3015 |

B.

Capitalization and indebtedness

Not applicable.

C.

Reasons for the offer and use of proceeds

Not applicable.

D.

Risk factors

Investors should carefully consider the risks and uncertainties described below before making an investment decision. If any of the following risks actually occur, our business, financial condition or operating results could be materially harmed. This could cause the trading price of our common shares to decline, and you may lose all or part of your investment.

RISKS ASSOCIATED WITH FINANCIAL RESULTS

The Company’s inability to generate sufficient cash flows from its operations Management believes that as a result of the recent turnaround, the Company has sufficient resources to met operating requirements for the next year. Should the Company fail to generate sufficient cash flows from operations, it will require additional financing. At December 31, 2008, the Company has accumulated a deficit of $32,514,569. The Company started to generate net profit from its continued operations through the fourth quarter of 2006 to the fourth quarter of 2008. However, it cannot be used as an indication of the Company’s future performance.

The Company has no debt obligations at the end of December 31, 2008. The profitable results earned in the last two fiscal years have provided the Company with some impetus towards a strong financial foundation. Based on the current financial results, management is confident in the ability of the Company to continue as a going concern. However, the Company still has challenges with respect to unevenness of sales patterns attributable to military transactions. This pattern combined with the current upheaval in the global economies makes it difficult to have absolute certainty about future cash flows.

The Company’s inability to accurately forecast its results from quarter to quarter may affect its cash resources and result in wide fluctuations in the market price of the Company's stock. The operating results have varied on a quarterly basis in the past and may fluctuate significantly in the future as a result of a variety of factors, many of which are described below. Due to these and other factors, most of which are outside of the Company’s control, the quarterly revenues and operating results are difficult to forecast. As a result, the Company may not be able to accurately predict its necessary cash expenditures during each quarter or obtain financing in a timely manner to cover any shortfalls. The Company also believes that period-to-period comparisons of its operating results may not be meaningful and reliance should not be placed on any such comparisons as an indication of future performance.

RISKS ASSOCIATED WITH BUSINESS AND OPERATIONS

The Company recognizes the threats posed by the current credit crisis and global recession, but cannot guarantee that it will be able to successfully navigate through the current downturn.The current global economic deterioration has impacted companies across a wide spectrum of industries, and the satellite communications industry is not immune to the recessionary trends. To succeed, the Company must be able to control spending and prudently

allocate financial resources to optimize value. To drive sales, the satellite products must meet the needs of the Company’s existing and potential customers and be competitively priced, additional judgement will need to be exercised if the granting of credit to customers is required to close the transaction. In view of the current difficulty, both in obtaining credit and accessing the capital markets, stewardship of cash will be critical to the continuation of operations.

The Company cannot be sure it will be able to identify emerging technology and market trends, enhance its existing technologies or develop new technologies in order to effectively compete in the satellite communications industry. The satellite communications industry is characterized by rapid technological changes, short technology and product life cycles, pressure to provide improved solutions at increasingly lower prices and frequent introduction of new technologies and products. To succeed, the Company must be able to identify emerging trends and enhance its existing technologies and develop new technologies and products to meet market requirements. To drive sales, the satellite products must meet the needs of the Company’s existing and potential customers and be competitively priced. Additionally, there must be sufficient interest in and demand for the Company’s products. If the Company does not develop these new t echnologies and products in a timely and cost effective manner, or if others develop new technologies ahead of the Company, the Company will not achieve profitability in the satellite communications industry and it may not be able to participate in selling these new technologies or products.

The Company has customer concentration. A significant portion of the Company’s revenues have been recognized from a limited number of customers. While the Company has been diversifying its customer base, the efforts to date may be insufficient to offset the effects of the quarterly variance of sales and delays associated with selling to the Government sector. The Company expects that a majority of the Satellite Systems revenues will continue tobe dependent on sales to a small number of customers. The Company also expect that customers will vary from period-to-period as existing customers are under no obligation to continue buying from Norsat.

If the Company fails to sell the products to one or more targeted customers in any particular period, or are unable to diversify the customer base and segments, its ability to generate revenues, achieve profitability, and invest in growth opportunities will be adversely affected. While the Company has been diversifying its customer base, the efforts to date may be insufficient to offset the effects of uneven sales and delays associated with selling to the Government sector. There are additional risks associated with non-US companies such as Norsat directly supplying to the US military.

The Company cannot be sure that it will be able to compete effectively with the current competitors. The satellite communications industry is intensely competitive. Some competitors have technologies and products that may be more advantageous and compete directly with the Company. Some of these competitors are large, established companies which have significantly greater resources than those of the Company.

The Company’s ability to compete effectively will depend on its ability to increase sales; attract new customers in a timely and cost effective manner and sell these products at competitive prices. The Company is dependent on others for the supply and manufacture of components and products it sells. The Company has outsourced substantially all of the manufacturing of the microwave products it sells; and for some of its portable satellite systems, the Company relies on its suppliers to provide components for the production of these satellite systems. If either the manufacturers or suppliers cannot deliver products to the Company on time, its revenues and profits will be adversely affected.

The Company has limited intellectual property protection. The Company’s success and ability to compete are dependent, in part, upon its proprietary technology, brand and reputation in the marketplace, and customer relationships. While the Company currently holds four patents

![[norsat20f033009002.gif]](https://capedge.com/proxy/20-F/0001137171-09-000215/norsat20f033009002.gif) | |

(US Patents # 5,019,910, 6,931,245 and 7,218,289; European Patent #1 184 930) and has applied for patent protection on certain other parts of its technology, it relies primarily on trade secrets and does not have adequate trademark and patent protection on all of its technology. The Company also enters into confidentiality, and non-compete agreements with its employees and limits the access to and distribution of the product design documentation and other proprietary information. The Company cannot be sure that these efforts will deter misappropriation or prevent an unauthorized third party, including former associates and former employees, from obtaining or using information, which it deems to be proprietary. Although the Company believes that its technology does not currently infringe upon patents or trademarks held by others, the Company cannot be sure that such infringements do not exist or will not exist in the future, parti cularly as the number of products and competitors in its industry segment grows.

If the Company experiences rapid growth and does not manage it effectively, profitability may be affected. If its technologies and products achieve widespread acceptance the Company may experience rapid growth. This growth may require the Company to hire more employees, recruit additional management, improve the Company’s financial control systems, and expand and manage the technical, sales and support service operations. The Company would need increased revenues and additional funding to operate these increased activities. If the Company does not manage its growth effectively, its profitability may be impacted.

The Company has had high employee turnover.In 2007, twenty-one employees were terminated or resigned and nineteen employees were hired. In 2008, thirteen employees departed and were replaced. High employee turnover affects knowledge retention, the effectiveness of processes, the value of existing intellectual property, and the ability to hire qualified candidates and maintain the healthy relationships with outside parties. The Company continues to evolve its hiring practices and is actively working on improving the work culture and its image in the community. The Company cannot be sure that these efforts will be successful in reducing employee turnover.

The Company depends on its key employees and it cannot be sure that it will be able to keep these employees or hire and train replacements. Our success depends on the skills, experience and performance of the senior management and other key personnel. While it offers competitive compensation packages and stock options to attract key employees, the Company does not carry key person insurance on these employees. Highly skilled technical employees and management in the satellite communications industry are in demand and the market for such persons is highly competitive. The Company cannot be sure that it will be able to retain these employees or hire replacements. If the Company does not successfully retain the key personnel or hire and train replacements it will be unable to develop the new products and technologies necessary to compete in its markets or to effectively manage its business.

The Company intends to expand its international operations, and thus faces a number of risks including tariffs, export controls and other trade barriers; political and economic instability in foreign markets; and fluctuations in foreign currencies.These external risks may not be under the Company’s control. Additional human and financial resources may be required for this expansion which the Company may not be able to attract or afford. Failure to expand internationally may impact the Company’s prospects for revenue growth and profitability.

The Company sells products which may, in certain instances, be subject to export and/or re-export restrictions.The export laws of the governments of Canada and United States apply to products that the Company sells.The United States Department of Commerce, through its Export Administration Regulations (EAR), and the Government of Canada, through its Export Controls Division,regulate exports and re-exports of "dual-use" items, i.e., goods, software and technologies with commercial and proliferation/ military applications. In ascertaining whether such items may be subject to export control restrictions, the Company is sometime forced to rely on information in the specifications of certain components from the manufacturers and vendors. Should this

information later prove to be incorrect, the Company may be subjected to penalties and fines. It may also be subjected to penalties and fines should there be a breach in the processes.

The Company buys components and products which may, in certain instances, be subject to contractual obligations to purchase minimum quantities during a given period, maintain resale records and abide by certain resale restrictions. Failure to fulfil any or all of these may negatively impact liquidity should the Company be forced to take ownership of any un-purchased units. It may also affect the Company’s ability to continue supplying products as originally specified and thus affect obligations to fulfil orders.

Some of the Company’s contracts require the Company to guarantee certain forms of price protection over an extended period of time. Failure to contain costs during the terms of these contracts may affect the Company’s profitability and liquidity. Failure to fulfil contractual obligations in this respect, may result in penalties or the cancellation of such contracts.

The Company may be subject to product liability claims, which are not fully covered by insurance. The manufacture, sale and marketing of the Company’s satellite products expose us to the risk of product liability claims. Given the complex nature of our products, the products may contain undetected errors or performance problems may arise. Although the Company’s products undergo testing prior to release into the market, it is possible that such products may yet still contain errors and performance problems, which are discovered only after commercial introduction. If these defects and errors are discovered after shipment, they could result in a loss of sales revenues, delay in market acceptance, product returns, warranty claims and the loss of a potential market. In addition, components and other products manufactured and distributed by others, which are incorporated into the Company’s products, may also contain suc h defects and errors, which could substantially reduce the performance of the products. The Company is also at risk of exposure to potential product liability claims from distributors and end-users for damages resulting from defects in products that it distributes. Although product defects have not been a significant factor, the Company maintains comprehensive general liability insurance which provides limited coverage against claims originating in product failure. We cannot be sure that this insurance will be adequate to cover all claims brought against us or that this insurance will continue to be available to us on acceptable terms. If these claims are not fully covered by the Company’s product liability insurance, they could severely and negatively impact the business liability insurance coverage and the available cash resources. A product liability claim, even one without merit or for which the Company has substantial coverage, could result in significant legal defence costs, thereby increasing the expenses, lowering the earnings and, depending on revenues, potentially resulting in additional losses.

The Company’s operations may be disrupted by natural disasters and extreme weather conditions. The Company’s headquarters is located in the Greater Vancouver region which has, in recent times, been subjected to high winds and extreme weather conditions. While the Company has managed to continue operating through some of these conditions, employee productivity during these periods is negatively impacted. Experts are also expecting a major earthquake in this region; a significant natural disaster may have the effect of paralysing the Company’s operations for an indefinite period.

RISKS ASSOCIATED WITH THE VALUE OF NORSAT SHARES

The exercise of the existing outstanding options, warrants, warrants to be issued, and the number of shares available for future issuance may substantially dilute the value of the Company’s common shares. The Company has 75,000,000 Common Shares authorized, of which 54,313,305 were outstanding at December 31, 2008 and an additional 3,091,501 Common Shares have been reserved for issuance upon the exercise of outstanding options, warrants and warrants to be issued. Although the Board of Directors has no present intention to do so, it has the authority, within parameters set by the Toronto Stock Exchange (the “TSX”), without action by the shareholders, to issue authorized and unissued Common Shares. Any series of Preferred

Stock, if and when established and issued, could also have rights superior to the Company’s Common Shares, particularly in regard to voting, the payment of dividends and upon liquidation of Norsat. Convertible debt, if issued to raise additional working capital for the Company could also have dilutive effect on the shareholders.

RISKS ASSOCIATED WITH FOREIGN EXCHANGE

The Company’s operations are heavily exposed to fluctuations in foreign currencies. Most of the Company’s international sales are denominated primarily in US dollars, Euros and UK pounds. While the Company expects its international revenues and expenses will continue to be denominated primarily in US dollars, a portion of its international revenues and expenses may be denominated in other foreign currencies in the future. As the functional currency is the Canadian dollar, the Company could experience and has experienced the risks of fluctuating currencies. Such exposure is partially hedged by inventory purchases which are dominated in US dollars as well. From time to time the Company may choose to engage in currency hedging activities, which may be unsuccessful and expensive.

The Company is exposed to foreign exchange fluctuations in the U.S. dollar. A stronger Canadian dollar reduces U.S. dollar-denominated revenues and expenses. Net income is also reduced because a higher percentage of revenues than expenses are generated in U.S. dollars. Although majority of the Company’s sales are in U.S. dollars, it has a natural hedge in that it also purchases majority of its inventory in US dollars. The Company engages in hedging transactions to mitigate foreign exchange risks for large sale transactions.

4. INFORMATION ON THE COMPANY

A.

History and Development of the Company

1.

The Company was incorporated in British Columbia, Canada on October 15, 1982 pursuant to theCompany Act (British Columbia). Effective September 27, 1989, the Company changed its name to NII Norsat International, Inc. At the Company’s Annual General Meeting held on June 9, 1999, shareholders passed a special resolution to change the Company’s name back to Norsat International Inc. Since July 2, 1999, the Company has operated under the name Norsat International Inc (herein “Norsat” or the “Company”).

2.

Norsat was incorporated under and continues to operate under the laws of the Province of British Columbia, Canada. The Company is administered from British Columbia. The corporate laws pertinent to Norsat are those of the Province of British Columbia, although it is also subject to the securities legislation of British Columbia, Ontario and the United States.

3.

The Company’s principal business is located at the following address:

110- 4020 Viking Way

Richmond, British Columbia

Canada V6V 2L4

Telephone: 604-821-2800

Fax: 604-821-2801

Email: investor@norsat.com

www.norsat.com

4.

The principal business events in Norsat’s 26 year history are (in chronological order):

1982

The Company developed the first commercial-grade satellite receivers.

1983

In March 1983, the Company, based in Surrey, British Columbia, completed its initial public offering on the Vancouver Stock Exchange.

The Company broke with industry norm and introduced a gallium arsenide low noise amplifier (LNA) instead of a silicon based LNA.

1984

The Company developed a new series of low noise blocker (LNB) compatible satellite receivers featuring synthesized video, stereo audio, and infrared remote control.

1985

The Company introduced synthesized receivers (JR Series) that enable internal melding of phase and frequency for a very high degree of accuracy; these receivers gain significant traction with private networks.

1987

The Company became a leading provider of Ku band private networks for business television and won a landmark deal to supply GTE Spacenet.

The Company also introduced the Microsat, an IBM PC compatible satellite communications expansion card for broadcast data networks, with optional audio/video capability. The Company later applied for a patent on key elements of this technology; the patent was eventually awarded in 1991.

1988

The Companyintroduced external reference receivers that provide a stable reference source, by minimizing temperature drift, for very low data rate applications. It also introduced a broadcast satellite data multiplexing network control system and a satellite delivered personal computer bulletin board service.

1989

In September 1989, the Company changed its name to NII Norsat International, Inc.

1990

In August 1990, the Company graduated to the Toronto Stock Exchange.

1991

The Company was issued United States Patent No. 5,019,910 entitled “Apparatus for Adapting Computer for Satellite Communications.”

1992

The Company introduces C-band and Ku-band receivers with noise figures of less than 1.5 dB.

1993

The Company introduced the first digital LNB optimized for low data rate applications.

1994

The Company introduced the Microsat 150 Multimedia PC receiver that enables a personal computer or laptop to capture real time satellite video, listen to and edit directly from the computer keyboard selections of audio programs, and monitor real time data broadcasts.

1995

The European Space Agency extends a grant to the Company to develop portable terminals.

1996

The Company introduced video scrambling technology (N-Code II) for cable distribution networks so authorized cable subscribers may receive telecasts.

1997

The Federal Court of Appeal rules that the use of U.S. based DTH systems in Canada contravened the Radiocommunication Act. Aurora Distributing, a division of Diamond Pacific Inc., the Company’s consumer products subsidiary, withdrew

from the U.S. based DTH receiving market after Norsat settled a lawsuit in which it was a distributor for those systems.

1998

The Company acquired IMT Comsys, a private company and originally the Satellite Communications Division of MPR Teltech. IMT Comsys’ products included Ka-band VSATs, solid state power amplifiers and low noise block downconverters (LNBs). The acquiree also had development contracts with the European and Canadian Space Agencies for Ka-band subscriber terminals.

The Company’s US Subsidiary, Diamond Pacific, was named the Master Systems Operator by the US Satellite Broadcasting Company, a major supplier of premium movie channels, to support its Multiple Dwelling Unit (MDU) market.

1999

Norsat introduced a line of C-band and Ku-band TNBs (Two-way Norsat block converters), a critical component for the proliferation of wireless broadband media.

Norsat released the NCS-300 Subscriber Management System to enable cable system operators to easily deliver pay-per-view television.

2000

In April, Norsat acquired Winnipeg-based SpectraWorks, a leading developer of systems and software for broadcasting multimedia broadband content across satellite, terrestrial and digital cable networks. Through this acquisition, Norsat added digital video broadcast (DVB) hubs to manage the flow of content into and out of the Internet backbone and between subscriber terminals; and a 100 Mbps IP encapsulator to enable end-to-end multimedia broadcast solutions.

In August, the Company formally exited the consumer satellite DBS. The Company discontinued the operations of Norsat America, a distribution business geared towards consumer-oriented, Direct Broadcasting Systems.

Norsat also became a leading provider of Ka-band satellite terminals for various consumer Internet applications through its relationship with SES Astra and Koreasat.

In October 2000, the Company began trading on NASDAQ. It was later de-listed in 2003.

2001

In June 2001, the Company received a $9.4 million Technology Partnerships Canada investment for the development of satellite interactive terminals.

In December 2001, the Company signed a contract for its pico-terminals with an Asian military. This was completed in October 2002.

The Company introduced a compact IP encapsulator that enables the transport of Internet content at very high speeds (i.e 200 Mbps) for both the satellite and cable markets.

2002

The Company built on its portable terminal experience by introducing a commercial grade flyaway terminal for news gathering organizations. It sold its first NewsLink system to CBS News.

2003

In May 2003, Norsat appointed SEG a master reseller for some if its microwave components.

The OmniLink family of portable satellite terminals which includes the NewsLink and SecureLink systems were launched, providing rapidly deployable broadband satellite data and video connectivity for a wide range of applications.

2004

The Company became a key supplier of newsgathering equipment to the US Army.

2005

The Company launched the GLOBETrekker, a backpackable satellite terminal initially capable of transmitting and receiving IP-based video and data content.

The Company was issued United States Patent No. 6,931,245 entitled “Downconverter for the Combined Reception of Linear and Circular Polarization Signal from Collocated Satellites.”

2006

In May 2006, the Company was awarded a GSA schedule, facilitating the purchase of its systems by various government agencies. In September 2006, the Company relocated its international headquarters to Richmond, British Columbia.

2007

The Company launched a line of Low Noise Amplifiers, the GlobeTrekker X-band and the Rapid Application Development Environment variant of the GlobeTrekker, which includes an environmentally-controlled baseband enclosure that is compatible with most commercial and specialized modems.

In addition, the Company introduced the Extended Ku-Band Transmitter and unveiled the Norsat Rover, a single backpack portable satellite terminal.

The Company received a United States patent for the GLOBETrekkerTM design and a European patent for its frequency selective surface waveguide filter design.

2008

The Company announced entry into the marine satellite industry and the Worldwide Interoperability for Microwave Access (WiMAX) network business in 2008.

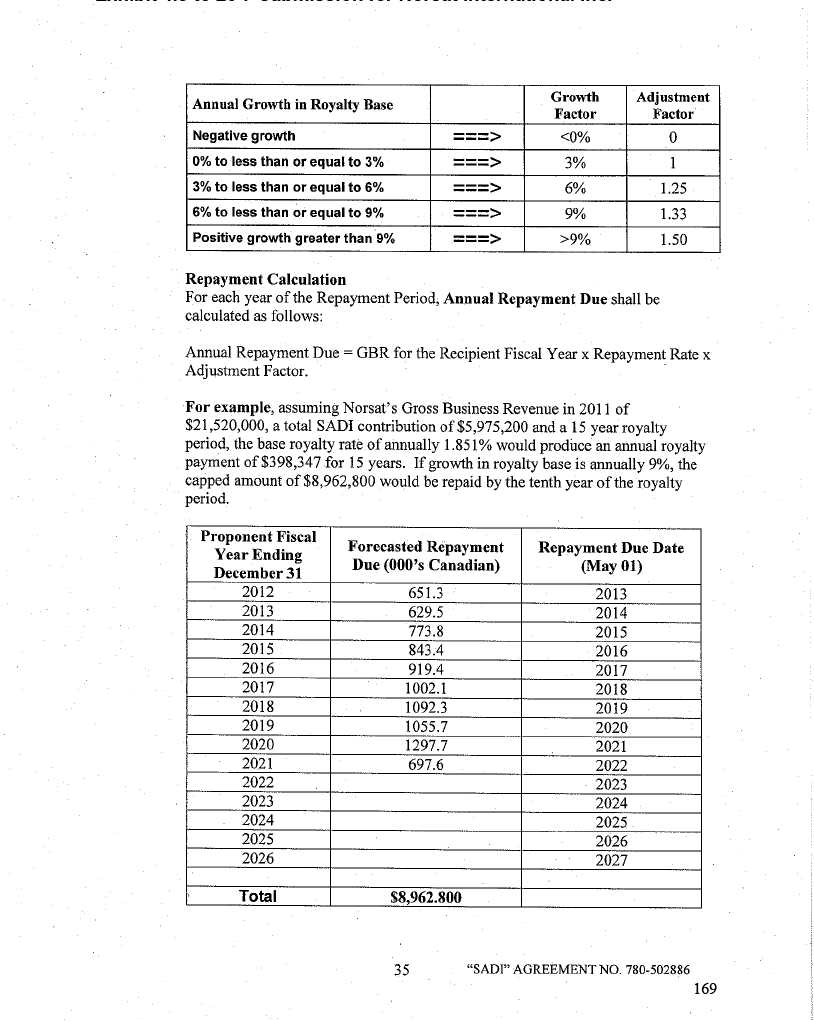

The Company received a repayable contribution from the Canadian government to assist in research and development activities. The funding program was made through the Ministry of Industry’s Strategic and Aerospace Defence Initiative (“SADI”). The total contribution will be a maximum of Canadian $5.97 million through to the year 2011.

In September 2008, the Company was awarded a $5.5 million contract from the U.S. Department of Defense for the delivery of portable satellite systems.

5.

Capital Expenditures -

During 2008, the Company made net purchases of property and equipment in the amounts of $302,331 primarily relating to the purchase of equipment for product development and test equipment. There are currently no major capital projects or divestitures in progress.

B.

Business overview

1. Norsat Business and Principal Activities

Norsat designs, develops and markets satellite ground equipment, which enables high speed transmission of data, audio and video over commercial and military satellites. The Company’s equipment is located on earth and thus falls under the broad category of “satellite ground equipment.” Norsat concentrates on ground equipment that is central to the transmission and reception of content for commercial and military applications, as opposed to consumer applications such as direct-to-home broadcasting.

While Norsat’s products have traditionally addressed the US government and broadcast television markets, there is growing interest from other NATO militaries; high-end commercial enterprise customers benefiting from the growth in commodity prices and the transportation companies who serve them; and commercial enterprise and government customers seeking to implement business continuity programs. Currently, approximately 51% of sales continues to be earned from the US military sector. As a result, sales can have significant swings from quarter to quarter due to the timing of orders from the US government.

Geographic Split

The Company generated revenues from external customers located in the following geographic locations:

| | | 2008 | | 2007 | | 2006 |

| Canada | $ | 597,728 | $ | 545,410 | $ | 824,555 |

| United States | | 12,577,704 | | 10,894,516 | | 8,103,225 |

| Europe and other | | 4,881,404 | | 5,011,095 | | 4,520,557 |

| | $ | 18,056,836 | $ | 16,450,661 | $ | 13,448,337 |

The Company’s portfolio of satellite ground equipment comprises primarily of microwave components and portable satellite systems. These components and systems are designed to interoperate with geostationary satellites orbiting the earth.

Business Segments

Norsat currently operates two strategic business segments: Microwave Products and Satellite Systems. While both business segments provide core elements of the satellite ground infrastructure, the characteristics and dynamics of the markets in which the two business segments operate are unique.

(a) Microwave Products Business Segment

Products

Microwave components enable the transmission, reception and amplification of signals to and from satellites. The Company’s product portfolio of microwave components includes a comprehensive range of satellite receivers (LNBs), transmitters (BUCs), solid-state power amplifiers (SSPAs) and other customized products.

Low Noise Block down converters (“LNBs”), are required by every satellite antenna (or “dish”) irrespective of aperture or location. The LNB is mounted at the focal point of the dish to convert incoming microwave signals into electrical signals that are routed to the remote receiver or indoor unit. Reliability is critical for these products as they are used in remote areas around the world.

Satellite transmitters or Block Up Converters (“BUCs”) convert electrical signals into microwave signals that can be transmitted to an orbiting satellite.

Market Profile

The Company’s primary customers include resellers, system integrators, antenna manufacturers and service providers located in North America, Europe and Asia. These customers integrate Norsat’s components into a complete satellite solution for end user customers located all over the world. On the microwave components side of the business, the Company will be focusing on the solid-state amplifier line and on military satellite components.

Competition

The primary competition for this business unit comes from New Japan Radio Corporation and to a lesser extent from the Company’s own suppliers.

(b) Satellite Systems Business Segment

Products

Portable satellite systems provide rapidly deployable broadband connectivity over satellite where traditional communications infrastructure is insufficient, unreliable, damaged or non-existent. The Company’s product portfolio of portable satellite systems includes the Norsat GLOBETrekker and OmniLink satellite systems.

The GLOBETrekkerTM is an intelligent, ultra-portable satellite system that enables users to establish a reliable broadband connection on short notice. It is designed to be carried in a backpack, is airline checkable, and fits in small vehicles. The GLOBETrekkerTM is ideal for users who are highly mobile. Examples of such users include Special Forces, first responders, business continuity managers, Search and Rescue personnel and journalists.

The Norsat Rover is a complete satellite terminal that fits into a single extended-mission backpack. The Norsat Rover offers a complete terminal that is capable of data transfer rates of approximately 1.0 Mbps and is still compact enough to fit into a single backpack.

The OmniLink™ product family also addresses the demanding needs of users seeking to establish broadband connectivity on a temporary basis but for longer periods of time. This product line is ideal for use by government and peacekeeping agencies, broadcasters, resource exploration companies, distance education institutions, financial institutions, and large corporations.

Market Profile

The market for portable satellite communications comprises users that need to establish broadband connectivity on short notice or redeploy their telecommunications infrastructure following an engagement. The primary markets for portable satellite systems are defense, emergency services (first responders, homeland security), and broadcasters. There has been growing interest from Fortune 1000 companies to employ such systems as part of a business continuity program wherein such systems would be used as a “backup measure” should their primary means of communications fail in the event of a natural disaster, an outage or a terrorist attack.

The overall market is going through a significant transformation due to the growth in the government sector. This change in demand is attributable to measures being taken by governments and corporations to counter the threat of terrorism.

The improved demand for portable satellite communications equipment stems from an initiative to “transform” the armed forces. With the onset of Operation Iraqi Freedom in 2003, the need to accelerate the “transformation” has become a top priority. Under this initiative, field units are being equipped with communications gear that will give them real-time access to the same information available at command and control centers.

Most programs within the government and broadcast sectors tend follow a formal competitive tendering process. From time to time, the government may indicate a preference for certain classes of vendors in the interest of social policy or national security objectives. As a result, it is critical that a vendor such as Norsat align themselves with such pre-qualified contractors.

The formality of the procurement process in the commercial sector tends to vary with the size of the company’s operations; larger companies tend to involve a lengthier sales cycle.

Competition

The competitive pressures in the United States Government market for portable satellite systems are markedly different from the broadcast and commercial markets. While there are some pricing pressures, they are less pronounced; system reliability, performance records and relationships with program offices are significantly more important. In this sector, the Company faces competition from GSC, a subsidiary of L3 (NYSE: LLL), TCS (NASDAQ:TSYS), Globecomm Systems (NASDAQ: GCOM) and privately held Gigasat. From time to time, the Company also faces competition from Swe-Dish, a subsidiary of Datapath, a privately held company. At times, the Company also faces competition from systems integrators who construct systems on a custom basis for the military including Thales, Finmecchanica, EADS, Lockheed Martin and Raytheon.

In the broadcast and commercial markets, the Company faces competition from terrestrial alternatives such as microwave radio vendors and the traditional providers of portable satellite systems including: Swe-Dish, VisLink PLC’s Advent business unit, Gigasat and Holkirk Communications. The Company also faces competition from service providers such as Caprock (www.caprock.com) and Spacenet, a subsidiary of Gilat.

2. Marketing

The Company sells most of its microwave components and portable satellite system, other than those bound for the US Government, through resellers. Almost all of the portable satellite systems sold to the US Government have been through the Company’s direct sales force.

The Company’s primary value proposition is rooted in its longevity and reputation for quality. Customers with critical applications tend to place significant value in the quality of Norsat products and the after-sales support infrastructure.

The Company continues to evolve its business model by (i) adding a recurring component through a

range of services, to its revenue stream, (ii) undertaking the turnkey responsibility to deliver a comprehensive solution instead of selling point products, and (iii) diversifying its base of customers to include non-defence customers.

3. Research and Development

Research and development activities and projects were focused on completing the GLOBETrekker family of products, modifying microwave components for various applications and submitting a number of patent applications. The Company spent approximately 4.4% of its annual revenues net of any government contributions and allocated 20% of its staff towards research and development activities.

4. Intellectual Property

The Company relies on patent, trademark, trade secret and copyright laws to protect our proprietary technology and to protect us against claims from others. The Company believes it has direct intellectual property rights covering substantially all of our material technologies. However, there can be no assurance that claims of infringement will not be asserted against the Company or against its customers in connection with their use of our systems and products, nor can there be any assurance as to the outcome of any such claims, given the technological complexity of our systems and products.

The Company has renewed interest in employing patent protection due to competition in its markets. The Company has a patent portfolio of 4 patents. Five patent applications were filed in 2007, three are pending. The Company does not believe that any single patent is material to our business as a whole.

C.

Organizational structure

As of December 31, 2008, the Company has five wholly-owned and active subsidiaries. These are: Norsat International (UK) Ltd. incorporated and located in Lincolnshire, England: Norsat International (America) Inc. incorporated and located in Annapolis, MD, United States of America; Norsat Korea Ltd. incorporated and located in Daejeon, South Korea; Norsat SA, incorporated in Lausanne, Switzerland and Norsat Italia, Srl incorporated and located in Rome, Italy.

The mandate of Norsat International (UK) Ltd. is to market and support microwave component products sold into the Europe Middle East and Africa region.

The mandate of Norsat International (America) Inc. is to market and support satellite systems into certain government markets.

On January 17, 2008 Norsat Korea Ltd. was granted incorporation status in the Republic of South Korea. The mandate of Norsat Korea Ltd. is to perform research and development work and leverage lower cost production technologies for the microwave segment of the business.

On September 11, 2008 Norsat Italia Srl was incorporated in Rome Italy to support the Company’s thrust into the marine satellite business.

On December 23, 2008 Norsat SA was incorporated in Lausanne, Switzerland to create a regional centre for the Company’s expanding level of activity in the European, Middle East and African markets.

D.

Property, plants and equipment

Description of Property

Our Company's head office and principal place of business has been located in Richmond, British Columbia, Canada since September 2006. The Company leases its head office premises.

The lease is for approximately 23,400 square feet of space. This location houses the Company's corporate office, engineering and production department and includes warehouse space. Most of the products are produced and shipped out of this location.

The monthly rent for this space is approximately $35,000 and is for a term of five years. The Company has the option for a further five-year term at the end of this lease, with a new rate to be negotiated.

In addition to the minimum rent, the Company is responsible to pay maintenance, utilities and taxes.

Norsat also operates out of leased premises in Lincoln, England, Maryland, USA, Daejeon, South Korea and Rome, Italy.

There are no known environmental issues that may affect the Company’s utilization of its assets at any of the above locations.

4A.

UNRESOLVED STAFF COMMENTS

Not applicable

5.

OPERATING AND FINANCIAL REVIEW AND PROSPECTS

A.

Operating results

The following information should be read in conjunction with the Company’s 2008 consolidated financial statements and related notes included therein, which are prepared in accordance with Canadian generally accepted accounting principles (Canadian GAAP). These principles differ in certain respects from United States generally accepted accounting principles (U.S. GAAP). The differences as they affect the financial statements of the Company are described in Note 28 to the Company’s audited consolidated financial statements. All amounts following are expressed in United States Dollars unless otherwise indicated.

The Company generates revenue from two business segments, Microwave Products and Satellite Systems as described herein. The Company’s annual and quarterly operating results are primarily affected by the level of its sales and costs of operations over these two business segments. Economic factors such as foreign exchange fluctuations, market prices of similar products and worldwide political environment may also play an important roll to affect the Company’s operating performance and volatility of its share price. To management’s knowledge, there are no known economic, political, foreign exchange fluctuations and inflation that have materially affected, directly or indirectly the Company’s operations.

Fiscal 2008 Compared to Fiscal 2007

| 2008 | 2007 |

| $ | $ |

Sales | 18,057 | 16,451 |

Earnings(Loss) from operations before income taxes | 2,200 | 1,385 |

Net earnings (loss) | 2,200 | 1,385 |

Earnings (loss) per share from operations - basic and diluted | .04 | .03 |

Earnings (loss) per share, - basic and diluted | .04 | .02 |

Total Assets | 13,327 | 9,528 |

Long-term debt | nil | nil |

| | |

| | | | |

Quarterly Financial Data (unaudited) (Expressed in thousands of dollars, except per share amounts) |

| Three Months Ended (unaudited) |

| Mar 31 | Jun 30 | Sep 30 | Dec 31 |

2008 | $ | $ | $ | $ |

Sales | 2,929 | 3,960 | 4,888 | 6,280 |

Earnings from operations before income taxes | 5 | 135 | 742 | 1,318 |

Net earnings | 5 | 135 | 742 | 1,318 |

Earnings per share from operations – basic and diluted |

0.00 |

0.00 |

0.01 |

0.02 |

Earnings per share – basic and diluted | 0.00 | 0.00 | 0.01 | 0.02 |

Weighted average common shares outstanding | # | # | # | # |

Basic | 51,911 | 53,668 | 53,698 | 54,117 |

Diluted | 55,659 | 57,335 | 57,140 | 54,117 |

| | | | |

2007 | $ | $ | $ | $ |

Sales | 3,763 | 4,122 | 3,786 | 4,780 |

Earnings from continuing operations | 462 | 526 | 167 | 230 |

Net earnings | 462 | 526 | 167 | 230 |

Earnings per share from operations - Basic and diluted |

0.01 |

0.01 |

0.00 |

0.00 |

Earnings per share – Basic and diluted | 0.01 | 0.01 | 0.00 | 0.00 |

Weighted average common shares outstanding | # | # | # | # |

Basic | 50,486 | 50,558 | 50,584 | 50,646 |

Diluted | 50,486 | 55,371 | 55,769 | 55,871 |

Results of Operations

| | | | | | |

Sales ($000’s) | Three Months Ended (2008) (unaudited) | Year Ended (audited) |

Mar 31 | Jun 30 | Sep 30 | Dec 31 | 2008 | 2007 |

Microwave Products | $1,974 | $2,103 | $2,262 | $2,329 | $ 8,668 | $ 9,111 |

Satellite Systems | 955 | 1,857 | 2,626 | 3,951 | 9,389 | 7,340 |

| $2,929 | $3,960 | $4,888 | $6,280 | $18,057 | $16,451 |

Total sales for 2008 were $18.1 million, up from the $16.5 million sold in 2007. Fiscal 2008 saw sales grow by 9.8% over fiscal 2007. This sales growth continues the pattern set in 2007. Management is committed to continually growing the revenue line by entering new geographic markets, broadening its customer base, and/or expanding into new market verticals.

The current nature of the Company’s business is still expected to result in uneven sales results quarter on quarter. This is due to the fact that Norsat has a relatively small base of customers, who often place orders that represent a significant share of sales for a given quarter, and the timing of those orders is unpredictable. Management is addressing this by cultivating revenue streams that are more evenly distributed throughout the year.

Sales from Microwave Products were $8.7 million, down 5% from the $9.1 million in sales recorded in 2007. Sales in the previous year were atypical as there was a large backlog of orders from 2006 that was filled in fiscal 2007. Towards the latter part of 2008, a number of the Company’s resellers reported a softening of the market as end customers have elected to postpone or defer orders for microwave components due to market conditions. The Company continues to be a prominent player in the Low Noise Blockdown Converter (LNB) market and will continue to maintain its market leadership position.

Sales of Satellite systems were $9.4 million, up 28%, compared to $7.3 million last year. The improvement is a continuation from last year’s efforts to increase penetration of the market and generate higher sales from the Company’s reseller channels. Partial shipments against the $5.5 Million US Department of Defense order also provided a boost to current year sales.

| | | | | | |

Gross Margin | Three Months Ended (2008) (unaudited) |

Year Ended (audited) |

Mar 31 | Jun 30 | Sep 30 | Dec 31 | 2008 | 2007 |

Microwave | 43% | 39% | 37% | 53% | 43% | 48% |

Satellite systems | 67% | 62% | 57% | 57% | 59% | 57% |

Combined | 51% | 50% | 48% | 56% | 51% | 52% |

The Company’s overall gross margin for 2008 was 51% compared to 52% in 2007. Gross margins were down slightly from 2007, primarily due to the softening of margins in the Microwave business as a result of the global economic slowdown. This weakening was offset by an increase, in the Satellite System gross margins.

The gross margin for Microwave Products was 43% in 2008 compared to 48% in 2007. A number of new microwave product introductions in 2007 resulted in higher margins for that year. The global recessionary trends also put downward pressure on margins on the more commoditized items of the product portfolio. The Company is committed to maintaining market leadership through continually improving Microwave product offerings, but may be unable to sustain a high rate of refresh due to the maturity of the market segment.

The gross profit margin for Satellite Systems increased marginally to 59% in 2008 compared to 57% in 2007. Although the Company saw increased raw material and subcomponent prices, these increases were offset by production efficiency gains attributable to higher volume production runs..

| | | | | | |

Operating Costs ($000’s) | Three Months Ended (2008) (unaudited) | Year Ended (audited) |

Mar 31 | Jun 30 | Sep 30 | Dec 31 | 2008 | 2007 |

S G & A | $1,303 | $1,527 | $1,468 | $1,955 | $ 6,253 | $ 5,331 |

Product development | 185 | 225 | 83 | 306 | 799 | 726 |

Amortization | 90 | 92 | 97 | 68 | 347 | 333 |

Other (Income) Expenses | (93) | (12) | (66) | (159) | (330) | 767 |

Total Operating Costs | $1,485 | $1,832 | $1,582 | $2,170 | $7,069 | $7,157 |

For the year ended December 31, 2008, the total operating expenses were $7.1 million down slightly from the $7.2 million in 2007.

Selling, general and administrative (SG&A) expenses increased to $6.3 million in 2008 from $5.3 million in 2007. Selling, General and Administrative expenses in 2007 were significantly lower as the Company operated with some vacancies and other cash conservation initiatives initiated to preserve the Company. In 2008, the vacancies were filled and the Company operationally shifted towards a sustainable and frugal operating level. The current year expenses also included corporate expansion and development costs. Throughout the year, the Company’s management team continues to focus on meeting customers’ needs and developing strong partnerships with resellers in key markets, while still maintaining tight cost controls.

The increases are due to a number of factors, most significantly among them were: i) Corporate development initiatives undertaken throughout the year cost $0.5 million, these initiatives included exploration of growth opportunities through potential mergers and acquisitions; ii) Senior executive changes the Company implemented in October of 2008. The one time expenses related to these changes accounted for $0.3 million.

Product development expenses increased to $0.8 million in 2008 from $0.7 million in 2007. The increase in product development spending represents a renewed commitment to scientific research and development and customer service excellence. The expenses reported are net of government contributions of $0.7 million. These contributions were from two different government programs – Industrial Research Assistance Program (IRAP) and Strategic Aerospace and Defense Initiative (SADI). The Company’s reported product development expenses without these reductions would have been $1.5 million. The Company continues to pursue a strategy off offloading non-core development expenses to strategic suppliers and partners. The Company will continue to take responsibility for its core R&D activities, and plans to continue to lead the market with introductions of innovative new products.

Amortization expense in 2008 was $0.3 million compared to $0.3 million for the year ended December 31, 2007.

Other expenses in 2008 improved significantly to a gain of $0.3 million from an expense of $0.8 million in 2007. The most significant item was the weakening of the Canadian Dollar relative to the United States Dollar in 2008. In 2008, foreign exchange gains were $0.4 million compared to an exchange loss of $0.5 million in 2007, resulting in a net improvement of $0.9 million.

| | | | | | |

Earnings (loss) (in 000’s) except earnings per share | Three Months Ended (2008) (unaudited) | Year Ended (audited) |

Mar 31 | Jun 30 | Sep 30 | Dec 31 | 2008 | 2007 |

Earnings from operations before taxes | $5 | $135 | $742 | $1,318 | $2,200 | $1,385 |

Net earnings per share, basic | $0.003 | $0.003 | $0.014 | $0.02 | $0.04 | $0.03 |

and diluted before income taxes | $0.003 | $0.003 | $0.014 | $0.02 | $0.04 | $0.02 |

Earnings from operations before taxes and other expenses were $2.2 million in 2008, compared to the $1.4 million profit in 2007. The improvement was mainly due to increased sales in both business segments, while maintaining operating expenses constant year on year

Critical Accounting Estimates

The Company prepares its consolidated financial statements in accordance with Canadian generally accepted accounting principles, and makes estimates and assumptions that affect its reported amounts of assets, liabilities, revenue and expenses, and the related disclosures of contingent liabilities. The Company bases its estimates on historical experience and other assumptions that it believes are reasonable in the circumstances. Actual results may differ from these estimates.

Management has discussed the development and selection of the Company’s critical accounting estimates with the Audit Committee of the Company’s Board of Directors, and the Audit Committee has reviewed the following disclosures.

The following critical accounting policies reflect the Company’s more significant estimates and assumptions used in preparing its consolidated financial statements:

Allowance for Doubtful Accounts

Ø

The Company maintains an allowance for doubtful accounts for estimated losses that may arise if any of its customers are unable to make required payments. Management specifically analyzes the age of outstanding customer balances, historical bad debt experience, customer credit-worthiness and changes in customer payment terms when making estimates of collectability of the Company’s accounts receivable balance. If the Company determines that the financial condition of any of its customers has deteriorated, increases in the allowance may be made. At December 31, 2008, the Company has set aside an amount of $0.04 million (December 2007 - $0.04 million) for allowance of doubtful accounts as a reduction to accounts receivable.

Inventories

Ø

The Company values its finished goods and work-in-process inventories at the lower of weighted average cost and net realizable value. Net realizable value reflects the current estimated net selling price or value in use of the item in inventory in a non-forced sale. The Company assesses the need for inventory write-downs based on its assessment of estimated net realizable value using assumptions about future demand and market conditions. When the results of these assumptions differ from the Company’s projections, an additional inventory write-down may be required. In addition, changes in the underlying factors used in the Company’s projections may necessitate additional write-downs in the future. Market factors are generally outside of the Company’s control. At

December 31, 2008 the Company has recorded an estimate for obsolescence provision in the amount of $0.7 million (December 2007 - $1.3 million) as a reduction to inventory.

Revenue Recognition

Ø

Revenues consist of sales of hardware, software, consulting, installation, training and post contract services. These services are set forth separately in the contractual arrangements such that the total price of the customer arrangement is expected to vary as a result of the inclusion or exclusion of services. For those contracts where the services are not essential to the functionality of any other element of the transaction, the Company determines vendor-specific objective evidence (“VSOE”) of fair value for these services based upon normal pricing and discounting practices for these services when sold separately.

Ø

The Company’s multiple-element sales arrangements include arrangements where software licenses and the associated post contract customer support (“PCS”) are sold together. The company has established VSOE of the fair value of the undelivered PCS element based on the contracted price for renewal PCS included in the original multiple-element sales arrangement. The Company’s multiple-element sales arrangements generally include rights for the customer to renew PCS after the bundled term ends. These rights are irrevocable to the customer’s benefit, are for specified prices, are consistent with the initial price in the original multiple-element sales arrangement, and the customer is not subject to any economic or other penalty for failure to renew. Further, the renewal PCS options are for services comparable to the bundled PCS and cover similar terms.

Ø

PCS revenue associated with software licenses is recognized ratably over the term of the PCS period, which typically is one year. PCS revenue includes different levels of support that provide customers with access to telephone support for trouble-shooting, diagnosis and extends to on-site repair of products.

Ø

The Company recognizes revenue from the sales of hardware products upon the latter of transfer of title or upon shipment of the hardware product to the customer so long as persuasive evidence of an arrangement exists, delivery has occurred, the fee is fixed or determinable, and collectability is reasonably assured.

Stock Based Compensation

Ø

Effective January 1, 2005, the Company adopted the new provision of the CICA Handbook Section 3870, “Stock-Based Compensation and Other Stock-Based Payments’, which requires companies to adopt the fair value based method for all stock-based awards. In accordance with the provisions of this section, the Company has accounted for all director, officer and employee (“employee”) stock options granted, settled, or modified since September 1, 2002 using the fair value method. The fair value method requires the Company to expense the fair value of the employee options granted and vested, or modified during the period. The Black-Scholes Option Pricing Model was used to determine fair value.

Ø

Prior to the adoption of the new standard, no compensation expense was recognized when stock options were issued to employees at the market value of the shares at the date of the grant. Consideration paid by employees on the purchase of shares under the employee share purchase plan and exercise of stock options was recorded as share capital.

Income Tax

Ø

The Company follows the liability method of accounting for income taxes. Under this method, future income tax assets and liabilities are recognized for the future tax consequences attributable to differences between the financial statement carrying values of existing assets and liabilities and their respective income tax bases. The resulting

changes in the net future income tax asset or liability are included in income. Future income tax assets and liabilities are measured using substantively enacted tax rates expected to apply to taxable income in the year in which temporary differences are expected to be recovered or settled. The effect on future income tax assets and liabilities of a change in tax rates is included in income when a change in tax rates is substantively enacted. Future income tax assets are evaluated periodically and if realization is not considered “more likely than not” a valuation allowance is provided.

Related Party Transactions

During 2008, the Company entered into a related party transaction. On December 23, 2008, $94,185 (Cdn$114,720) was transferred to a member of the board’s bank account as share capital for Norsat SA. The board member was holding this cash for Norsat SA until a bank account could be set up. The amount is classified as cash on the Company’s consolidated balance sheet. Subsequent to the year end, the cash was deposited in its entirety to the newly established Company bank account.

During 2007, the Company entered into the following related party transactions:

(i) On March 28, 2007 the Company received a bridge loan of Cdn$150,000 from an officer of the Company subjected to certain terms and conditions as follows:

Interest at the rate of 8% per annum over the balance of the loan, payable at the end of the term, or on the day of loan retirement,

60 day term maturing May 31, 2007,

Payment in full May 31, 2007, or partial payments within the 60 day term at discretion of the Company.

The loan was fully repaid on May 31, 2007.

(ii) On April 24, and June 12, 2007 the Company received bridge loans of Cdn$250,000, and Cdn$200,000 respectively from the same officer of the Company subjected to certain terms and conditions as follows:

Interest at the rate of 8% per annum over the balance of the loan, payable at the end of the term, or on the day of loan retirement,

9 day terms, with an option to renew

Payment in full on or partial payments within the 9 day term at discretion of the Company.

The loans were fully repaid on May 2, and June 20, 2007.

(iii) On November 14, 2007 the Company received a bridge loan of Cdn$450,000 from the same officer of the Company subjected to certain terms and conditions as follows:

Interest at the rate of 8% per annum over the balance of the loan, payable at the end of the term, or on the day of loan retirement,

9 day terms, with an option to renew

Payment in full on or partial payments within the 9 day term at discretion of the Company.

On November 22, 2007 the Company renewed this bridge loan with the same interest rate, but maturing on November 27, 2007.

The loan was fully repaid on November 27, 2007

(refer to 5. B “Liquidity and capital resources”).

Recent Accounting Pronouncements

Change in Reporting Currency

Effective January 1, 2008, the Company changed its reporting currency to the US Dollar (USD). The change in reporting currency increases transparency of the financial results of the Company and provides better visibility for the stakeholders.

Prior to January 1, 2008, the Company reported its annual and quarterly consolidated financial statements in Canadian dollars (CDN). In making the change in reporting currency, the Company followed the recommendations of the Emerging Issues Committee (EIC) of the Canadian Institute of Chartered Accountants (CICA), set out in EIC-130 – “Translation Method when the Reporting Currency Differs from the Measurement Currency or there is a Change in the Reporting Currency”.

In accordance with EIC-130, the financial statements for all the years and periods presented have been translated to the new reporting currency (USD) using the current rate method. Under this method, the statements of operations, deficit and comprehensive (loss) income and cash flows statement items for each year and period have been translated into the reporting currency using the average exchange rates prevailing during each reporting period. All assets and liabilities have been translated using the exchange rate prevailing at the consolidated balance sheets dates. Shareholders’ equity transactions have been translated using the rates of exchange in effect as at the date of the various capital transactions.

All resulting exchange differences arising from the translation are included as a separate component of other comprehensive income. All comparative financial information has been restated to reflect the Company’s results as if they had been historically reported in US dollars.

Inventories

On January 1, 2008, the Company adopted CICA Handbook Section 3031 - “Inventories”, which replaces Section 3030, of the same name. The new section provides guidance on the basis and method of measurement of inventories and allows for reversal of previous write-downs. The section also establishes new standards on disclosure of accounting policies used, carrying amounts, amounts recognized as an expense, write-downs and the amount of any reversal of any write-downs.

Due to circumstances that previously caused the inventories to be written down below cost no longer existed, and the net realizable value of the inventories had increased as a result of the Company’s change in economic conditions, the amount of the write down of inventories had been reversed. As a result of adopting CICA Section 3031, a reversal of previous write-downs of $285,396 was recorded as an increase to inventory and a decrease in opening deficit as at January 1, 2008.

Prior to the adoption of CICA 3031, parts and supplies inventory were stated at the lower of weighted average cost and replacement cost. Subsequent to the adoption of CICA 3031, parts and supplies inventory are stated at the lower of weighted average cost and net realizable value.

Capital Disclosures

On January 1, 2008, the Company adopted CICA Handbook Section 1535 – “Capital Disclosures”. Section 1535 requires a company to disclose information that enables users of its financial statements to evaluate the Company’s objectives, policies and processes for managing capital, including disclosures of any externally imposed capital requirements and the consequences of non-compliance.

Financial Statement – Presentation

On January 1, 2008, the Company adopted CICA Handbook Sections 3862 – “Financial Instruments – Disclosure” and 3863 – “Financial Instruments – Presentation” (“Sections 3862 and 3863”) which replaces Section 3861 – “Financial Instruments – Disclosure and Presentation”. Sections 3862 and 3863 require an increased emphasis on disclosures about the nature and extent of risk arising from financial instruments and how a company manages these risks.

Convergence with International Financial Reporting Standards

In February 2008, Canada’s Accounting Standards Board confirmed that Canadian GAAP, as used by public companies, will be converged with International Financial Reporting Standards (IFRS) effective January 1, 2011. The transition from Canadian GAAP to IFRS will be applicable for the Company for the first quarter of 2011 when the Company will prepare both the current and comparative financial information using IFRS.

While IFRS uses a conceptual framework similar to Canadian GAAP, there are significant differences on recognition, measurement, and disclosures. The Company commenced its IFRS conversion project in 2008 by commissioning a study to evaluate the major differences between Canadian GAAP and IFRS as applicable to the Company. In the first half of 2009, the Company plans to assemble a cross functional team and, utilizing external expertise where required, will begin training of personnel and establish a project plan and key milestones for conversion. Accordingly when the Company develops its IFRS plan, it will have to include measures to review contracts and agreements and to increase the level of awareness and knowledge amongst management, the Board of Directors and the Audit Committee.