Exhibit 99.3

© 2017 Concurrent 1 Confidential & Proprietary Information Town Hall Meeting October 16, 2017

© 2017 Concurrent 2 Confidential & Proprietary Information Safe Harbor Certain statements made or incorporated herein may constitute “forward - looking statements” within the meaning of the federal securities laws. Statements regarding future events and developments and the company’s future performance, including, but not limited to, management’s expectations, beliefs, plans, estimates, or projections relating to the future, are forward - looking statements within the meaning of these laws. All forward - looking statements are subject to certain risks and uncertainties that could cause actual events to differ materially from those projected . Other important risk factors are discussed in Concurrent’s Form 10 - K filed September 20, 2017 with the Securities and Exchange Commission (“SEC”), and in subsequent filings of periodic reports with the SEC. The risk factors discussed in the Form 10 - K and subsequently filed periodic reports under the heading “Risk Factors” are specifically incorporated by reference in this press release. Forward - looking statements are based on current expectations and speak only as of the date of such statements. Concurrent undertakes no obligation to publicly update or revise any forward - looking statement, whether as a result of future events, new information, or otherwise .

© 2017 Concurrent 3 Confidential & Proprietary Information Announcement Details Concurrent enters into a definitive agreement to sell Content Delivery & Storage businesses to Vecima Networks for $29M. Headquartered in Victoria , British Columbia, Vecima is a leading designer and manufacturer of innovative network technology solutions. The transaction , which has been approved by the Board of Directors of both companies, is subject to various closing terms and conditions including stockholder approval from Concurrent . More details following some regulatory filings to be completed shortly.

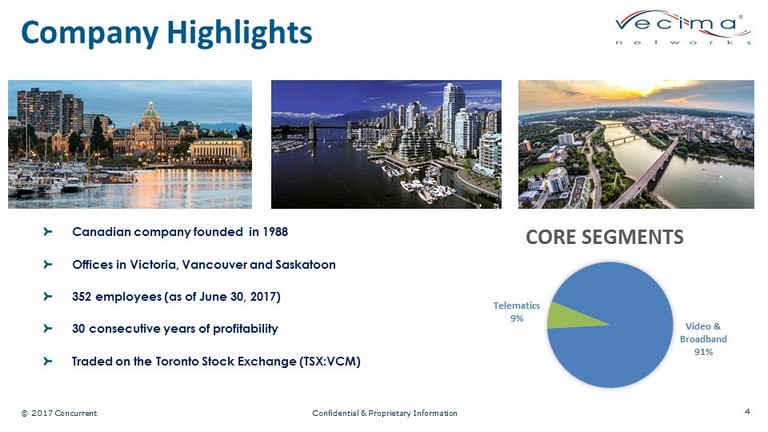

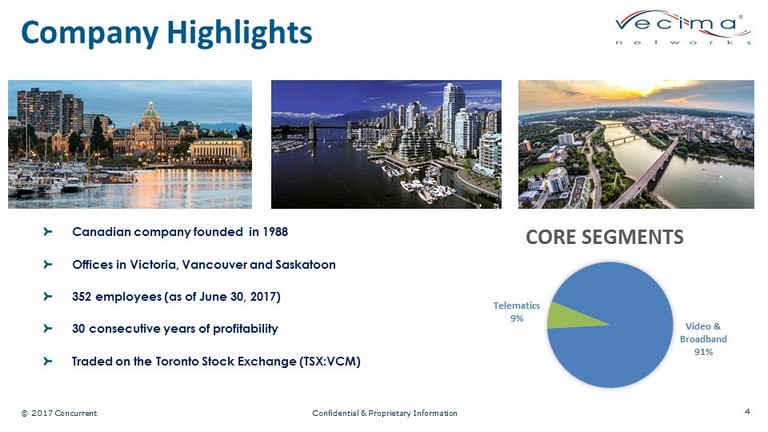

© 2017 Concurrent 4 Confidential & Proprietary Information Company Highlights Canadian company founded in 1988 Offices in Victoria, Vancouver and Saskatoon 352 employees (as of June 30, 2017) 30 consecutive years of profitability Traded on the Toronto Stock Exchange (TSX:VCM) Video & Broadband 91% Telematics 9% CORE SEGMENTS

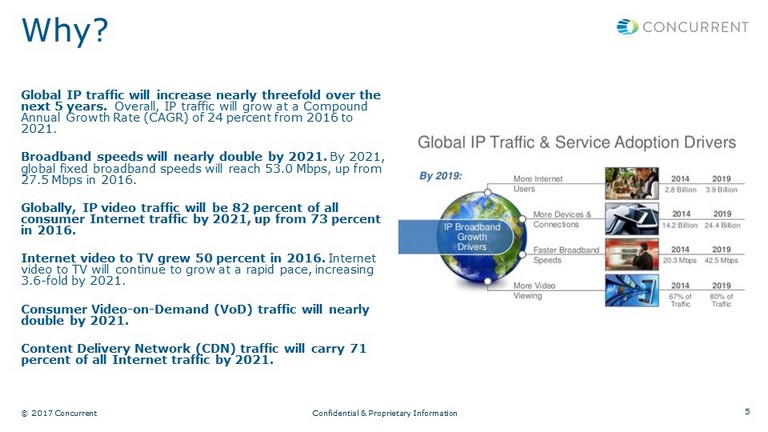

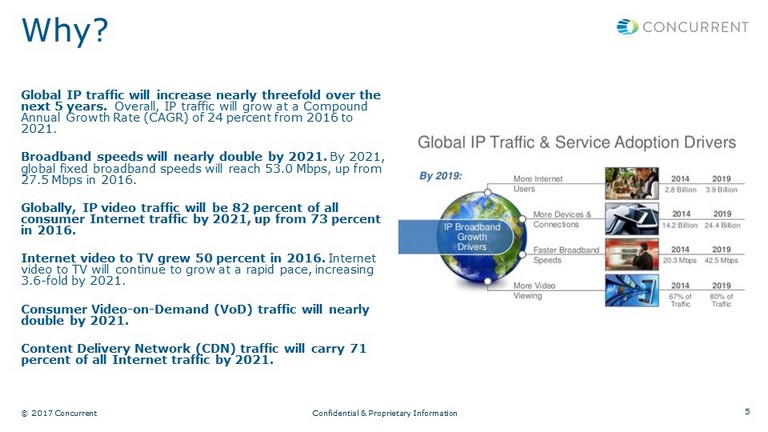

© 2017 Concurrent 5 Confidential & Proprietary Information Why? Global IP traffic will increase nearly threefold over the next 5 years. Overall , IP traffic will grow at a Compound Annual Growth Rate (CAGR) of 24 percent from 2016 to 2021. Broadband speeds will nearly double by 2021. By 2021, global fixed broadband speeds will reach 53.0 Mbps, up from 27.5 Mbps in 2016. Globally , IP video traffic will be 82 percent of all consumer Internet traffic by 2021, up from 73 percent in 2016 . Internet video to TV grew 50 percent in 2016. Internet video to TV will continue to grow at a rapid pace, increasing 3.6 - fold by 2021 . Consumer Video - on - Demand ( VoD ) traffic will nearly double by 2021 . Content Delivery Network (CDN) traffic will carry 71 percent of all Internet traffic by 2021 .

© 2017 Concurrent 6 Confidential & Proprietary Information What happens today … Business as usual. Transaction will take time to complete and has several regulatory milestones to work through. Focus on customer communication & closing out our Q2 deliverables.

© 2017 Concurrent 7 Confidential & Proprietary Information Q&A

© 2017 Concurrent 8 Confidential & Proprietary Information Closing • This is happening because of your hard work & success. • Business as usual. Keep Executing for our Customers! • Be Confident & Focused. • Close out Q2.

© 2017 Concurrent 9 Confidential & Proprietary Information Important Additional Information and Where to Find It In connection with the proposed transaction, Concurrent will file with the SEC and mail or otherwise provide to its stockhold ers a proxy statement regarding the proposed transaction. BEFORE MAKING ANY VOTING DECISION, CONCURRENT’S STOCKHOLDERS ARE URGED TO CAREFULLY READ THE PROXY STAT EME NT IN ITS ENTIRETY WHEN IT BECOMES AVAILABLE AND ANY OTHER DOCUMENTS FILED WITH THE SEC IN CONNECTION WITH THE PROPOSED TRANSACTION OR INCORPORATED BY REFERENCE THEREIN BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION AND THE PART IES TO THE PROPOSED TRANSACTION. Investors and security holders may obtain a free copy of the proxy statement and other document s t hat Concurrent files with the SEC (when available) from the SEC’s website at www.sec.gov and Concurrent’s website at http:// www.concurrent.com /about/investors/sec - filings/. In addition, the proxy statement and other documents filed by Concurrent with the SEC (when available) may be obtained from Conc urr ent free of charge by directing a written request to Corporate Secretary, Concurrent Computer Corporation, 4375 River Green Parkway, Suite 100, Duluth, Georgia 30096, Phone : (678) 258 - 4000. Media Relations: Sandra Dover (678) 258 - 4112 Sandra.dover@concurrent.com Investor Relations: Doug Sherk (415) 652 - 9100 dsherk@evcgroup.com Certain Participants in the Solicitation Derek Elder, director and Chief Executive Officer, Warren Sutherland, Chief Financial Officer, and certain other directors an d o fficers of Concurrent, are or may be deemed participants in Concurrent’s solicitation. Other than Mr. Elder, none of such participants owns in excess of 1% of Concurrent’s common stock. Mr. Elder may be deemed to own approximately 2.3% of Concurrent’s common stock. Additional information regarding such participants, including their direct or indirect interests, by security holdings or otherwise, will be included in the proxy statement and other relevant documents to be file d w ith the SEC in connection with the transaction. Information relating to the foregoing can also be found in Concurrent’s definitive proxy statement for its 2017 Ann ual Meeting of Stockholders (the “2017 Proxy Statement”), which was filed with the SEC on October 2, 2017. To the extent that holdings of Concurrent’s securit ies have changed since the amounts printed in the 2017 Proxy Statement, such changes have been or will be reflected on Statements of Change in Ownership on Form 4 filed with the SEC. Additional information regarding the interests of such individuals in the proposed transaction will be included in the proxy sta tement relating to such transaction when it is filed with the SEC. These documents may be obtained free of charge from the SEC’s website at www.sec.gov and Concurrent’s website at http:// www.concurrent.com /about/investors/sec - filings /.

© 2017 Concurrent 10 Confidential & Proprietary Information Thank You!