LOB INITIATIVES – MORTGAGE

Action

Initial

Results

Expand Retail, Broker, and Correspondent

channels while enhancing Consumer Direct

-

113 net new retail loan officers (155% of YTD

goal)

-

425 net new broker and correspondent

relationships (177% of YTD goal)

-

$2.1B bank referred production (162% of YTD goal)

-

Consumer Enhancements include:

-

Process and workflow improvements resulting

in significant service level improvements

-

Installation of new voice response technology

and CTI screen pop tools has led to more than

40% of customer service

calls being handled

by the automated solution

-

Strategies include the successful introduction

of Bundled Settlement Services,

comprehensive targeted marketing

campaigns, a relocation service and

expanded hours of operation. The result has

been a 22% conversion ratio (from referrals to

mortgage applications).

Launch out of footprint sales of mortgage and

home equity

-

Significantly ramped up out of footprint sales

force and are on track to meet goals of numbers

of new customers.

-

Have been successful with

the home equity

product in the markets it has been rolled out

within the Retail channels; major roll-out is

expected by year end.

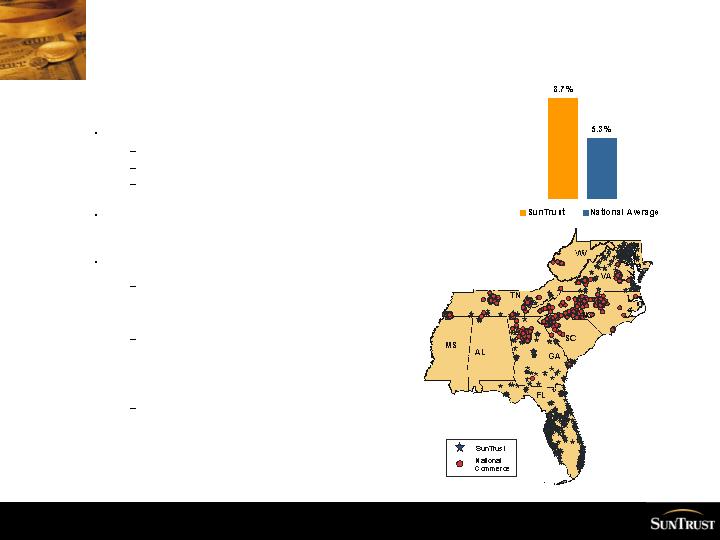

Long Term Growth Rate Target: 8 – 10%

19