LOB INITIATIVES – MORTGAGE

Action

Initial

Results

Expand Retail, Broker, and Correspondent

channels while enhancing Consumer Direct

113 net new retail loan officers (155% of YTD

goal)

425 net new broker and correspondent

relationships (177% of YTD goal)

$2.1B bank referred production (162% of YTD

goal)

Consumer Enhancements include:

-

Process and workflow improvements resulting

in significant service level improvements

-

Installation of new voice response technology

and CTI screen pop tools has led to more than

40% of customer service calls being handled

by the automated solution

-

Strategies include the successful introduction

of Bundled Settlement Services,

comprehensive targeted marketing

campaigns, a relocation service and expanded

hours of operation. The result has been a

22% conversion ratio (from referrals to

mortgage applications).

Launch out of footprint sales of mortgage and

home equity

Significantly ramped up out of footprint sales

force and are on track to meet goals of numbers

of new customers.

Have been successful with the home equity

product in the markets it has been rolled out

within the Retail channels; major roll-out is

expected by year end.

17

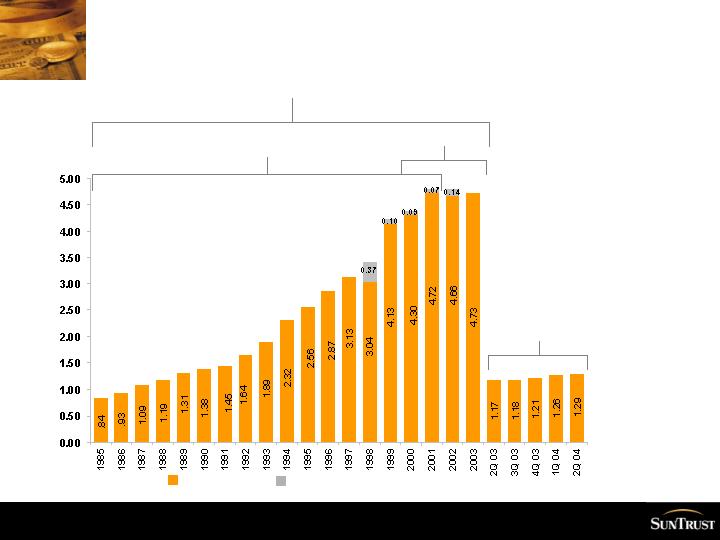

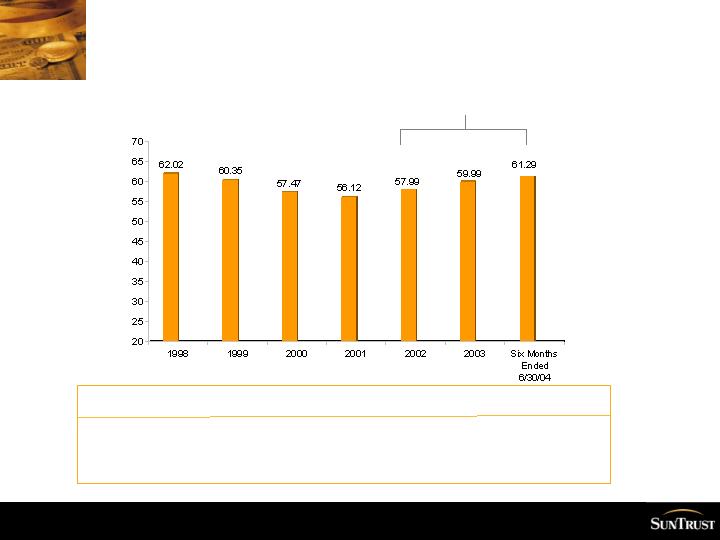

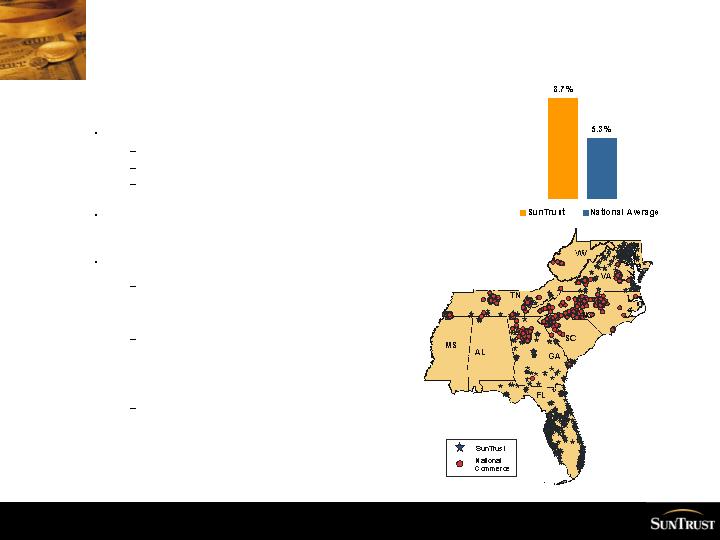

Long Term Growth Rate Target: 8 – 10%