UNITED STATES SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D. C. 20549

FORM 10-K

[ X ] ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2006.

OR

[ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Commission file number 0-13089

Hancock Holding Company

(Exact name of registrant as specified in its charter)

Mississippi 64-0693170

(State or other jurisdiction of incorporation or organization) (I.R.S. Employer Identification Number)

One Hancock Plaza, Gulfport, Mississippi 39501 (228) 868-4727

(Address of principal executive offices) (Zip Code) Registrant's telephone number, including area code

Securities registered pursuant to Section 12(b) of the Act:

COMMON STOCK, $3.33 PAR VALUE The NASDAQ Stock Market, LLC

(Title of Class) (Name of Exchange on Which Registered)

Securities registered pursuant to Section 12(g) of the Act: NONE

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the

Securities Act. Yes X No

------- -------

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d)

of the Act. Yes No X

-------- -------

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or

15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the

registrant was required to file such reports) and (2) has been subject to such filing requirements for the past

90 days. Yes X No

------- ---------

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained

herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information

statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. Yes X No

----- -----

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a

non-accelerated filer. See definition of "accelerated filer and large accelerated filer" in Rule 12b-2 of the

Exchange Act. (Check One):

Large accelerated filer X Accelerated filer Non-accelerated filer

------ ------- -------

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act).Yes No X

----- ------

The aggregate market value of the voting stock held by nonaffiliates of the registrant as of June 30, 2006 was

$1,502,420,422 based upon the closing market price on NASDAQ as of such date. For purposes of this calculation

only, shares held by nonaffiliates are deemed to consist of (a) shares held by all shareholders other than

directors and executive officers of the registrant plus (b) shares held by directors and officers as to which

beneficial ownership has been disclaimed.

On February 9, 2007, the registrant had outstanding 32,671,196 shares of common stock for financial statement

purposes.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the Registrant's Annual Report to Stockholders for the year ended December 31, 2006 are incorporated

by reference into Part I and Part II of this report.

Portions of the definitive Proxy Statement used in connection with the Registrant's Annual Meeting of

Shareholders to be held on March 29, 2007 are incorporated by reference into Part III of this report.

Hancock Holding Company

Form 10-K

Index

PART I

ITEM 1. BUSINESS 1

ITEM 1A. RISK FACTORS 10

ITEM 1B. UNRESOLVED STAFF COMMENTS 14

ITEM 2. PROPERTIES 14

ITEM 3. LEGAL PROCEEDINGS 14

ITEM 4. SUBMISSION OF MATTERS TO A VOTE OF SECURITY HOLDERS 14

PART II

ITEM 5. MARKET FOR THE REGISTRANT'S COMMON EQUITY, RELATED

STOCKHOLDER MATTERS AND ISSUER PURCHASES OF

EQUITY SECURITIES 15

ITEM 6. SELECTED FINANCIAL DATA 18

ITEM 7. MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL

CONDITION AND RESULTS OF OPERATIONS 21

ITEM 7A. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT

MARKET RISK 47

ITEM 8. FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA 48

ITEM 9. CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON

ACCOUNTING AND FINANCIAL DISCLOSURE 101

ITEM 9A. CONTROLS AND PROCEDURES 101

ITEM 9B. OTHER INFORMATION 101

PART III

ITEM 10. DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE 102

ITEM 11. EXECUTIVE COMPENSATION 102

ITEM 12. SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS

AND MANAGEMENT AND RELATED STOCKHOLDER MATTERS 102

ITEM 13. CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS,

AND DIRECTOR INDEPENDENCE 102

ITEM 14. PRINCIPAL ACCOUNTANT FEES AND SERVICES 102

PART IV

ITEM 15. EXHIBITS, FINANCIAL STATEMENT SCHEDULES 103

PART IITEM 1: BUSINESSORGANIZATION AND RECENT DEVELOPMENTSHancock Holding Company (the Company), organized in 1984 as a bank holding company registered under the Bank Holding Company Act of 1956, as amended, is headquartered in Gulfport, Mississippi. In 2002, the Company qualified as a financial holding company giving it broader powers. At December 31, 2006, the Company operated more than 140 banking and financial services offices and more than 130 automated teller machines (ATMs) in the states of Mississippi, Louisiana and Florida through three wholly-owned bank subsidiaries, Hancock Bank, Gulfport, Mississippi (Hancock Bank MS), Hancock Bank of Louisiana, Baton Rouge, Louisiana (Hancock Bank LA) and Hancock Bank of Florida, Tallahassee, Florida (Hancock Bank FL). Hancock Bank MS also operates a loan production office in the State of Alabama. Hancock Bank MS, Hancock Bank LA and Hancock Bank FL are referred to collectively as the “Banks”.

The Banks are community oriented and focus primarily on offering commercial, consumer and mortgage loans and deposit services to individuals and small to middle market businesses in their respective market areas. The Company’s operating strategy is to provide its customers with the financial sophistication and breadth of products of a regional bank, while successfully retaining the local appeal and level of service of a community bank. At December 31, 2006, the Company had total assets of $5.96 billion and 1,848 employees on a full-time equivalent basis.

Hancock Bank MS was originally chartered as Hancock County Bank in 1899. Since its organization, the strategy of Hancock Bank MS has been to achieve a dominant market share on the Mississippi Gulf Coast. Prior to a series of acquisitions begun in 1985, growth was primarily internal and was accomplished by branch expansions in areas of population growth where no dominant financial institution previously served the market area. Economic expansion on the Mississippi Gulf Coast has resulted primarily from growth of military and government-related facilities, tourism, port facility activities, industrial complexes and the gaming industry. Based on the most current available published data, Hancock Bank MS has the largest deposit market share in each of the following five counties: Harrison, Hancock, Jackson, Lamar and Pearl River. In addition, Hancock Bank MS has a presence in the following counties: Forrest and Jefferson Davis. With assets of $3.5 billion at December 31, 2006, Hancock Bank MS was ranked the third largest bank in Mississippi.

In August 1990, the Company formed Hancock Bank LA to assume the deposit liabilities and acquire the consumer loan portfolio, corporate credit card portfolio and non-adversely classified securities portfolio of American Bank and Trust, Baton Rouge, Louisiana, (AmBank), from the Federal Deposit Insurance Corporation (FDIC). Economic expansion in East Baton Rouge Parish has resulted from growth in state government and related service industries, educational and medical complexes, petrochemical industries, port facility activities and transportation and related industries. With assets of $2.4 billion at December 31, 2006, Hancock Bank LA was ranked the fourth largest bank in Louisiana.

CURRENT OPERATIONSLoan Production and Credit ReviewThe Banks’ primary lending focus is to provide commercial, consumer, leasing and real estate loans to consumers and to small and middle market businesses in their respective market areas. The Banks have no significant concentrations of loans to particular borrowers or industries or loans to any foreign entities. Each loan officer has Board approved loan limits on the principal amount of secured and unsecured loans that can be approved for a single borrower without prior approval of a loan committee. All loans, however, must meet the credit underwriting standards and loan policies of the Banks.

All loans over an individual loan officer’s Board approved lending authority must be approved by the Bank’s loan committee, the region’s loan committee or by another loan officer with greater lending authority. Both the regional loan committee and the Bank’s senior loan committee must review and approve any loan for a borrower whose total indebtedness exceeds the region’s approved limit. Each loan file is reviewed by the Bank’s loan operations quality assurance function, a component of its loan review system, to ensure proper documentation and asset quality.

1

Loan Review and Asset QualityEach Bank’s portfolio of loan relationships aggregating $500,000 or more is reviewed every 12 to 18 months by the Bank’s Loan Review staff to identify any deficiencies and report them to management to take corrective actions as necessary. Periodically, selected loan relationships aggregating less than $500,000 are also reviewed. As a result of such reviews, each Bank places on its Watch list, loans requiring close or frequent review. All loans over $100,000 classified by a regulatory auditor are also placed on the Watch list. All Watch list and past due loans are reviewed monthly by the Banks’ senior lending officers. All Watch list loans are reviewed monthly by the Bank’s Asset Quality Committee and quarterly by the Banks’ Board of Directors’ Loan Oversight Committee.

In addition, in the approval process, all loans to a particular borrower are considered, regardless of classification, each time such borrower requests a renewal or extension of any loan or requests a new loan. All lines of credit are reviewed before renewal. The Banks currently have mechanisms in place that require borrowers to submit annual financial statements, except borrowers with secured installment and residential mortgage loans.

Consumer loans, which become 30 days delinquent, are reviewed regularly by management. As a matter of policy, loans are placed on a nonaccrual status when the loan is (1) payment in full, of principal or interest is not expected or (2) the principal or interest has been in default for a period of 90 days, unless the loan is well secured and in the process of collection.

The Banks follow the standard FDIC loan classification system. This system provides management with (1) a general view of the quality of the overall loan portfolio (each Bank’s loan portfolio and each commercial loan officer’s loan portfolio) and (2) information on specific loans that may need individual attention.

The Bank’s nonperforming assets, consisting of real property, vehicles and other items held for resale, were acquired generally through the process of foreclosure. At December 31, 2006, the book value of those assets held for resale was approximately $568 thousand.

Securities PortfolioThe Banks maintain portfolios of securities consisting primarily of U.S. Treasury securities, U.S. government agency issues, mortgage-backed securities, CMOs and tax-exempt obligations of states and political subdivisions. The portfolios are designed to enhance liquidity while providing acceptable rates of return. Therefore, the Banks invest only in high quality securities of investment grade quality and with a target duration, for the overall portfolio, generally between two to five years.

The Banks’ policies limit investments to securities having a rating of no less than “Baa”, or its equivalent by a Nationally Recognized Statistical Rating Agency, except for certain obligations of Mississippi, Louisiana or Florida counties, parishes and municipalities.

DepositsThe Banks have several programs designed to attract depository accounts offered to consumers and to small and middle market businesses at interest rates generally consistent with market conditions. Additionally, the Banks operate more than 130 ATMs at the Company’s banking offices as well as free-standing ATMs at other locations. As members of regional and international ATM networks such as “STAR”, “PLUS” and “CIRRUS”, the Banks offer customers access to their depository accounts from regional, national and international ATM facilities. Deposit flows are controlled by the Banks primarily through pricing, and to a certain extent, through promotional activities. Management believes that the rates it offers, which are posted weekly on deposit accounts, are generally competitive with other financial institutions in the Banks’ respective market areas.

2

Trust ServicesThe Banks, through their respective Trust Departments, offer a full range of trust services on a fee basis. The Banks act as executor, administrator or guardian in administering estates. Also provided are investment custodial services for individuals, businesses and charitable and religious organizations. In their trust capacities, the Banks provide investment management services on an agency basis and act as trustee for pension plans, profit sharing plans, corporate and municipal bond issues, living trusts, life insurance trusts and various other types of trusts created by or for individuals, businesses and charitable and religious organizations. As of December 31, 2006, the Trust Departments of the Banks had approximately $7.1 billion of assets under administration compared to $5.5 billion as of December 31, 2005. As of December 31, 2006, $3.8 billion of administered assets were corporate accounts and the remaining balances were personal, employee benefit, estate and other trust accounts.

Operating Efficiency StrategyThe primary focus of the Company’s operating strategy is to increase operating income and to reduce operating expense. A Company’s operating efficiency ratio indicates the percentage of each dollar of net revenue that is used to fund operating expenses. Net revenue for a financial institution is the total of net interest income plus non-interest income, excluding securities transactions gains or losses. Operating expenses exclude the amortization of intangibles.

Other ActivitiesHancock Bank MS has 6 subsidiaries through which it engages in the following activities: providing consumer financing services; owning, managing and maintaining certain real property; providing general insurance agency services; holding investment securities; marketing credit life insurance; and providing discount investment brokerage services. The income of these subsidiaries generally accounts for less than 10% of the Company’s total net earnings.

During 2001, the Company began servicing mortgage loans for the Federal National Mortgage Association. At that time the loans serviced were originated and closed by the Company’s mortgage subsidiary. The servicing activity was also performed by this same subsidiary. In the middle of 2003, however, the Company modified its strategy and reverted to selling the majority of its conforming loans with servicing released. In December 2004, the Company’s mortgage subsidiary merged with Hancock Bank MS, its parent. Currently all mortgage activity is being reported by Hancock Bank, Hancock Bank of Louisiana, and Hancock Bank of Florida.

In July 2003, Hancock Bank MS opened a loan production office in Mobile, Alabama. Until September 2005, no deposits were accepted at this location. Subsequent to Hurricane Katrina the State of Alabama allowed Hancock Bank MS to open a temporary branch in Alabama. In January 2007, Hancock Bank of Alabama was granted a charter by the State of Alabama.

Hancock Bank MS also owns approximately 3,700 acres of timberland in Hancock County, Mississippi, most of which was acquired through foreclosure in the 1930's. Timber sales and oil and gas leases on this acreage generate less than 1% of the Company’s annual net income.

CompetitionThe deregulation of the financial services industry, the elimination of many previous distinctions between commercial banks and other financial institutions as well as legislation enacted in Mississippi, Louisiana and other states allowing state-wide branching, multi-bank holding companies and regional interstate banking have all served to foster a highly competitive environment for commercial banking in our market area. The principal competitive factors in the markets for deposits and loans are interest rates and fee structures associated with the various products offered. We also compete through the efficiency, quality, range of services and products it provides, as well as the convenience provided by an extensive network of customer access channels including local branch offices, ATM’s, online banking, and telebanking centers. Access to the bank’s extensive network of customer access points is further enhanced by convenient hours including Saturday banking at selected branch locations and through the bank’s telebanking service center.

3

In attracting deposits and in our lending activities, we generally compete with other commercial banks, savings associations, credit unions, mortgage banking firms, consumer finance companies, securities brokerage firms, mutual funds and insurance companies and other financial institutions. Many of these institutions have greater available resources than us.

Available InformationWe maintain an internet website at www.hancockbank.com. We make available free of charge on the website our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and amendments to those reports filed with the Securities and Exchange Commission. Our Annual Report to Stockholders is also available on our website. These reports are made available on our website as soon as reasonably practical after the reports are filed with the Commission. Information on our website is not incorporated into this Form 10-K or our other securities filings and is not part of them.

SUPERVISION AND REGULATIONBank Holding Company RegulationGeneralThe Company is subject to extensive regulation by the Board of Governors of the Federal Reserve System (the Federal Reserve) pursuant to the Bank Holding Company Act of 1956, as amended (the Bank Holding Company Act). On January 26, 2002 the Company qualified as a financial holding company, giving it broader powers as discussed below. To date, the Company has exercised its powers as a financial holding company to acquire a non-controlling interest in a third party service provider for insurance companies and, in December 2003, acquired Magna Insurance Company. The Company also is required to file certain reports with, and otherwise complies with the rules and regulations of, the Securities and Exchange Commission (the Commission) under federal securities laws.

Federal RegulationThe Bank Holding Company Act generally prohibits a corporation owning a bank from engaging in activities other than banking, managing or controlling banks or other permissible subsidiaries. Acquiring or obtaining control of more than 5% of the voting shares of any company engaged in activities other than those activities determined by the Federal Reserve to be so closely related to banking, managing or controlling banks as to be proper incident thereto is also prohibited. In determining whether a particular activity is permissible, the Federal Reserve considers whether the performance of the activity can reasonably be expected to produce benefits to the public that outweigh possible adverse effects. For example: making, acquiring or servicing loans; leasing personal property; providing certain investment or financial advice; performing certain data processing services; acting as agent or broker in selling credit life insurance, and performing certain insurance underwriting activities have all been determined by regulations of the Federal Reserve to be permissible activities. The Bank Holding Company Act does not place territorial limitations on permissible bank-related activities of bank holding companies. Despite prior approval, however, the Federal Reserve has the power to order a holding company or its subsidiaries to terminate any activity or its control of any subsidiary when it has reasonable cause to believe that continuation of such activity or control of such subsidiary constitutes a serious risk to the financial safety, soundness or stability of any bank subsidiary of that holding company.

The Bank Holding Company Act requires every bank holding company to obtain the prior approval of the Federal Reserve: (1) before it may acquire ownership or control of any voting shares of any bank if, after such acquisition, such bank holding company will own or control more than 5% of the voting shares of such bank, (2) before it or any of its subsidiaries other than a bank may acquire all of the assets of a bank, (3) before it may merge with any other bank holding company, or (4) before it may engage in permissible non-banking activities. In reviewing a proposed acquisition, the Federal Reserve considers financial, managerial and competitive aspects. The future prospects of the companies and banks concerned and the convenience and needs of the community to be served must also be considered. The Federal Reserve also reviews the indebtedness to be incurred by a bank holding company in connection with the proposed acquisition to ensure that the holding company can service such indebtedness without adversely affecting the capital requirements of the holding company or its subsidiaries. The Bank Holding Company Act further requires that consummation of approved bank holding company or bank acquisitions or mergers must be delayed for a period of not less than 15 or more than 30 days following the date of approval. During such 15 to 30-day period, complaining parties may obtain a review of the Federal Reserve’s order granting its approval by filing a petition in the appropriate United States Court of Appeals petitioning that the order be set aside.

4

On November 12, 1999, President Clinton signed into law the Gramm-Leach-Bliley Act of 1999 (the “Financial Services Modernization Act”). The Financial Services Modernization Act repeals the two affiliation provisions of the Glass-Steagall Act: Section 20, which restricted the affiliation of Federal Reserve Member Banks with firms “engaged principally” in specified securities activities; and Section 32, which restricts officer, director, or employee interlocks between a member bank and any company or person “primarily engaged” in specified securities activities. In addition, the Financial Services Modernization Act also contains provisions that expressly preempt any state law restricting the establishment of financial affiliations, primarily related to insurance. The general effect of the law is to establish a comprehensive framework to permit affiliations among qualified bank holding companies, commercial banks, insurance companies, securities firms, and other financial service providers by revising and expanding the Bank Holding Company Act framework to permit a holding company system to engage in a full range of financial activities through a new entity known as a Financial Holding Company. “Financial activities” is broadly defined to include not only banking, insurance, and securities activities, but also merchant banking and additional activities that the Federal Reserve, in consultation with the Secretary of the Treasury, determines to be financial in nature, incidental to such financial activities, or complementary activities that do not pose a substantial risk to the safety and soundness of depository institutions or the financial system generally.

Generally, the Financial Services Modernization Act:

o Repeals historical restrictions on, and eliminates many federal and state law barriers to, affiliations among banks, securities firms, insurance companies, and other financial service providers;

o Provides a uniform framework for the functional regulation of the activities of banks, savings institutions, and their holding companies;

o Broadens the activities that may be conducted by national banks, banking subsidiaries of bank holding companies, and their financial subsidiaries;

o Provides an enhanced framework for protecting the privacy of consumer information;

o Adopts a number of provisions related to the capitalization, membership, corporate governance, and other measures designed to modernize the Federal Home Loan Bank system;

o Modifies the laws governing the implementation of the Community Reinvestment Act ("CRA"); and

o Addresses a variety of other legal and regulatory issues affecting both day-to-day operations and long-term activities of financial institutions.

The Financial Services Modernization Act requires that each bank subsidiary of a financial holding company be well capitalized and well managed as determined by the subsidiary bank’s principal regulator. To be considered well managed, the bank must have received at least a satisfactory composite rating and a satisfactory management rating at its last examination. To be well capitalized, the bank must have a leverage capital ratio of 5%, a Tier 1 Risk-based capital ratio of 6% and a total risk-based capital ratio of 10%. These ratios are discussed further below. In the event a financial holding company becomes aware that a subsidiary bank ceases to be well capitalized or well managed, it must notify the Federal Reserve and enter into an agreement to cure such condition. The consequences of a failure to cure such condition are that the Federal Reserve Board may order divestiture of the bank. Alternatively, a financial holding company may comply with such order by ceasing to engage in the financial holding company activities that are unrelated to banking or otherwise impermissible for a bank holding company.

5

The Federal Reserve has adopted capital adequacy guidelines for use in its examination and regulation of bank holding companies and financial holding companies. The regulatory capital of a bank holding company or financial holding company under applicable federal capital adequacy guidelines is particularly important in the Federal Reserve’s evaluation of a holding company and any applications by the bank holding company to the Federal Reserve. If regulatory capital falls below minimum guideline levels, a financial holding company may lose its status as a financial holding company and a bank holding company or bank may be denied approval to acquire or establish additional banks or non-bank businesses or to open additional facilities. In addition, a financial institution’s failure to meet minimum regulatory capital standards can lead to other penalties, including termination of deposit insurance or appointment of a conservator or receiver for the financial institution. There are two measures of regulatory capital presently applicable to bank holding companies, (1) risk-based capital and (2) leverage capital ratios.

The Federal Reserve rates bank holding companies by a component and composite 1-5 rating system. This system is designed to help identify institutions, which require special attention. Financial institutions are assigned ratings based on evaluation and rating of their financial condition and operations. Components reviewed include capital adequacy, asset quality, management capability, the quality and level of earnings, the adequacy of liquidity and sensitivity to interest rate fluctuations.

The leverage ratios adopted by the Federal Reserve require all but the most highly rated bank holding companies to maintain Tier 1 Capital at 4% of total assets. Certain bank holding companies having a composite 1 rating and not experiencing or anticipating significant growth may satisfy the Federal Reserve guidelines by maintaining Tier 1 Capital of at least 3% of total assets. Tier 1 Capital for bank holding companies includes: stockholders’ equity, minority interest in equity accounts of consolidated subsidiaries and qualifying perpetual preferred stock. In addition, Tier 1 Capital excludes goodwill and other disallowed intangibles. The Company’s leverage capital ratio at December 31, 2006 was 8.63% and 7.85% at December 31, 2005.

The risk-based capital guidelines are designed to make regulatory capital requirements more sensitive to differences in risk profiles among banks and bank holding companies, to account for off-balance sheet exposure and to minimize disincentives for holding liquid assets. Under the risk-based capital guidelines, assets are assigned to one of four risk categories: 0%, 20%, 50% and 100%. As an example, U.S. Treasury securities are assigned to the 0% risk category while most categories of loans are assigned to the 100% risk category. A two-step process determines the risk weight of off-balance sheet items such as standby letters of credit. First, the amount of the off-balance sheet item is multiplied by a credit conversion factor of either 0%, 20%, 50% or 100%. The result is then assigned to one of the four risk categories. At December 31, 2006, the Company’s off-balance sheet items aggregated $1.0 billion; however, after the credit conversion these items represented $226.8 million of balance sheet equivalents.

The primary component of risk-based capital is Tier 1 Capital, which for the Company is essentially equal to common stockholders’ equity, less goodwill and other intangibles. Tier 2 Capital, which consists primarily of the excess of any perpetual preferred stock, mandatory convertible securities, subordinated debt and general allowances for loan losses, is a secondary component of risk-based capital. The risk-weighted asset base is equal to the sum of the aggregate dollar values of assets and off-balance sheet items in each risk category, multiplied by the weight assigned to that category. A ratio of Tier 1 Capital to risk-weighted assets of at least 4% and a ratio of Total Capital (Tier 1 and Tier 2) to risk-weighted assets of at least 8% must be maintained by bank holding companies. At December 31, 2006, the Company’s Tier 1 and Total Capital ratios were 12.46% and 13.60%, respectively. At December 31, 2005, the Company’s Tier 1 and Total Capital ratios were 11.47% and 12.73%, respectively.

The prior approval of the Federal Reserve must be obtained before the Company may acquire substantially all the assets of any bank, or ownership or control of any voting shares of any bank, if, after such acquisition, it would own or control, directly or indirectly, more than 5% of the voting shares of such bank. In no case, however, may the Federal Reserve approve an acquisition of any bank located outside Mississippi unless such acquisition is specifically authorized by the laws of the state in which the bank to be acquired is located. The banking laws of Mississippi presently permit out-of-state banking organizations to acquire Mississippi banking organizations, provided the out-of-state banking organization’s home state grants similar privileges to banking organizations in Mississippi. In addition, Mississippi banking organizations were granted similar powers to acquire certain out-of-state financial institutions pursuant to the Interstate Bank Branching Act, which was adopted in 1996.

6

With the passage of The Interstate Banking and Branching Efficiency Act of 1994, adequately capitalized and managed bank holding companies are permitted to acquire control of banks in any state, subject to federal regulatory approval, without regard to whether such a transaction is prohibited by the laws of any state. Beginning June 1, 1997, federal banking regulators may approve merger transactions involving banks located in different states, without regard to laws of any state prohibiting such transactions; except that, mergers may not be approved with respect to banks located in states that, before June 1, 1997, enacted legislation prohibiting mergers by banks located in such state with out-of-state institutions. Federal banking regulators may permit an out-of-state bank to open new branches in another state if such state has enacted legislation permitting interstate branching. The legislation further provides that a bank holding company may not, following an interstate acquisition, control more than 10% of nationwide insured deposits or 30% of deposits in the relevant state. States have the right to adopt legislation to lower the 30% limit. Additional provisions require that interstate activities conform to the Community Reinvestment Act.

The Company is required to give the Federal Reserve prior written notice of any purchase or redemption of its outstanding equity securities if the gross consideration for the purchase or redemption, when combined with the net consideration paid for all such purchases or redemptions during the preceding 12 months, is equal to 10% or more of the Company’s consolidated net worth. The Federal Reserve may disapprove such a transaction if it determines that the proposal constitutes an unsafe or unsound practice, would violate any law, regulation, Federal Reserve order or directive or any condition imposed by, or written agreement with, the Federal Reserve.

In November 1985, the Federal Reserve adopted its Policy Statement on Cash Dividends Not Fully Covered by Earnings (the Policy Statement). The Policy Statement sets forth various guidelines that the Federal Reserve believes that a bank holding company should follow in establishing its dividend policy. In general, the Federal Reserve stated that bank holding companies should pay dividends only out of current earnings. It also stated that dividends should not be paid unless the prospective rate of earnings retention by the holding company appears consistent with its capital needs, asset quality and overall financial condition.

The Company is a legal entity separate and distinct from the Banks. There are various restrictions that limit the ability of the Banks to finance, pay dividends or otherwise supply funds to the Company or other affiliates. In addition, subsidiary banks of holding companies are subject to certain restrictions on any extension of credit to the bank holding company or any of its subsidiaries, on investments in the stock or other securities thereof and on the taking of such stock or securities as collateral for loans to any borrower. Further, a bank holding company and its subsidiaries are prohibited from engaging in certain tie-in arrangements in connection with extensions of credit, or leases or sales of property or furnishing of services.

Bank RegulationThe operations of the Banks are subject to state and federal statutes applicable to state banks and the regulations of the Federal Reserve and the FDIC, to the extent states banks are granted parity with national banks. Such statutes and regulations relate to, among other things, required reserves, investments, loans, mergers and consolidations, issuance of securities, payment of dividends, establishment of branches and other aspects of the Banks’ operations.

Hancock Bank MS is subject to regulation and periodic examinations by the FDIC and the State of Mississippi Department of Banking and Consumer Finance. Hancock Bank LA is subject to regulation and periodic examinations by the FDIC and the Office of Financial Institutions, State of Louisiana. Hancock Bank FL is subject to regulation and periodic examinations by the FDIC and the Florida Department of Financial Services. These regulatory authorities examine such areas as reserves, loan and investment quality, management policies, procedures and practices and other aspects of operations. These examinations are designed for the protection of the Banks’ depositors, rather than their stockholders. In addition to these regular examinations, the Company and the Banks must furnish periodic reports to their respective regulatory authorities containing a full and accurate statement of their affairs.

As a result of the enactment of the Financial Institutions Reform, Recovery, and Enforcement Act of 1989 (FIRREA), a financial institution insured by the FDIC can be held liable for any losses incurred by, or reasonably expected to be incurred by, the FDIC in connection with (1) the default of a commonly controlled FDIC-insured financial institution or (2) any assistance provided by the FDIC to a commonly controlled financial institution in danger of default.

7

The Banks are members of the FDIC, and their deposits are insured as provided by law by the Bank Insurance Fund (BIF). On December 19, 1991, the Federal Deposit Insurance Corporation Improvement Act of 1991 (FDICIA) was enacted. The Federal Deposit Insurance Act, as amended by Section 302 of FDICIA, calls for risk-related deposit insurance assessment rates. The risk classification of an institution will determine its deposit insurance premium. Assignment to one of three capital groups, coupled with assignment to one of three supervisory sub-groups, determines which of the nine risk classifications is appropriate for an institution.

Effective in the first quarter of 1996, the FDIC lowered banks’ deposit insurance premiums from 4 to 31 cents per hundred dollars in insured deposits to a rate of 0 to 27 cents. The Banks have received a risk classification of 1A for assessment purposes. In 1997 an assessment for the Financing Corporation’s debt service was added to the FDIC quarterly premium payment. That assessment averaged 1.3 cents per hundred dollars of insured deposits during 2006 and 1.2 (annualized) for the first quarter of 2007. Total assessments paid to the FDIC amounted to $614.6 thousand in 2006.

Under the provisions of the Federal Deposit Insurance Reform Act of 2005, we received a one-time FDIC assessment credit of $3.2 million to be used against future deposit insurance assessments. This credit is not reflected in the accompanying consolidated financial statements. It will be recognized as an offset in future years against the FDIC assessments.

In general, FDICIA subjects banks and bank holding companies to significantly increased regulation and supervision. FDICIA increased the borrowing authority of the FDIC in order to recapitalize the BIF, and the future borrowings are to be repaid by increased assessments on FDIC member banks. Other significant provisions of FDICIA require a new regulatory emphasis linking supervision to bank capital levels. Also, federal banking regulators are required to take prompt regulatory action with respect to depository institutions that fall below specified capital levels and to draft non-capital regulatory measures to assure bank safety.

FDICIA contains a “prompt corrective action” section intended to resolve problem institutions at the least possible long-term cost to the deposit insurance funds. Pursuant to this section, the federal banking agencies are required to prescribe a leverage limit and a risk-based capital requirement indicating levels at which institutions will be deemed to be “well capitalized,” “adequately capitalized,” “undercapitalized,” “significantly undercapitalized” and “critically undercapitalized.” In the case of a depository institution that is “critically undercapitalized” (a term defined to include institutions which still have positive net worth); the federal banking regulators are generally required to appoint a conservator or receiver.

FDICIA further requires regulators to perform annual on-site bank examinations, places limits on real estate lending and tightens audit requirements. The new legislation eliminated the “too big to fail” doctrine, which protects uninsured deposits of large banks, and restricts the ability of undercapitalized banks to obtain extended loans from the Federal Reserve Board discount window. FDICIA also imposes new disclosure requirements relating to fees charged and interest paid on checking and deposit accounts. Most of the significant changes brought about by FDICIA required new regulations.

In addition to regulating capital, the FDIC has broad authority to prevent the development or continuance of unsafe or unsound banking practices. Pursuant to this authority, the FDIC has adopted regulations that restrict preferential loans and loan amounts to “affiliates” and “insiders” of banks, require banks to keep information on loans to major stockholders and executive officers and bar certain director and officer interlocks between financial institutions. The FDIC is also authorized to approve mergers, consolidations and assumption of deposit liability transactions between insured banks and between insured banks and uninsured banks or institutions to prevent capital or surplus diminution in such transactions where the resulting, continuing or assumed bank is an insured nonmember state bank, like Hancock Bank MS and Hancock Bank LA.

Although Hancock Bank MS, Hancock Bank LA and Hancock Bank FL are not members of the Federal Reserve System, they are subject to Federal Reserve regulations that require the Banks to maintain reserves against transaction accounts (primarily checking accounts). Because reserves generally must be maintained in cash or in noninterest-bearing accounts, the effect of the reserve requirements is to increase the cost of funds for the Banks. The Federal Reserve regulations currently require that reserves be maintained against net transaction accounts in the amount of 3% of the aggregate of such accounts up to $40.5 million, or, if the aggregate of such accounts exceeds $40.5 million, $1.215 million plus 10% of the total in excess of $40.5 million. This regulation is subject to an exemption from reserve requirements on a limited amount of an institution’s transaction accounts.

8

The Financial Services Modernization Act also permits national banks, and through state parity statutes, state banks, to engage in expanded activities through the formation of financial subsidiaries. A state bank may have a subsidiary engaged in any activity authorized for state banks directly or any financial activity, except for insurance underwriting, insurance investments, real estate investment or development, or merchant banking, which may only be conducted through a subsidiary of a Financial Holding Company. Financial activities include all activities permitted under new sections of the Bank Holding Company Act or permitted by regulation.

A state bank seeking to have a financial subsidiary, and each of its depository institution affiliates, must be “well-capitalized” and “well-managed.” The total assets of all financial subsidiaries may not exceed the lesser of 45% of a bank’s total assets, or $50 billion. A state bank must exclude from its assets and equity all equity investments, including retained earnings, in a financial subsidiary. The assets of the subsidiary may not be consolidated with the bank’s assets. The bank must also have policies and procedures to assess financial subsidiary risk and protect the bank from such risks and potential liabilities.

The Financial Services Modernization Act also includes a new section of the Federal Deposit Insurance Act governing subsidiaries of state banks that engage in “activities as principal that would only be permissible” for a national bank to conduct in a financial subsidiary. It expressly preserves the ability of a state bank to retain all existing subsidiaries. Because Mississippi permits commercial banks chartered by the state to engage in any activity permissible for national banks, the Bank will be permitted to form subsidiaries to engage in the activities authorized by the Financial Services Modernization Act. In order to form a financial subsidiary, a state bank must be well-capitalized, and the state bank would be subject to the same capital deduction, risk management and affiliate transaction rules as applicable to national banks.

In 2001, the Uniting and Strengthening America by Providing Appropriate Tools Required to Intercept and Obstruct Terrorism Act of 2001 (USA Patriot Act) was signed into law. The USA Patriot Act broadened the application of anti-money laundering regulations to apply to additional types of financial institutions, such as broker-dealers, and strengthened the ability of the U.S. Government to detect and prosecute international money laundering and the financing of terrorism. The principal provisions of Title III of the USA Patriot Act require that regulated financial institutions, including state member banks: (i) establish an anti-money laundering program that includes training and audit components; (ii) comply with regulations regarding the verification of the identity of any person seeking to open an account; (iii) take additional required precautions with non-U.S. owned accounts; and (iv) perform certain verification and certification of money laundering risk for their foreign correspondent banking relationships. The USA Patriot Act also expanded the conditions under which funds in a U.S. interbank account may be subject to forfeiture and increased the penalties for violation of anti-money laundering regulations. Failure of a financial institution to comply with the USA Patriot Act’s requirements could have serious legal and reputational consequences for the institution. The Bank has adopted policies, procedures and controls to address compliance with the requirements of the USA Patriot Act under the existing regulations and will continue to revise and update its policies, procedures and controls to reflect changes required by the USA Patriot Act and implementing regulations.

In July 2002, Congress enacted the Sarbanes-Oxley Act of 2002, which addresses, among other issues, corporate governance, auditing and accounting, executive compensation, and enhanced and timely disclosure of corporate information. Section 404 of the Sarbanes-Oxley Act requires the Company to include in its Annual Report, a report stating management’s responsibility to establish and maintain adequate internal control over financial reporting and management’s conclusion on the effectiveness of the internal controls at year end. Additionally, the Company’s independent registered public accounting firm is required to attest to and report on management’s evaluation of internal control over financial reporting.

9

SummaryThe foregoing is a brief summary of certain statutes, rules and regulations affecting the Company and the Banks. It is not intended to be an exhaustive discussion of all the statutes and regulations having an impact on the operations of such entities.

We do not believe that the Financial Services Modernization Act will have a material adverse effect on our operations in the near-term. However, to the extent that it permits holding companies, banks, securities firms, and insurance companies to affiliate, the financial services industry may experience further consolidation. The Financial Services Modernization Act is intended to grant to community banks certain powers as a matter of right that larger institutions have accumulated on an ad hoc basis. Nevertheless, this act may have the result of increasing the amount of competition that the Company and the Banks face from larger institutions and other types of companies offering financial products, some of which may have substantially more financial resources than us.

Finally, additional bills may be introduced in the future in the United States Congress and state legislatures to alter the structure, regulation and competitive relationships of financial institutions. It cannot be predicted whether and what form any of these proposals will be adopted or the extent to which the business of the Company and the Banks may be affected thereby.

Effect of Governmental PoliciesThe difference between the interest rate paid on deposits and other borrowings and the interest rate received on loans and securities comprise most of a bank’s earnings. In order to mitigate the interest rate risk inherent in the industry, the banking business is becoming increasingly dependent on the generation of fee and service charge revenue.

The earnings and growth of a bank will be affected by both general economic conditions and the monetary and fiscal policy of the United States Government and its agencies, particularly the Federal Reserve. The Federal Reserve sets national monetary policy such as seeking to curb inflation and combat recession. This is accomplished by its open-market operations in United States government securities, adjustments in the amount of reserves that financial institutions are required to maintain and adjustments to the discount rates on borrowings and target rates for federal funds transactions. The actions of the Federal Reserve in these areas influence the growth of bank loans, investments and deposits and also affect interest rates on loans and deposits. The nature and timing of any future changes in monetary policies and their potential impact on the Company cannot be predicted.

Impact of InflationOur non-interest income and expenses can be affected by increasing rates of inflation; however, unlike most industrial companies, the assets and liabilities of financial institutions such as the Banks are primarily monetary in nature. Interest rates, therefore, have a more significant impact on the Banks’ performance than the effect of general levels of inflation on the price of goods and services.

ITEM 1A. RISK FACTORSMaking or continuing an investment in securities issued by us, including our common stock, involves certain risks that you should carefully consider. The risks and uncertainties described below are not the only risks that may have a material adverse effect on us. Additional risks and uncertainties also could adversely affect our business and results of operations. If any of the following risks actually occur, our business, financial condition or results of operations could be negatively affected, the market price for your securities could decline, and you could lose all or a part of your investment. Further, to the extent that any of the information contained in this Annual Report on Form 10-K constitutes forward-looking statements, the risk factors set forth below also are cautionary statements identifying important factors that could cause our actual results to differ materially from those expressed in any forward-looking statements made by or on behalf of us.

10

We may be vulnerable to certain sectors of the economy.A portion of our loan portfolio is secured by real estate. If the economy deteriorated and depressed real estate values beyond a certain point, that collateral value of the portfolio and the revenue stream from those loans could come under stress and possibly require additional provision to the allowance for loan losses. Our ability to dispose of foreclosed real estate at prices above the respective carrying values could also be impinged, causing additional losses.

General economic conditions in the areas where our operations or loans are concentrated may adversely affect our customers' ability to meet their obligations.

A sudden or severe downturn in the economy in the geographic markets served by us in the states of Mississippi, Louisiana, Alabama, and Florida may affect the ability of our customers to meet loan payment obligations on a timely basis. The local economic conditions in these areas have a significant impact on our commercial, real estate, and construction loans, the ability of borrowers to repay these loans and the value of the collateral securing such loans. Changes resulting in adverse economic conditions of our market areas could negatively impact the financial results of our banking operations and our profitability. Additionally, adverse economic changes may cause customers to withdraw deposit balances, thereby causing a strain on our liquidity.

We are subject to a risk of rapid and significant changes in market interest rates.Our assets and liabilities are primarily monetary in nature, and as a result we are subject to significant risks tied to changes in interest rates. Our ability to operate profitably is largely dependent upon net interest income. Unexpected movement in interest rates markedly changing the slope of the current yield curve could cause our net interest margins to decrease, subsequently decreasing net interest income. In addition, such changes could adversely affect the valuation of our assets and liabilities.

At present our one-year interest rate sensitivity position is moderately asset sensitive, such that a gradual increase in interest rates during the next twelve months should not have a significant impact on net interest income during that period. However, as with most financial institutions, our results of operations are affected by changes in interest rates and our ability to manage this risk. The difference between interest rates charged on interest-earning assets and interest rates paid on interest-bearing liabilities may be affected by changes in market interest rates, changes in relationships between interest rate indices, and/or changes in the relationships between long-term and short-term market interest rates. A change in this difference might result in an increase in interest expense relative to interest income, or a decrease in our interest rate spread.

Certain changes in interest rates, inflation, or the financial markets could affect demand for our products and our ability to deliver products efficiently.

Loan originations, and potentially loan revenues, could be adversely impacted by sharply rising interest rates. Conversely, sharply falling rates could increase prepayments within our securities portfolio lowering interest earnings from those investments. An underperforming stock market could reduce brokerage transactions, therefore reducing investment brokerage revenues; in addition, wealth management fees associated with managed securities portfolios could also be adversely affected. An unanticipated increase in inflation could cause our operating costs related to salaries & benefits, technology, and supplies to increase at a faster pace than revenues.

The fair market value of our securities portfolio and the investment income from these securities also fluctuate depending on general economic and market conditions. In addition, actual net investment income and/or cash flows from investments that carry prepayment risk, such as mortgage-backed and other asset-backed securities, may differ from those anticipated at the time of investment as a result of interest rate fluctuations.

Changes in the policies of monetary authorities and other government action could adversely affect our profitability.

The results of operations are affected by credit policies of monetary authorities, particularly the Federal Reserve Board. The instruments of monetary policy employed by the Federal Reserve Board include open market operations in U.S. government securities, changes in the discount rate or the federal funds rate on bank borrowings and changes in reserve requirements against bank deposits. In view of changing conditions in the national economy and in the money markets, particularly in light of the continuing threat of terrorist attacks and the current military operations in the Middle East, we cannot predict possible future changes in interest rates, deposit levels, loan demand or our business and earnings. Furthermore, the actions of the United States government and other governments in responding to such terrorist attacks or the military operations in the Middle East may result in currency fluctuations, exchange controls, market disruption and other adverse effects.

11

Natural disasters could affect our ability to operate.Our market areas are susceptible to hurricanes. Natural disasters, such as hurricanes, can disrupt our operations, result in damage to properties and negatively affect the local economies in which we operate.

We cannot predict whether or to what extent damage caused by future hurricanes will affect our operations or the economies in our market areas, but such weather events could cause a decline in loan originations, a decline in the value or destruction of properties securing the loans and an increase in the risk of delinquencies, foreclosures or loan losses.

InsuranceAs a result of Hurricane Katrina and other storms, windstorm insurance costs have increased during the past year regionally, and have also increased for all of our properties. Currently, we have total windstorm coverage on our Mississippi branches with property values of $30.4 million subject to a 2% deductible per location. We also have separate flood coverage on the branches that flooded during Hurricane Katrina. Our corporate headquarters located in downtown Gulfport, MS has a $15 million deductible and the branches have a $100,000 deductible per occurrence for fire and lightning losses. We also maintain business interruption insurance. We rely on our own liquidity during the hurricane season to cover two to three months of overhead costs, and we maintain additional capital to satisfy any emergency repairs before insurance recoveries are received. The future availability and costs of windstorm and flood insurance are unknown, but this factor may result in additional insurance costs to us.

Greater loan losses than expected may adversely affect our earnings.We as lender are exposed to the risk that our customers will be unable to repay their loans in accordance with their terms and that any collateral securing the payment of their loans may not be sufficient to assure repayment. Credit losses are inherent in the business of making loans and could have a material adverse effect on our operating results. Our credit risk with respect to our real estate and construction loan portfolio will relate principally to the creditworthiness of corporations and the value of the real estate serving as security for the repayment of loans. Our credit risk with respect to our commercial and consumer loan portfolio will relate principally to the general creditworthiness of businesses and individuals within our local markets.

We make various assumptions and judgments about the collectibility of our loan portfolio and provide an allowance for estimated loan losses based on a number of factors. We believe that our current allowance for loan losses is adequate. However, if our assumptions or judgments prove to be incorrect, the allowance for loan losses may not be sufficient to cover actual loan losses. We may have to increase our allowance in the future in response to the request of one of our primary banking regulators, to adjust for changing conditions and assumptions, or as a result of any deterioration in the quality of our loan portfolio. The actual amount of future provisions for loan losses cannot be determined at this time and may vary from the amounts of past provisions.

The projected benefit obligations of our pension plan exceed the fair market value of the Plan's assets.Investments in the portfolio of our pension plan may not provide adequate returns to fully fund benefits as they come due, thus causing higher annual plan expenses and requiring additional contributions by us.

12

We may need to rely on the financial markets to provide needed capital.Our stock is listed and traded on the NASDAQ Global Select. Although we anticipate that our capital resources will be adequate for the foreseeable future to meet our capital requirements, at times we may depend on the liquidity of the NASDAQ market to raise equity capital. If the market should fail to operate, or if conditions in the capital markets are adverse, we may be constrained in raising capital. We maintain a consistent analyst following; therefore, downgrades in our prospects by an analyst(s) may cause our stock price to fall and significantly limit our ability to access the markets for additional capital requirements. Should these risks materialize, our ability to further expand our operations through internal growth may be limited.

We are subject to regulation by various Federal and State entities.We are subject to the regulations of the Securities and Exchange Commission (“SEC”), the Federal Reserve Board, the Federal Deposit Insurance Corporation, the Mississippi Department of Banking and Consumer Finance, the Louisiana Office of Financial Institutions, the Florida Office of Financial Regulation, the Alabama Banking Department and the Mississippi Department of Insurance. New regulations issued by these agencies may adversely affect our ability to carry on our business activities. We are subject to various Federal and State laws and certain changes in these laws and regulations may adversely affect our operations. Non compliance with certain of these regulations may impact our business plans, including ability to branch, offer certain products, or execute existing or planned business strategies.

We are also subject to the accounting rules and regulations of the SEC and the Financial Accounting Standards Board. Changes in accounting rules could adversely affect the reported financial statements or our results of operations and may also require extraordinary efforts or additional costs to implement.

Any of these laws or regulations may be modified or changed from time to time, and we cannot be assured that such modifications or changes will not adversely affect us.

We engage in acquisitions of other businesses from time to time.On occasion, we will engage in acquisitions of other businesses. Inability to successfully integrate acquired businesses can pose varied risks to us, including customer and employee turnover, thus increasing the cost of operating the new businesses. The acquired companies may also have legal contingencies, beyond those that we are aware of, that could result in unexpected costs. Moreover, there can be no assurance that acquired businesses will achieve prior or planned results of operations.

We are subject to industry competition which may have an impact upon our success.Our profitability depends on our ability to compete successfully. We operate in a highly competitive financial services environment. Certain competitors are larger and may have more resources than we do. We face competition in our regional market areas from other commercial banks, savings and loan associations, credit unions, internet banks, finance companies, mutual funds, insurance companies, brokerage and investment banking firms, and other financial intermediaries that offer similar services. Some of our nonbank competitors are not subject to the same extensive regulations that govern us or the Bank and may have greater flexibility in competing for business.

Another competitive factor is that the financial services market, including banking services, is undergoing rapid changes with frequent introductions of new technology-driven products and services. Our future success may depend, in part, on its ability to use technology competitively to provide products and services that provide convenience to customers and create additional efficiencies in our operations.

Future issuances of additional securities could result in dilution of shareholders' ownership.We may determine from time to time to issue additional securities to raise additional capital, support growth, or to make acquisitions. Further, we may issue stock options or other stock grants to retain and motivate our employees. Such issuances of our securities will dilute the ownership interests of our shareholders.

13

Anti-takeover laws and certain agreements and charter provisions may adversely affect share value.Certain provisions of state and federal law and our articles of incorporation may make it more difficult for someone to acquire control of us. Under federal law, subject to certain exemptions, a person, entity, or group must notify the federal banking agencies before acquiring 10% or more of the outstanding voting stock of a bank holding company, including our shares. Banking agencies review the acquisition to determine if it will result in a change of control. The banking agencies have 60 days to act on the notice, and take into account several factors, including the resources of the acquirer and the antitrust effects of the acquisition. There also are Mississippi statutory provisions and provisions in our articles of incorporation that may be used to delay or block a takeover attempt. As a result, these statutory provisions and provisions in our articles of incorporation could result in our being less attractive to a potential acquirer.

Securities issued by us, including our common stock, are not FDIC insured.Securities issued by us, including our common stock, are not savings or deposit accounts or other obligations of any bank and are not insured by the FDIC, the Bank Insurance Fund, or any other governmental agency or instrumentality, or any private insurer, and are subject to investment risk, including the possible loss of principal.

ITEM 1B. UNRESOLVED STAFF COMMENTSNone

ITEM 2. PROPERTIESOur main office is located at One Hancock Plaza, in Gulfport, Mississippi.

We operate 149 banking and financial services offices and 131 automated teller machines across south Mississippi, Louisiana, south Alabama and the Florida Panhandle. We lease 69 of the 149 locations with the remainder being owned.

In addition to the above, Hancock Bank MS owns land and other properties acquired through foreclosures of loan collateral. The major item is approximately 3,700 acres of timberland in Hancock County, Mississippi, which Hancock Bank MS acquired by foreclosure in the 1930's.

ITEM 3. LEGAL PROCEEDINGSWe are party to various legal proceedings arising in the ordinary course of business. In the opinion of management, after consultation with legal counsel, all such matters are adequately covered by insurance or, if not so covered, are not expected to have a material adverse effect on our financial statements.

ITEM 4. SUBMISSION OF MATTERS TO A VOTE OF SECURITY HOLDERSThere were no matters submitted to a vote of security holders during the quarter ended December 31, 2006.

14

PART IIITEM 5. MARKET FOR THE REGISTRANT'S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIESMarket InformationOur common stock trades on the NASDAQ Stock Market under the symbol “HBHC” and is quoted in publications under “HancHd.” The following table sets forth the high and low sale prices of our common stock as reported on the NASDAQ Stock Market. These prices do not reflect retail mark-ups, mark-downs or commissions.

Cash

High Low Dividends

Sale Sale Paid

------------ ------------ --------------

2006

4th quarter $56.00 $50.85 $0.240

3rd quarter 56.79 49.71 0.240

2nd quarter 57.19 44.02 0.220

1st quarter 46.67 37.75 0.195

2005

4th quarter $39.90 $31.08 $0.195

3rd quarter 37.84 29.93 0.195

2nd quarter 34.87 28.25 0.165

1st quarter 34.20 30.25 0.165

There were 5,797 registered holders and approximately 5,500 unregistered holders of common stock of the Company at February 9, 2007 and 32,671,196 shares issued. On February 9, 2007, the high and low sale prices of the Company’s common stock as reported on the NASDAQ Stock Market were $47.25 and $45.94, respectively. The principal source of funds to the Company to pay cash dividends is the dividends received from Hancock Bank, Gulfport, Mississippi and Hancock Bank of Louisiana, Baton Rouge, Louisiana and Hancock Bank of Florida, Tallahassee, Florida. Consequently, dividends are dependent upon earnings, capital needs, regulatory policies and statutory limitations affecting the banks. Federal and state banking laws and regulations restrict the amount of dividends and loans a bank may make to its parent company. Dividends paid to the Company by Hancock Bank are subject to approval by the Commissioner of Banking and Consumer Finance of the State of Mississippi and those paid by Hancock Bank of Louisiana are subject to approval by the Commissioner for Financial Institutions of the State of Louisiana. Dividends paid by Hancock Bank of Florida are subject to approval by the Florida Department of Financial Services. The Company’s management does not expect regulatory restrictions to affect its policy of paying cash dividends. Although no assurance can be given that Hancock Holding Company will continue to declare and pay regular quarterly cash dividends on its common stock, the Company has paid regular cash dividends since 1937.

15

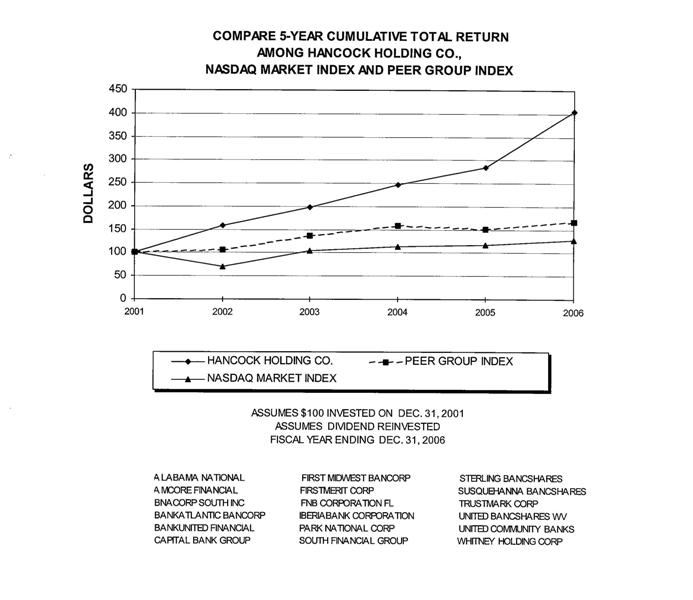

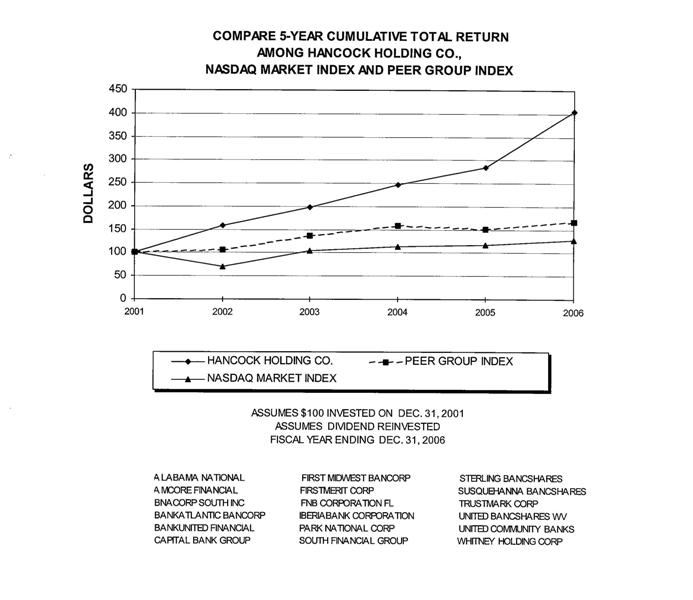

Stock Performance Graph

The following is a line graph presentation comparing cumulative, five-year shareholder returns on an indexed basis with a performance indicator of the overall stock market and an index of peer companies selected by us. The broad market index used in the graph is the NASDAQ Market Index. The peer group index is a group of financial institutions in the Southeast with approximate market capitalization ranging from $1.0 billion to $2.0 billion; a list of the Companies included in the index follows the graph.

16

16

Issuer Purchases of Equity SecuritiesThe following table provides information with respect to purchases made by the issuer or any affiliated purchaser of the issuer’s equity securities.

(a) (b) (c) (d)

Total number of Maximum number

shares purchased of shares

Total number as a part of publicly that may yet be

of shares or Average Price announced plans purchased under

units purchased Paid per Share or programs (1) Plans or Programs

----------------- ----------------- -------------------------- -------------------------

Oct. 1, 2006 - Oct. 31, 2006 - $ - - 1,545,378

Nov. 1, 2006 - Nov. 30, 2006 - - - 1,545,378

Dec. 1, 2006 - Dec. 31, 2006 - - - 1,545,378

----------------- ----------------- --------------------------

Total - $ - -

================= ================= ==========================

(1) The Company publicly announced its stock buy-back program on July 18, 2000.

17

ITEM 6. SELECTED FINANCIAL DATAThe following table sets forth certain selected historical consolidated financial data and should be read in conjunction with “Item 7. Management’s Discussion and Analysis of Financial Condition and results of Operations” and the consolidated Financial Statements and Notes thereto included elsewhere herein. The following information may not be deemed indicative of our future operating results.

At and For the Years Ended December 31,

------------------------------------------------------------------------

2006 2005 2004 2003 2002

------------- ------------- ------------- ------------ -------------

(Unaudited, in thousands)

Period-End Balance Sheet Data:

Securities $ 1,903,658 $ 1,959,261 $ 1,302,369 $ 1,278,049 $ 1,486,810

Short-term investments 222,439 410,226 150,261 11,288 47,257

Loans, net of unearned income 3,266,584 2,989,186 2,748,560 2,448,644 2,104,982

Total earning assets 5,392,680 5,358,673 4,201,191 3,737,981 3,639,049

Allowance for loan losses 46,772 74,558 40,682 36,750 34,740

Total assets 5,964,565 5,950,187 4,664,726 4,150,358 3,973,147

Total deposits 5,030,991 4,989,820 3,797,945 3,447,847 3,301,500

Short-term notes - - - 9,400 -

Long-term notes 258 50,266 50,273 50,428 51,020

Total preferred stockholders' equity - - - 37,067 37,069

Total common stockholders' equity 558,410 477,415 464,582 397,814 387,513

Average Balance Sheet Data:

Securities $ 2,228,822 $ 1,434,415 $ 1,345,350 $ 1,466,156 $ 1,493,574

Short-term investments 211,511 137,821 34,911 57,986 83,427

Loans, net of unearned income 3,062,222 2,883,020 2,599,561 2,238,245 1,961,299

Total earning assets 5,502,555 4,455,256 3,979,822 3,762,387 3,538,300

Allowance for loan losses 64,285 50,107 38,117 35,391 33,135

Total assets 6,031,800 4,931,030 4,424,334 4,111,949 3,857,698

Total deposits 5,069,427 4,001,426 3,602,734 3,407,205 3,174,946

Short-term notes 1,068 3,836 2,311 26 -

Long-term notes 13,278 50,275 50,312 50,677 51,299

Total preferred stockholders' equity - - 2,240 37,069 37,069

Total common stockholders' equity 513,656 475,701 447,384 396,034 388,821

18

At and For the Years Ended December 31,

---------------------------------------------------------------------

2006 2005 2004 2003 2002

----------- -------------- ------------- ------------ -----------

(Unaudited, in thousands)

Performance Ratios:

Return on average assets 1.69% 1.10% 1.39% 1.34% 1.32%

Return on average common equity 19.82% 11.36% 13.79% 13.88% 13.13%

Net interest margin (te)* 4.23% 4.40% 4.44% 4.45% 4.70%

Average loans to average deposits 60.41% 72.05% 72.16% 65.69% 61.77%

Noninterest income excluding storm-related insurance

gain, gain on sale of branches and credit card

merchant, and securities transactions,

as a percent of total revenue (te) 30.87% 31.86% 33.77% 30.40% 30.11%

Noninterest expense as a percent of total revenue (te)

before amortization of purchased intangibles,

storm-related insurance gain, gains on sale of

branches and credit card merchant, and

securities transactions 58.99% 58.82% 57.33% 57.83% 57.83%

Allowance for loan losses to period-end loans 1.43% 2.49% 1.48% 1.50% 1.65%

Non-performing assets to loans plus other real estate 0.13% 0.42% 0.40% 0.73% 0.84%

Allowance for loan losses to non-performing loans

and accruing loans 90 days past due 694.67% 195.50% 251.85% 169.73% 143.48%

Net charge-offs to average loans 0.23% 0.30% 0.48% 0.59% 0.91%

FTE employees (period-end) 1,848 1,735 1,767 1,734 1,790

Capital Ratios:

Common stockholders' equity to total assets 9.36% 8.02% 9.96% 9.59% 9.75%

Tier 1 leverage 8.63% 7.85% 8.97% 9.29% 9.19%

Tier 1 risk-based 12.46% 11.47% 12.39% 13.65% 14.88%

Total risk-based 13.60% 12.73% 13.58% 14.88% 16.11%

Income Data:

Interest income $ 344,330 $ 263,631 $ 226,774 $ 218,149 $ 230,781

Interest expense 119,863 74,819 57,270 57,961 72,053

Net interest income 224,467 188,812 169,504 160,188 158,728

Net interest income (te) 232,730 196,189 176,777 167,358 166,190

Provision for (reversal of) loan losses (20,762) 42,635 16,537 15,154 18,495

Noninterest income excluding storm-related insurance

gain, gains on sale of branches and credit card

merchant and securities transactions 103,918 91,738 84,860 73,089 71,589

Net storm-related items 5,084 6,584 - - -

Gains/(losses) on sales of securities, net (5,169) (53) 163 1,667 4

Gains on sales of branches - - 2,258 - -

Gain on sale of credit card merchant

services business - - 3,000 - -

Noninterest expense excluding amortization

of intangibles 198,591 169,349 153,006 139,060 137,508

Amortization of intangibles 2,125 2,194 1,945 1,148 750

Net income before income taxes 148,346 72,903 88,297 79,582 73,569

Net income 101,802 54,032 61,704 54,955 51,043

Net income available to common stockholders 101,802 54,032 61,704 52,302 48,390

*Tax Equivalent (te) amounts are calculated using a marginal federal income tax rate of 35%.

19

At and For the Years Ended December 31,

------------------------------------------------------------------------------------

2006 2005 2004 2003 2002

------------- ----------------- ---------------- --------------- --------------

Per Common Share Data: (Unaudited, in thousands except per share data)

Basic earnings per share $ 3.13 $ 1.67 $ 1.91 $ 1.70 $ 1.54

Diluted earnings per share $ 3.06 $ 1.64 $ 1.87 $ 1.64 $ 1.50

Cash dividends paid $ 0.895 $ 0.72 $ 0.58 $ 0.44 $ 0.40

Book value $ 17.09 $ 14.78 $ 14.32 $ 13.06 $ 12.55

Dividend payout ratio 28.59% 43.11% 30.37% 25.88% 25.97%

Weighted average number of shares outstanding

Basic 32,534 32,365 32,390 30,714 31,486

Diluted 33,304 32,966 33,052 33,410 34,084

Number of shares outstanding (period end) 32,666 32,301 32,440 30,455 30,887

Market data:

High closing price $ 57.19 $ 39.90 $ 34.83 $ 29.25 $ 25.19

Low closing price $ 37.75 $ 28.25 $ 25.00 $ 21.00 $ 13.78

Period-end closing price $ 52.84 $ 37.81 $ 33.46 $ 27.29 $ 22.33

Trading volume 27,275 22,404 11,572 11,410 18,812

20

ITEM 7. MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONSThe purpose of this discussion and analysis is to focus on significant changes and events in the financial condition and results of operations of Hancock Holding Company and its subsidiaries (Hancock) during 2006 and selected prior periods. This discussion and analysis is intended to highlight and supplement data and information presented elsewhere in this report, including the preceding consolidated financial statements and related notes. Certain information relating to prior years has been reclassified to conform to the current year’s presentation.

FORWARD-LOOKING STATEMENTSCongress passed the Private Securities Litigation Act of 1995 in an effort to encourage corporations to provide information about a company’s anticipated future financial performance. This act provides a safe harbor for such disclosure, which protects us from unwarranted litigation, if actual results are different from management expectations. This discussion and analysis contains forward-looking statements and reflects management’s current views and estimates of future economic circumstances, industry conditions, company performance and financial results. The words “may,” “should,” “expect,” “anticipate,” “intend,” “plan,” “continue,” “believe,” “seek,” “estimate” and similar expressions are intended to identify forward-looking statements. These forward-looking statements are subject to a number of factors and uncertainties, which could cause our actual results and experience to differ from the anticipated results and expectations, expressed in such forward-looking statements.