J. & W. Seligman & Co. Incorporated is a firm with a long tradition of investment expertise, offering a broad array of investment choices to help today’s investors seek their long-term financial goals.

Established in 1864, Seligman has a history of providing financial services marked not by fanfare, but rather by a quiet and firm adherence to financial prudence. While the world has changed dramatically in the 141 years since Seligman first opened its doors, the firm has continued to offer its clients high-quality investment solutions through changing times.

In the late 19th century, as the country grew, Seligman helped finance the westward expansion of the railroads, the construction of the Panama Canal, and the launching of urban transit systems. In the early 20th century, the firm helped fund the growing capital needs of new industries, including the nascent automobile and steel industries.

With the formation of Tri-Continental Corporation in 1929 — today, one of the nation’s largest diversified publicly-traded closed-end equity investment companies — Seligman began shifting its emphasis to investment management. In 1930, Seligman established what would be the first in an impressive lineup of mutual funds.

Seligman is proud of its distinctive past and of the traditional values that continue to shape the firm’s business decisions and investment judgment. While much has changed over the years, the firm’s commitment to providing prudent investment management that seeks to build wealth for clients over time is an enduring value that will continue to guide Seligman.

Table of Contents

| To The Shareholders | 1 |

| | |

| Interview With Your Portfolio Managers | 2 |

| | |

| Performance and Portfolio Overview | 5 |

| | |

| Understanding and Comparing Your Series’ Expenses | 11 |

| | |

| Portfolios of Investments | 13 |

| | |

| Statements of Assets and Liabilities | 18 |

| | |

| Statements of Operations | 20 |

| | |

| Statements of Changes in Net Assets | 21 |

| | |

| Notes to Financial Statements | 25 |

| | |

| Financial Highlights | 36 |

| | |

| Report of Independent Registered Public Accounting Firm | 48 |

| | |

| Trustees and Officers of the Trust | 49 |

| | |

| Additional Fund Information | back cover |

To The Shareholders

We are pleased to present the annual report for Seligman Municipal Series Trust, covering the fiscal year ended September 30, 2005. This report contains a discussion with your Portfolio Managers, as well as each Series’ investment results, financial statements, and portfolio of investments.

Thank you for your continued support of Seligman Municipal Series Trust. We look forward to serving your investment needs for many years to come.

By order of the Trustees,

William C. Morris

Chairman

Brian T. Zino

President

November 14, 2005

Manager | Shareholder Service Agent | Important Telephone Numbers |

| J. & W. Seligman & Co. | Seligman Data Corp. | (800) 221-2450 | Shareholder Services |

| Incorporated | 100 Park Avenue | (800) 445-1777 | Retirement Plan Services |

| 100 Park Avenue | New York, NY 10017 | (212) 682-7600 | Outside the United States |

| New York, NY 10017 | | (800) 622-4597 | 24-Hour Automated Telephone Access Service |

| | | | |

General Distributor | General Counsel | | |

| Seligman Advisors, Inc. | Sullivan & Cromwell LLP | | |

| 100 Park Avenue | | | |

| New York, NY 10017 | Independent Registered | | |

| | | | |

| | Deloitte & Touche LLP | | |

Interview With Your Portfolio Managers

Thomas G. Moles and Eileen A. Comerford

Q: | What market conditions and events materially affected the performance of the Series in Seligman Municipal Series Trust during the fiscal year ended September 30, 2005? |

| | |

A: | The Seligman Municipal Series Trust posted positive investment returns for the fiscal year ended September 30, 2005; however, results were comprised principally, if not wholly, of interest income rather than price return. Performance results were attributable to a constructive municipal market environment characterized by stable long-term municipal yields, rising short-term municipal yields, improving credit conditions and record-setting refunding activity. |

| | |

| | During the Series’ fiscal year, the Federal Open Market Committee increased the federal funds rate by two percentage points, which led to sharply higher short-term municipal yields. As yields at the front-end of the municipal yield curve rose, the prices of many of the Series’ shorter-maturity holdings declined, tempering positive investment results (in general, fixed-rate bond prices decline as interest rates increase). Subsequent to the close of the reporting period, the federal funds rate was increased by an additional 0.25%. |

| | |

| | The Series’ holdings of variable rate demand notes – the preferred investment vehicle for managing the Series’ cash flows – did benefit from the higher short-term yield environment, particularly given that cash balances over the past fiscal year, in general, have been maintained at higher percentages than they have historically been. |

| | |

| | The US economy continued to expand over the past 12 months, leading to considerable improvement in state and local government finances. The Rockefeller Institute of Government reports that state tax revenues for the second quarter of 2005 rose 13.3% compared with the same period last year. Notably, most increases in tax receipts were achieved without meaningful hikes in tax rates. Further, tax receipts rose for personal, corporate, and sales taxes with corporate taxes experiencing the strongest growth. States and municipalities have made significant progress in restoring fiscal balance, leading to an overall strengthening in credit trends. Still, substantial challenges remain, including the escalating costs of Medicaid programs, public pension liabilities and education funding. In addition, the failure of many states to adequately address structural imbalances poses a risk to future financial stability. |

| | |

| | Year-to-date, the favorable interest rate environment continued to support the issuance of refunding bonds. In general, refunding bonds are issued to retire outstanding, higher-cost debt. Refunding activity in the municipal market has had a significant impact on the Series. Over the past year, a significant percentage of the Series’ holdings were pre-refunded to future call dates. When municipal bonds are refunded, principal and interest payments are typically secured by escrow accounts comprised of US government securities, making them secure and highly liquid securities. In addition, the shortened maturity date and enhanced credit quality of pre-refunded bonds often results in price appreciation, which contributes positively to investment results. Currently, refunded bonds (pre-refunded bonds and escrowed-to-maturity bonds) represent the largest sector in the California High-Yield, Florida, and North Carolina Series and the second largest in California Quality Series. |

Interview With Your Portfolio Managers

Thomas G. Moles and Eileen A. Comerford

| | The Series also experienced a high percentage of bond calls during the reporting period. The loss of high-yielding bonds reduced investment income because the proceeds of called bonds were reinvested at lower prevailing yields. |

| | |

| | As municipal yields have trended lower, investors have stepped up purchases of lower-rated credits. The increase in demand for lesser-rated bonds has caused yield spreads to compress. As a result, lower-rated bonds have outperformed higher-quality bonds by a wide margin over the past 12 months. The Series, with the exception of California High-Yield Series, is comprised principally of higher-quality municipal bonds. |

| | |

Q: | What investment strategies or techniques materially affected the Series’ performance during the period? |

| | |

A: | Over the past fiscal year, our primary objective has been to lessen the impact of an expected increase in long-term municipal yields and significantly higher short-term yields (yield curve flattening) on the Series’ performance. The following strategies were implemented, although the extent of their use varied among the individual portfolios: |

| | |

| | In an effort to lower the interest rate exposure of our funds, portfolio average maturities have been allowed to decline to lower levels than in recent years. In general, the longer the maturity of a bond is, the greater its interest rate sensitivity. New purchases have been concentrated in the 20-year maturity range. Over the 12-month reporting period, however, the longest maturity bonds unexpectedly enjoyed the best performance while the 20-year sector ranked second. |

| | |

| | Portfolio holdings that were pre-refunded prior to the start of the current fiscal year were maintained given their attractive coupon interest and inherently defensive nature. Investment income has benefited from our decision to retain these higher-yielding securities. However, given the shorter maturity dates of the Series’ pre-refunded bonds, the increase in short-term yields over the past year caused performance results to significantly lag that of longer-term securities. On a more positive note, the Series held the majority of portfolio holdings that were pre-refunded during the Series’ fiscal year. The shortened maturity date and enhanced credit quality often resulted in price appreciation for the newly pre-refunded bonds, contributing to positive investment results. |

| | |

| | The Series’ portfolios are comprised almost entirely of premium-coupon bonds (market price above par). Premium coupon bonds are generally less sensitive to interest rate changes than par or discount bonds (market price below par). In a rising interest rate environment, premium bonds typically outperform lower coupon |

A Team Approach

Seligman Municipal Series Trust is managed by the Seligman Municipals Team, headed by Thomas G. Moles. Mr. Moles and Co-Portfolio Manager Eileen A. Comerford are assisted in the management of the Trust by a group of seasoned professionals who are responsible for research and trading consistent with the Trust’s investment objective. Team members include Senior Credit Analyst Audrey Kuchtyak, Michelle Lowery, and Debra McGuinness.

Interview With Your Portfolio Managers

Thomas G. Moles and Eileen A. Comerford

| | | bonds. However, the decline in long-term municipal yields over the past fiscal year, favored par and discount-coupon bonds. |

| | | |

| | | The majority of holdings in the Series, with the exception of California High-Yield Series, are higher-quality bonds, with the largest concentration in AAA-rated insured bonds. California High-Yield Series contains only investment-grade municipal bonds with the majority of holdings rated A. Yields offered on most lower quality bonds have not, in our opinion, adequately compensated investors for accepting a greater degree of credit risk. Nevertheless, strong demand for higher-yielding securities has led to a narrowing of credit spreads. As a result, lower-quality bonds outperformed higher-quality bonds over the past 12 months. As a result, the California High-Yield Series had the best performance of the Series in Seligman Municipal Series Trust. |

| | | |

| | | The Series does not own tobacco bonds due to concerns over legal challenges to the Master Settlement Agreement (MSA) — the source of principal and interest payment for tobacco bonds — as well as the impact of punitive jury awards and continuing litigation on tobacco companies. Additionally, tobacco company contributions to the MSA are based on the quantity of cigarettes sold. Cigarette sales have already fallen below projection, and are expected to decline further, reducing the tobacco company payments to the MSA. Despite these factors, Tobacco Securitization Bonds posted strong performance for the period, enhancing the returns of other funds that held them. |

| | | |

| | | Fiscal year performance results for the Series, with the exception of California High-Yield Series, lagged that of the Lehman Brothers Municipal Bond Index (the “Lehman Index”) — the Series’ stated benchmark. Our more defensive portfolio positioning, relative to the Lehman Index was the primary reason for the underperformance of the Series, except California High-Yield Series, given the continued, albeit modest, decline in long-term municipal yields over the past 12 months. Additionally, overweighting of the pre-refunded bond sector and avoidance of Tobacco bonds (in all Series), compared with the Lehman Index, caused a lag in period returns. |

| | | |

| | | It should be noted that the Lehman Index is an unmanaged index comprised of a wide range of investment-grade municipal bonds, and that its components may differ significantly from that of the Series of Seligman Municipal Series Trust. Further, the Lehman Index does not reflect the impact of fees or expenses as do the Series’ returns. |

__________

The views and opinions expressed are those of the Portfolio Managers, are provided for general information only, and do not constitute specific tax, legal, or investment advice to, or recommendations for, any person. There can be no guarantee as to the accuracy of market forecasts. Opinions, estimates, and forecasts may be changed without notice.

Performance and Portfolio Overview

This section of the report is intended to help you understand the performance of each Series of Seligman Municipal Series Trust (the “Trust”) and to provide a summary of the portfolio characteristics of each Series.

Performance data quoted in this report represents past performance and does not guarantee or indicate future investment results. The rates of return will vary and the principal value of an investment will fluctuate. Shares, if redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. Total returns of each of the Series as of the most recent month-end will be available at www.seligman.com1 by the seventh business day following that month-end. Calculations assume reinvestment of distributions. Performance data quoted does not reflect the deduction of taxes that an investor may pay on distributions or the redemption of shares. J. & W. Seligman & Co. Incorporated (the “Manager”), at its discretion, waived a portion of its management fees for the California High-Yield and Florida Series. Such waivers may be discontinued at any time. Absent such waivers, returns and yields for those Series would have been lower. A portion of each Series’ income may be subject to applicable state and local taxes, and any amount may be subject to the federal alternative minimum tax. Capital gain distributions are subject to federal, state and local taxes.

Returns for Class A shares are calculated with and without the effect of the initial 4.75% maximum sales charge. Returns for Class C shares are calculated with and without the effect of the initial 1% maximum sales charge and the 1% contingent deferred sales charge (“CDSC”), charged on redemptions made within 18 months of purchase. Returns for Class D shares are calculated with and without the effect of the 1% CDSC, charged on redemptions made within one year of purchase.

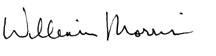

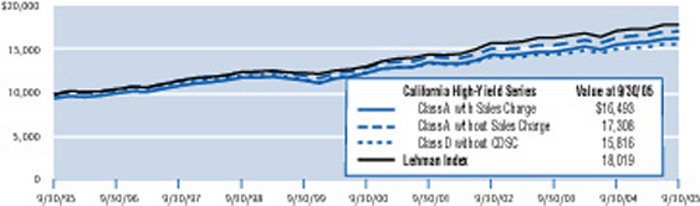

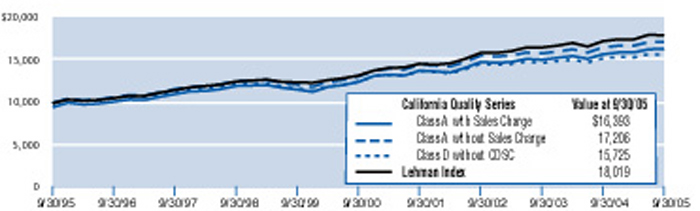

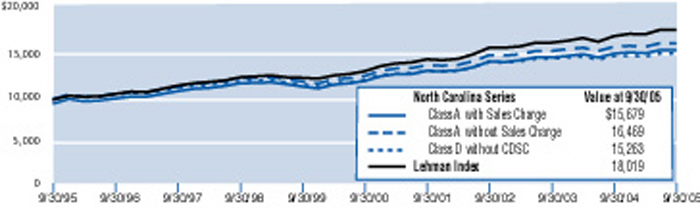

The chart compares a $10,000 hypothetical investment made in Class A shares, with and without the initial 4.75% maximum sales charge, and in Class D shares, without the 1% CDSC, to a $10,000 investment made in the Lehman Brothers Municipal Bond Index (the “Lehman Index”) for the 10-year period ended September 30, 2005. The performance of Class C shares, which commenced on a later date, and of Class A and Class D shares for other periods, with and without applicable sales charges and CDSCs, is not shown in the charts but is included in the total returns table that follows the chart. The performance of Class C shares will differ from the performances shown for Class A and Class D shares, based on the differences in sales charges and fees paid by shareholders. The Lehman Index does not include the effect of taxes, fees or sales charges, and does not reflect state-specific bond market performance.

An investment in a Series is not a deposit of a bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency.

__________

See footnotes on page 10.

Performance and Portfolio Overview

California High-Yield Series

Investment Results

Total Returns

For Periods Ended September 30, 2005

| | | Average Annual |

Class A | | | Six Months | * | | One Year | | | Five Years | | | Ten Years | | | Class C Since Inception 5/27/99 | |

| With Sales Charge | | | (2.24 | )% | | (0.32 | )% | | 4.67 | % | | 5.13 | % | | n/a | |

| Without Sales Charge | | | 2.67 | | | 4.63 | | | 5.70 | | | 5.64 | | | n/a | |

Class C | | | | | | | | | | | | | | | | |

| With Sales Charge and CDSC# | | | 0.14 | | | 1.63 | | | 4.56 | | | n/a | | | 3.98 | % |

| Without Sales Charge and CDSC | | | 2.20 | | | 3.69 | | | 4.76 | | | n/a | | | 4.15 | |

Class D | | | | | | | | | | | | | | | | |

| With 1% CDSC | | | 1.20 | | | 2.70 | | | n/a | | | n/a | | | n/a | |

| Without CDSC | | | 2.20 | | | 3.69 | | | 4.76 | | | 4.69 | | | n/a | |

Lehman Index** | | | 2.80 | | | 4.05 | | | 6.34 | | | 6.07 | | | 5.65 | ‡ |

| | | | | | | | | Dividend and Capital Gain Per Share, and Yield Information |

Net Asset Value Per Share | | | For Periods Ended September 30, 2005 |

| | | 9/30/05 | | 3/31/05 | | 9/30/04 | | Dividend† | | Capital Gain† | | SEC 30-Day Yield†† | |

Class A | | $ | 6.62 | | $ | 6.58 | | $ | 6.65 | | $ | 0.262 | | $ | 0.069 | | | 3.39% | |

Class C | | | 6.63 | | | 6.59 | | | 6.66 | | | 0.202 | | | 0.069 | | | 2.63 | |

Class D | | | 6.63 | | | 6.59 | | | 6.66 | | | 0.202 | | | 0.069 | | | 2.66 | |

Holdings by Market Sectorø | | | Holdings by Credit Quality2ø |

| Revenue Bonds | 82% | | AAA | 15% |

General Obligation Bondsøø | 18 | | AA | 10 |

| | | | A | 61 |

Weighted Average Maturity## | 23.1 years | | BBB | 14 |

__________

See footnotes on page 10.

Performance and Portfolio Overview

California Quality Series

Investment Results

Total Returns

For Periods Ended September 30, 2005

| | | | | Average Annual |

Class A | | Six Months | * | One Year | | Five Years | | Ten Years | | Class C Since Inception 5/27/99 | |

| With Sales Charge | | | (2.39 | )% | | (0.98 | )% | | 4.47 | % | | 5.07 | % | | n/a | |

| Without Sales Charge | | | 2.52 | | | 3.90 | | | 5.51 | | | 5.58 | | | n/a | |

Class C | | | | | | | | | | | | | | | | |

| With Sales Charge and CDSC# | | | (0.12 | ) | | 0.83 | | | 4.34 | | | n/a | | | 3.85 | % |

| Without Sales Charge and CDSC | | | 1.92 | | | 2.84 | | | 4.56 | | | n/a | | | 4.02 | |

Class D | | | | | | | | | | | | | | | | |

| With 1% CDSC | | | 0.92 | | | 1.85 | | | n/a | | | n/a | | | n/a | |

| Without CDSC | | | 1.92 | | | 2.84 | | | 4.56 | | | 4.63 | | | n/a | |

Lehman Index** | | | 2.80 | | | 4.05 | | | 6.34 | | | 6.07 | | | 5.65 | ‡ |

| | | | | | | | | Dividend and Capital Gain Per Share, and Yield Information |

Net Asset Value Per Share | | | | For Periods Ended September 30, 2005 |

| | | 9/30/05 | | 3/31/05 | | 9/30/04 | | Dividend | † | Capital Gain† | | SEC 30-Day Yield†† | |

Class A | | $ | 6.79 | | $ | 6.76 | | $ | 6.89 | | $ | 0.274 | | $ | 0.088 | | | 2.76% | |

Class C | | | 6.76 | | | 6.74 | | | 6.87 | | | 0.213 | | | 0.088 | | | 1.98 | |

Class D | | | 6.76 | | | 6.74 | | | 6.87 | | | 0.213 | | | 0.088 | | | 2.00 | |

Holdings by Market Sectorø | | | Holdings by Credit Quality2ø |

| Revenue Bonds | 74% | | AAA | 66% |

General Obligation Bondsøø | 26 | | AA | 7 |

| | | | A | 27 |

Weighted Average Maturity## | 17.6 years | | | |

__________

See footnotes on page 10.

Performance and Portfolio Overview

Florida Series

Investment Results

Total Returns

For Periods Ended September 30, 2005

| | | | | Average Annual |

Class A | | Six Months | * | One Year | | Five Years | | Ten Years | | Class C Since Inception 5/27/99 | |

| With Sales Charge | | | (2.60 | )% | | (1.74 | )% | | 4.63 | % | | 4.88 | % | | n/a | |

| Without Sales Charge | | | 2.21 | | | 3.17 | | | 5.65 | | | 5.38 | | | n/a | |

Class C | | | | | | | | | | | | | | | | |

| With Sales Charge and CDSC# | | | (0.31 | ) | | 0.28 | | | 4.61 | | | n/a | | | 3.93 | % |

| Without Sales Charge and CDSC | | | 1.69 | | | 2.27 | | | 4.83 | | | n/a | | | 4.10 | |

Class D | | | | | | | | | | | | | | | | |

| With 1% CDSC | | | 0.69 | | | 1.28 | | | n/a | | | n/a | | | n/a | |

| Without CDSC | | | 1.69 | | | 2.27 | | | 4.83 | | | 4.59 | | | n/a | |

Lehman Index** | | | 2.80 | | | 4.05 | | | 6.34 | | | 6.07 | | | 5.65 | ‡ |

| | | | | | | | | Dividend and Capital Gain Per Share, and Yield Information |

Net Asset Value Per Share | | For Periods Ended September 30, 2005 |

| | | 9/30/05 | | 3/31/05 | | 9/30/04 | | Dividend† | | Capital Gain† | | SEC 30-Day Yield†† | |

Class A | | $ | 7.92 | | $ | 7.91 | | $ | 8.00 | | $ | 0.324 | | $ | 0.005 | | | 2.85% | |

Class C | | | 7.93 | | | 7.93 | | | 8.02 | | | 0.264 | | | 0.005 | | | 2.22 | |

Class D | | | 7.93 | | | 7.93 | | | 8.02 | | | 0.264 | | | 0.005 | | | 2.24 | |

Holdings by Market Sectorø | | | Holdings by Credit Quality2ø |

| Revenue Bonds | 48% | | AAA | 66% |

General Obligation Bondsøø | 52 | | AA | 8 |

| | | | A | 26 |

Weighted Average Maturity## | 14.3 years | | | |

__________

See footnotes on page 10.

Performance and Portfolio Overview

North Carolina Series

Investment Results

Total Returns

For Periods Ended September 30, 2005

| | | | | Average Annual |

Class A | | Six Months | * | One Year | | Five Years | | Ten Years | | Class C Since Inception 5/27/99 | |

| With Sales Charge | | | (2.58 | )% | | (2.40 | )% | | 4.23 | % | | 4.60 | % | | n/a | |

| Without Sales Charge | | | 2.22 | | | 2.45 | | | 5.26 | | | 5.12 | | | n/a | |

Class C | | | | | | | | | | | | | | | | |

| With Sales Charge and CDSC# | | | (0.04 | ) | | (0.16 | ) | | 4.26 | | | n/a | | | 3.50 | % |

| Without Sales Charge and CDSC | | | 1.97 | | | 1.82 | | | 4.48 | | | n/a | | | 3.66 | |

Class D | | | | | | | | | | | | | | | | |

| With 1% CDSC | | | 0.84 | | | 0.70 | | | n/a | | | n/a | | | n/a | |

| Without CDSC | | | 1.84 | | | 1.69 | | | 4.46 | | | 4.32 | | | n/a | |

Lehman Index** | | | 2.80 | | | 4.05 | | | 6.34 | | | 6.07 | | | 5.65 | ‡ |

Net Asset Value Per Share | | Dividend and Capital Gain Per Share, and Yield Information For Periods Ended September 30, 2005 |

| | | 9/30/05 | | 3/31/05 | | 9/30/04 | | Dividend† | | Capital Gain† | | SEC 30-Day Yield†† | |

Class A | | $ | 7.94 | | $ | 7.91 | | $ | 8.05 | | $ | 0.283 | | $ | 0.021 | | | 2.54% | |

Class C | | | 7.94 | | | 7.90 | | | 8.04 | | | 0.223 | | | 0.021 | | | 1.89 | |

Class D | | | 7.93 | | | 7.90 | | | 8.04 | | | 0.223 | | | 0.021 | | | 1.91 | |

Holdings by Market Sectorø | | Holdings by Credit Quality2ø |

| Revenue Bonds | 63% | | AAA | 45% |

General Obligation Bondsøø | 37 | | AA | 39 |

| | | | A | 7 |

Weighted Average Maturity## | 11.6 years | | BBB | 9 |

__________

See footnotes on page 10.

Performance and Portfolio Overview

__________

1 | The reference to Seligman’s website is an inactive textual reference and information contained in or otherwise accessible through Seligman’s website does not form a part of this report or the Trust’s prospectus. |

2 | Credit ratings are primarily those issued by Moody’s Investors Service, Inc. (“Moody’s”). Where Moody’s ratings have not been assigned, ratings from Standard & Poor’s Corporation (“S&P”) were used. A generic rating designation has been utilized, and therefore, it cannot be inferred solely from the rating category whether ratings reflect those assigned by Moody’s or S&P. Pre-refunded and escrowed-to-maturity securities that have been rerated as AAA or its equivalent by either Moody’s or S&P have been included in the AAA category. Holdings and credit ratings are subject to change. |

| * | Returns for periods of less than one year are not annualized. |

| ** | The Lehman Index is an unmanaged list of long-term, fixed-rate, investment-grade, tax-exempt bonds representative of the municipal bond market. The index does not include any taxes, fees or sales charges and does not reflect state-specific bond market performance. It is composed of approximately 60% revenue bonds and 40% state government obligations. Investors cannot invest directly in an index. |

| # | The CDSC is 1% for periods of 18 months or less. |

| ## | Excludes variable rate demand notes. |

| ‡ | From 5/28/99. |

| † | Represents per share amount paid or declared for the year ended September 30, 2005. |

| †† | Current yield, representing the annualized yield for the 30-day period ended September 30, 2005, has been computed in accordance with SEC regulations and will vary. During the period, the Manager, at its discretion, waived a portion of its management fee for the California High-Yield and Florida Series. Such waivers may be discontinued at any time. Without these waivers the yields would be as follows: |

| | | Class A | Class C | Class D |

| | California High-Yield Series | 3.29% | 2.53% | 2.56% |

| | Florida Series | 2.70 | 2.07 | 2.09 |

ø | Percentages based on current market values of long-term holdings at September 30, 2005. |

øø | Includes pre-refunded and escrowed-to-maturity securities. |

Understanding and Comparing Your Series’ Expenses

As a shareholder of a Series of the Trust, you incur ongoing expenses, such as management fees, distribution and service (12b-1) fees, and other fund expenses. The information below is intended to help you understand your ongoing expenses (in dollars) of investing in a Series and to compare them with the ongoing expenses of investing in other mutual funds. Please note that the expenses shown in the table are meant to highlight your ongoing expenses only and do not reflect any transactional costs, such as sales charges (also known as loads) on certain purchases or redemptions. Therefore, the table is useful in comparing ongoing expenses only, and will not help you determine the relative total expenses of owning different funds. In addition, if transactional costs were included, your total expenses would have been higher.

The table is based on an investment of $1,000 invested at the beginning of April 1, 2005 and held for the entire six-month period ended September 30, 2005.

Actual Expenses

The table below provides information about actual expenses and actual account values. You may use the information, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value at the beginning of the period by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number under the heading entitled “Expenses Paid During Period” for the share class of the Series that you own to estimate the expenses that you paid on your account during the period.

Hypothetical Example for Comparison Purposes

The table below also provides information about hypothetical expenses and hypothetical account values based on the actual expense ratios of each Series and an assumed rate of return of 5% per year before expenses, which is not the actual return of any Series. The hypothetical expenses and account values may not be used to estimate the ending account value or the actual expenses you paid for the period. You may use this information to compare the ongoing expenses of investing in a Series and other mutual funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other mutual funds.

(Continued on next page.)

Understanding and Comparing Your Series’ Expenses (continued)

| | | | | | Actual | | Hypothetical | |

| | | Beginning Account Value 4/1/05 | | | Annualized Expense Ratio* | | | Ending Account Value 9/30/05 | | | Expenses Paid During Period** 4/1/05 to 9/30/05 | | | Ending Account Value 9/30/05 | | | Expenses Paid During Period** 4/1/05 to 9/30/05 | |

California High-Yield | | | | | | | | | | | | | | | |

| Class A | $ | 1,000.00 | | | 0.91% | | $ | 1,026.70 | | $ | | | $ | 1,020.52 | | $ | 4.59 | |

| Class C | | 1,000.00 | | | 1.81 | | | 1,022.00 | | | 9.16 | | | 1,016.02 | | | 9.13 | |

| Class D | | 1,000.00 | | | 1.81 | | | 1,022.00 | | | 9.16 | | | 1,016.02 | | | 9.13 | |

California Quality | | | | | | | | | | | | | | | |

| Class A | | 1,000.00 | | | 0.93 | | | 1,025.20 | | | 4.72 | | | 1,020.40 | | | 4.71 | |

| Class C | | 1,000.00 | | | 1.83 | | | 1,019.20 | | | 9.25 | | | 1,015.90 | | | 9.25 | |

| Class D | | 1,000.00 | | | 1.83 | | | 1,019.20 | | | 9.25 | | | 1,015.90 | | | 9.25 | |

Florida | | | | | | | | | | | | | | | | | | |

| Class A | | 1,000.00 | | | 0.97 | | | 1,022.10 | | | 4.93 | | | 1,020.19 | | | 4.93 | |

| Class C | | 1,000.00 | | | 1.72 | | | 1,016.90 | | | 8.69 | | | 1,016.46 | | | 8.69 | |

| Class D | | 1,000.00 | | | 1.72 | | | 1,016.90 | | | 8.69 | | | 1,016.46 | | | 8.69 | |

North Carolina | | | | | | | | | | | | | | | |

| Class A | | 1,000.00 | | | 1.23 | | | 1,022.20 | | | 6.21 | | | 1,018.92 | | | 6.20 | |

| Class C | | 1,000.00 | | | 1.97 | | | 1,019.70 | | | 9.97 | | | 1,015.19 | | | 9.95 | |

| Class D | | 1,000.00 | | | 1.97 | | | 1,018.40 | | | 9.98 | | | 1,015.19 | | | 9.95 | |

__________

| * | Expenses of Class C and Class D shares differ from the expenses of Class A shares due to the difference in 12b-1 fees paid by each share class. See the Trust's prospectus for a description of each share class and its expenses and sales charges. J. & W. Seligman & Co. Incorporated, the Manager, at its discretion, waived 0.10% and 0.15% per annum of its fees for the California High-Yield and Florida Series, respectively. Absent such waiver, the expense ratios and expenses paid for the period would have been higher. |

| ** | Expenses are equal to the Series' annualized expense ratios based on actual expenses for the period April 1, 2005 to September 30, 2005, multiplied by the average account value over the period, multiplied by 183/365 (number of days in the period). |

Portfolios of Investments

September 30, 2005

California High-Yield Series

Face Amount | | Municipal Bonds | Rating† | | Value |

| $1,000,000 | | California Department of Veterans Affairs (Home Purchase Rev.), 51/2% due 12/1/2018* | Aa2 | $ | 1,045,390 |

| 1,500,000 | | California Department of Veterans Affairs (Home Purchase Rev.), 5.60% due 12/1/2028 | Aaa | | 1,536,735 |

| 2,000,000 | | California Educational Facilities Authority Rev. (Scripps College) 5% due 8/1/2031 | A1 | | 2,047,620 |

| 3,000,000 | | California Health Facilities Financing Authority Rev. (Cedars-Sinai Medical Center), 61/4% due 12/1/2034ø | A3 | | 3,391,050 |

| 750,000 | | California Health Facilities Financing Authority Rev. (Cedars-Sinai Medical Center), 5% due 11/15/2027 | A3 | | 769,140 |

| 2,750,000 | | California Health Facilities Financing Authority Rev. (Kaiser Permanente), 5.40% due 5/1/2028†† | AAA‡ | | 2,848,533 |

| 2,280,000 | | California Housing Finance Agency (Multi-Family Housing Rev.), 53/8% due 2/1/2036* | Aa3 | | 2,315,500 |

| 810,000 | | California Housing Finance Agency (Single Family Mortgage Rev.), 5.40% due 8/1/2028* | Aaa | | 829,213 |

| 2,500,000 | | California Infrastructure and Economic Development Bank Rev. (The J. David Gladstone Institutes Project), 51/4% due 10/1/2034 | A-‡ | | 2,570,125 |

| 2,500,000 | | California Statewide Communities Development Authority Rev. (Sutter Health), 55/8% due 8/15/2042 | A1 | | 2,639,625 |

| 1,500,000 | | Foothill/Eastern Transportation Corridor Agency, CA Toll Road Rev., 53/4% due 1/15/2040 | Baa3 | | 1,537,185 |

| 2,685,000 | | Modesto, CA Irrigation District Certificates of Participation, 5.30% due 7/1/2022 | A2 | | 2,686,745 |

| 3,000,000 | | Puerto Rico Highway & Transportation Authority Rev., 51/2% due 7/1/2036 | Baa2 | | 3,288,180 |

| 3,000,000 | | San Bernardino, CA Joint Powers Financing Authority (California Dept. of Transportation Lease), 51/2% due 12/1/2020 | A3 | | 3,064,500 |

| 2,000,000 | | San Francisco, CA City & County Public Utilities Commission Rev., 5% due 11/1/2026 | A1 | | 2,030,160 |

| 2,000,000 | | Washington Township, CA Hospital District Hospital Healthcare System Rev., 51/4% due 7/1/2029 | A2 | | 2,059,660 |

| | | Total Municipal Bonds (Cost $32,865,750) — 93.9% | | | 34,659,361 |

| | | Variable Rate Demand Notes | | | |

| 1,500,000 | | New York City, NY GOs due 8/15/2018 | VMIG 1 | | 1,500,000 |

| 300,000 | | Port Authority of New York & New Jersey Special Obligation Rev. due 5/1/2019 | VMIG 1 | | 300,000 |

Total Variable Rate Demand Notes (Cost $1,800,000) — 4.9% | | | 1,800,000 |

Total Investments (Cost $34,665,750) — 98.8% | | | 36,459,361 |

Other Assets Less Liabilities — 1.2% | | | 435,635 |

Net Assets — 100.0% | | | $36,894,996 |

__________

See footnotes on page 17.

Portfolios of Investments

September 30, 2005

California Quality Series

Face Amount | | Municipal Bonds | Rating† | | Value |

| $3,000,000 | | California Educational Facilities Authority Rev. (Pepperdine University), 5% due 11/1/2029 | A1 | $ | 3,111,180 |

| 2,000,000 | | California Educational Facilities Authority Rev. (Stanford University), 5.35% due 6/1/2027 | Aaa | | 2,096,040 |

| 3,000,000 | | California Educational Facilities Authority Rev. (University of San Diego), 5% due 10/1/2028 | Aaa | | 3,095,070 |

| 1,000,000 | | California Infrastructure & Economic Development Bank Rev. (Bay Area Toll Bridge Seismic Retrofit) 5% due 7/1/2023 | Aaa | | 1,054,330 |

| 4,000,000 | | California Pollution Control Financing Authority Rev. (Mobil Oil Corporation Project), 51/2% due 12/1/2029* | Aaa | | 4,171,280 |

| 4,000,000 | | California State GOs, 53/8% due 10/1/2027 | A2 | | 4,278,000 |

| 2,420,000 | | California State Veterans' GOs, 5.70% due 12/1/2032* | A2 | | 2,496,811 |

| 2,000,000 | | California Statewide Communities Development Authority Rev. (Kaiser Permanente), 51/2% due 11/1/2032 | A3 | | 2,095,640 |

| 865,000 | | East Bay, CA Municipal Utility District Water System Rev., 5% due 6/1/2026 | Aaa | | 890,371 |

| 2,500,000 | | Eastern Municipal Water District, CA Water and Sewer Rev., 63/4% due 7/1/2012 | Aaa | | 2,937,050 |

| 2,000,000 | | Los Angeles, CA Department of Water & Power Water System Rev., 51/8% due 7/1/2041 | Aa3 | | 2,057,380 |

| 3,000,000 | | Orange County, CA Local Transportation Authority (Measure M Sales Tax Rev.), 6% due 2/15/2009 | Aaa | | 3,280,140 |

| 1,000,000 | | Rancho, CA Water District Financing Authority Rev., 5.90% due 11/1/2015ø | Aaa | | 1,022,650 |

| 4,000,000 | | Regents of the University of California Rev. (Multiple Purpose Projects), 53/8% due 9/1/2024 | Aaa | | 4,189,080 |

| 1,000,000 | | Sacramento County, CA Sanitation Districts Financing Authority Rev. (Sacramento Regional County Sanitation District), 57/8% due 12/1/2027ø | Aa3 | | 1,014,720 |

| 2,000,000 | | Sacramento County, CA Sanitation Districts Financing Authority Rev. (Sacramento Regional County Sanitation District), 5% due 12/1/2027 | Aaa | | 2,073,740 |

| 500,000 | | Sacramento, CA Municipal Utility District Electric Rev., 51/4% due 5/15/2024 | Aaa | | 539,885 |

| 2,720,000 | | San Francisco, CA Bay Area Rapid Transit District (Sales Tax Rev.) 5% due 7/1/2028ø | Aaa | | 2,891,360 |

| 1,530,000 | | San Francisco, CA Bay Area Rapid Transit District (Sales Tax Rev.) 5% due 7/1/2028 | Aaa | | 1,598,207 |

Total Municipal Bonds (Cost $41,931,698) — 87.2% | | | 44,892,934 |

(Continued on next page.)

__________

See footnotes on page 17.

Portfolios of Investments

September 30, 2005

California Quality Series (continued)

Face Amount | | Short-Term Holdings | Rating† | | Value |

| $3,000,000 | | California Department of Water Resources Water System Rev. (Central Valley Project), 6.10% due 12/1/2029ø | Aaa | $ | 3,095,520 |

| 1,135,000 | | East Bay, CA Municipal Utility District Water System Rev., 5% due 6/1/2026ø | Aaa | | 1,173,942 |

| 600,000 | | Missouri State Health & Educational Facilities Authority Health Facility Rev. (Cox Health System), VRDN, due 6/1/2022 | VMIG 1 | | 600,000 |

| 1,000,000 | | New York City, NY GOs, VRDN, due 8/1/2016 | VMIG 1 | | 1,000,000 |

Total Short-Term Holdings (Cost $5,753,312) —11.4% | | | 5,869,462 |

Total Investments (Cost $47,685,010) — 98.6% | | | 50,762,396 |

Other Assets Less Liabilities — 1.4% | | | 705,264 |

Net Assets — 100.0% | | $ | 51,467,660 |

Face Amount | | Municipal Bonds | Rating† | | Value |

| $2,000,000 | | Broward County, FL Airport System Rev., 51/4% due 10/1/2026* | Aaa | $ | 2,089,240 |

| 2,000,000 | | Dade County, FL Public Improvement GOs, 53/4% due 10/1/2016 | Aaa | | 2,072,940 |

| 1,750,000 | | Escambia County, FL Health Facilities Authority Rev. (Ascension Health Credit Group), 6% due 11/15/2031ø | AAA | | 1,944,250 |

| 70,000 | | Florida Housing Finance Agency Rev. (General Mortgage), 6.35% due 6/1/2014 | AA‡ | | 70,109 |

| 460,000 | | Florida Housing Finance Agency Rev. (Homeowner Mortgage), 6.20% due 7/1/2027* | Aa2 | | 470,562 |

| 450,000 | | Florida Housing Finance Corporation Rev. (Homeowner Mortgage), 5.95% due 1/1/2032* | Aaa | | 469,197 |

| 2,500,000 | | Florida Ports Financing Commission Rev. (State Transportation Trust Fund), 53/8% due 6/1/2027* | Aaa | | 2,587,775 |

| 2,000,000 | | Greater Orlando Aviation Authority, FL Airport Facilities Rev., 51/4% due 10/1/2023* | Aaa | | 2,072,560 |

| 2,000,000 | | Hillsborough County, FL School Board (Certificates of Participation), 6% due 7/1/2025ø | Aaa | | 2,214,180 |

| 2,000,000 | | Jacksonville, FL Electric Authority System Rev., 51/2% due 10/1/2041ø | Aa2 | | 2,095,700 |

| 1,500,000 | | Jacksonville, FL Electric Authority Water & Sewer System Rev., 53/8% due 10/1/2030ø | Aaa | | 1,539,780 |

| 1,000,000 | | Jacksonville, FL Port Authority Airport Rev., 61/4% due 10/1/2024*ø | Aaa | | 1,020,090 |

| 2,000,000 | | Jacksonville, FL Sewage & Solid Waste Disposal Facilities Rev. (Anheuser-Busch Project), 57/8% due 2/1/2036* | A1 | | 2,056,920 |

| 1,000,000 | | Lee County, FL Water & Sewer Rev., 5% due 10/1/2023 | Aaa | | 1,053,640 |

(Continued on next page.)

__________

See footnotes on page 17.

Portfolios of Investments

September 30, 2005

Florida Series (continued)

Face Amount | | Municipal Bonds | Rating† | | Value |

| $2,000,000 | | Marion County, FL Hospital District Health System Rev. (Munroe Regional Health System), 55/8% due 10/1/2024 | A2 | $ | 2,092,340 |

| 1,750,000 | | Orange County, FL Health Facilities Authority Hospital Rev. (Adventist Health System / Sunbelt Obligation Group), 63/8% due 11/15/2020ø | A2 | | 2,004,957 |

| 2,000,000 | | Pinellas County, FL Health Facilities Authority Rev. (Baycare Health System), 51/2% due 11/15/2033 | A1 | | 2,101,420 |

| 1,770,000 | | Reedy Creek, FL Improvement District Utilities Rev., 51/8% due 10/1/2019ø | Aaa | | 1,858,553 |

| 230,000 | | Reedy Creek, FL Improvement District Utilities Rev., 51/8% due 10/1/2019 | Aaa | | 240,348 |

| 1,750,000 | | Tampa Bay, FL Regional Water Supply Utility System Authority Rev., 53/4% due 10/1/2029ø | Aaa | | 1,968,574 |

Total Municipal Bonds (Cost $30,001,965) — 93.1% | | | 32,023,135 |

| | | Variable Rate Demand Notes | | | |

| 400,000 | | New York City, NY Transitional Finance Authority Series 3 due 11/1/2022 | VMIG 1 | | 400,000 |

| 100,000 | | New York City, NY Transitional Finance Authority Sub Series 2A due 11/1/2022 | VMIG 1 | | 100,000 |

| 1,210,000 | | Sarasota County, FL Public Hospital Board (Sarasota Memorial Hospital Project) due 7/1/2037 | VMIG 1 | | 1,210,000 |

Total Variable Rate Demand Notes (Cost $1,710,000) — 5.0% | | | 1,710,000 |

Total Investments (Cost $31,711,965) — 98.1% | | | 33,733,135 |

Other Assets Less Liabilities — 1.9% | | | 647,421 |

Net Assets — 100.0% | | $ | 34,380,556 |

North Carolina Series

Face Amount | | Municipal Bonds | Rating† | | Value |

| $1,250,000 | | Appalachian State University, NC Housing & Student Center System Rev., 5.60% due 7/15/2020ø | Aaa | $ | 1,388,725 |

| 1,250,000 | | Asheville, NC Water System Rev., 5.70% due 8/1/2025 | Aaa | | 1,298,838 |

| 1,185,000 | | Buncombe County, NC Metropolitan Sewer District Sewer System Rev., 5% due 7/1/2020 | Aaa | | 1,257,510 |

| 1,000,000 | | Charlotte, NC Storm Water Fee Rev., 6% due 6/1/2025ø | Aa2 | | 1,126,010 |

| 1,250,000 | | Charlotte, NC Water & Sewer System Rev., 51/4% due 6/1/2025ø | AAA‡ | | 1,367,225 |

| 2,000,000 | | Charlotte-Mecklenburg Hospital Authority, NC Health Care System Rev., 53/4% due 1/15/2021 | Aa3 | | 2,053,420 |

| 215,000 | | Greensboro, NC Combined Enterprise System Rev., 51/4% due 6/1/2022 | Aa3 | | 234,367 |

(Continued on next page.)

__________

See footnotes on page 17.

Portfolios of Investments

September 30, 2005

North Carolina Series (continued)

Face Amount | | Municipal Bonds | Rating† | | Value |

| $1,500,000 | | Martin County, NC Industrial Facilities and Pollution Control Financing Authority Solid Waste Disposal Rev. (Weyerhaeuser Company Project), 6% due 11/1/2025* | Baa2 | $ | 1,533,060 |

| 360,000 | | North Carolina Housing Finance Agency Rev. (Home Ownership), 6.40% due 7/1/2028* | Aa2 | | 380,218 |

| 85,000 | | North Carolina Housing Finance Agency Rev. (Single Family), 61/2% due 3/1/2018 | Aa2 | | 85,256 |

| 1,500,000 | | North Carolina Medical Care Commission Hospital Rev. (First Health of the Carolinas Project), 5% due 10/1/2028 | Aa3 | | 1,529,895 |

| 1,750,000 | | North Carolina Municipal Power Agency No. 1 (Catawba Electric Rev.), 5% due 1/1/2020†† | Aaa | | 1,937,652 |

| 1,000,000 | | Raleigh, NC Combined Enterprise System Rev., 5% due 3/1/2024 | Aa1 | | 1,056,940 |

| 1,000,000 | | Wake County, NC Industrial Facilities & Pollution Control Financing Authority Rev. (Carolina Power & Light), 53/8% due 2/1/2017 | A3 | | 1,066,070 |

| 250,000 | | Winston-Salem, NC Water & Sewer System Rev., 51/8% due 6/1/2028ø | AAA‡ | | 274,352 |

Total Municipal Bonds (Cost $15,433,856) — 88.6% | | | 16,589,538 |

| | | Short-Term Holdings | | | |

| 750,000 | | Missouri State Health & Educational Facilities Authority Health Facility Rev. (Cox Health System), VRDN, due 6/1/2022 | VMIG 1 | | 750,000 |

| 100,000 | | Sarasota County, FL Public Hospital Board (Sarasota Memorial Hospital Project), VRDN, due 7/1/2037 | VMIG 1 | | 100,000 |

| 1,000,000 | | University of North Carolina at Chapel Hill Hospital Rev., 51/4% due 2/15/2026ø | AA-‡ | | 1,029,010 |

Total Short-Term Holdings (Cost $1,803,600) — 10.0% | | | 1,879,010 |

Total Investments (Cost $17,237,456) — 98.6% | | | 18,468,548 |

Other Assets Less Liabilities — 1.4% | | | 258,779 |

Net Assets — 100.0% | | | $18,727,327 |

| † | Credit ratings are primarily those issued by Moody’s Investors Service, Inc. (“Moody’s”). Where Moody’s ratings have not been assigned, ratings from Standard & Poor’s Corporation (“S&P”) were used (indicated by the symbol ‡). Pre-refunded and escrowed-to-maturity securities that have been rerated as AAA by S&P but have not been rerated by Moody’s have been reported as AAA. Ratings have not been audited by Deloitte & Touche LLP. |

ø | Pre-refunded security. Such securities that will be paid off within one year are classified as short-term holdings. |

| †† | Escrowed-to-maturity security. |

| * | Interest income earned from this security is subject to the federal alternative minimum tax. |

VRDN - variable rate demand note.

See Notes to Financial Statements.

Statements of Assets and Liabilities

September 30, 2005

| | | California High-Yield Series | | California Quality Series | | Florida Series | | North Carolina Series |

Assets: | | | | | | | | |

| Investments, at value:* | | | | | | | | |

| Long-term holdings | $ | 34,659,361 | $ | 44,892,934 | $ | 32,023,135 | $ | 16,589,538 |

| Short-term holdings | | 1,800,000 | | 5,869,462 | | 1,710,000 | | 1,879,010 |

| Total investments | | 36,459,361 | | 50,762,396 | | 33,733,135 | | 18,468,548 |

| Cash** | | 19,823 | | 70,686 | | 86,993 | | 28,769 |

| Interest receivable | | 529,583 | | 805,155 | | 712,426 | | 240,322 |

Expenses prepaid to shareholder service agent | | 5,236 | | 5,597 | | 3,611 | | 2,347 |

| Receivable for securities sold | | — | | — | | — | | 55,351 |

Receivable for Shares of Beneficial Interest Sold | | — | | — | | 1,680 | | — |

| Other | | 2,340 | | 3,277 | | 2,223 | | 1,339 |

Total Assets | | 37,016,343 | | 51,647,111 | | 34,540,068 | | 18,796,676 |

| | | | | | | | | |

Liabilities: | | | | | | | | |

| Dividends payable | | 55,782 | | 78,937 | | 50,420 | | 27,292 |

| Management fee payable | | 12,200 | | 21,220 | | 9,929 | | 7,817 |

| Distribution and service fees payable | | 7,112 | | 7,414 | | 10,220 | | 5,146 |

Payable for Shares of Beneficial Interest repurchased | | 5,005 | | 21,250 | | 50,050 | | — |

| Accrued expenses and other | | 41,248 | | 50,630 | | 38,893 | | 29,094 |

Total Liabilities | | 121,347 | | 179,451 | | 159,512 | | 69,349 |

Net Assets | $ | 36,894,996 | $ | 51,467,660 | $ | 34,380,556 | $ | 18,727,327 |

| | | | | | | | | |

Composition of Net Assets: | | | | | | | | |

| Shares of Beneficial Interest, at par: | | | | | | | | |

| Class A | $ | 4,745 | $ | 6,952 | $ | 3,701 | $ | 2,112 |

| Class C | | 373 | | 482 | | 492 | | 178 |

| Class D | | 451 | | 151 | | 148 | | 67 |

| Additional paid-in capital | | 35,037,547 | | 48,110,353 | | 32,106,788 | | 17,314,250 |

Undistributed net investment income | | 58,269 | | 188,326 | | 74,147 | | 50,553 |

| Accumulated net realized gain | | — | | 84,010 | | 174,110 | | 129,075 |

Net unrealized appreciation of investments | | 1,793,611 | | 3,077,386 | | 2,021,170 | | 1,231,092 |

Net Assets | $ | 36,894,996 | $ | 51,467,660 | $ | 34,380,556 | $ | 18,727,327 |

(Continued on next page.)

__________

See footnotes on page 19.

Statements of Assets and Liabilities

(continued)

September 30, 2005

| | | California High-Yield Series | | California Quality Series | | Florida Series | | North Carolina Series |

Net Assets: | | | | | | | | |

| Class A | $ | 31,431,576 | $ | 47,186,430 | $ | 29,297,510 | $ | 16,781,256 |

| Class C | $ | 2,474,950 | $ | 3,259,326 | $ | 3,907,013 | $ | 1,414,120 |

| Class D | $ | 2,988,470 | $ | 1,021,904 | $ | 1,176,033 | $ | 531,951 |

| | | | | | | | | |

Shares of Beneficial Interest Outstanding (unlimited shares authorized; $0.001 par value): | | | | | | | | |

| Class A | | 4,745,010 | | 6,952,092 | | 3,700,558 | | 2,112,496 |

| Class C | | 373,245 | | 481,980 | | 492,486 | | 178,200 |

| Class D | | 450,615 | | 151,112 | | 148,240 | | 67,056 |

| | | | | | | | | |

Net Asset Value per Share: | | | | | | | | |

Class A | | $6.62 | | $6.79 | | $7.92 | | $7.94 |

Class C | | $6.63 | | $6.76 | | $7.93 | | $7.94 |

Class D | | $6.63 | | $6.76 | | $7.93 | | $7.93 |

| | | | | | | | | |

| __________ | | | | | | | | |

| * Cost of total investments | $ | 34,665,750 | $ | 47,685,010 | $ | 31,711,965 | $ | 17,237,456 |

| ** Includes restricted cash of | $ | 5,300 | $ | 6,300 | $ | 2,000 | $ | — |

See Notes to Financial Statements.

Statements of Operations

For the Year Ended September 30, 2005

| | | California High-Yield Series | | California Quality Series | | Florida Series | | North Carolina Series | |

Investment Income: | | | | | | | | | |

| Interest | | $ | 1,877,101 | | $ | 2,701,536 | | $ | 1,865,858 | | $ | 1,054,749 | |

| | | | | | | | | | | | | | |

Expenses: | | | | | | | | | | | | | |

| Management fees | | | 191,657 | | | 271,020 | | | 182,988 | | | 109,045 | |

| Distribution and service fees | | | 88,704 | | | 98,864 | | | 133,271 | | | 79,462 | |

| Shareholder account services | | | 80,636 | | | 87,916 | | | 60,376 | | | 37,783 | |

| Auditing and legal fees | | | 32,291 | | | 40,634 | | | 32,773 | | | 30,290 | |

| Registration | | | 17,641 | | | 17,519 | | | 14,571 | | | 13,684 | |

| Custody and related services | | | 12,491 | | | 17,383 | | | 13,081 | | | 8,664 | |

| Trustees’ fees and expenses | | | 8,354 | | | 8,812 | | | 7,975 | | | 7,424 | |

| Shareholder reports and communications | | | 6,259 | | | 7,842 | | | 6,872 | | | 4,802 | |

| Miscellaneous | | | 5,230 | | | 6,816 | | | 5,053 | | | 3,724 | |

Total Expenses Before Management Fee Waiver | | | 443,263 | | | 556,806 | | | 456,960 | | | 294,878 | |

| Management Fee Waiver (Note 3) | | | (38,332 | ) | | — | | | (54,896 | ) | | — | |

Total Expenses After Management Fee Waiver | | | 404,931 | | | 556,806 | | | 402,064 | | | 294,878 | |

Net Investment Income | | | 1,472,170 | | | 2,144,730 | | | 1,463,794 | | | 759,871 | |

| | | | | | | | | | | | | | |

Net Realized and Unrealized Gain (Loss) on Investments: | | | | | | | | | | | | | |

| Net realized gain on investments | | | — | | | 330,304 | | | 172,452 | | | 122,197 | |

| Net change in unrealized appreciation of investments | | | 239,831 | | | (462,651 | ) | | (553,167 | ) | | (372,492 | ) |

Net Gain (Loss) on Investments | | | 239,831 | | | (132,347 | ) | | (380,715 | ) | | (250,295 | ) |

| | | | | | | | | | | | | | |

Increase in Net Assets from Operations | | $ | 1,712,001 | | $ | 2,012,383 | | $ | 1,083,079 | | $ | 509,576 | |

__________

See Notes to Financial Statements.

Statements of Changes in Net Assets

| | | California High-Yield Series | | California Quality Series | |

| | | Year Ended September 30, | | Year Ended September 30 | |

| | | 2005 | | 2004 | | 2005 | | 2004 | |

Operations: | | | | | | | | | |

| Net investment income | | $ | 1,472,170 | | $ | 1,722,860 | | $ | 2,144,730 | | $ | 2,479,557 | |

| Net realized gain on investments | | | — | | | 307,558 | | | 330,304 | | | 617,043 | |

| Net change in unrealized appreciation of investments | | | 239,831 | | | 97,141 | | | (462,651 | ) | | (549,645 | ) |

Increase in Net Assets from Operations | | | 1,712,001 | | | 2,127,559 | | | 2,012,383 | | | 2,546,955 | |

| | | | | | | | | | | | | | |

Distributions to Shareholders: | | | | | | | | | | | | | |

| Net investment income: | | | | | | | | | | | | | |

| Class A | | | (1,290,395 | ) | | (1,489,562 | ) | | (1,973,546 | ) | | (2,244,666 | ) |

| Class C | | | (79,080 | ) | | (101,600 | ) | | (120,885 | ) | | (159,370 | ) |

| Class D | | | (91,036 | ) | | (104,102 | ) | | (33,700 | ) | | (41,323 | ) |

| Total | | | (1,460,511 | ) | | (1,695,264 | ) | | (2,128,131 | ) | | (2,445,359 | ) |

| Net realized long-term gain on investments: | | | | | | | | | | | | | |

| Class A | | | (348,442 | ) | | (52,401 | ) | | (652,732 | ) | | — | |

| Class C | | | (28,555 | ) | | (4,748 | ) | | (55,969 | ) | | — | |

| Class D | | | (31,371 | ) | | (5,012 | ) | | (14,803 | ) | | — | |

| Total | | | (408,368 | ) | | (62,161 | ) | | (723,504 | ) | | — | |

Decrease in Net Assets from Distributions | | | (1,868,879 | ) | | (1,757,425 | ) | | (2,851,635 | ) | | (2,445,359 | ) |

(Continued on page 22.)

Statements of Changes in Net Assets

(continued)

| | | California High-Yield Series | | California Quality Series | |

| | | Year Ended September 30, | | Year Ended September 30, | |

| | | | 2005 | | | 2004 | | | 2005 | | | 2004 | |

Transactions in Shares of Beneficial Interest: | | | | | | | | | | | | | |

| Net proceeds from sales of shares | | $ | 503,407 | | $ | 617,449 | | $ | 1,044,303 | | $ | 857,790 | |

| Investment of dividends | | | 863,684 | | | 1,057,819 | | | 1,154,063 | | | 1,319,522 | |

| Exchanged from associated funds | | | 792,816 | | | 214,110 | | | 588,958 | | | 392,872 | |

Shares issued in payment of gain distributions | | | 293,176 | | | 45,728 | | | 493,409 | | | — | |

| Total | | | 2,453,083 | | | 1,935,106 | | | 3,280,733 | | | 2,570,184 | |

| Cost of shares repurchased | | | (4,977,036 | ) | | (7,594,446 | ) | | (8,061,544 | ) | | (13,256,279 | ) |

| Exchanged into associated funds | | | (222,590 | ) | | (2,023,689 | ) | | (397,068 | ) | | (781,100 | ) |

| Total | | | (5,199,626 | ) | | (9,618,135 | ) | | (8,458,612 | ) | | (14,037,379 | ) |

Decrease in Net Assets from Transactions in Shares of Beneficial Interest | | | (2,746,543 | ) | | (7,683,029 | ) | | (5,177,879 | ) | | (11,467,195 | ) |

Decrease in Net Assets | | | (2,903,421 | ) | | (7,312,895 | ) | | (6,017,131 | ) | | (11,365,599 | ) |

| | | | | | | | | | | | | | |

Net Assets: | | | | | | | | | | | | | |

| Beginning of year | | | 39,798,417 | | | 47,111,312 | | | 57,484,791 | | | 68,850,390 | |

End of Year* | | $ | 36,894,996 | | $ | 39,798,417 | | $ | 51,467,660 | | $ | 57,484,791 | |

| | | | | | | | | | | | | | |

| __________ | | | | | | | | | | | | | |

* Including undistributed net investment income | | $ | 58,269 | | $ | 46,610 | | $ | 188,326 | | $ | 204,224 | |

See Notes to Financial Statements.

Statements of Changes in Net Assets

(continued)

| | | Florida Series | | North Carolina Series | |

| | | Year Ended September 30, | | Year Ended September 30, | |

| | | 2005 | | 2004 | | 2005 | | 2004 | |

Operations: | | | | | | | | | |

| Net investment income | | $ | 1,463,794 | | $ | 1,577,895 | | $ | 759,871 | | $ | 860,919 | |

| Net realized gain on investments | | | 172,452 | | | 2,641 | | | 122,197 | | | 109,021 | |

| Net change in unrealized appreciation of investments | | | (553,167 | ) | | (373,860 | ) | | (372,492 | ) | | (316,637 | ) |

Increase in Net Assets from Operations | | | 1,083,079 | | | 1,206,676 | | | 509,576 | | | 653,303 | |

| | | | | | | | | | | | | | |

Distributions to Shareholders: | | | | | | | | | | | | | |

| Net investment income: | | | | | | | | | | | | | |

| Class A | | | (1,264,083 | ) | | (1,359,437 | ) | | (653,505 | ) | | (741,627 | ) |

| Class C | | | (139,901 | ) | | (155,059 | ) | | (72,461 | ) | | (83,757 | ) |

| Class D | | | (44,218 | ) | | (47,152 | ) | | (19,398 | ) | | (21,066 | ) |

| Total | | | (1,448,202 | ) | | (1,561,648 | ) | | (745,364 | ) | | (846,450 | ) |

| Net realized long-term gain on investments: | | | | | | | | | | | | | |

| Class A | | | (19,968 | ) | | (67,424 | ) | | (51,439 | ) | | (94,021 | ) |

| Class C | | | (2,907 | ) | | (9,437 | ) | | (7,560 | ) | | (13,462 | ) |

| Class D | | | (839 | ) | | (3,002 | ) | | (1,847 | ) | | (3,449 | ) |

| Total | | | (23,714 | ) | | (79,863 | ) | | (60,846 | ) | | (110,932 | ) |

Decrease in Net Assets from Distributions | | | (1,471,916 | ) | | (1,641,511 | ) | | (806,210 | ) | | (957,382 | ) |

(Continued on page 24.)

Statements of Changes in Net Assets

(continued)

| | | Florida Series | | North Carolina Series | |

| | | Year Ended September 30, | | Year Ended September 30, | |

| | | 2005 | | 2004 | | 2005 | | 2004 | |

Transactions in Shares of Beneficial Interest: | | | | | | | | | |

| Net proceeds from sales of shares | | $ | 1,045,897 | | $ | 3,745,067 | | $ | 272,380 | | $ | 732,808 | |

| Investment of dividends | | | 758,900 | | | 838,907 | | | 479,784 | | | 558,248 | |

| Exchanged from associated funds | | | 617,634 | | | 449,231 | | | 133,328 | | | 354,851 | |

| Shares issued in payment of gain distributions | | | 16,047 | | | 54,728 | | | 49,160 | | | 86,785 | |

| Total | | | 2,438,478 | | | 5,087,933 | | | 934,652 | | | 1,732,692 | |

| Cost of shares repurchased | | | (5,945,877 | ) | | (6,321,997 | ) | | (5,388,968 | ) | | (4,106,771 | ) |

| Exchanged into associated funds | | | (227,031 | ) | | (211,752 | ) | | (95,331 | ) | | (128,064 | ) |

| Total | | | (6,172,908 | ) | | (6,533,749 | ) | | (5,484,299 | ) | | (4,234,835 | ) |

Decrease in Net Assets from Transactions in Shares of Beneficial Interest | | | (3,734,430 | ) | | (1,445,816 | ) | | (4,549,647 | ) | | (2,502,143 | ) |

Decrease in Net Assets | | | (4,123,267 | ) | | (1,880,651 | ) | | (4,846,281 | ) | | (2,806,222 | ) |

| | | | | | | | | | | | | | |

Net Assets: | | | | | | | | | | | | | |

| Beginning of year | | | 38,503,823 | | | 40,384,474 | | | 23,573,608 | | | 26,379,830 | |

End of Year* | | $ | 34,380,556 | | $ | 38,503,823 | | $ | 18,727,327 | | $ | 23,573,608 | |

| | | | | | | | | | | | | | |

| __________ | | | | | | | | | | | | | |

* Including undistributed net investment income | | $ | 74,147 | | $ | 83,163 | | $ | 50,553 | | $ | 44,730 | |

See Notes to Financial Statements.

Notes to Financial Statements

1. | Multiple Classes of Shares — Seligman Municipal Series Trust (the “Trust”) consists of four separate series: the “California High-Yield Series,” the “California Quality Series,” the “Florida Series,” and the “North Carolina Series.” Each Series of the Trust offers three classes of shares. |

| | |

| | Class A shares are sold with an initial sales charge of up to 4.75% and a continuing service fee of up to 0.25% on an annual basis. Class A shares purchased in an amount of $1,000,000 or more are sold without an initial sales charge but are subject to a contingent deferred sales charge (“CDSC”) of 1% on redemptions within 18 months of purchase. |

| | |

| | Class C shares are sold primarily with an initial sales charge of up to 1%, and a CDSC, if applicable, of 1% imposed on redemptions made within 18 months of purchase. Class C shares purchased through certain financial intermediaries may be bought without an initial sales charge and with a 1% CDSC on redemptions made within 12 months of purchase. All Class C shares are subject to a distribution fee of up to 0.75% and a service fee of up to 0.25% on an annual basis. |

| | |

| | Class D shares are sold without an initial sales charge but are subject to a distribution fee of up to 0.75% and a service fee of up to 0.25% on an annual basis, and a CDSC, if applicable, of 1% imposed on redemptions made within one year of purchase. |

| | |

| | The three classes of shares for each Series represent interests in the same portfolio of investments, have the same rights and are generally identical in all respects except that each class bears its separate distribution and certain other class-specific expenses, and has exclusive voting rights with respect to any matter on which a separate vote of any class is required. |

| | |

2. | Significant Accounting Policies — The financial statements have been prepared in conformity with accounting principles generally accepted in the United States of America, which require management to make certain estimates and assumptions at the date of the financial statements. Actual results may differ from these estimates. The following summarizes the significant accounting policies of the Trust: |

| | a. | Security Valuation — Traded securities are valued at the last sales price on the primary market on which they are traded. Securities for which there is no last sales price are valued by independent pricing services based on bid prices which consider such factors as transactions in bonds, quotations from bond dealers, market transactions in comparable securities and various relationships between securities or are valued by J. & W. Seligman & Co. Incorporated (the “Manager”) based on quotations provided by primary market makers in such securities. Securities for which market quotations are not readily available (or are otherwise no longer valid or reliable) are valued at fair value determined in accordance with procedures approved by the Trustees. This can occur in the event of, among other things, natural disasters, acts of terrorism, market disruptions, intra-day trading halts, and extreme market volatility. Short-term holdings maturing in 60 days or less are valued at amortized cost. |

| | | |

| | b. | Federal Taxes — There is no provision for federal income tax. Each Series has elected to be taxed as a regulated investment company and intends to distribute substantially all taxable net income and net realized gains. |

| | c. | Security Transactions and Related Investment Income — Investment transactions are recorded on trade dates. Identified cost of investments sold is used for both financial reporting and federal income tax purposes. Interest income is recorded on the accrual basis. The Trust amortizes discounts and premiums paid on bonds and other debt securities for financial reporting purposes. Short-term holdings include securities with stated or effective maturity dates of less than one year. Variable rate demand notes purchased by the Trust may be put back to the designated remarketing agent for the issue at par on any day, for settlement within seven days, and, accordingly, are treated as short-term holdings. These notes bear interest at a rate that resets daily or weekly. At September 30, 2005, the interest rates paid on these notes ranged from 2.72% to 2.95%. |

Notes to Financial Statements

| | d. | Multiple Class Allocations — Each Series’ income, expenses (other than class-specific expenses), and realized and unrealized gains or losses are allocated daily to each class of shares of that Series based upon the relative value of the shares of each class. Class-specific expenses, which include distribution and service fees and any other items that are specifically attributable to a particular class, are charged directly to such class. For the year ended September 30, 2005, distribution and service fees were the only class-specific expenses. |

| | | |

| | e. | Distributions to Shareholders — Dividends are declared daily and paid monthly. Other distributions paid by the Trust are recorded on the ex-dividend date. |

| | | |

| | f. | Restricted Cash — Restricted cash represents deposits that are being held as collateral for letters of credit issued by banks in connection with the Fund’s insurance policies. |

3. | Management Fee, Distribution Services, and Other Transactions — The Manager manages the affairs of the Trust and provides the necessary personnel and facilities. Compensation of all officers of the Trust, all trustees of the Trust who are employees of the Manager, and all personnel of the Trust and the Manager is paid by the Manager. The Manager’s fee is calculated daily and payable monthly, equal to 0.50% per annum of each Series’ average daily net assets. The Manager, at its discretion, agreed to waive a portion of its fees for the year ended September 30, 2005 to limit the per annum fee of California High-Yield Series and Florida Series to 0.40% and 0.35%, respectively. For the year ended September 30, 2005, the amounts of fees waived by the Manager for California High-Yield Series and Florida Series were $38,332 and $54,896, respectively. |

| | |

| | Seligman Advisors, Inc. (the “Distributor”), agent for the distribution of the Trust’s shares and an affiliate of the Manager, received the following concessions from sales of Class A shares, after commissions were paid to dealers for sales of Class A and Class C shares: |

| | Series | Distributor Concessions | | Dealer Commissions |

| | California High-Yield | $1,688 | | $11,350 |

| | California Quality | 3,879 | | 28,036 |

| | Florida | 3,315 | | 24,923 |

| | North Carolina | 1,231 | | 8,418 |

| | The Trust has an Administration, Shareholder Services and Distribution Plan (the “Plan”) with respect to distribution of its shares. Under the Plan, with respect to Class A shares, service organizations can enter into agreements with the Distributor and receive continuing fees of up to 0.25% on an annual basis of the average daily net assets of the Class A shares attributable to the particular service organizations for providing personal services and/or the maintenance of shareholder accounts. The Distributor charges such fees to the Trust monthly pursuant to the Plan. For the year ended September 30, 2005, for California High-Yield Series, California Quality Series, Florida Series, and North Carolina Series, fees incurred under the Plan aggregated to $32,705, $49,273, $77,637, and $46,272, respectively, or 0.10%, 0.10%, 0.25%, and 0.25%, respectively, per annum of average daily net assets of Class A shares. |

| | |

| | Under the Plan, with respect to Class C shares and Class D shares, service organizations can enter into agreements with the Distributor and receive continuing fees for providing personal services and/or the maintenance of shareholder accounts of up to 0.25% on an annual basis of the average daily net assets of the Class C and Class D shares for which the organizations are responsible, and fees for providing other distribution assistance of up to 0.75% on an annual basis of such average daily net assets. Such fees are paid monthly by the Trust to the Distributor pursuant to the Plan. For the year ended September 30, 2005, fees incurred under the Plan equivalent to 1% per annum of the average daily net assets of Class C and Class D shares were as follows: |

Notes to Financial Statements

| | Series | | Class C | | Class D | |

| | California High-Yield | $ | 26,081 | $ | 29,918 | |

| | California Quality | | 38,786 | | 10,805 | |

| | Florida | | 42,281 | | 13,353 | |

| | North Carolina | | 26,231 | | 6,959 | |

| | The Distributor is entitled to retain any CDSC imposed on certain redemptions of Class A, Class C and Class D shares. For the year ended September 30, 2005, such charges amounted to $931 for California High-Yield Series, $366 for California Quality Series, $197 for Florida Series, and $875 for North Carolina Series. |

| | |

| | Seligman Services, Inc., an affiliate of the Manager, is eligible to receive commissions from certain sales of Trust shares, as well as distribution and service fees pursuant to the Plan. For the year ended September 30, 2005, Seligman Services, Inc. received commissions from the sales of shares of each Series and distribution and service fees, pursuant to the Plan, as follows: |

| | Series | | Commissions | | Distribution and Service Fees | |

| | California High-Yield | $ | 369 | $ | 3,984 | |

| | California Quality | | 1,560 | | 2,934 | |

| | Florida | | 1,338 | | 4,771 | |

| | North Carolina | | — | | 2,589 | |

| | Seligman Data Corp., which is owned by certain associated investment companies, charged each Series at cost for shareholder account services in accordance with a methodology approved by the Trust’s trustees as follows: |

| | Series | | |

| | California High-Yield | $80,636 | |

| | California Quality | 87,916 | |

| | Florida | 60,376 | |

| | North Carolina | 37,783 | |

| | Costs of Seligman Data Corp. directly attributable to a Series were charged to that Series. The remaining charges were allocated to each Series by Seligman Data Corp. pursuant to a formula based on each Series’ net assets, shareholder transaction volume and number of shareholder accounts. |

| | |

| | The Trust and certain other associated investment companies (together, the “Guarantors”) have severally but not jointly guaranteed the performance and observance of all the terms and conditions of two leases entered into by Seligman Data Corp., including the payment of rent by Seligman Data Corp. (the “Guaranties”). The leases and the Guaranties expire in September 2008 and January 2009. The obligation of the Trust to pay any amount due under either Guaranty is limited to a specified percentage of the full amount, which generally is based on the Trust’s percentage of the expenses billed by Seligman Data Corp. to all Guarantors in the most recent calendar quarter. As of September 30, 2005, the Trust’s potential obligation under the Guaranties is $45,500. As of September 30, 2005, no event has occurred which would result in the Trust becoming liable to make any payment under a Guaranty. Each Series would bear a portion of any payments made by the Trust under the Guaranties. A portion of rent paid by Seligman Data Corp. is charged to the Trust as part of Seligman Data Corp.’s shareholder account services cost. |

| | |

| | Certain officers and trustees of the Trust are officers or directors of the Manager, the Distributor, Seligman Services, Inc., and/or Seligman Data Corp. |

Notes to Financial Statements

| | The Trust has a compensation agreement under which trustees who receive fees may elect to defer receiving such fees. Trustees may elect to have their deferred fees accrue interest or earn a return based on the performance of selected Series of the Trust or other funds in the Seligman Group of Investment Companies. Deferred fees and related accrued earnings are not deductible for federal income tax purposes until such amounts are paid. The cost of such fees and earnings/losses accrued thereon is included in trustees’ fees and expenses, and the accumulated balances thereof at September 30, 2005, are included in accrued expenses and other liabilities as follows: |

| | Series | | |

| | California High-Yield | $8,794 | |

| | California Quality | 9,004 | |

| | Florida | 5,814 | |

| | North Carolina | 4,955 | |

4. | Committed Line of Credit — The Trust is a participant in a joint $400 million committed line of credit that is shared by substantially all open-end funds in the Seligman Group of Investment Companies. Each Series’ borrowings are limited to 10% of its net assets. Borrowings pursuant to the credit facility are subject to interest at a per annum rate equal to the overnight federal funds rate plus 0.50%. Each Series incurs a commitment fee of 0.10% per annum on its share of the unused portion of the credit facility. The credit facility may be drawn upon only for temporary purposes and is subject to certain other customary restrictions. The credit facility commitment expires in June 2006, but is renewable annually with the consent of the participating banks. For the year ended September 30, 2005, the Trust did not borrow from the credit facility. |

| | |

5. | Purchases and Sales of Securities — Purchases and sales of portfolio securities, excluding short-term investments, for the year ended September 30, 2005, were as follows: |

| | Series | Purchases | | Sales | |

| | California High-Yield | $775,508 | $ | 505,000 | |

| | California Quality | — | | 6,149,910 | |

| | Florida | — | | 4,345,110 | |

| | North Carolina | — | | 3,427,864 | |

6. | Federal Tax Information — Certain components of income, expense and realized capital gain and loss are recognized at different times or have a different character for federal income tax purposes and for financial reporting purposes. Where such differences are permanent in nature, they are reclassified in the components of net assets based on their characterization for federal income tax purposes. Any such reclassifications will have no effect on net assets, results of operations or net asset value per share of the Fund. As a result of the differences described above, the treatment for financial reporting purposes of distributions made during the year from net investment income or net realized gains may differ from their ultimate treatment for federal income tax purposes. Further, the cost of investments also can differ for federal income tax purposes. |

| | |

| | At September 30, 2005, each Series’ tax basis cost of investments for federal income tax purposes was less than the cost for financial reporting purposes due to the amortization of market discount for financial reporting purposes, offset, in part, for the California Quality Series by the tax deferral of losses on wash sales of $149,160. The tax basis cost of investments was as follows: |

Notes to Financial Statements

| | Series | | Tax Basis Cost | |

| | California High-Yield | $ | 34,607,481 | |

| | California Quality | | 47,645,844 | |

| | Florida | | 31,637,818 | |

| | North Carolina | | 17,186,903 | |

| | At September 30, 2005, the tax basis components of accumulated earnings were as follows: |

| | Series | California High-Yield | | California Quality | | Florida | | North Carolina | |

| | Gross unrealized appreciation of portfolio securities | $1,857,894 | | $3,116,552 | | $2,095,317 | | $1,281,645 | |

| | Gross unrealized depreciation of portfolio securities | (6,014 | ) | — | | — | | — | |

| | Net unrealized appreciation of portfolio securities | 1,851,880 | | 3,116,552 | | 2,095,317 | | 1,281,645 | |

| | Undistributed tax-exempt income | 13,581 | | 89,481 | | 56,797 | | 32,488 | |

| | Accumulated net realized gain | — | | 233,170 | | 174,110 | | 129,075 | |

| | Total accumulated earnings | $1,865,461 | | $3,439,203 | | $2,326,224 | | $1,443,208 | |

| | The tax characterization of distributions paid was as follows: |

| | | | Year Ended September 30, | |

| | | | 2005 | | 2004 | |

| | Tax-exempt income: | | | | | |

| | California High-Yield | $ | 1,513,097 | $ | 1,695,264 | |

| | California Quality | | 2,128,131 | | 2,445,359 | |

| | Florida | | 1,448,202 | | 1,561,648 | |

| | North Carolina | | 745,364 | | 846,450 | |

| | Long-term capital gains: | | | | | |

| | California High-Yield | | 355,782 | | 62,161 | |

| | California Quality | | 723,504 | | — | |

| | Florida | | 23,714 | | 79,863 | |

| | North Carolina | | 60,846 | | 110,932 | |

| | For the year ended September 30, 2005, the California Quality Series repurchased 1,183,429 shares from shareholders aggregating $8,061,544, of which approximately $14,200 represents capital gain distributions. This information is provided for federal tax purposes only. |

Notes to Financial Statements

7. | Transactions in Shares of Beneficial Interest — Transactions in Shares of Beneficial Interest were as follows: |

| | California High-Yield Series | | | | | | | | | |

| | | | Year Ended September 30, | |

| | | | 2005 | | 2004 | |

| | Class A | | Shares | | Amount | | Shares | | Amount | |

| | Net proceeds from sales of shares | | | 59,615 | | $ | 395,391 | | | 57,113 | | $ | 375,394 | |

| | Investment of dividends | | | 113,844 | | | 754,713 | | | 138,030 | | | 910,389 | |

| | Exchanged from associated funds | | | 30,967 | | | 204,413 | | | 31,079 | | | 204,193 | |

| | Shares issued in payment of gain distributions | | | 37,131 | | | 244,320 | | | 5,700 | | | 37,619 | |

| | Total | | | 241,557 | | | 1,598,837 | | | 231,922 | | | 1,527,595 | |

| | Cost of shares repurchased | | | (622,899 | ) | | (4,130,453 | ) | | (914,361 | ) | | (6,028,373 | ) |

| | Exchanged into associated funds | | | (32,609 | ) | | (217,152 | ) | | (46,820 | ) | | (311,799 | ) |

| | Total | | | (655,508 | ) | | (4,347,605 | ) | | (961,181 | ) | | (6,340,172 | ) |

| | Decrease | | | (413,951 | ) | $ | (2,748,768 | ) | | (729,259 | ) | $ | (4,812,577 | ) |

| | Class C | | | Shares | | | Amount | | | Shares | | | Amount | |

| | Net proceeds from sales of shares | | | 12,984 | | $ | 86,027 | | | 21,506 | | $ | 142,215 | |

| | Investment of dividends | | | 7,953 | | | 52,760 | | | 11,774 | | | 77,751 | |

| | Exchanged from associated funds | | | 4,728 | | | 31,382 | | | — | | | — | |

| | Shares issued in payment of gain distributions | | | 3,786 | | | 24,951 | | | 618 | | | 4,087 | |

| | Total | | | 29,451 | | | 195,120 | | | 33,898 | | | 224,053 | |

| | Cost of shares repurchased | | | (101,439 | ) | | (675,224 | ) | | (116,624 | ) | | (769,512 | ) |

| | Total | | | (101,439 | ) | | (675,224 | ) | | (116,624 | ) | | (769,512 | ) |

| | Decrease | | | (71,988 | ) | $ | (480,104 | ) | | (82,726 | ) | $ | (545,459 | ) |

| | Class D | | | Shares | | | Amount | | | Shares | | | Amount | |

| | Net proceeds from sales of shares | | | 3,299 | | $ | 21,989 | | | 15,309 | | $ | 99,840 | |

| | Investment of dividends | | | 8,473 | | | 56,211 | | | 10,548 | | | 69,679 | |

| | Exchanged from associated funds | | | 83,528 | | | 557,021 | | | 1,501 | | | 9,917 | |

| | Shares issued in payment of gain distributions | | | 3,628 | | | 23,905 | | | 609 | | | 4,022 | |

| | Total | | | 98,928 | | | 659,126 | | | 27,967 | | | 183,458 | |

| | Cost of shares repurchased | | | (25,714 | ) | | (171,359 | ) | | (121,739 | ) | | (796,561 | ) |

| | Exchanged into associated funds | | | (820 | ) | | (5,438 | ) | | (260,534 | ) | | (1,711,890 | ) |

| | Total | | | (26,534 | ) | | (176,797 | ) | | (382,273 | ) | | (2,508,451 | ) |

| | Increase (decrease) | | | 72,394 | | $ | 482,329 | | | (354,306 | ) | $ | (2,324,993 | ) |

Notes to Financial Statements

| | California Quality Series | | | | | | | | | |