UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-4250

Seligman Municipal Series Trust

(Exact name of Registrant as specified in charter)

100 Park Avenue

New York, New York 10017

(Address of principal executive offices) (Zip code)

Lawrence P. Vogel

100 Park Avenue

New York, New York 10017

(Name and address of agent for service)

Registrant’s telephone number, including area code: (212) 850-1864

Date of fiscal year end: 9/30

Date of reporting period: 9/30/03

FORM N-CSR

ITEM 1. REPORTS TO STOCKHOLDERS.

SELIGMAN MUNICIPAL SERIES TRUST

Annual Report September 30, 2003

| Seligman |

| Municipal Series Trust |

California High-Yield Series California Quality Series Florida Series North Carolina Series | |

| | |

| | Annual Report |

| | September 30, 2003 |

| | Seeking Income Exempt |

| | From Regular Income Tax |

| | |

| |  |

Seligman

139 Years of Investment Experience

J. & W. Seligman & Co. Incorporated is a firm with a long tradition of investment expertise, offering a broad array of investment choices to help today’s investors seek their long-term financial goals.

Established in 1864, Seligman has a history of providing financial services marked not by fanfare, but rather by a quiet and firm adherence to financial prudence. While the world has changed dramatically in the 139 years since Seligman first opened its doors, the firm has continued to offer its clients high-quality investment solutions through changing times.

In the late 19th century, as the country grew, Seligman helped finance the westward expansion of the railroads, the construction of the Panama Canal, and the launching of urban transit systems. In the early 20th century, the firm helped fund the growing capital needs of new industries, including the nascent automobile and steel industries.

With the formation of Tri-Continental Corporation in 1929 — today, the nation’s largest diversified publicly- traded closed-end equity investment company — Seligman began shifting its emphasis to investment management. In 1930, Seligman established what would be the first in an impressive lineup of mutual funds.

Seligman is proud of its distinctive past and of the traditional values that continue to shape the firm’s business decisions and investment judgment. While much has changed over the years, the firm’s commitment to providing prudent investment management that seeks to build wealth for clients over time is an enduring value that will continue to guide Seligman.

Table of Contents | | |

| | | |

| | 1 |

| | | |

| | 2 |

| | | |

| | 4 |

| | | |

| | 10 |

| | | |

| | 15 |

| | | |

| | 17 |

| | | |

| | 18 |

| | | |

| | 22 |

| | | |

| | 30 |

| | | |

| | 42 |

| | | |

| | 43 |

| | | |

| | 47 |

| | | |

| | back cover |

We are pleased to present the annual report for Seligman Municipal Series Trust, covering the fiscal year ended September 30, 2003. This report contains a discussion with your Portfolio Managers, performance information, as well as the Series’ investment results and audited financial statements, including their portfolios of investments.

We appreciate your confidence in Seligman Municipal Series Trust and look forward to serving your investment needs for many years to come.

By Order of the Trustees,

William C. Morris Chairman

Brian T. Zino President

November 14, 2003

1

Thomas G. Moles and Eileen A. Comerford

Q: What market conditions and events materially affected the performance of the Series in Seligman Municipal Series Trust during the fiscal year ended September 30, 2003?

A: At this time last year, the US economy was exhibiting signs of strengthening which provided a needed boost to investor confidence and sparked a strong stock market rally. Hopes for a more vigorous recovery soon faded, though, as the growing prospect of military action in Iraq caused consumers and businesses to curtail spending and investment, resulting in sharp reductions in growth forecasts. The collapse of the ruling regime in Iraq triggered a brief period of optimism but failed to provide the anticipated boost to economic activity. The pace of the recovery remained sluggish throughout the second quarter of 2003, contributing to a steady decline in bond yields. The bond rally intensified in May after the Federal Reserve Board in dicated that the possibility of deflation, while remote, was a concern. By mid-June, long-term municipal yields had fallen to the lowest level in 35 years. Just two weeks later, however, the Federal Reserve Board surprised the markets by reducing the federal funds rate less than generally expected. The Fed’s more favorable economic outlook caused a dramatic shift in market sentiment, spurring a powerful bond market reversal that sent municipal bond yields almost a full percentage point higher. Long-term municipal yields, as measured by the Bond Buyer 20-Bond General Obligation Index, reached a 12- month high in mid-August then gradually declined, ending the recently completed fiscal year approximately 1/8 point higher than at the start of the period.

The attractive interest rate environment continues to spur heavy municipal bond issuance. Through September 30th, supply totaled $286 billion, an increase of 12.9% over the same period last year. Refunding bonds, which are typically issued to retire outstanding, higher-cost debt, comprised a significant percentage of total volume.

Among the largest state issuers, volume varied widely—issuance increased 60% in California, decreased 18.6% in New York and was unchanged in Texas. Increasingly, states and municipalities are resorting to deficit financing as a means of closing budget gaps, which includes the issuance of controversial tobacco securitization bonds and pension obligation bonds.

Demand for municipal bonds, both retail and institutional, has been strong over the past year, supporting the increased supply as well as providing stability to the market during periods of interest rate volatility. For many investors, municipal bonds offer a yield advantage compared with the after-tax returns of Treasury bonds. In addition, municipals continue to offer diversification from equity market volatility. While the stock market has historically provided superior investment returns in comparison to municipal investments, investors have been exposed to considerably higher risk in exchange for the extra performance. By including municipal securities in an investment portfolio, risk profiles can be reduced.

The recent recession and lackluster recovery resulted in significant state and local revenue shortfalls. The fiscal and political difficulties of the states have been headline news throughout the year. At present, a substantial number of US states have negative outlooks. Budget deficits for fiscal year 2004 were estimated at $80-100 billion and a return to balanced budgets for the majority of states is not expected until at least fiscal year 2005. Despite the severity of the states’ fiscal crises, we believe that, with few exceptions, state general obligation debt continues to be a good investment option. According to Standard & Poor’s Rating Services "state ratings remain S&P’s most creditworthy sector in public finance with an average rating of ‘AA’ or better."

Q: What investment strategies or techniques materially affected the Series’ performance during the period?

2

Interview With Your Portfolio Managers

Thomas G. Moles and Eileen A. Comerford

A: Over the past fiscal year, we expected economic growth to accelerate and lead to a modest increase in yields. We were also concerned that a rising stock market would lessen demand for municipal bonds, putting additional upward pressure on yields. Portfolio cash balances were generally maintained at higher than normal levels in anticipation of a gradual increase in yields as conditions improved, although there were periods where cash diverged from targeted levels. During the first three quarters of the current fiscal-year, long-term municipal bond yields trended lower, reaching a 35- year low in mid-June (in general, prices on fixed-coupon bonds rise as yields fall). Much of the decline in yields can be attributed to a flight-to-quality r esponse prompted by prolonged economic weakness, geopolitical concerns, and stock market volatility. Long-term municipal yields did not begin to move meaningfully higher until the Trust’s fourth fiscal quarter, later than we had forecast. Still, the sharp increase in yields during July and August provided us with an opportunity to re-deploy a portion of cash holdings in each of the Series at more attractive levels than had been available during most of the year. New purchases were concentrated in the 20-year maturity range, somewhat shorter than typical. The municipal yield curve had flattened at approximately this point, which enabled the Trust to capture maximum yields while reducing interest rate risk (in general, the longer the maturity, the greater the price sensitivity to changes in interest rates).

Our investment strategy during the past fiscal year was more defensive than was warranted by actual market conditions. Nevertheless, all of the Series outperformed their peer-group average (Lipper Analytical Services, Inc.) for the 12-month period ended September 30, 2003. The Series’ positive investment performance was primarily attributable to interest income. However, the increase in yields during the period resulted in price return that was slightly negative for each Series except the Florida Series, for which it was flat.

The Series in Seligman Municipal Series Trust place considerable emphasis on credit research. All portfolio holdings are carefully analyzed prior to purchase and are regularly monitored to ensure that they continue to meet our credit criteria. The Trust does not own tobacco securitization bonds—tobacco bonds, as they are currently structured, do not meet our credit criteria and have never been approved for purchase. The nation’s airlines continue to struggle, and their outlook remains negative. The Trust has no exposure to airline debt. The California Quality, Florida, and North Carolina Series own airport bonds, which have a broader source of revenue than airline bonds. All airport holdings are insured and rated "AAA." Credit quality in the Trust remains high with the exception of the California High-Yield Series, at least 86% of each Series’ holdings are rated "A" or higher.

______________

The views and opinions expressed are those of the Portfolio Manager(s), are provided for general information only, and do not constitute specific tax, legal, or investment advice to, or recommendations for, any person. There can be no guarantee as to the accuracy of market forecasts. Opinions, estimates, and forecasts may be changed without notice.

A Team Approach

Seligman Municipal Series Trust is managed by the Seligman Municipals Team, headed by Thomas G. Moles. Mr. Moles and Co-Portfolio Manager Eileen Comerford are assisted in the management of the Trust by a group of seasoned professionals who are responsible for research and trading consistent with the Trust’s investment objective. Team members include Senior Credit Analyst Audrey Kuchtyak, Theresa Barion, and Debra McGuinness.

3

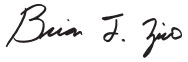

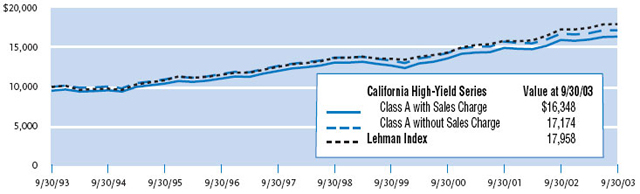

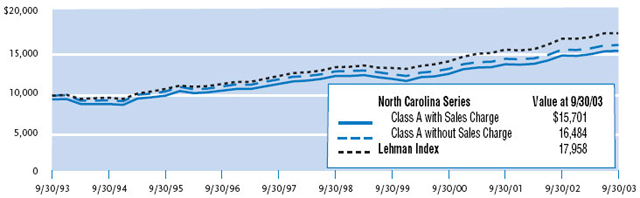

The following charts compare a $10,000 hypothetical investment made in each Series of Seligman Municipal Series Trust Class A shares, with and without the initial 4.75% maximum sales charge, to a $10,000 investment in the Lehman Brothers Municipal Bond Index (Lehman Index), for the ten-year period ended September 30, 2003. Calculations assume reinvestment of distributions. The performances of each Series of Seligman Municipal Series Trust Class C and Class D shares are not shown in the charts but are included in the table following each chart. Performance data quoted does not reflect the deduction of taxes that an investor may pay on Trust distributions or the redemption of Trust shares. Past performance i s not indicative of future investment results. It is important to keep in mind that the Lehman Index does not include the effect of taxes, or sales charges, and does not reflect state-specific bond market performance. The table following each chart also includes relevant portfolio characteristics for each Series.

California High-Yield Series

The performance of Class C and Class D shares will differ from the performance shown for Class A shares, based on the difference in sales charges and fees paid by shareholders.

(Continued on next page.)

4

Performance Overview and Portfolio Summary

California High-Yield Series (continued)

Investment Results

Total Returns

For Periods Ended September 30, 2003

| | | | | | Average Annual |

| | | | |

|

|

|

|

|

|

|

|

|

| | | | | | | | | | | | | | | Class C | | Class D |

| | | | | | | | | | | | | | | Since | | Since |

| | | Six | | One | | Five | | Ten | | Inception | | Inception |

Class A ** | | Months * | | Year | | Years | | Years | | 5/27/99 | | 2/1/94 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| With Sales Charge | | (2.87 | )% | | (2.44 | )% | | 3.57 | % | | 5.04 | % | | n/a | | | n/a | |

| Without Sales Charge | | 1.99 | | | 2.48 | | | 4.58 | | | 5.56 | | | n/a | | | n/a | |

Class C ** | | | | | | | | | | | | | | | | | | |

|

|

|

|

|

|

|

|

|

|

|

|

|

| With Sales Charge and CDSC# | | (0.37 | ) | | (0.45 | ) | | n/a | | | n/a | | | 3.96 | % | | n/a | |

| Without Sales Charge and CDSC | | 1.68 | | | 1.56 | | | n/a | | | n/a | | | 4.22 | | | n/a | |

Class D ** | | | | | | | | | | | | | | | | | | |

|

|

|

|

|

|

|

|

|

|

|

|

|

| With 1% CDSC | | 0.68 | | | 0.58 | | | 3.68 | | | n/a | | | n/a | | | n/a | |

| Without CDSC | | 1.68 | | | 1.56 | | | 3.68 | | | n/a | | | n/a | | | 4.56 | % |

Lehman Index *** | | 2.66 | | | 3.89 | | | 5.67 | | | 6.03 | | | 6.28 | ‡ | | 5.97 | ‡‡ |

|

|

|

|

|

|

|

|

|

|

|

|

|

| | | | | | | | | Dividend, Capital Gain, and Yield Information Per Share |

| Net Asset Value Per Share | | For Periods Ended September 30, 2003 |

| |

|

| | | 9/30/03 | | 3/31/03 | | 9/30/02 | | Dividends † | | Capital Gain † | | SEC Yield †† |

| |

|

| Class A | | $6.59 | | $6.60 | | $6.74 | | $0.281 | | $0.029 | | 3.80% |

| Class C | | 6.60 | | 6.60 | | 6.75 | | 0.221 | | 0.029 | | 3.06 |

| Class D | | 6.60 | | 6.60 | | 6.75 | | 0.221 | | 0.029 | | 3.10 |

Holdings By Market Sector ø | | Moody’s/S&P Ratings ø |

| |

|

| Revenue Bonds | | 92% | | Aaa/AAA | | 10% |

| General Obligation Bondsøø | | 8 | | Aa/AA | | 8 |

| | | | | A/A | | 54 |

| Weighted Average Maturity | | 23.8 years | | Baa/BBB | | 22 |

| | Ca/CCC | | 6 |

_________

See footnotes on page 9.

5

Performance Overview and Portfolio Summary

California Quality Series

The performance of Class C and Class D shares will differ from the performance shown for Class A shares, based on the difference in sales charges and fees paid by shareholders.

Investment Results

Total Returns

For Periods Ended September 30, 2003

| | | | | | Average Annual |

| | | | |

|

|

|

|

|

|

|

|

|

| | | | | | | | | | | | | | | Class C | | Class D |

| | | | | | | | | | | | | | | Since | | Since |

| | | Six | | One | | Five | | Ten | | Inception | | Inception |

Class A ** | | Months * | | Year | | Years | | Years | | 5/27/99 | | 2/1/94 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| With Sales Charge | | (3.18 | )% | | (3.19 | )% | | 3.63 | % | | 4.69 | % | | n/a | | | n/a | |

| Without Sales Charge | | 1.58 | | | 1.63 | | | 4.65 | | | 5.19 | | | n/a | | | n/a | |

Class C ** | | | | | | | | | | | | | | | | | | |

|

|

|

|

|

|

|

|

|

|

|

|

|

| With Sales Charge and CDSC# | | (1.02 | ) | | (1.24 | ) | | n/a | | | n/a | | | 4.18 | % | | n/a | |

| Without Sales Charge and CDSC | | 0.98 | | | 0.72 | | | n/a | | | n/a | | | 4.43 | | | n/a | |

Class D ** | | | | | | | | | | | | | | | | | | |

|

|

|

|

|

|

|

|

|

|

|

|

| With 1% CDSC | | (0.01 | ) | | (0.26 | ) | | n/a | | | n/a | | | n/a | | | n/a | |

| Without CDSC | | 0.98 | | | 0.72 | | | 3.70 | | | n/a | | | n/a | | | 4.23 | % |

Lehman Index *** | | 2.66 | | | 3.89 | | | 5.67 | | | 6.03 | | | 6.28 | ‡ | | 5.97 | ‡‡ |

|

|

|

|

|

|

|

|

|

|

|

|

|

| | | | | | | | | Dividend and Yield Information Per Share |

| Net Asset Value Per Share | | For Periods Ended September 30, 2003 |

| |

|

| | | 9/30/03 | | 3/31/03 | | 9/30/02 | | Dividends † | | SEC Yield †† |

|

|

|

|

|

|

| |

|

|

|

| Class A | | $6.88 | | $6.91 | | $7.04 | | $0.270 | | 3.13% |

| Class C | | 6.85 | | 6.89 | | 7.01 | | 0.208 | | 2.38 |

| Class D | | 6.85 | | 6.89 | | 7.01 | | 0.208 | | 2.41 |

Holdings By Market Sector ø | | Moody’s/S&P Ratings ø |

| |

|

| Revenue Bonds | | 85% | | Aaa/AAA | | 70% |

| General Obligation Bonds øø | | 15 | | Aa/AA | | 12 |

| | | | | A/A | | 12 |

| Weighted Average Maturity | | 21.9 years | | Baa/BBB | | 6 |

|

|

| | | | |

_____________

See footnotes on page 9.

6

Performance Overview and Portfolio Summary

Florida Series

The performance of Class C and Class D shares will differ from the performance shown for Class A shares, based on the difference in sales charges and fees paid by shareholders.

Investment Results

Total Returns

For Periods Ended September 30, 2003

| | | | | | Average Annual |

| | | | | |

|

| | | | | | | | | | | | | | | Class C | | Class D |

| | | | | | | | | | | | | | | Since | | Since |

| | | Six | | One | | Five | | Ten | | Inception | | Inception |

Class A ** | | Months * | | Year | | Years | | Years | | 5/27/99 | | 2/1/94 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| With Sales Charge | | (2.48 | )% | | (0.76 | )% | | 3.96 | % | | 4.86 | % | | n/a | | | n/a | |

| Without Sales Charge | | 2.36 | | | 4.16 | | | 4.97 | | | 5.38 | | | n/a | | | n/a | |

Class C ** | | | | | | | | | | | | | | | | | | |

|

|

|

|

|

|

|

|

|

|

|

|

|

| With Sales Charge and CDSC# | | (0.14 | ) | | 1.24 | | | n/a | | | n/a | | | 4.63 | % | | n/a | |

| Without Sales Charge and CDSC | | 1.85 | | | 3.24 | | | n/a | | | n/a | | | 4.87 | | | n/a | |

Class D ** | | | | | | | | | | | | | | | | | | |

|

|

|

|

|

|

|

|

|

|

|

|

|

| With 1% CDSC | | 0.98 | | | 2.37 | | | n/a | | | n/a | | | n/a | | | n/a | |

| Without CDSC | | 1.98 | | | 3.37 | | | 4.21 | | | n/a | | | n/a | | | 4.55 | % |

Lehman Index *** | | 2.66 | | | 3.89 | | | 5.97 | | | 6.03 | | | 6.28 | ‡ | | 5.97 | ‡‡ |

|

|

|

|

|

|

|

|

|

|

| |

|

|

| | | | | | | | | Dividend, Capital Gain, and Yield Information Per Share |

| Net Asset Value Per Share | | For Periods Ended September 30, 2003 |

| |

|

| | | 9/30/03 | | 3/31/03 | | 9/30/02 | | Dividends † | | Capital Gain † | | SEC Yield †† |

|

|

|

|

|

|

| |

|

|

|

|

|

| Class A | | $8.08 | | $8.05 | | $8.08 | | $0.316 | | $0.011 | | 2.75% |

| Class C | | 8.09 | | 8.07 | | 8.10 | | 0.255 | | 0.011 | | 2.13 |

| Class D | | 8.10 | | 8.07 | | 8.10 | | 0.255 | | 0.011 | | 2.15 |

Holdings By Market Sector ø | | Moody’s/S&P Ratings ø |

| |

|

| Revenue Bonds | | 70% | | Aaa/AAA | | 71% |

| General Obligation Bonds øø | | 30 | | Aa/AA | | 8 |

| | | | | A/A | | 21 |

| Weighted Average Maturity | | 18.5 years | | | | |

|

|

| | | | |

______________

See footnotes on page 9.

7

Performance Overview and Portfolio Summary

North Carolina Series

The performance of Class C and Class D shares will differ from the performance shown for Class A shares, based on the difference in sales charges and fees paid by shareholders.

Investment Results

Total Returns

For Periods Ended September 30, 2003

| | | | | | Average Annual |

| | | | | |

|

| | | | | | | | | | | | | | | Class C | | Class D |

| | | | | | | | | | | | | | | Since | | Since |

| | | Six | | One | | Five | | Ten | | Inception | | Inception |

Class A ** | | Months * | | Year | | Years | | Years | | 5/27/99 | | 2/1/94 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| With Sales Charge | | (2.33 | )% | | (1.43 | )% | | 3.61 | % | | 4.61 | % | | n/a | | | n/a | |

| Without Sales Charge | | 2.51 | | | 3.51 | | | 4.61 | | | 5.12 | | | n/a | | | n/a | |

Class C ** | | | | | | | | | | | | | | | | | | |

|

|

|

|

|

|

|

|

|

|

|

|

|

| With Sales Charge and CDSC# | | 0.01 | | | 0.76 | | | n/a | | | n/a | | | 4.23 | % | | n/a | |

| Without Sales Charge and CDSC | | 2.00 | | | 2.74 | | | n/a | | | n/a | | | 4.47 | | | n/a | |

Class D ** | | | | | | | | | | | | | | | | | | |

|

|

|

|

|

|

|

|

|

|

|

|

|

| With 1% CDSC | | 1.00 | | | 1.75 | | | n/a | | | n/a | | | n/a | | | n/a | |

| Without CDSC | | 2.00 | | | 2.74 | | | 3.81 | | | n/a | | | n/a | | | 4.31 | % |

Lehman Index *** | | 2.66 | | | 3.89 | | | 5.67 | | | 6.03 | | | 6.28 | ‡ | | 5.97 | ‡‡ |

|

|

|

|

|

|

|

|

|

|

|

|

|

| | | | | | | | | Dividend, Capital Gain, and Yield Information Per Share |

| Net Asset Value Per Share | | For Periods Ended September 30, 2003 |

| |

|

| | | 9/30/03 | | 3/31/03 | | 9/30/02 | | Dividends † | | Capital Gain † | | SEC Yield †† |

|

|

|

|

|

|

| |

|

|

|

|

|

| Class A | | $8.14 | | $8.08 | | $8.19 | | $0.291 | | $0.037 | | 2.85% |

| Class C | | 8.13 | | 8.08 | | 8.18 | | 0.230 | | 0.037 | | 2.23 |

| Class D | | 8.13 | | 8.08 | | 8.18 | | 0.230 | | 0.037 | | 2.26 |

Holdings By Market Sector ø | | Moody’s/S&P Ratings ø |

| |

|

| Revenue Bonds | | 72% | | Aaa/AAA | | 45% |

| General Obligation Bonds øø | | 28 | | Aa/AA | | 31 |

| | | | | A/A | | 10 |

| Weighted Average Maturity | | 17.6 years | | Baa/BBB | | 14 |

|

|

| | | | |

_____________

See footnotes on page 9.

8

Performance Overview and Portfolio Summary

______________

| * | | Returns for periods of less than one year are not annualized. |

| | | |

| ** | | Return figures reflect any change in price and assume all distributions within the period are reinvested in additional shares. Returns for Class A shares are calculated with and without the effect of the initial 4.75% maximum sales charge. Returns for Class C shares are calculated with and without the effect of the initial 1% maximum sales charge and the 1% contingent deferred sales charge ("CDSC") that is charged on redemptions made within 18 months of purchase. Returns for Class D shares are calculated with and without the effect of the 1% CDSC, charged on redemptions made within one year of purchase. The rates of return will vary and the principal value of an investment will fluctuate. Shares, if redeemed, may be worth more or less than their original cost. A portion of each Series’ income may be s ubject to applicable state and local taxes, and any amount may be subject to the federal alternative minimum tax. An investment in the Trust is not insured by the Federal Deposit Insurance Corporation or any other government agency. Past performance is not indicative of future investment results. During the periods presented, the Manager, at its discretion, waived a portion of its management fee for the California High-Yield and Florida Series. Absent such waivers, returns would have been lower. |

| | | |

| *** | | The Lehman Index is an unmanaged index that does not include any fees or sales charges. It is composed of approximately 60% revenue bonds and 40% state government obligations. Investors cannot invest directly in an index. |

| | | |

| # | | The CDSC is 1% for periods of 18 months or less. |

| | | |

| ‡ | | From 5/31/99. |

| | | |

| ‡‡ | | From 1/31/94. |

| | | |

| † | | Represents per share amount paid or declared for the year ended September 30, 2003. |

| | | |

| †† | | Current yield, representing the annualized yield for the 30-day period ended September 30, 2003, has been computed in accordance with SEC regulations and will vary. During the period, the Manager, at its discretion, waived a portion of its management fee for the California High-Yield and Florida Series. Without these waivers the yields would be as follows: |

| | | Class A | | Class C | | Class D | |

|

| California High-Yield Series | | 3.70% | | 2.96% | | 3.00% | |

| Florida Series | | 2.60 | | 1.98 | | 2.00 | |

ø | | Percentages based on current market values of long-term holdings at September 30, 2003. |

øø | | Includes pre-refunded and escrowed-to-maturity securities. |

9

September 30, 2003

California High-Yield Series

Face Amount | | Municipal Bonds | | Ratings Moody’s/S&P † | | Market Value |

|

|

|

|

|

|

|

| $1,000,000 | | California Department of Veterans’Affairs (Home Purchase Rev.), 5 1/2% due 12/1/2018* | | Aa2/AA | | $ 1,045,070 |

| 1,500,000 | | California Department of Veterans’Affairs (Home Purchase Rev.), 5.60% due 12/1/2028 | | Aaa/AAA | | 1,534,860 |

| 1,000,000 | | California Educational Facilities Authority Rev. (Loyola Marymount University), 5 3/4% due 10/1/2024ø | | Aaa/NR | | 1,043,870 |

| 275,000 | | California Educational Facilities Authority Rev. (Loyola Marymount University), 5 3/4% due 10/1/2024 | | A2/NR | | 285,651 |

| 2,500,000 | | California Educational Facilities Authority Rev. (Scripps College), 5% due 8/1/2031 | | A1/NR | | 2,488,650 |

| 3,000,000 | | California Health Facilities Financing Authority Rev. (Cedars-Sinai Medical Center), 6 1/4% due 12/1/2034 | | A3/NR | | 3,212,400 |

| 2,750,000 | | California Health Facilities Financing Authority Rev. (Kaiser Permanente), 5.40% due 5/1/2028 | | A3/A | | 2,776,235 |

| 2,500,000 | | California Housing Finance Agency (Multi-Family Housing Rev.), 5 3/8% due 2/1/2036* | | Aa3/AA- | | 2,506,250 |

| 1,775,000 | | California Housing Finance Agency (Single Family Mortgage), 5.40% due 8/1/2028* | | Aaa/AAA | | 1,802,246 |

| 2,500,000 | | California Infrastructure and Economic Development Bank Rev. (The J. David Gladstone Institutes), 51/4% due 10/1/2034 | | NR/A- | | 2,521,950 |

| 1,750,000 | | California Pollution Control Financing Authority Rev. (Pacific Gas & Electric Co.), 5 7/8% due 6/1/2023* | | B3/CCC | | 1,701,368 |

| 1,000,000 | | California Pollution Control Financing Authority Rev. (Pacific Gas & Electric Co.), 5.85% due 12/1/2023* | | B3/CCC | | 972,240 |

| 2,500,000 | | California Statewide Communities Development Authority Rev., (Sutter Health), 5 5/8% due 8/15/2042 | | A1/A+ | | 2,554,450 |

| 1,500,000 | | Foothill/Eastern Transportation Corridor Agency, CA Toll Road Rev., 5 3/4% due 1/15/2040 | | Baa3/BBB- | | 1,523,565 |

| 2,870,000 | | Modesto, CA Irrigation District Certificates of Participation, 5.30% due 7/1/2022 | | A2/A+ | | 2,871,119 |

| 2,005,000 | | Pleasanton, CA Joint Powers Financing Authority Reassessment Rev., 6.15% due 9/2/2012 | | | | |

| 3,000,000 | | Puerto Rico Highway & Transportation Authority Rev., 5 1/2% due 7/1/2036 | | Baa1/A | | 3,169,560 |

| 1,795,000 | | Sacramento, CA Municipal Utility District Electric Rev., 5 1/4% due 7/1/2028ø | | A2/A | | 1,870,139 |

| 705,000 | | Sacramento, CA Municipal Utility District Electric Rev., 5 1/4% due 7/1/2028ø | | A2/A | | 734,398 |

| 3,000,000 | | San Bernardino, CA Joint Powers Financing Authority (California Dept. of Transportation Lease), 5 1/2% due 12/1/2020 | | Baa1/BBB- | | 3,102,330 |

| 2,160,000 | | San Francisco, CA City & County Public Utilities Commission Rev., 5% due 11/1/2026 | | A1/A+ | | 2,166,631 |

| 2,000,000 | | Washington Township, CA Hospital District Hospital Healthcare System Rev., 5 1/4% due 7/1/2029 | | A2/NR | | 2,020,120 |

|

|

|

|

|

|

|

Total Municipal Bonds (Cost $42,498,641) —93.3% | | | | 43,955,280 |

|

|

|

|

|

_____________

See footnotes on page 14.

10

Portfolios of Investments

September 30, 2003

California High-Yield Series(continued)

| $ 450,000 | | Lehigh County, PA General Purpose Authority Rev. (Lehigh Valley Hospital) due 7/1/2029 | | VMIG 1/NR | | $ 450,000 |

| 1,200,000 | | New York City, NY GOs Subseries E-5 due 8/1/2015 | | VMIG 1/A-1+ | | 1,200,000 |

| 900,000 | | New York City, NY Municipal Water Finance Authority, Water & Sewer System Rev. due 6/15/2025 | | VMIG 1/A-1+ | | 900,000 |

|

|

|

|

|

|

|

Total Variable Rate Demand Notes (Cost $2,550,000) —5.4% | | | | 2,550,000 |

|

|

|

|

|

Total Investments (Cost $45,048,641) —98.7% | | | | 46,505,280 |

|

|

|

|

|

Other Assets Less Liabilities —1.3% | | | | 606,032 |

|

|

|

|

|

Net Assets —100.0% | | | | $47,111,312 |

|

California Quality Series

Face Amount | | Municipal Bonds | | Ratings Moody’s/S&P † | | Market Value |

|

|

|

|

|

|

|

| $3,000,000 | | California Department of Water Resources Water System Rev. (Central Valley Project), 6.10% due 12/1/2029ø | | Aaa/AA | | $ 3,406,620 |

| 3,000,000 | | California Educational Facilities Authority Rev. (Pepperdine University), 5% due 11/1/2029 | | A1/NR | | 3,017,700 |

| 2,000,000 | | California Educational Facilities Authority Rev. (Stanford University), 5.35% due 6/1/2027 | | Aaa/AAA | | 2,105,500 |

| 3,000,000 | | California Educational Facilities Authority Rev. (University of San Diego), 5% due 10/1/2028 | | Aaa/NR | | 3,035,490 |

| 3,000,000 | | California Educational Facilities Authority Rev. (University of Southern California), 5% due 10/1/2028 | | Aa1/AA+ | | 3,019,380 |

| 1,000,000 | | California Infrastructure & Economic Development Bank Rev. (Bay Area Toll Bridges Seismic Retrofit Bonds), 5% due 7/1/2023 | | Aaa/AAA | | 1,027,120 |

| 4,000,000 | | California Pollution Control Financing Authority Rev. (Mobil Oil Corporation Project), 51/2% due 12/1/2029* | | Aaa/AAA | | 4,217,480 |

| 4,000,000 | | California State GOs, 5 3/8% due 10/1/2027 | | A3/BBB | | 4,057,960 |

| 2,420,000 | | California State Veterans' GOs, 5.70% due 12/1/2032* | | A3/A | | 2,473,361 |

| 3,000,000 | | California Statewide Communities Development Authority Certificates of Participation (The Trustees of the J. Paul Getty Trust), 5% due 10/1/2023 | | Aaa/AAA | | 3,027,450 |

| 2,000,000 | | California Statewide Communities Development Authority Rev., (Kaiser Permanente), 51/2% due 11/1/2032 | | A3/A | | 2,024,560 |

| 3,000,000 | | East Bay, CA Municipal Utility District Water System Rev., 5% due 6/1/2026 | | Aaa/AAA | | 3,024,630 |

| 2,500,000 | | Eastern Municipal Water District, CA Water and Sewer Rev., 63/4% due 7/1/2012 | | Aaa/AAA | | 3,060,250 |

| 3,000,000 | | Fresno, CA Sewer System Rev., 5 1/4% due 9/1/2019 | | Aaa/AAA | | 3,377,820 |

| 4,000,000 | | Los Angeles, CA Department of Water & Power Water System Rev., 5 1/8% due 7/1/2041 | | Aa3/AA | | 4,028,680 |

| 3,000,000 | | Orange County, CA Local Transportation Authority (Measure M Sales Tax Rev.), 6% due 2/15/2009 | | Aaa/AAA | | 3,534,840 |

_____________

See footnotes on page 14.

11

Portfolios of Investments

September 30, 2003

California Quality Series (continued)

Face Amount | | Municipal Bonds | | Ratings Moody’s/S&P † | | Market Value |

|

| $1,000,000 | | Rancho, CA Water District Financing Authority Rev., 5.90% due 11/1/2015 | | Aaa/AAA | | $ 1,106,110 |

| 4,000,000 | | Regents of the University of California Rev. (Multiple Purpose Projects), 5 3/8% due 9/1/2024 | | | | |

| 4,000,000 | | Sacramento County, CA Sanitation Districts Financing Authority Rev. (Sacramento Regional County Sanitation District), 5% due 12/1/2027 | | Aaa/AAA | | 4,053,120 |

| 1,000,000 | | Sacramento County, CA Sanitation Districts Financing Authority Rev. (Sacramento Regional County Sanitation District), 5 7/8% due 12/1/2027 ø | | Aa3/AA | | 1,094,470 |

| 4,250,000 | | San Francisco Bay Area Rapid Transit District, CA (Sales Tax Rev.), 5% due 7/1/2028 | | Aaa/AAA | | 4,288,463 |

| 3,000,000 | | San Francisco, CA City and County Airports Commission Rev. (International Airport), 6.60% due 5/1/2024* | | Aaa/AAA | | 3,151,860 |

|

Total Municipal Bonds (Cost $62,262,942) —96.4% | | 66,352,624 |

|

Variable Rate Demand Notes (Cost $1,500,000) —2.2% | | 1,500,000 |

|

Total Investments (Cost $63,762,942) —98.6% | | 67,852,624 |

|

Other Assets Less Liabilities —1.4% | | 997,766 |

|

Net Assets —100.0% | | $68,850,390 |

|

Florida Series

Face Amount | | Municipal Bonds | | Ratings Moody’s/S&P † | | Market Value |

|

|

|

|

|

|

|

| $2,000,000 | | Broward County, FL Airport System Rev., 5 1/4% due 10/1/2026* | | Aaa/AAA | | $ 2,041,700 |

| 1,000,000 | | Dade County, FL Aviation Rev., 6 1/8% due 10/1/2020*ø | | Aaa/AAA | | 1,066,820 |

| 2,000,000 | | Dade County, FL Public Improvement GOs, 5 3/4% due 10/1/2016 | | Aaa/AAA | | 2,225,800 |

| 1,750,000 | | Escambia County, FL Health Facilities Authority Rev. (Ascension Health Credit Group), 6% due 11/15/2031ø | | Aa2/AAA | | 2,096,028 |

| 720,000 | | Florida Housing Finance Agency Rev. (General Mortgage), 6.20% due 7/1/2027* | | Aa2/AA | | 747,583 |

| 710,000 | | Florida Housing Finance Agency Rev. (Homeowner Mortgage), 6.35% due 6/1/2014* | | NR/AAA | | 725,201 |

| 645,000 | | Florida Housing Finance Agency Rev. (Homeowner Mortgage), 5.95% due 1/1/2032* | | Aaa/AAA | | 667,840 |

| 375,000 | | Florida Housing Finance Agency Rev. (Single Family Mortgage), 6.55% due 7/1/2014* | | Aaa/AAA | | 388,421 |

| 2,500,000 | | Florida Ports Financing Commission Rev. (State Transportation Trust Fund), 5 3/8% due 6/1/2027* | | Aaa/AAA | | 2,555,000 |

| 2,500,000 | | Florida State Turnpike Authority Rev., 5 5/8% due 7/1/2025ø | | Aaa/AAA | | 2,719,400 |

| 2,000,000 | | Greater Orlando Aviation Authority, FL Airport Facilities Rev., 5 1/4% due 10/1/2023* | | Aaa/AAA | | 2,042,380 |

| 2,000,000 | | Hillsborough County, FL School Board (Certificates of Participation), 6% due 7/1/2025 ø | | Aaa/AAA | | 2,388,380 |

See footnotes on page 14.

12

Portfolios of Investments

September 30, 2003

Florida Series (continued)

Face Amount | | Municipal Bonds | | Ratings Moody’s/S&P † | | Market Value |

| $2,000,000 | | Jacksonville Electric Authority, FL (Electric System Rev.), 5 1/2% due 10/1/2041 | | Aa2/AA | | $ 2,130,200 |

| 2,000,000 | | Jacksonville Electric Authority, FL (Water & Sewer System Rev.), 5 5/8% due 10/1/2030 | | Aaa/AAA | | 2,098,260 |

| 1,000,000 | | Jacksonville, FL Port Authority Airport Rev., 6 1/4% due 10/1/2024* | | Aaa/AAA | | 1,101,620 |

| 2,000,000 | | Jacksonville, FL Sewage & Solid Waste Disposal Facilities Rev. (Anheuser-Busch Project), 5 7/8% due 2/1/2036* | | A1/A+ | | 2,075,740 |

| 1,000,000 | | Lee County, FL (Water & Sewer Rev.), 5% due 10/1/2023 | | Aaa/AAA | | 1,033,400 |

| 2,000,000 | | Marion County, FL Hospital District Health System Rev. (Munroe Regional Health System), 5 5/8% due 10/1/2024 | | A2/NR | | 2,036,440 |

| 1,750,000 | | Orange County, FL Health Facilities Authority Hospital Rev. (Adventist Health System/Sunbelt Obligation Group), 6 3/8% due 11/15/2020 | | A3/A | | 1,934,835 |

| 2,000,000 | | Pinellas County, FL Health Facilities Authority Rev. (Baycare Health System), 5 1/2% due 11/15/2033 | | A1/NR | | 2,014,720 |

| 2,000,000 | | Reedy Creek Improvement District, FL Utilities Rev., 5 1/8% due 10/1/2019 | | Aaa/AAA | | 2,136,780 |

| 1,750,000 | | Tampa Bay, FL Regional Water Supply Utility System Authority Rev., 5 3/4% due 10/1/2029 ø | | Aaa/AAA | | 2,070,320 |

|

|

|

|

|

|

|

Total Municipal Bonds (Cost $35,348,670) —94.8% | | 38,296,868 |

|

|

|

Variable Rate Demand Notes (Cost $1,200,000) —3.0% | | 1,200,000 |

|

|

|

Total Investments (Cost $36,548,670) —97.8% | | 39,496,868 |

|

|

|

Other Assets Less Liabilities —2.2% | | 887,606 |

|

|

|

Net Assets —100.0% | | $40,384,474 |

|

North Carolina Series

Face Amount | | Municipal Bonds | | Ratings Moody’s/S&P † | | Market Value |

|

|

|

|

|

|

|

| $1,250,000 | | Appalachian State University, NC Housing & Student Center System Rev., 5.60% due 7/15/2020 | | Aaa/NR | | $ 1,391,912 |

| 1,250,000 | | Asheville, NC Water System Rev., 5.70% due 8/1/2025 | | Aaa/AAA | | 1,361,525 |

| 1,185,000 | | Buncombe County, NC Metropolitan Sewer District Sewer System Rev., 5% due 7/1/2020 | | Aaa/AAA | | 1,254,311 |

| 1,000,000 | | Charlotte, NC Storm Water Fee Rev., 6% due 6/1/2025ø | | Aa2/AA+ | | 1,196,850 |

| 1,000,000 | | Charlotte, NC Water & Sewer GOs, 5.90% due 2/1/2017ø | | Aaa/AAA | | 1,036,560 |

| 1,250,000 | | Charlotte, NC Water & Sewer System Rev., 5 1/4% due 6/1/2025ø | | Aa1/AAA | | 1,441,188 |

| 2,000,000 | | Charlotte-Mecklenburg Hospital Authority, NC Health Care System Rev., 5 3/4% due 1/15/2021 | | Aa3/AA | | 2,175,020 |

| 250,000 | | City of Winston-Salem, NC Water & Sewer System Rev., 5 1/8% due 6/1/2028ø | | Aa2/AAA | | 285,402 |

| 215,000 | | Greensboro, NC Combined Enterprise System Rev., 5 1/4% due 6/1/2022 | | Aa3/AA+ | | 229,254 |

_____________

See footnotes on page 14.

13

Portfolios of Investments

September 30, 2003

North Carolina Series (continued)

Face Amount | | Municipal Bonds | | Ratings Moody’s/S&P † | | Market Value |

|

|

|

|

|

|

|

| $2,500,000 | | Martin County Industrial Facilities and Pollution Control Financing Authority, NC Solid Waste Disposal Rev.(Weyerhaeuser Company Project), 6% due 11/1/2025* | | Baa2/BBB | | $ 2,518,700 |

| 1,250,000 | | North Carolina Capital Facilities Finance Agency Rev., (Duke University Project), 5 1/8% due 10/1/2041 | | Aa1/AA+ | | 1,267,775 |

| 735,000 | | North Carolina Housing Finance Agency Rev. (Home Ownership), 6.40% due 7/1/2028* | | Aa2/AA | | 778,600 |

| 605,000 | | North Carolina Housing Finance Agency Rev. (Single Family), 6 1/2% due 3/1/2018 | | Aa2/AA | | 618,141 |

| 1,500,000 | | North Carolina Medical Care Commission Hospital Rev. (First Health of the Carolinas Project), 5% due 10/1/2028 | | Aa3/AA | | 1,503,510 |

| 1,500,000 | | North Carolina Medical Care Commission Hospital Rev. (Gaston Health Care), 5% due 2/15/2029 | | A1/A+ | | 1,457,895 |

| 1,750,000 | | North Carolina Municipal Power Agency No. 1 Catawba Electric Rev., 5% due 1/1/2020 †† | | Aaa/AAA | | 1,912,225 |

| 1,000,000 | | Puerto Rico Electric Power Authority Rev., 5 1/4% due 7/1/2021 | | Aaa/AAA | | 1,118,380 |

| 1,000,000 | | University of North Carolina at Chapel Hill Hospital Rev., 5 1/4% due 2/15/2026ø | | A1/AA | | 1,110,080 |

| 1,250,000 | | University of North Carolina at Charlotte Rev. (Student Activity Center), 5 1/2% due 6/1/2021 | | Aaa/AAA | | 1,343,250 |

| 1,000,000 | | Wake County Industrial Facilities & Pollution Control Financing Authority Rev., NC (Carolina Power & Light), 5 3/8% due 2/1/2017 | | A3/BBB | | 1,070,700 |

|

|

|

|

|

|

|

Total Municipal Bonds (Cost $23,151,057) —95.0% | | 25,071,278 |

|

|

|

Variable Rate Demand Notes (Cost $700,000) —2.7% | | 700,000 |

|

|

|

Total Investments (Cost $23,851,057) —97.7% | | 25,771,278 |

|

|

|

Other Assets Less Liabilities —2.3% | | 608,552 |

|

|

|

Net Assets —100.0% | | $26,379,830 |

|

_______________

† Ratings have not been audited by Deloitte & Touche LLP.

†† Escrowed-to-maturity security.

ø Pre-refunded security.

* Interest income earned from this security is subject to the federal alternative minimum tax.

See Notes to Financial Statements.

14

Statements of Assets and LiabilitiesSeptember 30, 2003| | | California | | California | | | | | North | |

| | | High-Yield | | Quality | | Florida | | Carolina | |

| | | Series | | Series | | Series | | Series | |

| |

| Assets: | | | | | | | | | | | | | |

| |

| Investments, at value:* | | | | | | | | | | | | | |

| Long-term holdings | | $ | 43,955,280 | | $ | 66,352,624 | | $ | 38,296,868 | | $ | 25,071,278 | |

| Short-term holdings | | | 2,550,000 | | | 1,500,000 | | | 1,200,000 | | | 700,000 | |

| | | | 46,505,280 | | | 67,852,624 | | | 39,496,868 | | | 25,771,278 | |

| Cash | | | 88,030 | | | 69,847 | | | 52,546 | | | 95,620 | |

| Interest receivable | | | 672,043 | | | 1,110,175 | | | 799,261 | | | 347,863 | |

| Expenses prepaid to shareholder | | | | | | | | | | | | | |

| service agent | | | 16,242 | | | 18,153 | | | 12,420 | | | 7,643 | |

| Receivable for Shares of | | | | | | | | | | | | | |

| Beneficial Interest sold | | | 16,000 | | | — | | | 151,049 | | | — | |

| Receivable for securities sold | | | — | | | — | | | — | | | 313,320 | |

| Other | | | 2,118 | | | 3,138 | | | 1,846 | | | 1,191 | |

| |

| Total Assets | | | 47,299,713 | | | 69,053,937 | | | 40,513,990 | | | 26,536,915 | |

| |

| | | | | | | | | | | | | | |

| Liabilities: | | | | | | | | | | | | | |

| |

| Dividends payable | | | 78,654 | | | 105,785 | | | 61,302 | | | 45,201 | |

| Payable for Shares | | | | | | | | | | | | | |

| of Beneficial Interest repurchased | | | 41,249 | | | 6,000 | | | 10,490 | | | 65,170 | |

| Management fee payable | | | 15,354 | | | 27,945 | | | 11,602 | | | 10,830 | |

| Distribution and service fees payable | | | 9,277 | | | 10,286 | | | 11,437 | | | 7,163 | |

| Accrued expenses and other | | | 43,867 | | | 53,531 | | | 34,685 | | | 28,721 | |

| Total Liabilities | | | 188,401 | | | 203,547 | | | 129,516 | | | 157,085 | |

| |

| Net Assets | | $ | 47,111,312 | | $ | 68,850,390 | | $ | 40,384,474 | | $ | 26,379,830 | |

| |

| | | | | | | | | | | | | | |

| Composition of Net Assets: | | | | | | | | | | | | | |

| |

| Shares of Beneficial Interest, at par: | | | | | | | | | | | | | |

| Class A | | $ | 5,888 | | $ | 8,952 | | $ | 4,224 | | $ | 2,798 | |

| Class C | | | 528 | | | 842 | | | 579 | | | 342 | |

| Class D | | | 733 | | | 221 | | | 194 | | | 101 | |

| Additional paid-in capital | | | 45,518,125 | | | 64,738,764 | | | 37,286,379 | | | 24,365,158 | |

| Undistributed net investment income | | | 116,767 | | | 180,123 | | | 67,995 | | | 43,575 | |

| Undistributed/accumulated net | | | | | | | | | | | | | |

| realized gain (loss) | | | 12,632 | | | (168,194 | ) | | 76,905 | | | 47,635 | |

| Net unrealized appreciation | | | | | | | | | | | | | |

| of investments | | | 1,456,639 | | | 4,089,682 | | | 2,948,198 | | | 1,920,221 | |

| |

| Net Assets | | $ | 47,111,312 | | $ | 68,850,390 | | $ | 40,384,474 | | $ | 26,379,830 | |

| |

(Continued on page 16. )

______________

See footnotes on page 16.

15

Statements of Assets and Liabilities

(continued)

| | | California | | California | | | | | North | |

| | | High-Yield | | Quality | | Florida | | Carolina | |

| | | Series | | Series | | Series | | Series | |

|

| |

| Net Assets: | | | | | | | | | | | | | |

| |

| Class A | | $ | 38,797,689 | | $ | 61,565,685 | | $ | 34,130,985 | | $ | 22,778,362 | |

| Class C | | $ | 3,482,097 | | $ | 5,772,456 | | $ | 4,686,308 | | $ | 2,777,909 | |

| Class D | | $ | 4,831,526 | | $ | 1,512,249 | | $ | 1,567,181 | | $ | 823,559 | |

| | | | | | | | | | | | | | |

Shares of Beneficial Interest Outstanding (unlimited shares authorized; $0.001 par value) : | | | | | | | | | | | | | |

| |

| Class A | | | 5,888,220 | | | 8,952,255 | | | 4,224,358 | | | 2,797,815 | |

| Class C | | | 527,959 | | | 842,199 | | | 578,930 | | | 341,595 | |

| Class D | | | 732,527 | | | 220,627 | | | 193,598 | | | 101,270 | |

| | | | | | | | | | | | | | |

| Net Asset Value per Share: | | | | | | | | | | | | | |

| |

| Class A | | $ | 6.59 | | $ | 6.88 | | $ | 8.08 | | $ | 8.14 | |

| Class C | | $ | 6.60 | | $ | 6.85 | | $ | 8.09 | | $ | 8.13 | |

| Class D | | $ | 6.60 | | $ | 6.85 | | $ | 8.10 | | $ | 8.13 | |

| | | | | | | | | | | | | | |

| _____________ |

| * Cost of investments | | $ | 45,048,641 | | $ | 63,762,942 | | $ | 36,548,670 | | $ | 23,851,057 | |

See Notes to Financial Statements.

16

| | | California | | California | | | | | North | |

| | | High-Yield | | Quality | | Florida | | Carolina | |

| | | Series | | Series | | Series | | Series | |

| |

| Investment Income: | | | | | | | | | | | | | |

| |

| Interest | | $ | 2,669,152 | | $ | 3,659,813 | | $ | 2,126,989 | | $ | 1,356,999 | |

| |

| | | | | | | | | | | | | | |

| Expenses: | | | | | | | | | | | | | |

| |

| Management fees | | | 255,537 | | | 374,016 | | | 213,775 | | | 140,411 | |

| Distribution and service fees | | | 126,079 | | | 138,683 | | | 153,592 | | | 98,525 | |

| Shareholder account services | | | 117,045 | | | 141,904 | | | 94,048 | | | 59,749 | |

| Auditing and legal fees | | | 27,138 | | | 34,142 | | | 25,506 | | | 19,192 | |

| Custody and related services | | | 25,422 | | | 30,056 | | | 19,542 | | | 15,036 | |

| Registration | | | 14,515 | | | 14,945 | | | 12,638 | | | 12,071 | |

| Trustee’s fees and expenses | | | 8,815 | | | 9,564 | | | 7,860 | | | 7,220 | |

| Shareholder reports | | | | | | | | | | | | | |

| and communications | | | 6,236 | | | 10,693 | | | 5,696 | | | 5,808 | |

| Miscellaneous | | | 4,636 | | | 5,734 | | | 3,776 | | | 3,204 | |

| |

| Total Expenses | | | | | | | | | | | | | |

| Before Management Fee Waiver | | | 585,423 | | | 759,737 | | | 536,433 | | | 361,216 | |

| |

| Fee Waiver (Note 4) | | | (51,109 | ) | | — | | | (64,132 | ) | | — | |

| |

| Total Expenses | | | | | | | | | | | | | |

| After Management Fee Waiver | | | 534,314 | | | 759,737 | | | 472,301 | | | 361,216 | |

| |

| Net Investment Income | | | 2,134,838 | | | 2,900,076 | | | 1,654,688 | | | 995,783 | |

| |

| | | | | | | | | | | | | | |

| Net Realized and Unrealized Gain (Loss) on Investments: | | | | | | | | | | | | | |

| |

| Net realized gain on investments | | | 140,138 | | | 22,618 | | | 66,794 | | | 41,191 | |

| Net change in unrealized appreciation of investments | | | (1,238,128 | ) | | (1,945,933 | ) | | (76,255 | ) | | (109,179 | ) |

| |

| Net Loss on Investments | | | (1,097,990 | ) | | (1,923,315 | ) | | (9,461 | ) | | (67,988 | ) |

| |

| Increase in Net Assets from Operations | | $ | 1,036,848 | | $ | 976,761 | | $ | 1,645,227 | | $ | 927,795 | |

| |

_______________

See footnotes on page 16.

17

| | | California High-Yield Series | | California Quality Series | |

| | |

| |

| | | Year Ended September 30, | | Year Ended September 30, | |

| | |

| |

| |

| | | 2003 | | 2002 | | 2003 | | 2002 | |

|

| |

| Operations: | | | | | | | | | | | | | |

| |

| Net investment income | | $ | 2,134,838 | | $ | 2,415,922 | | $ | 2,900,076 | | $ | 3,335,069 | |

| Net realized gain (loss) on investments | | | 140,138 | | | 161,411 | | | 22,618 | | | (52,470 | ) |

| Net change in unrealized appreciation of investments | | | (1,238,128 | ) | | 1,073,987 | | | (1,945,933 | ) | | 2,173,479 | |

| |

| Increase in Net Assets from Operations | | | 1,036,848 | | | 3,651,320 | | | 976,761 | | | 5,456,078 | |

| |

| Distributions to Shareholders: | | | | | | | | | | | | | |

| |

| Net investment income: | | | | | | | | | | | | | |

| Class A | | | (1,822,424 | ) | | (2,084,717 | ) | | (2,650,341 | ) | | (3,138,850 | ) |

| Class C | | | (112,043 | ) | | (120,977 | ) | | (160,286 | ) | | (96,892 | ) |

| Class D | | | (168,572 | ) | | (191,021 | ) | | (55,316 | ) | | (72,824 | ) |

| |

| Total | | | (2,103,039 | ) | | (2,396,715 | ) | | (2,865,943 | ) | | (3,308,566 | ) |

| |

| Net realized short-term gain on investments: † | | | | | | | | | | | | | |

| Class A | | | (125,405 | ) | | — | | | — | | | — | |

| Class C | | | (8,656 | ) | | — | | | — | | | — | |

| Class D | | | (13,453 | ) | | — | | | — | | | — | |

| |

| Total | | | (147,514 | ) | | — | | | — | | | — | |

| |

| Net realized long-term gain on investments: | | | | | | | | | | | | | |

| Class A | | | (88,522 | ) | | (136,035 | ) | | — | | | (669,363 | ) |

| Class C | | | (6,110 | ) | | (9,158 | ) | | — | | | (17,701 | ) |

| Class D | | | (9,496 | ) | | (15,440 | ) | | — | | | (28,044 | ) |

| |

| Total | | | (104,128 | ) | | (160,633 | ) | | — | | | (715,108 | ) |

| |

| Decrease in Net Assets from | | | | | | | | | | | | | |

| |

| Distributions | | | (2,354,681 | ) | | (2,557,348 | ) | | (2,865,943 | ) | | (4,023,674 | ) |

| |

(Continued on page 19. )

____________

See footnotes on page 19.

18

Statements of Changes in Net Assets

(continued)

| | | California High-Yield Series | | California Quality Series | |

| |

| |

| | | Year Ended September 30, | | Year Ended September 30, | |

| |

| |

| |

| | | 2003 | | 2002 | | 2003 | | 2002 | |

| |

| Capital Share Transactions: | | | | | | | | | | | | | |

| |

| Net proceeds from sales of shares | | $ | 1,532,392 | | $ | 2,990,070 | | $ | 4,974,059 | | $ | 16,952,913 | |

| Investment of dividends | | | 1,243,133 | | | 1,388,559 | | | 1,478,061 | | | 1,614,524 | |

| Exchanged from associated funds | | | 15,772,060 | | | 14,607,950 | | | 1,676,737 | | | 1,235,384 | |

Shares issued in payment of gain distributions | | | 182,579 | | | 117,873 | | | — | | | 460,051 | |

| |

| Total | | | 18,730,164 | | | 19,104,452 | | | 8,128,857 | | | 20,262,872 | |

| |

| Cost of shares repurchased | | | (6,600,451 | ) | | (5,037,549 | ) | | (16,337,268 | ) | | (18,363,638 | ) |

| Exchanged into associated funds | | | (23,587,901 | ) | | (14,743,265 | ) | | (2,788,344 | ) | | (1,476,492 | ) |

| |

| Total | | | (30,188,352 | ) | | (19,780,814 | ) | | (19,125,612 | ) | | (19,840,130 | ) |

| |

| Increase (Decrease) in Net Assets | | | | | | | | | | | | | |

| from Capital Share Transactions | | | (11,458,188 | ) | | (676,362 | ) | | (10,996,755 | ) | | 422,742 | |

|

| |

| Increase (Decrease) in Net Assets | | | (12,776,021 | ) | | 417,610 | | | (12,885,937 | ) | | 1,855,146 | |

| |

| Net Assets: | | | | | | | | | | | | | |

| |

| Beginning of year | | | 59,887,333 | | | 59,469,723 | | | 81,736,327 | | | 79,881,181 | |

| |

End of Year * | | $ | 47,111,312 | | $ | 59,887,333 | | $ | 68,850,390 | | $ | 81,736,327 | |

| |

| | | | | | | | | | | | | | |

__________________ |

| * Including undistributed net investment income as follows: | | $ | 116,767 | | $ | 102,692 | | $ | 180,123 | | $ | 156,808 | |

| † �� For tax purposes, these distributions are considered ordinary income. | | | | | | | | | | | | | |

See Notes to Financial Statements.

19

Statements of Changes in Net Assets

(continued)

| | | Florida Series | | North Carolina Series | |

| | |

| |

| | | Year Ended September 30, | | Year Ended September 30, | |

| | |

| |

| |

| | | | 2003 | | | 2002 | | | 2003 | | | 2002 | |

| |

| Operations: | | | | | | | | | | | | | |

| |

| Net investment income | | $ | 1,654,688 | | $ | 1,745,510 | | $ | 995,783 | | $ | 1,175,377 | |

| Net realized gain on investments | | | 66,794 | | | 74,668 | | | 41,191 | | | 117,215 | |

| Net change in unrealized appreciation of investments | | | (76,255 | ) | | 993,334 | | | (109,179 | ) | | 987,590 | |

| |

| Increase in Net Assets from Operations | | | 1,645,227 | | | 2,813,512 | | | 927,795 | | | 2,280,182 | |

| |

| | | | | | | | | | | | | | |

| Distributions to Shareholders: | | | | | | | | | | | | | |

| |

| Net investment income: | | | | | | | | | | | | | |

| Class A | | | (1,439,063 | ) | | (1,568,880 | ) | | (875,583 | ) | | (1,028,081 | ) |

| Class C | | | (140,805 | ) | | (98,276 | ) | | (82,387 | ) | | (90,604 | ) |

| Class D | | | (57,918 | ) | | (63,496 | ) | | (25,624 | ) | | (45,412 | ) |

| |

| Total | | | (1,637,786 | ) | | (1,730,652 | ) | | (983,594 | ) | | (1,164,097 | ) |

| |

| Net realized short-term gain on investments: † | | | | | | | | | | | | | |

| |

| Class A | | | — | | | — | | | (21,521 | ) | | — | |

| Class C | | | — | | | — | | | (2,424 | ) | | — | |

| Class D | | | — | | | — | | | (803 | ) | | — | |

| |

| Total | | | — | | | — | | | (24,748 | ) | | — | |

| |

| Net realized long-term gain on investments: | | | | | | | | | | | | | |

| Class A | | | (50,295 | ) | | — | | | (92,232 | ) | | (22,817 | ) |

| Class C | | | (5,431 | ) | | — | | | (10,386 | ) | | (2,204 | ) |

| Class D | | | (2,384 | ) | | — | | | (3,440 | ) | | (1,347 | ) |

| |

| Total | | | (58,110 | ) | | — | | | (106,058 | ) | | (26,368 | ) |

| |

Decrease in Net Assets from Distributions | | | (1,695,896 | ) | | (1,730,652 | ) | | (1,114,400 | ) | | (1,190,465 | ) |

| |

(Continued on page 21. )

______________

See footnotes on page 21.

20

Statements of Changes in Net Assets

(continued)

| | | Florida Series | | North Carolina Series | |

| | |

| |

| | | Year Ended September 30, | | Year Ended September 30, | |

| | |

| |

| |

| | | 2003 | | 2002 | | 2003 | | 2002 | |

| |

| Capital Share Transactions: | | | | | | | | | | | | | |

| |

| Net proceeds from sales of shares | | $ | 4,358,821 | | $ | 4,543,758 | | $ | 3,745,650 | | $ | 4,829,290 | |

| Investment of dividends | | | 759,368 | | | 788,699 | | | 588,430 | | | 649,812 | |

| Exchanged from associated funds | | | 1,566,632 | | | 2,433,758 | | | 4,162,491 | | | 3,051,795 | |

| Shares issued in payment of | | | | | | | | | | | | | |

| gain distributions | | | 27,939 | | | — | | | 93,143 | | | 18,346 | |

| |

| Total | | | 6,712,760 | | | 7,766,215 | | | 8,589,714 | | | 8,549,243 | |

| |

| Cost of shares repurchased | | | (8,503,284 | ) | | (4,409,030 | ) | | (5,956,929 | ) | | (5,006,154 | ) |

| Exchanged into associated funds | | | (1,030,121 | ) | | (1,963,962 | ) | | (5,355,336 | ) | | (4,644,798 | ) |

| |

| Total | | | (9,533,405 | ) | | (6,372,992 | ) | | (11,312,265 | ) | | (9,650,952 | ) |

| |

| Increase (Decrease) in Net Assets from Capital Share Transactions | | | (2,820,645 | ) | | 1,393,223 | | | (2,722,551 | ) | | (1,101,709 | ) |

| |

| Increase (Decrease) in Net Assets | | | (2,871,314 | ) | | 2,476,083 | | | (2,909,156 | ) | | (11,992 | ) |

| |

| Net Assets: | | | | | | | | | | | | | |

| Beginning of year | | | 43,255,788 | | | 40,779,705 | | | 29,288,986 | | | 29,300,978 | |

| |

End of Year * | | $ | 40,384,474 | | $ | 43,255,788 | | $ | 26,379,830 | | $ | 29,288,986 | |

| |

| | | | | | | | | | | | | | |

| _________________ |

| * Including undistributed net investment income as follows: | | $ | 67,995 | | $ | 67,360 | | $ | 43,575 | | $ | 53,226 | |

† For tax purposes, these distributions are considered ordinary income.

See Notes to Financial Statements.

21

Notes to Financial Statements

1. Multiple Classes of Shares — Seligman Municipal Series Trust (the "Trust") consists of four separate series: the "California High-Yield Series," the "California Quality Series," the "Florida Series," and the "North Carolina Series." Each Series of the Trust offers three classes of shares. Class A shares are sold with an initial sales charge of up to 4.75% and a continuing service fee of up to 0.25% on an annual basis. Class A shares purchased in an amount of $1,000,000 or more are sold without an initial sales charge but are subject to a contingent deferred sales charge ("CDSC") of 1% on redemptions within 18 months of purchase. Class C shares are sold with an initial sales charge of up to 1% and are subject to a distributio n fee of up to 0.75% and a service fee of up to 0.25% on an annual basis, and a CDSC, if applicable, of 1% imposed on redemptions made within 18 months of purchase. Class D shares are sold without an initial sales charge but are subject to a distribution fee of up to 0.75% and a service fee of up to 0.25% on an annual basis, and a CDSC, if applicable, of 1% imposed on redemptions made within one year of purchase. The three classes of shares for each Series represent interests in the same portfolio of investments, have the same rights and are generally identical in all respects except that each class bears its separate distribution and certain other class-specific expenses, and has exclusive voting rights with respect to any matter on which a separate vote of any class is required.

2. Significant Accounting Policies — The financial statements have been prepared in conformity with accounting principles generally accepted in the United States of America, which require management to make certain estimates and assumptions at the date of the financial statements. The following summarizes the significant accounting policies of the Trust:

a. Security Valuation — All municipal securities and other short-term holdings maturing in more than 60 days are valued based upon quotations provided by an independent pricing service or, in their absence, at fair value determined in accordance with procedures approved by the Trustees. Short- term holdings maturing in 60 days or less are generally valued at amortized cost.

b. Federal Taxes — There is no provision for federal income tax. Each Series has elected to be taxed as a regulated investment company and intends to distribute substantially all taxable net income and net realized gains.

c. Security Transactions and Related Investment Income — Investment transactions are recorded on trade dates. Identified cost of investments sold is used for both financial reporting and federal income tax purposes. Interest income is recorded on the accrual basis. The Trust amortizes discounts and premiums paid on bonds and other debt securities for financial reporting purposes.

Variable rate demand notes purchased by the Trust may be put back to the designated remarketing agent for the issue at par on any day, for settlement within seven days, and, accordingly, are treated as short-term holdings. These notes bear interest at a rate that resets daily or weekly. At September 30, 2003, the interest rates paid on these notes ranged from 1.14% to 1.23%.

d. Multiple Class Allocations — Each Series’ income, expenses (other than class-specific expenses), and realized and unrealized gains or losses are allocated daily to each class of shares of that Series based upon the relative value of the shares of each class. Class-specific expenses, which include distribution and service fees and any other items that are specifically attributable to a particular class, are charged directly to such class. For the year ended September 30, 2003, distribution and service fees were the only class-specific expenses.

e. Distributions to Shareholders — Dividends are declared daily and paid monthly. Other distributions paid by the Trust are recorded on the ex-dividend date. The treatment for financial reporting purposes of distributions made to shareholders during the year from net investment income or net realized gains may differ from their ultimate treatment for federal income tax purposes. These differences

22

Notes to Financial Statements

are caused primarily by differences in the timing of the recognition of certain components of income, expense, or realized capital gain for federal income tax purposes. Where such differences are permanent in nature, they are reclassified in the components of net assets based on their ultimate characterization for federal income tax purposes. Any such reclassifications will have no effect on net assets, results of operations, or net asset values per share of any Series of the Trust.

3. Purchases and Sales of Securities — Purchases and sales of portfolio securities, excluding short-term investments, for the year ended September 30, 2003, were as follows:

| Series | | Purchases | | Sales |

|

| California High-Yield | | $2,133,648 | | $10,547,700 |

| California Quality | | 993,710 | | 5,844,095 |

| Florida | | 4,859,495 | | 4,938,140 |

| North Carolina | | 2,524,227 | | 3,748,800 |

At September 30, 2003, the tax basis cost of investments for federal income tax purposes of each Series was less than the cost for financial reporting purposes due to the amortization of market discount for financial reporting purposes, offset, in part, for the California Quality Series by the tax deferral of losses on wash sales of $149,160. The tax basis cost and gross unrealized appreciation and depreciation of portfolio securities were as follows:

| | | | | Total | | Total |

| | | Tax | | Unrealized | | Unrealized |

| Series | | Basis Cost | | Appreciation | | Depreciation |

|

|

|

|

|

|

|

| California High-Yield | | $44,931,874 | | $1,699,300 | | $125,894 |

| California Quality | | 63,731,979 | | 4,120,645 | | — |

| Florida | | 36,480,675 | | 3,016,193 | | — |

| North Carolina | | 23,807,482 | | 1,963,796 | | — |

4. Management Fee, Distribution Services, and Other Transactions — J. & W. Seligman & Co. Incorporated (the "Manager") manages the affairs of the Trust and provides the necessary personnel and facilities. Compensation of all officers of the Trust, all trustees of the Trust who are employees of the Manager, and all personnel of the Trust and the Manager is paid by the Manager. The Manager’s fee is calculated daily and payable monthly, equal to 0.50% per annum of each Series’ average daily net assets. The Manager, at its discretion, agreed to waive a portion of its fees for the year ended September 30, 2003 to limit the per annum fee of California High-Yield Series and Florida Series to 0.40% and 0.35%, respectivel y. For the year ended September 30, 2003, the amount of fees waived by the Manager was $51,109 and $64,132, respectively.

Seligman Advisors, Inc. (the "Distributor"), agent for the distribution of the Trust’s shares and an affiliate of the Manager, received the following concessions from sales of Class A shares, after commissions were paid to dealers for sales of Class A and Class C shares:

| | | Distributor | | Dealer |

| Series | | Concessions | | Commissions |

|

|

|

|

|

| California High-Yield | | $2,679 | | $23,030 |

| California Quality | | 8,394 | | 70,908 |

| Florida | | 7,633 | | 64,910 |

| North Carolina | | 4,473 | | 38,073 |

23

Notes to Financial Statements

The Trust has an Administration, Shareholder Services and Distribution Plan (the "Plan") with respect to distribution of its shares. Under the Plan, with respect to Class A shares, service organizations can enter into agreements with the Distributor and receive continuing fees of up to 0.25% on an annual basis of the average daily net assets of the Class A shares attributable to the particular service organizations for providing personal services and/or the maintenance of shareholder accounts. The Distributor charges such fees to the Trust monthly pursuant to the Plan. For the year ended September 30, 2003, for California High-Yield Series, California Quality Series, Florida Series, and North Carolina Series, fees incurred under the Plan aggregated $42,554, $67,597, $91,158, and $60,609, respectively, or 0.10%, 0.10%, 0.25%, and 0.25%, respectiv ely, per annum of average daily net assets of Class A shares.

Under the Plan, with respect to Class C shares and Class D shares, service organizations can enter into agreements with the Distributor and receive continuing fees for providing personal services and/or the maintenance of shareholder accounts of up to 0.25% on an annual basis of the average daily net assets of the Class C and Class D shares for which the organizations are responsible, and fees for providing other distribution assistance of up to 0.75% on an annual basis of such average daily net assets. Such fees are paid monthly by the Trust to the Distributor pursuant to the Plan. For the year ended September 30, 2003, fees incurred under the Plan equivalent to 1% per annum of the average daily net assets of Class C and Class D shares were as follows:

| Series | | Class C | | Class D |

|

|

|

|

|

| California High-Yield | | $33,337 | | $50,188 |

| California Quality | | 52,769 | | 18,317 |

| Florida | | 44,216 | | 18,218 |

| North Carolina | | 28,948 | | 8,968 |

The Distributor is entitled to retain any CDSC imposed on certain redemptions of Class A and Class C shares occurring within 18 months of purchase and on redemptions of Class D shares occurring within one year of purchase. For the year ended September 30, 2003, such charges amounted to $0 for California High-Yield Series, $6,423 for California Quality Series, $5,239 for Florida Series, and $7,496 for North Carolina Series.

Seligman Services, Inc., an affiliate of the Manager, is eligible to receive commissions from certain sales of Trust shares, as well as distribution and service fees pursuant to the Plan. For the year ended September 30, 2003, Seligman Services, Inc. received commissions from the sales of shares of each Series and distribution and service fees, pursuant to the Plan, as follows:

| | | | | Distribution and |

| Series | | Commissions | | Service Fees |

|

|

|

|

|

| California High-Yield | | $ 534 | | $4,423 |

| California Quality | | 3,361 | | 3,699 |

| Florida | | 417 | | 4,269 |

| North Carolina | | — | | 2,055 |

Seligman Data Corp., which is owned by certain associated investment companies, charged each Series at cost for shareholder account services in accordance with a methodology approved by the Trust’s trustees as follows:

Series | | | |

|

|

|

|

| California High-Yield | | $117,045 | |

| California Quality | | 141,904 | |

| Florida | | 94,048 | |

| North Carolina | | 59,749 | |

24

Notes to Financial Statements

Costs of Seligman Data Corp. directly attributable to a Series were charged to that Series. The remaining charges were allocated to each Series by Seligman Data Corp. pursuant to a formula based on each Series’ net assets, shareholder transaction volume and number of shareholder accounts.

The Trust and certain other associated investment companies (together, the "Guarantors") have severally but not jointly guaranteed the performance and observance of all the terms and conditions of two leases entered into by Seligman Data Corp., including the payment of rent by Seligman Data Corp. (the "Guaranties"). The leases and the Guaranties expire in September 2008 and January 2009. The obligation of the Trust to pay any amount due under either Guaranty is limited to a specified percentage of the full amount, which generally is based on the Trust’s percentage of the expenses billed by Seligman Data Corp. to all Guarantors in the preceding calendar quarter. As of September 30, 2003, the Trust’s potential obligation under the Guaranties is $87,400. As of September 30, 2003, no event has occurred which would result in the Trust becom ing liable to make any payment under a Guaranty. Each Series would bear a portion of any payments made by the Trust under the Guaranties. A portion of rent paid by Seligman Data Corp. is charged to the Trust as part of Seligman Data Corp.’s shareholder account services cost.

Certain officers and trustees of the Trust are officers or directors of the Manager, the Distributor, Seligman Services, Inc., and/or Seligman Data Corp.

The Trust has a compensation agreement under which trustees who receive fees may elect to defer receiving such fees. Trustees may elect to have their deferred fees accrue interest or earn a return based on the performance of selected Series of the Trust or other funds in the Seligman Group of Investment Companies. Deferred fees and related accrued earnings are not deductible for federal income tax purposes until such amounts are paid. The cost of such fees and earnings/losses accrued thereon is included in trustees’ fees and expenses, and the accumulated balances thereof at September 30, 2003, are included in accrued expenses and other liabilities as follows:

Series | | | |

|

|

|

|

| California High-Yield | | $11,318 | |

| California Quality | | 11,497 | |

| Florida | | 6,797 | |

| North Carolina | | 5,539 | |

5. Committed Line of Credit — The Trust is a participant in a joint $420 million committed line of credit that is shared by substantially all open-end funds in the Seligman Group of Investment Companies. Each Series’ borrowings are limited to 10% of its net assets. Borrowings pursuant to the credit facility are subject to interest at a per annum rate equal to the overnight federal funds rate plus 0.50%. Each Series incurs a commitment fee of 0.10% per annum on its share of the unused portion of the credit facility. The credit facility may be drawn upon only for temporary purposes and is subject to certain other customary restrictions. The credit facility commitment expires in June 2004, but is renewable annually with the c onsent of the participating banks. For the year ended September 30, 2003, the Trust did not borrow from the credit facility.

6. Capital Loss Carryforward and Other Tax Adjustments — At September 30, 2003, the California Quality Series had a net capital loss carryforward for federal income tax purposes of $19,034, expiring in 2011, which is available for offset against future taxable net capital gains. Accordingly, no capital gain distributions are expected to be paid to shareholders of this Series until net capital gains have been realized in excess of the available capital loss carryforward.

25

Notes to Financial Statements

7. Transactions in Shares of Beneficial Interest — Transactions in Shares of Beneficial Interest were as follows:

California High-Yield Series

|

| |

| | | Year Ended September 30, | |

| |

| | | | 2003 | | 2002 | |

| |

| Class A | | | Shares | | | Amount | | | Shares | | | Amount | |

| |

| Net proceeds from sales of shares | | | 124,441 | | $ | 818,547 | | | 320,139 | | $ | 2,102,918 | |

| Investment of dividends | | | 157,158 | | | 1,034,298 | | | 180,008 | | | 1,177,632 | |

| Exchanged from associated funds | | | 2,378,200 | | | 15,699,417 | | | 2,242,274 | | | 14,514,200 | |

Shares issued in payment of gain distributions | | | 23,350 | | | 152,707 | | | 14,874 | | | 98,617 | |

| |

| Total | | | 2,683,149 | | | 17,704,969 | | | 2,757,295 | | | 17,893,367 | |

| |

| Cost of shares repurchased | | | (818,165 | ) | | (5,389,247 | ) | | (550,019 | ) | | (3,608,289 | ) |

| Exchanged into associated funds | | | (3,546,399 | ) | | (23,415,548 | ) | | (2,219,063 | ) | | (14,464,774 | ) |

| |

| Total | | | (4,364,564 | ) | | (28,804,795 | ) | | (2,769,082 | ) | | (18,073,063 | ) |

| |

| Decrease | | | (1,681,415 | ) | $ | (11,099,826 | ) | | (11,787 | ) | $ | (179,696 | ) |

| |

| Class C | | | Shares | | | Amount | | | Shares | | | Amount | |

| |

| Net proceeds from sales of shares | | | 87,104 | | $ | 579,047 | | | 101,708 | | $ | 665,889 | |

| Investment of dividends | | | 12,010 | | | 79,055 | | | 12,133 | | | 79,356 | |

| Exchanged from associated funds | | | 145 | | | 980 | | | 635 | | | 4,168 | |

| Shares issued in payment of gain | | | | | | | | | | | | | |

| distributions | | | 1,861 | | | 12,188 | | | 1,061 | | | 7,042 | |

| |

| Total | | | 101,120 | | | 671,270 | | | 115,537 | | | 756,455 | |

| |

| Cost of shares repurchased | | | (84,856 | ) | | (561,520 | ) | | (99,497 | ) | | (650,192 | ) |

| Exchanged into associated funds | | | (654 | ) | | (4,386 | ) | | — | | | — | |

| |

| Total | | | (85,510 | ) | | (565,906 | ) | | (99,497 | ) | | (650,192 | ) |

| |

| Increase | | | 15,610 | | $ | 105,364 | | | 16,040 | | $ | 106,263 | |

| |

| Class D | | | Shares | | | Amount | | | Shares | | | Amount | |

| |

| Net proceeds from sales of shares | | | 20,466 | | $ | 134,798 | | | 33,741 | | $ | 221,263 | |

| Investment of dividends | | | 19,706 | | | 129,780 | | | 20,128 | | | 131,571 | |

| Exchanged from associated funds | | | 10,918 | | | 71,663 | | | 13,470 | | | 89,582 | |

| Shares issued in payment of gain distributions | | | 2,700 | | | 17,684 | | | 1,839 | | | 12,214 | |

| |

| Total | | | 53,790 | | | 353,925 | | | 69,178 | | | 454,630 | |

| |

| Cost of shares repurchased | | | (98,831 | ) | | (649,684 | ) | | (119,047 | ) | | (779,068 | ) |

| Exchanged into associated funds | | | (25,719 | ) | | (167,967 | ) | | (41,820 | ) | | (278,491 | ) |

| |

| Total | | | (124,550 | ) | | (817,651 | ) | | (160,867 | ) | | (1,057,559 | ) |

| |

| Decrease | | | (70,760 | ) | $ | (463,726 | ) | | (91,689 | ) | $ | (602,929 | ) |

| |

26

Notes to Financial Statements

| California Quality Series |

| |

| | | | Year Ended September 30, | |

|

| | | | 2003 | | | 2002 |

| |

| Class A | | | Shares | | | Amount | | | Shares | | | Amount | |

| |

| Net proceeds from sales of shares | | | 454,386 | | $ | 3,116,697 | | | 1,961,711 | | $ | 13,403,676 | |

| Investment of dividends | | | 197,996 | | | 1,362,841 | | | 224,654 | | | 1,529,185 | |

| Exchanged from associated funds | | | 203,496 | | | 1,398,476 | | | 170,580 | | | 1,155,749 | |

Shares issued in payment of gain distributions | | | — | | | — | | | 64,258 | | | 442,096 | |

| |

| Total | | | 855,878 | | | 5,878,014 | | | 2,421,203 | | | 16,530,706 | |

| |

| Cost of shares repurchased | | | (2,189,530 | ) | | (15,075,151 | ) | | (2,423,487 | ) | | (16,398,180 | ) |

| Exchanged into associated funds | | | (330,355 | ) | | (2,269,490 | ) | | (189,932 | ) | | (1,283,088 | ) |

| |

| Total | | | (2,519,885 | ) | | (17,344,641 | ) | | (2,613,419 | ) | | (17,681,268 | ) |

| |

| Decrease | | | (1,664,007 | ) | $ | (11,466,627 | ) | | (192,216 | ) | $ | (1,150,562 | ) |

| |

| Class C | | | Shares | | | Amount | | | Shares | | | Amount | |

| |

| Net proceeds from sales of shares | | | 265,193 | | $ | 1,852,962 | | | 501,589 | | $ | 3,387,528 | |

| Investment of dividends | | | 12,819 | | | 87,959 | | | 7,914 | | | 53,629 | |

| Exchanged from associated funds | | | 33,331 | | | 228,840 | | | 8,740 | | | 59,200 | |