| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | Annual Report March 31, 2015 |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Hawaiian Tax-Free Trust “Aquila’s Guiding Principles” Serving Hawaii investors since 1985 | |

May, 2015

Dear Fellow Shareholder:

As you may know, Aquila Management Corporation celebrated its 30th anniversary this past year.

Back in 1984 when we were investigating whether or not it made sense to launch Hawaiian Tax-Free Trust, we didn’t have much of a road map to follow. We knew that if we went ahead, we would be creating the first fund of its kind in Hawaii and one of only a few dozen such funds in the entire country. And, we knew that in order to be successful in launching such a fund, it would have to be top notch – a product in which both we and the people of the state could be proud.

So, we spent a lot of time listening to potential investors and their financial advisers – learning what fund features and concerns were utmost in their minds. Hawaiian Tax-Free Trust and each of the tax-free bond funds that we launched subsequently, was truly designed with you, our shareholders, in mind.

As the funds have matured, so has our game plan – over time, we have made a concerted effort to sharpen, clearly define and communicate just who Aquila is and what we stand for. Our long-standing philosophy has been formalized into a set of four guiding principles. These are:

Manage Conservatively – most people are more sensitive to potential investment losses than they are eager for outsized gains. We seek to manage our bond funds accordingly.

Since we strive to preserve the value of shareholder assets, investment quality is critical to our investment strategy. We focus on the source and reliability of revenue and income streams, issuer management teams and the financial decisions they make, as well as the discipline those issuers apply to executing their strategic and budgeting plans. Through our security selection processes, we seek to pursue the funds’ objectives while attempting to limit risk.

Our investment strategy with our municipal bond funds also focuses upon intermediate maturities in order to limit volatility with any change in interest rates.

Focus On What We Know Best – our core investment skill is finding securities that we believe have a sound basis for investment. With our municipal bond funds, we do this through research conducted by locally-based municipal bond teams.

NOT A PART OF THE ANNUAL REPORT

We have never tried to be all things to all people. We know that our municipal bond fund shareholder base is comprised of individuals seeking capital preservation, tax-free income and stability.

Put Customers First – the money we manage belongs to those who entrust it to us. We view every interaction with investors and advisors as an opportunity to strengthen a relationship. Since day one, we have said that it is your money, invested in projects in your communities and state.

Know What’s Important – we measure success by how well we meet expectations. By working to satisfy our shareholders, the success of our business will follow.

We are very proud of the fact that, in continuing to focus upon these four guiding principles, Hawaiian Tax-Free Trust, and the 6 other single state tax-free municipal bond funds sponsored by Aquila, have, in our view, served thousands of residents and local projects well over the years.

Diana P. Herrmann, Vice Chair and President

Any information in this Annual Report regarding market or economic trends or the factors influencing the Trust’s historical or future performance are statements of opinion as of the date of this report. These statements should not be relied upon for any other purposes. Past performance is no guarantee of future results, and there is no guarantee that any market forecasts discussed will be realized.

NOT A PART OF THE ANNUAL REPORT

| Hawaiian Tax-Free Trust ANNUAL REPORT Management Discussion Serving Hawaii investors since 1985 | |

Fund Performance

Hawaiian Tax-Free Trust (the “Trust”) had a total return, without sales charges, of 5.40% for Class A shares, 4.71% for Class C shares, and 5.60% for Class Y shares for the calendar year ending December 31, 2014. For the fiscal year ending March 31, 2015, the total return, without sales charges, was 4.14% for Class A shares, 3.31% for Class C shares, and 4.34% for Class Y shares. The Barclays Capital Quality Intermediate Municipal Bond Index had a total return of 5.12% for the calendar year 2014, and 4.25% for the Trust’s fiscal year. The Trust outperformed the index due to its exposure to longer duration bonds and prudent cash management.

Municipal Market

The year over year changes in the municipal yield curve as of March 31, 2015 had the short end increasing 22 basis points (“bp”, a basis point is 1/100th of 1%) from 0.32% to 0.54%, while 30 year municipal rates decreased 128 bp from 4.22% to 2.94%. Short rates remained low, but did increase due to the ongoing influence of the near 0% overnight Federal Funds rate and the demand for short term bonds balanced with market expectations of a possible Federal Reserve (“Fed”) rate increase. On the longer end, municipal rates decreased due to the positive but slow performance in the domestic economy, slower global growth and strengthening U.S. dollar. While issuers continue to refund existing debt, investor demand remains strong. However, municipal bonds still remain attractive relative to U.S. Treasury and government agency securities.

U.S. Economy

The U.S. economy enjoyed solid results in 2014 compared to other developed economies – China’s economy showed signs of slowing, the euro zone struggled, while Japan’s economy actually slid back into recession in the third quarter. The domestic labor market continued to show progress adding 2.95 million jobs for the year, ending with an unemployment rate of 5.6% compared to 6.7% at the beginning of the year. However, slow wage growth, combined with the fall in energy costs, have kept inflation below the Fed’s 2% target. Fortunately, since the end of 2004, the Personal Consumption Expenditures (“PCE”) Index shows core prices increasing at a 1.7% annual rate, suggesting the absence of deflationary risk. Fed officials have indicated that they will look past the “transitory” effects of cheaper oil and that they could begin raising short-term interest rates as long as inflation is expected to move toward the Fed’s 2% goal.

The U.S. economy has positive momentum heading into 2015 with consensus expectations forecasting 3.0% growth for the year. Economic growth surpassed expectations in the 2nd and 3rd quarters of 2014, growing by an annualized rate of 4.8%, the strongest two-quarter change since the 4th quarter of 2008. For 2014, the U.S. economy grew 2.4%, the most in four years, following a 2.2% advance in 2013.

1 | Hawaiian Tax-Free Trust

MANAGEMENT DISCUSSION (continued)

If domestic employment continues to improve while inflation remains low, momentum should continue into 2015. Risks to the growth outlook exist in the form of the challenging global backdrop, stronger dollar and geopolitical tensions.

Hawaii Economy

The visitor industry posted another record year in 2014. After a slow start but a strong 4th quarter, visitor arrivals for the year were above 8.1 million, with expenditures over $14.7 billion. Visitor spending again reached record levels, but when adjusting for inflation remain below the 1989 peak. Hotel occupancy rates are near historic highs and room rates have surged 50% since the depth of the recession.

The local construction industry remains mixed. 2014 saw a surge in non-residential permitting, but there was a dramatic slowdown in permits for residential building (large scale projects can be built more efficiently than single family homes).

Heading into 2015 with just a 4% unemployment rate, the marginal gains in tourism will be offset by steady labor market improvements and moderate income growth. While the Japanese and European economies struggle, visitor arrivals from other international locations and mainland U.S. are expected to increase, as decreased oil costs keep airfare affordable. New flights introduced from the Midwest to Honolulu and West Coast to the Big Island, as well as new inter-island flights to Molokai should provide opportunities for visitors to explore attractions across the state. Additionally, lower oil prices free up purchasing power for consumers that would otherwise be used on transportation and energy costs for state residents. A potential headwind is the possibility of a substantial cut in active duty military but that process, if implemented, is expected to take several years.

Outlook and Strategy

In managing Hawaiian Tax-Free Trust, we keep in mind the Trust’s goal of achieving a reasonable level of double tax-free income together with relatively low principal fluctuation. Accordingly, we continually seek to manage the Trust prudently, both in terms of credit quality and interest rate risk, by investing primarily in highly rated municipal bonds with intermediate maturities.

Mutual fund investing involves risk and loss of principal is possible.

The market prices of the Trust’s securities may rise or decline in value due to general market conditions, such as real or perceived adverse economic or political conditions, inflation, changes in interest rates, lack of liquidity in the bond markets or adverse investor sentiment. When market prices fall, the value of your investment may go down.

The value of your investment may go down when interest rates rise. A rise in interest rates tends to have a greater impact on the prices of longer term securities. Conversely, when interest rates fall, the value of your investment may rise. Interest rates in the U.S. recently have been historically low and are expected to rise at some point of time.

Investments in the Trust are subject to possible loss due to the financial failure of the issuers of underlying securities and their inability to meet their debt obligations.

The value of municipal securities can be adversely affected by changes in the financial condition of one or more individual municipal issuers or insurers of municipal issuers, regulatory developments, legislative actions, and by uncertainties and public perceptions concerning these and other factors. The Trust may be affected significantly by adverse economic, political or other events affecting state and other municipal issuers in which it invests, and may be more volatile than a more geographically diverse fund.

2 | Hawaiian Tax-Free Trust

MANAGEMENT DISCUSSION (continued)

If interest rates fall, an issuer may exercise its right to prepay its securities, and the Trust could be forced to reinvest prepayment proceeds at a time when yields on securities available in the market are lower than the yield on the prepaid security.

A portion of income may be subject to local, state, Federal and/or alternative minimum tax. Capital gains, if any, are subject to capital gains tax.

These risks may result in share price volatility.

Past performance is no guarantee of future results, and there is no guarantee that any market forecasts discussed will be realized.

Any information in this Annual Report regarding market or economic trends or the factors influencing the Trust’s historical or future performance are statements of opinion as of the date of this report. These statements should not be relied upon for any other purposes.

3 | Hawaiian Tax-Free Trust

PERFORMANCE REPORT

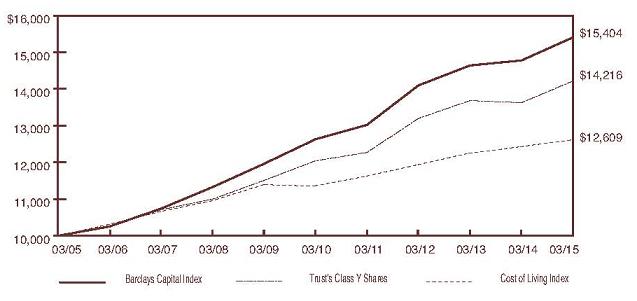

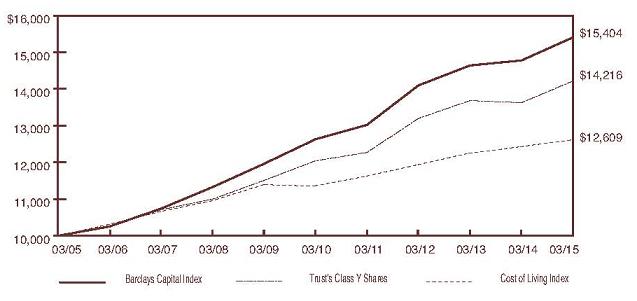

The following graph illustrates the value of $10,000 invested in the Class Y shares of Hawaiian Tax-Free Trust for the 10-year period ended March 31, 2015 as compared with the Barclays Capital Quality Intermediate Municipal Bond Index (the “Barclays Capital Index”) and the Consumer Price Index (a cost of living index). The performance of each of the other classes is not shown in the graph but is included in the table below. It should be noted that the Barclays Capital Index does not include any operating expenses nor sales charges, and being nationally oriented, does not reflect state-specific bond market performance.

| | | Average Annual Total Return | |

| | | for periods ended March 31, 2015 | |

| | | | | | | | | | | | Since | |

| Class and Inception Date | | 1 Year | | | 5 Years | | | 10 Years | | | Inception | |

| Class A since 2/20/85 | | | | | | | | | | | | |

| With Maximum Sales Charge | | | 0.00 | % | | | 2.34 | % | | | 2.94 | % | | | 5.55 | % |

| Without Sales Charge | | | 4.14 | | | | 3.17 | | | | 3.37 | | | | 5.69 | |

| Class C since 4/01/96 | | | | | | | | | | | | | | | | |

| With CDSC** | | | 2.30 | | | | 2.33 | | | | 2.54 | | | | 3.31 | |

| Without CDSC | | | 3.31 | | | | 2.33 | | | | 2.54 | | | | 3.31 | |

| Class Y since 4/01/96 | | | | | | | | | | | | | | | | |

| No Sales Charge | | | 4.34 | | | | 3.37 | | | | 3.58 | | | | 4.47 | |

| Barclays Capital Index | | | 4.25 | | | | 4.05 | | | | 4.42 | | | 5.41 | * (Class A) |

| | | | | | | | | | | | | | | 4.62 | (Class C & Y) |

Total return figures shown for the Trust reflect any change in price and assume all distributions, including capital gains, within the period were invested in additional shares. The returns shown do not reflect the deduction of taxes that a shareholder would pay on Trust distributions or the redemption of Trust Shares. The rates of return will vary and the principal value of an investment will fluctuate with market conditions. Shares, if redeemed, may be worth more or less than their original cost. A portion of each class’s income may be subject to Federal and state income taxes and/or the Federal Alternative Minimum Tax (AMT). Past performance is not predictive of future investment results.

* From commencement of the index on 1/1/87.

** CDSC = 1% contingent deferred sales charge imposed on redemptions made withing the first 12 months after purcchase.

4 | Hawaiian Tax-Free Trust

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Board of Trustees and Shareholders of

Hawaiian Tax-Free Trust:

We have audited the accompanying statement of assets and liabilities, including the schedule of investments, of Hawaiian Tax-Free Trust as of March 31, 2015 and the related statement of operations for the year then ended, the statements of changes in net assets for each of the two years in the period then ended, and the financial highlights for each of the five years in the period then ended. These financial statements and financial highlights are the responsibility of the Trust’s management. Our responsibility is to express an opinion on these financial statements and financial highlights based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement. The Trust is not required to have, nor were we engaged to perform, an audit of the Trust’s internal control over financial reporting. Our audits included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Trust’s internal control over financial reporting. Accordingly, we express no such opinion. An audit also includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. Our procedures included confirmation of securities owned as of March 31, 2015, by correspondence with the custodian and brokers, or by other appropriate auditing procedures where replies from brokers were not received. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements and financial highlights referred to above present fairly, in all material respects, the financial position of Hawaiian Tax-Free Trust as of March 31, 2015, the results of its operations for the year then ended, the changes in its net assets for each of the two years in the period then ended, and the financial highlights for each of the five years in the period then ended, in conformity with accounting principles generally accepted in the United States of America.

TAIT, WELLER & BAKER LLP

Philadelphia, Pennsylvania

May 29, 2015

5 | Hawaiian Tax-Free Trust

| HAWAIIAN TAX-FREE TRUST |

| SCHEDULE OF INVESTMENTS |

MARCH 31, 2015 |

| | | | | Rating | | | |

| | | | | Moody’s, S&P | | | |

| Principal | | | | and Fitch | | | |

| Amount | | General Obligation Bonds (61.6)% | | (unaudited) | | Value | |

| | | City and County of Honolulu, Hawaii, | | | | | |

| | | Prerefunded to 07/01/15 @100 | | | | | |

| $ | 7,720,000 | | 5.000%, 07/01/21 NPFG/ FGIC Insured | | Aa1/NR/AA+ | | $ | 7,812,022 | |

| | 1,000,000 | | 5.000%, 07/01/22 NPFG/ FGIC Insured | | Aa1/NR/AA+ | | | 1,011,920 | |

| | | | City and County of Honolulu, Hawaii, | | | | | | |

| | | | Prerefunded to 07/01/15 @100 | | | | | | |

| | 8,270,000 | | 5.000%, 07/01/21 NPFG/ FGIC Insured | | Aa1/NR/AA+ | | | 8,368,578 | |

| | | | City and County of Honolulu, Hawaii, | | | | | | |

| | | | Refunding, Series B | | | | | | |

| | 5,000,000 | | 5.000%, 12/01/30 | | Aa1/NR/AA+ | | | 5,832,750 | |

| | 3,000,000 | | 5.000%, 12/01/33 | | Aa1/NR/AA+ | | | 3,476,970 | |

| | 5,000,000 | | 4.750%, 12/01/35 | | Aa1/NR/AA+ | | | 5,603,450 | |

| | | | City and County of Honolulu, Hawaii, | | | | | | |

| | | | Refunding, Series F, Prerefunded to | | | | | | |

| | | | 07/01/15 @100 | | | | | | |

| | 1,500,000 | | 5.000%, 07/01/28 NPFG/ FGIC Insured | | Aa1/NR/AA+ | | | 1,517,880 | |

| | | | City and County of Honolulu, Hawaii, | | | | | | |

| | | | Series A | | | | | | |

| | 2,000,000 | | 5.000%, 10/01/20 | | Aa1/NR/AA+ | | | 2,368,480 | |

| | 2,000,000 | | 5.000%, 10/01/21 | | Aa1/NR/AA+ | | | 2,406,420 | |

| | 2,000,000 | | 5.000%, 10/01/22 | | Aa1/NR/AA+ | | | 2,430,740 | |

| | 2,000,000 | | 5.000%, 10/01/23 | | Aa1/NR/AA+ | | | 2,464,400 | |

| | 5,000,000 | | 5.000%, 10/01/24 | | Aa1/NR/AA+ | | | 6,221,800 | |

| | 5,000,000 | | 5.000%, 10/01/25 | | Aa1/NR/AA+ | | | 6,278,000 | |

| | 5,000,000 | | 5.000%, 10/01/26 | | Aa1/NR/AA+ | | | 6,225,100 | |

| | 2,000,000 | | 5.000%, 11/01/26 | | Aa1/NR/AA+ | | | 2,422,620 | |

| | 5,000,000 | | 5.000%, 11/01/27 | | Aa1/NR/AA+ | | | 6,025,350 | |

| | 5,000,000 | | 5.000%, 11/01/31 | | Aa1/NR/AA+ | | | 5,853,350 | |

| | 5,000,000 | | 5.000%, 11/01/32 | | Aa1/NR/AA+ | | | 5,834,600 | |

| | 5,000,000 | | 4.000%, 11/01/35 | | Aa1/NR/AA+ | | | 5,232,650 | |

| | | | City and County of Honolulu, Hawaii, | | | | | | |

| | | | Series A, Prerefunded to 7/1/17 @100 | | | | | | |

| | 3,000,000 | | 5.000%, 07/01/29 AGM Insured | | Aa1/AA/AA+ | | | 3,292,410 | |

| | | | City and County of Honolulu, Hawaii, | | | | | | |

| | | | Series A, Prerefunded to 07/01/15 | | | | | | |

| | | | @100 | | | | | | |

| | 5,000,000 | | 5.000%, 07/01/22 NPFG Insured | | Aa1/NR/AA+ | | | 5,059,600 | |

| | | | City and County of Honolulu, Hawaii, | | | | | | |

| | | | Series A, Prerefunded to 04/01/19 | | | | | | |

| | | | @100 | | | | | | |

| | 1,530,000 | | 5.250%, 04/01/32 | | Aa1/NR/AA+ | | | 1,776,162 | |

6 | Hawaiian Tax-Free Trust

| HAWAIIAN TAX-FREE TRUST |

| SCHEDULE OF INVESTMENTS (continued) |

MARCH 31, 2015 |

| | | | | Rating | | | |

| | | | | Moody’s, S&P | | | |

| Principal | | | | and Fitch | | | |

| Amount | | General Obligation Bonds (continued) | | (unaudited) | | Value | |

| | | City and County of Honolulu, Hawaii, | | | | | |

| | | Series A, Refunding | | | | | |

| $ | 2,000,000 | | 5.250%, 04/01/17 | | Aa1/NR/AA+ | | $ | 2,181,660 | |

| | 5,000,000 | | 5.000%, 04/01/19 | | Aa1/NR/AA+ | | | 5,743,700 | |

| | | | City and County of Honolulu, Hawaii, | | | | | | |

| | | | Series A, Prerefunded to 4/1/19 @100 | | | | | | |

| | 3,930,000 | | 5.000%, 04/01/20 | | Aa1/NR/AA+ | | | 4,524,019 | |

| | | | City and County of Honolulu, Hawaii, | | | | | | |

| | | | Series B | | | | | | |

| | 4,430,000 | | 5.000%, 11/01/21 | | Aa1/NR/AA+ | | | 5,341,118 | |

| | 5,000,000 | | 5.000%, 11/01/22 | | Aa1/NR/AA+ | | | 6,095,800 | |

| | 5,000,000 | | 4.000%, 11/01/27 | | Aa1/NR/AA+ | | | 5,503,350 | |

| | 5,000,000 | | 4.500%, 11/01/28 | | Aa1/NR/AA+ | | | 5,659,900 | |

| | 5,000,000 | | 4.500%, 11/01/29 | | Aa1/NR/AA+ | | | 5,594,200 | |

| | | | City and County of Honolulu, Hawaii, | | | | | | |

| | | | Series C, Prerefunded to 07/01/15 | | | | | | |

| | | | @100 | | | | | | |

| | 6,740,000 | | 5.000%, 07/01/18 NPFG Insured | | Aa1/NR/AA+ | | | 6,820,341 | |

| | | | City and County of Honolulu, Hawaii, | | | | | | |

| | | | Series D | | | | | | |

| | 3,500,000 | | 5.250%, 09/01/26 | | Aa1/NR/AA+ | | | 4,091,325 | |

| | 3,820,000 | | 5.250%, 09/01/27 | | Aa1/NR/AA+ | | | 4,452,898 | |

| | 7,390,000 | | 5.250%, 09/01/28 | | Aa1/NR/AA+ | | | 8,597,156 | |

| | 8,585,000 | | 5.250%, 09/01/30 | | Aa1/NR/AA+ | | | 9,955,509 | |

| | 9,105,000 | | 5.250%, 09/01/31 | | Aa1/NR/AA+ | | | 10,541,678 | |

| | | | City and County of Honolulu, Hawaii, | | | | | | |

| | | | Series D, Prerefunded to 07/01/15 | | | | | | |

| | | | @100 | | | | | | |

| | 595,000 | | 5.000%, 07/01/22 AGM - CR/ NPFG | | | | | | |

| | | | Insured | | Aa1/AA/NR | | | 602,092 | |

| | | | City and County of Honolulu, Hawaii, | | | | | | |

| | | | Series D, Prerefunded to 07/01/15 | | | | | | |

| | | | @100 | | | | | | |

| | 750,000 | | 5.000%, 07/01/19 NPFG Insured | | Aa1/NR/AA+ | | | 758,940 | |

| | 6,080,000 | | 5.000%, 07/01/21 NPFG Insured | | Aa1/NR/AA+ | | | 6,152,474 | |

| | | | City and County of Honolulu, Hawaii, | | | | | | |

| | | | Series F | | | | | | |

| | 5,000,000 | | 5.000%, 09/01/19 | | Aa1/NR/AA+ | | | 5,798,400 | |

| | 5,000,000 | | 5.000%, 09/01/20 | | Aa1/NR/AA+ | | | 5,807,700 | |

7 | Hawaiian Tax-Free Trust

| HAWAIIAN TAX-FREE TRUST |

| SCHEDULE OF INVESTMENTS (continued) |

MARCH 31, 2015 |

| | | | | Rating | | | |

| | | | | Moody’s, S&P | | | |

| Principal | | | | and Fitch | | | |

| Amount | | General Obligation Bonds (continued) | | (unaudited) | | Value | |

| | | City and County of Honolulu, Hawaii, | | | | | |

| | | Series F, Prerefunded to 07/01/15 | | | | | |

| | | @100 | | | | | |

| $ | 1,000,000 | | 5.250%, 07/01/19 NPFG/ FGIC Insured | | Aa1/NR/AA+ | | $ | 1,012,530 | |

| | 5,335,000 | | 5.250%, 07/01/20 NPFG/ FGIC Insured | | Aa1/NR/AA+ | | | 5,401,848 | |

| | | | City and County of Honolulu, Hawaii, | | | | | | |

| | | | Water Utility Refunding and | | | | | | |

| | | | Improvement, ETM, Collateral: U.S. | | | | | | |

| | | | Government Securities | | | | | | |

| | 1,050,000 | | 6.000%, 12/01/15 FGIC/ TCRS Insured | | Aa1/NR/NR | | | 1,090,351 | |

| | | | County of Hawaii | | | | | | |

| | 1,890,000 | | 5.500%, 07/15/22 | | Aa2/AA-/AA- | | | 2,154,770 | |

| | 2,245,000 | | 5.500%, 07/15/23 | | Aa2/AA-/AA- | | | 2,558,739 | |

| | 1,990,000 | | 5.750%, 07/15/24 | | Aa2/AA-/AA- | | | 2,283,346 | |

| | 2,370,000 | | 5.750%, 07/15/25 | | Aa2/AA-/AA- | | | 2,718,532 | |

| | 3,585,000 | | 6.000%, 07/15/27 | | Aa2/AA-/AA- | | | 4,137,198 | |

| | | | County of Hawaii, Series A | | | | | | |

| | 1,500,000 | | 5.000%, 09/01/30 | | Aa2/AA-/AA- | | | 1,750,860 | |

| | | | County of Hawaii, Series A | | | | | | |

| | 2,850,000 | | 5.000%, 07/15/20 AGC Insured | | Aa2/AA/NR | | | 3,014,587 | |

| | | | County of Hawaii, Series A | | | | | | |

| | 2,000,000 | | 5.000%, 07/15/17 AMBAC Insured | | Aa2/AA-/AA- | | | 2,192,520 | |

| | | | County of Hawaii, Series B | | | | | | |

| | 1,185,000 | | 4.000%, 09/01/19 | | Aa2/AA-/AA- | | | 1,319,853 | |

| | | | County of Hawaii, 2010-Series A | | | | | | |

| | 1,650,000 | | 5.000%, 03/01/19 | | Aa2/AA-/AA- | | | 1,891,065 | |

| | 2,870,000 | | 5.000%, 03/01/29 | | Aa2/AA-/AA- | | | 3,294,731 | |

| | | | County of Hawaii, 2013-Series A | | | | | | |

| | 500,000 | | 5.000%, 09/01/23 | | Aa2/AA-/AA- | | | 611,585 | |

| | 1,000,000 | | 5.000%, 09/01/24 | | Aa2/AA-/AA- | | | 1,215,430 | |

| | 1,000,000 | | 5.000%, 09/01/25 | | Aa2/AA-/AA- | | | 1,209,280 | |

| | 1,575,000 | | 5.000%, 09/01/26 | | Aa2/AA-/AA- | | | 1,894,993 | |

| | 1,000,000 | | 5.000%, 09/01/27 | | Aa2/AA-/AA- | | | 1,194,060 | |

| | 1,000,000 | | 5.000%, 09/01/28 | | Aa2/AA-/AA- | | | 1,182,800 | |

| | | | County of Kauai, Hawaii, 2005-Series A, | | | | | | |

| | | | Prerefunded to 08/01/15 @ 100 | | | | | | |

| | 845,000 | | 5.000%, 08/01/16 NPFG/ FGIC Insured | | Aa2/AA-/NR | | | 858,368 | |

| | 1,080,000 | | 5.000%, 08/01/17 NPFG/ FGIC Insured | | Aa2/AA-/NR | | | 1,097,086 | |

| | 1,300,000 | | 5.000%, 08/01/18 NPFG/ FGIC Insured | | Aa2/AA-/NR | | | 1,320,566 | |

| | 890,000 | | 5.000%, 08/01/19 NPFG/ FGIC Insured | | Aa2/AA-/NR | | | 904,080 | |

8 | Hawaiian Tax-Free Trust

| HAWAIIAN TAX-FREE TRUST |

| SCHEDULE OF INVESTMENTS (continued) |

MARCH 31, 2015 |

| | | | | Rating | | | |

| | | | | Moody’s, S&P | | | |

| Principal | | | | and Fitch | | | |

| Amount | | General Obligation Bonds (continued) | | (unaudited) | | Value | |

| | | County of Kauai, Hawaii, 2005-Series A, | | | | | |

| | | Unrefunded | | | | | |

| $ | 715,000 | | 5.000%, 08/01/16 NPFG/ FGIC Insured | | Aa2/AA/NR | | $ | 726,211 | |

| | 930,000 | | 5.000%, 08/01/17 NPFG/ FGIC Insured | | Aa2/AA/NR | | | 944,620 | |

| | 760,000 | | 5.000%, 08/01/18 NPFG/ FGIC Insured | | Aa2/AA/NR | | | 771,917 | |

| | 510,000 | | 5.000%, 08/01/19 NPFG/ FGIC Insured | | Aa2/AA/NR | | | 517,981 | |

| | | | County of Kauai, Hawaii, Refunding, | | | | | | |

| | | | Series A | | | | | | |

| | 1,000,000 | | 3.250%, 08/01/21 | | Aa2/AA/AA- | | | 1,095,630 | |

| | 1,445,000 | | 4.000%, 08/01/22 | | Aa2/AA/AA- | | | 1,630,379 | |

| | 1,240,000 | | 4.000%, 08/01/24 | | Aa2/AA/AA- | | | 1,389,209 | |

| | 1,000,000 | | 3.625%, 08/01/25 | | Aa2/AA/AA- | | | 1,077,490 | |

| | 970,000 | | 3.000%, 08/01/25 | | Aa2/AA/AA- | | | 1,013,485 | |

| | 600,000 | | 3.000%, 08/01/26 | | Aa2/AA/AA- | | | 623,202 | |

| | 2,280,000 | | 4.500%, 08/01/28 | | Aa2/AA/AA- | | | 2,571,817 | |

| | 345,000 | | 5.000%, 08/01/29 | | Aa2/AA/AA- | | | 401,100 | |

| | | | County of Kauai, Hawaii, Series A | | | | | | |

| | 855,000 | | 2.250%, 08/01/17 | | Aa2/AA/AA- | | | 884,429 | |

| | | | County of Kauai, Hawaii, Series A, | | | | | | |

| | | | Prerefunded to 08/01/15 @100 | | | | | | |

| | 1,000,000 | | 5.000%, 08/01/23 NPFG/ FGIC Insured | | Aa2/AA/AA- | | | 1,015,820 | |

| | 1,555,000 | | 5.000%, 08/01/24 NPFG/ FGIC Insured | | Aa2/AA/AA- | | | 1,579,600 | |

| | 1,500,000 | | 5.000%, 08/01/25 NPFG/ FGIC Insured | | Aa2/AA/AA- | | | 1,523,730 | |

| | 1,000,000 | | 5.000%, 08/01/28 NPFG/ FGIC Insured | | Aa2/AA/AA- | | | 1,015,820 | |

| | 1,000,000 | | 5.000%, 08/01/29 NPFG/ FGIC Insured | | Aa2/AA/AA- | | | 1,015,820 | |

| | | | County of Maui, Hawaii | | | | | | |

| | 1,035,000 | | 3.000%, 06/01/27 | | Aa1/AA+/AA+ | | | 1,056,042 | |

| | 2,000,000 | | 3.000%, 06/01/28 | | Aa1/AA+/AA+ | | | 2,014,380 | |

| | | | County of Maui, Hawaii | | | | | | |

| | 1,250,000 | | 3.800%, 03/01/16 NPFG Insured | | Aa1/AA+/AA+ | | | 1,253,575 | |

| | | | County of Maui, Hawaii, Refunding, | | | | | | |

| | | | Series B | | | | | | |

| | 3,950,000 | | 4.000%, 06/01/19 | | Aa1/AA+/AA+ | | | 4,381,419 | |

| | 4,620,000 | | 4.000%, 06/01/20 | | Aa1/AA+/AA+ | | | 5,188,168 | |

| | 2,385,000 | | 4.000%, 06/01/21 | | Aa1/AA+/AA+ | | | 2,658,226 | |

| | | | County of Maui, Hawaii, Series 2014 | | | | | | |

| | 4,065,000 | | 5.000%, 06/01/20 | | Aa1/AA+/AA+ | | | 4,765,684 | |

| | | | County of Maui, Hawaii, Series 2014 | | | | | | |

| | | | Refunding | | | | | | |

| | 1,500,000 | | 5.000%, 06/01/19 | | Aa1/AA+/AA+ | | | 1,724,295 | |

| | 1,900,000 | | 5.000%, 06/01/22 | | Aa1/AA+/AA+ | | | 2,297,784 | |

| | 1,000,000 | | 5.000%, 06/01/23 | | Aa1/AA+/AA+ | | | 1,219,580 | |

| | 4,015,000 | | 5.000%, 06/01/24 | | Aa1/AA+/AA+ | | | 4,942,264 | |

9 | Hawaiian Tax-Free Trust

| HAWAIIAN TAX-FREE TRUST |

| SCHEDULE OF INVESTMENTS (continued) |

MARCH 31, 2015 |

| | | | | Rating | | | |

| | | | | Moody’s, S&P | | | |

| Principal | | | | and Fitch | | | |

| Amount | | General Obligation Bonds (continued) | | (unaudited) | | Value | |

| | | County of Maui, Hawaii, Series A | | | | | |

| | | Prerefunded to 07/01/16 @ 100 | | | | | |

| $ | 1,165,000 | | 4.375%, 07/01/19 NPFG Insured | | Aa1/AA+/AA+ | | $ | 1,223,914 | |

| | 750,000 | | 5.000%, 07/01/20 NPFG Insured | | Aa1/AA+/AA+ | | | 793,747 | |

| | | | County of Maui, Hawaii, Unrefunded | | | | | | |

| | | | Balance | | | | | | |

| | 820,000 | | 5.000%, 03/01/18 NPFG Insured | | Aa1/NR/NR | | | 822,780 | |

| | 590,000 | | 5.000%, 03/01/19 NPFG Insured | | Aa1/NR/NR | | | 591,971 | |

| | | | State of Hawaii | | | | | | |

| | 6,285,000 | | 5.000%, 05/01/19 | | Aa2/AA/AA | | | 7,055,227 | |

| | | | State of Hawaii, Prerefunded to | | | | | | |

| | | | 05/01/18 @100 | | | | | | |

| | 715,000 | | 5.000%, 05/01/19 | | NR/NR/NR* | | | 803,317 | |

| | | | State of Hawaii, Series CM | | | | | | |

| | 3,000,000 | | 6.500%, 12/01/15 NPFG/ FGIC Insured | | Aa2/AA/NR | | | 3,124,050 | |

| | | | State of Hawaii, Series DF, Prerefunded | | | | | | |

| | | | 7/1/15 @100 | | | | | | |

| | 5,000,000 | | 5.000%, 07/01/25 AMBAC Insured | | Aa2/AA/NR | | | 5,059,000 | |

| | | | State of Hawaii, Series DF Prerefunded | | | | | | |

| | | | to 07/01/15 @100 | | | | | | |

| | 3,500,000 | | 5.000%, 07/01/18 AMBAC Insured | | Aa2/AA/NR | | | 3,541,300 | |

| | 7,005,000 | | 5.000%, 07/01/22 AMBAC Insured | | Aa2/AA/NR | | | 7,087,659 | |

| | 2,995,000 | | 5.000%, 07/01/22 AMBAC Insured | | Aa2/NR/NR | | | 3,030,341 | |

| | 3,390,000 | | 5.000%, 07/01/23 AMBAC Insured | | Aa2/NR/NR | | | 3,430,002 | |

| | 1,610,000 | | 5.000%, 07/01/23 AMBAC Insured | | Aa2/AA/NR | | | 1,628,998 | |

| | 5,510,000 | | 5.000%, 07/01/24 AMBAC Insured | | Aa2/AA/NR | | | 5,575,018 | |

| | | | State of Hawaii, Series DG, Refunding, | | | | | | |

| | | | Prerefunded to 07/01/15 @100 | | | | | | |

| | 2,000,000 | | 5.000%, 07/01/17 AMBAC Insured | | Aa2/AA/NR | | | 2,023,600 | |

| | | | State of Hawaii, Series DI, Prerefunded | | | | | | |

| | | | to 03/01/16 @100 | | | | | | |

| | 5,000,000 | | 5.000%, 03/01/20 AGM Insured | | Aa2/AA/NR | | | 5,216,450 | |

| | 2,750,000 | | 5.000%, 03/01/21 AGM Insured | | Aa2/AA/NR | | | 2,869,047 | |

| | 5,000,000 | | 5.000%, 03/01/22 AGM Insured | | Aa2/AA/NR | | | 5,216,450 | |

| | | | State of Hawaii, Series DJ, Prerefunded | | | | | | |

| | | | to 04/1/17 @100 | | | | | | |

| | 5,000,000 | | 5.000%, 04/01/23 AGM - CR AMBAC | | | | | | |

| | | | Insured | | Aa2/AA/NR | | | 5,436,550 | |

| | | | State of Hawaii, Series DJ, Prerefunded | | | | | | |

| | | | to 04/1/17 @100 | | | | | | |

| | 6,130,000 | | 5.000%, 04/01/25 AMBAC Insured | | Aa2/NR/NR | | | 6,671,647 | |

10 | Hawaiian Tax-Free Trust

| HAWAIIAN TAX-FREE TRUST |

| SCHEDULE OF INVESTMENTS (continued) |

MARCH 31, 2015 |

| | | | | Rating | | | |

| | | | | Moody’s, S&P | | | |

| Principal | | | | and Fitch | | | |

| Amount | | General Obligation Bonds (continued) | | (unaudited) | | Value | |

| | | State of Hawaii, Series DJ, Prerefunded | | | | | |

| | | to 04/01/17 @100 | | | | | |

| $ | 2,535,000 | | 5.000%, 04/01/23 AMBAC Insured | | Aa2/AA/NR | | $ | 2,758,993 | |

| | 2,465,000 | | 5.000%, 04/01/23 AMBAC Insured | | Aa2/AA/NR | | | 2,682,807 | |

| | | | State of Hawaii, Series DK, ETM 5/1/18 | | | | | | |

| | 470,000 | | 5.000%, 05/01/18 | | NR/NR/NR* | | | 528,054 | |

| | | | State of Hawaii, Series DK, Prerefunded | | | | | | |

| | | | to 05/01/18 @100 | | | | | | |

| | 930,000 | | 5.000%, 05/01/20 | | NR/NR/NR* | | | 1,044,874 | |

| | | | State of Hawaii, Series DK, Unrefunded | | | | | | |

| | | | Balance | | | | | | |

| | 70,000 | | 5.000%, 05/01/20 | | Aa2/AA/AA | | | 78,601 | |

| | | | State of Hawaii, Series DN | | | | | | |

| | 1,000,000 | | 5.250%, 08/01/25 | | Aa2/AA/AA | | | 1,141,230 | |

| | | | State of Hawaii, Series DQ | | | | | | |

| | 10,000,000 | | 5.000%, 06/01/23 | | Aa2/AA/AA | | | 11,552,300 | |

| | | | State of Hawaii, Series DR | | | | | | |

| | 1,075,000 | | 5.000%, 06/01/17 | | Aa2/AA/AA | | | 1,175,770 | |

| | | | State of Hawaii, Series DY, Refunding | | | | | | |

| | 725,000 | | 5.000%, 02/01/16 | | Aa2/AA/AA | | | 753,478 | |

| | 3,765,000 | | 5.000%, 02/01/20 | | Aa2/AA/AA | | | 4,404,071 | |

| | | | State of Hawaii, Series DZ | | | | | | |

| | 1,500,000 | | 5.000%, 12/01/19 | | Aa2/AA/AA | | | 1,750,500 | |

| | 7,500,000 | | 5.000%, 12/01/26 | | Aa2/AA/AA | | | 8,930,850 | |

| | 5,000,000 | | 5.000%, 12/01/28 | | Aa2/AA/AA | | | 5,912,800 | |

| | 10,575,000 | | 5.000%, 12/01/29 | | Aa2/AA/AA | | | 12,455,235 | |

| | 6,500,000 | | 5.000%, 12/01/30 | | Aa2/AA/AA | | | 7,624,825 | |

| | | | State of Hawaii, Series EA | | | | | | |

| | 1,600,000 | | 5.000%, 12/01/16 | | Aa2/AA/AA | | | 1,718,624 | |

| | | | State of Hawaii, Series EE | | | | | | |

| | 1,195,000 | | 5.000%, 11/01/21 | | Aa2/AA/AA | | | 1,444,086 | |

| | 5,000,000 | | 5.000%, 11/01/22 | | Aa2/AA/AA | | | 6,115,550 | |

| | 1,000,000 | | 5.000%, 11/01/24 | | Aa2/AA/AA | | | 1,217,590 | |

| | 1,000,000 | | 5.000%, 11/01/27 | | Aa2/AA/AA | | | 1,198,870 | |

| | | | State of Hawaii, Series EH | | | | | | |

| | 1,500,000 | | 5.000%, 08/01/18 | | Aa2/AA/AA | | | 1,698,030 | |

| | 1,500,000 | | 5.000%, 08/01/20 | | Aa2/AA/AA | | | 1,773,315 | |

| | | | State of Hawaii, Series EK, Refunding | | | | | | |

| | 1,500,000 | | 5.000%, 08/01/16 | | Aa2/AA/AA | | | 1,591,110 | |

| | | | State of Hawaii, Series EL, Refunding | | | | | | |

| | 2,000,000 | | 5.000%, 08/01/23 | | Aa2/AA/AA | | | 2,468,040 | |

11 | Hawaiian Tax-Free Trust

| HAWAIIAN TAX-FREE TRUST |

| SCHEDULE OF INVESTMENTS (continued) |

MARCH 31, 2015 |

| | | | | Rating | | | |

| | | | | Moody’s, S&P | | | |

| Principal | | | | and Fitch | | | |

| Amount | | General Obligation Bonds (continued) | | (unaudited) | | Value | |

| | | State of Hawaii, Series EO, Refunding | | | | | |

| $ | 2,000,000 | | 5.000%, 08/01/27 | | Aa2/AA/AA | | $ | 2,437,460 | |

| | 2,000,000 | | 5.000%, 08/01/28 | | Aa2/AA/AA | | | 2,415,160 | |

| | 1,000,000 | | 5.000%, 08/01/29 | | Aa2/AA/AA | | | 1,200,210 | |

| | 1,000,000 | | 5.000%, 08/01/30 | | Aa2/AA/AA | | | 1,192,900 | |

| | | | State of Hawaii, Series EP, Refunding | | | | | | |

| | 2,000,000 | | 5.000%, 08/01/22 | | Aa2/AA/AA | | | 2,437,000 | |

| | 5,000,000 | | 5.000%, 08/01/23 | | Aa2/AA/AA | | | 6,170,100 | |

| | 5,000,000 | | 5.000%, 08/01/24 | | Aa2/AA/AA | | | 6,235,750 | |

| | 5,000,000 | | 5.000%, 08/01/25 | | Aa2/AA/AA | | | 6,192,700 | |

| | 3,000,000 | | 5.000%, 08/01/26 | | Aa2/AA/AA | | | 3,684,360 | |

| | | | Total General Obligation Bonds | | | | | 484,532,678 | |

| | | | | | | | | | |

| | | | Revenue Bonds (37.2%) | | | | | | |

| | | | Airport (4.7%) | | | | | | |

| | | | State of Hawaii Airport System | | | | | | |

| | | | Revenue Refunding, AMT | | | | | | |

| | 14,000,000 | | 5.000%, 07/01/21 | | A2/A/A | | | 16,534,700 | |

| | 5,000,000 | | 5.000%, 07/01/22 | | A2/A/A | | | 5,812,500 | |

| | 1,500,000 | | 5.000%, 07/01/23 | | A2/A/A | | | 1,727,670 | |

| | 3,000,000 | | 5.000%, 07/01/24 | | A2/A/A | | | 3,434,730 | |

| | | | State of Hawaii Airport System | | | | | | |

| | | | Revenue Refunding, Series A | | | | | | |

| | 1,150,000 | | 5.250%, 07/01/21 | | A2/A/A | | | 1,360,312 | |

| | 1,000,000 | | 5.250%, 07/01/23 | | A2/A/A | | | 1,177,920 | |

| | 1,000,000 | | 5.250%, 07/01/27 | | A2/A/A | | | 1,170,800 | |

| | | | State of Hawaii Airport System | | | | | | |

| | | | Revenue, Series A | | | | | | |

| | 2,000,000 | | 4.000%, 07/01/20 | | A2/A/A | | | 2,262,020 | |

| | 3,000,000 | | 5.000%, 07/01/22 | | A2/A/A | | | 3,492,990 | |

| | | | Total Airport | | | | | 36,973,642 | |

| | | | Education (4.1%) | | | | | | |

| | | | University of Hawaii | | | | | | |

| | 5,000,000 | | 5.000%, 07/15/21 NPFG Insured | | Aa2/AA-/AA | | | 5,281,450 | |

| | | | University of Hawaii | | | | | | |

| | 2,325,000 | | 5.000%, 10/01/23 AGC-ICC NPFG | | | | | | |

| | | | Insured | | Aa2/AA/NR | | | 2,476,613 | |

| | | | University of Hawaii, Revenue | | | | | | |

| | | | Refunding, Series A | | | | | | |

| | 775,000 | | 5.000%, 07/01/22 NPFG Insured | | Aa2/AA-/AA | | | 818,524 | |

| | 1,000,000 | | 4.500%, 07/15/23 NPFG Insured | | Aa2/AA-/AA | | | 1,047,530 | |

| | 4,840,000 | | 4.500%, 07/15/25 NPFG Insured | | Aa2/AA-/AA | | | 5,061,140 | |

12 | Hawaiian Tax-Free Trust

| HAWAIIAN TAX-FREE TRUST |

| SCHEDULE OF INVESTMENTS (continued) |

MARCH 31, 2015 |

| | | | | Rating | | | |

| | | | | Moody’s, S&P | | | |

| Principal | | | | and Fitch | | | |

| Amount | | Revenue Bonds (continued) | | (unaudited) | | Value | |

| | | Education (continued) | | | | | |

| | | University of Hawaii, Series A | | | | | |

| $ | 760,000 | | 5.000%, 10/01/15 | | Aa2/A+/AA | | $ | 777,982 | |

| | 1,510,000 | | 5.000%, 10/01/17 | | Aa2/A+/AA | | | 1,653,329 | |

| | | | University of Hawaii, Series A | | | | | | |

| | 1,000,000 | | 4.000%, 10/01/18 | | Aa2/A+/AA | | | 1,085,510 | |

| | 2,725,000 | | 5.500%, 10/01/22 | | Aa2/A+/AA | | | 3,232,259 | |

| | 5,225,000 | | 5.250%, 10/01/34 | | Aa2/A+/AA | | | 5,999,920 | |

| | | | University of Hawaii, Series A-2 | | | | | | |

| | 500,000 | | 4.000%, 10/01/15 | | Aa2/A+/AA | | | 509,400 | |

| | 1,125,000 | | 4.000%, 10/01/16 | | Aa2/A+/AA | | | 1,184,434 | |

| | 2,175,000 | | 4.000%, 10/01/17 | | Aa2/A+/AA | | | 2,343,193 | |

| | 1,000,000 | | 4.000%, 10/01/19 | | Aa2/A+/AA | | | 1,112,410 | |

| | | | Total Education | | | | | 32,583,694 | |

| | | | Housing (1.1%) | | | | | | |

| | | | Hawaii State Department of Hawaiian | | | | | | |

| | | | Home Lands | | | | | | |

| | 500,000 | | 5.000%, 04/01/15 | | A1/NR/A | | | 500,052 | |

| | 715,000 | | 5.000%, 04/01/17 | | A1/NR/A | | | 758,429 | |

| | 1,000,000 | | 5.500%, 04/01/20 | | A1/NR/A | | | 1,104,340 | |

| | | | State of Hawaii Housing Finance and | | | | | | |

| | | | Development Corp., Iwilei | | | | | | |

| | | | Apartments, Series A | | | | | | |

| | 2,000,000 | | 3.750%, 01/01/31 FHLMC Insured | | NR/AA+/NR | | | 2,054,320 | |

| | | | State of Hawaii Housing Finance and | | | | | | |

| | | | Development Corp., Kalani Gardens, | | | | | | |

| | | | Series A | | | | | | |

| | 1,900,000 | | 0.700%, 04/01/17 | | NR/AAA/NR | | | 1,900,931 | |

| | | | State of Hawaii Housing Finance and | | | | | | |

| | | | Development Corp. Single Family | | | | | | |

| | | | Mortgage, Series B | | | | | | |

| | 1,805,000 | | 4.500%, 01/01/26 FNMA/GNMA | | | | | | |

| | | | Collateralized | | Aaa/AA+/AAA | | | 1,896,676 | |

| | | | Total Housing | | | | | 8,214,748 | |

| | | | Medical (2.4%) | | | | | | |

| | | | Hawaii State Department of Budget | | | | | | |

| | | | and Finance, Special Purpose Revenue | | | | | | |

| | | | (Hawaii Pacific Health) Series A | | | | | | |

| | 150,000 | | 5.000%, 07/01/19 | | A2/A/A | | | 169,788 | |

13 | Hawaiian Tax-Free Trust

| HAWAIIAN TAX-FREE TRUST |

| SCHEDULE OF INVESTMENTS (continued) |

MARCH 31, 2015 |

| | | | | Rating | | | |

| | | | | Moody’s, S&P | | | |

| Principal | | | | and Fitch | | | |

| Amount | | Revenue Bonds (continued) | | (unaudited) | | Value | |

| | | Medical (continued) | | | | | |

| | | Hawaii State Department of Budget and | | | | | |

| | | Finance, Special Purpose Revenue | | | | | |

| | | (Queens Health System) Series A | | | | | |

| $ | 2,015,000 | | 5.000%, 07/01/20 | | A1/AA-/NR | | $ | 2,349,430 | |

| | 750,000 | | 5.000%, 07/01/21 | | A1/AA-/NR | | | 887,243 | |

| | 1,500,000 | | 5.000%, 07/01/22 | | A1/AA-/NR | | | 1,785,315 | |

| | 865,000 | | 5.000%, 07/01/23 | | A1/AA-/NR | | | 1,039,453 | |

| | 2,760,000 | | 5.000%, 07/01/24 | | A1/AA-/NR | | | 3,333,859 | |

| | 1,310,000 | | 5.000%, 07/01/25 | | A1/AA-/NR | | | 1,593,746 | |

| | 1,715,000 | | 5.000%, 07/01/26 | | A1/AA-/NR | | | 2,065,889 | |

| | 1,500,000 | | 5.000%, 07/01/35 | | A1/AA-/NR | | | 1,722,870 | |

| | | | Hawaii State Department of Budget and | | | | | | |

| | | | Finance, Special Purpose Revenue | | | | | | |

| | | | (Senior Living Revenue, Kahala Nui) | | | | | | |

| | 3,575,000 | | 5.125%, 11/15/32 | | NR/NR/BBB | | | 3,930,212 | |

| | | | Total Medical | | | | | 18,877,805 | |

| | | | Transportation (9.3%) | | | | | | |

| | | | State of Hawaii Harbor System, Series A | | | | | | |

| | 16,500,000 | | 5.750%, 07/01/35 | | A2/A+/A+ | | | 19,493,430 | |

| | 4,000,000 | | 5.625%, 07/01/40 | | A2/A+/A+ | | | 4,666,320 | |

| | | | State of Hawaii Harbor System, | | | | | | |

| | | | Series A 2006, AMT | | | | | | |

| | 4,910,000 | | 5.250%, 01/01/25 AGM Insured | | A2/AA/A+ | | | 5,061,670 | |

| | 1,450,000 | | 5.250%, 01/01/27 AGM Insured | | A2/AA/A+ | | | 1,494,138 | |

| | | | State of Hawaii Harbor System, | | | | | | |

| | | | Series A-AMT | | | | | | |

| | 2,000,000 | | 5.250%, 07/01/15 AGM Insured | | A2/AA/A+ | | | 2,023,140 | |

| | 2,215,000 | | 5.250%, 07/01/17 AGM Insured | | A2/AA/A+ | | | 2,414,572 | |

| | | | State of Hawaii Highway Revenue | | | | | | |

| | 1,000,000 | | 5.250%, 01/01/17 | | Aa2/AA+/AA | | | 1,081,630 | |

| | 1,000,000 | | 5.250%, 01/01/18 | | Aa2/AA+/AA | | | 1,118,450 | |

| | 5,135,000 | | 5.500%, 07/01/18 | | Aa2/AA+/AA | | | 5,874,235 | |

| | 5,220,000 | | 6.000%, 01/01/23 | | Aa2/AA+/AA | | | 6,111,628 | |

| | | | State of Hawaii Highway Revenue, | | | | | | |

| | | | Series A | | | | | | |

| | 750,000 | | 5.000%, 01/01/21 | | Aa2/AA+/AA | | | 893,490 | |

| | 500,000 | | 5.000%, 01/01/24 | | Aa2/AA+/AA | | | 618,870 | |

| | 1,500,000 | | 5.000%, 01/01/25 | | Aa2/AA+/AA | | | 1,855,200 | |

14 | Hawaiian Tax-Free Trust

| HAWAIIAN TAX-FREE TRUST |

| SCHEDULE OF INVESTMENTS (continued) |

MARCH 31, 2015 |

| | | | | Rating | | | |

| | | | | Moody’s, S&P | | | |

| Principal | | | | and Fitch | | | |

| Amount | | Revenue Bonds (continued) | | (unaudited) | | Value | |

| | | Transportation (continued) | | | | | |

| | | State of Hawaii Highway Revenue, | | | | | |

| | | Series A | | | | | |

| $ | 6,000,000 | | 5.000%, 01/01/28 | | Aa2/AA+/AA | | $ | 6,961,800 | |

| | 4,100,000 | | 5.000%, 01/01/29 | | Aa2/AA+/AA | | | 4,735,131 | |

| | 3,980,000 | | 5.000%, 01/01/30 | | Aa2/AA+/AA | | | 4,580,542 | |

| | 3,040,000 | | 5.000%, 01/01/32 | | Aa2/AA+/AA | | | 3,488,552 | |

| | | | State of Hawaii Highway Revenue, | | | | | | |

| | | | Series A Prerefunded to 07/01/15 | | | | | | |

| | | | @100 | | | | | | |

| | 1,000,000 | | 5.000%, 07/01/20 AGM Insured | | Aa2/AA+/AA | | | 1,011,800 | |

| | | | Total Transportation | | | | | 73,484,598 | |

| | | | Utility (0.6%) | | | | | | |

| | | | State of Hawaii, Department of Business, | | | | | | |

| | | | Economic Development and Tourism | | | | | | |

| | | | Green Energy Market Securitization | | | | | | |

| | | | Bonds, Series A (Federally Taxable) | | | | | | |

| | 5,000,000 | | 1.467%, 07/01/22 | | Aaa/AAA/AAA | | | 5,042,950 | |

| | | | Water & Sewer (15.0%) | | | | | | |

| | | | City and County of Honolulu, Hawaii, | | | | | | |

| | | | Board of Water Supply Water System | | | | | | |

| | | | Prerefunded 7/1/16 @100 | | | | | | |

| | 5,000,000 | | 5.000%, 07/01/26 NPFG Insured | | Aa2/AA-/NR | | | 5,291,650 | |

| | | | City and County of Honolulu, Hawaii, | | | | | | |

| | | | Board of Water Supply Water System, | | | | | | |

| | | | Prerefunded to 07/01/16 @100 | | | | | | |

| | 2,005,000 | | 4.500%, 07/01/22 NPFG Insured | | Aa2/AA-/NR | | | 2,109,521 | |

| | | | City and County of Honolulu, Hawaii, | | | | | | |

| | | | Board of Water Supply Water System, | | | | | | |

| | | | Refunding Series A, Prerefunded | | | | | | |

| | | | to 7/1/16 @100 | | | | | | |

| | 4,525,000 | | 4.500%, 07/01/24 NPFG Insured | | Aa2/AA-/NR | | | 4,760,888 | |

| | | | City and County of Honolulu, Hawaii, | | | | | | |

| | | | Board of Water Supply Water System, | | | | | | |

| | | | Refunding Series A | | | | | | |

| | 4,795,000 | | 4.500%, 07/01/29 | | Aa2/NR/AA+ | | | 5,342,589 | |

| | 4,955,000 | | 4.500%, 07/01/30 | | Aa2/NR/AA+ | | | 5,489,942 | |

| | 5,020,000 | | 5.000%, 07/01/31 | | Aa2/NR/AA+ | | | 5,789,164 | |

| | 3,040,000 | | 5.000%, 07/01/32 | | Aa2/NR/AA+ | | | 3,488,522 | |

| | 3,495,000 | | 5.000%, 07/01/33 | | Aa2/NR/AA+ | | | 3,995,868 | |

15 | Hawaiian Tax-Free Trust

| HAWAIIAN TAX-FREE TRUST |

| SCHEDULE OF INVESTMENTS (continued) |

MARCH 31, 2015 |

| | | | | Rating | | | |

| | | | | Moody’s, S&P | | | |

| Principal | | | | and Fitch | | | |

| Amount | | Revenue Bonds (continued) | | (unaudited) | | Value | |

| | | Water & Sewer (continued) | | | | | |

| | | City and County of Honolulu, Hawaii, | | | | | |

| | | Board of Water Supply Water System, | | | | | |

| | | Refunding Series A Prerefunded | | | | | |

| | | 7/1/16 @100 | | | | | |

| $ | 3,010,000 | | 4.750%, 07/01/31 NPFG Insured | | Aa2/AA-/NR | | $ | 3,176,242 | |

| | | | City and County of Honolulu, Hawaii, | | | | | | |

| | | | Board of Water Supply Water System, | | | | | | |

| | | | Series A | | | | | | |

| | 1,000,000 | | 5.000%, 07/01/23 | | Aa2/NR/AA+ | | | 1,230,360 | |

| | 1,000,000 | | 5.000%, 07/01/24 | | Aa2/NR/AA+ | | | 1,245,340 | |

| | | | City and County of Honolulu, Hawaii, | | | | | | |

| | | | Wastewater System | | | | | | |

| | 5,360,000 | | 4.500%, 07/01/28 | | Aa2/NR/AA | | | 6,048,760 | |

| | 4,480,000 | | 4.500%, 07/01/30 | | Aa2/NR/AA | | | 4,986,688 | |

| | 1,000,000 | | 4.000%, 07/01/31 | | Aa2/NR/AA | | | 1,067,090 | |

| | 2,000,000 | | 5.250%, 07/01/36 | | Aa2/NR/AA | | | 2,357,860 | |

| | | | City and County of Honolulu, Hawaii, | | | | | | |

| | | | Wastewater System | | | | | | |

| | 3,000,000 | | 5.000%, 07/01/32 NPFG Insured | | Aa3/NR/AA- | | | 3,151,830 | |

| | | | City and County of Honolulu, Hawaii, | | | | | | |

| | | | Wastewater System | | | | | | |

| | 405,000 | | 5.000%, 07/01/18 NPFG/ FGIC Insured | | Aa2/AA-/NR | | | 409,577 | |

| | 220,000 | | 5.000%, 07/01/22 NPFG/ FGIC Insured | | Aa2/AA-/NR | | | 222,446 | |

| | 240,000 | | 5.000%, 07/01/24 NPFG/ FGIC Insured | | Aa2/AA-/NR | | | 242,628 | |

| | | | City and County of Honolulu, Hawaii, | | | | | | |

| | | | Wastewater System, Prerefunded to | | | | | | |

| | | | 07/01/15 @100 | | | | | | |

| | 2,965,000 | | 5.000%, 07/01/18 NPFG/ FGIC Insured | | Aa2/AA-/NR | | | 2,999,987 | |

| | 1,605,000 | | 5.000%, 07/01/22 NPFG/ FGIC Insured | | Aa2/AA-/NR | | | 1,623,939 | |

| | 1,760,000 | | 5.000%, 07/01/24 NPFG/ FGIC Insured | | Aa2/AA-/NR | | | 1,780,768 | |

| | | | City and County of Honolulu, Hawaii, | | | | | | |

| | | | Wastewater System (First Bond | | | | | | |

| | | | Resolution) Senior Series 2009 A | | | | | | |

| | 1,000,000 | | 5.000%, 07/01/20 | | Aa2/NR/AA | | | 1,157,220 | |

| | 2,455,000 | | 5.000%, 07/01/21 | | Aa2/NR/AA | | | 2,839,870 | |

| | 2,800,000 | | 5.000%, 07/01/22 | | Aa2/NR/AA | | | 3,237,696 | |

| | 3,300,000 | | 5.000%, 07/01/23 | | Aa2/NR/AA | | | 3,814,404 | |

| | 2,500,000 | | 5.000%, 07/01/24 | | Aa2/NR/AA | | | 2,887,450 | |

16 | Hawaiian Tax-Free Trust

| HAWAIIAN TAX-FREE TRUST |

| SCHEDULE OF INVESTMENTS (continued) |

MARCH 31, 2015 |

| | | | | Rating | | | |

| | | | | Moody’s, S&P | | | |

| Principal | | | | and Fitch | | | |

| Amount | | Revenue Bonds (continued) | | (unaudited) | | Value | |

| | | Water & Sewer (continued) | | | | | |

| | | City and County of Honolulu, Hawaii, | | | | | |

| | | Wastewater System (First Bond | | | | | |

| | | Resolution) Senior Series 2012 A | | | | | |

| $ | 2,000,000 | | 5.000%, 07/01/29 | | Aa2/NR/AA | | $ | 2,315,000 | |

| | 1,000,000 | | 5.000%, 07/01/30 | | Aa2/NR/AA | | | 1,153,220 | |

| | 1,000,000 | | 5.000%, 07/01/31 | | Aa2/NR/AA | | | 1,148,960 | |

| | 1,500,000 | | 5.000%, 07/01/32 | | Aa2/NR/AA | | | 1,719,195 | |

| | 4,000,000 | | 5.000%, 07/01/37 | | Aa2/NR/AA | | | 4,559,160 | |

| | 2,500,000 | | 5.000%, 07/01/42 | | Aa2/NR/AA | | | 2,842,450 | |

| | | | City and County of Honolulu, Hawaii, | | | | | | |

| | | | Wastewater System (First Bond | | | | | | |

| | | | Resolution) Senior Series 2012 B | | | | | | |

| | 2,500,000 | | 5.000%, 07/01/22 | | Aa2/NR/AA | | | 3,046,700 | |

| | 2,000,000 | | 4.000%, 07/01/28 | | Aa2/NR/AA | | | 2,194,820 | |

| | 3,000,000 | | 4.000%, 07/01/30 | | Aa2/NR/AA | | | 3,222,240 | |

| | | | City and County of Honolulu, Hawaii, | | | | | | |

| | | | Wastewater System (Second Bond | | | | | | |

| | | | Resolution) Junior Series 2009 A | | | | | | |

| | 1,080,000 | | 5.000%, 07/01/22 | | Aa3/NR/AA- | | | 1,239,170 | |

| | | | City and County of Honolulu, Hawaii, | | | | | | |

| | | | Wastewater System (Second Bond | | | | | | |

| | | | Resolution) Junior Series 2010 A | | | | | | |

| | 7,400,000 | | 4.500%, 07/01/27 | | Aa3/NR/AA- | | | 8,261,804 | |

| | | | City and County of Honolulu, Hawaii, | | | | | | |

| | | | Wastewater System (Second Bond | | | | | | |

| | | | Resolution) Junior Series B-1 | | | | | | |

| | | | Remarket 09/15/06 | | | | | | |

| | 1,340,000 | | 5.000%, 07/01/18 NPFG Insured | | Aa3/NR/AA- | | | 1,414,879 | |

| | 1,935,000 | | 5.000%, 07/01/19 NPFG Insured | | Aa3/NR/AA- | | | 2,043,631 | |

| | 2,035,000 | | 5.000%, 07/01/20 NPFG Insured | | Aa3/NR/AA- | | | 2,148,980 | |

| | | | Total Water & Sewer | | | | | 118,058,508 | |

| | | | Total Revenue Bonds | | | | | 293,235,945 | |

| | | | Total Investments (cost $739,089,488 - | | | | | | |

| | | | note 4) | | 98.8% | | | 777,768,623 | |

| | | | Other assets less liabilities | | 1.2 | | | 9,127,676 | |

| | | | Net Assets | | 100.0% | | $ | 786,896,299 | |

17 | Hawaiian Tax-Free Trust

| HAWAIIAN TAX-FREE TRUST |

| SCHEDULE OF INVESTMENTS (continued) |

MARCH 31, 2015 |

| | | Percent of | |

| Portfolio Distribution by Quality Rating (unaudited) | | Portfolio† | |

| Aaa of Moody’s or AAA of S&P | | | 1.1 | % |

| Pre-Refunded bonds††/ETM bonds | | | 19.9 | |

| Aa of Moody’s or AA of S&P/Fitch | | | 67.0 | |

| A of Moody’s | | | 11.5 | |

| BBB of Fitch | | | 0.5 | |

| | | | 100.0 | % |

PORTFOLIO ABBREVIATIONS:

| AGC – Assured Guaranty Insurance | | FNMA – Federal National Mortgage Association |

| AGM – Assured Guaranty Municipal Corp. | | GNMA – Government National Mortgage Association |

| AMBAC – American Municipal Bond Assurance Corporation | | ICC – Insured Custody Certificate |

| AMT – Alternative Minimum Tax | | NPFG – National Public Finance Guarantee |

| CR – Custodial Receipts | | NR – Not Rated |

| ETM – Escrowed to Maturity | | TCRS – Transferable Custodial Receipts |

| FGIC – Financial Guaranty Insurance Co. | | |

| FHLMC – Federal Home Loan Mortgage Corporation | | |

| * | Any security not rated (“NR”) by any of the Nationally Recognized Statistical Rating Organizations (“NRSRO”) has been determined by the Investment Adviser to have sufficient quality to be ranked in the top four credit ratings if a credit rating were to be assigned by a NRSRO. |

| | |

| † | Calculated using the Moody’s rating unless otherwise noted. |

| | |

| †† | Pre-refunded bonds are bonds for which U.S. Government Obligations usually have been placed in escrow to retire the bonds at their earliest call date. |

See accompanying notes to financial statements.

18 | Hawaiian Tax-Free Trust

| HAWAIIAN TAX-FREE TRUST |

| STATEMENT OF ASSETS AND LIABILITIES |

MARCH 31, 2015 |

| ASSETS | | | |

| Investments at value (cost $739,089,488) | | $ | 777,768,623 | |

| Cash | | | 21,137,478 | |

| Interest receivable | | | 9, 061,763 | |

| Receivable for investment securities sold | | | 7,472,953 | |

| Receivable for Trust shares sold | | | 1,133,641 | |

| Other assets | | | 93,975 | |

| Total assets | | | 816,668,433 | |

| LIABILITIES | | | | |

| Payable for investment securities purchased | | | 28,081,310 | |

| Payable for Trust shares redeemed | | | 818,193 | |

| Advisory and Administrative fees payable | | | 300,093 | |

| Dividends payable | | | 287,303 | |

| Distribution and service fees payable | | | 38,167 | |

| Accrued expenses payable | | | 247,068 | |

| Total liabilities | | | 29,772,134 | |

| NET ASSETS | | $ | 786,896,299 | |

| Net Assets consist of: | | | | |

| Capital Stock – Authorized an unlimited number of shares, | | | | |

| par value $0.01 per share | | $ | 682,649 | |

| Additional paid-in capital | | | 753,774,828 | |

| Net unrealized appreciation on investments (note 4) | | | 38,679,135 | |

| Accumulated net realized loss on investments | | | (6,240,313 | ) |

| | | $ | 786,896,299 | |

| CLASS A | | | | |

| Net Assets | | $ | 678,136,896 | |

| Capital shares outstanding | | | 58,832,242 | |

| Net asset value and redemption price per share | | $ | 11.53 | |

| Maximum offering price per share (100/96 of $11.53) | | $ | 12.01 | |

| CLASS C | | | | |

| Net Assets | | $ | 63,317,663 | |

| Capital shares outstanding | | | 5,496,638 | |

| Net asset value and offering price per share | | $ | 11.52 | |

| Redemption price per share (*a charge of 1% is imposed | | | | |

| on the redemption proceeds, or on the original price, | | | | |

| whichever is lower, if redeemed during the first 12 | | | | |

| months after purchase) | | $ | 11.52 | * |

| CLASS Y | | | | |

| Net Assets | | $ | 45,441,740 | |

| Capital shares outstanding | | | 3,936,013 | |

| Net asset value, offering and redemption price per share | | $ | 11.55 | |

See accompanying notes to financial statements.

19 | Hawaiian Tax-Free Trust

HAWAIIAN TAX-FREE TRUST

STATEMENT OF OPERATIONS

YEAR ENDED MARCH 31, 2015

| Investment Income: | | | | | | |

| Interest income | | | | | $ | 26,548,524 | |

| Expenses: | | | | | | | |

| | |

| Investment Adviser fees (note 3) | | $ | 1,802,623 | | | | | |

| Distribution and service fees (note 3) | | | 2,015,620 | | | | | |

| Administrator/Business Manager fees (note 3) | | | 1,724,241 | | | | | |

| Transfer and shareholder servicing agent fees | | | 391,246 | | | | | |

| Trustees’ fees and expenses (note 8) | | | 232,201 | | | | | |

| Legal fees | | | 191,580 | | | | | |

| Fund accounting fees | | | 149,544 | | | | | |

| Shareholders’ reports and proxy statements | | | 64,216 | | | | | |

| Custodian fees (note 6) | | | 54,597 | | | | | |

| Insurance | | | 42,892 | | | | | |

| Registration fees and dues | | | 38,644 | | | | | |

| Auditing and tax fees | | | 26,800 | | | | | |

| Chief compliance officer services (note 3) | | | 5,526 | | | | | |

| Miscellaneous | | | 80,016 | | | | | |

| Total expenses | | | | | | | 6,819,746 | |

| Net investment income | | | | | | | 19,728,778 | |

| | |

| Realized and Unrealized Gain (Loss) on Investments: | | | | | | | | |

| | |

| Net realized gain (loss) from securities | | | | | | | | |

| transactions | | | 601,455 | | | | | |

| Change in unrealized appreciation on | | | | | | | | |

| investments | | | 10,986,723 | | | | | |

| | |

| Net realized and unrealized gain | | | | | | | | |

| on investments | | | | | | | 11,588,178 | |

| Net change in net assets resulting from | | | | | | | | |

| operations | | | | | | $ | 31,316,956 | |

See accompanying notes to financial statements.

20 | Hawaiian Tax-Free Trust

| HAWAIIAN TAX-FREE TRUST |

| STATEMENTS OF CHANGES IN NET ASSETS |

| | | Year Ended | | | Year Ended | |

| | | March 31, 2015 | | | March 31, 2014 | |

| OPERATIONS: | | | | | | |

| Net investment income | | $ | 19,728,778 | | | $ | 21,552,910 | |

| Net realized gain (loss) from securities | | | | | | | | |

| transactions | | | 601,455 | | | | (1,079,045 | ) |

| Change in unrealized appreciation on | | | | | | | | |

| investments | | | 10,986,723 | | | | (28,942,958 | ) |

| Net change in net assets resulting from | | | | | | | | |

| operations | | | 31,316,956 | | | | (8,469,093 | ) |

| | |

| DISTRIBUTIONS TO SHAREHOLDERS (note 10): | | | | | | | | |

| Class A Shares: | | | | | | | | |

| Net investment income | | | (17,511,442 | ) | | | (19,045,111 | ) |

| | |

| Class C Shares: | | | | | | | | |

| Net investment income | | | (1,163,585 | ) | | | (1,494,331 | ) |

| | |

| Class Y Shares: | | | | | | | | |

| Net investment income | | | (1,053,751 | ) | | | (1,013,468 | ) |

| Change in net assets from distributions | | | (19,728,778 | ) | | | (21,552,910 | ) |

| | |

| CAPITAL SHARE TRANSACTIONS (note 7): | | | | | | | | |

| Proceeds from shares sold | | | 65,472,325 | | | | 51,181,687 | |

| Reinvested dividends and distributions | | | 14,718,601 | | | | 14,771,558 | |

| Cost of shares redeemed | | | (94,484,783 | ) | | | (151,734,183 | ) |

| Change in net assets from capital share | | | | | | | | |

| transactions | | | (14,293,857 | ) | | | (85,780,938 | ) |

| | |

| Change in net assets | | | (2,705,679 | ) | | | (115,802,941 | ) |

| | |

| NET ASSETS: | | | | | | | | |

| Beginning of period | | | 789,601,978 | | | | 905,404,919 | |

| | |

| End of period | | $ | 786,896,299 | | | $ | 789,601,978 | |

See accompanying notes to financial statements.

21 | Hawaiian Tax-Free Trust

HAWAIIAN TAX-FREE TRUST

NOTES TO FINANCIAL STATEMENTS

MARCH 31, 2015

1. Organization

Hawaiian Tax-Free Trust (the “Trust”), a non-diversified, open-end investment company, was organized on May 7, 1984, as a Massachusetts business trust and commenced operations on February 20, 1985. The Trust is authorized to issue an unlimited number of shares. Class A Shares are sold at net asset value plus a sales charge of varying size (depending upon a variety of factors) paid at the time of purchase and bear a distribution fee. Class C Shares are sold at net asset value with no sales charge payable at the time of purchase but with a level charge for service and distribution fees for six years thereafter. Class C Shares automatically convert to Class A Shares after six years. Class Y Shares are sold only through authorized financial institutions acting for investors in a fiduciary, advisory, agency, custodial or similar capacity, and are not offered directly to retail customers. Class Y Shares are sold at net asset value with no sales charge, no redemption fee, no contingent deferred sales charge (“CDSC”) and no distribution fee. Class I Shares are offered and sold only through financial intermediaries and are not offered directly to retail customers. Class I Shares are sold at net asset value with no sales charge and no redemption fee or CDSC, although a financial intermediary may charge a fee for effecting a purchase or other transaction on behalf of its customers. Class I Shares carry a distribution and a service fee. As of the report date, there were no Class I Shares outstanding. All classes of shares represent interests in the same portfolio of investments and are identical as to rights and privileges but differ with respect to the effect of sales charges, the distribution and/or service fees borne by each class, expenses specific to each class, voting rights on matters affecting a single class and the exchange privileges of each class.

2. Significant Accounting Policies

The following is a summary of significant accounting policies followed by the Trust in the preparation of its financial statements. The policies are in conformity with accounting principles generally accepted in the United States of America for investment companies.

| a) | Portfolio valuation: Municipal securities are valued each business day based upon information provided by a nationally prominent independent pricing service and periodically verified through other pricing services. In the case of securities for which market quotations are readily available, securities are valued by the pricing service at the mean of bid and asked quotations. If a market quotation or a valuation from the pricing service is not readily available, the security is valued at fair value determined in good faith under procedures established by and under the general supervision of the Board of Trustees. |

| b) | Fair value measurements: The Trust follows a fair value hierarchy that distinguishes between market data obtained from independent sources (observable inputs) and the Trust’s own market assumptions (unobservable inputs). These inputs are used in determining the value of the Trust’s investments and are summarized in the following fair value hierarchy: |

Level 1 – Unadjusted quoted prices in active markets for identical assets or liabilities that the Trust has the ability to access.

22 | Hawaiian Tax-Free Trust

HAWAIIAN TAX-FREE TRUST

NOTES TO FINANCIAL STATEMENTS (continued)

MARCH 31, 2015

Level 2 – Observable inputs other than quoted prices included in Level 1 that are observable for the asset or liability, either directly or indirectly. These inputs may include quoted prices for the identical instrument on an inactive market, prices for similar instruments, interest rates, prepayment speeds, credit risk, yield curves, default rates and similar data.

Level 3 – Unobservable inputs for the asset or liability, to the extent relevant observable inputs are not available, representing the Trust’s own assumptions about the assumptions a market participant would use in valuing the asset or liability, based on the best information available.

The inputs or methodology used for valuing securities are not an indication of the risk associated with investing in those securities.

The following is a summary of the valuation inputs, representing 100% of the Trust’s investments, used to value the Trust’s net assets as of March 31, 2015:

| Valuation Inputs | | | Investments in Securities | |

| Level 1 – Quoted Prices | | $ | — | |

| Level 2 – Other Significant Observable | | | | |

| Inputs – Municipal Bonds* | | | 777,768,623 | |

| Level 3 – Significant Unobservable Inputs | | | – | |

| Total | | $ | 777,768,623 | |

*See schedule of investments for a detailed listing of securities.

| c) | Subsequent events: In preparing these financial statements, the Trust has evaluated events and transactions for potential recognition or disclosure through the date these financial statements were issued. |

| d) | Securities transactions and related investment income: Securities transactions are recorded on the trade date. Realized gains and losses from securities transactions are reported on the identified cost basis. Interest income is recorded daily on the accrual basis and is adjusted for amortization of premium and accretion of original issue discount and market discount. |

| e) | Federal income taxes: It is the policy of the Trust to continue to qualify as a regulated investment company by complying with the provisions of the Internal Revenue Code applicable to certain investment companies. The Trust intends to make distributions of income and securities profits sufficient to relieve it from all, or substantially all, Federal income and excise taxes. |

Management has reviewed the tax positions for each of the open tax years (2012–2014) or expected to be taken in the Fund’s 2015 tax returns and has concluded that there are no significant uncertain tax positions that would require recognition in the financial statements.

| f) | Multiple class allocations: All income, expenses (other than class-specific expenses), and realized and unrealized gains or losses are allocated daily to each class of shares based on the relative net assets of each class. Class-specific expenses, which include distribution and service fees and any other items that are specifically attributed to a particular class, are also charged directly to such class on a daily basis. |

23 | Hawaiian Tax-Free Trust

HAWAIIAN TAX-FREE TRUST

NOTES TO FINANCIAL STATEMENTS (continued)

MARCH 31, 2015

| g) | Use of estimates: The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of increases and decreases in net assets from operations during the reporting period. Actual results could differ from those estimates. |

| h) | Reclassification of capital accounts: Accounting principles generally accepted in the United States of America require that certain components of net assets relating to permanent differences be reclassified between financial and tax reporting. On March 31, 2015, the Trust decreased additional paid-in capital by $1,982,286 and increased accumulated net realized loss by $1,982,286. These reclassifications had no effect on net assets or net asset value per share. |

| i) | The Trust is an investment company and accordingly follows the investment company accounting and reporting guidance of the Financial Accounting Standards Board (FASB) Accounting Standard Codification Topic 946 “Financial Services-Investment Companies”. |

3. Fees and Related Party Transactions

a) Management Arrangements:

The Asset Management Group of Bank of Hawaii (“the Adviser”), serves as Investment Adviser to the Trust. In this role, under an Investment Advisory Agreement, the Adviser supervises the Trust’s investments. Aquila Investment Management LLC (the “Administrator/ Business Manager”), a wholly-owned subsidiary of Aquila Management Corporation, the Trust’s founder and sponsor, serves as the Administrator/Business Manager for the Trust under an Administration and Business Management Agreement with the Trust. The Administrator/Business Manager provides all administrative services to the Trust other than those relating to its investment portfolio. These include providing the office of the Trust and all related services as well as overseeing the activities of all the various support organizations to the Trust such as the shareholder servicing agent, fund accounting agent, custodian, legal counsel, auditors and distributor.

The Trust pays the Adviser a fee which is payable monthly and computed on the net assets of the Trust as of the close of business each day at the annual rate of 0.23% of the Trust’s net assets up to and including $875 million; 0.17% of the Trust’s net assets between $875 million and $1.5 billion; and 0.155% of the Trust’s net assets over $1.5 billion. For its services, the Administrator/Business Manager is entitled to receive a fee which is payable monthly and computed as of the close of business each day at the annual rate of 0.22% of the Trust’s net assets.

Under a Compliance Agreement with the Administrator/Business Manager, the Administrator/Business Manager is additionally compensated by the Trust for Chief Compliance Officer related services provided to enable the Trust to comply with Rule 38a-1 of the Investment Company Act of 1940.

24 | Hawaiian Tax-Free Trust

HAWAIIAN TAX-FREE TRUST

NOTES TO FINANCIAL STATEMENTS (continued)

MARCH 31, 2015

Specific details as to the nature and extent of the services provided by the Adviser and the Administrator/Business Manager are more fully defined in the Trust’s Prospectus and Statement of Additional Information.

b) Distribution and Service Fees:

The Trust has adopted a Distribution Plan (the “Plan”) pursuant to Rule 12b-1 (the “Rule”) under the Investment Company Act of 1940. Under one part of the Plan, with respect to Class A Shares, the Trust is authorized to make distribution fee payments to broker-dealers or others (“Qualified Recipients”) selected by Aquila Distributors, Inc. (the “Distributor”), including, but not limited to, any principal underwriter of the Trust, with which the Distributor has entered into written agreements contemplated by the Rule and which have rendered assistance in the distribution and/or retention of the Trust’s shares or servicing of shareholder accounts. The Trust makes payment of this distribution fee at the annual rate of 0.20% of the Trust’s average net assets represented by Class A Shares. For the year ended ended March 31, 2015, service fees on Class A Shares amounted to $1,360,271 of which the Distributor retained $62,048.

Under another part of the Plan, the Trust is authorized to make payments with respect to Class C Shares to Qualified Recipients which have rendered assistance in the distribution and/or retention of the Trust’s Class C shares or servicing of shareholder accounts. These payments are made at the annual rate of 0.75% of the Trust’s average net assets represented by Class C Shares and for the year ended March 31, 2015, amounted to $491,512. In addition, under a Shareholder Services Plan, the Trust is authorized to make service fee payments with respect to Class C Shares to Qualified Recipients for providing personal services and/or maintenance of shareholder accounts. These payments are made at the annual rate of 0.25% of the Trust’s average net assets represented by Class C Shares and for the year ended March 31, 2015, amounted to $163,837. The total of these payments made with respect to Class C Shares amounted to $655,349 of which the Distributor retained $155,105.

Specific details about the Plans are more fully defined in the Trust’s Prospectus and Statement of Additional Information.

Under a Distribution Agreement, the Distributor serves as the exclusive distributor of the Trust’s shares. Through agreements between the Distributor and various brokerage and advisory firms (“intermediaries”), the Trust’s shares are sold primarily through the facilities of these intermediaries having offices within Hawaii, with the bulk of any sales commissions inuring to such intermediaries. For the year ended March 31, 2015, total commissions on sales of Class A Shares amounted to $613,161, of which the Distributor received $65,041.

4. Purchases and Sales of Securities

During the year ended March 31, 2015, purchases of securities and proceeds from the sales of securities aggregated $130,170,204 and $108,299,943, respectively.

25 | Hawaiian Tax-Free Trust

HAWAIIAN TAX-FREE TRUST

NOTES TO FINANCIAL STATEMENTS (continued)

MARCH 31, 2015

At March 31, 2015, the aggregate tax cost for all securities was $739,089,488. At March 31, 2015, the aggregate gross unrealized appreciation for all securities in which there is an excess of value over tax cost amounted to $39,061,395 and aggregate gross unrealized depreciation for all securities in which there is an excess of tax cost over value amounted to $382,260 for a net unrealized appreciation of $38,679,135.

5. Portfolio Orientation

Since the Trust invests principally and may invest entirely in double tax-free municipal obligations of issuers within Hawaii, it is subject to possible risks associated with economic, political, or legal developments or industrial or regional matters specifically affecting Hawaii and whatever effects these may have upon Hawaii issuers’ ability to meet their obligations.

6. Expenses

The Trust has negotiated an expense offset arrangement with its custodian wherein it receives credit toward the reduction of custodian fees and other Trust expenses whenever there are uninvested cash balances. The Statement of Operations reflects the total expenses before any offset, the amount of offset, if any, and the net expenses.

7. Capital Share Transactions

Transactions in Capital Shares of the Trust were as follows:

| | | Year Ended | | | Year Ended | |

| | | March 31, 2015 | | | March 31, 2014 | |

| | | Shares | | | Amount | | | Shares | | | Amount | |

| Class A Shares: | | | | | | | | | | | | |

| Proceeds from shares sold | | | 3,296,636 | | | $ | 37,983,177 | | | | 3,243,271 | | | $ | 37,090,186 | |

| Reinvested distributions | | | 1,161,983 | | | | 13,386,967 | | | | 1,178,941 | | | | 13,383,952 | |

| Cost of shares redeemed | | | (6,131,972 | ) | | | (70,513,812 | ) | | | (9,867,303 | ) | | | (112,096,010 | ) |

| Net change | | | (1,673,353 | ) | | | (19,143,668 | ) | | | (5,445,091 | ) | | | (61,621,872 | ) |

| Class C Shares: | | | | | | | | | | | | | | | | |

| Proceeds from shares sold | | | 783,599 | | | | 9,041,520 | | | | 802,231 | | | | 9,240,191 | |

| Reinvested distributions | | | 71,487 | | | | 822,946 | | | | 89,841 | | | | 1,019,640 | |

| Cost of shares redeemed | | | (1,491,645 | ) | | | (17,154,535 | ) | | | (2,612,280 | ) | | | (29,602,088 | ) |

| Net change | | | (636,559 | ) | | | (7,290,069 | ) | | | (1,720,208 | ) | | | (19,342,257 | ) |

| Class Y Shares: | | | | | | | | | | | | | | | | |

| Proceeds from shares sold | | | 1,595,937 | | | | 18,447,628 | | | | 420,928 | | | | 4,851,310 | |

| Reinvested distributions | | | 44,025 | | | | 508,688 | | | | 32,319 | | | | 367,966 | |

| Cost of shares redeemed | | | (589,630 | ) | | | (6,816,436 | ) | | | (882,864 | ) | | | (10,036,085 | ) |

| Net change | | | 1,050,332 | | | | 12,139,880 | | | | (429,617 | ) | | | (4,816,809 | ) |

| Total transactions in Trust | | | | | | | | | | | | | | | | |

| shares | | | (1,259,580 | ) | | $ | (14,293,857 | ) | | | (7,594,916 | ) | | $ | (85,780,938 | ) |

26 | Hawaiian Tax-Free Trust

HAWAIIAN TAX-FREE TRUST

NOTES TO FINANCIAL STATEMENTS (continued)

MARCH 31, 2015

8. Trustees’ Fees and Expenses

At March 31, 2015 there were 5 Trustees, one of whom is affiliated with the Administrator/ Business Manager and is not paid any fees. The total amount of Trustees’ service fees (for carrying out their responsibilities) and attendance fees paid during the year ended March 31, 2015 was $188,067. Attendance fees are paid to those in attendance at regularly scheduled quarterly Board Meetings and meetings of the Independent Trustees held prior to each quarterly Board Meeting, as well as additional meetings (such as Audit, Nominating, Shareholder and special meetings). Trustees are reimbursed for their expenses such as travel, accommodations and meals incurred in connection with attendance at Board Meetings and the Annual and Outreach Meetings of Shareholders. For the year ended March 31, 2015, such meeting-related expenses amounted to $44,134.

9. Securities Traded on a When-Issued Basis

The Trust may purchase or sell securities on a when-issued basis. When-issued transactions arise when securities are purchased or sold by the Trust with payment and delivery taking place in the future in order to secure what is considered to be an advantageous price and yield to the Trust at the time of entering into the transaction. Beginning on the date the Trust enters into a when-issued transaction, cash or other liquid securities are segregated in an amount equal to or greater than the value of the when-issued transaction. These transactions are subject to market fluctuations and their current value is determined in the same manner as for other securities.