UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-04087

--------------------------------------------------

Manning & Napier Fund, Inc.

------------------------------------------------------------------------------------

(Exact name of registrant as specified in charter)

290 Woodcliff Drive, Fairport, NY 14450

------------------------------------------------------------------------------------

(Address of principal executive offices)(Zip Code)

B. Reuben Auspitz 290 Woodcliff Drive, Fairport, NY 14450

------------------------------------------------------------------------------------

(Name and address of agent for service)

Registrant’s telephone number, including area code: 585-325-6880

----------------------------------

Date of fiscal year end: December 31

------------------------------------------------------------

Date of reporting period: January 1, 2013 through June 30, 2013

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 100 F Street, NE, Washington, DC 20549. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

ITEM 1: | REPORTS TO STOCKHOLDERS. |

| | | | | | |

| | | | LIFE SCIENCES SERIES | | |

www.manning-napier.com | | | |  |

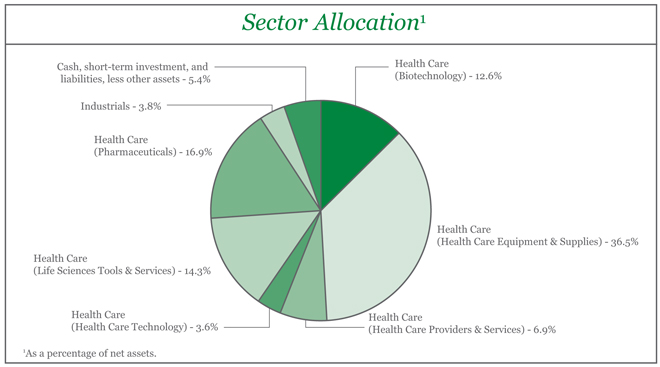

Life Sciences Series

Shareholder Expense Example

(unaudited)

As a shareholder of the Series, you may incur two types of costs: (1) transaction costs and (2) ongoing costs, including management fees and other Series expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Series and to compare these costs with the ongoing costs of investing in other mutual funds.

The example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period (January 1, 2013 to June 30, 2013).

Actual Expenses

The first line of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line of the table below provides information about hypothetical account values and hypothetical expenses based on the Series’ actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Series’ actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid during the period. You may use this information to compare the ongoing costs of investing in the Series and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transaction costs. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transaction costs were included, your costs would have been higher.

| | | | | | |

| | | BEGINNING ACCOUNT VALUE 1/1/13 | | ENDING ACCOUNT VALUE 6/30/13 | | EXPENSES PAID

DURING PERIOD*

1/1/13-6/30/13 |

Actual | | $1,000.00 | | $1,060.60 | | $6.03 |

Hypothetical (5% return before expenses) | | $1,000.00 | | $1,018.94 | | $5.91 |

*Expenses are equal to the Series’ annualized expense ratio (for the six-month period) of 1.18%, multiplied by the average account value over the period, multiplied by 181/365 (to reflect the one-half year period). Expenses are based on the most recent fiscal half year.

1

Life Sciences Series

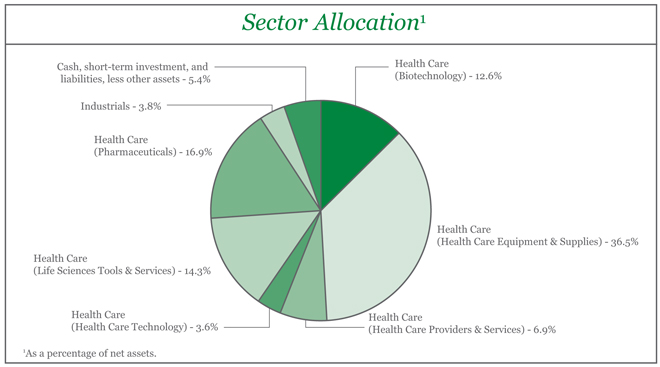

Portfolio Composition as of June 30, 2013

(unaudited)

| | | | | | | | | | | | |

| Top Ten Stock Holdings2 | |

Oxford Nanopore Technologies Ltd. (United Kingdom) | | | 6.1 | % | | | | Volcano Corp. | | | 4.4% | |

Lonza Group AG (Switzerland) | | | 5.1 | % | | | | Johnson & Johnson | | | 4.0% | |

Green Cross Corp. (South Korea) | | | 4.7 | % | | | | Becton, Dickinson and Co. | | | 4.0% | |

The Cooper Companies, Inc. | | | 4.5 | % | | | | Pall Corp. | | | 3.8% | |

Sirona Dental Systems, Inc. | | | 4.5 | % | | | | Greenway Medical Technologies, Inc. | | | 3.5% | |

2As a percentage of total investments. | | | | | | | | | | | | |

2

Life Sciences Series

Investment Portfolio - June 30, 2013

(unaudited)

| | | | | | | | | | |

| | | SHARES | | | VALUE (NOTE 2) | | | |

| | | |

COMMON STOCKS - 94.6% | | | | | | | | | | |

| | | |

Health Care - 90.8% | | | | | | | | | | |

Biotechnology - 12.6% | | | | | | | | | | |

Green Cross Corp. (South Korea)1 | | | 81,525 | | | $ | 8,727,035 | | | |

Incyte Corp. Ltd.* | | | 236,000 | | | | 5,192,000 | | | |

Myriad Genetics, Inc.* | | | 181,000 | | | | 4,863,470 | | | |

Seattle Genetics, Inc.* | | | 137,000 | | | | 4,310,020 | | | |

| | | | | | | | | | |

| | | |

| | | | | | | 23,092,525 | | | |

| | | | | | | | | | |

Health Care Equipment & Supplies - 36.5% | | | | | | | | | | |

Becton, Dickinson and Co. | | | 75,000 | | | | 7,412,250 | | | |

The Cooper Companies, Inc. | | | 71,000 | | | | 8,452,550 | | | |

DexCom, Inc.* | | | 155,000 | | | | 3,479,750 | | | |

GN Store Nord A/S (Denmark)1 | | | 197,000 | | | | 3,720,460 | | | |

HeartWare International, Inc.* | | | 55,900 | | | | 5,316,649 | | | |

Insulet Corp.* | | | 200,000 | | | | 6,282,000 | | | |

Mindray Medical International Ltd. - ADR (China) | | | 137,000 | | | | 5,130,650 | | | |

Quidel Corp.* | | | 10,245 | | | | 261,555 | | | |

Sirona Dental Systems, Inc.* | | | 128,100 | | | | 8,439,228 | | | |

Sonova Holding AG (Switzerland)1 | | | 54,500 | | | | 5,765,863 | | | |

Thoratec Corp.* | | | 148,000 | | | | 4,633,880 | | | |

Volcano Corp.* | | | 447,000 | | | | 8,104,110 | | | |

| | | | | | | | | | |

| | | |

| | | | | | | 66,998,945 | | | |

| | | | | | | | | | |

Health Care Providers & Services - 6.9% | | | | | | | | | | |

Diagnosticos da America S.A. (Brazil) | | | 995,500 | | | | 5,152,945 | | | |

Life Healthcare Group Holdings Ltd. (South Africa)1 | | | 1,100,000 | | | | 4,172,132 | | | |

Qualicorp S.A. (Brazil)* | | | 445,000 | | | | 3,388,330 | | | |

| | | | | | | | | | |

| | | |

| | | | | | | 12,713,407 | | | |

| | | | | | | | | | |

Health Care Technology - 3.6% | | | | | | | | | | |

Greenway Medical Technologies, Inc.* | | | 525,450 | | | | 6,484,053 | | | |

| | | | | | | | | | |

Life Sciences Tools & Services - 14.3% | | | | | | | | | | |

Lonza Group AG (Switzerland)1 | | | 126,200 | | | | 9,482,354 | | | |

Oxford Nanopore Technologies Ltd. (United Kingdom)*2,3,4 | | | 45,464 | | | | 11,330,044 | | | |

QIAGEN N.V. - ADR (Netherlands)* | | | 273,000 | | | | 5,435,430 | | | |

| | | | | | | | | | |

| | | |

| | | | | | | 26,247,828 | | | |

| | | | | | | | | | |

Pharmaceuticals - 16.9% | | | | | | | | | | |

Glenmark Pharmaceuticals Ltd. (India)1 | | | 567,000 | | | | 5,212,952 | | | |

Johnson & Johnson | | | 87,000 | | | | 7,469,820 | | | |

Lupin Ltd. (India)1 | | | 259,150 | | | | 3,399,584 | | | |

Novo Nordisk A/S - Class B (Denmark)1 | | | 22,500 | | | | 3,497,905 | | | |

UCB S.A. (Belgium)1 | | | 105,000 | | | | 5,636,455 | �� | | |

The accompanying notes are an integral part of the financial statements.

3

Life Sciences Series

Investment Portfolio - June 30, 2013

(unaudited)

| | | | | | | | |

| | | SHARES | | | VALUE (NOTE 2) | |

| | |

COMMON STOCKS (continued) | | | | | | | | |

| | |

Health Care (continued) | | | | | | | | |

Pharmaceuticals (continued) | | | | | | | | |

ViroPharma, Inc.* | | | 200,300 | | | $ | 5,738,595 | |

| | | | | | | | |

| | |

| | | | | | | 30,955,311 | |

| | | | | | | | |

| | |

Total Health Care | | | | | | | 166,492,069 | |

| | | | | | | | |

Industrials - 3.8% | | | | | | | | |

Machinery - 3.8% | | | | | | | | |

Pall Corp. | | | 106,000 | | | | 7,041,580 | |

| | | | | | | | |

TOTAL COMMON STOCKS | | | | | | | | |

(Identified Cost $147,908,401) | | | | | | | 173,533,649 | |

| | | | | | | | |

| | |

SHORT-TERM INVESTMENT - 6.8% | | | | | | | | |

Dreyfus Cash Management, Inc. - Institutional Shares5, 0.05%, | | | | | | | | |

(Identified Cost $12,369,576) | | | 12,369,576 | | | | 12,369,576 | |

| | | | | | | | |

| | |

TOTAL INVESTMENTS - 101.4% | | | | | | | | |

(Identified Cost $160,277,977) | | | | | | | 185,903,225 | |

LIABILITIES, LESS OTHER ASSETS - (1.4%) | | | | | | | (2,513,540 | ) |

| | | | | | | | |

| | |

NET ASSETS - 100% | | | | | | $ | 183,389,685 | |

| | | | | | | | |

ADR - American Depository Receipt

*Non-income producing security.

1A factor from a third party vendor was applied to determine the security’s fair value following the close of local trading.

2This security was acquired on April 26, 2011 at a cost of $6,149,543 ($150.34 per share) and on May 2, 2012 at a cost of $1,209,529 ($265.31 per share) and has been determined to be illiquid under guidelines established by the Board of Directors.

3Restricted securities - Investment in securities that are restricted as to public resale under the Securities Act of 1933, as amended. These securities amount to $11,330,044 or 6.2% of the Series’ net assets as of June 30, 2013 (see Note 2 to the financial statements).

4Security has been valued at fair value as determined in good faith by the Advisor.

5Rate shown is the current yield as of June 30, 2013.

The accompanying notes are an integral part of the financial statements.

4

Life Sciences Series

Statement of Assets and Liabilities

June 30, 2013 (unaudited)

| | | | |

ASSETS: | | | | |

| |

Investments, at value (identified cost $160,277,977) (Note 2) | | $ | 185,903,225 | |

Cash | | | 1,979,718 | |

Receivable for securities sold | | | 2,118,042 | |

Receivable for fund shares sold | | | 114,062 | |

Foreign tax reclaims receivable | | | 30,593 | |

Dividends receivable | | | 535 | |

Prepaid expenses | | | 1,081 | |

| | | | |

| |

TOTAL ASSETS | | | 190,147,256 | |

| | | | |

| |

LIABILITIES: | | | | |

| |

Accrued foreign capital gains tax (Note 2) | | | 312,530 | |

Foreign capital gains tax payable (Note 2) | | | 2,234 | |

Accrued management fees (Note 3) | | | 151,474 | |

Accrued fund accounting and administration fees (Note 3) | | | 7,291 | |

Accrued transfer agent fees (Note 3) | | | 3,120 | |

Accrued Chief Compliance Officer service fees (Note 3) | | | 339 | |

Payable for securities purchased | | | 5,678,520 | |

Payable for fund shares repurchased | | | 465,291 | |

Other payables and accrued expenses | | | 136,772 | |

| | | | |

| |

TOTAL LIABILITIES | | | 6,757,571 | |

| | | | |

| |

TOTAL NET ASSETS | | $ | 183,389,685 | |

| | | | |

| |

NET ASSETS CONSIST OF: | | | | |

| |

Capital stock | | $ | 134,397 | |

Additional paid-in-capital | | | 132,402,344 | |

Accumulated net investment loss | | | (549,199 | ) |

Accumulated net realized gain on investments, foreign currency and translation of other assets and liabilities | | | 26,089,583 | |

Net unrealized appreciation on investments (net of foreign capital gains tax of $312,530), foreign currency and translation of other assets and liabilities | | | 25,312,560 | |

| | | | |

| |

TOTAL NET ASSETS | | $ | 183,389,685 | |

| | | | |

| |

NET ASSET VALUE, OFFERING PRICE AND REDEMPTION PRICE PER SHARE - CLASS A ($183,389,685/13,439,685 shares) | | $ | 13.65 | |

| | | | |

The accompanying notes are an integral part of the financial statements.

5

Life Sciences Series

Statement of Operations

For the Six Months Ended June 30, 2013 (unaudited)

| | | | |

INVESTMENT INCOME: | | | | |

| |

Dividends (net of foreign taxes withheld, $40,151) | | $ | 782,620 | |

| | | | |

| |

EXPENSES: | | | | |

| |

Management fees (Note 3) | | | 1,129,596 | |

Fund accounting and administration fees (Note 3) | | | 26,426 | |

Transfer agent fees (Note 3) | | | 8,278 | |

Directors’ fees (Note 3) | | | 2,664 | |

Chief Compliance Officer service fees (Note 3) | | | 1,117 | |

Custodian fees | | | 103,557 | |

Miscellaneous | | | 60,181 | |

| | | | |

| |

Total Expenses | | | 1,331,819 | |

| | | | |

| |

NET INVESTMENT LOSS | | | (549,199 | ) |

| | | | |

| |

REALIZED AND UNREALIZED GAIN (LOSS) ON INVESTMENTS AND FOREIGN CURRENCY: | | | | |

| |

Net realized gain (loss) on-

Investments (net of India tax of $423,407) | | | 24,118,936 | |

Foreign currency and translation of other assets and liabilities | | | (143,671 | ) |

| | | | |

| |

| | | 23,975,265 | |

| | | | |

Net change in unrealized appreciation (depreciation) on-

Investments (net of decrease in accrued foreign capital gains tax of $654,858) | | | (7,623,021 | ) |

Foreign currency and translation of other assets and liabilities | | | 3,479 | |

| | | | |

| |

| | | (7,619,542 | ) |

| | | | |

| |

NET REALIZED AND UNREALIZED GAIN (LOSS) ON INVESTMENTS AND FOREIGN CURRENCY | | | 16,355,723 | |

| | | | |

| |

NET INCREASE IN NET ASSETS RESULTING FROM OPERATIONS | | $ | 15,806,524 | |

| | | | |

The accompanying notes are an integral part of the financial statements.

6

Life Sciences Series

Statements of Changes in Net Assets

| | | | | | | | |

| | | FOR THE SIX MONTHS ENDED 6/30/13

(UNAUDITED) | | | FOR THE YEAR ENDED

12/31/12 | |

INCREASE (DECREASE) IN NET ASSETS: | | | | | | | | |

| | |

OPERATIONS: | | | | | | | | |

| | |

Net investment loss | | $ | (549,199 | ) | | $ | (1,343,685 | ) |

Net realized gain (loss) on investments and foreign currency | | | 23,975,265 | | | | 16,082,256 | |

Net change in unrealized appreciation (depreciation) on investments and foreign currency | | | (7,619,542 | ) | | | 35,502,919 | |

| | | | | | | | |

| | |

Net increase from operations | | | 15,806,524 | | | | 50,241,490 | |

| | | | | | | | |

| | |

DISTRIBUTIONS TO SHAREHOLDERS (Note 9): | | | | | | | | |

| | |

From net realized gain on investments | | | — | | | | (15,587,617 | ) |

| | | | | | | | |

| | |

CAPITAL STOCK ISSUED AND REPURCHASED: | | | | | | | | |

| | |

Net increase (decrease) from capital share transactions (Note 5) | | | (65,009,522 | ) | | | 1,388,522 | |

| | | | | | | | |

| | |

Net increase (decrease) in net assets | | | (49,202,998 | ) | | | 36,042,395 | |

| | |

NET ASSETS: | | | | | | | | |

| | |

Beginning of period | | | 232,592,683 | | | | 196,550,288 | |

| | | | | | | | |

| | |

End of period (including accumulated net investment loss of $549,199 and $0, respectively) | | $ | 183,389,685 | | | $ | 232,592,683 | |

| | | | | | | | |

The accompanying notes are an integral part of the financial statements.

7

Life Sciences Series

Financial Highlights

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | FOR THE SIX MONTHS ENDED

6/30/13

(UNAUDITED) | | | FOR THE YEARS ENDED | |

| | | | 12/31/12 | | | 12/31/11 | | | 12/31/10 | | | 12/31/09 | | | 12/31/08 | |

Per share data (for a share outstanding throughout each period): | | | | | | | | | | | | | | | | | | | | | | | | |

Net asset value - Beginning of period | | $ | 12.87 | | | $ | 10.95 | | | $ | 12.18 | | | $ | 10.61 | | | $ | 6.99 | | | $ | 11.54 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Income (loss) from investment operations: | | | | | | | | | | | | | | | | | | | | | | | | |

Net investment loss | | | (0.03 | )1 | | | (0.08 | )1 | | | (0.07 | )1 | | | (0.04 | )1 | | | (0.05 | )1 | | | (0.06 | ) |

Net realized and unrealized gain (loss) on investments | | | 0.81 | | | | 2.91 | | | | (0.84 | ) | | | 1.61 | | | | 3.67 | | | | (4.38 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Total from investment operations | | | 0.78 | | | | 2.83 | | | | (0.91 | ) | | | 1.57 | | | | 3.62 | | | | (4.44 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Less distributions to shareholders: | | | | | | | | | | | | | | | | | | | | | | | | |

From net realized gain on investments | | | — | | | | (0.91 | ) | | | (0.32 | ) | | | — | | | | — | | | | (0.11 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Net asset value - End of period | | $ | 13.65 | | | $ | 12.87 | | | $ | 10.95 | | | $ | 12.18 | | | $ | 10.61 | | | $ | 6.99 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Net assets - End of period (000’s omitted) | | $ | 183,390 | | | $ | 232,593 | | | $ | 196,550 | | | $ | 247,564 | | | $ | 272,944 | | | $ | 182,704 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Total return2 | | | 6.06 | % | | | 25.89 | % | | | (7.33 | %) | | | 14.80 | % | | | 51.79 | % | | | (38.77 | %) |

Ratios (to average net assets)/ | | | | | | | | | | | | | | | | | | | | | | | | |

Supplemental Data: | | | | | | | | | | | | | | | | | | | | | | | | |

Expenses* | | | 1.18 | %3 | | | 1.16 | % | | | 1.11 | % | | | 1.09 | % | | | 1.11 | % | | | 1.12 | % |

Net investment loss | | | (0.49 | %)3 | | | (0.60 | %) | | | (0.60 | %) | | | (0.41 | %) | | | (0.55 | %) | | | (0.65 | %) |

Portfolio turnover | | | 50 | % | | | 75 | % | | | 84 | % | | | 67 | % | | | 95 | % | | | 94 | % |

|

| * The investment advisor did not impose all or a portion of its management and/or other fees, and in some periods may have paid a portion of the Series’ expenses. If these expenses had been incurred by the Series, the expense ratio (to average net assets) would have increased by the following amount: | |

| | | | | | |

| | | N/A | | | | N/A | | | | N/A | | | | 0.00 | %4 | | | 0.01 | % | | | N/A | |

1Calculated based on average shares outstanding during the periods.

2Represents aggregate total return for the periods indicated, and assumes reinvestment of all distributions. Total return would have been lower had certain expenses not been waived or reimbursed during certain periods. Periods less than one year are not annualized.

3Annualized.

4Less than 0.01%.

The accompanying notes are an integral part of the financial statements.

8

Life Sciences Series

Notes to Financial Statements

(unaudited)

Life Sciences Series (the “Series”) is a no-load diversified series of Manning & Napier Fund, Inc. (the “Fund”). The Fund is organized in Maryland and is registered under the Investment Company Act of 1940, as amended, as an open-end management investment company.

The Series’ investment objective is to provide long-term growth by investing principally in the common stocks of companies in the life sciences industry.

The Fund’s advisor is Manning & Napier Advisors, LLC (the “Advisor”). Shares of the Series are offered to advisory clients and employees of the Advisor and its affiliates. The total authorized capital stock of the Fund consists of 15 billion shares of common stock each having a par value of $0.01. As of June 30, 2013, 10.3 billion shares have been designated in total among 42 series, of which 100 million have been designated as Life Sciences Series Class A common stock.

| 2. | Significant Accounting Policies |

Security Valuation

Portfolio securities, including domestic equities, foreign equities, warrants and options, listed on an exchange other than the NASDAQ Stock Market are valued at the latest quoted sales price of the exchange on which the security is primarily traded. Securities not traded on valuation date or securities not listed on an exchange are valued at the latest quoted bid price provided by the Fund’s pricing service. Securities listed on the NASDAQ Stock Market are valued in accordance with the NASDAQ Official Closing Price.

Short-term investments that mature in sixty days or less are valued at amortized cost, which approximates fair value. Investments in open-end investment companies are valued at their net asset value per share on valuation date.

Volume and level of activity in established markets for an asset or liability are evaluated to determine whether recent transactions and quoted prices are determinative of fair value. Where there have been significant decreases in volume and level of activity, further analysis and adjustment may be necessary to estimate fair value. The Series measures fair value in these instances by the use of inputs and valuation techniques which may be based upon current market prices of securities that are comparable in coupon, rating, maturity and industry and/or expectation of future cash flows. As a result of trading in relatively thin markets and/or markets that experience significant volatility, the prices used by the Series to value these securities may differ from the value that would be realized if these securities were sold, and the differences could be material.

Securities for which representative valuations or prices are not available from the Series’ pricing service may be valued at fair value as determined in good faith by the Advisor under procedures approved by and under the general supervision and responsibility of the Fund’s Board of Directors (the “Board”). The Fair Value Committee (the “Committee”) is responsible for carrying out the valuation procedures approved by the Board. The Committee consists of senior members from various groups within the Advisor’s organization, including operations, accounting, trading, and research/investments. The Committee meets at least annually to review and approve valuation matters, which may include data regarding pricing information received from approved pricing vendors and brokers and the results of Board-approved valuation control policies and procedures (the “Policies”). The Policies address, among other things, instances when market quotations are readily available, including recommendations of third party pricing vendors and a determination of appropriate pricing methodologies; events that require specific valuation determinations and assessment of fair value techniques; and securities with a potential for stale pricing. The Committee meets more frequently, as needed, to discuss additional valuation matters, which may include the need to review back-testing results, review time-sensitive information or approve related valuation actions. The Committee reports to the Board, with members of the Committee available at each of the Board’s regularly scheduled meetings to discuss valuation matters and actions during the period, similar to those described earlier. For investments categorized as Level 3, the Committee monitors information similar to that described above, which may include: (i) data specific to the issuer or comparable issuers, (ii) general market or specific sector news and (iii) quoted prices and specific or similar security transactions. The Committee considers this data and any changes from prior periods in order to assess the reasonableness of observable and unobservable inputs, any assumptions used to value those securities and changes in fair value. This data is also used to corroborate, when available, information received from approved pricing vendors and brokers. Various factors impact the frequency of monitoring this

9

Life Sciences Series

Notes to Financial Statements (continued)

(unaudited)

| 2. | Significant Accounting Policies (continued) |

Security Valuation (continued)

information. However, the Committee may determine that changes to inputs and assumptions are not required as a result of the monitoring procedures performed. Due to the inherent uncertainty of valuations of such securities, the fair value may differ significantly from the values that would have been used had a ready market for such securities existed. If trading or events occurring after the close of the principal market in which securities are traded are expected to materially affect the value of those securities, then they may be valued at their fair value, taking this trading or these events into account. In accordance with the procedures approved by the Board, the values of certain securities trading outside the U.S. were adjusted following the close of local trading using a factor from a third party vendor. The third party vendor uses statistical analyses and quantitative models, which consider among other things subsequent movement and changes in the prices of indices, securities and exchange rates in other markets, to determine the factors which are used to adjust local market prices. The value of securities used for net asset value calculation under these procedures may differ from published prices for the same securities. It is the Fund’s policy to classify each foreign equity security where a factor from a third party vendor is provided as a Level 2 security.

Various inputs are used in determining the value of the Series’ assets or liabilities carried at fair value. These inputs are summarized in three broad levels. Level 1 includes quoted prices in active markets for identical assets and liabilities. Level 2 includes other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.). Level 3 includes significant unobservable inputs (including the Series’ own assumptions in determining the fair value of investments). A financial instrument’s level within the fair value hierarchy is based on the lowest level of any input both individually and in aggregate that is significant to the fair value measurement. The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities.

The following is a summary of the valuation levels used for major security types as of June 30, 2013 in valuing the Series’ assets or liabilities carried at fair value:

| | | | | | | | | | | | | | | | |

| DESCRIPTION | | TOTAL | | | LEVEL 1 | | | LEVEL 2 | | | LEVEL 3 | |

Assets: | | | | | | | | | | | | | | | | |

Equity securities: | | | | | | | | | | | | | | | | |

Health Care | | $ | 166,492,069 | | | $ | 105,547,285 | | | $ | 49,614,740 | | | $ | 11,330,044 | * |

Industrials | | | 7,041,580 | | | | 7,041,580 | | | | — | | | | — | |

Mutual fund | | | 12,369,576 | | | | 12,369,576 | | | | — | | | | — | |

| | | | | | | | | | | | | | | | |

Total assets | | $ | 185,903,225 | | | $ | 124,958,441 | | | $ | 49,614,740 | | | $ | 11,330,044 | |

| | | | | | | | | | | | | | | | |

The following table is a reconciliation of Level 3 investments for which significant unobservable inputs were used to determine fair value:

| | | | |

| LEVEL 3 RECONCILIATION | | EQUITY

SECURITIES | |

Balance as of December 31, 2012 (market value) | | $ | 12,101,037 | |

Net realized gain (loss) | | | — | |

Change in unrealized appreciation (depreciation) | | | (770,993 | ) |

Purchases | | | | |

Sales | | | — | |

Transfers in | | | — | |

Transfers out | | | — | |

| | | | |

Balance as of June 30, 2013 (market value) | | $ | 11,330,044 | |

| | | | |

Please see the Investment Portfolio for foreign securities where a factor from a third party vendor was applied to determine the security’s fair value following the close of local trading. Such securities are included in Level 2 in the table above.

*Amount represents the Series’ investment in Oxford Nanopore Technologies Ltd. (“Oxford”). Oxford was initially valued at transaction price, which is considered the best initial estimate of fair value. On April 10, 2012, the Fund adjusted its valuation of

10

Life Sciences Series

Notes to Financial Statements (continued)

(unaudited)

| 2. | Significant Accounting Policies (continued) |

Security Valuation (continued)

the fair value holding to 163.85 GBP per share (from 91.39 GBP per share) as a result of a subsequent round of financing of the investee company. Subsequently, the Series uses, or will use, other methodologies and significant inputs to determine fair value. Such methodologies and significant inputs include: subsequent rounds of financing for Oxford; recent transactions in similar instruments; discounted cash flow techniques; third-party appraisals; industry multiples and public comparables; and Oxford’s current financial performance compared to projected performance.

The Fund’s policy is to recognize transfers in and transfers out of the valuation levels as of the beginning of the reporting period. There were no transfers between Level 1 and Level 2 during the six months ended June 30, 2013.

The following table summarizes the quantitative inputs and assumptions used for items categorized in Level 3 of the fair value hierarchy as of June 30, 2013.

| | | | | | | | |

| QUANTITATIVE INFORMATION ABOUT LEVEL 3 FAIR VALUE MEASUREMENTS |

| | | FAIR

VALUE AT

6/30/13 | | VALUATION TECHNIQUE(S) | | UNOBSERVABLE

INPUT | | RANGE (WEIGHTED

AVERAGE) |

Equity securities | | $11,330,044 | | Acquisition cost | | Premium/ | | 0%-0% |

| | | | adjusted for | | Discount | | |

| | | | premiums or | | | | |

| | | | discounts | | | | |

The significant unobservable inputs used in the fair value measurement of the Fund’s equity securities are premiums and discounts to the acquisition cost. Significant increases in the premium (or discount) in isolation would result in a significantly higher (lower) fair value measurement.

Security Transactions, Investment Income and Expenses

Security transactions are accounted for on trade date. Dividend income is recorded on the ex-dividend date, except that if the ex-dividend date has passed, certain dividends from foreign securities are recorded as soon as the Series is informed of the ex-dividend date. Non-cash dividends, if any, are recorded at the fair value of the securities received. Interest income, including amortization of premium and accretion of discounts using the effective interest method, is earned from settlement date and accrued daily.

Expenses are recorded on an accrual basis. Most expenses of the Fund can be attributed to a specific series. Expenses which cannot be directly attributed are apportioned among the series in the Fund in such a manner as deemed equitable by the Fund’s Board, taking into consideration, among other things, the nature and type of expense.

The Series uses the identified cost method for determining realized gain or loss on investments for both financial statement and federal income tax reporting purposes.

Foreign Currency Translation

The books and records of the Series are maintained in U.S. dollars. Foreign currencies, investments and other assets and liabilities are translated into U.S. dollars at the current exchange rates. Purchases and sales of investment securities and income and expenses are translated on the respective dates of such transactions. The Series does not isolate realized and unrealized gains and losses attributable to changes in the exchange rates from gains and losses that arise from changes in the fair value of investments. Such fluctuations are included with net realized and unrealized gain or loss on investments. Net realized foreign currency gains and losses represent foreign currency gains and losses between trade date and settlement date on securities transactions, gains and losses on disposition of foreign currencies and the difference between the amount of income and foreign withholding taxes recorded on the books of the Series and the amounts actually received or paid.

11

Life Sciences Series

Notes to Financial Statements (continued)

(unaudited)

| 2. | Significant Accounting Policies (continued) |

Restricted Securities

Restricted securities are purchased in private placement transactions, are not registered under the Securities Act of 1933, as amended, and may have contractual restrictions on resale. Information regarding restricted securities is included at the end of the Series’ Investment Portfolio.

Illiquid Securities

A security may be considered illiquid if so deemed in good faith by the Advisor under procedures approved by and under the general supervision and responsibility of the Fund’s Board. Securities that are illiquid are marked with the applicable footnote on the Investment Portfolio.

Federal Taxes

The Series’ policy is to comply with the provisions of the Internal Revenue Code applicable to regulated investment companies. The Series is not subject to federal income tax or excise tax to the extent that the Series distributes to shareholders each year its taxable income, including any net realized gains on investments, in accordance with requirements of the Internal Revenue Code. Accordingly, no provision for federal income tax or excise tax has been made in the financial statements.

Management evaluates its tax positions to determine if the tax positions taken meet the minimum recognition threshold in connection with accounting for uncertainties in income tax positions taken or expected to be taken for the purposes of measuring and recognizing tax liabilities in the financial statements. Recognition of tax benefits of an uncertain tax position is required only when the position is “more likely than not” to be sustained assuming examination by taxing authorities. At June 30, 2013, the Series has recorded no liability for net unrecognized tax benefits relating to uncertain income tax positions taken or expected to be taken in future tax returns.

The Series files income tax returns in the U.S. federal jurisdiction, various states and foreign jurisdictions, as required. No income tax returns are currently under investigation. The statute of limitations on the Series’ tax returns remains open for the years ended December 31, 2009 through December 31, 2012. The Series is not aware of any tax positions for which it is reasonably possible that the total amounts of unrecognized tax benefits will significantly change in the next twelve months.

Foreign Taxes

Based on the Series’ understanding of the tax rules and rates related to income, gains and currency purchase/repatriation transactions for foreign jurisdictions in which it invests, the Series will provide for foreign taxes, and where appropriate, deferred foreign tax. The Series is subject to a tax imposed on short term capital gains on securities of issuers domiciled in India. The Series records an estimated deferred tax liability for securities that have been held for less than a year at the end of the reporting period, assuming those positions were disposed of at the end of the period. This amount is reported in Accrued foreign capital gains tax in the accompanying Statement of Assets and Liabilities. Realized losses on the sale of securities of issuers domiciled in India can be carried forward for eight years to offset potential future short term realized capital gains.

Distributions of Income and Gains

Distributions to shareholders of net investment income and net realized gains are made annually. An additional distribution may be necessary to avoid taxation of the Series. Distributions are recorded on the ex-dividend date.

Indemnifications

The Fund’s organizational documents provide former and current directors and officers with a limited indemnification against liabilities arising in connection with the performance of their duties to the Fund. In the normal course of business, the Fund may also enter into contracts that provide general indemnifications. The Fund’s maximum exposure under these arrangements is unknown as this would be dependent on future claims that may be made against the Fund. The risk of material loss from such claims is considered remote.

Other

The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and

12

Life Sciences Series

Notes to Financial Statements (continued)

(unaudited)

| 2. | Significant Accounting Policies (continued) |

Other (continued)

the disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of income and expenses during the reporting period. Actual results could differ from those estimates.

| 3. | Transactions with Affiliates |

The Fund has an Investment Advisory Agreement (the “Agreement”) with the Advisor, for which the Series pays a fee, computed daily and payable monthly, at an annual rate of 1.00% of the Series’ average daily net assets.

Under the Agreement, personnel of the Advisor provide the Series with advice and assistance in the choice of investments and the execution of securities transactions, and otherwise maintain the Series’ organization. The Advisor also provides the Fund with necessary office space and fund administration and support services. The salaries of all officers of the Fund (except a percentage of the Fund’s Chief Compliance Officer’s salary, which is paid by the Fund), and of all Directors who are “affiliated persons” of the Fund, or of the Advisor, and all personnel of the Fund, or of the Advisor, performing services relating to research, statistical and investment activities, are paid by the Advisor. Each “non-affiliated” Director receives an annual stipend, which is allocated among all the active series of the Fund. In addition, these Directors also receive a fee per Board meeting attended plus a fee for each committee meeting attended.

Manning & Napier Investor Services, Inc., a registered broker-dealer affiliate of the Advisor, acts as distributor for the Fund’s shares. The services of Manning & Napier Investor Services, Inc. are provided at no additional cost to the Series.

The Advisor did not waive any fees for the six months ended June 30, 2013. The Advisor is not eligible to recoup any expenses that have been waived or reimbursed in prior years.

The Advisor has agreements with BNY Mellon Investment Servicing (U.S.) Inc. (“BNY”) under which BNY serves as sub-accountant services agent and sub-transfer agent. The Fund pays the Advisor an annual fee related to fund accounting and administration of 0.0175% on the first $3 billion of average daily net assets (excluding Target Series and Strategic Income Series); 0.015% on the next $3 billion of average daily net assets (excluding Target Series and Strategic Income Series); and 0.01% of the average daily net assets in excess of $6 billion (excluding Target Series and Strategic Income Series); plus a base fee of $25,500 per series. Transfer Agent fees are charged to the Fund on a per account basis. Additionally, certain transaction and cusip-based fees and out-of-pocket expenses, including charges for reporting relating to the Fund’s compliance program, are charged. Effective October 1, 2012, the aforementioned agreements were modified to reduce the annual fee related to fund accounting and administration, as well as transfer agent fees, by 10%, excluding out-of-pocket expenses.

Expenses not directly attributable to a series are allocated based on each series’ relative net assets or number of accounts, depending on the expense.

| 4. | Purchases and Sales of Securities |

For the six months ended June 30, 2013, purchases and sales of securities, other than U.S. Government securities and short-term securities, were $105,784,558 and $181,734,882 respectively. There were no purchases or sales of U.S. Government securities.

13

Life Sciences Series

Notes to Financial Statements (continued)

(unaudited)

| 5. | Capital Stock Transactions |

Transactions in shares of Life Sciences Series were:

| | | | | | | | | | | | | | | | |

| | | FOR THE SIX MONTHS ENDED 6/30/13 | | | FOR THE YEAR ENDED 12/31/12 | |

| | | SHARES | | | AMOUNT | | | SHARES | | | AMOUNT | |

Sold | | | 555,294 | | | $ | 7,536,175 | | | | 910,690 | | | $ | 11,481,196 | |

Reinvested | | | — | | | | — | | | | 1,200,003 | | | | 15,448,274 | |

Repurchased | | | (5,181,147 | ) | | | (72,545,697 | ) | | | (1,988,833 | ) | | | (25,540,948 | ) |

| | | | | | | | | | | | | | | | |

Total | | | (4,625,853 | ) | | $ | (65,009,522 | ) | | | 121,860 | | | $ | 1,388,522 | |

| | | | | | | | | | | | | | | | |

Substantially all of the Series’ shares represent investments by fiduciary accounts over which the Advisor has sole investment discretion.

The Series may trade in instruments including written and purchased options, forward foreign currency exchange contracts and futures contracts and other derivatives in the normal course of investing activities to assist in managing exposure to various market risks. The Series may be subject to various elements of risk, which may involve, to a varying degree, elements of risk in excess of the amounts recognized for financial statement purposes. These risks include: the risk that changes in the value of a derivative may not correlate perfectly with the underlying asset, rate or index; counterparty credit risk related to over the counter derivative counterparties’ failure to perform under contract terms; liquidity risk related to the lack of a liquid market for these contracts allowing the fund to close out its position(s); and documentation risk relating to disagreement over contract terms. No such investments were held by the Series as of June 30, 2013.

Investing in securities of foreign companies and foreign governments involves special risks and considerations not typically associated with investing in securities of domestic companies and the U.S. Government. These risks include revaluation of currencies and future adverse political and economic developments. Moreover, securities of foreign companies and foreign governments and their markets may be less liquid and their prices more volatile than those of comparable domestic companies and the U.S. Government.

| 8. | Life Sciences Securities |

The Series may focus its investments in certain related life sciences industries; hence, the Series may subject itself to a greater degree of risk than a series that is more diversified.

| 9. | Federal Income Tax Information |

The amount and characterization of certain income and capital gains to be distributed are determined in accordance with federal income tax regulations, which may differ from accounting principles generally accepted in the United States of America. The Series may periodically make reclassifications among its capital accounts to reflect income and gains available for distribution (or available capital loss carryovers) under income tax regulations, without impacting the Series’ net asset value. Any such reclassifications are not reflected in the financial highlights.

The final determination of the tax character of current year distributions will be made at the conclusion of the fiscal year. The tax character of distributions paid for the year ended December 31, 2012, was as follows:

| | | | |

Ordinary income | | $ | 5,917,652 | |

Long-term capital gains | | | 9,669,965 | |

14

Life Sciences Series

Notes to Financial Statements (continued)

(unaudited)

| 9. | Federal Income Tax Information (continued) |

At June 30, 2013, the identified cost of investments for federal income tax purposes, the resulting gross unrealized appreciation and depreciation, and the net unrealized appreciation were as follows:

| | | | |

Cost for federal income tax purposes | | $ | 160,665,852 | |

Unrealized appreciation | | | 29,198,826 | |

Unrealized depreciation | | | (3,961,453 | ) |

| | | | |

Net unrealized appreciation | | $ | 25,237,373 | |

| | | | |

15

{This page intentionally left blank}

16

{This page intentionally left blank}

17

Life Sciences Series

Literature Requests

(unaudited)

Proxy Voting Policies and Procedures

A description of the policies and procedures that the Fund uses to determine how to vote proxies relating to portfolio securities is available, without charge, upon request:

| | | | |

| By phone | | 1-800-466-3863 | | |

On the Securities and Exchange Commission’s (SEC) web site | | http://www.sec.gov | | |

Proxy Voting Record

Information regarding how the Fund voted proxies relating to portfolio securities during the most recent 12-month period ended June 30th is available, without charge, upon request:

| | | | |

| By phone | | 1-800-466-3863 | | |

| On the SEC’s web site | | http://www.sec.gov | | |

Quarterly Portfolio Holdings

The Series’ complete schedule of portfolio holdings for the 1st and 3rd quarters of each fiscal year are provided on Form N-Q, and are available, without charge, upon request:

| | | | |

| By phone | | 1-800-466-3863 | | |

| On the SEC’s web site | | http://www.sec.gov | | |

The Series’ Form N-Q may be reviewed and copied at the SEC’s Public Reference Room in Washington, D.C. Information on the operation of the Public Reference Room may be obtained by calling 1-800-SEC-0330.

Prospectus and Statement of Additional Information (SAI)

The prospectus and SAI provide additional information about each Series, including charges, expenses and risks. These documents are available, without charge, upon request:

| | | | |

| By phone | | 1-800-466-3863 | | |

| On the SEC’s web site | | http://www.sec.gov | | |

| On our web site | | http://www.manning-napier.com | | |

Additional information available at www.manning-napier.com

1. Fund Holdings - Month-End

2. Fund Holdings - Quarter-End

3. Shareholder Report - Annual

4. Shareholder Report - Semi-Annual

The Fund also offers electronic notification or “e-delivery” when certain documents are available on-line to be downloaded or reviewed. Direct shareholders can elect to receive electronic notification when shareholder reports, prospectus updates, and/or statements are available. If you do not currently have on-line access to your account, you can establish access by going to www.manning-napier.com, click on “Login” in the top corner of the page, and follow the prompts to self-enroll. Once enrolled, you can set your electronic notification preferences by clicking on the Account Options tab located within the green toolbar and then select E-Delivery Option. Should you have any questions on either how to establish on-line access or how to update your account settings, please contact Investor Services at 1-800-466-3863.

MNLFS-6/13-SAR

| | | | | | |

| | | | SMALL CAP SERIES | | |

www.manning-napier.com | | | |  |

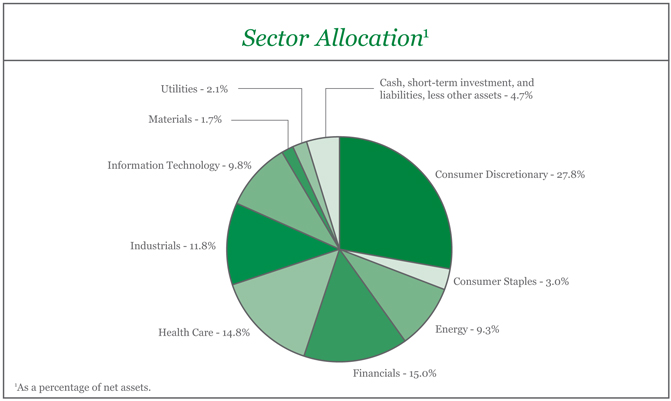

Small Cap Series

Shareholder Expense Example

(unaudited)

As a shareholder of the Series, you may incur two types of costs: (1) transaction costs and (2) ongoing costs, including management fees and other Series expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Series and to compare these costs with the ongoing costs of investing in other mutual funds.

The example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period (January 1, 2013 to June 30, 2013).

Actual Expenses

The first line of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line of the table below provides information about hypothetical account values and hypothetical expenses based on the Series’ actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Series’ actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid during the period. You may use this information to compare the ongoing costs of investing in the Series and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transaction costs. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transaction costs were included, your costs would have been higher.

| | | | | | |

| | | BEGINNING

ACCOUNT VALUE

1/1/13 | | ENDING

ACCOUNT VALUE

6/30/13 | | EXPENSES PAID

DURING PERIOD*

1/1/13-6/30/13 |

Actual | | $1,000.00 | | $1,167.30 | | $5.91 |

Hypothetical (5% return before expenses) | | $1,000.00 | | $1,019.34 | | $5.51 |

*Expenses are equal to the Series annualized expense ratio (for the six-month period) of 1.10%, multiplied by the average account value over the period, multiplied by 181/365 to reflect the one-half year period. Expenses are based on the most recent fiscal half year.

1

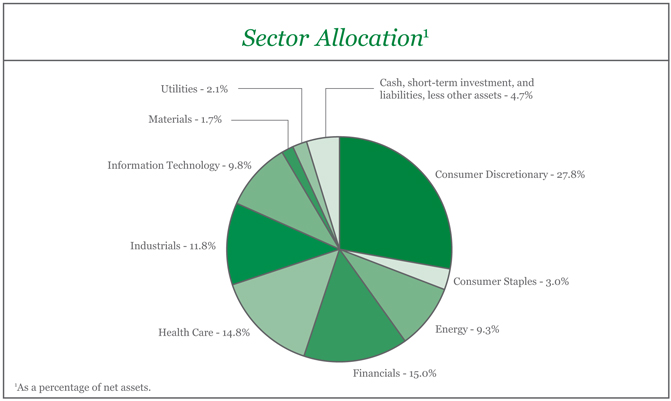

Small Cap Series

Portfolio Composition as of June 30, 2013

(unaudited)

| | | | |

Market Capitalization | |

Average | | $ | 1,803.79 Million | |

Median | | | 1,560.65 Million | |

Weighted Average | | | 1,851.03 Million | |

| | | | |

Top Ten Stock Holdings2 | |

Ocado Group plc (United Kingdom) | | | 3.5 | % |

US Airways Group, Inc. | | | 3.4 | % |

Cloud Peak Energy, Inc. | | | 2.5 | % |

JSE Ltd. (South Africa) | | | 2.4 | % |

Spirit Airlines, Inc. | | | 2.4 | % |

Starz - Class A | | | 2.2 | % |

Calfrac Well Services Ltd. (Canada) | | | 2.2 | % |

Valassis Communications, Inc. | | | 2.2 | % |

Dynegy, Inc. | | | 2.1 | % |

DexCom, Inc. | | | 2.1 | % |

2As a percentage of total investments. | | | | |

2

Small Cap Series

Investment Portfolio - June 30, 2013

(unaudited)

| | | | | | | | | | |

| | | SHARES | | | VALUE (NOTE 2) | | | |

| | | |

COMMON STOCKS - 95.3% | | | | | | | | | | |

| | | |

Consumer Discretionary - 27.8% | | | | | | | | | | |

Automobiles - 0.9% | | | | | | | | | | |

Tesla Motors, Inc.* | | | 19,410 | | | $ | 2,085,216 | | | |

| | | | | | | | | | |

Distributors - 1.0% | | | | | | | | | | |

Inchcape plc (United Kingdom)1 | | | 300,081 | | | | 2,284,688 | | | |

| | | | | | | | | | |

Hotels, Restaurants & Leisure - 3.4% | | | | | | | | | | |

BJ’s Restaurants, Inc.* | | | 125,120 | | | | 4,641,952 | | | |

Orient-Express Hotels Ltd. - ADR - Class A* | | | 238,080 | | | | 2,895,053 | | | |

| | | | | | | | | | |

| | | |

| | | | | | | 7,537,005 | | | |

| | | | | | | | | | |

Internet & Catalog Retail - 6.4% | | | | | | | | | | |

HomeAway, Inc.* | | | 116,140 | | | | 3,755,968 | | | |

Ocado Group plc (United Kingdom)*1 | | | 1,721,640 | | | | 7,811,116 | | | |

Shutterfly, Inc.* | | | 49,640 | | | | 2,769,416 | | | |

| | | | | | | | | | |

| | | |

| | | | | | | 14,336,500 | | | |

| | | | | | | | | | |

Media - 7.4% | | | | | | | | | | |

Imax Corp. (Canada)* | | | 170,490 | | | | 4,238,381 | | | |

Starz - Class A* | | | 228,210 | | | | 5,043,441 | | | |

Valassis Communications, Inc. | | | 198,110 | | | | 4,871,525 | | | |

Zon Multimedia Servicos de Telecomunicacoes e Multimedia SGPS S.A. (Portugal)1 | | | 531,740 | | | | 2,567,823 | | | |

| | | | | | | | | | |

| | | |

| | | | | | | 16,721,170 | | | |

| | | | | | | | | | |

Specialty Retail - 8.7% | | | | | | | | | | |

Aeropostale, Inc.* | | | 216,810 | | | | 2,991,978 | | | |

American Eagle Outfitters, Inc. | | | 111,430 | | | | 2,034,712 | | | |

Chico’s FAS, Inc. | | | 102,870 | | | | 1,754,962 | | | |

Dick’s Sporting Goods, Inc. | | | 40,780 | | | | 2,041,447 | | | |

Group 1 Automotive, Inc. | | | 31,370 | | | | 2,018,032 | | | |

Penske Automotive Group, Inc. | | | 63,570 | | | | 1,941,428 | | | |

Rent-A-Center, Inc. | | | 88,980 | | | | 3,341,199 | | | |

Select Comfort Corp.* | | | 45,602 | | | | 1,142,786 | | | |

Sonic Automotive, Inc. - Class A | | | 105,400 | | | | 2,228,156 | | | |

| | | | | | | | | | |

| | | |

| | | | | | | 19,494,700 | | | |

| | | | | | | | | | |

| | | |

Total Consumer Discretionary | | | | | | | 62,459,279 | | | |

| | | | | | | | | | |

| | | |

Consumer Staples - 3.0% | | | | | | | | | | |

Beverages - 1.8% | | | | | | | | | | |

C&C Group plc (Ireland)*1 | | | 762,710 | | | | 4,137,219 | | | |

| | | | | | | | | | |

Food & Staples Retailing - 0.5% | | | | | | | | | | |

Distribuidora Internacional de Alimentacion S.A. (Spain)1 | | | 160,700 | | | | 1,213,965 | | | |

| | | | | | | | | | |

Food Products - 0.7% | | | | | | | | | | |

Tootsie Roll Industries, Inc. | | | 46,948 | | | | 1,492,007 | | | |

| | | | | | | | | | |

| | | |

Total Consumer Staples | | | | | | | 6,843,191 | | | |

| | | | | | | | | | |

The accompanying notes are an integral part of the financial statements.

3

Small Cap Series

Investment Portfolio - June 30, 2013

(unaudited)

| | | | | | | | | | |

| | | SHARES | | | VALUE (NOTE 2) | | | |

| | | |

COMMON STOCKS (continued) | | | | | | | | | | |

| | | |

Energy - 9.3% | | | | | | | | | | |

Energy Equipment & Services - 5.6% | | | | | | | | | | |

Calfrac Well Services Ltd. (Canada) | | | 171,080 | | | $ | 4,930,526 | | | |

CARBO Ceramics, Inc. | | | 11,020 | | | | 743,079 | | | |

Global Geophysical Services, Inc.* | | | 153,680 | | | | 725,370 | | | |

ION Geophysical Corp.* | | | 303,010 | | | | 1,824,120 | | | |

Key Energy Services, Inc.* | | | 133,470 | | | | 794,147 | | | |

Petroleum Geo-Services ASA (Norway)1 | | | 72,340 | | | | 883,272 | | | |

Trican Well Service Ltd. (Canada) | | | 191,910 | | | | 2,551,014 | | | |

| | | | | | | | | | |

| | | |

| | | | | | | 12,451,528 | | | |

| | | | | | | | | | |

Oil, Gas & Consumable Fuels - 3.7% | | | | | | | | | | |

Cloud Peak Energy, Inc.* | | | 347,710 | | | | 5,730,261 | | | |

Paladin Energy Ltd.*1 | | | 1,220,000 | | | | 971,788 | | | |

Paladin Energy Ltd. (Australia)*2 | | | 2,052,100 | | | | 1,678,051 | | | |

| | | | | | | | | | |

| | | |

| | | | | | | 8,380,100 | | | |

| | | | | | | | | | |

| | | |

Total Energy | | | | | | | 20,831,628 | | | |

| | | | | | | | | | |

| | | |

Financials - 15.0% | | | | | | | | | | |

Commercial Banks - 1.0% | | | | | | | | | | |

Cathay General Bancorp. | | | 107,590 | | | | 2,189,457 | | | |

| | | | | | | | | | |

Consumer Finance - 1.9% | | | | | | | | | | |

DFC Global Corp.* | | | 310,730 | | | | 4,291,181 | | | |

| | | | | | | | | | |

Diversified Financial Services - 4.0% | | | | | | | | | | |

JSE Ltd. (South Africa)1 | | | 764,540 | | | | 5,491,357 | | | |

MarketAxess Holdings, Inc. | | | 77,750 | | | | 3,634,813 | | | |

| | | | | | | | | | |

| | | |

| | | | | | | 9,126,170 | | | |

| | | | | | | | | | |

Insurance - 1.6% | | | | | | | | | | |

Brasil Insurance Participacoes e Administracao S.A. (Brazil) | | | 361,270 | | | | 3,550,609 | | | |

| | | | | | | | | | |

Real Estate Investment Trusts (REITS) - 5.9% | | | | | | | | | | |

AmREIT, Inc. - Class B | | | 64,000 | | | | 1,237,760 | | | |

Associated Estates Realty Corp. | | | 46,300 | | | | 744,504 | | | |

Cedar Realty Trust, Inc. | | | 207,440 | | | | 1,074,539 | | | |

Coresite Realty Corp. | | | 37,210 | | | | 1,183,650 | | | |

Corporate Office Properties Trust | | | 42,440 | | | | 1,082,220 | | | |

DuPont Fabros Technology, Inc. | | | 34,700 | | | | 838,005 | | | |

Education Realty Trust, Inc. | | | 140,020 | | | | 1,432,405 | | | |

Healthcare Realty Trust, Inc. | | | 44,680 | | | | 1,139,340 | | | |

Mack-Cali Realty Corp. | | | 37,130 | | | | 909,314 | | | |

Mid-America Apartment Communities, Inc. | | | 11,280 | | | | 764,446 | | | |

Pebblebrook Hotel Trust | | | 111,580 | | | | 2,884,343 | | | |

| | | | | | | | | | |

| | | |

| | | | | | | 13,290,526 | | | |

| | | | | | | | | | |

The accompanying notes are an integral part of the financial statements.

4

Small Cap Series

Investment Portfolio - June 30, 2013

(unaudited)

| | | | | | | | | | |

| | | SHARES | | | VALUE (NOTE 2) | | | |

| | | |

COMMON STOCKS (continued) | | | | | | | | | | |

| | | |

Financials (continued) | | | | | | | | | | |

Real Estate Management & Development - 0.6% | | | | | | | | | | |

General Shopping Brasil S.A. (Brazil)* | | | 328,590 | | | $ | 1,267,914 | | | |

| | | | | | | | | | |

| | | |

Total Financials | | | | | | | 33,715,857 | | | |

| | | | | | | | | | |

| | | |

Health Care - 14.8% | | | | | | | | | | |

Biotechnology - 5.2% | | | | | | | | | | |

Green Cross Corp. (South Korea)1 | | | 28,571 | | | | 3,058,396 | | | |

Myriad Genetics, Inc.* | | | 156,260 | | | | 4,198,706 | | | |

Seattle Genetics, Inc.* | | | 142,820 | | | | 4,493,117 | | | |

| | | | | | | | | | |

| | | |

| | | | | | | 11,750,219 | | | |

| | | | | | | | | | |

Health Care Equipment & Supplies - 7.6% | | | | | | | | | | |

DexCom, Inc.* | | | 210,140 | | | | 4,717,643 | | | |

HeartWare International, Inc.* | | | 47,730 | | | | 4,539,600 | | | |

Insulet Corp.* | | | 146,910 | | | | 4,614,443 | | | |

Thoratec Corp.* | | | 99,990 | | | | 3,130,687 | | | |

| | | | | | | | | | |

| | | |

| | | | | | | 17,002,373 | | | |

| | | | | | | | | | |

Health Care Technology - 1.4% | | | | | | | | | | |

Greenway Medical Technologies, Inc.* | | | 253,390 | | | | 3,126,833 | | | |

| | | | | | | | | | |

Pharmaceuticals - 0.6% | | | | | | | | | | |

ViroPharma, Inc.* | | | 44,900 | | | | 1,286,385 | | | |

| | | | | | | | | | |

| | | |

Total Health Care | | | | | | | 33,165,810 | | | |

| | | | | | | | | | |

| | | |

Industrials - 11.8% | | | | | | | | | | |

Airlines - 5.8% | | | | | | | | | | |

Spirit Airlines, Inc.* | | | 168,520 | | | | 5,353,880 | | | |

US Airways Group, Inc.* | | | 468,090 | | | | 7,686,038 | | | |

| | | | | | | | | | |

| | | |

| | | | | | | 13,039,918 | | | |

| | | | | | | | | | |

Commercial Services & Supplies - 0.5% | | | | | | | | | | |

Interface, Inc. | | | 61,360 | | | | 1,041,279 | | | |

| | | | | | | | | | |

Machinery - 3.8% | | | | | | | | | | |

Titan International, Inc. | | | 107,480 | | | | 1,813,188 | | | |

Wabash National Corp.* | | | 226,840 | | | | 2,309,231 | | | |

Westport Innovations, Inc. - ADR (Canada)* | | | 133,870 | | | | 4,488,661 | | | |

| | | | | | | | | | |

| | | |

| | | | | | | 8,611,080 | | | |

| | | | | | | | | | |

Marine - 1.7% | | | | | | | | | | |

Baltic Trading Ltd. | | | 411,730 | | | | 1,527,518 | | | |

D/S Norden A/S (Denmark)1 | | | 44,790 | | | | 1,519,214 | | | |

Sinotrans Shipping Ltd. (China)1 | | | 3,579,000 | | | | 854,668 | | | |

| | | | | | | | | | |

| | | |

| | | | | | | 3,901,400 | | | |

| | | | | | | | | | |

| | | |

Total Industrials | | | | | | | 26,593,677 | | | |

| | | | | | | | | | |

The accompanying notes are an integral part of the financial statements.

5

Small Cap Series

Investment Portfolio - June 30, 2013

(unaudited)

| | | | | | | | | | |

| | | SHARES | | | VALUE (NOTE 2) | | | |

| | | |

COMMON STOCKS (continued) | | | | | | | | | | |

| | | |

Information Technology - 9.8% | | | | | | | | | | |

Communications Equipment - 2.0% | | | | | | | | | | |

Infinera Corp.* | | | 307,570 | | | $ | 3,281,772 | | | |

Polycom, Inc.* | | | 117,490 | | | | 1,238,345 | | | |

| | | | | | | | | | |

| | | |

| | | | | | | 4,520,117 | | | |

| | | | | | | | | | |

Computers & Peripherals - 0.3% | | | | | | | | | | |

Fusion-io, Inc.* | | | 52,110 | | | | 742,046 | | | |

| | | | | | | | | | |

Electronic Equipment, Instruments & Components - 1.0% | | | | | | | | | | |

Rofin-Sinar Technologies, Inc.* | | | 86,410 | | | | 2,155,065 | | | |

| | | | | | | | | | |

Internet Software & Services - 3.2% | | | | | | | | | | |

Liquidity Services, Inc.* | | | 36,680 | | | | 1,271,696 | | | |

LogMeIn, Inc.* | | | 175,070 | | | | 4,282,212 | | | |

SciQuest, Inc.* | | | 69,520 | | | | 1,741,476 | | | |

| | | | | | | | | | |

| | | |

| | | | | | | 7,295,384 | | | |

| | | | | | | | | | |

IT Services - 2.5% | | | | | | | | | | |

InterXion Holding N.V. - ADR (Netherlands)* | | | 31,570 | | | | 824,924 | | | |

Wirecard AG (Germany)1 | | | 172,090 | | | | 4,682,536 | | | |

| | | | | | | | | | |

| | | |

| | | | | | | 5,507,460 | | | |

| | | | | | | | | | |

Software - 0.8% | | | | | | | | | | |

RealPage, Inc.* | | | 101,660 | | | | 1,864,444 | | | |

| | | | | | | | | | |

| | | |

Total Information Technology | | | | | | | 22,084,516 | | | |

| | | | | | | | | | |

| | | |

Materials - 1.7% | | | | | | | | | | |

Chemicals - 1.0% | | | | | | | | | | |

Tronox Ltd. - Class A | | | 108,400 | | | | 2,184,260 | | | |

| | | | | | | | | | |

Metals & Mining - 0.7% | | | | | | | | | | |

Noranda Aluminum Holding Corp. | | | 481,260 | | | | 1,554,470 | | | |

| | | | | | | | | | |

| | | |

Total Materials | | | | | | | 3,738,730 | | | |

| | | | | | | | | | |

| | | |

Utilities - 2.1% | | | | | | | | | | |

Independent Power Producers & Energy Traders - 2.1% | | | | | | | | | | |

Dynegy, Inc.* | | | 212,890 | | | | 4,800,669 | | | |

| | | | | | | | | | |

TOTAL COMMON STOCKS | | | | | | | | | | |

(Identified Cost $186,185,516) | | | | | | | 214,233,357 | | | |

| | | | | | | | | | |

| | | |

SHORT-TERM INVESTMENT - 5.3% | | | | | | | | | | |

| | | |

Dreyfus Cash Management, Inc. - Institutional Shares3, 0.05% (Identified Cost $11,860,977) | | | 11,860,977 | | | | 11,860,977 | | | |

| | | | | | | | | | |

The accompanying notes are an integral part of the financial statements.

6

Small Cap Series

Investment Portfolio - June 30, 2013

(unaudited)

| | | | | | |

| | | VALUE (NOTE 2) | | | |

| | |

TOTAL INVESTMENTS - 100.6% | | | | | | |

(Identified Cost $198,046,493) | | $ | 226,094,334 | | | |

LIABILITIES, LESS OTHER ASSETS - (0.6%) | | | (1,389,005 | ) | | |

| | | | | | |

| | |

NET ASSETS - 100% | | $ | 224,705,329 | | | |

| | | | | | |

ADR - American Depository Receipt

*Non-income producing security.

1 A factor from a third party vendor was applied to determine the security’s fair value following the close of local trading.

2 Traded on Canadian Stock Exchange.

3 Rate shown is the current yield as of June 30, 2013.

The accompanying notes are an integral part of the financial statements.

7

Small Cap Series

Statement of Assets and Liabilities

June 30, 2013 (unaudited)

| | | | |

ASSETS: | | | | |

| |

Investments (identified cost $198,046,493) (Note 2) | | $ | 226,094,334 | |

Cash | | | 1,394 | |

Receivable for securities sold | | | 2,071,169 | |

Dividends receivable | | | 251,411 | |

Receivable for fund shares sold | | | 108,424 | |

Foreign tax reclaims receivable | | | 47,555 | |

Prepaid expenses | | | 955 | |

| | | | |

| |

TOTAL ASSETS | | | 228,575,242 | |

| | | | |

| |

LIABILITIES: | | | | |

| |

Accrued management fees (Note 3) | | | 186,749 | |

Accrued fund accounting and administration fees (Note 3) | | | 8,049 | |

Accrued transfer agent fees (Note 3) | | | 3,201 | |

Accrued Chief Compliance Officer service fees (Note 3) | | | 340 | |

Payable for securities purchased | | | 3,075,397 | |

Payable for fund shares repurchased | | | 547,572 | |

Other payables and accrued expenses | | | 48,605 | |

| | | | |

| |

TOTAL LIABILITIES | | | 3,869,913 | |

| | | | |

| |

TOTAL NET ASSETS | | $ | 224,705,329 | |

| | | | |

| |

NET ASSETS CONSIST OF: | | | | |

| |

Capital stock | | $ | 194,108 | |

Additional paid-in-capital | | | 200,837,871 | |

Accumulated net investment loss | | | (6,417 | ) |

Accumulated net realized loss on investments, foreign currency and translation of other assets and liabilities | | | (4,367,389 | ) |

Net unrealized appreciation on investments, foreign currency and translation of other assets and liabilities | | | 28,047,156 | |

| | | | |

| |

TOTAL NET ASSETS | | $ | 224,705,329 | |

| | | | |

| |

NET ASSET VALUE, OFFERING PRICE AND REDEMPTION PRICE PER SHARE - CLASS A ($224,705,329/19,410,787 shares) | | $ | 11.58 | |

| | | | |

The accompanying notes are an integral part of the financial statements.

8

Small Cap Series

Statement of Operations

For the Six Months Ended June 30, 2013 (unaudited)

| | | | |

INVESTMENT INCOME: | | | | |

| |

Dividends (net of foreign taxes withheld, $61,380) | | $ | 1,073,763 | |

| | | | |

| |

EXPENSES: | | | | |

| |

Management fees (Note 3) | | | 1,084,512 | |

Fund accounting and administration fees (Note 3) | | | 25,956 | |

Transfer agent fees (Note 3) | | | 8,657 | |

Directors’ fees (Note 3) | | | 2,311 | |

Chief Compliance Officer service fees (Note 3) | | | 1,117 | |

Custodian fees | | | 15,218 | |

Miscellaneous | | | 52,395 | |

| | | | |

| |

Total Expenses | | | 1,190,166 | |

| | | | |

| |

NET INVESTMENT LOSS | | | (116,403 | ) |

| | | | |

| |

REALIZED AND UNREALIZED GAIN (LOSS) ON INVESTMENTS AND FOREIGN CURRENCY: | | | | |

| |

Net realized gain (loss) on-

Investments | | | 16,567,600 | |

Foreign currency and translation of other assets and liabilities | | | (12,408 | ) |

| | | | |

| |

| | | 16,555,192 | |

| | | | |

Net change in unrealized appreciation (depreciation) on-

Investments | | | 16,704,631 | |

Foreign currency and translation of other assets and liabilities | | | (231 | ) |

| | | | |

| |

| | | 16,704,400 | |

| | | | |

| |

NET REALIZED AND UNREALIZED GAIN (LOSS) ON INVESTMENTS AND FOREIGN CURRENCY | | | 33,259,592 | |

| | | | |

| |

NET INCREASE IN NET ASSETS RESULTING FROM OPERATIONS | | $ | 33,143,189 | |

| | | | |

The accompanying notes are an integral part of the financial statements.

9

Small Cap Series

Statements of Changes in Net Assets

| | | | | | | | |

| | | FOR THE SIX

MONTHS ENDED

6/30/13

(UNAUDITED) | | | FOR THE YEAR ENDED

12/31/12 | |

INCREASE IN NET ASSETS: | | | | | | | | |

| | |

OPERATIONS: | | | | | | | | |

| | |

Net investment income (loss) | | $ | (116,403 | ) | | $ | 154,493 | |

Net realized gain (loss) on investments and foreign currency | | | 16,555,192 | | | | 17,697,218 | |

Net change in unrealized appreciation (depreciation) on investments and foreign currency | | | 16,704,400 | | | | 15,044,668 | |

| | | | | | | | |

| | |

Net increase from operations | | | 33,143,189 | | | | 32,896,379 | |

| | | | | | | | |

| | |

CAPITAL STOCK ISSUED AND REPURCHASED: | | | | | | | | |

| | |

Net decrease from capital share transactions (Note 5) | | | (11,723,973 | ) | | | (8,935,366 | ) |

| | | | | | | | |

| | |

Net increase in net assets | | | 21,419,216 | | | | 23,961,013 | |

| | |

NET ASSETS: | | | | | | | | |

| | |

Beginning of period | | | 203,286,113 | | | | 179,325,100 | |

| | | | | | | | |

| | |

End of period (including accumulated net investment loss of $6,417 and undistributed net investment income of $109,986, respectively) | | $ | 224,705,329 | | | $ | 203,286,113 | |

| | | | | | | | |

The accompanying notes are an integral part of the financial statements.

10

Small Cap Series

Financial Highlights

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | FOR THE SIX MONTHS ENDED

6/30/13

(UNAUDITED) | | | FOR THE YEARS ENDED | |

| | | | 12/31/12 | | | 12/31/11 | | | 12/31/10 | | | 12/31/09 | | | 12/31/08 | |

Per share data (for a share outstanding throughout each period): | | | | | | | | | | | | | | | | | | | | | | | | |

Net asset value - Beginning of period | | $ | 9.92 | | | $ | 8.36 | | | $ | 9.29 | | | $ | 7.39 | | | $ | 4.98 | | | $ | 10.21 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Income (loss) from investment operations: | | | | | | | | | | | | | | | | | | | | | | | | |

Net investment income (loss) | | | (0.01 | )1 | | | 0.01 | 1 | | | (0.02 | )1 | | | (0.01 | )1 | | | (0.02 | )1 | | | (0.02 | ) |

Net realized and unrealized gain (loss) on investments | | | 1.67 | | | | 1.55 | | | | (0.91 | ) | | | 1.91 | | | | 2.43 | | | | (5.12 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Total from investment operations | | | 1.66 | | | | 1.56 | | | | (0.93 | ) | | | 1.90 | | | | 2.41 | | | | (5.14 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Less distributions to shareholders: | | | | | | | | | | | | | | | | | | | | | | | | |

From net realized gain on investments | | | — | | | | — | | | | — | | | | — | | | | — | | | | (0.09 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Net asset value - End of period | | $ | 11.58 | | | $ | 9.92 | | | $ | 8.36 | | | $ | 9.29 | | | $ | 7.39 | | | $ | 4.98 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Net assets - End of period (000’s omitted) | | $ | 224,705 | | | $ | 203,286 | | | $ | 179,325 | | | $ | 208,397 | | | $ | 171,910 | | | $ | 120,162 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Total return2 | | | 16.73 | % | | | 18.66 | % | | | (10.01 | %) | | | 25.71 | % | | | 48.39 | % | | | (50.68 | %) |

Ratios (to average net assets)/ | | | | | | | | | | | | | | | | | | | | | | | | |

Supplemental Data: | | | | | | | | | | | | | | | | | | | | | | | | |

Expenses* | | | 1.10 | %3 | | | 1.10 | % | | | 1.11 | % | | | 1.12 | % | | | 1.15 | % | | | 1.15 | % |

Net investment income (loss) | | | (0.11 | %)3 | | | 0.08 | % | | | (0.27 | %) | | | (0.13 | %) | | | (0.34 | %) | | | (0.39 | %) |

Portfolio turnover | | | 25 | % | | | 65 | % | | | 75 | % | | | 75 | % | | | 76 | % | | | 68 | % |

|

| * For certain periods presented, the investment advisor did not impose all or a portion of its management and/or other fees, and in some periods may have paid a portion of the Series’ expenses. If these expenses had been incurred by the Series, the expense ratio (to average net assets) would have increased by the following amounts: | |

| | | | | | |

| | | N/A | | | | N/A | | | | N/A | | | | 0.00 | %4 | | | 0.00 | %4 | | | N/A | |

1Calculated based on average shares outstanding during the periods.

2Represents aggregate total return for the periods indicated, and assumes reinvestment of all distributions. Total return would have been lower had certain expenses not been waived or reimbursed during the periods. Periods less than one year are not annualized.

3Annualized.

4Less than 0.01%.

The accompanying notes are an integral part of the financial statements.

11

Small Cap Series

Notes to Financial Statements

(unaudited)

Small Cap Series (the “Series”) is a no-load diversified series of Manning & Napier Fund, Inc. (the “Fund”). The Fund is organized in Maryland and is registered under the Investment Company Act of 1940, as amended, as an open-end management investment company.

The Series’ investment objective is to provide long-term growth by investing principally in the common stocks of companies with small market capitalizations.

The Series is authorized to issue five classes of shares (Class A, B, D, E and Z). Currently, only Class A shares have been issued. Each class of shares is substantially the same, except that class-specific distribution and shareholder servicing expenses are borne by the specific class of shares to which they relate.

The Fund’s advisor is Manning & Napier Advisors, LLC (the “Advisor”). Shares of the Series are offered to investors, clients and employees of the Advisor and its affiliates. The total authorized capital stock of the Fund consists of 15 billion shares of common stock each having a par value of $0.01. As of June 30, 2013, 10.3 billion shares have been designated in total among 42 series, of which 87.5 million have been designated as Small Cap Series Class A common stock.

| 2. | Significant Accounting Policies |

Security Valuation

Portfolio securities, including domestic equities, foreign equities, warrants and options, listed on an exchange other than the NASDAQ Stock Market are valued at the latest quoted sales price of the exchange on which the security is primarily traded. Securities not traded on valuation date or securities not listed on an exchange are valued at the latest quoted bid price provided by the Fund’s pricing service. Securities listed on the NASDAQ Stock Market are valued in accordance with the NASDAQ Official Closing Price.

Short-term investments that mature in sixty days or less are valued at amortized cost, which approximates fair value. Investments in open-end investment companies are valued at their net asset value per share on valuation date.

Volume and level of activity in established markets for an asset or liability are evaluated to determine whether recent transactions and quoted prices are determinative of fair value. Where there have been significant decreases in volume and level of activity, further analysis and adjustment may be necessary to estimate fair value. The Series measures fair value in these instances by the use of inputs and valuation techniques which may be based upon current market prices of securities that are comparable in coupon, rating, maturity and industry and/or expectation of future cash flows. As a result of trading in relatively thin markets and/or markets that experience significant volatility, the prices used by the Series to value these securities may differ from the value that would be realized if these securities were sold, and the differences could be material.