UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-04087

Manning & Napier Fund, Inc.

(Exact name of registrant as specified in charter)

290 Woodcliff Drive, Fairport, NY 14450

(Address of principal executive offices)(Zip Code)

Paul J. Battaglia, 290 Woodcliff Drive, Fairport, NY 14450

(Name and address of agent for service)

Registrant’s telephone number, including area code: 585-325-6880

Date of fiscal year end: December 31

Date of reporting period: January 1, 2023 through June 30, 2023

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget ("OMB") control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

| Item 1: | Reports to Stockholders. |

www.manning-napier.com

Manning & Napier Fund, Inc.

Real Estate Series

Real Estate Series

Shareholder Expense Example

(unaudited)

As a shareholder of the Series, you incur ongoing costs, including management fees, shareholder service fees and other Series expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Series and to compare these costs with the ongoing costs of investing in other mutual funds.

The example is based on an investment of $1,000 invested in each class at the beginning of the period and held for the entire period (January 1, 2023 to June 30, 2023).

Actual Expenses

The Actual lines of the table below provide information about actual account values and actual expenses. You may use the information in these lines, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the Actual line for the Class in which you have invested under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The Hypothetical lines of each class in the table below provide information about hypothetical account values and hypothetical expenses based on the Class’ actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Class’ actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid during the period. You may use this information to compare the ongoing costs of investing in a class of the Series and other funds. To do so, compare this 5% hypothetical example for the Class in which you have invested with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transaction costs, such as sales charges (loads), redemption fees, or exchange fees that you may incur in other mutual funds. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds.

| | | BEGINNING

ACCOUNT VALUE

1/1/23 | | ENDING

ACCOUNT VALUE

6/30/23 | | EXPENSES PAID

DURING PERIOD*

1/1/23 - 6/30/23 | | ANNUALIZED

EXPENSE

RATIO |

| Class S | | | | | | | | |

| Actual | | $1,000.00 | | $1,072.10 | | $5.65 | | 1.10% |

| Hypothetical | | | | | | | | |

| (5% return before expenses) | | $1,000.00 | | $1,019.34 | | $5.51 | | 1.10% |

| Class I | | | | | | | | |

| Actual | | $1,000.00 | | $1,074.30 | | $4.37 | | 0.85% |

| Hypothetical | | | | | | | | |

| (5% return before expenses) | | $1,000.00 | | $1,020.58 | | $4.26 | | 0.85% |

| Class W | | | | | | | | |

| Actual | | $1,000.00 | | $1,078.40 | | $0.52 | | 0.10% |

| Hypothetical | | | | | | | | |

| (5% return before expenses) | | $1,000.00 | | $1,024.30 | | $0.50 | | 0.10% |

| Class Z | | | | | | | | |

| Actual | | $1,000.00 | | $1,074.40 | | $3.60 | | 0.70% |

| Hypothetical | | | | | | | | |

| (5% return before expenses) | | $1,000.00 | | $1,021.32 | | $3.51 | | 0.70% |

*Expenses are equal to each Class’ annualized expense ratio (for the six-month period), multiplied by the average account value over the period, multiplied by 181/365 (to reflect the one-half year period). The Class’ total return would have been lower had certain expenses not been waived or reimbursed during the period.

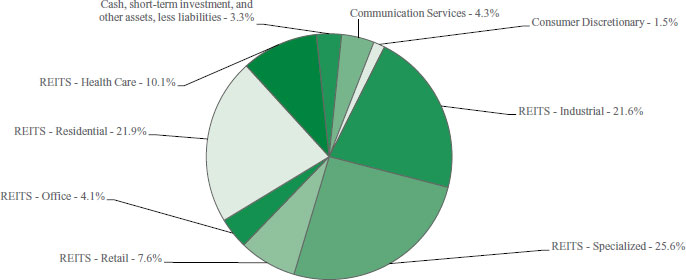

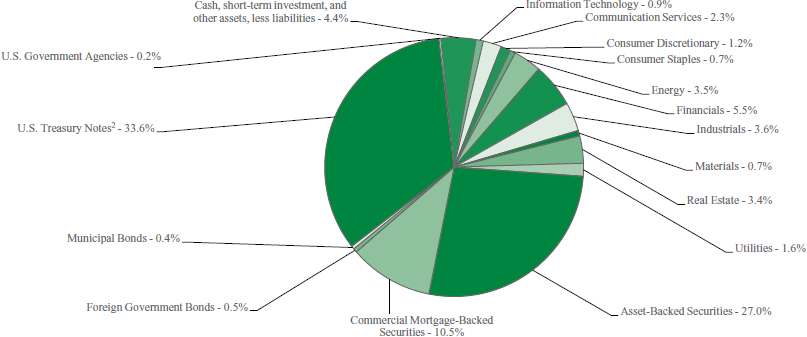

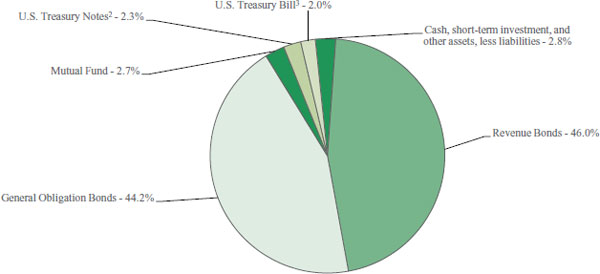

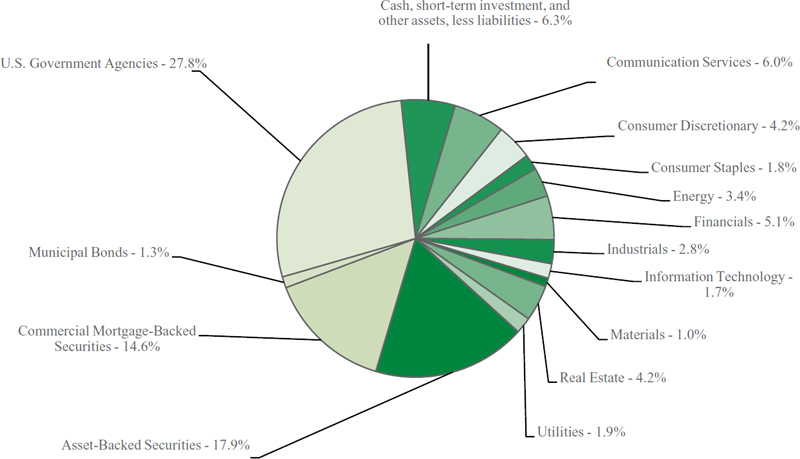

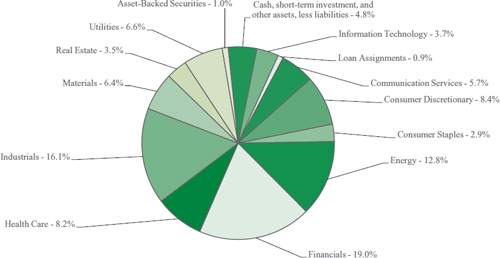

Real Estate Series

Portfolio Composition as of June 30, 2023

(unaudited)

| Sector Allocation1 |

|

| |

| 1 As a percentage of net assets. |

| Top Ten Stock Holdings2 | |

| Equinix, Inc. | 12.0% | | Americold Realty Trust, Inc. | 3.5% |

| Prologis, Inc. | 11.6% | | Cellnex Telecom S.A. (Spain) | 3.3% |

| Public Storage | 4.4% | | Equity LifeStyle Properties, Inc. | 3.3% |

| SBA Communications Corp. | 4.0% | | Agree Realty Corp. | 3.1% |

| Sun Communities, Inc. | 4.0% | | UDR, Inc. | 3.1% |

| | | | | |

| 2As a percentage of total investments. | | | | |

Real Estate Series

Investment Portfolio - June 30, 2023

(unaudited)

| | | | | | | |

| | | SHARES | | | VALUE

(NOTE 2) | |

| | | | | | | | | |

| COMMON STOCKS - 96.7% | | | | | | | | |

| | | | | | | | | |

| Communication Services - 4.3% | | | | | | | | |

| Diversified Telecommunication Services - 4.3% | | | | | | | | |

| Cellnex Telecom S.A. (Spain)1 | | | 225,925 | | | $ | 9,128,223 | |

| Helios Towers plc (Tanzania)* | | | 2,253,833 | | | | 2,674,845 | |

| Total Communication Services | | | | | | | 11,803,068 | |

| Consumer Discretionary - 1.5% | | | | | | | | |

| Hotels, Restaurants & Leisure - 1.5% | | | | | | | | |

| Monarch Casino & Resort, Inc. | | | 56,835 | | | | 4,004,026 | |

| Real Estate - 90.9% | | | | | | | | |

| Health Care REITs - 10.1% | | | | | | | | |

| CareTrust REIT, Inc. | | | 266,710 | | | | 5,296,861 | |

| Community Healthcare Trust, Inc. | | | 119,856 | | | | 3,957,645 | |

| Healthcare Realty Trust, Inc. | | | 233,406 | | | | 4,402,037 | |

| Physicians Realty Trust | | | 190,240 | | | | 2,661,458 | |

| Ventas, Inc. | | | 89,571 | | | | 4,234,021 | |

| Welltower, Inc. | | | 87,423 | | | | 7,071,646 | |

| | | | | | | | 27,623,668 | |

| Industrial REITs - 21.6% | | | | | | | | |

| Americold Realty Trust, Inc. | | | 299,590 | | | | 9,676,757 | |

| LXP Industrial Trust | | | 482,649 | | | | 4,705,828 | |

| Prologis, Inc. | | | 257,455 | | | | 31,571,707 | |

| Rexford Industrial Realty, Inc. | | | 104,484 | | | | 5,456,154 | |

| STAG Industrial, Inc. | | | 78,395 | | | | 2,812,813 | |

| Terreno Realty Corp. | | | 85,301 | | | | 5,126,590 | |

| | | | | | | | 59,349,849 | |

| Office REITs - 4.1% | | | | | | | | |

| Brandywine Realty Trust | | | 283,017 | | | | 1,316,029 | |

| Cousins Properties, Inc. | | | 217,175 | | | | 4,951,590 | |

| Equity Commonwealth | | | 240,980 | | | | 4,882,255 | |

| | | | | | | | 11,149,874 | |

| Residential REITs - 21.9% | | | | | | | | |

| American Homes 4 Rent - Class A | | | 87,865 | | | | 3,114,814 | |

| Apartment Income REIT Corp. | | | 93,165 | | | | 3,362,325 | |

| AvalonBay Communities, Inc. | | | 27,432 | | | | 5,192,055 | |

| Equity LifeStyle Properties, Inc. | | | 133,737 | | | | 8,945,668 | |

| Essex Property Trust, Inc. | | | 12,071 | | | | 2,828,235 | |

| Flagship Communities REIT | | | 241,812 | | | | 3,929,445 | |

| Invitation Homes, Inc. | | | 228,387 | | | | 7,856,513 | |

| Mid-America Apartment Communities, Inc. | | | 36,827 | | | | 5,592,548 | |

| Sun Communities, Inc. | | | 83,929 | | | | 10,949,377 | |

| UDR, Inc. | | | 195,513 | | | | 8,399,239 | |

| | | | | | | | 60,170,219 | |

| Retail REITs - 7.6% | | | | | | | | |

| Agree Realty Corp. | | | 129,384 | | | | 8,460,420 | |

| Getty Realty Corp. | | | 164,800 | | | | 5,573,536 | |

| Realty Income Corp. | | | 116,818 | | | | 6,984,548 | |

| | | | | | | | 21,018,504 | |

| Specialized REITs - 25.6% | | | | | | | | |

| American Tower Corp. | | | 31,464 | | | | 6,102,128 | |

| Equinix, Inc. | | | 41,828 | | | | 32,790,642 | |

| | | | | | | |

| | | SHARES | | | VALUE

(NOTE 2) | |

| | | | | | | | | |

| COMMON STOCKS (continued) | | | | | | | | |

| | | | | | | | | |

| Real Estate (continued) | | | | | | | | |

| Specialized REITs (continued) | | | | | | | | |

| Extra Space Storage, Inc. | | | 11,755 | | | $ | 1,749,732 | |

| Life Storage, Inc. | | | 49,514 | | | | 6,583,381 | |

| Public Storage | | | 40,874 | | | | 11,930,303 | |

| SBA Communications Corp. | | | 47,468 | | | | 11,001,184 | |

| | | | | | | | 70,157,370 | |

| Total Real Estate | | | | | | | 249,469,484 | |

| | | | | | | | | |

| TOTAL COMMON STOCKS | | | | | | | | |

| (Identified Cost $251,974,860) | | | | | | | 265,276,578 | |

| | | | | | | | | |

| SHORT-TERM INVESTMENT - 2.7% | | | | | | | | |

| Dreyfus Government Cash Management, Institutional Shares, 5.00%2 | | | | | | | | |

| (Identified Cost $7,543,639) | | | 7,543,639 | | | | 7,543,639 | |

| TOTAL INVESTMENTS - 99.4% | | | | | | | | |

| (Identified Cost $259,518,499) | | | | | | | 272,820,217 | |

| OTHER ASSETS, LESS LIABILITIES - 0.6% | | | | | | | 1,572,618 | |

| NET ASSETS - 100% | | | | | | $ | 274,392,835 | |

REIT - Real Estate Investment Trust

The accompanying notes are an integral part of the financial statements.

Real Estate Series

Investment Portfolio - June 30, 2023

(unaudited)

*Non-income producing security.

1Security purchased or received in a transaction exempt from registration under the Securities Act of 1933, as amended (the “1933 Act”) and determined to be liquid under the Fund’s Liquidity Risk Management Program. The security may be resold pursuant to an exemption from registration under the 1933 Act, typically to qualified institutional buyers. The aggregate value of these securities at June 30, 2023 was $9,128,223, which represented 3.3% of the Series’ Net Assets.

2Rate shown is the current yield as of June 30, 2023.

The Global Industry Classification Standard (GICS) was developed by and is the exclusive property and a service mark of MSCI Inc. (MSCI) and Standard & Poor’s, a division of S&P Global Inc. (S&P), and is licensed for use by Manning & Napier when referencing GICS sectors. Neither MSCI, S&P, nor any third party involved in making or compiling the GICS or any GICS classifications makes any express or implied warranties or representations with respect to such standard or classification, nor shall any such party have any liability therefrom.

The accompanying notes are an integral part of the financial statements.

Real Estate Series

Statement of Assets and Liabilities

June 30, 2023 (unaudited)

| ASSETS: | | | |

| | | | |

| Investments, at value (identified cost $259,518,499) (Note 2). | | $ | 272,820,217 | |

| Cash | | | 2,903 | |

| Receivable for fund shares sold | | | 1,148,940 | |

| Dividends receivable | | | 756,855 | |

| Foreign tax reclaims receivable | | | 736 | |

| Prepaid expenses | | | 15,501 | |

| | | | | |

| TOTAL ASSETS | | | 274,745,152 | |

| | | | | |

| LIABILITIES: | | | | |

| | | | | |

| Accrued management fees (Note 3) | | | 29,250 | |

| Accrued sub-transfer agent fees (Note 3) | | | 26,778 | |

| Accrued fund accounting and administration fees (Note 3) | | | 14,959 | |

| Accrued distribution and service (Rule 12b-1) fees (Class S) (Note 3) | | | 7,006 | |

| Accrued Chief Compliance Officer service fees (Note 3) | | | 4,087 | |

| Payable for fund shares repurchased | | | 208,229 | |

| Professional fees payable | | | 34,064 | |

| Other payables and accrued expenses | | | 27,944 | |

| | | | | |

| TOTAL LIABILITIES | | | 352,317 | |

| | | | | |

| TOTAL NET ASSETS | | $ | 274,392,835 | |

| | | | | |

| NET ASSETS CONSIST OF: | | | | |

| | | | | |

| Capital stock | | $ | 193,755 | |

| Additional paid-in-capital | | | 256,421,769 | |

| Total distributable earnings (loss) | | | 17,777,311 | |

| | | | | |

| TOTAL NET ASSETS | | $ | 274,392,835 | |

| | | | | |

| NET ASSET VALUE, OFFERING PRICE AND REDEMPTION PRICE PER SHARE - Class S | | | | |

| ($34,450,997/2,439,163 shares) | | $ | 14.12 | |

| | | | | |

| NET ASSET VALUE, OFFERING PRICE AND REDEMPTION PRICE PER SHARE - Class I | | | | |

| ($32,989,992/2,328,828 shares)1 | | $ | 14.17 | |

| | | | | |

| NET ASSET VALUE, OFFERING PRICE AND REDEMPTION PRICE PER SHARE - Class W | | | | |

| ($204,908,877/14,463,214 shares) | | $ | 14.17 | |

| | | | | |

| NET ASSET VALUE, OFFERING PRICE AND REDEMPTION PRICE PER SHARE - Class Z | | | | |

| ($2,042,969/144,342 shares)1 | | $ | 14.15 | |

The accompanying notes are an integral part of the financial statements.

Real Estate Series

Statement of Operations

For the Six Months Ended June 30, 2023 (unaudited)

| INVESTMENT INCOME: | | | | |

| | | | | |

| Dividends | | $ | 5,004,311 | |

| | | | | |

| EXPENSES: | | | | |

| | | | | |

| Management fees (Note 3) | | | 819,250 | |

| Sub-transfer agent fees (Note 3) | | | 49,857 | |

| Distribution and service (Rule 12b-1) fees (Class S) (Note 3) | | | 42,722 | |

| Fund accounting and administration fees (Note 3) | | | 42,112 | |

| Directors’ fees (Note 3) | | | 15,939 | |

| Chief Compliance Officer service fees (Note 3) | | | 4,087 | |

| Custodian fees | | | 4,313 | |

| Miscellaneous | | | 120,776 | |

| | | | | |

| Total Expenses | | | 1,099,056 | |

| Less reduction of expenses (Note 3) | | | (656,181 | ) |

| | | | | |

| Net Expenses | | | 442,875 | |

| | | | | |

| NET INVESTMENT INCOME | | | 4,561,436 | |

| | | | | |

| REALIZED AND UNREALIZED GAIN (LOSS) ON INVESTMENTS AND FOREIGN CURRENCY: | | | | |

| | | | | |

| Net realized gain (loss) on- | | | | |

| Investments | | | (870 | ) |

| Foreign currency and translation of other assets and liabilities | | | 239 | |

| | | | | |

| | | | (631 | ) |

| Net change in unrealized appreciation (depreciation) on- | | | | |

| Investments | | | 15,544,564 | |

| Foreign currency and translation of other assets and liabilities | | | 491 | |

| | | | | |

| | | | 15,545,055 | |

| | | | | |

| NET REALIZED AND UNREALIZED GAIN (LOSS) ON INVESTMENTS AND FOREIGN CURRENCY | | | 15,544,424 | |

| | | | | |

| NET INCREASE IN NET ASSETS RESULTING FROM OPERATIONS | | $ | 20,105,860 | |

The accompanying notes are an integral part of the financial statements.

Real Estate Series

Statements of Changes in Net Assets

| | | FOR THE | | | | |

| | | SIX MONTHS | | | | |

| | | ENDED | | | FOR THE | |

| | | 6/30/23 | | | YEAR ENDED | |

| | | (UNAUDITED) | | | 12/31/22 | |

| INCREASE (DECREASE) IN NET ASSETS: | | | | | | | | |

| | | | | | | | | |

| OPERATIONS: | | | | | | | | |

| | | | | | | | | |

| Net investment income | | $ | 4,561,436 | | | $ | 5,373,826 | |

| Net realized gain (loss) on investments and foreign currency | | | (631 | ) | | | 30,154,454 | |

| Net change in unrealized appreciation (depreciation) on investments and foreign currency | | | 15,545,055 | | | | (135,524,555 | ) |

| | | | | | | | | |

| Net increase (decrease) from operations | | | 20,105,860 | | | | (99,996,275 | ) |

| | | | | | | | | |

| DISTRIBUTIONS TO SHAREHOLDERS (Note 10): | | | | | | | | |

| | | | | | | | | |

| Class S | | | – | | | | (4,530,110 | ) |

| Class I | | | – | | | | (4,983,168 | ) |

| Class W | | | – | | | | (28,120,697 | ) |

| Class Z | | | – | | | | (312,579 | ) |

| Total distributions to shareholders. | | | – | | | | (37,946,554 | ) |

| | | | | | | | | |

| CAPITAL STOCK ISSUED AND REPURCHASED: | | | | | | | | |

| | | | | | | | | |

| Net increase (decrease) from capital share transactions (Note 5) | | | (9,505,883 | ) | | | 11,190,953 | |

| | | | | | | | | |

| Net increase (decrease) in net assets | | | 10,599,977 | | | | (126,751,876 | ) |

| | | | | | | | | |

| NET ASSETS: | | | | | | | | |

| | | | | | | | | |

| Beginning of period | | | 263,792,858 | | | | 390,544,734 | |

| | | | | | | | | |

| End of period | | $ | 274,392,835 | | | $ | 263,792,858 | |

The accompanying notes are an integral part of the financial statements.

Real Estate Series

Financial Highlights - Class S

| | | FOR THE | | FOR THE YEAR ENDED |

| | | SIX MONTHS | | | | | | | | | | |

| | | ENDED | | | | | | | | | | |

| | | 6/30/23 | | | | | | | | | | | | | | | | |

| | | (UNAUDITED) | | | 12/31/22 | | | 12/31/21 | | | 12/31/20 | | | 12/31/19 | | | 12/31/18 | |

| Per share data (for a share outstanding throughout each period): | | | | | | | | | | | | | | | | | | |

| Net asset value - Beginning of period | | $13.17 | | | $20.66 | | | $14.92 | | | $16.31 | | | $13.09 | | | $14.93 | |

| Income (loss) from investment operations: | | | | | | | | | | | | | | | | | | |

| Net investment income1 | | 0.18 | | | 0.16 | | | 0.12 | | | 0.12 | 2 | | 0.15 | | | 0.26 | |

| Net realized and unrealized gain (loss) on investments | | 0.77 | | | (5.63 | ) | | 6.35 | | | (1.15 | ) | | 3.65 | | | (1.24 | ) |

| Total from investment operations | | 0.95 | | | (5.47 | ) | | 6.47 | | | (1.03 | ) | | 3.80 | | | (0.98 | ) |

| Less distributions to shareholders: | | | | | | | | | | | | | | | | | | |

| From net investment income | | — | | | (0.23 | ) | | (0.10 | ) | | (0.13 | ) | | (0.16 | ) | | (0.21 | ) |

| From net realized gain on investments | | — | | | (1.79 | ) | | (0.63 | ) | | (0.19 | ) | | (0.42 | ) | | (0.63 | ) |

| From return of capital | | — | | | — | | | — | | | (0.04 | ) | | — | | | (0.02 | ) |

| Total distributions to shareholders | | — | | | (2.02 | ) | | (0.73 | ) | | (0.36 | ) | | (0.58 | ) | | (0.86 | ) |

| Net asset value - End of period | | $14.12 | | | $13.17 | | | $20.66 | | | $14.92 | | | $16.31 | | | $13.09 | |

| Net assets - End of period (000’s omitted) | | $34,451 | | | $33,005 | | | $48,549 | | | $37,762 | | | $59,923 | | | $214,722 | |

| Total return3 | | 7.21% | | | (26.96% | ) | | 43.67% | | | (6.27% | ) | | 29.14% | 4 | | (6.73% | ) |

| Ratios (to average net assets)/Supplemental Data: | | | | | | | | | | | | | | | | | | |

| Expenses* | | 1.10% | 5 | | 1.10% | | | 1.10% | | | 1.10% | | | 1.11% | | | 1.11% | |

| Net investment income | | 2.56% | 5 | | 0.96% | | | 0.66% | | | 0.81% | 2 | | 1.02% | | | 1.82% | |

| Series portfolio turnover | | 23% | | | 43% | | | 26% | | | 69% | | | 24% | | | 44% | |

| | | | | | | | | | | | | | | | | | | |

| *For certain periods presented, the investment advisor did not impose all or a portion of its management and/or other fees, and in some periods may have paid a portion of the Series’ expenses. If these expenses had been incurred by the Class, the expense ratio (to average net assets) would have increased by the following amounts: |

| |

| | | 0.04% | 5 | | 0.02% | | | 0.01% | | | 0.03% | | | 0.00% | 6 | | N/A | |

1 Calculated based on average shares outstanding during the periods.

2 Includes special dividends from two of the Series’ securities. Excluding this amount, the net investment income per share would have been $0.11 and the net investment income ratio would have been 0.72%.

3 Represents aggregate total return for the periods indicated, and assumes reinvestment of all distributions. Total return would have been lower had certain expenses not been waived or reimbursed during certain periods. Periods less than one year are not annualized.

4 Includes litigation proceeds. Excluding this amount, the total return is 29.06%.

5 Annualized.

6 Less than 0.01%.

The accompanying notes are an integral part of the financial statements.

Real Estate Series

Financial Highlights - Class I1

| | | FOR THE | | FOR THE YEAR ENDED |

| | | SIX MONTHS | | | | | | | | | | |

| | | ENDED | | | | | | | | | | |

| | | 6/30/23 | | | | | | | | | | | | | | | |

| | | (UNAUDITED) | | 12/31/22 | | | 12/31/21 | | | 12/31/20 | | | 12/31/19 | | | 12/31/18 | |

| Per share data (for a share outstanding throughout each period): | | | | | | | | | | | | | | | | | | |

| Net asset value - Beginning of period | | $13.19 | | | $20.71 | | | $16.04 | | | $18.35 | | | $15.67 | | | $19.40 | |

| Income (loss) from investment operations: | | | | | | | | | | | | | | | | | | |

| Net investment income2 | | 0.19 | | | 0.21 | | | 0.17 | | | 0.17 | 3 | | 0.31 | | | 0.40 | |

| Net realized and unrealized gain (loss) on investments | | 0.79 | | | (5.66 | ) | | 6.78 | | | (1.28 | ) | | 4.25 | | | (1.57 | ) |

| Total from investment operations | | 0.98 | | | (5.45 | ) | | 6.95 | | | (1.11 | ) | | 4.56 | | | (1.17 | ) |

| Less distributions to shareholders: | | | | | | | | | | | | | | | | | | |

| From net investment income | | — | | | (0.28 | ) | | (0.48 | ) | | (0.52 | ) | | (0.68 | ) | | (0.68 | ) |

| From net realized gain on investments | | — | | | (1.79 | ) | | (1.80 | ) | | (0.54 | ) | | (1.20 | ) | | (1.79 | ) |

| From return of capital | | — | | | — | | | — | | | (0.14 | ) | | — | | | (0.09 | ) |

| Total distributions to shareholders | | — | | | (2.07 | ) | | (2.28 | ) | | (1.20 | ) | | (1.88 | ) | | (2.56 | ) |

| Net asset value - End of period | | $14.17 | | | $13.19 | | | $20.71 | | | $16.04 | | | $18.35 | | | $15.67 | |

| Net assets - End of period (000’s omitted) | | $32,990 | | | $34,719 | | | $51,320 | | | $30,787 | | | $50,025 | | | $50,111 | |

| Total return4 | | 7.43% | | | (26.83% | ) | | 44.14% | | | (5.96% | ) | | 29.31% | | | (6.41% | ) |

| Ratios (to average net assets)/Supplemental Data: | | | | | | | | | | | | | | | | | | |

| Expenses* | | 0.85% | 5 | | 0.85% | | | 0.84% | 6 | | 0.85% | | | 0.84% | | | 0.86% | |

| Net investment income | | 2.79% | 5 | | 1.20% | | | 0.92% | | | 1.02% | 3 | | 1.62% | | | 2.12% | |

| Series portfolio turnover | | 23% | | | 43% | | | 26% | | | 69% | | | 24% | | | 44% | |

| | | | | | | | | | | | | | | | | | | |

| *For certain periods presented, the investment advisor did not impose all or a portion of its management and/or other fees, and in some periods may have paid a portion of the Series’ expenses. If these expenses had been incurred by the Class, the expense ratio (to average net assets) would have increased by the following amounts: |

| |

| | | 0.03% | 5 | | 0.01% | | | N/A | | | 0.01% | | | N/A | | | N/A | |

1 Share amounts include a reverse stock split effective after the close of business on November 4, 2022. See Note 1 of the Notes to Financial Statements.

2 Calculated based on average shares outstanding during the periods.

3 Includes special dividends from two of the Series’ securities. Excluding this amount, the net investment income per share would have been $0.14 and the net investment income ratio would have been 0.93%.

4 Represents aggregate total return for the periods indicated, and assumes reinvestment of all distributions. Total return would have been lower had certain expenses not been waived or reimbursed during certain periods. Periods less than one year are not annualized.

5 Annualized.

6 Includes recoupment of past waived and/or reimbursed fees. Excluding this amount, the expense ratio (to average net assets) would have decreased by less than 0.01%.

The accompanying notes are an integral part of the financial statements.

Real Estate Series

Financial Highlights - Class W

| | | FOR THE | | FOR THE YEAR ENDED | | | | FOR THE |

| | | SIX MONTHS | | | | | | | | PERIOD |

| | | ENDED 6/30/23 | | | | | | | | 3/1/191 TO |

| | | (UNAUDITED) | | 12/31/22 | | 12/31/21 | | 12/31/20 | | 12/31/19 |

| Per share data (for a share outstanding throughout each period): | | | | | | | | | | | | | | | |

| Net asset value - Beginning of period | | $13.14 | | | $20.65 | | | $14.89 | | | $16.27 | | | $14.76 | |

| Income (loss) from investment operations: | | | | | | | | | | | | | | | |

| Net investment income2 | | 0.25 | | | 0.33 | | | 0.29 | | | 0.33 | 3 | | 0.35 | |

| Net realized and unrealized gain (loss) on investments | | 0.78 | | | (5.64 | ) | | 6.38 | | | (1.20 | ) | | 1.91 | |

| Total from investment operations | | 1.03 | | | (5.31 | ) | | 6.67 | | | (0.87 | ) | | 2.26 | |

| Less distributions to shareholders: | | | | | | | | | | | | | | | |

| From net investment income | | — | | | (0.41 | ) | | (0.29 | ) | | (0.25 | ) | | (0.33 | ) |

| From net realized gain on investments | | — | | | (1.79 | ) | | (0.63 | ) | | (0.19 | ) | | (0.42 | ) |

| From return of capital | | — | | | — | | | — | | | (0.07 | ) | | — | |

| Total distributions to shareholders | | — | | | (2.20 | ) | | (0.92 | ) | | (0.51 | ) | | (0.75 | ) |

| Net asset value - End of period | | $14.17 | | | $13.14 | | | $20.65 | | | $14.89 | | | $16.27 | |

| Net assets - End of period (000’s omitted) | | $204,909 | | | $194,053 | | | $288,394 | | | $214,871 | | | $191,373 | |

| Total return4 | | 7.84% | | | (26.26% | ) | | 45.19% | | | (5.33% | ) | | 15.43% | 5 |

| Ratios (to average net assets)/Supplemental Data: | | | | | | | | | | | | | | | |

| Expenses* | | 0.10% | 6 | | 0.10% | | | 0.10% | | | 0.10% | | | 0.10% | 6 |

| Net investment income | | 3.57% | 6 | | 1.95% | | | 1.66% | | | 2.27% | 3 | | 2.58% | 6 |

| Series portfolio turnover | | 23% | | | 43% | | | 26% | | | 69% | | | 24% | |

| | | | | | | | | | | | | | | | |

| *The investment advisor did not impose all or a portion of its management and/or other fees during the periods, and may have paid a portion of the Series’ expenses. If these expenses had been incurred by the Class, the expense ratio (to average net assets)would have increased by the following amounts: |

| |

| | | 0.64% | 6 | | 0.62% | | | 0.61% | | | 0.64% | | | 0.62% | 6 |

1 Commencement of operations.

2 Calculated based on average shares outstanding during the periods.

3 Includes special dividends from two of the Series’ securities. Excluding this amount, the net investment income per share would have been $0.31 and the net investment income ratio would have been 2.14%.

4 Represents aggregate total return for the periods indicated, and assumes reinvestment of all distributions. Total return would have been lower had certain expenses not been waived or reimbursed during the periods. Periods less than one year are not annualized.

5 Includes litigation proceeds. Excluding this amount, the total return would have been 15.36%.

6Annualized.

The accompanying notes are an integral part of the financial statements.

Real Estate Series

Financial Highlights - Class Z1

| | | FOR THE | | FOR THE YEAR ENDED | | FOR THE |

| | | SIX MONTHS | | | | | | | | PERIOD |

| | | ENDED 6/30/23 | | | | | | | | 3/1/192 TO |

| | | (UNAUDITED) | | 12/31/22 | | 12/31/21 | | 12/31/20 | | 12/31/19 |

| Per share data (for a share outstanding throughout each period): | | | | | | | | | | | | | | | |

| Net asset value - Beginning of period | | $13.17 | | | $20.67 | | | $15.99 | | | $18.32 | | | $17.61 | |

| Income (loss) from investment operations: | | | | | | | | | | | | | | | |

| Net investment income3 | | 0.21 | | | 0.25 | | | 0.23 | | | 0.25 | 4 | | 0.23 | |

| Net realized and unrealized gain (loss) on investments | | 0.77 | | | (5.66 | ) | | 6.75 | | | (1.36 | ) | | 2.38 | |

| Total from investment operations | | 0.98 | | | (5.41 | ) | | 6.98 | | | (1.11 | ) | | 2.61 | |

| Less distributions to shareholders: | | | | | | | | | | | | | | | |

| From net investment income | | — | | | (0.30 | ) | | (0.51 | ) | | (0.54 | ) | | (0.71 | ) |

| From net realized gain on investments | | — | | | (1.79 | ) | | (1.79 | ) | | (0.54 | ) | | (1.19 | ) |

| From return of capital | | — | | | — | | | — | | | (0.14 | ) | | — | |

| Total distributions to shareholders | | — | | | (2.09 | ) | | (2.30 | ) | | (1.22 | ) | | (1.90 | ) |

| Net asset value - End of period | | $14.15 | | | $13.17 | | | $20.67 | | | $15.99 | | | $18.32 | |

| Net assets - End of period (000’s omitted) | | $2,043 | | | $2,016 | | | $2,281 | | | $549 | | | $539 | |

| Total return5 | | 7.44% | | | (26.67% | ) | | 44.36% | | | (5.96% | ) | | 14.98% | 6 |

| Ratios (to average net assets)/Supplemental Data: | | | | | | | | | | | | | | | |

| Expenses* | | 0.70% | 7 | | 0.70% | | | 0.70% | | | 0.70% | | | 0.70% | 7 |

| Net investment income | | 2.97% | 7 | | 1.51% | | | 1.15% | | | 1.51% | 4 | | 1.42% | 7 |

| Series portfolio turnover | | 23% | | | 43% | | | 26% | | | 69% | | | 24% | |

| | | | | | | | | | | | | | | | |

| *The investment advisor did not impose all or a portion of its management and/or other fees during the periods, and may have paid a portion of the Series’ expenses. If these expenses had been incurred by the Class, the expense ratio (to average net assets)would have increased by the following amounts: |

| |

| | | 0.04% | 7 | | 0.02% | | | 0.01% | | | 0.04% | | | 0.02% | 7 |

1 Share amounts include a reverse stock split effective after the close of business on November 4, 2022. See Note 1 of the Notes to Financial Statements.

2 Commencement of operations.

3 Calculated based on average shares outstanding during the periods.

4 Includes special dividends from two of the Series’ securities. Excluding this amount, the net investment income per share would have been $0.23 and the net investment income ratio would have been 1.39%.

5 Represents aggregate total return for the periods indicated, and assumes reinvestment of all distributions. Total return would have been lower had certain expenses not been waived or reimbursed during the periods. Periods less than one year are not annualized.

6 Includes litigation proceeds. Excluding this amount, the total return would have been 14.62%

7Annualized.

The accompanying notes are an integral part of the financial statements.

Real Estate Series

Notes to Financial Statements

(unaudited)

Real Estate Series (the “Series”) is a no-load diversified series of Manning & Napier Fund, Inc. (the “Fund”). The Fund is organized in Maryland and is registered under the Investment Company Act of 1940, as amended, as an open-end management investment company.

The Series’ investment objective is to provide high current income and long-term capital appreciation by investing principally in companies in the real estate industry.

The Fund’s advisor is Manning & Napier Advisors, LLC (the “Advisor”). Shares of the Series are offered to investors, clients and employees of the Advisor and its affiliates. The Series is authorized to issue four classes of shares (Class S, I, W, and Z). Each class of shares is substantially the same, except that class specific distribution and shareholder servicing expenses are borne by the specific class of shares to which they relate. The total authorized capital stock of the Fund consists of 15 billion shares of common stock each having a par value of $0.01. As of June 30, 2023, 6.4 billion shares have been designated in total among 15 series, of which 100 million have been designated as Real Estate Series Class I common stock, Real Estate Series Class S common stock and Real Estate Series Class Z common stock and 75 million have been designated as Real Estate Series Class W common stock.

On November 4, 2022, a Reverse Stock Split, approved by the Fund's Board of Directors, was executed for Class I and Z of the Series after the close of trading. Shareholders who owned Class I and Z shares of the Series received a proportional number of Class I and Z shares of the Series. Following the Reverse Stock Split, the total dollar value of a shareholder's investment in the Series remained unchanged and each shareholder owned the same percentage (by value) of the Series as the shareholder did immediately prior to the Reverse Stock Split. Reverse Stock Split Ratios for the impacted Series/Classes are as follows:

| CLASS | REVERSE STOCK SPLIT RATIO (old to new) |

| Class I | 1 : 0.351034 |

| Class Z | 1 : 0.352711 |

| 2. | Significant Accounting Policies |

The following is a summary of significant accounting policies followed by the Series. The Series is an investment company and, accordingly, follows the investment company accounting and reporting guidance of the Financial Accounting Standards Board Accounting Standards Codification Topic 946 - Investment Companies, which is part of accounting principles generally accepted in the United States of America (“GAAP”).

Security Valuation

Portfolio securities, including domestic equities, foreign equities, warrants and options, listed on an exchange other than the NASDAQ Stock Market are valued at the latest quoted sales price of the exchange on which the security is primarily traded. Securities not traded on valuation date or securities not listed on an exchange are valued at the latest quoted bid price provided by the Fund’s pricing service. Securities listed on the NASDAQ Stock Market are valued in accordance with the NASDAQ Official Closing Price.

Short-term investments that mature in sixty days or less may be valued at amortized cost, which approximates fair value.

Investments in open-end investment companies are valued at their net asset value per share on valuation date.

Volume and level of activity in established markets for an asset or liability are evaluated to determine whether recent transactions and quoted prices are determinative of fair value. Where there have been significant decreases in volume and level of activity, further analysis and adjustment may be necessary to estimate fair value. In these instances fair value is measured by the use of inputs and valuation techniques which may be based upon current market prices of securities that are comparable in coupon, rating, maturity and industry and/or expectation of future cash flows. As a result of trading in relatively thin markets and/or markets that experience significant volatility, the prices used to value these securities may differ from the value that would be realized if these securities were sold, and the differences could be material.

Real Estate Series

Notes to Financial Statements (continued)

(unaudited)

| 2. | Significant Accounting Policies (continued) |

Fair Value

The Series’ financial instruments are valued at the close of the NYSE and are reported at fair value, which GAAP defines as the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date. The Board has designated the Advisor as the Fund’s valuation designee (Valuation Designee) to make all fair value determinations with respect to each Series’ portfolio investments. Subject to oversight by the Board, the Valuation Designee performs the following functions in performing fair value determinations: assesses and manages valuation risks; establishes and applies fair value methodologies; tests fair value methodologies; and evaluates pricing vendors and pricing agents. The Advisor has adopted and implemented policies and procedures to be followed when making fair value determinations, and it has established a Valuation Committee through which the Advisor makes fair value determinations. The Valuation Designee provides periodic reporting to the Board on valuation matters. The Advisor’s determination of a security’s fair value price often involves the consideration of a number of subjective factors, and is therefore subject to the unavoidable risk that the value assigned to a security may be higher or lower than the security’s value would be if a reliable market quotation for the security was readily available. If trading or events occurring after the close of the principal market in which securities are traded are expected to materially affect the value of those securities, then they may be valued at their fair value, taking this trading or these events into account. The Advisor may use a pricing service to obtain the value of the Fund’s portfolio securities where the prices provided by such pricing service are believed to reflect the fair market value of such securities. The methods used by the pricing service and the valuations so established will be reviewed by the Advisor under the general supervision of the Fund’s Board of Directors. Several pricing services are available, one or more of which may be used by the Advisor, as approved by the Board. A change in a pricing service or a material change in a pricing methodology for investments with no readily available market quotations will be reported to the Board by the Advisor in accordance with certain requirements.

GAAP establishes the following fair value hierarchy that categorizes the inputs used to measure fair value. Level 1 includes quoted prices (unadjusted) in active markets for identical financial instruments that the Series’ can access at the reporting date. Level 2 includes other significant observable inputs (including, but not limited to, quoted prices for similar financial instruments in active markets, quoted prices for identical or similar financial instruments in inactive markets, interest rates and yield curves, implied volatilities, and credit spreads). Level 3 includes unobservable inputs (including the Valuation Designee’s own assumptions in determining fair value). A financial instrument’s level within the fair value hierarchy is based on the lowest level of any input both individually and in aggregate that is significant to the fair value measurement. The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities.

The following is a summary of the valuation levels used for major security types as of June 30, 2023 in valuing the Series’ assets or liabilities carried at fair value:

| DESCRIPTION | | TOTAL | | | LEVEL 1 | | | LEVEL 2# | | | LEVEL 3 | |

| Assets: |

| Equity securities: |

| Communication Services | | $ | 11,803,068 | | | $ | — | | | $ | 11,803,068 | | | $ | — | |

| Consumer Discretionary | | | 4,004,026 | | | | 4,004,026 | | | | — | | | | — | |

| Real Estate* | | | 249,469,484 | | | | 249,469,484 | | | | — | | | | — | |

| Short-Term Investment | | | 7,543,639 | | | | 7,543,639 | | | | — | | | | — | |

| Total assets | | $ | 272,820,217 | | | $ | 261,017,149 | | | $ | 11,803,068 | | | $ | — | |

*Please refer to the Investment Portfolio for the industry classifications of these portfolio holdings.

#Includes certain foreign equity securities for which a factor from a third party vendor was applied to determine the securities’ fair value following the close of local trading.

There were no Level 3 securities held by the Series as of December 31, 2022 or June 30, 2023.

Real Estate Series

Notes to Financial Statements (continued)

(unaudited)

| 2. | Significant Accounting Policies (continued) |

Security Transactions, Investment Income and Expenses

Security transactions are accounted for on trade date. Dividend income is recorded on the ex-dividend date, except that if the ex-dividend date has passed, certain dividends from foreign securities are recorded as soon as the Series is informed of the ex-dividend date. Non-cash dividends, if any, are recorded at the fair value of the securities received. Interest income, including amortization of premium and accretion of discounts using the effective interest method, is earned from settlement date and accrued daily.

Expenses are recorded on an accrual basis. Most expenses of the Fund can be attributed to a specific series. Expenses which cannot be directly attributed are apportioned among the series in the Fund in such a manner as deemed equitable by the Fund’s Board, taking into consideration, among other things, the nature and type of expense. Income, expenses (other than shareholder services fees), and realized and unrealized gains and losses are prorated among the classes based on the relative net assets of each class. Class specific expenses are directly charged to that Class.

The Fund records distributions received in excess of income from underlying investments as a reduction of cost of investments and/or realized gain. Such amounts are based on estimates if actual amounts are not available and actual amounts of income, realized gain and return of capital may differ from the estimated amounts. The Fund adjusts the estimated amounts of components of distributions (and consequently its net investment income) as necessary once the issuers provide information about the actual composition of the distributions.

The Series uses the identified cost method for determining realized gain or loss on investments for both financial statement and federal income tax reporting purposes.

Foreign Currency Translation

The books and records of the Series are maintained in U.S. dollars. Foreign currencies, investments and other assets and liabilities are translated into U.S. dollars at the current exchange rates. Purchases and sales of investment securities and income and expenses are translated on the respective dates of such transactions. The Series does not isolate realized and unrealized gains and losses attributable to changes in the exchange rates from gains and losses that arise from changes in the market value of investments. Such fluctuations are included with net realized and unrealized gain or loss on investments. Net realized foreign currency gains and losses represent foreign currency gains and losses between trade date and settlement date on securities transactions, gains and losses on disposition of foreign currencies and the difference between the amount of income and foreign withholding taxes recorded on the books of the Series and the amounts actually received or paid.

Federal Taxes

The Series’ policy is to comply with the provisions of the Internal Revenue Code applicable to regulated investment companies. The Series is not subject to federal income tax or excise tax to the extent that the Series distributes to shareholders each year its taxable income, including any net realized gains on investments, in accordance with requirements of the Internal Revenue Code. Accordingly, no provision for federal income tax or excise tax has been made in the financial statements.

Management evaluates its tax positions to determine if the tax positions taken meet the minimum recognition threshold in connection with accounting for uncertainties in income tax positions taken or expected to be taken for the purposes of measuring and recognizing tax liabilities in the financial statements. Recognition of tax benefits of an uncertain tax position is required only when the position is “more likely than not” to be sustained assuming examination by taxing authorities. At June 30, 2023, the Series has recorded no liability for net unrecognized tax benefits relating to uncertain income tax positions taken or expected to be taken in future tax returns.

The Series files income tax returns in the U.S. federal jurisdiction, various states and foreign jurisdictions, as required. No income tax returns are currently under investigation. The statute of limitations on the Series’ tax returns remains open for the years ended December 31, 2019 through December 31, 2022. The Series is not aware of any tax positions for which it is reasonably possible that the total amounts of unrecognized tax benefits will significantly change in the next twelve months.

Real Estate Series

Notes to Financial Statements (continued)

(unaudited)

| 2. | Significant Accounting Policies (continued) |

Foreign Taxes

Based on the Series’ understanding of the tax rules and rates related to income, gains and currency purchase/repatriation transactions for foreign jurisdictions in which it invests, the Series will provide for foreign taxes, and where appropriate, deferred foreign tax.

Distributions of Income and Gains

Distributions to shareholders of net investment income and net realized gains are made annually. An additional distribution may be necessary to avoid taxation of the Series. Distributions are recorded on the ex-dividend date.

Indemnifications

The Fund’s organizational documents provide former and current directors and officers with a limited indemnification against liabilities arising in connection with the performance of their duties to the Fund. In the normal course of business, the Fund may also enter into contracts that provide general indemnifications. The Fund’s maximum exposure under these arrangements is unknown as this would be dependent on future claims that may be made against the Fund. The risk of material loss from such claims is considered remote.

Other

The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and the disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of income and expenses during the reporting period. Actual results could differ from those estimates.

| 3. | Transactions with Affiliates |

The Fund has an Investment Advisory Agreement (the “Agreement”) with the Advisor, for which the Series pays a fee, computed daily and payable monthly, at an annual rate of 0.60% of the Series’ average daily net assets.

Under the Agreement, personnel of the Advisor provide the Series with advice and assistance in the choice of investments and the execution of securities transactions, and otherwise maintain the Series’ organization. The Advisor also provides the Fund with necessary office space and fund administration and support services. The salaries of all officers of the Fund (except a percentage of the Fund’s Chief Compliance Officer’s salary, which is paid by the Fund), and of all Directors who are “affiliated persons” of the Fund, or of the Advisor, and all personnel of the Fund, or of the Advisor, performing services relating to research, statistical and investment activities, are paid by the Advisor. Each “non-affiliated” Director receives an annual stipend, which is allocated among all the active series of the Fund. In addition, these Directors also receive a fee per Board meeting attended plus a fee for each committee meeting attended and are reimbursed for travel and other out-of-pocket expenses incurred by them in connection with attending such meetings. The Fund also has an Audit Committee Chair, Governance & Nominating Committee Chair and Lead Independent Director, who each receive an additional annual stipend for these roles.

The Fund may enter into agreements with financial intermediaries pursuant to which the Fund may pay financial intermediaries for non-distribution related sub-transfer agency, administrative, sub-accounting, and other shareholder services in an annual amount not to exceed 0.15% of the average daily net assets of the Class I and Class S shares of the Series. Payments made pursuant to such agreements are generally based on the current assets and/or number of accounts of the Series attributable to the financial intermediary. Any payments made pursuant to such agreements may be in addition to, rather than in lieu of, any Distribution and Shareholder Services Fee payable under the Rule 12b-1 plan of the Fund. For the six months ended June 30, 2023, the sub-transfer agency expenses incurred by Class S and Class I were $25,289 and $24,568 respectively.

Manning & Napier Investor Services, Inc., a registered broker-dealer affiliate of the Advisor, acts as distributor for the Fund’s shares. The Series compensates the distributor for distributing and servicing the Series’ Class S shares pursuant to a distribution plan adopted under Rule 12b-1 of the 1940 Act, regardless of expenses actually incurred. Under the agreement, the Series pays distribution and service fees to the distributor at an annual rate of 0.25% of average daily net assets attributable to Class S shares. There are no distribution and service fees on the Class I, Class W or Class Z shares. The fees are accrued daily and paid monthly.

Real Estate Series

Notes to Financial Statements (continued)

(unaudited)

| 3. | Transactions with Affiliates (continued) |

Pursuant to a master services agreement, the Fund pays the Advisor an annual fee related to fund accounting and administration of 0.0085% on the first $25 billion of average daily net assets; 0.0075% on the next $15 billion of average daily net assets; and 0.0065% of average daily net assets in excess of $40 billion; plus a base fee of $30,400 per series. Additionally, certain transaction and out-of-pocket expenses, including charges for reporting relating to the Fund’s compliance program, are charged. The Advisor has agreements with BNY Mellon Investment Servicing (U.S.) Inc. (“BNY”) under which BNY serves as sub-accountant services agent.

Pursuant to an advisory fee waiver agreement, the Advisor has contractually agreed to waive the management fee for the Class W shares. The full management fee will be waived under this agreement because Class W shares are only available to discretionary investment accounts and other accounts managed by the Advisor. These clients pay a management fee to the Advisor that is separate from the Fund’s expenses. In addition, pursuant to a separate expense limitation agreement, the Advisor has contractually agreed to limit its fees and reimburse expenses to the extent necessary so that the total direct annual fund operating expenses, exclusive of the shareholder services fee and/or distribution and service (12b-1) fees and waived Class W management fees (collectively, “excluded expenses”), do not exceed 0.85% of the average daily net assets of the Class S and Class I shares, 0.10% of the average daily net assets of the Class W shares, and 0.70% of the average daily net assets of the Class Z shares. These contractual waivers are expected to continue indefinitely, and may not be amended or terminated by the Advisor without the approval of the Series’ Board of Directors. The Advisor may receive from a Class the difference between the Class’s total direct annual fund operating expenses, not including excluded expenses, and the Class’s contractual expense limit to recoup all or a portion of its prior fee waivers (other than Class W management fee waivers) or expense reimbursements made during the rolling three-year period preceding the recoupment if at any point the total direct annual fund operating expenses, not including excluded expenses, are below the contractual expense limit (a) at the time of the fee waiver and/or expense reimbursement and (b) at the time of the recoupment.

Pursuant to the advisory fee waiver, the Advisor waived $607,052 in management fees for Class W for the six months ended June 30, 2023. In addition, pursuant to the separate expense limitation agreement, the Advisor waived or reimbursed expenses of $6,002, $5,134, $37,589 and $404 for Class S, Class I Class W and Class Z, respectively, for the six months ended June 30, 2023. These amounts are included as a reduction of expenses on the Statement of Operations.

As of June 30, 2023, the class specific waivers or reimbursements subject to possible future recoupment under the expense limitation agreement are as follows:

| CLASS | | | EXPIRING DECEMBER 31, | | | |

| | | 2023 | | | | 2024 | | | | 2025 | | | | 2026 | | | | TOTAL | |

| Class S | | $ | 12,058 | | | $ | 2,956 | | | $ | 7,032 | | | $ | 6,002 | | | $ | 28,048 | |

| Class I | | | 5 | | | | — | | | | 2,875 | | | | 5,134 | | | | 8,014 | |

| Class W | | | 67,990 | | | | 30,356 | | | | 48,609 | | | | 37,589 | | | | 184,544 | |

| Class Z | | | 190 | | | | 96 | | | | 417 | | | | 404 | | | | 1,107 | |

For the six months ended June 30, 2023, the Advisor did not recoup any expenses that have been previously waived or reimbursed.

| 4. | Purchases and Sales of Securities |

For the six months ended June 30, 2023, purchases and sales of securities, other than U.S. Government securities and short-term securities, were $62,088,325 and $73,009,501, respectively. There were no purchases or sales of U.S. Government securities.

Real Estate Series

Notes to Financial Statements (continued)

(unaudited)

| 5. | Capital Stock Transactions |

Transactions in Class S, Class I, Class W and Class Z shares of Real Estate Series were:

| CLASS S | | FOR THE SIX MONTHS

ENDED 6/30/23 | | | FOR THE YEAR ENDED

12/31/22 | |

| | | SHARES | | | AMOUNT | | | SHARES | | | AMOUNT | |

| Sold | | 220,032 | | | $ | 3,061,763 | | | 346,357 | | | $ | 6,141,623 | |

| Reinvested | | — | | | | — | | | 314,796 | | | | 4,363,076 | |

| Repurchased | | (287,831 | ) | | | (4,015,366 | ) | | (503,878 | ) | | | (8,548,741 | ) |

| Total | | (67,799 | ) | | $ | (953,603 | ) | | 157,275 | | | $ | 1,955,958 | |

| | | | | | | | | | | | | | | |

| CLASS I | | FOR THE SIX MONTHS

ENDED 6/30/23 | | | FOR THE YEAR ENDED

12/31/22 | |

| | | SHARES1 | | | AMOUNT | | | SHARES1 | | | AMOUNT | |

| Sold | | 258,241 | | | $ | 3,630,988 | | | 856,809 | | | $ | 15,125,704 | |

| Reinvested | | — | | | | — | | | 313,216 | | | | 4,347,440 | |

| Repurchased | | (562,036 | ) | | | (7,813,504 | ) | | (1,016,524 | ) | | | (16,727,072 | ) |

| Total | | (303,795 | ) | | $ | (4,182,516 | ) | | 153,501 | | | $ | 2,746,072 | |

| | | | | | | | | | | | | | | |

| CLASS W | | FOR THE SIX MONTHS

ENDED 6/30/23 | | | FOR THE YEAR ENDED

12/31/22 | |

| | | SHARES | | | AMOUNT | | | SHARES | | | AMOUNT | |

| Sold | | 442,912 | | | $ | 6,167,521 | | | 559,696 | | | $ | 9,333,852 | |

| Reinvested | | — | | | | — | | | 1,988,426 | | | | 27,499,927 | |

| Repurchased | | (747,328 | ) | | | (10,423,890 | ) | | (1,746,092 | ) | | | (30,948,554 | ) |

| Total | | (304,416 | ) | | $ | (4,256,369 | ) | | 802,030 | | | $ | 5,885,225 | |

| | | | | | | | | | | | | | | |

| CLASS Z | | FOR THE SIX MONTHS

ENDED 6/30/23 | | | FOR THE YEAR ENDED

12/31/22 | |

| | | SHARES1 | | | AMOUNT | | | SHARES1 | | | AMOUNT | |

| Sold | | 30,886 | | | $ | 434,974 | | | 121,176 | | | $ | 2,056,232 | |

| Reinvested | | — | | | | — | | | 22,553 | | | | 312,579 | |

| Repurchased | | (39,618 | ) | | | (548,369 | ) | | (100,984 | ) | | | (1,765,113 | ) |

| Total | | (8,732 | ) | | $ | (113,395 | ) | | 42,745 | | | $ | 603,698 | |

| 1 | Per share amounts have been adjusted to reflect a reverse stock split effective after the close of business on November 4th. 2022. See Note 1 of the Notes to Financial Statements for details on ratios. |

Approximately 75% of the shares outstanding are fiduciary accounts where the Advisor has sole investment discretion.

The Fund has entered into a 364-day, $50 million credit agreement (the “line of credit”) with Bank of New York Mellon. Each series of the Fund may borrow under the line of credit for temporary or emergency purposes, including funding shareholder redemptions and other short-term liquidity purposes. The Fund pays an annual fee on the unused commitment amount, payable quarterly, and is allocated among all the series of the Fund and included in miscellaneous expenses in the Statement of Operations for each series. The line of credit expires in September 2023 unless extended or renewed. During the six months ended June 30, 2023, the Series did not borrow under the line of credit.

Real Estate Series

Notes to Financial Statements (continued)

(unaudited)

The Series may trade in instruments including written and purchased options, forward foreign currency exchange contracts and futures contracts and other derivatives in the normal course of investing activities to assist in managing exposure to various market risks. The Series may be subject to various elements of risk, which may involve, to a varying degree, elements of risk in excess of the amounts recognized for financial statement purposes. These risks include: the risk that changes in the value of a derivative may not correlate perfectly with the underlying asset, rate or index; counterparty credit risk related to over the counter derivative counterparties’ failure to perform under contract terms; liquidity risk related to the lack of a liquid market for these contracts allowing the fund to close out its position(s); and documentation risk relating to disagreement over contract terms. No such investments were held by the Series as of June 30, 2023.

Investing in securities of foreign companies and foreign governments involves special risks and considerations not typically associated with investing in securities of domestic companies and the U.S. Government. These risks include revaluation of currencies and future adverse political and economic developments. Moreover, securities of foreign companies and foreign governments and their markets may be less liquid and their prices more volatile than those of comparable domestic companies and the U.S. Government.

The Series may focus its investments in certain real estate related industries; hence, the Series may subject itself to a greater degree of risk than a series that is more diversified.

| 10. | Federal Income Tax Information |

The amount and characterization of certain income and capital gains to be distributed are determined in accordance with federal income tax regulations, which may differ from GAAP. The Series may periodically make reclassifications among its capital accounts to reflect income and gains available for distribution (or available capital loss carryovers) under income tax regulations, without impacting the Series’ net asset value. Any such reclassifications are not reflected in the financial highlights.

The final determination of the tax character of current year distributions will be made at the conclusions of the fiscal year. The tax character of distributions paid for the year ended December 31, 2022 were as follows:

| Ordinary income | | $ | 5,471,177 | |

| Long-term capital gains | | $ | 32,475,377 | |

At June 30, 2023, the tax basis of components of distributable earnings and the net unrealized appreciation based on the identified cost of investments for federal income tax purposes were as follows:

| Cost for federal income tax purposes | | $ | 259,828,233 | |

| Unrealized appreciation | | | 28,856,110 | |

| Unrealized depreciation | | | (15,864,126 | ) |

| | | | | |

| Net unrealized appreciation | | $ | 12,991,984 | |

Real Estate Series

Notes to Financial Statements (continued)

(unaudited)

Significant disruptions and volatility in the global financial markets and economies, like the current conditions caused by the Russian invasion of Ukraine and the COVID-19 pandemic, could negatively impact the investment performance of the Series. The global market and economic climate may become increasingly uncertain due to numerous factors beyond our control, including but not limited to, the effectiveness and acceptance of vaccines to prevent COVID-19, impacts on business operations in the U.S. related to the COVID-19 pandemic, such as supply chain disruptions and inflation, concerns related to unpredictable global market and economic factors, uncertainty in U.S. federal fiscal, tax, trade or regulatory policy and the fiscal, tax, trade or regulatory policy of foreign governments, rising interest rates, inflation or deflation, the availability of credit, performance of financial markets, terrorism, natural or biological catastrophes, public health emergencies, or political uncertainty.

Real Estate Series

Liquidity Risk Management Program Disclosure

(unaudited)

The Securities and Exchange commission adopted Rule 22e-4 under the Investment Company Act of 1940, as amended (the “Liquidity Rule”) to promote effective liquidity risk management by open-end investment companies and reduce Liquidity Risk, which is the risk that open-end investment companies are unable to meet redemption obligations without a significant dilution of remaining shareholder interests.

The Manning & Napier Fund, Inc. and each of its series (each a “Fund” or collectively, the “Funds”) adopted a Liquidity Risk Management Program (the “Program”) and obtained approval from the Board of Directors (the “Board”), including a majority of Directors who are not interested persons of the Fund, to appoint a Liquidity Risk Management Committee (the “Committee”) to assess and manage the Fund’s Liquidity Risk.

Under the Program, assessment and management of Liquidity Risk takes into consideration certain factors, such as each Fund’s investment strategy and the liquidity of its portfolio investments during normal and reasonably foreseeable stressed conditions, its short- and long-term cash-flow projections during both normal and reasonably foreseeable stressed conditions, and its cash and cash-equivalent holdings and access to other funding sources. As required by the Liquidity Rule, the Program includes policies and procedures for the classification of each Fund’s portfolio holdings into four liquidity categories, establishes a 15% limit on holdings of illiquid investments, and sets forth procedures for the override of vendor-derived classifications.

The Committee prepares an annual assessment (“assessment”) of the Program to review the operation of the Program, including the adequacy of controls designed to manage the Funds’ Liquidity Risk. Through this assessment, the Committee re-considers prior conclusions around each factor that the Fund must consider to assess, manage, and review its Liquidity Risk and evaluates the effectiveness of processes to classify Fund assets into liquidity categories, including Committee override determinations. As part of this evaluation the Committee re-affirms that each Fund operates as a Primarily Highly Liquid Fund, with greater than 50% of net assets consistently invested in Highly Liquid Investments, thereby negating a need to establish a Highly Liquid Investment Minimum for any Fund. Lastly, the assessment considers the effectiveness of the safeguards that the Committee adopted to prevent a violation of the Liquidity Rule’s limit on a Fund’s holding of Illiquid Investments.

The most recent assessment covered January 1, 2022, through December 31, 2022, and was presented to the Board in February 2023. This assessment confirmed that the Program continues to operate effectively in all material respects to address the requirements of the Liquidity Rule and manage the Funds’ Liquidity Risk.

{This page intentionally left blank}

Real Estate Series

Literature Requests

(unaudited)

Proxy Voting Policies and Procedures

A description of the policies and procedures that the Fund uses to determine how to vote proxies relating to portfolio securities is available, without charge, upon request:

| By phone | 1-800-466-3863 |

| On the Securities and Exchange | |

| Commission’s (SEC) web site | http://www.sec.gov |

Proxy Voting Record

Information regarding how the Fund voted proxies relating to portfolio securities during the most recent 12-month period ended June 30th is available, without charge, upon request:

| On the SEC’s web site | http://www.sec.gov |

Quarterly Portfolio Holdings

The Series’ complete schedule of portfolio holdings for the 1st and 3rd quarters of each fiscal year are provided on Form N-PORT, and are available, without charge, upon request:

| On the SEC’s web site | http://www.sec.gov |

Prospectus and Statement of Additional Information (SAI)

For more information about any of the Manning & Napier Fund, Inc. Series, you may obtain a prospectus and SAI at www.manning-napier.com or by calling 1-(800) 466-3863. Before investing, carefully consider the objectives, risks, charges and expenses of the investment and read the prospectus carefully as it contains this and other information about the investment company. In addition, this information can be found on the SEC’s web site, http://www.sec.gov.

Additional information available at www.manning-napier.com

| 1. | Fund Holdings - Month-End |

| 2. | Fund Holdings - Quarter-End |

| 3. | Shareholder Report - Annual |

| 4. | Shareholder Report - Semi-Annual |

The Fund also offers electronic notification or “e-delivery” when certain documents are available on-line to be downloaded or reviewed. Direct shareholders can elect to receive electronic notification when shareholder reports, prospectus updates, and/or statements are available. If you do not currently have on-line access to your account, you can establish access by going to www.manning-napier.com, click on “Login” in the top corner of the page, and follow the prompts to self-enroll. Once enrolled, you can set your electronic notification preferences by clicking on the Account Options tab located within the green toolbar and then select E-Delivery Option. Should you have any questions on either how to establish on-line access or how to update your account settings, please contact Investor Services at 1-800-466-3863.

The Manning & Napier Fund, Inc. is managed by Manning & Napier Advisors, LLC. Manning & Napier Investor Services, Inc., an affiliate of Manning & Napier Advisors, LLC, is the distributor of the Fund shares.

MNRES-06/23-SAR

www.manning-napier.com

Manning & Napier Fund, Inc.

Diversified Tax Exempt Series

Diversified Tax Exempt Series

Shareholder Expense Example

(unaudited)

As a shareholder of the Series, you incur ongoing costs, including management fees, shareholder service fees and other Series expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Series and to compare these costs with the ongoing costs of investing in other mutual funds.

The example is based on an investment of $1,000 invested in each class at the beginning of the period and held for the entire period (January 1, 2023 to June 30, 2023).

Actual Expenses

The Actual lines of the table below provide information about actual account values and actual expenses. You may use the information in these lines, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the Actual line for the Class in which you have invested under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The Hypothetical lines of each class in the table below provide information about hypothetical account values and hypothetical expenses based on the Class’ actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Class’ actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid during the period. You may use this information to compare the ongoing costs of investing in a class of the Series and other funds. To do so, compare this 5% hypothetical example for the Class in which you have invested with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transaction costs, such as sales charges (loads), redemption fees, or exchange fees that you may incur in other mutual funds. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds.

| | BEGINNING ACCOUNT VALUE 1/1/23 | ENDING ACCOUNT VALUE 6/30/23 | EXPENSES PAID DURING PERIOD* 1/1/23 - 6/30/23 | ANNUALIZED EXPENSE RATIO |

| Class A | | | | |

| Actual | $1,000.00 | $1,011.00 | $3.04 | 0.61% |

| Hypothetical | | | | |

| (5% return before expenses) | $1,000.00 | $1,021.77 | $3.06 | 0.61% |

| Class W | | | | |

| Actual | $1,000.00 | $1,014.10 | $0.55 | 0.11% |

| Hypothetical | | | | |

| (5% return before expenses) | $1,000.00 | $1,024.25 | $0.55 | 0.11% |

*Expenses are equal to each Class’ annualized expense ratio (for the six-month period), multiplied by the average account value over the period, multiplied by 181/365 (to reflect the one-half year period). The Class’ total return would have been lower had certain expenses not been waived or reimbursed during the period.

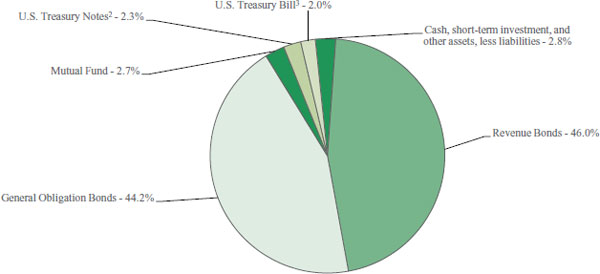

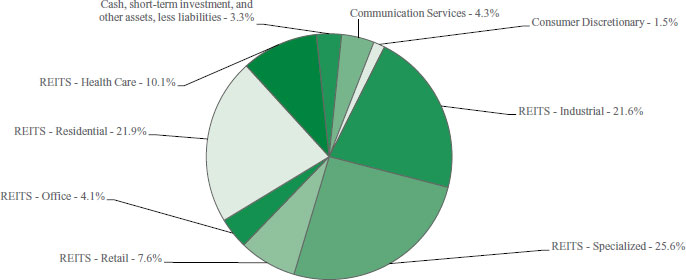

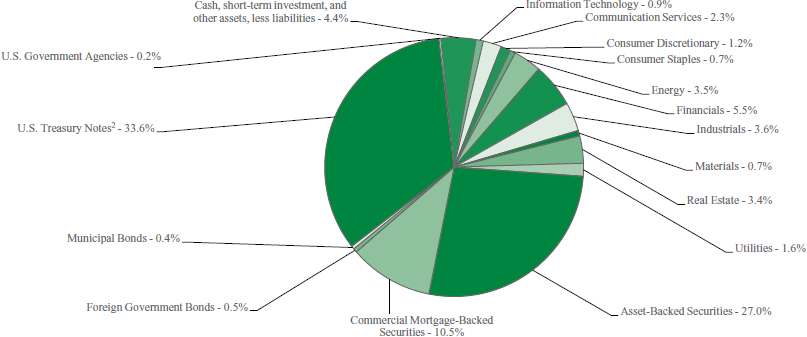

Diversified Tax Exempt Series

Portfolio Composition as of June 30, 2023

(unaudited)

| Sector Allocation1 |

|

| |

1 As a percentage of net assets. 2 A U.S. Treasury Note is an intermediate long-term obligation of the U.S. Treasury issued with a maturity period between one and ten years. 3 A U.S. Treasury Bill is a short-term obligation of the U.S. Treasury issued with a maturity less than one year. |

| Top Ten States4 |

| New York | 13.0% | Massachusetts | 4.2% |

| Texas | 8.9% | Ohio | 3.7% |

| Florida | 8.4% | Tennessee | 3.4% |

| Washington | 8.1% | District of Columbia | 3.3% |

| Maryland | 4.6% | Illinois | 3.3% |

| | | | |

| 4As a percentage of total investments. | | | |

Diversified Tax Exempt Series

Investment Portfolio - June 30, 2023

(unaudited)

| | | PRINCIPAL AMOUNT1/ SHARES | | | VALUE (NOTE 2) | |

| | | | | | | |

| MUNICIPAL BONDS - 90.2% | | | | | | | | |

| ALABAMA - 0.4% | | | | | | | | |

| Cullman Utilities Board Water Division, Revenue Bond, AGM, 4.000%, 9/1/2025 | | | 1,000,000 | | | $ | 1,017,200 | |

| | | | | | | | | |

| ALASKA - 0.7% | | | | | | | | |

| Alaska Municipal Bond Bank Authority | | | | | | | | |

| Electric Light & Power Impt., Revenue Bond, 5.000%, 12/1/2025 | | | 750,000 | | | | 781,219 | |

| Electric Light & Power Impt., Revenue Bond, 5.000%, 12/1/2030 | | | 875,000 | | | | 993,155 | |

| | | | | | | | 1,774,374 | |

| CALIFORNIA - 0.6% | | | | | | | | |

| California, G.O. Bond, 5.000%, 8/1/2025 | | | 1,410,000 | | | | 1,469,743 | |

| | | | | | | | | |

| COLORADO - 0.8% | | | | | | | | |

| Denver Wastewater Management Division Department of Public Works, Public Impt., Revenue Bond, 5.000%, 11/1/2029 | | | 750,000 | | | | 838,986 | |

| E-470 Public Highway Authority, Senior Lien, Series A, Revenue Bond, 5.000%, 9/1/2026 | | | 1,000,000 | | | | 1,056,364 | |

| | | | | | | | 1,895,350 | |

| DISTRICT OF COLUMBIA - 3.3% | | | | | | | | |

| District of Columbia | | | | | | | | |

| Public Impt., Series A, G.O. Bond, 5.000%, 10/15/2036 | | | 1,265,000 | | | | 1,391,296 | |

| Public Impt., Series A, G.O. Bond, 5.000%, 1/1/2041 | | | 2,000,000 | | | | 2,257,061 | |

| School Impt., Series A, Revenue Bond, 5.000%, 7/1/2041 | | | 1,115,000 | | | | 1,248,038 | |

| School Impt., Series A, Revenue Bond, 5.000%, 7/1/2042 | | | 1,895,000 | | | | 2,108,896 | |

| District of Columbia Water & Sewer Authority, Water Utility Impt., Series B, Revenue Bond, 5.000%, 10/1/2047 | | | 1,000,000 | | | | 1,087,829 | |

| | | | | | | | 8,093,120 | |

| FLORIDA - 8.3% | | | | | | | | |

| Broward County, Water & Sewer Utility, Sewer Impt., Series A, Revenue Bond, 5.000%, 10/1/2038 | | | 4,000,000 | | | | 4,387,285 | |

Central Florida Expressway Authority

Senior Lien, Revenue Bond, 5.000%, 7/1/2024 | | | 500,000 | | | | 508,879 | |

| Senior Lien, Revenue Bond, 5.000%, 7/1/2027 | | | 500,000 | | | | 539,650 | |

| Senior Lien, Revenue Bond, 5.000%, 7/1/2038 | | | 530,000 | | | | 557,235 | |

| Florida | | | | | | | | |

| Series A, G.O. Bond, 5.000%, 6/1/2025 | | | 1,857,000 | | | | 1,925,826 | |

| Series B, G.O. Bond, 5.000%, 6/1/2024 | | | 930,000 | | | | 945,771 | |

| Florida Department of Transportation Turnpike System, Series B, Revenue Bond, 2.500%, 7/1/2026 | | | 505,000 | | | | 493,941 | |

| | | PRINCIPAL AMOUNT1/ SHARES | | | VALUE (NOTE 2) | |

| | | | | | | | | |

| MUNICIPAL BONDS (continued) | | | | | | | | |

| FLORIDA (continued) | | | | | | | | |

| Fort Lauderdale, Public Impt., Series A, G.O. Bond, 5.000%, 7/1/2043 | | | 1,010,000 | | | $ | 1,119,382 | |

| JEA Electric System, Series A, Revenue Bond, 5.000%, 10/1/2028 | | | 1,000,000 | | | | 1,093,544 | |

| Miami-Dade County, Revenue Bond, 5.000%, 4/1/2028 | | | 1,015,000 | | | | 1,106,961 | |

| Miami-Dade County, Water & Sewer System, Sewer Impt., Revenue Bond, 5.000%, 10/1/2028 | | | 2,000,000 | | | | 2,207,006 | |

| Orlando Utilities Commission, Series C, Revenue Bond, 5.000%, 10/1/2025 | | | 665,000 | | | | 694,096 | |

| Port St. Lucie Utility System, Water Utility Impt., Revenue Bond, NATL, 5.250%, 9/1/2023 | | | 500,000 | | | | 501,497 | |

| School District of Broward County, School Impt., G.O. Bond, 5.000%, 7/1/2032 | | | 1,895,000 | | | | 2,203,832 | |

| Tampa, Water & Wastewater System, Water Utility Impt., Series A, Revenue Bond, 5.000%, 10/1/2034 | | | 950,000 | | | | 1,130,844 | |

| Tampa-Hillsborough County Expressway Authority, Highway Impt., Series A, Revenue Bond, BAM, 5.000%, 7/1/2028 | | | 1,000,000 | | | | 1,090,763 | |

| | | | | | | | 20,506,512 | |

| GEORGIA - 2.7% | | | | | | | | |

| Atlanta, Series A-1, G.O. Bond, 5.000%, 12/1/2042 | | | 800,000 | | | | 890,889 | |

| Georgia, School Impt., Series A, G.O. Bond, 5.000%, 7/1/2033 | | | 5,000,000 | | | | 5,881,763 | |

| | | | | | | | 6,772,652 | |

| HAWAII - 1.9% | | | | | | | | |

| City & County of Honolulu, Transit Impt., Series E, G.O. Bond, 5.000%, 3/1/2027 | | | 2,000,000 | | | | 2,151,009 | |

| Hawaii | | | | | | | | |

| Series FE, G.O. Bond, 5.000%, 10/1/2025 | | | 1,505,000 | | | | 1,570,862 | |

| Series GJ, G.O. Bond, 1.033%, 8/1/2025 | | | 500,000 | | | | 460,140 | |

| Honolulu County, Series E, G.O. Bond, 5.000%, 9/1/2028 | | | 500,000 | | | | 545,182 | |

| | | | | | | | 4,727,193 | |

| ILLINOIS - 3.2% | | | | | | | | |

| Aurora, Waterworks & Sewerage, Series B, Revenue Bond, 3.000%, 12/1/2023 | | | 625,000 | | | | 624,704 | |

| Illinois, Public Impt., Series A, G.O. Bond, 5.000%, 11/1/2024 | | | 1,800,000 | | | | 1,832,214 | |

Illinois Municipal Electric Agency

Series A, Revenue Bond, 5.000%, 2/1/2025 | | | 2,000,000 | | | | 2,053,649 | |

| Series A, Revenue Bond, 5.000%, 2/1/2026 | | | 730,000 | | | | 756,527 | |

| Illinois State Toll Highway Authority Highway Impt., Series B, Revenue Bond, 5.000%, 1/1/2038 | | | 1,050,000 | | | | 1,092,874 | |

The accompanying notes are an integral part of the financial statements.

Diversified Tax Exempt Series

Investment Portfolio - June 30, 2023

(unaudited)

| | | PRINCIPAL AMOUNT1/ SHARES | | | VALUE (NOTE 2) | |

| | | | | | | |

| MUNICIPAL BONDS (continued) | | | | | | |

| ILLINOIS (continued) | | | | | | |

| Illinois State Toll Highway Authority (continued) | | | | | | |

| Series B, Revenue Bond, 5.000%, 1/1/2031 | | | 1,500,000 | | | $ | 1,687,636 | |

| | | | | | | | 8,047,604 | |

| INDIANA - 0.4% | | | | | | | | |

| South Bend Sewage Works, Revenue Bond, 3.000%, 12/1/2025 | | | 1,075,000 | | | | 1,072,047 | |

| | | | | | | | | |

| IOWA - 0.4% | | | | | | | | |

| Des Moines, Stormwater Utility, Public Impt., Series B, Revenue Bond, 5.000%, 6/1/2031 | | | 865,000 | | | | 988,253 | |

| | | | | | | | | |

| KANSAS - 0.2% | | | | | | | | |

| Wichita, Water & Sewer Utility, Series A, Revenue Bond, 5.000%, 10/1/2024 | | | 500,000 | | | | 511,494 | |

| | | | | | | | | |

| KENTUCKY - 1.7% | | | | | | | | |

| Kentucky Municipal Power Agency, Series A, Revenue Bond, NATL, 5.000%, 9/1/2024 | | | 1,355,000 | | | | 1,369,417 | |

| Louisville/Jefferson County Metropolitan Government, Public Impt., G.O. Bond, 4.900%, 11/15/2023 | | | 2,760,000 | | | | 2,751,403 | |

| | | | | | | | 4,120,820 | |