UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-4085

Fidelity Income Fund

(Exact name of registrant as specified in charter)

82 Devonshire St., Boston, Massachusetts 02109

(Address of principal executive offices) (Zip code)

Eric D. Roiter, Secretary

82 Devonshire St.

Boston, Massachusetts 02109

(Name and address of agent for service)

Registrant's telephone number, including area code: 617-563-7000

Date of fiscal year end: | July 31 |

Date of reporting period: | January 31, 2008 |

Item 1. Reports to Stockholders

Fidelity® Ginnie Mae Fund

Fidelity Intermediate

Government Income Fund

Semiannual Report

January 31, 2008

(2_fidelity_logos) (Registered_Trademark)

Contents

Chairman's Message | Ned Johnson's message to shareholders. | |

Shareholder Expense Example | An example of shareholder expenses. | |

Fidelity Ginnie Mae Fund | ||

Investment Changes | ||

Investments | ||

Financial Statements | ||

Fidelity Intermediate Government Income Fund | ||

Investment Changes | ||

Investments | ||

Financial Statements | ||

Notes | Notes to the financial statements | |

To view a fund's proxy voting guidelines and proxy voting record for the 12-month period ended June 30, visit http://www.fidelity.com (search for "proxy voting guidelines") or visit the Securities and Exchange Commission's (SEC) web site at http://www.sec.gov. You may also call 1-800-544-8544 to request a free copy of the proxy voting guidelines.

Standard & Poor's, S&P and S&P 500 are registered service marks of The McGraw-Hill Companies, Inc. and have been licensed for use by Fidelity Distributors Corporation.

Other third party marks appearing herein are the property of their respective owners.

All other marks appearing herein are registered or unregistered trademarks or service marks of FMR LLC or an affiliated company.

This report and the financial statements contained herein are submitted for the general information of the shareholders of the funds. This report is not authorized for distribution to prospective investors in the funds unless preceded or accompanied by an effective prospectus.

A fund files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. Forms N-Q are available on the SEC's web site at http://www.sec.gov. A fund's Forms N-Q may be reviewed and copied at the SEC's Public Reference Room in Washington, DC. Information regarding the operation of the SEC's Public Reference Room may be obtained by calling 1-800-SEC-0330. For a complete list of a fund's portfolio holdings, view the most recent holdings listing, semiannual report, or annual report on Fidelity's web site at http://www.fidelity.com or http://www.advisor.fidelity.com, as applicable.

NOT FDIC INSURED · MAY LOSE VALUE · NO BANK GUARANTEE

Neither the funds nor Fidelity Distributors Corporation is a bank.

Semiannual Report

Chairman's Message

(photo_of_Edward_C_Johnson_3d)

Dear Shareholder:

Stocks got off to a poor start in 2008, while investment-grade bonds and money markets showed positive returns, once again underscoring the importance of a diversified portfolio. Financial markets are always unpredictable, but there are a number of time-tested principles that can put the historical odds in your favor.

One of the basic tenets is to invest for the long term. Over time, riding out the markets' inevitable ups and downs has proven much more effective than selling into panic or chasing the hottest trend. Even missing only a few of the markets' best days can significantly diminish investor returns. Patience also affords the benefits of compounding - of earning interest on additional income or reinvested dividends and capital gains. There are tax advantages and cost benefits to consider as well. The more you sell, the more taxes you pay, and the more you trade, the higher the costs. While staying the course doesn't eliminate risk, it can considerably lessen the effect of short-term declines.

You can further manage your investing risk through diversification. And today, more than ever, geographic diversification should be taken into account. Studies indicate that asset allocation is the single most important determinant of a portfolio's long-term success. The right mix of stocks, bonds and cash - aligned to your particular risk tolerance and investment objective - is very important. Age-appropriate rebalancing is also an essential aspect of asset allocation. For younger investors, an emphasis on equities - which historically have been the best-performing asset class over time - is encouraged. As investors near their specific goal, such as retirement or sending a child to college, consideration may be given to replacing volatile assets (e.g. common stocks) with more-stable fixed investments (bonds or savings plans).

A third investment principle - investing regularly - can help lower the average cost of your purchases. Investing a certain amount of money each month or quarter helps ensure you won't pay for all your shares at market highs. This strategy - known as dollar cost averaging - also reduces unconstructive "emotion" from investing, helping shareholders avoid selling weak performers just prior to an upswing, or chasing a hot performer just before a correction.

We invite you to contact us via the Internet, through our Investor Centers or over the phone. It is our privilege to provide you the information you need to make the investments that are right for you.

Sincerely,

/s/Edward C. Johnson 3d

Edward C. Johnson 3d

Semiannual Report

Shareholder Expense Example

As a shareholder of a Fund, you incur two types of costs: (1) transaction costs, and (2) ongoing costs, including management fees and other Fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in the Funds and to compare these costs with the ongoing costs of investing in other mutual funds.

The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period (August 1, 2007 to January 31, 2008).

Actual Expenses

The first line of the accompanying table for each fund provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000.00 (for example, an $8,600 account value divided by $1,000.00 = 8.6), then multiply the result by the number in the first line for a fund under the heading entitled "Expenses Paid During Period" to estimate the expenses you paid on your account during this period. A small balance maintenance fee of $12.00 that is charged once a year may apply for certain accounts with a value of less than $2,000. This fee is not included in the table below. If it was, the estimate of expenses you paid during the period would be higher, and your ending account value lower, by this amount.

Hypothetical Example for Comparison Purposes

The second line of the accompanying table for each fund provides information about hypothetical account values and hypothetical expenses based on a fund's actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund's actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds. A small balance maintenance fee of $12.00 that is charged once a year may apply for certain accounts with a value of less than $2,000. This fee is not included in the table below. If it was, the estimate of expenses you paid during the period would be higher, and your ending account value lower, by this amount.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transaction costs. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds.

Semiannual Report

Beginning | Ending | Expenses Paid | |

Ginnie Mae Fund | |||

Actual | $ 1,000.00 | $ 1,069.00 | $ 2.34 |

HypotheticalA | $ 1,000.00 | $ 1,022.87 | $ 2.29 |

Intermediate Government | |||

Actual | $ 1,000.00 | $ 1,077.50 | $ 2.35 |

HypotheticalA | $ 1,000.00 | $ 1,022.87 | $ 2.29 |

A 5% return per year before expenses

* Expenses are equal to each Fund's annualized expense ratio (shown in the table below); multiplied by the average account value over the period, multiplied by 184/366 (to reflect the one-half year period).

Annualized | |

Ginnie Mae Fund | .45% |

Intermediate Government Income Fund | .45% |

Semiannual Report

Fidelity Ginnie Mae Fund

Investment Changes

Coupon Distribution as of January 31, 2008 | ||

% of fund's investments | % of fund's investments | |

Less than 4% | 3.0 | 4.5 |

4 - 4.99% | 10.9 | 11.3 |

5 - 5.99% | 44.3 | 42.3 |

6 - 6.99% | 33.7 | 28.3 |

7 - 7.99% | 4.4 | 4.7 |

8% and over | 1.1 | 1.2 |

Coupon distribution shows the range of stated interest rates on the fund's investments, excluding short-term investments. |

Weighted Average Maturity as of January 31, 2008 | ||

6 months ago | ||

Years | 5.0 | 5.8 |

The weighted average maturity is based on the dollar-weighted average length of time until principal payments are expected or until securities reach maturity, taking into account any maturity shortening feature such as a call, refunding or redemption provision. |

Duration as of January 31, 2008 | ||

6 months ago | ||

Years | 3.1 | 4.3 |

Duration shows how much a bond fund's price fluctuates with changes in comparable interest rates. If rates rise 1%, for example, a fund with a five-year duration is likely to lose about 5% of its value. Other factors also can influence a bond fund's performance and share price. Accordingly, a bond fund's actual performance may differ from this example. |

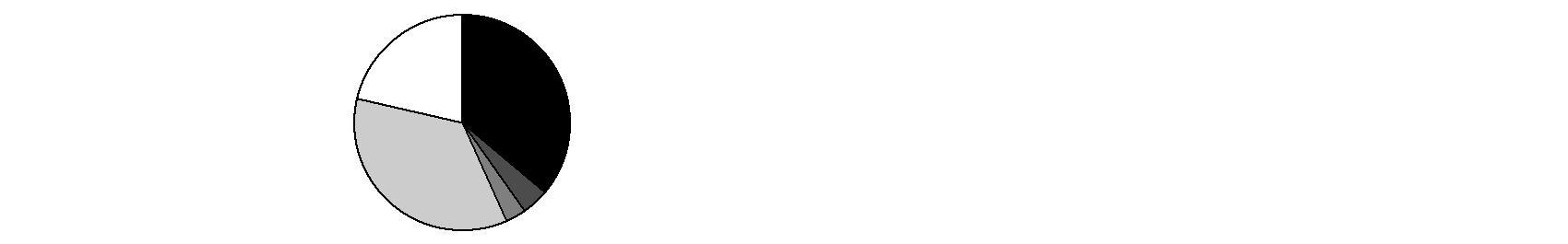

Asset Allocation (% of fund's net assets) | |||||||

As of January 31, 2008 *A | As of July 31, 2007**B | ||||||

| Mortgage |  | Mortgage | ||||

| CMOs and |  | CMOs and | ||||

| Asset-Backed |  | Asset-Backed | ||||

| Short-Term |  | Short-Term | ||||

* GNMA Securities | 98.2% | ** GNMA Securities | 94.5% | ||||

A Futures and Swaps | (9.7)% | B Futures and Swaps | (7.1)% | ||||

(dagger) Short-Term Investments and Net Other Assets are not included in the pie chart. |

Semiannual Report

Fidelity Ginnie Mae Fund

Investments January 31, 2008 (Unaudited)

Showing Percentage of Net Assets

U.S. Government Agency - Mortgage Securities - 95.2% | ||||

Principal Amount (000s) | Value (000s) | |||

Fannie Mae - 9.5% | ||||

3.595% 9/1/33 (d) | $ 1,362 | $ 1,376 | ||

3.718% 6/1/33 (d) | 4,245 | 4,298 | ||

3.751% 10/1/33 (d) | 400 | 402 | ||

3.784% 6/1/33 (d) | 4,817 | 4,848 | ||

3.806% 4/1/33 (d) | 1,004 | 1,011 | ||

3.81% 10/1/33 (d) | 3,506 | 3,553 | ||

3.885% 9/1/33 (d) | 3,759 | 3,814 | ||

3.962% 6/1/33 (d) | 1,610 | 1,621 | ||

3.965% 8/1/33 (d) | 1,859 | 1,880 | ||

3.995% 4/1/34 (d) | 4,362 | 4,407 | ||

4.019% 6/1/34 (d) | 7,904 | 7,983 | ||

4.028% 3/1/34 (d) | 8,025 | 8,104 | ||

4.067% 7/1/34 (d) | 12,026 | 12,164 | ||

4.115% 4/1/34 (d) | 5,142 | 5,169 | ||

4.119% 5/1/34 (d) | 4,245 | 4,285 | ||

4.134% 2/1/35 (d) | 14,432 | 14,611 | ||

4.16% 8/1/34 (d) | 2,183 | 2,202 | ||

4.161% 12/1/33 (d) | 3,198 | 3,238 | ||

4.162% 9/1/33 (d) | 2,653 | 2,691 | ||

4.169% 1/1/35 (d) | 6,617 | 6,717 | ||

4.178% 1/1/35 (d) | 5,650 | 5,748 | ||

4.187% 10/1/33 (d) | 3,889 | 3,937 | ||

4.237% 1/1/34 (d) | 996 | 1,007 | ||

4.261% 10/1/33 (d) | 161 | 163 | ||

4.268% 6/1/33 (d) | 180 | 183 | ||

4.292% 3/1/33 (d) | 186 | 188 | ||

4.329% 5/1/34 (d) | 5,139 | 5,180 | ||

4.33% 3/1/33 (d) | 305 | 310 | ||

4.33% 4/1/35 (d) | 203 | 206 | ||

4.396% 10/1/34 (d) | 1,928 | 1,956 | ||

4.418% 6/1/35 (d) | 1,489 | 1,508 | ||

4.493% 3/1/35 (d) | 1,608 | 1,627 | ||

4.51% 8/1/34 (d) | 7,632 | 7,710 | ||

4.534% 7/1/35 (d) | 1,311 | 1,327 | ||

4.54% 5/1/35 (d) | 1,083 | 1,099 | ||

4.546% 2/1/35 (d) | 16,601 | 16,941 | ||

4.569% 10/1/35 (d) | 117 | 119 | ||

4.579% 2/1/36 (d) | 5,375 | 5,452 | ||

4.588% 9/1/36 (d) | 4,054 | 4,110 | ||

4.595% 1/1/34 (d) | 9,659 | 9,855 | ||

4.609% 8/1/35 (d) | 4,503 | 4,589 | ||

4.665% 6/1/35 (d) | 1,601 | 1,622 | ||

U.S. Government Agency - Mortgage Securities - continued | ||||

Principal Amount (000s) | Value (000s) | |||

Fannie Mae - continued | ||||

4.665% 8/1/35 (d) | $ 2,032 | $ 2,059 | ||

4.685% 3/1/35 (d) | 93 | 95 | ||

4.695% 8/1/35 (d) | 2,138 | 2,166 | ||

4.75% 1/1/35 (d) | 1,376 | 1,405 | ||

4.77% 12/1/34 (d) | 367 | 373 | ||

4.819% 10/1/35 (d) | 887 | 905 | ||

4.829% 9/1/34 (d) | 1,780 | 1,812 | ||

4.832% 10/1/34 (d) | 3,868 | 3,937 | ||

4.852% 9/1/34 (d) | 1,902 | 1,937 | ||

4.853% 1/1/35 (d) | 1,472 | 1,498 | ||

4.871% 9/1/34 (d) | 601 | 611 | ||

4.909% 3/1/33 (d) | 1,172 | 1,194 | ||

4.92% 1/1/35 (d) | 8,029 | 8,117 | ||

4.957% 2/1/33 (d) | 476 | 485 | ||

4.975% 9/1/34 (d) | 516 | 526 | ||

5.016% 7/1/34 (d) | 186 | 189 | ||

5.047% 5/1/35 (d) | 2,163 | 2,200 | ||

5.059% 8/1/34 (d) | 279 | 282 | ||

5.067% 10/1/36 (d) | 9,398 | 9,552 | ||

5.082% 9/1/34 (d) | 351 | 358 | ||

5.112% 3/1/34 (d) | 6,375 | 6,489 | ||

5.135% 3/1/35 (d) | 181 | 185 | ||

5.157% 8/1/33 (d) | 489 | 496 | ||

5.19% 6/1/35 (d) | 1,532 | 1,560 | ||

5.194% 7/1/35 (d) | 1,678 | 1,709 | ||

5.249% 11/1/36 (d) | 1,255 | 1,278 | ||

5.309% 12/1/34 (d) | 452 | 461 | ||

5.315% 7/1/35 (d) | 188 | 192 | ||

5.354% 1/1/36 (d) | 4,549 | 4,631 | ||

5.458% 11/1/36 (d) | 4,455 | 4,534 | ||

5.48% 6/1/47 (d) | 918 | 937 | ||

5.5% 11/1/13 to 3/1/20 (c) | 15,122 | 15,549 | ||

5.521% 2/1/37 (d) | 10,479 | 10,699 | ||

5.628% 4/1/37 (d) | 5,058 | 5,173 | ||

5.758% 4/1/36 (d) | 4,724 | 4,866 | ||

5.779% 5/1/34 (d) | 10,974 | 11,134 | ||

5.836% 12/1/35 (d) | 4,898 | 4,979 | ||

5.855% 3/1/36 (d) | 3,589 | 3,691 | ||

5.923% 5/1/36 (d) | 3,356 | 3,459 | ||

6.398% 7/1/36 (d) | 6,898 | 7,131 | ||

6.5% 10/1/17 to 7/1/32 | 14,086 | 14,808 | ||

7% 11/1/16 to 3/1/17 | 1,687 | 1,816 | ||

U.S. Government Agency - Mortgage Securities - continued | ||||

Principal Amount (000s) | Value (000s) | |||

Fannie Mae - continued | ||||

7.5% 2/1/08 to 4/1/17 | $ 1,595 | $ 1,689 | ||

8.5% 12/1/27 | 216 | 241 | ||

9.5% 9/1/30 | 466 | 538 | ||

10.25% 10/1/18 | 11 | 12 | ||

11.5% 5/1/14 to 7/1/15 | 28 | 32 | ||

12.5% 11/1/13 to 7/1/16 | 59 | 68 | ||

13.25% 9/1/11 | 33 | 37 | ||

317,306 | ||||

Freddie Mac - 5.5% | ||||

3.757% 10/1/33 (d) | 4,669 | 4,716 | ||

3.896% 6/1/33 (d) | 5,609 | 5,673 | ||

4.075% 7/1/35 (d) | 3,002 | 3,029 | ||

4.077% 6/1/33 (d) | 5,742 | 5,816 | ||

4.18% 1/1/35 (d) | 6,044 | 6,109 | ||

4.236% 6/1/33 (d) | 5,606 | 5,639 | ||

4.376% 9/1/36 (d) | 18,409 | 18,609 | ||

4.426% 6/1/35 (d) | 11,531 | 11,608 | ||

4.595% 6/1/33 (d) | 1,874 | 1,882 | ||

4.647% 5/1/35 (d) | 3,935 | 3,960 | ||

4.667% 6/1/35 (d) | 9,218 | 9,333 | ||

4.725% 3/1/34 (d) | 6,126 | 6,174 | ||

4.839% 3/1/33 (d) | 148 | 151 | ||

4.866% 10/1/35 (d) | 2,508 | 2,557 | ||

5.012% 10/1/36 (d) | 2,516 | 2,555 | ||

5.098% 3/1/36 (d) | 10,622 | 10,803 | ||

5.204% 12/1/35 (d) | 1,971 | 2,013 | ||

5.275% 11/1/35 (d) | 2,326 | 2,359 | ||

5.328% 7/1/36 (d) | 4,357 | 4,451 | ||

5.346% 10/1/35 (d) | 7,371 | 7,538 | ||

5.43% 3/1/37 (d) | 826 | 840 | ||

5.5% 11/1/17 to 1/1/25 | 12,166 | 12,431 | ||

5.642% 4/1/36 (d) | 2,438 | 2,503 | ||

5.743% 6/1/37 (d) | 12,906 | 13,197 | ||

5.801% 11/1/36 (d) | 6,894 | 7,081 | ||

5.822% 5/1/37 (d) | 899 | 917 | ||

6.369% 8/1/34 (d) | 1,119 | 1,137 | ||

6.584% 10/1/36 (d) | 11,279 | 11,628 | ||

6.744% 9/1/36 (d) | 19,235 | 19,826 | ||

8.5% 2/1/09 to 6/1/25 | 53 | 58 | ||

9% 7/1/08 to 4/1/21 | 54 | 58 | ||

9.5% 7/1/30 | 75 | 88 | ||

U.S. Government Agency - Mortgage Securities - continued | ||||

Principal Amount (000s) | Value (000s) | |||

Freddie Mac - continued | ||||

9.75% 4/1/13 | $ 5 | $ 5 | ||

10% 1/1/09 to 11/1/19 | 220 | 248 | ||

10.25% 2/1/09 to 11/1/16 | 60 | 63 | ||

10.5% 5/1/10 | 1 | 1 | ||

11.25% 2/1/10 | 8 | 8 | ||

11.75% 11/1/11 | 7 | 8 | ||

12% 5/1/10 to 2/1/17 | 51 | 59 | ||

12.5% 11/1/12 to 5/1/15 | 71 | 82 | ||

13% 5/1/14 to 11/1/14 | 10 | 12 | ||

13.5% 1/1/13 to 12/1/14 | 5 | 6 | ||

185,231 | ||||

Government National Mortgage Association - 80.2% | ||||

3.5% 3/20/34 | 1,221 | 1,121 | ||

3.5% 5/20/35 (d) | 1,572 | 1,563 | ||

3.5% 6/20/35 (d) | 1,610 | 1,601 | ||

3.75% 4/20/35 (d) | 621 | 618 | ||

4% 11/20/33 | 1,417 | 1,360 | ||

4% 4/20/35 (d) | 9,244 | 9,278 | ||

4% 5/20/35 (d) | 10,224 | 10,260 | ||

4.5% 7/20/33 to 4/20/34 | 50,731 | 48,963 | ||

4.5% 5/20/34 (d) | 1,076 | 1,094 | ||

4.5% 3/20/35 (d) | 861 | 865 | ||

4.75% 4/20/34 (d) | 17,790 | 17,887 | ||

4.75% 6/20/34 (d) | 17,161 | 17,254 | ||

4.75% 10/20/35 (d) | 4,668 | 4,728 | ||

5% 8/15/18 to 4/20/36 (c) | 345,911 | 346,664 | ||

5% 4/20/37 (d) | 42,265 | 43,103 | ||

5% 2/20/38 (a) | 4,000 | 4,013 | ||

5.25% 7/20/34 (d) | 944 | 960 | ||

5.25% 7/20/34 (d) | 2,562 | 2,611 | ||

5.5% 12/20/18 to 12/20/37 | 479,499 | 488,998 | ||

5.5% 9/20/34 (d) | 4,193 | 4,273 | ||

5.5% 6/20/35 (d) | 3,203 | 3,247 | ||

5.5% 2/1/38 (a) | 26,000 | 26,531 | ||

5.5% 2/1/38 (a) | 71,200 | 72,653 | ||

5.5% 2/1/38 (a) | 51,000 | 52,041 | ||

5.5% 2/1/38 (a) | 65,000 | 66,326 | ||

5.5% 2/1/38 (a) | 102,000 | 104,082 | ||

5.5% 2/1/38 (a) | 17,000 | 17,304 | ||

5.5% 2/1/38 (a) | 25,000 | 25,447 | ||

5.5% 2/20/38 (a) | 45,000 | 45,918 | ||

U.S. Government Agency - Mortgage Securities - continued | ||||

Principal Amount (000s) | Value (000s) | |||

Government National Mortgage Association - continued | ||||

5.5% 2/20/38 (a) | $ 6,000 | $ 6,122 | ||

5.75% 8/20/35 (d) | 617 | 633 | ||

6% 8/15/17 to 12/15/37 | 618,633 | 648,075 | ||

6% 2/1/38 (a)(b) | 50,000 | 51,632 | ||

6% 2/1/38 (a)(b) | 54,000 | 55,662 | ||

6% 2/20/38 (a) | 7,000 | 7,228 | ||

6% 2/20/38 (a) | 5,000 | 5,163 | ||

6% 2/20/38 (a)(b) | 4,000 | 4,131 | ||

6.5% 4/15/23 to 12/15/37 | 289,720 | 309,813 | ||

7% 10/20/16 to 9/20/34 | 103,593 | 109,488 | ||

7.25% 9/15/27 | 255 | 272 | ||

7.395% 6/20/25 to 11/20/27 | 1,855 | 1,967 | ||

7.5% 5/15/17 to 9/20/32 | 40,620 | 44,124 | ||

8% 7/15/08 to 7/15/32 | 10,641 | 11,817 | ||

8.5% 7/15/08 to 2/15/31 | 3,690 | 4,127 | ||

9% 2/15/09 to 5/15/30 | 1,550 | 1,772 | ||

9.5% 12/20/15 to 4/20/17 | 541 | 619 | ||

10.5% 1/15/14 to 5/15/19 | 652 | 758 | ||

13% 2/15/11 to 1/15/15 | 113 | 134 | ||

13.5% 7/15/10 to 1/15/15 | 18 | 20 | ||

2,684,320 | ||||

TOTAL U.S. GOVERNMENT AGENCY - MORTGAGE SECURITIES (Cost $3,117,409) | 3,186,857 | |||

Asset-Backed Securities - 0.2% | ||||

Fannie Mae Grantor Trust Series 2005-T4 Class A1C, 3.5263% 9/25/35 (d) | 8,669 | 8,611 | ||

Collateralized Mortgage Obligations - 19.6% | ||||

U.S. Government Agency - 19.6% | ||||

Fannie Mae: | ||||

floater Series 2007-95 Class A1, 3.6263% 8/27/36 (d) | 34,759 | 34,748 | ||

Series 2003-39 Class IA, 5.5% 10/25/22 (d)(e) | 4,097 | 471 | ||

Series 2006-48 Class LF, 0% 8/25/34 (d) | 468 | 463 | ||

target amortization class Series G94-2 Class D, 6.45% 1/25/24 | 2,796 | 2,867 | ||

Collateralized Mortgage Obligations - continued | ||||

Principal Amount (000s) | Value (000s) | |||

U.S. Government Agency - continued | ||||

Fannie Mae STRIP: | ||||

Series 331 Class 12, 6.5% 2/1/33 (e) | $ 2,657 | $ 544 | ||

Series 339 Class 5, 5.5% 7/1/33 (e) | 4,162 | 752 | ||

Series 343 Class 16, 5.5% 5/1/34 (e) | 2,968 | 547 | ||

Freddie Mac Multi-class participation certificates guaranteed: | ||||

floater: | ||||

Series 2861 Class JF, 4.5363% 4/15/17 (d) | 2,560 | 2,567 | ||

Series 3094 Class UF, 0% 9/15/34 (d) | 419 | 411 | ||

planned amortization class: | ||||

Series 2220 Class PD, 8% 3/15/30 (c) | 3,664 | 3,861 | ||

Series 2787 Class OI, 5.5% 10/15/24 (e) | 2,248 | 51 | ||

Series 40 Class K, 6.5% 8/17/24 (c) | 1,645 | 1,723 | ||

sequential payer: | ||||

Series 2204 Class N, 7.5% 12/20/29 (c) | 6,939 | 7,298 | ||

Series 2601 Class TI, 5.5% 10/15/22 (e) | 17,212 | 2,098 | ||

Series 2750 Class ZT, 5% 2/15/34 | 6,225 | 5,951 | ||

Series 2866 Class CY, 4.5% 10/15/19 | 4,491 | 4,381 | ||

Series 2957 Class SW, 1.7638% 4/15/35 (d)(e) | 11,953 | 665 | ||

Ginnie Mae guaranteed Multi-family REMIC pass-thru securities sequential payer Series 2002-71: | ||||

Class Z, 5.5% 10/20/32 | 46,905 | 47,415 | ||

Class ZJ, 6% 10/20/32 | 23,961 | 24,755 | ||

Ginnie Mae guaranteed REMIC pass-thru securities: | ||||

floater: | ||||

Series 2001-22 Class FM, 4.3088% 5/20/31 (d) | 658 | 658 | ||

Series 2002-41 Class HF, 4.4813% 6/16/32 (d) | 723 | 724 | ||

Series 2007-22 Class TC, 0% 4/20/37 (d) | 2,469 | 2,694 | ||

planned amortization class: | ||||

Series 1993-13 Class PD, 6% 5/20/29 | 16,631 | 17,235 | ||

Series 1994-4 Class KQ, 7.9875% 7/16/24 | 1,082 | 1,173 | ||

Series 2000-26 Class PK, 7.5% 9/20/30 | 2,797 | 2,924 | ||

Series 2001-65 Class PH, 6% 11/20/28 | 6,323 | 6,454 | ||

Series 2002-5 Class PD, 6.5% 5/16/31 | 7,204 | 7,252 | ||

Series 2002-50 Class PE, 6% 7/20/32 | 17,485 | 18,142 | ||

Series 2003-31 Class PI, 5.5% 4/16/30 (e) | 3,437 | 158 | ||

Series 2003-7 Class IN, 5.5% 1/16/28 (e) | 2,262 | 15 | ||

Series 2003-70 Class LE, 5% 7/20/32 | 44,000 | 44,168 | ||

Series 2004-19: | ||||

Class DJ, 4.5% 3/20/34 | 2,541 | 2,565 | ||

Class DP, 5.5% 3/20/34 | 3,895 | 4,028 | ||

Collateralized Mortgage Obligations - continued | ||||

Principal Amount (000s) | Value (000s) | |||

U.S. Government Agency - continued | ||||

Ginnie Mae guaranteed REMIC pass-thru securities: - continued | ||||

planned amortization class: | ||||

Series 2004-30: | ||||

Class PC, 5% 11/20/30 | $ 19,736 | $ 19,961 | ||

Class UA, 3.5% 2/20/32 | 4,894 | 4,852 | ||

Series 2004-64 Class KE, 5.5% 12/20/33 | 22,978 | 23,480 | ||

Series 2004-98 Class IG, 5.5% 2/20/30 (e) | 2,581 | 196 | ||

Series 2005-17 Class IA, 5.5% 8/20/33 (e) | 7,093 | 521 | ||

Series 2005-24 Class TC, 5.5% 3/20/35 | 5,403 | 5,426 | ||

Series 2005-54 Class BM, 5% 7/20/35 | 9,658 | 9,737 | ||

Series 2005-57 Class PB, 5.5% 7/20/35 | 5,673 | 5,700 | ||

Series 2005-58 Class NJ, 4.5% 8/20/35 | 64,950 | 65,559 | ||

Series 2006-50 Class JC, 5% 6/20/36 | 11,780 | 11,664 | ||

Series 2008-28 Class PC, 5.5% 4/20/34 | 18,652 | 19,068 | ||

sequential payer: | ||||

Series 1995-4 Class CQ, 8% 6/20/25 | 750 | 813 | ||

Series 2001-40 Class Z, 6% 8/20/31 | 8,442 | 8,831 | ||

Series 2002-18 Class ZB, 6% 3/20/32 | 8,158 | 8,452 | ||

Series 2002-29 Class SK, 8.25% 5/20/32 (d) | 366 | 386 | ||

Series 2002-45 Class Z, 6% 6/20/32 | 2,794 | 2,880 | ||

Series 2002-67 Class ZA, 6% 9/20/32 | 84,525 | 87,008 | ||

Series 2003-7 Class VP, 6% 11/20/13 | 4,669 | 4,755 | ||

Series 2004-65 Class VE, 5.5% 7/20/15 | 4,439 | 4,603 | ||

Series 2004-86 Class G, 6% 10/20/34 | 6,273 | 6,529 | ||

Series 2005-28 Class AJ, 5.5% 4/20/35 | 31,605 | 32,615 | ||

Series 2005-47 Class ZY, 6% 6/20/35 | 4,669 | 4,815 | ||

Series 2005-6 Class EX, 5.5% 11/20/34 | 1,001 | 1,007 | ||

Series 2005-82 Class JV, 5% 6/20/35 | 3,500 | 3,356 | ||

Series 1995-6 Class Z, 7% 9/20/25 | 2,192 | 2,327 | ||

Series 2003-11 Class S, 2.4688% 2/16/33 (d)(e) | 9,689 | 805 | ||

Series 2003-92 Class SN, 2.3488% 10/16/33 (d)(e) | 30,458 | 2,246 | ||

Series 2004-32 Class GS, 2.4188% 5/16/34 (d)(e) | 2,845 | 230 | ||

Series 2005-6 Class EY, 5.5% 11/20/33 | 1,016 | 1,023 | ||

Series 2006-13 Class DS, 5.1619% 3/20/36 (d) | 43,189 | 41,392 | ||

Series 2007-18 Class S, 2.7188% 4/16/37 (d)(e) | 46,739 | 4,142 | ||

Series 2007-35 Class SC, 15.7125% 6/16/37 (d) | 15,872 | 21,453 | ||

TOTAL COLLATERALIZED MORTGAGE OBLIGATIONS (Cost $636,033) | 655,590 | |||

Commercial Mortgage Securities - 0.4% | ||||

Principal Amount (000s) | Value (000s) | |||

Fannie Mae Series 1997-M1 Class N, 0.445% 10/17/36 (d)(e) | $ 7,403 | $ 58 | ||

Fannie Mae subordinate REMIC pass-thru certificates: | ||||

Series 1998-M3 Class IB, 0.793% 1/17/38 (d)(e) | 29,905 | 438 | ||

Series 1998-M4 Class N, 1.2415% 2/25/35 (d)(e) | 7,156 | 60 | ||

Ginnie Mae guaranteed Multi-family REMIC pass-thru securities: | ||||

sequential payer Series 2001-58 Class X, 1.1154% 9/16/41 (d)(e) | 139,457 | 2,789 | ||

Series 2001-12 Class X, 0.8249% 7/16/40 (d)(e) | 41,948 | 734 | ||

Ginnie Mae guaranteed REMIC pass-thru securities: | ||||

sequential payer Series 2002-81 Class IO, 1.844% 9/16/42 (d)(e) | 119,661 | 3,889 | ||

Series 2002-62 Class IO, 1.4217% 8/16/42 (d)(e) | 82,875 | 2,771 | ||

Series 2002-85 Class X, 1.7364% 3/16/42 (d)(e) | 65,287 | 4,437 | ||

TOTAL COMMERCIAL MORTGAGE SECURITIES (Cost $36,499) | 15,176 | |||

Cash Equivalents - 3.0% | |||

Maturity Amount (000s) | |||

Investments in repurchase agreements in a joint trading account at: | |||

1.69%, dated 1/31/08 due 2/1/08 (Collateralized by U.S. Treasury Obligations) # | 2,555 | 2,555 | |

3%, dated 1/31/08 due 2/1/08 (Collateralized by U.S. Government Obligations) # | 97,212 | 97,204 | |

TOTAL CASH EQUIVALENTS (Cost $99,759) | 99,759 | ||

TOTAL INVESTMENT PORTFOLIO - 118.4% (Cost $3,898,369) | 3,965,993 | ||

NET OTHER ASSETS - (18.4)% | (617,715) | ||

NET ASSETS - 100% | $ 3,348,278 | ||

Swap Agreements | |||||

Expiration Date | Notional Amount (000s) | Value (000s) | |||

Interest Rate Swaps | |||||

Receive quarterly a floating rate based on 3-month LIBOR and pay semi-annually a fixed rate equal to 4.92% with Morgan Stanley, Inc. | Sept. 2012 | $ 75,000 | $ (5,406) | ||

Receive quarterly a floating rate based on 3-month LIBOR and pay semi-annually a fixed rate equal to 5.135% with Credit Suisse First Boston | August 2009 | 90,000 | (4,689) | ||

Receive quarterly a floating rate based on 3-month LIBOR and pay semi-annually a fixed rate equal to 5.32% with Morgan Stanley, Inc. | July 2010 | 40,000 | (2,214) | ||

Receive quarterly a floating rate based on 3-month LIBOR and pay semi-annually a fixed rate equal to 5.47% with Credit Suisse First Boston | Sept. 2037 | 6,000 | (712) | ||

Receive quarterly a floating rate based on 3-month LIBOR and pay semi-annually a fixed rate equal to 5.523% with JPMorgan Chase, Inc. | August 2017 | 12,000 | (1,421) | ||

Receive quarterly a floating rate based on 3-month LIBOR and pay semi-annually a fixed rate equal to 5.524% with Credit Suisse First Boston | June 2009 | 121,000 | (4,334) | ||

$ 344,000 | $ (18,776) | ||||

Legend |

(a) Security or a portion of the security purchased on a delayed delivery or when-issued basis. |

(b) A portion of the security is subject to a forward commitment to sell. |

(c) Security or a portion of the security has been segregated as collateral for open swap agreements. At the period end, the value of securities pledged amounted to $4,341,000. |

(d) The coupon rate shown on floating or adjustable rate securities represents the rate at period end. |

(e) Security represents right to receive monthly interest payments on an underlying pool of mortgages or assets. Principal shown is the outstanding par amount of the pool held as of the end of the period. |

# Additional Information on each counterparty to the repurchase agreement is as follows: |

Repurchase Agreement / Counterparty | Value |

$2,555,000 due 2/01/08 at 1.69% | |

Banc of America Securities LLC | $ 558 |

Barclays Capital, Inc. | 804 |

ING Financial Markets LLC | 1,193 |

$ 2,555 | |

$97,204,000 due 2/01/08 at 3.00% | |

BNP Paribas Securities Corp. | $ 10,092 |

Banc of America Securities LLC | 4,037 |

Barclays Capital, Inc. | 43,253 |

Bear Stearns & Co., Inc. | 12,333 |

Citigroup Global Markets, Inc. | 2,883 |

Dresdner Kleinwort Securities LLC | 1,442 |

ING Financial Markets LLC | 1,827 |

J.P. Morgan Securities, | 8,650 |

Societe Generale, New York Branch | 11,534 |

WestLB AG | 1,153 |

$ 97,204 | |

Income Tax Information |

At July 31, 2007, the fund had a capital loss carryforward of approximately $55,811,000 of which $9,594,000 and $46,217,000 will expire on July 31, 2014 and 2015, respectively. |

See accompanying notes which are an integral part of the financial statements.

Semiannual Report

Financial Statements

Statement of Assets and Liabilities

Amounts in thousands (except per-share amount) | January 31, 2008 (Unaudited) | |

Assets | ||

Investment in securities, at value (including repurchase agreements of $99,759) - See accompanying schedule: Unaffiliated issuers (cost $3,898,369) | $ 3,965,993 | |

Commitment to sell securities on a delayed delivery basis | $ (108,845) | |

Receivable for securities sold on a delayed delivery basis | 109,031 | 186 |

Receivable for investments sold, regular delivery | 2,996 | |

Cash | 1 | |

Receivable for fund shares sold | 1,965 | |

Interest receivable | 17,092 | |

Other receivables | 61 | |

Total assets | 3,988,294 | |

Liabilities | ||

Payable for investments purchased | $ 70,793 | |

Delayed delivery | 544,767 | |

Payable for fund shares redeemed | 2,790 | |

Distributions payable | 1,495 | |

Swap agreements, at value | 18,776 | |

Accrued management fee | 863 | |

Other affiliated payables | 376 | |

Other payables and accrued expenses | 156 | |

Total liabilities | 640,016 | |

Net Assets | $ 3,348,278 | |

Net Assets consist of: | ||

Paid in capital | $ 3,349,986 | |

Distributions in excess of net investment income | (7,624) | |

Accumulated undistributed net realized gain (loss) on investments | (43,118) | |

Net unrealized appreciation (depreciation) on investments | 49,034 | |

Net Assets, for 301,844 shares outstanding | $ 3,348,278 | |

Net Asset Value, offering price and redemption price per share ($3,348,278 ÷ 301,844 shares) | $ 11.09 | |

See accompanying notes which are an integral part of the financial statements.

Semiannual Report

Financial Statements - continued

Statement of Operations

Amounts in thousands | Six months ended January 31, 2008 (Unaudited) | |

Investment Income | ||

Interest | $ 85,914 | |

Expenses | ||

Management fee | $ 5,053 | |

Transfer agent fees | 1,604 | |

Fund wide operations fee | 554 | |

Independent trustees' compensation | 7 | |

Miscellaneous | 5 | |

Total expenses before reductions | 7,223 | |

Expense reductions | (28) | 7,195 |

Net investment income | 78,719 | |

Realized and Unrealized Gain (Loss) Net realized gain (loss) on: | ||

Investment securities: | ||

Unaffiliated issuers | 20,646 | |

Swap agreements | 2,109 | |

Total net realized gain (loss) | 22,755 | |

Change in net unrealized appreciation (depreciation) on: Investment securities | 130,798 | |

Swap agreements | (17,296) | |

Delayed delivery commitments | 186 | |

Total change in net unrealized appreciation (depreciation) | 113,688 | |

Net gain (loss) | 136,443 | |

Net increase (decrease) in net assets resulting from operations | $ 215,162 | |

See accompanying notes which are an integral part of the financial statements.

Semiannual Report

Statement of Changes in Net Assets

Amounts in thousands | Six months ended January 31, 2008 (Unaudited) | Year ended |

Increase (Decrease) in Net Assets | ||

Operations | ||

Net investment income | $ 78,719 | $ 165,363 |

Net realized gain (loss) | 22,755 | (26,430) |

Change in net unrealized appreciation (depreciation) | 113,688 | 33,224 |

Net increase (decrease) in net assets resulting | 215,162 | 172,157 |

Distributions to shareholders from net investment income | (81,679) | (164,399) |

Share transactions | 295,745 | 321,666 |

Reinvestment of distributions | 72,227 | 145,593 |

Cost of shares redeemed | (325,478) | (667,711) |

Net increase (decrease) in net assets resulting from share transactions | 42,494 | (200,452) |

Total increase (decrease) in net assets | 175,977 | (192,694) |

Net Assets | ||

Beginning of period | 3,172,301 | 3,364,995 |

End of period (including distributions in excess of net investment income of $7,624 and distributions in excess of net investment income of $4,664, respectively) | $ 3,348,278 | $ 3,172,301 |

Other Information Shares | ||

Sold | 27,082 | 29,988 |

Issued in reinvestment of distributions | 6,640 | 13,559 |

Redeemed | (30,012) | (62,274) |

Net increase (decrease) | 3,710 | (18,727) |

See accompanying notes which are an integral part of the financial statements.

Semiannual Report

Financial Highlights

Six months ended | Years ended July 31, | |||||

(Unaudited) | 2007 | 2006 | 2005 | 2004 | 2003 | |

Selected Per-Share Data | ||||||

Net asset value, beginning of period | $ 10.64 | $ 10.62 | $ 11.00 | $ 11.00 | $ 11.05 | $ 11.11 |

Income from Investment Operations | ||||||

Net investment income D | .266 | .537 | .497 | .443 | .404 | .364 |

Net realized and unrealized gain (loss) | .460 | .017 | (.315) | .004 | .027 | (.029) |

Total from investment operations | .726 | .554 | .182 | .447 | .431 | .335 |

Distributions from net investment income | (.276) | (.534) | (.542) | (.447) | (.391) | (.395) |

Distributions from net realized gain | - | - | (.020) | - | (.090) | - |

Total distributions | (.276) | (.534) | (.562) | (.447) | (.481) | (.395) |

Net asset value, end of period | $ 11.09 | $ 10.64 | $ 10.62 | $ 11.00 | $ 11.00 | $ 11.05 |

Total Return B,C | 6.90% | 5.29% | 1.70% | 4.11% | 3.96% | 3.02% |

Ratios to Average Net Assets E | ||||||

Expenses before reductions | .45% A | .45% | .45% | .57% | .60% | .57% |

Expenses net of fee waivers, if any | .45% A | .45% | .45% | .57% | .60% | .57% |

Expenses net of all reductions | .45% A | .45% | .45% | .57% | .60% | .57% |

Net investment income | 4.88% A | 5.01% | 4.61% | 4.00% | 3.64% | 3.25% |

Supplemental Data | ||||||

Net assets, end of period (in millions) | $ 3,348 | $ 3,172 | $ 3,365 | $ 4,033 | $ 3,977 | $ 5,606 |

Portfolio turnover | 169% A | 165% | 183% | 160% | 155% | 262% |

B Total returns for periods of less than one year are not annualized.

C Total returns would have been lower had certain expenses not been reduced during the periods shown.

D Calculated based on average shares outstanding during the period.

E Expense ratios reflect operating expenses of the Fund. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or expense offset arrangements and do not represent the amount paid by the Fund during periods when reimbursements or reductions occur. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the Fund.

See accompanying notes which are an integral part of the financial statements.

Semiannual Report

Fidelity Intermediate Government Income Fund

Investment Changes

Coupon Distribution as of January 31, 2008 | ||

% of fund's investments | % of fund's investments | |

Less than 3% | 5.8 | 1.7 |

3 - 3.99% | 14.9 | 3.6 |

4 - 4.99% | 33.6 | 41.2 |

5 - 5.99% | 19.3 | 23.3 |

6 - 6.99% | 6.3 | 5.9 |

7% and over | 0.7 | 1.1 |

Coupon distribution shows the range of stated interest rates on the fund's investments, excluding short-term investments. |

Weighted Average Maturity as of January 31, 2008 | ||

6 months ago | ||

Years | 3.8 | 3.3 |

The weighted average maturity is based on the dollar-weighted average length of time until principal payments are expected or until securities reach maturity, taking into account any maturity shortening feature such as a call, refunding or redemption provision. |

Duration as of January 31, 2008 | ||

6 months ago | ||

Years | 3.5 | 3.4 |

Duration shows how much a bond fund's price fluctuates with changes in comparable interest rates. If rates rise 1%, for example, a fund with a five-year duration is likely to lose about 5% of its value. Other factors also can influence a bond fund's performance and share price. Accordingly, a bond fund's actual performance may differ from this example. |

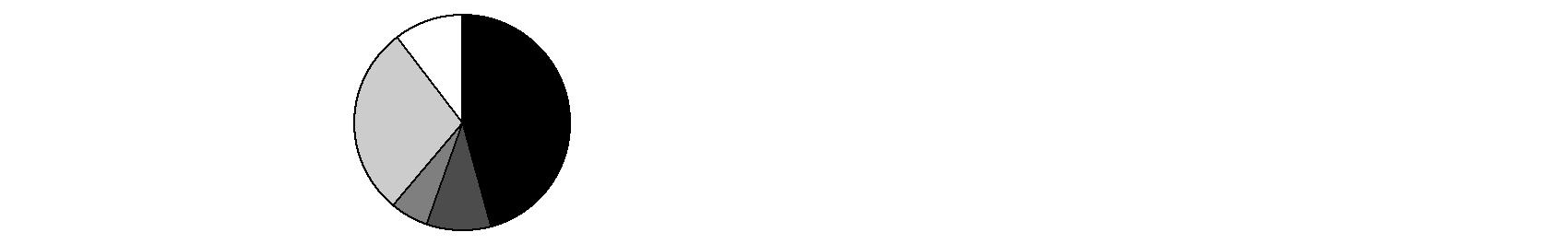

Asset Allocation (% of fund's net assets) | |||||||

As of January 31, 2008* | As of July 31, 2007** | ||||||

| Mortgage |  | Mortgage | ||||

| CMOs and |  | CMOs and | ||||

| U.S. Treasury |  | U.S. Treasury | ||||

| U.S. Government |  | U.S. Government | ||||

| Asset-Backed |  | Asset-Backed | ||||

| Short-Term |  | Short-Term | ||||

* Futures and Swaps | 7.2% | ** Futures and Swaps | 4.8% | ||||

(dagger) Short-Term Investments and Net Other Assets are not included in the pie chart. |

Semiannual Report

Fidelity Intermediate Government Income Fund

Investments January 31, 2008 (Unaudited)

Showing Percentage of Net Assets

U.S. Government and Government Agency Obligations - 66.5% | ||||

Principal Amount (000s) | Value (000s) | |||

U.S. Government Agency Obligations - 16.0% | ||||

Fannie Mae: | ||||

4.875% 4/15/09 | $ 1 | $ 1 | ||

6.625% 9/15/09 | 13,377 | 14,205 | ||

Federal Home Loan Bank: | ||||

4.5% 10/14/08 | 1,850 | 1,873 | ||

5.375% 8/19/11 | 16,960 | 18,272 | ||

5.8% 9/2/08 | 5,845 | 5,947 | ||

Freddie Mac: | ||||

4.125% 11/30/09 | 28,300 | 29,016 | ||

4.125% 12/21/12 | 16,000 | 16,512 | ||

5.125% 4/18/11 | 2,360 | 2,508 | ||

5.25% 7/18/11 | 58 | 62 | ||

5.5% 8/23/17 | 5,500 | 6,048 | ||

5.625% 3/15/11 | 1,000 | 1,076 | ||

Israeli State (guaranteed by U.S. Government through Agency for International Development): | ||||

6.6% 2/15/08 | 2,887 | 2,889 | ||

6.8% 2/15/12 | 7,500 | 8,017 | ||

Private Export Funding Corp.: | ||||

secured: | ||||

5.66% 9/15/11 (c) | 9,000 | 9,761 | ||

5.685% 5/15/12 | 3,915 | 4,284 | ||

4.974% 8/15/13 | 3,435 | 3,689 | ||

Small Business Administration guaranteed development participation certificates Series 2004-20H Class 1, 5.17% 8/1/24 | 730 | 754 | ||

U.S. Department of Housing and Urban Development Government guaranteed participation certificates Series 1999-A, 6.06% 8/1/10 | 10,000 | 10,156 | ||

TOTAL U.S. GOVERNMENT AGENCY OBLIGATIONS | 135,070 | |||

U.S. Treasury Inflation Protected Obligations - 2.1% | ||||

U.S. Treasury Inflation-Indexed Notes 2% 4/15/12 | 16,569 | 17,546 | ||

U.S. Treasury Obligations - 48.4% | ||||

U.S. Treasury Bonds 6.125% 8/15/29 | 1,000 | 1,245 | ||

U.S. Treasury Notes: | ||||

2.125% 1/31/10 (d) | 46,864 | 46,821 | ||

3.25% 12/31/09 (d) | 75,499 | 77,038 | ||

3.375% 11/30/12 (f) | 8,000 | 8,200 | ||

3.625% 12/31/12 (d) | 60,172 | 62,405 | ||

4.25% 11/15/14 (b) | 42,000 | 44,628 | ||

U.S. Government and Government Agency Obligations - continued | ||||

Principal Amount (000s) | Value (000s) | |||

U.S. Treasury Obligations - continued | ||||

U.S. Treasury Notes: - continued | ||||

4.25% 11/15/17 (b) | $ 22,000 | $ 23,103 | ||

4.625% 7/31/12 (b)(f) | 62,500 | 67,427 | ||

4.75% 5/15/14 (b) | 32,058 | 35,086 | ||

4.75% 8/15/17 (b)(d) | 40,953 | 44,576 | ||

TOTAL U.S. TREASURY OBLIGATIONS | 410,529 | |||

TOTAL U.S. GOVERNMENT AND GOVERNMENT AGENCY OBLIGATIONS (Cost $550,207) | 563,145 | |||

U.S. Government Agency - Mortgage Securities - 30.5% | ||||

Fannie Mae - 22.8% | ||||

3.595% 9/1/33 (g) | 296 | 299 | ||

3.718% 6/1/33 (g) | 926 | 937 | ||

3.751% 10/1/33 (g) | 82 | 83 | ||

3.784% 6/1/33 (g) | 1,052 | 1,058 | ||

3.798% 6/1/33 (g) | 80 | 81 | ||

3.874% 6/1/33 (g) | 374 | 377 | ||

3.892% 5/1/33 (g) | 452 | 455 | ||

3.899% 5/1/34 (g) | 599 | 605 | ||

3.909% 5/1/33 (g) | 25 | 26 | ||

3.937% 5/1/34 (g) | 467 | 471 | ||

3.954% 9/1/33 (g) | 713 | 720 | ||

3.965% 8/1/33 (g) | 405 | 410 | ||

4% 9/1/13 to 5/1/20 | 2,700 | 2,680 | ||

4% 3/1/34 (g) | 849 | 858 | ||

4% 4/1/34 (g) | 917 | 927 | ||

4.028% 3/1/34 (g) | 1,743 | 1,760 | ||

4.063% 3/1/35 (g) | 1,629 | 1,644 | ||

4.065% 10/1/18 (g) | 61 | 61 | ||

4.115% 4/1/34 (g) | 1,117 | 1,122 | ||

4.119% 5/1/34 (g) | 923 | 932 | ||

4.169% 8/1/33 (g) | 410 | 413 | ||

4.172% 1/1/35 (g) | 205 | 208 | ||

4.237% 1/1/34 (g) | 219 | 221 | ||

4.25% 2/1/35 (g) | 92 | 93 | ||

4.261% 10/1/33 (g) | 35 | 35 | ||

4.268% 6/1/33 (g) | 41 | 41 | ||

4.294% 3/1/35 (g) | 72 | 73 | ||

U.S. Government Agency - Mortgage Securities - continued | ||||

Principal Amount (000s) | Value (000s) | |||

Fannie Mae - continued | ||||

4.294% 5/1/35 (g) | $ 83 | $ 84 | ||

4.298% 6/1/33 (g) | 1,002 | 1,014 | ||

4.299% 3/1/33 (g) | 51 | 51 | ||

4.301% 4/1/33 (g) | 20 | 20 | ||

4.312% 1/1/35 (g) | 790 | 804 | ||

4.33% 3/1/33 (g) | 67 | 68 | ||

4.33% 4/1/35 (g) | 43 | 43 | ||

4.334% 2/1/35 (g) | 37 | 38 | ||

4.344% 10/1/19 (g) | 105 | 106 | ||

4.345% 1/1/35 (g) | 103 | 105 | ||

4.35% 8/1/33 (g) | 156 | 157 | ||

4.357% 2/1/34 (g) | 194 | 196 | ||

4.366% 11/1/35 (g) | 2,629 | 2,671 | ||

4.376% 1/1/34 (g) | 1,161 | 1,169 | ||

4.389% 5/1/35 (g) | 97 | 98 | ||

4.391% 2/1/35 (g) | 165 | 168 | ||

4.396% 10/1/34 (g) | 434 | 440 | ||

4.411% 10/1/33 (g) | 423 | 429 | ||

4.418% 8/1/34 (g) | 261 | 265 | ||

4.419% 8/1/34 (g) | 2,250 | 2,282 | ||

4.434% 3/1/35 (g) | 162 | 165 | ||

4.437% 11/1/33 (g) | 141 | 143 | ||

4.456% 8/1/35 (g) | 1,361 | 1,371 | ||

4.482% 1/1/35 (g) | 493 | 501 | ||

4.486% 12/1/34 (g) | 53 | 53 | ||

4.486% 5/1/35 (g) | 1,214 | 1,230 | ||

4.5% 3/1/18 to 10/1/18 | 2,655 | 2,671 | ||

4.501% 2/1/35 (g) | 1,135 | 1,148 | ||

4.51% 8/1/34 (g) | 1,669 | 1,686 | ||

4.524% 1/1/35 (g) | 98 | 99 | ||

4.53% 2/1/35 (g) | 67 | 69 | ||

4.534% 7/1/35 (g) | 284 | 287 | ||

4.54% 5/1/35 (g) | 240 | 244 | ||

4.552% 9/1/34 (g) | 2,038 | 2,069 | ||

4.566% 2/1/35 (g) | 383 | 389 | ||

4.569% 1/1/35 (g) | 752 | 765 | ||

4.569% 10/1/35 (g) | 59 | 59 | ||

4.575% 7/1/35 (g) | 272 | 275 | ||

4.579% 2/1/36 (g) | 1,232 | 1,250 | ||

4.609% 8/1/35 (g) | 1,021 | 1,041 | ||

4.618% 2/1/35 (g) | 37 | 38 | ||

4.642% 1/1/35 (g) | 520 | 530 | ||

U.S. Government Agency - Mortgage Securities - continued | ||||

Principal Amount (000s) | Value (000s) | |||

Fannie Mae - continued | ||||

4.646% 10/1/34 (g) | $ 318 | $ 323 | ||

4.665% 6/1/35 (g) | 356 | 360 | ||

4.682% 9/1/34 (g) | 1,282 | 1,307 | ||

4.685% 3/1/35 (g) | 20 | 20 | ||

4.69% 2/1/35 (g) | 1,338 | 1,364 | ||

4.693% 10/1/34 (g) | 280 | 285 | ||

4.695% 8/1/35 (g) | 466 | 472 | ||

4.703% 3/1/35 (g) | 579 | 589 | ||

4.714% 7/1/34 (g) | 260 | 265 | ||

4.716% 2/1/35 (g) | 611 | 623 | ||

4.726% 12/1/35 (g) | 3,838 | 3,908 | ||

4.77% 12/1/34 (g) | 76 | 77 | ||

4.773% 1/1/35 (g) | 435 | 443 | ||

4.792% 7/1/35 (g) | 411 | 420 | ||

4.796% 11/1/34 (g) | 224 | 228 | ||

4.797% 7/1/36 (g) | 399 | 404 | ||

4.803% 6/1/35 (g) | 325 | 329 | ||

4.819% 10/1/35 (g) | 183 | 186 | ||

4.822% 12/1/34 (g) | 940 | 957 | ||

4.829% 9/1/34 (g) | 407 | 415 | ||

4.829% 4/1/35 (g) | 1,143 | 1,161 | ||

4.836% 9/1/34 (g) | 873 | 889 | ||

4.853% 1/1/35 (g) | 335 | 341 | ||

4.853% 7/1/35 (g) | 549 | 561 | ||

4.856% 10/1/34 (g) | 896 | 913 | ||

4.883% 5/1/35 (g) | 175 | 179 | ||

4.885% 10/1/35 (g) | 153 | 155 | ||

4.901% 11/1/35 (g) | 931 | 941 | ||

4.909% 3/1/33 (g) | 268 | 273 | ||

4.934% 8/1/34 (g) | 844 | 859 | ||

4.943% 8/1/34 (g) | 680 | 693 | ||

4.948% 2/1/35 (g) | 474 | 484 | ||

4.952% 3/1/35 (g) | 467 | 477 | ||

4.957% 2/1/33 (g) | 98 | 100 | ||

4.997% 2/1/34 (g) | 698 | 713 | ||

5% 2/1/16 to 1/1/38 (e) | 53,321 | 53,463 | ||

5% 1/1/38 | 11,300 | 11,271 | ||

5.016% 7/1/34 (g) | 41 | 42 | ||

5.019% 12/1/32 (g) | 888 | 904 | ||

5.037% 10/1/35 (g) | 604 | 619 | ||

5.059% 8/1/34 (g) | 60 | 61 | ||

5.062% 9/1/34 (g) | 594 | 605 | ||

U.S. Government Agency - Mortgage Securities - continued | ||||

Principal Amount (000s) | Value (000s) | |||

Fannie Mae - continued | ||||

5.082% 9/1/34 (g) | $ 70 | $ 72 | ||

5.094% 5/1/35 (g) | 215 | 219 | ||

5.105% 10/1/35 (g) | 426 | 437 | ||

5.12% 8/1/34 (g) | 551 | 562 | ||

5.135% 3/1/35 (g) | 45 | 46 | ||

5.157% 8/1/33 (g) | 107 | 108 | ||

5.168% 3/1/36 (g) | 1,279 | 1,315 | ||

5.19% 6/1/35 (g) | 336 | 342 | ||

5.249% 11/1/36 (g) | 274 | 279 | ||

5.265% 4/1/36 (g) | 511 | 526 | ||

5.271% 12/1/36 (g) | 275 | 280 | ||

5.283% 7/1/35 (g) | 2,397 | 2,456 | ||

5.309% 12/1/34 (g) | 90 | 92 | ||

5.315% 7/1/35 (g) | 41 | 42 | ||

5.334% 2/1/36 (g) | 93 | 95 | ||

5.354% 1/1/36 (g) | 1,005 | 1,023 | ||

5.356% 2/1/36 (g) | 705 | 718 | ||

5.369% 3/1/37 (g) | 1,837 | 1,872 | ||

5.385% 2/1/37 (g) | 251 | 257 | ||

5.391% 2/1/37 (g) | 1,191 | 1,216 | ||

5.48% 6/1/47 (g) | 201 | 205 | ||

5.482% 2/1/37 (g) | 1,663 | 1,702 | ||

5.5% 1/1/09 to 6/1/20 | 19,860 | 20,455 | ||

5.521% 11/1/36 (g) | 511 | 521 | ||

5.618% 2/1/36 (g) | 298 | 307 | ||

5.628% 4/1/37 (g) | 1,105 | 1,131 | ||

5.65% 4/1/36 (g) | 1,134 | 1,169 | ||

5.661% 6/1/36 (g) | 695 | 716 | ||

5.792% 3/1/36 (g) | 2,257 | 2,325 | ||

5.804% 1/1/36 (g) | 279 | 287 | ||

5.815% 5/1/36 (g) | 1,687 | 1,737 | ||

5.893% 12/1/36 (g) | 417 | 430 | ||

5.897% 9/1/36 (g) | 471 | 481 | ||

5.923% 5/1/36 (g) | 734 | 756 | ||

5.966% 5/1/36 (g) | 270 | 279 | ||

6% 5/1/12 to 3/1/31 | 7,329 | 7,576 | ||

6.01% 4/1/36 (g) | 4,646 | 4,796 | ||

6.104% 3/1/37 (g) | 446 | 461 | ||

6.152% 4/1/36 (g) | 459 | 474 | ||

6.224% 6/1/36 (g) | 71 | 72 | ||

6.226% 3/1/37 (g) | 140 | 144 | ||

6.5% 6/1/16 to 7/1/32 | 2,062 | 2,154 | ||

U.S. Government Agency - Mortgage Securities - continued | ||||

Principal Amount (000s) | Value (000s) | |||

Fannie Mae - continued | ||||

7% 12/1/08 to 9/1/31 | $ 323 | $ 339 | ||

7.5% 5/1/37 | 371 | 394 | ||

9% 2/1/13 | 88 | 94 | ||

9.5% 11/15/09 | 89 | 93 | ||

10.25% 10/1/09 to 10/1/18 | 7 | 8 | ||

11% 8/1/10 to 1/1/16 | 226 | 244 | ||

11.25% 5/1/14 to 1/1/16 | 53 | 61 | ||

11.5% 9/1/11 to 6/15/19 | 169 | 191 | ||

12.25% 7/1/12 to 8/1/13 | 8 | 9 | ||

12.5% 9/1/12 to 7/1/16 | 139 | 163 | ||

12.75% 10/1/11 to 6/1/15 | 84 | 93 | ||

13% 7/1/13 to 7/1/15 | 62 | 74 | ||

13.25% 9/1/11 | 53 | 60 | ||

13.5% 11/1/14 to 12/1/14 | 14 | 17 | ||

15% 4/1/12 | 3 | 3 | ||

193,538 | ||||

Freddie Mac - 7.5% | ||||

3.374% 7/1/33 (g) | 919 | 923 | ||

3.998% 5/1/33 (g) | 1,320 | 1,337 | ||

4% 1/1/19 to 11/1/20 | 4,186 | 4,133 | ||

4.004% 4/1/34 (g) | 1,413 | 1,424 | ||

4.075% 7/1/35 (g) | 664 | 670 | ||

4.18% 1/1/35 (g) | 1,316 | 1,331 | ||

4.298% 12/1/34 (g) | 140 | 141 | ||

4.308% 3/1/35 (g) | 107 | 107 | ||

4.318% 2/1/35 (g) | 214 | 216 | ||

4.409% 2/1/34 (g) | 108 | 109 | ||

4.413% 6/1/35 (g) | 154 | 156 | ||

4.423% 3/1/35 (g) | 144 | 146 | ||

4.448% 3/1/35 (g) | 149 | 151 | ||

4.5% 2/1/18 to 11/1/20 | 1,540 | 1,547 | ||

4.54% 2/1/35 (g) | 255 | 258 | ||

4.595% 6/1/33 (g) | 410 | 411 | ||

4.647% 5/1/35 (g) | 873 | 879 | ||

4.66% 2/1/35 (g) | 3,350 | 3,408 | ||

4.697% 9/1/36 (g) | 296 | 299 | ||

4.703% 9/1/35 (g) | 3,634 | 3,693 | ||

4.789% 2/1/36 (g) | 125 | 128 | ||

4.807% 3/1/35 (g) | 257 | 261 | ||

4.819% 5/1/35 (g) | 2,318 | 2,361 | ||

4.839% 3/1/33 (g) | 32 | 33 | ||

U.S. Government Agency - Mortgage Securities - continued | ||||

Principal Amount (000s) | Value (000s) | |||

Freddie Mac - continued | ||||

4.866% 10/1/35 (g) | $ 549 | $ 560 | ||

4.897% 10/1/36 (g) | 1,740 | 1,766 | ||

5% 3/1/18 to 9/1/35 | 2,994 | 3,059 | ||

5.008% 4/1/35 (g) | 541 | 550 | ||

5.009% 7/1/35 (g) | 1,462 | 1,489 | ||

5.012% 10/1/36 (g) | 573 | 582 | ||

5.115% 7/1/35 (g) | 485 | 496 | ||

5.195% 12/1/33 (g) | 1,176 | 1,195 | ||

5.268% 2/1/36 (g) | 40 | 41 | ||

5.275% 11/1/35 (g) | 506 | 513 | ||

5.43% 3/1/37 (g) | 183 | 186 | ||

5.5% 8/1/14 to 11/1/20 | 3,241 | 3,337 | ||

5.501% 1/1/36 (g) | 438 | 449 | ||

5.524% 1/1/36 (g) | 614 | 628 | ||

5.542% 4/1/37 (g) | 271 | 276 | ||

5.586% 3/1/36 (g) | 1,891 | 1,938 | ||

5.656% 8/1/36 (g) | 1,867 | 1,912 | ||

5.748% 10/1/35 (g) | 122 | 125 | ||

5.767% 5/1/37 (g) | 2,060 | 2,104 | ||

5.778% 3/1/37 (g) | 966 | 985 | ||

5.794% 4/1/37 (g) | 927 | 949 | ||

5.822% 5/1/37 (g) | 197 | 201 | ||

5.829% 5/1/37 (g) | 301 | 307 | ||

5.839% 5/1/37 (g) | 1,175 | 1,199 | ||

5.839% 6/1/37 (g) | 719 | 735 | ||

5.945% 4/1/36 (g) | 2,418 | 2,484 | ||

6% 7/1/16 to 2/1/19 | 2,646 | 2,748 | ||

6.017% 6/1/36 (g) | 317 | 325 | ||

6.136% 12/1/36 (g) | 2,211 | 2,261 | ||

6.141% 2/1/37 (g) | 274 | 280 | ||

6.224% 5/1/36 (g) | 261 | 268 | ||

6.348% 7/1/36 (g) | 333 | 343 | ||

6.417% 6/1/37 (g) | 70 | 72 | ||

6.485% 9/1/36 (g) | 1,645 | 1,697 | ||

6.5% 5/1/08 to 12/1/21 | 938 | 976 | ||

6.717% 8/1/37 (g) | 523 | 539 | ||

7.581% 4/1/37 (g) | 75 | 78 | ||

8.5% 6/1/14 to 5/1/17 | 14 | 14 | ||

9% 11/1/09 to 8/1/16 | 31 | 35 | ||

9.5% 7/1/16 to 8/1/21 | 257 | 291 | ||

10% 7/1/09 to 3/1/21 | 505 | 574 | ||

10.5% 9/1/09 to 5/1/21 | 26 | 28 | ||

U.S. Government Agency - Mortgage Securities - continued | ||||

Principal Amount (000s) | Value (000s) | |||

Freddie Mac - continued | ||||

11% 9/1/20 | $ 19 | $ 23 | ||

11.25% 2/1/10 to 6/1/14 | 61 | 69 | ||

11.5% 10/1/15 to 8/1/19 | 46 | 53 | ||

11.75% 11/1/11 to 7/1/15 | 9 | 9 | ||

12% 10/1/09 to 11/1/19 | 113 | 128 | ||

12.25% 12/1/11 to 8/1/15 | 51 | 58 | ||

12.5% 10/1/09 to 6/1/19 | 547 | 630 | ||

12.75% 2/1/10 to 10/1/10 | 5 | 6 | ||

13% 9/1/10 to 5/1/17 | 91 | 106 | ||

13.25% 11/1/10 to 10/1/13 | 25 | 29 | ||

13.5% 11/1/10 to 8/1/11 | 29 | 33 | ||

14% 11/1/12 to 4/1/16 | 5 | 6 | ||

14.5% 12/1/10 | 1 | 1 | ||

14.75% 3/1/10 | 1 | 1 | ||

16.25% 7/1/11 | 0 | 0 | ||

63,869 | ||||

Government National Mortgage Association - 0.2% | ||||

8% 12/15/23 | 392 | 437 | ||

8.5% 6/15/16 to 2/15/17 | 7 | 8 | ||

10.5% 9/15/15 to 10/15/21 | 630 | 752 | ||

10.75% 12/15/09 to 3/15/10 | 6 | 6 | ||

11% 5/20/16 to 1/20/21 | 39 | 47 | ||

12.5% 12/15/10 | 1 | 1 | ||

13% 1/15/11 to 10/15/13 | 42 | 48 | ||

13.25% 8/15/14 | 9 | 11 | ||

13.5% 7/15/11 to 12/15/14 | 10 | 11 | ||

14% 6/15/11 | 5 | 6 | ||

1,327 | ||||

TOTAL U.S. GOVERNMENT AGENCY - MORTGAGE SECURITIES (Cost $250,901) | 258,734 | |||

Asset-Backed Securities - 0.2% | ||||

Fannie Mae Grantor Trust Series 2005-T4 Class A1C, 3.5263% 9/25/35 (g) | 1,895 | 1,882 | ||

Collateralized Mortgage Obligations - 9.2% | ||||

Principal Amount (000s) | Value (000s) | |||

U.S. Government Agency - 9.2% | ||||

Fannie Mae: | ||||

floater: | ||||

Series 1994-42 Class FK, 3.54% 4/25/24 (g) | $ 3,325 | $ 3,166 | ||

Series 2007-95 Class A1, 3.6263% 8/27/36 (g) | 1,738 | 1,737 | ||

planned amortization class: | ||||

Series 1988-21 Class G, 9.5% 8/25/18 | 75 | 83 | ||

Series 1994-12 Class PH, 6.25% 1/25/09 | 278 | 278 | ||

Series 2002-83 Class ME, 5% 12/25/17 | 5,150 | 5,168 | ||

Series 2003-28 Class KG, 5.5% 4/25/23 | 725 | 732 | ||

sequential payer Series 1993-238 Class C, 6.5% 12/25/08 | 1,169 | 1,173 | ||

Fannie Mae subordinate REMIC pass-thru certificates: | ||||

floater: | ||||

Series 2001-38 Class QF, 4.3563% 8/25/31 (g) | 651 | 663 | ||

Series 2002-60 Class FV, 4.3763% 4/25/32 (g) | 236 | 240 | ||

Series 2002-74 Class FV, 3.8263% 11/25/32 (g) | 3,222 | 3,226 | ||

Series 2002-75 Class FA, 4.3763% 11/25/32 (g) | 484 | 492 | ||

planned amortization class: | ||||

Series 2001-68 Class QZ, 5.5% 12/25/16 | 547 | 561 | ||

Series 2002-11: | ||||

Class QC, 5.5% 3/25/17 | 1,391 | 1,421 | ||

Class UC, 6% 3/25/17 | 1,086 | 1,125 | ||

Series 2002-16 Class PG, 6% 4/25/17 | 1,273 | 1,319 | ||

Series 2002-18 Class PC, 5.5% 4/25/17 | 1,790 | 1,834 | ||

Series 2002-61 Class PG, 5.5% 10/25/17 | 1,945 | 2,004 | ||

Series 2002-71 Class UC, 5% 11/25/17 | 3,155 | 3,191 | ||

Series 2002-9 Class PC, 6% 3/25/17 | 99 | 102 | ||

Series 2003-122 Class OL, 4% 12/25/18 | 880 | 850 | ||

Series 2003-128 Class NE, 4% 12/25/16 | 1,260 | 1,258 | ||

Series 2003-85 Class GD, 4.5% 9/25/18 | 1,425 | 1,422 | ||

Series 2004-80 Class LD, 4% 1/25/19 | 980 | 975 | ||

Series 2004-81: | ||||

Class KC, 4.5% 4/25/17 | 690 | 699 | ||

Class KD, 4.5% 7/25/18 | 1,315 | 1,329 | ||

Series 2005-52 Class PB, 6.5% 12/25/34 | 1,834 | 1,895 | ||

sequential payer: | ||||

Series 2002-56 Class MC, 5.5% 9/25/17 | 396 | 405 | ||

Series 2002-57 Class BD, 5.5% 9/25/17 | 347 | 355 | ||

Series 2003-18 Class EY, 5% 6/25/17 | 1,883 | 1,910 | ||

Collateralized Mortgage Obligations - continued | ||||

Principal Amount (000s) | Value (000s) | |||

U.S. Government Agency - continued | ||||

Freddie Mac Multi-class participation certificates guaranteed: | ||||

floater: | ||||

Series 2526 Class FC, 4.6363% 11/15/32 (g) | $ 731 | $ 732 | ||

Series 2630 Class FL, 4.7363% 6/15/18 (g) | 58 | 59 | ||

Series 2925 Class CQ, 0% 1/15/35 (g) | 227 | 208 | ||

planned amortization class: | ||||

Series 2356 Class GD, 6% 9/15/16 | 421 | 436 | ||

Series 2376 Class JE, 5.5% 11/15/16 | 368 | 380 | ||

Series 2378 Class PE, 5.5% 11/15/16 | 1,063 | 1,089 | ||

Series 2381 Class OG, 5.5% 11/15/16 | 295 | 302 | ||

Series 2390 Class CH, 5.5% 12/15/16 | 964 | 988 | ||

Series 2425 Class JH, 6% 3/15/17 | 512 | 531 | ||

Series 2628 Class OE, 4.5% 6/15/18 | 705 | 708 | ||

Series 2640 Class GE, 4.5% 7/15/18 | 3,690 | 3,717 | ||

Series 2695 Class DG, 4% 10/15/18 | 1,635 | 1,577 | ||

Series 2752 Class PW, 4% 4/15/22 | 1,474 | 1,466 | ||

Series 2770 Class UD, 4.5% 5/15/17 | 2,435 | 2,470 | ||

Series 2802 Class OB, 6% 5/15/34 | 1,355 | 1,403 | ||

Series 2810 Class PD, 6% 6/15/33 | 1,020 | 1,057 | ||

Series 2831 Class PB, 5% 7/15/19 | 1,975 | 1,986 | ||

Series 2866 Class XE, 4% 12/15/18 | 1,875 | 1,869 | ||

sequential payer: | ||||

Series 1929 Class EZ, 7.5% 2/17/27 | 2,120 | 2,252 | ||

Series 2546 Class C, 5% 12/15/17 | 1,115 | 1,129 | ||

Series 2570 Class CU, 4.5% 7/15/17 | 197 | 197 | ||

Series 2572 Class HK, 4% 2/15/17 | 281 | 280 | ||

Series 2617 Class GW, 3.5% 6/15/16 | 1,290 | 1,291 | ||

Series 2860 Class CP, 4% 10/15/17 | 207 | 207 | ||

Series 2866 Class N, 4.5% 12/15/18 | 1,335 | 1,350 | ||

Series 2937 Class HJ, 5% 10/15/19 | 924 | 937 | ||

Series 2998 Class LY, 5.5% 7/15/25 | 295 | 296 | ||

Series 3007 Class EW, 5.5% 7/15/25 | 1,125 | 1,135 | ||

Series 3013 Class VJ, 5% 1/15/14 | 1,856 | 1,898 | ||

Series 3266 Class C, 5% 2/15/20 | 663 | 674 | ||

Series 2715 Class NG, 4.5% 12/15/18 | 890 | 877 | ||

Series 2769 Class BU, 5% 3/15/34 | 1,014 | 962 | ||

Collateralized Mortgage Obligations - continued | ||||

Principal Amount (000s) | Value (000s) | |||

U.S. Government Agency - continued | ||||

Freddie Mac Multi-class participation certificates guaranteed: - continued | ||||

Series 2975 Class NA, 5% 7/15/23 | $ 586 | $ 595 | ||

Ginnie Mae guaranteed REMIC pass-thru securities planned amortization class Series 2005-58 Class NJ, 4.5% 8/20/35 | 3,465 | 3,497 | ||

TOTAL COLLATERALIZED MORTGAGE OBLIGATIONS (Cost $76,900) | 78,168 | |||

Cash Equivalents - 25.6% | |||

Maturity Amount (000s) | |||

Investments in repurchase agreements in a joint trading account at 3%, dated 1/31/08 due 2/1/08: | |||

(Collateralized by U.S. Government Obligations) # | 94,083 | 94,075 | |

(Collateralized by U.S. Government Obligations) # (a) | 122,662 | 122,652 | |

TOTAL CASH EQUIVALENTS (Cost $216,727) | 216,727 | ||

TOTAL INVESTMENT PORTFOLIO - 132.0% (Cost $1,096,630) | 1,118,656 | ||

NET OTHER ASSETS - (32.0)% | (271,044) | ||

NET ASSETS - 100% | $ 847,612 | ||

Futures Contracts | |||||

Expiration Date | Underlying Face Amount at Value (000s) | Unrealized Appreciation/ | |||

Purchased | |||||

Treasury Contracts | |||||

280 U.S. Treasury 5-Year Bond Contracts | March 2008 | $ 31,640 | $ 734 | ||

The face value of futures purchased as a percentage of net assets - 3.7% |

Swap Agreements | |||||

Notional Amount (000s) | Value (000s) | ||||

Interest Rate Swaps | |||||

Receive quarterly a floating rate based on 3-month LIBOR and pay semi-annually a fixed rate equal to 5.35% with Bank of America | March 2037 | $ 1,800 | $ (176) | ||

Receive semi-annually a fixed rate equal to 4.64% and pay quarterly a floating rate based on 3-month LIBOR with Morgan Stanley, Inc. | Oct. 2009 | 1,000 | 39 | ||

Receive semi-annually a fixed rate equal to 4.681% and pay quarterly a floating rate based on a 3-month LIBOR with JPMorgan Chase, Inc. | Sept. 2009 | 29,000 | 1,124 | ||

$ 31,800 | $ 987 | ||||

Legend |

(a) Includes investment made with cash collateral received from securities on loan. |

(b) Security or a portion of the security is on loan at period end. |

(c) Security exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be resold in transactions exempt from registration, normally to qualified institutional buyers. At the end of the period, the value of these securities amounted to $9,761,000 or 1.2% of net assets. |

(d) Security or a portion of the security purchased on a delayed delivery or when-issued basis. |

(e) A portion of the security is subject to a forward commitment to sell. |

(f) Security or a portion of the security was pledged to cover margin requirements for futures contracts. At the period end, the value of securities pledged amounted to $306,000. |

(g) The coupon rate shown on floating or adjustable rate securities represents the rate at period end. |

# Additional Information on each counterparty to the repurchase agreement is as follows: |

Repurchase Agreement / Counterparty | Value |

$94,075,000 due 2/01/08 at 3.00% | |

BNP Paribas Securities Corp. | $ 9,767 |

Banc of America Securities LLC | 3,907 |

Barclays Capital, Inc. | 41,860 |

Bear Stearns & Co., Inc. | 11,935 |

Citigroup Global Markets, Inc. | 2,791 |

Dresdner Kleinwort Securities LLC | 1,395 |

ING Financial Markets LLC | 1,769 |

J.P. Morgan Securities, Inc. | 8,372 |

Societe Generale, New York Branch | 11,163 |

WestLB AG | 1,116 |

$ 94,075 | |

$122,652,000 due 2/01/08 at 3.00% | |

ABN AMRO Bank N.V., New York Branch | $ 9,011 |

Banc of America Securities LLC | 67,581 |

Bank of America, NA | 36,043 |

Bear Stearns & Co., Inc. | 10,017 |

$ 122,652 | |

Income Tax Information |

At July 31, 2007, the fund had a capital loss carryforward of approximately $40,571,000 of which $11,911,000, $7,507,000, $3,266,000, $414,000, $6,019,000 and $11,454,000 will expire on July 31, 2008, 2009, 2012, 2013, 2014 and 2015, respectively. |

See accompanying notes which are an integral part of the financial statements.

Semiannual Report

Financial Statements

Statement of Assets and Liabilities

Amounts in thousands (except per-share amount) | January 31, 2008 (Unaudited) | |

Assets | ||

Investment in securities, at value (including securities loaned of $118,720 and repurchase agreements of $216,727) - See accompanying schedule: Unaffiliated issuers (cost $1,096,630) | $ 1,118,656 | |

Commitment to sell securities on a delayed delivery basis | $ (51,143) | |

Receivable for securities sold on a delayed delivery basis | 50,694 | (449) |

Receivable for investments sold, regular delivery | 650 | |

Cash | 1,369 | |

Receivable for fund shares sold | 1,544 | |

Interest receivable | 29,056 | |

Receivable for daily variation on futures contracts | 114 | |

Swap agreements, at value | 987 | |

Other receivables | 1 | |

Total assets | 1,151,928 | |

Liabilities | ||

Payable for investments purchased | $ 11,630 | |

Delayed delivery | 167,848 | |

Payable for fund shares redeemed | 1,163 | |

Distributions payable | 315 | |

Accrued management fee | 210 | |

Other affiliated payables | 94 | |

Other payables and accrued expenses | 423 | |

Collateral on securities loaned, at value | 122,633 | |

Total liabilities | 304,316 | |

Net Assets | $ 847,612 | |

Net Assets consist of: | ||

Paid in capital | $ 852,048 | |

Undistributed net investment income | 449 | |

Accumulated undistributed net realized gain (loss) on investments | (28,183) | |

Net unrealized appreciation (depreciation) on investments | 23,298 | |

Net Assets, for 80,819 shares outstanding | $ 847,612 | |

Net Asset Value, offering price and redemption price per share ($847,612 ÷ 80,819 shares) | $ 10.49 | |

See accompanying notes which are an integral part of the financial statements.

Semiannual Report

Statement of Operations

Amounts in thousands | Six months ended January 31, 2008 (Unaudited) | |

Investment Income | ||

Interest | $ 18,024 | |

Expenses | ||

Management fee | $ 1,173 | |

Transfer agent fees | 372 | |

Fund wide operations fee | 129 | |

Independent trustees' compensation | 2 | |

Total expenses before reductions | 1,676 | |

Expense reductions | (10) | 1,666 |

Net investment income | 16,358 | |

Realized and Unrealized Gain (Loss) Net realized gain (loss) on: | ||

Investment securities: | ||

Unaffiliated issuers | 14,339 | |

Swap agreements | 1,574 | |

Total net realized gain (loss) | 15,913 | |

Change in net unrealized appreciation (depreciation) on: Investment securities | 22,772 | |

Futures contracts | 734 | |

Swap agreements | 447 | |

Delayed delivery commitments | (449) | |

Total change in net unrealized appreciation (depreciation) | 23,504 | |

Net gain (loss) | 39,417 | |

Net increase (decrease) in net assets resulting from operations | $ 55,775 | |

See accompanying notes which are an integral part of the financial statements.

Semiannual Report

Financial Statements - continued

Statement of Changes in Net Assets

Amounts in thousands | Six months ended January 31, 2008 (Unaudited) | Year ended |

Increase (Decrease) in Net Assets | ||

Operations | ||

Net investment income | $ 16,358 | $ 31,542 |

Net realized gain (loss) | 15,913 | (5,105) |

Change in net unrealized appreciation (depreciation) | 23,504 | 9,911 |

Net increase (decrease) in net assets resulting | 55,775 | 36,348 |

Distributions to shareholders from net investment income | (17,817) | (32,742) |

Share transactions | 176,616 | 66,477 |

Reinvestment of distributions | 15,663 | 28,271 |

Cost of shares redeemed | (82,680) | (157,163) |

Net increase (decrease) in net assets resulting from share transactions | 109,599 | (62,415) |

Total increase (decrease) in net assets | 147,557 | (58,809) |

Net Assets | ||

Beginning of period | 700,055 | 758,864 |

End of period (including undistributed net investment income of $449 and undistributed net investment income of $1,908, respectively) | $ 847,612 | $ 700,055 |

Other Information Shares | ||

Sold | 17,155 | 6,665 |

Issued in reinvestment of distributions | 1,532 | 2,831 |

Redeemed | (8,099) | (15,756) |

Net increase (decrease) | 10,588 | (6,260) |

See accompanying notes which are an integral part of the financial statements.

Semiannual Report

Financial Highlights

Six months ended January 31, 2008 | Years ended July 31, | |||||

(Unaudited) | 2007 | 2006 | 2005 | 2004 | 2003 | |

Selected Per-Share Data | ||||||

Net asset value, beginning of period | $ 9.97 | $ 9.92 | $ 10.11 | $ 10.18 | $ 10.17 | $ 10.11 |

Income from Investment Operations | ||||||

Net investment income D | .224 | .435 | .414 | .330 | .274 | .329 |

Net realized and unrealized gain (loss) | .540 | .067 | (.219) | (.084) | .014 | .056 |

Total from investment operations | .764 | .502 | .195 | .246 | .288 | .385 |

Distributions from net investment income | (.244) | (.452) | (.385) | (.316) | (.278) | (.325) |

Net asset value, end of period | $ 10.49 | $ 9.97 | $ 9.92 | $ 10.11 | $ 10.18 | $ 10.17 |

Total Return B,C | 7.75% | 5.14% | 1.97% | 2.43% | 2.84% | 3.80% |

Ratios to Average Net Assets E | ||||||

Expenses before reductions | .45% A | .45% | .45% | .57% | .60% | .60% |

Expenses net of fee waivers, if any | .45% A | .45% | .45% | .57% | .60% | .60% |

Expenses net of all reductions | .45% A | .45% | .45% | .57% | .60% | .60% |

Net investment income | 4.37% A | 4.36% | 4.14% | 3.23% | 2.67% | 3.18% |

Supplemental Data | ||||||

Net assets, end of period | $ 848 | $ 700 | $ 759 | $ 884 | $ 963 | $ 1,283 |

Portfolio turnover rate | 435% A | 121% | 97% | 90% | 152% | 229% |

A Annualized

B Total returns for periods of less than one year are not annualized.

C Total returns would have been lower had certain expenses not been reduced during the periods shown.

D Calculated based on average shares outstanding during the period.

E Expense ratios reflect operating expenses of the Fund. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or expense offset arrangements and do not represent the amount paid by the Fund during periods when reimbursements or reductions occur. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the Fund.

See accompanying notes which are an integral part of the financial statements.

Semiannual Report

Notes to Financial Statements

For the period ended January 31, 2008 (Unaudited)

(Amounts in thousands except ratios)

1. Organization.

Fidelity Ginnie Mae Fund and Fidelity Intermediate Government Income Fund (the Funds) are funds of Fidelity Income Fund (the trust). The trust is registered under the Investment Company Act of 1940, as amended (the 1940 Act), as an open-end management investment company organized as a Massachusetts business trust. Each Fund is authorized to issue an unlimited number of shares.

2. Significant Accounting Policies.

The financial statements have been prepared in conformity with accounting principles generally accepted in the United States of America, which require management to make certain estimates and assumptions at the date of the financial statements. Actual results could differ from those estimates. The following summarizes the significant accounting policies of the Funds:

Security Valuation. Investments are valued and net asset value per share is calculated (NAV calculation) as of the close of business of the New York Stock Exchange, normally 4:00 p.m. Eastern time. Wherever possible, each Fund uses independent pricing services approved by the Board of Trustees to value their investments. Debt securities, including restricted securities, for which quotes are readily available, are valued by independent pricing services or by dealers who make markets in such securities. Pricing services consider yield or price of bonds of comparable quality, coupon, maturity and type as well as available dealer supplied prices.

When current market prices or quotations are not readily available or do not accurately reflect fair value, valuations may be determined in accordance with procedures adopted by the Board of Trustees. The frequency of when fair value pricing is used is unpredictable. The value of securities used for NAV calculation under fair value pricing may differ from published prices for the same securities. Investments in open-end mutual funds are valued at their closing net asset value each business day. Short-term securities with remaining maturities of sixty days or less for which quotations are not readily available are valued at amortized cost, which approximates value.

Investment Transactions and Income. For financial reporting purposes, the Funds' investment holdings and NAV include trades executed through the end of the last business day of the period. The NAV for processing shareholder transactions includes trades executed through the end of the prior business day. Gains and losses on securities sold are determined on the basis of identified cost. Interest income is accrued as earned. Interest income includes coupon interest and amortization of premium and accretion of discount on debt securities.

Semiannual Report

2. Significant Accounting Policies - continued

Expenses. Most expenses of the trust can be directly attributed to a fund. Expenses which cannot be directly attributed are apportioned among each Fund in the trust. Expense estimates are accrued in the period to which they relate and adjustments are made when actual amounts are known.

Deferred Trustee Compensation. Under a Deferred Compensation Plan (the Plan) for Fidelity Ginnie Mae Fund, Independent Trustees must defer receipt of a portion of, and may elect to defer receipt of an additional portion of, their annual compensation. Deferred amounts are invested in a cross-section of Fidelity funds, are marked-to-market and remain in the Fund until distributed in accordance with the Plan. The investment of deferred amounts and the offsetting payable to the Trustees are included in the accompanying Statement of Assets and Liabilities.

Income Tax Information and Distributions to Shareholders. Each year, each Fund intends to qualify as a regulated investment company by distributing substantially all of its taxable income and realized gains under Subchapter M of the Internal Revenue Code and filing its U.S. federal tax return. As a result, no provision for income taxes is required. Effective with the beginning of the Fund's fiscal year, each Fund adopted the provisions of FASB Interpretation No. 48, Accounting for Uncertainties in Income Taxes (FIN 48). FIN 48 sets forth a minimum threshold for financial statement recognition of the benefit of a tax position taken or expected to be taken in a tax return. The implementation of FIN 48 did not result in any unrecognized tax benefits in the accompanying financial statements. Each of the Funds' federal tax returns for the prior three fiscal years remains subject to examination by the Internal Revenue Service.

Dividends are declared daily and paid monthly from net investment income. Distributions from realized gains, if any, are recorded on the ex-dividend date. Income and capital gain distributions are determined in accordance with income tax regulations, which may differ from generally accepted accounting principles.

Capital accounts within the financial statements are adjusted for permanent book-tax differences. These adjustments have no impact on net assets or the results of operations. Temporary book-tax differences will reverse in a subsequent period.

Book-tax differences are primarily due to swap agreements, prior period premium and discount on debt securities, market discount, deferred trustees compensation, financing transactions, capital loss carryforwards, losses deferred due to wash sales and excise tax regulations.

Semiannual Report

Notes to Financial Statements (Unaudited) - continued

2. Significant Accounting Policies - continued

Income Tax Information and Distributions to Shareholders - continued

The federal tax cost of investments and unrealized appreciation (depreciation) as of period end were as follows for each Fund:

Cost for Federal | Unrealized | Unrealized | Net Unrealized | |

Ginnie Mae Fund | $ 3,904,584 | $ 87,848 | $ (26,439) | $ 61,409 |

Intermediate Government Income Fund | 1,096,469 | 23,373 | (1,186) | 22,187 |

New Accounting Pronouncement. In September 2006, Statement of Financial Accounting Standards No. 157, Fair Value Measurements (SFAS 157), was issued and is effective for fiscal years beginning after November 15, 2007. SFAS 157 defines fair value, establishes a framework for measuring fair value and expands disclosures about fair value measurements. Management is currently evaluating the impact the adoption of SFAS 157 will have on the Funds' financial statement disclosures.

3. Operating Policies.

Repurchase Agreements. Fidelity Management & Research Company (FMR) has received an Exemptive Order from the Securities and Exchange Commission (the SEC) which permits certain Funds and other affiliated entities of FMR to transfer uninvested cash balances into joint trading accounts which are then invested in repurchase agreements. Certain Funds may also invest directly with institutions in repurchase agreements. Repurchase agreements are collateralized by government or non-government securities. Upon settlement date, collateral is held in segregated accounts with custodian banks and may be obtained in the event of a default of the counterparty. Each applicable Fund monitors, on a daily basis, the value of the collateral to ensure it is at least equal to the principal amount of the repurchase agreement (including accrued interest). In the event of a default by the counterparty, realization of the collateral proceeds could be delayed, during which time the value of the collateral may decline.

Delayed Delivery Transactions and When-Issued Securities. Certain Funds may purchase or sell securities on a delayed delivery or when-issued basis. Payment and delivery may take place after the customary settlement period for that security. The price of the underlying securities and the date when the securities will be delivered and paid for are fixed at the time the transaction is negotiated. During the time a delayed delivery sell is outstanding, the contract is marked-to-market daily and equivalent deliverable securities are held for the transaction. The value of the securities purchased on a delayed delivery or when-issued basis are identified as such in each applicable Fund's Schedule of Investments. Certain Funds may receive compensation for interest forgone

Semiannual Report

3. Operating Policies - continued

Delayed Delivery Transactions and When-Issued Securities - continued