UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-4085

Fidelity Income Fund

(Exact name of registrant as specified in charter)

245 Summer St., Boston, Massachusetts 02210

(Address of principal executive offices) (Zip code)

Scott C. Goebel, Secretary

245 Summer St.

Boston, Massachusetts 02210

(Name and address of agent for service)

Registrant's telephone number, including area code: 617-563-7000

Date of fiscal year end: | August 31 |

| |

Date of reporting period: | February 28, 2015 |

Item 1. Reports to Stockholders

ContentsShareholder Expense ExampleInvestment Changes (Unaudited)Investments February 28, 2015 (Unaudited)Financial StatementsNotes to Financial StatementsBoard Approval of Investment Advisory Contracts and Management Fees

Fidelity® Intermediate

Government Income Fund

Semiannual Report

February 28, 2015

(Fidelity Cover Art)

Contents

Shareholder Expense Example | (Click Here) | An example of shareholder expenses. |

Investment Changes | (Click Here) | A summary of major shifts in the fund's investments over the past six months. |

Investments | (Click Here) | A complete list of the fund's investments with their market values. |

Financial Statements | (Click Here) | Statements of assets and liabilities, operations, and changes in net assets, as well as financial highlights. |

Notes | (Click Here) | Notes to the financial statements. |

Board Approval of Investment Advisory Contracts and Management Fees | (Click Here) | |

To view a fund's proxy voting guidelines and proxy voting record for the 12-month period ended June 30, visit http://www.fidelity.com/proxyvotingresults or visit the Securities and Exchange Commission's (SEC) web site at http://www.sec.gov. You may also call 1-800-544-8544 to request a free copy of the proxy voting guidelines.

Standard & Poor's, S&P and S&P 500 are registered service marks of The McGraw-Hill Companies, Inc. and have been licensed for use by Fidelity Distributors Corporation.

Other third-party marks appearing herein are the property of their respective owners.

All other marks appearing herein are registered or unregistered trademarks or service marks of FMR LLC or an affiliated company. © 2015 FMR LLC. All rights reserved.

This report and the financial statements contained herein are submitted for the general information of the shareholders of the fund. This report is not authorized for distribution to prospective investors in the fund unless preceded or accompanied by an effective prospectus.

A fund files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. Forms N-Q are available on the SEC's web site at http://www.sec.gov. A fund's Forms N-Q may be reviewed and copied at the SEC's Public Reference Room in Washington, DC. Information regarding the operation of the SEC's Public Reference Room may be obtained by calling 1-800-SEC-0330. For a complete list of a fund's portfolio holdings, view the most recent holdings listing, semiannual report, or annual report on Fidelity's web site at http://www.fidelity.com, http://www.advisor.fidelity.com, or http://www.401k.com, as applicable.

NOT FDIC INSURED • MAY LOSE VALUE • NO BANK GUARANTEE

Neither the fund nor Fidelity Distributors Corporation is a bank.

Semiannual Report

Shareholder Expense Example

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, and (2) ongoing costs, including management fees and other Fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period (September 1, 2014 to February 28, 2015).

Actual Expenses

The first line of the accompanying table provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000.00 (for example, an $8,600 account value divided by $1,000.00 = 8.6), then multiply the result by the number in the first line under the heading entitled "Expenses Paid During Period" to estimate the expenses you paid on your account during this period. A small balance maintenance fee of $12.00 that is charged once a year may apply for certain accounts with a value of less than $2,000. This fee is not included in the table below. If it was, the estimate of expenses you paid during the period would be higher, and your ending account value lower, by this amount.

Hypothetical Example for Comparison Purposes

The second line of the accompanying table provides information about hypothetical account values and hypothetical expenses based on the Fund's actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund's actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds. A small balance maintenance fee of $12.00 that is charged once a year may apply for certain accounts with a value of less than $2,000. This fee is not included in the table below. If it was, the estimate of expenses you paid during the period would be higher, and your ending account value lower, by this amount.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transaction costs. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds.

Semiannual Report

Shareholder Expense Example - continued

| Annualized

Expense RatioB | Beginning

Account Value

September 1, 2014 | Ending

Account Value

February 28, 2015 | Expenses Paid

During Period*

September 1, 2014

to February 28, 2015 |

Actual | .45% | $ 1,000.00 | $ 1,011.80 | $ 2.24 |

HypotheticalA | | $ 1,000.00 | $ 1,022.56 | $ 2.26 |

A 5% return per year before expenses

B Annualized expense ratio reflects expenses net of applicable fee waivers.

* Expenses are equal to the Fund's annualized expense ratio, multiplied by the average account value over the period, multiplied by 181/365 (to reflect the one-half year period).

Semiannual Report

Investment Changes (Unaudited)

Coupon Distribution as of February 28, 2015 |

| % of fund's investments | % of fund's investments

6 months ago |

0.01 - 0.99% | 20.6 | 20.9 |

1 - 1.99% | 28.9 | 18.5 |

2 - 2.99% | 18.9 | 21.5 |

3 - 3.99% | 9.4 | 9.2 |

4 - 4.99% | 7.6 | 11.6 |

5 - 5.99% | 8.7 | 10.0 |

6 - 6.99% | 1.2 | 1.3 |

7 - 7.99% | 0.1 | 0.1 |

8% and above | 2.8 | 2.1 |

Coupon distribution shows the range of stated interest rates on the fund's investments, excluding short-term investments. |

Weighted Average Maturity as of February 28, 2015 |

| | 6 months ago |

Years | 4.2 | 4.2 |

This is a weighted average of all the maturities of the securities held in a fund. Weighted Average Maturity (WAM) can be used as a measure of sensitivity to interest rate changes and market changes. Generally, the longer the maturity, the greater the sensitivity to such changes. WAM is based on the dollar-weighted average length of time until principal payments must be paid. Depending on the types of securities held in a fund, certain maturity shortening devices (e.g., demand features, interest rate resets, and call options) may be taken into account when calculating the WAM. |

Duration as of February 28, 2015 |

| | 6 months ago |

Years | 3.6 | 3.3 |

Duration is a measure of a security's price sensitivity to changes in interest rates. Duration differs from maturity in that it considers a security's interest payments in addition to the amount of time until the security reaches maturity, and also takes into account certain maturity shortening features (e.g., demand features, interest rate resets, and call options) when applicable. Securities with longer durations generally tend to be more sensitive to interest rate changes than securities with shorter durations. A fund with a longer average duration generally can be expected to be more sensitive to interest rate changes than a fund with a shorter average duration. |

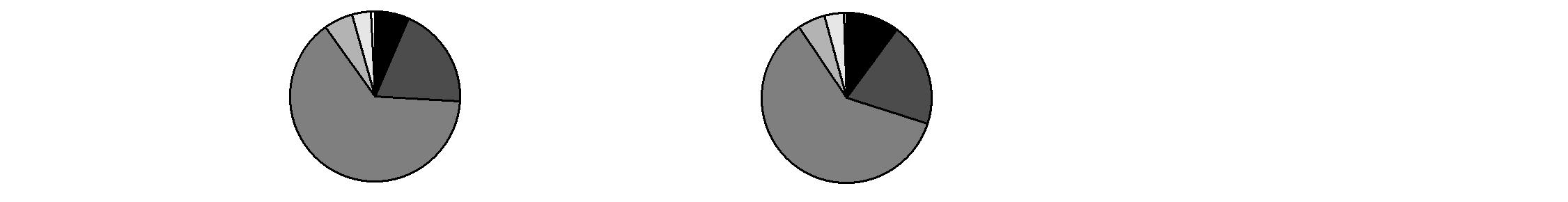

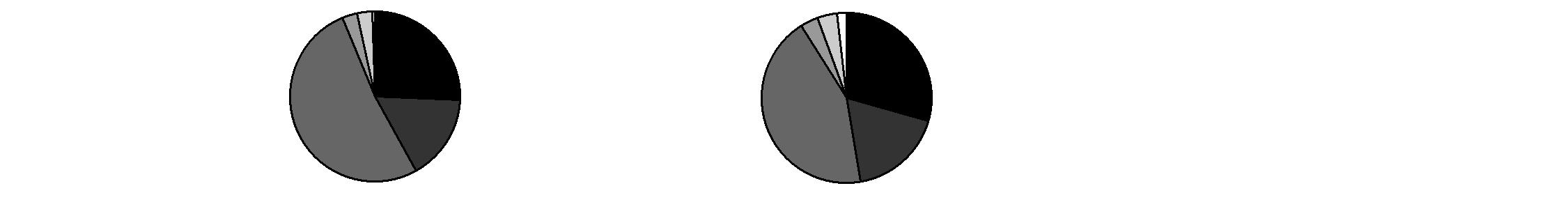

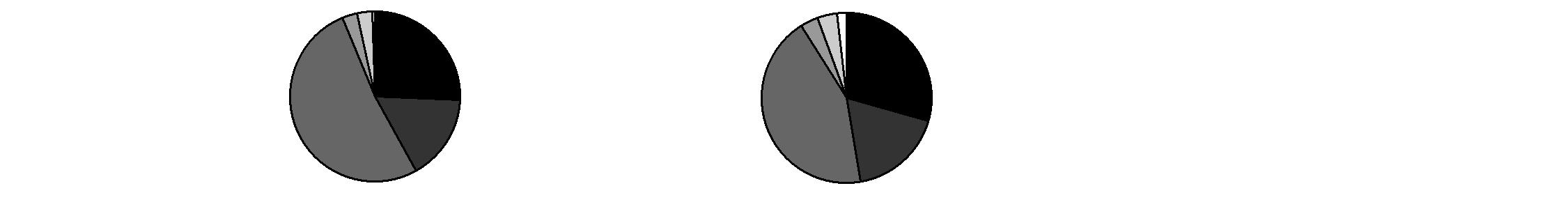

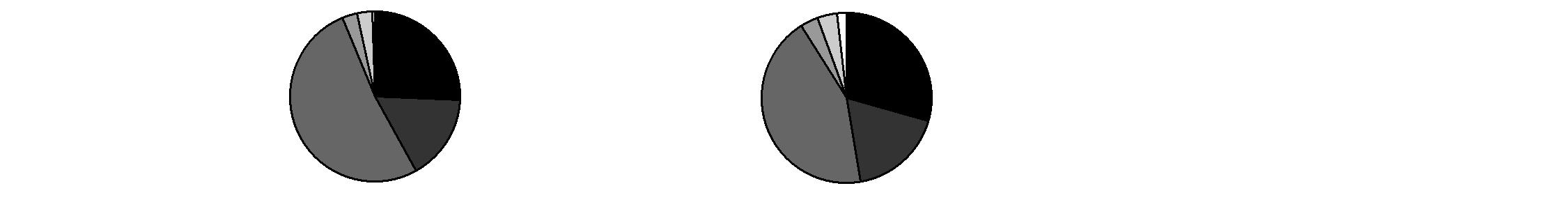

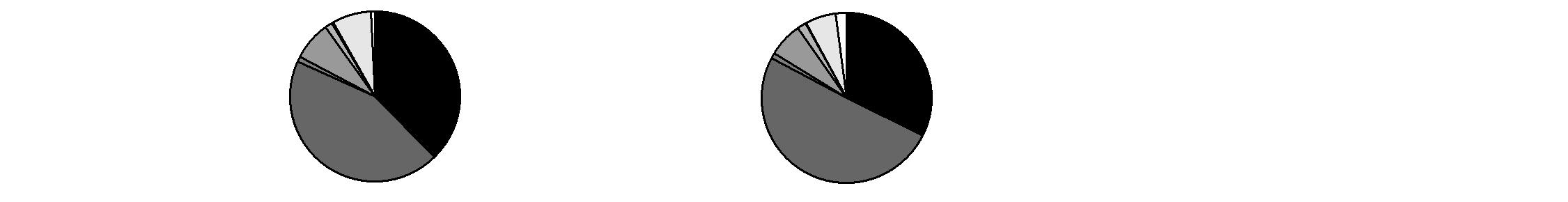

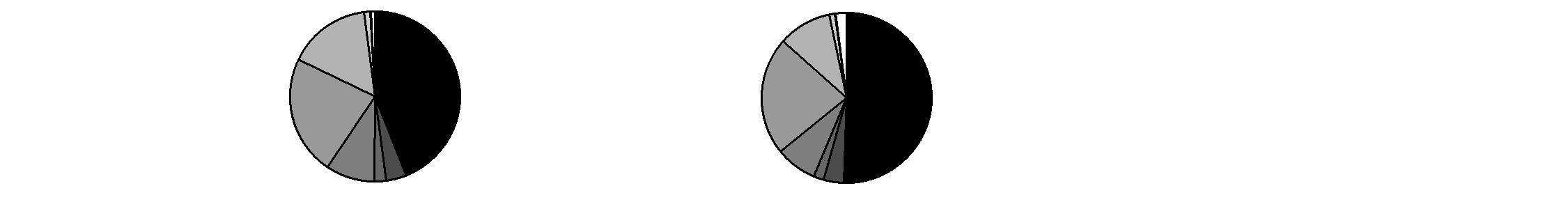

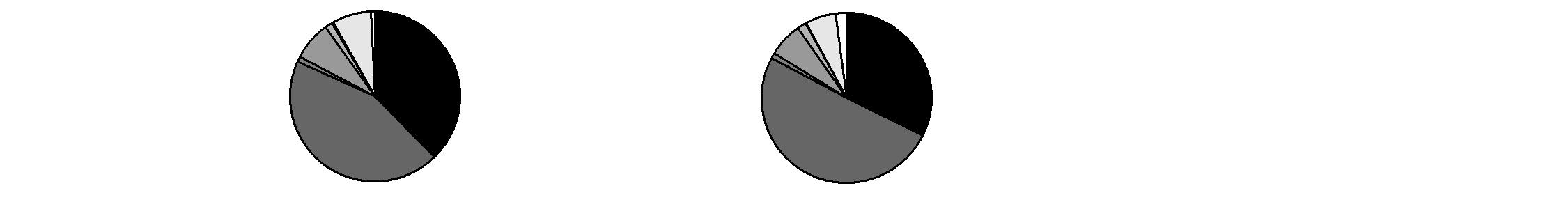

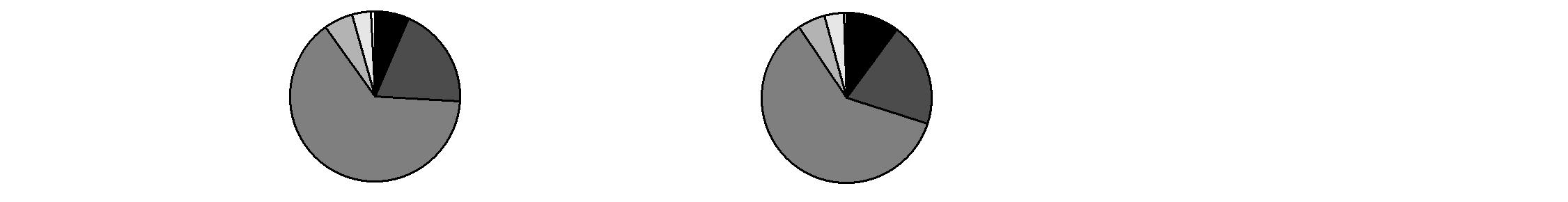

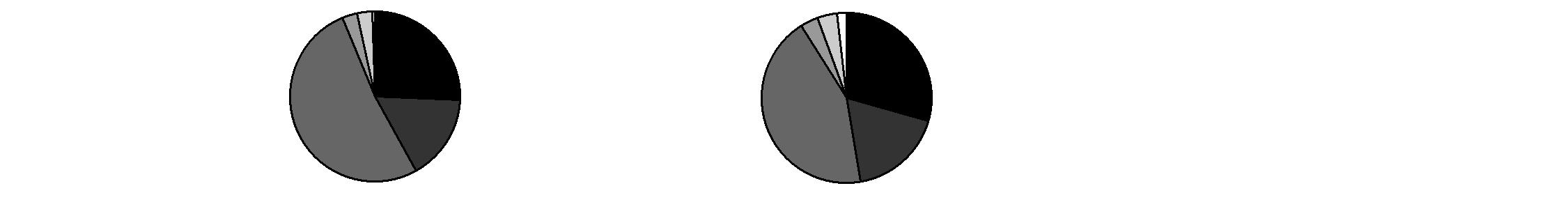

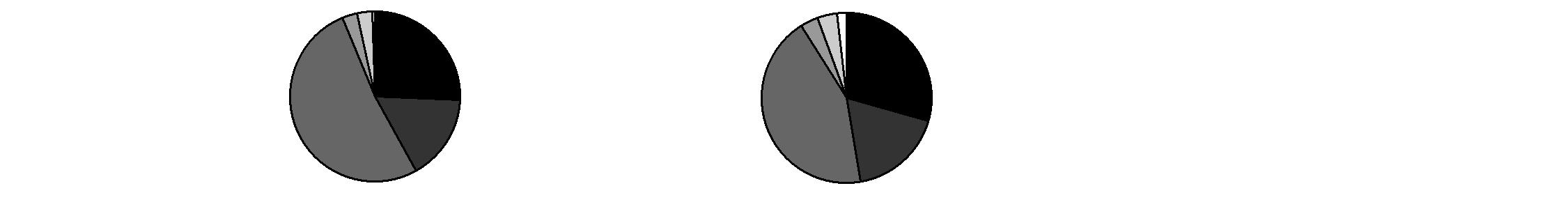

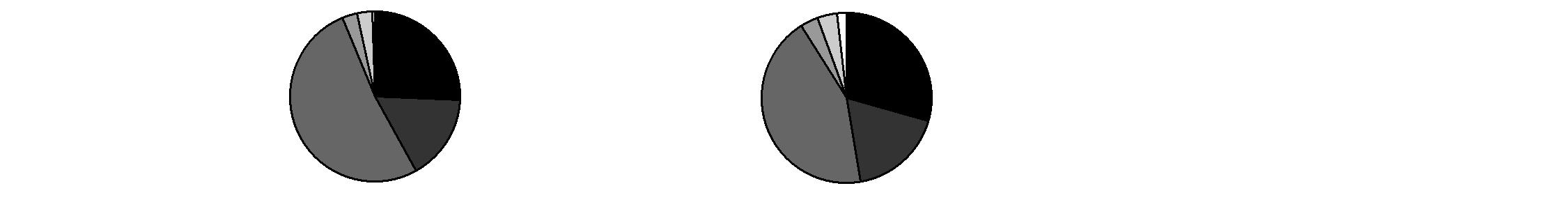

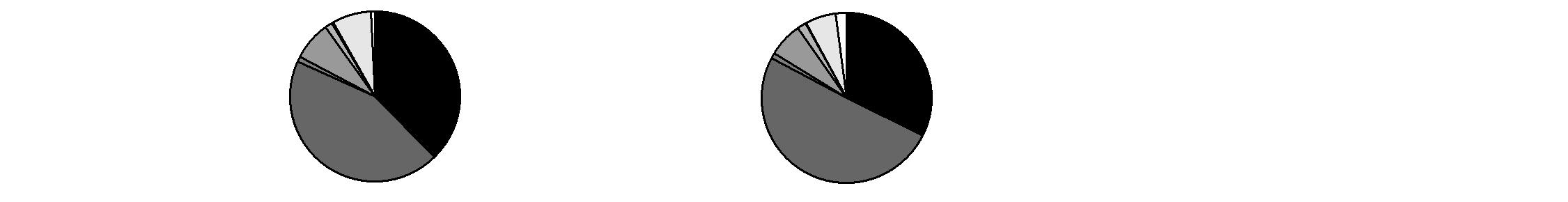

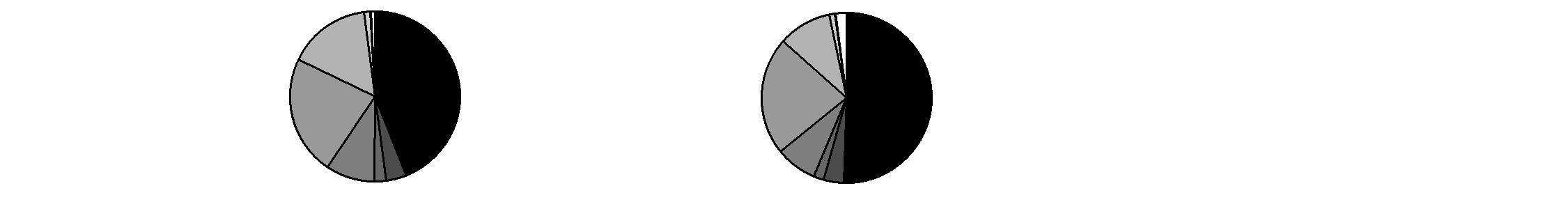

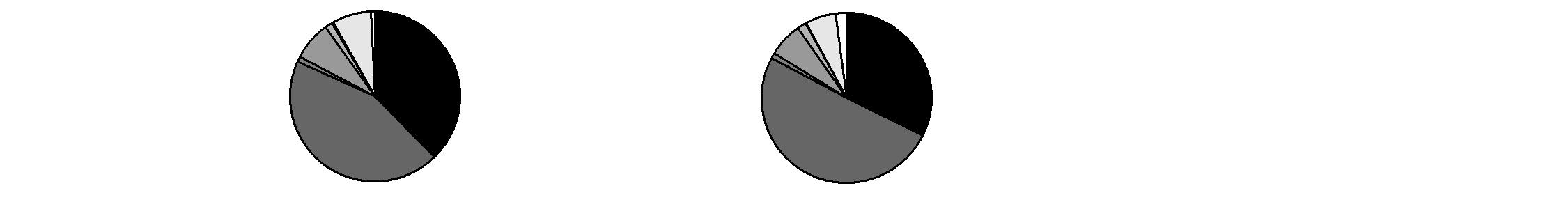

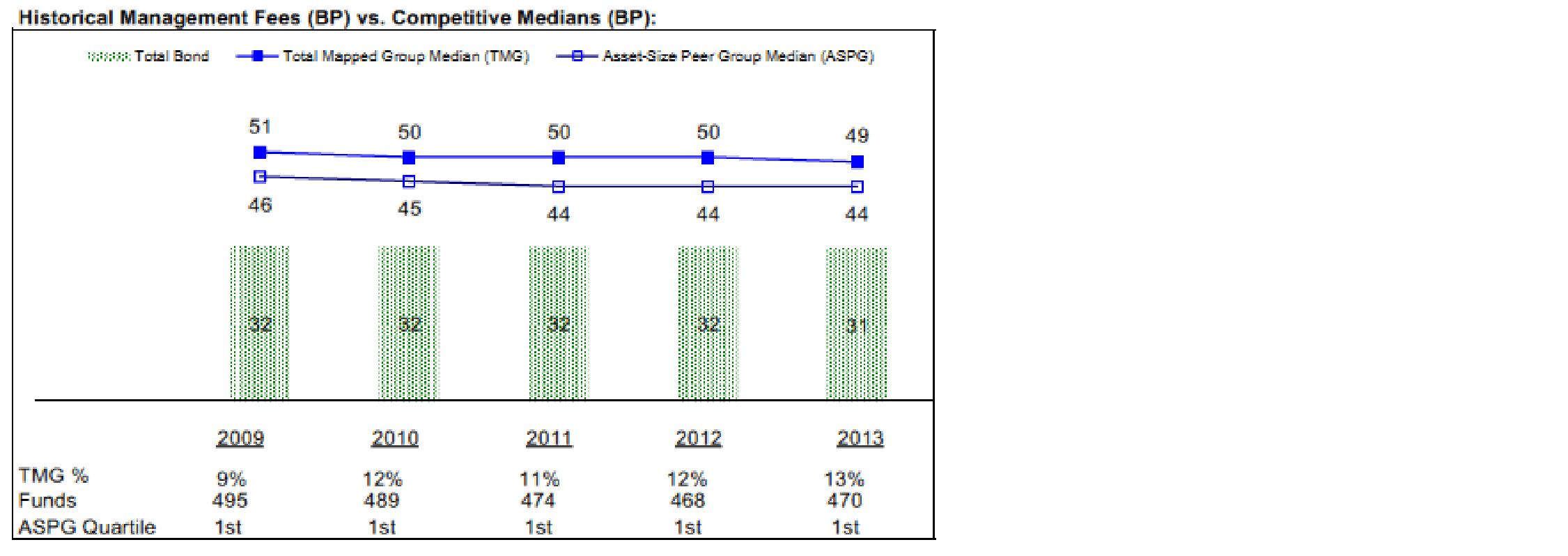

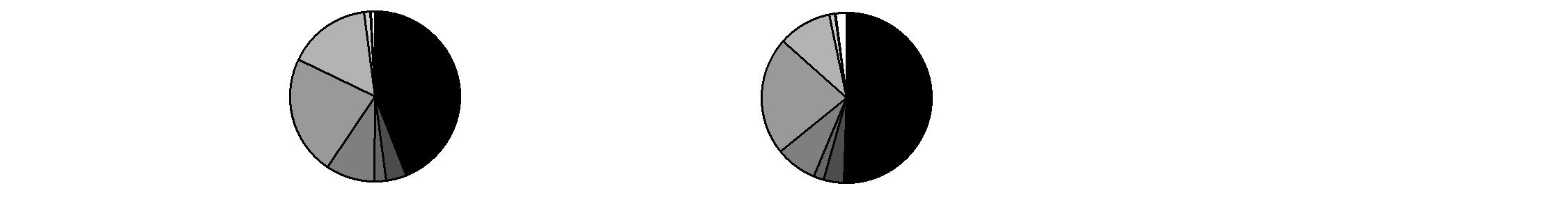

Asset Allocation (% of fund's net assets) |

As of February 28, 2015* | As of August 31, 2014** |

| Mortgage

Securities 6.4% | |  | Mortgage

Securities 10.1% | |

| CMOs and Other Mortgage Related Securities 19.4% | |  | CMOs and Other Mortgage Related Securities 19.8% | |

| U.S. Treasury

Obligations 64.2% | |  | U.S. Treasury

Obligations 60.7% | |

| U.S. Government

Agency

Obligations† 5.6% | |  | U.S. Government

Agency

Obligations† 5.2% | |

| Foreign Government

& Government

Agency Obligations 3.6% | |  | Foreign Government

& Government

Agency Obligations 3.7% | |

| Short-Term

Investments and

Net Other Assets (Liabilities) 0.8% | |  | Short-Term

Investments and

Net Other Assets (Liabilities) 0.5% | |

* Foreign investments | 3.6% | | ** Foreign investments | 3.7% | |

* Futures and Swaps | 6.0% | | ** Futures and Swaps | 5.5% | |

†Includes NCUA Guaranteed Notes. |

Semiannual Report

Showing Percentage of Net Assets

U.S. Government and Government Agency Obligations - 69.8% |

| Principal Amount (000s) | | Value (000s) |

U.S. Government Agency Obligations - 1.1% |

Federal Home Loan Bank 1% 6/21/17 | | $ 3,190 | | $ 3,204 |

Small Business Administration guaranteed development participation certificates Series 2004-20H Class 1, 5.17% 8/1/24 | | 162 | | 176 |

Tennessee Valley Authority 1.75% 10/15/18 | | 4,850 | | 4,903 |

TOTAL U.S. GOVERNMENT AGENCY OBLIGATIONS | | 8,283 |

U.S. Treasury Inflation-Protected Obligations - 1.3% |

U.S. Treasury Inflation-Indexed Notes 0.25% 1/15/25 | | 10,000 | | 10,005 |

U.S. Treasury Obligations - 62.9% |

U.S. Treasury Bonds 8.75% 5/15/17 | | 14,750 | | 17,343 |

U.S. Treasury Notes: | | | | |

0.25% 4/15/16 | | 1,354 | | 1,353 |

0.375% 1/15/16 | | 9,276 | | 9,289 |

0.375% 10/31/16 | | 4,000 | | 3,990 |

0.5% 1/31/17 | | 4,965 | | 4,955 |

0.625% 12/31/16 | | 18,905 | | 18,920 |

0.75% 6/30/17 | | 14,678 | | 14,669 |

0.875% 11/15/17 | | 9,368 | | 9,352 |

0.875% 1/31/18 | | 15,546 | | 15,493 |

0.875% 7/31/19 | | 22,596 | | 22,066 |

1% 9/30/16 | | 35,000 | | 35,295 |

1% 10/31/16 | | 4,099 | | 4,131 |

1% 12/15/17 | | 2,000 | | 2,003 |

1% 5/31/18 | | 15,739 | | 15,680 |

1.25% 11/30/18 | | 7,000 | | 6,996 |

1.25% 1/31/20 | | 9,000 | | 8,892 |

1.375% 7/31/18 | | 8,863 | | 8,924 |

1.375% 9/30/18 | | 3,911 | | 3,932 |

1.375% 2/28/19 | | 12,639 | | 12,658 |

1.5% 12/31/18 | | 1,151 | | 1,160 |

1.5% 1/31/19 | | 10,148 | | 10,222 |

1.5% 1/31/22 | | 37,406 | | 36,640 |

1.625% 4/30/19 | | 13,127 | | 13,264 |

1.625% 6/30/19 | | 17,114 | | 17,274 |

1.625% 12/31/19 | | 9,696 | | 9,755 |

1.75% 9/30/19 | | 9,904 | | 10,031 |

1.75% 10/31/20 | | 5,000 | | 5,028 |

1.75% 2/28/22 | | 4,000 | | 3,981 |

1.875% 10/31/17 | | 1,923 | | 1,971 |

U.S. Government and Government Agency Obligations - continued |

| Principal Amount (000s) | | Value (000s) |

U.S. Treasury Obligations - continued |

U.S. Treasury Notes: - continued | | | | |

2% 5/31/21 | | $ 8,000 | | $ 8,116 |

2% 2/15/25 | | 4,000 | | 4,000 |

2.25% 3/31/21 | | 40,560 | | 41,784 |

2.25% 4/30/21 | | 2,805 | | 2,889 |

2.25% 11/15/24 | | 4,000 | | 4,087 |

2.375% 7/31/17 | | 12,000 | | 12,449 |

2.375% 6/30/18 | | 6,062 | | 6,305 |

2.375% 8/15/24 | | 15,926 | | 16,446 |

2.625% 2/29/16 | | 12,000 | | 12,278 |

3% 2/28/17 | | 16,424 | | 17,189 |

3.125% 1/31/17 | | 1,323 | | 1,387 |

3.5% 2/15/18 (b) | | 4,299 | | 4,611 |

4.5% 5/15/17 (a) | | 1,369 | | 1,482 |

4.625% 2/15/17 | | 12,625 | | 13,609 |

4.75% 8/15/17 | | 12,139 | | 13,297 |

TOTAL U.S. TREASURY OBLIGATIONS | | 485,196 |

Other Government Related - 4.5% |

National Credit Union Administration Guaranteed Notes: | | | | |

Series 2010-A1 Class A, 0.521% 12/7/20 (NCUA Guaranteed) (c) | | 1,228 | | 1,229 |

Series 2011-R1 Class 1A, 0.6178% 1/8/20 (NCUA Guaranteed) (c) | | 2,499 | | 2,512 |

Series 2011-R4 Class 1A, 0.548% 3/6/20 (NCUA Guaranteed) (c) | | 900 | | 902 |

National Credit Union Administration Guaranteed Notes Master Trust: | | | | |

1.4% 6/12/15 (NCUA Guaranteed) | | 1,690 | | 1,695 |

2.35% 6/12/17 (NCUA Guaranteed) | | 14,740 | | 15,146 |

3.45% 6/12/21 (NCUA Guaranteed) | | 12,000 | | 12,971 |

TOTAL OTHER GOVERNMENT RELATED | | 34,455 |

TOTAL U.S. GOVERNMENT AND GOVERNMENT AGENCY OBLIGATIONS (Cost $531,648) | 537,939 |

U.S. Government Agency - Mortgage Securities - 6.4% |

| Principal Amount (000s) | | Value (000s) |

Fannie Mae - 2.2% |

1.865% 10/1/35 (c) | | $ 11 | | $ 11 |

1.885% 2/1/33 (c) | | 14 | | 15 |

1.91% 12/1/34 (c) | | 22 | | 23 |

1.91% 3/1/35 (c) | | 18 | | 19 |

1.915% 11/1/33 (c) | | 30 | | 31 |

1.93% 10/1/33 (c) | | 9 | | 9 |

1.94% 7/1/35 (c) | | 8 | | 8 |

2.05% 3/1/35 (c) | | 2 | | 2 |

2.053% 6/1/36 (c) | | 18 | | 19 |

2.057% 1/1/35 (c) | | 93 | | 98 |

2.105% 7/1/34 (c) | | 14 | | 15 |

2.142% 9/1/36 (c) | | 42 | | 45 |

2.19% 3/1/37 (c) | | 11 | | 11 |

2.236% 3/1/33 (c) | | 45 | | 48 |

2.27% 6/1/47 (c) | | 62 | | 66 |

2.276% 11/1/36 (c) | | 130 | | 138 |

2.277% 7/1/36 (c) | | 77 | | 82 |

2.32% 7/1/35 (c) | | 21 | | 23 |

2.333% 3/1/35 (c) | | 12 | | 13 |

2.362% 2/1/37 (c) | | 214 | | 229 |

2.372% 5/1/36 (c) | | 20 | | 22 |

2.421% 10/1/33 (c) | | 18 | | 19 |

2.445% 3/1/40 (c) | | 562 | | 600 |

2.503% 2/1/36 (c) | | 25 | | 27 |

2.512% 4/1/36 (c) | | 140 | | 149 |

2.69% 2/1/42 (c) | | 741 | | 771 |

2.703% 8/1/35 (c) | | 303 | | 324 |

2.763% 1/1/42 (c) | | 673 | | 701 |

3.15% 1/1/44 (c) | | 2,255 | | 2,364 |

3.163% 3/1/42 (c) | | 3,599 | | 3,780 |

3.437% 11/1/40 (c) | | 1,061 | | 1,123 |

5% 1/1/22 to 4/1/22 | | 43 | | 47 |

5.5% 10/1/20 to 1/1/29 | | 3,349 | | 3,642 |

6% 6/1/16 to 3/1/34 | | 537 | | 616 |

6.5% 6/1/16 to 8/1/36 | | 1,890 | | 2,185 |

10.25% 10/1/18 | | 1 | | 1 |

11% 1/1/16 | | 1 | | 1 |

11.25% 1/1/16 | | 1 | | 1 |

11.5% 6/15/19 | | 0* | | 0* |

| | 17,278 |

U.S. Government Agency - Mortgage Securities - continued |

| Principal Amount (000s) | | Value (000s) |

Freddie Mac - 0.8% |

1.82% 3/1/35 (c) | | $ 47 | | $ 49 |

1.825% 3/1/37 (c) | | 15 | | 16 |

2.022% 2/1/37 (c) | | 23 | | 24 |

2.04% 7/1/35 (c) | | 535 | | 561 |

2.05% 6/1/37 (c) | | 13 | | 13 |

2.055% 11/1/35 (c) | | 120 | | 128 |

2.095% 8/1/37 (c) | | 39 | | 42 |

2.1% 7/1/35 (c) | | 67 | | 72 |

2.121% 5/1/37 (c) | | 31 | | 34 |

2.16% 6/1/33 (c) | | 115 | | 123 |

2.314% 10/1/35 (c) | | 67 | | 71 |

2.333% 4/1/37 (c) | | 39 | | 42 |

2.346% 10/1/36 (c) | | 155 | | 165 |

2.355% 4/1/34 (c) | | 479 | | 512 |

2.375% 5/1/37 (c) | | 31 | | 33 |

2.385% 5/1/37 (c) | | 400 | | 428 |

2.385% 5/1/37 (c) | | 200 | | 213 |

2.405% 10/1/42 (c) | | 817 | | 860 |

2.415% 6/1/37 (c) | | 115 | | 124 |

2.489% 2/1/36 (c) | | 4 | | 4 |

2.545% 7/1/36 (c) | | 41 | | 44 |

2.595% 4/1/37 (c) | | 4 | | 4 |

2.673% 7/1/35 (c) | | 126 | | 135 |

2.723% 3/1/33 (c) | | 2 | | 3 |

3.078% 9/1/41 (c) | | 802 | | 837 |

3.136% 10/1/35 (c) | | 22 | | 24 |

3.465% 11/1/40 (c) | | 710 | | 755 |

6% 1/1/24 | | 437 | | 482 |

6.5% 12/1/21 | | 121 | | 133 |

9.5% 7/1/16 to 8/1/21 | | 29 | | 31 |

10% 3/1/16 to 3/1/21 | | 41 | | 45 |

10.5% 1/1/21 | | 1 | | 1 |

11% 9/1/20 | | 1 | | 2 |

12% 6/1/15 | | 0* | | 0* |

12.5% 5/1/15 to 6/1/19 | | 3 | | 3 |

| | 6,013 |

Ginnie Mae - 3.4% |

4.3% 8/20/61 (f) | | 1,046 | | 1,112 |

4.53% 10/20/62 (f) | | 1,113 | | 1,216 |

4.55% 5/20/62 (f) | | 8,007 | | 8,684 |

4.626% 3/20/62 (f) | | 1,811 | | 1,963 |

U.S. Government Agency - Mortgage Securities - continued |

| Principal Amount (000s) | | Value (000s) |

Ginnie Mae - continued |

4.649% 2/20/62 (f) | | $ 739 | | $ 801 |

4.65% 3/20/62 (f) | | 1,617 | | 1,757 |

4.682% 2/20/62 (f) | | 940 | | 1,018 |

4.684% 1/20/62 (f) | | 5,607 | | 6,069 |

5.47% 8/20/59 (f) | | 434 | | 454 |

5.5% 11/15/35 | | 613 | | 700 |

5.612% 4/20/58 (f) | | 575 | | 591 |

6% 6/15/36 | | 1,336 | | 1,544 |

8% 12/15/23 | | 106 | | 122 |

8.5% 2/15/17 | | 1 | | 1 |

10.5% 9/15/15 to 10/15/21 | | 109 | | 123 |

11% 5/20/16 to 1/20/21 | | 11 | | 13 |

| | 26,168 |

TOTAL U.S. GOVERNMENT AGENCY - MORTGAGE SECURITIES (Cost $48,322) | 49,459 |

Collateralized Mortgage Obligations - 13.9% |

|

U.S. Government Agency - 13.9% |

Fannie Mae: | | | | |

floater: | | | | |

Series 1994-42 Class FK, 1.35% 4/25/24 (c) | | 719 | | 726 |

Series 2001-38 Class QF, 1.151% 8/25/31 (c) | | 134 | | 137 |

Series 2002-60 Class FV, 1.171% 4/25/32 (c) | | 28 | | 29 |

Series 2002-74 Class FV, 0.621% 11/25/32 (c) | | 1,453 | | 1,464 |

Series 2002-75 Class FA, 1.171% 11/25/32 (c) | | 58 | | 60 |

Series 2008-76 Class EF, 0.671% 9/25/23 (c) | | 303 | | 304 |

Series 2010-15 Class FJ, 1.101% 6/25/36 (c) | | 2,037 | | 2,074 |

planned amortization class: | | | | |

Series 1988-21 Class G, 9.5% 8/25/18 | | 10 | | 11 |

Series 2002-16 Class PG, 6% 4/25/17 | | 73 | | 76 |

Series 2002-9 Class PC, 6% 3/25/17 | | 6 | | 6 |

Series 2003-28 Class KG, 5.5% 4/25/23 | | 336 | | 368 |

Series 2005-19 Class PA, 5.5% 7/25/34 | | 721 | | 784 |

Series 2005-27 Class NE, 5.5% 5/25/34 | | 577 | | 603 |

Series 2005-52 Class PB, 6.5% 12/25/34 | | 29 | | 29 |

Series 2005-64 Class PX, 5.5% 6/25/35 | | 691 | | 759 |

Series 2005-68 Class CZ, 5.5% 8/25/35 | | 1,218 | | 1,375 |

sequential payer: | | | | |

Series 2002-57 Class BD, 5.5% 9/25/17 | | 22 | | 23 |

Series 2003-117 Class MD, 5% 12/25/23 | | 329 | | 364 |

Collateralized Mortgage Obligations - continued |

| Principal Amount (000s) | | Value (000s) |

U.S. Government Agency - continued |

Fannie Mae: - continued | | | | |

sequential payer: | | | | |

Series 2004-52 Class KZ, 5.5% 7/25/34 | | $ 3,572 | | $ 4,026 |

Series 2004-91 Class Z, 5% 12/25/34 | | 2,074 | | 2,308 |

Series 2009-59 Class HB, 5% 8/25/39 | | 798 | | 888 |

Series 2010-139 Class NI, 4.5% 2/25/40 (d) | | 1,523 | | 222 |

Series 2010-39 Class FG, 1.091% 3/25/36 (c) | | 1,243 | | 1,275 |

Series 2011-67 Class AI, 4% 7/25/26 (d) | | 397 | | 48 |

Freddie Mac: | | | | |

floater: | | | | |

Series 2526 Class FC, 0.572% 11/15/32 (c) | | 228 | | 229 |

Series 2630 Class FL, 0.672% 6/15/18 (c) | | 8 | | 8 |

Series 2711 Class FC, 1.072% 2/15/33 (c) | | 696 | | 709 |

Series 3830 Class FD, 0.532% 3/15/41 (c) | | 1,406 | | 1,415 |

floater planned amortization class Series 2770 Class FH, 0.572% 3/15/34 (c) | | 629 | | 634 |

planned amortization class: | | | | |

Series 2006-3245 Class ME, 5.5% 6/15/35 | | 155 | | 156 |

Series 2356 Class GD, 6% 9/15/16 | | 19 | | 20 |

Series 2376 Class JE, 5.5% 11/15/16 | | 17 | | 18 |

Series 2381 Class OG, 5.5% 11/15/16 | | 10 | | 10 |

Series 2425 Class JH, 6% 3/15/17 | | 28 | | 29 |

Series 2672 Class MG, 5% 9/15/23 | | 1,630 | | 1,777 |

Series 2802 Class OB, 6% 5/15/34 | | 905 | | 1,010 |

Series 2810 Class PD, 6% 6/15/33 | | 4 | | 4 |

Series 3415 Class PC, 5% 12/15/37 | | 273 | | 294 |

Series 3763 Class QA, 4% 4/15/34 | | 605 | | 632 |

planned amortization class sequential payer Series 2005-2963 Class VB, 5% 11/15/34 | | 1,060 | | 1,102 |

planned amotization class Series 2006-3 Class FB, 0.471% 7/25/35 (c) | | 2,027 | | 2,037 |

sequential payer: | | | | |

Series 1929 Class EZ, 7.5% 2/17/27 | | 709 | | 805 |

Series 2004-2802 Class ZG, 5.5% 5/15/34 | | 2,358 | | 2,678 |

Series 2004-2862 Class NE, 5% 9/15/24 | | 6,011 | | 6,505 |

Series 2145 Class MZ, 6.5% 4/15/29 | | 920 | | 1,064 |

Series 2357 Class ZB, 6.5% 9/15/31 | | 459 | | 535 |

Series 2877 Class ZD, 5% 10/15/34 | | 2,394 | | 2,652 |

Series 2998 Class LY, 5.5% 7/15/25 | | 270 | | 297 |

Series 3007 Class EW, 5.5% 7/15/25 | | 1,125 | | 1,244 |

Series 4181 Class LA, 3% 3/15/37 | | 1,301 | | 1,348 |

Collateralized Mortgage Obligations - continued |

| Principal Amount (000s) | | Value (000s) |

U.S. Government Agency - continued |

Ginnie Mae guaranteed REMIC pass-thru certificates: | | | | |

floater: | | | | |

Series 2007-59 Class FC, 0.668% 7/20/37 (c) | | $ 348 | | $ 351 |

Series 2008-2 Class FD, 0.648% 1/20/38 (c) | | 87 | | 88 |

Series 2009-108 Class CF, 0.772% 11/16/39 (c) | | 393 | | 397 |

Series 2009-116 Class KF, 0.702% 12/16/39 (c) | | 318 | | 321 |

Series 2010-9 Class FA, 0.692% 1/16/40 (c) | | 512 | | 516 |

Series 2010-H17 Class FA, 0.4988% 7/20/60 (c)(f) | | 2,964 | | 2,950 |

Series 2010-H18 Class AF, 0.4583% 9/20/60 (c)(f) | | 3,346 | | 3,326 |

Series 2010-H19 Class FG, 0.4583% 8/20/60 (c)(f) | | 4,193 | | 4,167 |

Series 2010-H27 Series FA, 0.5383% 12/20/60 (c)(f) | | 1,019 | | 1,016 |

Series 2011-H05 Class FA, 0.6583% 12/20/60 (c)(f) | | 2,009 | | 2,012 |

Series 2011-H07 Class FA, 0.6675% 2/20/61 (c)(f) | | 3,668 | | 3,674 |

Series 2011-H12 Class FA, 0.6575% 2/20/61 (c)(f) | | 4,327 | | 4,332 |

Series 2011-H13 Class FA, 0.6583% 4/20/61 (c)(f) | | 1,666 | | 1,669 |

Series 2011-H14: | | | | |

Class FB, 0.6583% 5/20/61 (c)(f) | | 1,897 | | 1,901 |

Class FC, 0.6583% 5/20/61 (c)(f) | | 1,752 | | 1,755 |

Series 2011-H17 Class FA, 0.6883% 6/20/61 (c)(f) | | 2,264 | | 2,270 |

Series 2011-H21 Class FA, 0.7583% 10/20/61 (c)(f) | | 2,225 | | 2,238 |

Series 2012-H01 Class FA, 0.8583% 11/20/61 (c)(f) | | 1,862 | | 1,880 |

Series 2012-H03 Class FA, 0.8583% 1/20/62 (c)(f) | | 1,160 | | 1,172 |

Series 2012-H06 Class FA, 0.7883% 1/20/62 (c)(f) | | 1,768 | | 1,781 |

Series 2012-H07 Class FA, 0.7883% 3/20/62 (c)(f) | | 1,076 | | 1,086 |

floater sequential payer Series 2011-150 Class D, 3% 4/20/37 | | 88 | | 89 |

planned amortization class: | | | | |

Series 2011-136 Class WI, 4.5% 5/20/40 (d) | | 873 | | 128 |

Series 2011-68 Class EC, 3.5% 4/20/41 | | 1,542 | | 1,626 |

Series 1999-18 Class Z, 6.25% 5/16/29 | | 1,577 | | 1,775 |

Collateralized Mortgage Obligations - continued |

| Principal Amount (000s) | | Value (000s) |

U.S. Government Agency - continued |

Ginnie Mae guaranteed REMIC pass-thru certificates: - continued | | | | |

Series 2010-H15 Class TP, 5.15% 8/20/60 (f) | | $ 4,259 | | $ 4,632 |

Series 2010-H17 Class XP, 5.3001% 7/20/60 (c)(f) | | 5,450 | | 5,912 |

Series 2010-H18 Class PL, 5.01% 9/20/60 (c)(f) | | 4,020 | | 4,367 |

Series 2012-64 Class KB, 4.6316% 5/20/41 (c) | | 410 | | 454 |

Series 2013-124: | | | | |

Class ES, 8.4427% 4/20/39 (c)(e) | | 1,300 | | 1,491 |

Class ST, 8.576% 8/20/39 (c)(e) | | 2,443 | | 2,897 |

TOTAL COLLATERALIZED MORTGAGE OBLIGATIONS (Cost $106,225) | 107,444 |

Commercial Mortgage Securities - 5.5% |

|

Freddie Mac: | | | | |

pass thru-certificates floater Series KF01 Class A, 0.5183% 4/25/19 (c) | | 609 | | 610 |

pass-thru certificates sequential payer Series K011 Class A2, 4.084% 11/25/20 | | 780 | | 861 |

sequential payer: | | | | |

Series K006 Class A2, 4.251% 1/25/20 | | 5,360 | | 5,909 |

Series K009 Class A2, 3.808% 8/25/20 | | 6,820 | | 7,419 |

Series K034 Class A1, 2.669% 2/25/23 | | 3,200 | | 3,291 |

Series K032 Class A1, 3.016% 2/25/23 | | 5,706 | | 5,975 |

Series K039 Class A2, 3.303% 7/25/24 | | 5,032 | | 5,351 |

Series K042 Class A2, 2.67% 12/25/24 | | 4,200 | | 4,234 |

Series K501 Class A2, 1.655% 11/25/16 | | 2,080 | | 2,104 |

Series K714 Class A2, 3.034% 10/25/20 | | 6,000 | | 6,332 |

TOTAL COMMERCIAL MORTGAGE SECURITIES (Cost $41,396) | 42,086 |

Foreign Government and Government Agency Obligations - 3.6% |

|

Israeli State (guaranteed by U.S. Government through Agency for International Development): | | | | |

5.5% 9/18/23 | | 4,251 | | 5,258 |

5.5% 12/4/23 | | 10,710 | | 13,313 |

Jordanian Kingdom 2.503% 10/30/20 | | 8,609 | | 8,836 |

TOTAL FOREIGN GOVERNMENT AND GOVERNMENT AGENCY OBLIGATIONS (Cost $25,435) | 27,407 |

Cash Equivalents - 1.7% |

| Maturity Amount (000s) | | Value (000s) |

Investments in repurchase agreements in a joint trading account at: | | | |

0.06%, dated 2/27/15 due 3/2/15 (Collateralized by U.S. Treasury Obligations) # | $ 3,996 | | $ 3,996 |

0.07%, dated 2/27/15 due 3/2/15 (Collateralized by U.S. Government Obligations) # | 9,132 | | 9,132 |

TOTAL CASH EQUIVALENTS (Cost $13,128) |

13,128

|

TOTAL INVESTMENT PORTFOLIO - 100.9% (Cost $766,154) | | 777,463 |

NET OTHER ASSETS (LIABILITIES) - (0.9)% | | (6,917) |

NET ASSETS - 100% | $ 770,546 |

Futures Contracts |

| Expiration Date | | Underlying Face Amount at Value (000s) | | Unrealized Appreciation/

(Depreciation) (000s) |

Purchased |

Treasury Contracts |

58 CBOT 10 Year U.S. Treasury Note Contracts (United States) | June 2015 | | $ 7,412 | | $ 36 |

151 CBOT 2 Year U.S. Treasury Note Contracts (United States) | June 2015 | | 33,005 | | 33 |

131 CBOT 5 Year U.S. Treasury Note Contracts (United States) | June 2015 | | 15,626 | | 36 |

TOTAL TREASURY CONTRACTS | | $ 56,043 | | $ 105 |

Futures Contracts - continued |

| Expiration Date | | Underlying Face Amount at Value (000s) | | Unrealized Appreciation/

(Depreciation) (000s) |

Sold |

Treasury Contracts |

3 CBOT Ultra Long Term U.S. Treasury Bond Contracts (United States) | June 2015 | | $ 505 | | $ 0 |

| | $ 56,548 | | $ 105 |

The face value of futures purchased as a percentage of net assets is 7.3% |

|

The face value of futures sold as a percentage of net assets is 0.1% |

|

For the period, the average monthly underlying face amount at value for futures contracts in

the aggregate was $72,059,000. |

Swaps |

Interest Rate Swaps |

Clearinghouse/

Counterparty(1) | Expiration Date | Notional Amount

(000s) | Payment Received | Payment Paid | Value (000s) | Upfront Premium Received/

(Paid)(2) (000s) | Unrealized Appreciation/(Depreciation) (000s) |

CME | Mar. 2017 | $ 2,400 | 3-month LIBOR | 1.25% | $ (7) | $ 0 | $ (7) |

CME | Mar. 2020 | 1,400 | 3-month LIBOR | 2.25% | (13) | 0 | (13) |

CME | Mar. 2025 | 6,615 | 3-month LIBOR | 3% | (108) | 0 | (108) |

CME | Mar. 2045 | 200 | 3.5% | 3-month LIBOR | 13 | 0 | 13 |

TOTAL INTEREST RATE SWAPS | $ (115) | $ 0 | $ (115) |

(1) Swaps with CME Group (CME) are centrally cleared over-the-counter (OTC) swaps. |

|

(2) Any premiums for centrally cleared OTC swaps are recorded periodically throughout the term of the swap to variation margin and included in unrealized appreciation (depreciation). |

|

For the period, the average monthly notional amount for swaps in the aggregate was $11,896,000. |

Legend |

(a) Security or a portion of the security was pledged to cover margin requirements for futures contracts. At period end, the value of securities pledged amounted to $314,000. |

(b) Security or a portion of the security was pledged to cover margin requirements for centrally cleared OTC swaps. At period end, the value of securities pledged amounted to $277,000. |

(c) Coupon rates for floating and adjustable rate securities reflect the rates in effect at period end. |

(d) Security represents right to receive monthly interest payments on an underlying pool of mortgages or assets. Principal shown is the outstanding par amount of the pool as of the end of the period. |

(e) Coupon is inversely indexed to a floating interest rate multiplied by a specified factor. The price may be considerably more volatile than the price of a comparable fixed rate security. |

(f) Represents an investment in an underlying pool of reverse mortgages which typically do not require regular principal and interest payments as repayment is deferred until a maturity event. |

* Amount represents less than $1,000. |

# Additional information on each counterparty to the repurchase agreement is as follows: |

Repurchase Agreement / Counterparty | Value

(Amounts in thousands) |

$3,996,000 due 3/02/15 at 0.06% |

Citibank NA | $ 1,117 |

Merrill Lynch, Pierce, Fenner & Smith, Inc. | 780 |

Wachovia Bank NA | 2,099 |

| $ 3,996 |

$9,132,000 due 3/02/15 at 0.07% |

Commerz Markets LLC | $ 9,132 |

Other Information |

The following is a summary of the inputs used, as of February 28, 2015, involving the Fund's assets and liabilities carried at fair value. The inputs or methodology used for valuing securities may not be an indication of the risk associated with investing in those securities. For more information on valuation inputs, and their aggregation into the levels used in the table below, please refer to the Investment Valuation section in the accompanying Notes to Financial Statements. |

Valuation Inputs at Reporting Date: |

Description

(Amounts in thousands) | Total | Level 1 | Level 2 | Level 3 |

Investments in Securities: | | | | |

U.S. Government and Government Agency Obligations | $ 537,939 | $ - | $ 537,939 | $ - |

U.S. Government Agency - Mortgage Securities | 49,459 | - | 49,459 | - |

Collateralized Mortgage Obligations | 107,444 | - | 107,444 | - |

Commercial Mortgage Securities | 42,086 | - | 42,086 | - |

Foreign Government and Government Agency Obligations | 27,407 | - | 27,407 | - |

Cash Equivalents | 13,128 | - | 13,128 | - |

Total Investments in Securities: | $ 777,463 | $ - | $ 777,463 | $ - |

Derivative Instruments: | | | | |

Assets | | | | |

Futures Contracts | $ 105 | $ 105 | $ - | $ - |

Swaps | 13 | - | 13 | - |

Total Assets | $ 118 | $ 105 | $ 13 | $ - |

Liabilities | | | | |

Swaps | $ (128) | $ - | $ (128) | $ - |

Total Derivative Instruments: | $ (10) | $ 105 | $ (115) | $ - |

Value of Derivative Instruments |

The following table is a summary of the Fund's value of derivative instruments by primary risk exposure as of February 28, 2015. For additional information on derivative instruments, please refer to the Derivative Instruments section in the accompanying Notes to Financial Statements. |

Primary Risk Exposure /

Derivative Type | Value |

(Amounts in thousands) | Asset | Liability |

Interest Rate Risk | | |

Futures Contracts (a) | $ 105 | $ - |

Swaps (b) | 13 | (128) |

Total Value of Derivatives | $ 118 | $ (128) |

(a) Reflects gross cumulative appreciation (depreciation) on futures contracts as presented in the Schedule of Investments. Only the period end receivable or payable for daily variation margin and net unrealized appreciation (depreciation) are presented in the Statement of Assets and Liabilities. |

(b) For centrally cleared OTC swaps, reflects gross cumulative appreciation (depreciation) as presented in the Schedule of Investments. For centrally cleared OTC swaps, only the period end receivable or payable for daily variation margin and net unrealized appreciation (depreciation) are presented in the Statement of Assets and Liabilities. |

See accompanying notes which are an integral part of the financial statements.

Semiannual Report

Statement of Assets and Liabilities

Amounts in thousands (except per-share amount) | February 28, 2015 (Unaudited) |

| | |

Assets | | |

Investment in securities, at value (including repurchase agreements of $13,128) - See accompanying schedule: Unaffiliated issuers (cost $766,154) | | $ 777,463 |

Cash | | 1 |

Receivable for investments sold | | 2,050 |

Receivable for fund shares sold | | 497 |

Interest receivable | | 3,190 |

Receivable for daily variation margin for derivative instruments | | 28 |

Other receivables | | 1 |

Total assets | | 783,230 |

| | |

Liabilities | | |

Payable for investments purchased | $ 12,042 | |

Payable for fund shares redeemed | 301 | |

Distributions payable | 49 | |

Accrued management fee | 200 | |

Other affiliated payables | 91 | |

Other payables and accrued expenses | 1 | |

Total liabilities | | 12,684 |

| | |

Net Assets | | $ 770,546 |

Net Assets consist of: | | |

Paid in capital | | $ 757,081 |

Distributions in excess of net investment income | | (811) |

Accumulated undistributed net realized gain (loss) on investments | | 2,978 |

Net unrealized appreciation (depreciation) on investments | | 11,298 |

Net Assets, for 71,773 shares outstanding | | $ 770,546 |

Net Asset Value, offering price and redemption price per share ($770,546 ÷ 71,773 shares) | | $ 10.74 |

See accompanying notes which are an integral part of the financial statements.

Semiannual Report

Financial Statements - continued

Statement of Operations

Amounts in thousands Six months ended February 28, 2015 (Unaudited) |

| | |

Investment Income | | |

Interest | | $ 7,105 |

| | |

Expenses | | |

Management fee | $ 1,241 | |

Transfer agent fees | 399 | |

Fund wide operations fee | 154 | |

Independent trustees' compensation | 2 | |

Miscellaneous | 1 | |

Total expenses | | 1,797 |

Net investment income (loss) | | 5,308 |

Realized and Unrealized Gain (Loss) Net realized gain (loss) on: | | |

Investment securities: | | |

Unaffiliated issuers | 4,902 | |

Futures contracts | (57) | |

Swaps | (813) | |

Total net realized gain (loss) | | 4,032 |

Change in net unrealized appreciation (depreciation) on: Investment securities | (432) | |

Futures contracts | 92 | |

Swaps | 296 | |

Total change in net unrealized appreciation (depreciation) | | (44) |

Net gain (loss) | | 3,988 |

Net increase (decrease) in net assets resulting from operations | | $ 9,296 |

See accompanying notes which are an integral part of the financial statements.

Semiannual Report

Statement of Changes in Net Assets

Amounts in thousands | Six months ended February 28, 2015 (Unaudited) | Year ended

August 31,

2014 |

Increase (Decrease) in Net Assets | | |

Operations | | |

Net investment income (loss) | $ 5,308 | $ 10,798 |

Net realized gain (loss) | 4,032 | 4,589 |

Change in net unrealized appreciation (depreciation) | (44) | 7,644 |

Net increase (decrease) in net assets resulting from operations | 9,296 | 23,031 |

Distributions to shareholders from net investment income | (4,925) | (10,539) |

Distributions to shareholders from net realized gain | - | (4,764) |

Total distributions | (4,925) | (15,303) |

Share transactions

Proceeds from sales of shares | 50,736 | 81,769 |

Reinvestment of distributions | 4,469 | 13,634 |

Cost of shares redeemed | (112,258) | (196,207) |

Net increase (decrease) in net assets resulting from share transactions | (57,053) | (100,804) |

Total increase (decrease) in net assets | (52,682) | (93,076) |

| | |

Net Assets | | |

Beginning of period | 823,228 | 916,304 |

End of period (including distributions in excess of net investment income of $811 and distributions in excess of net investment income of $1,194, respectively) | $ 770,546 | $ 823,228 |

Other Information Shares | | |

Sold | 4,739 | 7,699 |

Issued in reinvestment of distributions | 417 | 1,284 |

Redeemed | (10,490) | (18,482) |

Net increase (decrease) | (5,334) | (9,499) |

See accompanying notes which are an integral part of the financial statements.

Semiannual Report

Financial Highlights

| Six months ended

February 28, 2015 | Years ended August 31, |

| (Unaudited) | 2014 | 2013 | 2012 | 2011 E | 2011 G | 2010 G |

Selected Per-Share Data | | | | | | |

Net asset value, beginning of period | $ 10.68 | $ 10.58 | $ 11.09 | $ 11.12 | $ 10.97 | $ 11.10 | $ 10.80 |

Income from Investment

Operations | | | | | | |

Net investment income (loss) D | .071 | .133 | .116 | .128 | .013 | .171 | .214 |

Net realized and unrealized gain (loss) | .055 | .153 | (.294) | .159 | .151 | .155 | .423 |

Total from investment operations | .126 | .286 | (.178) | .287 | .164 | .326 | .637 |

Distributions from net investment income | (.066) | (.130) | (.116) | (.129) | (.014) | (.172) | (.212) |

Distributions from net realized gain | - | (.056) | (.216) | (.188) | - | (.284) | (.125) |

Total distributions | (.066) | (.186) | (.332) | (.317) | (.014) | (.456) | (.337) |

Net asset value, end of period | $ 10.74 | $ 10.68 | $ 10.58 | $ 11.09 | $ 11.12 | $ 10.97 | $ 11.10 |

Total ReturnB, C | 1.18% | 2.72% | (1.66)% | 2.63% | 1.49% | 3.04% | 6.02% |

Ratios to Average Net Assets F | | | | | | |

Expenses before reductions | .45%A | .45% | .45% | .45% | .45%A | .45% | .45% |

Expenses net of fee waivers, if any | .45%A | .45% | .45% | .45% | .45%A | .45% | .45% |

Expenses net of all reductions | .45%A | .45% | .45% | .45% | .45%A | .45% | .45% |

Net investment income (loss) | 1.34%A | 1.25% | 1.07% | 1.16% | 1.37%A | 1.57% | 1.98% |

Supplemental Data | | | | | | | |

Net assets, end of period (in millions) | $ 771 | $ 823 | $ 916 | $ 1,132 | $ 1,206 | $ 1,191 | $ 1,417 |

Portfolio turnover rate | 88%A | 153% | 179% | 198% | 258%A | 339% | 227% |

A Annualized

B Total returns for periods of less than one year are not annualized.

C Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

D Calculated based on average shares outstanding during the period.

E For the one month period ended August 31. The Fund changed its fiscal year end from July 31 to August 31, effective August 31, 2011.

F Expense ratios reflect operating expenses of the Fund. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from expense offset arrangements and do not represent the amount paid by the Fund during periods when reimbursements or reductions occur. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the Fund.

G For the period ended July 31.

See accompanying notes which are an integral part of the financial statements.

Semiannual Report

For the period ended February 28, 2015 (Unaudited)

(Amounts in thousands except percentages)

1. Organization.

Fidelity® Intermediate Government Income Fund (the Fund) is a fund of Fidelity Income Fund (the Trust) and is authorized to issue an unlimited number of shares. Share transactions on the Statement of Changes in Net Assets may contain exchanges between funds. The Trust is registered under the Investment Company Act of 1940, as amended (the 1940 Act), as an open-end management investment company organized as a Massachusetts business trust.

2. Significant Accounting Policies.

The financial statements have been prepared in conformity with accounting principles generally accepted in the United States of America (GAAP), which require management to make certain estimates and assumptions at the date of the financial statements. Actual results could differ from those estimates. Subsequent events, if any, through the date that the financial statements were issued have been evaluated in the preparation of the financial statements. The following summarizes the significant accounting policies of the Fund:

Investment Valuation. Investments are valued as of 4:00 p.m. Eastern time on the last calendar day of the period. The Board of Trustees (the Board) has delegated the day to day responsibility for the valuation of the Fund's investments to the Fidelity Management & Research Company (FMR) Fair Value Committee (the Committee). In accordance with valuation policies and procedures approved by the Board, the Fund attempts to obtain prices from one or more third party pricing vendors or brokers to value its investments. When current market prices, quotations or currency exchange rates are not readily available or reliable, investments will be fair valued in good faith by the Committee, in accordance with procedures adopted by the Board. Factors used in determining fair value vary by investment type and may include market or investment specific events, changes in interest rates and credit quality. The frequency with which these procedures are used cannot be predicted and they may be utilized to a significant extent. The Committee oversees the Fund's valuation policies and procedures and reports to the Board on the Committee's activities and fair value determinations. The Board monitors the appropriateness of the procedures used in valuing the Fund's investments and ratifies the fair value determinations of the Committee.

The Fund categorizes the inputs to valuation techniques used to value its investments into a disclosure hierarchy consisting of three levels as shown below:

Level 1 - quoted prices in active markets for identical investments

Level 2 - other significant observable inputs (including quoted prices for similar investments, interest rates, prepayment speeds, etc.)

Level 3 - unobservable inputs (including the Fund's own assumptions based on the best information available)

Semiannual Report

Notes to Financial Statements (Unaudited) - continued

(Amounts in thousands except percentages)

2. Significant Accounting Policies - continued

Investment Valuation - continued

Valuation techniques used to value the Fund's investments by major category are as follows:

Debt securities, including restricted securities, are valued based on evaluated prices received from third party pricing vendors or from brokers who make markets in such securities. Foreign government and government agency obligations and U.S. government and government agency obligations are valued by pricing vendors who utilize matrix pricing which considers yield or price of bonds of comparable quality, coupon, maturity and type or by broker-supplied prices. Collateralized mortgage obligations, commercial mortgage securities and U.S. government agency mortgage securities are valued by pricing vendors who utilize matrix pricing which considers prepayment speed assumptions, attributes of the collateral, yield or price of bonds of comparable quality, coupon, maturity and type or by broker-supplied prices. Swaps are marked-to-market daily based on valuations from third party pricing vendors, registered derivatives clearing organizations (clearinghouses) or broker-supplied valuations. These pricing sources may utilize inputs such as interest rate curves, credit spread curves, default possibilities and recovery rates. When independent prices are unavailable or unreliable, debt securities and swaps may be valued utilizing pricing methodologies which consider similar factors that would be used by third party pricing vendors. Debt securities and swaps are generally categorized as Level 2 in the hierarchy but may be Level 3 depending on the circumstances.

Futures contracts are valued at the settlement price established each day by the board of trade or exchange on which they are traded and are categorized as Level 1 in the hierarchy. Short-term securities with remaining maturities of sixty days or less may be valued at amortized cost, which approximates fair value, and are categorized as Level 2 in the hierarchy.

Changes in valuation techniques may result in transfers in or out of an assigned level within the disclosure hierarchy. The aggregate value of investments by input level, as of February 28, 2015, is included at the end of the Fund's Schedule of Investments.

Investment Transactions and Income. For financial reporting purposes, the Fund's investment holdings and Net Asset Value (NAV) include trades executed through the end of the last business day of the period. The NAV per share for processing shareholder transactions is calculated as of the close of business of the New York Stock Exchange (NYSE), normally 4:00 p.m. Eastern time and includes trades executed through the end of the prior business day. Gains and losses on securities sold are determined on the basis of identified cost. Interest income is accrued as earned and includes coupon interest and amortization of premium and accretion of discount on debt securities as applicable.

Semiannual Report

2. Significant Accounting Policies - continued

Expenses. Expenses directly attributable to a fund are charged to that fund. Expenses attributable to more than one fund are allocated among the respective funds on the basis of relative net assets or other appropriate methods. Expense estimates are accrued in the period to which they relate and adjustments are made when actual amounts are known.

Income Tax Information and Distributions to Shareholders. Each year, the Fund intends to qualify as a regulated investment company under Subchapter M of the Internal Revenue Code, including distributing substantially all of its taxable income and realized gains. As a result, no provision for U.S. Federal income taxes is required. The Fund files a U.S. federal tax return, in addition to state and local tax returns as required. The Fund's federal income tax returns are subject to examination by the Internal Revenue Service (IRS) for a period of three fiscal years after they are filed. State and local tax returns may be subject to examination for an additional fiscal year depending on the jurisdiction.

Dividends are declared and recorded daily and paid monthly from net investment income. Distributions from realized gains, if any, are declared and recorded on the ex-dividend date. Income and capital gain distributions are determined in accordance with income tax regulations, which may differ from GAAP.

Capital accounts within the financial statements are adjusted for permanent book-tax differences. These adjustments have no impact on net assets or the results of operations. Capital accounts are not adjusted for temporary book-tax differences which will reverse in a subsequent period.

Book-tax differences are primarily due to futures contracts, swaps, market discount, deferred trustees compensation, capital loss carryforwards and losses deferred due to wash sales, futures transactions and excise tax regulations.

The federal tax cost of investment securities and unrealized appreciation (depreciation) as of period end were as follows:

Gross unrealized appreciation | $ 13,314 |

Gross unrealized depreciation | (1,788) |

Net unrealized appreciation (depreciation) on securities | $ 11,526 |

| |

Tax cost | $ 765,937 |

Capital loss carryforwards are only available to offset future capital gains of the Fund to the extent provided by regulations and may be limited. Under the Regulated Investment Company Modernization Act of 2010 (the Act), the Fund is permitted to carry forward capital losses incurred in taxable years beginning after December 22, 2010 for an unlimited period and such capital losses are required to be used prior to any losses that expire.

Semiannual Report

Notes to Financial Statements (Unaudited) - continued

(Amounts in thousands except percentages)

2. Significant Accounting Policies - continued

Income Tax Information and Distributions to Shareholders - continued

The capital loss carryforward information presented below, including any applicable limitation, is estimated as of prior fiscal period end and is subject to adjustment.

Fiscal year of expiration | |

No expiration | |

Short-term | $ (937) |

Repurchase Agreements. Pursuant to an Exemptive Order issued by the Securities and Exchange Commission (the SEC), the Fund along with other registered investment companies having management contracts with FMR, or other affiliated entities of FMR, are permitted to transfer uninvested cash balances into joint trading accounts which are then invested in repurchase agreements. The Fund may also invest directly with institutions in repurchase agreements. Repurchase agreements may be collateralized by government or non-government securities. Upon settlement date, collateral is held in segregated accounts with custodian banks and may be obtained in the event of a default of the counterparty. The Fund monitors, on a daily basis, the value of the collateral to ensure it is at least equal to the principal amount of the repurchase agreement (including accrued interest). In the event of a default by the counterparty, realization of the collateral proceeds could be delayed, during which time the value of the collateral may decline.

New Accounting Pronouncement. In June 2014, the Financial Accounting Standards Board issued Accounting Standard Update No. 2014-11, Repurchase-to-Maturity Transactions, Repurchase Financings, and Disclosures (the Update). The Update amends the accounting for certain repurchase agreements and expands disclosure requirements for reverse repurchase agreements, securities lending and other similar transactions. The disclosure requirements are effective for annual and interim reporting periods beginning after December 15, 2014. Management is currently evaluating the impact of the Update on the Fund's financial statements and related disclosures.

3. Derivative Instruments.

Risk Exposures and the Use of Derivative Instruments. The Fund's investment objective allows the Fund to enter into various types of derivative contracts, including futures contracts, options and swaps. Derivatives are investments whose value is primarily derived from underlying assets, indices or reference rates and may be transacted on an exchange or over-the-counter (OTC). Derivatives may involve a future commitment to buy or sell a specified asset based on specified terms, to exchange future cash flows at periodic intervals based on a notional principal amount, or for one party to make one or more payments upon the occurrence of specified events in exchange for periodic payments from the other party.

Semiannual Report

3. Derivative Instruments - continued

Risk Exposures and the Use of Derivative Instruments - continued

The Fund used derivatives to increase returns, to gain exposure to certain types of assets and to manage exposure to certain risks as defined below. The success of any strategy involving derivatives depends on analysis of numerous economic factors, and if the strategies for investment do not work as intended, the Fund may not achieve its objectives.

The Fund's use of derivatives increased or decreased its exposure to the following risk:

Interest Rate Risk | Interest rate risk relates to the fluctuations in the value of interest-bearing securities due to changes in the prevailing levels of market interest rates. |

The Fund is also exposed to additional risks from investing in derivatives, such as liquidity risk and counterparty credit risk. Liquidity risk is the risk that the Fund will be unable to close out the derivative in the open market in a timely manner. Counterparty credit risk is the risk that the counterparty will not be able to fulfill its obligation to the Fund. Derivative counterparty credit risk is managed through formal evaluation of the creditworthiness of all potential counterparties. On certain OTC derivatives such as options, the Fund attempts to reduce its exposure to counterparty credit risk by entering into an International Swaps and Derivatives Association, Inc. (ISDA) Master Agreement with each of its counterparties. The ISDA Master Agreement gives the Fund the right to terminate all transactions traded under such agreement upon the deterioration in the credit quality of the counterparty beyond specified levels. The ISDA Master Agreement gives each party the right, upon an event of default by the other party or a termination of the agreement, to close out all transactions traded under such agreement and to net amounts owed under each transaction to one net payable by one party to the other. To mitigate counterparty credit risk on bi-lateral OTC derivatives, the Fund receives collateral in the form of cash or securities once the Fund's net unrealized appreciation on outstanding derivative contracts under an ISDA Master Agreement exceeds certain applicable thresholds, subject to certain minimum transfer provisions. The collateral received is held in segregated accounts with the Fund's custodian bank in accordance with the collateral agreements entered into between the Fund, the counterparty and the Fund's custodian bank. The Fund could experience delays and costs in gaining access to the collateral even though it is held by the Fund's custodian bank. The Fund's maximum risk of loss from counterparty credit risk related to bi-lateral OTC derivatives is generally the aggregate unrealized appreciation and unpaid counterparty payments in excess of any collateral pledged by the counterparty to the Fund. The Fund may be required to pledge collateral for the benefit of the counterparties on bi-lateral OTC derivatives in an amount not less than each counterparty's unrealized appreciation on outstanding derivative contracts, subject to certain minimum transfer provisions, and any such pledged collateral is identified in the Schedule of Investments.

Semiannual Report

Notes to Financial Statements (Unaudited) - continued

(Amounts in thousands except percentages)

3. Derivative Instruments - continued

Risk Exposures and the Use of Derivative Instruments - continued

Exchange-traded futures contracts are not covered by the ISDA Master Agreement; however counterparty credit risk related to exchange-traded futures contracts may be mitigated by the protection provided by the exchange on which they trade. Counterparty credit risk related to centrally cleared OTC swaps may be mitigated by the protection provided by the clearinghouse.

Investing in derivatives may involve greater risks than investing in the underlying assets directly and, to varying degrees, may involve risk of loss in excess of any initial investment and collateral received and amounts recognized in the Statement of Assets and Liabilities. In addition, there may be the risk that the change in value of the derivative contract does not correspond to the change in value of the underlying instrument.

Net Realized Gain (Loss) and Change in Net Unrealized Appreciation (Depreciation) on Derivatives. The table below, which reflects the impacts of derivatives on the financial performance of the Fund, summarizes the net realized gain (loss) and change in net unrealized appreciation (depreciation) for derivatives during the period as presented in the Statement of Operations.

Primary Risk Exposure /

Derivative Type | Net Realized Gain (Loss) | Change in Net Unrealized Appreciation (Depreciation) |

Interest Rate Risk | | |

Futures Contracts | $ (57) | $ 92 |

Purchased Options | (267) | 257 |

Swaps | (813) | 296 |

Totals (a) | $ (1,137) | $ 645 |

(a) A summary of the value of derivatives by primary risk exposure as of period end, if any, is included at the end of the Schedule of Investments.

Futures Contracts. A futures contract is an agreement between two parties to buy or sell a specified underlying instrument for a fixed price at a specified future date. The Fund used futures contracts to manage its exposure to the bond market and fluctuations in interest rates.

Upon entering into a futures contract, a fund is required to deposit either cash or securities (initial margin) with a clearing broker in an amount equal to a certain percentage of the face value of the contract. Futures contracts are marked-to-market daily and subsequent daily payments (variation margin) are made or received by a fund depending on the daily fluctuations in the value of the futures contracts and are recorded as unrealized appreciation or (depreciation). This receivable and/or payable, if any, is included in daily variation margin for derivative instruments in the Statement of Assets and Liabilities. Realized gain or (loss) is recorded upon the expiration or closing of a futures contract. The net realized gain (loss) and change in net unrealized appreciation (depreciation) on futures contracts during the period is included in the Statement of Operations.

Semiannual Report

3. Derivative Instruments - continued

Futures Contracts - continued

Any open futures contracts at period end are presented in the Schedule of Investments under the caption "Futures Contracts." The underlying face amount at value reflects each contract's exposure to the underlying instrument or index at period end. Securities deposited to meet initial margin requirements are identified in the Schedule of Investments.

Options. Options give the purchaser the right, but not the obligation, to buy (call) or sell (put) an underlying security or financial instrument at an agreed exercise or strike price between or on certain dates. Options obligate the seller (writer) to buy (put) or sell (call) an underlying instrument at the exercise or strike price or cash settle an underlying derivative instrument if the holder exercises the option on or before the expiration date. The Fund uses OTC options, such as swaptions, which are options where the underlying instrument is a swap, to manage its exposure to market fluctuations in interest rates.

Upon entering into an options contract, a fund will pay or receive a premium. Premiums paid on purchased options are reflected as cost of investments and premiums received on written options are reflected as a liability on the Statement of Assets and Liabilities. Certain options may be purchased or written with premiums to be paid or received on a future date. Options are valued daily and any unrealized appreciation (depreciation) is reflected on the Statement of Assets and Liabilities. When an option is exercised, the cost or proceeds of the underlying instrument purchased or sold is adjusted by the amount of the premium. When an option is closed the Fundwill realize a gain or loss depending on whether the proceeds or amount paid for the closing sale transaction is greater or less than the premium received or paid. When an option expires, gains and losses are realized to the extent of premiums received and paid, respectively. The net realized and unrealized gains (losses) on purchased options are included on the Statement of Operations in net realized gain (loss) and change in net unrealized appreciation (depreciation) on investment securities. The net realized gain (loss) and change in net unrealized appreciation (depreciation) on written options are reflected separately on the Statement of Operations.

Any open options at period end are presented in the Schedule of Investments under the captions "Purchased Options," "Purchased Swaptions," "Written Options" and "Written Swaptions," as applicable, and are representative of volume of activity during the period.

Writing puts and buying calls tend to increase exposure to the underlying instrument while buying puts and writing calls tend to decrease exposure to the underlying instrument. For purchased options, risk of loss is limited to the premium paid, and for written options, risk of loss is the change in value in excess of the premium received.

Semiannual Report

Notes to Financial Statements (Unaudited) - continued

(Amounts in thousands except percentages)

3. Derivative Instruments - continued

Swaps. A swap is a contract between two parties to exchange future cash flows at periodic intervals based on a notional principal amount. A centrally cleared OTC swap is a transaction executed between a fund and a dealer counterparty, then cleared by a futures commission merchant (FCM) through a clearinghouse. Once cleared, the clearinghouse serves as a central counterparty, with whom a fund exchanges cash flows for the life of the transaction, similar to transactions in futures contracts.

Centrally cleared OTC swaps require a fund to deposit either cash or securities (initial margin) with the FCM, at the instruction of and for the benefit of the clearinghouse. Securities deposited to meet initial margin requirements are identified in the Schedule of Investments. Centrally cleared OTC swaps are marked-to-market daily and subsequent payments (variation margin) are made or received depending on the daily fluctuations in the value of the swaps and are recorded as unrealized appreciation or (depreciation). These daily payments, if any, are included in receivable or payable for daily variation margin for derivative instruments in the Statement of Assets and Liabilities. Any premiums for centrally cleared OTC swaps are recorded periodically throughout the term of the swap to variation margin and included in unrealized appreciation (depreciation) in the Statement of Assets and Liabilities. Any premiums are recognized as realized gain (loss) upon termination or maturity of the swap.

Payments are exchanged at specified intervals, accrued daily commencing with the effective date of the contract and recorded as realized gain or (loss). Some swaps may be terminated prior to the effective date and realize a gain or loss upon termination. The net realized gain (loss) and change in net unrealized appreciation (depreciation) on swaps during the period is included in the Statement of Operations.

Any open swaps at period end are included in the Schedule of Investments under the caption "Swaps."

Interest Rate Swaps. Interest rate swaps are agreements between counterparties to exchange cash flows, one based on a fixed rate, and the other on a floating rate. The Fund entered into interest rate swaps to manage its exposure to interest rate changes. Changes in interest rates can have an effect on both the value of bond holdings as well as the amount of interest income earned. In general, the value of bonds can fall when interest rates rise and can rise when interest rates fall.

4. Purchases and Sales of Investments.

Purchases and sales of securities, other than short-term securities and U.S. government securities, aggregated $0 and $3,220, respectively.

Semiannual Report

5. Fees and Other Transactions with Affiliates.

Management Fee. Fidelity Management & Research Company (the investment adviser) and its affiliates provide the Fund with investment management related services for which the Fund pays a monthly management fee. The management fee is the sum of an individual fund fee rate that is based on an annual rate of .20% of the Fund's average net assets and an annualized group fee rate that averaged .11% during the period. The group fee rate is based upon the average net assets of all the mutual funds advised by the investment adviser, including any mutual funds previously advised by the investment adviser that are currently advised by Fidelity SelectCo, LLC, an affiliate of the investment adviser. The group fee rate decreases as assets under management increase and increases as assets under management decrease. For the reporting period, the total annualized management fee rate was .31% of the Fund's average net assets.

Transfer Agent Fees. Fidelity Investments Institutional Operations Company, Inc. (FIIOC), an affiliate of the investment adviser, is the Fund's transfer, dividend disbursing and shareholder servicing agent. FIIOC receives an asset-based fee of .10% of the Fund's average net assets. FIIOC pays for typesetting, printing and mailing of shareholder reports, except proxy statements.

Fund Wide Operations Fee. Pursuant to the Fund Wide Operations and Expense Agreement (FWOE), the investment adviser has agreed to provide for fund level expenses (which do not include transfer agent, compensation of the independent Trustees, interest (including commitment fees), taxes or extraordinary expenses, if any) in return for a FWOE fee equal to .35% less the total amount of the management fee. The FWOE paid by the Fund is reduced by an amount equal to the fees and expenses paid to the independent Trustees. For the period, the FWOE fee was equivalent to an annualized rate of .04% of average net assets.

6. Committed Line of Credit.

The Fund participates with other funds managed by the investment adviser or an affiliate in a $4.25 billion credit facility (the "line of credit") to be utilized for temporary or emergency purposes to fund shareholder redemptions or for other short-term liquidity purposes. The Fund has agreed to pay commitment fees on its pro-rata portion of the line of credit, which amounted to $1 and is reflected in Miscellaneous expenses on the Statement of Operations. During the period, the Fund did not borrow on this line of credit.

Semiannual Report

Notes to Financial Statements (Unaudited) - continued

(Amounts in thousands except percentages)

7. Security Lending.

The Fund lends portfolio securities from time to time in order to earn additional income. On the settlement date of the loan, the Fund receives collateral (in the form of U.S. Treasury obligations, letters of credit and/or cash) against the loaned securities and maintains collateral in an amount not less than 100% of the market value of the loaned securities during the period of the loan. The market value of the loaned securities is determined at the close of business of the Fund and any additional required collateral is delivered to the Fund on the next business day. If the borrower defaults on its obligation to return the securities loaned because of insolvency or other reasons, the Fund may apply collateral received from the borrower against the obligation. The Fund may experience delays and costs in recovering the securities loaned. Any cash collateral received is maintained at the Fund's custodian and/or invested in cash equivalents. At period end, there were no security loans outstanding. Security lending income represents the income earned on investing cash collateral, less rebates paid to borrowers, plus any premium payments received for lending certain types of securities. Security lending income is presented in the Statement of Operations as a component of interest income. Total security lending income during the period amounted to $11.

8. Other.

The Fund's organizational documents provide former and current trustees and officers with a limited indemnification against liabilities arising in connection with the performance of their duties to the Fund. In the normal course of business, the Fund may also enter into contracts that provide general indemnifications. The Fund's maximum exposure under these arrangements is unknown as this would be dependent on future claims that may be made against the Fund. The risk of material loss from such claims is considered remote.

Semiannual Report

Fidelity Intermediate Government Income Fund

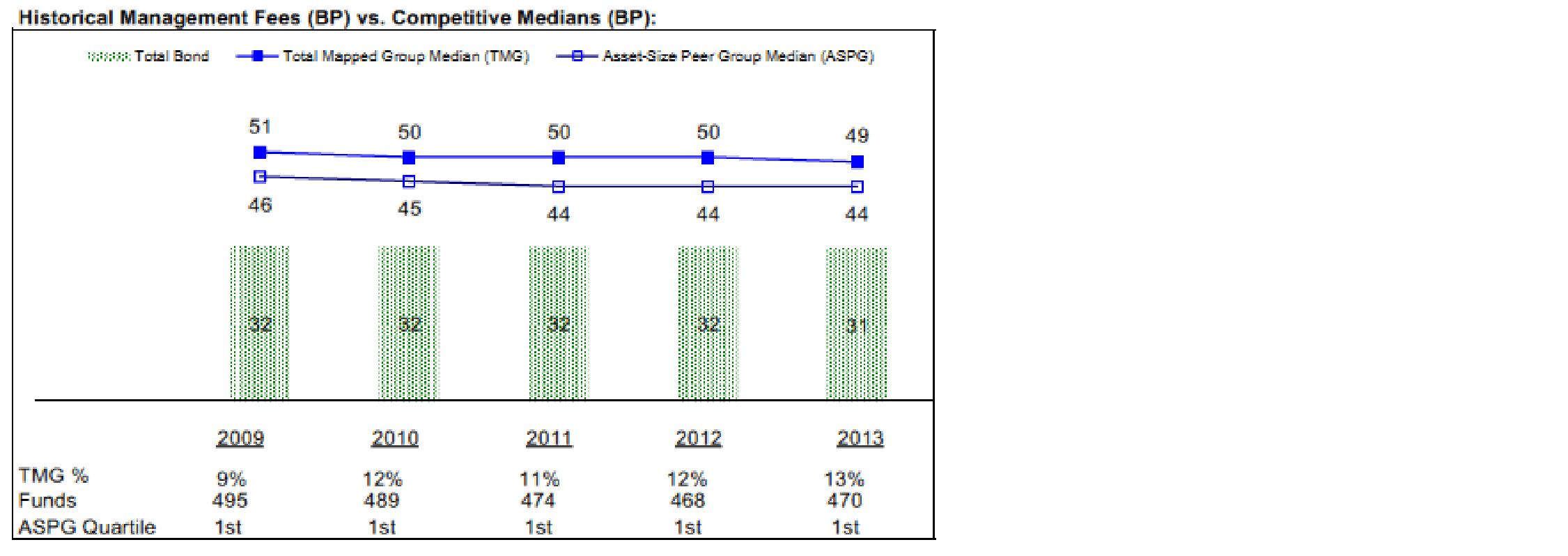

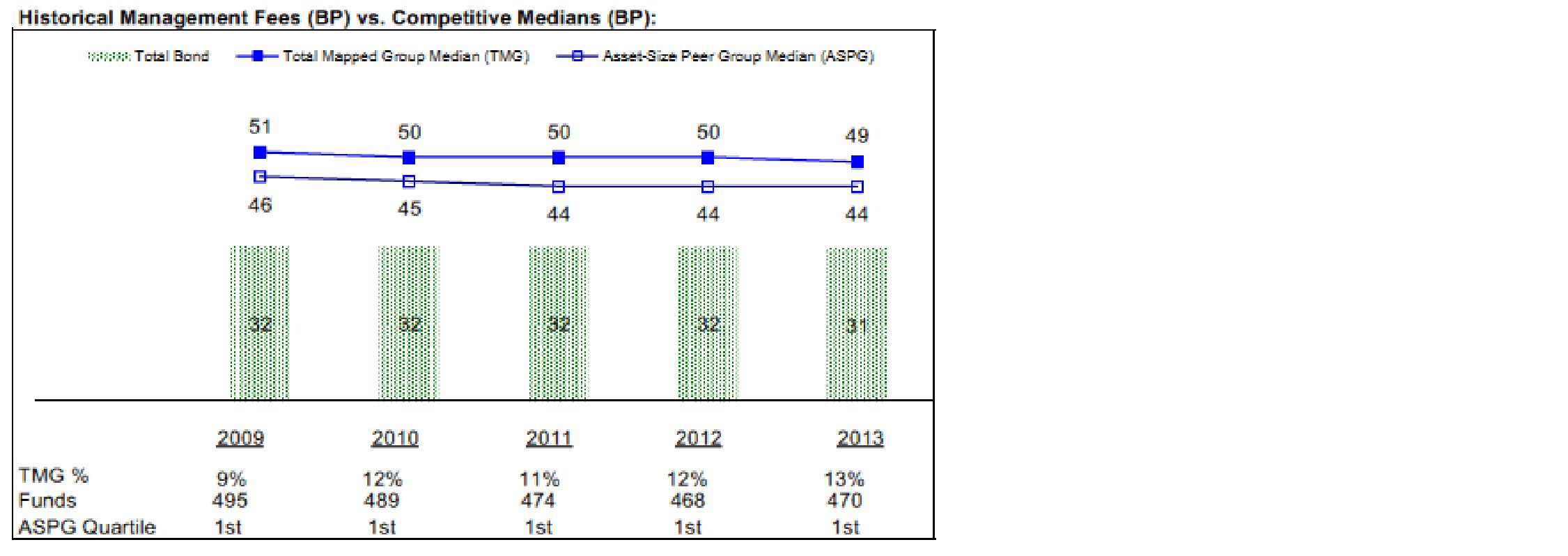

Each year, the Board of Trustees, including the Independent Trustees (together, the Board), votes on the renewal of the management contract with Fidelity Management & Research Company (FMR) and the sub-advisory agreements (together, the Advisory Contracts) for the fund. The Board, assisted by the advice of fund counsel and Independent Trustees' counsel, requests and considers a broad range of information relevant to the renewal of the Advisory Contracts throughout the year.

The Board meets regularly and, at each of its meetings, covers an extensive agenda of topics and materials and considers factors that are relevant to its annual consideration of the renewal of the fund's Advisory Contracts, including the services and support provided to the fund and its shareholders. The Board has established four standing committees (Committees) - Operations, Audit, Fair Valuation, and Governance and Nominating - each composed of and chaired by Independent Trustees with varying backgrounds, to which the Board has assigned specific subject matter responsibilities in order to enhance effective decision-making by the Board. The Operations Committee, of which all of the Independent Trustees are members, meets regularly throughout the year and considers, among other matters, information specifically related to the annual consideration of the renewal of the fund's Advisory Contracts. The Board, acting directly and through its Committees, requests and receives information concerning the annual consideration of the renewal of the fund's Advisory Contracts. The Board also meets as needed to consider matters specifically related to the Board's annual consideration of the renewal of the Advisory Contracts. Members of the Board may also meet with trustees of other Fidelity funds through ad hoc joint committees to discuss certain matters relevant to the Fidelity funds.

At its September 2014 meeting, the Board, including the Independent Trustees, unanimously determined to renew the fund's Advisory Contracts. In reaching its determination, the Board considered all factors it believed relevant, including (i) the nature, extent, and quality of the services to be provided to the fund and its shareholders (including the investment performance of the fund); (ii) the competitiveness of the fund's management fee and total expense ratio relative to peer funds; (iii) the total costs of the services to be provided by and the profits to be realized by Fidelity from its relationship with the fund; (iv) the extent to which economies of scale exist and would be realized as the fund grows; and (v) whether fee levels reflect these economies of scale, if any, for the benefit of fund shareholders. In connection with separate internal corporate reorganizations involving Fidelity Management & Research (U.K.) Inc. (FMR U.K.) and Fidelity Management & Research (Japan) Inc. (FMR Japan), the Board approved certain non-material amendments to the fund's sub-advisory agreements with FMR U.K. and FMR Japan to reflect that, after these reorganizations, FMR Investment Management (UK) Limited and Fidelity Management & Research (Japan) Limited will carry on the business of FMR U.K. and FMR Japan, respectively. The Board noted that no changes to the portfolio managers or to the foreign research or investment advisory services provided to the fund were expected in connection with either reorganization and that the same personnel and resources would continue to be available to the fund at the new entities.

Semiannual Report

Board Approval of Investment Advisory Contracts and

Management Fees - continued

In considering whether to renew the Advisory Contracts for the fund, the Board reached a determination, with the assistance of fund counsel and Independent Trustees' counsel and through the exercise of its business judgment, that the renewal of the Advisory Contracts was in the best interests of the fund and its shareholders and that the compensation payable under the Advisory Contracts was fair and reasonable. The Board's decision to renew the Advisory Contracts was not based on any single factor, but rather was based on a comprehensive consideration of all the information provided to the Board at its meetings throughout the year. The Board, in reaching its determination to renew the Advisory Contracts, was aware that shareholders of the fund have a broad range of investment choices available to them, including a wide choice among funds offered by Fidelity's competitors, and that the fund's shareholders, who have the opportunity to review and weigh the disclosure provided by the fund in its prospectus and other public disclosures, have chosen to invest in this fund, which is part of the Fidelity family of funds.

Nature, Extent, and Quality of Services Provided. The Board considered Fidelity's staffing as it relates to the fund, including the backgrounds of investment personnel of Fidelity, and also considered the fund's investment objective, strategies, and related investment philosophy. The Independent Trustees also had discussions with senior management of Fidelity's investment operations and investment groups. The Board considered the structure of the portfolio manager compensation program and whether this structure provides appropriate incentives to act in the best interests of the fund. Additionally, the Board considered the portfolio managers' investments, if any, in the funds that they manage.

Resources Dedicated to Investment Management and Support Services. The Board reviewed the general qualifications and capabilities of Fidelity's investment staff, including its size, education, experience, and resources, as well as Fidelity's approach to recruiting, training, managing, and compensating investment personnel. The Board noted that Fidelity has continued to increase the resources devoted to non-U.S. offices, including expansion of Fidelity's global investment organization. The Board also noted that Fidelity's analysts have extensive resources, tools and capabilities that allow them to conduct sophisticated quantitative and fundamental analysis, as well as credit analysis of issuers, counterparties and guarantors. Further, the Board believes that Fidelity's investment professionals have sufficient access to global information and data so as to provide competitive investment results over time, and that those professionals also have access to sophisticated tools that permit them to assess portfolio construction and risk and performance attribution characteristics continuously, as well as to transmit new information and research conclusions rapidly around the world. Additionally, in its deliberations, the Board considered Fidelity's trading, risk management, and compliance capabilities and resources, which are integral parts of the investment management process.

Semiannual Report

Shareholder and Administrative Services. The Board considered (i) the nature, extent, quality, and cost of advisory, administrative, and shareholder services performed by FMR, the sub-advisers (together with FMR, the Investment Advisers), and their affiliates under the Advisory Contracts and under separate agreements covering transfer agency, pricing and bookkeeping, and securities lending services for the fund; (ii) the nature and extent of the supervision of third party service providers, principally custodians and subcustodians; and (iii) the resources devoted to, and the record of compliance with, the fund's compliance policies and procedures.

The Board noted that the growth of fund assets over time across the complex allows Fidelity to reinvest in the development of services designed to enhance the value or convenience of the Fidelity funds as investment vehicles. These services include 24-hour access to account information and market information through telephone representatives and over the Internet, investor education materials and asset allocation tools, and the expanded availability of Fidelity Investor Centers.