UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-04085

Fidelity Income Fund

(Exact name of registrant as specified in charter)

245 Summer St., Boston, MA 02210

(Address of principal executive offices) (Zip code)

Cynthia Lo Bessette, Secretary

245 Summer St.

Boston, Massachusetts 02210

(Name and address of agent for service)

Registrant's telephone number, including area code:

617-563-7000

Date of fiscal year end: | July 31 |

Date of reporting period: | January 31, 2023 |

Item 1.

Reports to Stockholders

Contents

Top Holdings (% of Fund's net assets) | ||

| Fidelity Series 0-5 Year Inflation-Protected Bond Index Fund | 19.9 | |

| Fidelity Series Investment Grade Bond Fund | 11.9 | |

| Fidelity Series Government Bond Index Fund | 11.6 | |

| Fidelity Series Investment Grade Securitized Fund | 8.3 | |

| Fidelity Series Corporate Bond Fund | 7.9 | |

| Fidelity Series Treasury Bill Index Fund | 6.5 | |

| Fidelity Series Emerging Markets Opportunities Fund | 4.9 | |

| Fidelity Series Long-Term Treasury Bond Index Fund | 4.4 | |

| Fidelity Series International Developed Markets Bond Index Fund | 3.9 | |

| Fidelity Series Government Money Market Fund 4.42% | 2.3 | |

| 81.6 | ||

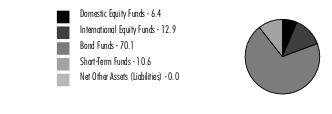

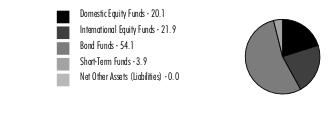

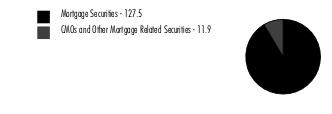

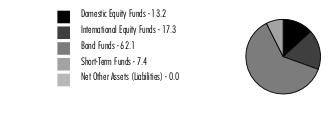

Asset Allocation (% of Fund's net assets) |

|

Percentages shown as 0.0% may reflect amounts less than 0.05%. |

| Domestic Equity Funds - 6.4% | |||

| Shares | Value ($) | ||

| Fidelity Series Blue Chip Growth Fund (a) | 19,476 | 218,521 | |

| Fidelity Series Commodity Strategy Fund (a) | 1,215 | 127,312 | |

| Fidelity Series Large Cap Growth Index Fund (a) | 9,425 | 138,178 | |

| Fidelity Series Large Cap Stock Fund (a) | 8,516 | 152,008 | |

| Fidelity Series Large Cap Value Index Fund (a) | 19,534 | 283,445 | |

| Fidelity Series Small Cap Core Fund (a) | 49 | 525 | |

| Fidelity Series Small Cap Opportunities Fund (a) | 5,496 | 70,185 | |

| Fidelity Series Value Discovery Fund (a) | 6,878 | 104,541 | |

| TOTAL DOMESTIC EQUITY FUNDS (Cost $1,047,672) | 1,094,715 | ||

| International Equity Funds - 12.9% | |||

| Shares | Value ($) | ||

| Fidelity Series Canada Fund (a) | 9,609 | 136,828 | |

| Fidelity Series Emerging Markets Fund (a) | 10,705 | 91,634 | |

| Fidelity Series Emerging Markets Opportunities Fund (a) | 48,864 | 841,926 | |

| Fidelity Series International Growth Fund (a) | 19,360 | 302,985 | |

| Fidelity Series International Index Fund (a) | 11,351 | 126,219 | |

| Fidelity Series International Small Cap Fund (a) | 5,923 | 94,356 | |

| Fidelity Series International Value Fund (a) | 27,842 | 301,249 | |

| Fidelity Series Overseas Fund (a) | 25,627 | 302,655 | |

| TOTAL INTERNATIONAL EQUITY FUNDS (Cost $2,142,925) | 2,197,852 | ||

| Bond Funds - 70.1% | |||

| Shares | Value ($) | ||

| Fidelity Series 0-5 Year Inflation-Protected Bond Index Fund (a) | 363,679 | 3,400,405 | |

| Fidelity Series 5+ Year Inflation-Protected Bond Index Fund (a) | 12,977 | 103,166 | |

| Fidelity Series Corporate Bond Fund (a) | 144,394 | 1,341,417 | |

| Fidelity Series Emerging Markets Debt Fund (a) | 11,754 | 89,097 | |

| Fidelity Series Emerging Markets Debt Local Currency Fund (a) | 3,222 | 29,227 | |

| Fidelity Series Floating Rate High Income Fund (a) | 1,901 | 16,961 | |

| Fidelity Series Government Bond Index Fund (a) | 211,710 | 1,979,491 | |

| Fidelity Series High Income Fund (a) | 11,095 | 92,200 | |

| Fidelity Series International Credit Fund (a) | 952 | 7,613 | |

| Fidelity Series International Developed Markets Bond Index Fund (a) | 78,302 | 671,051 | |

| Fidelity Series Investment Grade Bond Fund (a) | 199,732 | 2,033,267 | |

| Fidelity Series Investment Grade Securitized Fund (a) | 155,020 | 1,418,435 | |

| Fidelity Series Long-Term Treasury Bond Index Fund (a) | 121,160 | 757,248 | |

| Fidelity Series Real Estate Income Fund (a) | 3,268 | 32,644 | |

| TOTAL BOND FUNDS (Cost $13,230,504) | 11,972,222 | ||

| Short-Term Funds - 10.6% | |||

| Shares | Value ($) | ||

| Fidelity Series Government Money Market Fund 4.42% (a)(b) | 386,228 | 386,228 | |

| Fidelity Series Short-Term Credit Fund (a) | 32,625 | 314,828 | |

| Fidelity Series Treasury Bill Index Fund (a) | 111,804 | 1,112,453 | |

| TOTAL SHORT-TERM FUNDS (Cost $1,827,768) | 1,813,509 | ||

| TOTAL INVESTMENT IN SECURITIES - 100.0% (Cost $18,248,869) | 17,078,298 |

NET OTHER ASSETS (LIABILITIES) - 0.0% | (440) |

| NET ASSETS - 100.0% | 17,077,858 |

| (a) | Affiliated Fund |

| (b) | The rate quoted is the annualized seven-day yield of the fund at period end. |

| Affiliate | Value, beginning of period ($) | Purchases ($) | Sales Proceeds ($) | Dividend Income ($) | Realized Gain (loss) ($) | Change in Unrealized appreciation (depreciation) ($) | Value, end of period ($) |

| Fidelity Series 0-5 Year Inflation-Protected Bond Index Fund | 3,604,910 | 525,085 | 466,262 | 172,655 | (12,300) | (251,028) | 3,400,405 |

| Fidelity Series 5+ Year Inflation-Protected Bond Index Fund | 18,229 | 96,741 | 8,828 | 6,544 | (496) | (2,480) | 103,166 |

| Fidelity Series Blue Chip Growth Fund | 261,605 | 64,498 | 88,731 | 8,658 | (23,155) | 4,304 | 218,521 |

| Fidelity Series Canada Fund | 149,361 | 16,855 | 30,108 | 4,006 | (846) | 1,566 | 136,828 |

| Fidelity Series Commodity Strategy Fund | 272,004 | 170,821 | 151,080 | 146,920 | (75,207) | (89,226) | 127,312 |

| Fidelity Series Corporate Bond Fund | 1,389,346 | 126,336 | 137,820 | 25,638 | (11,289) | (25,156) | 1,341,417 |

| Fidelity Series Emerging Markets Debt Fund | 94,209 | 7,550 | 14,587 | 2,760 | (4,523) | 6,448 | 89,097 |

| Fidelity Series Emerging Markets Debt Local Currency Fund | 31,314 | 1,445 | 5,838 | - | (676) | 2,982 | 29,227 |

| Fidelity Series Emerging Markets Fund | 114,448 | 8,901 | 35,950 | 2,541 | (7,026) | 11,261 | 91,634 |

| Fidelity Series Emerging Markets Opportunities Fund | 1,035,222 | 93,712 | 329,231 | 21,274 | (80,381) | 122,604 | 841,926 |

| Fidelity Series Floating Rate High Income Fund | 17,773 | 4,466 | 5,398 | 668 | (292) | 412 | 16,961 |

| Fidelity Series Government Bond Index Fund | 2,040,519 | 236,915 | 217,954 | 20,674 | (18,764) | (61,225) | 1,979,491 |

| Fidelity Series Government Money Market Fund 4.42% | 334,931 | 96,997 | 45,700 | 6,428 | - | - | 386,228 |

| Fidelity Series High Income Fund | 97,582 | 9,158 | 12,405 | 3,244 | (1,024) | (1,111) | 92,200 |

| Fidelity Series International Credit Fund | 7,830 | 303 | - | 302 | - | (520) | 7,613 |

| Fidelity Series International Developed Markets Bond Index Fund | 721,484 | 65,882 | 71,573 | 4,175 | (5,311) | (39,431) | 671,051 |

| Fidelity Series International Growth Fund | 310,909 | 44,406 | 58,406 | 9,596 | (8,706) | 14,782 | 302,985 |

| Fidelity Series International Index Fund | 130,186 | 14,208 | 25,779 | 3,078 | (3,253) | 10,857 | 126,219 |

| Fidelity Series International Small Cap Fund | 95,915 | 13,288 | 12,439 | 5,284 | (2,836) | 428 | 94,356 |

| Fidelity Series International Value Fund | 308,251 | 31,457 | 66,143 | 9,396 | (4,990) | 32,674 | 301,249 |

| Fidelity Series Investment Grade Bond Fund | 2,109,226 | 207,394 | 214,615 | 37,845 | (16,220) | (52,518) | 2,033,267 |

| Fidelity Series Investment Grade Securitized Fund | 1,491,968 | 142,745 | 148,767 | 21,560 | (9,846) | (57,665) | 1,418,435 |

| Fidelity Series Large Cap Growth Index Fund | 165,518 | 29,914 | 47,234 | 919 | (1,067) | (8,953) | 138,178 |

| Fidelity Series Large Cap Stock Fund | 181,313 | 34,950 | 62,758 | 10,843 | (890) | (607) | 152,008 |

| Fidelity Series Large Cap Value Index Fund | 346,194 | 68,688 | 130,923 | 9,594 | 4,031 | (4,545) | 283,445 |

| Fidelity Series Long-Term Treasury Bond Index Fund | 795,851 | 137,903 | 111,960 | 11,101 | (15,839) | (48,707) | 757,248 |

| Fidelity Series Overseas Fund | 312,736 | 40,013 | 61,653 | 5,054 | (5,064) | 16,623 | 302,655 |

| Fidelity Series Real Estate Income Fund | 56,336 | 17,647 | 36,627 | 3,623 | (4,456) | (256) | 32,644 |

| Fidelity Series Short-Term Credit Fund | 334,147 | 18,078 | 36,082 | 3,408 | (782) | (533) | 314,828 |

| Fidelity Series Small Cap Opportunities Fund | 86,328 | 10,346 | 26,000 | 4,111 | (3,435) | 2,946 | 70,185 |

| Fidelity Series Small Cap Core Fund | - | 480 | - | - | - | 45 | 525 |

| Fidelity Series Treasury Bill Index Fund | 1,005,003 | 224,544 | 114,965 | 19,020 | (58) | (2,071) | 1,112,453 |

| Fidelity Series Value Discovery Fund | 127,676 | 22,876 | 45,396 | 5,178 | 1,551 | (2,166) | 104,541 |

| 18,048,324 | 2,584,602 | 2,821,212 | 586,097 | (313,150) | (420,266) | 17,078,298 |

| Valuation Inputs at Reporting Date: | ||||

| Description | Total ($) | Level 1 ($) | Level 2 ($) | Level 3 ($) |

Investments in Securities: | ||||

| Domestic Equity Funds | 1,094,715 | 1,094,715 | - | - |

| International Equity Funds | 2,197,852 | 2,197,852 | - | - |

| Bond Funds | 11,972,222 | 11,972,222 | - | - |

| Short-Term Funds | 1,813,509 | 1,813,509 | - | - |

| Total Investments in Securities: | 17,078,298 | 17,078,298 | - | - |

| Statement of Assets and Liabilities | ||||

January 31, 2023 (Unaudited) | ||||

| Assets | ||||

| Investment in securities, at value - See accompanying schedule: | ||||

Affiliated issuers (cost $18,248,869) | $ | 17,078,298 | ||

| Total Investment in Securities (cost $18,248,869) | $ | 17,078,298 | ||

| Cash | 14 | |||

| Receivable for investments sold | 175,879 | |||

| Receivable for fund shares sold | 63 | |||

Total assets | 17,254,254 | |||

| Liabilities | ||||

| Payable for investments purchased | $ | 157,277 | ||

| Payable for fund shares redeemed | 12,685 | |||

| Accrued management fee | 6,294 | |||

| Distribution and service plan fees payable | 140 | |||

| Total Liabilities | 176,396 | |||

| Net Assets | $ | 17,077,858 | ||

| Net Assets consist of: | ||||

| Paid in capital | $ | 18,821,698 | ||

| Total accumulated earnings (loss) | (1,743,840) | |||

| Net Assets | $ | 17,077,858 | ||

| Net Asset Value and Maximum Offering Price | ||||

| Class A : | ||||

Net Asset Value and redemption price per share ($679,063 ÷ 12,607.88 shares) (a) | $ | 53.86 | ||

| Maximum offering price per share (100/94.25 of $53.86) | $ | 57.15 | ||

| Fidelity Managed Retirement Income : | ||||

Net Asset Value , offering price and redemption price per share ($15,496,357 ÷ 287,785.96 shares) | $ | 53.85 | ||

| Class K : | ||||

Net Asset Value , offering price and redemption price per share ($124,423 ÷ 2,310.35 shares) | $ | 53.85 | ||

| Class K6 : | ||||

Net Asset Value , offering price and redemption price per share ($531,200 ÷ 9,862.67 shares) | $ | 53.86 | ||

| Class I : | ||||

Net Asset Value , offering price and redemption price per share ($140,748 ÷ 2,610.58 shares) | $ | 53.91 | ||

| Class Z6 : | ||||

Net Asset Value , offering price and redemption price per share ($106,067 ÷ 1,970.42 shares) | $ | 53.83 | ||

(a)Redemption price per share is equal to net asset value less any applicable contingent deferred sales charge. | ||||

| Statement of Operations | ||||

Six months ended January 31, 2023 (Unaudited) | ||||

| Investment Income | ||||

| Dividends: | ||||

| Affiliated issuers | $ | 549,213 | ||

| Expenses | ||||

| Management fee | $ | 38,379 | ||

| Distribution and service plan fees | 837 | |||

| Independent trustees' fees and expenses | 34 | |||

| Total expenses before reductions | 39,250 | |||

| Expense reductions | (82) | |||

| Total expenses after reductions | 39,168 | |||

| Net Investment income (loss) | 510,045 | |||

| Realized and Unrealized Gain (Loss) | ||||

| Net realized gain (loss) on: | ||||

| Investment Securities: | ||||

| Affiliated issuers | (313,150) | |||

| Capital gain distributions from underlying funds: | ||||

| Affiliated issuers | 36,884 | |||

| Total net realized gain (loss) | (276,266) | |||

| Change in net unrealized appreciation (depreciation) on: | ||||

| Investment Securities: | ||||

| Affiliated issuers | (420,266) | |||

| Total change in net unrealized appreciation (depreciation) | (420,266) | |||

| Net gain (loss) | (696,532) | |||

| Net increase (decrease) in net assets resulting from operations | $ | (186,487) | ||

| Statement of Changes in Net Assets | ||||

Six months ended January 31, 2023 (Unaudited) | Year ended July 31, 2022 | |||

| Increase (Decrease) in Net Assets | ||||

| Operations | ||||

| Net investment income (loss) | $ | 510,045 | $ | 512,071 |

| Net realized gain (loss) | (276,266) | 154,259 | ||

| Change in net unrealized appreciation (depreciation) | (420,266) | (2,331,406) | ||

| Net increase (decrease) in net assets resulting from operations | (186,487) | (1,665,076) | ||

| Distributions to shareholders | (718,225) | (799,835) | ||

| Share transactions - net increase (decrease) | (65,351) | (1,238,197) | ||

| Total increase (decrease) in net assets | (970,063) | (3,703,108) | ||

| Net Assets | ||||

| Beginning of period | 18,047,921 | 21,751,029 | ||

| End of period | $ | 17,077,858 | $ | 18,047,921 |

| Fidelity Advisor Managed Retirement Income Fund℠ Class A |

Six months ended (Unaudited) January 31, 2023 | Years ended July 31, 2022 | 2021 | 2020 | 2019 | 2018 | |||||||

Selected Per-Share Data | ||||||||||||

| Net asset value, beginning of period | $ | 56.57 | $ | 63.52 | $ | 60.44 | $ | 57.74 | $ | 57.55 | $ | 61.00 |

| Income from Investment Operations | ||||||||||||

Net investment income (loss) A,B | 1.495 | 1.317 | .309 | .684 | 1.029 | .884 | ||||||

| Net realized and unrealized gain (loss) | (2.085) | (6.180) | 4.009 | 3.226 | 1.594 | .494 | ||||||

| Total from investment operations | (.590) | (4.863) | 4.318 | 3.910 | 2.623 | 1.378 | ||||||

| Distributions from net investment income | (1.485) | (1.252) | (.329) | (.776) | (1.047) | (.853) | ||||||

| Distributions from net realized gain | (.635) | (.835) | (.909) | (.434) | (1.386) | (3.975) | ||||||

| Total distributions | (2.120) | (2.087) | (1.238) | (1.210) | (2.433) | (4.828) | ||||||

| Net asset value, end of period | $ | 53.86 | $ | 56.57 | $ | 63.52 | $ | 60.44 | $ | 57.74 | $ | 57.55 |

Total Return C,D,E | (.91)% | (7.90)% | 7.21% | 6.86% | 4.78% | 2.35% | ||||||

Ratios to Average Net Assets B,F,G | ||||||||||||

| Expenses before reductions | .70% H | .70% | .70% | .70% | .71% | .71% I | ||||||

| Expenses net of fee waivers, if any | .70% H | .70% | .70% | .70% | .71% | .71% I | ||||||

| Expenses net of all reductions | .70% H | .70% | .70% | .70% | .71% | .71% I | ||||||

| Net investment income (loss) | 5.60% H | 2.20% | .50% | 1.18% | 1.83% | 1.51% | ||||||

| Supplemental Data | ||||||||||||

| Net assets, end of period (000 omitted) | $ | 679 | $ | 717 | $ | 716 | $ | 453 | $ | 177 | $ | 147 |

Portfolio turnover rate J | 30% H | 64% | 31% | 62% K | 68% | 19% |

| Fidelity Managed Retirement Income Fund℠ |

Six months ended (Unaudited) January 31, 2023 | Years ended July 31, 2022 | 2021 | 2020 | 2019 | 2018 | |||||||

Selected Per-Share Data | ||||||||||||

| Net asset value, beginning of period | $ | 56.57 | $ | 63.52 | $ | 60.42 | $ | 57.73 | $ | 57.54 | $ | 61.00 |

| Income from Investment Operations | ||||||||||||

Net investment income (loss) A,B | 1.560 | 1.473 | .464 | .829 | 1.170 | 1.024 | ||||||

| Net realized and unrealized gain (loss) | (2.079) | (6.189) | 4.011 | 3.220 | 1.589 | .512 | ||||||

| Total from investment operations | (.519) | (4.716) | 4.475 | 4.049 | 2.759 | 1.536 | ||||||

| Distributions from net investment income | (1.566) | (1.399) | (.466) | (.925) | (1.183) | (1.021) | ||||||

| Distributions from net realized gain | (.635) | (.835) | (.909) | (.434) | (1.386) | (3.975) | ||||||

| Total distributions | (2.201) | (2.234) | (1.375) | (1.359) | (2.569) | (4.996) | ||||||

| Net asset value, end of period | $ | 53.85 | $ | 56.57 | $ | 63.52 | $ | 60.42 | $ | 57.73 | $ | 57.54 |

Total Return C,D | (.78)% | (7.68)% | 7.48% | 7.12% | 5.04% | 2.63% | ||||||

Ratios to Average Net Assets B,E,F | ||||||||||||

| Expenses before reductions | .45% G | .45% | .45% | .45% | .46% | .47% | ||||||

| Expenses net of fee waivers, if any | .45% G | .45% | .45% | .45% | .46% | .47% | ||||||

| Expenses net of all reductions | .45% G | .45% | .45% | .45% | .46% | .46% | ||||||

| Net investment income (loss) | 5.84% G | 2.45% | .75% | 1.43% | 2.08% | 1.76% | ||||||

| Supplemental Data | ||||||||||||

| Net assets, end of period (000 omitted) | $ | 15,496 | $ | 16,230 | $ | 19,995 | $ | 13,965 | $ | 6,060 | $ | 6,734 |

Portfolio turnover rate H | 30% G | 64% | 31% | 62% I | 68% | 19% |

| Fidelity Managed Retirement Income Fund℠ Class K |

Six months ended (Unaudited) January 31, 2023 | Years ended July 31, 2022 | 2021 | 2020 A | |||||

Selected Per-Share Data | ||||||||

| Net asset value, beginning of period | $ | 56.59 | $ | 63.54 | $ | 60.43 | $ | 57.81 |

| Income from Investment Operations | ||||||||

Net investment income (loss) B,C | 1.584 | 1.529 | .526 | .889 | ||||

| Net realized and unrealized gain (loss) | (2.088) | (6.186) | 4.010 | 3.146 | ||||

| Total from investment operations | (.504) | (4.657) | 4.536 | 4.035 | ||||

| Distributions from net investment income | (1.601) | (1.458) | (.517) | (.981) | ||||

| Distributions from net realized gain | (.635) | (.835) | (.909) | (.434) | ||||

| Total distributions | (2.236) | (2.293) | (1.426) | (1.415) | ||||

| Net asset value, end of period | $ | 53.85 | $ | 56.59 | $ | 63.54 | $ | 60.43 |

Total Return D | (.75)% | (7.58)% | 7.59% | 7.09% | ||||

Ratios to Average Net Assets C,E,F | ||||||||

| Expenses before reductions | .35% G | .35% | .35% | .35% | ||||

| Expenses net of fee waivers, if any | .35% G | .35% | .35% | .35% | ||||

| Expenses net of all reductions | .35% G | .35% | .35% | .35% | ||||

| Net investment income (loss) | 5.94% G | 2.55% | .85% | 1.53% | ||||

| Supplemental Data | ||||||||

| Net assets, end of period (000 omitted) | $ | 124 | $ | 106 | $ | 115 | $ | 107 |

Portfolio turnover rate H | 30% G | 64% | 31% | 62% I |

| Fidelity Managed Retirement Income Fund℠ Class K6 |

Six months ended (Unaudited) January 31, 2023 | Years ended July 31, 2022 | 2021 | 2020 A | |||||

Selected Per-Share Data | ||||||||

| Net asset value, beginning of period | $ | 56.60 | $ | 63.55 | $ | 60.42 | $ | 57.81 |

| Income from Investment Operations | ||||||||

Net investment income (loss) B,C | 1.615 | 1.583 | .588 | .941 | ||||

| Net realized and unrealized gain (loss) | (2.088) | (6.174) | 4.005 | 3.151 | ||||

| Total from investment operations | (.473) | (4.591) | 4.593 | 4.092 | ||||

| Distributions from net investment income | (1.632) | (1.524) | (.554) | (1.048) | ||||

| Distributions from net realized gain | (.635) | (.835) | (.909) | (.434) | ||||

| Total distributions | (2.267) | (2.359) | (1.463) | (1.482) | ||||

| Net asset value, end of period | $ | 53.86 | $ | 56.60 | $ | 63.55 | $ | 60.42 |

Total Return D,E | (.69)% | (7.48)% | 7.69% | 7.20% | ||||

Ratios to Average Net Assets C,F,G | ||||||||

| Expenses before reductions | .25% H | .25% | .25% | .25% | ||||

| Expenses net of fee waivers, if any | .25% H | .25% | .25% | .25% | ||||

| Expenses net of all reductions | .25% H | .25% | .25% | .25% | ||||

| Net investment income (loss) | 6.04% H | 2.65% | .95% | 1.62% | ||||

| Supplemental Data | ||||||||

| Net assets, end of period (000 omitted) | $ | 531 | $ | 711 | $ | 539 | $ | 434 |

Portfolio turnover rate I | 30% H | 64% | 31% | 62% J |

| Fidelity Advisor Managed Retirement Income Fund℠ Class I |

Six months ended (Unaudited) January 31, 2023 | Years ended July 31, 2022 | 2021 | 2020 | 2019 | 2018 | |||||||

Selected Per-Share Data | ||||||||||||

| Net asset value, beginning of period | $ | 56.64 | $ | 63.58 | $ | 60.48 | $ | 57.71 | $ | 57.52 | $ | 60.99 |

| Income from Investment Operations | ||||||||||||

Net investment income (loss) A,B | 1.565 | 1.480 | .464 | .828 | 1.167 | 1.025 | ||||||

| Net realized and unrealized gain (loss) | (2.097) | (6.193) | 4.011 | 3.233 | 1.593 | .500 | ||||||

| Total from investment operations | (.532) | (4.713) | 4.475 | 4.061 | 2.760 | 1.525 | ||||||

| Distributions from net investment income | (1.563) | (1.392) | (.466) | (.857) | (1.184) | (1.020) | ||||||

| Distributions from net realized gain | (.635) | (.835) | (.909) | (.434) | (1.386) | (3.975) | ||||||

| Total distributions | (2.198) | (2.227) | (1.375) | (1.291) | (2.570) | (4.995) | ||||||

| Net asset value, end of period | $ | 53.91 | $ | 56.64 | $ | 63.58 | $ | 60.48 | $ | 57.71 | $ | 57.52 |

Total Return C,D | (.80)% | (7.66)% | 7.48% | 7.14% | 5.04% | 2.62% | ||||||

Ratios to Average Net Assets B,E,F | ||||||||||||

| Expenses before reductions | .45% G | .45% | .45% | .45% | .46% | .46% H | ||||||

| Expenses net of fee waivers, if any | .45% G | .45% | .45% | .45% | .46% | .46% H | ||||||

| Expenses net of all reductions | .45% G | .45% | .45% | .45% | .46% | .46% H | ||||||

| Net investment income (loss) | 5.84% G | 2.45% | .75% | 1.43% | 2.08% | 1.76% | ||||||

| Supplemental Data | ||||||||||||

| Net assets, end of period (000 omitted) | $ | 141 | $ | 176 | $ | 270 | $ | 300 | $ | 96 | $ | 61 |

Portfolio turnover rate I | 30% G | 64% | 31% | 62% J | 68% | 19% |

| Fidelity Advisor Managed Retirement Income Fund℠ Class Z6 |

Six months ended (Unaudited) January 31, 2023 | Years ended July 31, 2022 | 2021 | 2020 A | |||||

Selected Per-Share Data | ||||||||

| Net asset value, beginning of period | $ | 56.57 | $ | 63.52 | $ | 60.41 | $ | 57.79 |

| Income from Investment Operations | ||||||||

Net investment income (loss) B,C | 1.612 | 1.587 | .588 | .947 | ||||

| Net realized and unrealized gain (loss) | (2.085) | (6.181) | 4.008 | 3.145 | ||||

| Total from investment operations | (.473) | (4.594) | 4.596 | 4.092 | ||||

| Distributions from net investment income | (1.632) | (1.521) | (.577) | (1.038) | ||||

| Distributions from net realized gain | (.635) | (.835) | (.909) | (.434) | ||||

| Total distributions | (2.267) | (2.356) | (1.486) | (1.472) | ||||

| Net asset value, end of period | $ | 53.83 | $ | 56.57 | $ | 63.52 | $ | 60.41 |

Total Return D | (.69)% | (7.49)% | 7.69% | 7.20% | ||||

Ratios to Average Net Assets B,E,F | ||||||||

| Expenses before reductions | .25% G | .25% | .25% | .25% | ||||

| Expenses net of fee waivers, if any | .25% G | .25% | .25% | .25% | ||||

| Expenses net of all reductions | .25% G | .25% | .25% | .25% | ||||

| Net investment income (loss) | 6.04% G | 2.65% | .95% | 1.62% | ||||

| Supplemental Data | ||||||||

| Net assets, end of period (000 omitted) | $ | 106 | $ | 107 | $ | 115 | $ | 107 |

Portfolio turnover rate H | 30% G | 64% | 31% | 62% I |

Top Holdings (% of Fund's net assets) | ||

| Fidelity Series 0-5 Year Inflation-Protected Bond Index Fund | 18.0 | |

| Fidelity Series Investment Grade Bond Fund | 11.5 | |

| Fidelity Series Government Bond Index Fund | 11.2 | |

| Fidelity Series Investment Grade Securitized Fund | 8.1 | |

| Fidelity Series Corporate Bond Fund | 7.6 | |

| Fidelity Series Treasury Bill Index Fund | 6.0 | |

| Fidelity Series Emerging Markets Opportunities Fund | 5.2 | |

| Fidelity Series Long-Term Treasury Bond Index Fund | 4.5 | |

| Fidelity Series International Developed Markets Bond Index Fund | 3.9 | |

| Fidelity Series Large Cap Value Index Fund | 2.2 | |

| 78.2 | ||

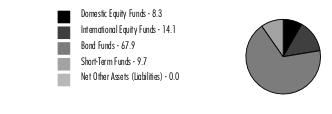

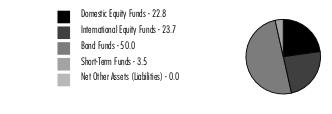

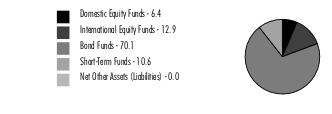

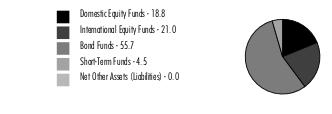

Asset Allocation (% of Fund's net assets) |

|

Percentages shown as 0.0% may reflect amounts less than 0.05%. |

| Domestic Equity Funds - 8.3% | |||

| Shares | Value ($) | ||

| Fidelity Series Blue Chip Growth Fund (a) | 9,892 | 110,988 | |

| Fidelity Series Commodity Strategy Fund (a) | 461 | 48,317 | |

| Fidelity Series Large Cap Growth Index Fund (a) | 4,787 | 70,182 | |

| Fidelity Series Large Cap Stock Fund (a) | 4,325 | 77,202 | |

| Fidelity Series Large Cap Value Index Fund (a) | 9,920 | 143,936 | |

| Fidelity Series Small Cap Core Fund (a) | 24 | 260 | |

| Fidelity Series Small Cap Opportunities Fund (a) | 2,792 | 35,649 | |

| Fidelity Series Value Discovery Fund (a) | 3,492 | 53,081 | |

| TOTAL DOMESTIC EQUITY FUNDS (Cost $496,423) | 539,615 | ||

| International Equity Funds - 14.1% | |||

| Shares | Value ($) | ||

| Fidelity Series Canada Fund (a) | 4,093 | 58,282 | |

| Fidelity Series Emerging Markets Fund (a) | 4,335 | 37,106 | |

| Fidelity Series Emerging Markets Opportunities Fund (a) | 19,765 | 340,546 | |

| Fidelity Series International Growth Fund (a) | 8,244 | 129,019 | |

| Fidelity Series International Index Fund (a) | 4,835 | 53,763 | |

| Fidelity Series International Small Cap Fund (a) | 2,522 | 40,169 | |

| Fidelity Series International Value Fund (a) | 11,855 | 128,274 | |

| Fidelity Series Overseas Fund (a) | 10,913 | 128,878 | |

| TOTAL INTERNATIONAL EQUITY FUNDS (Cost $856,528) | 916,037 | ||

| Bond Funds - 67.9% | |||

| Shares | Value ($) | ||

| Fidelity Series 0-5 Year Inflation-Protected Bond Index Fund (a) | 124,548 | 1,164,523 | |

| Fidelity Series 5+ Year Inflation-Protected Bond Index Fund (a) | 12,276 | 97,596 | |

| Fidelity Series Corporate Bond Fund (a) | 53,107 | 493,362 | |

| Fidelity Series Emerging Markets Debt Fund (a) | 4,463 | 33,828 | |

| Fidelity Series Emerging Markets Debt Local Currency Fund (a) | 1,224 | 11,097 | |

| Fidelity Series Floating Rate High Income Fund (a) | 713 | 6,363 | |

| Fidelity Series Government Bond Index Fund (a) | 77,866 | 728,050 | |

| Fidelity Series High Income Fund (a) | 4,211 | 34,990 | |

| Fidelity Series International Credit Fund (a) | 655 | 5,240 | |

| Fidelity Series International Developed Markets Bond Index Fund (a) | 29,459 | 252,463 | |

| Fidelity Series Investment Grade Bond Fund (a) | 73,459 | 747,817 | |

| Fidelity Series Investment Grade Securitized Fund (a) | 57,016 | 521,692 | |

| Fidelity Series Long-Term Treasury Bond Index Fund (a) | 46,836 | 292,726 | |

| Fidelity Series Real Estate Income Fund (a) | 1,246 | 12,447 | |

| TOTAL BOND FUNDS (Cost $4,810,344) | 4,402,194 | ||

| Short-Term Funds - 9.7% | |||

| Shares | Value ($) | ||

| Fidelity Series Government Money Market Fund 4.42% (a)(b) | 135,243 | 135,243 | |

| Fidelity Series Short-Term Credit Fund (a) | 10,963 | 105,790 | |

| Fidelity Series Treasury Bill Index Fund (a) | 38,856 | 386,616 | |

| TOTAL SHORT-TERM FUNDS (Cost $632,223) | 627,649 | ||

| TOTAL INVESTMENT IN SECURITIES - 100.0% (Cost $6,795,518) | 6,485,495 |

NET OTHER ASSETS (LIABILITIES) - 0.0% | (136) |

| NET ASSETS - 100.0% | 6,485,359 |

| (a) | Affiliated Fund |

| (b) | The rate quoted is the annualized seven-day yield of the fund at period end. |

| Affiliate | Value, beginning of period ($) | Purchases ($) | Sales Proceeds ($) | Dividend Income ($) | Realized Gain (loss) ($) | Change in Unrealized appreciation (depreciation) ($) | Value, end of period ($) |

| Fidelity Series 0-5 Year Inflation-Protected Bond Index Fund | 1,177,959 | 150,974 | 79,072 | 56,805 | (3,446) | (81,892) | 1,164,523 |

| Fidelity Series 5+ Year Inflation-Protected Bond Index Fund | 81,140 | 38,544 | 11,414 | 6,270 | (741) | (9,933) | 97,596 |

| Fidelity Series Blue Chip Growth Fund | 131,529 | 24,878 | 36,998 | 4,212 | (5,857) | (2,564) | 110,988 |

| Fidelity Series Canada Fund | 63,755 | 4,302 | 10,174 | 1,672 | (257) | 656 | 58,282 |

| Fidelity Series Commodity Strategy Fund | 100,692 | 58,019 | 51,382 | 52,719 | (27,762) | (31,250) | 48,317 |

| Fidelity Series Corporate Bond Fund | 495,223 | 30,176 | 20,215 | 9,021 | (188) | (11,634) | 493,362 |

| Fidelity Series Emerging Markets Debt Fund | 34,850 | 1,527 | 3,313 | 1,006 | (860) | 1,624 | 33,828 |

| Fidelity Series Emerging Markets Debt Local Currency Fund | 11,534 | 98 | 1,399 | - | (243) | 1,107 | 11,097 |

| Fidelity Series Emerging Markets Fund | 45,177 | 1,983 | 11,823 | 990 | (1,870) | 3,639 | 37,106 |

| Fidelity Series Emerging Markets Opportunities Fund | 409,947 | 20,650 | 107,595 | 8,289 | (17,320) | 34,864 | 340,546 |

| Fidelity Series Floating Rate High Income Fund | 6,700 | 334 | 723 | 249 | (43) | 95 | 6,363 |

| Fidelity Series Government Bond Index Fund | 727,371 | 65,307 | 37,387 | 7,284 | (1,511) | (25,730) | 728,050 |

| Fidelity Series Government Money Market Fund 4.42% | 109,031 | 36,666 | 10,454 | 2,126 | - | - | 135,243 |

| Fidelity Series High Income Fund | 36,176 | 2,166 | 2,621 | 1,184 | (282) | (449) | 34,990 |

| Fidelity Series International Credit Fund | 5,389 | 209 | - | 208 | - | (358) | 5,240 |

| Fidelity Series International Developed Markets Bond Index Fund | 267,488 | 14,033 | 12,948 | 1,517 | (1,604) | (14,506) | 252,463 |

| Fidelity Series International Growth Fund | 132,711 | 11,732 | 18,098 | 4,006 | (3,740) | 6,414 | 129,019 |

| Fidelity Series International Index Fund | 55,569 | 3,248 | 8,259 | 1,285 | (758) | 3,963 | 53,763 |

| Fidelity Series International Small Cap Fund | 40,933 | 3,666 | 3,483 | 2,206 | (842) | (105) | 40,169 |

| Fidelity Series International Value Fund | 131,571 | 7,198 | 22,128 | 3,923 | (1,320) | 12,953 | 128,274 |

| Fidelity Series Investment Grade Bond Fund | 751,853 | 53,825 | 34,919 | 13,261 | (606) | (22,336) | 747,817 |

| Fidelity Series Investment Grade Securitized Fund | 531,821 | 37,527 | 24,783 | 7,599 | (464) | (22,409) | 521,692 |

| Fidelity Series Large Cap Growth Index Fund | 83,223 | 10,417 | 18,901 | 462 | (143) | (4,414) | 70,182 |

| Fidelity Series Large Cap Stock Fund | 91,164 | 12,107 | 25,555 | 5,447 | 92 | (606) | 77,202 |

| Fidelity Series Large Cap Value Index Fund | 174,072 | 21,504 | 51,845 | 4,831 | 3,712 | (3,507) | 143,936 |

| Fidelity Series Long-Term Treasury Bond Index Fund | 301,592 | 40,165 | 25,788 | 4,133 | (5,403) | (17,840) | 292,726 |

| Fidelity Series Overseas Fund | 133,492 | 10,433 | 19,977 | 2,110 | (2,785) | 7,715 | 128,878 |

| Fidelity Series Real Estate Income Fund | 18,845 | 3,261 | 8,160 | 1,257 | (1,080) | (419) | 12,447 |

| Fidelity Series Short-Term Credit Fund | 108,776 | 2,194 | 4,815 | 1,098 | (70) | (295) | 105,790 |

| Fidelity Series Small Cap Opportunities Fund | 43,997 | 3,186 | 11,547 | 1,990 | (589) | 602 | 35,649 |

| Fidelity Series Small Cap Core Fund | - | 238 | - | - | - | 22 | 260 |

| Fidelity Series Treasury Bill Index Fund | 327,268 | 77,242 | 17,219 | 6,267 | (17) | (658) | 386,616 |

| Fidelity Series Value Discovery Fund | 64,198 | 6,577 | 17,483 | 2,599 | 1,324 | (1,535) | 53,081 |

| 6,695,046 | 754,386 | 710,478 | 216,026 | (74,673) | (178,786) | 6,485,495 |

| Valuation Inputs at Reporting Date: | ||||

| Description | Total ($) | Level 1 ($) | Level 2 ($) | Level 3 ($) |

Investments in Securities: | ||||

| Domestic Equity Funds | 539,615 | 539,615 | - | - |

| International Equity Funds | 916,037 | 916,037 | - | - |

| Bond Funds | 4,402,194 | 4,402,194 | - | - |

| Short-Term Funds | 627,649 | 627,649 | - | - |

| Total Investments in Securities: | 6,485,495 | 6,485,495 | - | - |

| Statement of Assets and Liabilities | ||||

January 31, 2023 (Unaudited) | ||||

| Assets | ||||

| Investment in securities, at value - See accompanying schedule: | ||||

Affiliated issuers (cost $6,795,518) | $ | 6,485,495 | ||

| Total Investment in Securities (cost $6,795,518) | $ | 6,485,495 | ||

| Cash | 56 | |||

| Receivable for investments sold | 73,277 | |||

Total assets | 6,558,828 | |||

| Liabilities | ||||

| Payable for investments purchased | $ | 71,021 | ||

| Accrued management fee | 2,386 | |||

| Distribution and service plan fees payable | 62 | |||

| Total Liabilities | 73,469 | |||

| Net Assets | $ | 6,485,359 | ||

| Net Assets consist of: | ||||

| Paid in capital | $ | 6,900,790 | ||

| Total accumulated earnings (loss) | (415,431) | |||

| Net Assets | $ | 6,485,359 | ||

| Net Asset Value and Maximum Offering Price | ||||

| Class A : | ||||

Net Asset Value and redemption price per share ($295,739 ÷ 5,766.87 shares) (a) | $ | 51.28 | ||

| Maximum offering price per share (100/94.25 of $51.28) | $ | 54.41 | ||

| Fidelity Managed Retirement 2010 : | ||||

Net Asset Value , offering price and redemption price per share ($5,466,001 ÷ 106,502.9 shares) | $ | 51.32 | ||

| Class K : | ||||

Net Asset Value , offering price and redemption price per share ($126,741 ÷ 2,470.54 shares) | $ | 51.30 | ||

| Class K6 : | ||||

Net Asset Value , offering price and redemption price per share ($331,066 ÷ 6,453.87 shares) | $ | 51.30 | ||

| Class I : | ||||

Net Asset Value , offering price and redemption price per share ($102,713 ÷ 2,001.81 shares) | $ | 51.31 | ||

| Class Z6 : | ||||

Net Asset Value , offering price and redemption price per share ($163,099 ÷ 3,179.8 shares) | $ | 51.29 | ||

(a)Redemption price per share is equal to net asset value less any applicable contingent deferred sales charge. | ||||

| Statement of Operations | ||||

Six months ended January 31, 2023 (Unaudited) | ||||

| Investment Income | ||||

| Dividends: | ||||

| Affiliated issuers | $ | 198,802 | ||

| Expenses | ||||

| Management fee | $ | 14,110 | ||

| Distribution and service plan fees | 375 | |||

| Independent trustees' fees and expenses | 12 | |||

| Total expenses before reductions | 14,497 | |||

| Expense reductions | (71) | |||

| Total expenses after reductions | 14,426 | |||

| Net Investment income (loss) | 184,376 | |||

| Realized and Unrealized Gain (Loss) | ||||

| Net realized gain (loss) on: | ||||

| Investment Securities: | ||||

| Affiliated issuers | (74,673) | |||

| Capital gain distributions from underlying funds: | ||||

| Affiliated issuers | 17,224 | |||

| Total net realized gain (loss) | (57,449) | |||

| Change in net unrealized appreciation (depreciation) on: | ||||

| Investment Securities: | ||||

| Affiliated issuers | (178,786) | |||

| Total change in net unrealized appreciation (depreciation) | (178,786) | |||

| Net gain (loss) | (236,235) | |||

| Net increase (decrease) in net assets resulting from operations | $ | (51,859) | ||

| Statement of Changes in Net Assets | ||||

Six months ended January 31, 2023 (Unaudited) | Year ended July 31, 2022 | |||

| Increase (Decrease) in Net Assets | ||||

| Operations | ||||

| Net investment income (loss) | $ | 184,376 | $ | 175,948 |

| Net realized gain (loss) | (57,449) | 200,489 | ||

| Change in net unrealized appreciation (depreciation) | (178,786) | (952,936) | ||

| Net increase (decrease) in net assets resulting from operations | (51,859) | (576,499) | ||

| Distributions to shareholders | (291,592) | (449,109) | ||

| Share transactions - net increase (decrease) | 133,904 | 11,415 | ||

| Total increase (decrease) in net assets | (209,547) | (1,014,193) | ||

| Net Assets | ||||

| Beginning of period | 6,694,906 | 7,709,099 | ||

| End of period | $ | 6,485,359 | $ | 6,694,906 |

| Fidelity Advisor Managed Retirement 2010 Fund℠ Class A |

Six months ended (Unaudited) January 31, 2023 | Years ended July 31, 2022 | 2021 | 2020 | 2019 | 2018 | |||||||

Selected Per-Share Data | ||||||||||||

| Net asset value, beginning of period | $ | 54.07 | $ | 62.41 | $ | 58.79 | $ | 56.34 | $ | 56.78 | $ | 63.87 |

| Income from Investment Operations | ||||||||||||

Net investment income (loss) A,B | 1.407 | 1.275 | .342 | .777 | .979 | .808 | ||||||

| Net realized and unrealized gain (loss) | (1.925) | (6.182) | 5.126 | 3.204 | 1.401 | 1.278 | ||||||

| Total from investment operations | (.518) | (4.907) | 5.468 | 3.981 | 2.380 | 2.086 | ||||||

| Distributions from net investment income | (1.402) | (1.207) | (.379) | (.812) | (1.001) | (.794) | ||||||

| Distributions from net realized gain | (.870) | (2.226) | (1.469) | (.719) | (1.819) | (8.382) | ||||||

| Total distributions | (2.272) | (3.433) | (1.848) | (1.531) | (2.820) | (9.176) | ||||||

| Net asset value, end of period | $ | 51.28 | $ | 54.07 | $ | 62.41 | $ | 58.79 | $ | 56.34 | $ | 56.78 |

Total Return C,D,E | (.81)% | (8.32)% | 9.46% | 7.19% | 4.47% | 3.60% | ||||||

Ratios to Average Net Assets A,F,G | ||||||||||||

| Expenses before reductions | .71% H | .71% | .71% | .71% | .75% | .78% | ||||||

| Expenses net of fee waivers, if any | .71% H | .71% | .71% | .71% | .75% | .78% | ||||||

| Expenses net of all reductions | .71% H | .71% | .71% | .71% | .75% | .78% | ||||||

| Net investment income (loss) | 5.53% H | 2.21% | .56% | 1.37% | 1.78% | 1.40% | ||||||

| Supplemental Data | ||||||||||||

| Net assets, end of period (000 omitted) | $ | 296 | $ | 325 | $ | 394 | $ | 188 | $ | 202 | $ | 133 |

Portfolio turnover rate I | 22% H | 54% | 41% | 45% | 62% | 21% |

| Fidelity Managed Retirement 2010 Fund℠ |

Six months ended (Unaudited) January 31, 2023 | Years ended July 31, 2022 | 2021 | 2020 | 2019 | 2018 | |||||||

Selected Per-Share Data | ||||||||||||

| Net asset value, beginning of period | $ | 54.12 | $ | 62.47 | $ | 58.82 | $ | 56.37 | $ | 56.80 | $ | 63.88 |

| Income from Investment Operations | ||||||||||||

Net investment income (loss) A,B | 1.470 | 1.421 | .493 | .920 | 1.113 | .955 | ||||||

| Net realized and unrealized gain (loss) | (1.929) | (6.181) | 5.129 | 3.204 | 1.402 | 1.280 | ||||||

| Total from investment operations | (.459) | (4.760) | 5.622 | 4.124 | 2.515 | 2.235 | ||||||

| Distributions from net investment income | (1.471) | (1.364) | (.503) | (.955) | (1.126) | (.933) | ||||||

| Distributions from net realized gain | (.870) | (2.226) | (1.469) | (.719) | (1.819) | (8.382) | ||||||

| Total distributions | (2.341) | (3.590) | (1.972) | (1.674) | (2.945) | (9.315) | ||||||

| Net asset value, end of period | $ | 51.32 | $ | 54.12 | $ | 62.47 | $ | 58.82 | $ | 56.37 | $ | 56.80 |

Total Return C,D | (.69)% | (8.08)% | 9.73% | 7.46% | 4.73% | 3.87% | ||||||

Ratios to Average Net Assets B,E,F | ||||||||||||

| Expenses before reductions | .46% G | .46% | .46% | .46% | .50% | .53% | ||||||

| Expenses net of fee waivers, if any | .46% G | .46% | .46% | .46% | .50% | .53% | ||||||

| Expenses net of all reductions | .46% G | .46% | .46% | .46% | .50% | .53% | ||||||

| Net investment income (loss) | 5.79% G | 2.46% | .81% | 1.62% | 2.02% | 1.65% | ||||||

| Supplemental Data | ||||||||||||

| Net assets, end of period (000 omitted) | $ | 5,466 | $ | 5,655 | $ | 6,728 | $ | 7,144 | $ | 9,091 | $ | 9,054 |

Portfolio turnover rate H | 22% G | 54% | 41% | 45% | 62% | 21% |

| Fidelity Managed Retirement 2010 Fund℠ Class K |

Six months ended (Unaudited) January 31, 2023 | Years ended July 31, 2022 | 2021 | 2020 A | |||||

Selected Per-Share Data | ||||||||

| Net asset value, beginning of period | $ | 54.10 | $ | 62.45 | $ | 58.81 | $ | 56.39 |

| Income from Investment Operations | ||||||||

Net investment income (loss) B,C | 1.492 | 1.474 | .554 | .976 | ||||

| Net realized and unrealized gain (loss) | (1.924) | (6.173) | 5.122 | 3.182 | ||||

| Total from investment operations | (.432) | (4.699) | 5.676 | 4.158 | ||||

| Distributions from net investment income | (1.498) | (1.425) | (.567) | (1.019) | ||||

| Distributions from net realized gain | (.870) | (2.226) | (1.469) | (.719) | ||||

| Total distributions | (2.368) | (3.651) | (2.036) | (1.738) | ||||

| Net asset value, end of period | $ | 51.30 | $ | 54.10 | $ | 62.45 | $ | 58.81 |

Total Return D,E | (.64)% | (7.99)% | 9.83% | 7.52% | ||||

Ratios to Average Net Assets C,F,G | ||||||||

| Expenses before reductions | .36% H | .36% | .36% | .36% | ||||

| Expenses net of fee waivers, if any | .36% H | .36% | .36% | .36% | ||||

| Expenses net of all reductions | .36% H | .36% | .36% | .36% | ||||

| Net investment income (loss) | 5.88% H | 2.56% | .91% | 1.72% | ||||

| Supplemental Data | ||||||||

| Net assets, end of period (000 omitted) | $ | 127 | $ | 109 | $ | 118 | $ | 108 |

Portfolio turnover rate I | 22% H | 54% | 41% | 45% |

| Fidelity Managed Retirement 2010 Fund℠ Class K6 |

Six months ended (Unaudited) January 31, 2023 | Years ended July 31, 2022 | 2021 | 2020 A | |||||

Selected Per-Share Data | ||||||||

| Net asset value, beginning of period | $ | 54.10 | $ | 62.46 | $ | 58.82 | $ | 56.39 |

| Income from Investment Operations | ||||||||

Net investment income (loss) B,C | 1.521 | 1.503 | .615 | 1.029 | ||||

| Net realized and unrealized gain (loss) | (1.925) | (6.145) | 5.120 | 3.191 | ||||

| Total from investment operations | (.404) | (4.642) | 5.735 | 4.220 | ||||

| Distributions from net investment income | (1.526) | (1.492) | (.626) | (1.071) | ||||

| Distributions from net realized gain | (.870) | (2.226) | (1.469) | (.719) | ||||

| Total distributions | (2.396) | (3.718) | (2.095) | (1.790) | ||||

| Net asset value, end of period | $ | 51.30 | $ | 54.10 | $ | 62.46 | $ | 58.82 |

Total Return D,E | (.58)% | (7.90)% | 9.94% | 7.64% | ||||

Ratios to Average Net Assets C,F,G | ||||||||

| Expenses before reductions | .26% H | .26% | .26% | .26% | ||||

| Expenses net of fee waivers, if any | .26% H | .26% | .26% | .26% | ||||

| Expenses net of all reductions | .26% H | .26% | .26% | .26% | ||||

| Net investment income (loss) | 5.99% H | 2.65% | 1.01% | 1.82% | ||||

| Supplemental Data | ||||||||

| Net assets, end of period (000 omitted) | $ | 331 | $ | 337 | $ | 174 | $ | 160 |

Portfolio turnover rate I | 22% H | 54% | 41% | 45% |

| Fidelity Advisor Managed Retirement 2010 Fund℠ Class I |

Six months ended (Unaudited) January 31, 2023 | Years ended July 31, 2022 | 2021 | 2020 | 2019 | 2018 | |||||||

Selected Per-Share Data | ||||||||||||

| Net asset value, beginning of period | $ | 54.11 | $ | 62.46 | $ | 58.82 | $ | 56.36 | $ | 56.79 | $ | 63.88 |

| Income from Investment Operations | ||||||||||||

Net investment income (loss) A,B | 1.469 | 1.417 | .493 | .919 | 1.105 | .950 | ||||||

| Net realized and unrealized gain (loss) | (1.927) | (6.176) | 5.120 | 3.213 | 1.414 | 1.280 | ||||||

| Total from investment operations | (.458) | (4.759) | 5.613 | 4.132 | 2.519 | 2.230 | ||||||

| Distributions from net investment income | (1.472) | (1.365) | (.504) | (.953) | (1.130) | (.938) | ||||||

| Distributions from net realized gain | (.870) | (2.226) | (1.469) | (.719) | (1.819) | (8.382) | ||||||

| Total distributions | (2.342) | (3.591) | (1.973) | (1.672) | (2.949) | (9.320) | ||||||

| Net asset value, end of period | $ | 51.31 | $ | 54.11 | $ | 62.46 | $ | 58.82 | $ | 56.36 | $ | 56.79 |

Total Return C,D | (.69)% | (8.08)% | 9.72% | 7.47% | 4.74% | 3.86% | ||||||

Ratios to Average Net Assets B,E,F | ||||||||||||

| Expenses before reductions | .46% G | .46% | .46% | .46% | .50% | .53% | ||||||

| Expenses net of fee waivers, if any | .46% G | .46% | .46% | .46% | .50% | .53% | ||||||

| Expenses net of all reductions | .46% G | .46% | .46% | .46% | .50% | .53% | ||||||

| Net investment income (loss) | 5.78% G | 2.46% | .81% | 1.62% | 2.03% | 1.65% | ||||||

| Supplemental Data | ||||||||||||

| Net assets, end of period (000 omitted) | $ | 103 | $ | 103 | $ | 113 | $ | 113 | $ | 110 | $ | 35 |

Portfolio turnover rate H | 22% G | 54% | 41% | 45% | 62% | 21% |

| Fidelity Advisor Managed Retirement 2010 Fund℠ Class Z6 |

Six months ended (Unaudited) January 31, 2023 | Years ended July 31, 2022 | 2021 | 2020 A | |||||

Selected Per-Share Data | ||||||||

| Net asset value, beginning of period | $ | 54.10 | $ | 62.45 | $ | 58.81 | $ | 56.38 |

| Income from Investment Operations | ||||||||

Net investment income (loss) B,C | 1.520 | 1.532 | .614 | 1.029 | ||||

| Net realized and unrealized gain (loss) | (1.933) | (6.173) | 5.122 | 3.191 | ||||

| Total from investment operations | (.413) | (4.641) | 5.736 | 4.220 | ||||

| Distributions from net investment income | (1.527) | (1.483) | (.627) | (1.071) | ||||

| Distributions from net realized gain | (.870) | (2.226) | (1.469) | (.719) | ||||

| Total distributions | (2.397) | (3.709) | (2.096) | (1.790) | ||||

| Net asset value, end of period | $ | 51.29 | $ | 54.10 | $ | 62.45 | $ | 58.81 |

Total Return D,E | (.60)% | (7.90)% | 9.94% | 7.64% | ||||

Ratios to Average Net Assets C,F,G | ||||||||

| Expenses before reductions | .26% H | .26% | .26% | .26% | ||||

| Expenses net of fee waivers, if any | .26% H | .26% | .26% | .26% | ||||

| Expenses net of all reductions | .26% H | .26% | .26% | .26% | ||||

| Net investment income (loss) | 5.98% H | 2.65% | 1.01% | 1.82% | ||||

| Supplemental Data | ||||||||

| Net assets, end of period (000 omitted) | $ | 163 | $ | 166 | $ | 183 | $ | 169 |

Portfolio turnover rate I | 22% H | 54% | 41% | 45% |

Top Holdings (% of Fund's net assets) | ||

| Fidelity Series 0-5 Year Inflation-Protected Bond Index Fund | 13.9 | |

| Fidelity Series Investment Grade Bond Fund | 10.8 | |

| Fidelity Series Government Bond Index Fund | 10.5 | |

| Fidelity Series Investment Grade Securitized Fund | 7.5 | |

| Fidelity Series Corporate Bond Fund | 7.1 | |

| Fidelity Series Emerging Markets Opportunities Fund | 5.9 | |

| Fidelity Series Treasury Bill Index Fund | 4.8 | |

| Fidelity Series Long-Term Treasury Bond Index Fund | 4.7 | |

| Fidelity Series International Developed Markets Bond Index Fund | 3.9 | |

| Fidelity Series Large Cap Value Index Fund | 3.4 | |

| 72.5 | ||

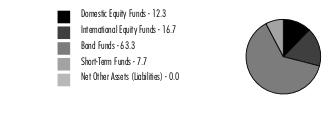

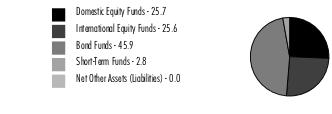

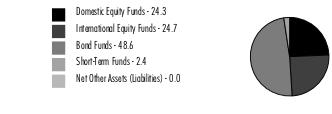

Asset Allocation (% of Fund's net assets) |

|

Percentages shown as 0.0% may reflect amounts less than 0.05%. |

| Domestic Equity Funds - 12.3% | |||

| Shares | Value ($) | ||

| Fidelity Series Blue Chip Growth Fund (a) | 15,412 | 172,925 | |

| Fidelity Series Commodity Strategy Fund (a) | 472 | 49,423 | |

| Fidelity Series Large Cap Growth Index Fund (a) | 7,459 | 109,349 | |

| Fidelity Series Large Cap Stock Fund (a) | 6,739 | 120,291 | |

| Fidelity Series Large Cap Value Index Fund (a) | 15,454 | 224,241 | |

| Fidelity Series Small Cap Core Fund (a) | 37 | 399 | |

| Fidelity Series Small Cap Opportunities Fund (a) | 4,349 | 55,542 | |

| Fidelity Series Value Discovery Fund (a) | 5,440 | 82,680 | |

| TOTAL DOMESTIC EQUITY FUNDS (Cost $743,902) | 814,850 | ||

| International Equity Funds - 16.7% | |||

| Shares | Value ($) | ||

| Fidelity Series Canada Fund (a) | 5,133 | 73,087 | |

| Fidelity Series Emerging Markets Fund (a) | 5,006 | 42,848 | |

| Fidelity Series Emerging Markets Opportunities Fund (a) | 22,778 | 392,472 | |

| Fidelity Series International Growth Fund (a) | 10,352 | 162,010 | |

| Fidelity Series International Index Fund (a) | 6,063 | 67,419 | |

| Fidelity Series International Small Cap Fund (a) | 3,162 | 50,370 | |

| Fidelity Series International Value Fund (a) | 14,866 | 160,849 | |

| Fidelity Series Overseas Fund (a) | 13,684 | 161,610 | |

| TOTAL INTERNATIONAL EQUITY FUNDS (Cost $1,028,560) | 1,110,665 | ||

| Bond Funds - 63.3% | |||

| Shares | Value ($) | ||

| Fidelity Series 0-5 Year Inflation-Protected Bond Index Fund (a) | 98,793 | 923,721 | |

| Fidelity Series 5+ Year Inflation-Protected Bond Index Fund (a) | 28,199 | 224,184 | |

| Fidelity Series Corporate Bond Fund (a) | 50,688 | 470,888 | |

| Fidelity Series Emerging Markets Debt Fund (a) | 4,569 | 34,632 | |

| Fidelity Series Emerging Markets Debt Local Currency Fund (a) | 1,253 | 11,362 | |

| Fidelity Series Floating Rate High Income Fund (a) | 735 | 6,553 | |

| Fidelity Series Government Bond Index Fund (a) | 74,364 | 695,306 | |

| Fidelity Series High Income Fund (a) | 4,307 | 35,790 | |

| Fidelity Series International Credit Fund (a) | 285 | 2,278 | |

| Fidelity Series International Developed Markets Bond Index Fund (a) | 30,522 | 261,575 | |

| Fidelity Series Investment Grade Bond Fund (a) | 70,155 | 714,177 | |

| Fidelity Series Investment Grade Securitized Fund (a) | 54,453 | 498,247 | |

| Fidelity Series Long-Term Treasury Bond Index Fund (a) | 49,761 | 311,004 | |

| Fidelity Series Real Estate Income Fund (a) | 1,276 | 12,751 | |

| TOTAL BOND FUNDS (Cost $4,672,433) | 4,202,468 | ||

| Short-Term Funds - 7.7% | |||

| Shares | Value ($) | ||

| Fidelity Series Government Money Market Fund 4.42% (a)(b) | 112,996 | 112,996 | |

| Fidelity Series Short-Term Credit Fund (a) | 8,497 | 81,995 | |

| Fidelity Series Treasury Bill Index Fund (a) | 32,048 | 318,876 | |

| TOTAL SHORT-TERM FUNDS (Cost $517,246) | 513,867 | ||

| TOTAL INVESTMENT IN SECURITIES - 100.0% (Cost $6,962,141) | 6,641,850 |

NET OTHER ASSETS (LIABILITIES) - 0.0% | (353) |

| NET ASSETS - 100.0% | 6,641,497 |

| (a) | Affiliated Fund |

| (b) | The rate quoted is the annualized seven-day yield of the fund at period end. |

| Affiliate | Value, beginning of period ($) | Purchases ($) | Sales Proceeds ($) | Dividend Income ($) | Realized Gain (loss) ($) | Change in Unrealized appreciation (depreciation) ($) | Value, end of period ($) |

| Fidelity Series 0-5 Year Inflation-Protected Bond Index Fund | 994,376 | 136,787 | 138,880 | 45,198 | (3,298) | (65,264) | 923,721 |

| Fidelity Series 5+ Year Inflation-Protected Bond Index Fund | 229,067 | 57,343 | 33,464 | 14,100 | (3,240) | (25,522) | 224,184 |

| Fidelity Series Blue Chip Growth Fund | 209,150 | 36,912 | 60,857 | 6,451 | (16,494) | 4,214 | 172,925 |

| Fidelity Series Canada Fund | 85,646 | 6,103 | 19,137 | 2,128 | 2,778 | (2,303) | 73,087 |

| Fidelity Series Commodity Strategy Fund | 110,544 | 64,294 | 62,428 | 56,229 | (28,259) | (34,728) | 49,423 |

| Fidelity Series Corporate Bond Fund | 505,723 | 32,713 | 55,678 | 8,675 | (2,783) | (9,087) | 470,888 |

| Fidelity Series Emerging Markets Debt Fund | 38,274 | 1,617 | 6,024 | 1,040 | (2,102) | 2,867 | 34,632 |

| Fidelity Series Emerging Markets Debt Local Currency Fund | 12,707 | 196 | 2,421 | - | (449) | 1,329 | 11,362 |

| Fidelity Series Emerging Markets Fund | 55,240 | 2,356 | 16,798 | 1,140 | (1,884) | 3,934 | 42,848 |

| Fidelity Series Emerging Markets Opportunities Fund | 499,014 | 24,731 | 151,224 | 9,566 | (18,165) | 38,116 | 392,472 |

| Fidelity Series Floating Rate High Income Fund | 7,347 | 1,580 | 2,423 | 254 | (117) | 166 | 6,553 |

| Fidelity Series Government Bond Index Fund | 742,814 | 71,977 | 92,673 | 7,000 | (3,726) | (23,086) | 695,306 |

| Fidelity Series Government Money Market Fund 4.42% | 91,044 | 40,151 | 18,199 | 1,758 | - | - | 112,996 |

| Fidelity Series High Income Fund | 39,670 | 2,621 | 5,731 | 1,223 | (819) | 49 | 35,790 |

| Fidelity Series International Credit Fund | 2,343 | 91 | - | 90 | - | (156) | 2,278 |

| Fidelity Series International Developed Markets Bond Index Fund | 293,341 | 21,870 | 36,672 | 1,579 | (3,142) | (13,822) | 261,575 |

| Fidelity Series International Growth Fund | 178,276 | 15,572 | 35,057 | 5,096 | (1,847) | 5,066 | 162,010 |

| Fidelity Series International Index Fund | 74,651 | 4,312 | 15,555 | 1,634 | 280 | 3,731 | 67,419 |

| Fidelity Series International Small Cap Fund | 54,975 | 4,438 | 7,714 | 2,806 | (262) | (1,067) | 50,370 |

| Fidelity Series International Value Fund | 176,756 | 9,048 | 39,618 | 4,990 | (1,003) | 15,666 | 160,849 |

| Fidelity Series Investment Grade Bond Fund | 767,790 | 62,324 | 93,181 | 12,750 | (3,068) | (19,688) | 714,177 |

| Fidelity Series Investment Grade Securitized Fund | 543,101 | 41,017 | 63,156 | 7,303 | (3,076) | (19,639) | 498,247 |

| Fidelity Series Large Cap Growth Index Fund | 132,345 | 16,385 | 32,649 | 726 | 1,513 | (8,245) | 109,349 |

| Fidelity Series Large Cap Stock Fund | 144,986 | 17,763 | 41,998 | 8,317 | 1,027 | (1,487) | 120,291 |

| Fidelity Series Large Cap Value Index Fund | 276,852 | 25,098 | 78,401 | 7,606 | 6,458 | (5,766) | 224,241 |

| Fidelity Series Long-Term Treasury Bond Index Fund | 343,883 | 42,210 | 49,799 | 4,431 | (2,867) | (22,423) | 311,004 |

| Fidelity Series Overseas Fund | 179,321 | 12,901 | 36,619 | 2,684 | (106) | 6,113 | 161,610 |

| Fidelity Series Real Estate Income Fund | 22,362 | 2,680 | 10,609 | 1,361 | (1,187) | (495) | 12,751 |

| Fidelity Series Short-Term Credit Fund | 90,832 | 1,955 | 10,467 | 862 | (293) | (32) | 81,995 |

| Fidelity Series Small Cap Opportunities Fund | 70,833 | 4,651 | 20,101 | 3,061 | (342) | 501 | 55,542 |

| Fidelity Series Small Cap Core Fund | - | 365 | - | - | - | 34 | 399 |

| Fidelity Series Treasury Bill Index Fund | 273,248 | 79,380 | 33,209 | 5,116 | (48) | (495) | 318,876 |

| Fidelity Series Value Discovery Fund | 102,106 | 9,242 | 28,403 | 4,082 | 2,059 | (2,324) | 82,680 |

| 7,348,617 | 850,683 | 1,299,145 | 229,256 | (84,462) | (173,843) | 6,641,850 |

| Valuation Inputs at Reporting Date: | ||||

| Description | Total ($) | Level 1 ($) | Level 2 ($) | Level 3 ($) |

Investments in Securities: | ||||

| Domestic Equity Funds | 814,850 | 814,850 | - | - |

| International Equity Funds | 1,110,665 | 1,110,665 | - | - |

| Bond Funds | 4,202,468 | 4,202,468 | - | - |

| Short-Term Funds | 513,867 | 513,867 | - | - |

| Total Investments in Securities: | 6,641,850 | 6,641,850 | - | - |

| Statement of Assets and Liabilities | ||||

January 31, 2023 (Unaudited) | ||||

| Assets | ||||

| Investment in securities, at value - See accompanying schedule: | ||||

Affiliated issuers (cost $6,962,141) | $ | 6,641,850 | ||

| Total Investment in Securities (cost $6,962,141) | $ | 6,641,850 | ||

| Cash | 5 | |||

| Receivable for investments sold | 77,610 | |||

Total assets | 6,719,465 | |||

| Liabilities | ||||

| Payable for investments purchased | $ | 75,291 | ||

| Accrued management fee | 2,433 | |||

| Distribution and service plan fees payable | 244 | |||

| Total Liabilities | 77,968 | |||

| Net Assets | $ | 6,641,497 | ||

| Net Assets consist of: | ||||

| Paid in capital | $ | 7,126,281 | ||

| Total accumulated earnings (loss) | (484,784) | |||

| Net Assets | $ | 6,641,497 | ||

| Net Asset Value and Maximum Offering Price | ||||

| Class A : | ||||

Net Asset Value and redemption price per share ($1,180,504 ÷ 23,671.17 shares) (a) | $ | 49.87 | ||

| Maximum offering price per share (100/94.25 of $49.87) | $ | 52.91 | ||

| Fidelity Managed Retirement 2015 : | ||||

Net Asset Value , offering price and redemption price per share ($4,692,974 ÷ 94,009.53 shares) | $ | 49.92 | ||

| Class K : | ||||

Net Asset Value , offering price and redemption price per share ($129,556 ÷ 2,595.78 shares) | $ | 49.91 | ||

| Class K6 : | ||||

Net Asset Value , offering price and redemption price per share ($253,904 ÷ 5,085.65 shares) | $ | 49.93 | ||

| Class I : | ||||

Net Asset Value , offering price and redemption price per share ($273,392 ÷ 5,476.04 shares) | $ | 49.93 | ||

| Class Z6 : | ||||

Net Asset Value , offering price and redemption price per share ($111,167 ÷ 2,226.06 shares) | $ | 49.94 | ||

(a)Redemption price per share is equal to net asset value less any applicable contingent deferred sales charge. | ||||

| Statement of Operations | ||||

Six months ended January 31, 2023 (Unaudited) | ||||

| Investment Income | ||||

| Dividends: | ||||

| Affiliated issuers | $ | 204,106 | ||

| Expenses | ||||

| Management fee | $ | 14,582 | ||

| Distribution and service plan fees | 1,457 | |||

| Independent trustees' fees and expenses | 13 | |||

| Total expenses before reductions | 16,052 | |||

| Expense reductions | (69) | |||

| Total expenses after reductions | 15,983 | |||

| Net Investment income (loss) | 188,123 | |||

| Realized and Unrealized Gain (Loss) | ||||

| Net realized gain (loss) on: | ||||

| Investment Securities: | ||||

| Affiliated issuers | (84,462) | |||

| Capital gain distributions from underlying funds: | ||||

| Affiliated issuers | 25,150 | |||

| Total net realized gain (loss) | (59,312) | |||

| Change in net unrealized appreciation (depreciation) on: | ||||

| Investment Securities: | ||||

| Affiliated issuers | (173,843) | |||

| Total change in net unrealized appreciation (depreciation) | (173,843) | |||

| Net gain (loss) | (233,155) | |||

| Net increase (decrease) in net assets resulting from operations | $ | (45,032) | ||

| Statement of Changes in Net Assets | ||||

Six months ended January 31, 2023 (Unaudited) | Year ended July 31, 2022 | |||

| Increase (Decrease) in Net Assets | ||||

| Operations | ||||

| Net investment income (loss) | $ | 188,123 | $ | 200,628 |

| Net realized gain (loss) | (59,312) | 197,576 | ||

| Change in net unrealized appreciation (depreciation) | (173,843) | (1,146,423) | ||

| Net increase (decrease) in net assets resulting from operations | (45,032) | (748,219) | ||

| Distributions to shareholders | (295,000) | (451,806) | ||

| Share transactions - net increase (decrease) | (366,723) | (374,012) | ||

| Total increase (decrease) in net assets | (706,755) | (1,574,037) | ||

| Net Assets | ||||

| Beginning of period | 7,348,252 | 8,922,289 | ||

| End of period | $ | 6,641,497 | $ | 7,348,252 |

| Fidelity Advisor Managed Retirement 2015 Fund℠ Class A |

Six months ended (Unaudited) January 31, 2023 | Years ended July 31, 2022 | 2021 | 2020 | 2019 | 2018 | |||||||

Selected Per-Share Data | ||||||||||||

| Net asset value, beginning of period | $ | 52.42 | $ | 60.51 | $ | 55.51 | $ | 53.13 | $ | 53.98 | $ | 64.42 |

| Income from Investment Operations | ||||||||||||

Net investment income (loss) A,B | 1.351 | 1.241 | .335 | .690 | .887 | .739 | ||||||

| Net realized and unrealized gain (loss) | (1.726) | (6.395) | 6.385 | 3.244 | 1.236 | 1.737 | ||||||

| Total from investment operations | (.375) | (5.154) | 6.720 | 3.934 | 2.123 | 2.476 | ||||||

| Distributions from net investment income | (1.375) | (1.207) | (.369) | (.769) | (.884) | (.726) | ||||||

| Distributions from net realized gain | (.800) | (1.729) | (1.351) | (.785) | (2.089) | (12.190) | ||||||

| Total distributions | (2.175) | (2.936) | (1.720) | (1.554) | (2.973) | (12.916) | ||||||

| Net asset value, end of period | $ | 49.87 | $ | 52.42 | $ | 60.51 | $ | 55.51 | $ | 53.13 | $ | 53.98 |

Total Return C,D,E | (.54)% | (8.96)% | 12.31% | 7.54% | 4.26% | 4.46% | ||||||

Ratios to Average Net Assets B,F,G | ||||||||||||

| Expenses before reductions | .71% H | .71% | .72% | .72% | .78% | .83% | ||||||

| Expenses net of fee waivers, if any | .71% H | .71% | .72% | .72% | .78% | .83% | ||||||

| Expenses net of all reductions | .71% H | .71% | .72% | .72% | .78% | .82% | ||||||

| Net investment income (loss) | 5.49% H | 2.20% | .58% | 1.30% | 1.71% | 1.34% | ||||||

| Supplemental Data | ||||||||||||

| Net assets, end of period (000 omitted) | $ | 1,181 | $ | 1,242 | $ | 1,461 | $ | 1,024 | $ | 244 | $ | 246 |

Portfolio turnover rate I | 26% H | 60% | 32% | 61% | 67% | 20% |

| Fidelity Managed Retirement 2015 Fund℠ |

Six months ended (Unaudited) January 31, 2023 | Years ended July 31, 2022 | 2021 | 2020 | 2019 | 2018 | |||||||

Selected Per-Share Data | ||||||||||||

| Net asset value, beginning of period | $ | 52.47 | $ | 60.56 | $ | 55.53 | $ | 53.11 | $ | 53.97 | $ | 64.41 |

| Income from Investment Operations | ||||||||||||

Net investment income (loss) A,B | 1.413 | 1.389 | .481 | .825 | 1.017 | .879 | ||||||

| Net realized and unrealized gain (loss) | (1.728) | (6.410) | 6.395 | 3.250 | 1.226 | 1.740 | ||||||

| Total from investment operations | (.315) | (5.021) | 6.876 | 4.075 | 2.243 | 2.619 | ||||||

| Distributions from net investment income | (1.435) | (1.340) | (.495) | (.870) | (1.014) | (.869) | ||||||

| Distributions from net realized gain | (.800) | (1.729) | (1.351) | (.785) | (2.089) | (12.190) | ||||||

| Total distributions | (2.235) | (3.069) | (1.846) | (1.655) | (3.103) | (13.059) | ||||||

| Net asset value, end of period | $ | 49.92 | $ | 52.47 | $ | 60.56 | $ | 55.53 | $ | 53.11 | $ | 53.97 |

Total Return C,D | (.42)% | (8.74)% | 12.60% | 7.83% | 4.50% | 4.73% | ||||||

Ratios to Average Net Assets B,E,F | ||||||||||||

| Expenses before reductions | .46% G | .46% | .47% | .47% | .53% | .58% | ||||||

| Expenses net of fee waivers, if any | .46% G | .46% | .47% | .47% | .53% | .58% | ||||||

| Expenses net of all reductions | .46% G | .46% | .47% | .47% | .53% | .57% | ||||||

| Net investment income (loss) | 5.74% G | 2.45% | .83% | 1.55% | 1.96% | 1.59% | ||||||

| Supplemental Data | ||||||||||||

| Net assets, end of period (000 omitted) | $ | 4,693 | $ | 4,768 | $ | 6,736 | $ | 5,155 | $ | 4,087 | $ | 3,714 |

Portfolio turnover rate H | 26% G | 60% | 32% | 61% | 67% | 20% |

| Fidelity Managed Retirement 2015 Fund℠ Class K |

Six months ended (Unaudited) January 31, 2023 | Years ended July 31, 2022 | 2021 | 2020 A | |||||

Selected Per-Share Data | ||||||||

| Net asset value, beginning of period | $ | 52.46 | $ | 60.55 | $ | 55.52 | $ | 53.08 |

| Income from Investment Operations | ||||||||

Net investment income (loss) B,C | 1.435 | 1.436 | .539 | .879 | ||||

| Net realized and unrealized gain (loss) | (1.725) | (6.395) | 6.392 | 3.270 | ||||

| Total from investment operations | (.290) | (4.959) | 6.931 | 4.149 | ||||

| Distributions from net investment income | (1.460) | (1.402) | (.550) | (.924) | ||||

| Distributions from net realized gain | (.800) | (1.729) | (1.351) | (.785) | ||||

| Total distributions | (2.260) | (3.131) | (1.901) | (1.709) | ||||

| Net asset value, end of period | $ | 49.91 | $ | 52.46 | $ | 60.55 | $ | 55.52 |

Total Return D | (.37)% | (8.64)% | 12.71% | 7.98% | ||||

Ratios to Average Net Assets C,E,F | ||||||||

| Expenses before reductions | .36% G | .36% | .37% | .37% | ||||

| Expenses net of fee waivers, if any | .36% G | .36% | .37% | .37% | ||||

| Expenses net of all reductions | .36% G | .36% | .37% | .37% | ||||

| Net investment income (loss) | 5.84% G | 2.55% | .93% | 1.65% | ||||

| Supplemental Data | ||||||||

| Net assets, end of period (000 omitted) | $ | 130 | $ | 111 | $ | 122 | $ | 108 |

Portfolio turnover rate H | 26% G | 60% | 32% | 61% |

| Fidelity Managed Retirement 2015 Fund℠ Class K6 |

Six months ended (Unaudited) January 31, 2023 | Years ended July 31, 2022 | 2021 | 2020 A | |||||

Selected Per-Share Data | ||||||||

| Net asset value, beginning of period | $ | 52.46 | $ | 60.56 | $ | 55.53 | $ | 53.08 |

| Income from Investment Operations | ||||||||

Net investment income (loss) B,C | 1.488 | 1.434 | .597 | .932 | ||||

| Net realized and unrealized gain (loss) | (1.749) | (6.334) | 6.391 | 3.274 | ||||

| Total from investment operations | (.261) | (4.900) | 6.988 | 4.206 | ||||

| Distributions from net investment income | (1.469) | (1.471) | (.607) | (.971) | ||||

| Distributions from net realized gain | (.800) | (1.729) | (1.351) | (.785) | ||||

| Total distributions | (2.269) | (3.200) | (1.958) | (1.756) | ||||

| Net asset value, end of period | $ | 49.93 | $ | 52.46 | $ | 60.56 | $ | 55.53 |

Total Return D,E | (.31)% | (8.54)% | 12.82% | 8.09% | ||||

Ratios to Average Net Assets C,F,G | ||||||||

| Expenses before reductions | .26% H | .26% | .27% | .27% | ||||

| Expenses net of fee waivers, if any | .26% H | .26% | .27% | .27% | ||||

| Expenses net of all reductions | .25% H | .26% | .27% | .27% | ||||

| Net investment income (loss) | 5.95% H | 2.65% | 1.03% | 1.75% | ||||

| Supplemental Data | ||||||||

| Net assets, end of period (000 omitted) | $ | 254 | $ | 837 | $ | 204 | $ | 112 |

Portfolio turnover rate I | 26% H | 60% | 32% | 61% |

| Fidelity Advisor Managed Retirement 2015 Fund℠ Class I |

Six months ended (Unaudited) January 31, 2023 | Years ended July 31, 2022 | 2021 | 2020 | 2019 | 2018 | |||||||

Selected Per-Share Data | ||||||||||||

| Net asset value, beginning of period | $ | 52.48 | $ | 60.57 | $ | 55.54 | $ | 53.12 | $ | 53.98 | $ | 64.42 |

| Income from Investment Operations | ||||||||||||

Net investment income (loss) A,B | 1.413 | 1.376 | .481 | .827 | 1.015 | .877 | ||||||

| Net realized and unrealized gain (loss) | (1.727) | (6.387) | 6.390 | 3.242 | 1.227 | 1.742 | ||||||

| Total from investment operations | (.314) | (5.011) | 6.871 | 4.069 | 2.242 | 2.619 | ||||||

| Distributions from net investment income | (1.436) | (1.350) | (.490) | (.864) | (1.013) | (.869) | ||||||

| Distributions from net realized gain | (.800) | (1.729) | (1.351) | (.785) | (2.089) | (12.190) | ||||||

| Total distributions | (2.236) | (3.079) | (1.841) | (1.649) | (3.102) | (13.059) | ||||||

| Net asset value, end of period | $ | 49.93 | $ | 52.48 | $ | 60.57 | $ | 55.54 | $ | 53.12 | $ | 53.98 |

Total Return C,D | (.42)% | (8.72)% | 12.59% | 7.81% | 4.50% | 4.73% | ||||||

Ratios to Average Net Assets B,E,F | ||||||||||||

| Expenses before reductions | .46% G | .46% | .47% | .47% | .53% | .58% | ||||||

| Expenses net of fee waivers, if any | .46% G | .46% | .47% | .47% | .53% | .58% | ||||||

| Expenses net of all reductions | .46% G | .46% | .47% | .47% | .53% | .57% | ||||||

| Net investment income (loss) | 5.74% G | 2.45% | .83% | 1.55% | 1.97% | 1.59% | ||||||

| Supplemental Data | ||||||||||||

| Net assets, end of period (000 omitted) | $ | 273 | $ | 279 | $ | 278 | $ | 274 | $ | 287 | $ | 185 |

Portfolio turnover rate H | 26% G | 60% | 32% | 61% | 67% | 20% |

| Fidelity Advisor Managed Retirement 2015 Fund℠ Class Z6 |

Six months ended (Unaudited) January 31, 2023 | Years ended July 31, 2022 | 2021 | 2020 A | |||||

Selected Per-Share Data | ||||||||

| Net asset value, beginning of period | $ | 52.49 | $ | 60.58 | $ | 55.55 | $ | 53.09 |

| Income from Investment Operations | ||||||||

Net investment income (loss) B,C | 1.463 | 1.493 | .597 | .932 | ||||

| Net realized and unrealized gain (loss) | (1.728) | (6.396) | 6.390 | 3.276 | ||||

| Total from investment operations | (.265) | (4.903) | 6.987 | 4.208 | ||||

| Distributions from net investment income | (1.485) | (1.458) | (.606) | (.963) | ||||

| Distributions from net realized gain | (.800) | (1.729) | (1.351) | (.785) | ||||

| Total distributions | (2.285) | (3.187) | (1.957) | (1.748) | ||||

| Net asset value, end of period | $ | 49.94 | $ | 52.49 | $ | 60.58 | $ | 55.55 |

Total Return D,E | (.32)% | (8.54)% | 12.81% | 8.09% | ||||

Ratios to Average Net Assets C,F,G | ||||||||

| Expenses before reductions | .26% H | .26% | .27% | .27% | ||||

| Expenses net of fee waivers, if any | .26% H | .26% | .27% | .27% | ||||

| Expenses net of all reductions | .26% H | .26% | .27% | .27% | ||||

| Net investment income (loss) | 5.94% H | 2.65% | 1.03% | 1.75% | ||||

| Supplemental Data | ||||||||

| Net assets, end of period (000 omitted) | $ | 111 | $ | 112 | $ | 122 | $ | 108 |

Portfolio turnover rate I | 26% H | 60% | 32% | 61% |

Top Holdings (% of Fund's net assets) | ||

| Fidelity Series Investment Grade Bond Fund | 10.0 | |

| Fidelity Series 0-5 Year Inflation-Protected Bond Index Fund | 9.9 | |

| Fidelity Series Government Bond Index Fund | 9.7 | |

| Fidelity Series Investment Grade Securitized Fund | 7.0 | |

| Fidelity Series Corporate Bond Fund | 6.6 | |

| Fidelity Series Emerging Markets Opportunities Fund | 6.6 | |

| Fidelity Series 5+ Year Inflation-Protected Bond Index Fund | 5.2 | |

| Fidelity Series Long-Term Treasury Bond Index Fund | 4.8 | |

| Fidelity Series Large Cap Value Index Fund | 4.5 | |

| Fidelity Series International Developed Markets Bond Index Fund | 4.0 | |

| 68.3 | ||

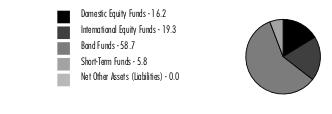

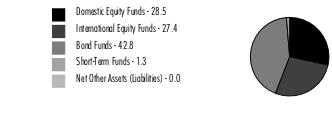

Asset Allocation (% of Fund's net assets) |

|

Percentages shown as 0.0% may reflect amounts less than 0.05%. |

| Domestic Equity Funds - 16.2% | |||

| Shares | Value ($) | ||

| Fidelity Series Blue Chip Growth Fund (a) | 29,438 | 330,289 | |

| Fidelity Series Commodity Strategy Fund (a) | 670 | 70,224 | |

| Fidelity Series Large Cap Growth Index Fund (a) | 14,247 | 208,862 | |

| Fidelity Series Large Cap Stock Fund (a) | 12,872 | 229,762 | |

| Fidelity Series Large Cap Value Index Fund (a) | 29,518 | 428,313 | |

| Fidelity Series Small Cap Core Fund (a) | 72 | 770 | |

| Fidelity Series Small Cap Opportunities Fund (a) | 8,307 | 106,084 | |

| Fidelity Series Value Discovery Fund (a) | 10,389 | 157,919 | |

| TOTAL DOMESTIC EQUITY FUNDS (Cost $1,448,326) | 1,532,223 | ||

| International Equity Funds - 19.3% | |||

| Shares | Value ($) | ||

| Fidelity Series Canada Fund (a) | 8,613 | 122,654 | |

| Fidelity Series Emerging Markets Fund (a) | 7,935 | 67,922 | |

| Fidelity Series Emerging Markets Opportunities Fund (a) | 36,056 | 621,239 | |

| Fidelity Series International Growth Fund (a) | 17,403 | 272,361 | |

| Fidelity Series International Index Fund (a) | 10,216 | 113,601 | |

| Fidelity Series International Small Cap Fund (a) | 5,315 | 84,674 | |

| Fidelity Series International Value Fund (a) | 25,026 | 270,779 | |

| Fidelity Series Overseas Fund (a) | 22,985 | 271,458 | |

| TOTAL INTERNATIONAL EQUITY FUNDS (Cost $1,740,783) | 1,824,688 | ||

| Bond Funds - 58.7% | |||

| Shares | Value ($) | ||

| Fidelity Series 0-5 Year Inflation-Protected Bond Index Fund (a) | 99,669 | 931,907 | |

| Fidelity Series 5+ Year Inflation-Protected Bond Index Fund (a) | 62,341 | 495,614 | |

| Fidelity Series Corporate Bond Fund (a) | 66,917 | 621,662 | |

| Fidelity Series Emerging Markets Debt Fund (a) | 6,499 | 49,260 | |

| Fidelity Series Emerging Markets Debt Local Currency Fund (a) | 1,782 | 16,162 | |

| Fidelity Series Floating Rate High Income Fund (a) | 1,040 | 9,280 | |

| Fidelity Series Government Bond Index Fund (a) | 98,174 | 917,930 | |

| Fidelity Series High Income Fund (a) | 6,120 | 50,858 | |

| Fidelity Series International Credit Fund (a) | 228 | 1,825 | |

| Fidelity Series International Developed Markets Bond Index Fund (a) | 43,581 | 373,485 | |

| Fidelity Series Investment Grade Bond Fund (a) | 92,617 | 942,845 | |

| Fidelity Series Investment Grade Securitized Fund (a) | 71,889 | 657,782 | |

| Fidelity Series Long-Term Treasury Bond Index Fund (a) | 73,352 | 458,452 | |

| Fidelity Series Real Estate Income Fund (a) | 1,809 | 18,069 | |

| TOTAL BOND FUNDS (Cost $6,239,751) | 5,545,131 | ||

| Short-Term Funds - 5.8% | |||

| Shares | Value ($) | ||

| Fidelity Series Government Money Market Fund 4.42% (a)(b) | 124,534 | 124,534 | |

| Fidelity Series Short-Term Credit Fund (a) | 8,202 | 79,151 | |

| Fidelity Series Treasury Bill Index Fund (a) | 34,589 | 344,162 | |

| TOTAL SHORT-TERM FUNDS (Cost $551,062) | 547,847 | ||

| TOTAL INVESTMENT IN SECURITIES - 100.0% (Cost $9,979,922) | 9,449,889 |

NET OTHER ASSETS (LIABILITIES) - 0.0% | (262) |

| NET ASSETS - 100.0% | 9,449,627 |

| (a) | Affiliated Fund |

| (b) | The rate quoted is the annualized seven-day yield of the fund at period end. |

| Affiliate | Value, beginning of period ($) | Purchases ($) | Sales Proceeds ($) | Dividend Income ($) | Realized Gain (loss) ($) | Change in Unrealized appreciation (depreciation) ($) | Value, end of period ($) |

| Fidelity Series 0-5 Year Inflation-Protected Bond Index Fund | 973,591 | 178,150 | 149,557 | 45,974 | (5,947) | (64,330) | 931,907 |

| Fidelity Series 5+ Year Inflation-Protected Bond Index Fund | 515,293 | 119,864 | 70,826 | 31,264 | (9,599) | (59,118) | 495,614 |

| Fidelity Series Blue Chip Growth Fund | 382,544 | 75,450 | 102,416 | 12,385 | (26,950) | 1,661 | 330,289 |

| Fidelity Series Canada Fund | 141,395 | 12,972 | 32,117 | 3,599 | (233) | 637 | 122,654 |

| Fidelity Series Commodity Strategy Fund | 154,277 | 98,997 | 90,643 | 82,694 | (48,420) | (43,987) | 70,224 |

| Fidelity Series Corporate Bond Fund | 653,761 | 69,358 | 83,290 | 11,603 | (7,138) | (11,029) | 621,662 |

| Fidelity Series Emerging Markets Debt Fund | 53,422 | 3,509 | 8,561 | 1,502 | (1,536) | 2,426 | 49,260 |

| Fidelity Series Emerging Markets Debt Local Currency Fund | 17,731 | 608 | 3,376 | - | (459) | 1,658 | 16,162 |

| Fidelity Series Emerging Markets Fund | 84,756 | 5,817 | 25,527 | 1,783 | (4,809) | 7,685 | 67,922 |

| Fidelity Series Emerging Markets Opportunities Fund | 765,590 | 56,272 | 228,527 | 15,024 | (46,688) | 74,592 | 621,239 |

| Fidelity Series Floating Rate High Income Fund | 10,170 | 2,802 | 3,755 | 364 | (177) | 240 | 9,280 |

| Fidelity Series Government Bond Index Fund | 960,216 | 130,487 | 134,810 | 9,355 | (6,473) | (31,490) | 917,930 |

| Fidelity Series Government Money Market Fund 4.42% | 87,618 | 48,993 | 12,077 | 1,841 | - | - | 124,534 |

| Fidelity Series High Income Fund | 55,379 | 5,419 | 8,651 | 1,764 | (997) | (292) | 50,858 |

| Fidelity Series International Credit Fund | 1,877 | 73 | - | 73 | - | (125) | 1,825 |

| Fidelity Series International Developed Markets Bond Index Fund | 409,032 | 46,720 | 56,687 | 2,296 | (7,057) | (18,523) | 373,485 |

| Fidelity Series International Growth Fund | 294,302 | 34,910 | 60,937 | 8,620 | (9,078) | 13,164 | 272,361 |

| Fidelity Series International Index Fund | 123,237 | 10,349 | 26,286 | 2,765 | (2,992) | 9,293 | 113,601 |

| Fidelity Series International Small Cap Fund | 90,920 | 9,197 | 12,735 | 4,746 | (2,882) | 174 | 84,674 |

| Fidelity Series International Value Fund | 291,606 | 22,771 | 67,521 | 8,441 | (5,170) | 29,093 | 270,779 |

| Fidelity Series Investment Grade Bond Fund | 992,561 | 118,283 | 134,724 | 17,048 | (10,298) | (22,977) | 942,845 |

| Fidelity Series Investment Grade Securitized Fund | 702,080 | 80,497 | 92,482 | 9,761 | (7,299) | (25,014) | 657,782 |

| Fidelity Series Large Cap Growth Index Fund | 242,075 | 35,853 | 55,263 | 1,386 | 1,488 | (15,291) | 208,862 |

| Fidelity Series Large Cap Stock Fund | 265,195 | 39,857 | 74,000 | 15,879 | 990 | (2,280) | 229,762 |

| Fidelity Series Large Cap Value Index Fund | 506,406 | 51,173 | 129,507 | 14,530 | 13,150 | (12,909) | 428,313 |

| Fidelity Series Long-Term Treasury Bond Index Fund | 496,350 | 73,357 | 70,413 | 6,622 | (3,073) | (37,769) | 458,452 |

| Fidelity Series Overseas Fund | 296,030 | 30,651 | 64,313 | 4,540 | (5,271) | 14,361 | 271,458 |

| Fidelity Series Real Estate Income Fund | 31,887 | 6,633 | 17,883 | 1,971 | (1,964) | (604) | 18,069 |

| Fidelity Series Short-Term Credit Fund | 87,414 | 4,525 | 12,375 | 855 | (391) | (22) | 79,151 |

| Fidelity Series Small Cap Opportunities Fund | 130,081 | 11,550 | 35,733 | 5,853 | (4,352) | 4,538 | 106,084 |

| Fidelity Series Small Cap Core Fund | - | 704 | - | - | - | 66 | 770 |

| Fidelity Series Treasury Bill Index Fund | 263,033 | 141,353 | 59,622 | 5,530 | (44) | (558) | 344,162 |

| Fidelity Series Value Discovery Fund | 186,766 | 22,824 | 50,885 | 7,786 | 3,792 | (4,578) | 157,919 |

| 10,266,595 | 1,549,978 | 1,975,499 | 337,854 | (199,877) | (191,308) | 9,449,889 |

| Valuation Inputs at Reporting Date: | ||||

| Description | Total ($) | Level 1 ($) | Level 2 ($) | Level 3 ($) |

Investments in Securities: | ||||

| Domestic Equity Funds | 1,532,223 | 1,532,223 | - | - |

| International Equity Funds | 1,824,688 | 1,824,688 | - | - |

| Bond Funds | 5,545,131 | 5,545,131 | - | - |