UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-04085

Fidelity Income Fund

(Exact name of registrant as specified in charter)

245 Summer St., Boston, MA 02210

(Address of principal executive offices) (Zip code)

Margaret Carey, Secretary

245 Summer St.

Boston, Massachusetts 02210

(Name and address of agent for service)

Registrant's telephone number, including area code:

617-563-7000

Date of fiscal year end: | August 31 |

Date of reporting period: | February 29, 2024 |

Item 1.

Reports to Stockholders

Contents

| Coupon Distribution (% of Fund's Investments) | ||

| Zero coupon bonds | 0.0 | |

| 0.01 - 0.99% | 4.2 | |

| 1 - 1.99% | 8.9 | |

| 2 - 2.99% | 30.9 | |

| 3 - 3.99% | 20.2 | |

| 4 - 4.99% | 15.2 | |

| 5 - 5.99% | 4.2 | |

| 6 - 6.99% | 6.3 | |

| 7 - 7.99% | 0.0 | |

| 8 - 8.99% | 0.0 | |

| Coupon distribution shows the range of stated interest rates on the fund's investments, excluding short-term investments. | ||

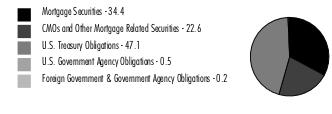

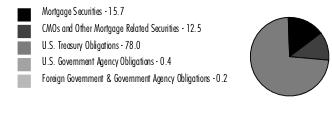

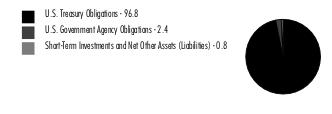

Asset Allocation (% of Fund's net assets) |

|

Short-Term Investments and Net Other Assets (Liabilities) - (4.8)% |

Futures and Swaps - 6.4% |

Percentages in the above tables are adjusted for the effect of TBA Sale Commitments. |

| U.S. Government and Government Agency Obligations - 47.6% | |||

Principal Amount (a) (000s) | Value ($) (000s) | ||

| U.S. Government Agency Obligations - 0.2% | |||

| Tennessee Valley Authority: | |||

| 5.25% 9/15/39 | 2,235 | 2,313 | |

| 5.375% 4/1/56 | 2,737 | 2,908 | |

TOTAL U.S. GOVERNMENT AGENCY OBLIGATIONS | 5,221 | ||

| U.S. Treasury Obligations - 47.1% | |||

| U.S. Treasury Bonds: | |||

| 2% 8/15/51 | 62,512 | 38,496 | |

| 2.375% 2/15/42 | 353 | 259 | |

| 2.5% 2/15/45 | 22,121 | 16,034 | |

| 2.875% 5/15/49 | 4,458 | 3,371 | |

| 3% 2/15/49 | 95,774 | 74,210 | |

| 3.625% 2/15/53 | 86,159 | 75,329 | |

| 3.625% 5/15/53 | 11,120 | 9,729 | |

| 4.125% 8/15/53 | 24,400 | 23,359 | |

| 4.375% 8/15/43 | 132,480 | 129,705 | |

| 4.75% 2/15/37 | 13,733 | 14,506 | |

| U.S. Treasury Notes: | |||

| 0.25% 9/30/25 | 870 | 811 | |

| 0.25% 10/31/25 | 14,460 | 13,426 | |

| 0.75% 8/31/26 | 125,830 | 114,781 | |

| 1.125% 10/31/26 | 47,300 | 43,352 | |

| 1.125% 8/31/28 | 104,478 | 91,035 | |

| 1.5% 1/31/27 | 22,230 | 20,464 | |

| 1.625% 9/30/26 | 1,028 | 958 | |

| 2.25% 3/31/26 | 928 | 885 | |

| 2.5% 2/28/26 | 25,808 | 24,774 | |

| 2.5% 3/31/27 | 46,600 | 44,062 | |

| 2.625% 5/31/27 | 45,180 | 42,766 | |

| 2.625% 7/31/29 | 39,109 | 36,018 | |

| 2.75% 4/30/27 | 40,000 | 38,061 | |

| 2.75% 7/31/27 | 33,510 | 31,787 | |

| 2.75% 8/15/32 | 12,060 | 10,767 | |

| 2.875% 5/15/32 | 28,790 | 26,021 | |

| 3.5% 1/31/28 | 5,750 | 5,577 | |

| 3.75% 5/31/30 | 55,440 | 53,827 | |

| 3.75% 6/30/30 | 26,780 | 25,992 | |

| 3.875% 1/15/26 | 10,020 | 9,877 | |

| 4% 1/15/27 | 14,790 | 14,617 | |

| 4% 2/15/27 | 97,910 | 97,107 | |

| 4% 7/31/30 | 6,990 | 6,880 | |

| 4% 1/31/31 | 5,660 | 5,568 | |

| 4.125% 6/15/26 | 27,990 | 27,730 | |

| 4.125% 10/31/27 | 24,500 | 24,299 | |

| 4.125% 8/31/30 | 1,950 | 1,932 | |

| 4.125% 11/15/32 | 6,702 | 6,631 | |

| 4.375% 12/15/26 | 2,400 | 2,395 | |

| 4.625% 11/15/26 | 36,520 | 36,657 | |

TOTAL U.S. TREASURY OBLIGATIONS | 1,244,055 | ||

| Other Government Related - 0.3% | |||

| Private Export Funding Corp. Secured 1.75% 11/15/24 | 8,660 | 8,445 | |

| TOTAL U.S. GOVERNMENT AND GOVERNMENT AGENCY OBLIGATIONS (Cost $1,352,533) | 1,257,721 | ||

| U.S. Government Agency - Mortgage Securities - 44.8% | |||

Principal Amount (a) (000s) | Value ($) (000s) | ||

| Fannie Mae - 15.2% | |||

| Refinitiv USD IBOR Consumer Cash Fallbacks Term 1Y + 1.360% 5.615% 10/1/35 (b)(c) | 5 | 6 | |

| Refinitiv USD IBOR Consumer Cash Fallbacks Term 1Y + 1.440% 3.945% 4/1/37 (b)(c) | 1 | 1 | |

| Refinitiv USD IBOR Consumer Cash Fallbacks Term 1Y + 1.460% 6.085% 1/1/35 (b)(c) | 3 | 3 | |

| Refinitiv USD IBOR Consumer Cash Fallbacks Term 1Y + 1.470% 5.058% 10/1/33 (b)(c) | 14 | 14 | |

| Refinitiv USD IBOR Consumer Cash Fallbacks Term 1Y + 1.480% 5.73% 7/1/34 (b)(c) | 6 | 7 | |

| Refinitiv USD IBOR Consumer Cash Fallbacks Term 1Y + 1.500% 5.755% 1/1/35 (b)(c) | 2 | 2 | |

| Refinitiv USD IBOR Consumer Cash Fallbacks Term 1Y + 1.510% 7.316% 2/1/33 (b)(c) | 12 | 12 | |

| Refinitiv USD IBOR Consumer Cash Fallbacks Term 1Y + 1.530% 5.461% 12/1/34 (b)(c) | 14 | 14 | |

| Refinitiv USD IBOR Consumer Cash Fallbacks Term 1Y + 1.530% 5.484% 3/1/36 (b)(c) | 60 | 61 | |

| Refinitiv USD IBOR Consumer Cash Fallbacks Term 1Y + 1.530% 5.785% 3/1/35 (b)(c) | 12 | 12 | |

| Refinitiv USD IBOR Consumer Cash Fallbacks Term 1Y + 1.550% 5.131% 2/1/44 (b)(c) | 20 | 20 | |

| Refinitiv USD IBOR Consumer Cash Fallbacks Term 1Y + 1.550% 5.241% 5/1/44 (b)(c) | 31 | 32 | |

| Refinitiv USD IBOR Consumer Cash Fallbacks Term 1Y + 1.550% 5.803% 6/1/36 (b)(c) | 15 | 15 | |

| Refinitiv USD IBOR Consumer Cash Fallbacks Term 1Y + 1.550% 7.3% 9/1/33 (b)(c) | 24 | 24 | |

| Refinitiv USD IBOR Consumer Cash Fallbacks Term 1Y + 1.550% 7.308% 10/1/33 (b)(c) | 7 | 7 | |

| Refinitiv USD IBOR Consumer Cash Fallbacks Term 1Y + 1.560% 4.065% 3/1/37 (b)(c) | 78 | 79 | |

| Refinitiv USD IBOR Consumer Cash Fallbacks Term 1Y + 1.560% 5.319% 2/1/44 (b)(c) | 52 | 53 | |

| Refinitiv USD IBOR Consumer Cash Fallbacks Term 1Y + 1.560% 7.359% 7/1/35 (b)(c) | 9 | 9 | |

| Refinitiv USD IBOR Consumer Cash Fallbacks Term 1Y + 1.570% 4.599% 4/1/44 (b)(c) | 96 | 99 | |

| Refinitiv USD IBOR Consumer Cash Fallbacks Term 1Y + 1.580% 4.08% 4/1/44 (b)(c) | 37 | 38 | |

| Refinitiv USD IBOR Consumer Cash Fallbacks Term 1Y + 1.580% 5.83% 1/1/44 (b)(c) | 54 | 55 | |

| Refinitiv USD IBOR Consumer Cash Fallbacks Term 1Y + 1.620% 5.608% 3/1/33 (b)(c) | 8 | 8 | |

| Refinitiv USD IBOR Consumer Cash Fallbacks Term 1Y + 1.630% 5.815% 9/1/36 (b)(c) | 1 | 1 | |

| Refinitiv USD IBOR Consumer Cash Fallbacks Term 1Y + 1.640% 5.422% 11/1/36 (b)(c) | 11 | 12 | |

| Refinitiv USD IBOR Consumer Cash Fallbacks Term 1Y + 1.640% 5.864% 5/1/35 (b)(c) | 2 | 2 | |

| Refinitiv USD IBOR Consumer Cash Fallbacks Term 1Y + 1.640% 5.895% 6/1/47 (b)(c) | 15 | 15 | |

| Refinitiv USD IBOR Consumer Cash Fallbacks Term 1Y + 1.680% 5.741% 7/1/43 (b)(c) | 20 | 20 | |

| Refinitiv USD IBOR Consumer Cash Fallbacks Term 1Y + 1.700% 5.144% 6/1/42 (b)(c) | 43 | 44 | |

| Refinitiv USD IBOR Consumer Cash Fallbacks Term 1Y + 1.730% 5.842% 3/1/40 (b)(c) | 127 | 130 | |

| Refinitiv USD IBOR Consumer Cash Fallbacks Term 1Y + 1.740% 5.519% 5/1/36 (b)(c) | 23 | 24 | |

| Refinitiv USD IBOR Consumer Cash Fallbacks Term 1Y + 1.750% 5.649% 7/1/35 (b)(c) | 22 | 22 | |

| Refinitiv USD IBOR Consumer Cash Fallbacks Term 1Y + 1.750% 6% 8/1/41 (b)(c) | 4 | 4 | |

| Refinitiv USD IBOR Consumer Cash Fallbacks Term 1Y + 1.770% 5.995% 2/1/37 (b)(c) | 23 | 23 | |

| Refinitiv USD IBOR Consumer Cash Fallbacks Term 1Y + 1.800% 6.05% 7/1/41 (b)(c) | 18 | 19 | |

| Refinitiv USD IBOR Consumer Cash Fallbacks Term 1Y + 1.800% 6.051% 12/1/40 (b)(c) | 75 | 77 | |

| Refinitiv USD IBOR Consumer Cash Fallbacks Term 1Y + 1.800% 6.055% 1/1/42 (b)(c) | 134 | 136 | |

| Refinitiv USD IBOR Consumer Cash Fallbacks Term 1Y + 1.810% 4.519% 2/1/42 (b)(c) | 84 | 86 | |

| Refinitiv USD IBOR Consumer Cash Fallbacks Term 1Y + 1.810% 6.05% 7/1/41 (b)(c) | 32 | 33 | |

| Refinitiv USD IBOR Consumer Cash Fallbacks Term 1Y + 1.810% 6.06% 12/1/39 (b)(c) | 1 | 1 | |

| Refinitiv USD IBOR Consumer Cash Fallbacks Term 1Y + 1.810% 6.068% 9/1/41 (b)(c) | 16 | 17 | |

| Refinitiv USD IBOR Consumer Cash Fallbacks Term 1Y + 1.820% 4.757% 2/1/35 (b)(c) | 4 | 4 | |

| Refinitiv USD IBOR Consumer Cash Fallbacks Term 1Y + 1.830% 6.08% 10/1/41 (b)(c) | 14 | 14 | |

| Refinitiv USD IBOR Consumer Cash Fallbacks Term 1Y + 1.850% 4.429% 4/1/36 (b)(c) | 18 | 18 | |

| Refinitiv USD IBOR Consumer Cash Fallbacks Term 1Y + 1.890% 5.582% 8/1/35 (b)(c) | 16 | 16 | |

| Refinitiv USD IBOR Consumer Cash Fallbacks Term 1Y + 1.950% 5.771% 7/1/37 (b)(c) | 4 | 4 | |

| Refinitiv USD IBOR Consumer Cash Fallbacks Term 1Y + 1.960% 5.418% 9/1/35 (b)(c) | 0 | 0 | |

| U.S. TREASURY 1 YEAR INDEX + 2.180% 6.079% 7/1/36 (b)(c) | 2 | 2 | |

| U.S. TREASURY 1 YEAR INDEX + 2.200% 4.583% 3/1/35 (b)(c) | 12 | 12 | |

| U.S. TREASURY 1 YEAR INDEX + 2.270% 6.395% 6/1/36 (b)(c) | 2 | 2 | |

| U.S. TREASURY 1 YEAR INDEX + 2.280% 6.404% 10/1/33 (b)(c) | 19 | 19 | |

| U.S. TREASURY 1 YEAR INDEX + 2.460% 5.988% 7/1/34 (b)(c) | 2 | 2 | |

| 1.5% 11/1/35 to 1/1/51 | 47,788 | 37,859 | |

| 2% 2/1/28 to 2/1/52 | 143,571 | 122,910 | |

| 2.5% 1/1/28 to 12/1/51 | 75,016 | 65,753 | |

| 3% 1/1/28 to 2/1/52 | 60,897 | 53,707 | |

| 3.4% 8/1/42 to 9/1/42 | 24 | 22 | |

| 3.5% 5/1/35 to 3/1/52 (d) | 61,138 | 54,936 | |

| 3.5% 12/1/46 | 4,230 | 3,889 | |

| 4% 3/1/36 to 4/1/49 | 6,486 | 6,107 | |

| 4.25% 11/1/41 | 5 | 5 | |

| 4.5% to 4.5% 6/1/24 to 2/1/49 | 2,837 | 2,757 | |

| 5% 10/1/29 to 12/1/52 | 22,144 | 21,792 | |

| 5.29% 8/1/41 (b) | 51 | 50 | |

| 5.5% 8/1/25 to 11/1/52 | 10,070 | 9,981 | |

| 6% to 6% 9/1/29 to 9/1/53 | 14,062 | 14,317 | |

| 6% 11/1/53 | 1,300 | 1,310 | |

| 6.5% 10/1/24 to 9/1/53 | 5,143 | 5,315 | |

| 6.705% 2/1/39 (b) | 23 | 23 | |

| 7% to 7% 12/1/24 to 10/1/32 | 14 | 15 | |

| 7.5% to 7.5% 9/1/25 to 11/1/31 | 9 | 9 | |

TOTAL FANNIE MAE | 402,087 | ||

| Freddie Mac - 10.7% | |||

| Refinitiv USD IBOR Consumer Cash Fallbacks Term 1Y + 1.120% 5.029% 8/1/37 (b)(c) | 2 | 2 | |

| Refinitiv USD IBOR Consumer Cash Fallbacks Term 1Y + 1.320% 5.575% 1/1/36 (b)(c) | 6 | 6 | |

| Refinitiv USD IBOR Consumer Cash Fallbacks Term 1Y + 1.370% 5.625% 3/1/36 (b)(c) | 4 | 4 | |

| Refinitiv USD IBOR Consumer Cash Fallbacks Term 1Y + 1.500% 5.824% 3/1/36 (b)(c) | 3 | 3 | |

| Refinitiv USD IBOR Consumer Cash Fallbacks Term 1Y + 1.660% 5.165% 1/1/37 (b)(c) | 5 | 5 | |

| Refinitiv USD IBOR Consumer Cash Fallbacks Term 1Y + 1.660% 6.04% 7/1/36 (b)(c) | 19 | 19 | |

| Refinitiv USD IBOR Consumer Cash Fallbacks Term 1Y + 1.660% 7.54% 7/1/35 (b)(c) | 3 | 3 | |

| Refinitiv USD IBOR Consumer Cash Fallbacks Term 1Y + 1.750% 6% 12/1/40 (b)(c) | 28 | 29 | |

| Refinitiv USD IBOR Consumer Cash Fallbacks Term 1Y + 1.750% 6% 7/1/41 (b)(c) | 7 | 7 | |

| Refinitiv USD IBOR Consumer Cash Fallbacks Term 1Y + 1.750% 6% 9/1/41 (b)(c) | 242 | 246 | |

| Refinitiv USD IBOR Consumer Cash Fallbacks Term 1Y + 1.860% 5.239% 4/1/36 (b)(c) | 2 | 2 | |

| Refinitiv USD IBOR Consumer Cash Fallbacks Term 1Y + 1.880% 5.255% 4/1/41 (b)(c) | 7 | 7 | |

| Refinitiv USD IBOR Consumer Cash Fallbacks Term 1Y + 1.880% 5.489% 10/1/36 (b)(c) | 33 | 34 | |

| Refinitiv USD IBOR Consumer Cash Fallbacks Term 1Y + 1.880% 6.13% 9/1/41 (b)(c) | 22 | 22 | |

| Refinitiv USD IBOR Consumer Cash Fallbacks Term 1Y + 1.880% 6.13% 10/1/41 (b)(c) | 301 | 307 | |

| Refinitiv USD IBOR Consumer Cash Fallbacks Term 1Y + 1.900% 6.008% 10/1/42 (b)(c) | 103 | 105 | |

| Refinitiv USD IBOR Consumer Cash Fallbacks Term 1Y + 1.910% 5.213% 5/1/41 (b)(c) | 46 | 48 | |

| Refinitiv USD IBOR Consumer Cash Fallbacks Term 1Y + 1.910% 5.568% 5/1/41 (b)(c) | 54 | 55 | |

| Refinitiv USD IBOR Consumer Cash Fallbacks Term 1Y + 1.910% 5.699% 6/1/41 (b)(c) | 45 | 46 | |

| Refinitiv USD IBOR Consumer Cash Fallbacks Term 1Y + 1.910% 6.16% 6/1/41 (b)(c) | 16 | 17 | |

| Refinitiv USD IBOR Consumer Cash Fallbacks Term 1Y + 1.990% 6% 10/1/35 (b)(c) | 17 | 17 | |

| Refinitiv USD IBOR Consumer Cash Fallbacks Term 1Y + 2.010% 7.885% 5/1/37 (b)(c) | 3 | 3 | |

| Refinitiv USD IBOR Consumer Cash Fallbacks Term 1Y + 2.020% 4.936% 4/1/38 (b)(c) | 2 | 2 | |

| Refinitiv USD IBOR Consumer Cash Fallbacks Term 1Y + 2.020% 7.885% 6/1/37 (b)(c) | 7 | 7 | |

| Refinitiv USD IBOR Consumer Cash Fallbacks Term 1Y + 2.030% 6.158% 3/1/33 (b)(c) | 1 | 1 | |

| Refinitiv USD IBOR Consumer Cash Fallbacks Term 1Y + 2.040% 6.256% 7/1/36 (b)(c) | 105 | 107 | |

| Refinitiv USD IBOR Consumer Cash Fallbacks Term 1Y + 2.200% 6.45% 12/1/36 (b)(c) | 2 | 2 | |

| Refinitiv USD IBOR Consumer Cash Fallbacks Term 1Y + 2.680% 8.249% 10/1/35 (b)(c) | 11 | 11 | |

| U.S. TREASURY 1 YEAR INDEX + 2.030% 5.183% 6/1/33 (b)(c) | 23 | 23 | |

| U.S. TREASURY 1 YEAR INDEX + 2.230% 5.062% 4/1/34 (b)(c) | 8 | 8 | |

| U.S. TREASURY 1 YEAR INDEX + 2.260% 5.231% 6/1/33 (b)(c) | 6 | 6 | |

| U.S. TREASURY 1 YEAR INDEX + 2.430% 6.385% 3/1/35 (b)(c) | 11 | 11 | |

| U.S. TREASURY 1 YEAR INDEX + 2.540% 5.875% 7/1/35 (b)(c) | 124 | 126 | |

| 1.5% 11/1/35 to 2/1/51 | 40,367 | 30,917 | |

| 2% 5/1/35 to 4/1/52 | 41,361 | 35,200 | |

| 2.5% 1/1/28 to 1/1/52 (e) | 74,711 | 65,374 | |

| 3% 6/1/31 to 3/1/52 | 21,805 | 19,095 | |

| 3.5% 3/1/32 to 3/1/52 | 36,690 | 33,272 | |

| 3.5% 7/1/42 | 1,112 | 1,024 | |

| 3.5% 7/1/42 | 493 | 454 | |

| 3.5% 9/1/42 | 1,444 | 1,329 | |

| 3.5% 11/1/42 | 437 | 402 | |

| 4% 1/1/36 to 2/1/50 | 6,017 | 5,688 | |

| 4% 4/1/48 | 2 | 2 | |

| 4.5% 6/1/25 to 10/1/48 | 1,782 | 1,731 | |

| 5% 8/1/33 to 12/1/52 | 22,026 | 21,654 | |

| 5.5% 10/1/52 to 3/1/53 (e)(f) | 18,109 | 18,174 | |

| 6% 2/1/29 to 11/1/53 | 18,288 | 18,578 | |

| 6.5% 5/1/26 to 10/1/53 | 27,994 | 28,890 | |

| 7% 8/1/26 to 9/1/36 | 18 | 19 | |

| 7.5% 1/1/27 to 11/1/30 | 0 | 0 | |

| 8% 7/1/24 to 8/1/30 | 0 | 0 | |

| 8.5% 8/1/26 to 8/1/27 | 0 | 0 | |

TOTAL FREDDIE MAC | 283,094 | ||

| Ginnie Mae - 12.7% | |||

| 3.5% 11/15/40 to 12/20/49 | 2,169 | 2,001 | |

| 4% 8/15/39 to 5/20/49 | 7,967 | 7,552 | |

| 4.5% 6/20/33 to 6/20/41 | 1,308 | 1,274 | |

| 5.5% 10/15/35 to 9/15/39 | 38 | 39 | |

| 7% to 7% 1/15/28 to 8/15/32 | 12 | 12 | |

| 7.5% to 7.5% 9/15/25 to 1/15/31 | 3 | 3 | |

| 8% 9/15/24 to 12/15/27 | 0 | 0 | |

| 8.5% 8/15/29 to 1/15/31 | 0 | 0 | |

| 2% 11/20/50 to 1/20/52 | 23,471 | 19,108 | |

| 2% 3/1/54 (g) | 5,950 | 4,842 | |

| 2% 3/1/54 (g) | 4,250 | 3,459 | |

| 2% 3/1/54 (g) | 5,800 | 4,720 | |

| 2% 3/1/54 (g) | 3,350 | 2,726 | |

| 2% 3/1/54 (g) | 5,100 | 4,150 | |

| 2% 3/1/54 (g) | 4,450 | 3,621 | |

| 2% 3/1/54 (g) | 12,300 | 10,010 | |

| 2% 3/1/54 (g) | 8,300 | 6,755 | |

| 2% 3/1/54 (g) | 6,300 | 5,127 | |

| 2% 3/1/54 (g) | 2,000 | 1,628 | |

| 2% 3/1/54 (g) | 26,400 | 21,484 | |

| 2% 3/1/54 (g) | 18,600 | 15,137 | |

| 2% 4/1/54 (g) | 20,800 | 16,939 | |

| 2% 4/1/54 (g) | 2,075 | 1,690 | |

| 2% 4/1/54 (g) | 1,325 | 1,079 | |

| 2% 4/1/54 (g) | 10,600 | 8,632 | |

| 2% 4/1/54 (g) | 22,100 | 17,997 | |

| 2% 4/1/54 (g) | 44,250 | 36,035 | |

| 2% 4/1/54 (g) | 1,650 | 1,344 | |

| 2.5% 6/20/51 to 12/20/51 | 40,905 | 34,294 | |

| 3% 5/15/42 to 2/20/50 | 875 | 781 | |

| 5% 9/20/33 to 4/20/48 | 728 | 727 | |

| 5.47% 8/20/59 (b)(h) | 1 | 1 | |

| 6% 11/20/31 to 5/15/40 | 1,305 | 1,339 | |

| 6% 3/1/54 (g) | 7,500 | 7,539 | |

| 6.5% 3/20/31 to 8/15/36 | 7 | 7 | |

| 6.5% 3/1/54 (g) | 8,700 | 8,819 | |

| 6.5% 3/1/54 (g) | 9,050 | 9,174 | |

| 6.5% 3/1/54 (g) | 8,000 | 8,109 | |

| 6.5% 3/1/54 (g) | 14,700 | 14,901 | |

| 6.5% 3/1/54 (g) | 21,000 | 21,287 | |

| 6.5% 4/1/54 (g) | 9,050 | 9,167 | |

| 6.5% 4/1/54 (g) | 20,900 | 21,171 | |

TOTAL GINNIE MAE | 334,680 | ||

| Uniform Mortgage Backed Securities - 6.2% | |||

| 2% 3/1/54 (g) | 19,900 | 15,642 | |

| 2% 3/1/54 (g) | 20,300 | 15,957 | |

| 2.5% 3/1/54 (g) | 425 | 349 | |

| 2.5% 3/1/54 (g) | 1,375 | 1,130 | |

| 2.5% 3/1/54 (g) | 700 | 575 | |

| 2.5% 3/1/54 (g) | 675 | 555 | |

| 2.5% 4/1/54 (g) | 1,100 | 905 | |

| 3% 3/1/54 (g) | 20,000 | 17,111 | |

| 3% 3/1/54 (g) | 30,300 | 25,923 | |

| 5.5% 3/1/54 (g) | 2,325 | 2,300 | |

| 6% 3/1/54 (g) | 15,800 | 15,869 | |

| 6.5% 3/1/54 (g) | 5,200 | 5,291 | |

| 6.5% 3/1/54 (g) | 15,200 | 15,466 | |

| 6.5% 3/1/54 (g) | 11,100 | 11,294 | |

| 6.5% 3/1/54 (g) | 4,900 | 4,986 | |

| 6.5% 3/1/54 (g) | 14,500 | 14,754 | |

| 6.5% 3/1/54 (g) | 14,800 | 15,059 | |

TOTAL UNIFORM MORTGAGE BACKED SECURITIES | 163,166 | ||

| TOTAL U.S. GOVERNMENT AGENCY - MORTGAGE SECURITIES (Cost $1,223,001) | 1,183,027 | ||

| Collateralized Mortgage Obligations - 12.8% | |||

Principal Amount (a) (000s) | Value ($) (000s) | ||

| U.S. Government Agency - 12.8% | |||

| Fannie Mae: | |||

| floater: | |||

Series 1994-42 Class FK, 10-Year Treasury Constant Maturity Rate - 0.500% 3.64% 4/25/24 (b)(c) | 0 | 0 | |

Series 2001-38 Class QF, U.S. 30-Day Avg. Secured Overnight Fin. Rate (SOFR) Index + 1.090% 6.4161% 8/25/31 (b)(c) | 21 | 21 | |

Series 2002-18 Class FD, U.S. 30-Day Avg. Secured Overnight Fin. Rate (SOFR) Index + 0.910% 6.2361% 2/25/32 (b)(c) | 0 | 0 | |

Series 2002-39 Class FD, U.S. 30-Day Avg. Secured Overnight Fin. Rate (SOFR) Index + 1.110% 6.4389% 3/18/32 (b)(c) | 1 | 1 | |

Series 2002-49 Class FB, U.S. 30-Day Avg. Secured Overnight Fin. Rate (SOFR) Index + 0.710% 6.0389% 11/18/31 (b)(c) | 17 | 17 | |

Series 2002-60 Class FV, U.S. 30-Day Avg. Secured Overnight Fin. Rate (SOFR) Index + 1.110% 6.4361% 4/25/32 (b)(c) | 9 | 9 | |

Series 2002-63 Class FN, U.S. 30-Day Avg. Secured Overnight Fin. Rate (SOFR) Index + 1.110% 6.4361% 10/25/32 (b)(c) | 1 | 1 | |

Series 2002-7 Class FC, U.S. 30-Day Avg. Secured Overnight Fin. Rate (SOFR) Index + 0.860% 6.1861% 1/25/32 (b)(c) | 0 | 0 | |

Series 2002-74 Class FV, U.S. 30-Day Avg. Secured Overnight Fin. Rate (SOFR) Index + 0.560% 5.8861% 11/25/32 (b)(c) | 15 | 14 | |

Series 2002-75 Class FA, U.S. 30-Day Avg. Secured Overnight Fin. Rate (SOFR) Index + 1.110% 6.4361% 11/25/32 (b)(c) | 16 | 16 | |

Series 2003-118 Class S, 7.980% - U.S. 30-Day Avg. Secured Overnight Fin. Rate (SOFR) Index 2.6639% 12/25/33 (b)(i)(j) | 17 | 2 | |

Series 2006-104 Class GI, 6.560% - U.S. 30-Day Avg. Secured Overnight Fin. Rate (SOFR) Index 1.2439% 11/25/36 (b)(i)(j) | 12 | 1 | |

Series 2010-15 Class FJ, U.S. 30-Day Avg. Secured Overnight Fin. Rate (SOFR) Index + 1.040% 6.3661% 6/25/36 (b)(c) | 1,476 | 1,481 | |

| planned amortization class: | |||

Series 1996-28 Class PK, 6.5% 7/25/25 | 0 | 0 | |

Series 1999-17 Class PG, 6% 4/25/29 | 4 | 4 | |

Series 1999-32 Class PL, 6% 7/25/29 | 5 | 5 | |

Series 1999-33 Class PK, 6% 7/25/29 | 4 | 4 | |

Series 2001-52 Class YZ, 6.5% 10/25/31 | 1 | 1 | |

Series 2003-70 Class BJ, 5% 7/25/33 | 27 | 27 | |

Series 2005-102 Class CO 11/25/35 (k) | 3 | 3 | |

Series 2005-64 Class PX, 5.5% 6/25/35 | 39 | 39 | |

Series 2005-68 Class CZ, 5.5% 8/25/35 | 1,373 | 1,374 | |

Series 2005-73 Class SA, 17.500% x U.S. 30-Day Avg. Secured Overnight Fin. Rate (SOFR) Index 3.4161% 8/25/35 (b)(c)(j) | 1 | 1 | |

Series 2005-81 Class PC, 5.5% 9/25/35 | 10 | 10 | |

Series 2006-12 Class BO 10/25/35 (k) | 12 | 10 | |

Series 2006-15 Class OP 3/25/36 (k) | 17 | 14 | |

Series 2006-37 Class OW 5/25/36 (k) | 2 | 1 | |

Series 2006-45 Class OP 6/25/36 (k) | 160 | 126 | |

Series 2006-62 Class KP 4/25/36 (k) | 8 | 7 | |

Series 2010-118 Class PB, 4.5% 10/25/40 | 1,518 | 1,477 | |

Series 2012-149: | |||

Class DA, 1.75% 1/25/43 | 278 | 251 | |

Class GA, 1.75% 6/25/42 | 313 | 282 | |

Series 2012-93 Class QW, 5% 1/25/42 | 65 | 64 | |

Series 2017-1 Class JP, 3.5% 4/25/45 | 436 | 415 | |

Series 2017-22 Class JN, 4.5% 4/25/46 | 1,020 | 992 | |

Series 2019-52 Class M, 3.5% 3/25/49 | 139 | 133 | |

Series 2019-64 Class MJ, 4.5% 6/25/49 | 1,741 | 1,669 | |

Series 2019-74 Class LB, 3% 10/25/49 | 804 | 713 | |

Series 2021-26 Class HC, 1% 11/25/49 | 7,802 | 6,483 | |

Series 2021-65 Class MA, 2% 8/25/51 | 6,712 | 5,683 | |

Series 2022-2 Class TH, 2.5% 2/25/52 | 1,142 | 1,011 | |

| sequential payer: | |||

Series 1997-41 Class J, 7.5% 6/18/27 | 1 | 1 | |

Series 1999-25 Class Z, 6% 6/25/29 | 4 | 4 | |

Series 2001-20 Class Z, 6% 5/25/31 | 5 | 5 | |

Series 2001-31 Class ZC, 6.5% 7/25/31 | 2 | 2 | |

Series 2002-16 Class ZD, 6.5% 4/25/32 | 2 | 2 | |

Series 2002-74 Class SV, 7.430% - U.S. 30-Day Avg. Secured Overnight Fin. Rate (SOFR) Index 2.1139% 11/25/32 (b)(i)(j) | 3 | 0 | |

Series 2004-52 Class KZ, 5.5% 7/25/34 | 133 | 132 | |

Series 2004-91 Class Z, 5% 12/25/34 | 1,300 | 1,277 | |

Series 2005-117 Class JN, 4.5% 1/25/36 | 59 | 58 | |

Series 2005-14 Class ZB, 5% 3/25/35 | 402 | 395 | |

Series 2006-72 Class CY, 6% 8/25/26 | 220 | 220 | |

Series 2009-59 Class HB, 5% 8/25/39 | 622 | 615 | |

Series 2012-67 Class AI, 4.5% 7/25/27 (i) | 3 | 0 | |

Series 2017-89 Class KV, 3.5% 8/25/47 | 2,281 | 2,227 | |

Series 2020-101 Class BA, 1.5% 9/25/45 | 2,910 | 2,463 | |

Series 2020-49 Class JA, 2% 8/25/44 | 1,036 | 931 | |

Series 2020-51 Class BA, 2% 6/25/46 | 3,289 | 2,803 | |

Series 2020-67 Class KZ, 3.25% 9/25/40 | 10,942 | 9,905 | |

Series 2020-75 Class HA, 1.5% 12/25/44 | 10,984 | 9,313 | |

Series 2021-68 Class A, 2% 7/25/49 | 2,133 | 1,663 | |

Series 2021-85 Class L, 2.5% 8/25/48 | 1,170 | 1,010 | |

Series 2021-96 Class HA, 2.5% 2/25/50 | 1,867 | 1,603 | |

Series 2022-1 Class KA, 3% 5/25/48 | 1,895 | 1,695 | |

Series 2022-3: | |||

Class G, 2% 11/25/47 | 48,829 | 41,388 | |

Class N, 2% 10/25/47 | 15,291 | 13,023 | |

Series 2022-4 Class B, 2.5% 5/25/49 | 1,372 | 1,183 | |

Series 2022-49 Class TE, 4.5% 12/25/48 | 14,306 | 13,781 | |

Series 2022-5: | |||

Class 0, 2.5% 6/25/48 | 1,978 | 1,719 | |

Class BA, 2.5% 12/25/49 | 1,616 | 1,367 | |

Series 2022-65 Class GA, 5% 4/25/46 | 14,386 | 13,892 | |

Series 2022-7 Class A, 3% 5/25/48 | 2,702 | 2,416 | |

| Series 06-116 Class SG, 6.520% - U.S. 30-Day Avg. Secured Overnight Fin. Rate (SOFR) Index 1.2039% 12/25/36 (b)(i)(j) | 8 | 1 | |

| Series 07-40 Class SE, 6.320% - U.S. 30-Day Avg. Secured Overnight Fin. Rate (SOFR) Index 1.0039% 5/25/37 (b)(i)(j) | 4 | 0 | |

| Series 2003-21 Class SK, 7.980% - U.S. 30-Day Avg. Secured Overnight Fin. Rate (SOFR) Index 2.6639% 3/25/33 (b)(i)(j) | 1 | 0 | |

| Series 2005-72 Class ZC, 5.5% 8/25/35 | 67 | 67 | |

| Series 2005-79 Class ZC, 5.9% 9/25/35 | 40 | 40 | |

| Series 2007-57 Class SA, 40.600% x U.S. 30-Day Avg. Secured Overnight Fin. Rate (SOFR) Index 8.0032% 6/25/37 (b)(c)(j) | 4 | 4 | |

| Series 2007-66: | |||

Class SA, 38.910% x U.S. 30-Day Avg. Secured Overnight Fin. Rate (SOFR) Index 6.9832% 7/25/37 (b)(c)(j) | 5 | 6 | |

Class SB, 38.910% x U.S. 30-Day Avg. Secured Overnight Fin. Rate (SOFR) Index 6.9832% 7/25/37 (b)(c)(j) | 2 | 2 | |

| Series 2010-135 Class ZA, 4.5% 12/25/40 | 16 | 16 | |

| Series 2010-139 Class NI, 4.5% 2/25/40 (i) | 38 | 0 | |

| Series 2010-150 Class ZC, 4.75% 1/25/41 | 152 | 148 | |

| Series 2010-39 Class FG, U.S. 30-Day Avg. Secured Overnight Fin. Rate (SOFR) Index + 1.030% 6.3561% 3/25/36 (b)(c) | 999 | 1,002 | |

| Series 2010-95 Class ZC, 5% 9/25/40 | 319 | 316 | |

| Series 2011-39 Class ZA, 6% 11/25/32 | 19 | 20 | |

| Series 2011-4 Class PZ, 5% 2/25/41 | 49 | 46 | |

| Series 2011-67 Class AI, 4% 7/25/26 (i) | 8 | 0 | |

| Series 2012-100 Class WI, 3% 9/25/27 (i) | 46 | 2 | |

| Series 2012-27 Class EZ, 4.25% 3/25/42 | 2,383 | 2,240 | |

| Series 2012-9 Class SH, 6.430% - U.S. 30-Day Avg. Secured Overnight Fin. Rate (SOFR) Index 1.1139% 6/25/41 (b)(i)(j) | 5 | 0 | |

| Series 2013-133 Class IB, 3% 4/25/32 (i) | 14 | 0 | |

| Series 2013-134 Class SA, 5.930% - U.S. 30-Day Avg. Secured Overnight Fin. Rate (SOFR) Index 0.6139% 1/25/44 (b)(i)(j) | 20 | 2 | |

| Series 2013-51 Class GI, 3% 10/25/32 (i) | 20 | 1 | |

| Series 2013-N1 Class A, 6.600% - U.S. 30-Day Avg. Secured Overnight Fin. Rate (SOFR) Index 1.2839% 6/25/35 (b)(i)(j) | 23 | 2 | |

| Series 2015-42 Class IL, 6% 6/25/45 (i) | 116 | 19 | |

| Series 2015-70 Class JC, 3% 10/25/45 | 129 | 120 | |

| Series 2016-26 Class CG, 3% 5/25/46 | 4,334 | 4,025 | |

| Series 2017-30 Class AI, 5.5% 5/25/47 (i) | 65 | 11 | |

| Series 2018-45 Class GI, 4% 6/25/48 (i) | 778 | 163 | |

| Series 2020-45 Class JL, 3% 7/25/40 | 668 | 597 | |

| Series 2021-59 Class H, 2% 6/25/48 | 1,200 | 961 | |

| Series 2021-66: | |||

Class DA, 2% 1/25/48 | 1,302 | 1,047 | |

Class DM, 2% 1/25/48 | 1,383 | 1,112 | |

| Fannie Mae Stripped Mortgage-Backed Securities: | |||

| Series 339 Class 5, 5.5% 7/25/33 (i) | 4 | 1 | |

| Series 343 Class 16, 5.5% 5/25/34 (i) | 4 | 1 | |

| Series 348 Class 14, 6.5% 8/25/34 (b)(i) | 3 | 0 | |

| Series 351: | |||

Class 12, 5.5% 4/25/34 (b)(i) | 2 | 0 | |

Class 13, 6% 3/25/34 (i) | 2 | 0 | |

| Series 359 Class 19, 6% 7/25/35 (b)(i) | 2 | 0 | |

| Series 384 Class 6, 5% 7/25/37 (i) | 17 | 3 | |

| Freddie Mac: | |||

| floater: | |||

Series 2412 Class FK, U.S. 30-Day Avg. Secured Overnight Fin. Rate (SOFR) Index + 0.910% 6.2392% 1/15/32 (b)(c) | 0 | 0 | |

Series 2423 Class FA, U.S. 30-Day Avg. Secured Overnight Fin. Rate (SOFR) Index + 1.010% 6.3392% 3/15/32 (b)(c) | 1 | 1 | |

Series 2424 Class FM, U.S. 30-Day Avg. Secured Overnight Fin. Rate (SOFR) Index + 1.110% 6.4392% 3/15/32 (b)(c) | 0 | 0 | |

Series 2432: | |||

Class FE, U.S. 30-Day Avg. Secured Overnight Fin. Rate (SOFR) Index + 1.010% 6.3392% 6/15/31 (b)(c) | 1 | 1 | |

Class FG, U.S. 30-Day Avg. Secured Overnight Fin. Rate (SOFR) Index + 1.010% 6.3392% 3/15/32 (b)(c) | 0 | 0 | |

Series 2526 Class FC, U.S. 30-Day Avg. Secured Overnight Fin. Rate (SOFR) Index + 0.510% 5.8392% 11/15/32 (b)(c) | 6 | 6 | |

Series 2530 Class FE, U.S. 30-Day Avg. Secured Overnight Fin. Rate (SOFR) Index + 0.710% 6.0392% 2/15/32 (b)(c) | 10 | 10 | |

Series 2682 Class FB, U.S. 30-Day Avg. Secured Overnight Fin. Rate (SOFR) Index + 1.010% 6.3392% 10/15/33 (b)(c) | 545 | 546 | |

Series 2711 Class FC, U.S. 30-Day Avg. Secured Overnight Fin. Rate (SOFR) Index + 1.010% 6.3392% 2/15/33 (b)(c) | 366 | 366 | |

| floater planned amortization class Series 2770 Class FH, U.S. 30-Day Avg. Secured Overnight Fin. Rate (SOFR) Index + 0.510% 5.8392% 3/15/34 (b)(c) | 133 | 131 | |

| planned amortization class: | |||

Series 2021-5122 Class TE, 1.5% 6/25/51 | 4,350 | 3,515 | |

Series 2022-5213 Class JM, 3.5% 9/25/51 | 6,640 | 6,234 | |

Series 2022-5214 Class CG, 3.5% 4/25/52 | 2,175 | 2,007 | |

Series 2022-5220 Class PK, 3.5% 1/25/51 | 2,960 | 2,759 | |

Series 2022-5224 Class DQ, 3.75% 8/25/44 | 3,727 | 3,516 | |

Series 2095 Class PE, 6% 11/15/28 | 5 | 5 | |

Series 2101 Class PD, 6% 11/15/28 | 3 | 3 | |

Series 2121 Class MG, 6% 2/15/29 | 2 | 2 | |

Series 2131 Class BG, 6% 3/15/29 | 15 | 15 | |

Series 2137 Class PG, 6% 3/15/29 | 2 | 3 | |

Series 2154 Class PT, 6% 5/15/29 | 4 | 4 | |

Series 2162 Class PH, 6% 6/15/29 | 1 | 1 | |

Series 2520 Class BE, 6% 11/15/32 | 8 | 9 | |

Series 2682 Class LD, 4.5% 10/15/33 | 121 | 119 | |

Series 2693 Class MD, 5.5% 10/15/33 | 18 | 18 | |

Series 2802 Class OB, 6% 5/15/34 | 15 | 15 | |

Series 2996 Class MK, 5.5% 6/15/35 | 5 | 5 | |

Series 3002 Class NE, 5% 7/15/35 | 19 | 19 | |

Series 3110 Class OP 9/15/35 (k) | 4 | 3 | |

Series 3119 Class PO 2/15/36 (k) | 19 | 16 | |

Series 3121 Class KO 3/15/36 (k) | 3 | 3 | |

Series 3123 Class LO 3/15/36 (k) | 11 | 9 | |

Series 3145 Class GO 4/15/36 (k) | 12 | 9 | |

Series 3189 Class PD, 6% 7/15/36 | 18 | 18 | |

Series 3225 Class EO 10/15/36 (k) | 6 | 5 | |

Series 3258 Class PM, 5.5% 12/15/36 | 6 | 7 | |

Series 3415 Class PC, 5% 12/15/37 | 170 | 167 | |

Series 3806 Class UP, 4.5% 2/15/41 | 40 | 39 | |

Series 3832 Class PE, 5% 3/15/41 | 78 | 77 | |

Series 3857 Class ZP, 5% 5/15/41 | 3,922 | 3,882 | |

Series 4135 Class AB, 1.75% 6/15/42 | 239 | 216 | |

| sequential payer: | |||

Series 1929 Class EZ, 7.5% 2/17/27 | 2 | 2 | |

Series 2004-2802 Class ZG, 5.5% 5/15/34 | 1,636 | 1,653 | |

Series 2020-5018: | |||

Class LC, 3% 10/25/40 | 4,490 | 4,017 | |

Class LT, 3.25% 10/25/40 | 11,323 | 10,233 | |

Class LY, 3% 10/25/40 | 3,412 | 3,052 | |

Series 2021-5137 Class TA, 2% 3/25/39 | 10,863 | 9,500 | |

Series 2021-5175 Class CB, 2.5% 4/25/50 | 6,720 | 5,771 | |

Series 2021-5180 Class KA, 2.5% 10/25/47 | 1,360 | 1,187 | |

Series 2022-5189 Class DA, 2.5% 5/25/49 | 1,451 | 1,236 | |

Series 2022-5190 Class BA, 2.5% 11/25/47 | 1,392 | 1,214 | |

Series 2022-5191 Class CA, 2.5% 4/25/50 | 1,603 | 1,367 | |

Series 2022-5197 Class DA, 2.5% 11/25/47 | 1,057 | 922 | |

Series 2022-5198 Class BA, 2.5% 11/25/47 | 5,147 | 4,563 | |

Series 2022-5200 Class LA, 3% 10/25/48 | 2,485 | 2,244 | |

Series 2022-5202 Class LB, 2.5% 10/25/47 | 1,128 | 986 | |

Series 2135 Class JE, 6% 3/15/29 | 1 | 1 | |

Series 2145 Class MZ, 6.5% 4/15/29 | 15 | 15 | |

Series 2274 Class ZM, 6.5% 1/15/31 | 2 | 2 | |

Series 2281 Class ZB, 6% 3/15/30 | 3 | 3 | |

Series 2303 Class ZV, 6% 4/15/31 | 10 | 10 | |

Series 2357 Class ZB, 6.5% 9/15/31 | 27 | 27 | |

Series 2502 Class ZC, 6% 9/15/32 | 3 | 3 | |

Series 2519 Class ZD, 5.5% 11/15/32 | 5 | 5 | |

Series 2587 Class AD, 4.71% 3/15/33 | 378 | 373 | |

Series 2877 Class ZD, 5% 10/15/34 | 1,597 | 1,571 | |

Series 2998 Class LY, 5.5% 7/15/25 | 2 | 2 | |

Series 3007 Class EW, 5.5% 7/15/25 | 172 | 172 | |

Series 3871 Class KB, 5.5% 6/15/41 | 4,194 | 4,282 | |

Series 3889 Class DZ, 4% 1/15/41 | 11,584 | 10,968 | |

| Series 06-3115 Class SM, 6.480% - U.S. 30-Day Avg. Secured Overnight Fin. Rate (SOFR) Index 1.1608% 2/15/36 (b)(i)(j) | 6 | 0 | |

| Series 2013-4281 Class AI, 4% 12/15/28 (i) | 3 | 0 | |

| Series 2017-4683 Class LM, 3% 5/15/47 | 164 | 154 | |

| Series 2020-5041 Class LB, 3% 11/25/40 | 7,645 | 6,845 | |

| Series 2021-5083 Class VA, 1% 8/15/38 | 14,620 | 13,624 | |

| Series 2021-5176 Class AG, 2% 1/25/47 | 5,055 | 4,312 | |

| Series 2021-5182 Class A, 2.5% 10/25/48 | 8,824 | 7,680 | |

| Series 2022-5236 Class P, 5% 4/25/48 | 2,208 | 2,182 | |

| Series 2022-5266 Class CD, 4.5% 10/25/44 | 1,554 | 1,515 | |

| Series 2933 Class ZM, 5.75% 2/15/35 | 90 | 91 | |

| Series 2935 Class ZK, 5.5% 2/15/35 | 68 | 68 | |

| Series 2947 Class XZ, 6% 3/15/35 | 34 | 35 | |

| Series 2996 Class ZD, 5.5% 6/15/35 | 58 | 59 | |

| Series 3237 Class C, 5.5% 11/15/36 | 79 | 79 | |

| Series 3244 Class SG, 6.540% - U.S. 30-Day Avg. Secured Overnight Fin. Rate (SOFR) Index 1.2208% 11/15/36 (b)(i)(j) | 25 | 2 | |

| Series 3336 Class LI, 6.460% - U.S. 30-Day Avg. Secured Overnight Fin. Rate (SOFR) Index 1.1408% 6/15/37 (b)(i)(j) | 17 | 2 | |

| Series 3843 Class PZ, 5% 4/15/41 | 2,611 | 2,587 | |

| Series 3949 Class MK, 4.5% 10/15/34 | 13 | 13 | |

| Series 4055 Class BI, 3.5% 5/15/31 (i) | 9 | 0 | |

| Series 4314 Class AI, 5% 3/15/34 (i) | 2 | 0 | |

| Series 4427 Class LI, 3.5% 2/15/34 (i) | 56 | 3 | |

| Series 4471 Class PA 4% 12/15/40 | 50 | 49 | |

| target amortization class: | |||

Series 2007-3366 Class FD, U.S. 30-Day Avg. Secured Overnight Fin. Rate (SOFR) Index + 0.360% 5.6892% 5/15/37 (b)(c) | 22 | 21 | |

Series 2156 Class TC, 6.25% 5/15/29 | 1 | 1 | |

| Freddie Mac Manufactured Housing participation certificates guaranteed sequential payer: | |||

| Series 2043 Class ZH, 6% 4/15/28 | 2 | 2 | |

| Series 2056 Class Z, 6% 5/15/28 | 4 | 4 | |

| Freddie Mac Multi-family Structured pass-thru certificates: | |||

| sequential payer: | |||

Series 2021-5159 Class GC, 2% 11/25/47 | 1,088 | 915 | |

Series 4341 Class ML, 3.5% 11/15/31 | 1,973 | 1,888 | |

| Series 4386 Class AZ, 4.5% 11/15/40 | 184 | 177 | |

| Ginnie Mae guaranteed REMIC pass-thru certificates: | |||

| floater: | |||

Series 2007-37 Class TS, 6.570% - CME Term SOFR 1 Month Index 1.2542% 6/16/37 (b)(i)(j) | 11 | 1 | |

Series 2007-59 Class FC, CME Term SOFR 1 Month Index + 0.610% 5.9343% 7/20/37 (b)(c) | 78 | 78 | |

Series 2008-2 Class FD, CME Term SOFR 1 Month Index + 0.590% 5.9143% 1/20/38 (b)(c) | 79 | 78 | |

Series 2008-73 Class FA, CME Term SOFR 1 Month Index + 0.970% 6.2943% 8/20/38 (b)(c) | 544 | 546 | |

Series 2008-83 Class FB, CME Term SOFR 1 Month Index + 1.010% 6.3343% 9/20/38 (b)(c) | 395 | 397 | |

Series 2009-108 Class CF, CME Term SOFR 1 Month Index + 0.710% 6.0358% 11/16/39 (b)(c) | 396 | 392 | |

Series 2009-116 Class KF, CME Term SOFR 1 Month Index + 0.640% 5.9658% 12/16/39 (b)(c) | 63 | 62 | |

Series 2010-H03 Class FA, CME Term SOFR 1 Month Index + 0.660% 6.0011% 3/20/60 (b)(c)(h) | 73 | 73 | |

Series 2010-H17 Class FA, CME Term SOFR 1 Month Index + 0.440% 5.7811% 7/20/60 (b)(c)(h) | 791 | 787 | |

Series 2010-H18 Class AF, CME Term SOFR 1 Month Index + 0.410% 5.7629% 9/20/60 (b)(c)(h) | 723 | 718 | |

Series 2010-H19 Class FG, CME Term SOFR 1 Month Index + 0.410% 5.7629% 8/20/60 (b)(c)(h) | 656 | 652 | |

Series 2010-H27 Class FA, CME Term SOFR 1 Month Index + 0.380% 5.8429% 12/20/60 (b)(c)(h) | 339 | 337 | |

Series 2011-H05 Class FA, CME Term SOFR 1 Month Index + 0.610% 5.9629% 12/20/60 (b)(c)(h) | 269 | 268 | |

Series 2011-H07 Class FA, CME Term SOFR 1 Month Index + 0.610% 5.9629% 2/20/61 (b)(c)(h) | 225 | 224 | |

Series 2011-H12 Class FA, CME Term SOFR 1 Month Index + 0.600% 5.9529% 2/20/61 (b)(c)(h) | 339 | 338 | |

Series 2011-H13 Class FA, CME Term SOFR 1 Month Index + 0.610% 5.9629% 4/20/61 (b)(c)(h) | 259 | 258 | |

Series 2011-H14: | |||

Class FB, CME Term SOFR 1 Month Index + 0.610% 5.9629% 5/20/61 (b)(c)(h) | 328 | 327 | |

Class FC, CME Term SOFR 1 Month Index + 0.610% 5.9629% 5/20/61 (b)(c)(h) | 304 | 303 | |

Series 2011-H17 Class FA, CME Term SOFR 1 Month Index + 0.640% 5.9929% 6/20/61 (b)(c)(h) | 326 | 325 | |

Series 2011-H20 Class FA, CME Term SOFR 1 Month Index + 0.660% 6.0129% 9/20/61 (b)(c)(h) | 1,620 | 1,616 | |

Series 2011-H21 Class FA, CME Term SOFR 1 Month Index + 0.710% 6.0629% 10/20/61 (b)(c)(h) | 1,052 | 1,050 | |

Series 2012-98 Class FA, CME Term SOFR 1 Month Index + 0.510% 5.8343% 8/20/42 (b)(c) | 86 | 84 | |

Series 2012-H01 Class FA, CME Term SOFR 1 Month Index + 0.810% 6.1629% 11/20/61 (b)(c)(h) | 1,128 | 1,127 | |

Series 2012-H03 Class FA, CME Term SOFR 1 Month Index + 0.810% 6.1629% 1/20/62 (b)(c)(h) | 548 | 548 | |

Series 2012-H06 Class FA, CME Term SOFR 1 Month Index + 0.740% 6.0929% 1/20/62 (b)(c)(h) | 1,044 | 1,042 | |

Series 2012-H07 Class FA, CME Term SOFR 1 Month Index + 0.740% 6.0929% 3/20/62 (b)(c)(h) | 504 | 503 | |

Series 2012-H21 Class DF, CME Term SOFR 1 Month Index + 0.760% 6.1129% 5/20/61 (b)(c)(h) | 18 | 18 | |

Series 2013-H19 Class FC, CME Term SOFR 1 Month Index + 0.600% 6.0629% 8/20/63 (b)(c)(h) | 77 | 77 | |

Series 2014-H02 Class FB, CME Term SOFR 1 Month Index + 0.650% 6.1129% 12/20/63 (b)(c)(h) | 3,271 | 3,265 | |

Series 2014-H03 Class FA, CME Term SOFR 1 Month Index + 0.710% 6.0629% 1/20/64 (b)(c)(h) | 1,200 | 1,197 | |

Series 2014-H05 Class FB, CME Term SOFR 1 Month Index + 0.710% 6.0629% 12/20/63 (b)(c)(h) | 50 | 50 | |

Series 2014-H11 Class BA, CME Term SOFR 1 Month Index + 0.610% 5.9629% 6/20/64 (b)(c)(h) | 82 | 81 | |

Series 2015-H13 Class FL, CME Term SOFR 1 Month Index + 0.390% 5.7429% 5/20/63 (b)(c)(h) | 30 | 29 | |

Series 2015-H19 Class FA, CME Term SOFR 1 Month Index + 0.310% 5.6629% 4/20/63 (b)(c)(h) | 40 | 39 | |

Series 2016-H20 Class FM, CME Term SOFR 1 Month Index + 0.510% 5.8629% 12/20/62 (b)(c)(h) | 39 | 39 | |

| planned amortization class: | |||

Series 2010-31 Class BP, 5% 3/20/40 | 3,886 | 3,820 | |

Series 2011-136 Class WI, 4.5% 5/20/40 (i) | 27 | 2 | |

Series 2011-68 Class EC, 3.5% 4/20/41 | 43 | 41 | |

Series 2016-69 Class WA, 3% 2/20/46 | 91 | 82 | |

Series 2017-134 Class BA, 2.5% 11/20/46 | 338 | 302 | |

Series 2017-153 Class GA, 3% 9/20/47 | 241 | 213 | |

Series 2017-182 Class KA, 3% 10/20/47 | 191 | 172 | |

Series 2018-13 Class Q, 3% 4/20/47 | 237 | 216 | |

| sequential payer: | |||

Series 2004-24 Class ZM, 5% 4/20/34 | 29 | 29 | |

Series 2010-160 Class DY, 4% 12/20/40 | 230 | 221 | |

Series 2010-170 Class B, 4% 12/20/40 | 51 | 49 | |

Series 2011-69 Class GX, 4.5% 5/16/40 | 1,894 | 1,874 | |

Series 2014-H04 Class HA, 2.75% 2/20/64 (h) | 286 | 279 | |

Series 2017-139 Class BA, 3% 9/20/47 | 3,362 | 2,975 | |

Series 2018-H12 Class HA, 3.25% 8/20/68 (h) | 801 | 767 | |

| Series 2004-22 Class M1, 5.5% 4/20/34 | 834 | 839 | |

| Series 2004-32 Class GS, 6.380% - CME Term SOFR 1 Month Index 1.0642% 5/16/34 (b)(i)(j) | 6 | 0 | |

| Series 2004-73 Class AL, 7.080% - CME Term SOFR 1 Month Index 1.7642% 8/17/34 (b)(i)(j) | 6 | 0 | |

| Series 2010-116 Class QB, 4% 9/16/40 | 17 | 16 | |

| Series 2010-169 Class Z, 4.5% 12/20/40 | 4,163 | 3,784 | |

| Series 2010-H10 Class FA, CME Term SOFR 1 Month Index + 0.440% 5.7811% 5/20/60 (b)(c)(h) | 52 | 51 | |

| Series 2010-H16 Class BA, 3.55% 7/20/60 (h) | 126 | 123 | |

| Series 2010-H18 Class PL, 5.0108% 9/20/60 (b)(h) | 35 | 34 | |

| Series 2011-94 Class SA, 5.980% - CME Term SOFR 1 Month Index 0.6657% 7/20/41 (b)(i)(j) | 21 | 2 | |

| Series 2013-149 Class MA, 2.5% 5/20/40 | 144 | 138 | |

| Series 2013-H01 Class FA, 1.65% 1/20/63 (h) | 0 | 0 | |

| Series 2013-H04 Class BA, 1.65% 2/20/63 (h) | 0 | 0 | |

| Series 2014-2 Class BA, 3% 1/20/44 | 455 | 411 | |

| Series 2014-21 Class HA, 3% 2/20/44 | 170 | 153 | |

| Series 2014-25 Class HC, 3% 2/20/44 | 289 | 260 | |

| Series 2014-5 Class A, 3% 1/20/44 | 241 | 217 | |

| Series 2015-H13 Class HA, 2.5% 8/20/64 (h) | 1 | 1 | |

| Series 2015-H30 Class HA, 1.75% 9/20/62 (b)(h) | 136 | 131 | |

| Series 2016-H13 Class FB, U.S. TREASURY 1 YEAR INDEX + 0.500% 5.31% 5/20/66 (b)(c)(h) | 2,058 | 2,051 | |

| Series 2017-186 Class HK, 3% 11/16/45 | 248 | 221 | |

| Series 2017-H06 Class FA, U.S. TREASURY 1 YEAR INDEX + 0.350% 5.16% 8/20/66 (b)(c)(h) | 3,157 | 3,144 | |

| Series 2090-118 Class XZ, 5% 12/20/39 | 9,030 | 8,977 | |

| TOTAL COLLATERALIZED MORTGAGE OBLIGATIONS (Cost $343,757) | 339,404 | ||

| Commercial Mortgage Securities - 9.8% | |||

Principal Amount (a) (000s) | Value ($) (000s) | ||

| Fannie Mae Series 2022-66, Class KA, 5% 10/25/52 | 2,780 | 2,738 | |

| Freddie Mac: | |||

| sequential payer: | |||

Series 2015-K043 Class A2, 3.062% 12/25/24 | 10,584 | 10,389 | |

Series 2015-K049 Class A2, 3.01% 7/25/25 | 306 | 298 | |

Series 2015-K050 Class A2, 3.334% 8/25/25 (b) | 12,319 | 12,017 | |

Series 2015-KPLB Class A, 2.77% 5/25/25 | 8,620 | 8,364 | |

Series 2016-K052 Class A2, 3.151% 11/25/25 | 13,881 | 13,472 | |

Series 2016-K055 Class A2, 2.673% 3/25/26 | 3,050 | 2,920 | |

Series 2016-K060 Class A2, 3.3% 10/25/26 | 2,000 | 1,926 | |

Series 2017-K066 Class A2, 3.117% 6/25/27 | 2,370 | 2,257 | |

Series 2017-K729 Class A2, 3.136% 10/25/24 | 6,464 | 6,364 | |

Series 2018-K732 Class A2, 3.7% 5/25/25 | 13,971 | 13,729 | |

Series 2018-K733 Class A2, 3.75% 8/25/25 | 18,375 | 18,012 | |

Series 2019-K088 Class A2, 3.69% 1/25/29 | 10,000 | 9,554 | |

Series 2019-K092 Class A2, 3.298% 4/25/29 | 2,300 | 2,153 | |

Series 2019-K736 Class A2, 2.282% 7/25/26 | 7,700 | 7,286 | |

Series 2020-K117 Class A2, 1.406% 8/25/30 | 6,500 | 5,311 | |

Series 2021-K746 Class A2, 2.031% 9/25/28 | 7,240 | 6,438 | |

Series 2022-K747 Class A2, 2.05% 11/25/28 | 4,300 | 3,815 | |

Series 2022-K750 Class A2, 3% 9/25/29 | 14,800 | 13,621 | |

Series 2023-160 Class A1, 4.68% 10/25/32 | 3,792 | 3,743 | |

Series 2023-K751 Class A2, 4.412% 3/25/30 | 4,830 | 4,740 | |

Series 2023-K754 Class A2, 4.94% 11/25/30 | 3,100 | 3,124 | |

Series K058 Class A2, 2.653% 8/25/26 | 11,075 | 10,522 | |

Series K065 Class A2, 3.243% 4/25/27 | 3,200 | 3,066 | |

Series K071 Class A2, 3.286% 11/25/27 | 12,864 | 12,268 | |

Series K073 Class A2, 3.35% 1/25/28 | 2,470 | 2,350 | |

| Series 2016-K059 Class A2, 3.12% 9/25/26 (b) | 2,200 | 2,112 | |

| Series 2017-K727 Class A2, 2.946% 7/25/24 | 20,072 | 19,874 | |

| Series 2022 K748 Class A2, 2.26% 1/25/29 | 6,287 | 5,613 | |

| Series K053 Class A2, 2.995% 12/25/25 | 9,700 | 9,380 | |

| Series K056 Class A2, 2.525% 5/25/26 | 1,300 | 1,239 | |

| Series K063 Class A2, 3.43% 1/25/27 | 1,700 | 1,640 | |

| Series K076 Class A2, 3.9% 4/25/28 | 3,700 | 3,582 | |

| Series K086 Class A2, 3.859% 11/25/28 | 4,017 | 3,868 | |

| Series K090 Class A2, 3.422% 2/25/29 | 2,300 | 2,170 | |

| Series K734 Class A2, 3.208% 2/25/26 | 7,400 | 7,175 | |

| Freddie Mac Multi-family Structured pass-thru certificates Series K044 Class A2, 2.811% 1/25/25 | 7,835 | 7,667 | |

| FREMF 2015-KPLB Mortgage Trust Series 2015-KPLB Class B, 2.5% 5/25/25 (l) | 15,200 | 14,570 | |

| TOTAL COMMERCIAL MORTGAGE SECURITIES (Cost $259,366) | 259,367 | ||

| Foreign Government and Government Agency Obligations - 0.2% | |||

Principal Amount (a) (000s) | Value ($) (000s) | ||

Israeli State 5.5% 4/26/24 (Cost $4,849) | 4,828 | 4,827 | |

| Money Market Funds - 1.2% | |||

| Shares | Value ($) (000s) | ||

Fidelity Cash Central Fund 5.39% (m) (Cost $31,545) | 31,540,423 | 31,547 | |

| Purchased Swaptions - 0.1% | ||||

Expiration Date | Notional Amount (a) (000s) | Value ($) (000s) | ||

| Put Options - 0.1% | ||||

| Option on an interest rate swap with Citibank N.A. to receive annually a floating rate based on the U.S. Secured Overnight Fin. Rate (SOFR) Index and pay a fixed rate of 3.694%, expiring December 2033. | 12/12/28 | 25,600 | 1,038 | |

| Option on an interest rate swap with Goldman Sachs Bank U.S.A. to pay annually a fixed rate of 3.3525% and receive annually a floating rate based on the U.S. Secured Overnight Fin. Rate (SOFR) Index, expiring February 2035. | 2/03/25 | 13,600 | 693 | |

| TOTAL PUT OPTIONS | 1,731 | |||

| Call Options - 0.0% | ||||

| Option on an interest rate swap with Citibank N.A. to receive annually a fixed rate of 3.694% and pay a floating rate based on the U.S. Secured Overnight Fin. Rate (SOFR) Index, expiring December 2033. | 12/12/28 | 25,600 | 1,033 | |

| Option on an interest rate swap with Goldman Sachs Bank U.S.A. to receive annually a fixed rate of 3.3525% and pay annually a floating rate based on the U.S. Secured Overnight Fin. Rate (SOFR) Index, expiring February 2035. | 2/03/25 | 13,600 | 291 | |

| TOTAL CALL OPTIONS | 1,324 | |||

TOTAL PURCHASED SWAPTIONS (Cost $3,058) | 3,055 | |||

| TOTAL INVESTMENT IN SECURITIES - 116.5% (Cost $3,218,109) | 3,078,948 |

NET OTHER ASSETS (LIABILITIES) - (16.5)% | (436,073) |

| NET ASSETS - 100.0% | 2,642,875 |

| TBA Sale Commitments | ||

Principal Amount (a) (000s) | Value ($) (000s) | |

| Ginnie Mae | ||

| 2% 3/1/54 | (20,800) | (16,927) |

| 2% 3/1/54 | (2,075) | (1,689) |

| 2% 3/1/54 | (1,325) | (1,078) |

| 2% 3/1/54 | (10,600) | (8,626) |

| 2% 3/1/54 | (22,100) | (17,985) |

| 2% 3/1/54 | (44,250) | (36,011) |

| 2% 3/1/54 | (1,650) | (1,343) |

| 6.5% 3/1/54 | (9,050) | (9,174) |

| 6.5% 3/1/54 | (20,900) | (21,186) |

| TOTAL GINNIE MAE | (114,019) | |

| Uniform Mortgage Backed Securities | ||

| 2% 3/1/54 | (1,300) | (1,022) |

| 2% 3/1/54 | (6,800) | (5,345) |

| 2% 3/1/54 | (20,275) | (15,937) |

| 2% 3/1/54 | (14,250) | (11,201) |

| 2.5% 3/1/54 | (1,100) | (904) |

| 2.5% 3/1/54 | (3,175) | (2,608) |

| 3% 3/1/54 | (20,000) | (17,111) |

| 3% 3/1/54 | (6,900) | (5,903) |

| 3% 3/1/54 | (6,300) | (5,390) |

| 3.5% 3/1/54 | (35,500) | (31,580) |

| 4.5% 3/1/54 | (1,300) | (1,230) |

| 5% 3/1/54 | (32,475) | (31,496) |

| 5.5% 3/1/54 | (2,325) | (2,300) |

| 6% 3/1/54 | (450) | (452) |

| 6% 3/1/54 | (50) | (50) |

| 6% 3/1/54 | (500) | (502) |

| 6% 3/1/54 | (1,300) | (1,306) |

| 6.5% 3/1/54 | (5,200) | (5,291) |

| 6.5% 3/1/54 | (12,900) | (13,126) |

| 6.5% 3/1/54 | (9,100) | (9,259) |

| TOTAL UNIFORM MORTGAGE BACKED SECURITIES | (162,013) | |

TOTAL TBA SALE COMMITMENTS (Proceeds $276,547) | (276,032) | |

| Futures Contracts | |||||

Number of contracts | Expiration Date | Notional Amount ($) (000s) | Value ($) (000s) | Unrealized Appreciation/ (Depreciation) ($) (000s) | |

| Purchased | |||||

| Treasury Contracts | |||||

| CBOT 10-Year U.S. Treasury Note Contracts (United States) | 1,209 | Jun 2024 | 133,519 | 480 | 480 |

| CBOT 2-Year U.S. Treasury Note Contracts (United States) | 1,784 | Jun 2024 | 365,274 | 192 | 192 |

| CBOT 5-Year U.S. Treasury Note Contracts (United States) | 181 | Jun 2024 | 19,350 | 22 | 22 |

| CBOT Long Term U.S. Treasury Bond Contracts (United States) | 283 | Jun 2024 | 33,748 | 331 | 331 |

| CBOT Ultra Long Term U.S. Treasury Bond Contracts (United States) | 56 | Jun 2024 | 7,161 | 104 | 104 |

| TOTAL FUTURES CONTRACTS | 1,129 | ||||

| The notional amount of futures purchased as a percentage of Net Assets is 21.2% | |||||

| Interest Rate Swaps | ||||||||||

| Payment Received | Payment Frequency | Payment Paid | Payment Frequency | Clearinghouse / Counterparty(1) | Maturity Date | Notional Amount (000s)(2) | Value ($) (000s) | Upfront Premium Received/ (Paid) ($) (000s)(3) | Unrealized Appreciation/ (Depreciation) ($) (000s) | |

U.S. Secured Overnight Fin. Rate (SOFR) Index(4) | Annual | 4% | Annual | LCH | Mar 2026 | 217,944 | 1,073 | 0 | 1,073 | |

U.S. Secured Overnight Fin. Rate (SOFR) Index(4) | Annual | 4.5% | Annual | LCH | Mar 2027 | 89,497 | 490 | 0 | 490 | |

U.S. Secured Overnight Fin. Rate (SOFR) Index(4) | Annual | 4.25% | Annual | LCH | Mar 2029 | 1,153 | 8 | 0 | 8 | |

U.S. Secured Overnight Fin. Rate (SOFR) Index(4) | Annual | 4.25% | Annual | LCH | Mar 2031 | 83,661 | 564 | 0 | 564 | |

| 4% | Annual | U.S. Secured Overnight Fin. Rate (SOFR) Index(4) | Annual | LCH | Mar 2044 | 520 | (3) | 0 | (3) | |

| 4% | Annual | U.S. Secured Overnight Fin. Rate (SOFR) Index(4) | Annual | LCH | Mar 2054 | 3,111 | (21) | 0 | (21) | |

| TOTAL INTEREST RATE SWAPS | 2,111 | 0 | 2,111 | |||||||

| (a) | Amount is stated in United States dollars unless otherwise noted. |

| (b) | Coupon rates for floating and adjustable rate securities reflect the rates in effect at period end. |

| (c) | Coupon is indexed to a floating interest rate which may be multiplied by a specified factor and/or subject to caps or floors. |

| (d) | Security or a portion of the security was pledged to cover margin requirements for centrally cleared swaps. At period end, the value of securities pledged amounted to $9,720,000. |

| (e) | Security or a portion of the security has been segregated as collateral for mortgage-backed or asset-backed securities purchased on a delayed delivery or when-issued basis. At period end, the value of securities pledged amounted to $716,000. |

| (f) | Security or a portion of the security was pledged to cover margin requirements for futures contracts. At period end, the value of securities pledged amounted to $7,313,000. |

| (g) | Security or a portion of the security purchased on a delayed delivery or when-issued basis. |

| (h) | Represents an investment in an underlying pool of reverse mortgages which typically do not require regular principal and interest payments as repayment is deferred until a maturity event. |

| (i) | Interest Only (IO) security represents the right to receive only monthly interest payments on an underlying pool of mortgages or assets. Principal shown is the outstanding par amount of the pool as of the end of the period. |

| (j) | Coupon is inversely indexed to a floating interest rate multiplied by a specified factor. The price may be considerably more volatile than the price of a comparable fixed rate security. |

| (k) | Principal Only Strips represent the right to receive the monthly principal payments on an underlying pool of mortgage loans. |

| (l) | Security exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be resold in transactions exempt from registration, normally to qualified institutional buyers. At the end of the period, the value of these securities amounted to $14,570,000 or 0.6% of net assets. |

| (m) | Affiliated fund that is generally available only to investment companies and other accounts managed by Fidelity Investments. The rate quoted is the annualized seven-day yield of the fund at period end. A complete unaudited listing of the fund's holdings as of its most recent quarter end is available upon request. In addition, each Fidelity Central Fund's financial statements are available on the SEC's website or upon request. |

| Affiliate (Amounts in thousands) | Value, beginning of period ($) | Purchases ($) | Sales Proceeds ($) | Dividend Income ($) | Realized Gain (loss) ($) | Change in Unrealized appreciation (depreciation) ($) | Value, end of period ($) | % ownership, end of period |

| Fidelity Cash Central Fund 5.39% | 83,962 | 830,140 | 882,555 | 1,201 | - | - | 31,547 | 0.1% |

| Fidelity Securities Lending Cash Central Fund 5.39% | - | 400,498 | 400,498 | 21 | - | - | - | 0.0% |

| Total | 83,962 | 1,230,638 | 1,283,053 | 1,222 | - | - | 31,547 | |

| Valuation Inputs at Reporting Date: | ||||

Description (Amounts in thousands) | Total ($) | Level 1 ($) | Level 2 ($) | Level 3 ($) |

Investments in Securities: | ||||

| U.S. Government and Government Agency Obligations | 1,257,721 | - | 1,257,721 | - |

| U.S. Government Agency - Mortgage Securities | 1,183,027 | - | 1,183,027 | - |

| Collateralized Mortgage Obligations | 339,404 | - | 339,404 | - |

| Commercial Mortgage Securities | 259,367 | - | 259,367 | - |

| Foreign Government and Government Agency Obligations | 4,827 | - | 4,827 | - |

| Money Market Funds | 31,547 | 31,547 | - | - |

| Purchased Swaptions | 3,055 | - | 3,055 | - |

| Total Investments in Securities: | 3,078,948 | 31,547 | 3,047,401 | - |

Derivative Instruments: Assets | ||||

Futures Contracts | 1,129 | 1,129 | - | - |

Swaps | 2,135 | - | 2,135 | - |

| Total Assets | 3,264 | 1,129 | 2,135 | - |

| Liabilities | ||||

Swaps | (24) | - | (24) | - |

| Total Liabilities | (24) | - | (24) | - |

| Total Derivative Instruments: | 3,240 | 1,129 | 2,111 | - |

Other Financial Instruments: | ||||

TBA Sale Commitments | (276,032) | - | (276,032) | - |

| Total Other Financial Instruments: | (276,032) | - | (276,032) | - |

Primary Risk Exposure / Derivative Type | Value | |

| (Amounts in thousands) | Asset ($) | Liability ($) |

| Interest Rate Risk | ||

Futures Contracts (a) | 1,129 | 0 |

Purchased Swaptions (b) | 3,055 | 0 |

Swaps (c) | 2,135 | (24) |

| Total Interest Rate Risk | 6,319 | (24) |

| Total Value of Derivatives | 6,319 | (24) |

| Statement of Assets and Liabilities | ||||

| Amounts in thousands (except per-share amounts) | February 29, 2024 (Unaudited) | |||

| Assets | ||||

| Investment in securities, at value - See accompanying schedule: | ||||

Unaffiliated issuers (cost $3,186,564) | $ | 3,047,401 | ||

Fidelity Central Funds (cost $31,545) | 31,547 | |||

| Total Investment in Securities (cost $3,218,109) | $ | 3,078,948 | ||

| Receivable for investments sold | 6 | |||

| Receivable for TBA sale commitments | 276,547 | |||

| Receivable for fund shares sold | 2,067 | |||

| Interest receivable | 8,911 | |||

| Distributions receivable from Fidelity Central Funds | 181 | |||

| Receivable for daily variation margin on futures contracts | 287 | |||

| Receivable from investment adviser for expense reductions | 35 | |||

Total assets | 3,366,982 | |||

| Liabilities | ||||

| Payable for investments purchased | ||||

Regular delivery | $ | 12,408 | ||

Delayed delivery | 431,190 | |||

| TBA sale commitments, at value | 276,032 | |||

| Payable for fund shares redeemed | 2,847 | |||

| Distributions payable | 330 | |||

| Accrued management fee | 660 | |||

| Distribution and service plan fees payable | 54 | |||

| Payable for daily variation margin on centrally cleared swaps | 250 | |||

| Other affiliated payables | 336 | |||

| Total Liabilities | 724,107 | |||

| Net Assets | $ | 2,642,875 | ||

| Net Assets consist of: | ||||

| Paid in capital | $ | 3,211,461 | ||

| Total accumulated earnings (loss) | (568,586) | |||

| Net Assets | $ | 2,642,875 | ||

| Net Asset Value and Maximum Offering Price | ||||

| Class A : | ||||

Net Asset Value and redemption price per share ($96,351 ÷ 10,605 shares)(a) | $ | 9.09 | ||

| Maximum offering price per share (100/96.00 of $9.09) | $ | 9.47 | ||

| Class M : | ||||

Net Asset Value and redemption price per share ($78,997 ÷ 8,696 shares)(a) | $ | 9.08 | ||

| Maximum offering price per share (100/96.00 of $9.08) | $ | 9.46 | ||

| Class C : | ||||

Net Asset Value and offering price per share ($20,248 ÷ 2,242 shares)(a) | $ | 9.03 | ||

| Government Income : | ||||

Net Asset Value, offering price and redemption price per share ($1,501,011 ÷ 165,447 shares) | $ | 9.07 | ||

| Class I : | ||||

Net Asset Value, offering price and redemption price per share ($200,262 ÷ 22,041 shares) | $ | 9.09 | ||

| Class Z : | ||||

Net Asset Value, offering price and redemption price per share ($746,006 ÷ 82,062 shares) | $ | 9.09 | ||

(a)Redemption price per share is equal to net asset value less any applicable contingent deferred sales charge. | ||||

| Statement of Operations | ||||

| Amounts in thousands | Six months ended February 29, 2024 (Unaudited) | |||

| Investment Income | ||||

| Interest | $ | 57,857 | ||

| Income from Fidelity Central Funds (including $21 from security lending) | 1,222 | |||

| Total Income | 59,079 | |||

| Expenses | ||||

| Management fee | $ | 4,820 | ||

| Transfer agent fees | 1,411 | |||

| Distribution and service plan fees | 337 | |||

| Fund wide operations fee | 882 | |||

| Independent trustees' fees and expenses | 6 | |||

| Total expenses before reductions | 7,456 | |||

| Expense reductions | (286) | |||

| Total expenses after reductions | 7,170 | |||

| Net Investment income (loss) | 51,909 | |||

| Realized and Unrealized Gain (Loss) | ||||

| Net realized gain (loss) on: | ||||

| Investment Securities: | ||||

| Unaffiliated issuers | (143,328) | |||

| Futures contracts | (10,797) | |||

| Swaps | (5,049) | |||

| Total net realized gain (loss) | (159,174) | |||

| Change in net unrealized appreciation (depreciation) on: | ||||

| Investment Securities: | ||||

| Unaffiliated issuers | 162,446 | |||

| Futures contracts | (242) | |||

| Swaps | 2,522 | |||

| TBA Sale commitments | 1,100 | |||

| Total change in net unrealized appreciation (depreciation) | 165,826 | |||

| Net gain (loss) | 6,652 | |||

| Net increase (decrease) in net assets resulting from operations | $ | 58,561 | ||

| Statement of Changes in Net Assets | ||||

| Amount in thousands | Six months ended February 29, 2024 (Unaudited) | Year ended August 31, 2023 | ||

| Increase (Decrease) in Net Assets | ||||

| Operations | ||||

| Net investment income (loss) | $ | 51,909 | $ | 83,700 |

| Net realized gain (loss) | (159,174) | (132,679) | ||

| Change in net unrealized appreciation (depreciation) | 165,826 | (44,414) | ||

| Net increase (decrease) in net assets resulting from operations | 58,561 | (93,393) | ||

| Distributions to shareholders | (48,440) | (79,823) | ||

| Share transactions - net increase (decrease) | (1,030,407) | 240,581 | ||

| Total increase (decrease) in net assets | (1,020,286) | 67,365 | ||

| Net Assets | ||||

| Beginning of period | 3,663,161 | 3,595,796 | ||

| End of period | $ | 2,642,875 | $ | 3,663,161 |

| Fidelity Advisor® Government Income Fund Class A |

Six months ended (Unaudited) February 29, 2024 | Years ended August 31, 2023 | 2022 | 2021 | 2020 | 2019 | |||||||

Selected Per-Share Data | ||||||||||||

| Net asset value, beginning of period | $ | 9.06 | $ | 9.51 | $ | 10.78 | $ | 11.17 | $ | 10.70 | $ | 10.00 |

| Income from Investment Operations | ||||||||||||

Net investment income (loss) A,B | .127 | .189 | .076 | .052 | .117 | .199 | ||||||

| Net realized and unrealized gain (loss) | .021 | (.461) | (1.269) | (.255) | .477 | .696 | ||||||

| Total from investment operations | .148 | (.272) | (1.193) | (.203) | .594 | .895 | ||||||

| Distributions from net investment income | (.118) | (.178) | (.077) | (.046) | (.124) | (.195) | ||||||

| Distributions from net realized gain | - | - | - | (.141) | - | - | ||||||

| Total distributions | (.118) | (.178) | (.077) | (.187) | (.124) | (.195) | ||||||

| Net asset value, end of period | $ | 9.09 | $ | 9.06 | $ | 9.51 | $ | 10.78 | $ | 11.17 | $ | 10.70 |

Total Return C,D,E | 1.65% | (2.87)% | (11.11)% | (1.84)% | 5.59% | 9.06% | ||||||

Ratios to Average Net Assets B,F,G | ||||||||||||

| Expenses before reductions | .79% H | .79% | .77% | .76% | .77% | .78% | ||||||

| Expenses net of fee waivers, if any | .79% H | .79% | .77% | .76% | .77% | .78% | ||||||

| Expenses net of all reductions | .79% H | .79% | .77% | .76% | .77% | .78% | ||||||

| Net investment income (loss) | 2.84% H | 2.05% | .74% | .48% | 1.08% | 1.96% | ||||||

| Supplemental Data | ||||||||||||

| Net assets, end of period (in millions) | $ | 96 | $ | 103 | $ | 119 | $ | 185 | $ | 215 | $ | 139 |

Portfolio turnover rate I | 421% H | 354% | 318% J | 223% | 255% J | 246% |

| Fidelity Advisor® Government Income Fund Class M |

Six months ended (Unaudited) February 29, 2024 | Years ended August 31, 2023 | 2022 | 2021 | 2020 | 2019 | |||||||

Selected Per-Share Data | ||||||||||||

| Net asset value, beginning of period | $ | 9.06 | $ | 9.51 | $ | 10.77 | $ | 11.17 | $ | 10.70 | $ | 10.00 |

| Income from Investment Operations | ||||||||||||

Net investment income (loss) A,B | .128 | .191 | .077 | .052 | .118 | .201 | ||||||

| Net realized and unrealized gain (loss) | .011 | (.460) | (1.259) | (.265) | .477 | .696 | ||||||

| Total from investment operations | .139 | (.269) | (1.182) | (.213) | .595 | .897 | ||||||

| Distributions from net investment income | (.119) | (.181) | (.078) | (.046) | (.125) | (.197) | ||||||

| Distributions from net realized gain | - | - | - | (.141) | - | - | ||||||

| Total distributions | (.119) | (.181) | (.078) | (.187) | (.125) | (.197) | ||||||

| Net asset value, end of period | $ | 9.08 | $ | 9.06 | $ | 9.51 | $ | 10.77 | $ | 11.17 | $ | 10.70 |

Total Return C,D,E | 1.55% | (2.85)% | (11.01)% | (1.92)% | 5.61% | 9.08% | ||||||

Ratios to Average Net Assets B,F,G | ||||||||||||

| Expenses before reductions | .76% H | .76% | .76% | .75% | .76% | .76% | ||||||

| Expenses net of fee waivers, if any | .76% H | .76% | .76% | .75% | .76% | .76% | ||||||

| Expenses net of all reductions | .76% H | .76% | .76% | .75% | .76% | .76% | ||||||

| Net investment income (loss) | 2.87% H | 2.07% | .75% | .48% | 1.09% | 1.98% | ||||||

| Supplemental Data | ||||||||||||

| Net assets, end of period (in millions) | $ | 79 | $ | 83 | $ | 95 | $ | 128 | $ | 151 | $ | 131 |

Portfolio turnover rate I | 421% H | 354% | 318% J | 223% | 255% J | 246% |

| Fidelity Advisor® Government Income Fund Class C |

Six months ended (Unaudited) February 29, 2024 | Years ended August 31, 2023 | 2022 | 2021 | 2020 | 2019 | |||||||

Selected Per-Share Data | ||||||||||||

| Net asset value, beginning of period | $ | 9.01 | $ | 9.45 | $ | 10.73 | $ | 11.16 | $ | 10.70 | $ | 10.00 |

| Income from Investment Operations | ||||||||||||

Net investment income (loss) A,B | .093 | .119 | (.002) | (.032) | .034 | .122 | ||||||

| Net realized and unrealized gain (loss) | .011 | (.451) | (1.261) | (.257) | .472 | .695 | ||||||

| Total from investment operations | .104 | (.332) | (1.263) | (.289) | .506 | .817 | ||||||

| Distributions from net investment income | (.084) | (.108) | (.017) | - C | (.046) | (.117) | ||||||

| Distributions from net realized gain | - | - | - | (.141) | - | - | ||||||

| Total distributions | (.084) | (.108) | (.017) | (.141) | (.046) | (.117) | ||||||

| Net asset value, end of period | $ | 9.03 | $ | 9.01 | $ | 9.45 | $ | 10.73 | $ | 11.16 | $ | 10.70 |

Total Return D,E,F | 1.16% | (3.52)% | (11.78)% | (2.61)% | 4.75% | 8.24% | ||||||

Ratios to Average Net Assets B,G,H | ||||||||||||

| Expenses before reductions | 1.55% I | 1.54% | 1.53% | 1.53% | 1.53% | 1.54% | ||||||

| Expenses net of fee waivers, if any | 1.55% I | 1.54% | 1.53% | 1.53% | 1.53% | 1.54% | ||||||

| Expenses net of all reductions | 1.55% I | 1.54% | 1.53% | 1.53% | 1.53% | 1.54% | ||||||

| Net investment income (loss) | 2.09% I | 1.29% | (.02)% | (.29)% | .31% | 1.20% | ||||||

| Supplemental Data | ||||||||||||

| Net assets, end of period (in millions) | $ | 20 | $ | 26 | $ | 33 | $ | 48 | $ | 80 | $ | 51 |

Portfolio turnover rate J | 421% I | 354% | 318% K | 223% | 255% K | 246% |

| Fidelity® Government Income Fund |

Six months ended (Unaudited) February 29, 2024 | Years ended August 31, 2023 | 2022 | 2021 | 2020 | 2019 | |||||||

Selected Per-Share Data | ||||||||||||

| Net asset value, beginning of period | $ | 9.05 | $ | 9.49 | $ | 10.76 | $ | 11.15 | $ | 10.68 | $ | 9.99 |

| Income from Investment Operations | ||||||||||||

Net investment income (loss) A,B | .142 | .220 | .108 | .085 | .152 | .232 | ||||||

| Net realized and unrealized gain (loss) | .011 | (.451) | (1.269) | (.257) | .476 | .686 | ||||||

| Total from investment operations | .153 | (.231) | (1.161) | (.172) | .628 | .918 | ||||||

| Distributions from net investment income | (.133) | (.209) | (.109) | (.077) | (.158) | (.228) | ||||||

| Distributions from net realized gain | - | - | - | (.141) | - | - | ||||||

| Total distributions | (.133) | (.209) | (.109) | (.218) | (.158) | (.228) | ||||||

| Net asset value, end of period | $ | 9.07 | $ | 9.05 | $ | 9.49 | $ | 10.76 | $ | 11.15 | $ | 10.68 |

Total Return C,D | 1.71% | (2.44)% | (10.84)% | (1.56)% | 5.94% | 9.33% | ||||||

Ratios to Average Net Assets B,E,F | ||||||||||||

| Expenses before reductions | .45% G | .45% | .45% | .45% | .45% | .45% | ||||||

| Expenses net of fee waivers, if any | .45% G | .45% | .45% | .45% | .45% | .45% | ||||||

| Expenses net of all reductions | .45% G | .45% | .45% | .45% | .45% | .45% | ||||||

| Net investment income (loss) | 3.18% G | 2.38% | 1.06% | .79% | 1.39% | 2.29% | ||||||

| Supplemental Data | ||||||||||||

| Net assets, end of period (in millions) | $ | 1,501 | $ | 1,556 | $ | 1,756 | $ | 2,130 | $ | 2,743 | $ | 2,633 |

Portfolio turnover rate H | 421% G | 354% | 318% I | 223% | 255% I | 246% |

| Fidelity Advisor® Government Income Fund Class I |

Six months ended (Unaudited) February 29, 2024 | Years ended August 31, 2023 | 2022 | 2021 | 2020 | 2019 | |||||||

Selected Per-Share Data | ||||||||||||

| Net asset value, beginning of period | $ | 9.06 | $ | 9.51 | $ | 10.78 | $ | 11.17 | $ | 10.70 | $ | 10.00 |

| Income from Investment Operations | ||||||||||||

Net investment income (loss) A,B | .140 | .215 | .105 | .081 | .148 | .228 | ||||||

| Net realized and unrealized gain (loss) | .021 | (.460) | (1.270) | (.257) | .477 | .696 | ||||||

| Total from investment operations | .161 | (.245) | (1.165) | (.176) | .625 | .924 | ||||||

| Distributions from net investment income | (.131) | (.205) | (.105) | (.073) | (.155) | (.224) | ||||||

| Distributions from net realized gain | - | - | - | (.141) | - | - | ||||||

| Total distributions | (.131) | (.205) | (.105) | (.214) | (.155) | (.224) | ||||||

| Net asset value, end of period | $ | 9.09 | $ | 9.06 | $ | 9.51 | $ | 10.78 | $ | 11.17 | $ | 10.70 |

Total Return C,D | 1.79% | (2.59)% | (10.85)% | (1.59)% | 5.89% | 9.38% | ||||||

Ratios to Average Net Assets B,E,F | ||||||||||||

| Expenses before reductions | .50% G | .50% | .49% | .49% | .49% | .49% | ||||||

| Expenses net of fee waivers, if any | .50% G | .50% | .49% | .49% | .49% | .49% | ||||||

| Expenses net of all reductions | .50% G | .50% | .49% | .49% | .49% | .49% | ||||||

| Net investment income (loss) | 3.13% G | 2.34% | 1.02% | .75% | 1.36% | 2.25% | ||||||

| Supplemental Data | ||||||||||||

| Net assets, end of period (in millions) | $ | 200 | $ | 195 | $ | 199 | $ | 280 | $ | 411 | $ | 407 |

Portfolio turnover rate H | 421% G | 354% | 318% I | 223% | 255% I | 246% |

| Fidelity Advisor® Government Income Fund Class Z |

Six months ended (Unaudited) February 29, 2024 | Years ended August 31, 2023 | 2022 | 2021 | 2020 | 2019 A | |||||||

Selected Per-Share Data | ||||||||||||

| Net asset value, beginning of period | $ | 9.07 | $ | 9.51 | $ | 10.78 | $ | 11.18 | $ | 10.70 | $ | 9.91 |

| Income from Investment Operations | ||||||||||||

Net investment income (loss) B,C | .147 | .228 | .116 | .095 | .163 | .198 | ||||||

| Net realized and unrealized gain (loss) | .010 | (.450) | (1.268) | (.267) | .485 | .808 | ||||||

| Total from investment operations | .157 | (.222) | (1.152) | (.172) | .648 | 1.006 | ||||||

| Distributions from net investment income | (.137) | (.218) | (.118) | (.087) | (.168) | (.216) | ||||||

| Distributions from net realized gain | - | - | - | (.141) | - | - | ||||||

| Total distributions | (.137) | (.218) | (.118) | (.228) | (.168) | (.216) | ||||||

| Net asset value, end of period | $ | 9.09 | $ | 9.07 | $ | 9.51 | $ | 10.78 | $ | 11.18 | $ | 10.70 |

Total Return D,E | 1.75% | (2.35)% | (10.74)% | (1.55)% | 6.12% | 10.27% | ||||||

Ratios to Average Net Assets C,F,G | ||||||||||||

| Expenses before reductions | .40% H | .40% | .40% | .40% | .40% | .40% H | ||||||

| Expenses net of fee waivers, if any | .36% H | .36% | .36% | .36% | .36% | .36% H | ||||||

| Expenses net of all reductions | .36% H | .36% | .36% | .36% | .36% | .36% H | ||||||

| Net investment income (loss) | 3.27% H | 2.47% | 1.15% | .88% | 1.48% | 2.27% H | ||||||

| Supplemental Data | ||||||||||||

| Net assets, end of period (in millions) | $ | 746 | $ | 1,699 | $ | 1,394 | $ | 735 | $ | 937 | $ | 139 |

Portfolio turnover rate I | 421% H | 354% | 318% J | 223% | 255% J | 246% |

| Fidelity Central Fund | Investment Manager | Investment Objective | Investment Practices | Expense RatioA |

| Fidelity Money Market Central Funds | Fidelity Management & Research Company LLC (FMR) | Each fund seeks to obtain a high level of current income consistent with the preservation of capital and liquidity. | Short-term Investments | Less than .005% |

| Gross unrealized appreciation | $26,329 |

| Gross unrealized depreciation | (154,294) |

| Net unrealized appreciation (depreciation) | $(127,965) |

| Tax cost | $3,210,668 |

| Short-term | $(165,808) |

| Long-term | (115,225) |

Total capital loss carryforward | $(281,033) |

| Interest Rate Risk | Interest rate risk relates to the fluctuations in the value of interest-bearing securities due to changes in the prevailing levels of market interest rates. |

| Primary Risk Exposure / Derivative Type | Net Realized Gain (Loss)($) | Change in Net Unrealized Appreciation (Depreciation)($) |

| Fidelity Government Income Fund | ||

| Interest Rate Risk | ||

| Futures Contracts | (10,797) | (242) |

| Purchased Options | - | (3) |

| Swaps | (5,049) | 2,522 |

| Total Interest Rate Risk | (15,846) | 2,277 |

| Totals | (15,846) | 2,277 |

| Purchases ($) | Sales ($) | |

| Fidelity Government Income Fund | 3,759,479 | 3,822,738 |

| Distribution Fee | Service Fee | Total Fees | Retained by FDC | |

| Class A | - % | .25% | $122 | $2 |

| Class M | - % | .25% | 100 | -A |

| Class C | .75% | .25% | 115 | 11 |

| $337 | $13 |

| Retained by FDC | |

| Class A | $6 |

| Class M | -B |

Class CA | -B |

| $6 |

| Amount | % of Class-Level Average Net AssetsA | |

| Class A | $93 | .19 |

| Class M | 64 | .16 |

| Class C | 22 | .19 |

| Government Income | 748 | .10 |

| Class I | 139 | .15 |

| Class Z | 345 | .05 |

| $1,411 |

| Fidelity Government Income Fund | .05% |

| Total Security Lending Fees Paid to NFS | Security Lending Income From Securities Loaned to NFS | Value of Securities Loaned to NFS at Period End | |

| Fidelity Government Income Fund | $2 | $- | $- |

| Expense Limitations | Reimbursement | |

| Class Z | .36% | $280 |

Six months ended February 29, 2024 | Year ended August 31, 2023 | |

| Fidelity Government Income Fund | ||

| Distributions to shareholders | ||

| Class A | $1,279 | $2,110 |

| Class M | 1,054 | 1,702 |

| Class C | 214 | 336 |

| Government Income | 22,104 | 37,026 |

| Class I | 2,688 | 4,277 |

| Class Z | 21,101 | 34,372 |

Total | $48,440 | $79,823 |

| Shares | Shares | Dollars | Dollars | |

Six months ended February 29, 2024 | Year ended August 31, 2023 | Six months ended February 29, 2024 | Year ended August 31, 2023 | |

| Fidelity Government Income Fund | ||||

| Class A | ||||

| Shares sold | 897 | 1,513 | $8,099 | $13,966 |

| Reinvestment of distributions | 136 | 220 | 1,227 | 2,022 |

| Shares redeemed | (1,838) | (2,876) | (16,483) | (26,482) |

| Net increase (decrease) | (805) | (1,143) | $(7,157) | $(10,494) |

| Class M | ||||

| Shares sold | 805 | 2,172 | $7,227 | $20,012 |

| Reinvestment of distributions | 107 | 169 | 967 | 1,558 |

| Shares redeemed | (1,385) | (3,211) | (12,428) | (29,618) |

| Net increase (decrease) | (473) | (870) | $(4,234) | $(8,048) |

| Class C | ||||

| Shares sold | 94 | 357 | $855 | $3,270 |

| Reinvestment of distributions | 24 | 36 | 212 | 332 |

| Shares redeemed | (774) | (959) | (6,890) | (8,788) |

| Net increase (decrease) | (656) | (566) | $(5,823) | $(5,186) |

| Government Income | ||||

| Shares sold | 17,147 | 38,534 | $154,719 | $355,883 |

| Reinvestment of distributions | 2,296 | 3,764 | 20,674 | 34,583 |

| Shares redeemed | (26,040) | (55,194) | (233,735) | (507,770) |

| Net increase (decrease) | (6,597) | (12,896) | $(58,342) | $(117,304) |

| Class I | ||||

| Shares sold | 6,203 | 10,672 | $56,304 | $98,225 |

| Reinvestment of distributions | 292 | 455 | 2,631 | 4,187 |

| Shares redeemed | (6,018) | (10,495) | (53,687) | (96,612) |

| Net increase (decrease) | 477 | 632 | $5,248 | $5,800 |

| Class Z | ||||

| Shares sold | 12,977 | 72,658 | $117,182 | $672,939 |

| Reinvestment of distributions | 2,284 | 3,658 | 20,553 | 33,676 |

| Shares redeemed | (120,590) | (35,436) | (1,097,834) | (330,802) |

| Net increase (decrease) | (105,329) | 40,880 | $(960,099) | $375,813 |

| Strategic Advisers Fidelity Core Income Fund | |

| Fidelity Government Income Fund | 11% |

| The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period (September 1, 2023 to February 29, 2024). |

Annualized Expense Ratio- A | Beginning Account Value September 1, 2023 | Ending Account Value February 29, 2024 | Expenses Paid During Period- C September 1, 2023 to February 29, 2024 | |||||||

| Fidelity® Government Income Fund | ||||||||||

| Class A | .79% | |||||||||

| Actual | $ 1,000 | $ 1,016.50 | $ 3.96 | |||||||

Hypothetical-B | $ 1,000 | $ 1,020.93 | $ 3.97 | |||||||

| Class M | .76% | |||||||||

| Actual | $ 1,000 | $ 1,015.50 | $ 3.81 | |||||||

Hypothetical-B | $ 1,000 | $ 1,021.08 | $ 3.82 | |||||||

| Class C | 1.55% | |||||||||

| Actual | $ 1,000 | $ 1,011.60 | $ 7.75 | |||||||

Hypothetical-B | $ 1,000 | $ 1,017.16 | $ 7.77 | |||||||

| Fidelity® Government Income Fund | .45% | |||||||||

| Actual | $ 1,000 | $ 1,017.10 | $ 2.26 | |||||||

Hypothetical-B | $ 1,000 | $ 1,022.63 | $ 2.26 | |||||||

| Class I | .50% | |||||||||

| Actual | $ 1,000 | $ 1,017.90 | $ 2.51 | |||||||

Hypothetical-B | $ 1,000 | $ 1,022.38 | $ 2.51 | |||||||

| Class Z | .36% | |||||||||

| Actual | $ 1,000 | $ 1,017.50 | $ 1.81 | |||||||

Hypothetical-B | $ 1,000 | $ 1,023.07 | $ 1.81 | |||||||

- Highly liquid investments - cash or convertible to cash within three business days or less

- Moderately liquid investments - convertible to cash in three to seven calendar days

- Less liquid investments - can be sold or disposed of, but not settled, within seven calendar days

- Illiquid investments - cannot be sold or disposed of within seven calendar days

| A special meeting of shareholders was held on October 18, 2023. The results of votes taken among shareholders on the proposal before them are reported below. Each vote reported represents one dollar of net asset value held on the record date for the meeting. | ||

| Proposal 1 | ||

| To elect a Board of Trustees. | ||

# of Votes | % of Votes | |

| Abigail P. Johnson | ||

| Affirmative | 29,408,520,731.18 | 96.84 |

| Withheld | 958,659,352.64 | 3.16 |

| TOTAL | 30,367,180,083.82 | 100.00 |

| Jennifer Toolin McAuliffe | ||

| Affirmative | 29,484,249,185.02 | 97.09 |

| Withheld | 882,930,898.80 | 2.91 |

| TOTAL | 30,367,180,083.82 | 100.00 |

| Christine J. Thompson | ||

| Affirmative | 29,483,889,948.58 | 97.09 |

| Withheld | 883,290,135.24 | 2.91 |

| TOTAL | 30,367,180,083.82 | 100.00 |

| Elizabeth S. Acton | ||

| Affirmative | 29,471,265,000.64 | 97.05 |

| Withheld | 895,915,083.18 | 2.95 |

| TOTAL | 30,367,180,083.82 | 100.00 |

| Laura M. Bishop | ||

| Affirmative | 29,508,015,754.27 | 97.17 |

| Withheld | 859,164,329.55 | 2.83 |

| TOTAL | 30,367,180,083.82 | 100.00 |

| Ann E. Dunwoody | ||

| Affirmative | 29,470,432,034.14 | 97.05 |

| Withheld | 896,748,049.68 | 2.95 |

| TOTAL | 30,367,180,083.82 | 100.00 |

| John Engler | ||

| Affirmative | 29,326,181,411.39 | 96.57 |

| Withheld | 1,040,998,672.43 | 3.43 |

| TOTAL | 30,367,180,083.82 | 100.00 |

| Robert F. Gartland | ||

| Affirmative | 29,422,803,481.93 | 96.89 |

| Withheld | 944,376,601.89 | 3.11 |

| TOTAL | 30,367,180,083.82 | 100.00 |

| Robert W. Helm | ||

| Affirmative | 29,445,540,968.38 | 96.97 |

| Withheld | 921,639,115.44 | 3.03 |

| TOTAL | 30,367,180,083.82 | 100.00 |

| Arthur E. Johnson | ||

| Affirmative | 29,395,582,286.37 | 96.80 |

| Withheld | 971,597,797.45 | 3.20 |

| TOTAL | 30,367,180,083.82 | 100.00 |

| Michael E. Kenneally | ||

| Affirmative | 29,420,582,069.08 | 96.88 |

| Withheld | 946,598,014.74 | 3.12 |

| TOTAL | 30,367,180,083.82 | 100.00 |

| Mark A. Murray | ||

| Affirmative | 29,446,384,581.44 | 96.97 |

| Withheld | 920,795,502.38 | 3.03 |

| TOTAL | 30,367,180,083.82 | 100.00 |

| Carol J. Zierhoffer | ||

| Affirmative | 29,510,392,522.55 | 97.18 |

| Withheld | 856,787,561.27 | 2.82 |

| TOTAL | 30,367,180,083.82 | 100.00 |

| Proposal 1 reflects trust wide proposal and voting results. | ||

|

Contents

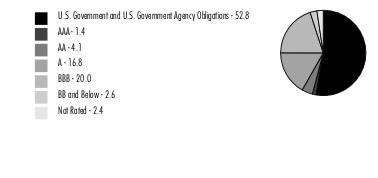

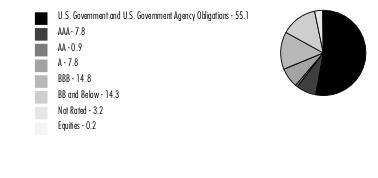

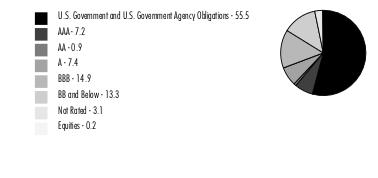

Quality Diversification (% of Fund's net assets) |

|

Short-Term Investments and Net Other Assets (Liabilities) - (0.1)% |

| We have used ratings from Moody's Investors Service, Inc. Where Moody's® ratings are not available, we have used S&P® ratings. All ratings are as of the date indicated and do not reflect subsequent changes. |

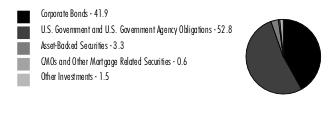

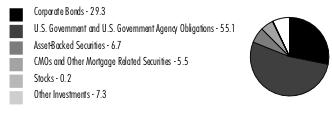

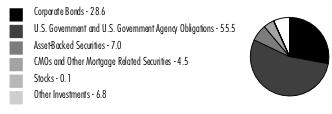

Asset Allocation (% of Fund's net assets) |

|

Short-Term Investments and Net Other Assets (Liabilities) - (0.1)% |

Futures - 6.5% |

Forward foreign currency contracts - (8.9)% |

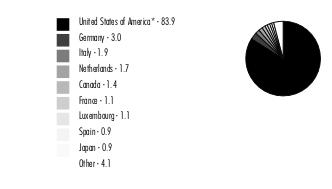

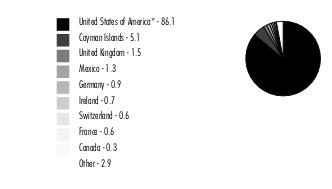

Geographic Diversification (% of Fund's net assets) |

|