Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF

REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-04096

MFS MUNICIPAL SERIES TRUST*

(Exact name of registrant as specified in charter)

500 Boylston Street, Boston, Massachusetts 02116

(Address of principal executive offices) (Zip code)

Susan S. Newton

Massachusetts Financial Services Company

500 Boylston Street

Boston, Massachusetts 02116

(Name and address of agents for service)

Registrant’s telephone number, including area code: (617) 954-5000

Date of fiscal year end: March 31

Date of reporting period: March 31, 2012

| * | MFS Florida Municipal Bond Fund was reorganized into the MFS Municipal Income Fund, as of November 4, 2011. MFS Florida Municipal Bond Fund was terminated as a series of the Registrant effective November 17, 2011. |

Table of Contents

| ITEM 1. | REPORTS TO STOCKHOLDERS. |

Table of Contents

MFS® Municipal Income Fund

ANNUAL REPORT

March 31, 2012

LMB-ANN

Table of Contents

SIPC Contact Information: You may obtain information about the Securities Investor Protection Corporation (“SIPC”), including the SIPC Brochure, by contacting SIPC either by telephone (1-202-371-8300) or by accessing SIPC’s web site address (www.sipc.org).

The report is prepared for the general information of shareholders.

It is authorized for distribution to prospective investors only when preceded or accompanied by a current prospectus.

NOT FDIC INSURED Ÿ MAY LOSE VALUE Ÿ NO BANK GUARANTEE

Table of Contents

LETTER FROM THE CHAIRMAN AND CEO

Dear Shareholders:

We are indeed living through some volatile times. Economic uncertainty is everywhere, as it seems no place in the world has been unmoved by crisis. Over the past year, protests have changed the face of the Middle East and left in their wake lingering tensions and questions about oil supplies. We have seen debt limits tested in Europe and the United States and policymakers grappling to craft often unpopular monetary and fiscal responses as consumers and businesses struggle with what appears to be a slowing global economy. And now, as the US economy begins to regain its footing, we see the economies of the eurozone heading toward recession, and that region’s leaders striving to address sovereign debt crises. At the same time, many emerging countries are enjoying a period of strong growth, propelled by the emergence of a middle class.

When markets become volatile, managing risk becomes a top priority for investors and their advisors. At MFS® risk management is foremost in our minds in all market climates. Our global research platform is designed to ensure the smooth functioning of our investment process in all business climates. That platform enables our analysts to uncover attractive global opportunities across asset classes. Additionally, we have a team of quantitative analysts that measures and assesses the risk profiles of our portfolios and securities on an ongoing basis. The chief investment risk officer, who oversees the team, reports directly to the firm’s president and chief investment officer so the risk associated with each portfolio can be assessed objectively and independently of the portfolio management team.

As always, we continue to be mindful of the many economic challenges faced at the local, national, and international levels. It is in times such as these that we want to remind investors of the merits of maintaining a long-term view, adhering to basic investing principles such as asset allocation and diversification, and working closely with their advisors to research and identify appropriate investment opportunities.

Respectfully,

Robert J. Manning

Chairman and Chief Executive Officer

MFS Investment Management®

May 16, 2012

The opinions expressed in this letter are subject to change, may not be relied upon for investment advice, and no forecasts can be guaranteed.

1

Table of Contents

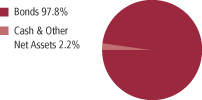

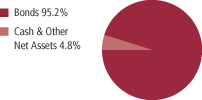

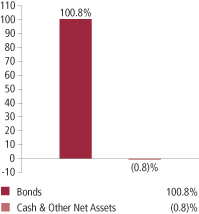

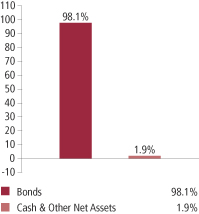

Portfolio structure (i)

| Top five industries (i) | ||||

| Healthcare Revenue – Hospitals | 16.1% | |||

| Universities – Colleges | 9.8% | |||

| General Obligations – General Purpose | 7.7% | |||

| Water & Sewer Utility Revenue | 7.0% | |||

| Utilities – Municipal Owned | 6.7% | |||

| Composition including fixed income credit quality (a)(i) | ||||

| AAA | 9.2% | |||

| AA | 27.4% | |||

| A | 25.6% | |||

| BBB | 29.1% | |||

| BB | 2.2% | |||

| B | 2.2% | |||

| CCC | 0.1% | |||

| CC (o) | 0.0% | |||

| C | 0.1% | |||

| Not Rated | 1.9% | |||

| Cash & Other | 2.2% | |||

| Portfolio facts (i) | ||||

| Average Duration (d) | 9.1 | |||

| Average Effective Maturity (m) | 18.0 yrs. |

| (a) | For all securities other than those specifically described below, ratings are assigned to underlying securities utilizing ratings from Moody’s, Fitch, and Standard & Poor’s rating agencies and applying the following hierarchy: If all three agencies provide a rating, the middle rating (after dropping the highest and lowest ratings) is assigned; if two of the three agencies rate a security, the lower of the two is assigned. Ratings are shown in the S&P and Fitch scale (e.g., AAA). All ratings are subject to change. Not Rated includes fixed income securities, including fixed income futures, which have not been rated by any rating agency. Cash & Other includes cash, other assets less liabilities, offsets to derivative positions, and short-term securities. The fund may not hold all of these instruments. The fund is not rated by these agencies. |

| (d) | Duration is a measure of how much a bond’s price is likely to fluctuate with general changes in interest rates, e.g., if rates rise 1.00%, a bond with a 5-year duration is likely to lose about 5.00% of its value due to the interest rate move. |

2

Table of Contents

Portfolio Composition – continued

| (i) | For purposes of this presentation, the components include the market value of securities, and reflect the impact of the equivalent exposure of derivative positions, if any. These amounts may be negative from time to time. The bond component will include any accrued interest amounts. Equivalent exposure is a calculated amount that translates the derivative position into a reasonable approximation of the amount of the underlying asset that the portfolio would have to hold at a given point in time to have the same price sensitivity that results from the portfolio’s ownership of the derivative contract. When dealing with derivatives, equivalent exposure is a more representative measure of the potential impact of a position on portfolio performance than market value. Where the fund holds convertible bonds, these are treated as part of the equity portion of the portfolio. |

| (m) | In determining an instrument’s effective maturity for purposes of calculating the fund’s dollar-weighted average effective maturity, MFS uses the instrument’s stated maturity or, if applicable, an earlier date on which MFS believes it is probable that a maturity-shortening device (such as a put, pre-refunding or prepayment) will cause the instrument to be repaid. Such an earlier date can be substantially shorter than the instrument’s stated maturity. |

| (o) | Less than 0.1%. |

Percentages are based on net assets as of 3/31/12.

The portfolio is actively managed and current holdings may be different.

3

Table of Contents

Summary of Results

For the twelve months ended March 31, 2012, Class A shares of the MFS Municipal Income Fund (the “fund”) provided a total return of 14.83%, at net asset value. This compares with a return of 12.07% for the fund’s benchmark, the Barclays Capital Municipal Bond Index.

Market Environment

Prior to the beginning of the reporting period, looser U.S. monetary and fiscal policy fostered a sharp rebound in market risk sentiment. By the beginning of the period, global macroeconomic conditions had begun to weaken and renewed concerns surrounding eurozone sovereign debt arose, causing the recovery in asset valuations to plateau. During the middle of the reporting period, worries about U.S. sovereign debt default and the long-term sustainability of the trend in U.S. fiscal policy resulted in one agency downgrading U.S. credit quality. Amidst this turmoil, global equity markets declined sharply and credit spreads widened. At the same time, global consumer and producer sentiment indicators fell precipitously and highly-rated sovereign bond yields hit multi-decade lows. Late in the period, however, additional liquidity from the U.S. Federal Reserve (in the form of “Operation Twist”) and the European Central Bank (in the form of 3-year, Longer Term Refinancing Operations, or LTROs), coupled with improved global macroeconomic conditions, ushered in improved market dynamics.

Over the past twelve months ended March 31, 2012, the municipal bond market followed the lead of the U.S. Treasury market, with prices rising and rates declining across the yield curve year-over-year. More specific to municipal bonds, the market benefited from a change in investor demand. Municipal bond mutual fund flows, which had been generally negative from late 2010 through August 2011, turned positive. This increase in fund flows more than offset an increase in supply helping to push municipal bond yields lower. Further driving prices higher was waning concerns over state and local finances. The combination of continued revenue growth (through the end of calendar 2011) and restrained spending growth, as well as reductions in state and local employment, appeared to have led investors to become more comfortable with lower-quality credit, the result of which was a tightening of spreads between high-quality “AAA” rated municipal bonds and lower-quality “A” or “BBB” rated municipals. Over the year, “BBB” rated bonds returned more than twice as much as “AAA” rated bonds, according to Barclays Capital Municipal Bond Index data.

Factors Affecting Performance

A key factor that supported positive performance relative to the Barclays Capital Municipal Bond Index was the fund’s longer duration (d) stance. The

4

Table of Contents

Management Review – continued

fund’s greater exposure to bonds rated (r) “BBB” and “B”, and its lesser exposure to bonds with credit quality above “BBB”, aided relative performance. Security selection in the education and credit enhanced sectors was another positive factor for relative returns. Additionally, the fund’s greater exposure to the health care sector benefited results as this sector performed well compared with the performance of the benchmark.

On the negative side, security selection within bonds rated “AAA” and “BBB” held back relative performance. Security selection within the airlines sector also dampened relative results. Additionally, the fund’s lesser exposure to the transportation sector weakened relative performance as the sector outperformed the benchmark.

Respectfully,

Geoffrey Schechter

Portfolio Manager

| (d) | Duration is a measure of how much a bond’s price is likely to fluctuate with general changes in interest rates, e.g., if rates rise 1.00%, a bond with a 5-year duration is likely to lose about 5.00% of its value. |

| (r) | Bonds rated “BBB”, “Baa”, or higher are considered investment grade; bonds rated “BB”, “Ba”, or below are considered non-investment grade. The primary source for bond quality ratings is Moody’s Investors Service. If not available, ratings by Standard & Poor’s are used, else ratings by Fitch, Inc. For securities which are not rated by any of the three agencies, the security is considered Not Rated. |

The views expressed in this report are those of the portfolio manager only through the end of the period of the report as stated on the cover and do not necessarily reflect the views of MFS or any other person in the MFS organization. These views are subject to change at any time based on market or other conditions, and MFS disclaims any responsibility to update such views. These views may not be relied upon as investment advice or an indication of trading intent on behalf of any MFS portfolio. References to specific securities are not recommendations of such securities, and may not be representative of any MFS portfolio’s current or future investments.

5

Table of Contents

PERFORMANCE SUMMARY THROUGH 3/31/12

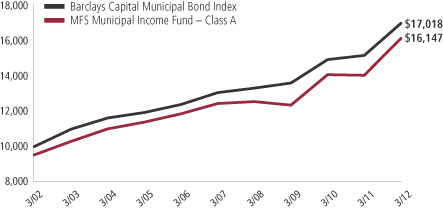

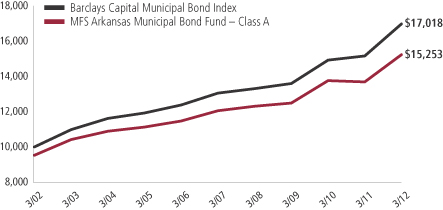

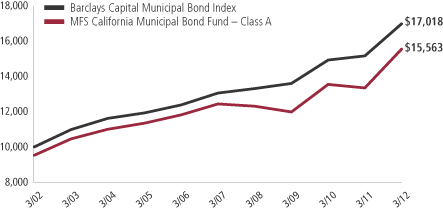

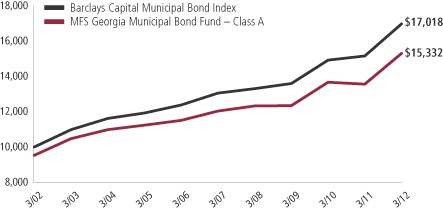

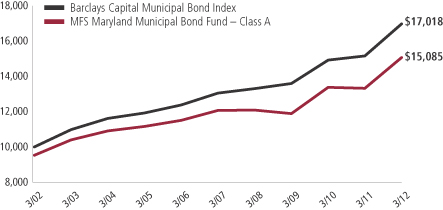

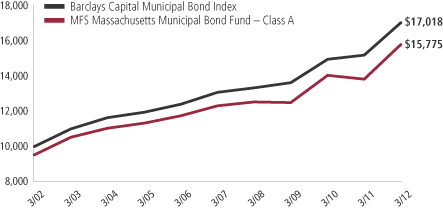

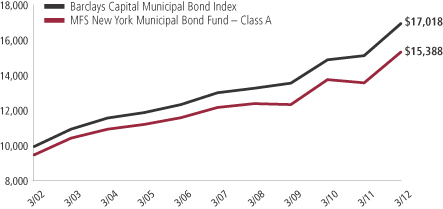

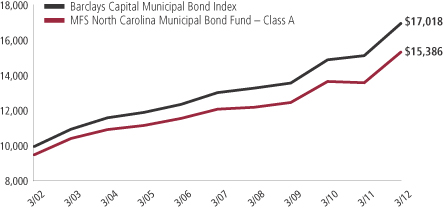

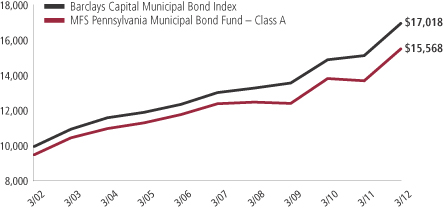

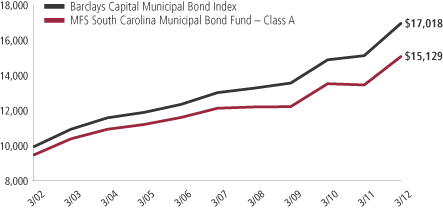

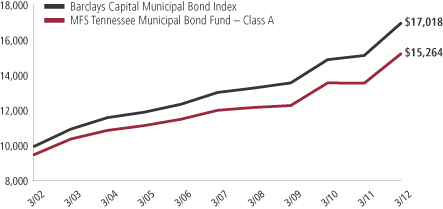

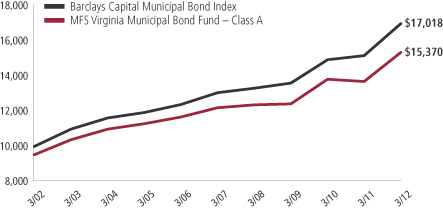

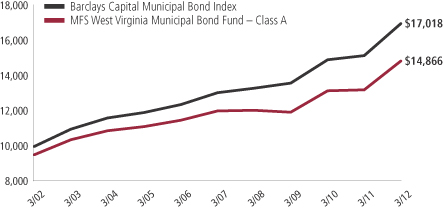

The following chart illustrates a representative class of the fund’s historical performance in comparison to its benchmark(s). Performance results include the deduction of the maximum applicable sales charge and reflect the percentage change in net asset value, including reinvestment of dividends and capital gains distributions. The performance of other share classes will be greater than or less than that of the class depicted below. Benchmarks are unmanaged and may not be invested in directly. Benchmark returns do not reflect sales charges, commissions or expenses. (See Notes to Performance Summary.)

Performance data shown represents past performance and is no guarantee of future results. Investment return and principal value fluctuate so your shares, when sold, may be worth more or less than the original cost; current performance may be lower or higher than quoted. The performance shown does not reflect the deduction of taxes, if any, that a shareholder would pay on fund distributions or the redemption of fund shares.

Growth of a Hypothetical $10,000 Investment

6

Table of Contents

Performance Summary – continued

Total Returns through 3/31/12

Average annual without sales charge

| Share class | Class inception date | 1-yr | 5-yr | 10-yr | Life (t) | |||||||||

| A | 9/07/93 | 14.83% | 5.33% | 5.42% | N/A | |||||||||

| B | 12/29/86 | 14.09% | 4.54% | 4.64% | N/A | |||||||||

| C | 1/03/94 | 13.92% | 4.51% | 4.64% | N/A | |||||||||

| I | 8/01/11 | N/A | N/A | N/A | 8.75% | |||||||||

| A1 | 6/25/07 | 15.11% | N/A | N/A | 6.06% | |||||||||

| B1 | 6/25/07 | 14.24% | N/A | N/A | 5.23% | |||||||||

| Comparative benchmark | ||||||||||||||

| Barclays Capital Municipal Bond Index (f) | 12.07% | 5.42% | 5.46% | N/A | ||||||||||

| Average annual with sales charge | ||||||||||||||

| A With Initial Sales Charge (4.75%) | 9.38% | 4.31% | 4.91% | N/A | ||||||||||

| B With CDSC (Declining over six years from 4% to 0%) (x) | 10.09% | 4.20% | 4.64% | N/A | ||||||||||

| C With CDSC (1% for 12 months) (x) | 12.92% | 4.51% | 4.64% | N/A | ||||||||||

| A1 With Initial Sales Charge (4.75%) | 9.64% | N/A | N/A | 4.99% | ||||||||||

| B1 With CDSC (Declining over six years from 4% to 0%) (x) | 10.24% | N/A | N/A | 4.89% | ||||||||||

Class I shares do not have a sales charge.

CDSC – Contingent Deferred Sales Charge.

| (f) | Source: FactSet Research Systems Inc. |

| (t) | For the period from the class inception date through the stated period end (for those share classes with less than 10 years of performance history). No comparative benchmark performance information is provided for “life” periods. (See Notes to Performance Summary.) |

| (x) | Assuming redemption at the end of the applicable period. |

Benchmark Definition

Barclays Capital Municipal Bond Index – a market capitalization-weighted index that measures the performance of the tax-exempt bond market.

It is not possible to invest directly in an index.

Notes to Performance Summary

Average annual total return represents the average annual change in value for each share class for the periods presented. Life returns are presented where the share class has less than 10 years of performance history and represent the

7

Table of Contents

Performance Summary – continued

average annual total return from the class inception date to the stated period end date. As the fund’s share classes may have different inception dates, the life returns may represent different time periods and may not be comparable. As a result, no comparative benchmark performance information is provided for life periods.

Performance results reflect any applicable expense subsidies and waivers in effect during the periods shown. Without such subsidies and waivers the fund’s performance results would be less favorable. Please see the prospectus and financial statements for complete details.

Performance results do not include adjustments made for financial reporting purposes in accordance with U.S. generally accepted accounting principles and may differ from amounts reported in the financial highlights.

A portion of income may be subject to state, federal, and/or alternative minimum tax. Capital gains, if any, are subject to a capital gains tax.

From time to time the fund may receive proceeds from litigation settlements, without which performance would be lower.

8

Table of Contents

Fund expenses borne by the shareholders during the period,

October 1, 2011 through March 31, 2012

As a shareholder of the fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on certain purchase or redemption payments, and (2) ongoing costs, including management fees; distribution and service (12b-1) fees; and other fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period October 1, 2011 through March 31, 2012.

Actual Expenses

The first line for each share class in the following table provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line for each share class in the following table provides information about hypothetical account values and hypothetical expenses based on the fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads). Therefore, the second line for each share class in the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

9

Table of Contents

Expense Table – continued

| Share Class | Annualized Ratio | Beginning Account Value 10/01/11 | Ending Account Value | Expenses Paid During 10/01/11-3/31/12 | ||||||||||||||

| A | Actual | 0.77% | $1,000.00 | $1,055.83 | $3.96 | |||||||||||||

| Hypothetical (h) | 0.77% | $1,000.00 | $1,021.15 | $3.89 | ||||||||||||||

| B | Actual | 1.52% | $1,000.00 | $1,053.01 | $7.80 | |||||||||||||

| Hypothetical (h) | 1.52% | $1,000.00 | $1,017.40 | $7.67 | ||||||||||||||

| C | Actual | 1.52% | $1,000.00 | $1,052.94 | $7.80 | |||||||||||||

| Hypothetical (h) | 1.52% | $1,000.00 | $1,017.40 | $7.67 | ||||||||||||||

| I | Actual | 0.52% | $1,000.00 | $1,056.99 | $2.67 | |||||||||||||

| Hypothetical (h) | 0.52% | $1,000.00 | $1,022.40 | $2.63 | ||||||||||||||

| A1 | Actual | 0.52% | $1,000.00 | $1,058.38 | $2.68 | |||||||||||||

| Hypothetical (h) | 0.52% | $1,000.00 | $1,022.40 | $2.63 | ||||||||||||||

| B1 | Actual | 1.28% | $1,000.00 | $1,053.14 | $6.57 | |||||||||||||

| Hypothetical (h) | 1.28% | $1,000.00 | $1,018.60 | $6.46 | ||||||||||||||

| (h) | 5% class return per year before expenses. |

| (p) | Expenses paid are equal to each class’ annualized expense ratio, as shown above, multiplied by the average account value over the period, multiplied by the number of days in the period, divided by the number of days in the year. Expenses paid do not include any applicable sales charges (loads). If these transaction costs had been included, your costs would have been higher. |

Expenses Impacting Table

Expense ratios include 0.03% of investment related expenses from inverse floaters that are outside of the expense cap arrangement (See Note 3 of the Notes to Financial Statements).

10

Table of Contents

3/31/12

The Portfolio of Investments is a complete list of all securities owned by your fund. It is categorized by broad-based asset classes.

| Municipal Bonds - 97.3% | ||||||||

| Issuer | Shares/Par | Value ($) | ||||||

| Airport Revenue - 2.2% | ||||||||

| Chicago, IL, O’Hare International Airport Rev., Third Lien, “A”, 5.625%, 2035 | $ | 7,125,000 | $ | 8,055,702 | ||||

| Cleveland, OH, Airport System Rev., “A”, AGM, 5%, 2030 | 1,640,000 | 1,737,170 | ||||||

| Cleveland, OH, Airport System Rev., “A”, AGM, 5%, 2031 | 1,095,000 | 1,158,981 | ||||||

| Houston, TX, Airport System Rev., “B”, 5%, 2026 | 1,855,000 | 2,080,772 | ||||||

| Houston, TX, Airport System Rev., Subordinate Lien, “A”, 5%, 2031 | 2,345,000 | 2,467,761 | ||||||

| Los Angeles, CA, Department of Airports Rev. (Los Angeles International), “A”, 5%, 2029 | 2,990,000 | 3,340,129 | ||||||

| Miami-Dade County, FL, Aviation Rev., “B”, AGM, 5%, 2035 | 5,885,000 | 6,218,326 | ||||||

| Niagara, NY, Frontier Transportation Authority Rev. (Buffalo-Niagara International Airport), NATL, 5.875%, 2013 | 1,485,000 | 1,486,827 | ||||||

| Port Authority NY & NJ, Special Obligation Rev. (JFK International Air Terminal LLC), 6%, 2036 | 2,315,000 | 2,591,527 | ||||||

| San Francisco, CA, City & County Airports Commission, International Airport Rev., “A”, 5%, 2028 | 6,000,000 | 6,416,280 | ||||||

| San Jose, CA, Airport Rev., “A-2”, 5.25%, 2034 | 7,570,000 | 8,074,162 | ||||||

|

| |||||||

| $ | 43,627,637 | |||||||

| General Obligations - General Purpose - 7.6% | ||||||||

| Chicago, IL, Greater Chicago Metropolitan Water Reclamation District, “C”, 5%, 2029 | $ | 9,145,000 | $ | 10,437,646 | ||||

| Commonwealth of Massachusetts, “A”, AMBAC, 5.5%, 2030 | 5,000,000 | 6,481,900 | ||||||

| Commonwealth of Puerto Rico, “A”, ETM, FGIC, 5.5%, 2015 (c) | 5,000 | 5,778 | ||||||

| Commonwealth of Puerto Rico, “A”, ETM, FGIC, 5.5%, 2015 (c)(u) | 5,580,000 | 6,448,583 | ||||||

| Commonwealth of Puerto Rico, Public Improvement, “A”, 5.5%, 2039 | 22,640,000 | 22,974,393 | ||||||

| Commonwealth of Puerto Rico, Public Improvement, “B”, 6.5%, 2037 | 2,180,000 | 2,426,798 | ||||||

| Country Club Hills, IL, NATL, 5%, 2031 | 3,170,000 | 3,084,695 | ||||||

| Detroit, MI, 5.25%, 2035 | 5,000,000 | 5,217,150 | ||||||

| Las Vegas Valley, NV, Water District, “C”, 5%, 2029 | 8,145,000 | 9,034,271 | ||||||

| Luzerne County, PA, AGM, 6.75%, 2023 | 1,200,000 | 1,391,676 | ||||||

| New York, NY, “B”, 5%, 2020 | 10,730,000 | 13,021,928 | ||||||

| Palm Beach County, FL, Public Improvement Rev. “2”, 5.375%, 2028 | 1,000,000 | 1,140,100 | ||||||

| State of California, 5.25%, 2028 | 2,965,000 | 3,314,929 | ||||||

| State of California, 5.125%, 2033 | 2,155,000 | 2,264,280 | ||||||

| State of California, 6.5%, 2033 | 4,000,000 | 4,840,600 | ||||||

11

Table of Contents

Portfolio of Investments – continued

| Issuer | Shares/Par | Value ($) | ||||||

| Municipal Bonds - continued | ||||||||

| General Obligations - General Purpose - continued | ||||||||

| State of California, 6%, 2039 | $ | 3,000,000 | $ | 3,443,550 | ||||

| State of California, 5%, 2041 | 2,165,000 | 2,280,351 | ||||||

| State of Hawaii, “DZ”, 5%, 2031 | 2,230,000 | 2,537,294 | ||||||

| State of Maryland, “C”, 5%, 2019 | 6,890,000 | 8,543,738 | ||||||

| State of Tennessee, “A”, 5%, 2029 | 1,000,000 | 1,178,610 | ||||||

| State of Washington, 6%, 2012 | 4,360,000 | 4,400,374 | ||||||

| State of Washington, “A”, NATL, 5%, 2033 | 5,000,000 | 5,478,650 | ||||||

| Washington Motor Vehicle Fuel Tax, “B”, NATL, 5%, 2032 (u) | 25,010,000 | 28,194,023 | ||||||

|

| |||||||

| $ | 148,141,317 | |||||||

| General Obligations - Improvement - 0.8% | ||||||||

| Guam Government, “A”, 7%, 2039 | $ | 910,000 | $ | 987,432 | ||||

| Massachusetts Bay Transportation Authority, “A”, ETM, 7%, 2021 (c) | 4,700,000 | 5,544,308 | ||||||

| Massachusetts Bay Transportation Authority, “A”, 7%, 2021 | 3,800,000 | 4,892,918 | ||||||

| Massachusetts Bay Transportation Authority, “C”, ETM, 6.1%, 2013 (c) | 3,640,000 | 3,834,449 | ||||||

|

| |||||||

| $ | 15,259,107 | |||||||

| General Obligations - Schools - 4.4% | ||||||||

| Beverly Hills, CA, Unified School District (Election of 2008), Capital Appreciation, 0%, 2031 | $ | 2,010,000 | $ | 812,864 | ||||

| Beverly Hills, CA, Unified School District (Election of 2008), Capital Appreciation, 0%, 2032 | 2,035,000 | 776,027 | ||||||

| Beverly Hills, CA, Unified School District (Election of 2008), Capital Appreciation, 0%, 2033 | 4,070,000 | 1,461,741 | ||||||

| Chicago, IL, Board of Education, NATL, 6.25%, 2015 | 15,670,000 | 16,474,028 | ||||||

| Chicago, IL, Board of Education, “A”, 5%, 2041 | 2,700,000 | 2,839,212 | ||||||

| Escondido, CA, Union High School District (Election of 2008), Capital Appreciation, “A”, ASSD GTY, 0%, 2030 | 4,495,000 | 1,795,842 | ||||||

| Escondido, CA, Union High School District (Election of 2008), Capital Appreciation, “A”, ASSD GTY, 0%, 2031 | 4,015,000 | 1,502,895 | ||||||

| Escondido, CA, Union High School District (Election of 2008), Capital Appreciation, “A”, ASSD GTY, 0%, 2032 | 2,825,000 | 991,180 | ||||||

| Escondido, CA, Union High School District (Election of 2008), Capital Appreciation, “A”, ASSD GTY, 0%, 2033 | 2,785,000 | 910,890 | ||||||

| Florence, AL, Board of Education, Tax Anticipation School Warrants, 4%, 2025 | 1,225,000 | 1,294,813 | ||||||

| Florida Board of Education, Capital Outlay, 9.125%, 2014 | 1,685,000 | 1,768,846 | ||||||

| Florida Board of Education, Capital Outlay, “E”, 5%, 2023 | 250,000 | 295,523 | ||||||

| Florida Board of Education, Capital Outlay, ETM, 9.125%, 2014 (c) | 665,000 | 766,000 | ||||||

| Florida Board of Education, Public Education, “J”, 5%, 2033 | 1,000,000 | 1,035,480 | ||||||

| Fresno, CA, Unified School District, NATL, 6.55%, 2020 | 1,225,000 | 1,309,880 | ||||||

12

Table of Contents

Portfolio of Investments – continued

| Issuer | Shares/Par | Value ($) | ||||||

| Municipal Bonds - continued | ||||||||

| General Obligations - Schools - continued | ||||||||

| Hartnell, CA, Community College District (Election of 2002), Capital Appreciation, “D”, 0%, 2039 | $ | 9,645,000 | $ | 1,561,140 | ||||

| Knox County, KY, SYNCORA, 5.5%, 2014 (c) | 640,000 | 718,054 | ||||||

| Knox County, KY, SYNCORA, 5.625%, 2014 (c) | 1,150,000 | 1,294,026 | ||||||

| Lancaster, TX, Independent School District, Capital Appreciation, AGM, 0%, 2014 (c) | 2,250,000 | 1,078,583 | ||||||

| Lancaster, TX, Independent School District, Capital Appreciation, AGM, 0%, 2014 (c) | 2,000,000 | 901,500 | ||||||

| Long Beach, CA, Community College District (Election of 2008), Capital Appreciation, “A”, AGM, 0%, 2028 | 5,025,000 | 2,213,060 | ||||||

| Los Angeles, CA, Community College District (Election of 2008), “C”, 5.25%, 2039 | 5,000,000 | 5,724,050 | ||||||

| Los Angeles, CA, Unified School District, “D”, 5%, 2034 | 825,000 | 896,363 | ||||||

| Merced, CA, Union High School District, Capital Appreciation, “A”, ASSD GTY, 0%, 2030 | 580,000 | 216,520 | ||||||

| Oceanside, CA, Unified School District, Capital Appreciation, ASSD GTY, 0%, 2024 | 2,900,000 | 1,622,086 | ||||||

| Oceanside, CA, Unified School District, Capital Appreciation, ASSD GTY, 0%, 2027 | 1,930,000 | 888,032 | ||||||

| Oceanside, CA, Unified School District, Capital Appreciation, ASSD GTY, 0%, 2029 | 3,915,000 | 1,589,803 | ||||||

| Oceanside, CA, Unified School District, Capital Appreciation, ASSD GTY, 0%, 2030 | 4,335,000 | 1,653,326 | ||||||

| Reading, PA, School District, “A”, 5%, 2020 | 1,000,000 | 1,141,180 | ||||||

| San Marcos, TX, Independent School District, PSF, 5.625%, 2014 (c) | 2,000,000 | 2,242,080 | ||||||

| San Marcos, TX, Independent School District, PSF, 5.625%, 2014 (c) | 2,000,000 | 2,242,080 | ||||||

| San Mateo County, CA, Community College District (2005 Election), Capital Appreciation, “A”, NATL, 0%, 2026 | 5,100,000 | 2,712,639 | ||||||

| San Rafael, CA, Elementary School District (Election of 1999), NATL, 5%, 2028 (c) | 2,500,000 | 2,539,200 | ||||||

| Schertz-Cibolo-Universal City, TX, Independent School District, PSF, 5%, 2036 | 10,000,000 | 10,818,800 | ||||||

| Sunnyvale, TX, Independent School District, PSF, 5.25%, 2028 | 1,900,000 | 2,018,503 | ||||||

| Wattsburg, PA, Public School Building Authority Rev., Capital Appreciation, NATL, 0%, 2029 | 2,150,000 | 932,692 | ||||||

| West Contra Costa, CA, Unified School District (Election of 2005), Capital Appreciation, “C”, ASSD GTY, 0%, 2029 | 3,440,000 | 1,371,218 | ||||||

| Whittier, CA, Union High School District, Capital Appreciation, 0%, 2034 | 2,005,000 | 507,205 | ||||||

| Wylie, TX, Independent School District, PSF, 5.25%, 2029 | 5,035,000 | 5,076,287 | ||||||

|

| |||||||

| $ | 85,993,648 | |||||||

13

Table of Contents

Portfolio of Investments – continued

| Issuer | Shares/Par | Value ($) | ||||||

| Municipal Bonds - continued | ||||||||

| Healthcare Revenue - Hospitals - 15.8% | ||||||||

| Allegheny County, PA, Hospital Development Authority Rev. (West Penn Allegheny Health), “A”, 5%, 2028 | $ | 255,000 | $ | 211,035 | ||||

| Allegheny County, PA, Hospital Development Authority Rev. (West Penn Allegheny Health), “A”, 5.375%, 2040 | 3,995,000 | 3,263,915 | ||||||

| Baxter County, AR, Hospital Rev., 5.375%, 2014 | 15,000 | 15,040 | ||||||

| Brunswick, GA, Hospital Authority Rev. (Glynn-Brunswick Memorial Hospital), 5.625%, 2034 | 1,320,000 | 1,425,732 | ||||||

| California Health Facilities Financing Authority Rev. (St. Joseph Health System), “A”, 5.75%, 2039 | 2,580,000 | 2,820,559 | ||||||

| California Health Facilities Financing Authority Rev. (Sutter Health), “D”, 5.25%, 2031 | 5,000,000 | 5,625,250 | ||||||

| California Statewide Communities Development Authority Rev. (Enloe Medical Center), CALHF, 5.75%, 2038 | 2,640,000 | 2,798,215 | ||||||

| Citrus County, FL, Hospital Development Authority Rev. (Citrus Memorial Hospital), 6.25%, 2023 | 370,000 | 366,999 | ||||||

| Cullman County, AL, Health Care Authority (Cullman Regional Medical Center), “A”, 6.75%, 2029 | 3,550,000 | 3,593,985 | ||||||

| DeKalb County, GA, Hospital Authority Rev. (DeKalb Medical Center, Inc.), 6.125%, 2040 | 4,850,000 | 5,223,984 | ||||||

| Erie County, PA, Hospital Authority Rev. (St. Vincent’s Health), “A”, 7%, 2027 | 3,135,000 | 3,344,512 | ||||||

| Florence County, SC, Hospital Rev. (McLeod Regional Medical Center), “A”, AGM, 5.25%, 2034 | 5,000,000 | 5,137,750 | ||||||

| Grundy County, MO, Industrial Development Authority, Health Facilities Rev. (Wright Memorial Hospital), 6.75%, 2034 | 1,410,000 | 1,483,588 | ||||||

| Harris County, TX, Health Facilities Development Corp., Hospital Rev. (Memorial Hermann Healthcare Systems), “B”, 7%, 2027 | 1,795,000 | 2,181,805 | ||||||

| Harris County, TX, Health Facilities Development Corp., Hospital Rev. (Memorial Hermann Healthcare Systems), “B”, 7.25%, 2035 | 2,050,000 | 2,512,501 | ||||||

| Harris County, TX, Health Facilities Development Corp., Hospital Rev. (Texas Children’s Hospital Project), “A”, ETM, 5.375%, 2015 (c) | 4,300,000 | 4,314,749 | ||||||

| Harrison County, TX, Health Facilities Development Corp., Hospital Rev. (Good Shepherd Health System), 5.25%, 2028 | 5,000,000 | 5,036,150 | ||||||

| Henrico County, VA, Industrial Development Authority Rev. (Bon Secours Health Systems, Inc.), RIBS, FRN, AGM, 11.144%, 2027 (p) | 4,850,000 | 6,251,359 | ||||||

| Hillsborough County, FL, Industrial Development Authority Rev. (University Community Hospital), NATL, 6.5%, 2019 (c) | 1,000,000 | 1,236,680 | ||||||

| Hillsborough County, FL, Industrial Development Authority Rev. (University Community Hospital), “A”, 5.625%, 2018 (c) | 300,000 | 377,742 | ||||||

| Illinois Finance Authority Rev. (Edward Hospital), “A”, AMBAC, 5.5%, 2040 | 3,040,000 | 3,173,486 | ||||||

14

Table of Contents

Portfolio of Investments – continued

| Issuer | Shares/Par | Value ($) | ||||||

| Municipal Bonds - continued | ||||||||

| Healthcare Revenue - Hospitals - continued | ||||||||

| Illinois Finance Authority Rev. (KishHealth Systems Obligated Group), 5.75%, 2028 | $ | 2,990,000 | $ | 3,319,020 | ||||

| Illinois Finance Authority Rev. (O.S.F. Healthcare Systems) “A”, 7%, 2029 | 2,975,000 | 3,484,499 | ||||||

| Illinois Finance Authority Rev. (O.S.F. Healthcare Systems) “A”, 7.125%, 2037 | 2,445,000 | 2,892,264 | ||||||

| Illinois Finance Authority Rev. (Provena Health), “A”, 7.75%, 2034 | 3,685,000 | 4,516,447 | ||||||

| Illinois Finance Authority Rev. (Resurrection Health), 6.125%, 2025 | 6,900,000 | 7,731,657 | ||||||

| Illinois Finance Authority Rev. (Silver Cross Hospital & Medical Centers), 6.875%, 2038 | 1,500,000 | 1,674,300 | ||||||

| Illinois Finance Authority Rev. (Silver Cross Hospital & Medical Centers), 7%, 2044 | 2,455,000 | 2,742,972 | ||||||

| Illinois Finance Authority Rev. (Silver Cross Hospital & Medical Centers), “A”, 5.5%, 2030 | 2,975,000 | 3,016,204 | ||||||

| Illinois Health Facilities Authority Rev. (Riverside Health Systems), 5.75%, 2012 (c) | 2,625,000 | 2,713,174 | ||||||

| Indiana Finance Authority, Hospital Rev. (Deaconess Hospital, Inc.), “A”, 6.75%, 2039 | 3,000,000 | 3,475,890 | ||||||

| Indiana Health & Educational Facilities Authority, Hospital Rev. (Clarian Hospital), “B”, 5%, 2033 | 2,490,000 | 2,600,880 | ||||||

| Indiana Health & Educational Facilities Authority, Hospital Rev. (Deaconess Hospital), “A”, AMBAC, 5.375%, 2034 | 2,640,000 | 2,707,426 | ||||||

| Indiana Health & Educational Facilities Authority, Hospital Rev. (Riverview Hospital), 6.125%, 2012 (c) | 250,000 | 257,123 | ||||||

| Jacksonville, FL, Health Facilities Rev. (Ascension Health), “A”, 5.25%, 2032 | 1,000,000 | 1,024,480 | ||||||

| Jefferson Parish, LA, Hospital Rev., Hospital Service District No. 1 (West Jefferson Medical Center), “B”, AGM, 5.25%, 2028 | 1,980,000 | 2,120,144 | ||||||

| Jefferson Parish, LA, Hospital Service District No. 2 (East Jefferson General Hospital), 6.25%, 2031 | 3,355,000 | 3,759,613 | ||||||

| Kentucky Economic Development Finance Authority, Hospital Facilities Rev. (Baptist Healthcare System), “A”, 5.375%, 2024 | 2,305,000 | 2,611,358 | ||||||

| Kentucky Economic Development Finance Authority, Hospital Facilities Rev. (Baptist Healthcare System), “A”, 5.625%, 2027 | 770,000 | 872,918 | ||||||

| Kentucky Economic Development Finance Authority, Hospital Facilities Rev. (Owensboro Medical Health System), “A”, 6%, 2030 | 640,000 | 718,842 | ||||||

| Kentucky Economic Development Finance Authority, Hospital Facilities Rev. (Owensboro Medical Health System), “A”, 6.375%, 2040 | 4,445,000 | 5,008,537 | ||||||

| Knox County, TN, Health, Educational, Hospital & Housing Facilities Board (Catholic Health Partners), 6.375%, 2022 (c) | 1,000,000 | 1,011,900 | ||||||

15

Table of Contents

Portfolio of Investments – continued

| Issuer | Shares/Par | Value ($) | ||||||

| Municipal Bonds - continued | ||||||||

| Healthcare Revenue - Hospitals - continued | ||||||||

| Knox County, TN, Health, Educational, Hospital & Housing Facilities Board Rev. (Covenant Health), Capital Appreciation, “A”, 0%, 2035 | $ | 3,205,000 | $ | 999,479 | ||||

| Knox County, TN, Health, Educational, Hospital & Housing Facilities Board Rev. (Covenant Health), Capital Appreciation, “A”, 0%, 2036 | 2,010,000 | 585,935 | ||||||

| Laramie County, WY, Hospital Rev. (Cheyenne Regional Medical Center Project), 5%, 2032 | 440,000 | 464,618 | ||||||

| Laramie County, WY, Hospital Rev. (Cheyenne Regional Medical Center Project), 5%, 2037 | 1,005,000 | 1,053,521 | ||||||

| Laramie County, WY, Hospital Rev. (Cheyenne Regional Medical Center Project), 5%, 2042 | 2,205,000 | 2,311,457 | ||||||

| Lebanon County, PA, Health Facilities Authority Rev. (Good Samaritan Hospital), 5.9%, 2028 | 1,700,000 | 1,703,485 | ||||||

| Louisiana Public Facilities Authority Hospital Rev. (Lake Charles Memorial Hospital), 6.375%, 2034 | 3,990,000 | 4,045,541 | ||||||

| Louisiana Public Facilities Authority, Hospital Rev. (Lafayette General Medical Center), 5.5%, 2040 | 5,000,000 | 5,269,450 | ||||||

| Louisville & Jefferson County, KY, Metropolitan Government Healthcare Systems Rev. (Norton Healthcare, Inc.), 5.25%, 2036 | 5,850,000 | 6,024,213 | ||||||

| Lufkin, TX, Health Facilities Development Corp. Rev. (Memorial Health System), 5.5%, 2032 | 295,000 | 295,850 | ||||||

| Lufkin, TX, Health Facilities Development Corp. Rev. (Memorial Health System), 5.5%, 2037 | 310,000 | 302,997 | ||||||

| Macomb County, MI, Hospital Finance Authority Rev. (Mount Clemens General Hospital), 5.75%, 2013 (c) | 1,000,000 | 1,087,670 | ||||||

| Marshall County, AL, Health Care Authority Rev., “A”, 5.75%, 2015 | 770,000 | 779,132 | ||||||

| Marshall County, AL, Health Care Authority Rev., “A”, 6.25%, 2022 | 1,000,000 | 1,012,030 | ||||||

| Martin County, FL, Health Facilities Authority Rev. (Martin Memorial Medical Center), 5.5%, 2042 | 1,840,000 | 1,892,458 | ||||||

| Martin County, FL, Health Facilities Authority Rev. (Martin Memorial Medical Center), “A”, 5.75%, 2012 (c) | 850,000 | 886,491 | ||||||

| Martin County, FL, Health Facilities Authority Rev. (Martin Memorial Medical Center), “B”, 5.875%, 2012 (c) | 2,200,000 | 2,296,140 | ||||||

| Maryland Health & Higher Educational Facilities Authority Rev. (Anne Arundel Health System, Inc.), “A”, 6.75%, 2039 | 1,510,000 | 1,798,002 | ||||||

| Massachusetts Development Finance Agency Rev. (Partners Healthcare), “L”, 5%, 2031 | 2,780,000 | 3,088,135 | ||||||

| Massachusetts Development Finance Agency Rev. (Partners Healthcare), “L”, 5%, 2036 | 1,670,000 | 1,820,768 | ||||||

| Mecosta County, MI, General Hospital Rev., 6%, 2018 | 245,000 | 245,176 | ||||||

| Miami Beach, FL, Health Facilities Authority Rev. (Mount Sinai Medical Center), “A”, 6.7%, 2019 | 1,000,000 | 1,012,180 | ||||||

16

Table of Contents

Portfolio of Investments – continued

| Issuer | Shares/Par | Value ($) | ||||||

| Municipal Bonds - continued | ||||||||

| Healthcare Revenue - Hospitals - continued | ||||||||

| Miami-Dade County, FL, Health Facilities Authority, Hospital Rev. (Variety Children’s Hospital), “A”, 6.125%, 2042 | $ | 2,240,000 | $ | 2,565,539 | ||||

| Michigan Finance Authority Rev. (Trinity Health Corp.), 5%, 2035 | 3,195,000 | 3,422,260 | ||||||

| Michigan Hospital Finance Authority Rev. (Henry Ford Health System), 5.625%, 2029 | 1,270,000 | 1,406,004 | ||||||

| Michigan Hospital Finance Authority Rev. (Henry Ford Health System), 5.75%, 2039 | 7,165,000 | 7,804,046 | ||||||

| Monroe County, PA, Hospital Authority Rev. (Pocono Medical Center), 6%, 2014 (c) | 750,000 | 821,573 | ||||||

| Monroe County, PA, Hospital Authority Rev. (Pocono Medical Center), “A”, 5%, 2032 | 610,000 | 629,910 | ||||||

| Monroe County, PA, Hospital Authority Rev. (Pocono Medical Center), “A”, 5%, 2041 | 440,000 | 446,411 | ||||||

| Montgomery, AL, Medical Clinic Board Health Care Facility Rev. (Jackson Hospital & Clinic), 5.25%, 2031 | 585,000 | 589,487 | ||||||

| Mount Lebanon, PA, Hospital Authority Rev. (St. Clair Memorial Hospital), 5.625%, 2032 | 1,710,000 | 1,716,584 | ||||||

| New Hampshire Business Finance Authority Rev. (Elliot Hospital Obligated Group), “A”, 6%, 2027 | 4,610,000 | 5,060,996 | ||||||

| New Hampshire Business Finance Authority Rev. (Huggins Hospital), 6.875%, 2039 | 495,000 | 525,418 | ||||||

| New Hampshire Health & Education Facilities Authority Rev. (Covenant Health System), 6.5%, 2017 | 70,000 | 70,963 | ||||||

| New Hampshire Health & Education Facilities Authority Rev. (Memorial Hospital at Conway), 5.25%, 2036 | 565,000 | 529,716 | ||||||

| New Jersey Health Care Facilities, Financing Authority Rev. (Palisades Medical Center), 6.5%, 2021 | 500,000 | 505,510 | ||||||

| New York Dormitory Authority Rev., Non-State Supported Debt (Bronx-Lebanon Hospital Center), LOC, 6.5%, 2030 | 1,475,000 | 1,692,430 | ||||||

| New York Dormitory Authority Rev., Non-State Supported Debt (Bronx-Lebanon Hospital Center), LOC, 6.25%, 2035 | 1,395,000 | 1,593,383 | ||||||

| Norman, OK, Regional Hospital Authority Rev., 5.125%, 2037 | 3,350,000 | 3,092,921 | ||||||

| North Texas Health Facilities Development Corp. Rev. (United Regional Health Care System, Inc.), 6%, 2013 (c) | 5,000,000 | 5,389,100 | ||||||

| Ohio Higher Educational Facility Commission Rev. (University Hospital Health System), 6.75%, 2039 | 6,000,000 | 6,510,300 | ||||||

| Oklahoma Development Finance Authority Rev. (Comanche County Hospital), “B”, 6.6%, 2031 | 255,000 | 260,720 | ||||||

| Orange County, FL, Health Facilities Authority Hospital Rev. (Orlando Regional Healthcare), 5.75%, 2012 (c) | 2,230,000 | 2,311,083 | ||||||

| Orange County, FL, Health Facilities Authority Rev. (Adventist Health System), 5.625%, 2012 (c) | 1,490,000 | 1,553,772 | ||||||

17

Table of Contents

Portfolio of Investments – continued

| Issuer | Shares/Par | Value ($) | ||||||

| Municipal Bonds - continued | ||||||||

| Healthcare Revenue - Hospitals - continued | ||||||||

| Orange County, FL, Health Facilities Authority, Hospital Rev. (Orlando Regional Healthcare), “C”, 5.25%, 2035 | $ | 1,000,000 | $ | 1,027,080 | ||||

| Palomar Pomerado Health Care District, CA, COP, 6.75%, 2039 | 2,210,000 | 2,380,568 | ||||||

| Philadelphia, PA, Hospitals & Higher Education Facilities Authority Rev. (Temple University Health System), “A”, 6.625%, 2023 | 2,530,000 | 2,534,023 | ||||||

| Rhode Island Health & Educational Building Corp. Rev., Hospital Financing (Lifespan Obligated Group), 6.375%, 2012 (c) | 1,730,000 | 1,769,029 | ||||||

| Rhode Island Health & Educational Building Corp. Rev., Hospital Financing (Lifespan Obligated Group), “A”, ASSD GTY, 7%, 2039 | 7,645,000 | 8,847,406 | ||||||

| Rhode Island Health & Educational Building Corp., Hospital Financing (Lifespan Obligated Group), 6.5%, 2012 (c) | 2,000,000 | 2,046,020 | ||||||

| Richmond, IN, Hospital Authority Rev. (Reid Hospital & Health Center Services), “A”, 6.625%, 2039 | 4,715,000 | 5,365,057 | ||||||

| Royal Oak, MI, Hospital Finance Authority Rev. (William Beaumont Hospital), 8.25%, 2039 | 2,325,000 | 2,958,539 | ||||||

| Scioto County, OH, Hospital Facilities Rev. (Southern Ohio Medical Center), 5.625%, 2031 | 1,095,000 | 1,176,479 | ||||||

| Scioto County, OH, Hospital Facilities Rev. (Southern Ohio Medical Center), 5.75%, 2038 | 4,195,000 | 4,504,843 | ||||||

| Shelby County, TN, Educational & Hospital Facilities Board Hospital Rev. (Methodist Healthcare), 6.375%, 2012 (c) | 1,255,000 | 1,286,777 | ||||||

| Shelby County, TN, Educational & Housing Facilities Board Hospital Rev. (Methodist Healthcare), 6%, 2012 (c) | 300,000 | 307,137 | ||||||

| Shelby County, TN, Educational & Housing Facilities Board Hospital Rev. (Methodist Healthcare), 6%, 2012 (c) | 500,000 | 511,895 | ||||||

| Shelby County, TN, Educational & Housing Facilities Board Hospital Rev. (Methodist Healthcare), 6.375%, 2012 (c) | 745,000 | 763,863 | ||||||

| Skagit County, WA, Public Hospital District No. 001 Rev. (Skagit Valley Hospital), 5.625%, 2025 | 1,000,000 | 1,079,920 | ||||||

| South Broward, FL, Hospital District Rev., 5%, 2036 | 500,000 | 523,965 | ||||||

| South Carolina Jobs & Economic Development Authority (Bon Secours - St. Francis Medical Center, Inc.), 5.625%, 2012 (c) | 430,000 | 444,250 | ||||||

| South Carolina Jobs & Economic Development Authority (Bon Secours - St. Francis Medical Center, Inc.), 5.625%, 2030 | 1,625,000 | 1,661,936 | ||||||

| South Dakota Health & Educational Facilities Authority Rev. (Prairie Lakes Health Care System, Inc.), 5.625%, 2013 (c) | 500,000 | 526,805 | ||||||

| South Lake County, FL, Hospital District Rev. (South Lake Hospital), “A”, 6%, 2029 | 1,025,000 | 1,110,598 | ||||||

| St. Louis Park, MN, Health Care Facilities Rev. (Nicollet Health Services), 5.75%, 2039 | 6,445,000 | 7,029,110 | ||||||

| Sullivan County, TN, Health, Educational & Housing Facilities Board Hospital Rev. (Wellmont Health Systems Project), “C”, 5.25%, 2026 | 3,135,000 | 3,278,928 | ||||||

18

Table of Contents

Portfolio of Investments – continued

| Issuer | Shares/Par | Value ($) | ||||||

| Municipal Bonds - continued | ||||||||

| Healthcare Revenue - Hospitals - continued | ||||||||

| Sumner County, TN, Health, Educational & Housing Facilities Board Rev. (Sumner Regional Health Systems, Inc.), “A”, 5.5%, 2046 (a)(d) | $ | 2,000,000 | $ | 170,000 | ||||

| Tallahassee, FL, Health Facilities Rev. (Tallahassee Memorial Healthcare, Inc.), 6.25%, 2020 | 3,300,000 | 3,305,082 | ||||||

| Tallahassee, FL, Health Facilities Rev. (Tallahassee Memorial Regional Medical Center), NATL, 6.625%, 2013 | 330,000 | 331,551 | ||||||

| Tyler, TX, Health Facilities Development Corp. (East Texas Medical Center), “A”, 5.25%, 2032 | 1,715,000 | 1,695,792 | ||||||

| Tyler, TX, Health Facilities Development Corp. (East Texas Medical Center), “A”, 5.375%, 2037 | 1,410,000 | 1,410,268 | ||||||

| Tyler, TX, Health Facilities Development Corp. (Mother Frances Hospital), 5.5%, 2027 | 5,360,000 | 5,757,015 | ||||||

| Upland, CA, COP (San Antonio Community Hospital), 6.375%, 2032 | 2,075,000 | 2,417,064 | ||||||

| Upland, CA, COP (San Antonio Community Hospital), 6.5%, 2041 | 915,000 | 1,058,152 | ||||||

| Upper Illinois River Valley Development, Health Facilities Rev. (Morris Hospital), 6.625%, 2031 | 500,000 | 505,435 | ||||||

| Wapello County, IA, Hospital Authority Rev. (Ottumwa Regional Health Center), 6.375%, 2012 (c) | 750,000 | 772,673 | ||||||

| Washington Health Care Facilities Authority Rev. (Central Washington Health Services), 6.75%, 2029 | 1,450,000 | 1,646,722 | ||||||

| Washington Health Care Facilities Authority Rev. (Central Washington Health Services), 7%, 2039 | 3,690,000 | 4,090,845 | ||||||

| Washington Health Care Facilities Authority Rev. (Highline Medical Center), FHA, 6.25%, 2036 | 5,285,000 | 6,106,183 | ||||||

| Washington Health Care Facilities Authority Rev. (Virginia Mason Medical Center), “A”, 6.25%, 2042 | 3,955,000 | 4,225,008 | ||||||

| Weirton, WV, Municipal Hospital Building, Commission Rev. (Weirton Hospital Medical Center), 6.375%, 2031 | 400,000 | 386,964 | ||||||

| West Virginia Hospital Finance Authority, Hospital Rev. (Thomas Health System), 6.5%, 2038 | 2,110,000 | 2,113,292 | ||||||

| Wisconsin Health & Educational Facilities Authority Rev. (Aurora Health Care, Inc.), 6.875%, 2030 | 2,750,000 | 2,863,603 | ||||||

| Wisconsin Health & Educational Facilities Authority Rev. (Aurora Health Care, Inc.), “A”, 5%, 2026 | 2,215,000 | 2,397,693 | ||||||

| Wisconsin Health & Educational Facilities Authority Rev. (Aurora Health Care, Inc.), “A”, 5%, 2028 | 665,000 | 710,240 | ||||||

| Wisconsin Health & Educational Facilities Authority Rev. (ProHealth Care, Inc. Obligated Group), 6.625%, 2032 | 1,730,000 | 1,835,651 | ||||||

| Wisconsin Health & Educational Facilities Authority Rev. (ProHealth Care, Inc. Obligated Group), 6.625%, 2039 | 1,220,000 | 1,409,698 | ||||||

| Wisconsin Health & Educational Facilities Authority Rev. (Wheaton Franciscan Healthcare), 5.25%, 2018 | 1,500,000 | 1,625,520 | ||||||

19

Table of Contents

Portfolio of Investments – continued

| Issuer | Shares/Par | Value ($) | ||||||

| Municipal Bonds - continued | ||||||||

| Healthcare Revenue - Hospitals - continued | ||||||||

| Wisconsin Health & Educational Facilities Authority Rev. (Wheaton Franciscan Healthcare), 5.25%, 2031 | $ | 4,155,000 | $ | 4,222,685 | ||||

| Wisconsin Health & Educational Facilities Authority Rev. (Wheaton Franciscan Services), 5.25%, 2034 | 1,360,000 | 1,376,279 | ||||||

|

| |||||||

| $ | 309,695,181 | |||||||

| Healthcare Revenue - Long Term Care - 2.9% | ||||||||

| Bell County, TX, Health Facility Development Corp. (Advanced Living Technologies, Inc.), 8%, 2036 | $ | 1,595,000 | $ | 1,345,925 | ||||

| Bucks County, PA, Industrial Development Authority Retirement Community Rev. (Ann’s Choice, Inc.), “A”, 6.25%, 2035 | 1,120,000 | 1,120,414 | ||||||

| California Statewide Communities Development Authority Rev. (American Baptist Homes of the West), 6.25%, 2039 | 1,050,000 | 1,089,995 | ||||||

| Colorado Health Facilities Authority Rev. (Evangelical Lutheran), 6.9%, 2025 | 195,000 | 197,340 | ||||||

| Cumberland County, PA, Municipal Authority Retirement Community Rev. (Wesley), “A”, 7.25%, 2013 (c) | 270,000 | 286,667 | ||||||

| Cumberland County, PA, Municipal Authority Retirement Community Rev. (Wesley), “A”, 7.25%, 2013 (c) | 105,000 | 111,482 | ||||||

| Cumberland County, PA, Municipal Authority Rev. (Asbury Atlantic, Inc.), 6%, 2030 | 715,000 | 729,543 | ||||||

| Cumberland County, PA, Municipal Authority Rev. (Asbury Atlantic, Inc.), 6%, 2040 | 505,000 | 509,919 | ||||||

| Cumberland County, PA, Municipal Authority Rev. (Diakon Lutheran Social Ministries), 6.125%, 2029 | 830,000 | 900,583 | ||||||

| Cumberland County, PA, Municipal Authority Rev. (Diakon Lutheran Social Ministries), 6.375%, 2039 | 5,045,000 | 5,443,353 | ||||||

| Eden Township, CA, Healthcare District, COP, 6.125%, 2034 | 1,510,000 | 1,570,234 | ||||||

| Hawaii Department of Budget & Finance, Special Purpose Rev. (15 Craigside Project), “A”, 8.75%, 2029 | 375,000 | 436,009 | ||||||

| Hawaii Department of Budget & Finance, Special Purpose Rev. (15 Craigside Project), “A”, 9%, 2044 | 1,100,000 | 1,284,569 | ||||||

| Illinois Finance Authority Rev. (Christian Homes, Inc.), 5.5%, 2023 | 3,355,000 | 3,409,385 | ||||||

| Indiana Health Facilities Financing Authority Rev. (Hoosier Care, Inc.), “A”, 7.125%, 2034 | 735,000 | 726,437 | ||||||

| Iowa Finance Authority, Health Care Facilities Rev. (Care Initiatives), “A”, 5.5%, 2025 | 1,205,000 | 1,092,983 | ||||||

| Maryland Health & Higher Educational Facilities Authority Rev. (Charlestown Community), 6.25%, 2041 | 2,225,000 | 2,434,640 | ||||||

| Montgomery County, OH, Health Care & Multifamily Housing Rev. (St. Leonard), 6.375%, 2030 | 1,915,000 | 2,008,299 | ||||||

| Montgomery County, OH, Health Care & Multifamily Housing Rev. (St. Leonard), 6.625%, 2040 | 2,770,000 | 2,882,185 | ||||||

20

Table of Contents

Portfolio of Investments – continued

| Issuer | Shares/Par | Value ($) | ||||||

| Municipal Bonds - continued | ||||||||

| Healthcare Revenue - Long Term Care - continued | ||||||||

| Palm Beach County, FL, Health Facilities Authority, Retirement Community Rev. (ACTS Retirement - Life Communities, Inc.), 5.5%, 2033 | $ | 5,000,000 | $ | 5,237,100 | ||||

| Pell City, AL, Special Care Facilities, Financing Authority Rev. (Noland Health), 5%, 2039 | 1,750,000 | 1,771,280 | ||||||

| St. John’s County, FL, Industrial Development Authority (Bayview Project), “A”, 5.2%, 2027 | 150,000 | 124,217 | ||||||

| St. John’s County, FL, Industrial Development Authority Rev. (Presbyterian Retirement), “A”, 6%, 2045 | 6,795,000 | 7,228,793 | ||||||

| Tarrant County, TX, Cultural Education Facilities Finance Corp. Retirement Facility (Air Force Village), 6.125%, 2029 | 395,000 | 430,127 | ||||||

| Tarrant County, TX, Cultural Education Facilities Finance Corp. Retirement Facility (Air Force Village), 5.125%, 2037 | 1,600,000 | 1,525,008 | ||||||

| Tarrant County, TX, Cultural Education Facilities Finance Corp. Retirement Facility (Air Force Village), 6.375%, 2044 | 3,100,000 | 3,332,438 | ||||||

| Tarrant County, TX, Cultural Education Facilities Finance Corp. Retirement Facility (Stayton at Museum Way), 8.25%, 2044 | 4,500,000 | 4,786,245 | ||||||

| Travis County, TX, Health Facilities Development Corp. Rev. (Westminster Manor Health), 7%, 2030 | 735,000 | 823,398 | ||||||

| Travis County, TX, Health Facilities Development Corp. Rev. (Westminster Manor Health), 7.125%, 2040 | 2,575,000 | 2,846,766 | ||||||

| Wisconsin Health & Educational Facilities Authority Rev. (St. John’s Community, Inc.), “A”, 7.25%, 2029 | 430,000 | 479,626 | ||||||

| Wisconsin Health & Educational Facilities Authority Rev. (St. John’s Community, Inc.), “A”, 7.625%, 2039 | 1,390,000 | 1,546,028 | ||||||

|

| |||||||

| $ | 57,710,988 | |||||||

| Human Services - 0.1% | ||||||||

| Nassau County, NY, Industrial Development Civic (Special Needs Facilities), 6.1%, 2012 | $ | 35,000 | $ | 35,102 | ||||

| Orange County, FL, Health Facilities Authority Rev. (GF/Orlando Healthcare Facilities), 8.875%, 2021 | 300,000 | 301,197 | ||||||

| Orange County, FL, Health Facilities Authority Rev. (GF/Orlando Healthcare Facilities), 9%, 2031 | 1,000,000 | 997,040 | ||||||

|

| |||||||

| $ | 1,333,339 | |||||||

| Industrial Revenue - Airlines - 0.5% | ||||||||

| Clayton County, GA, Development Authority Special Facilities Rev. (Delta Airlines, Inc.), “A”, 8.75%, 2029 | $ | 1,295,000 | $ | 1,537,579 | ||||

| Clayton County, GA, Development Authority Special Facilities Rev. (Delta Airlines, Inc.), “B”, 9%, 2035 | 970,000 | 1,048,706 | ||||||

| Denver, CO, City & County Airport Rev. (United Airlines), 5.25%, 2032 | 720,000 | 665,575 | ||||||

21

Table of Contents

Portfolio of Investments – continued

| Issuer | Shares/Par | Value ($) | ||||||

| Municipal Bonds - continued | ||||||||

| Industrial Revenue - Airlines - continued | ||||||||

| Denver, CO, City & County Airport Rev. (United Airlines), 5.75%, 2032 | $ | 615,000 | $ | 602,682 | ||||

| Houston, TX, Airport Systems Rev., Special Facilities (Continental Airlines, Inc.), “E”, 6.75%, 2029 | 570,000 | 578,180 | ||||||

| Los Angeles, CA, Regional Airport Lease Rev. (American Airlines), “C”, 7.5%, 2024 (a)(d) | 1,435,000 | 1,406,171 | ||||||

| New Jersey Economic Development Authority, Special Facilities Rev. (Continental Airlines, Inc.), 6.25%, 2029 | 1,970,000 | 1,977,959 | ||||||

| New York, NY, City Industrial Development Agency Special Facility Rev. (American Airlines, Inc. - JFK International Airport), 7.75%, 2031 (a)(d) | 1,190,000 | 1,166,724 | ||||||

|

| |||||||

| $ | 8,983,576 | |||||||

| Industrial Revenue - Chemicals - 1.5% | ||||||||

| Brazos River, TX, Brazoria County Environmental Rev. (Dow Chemical, Co.), “A-7”, 6.625%, 2033 | $ | 500,000 | $ | 505,700 | ||||

| Brazos River, TX, Harbor Navigation District (Dow Chemical Co.), 5.7%, 2033 (b) | 4,500,000 | 4,521,285 | ||||||

| Brazos River, TX, Harbor Navigation District (Dow Chemical Co.), “A”, 5.95%, 2033 | 7,310,000 | 7,839,683 | ||||||

| Brazos River, TX, Harbor Navigation District (Dow Chemical Co.), “B-2”, 4.95%, 2033 | 2,295,000 | 2,396,921 | ||||||

| Louisiana Environmental Facilities & Community Development Authority Rev. (Westlake Chemical), 6.75%, 2032 | 1,600,000 | 1,754,224 | ||||||

| Louisiana Environmental Facilities & Community Development Authority Rev. (Westlake Chemical), “A”, 6.5%, 2029 | 1,400,000 | 1,582,140 | ||||||

| Louisiana Environmental Facilities & Community Development Authority Rev. (Westlake Chemical), “A-2”, 6.5%, 2035 | 6,000,000 | 6,683,100 | ||||||

| Michigan Strategic Fund Ltd. Obligation Rev. (Dow Chemical Co.), 6.25%, 2014 | 2,870,000 | 3,167,447 | ||||||

| Red River Authority, TX, Pollution Control Rev. (Celanese Project) “B”, 6.7%, 2030 | 1,200,000 | 1,208,664 | ||||||

|

| |||||||

| $ | 29,659,164 | |||||||

| Industrial Revenue - Environmental Services - 0.3% | ||||||||

| California Pollution Control Financing Authority, Solid Waste Disposal Rev. (Republic Services, Inc.), “B”, 5.25%, 2023 (b) | $ | 950,000 | $ | 1,063,060 | ||||

| California Pollution Control Financing Authority, Solid Waste Disposal Rev. (Waste Management, Inc.), “C”, 5.125%, 2023 | 1,665,000 | 1,762,919 | ||||||

| Cobb County, GA, Development Authority, Solid Waste Disposal Rev. (Waste Management, Inc.), “A”, 5%, 2033 | 1,410,000 | 1,381,278 | ||||||

| Colorado Housing & Finance Authority, Solid Waste Rev. (Waste Management, Inc.), 5.7%, 2018 | 1,960,000 | 2,280,911 | ||||||

22

Table of Contents

Portfolio of Investments – continued

| Issuer | Shares/Par | Value ($) | ||||||

| Municipal Bonds - continued | ||||||||

| Industrial Revenue - Environmental Services - continued | ||||||||

| Gulf Coast Waste Disposal Authority (Waste Management, Inc.), 5.2%, 2028 | $ | 300,000 | $ | 313,422 | ||||

|

| |||||||

| $ | 6,801,590 | |||||||

| Industrial Revenue - Other - 1.2% | ||||||||

| California Statewide Communities, Development Authority Environmental Facilities (Microgy Holdings), 9%, 2038 (a)(d) | $ | 126,224 | $ | 1,262 | ||||

| Gulf Coast, TX, Industrial Development Authority Rev. (Microgy Holdings LLC Project), 7%, 2036 (a)(d) | 116,013 | 1,160 | ||||||

| Gulf Coast, TX, Industrial Development Authority Rev. (Valero Energy Corp.), 5.6%, 2031 | 500,000 | 500,085 | ||||||

| Hardeman County, TN, Correctional Facilities Corp. (Corrections Corp. of America), 7.375%, 2017 | 500,000 | 500,150 | ||||||

| Houston, TX, Industrial Development Corp. (United Parcel Service, Inc.), 6%, 2023 | 265,000 | 244,616 | ||||||

| Massachusetts Development Finance Agency Rev., Resource Recovery (Fluor Corp.), 5.625%, 2019 | 11,545,000 | 11,563,703 | ||||||

| Massachusetts Industrial Finance Agency Rev. (Welch Foods, Inc.), 5.6%, 2017 | 1,300,000 | 1,303,757 | ||||||

| Park Creek Metropolitan District, CO, Rev. (Custodial Receipts), “CR-2”, 7.875%, 2032 (b)(n) | 560,000 | 580,675 | ||||||

| Peninsula Ports Authority, VA, Coal Terminal Rev. (Dominion Terminal Associates), 6%, 2033 | 470,000 | 479,146 | ||||||

| Tooele County, UT, Hazardous Waste Treatment Rev. (Union Pacific Corp.), 5.7%, 2026 | 7,945,000 | 7,971,934 | ||||||

|

| |||||||

| $ | 23,146,488 | |||||||

| Industrial Revenue - Paper - 0.5% | ||||||||

| Butler, AL, Industrial Development Board, Solid Waste Disposal Rev. (Georgia-Pacific Corp.), 5.75%, 2028 | $ | 1,760,000 | $ | 1,789,110 | ||||

| Delta County, MI, Economic Development Corp., Environmental Improvement Rev. (Mead Westvaco Escanaba), “A”, 6.25%, 2012 (c) | 2,400,000 | 2,404,464 | ||||||

| Jay, ME, Solid Waste Disposal Rev. (International Paper Co.), “A”, 5.125%, 2018 | 1,500,000 | 1,537,170 | ||||||

| Rockdale County, GA, Development Authority Project Rev. (Visy Paper Project), “A”, 6.125%, 2034 | 2,055,000 | 2,105,183 | ||||||

| Sabine River, LA, Water Facilities Authority Rev. (International Paper Co.), 6.2%, 2025 | 1,250,000 | 1,261,588 | ||||||

| West Point, VA, Industrial Development Authority, Solid Waste Disposal Rev. (Chesapeake Corp.), “A”, 6.375%, 2019 (a)(d) | 550,000 | 11,550 | ||||||

|

| |||||||

| $ | 9,109,065 | |||||||

23

Table of Contents

Portfolio of Investments – continued

| Issuer | Shares/Par | Value ($) | ||||||

| Municipal Bonds - continued | ||||||||

| Miscellaneous Revenue - Entertainment & Tourism - 0.7% | ||||||||

| Brooklyn, NY, Arena Local Development Corp. (Barclays Center Project), 6%, 2030 | $ | 2,015,000 | $ | 2,201,730 | ||||

| Brooklyn, NY, Arena Local Development Corp. (Barclays Center Project), 6.25%, 2040 | 3,205,000 | 3,531,910 | ||||||

| Harris County, Houston, TX, Sports Authority, Special Rev., “A”, NATL, 5%, 2025 | 2,460,000 | 2,393,580 | ||||||

| Seminole Tribe, FL, Special Obligation Rev., “A”, 5.75%, 2022 (n) | 2,850,000 | 3,017,381 | ||||||

| Seminole Tribe, FL, Special Obligation Rev., “A”, 5.5%, 2024 (n) | 2,000,000 | 2,032,140 | ||||||

| Seneca Nation Indians, NY, Capital Improvements Authority, Special Obligation, 5%, 2023 (n) | 670,000 | 588,173 | ||||||

|

| |||||||

| $ | 13,764,914 | |||||||

| Miscellaneous Revenue - Other - 1.5% | ||||||||

| Austin, TX, Convention Center (Convention Enterprises, Inc.), “A”, SYNCORA, 5.25%, 2017 | $ | 845,000 | $ | 890,157 | ||||

| Austin, TX, Convention Center (Convention Enterprises, Inc.), “A”, SYNCORA, 5.25%, 2019 | 1,375,000 | 1,418,491 | ||||||

| Austin, TX, Convention Center (Convention Enterprises, Inc.), “A”, SYNCORA, 5.25%, 2020 | 1,120,000 | 1,142,490 | ||||||

| Austin, TX, Convention Center (Convention Enterprises, Inc.), “A”, SYNCORA, 5.25%, 2024 | 2,230,000 | 2,252,166 | ||||||

| Capital Trust Agency Rev. (Aero Miami FX LLC), “A”, 5.35%, 2029 | 4,000,000 | 4,034,120 | ||||||

| Citizens Property Insurance Corp., “A-1”, 5.25%, 2017 | 750,000 | 839,190 | ||||||

| Citizens Property Insurance Corp., FL, “A-1”, 5%, 2019 | 505,000 | 559,656 | ||||||

| Citizens Property Insurance Corp., FL, “A-1”, 5%, 2020 | 2,770,000 | 3,062,540 | ||||||

| Cleveland-Cuyahoga County, OH, Port Authority Rev., 7%, 2040 | 1,105,000 | 1,165,477 | ||||||

| Fulton County, GA, Development Authority Rev. (Georgia Tech Athletic Association), “A”, 5%, 2042 | 2,320,000 | 2,443,934 | ||||||

| Massachusetts Port Authority Facilities Rev. (Conrac Project), “A”, 5.125%, 2041 | 465,000 | 493,244 | ||||||

| Miami-Dade County, FL, Special Obligation, Capital Appreciation, “A”, NATL, 0%, 2032 | 2,000,000 | 595,540 | ||||||

| New Orleans, LA, Aviation Board Gulf Opportunity Zone CFC Rev. (Consolidated Rental Car), “A”, 6.25%, 2030 | 1,810,000 | 1,982,366 | ||||||

| New York Liberty Development Corp., Liberty Rev. (World Trade Center Project), 5%, 2031 | 2,300,000 | 2,476,272 | ||||||

| Oklahoma Industries Authority Rev. (Oklahoma Medical Research Foundation Project), 5.5%, 2029 | 4,400,000 | 4,850,428 | ||||||

| Summit County, OH, Port Authority Building Rev. (Flats East Development Recovery Zone Facility Bonds), 6.875%, 2040 | 415,000 | 437,688 | ||||||

| Summit County, OH, Port Authority Building Rev. (Seville Project), “A”, 5.1%, 2025 | 165,000 | 153,853 | ||||||

|

| |||||||

| $ | 28,797,612 | |||||||

24

Table of Contents

Portfolio of Investments – continued

| Issuer | Shares/Par | Value ($) | ||||||

| Municipal Bonds - continued | ||||||||

| Multi-Family Housing Revenue - 0.3% | ||||||||

| Bay County, FL, Housing Finance Authority, Multi-Family Rev. (Andrews Place II Apartments), AGM, 5%, 2035 | $ | 1,045,000 | $ | 1,048,595 | ||||

| Eden Prairie, MN, Multi-Family Rev. (Coll-Rolling Hills), “A”, GNMA, 6%, 2021 | 200,000 | 210,240 | ||||||

| Indianapolis, IN, Multi-Family Rev. (Cambridge Station Apartments II), FNMA, 5.25%, 2039 (b) | 1,375,000 | 1,387,416 | ||||||

| Michigan Housing Development Authority, GNMA, 5.2%, 2038 | 1,200,000 | 1,218,684 | ||||||

| MuniMae TE Bond Subsidiary LLC, “A-2”, 4.9%, 2049 (z) | 2,000,000 | 1,640,680 | ||||||

|

| |||||||

| $ | 5,505,615 | |||||||

| Parking - 0.2% | ||||||||

| Boston, MA, Metropolitan Transit Parking Corp., Systemwide Parking Rev., 5.25%, 2036 | $ | 3,250,000 | $ | 3,537,495 | ||||

| Port Revenue - 0.3% | ||||||||

| Maryland Economic Development Corp. Rev. (Port America Chesapeake Terminal Project), “B”, 5.375%, 2025 | $ | 795,000 | $ | 847,041 | ||||

| Maryland Economic Development Corp. Rev. (Port America Chesapeake Terminal Project), “B”, 5.75%, 2035 | 1,535,000 | 1,619,655 | ||||||

| Massachusetts Port Authority Rev., ETM, 13%, 2013 (c) | 1,035,000 | 1,131,721 | ||||||

| Seattle, WA, Port Rev., “B”, 5%, 2024 | 3,000,000 | 3,342,930 | ||||||

|

| |||||||

| $ | 6,941,347 | |||||||

| Sales & Excise Tax Revenue - 6.0% | ||||||||

| Chicago, IL, Transit Authority Sales Tax Receipts Rev., 5.25%, 2029 | $ | 1,755,000 | $ | 1,963,547 | ||||

| Chicago, IL, Transit Authority Sales Tax Receipts Rev., 5.25%, 2030 | 3,505,000 | 3,903,483 | ||||||

| Chicago, IL, Transit Authority Sales Tax Receipts Rev., 5.25%, 2031 | 655,000 | 727,233 | ||||||

| Chicago, IL, Transit Authority Sales Tax Receipts Rev., 5.25%, 2040 | 4,685,000 | 5,106,978 | ||||||

| Colorado Regional Transportation District, Private Activity Rev. (Denver Transportation Partners), 6.5%, 2030 | 6,150,000 | 6,910,509 | ||||||

| Colorado Regional Transportation District, Private Activity Rev. (Denver Transportation Partners), 6%, 2034 | 7,425,000 | 8,037,860 | ||||||

| Illinois Sales Tax Rev., “P”, 6.5%, 2022 | 5,000,000 | 6,019,700 | ||||||

| Massachusetts Bay Transportation Authority, Sales Tax Rev., “A”, 5%, 2024 | 9,445,000 | 11,618,672 | ||||||

| Massachusetts Bay Transportation Authority, Sales Tax Rev., “A-1”, 5.25%, 2031 | 3,615,000 | 4,443,450 | ||||||

| Massachusetts Bay Transportation Authority, Sales Tax Rev., Capital Appreciation, “A-2”, 0%, 2028 | 6,930,000 | 3,376,781 | ||||||

| Massachusetts School Building Authority, Sales Tax Rev., “B”, 5%, 2032 (u) | 10,730,000 | 12,164,172 | ||||||

25

Table of Contents

Portfolio of Investments – continued

| Issuer | Shares/Par | Value ($) | ||||||

| Municipal Bonds - continued | ||||||||

| Sales & Excise Tax Revenue - continued | ||||||||

| Metropolitan Atlanta, GA, Rapid Transit Authority Rev., 6.25%, 2018 | $ | 4,125,000 | $ | 4,767,758 | ||||

| Metropolitan Pier & Exposition Authority, Dedicated State Tax Rev. (McCormick Place), “B”, AGM, 5%, 2050 (u) | 20,000,000 | 20,636,400 | ||||||

| Puerto Rico Sales Tax Financing Corp., Sales Tax Rev., “A”, 5.5%, 2019 (c) | 45,000 | 57,657 | ||||||

| Puerto Rico Sales Tax Financing Corp., Sales Tax Rev., “A”, 5.5%, 2028 | 5,855,000 | 6,442,666 | ||||||

| Puerto Rico Sales Tax Financing Corp., Sales Tax Rev., “A”, 5.5%, 2037 | 1,105,000 | 1,193,013 | ||||||

| Puerto Rico Sales Tax Financing Corp., Sales Tax Rev., “A”, 5.375%, 2039 | 1,745,000 | 1,867,220 | ||||||

| Puerto Rico Sales Tax Financing Corp., Sales Tax Rev., “A”, 5.5%, 2042 | 1,530,000 | 1,650,809 | ||||||

| Puerto Rico Sales Tax Financing Corp., Sales Tax Rev., “A”, 6%, 2042 | 3,460,000 | 3,872,121 | ||||||

| Puerto Rico Sales Tax Financing Corp., Sales Tax Rev., “C”, 5.375%, 2038 | 605,000 | 650,073 | ||||||

| Puerto Rico Sales Tax Financing Corp., Sales Tax Rev., Capital Appreciation, “A”, 0%, 2032 | 4,190,000 | 4,001,492 | ||||||

| Puerto Rico Sales Tax Financing Corp., Sales Tax Rev., Capital Appreciation, “A”, 0%, 2033 | 2,345,000 | 1,864,838 | ||||||

| Puerto Rico Sales Tax Financing Corp., Sales Tax Rev., Capital Appreciation, “A”, 0%, 2033 | 490,000 | 149,965 | ||||||

| State of Illinois, “B”, 5.25%, 2034 | 1,275,000 | 1,350,021 | ||||||

| Utah Transit Authority Sales Tax Rev., Capital Appreciation, “A”, NATL, 0%, 2028 | 2,225,000 | 985,742 | ||||||

| Volusia County, FL, Tourist Development Tax Rev., AGM, 5%, 2034 | 815,000 | 834,487 | ||||||

| Wyandotte County/Kansas City, KS, Unified Government Special Obligation Rev., Capital Appreciation, “B”, 0%, 2021 | 3,970,000 | 2,619,922 | ||||||

|

| |||||||

| $ | 117,216,569 | |||||||

| Single Family Housing - Local - 0.8% | ||||||||

| California Rural Home Mortgage Finance Authority Rev., GNMA, 7.3%, 2031 | $ | 15,000 | $ | 15,748 | ||||

| Chicago, IL, Single Family Mortgage Rev., “B”, GNMA, 6%, 2033 | 235,000 | 239,453 | ||||||

| Chicago, IL, Single Family Mortgage Rev., “C”, GNMA, 5.5%, 2038 | 1,130,000 | 1,192,523 | ||||||

| Chicago, IL, Single Family Mortgage Rev., “C”, GNMA, 5.75%, 2042 | 1,820,000 | 1,867,284 | ||||||

| Denver, CO, Single Family Mortgage Rev., GNMA, 7.3%, 2031 | 60,000 | 60,617 | ||||||

| Manatee County, FL, Housing Finance Mortgage Rev., Single Family, Sub-Series 2, GNMA, 6.5%, 2023 | 35,000 | 36,593 | ||||||

26

Table of Contents

Portfolio of Investments – continued

| Issuer | Shares/Par | Value ($) | ||||||

| Municipal Bonds - continued | ||||||||

| Single Family Housing - Local - continued | ||||||||

| Manatee County, FL, Housing Finance Mortgage Rev., Single Family, Sub-Series 3, GNMA, 5.3%, 2028 | $ | 225,000 | $ | 229,055 | ||||

| Manatee County, FL, Housing Finance Mortgage Rev., Single Family, Sub-Series 3, GNMA, 5.4%, 2029 | 180,000 | 182,255 | ||||||

| Nortex, TX, Housing Finance Corp., Single Family Mortgage Rev., “A”, GNMA, 5.5%, 2038 | 1,970,000 | 2,051,263 | ||||||

| Oklahoma County, OK, Home Finance Authority, Single Family Mortgage Rev., “A”, GNMA, 5.4%, 2038 | 1,175,000 | 1,194,576 | ||||||

| Permian Basin Housing Finance Corp., TX, Single Family Mortgage Backed Securities (Mortgage Backed Project) “A”, GNMA, 5.65%, 2038 | 1,185,000 | 1,234,829 | ||||||

| Sedgwick & Shawnee Counties, KS, Single Family Housing Rev., “A”, GNMA, 5.9%, 2035 | 415,000 | 435,742 | ||||||

| Sedgwick & Shawnee Counties, KS, Single Family Housing Rev., “A”, GNMA, 6.25%, 2035 | 155,000 | 163,607 | ||||||

| Sedgwick & Shawnee Counties, KS, Single Family Housing Rev., “A”, GNMA, 5.8%, 2036 | 1,460,000 | 1,522,809 | ||||||

| Sedgwick & Shawnee Counties, KS, Single Family Housing Rev., “A-1”, GNMA, 5.75%, 2037 | 95,000 | 99,415 | ||||||

| Sedgwick & Shawnee Counties, KS, Single Family Housing Rev., “A-3”, GNMA, 6%, 2035 | 475,000 | 498,864 | ||||||

| Sedgwick & Shawnee Counties, KS, Single Family Housing Rev., “A-3”, GNMA, 5.5%, 2037 | 675,000 | 700,718 | ||||||

| Sedgwick & Shawnee Counties, KS, Single Family Housing Rev., “A-4”, GNMA, 5.85%, 2037 | 140,000 | 144,085 | ||||||

| Sedgwick & Shawnee Counties, KS, Single Family Housing Rev., “A-5”, GNMA, 5.8%, 2027 | 435,000 | 454,414 | ||||||

| Sedgwick & Shawnee Counties, KS, Single Family Housing Rev., “A-5”, GNMA, 5.7%, 2036 | 1,270,000 | 1,332,230 | ||||||

| Sedgwick & Shawnee Counties, KS, Single Family Housing Rev., “A-5”, GNMA, 5.9%, 2037 | 240,000 | 248,270 | ||||||

| Sedgwick & Shawnee Counties, KS, Single Family Mortgage Rev., “A”, GNMA, 5.45%, 2038 | 1,805,000 | 1,867,706 | ||||||

|

| |||||||

| $ | 15,772,056 | |||||||

| Single Family Housing - State - 1.3% | ||||||||

| California Housing Finance Agency Rev. (Home Mortgage), “G”, 4.95%, 2023 | $ | 4,595,000 | $ | 4,623,673 | ||||

| California Housing Finance Agency Rev. (Home Mortgage), “G”, 5.5%, 2042 | 2,230,000 | 2,258,856 | ||||||

| California Housing Finance Agency Rev. (Home Mortgage), “I”, 4.7%, 2026 | 1,365,000 | 1,284,970 | ||||||

27

Table of Contents

Portfolio of Investments – continued

| Issuer | Shares/Par | Value ($) | ||||||

| Municipal Bonds - continued | ||||||||

| Single Family Housing - State - continued | ||||||||

| California Housing Finance Agency Rev. (Home Mortgage), “L”, 5.45%, 2033 | $ | 6,600,000 | $ | 6,609,240 | ||||

| California Housing Finance Agency Rev. (Home Mortgage), “L”, FNMA, 5.5%, 2038 | 2,595,000 | 2,596,064 | ||||||

| Colorado Housing & Finance Authority Rev., 6.05%, 2016 | 30,000 | 31,067 | ||||||

| Colorado Housing & Finance Authority Rev., 7.45%, 2016 | 45,000 | 47,083 | ||||||

| Colorado Housing & Finance Authority Rev., 6.8%, 2030 | 40,000 | 40,312 | ||||||

| Colorado Housing & Finance Authority Rev., “B-2”, 6.1%, 2023 | 50,000 | 50,772 | ||||||

| Colorado Housing & Finance Authority Rev., “B-3”, 6.55%, 2033 | 55,000 | 56,648 | ||||||

| Colorado Housing & Finance Authority Rev., “C-2”, 5.9%, 2023 | 335,000 | 352,015 | ||||||

| Colorado Housing & Finance Authority Rev., “C-2”, FHA, 6.6%, 2032 | 270,000 | 283,902 | ||||||

| Colorado Housing & Finance Authority Rev., “C-3”, 6.75%, 2021 | 45,000 | 46,760 | ||||||

| Colorado Housing & Finance Authority Rev., “C-3”, FHA, 6.375%, 2033 | 30,000 | 31,176 | ||||||

| Colorado Housing & Finance Authority Rev., Single Family Program, “C-2”, 8.4%, 2021 | 45,000 | 47,296 | ||||||

| Colorado Housing & Finance Authority, “B-2”, 7.25%, 2031 | 80,000 | 83,022 | ||||||

| Delaware Housing Authority Rev. (Single Family), “C”, 6.25%, 2037 | 825,000 | 886,116 | ||||||

| Florida Housing Finance Corp. Rev. (Homeowner Mortgage), “1”, GNMA, 4.8%, 2031 | 550,000 | 557,040 | ||||||

| Iowa Finance Authority Single Family Mortgage Rev. (Mortgage Backed Securities), “A”, GNMA, 5.3%, 2033 | 565,000 | 588,657 | ||||||

| Louisiana Housing Finance Agency, Single Family Mortgage Rev., GNMA, 6.375%, 2033 | 170,000 | 171,348 | ||||||

| Mississippi Home Corp., Single Family Rev., “A”, GNMA, 6.1%, 2034 | 930,000 | 974,380 | ||||||

| Missouri Housing Development Commission, Single Family Mortgage Rev. (Home Loan Program), GNMA, 6.75%, 2034 | 140,000 | 147,204 | ||||||

| New Hampshire Housing Finance Authority Rev., 6.85%, 2030 | 230,000 | 230,798 | ||||||

| New Hampshire Housing Finance Authority Rev., “B”, 6.5%, 2035 | 115,000 | 118,164 | ||||||

| New Mexico Mortgage Finance Authority Rev., GNMA, 5.95%, 2037 | 790,000 | 842,361 | ||||||

| New Mexico Mortgage Finance Authority Rev., “I”, GNMA, 5.75%, 2038 | 1,055,000 | 1,093,529 | ||||||

| Oregon Health & Community Services (Single Family Mortgage), “B”, 6.25%, 2031 | 830,000 | 881,277 | ||||||

| Texas Affordable Housing Corp. (Single Family Mortgage), “B”, GNMA, 5.25%, 2039 | 480,000 | 498,912 | ||||||

|

| |||||||

| $ | 25,432,642 | |||||||

| Solid Waste Revenue - 0.2% | ||||||||

| Delaware County, PA, Industrial Development Authority, Resource Recovery Facilities Rev. (American Ref-Fuel Co.), “A”, 6.2%, 2019 | $ | 1,950,000 | $ | 1,950,780 | ||||

| Massachusetts Development Finance Agency, Resource Recovery Rev. (Ogden Haverhill Associates), “A”, 6.7%, 2014 | 355,000 | 355,600 | ||||||

28

Table of Contents

Portfolio of Investments – continued

| Issuer | Shares/Par | Value ($) | ||||||

| Municipal Bonds - continued | ||||||||

| Solid Waste Revenue - continued | ||||||||

| Massachusetts Development Finance Agency, Resource Recovery Rev. (Ogden Haverhill Associates), “A”, 5.6%, 2019 | $ | 1,000,000 | $ | 1,002,650 | ||||

| Palm Beach County, FL, Solid Waste Authority Rev. Improvement, BHAC, 5%, 2027 | �� | 295,000 | 333,899 | |||||

| Pennsylvania Economic Development Financing Authority, Sewer Sludge Disposal Rev. (Philadelphia Biosolids Facility), 6.25%, 2032 | 575,000 | 632,230 | ||||||

|

| |||||||

| $ | 4,275,159 | |||||||

| State & Agency - Other - 0.1% | ||||||||

| Commonwealth of Puerto Rico (Mepsi Campus), “A”, 6.5%, 2037 | $ | 1,200,000 | $ | 1,206,576 | ||||

| Massachusetts Development Finance Agency (Visual & Performing Arts), 6%, 2021 | 1,000,000 | 1,198,850 | ||||||

|

| |||||||

| $ | 2,405,426 | |||||||

| State & Local Agencies - 5.4% | ||||||||

| California Public Works Board Lease Rev. (Various Capital Projects), “G-1”, 5.75%, 2030 | $ | 2,950,000 | $ | 3,279,338 | ||||

| Cape Coral, FL, Special Obligation Rev., NATL, 5%, 2030 | 500,000 | 534,350 | ||||||

| Delaware Valley, PA, Regional Finance Authority, AMBAC, 5.5%, 2018 | 7,840,000 | 8,831,290 | ||||||

| Delaware Valley, PA, Regional Finance Authority, “B”, FRN, AMBAC, 0.744%, 2018 | 250,000 | 250,000 | ||||||

| Delaware Valley, PA, Regional Finance Authority, “C”, FRN, 1.074%, 2037 | 7,000,000 | 4,636,800 | ||||||

| Delaware Valley, PA, Regional Finance Authority, RITES, FRN, AMBAC, 9.943%, 2018 (p) | 900,000 | 1,127,592 | ||||||

| Florida Municipal Loan Council Rev., “C”, NATL, 5.25%, 2022 | 1,000,000 | 1,023,580 | ||||||

| FYI Properties Lease Rev. (Washington State Project), 5.5%, 2034 | 2,255,000 | 2,487,220 | ||||||

| Golden State, CA, Tobacco Securitization Corp., Tobacco Settlement Rev., “A”, AGM, 4.55%, 2022 | 3,415,000 | 3,493,989 | ||||||

| Golden State, CA, Tobacco Securitization Corp., Tobacco Settlement Rev., Enhanced, “A”, AMBAC, 5%, 2029 | 10,000,000 | 10,015,600 | ||||||