UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT

OF

REGISTERED MANAGEMENT COMPANY

| Investment Company Act file number: | 811-4098 |

| Name of Registrant: | Vanguard Chester Funds |

| Address of Registrant: | P.O. Box 2600 Valley Forge, PA 19482 |

| Name and address of agent for service: | Heidi Stam, Esquire P.O. Box 876 Valley Forge, PA 19482 |

Registrant’s telephone number, including area code: (610) 669-1000

| Date of fiscal year end: | September 30 |

| Date of reporting period: | October 1, 2005 - September 30, 2006 |

| Item 1: | Reports to Shareholders |

|

|

|

|

| Vanguard® PRIMECAP Fund |

|

|

|

|

|

|

|

|

|

|

| > Annual Report |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| September 30, 2006 |

|

|

|

|

|

|

|

| ||

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

> | Vanguard PRIMECAP Fund returned more than 12% during fiscal 2006, handily outpacing the market return and the average result for peer funds. |

> | The fund benefited from excellent stock selection in the information technology, industrials, and consumer discretionary sectors. |

> | The fund missed some opportunities among financial stocks. |

Contents |

|

|

|

Your Fund’s Total Returns | 1 |

Chairman’s Letter | 2 |

Advisor’s Report | 7 |

Fund Profile | 10 |

Performance Summary | 11 |

Financial Statements | 13 |

Your Fund’s After-Tax Returns | 25 |

About Your Fund’s Expenses | 26 |

Trustees Approve Advisory Agreement | 28 |

Glossary | 29 |

Please note: The opinions expressed in this report are just that—informed opinions. They should not be considered promises or advice. Also, please keep in mind that the information and opinions cover the period through the date on the cover of this report. Of course, the risks of investing in your fund are spelled out in the prospectus.

Your Fund’s Total Returns

Fiscal Year Ended September 30, 2006 |

|

| Total |

| Return |

Vanguard PRIMECAP Fund |

|

Investor Shares | 12.3% |

Admiral™ Shares1 | 12.5 |

S&P 500 Index | 10.8 |

Average Multi-Cap Growth Fund2 | 4.9 |

Your Fund’s Performance at a Glance |

|

|

| |

September 30, 2005–September 30, 2006 |

|

|

| |

|

|

| Distributions Per Share | |

| Starting | Ending | Income | Capital |

| Share Price | Share Price | Dividends | Gains |

Vanguard PRIMECAP Fund |

|

|

|

|

Investor Shares | $64.79 | $70.30 | $0.386 | $1.908 |

Admiral Shares | 67.28 | 73.03 | 0.472 | 1.980 |

1 A lower-cost class of shares available to many longtime shareholders and to those with significant investments in the fund.

2 Derived from data provided by Lipper Inc.

1

Chairman’s Letter

Dear Shareholder,

Vanguard PRIMECAP Fund returned more than 12%, handily outpacing the gain of its benchmark and the average return of its growth-oriented peers, for the fiscal year ended September 30, 2006. Your fund’s strong performance reflected excellent security selection among technology, industrial, and consumer-oriented stocks.

If you own Vanguard PRIMECAP Fund in a taxable account, you may wish to review our report on the fund’s after-tax returns on page 25. Please note that as of September 30 the fund remained closed to new investors. Existing shareholders may make additional purchases of up to $25,000 per year.

Stocks endured some rough going, then recovered to post strong results

The stock market advanced through the first part of the fund’s fiscal year, then hit a speed bump in May, as investors feared that the economy was growing too rapidly. But a slowdown in the housing market, coupled with a late-summer decline in oil prices, helped to allay inflation concerns. The broad market rebounded to post a solid 10.5% return for the 12-month period. Value-oriented stocks outperformed growth stocks, and large-capitalization stocks edged out small-caps, one of the market’s best-performing segments in recent years.

2

International stocks handily outpaced domestic issues, continuing a multiyear trend. European and emerging market stocks fared particularly well. Stocks in the Pacific region also performed admirably, even though Japanese stocks did not fully participate in the global market’s summer recovery.

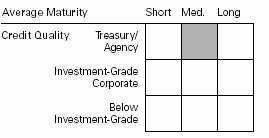

In the bond market, prices rallied as the Fed paused

At its August and September meetings, the Federal Reserve Board twice voted to maintain the federal funds rate at 5.25%, marking a pause in the central bank’s two-year inflation-fighting campaign. With investor sentiment buoyed by the Fed’s near-term inflation outlook, interest rates decreased, driving bond prices higher.

The broad taxable bond market finished the period with a 3.7% return, and municipal bonds performed slightly better.

Although rates decreased along the entire maturity spectrum in late summer, the difference between the yields of the shortest- and longest-term issues remained narrow by historical standards. At the end of September, the U.S. Treasury yield curve was actually inverted, meaning that short-term issues such as 3-month and 6-month Treasury notes offered higher yields than those with longer maturities.

The fund tapped into some surprising sources of strength

Although stocks registered a strong advance during the past 12 months, broad market themes had limited bearing on your

Market Barometer |

|

|

|

| Average Annual Total Returns | ||

| Periods Ended September 30, 2006 | ||

| One Year | Three Years | Five Years |

Stocks |

|

|

|

Russell 1000 Index (Large-caps) | 10.2% | 12.8% | 7.6% |

Russell 2000 Index (Small-caps) | 9.9 | 15.5 | 13.8 |

Dow Jones Wilshire 5000 Index (Entire market) | 10.5 | 13.3 | 8.6 |

MSCI All Country World Index ex USA (International) | 19.4 | 23.9 | 16.4 |

|

|

|

|

Bonds |

|

|

|

Lehman Aggregate Bond Index (Broad taxable market) | 3.7% | 3.4% | 4.8% |

Lehman Municipal Bond Index | 4.5 | 4.4 | 5.2 |

Citigroup 3-Month Treasury Bill Index | 4.4 | 2.6 | 2.2 |

|

|

|

|

CPI |

|

|

|

Consumer Price Index | 2.1% | 3.1% | 2.6% |

3

Fund’s performance. For example, Vanguard PRIMECAP Fund earned excellent returns from a handful of software and chip-maker stocks, even as the information technology sector turned in some of the broad market’s weaker results.

The fund’s consumer discretionary holdings—companies at the intersection of digital-entertainment delivery and production, such as DIRECTV and Sony—returned about eight percentage points more than the consumer discretionary stocks in the Standard & Poor’s 500 Index.

This divergence between market dynamics and PRIMECAP performance is not unusual. The fund’s advisor, PRIMECAP Management Company, relies on intensive research to identify companies that seem to boast impressive growth prospects, and then establishes large positions in the most promising candidates, regardless of their weight in market indexes. FedEx, the portfolio’s largest holding, accounts for some 5% of fund assets, but less than half a percentage point of the S&P 500 Index’s value. (During the past 12 months, incidentally, the global freight carrier returned about 25%, making a significant contribution to your fund’s performance.)

The fund’s distinctive investment strategy was also apparent in its weak spots during the 12 months. The fund missed out on much of the bounty in the financials sector. Its allocation to financials was relatively small, and its stock selections underperformed. The fund also trailed the market in the energy sector. These stocks

Expense Ratios1 |

|

|

|

Your fund compared with its peer group |

|

|

|

|

|

| Average |

| Investor | Admiral | Multi-Cap |

| Shares | Shares | Growth Fund |

PRIMECAP Fund | 0.46% | 0.31% | 1.65% |

1 Fund expense ratios reflect the 12 months ended September 30, 2006. Peer-group expense ratio is derived from data provided by Lipper Inc. and captures information through year-end 2005.

4

have pulled back recently as oil prices have tumbled, but the fund’s relatively modest group of holdings in the sector fell especially hard.

Talent and conviction have combined to produce long-term excellence

The talent for identifying investment opportunities and the confidence to seize them have been hallmarks of Vanguard PRIMECAP Fund’s performance not just during the past 12 months but since the fund’s 1984 inception.

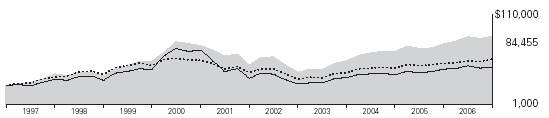

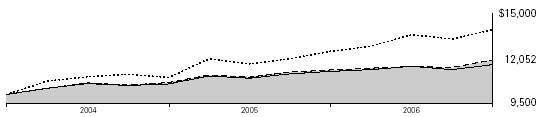

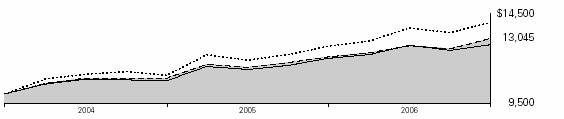

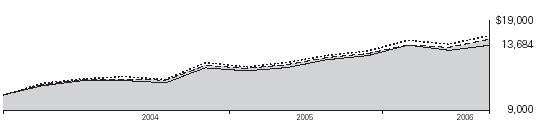

During the past ten years, the fund has produced an annualized return of 12.9%. Its benchmark index advanced by 8.6% per year, while the average annual return of competing funds was just 6.5%. In dollar terms, these percentage-point shortfalls would have translated into dramatic gaps in wealth accumulation. A hypothetical investment of $25,000 in Vanguard PRIMECAP Fund would have grown to more than $84,000 over the decade; the same investment compounded at the peer-group average would have been worth $46,751. While we remain confident in the fund managers’ ability to deliver outstanding long-term performance, it would be unreasonable to expect such margins of superiority to persist indefinitely.

Provision your portfolio for a long-term journey

Although the U.S. stock market finished the 12-month period with a solid return, the journey was circuitous: a strong start, a mid-May swoon, a powerful finish. These ups and downs are an unavoidable fact of investing life.

Total Returns |

|

|

Ten Years Ended September 30, 2006 |

|

|

| Average | Final Value of a $25,000 |

| Annual Return | Initial Investment |

PRIMECAP Fund Investor Shares | 12.9% | $84,455 |

S&P 500 Index | 8.6 | 56,979 |

Average Multi-Cap Growth Fund | 6.5 | 46,751 |

5

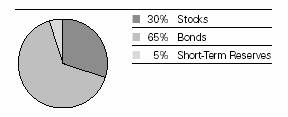

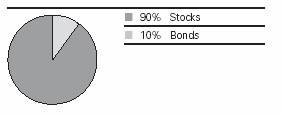

Our time-tested counsel to shareholders traveling across the market’s peaks and valleys toward long-term goals is to diversify both within and across asset classes. Within the stock market portion of your portfolio, for example, you can complement the large-cap-oriented PRIMECAP Fund with smaller stocks, potentially moderating the overall volatility of your stock investments. You can temper portfolio risk more dramatically by balancing stock funds with bond and money market funds in an allocation consistent with your goals and circumstances.

This simple plan gives you the opportunity to pursue the potentially high returns available from stocks while paying heed to risk control. Vanguard PRIMECAP Fund can play an important role in such a plan.

Thank you for entrusting your assets to Vanguard.

John J. Brennan

Chairman and Chief Executive Officer

October 13, 2006

6

Advisor’s Report

During the past 12 months, equity markets delivered solid returns. The Investor Shares of Vanguard PRIMECAP Fund returned 12.3%, exceeding the 10.8% return of the S&P 500 Index and the 4.9% average gain of the fund’s peer group.

Investment environment

Overall, fiscal 2006 was a strong year for stocks; however, it was a relatively challenging environment for growth stocks, as investors showed a strong preference for value stocks. Stocks struggled during the summer as the market wrestled with whether the Federal Reserve Board would continue to hike interest rates, threatening economic growth, or would pause, satisfied that the specter of inflation was less of a concern than preserving economic growth.

Since the Fed’s August 8 decision to leave short-term interest rates unchanged, stocks have trended higher. Additionally, energy and commodity prices have recently declined from historical highs, providing much needed relief to consumers and further mitigating inflationary concerns. Valuations, in our view, appear attractive in light of low long-term interest rates and modest inflationary expectations; however, with corporate profit margins at record highs, multiple expansion from the current level may prove difficult.

We continue to see relatively low premiums for high-quality growth stocks. The valuation differential between growth and value stocks remains near a 20-year low. Because our objective is to buy companies with superior growth at reasonable prices, we believe this valuation compression has afforded us some compelling investment opportunities.

Our successes

The fund’s outperformance relative to the index reflected stock selections in the information technology, industrials, and consumer discretionary sectors. Among technology stocks, our increased emphasis on software companies contributed significantly to the year’s results. During the year, we earned strong returns from Adobe Systems, Oracle, and Intuit. All three companies represent financially strong market leaders in consolidating industries.

In the industrials sector, successes included air-freight giant FedEx, the fund’s largest holding, which is increasing its share of the ground-parcel delivery market. Our airline stocks also generated strong returns, as increased load factors and lowered cost structures more than offset higher fuel prices. The fund earned excellent returns in the consumer discretionary sector from both broadcasting and entertainment companies, such as DIRECTV, Walt Disney, and select retailers. Schlumberger, Micron Technology, Inco, and Novartis also made strong contributions to our returns this year.

7

Our shortfalls

We sustained setbacks in our health care positions. Medical-device makers Boston Scientific and Medtronic performed poorly. Product recalls, FDA inquiries, safety concerns, and declining reimbursement rates have had a short-term impact on growth rates and investor psychology. Additionally, Boston Scientific has found the initial integration of Guidant to be more challenging than expected. We have increased our holdings in these two companies, as we believe the short-term issues will eventually be favorably resolved and the long-term growth prospects of the implantable-device and stent industries remain intact.

Other shortfalls included telecommunications-equipment stocks Plantronics, Nortel, and QUALCOMM; energy stocks ConocoPhillips and Pogo Producing; and Internet company eBay.

Outlook

We remain especially enthusiastic about companies in information technology and health care—sectors that accounted for many of our largest purchases during the past 12 months. We’ve added to some of the software companies that helped generate strong returns during the past year, including Oracle. We believe that four major trends will drive strong demand for software through the rest of the decade and beyond: (1) the availability of inexpensive bandwidth as the U.S. household broadband penetration doubles from 40%; (2) the sharing and storage of digital information, such as photos, data files, music, and video; (3) the convergence of voice, data, video, and wireless services; and (4) the need to protect and secure data and identities.

We’ve also been adding to our positions in the health care sector, although the recent performance of health care stocks continues to be poor. Pharmaceuticals have been among the worst-performing industry groups within the S&P 500 Index for the past four years, and we have continued to increase our commitment to the group. Despite public concern about drug prices, we see pharmaceuticals as part of the solution to higher health care costs. A recent study of nearly 200,000 patients published in the New England Journal of Medicine showed that capping drug benefits not only resulted in increased hospitalizations and deaths but produced no net cost savings. The money saved by spending less on drugs was spent on increased medical care for those patients whose drug benefits were capped. With the difference between the price/earnings ratios of pharmaceutical stocks and that of the S&P 500 Index close to a 40-year low, they appear undervalued.

8

We believe that the two segments of the economy most vulnerable to a slowdown are consumers and financial institutions. Consumer home equity extractions, which ranged between $100 billion and $200 billion for most of the 1980s and early 1990s, increased to $700 billion in 2005. With short-term interest rates rising and the housing market seemingly slowing, this source of liquidity is drying up.

Financial institutions will be hurt by deteriorating consumer finances, as well as by the relatively flat yield curve, which makes it more difficult for banks to arbitrage the difference between the interest rates of short-term deposits and long-term investments. While financials stocks account for approximately 22% of the S&P 500 Index’s value, the sector makes up less than 6% of portfolio assets, reflecting our pessimism for this area.

Howard B. Schow |

| Theo A. Kolokotrones |

Portfolio Manager |

| Portfolio Manager |

| Joel P. Fried |

|

| Portfolio Manager |

|

Mitchell J. Milias |

| Alfred W. Mordecai |

Portfolio Manager |

| Portfolio Manager |

|

|

|

|

|

|

PRIMECAP Management Company, LLP | October 18, 2006 | |

9

Fund Profile

As of September 30, 2006

Portfolio Characteristics |

|

|

|

| Comparative |

| Fund | Index1 |

Number of Stocks | 125 | 500 |

Median Market Cap | $28.3B | $56.1B |

Price/Earnings Ratio | 20.1x | 17.0x |

Price/Book Ratio | 2.9x | 2.8x |

Yield |

| 1.9% |

Investor Shares | 0.6% |

|

Admiral Shares | 0.8% |

|

Return on Equity | 14.7% | 18.9% |

Earnings Growth Rate | 20.0% | 17.0% |

Foreign Holdings | 12.3% | 0.0% |

Turnover Rate | 10% | — |

Expense Ratio |

| — |

Investor Shares | 0.46% |

|

Admiral Shares | 0.31% |

|

Short-Term Reserves | 3% | — |

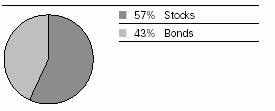

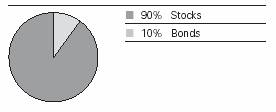

Sector Diversification (% of portfolio) |

|

|

|

| Comparative |

| Fund | Index1 |

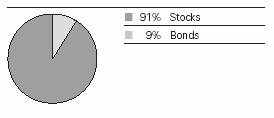

Consumer Discretionary | 11% | 10% |

Consumer Staples | 1 | 10 |

Energy | 7 | 9 |

Financials | 5 | 22 |

Health Care | 21 | 13 |

Industrials | 12 | 11 |

Information Technology | 31 | 15 |

Materials | 8 | 3 |

Telecommunication Services | 1 | 4 |

Utilities | 0 | 3 |

Short-Term Reserves | 3% | — |

Volatility Measures2 |

|

| Fund Versus |

| Comparative Index1 |

R-Squared | 0.83 |

Beta | 1.21 |

Ten Largest Holdings3 (% of total net assets) |

| |

|

|

|

FedEx Corp. | air freight and logistics | 4.9% |

Adobe Systems, Inc. | application software | 4.2 |

Texas Instruments, Inc. | semiconductors | 3.2 |

Novartis AG ADR | pharmaceuticals | 3.2 |

Eli Lilly & Co. | pharmaceuticals | 2.8 |

Biogen Idec Inc. | biotechnology | 2.7 |

Pfizer Inc. | pharmaceuticals | 2.5 |

Microsoft Corp. | systems software | 2.4 |

Oracle Corp. | systems software | 2.4 |

Medtronic, Inc. | health care equipment | 2.4 |

Top Ten |

| 30.7% |

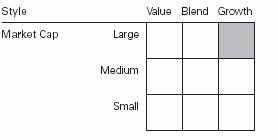

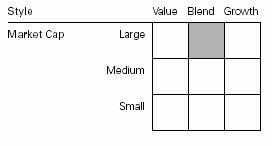

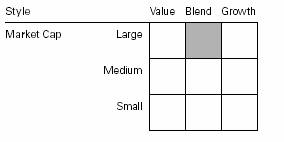

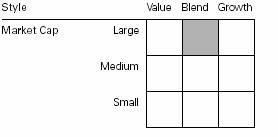

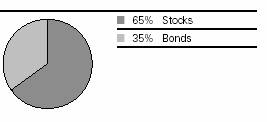

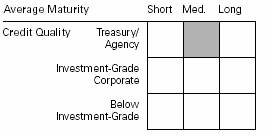

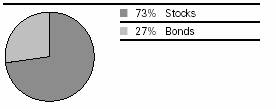

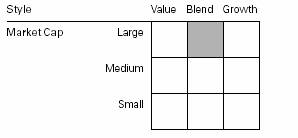

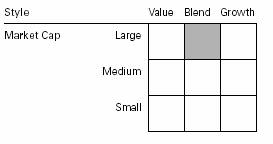

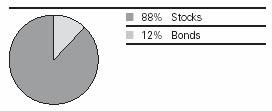

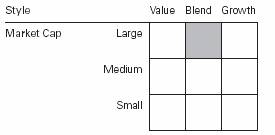

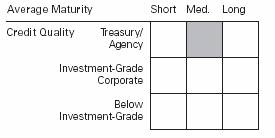

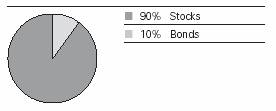

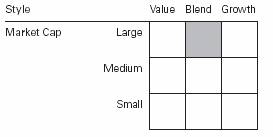

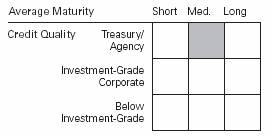

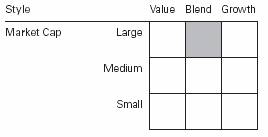

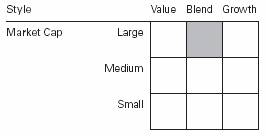

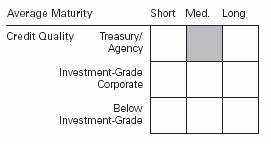

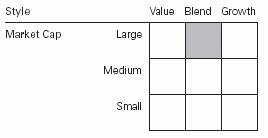

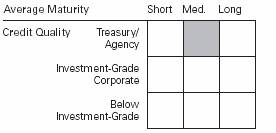

Investment Focus

1 S&P 500 Index.

2 For an explanation of R-squared, beta, and other terms used here, see the Glossary on page 29.

3“Ten Largest Holdings” excludes any temporary cash investments and equity index products.

10

Performance Summary

All of the returns in this report represent past performance, which is not a guarantee of future results that may be achieved by the fund. (Current performance may be lower or higher than the performance data cited. For performance data current to the most recent month-end, visit our website at www.vanguard.com.) Note, too, that both investment returns and principal value can fluctuate widely, so an investor’s shares, when sold, could be worth more or less than their original cost. The returns shown do not reflect taxes that a shareholder would pay on fund distributions or on the sale of fund shares.

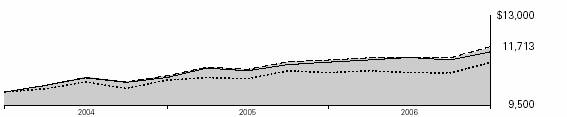

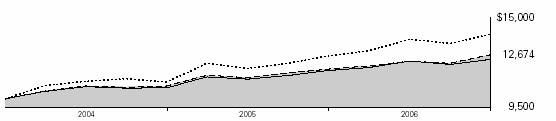

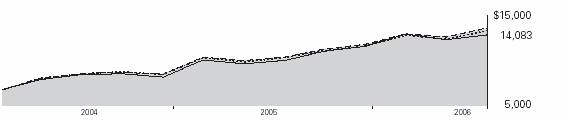

Cumulative Performance: September 30, 1996–September 30, 2006

Initial Investment of $25,000

| Average Annual Total Returns | Final Value | ||

| Periods Ended September 30, 2006 | of a $25,000 | ||

| One Year | Five Years | Ten Years | Investment |

PRIMECAP Fund Investor Shares1 | 12.30% | 11.34% | 12.95% | $84,455 |

S&P 500 Index | 10.79 | 6.97 | 8.59 | 56,979 |

Average Multi-Cap Growth Fund2 | 4.86 | 6.75 | 6.46 | 46,751 |

|

|

| Final Value |

|

| Since | of a $100,000 |

| One Year | Inception3 | Investment |

PRIMECAP Fund Admiral Shares1 | 12.45% | 9.49% | $155,681 |

S&P 500 Index | 10.79 | 5.55 | 130,186 |

1 Total return figures do not reflect the 1% fee assessed on redemptions of shares held less than one year, or the 1% fee assessed until March 23, 2005, on shares purchased on or after April 23, 2001, and held for less than five years.

2 Derived from data provided by Lipper Inc.

3 November 12, 2001.

11

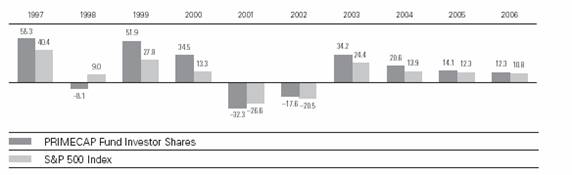

Fiscal-Year Total Returns (%): September 30, 1996–September 30, 2006

Note: See Financial Highlights tables on pages 18 and 19 for dividend and capital gains information.

12

Financial Statements

Statement of Net Assets

As of September 30, 2006

The fund provides a complete list of its holdings four times in each fiscal year, at the quarter-ends. For the second and fourth fiscal quarters, the lists appear in the fund’s semiannual and annual reports to shareholders. For the first and third fiscal quarters, the fund files the lists with the Securities and Exchange Commission on Form N-Q. Shareholders can look up the fund’s Forms N-Q on the SEC’s website at www.sec.gov. Forms N-Q may also be reviewed and copied at the SEC’s Public Reference Room (see the back cover of this report for further information).

|

|

| Market |

|

|

| Value• |

|

| Shares | ($000) |

Common Stocks (97.2%) |

|

| |

Consumer Discretionary (10.9%) |

|

| |

* | DIRECTV Group, Inc. | 29,776,749 | 586,006 |

| Sony Corp. ADR | 11,350,000 | 458,086 |

| TJX Cos., Inc. | 12,394,800 | 347,426 |

| Whirlpool Corp. | 3,600,000 | 302,796 |

| Target Corp. | 5,019,000 | 277,300 |

* | Univision Communications Inc. | 6,000,000 | 206,040 |

^ | Eastman Kodak Co. | 9,000,000 | 201,600 |

* | Kohl’s Corp. | 3,014,600 | 195,708 |

| The Walt Disney Co. | 5,650,000 | 174,642 |

* | Comcast Corp. Class A | 3,268,000 | 120,426 |

| Best Buy Co., Inc. | 1,575,000 | 84,357 |

| Mattel, Inc. | 3,707,900 | 73,046 |

* | Bed Bath & Beyond, Inc. | 1,850,975 | 70,818 |

| Lowe’s Cos., Inc. | 2,450,000 | 68,747 |

| Time Warner, Inc. | 2,609,600 | 47,573 |

| Abercrombie & Fitch Co. | 375,000 | 26,055 |

| Yum! Brands, Inc. | 500,000 | 26,025 |

| ArvinMeritor, Inc. | 1,620,600 | 23,077 |

| Tiffany & Co. | 542,000 | 17,994 |

| Weight Watchers International, Inc. | 150,000 | 6,651 |

| Brunswick Corp. | 112,000 | 3,493 |

|

|

| 3,317,866 |

Consumer Staples (1.4%) |

|

| |

| Costco Wholesale Corp. | 7,000,000 | 347,760 |

| Avon Products, Inc. | 2,460,000 | 75,424 |

|

|

| 423,184 |

Energy (7.1%) |

|

| |

| ConocoPhillips Co. | 11,300,000 | 672,689 |

| Schlumberger Ltd. | 5,573,500 | 345,724 |

| Noble Energy, Inc. | 5,960,000 | 271,716 |

| Hess Corp. | 6,000,000 | 248,520 |

| EnCana Corp. | 3,650,200 | 170,428 |

1 | Pogo Producing Co. | 3,260,000 | 133,497 |

| GlobalSantaFe Corp. | 1,676,600 | 83,813 |

* | Transocean Inc. | 1,100,000 | 80,553 |

| EOG Resources, Inc. | 1,200,000 | 78,060 |

| Chevron Corp. | 300,000 | 19,458 |

| Noble Corp. | 300,000 | 19,254 |

| Murphy Oil Corp. | 350,000 | 16,643 |

* | Cameron International Corp. | 230,400 | 11,131 |

|

|

| 2,151,486 |

Financials (5.5%) |

|

| |

| The Bank of New York Co., Inc. | 9,800,000 | 345,548 |

| Marsh & McLennan Cos., Inc. | 9,102,300 | 256,230 |

| The Chubb Corp. | 4,766,800 | 247,683 |

| American International Group, Inc. | 3,325,000 | 220,315 |

* | Berkshire Hathaway Inc. Class B | 65,600 | 208,214 |

| Fannie Mae | 1,800,000 | 100,638 |

| Transatlantic Holdings, Inc. | 1,054,687 | 63,714 |

| AFLAC Inc. | 1,200,000 | 54,912 |

| JPMorgan Chase & Co. | 980,000 | 46,021 |

| Wells Fargo & Co. | 1,150,000 | 41,607 |

| Capital One Financial Corp. | 415,000 | 32,644 |

| Freddie Mac | 295,000 | 19,567 |

| Fifth Third Bancorp | 450,000 | 17,136 |

| State Street Corp. | 200,000 | 12,480 |

| SLM Corp. | 185,000 | 9,616 |

| Washington Mutual, Inc. | 100,000 | 4,347 |

|

|

| 1,680,672 |

Health Care (20.8%) |

|

| |

| Novartis AG ADR | 16,377,860 | 957,122 |

| Eli Lilly & Co. | 15,150,000 | 863,550 |

* 1 | Biogen Idec Inc. | 18,131,020 | 810,094 |

| Pfizer Inc. | 26,968,793 | 764,835 |

| Medtronic, Inc. | 15,573,452 | 723,231 |

| Roche Holdings AG | 2,950,000 | 508,241 |

* | Boston Scientific Corp. | 25,728,010 | 380,517 |

* | Genzyme Corp. | 4,400,000 | 296,868 |

| Applera Corp.-Applied Biosystems Group | 8,945,300 | 296,179 |

13

|

|

| Market |

|

|

| Value• |

|

| Shares | ($000) |

| GlaxoSmithKline PLC ADR | 4,403,800 | 234,414 |

*^ | Sepracor Inc. | 3,600,000 | 174,384 |

* 1 | Millipore Corp. | 2,820,000 | 172,866 |

* | Amgen, Inc. | 1,795,500 | 128,432 |

| Applera Corp.-Celera Genomics Group | 1,073,600 | 14,945 |

|

|

| 6,325,678 |

Industrials (12.0%) |

|

| |

| FedEx Corp. | 13,575,800 | 1,475,417 |

| Union Pacific Corp. | 6,570,000 | 578,160 |

| Southwest Airlines Co. | 23,914,737 | 398,420 |

| Caterpillar, Inc. | 5,256,900 | 345,904 |

* | AMR Corp. | 9,528,200 | 220,483 |

1 | Granite Construction Co. | 3,150,000 | 168,052 |

| Fluor Corp. | 1,400,000 | 107,646 |

* 1 | Alaska Air Group, Inc. | 2,540,000 | 96,621 |

| Deere & Co. | 1,048,500 | 87,979 |

| Pall Corp. | 2,000,000 | 61,620 |

| Donaldson Co., Inc. | 1,600,000 | 59,040 |

| United Parcel Service, Inc. | 315,270 | 22,681 |

| 3M Co. | 300,000 | 22,326 |

|

|

| 3,644,349 |

Information Technology (31.2%) |

|

| |

| Communications Equipment (5.3%) |

|

|

* | Corning, Inc. | 18,297,000 | 446,630 |

| QUALCOMM Inc. | 10,403,000 | 378,149 |

| Motorola, Inc. | 14,050,000 | 351,250 |

* | Nortel Networks Corp. | 83,009,400 | 190,922 |

^ | LM Ericsson Telephone Co. ADR Class B | 4,637,857 | 159,774 |

1 | Plantronics, Inc. | 4,701,500 | 82,417 |

|

|

|

|

| Computers & Peripherals (2.2%) |

|

|

| Hewlett-Packard Co. | 11,805,000 | 433,125 |

* | EMC Corp. | 17,129,200 | 205,208 |

* | Dell Inc. | 1,380,000 | 31,519 |

|

|

|

|

| Electronic Equipment & Instruments (1.1%) |

|

|

1 | Tektronix, Inc. | 6,629,600 | 191,794 |

| Symbol Technologies, Inc. | 5,200,000 | 77,272 |

* | Coherent, Inc. | 1,420,000 | 49,217 |

* | Agilent Technologies, Inc. | 237,681 | 7,770 |

|

|

|

|

| Internet Software & Services (1.8%) |

|

|

* | Google Inc. | 717,500 | 288,363 |

* | eBay Inc. | 6,625,000 | 187,885 |

* | Yahoo! Inc. | 2,079,500 | 52,570 |

|

|

|

|

| IT Services (0.6%) |

|

|

| Accenture Ltd. | 4,136,200 | 131,159 |

| Paychex, Inc. | 1,400,000 | 51,590 |

| Semiconductors & Semiconductor Equipment (7.8%) |

|

|

| Texas Instruments, Inc. | 29,100,000 | 967,575 |

* | Micron Technology, Inc. | 36,512,373 | 635,315 |

| Intel Corp. | 17,100,000 | 351,747 |

| Applied Materials, Inc. | 7,330,000 | 129,961 |

* | Freescale Semiconductor, Inc. Class B | 2,163,863 | 82,248 |

* | NVIDIA Corp. | 2,150,000 | 63,619 |

* | ASML Holding (New York) | 2,001,000 | 46,583 |

* | Rambus Inc. | 2,500,000 | 43,600 |

* | Entegris Inc. | 2,583,472 | 28,186 |

| KLA-Tencor Corp. | 525,000 | 23,347 |

|

|

|

|

| Software (12.4%) |

|

|

* 1 | Adobe Systems, Inc. | 33,800,000 | 1,265,810 |

| Microsoft Corp. | 27,183,347 | 742,921 |

* | Oracle Corp. | 41,150,600 | 730,012 |

* | Intuit, Inc. | 14,200,000 | 455,678 |

*1 | Citrix Systems, Inc. | 9,600,000 | 347,616 |

* | Symantec Corp. | 10,805,200 | 229,935 |

|

|

| 9,460,767 |

Materials (7.6%) |

|

| |

1 | Potash Corp. of Saskatchewan, Inc. | 6,851,400 | 713,847 |

| Weyerhaeuser Co. | 5,330,000 | 327,955 |

| Monsanto Co. | 6,594,360 | 310,001 |

| Inco Ltd. | 4,000,000 | 305,080 |

| Praxair, Inc. | 3,850,100 | 227,772 |

| Dow Chemical Co. | 5,650,000 | 220,237 |

| Alcoa Inc. | 4,854,000 | 136,106 |

1 | MacDermid, Inc. | 1,701,000 | 55,487 |

| Phelps Dodge Corp. | 280,000 | 23,716 |

| Temple-Inland Inc. | 70,000 | 2,807 |

|

|

| 2,323,008 |

Telecommunication Services (0.7%) |

|

| |

| Sprint Nextel Corp. | 10,393,800 | 178,254 |

| Embarq Corp. | 502,440 | 24,303 |

|

|

| 202,557 |

Total Common Stocks |

|

| |

(Cost $19,084,627) |

| 29,529,567 | |

Temporary Cash Investments (3.1%) |

|

| |

2 | Vanguard Market |

|

|

| Liquidity Fund, 5.306% | 872,849,044 | 872,849 |

2 | Vanguard Market |

|

|

| Liquidity Fund, |

|

|

| 5.306%—Note G | 67,595,000 | 67,595 |

Total Temporary Cash Investments |

|

| |

(Cost $940,444) |

| 940,444 | |

Total Investments (100.3%) |

|

| |

(Cost $20,025,071) |

| 30,470,011 | |

Other Assets and Liabilities—Net (–0.3%) |

| (99,441) | |

|

|

|

|

Net Assets (100%) |

| 30,370,570 | |

14

| Market |

| Value• |

| ($000) |

Statement of Assets and Liabilities |

|

Assets |

|

Investments in Securities, at Value | 30,470,011 |

Receivables for Capital Shares Issued | 34,424 |

Other Assets—Note C | 29,203 |

Total Assets | 30,533,638 |

Liabilities |

|

Security Lending Collateral |

|

Payable to Brokers—Note G | 67,595 |

Other Liabilities | 95,473 |

Total Liabilities | 163,068 |

Net Assets | 30,370,570 |

At September 30, 2006, net assets consisted of:3 |

|

| Amount |

| ($000) |

Paid-in Capital | 18,426,237 |

Undistributed Net Investment Income | 108,084 |

Accumulated Net Realized Gains | 1,391,265 |

Unrealized Appreciation |

|

Investment Securities | 10,444,940 |

Foreign Currencies | 44 |

Net Assets | 30,370,570 |

|

|

Investor Shares—Net Assets |

|

Applicable to 310,500,758 outstanding $.001 |

|

par value shares of beneficial interest |

|

(unlimited authorization) | 21,828,190 |

Net Asset Value Per Share— |

|

Investor Shares | $70.30 |

|

|

Admiral Shares—Net Assets |

|

Applicable to 116,965,480 outstanding $.001 |

|

par value shares of beneficial interest |

|

(unlimited authorization) | 8,542,380 |

Net Asset Value Per Share— |

|

Admiral Shares | $73.03 |

• | See Note A in Notes to Financial Statements. |

* | Non-income-producing security. |

^ | Part of security position is on loan to broker-dealers. See Note G in Notes to Financial Statements. |

1 Considered an affiliated company of the fund as the fund owns more than 5% of the outstanding voting securities of such company. See Note I in Notes to Financial Statements.

2 Affiliated money market fund available only to Vanguard funds and certain trusts and accounts managed by Vanguard. Rate shown is the 7-day yield.

3 See Note E in Notes to Financial Statements for the tax-basis components of net assets.

ADR—American Depositary Receipt.

15

Statement of Operations

| Year Ended |

| September 30, 2006 |

| ($000) |

Investment Income |

|

Income |

|

Dividends1,2 | 270,002 |

Interest2 | 48,222 |

Security Lending | 1,628 |

Total Income | 319,852 |

Expenses |

|

Investment Advisory Fees—Note B | 62,097 |

The Vanguard Group—Note C |

|

Management and Administrative |

|

Investor Shares | 46,254 |

Admiral Shares | 5,969 |

Marketing and Distribution |

|

Investor Shares | 4,670 |

Admiral Shares | 1,423 |

Custodian Fees | 449 |

Auditing Fees | 19 |

Shareholders’ Reports |

|

Investor Shares | 454 |

Admiral Shares | 15 |

Trustees’ Fees and Expenses | 32 |

Total Expenses | 121,382 |

Expenses Paid Indirectly—Note D | (682) |

Net Expenses | 120,700 |

Net Investment Income | 199,152 |

Realized Net Gain (Loss) |

|

Investment Securities Sold2 | 1,712,252 |

Foreign Currencies | (29) |

Realized Net Gain (Loss) | 1,712,223 |

Change in Unrealized Appreciation (Depreciation) |

|

Investment Securities | 1,447,579 |

Foreign Currencies | 44 |

Change in Unrealized Appreciation (Depreciation) | 1,447,623 |

Net Increase (Decrease) in Net Assets Resulting from Operations | 3,358,998 |

1 Dividends are net of foreign withholding taxes of $4,770,000.

2 Dividend income, interest income, and realized net gain (loss) from affiliated companies of the fund were $10,428,000, $48,219,000, and $450,750,000, respectively.

16

Statement of Changes in Net Assets

| Year Ended September 30, | |

| 2006 | 2005 |

| ($000) | ($000) |

Increase (Decrease) in Net Assets |

|

|

Operations |

|

|

Net Investment Income | 199,152 | 230,848 |

Realized Net Gain (Loss) | 1,712,223 | 712,533 |

Change in Unrealized Appreciation (Depreciation) | 1,447,623 | 2,542,634 |

Net Increase (Decrease) in Net Assets Resulting from Operations | 3,358,998 | 3,486,015 |

Distributions |

|

|

Net Investment Income |

|

|

Investor Shares | (120,479) | (163,617) |

Admiral Shares | (50,404) | (36,076) |

Realized Capital Gain |

|

|

Investor Shares | (595,528) | — |

Admiral Shares | (211,443) | — |

Total Distributions | (977,854) | (199,693) |

Capital Share Transactions—Note H |

|

|

Investor Shares | (553,866) | (2,992,661) |

Admiral Shares | 969,966 | 2,573,706 |

Net Increase (Decrease) from Capital Share Transactions | 416,100 | (418,955) |

Total Increase (Decrease) | 2,797,244 | 2,867,367 |

Net Assets |

|

|

Beginning of Period | 27,573,326 | 24,705,959 |

End of Period1 | 30,370,570 | 27,573,326 |

1 Net Assets—End of Period includes undistributed net investment income of $108,084,000 and $89,985,000.

17

Financial Highlights

PRIMECAP Fund Investor Shares | |||||||

|

|

|

|

|

|

| |

| Year Ended | Sept. 1 to |

|

| |||

For a Share Outstanding | September 30, | Sept. 30, | Year Ended August 31, | ||||

Throughout Each Period | 2006 | 2005 | 20041 | 2004 | 2003 | 2002 | |

Net Asset Value, |

|

|

|

|

|

| |

Beginning of Period | $64.79 | $57.18 | $54.93 | $48.50 | $39.51 | $51.90 | |

Investment Operations |

|

|

|

|

|

| |

Net Investment Income | .437 | .5112 | .03 | .25 | .23 | .188 | |

Net Realized and Unrealized |

|

|

|

|

|

| |

Gain (Loss) on Investments | 7.367 | 7.544 | 2.22 | 6.39 | 8.97 | (12.183) | |

Total from |

|

|

|

|

|

| |

Investment Operations | 7.804 | 8.055 | 2.25 | 6.64 | 9.20 | (11.995) | |

Distributions |

|

|

|

|

|

| |

Dividends from |

|

|

|

|

|

| |

Net Investment Income | (.386) | (.445) | — | (.21) | (.21) | (.260) | |

Distributions from |

|

|

|

|

|

| |

Realized Capital Gains | (1.908) | — | — | — | — | (.135) | |

Total Distributions | (2.294) | (.445) | — | (.21) | (.21) | (.395) | |

Net Asset Value, |

|

|

|

|

|

| |

End of Period | $70.30 | $64.79 | $57.18 | $54.93 | $48.50 | $39.51 | |

|

|

|

|

|

|

| |

Total Return3 | 12.30% | 14.13% | 4.10% | 13.72% | 23.41% | –23.28% | |

|

|

|

|

|

|

| |

Ratios/Supplemental Data |

|

|

|

|

|

| |

Net Assets, |

|

|

|

|

|

| |

End of Period (Millions) | $21,828 | $20,643 | $20,933 | $20,115 | $16,886 | $13,216 | |

Ratio of Total Expenses to |

|

|

|

|

|

| |

Average Net Assets | 0.46% | 0.46% | 0.45%* | 0.46% | 0.51% | 0.49% | |

Ratio of Net Investment |

|

|

|

|

|

| |

Income to Average Net Assets | 0.64% | 0.85%2 | 0.57%* | 0.48% | 0.56% | 0.42% | |

Portfolio Turnover Rate | 10% | 12% | 1% | 9% | 12% | 11% | |

1 The fund’s fiscal year-end changed from August 31 to September 30, effective September 30, 2004.

2 Net investment income per share and the ratio of net investment income to average net assets include $.144 and 0.24%, respectively, resulting from a special dividend from Microsoft Corp. in December 2004.

3 Total returns do not reflect the 1% fee assessed on redemptions after March 23, 2005, of shares held for less than one year, or the 1% fee assessed until March 23, 2005, on shares purchased on or after April 23, 2001, and held for less than five years.

* Annualized.

18

PRIMECAP Fund Admiral Shares |

|

|

|

|

| ||

|

|

|

|

|

| Nov. 12, | |

| Year Ended | Sept. 1 to | Year Ended | 20012 to | |||

For a Share Outstanding | September 30, | Sept. 30, | August 31, | Aug. 31, | |||

Throughout Each Period | 2006 | 2005 | 20041 | 2004 | 2003 | 2002 | |

Net Asset Value, |

|

|

|

|

|

| |

Beginning of Period | $67.28 | $59.36 | $57.02 | $50.34 | $41.00 | $50.00 | |

Investment Operations |

|

|

|

|

|

| |

Net Investment Income | .562 | .6363 | .03 | .35 | .295 | .191 | |

Net Realized and Unrealized |

|

|

|

|

|

| |

Gain (Loss) on Investments | 7.640 | 7.836 | 2.31 | 6.62 | 9.310 | (8.776) | |

Total from |

|

|

|

|

|

| |

Investment Operations | 8.202 | 8.472 | 2.34 | 6.97 | 9.605 | (8.585) | |

Distributions |

|

|

|

|

|

| |

Dividends from |

|

|

|

|

|

| |

Net Investment Income | (.472) | (.552) | — | (.29) | (.265) | (.275) | |

Distributions from |

|

|

|

|

|

| |

Realized Capital Gains | (1.980) | — | — | — | — | (.140) | |

Total Distributions | (2.452) | (.552) | — | (.29) | (.265) | (.415) | |

Net Asset Value, |

|

|

|

|

|

| |

End of Period | $73.03 | $67.28 | $59.36 | $57.02 | $50.34 | $41.00 | |

|

|

|

|

|

|

| |

Total Return4 | 12.45% | 14.33% | 4.10% | 13.88% | 23.58% | –17.35% | |

|

|

|

|

|

|

| |

Ratios/Supplemental Data |

|

|

|

|

|

| |

Net Assets, |

|

|

|

|

|

| |

End of Period (Millions) | $8,542 | $6,930 | $3,773 | $3,605 | $2,067 | $1,369 | |

Ratio of Total Expenses to |

|

|

|

|

|

| |

Average Net Assets | 0.31% | 0.31% | 0.30%* | 0.31% | 0.37% | 0.38%* | |

Ratio of Net Investment |

|

|

|

|

|

| |

Income to Average Net Assets | 0.79% | 0.96%3 | 0.72%* | 0.63% | 0.69% | 0.52%* | |

Portfolio Turnover Rate | 10% | 12% | 1% | 9% | 12% | 11% | |

1 The fund’s fiscal year-end changed from August 31 to September 30, effective September 30, 2004.

2 Inception.

3 Net investment income per share and the ratio of net investment income to average net assets include $.149 and 0.24%, respectively, resulting from a special dividend from Microsoft Corp. in December 2004.

4 Total returns do not reflect the 1% fee assessed on redemptions after March 23, 2005, of shares held for less than one year, or the 1% fee previously assessed on shares held for less than five years.

* | Annualized. |

See accompanying Notes, which are an integral part of the Financial Statements.

19

Notes to Financial Statements

Vanguard PRIMECAP Fund is registered under the Investment Company Act of 1940 as an open-end investment company, or mutual fund. The fund files reports with the SEC under the company name Vanguard Chester Funds. The fund offers two classes of shares, Investor Shares and Admiral Shares. Investor Shares are available to any investor who meets the fund’s minimum purchase requirements. Admiral Shares are designed for investors who meet certain administrative, servicing, tenure, and account-size criteria.

A. The following significant accounting policies conform to generally accepted accounting principles for U.S. mutual funds. The fund consistently follows such policies in preparing its financial statements.

1. Security Valuation: Securities are valued as of the close of trading on the New York Stock Exchange (generally 4:00 p.m., Eastern time) on the valuation date. Equity securities are valued at the latest quoted sales prices or official closing prices taken from the primary market in which each security trades; such securities not traded on the valuation date are valued at the mean of the latest quoted bid and asked prices. Securities for which market quotations are not readily available, or whose values have been affected by events occurring before the fund’s pricing time but after the close of the securities’ primary markets, are valued at their fair values calculated according to procedures adopted by the board of trustees. These procedures include obtaining quotations from an independent pricing service, monitoring news to identify significant market- or security-specific events, and evaluating changes in the values of foreign market proxies (for example, ADRs, futures contracts, or exchange-traded funds), between the time the foreign markets close and the fund’s pricing time. When fair-value pricing is employed, the prices of securities used by a fund to calculate its net asset value may differ from quoted or published prices for the same securities. Investments in Vanguard Market Liquidity Fund are valued at that fund’s net asset value.

2. Foreign Currency: Securities and other assets and liabilities denominated in foreign currencies are translated into U.S. dollars at the exchange rates on the valuation date as employed by Morgan Stanley Capital International (MSCI) in the calculation of its indexes. As part of the fund’s fair-value procedures, exchange rates may be adjusted if they change significantly before the fund’s pricing time but after the time at which the MSCI rates are determined (generally 11:00 a.m., Eastern time).

Realized gains (losses) and unrealized appreciation (depreciation) on investment securities include the effects of changes in exchange rates since the securities were purchased, combined with the effects of changes in security prices. Fluctuations in the value of other assets and liabilities resulting from changes in exchange rates are recorded as unrealized foreign currency gains (losses) until the asset or liability is settled in cash, when they are recorded as realized foreign currency gains (losses).

3. Federal Income Taxes: The fund intends to continue to qualify as a regulated investment company and distribute all of its taxable income. Accordingly, no provision for federal income taxes is required in the financial statements.

4. Distributions: Distributions to shareholders are recorded on the ex-dividend date.

5. Security Lending: The fund may lend its securities to qualified institutional borrowers to earn additional income. Security loans are required to be secured at all times by collateral at least equal to the market value of securities loaned. The fund invests cash collateral received in Vanguard Market Liquidity Fund, and records a liability for the return of the collateral, during the period the securities are on loan. Security lending income represents the income earned on investing cash collateral, less expenses associated with the loan.

20

6. Other: Dividend income is recorded on the ex-dividend date. Interest income includes income distributions received from Vanguard Market Liquidity Fund and is accrued daily. Security transactions are accounted for on the date securities are bought or sold. Costs used to determine realized gains (losses) on the sale of investment securities are those of the specific securities sold. Fees assessed on redemptions of capital shares are credited to paid-in capital.

Each class of shares has equal rights as to assets and earnings, except that each class separately bears certain class-specific expenses related to maintenance of shareholder accounts (included in Management and Administrative expenses) and shareholder reporting. Marketing and distribution expenses are allocated to each class of shares based on a method approved by the board of trustees. Income, other non-class-specific expenses, and gains and losses on investments are allocated to each class of shares based on its relative net assets.

B. PRIMECAP Management Company provides investment advisory services to the fund for a fee calculated at an annual percentage rate of average net assets. For the year ended September 30, 2006, the investment advisory fee represented an effective annual rate of 0.21% of the fund’s average net assets.

C. The Vanguard Group furnishes at cost corporate management, administrative, marketing, and distribution services. The costs of such services are allocated to the fund under methods approved by the board of trustees. The fund has committed to provide up to 0.40% of its net assets in capital contributions to Vanguard. At September 30, 2006, the fund had contributed capital of $3,117,000 to Vanguard (included in Other Assets), representing 0.01% of the fund’s net assets and 3.12% of Vanguard’s capitalization. The fund’s trustees and officers are also directors and officers of Vanguard.

D. The fund has asked its investment advisor to direct certain security trades, subject to obtaining the best price and execution, to brokers who have agreed to rebate to the fund part of the commissions generated. Such rebates are used solely to reduce the fund’s management and administrative expenses. The fund’s custodian bank has also agreed to reduce its fees when the fund maintains cash on deposit in the non-interest-bearing custody account. For the year ended September 30, 2006, these arrangements reduced the fund’s management and administrative expenses by $633,000 and custodian fees by $49,000.

E. Distributions are determined on a tax basis and may differ from net investment income and realized capital gains for financial reporting purposes. Differences may be permanent or temporary. Permanent differences are reclassified among capital accounts in the financial statements to reflect their tax character. Temporary differences arise when certain items of income, expense, gain, or loss are recognized in different periods for financial statement and tax purposes; these differences will reverse at some time in the future. Differences in classification may also result from the treatment of short-term gains as ordinary income for tax purposes.

During the year ended September 30, 2006, the fund realized net foreign currency losses of $29,000, which decreased distributable net income for tax purposes; accordingly, such losses have been reclassified from accumulated net realized gains to undistributed net investment income.

The fund used a tax accounting practice to treat a portion of the price of capital shares redeemed during the year as distributions from net investment income and realized capital gains. Accordingly, the fund has reclassified $10,141,000 from undistributed net investment income, and $84,109,000 from accumulated net realized gains, to paid-in capital.

21

For tax purposes, at September 30, 2006, the fund had $165,037,000 of ordinary income and $1,375,972,000 of long-term capital gains available for distribution.

At September 30, 2006, the cost of investment securities for tax purposes was $20,025,071,000. Net unrealized appreciation of investment securities for tax purposes was $10,444,940,000 consisting of unrealized gains of $11,282,360,000 on securities that had risen in value since their purchase and $837,420,000 in unrealized losses on securities that had fallen in value since their purchase.

F. During the year ended September 30, 2006, the fund purchased $2,925,726,000 of investment securities and sold $3,575,945,000 of investment securities, other than temporary cash investments.

G. The market value of securities on loan to broker-dealers at September 30, 2006, was $64,634,000, for which the fund received cash collateral of $67,595,000.

H. Capital share transactions for each class of shares were:

|

| Year Ended September 30, | ||

|

| 2006 |

| 2005 |

| Amount | Shares | Amount | Shares |

| ($000) | (000) | ($000) | (000) |

Investor Shares |

|

|

|

|

Issued | $1,953,345 | 28,851 | $2,112,455 | 34,784 |

Issued in Lieu of Cash Distributions | 705,002 | 10,739 | 159,904 | 2,613 |

Redeemed1 | (3,212,213) | (47,710) | (5,265,020) | (84,896) |

Net Increase (Decrease)—Investor Shares | (553,866) | (8,120) | (2,992,661) | (47,499) |

Admiral Shares |

|

|

|

|

Issued | 1,539,872 | 22,010 | 3,013,929 | 46,362 |

Issued in Lieu of Cash Distributions | 247,413 | 3,631 | 33,026 | 520 |

Redeemed1 | (817,319) | (11,681) | (473,249) | (7,435) |

Net Increase (Decrease)—Admiral Shares | 969,966 | 13,960 | 2,573,706 | 39,447 |

1 Net of redemption fees of $672,000 and $1,126,000 (fund totals).

22

I. Certain of the fund’s investments are in companies that are considered to be affiliated companies of the fund because the fund owns more than 5% of the outstanding voting securities of the company. Transactions during the period in securities of these companies were as follows:

|

| Current-Period Transactions |

|

| |

| Sept. 30, 2005 |

| Proceeds from |

| Sept. 30, 2006 |

| Market | Purchases | Securities | Dividend | Market |

| Value | at Cost | Sold | Income | Value |

| ($000) | ($000) | ($000) | ($000) | ($000) |

Adobe Systems, Inc. | 1,019,557 | 3,772 | 19,419 | — | 1,265,810 |

Alaska Air Group, Inc. | 73,812 | — | — | — | 96,621 |

AMR Corp. | 103,974 | 5,800 | — | — | n/a1 |

Biogen Idec Inc. | 715,813 | — | — | — | 810,094 |

Citrix Systems, Inc. | 245,115 | — | 5,167 | — | 347,616 |

Granite Construction Co. | 120,456 | — | — | 1,260 | 168,052 |

MacDermid, Inc. | 44,668 | — | — | 408 | 55,487 |

Micron Technology, Inc. | 485,615 | — | — | — | n/a1 |

Millipore Corp. | 177,350 | — | — | — | 172,866 |

The Neiman Marcus Group, Inc. |

|

|

|

|

|

Class A | 179,910 | — | 180,000 | — | — |

The Neiman Marcus Group, Inc. |

|

|

|

|

|

Class B | 102,706 | — | 102,881 | — | — |

Plantronics, Inc. | 144,853 | — | — | 940 | 82,417 |

Pogo Producing Co. | 192,144 | — | — | 937 | 133,497 |

Potash Corp. of Saskatchewan, Inc. | 630,041 | 7,792 | — | 3,481 | 713,847 |

Robert Half International, Inc. | 310,523 | — | 326,785 | 1,811 | — |

Tektronix, Inc. | 167,265 | — | — | 1,591 | 191,794 |

| 4,713,802 |

|

| 10,428 | 4,038,101 |

J. In June 2006, the Financial Accounting Standards Board issued Interpretation No. 48 (“FIN 48”), “Accounting for Uncertainty in Income Taxes.” FIN 48 establishes the minimum threshold for recognizing, and a system for measuring, the benefits of tax-return positions in financial statements. FIN 48 will be effective for the fund’s fiscal year beginning October 1, 2007. Management is in the process of analyzing the fund’s tax positions for purposes of implementing FIN 48; based on the analysis completed to date, management does not believe the adoption of FIN 48 will result in any material impact to the fund’s financial statements.

1 At September 30, 2006, the security is still held but the issuer is no longer an affiliated company of the fund.

23

Report of Independent Registered Public Accounting Firm

To the Trustees of Vanguard Chester Funds and the Shareholders of Vanguard PRIMECAP Fund:

In our opinion, the accompanying statement of net assets, including the statement of assets and liabilities, and the related statements of operations and of changes in net assets and the financial highlights present fairly, in all material respects, the financial position of Vanguard PRIMECAP Fund (the “Fund”) at September 30, 2006, the results of its operations for the year then ended, the changes in its net assets for each of the two years in the period then ended, and the financial highlights for each of the periods indicated, in conformity with accounting principles generally accepted in the United States of America. These financial statements and financial highlights (hereafter referred to as “financial statements”) are the responsibility of the Fund’s management; our responsibility is to express an opinion on these financial statements based on our audits. We conducted our audits of these financial statements in accordance with the standards of the Public Company Accounting Oversight Board (United States), which require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, and evaluating the overall financial statement presentation. We believe that our audits, which included confirmation of securities at September 30, 2006 by correspondence with the custodian and by agreement to the underlying ownership records for Vanguard Market Liquidity Fund, provide a reasonable basis for our opinion.

PricewaterhouseCoopers LLP

Philadelphia, Pennsylvania

November 13, 2006

Special 2006 tax information (unaudited) for Vanguard PRIMECAP Fund

This information for the fiscal year ended September 30, 2006, is included pursuant to provisions of the Internal Revenue Code.

The fund distributed $890,247,000 as capital gain dividends (from net long-term capital gains) to shareholders during the fiscal year.

The fund distributed $170,884,000 of qualified dividend income to shareholders during the fiscal year.

For corporate shareholders, 100% of investment income (dividend income plus short-term gains, if any) qualifies for the dividends-received deduction.

24

Your Fund’s After-Tax Returns

This table presents returns for your fund both before and after taxes. The after-tax returns are shown in two ways: (1) assuming that an investor owned the fund during the entire period and paid taxes on the fund’s distributions, and (2) assuming that an investor paid taxes on the fund’s distributions and sold all shares at the end of each period.

Calculations are based on the highest individual federal income tax and capital gains tax rates in effect at the times of the distributions and the hypothetical sales. State and local taxes were not considered. After-tax returns reflect any qualified dividend income, using actual prior-year figures and estimates for 2006. (In the example, returns after the sale of fund shares may be higher than those assuming no sale. This occurs when the sale would have produced a capital loss. The calculation assumes that the investor received a tax deduction for the loss.)

The table shows returns for Investor Shares only; returns for other share classes will differ. Please note that your actual after-tax returns will depend on your tax situation and may differ from those shown. Also note that if you own the fund in a tax-deferred account, such as an individual retirement account or a 401(k) plan, this information does not apply to you. Such accounts are not subject to current taxes.

Finally, keep in mind that a fund’s performance—whether before or after taxes—does not guarantee future results.

Average Annual Total Returns: PRIMECAP Fund Investor Shares | |||

Periods Ended September 30, 2006 |

|

|

|

| One | Five | Ten |

| Year1 | Years | Years |

Returns Before Taxes | 12.30% | 11.34% | 12.95% |

Returns After Taxes on Distributions | 11.73 | 11.08 | 12.06 |

Returns After Taxes on Distributions and Sale of Fund Shares | 8.68 | 9.81 | 11.16 |

1 Total return figures do not reflect the 1% fee assessed on redemptions of shares held less than one year, or the 1% fee assessed until March 23, 2005, on shares purchased on or after April 23, 2001, and held for less than five years.

25

About Your Fund’s Expenses

As a shareholder of the fund, you incur ongoing costs, which include costs for portfolio management, administrative services, and shareholder reports (like this one), among others. Operating expenses, which are deducted from a fund’s gross income, directly reduce the investment return of the fund.

A fund’s expenses are expressed as a percentage of its average net assets. This figure is known as the expense ratio. The following examples are intended to help you understand the ongoing costs (in dollars) of investing in your fund and to compare these costs with those of other mutual funds. The examples are based on an investment of $1,000 made at the beginning of the period shown and held for the entire period.

The table below illustrates your fund’s costs in two ways:

• Based on actual fund return. This section helps you to estimate the actual expenses that you paid over the period. The “Ending Account Value” shown is derived from the fund’s actual return, and the third column shows the dollar amount that would have been paid by an investor who started with $1,000 in the fund. You may use the information here, together with the amount you invested, to estimate the expenses that you paid over the period.

To do so, simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number given for your fund under the heading “Expenses Paid During Period.”

• Based on hypothetical 5% yearly return. This section is intended to help you compare your fund’s costs with those of other mutual funds. It assumes that the fund had a yearly return of 5% before expenses, but that the expense ratio is unchanged. In this case—because the return used is not the fund’s actual return—the results do not apply to your investment. The example is useful in making comparisons because the Securities and Exchange Commission requires all mutual funds to calculate expenses based on a 5% return. You can assess your fund’s costs by comparing this hypothetical example with the hypothetical examples that appear in shareholder reports of other funds.

Six Months Ended September 30, 2006 |

|

|

|

| Beginning | Ending | Expenses |

| Account Value | Account Value | Paid During |

PRIMECAP Fund | 3/31/2006 | 9/30/2006 | Period1 |

Based on Actual Fund Return |

|

|

|

Investor Shares | $1,000.00 | $1,007.45 | $2.31 |

Admiral Shares | 1,000.00 | 1,008.14 | 1.56 |

Based on Hypothetical 5% Yearly Return |

|

|

|

Investor Shares | $1,000.00 | $1,022.76 | $2.33 |

Admiral Shares | 1,000.00 | 1,023.51 | 1.57 |

1 The calculations are based on expenses incurred in the most recent six-month period. The fund’s annualized six-month expense ratios for that period are 0.46% for Investor Shares and 0.31% for Admiral Shares. The dollar amounts shown as “Expenses Paid” are equal to the annualized expense ratio multiplied by the average account value over the period, multiplied by the number of days in the most recent six-month period, then divided by the number of days in the most recent 12-month period.

26

Note that the expenses shown in the table are meant to highlight and help you compare ongoing costs only; they do not include your fund’s low-balance fee or the 1% fee on redemptions of shares held for less than one year. These fees are fully described in the prospectus. If the fees were applied to your account, your costs would be higher. Your fund does not carry a “sales load.”

The calculations assume no shares were bought or sold during the period. Your actual costs may have been higher or lower, depending on the amount of your investment and the timing of any purchases or redemptions.

You can find more information about the fund’s expenses, including annual expense ratios, in the Financial Statements section of this report. For additional information on operating expenses and other shareholder costs, please refer to the appropriate fund prospectus.

27

Trustees Approve Advisory Agreement

The board of trustees of Vanguard PRIMECAP Fund has renewed the fund’s investment advisory agreement with PRIMECAP Management Company. The board determined that the retention of the advisor was in the best interests of the fund and its shareholders.

The board based its decision upon an evaluation of PRIMECAP Management’s investment staff, portfolio management process, and performance. The trustees considered the factors discussed below, among others. However, no single factor determined whether the board approved the agreement. Rather, it was the totality of the circumstances that drove the board’s decision.

Nature, extent, and quality of services

The board considered the quality of the fund’s investment management over both the short and long term and took into account the organizational depth and stability of the firm. The board noted that PRIMECAP Management, founded in 1983, is recognized for its long-term approach to growth equity investing. The firm has managed the PRIMECAP Fund since its inception in 1984. Five experienced portfolio managers are responsible for separate subportfolios, and each portfolio manager employs a fundamental, research-driven approach in seeking to identify companies with long-term growth potential overlooked by the market and trading at attractive valuation levels.

The board concluded that PRIMECAP Management’s experience, stability, depth, and performance, among other factors, warranted continuation of the advisory agreement.

Investment performance

The board considered the short- and long-term performance of the fund, including any periods of outperformance or underperformance of a relevant benchmark and peer group. The board noted that PRIMECAP Management has carried out its investment strategy in disciplined fashion, and the results have been strong, as the fund has outperformed its relevant benchmark and peer group since its inception. Information about the fund’s performance, including some of the data considered by the board, can be found in the Performance Summary section of this report.

Cost

The board concluded that the fund’s expense ratio was far below the average expense ratio charged by funds in its peer group. The board noted that the fund’s advisory fee was also well below the peer-group average. Information about the fund’s expense ratio appears in the About Your Fund’s Expenses section of this report as well as in the Financial Statements section, which also includes information about the advisory fee rate. The board did not consider profitability of PRIMECAP Management in determining whether to approve the advisory fee, because PRIMECAP Management is independent of Vanguard and the advisory fee is the result of arm’s-length negotiations.

The benefit of economies of scale

The board concluded that the fund’s shareholders benefit from economies of scale because of breakpoints in the fund’s advisory fee schedule. The breakpoints reduce the effective rate of the fee as the fund’s assets increase.

The board also approved a change to the process for the quarterly calculation of PRIMECAP’s asset-based advisory fee. The calculation now will be based on the average daily net assets of the fund rather than the average month-end net assets.

The advisory agreement will continue for one year and is renewable by the fund’s board after that for successive one-year periods.

28

Glossary

Beta. A measure of the magnitude of a fund’s past share-price fluctuations in relation to the ups and downs of a given market index. The index is assigned a beta of 1.00. Compared with a given index, a fund with a beta of 1.20 typically would have seen its share price rise or fall by 12% when the index rose or fell by 10%. A fund’s beta should be reviewed in conjunction with its R-squared (see definition below). The lower the R-squared, the less correlation there is between the fund and the index, and the less reliable beta is as an indicator of volatility.

Earnings Growth Rate. The average annual rate of growth in earnings over the past five years for the stocks now in a fund.

Expense Ratio. The percentage of a fund’s average net assets used to pay its annual administrative and advisory expenses. These expenses directly reduce returns to investors.

Foreign Holdings. The percentage of a fund represented by stocks or depositary receipts of companies based outside the United States.

Median Market Cap. An indicator of the size of companies in which a fund invests; the midpoint of market capitalization (market price x shares outstanding) of a fund’s stocks, weighted by the proportion of the fund’s assets invested in each stock. Stocks representing half of the fund’s assets have market capitalizations above the median, and the rest are below it.

Price/Book Ratio. The share price of a stock divided by its net worth, or book value, per share. For a fund, the weighted average price/book ratio of the stocks it holds.

Price/Earnings Ratio. The ratio of a stock’s current price to its per-share earnings over the past year. For a fund, the weighted average P/E of the stocks it holds. P/E is an indicator of market expectations about corporate prospects; the higher the P/E, the greater the expectations for a company’s future growth.

R-Squared. A measure of how much of a fund’s past returns can be explained by the returns from the market in general, as measured by a given index. If a fund’s total returns were precisely synchronized with an index’s returns, its R-squared would be 1.00. If the fund’s returns bore no relationship to the index’s returns, its R-squared would be 0.

Return on Equity. The annual average rate of return generated by a company during the past five years for each dollar of shareholder’s equity (net income divided by shareholder’s equity). For a fund, the weighted average return on equity for the companies whose stocks it holds.

Short-Term Reserves. The percentage of a fund invested in highly liquid, short-term securities that can be readily converted to cash.

Turnover Rate. An indication of the fund’s trading activity. Funds with high turnover rates incur higher transaction costs and may be more likely to distribute capital gains (which may be taxable to investors). The turnover rate excludes in-kind transactions, which have minimal impact on costs.

Yield. A snapshot of a fund’s income from interest and dividends. The yield, expressed as a percentage of the fund’s net asset value, is based on income earned over the past 30 days and is annualized, or projected forward for the coming year. The index yield is based on the current annualized rate of income provided by securities in the index.

29

This page intentionally left blank.

This page intentionally left blank.

The People Who Govern Your Fund

��

The trustees of your mutual fund are there to see that the fund is operated and managed in your best interests since, as a shareholder, you are a part owner of the fund. Your fund’s trustees also serve on the board of directors of The Vanguard Group, Inc., which is owned by the Vanguard funds and provides services to them on an at-cost basis.

A majority of Vanguard’s board members are independent, meaning that they have no affiliation with Vanguard or the funds they oversee, apart from the sizable personal investments they have made as private individuals.

Our independent board members bring distinguished backgrounds in business, academia, and public service to their task of working with Vanguard officers to establish the policies and oversee the activities of the funds. Among board members’ responsibilities are selecting investment advisors for the funds; monitoring fund operations, performance, and costs; reviewing contracts; nominating and selecting new trustees/directors; and electing Vanguard officers.

Each trustee serves a fund until its termination; or until the trustee’s retirement, resignation, or death; or otherwise as specified in the fund’s organizational documents. Any trustee may be removed at a shareholders’ meeting by a vote representing two-thirds of the net asset value of all shares of the fund together with shares of other Vanguard funds organized within the same trust. The table on these two pages shows information for each trustee and executive officer of the fund. The mailing address of the trustees and officers is P.O. Box 876, Valley Forge, PA 19482.

Chairman of the Board, Chief Executive Officer, and Trustee | |

|

|

John J. Brennan1 |

|

Born 1954 | Principal Occupation(s) During the Past Five Years: Chairman of the Board, Chief |

Trustee since May 1987; | Executive Officer, and Director/Trustee of The Vanguard Group, Inc., and of each |

Chairman of the Board and | of the investment companies served by The Vanguard Group. |

Chief Executive Officer |

|

142 Vanguard Funds Overseen | |

|

|

Independent Trustees |

|

|

|

Charles D. Ellis |

|

Born 1937 | Principal Occupation(s) During the Past Five Years: Applecore Partners (pro bono ventures |

Trustee since January 2001 | in education); Senior Advisor to Greenwich Associates (international business strategy |

142 Vanguard Funds Overseen | consulting); Successor Trustee of Yale University; Overseer of the Stern School of Business |

| at New York University; Trustee of the Whitehead Institute for Biomedical Research. |

|

|

Rajiv L. Gupta |

|

Born 1945 | Principal Occupation(s) During the Past Five Years: Chairman and Chief Executive Officer |

Trustee since December 20012 | of Rohm and Haas Co. (chemicals); Board Member of the American Chemistry Council; |

142 Vanguard Funds Overseen | Director of Tyco International, Ltd. (diversified manufacturing and services) (since 2005); |

| Trustee of Drexel University and of the Chemical Heritage Foundation. |

|

|

Amy Gutmann |

|

Born 1949 | Principal Occupation(s) During the Past Five Years: President of the University of |

Trustee since June 2006 | Pennsylvania since 2004; Professor in the School of Arts and Sciences, Annenberg School |

142 Vanguard Funds Overseen | for Communication, and Graduate School of Education of the University of Pennsylvania |

| since 2004; Provost (2001–2004) and Laurance S. Rockefeller Professor of Politics and the |

| University Center for Human Values (1990–2004), Princeton University; Director of Carnegie |

| Corporation of New York and of Philadelphia 2016 (since 2005) and of Schuylkill River |

| Development Corporation and Greater Philadelphia Chamber of Commerce (since 2004). |

JoAnn Heffernan Heisen |

| |

Born 1950 | Principal Occupation(s) During the Past Five Years: Corporate Vice President and Chief | |

Trustee since July 1998 | Global Diversity Officer (since January 2006), Vice President and Chief Information | |

142 Vanguard Funds Overseen | Officer (1997–2005), and Member of the Executive Committee of Johnson & Johnson | |

| (pharmaceuticals/consumer products); Director of the University Medical Center at | |

| Princeton and Women’s Research and Education Institute. | |

|

| |

André F. Perold |

| |

Born 1952 | Principal Occupation(s) During the Past Five Years: George Gund Professor of Finance and | |

Trustee since December 2004 | Banking, Harvard Business School (since 2000); Senior Associate Dean, Director of Faculty | |

142 Vanguard Funds Overseen | Recruiting, and Chair of Finance Faculty, Harvard Business School; Director and Chairman | |

| of UNX, Inc. (equities trading firm) (since 2003); Director of registered investment | |

| companies advised by Merrill Lynch Investment Managers and affiliates (1985–2004), | |

| Genbel Securities Limited (South African financial services firm) (1999–2003), Gensec | |

| Bank (1999–2003), Sanlam, Ltd. (South African insurance company) (2001–2003), and | |

| Stockback, Inc. (credit card firm) (2000–2002). | |

|

| |

Alfred M. Rankin, Jr. |

| |

Born 1941 | Principal Occupation(s) During the Past Five Years: Chairman, President, Chief Executive | |

Trustee since January 1993 | Officer, and Director of NACCO Industries, Inc. (forklift trucks/housewares/ lignite); | |

142 Vanguard Funds Overseen | Director of Goodrich Corporation (industrial products/aircraft systems and services). | |

|

| |

J. Lawrence Wilson |

| |

Born 1936 | Principal Occupation(s) During the Past Five Years: Retired Chairman and Chief Executive | |

Trustee since April 1985 | Officer of Rohm and Haas Co. (chemicals); Director of Cummins Inc. (diesel engines), | |

142 Vanguard Funds Overseen | MeadWestvaco Corp. (packaging products), and AmerisourceBergen Corp. (pharmaceutical | |

| distribution); Trustee of Vanderbilt University and of Culver Educational Foundation. | |

|

| |

Executive Officers1 |

| |

|

| |

Heidi Stam |

| |

Born 1956 | Principal Occupation(s) During the Past Five Years: Principal of The Vanguard Group, Inc., | |

Secretary since July 2005 | since November 1997; General Counsel of The Vanguard Group since July 2005; | |

142 Vanguard Funds Overseen | Secretary of The Vanguard Group and of each of the investment companies served | |

| by The Vanguard Group since July 2005. | |

|

| |

Thomas J. Higgins |

| |

Born 1957 | Principal Occupation(s) During the Past Five Years: Principal of The Vanguard Group, Inc.; | |

Treasurer since July 1998 | Treasurer of each of the investment companies served by The Vanguard Group. | |

142 Vanguard Funds Overseen |

| |

|

| |

Vanguard Senior Management Team | ||

|

| |

R. Gregory Barton | Kathleen C. Gubanich | Michael S. Miller |

Mortimer J. Buckley | Paul A. Heller | Ralph K. Packard |

James H. Gately | F. William McNabb, III | George U. Sauter |

|

| |

Founder |

| |

|

| |

John C. Bogle |

| |

Chairman and Chief Executive Officer, 1974–1996 | ||

1 Officers of the funds are “interested persons” as defined in the Investment Company Act of 1940.

2 December 2002 for Vanguard Equity Income Fund, Vanguard Growth Equity Fund, the Vanguard Municipal Bond Funds, and the Vanguard State Tax-Exempt Funds.

More information about the trustees is in the Statement of Additional Information, available from The Vanguard Group.

|

|

| P.O. Box 2600 |

| Valley Forge, PA 19482-2600 |

Connect with Vanguard™ > www.vanguard.com

Fund Information > 800-662-7447 | Vanguard, Admiral, Connect with Vanguard, and the ship |

| logo are trademarks of The Vanguard Group, Inc. |

Direct Investor Account Services > 800-662-2739 |

|