- OMI Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

Owens & Minor (OMI) DEF 14ADefinitive proxy

Filed: 17 Mar 21, 4:02pm

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant ☒ Filed by a party other than the Registrant ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement | |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| ☒ | Definitive Proxy Statement | |

| ☐ | Definitive Additional Materials | |

| ☐ | Soliciting Material Under Rule 14a-12 | |

Owens & Minor, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☒ | No fee required. | |||

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

| (1) | Title of each class of securities to which transaction applies:

| |||

| (2) | Aggregate number of securities to which transaction applies:

| |||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

| |||

| (4) | Proposed maximum aggregate value of transaction:

| |||

| (5) | Total fee paid:

| |||

| ☐ | Fee paid previously with preliminary materials. | |||

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing: | |||

| (1) | Amount previously paid:

| |||

| (2) | Form, Schedule or Registration Statement No:

| |||

| (3) | Filing party:

| |||

| (4) | Date Filed:

| |||

| ||||

9120 Lockwood Boulevard | ||||

| Mechanicsville, Virginia 23116 | ||||

| (804) 723-7000 |

March 17, 2021

Dear Shareholders:

It is a pleasure to invite you to the Owens & Minor, Inc. Annual Meeting of Shareholders on Thursday, April 29, 2021 at 9:00 a.m. Eastern Time. Due to ongoing concerns regarding the COVID-19 virus, the Annual Meeting will be held in a virtual meeting format only, via the Internet. Additionally, we believe that a virtual meeting allows us to make participation accessible for shareholders from any geographic location while reducing the costs and environmental impact associated with holding an in-person meeting. Information regarding attending the virtual Annual Meeting can be found on page 51 of the Proxy Statement.

The Notice of 2021 Annual Meeting of Shareholders and Proxy Statement describe the items of business for the meeting. In addition to considering these matters, we will review significant accomplishments and events since our last shareholders’ meeting as well as future opportunities and initiatives we intend to pursue. Our Board of Directors and management team will be there to discuss items of interest and to answer any questions.

The Notice of 2021 Annual Meeting of Shareholders contains instructions on how to access our proxy materials and our 2020 Annual Report/Form 10-K over the Internet as well as how shareholders can receive paper copies of such documents, if they so desire.

You may vote your shares via the Internet or by telephone or, if you prefer, you may request paper copies of the proxy materials and submit your vote by mail by following the instructions on the proxy card. We encourage you to vote via the Internet. Whichever method you choose, your vote is important so please vote as soon as possible. All of us at Owens & Minor appreciate your continued interest and support.

Warm regards,

Mark A. Beck

Chair of the Board of Directors

Owens & Minor, Inc.

WHETHER OR NOT YOU PRESENTLY PLAN TO ATTEND THE MEETING,

THE BOARD OF DIRECTORS URGES YOU TO VOTE.

Proxy Statement

| Page | ||||

| i |

| ||

| 1 |

| ||

| 4 |

| ||

| 5 |

| ||

| 6 |

| ||

| 9 |

| ||

| 9 |

| ||

| 10 |

| ||

| 12 |

| ||

| 12 |

| ||

| 13 |

| ||

| 13 |

| ||

| 18 |

| ||

Proposal 2: Ratification Of Independent Registered Public Accounting Firm | 19 | |||

| 19 | ||||

| 20 |

| ||

| Page | ||||

| 22 |

| ||

| 22 | ||||

| 22 | ||||

| 23 |

| ||

| 23 |

| ||

| 24 |

| ||

| 24 |

| ||

| 25 |

| ||

| 33 |

| ||

| 43 |

| ||

| 46 | ||||

Proposal 3: Advisory Shareholder Vote to Approve Executive Compensation | 49 | |||

| 50 |

| ||

| 50 |

| ||

Further Information About Attending the Virtual Annual Meeting | 51 | |||

| 52 |

| ||

Your Vote Is Important

Whether or not you plan to attend the Annual Meeting, please vote your shares promptly, as instructed in the Notice Regarding the Availability of Proxy Materials, by the Internet or by telephone. You may also request a paper proxy card to submit your vote by mail, if you prefer. We encourage you to vote via the Internet.

Notice of Annual Meeting of Shareholders

To Be Held Thursday, April 29, 2021

TOTHE SHAREHOLDERSOF OWENS & MINOR, INC.:

The Annual Meeting of Shareholders of Owens & Minor, Inc. (the “Company” or “Owens & Minor”) will be held on Thursday, April 29, 2021 at 9:00 a.m. EDT in a virtual meeting format only, via the Internet. You will not be able to attend the Annual Meeting in person. To be admitted to the Annual Meeting at www.meetingcenter.io/294274694 you must enter the 15-digit control number found on your proxy card, voting instruction form or notice you previously received. We encourage you to access the meeting in advance of the designated start time.

The purposes of the meeting are:

| 1. | To elect the eight directors named in the attached Proxy Statement, each for a one-year term and until their respective successors are elected and qualified; |

| 2. | To ratify the appointment of KPMG LLP as the Company’s independent registered public accounting firm for the year ending December 31, 2021; |

| 3. | To conduct an advisory vote to approve the compensation of the Company’s named executive officers; and |

| 4. | To transact any other business properly before the Annual Meeting. |

Shareholders of record as of March 5, 2021 will be entitled to vote at the Annual Meeting.

Your attention is directed to the attached Proxy Statement. The Notice Regarding the Availability of Proxy Materials is being distributed on or about March 17, 2021. This Proxy Statement, the proxy card and Owens & Minor’s 2020 Annual Report/Form 10-K are being furnished on the Internet on or about March 17, 2021.

BY ORDEROFTHE BOARDOF DIRECTORS

NICHOLAS J. PACE

Executive Vice President, General Counsel &

Corporate Secretary

Owens & Minor, Inc. ● 2021 Proxy Statement i

| Street Address | Mailing Address | |

| 9120 Lockwood Boulevard | P.O. Box 27626 | |

| Mechanicsville, Virginia 23116 | Richmond, Virginia 23261-7626 |

Proxy Statement

Annual Meeting of Shareholders

to be held on April 29, 2021

When and Where the Annual Meeting Will Be Held

The Annual Meeting will be held virtually on Thursday, April 29, 2021 at 9:00 a.m. EDT at www.meetingcenter.io/294274694 through a live webcast. We have adopted a virtual format for our Annual Meeting to ensure the health and well-being of our teammates, directors and shareholders in the current COVID-19 environment. Additionally, we believe that a virtual meeting allows us to make participation accessible for shareholders from any geographic location with Internet connectivity, while reducing costs and environmental impact associated with holding and arranging for an in-person meeting.

How to Attend the Virtual Annual Meeting

Shareholders at the close of business on March 5, 2021 (the “Record Date”) have a right to attend the Annual Meeting. In order to be admitted to the Annual Meeting at www.meetingcenter.io/294274694, registered shareholders must enter the 15-digit control number found in the shaded bar on your Notice of Internet Availability or proxy card. The password for the meeting is OMI2021. Further information regarding attending the virtual Annual Meeting can be found at page 51 of this Proxy Statement.

What You Are Voting On

Proxies are being solicited by the Board of Directors for purposes of voting on the following proposals and any other business properly brought before the meeting:

| Proposal 1: | Election of the eight directors named in this Proxy Statement, each for a one-year term and until their respective successors are elected and qualified. | |

| Proposal 2: | Ratification of KPMG LLP as the Company’s independent registered public accounting firm for the year ending December 31, 2021. | |

| Proposal 3: | Advisory vote to approve the compensation of our named executive officers (the “Say on Pay Proposal”). |

Who is Entitled to Vote

Shareholders of Owens & Minor, Inc. (the “Company” or “Owens & Minor”) as of the close of business on March 5, 2021 (the “Record Date”) are entitled to vote. Each share of the Company’s common stock (“Common Stock”) is entitled to one vote with respect to each matter to be voted upon at the meeting. As of March 5, 2021, 73,504,099 shares of Common Stock were issued and outstanding.

Owens & Minor, Inc. ● 2021 Proxy Statement 1

About the Meeting |

How to Vote

You can vote via the Internet, by telephone or by mail.

By Internet. You may vote via the Internet by following the specific instructions on the Notice of Internet Availability of Proxy Materials. Shareholders who have requested a paper copy of a proxy card by mail may submit proxies over the Internet by following the instructions on the proxy card. We encourage you to vote via the Internet. If your shares are held by your bank or broker in street name, please refer to the instruction form that you receive from your bank or broker or contact your bank or broker to determine whether you will be able to vote via the Internet.

By Telephone. You may vote by telephone by calling the toll-free number on the proxy card and following the instructions. Shareholders will need to have the control number that appears on their notice available when voting. If your shares are held by your bank or broker in street name, please refer to the instruction form that you receive from your bank or broker or contact your bank or broker to determine whether you will be able to vote by telephone.

By Mail. Shareholders who have requested a paper copy of a proxy card by mail may submit proxies by completing, signing and dating the enclosed proxy card and returning it in the postage-paid envelope provided.

However you choose to vote, you may revoke a proxy prior to the meeting by (1) submitting a subsequently dated proxy by any of the methods described above, (2) giving notice in writing to the Corporate Secretary of the Company or (3) voting at the virtual meeting (attendance at the meeting will not itself revoke a proxy).

What Happens if You Do Not Make Selections on Your Proxy

If your proxy contains specific voting instructions, those instructions will be followed. However, if you sign and return your proxy card by mail or submit your proxy by telephone or via the Internet without making a selection on one or more proposals, you give authority to the individuals designated on the proxy card to vote on the proposal(s) for which you have not made specific selections or given instructions and any other matter that may arise at the meeting. If no specific selection is made or instructions given, it is intended that all proxies that are signed and returned or submitted via telephone or Internet will be voted “FOR” the election of all nominees for director, “FOR” the ratification of KPMG LLP as our independent registered public accounting firm in 2021, and “FOR” the approval of the Say on Pay Proposal.

Whether Your Shares Will be Voted if You Don’t Provide Your Proxy

Whether your shares will be voted if you do not provide your proxy depends on how your ownership of shares of Common Stock is registered. If you own your shares as a registered holder, which means that your shares of Common Stock are registered in your name, and you do not provide your proxy, your shares will not be represented at the meeting, will not count toward the quorum requirement, which is explained below, and will not be voted.

If you own your shares of Common Stock in street name, your shares may be voted even if you do not provide your broker with voting instructions. Brokers have the authority under New York Stock Exchange (“NYSE”) rules to vote shares for which their beneficial owner customers do not provide voting instructions on certain “routine” matters. When a proposal is not a routine matter and the brokerage firm has not received voting instructions from the beneficial owner of the shares with respect to that proposal, the brokerage firm cannot vote the shares on that proposal. This is called a broker non-vote.

The Company believes that only the proposal to ratify the appointment of KPMG LLP as the Company’s independent registered public accounting firm for 2021 is a routine matter for which brokerage firms will have discretionary voting power if you do not give voting instructions with respect to this proposal. The proposal to elect directors and the Say on Pay Proposal, are non-routine matters for which brokerage firms will not have discretionary voting power and for which specific voting instructions from their customers are required. As a result, brokerage firms will not be allowed to vote on these non-routine matters on behalf of their customers if the customers do not return specific voting instructions.

2 Owens & Minor, Inc. ● 2021 Proxy Statement

About the Meeting |

What Constitutes a Quorum

A majority of the outstanding shares of Common Stock present or represented by proxy constitutes a quorum. A quorum is required to conduct the Annual Meeting. If you vote your proxy, you will be considered part of the quorum. Abstentions and shares held by brokers or banks in street name (“broker shares”) that are voted on any matter are included in the quorum. Broker shares that are not voted on any matter will not be included in determining whether a quorum is present.

The Vote Required to Approve Each Item

Election of Directors. The affirmative vote of a majority of the votes cast at the meeting is required for the election of each director. A majority of votes cast means that the number of votes cast “FOR” a nominee’s election must exceed the number of votes cast “AGAINST” that nominee’s election. Abstentions and broker non-votes will not be counted as votes cast and will have no effect on the results of this vote.

Ratification of Appointment of KPMG LLP. The appointment of KPMG LLP will be ratified if the votes cast “FOR” this proposal exceed the number of votes cast “AGAINST” this proposal. Abstentions will not be counted as votes cast on this proposal and will have no effect on the results of this vote. There should be no broker non-votes because this is considered a routine matter under the rules of the NYSE.

Advisory Vote to Approve the Say on Pay Proposal. The compensation of our executive officers named in the Summary Compensation Table will be approved on an advisory basis if the votes cast “FOR” this proposal exceed the number of votes cast “AGAINST” this proposal. Abstentions and broker non-votes will not be counted as votes cast on this proposal and will have no effect on the results of this vote.

How to Obtain a Paper Copy of the Proxy Materials

Shareholders will find instructions about how to obtain a paper copy of the proxy materials on the notice they received in the mail about the Internet availability of proxy materials.

What it Means if You Get More Than One Notice about the Internet Availability of Proxy Materials

Your shares are probably registered differently or are held in more than one account. Please vote all proxies to ensure that all your shares are voted. Also, please have all of your accounts registered in the same name and address. You may do this by contacting our transfer agent, Computershare, Inc., at 1-866-252-0358.

Costs of Soliciting Proxies

Owens & Minor will pay all costs of this proxy solicitation. The Company has retained Georgeson, LLC to aid in the distribution and solicitation of proxies for approximately $7,500 plus expenses. The Company will reimburse brokers and other custodians, nominees and fiduciaries for their expenses in forwarding proxy and solicitation materials.

Owens & Minor, Inc. ● 2021 Proxy Statement 3

General. The Company is managed under the direction of the Board of Directors, which has adopted Corporate Governance Guidelines to set forth certain corporate governance practices. Each year, we review our corporate governance policies and practices relative to applicable laws, including the Dodd-Frank Wall Street Reform and Consumer Protection Act and the Sarbanes-Oxley Act of 2002 and rules and regulations promulgated thereunder or adopted by the Securities and Exchange Commission (“SEC”) and the NYSE, the exchange on which the Common Stock is listed, as well as the policies and practices recommended by groups and authorities active in corporate governance.

Corporate Governance Materials. The Company’s Bylaws, Corporate Governance Guidelines, Code of Honor and the charters of the Audit Committee, the Compensation & Benefits Committee (the “Compensation Committee”), and the Governance & Nominating Committee are available on our website at http://www.owens-minor.com under “Corporate Governance” in the “Investor Relations” tab. The information available on, or that can be accessed through, our website is not a part of, or incorporated by reference into, this Proxy Statement.

Code of Honor. The Board of Directors has adopted a Code of Honor that is applicable to all teammates of the Company, including the principal executive officer, the principal financial officer and the principal accounting officer, as well as the members of the Board of Directors. We would post any amendments to or waivers from our Code of Honor (to the extent applicable to the Company’s principal executive officer, principal financial officer, principal accounting officer, any other executive officer or any director) on our website http://www.owens-minor.com under “Corporate Governance” in the “Investor Relations” tab.

Director Independence. The Board of Directors has determined that the following Board members and/or nominees are “independent” within the meaning of the NYSE listing standards and the Company’s Corporate Governance Guidelines: Aster Angagaw, Mark A. Beck, Gwendolyn M. Bingham, Robert J. Henkel, Stephen W. Klemash, Mark F. McGettrick, Eddie N. Moore, Jr., Michael C. Riordan, and Robert C. Sledd. To assist it in making determinations of independence, the Board has adopted categorical standards which are included in the Company’s Corporate Governance Guidelines available on our website at http://www.owens-minor.com under “Corporate Governance” in the “Investor Relations” tab. The Board has determined that all directors and/or nominees identified as independent in this Proxy Statement meet these standards.

Structure and Leadership of the Board. The Board of Directors does not have a firm policy with respect to the separation of the offices of Chair of the Board and the Chief Executive Officer. Instead, the Board believes that it is in the best interests of the Company for the Board to make this determination as part of the succession planning process when it selects a new Chief Executive Officer or when a Chair ceases his or her service on the Board. At this juncture, the Board believes that the separation of the Chair and Chief Executive Officer roles currently serves the best interests of the Company by allowing a non-executive, independent director to lead the Board while our current Chief Executive Officer focuses on the Company’s performance, day-to-day operations, customer service, teammate engagement and the implementation of strategic initiatives.

Our Corporate Governance Guidelines also provide for the annual election of a lead independent director by our non-management directors in the event that the Chair is not independent. The lead independent director primarily presides at Board meetings in the absence of the Chair, presides at meetings of the independent directors, serves as the principal liaison between the independent directors and the Chair and Chief Executive Officer, and advises the Chair with respect to agendas and information requirements relating to the Board and committee meetings. The Board believes that the lead independent director, when the Chair is not independent, enhances communications between Board members (including the Chair) and committees as well as the overall functioning of the Board’s leadership.

Majority Vote Requirement for Election of Directors. The Company’s Bylaws and Corporate Governance Guidelines provide for the election of directors by majority vote in uncontested elections. Under the Company’s Corporate Governance Guidelines, with respect to director nominations, the Board will only nominate those incumbent directors who submit irrevocable resignations effective upon the failure of such director nominee to receive the required vote for re-election and Board’s acceptance of such resignation. In the event an incumbent director fails to receive a majority of the votes cast, the Governance & Nominating Committee (or such other committee designated by the Board) will make a recommendation to the Board as to whether to accept or reject the resignation. The Board must act on the resignation, taking into account the Governance & Nominating Committee’s recommendation, and publicly disclose its decision regarding the resignation, including, if applicable, its rationale for rejecting a resignation, in a press release and an appropriate disclosure with the SEC within 90 days following certification of the election results. The Governance & Nominating Committee in making its recommendation, and the Board in making its decision, may each consider any factors or other information that it considers appropriate and relevant.

4 Owens & Minor, Inc. ● 2021 Proxy Statement

Corporate Governance |

The Board’s Role in Risk Oversight. The Board of Directors currently administers its risk oversight function through the full Board and not through a separate risk committee of the Board. However, each of the Audit Committee, the Compensation Committee and the Governance & Nominating Committee oversees the specific financial, compensation, compliance and governance risks, respectively, relating to its functions and responsibilities and reports on these matters to the full Board. The Board performs its risk oversight function through regular reporting by the Board committees as well as the officers and management-level personnel who supervise the day-to-day risk management activities of the Company, including an enterprise risk steering committee comprised of senior leaders of the Company.

Annual Performance Evaluation. The Board conducts an annual self-evaluation to determine whether it and its committees are functioning effectively. The Governance & Nominating Committee receives comments from all directors and reports annually to the Board with an assessment of the Board’s performance. The assessment focuses on the Board’s contribution to the Company and specifically focuses on areas in which the Board or management believes that the Board can improve.

Board Diversity. Consistent with the Company’s Corporate Governance Guidelines, the Governance & Nominating Committee seeks to select Directors who reflect a diverse set of skills, professional and personal backgrounds, perspectives and experiences. While the Board has not adopted a formal policy with regard to the consideration of diversity in identifying director nominees, the Governance & Nominating Committee and the Board believe that considering diversity is consistent with the goal of creating a Board that best serves the needs of the Company and the interests of its shareholders, and it is one of the many factors that they consider when identifying individuals for Board membership. Twenty-five percent of our Director nominees are women and/or ethnically diverse.

Report of the Governance & Nominating Committee

The Governance & Nominating Committee is composed of six directors, all of whom are independent. The Governance & Nominating Committee met five times during 2020. In performing the various duties and responsibilities outlined in its charter, the Governance & Nominating Committee, among other things, received regular reports on the Company’s enterprise quality and regulatory compliance; reviewed and approved changes to its charter and the Corporate Governance Guidelines; reviewed and assessed the Company’s director compensation program relative to comparable peer companies, including appropriate compensation for the non-executive Chair of the Board; and led the annual Board assessment process. During 2020, the Committee reviewed and along with the full Board devoted time to management succession planning, including the review and approval of updates to the CEO emergency replacement plan and, in conjunction with the Compensation Committee, reviewed the performance of the Chief Executive Officer. Also during 2020, the Committee undertook oversight of the Company’s environmental, social and governance programs.

Due to the upcoming retirement of two directors during 2021, the Committee devoted considerable time and attention to director succession planning, which included the engagement with an outside consulting firm to assist in the identification and strategic recruitment of directors possessing the qualities, character, experience and expertise that will contribute to the leadership and success of the Company.

| THE GOVERNANCE & NOMINATING COMMITTEE |

| Eddie N. Moore, Jr., Chair |

| Aster Angagaw |

| Mark A. Beck |

| Gwendolyn M. Bingham |

| Robert J. Henkel |

| Michael C. Riordan |

Owens & Minor, Inc. ● 2021 Proxy Statement 5

Corporate Governance |

Environmental, Social and Governance

The world has changed since Owens & Minor’s founding in 1882, but one constant over the years is our commitment to taking care of our teammates, customers and the communities in which we operate. Owens & Minor is committed to conducting our business in an environmentally friendly, socially conscious and sustainable manner.

In 2020 we formalized our environmental, social and governance (“ESG”) program as discussed below and in 2021, we expect to advance our commitment to ESG by performing an ESG materiality assessment and further developing our program. This assessment will help us identify our priority ESG topics that are salient for our Company and our ability to create long-term value. These priority ESG topics will also serve as the foundation for our ESG strategy and inaugural ESG report, which we expect to publish this year.

In the sections below, we have provided an overview of how Owens & Minor is beginning to integrate ESG practices across our governance, operations, supply chain and communities in which we operate.

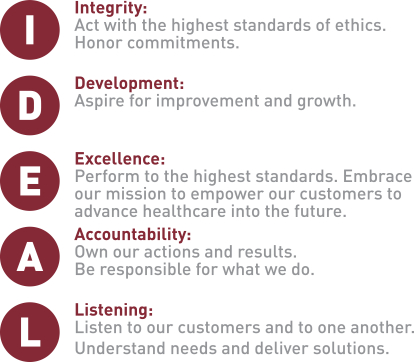

Our Values

Our values reflect our commitment to our customers, our teammates, the environment and the communities where we live and work. They embody “IDEAL” behavior — Integrity, Development, Excellence, Accountability and Listening. All Owens & Minor teammates are responsible for embodying these values every day.

GOVERNANCE

We maintain a Code of Honor (the “Code”) that sets forth the standards and guidelines for ethical behavior expected of everyone who works for and with our company. The Code is core to our mission and values. We require that every Owens & Minor teammate and member of our Board of Directors pledge to abide by the standards set forth by the Code. The Code addresses a variety of topics, including our expectations related to diversity and equal opportunity employment, data privacy, fair compensation and anti-bribery.

6 Owens & Minor, Inc. ● 2021 Proxy Statement

Corporate Governance |

ESG Governance

In 2020, our executive leadership together with a subcommittee of Board members began defining our ESG governance, strategy and accountability structure. It is expected that the Governance & Nominating Committee will oversee the development and implementation of Owens & Minor’s ESG strategy and this Committee’s charter will be amended in 2021 to include information regarding our ESG strategy and governance.

In addition, leadership has designated an ESG team comprised of teammates from functions across the company to develop the ESG strategy. Representatives from Investor Relations, Human Resources, Supply Chain, Community Engagement, Environment, Health and Safety, Compliance and Legal as well as other functions are expected to contribute to this effort.

Ethics and Compliance

We have combined social compliance and environmental sustainability into one overarching Corporate Responsibility Policy Statement that demonstrates our commitment to our teammates, suppliers, shareholders, and customers. Among other issues, the Statement includes topics such as business integrity, code of honor, anti-bribery and corruption and protections against child labor and forced labor practices. The Statement can be found on our website at “Corporate Governance” in the “Investor Relations” tab.

OPERATIONS

Environment, Health and Safety

Environmental Initiatives

We are committed to environmentally responsible business practices and conducting business in compliance with applicable environmental laws, rules, and regulations. We aim to comply with all relevant regulatory standards pertaining to air emissions, storm water and pollution prevention under the U.S. EPA and other global authorities. We have also developed environmental initiatives that focus on reducing our impact across our manufacturing sites and vehicle fleets.

At our manufacturing sites, we strive to eliminate waste, reduce our carbon footprint and increase the use of renewable energy. A majority of our global manufacturing sites have measured greenhouse gas emissions (“GHG”), water and waste data annually since 2015 and use this data to implement site-level goals and initiatives to reduce their environmental footprint. In addition, several sites have established site-level goals, including commitments to zero waste-to-landfill and sourcing 100% renewable energy. Several manufacturing sites are also in the process of obtaining ISO 14001 certification for their environmental management systems.

From a vehicle fleet perspective, Owens & Minor uses a combination of owned fleet and contract carriers to conduct deliveries from our distribution centers to customers. Our Field Operations team focuses on fuel efficiency initiatives including route optimization and replacing equipment regularly to reduce our fuel consumption.

Health and Safety Initiatives

The safety of our teammates is paramount to our success. We are committed to providing a work environment that empowers all teammates to make safe choices and leave work safely each day. A substantial part of our workforce is comprised of teammates who work in distribution centers and manufacturing facilities, operating equipment and machinery and performing physical labor.

Across our manufacturing and distribution center operations, we have a Safety Management System (“SMS”) to standardize safety procedures and to improve performance. We continuously assess the health and safety risks our teammates face in their jobs, and we work to mitigate those risks using our SMS through job hazard assessments, Behavior Based Safety (“BBS”) protocols, teammate engagement programs, and internal safety inspections.

Moreover, in 2020, we established a Global Safety & Risk Council to bring together all Owens & Minor business units to share best practices, standardize compliance procedures and strengthen the Company’s safety culture. Our commitment to safety and investments in training has led to a 71% reduction in our Total Recordable Incident Rate (“TRIR”) for our manufacturing and distribution center operations since 2018.

Owens & Minor, Inc. ● 2021 Proxy Statement 7

Corporate Governance |

Our COVID-19 Safety Measures

Our first and foremost priority is always teammate safety. We have established a COVID-19 Steering Committee which is responsible for establishing and overseeing implementation of COVID-19 protocols across the Company, including usage of PPE, social distancing, limiting the number of visitors, temperature checks, testing and most recently, vaccination availability. The Committee members meet on a weekly basis with Operations and Distribution leaders to track cases and provide resources necessary for our teammates to continue producing and delivering life-saving medical products to health care systems globally.

Additional information on our COVID-19 response can be found in “Taking Care of Our Teammates” on page 26 of this Proxy Statement and on our website at https://www.owens-minor.com/COVID-19/.

Diversity and Inclusion

We are committed to fostering an empowering work environment that enables our teammates to thrive. Diversity and inclusion are a critical part of fulfilling our IDEAL Values and delivering on our mission. We actively participate in and support initiatives that promote diversity and inclusion in our workplace.

For example, in 2020, we created Teammate Resource Groups (“TRGs”) that provide space, resources and support for underrepresented identity groups. Our current TRGs include African American/Black, Veteran, LGBTQ+, Military, Women in Healthcare and Women in Tech TRGs.

We also embed diversity and inclusion in our teammate recruitment practices. Our diversity recruiting initiatives include actively partnering with Historically Black Colleges and Universities (“HBCUs”) to increase the visibility of Owens & Minor’s hiring opportunities for students and alumni. In addition, we are a proud military employer of choice and we partner with multiple military and Veteran organizations to support the service-members in our Company and communities.

We track and measure representation across gender and ethnic minority as part of our commitment to fostering an empowering work environment where every teammate can thrive, and are committed to increasing diversity in our workforce, particularly in leadership roles.

SUPPLY CHAIN

Supply Chain Integration into Supplier Standards

We believe that good corporate citizenship by our Company and those we do business with is essential to our long-term business success. We engage in business globally and work with third-party suppliers across our global supply chain. We maintain Supplier Social Compliance Standards (“SSCS”) to hold our third-party suppliers accountable to our expectations. These standards communicate our values and address our expectation of our suppliers with respect to health and safety, environmental impact, prohibition of child or forced labor, working conditions, freedom of association and collective bargaining, anti-discrimination, integrity and conflict minerals.

Our Social Compliance Leadership Committee oversees the implementation of our SSCS internally and externally within our supply chain. This Committee also oversees the auditing and due diligence of suppliers, conducts trainings to educate teams across manufacturing, supply chain and procurement and raises awareness of trends and issues related to global social compliance.

We are also committed to advancing supplier diversity by working with minority, women, disabled and veteran owned businesses. We believe a thriving community of diverse suppliers generates innovation while contributing to the economic development of the communities in which we live and work.

COMMUNITIES

Community Engagement

We are active members of the communities where we operate. By contributing financially and through volunteer work, we help build stronger communities and create a better environment. We accomplish this in a number of ways, including direct

8 Owens & Minor, Inc. ● 2021 Proxy Statement

Corporate Governance |

contributions and corporate sponsorships to charitable organizations, specific programs designed to enrich our communities and community volunteer efforts. Our primary focus areas are:

| • | Health and wellness: We strive to improve the quality of life for our teammates and the people in our communities by supporting organizations such as the Special Olympics, American Heart Association and American Cancer Society. |

| • | Education: The quality of an education ensures the growth of the future workforce and provides better opportunities for our community. We strive to strengthen programs by supporting Community in Schools, the Boys & Girls Club and local high schools. |

| • | Civic and community: We invest in our communities by providing opportunities for teammates to volunteer where they live and work, supporting organizations such as FeedMore and Red Cross of America. |

Our teammates are active members of our larger, global communities through fundraising and volunteering with community groups. We actively engage our teammates to identify organizations to support through our Charitable Contribution Committee.

Our Path Forward

In 2021, we expect to reinforce our commitment to ESG through developing a formal strategy with focus areas and goals to track progress and an external report to increase transparency of our ESG initiatives.

We provide disclosures on our ESG efforts and relevant policies on our website at http://www.owens-minor.com under “Corporate Governance” in the “Investor Relations” tab.

The Board of Directors held 16 meetings during 2020. All directors attended at least 75% of the meetings of the Board and committees on which they served. Our directors attend our Annual Meeting of shareholders unless there is compelling reason why they cannot. All of our directors in office at that time attended our 2020 Annual Meeting of Shareholders.

Under the Company’s Corporate Governance Guidelines, the independent directors meet in executive session after each regularly scheduled Board meeting. These meetings are chaired by our Chair who is elected annually by the non-management directors following the Annual Meeting of Shareholders. Shareholders and other interested parties may contact the Chair by following the procedures set forth in “Communications with the Board of Directors” on page 12 of this Proxy Statement.

The Board of Directors currently has the following committees, which the Board established to assist it with its responsibilities:

Audit Committee: Oversees (i) the integrity of the Company’s financial statements, (ii) the Company’s compliance with legal and regulatory requirements, (iii) the qualification and independence of the Company’s independent registered public accounting firm, (iv) the performance of the Company’s independent registered public accounting firm and internal audit functions and (v) issues involving the Company’s ethical and legal compliance responsibilities. The Audit Committee has sole authority to appoint, retain, compensate, evaluate and terminate the Company’s independent registered public accounting firm. The Board of Directors has determined that each of Messrs. McGettrick and Moore is an “audit committee financial expert,” as defined by SEC regulations and that each member of the Audit Committee is financially literate under NYSE listing standards. All members of the Audit Committee are independent as such term is defined under the enhanced independence standards for audit committees in the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and the rules thereunder as incorporated into the NYSE listing standards and under the Company’s Corporate Governance Guidelines. The Audit Committee met 10 times during 2020.

Compensation & Benefits Committee: Administers executive compensation programs, policies and practices. Advises the Board on salaries and compensation of the executive officers and makes other studies and recommendations concerning

Owens & Minor, Inc. ● 2021 Proxy Statement 9

Corporate Governance |

compensation and compensation policies. May delegate authority for day-to-day administration and interpretation of compensation plans to certain senior officers of the Company (other than for matters affecting executive officer compensation and benefits). All members of the Compensation Committee are independent within the meaning of the enhanced NYSE listing standards and the Company’s Corporate Governance Guidelines and are “non-employee directors” as defined in Rule 16b-3 under the Exchange Act. The Compensation Committee met six times during 2020.

Governance & Nominating Committee: Considers and recommends nominees for election as directors and officers and nominees for each Board committee. Reviews and recommends changes to director compensation. Reviews and evaluates the procedures, practices and policies of the Board and its members and leads the Board in its annual self-review. Oversees the governance of the Company, including reviewing and recommending changes to the Corporate Governance Guidelines. Conducts succession planning for senior management. All members of the Governance & Nominating Committee are independent within the meaning of the NYSE listing standards and the Company’s Corporate Governance Guidelines. The Governance & Nominating Committee met five times during 2020.

Executive Committee: Exercises limited powers of the Board when the Board is not in session. The Executive Committee did not meet during 2020.

Board Committee Membership

Director | Board | Audit | Compensation & Benefits | Executive | Governance & Nominating | ||||||||||||||||||||

Aster Angagaw** |

| X |

| X | |||||||||||||||||||||

Mark A. Beck |

| X | * |

| X |

| X | * |

| X | |||||||||||||||

Gwendolyn M. Bingham |

| X |

| X |

| X | |||||||||||||||||||

Robert J. Henkel |

| X |

| X | * |

| X |

| X | ||||||||||||||||

Stephen W. Klemash** |

| X |

| X |

| X | |||||||||||||||||||

Mark F. McGettrick |

| X |

| X | * |

| X |

| X | ||||||||||||||||

Eddie N. Moore, Jr. |

| X |

| X |

| X |

| X | * | ||||||||||||||||

Edward A. Pesicka |

| X |

| X | |||||||||||||||||||||

Michael C. Riordan |

| X |

| X |

| X | |||||||||||||||||||

Robert C. Sledd |

| X |

| X | |||||||||||||||||||||

No. of Meetings in 2020 |

| 16 |

| 10 |

| 6 |

| 0 |

| 5 | |||||||||||||||

| * | Chair of the Board of Directors or respective Committee. |

| ** | Ms. Angagaw and Mr. Klemash were elected to the Board of Directors on March 1, 2021 and subsequently appointed to their respective Committees. |

The Governance & Nominating Committee reviews director compensation annually, and it is the responsibility of this committee to recommend to the Board of Directors any changes in director compensation. The Board of Directors makes the final determination with respect to director compensation. The Governance & Nominating Committee has the authority under its charter to retain outside consultants or advisors to assist it in gathering information and making decisions.

The Company uses a combination of cash and equity compensation to attract and retain qualified candidates to serve on its Board of Directors. In setting director compensation, the Company considers the commitment of time directors must make in performing their duties, the level of skills required by the Company of its Board members and the market competitiveness of its director compensation levels. Additionally, from time to time, the Company performs a market review with respect to other leading companies of similar size to the Company and with respect to the Company’s peer group, under the supervision of the Governance & Nominating Committee, and upon recommendation of the Company’s independent compensation consultant, to determine the compensation arrangements for the independent directors of the Company. The table below sets forth the schedule of fees paid to non-employee directors for their annual retainer and service in various capacities on Board committees and in Board leadership roles. Employee directors do not receive any additional compensation for serving on the Board or any of its committees.

10 Owens & Minor, Inc. ● 2021 Proxy Statement

Corporate Governance |

Schedule of Director Fees

Type of Fee | Cash | Equity | ||||||

Annual Retainer | $ | 125,000 |

| $ | 125,000 | (1) | ||

Additional Annual Retainer for the Chair |

| 60,000 |

|

| N/A |

| ||

Additional Annual Retainer for Audit Committee Chair |

| 20,000 |

|

| N/A |

| ||

Additional Annual Retainer for Compensation Committee Chair |

| 20,000 |

|

| N/A |

| ||

Additional Annual Retainer for Governance & Nominating Committee Chair |

| 15,000 |

|

| N/A |

| ||

| (1) | Restricted stock grant with one-year vesting period. |

Directors may defer the receipt of all or part of their director fees under the Directors’ Deferred Compensation Plan. Amounts deferred are “invested” in bookkeeping accounts that measure earnings and losses based on the performance of a particular investment. Directors may elect to defer their fees into the following two subaccounts: (i) an account based upon the price of the Common Stock and (ii) an account based upon the current interest rate of the Company’s fixed income fund in its Retirement and Savings Plan (the “401(k) Plan”). Subject to certain restrictions, a director may take cash distributions from a deferred fee account either prior to or following the termination of his or her service as a director.

Director Compensation Table

The table below summarizes the actual compensation paid by the Company to non-employee directors who served during the year ended December 31, 2020.

(a) | (b) | (c) | (d) | (e) | (f) | (g) | (h) | ||||||||||||||||||||||||||||

Name | Fees Earned in Cash ($)(1) | Stock Awards ($)(1)(2)(4) | Option Awards ($)(3) | Non-Equity ($) | Change in Compensation Earnings ($) | All Other Compensation ($) | Total ($) | ||||||||||||||||||||||||||||

Aster Angagaw(5) |

| N/A |

| N/A |

| N/A |

| N/A |

| N/A |

| N/A |

| N/A | |||||||||||||||||||||

Mark A. Beck |

| 161,667 |

| 125,000 |

| — |

| — |

| — |

| — |

| 286,667 | |||||||||||||||||||||

Gwendolyn M. Bingham |

| 114,583 |

| 145,833 |

| — |

| — |

| — |

| — |

| 260,416 | |||||||||||||||||||||

Robert J. Henkel |

| 130,000 |

| 125,000 |

| — |

| — |

| — |

| — |

| 255,000 | |||||||||||||||||||||

Stephen W. Klemash(5) |

| N/A |

| N/A |

| N/A |

| N/A |

| N/A |

| N/A |

| N/A | |||||||||||||||||||||

Mark F. McGettrick |

| 145,000 |

| 125,000 |

| — |

| — |

| — |

| — |

| 270,000 | |||||||||||||||||||||

Eddie N. Moore, Jr. |

| 140,000 |

| 125,000 |

| — |

| — |

| — |

| — |

| 265,000 | |||||||||||||||||||||

Michael C. Riordan |

| 125,000 |

| 125,000 |

| — |

| — |

| — |

| — |

| 250,000 | |||||||||||||||||||||

Robert C. Sledd |

| 170,000 |

| 125,000 |

| — |

| — |

| — |

| — |

| 295,000 | |||||||||||||||||||||

| (1) | Includes amounts deferred by the directors under the Directors’ Deferred Compensation Plan. |

| (2) | The amounts included in the “Stock Awards” column are the aggregate grant date fair value of the awards computed in accordance with the FASB ASC Topic 718. |

| (3) | Option Awards were not granted to Directors in 2020. |

| (4) | The Stock Award amount of $125,000 equated to 17,242 shares of Restricted Stock based on the closing stock price of $7.25 on May 11, 2020, the date of grant. These shares vest on May 11, 2021. Upon her appointment to the Board on March 5, 2020, Ms. Bingham received a Stock Award in the amount of $20,833 which equated to 3,513 shares of Restricted Stock based on the closing price of $5.93 on that date. These shares vested on March 5, 2021. |

| (5) | Ms. Angagaw and Mr. Klemash were elected to the Board of Directors on March 1, 2021 and did not receive compensation during the year ended December 31, 2020. |

Owens & Minor, Inc. ● 2021 Proxy Statement 11

Corporate Governance |

Stock Ownership Guidelines for Directors

The Company maintains stock ownership guidelines for its directors and modified those guidelines in 2018 to provide that each director shall attain, within five years after his or her service on the Board begins (or by May 8, 2023 for directors serving as of May 8, 2018), a level of equity ownership of Common Stock having a value of at least $325,000.

Director Candidate Recommendations and Nominations by Shareholders. The Governance & Nominating Committee charter provides that the Governance & Nominating Committee will consider director candidate recommendations by shareholders. Shareholders should submit any such recommendations to the Governance & Nominating Committee through the method described under “Communications with the Board of Directors” below. In addition, our Bylaws provide that any shareholder of record entitled to vote for the election of directors at the applicable meeting of shareholders may nominate directors by complying with the notice procedures set forth in the Bylaws and summarized in “Shareholder Proposals” on page 50 of this Proxy Statement.

Process for Identifying and Evaluating Director Candidates. The Governance & Nominating Committee evaluates all director candidates in accordance with the director qualification standards and the criteria described in our Corporate Governance Guidelines. These guidelines require the Governance & Nominating Committee on an annual basis to review and evaluate the requisite skills and characteristics of individual Board members and nominees as well as the composition of the Board as a whole. This assessment includes whether the member or candidate is independent and includes considerations of diversity, age, skills and experience in the context of the Board’s needs. The goal of the Governance & Nominating Committee is to have a Board whose membership reflects a mix of diverse skill sets, technical expertise, educational and professional backgrounds, industry experiences and public service as well as perspectives of different genders and ethnicities. The Governance & Nominating Committee reviews its annual assessment with the Board each year and, as new member candidates are sought, attempts to maintain and enhance the level of diverse backgrounds and viewpoints of directors constituting the Board. As part of the Board’s annual self-assessment process, the Board will consider the effectiveness of its overall composition and structure as well as its performance and functioning.

There are no differences in the manner in which the Governance & Nominating Committee evaluates director candidates based on whether the candidate is recommended by a shareholder. The Governance & Nominating Committee did not receive any nominations from shareholders for the 2021 Annual Meeting.

Our Bylaws provide that no director nominee can stand for election if, at the time of appointment or election, the nominee is over the age of 72; however, on exceptional circumstances, the Board may waive on a temporary basis the director age limitations to allow a director to be appointed, elected and serve past age 72.

Proxy Access. Our Bylaws further permit a shareholder, or a group of up to 20 shareholders, owning 3% or more of the outstanding shares of the Company’s stock eligible to vote in the election of directors continuously for at least three years, to nominate and include in the Company’s Annual Meeting proxy materials director candidates to comprise generally up to two or 20% of the Board seats (whichever is greater), provided that such shareholder or group of shareholders satisfies the requirements set forth in Article I, Section 1.10 of the Bylaws. No shareholder nominated a director candidate for the

2021 Annual Meeting.

Communications with the Board of Directors

The Board of Directors has approved a process for shareholders and other interested parties to send communications to the Board. Shareholders and other interested parties can send written communications to the Board, any committee of the Board, non-management directors as a group, the Chair, the lead director or any other individual director at the following address: P.O. Box 2076, Mechanicsville, VA 23116-2076. All communications will be relayed directly to the applicable director(s).

12 Owens & Minor, Inc. ● 2021 Proxy Statement

Proposal 1: Election of Directors

Eight directors have been nominated for election to the Board of Directors for a one-year term expiring at the 2022 Annual Meeting of Shareholders or until their respective successors are elected. Each nominee has agreed to serve if elected and qualified. If any nominee is not able to serve, the Board may designate a substitute or reduce the number of directors serving on the Board. Proxies will be voted for the nominees shown below (or if not able to serve, such substitutes as may be designated by the Board). The Board has no reason to believe that any of the nominees will be unable to serve.

Our Bylaws currently provide that the Board of Directors shall consist of 10 directors and the Company intends to amend its Bylaws to provide for eight directors upon the election of the eight nominees in this Proxy Statement. The Governance & Nominating Committee has recommended to the Board of Directors, and the Board of Directors has approved, eight persons as nominees for election to the Board of Directors. At its meeting immediately following the 2021 Annual Meeting, the Board of Directors intends to amend the Bylaws to decrease the size of the Board of directors from 10 to eight directors to remove vacancies created by the departure of retiring directors Messrs. Moore and Sledd. Proxies cannot be voted for a greater number of directors than the number of nominees named.

Information on each nominee, including the particular experience, qualifications, attributes or skills that led the Board to conclude that he or she should serve as a director of the Company, is set forth below.

Aster Angagaw

| ||

Principal Occupation: Former President,

Age 57 Director since March 2021 Independent Director

Committees: Governance & Nominating

|

Background:

Ms. Angagaw served as President, ServiceMaster Brands from May 2019 to October 2020 until ServiceMaster Brands was acquired by Roark Capital in October 2020. Prior to that from 2016 to 2018, Ms. Angagaw was Chief Executive Officer, Healthcare North America division of Sodexo, a global integrated food service and facilities management company with more than 6,000 employees across the U.S. and Canada. Prior to becoming CEO, Ms. Angagaw held the following positions with Sodexo, including Senior Vice President, Global Head of Sales and Business Development, Healthcare from 2015 to 2016, Group Vice President, Global Transformation from 2012 to 2015, Senior Vice President, Market Development, Business and Industries US from 2008 to 2012, Senior Vice President, Strategy, Planning & Quality, Business & Industries US from 2004 to 2008, and Vice President, Operations from 2000 to 2004. Prior to Sodexo, Ms. Angagaw held operational roles for The Wood Company and Spirit Cruises.

Qualifications:

The Board of Directors has nominated Ms. Angagaw to continue her service as a director of the Company based on her over 20 years of senior executive leadership experience with a successful record of accomplishments in operations, strategy and business development, organizational transformation, sales growth and customer retention. | |

Owens & Minor, Inc. ● 2021 Proxy Statement 13

Proposal 1: Election of Directors |

Mark A. Beck

| ||

Principal Occupation: Co-founder and CEO of B-Square Precision, LLC

Age 55 Director since 2019 Independent Director, Chair of the Board

Committees: Compensation & Benefits, Executive,

|

Background:

Mr. Beck serves as the Board’s Chair, a position he has held since September 2020, and is the co-founder and CEO of B-Square Precision, LLC, a private company engaged in the acquisition and management of companies that manufacture high-precision tools, dies, molds and components. Previously, Mr. Beck served as President and Chief Executive Officer of JELD-WEN Holding, Inc. (JELD-WEN), one of the world’s largest door and window manufacturers, from November 2015 to February 2018, and was a director of JELD-WEN from May 2016 to February 2018. Prior to JELD-WEN, Mr. Beck served as an Executive Vice President at Danaher Corporation, leading Danaher’s water quality and dental platforms, beginning in April 2014. Previously, he spent 18 years with Corning Incorporated in a series of management positions with increasing responsibility, culminating in his appointment as Executive Vice President overseeing Corning’s environmental technologies and life science units in July 2012. Mr. Beck currently serves on the board of directors of IDEX Corporation. He formerly served on the board of directors of Dow-Corning Corporation from 2010 to 2014.

Qualifications:

The Board of Directors has nominated Mr. Beck to continue his service as a director based on his experience as a chief executive officer of a public company with significant international operations and his track-record of innovation and successfully integrating acquired businesses. His insights into the manufacturing industry, both domestic and international, bring a unique perspective to Owens & Minor’s Board that assists us strategically as we grow our proprietary product manufacturing and sales capabilities and seek to manage our many relationships with the manufacturing community globally. | |

Gwendolyn M. Bingham

| ||

Principal Occupation: Retired United States Army (three-stars)

Age 61 Director since March 2020 Independent Director

Committees: Compensation & Benefits, |

Background:

Lieutenant General (three-stars) Bingham retired in September 2019 from the United States Army following a 38-year career in the military. During her military career, LTG (retired) Bingham served as Department of the Army Assistant Chief of Staff for Installation Management from 2016 through her retirement in 2019. Previously, she was Commanding General, US Army Tank-Automotive and Armaments Lifecycle Management Command from 2014 to 2016; Commanding General, White Sands Missile Range from 2012 to 2014; Commandant, US Army Quartermaster School from 2010 to 2012; and Chief of Staff, Combined Arms Support Command and Sustainment Center of Excellence from 2008 to 2010. LTG (retired) Bingham holds numerous civic and military honors and was the first woman to hold numerous positions as a US Army General Officer including: the Army’s 51st Quartermaster General and Commandant of the US Army Quartermaster School, Fort Lee, Virginia; the Commanding General, White Sands Missile Range, New Mexico and as Commanding General, Tank-automotive and Armaments Life Cycle Management Command, Warren, Michigan.

Qualifications:

The Board of Directors has nominated LTG (retired) Bingham to continue her service as a director of the Company based on her over 20 years of senior executive leadership experience in complex logistics and supply chain management, resource management, environmental and energy matters, talent management and strategic planning. Additionally, LTG (retired) Bingham has unique experience in leading the Army’s most significant integrated material management center with manufacturing centers in multiple locations and personnel worldwide to support the Army’s efforts to sustain, prepare and transform its operations, which provides insight into the challenges faced in the business of global distribution and supply chain management. | |

14 Owens & Minor, Inc. ● 2021 Proxy Statement

Proposal 1: Election of Directors |

Robert J. Henkel

| ||

Principal Occupation: President, Healthcare Transformation at the THEO Executive Group

Age 66 Director since 2019 Independent Director

Committees: Compensation & Benefits (Chair), Executive, Governance & Nominating

|

Background:

Mr. Henkel is President, Healthcare Transformation at the THEO Executive Group, since January 2019. Previously, Mr. Henkel served as President and Chief Executive Officer of Ascension Healthcare from 2012 to July, 2017, and was Chief Operating Officer of Ascension Healthcare from 2004 to 2011. Ascension Health, Inc. is the largest non-profit healthcare system in the United States and the world’s largest Catholic health system. During his 25-year tenure with Ascension Health, Mr. Henkel was Chair of the Ascension Innovation Counsel for Ascension Health, Inc. from July 2017 to 2019, and also served in a number of different roles including President of the Great Lakes and Mid-Atlantic States Operating Group. Prior to Ascension Health, Mr. Henkel held numerous executive leadership positions with other healthcare organizations, including the Daughters of Charity National Health System, St. Louis; Mount Sinai Medical Center, Miami Beach, Fla.; SSM Health Care in St. Louis; and Montefiore Medical Center, Bronx, New York. Mr. Henkel is a Life Fellow with the American College of Healthcare Executives and an adjunct professor of health policy and management with the University of Pittsburgh Graduate School of Public Health.

Qualifications:

The Board of Directors has nominated Mr. Henkel to continue his service as a director of the Company based on his extensive experience in the healthcare industry. Mr. Henkel brings deep leadership and management experience and insight both generally and specific to the healthcare industry, including unique strategic and operational experience from the healthcare industry. His unique perspective will benefit Owens & Minor as it continues to expand as a full-service partner for customers that focus on global healthcare solutions and understand the challenges faced at multiple levels within the global healthcare marketplace. | |

Stephen W. Klemash

| ||

Principal Occupation: Lead Partner, Ernst & Young

Age 60 Director since March 2021 Independent Director

Committees: Audit, Compensation &

|

Background:

Mr. Klemash has been a Partner with Ernst & Young LLP (EY) since 1997, and is currently the Lead Partner with the EY Americas Center for Board Matters (CBM), a position he has held since 2016. Prior to that Mr. Klemash held multiple Managing Partner positions for EY including from 2011 to 2016 East Central and Central Managing Partner of Accounts, from 2009 to 2011 East Central Region Managing Partner of Advisory, from 2007 to 2009 North Central Region Managing Partner of Assurance and Advisory Business Services and from 2002 to 2007 Pittsburgh Office Managing Partner. Prior to 2002, Mr. Klemash was an assurance practioner, from the date of his hire by EY in 1984, serving clients in a variety of industries. Mr. Klemash is a certified public accountant and member of the American Institute of Certified Public Accountants.

Qualifications:

The Board of Directors has nominated Mr. Klemash to serve as a director of the Company based on his extensive experience working with public companies, strong financial knowledge and breadth of experience in business consulting, accounting, risk management, and corporate governance. The Board believes that the Company will benefit from Mr. Klemash’s comprehensive knowledge of board governance including ESG criteria along with his accounting and general business advisory skills. | |

Owens & Minor, Inc. ● 2021 Proxy Statement 15

Proposal 1: Election of Directors |

| Mark F. McGettrick

| ||

Principal Occupation: Retired Executive Vice President and Chief Financial Officer of Dominion Energy Inc.

Age 63 Director since 2018 Independent Director

Committees: Audit (Chair), Compensation & Benefits, Executive

|

Background:

Mr. McGettrick retired in December 2018 as Executive Vice President and Chief Financial Officer of Dominion Energy Inc., a position he held since June 2009. In addition, Mr. McGettrick also previously served as Executive Vice President, Chief Financial Officer and a member of the board of directors of Dominion Energy Midstream GP, LLC, the general partner of Dominion Energy Midstream Partners, LP, from March 2014 until 2018. From January 2003 to 2009, Mr. McGettrick served as Chief Executive Officer of the company’s Dominion Generation operating segment. Mr. McGettrick joined Dominion Energy, Inc. in 1980 and during his tenure has held a variety of other management positions in distribution design, accounting, customer service and generation. He formerly served on the board of directors of Virginia Electric and Power Company and Dominion Energy Gas Holdings, LLC, which are wholly-owned subsidiaries of Dominion Energy, Inc.

Qualifications:

The Board of Directors has nominated Mr. McGettrick to serve as a director of the Company based on his background and breadth of experience in risk management, business planning, accounting, mergers and acquisitions and financial analysis through his service as a Chief Financial Officer of a large publicly-traded company. The Board of Directors has also designated Mr. McGettrick as an audit committee financial expert based on his strong financial knowledge and experience. | |

Edward A. Pesicka

| ||

Principal Occupation: President and Chief Executive Officer of

Age 53 Director since 2019

Committees: Executive |

Background:

Mr. Pesicka is the President and Chief Executive Officer of Owens & Minor, Inc. since March 2019. Previously Mr. Pesicka served as an independent consultant and advisor in the healthcare, life sciences and distribution industries since January 1, 2016. From January 2000 through April 2015, Mr. Pesicka served in various roles of increasing responsibility at Thermo Fisher Scientific Inc., including, most recently, Chief Commercial Officer and Senior Vice President from January 2014 to April 2015. Prior to that, he was President, Customer Channels at Thermo Fisher from July 2008 to January 2014 and President, Research Market from November 2006 to July 2008. Earlier in his career, Mr. Pesicka held various Vice President-level roles in Thermo Fischer Scientific’s finance department, serving as Chief Financial Officer of numerous divisions. Prior to Thermo Fisher Scientific, Mr. Pesicka spent eight years with TRW, Inc. in its finance department and three years with PricewaterhouseCoopers as an auditor.

Qualifications:

The Board of Directors has nominated Mr. Pesicka to serve as a director of the Company based upon his unique ability as President and Chief Executive Officer to communicate to and inform the Board about the Company’s day-to-day operations, implementation of strategic initiatives, and industry developments. The Board believes that Mr. Pesicka brings an important perspective on the Company’s current operations and ongoing relationships with customers and suppliers. Mr. Pesicka’s substantial experience and expertise in distribution, as well as the healthcare and life sciences industries, allow him to contribute valuable industry perspectives and strategic leadership to the Board. | |

16 Owens & Minor, Inc. ● 2021 Proxy Statement

Proposal 1: Election of Directors |

Michael C. Riordan

| ||

Principal Occupation: Former Co-Chief Executive Prisma Health

Age 62 Director since 2019 Independent Director

Committees: Audit, Governance &

|

Background:

Mr. Riordan served as Co-Chief Executive Officer and Director of Prisma Health, the largest Health System in South Carolina, from November 2017 to June 2019. Prior to the formation of Prisma Health company in 2017, he served as the President and Chief Executive Officer for the Greenville Health System (“GHS”) from 2006 to 2016. Before joining GHS, he served as President and CEO of the University of Chicago Hospitals and Health System and as Chief Operating Officer for Emory University Hospital. Prior to that, Mr. Riordan held multiple administrative roles at Crawford Long Hospital in Atlanta, Georgia. He also served three years as an infantry officer in the United States Marine Corps.

Qualifications:

The Board of Directors has nominated Mr. Riordan to continue his service as a director of the Company based on his extensive experience in the healthcare industry. Mr. Riordan brings considerable leadership and management experience and insight specific to the healthcare industry, including unique strategic and operational experience from the healthcare industry. His unique perspective will benefit Owens & Minor as it continues to expand as a full-service partner for customers that focus on healthcare solutions and understand the challenges faced at multiple levels within the healthcare industry. | |

The Board of Directors recommends a vote FOR the election of each nominee as director.

Owens & Minor, Inc. ● 2021 Proxy Statement 17

Proposal 1: Election of Directors |

Effective immediately following the Annual Meeting, Messrs. Moore and Sledd’s respective terms will expire, at which time each of them will retire from the Board. The Company gratefully acknowledges and thanks Messrs. Moore and Sledd for their respective years of service on the Board and dedication to the Company, its shareholders and teammates.

Eddie N. Moore, JR.

| ||

Principal Occupation: Retired President & Chief Executive Officer of Norfolk

Age 72 Director since 2005 Independent Director

Committees: Audit, Executive, Governance & Nominating (Chair)

|

Mr. Moore retired in 2017 as President & Chief Executive Officer of Norfolk State University, a position he held since January 2015, after serving as the Interim President beginning in September 2013. From 2011 to 2012, he served as President of St. Paul’s College. He is President Emeritus of Virginia State University after serving as its President from 1993 to 2010. Prior to leading Virginia State University, Mr. Moore served as state treasurer for the Commonwealth of Virginia, heading the Department of the Treasury and serving on fifteen state boards and authorities. He also previously served on the board of directors of Universal Corporation. During his 16 years of service as a director of the Company, Mr. Moore has served on the Audit and Governance & Nominating Committees, including Chair of the Governance & Nominating Committee, and has contributed his breadth of experience in accounting and finance, governance, leadership and experience in the public sector. | |

Robert C. Sledd

| ||

Principal Occupation: Managing Partner of Pinnacle Ventures, LLC

Age 67 Director since 2007 Independent Director

Committees: Audit

|

Mr. Sledd served as the Board’s Chairman from 2018 to September 2020 and previously as the Interim President and Chief Executive Officer of Owens & Minor, Inc., from November 2018 to March 2019. He previously served as a Senior Economic Advisor to the Governor of Virginia from 2010 to 2014. Since 2008, he also has served as Managing Partner of Pinnacle Ventures, LLC and Sledd Properties, LLC. From 1995 to 2008, he served as Chairman of Performance Food Group Co. (“PFG”), a foodservice distribution company that he co-founded in 1987. He served as Chief Executive Officer of PFG from 1987 to 2001 and from 2004 to 2006. He also serves on the boards of directors of SCP Pool Corporation and Universal Corporation. During his 14 years of service as a director of the Company, Mr. Sledd has served on the Audit, Compensation & Benefits and Governance & Nominating Committees, including Chair of the Compensation & Benefits Committee, and has contributed his expertise in economic and business development, as well as his experience as a former chief executive officer of a distribution company, and breadth of perspectives on corporate management and strategic growth. | |

18 Owens & Minor, Inc. ● 2021 Proxy Statement

Proposal 2: Ratification of Independent Registered Public Accounting Firm

The Audit Committee (with confirmation of the Board) has selected KPMG LLP to serve as the Company’s independent registered public accounting firm for the year ending December 31, 2021 and has directed that management submit such appointment of KPMG LLP for ratification by the shareholders at the Annual Meeting. Representatives of KPMG LLP will be present at the Annual Meeting to answer questions and to make a statement, if they desire to do so.

Under the Sarbanes-Oxley Act of 2002 and the rules of the SEC promulgated thereunder, the Audit Committee is solely responsible for the appointment, compensation and oversight of the work of the Company’s independent registered public accounting firm. Shareholder ratification of this appointment is not required by the Company’s Bylaws or otherwise. If shareholders fail to ratify the appointment, the Audit Committee will take such failure into consideration in future years. If shareholders ratify the appointment, the Audit Committee, in its discretion, may direct the appointment of a different independent registered public accounting firm at any time during the year if it is determined that such a change would be in the best interests of the Company.

Prior to selecting KPMG LLP for fiscal 2021, the Audit Committee evaluated KPMG LLP’s performance with respect to fiscal 2020. In conducting this annual evaluation, the Audit Committee considered management’s assessment of KPMG LLP’s performance in areas such as (i) independence, (ii) the quality and the efficiency of the services provided, including audit planning and coordination, (iii) industry knowledge and (iv) the quality of communications, including KPMG LLP staff accessibility and keeping management apprised of issues. The Audit Committee also considered KPMG LLP’s tenure, the impact on the Company of changing auditors and the reasonableness of KPMG LLP’s billable rates. The Audit Committee is responsible for the audit fee negotiations associated with the retention of KPMG LLP. In order to assure continuing auditor independence, the Audit Committee periodically considers whether there should be a regular rotation of the independent registered accounting firm. Further, in conjunction with the rotation of the auditing firm’s lead engagement partner every five years, the Audit Committee and its chair will continue to be directly involved in the selection of KPMG LLP’s new lead engagement partner. The members of the Audit Committee and the Board believe that the continued retention of KPMG LLP to serve as our independent external auditor is in the best interests of us and our shareholders.

The Board of Directors recommends a vote FOR the ratification of the appointment of KPMG LLP to serve as

the Company’s independent registered public accounting firm for the year ending December 31, 2021.

Fees Paid to Independent Registered Public Accounting Firm

For each of the years ended December 31, 2020 and 2019, KPMG LLP billed the Company the fees set forth below in connection with professional services rendered by that firm to the Company:

| Year 2020 | Year 2019 | |||||||

Audit Fees | $ | 3,571,000 |

| $ | 4,449,000 |

| ||

Audit-Related Fees |

| 40,000 |

|

| 30,000 |

| ||

Tax Fees |

| 345,000 |

|

| 835,000 |

| ||

All Other Fees |

| 2,000 |

|

| — |

| ||

Total | $ | 3,958,000 |

| $ | 5,314,000 |

| ||

Audit Fees. These were fees for professional services performed for the audit of the Company’s annual financial statements and review of financial statements included in the Company’s filings on Forms 10-K and 10-Q, Sarbanes-Oxley compliance, and services normally provided in connection with statutory and regulatory filings or engagements.

Audit-Related Fees. These were fees primarily for the annual audits of the Company’s employee benefit plan financial statements, internal control attestations in certain foreign jurisdictions and consultations by management related to financial accounting and reporting matters.

Tax Fees. These were fees primarily for advice and consulting services related to the structuring of international operations, and the restructuring of business operations.

Owens & Minor, Inc. ● 2021 Proxy Statement 19

Proposal 2: Ratification of Independent Registered Public Accounting Firm |

All Other Fees. All other fees in 2020 include fees for online resources provided by KPMG LLP. There were no other fees in 2019 other than those described above.