- OMI Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

Owens & Minor (OMI) DEF 14ADefinitive proxy

Filed: 17 Mar 22, 4:02pm

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant ☒ Filed by a party other than the Registrant ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☒ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material Pursuant to §240.14a-12 |

Owens & Minor, Inc.

(Name of Registrant as Specified in its Charter)

Not applicable.

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

| ☒ | No fee required. | |||

| ☐ | Fee paid previously with preliminary materials. | |||

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

| ||||

9120 Lockwood Boulevard | ||||

| Mechanicsville, Virginia 23116 | ||||

| (804) 723-7000 |

March 17, 2022

Dear Shareholders:

It is a pleasure to invite you to the Owens & Minor, Inc. Annual Meeting of Shareholders on Friday, April 29, 2022 at 9:00 a.m. Eastern Time. Due to ongoing concerns regarding the COVID-19 virus, the Annual Meeting will be held in a virtual meeting format only, via the Internet. Additionally, we believe that a virtual meeting allows us to make participation accessible for shareholders from any geographic location while reducing the costs and environmental impact associated with holding an in-person meeting. Information regarding attending the virtual Annual Meeting can be found on page 54 of the Proxy Statement.

The Notice of 2022 Annual Meeting of Shareholders and Proxy Statement describe the items of business for the meeting. In addition to considering these matters, we will review significant accomplishments and events since our last shareholders’ meeting as well as future opportunities and initiatives we intend to pursue. Our Board of Directors and management team will be present to discuss items of interest and to answer questions.

The Notice of 2022 Annual Meeting of Shareholders contains instructions on how to access our proxy materials and our 2021 Annual Report/Form 10-K over the Internet as well as how shareholders can receive paper copies of such documents, if they so desire.

You may vote your shares via the Internet or by telephone or, if you prefer, you may request paper copies of the proxy materials and submit your vote by mail by following the instructions on the proxy card. We encourage you to vote via the Internet. Whichever method you choose, your vote is important so please vote as soon as possible. All of us at Owens & Minor appreciate your continued interest and support.

Warm regards,

Mark A. Beck

Chair of the Board of Directors

Owens & Minor, Inc.

WHETHER OR NOT YOU PRESENTLY PLAN TO ATTEND THE MEETING,

THE BOARD OF DIRECTORS URGES YOU TO VOTE.

Proxy Statement

Page | ||

i | ||

1 | ||

4 | ||

6 | ||

7 | ||

7 | ||

11 | ||

11 | ||

13 | ||

15 | ||

15 | ||

16 | ||

17 | ||

Proposal 2: Ratification Of Independent Registered Public Accounting Firm | 21 | |

| 21 | ||

22 | ||

Page | ||

24 | ||

| 24 | ||

| 25 | ||

25 | ||

26 | ||

26 | ||

40 | ||

41 | ||

43 | ||

44 | ||

45 | ||

47 | ||

| 50 | ||

Proposal 3: Advisory Shareholder Vote to Approve Executive Compensation | 51 | |

Proposal 4: Advisory Vote on Frequency of Shareholder Vote on Executive Compensation | 52 | |

53 | ||

53 | ||

Further Information About Attending the Virtual Annual Meeting | 54 | |

55 | ||

Your Vote Is Important

Whether or not you plan to attend the Annual Meeting, please vote your shares promptly, as instructed in the Notice Regarding the Availability of Proxy Materials, by the Internet or by telephone. You may also request a paper proxy card to submit your vote by mail, if you prefer. We encourage you to vote via the Internet.

Notice of Annual Meeting of Shareholders

To Be Held Friday, April 29, 2022

TOTHE SHAREHOLDERSOF OWENS & MINOR, INC.:

The Annual Meeting of Shareholders of Owens & Minor, Inc. (the “Company” or “Owens & Minor”) will be held on Friday, April 29, 2022 at 9:00 a.m. EDT in a virtual meeting format only, via the Internet. You will not be able to attend the Annual Meeting in person. To be admitted to the Annual Meeting at www.meetnow.global/MUX79MR you must enter the control number found on your proxy card, voting instruction form or notice you previously received. We encourage you to access the meeting in advance of the designated start time.

The purposes of the meeting are:

| 1. | To elect the seven directors named in the attached Proxy Statement, each for a one-year term and until their respective successors are elected and qualified; |

| 2. | To ratify the appointment of KPMG LLP as the Company’s independent registered public accounting firm for the year ending December 31, 2022; |

| 3. | To conduct an advisory vote to approve the compensation of the Company’s named executive officers; |

| 4. | To conduct an advisory vote on the frequency of a shareholder vote on the compensation of our named executive officers; and |

| 5. | To transact any other business properly before the Annual Meeting. |

Shareholders of record as of March 4, 2022 will be entitled to vote at the Annual Meeting.

Your attention is directed to the attached Proxy Statement. The Notice Regarding the Availability of Proxy Materials is being distributed on or about March 17, 2022. This Proxy Statement, the proxy card and Owens & Minor’s 2021 Annual Report/Form 10-K are being furnished on the Internet on or about March 17, 2022.

BY ORDEROFTHE BOARDOF DIRECTORS

NICHOLAS J. PACE

Executive Vice President, General Counsel &

Corporate Secretary

Owens & Minor, Inc. ● 2022 Proxy Statement i

| Street Address | Mailing Address | |

| 9120 Lockwood Boulevard | P.O. Box 27626 | |

| Mechanicsville, Virginia 23116 | Richmond, Virginia 23261-7626 |

Proxy Statement

Annual Meeting of Shareholders

to be held on April 29, 2022

When and Where the Annual Meeting Will Be Held

The Annual Meeting will be held virtually on Friday, April 29, 2022 at 9:00 a.m. EDT at www.meetnow.global/MUX79MR through a live webcast. We have adopted a virtual format for our Annual Meeting to ensure the health and well-being of our teammates, directors and shareholders in the current COVID-19 environment. Additionally, we believe that a virtual meeting allows us to make participation accessible for shareholders from any geographic location with Internet connectivity, while reducing costs and environmental impact associated with holding and arranging for an in-person meeting.

How to Attend the Virtual Annual Meeting

Shareholders at the close of business on March 4, 2022 (the “Record Date”) have a right to attend the Annual Meeting. In order to be admitted to the Annual Meeting at www.meetnow.global/MUX79MR, registered shareholders must enter the 15-digit control number found in the shaded bar on your Notice of Internet Availability or proxy card. Further information regarding attending the virtual Annual Meeting can be found at page 54 of this Proxy Statement.

What You Are Voting On

Proxies are being solicited by the Board of Directors for purposes of voting on the following proposals and any other business properly brought before the meeting:

| Proposal 1: | Election of the seven directors named in this Proxy Statement, each for a one-year term and until their respective successors are elected and qualified. | |

| Proposal 2: | Ratification of KPMG LLP as the Company’s independent registered public accounting firm for the year ending December 31, 2022. | |

| Proposal 3: | Advisory vote to approve the compensation of our named executive officers (the “Say on Pay Proposal”). | |

| Proposal 4: | Advisory vote on the frequency of a shareholder vote on the compensation of our named executive officers (the “Say on Frequency Proposal”). |

Who is Entitled to Vote

Shareholders of Owens & Minor, Inc. (the “Company” or “Owens & Minor”) as of the close of business on March 4, 2022 (the “Record Date”) are entitled to vote. Each share of the Company’s common stock (“Common Stock”) is entitled to one vote with respect to each matter to be voted upon at the meeting. As of March 4, 2022, 76,682,879 shares of Common Stock were issued and outstanding.

Owens & Minor, Inc. ● 2022 Proxy Statement 1

About the Meeting

|

How to Vote

You can vote via the Internet, by telephone or by mail.

By Internet. You may vote via the Internet by following the specific instructions on the Notice of Internet Availability of Proxy Materials. Shareholders who have requested a paper copy of a proxy card by mail may submit proxies over the Internet by following the instructions on the proxy card. We encourage you to vote via the Internet. If your shares are held by your bank or broker in street name, please refer to the instruction form that you receive from your bank or broker or contact your bank or broker to determine whether you will be able to vote via the Internet.

By Telephone. You may vote by telephone by calling the toll-free number on the proxy card and following the instructions. Shareholders will need to have the control number that appears on their notice available when voting. If your shares are held by your bank or broker in street name, please refer to the instruction form that you receive from your bank or broker or contact your bank or broker to determine whether you will be able to vote by telephone.

By Mail. Shareholders who have requested a paper copy of a proxy card by mail may submit proxies by completing, signing and dating the enclosed proxy card and returning it in the postage-paid envelope provided.

However you choose to vote, you may revoke a proxy prior to the meeting by (1) submitting a subsequently dated proxy by any of the methods described above, (2) giving notice in writing to the Corporate Secretary of the Company or (3) voting at the virtual meeting (attendance at the meeting will not itself revoke a proxy).

What Happens if You Do Not Make Selections on Your Proxy

If your proxy contains specific voting instructions, those instructions will be followed. However, if you sign and return your proxy card by mail or submit your proxy by telephone or via the Internet without making a selection on one or more proposals, you give authority to the individuals designated on the proxy card to vote on the proposal(s) for which you have not made specific selections or given instructions and any other matter that may arise at the meeting. If no specific selection is made or instructions given, it is intended that all proxies that are signed and returned or submitted via telephone or Internet will be voted “FOR” the election of all nominees for director, “FOR” the ratification of KPMG LLP as our independent registered public accounting firm in 2022, “FOR” the approval of the Say on Pay Proposal and “FOR” the approval of conducting an advisory vote on the compensation of our NEOs every year.

Whether Your Shares Will be Voted if You Don’t Provide Your Proxy

Whether your shares will be voted if you do not provide your proxy depends on how your ownership of shares of Common Stock is registered. If you own your shares as a registered holder, which means that your shares of Common Stock are registered in your name, and you do not provide your proxy, your shares will not be represented at the meeting, will not count toward the quorum requirement, which is explained below, and will not be voted.

If you own your shares of Common Stock in street name, your shares may be voted even if you do not provide your broker with voting instructions. Brokers have the authority under New York Stock Exchange (“NYSE”) rules to vote shares for which their beneficial owner customers do not provide voting instructions on certain “routine” matters. When a proposal is not a routine matter and the brokerage firm has not received voting instructions from the beneficial owner of the shares with respect to that proposal, the brokerage firm cannot vote the shares on that proposal. This is called a broker non-vote.

The Company believes that only the proposal to ratify the appointment of KPMG LLP as the Company’s independent registered public accounting firm for 2022 is a routine matter for which brokerage firms will have discretionary voting power if you do not give voting instructions with respect to this proposal. The proposal to elect directors, the Say on Pay Proposal and the Say on Frequency Proposal are non-routine matters for which brokerage firms will not have discretionary voting power and for which specific voting instructions from their customers are required. As a result, brokerage firms will not be allowed to vote on these non-routine matters on behalf of their customers if the customers do not return specific voting instructions.

2 Owens & Minor, Inc. ● 2022 Proxy Statement

About the Meeting

|

What Constitutes a Quorum

A majority of the outstanding shares of Common Stock present or represented by proxy constitutes a quorum. A quorum is required to conduct the Annual Meeting. If you vote your proxy, you will be considered part of the quorum. Abstentions and shares held by brokers or banks in street name (“broker shares”) that are voted on any matter are included in the quorum. Broker shares that are not voted on any matter will not be included in determining whether a quorum is present.

The Vote Required to Approve Each Item

Election of Directors. The affirmative vote of a majority of the votes cast at the meeting is required for the election of each director. A majority of votes cast means that the number of votes cast “FOR” a nominee’s election must exceed the number of votes cast “AGAINST” that nominee’s election. Abstentions and broker non-votes will not be counted as votes cast and will have no effect on the results of this vote.

Ratification of Appointment of KPMG LLP. The appointment of KPMG LLP will be ratified if the votes cast “FOR” this proposal exceed the number of votes cast “AGAINST” this proposal. Abstentions will not be counted as votes cast on this proposal and will have no effect on the results of this vote. There should be no broker non-votes because this is considered a routine matter under the rules of the NYSE.

Advisory Vote to Approve the Say on Pay Proposal. The compensation of our executive officers named in the Summary Compensation Table will be approved on an advisory basis if the votes cast “FOR” this proposal exceed the number of votes cast “AGAINST” this proposal. Abstentions and broker non-votes will not be counted as votes cast on this proposal and will have no effect on the results of this vote.

Advisory Vote to Approve the Say on Frequency Proposal. The frequency (i.e., every year, every two years or every three years) of the shareholder advisory vote on the compensation of our NEOs receiving the greatest number of votes cast (i.e., a plurality) will be considered the frequency recommended by shareholders.

How to Obtain a Paper Copy of the Proxy Materials

Shareholders will find instructions about how to obtain a paper copy of the proxy materials on the notice they received in the mail about the Internet availability of proxy materials.

What it Means if You Get More Than One Notice about the Internet Availability of Proxy Materials

Your shares are probably registered differently or are held in more than one account. Please vote all proxies to ensure that all your shares are voted. Also, please have all of your accounts registered in the same name and address. You may do this by contacting our transfer agent, Computershare, Inc., at 1-866-252-0358.

Costs of Soliciting Proxies

Owens & Minor will pay all costs of this proxy solicitation. The Company has retained Georgeson, LLC to aid in the distribution and solicitation of proxies for approximately $7,500 plus expenses. The Company will reimburse brokers and other custodians, nominees and fiduciaries for their expenses in forwarding proxy and solicitation materials.

Owens & Minor, Inc. ● 2022 Proxy Statement 3

General. The Company is managed under the direction of the Board of Directors, which has adopted Corporate Governance Guidelines to set forth certain corporate governance practices. Each year, we review our corporate governance policies and practices relative to applicable laws, including the Dodd-Frank Wall Street Reform and Consumer Protection Act and the Sarbanes-Oxley Act of 2002 and rules and regulations promulgated thereunder or adopted by the Securities and Exchange Commission (“SEC”) and the NYSE, the exchange on which the Common Stock is listed, as well as the policies and practices recommended by groups and authorities active in corporate governance.

Corporate Governance Materials. The Company’s Bylaws, Corporate Governance Guidelines, Code of Honor and the charters of the Audit Committee, the Our People & Culture Committee (the “OP&C Committee”), and the Governance & Nominating Committee are available on our website at http://www.owens-minor.com under “Corporate Governance” in the “Investor Relations” tab. The information available on, or that can be accessed through, our website is not a part of, or incorporated by reference into, this Proxy Statement.

Code of Honor. The Board of Directors has adopted a Code of Honor that is applicable to all teammates of the Company, including the principal executive officer, the principal financial officer and the principal accounting officer, as well as the members of the Board of Directors. We would post any amendments to or waivers from our Code of Honor (to the extent applicable to the Company’s principal executive officer, principal financial officer, principal accounting officer, any other executive officer or any director) on our website http://www.owens-minor.com under “Corporate Governance” in the “Investor Relations” tab.

Director Independence. The Board of Directors has determined that the following Board members and/or nominees are “independent” within the meaning of the NYSE listing standards and the Company’s Corporate Governance Guidelines: Aster Angagaw, Mark A. Beck, Gwendolyn M. Bingham, Kenneth Gardner-Smith, Robert J. Henkel, Stephen W. Klemash and Mark F. McGettrick. To assist it in making determinations of independence, the Board has adopted categorical standards which are included in the Company’s Corporate Governance Guidelines available on our website at http://www.owens-minor.com under “Corporate Governance” in the “Investor Relations” tab. The Board has determined that all directors and/or nominees identified as independent in this Proxy Statement meet these standards.

Structure and Leadership of the Board. The Board of Directors does not have a firm policy with respect to the separation of the offices of Chair of the Board and the Chief Executive Officer. Instead, the Board believes that it is in the best interests of the Company for the Board to make this determination as part of the succession planning process when it selects a new Chief Executive Officer or when a Chair ceases his or her service on the Board. At this juncture, the Board believes that the separation of the Chair and Chief Executive Officer roles currently serves the best interests of the Company by allowing a non-executive, independent director to lead the Board while our current Chief Executive Officer focuses on the Company’s performance, day-to-day operations, customer service, teammate engagement and the implementation of strategic initiatives.

Our Corporate Governance Guidelines also provide for the annual election of a lead independent director by our non-management directors if the Chair is not independent. The lead independent director primarily presides at Board meetings in the absence of the Chair, presides at meetings of the independent directors, serves as the principal liaison between the independent directors and the Chair and Chief Executive Officer, and advises the Chair with respect to agendas and information requirements relating to the Board and committee meetings. The Board believes that the lead independent director, when the Chair is not independent, enhances communications between Board members (including the Chair) and committees as well as the overall functioning of the Board’s leadership.

Majority Vote Requirement for Election of Directors. The Company’s Bylaws and Corporate Governance Guidelines provide for the election of directors by majority vote in uncontested elections. Under the Company’s Corporate Governance Guidelines, with respect to director nominations, the Board will only nominate those incumbent directors who submit irrevocable resignations effective upon the failure of such director nominee to receive the required vote for re-election and Board’s acceptance of such resignation. In the event an incumbent director fails to receive a majority of the votes cast, the Governance & Nominating Committee (or such other committee designated by the Board) will make a recommendation to the Board as to whether to accept or reject the resignation. The Board must act on the resignation, taking into account the Governance & Nominating Committee’s recommendation, and publicly disclose its decision regarding the resignation, including, if applicable, its rationale for rejecting a resignation, in a press release and an appropriate disclosure with the SEC within 90 days following certification of the election results. The Governance & Nominating Committee in making its recommendation, and the Board in making its decision, may each consider any factors or other information that it considers appropriate and relevant.

4 Owens & Minor, Inc. ● 2022 Proxy Statement

Corporate Governance

|

The Board’s Role in Risk Oversight. The Board of Directors currently administers its risk oversight function through the full Board and not through a separate risk committee of the Board. However, each of the Audit Committee, the OP&C Committee and the Governance & Nominating Committee oversees the specific financial, compensation, and governance risks, respectively, relating to its functions and responsibilities and reports on these matters to the full Board. The Board performs its risk oversight function through regular reporting by the Board committees as well as the officers and management-level personnel who supervise the day-to-day risk management activities of the Company, including an enterprise risk steering committee comprised of senior leaders of the Company that is one component of the Company’s enterprise risk management (“ERM”) program.

Cybersecurity Risks. The Board recognizes the importance of oversight of cybersecurity and information security risks and at least annually receives a comprehensive presentation and report from management on the state of the Company’s cybersecurity program and systems protection. The presentation and report address topics and updates on all layers of cybersecurity, technology, applications, threat environment, and processes to prevent, detect and respond to threats. Cybersecurity and information security monitoring, mitigation and threat assessment are also part of the Company’s ERM program. Additionally, the Audit Committee monitors our information security programs and receives updates on matters related to cybersecurity incidents.

We model our cybersecurity program to align with practices and standards referenced within the NIST Cybersecurity Framework. Our information security program includes, but is not limited to:

| • | Following the methodology of Identify, Protect, Detect, Respond, and Recover; |

| • | Mandatory cybersecurity awareness training for all persons (teammates and contractors) accessing the Company’s network; |

| • | Monthly Company-wide phishing exercises; |

| • | Identification and remediation of information security risks and vulnerabilities in our IT systems, including regular scanning of both internal and externally facing systems and annual third-party penetration testing; |

| • | Implementation of security technologies that are able to identify and assist in containing and remediating malware risks; |

| • | Active monitoring of logs and events for our network perimeter and internal systems; |

| • | Due diligence of information security programs for third-party vendors that handle sensitive data; and |

| • | Partnering with Cybersecurity and Infrastructure Security Agency (“CISA”)/United States Department of Homeland Security/Federal Bureau of Investigation, to leverage their provided sensitive/confidential threat intel and with CISA for weekly vulnerability scans of our key public facing servers. |

The Company also maintains a cyber insurance policy that provides coverage for security breach recovery and response.

Environmental, Social and Governance (“ESG”). In 2021, the Governance & Nominating Committee amended its charter to include review and oversight of the ESG framework and establishment of an ESG governance structure.

Annual Performance Evaluation. The Board conducts an annual self-evaluation (for the full Board and for each of its committees) to determine whether it and its committees are functioning effectively. The Governance & Nominating Committee receives comments from all directors and reports annually to the Board with an assessment of the Board’s performance. The assessment focuses on the Board’s contribution to the Company and specifically focuses on areas in which the Board or management believes that the Board can improve.

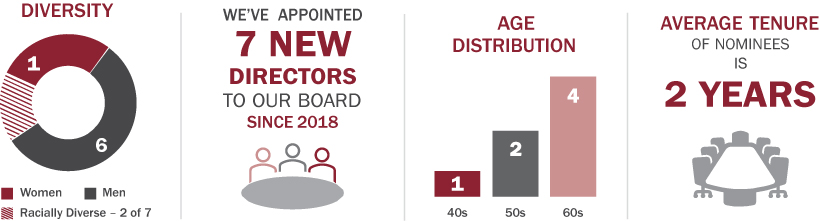

Board Diversity. Consistent with the Company’s Corporate Governance Guidelines, the Governance & Nominating Committee seeks to select Directors who reflect a diverse set of skills, professional and personal backgrounds, perspectives and experiences. While the Board has not adopted a formal policy with regard to the consideration of diversity in identifying director nominees, the Governance & Nominating Committee and the Board believe that considering diversity is consistent with the goal of creating a Board that best serves the needs of the Company and the interests of its shareholders, and it is one of the many factors that they consider when identifying individuals for Board membership. The chart on page 16 sets forth the diversity, experience and tenure of our director nominees.

Owens & Minor, Inc. ● 2022 Proxy Statement 5

Corporate Governance

|

Report of the Governance & Nominating Committee

The Governance & Nominating Committee is composed of three directors, all of whom are independent. The Governance & Nominating Committee met six times during 2021. In performing the various duties and responsibilities outlined in its charter, the Governance & Nominating Committee, among other things, received regular reports on the Company’s enterprise quality and regulatory compliance programs; reviewed and approved changes to its charter and the Corporate Governance Guidelines; reviewed and assessed the Company’s director compensation program relative to comparable peer companies, including appropriate compensation for the non-executive Chair of the Board; reviewed and approved changes to the Director equity ownership policy; and led the annual Board and committee assessment process. During 2021, the Governance & Nominating Committee reviewed and along with the full Board devoted time to management succession planning, including the review and approval of updates to the CEO emergency replacement plan and, in conjunction with the OP&C Committee, reviewed the performance of the Chief Executive Officer. The Governance & Nominating Committee also undertook oversight of the Company’s environmental, social and governance (“ESG”) programs.

Additionally, in 2021, the Governance & Nominating Committee devoted considerable time and attention to director succession planning, which included continued engagement with an outside consulting firm to assist in the identification and strategic recruitment of directors possessing the qualities, character, experience and expertise that would contribute to the leadership and success of the Company.

| THE GOVERNANCE & NOMINATING COMMITTEE |

| Gwendolyn M. Bingham, Chair |

| Aster Angagaw |

| Robert J. Henkel |

6 Owens & Minor, Inc. ● 2022 Proxy Statement

Corporate Governance

|

Our Board of Directors and our leadership value our shareholders’ perspectives. Shareholder engagement is an integral part of the Company’s strategy. To help ensure that we understand and focus on the priorities that matter most to our shareholders, our Board of Directors and senior management proactively conduct investor outreach throughout the year.

We engage with shareholders through various outreach initiatives, including:

| • | Quarterly earnings releases with corresponding conference calls and webcasts; |

| • | Regular reports filed with the SEC, including annual and quarterly reports; |

| • | Participation in investor conferences and non-deal roadshows; |

| • | In-person and virtual meetings with current and prospective investors and research analysts; |

| • | Proactive outreach to institutional investors, pension funds and governance professionals; and |

| • | Our annual shareholders meeting. |

In addition to discussing business results and initiatives, strategy and capital structure, we engage with investors on various other matters essential to our business and the Company, such as governance practices, risk management and ESG. Our senior executives regularly share with our Board the feedback received from our shareholders.

Specific Ways We Engaged with Shareholders in 2021

In 2021, we engaged shareholders holding over 50% of our shares through a variety of outreach initiatives. Along with our quarterly earnings presentations, we presented at four industry conferences and held one non-deal roadshow. Presentation materials from our attendance at investor conferences are available to our shareholders generally through our filings with the SEC or on the “Investors” section of our website at www.investors.owens-minor.com.

In addition, we presented our long-term strategy at our 2021 Investor Day in May 2021. We purposefully chose a virtual format for this event to provide all shareholders the opportunity to attend. During the presentation, members of the Company’s leadership team provided their perspective on future business trends and highlighted the strategic priorities that will drive long-term growth, including long-term financial targets. The virtual Investor Day format allowed us to achieve record attendance.

Further, as discussed on pages 7-11, we published our inaugural ESG report. The report outlines the Company’s ESG focus and contributions and provides visibility to our shareholders into the performance metrics and achievements that support the Company’s ESG focus. We received positive feedback from shareholders on our report and helpful input with respect to various aspects of our efforts.

We concluded the year by sharing with our shareholders our progress on the activities of the Owens & Minor Foundation. As discussed on page 9, the Foundation is dedicated to impacting and empowering communities through three primary areas of focus: Healthcare, Environment, and Diversity and Inclusion (“D&I”). In 2021, and in accordance with its founding principles, the Foundation provided financial support to 19 organizations.

Environmental, Social and Governance

Introduction. Since our founding in 1882, Owens & Minor has remained committed to our teammates, customers, and communities where we do business. We recognize the need to identify, prioritize, and manage Environmental, Social and Governance (“ESG”) impacts from our operations.

In 2021, we completed our first ESG materiality assessment to identify and prioritize ESG topics most relevant to our key stakeholders. Using the results of the materiality assessment, we then developed a framework to align ESG risks and opportunities with our overall business strategy while striving to improve our ESG-related impacts. To effectively manage the implementation of our ESG strategy, we developed a governance structure to embed awareness and related roles and responsibilities across our organizational structure. We are also proud to have issued our inaugural ESG Report in 2021 and look forward to continuing to build on our efforts.

Owens & Minor, Inc. ● 2022 Proxy Statement 7

Corporate Governance

|

Owens & Minor’s ESG Framework. Our ESG framework forms the basis of our ESG program, integrating the priorities identified in our materiality assessment into key aspects of our operations and overall business strategy. To define our framework, we conducted a number of “visioning” sessions that presented our materiality assessment findings to our ESG team and executive leadership, as well as held comprehensive discussions to formulate the core components of our framework, focus areas, and corresponding commitments.

Our ESG framework is grounded in our mission of, “Empowering Our Customers to Advance Healthcare,” and emphasizes the importance of incorporating ESG commitments into our Company culture and values. Our framework and mission is supported by the following four focus areas:

Empowering our Teammates: Foster an empowering, safe, diverse, and inclusive work environment where all Teammates can thrive

Caring for our Customers and Communities: Deliver superior and easily acceptable care for customers and the communities we support

Operating Responsibly: Demonstrate sound governance, accountability, and responsible sourcing

Ensuring Environmental Stewardship: Minimize the impact of our operations on the environment

Empowering Our Teammates

Diversity and Inclusion (“D&I”). We encourage a working environment that promotes the success and well-being of all our teammates. We continuously advocate for D&I across our business to succeed in delivering on our mission.

Our D&I Steering Committee oversees all initiatives in support of our D&I strategy. Building on the creation of our Teammate Resource Groups (“TRGs”) in 2020 for engagement and support for underrepresented identity groups, in 2021 we expanded our TRGs to include African American/Black, Veteran, LGBTQ+, Military, Women in Healthcare, LatinX, Asian American/Pacific Islanders, and Women in Tech. The D&I Steering Committee also manages the development of D&I metrics as well as relationship development with historically black colleges and universities (“HBCUs”) to hire more diverse talent. We are committed to increasing D&I across all levels of our workforce. To succeed in this area, we track representation across gender and ethnic minority groups.

Health and Safety. Teammate safety and well-being is of the utmost importance and we recognize these elements are critical to our Company’s continued success. We strive to offer a work environment that empowers all teammates to make safe choices and hold themselves and others accountable for their safety, health, and well-being. We consider this to be particularly important, as a significant part of our workforce performs physical labor in our manufacturing sites and distribution centers.

We continue to utilize our Safety Management System (“SMS”) to standardize our safety procedures across our manufacturing and distribution center operations. We proactively manage safety through several safety and health initiatives such as formal risk assessment procedures at manufacturing sites, job hazard assessments, internal safety inspections, and teammate engagement methods. We track indicators that enable us to take a proactive approach to preventing incidents and conduct a formal review process and root cause analysis to develop action plans for continued improvements to safety. Our manufacturing Behavior Based Safety (“BBS”) program continues to drive improvements in our recordable incident rate down to 0.14, well below industry average. These observations target specific areas where recordable injuries have occurred or near misses have been identified and drives collaborative process improvement. Over the year, teammates recorded 110% of the target participation rate in this program.

In 2021, 30 of our sites (60%) earned our “Crystal Eagle” Excellence Safety Award for working one year free of recordable injury. Furthermore in 2021, the overall Company cases of Days Away, Restrictions, or Transfer (“DART”) rate was 4% better than during 2020. In 2021, our DART rate across all business units was 0.27, an improvement from 2020 (0.33) and significantly better than the industry average of 1.8 as reported by the 2020 Bureau of Labor Statistics.

Our Global Safety & Risk Council convenes with all of our business units to share leading practices and education on safety protocols. Since 2020, this collaboration has helped Owens & Minor standardize our safety training curriculum across our sites. This curriculum is now shared in a Global Safety Week for teammates.

8 Owens & Minor, Inc. ● 2022 Proxy Statement

Corporate Governance

|

We continue to adapt and implement COVID-19 response measures as recommended by our COVID-19 Steering Committee, which is responsible for developing and implementing COVID-19 protocols Company-wide.

Caring for Our Customers and Communities

Community Engagement. We are actively engaged in the communities where we live and work. We are strengthening our communities and the environment through three focus areas:

Health and wellness: We are committed to advancing the wellbeing of our teammates, customers, and community members by supporting organizations such as the Special Olympics, YMCA of Greater Richmond, and St. Jude Children’s Research Hospital.

Education: We continue to support educational programs that strengthen our community and teammates such as the Boys & Girls Club and United Negro College Fund.

Civic and community: We invest in our communities by offering ways for our teammates to volunteer and give back in support of organizations such as the Ronald McDonald House Charities and Feeding America.

We strongly support charitable contributions, including financial giving and corporate sponsorship for charitable organizations, and volunteerism. This includes financial giving and corporate sponsorship for charitable organizations, such as those previously noted in our focus areas. In 2021, Owens & Minor founded The Owens & Minor Foundation (the “Foundation”) dedicated to making impactful investments to charitable organizations in the communities we serve. Upon formation, the Company contributed $10 million to the Foundation which will be used to contribute to charitable organizations engaged in three primary areas: environment, healthcare, and D&I. In 2021, the Foundation donated to 19 charitable organizations. Our community engagement is also extended through our teammates, who actively participate with their communities through fundraising and volunteering.

Product Quality and Safety. One of our main priorities is to provide the highest quality products to support superior customer and patient care. To maintain product quality and meet regulatory requirements, we have a dedicated team of Quality Assurance and Regulatory Affairs personnel to oversee the entire product lifecycle. Globally, we have further improved our product quality and safety processes by updating our corporate quality policy, standardizing our corrective action preventive action, or “CAPA,” process, and deploying a human factors-based root cause investigation methodology. We also continuously track the quality and safety of our products and services.

We manage our internal quality system audits as required by the Federal Drug Administration (“FDA”) and International Organization for Standardization (“ISO”), as well as through third party audits.

Demonstrate Sound Governance, Accountability, and Responsible Sourcing

ESG Governance. Building on our efforts in 2020 to develop a formal ESG program, in 2021 we formalized an ESG governance structure, strategy, and accountability framework. The Governance & Nominating Committee amended its charter in 2021 to include oversight and implementation of the ESG framework and establishment of an ESG governance structure.

We strive to deliver on our ESG program by organizing and leading an ESG steering committee and working groups, as well as establishing structure, goals, and sustainability key performance indicators (“KPIs”), grounded in continuous improvement practices. In November 2021, we hired our first Sustainability Programs Steward (“ESG Lead”) to drive the ESG goals of our Company forward and engage teammates and business leaders across business units and functions. Under the oversight of the Board of Directors and Governance & Nominating Committee, our executive leadership team provides accountability over the ESG steering committee and ESG Lead. Our executive leadership team is responsible for approving ESG strategy, goals, direction, and stances on ESG issues, and ensuring integration across business units.

Data Privacy and Security. We are committed to safeguarding the data of our customers, business partners, and Teammates. We maintain data privacy policies that help us manage our approach to specific regulations. We have provided our teammates with relevant training related to the European Union’s General Data Protection Regulation (“GDPR”) and the US Health Insurance Portability and Accountability Act of 1966 (“HIPAA”). Our goal in these trainings is to promote awareness of the importance of privacy in all aspects of our Company.

Owens & Minor, Inc. ● 2022 Proxy Statement 9

Corporate Governance

|

Our cybersecurity program is overseen by the Vice President of Information Technology Security who provides updates to the Board regarding our IT Security Program no less than annually. As discussed on page 5 regular data security audits are also conducted and other processes and controls are maintained to help support an effective data security program.

Ethics, Anti-bribery and Anti-corruption. We maintain a Code of Honor that creates a standard for ethical behavior that is required of all people who work with us and for us. We require all teammates and our Board of Directors to annually pledge to uphold the Code’s standards. The Code outlines expectations surrounding specific topics including anti-bribery and anti-corruption.

We monitor corruption and bribery through our corporate internal audit, procurement, compliance, and vendor relations teams, who review various reports from all aspects of our business. Owens & Minor prohibits all forms of bribery and corruption and actively maintains policies and procedures to mitigate unethical business practices.

Our ethics and compliance program ensures that we protect our teammates, customers, shareholders, and all other stakeholders. To maintain compliance with all laws and regulations, our internal audit, procurement, and vendor relations teams hold various compliance trainings. We also maintain a hotline to report compliance concerns.

Responsible Supply Chain and Human Rights (including Supplier D&I). Our Supplier Social Compliance Standards require our suppliers to comply with the same standards as our teammates and Board of Directors. Any supplier deemed to be high-risk is subject to our third-party audit process, and we ensure that they are aware of our social compliance and environmental objectives. We strive to partner with suppliers who share our values and align with our Code of Honor.

We look to advance a responsible supply chain that includes qualified businesses with women-owned, minority, LGBTQ, disabled, and veteran representation. To further our supplier diversity mission, we created the Supply Chain Diversity Council with representatives from all our business segments to share ideas, standardize policies and reporting, and drive our supplier diversity strategy.

We have also established a Vendor Code of Conduct, which outlines basic requirements for vendors, distributors, agents, suppliers, representatives, and other business partners and their employees, directors, officers, agents, representatives, and subcontractors.

We are committed to supporting human rights. In 2021, we completed the UK Modern Slavery Assessment to evaluate human rights risk in our supply chain. We also maintain an active oversight and audit program to ensure that our suppliers and our own manufacturing facilities outside of the United States allow freedom of association and collective bargaining, protection against child labor, prohibitions against discrimination, and compliance with wage, hours, and safety standards across our supply chain.

Minimize the Impacts of Our Operations on the Environment

Environmental Stewardship. We are committed to conducting business in compliance with applicable environmental laws and regulations as well as through leading practices that are environmentally responsible. We comply with relevant regulatory standards pertaining to air emissions, storm water, and pollution prevention under the US Environmental Protection Agency (“EPA”) and other global authorities. We also develop and maintain environmental objectives that focus on reducing our impact across our manufacturing sites and vehicle fleets.

At our manufacturing sites, we have adopted practices to limit our environmental impact including efforts to eliminate waste, reduce our carbon footprint, and increase renewable energy usage. We collect annual data at our manufacturing sites to measure greenhouse gas (“GHG”) emissions, water usage, and waste to set and implement site-specific goals to reduce our environmental footprint. Despite significant increases in production to combat the ongoing COVID-19 pandemic, our initial observations suggest the effectiveness of efficiency initiatives as we’ve seen improvements to energy and water consumption across our measured portfolio. Enhancements to energy efficiency at our sites will help in reducing our GHG emissions as we measure and address the impacts of our distribution fleet. In addition, our Products & Healthcare Services segment is focused on pursuing zero waste-to-landfill and evaluating the most effective methods of sourcing 100% renewable energy. We are also preparing to earn ISO 14001 certification in 2022, which maps out a framework to set up an effective environmental management system.

10 Owens & Minor, Inc. ● 2022 Proxy Statement

Corporate Governance

|

Climate Risk. We are cognizant that there are climate risks and opportunities resulting from our operations. We continue to consider steps to lessen the impact of our energy usage and business operations primarily by improving energy and fleet efficiency. We recognize that there are additional opportunities to manage climate risks and opportunities in our business, and we plan to continue working on this in the future.

Fleet Efficiency. In addition to our manufacturing sites, we utilize a fleet of vehicles that are owned and operated by a third-party, under the direction of our Transportation team, to serve our customers. We established targets for our fleet in 2020 and continue to engage with our carriers to meet our goals through leading practices in efficiency optimization, such as fuel efficiency and stop/idle rate, and to promote participation in the EPA’s SmartWay program. The SmartWay program, launched in 2004, provides a system for tracking and sharing fuel and environmental information across carriers, developing more energy efficient, environmentally friendly shipping methods, and reducing business and environmental risk associated with freight transportation.

Waste Management. Our manufacturing facilities continue to maintain a focus on the waste generated in conjunction with the products created at the sites. In 2021, we achieved 97% landfill free operations across our manufacturing sites, largely by developing circular processes that utilize waste generated by the facility to fuel our on-site boilers used for steam generation.

We also continue to implement recycling programs at our distribution centers for the wood pallets, plastic shrink wrap, plastic totes and discarded cardboard. In 2021, approximately 60% of our material generation was recycled, thereby reducing our waste disposal and protecting the environment.

Water Management. We strive to limit and reduce our water consumption by tracking usage throughout our manufacturing sites and creating ways to reduce our water needs. Examples include enhanced metering controls, water-saving valves on site hoses, and wastewater recycling in cooling process, among others.

Our Path Forward. In 2021, we built on our commitment to ESG by formalizing our ESG strategy and governance structure and issuing our inaugural ESG report. We will continue to work on and report our progress on our website at https://investors.owens-minor.com/esg and within our forthcoming 2021 ESG Report.

The Board of Directors held 17 meetings during 2021. All directors attended at least 75% of the meetings of the Board and committees on which they served. Our directors attend our Annual Meeting of Shareholders unless there is compelling reason why they cannot. All of our directors in office at that time attended our 2021 Annual Meeting of Shareholders.

Under the Company’s Corporate Governance Guidelines, the independent directors meet in executive session after each regularly scheduled Board meeting. These meetings are chaired by our Chair who is elected annually by the non-management directors following the Annual Meeting of Shareholders. Shareholders and other interested parties may contact the Chair by following the procedures set forth in “Communications with the Board of Directors” on page 15 of this Proxy Statement.

The Board of Directors currently has the following committees, which the Board established to assist it with its responsibilities:

Audit Committee: The Audit Committee oversees:

| • | Integrity of the Company’s financial statements; |

| • | The Company’s compliance with legal and regulatory requirements; |

| • | Qualification and independence of the Company’s independent registered public accounting firm; |

| • | Performance of the Company’s independent registered public accounting firm and internal audit functions; |

Owens & Minor, Inc. ● 2022 Proxy Statement 11

Corporate Governance

|

| • | Certain aspects of the Company’s ERM program, including cybersecurity risk; and |

| • | Issues involving the Company’s ethical and legal compliance responsibilities. |

The Audit Committee has sole authority to appoint, retain, compensate, evaluate and terminate the Company’s independent registered public accounting firm. The Board of Directors has determined that each of Messrs. McGettrick and Klemash is an “audit committee financial expert,” as defined by SEC regulations and that each member of the Audit Committee is financially literate under NYSE listing standards. All members of the Audit Committee are independent as such term is defined under the enhanced independence standards for audit committees in the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and the rules thereunder as incorporated into the NYSE listing standards and under the Company’s Corporate Governance Guidelines. The Audit Committee met five times during 2021.

Our People & Culture Committee: In 2021, the Company changed the name of this committee from the Compensation & Benefits Committee to the Our People & Culture Committee (the “OP&C Committee”) to recognize this Committee’s broad oversight role of matters affecting our teammates that extends beyond compensation and benefits.

The OP&C Committee:

| • | Administers executive compensation programs, policies and practices; |

| • | Advises the Board on salaries and compensation of the executive officers; |

| • | Conducts studies and recommendations concerning compensation and compensation policies; |

| • | May delegate authority for day-to-day administration and interpretation of compensation plans to certain senior officers of the Company (other than for matters affecting executive officer compensation and benefits); and |

| • | Exercises oversight over other matters affecting our culture and our teammates such as D&I, teammate satisfaction, teammate health and well-being, job satisfaction and turnover. |

All members of the OP&C Committee are independent within the meaning of the enhanced NYSE listing standards and the Company’s Corporate Governance Guidelines and are “non-employee directors” as defined in Rule 16b-3 under the Exchange Act. The OP&C Committee met seven times during 2021.

Governance & Nominating Committee: The Governance & Nominating Committee:

| • | Considers and recommends nominees for election as directors and officers and nominees for each Board committee; |

| • | Reviews and recommends changes to director compensation; |

| • | Reviews and evaluates the procedures, practices and policies of the Board and its members and leads the Board in its annual self-review; |

| • | Oversees the governance of the Company, including reviewing and recommending changes to the Corporate Governance Guidelines; |

| • | Conducts succession planning for senior management; and |

| • | Reviews the Company’s environmental, social and governance programs and practices. |

All members of the Governance & Nominating Committee are independent within the meaning of the NYSE listing standards and the Company’s Corporate Governance Guidelines. The Governance & Nominating Committee met six times during 2021.

Executive Committee: Exercises limited powers of the Board when the Board is not in session. The Executive Committee did not meet during 2021.

12 Owens & Minor, Inc. ● 2022 Proxy Statement

Corporate Governance

|

Board Committee Membership

Director | Board | Audit | Our People & Culture | Executive | Governance & Nominating | ||||||||||||||||||||

Aster Angagaw |

| X |

| X |

|

|

|

|

|

|

| X | |||||||||||||

Mark A. Beck |

| X* |

|

| X |

|

|

|

| X* |

|

|

| ||||||||||||

Gwendolyn M. Bingham |

| X |

|

|

|

| X |

| X |

| X* | ||||||||||||||

Kenneth Gardner-Smith** |

| X |

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||

Robert J. Henkel |

| X |

|

|

|

| X* |

| X |

| X | ||||||||||||||

Stephen W. Klemash |

| X |

| X |

| X |

|

|

|

|

|

| |||||||||||||

Mark F. McGettrick |

| X |

| X* |

|

| X |

| X |

|

|

| |||||||||||||

Edward A. Pesicka |

| X |

|

|

|

|

|

|

| X |

|

|

| ||||||||||||

No. of Meetings in 2021 |

| 17 |

| 5 |

| 7 |

| 0 |

| 6 | |||||||||||||||

| * | Chair of the Board of Directors or respective Committee. |

| ** | Mr. Gardner-Smith was elected to the Board of Directors on March 1, 2022 and has not yet been appointed to any Committees of the Board. |

The Governance & Nominating Committee reviews director compensation annually, and it is the responsibility of this committee to recommend to the Board of Directors any changes in director compensation. The Board of Directors makes the final determination with respect to director compensation. The Governance & Nominating Committee has the authority under its charter to retain outside consultants or advisors to assist it in gathering information and making decisions.

The Company uses a combination of cash and equity compensation to attract and retain qualified candidates to serve on its Board of Directors. In setting director compensation, the Company considers the commitment of time directors must make in performing their duties, the level of skills required by the Company of its Board members and the market competitiveness of its director compensation levels. Additionally, from time to time, the Company performs a market review with respect to other leading companies of similar size to the Company and with respect to the Company’s peer group, under the supervision of the Governance & Nominating Committee, and upon recommendation of the Company’s independent compensation consultant, to determine the compensation arrangements for the independent directors of the Company. In April 2021, after conducting a market review with respect to other leading companies of similar size to the Company and with respect to the Company’s peer group, under the supervision of the Governance & Nominating Committee, and upon recommendation of the Company’s independent compensation consultant, the Board approved changes to the compensation arrangements for the independent directors of the Company. The changes align director compensation with the approximate median director compensation of the Company’s peer group. The Board also increased the annual equity retainer for directors and increased the requirement for the independent directors to own Company common stock to a level of stock ownership having the value of four times the annual cash retainer, which is consistent with the median value of the Company’s peer group. Existing independent directors have until July 30, 2026 to reach this ownership level and any new independent directors elected have until five years after their election to reach this ownership level.

The table below sets forth the schedule of fees paid to non-employee directors for their annual retainer and service in various capacities on Board committees and in Board leadership roles. Employee directors do not receive any additional compensation for serving on the Board or any of its committees.

Owens & Minor, Inc. ● 2022 Proxy Statement 13

Corporate Governance

|

Schedule of Director Fees

Type of Fee | Cash | Equity | ||||||

Annual Retainer | $ | 125,000 |

| $ | 150,000 | (1) | ||

Additional Annual Retainer for Independent Board Chair |

| 100,000 |

|

| N/A |

| ||

Additional Annual Retainer for Audit Committee Chair |

| 30,000 |

|

| N/A |

| ||

Additional Annual Retainer for OP&C Committee Chair |

| 25,000 |

|

| N/A |

| ||

Additional Annual Retainer for Governance & Nominating Committee Chair |

| 25,000 |

|

| N/A |

| ||

| (1) | Restricted stock grant with one-year vesting period. |

Directors may defer the receipt of all or part of their director fees under the Directors’ Deferred Compensation Plan. Amounts deferred are “invested” in bookkeeping accounts that measure earnings and losses based on the performance of a particular investment. Directors may elect to defer their fees into the following two subaccounts: (i) an account based upon the price of the Common Stock and (ii) an account based upon the current interest rate of the Company’s fixed income fund in its Retirement and Savings Plan (the “401(k) Plan”). Subject to certain restrictions, a director may take cash distributions from a deferred fee account either prior to or following the termination of his or her service as a director.

Director Compensation Table

The table below summarizes the actual compensation paid by the Company to non-employee directors who served during the year ended December 31, 2021.

Name | Fees Earned or Paid in Cash ($)(1) | Stock ($)(1)(2)(4) | Option ($)(3) | Non-Equity ($) | Change in Compensation Earnings ($) | All Other Compensation ($) | Total ($) | ||||||||||||||||||||||||||||

Aster Angagaw(5) |

| 114,583 |

| 170,833 |

| — |

| — |

| — |

| — |

| 285,416 | |||||||||||||||||||||

Mark A. Beck |

| 215,000 |

| 150,000 |

| — |

| — |

| — |

| — |

| 365,000 | |||||||||||||||||||||

Gwendolyn M. Bingham |

| 143,750 |

| 150,000 |

| — |

| — |

| — |

| — |

| 293,750 | |||||||||||||||||||||

Kenneth Gardner-Smith(6) |

| N/A |

| N/A |

| N/A |

| N/A |

| N/A |

| N/A |

| N/A | |||||||||||||||||||||

Robert J. Henkel |

| 111,563 |

| 150,000 |

| — |

| — |

| — |

| — |

| 261,563 | |||||||||||||||||||||

Stephen W. Klemash |

| 114,583 |

| 170,833 |

| — |

| — |

| — |

| — |

| 285,416 | |||||||||||||||||||||

Mark F. McGettrick |

| 152,500 |

| 150,000 |

| — |

| — |

| — |

| — |

| 302,500 | |||||||||||||||||||||

Eddie N. Moore, Jr.(7) |

| 35,000 |

| — |

| — |

| — |

| — |

| — |

| 35,000 | |||||||||||||||||||||

Michael C. Riordan(7) |

| 125,000 |

| 150,000 |

| — |

| — |

| — |

| — |

| 275,000 | |||||||||||||||||||||

Robert C. Sledd(7) |

| 31,250 |

| — |

| — |

| — |

| — |

| — |

| 31,250 | |||||||||||||||||||||

| (1) | Includes amounts deferred by the directors under the Directors’ Deferred Compensation Plan. |

| (2) | The amounts included in the “Stock Awards” column are the aggregate grant date fair value of the awards computed in accordance with the FASB ASC Topic 718. |

| (3) | Option Awards were not granted to Directors in 2021. |

| (4) | The Stock Award amount of $150,000 equated to 4,098 shares of restricted stock based on the closing stock price of $36.61 on April 29, 2021, the date of grant. These shares vest on April 29, 2022. Upon their appointment to the Board on March 1, 2021, Ms. Angagaw and Mr. Klemash each received a Stock Award in the amount of $20,833 which equated to 610 shares of restricted stock based on the closing price of $34.14 on that date. These shares vested on March 1, 2022. |

| (5) | Ms. Angagaw was not nominated for re-election due to her acceptance of a full-time employment role. |

| (6) | Mr. Gardner-Smith was elected to the Board of Directors on March 1, 2022 and did not receive compensation during the year ended December 31, 2021. |

| (7) | Mr. Moore and Mr. Sledd retired from the Board on April 29, 2021. Mr. Riordan resigned from the Board effective January 31, 2022 as a result of his acceptance of a full-time role as CEO & President of a hospital system. |

14 Owens & Minor, Inc. ● 2022 Proxy Statement

Corporate Governance

|

Stock Ownership Guidelines for Directors

The Company maintains stock ownership guidelines for its directors and modified those guidelines in 2021 to provide that each director shall attain, within five years after his or her service on the Board begins (or by July 30, 2026 for directors serving as of July 30, 2021), a level of equity ownership of Common Stock having a value of at least four times the Director’s annual cash retainer. Currently, the annual cash retainer is $125,000 and the equity ownership guideline value is $500,000.

Director Candidate Recommendations and Nominations by Shareholders. The Governance & Nominating Committee charter provides that the Governance & Nominating Committee will consider director candidate recommendations by shareholders. Shareholders should submit any such recommendations to the Governance & Nominating Committee through the method described under “Communications with the Board of Directors” below. In addition, our Bylaws provide that any shareholder of record entitled to vote for the election of directors at the applicable meeting of shareholders may nominate directors by complying with the notice procedures set forth in the Bylaws and summarized in “Shareholder Proposals” on page 53 of this Proxy Statement.

Process for Identifying and Evaluating Director Candidates. The Governance & Nominating Committee evaluates all director candidates in accordance with the director qualification standards and the criteria described in our Corporate Governance Guidelines. These guidelines require the Governance & Nominating Committee on an annual basis to review and evaluate the requisite skills and characteristics of individual Board members and nominees as well as the composition of the Board as a whole. This assessment includes whether the member or candidate is independent and includes considerations of diversity, age, skills and experience in the context of the Board’s needs. The goal of the Governance & Nominating Committee is to have a Board whose membership reflects a mix of diverse skill sets, technical expertise, educational and professional backgrounds, industry experiences and public service as well as perspectives of different genders and ethnicities. The Governance & Nominating Committee reviews its annual assessment with the Board each year and, as new member candidates are sought, attempts to maintain and enhance the level of diverse backgrounds and viewpoints of directors constituting the Board. As part of the Board’s annual self-assessment process, the Board will consider the effectiveness of its overall composition and structure as well as its performance and functioning.

There are no differences in the manner in which the Governance & Nominating Committee evaluates director candidates based on whether the candidate is recommended by a shareholder. The Governance & Nominating Committee did not receive any nominations from shareholders for the 2022 Annual Meeting.

Our Bylaws provide that no director nominee can stand for election if, at the time of appointment or election, the nominee is over the age of 72; however, on exceptional circumstances, the Board may waive on a temporary basis the director age limitations to allow a director to be appointed, elected and serve past age 72.

Proxy Access. Our Bylaws further permit a shareholder, or a group of up to 20 shareholders, owning 3% or more of the outstanding shares of the Company’s stock eligible to vote in the election of directors continuously for at least three years, to nominate and include in the Company’s Annual Meeting proxy materials director candidates to comprise generally up to two or 20% of the Board seats (whichever is greater), provided that such shareholder or group of shareholders satisfies the requirements set forth in Article I, Section 1.10 of the Bylaws. No shareholder nominated a director candidate for the

2022 Annual Meeting.

Communications with the Board of Directors

The Board of Directors has approved a process for shareholders and other interested parties to send communications to the Board. Shareholders and other interested parties can send written communications to the Board, any committee of the Board, non-management directors as a group, the Chair, the lead director or any other individual director at the following address: P.O. Box 2076, Mechanicsville, VA 23116-2076. All communications will be relayed directly to the applicable director(s).

Owens & Minor, Inc. ● 2022 Proxy Statement 15

Proposal 1: Election of Directors

Seven directors have been nominated for election to the Board of Directors for a one-year term expiring at the 2022 Annual Meeting of Shareholders or until their respective successors are elected. Each nominee has agreed to serve if elected and qualified. If any nominee is not able to serve, the Board may designate a substitute or reduce the number of directors serving on the Board. Proxies will be voted for the nominees shown below (or if not able to serve, such substitutes as may be designated by the Board). The Board has no reason to believe that any of the nominees will be unable to serve.

Our Bylaws currently provide that the Board of Directors shall consist of eight directors and the Company intends to amend its Bylaws to provide for seven directors upon the election of the seven nominees in this Proxy Statement. The Governance & Nominating Committee has recommended to the Board of Directors, and the Board of Directors has approved, seven persons as nominees for election to the Board of Directors. At its meeting immediately following the 2022 Annual Meeting, the Board of Directors intends to amend the Bylaws to decrease the size of the Board of Directors from eight to seven directors to remove the vacancy created by the departure of Ms. Angagaw. Proxies cannot be voted for a greater number of directors than the number of nominees named.

Information on each nominee, including the particular experience, qualifications, attributes or skills that led the Board to conclude that he or she should serve as a director of the Company, is set forth below in the following tables and in nominee specific disclosures.

Director Nominee Group Information

Experience and Skills of Director Nominees

Director | Significant Leadership Experience | Healthcare Experience | Manufacturing / Operations Experience | Global, Emerging Markets Experience | Supply Chain & Logistics Experience | Technology, Cybersecurity or IT Oversight | Financial Literacy and Reporting | Risk Oversight/ Risk Management | Public Company Governance | Environmental, Governance (ESG) | ||||||||||||||||||||||||||||||||||||||||

Mark A. Beck

|

|

|

|

|

|

|

|

|

|

| ||||||||||||||||||||||||||||||||||||||||

Gwendolyn M. Bingham

|

|

|

|

|

|

|

|

|

| |||||||||||||||||||||||||||||||||||||||||

Kenneth Gardner-Smith

|

|

|

|

|

|

|

|

| ||||||||||||||||||||||||||||||||||||||||||

Robert J. Henkel

|

|

|

|

|

|

|

|

| ||||||||||||||||||||||||||||||||||||||||||

Stephen W. Klemash

|

|

|

|

|

|

|

|

|

|

| ||||||||||||||||||||||||||||||||||||||||

Mark F. McGettrick

|

|

|

|

|

|

|

|

| ||||||||||||||||||||||||||||||||||||||||||

Edward A. Pesicka

|

|

|

|

|

|

|

|

|

|

| ||||||||||||||||||||||||||||||||||||||||

16 Owens & Minor, Inc. ● 2022 Proxy Statement

Proposal 1: Election of Directors

|

Mark A. Beck

| ||

Principal Occupation: Co-founder and CEO of B-Square Precision, LLC

Age 56 Director since 2019 Independent Director, Chair of the Board

Committees: Audit, Executive

|

Background:

Mr. Beck serves as the Board’s Chair, a position he has held since September 2020, and is the co-founder and CEO of B-Square Precision, LLC, a private company engaged in the acquisition and management of companies that manufacture high-precision tools, dies, molds and components. Previously, Mr. Beck served as President and Chief Executive Officer of JELD-WEN Holding, Inc. (JELD-WEN), one of the world’s largest door and window manufacturers, from November 2015 to February 2018, and was a director of JELD-WEN from May 2016 to February 2018. Prior to JELD-WEN, Mr. Beck served as an Executive Vice President at Danaher Corporation, leading Danaher’s water quality and dental platforms, beginning in April 2014. Previously, he spent 18 years with Corning Incorporated in a series of management positions with increasing responsibility, culminating in his appointment as Executive Vice President overseeing Corning’s environmental technologies and life science units in July 2012. Mr. Beck currently serves on the board of directors of IDEX Corporation. He formerly served on the board of directors of Dow-Corning Corporation from 2010 to 2014.

Qualifications:

The Board of Directors has nominated Mr. Beck to continue his service as a director based on his experience as a chief executive officer of a public company with significant international operations and his track-record of innovation and successfully integrating acquired businesses. His insights into the manufacturing industry, both domestic and international, bring a unique perspective to Owens & Minor’s Board that assists us strategically as we grow our proprietary product manufacturing and sales capabilities and seek to manage our many relationships with the manufacturing community globally. | |

Gwendolyn M. Bingham

| ||

Principal Occupation: Retired United States Army (three-stars)

Age 62 Director since March 2020 Independent Director

Committees: Our People & Culture, Nominating (Chair)

|

Background:

Lieutenant General (three-stars) Bingham retired in September 2019 from the United States Army following a 38-year career in the military. During her military career, LTG (retired) Bingham served as Department of the Army Assistant Chief of Staff for Installation Management from 2016 through her retirement in 2019. Previously, she was Commanding General, US Army Tank-Automotive and Armaments Lifecycle Management Command from 2014 to 2016; Commanding General, White Sands Missile Range from 2012 to 2014; Commandant, US Army Quartermaster School from 2010 to 2012; and Chief of Staff, Combined Arms Support Command and Sustainment Center of Excellence from 2008 to 2010. LTG (retired) Bingham holds numerous civic and military honors and was the first woman to hold numerous positions as a US Army General Officer including: the Army’s 51st Quartermaster General and Commandant of the US Army Quartermaster School, Fort Lee, Virginia; the Commanding General, White Sands Missile Range, New Mexico and as Commanding General, Tank-automotive and Armaments Life Cycle Management Command, Warren, Michigan.

Qualifications:

The Board of Directors has nominated LTG (retired) Bingham to continue her service as a director of the Company based on her over 20 years of senior executive leadership experience in complex logistics and supply chain management, resource management, environmental and energy matters, talent management and strategic planning. Additionally, LTG (retired) Bingham has unique experience in leading the Army’s most significant integrated material management center with manufacturing centers in multiple locations and personnel worldwide to support the Army’s efforts to sustain, prepare and transform its operations, which provides insight into the challenges faced in the business of global distribution and supply chain management. | |

Owens & Minor, Inc. ● 2022 Proxy Statement 17

Proposal 1: Election of Directors

|

Kenneth Gardner-Smith

| ||

Principal Occupation: Chief People Officer, DaVita Inc.

Age 41 Director since March 2022 Independent Director

Committees: None currently

|

Background:

Mr. Gardner-Smith has served as the Chief People Officer since 2020 for DaVita, Inc., a Fortune 500 kidney dialysis service provider. Prior to that Mr. Gardner-Smith has held the following positions with DaVita, including Regional Group VP, Field Operations - Southeast from 2015 to 2019, Division VP from 2014 to 2015, Group Director from 2013 to 2014, and Regional Director, Operations from 2011 to 2013. Prior to his employment with DaVita from 2008 to 2011, Mr. Gardner-Smith worked as an investment banker at Morgan Stanley focused on mergers and acquisitions. From 2003 to 2006, Mr. Gardner-Smith was Relationship Manager for Wells Fargo.

Qualifications:

The Board of Directors has nominated Mr. Gardner-Smith to continue his service as a director of the Company based on his extensive experience and business management leadership in the healthcare industry, including home healthcare, as well as his experience developing process innovation, transformation, and talent strategies. His experience and range of perspectives as a senior healthcare executive in compensation, succession planning and diversity and inclusion will benefit the Company as it continues to develop talent and invest in human capital resources and expand as a medical product manufacturer and healthcare solutions partner for the healthcare industry. | |

Robert J. Henkel

| ||

Principal Occupation: President, Healthcare THEO Executive Group

Age 67 Director since 2019 Independent Director

Committees: Our People & Culture (Chair), Executive, Governance & Nominating

|

Background:

Mr. Henkel is President, Healthcare Transformation at the THEO Executive Group, since January 2019. Previously, Mr. Henkel served as President and Chief Executive Officer of Ascension Healthcare from 2012 to July 2017, and was Chief Operating Officer of Ascension Healthcare from 2004 to 2011. Ascension Health, Inc. is the largest non-profit healthcare system in the United States and the world’s largest Catholic health system. During his 25-year tenure with Ascension Health, Mr. Henkel was Chair of the Ascension Innovation Counsel for Ascension Health, Inc. from July 2017 to 2019, and also served in a number of different roles including President of the Great Lakes and Mid-Atlantic States Operating Group. Prior to Ascension Health, Mr. Henkel held numerous executive leadership positions with other healthcare organizations, including the Daughters of Charity National Health System, St. Louis; Mount Sinai Medical Center, Miami Beach, Fla.; SSM Health Care in St. Louis; and Montefiore Medical Center, Bronx, New York. Mr. Henkel is a Life Fellow with the American College of Healthcare Executives and an adjunct professor of health policy and management with the University of Pittsburgh Graduate School of Public Health.

Qualifications: